UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-21625

Investment Company Act file number

Intrepid Capital Management Funds Trust

(Exact name of registrant as specified in charter)

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Address of principal executive offices) (Zip code)

Mark F. Travis

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Name and address of agent for service)

1-904-246-3433

Registrant's telephone number, including area code

Date of fiscal year end: 09/30/2016

Date of reporting period: 03/31/2016

Item 1. Reports to Stockholders.

Intrepid Capital Fund

Intrepid Endurance Fund

Intrepid Income Fund

Intrepid Disciplined Value Fund

Intrepid International Fund

Intrepid Select Fund

Semi-Annual Report

March 31, 2016

| | | | |

April 1, 2016 “Indeed it has been said that democracy is the worst form of government except for all those other forms tried from time to time” - Winston Churchill | | | |

| | | | |

| | | Mark F. Travis, President/C.E.O. | |

| | | | |

Dear Friends and Clients,

After reading the reference to democracy in the quote above, I am also reminded of watching sausage being made – not a pretty process! As we enter the ‘silly season’ of presidential politics, the electorate is angry and frustrated that Washington doesn’t work the way voters wish it did. This frustration, along with inflation adjusted incomes lower than they were eight years ago, is manifested on both sides of the aisle by the presidential candidates. This could get interesting.

On a happier note, for the first quarter ending March 31, 2016, the Intrepid Capital Fund – ICMBX (the “Fund”) increased 2.27% compared to the returns of 1.35% for the S&P 500 Index and 3.25% for the BAML High Yield Master II Index. 2016 began with the markets selling off, led by companies with exposure to oil, which fell below $30/barrel by mid-January. The billions in debt borrowed in the last six to seven years to expand the U.S. oil and gas production business is now an albatross around the industry’s neck. What modeled out beautifully at $100/barrel doesn’t work at $30/barrel. Much of the issuance in the high yield (less than investment grade) bond market has been borrowed by the oil and gas industry.

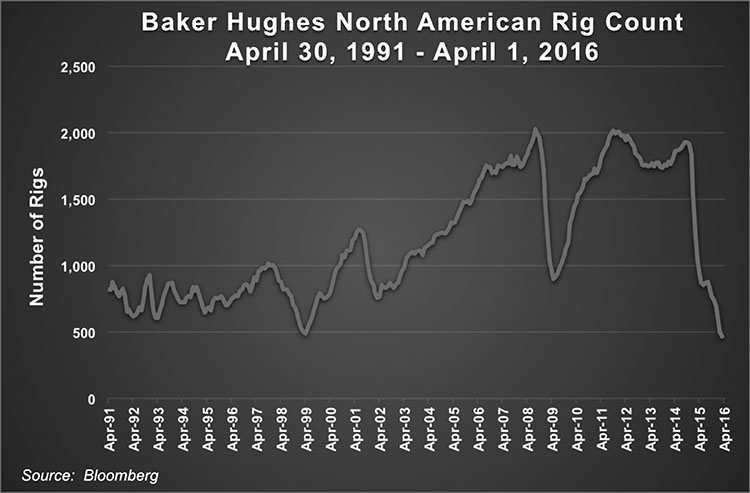

As the chart below shows, the U.S. rig count compiled weekly by Baker Hughes has now dropped to 25 year lows. Although we believe this reduction in new wells will eventually restrict production and push oil prices higher, we just don’t know when.

The interest rate decisions made by the Federal Reserve affect the bond market. It has been said that when the bond market sneezes, the stock market catches a cold. As the bond market has demanded higher and higher interest rates on loans (bonds) to the oil and gas industry, this has had a chilling effect on the equity market. We like to remind shareholders that the “bankers eat first” in a business with a lot of debt, while the equity holders get what is left. For many companies in the oil and gas industry, the bankers’ portion – interest and principal payments – consumes any profits, leaving the equity virtually worthless.

As defensive portfolio managers with what many of our peers would consider intolerably large cash balances, we welcome the lower equity prices as an opportunity to put money to work at attractive prices. Please keep in mind, this desire of ours is often juxtaposed with those of our shareholders, many of whom, as I sarcastically say, “buy high, sell low,” and treat a market down 10% or more as an opportunity to flee! We would contend that the better time to withdraw would be after a large upswing in Net Asset Value (NAV), like after 2009, when the Fund increased 31.28% for the calendar year. Our underperformance is generally driven by our conservatism and willingness to sell when prices reach our estimates of value. The corresponding cash balances become a sea anchor, particularly if prices continue to rise.

We believe the first quarter increase in the Fund was driven by our global search for value and the stubborn ability to hang on until that value is reached. The Fund’s five largest contributors during the quarter were Tetra Tech (ticker: TTEK), Coach (ticker: COH), Fabrinet (ticker: FN), Dundee Corp. (ticker: DC/A CN), and Verizon (ticker: VZ). The Fund’s five largest detractors for the quarter were American Science & Engineering (ticker: ASEI), Express Scripts (ticker: ESRX),

Telephone & Data Services (ticker: TDS), EZCORP 2.125% convertible bonds due 6/15/19, and Unit Corp. (ticker: UNT). The irony in looking at the first quarter top performers is that many are the same companies that caused our performance to drag in calendar year 2015.

We are pleased with our results over the last decade, less so with the shorter periods. Unfortunately, to obtain the long-term results that most people express is their desire (we can debate this one in future letters!), we often have to suffer in the short run. This bull market is old (greater than 7 years), faces an interest rate headwind (Mrs. Yellen – Federal Reserve Chairwoman), and is expensive, with a price earnings (P/E) ratio of 22 compared to a long-term average of 16. These indicate to me that we will face challenges ahead. The good news is we at Intrepid Capital will be ready!

Thank you for your continued support as we attempt to compound your capital, and ours, at an attractive risk-adjusted rate.

Best regards,

Mark F. Travis President

Intrepid Capital Fund Portfolio Manager

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The S&P 500 Index is a broad-based, unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Bank of America Merrill Lynch High Yield Master II Index is Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. You cannot invest directly in an index.

Investment Grade is a bond with credit rating of BBB or higher by Standard & Poor’s or Baa3 or higher by Moody’s. Price to Earnings (P/E) Ratio is calculated by dividing the current price of the stock by the company’s trailing 12 months’ earnings per share. The Baker Hughes U.S. Oil and Gas Rotary Rig Count is a weekly estimate of all active rotary rigs drilling oil or natural gas wells within the U.S., compiled by oil and gas services company Baker Hughes Inc. To be counted as active, a rig must be on location and drilling a new well; rigs that are in transit, rigging up, or being used in non-drilling activities are not included.

Fund Holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments in this report for complete Fund holdings.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| | | |

April 1, 2016 Janet Yellen’s Playlist Defying Gravity (“Wicked” soundtrack) I’m through with playing by The rules of someone else’s game Too late for second guessing Too late to go back to sleep It’s time to trust my instincts Close my eyes, and leap… It’s time to try defying gravity I think I’ll try defying gravity And you can’t pull me down I’m through accepting limits ‘Cause someone says they’re so Some things I cannot change But ‘til I try, I’ll never know -Sung by Elphaba, aka The Wicked Witch of the West | | | |

| | |

| Jayme Wiggins, | |

| Endurance Fund Portfolio Manager | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Dear Fellow Shareholders,

Are central bankers wicked megalomaniacs or well-intentioned public servants? Janet Yellen, Greenspan and Bernanke before her, and their international ilk have plenty of cheerleaders. Wall Street sings their praises. First they argued the Fed had to adopt extraordinary measures to help rescue the banks in 2008 to prevent a depression. The extraordinary has become the expected. Now, over seven years later, we’re inching toward negative interest rates, sending stocks to near-record levels. Certain academics and government bureaucrats have proposed an outright ban on cash. Their apparent goal is to trap you inside of a banking system that plunders your savings in order to support the welfare state and ensure the capital markets continue “defying gravity.”

Some might call this arrangement an unholy alliance between the very rich (stocks stay high) and very poor (get free stuff), but that’s unfair. Citizens all across the wealth spectrum are primarily bystanders to the biggest financial experiment in history. The Federal Reserve, European Central Bank, Bank of Japan, and others are finished “playing by the rules of someone else’s game.” They no longer accept zero as a lower limit for interest rates, even though the time value of money, an immutable law of finance, dictates that a dollar today is worth more than a dollar in the future. And what about the fact that years of easy money have delivered the weakest economic recovery in history? For the bankers who believe they can steer markets and economies alike, it’s too late for second guessing. They close their eyes, and leap.

Quantitative easing and pushing interest rates negative are desperate acts. History has shown that extreme monetary policy rarely spares us from economic pain—it only defers it. Since retiring as Fed Chair, Ben Bernanke is paid speaking fees of up to $400,000 per event, and he is on the payroll of Citadel, one of the largest, most levered high-frequency trading hedge funds. When central bankers close their eyes and leap, they have parachutes. The U.S. economy does not. Attempts to eliminate the business cycle lead to distortions and busts.

Almost nine years have elapsed since the beginning of the last bear market, which was accompanied by the implosion of the housing bubble. The recent release of The Big Short on film provides a timely reminder of the willingness of Wall Street to perpetuate bubbles for financial gain. The Big Short is the story of a small, intrepid group of investment professionals who bet against the U.S. housing market. At the time, this was an almost unheard of position. In fact, the story’s protagonist, Michael Burry, had to ask the banks to create a new security that would allow him to express his negative views on home prices, specifically those owned by subprime borrowers.1 The banks did, for a price. When subprime homeowners stopped making mortgage payments, Burry expected the banks to begin marking higher the value of his short positions. They didn’t because they sat on the other side of the trade. The banks were on the hook for huge payouts to Burry as mortgage delinquencies rose.

Eventually, Burry scored huge gains after his short positions were appropriately marked. But this didn’t occur until the banks had offloaded their risk. The banks kept the price of anti-housing bets artificially low until they could leave someone else holding the bag. This was a maddening period for Burry. He knew he was right, but this wasn’t reflected in his sagging investment performance. Clients questioned his sanity and asked for their money back. Burry stood firm.

Mark Twain said, “History doesn’t repeat itself but it often rhymes.” We’re hearing music; are you? We’re not contending that the housing bubble is reincarnated, although home prices in hot markets (New York/San Francisco/Vancouver) have rocketed to new highs and the government is promoting low down payment loans again. We think the bubble is even broader today than it was a decade ago. It extends across global asset classes for stocks, bonds, real estate, art—almost anything that offers a yield or the potential for capital gains. The value of the U.S. housing stock is a gargantuan $28.5 trillion. However, the size of global stock and bond markets exceeds $200 trillion. With global trade and corporate earnings in decline and valuation multiples extended, the evidence suggests that stock prices should be dropping. But they’re defying gravity. You can’t hold them down.

_________________

1 | The technical jargon is Credit Default Swaps (CDS) on Subprime Mortgage-Backed Securities (MBS) |

Each week, Jacksonville’s local newspaper, the Florida Times Union, reports real estate transactions in the area. Last week, there were three deals that disclosed prior selling prices. Two of these properties are located within five miles of my home, an area I know well.

The Josephs Group of Orangeburg, N.Y., paid $25.7 million for the Publix-anchored Medical and Merchants Center of San Pablo at 14444 Beach Blvd. Most of the 156,153-square-foot center on 23 acres was built in 1993, though other buildings were added later. It last sold for $12 million in 2013.

Publix Supermarkets has purchased the Harbour Place Shopping Center that it anchors at 13170 Atlantic Blvd. for $24 million. The 103,552-square-foot center on 18 acres was built in 1990 and last sold for $6.5 million in 2007.

Lexerd Capital Management of Summit, N.J., paid $8 million for the San Marco Village apartments at 2165 Dunsford Terrace. The 106-unit complex was built in 1973 and last sold for $3.73 million in 2012.

The implied annual rate of appreciation on these deals is between 16% and 29%—far above stock market gains over the same time periods. Fortunes have been made in commercial real estate. And, we suspect, fortunes will be lost.

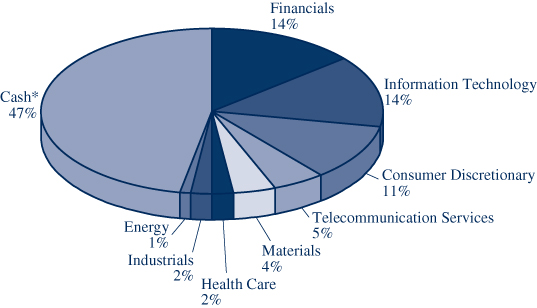

The U.S. stock market sputtered as 2016 began, hitting its lows in February before staging the greatest intra-quarter comeback in history. At one point, the Russell 2000 Index of small caps was down 15.93% year-to-date, but it finished the quarter off 1.52%. The Intrepid Endurance Fund (the “Fund”) was off 3.43% at its worst point in the quarter, but recovered to end up 2.16% as of March 31, 2016. The Fund’s cash, which ended the quarter at 68.6% of assets, helped cushion the downside during January and early February. However, the Fund’s holdings had good performance in the three month period, contributing to the positive return for the Fund versus losses for the small cap benchmarks.

Several of the Fund’s biggest losers from 2015 were its largest contributors in the first quarter, including Corus Entertainment (ticker: CJR/B CN), Sandstorm Gold (ticker: SAND), and Silver Wheaton (ticker: SLW). On January 13th, Corus announced the acquisition of Shaw Media for $2.65 billion. This transaction ties Corus with Bell Media as the largest owner of television networks in Canada and makes Corus the undisputed heavyweight in channels targeting women and kids. It gives the company tremendous heft in dealing with advertisers and negotiating with distributors over carriage fees. Strategically, it’s a win, in our book, as there are significant synergies between the two businesses. Financially, it stretches Corus’s balance sheet, but the company’s robust free cash flow should enable quick deleveraging. The stock initially sold off on the deal, which included a dilutive equity component. However, it recovered into quarter end as investors began embracing the strategic rationale of the merger alongside Corus’s extremely low valuation multiple.

Sandstorm Gold and Silver Wheaton participated in the rally in gold and silver prices off of multiyear lows. Silver Wheaton’s shares struggled last year because the Canadian government is arguing that the company owes it a significant amount of back taxes. We think many investors have fully factored a negative outcome for the tax dispute into their models for the company, and they moved past this issue to focus on Silver Wheaton’s solid execution and the stock’s discounted multiple versus comparable firms.

In our view, Sandstorm Gold has been the most inexpensive precious metals streaming company, often trading at multiples that are half those of its peers. A couple of years ago, the vast majority of Sandstorm’s revenue came from junior miner counterparties, and a few of them had weak balance sheets or above-average breakeven costs. Sandstorm has dramatically upgraded the quality of its counterparty portfolio through streaming and royalty acquisitions, and the company has also benefited from the acquisition of its partners by larger mining firms. Today, over three quarters of Sandstorm’s cash flow comes from major and mid-tier miners. We believe the firm’s counterparty risk profile is as good as larger streaming companies like Franco Nevada, Silver Wheaton, and Royal Gold.

The Fund’s largest detractors in Q1 were EZCORP convertible bonds (CUSIP 302301AB2), Unit Corp. (ticker: UNT), and American Science & Engineering (ticker: ASEI). EZCORP’s converts have tracked the stock lower, but we think the risk/reward equation is more favorable for the debt, which finished the quarter yielding 18%. We believe the underlying value inherent in EZCORP’s high-quality pawn shops has been obscured by several factors, including poor corporate governance, declining gold scrapping profits, and a material accounting restatement at a payroll withholding business in Mexico. Much of the debt consolidated onto EZCORP’s balance sheet is non-recourse to the company and is tied to a money-losing subsidiary. Once management rids itself of this headache, a cleaner investment story should emerge. We continue to believe our bonds are covered under all plausible scenarios. The current enterprise value of EZCORP, marking the bonds to market, implies a per store value for EZCORP’s pawn locations that is approximately one-quarter the level of its publicly-traded, acquisitive peers.

Unit Corp. fell in price again in the first quarter, bucking the energy sector trend. This may have been related to the company’s high exposure to natural gas, which performed worse than oil prices in Q1. We believe at least half of U.S. small cap energy companies would face a restructuring before Unit, given the firm’s better balance sheet at the beginning of the slide in commodity prices. Although oil is off the lows, prices are still far too weak to allow the industry to heal. We expect oil and natural gas to eventually recover further, however, the timing of a rebound has become increasingly crucial to investment positioning. If our estimated recovery is off by a year, many more companies could be forced to restructure than we originally anticipated. We currently have minimal exposure to the sector.

American Science & Engineering’s stock (ticker: ASEI) dropped sharply in the first quarter after the company reported weak results. ASEI specializes in x-ray inspection and screening systems used to combat terrorism, drug trafficking, weapons smuggling, and illegal immigration. In today’s world, you’d think they’d be knocking it out of the park, but results have suffered from troop withdrawals from Iraq and Afghanistan. We think the worst is behind the company, which has cutting-edge technology. We added to our small stake in the quarter, when the company’s enterprise value was equivalent to three years’ worth of its research & development spending. We think shareholder value would be maximized if ASEI were part of a larger defense technology firm.

The Fund sold out of one position and purchased one new name in the first quarter. We exited our remaining stake in Ingram Micro (ticker: IM) on February 17th as the stock exceeded our intrinsic value estimate. This proved to be comically bad timing, as the company was bought out later that same day, robbing the Fund of about 29 basis points of additional performance.

We established a new holding in Starz (ticker: STRZA) after it declined on disappointing earnings guidance from Lions Gate, a major Starz shareholder and potential corporate suitor. Starz operates one of the leading premium television networks in the U.S. Since 2010, the company has shifted its lineup from movies to original programming, in hopes of mimicking the success of HBO and Showtime. Starz’ bargaining position with cable distributors has generally improved as the network now features successful original series such as Black Sails, Outlander, and Power, and is not just a reseller of feature films. On the other hand, distributors are consolidating and Starz may alienate them by recently offering its network over-the-top. Furthermore, premium channels face a growing competitive threat from Netflix, which is aggressively investing in original programming. We think the endgame for Starz is a union with another media company like Lions Gate, which owns 14% of Starz’ equity. Absent a deal, we still believe Starz is a viable standalone business with stable subscription-based revenues and an attractive free cash flow stream. We purchased the stock for less than 8x operating income but subsequently reduced our position after the shares quickly rebounded.

Last June, Bank of Japan (BOJ) Governor Haruhiko Kuroda spoke at a conference. The BOJ appears even more committed to financial arson than the Federal Reserve, given Japan’s ailing economy, aging demographics, and mountainous debt. Kuroda said that central bankers needed to operate with a positive attitude and conviction, which he likened to the Peter Pan Principle: “the moment you doubt whether you can fly, you cease forever to be able to do it.” Japan is past the point of no return, in our judgment. Statements like Kuroda’s demonstrate the direness of that country’s predicament. We can only hope that our Fed soon realizes they have averted a speedbump but are careening toward a concrete wall. A week ago, on March 30, 2016, Richard Fisher, Former Dallas Fed President, was featured on CNBC. During

his time at the Fed, Fisher was often a lone critic of financial bailouts and QE. He commented on today’s Fed: “They’re living in constant fear of a market reaction. This is not the way you manage central bank policy.” Well said.

Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Intrepid Endurance Fund Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

Prior to June 26, 2015, the Fund was named the Intrepid Small Cap Fund.

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as a representative of the equity market in general. You cannot invest directly in an index.

Cash Flow measures the cash generating capability of a company by adding non-cash charges and interest to pretax income. Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. Enterprise Value equals market capitalization plus debt minus cash. Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Quantitative Easing (QE) is a monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| | | |

| | | |

| | | |

| | Jason Lazarus, | |

| | Income Fund Portfolio Manager | |

| | | | |

April 1, 2016

Dear Fellow Shareholders,

To the casual observer, the capital markets’ performance in the first quarter of 2016 would appear relatively uneventful. Nearly every major asset class posted moderately positive returns in the period. International equity indexes were mixed and most domestic benchmarks reported low single digit gains. However, the quarter was anything but routine. One can get a sense of how volatile the quarter was by simply looking at the significant outperformance posted by “safe-haven” assets. Long-duration government bonds and our favorite “Pet Rock” (gold!) experienced large gains in the first quarter.

Risk assets fluctuated wildly in what could be a called “A Tale of Two Markets.” The first tale, running essentially halfway through the period, is one of fear and despair. Oil prices cratered to 12-year lows in early 2016, touching nearly $25 per barrel. Stocks crashed into bear market territory. High yield credit performed similarly. Through February 11th, the Bank of America Merrill Lynch High Yield Master II Index (the “BAML HY Master II Index”) had declined 5.14% on the back of a 4.64% drop in 2015. As was the case in 2015, the damage was significantly greater in the most heavily indebted issuers and those operating in commodity industries. The Bank of America Merrill Lynch High Yield Energy Index (the “High Yield Energy Index”) sank 18.98% through February 11th, and distressed bonds, as measured by the Bank of America Merrill Lynch US Distressed High Yield Index (the “Distressed”), lost 14.49%. There were significant outflows from the asset class during this period, and the new issue market was effectively shut down.

The second tale is one of euphoria and complete faith in central bank omnipotence. Following rumors of a potential meeting of Organization of the Petroleum Exporting Countries (OPEC) members to discuss production cuts, crude oil jumped the most in years and regained $30 per barrel. The rally was solidified when St. Louis Federal Reserve President James Bullard watered down the likelihood of four interest rate hikes in 2016. Mr. Bullard concluded that it would be “unwise to continue a [rate] normalization strategy” as inflation expectations continued to fall. This provided the “all clear” investors were looking for. Risk assets staged a dramatic comeback and managed to eke out gains in the first quarter.

High-yield bonds performed brilliantly in the second half of the quarter, rising in 23 of the 34 trading days from February 12th to March 31st. The BAML HY Master II Index returned 8.84% over the same period, with the returns largely driven by commodity-related and low-quality issues. The Distressed benchmark returned

20.98% from February 12th to March 31st, and high-yield energy bonds, as measured by the BAML HY Energy Index, gained 26.59%. It’s worth noting that the High Yield Energy Index is still down 21.62% since the end of 2014. The rally helped push the BAML HY Master II Index into the green by early March. The Index returned 3.25% in the first quarter of 2016.

Investment-grade bonds also benefited from the increase in oil prices and risk-on attitude of market participants. The Bank of America Merrill Lynch U.S. Corporate Index (the “U.S. Corporate”) returned 3.92% in the first quarter of 2016. As was the case with high-yield bonds, investment-grade returns were significantly impacted by energy credits. In fact, energy bonds accounted for roughly two-thirds of the top 300 best performing investment grade corporate bonds in March, despite representing less than 12% of the U.S. Corporate Index. Many returned over 20% in the month, but the median return of the investment-grade index in the month was only 1.40%.

The Intrepid Income Fund (the “Fund”) returned 1.42% in the quarter ended March 31, 2016. The Fund captured roughly 22% of the peak-to-trough decline of the BAML HY Master II Index through February 11th, falling 1.14% versus the Index’s drop of 5.14%. The Fund benefited from relatively low exposure to energy-related credits. One of our few energy bonds actually produced a positive return in this period. Unfortunately, the Fund significantly underperformed the Index during the subsequent rally due to our conservative positioning, rising only 2.59% from February 12th to March 31st. While we participated more in the rally than we did in the decline, the Fund only captured 29% of the market's rebound during this period.

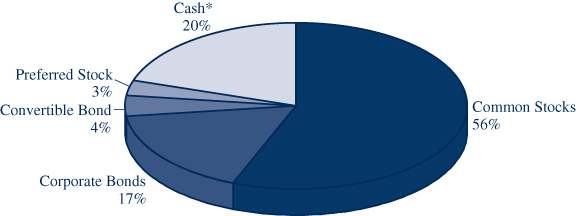

Many of our largest positions are low-beta holdings, and therefore these bonds did not move significantly during the downturn or the rally. Further, a sizeable portion of the Fund is invested in short-duration investment-grade bonds and cash. Cash averaged roughly 26% of the Fund’s assets in the first quarter.

The Fund’s largest contributors in the first quarter ended March 31, 2016 were Regis Corp 5.50% due 12/02/2019, PHI Inc 5.25% due 3/15/2019, and Corus Entertainment common stock (ticker: CJR/B CN). The Fund also benefited from its exposure to precious metals mining and royalty/streaming businesses, which averaged about 6% of the Fund’s assets in the quarter. Only two securities detracted from the Income Fund’s performance in the first quarter: EZCORP 2.125% convertible bonds due 6/15/2019 and Unit Corp 6.625% due 5/15/2021. EZCORP is one of the Fund’s serial offenders. The holding was a primary detractor in 2015 as well. While the situation has certainly been messier than we expected when we initiated the position, we continue to believe market participants are not properly valuing EZCORP’s core pawn business. Even if a restructuring were required, we believe the convertible bonds would recover substantially more value than current trading levels suggest.

The Fund was fairly active in the first quarter. We initiated positions in three high-yield corporate bonds and increased our holdings in three more. Additionally, we sourced several short-duration investment-grade corporate bonds that we believe are offering attractive yields. The investment-grade holdings include the bonds of well-known businesses, such as Verizon Communications and Express Scripts.

The largest of the new high-yield positions is Caleres Inc 6.25% due 8/15/2023. The company was formerly known as Brown Shoe, and Intrepid has been a lender to the business on several occasions since 2008. Caleres is a global footwear retailer and wholesaler, operating over 1,000 stores in the United States under the banner Family Footwear. The company also owns a large stable of brands, which includes well-known brands such as Dr. Scholl’s and Sam Edelman. While Caleres is exposed to consumer spending, we believe the business is conservatively financed and will be able to navigate a more difficult retail environment.

Only one of the Fund’s holdings was called by the issuer in the first quarter: Crown Americas 6.250% due 2/01/2021. In light of the market’s strength near the end of the quarter, we took the opportunity to rebalance some of the Fund’s key holdings. We slightly reduced our positions in Alamos Gold, PHI Inc, and Pitney Bowes preferred stock. We ended the first quarter with roughly 21% of the Fund’s assets in cash and 22% in short-term investment-grade bonds. In the absence of attractively-priced high-yield securities, we will utilize investment-grade bonds that carry little interest rate risk. The high-yield opportunity set still seems rather limited to us. Many bonds issued by more stable companies are trading near all-time lows.

Furthermore, there are significant doubts as to whether the most heavily indebted issuers can service their debt loads. We will continue to be deliberate and thoughtful in selecting investments for your portfolio. Thank you for your investment.

Sincerely,

Jason Lazarus, CFA

Intrepid Income Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is generally greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual securities volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The Bank of America Merrill Lynch High Yield Master II Index (BAML HY Master II Index) tracks the performance of below investment grade, but not in default, US dollar-denominated corporate bonds publicly issued in the US domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody’s and S&P. Barclays Capital U.S. Aggregate Bond Index is an index representing about 8,200 fixed income securities. To be included in the index, bonds must be rated investment grade by Moody’s and S&P. Bank of America Merrill Lynch U.S. Corporate Index (BAML US Corporate Index) is an unmanaged index of U.S. dollar denominated investment grade corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity. The BAML US HY Energy Index is a subset of the BAML HY Master II Index including all securities of Energy issuers. Bank of America Merrill Lynch U.S. Distressed High Yield Index is a subset of the BAML US High Yield Index including all securities with an option-adjusted spread greater than or equal to 1,000 basis points. You cannot invest directly in an index.

Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. Yield is the income return on an investment. It refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. Investment Grade is a bond with credit rating of BBB or higher by Standard & Poor’s or Baa3 or higher by Moody’s. Cash Flow measures the cash generating capability of a company by adding non-cash charges and interest to pretax income. Beta is a measure of volatility of systematic risk, of a security or a portfolio, in comparison to the market as a whole. Duration is an approximate measure of the price sensitivity of a fixed-income investment to a change in interest rates, expressed as a number of years.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| Intrepid Disciplined Value Fund |

| | | |

| | | |

| | | |

| | Greg Estes, | |

| | Disciplined Value Fund | |

| | Portfolio Manager | |

April 1, 2016

Dear Fellow Shareholders,

When prognosticators and pundits opine on the future prospects of the stock market, they will often look to the state of the U.S. economy. The conventional wisdom is that the simplest way to measure the health of the U.S. economy is by looking at the growth in the U.S. Gross Domestic Product (GDP). GDP is the total output of goods and services in the economy, and is calculated as the sum of consumer spending, investments by businesses (capital spending), the value of government purchases of goods and services, and net exports (exports minus imports). A growing GDP should be good for businesses because it implies that there is more opportunity for growth in profits.

Over the past five years, the U.S. economy, as measured by GDP, appears to have grown modestly well. As a matter of fact, when compared to European and Japanese GDP, the U.S. appears a more attractive place to invest. The European Central Bank and the Bank of Japan, concerned over the sluggishness of their respective economies, have both ventured into the uncharted waters of negative interest rates.

The low and negative interest rate environment should force more capital to flow into risky assets simply in the hopes of achieving a positive return. For example, why would a European investor, who wants a low-risk or risk-free asset, put money into an investment that is guaranteed a negative return? The current interest rate environment forces that investor to instead put the money into something less

| Intrepid Disciplined Value Fund |

appropriate from a risk perspective in the hopes of earning some positive return. Perhaps our hypothetical investor decides to invest in the stock market instead. Now imagine this one hypothetical investor becomes millions of global investors. Under normal circumstances, those investors might have purchased lower-risk government or high-grade corporate debt. Now, because they do not wish to lock in a zero or negative guaranteed return, they are forced out of their natural investment preference in the hope of earning some positive return. All of this risk-seeking behavior should benefit the stock market as more capital flows into it. Right?

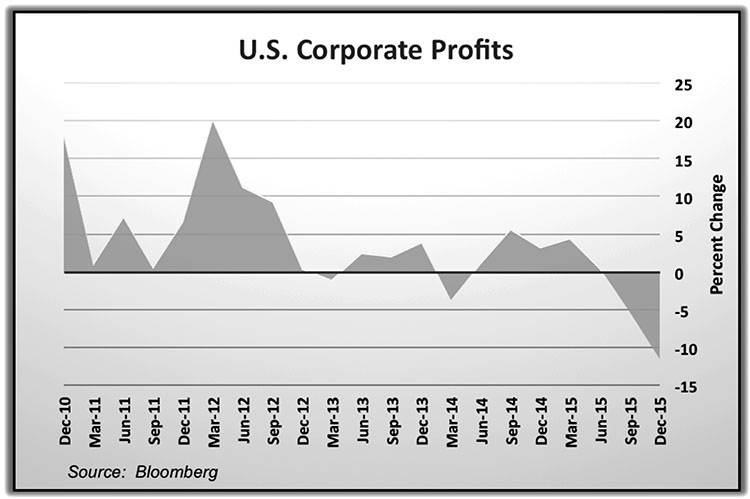

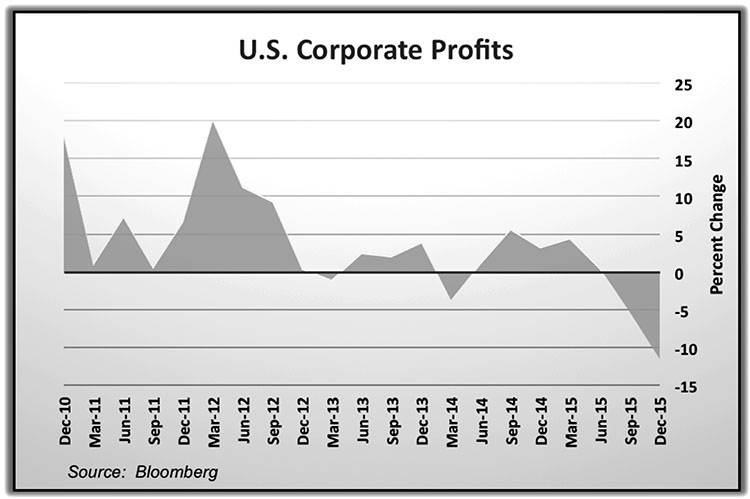

Because we are focusing on the investment in equities, it makes sense to look a little deeper at what supports the underlying businesses and how that impacts stock prices. Earnings are a major factor, and they have been falling over the past two quarters. The fourth quarter alone saw a decrease in total U.S. corporate profits of 11.5% compared to the fourth quarter of 2014. There are a couple of mitigating factors which give some investors comfort. First, BP plc had to pay a $20.8 billion penalty as a settlement for the 2010 Gulf of Mexico oil spill. Excluding that factor, corporate profits were down 7.6% instead of 11.5%.2 Another point made is that most of the profit weakness came from the energy sector. While that is true, what had previously been a source for investment (and employment) in the U.S. is now gone.

We think that dismissing the decline in corporate profits is akin to whistling past the graveyard. Even after making revisions to exclude the worst of the data, it still appears that profits are down 3.9%.3 For stock prices to continue to move up,

_________________

2 | Miller, Rich and Tazi, Alex. “Behind U.S. GDP Data Is Reason for Recession Worry: Weak Profits.” Bloomberg News. 25 March 2016. |

3 | Silva Laughlin, Laura. “Here’s Another Sign a Recession is Coming.” Fortune. 29 March 2016. |

| Intrepid Disciplined Value Fund |

investors generally need to feel optimistic that profits will grow in the future. That is not happening right now. According to Factset, analysts lowered earnings estimates for Q1 2016 by 9.6% for S&P 500 companies. That means that analysts felt worse about S&P 500 companies’ next earnings release over the course of the past three months. Much of that is based on what company management teams said during their Q4 2015 earnings calls about their future prospects.

Our last point about the state of the equity market is illustrated in the chart above, in which we show the Price-to-Earnings ratio for the S&P 500 Index. It had been growing for the past three years. P/E ratios, which take today’s price and divide by the trailing twelve month earnings per share, typically increase when investors are optimistic about future growth in earnings per share. Only within the past year have we seen the S&P 500 Index P/E falter twice – first in the summer of 2015 and then again during January and February of this year. The only counter to this perceived heightened uncertainty came from the incredibly dovish comments from Federal Reserve Chairwoman Janet Yellen, when she indicated that the Fed would take an extremely slow approach to increasing rates due to global concerns. Based upon recent behavior then, it appears that the two opposing forces at work in equity markets are: 1) increased uncertainty about future corporate earnings along with potential earnings declines, and 2) relief that near-zero interest rates may continue to fuel capital flows into equities. Factor one is a case against stocks while factor two is a case for stocks. While factor two has been playing out for several years, factor one appears to be increasing in strength. As investors, we believe that we are better served by “missing out” on some stock price reflation caused by low rates than we are by fully participating in a stock market reaction to a corporate earnings decline. At times, this decision makes us look a step slow, but we believe it is the responsible thing to do.

| Intrepid Disciplined Value Fund |

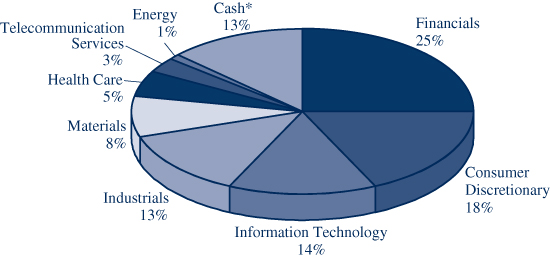

For the 1st quarter of 2016, the Intrepid Disciplined Value Fund (the “Fund”) returned 4.04% compared to 1.35% for the S&P 500 Index and 0.97% for the Russell 3000 Index. The lowest return for the Fund during the period occurred in late January when it was down -5.80%. Setting aside specific holdings for the moment, the general theme was that we suffered less than the market as it fell through January and February while capturing some of the market’s gains through March. Our allocation to precious metals and some out-of-favor consumer discretionary stocks helped the return, while overall, our allocation to financial stocks hindered.

The Fund’s top contributors for the quarter were Alamos Gold (ticker: AGI), Mattel (ticker: MAT), and Silver Wheaton (ticker: SLW). Both Alamos and Silver Wheaton participated in an overall strong showing for precious metals, with the dollar spot price of gold rising 16% from $1,061.10 per troy ounce at year end to close the quarter at $1,232.75 per troy ounce. In a similar fashion, the dollar spot price for silver rose 11% from a year-end $13.85 per troy ounce to close the quarter at $15.44 per troy ounce. Late in the quarter, we trimmed back the Alamos position. Mattel made the list on the strength of a Barbie resurgence. As a matter of fact, Barbie posted her first quarter of sales growth in nine quarters. To paraphrase Mark Twain, the reports of Barbie’s death have been greatly exaggerated. Other consumer discretionary names that contributed to performance were Corus Entertainment (ticker: CJR/B), which has been cleared to acquire Shaw Media. This acquisition will more than double Corus’ size and give the company a huge presence in the Canadian TV market. Coach (ticker: COH) had a similar story to Mattel; its latest earnings release showed that it is making progress in selling its newer line of products. As a matter of fact, Coach is already achieving same-store sales growth at its refurbished locations.

On the other side, the Fund’s worst return detractors were American Science & Engineering (ticker: ASEI), Northern Trust (ticker: NTRS), and Unit Corp (ticker: UNT). ASEI had a big 4th quarter revenue miss due to order delays initiated by a handful of foreign customers. The company, which sells sophisticated X-ray detection equipment, could be thought of as an indirect victim of low oil prices, since many of its customers are Middle Eastern governments whose budgets are under pressure and must therefore delay expenditures. We still have conviction that, because of the security environment today, customers cannot indefinitely delay purchasing. Northern Trust has been hit by both an industry and a company-specific problem. Asset managers and custody banks have been hurt in the quarter due to declining market values and by the prospect of future declines. For the entire quarter, the S&P 500’s Asset Management & Custody Bank subindustry declined 5.08%. In addition, Northern Trust’s Q4 results, reported in January, indicated that management must keep a tighter control on noninterest expenses. Finally, Unit Corp has seen its share price trade down virtually in lock-step with the price of West Texas Intermediate (WTI) crude. The Fund's position is relatively small at less than 50 bps. We view it as a call option on the price of oil.

| Intrepid Disciplined Value Fund |

Activity during the quarter was muted. As mentioned above, we trimmed our Alamos position on the strength of gold prices. We also sold out of our Microsoft (ticker: MSFT) position entirely. We felt that, although its cloud business growth has been strong and CEO Satya Nadella has the company on the right track, the stock price has outpaced the actual operational gains. As the stock price moved beyond our intrinsic value estimate, we sold. We also added to some of the unloved stocks in our portfolio. We mentioned Northern Trust’s reasons for declining in the quarter. We take a contrarian view of asset managers, and in the case of Northern Trust, we believe that management can get better control of expenses and that there is value in being a custodial bank that the market is overlooking. Along a similar line, we added to Oaktree Capital (ticker: OAK), which is a premier distressed debt investor. They manage nearly $98 billion and have $21.7 billion in dry powder. For them, heightened uncertainty means more opportunities to put that capital to work, as they have done in the past. OAK also has a 20% stake in DoubleLine Capital, which is headed by renowned investor Jeffrey Gundlach. At the end of 2015, DoubleLine managed $85 billion. This asset is carried at cost on OAK’s books, not at its fair market value. The original investment into DoubleLine was $18 million. For 2015, DoubleLine accounted for $52 million in distributable income to Oaktree.

In other news, our SanDisk (ticker: SNDK) holding will be acquired by Western Digital (ticker: WDC) by the end of the second quarter. The original all-cash deal, backed by Chinese investor Tsinghua Unispendour, fell through after concerns arose from the Committee on Foreign Investment in the U.S. The secondary arrangement, in which Western Digital had no equity partner, received shareholder approval. We will be receiving $67.50 in cash and 0.2387 shares of Western Digital for each share of SanDisk. At the current price of WDC, that translates into a total buyout of $78.60 per share of SNDK.

We will close this letter as we always do by noting the average intrinsic value discount. Every stock we own has a corresponding intrinsic value that we calculate and compare to the underlying stock price. Stocks that are trading below our intrinsic value have what we believe is a discount. Stocks trading above our intrinsic values have a premium. The average discount within the Fund was 18%. That’s a little bit narrower than at the end of Q4. We are hopeful that increasing market volatility will enable us to find more opportunities in which the underlying value of the investment is mispriced. We thank you for investing alongside us.

Sincerely,

Greg Estes, CFA

Intrepid Disciplined Value Fund Portfolio Manager

| Intrepid Disciplined Value Fund |

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

Prior to April 1, 2013, the Fund was named the Intrepid All Cap Fund.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 3000 Index is an index representing the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. You cannot invest directly in an index.

West Texas Intermediate (WTI), is a grade of crude oil used as a benchmark in oil pricing. Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Price to Earnings (P/E) Ratio is calculated by dividing the current price of the stock by the company’s trailing 12 months’ earnings per share. Call Option is an option to buy assets at an agreed price on or before a particular date.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| Intrepid International Fund |

| | | |

April 1, 2016 Thirty seconds. We went like this, he went like that. I said to Hollywood, “Where’d he go?” Hollywood says, “Where’d who go?” -Wolfman (Character), Top Gun | | | |

| | | |

| | Ben Franklin, | |

| | International Fund | |

| | Portfolio Manager | |

| | | |

Dear Fellow Shareholders,

If you blinked, you missed it; the markets had a rough start to the year, but before many took notice it was raging back. The MSCI EAFE Index (the “Index”), still ended the first quarter negative, at -3.01%, but that was a much better result than what would have happened if the quarter ended in mid-February when it bottomed out at -12.95%.4 The Intrepid International Fund (the “Fund”) returned a positive 3.67% for the quarter ended March 31, 2016. Our outperformance was almost entirely on the downside – when the Index hit bottom in February, the Fund had fallen only 7.12%. On the way back up, the Index and the Fund rebounded by 11.43% and 11.62%, respectively. The quarter was filled with plenty of news stories, most of which revolved around lowering interest rates.

The weakness that kicked off the year was spurred by concerns in China when their central bank weakened the yuan, signaling they were struggling with economic growth and striving to rekindle exports. Concerns from the East were not limited to China, as North Korea claimed it successfully detonated a hydrogen bomb. Globally, investors were struggling with weak oil prices that plunged to below $30 per barrel. Concerns about economic growth did not go unseen by central bankers, and their reactions were not unheard by the markets. On January 21st, the President of the European Central Bank, Mario Draghi, announced they would consider changes to their monetary policy during their next meeting in March. The European market, as measured by the STOXX Europe 600 Index, responded with a daily increase of nearly 2%. A week later, on January 29th, Bank of Japan (BOJ) Governor Haruhiko Kuroda lowered rates to -0.1%, a move made to spur banks to lend as they are essentially punished for keeping cash. To us, this move appeared extreme; however, Bloomberg reported, “The BOJ won’t hesitate to add further monetary stimulus if needed and has scope to make deeper cuts to the negative rate or to increase its asset purchases.”5 On February 11th, Sweden’s central bank (Riksbank) lowered their benchmark interest rate by 15 basis points (bps), to 0.5%. Sweden’s economy is performing just fine and the low interest rate is confounding. On March 10th, Draghi revealed what he meant with his prior statement, and expanded Quantitative Easing monthly bond purchases from €60 billion to €80 billion (they’ll buy

_________________

5 | Fujioka, Toru and Hidaka, Masahiro. “Bank of Japan Adopts Negative Rates, Keeps Asset-Buying Target.” Bloomberg.com. Bloomberg LP. 28 January 2016. |

| Intrepid International Fund |

corporate bonds to boot!), and reduced rates by 10 bps to -0.4%. Central bankers appear to be competing in a race to see who can inflate the fastest; they must have misread mathematician’s Carl Jacobi’s quote “Invert, always invert” as “Inflate, always inflate.” Each week’s announcement had us feeling like we were watching the musical, Annie Get Your Gun.

[Annie:]

Anything you can do, I can do better!

I can do anything better than you!

[Frank:] No you can’t!

[Annie:] Yes, I can!

[Frank:] No, you can’t!

[Annie:] Yes, I can!

[Frank:] No, you can’t!

[Annie:] Yes, I can, Yes, I can!

Much of the central bank action others base investment decisions on is simply entertainment for us. We highlight it in part to differentiate between investing and speculating. Ben Graham and David Dodd attempted to differentiate between investing and speculation in their influential book, Security Analysis (1934): “An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.” Buying bonds with a negative yield may provide a feeling of safety of principal, but we’d be hard-pressed to find any investor admit that the promise of a loss embedded with a negative yield provides a satisfactory return. While we are not interested in purchasing negative yield securities, we are intrigued with the underlying value of companies, and buying when we think prices are low. In fact, we think our outperformance in the first quarter can be understood by re-reading a portion of our letter from the fourth quarter of 2015, one in which we underperformed:

For several reasons, we are not troubled by our negative performance in the quarter. Firstly, one quarter is a very short time period; investing takes patience, and some stocks can take years to work out. Secondly, we took the weak performance in several of our stocks as a great opportunity to buy. We do not believe a fall in the price of a stock alone is enough to buy more. However, if the price of one of our holdings falls substantially while we believe the fundamentals have remained strong, we will likely take this as an opportunity to buy.

The first quarter’s performance is again a very short time period. Additionally, some of the stocks we added to during the weakness in the fourth quarter of 2015 became top performers this period. The top three contributors to the Fund in the first quarter were Balda (ticker: BAF GR), Pacific Brands (ticker: PBG AU), and Dundee Corp (ticker: DC/A CN). The two largest detractors were Programmed Maintenance Services (ticker: PRG AU) and GUD Holdings (ticker: GUD AU).

| Intrepid International Fund |

Balda has been discussed in more detail in prior commentaries, but an update is warranted. After several months of a bidding war, the company sold its operations for €95 million, up from the original bid of €63 million. In addition, the company has about €120 million in cash and commercial paper. The stock continues to trade at a discount to the existing net cash plus the proceeds to be received. The future of the new shell is uncertain, which is one reason we believe it is trading at a discount. However, we believe the magnitude of the difference is unwarranted, especially when considering the millions the company has in tax loss carryforwards and the Chairman’s historical conservative view towards acquisitions. Furthermore, shareholders have approved a recapitalization whereby much of the excess cash will be returned to the shareholders. Once this return of capital is completed, our large weight will be reduced meaningfully but our estimated discount will increase. A simple math example will help explain (see table below): Imagine there is a stock out there with no operations, no liabilities, and the only asset is $1.30 per share in cash. Now let’s say this stock trades at $1.00 per share, or a 23% discount to the net cash on the books. Said company decides they do not need all of this cash, so they return $0.30 per share to the shareholders. The market price of the stock should fall by the same $0.30, and would be $0.70 per share. However, the net cash on the books is now $1.00 per share, indicating the shares are now trading at a 30% discount. This may seem like financial engineering, something we are generally opposed to. However, the math and concept are quite simple, something we relish.

| Theoretical Example (per share) |

| | Pre-Div | Div | Post-Div |

| Cash | 1.30 | -0.30 | 1.00 |

| Stock price | 1.00 | -0.30 | 0.70 |

| Discount | 23% | | 30% |

Pacific Brands has been a top contributor in the past. Their largest and most profitable segment sells the market leading underwear brand in Australia, BONDS. The company has divested noncore businesses and significantly shored up their balance sheet. Additionally, they have supplemented their wholesale business with retail. Other market participants have finally taken notice of the changes, and the stock price responded in-kind. We have utilized the market strength to reduce this position.

Dundee has been discussed ad-nauseam in the past. This Canadian-based company has a complicated holding structure with investments in myriad companies, many of which are in the resource sector. Last quarter, we discussed the possibility that the weakness in the stock price was beyond the cyclical nature of the holdings to which it is exposed, and we believed was partially due to blind selling for tax loss reasons. We took this time to add to the position. During this quarter the stock price significantly rebounded, although we are still in the red since our initial purchase. Nevertheless, our knowledge of the common equity allowed us to make quick moves in purchasing securities across the capital structure of the firm. During the quarter

| Intrepid International Fund |

we purchased two separate preferred stock issues from the company. We have since sold out of one of these two securities at a profit, and hold the other with an unrealized gain. Both of the securities were small issues, highlighting the ability of the fund to take advantage of situations involving smaller and less liquid securities.

Programmed Maintenance Services is a provider of staffing, maintenance, and facility management services. The company recently merged with one of their largest competitors, which is unfolding in an ugly way. The acquired company is in the same industry, but is more sensitive to the weak resource sector. Programmed released a business update in February, guiding that fiscal 2016 earnings would be down substantially. The announcement sent the shares plummeting. “Plummeting” is a term we imagine our investors would rather not read, but it is part of the game and full disclosure is important to us. We took advantage of the decline to add to the position. Since the “plummeting,” the shares have rebounded, although not to where they were pre-announcement.

GUD Holdings reported weak results and reduced guidance in late January, causing the stock to fall. The weakness was in segments we consider non-core, while their strong Automotive segment performed well. We took the opportunity to add to the position.

While we have highlighted some of the larger stories that pundits claim drive the markets, our time and energy is focused on the latter part of the letter regarding our holdings. We encourage our investors to place their focus here as well. The hours we put into scrutinizing each of our holdings can be exhausting, and we write detailed reports to summarize our thinking. We welcome clients and prospects of the Fund wishing to get a better understanding, and who want to get in the weeds with us regarding our thinking, to email or call.

Thank you for your investment,

Ben Franklin, CFA

Intrepid International Fund Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

Stocks are generally perceived to have more financial risk than bonds in that bond holders have a claim on firm operations or assets that is senior to that of equity holders. In addition, stock prices are generally more volatile than bond prices. Investments in debt securities typically decrease in value when interest

| Intrepid International Fund |

rates rise. This risk is usually greater for longer-term debt securities. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. Similarly, the transaction costs involved in trading a stock may be more or less than a particular bond depending on the factors mentioned above and whether the stock or bond trades upon an exchange. Depending on the entity issuing the bond, it may or may not afford additional protections to the investor, such as a guarantee of return of principal by a government or bond insurance company. There is typically no guarantee of any kind associated with the purchase of an individual stock. Bonds are often owned by individuals interested in current income while stocks are generally owned by individuals seeking price appreciation with income a secondary concern. The tax treatment of return of bonds and stocks also differs given differential tax treatment of income versus capital gain.

The MSCI EAFE Index is recognized as the pre-eminent benchmark in the United States to measure international equity performance. The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 18 countries of the European region. You cannot invest directly in an index.

Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Yuan is the basic monetary unit of China. Quantitative Easing (QE) is a monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective. Yield is the income return on an investment. It refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

As of 3/31/2016, € = $1.138

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| | | | | |

| | | |  | |

| | | | | |

| | Jayme Wiggins, | | Greg Estes, | |

| | Select Fund | | Select Fund | |

| | Co-Portfolio Manager | | Co-Portfolio Manager | |

| | | | | |

April 1, 2016

Dear Fellow Shareholders,

For the three months ending March 31, 2016, the Intrepid Select Fund (the “Fund”) returned 6.96% compared to a 1.52% loss for the Russell 2000 Index and a 3.78% increase for the S&P 400 Midcap index. Cash ended the quarter at 10.9% of Fund assets. As a reminder, the Select Fund is a more fully invested version of Intrepid’s small and mid-cap strategies. It will typically hold larger position sizes.

Several of the Fund’s biggest losers from 2015 were its largest contributors in the first quarter, including Dundee Corp. (ticker: DC/A CN), Corus Entertainment (ticker: CJR/B CN), and Sandstorm Gold (ticker: SAND). Although Dundee’s shares rebounded partially over the first quarter, we’re still deep in the red on the investment. The stock experienced relief as management successfully extended the maturity date of one class of preferred stock, which freed up liquidity. Additionally, the company announced other actions to minimize the earnings drag from unprofitable subsidiaries, including a deal to divest most of its retail broker dealer operations to Euro Pacific Capital. Dundee’s publicly-traded investment holdings also recovered some value during the quarter. We expect management to continue pruning the company’s portfolio with a targeted focus on the disposal of loss-making entities.

On January 13th, Corus announced the acquisition of Shaw Media for $2.65 billion. This transaction ties Corus with Bell Media as the largest owner of television networks in Canada and makes Corus the undisputed heavyweight in channels targeting women and kids. It gives the company tremendous heft in dealing with advertisers and negotiating with distributors over carriage fees. Strategically, it’s a win, in our book, as there are significant synergies between the two businesses. Financially, it stretches Corus’s balance sheet, but the company’s robust free cash flow should enable quick deleveraging. The stock initially sold off on the deal, which included a dilutive equity component. However, it recovered into quarter end as investors began embracing the strategic rationale of the merger alongside Corus’s extremely low valuation multiple.

Sandstorm Gold participated in the rally in gold prices off of multiyear lows. In our view, Sandstorm has been the most inexpensive precious metals streaming company, often trading at multiples that are half those of its peers. A couple of years ago, the vast majority of Sandstorm’s revenue came from junior miner counterparties, and a

few of them had weak balance sheets or above-average breakeven costs. Sandstorm has dramatically upgraded the quality of its counterparty portfolio through streaming and royalty acquisitions, and the company has also benefited from the acquisition of its partners by larger mining firms. Today, over three quarters of Sandstorm’s cash flow comes from major and mid-tier miners. We believe the firm’s counterparty risk profile is as good as larger streaming companies like Franco Nevada, Silver Wheaton, and Royal Gold.

The Fund’s largest detractors in Q1 were EZCORP convertible bonds (CUSIP 302301AB2), American Science & Engineering (ticker: ASEI), and Leucadia (ticker: LUK). EZCORP’s converts have tracked the stock lower, but we think the risk/reward equation is more favorable for the debt, which finished the quarter yielding 18%. We believe the underlying value inherent in EZCORP’s high-quality pawn shops has been obscured by several factors, including poor corporate governance, declining gold scrapping profits, and a material accounting restatement at a payroll withholding business in Mexico. Much of the debt consolidated onto EZCORP’s balance sheet is non-recourse to the company and is tied to a money losing subsidiary. Once management rids itself of this headache, a cleaner investment story will emerge. We continue to believe our bonds are well-covered under all plausible scenarios. The current enterprise value of EZCORP, marking the bonds to market, implies a per store value for EZCORP’s pawn locations that is approximately one-quarter the level of its publicly-traded, acquisitive peers.

American Science & Engineering’s stock dropped sharply in the first quarter after the company reported weak results. ASEI specializes in x-ray inspection and screening systems used to combat terrorism, drug trafficking, weapons smuggling, and illegal immigration. In today’s world, you’d think they’d be knocking it out of the park, but results have suffered the last several years because of troop withdrawals from Iraq and Afghanistan. We think the worst is behind the company, which has cutting-edge technology. We added to our small stake in the quarter, when the company’s enterprise value was equivalent to three years’ worth of research & development spending. We think shareholder value would be maximized if ASEI were part of a larger defense technology firm.

Leucadia had an awful January and February. It began the year at $17, and by the time it released its 10-K in late February, it had seen its price drop to a low of $14.27. Leucadia’s biggest asset is the investment bank Jefferies Group, which represents almost half of LUK’s invested capital. Jefferies has seen fixed income trading revenue plummet as investors avoid riskier bonds and flee into highly liquid, short-term securities. Its other big investment is the beef processor National Beef, which has been mired in a difficult operating environment for three years running. The spread earned between cattle prices and boxed beef prices has been so small that National Beef struggles to earn a positive profit. It has responded by closing some

processing plants. More recently, the spreads have widened a bit, but just when that could have helped the bottom line, volume declined, thus sending National Beef to another quarterly loss. While National Beef might take some time to right the ship, we believe that Jefferies can return to better profits as trading behavior normalizes. By quarter end, shares of LUK closed at $16.17.

The Fund sold out of one position and purchased one new name in the first quarter. We exited our remaining stake in Ingram Micro (ticker: IM) on February 17th as the stock exceeded our intrinsic value estimate. This proved to be comically bad timing, as the company was bought out later that day, robbing the Fund of about 72 basis points of additional performance.

We established a new holding in Starz (ticker: STRZA) after it declined on disappointing earnings guidance from Lions Gate, a major Starz shareholder and potential corporate suitor. Starz operates one of the leading premium television networks in the U.S. Since 2010, the company has shifted its lineup from movies to original programming, in hopes of mimicking the success of HBO and Showtime. Starz’ bargaining position with cable distributors has generally improved as the network now features successful original series such as Black Sails, Outlander, and Power, and is not just a reseller of feature films. On the other hand, distributors are consolidating and Starz may alienate them by recently offering its network over-the-top. Furthermore, premium channels face a growing competitive threat from Netflix, which is aggressively investing in original programming. We think the endgame for Starz is a union with another media company like Lions Gate, which owns 14% of Starz’ equity. Absent a deal, we still believe Starz is a viable standalone business with stable subscription-based revenues and an attractive free cash flow stream. We purchased the stock for less than 8x operating income but subsequently reduced our position after the shares quickly rebounded.

Thank you for your interest in our Fund.

Sincerely,

|  |

| | |

| Jayme Wiggins, CFA | Greg Estes, CFA |

| Intrepid Select Fund | Intrepid Select Fund |

| Co-Portfolio Manager | Co-Portfolio Manager |

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller and medium companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to

individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. There can be no assurance that a newly organized Fund will grow to or maintain an economically viable size.

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The S&P MidCap 400 Index seeks to track the performance of mid-cap U.S. equities, representing more than 7% of available U.S. market cap. You cannot invest directly in an index.

Cash Flow measures the cash generating capability of a company by adding non-cash charges and interest to pretax income. Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. Enterprise Value equals market capitalization plus debt minus cash. Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| EXPENSE EXAMPLE |

| March 31, 2016 (Unaudited) |

As a shareholder of the Intrepid Capital Management Funds Trust (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other expenses incurred by the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period of October 1, 2015 through March 31, 2016.

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| EXPENSE EXAMPLE (continued) |

| March 31, 2016 (Unaudited) |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

INTREPID CAPITAL FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2015 - |

| | October 1, 2015 | March 31, 2016 | March 31, 2016 |

| Actual | $1,000.00 | $1,028.20 | $7.10 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.00 | 7.06 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

INTREPID CAPITAL FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2015 - |

| | October 1, 2015 | March 31, 2016 | March 31, 2016 |

| Actual | $1,000.00 | $1,029.60 | $5.84 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.25 | 5.81 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

INTREPID ENDURANCE CAP FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2015 - |

| | October 1, 2015 | March 31, 2016 | March 31, 2016 |

| Actual | $1,000.00 | $1,014.90 | $7.05 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.00 | 7.06 |