UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-21625

Investment Company Act file number

Intrepid Capital Management Funds Trust

(Exact name of registrant as specified in charter)

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Address of principal executive offices) (Zip code)

Mark F. Travis

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Name and address of agent for service)

1-904-246-3433

Registrant's telephone number, including area code

Date of fiscal year end: 09/30/2017

Date of reporting period: 03/31/2017

Item 1. Reports to Stockholders.

Intrepid Capital Fund

Intrepid Endurance Fund

Intrepid Income Fund

Intrepid Disciplined Value Fund

Intrepid International Fund

Intrepid Select Fund

Semi-Annual Report

March 31, 2017

April 4, 2017

| “Better to remain silent and be thought a fool than to speak out and remove all doubt.” | |

| - Abraham Lincoln |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Mark F. Travis, President/C.E.O. |

Dear Friends and Clients,

No, I am not referring to Donald Trump or his incessant tweets. As an aside, I am not certain “tweeting” is appropriate for the President of the United States, especially since they seem to go out unfiltered to the public, which could be a positive or negative depending on your point of view. I was thinking how it would be much more comfortable for those of us at Intrepid Capital to “remain silent” than offer our opinions on the state of the capital markets. I am also reminded of the peril in what I would call “The Boy Who Cried Wolf” syndrome. We have consistently expressed the view that stock prices in relation to the underlying business values are high and likely distorted by the interest rate suppression activity of central banks across the globe. Frankly, I am sure you are tired of hearing this refrain, but it is true, using almost any valuation method one chooses. Always remember the quote from the godfather of value investing, Warren Buffett: “Price is what you pay. Value is what you get.”

My concern for our shareholders, after a long period of both low volatility and higher than normal annualized returns in the U.S. equity markets, is that it becomes expected that one will earn 15% with little risk. If only it were so! Since January 3, 2005, the inception date of the Intrepid Capital Fund (“the Fund”), the annualized rate of return of the S&P 500 is slightly higher than 7%, not twice that rate. The past twelve years encompass two bullish phases of upward equity prices and only one bearish phase, 2007-2009 – posthumously referred to as the Financial Crisis. This bullish phase commenced around this time eight years ago, interrupted only briefly by some volatility in the summer of 2011 around the U.S. debt downgrade. This business of money management is a strange one in that investors, contrary to consumers in virtually any other industry, generally want to buy more stocks, bonds, and commodities after – and only after – prices have risen considerably. Conversely, when stocks are on sale at deeply discounted prices, the majority of investors won’t touch them with a 10-foot pole. This is what I refer to regularly, and sarcastically, as “buying high and selling low!”

Intuitively, in order to create the mispriced opportunities we seek, there must be either a micro event (e.g. company specific - missed earnings, debt downgrade) or macro event (e.g. unexpected change in interest, outbreak of war). Unfortunately, with cheap credit available to all and no obvious global seismic shifts such as sudden

currency devaluations, we are left with mostly odds and ends to add to the portfolio. So, we sit here like firemen, waiting to slide down the pole when the bell rings to ferret out investments that meet the stringent qualifications of what we consider absolute value. In the interim, we wait, wait, and wait some more. What will be the catalyst that changes this placid sea into a stormy hurricane? I wish I knew! Believe me, if I did, I would rush to position the portfolio to take advantage of it.

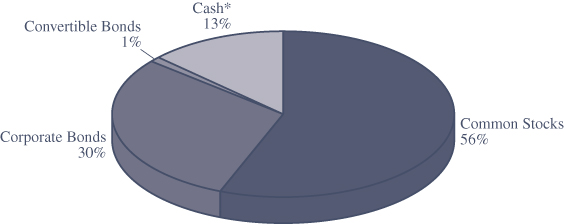

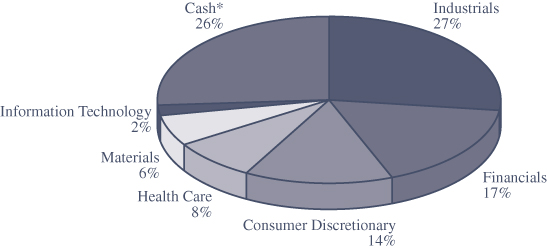

With all of that said, we are pleased with some recently received validation of our investment process. During the quarter, two of our portfolio holdings, Dominion Diamond (ticker: DDC) and Spotless Group (ticker: SPO AU), received buyout offers which helped the stocks reach our internal valuations for each company and led to positive performance for the Fund. For the quarter ending March 31, 2017, the Fund increased 2.54%. For the same period, the S&P 500 Index returned 6.07% and the Bank of America Merrill Lynch US High Yield Index returned 2.71%. Considering the minimal risk incurred due to a healthy 12.1% cash position at the end of the quarter, along with 32.1% in bonds, both investment grade and short duration high yield, and 55.8% in equities, both domestic and international, we are pleased with the performance of the Fund for the period.

The Fund’s five largest contributors during the quarter were Western Digital (ticker: WDC), Dominion Diamond (ticker: DDC), Oaktree Capital (ticker: OAK), Teradata (ticker: TDC), and Leucadia National (ticker: LUK). The Fund’s five largest detractors for the quarter were Syntel (ticker: SYNT), Dundee Corp. (ticker: DC/A CN), Patterson-UTI Energy (ticker: PTEN), Royal Mail PLC (ticker: RMG), and Verizon (ticker: VZ).

For the first six months of the fiscal year, which began September 30, 2016, the Fund increased 4.94% compared to the returns of the S&P 500 Index and Bank of America Merrill Lynch US High Yield Index of 10.12% and 4.64%, respectively. Contributors to the Fund for the six-month period were Western Digital, Leucadia National, Dominion Diamond, Fenner (ticker: FENR), and Tetra Tech (ticker: TTEK). Detractors to the Fund for the same period were Syntel, Royal Mail, Dundee (ticker: DC.A), Express Scripts (ticker: ESRX), and Primero Mining’s 5.75% convertible bonds due 2/28/2020.

Thank you for your continued support and entrusting us with your hard-earned capital.

Best regards,

Mark F. Travis President

Intrepid Capital Fund Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The S&P 500 Index is a broad-based, unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The BofA Merrill Lynch US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. You cannot invest directly in an index.

Active investing has higher management fees because of the manager’s increased level of involvement while passive investing has lower management and operating fees. Investing in both actively and passively managed mutual funds involves risk and principal loss is possible. Both actively and passively managed mutual funds generally have daily liquidity. There are no guarantees regarding the performance of actively and passively managed mutual funds. Actively managed mutual funds may have higher portfolio turnover than passively managed funds. Excessive turnover can limit returns and can incur capital gains.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

April 5, 2017

| “If your business is not a brand, it is a commodity.” | |

| - Donald Trump |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Jayme Wiggins, CIO |

| | | Endurance Fund Portfolio Manager |

Dear Fellow Shareholders,

You know that a brand has achieved success when it becomes the default word for the product or service to which it’s attached. We Google to search the Internet, ride a Jet Ski, need a Band-Aid, throw a Frisbee, drink from a Thermos, and relax in a Jacuzzi. Thirteen years ago, a Saturday Night Live skit spawned a neologism for a perennially pessimistic person: Debbie Downer.

Jingle:

“You’re enjoying your day, everything’s going your way

Then, along comes Debbie Downer!

Always there to tell you about a new disease

A car accident or killer bees.

You’ll beg her to spare you, “Debbie, please.”

But you can’t stop Debbie Downer!”

Dad: We did it, gang! We pulled it off! A family reunion at Disney! I don’t know about you guys, but the first thing I’m gonna do is ride that haunted elevator thingie! [laughs] It drops you straight down!

Sister 1: This is my dream come true! I mean, I’m totally serious! Tigger hugged me at the door, and I thought I was gonna cry!

Debbie Downer: [sullenly] I guess Roy isn’t doing as well as I first thought.

Sister 2: What? Who’s Roy?

Debbie Downer: Roy? Of Siegfried and Roy? He was attacked by his own tiger and suffered devastating injuries.

[drunken trombone sound effect “wah-wah”, as camera zooms in on Debbie’s comic distraught face]1

During the past few years, we have received friendly advice that our unenthusiastic view of small cap valuations could cause us to be seen as “perma-bears”…and nobody wants to hang out with a Debbie Downer. The path of least resistance in the investment business is to put on a happy face. We readily admit that we are wired to be more skeptical than your average Joe, but we hope the brand we are building will eventually be regarded as less Chicken Little and more Jiminy Cricket, the level-headed conscience of Pinocchio. We try to tell it like it is, ugly or not.

_________________

1 | http://www.nbc.com/saturday-night-live/video/debbie-downer/n11825?snl=1 |

While small cap stock prices should seem quite beautiful to a seller today, for a buyer eager to deploy capital, they’re downright hideous. The P/E ratio of the Russell 2000 is in the triple digits (113x), and the index’s constituents haven’t collectively grown GAAP earnings over the past 20 years. U.S. economic growth has been declining and leverage in the system has been rising, yet the EV/EBITDA of the benchmark is nearly 50% above the peak multiple reached before the credit crisis.

While I was writing this letter, a colleague forwarded to me just-released market commentary from a prominent small cap mutual fund company. That manager believes the small cap cycle has more room to run. They base this on the market’s resilience over the past year, in light of developments such as Brexit and the U.S. election. They support their argument by saying that this cycle is young, identifying the February 2016 pullback as the trough. They also noted that since the inception of the Russell 2000 in 1979, the index has declined by 15% or more 12 times. According to their analysis, the median return during the subsequent rebound was 99%. Since the Russell 2000 is only up 48% from their February 11, 2016 trough, they think we are less than halfway through a recovery. While we don’t know whether the market will continue to grind higher in the short-term, we couldn’t disagree more with their logic.

We believe it is highly misleading to claim that this cycle is “young.” We’re currently in the second longest bull market in history, as this one began in March 2009. While the Russell 2000 did experience a 26% peak-to-trough pullback from June 2015 to February 2016, in our opinion, this hardly qualifies as a bear market given its brevity and the extremes of the peak. The aforementioned small cap fund company thinks we’re halfway through the rebound based on a mechanical calculation of the median return from previous corrections exceeding 15%. The problem with this argument is that the small cap market was far cheaper at historical troughs than it was in February 2016.

| | Russell 2000 Peaks and Troughs Since Inception |

| | (Troughs defined by manager as at least 15% fall from peak) |

| | | | | | Russell | |

| | | Cycle | Index | % Price | 2000 EV/ | S&P 500 |

| | Date | Point | Price | Change* | EBITDA | P/E |

| | October 5, 1979 | Peak | 55.9 | | | |

| | October 23, 1979 | Trough | 47.2 | -15% | | 7.3 |

| | February 8, 1980 | Peak | 61.9 | 31% | | |

| | March 27, 1980 | Trough | 45.4 | -27% | | 6.8 |

| | June 15, 1981 | Peak | 85.2 | 88% | | |

| | August 12, 1982 | Trough | 60.3 | -29% | | 7.1 |

| | June 24, 1983 | Peak | 127.0 | 110% | | |

| | July 25, 1984 | Trough | 94.0 | -26% | | 9.8 |

| | August 25, 1987 | Peak | 174.4 | 86% | | |

| | October 28, 1987 | Trough | 106.1 | -39% | | 16.8 |

| | October 9, 1989 | Peak | 180.8 | 70% | | |

| | October 30, 1990 | Trough | 118.8 | -34% | | 13.9 |

| | May 22, 1996 | Peak | 364.6 | 207% | | |

| | July 24, 1996 | Trough | 307.8 | -16% | 9.2 | 17.8 |

| | April 21, 1998 | Peak | 491.4 | 60% | | |

| | October 8, 1998 | Trough | 310.3 | -37% | 9.8 | 22.0 |

| | March 9, 2000 | Peak | 606.1 | 95% | | |

| | October 9, 2002 | Trough | 327.0 | -46% | 9.8 | 17.3 |

| | July 13, 2007 | Peak | 855.8 | 162% | | |

| | March 9, 2009 | Trough | 343.3 | -60% | 7.8 | 11.1 |

| | April 29, 2011 | Peak | 865.3 | 152% | | |

| | October 31, 2011 | Trough | 609.5 | -30% | 9.4 | 13.9 |

| | June 23, 2015 | Peak | 1,295.8 | 113% | | |

| | February 11, 2016 | Trough | 953.7 | -26% | 17.9 | 16.8 |

| | March 31, 2017 | Present | 1,385.9 | 45% | | |

*Excluding dividends Source: Bloomberg

Our firm only has access to Russell 2000 earnings data going back to 1995. Per share earnings for the small cap index are extremely volatile and sometimes negative, so we examined the historical EV/EBITDA multiple of the Russell at the last five troughs prior to 2016. The average multiple was 9.2x. The multiple in February 2016 was 17.9x. For the periods prior to 1995 where we don’t have Russell data, we do have access to S&P 500 earnings. The P/E of the S&P 500 in these earlier years was much lower, on average, than it was in the late 90’s and 2000’s. While large and small caps don’t always behave similarly (e.g. during the tech bubble), we are confident that the 17.9x EV/EBITDA seen in February 2016 was above any previous trough valuation for the Russell index. Therefore, we think it’s extremely imprudent to project past returns from Russell 2000 troughs onto today’s market without acknowledging the materially different starting point for valuations. Simply put, small caps have never been this expensive.

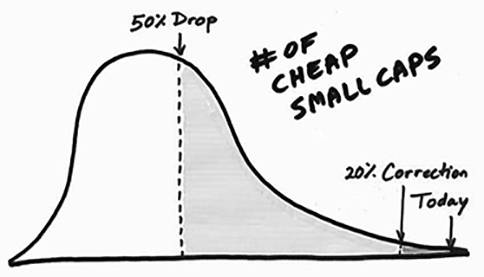

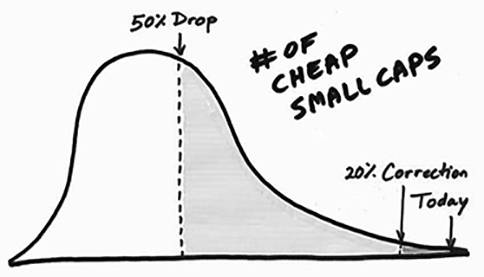

We are often asked what it will take for us to put more money to work. One good new idea would get us excited. We found two of them in Q4 but none this quarter. We would probably need more than a dozen opportunities for the Intrepid Endurance Fund (the “Fund”) to reach a more fully invested status. While that could happen even amid the broadest small cap bubble of all time, our gut tells us the market will need to fall significantly before the Endurance Fund is fully invested again. To help visualize how we judge today’s opportunity set, for illustrative purposes only, consider a positively skewed distribution.2 We are currently on the far end of the right tail. With a correction of 10% or 20% to small cap prices, we would still remain close to valuation extremes. A 50% plummet would just take us back to levels reached in 2011. While we expect that we would be aggressively deploying capital under that scenario, the market would not be reflecting the fire sale valuations we saw in 2009.

Source: Intrepid Capital

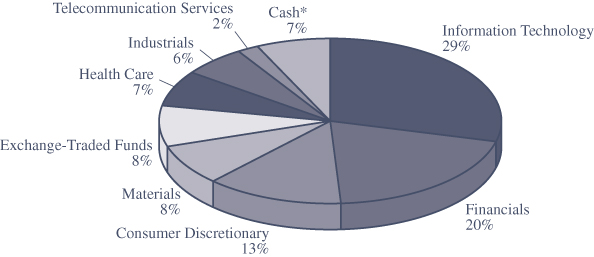

The Endurance Fund was exactly flat for the calendar first quarter ending March 31, 2017, while the Russell 2000 increased 2.47%. The median stock in the Russell 2000 was up 0.12% in the quarter, so almost all of the index’s performance was derived from larger capitalization constituents. For most of the quarter, the Fund’s return was in negative territory, as a few of our top holdings experienced large markdowns. However, performance improved near the end of the quarter due to a proposed takeover for one of the Fund’s main positions and increases in the value of other holdings.

This begs the question: how can we have so much cash and still have been losing money until the very end of Q1? It’s not easy! We often invest in complicated situations and unloved businesses, but usually not in unloved business models. Currently, we own very few securities that belong to the Russell 2000 benchmark, and that’s not a coincidence. Russell stocks are expensive, no doubt pumped up by indiscriminate ETF buying. The Fund’s holdings are as uncorrelated to the market as they have ever been, which has been achieved by owning foreign securities, convertible bonds, precious metals, and other investments that fall outside of the U.S. small cap benchmark.

_________________

2 | We chose a positively skewed distribution because we believe periods of overvaluation are more extreme and frequent than the periods of undervaluation. |

While the Fund’s performance over the past two quarters has not been impressive, we believe there are two points worth considering. First, price does not equal value. In general, we think that some our key holdings became even better bargains in recent months. Many of our top losers from 2015, a difficult year, were top gainers for us in 2016. Second, it’s not unusual for the Fund’s performance to deviate significantly from the small cap index. Last year, all of the Fund’s return came in the first 8 months of the year, and we didn’t rally at all post-election. The small cap market exhibited the opposite behavior.

The largest contributors to the Fund in the first quarter were Dominion Diamond (ticker: DDC), Corus Entertainment (ticker: CJR/B CN), and the iShares Gold Trust (ticker: IAU). On March 16th, Dominion announced strong guidance for its 2018 fiscal year, which ends on January 31, 2018. This led to a 12% spike in the stock, which had been selling off over concerns that India’s demonetization could have longer-lasting impacts on rough diamond prices than previously thought. That weekend, The Washington Companies disclosed that it made a U.S. $13.50 per share takeover offer to Dominion’s board in February, which was a 54% premium to where the stock traded before the company issued guidance. We were not completely surprised by the offer, since Dominion’s balance sheet has a large amount of cash and because the stock had been trading near multiyear lows. Washington consists of a group of privately held businesses in the U.S. and Canada, including one of the largest copper and molybdenum mines in North America. Billionaire Dennis Washington owns the firm, and the bid for Dominion was rumored to be pushed by David Batchelder, the activist who co-founded Relational Investors and who sits on Washington’s board. Dominion and Washington have not been able to agree on terms that would allow Washington to complete its due diligence. Both parties have publicized their dispute.

On March 27th, Dominion said it would explore strategic alternatives that could include a sale of the company. The firm engaged in a similar process beginning in 2015, but the effort seemed to fizzle after Dominion entered into a settlement with an activist group. We believe the odds are higher of a deal being completed this time due to Washington’s expressed interest and because the composition of the board has changed. The rough diamond market is also in better shape today. Dominion’s shares are now fully valued using our base case assumptions, so we partially reduced the position. However, the stock continues to trade below Washington’s conditional offer. We think Dominion could be more valuable in the arms of a strategic suitor, so we have maintained exposure to the name.

Corus Entertainment’s stock appreciated modestly in the first quarter. We believe the company’s television advertising revenue is only one quarter away from showing year-over-year growth, which would end a painful chapter in Corus’s history. If Corus’s earnings start to improve, we think investors should be willing to assign a higher

multiple to the company’s free cash flow stream. Corus’s shares currently offer a dividend yield of 8.7%. We expect management to apply cash flow to debt reduction.

iShares Gold Trust benefited from the 8.9% increase in the price of gold over the first three months of the calendar year. We don’t envision this as a permanent holding for the Fund and would rather own actual businesses, like precious metal streamers. Nevertheless, if streaming companies or miners trade at higher valuations than can be justified by current metals prices, we will sell them, just like any other stock.

The top detractors from Q1 performance were Dundee Corp. (ticker: DC/A CN), Syntel (ticker: SYNT), and Primero Mining’s 5.75% Convertible Notes (CUSIP: 74164WAB2). Dundee’s performance has been abysmal, and that comment doesn’t just apply to the stock. The company is involved in many different ventures, but almost nothing has worked out. We attribute at least half of the unfavorable outcomes to poor decisions by management and the rest to bad luck. Hindsight is 20/20, and our involvement in Dundee came from trying too hard to find value in an over-picked market. Our fair value for the stock is based on asset value, in contrast to our typical discounted free cash flow valuation. We felt comfortable with this approach because the assets were originally anchored by publicly-traded equities that seemed reasonably valued to us on inspection. Dundee’s cash flow has been negative as the team attempted to nurture a basket of various nascent businesses into self-sustaining enterprises. It hasn’t worked. We had chances to revisit the investment as the situation changed and decent investments were exchanged for speculative ones. The mistake is on me, your Portfolio Manager. We have not added to the holding in over a year and reduced our position last summer at better prices—a small victory in an otherwise dreadful investment.

So where do we go from here? Dundee is a $3.50 stock with $12.25 of book value. That book value continues to decline as the company’s portfolio is not generating cash flow but Dundee is incurring corporate overhead and financing costs. Right now the market is implying that every single private company Dundee manages is worth nothing, plus that the business burns cash at the current rate for another three years. We have urged management to sell Dundee’s public investments to pay off bank debt and preferred stock, which would reduce cash burn by half. If the company then catches a break on one of its major private investments, it could mark a turning point for the company’s fortunes. We’re not holding our breath but aren’t yet inclined to sell Dundee at today’s prices. The Fund’s weight in Dundee is approximately 1%, so its impact on performance going forward should be more limited.

Dundee Corp. Net Assets

| Assets | | Liabilities | |

| Publicly-traded investments | | $ | 283,445 | | Corporate net debt | | $ | (52,954 | ) |

| Private inv mgd by Dundee | | $ | 387,198 | | Preference shares | | $ | (201,455 | ) |

| Private inv mgd by 3rd parties | | $ | 303,115 | | | | $ | (254,409 | ) |

| | | $ | 973,758 | | | | | | |

| | Assets - Liabilities | $719,349 | |

| | Market cap | $205,578 | |

| | Shares outstanding | 58,736 | |

| | Equity per share | $12.25 | |

| | Price per share | $3.50 | |

Our investment in Syntel started off well, increasing over 15% in just a few months…then the company announced guidance in February. The stock gave it all back and then some, so now we’re about 15% in the red. While fourth quarter results were in line with projections, the company’s outlook for 2017 was well below consensus estimates. Management painted a subdued spending picture for the industries Syntel serves. The stock’s underperformance is primarily tied to Syntel’s revenue declines versus growth for the rest of the IT services industry. The company coasted for years on sales growth from its largest customers—American Express, State Street, and FedEx. Those customers are now reducing spending, and Syntel’s smaller clients are not picking up the slack. This has prompted management to increase the heretofore lean marketing budget.

Some investors are also concerned about Syntel’s chops in the digital arena, but the company’s well-regarded SyntBots automation platform demonstrates that Syntel can develop cutting edge IP. Lastly, legal immigration policy remains an overhang, as there are several bills in Congress that seek to change the H-1B visa program, and the Trump administration has already made a couple of marginal changes that could negatively impact outsourcers. We take some comfort that both Chuck Schumer (D-NY) and Paul Ryan (R-WI) have previously expressed support for the H-1B program, suggesting that it may be difficult to push a bill through Congress that severely curtails visa issuances. Even if we are wrong, Syntel has several ways to deal with fewer visas, including sending more work offshore, increasing local hiring of Americans, expanding automation to reduce labor, and also passing along cost increases to customers. Syntel trades for about 9x expected free cash flow. It is now the second largest position in the Fund and one of the biggest discounts to our estimated fair value.

Primero Mining experienced an eventful quarter, which included a mine strike, reserve reduction, CEO resignation, and going concern language. Did we mention we like this security? The bonds certainly carry risk, but they yield 25%. We believe the strike at the San Dimas Mine in Mexico will end shortly, since the miners have

few other options for employment. Additionally, Silver Wheaton has indicated that it is willing to modify its silver stream with Primero if it is fairly compensated. Silver Wheaton also recently guaranteed Primero’s credit facility, enabling a six month extension that gives Primero time to explore strategic alternatives. In other words, Silver Wheaton is as attached as ever to Primero. We view this relationship as the main lever to improve the company’s health.

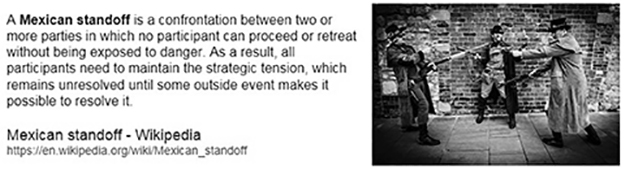

With that said, Primero, Silver Wheaton, and the Tax Administration Service (SAT) are embroiled in a Mexican standoff at the moment (pun intended). Primero can survive if either the SAT relinquishes its pursuit of Primero for higher taxes on its silver production or if Silver Wheaton reduces the burden of its silver stream on San Dimas. However, if either the SAT or Silver Wheaton acts, the other party may not have to yield anything. We think Silver Wheaton will cave first, since its Herculean efforts to avoid paying taxes in Mexico and almost everywhere else make it unlikely that it would want to see this situation through a restructuring. Silver Wheaton as a mine owner in Mexico would be a much juicier target than Primero.

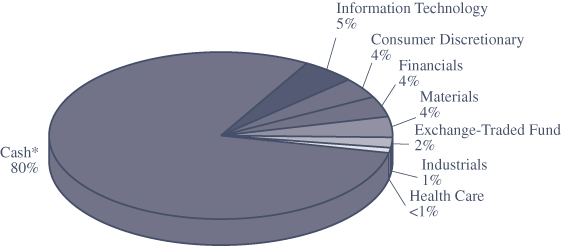

Our promise to you is straightforward: we have a process and we’re sticking to it, come hell or high water. The linchpin of our process is to not own stocks that we think are overvalued, which covers just about everything today. If we cannot find an undervalued security, we hold cash or equivalents. As a result, cash and Treasury bills account for 79.4% of the Endurance Fund—an all-time high. Some shareholders have departed because they don’t want to pay us a fee on cash, even though they respect our stock selection. We understand. In spite of the temporary consequences to fund flows for holding “too much cash,” we wouldn’t feel comfortable justifying our management fee by intentionally owning overvalued stocks.

Investing is a tough, competitive business. The hardest aspect is managing your emotions. When do you get into the market? When do you get out? Most investors struggle with these questions. This Fund is designed to take that burden from you. If the stock market is bubbly, our positioning is sober. If it’s a bloodbath, we’re Bram Stoker. We’re not any smarter than the next guy and we make plenty of mistakes, but our process is our guidepost. The one thing that we’re certain we do well is follow

our investment process. As shareholders in the Fund, that helps us sleep well at night. Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Endurance Fund Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.

Prior to June 26, 2015, the Fund was named the Intrepid Small Cap Fund.

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The S&P 500 Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index.

Cash Flow measures the cash generating capability of a company by adding non-cash charges and interest to pretax income. Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. Enterprise Value equals market capitalization plus debt minus cash. EV/EBITDA equals the company’s Enterprise Value (EV) divided by Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Yield is the income return on an investment. It refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. A Credit Facility is a type of loan made in a business or corporate finance context, involving revolving credit, term loans, committed facilities, letters of credit and most retail credit accounts. Bank Revolver is a credit card consumer who carries a balance from month to month. Streaming Partner refers to two or more parties involved in financing arrangements customized to fit the specific needs of a particular mining company, a particular project and the related financing requirements. Book Value is the value of a security or asset as entered in a company’s books.

Fund Holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments in this report for complete Fund holdings.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| | |

| | Jason Lazarus, |

| | Income Fund Portfolio Manager |

April 1, 2017

Dear Fellow Shareholders,

The Trump euphoria continued almost unabated into the first quarter of 2017 despite mediocre macroeconomic results, higher inflation, and another 25 basis point rate hike. Small caps felt some pressure in March due to declining oil prices and pressure on the retail sector, but they subsequently recovered when crude regained $50 per barrel. Large caps essentially shrugged off any negative news and rocketed 6.07% higher in the first quarter with historically low volatility. In fact, the S&P 500 traded lower on just three of the nineteen trading days in February. Here’s another fun fact: the Dow Jones Industrial Average closed at record highs for twelve straight days in February. This has only occurred two other times in history.

U.S. fixed income assets also recorded positive returns in the first quarter. Longer duration risk-free bond yields spiked in March to the highest levels seen in years. This caused moderate losses, but bonds recovered significantly over the last three weeks. By the end of the quarter, longer-dated Treasury bond yields were slightly lower, adding positive pricing contribution to the income production. The appetite for risk resulted in credit spread tightening. The worse the credit rating, the greater the magnitude of the tightening, meaning riskier bonds outperformed safer bonds. The Bloomberg Barclays US Aggregate Index gained 0.82% in the quarter ended March 31, 2017. Investment-grade corporates, as measured by the BAML US Corporate Index, returned 1.42% in the quarter. As experienced in equities, the decline in oil prices had a negative impact on riskier bonds, but only temporarily. The high-yield market, as measured by the BAML High Yield Index, rose 2.71% in the quarter.

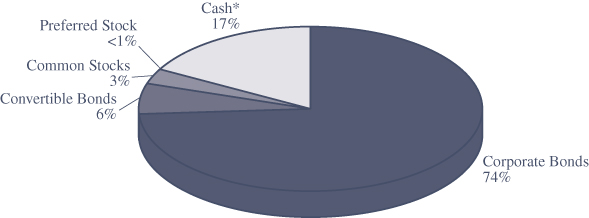

The Intrepid Income Fund (the “Fund”) gained 1.16% in the quarter. The Fund participated in little if any of the volatility experienced by the indexes presented above. This is explained by the Fund’s very low energy exposure, ownership of less-volatile short-term investment grade corporates (~36% of the Fund’s assets) and U.S. Treasury bills (~15% of AUM). Furthermore, the Fund typically exhibits a low correlation to the high-yield index simply because many of our holdings are not included in the Index. At the end of the quarter, approximately 16% of the Fund’s assets were invested in bonds that are represented in the high-yield index. Lastly, the Fund has a much shorter duration than the indexes presented above, so the impact of changes in interest rates was minimal. At the end of the quarter, the effective duration of the Fund was 1.2 years.

Last year we owned the bonds of three different publicly-traded pawn shop operators – EZCORP (ticker: EZPW), Cash America (ticker: CSH), and First Cash Financial (ticker: FCFS). First Cash acquired Cash America last September and retired the Cash

America bonds at a significant premium as required by the make-whole covenant. The Cash America notes were one of the Fund’s top contributors last year. After the notes were retired, we were contacted by a broker asking us to sell our rights to participate in a legal settlement. The lawsuit was related to the retirement of $103.5 million of the notes after Cash America spun off an online lending business in 2014. Despite the notes being non-callable at the time, CSH did not pay a make-whole premium on the retirement. A hedge fund has been suing since then.

The broker offered us 1-2 cents on the dollar for our participation rights. We analyzed the relevant documents and spoke to one of the lawyers on the case and determined that the case might possibly be resolved within a few months. Summary judgment had already been completed on September 19, 2016, and was in favor of the bondholders. The only disagreement was the amount of compensation that would be awarded to bondholders. We chose to hold onto the rights. After several short delays, the parties came to an agreement. On January 13, 2017, the Fund received 8.6 cents on the dollar in compensation. This gain was the top contributor in the three-month period ended March 31, 2017.

Dominion Diamond common stock (ticker: DDC) is one of the Fund’s newest positions and happened to be the second largest contributor in the first quarter. Dominion is the world’s third largest diamond producer. The company owns interests in two mines located in Canada, which is one of the most stable political jurisdictions in the world.

While the diamond industry is not recession-resistant, the long-term supply and demand fundamentals appear to be supportive of prices. Diamond mines can take over a decade to construct from start to finish, which tends to stabilize the supply side of the equation. Furthermore, because just four producers account for roughly 75% of global production value, the industry has historically been quite rational in pulling back supply in the face of weak end-market demand.

Last month we attended a mining conference where we met with Dominion’s management team and that of a competing diamond producer. We left more confident in the long-term industry fundamentals, as well as Dominion’s capital allocation plans. Dominion’s equity appeared quite a bit cheaper than comparable diamond producers. The firm has a very strong balance sheet that includes a large cash balance and sizeable inventory of diamonds. We purchased the stock in early March. Two weeks later, Dominion received an unsolicited buyout offer from billionaire David Washington at a 36% premium to the prior closing price.

Rent-A-Center 4.75% notes due 5/01/2021 (ticker: RCII) were our worst performing security in the quarter but had an immaterial impact on the Fund’s performance. We cut our position last year and exited the remainder in the first quarter. The business began to show cracks in the November earnings report when operations were hurt by bugs in a new software system that impacted stores’ ability to sell and collect payment. We assumed the software issues were fixable, but the sales trends were

clearly deteriorating, even excluding management’s estimate of the software impact. We have various ideas as to why the top line might be experiencing secular pressure, but what was most enlightening to us was the level of operating leverage the business exhibited with a higher than nominal change in sales. The company has been cutting store-level costs for years to battle a slowing declining business, which masked the operating leverage.

Fast forward to January. Rent-A-Center pre-announced fourth quarter earnings. A pre-announcement is almost never good. It means the business has deteriorated significantly (or not improved as hoped) in relatively short order. Importantly, there was no issue with the software system, yet sales deteriorated even further. The firm announced same store sales in the core rent-to-own business were down about 14%. The company also announced management turnover. Our view is that Rent-A-Center is not suffering from company-specific or transient issues. We exited the position when we learned the point-of-sale system was not responsible for the operational missteps. Our timing could have been better, as a well-known activist hedge fund stepped in less than two weeks later and so far has provided significant support for the bonds and the stock.

As short-term rates have risen over the past few quarters, we have had some success in identifying investment-grade bonds maturing in 1-2 years that in some cases offer yields close to 2%. We believe such bonds are an attractive use of cash in the current environment of extremely low yields offered by lower-rated issues. We sourced several new short-term investment-grade ideas in the first quarter, including the bonds of familiar businesses such as Hasbro and Wyndham Worldwide. We also added to existing investment-grade and high-yield positions. The Fund initiated positions in two new high-yield securities in the quarter; Actuant Corp 5.625% due 6/15/2022 and Cable One 5.75% due 6/15/2022. As for the Fund’s sales, the exit of the Rent-A-Center position was discussed previously. Lion’s Gate finally completed its acquisition of Starz in December, and our Starz bonds were retired. Lastly, two short-term investment-grade issues matured.

Actuant (ticker: ATU) is a leading provider of niche tools and solutions to diverse end markets. The firm’s Enerpac business has dominated its market for years and has branded itself as the most trusted supplier of heavy lifting products, and Actuant also has commanding positions in other product lines. While its end markets can be highly cyclical, the company prints cash in good times and in bad. This is a blessing during recessionary periods, as ATU generates plenty of cash to service and reduce debt. However, limited reinvestment opportunities have resulted in a number of questionable acquisitions over the last several years, mostly funded with debt.

All of Actuant’s businesses have struggled over the last two years due to weak end markets, which has pushed leverage above the high end of management’s targeted range, but the market for high-margin industrial tools appears to have stabilized. Actuant has a long history of generating significant free cash flow. While gross

leverage appears elevated for an industrial firm, its debt/free cash flow is quite low at 3.9x. Actuant also holds $180 million in cash, or 31% of the outstanding debt. Furthermore, we believe management has the ability and willingness to pull multiple levers, if needed, including potentially divesting segments. Our view is that the Enerpac business alone is worth more than the par value of all of the debt.

Cable One (ticker: CABO) is one of the largest cable operators in the United States. The company targets smaller metro areas with less competition. CABO has been transitioning its business toward data as video subscribers have turned to over-the-top offerings, such as Netflix, Amazon, and Hulu. While the firm did use debt to fund a recent acquisition, we believe the obligations are manageable. Cable One has one of the better balance sheets in the industry. We believe the notes maturing in 2022 offer a fair return for the risks.

There have been some rumblings in the high-yield market recently, specifically in energy and distressed retailers. Several of the largest brick-and-mortar retailers are closing stores at a rapid pace, and the number of retailer bankruptcies is on pace to exceed 2008. So far this year, well-known retailers Gander Mountain, HHGregg, Wet Seal, and Limited Stores have declared bankruptcy, in addition to five other large businesses. RadioShack filed Chapter 22, meaning the firm has entered Chapter 11 for the second time in recent history. Several others are on the brink. Some distressed retailers may be able exit bankruptcy and continue to operate with newly restructured balance sheets. The weaker concepts may be shuttered for good. Wet Seal and Limited have already closed all of their stores. HHGregg is likely to follow suit. The Income Fund has limited exposure to the discretionary retail sector, a position we have maintained for some time considering the current state of the economic cycle, but we welcome any market dislocations that might lead to attractive investment opportunities.

As always, we are diligently searching for undervalued securities on your behalf. Thank you for your investment.

Sincerely,

Jason Lazarus, CFA

Intrepid Income Fund Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is generally greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The BofA Merrill Lynch US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. Barclays Capital U.S. Aggregate Bond Index is an index representing about 8,200 fixed income securities. To be included in the index, bonds must be rated investment grade by Moody’s and S&P. BofA Merrill Lynch U.S. Corporate Index (Corporate) is an unmanaged index of U.S. dollar denominated investment grade corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity. The Dow Jones Industrial Average a price-weighted average of 30 significant stocks traded on the New York Stock Exchange. You cannot invest directly in an index.

Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade.

Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Yield is the income return on an investment. It refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. Investment Grade (IG) is a bond with credit rating of BBB or higher by Standard & Poor’s or Baa3 or higher by Moody’s. Yield to Maturity is the total return anticipated on a bond if the bond is held until the end of its lifetime. Dividend Yield is calculated by dividing the dollar value of dividends paid in a given year per share of stock held by the dollar value of one share of stock. Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| Intrepid Disciplined Value Fund |

| |  |

| | |

| | Mark F. Travis, President/C.E.O. |

April 4, 2017

Dear Fellow Shareholders,

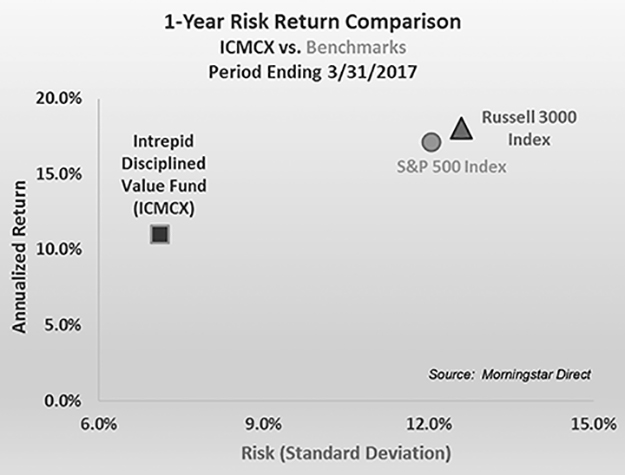

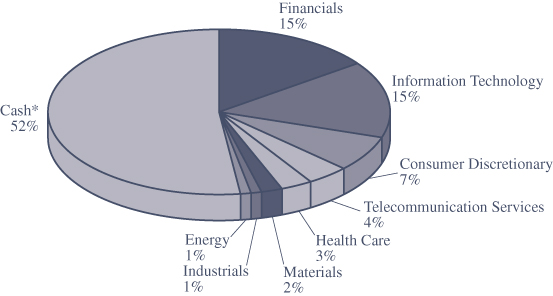

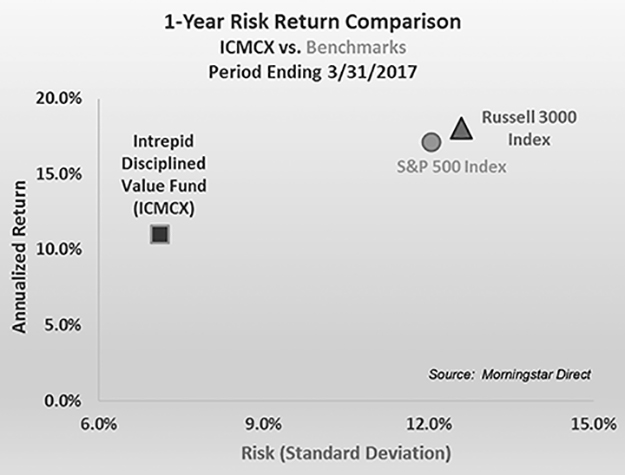

We are pleased to announce the performance of the Intrepid Disciplined Value Fund (the “Fund”) for the quarter and six-month periods ending March 31, 2017. For the quarter, the Fund increased 3.08%, which brings the return to 5.03% for the first six months of the fiscal year, which commenced September 30, 2016. For comparison, the returns of the S&P 500 Index and the Russell 3000 Index for the quarter were 6.07% and 5.74%, respectively. For the six-month period, the S&P 500 Index and the Russell 3000 Index returned 10.12% and 10.19%, respectively. Considering that the Fund held 52.2% in cash at the end of the period and cash has been at a consistently high level over the last several periods due to the challenge of finding high-quality businesses at what we consider a discount to intrinsic value, we believe the Fund has performed well with less risk than the benchmarks in this continued bull market.

The Fund’s five largest contributors during the quarter were Western Digital (ticker: WDC), Oaktree Capital (ticker: OAK), Apple (ticker: AAPL), Teradata (ticker: TDC), and Coach (ticker: COH). The Fund’s five largest detractors for the quarter were Dundee Corp. (ticker: DC/A CN), Verizon (ticker: VZ), Contango Oil & Gas (ticker: MCF), Telephone & Data Systems (ticker: TDS), and Western Union (ticker:

| Intrepid Disciplined Value Fund |

WU). Contributors to the Fund for the six-month period were Western Digital, Northern Trust (ticker: NTRS), Leucadia National (ticker: LUK), Apple, and Oaktree Capital. Detractors to the Fund for the same period were Dundee, Contango Oil & Gas, Verizon Communications, Alamos Gold (ticker: AGI), and Baldwin & Lyons (ticker: BWINB).

As you know from any recent communication from Intrepid Capital, we believe prices continue to be high, with the current trailing price-to-earnings ratio (P/E) of the S&P 500 north of 21x. The Fund has ample cash reserves if something were to go “bump in the night.” To be fully invested today assumes there will be no better opportunity tomorrow. Since we are stewards of your hard-earned capital, our goal is to first protect and then strive to grow what has been entrusted to us. Between the cash in the Fund and a now more global reach in our equity search than when the firm began, we hope to find more suitable investments in the days ahead, enabling us to put some of the cash to work.

There are changes afoot with the Fund going forward. Effective March 31, 2017, Gregory Estes, CFA, resigned from Intrepid Capital Management. After 16 years of working closely with Greg, I will miss his keen intellect and sense of humor. His departure is almost a calling from the Catholic Church. Greg was raised in Jacksonville, FL, receiving his early and high school education in local Catholic schools before heading off to Notre Dame for his undergraduate degree, then returning to attend the University of Florida for his graduate degree. He has continued his involvement with the Church over the years. Greg is moving to a local asset management firm which works with the local Diocese and will help them pursue other opportunities of this kind. We wish him well with his new adventure and appreciate his work here at Intrepid Capital. The two of us have a lunch bet on the outcome of the UGA v. Notre Dame football game, September 9th in South Bend. The outcome will be known by our fiscal year end September 30th, so stay tuned.

Assisting me in the role of lead portfolio manager of the Disciplined Value Fund are two analysts who both started here as summer interns between their undergraduate and graduate coursework. Clay Kirkland, CFA, was an All-American swimmer at Auburn University and completed his MBA at Columbia University. Prior to joining Intrepid Capital in 2012, he worked at UBS in New York City. Matt Parker, CPA, interned with us for two summers while earning his undergraduate and graduate degrees at the University of North Carolina at Chapel Hill. After he earned his Master of Accounting degree, Matt worked in the audit practice of EY in Atlanta. In 2014, Matt returned to Jacksonville to join Intrepid Capital and is currently a Level II candidate in the Chartered Financial Analyst® program. With my 32 years of “wisdom” in the investment management business, coupled with their collective skills and intellect, I am confident this will be a productive combination, and we will continue with our goal of providing attractive risk-

| Intrepid Disciplined Value Fund |

adjusted returns to our shareholders. We thank you for your investment and your continued confidence in our process.

Best regards,

Mark F. Travis President

Intrepid Disciplined Value Fund Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.

Prior to April 1, 2013, the Fund was named the Intrepid All Cap Fund.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 3000 Index is an index representing the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. You cannot invest directly in an index.

Price-to-Earnings (P/E) Ratio is calculated by dividing the current price of the stock by the company’s trailing 12 months’ earnings per share. Forward P/E Ratio is calculated by dividing the current price of the stock by the company’s expected earnings per share. Earnings Per Share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| Intrepid International Fund |

| |  |

| | |

| | Ben Franklin, |

| | International Fund |

| | Portfolio Manager |

April 1, 2017

Dear Fellow Shareholders,

The Intrepid International Fund (the “Fund”) increased 0.31% in the first quarter of 2017 compared to a gain of 7.25% for the MSCI EAFE Net Index (the “Index”). As we commonly do, we’d like to remind the reader that we typically do not look like the index and don’t behave like one – the large difference in performance is to be expected. That being said, there were some negative developments this quarter in some of the companies in the portfolio. However, we do not believe the securities are permanently impaired.

There appear to be cracks in the European Union, with “-exit” being used to describe a growing number of countries (e.g. Brexit, Grexit, etc.). The upcoming French and German elections will be good indicators of the amount of populism and nationalism within the group. Despite these risks, European stocks appear to be on Viagra as investors continue to take more risk in an already expensive market. Fund flows poured into European stock funds during the quarter, causing markets to rise.

Here in the United States, a potential border-adjustment tax has been proposed. The 20% tax on imports would theoretically cause the dollar to strengthen by 25%. Pundits from all over claim this to be true, but we think they should adhere to the proverb, “In theory, there is no difference between practice and theory. In practice, there is.” There are likely secondary and tertiary impacts, some of which are impossible to predict. If the dollar were to strengthen by 25%, many of our holdings would “theoretically” decline in value on a dollar basis. However, we wish to remind our investors that we hedge our currency exposure. At quarter end, nearly 90% of foreign denominated securities were hedged.

In practice, the top three contributors during the period were Dominion Diamond (ticker: DDC CN), RM PLC (ticker: RM/ LN), and G.U.D. Holdings (ticker: GUD AU). Our three largest detractors were Dundee (ticker: DC/A CN), Noranda Income Fund (ticker: NIF-U CN), and Coventry Group (ticker: CYG AU).

In March, Dominion Diamond announced guidance far above market expectations, causing the stock to jump. Soon thereafter, the company received a buyout offer that was more than 50% above where the stock was trading prior to the increased guidance. This is a short-term gain for us, as our original purchases occurred in September of last year.

RM provides school supplies, IT and other professional services to the UK education market. It’s a high-quality, recession-resistant business that delivers industry-leading margins, strong free cash flow, and has a debt-free balance sheet. The stock fell in early 2016 as investors were concerned that the election of the Conservative Party would result in cuts to education spending that would weigh on the earnings of RM.

| Intrepid International Fund |

While we acknowledged the risk was important, we thought the market was overreacting based on the spending pledges of the incoming party. We established a position midway through 2016. In February 2017, the company reported solid earnings due to margins which held up better than investors expected. They also announced that they would be acquiring an important competitor called Consortium – the education division of Connect Group (ticker: CNCT LN). RM did not overpay for the acquisition, and the combination should strengthen their position in the industry. The market rewarded the stock and we exited the position as the price reached our estimate of intrinsic value.

G.U.D. Holdings is an Australian company that owns several businesses, with their automotive segment being their largest. The company reported satisfactory earnings in early February, and we believe the market is starting to realize the potential this company has with their recently acquired Brown and Watson International acquisition.

Dundee Corporation is habitually either a top contributor or detractor, but has been a detractor far more often. While net tangible assets are significantly higher than the stock’s current price, the company has been burning cash. Additionally, while the holding company has many different investments, it seems as if nothing can go right with any of them. We don’t believe this will be true in perpetuity, but in the short-term the problems mount.

Noranda Income Fund is a Canadian zinc smelter. The company has historically benefited from an agreement with Glencore, which owns 25% of the company, whereby they received stable fees for converting zinc concentrate into zinc metal. However, the agreement ends May 2nd and the company will be forced to switch to operating on market terms. Unfortunately, the timing could not be worse. The fees smelters earn for converting the concentrate into the metal are at, or near, historic lows. Additionally, this change required the company, which has had a stable dividend for years, to discontinue paying dividends. The security is widely held by both income funds and retail investors. We believe the weakness in the stock was exacerbated by these types of investors selling. We also believe the net asset value of the company, which owns 866 acres on the St. Lawrence River just outside of Montreal, is higher than the current trading price. Additionally, if and when the cycle rebounds from the current down cycle, this low-cost smelter should be operating at significantly higher earnings. One additional risk, however, is that the company is 25% owned by behemoth commodity company Glencore (ticker: GLEN LN), and their interests may not be aligned with other shareholders.

Coventry Group is an Australian nuts and bolts company. Their largest business literally sells these commodities. The company has net tangible assets per share of AUD $1.86, compared to a current share price of only AUD $0.70. However, the company recently reported earnings and they are burning cash. We are not happy with the operations and have sent a letter to the company’s Board of Directors urging them to liquidate this failing operation. This activism is a rare occurrence for the

| Intrepid International Fund |

Fund, but we feel in this case that it is justified. Coventry’s assets are worth significantly more than the trading price, but the cash burn is swiftly deteriorating value. If management’s interests were truly aligned with shareholders, we believe they should be willing to sell the operations rather than continue to destroy value. At the end of the quarter, the company announced its CEO has stepped down, with reports that there were “differences of opinion” between directors and the CEO.

While there were negative developments with some of the companies in the portfolio, that is expected to occur from time to time. We are invested in the Fund alongside our investors and manage it for our own future as well as our investors’. We view money as work, and we don’t want to lose what we’ve worked for. However, we feel comfortable having our money invested in a security that has gone down in price if we have good reason to believe the value remains higher than the price. In fact, we’d rather have excess cash invested in this type of security than in an overvalued stock or cash. While we spent much of this quarter reviewing our existing positions, we also continue to search for new undervalued investments.

Thank you for your investment,

Ben Franklin, CFA

Intrepid International Fund Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.

The MSCI EAFE Net Index is recognized as the pre-eminent benchmark in the United States to measure international equity performance. The MSCI EAFE Hedged Index represents a close estimation of the performance that can be achieved by hedging the currency exposures of its parent index, the MSCI EAFE Index, to the USD, the “home” currency for the hedged index. The index is 100% hedged to the USD by selling each foreign currency forward at the one-month Forward weight. You cannot invest directly in an index.

Yield is the income return on an investment. It refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. Dividend Yield is calculated by dividing the dollar value of dividends paid in a given year per share of stock held by the dollar value of one share of stock. Net tangible assets, or net asset value, is calculated as a company’s total assets, minus intangible assets (goodwill, patents, trademarks, etc.) and all liabilities.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| |  |

| | |

| | Jayme Wiggins, CIO |

| | Select Fund |

| | Portfolio Manager |

April 5, 2017

Dear Fellow Shareholders,

The Intrepid Select Fund (the “Fund”) increased 4.47% for the first quarter ending March 31, 2017, while the Russell 2000 increased 2.47%. The larger capitalization securities in the Fund generally performed better over this period, which was consistent with the overall market. The S&P MidCap 400 rose 3.94% during Q1. Cash accounted for 12.8% of the Fund’s assets as of March 31st.

The largest contributors to the Fund in the first quarter were Dominion Diamond (ticker: DDC), Western Digital (ticker: WDC), and Oaktree Capital (ticker: OAK). On March 16th, Dominion announced strong guidance for its 2018 fiscal year, which ends on January 31, 2018. This led to a 12% spike in the stock, which had been selling off over concerns that India’s demonetization could have longer-lasting impacts on rough diamond prices than previously thought. That weekend, The Washington Companies disclosed that it made a U.S. $13.50 per share takeover offer to Dominion’s board in February, which was a 54% premium to where the stock traded before the company issued guidance. We were not completely surprised by the offer, since Dominion’s balance sheet has a large amount of cash and because the stock had been trading near multiyear lows. Washington consists of a group of privately held businesses in the U.S. and Canada, including one of the largest copper and molybdenum mines in North America. Billionaire Dennis Washington owns the firm, and the bid for Dominion was rumored to be pushed by David Batchelder, the activist who co-founded Relational Investors and who sits on Washington’s board. Dominion and Washington have not been able to agree on terms that would allow Washington to complete it due diligence. Both parties have publicized their dispute.

On March 27th, Dominion said it would explore strategic alternatives that could include a sale of the company. The firm engaged in a similar process beginning in 2015, but the effort seemed to fizzle after Dominion entered into a settlement with an activist group. We believe the odds are higher of a deal being completed this time due to Washington’s expressed interest and because the composition of the board has changed. The rough diamond market is also in better shape today. Dominion’s shares are now fully valued using our base case assumptions, so we partially reduced the position. However, the stock continues to trade below Washington’s conditional offer. We think Dominion could be more valuable in the arms of a strategic suitor, so we have maintained exposure to the name.

Western Digital has been a standout performer for the Fund over the past year. The company’s results, announced in January, were once again better than anticipated, with strength in each end-market. Data center growth is being driven by cloud-

related storage demand, while mobile phones are experiencing increasing storage capacity. Our thesis is that Western Digital can continue to improve results through cost cutting at its acquired Hitachi Global and SanDisk subsidiaries, combined with an industry recovery for Solid State Drives and Hard Disk Drives.

Oaktree Capital now has over $100 billion of assets under management. On the latest earnings call, Chairman Howard Marks commented, “We still face some of the lowest prospective returns in history as well as asset prices that I generally describe as being, on the high side of fair or the beginning of rich.” We agree with the first half of that comment but are much more negative than Mr. Marks about asset prices. In our opinion, we are way beyond “the beginning of rich.” We think the market is Uncle Scrooge Rich, except it isn’t backed by a giant swimming pool full of gold coins like that owned by the Disney character. Nevertheless, we think our pessimistic view of asset prices should eventually be favorable for Oaktree, since they are renowned distressed debt investors.

The top detractors from Q1 performance were Dundee Corp. (ticker: DC/A CN), Syntel (ticker: SYNT), and Primero Mining’s 5.75% Convertible Notes (CUSIP: 74164WAB2). Dundee’s performance has been abysmal, and that comment doesn’t just apply to the stock. The company is involved in many different ventures, but almost nothing has worked out. We attribute at least half of the unfavorable outcomes to poor decisions by management and the rest to bad luck. Hindsight is 20/20, and our involvement in Dundee came from trying too hard to find value in an over-picked market. Our fair value for the stock is based on asset value, in contrast to our typical discounted free cash flow valuation. We felt comfortable with this approach because the assets were originally anchored by publicly-traded equities that seemed reasonably valued to us on inspection. Dundee’s cash flow has been negative as the team attempted to nurture a basket of various nascent businesses into self-sustaining enterprises. It hasn’t worked. We had chances to revisit the investment as the situation changed and decent investments were exchanged for speculative ones. The mistake is on me, your Portfolio Manager.

So where do we go from here? Dundee is a $3.50 stock with $12.25 of book value. That book value continues to decline as the company’s portfolio is not generating cash flow but Dundee is incurring corporate overhead and financing costs. Right now the market is implying that every single private company Dundee manages is worth nothing, plus that the business burns cash at the current rate for another three years. We have urged management to sell Dundee’s public investments to pay off bank debt and preferred stock, which would reduce cash burn by half. If the company then catches a break on one of its major private investments, it could mark a turning point for the company’s fortunes. We’re not holding our breath but aren’t yet inclined to sell Dundee at today’s prices.

Dundee Corp. Net Assets

| Assets | | Liabilities | |

| Publicly-traded investments | | $ | 283,445 | | Corporate net debt | | $ | (52,954 | ) |

| Private inv mgd by Dundee | | $ | 387,198 | | Preference shares | | $ | (201,455 | ) |

| Private inv mgd by 3rd parties | | $ | 303,115 | | | | $ | (254,409 | ) |

| | | $ | 973,758 | | | | | | |

| | Assets - Liabilities | $719,349 | |

| | Market cap | $205,578 | |

| | Shares outstanding | 58,736 | |

| | Equity per share | $12.25 | |

| | Price per share | $3.50 | |

Our investment in Syntel started off well, increasing over 15% in just a few months…then the company announced guidance in February. The stock gave it all back and then some, so now we’re about 15% in the red. While fourth quarter results were in line with projections, the company’s outlook for 2017 was well below consensus estimates. Management painted a subdued spending picture for the industries Syntel serves. The stock’s underperformance is primarily tied to Syntel’s revenue declines versus growth for the rest of the IT services industry. The company coasted for years on sales growth from its largest customers—American Express, State Street, and FedEx. Those customers are now reducing spending, and Syntel’s smaller clients are not picking up the slack. This has prompted management to increase the heretofore lean marketing budget.

Some investors are also concerned about Syntel’s chops in the digital arena, but the company’s well-regarded SyntBots automation platform demonstrates that Syntel can develop cutting edge IP. Lastly, legal immigration policy remains an overhang, as there are several bills in Congress that seek to change the H-1B visa program, and the Trump administration has already made a couple of marginal changes that could negatively impact outsourcers. We take some comfort that both Chuck Schumer (D-NY) and Paul Ryan (R-WI) have previously expressed support for the H-1B program, suggesting that it may be difficult to push a bill through Congress that severely curtails visa issuances. Even if we are wrong, Syntel has several ways to deal with fewer visas, including sending more work offshore, increasing local hiring of Americans, expanding automation to reduce labor, and also passing along cost increases to customers. Syntel trades for about 9x expected free cash flow. It is now the second largest position in the Fund and one of the biggest discounts to our estimated fair value.

Primero Mining experienced an eventful quarter, which included a mine strike, reserve reduction, CEO resignation, and going concern language. Did we mention we like this security? The bonds certainly carry risk, but they yield 25%. We believe the strike at the San Dimas Mine in Mexico will end shortly, since the miners have

few other options for employment. Additionally, Silver Wheaton has indicated that it is willing to modify its silver stream with Primero if it is fairly compensated. Silver Wheaton also recently guaranteed Primero’s credit facility, enabling a 6 month extension that gives Primero time to explore strategic alternatives. In other words, Silver Wheaton is as attached as ever to Primero. We view this relationship as the main lever to improve the company’s health.

With that said, Primero, Silver Wheaton, and the Tax Administration Service (SAT) are embroiled in a Mexican standoff at the moment (pun intended). Primero can survive if either the SAT relinquishes its pursuit of Primero for higher taxes on its silver production or if Silver Wheaton reduces the burden of its silver stream on San Dimas. However, if either the SAT or Silver Wheaton acts, the other party may not have to yield anything. We think Silver Wheaton will cave first, since its Herculean efforts to avoid paying taxes in Mexico and almost everywhere else make it unlikely that it would want to see this situation through a restructuring. Silver Wheaton as a mine owner in Mexico would be a much juicier target than Primero.

The Select Fund’s Co-Lead Portfolio Manager, Greg Estes, notified us last month that he would be leaving Intrepid Capital for another opportunity in the Jacksonville area. Greg has been a valued employee of Intrepid since 2000. His focus was on sourcing mid and large capitalization equity ideas. Two Intrepid analysts have absorbed primary coverage of the mid cap names held in the Select Fund that Greg previously followed. We are also in the process of hiring a new analyst for our investment team.

Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Select Fund Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller and medium companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. There can be no assurance that a newly organized Fund will grow to or maintain an economically viable size. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The S&P MidCap 400 Index seeks to track the performance of mid-cap U.S. equities, representing more than 7% of available U.S. market cap. You cannot invest directly in an index.

Yield is the income return on an investment. It refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. A Credit Facility is a type of loan made in a business or corporate finance context, involving revolving credit, term loans, committed facilities, letters of credit and most retail credit accounts. Streaming Partner refers to two or more parties involved in financing arrangements customized to fit the specific needs of a particular mining company, a particular project and the related financing requirements.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| EXPENSE EXAMPLE |

| March 31, 2017 (Unaudited) |

As a shareholder of the Intrepid Capital Management Funds Trust (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other expenses incurred by the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period of October 1, 2016 through March 31, 2017.

Actual Expenses