UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-21625

Investment Company Act file number

Intrepid Capital Management Funds Trust

(Exact name of registrant as specified in charter)

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Address of principal executive offices) (Zip code)

Mark F. Travis

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Name and address of agent for service)

1-904-246-3433

Registrant's telephone number, including area code

Date of fiscal year end: 09/30/2012

Date of reporting period: 03/31/2013

Item 1. Reports to Stockholders.

Intrepid Capital Fund

Intrepid Small Cap Fund

Intrepid Income Fund

Intrepid Disciplined Value Fund

Semi-Annual Report

March 31, 2013

Intrepid Capital Fund

| |

Mark F. Travis, President/C.E.O. | |

April 1, 2013

“We do better when the wind is in our face.”

Warren Buffett

Berkshire Hathaway 2012 Shareholder Letter

Dear Fellow Shareholders,

The stated corporate objective at Intrepid Capital is “to participate in a bull market, but to preserve capital in a bear market.” As we crossed the four year anniversary of the March 2009 market lows, it has become increasingly more difficult for us “to participate in a bull market.” The 150% return posted by the Russell 3000 since the 2009 market trough has made our job of finding high quality, conservatively-financed businesses trading at discounts an increasingly challenging endeavor.

We chuckled when reading Mr. Buffett’s quote as he was lamenting that he only achieved a $24 billion gain for shareholders and that the percentage increase in book value was less than the performance of the S&P 500 Index in 2012. The Intrepid Capital Fund (the “Fund”) also underperformed in 2012, a relatively short time period. Our underperformance is to be expected in a sharply rising market where we believe valuations were, and continue to be, stretched. As we moved into 2013, the markets have continued to rise, increasing at virtually 1% per week in the first quarter!

The Fund returned 5.67% in the three month period ending March 31, 2013. In the first six months of the Fund’s fiscal year, the Fund rose 6.01%. While we consider ourselves to be true absolute return investors and therefore do not manage the Fund to an index, we compare the Fund’s performance to a blended benchmark consisting of 60% invested in the S&P 500 and 40% invested in the Bank of America/Merrill Lynch High Yield Master II Index. Over the same three- and six-month periods, the benchmark returned 7.46% and 8.58%, respectively. For the one, three, five year and since inception (1/3/05) periods ending March 31, 2013, the Fund’s annualized returns were 10.02%, 9.22%, 9.56%, and 7.42% respectively. The benchmark returned 13.69%, 12.09%, 8.18%, and 6.77% over the same periods. The fund’s gross expense ratio is 1.45%.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held less than 30 days. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

The top contributors to the Fund’s performance in the first three months of 2013 were: Patterson UTI (ticker: PTEN), Big Lots (ticker: BIG), Bio Rad (ticker: BIO)

Intrepid Capital Fund

and Berkshire Hathaway (ticker: BRK/B). In contrast, the largest detractors for the same period were: Newfield Exploration (ticker: NFX), Newmont Mining (ticker: NEM), Royal Gold (ticker: RGLD) and Pan American Silver (ticker: PAAS). Several of these holdings are discussed in our Small Cap Fund and Disciplined Value Fund (formerly known as the Intrepid All Cap Fund) commentaries.

Once again, the Intrepid Capital Fund (ICMBX) received an overall 5-Star Morningstar Rating, the highest rating for risk-adjusted returns, out of 802 Moderate Allocation funds for the period ending March 31, 2013. Morningstar also ranked the Fund in the top 34%, 27%, and 1% out of 920, 802, and 697 Moderate Allocation funds for the one-, three-, and five-year periods, ending March 31, 2013, respectively, based on total returns.

The rules at Intrepid simple: buy low and sell high. One could say the rules are easy to understand but hard to follow. As prices for equities and fixed income securities have climbed and surpassed our conservative estimations of intrinsic value, we have been exiting positions. If attractive replacement ideas are in low supply, our sale proceeds are comfortably (or uncomfortably, depending on your perspective) held in cash, patiently waiting for opportunities to appear. We would like to draw a sharp contrast to many of our “index centric” peers who feel compelled (or pressured) to be fully invested, all of the time. In our opinion, to be fully invested today is to operate under the assumption that no better opportunities will appear in the future. That is not an assumption we have been willing to make.

Our hometown NFL team, the Jacksonville Jaguars, had a motto for the 2012 season: “All In.” We can say the same for our personal investments in Intrepid Capital Funds – we’re “all in.” We appreciate your continued support. It is not a position we take lightly.

Sincerely,

Mark F. Travis

President

Intrepid Capital Fund Portfolio Manager

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments by the

Intrepid Capital Fund

Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities.

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at anytime and should not be considered a recommendation to buy or sell any security.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Bank of America/Merrill Lynch High Yield Master II Index is Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. US OE Moderate Allocation is a group of moderate allocation funds that seek to provide both capital appreciation and income by investing in three major areas: stocks, bonds, and cash. These funds tend to hold larger positions in stocks than conservative-allocation funds. These funds typically have 50% to 70% of assets in equities and the remainder in fixed income and cash. The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The Russell 3000 Index is an index representing the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. You cannot invest directly in an index.

Book Value is the net asset value of a company, calculated by subtracting total liabilities from total assets. Cash Flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

©2013 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating (based on a Morningstar risk-adjusted return measure that accounts for variation in a fund’s monthly performance, including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The Intrepid Capital Fund (ICMBX) was rated 4-Stars and 5-Stars against the following numbers of U.S. domiciled Moderate Allocation funds over the following time periods: 802 and 697 funds in the last three- and five-years respectively.

Morningstar Rankings represent a fund’s total-return percentile rank relative to all funds that have the same Morningstar Category. The highest percentile rank is 1, the lowest is 100. It is based on Morningstar total return, which includes both income and capital gains or losses and is not adjusted for sales charges or redemption fees. The Intrepid Capital Fund’s (Investor) Morningstar percentile ranking over the one-, three-, and five-year periods is 34%, 27%, and 1% among 920, 802, and 697 Moderate Allocation funds, respectively, based on total return as of March 31, 2013.

Absolute return investing is not intended to outperform stocks and bonds during strong market rallies.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

Intrepid Small Cap Fund

| |

Jayme Wiggins, Small Cap Fund Portfolio Manager | |

April 1, 2013

“I want my cake, wanna eat it too.”

-I Wanna Be Rich by Calloway

Dear Fellow Shareholders,

It’s all about the Benjamin baby. In early March Warren Buffett told CNBC, “Bernanke has sort of carried the load himself during this period,” and, “There’s no question stocks are higher—because interest rates are essentially zero—than they would be otherwise.” We have a consensus. The stock market is breaking records thanks to the Fed. All hail the Incredible Ben Bernanke, greatest magician ever! He waves his magic wand and money appears from thin air. Penn & Teller levitate a woman, but Bernanke levitates markets. Houdini escapes from chains underwater, and Bernanke rescues a nation of underwater borrowers. Copperfield makes the Statue of Liberty vanish, while Bernanke makes interest rates vanish.

Observing the capital markets today is like watching your kid conduct a magic show. You know it’s fake, but to keep everyone happy you pretend to believe in it. The stock market has rallied this year on relief from avoiding the fiscal cliff and any immediate disastrous impact from sequestration. A couple of famous bond market investors have recently proclaimed that fixed income buyers have it rough (no argument here), but equities look reasonable. We’ll forgive them for their relativist rants. Has the economy improved enough to justify investor bullishness?

We don’t believe the recovery story because it is not supported by a strong foundation. If you build your economic house of straw, it can be toppled by the slightest of winds. Imagine the impact of a 200 to 300 basis point rise in interest rates. Refinancing accounts for 75% of mortgage activity today and is generating significant fees for banks. Who would be refinancing their home if mortgage rates were 6%? Would home prices be increasing? The U.S. government paid $360 billion in interest on debt outstanding in fiscal 2012. In 1998, it paid $364 billion. Debt was $5.6 trillion then and is over $16 trillion now. The deficit would be hundreds of billions higher if the average government borrowing rate was 4.5%, which is in between the 1998 and 2012 rates. Low interest rates and high deficits have helped push corporate profit margins to record levels. We fear that too many investors believe current margins are sustainable.

We take most media reports of economic improvement with a grain of salt. The advertised unemployment rate ignores people who have stopped looking for work, which is at the highest level in over 30 years (highest on record for men). Additionally, the number of people who have part time jobs but wish they had full time jobs is 4 million higher than it was before the recession. Government

Intrepid Small Cap Fund

Debt/Gross Domestic Product exceeds 100%, although some economists and politicians wearing rose-colored glasses argue that only the “public” debt matters. In other words, they claim we shouldn’t count the $5 trillion of intragovernmental debt held as assets in accounts like the Social Security and Medicare Trust Funds. When Social Security is running a surplus, the government treats your payroll taxes as a loan to be spent on other things. Public Debt advocates claim this is money the government owes itself, not the people who have paid into these funds for years. Politicians will ultimately have to reduce benefits for future retirees, since unfunded liabilities exceed $80 trillion and could swamp our economy. Not helping matters is that a growing block of the working age population becomes lazier by the day—they want their cake, and they want to eat it too. More seniors reliant on the government + Fewer workers + Insufficient savings = Huge problem.

Our economic problems aren’t insurmountable, but let’s not pretend everything is peachy keen. We need to stop spending money we don’t have. The near-term implications of this would not be welcomed by politicians: Recession? Not under my watch! Who will be the responsible ones? There’s no easy way out of this situation. While the short-term repercussions of less Fed intervention, fiscal discipline, and a rebuilding of household savings would potentially be negative for the stock market, in the long run it should help us avoid economic calamity and ensure a brighter future. At Intrepid Capital, we are playing the long game. We are investing in what we believe are durable businesses when they can be purchased at a discount. We are not speculating by hopping on the Fed’s market bandwagon.

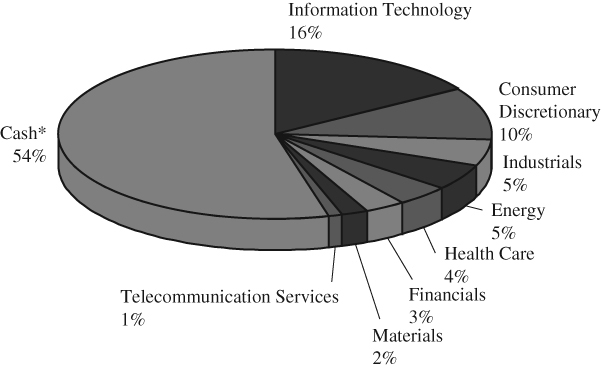

During the three months ending March 31, 2013, the Intrepid Small Cap Fund (the “Fund”) increased 4.47% compared to a 12.39% gain for the Russell 2000 benchmark. For the Fund’s fiscal six month period ending March 31, 2013, the Fund rose 6.03% versus 14.48% for the Russell Index. Our underperformance is primarily tied to our cash position, which swelled to 54.2% of Fund assets at quarter end. Lately, we have not found many durable businesses that can be bought cheaply. The absence of downside volatility makes true value investing difficult. Unfortunately, we can’t manufacture a good investment idea. If we could, here’s what it would look like:

•Predictable business that has weathered multiple economic cycles

•Significant recurring free cash flow

•Lightly levered balance sheet

•Management with a strong record of capital allocation

•Trading at or close to a double digit normalized free cash flow yield

During the first quarter, we purchased one new position and sold six existing holdings, three of which had weightings below 1% of assets. Think of it as spring cleaning. We bought SAIC (ticker: SAI), a defense IT services firm, in a pair trade

Intrepid Small Cap Fund

with ManTech (ticker: MANT). SAIC is larger, more diversified, and has a higher proportion of non-defense revenue compared to ManTech. Additionally, SAIC is pursuing a split into two companies in an effort to maximize shareholder value. To date, we have been disappointed with ManTech’s unwillingness to repurchase shares. When SAIC traded at a discount similar to ManTech, we sold some of our ManTech position and rotated into SAIC, which we viewed as a higher quality discount. We currently own stakes in both firms. Our first quarter portfolio sales included Patterson UTI (ticker: PTEN), Potlatch (ticker: PCH), Iconix Brand Group (ticker: ICON), Amerisafe (ticker: AMSF), Cott (ticker: COT), and TeleTech (ticker: TTEC). Each of these names exceeded our valuation.

The top three portfolio gainers during the first quarter were Bio-Rad (ticker: BIO), Aspen Insurance (ticker: AHL), and Big Lots (ticker: BIG). All of these were larger positions. Bio-Rad is a leading life sciences company with substantial recurring revenue. It has traded cheaper than peers for years because of the family controlled voting structure. The company has a large amount of long-term investments that do not show up in common screens and are worth about 15% of the market cap. Aspen Insurance is an insurance and reinsurance company that we purchased in 2011 at more than a 30% discount to tangible book value. The firm has a history of consistent reserving. Favorable underwriting results in 2012 as well as recent share repurchases have contributed to gains in the stock. Big Lots (ticker: BIG) was purchased a couple of quarters ago. While the closeout retailer hasn’t yet turned around operationally, the most recent quarter’s results met expectations, and the stock may be rising due to persistent buyout rumors.

The worst performers in the Fund over the past three months were Newfield Exploration (ticker: NFX), Pan American Silver (ticker: PAAS), and American Greetings (ticker: AM). Pan American’s underperformance was in line with other precious metals miners and can probably be attributed to renewed hope in the economy and stock market. Newfield’s shares fell significantly after the company announced that it intended to sell its Malaysia and China assets to fund domestic growth. Newfield’s international assets account for a large proportion of current production but a much smaller part of reserves. Sell side analysts said Newfield would receive a lower multiple on its short tail international EBITDA than the company’s current EBITDA multiple, implying that the sale would be dilutive to Newfield’s intrinsic value. They are valuing Newfield by using a multiple on EBITDA, whereas we primarily value energy companies based on reserves. As a result, the EBITDA multiple received for these finite assets matters much less to us than the sale price relative to the discounted cash flow stream. Newfield is trading at an Enterprise Value (EV) of $1.75/Mcfe per proved reserve ($10.50/Bbl), while the industry average is around $3.00/Mcfe ($18/Bbl). The company has a similar liquids mix and proportion of developed reserves relative to the industry, and we see no

Intrepid Small Cap Fund

compelling reason for the large discount. At current commodity prices, we believe that Newfield is undervalued based on all relevant metrics including the discounted cash flow stream of its existing assets, EV/EBITDA and EV/reserves compared to peers, and transaction comps within its producing areas.

American Greetings fell slightly during the first quarter. Last September, management offered to buy the company for $17.18 per share, which was a 20% premium to the intraday low from the prior day. In spite of the offer, short interest in the shares remained close to 40% of the float or higher. In reaction to a 7% unexplained drop in the shares over a two day period in January, management issued a press release stating that they had almost secured the necessary financing and were “materially” raising their offer to $17.50 per share (a 1.9% bump). American Greetings’ stock continued to trade at a persistent high single digit discount to the new offer price, likely because investors did not trust management to complete the transaction. We also have a negative opinion of the company’s management team, but we saw little reason for them to temporarily game the share price with a fake takeover offer, and we believed there were limited obstacles to obtaining sufficient financing.

Today, on April 1, 2013, the board announced it supported a final offer of $18.20 per share, and the shares quickly traded above $18. In the hands of better management, we think the stock could be worth significantly more. Unfortunately, there is no realistic option to replace the entrenched family management team, who collectively controls 43% of the voting power. While the merger requires a majority vote of shareholders other than management, we think it’s likely to be approved. Voting down the merger would only hand the company back to existing management, who could continue to make bad capital allocation decisions. We’re walking away from this one. We made a little bit of money on American Greetings, but it was not a very successful investment for the Fund.

There are still plenty of market skeptics today, but they are more likely to be retail investors burned by the credit crisis instead of professional investors. Stock prices are at highs. Mutual fund and hedge fund cash levels are near lows. Margins have stopped rising and profit growth has started to slow, yet expectations are robust. Whether it’s March 2009 or March 2013, too many investors make decisions by looking in the rearview mirror. Today, they see a scene straight out of investment utopia. Bushy-tailed rabbits are jumping in lush fields of green stock prices, while rainbows beam from pots of gold and cut across the pale blue sky. Up in the heavens, written in soft white clouds is, according to some, the only investment advice you’ll ever need: “Don’t Fight the Fed.” We need the occasional rainstorm to keep the investment landscape healthy. It’s not in our DNA to be Fed puppets when investment fundamentals don’t make sense. Given a choice between buying an overvalued asset or earning nothing, we’ll take the latter. Small capitalization stocks

Intrepid Small Cap Fund

continue to be priced richly, and we expect better opportunities in the future. Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Intrepid Small Cap Fund Portfolio Manager

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund.

The Advisor believes that current market conditions warrant a defensive position from the requirement to invest at least 80% of its net assets in equity securities of small capitalization companies.

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at anytime and should not be considered a recommendation to buy or sell any security.

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. Companies in the Russell 3000 Index, as ranked by market capitalization. You cannot invest directly in an index.

Cash Flow measures the cash generating capability of a company by adding non-cash charges and interest to pretax income. Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. EBITDA is calculated as the company’s Earnings before Interest, Taxes and Depreciation. EV/EBITDA is the ratio of Enterprise Value to Earnings before Interest, Taxes, Depreciation, and Amortization. Enterprise Value equals market capitalization plus debt minus cash. Basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Market cap is the market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share. Tangible Book Value is calculated as shareholders’ equity minus intangible assets including goodwill. Normalized free cash flow is the free cash flow we expect a company to generate in a typical year given normal economic conditions, without large swings in working capital or unusually high or low capital spending. EV/Reserves is enterprise value divided by proved oil and gas reserves as reported in SEC filings.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

Intrepid Income Fund

|  | |

| | | |

| Jason Lazarus, | Ben Franklin, | |

| Income Fund Co-Portfolio Manager | Income Fund Co-Portfolio Manager | |

April 1, 2013

Dear Fellow Shareholders,

The high yield market continued its strong performance into the first quarter of 2013 in conjunction with equity indices hitting all-time highs. The Bank of America / Merrill Lynch High Yield Master II Index completed its 10th straight month of positive performance. The yield-to-worst offered by index hit a new all-time low of 5.60% during the quarter, and stood at 5.71% on March 31, 2013. We believe the apparent optimism of market participants is largely misguided, and is rooted in the actions of “Helicopter Ben” and his sidekicks at the Federal Reserve. Unprecedented levels of market intervention, combined with chronic budget deficits, leave us increasingly wary of committing capital to risky asset classes.

The Intrepid Income Fund (the “Fund”) underperformed the high-yield index in the first quarter of the calendar year and in the first six months of the Fund’s fiscal year, which began on September 30, 2012. The Fund gained 0.95% in the three-month period and 1.91% in the six-month period ending March 31, 2013. In the same periods, the index rose 2.85% and 6.13%, respectively. Returns were diminished by our under-allocation to lower-rated bonds, which outperformed the broad market, as well as the high cash balance.

The Fund is positioned differently than a traditional high-yield fund and an investment-grade corporate bond fund. We generally have a higher-quality bias and hold cash to take advantage of market dislocations. Further, the Fund’s duration, a measure of interest rate sensitivity, is short in this record low interest rate environment. Investment grade bonds typically have a much longer duration and are therefore more exposed to interest rate risk. Given the higher-quality holdings and elevated cash position that averaged 45% of assets, the Fund performed as would be expected. Investment grade credit spreads remained essentially flat near 150 basis points, and prices declined in response to higher Treasury rates.

Portfolio activity was relatively muted in the quarter. Two of our largest holdings, Gibraltar Industries 8.00% due 12/01/2015 and Spartan Stores 3.375% convertible notes, were called in their entirety. It can be frustrating to see our portfolio companies call our notes and issue new longer-dated, lower-coupon bonds. In most cases we don’t believe the new paper is particularly attractive and therefore don’t get involved. Case in point is Gibraltar’s new issue, sporting a 6.25% coupon with a

Intrepid Income Fund

2/01/2021 maturity. It’s difficult for us to get excited about a moderately-leveraged, cyclical building products company even if it were trading near par. Apparently market participants disagree with us, as the notes are trading near $107 and offer a measly 5.1% yield for the next eight years. However, there are rare cases where we believe the new notes are attractive. We were able to get involved in Spartan’s new 6.625% notes due 12/15/2016 at what we believe is an attractive price for paper maturing in less than four years.

The Intrepid Income Fund has been a lender to Spartan Stores since late 2009. To refresh your memory, Spartan Stores is a leading grocery distributor and retailer operating almost exclusively in Michigan. The company holds the #1 or #2 market share in Northern and Western Michigan markets, and has the #3 position in other markets. Spartan has been battling against a very tough Michigan economy, and its financial performance has suffered. However, management has done an admirable job keeping costs contained, and has maintained a conservative balance sheet. Based on our adjusted figures, the company’s debt-to-EBITDA is only 1.2x. While poor capital allocation decisions are always a risk to a company’s credit quality, we are confident that a transaction would not impair the company’s ability to service its debt.

Over the past few months we worked to set up the back office infrastructure to support trading of term loans. For those unfamiliar with term loans, the instruments allow us to become senior lenders generally receiving a floating rate coupon, thereby minimizing interest rate risk. Having the ability to purchase term loans also broadens our investment universe. We purchased a sizeable position in The Pantry, Inc.’s 1st lien term loan B. The Pantry is a regional convenience store and fuel center operator. The Fund was previously an owner of The Pantry’s notes, which were called several months ago. The term loan pays us LIBOR + 450 bps with a floor of 125 bps for a current coupon of 5.75%. While we paid a premium to par to acquire the loan, we believe the yield is attractive given our position in the capital structure. The company has more debt than our typical holdings, but the loan is senior to the bonds and leases.

The Spartan notes and Pantry term loan were the only major positions established in the quarter. We added incrementally to some smaller positions, including Scotts Miracle-Gro 7.25% due 1/15/2018 and Cott Beverage 8.00% due 6/01/2019. Both of these positions were discussed in our fourth quarter 2012 commentary.

The largest contributors to the Fund’s performance in the quarter were PetroQuest 10.00% due 9/01/2017, EPL Oil & Gas 8.25% due 2/15/2018, and Ruby Tuesday 7.625% due 5/15/2020. PQ and EPL were top contributors in the fourth quarter as well. These securities materially outperformed the market and constitute larger positions. A combination of higher energy prices and more conservative capital allocation plans for 2013 probably supported the energy names. Additionally, lower-

Intrepid Income Fund

rated bonds such as these generally outperformed better quality high-yield bonds in the quarter (although we don’t believe these issuers are low quality). The few detractors had an immaterial impact on the Fund’s performance.

As regular readers of our letters know, our holdings have been called consistently over the past two or three years as high-yield rates continue to descend to historic lows. We expect several holdings to be called through the summer if the high-yield market remains strong. As we have stated in past letters, we are not required to reinvest this cash. If we cannot find securities that can stand on their own merits, we will default to cash and await more attractive opportunities. Absent a significant increase in interest rates or widening of credit spreads, our cash position could continue to grow.

To reiterate our view on cash, one that has been stated consistently in our commentaries, our cash position is solely a function of the opportunities available in the market. It is not a top-down call on asset prices. We believe our current holdings offer attractive returns for the risk borne, but unfortunately opportunities such as these do not abound. With that said, attractive ideas can be unearthed even when the environment is toughest for value investors – when prices are unreasonably high and opportunities are scarce. We are consistently finding new ideas, but must be increasingly selective in the process. Looking forward, we think it is prudent to maintain our defensive posture, both from a credit risk and interest rate risk perspective. We will continue to focus on higher-quality businesses while maintaining our short duration, which was 1.67 years at quarter-end. Thank you for your investment.

Sincerely,

|  |

| Ben Franklin, CFA | Jason Lazarus, CFA |

| Intrepid Income | Intrepid Income |

| Co-Lead Portfolio Manager | Co-Lead Portfolio Manager |

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is generally greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual securities volatility than a diversified fund.

Intrepid Income Fund

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at anytime and should not be considered a recommendation to buy or sell any security.

The Bank of America Merrill Lynch High Yield Master II Index is Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. You cannot invest directly in an index.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration. Yield-to-Worst is the bond yield computed by using the lower of either the yield to maturity or the yield to call on every possible call date. Basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Debt-to-EBITDA is calculated as Debt divided by Earnings, Before Interest, Taxes, Depreciation, and Amortization. LIBOR stands for London InterBank Offered Rate. It is the interest rate at which banks offer to lend funds to one another in the international interbank market.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

Intrepid Disciplined Value Fund

| |

Greg Estes, Disciplined Value Fund Portfolio Manager | |

April 1, 2013

Dear Fellow Shareholders,

The stock market has been on a tear in the past quarter, and we are doing our best under the circumstances to keep up. Make no mistake- this is not the ideal environment for a value investor. With investor sentiment increasingly expecting economic expansion (and the ensuing earnings increases caused by it), market highs are being tested. Put another way, prevailing investor sentiment believes that earnings will improve, so it has pushed stock prices higher ahead of such improvement actually occurring. To be fair, there are some signs of an economy that might be improving. Housing prices appear to be better, although housing inventory is incredibly low and may be forcing too many buyers to bid up prices on too few houses. Jobless rates appear to be improving, although underemployment and wages appear to be no better. We think that this data is not at all definitive. And yet in the short-term, a wave of good feeling can propel a market higher, while investors like us, who always strive to be conscious of the prices we pay, must make a decision to either play along with the market, buying stocks that we believe are not cheap, or allow our cash levels to rise as we avoid paying higher prices. We have opted to forgo purchasing what we believe are overpriced securities.

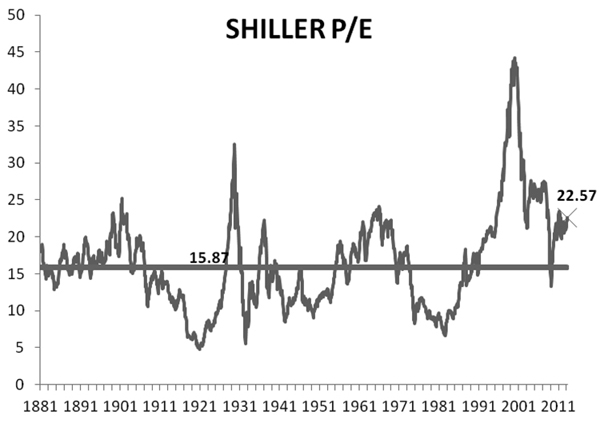

Consider the Shiller P/E, a stock market measure developed by Yale University economist Robert Shiller. Rather than a basic P/E ratio, which takes a current stock or index price and divides it by the latest annual earnings, the Shiller P/E uses the current S&P 500 Index and divides it by the average of yearly earnings over the past ten years, adjusting for inflation. By using ten years, Shiller hopes to avoid looking at a particular part of a cycle (expansion or recession) and get a broader view that encompasses one or two economic cycles. Dr. Shiller is kind enough to make his data public, and we have produced the historical chart below:

The huge spike was the tech bubble from the 1990’s. There was a short-lived reduction in the Shiller P/E after the tech bubble burst, and then the market corrected again from 2008 through early 2009. However, since that time, the market has quickly reinflated and, as of March 31, 2013, had a value of 22.57, which is well above the long-term median

Intrepid Disciplined Value Fund

Shiller P/E of 15.87. Now, one might reasonably argue that this long-term median might not be as applicable in today’s market. However, we believe that the Shiller P/E does provide some insight into the volatile nature of market outlook and expectations, especially in recent years. It appears to us to be an inflationary pattern, likely driven by an easy monetary policy along with large deficit spending. While we cannot accurately predict when corrections will occur, we can see that they are sudden and painful. This is not the experience we would choose for ourselves or for our shareholders.

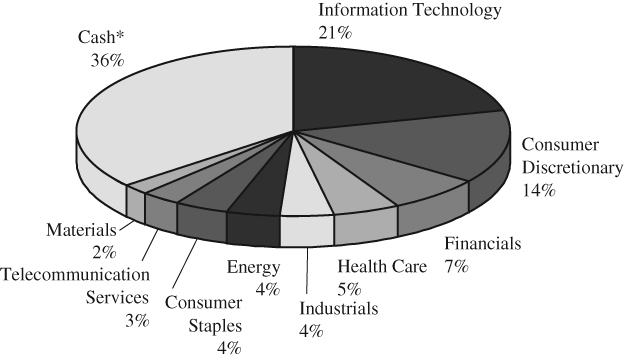

For the quarter ended March 31, 2013, the Intrepid Disciplined Value Fund (the “Fund”) gained 8.51%, while the S&P 500 Index gained 10.61% and the Russell 3000 Index was up 11.07%. Our goal in the current climate is to participate in the market gain. The Fund’s quarterly return was roughly 77% of the Russell 3000’s return while the Fund’s cash level rose from 27.3% as of December 31, 2012 to 36.2% at quarter end. For the first six months of the Fund’s fiscal year, the Intrepid Disciplined Value Fund was up 8.82% while the S&P 500 was up 10.19% and the Russell 3000 was up 11.35%.

Effective April 1, 2013, the Funds name changed to the Intrepid Disciplined Value Fund. The decision to change the name was motivated by our desire to highlight the investment process and commitment to find value where possible. As we mentioned above, we may not always make the comfortable choice, but when it comes to our shareholders’ investment in the Fund, we feel that our mandate is to maintain the discipline of our process above everything else.

Activity during the quarter was skewed more towards selling than purchasing, as five names were sold out of the Fund with only one being added. Potlatch (ticker: PCH), Johnson & Johnson (ticker: JNJ), Federated Investors (ticker: FII), Patterson UTI (ticker: PTEN), and Iconix (ticker: ICON) were all sold as the stocks hit our intrinsic value estimates. The sole addition to the portfolio was GameStop (ticker: GME). Somewhat of a contrarian idea, GameStop is a market leading retailer of new console video games. In addition, its used game business is highly profitable and has driven high returns on the company’s tangible capital. The stock has been heavily shorted for a few reasons. First, some investors fear that when new consoles, such as Sony’s PlayStation 4 and Microsoft’s Xbox, are launched, gamers who buy used titles will be unable to play those games on the newer consoles. Sony has all but completely dispelled this notion, and we think Microsoft is unlikely to go it alone and prevent used game play on its new console for fear of consumer backlash. A second fear is that games sales have been weak for the past couple of years, but we are likely to be entering a new gaming cycle with the advent of one or two new game consoles in time for the 2013 Holiday season. We look at this as an opportunity to buy a business on share price weakness, believing that it can generate free cash flow even in a challenging environment.

Intrepid Disciplined Value Fund

Top contributors for the quarter were Dell (ticker: DELL), Staples (ticker: SPLS), and Patterson UTI. In our opinion, the respective stock price for each company had been suppressed by concerns specific either to the company’s industry, as with Patterson and Dell, or to the firm itself, as with Staples’ reorganization of its European stores. These stocks started the quarter with relatively larger discounts. In the case of Dell, the competing go-private offers have driven the stock price considerably higher from where it started the quarter. Patterson UTI exceeded expectations in its most recent earnings release. In the case of Staples, we suspect that the market felt that, given the attractive dividend and the credible steps management is taking to control its costs in its international stores, the low share price was unwarranted.

The worst laggards in the quarter were Newfield Exploration (ticker: NFX), Pan American Silver (ticker: PAAS), and Telephone & Data Systems (ticker: TDS). In the case of TDS, the company continues to build out its 4G wireless infrastructure, which is weighing on free cash flow in the short-term. We believe that there is a potential for asset sales of the company’s less profitable business geographies which could add to shareholder value. As a precious metals miner, Pan American Silver is in an out-of-favor segment. Newfield is a company that we believe is misunderstood by the market, which is pricing the company well below its peers in the energy exploration & production industry.

We will close this letter as we have often done, by citing our estimated average discount within the Fund. Each investment will have a discount to intrinsic value which is based upon its market price and our calculated intrinsic value. The average discount within the Fund is roughly 11%. This discount has shrunk as the market has made such a sharp move up in the quarter. Nonetheless, we continue to look for suitable new value investments, but we recognize that the current climate is challenging. We thank you for your confidence in our process.

Sincerely,

Greg Estes, CFA

Intrepid Disciplined Value Fund Portfolio Manager

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund.

Intrepid Disciplined Value Fund

The Advisor believes that current market conditions warrant a temporary defensive position invested more in cash and cash equivalents and away from the requirement to invest at least 80% of its net assets in equity securities.

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at anytime and should not be considered a recommendation to buy or sell any security.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 3000 Index is an index representing the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. You cannot invest directly in an index.

Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. Discount to Intrinsic Value is the difference between what an investor believes the company is worth and what the market price is of the company.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

Intrepid Funds

EXPENSE EXAMPLE

March 31, 2013 (Unaudited)

As a shareholder of the Intrepid Capital Management Funds Trust (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other expenses incurred by the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period of October 1, 2012 through March 31, 2013.

ACTUAL EXPENSES

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2013 (Unaudited)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

INTREPID CAPITAL FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2012 - |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,060.10 | $7.19 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.95 | 7.04 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID CAPITAL FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2012 - |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,061.30 | $5.91 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.19 | 5.79 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID SMALL CAP FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2012 - |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,060.30 | $7.19 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.95 | 7.04 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2013 (Unaudited)

INTREPID SMALL CAP FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2012 - |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,061.70 | $5.92 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.19 | 5.80 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID INCOME FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2012 - |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,019.10 | $5.79 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.20 | 5.79 |

��

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID INCOME FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2012 - |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,020.40 | $4.53 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,020.44 | 4.53 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.90%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2013 (Unaudited)

INTREPID DISCIPLINED VALUE FUND*

| | | | Expenses Paid |

| | Beginning | Ending | During Period** |

| | Account Value | Account Value | October 1, 2012 - |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,088.20 | $7.29 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.95 | 7.04 |

| * | Effective April 1, 2013, the Intrepid All Cap Fund changed its name to Intrepid Disciplined Value Fund and its principal investment strategies changed (see Footnote 1 to the Financial Statements). |

| ** | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

Intrepid Capital Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2013 (Unaudited)

INTREPID CAPITAL FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Common Stocks | | $ | 223,368,332 | |

| Corporate Bonds | | | 85,485,004 | |

| Senior Loans | | | 3,016,122 | |

| Cash* | | | 112,411,819 | |

| | | $ | 424,281,277 | |

* Cash, cash equivalents and other assets less liabilities.

Intrepid Small Cap Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2013 (Unaudited)

INTREPID SMALL CAP FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Information Technology | | $ | 116,618,967 | |

| Consumer Discretionary | | | 69,387,651 | |

| Industrials | | | 39,834,697 | |

| Energy | | | 32,892,217 | |

| Health Care | | | 25,712,694 | |

| Financials | | | 24,059,894 | |

| Materials | | | 12,726,850 | |

| Telecommunication Services | | | 8,398,776 | |

| Cash* | | | 390,060,621 | |

| | | $ | 719,692,367 | |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

* Cash, cash equivalents and other assets less liabilities.

Intrepid Income Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2013 (Unaudited)

INTREPID INCOME FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Corporate Bonds | | $ | 51,532,665 | |

| Senior Loans | | | 2,010,748 | |

| Common Stocks | | | 1,940,161 | |

| Cash* | | | 53,820,439 | |

| | | $ | 109,304,013 | |

* Cash, cash equivalents and other assets less liabilities.

Intrepid Disciplined Value Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2013 (Unaudited)

INTREPID DISCIPLINED VALUE FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Information Technology | | $ | 8,164,111 | |

| Consumer Discretionary | | | 5,643,068 | |

| Financials | | | 2,633,662 | |

| Health Care | | | 1,780,648 | |

| Industrials | | | 1,693,758 | |

| Energy | | | 1,599,298 | |

| Consumer Staples | | | 1,597,075 | |

| Telecommunication Services | | | 1,007,947 | |

| Materials | | | 778,214 | |

| Cash* | | | 14,057,639 | |

| | | $ | 38,955,420 | |

* Cash, cash equivalents and other assets less liabilities.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 52.65% | | | | | | |

Commercial & Professional Services - 3.67% | | | | | | |

| FTI Consulting, Inc. (a) | | | 285,327 | | | $ | 10,745,415 | |

| Securitas AB (b) | | | 514,929 | | | | 4,847,794 | |

| | | | | | | | 15,593,209 | |

| Consumer Services - 1.84% | | | | | | | | |

| Speedway Motorsports, Inc. | | | 435,200 | | | | 7,829,248 | |

Diversified Financials - 5.21% | | | | | | | | |

| The Bank Of New York Mellon Corp. | | | 403,000 | | | | 11,279,970 | |

| The Western Union Co. | | | 718,470 | | | | 10,805,789 | |

| | | | | | | | 22,085,759 | |

| Energy - 5.50% | | | | | | | | |

| Bill Barrett Corp. (a) | | | 648,570 | | | | 13,146,514 | |

| Newfield Exploration Co. (a) | | | 278,130 | | | | 6,235,674 | |

| Swift Energy Co. (a) | | | 267,070 | | | | 3,955,307 | |

| | | | | | | | 23,337,495 | |

| Food & Staples Retailing - 0.98% | | | | | | | | |

| The Pantry, Inc. (a) | | | 332,233 | | | | 4,142,945 | |

Food, Beverage & Tobacco - 2.67% | | | | | | | | |

| Molson Coors Brewing Co. | | | 232,000 | | | | 11,351,760 | |

Household & Personal Products - 1.42% | | | | | | | | |

| American Greetings Corp. | | | 374,008 | | | | 6,021,529 | |

Insurance - 3.68% | | | | | | | | |

| Baldwin & Lyons, Inc. - Class B | | | 70,272 | | | | 1,671,771 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 134,000 | | | | 13,962,800 | |

| | | | | | | | 15,634,571 | |

| Materials - 4.52% | | | | | | | | |

| Newmont Mining Corp. | | | 214,630 | | | | 8,990,851 | |

| Pan American Silver Corp. (b) | | | 316,800 | | | | 5,189,184 | |

| Royal Gold, Inc. | | | 70,500 | | | | 5,007,615 | |

| | | | | | | | 19,187,650 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 52.65% (continued) | | | | | | |

Media - 1.65% | | | | | | |

| World Wrestling Entertainment, Inc. (c) | | | 792,769 | | | $ | 6,992,223 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 2.86% | | | | | | | | |

| Bio-Rad Laboratories, Inc. (a) | | | 96,327 | | | | 12,137,202 | |

Retailing - 4.38% | | | | | | | | |

| Aaron’s, Inc. | | | 73,674 | | | | 2,112,970 | |

| Big Lots, Inc. (a) | | | 334,610 | | | | 11,801,694 | |

| Staples, Inc. | | | 345,000 | | | | 4,633,350 | |

| | | | | | | | 18,548,014 | |

| Software & Services - 8.96% | | | | | | | | |

| Amdocs Ltd. (b) | | | 233,400 | | | | 8,460,750 | |

| CSG Systems International, Inc. (a) | | | 355,925 | | | | 7,542,051 | |

| EPIQ Systems, Inc. (c) | | | 612,066 | | | | 8,587,286 | |

| ManTech International Corp. | | | 206,660 | | | | 5,552,954 | |

| Microsoft Corp. | | | 275,000 | | | | 7,867,750 | |

| | | | | | | | 38,010,791 | |

| Technology Hardware & Equipment - 4.53% | | | | | | | | |

| Dell, Inc. | | | 928,000 | | | | 13,298,240 | |

| Ingram Micro, Inc. (a) | | | 299,521 | | | | 5,894,573 | |

| | | | | | | | 19,192,813 | |

| Telecommunication Services - 0.78% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 156,769 | | | | 3,303,123 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $203,058,454) | | | | | | | 223,368,332 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| CORPORATE BONDS - 20.15% | | | | | | | | |

| Automobiles & Components - 0.75% | | | | | | | | |

| Affinia Group, Inc. (d) | | | | | | | | |

| 10.750%, 08/15/2016 | | $ | 2,945,000 | | | | 3,195,325 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 20.15% (continued) | | | | | | |

Capital Goods - 1.37% | | | | | | |

| Thermon Industries, Inc. | | | | | | |

| 9.500%, 05/01/2017 | | $ | 5,226,000 | | | $ | 5,800,860 | |

Commercial & Professional Services - 0.85% | | | | | | | | |

| ADS Tactical, Inc. (d)(e) | | | | | | | | |

| 11.000%, 04/01/2018 | | | 3,648,000 | | | | 3,620,640 | |

Consumer Durables & Apparel - 1.30% | | | | | | | | |

| Smith & Wesson Holding Corp. (d)(e) | | | | | | | | |

| 9.500%, 01/14/2016 | | | 5,089,000 | | | | 5,521,565 | |

Consumer Services - 3.55% | | | | | | | | |

| Ruby Tuesday, Inc. (d) | | | | | | | | |

| 7.625%, 05/15/2020 | | | 7,614,000 | | | | 7,556,895 | |

| Speedway Motorsports, Inc. | | | | | | | | |

| 8.750%, 06/01/2016 | | | 7,122,000 | | | | 7,513,710 | |

| | | | | | | | 15,070,605 | |

| Energy - 4.30% | | | | | | | | |

| Bill Barrett Corp. | | | | | | | | |

| 9.875%, 07/15/2016 | | | 5,665,000 | | | | 6,061,550 | |

| EPL Oil & Gas, Inc. | | | | | | | | |

| 8.250%, 02/15/2018 | | | 4,353,000 | | | | 4,625,062 | |

| PetroQuest Energy, Inc. | | | | | | | | |

| 10.000%, 09/01/2017 | | | 6,182,000 | | | | 6,630,195 | |

| PHI, Inc. | | | | | | | | |

| 8.625%, 10/15/2018 | | | 863,000 | | | | 938,513 | |

| | | | | | | | 18,255,320 | |

| Food, Beverage & Tobacco - 1.71% | | | | | | | | |

| Cott Beverages, Inc. | | | | | | | | |

| 8.125%, 09/01/2018 | | | 6,632,000 | | | | 7,245,460 | |

Food & Staples Retailing - 0.75% | | | | | | | | |

| Spartan Stores, Inc. (d)(e)(f) | | | | | | | | |

| 6.625%, 12/15/2016 | | | 3,000,000 | | | | 3,178,125 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 20.15% (continued) | | | | | | |

Household & Personal Products - 1.73% | | | | | | |

| Central Garden & Pet Co. | | | | | | |

| 8.250%, 03/01/2018 | | $ | 2,925,000 | | | $ | 3,012,750 | |

| The Scotts Miracle-Gro Co. | | | | | | | | |

| 7.250%, 01/15/2018 | | | 4,047,000 | | | | 4,310,055 | |

| | | | | | | | 7,322,805 | |

| Materials - 0.87% | | | | | | | | |

| Compass Minerals International, Inc. | | | | | | | | |

| 8.000%, 06/01/2019 | | | 1,151,000 | | | | 1,248,835 | |

| Intertape Polymer US, Inc. | | | | | | | | |

| 8.500%, 08/01/2014 | | | 2,479,000 | | | | 2,479,000 | |

| | | | | | | | 3,727,835 | |

| Media - 0.71% | | | | | | | | |

| Scholastic Corp. | | | | | | | | |

| 5.000%, 04/15/2013 | | | 2,977,000 | | | | 2,980,751 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 0.44% | | | | | | | | |

| Bio-Rad Laboratories, Inc. | | | | | | | | |

| 8.000%, 09/15/2016 | | | 1,739,000 | | | | 1,853,223 | |

Transportation - 1.82% | | | | | | | | |

| Quality Distribution LLC / QD Capital Corp. | | | | | | | | |

| 9.875%, 11/01/2018 | | | 4,636,000 | | | | 5,099,600 | |

| Swift Services Holdings, Inc. | | | | | | | | |

| 10.000%, 11/15/2018 | | | 2,282,000 | | | | 2,612,890 | |

| | | | | | | | 7,712,490 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $84,336,229) | | | | | | | 85,485,004 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| SENIOR LOANS - 0.71% | | | | | | |

Food & Staples Retailing - 0.71% | | | | | | |

| The Pantry, Inc. (g) | | | | | | |

| 5.750%, 08/03/2019 | | $ | 2,992,481 | | | $ | 3,016,122 | |

| TOTAL SENIOR LOANS | | | | | | | | |

| (Cost $3,063,505) | | | | | | | 3,016,122 | |

Total Investments | | | | | | | | |

| (Cost $290,458,188) - 73.51% | | | | | | | 311,869,458 | |

| Other Assets in Excess of Liabilities - 26.49% | | | | | | | 112,411,819 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 424,281,277 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Affiliated company. See Footnote 7. |

| (d) | Denotes a security is either fully or partially restricted to resale. The aggregate value of restricted securities as of March 31, 2013 was $23,072,550, which represented 5.44% of net assets. |

| (e) | Security is considered illiquid and may be difficult to sell. |

| (f) | Fair valued security. The aggregate value of fair valued securities as of March 31, 2013 was $3,178,125, which represented 0.75% of net assets. |

| (g) | Variable rate security. The rate is as of March 31, 2013. |

SCHEDULE OF OPEN FORWARD CURRENCY CONTRACTSMarch 31, 2013 (Unaudited)

| | Forward | | | Amount of | | | | Amount of | | | | |

| Counterparty | Expiration | Currency to | | Currency to | | Currency to | | Currency to | | | Unrealized | |

| of Contract | Date | be Received | | be Received | | be Delivered | | be Delivered | | | Depreciation | |

| Morgan | | | | | | Swedish | | | | | | |

| Stanley | 5/20/13 | U.S. Dollars | | | 5,145,924 | | Krona | | | 35,000,000 | | | $ | (218,849 | ) |

| | | | | | | | | | | | | | $ | (218,849 | ) |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 45.80% | | | | | | |

Commercial & Professional Services - 5.54% | | | | | | |

| Forrester Research, Inc. | | | 1,800 | | | $ | 56,970 | |

| FTI Consulting, Inc. (a) | | | 660,821 | | | | 24,886,519 | |

| Securitas AB (b) | | | 1,587,784 | | | | 14,948,178 | |

| | | | | | | | 39,891,667 | |

| Consumer Services - 0.92% | | | | | | | | |

| International Speedway Corp. - Class A | | | 175,459 | | | | 5,734,000 | |

| Speedway Motorsports, Inc. | | | 48,054 | | | | 864,492 | |

| | | | | | | | 6,598,492 | |

| Energy - 4.57% | | | | | | | | |

| Bill Barrett Corp. (a) | | | 756,006 | | | | 15,324,241 | |

| Newfield Exploration Co. (a) | | | 783,585 | | | | 17,567,976 | |

| | | | | | | | 32,892,217 | |

| Household & Personal Products - 1.51% | | | | | | | | |

| American Greetings Corp. | | | 676,886 | | | | 10,897,865 | |

Insurance - 3.34% | | | | | | | | |

| Aspen Insurance Holdings Ltd. (b) | | | 569,081 | | | | 21,955,145 | |

| Baldwin & Lyons, Inc. - Class B | | | 88,472 | | | | 2,104,749 | |

| | | | | | | | 24,059,894 | |

| Materials - 1.77% | | | | | | | | |

| Pan American Silver Corp. (b) | | | 776,975 | | | | 12,726,850 | |

Media - 2.52% | | | | | | | | |

| World Wrestling Entertainment, Inc. (c) | | | 2,055,828 | | | | 18,132,403 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 3.57% | | | | | | | | |

| Bio-Rad Laboratories, Inc. (a) | | | 204,069 | | | | 25,712,694 | |

Retailing - 4.69% | | | | | | | | |

| Aaron’s, Inc. | | | 625,130 | | | | 17,928,728 | |

| Big Lots, Inc. (a) | | | 448,828 | | | | 15,830,164 | |

| | | | | | | | 33,758,892 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 45.80% (continued) | | | | | | |

Software & Services - 13.08% | | | | | | |

| Amdocs Ltd. (b) | | | 570,321 | | | $ | 20,674,136 | |

| CSG Systems International, Inc. (a) | | | 433,654 | | | | 9,189,128 | |

| EPIQ Systems, Inc. (c) | | | 1,460,074 | | | | 20,484,838 | |

| Global Payments, Inc. | | | 411,129 | | | | 20,416,666 | |

| ManTech International Corp. | | | 576,486 | | | | 15,490,179 | |

| SAIC, Inc. | | | 578,680 | | | | 7,841,114 | |

| | | | | | | | 94,096,061 | |

| Technology Hardware & Equipment - 3.12% | | | | | | | | |

| Ingram Micro, Inc. (a) | | | 1,101,323 | | | | 21,674,037 | |

| Tech Data Corp. (a) | | | 17,370 | | | | 791,898 | |

| | | | | | | | 22,465,935 | |

| Telecommunication Services - 1.17% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 398,613 | | | | 8,398,776 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $291,854,785) | | | | | | | 329,631,746 | |

Total Investments | | | | | | | | |

| (Cost $291,854,785) - 45.80% | | | | | | | 329,631,746 | |

| Other Assets in Excess of Liabilities - 54.20% | | | | | | | 390,060,621 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 719,692,367 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Affiliated company. See Footnote 7. |

SCHEDULE OF OPEN FORWARD CURRENCY CONTRACTSMarch 31, 2013 (Unaudited)

| | Forward | | | Amount of | | | | Amount of | | | | |

| Counterparty | Expiration | Currency to | | Currency to | | Currency to | | Currency to | | | Unrealized | |

| of Contract | Date | be Received | | be Received | | be Delivered | | be Delivered | | | Depreciation | |

| Morgan | | | | | | Swedish | | | | | | |

| Stanley | 7/10/13 | U.S. Dollars | | | 12,162,676 | | Krona | | | 80,000,000 | | | $ | (86,618 | ) |

| | | | | | | | | | | | | | $ | (86,618 | ) |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 1.77% | | | | | | |

Media - 0.95% | | | | | | |

| World Wrestling Entertainment, Inc. (a) | | | 118,525 | | | $ | 1,045,390 | |

Software & Services - 0.82% | | | | | | | | |

| ManTech International Corp. | | | 33,300 | | | | 894,771 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $1,837,754) | | | | | | | 1,940,161 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| CORPORATE BONDS - 47.15% | | | | | | | | |

Automobiles & Components - 1.49% | | | | | | | | |

| Affinia Group, Inc. (b) | | | | | | | | |

| 10.750%, 08/15/2016 | | $ | 1,499,000 | | | | 1,626,415 | |

Capital Goods - 3.72% | | | | | | | | |

| Thermon Industries, Inc. | | | | | | | | |

| 9.500%, 05/01/2017 | | | 3,660,000 | | | | 4,062,600 | |

Commercial & Professional Services - 1.30% | | | | | | | | |

| ADS Tactical, Inc. (b)(c) | | | | | | | | |

| 11.000%, 04/01/2018 | | | 1,432,000 | | | | 1,421,260 | |

Consumer Durables & Apparel - 3.33% | | | | | | | | |

| Smith & Wesson Holding Corp. (b)(c) | | | | | | | | |

| 9.500%, 01/14/2016 | | | 3,353,000 | | | | 3,638,005 | |

Consumer Services - 6.01% | | | | | | | | |

| Ruby Tuesday, Inc. (b) | | | | | | | | |

| 7.625%, 05/15/2020 | | | 2,636,000 | | | | 2,616,230 | |

| Speedway Motorsports, Inc. | | | | | | | | |

| 8.750%, 06/01/2016 | | | 3,749,000 | | | | 3,955,195 | |

| | | | | | | | 6,571,425 | |

| Energy - 11.45% | | | | | | | | |

| Bill Barrett Corp. | | | | | | | | |

| 9.875%, 07/15/2016 | | | 3,916,000 | | | | 4,190,120 | |

| EPL Oil & Gas, Inc. | | | | | | | | |

| 8.250%, 02/15/2018 | | | 2,950,000 | | | | 3,134,375 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 47.15% (continued) | | | | | | |

Energy - 11.45% (continued) | | | | | | |

| PetroQuest Energy, Inc. | | | | | | |

| 10.000%, 09/01/2017 | | $ | 3,662,000 | | | $ | 3,927,495 | |

| PHI, Inc. | | | | | | | | |

| 8.625%, 10/15/2018 | | | 556,000 | | | | 604,650 | |

| Swift Energy Co. | | | | | | | | |

| 7.125%, 06/01/2017 | | | 644,000 | | | | 660,100 | |

| | | | | | | | 12,516,740 | |

| Food, Beverage & Tobacco - 3.89% | | | | | | | | |

| Cott Beverages, Inc. | | | | | | | | |

| 8.125%, 09/01/2018 | | | 3,896,000 | | | | 4,256,380 | |

Food & Staples Retailing - 1.94% | | | | | | | | |

| Spartan Stores, Inc. (b)(c)(d) | | | | | | | | |

| 6.625%, 12/15/2016 | | | 2,000,000 | | | | 2,118,750 | |

Household & Personal Products - 4.18% | | | | | | | | |

| Central Garden & Pet Co. | | | | | | | | |

| 8.250%, 03/01/2018 | | | 1,890,000 | | | | 1,946,700 | |

| The Scotts Miracle-Gro Co. | | | | | | | | |

| 7.250%, 01/15/2018 | | | 2,465,000 | | | | 2,625,225 | |

| | | | | | | | 4,571,925 | |

| Materials - 1.90% | | | | | | | | |

| Intertape Polymer US, Inc. | | | | | | | | |

| 8.500%, 08/01/2014 | | | 1,288,000 | | | | 1,288,000 | |

| Compass Minerals International, Inc. | | | | | | | | |

| 8.000%, 06/01/2019 | | | 723,000 | | | | 784,455 | |

| | | | | | | | 2,072,455 | |

| Media - 1.71% | | | | | | | | |

| Scholastic Corp. | | | | | | | | |

| 5.000%, 04/15/2013 | | | 1,868,000 | | | | 1,870,354 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 2.22% | | | | | | | | |

| Bio-Rad Laboratories, Inc. | | | | | | | | |

| 8.000%, 09/15/2016 | | | 2,278,000 | | | | 2,427,626 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 47.15% (continued) | | | | | | |

Software & Services - 0.41% | | | | | | |

| ManTech International Corp. | | | | | | |

| 7.250%, 04/15/2018 | | $ | 420,000 | | | $ | 445,200 | |

Transportation - 3.60% | | | | | | | | |

| Quality Distribution LLC / QD Capital Corp. | | | | | | | | |

| 9.875%, 11/01/2018 | | | 2,000,000 | | | | 2,200,000 | |

| Swift Services Holdings, Inc. | | | | | | | | |

| 10.000%, 11/15/2018 | | | 1,514,000 | | | | 1,733,530 | |

| | | | | | | | 3,933,530 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $50,736,209) | | | | | | | 51,532,665 | |

| | | | | | | | | |

| SENIOR LOANS - 1.84% | | | | | | | | |

Food & Staples Retailing - 1.84% | | | | | | | | |

| The Pantry, Inc. (e) | | | | | | | | |

| 5.750%, 08/03/2019 | | | 1,994,987 | | | | 2,010,748 | |

| TOTAL SENIOR LOANS | | | | | | | | |

| (Cost $2,042,327) | | | | | | | 2,010,748 | |

Total Investments | | | | | | | | |

| (Cost $54,616,290) - 50.76% | | | | | | | 55,483,574 | |

| Other Assets in Excess of Liabilities - 49.24% | | | | | | | 53,820,439 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 109,304,013 | |

Percentages are stated as a percent of net assets.

| (a) | Affiliated company. See Footnote 7. |

| (b) | Denotes a security is either fully or partially restricted to resale. The aggregate value of restricted securities at March 31, 2013 was $11,420,660, which represented 10.45% of net assets. |

| (c) | Security is considered illiquid and may be difficult to sell. |

| (d) | Fair valued security. The aggregate value of fair valued securities as of March 31, 2013 was $2,118,750, which represented 1.94% of net assets. |

| (e) | Variable rate security. The rate is as of March 31, 2013. |

See notes to financial statements.

Intrepid Disciplined Value Fund

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 63.91% | | | | | | |

Commercial & Professional Services - 4.35% | | | | | | |

| FTI Consulting, Inc. (a) | | | 44,975 | | | $ | 1,693,758 | |

Consumer Services - 5.83% | | | | | | | | |

| International Speedway Corp. | | | 30,260 | | | | 988,897 | |

| Regis Corp. | | | 20,406 | | | | 371,185 | |

| Speedway Motorsports, Inc. | | | 50,760 | | | | 913,172 | |

| | | | | | | | 2,273,254 | |

| Diversified Financials - 3.94% | | | | | | | | |

| The Bank Of New York Mellon Corp. | | | 54,810 | | | | 1,534,132 | |

Energy - 4.10% | | | | | | | | |

| Bill Barrett Corp. (a) | | | 48,870 | | | | 990,595 | |

| Newfield Exploration Co. (a) | | | 27,150 | | | | 608,703 | |

| | | | | | | | 1,599,298 | |

| Food, Beverage & Tobacco - 4.10% | | | | | | | | |

| Molson Coors Brewing Co. | | | 32,640 | | | | 1,597,075 | |

Health Care Equipment & Services - 1.42% | | | | | | | | |

| CR Bard, Inc. | | | 5,490 | | | | 553,282 | |

Household & Personal Products - 1.60% | | | | | | | | |

| American Greetings Corp. | | | 38,789 | | | | 624,503 | |

Insurance - 2.82% | | | | | | | | |

| Aspen Insurance Holdings Ltd. (b) | | | 28,500 | | | | 1,099,530 | |

Materials - 2.00% | | | | | | | | |

| Pan American Silver Corp. (b) | | | 47,510 | | | | 778,214 | |

Media - 2.32% | | | | | | | | |

| World Wrestling Entertainment, Inc. (c) | | | 102,231 | | | | 901,678 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 3.15% | | | | | | | | |

| Bio-Rad Laboratories, Inc. (a) | | | 9,741 | | | | 1,227,366 | |

Retailing - 4.73% | | | | | | | | |

| Big Lots, Inc. (a) | | | 18,700 | | | | 659,549 | |

| GameStop Corp. | | | 23,800 | | | | 665,686 | |

See notes to financial statements.

Intrepid Disciplined Value Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 63.91% (continued) | | | | | | |

Retailing - 4.73% (continued) | | | | | | |

| Staples, Inc. | | | 38,600 | | | $ | 518,398 | |

| | | | | | | | 1,843,633 | |

| Software & Services - 13.73% | | | | | | | | |

| Amdocs Ltd. (b) | | | 20,580 | | | | 746,025 | |

| CSG Systems International, Inc. (a) | | | 37,695 | | | | 798,757 | |

| EPIQ Systems, Inc. (c) | | | 67,170 | | | | 942,395 | |

| Global Payments, Inc. | | | 18,610 | | | | 924,173 | |

| Microsoft Corp. | | | 37,030 | | | | 1,059,428 | |

| SAIC, Inc. | | | 64,710 | | | | 876,820 | |

| | | | | | | | 5,347,598 | |

| Technology Hardware & Equipment - 7.23% | | | | | | | | |

| Dell, Inc. | | | 84,710 | | | | 1,213,894 | |

| Ingram Micro, Inc. (a) | | | 63,123 | | | | 1,242,261 | |

| Tellabs, Inc. | | | 172,420 | | | | 360,358 | |

| | | | | | | | 2,816,513 | |

| Telecommunication Services - 2.59% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 47,838 | | | | 1,007,947 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $21,629,513) | | | | | | | 24,897,781 | |

Total Investments | | | | | | | | |

| (Cost $21,629,513) - 63.91% | | | | | | | 24,897,781 | |

| Other Assets in Excess of Liabilities - 36.09% | | | | | | | 14,057,639 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 38,955,420 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Affiliated company. See Footnote 7. |

See notes to financial statements.

Intrepid Funds

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2013 (Unaudited)

| | | Intrepid | | | Intrepid Small | |

| | | Capital Fund | | | Cap Fund | |