UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-21625

Investment Company Act file number

Intrepid Capital Management Funds Trust

(Exact name of registrant as specified in charter)

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Address of principal executive offices) (Zip code)

Mark F. Travis

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach FL 32250

(Name and address of agent for service)

1-904-246-3433

Registrant's telephone number, including area code

Date of fiscal year end: 09/30/2010

Date of reporting period: 03/31/2010

Item 1. Report to Stockholders.

Intrepid Capital Fund

Intrepid Small Cap Fund

Intrepid Income Fund

Intrepid All Cap Fund

Semi-Annual Report

March 31, 2010

Intrepid Capital Fund

Mark F. Travis, President/C.E.O.

April 22, 2010

Dear Fellow Shareholders,

Spring is here and flowers are not the only thing in full bloom! Prices of equity and debt securities in the Intrepid Capital Fund have blossomed as well. I am happy to announce that for the first six months of the fiscal year ending March 31, 2010, The Intrepid Capital Fund (ICMBX) had a total non-annualized return of 11.10%. This is comparable to the return of the all-equity indices (S&P 500, Dow Jones Industrial Average, Russell 2000), which appreciated 11.75%, 13.31% and 13.07% in the same time period.

Standardized performance data for 1 year, 5 year, and Since Inception (01/03/2005) for the period ending March 31, 2010 was 41.84%, 7.31%, and 6.41%, respectively. For the same periods, the S&P 500 Index returns were 49.77%, 1.92%, and 1.57%, the Dow Jones Industrial Average returns were 46.93%, 3.34%, and 2.87%, and the Russell 2000 Index returned 62.76%, 3.36%, and 2.46%. The funds gross expense ratio is 1.72%.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Funds impose a 2.00% redemption fee on shares held less than one month. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

The capital markets have generally increased over this time frame, with only brief interludes of price volatility, making it increasingly difficult to find securities that meet our selection criteria. I am pleased with our six month performance, as the total return is what I would have anticipated over a twelve-month period.

It is important to keep several things in mind. First, I would not annualize our six-month performance by multiplying by two. Second, the return of ICMBX in this six-month period is in line with long-term (70+ years) annualized equity-only index returns, as measured by the S&P Index, as calculated by Ibbotson Associates. Third, the indices I referenced above are all-equity, all the time, while ICMBX is a “balanced” fund, seldom investing more than 60% of its assets in the equity markets.

ICMBX continues to garner national attention with its five-star Overall Morningstar Rating as of 3/31/2010 out of 955 Moderate Allocation Funds. (The Overall Morningstar Rating™ for a fund is derived from a weighted average of the funds three year Morningstar Ratings™ metrics, which are based on risk adjusted returns). This recognition reflects our track record which is directly attributable to our disciplined investment process. With share prices meeting our valuation estimates

Intrepid Capital Fund

and a number of bonds being called, our discipline is being tested once again. I will continue to nibble at securities I already own, but would prefer a few big gulps if prices were to fall. So the next time you turn on the television and see that the equity markets have dropped 2% to 3%, think of me as I will have my shopping list ready.

I believe the Fund’s turnover rate has been unusually high, but this is directly correlated to the extreme swings in stock and bond pricing since the fall of 2008. I am hopeful next year’s expected tax increase will help moderate turnover, eventually returning it to our investment firm’s historical average (less than 50% annually).

The fund paid a per share dividend of $0.0388 on March 26, 2010. After the distribution the share price dropped to reflect the payment. ICMBX pays a quarterly dividend that includes all interest income and dividends received by the fund over the preceding calendar quarter. Short and long-term capital gains are distributed annually just before calendar year end.

Thank you for entrusting Intrepid Capital Funds with your hard-earned capital. In a world of almost infinite choice, the decision on your part is not one we take for granted. If there is anything we can do to serve you better, please call us at 1-866-996-FUND.

Best regards,

Mark F. Travis

President

| | |

| Berkshire Hathaway (BRK-B) | 3.1% |

| Tidewater (TDW) | 2.9% |

| Newmont Mining (NEM) | 2.2% |

| CR Bard (BCR) | 2.2% |

| JAKKS Pacific (JAKK) | 2.1% |

| Prestige Brands Holdings (PBH) | 2.1% |

| Foot Locker (FL) | 2.0% |

| Baldwin & Lyons (BWINB) | 1.9% |

| CSG Systems International (CSGS) | 1.8% |

| Oil-Dri Corporation of America (ODC) | 1.8% |

Intrepid Capital Fund

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Past performance is no guarantee of future results.

The Fund is subject to special risks including volatility and less liquidity due to investments in small- and mid-cap stocks, high yield securities and is considered non-diversified as a result of limiting its holdings to a relatively small number of positions. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities.

Must be preceded or accompanied by a prospectus.

©2010 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating (based on a Morningstar risk-adjusted return measure that accounts for variation in a fund’s monthly performance, including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The Intrepid Capital Fund was rated 5-Stars against the following numbers of U.S. domiciled Moderate Allocation funds over the following time periods: 955 and 777 funds in the last three- and five-years respectively.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Dow Jones Industrial Average is an unmanaged index of common stocks comprised of major industrial companies and assumes reinvestment of dividends. The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization.

One cannot invest directly in an index.

Intrepid Small Cap Fund

Eric Cinnamond,

Small Cap Fund Portfolio Manager

April 22, 2010

Dear Fellow Shareholders,

The Intrepid Small Cap Fund returned 11.26% over the six month period ending March 31, 2010. This result lagged the small cap market, with the Russell 2000 increasing 13.07% during the same six month period.

As mentioned in the last quarterly letter, the Intrepid Capital Small Cap Fund is more defensively positioned than a year ago. Cash remains near the 20% level as we’ve had difficulty replacing recent sales with enough small-cap investments that meet our buy criteria. We continue to search for businesses that we believe are high-quality, have above-average visibility, possess strong or improving balance sheets, and generate attractive free cash flows. Many of the small-cap businesses that have these characteristics are trading at or above our calculated valuations; therefore, our plan is to remain patient and possibly less active until prices become more advantageous to the buyer. We believe that the Fund underperformed its benchmark and its peers during the past six months due to our re latively defensive position.

When discussing whether small-cap valuations are attractive or expensive, some in the investment industry look to the risk premium for guidance. In the academic world, the risk premium is defined as the expected rate of return of a risky investment, such as a small-cap stock, over a “risk-free” investment, such as a Treasury bill. As the theory goes, when the risk premium is high, investors are getting paid an above average rate of return to take risk (the investment is attractively priced). Conversely, when the risk premium is low, investors are getting paid a below average rate of return for assuming risk (the investment is expensive).

In our opinion, this academic formula doesn’t measure the attractiveness of risky assets precisely due to the uncertainty of its two variables – the expected rate of return and the risk-free rate. Although the academic world also has a formula to help investors determine the expected rate of return of a risky investment, in practice, the expected rate of return is very subjective. Furthermore, the risk-free rate is often volatile in the short-term, which makes it difficult to apply to any long-term decision making model. For example, in 2007, T-bills were yielding 5.00%. Today, T-bills are yielding a measly 0.15%. Which risk-free rate should an investor use? Where will risk free rates be in 2011? No one knows for certain.

When risk-free rates are historically low, as they are now, the risk premium may appear adequate; however, after considering the absolute expected return of a particular investment, the risk premium may actually seem too low. For example, many junk bonds are now only yielding in the 5% to 6% range. This may be an attractive yield versus today’s T-bill rate, but from an absolute perspective, it is relatively low given the risks the investor is taking. Therefore, even when risk

Intrepid Small Cap Fund

premiums seem reasonable based on the academic definition, they may not be sufficient given the real world risks associated with the underlying investment.

When selecting small cap equities for the Fund, we view the expected rate of return on our investments from an absolute perspective, not simply as it compares to the current risk-free rate. Specifically, we attempt to generate a required rate of return on our small-cap investments that is commensurate with the risks we are taking as a partial owner of the underlying business. Although we consider the range of expected risk-free rates in our valuation, we are more concerned about the risks to the business’s cash flow and balance sheet. These operating and financial risks are the main variables we use in determining our expected or required rate of return.

The required rate of return we choose is essential in our valuation process as it is an important variable that we use to discount a business’s free cash flow. Historically, our required rate of return for most of our small-cap investments has been 10% to 15%, depending on the risks of the business (the higher the risk, the higher the required rate of return).

Despite historically low risk-free rates over the past year, we have not altered our required rate of return when valuing small-cap businesses. We believe small-cap investors should demand a healthy return premium considering the amount of business risk the investor is assuming. As we continue to use a 10% to 15% required rate of return when valuing small-cap businesses, fewer investments are selling at what we believe are sufficient discounts to intrinsic value.

When investing in small-cap stocks, there is a time to take risk and there is a time to step back and wait for better opportunities. In 2009, risk premiums in small-cap stocks were very high and valuations were attractive – we took risk as we believed we were being paid to do so. As of April 22, 2010, the Russell 2000 has increased 117% from its March 2009 lows. The small-cap investment environment has changed considerably. At current prices, we believe that risk premiums in the small-cap market on average are not high enough to provide investors with an adequate margin of safety. We base this assumption on our belief that implied return expectations on many small-cap stocks have declined to absolute levels that are insufficient relative to the risk assumed. Furthe rmore, we believe that risk-free rates will not remain at historically low levels indefinitely. As a result, we have not used current risk-free rates in our calculation of small-cap risk premiums.

Assuming small-cap risk premiums remain below our comfort level, we expect the portfolio to remain more defensively positioned than it was in 2009. Because of this defensive stance, we would expect the portfolio to continue to lag its peers and the Russell 2000 assuming the small-cap market continues its aggressive advance higher. Furthermore, as we tend to invest in what we believe are higher quality small-cap businesses, the Fund’s equity holdings could underperform assuming the more volatile and riskier sections of the small cap market continue their sprint higher.

Intrepid Small Cap Fund

In the April 19, 2010 edition of Barron’s, there was an interesting article written by Kopin Tan that broke out performance of small-cap stocks by their return on equity. In the first quarter of 2010, the top fifth of small-cap stocks with the highest return on equity performed poorly (up 7.4%) relative to the other 80% of small cap stocks in the Russell 2000. The small-cap stocks with the lowest return on equity, the bottom fifth of the Russell 2000, performed well relatively and were up 10.1%. The small-cap stocks that performed the best were those that did not make money (up 11.1%)! Regardless of how well lower-quality small cap stocks perform, especially those that are not profitable, you will not find us investing your capital in these types of businesses.

Refraining from speculating has hurt the Fund’s relative performance during certain periods of market enthusiasm; however, it has been essential to providing our shareholders with what we believe have been attractive risk-adjusted returns since inception. Our defensive posture is not an attempt on our part to time the market or to look uncompetitive, but it is a direct result of our strict valuation discipline of only buying businesses that we believe are undervalued. Furthermore, we strongly believe that to have superior long-term results, there will be periods where less than average short-term results are not only prudent, but necessary.

Although we consider small-caps fairly priced and in some cases expensive (valuations look rich in more cyclical and lower-quality names), we are not sitting idle hoping for volatility to return. As we patiently wait for the small-cap market to present a broader range of opportunities, we are working hard to find what we believe are attractively-priced small-cap equities. Although it has become more difficult to discover these small-cap gems, we continue to find interesting ideas that we believe are either misunderstood or underfollowed. A good example is one of our most recent purchases, EPIQ Systems (ticker: EPIQ).

EPIQ Systems is a leading technology provider to the legal industry. EPIQ’s focus is on bankruptcy administration, litigation and class action settlements. We believe its business will benefit from the higher level of bankruptcies, which we believe have been temporarily depressed from 2006-2008 due to a strong economy and changes in bankruptcy laws in 2005. Furthermore, based on our calculations, EPIQ’s earnings are not reflecting the true potential of its Chapter 7 business.

EPIQ Systems provides Chapter 7 bankruptcy trustees, at no cost, with the products (software) and services needed to process bankruptcies. In return, EPIQ receives deposit based fees from the liquidated proceeds. The fees received vary and depend mainly on the level of deposits being held by the trustees and the interest rates on these deposits. Chapter 7 deposit growth has been strong as the deposit base is up 25% year over year and recently reached an all-time record of $2 billion. However, abnormally low interest rates have masked this strong deposit performance and have cut this potential source of revenue growth considerably. We believe that when interest rates on these bank deposits rise, this business will improve.

Intrepid Small Cap Fund

We believe the normalized free cash flow of EPIQ Systems is higher than its current earnings run rate. Selling at 6.5x EBITDA (2010 estimate) and 12.0x our normalized free cash flow estimate, we believe EPIQ Systems is an attractively-priced software business, especially given its established market leader position. With a strong balance sheet and excess free cash flow, we could also expect EPIQ Systems to reward shareholders with a newly initiated dividend in the near future.

We had several small purchases and sales during the first quarter as we continue to reduce or exit positions that have reached our valuations and initiate new positions that are selling at discounts to what we believe the underlying businesses are worth. We expect this rotation to continue as long as the small-cap market marches higher. If the small-cap market declines – something we’d actually welcome – we will be ready with our potential buy list in hand along with the Fund’s available cash balance.

Sincerely,

Eric Cinnamond

Small Cap Portfolio Manager

Past performance is not a guarantee of future results.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

The Fund is subject to special risks including volatility and less liquidity due to investments in smaller companies and is considered nondiversified as a result of limiting its holdings to a relatively small number of positions.

Must be preceded or accompanied by a prospectus.

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. Companies in the Russell 3000 Index, as ranked by market capitalization. You cannot invest directly in an index.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization. An approximate measure of a company’s operating cash flow based on data from the company’s income statement.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please see the Schedule of Investments included in this report.

Intrepid Income Fund

|  |

| Jason Lazarus, | Ben Franklin, |

| Research Analyst | Research Analyst |

April 22, 2010

Dear Fellow Shareholders,

The high-yield market posted its fifth consecutive quarterly gain during the three month period ended March 31, 2010. As spreads have continued to compress, companies have taken advantage by issuing record levels of high-yield debt. March marked the highest ever monthly issuance at $36.2 billion. Many companies that looked headed toward bankruptcy just a few quarters ago have been able to refinance maturing debt. The ability of the market to absorb this level of issuance demonstrates that investors still have large appetites for high-yield risk. Combined with high-yield fund net inflows in 30 of the last 33 weeks, managers are increasingly reaching for yield. At Intrepid Capital, we believe these investors are misguided. By living through the last decade, many of us know what happens when investors get greedy.

We intend to keep the portfolio’s duration, a measure of sensitivity to changes in interest rates, on the short end due to the historically low risk-free rates available in the market. In line with this strategy, we have not invested in any new issues because these bonds typically mature in more than seven years. As the companies in the Intrepid High Yield portfolio have called (repurchased) their bonds from us and issued longer-dated, lower-coupon notes, our cash levels have increased. Our policy is to not force invest this cash into credits that do not meet our criteria. Thus, we were not invited to the party that was the high-yield bond market in the six months ending March 31, 2010. The Intrepid Income Fund returned 5.18% over the six-month period versus the Bank of Ameri ca/Merrill Lynch High Yield Master II Index return of 11.15%

During the period, we invested our clients’ hard-earned capital only in bonds that we felt offered attractive risk-adjusted returns. We established positions in AEP Industries 7.875% due 3/15/2013, Interline Brands 8.125% due 6/15/2014, Spartan Stores 3.375% convertible bond putable 5/15/2014, Mobile Services Group 9.75% due 8/01/2014, Valassis Communications 8.25% due 3/01/2015, and Phillips Van Heusen 8.125% due 5/01/2013.

Additionally, our positions in Eye Care Centers, Prestige Brands (ticker: PBH), Thermo Fisher Scientific (ticker: TMO) Constellation Brands (ticker: STZ), and Central Garden (ticker: CENT) were all repurchased by the issuers. Our Home Depot floating-rate bonds matured in December. We exited our positions in two bonds, American Real Estate Partners (ticker: IEP) and Neenah Paper (ticker: NP), as well as reduced our position in Chemed 1.875% convertible bonds due 5/15/2014. In the case of the two former bonds, we continued to follow our strategy of upgrading

Intrepid Income Fund

the quality of the portfolio as high-yield markets grind higher. With the Chemed position, the bond had rallied so much that felt it necessary to pare back the position in search of other ideas. As we find more appropriately priced bond ideas, we will look to exit the CHE position. In all of these scenarios, we simply believe we were not being well compensated for the risks being undertaken.

In our letters to shareholders, we like to give added detail on one of our newly entered positions, in this case Interline Brands. Interline Brands (ticker: IBI) is a national distributor and marketer of maintenance, repair and operations products headquartered in Jacksonville, FL. The company stocks over 100,000 products used in plumbing, janitorial and sanitary, electrical, lighting, hardware, security, heating, ventilation and air conditioning, as well as other miscellaneous products. 75% of the company’s sales are to the facilities maintenance end-market, which has historically been less cyclical than other markets such as manufacturing and new construction. IBI has solid credit metrics that will improve as sales demand returns. Total debt is low at just over $300 million . The balance sheet is strong, accounts receivable and inventory alone are greater than total debt, and the company has $63 million in cash. Additionally, IBI has a solid record of debt repayment and conservative uses of free cash. We believe the yield on this note is attractive and established a half weight, increasing the allocation if the bonds cheapen.

As we have noted in prior letters, we search for attractive absolute returns where we believe we are being well compensated for assuming risk. We will continue to be prudent stewards of our clients’ capital by not following the herd.

Sincerely,

|  |

| Ben Franklin | Jason Lazarus |

| Research Analyst | Research Analyst |

Past performance is no guarantee of future results.

The Fund is subject to special risks including volatility due to investments in high yield securities and is considered non-diversified as a result of limiting its holdings to a relatively small number of positions. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities.

Must be preceded or accompanied by a prospectus.

The Bank of America/Merrill Lynch High Yield Master II Index is Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. You cannot invest directly in an index.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Please refer to the Schedule of Investments included in this report for a complete list of fund holdings.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Intrepid All Cap Fund

Greg Estes,

All Cap Fund Portfolio Manager

April 22, 2010

Dear Fellow Shareholders,

For the first six months of the fiscal year ending March 31st, 2010, the Intrepid All Cap Fund gained 12.93%. This result was slightly ahead of the S&P 500 Index, which returned 11.75% over the same period. Barring a bit of a pullback in the month of February, the equity market continued its unabated upward progress for the fourth consecutive quarter. Over the last twelve months, the S&P 500 Index has moved from a low of 783.32 on April 1, 2009 to a high of 1180.69 on March 25, 2010. What makes this bull market period stand out from others since 1980 is not the absolute increase. The bull markets periods from 1995 to 2000 and from 2003 through 2007 were bigger. Rather, it is the steepness of the run in such a short time. While we are pleased to generate solid results for our clients, we grow con cerned when the market moves so quickly in such a relatively short period of time. We prefer to see stocks appreciate based upon improvements in their respective underlying business fundamentals. To be fair, there were indeed improvements among many companies in the back half of 2009; however, much of that growth in earnings can be attributed to cost cutting. So, we are left to wonder whether the market’s run-up is truly due to better underlying performance or to the anticipation of better performance over the next year. We listen to many conference calls when following our investments, and many of the executives on those calls remain cautious about 2010. We think that caution should be first and foremost in the mind of the value investor.

A related reason for caution is in the shrinking risk premium, which goes hand-in-hand with the equity market’s run-up. The Price-Earnings (P/E) ratio for a stock tells us how much an investor is willing to pay for $1 in company net income. The higher the P/E ratio, the more expensive the stock is, and this is accompanied by an expectation of faster earnings growth. Just as we can view an individual stock’s P/E ratio, we can also look at an index’s P/E. Over the last ten years, the P/E ratio for the S&P 500 Index has fluctuated between a high of 29.4 times at the end of the internet bubble in April 2000 to a low of 10.0 times earnings in March 2009. Today, that ratio is 18.7 times, which is close to the average P/E (19.1 times) over that 10 year time frame.� 60; We can say that a dollar of earnings was much cheaper a year ago than it is today. We can also say that we are not being compensated as much today to take on risk as we were a year ago; however you look at it, taking on risk is not as rewarding as it was just a short time ago. In this environment, it is challenging to find new ideas that trade at discounts to intrinsic values.

Intrepid All Cap Fund

Given the performance over the period, nearly all stocks in the Fund composite generated a positive return. We will single out one investment in particular which contributed beneficially to the portfolio’s performance. Endo Pharmaceuticals (ticker: ENDP), a specialty drug company with a pain management franchise, exceeded the “Street’s” estimated earnings for the last quarter of 2009. More importantly, the market liked the company’s much improved forecast for 2010. Endo is a focused, niche company with a solid barrier to entry in the form of patent-protected drugs. It operates within a well-controlled cost structure. Its 2010 forecast shows improvement coming not only from cost controls, but also from sales growth in its Lidoderm patch, whic h is designed to alleviate after-shingles pain. We think that companies like Endo, which have entrenched products and stable cash flows, are reasonable investments that can perform well whether we have a rapid economic recovery or not.

On the flip side, our primary portfolio detractor for the quarter was Total Systems Services (ticker: TSS). More commonly referred to as TSYS, this business sells outsourcing services to banks to handle all aspects of electronic payment processing. If you have a credit card, there is a high likelihood that TSYS handles the processing of any transaction on the card as well as the account management, billing, and statements. It also handles merchant acquisition services, which is the other side (i.e., the seller) of the transaction on behalf of banks and their business customers. The challenge in the first quarter for TSYS can be boiled down to one major problem; transaction volume in the U.S. has not rebounded as much as management hoped and the executives at TSYS are very cautious about furth er improvement in 2010. In other words, folks in the U.S. are using their credit cards, corporate cards and/or debit cards with less frequency than they had been in the past. In TSYS’s case, it is not so much the total amount of spending but the level of transaction frequency that is the problem. In spite of this setback, we believe there is much to like in TSYS. It has a clean balance sheet with no net debt, and it is a market leader in payment processing services. We believe that the long-term thesis still holds for TSYS: the Company has an opportunity to capture new bank and corporate clients globally, and that coupled with increasing usage of electronic forms of payment outside the U.S., will mean more business for TSYS. At some point, improved transaction volume in the U.S. will also boost cash flows. We are maintaining this position in our portfolios and will continue to monitor its performance.

To close, we would like to review the average discount within the portfolio. Each investment will have a discount to intrinsic value which is based upon its market price and our calculated intrinsic value. The average discount at end of the first quarter for the All Cap composite was 7%, which means that more stocks within the

Intrepid All Cap Fund

portfolio are approaching fair value. We will continue to exercise care in putting our clients’ money to work by searching for stocks which trade at discounts to intrinsic value.

Sincerely,

Greg Estes

All Cap Fund Portfolio Manager

Past performance is no guarantee of future results.

The Fund is subject to special risks including volatility and less liquidity due to investments in small- and mid-cap stocks and is considered non-diversified as a result of limiting its holdings to a relatively small number of positions.

Must be preceded or accompanied by a prospectus

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index.

Price to earnings ratio is a common tool for comparing the prices of different common stocks and is calculated by dividing the current market price of a stock by the earnings per share.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Please refer to the Schedule of Investments included in this report for a complete list of fund holdings.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Intrepid Funds

EXPENSE EXAMPLE

March 31, 2010 (Unaudited)

As a shareholder of the Intrepid Capital Management Funds Trust (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other expenses incurred by the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period of October 1, 2009 (November 3, 2009 for the Intrepid Small Cap Fund Institutional Class) through March 31, 2010.

ACTUAL EXPENSES

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fun d. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2010 (Unaudited)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

INTREPID CAPITAL FUND

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2009 - | |

| | | October 1, 2009 | | | March 31, 2010 | | | March 31, 2010 | |

| Actual | | $ | 1,000.00 | | | $ | 1,111.00 | | | $ | 7.84 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,017.50 | | | | 7.49 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.49%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID SMALL CAP FUND – INVESTOR CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2009 - | |

| | | October 1, 2009 | | | March 31, 2010 | | | March 31, 2010 | |

| Actual | | $ | 1,000.00 | | | $ | 1,112.60 | | | $ | 7.43 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,017.90 | | | | 7.09 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.41%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID SMALL CAP FUND – INSTITUTIONAL CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During the Period* | |

| | | Account Value | | | Account Value | | | November 3, 2009 - | |

| | | November 3, 2009 | | | March 31, 2010 | | | March 31, 2010 | |

| Actual | | $ | 1,000.00 | | | $ | 1,124.80 | | | $ | 4.92 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,015.51 | | | | 4.67 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 147/365 to reflect the period. |

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2010 (Unaudited)

INTREPID INCOME FUND

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2009 - | |

| | | October 1, 2009 | | | March 31, 2010 | | | March 31, 2010 | |

| Actual | | $ | 1,000.00 | | | $ | 1,051.80 | | | $ | 6.39 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,018.70 | | | | 6.29 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID ALL CAP FUND

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2009 - | |

| | | October 1, 2009 | | | March 31, 2010 | | | March 31, 2010 | |

| Actual | | $ | 1,000.00 | | | $ | 1,129.30 | | | $ | 10.35 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,015.21 | | | | 9.80 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.95%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

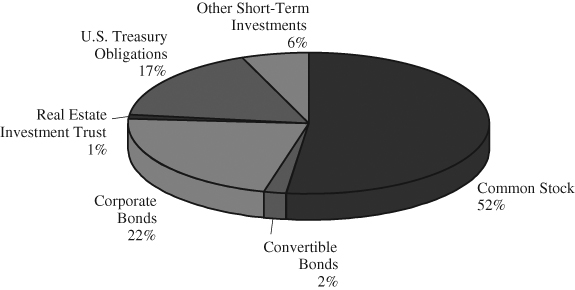

Intrepid Capital Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2010 (Unaudited)

INTREPID CAPITAL FUND

(as a % of total investments)

COMPONENTS OF PORTFOLIO HOLDINGS

| Common Stocks | | $ | 58,548,249 | |

| Convertible Bonds | | | 1,988,091 | |

| Corporate Bonds | | | 25,104,707 | |

| Real Estate Investment Trust | | | 959,045 | |

| U.S. Treasury Obligations | | | 19,993,700 | |

| Other Short-Term Investments | | | 6,519,273 | |

| Total | | $ | 113,113,065 | |

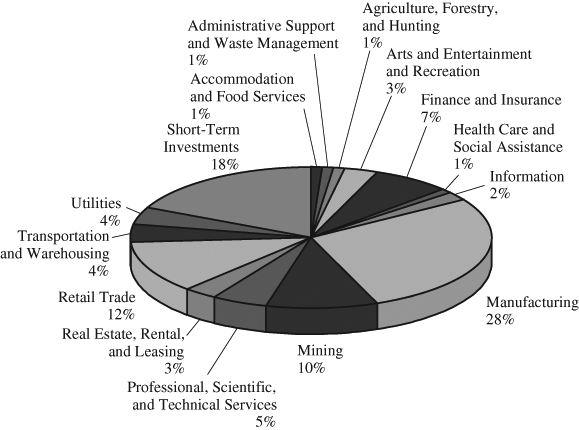

Intrepid Small Cap Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2010 (Unaudited)

INTREPID SMALL CAP FUND

(as a % of total investments)

COMPONENTS OF PORTFOLIO HOLDINGS

| Accommodation and Food Services | | $ | 1,755,203 | |

| Administrative Support and Waste Management | | | 4,111,486 | |

| Agriculture, Forestry, and Hunting | | | 2,374,800 | |

| Arts and Entertainment and Recreation | | | 10,613,087 | |

| Finance and Insurance | | | 25,745,410 | |

| Health Care and Social Assistance | | | 1,903,300 | |

| Information | | | 9,560,963 | |

| Manufacturing | | | 110,309,158 | |

| Mining | | | 39,052,131 | |

| Professional, Scientific, and Technical Services | | | 20,080,435 | |

| Real Estate, Rental, and Leasing | | | 11,657,085 | |

| Retail Trade | | | 48,711,901 | |

| Transportation and Warehousing | | | 16,337,205 | |

| Utilities | | | 14,870,664 | |

| Short-Term Investments | | | 75,152,832 | |

| Total | | $ | 392,235,660 | |

Intrepid Income Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2010 (Unaudited)

INTREPID INCOME FUND

(as a % of total investments)

COMPONENTS OF PORTFOLIO HOLDINGS

| Convertible Bonds | | $ | 5,682,395 | |

| Corporate Bonds | | | 43,471,333 | |

| U.S. Treasury Obligations | | | 13,997,929 | |

| Other Short-Term Investments | | | 3,558,324 | |

| Total | | $ | 66,709,981 | |

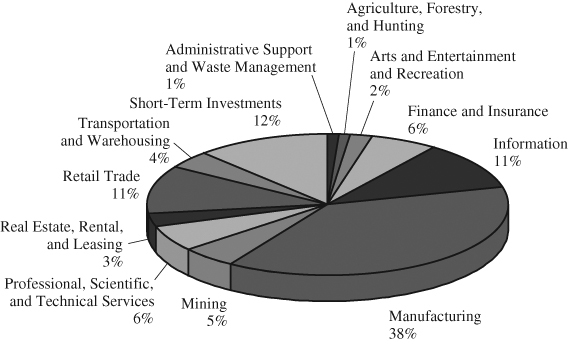

Intrepid All Cap Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2010 (Unaudited)

INTREPID ALL CAP FUND

(as a % of total investments)

COMPONENTS OF PORTFOLIO HOLDINGS

| Administrative Support and Waste Management | | $ | 97,660 | |

| Agriculture, Forestry, and Hunting | | | 192,900 | |

| Arts and Entertainment and Recreation | | | 436,802 | |

| Finance and Insurance | | | 1,262,467 | |

| Information | | | 2,234,952 | |

| Manufacturing | | | 7,369,005 | |

| Mining | | | 1,073,628 | |

| Professional, Scientific, and Technical Services | | | 1,085,977 | |

| Real Estate, Rental, and Leasing | | | 562,397 | |

| Retail Trade | | | 2,112,176 | |

| Transportation and Warehousing | | | 852,819 | |

| Short-Term Investments | | | 2,299,289 | |

| Total | | $ | 19,580,072 | |

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 51.58% | | | | | | |

Animal Production - 0.61% | | | | | | |

| HQ Sustainable Maritime Industries, Inc. (a) | | | 115,700 | | | $ | 694,200 | |

Beverage and Tobacco | | | | | | | | |

| Product Manufacturing - 2.96% | | | | | | | | |

| Brown Forman Corp. - Class B | | | 30,530 | | | | 1,815,009 | |

| Constellation Brands, Inc. (a) | | | 94,200 | | | | 1,548,648 | |

| | | | | | | | 3,363,657 | |

| Broadcasting (except Internet) - 1.71% | | | | | | | | |

| Comcast Corp. - Class A | | | 103,120 | | | | 1,940,718 | |

Chemical Manufacturing - 3.22% | | | | | | | | |

| Endo Pharmaceuticals Holdings, Inc. (a) | | | 54,300 | | | | 1,286,367 | |

| Prestige Brands Holdings, Inc. (a) | | | 262,606 | | | | 2,363,454 | |

| | | | | | | | 3,649,821 | |

| Clothing and Clothing Accessories Stores - 1.99% | | | | | | | | |

| Foot Locker, Inc. | | | 150,000 | | | | 2,256,000 | |

Computer and Electronic | | | | | | | | |

| Product Manufacturing - 4.56% | | | | | | | | |

| CSG Systems International, Inc. (a) | | | 97,325 | | | | 2,039,932 | |

| Dell, Inc. (a) | | | 77,605 | | | | 1,164,851 | |

| Mocon, Inc. | | | 26,300 | | | | 280,621 | |

| Tellabs, Inc. | | | 223,015 | | | | 1,688,224 | |

| | | | | | | | 5,173,628 | |

| Data Processing, Hosting | | | | | | | | |

| and Related Services - 1.38% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 35,172 | | | | 1,564,099 | |

Food and Beverage Stores - 1.79% | | | | | | | | |

| Spartan Stores, Inc. | | | 3,677 | | | | 53,022 | |

| Weis Markets, Inc. | | | 54,430 | | | | 1,979,075 | |

| | | | | | | | 2,032,097 | |

| Food Manufacturing - 2.02% | | | | | | | | |

| Kraft Foods, Inc. | | | 32,677 | | | | 988,152 | |

| Sara Lee Corp. | | | 93,800 | | | | 1,306,634 | |

| | | | | | | | 2,294,786 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 51.58% (continued) | | | | | | |

Insurance Carriers and Related Activities - 6.35% | | | | | | |

| Baldwin & Lyons, Inc. | | | 91,273 | | | $ | 2,198,767 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 42,500 | | | | 3,453,975 | |

| The Travelers Companies, Inc. | | | 28,796 | | | | 1,553,256 | |

| | | | | | | | 7,205,998 | |

| Merchant Wholesalers, Nondurable Goods - 1.42% | | | | | | | | |

| Central Garden & Pet Co. (a) | | | 176,080 | | | | 1,612,893 | |

Mining (except Oil and Gas) - 2.90% | | | | | | | | |

| Newmont Mining Corp. | | | 49,645 | | | | 2,528,420 | |

| Pan American Silver Corp. (a)(b) | | | 33,135 | | | | 767,075 | |

| | | | | | | | 3,295,495 | |

| Miscellaneous Manufacturing - 6.56% | | | | | | | | |

| CR Bard, Inc. | | | 28,600 | | | | 2,477,332 | |

| Jakks Pacific, Inc. (a) | | | 183,734 | | | | 2,397,729 | |

| Semperit AG Holding (b) | | | 13,265 | | | | 517,965 | |

| Oil-Dri Corporation of America | | | 105,847 | | | | 2,046,022 | |

| | | | | | | | 7,439,048 | |

| Motor Vehicle and Parts Dealers - 1.05% | | | | | | | | |

| Midas Group, Inc. (a) | | | 105,500 | | | | 1,190,040 | |

Performing Arts, Spectator | | | | | | | | |

| Sports, and Related Industries - 2.61% | | | | | | | | |

| Dover Motorsports, Inc. | | | 470,850 | | | | 969,951 | |

| International Speedway Corp. | | | 77,493 | | | | 1,996,995 | |

| | | | | | | | 2,966,946 | |

| Professional, Scientific, | | | | | | | | |

| and Technical Services - 4.35% | | | | | | | | |

| EPIQ Systems, Inc. (a) | | | 162,536 | | | | 2,020,323 | |

| Pharmaceutical Product Development, Inc. | | | 52,900 | | | | 1,256,375 | |

| Total Systems Services, Inc. | | | 105,920 | | | | 1,658,707 | |

| | | | | | | | 4,935,405 | |

| Publishing Industries (except Internet) - 1.00% | | | | | | | | |

| John Wiley & Sons, Inc. - Class A | | | 26,350 | | | | 1,140,428 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 51.58% (continued) | | | | | | |

Rental and Leasing Services - 1.35% | | | | | | |

| Rent-A-Center, Inc. (a) | | | 64,800 | | | $ | 1,532,520 | |

Support Activities for Transportation - 2.84% | | | | | | | | |

| Tidewater, Inc. | | | 68,200 | | | | 3,223,814 | |

Telecommunications - 0.91% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 30,625 | | | | 1,036,656 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $50,325,022) | | | | | | | 58,548,249 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| CONVERTIBLE BONDS - 1.75% | | | | | | | | |

Merchant Wholesalers, Nondurable Goods - 0.60% | | | | | | | | |

| Spartan Stores, Inc. | | | | | | | | |

| 3.375%, 05/15/2027 | | $ | 793,000 | | | | 686,936 | |

Miscellaneous Manufacturing - 0.56% | | | | | | | | |

| Jakks Pacific, Inc. | | | | | | | | |

| 4.625%, 06/15/2023 | | | 635,000 | | | | 630,238 | |

Oil and Gas Extraction - 0.59% | | | | | | | | |

| Bill Barrett Corp. | | | | | | | | |

| 5.000%, 03/15/2028 | | | 682,000 | | | | 670,917 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | |

| (Cost $1,904,394) | | | | | | | 1,988,091 | |

| | | | | | | | | |

| CORPORATE BONDS - 22.11% | | | | | | | | |

Apparel Manufacturing - 2.16% | | | | | | | | |

| Perry Ellis International, Inc. | | | | | | | | |

| 8.875%, 09/15/2013 | | | 622,000 | | | | 635,217 | |

| Phillips Van Heusen Corp. | | | | | | | | |

| 8.125%, 05/01/2013 | | | 221,000 | | | | 224,591 | |

| Phillips-Van Heusen Corp. | | | | | | | | |

| 7.250%, 02/15/2011 | | | 1,589,000 | | | | 1,592,973 | |

| | | | | | | | 2,452,781 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 22.11% (continued) | | | | | | |

Chemical Manufacturing - 0.04% | | | | | | |

| Church & Dwight, Inc. | | | | | | |

| 6.000%, 12/15/2012 | | $ | 46,000 | | | $ | 46,690 | |

Clothing and Clothing Accessories Stores - 2.93% | | | | | | | | |

| Collective Brands, Inc. | | | | | | | | |

| 8.250%, 08/01/2013 | | | 1,991,000 | | | | 2,030,820 | |

| Hanesbrands, Inc. | | | | | | | | |

| 6.508%, 12/15/2014 (c) | | | 1,359,000 | | | | 1,297,845 | |

| | | | | | | | 3,328,665 | |

| Construction of Buildings - 1.75% | | | | | | | | |

| Blount, Inc. | | | | | | | | |

| 8.875%, 08/01/2012 | | | 1,968,000 | | | | 1,990,140 | |

Data Processing, Hosting | | | | | | | | |

| and Related Services - 1.08% | | | | | | | | |

| Affiliated Computer Services, Inc. | | | | | | | | |

| 4.700%, 06/01/2010 | | | 1,225,000 | | | | 1,229,594 | |

Fabricated Metal Product Manufacturing - 1.08% | | | | | | | | |

| Silgan Holdings, Inc. | | | | | | | | |

| 6.750%, 11/15/2013 | | | 1,209,000 | | | | 1,224,113 | |

Food Services and Drinking Places - 1.12% | | | | | | | | |

| Brinker International, Inc. | | | | | | | | |

| 5.750%, 06/01/2014 | | | 1,233,000 | | | | 1,276,072 | |

Machinery Manufacturing - 0.93% | | | | | | | | |

| Da-Lite Screen Co., Inc. | | | | | | | | |

| 9.500%, 05/15/2011 | | | 1,035,000 | | | | 1,058,287 | |

Merchant Wholesalers, Durable Goods - 0.61% | | | | | | | | |

| Interline Brands, Inc. | | | | | | | | |

| 8.125%, 06/15/2014 | | | 667,000 | | | | 687,010 | |

Performing Arts, Spectator | | | | | | | | |

| Sports, and Related Industries - 1.52% | | | | | | | | |

| Speedway Motorsports, Inc. | | | | | | | | |

| 6.750%, 06/01/2013 | | | 1,725,000 | | | | 1,725,000 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 22.11% (continued) | | | | | | |

Plastics and Rubber | | | | | | |

| Products Manufacturing - 0.78% | | | | | | |

| AEP Industries, Inc. | | | | | | |

| 7.875%, 03/15/2013 | | $ | 898,000 | | | $ | 891,265 | |

Primary Metal Manufacturing - 0.97% | | | | | | | | |

| Gibraltar Industries, Inc. | | | | | | | | |

| 8.000%, 12/01/2015 (c) | | | 1,113,000 | | | | 1,096,305 | |

Professional, Scientific, | | | | | | | | |

| and Technical Services - 1.50% | | | | | | | | |

| Bio Rad Labs, Inc. | | | | | | | | |

| 7.500%, 08/15/2013 | | | 1,044,000 | | | | 1,064,880 | |

| Valassis Communications, Inc. | | | | | | | | |

| 8.250%, 03/01/2015 | | | 618,000 | | | | 634,995 | |

| | | | | | | | 1,699,875 | |

| Publishing Industries (except Internet) - 1.74% | | | | | | | | |

| Scholastic Corp. | | | | | | | | |

| 5.000%, 04/15/2013 | | | 2,029,000 | | | | 1,973,203 | |

Rental and Leasing Services - 1.07% | | | | | | | | |

| Mobile Mini, Inc. | | | | | | | | |

| 6.875%, 05/01/2015 | | | 963,000 | | | | 897,997 | |

| Mobile Mini, Inc. | | | | | | | | |

| 9.750%, 08/01/2014 | | | 311,000 | | | | 321,885 | |

| | | | | | | | 1,219,882 | |

| Special Purpose Entity - 1.19% | | | | | | | | |

| AMR Holding Co. / Emcare Holding Co. | | | | | | | | |

| 10.000%, 02/15/2015 | | | 1,284,000 | | | | 1,349,002 | |

Telecommunications - 1.64% | | | | | | | | |

| Syniverse Technologies, Inc. | | | | | | | | |

| 7.750%, 08/15/2013 | | | 1,843,000 | | | | 1,856,823 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $24,126,566) | | | | | | | 25,104,707 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| REAL ESTATE INVESTMENT TRUST - 0.84% | | | | | | |

| Potlatch Corp. | | | 27,370 | | | $ | 959,045 | |

| TOTAL REAL ESTATE INVESTMENT TRUST | | | | | | | | |

| (Cost $759,649) | | | | | | | 959,045 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 23.35% | | | | | | | | |

Money Market Funds - 5.74% | | | | | | | | |

| AIM - STIT Treasury Portfolio 0.03% (c) | | | 2,019,273 | | | | 2,019,273 | |

| Fidelity Institutional Money Market Funds - | | | | | | | | |

| Government Portfolio 0.04% (c) | | | 2,250,000 | | | | 2,250,000 | |

| SEI Daily Income Trust Treasury Fund 0.01% (c) | | | 2,250,000 | | | | 2,250,000 | |

| | | | | | | | 6,519,273 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| U.S. Treasury Bills - 17.61% | | | | | | | | |

| 0.095%, 04/08/2010 (d) | | $ | 4,000,000 | | | | 3,999,926 | |

| 0.110%, 05/27/2010 (d) | | | 4,000,000 | | | | 3,999,317 | |

| 0.110%, 06/03/2010 (d) | | | 4,000,000 | | | | 3,999,022 | |

| 0.161%, 07/29/2010 (d) | | | 4,000,000 | | | | 3,997,884 | |

| 0.176%, 08/05/2010 (d) | | | 4,000,000 | | | | 3,997,551 | |

| | | | | | | | 19,993,700 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $26,512,973) | | | | | | | 26,512,973 | |

Total Investments - 99.63% | | | | | | | | |

| (Cost $103,628,604) | | | | | | | 113,113,065 | |

| Other Assets in Excess of Liabilities - 0.37% | | | | | | | 415,681 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 113,528,746 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Variable rate security. The rate shown is as of March 31, 2010. |

| (d) | Rate shown is the effective yield based on purchase price. The calculation assumes the security is held to maturity. |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 79.43% | | | | | | |

Accommodation - 1.84% | | | | | | |

| Gencor Industries, Inc. (a) | | | 179,435 | | | $ | 1,349,351 | |

| International Speedway Corporation - Class A | | | 227,490 | | | | 5,862,418 | |

| | | | | | | | 7,211,769 | |

| Administrative and Support Services - 1.05% | | | | | | | | |

| Mantech International Corp. (a) | | | 84,200 | | | | 4,111,486 | |

Ambulatory Health Care Services - 0.49% | | | | | | | | |

| Chemed Corp. | | | 35,000 | | | | 1,903,300 | |

Animal Production - 0.61% | | | | | | | | |

| HQ Sustainable Maritime Industries, Inc. (a) | | | 395,800 | | | | 2,374,800 | |

Apparel Manufacturing - 1.64% | | | | | | | | |

| Maidenform Brands, Inc. (a) | | | 293,855 | | | | 6,420,732 | |

Beverage and Tobacco | | | | | | | | |

| Product Manufacturing - 2.32% | | | | | | | | |

| Constellation Brands, Inc. (a) | | | 419,410 | | | | 6,895,100 | |

| Hansen Natural Corp. (a) | | | 50,400 | | | | 2,186,352 | |

| | | | | | | | 9,081,452 | |

| Chemical Manufacturing - 6.19% | | | | | | | | |

| Endo Pharmaceuticals Holdings, Inc. (a) | | | 237,000 | | | | 5,614,530 | |

| Landec Corp. (a) | | | 292,842 | | | | 1,941,542 | |

| Prestige Brands Holdings, Inc. (a) | | | 1,148,365 | | | | 10,335,285 | |

| Sensient Technologies Corp. | | | 218,767 | | | | 6,357,369 | |

| | | | | | | | 24,248,726 | |

| Clothing and Clothing Accessories Stores - 1.01% | | | | | | | | |

| Foot Locker, Inc. | | | 263,545 | | | | 3,963,717 | |

Computer and Electronic | | | | | | | | |

| Product Manufacturing - 8.67% | | | | | | | | |

| Applied Signal Technology, Inc. | | | 156,918 | | | | 3,072,455 | |

| Communications Systems, Inc. | | | 152,069 | | | | 1,966,252 | |

| CSG Systems International, Inc. (a) | | | 492,417 | | | | 10,321,060 | |

| Mocon, Inc. | | | 105,158 | | | | 1,122,036 | |

| Tekelec (a) | | | 322,500 | | | | 5,856,600 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 79.43% (continued) | | | | | | |

Computer and Electronic | | | | | | |

| Product Manufacturing - 8.67% (continued) | | | | | | |

| Tellabs, Inc. | | | 1,536,340 | | | $ | 11,630,094 | |

| | | | | | | | 33,968,497 | |

| Credit Intermediation | | | | | | | | |

| and Related Activities - 2.23% | | | | | | | | |

| Fifth Street Finance Corp. | | | 355,610 | | | | 4,128,632 | |

| OceanFirst Financial Corp. | | | 163,800 | | | | 1,860,768 | |

| Washington Federal, Inc. | | | 134,499 | | | | 2,733,020 | |

| | | | | | | | 8,722,420 | |

| Electronics and Appliance Stores - 2.53% | | | | | | | | |

| Aarons, Inc. | | | 297,800 | | | | 9,928,652 | |

Fabricated Metal Product Manufacturing - 1.48% | | | | | | | | |

| Ducommun, Inc. | | | 276,605 | | | | 5,811,471 | |

Food and Beverage Stores - 6.37% | | | | | | | | |

| Core Mark Holding Co., Inc. (a) | | | 352,667 | | | | 10,795,137 | |

| Ruddick Corp. | | | 27,000 | | | | 854,280 | |

| Spartan Stores, Inc. | | | 132,000 | | | | 1,903,440 | |

| Weis Markets, Inc. | | | 313,583 | | | | 11,401,878 | |

| | | | | | | | 24,954,735 | |

| Food Manufacturing - 0.22% | | | | | | | | |

| Harbinger Group, Inc. (a) | | | 130,074 | | | | 880,601 | |

Food Services and Drinking Places - 0.45% | | | | | | | | |

| Nathan’s Famous, Inc. (a) | | | 113,312 | | | | 1,755,203 | |

Insurance Carriers and Related Activities - 4.34% | | | | | | | | |

| Baldwin & Lyons, Inc. - Class B | | | 248,520 | | | | 5,986,847 | |

| Brown & Brown, Inc. | | | 498,200 | | | | 8,927,744 | |

| Horace Mann Educators Corp. | | | 140,000 | | | | 2,108,400 | |

| | | | | | | | 17,022,991 | |

| Machinery Manufacturing - 0.39% | | | | | | | | |

| Blount International, Inc. (a) | | | 146,160 | | | | 1,514,218 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 79.43% (continued) | | | | | | |

Merchant Wholesalers, Nondurable Goods - 0.51% | | | | | | |

| Central Garden & Pet Co. - Class A (a) | | | 219,224 | | | $ | 2,008,092 | |

Mining (except Oil and Gas) - 5.90% | | | | | | | | |

| Pan American Silver Corp. (a)(b) | | | 588,828 | | | | 13,631,368 | |

| Royal Gold, Inc. | | | 204,900 | | | | 9,468,429 | |

| | | | | | | | 23,099,797 | |

| Miscellaneous Manufacturing - 5.40% | | | | | | | | |

| Hillenbrand, Inc. | | | 205,100 | | | | 4,510,149 | |

| Jakks Pacific, Inc. (a) | | | 351,100 | | | | 4,581,855 | |

| Oil-Dri Corporation of America (c) | | | 336,052 | | | | 6,495,885 | |

| Semperit AG Holding (b) | | | 47,860 | | | | 1,868,814 | |

| Steris Corp. | | | 110,000 | | | | 3,702,600 | |

| | | | | | | | 21,159,303 | |

| Miscellaneous Store Retailers - 0.94% | | | | | | | | |

| PetSmart, Inc. | | | 115,155 | | | | 3,680,354 | |

Motor Vehicle and Parts Dealers - 1.07% | | | | | | | | |

| Midas Group, Inc. (a) | | | 370,244 | | | | 4,176,352 | |

Oil and Gas Extraction - 4.07% | | | | | | | | |

| Bill Barrett Corp. (a) | | | 295,077 | | | | 9,061,814 | |

| Contango Oil & Gas Company (a) | | | 134,712 | | | | 6,890,519 | |

| | | | | | | | 15,952,333 | |

| Performing Arts, Spectator | | | | | | | | |

| Sports, and Related Industries - 1.21% | | | | | | | | |

| Speedway Motorsports, Inc. | | | 304,335 | | | | 4,750,669 | |

Pipeline Transportation - 1.40% | | | | | | | | |

| WGL Holdings, Inc. | | | 158,397 | | | | 5,488,456 | |

Professional, Scientific, | | | | | | | | |

| and Technical Services - 5.12% | | | | | | | | |

| EPIQ Systems, Inc. (a) | | | 851,814 | | | | 10,588,048 | |

| Total Systems Services, Inc. | | | 606,155 | | | | 9,492,387 | |

| | | | | | | | 20,080,435 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 79.43% (continued) | | | | | | |

Rental and Leasing Services - 2.97% | | | | | | |

| Rent-A-Center, Inc. (a) | | | 492,900 | | | $ | 11,657,085 | |

Support Activities for Transportation - 2.77% | | | | | | | | |

| Tidewater, Inc. | | | 229,506 | | | | 10,848,749 | |

Telecommunications - 2.44% | | | | | | | | |

| Syniverse Holdings, Inc. (a) | | | 207,674 | | | | 4,043,413 | |

| Telephone & Data Systems, Inc. | | | 163,000 | | | | 5,517,550 | |

| | | | | | | | 9,560,963 | |

| Utilities - 3.80% | | | | | | | | |

| Central Vermont Public Service Corp. | | | 94,732 | | | | 1,910,745 | |

| Middlesex Water Co. | | | 77,425 | | | | 1,320,096 | |

| Portland General Electric Co. | | | 305,300 | | | | 5,895,343 | |

| Westar Energy, Inc. | | | 257,600 | | | | 5,744,480 | |

| | | | | | | | 14,870,664 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $265,955,963) | | | | | | | 311,208,022 | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUST - 1.50% | | | | | | | | |

| Potlatch Corp. | | | 167,660 | | | | 5,874,806 | |

| TOTAL REAL ESTATE INVESTMENT TRUST | | | | | | | | |

| (Cost $4,489,168) | | | | | | | 5,874,806 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 19.18% | | | | | | | | |

Money Market Funds - 9.48% | | | | | | | | |

| AIM - STIT Treasury Portfolio 0.03% (d) | | | 7,810,000 | | | | 7,810,000 | |

| AIM STIT - STIC Prime Portfolio 0.11%% (d) | | | 5,921,630 | | | | 5,921,630 | |

| Fidelity Institutional Money Market Funds - | | | | | | | | |

| Government Portfolio 0.04% (d) | | | 7,810,000 | | | | 7,810,000 | |

| Fidelity Institutional Money Market Funds - | | | | | | | | |

| Money Market Portfolio 0.16% (d) | | | 7,810,000 | | | | 7,810,000 | |

| SEI Daily Income Trust Treasury Fund 0.01% (d) | | | 7,810,000 | | | | 7,810,000 | |

| | | | | | | | 37,161,630 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| SHORT-TERM INVESTMENTS - 19.18% (continued) | | | | | | |

| U.S. Treasury Bills - 9.70% | | | | | | |

| 0.069%, 04/15/2010 (e) | | $ | 18,000,000 | | | $ | 17,999,510 | |

| 0.142%, 07/15/2010 (e) | | | 20,000,000 | | | | 19,991,692 | |

| | | | | | | | 37,991,202 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $75,152,832) | | | | | | | 75,152,832 | |

Total Investments - 100.11% | | | | | | | | |

| (Cost $345,597,963) | | | | | | | 392,235,660 | |

| Liabilities in Excess of Other Assets - (0.11)% | | | | | | | (413,294 | ) |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 391,822,366 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Affiliated issuer. See footnote 3 to the financial statements. |

| (d) | Variable rate security. The rate listed is as of March 31, 2010. |

| (e) | Rate shown is the effective yield based on the purchase price. The calculation assumes the security is held to maturity. |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS

March 31, 2010 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CONVERTIBLE BONDS - 8.48% | | | | | | |

Ambulatory Health Care Services - 2.89% | | | | | | |

| Chemed Corp. | | | | | | |

| 1.875%, 05/15/2014 | | $ | 2,120,000 | | | $ | 1,937,150 | |

Merchant Wholesalers, Nondurable Goods - 2.02% | | | | | | | | |

| Spartan Stores, Inc. | | | | | | | | |

| 3.375%, 05/15/2027 | | | 1,560,000 | | | | 1,351,350 | |

Miscellaneous Manufacturing - 1.90% | | | | | | | | |

| Jakks Pacific, Inc. | | | | | | | | |

| 4.625%, 06/15/2023 | | | 1,286,000 | | | | 1,276,355 | |

Oil and Gas Extraction - 1.67% | | | | | | | | |

| Bill Barrett Corp. | | | | | | | | |

| 5.000%, 03/15/2028 | | | 1,136,000 | | | | 1,117,540 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | |

| (Cost $5,256,776) | | | | | | | 5,682,395 | |

| | | | | | | | | |

| CORPORATE BONDS - 64.86% | | | | | | | | |

Apparel Manufacturing - 6.24% | | | | | | | | |

| Perry Ellis International, Inc. | | | | | | | | |

| 8.875%, 09/15/2013 | | | 1,173,000 | | | | 1,197,926 | |

| Phillips-Van Heusen Corp. | | | | | | | | |

| 8.125%, 05/01/2013 | | | 425,000 | | | | 431,906 | |

| Phillips-Van Heusen Corp. | | | | | | | | |

| 7.250%, 02/15/2011 | | | 2,547,000 | | | | 2,553,368 | |

| | | | | | | | 4,183,200 | |

| Beverage and Tobacco | | | | | | | | |

| Product Manufacturing - 1.41% | | | | | | | | |

| Reynolds American, Inc. | | | | | | | | |

| 6.500%, 07/15/2010 | | | 931,000 | | | | 941,941 | |

Chemical Manufacturing - 3.79% | | | | | | | | |

| Church & Dwight, Inc. | | | | | | | | |

| 6.000%, 12/15/2012 | | | 2,506,000 | | | | 2,543,590 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 64.86% (continued) | | | | | | |

Clothing and Clothing Accessories Stores - 7.32% | | | | | | |

| Collective Brands, Inc. | | | | | | |

| 8.250%, 08/01/2013 | | $ | 2,818,000 | | | $ | 2,874,360 | |

| Hanesbrands, Inc. | | | | | | | | |

| 3.831%, 12/15/2014 (a) | | | 2,138,000 | | | | 2,041,790 | |

| | | | | | | | 4,916,150 | |

| Construction of Buildings - 4.12% | | | | | | | | |

| Blount, Inc. | | | | | | | | |

| 8.875%, 08/01/2012 | | | 2,730,000 | | | | 2,760,712 | |

Data Processing, Hosting | | | | | | | | |

| and Related Services - 3.69% | | | | | | | | |

| Affiliated Computer Services, Inc. | | | | | | | | |

| 4.700%, 06/01/2010 | | | 2,467,000 | | | | 2,476,251 | |

Fabricated Metal Product Manufacturing - 3.70% | | | | | | | | |

| Silgan Holdings, Inc. | | | | | | | | |

| 6.750%, 11/15/2013 | | | 2,447,000 | | | | 2,477,588 | |

Food Services and Drinking Places - 2.82% | | | | | | | | |

| Brinker International, Inc. | | | | | | | | |

| 5.750%, 06/01/2014 | | | 1,825,000 | | | | 1,888,753 | |

Machinery Manufacturing - 2.08% | | | | | | | | |

| Da-Lite Screen Co., Inc. | | | | | | | | |

| 9.500%, 05/15/2011 | | | 1,365,000 | | | | 1,395,712 | |

Merchant Wholesalers, Durable Goods - 2.60% | | | | | | | | |

| Interline Brands, Inc. | | | | | | | | |

| 8.125%, 06/15/2014 | | | 1,692,000 | | | | 1,742,760 | |

Performing Arts, Spectator Sports, | | | | | | | | |

| and Related Industries - 3.67% | | | | | | | | |

| Speedway Motorsports, Inc. | | | | | | | | |

| 6.750%, 06/01/2013 | | | 2,458,000 | | | | 2,458,000 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 64.86% (continued) | | | | | | |

Plastics and Rubber | | | | | | |

| Products Manufacturing - 2.00% | | | | | | |

| AEP Industries, Inc. | | | | | | |

| 7.875%, 03/15/2013 | | $ | 1,351,000 | | | $ | 1,340,867 | |

Primary Metal Manufacturing - 2.76% | | | | | | | | |

| Gibraltar Industries, Inc. | | | | | | | | |

| 8.000%, 12/01/2015 | | | 1,875,000 | | | | 1,846,875 | |

Professional, Scientific, | | | | | | | | |

| and Technical Services - 3.89% | | | | | | | | |

| Bio-Rad Labs, Inc. | | | | | | | | |

| 7.500%, 08/15/2013 | | | 1,552,000 | | | | 1,583,040 | |

| Valassis Communications, Inc. | | | | | | | | |

| 8.250%, 03/01/2015 | | | 1,000,000 | | | | 1,027,500 | |

| | | | | | | | 2,610,540 | |

| Publishing Industries (except Internet) - 4.16% | | | | | | | | |

| Scholastic Corp. | | | | | | | | |

| 5.000%, 04/15/2013 | | | 2,869,000 | | | | 2,790,103 | |

Rental and Leasing Services - 2.87% | | | | | | | | |

| Mobile Mini, Inc. | | | | | | | | |

| 6.875%, 05/01/2015 | | | 1,928,000 | | | | 1,797,860 | |

| Mobile Mini, Inc. | | | | | | | | |

| 9.750%, 08/01/2014 | | | 114,000 | | | | 117,990 | |

| | | | | | | | 1,915,850 | |

| Special Purpose Entity - 3.66% | | | | | | | | |

| AMR Holding Co. / Emcare Holding Co. | | | | | | | | |

| 10.000%, 02/15/2015 | | | 2,333,000 | | | | 2,451,108 | |

Telecommunications - 4.08% | | | | | | | | |

| Syniverse Technologies, Inc. | | | | | | | | |

| 7.750%, 08/15/2013 | | | 2,711,000 | | | | 2,731,333 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $41,654,353) | | | | | | | 43,471,333 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS - 26.19% | | | | | | |

Money Market Funds - 5.31% | | | | | | |

| AIM - STIT Treasury Portfolio 0.03% (a) | | | 906,324 | | | $ | 906,324 | |

| Fidelity Institutional Money Market Funds - | | | | | | | | |

| Government Portfolio 0.04% (a) | | | 1,326,000 | | | | 1,326,000 | |

| SEI Daily Income Trust Treasury Fund 0.01% (a) | | | 1,326,000 | | | | 1,326,000 | |

| | | | | | | | 3,558,324 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| U.S. Treasury Bills - 20.88% | | | | | | | | |

| 0.073%, 04/15/2010 (b) | | $ | 8,000,000 | | | | 7,999,797 | |

| 0.111%, 04/22/2010 (b) | | | 1,000,000 | | | | 999,933 | |

| 0.149%, 06/17/2010 (b) | | | 3,000,000 | | | | 2,999,046 | |

| 0.146%, 07/15/2010 (b) | | | 2,000,000 | | | | 1,999,153 | |

| | | | | | | | 13,997,929 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $17,556,253) | | | | | | | 17,556,253 | |

Total Investments - 99.53% | | | | | | | | |

| (Cost $64,467,382) | | | | | | | 66,709,981 | |

| Other Assets in Excess of Liabilities - 0.47% | | | | | | | 316,691 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 67,026,672 | |

Percentages are stated as a percent of net assets.

| (a) | Variable rate security. The rate listed is as of March 31, 2010. |

| (b) | The rate shown is the effective yield based on purchase price. The calculation assumes the security is held to maturity. |

See notes to financial statements.

Intrepid All Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 83.75% | | | | | | |

Administrative and Support Services - 0.49% | | | | | | |

| Mantech International Corp. (a) | | | 2,000 | | | $ | 97,660 | |

Animal Production - 0.96% | | | | | | | | |

| HQ Sustainable Maritime Industries, Inc. (a) | | | 32,150 | | | | 192,900 | |

Beverage and Tobacco | | | | | | | | |

| Product Manufacturing - 7.72% | | | | | | | | |

| Brown Forman Corp. - Class B | | | 11,370 | | | | 675,946 | |

| Constellation Brands, Inc. (a) | | | 40,175 | | | | 660,477 | |

| Hansen Natural Corp. (a) | | | 5,000 | | | | 216,900 | |

| | | | | | | | 1,553,323 | |

| Broadcasting (except Internet) - 3.36% | | | | | | | | |

| Comcast Corp. - Class A | | | 35,865 | | | | 674,979 | |

Chemical Manufacturing - 6.56% | | | | | | | | |

| Endo Pharmaceuticals Holdings, Inc. (a) | | | 33,890 | | | | 802,854 | |

| Prestige Brands Holdings, Inc. (a) | | | 57,489 | | | | 517,401 | |

| | | | | | | | 1,320,255 | |

| Clothing and Clothing Accessories Stores - 3.02% | | | | | | | | |

| Foot Locker, Inc. | | | 40,450 | | | | 608,368 | |

Computer and Electronic | | | | | | | | |

| Product Manufacturing - 7.41% | | | | | | | | |

| CSG Systems International, Inc. (a) | | | 9,800 | | | | 205,408 | |

| Dell, Inc. (a) | | | 41,490 | | | | 622,765 | |

| Tellabs, Inc. | | | 87,500 | | | | 662,375 | |

| | | | | | | | 1,490,548 | |

| Credit Intermediation and Related Activities - 0.98% | | | | | | | | |

| Fifth Street Finance Corp. | | | 17,000 | | | | 197,370 | |

Electronics and Appliance Stores - 2.34% | | | | | | | | |

| Aarons, Inc. | | | 14,100 | | | | 470,094 | |

Food and Beverage Stores - 3.66% | | | | | | | | |

| Ruddick Corp. | | | 3,200 | | | | 101,248 | |

| Weis Markets, Inc. | | | 17,450 | | | | 634,482 | |

| | | | | | | | 735,730 | |

See notes to financial statements.

Intrepid All Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 83.75% (continued) | | | | | | |

Food Manufacturing - 6.71% | | | | | | |

| Kraft Foods, Inc. | | | 17,880 | | | $ | 540,691 | |

| Sara Lee Corp. | | | 58,160 | | | | 810,169 | |

| | | | | | | | 1,350,860 | |

| General Merchandise Stores - 0.50% | | | | | | | | |

| Family Dollar Stores, Inc. | | | 2,735 | | | | 100,128 | |

Insurance Carriers and Related Activities - 5.29% | | | | | | | | |

| Baldwin & Lyons, Inc. - Class B | | | 15,340 | | | | 369,541 | |

| The Travelers Companies, Inc. | | | 12,895 | | | | 695,556 | |

| | | | | | | | 1,065,097 | |

| Merchant Wholesalers, Nondurable Goods - 0.98% | | | | | | | | |

| Central Garden & Pet Co. - Class A (a) | | | 21,600 | | | | 197,856 | |

Mining (except Oil and Gas) - 5.34% | | | | | | | | |

| Newmont Mining Corp. | | | 11,310 | | | | 576,019 | |

| Pan American Silver Corp. (a)(b) | | | 21,495 | | | | 497,609 | |

| | | | | | | | 1,073,628 | |

| Miscellaneous Manufacturing - 6.07% | | | | | | | | |

| CR Bard, Inc. | | | 9,320 | | | | 807,298 | |

| Hillenbrand, Inc. | | | 9,900 | | | | 217,701 | |

| Jakks Pacific, Inc. (a) | | | 15,000 | | | | 195,750 | |

| | | | | | | | 1,220,749 | |

| Performing Arts, Spectator Sports, | | | | | | | | |

| and Related Industries - 2.17% | | | | | | | | |

| International Speedway Corp. - Class A | | | 16,950 | | | | 436,802 | |

Pipeline Transportation - 1.05% | | | | | | | | |

| WGL Holdings, Inc. | | | 6,100 | | | | 211,365 | |

Professional, Scientific, | | | | | | | | |

| and Technical Services - 5.40% | | | | | | | | |

| Cephalon, Inc. (a) | | | 2,985 | | | | 202,323 | |

| EPIQ Systems, Inc. (a) | | | 17,300 | | | | 215,039 | |

| Pharmaceutical Product Development, Inc. | | | 9,380 | | | | 222,775 | |

| Total Systems Services, Inc. | | | 28,470 | | | | 445,840 | |

| | | | | | | | 1,085,977 | |

See notes to financial statements.

Intrepid All Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2010 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 83.75% (continued) | | | | | | |

Publishing Industries (except Internet) - 3.75% | | | | | | |

| John Wiley & Sons, Inc. - Class A | | | 17,445 | | | $ | 755,020 | |

Rental and Leasing Services - 2.80% | | | | | | | | |

| Rent-A-Center, Inc. (a) | | | 23,780 | | | | 562,397 | |

Support Activities for Transportation - 3.19% | | | | | | | | |

| Tidewater, Inc. | | | 13,570 | | | | 641,454 | |

Telecommunications - 4.00% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 23,780 | | | | 804,953 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $14,135,056) | | | | | | | 16,847,513 | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUST - 2.15% | | | | | | | | |

| Potlatch Corp. | | | 12,365 | | | | 433,270 | |

| TOTAL REAL ESTATE INVESTMENT TRUST | | | | | | | | |

| (Cost $433,270) | | | | | | | 433,270 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| SHORT-TERM INVESTMENTS - 11.43% | | | | | | | | |

U.S. Treasury Bills - 11.43% | | | | | | | | |

| 0.037%, 04/15/2010 (c) | | $ | 800,000 | | | | 799,988 | |

| 0.150%, 05/13/2010 (c) | | | 700,000 | | | | 699,878 | |

| 0.240%, 07/29/2010 (c) | | | 800,000 | | | | 799,423 | |

| | | | | | | | 2,299,289 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $2,299,289) | | | | | | | 2,299,289 | |

Total Investments - 97.33% | | | | | | | | |

| (Cost $16,867,615) | | | | | | | 19,580,072 | |

| Other Assets in Excess of Liabilities - 2.67% | | | | | | | 537,941 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 20,118,013 | |