Intrepid Capital Fund

Intrepid Small Cap Fund

Intrepid Income Fund

Intrepid Disciplined Value Fund

Semi-Annual Report

March 31, 2014

Intrepid Capital Fund

April 3, 2014

“There can be no freedom of the individual, no democracy, without the capital system, the profit system, the private enterprise system. These are, in the end, inseparable. Those who would destroy freedom have only first to destroy the hope of gain, the profit of enterprise and risk-taking, the hope of accumulating capital, the hope to save something for one’s old age and for one’s children. For a community of men without property, and without the hope of getting it by honest effort, is a community of slaves of a despotic State.”

-Russell C. Leffingwell

| | |

| | | |

| Mark F. Travis, President/C.E.O. | | |

Dear Friends and Clients,

We are pleased to report our results once again differ from the indices, but this time to the positive side. The Intrepid Capital Fund (the “Fund”) returned 4.40% in the quarter ended March 31, 2014, while the S&P 500 and the Russell 2000 rose 1.81% and 1.12%, respectively. This result is driven by the fact that Intrepid portfolios are built from the ground up, without consideration to sector or security allocations in an index. Operationally, it would be much easier to be index huggers. However, such a posture, which owns securities without consideration for market prices, subjects capital to the risk of permanent impairment.

As pleased as we are with year-to-date performance, we are much less sanguine regarding prospective returns. To move forward it’s helpful to reflect back. As Mark Twain said, “History doesn’t repeat itself, but it does rhyme.” The 5-year annualized returns of the S&P 500 and the Russell 2000 are north of 20%. This is considerably above the longer term performance record of around 10%. In addition, the average mutual fund portfolio manager now keeps roughly 3% of the fund’s assets in cash (the Intrepid Capital Fund is over 8 times that figure), and margin debt has now surpassed the peaks reached in 2000 and 2007. We believe investors with high equity exposure should be wary, particularly should something go bump in the night. While we are pleased to be up 4.40% for the first quarter of 2014, the contrarian indicators and a dearth of new equity or debt ideas cause us to approach the capital markets with caution.

The top contributors to the Fund’s performance in the quarter ending March 31, 2014 were Newfield Exploration (ticker: NFX), World Wrestling Entertainment (ticker: WWE), Royal Gold (ticker: RGLD), Ingram Micro (ticker: IM), and Big Lots (ticker: BIG). Each of these ideas produced double-digit returns, with four of the five returning more than 25% in the quarter. Newfield Exploration, World Wrestling Entertainment, and Ingram Micro are each discussed in the Small Cap commentary.

Intrepid Capital Fund

The top detractors with an impact on the portfolio of more than 10 basis points included FTI Consulting (ticker: FCN), American Eagle Outfitters (ticker: AEO), and Western Union (ticker: WU). FTI Consulting and American Eagle had significantly larger impacts than Western Union, with both declining in the mid- to high-teens. FTI Consulting is discussed in the Small Cap Fund commentary.

We are pleased to report that the Intrepid Capital Fund (Investor Class) received an overall 4-Star Morningstar Rating out of 742 Moderate Allocation funds for the period ending March 31, 2014 (derived from a weighted average of the fund’s three-, five-, and ten-year risk adjusted return measure, if applicable).

Thank you for entrusting your hard earned capital to our firm. It is not a responsibility we take lightly.

Best regards,

Mark F. Travis

President

Intrepid Capital Fund Portfolio Manager

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Bank of America/Merrill Lynch High Yield Master II Index is Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The Russell 3000 Index is an index representing the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. You cannot invest directly in an index.

Morningstar Proprietary Ratings reflect risk-adjusted performance as of 3/31/14. For each fund with at least a three year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar risk-adjusted return measure that accounts for variation in a fund’s monthly performance placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. Each share class is counted as a fraction of one fund

Intrepid Capital Fund

within this scale and rated separately, which may cause slight variations in distribution percentage. The Intrepid Capital Fund received 4 Stars among 742 for the three-year and 4 Stars among 666 Moderate Allocation Funds for the five-year period ending 3/31/14. ©Morningstar, Inc. All Rights Reserved. Past performance is no guarantee of future results.

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid Small Cap Fund

| | |

| | | |

| Jayme Wiggins, | | |

| Small Cap Fund Portfolio Manager | | |

April 1, 2014

Dear Fellow Shareholders,

Thanks to a surge in small cap stocks on the last day of March, the Russell 2000 Index (the “Index”) notched its seventh consecutive quarterly gain. The 1.84% jump in the Index on March 31st was the second largest daily increase for the entire three month period. Media reports attributed the end-of-quarter rally to a dovish speech by the Fed’s newly-installed leader, Janet Yellen, but we think Wall Street was prepared to use any excuse to push stocks into positive territory for the first quarter. The show goes on.

In a classic scene from Star Wars, Obi-Wan Kenobi admonished Darth Vader, “If you strike me down, I shall become more powerful than you can possibly imagine.” Since the beginning of the bull market, stocks have demonstrated an Obi-Wan resilience that has only increased in intensity. Every negative data point is quickly explained away by ardent bulls. Poor retail sales during the holiday season were attributed to a migration of shoppers to the Internet, where market share hippos like Amazon.com garner $157 billion valuations and triple digit P/E ratios. Harsh winter weather has been squarely blamed for a raft of recent weak economic data, and economists project that the demand suppressed by winter storms will snap back like a rubber band once the nation thaws. If we happen to receive more GDP-killing bad weather this month, it’s no matter, as April showers bring May flowers. Stocks momentarily lost their breath in late January, on fears of the potential impact from a pullback in unprecedented Fed stimulus. However, investors were reassured that the Fed has no intention of actually shrinking its bloated balance sheet or raising short-term interest rates anytime soon. Savers be damned, cheap money is bullish for speculation.

You may have noticed recent press coverage describing underperformance in the more frothy areas of the market. Biotech stocks were called out, in particular, and the Russell 2000 Biotechnology Index ended the first quarter 15.5% off the highs. Do not be fooled. The small cap biotech index still rose 7.9% during the three months ending March 31, 2014, trouncing the returns of all major indexes. At one point in the first quarter, the Biotechnology Index was up 27.8% year-to-date. This same group of stocks skyrocketed 55% in 2013. We found 189 companies in the Russell 2000 classified as belonging to the biotechnology and pharmaceutical industries. As of April 1, 2014, these names collectively sold for $154 billion, while the group incurred an aggregate net loss of $6.6 billion over the trailing twelve months. If past is prologue, a handful of names on this list will hit pay dirt and be acquired by a larger entity, but far more will never generate a dollar of profit and will disappear. Just for kicks, we also carved out Russell 2000 companies belonging to the Internet industry. These 78 companies traded for $64 billion with combined

Intrepid Small Cap Fund

losses of $300 million. This list has many companies that make money, like Orbitz and Shutterfly, but more that do not, such as Yelp and Angie’s List.

| |

| Russell 2000 Biotechnology Index |

| |

|

| |

Past performance does not guarantee future results.

The biotech, pharmaceutical, and Internet small caps together constitute about 10% of the total market capitalization of the Russell 2000. While they offer some of the clearest examples of excess, they are not outliers. The P/E of the Russell 2000 is approximately 60x today. The median free cash flow multiple for nonfinancial firms is over 50x. We believe the small cap market is broadly overvalued. A small, brief retreat, like the one we experienced through early February of this year, did little to rectify the situation. We’re feeling a bit like a starved vampire, highly attuned to any signs of blood, but the small cap sunshine is never ending. And so we wait.

For the quarter ending March 31, 2014, the Intrepid Small Cap Fund (the “Fund”) increased 2.53%. The Russell 2000 Index gained 1.12%. The Fund’s equity holdings significantly outperformed the benchmark, as our equity-only return was 9.22% in the first quarter. However, our cash position muted overall returns. Cash was 70.9% of assets at March 31st.

The largest positive contributors to the Fund’s performance in the first quarter were Newfield Exploration (ticker: NFX), Ingram Micro (ticker: IM), and World Wrestling Entertainment (ticker: WWE). The energy exploration and production company Newfield had underperformed in the fourth quarter. The stock’s recovery this quarter was based on positive indications from the firm’s nascent, liquids-rich Anadarko Basin plays as well as an implied disposition value for the company’s Chinese assets that was larger than expected. Ingram Micro was historically a distributor of

Intrepid Small Cap Fund

broadline IT products like PCs and peripherals, but the company is demonstrating improved performance from the distribution and servicing of higher value products, such as mobile phones. WWE was one of the market’s best performing stocks in the first quarter, as investor enthusiasm about the company’s TV rights and new WWE Network have reached a fever pitch.

The largest detractors to first quarter returns were FTI Consulting (ticker: FCN) and CSG Systems International (ticker: CSGS). No other positions impacted the Fund by more than 10 basis points. FTI Consulting’s shares fell sharply after management warned that margins in one of its primary segments would be permanently lower due to contract renegotiations with key personnel, who will now keep a larger portion of the revenue they generate. We did not anticipate this impact, and we have adjusted our valuation accordingly. The Street didn’t like CSG Systems’ 2014 guidance, but it met our expectations. CSG is a growth-challenged operator that nonetheless produces substantial free cash flow.

We fully exited our holdings of ManTech (ticker: MANT) and WWE in the first quarter. Both were long-term holdings, but they had very different outcomes. We incurred a modest loss on ManTech over our holding period. The defense IT services company had a large exposure to overseas operations in Iraq and Afghanistan, which wound down sooner than expected. More importantly, curbs on U.S. defense spending have led to increased competition and lower margins for many of ManTech’s contracts. While the stock still appears cheap based on trailing earnings and free cash flow, we have become accustomed to a management team that predictably fails to meet projections. Additionally, we are concerned that management is likely to use cash flow to overpay for acquisitions in order to offset organic revenue declines.

WWE was an important and successful position for Intrepid Capital, and it has occupied a fair amount of real estate in our past quarterly letters to you. We sold out of the position by the end of January as the stock surged past our valuation. Since then, WWE’s shares have continued to appreciate to all-time highs. There are two large unknowns driving the stock price: the value WWE will receive once it renews its domestic television agreements and the success of the WWE Network. We are bullish on the first and bearish on the second.

Management claims the WWE Network needs 1 million domestic subscribers to break even on an EBITDA basis, which would still leave the company $15 million per year worse off on EBIT basis. Factoring in capital spending (the “DA” in EBITDA), the true domestic breakeven is probably closer to 1.2 million subscribers. It may even be higher, since we believe management underestimated the percentage of subscription revenue WWE must share with technology partners like Apple and Roku. Each year, around 650,000 U.S. households purchase WrestleMania, WWE’s signature pay-per-view event. We believe there are relatively few WWE fans who do not purchase WrestleMania but buy other WWE pay-per-views. Our guess is that there could be 800,000 households in the U.S. who have demonstrated a willingness

Intrepid Small Cap Fund

to pay for WWE content. Therefore, we believe the company will need to enlist an additional 400,000 U.S. fans as WWE Network subscribers (~1.2 million total) just to get back to square one. We doubt it will get much better than that for the WWE Network. The current Enterprise Value for WWE is $2.14 billion. Assuming the WWE Network is valuation-neutral, the shares are pricing in more than a doubling of the company’s global TV rights deals. We think WWE will register a solid increase for its domestic television rights renewal, but we do not expect the tripling that has been discussed in some media articles. Over the next two months, the company should unveil enough new information to help investors decide whether the current valuation is reasonable.

We purchased Corus Entertainment (ticker: CJR/B CN) during the first quarter. This was our first new purchase since last July. Corus owns leading specialty television networks and radio stations in Canada. TV accounts for approximately 80% of cash flow. The company derives almost half of revenue from advertising and the remainder from subscription fees and licensing. Corus’s TV channels dominate the target markets for women and children. Popular HGTV programs such as Love It or List It and Property Brothers first aired on Corus’s W Network in Canada. The company controls over 90% of the purchasable TV ratings points in Canada for kids. Corus is Canada’s last remaining pure-play media and entertainment company. The rest have been acquired by large, vertically-integrated communication firms including Bell Canada, Rogers, and Shaw. Shaw spun off Corus in 1999, when the government encouraged the separation of television distribution and content, but the official position has since shifted back the other way. The Shaw family still controls Corus through super-voting stock.

The Canadian television industry is more regulated than the U.S. One risk facing Corus is that the government mandates that cable and satellite providers offer a la carte programming, which is called pick and pay in Canada, and would allow consumers to choose which channels they pay for. The purpose of a la carte is to lower cable bills, but the primary reason for cable inflation is the sports networks, and Corus owns none of these. We expect Corus to withstand major damage from an implementation of a la carte, since they mainly operate top specialty networks with strong viewership. While declines in distribution would negatively impact subscriber fees, the industry is likely to offset lower volume by raising per household pricing. Furthermore, the majority of Corus’s earnings come from advertising revenue and premium channel subscriptions, both of which should be far less impacted by pick and pay. Nevertheless, Corus’s juicy 30% operating margins could make them a potential regulatory piñata in Canada. The company benefits from genre-protection rules that protect their networks from competition but also indirectly limit their ability to raise subscriber fees. Leading U.S. specialty network owners such as AMC, Scripps, and Discovery have operating margins ranging from 28%-39% in a more market-based environment where pricing power and competition are both prevalent.

Intrepid Small Cap Fund

The business performed very well during the last recession, when declines in advertising revenue were offset by the launch of new networks and higher merchandising sales. In music to our ears, management recently said, “Typically the street looks at a multiple of EBITDA…However, we believe the truest measure of shareholder value is sustainable free cash flow, because it’s cash you can return to shareholders.” Corus pays a dividend yield exceeding 4% and is currently trading at 12.5x free cash flow. In Corus, we believe we have found a good business trading at a reasonable discount to fair value. We also think there is an above-average chance of a takeover. We have hedged the currency risk on this investment.

In today’s market, cheap small caps seem as elusive as Bigfoot. While there are plenty of sightings (see www.bfro.net), they turn out to be bogus. We aren’t sure when this market will turn, but when it does, we are ready to act. Our high cash is not a permanent feature of the Intrepid Small Cap Fund. Historically, our cash levels have grown slowly as bull markets age and then declined rapidly along with plummeting stock prices. Most recently, this occurred in the summer of 2011. Before that, late 2008. We promise to continue managing the Fund according to our philosophy of selling positions once they exceed our estimates of intrinsic value, since we firmly believe this will produce the best long-term outcome for you, our fund holders. Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Intrepid Small Cap Fund Portfolio Manager

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results.

Past performance does not guarantee future results. Index performance is not indicative of fund performance. To obtain standardized fund performance visit www.intrepidcapitalfunds.com or call 866-996-FUND (3863).

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The Advisor believes that current market conditions warrant a defensive position from the requirement to invest at least 80% of its net assets in equity securities of small capitalization companies.

Intrepid Small Cap Fund

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. Companies in the Russell 3000 Index, as ranked by market capitalization. The Russell 1000 Index consists of the largest 1,000 companies in the Russell 3000 Index. The Russell 2000 Biotechnology Index is comprised of the smallest Biotechnology companies in the Russell 3000 Index. You cannot invest directly in an index.

Cash Flow measures the cash generating capability of a company by adding non-cash charges and interest to pretax income. Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. EBIT is calculated as the company’s Earnings Before Interest and Taxes. EBITDA is calculated as the company’s Earnings Before Interest, Taxes, Depreciation and Amortization. Price-to-Earnings Ratio (P/E Ratio) is an equity valuation multiple calculated as market price per share divided by annual earnings per share. Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Gross Domestic Product (GDP) is the market value of all officially recognized final goods and services produced within a country in a year, or other given period of time.

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid Income Fund

| |  | |

| | | | |

| Jason Lazarus, | | Ben Franklin, | |

| Income Fund Co-Portfolio Manager | | Income Fund Co-Portfolio Manager | |

April 4, 2014

Dear Fellow Shareholders,

Fixed income assets rallied across the board in the quarter ended March 31, 2014, due to both spread compression and lower risk-free rates. The ten-year U.S. Treasury rate declined to 2.72% from 3.03% at the end of calendar year 2013. The Barclays U.S. Aggregate, which is a proxy for the broader investment-grade fixed income market, rallied 1.84% after struggling last year. Corporate bonds performed even better as spreads compressed to levels not experienced since the summer of 2007. This led to impressive performances by investment-grade and high-yield corporate bonds, which returned 2.97% and 3.00%, respectively, in the period ending March 31, 2014, as measured by the BofA ML US Corporate Index and the BofA ML High Yield Master II Index (the “Index”).

The high-yield market has seen significant inflows this year as investors continue to search for yield. The asset class is flooded with cash, and managers with a full-invested mandate are forced to put money to work regardless of price levels, pushing bond prices up further. This constant need to put money to work has distorted the high-yield bond market by allowing distressed businesses to kick the can down the road, rather than restructure as a free market system would obligate them to do. When companies that should fail are bailed out by yield-hungry investors, those who have taken the most risk have reaped the rewards. At Intrepid, we manage our fixed income assets differently. We do not analyze technical factors such as fund flows, nor do we allocate capital based on expected market default rates. Most importantly, we have no mandate to be fully invested, and therefore only put money to work when we believe we are being compensated to assume the risks. When we cannot find a suitable investment candidate, we will hold what most investors seem to hate: cash. Due to the dearth of opportunities, we have been holding quite a lot of cash, which averaged 38% of assets in the quarter. The Intrepid Income Fund’s (the “Fund”) cash position was also 38.8% at the end of the quarter, but we expect this to increase, absent a pullback in bond prices, as several of our holdings are likely to be called in coming months. Our significant cash position and higher-quality bond portfolio resulted in a wide gap in performance between the Fund and the Index. The Fund returned 1.47% in the quarter and 2.98% in the six month period ending March 31, 2014, while the Index returned 3.00% and 6.60% in the same periods.

The Fund had no material detractors to performance in the quarter. PetroQuest Energy 10% due 9/01/2017 and Smith & Wesson 5.875% due 6/15/2017 were top contributors to the Fund’s quarterly performance. Both issues represent large

Intrepid Income Fund

holdings and outperformed the high-yield benchmark. We see several reasons the PetroQuest bonds may have been bid up. The company’s near-term credit quality has been boosted by higher natural gas prices and the rolling off of a contract to sell gas at unfavorable prices. Additionally, the company has expanded its hedging program, reducing some of the inherent commodity risk. Lastly, we believe yield-to-call buyers have become interested in the issue due to the upcoming September call date. As for our Smith & Wesson holding, the company continues to increase revenue despite an overall industry decline from recent highs. The company’s balance sheet remains lightly levered, which is required for this holding as we view gun industry sales at above normalized levels.

AuRico Gold (ticker: AUQ) has a small convertible bond issued by subsidiary Northgate Minerals. The 3.5% convertible notes represent a fairly new position that was established in the fall of 2013, and were the top contributor to the Fund’s performance in the quarter ended March 31, 2014. The bonds jumped in early March when AuRico announced its intention to redeem the notes at a substantial premium with proceeds from a new longer-dated issue. We analyzed the new bond in depth, but concluded we weren’t being compensated adequately for the credit risk and long 2022 maturity. We weren’t the only ones with this opinion. Demand for the issue was weak, and substantial changes were made to attract investors. The company shortened the maturity date by two years, increased the bonds’ priority in the capital structure from senior to second lien, and offered the bonds at a discount to par. We decided to participate in the altered deal, and together with secondary market purchases were able to accumulate a 2.5% position in the new 7.75% second lien notes due April 1, 2020.

In addition to the new AuRico Gold notes, we purchased small positions in two businesses we have followed for several years; Oshkosh 8.5% due 3/01/2020 (ticker: OSK) and two Rent-A-Center bonds (ticker: RCII). Our largest new position is PHI Inc 5.25% due 3/15/2019 (ticker: PHII). We first became involved in PHI in late 2012 and subsequently built up the position over the next several months. We outlined our thesis on the company in our quarterly letter for the period ending September 30, 2013. PHI issued new notes late in the most recent quarter, and offered to repurchase the old notes, which we elected to do. We were able to purchase the new notes at what we believe to be attractive prices for a business with a solid credit profile and tangible assets.

On the sales side, two of our large positions were repurchased by the issuers; PHI Inc, as mentioned above, and Scotts Miracle Gro 7.250% due 1/15/2018 (ticker: SMG). The repurchase of the Scotts bonds was expected. We also exited our position in WWE common stock (ticker: WWE), for a solid gain. WWE is discussed in more detail in the Small Cap commentary. Lastly, we decided to sell our holdings in Texas-based Swift Energy’s 8.875% notes due 1/15/2020, which gives us the opportunity to delineate how we think about selling when a business has deteriorated.

Intrepid Income Fund

Swift Energy is a small-cap energy exploration and production business (E&P) with core assets in the prolific Eagle Ford shale in South Texas. About a year ago, we identified Swift as a potentially attractive bond holding due to its average leverage and significant undeveloped, but highly valuable, oil and gas reserves. Our view was that the reserves easily covered the company’s debt even if energy prices were to weaken, and we believed the bonds compensated us well given the risks. Since we first purchased the notes, our valuation of the assets protecting our investment has declined. Additionally, our confidence in management to execute on its plans has deteriorated. Going further, we now have serious questions regarding management’s integrity.

In the last year, Swift has twice attempted to monetize assets, both through a joint venture and an asset sale, the proceeds of which would be used to reduce debt. In the first case, a joint venture in the key Eagle Ford properties was abandoned for the sale of other properties, presumably because no joint venture partner would sign on under terms that were attractive to Swift’s management. In the second case, management put its Central Louisiana assets up for sale in lieu of the joint venture. The bid deadline was initially in November 2013, and on the Q313 conference call held in late October management said it was “pleased with the progress thus far” and anticipated bids in the fourth quarter with a deal closing in Q114. As we rolled into 2014 with no announcement, our confidence in the management team had dwindled to almost nothing, and we highly doubted a deal could be done on favorable terms. We concluded that nothing positive would come by holding through the fourth quarter earnings report, and sold the notes prior to the earnings release. Our suspicions proved to be correct, and Swift’s stock sank when management did not announce a deal and stated it would seek another joint venture for natural gas assets in South Texas. These and other issues, including skepticism about the reserve audit and related party transactions, led us to question management’s integrity and ability to execute.

We should note that even with the issues described, we still made money on our investment in Swift’s bonds. However, making or losing money on an investment does not necessarily equate to success or failure, in our opinion. At Intrepid, we believe the focus should be on the process, not the outcome. We feel strongly that process-driven investing is the only way to produce repeatable results over the long-term. To paraphrase Nassim Nicholas Taleb in his book Fooled by Randomness, if you put enough monkeys in front of typewriters, one of them will eventually pound out the Iliad. But would you bet money that our literary primate would write the Odyssey next?

To close, we would like everyone to know that the Fund’s Investor Class shares have been converted to the Institutional Class, and the Investor Class has been closed. This action will reduce the total operating expense paid by Investor Class owners to 90 basis points. We have also reduced the investment minimum of the Institutional

Intrepid Income Fund

Class to $2,500. This is our commitment to offer the product you desire at a reasonable price. Thank you for your investment.

Sincerely,

|  |

| | |

| Jason Lazarus, CFA | Ben Franklin, CFA |

| Intrepid Income | Intrepid Income |

| Co-Lead Portfolio Manager | Co-Lead Portfolio Manager |

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is generally greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual securities volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The Bank of America Merrill Lynch High Yield Master II Index is Bank of America Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. Bank of America Merrill Lynch US Corporate Index is an unmanaged index of U.S. dollar denominated investment grade corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity. Barclays Capital U.S. Aggregate Bond Index is an index representing about 8,200 fixed income securities. To be included in the index, bonds must be rated investment grade by Moody’s and S&P. You cannot invest directly in an index.

Yield-to-Call means that the issuer of the bond can redeem the bond prior to maturity by paying the call price, whichever is greater than the face value of the bond, to the bondholder. Basis Point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid Disciplined Value Fund

| | |

| | | |

| Greg Estes, | | |

| Disciplined Value Fund | | |

| Portfolio Manager | | |

April 2, 2014

Dear Fellow Shareholders,

For the quarter ended March 31, 2014, the S&P 500 Index returned 1.81%, and the Russell 3000 Index returned 1.97%. For the same period, the Intrepid Disciplined Value Fund (the “Fund”) returned 2.73%. At first blush, the quarter appears to be rather boring in light of some of the much higher returns achieved in other recent quarters. But when we dig a bit deeper, we see a market with much more volatility, as shown in the chart below. By February 3, 2014, the S&P 500 Index’s year-to-date return was -5.66%, while the Russell 3000 Index was down -5.51%. In that same window of time, the Fund was down -1.32%. In our opinion, the markets were down because of fear that company results could not match the relatively high earnings multiples being placed on the underlying stocks. In addition, investors were worried about the Federal Reserve reducing its monetary stimulus scheme which has kept short term rates near zero for more than five years. By the end of February, however, most of this fear had subsided. As March ended, Federal Reserve Chairwoman Janet Yellen reassured investors that the Fed’s easy monetary policy would continue until the employment picture looked better. The last two weeks of January were like a bad dream that investors were happy to forget.

| |

| Comparative Total Return |

| First Quarter 2014 |

| |

|

| |

Figure 1 Source: Bloomberg.

Past performance does not guarantee future results.

And yet the short period in late January should serve as a reminder to all investors of what could happen when an outside force- in this case, the Federal Reserve- discontinues its interference. And we firmly believe that the market’s reflation is a result of the Fed’s easy monetary policy. Consider the chart on the following page. The dark shaded line shows the value of the S&P 500 beginning four years ago in April 2010. With the exception of a few hiccups along the way, it has climbed inexorably to an all time high. Meanwhile, the price to earnings ratio for the S&P 500 (the light shaded line) has also been climbing. Why? Is a dollar of corporate earnings inherently more valuable than it was four years ago? We think not. Rather, with interest rates near zero, we believe that the Fed has forced money into the equity market, because there is

Intrepid Disciplined Value Fund

nowhere else for the money to go. Thus, equity investment becomes less of an exercise in determining what a business is worth, and more of a game of musical chairs. The Fed makes the music while investors walk around the chairs. To remain fully committed to such a market is in our minds a dangerous game, and it is clear to see what happens when investors fear that the music is about to stop. No song can last forever.

| |

| S & P 500 Index |

| |

|

| |

Figure 2 Source: Bloomberg

Past performance does not guarantee future results.

In light of the current environment, what is an investor to do? It is our goal not only to outperform the market when it is selling down, but also to find new ideas for investment when prices become more favorable. Last quarter, we reported the Fund’s cash level at an all-time high of 61.3%. The brief selloff in this quarter did enable us to pick up some new investments. By quarter end, cash was at 48.8%. The purchasing activity includes both new purchases and additions to existing positions.

Among the new additions to the portfolio were some recognizable names that we consider to be somewhat out of favor. We’d like to highlight a few of those. We’ll start with the most recognizable company in the stock market: Apple, Inc. (ticker: AAPL). The very simple case for investing is this: the balance sheet is loaded with cash and at the time of investment, the stock was selling for just over six times its EBIT (Earnings before Interest and Taxes). The company had just released results and guided revenue to be flat to down for the next quarter, which is something Apple had not done in ten years. The stock sold off, and we saw that as an opportunity. Will Apple be able to permanently maintain dominant market share and command massive gross margins from 45% to 55% for iPhones? We don’t think it can. Nor do we think it must to justify investing in it. As a matter of fact, when we value this business, we assume a reduction in gross margin. And yet we still believe that we own a company that trades at a discount to its intrinsic value.

We also purchased shares of Mattel, Inc (ticker: MAT). Mattel is the world’s largest toy maker and owns a diversified portfolio of enduring brands including Barbie, Fisher-Price, American Girl, and Hot Wheels. Mattel caught our eye as shares declined sharply in early February due to poor fourth-quarter sales. We were able to buy shares of this shareholder-friendly company at a 4% dividend yield and a reasonable discount to our valuation.

Another investment was Intuitive Surgical (ticker: ISRG). Intuitive is the market leader in robotic assisted surgical units. Actually, it is the only FDA-approved device

Intrepid Disciplined Value Fund

maker for robotic surgery. Its product is known as the da Vinci, and its applications for minimally invasive surgery can be found in the fields of urology, gynecology, cardiothoracic and general surgery. Like several of our recent investments, this was an opportunistic purchase. The stock had sold down on concerns that unit sales had slowed, which is natural given the changing regulations in U.S. healthcare. In addition, there are criticisms that outcomes for robotic-assisted surgery are no better than more standard laparoscopic surgery. However, we believe that adoption of robotic assisted surgery will continue onward as more physicians become trained on it and as the FDA approves the device for more types of procedures. The implementation of the ACA (Affordable Care Act) is more of a general concern among all healthcare companies. We believe that, as the only company in this field, the company is well positioned and it should continue to see procedure growth in robotic-assisted surgeries.

The top performers in the quarter were varied. Newfield Exploration (ticker: NFX) was the Fund’s top gainer as commodity companies were among the best performers in the market for the quarter. World Wrestling Entertainment (ticker: WWE) gained on continued speculation that the company would sign a more lucrative television deal, thus boosting operating profits. The decision has not yet been announced, and we have exited the position because the current price is above our estimate of the company’s underlying worth. Finally, the Fund’s investment in two lab service providers, Quest Diagnostics (ticker: DGX) and Labcorp (ticker: LH) both rebounded in the quarter on news that Congress is considering controlling the amount of reimbursement cuts for lab service paid by Medicare and Medicaid.

The Fund’s worst performers included FTI Consulting (ticker: FCN), which posted weak forward guidance for 2014. Staples (ticker: SPLS), a name we have owned in the past and had repurchased in the quarter, announced that it will be cutting its brick-and-mortar footprint in the U.S. to focus more resources towards its online presence. Although this development gave us an opportunity to purchase, our timing was not perfect. We believe that Staples will be able to add value by shrinking its less profitable operations over time. Finally, CSG Systems (ticker: CSGS) delivered what was, in our opinion, a solid fourth quarter. However, the market wanted better forward guidance for 2014 than the company delivered. Therefore, the shares traded down for the quarter.

As we have done with every quarterly letter, we close by citing the average discount within the Fund. We derive our own internal values for each stock, and we compare those values with their corresponding stock prices to calculate the discount for each position. When we cite the average discount in the Fund then, we are simply giving you the mid-point among all the individual discounts within the Fund. At quarter end, that average discount was 7%. To us, this indicates that discounts are small, which should come as no surprise given the increase in the stock market over the past five years. We will, however, continue searching for value and when possible take

Intrepid Disciplined Value Fund

opportunities in the event of a market selloff. We appreciate your confidence in our investment process.

Sincerely,

Greg Estes, CFA

Intrepid Disciplined Value Fund Portfolio Manager

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

Past performance does not guarantee future results. Index performance is not indicative of fund performance. To obtain standardized fund performance visit www.intrepidcapitalfunds.com or call 866-996-FUND (3863).

Diversification does not assure a profit or protect against a loss in a declining market.

Prior to April 1, 2013, the Fund was named the Intrepid All Cap Fund.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 3000 Index is an index representing the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Dow Jones Industrial Average is an unmanaged index of common stocks comprised of major industrial companies and assumes reinvestment of dividends. You cannot invest directly in an index.

EBIT is calculated as the company’s Earnings Before Interest and Taxes. Price-to-Earnings Ratio (P/E Ratio) is an equity valuation multiple calculated as market price per share divided by annual earnings per share.

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid Funds

EXPENSE EXAMPLE

March 31, 2014 (Unaudited)

As a shareholder of the Intrepid Capital Management Funds Trust (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other expenses incurred by the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period of October 1, 2013 through March 31, 2014.

ACTUAL EXPENSES

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2014 (Unaudited)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

INTREPID CAPITAL FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2013 - |

| | October 1, 2013 | March 31, 2014 | March 31, 2014 |

| Actual | $1,000.00 | $1,092.60 | $7.30 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.95 | 7.04 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID CAPITAL FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2013 - |

| | October 1, 2013 | March 31, 2014 | March 31, 2014 |

| Actual | $1,000.00 | $1,093.10 | $6.00 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.20 | 5.79 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID SMALL CAP FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2013 - |

| | October 1, 2013 | March 31, 2014 | March 31, 2014 |

| Actual | $1,000.00 | $1,064.70 | $7.21 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.95 | 7.04 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

EXPENSE EXAMPLE (continued)

March 31, 2014 (Unaudited)

INTREPID SMALL CAP FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2013 - |

| | October 1, 2013 | March 31, 2014 | March 31, 2014 |

| Actual | $1,000.00 | $1,066.50 | $5.92 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.20 | 5.79 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID INCOME FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2013 - |

| | October 1, 2013 | March 31, 2014 | March 31, 2014 |

| Actual | $1,000.00 | $1,029.80 | $4.55 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,020.44 | 4.53 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.90%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID DISCIPLINED VALUE FUND*

| | | | Expenses Paid |

| | Beginning | Ending | During Period** |

| | Account Value | Account Value | October 1, 2013 - |

| | October 1, 2013 | March 31, 2014 | March 31, 2014 |

| Actual | $1,000.00 | $1,068.50 | $7.07 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.10 | 6.89 |

| * | Effective January 31, 2014, the Adviser contractually agreed to reduce its fees and/or reimburse the Fund to ensure that Total Annual Fund Operating Expenses After Waiver and/or Expense Reimbursement do not exceed 1.30% of the Fund’s average daily net assets. |

| ** | Expenses are equal to the Fund’s annualized expense ratio of 1.37%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

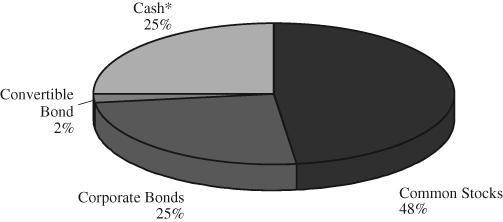

Intrepid Capital Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2014 (Unaudited)

INTREPID CAPITAL FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Common Stocks | | $ | 214,359,829 | |

| Corporate Bonds | | | 113,394,451 | |

| Convertible Bond | | | 6,125,130 | |

| Cash* | | | 113,349,108 | |

| | | $ | 447,228,518 | |

| * | Cash, cash equivalents and other assets less liabilities. |

Intrepid Small Cap Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2014 (Unaudited)

INTREPID SMALL CAP FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Information Technology | | $ | 60,029,435 | |

| Consumer Discretionary | | | 41,557,834 | |

| Industrials | | | 29,255,315 | |

| Health Care | | | 21,355,554 | |

| Energy | | | 21,199,360 | |

| Financials | | | 14,255,516 | |

| Materials | | | 13,402,502 | |

| Telecommunication Services | | | 6,277,793 | |

| Cash* | | | 504,583,310 | |

| | | $ | 711,916,619 | |

The sector and industry classifications used in this report, use the Global Industry Classification Standard (GICS®). GICS® was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| * | Cash, cash equivalents and other assets less liabilities. |

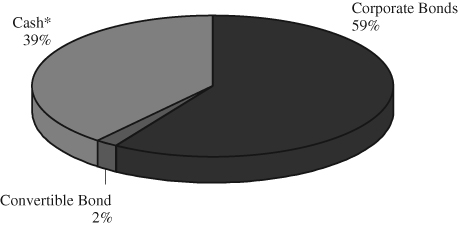

Intrepid Income Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2014 (Unaudited)

INTREPID INCOME FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Corporate Bonds | | $ | 62,703,600 | |

| Convertible Bond | | | 2,608,200 | |

| Cash* | | | 41,395,271 | |

| | | $ | 106,707,071 | |

| * | Cash, cash equivalents and other assets less liabilities. |

Intrepid Disciplined Value Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2014 (Unaudited)

INTREPID DISCIPLINED VALUE FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Information Technology | | $ | 6,363,572 | |

| Health Care | | | 3,918,756 | |

| Consumer Discretionary | | | 3,896,779 | |

| Financials | | | 3,015,053 | |

| Energy | | | 1,786,912 | |

| Materials | | | 1,320,574 | |

| Industrials | | | 1,216,756 | |

| Consumer Staples | | | 926,808 | |

| Telecommunication Services | | | 729,634 | |

| Cash* | | | 21,747,481 | |

| | | $ | 44,922,325 | |

| * | Cash, cash equivalents and other assets less liabilities. |

SCHEDULE OF INVESTMENTS

March 31, 2014 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS - 47.93% | | | | | | |

| | | | | | | |

| Commercial & Professional Services - 1.63% | | | | | | |

| FTI Consulting, Inc. (a) | | | 218,195 | | | $ | 7,274,621 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 4.15% | | | | | | | | |

| Coach, Inc. | | | 208,659 | | | | 10,362,006 | |

| Mattel, Inc. | | | 205,000 | | | | 8,222,550 | |

| | | | | | | | 18,584,556 | |

| | | | | | | | | |

| Consumer Services - 0.53% | | | | | | | | |

| Speedway Motorsports, Inc. | | | 126,606 | | | | 2,371,330 | |

| | | | | | | | | |

| Diversified Financials - 10.09% | | | | | | | | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 110,000 | | | | 13,746,700 | |

| Oaktree Capital Group LLC | | | 115,847 | | | | 6,737,662 | |

| The Bank Of New York Mellon Corp. | | | 403,000 | | | | 14,221,870 | |

| The Western Union Co. | | | 636,470 | | | | 10,412,649 | |

| | | | | | | | 45,118,881 | |

| | | | | | | | | |

| Energy - 5.41% | | | | | | | | |

| Bill Barrett Corp. (a) | | | 317,121 | | | | 8,118,298 | |

| Newfield Exploration Co. (a) | | | 474,870 | | | | 14,891,923 | |

| Warren Resources, Inc. (a) | | | 250,950 | | | | 1,204,560 | |

| | | | | | | | 24,214,781 | |

| | | | | | | | | |

| Health Care Equipment & Services - 2.04% | | | | | | | | |

| Intuitive Surgical, Inc. (a) | | | 20,800 | | | | 9,110,192 | |

| | | | | | | | | |

| Materials - 2.14% | | | | | | | | |

| Hawkins, Inc. | | | 9,619 | | | | 353,402 | |

| Royal Gold, Inc. | | | 147,500 | | | | 9,236,450 | |

| | | | | | | | 9,589,852 | |

| | | | | | | | | |

| Media - 1.70% | | | | | | | | |

| Corus Entertainment, Inc. - Class B (b) | | | 344,807 | | | | 7,613,513 | |

| | | | | | | | | |

| Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 2.76% | | | | | | | | |

| Bio-Rad Laboratories, Inc. (a) | | | 96,327 | | | | 12,341,415 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS - 47.93% (continued) | | | | | | |

| | | | | | | |

| Retailing - 8.08% | | | | | | |

| Aaron’s, Inc. | | | 330,834 | | | $ | 10,004,420 | |

| American Eagle Outfitters, Inc. | | | 545,610 | | | | 6,678,267 | |

| Big Lots, Inc. (a) | | | 305,610 | | | | 11,573,451 | |

| Staples, Inc. | | | 694,000 | | | | 7,869,960 | |

| | | | | | | | 36,126,098 | |

| | | | | | | | | |

| Software & Services - 4.66% | | | | | | | | |

| Amdocs Ltd. (b) | | | 233,400 | | | | 10,843,764 | |

| Check Point Software Technologies Ltd. (a)(b) | | | 63,980 | | | | 4,326,968 | |

| Microsoft Corp. | | | 138,000 | | | | 5,656,620 | |

| | | | | | | | 20,827,352 | |

| | | | | | | | | |

| Technology Hardware & Equipment - 3.82% | | | | | | | | |

| Cisco Systems, Inc. | | | 295,000 | | | | 6,610,950 | |

| Ingram Micro, Inc. (a) | | | 354,106 | | | | 10,467,373 | |

| | | | | | | | 17,078,323 | |

| | | | | | | | | |

| Telecommunication Services - 0.92% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 156,769 | | | | 4,108,915 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $175,358,490) | | | | | | | 214,359,829 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| | | | | | | | | |

| CORPORATE BONDS - 25.36% | | | | | | | | |

| | | | | | | | | |

| Capital Goods - 0.95% | | | | | | | | |

| Oshkosh Corp. | | | | | | | | |

| 8.500%, 03/01/2020 | | $ | 3,881,000 | | | | 4,259,397 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 1.97% | | | | | | | | |

| Smith & Wesson Holding Corp. | | | | | | | | |

| 5.875%, 06/15/2017 (c)(d) (Cost: $8,487,000. | | | | | | | | |

| Original acquisition date: 6/11/2013) | | | 8,487,000 | | | | 8,826,480 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| CORPORATE BONDS - 25.36% (continued) | | | | | | |

| | | | | | | |

| Consumer Services - 3.42% | | | | | | |

| Regis Corp. | | | | | | |

| 5.750%, 12/05/2017 (c)(d) (Cost: $8,275,000. | | | | | | |

| Original acquisition date: 11/27/2013) | | $ | 8,275,000 | | | $ | 8,502,563 | |

| Ruby Tuesday, Inc. | | | | | | | | |

| 7.625%, 05/15/2020 | | | 7,614,000 | | | | 6,795,495 | |

| | | | | | | | 15,298,058 | |

| | | | | | | | | |

| Diversified Financials - 0.88% | | | | | | | | |

| National Money Mart Co. | | | | | | | | |

| 10.375%, 12/15/2016 (b) | | | 3,901,000 | | | | 3,920,505 | |

| | | | | | | | | |

| Energy - 7.82% | | | | | | | | |

| EPL Oil & Gas, Inc. | | | | | | | | |

| 8.250%, 02/15/2018 | | | 8,355,000 | | | | 9,044,287 | |

| Northern Oil & Gas, Inc. | | | | | | | | |

| 8.000%, 06/01/2020 | | | 12,632,000 | | | | 13,421,500 | |

| PetroQuest Energy, Inc. | | | | | | | | |

| 10.000%, 09/01/2017 | | | 6,182,000 | | | | 6,583,830 | |

| PHI, Inc. | | | | | | | | |

| 5.250%, 03/15/2019 (c) (Cost: $5,903,841. | | | | | | | | |

| Original acquisition date: 3/6/2014) | | | 5,851,000 | | | | 5,909,510 | |

| | | | | | | | 34,959,127 | |

| | | | | | | | | |

| Food & Staples Retailing - 0.70% | | | | | | | | |

| Spartan Stores, Inc. | | | | | | | | |

| 6.625%, 12/15/2016 (c)(d) (Cost: $3,135,684. | | | | | | | | |

| Original acquisition date: 2/6/2013) | | | 3,000,000 | | | | 3,142,500 | |

| | | | | | | | | |

| Food, Beverage & Tobacco - 1.58% | | | | | | | | |

| Cott Beverages, Inc. | | | | | | | | |

| 8.125%, 09/01/2018 | | | 6,632,000 | | | | 7,038,210 | |

| | | | | | | | | |

| Household & Personal Products - 0.75% | | | | | | | | |

| Central Garden & Pet Co. | | | | | | | | |

| 8.250%, 03/01/2018 | | | 3,242,000 | | | | 3,343,312 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| CORPORATE BONDS - 25.36% (continued) | | | | | | |

| | | | | | | |

| Materials - 2.67% | | | | | | |

| AuRico Gold, Inc. | | | | | | |

| 7.750%, 04/01/2020 (b)(c) (Cost: $5,627,844. | | | | | | |

| Original acquisition date: 3/17/2014) | | $ | 5,663,000 | | | $ | 5,620,528 | |

| Compass Minerals International, Inc. | | | | | | | | |

| 8.000%, 06/01/2019 | | | 6,029,000 | | | | 6,330,450 | |

| | | | | | | | 11,950,978 | |

| | | | | | | | | |

| Retailing - 0.96% | | | | | | | | |

| Brown Shoe Co., Inc. | | | | | | | | |

| 7.125%, 05/15/2019 | | | 4,070,000 | | | | 4,304,025 | |

| | | | | | | | | |

| Software & Services - 1.55% | | | | | | | | |

| ManTech International Corp. | | | | | | | | |

| 7.250%, 04/15/2018 | | | 6,665,000 | | | | 6,916,604 | |

| | | | | | | | | |

| Transportation - 2.11% | | | | | | | | |

| Quality Distribution LLC / QD Capital Corp. | | | | | | | | |

| 9.875%, 11/01/2018 | | | 4,173,000 | | | | 4,559,003 | |

| Swift Services Holdings, Inc. | | | | | | | | |

| 10.000%, 11/15/2018 | | | 4,438,000 | | | | 4,876,252 | |

| | | | | | | | 9,435,255 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $112,585,966) | | | | | | | 113,394,451 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| CONVERTIBLE BOND - 1.37% | | | | | | |

| | | | | | | |

| Materials - 1.37% | | | | | | |

| AuRico Gold, Inc. | | | | | | |

| 3.500%, 10/01/2016 (b) | | $ | 5,918,000 | | | $ | 6,125,130 | |

| TOTAL CONVERTIBLE BOND | | | | | | | | |

| (Cost $5,644,261) | | | | | | | 6,125,130 | |

| Total Investments | | | | | | | | |

| (Cost $293,588,717) - 74.66% | | | | | | | 333,879,410 | |

| Other Assets in Excess of Liabilities - 25.34% | | | | | | | 113,349,108 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 447,228,518 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Security is restricted to resale. The aggregate value of restricted securities at March 31, 2014 was $32,001,581 which represented 7.2% of net assets. |

| (d) | Security is considered illiquid and may be difficult to sell. |

SCHEDULE OF OPEN FORWARD CURRENCY CONTRACTSMarch 31, 2014 (Unaudited)

| | Forward | | | Amount of | | | | Amount of | | | | |

| Counterparty | Expiration | Currency to | | Currency to | | Currency to | | Currency to | | | Unrealized | |

| of Contract | Date | be Received | | be Received | | be Delivered | | be Delivered | | | Depreciation | |

| Morgan | | | | | | Canadian | | | | | | |

| Stanley | 8/27/14 | U.S. Dollars | | | 7,622,635 | | Dollars | | | 8,500,000 | | | $ | (38,829 | ) |

| | | | | | | | | | | | | | $ | (38,829 | ) |

| | | | | | | | | | | | | | | | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2014 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS - 29.12% | | | | | | |

| | | | | | | |

| Commercial & Professional Services - 4.11% | | | | | | |

| FTI Consulting, Inc. (a) | | | 371,960 | | | $ | 12,401,146 | |

| Tetra Tech, Inc. (a) | | | 569,590 | | | | 16,854,168 | |

| | | | | | | | 29,255,314 | |

| | | | | | | | | |

| Energy - 2.98% | | | | | | | | |

| Newfield Exploration Co. (a) | | | 676,000 | | | | 21,199,360 | |

| | | | | | | | | |

| Insurance - 2.00% | | | | | | | | |

| Aspen Insurance Holdings Ltd. (b) | | | 359,081 | | | | 14,255,516 | |

| | | | | | | | | |

| Materials - 1.88% | | | | | | | | |

| AuRico Gold, Inc. (b) | | | 1,016,000 | | | | 4,419,600 | |

| Pan American Silver Corp. (b) | | | 335,000 | | | | 4,311,450 | |

| Royal Gold, Inc. | | | 74,600 | | | | 4,671,452 | |

| | | | | | | | 13,402,502 | |

| | | | | | | | | |

| Media - 1.93% | | | | | | | | |

| Corus Entertainment, Inc. - Class B (b) | | | 620,900 | | | | 13,709,787 | |

| | | | | | | | | |

| Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 3.00% | | | | | | | | |

| Bio-Rad Laboratories, Inc. (a) | | | 166,684 | | | | 21,355,554 | |

| | | | | | | | | |

| Retailing - 3.91% | | | | | | | | |

| Aaron’s, Inc. | | | 678,910 | | | | 20,530,238 | |

| Big Lots, Inc. (a) | | | 193,235 | | | | 7,317,810 | |

| | | | | | | | 27,848,048 | |

| | | | | | | | | |

| Software & Services - 5.33% | | | | | | | | |

| Amdocs Ltd. (b) | | | 527,321 | | | | 24,499,334 | |

| CSG Systems International, Inc. | | | 230,904 | | | | 6,012,740 | |

| Global Payments, Inc. | | | 105,000 | | | | 7,466,550 | |

| | | | | | | | 37,978,624 | |

| | | | | | | | | |

| Technology Hardware & Equipment - 3.10% | | | | | | | | |

| Ingram Micro, Inc. (a) | | | 500,408 | | | | 14,792,060 | |

| Tech Data Corp. (a) | | | 119,074 | | | | 7,258,751 | |

| | | | | | | | 22,050,811 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS - 29.12% | | | | | | |

| | | | | | | |

| Telecommunication Services - 0.88% | | | | | | |

| Telephone & Data Systems, Inc. | | | 239,519 | | | $ | 6,277,793 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $152,767,966) | | | | | | | 207,333,309 | |

| Total Investments | | | | | | | | |

| (Cost $152,767,966) - 29.12% | | | | | | | 207,333,309 | |

| Other Assets in Excess of Liabilities - 70.88% | | | | | | | 504,583,310 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 711,916,619 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

SCHEDULE OF OPEN FORWARD CURRENCY CONTRACTSMarch 31, 2014 (Unaudited)

| | Forward | | | Amount of | | | | Amount of | | | | |

| Counterparty | Expiration | Currency to | | Currency to | | Currency to | | Currency to | | | Unrealized | |

| of Contract | Date | be Received | | be Received | | be Delivered | | be Delivered | | | Appreciation | |

| Morgan | | | | | | Canadian | | | | | | |

| Stanley | 8/11/14 | U.S. Dollars | | | 13,550,136 | | Dollars | | | 15,000,000 | | | $ | 24,735 | |

| | | | | | | | | | | | | | $ | 24,735 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS

March 31, 2014 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| CORPORATE BONDS - 58.76% | | | | | | |

| | | | | | | |

| Capital Goods - 1.75% | | | | | | |

| Oshkosh Corp. | | | | | | |

| 8.500%, 03/01/2020 | | $ | 1,698,000 | | | $ | 1,863,555 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 4.57% | | | | | | | | |

| Smith & Wesson Holding Corp. | | | | | | | | |

| 5.875%, 06/15/2017 (a)(b) (Cost: $4,688,000. | | | | | | | | |

| Original acquisition date: 6/11/2013) | | | 4,688,000 | | | | 4,875,520 | |

| | | | | | | | | |

| Consumer Services - 6.94% | | | | | | | | |

| Regis Corp. | | | | | | | | |

| 5.750%, 12/05/2017 (a)(b) (Cost: $4,225,000. | | | | | | | | |

| Original acquisition date: 11/27/2013) | | | 4,225,000 | | | | 4,341,188 | |

| Ruby Tuesday, Inc. | | | | | | | | |

| 7.625%, 05/15/2020 | | | 3,434,000 | | | | 3,064,845 | |

| | | | | | | | 7,406,033 | |

| | | | | | | | | |

| Diversified Financials - 1.89% | | | | | | | | |

| National Money Mart Co. | | | | | | | | |

| 10.375%, 12/15/2016 (c) | | | 2,005,000 | | | | 2,015,025 | |

| | | | | | | | | |

| Energy - 15.82% | | | | | | | | |

| EPL Oil & Gas, Inc. | | | | | | | | |

| 8.250%, 02/15/2018 | | | 4,744,000 | | | | 5,135,380 | |

| Northern Oil & Gas, Inc. | | | | | | | | |

| 8.000%, 06/01/2020 | | | 4,395,000 | | | | 4,669,687 | |

| PetroQuest Energy, Inc. | | | | | | | | |

| 10.000%, 09/01/2017 | | | 3,662,000 | | | | 3,900,030 | |

| PHI, Inc. | | | | | | | | |

| 5.250%, 03/15/2019 (a) (Cost: $3,177,437. | | | | | | | | |

| Original acquisition date: 3/6/2014) | | | 3,149,000 | | | | 3,180,490 | |

| | | | | | | | 16,885,587 | |

| | | | | | | | | |

| Food & Staples Retailing - 1.96% | | | | | | | | |

| Spartan Stores, Inc. | | | | | | | | |

| 6.625%, 12/15/2016 (a)(b) (Cost: $2,090,456. | | | | | | | | |

| Original acquisition date: 2/6/2013) | | | 2,000,000 | | | | 2,095,000 | |

| | | | | | | | | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| CORPORATE BONDS - 58.76% | | | | | | |

| | | | | | | |

| Food, Beverage & Tobacco - 3.88% | | | | | | |

| Cott Beverages, Inc. | | | | | | |

| 8.125%, 09/01/2018 | | $ | 3,896,000 | | | $ | 4,134,630 | |

| | | | | | | | | |

| Household & Personal Products - 2.05% | | | | | | | | |

| Central Garden & Pet Co. | | | | | | | | |

| 8.250%, 03/01/2018 | | | 2,120,000 | | | | 2,186,250 | |

| | | | | | | | | |

| Materials - 6.40% | | | | | | | | |

| AuRico Gold, Inc. | | | | | | | | |

| 7.750%, 04/01/2020 (a)(c) (Cost: $2,720,001. | | | | | | | | |

| Original acquisition date: 3/17/2014) | | | 2,737,000 | | | | 2,716,473 | |

| Compass Minerals International, Inc. | | | | | | | | |

| 8.000%, 06/01/2019 | | | 3,921,000 | | | | 4,117,050 | |

| | | | | | | | 6,833,523 | |

| | | | | | | | | |

| Retailing - 5.48% | | | | | | | | |

| Brown Shoe Co., Inc. | | | | | | | | |

| 7.125%, 05/15/2019 | | | 3,452,000 | | | | 3,650,490 | |

| Rent-A-Center, Inc. | | | | | | | | |

| 6.625%, 11/15/2020 | | | 1,000,000 | | | | 1,032,500 | |

| 4.750%, 05/01/2021 | | | 1,250,000 | | | | 1,165,625 | |

| | | | | | | | 5,848,615 | |

| | | | | | | | | |

| Software & Services - 3.03% | | | | | | | | |

| ManTech International Corp. | | | | | | | | |

| 7.250%, 04/15/2018 | | | 3,120,000 | | | | 3,237,780 | |

| | | | | | | | | |

| Transportation - 4.99% | | | | | | | | |

| Quality Distribution LLC / QD Capital Corp. | | | | | | | | |

| 9.875%, 11/01/2018 | | | 1,800,000 | | | | 1,966,500 | |

| Swift Services Holdings, Inc. | | | | | | | | |

| 10.000%, 11/15/2018 | | | 3,054,000 | | | | 3,355,582 | |

| | | | | | | | 5,322,082 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $62,244,881) | | | | | | | 62,703,600 | |

| | | | | | | | | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| CONVERTIBLE BOND - 2.45% | | | | | | |

| | | | | | | |

| Materials - 2.45% | | | | | | |

| AuRico Gold, Inc. | | | | | | |

| 3.500%, 10/01/2016 (c) | | $ | 2,520,000 | | | $ | 2,608,200 | |

| TOTAL CONVERTIBLE BOND | | | | | | | | |

| (Cost $2,408,954) | | | | | | | 2,608,200 | |

| Total Investments | | | | | | | | |

| (Cost $64,653,835) - 61.21% | | | | | | | 65,311,800 | |

| Other Assets in Excess of Liabilities - 38.79% | | | | | | | 41,395,271 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 106,707,071 | |

Percentages are stated as a percent of net assets.

| (a) | Security is restricted to resale. The aggregate value of restricted securities at March 31, 2014 was 16.12% of net assets. |

| (b) | Security is considered illiquid and may be difficult to sell. |

| (c) | Foreign issued security. |

See notes to financial statements.

Intrepid Disciplined Value Fund

SCHEDULE OF INVESTMENTS

March 31, 2014 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS - 51.59% | | | | | | |

| | | | | | | |

| Commercial & Professional Services - 2.71% | | | | | | |

| FTI Consulting, Inc. (a) | | | 20,875 | | | $ | 695,972 | |

| Tetra Tech, Inc. (a) | | | 17,600 | | | | 520,784 | |

| | | | | | | | 1,216,756 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 4.16% | | | | | | | | |

| Coach, Inc. | | | 19,100 | | | | 948,506 | |

| Mattel, Inc. | | | 22,900 | | | | 918,519 | |

| | | | | | | | 1,867,025 | |

| | | | | | | | | |

| Diversified Financials - 6.89% | | | | | | | | |

| Northern Trust Corp. | | | 18,000 | | | | 1,180,080 | |

| The Bank Of New York Mellon Corp. | | | 35,010 | | | | 1,235,503 | |

| The Western Union Co. | | | 41,500 | | | | 678,940 | |

| | | | | | | | 3,094,523 | |

| | | | | | | | | |

| Energy - 3.98% | | | | | | | | |

| Bill Barrett Corp. (a) | | | 14,370 | | | | 367,872 | |

| Newfield Exploration Co. (a) | | | 45,250 | | | | 1,419,040 | |

| | | | | | | | 1,786,912 | |

| | | | | | | | | |

| Health Care Equipment & Services - 7.73% | | | | | | | | |

| Intuitive Surgical, Inc. (a) | | | 2,040 | | | | 893,500 | |

| Laboratory Corp. of America Holdings (a) | | | 13,600 | | | | 1,335,656 | |

| Quest Diagnostics, Inc. | | | 21,500 | | | | 1,245,280 | |

| | | | | | | | 3,474,436 | |

| | | | | | | | | |

| Household & Personal Products - 2.06% | | | | | | | | |

| Energizer Holdings, Inc. | | | 9,200 | | | | 926,808 | |

| | | | | | | | | |

| Insurance - 1.34% | | | | | | | | |

| Aspen Insurance Holdings Ltd. (b) | | | 15,100 | | | | 599,470 | |

| | | | | | | | | |

| Materials - 2.94% | | | | | | | | |

| AuRico Gold, Inc. (b) | | | 41,800 | | | | 181,830 | |

| Newmont Mining Corp. | | | 37,600 | | | | 881,344 | |

| Pan American Silver Corp. (b) | | | 20,000 | | | | 257,400 | |

| | | | | | | | 1,320,574 | |

See notes to financial statements.

Intrepid Disciplined Value Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2014 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS - 51.59% | | | | | | |

| | | | | | | |

| Pharmaceuticals, Biotechnology | | | | | | |

| & Life Sciences - 0.99% | | | | | | |

| Bio-Rad Laboratories, Inc. (a) | | | 3,468 | | | $ | 444,320 | |

| | | | | | | | | |

| Retailing - 4.52% | | | | | | | | |

| American Eagle Outfitters, Inc. | | | 54,000 | | | | 660,960 | |

| Big Lots, Inc. (a) | | | 6,200 | | | | 234,794 | |

| Staples, Inc. | | | 100,000 | | | | 1,134,000 | |

| | | | | | | | 2,029,754 | |

| | | | | | | | | |

| Software & Services - 5.98% | | | | | | | | |

| Amdocs Ltd. (b) | | | 9,980 | | | | 463,671 | |

| Check Point Software Technologies Ltd. (a)(b) | | | 8,000 | | | | 541,040 | |

| CSG Systems International, Inc. | | | 16,715 | | | | 435,258 | |

| Global Payments, Inc. | | | 3,110 | | | | 221,152 | |

| Microsoft Corp. | | | 25,030 | | | | 1,025,980 | |

| | | | | | | | 2,687,101 | |

| | | | | | | | | |

| Technology Hardware & Equipment - 6.67% | | | | | | | | |

| Apple, Inc. | | | 2,100 | | | | 1,127,154 | |

| Cisco Systems, Inc. | | | 61,700 | | | | 1,382,697 | |

| Tech Data Corp. (a) | | | 8,000 | | | | 487,680 | |

| | | | | | | | 2,997,531 | |

| | | | | | | | | |

| Telecommunication Services - 1.62% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 27,838 | | | | 729,634 | |

| TOTAL COMMON STOCKS | | | | | | | | |