UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-21625

Investment Company Act file number

Intrepid Capital Management Funds Trust

(Exact name of registrant as specified in charter)

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach, FL 32250

(Address of principal executive offices) (Zip code)

Mark F. Travis

1400 Marsh Landing Parkway, Suite 106

Jacksonville Beach FL 32250

(Name and address of agent for service)

1-904-246-3433

Registrant's telephone number, including area code

Date of fiscal year end: 09/30/2012

Date of reporting period: 03/31/2012

Item 1. Report to Stockholders.

Intrepid Capital Fund

Intrepid Small Cap Fund

Intrepid Income Fund

Intrepid All Cap Fund

Semi-Annual Report

March 31, 2012

Intrepid Capital Fund

Mark F. Travis, President/C.E.O.

April 11, 2012

Dear Fellow Shareholders,

For the period ended March 31, 2012, the Intrepid Capital Fund (the “Fund”) returned 6.56% in the first calendar quarter and 14.31% in the first six months of its fiscal year. Taking a step back, the Fund has produced annualized returns of 5.31%, 18.88%, 7.44%, and 7.07% over the last one year, three years, five years, and since the Fund’s inception on January 3, 2005, respectively. Over the same periods, the S&P 500 returned 12.59% for the first calendar quarter, 25.89% during the first six months of the fiscal year, and 8.54%, 23.42%, 2.01%, and 4.36% for the last one year, three year, five year, and since the Fund’s inception on an annualized basis. The Fund’s other benchmark, the Bank of America Merrill Lynch High Yield Master II Index returned 5.15% for the first calendar quarter, 11.65% during the first six months of the fiscal year, and 5.63%, 23.78%, 7.84%, and 7.76% for the last one year, three year, five year, and since the Fund’s inception on an annualized basis. The Fund’s gross expense ratio is 1.47%.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held less than 30 days. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

At this point in all of my letters, our lawyers force us to remind you that “past performance is no guarantee of future results.” With that out of the way, we do tend to agree with the lawyers on past performance, but we also think well designed strategies with a rigorous, disciplined process should continue to attain attractive risk-adjusted results over the long run.

Prospective investment returns depend on what an investor is willing to pay today for a stream of expected future cash flows, whether those cash flows are delivered by a stock, bond, or other type of investment vehicle. In an environment where broad equity indices such as the S&P 500 have annualized three-year returns exceeding 20%, finding strong businesses trading at attractive prices has become quite challenging. The same can be said of corporate debt securities, whose prices remain artificially inflated by the lowest interest rate environment in years.

The easy way to think of the investment process we deploy at Intrepid Capital is that when security prices are depressed and offer attractive prospective returns, our cash levels tend to be low. Conversely, when prices are high and your brother-in-law is bragging about his stock market winnings, our cash levels tend to be high.

Intrepid Capital Fund

I have often lamented over the last 17 years as a portfolio manager about how much easier my life would be if I were a “closet indexer,” holding a basket of securities that closely resembled market benchmarks and floating with the tide, whichever way it may be going. Easier for me, yes, but much harder for you, since I would be able to blame losses of your capital on “the market” and avoid accepting any culpability.

At Intrepid Capital our value-sensitive, contrarian-tilted investment process can be “painful” as we try to grow your capital base and ours, with an ever-watchful eye on risk. Risk is the evil twin sister of return that is often ignored when markets march upward, but will quickly find its way to the front of investors’ minds when asset values begin to fall.

For the quarter, the three biggest contributors to positive performance were: Computer Sciences (ticker: CSC), CoreLogic (ticker: CLGX), and Microsoft (ticker: MSFT). To be “fair and balanced” in our reporting, our largest detractors for the same period were: Newmont Mining (ticker: NEM) and Bill Barrett Corp. (ticker: BBG). Interestingly, these last two are what we refer to as “asset valuations,” where we think there is a material disconnect between the current market price of a business and the long-term value of its asset base net of liabilities. The recent decline in share prices has only increased our conviction, and we have taken the opportunity to increase our weights in these holdings.

I am pleased to say that for the period ending March 31, 2012, Morningstar ranked the Intrepid Capital Fund in the top 31%, 15%, and 1% out of 969, 839 and 749 Moderate Allocation Funds for the one-, three- and five-year periods, respectively, based on total returns. The Fund also received an Overall 5-Star Morningstar Rating, the highest rating for risk-adjusted returns, out of 839 Moderate Allocation Funds for the period ending March 31, 2012 (derived from a weighted average of the fund’s three-, five-, and ten-year risk-adjusted return measure, if applicable). The largest part of my family’s investments continues to be held in the Intrepid Capital Funds, along with the assets of the analytical staff at Intrepid Capital that made these results possible.

Thank you for entrusting your hard-earned assets to our care; it is not an obligation we take lightly.

Best regards,

Mark F. Travis

President

Intrepid Capital Fund Portfolio Manager

Must be preceded or accompanied by a prospectus.

Intrepid Capital Fund

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Bank of America/Merrill Lynch High Yield Master II Index is Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 Index, as ranked by market capitalization. You cannot invest directly in an index.

©2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Morningstar Rankings represent a fund’s total-return percentile rank relative to all funds that have the same Morningstar Category. The highest percentile rank is 1 and the lowest is 100. It is based on Morningstar total return, which includes both income and capital gains or losses and is not adjusted for sales charges or redemption fees. Morningstar ranked the Intrepid Capital Fund in the top 31%, 15% and 1% out of 969, 839, and 749 Moderate Allocation funds for the one- , three- and five-year periods ending 3/31/12, respectively.

The Intrepid Capital Fund was rated 4-Stars and 5-Stars against the following numbers of U.S. domiciled Moderate Allocation funds over the following time periods: 839 and 749 funds in the last three- and five-years, respectively.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating (based on a Morningstar risk-adjusted return measure that accounts for variation in a fund’s monthly performance, including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. deprecation) and interest expense to pretax income. Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid Small Cap Fund

Jayme Wiggins,

Small Cap Fund Portfolio Manager

April 5, 2012

Dear Fellow Shareholders,

Like a tired dog, Wall Street is accustomed to walking around in circles. Instead of writing this letter, we almost re-posted the commentary from last year’s first quarter. Little has changed since then, even though the market has bounced around quite a bit. Through the first three months of 2012, the Intrepid Small Cap Fund (the “Fund”) gained 5.23% versus a 12.44% increase for the Russell 2000 Index. During the Fund’s fiscal six month period, ending March 31, 2012, the Fund rose 14.54%, while the Russell 2000 gained 29.83%. We have trailed small cap benchmarks during this upswing, much like we did in last year’s early ramp. The reasons are basically the same. Small caps are back to all-time highs and undervalued securities are scarce. As a result, our portfolio consists of lower beta holdings and a large amount of cash.

Cash and equivalents equaled 47% of Fund assets at March 31, 2012. According to the Investment Company Institute, the average equity mutual fund has 3.6% of assets in cash, which is close to a historical low. A record high level of cash for the fund industry of almost 6% was reached in early 2009. That was the one time since the inception of the Intrepid Small Cap Fund that we held less cash than our peers. Our cash has returned to 2007 levels because the small cap opportunity set is similarly constrained. Unlike then, when we earned 5% in Treasury bills, the Federal Reserve has eliminated the returns from owning risk-free investments. By punishing savers and promoting higher stock prices, the Fed hopes to create a virtuous circle of consumer and corporate confidence. Why own a risk-free Treasury that pays nothing if an investment grade bond yields 3%? Why accept a high grade coupon of only 3% if junk bonds yield 7%? Why settle for below investment grade debt at 7% if stocks have increased 9% annually over the “long run”? The logic of the slope of relative returns is very slippery. Pitfalls abound.

Although certain European economies are worse off than the U.S. is today, America isn’t an economic oasis. Unfortunately, the short-term impact of doing the right thing by reducing spending is politically unpalatable. Today, the front page headline on The Wall Street Journal reads, “Markets Fear End of Stimulus.” Investors shouldn’t be trading on hopes of unsustainable government intervention, but it has existed for so long now that it’s difficult to discern how our economy would look standing on its own two feet. What would happen to the collective top line of Corporate America if our government had a balanced budget? To what extent has the decades-long decline in interest rates given a tailwind to borrowers?

There were rumblings of margin pressure in the fourth quarter, but corporate profitability remains near peak levels. Some market participants claim that small cap

Intrepid Small Cap Fund

margins, in contrast to large caps, are not yet back to the record highs of 2006. Based on our internal analysis, this is false. The median operating margin for non-financial companies in the Russell 2000 was 6.8% in 2011 and 7% in 2006. The market cap weighted average margin was 10.2% and 10.1% in 2011 and 2006, respectively, excluding outliers. Larger companies in the small cap index have higher profitability. Financials were excluded from the data because interest is a component of their operating profit. The margins of financial companies, namely banks, have fallen significantly since the housing bubble.

Some in the investment community claim that there have been structural changes in the economy (e.g. technology, globalization) that permit higher margins than were historically attainable. The economy has shifted from manufacturing toward services over the years. One can make the case that since service businesses generally require fewer assets than manufacturing businesses, the economy’s steady state margin should actually be lower, not higher. Competition drives down returns toward the cost of capital. The return on capital is the product of unlevered after-tax margins and invested capital turnover (operating margin * [1 – tax rate] * [sales/invested capital]). Therefore, if the economy becomes more asset light (i.e. invested capital declines), margins for companies without a sustainable competitive advantage should be competed downward. We believe small company margins are as high as they’ve been in a long time and expect them to eventually contract.

The Fund’s largest contributors during the first quarter included many of the same companies that fell furthest in the preceding quarter. The three stocks adding the most to the portfolio’s return were Federated Investors (ticker: FII), Computer Sciences (ticker: CSC), and CoreLogic (ticker: CLGX). Federated’s stock previously suffered from the specter of SEC regulation of money market funds, as well as the Fed’s pledge to keep interest rates near zero through 2014. Speculation has grown that the SEC committee charged with proposing money fund reforms is leaning in the direction of less harsh regulation. Additionally, the market has started to doubt that interest rates will remain at zero for another two years. These developments helped drive Federated’s shares up 48% in the quarter, adding 1% to the Fund’s overall return.

We opined in last quarter’s letter that Computer Sciences was “broadly hated” and believed the shares were attractive. The stock received a nice bounce in early February as the firm simultaneously announced earnings and the appointment of Mike Lawrie as CEO. Lawrie has a successful track record of turning around troubled firms, and the resignations of CSC’s former CEO and CFO could help restore credibility to the management team. The company’s earnings report was weak, but bookings were strong. CSC also is making progress in its negotiations with the U.K. National Health System. This contract has dogged the firm for years and clarity would be welcomed by investors.

CoreLogic was the Fund’s third largest gainer in the first quarter. The stock has been highly volatile over the past year, and we have taken advantage of these movements to

Intrepid Small Cap Fund

resize our position. For example, CoreLogic was briefly a 4% weighting and the Fund’s largest holding last August, before the company announced it was examining strategic alternatives. In Q1, CoreLogic said its strategic review was complete and the firm plans to remain independent. To the surprise of many, the stock rallied on this news, which was accompanied by solid guidance for 2012. As CoreLogic, Federated, and CSC have approached their intrinsic values, we have reduced the positions.

Bill Barrett (ticker: BBG) was the Fund’s only major detractor in the quarter. This position negatively impacted the Fund’s return by 65 basis points. Bill Barrett’s stock has been hammered by the lowest natural gas prices in ten years. The Wall Street Journal even speculated recently that natural gas prices will turn negative this summer (March 28, 2012: “Why Natural Gas Prices Could Fade to Red”). There’s no denying that natural gas inventories are bloated and prices are in the gutter. We do not expect natural gas prices to stay at existing low levels. There is no incentive for E&P companies to drill for new gas today, and we are fast approaching the point when operators will take a loss producing already developed reserves. We expect supply to fall and demand to gradually increase. Nevertheless, our investment thesis for Bill Barrett does not depend on a sharp rebound in natural gas prices back to the averages of recent years. While Bill Barrett is clearly perceived as a natural gas company (see chart below), approximately half of its revenue comes from oil and natural gas liquids, which are priced at a premium to dry gas. Ultimately, we believe that investors will recognize that Bill Barrett has substantial “wet” assets that are more highly valued in today’s market. We more than doubled our ownership in Bill Barrett’s stock during the quarter as the shares fell 23%.

| | | |

| | Per MMBtu = per 1 million Btus | Source: Intrepid |

Intrepid Small Cap Fund

New purchase activity was limited in the first quarter. We bought small positions in Amdocs (ticker: DOX) and Pan American Silver (ticker: PAAS). Amdocs is the world’s leading provider of billing and customer care solutions to the communications industry. It is a high-quality business that generates substantial free cash flow and possesses a pristine balance sheet. Pan American is a silver miner that we have previously owned. Over the past two years, the price of silver has doubled while Pan American’s stock has slightly declined. The stock trades for 5x operating income. Shares have fallen because of reduced expectations for another round of money printing by the Fed. In theory, no more quantitative easing should lower inflation expectations. In our opinion, the Fed’s money printing antics are not over. Pan American Silver provides a small hedge against the possibility of increased inflation. We will not claim to know the fair value for an ounce of silver, but our Pan American valuation assumes a normalized silver price that is well below recent levels.

During the quarter, we sold our holdings of ICU Medical (ticker: ICUI), Oshkosh (ticker: OSK), Scholastic (ticker: SCHL), Standard Parking (ticker: STAN), and Total Systems Services (ticker: TSS). Each of these stocks crossed our estimated fair value. Scholastic’s rise was more company-specific than the others, as the success of The Hunger Games gave a temporary boost to earnings.

Lower-quality stocks have outperformed this year. We don’t believe that increasing portfolio risk is prudent at current market valuations. We have a long shopping list of companies we want to own at the right price. While bargains are limited today, the sentiment of the market can change rapidly. We believe we are well-positioned to capitalize when this occurs. Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Intrepid Small Cap Fund Portfolio Manager

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund.

The Advisor believes that current market conditions warrant a defensive position from the requirement to invest at least 80% of its net assets in equity securities of small capitalization companies.

Intrepid Small Cap Fund

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. Companies in the Russell 3000 Index, as ranked by market capitalization. You cannot invest directly in an index.

Cash Flow measures the cash generating capability of a company by adding non-cash charges and interest to pretax income. Free Cash Flow measures the cash generating capability of a company by subtracting capital expenditures from cash flow from operations. Unlevered free cash flow equals free cash flow plus after-tax interest expense. Beta measures the sensitivity of rates of return on a fund to general market movements. Market Cap is the market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share. Basis Point is a unit that is equal to 1/100th of 1% and is used to denote a change in a financial instrument.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid Income Fund

| |

| Jason Lazarus, | Ben Franklin, |

| Income Fund Co-Portfolio Manager | Income Fund Co-Portfolio Manager |

April 5, 2012

Dear Fellow Shareholders,

The high-yield market extended the gains booked at the end of 2011, rising 5.15% in the first quarter, ended March 31, 2012, as measured by the Merrill Lynch / Bank of America High Yield Master II index (the “Index”). In contrast, the Intrepid Income Fund (the “Fund”) gained 2.45% in the quarter, net-of-fees. In the six months ended March 31, 2012, the Fund returned 5.36%, while the Index gained 11.65%. As discussed in previous quarterly commentaries, our short-duration, high-quality bias has tended to underperform in periods of rapidly rising prices.

Last quarter we reported that the only bond that negatively impacted the portfolio’s performance was Smith & Wesson 9.5% due 1/14/2016. While the notes fell less than 1% in the fourth quarter, we felt this was unwarranted and remained confident in our holding. We are happy to report that Smith & Wesson was our top performer in the first quarter 2012, both for total return and contribution. Fears of both regulatory reform from the upcoming election and a deteriorating economy have caused consumers to flock to firearm purchases. Many of these purchases are for second and third firearms. The company’s balance sheet continues to strengthen, and management has no intention of using resources to acquire. They appear focused on maintaining a conservative capital structure. This should bode well for the future of our investment. Rounding out the top performers, Central Garden & Pet 8.25% due 3/01/2018 and Spartan Stores 3.375% convertible notes putable 5/14/2014 both outperformed the market as a whole. These businesses are long-term holdings of the Intrepid Income Fund and represent large positions of around 4% of assets.

Due to the significant gains in the bond and equity markets, the Fund had only one detractor in the first quarter. We initiated a small position in World Wrestling Entertainment (ticker: WWE) common stock, which declined slightly after the target position was established. The position had an immaterial effect on the Fund’s return in the quarter. WWE is a market-leading producer of live and broadcasted wrestling events. The company’s Monday Night Raw program on USA is the longest running weekly entertainment show on television, which has strong and stable TV ratings. WWE not only offers a 5%+ dividend, but we believe is significantly undervalued at below $9 per share.

The first quarter was fairly active from a trading perspective. We initiated five new positions, primarily in ideas where we had completed our research but could not

Intrepid Income Fund

immediately find a willing seller. These positions include Affinia Group 10.75% due 8/15/2016, Computer Sciences 6.5% due 3/15/2018, Energy Partners 8.25% due 2/15/2018, Quality Distribution 9.875% due 11/01/2018, and World Wrestling Entertainment common stock. We also added to our holdings of Intertape Polymer 8.5% due 8/01/2014, Libbey Glass 10% due 2/15/2015, and PetroQuest Energy 10% due 9/01/2017.

Our small position in CoreLogic 7.25% due 6/01/2021 was sold early in the quarter as the security appreciated significantly. The CoreLogic position was initiated in the third quarter of 2011 as the corporate bond and equity markets collapsed. Intrepid’s equity team had been following the company for over a year and alerted us to the bond issue, which had fallen from par to below $90. While the bond’s duration is longer than our typical target of five years or less, we were very comfortable with the company’s credit quality and felt the 9.4% yield-to-maturity compensated us well for the increased interest rate risk. The CoreLogic position is a good example of how Intrepid’s investment team collaborates across asset classes.

The equity team is also responsible for sourcing our newly entered Computer Sciences bond. Early in the year, the market became concerned that the possible loss of a large contract with the United Kingdom’s National Health Service would result in a downgrade of the company’s credit rating. While this concern was not unfounded, we believed CSC’s credit quality would not be materially impaired if the contract were lost. CSC’s 6.5% issue is an investment grade bond. Because the Fund is not constrained to only the high-yield bond asset class, our flexibility allowed us to capitalize on this unique opportunity, acquiring an investment-grade credit offering a junk-bond yield.

Another new position, Quality Distribution, operates the largest chemical tank truck network in North America. The logistics company transports everything from the raw materials that go into Tide laundry detergent to herbicides for Monsanto. The growth in “fracking”, which requires massive amounts of water to be pumped into rock layer to extract oil and natural gas, has been an avenue of growth for Quality, which entered the space as a transporter of water in the fourth quarter of 2010. Recently, the company has been shifting to an asset-light business model that runs with less operating leverage. The new model utilizes independent affiliates to provide the physical transportation of chemicals. This can be thought of as a franchise model, and the new strategy requires capital expenditures of only about 1% of revenue, compared to industry-wide percentages of around 10%. This reduction in spending allows the company to use cash for other purposes, such as paying down debt.

Unlike last quarter, only one of our holdings was called by its issuer in the first quarter. Mac-Gray (ticker: TUC) repurchased its 7.625% notes. Our purchase activity more than offset the cash influx, and the fund finished the quarter with 23.2% in cash. While this level reflects a decline from the end of 2011, it is

Intrepid Income Fund

important to note that we expect several of our holdings to be called through the summer. As a reminder, our cash levels do not reflect any attempt to time the market. Cash will fluctuate purely as a function of the available opportunities. As such, we expect the fund’s cash level to grow over the next few quarters in the absence of a market sell-off.

The rise in high-yield bond prices has compressed the Index’s yield-to-worst down to 7.13%. This is a historically low level of potential return offered by the asset class. On only a handful of occasions over the last decade have yields been this low, first in 2004/2005 then again in early 2011. We believe the portfolio is positioned defensively to insulate our shareholders from adverse credit events and higher risk-free rates. The Fund’s modified duration as of quarter-end is 2.4 years. While the opportunity set looks to be fairly limited, persistence and patience are still allowing us to find attractive high-yield issues. Thank you for your investment.

Sincerely,

|  |

| Ben Franklin, CFA | Jason Lazarus |

| Intrepid Income | Intrepid Income |

| Co-Lead Portfolio Manager | Co-Lead Portfolio Manager |

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is generally greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified. Therefore, the Fund is more exposed to individual securities volatility than a diversified fund.

The Bank of America Merrill Lynch High Yield Master II Index is Merrill Lynch’s broadest high yield index, and as such is comparable with the broad indices published by other investment banks. You cannot invest directly in an index.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration. Modified Duration is a time measure of interest-rate risk exposure that estimates how much a bond, or a bond’s price, fluctuates with changes in interest rates. Yield-to-Worst is the bond yield computed by using the lower of either the yield to maturity or the yield to call on every possible call date. Par or par value is the face value of a bond.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid All Cap Fund

Greg Estes,

All Cap Fund Portfolio Manager

April 5, 2012

Dear Fellow Shareholders,

For the first calendar quarter ended March 31, 2012, the Intrepid All Cap Fund (the “Fund”) returned 9.04%. During the same period, the Standard & Poors 500 Index returned 12.59% and the Russell 3000 Index rose 12.87%. In this environment, in which the broad market increases so steeply, we believe our results will typically underperform compared to benchmark indices. We believe this because we strive to maintain a consistent investment process in all environments. Because we do not shift from our disciplined value investment process to a more growth-oriented or momentum-driven approach, we may sometimes encounter periods of underperformance, as we did in this quarter.

One result of our investment process was an increase in the Fund’s cash position. A rising market has usually resulted in fewer discounted investments available for purchase and more sales of existing holdings that reached our estimated intrinsic value. The Fund’s cash level has risen from 18.7% in the previous quarter to nearly 35% at the end of the most recent quarter. Naturally, this has a dampening effect on performance in current rising market conditions. On the other hand, there is a method to our madness. Our cash levels have typically been inversely related to our investment opportunities available. In times like these, where discounts are harder to find, cash will be high. Should the market pull back, we have cash to deploy in purchasing new opportunities. Our cash position has two purposes. First, we think that it should help hedge against potential losses in the event of a market correction. Second, it affords us the flexibility to buy new positions without having to sell other positions. In doing this, we believe that we can provide a lower-volatility experience for Fund investors.

For the first six months of the Fund’s fiscal year ended March 31, 2012, the Fund gained 19.80% versus the S&P 500 Index’s 25.89% and the Russell 3000 Index’s 26.55%. The two quarters were very similar, both in terms of the high benchmark returns and in the relative underperformance of the Fund. Again, cash muted the Fund’s return as the position grew through the six-month period.

When we write about our cash positions, the first question on most investors’ minds has to do with our expectations for future market performance. Given the Fund’s high level of cash, are we implying that we believe that the market will decline in the future? We respond by saying that we do not attempt to time the market. However, our cash position is evidence of our perception of the overall risk of the market. To us, risk and volatility are not synonymous. Volatility is short-term movement in market prices; risk is the potential for long-term loss of principal. Can we say with certainty that the market will decline? Of course we cannot. We know of many

Intrepid All Cap Fund

value investors who point to the S&P 500 Index’s P/E multiple (Price to Earnings ratio) and say that it looks reasonable. In our view, that number, currently 14.59 times, does look reasonable, but only if one assumes that the earnings in the statistic are maintained or grow. Statistics such as P/E only look at the trailing twelve month period, which in this case has seen growth in overall corporate profits. We do not consider future growth in profits to be a given.

As a matter of fact, we are concerned that overall corporate profit margins (defined as trailing twelve month net income divided by trailing twelve month net sales) are at or near peak values. Profit margin is a sign of a firm’s efficiency in generating profits, or viewed more simply, how well a firm is performing. They can fluctuate. In the case of the S&P 500 Index, the current profit margin is 13.81%. Over the past ten years, it has fluctuated, going as low as 8.30% in September 2009 and as high as 14.53% in January 2007. Likewise, the Russell 3000 Index’s profit margin is currently 13.41%, with a ten-year high of 17.62% in July 2011 and a low of 7.53% in September 2009. It is amazing to see how rapidly these margins re-inflated from their floors in September 2009. We believe that corporate profit margins have benefitted from aggressive cost cutting activities over the past two years. Going forward, we believe there is much less room for increasing efficiency through continued cost-cutting measures, and some of the measures currently benefiting margins may even be unsustainable.

For the quarter, there were not many holdings which performed poorly. Of the two which detracted from performance, one was a new addition and another was a position to which we are adding. The former is Bill Barrett Corporation (ticker: BBG), which is widely known as a natural gas driller. The stock has been hurt by the massive decline in natural gas prices. What is less obvious to casual observers is that Bill Barrett also has liquid production, both in petroleum and natural gas liquids. We think that the market is pricing Bill Barrett at trough natural gas prices instead of long-term normalized prices. The net result of our investment was a detraction of 44 basis points from the Fund’s quarterly return. You can read more about Bill Barrett in the Intrepid Small Cap Fund section. Our second underperformer, World Wrestling Entertainment (ticker: WWE), took away only approximately 3 basis points from the Fund’s quarterly return. Continued uncertainty over the launch of WWE’s television network has been weighing on the stock. We will continue adding to the position as the stock price permits.

The Fund’s performance benefitted from its flexibility to invest across all market capitalizations. Specifically, the Fund’s investment in select large cap equities added to overall quarterly performance. At the end of 2011, four of the Fund’s top five holdings were large caps: Gilead Sciences (ticker: GILD), Dell, Inc. (ticker: DELL), Microsoft Corp. (ticker: MSFT), and Bank of New York Mellon Corp. (ticker: BK). These four securities accounted for more than one third of the total return in the quarter. We were compelled to sell Gilead when it reached intrinsic value, and we

Intrepid All Cap Fund

are closely monitoring the discounts in the other stocks mentioned. The best performer in the quarter was Federated Investors (ticker: FII), which added 99 basis points to the Fund’s total return in the quarter. Prior to the first quarter, the uncertainty of money market regulation had weighed down FII’s share price. As the quarter progressed, the market seemed to grow more confident that: 1) added regulation is less certain than originally thought, and 2) if regulation is added, it will not happen anytime soon. Given the increase in FII’s share price and corresponding decrease in discount, we cut the position in half.

As we have stated before, sustained increases in stock prices have led to smaller discounts in our holdings, which means we will likely be selling more than we are buying. That was the case in this quarter. At the start of the quarter, the Fund comprised 36 equities. It ended the quarter with 30 holdings. We added two new positions in the quarter: Bill Barrett, mentioned above, and Cott Corp. (ticker: COT), a market leading private-label soft drink and juice manufacturer and distributor. Of the eight positions we exited completely, all were due to their stock prices reaching our corresponding intrinsic value estimates.

We end this letter by examining the discount within the Fund. Each security we own has a discount to its intrinsic value which is based upon its market price and our calculated intrinsic values. At the end of the quarter, that average discount was 12%. Bear in mind that this metric is a snapshot taken at the end of the quarter. We exited those positions whose discounts evaporated as their stock prices rose, so they are not included in the Fund’s discount calculation. Selling positions which have a small discount or a premium to our calculated intrinsic values while keeping those equities with larger discounts has a net effect of maintaining a larger average discount than if we had simply held a static portfolio over the quarter. As always, we thank you for your investment.

Sincerely,

Greg Estes, CFA

Intrepid All Cap Fund Portfolio Manager

Please see the Schedule of Investments in this report for a full list of fund holdings. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. The Fund is considered non-diversified as a result of limiting its holdings to a relatively small number of positions and may be more exposed to individual stock volatility than a diversified fund.

Intrepid All Cap Fund

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. Companies in the Russell 3000 Index, as ranked by market capitalization. The Russell 3000 Index is an index representing the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. You cannot invest directly in an index.

Price-to-Earnings Ratio (P/E) is a valuation ratio of a company’s current share price compared to its per-share earnings as calculated by Market Value per Share divided by Earnings per Share (EPS). Basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

Intrepid Funds

EXPENSE EXAMPLE

March 31, 2012 (Unaudited)

As a shareholder of the Intrepid Capital Management Funds Trust (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other expenses incurred by the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period of October 1, 2011 through March 31, 2012.

ACTUAL EXPENSES

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2012 (Unaudited)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

INTREPID CAPITAL FUND – INVESTOR CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2011 - | |

| | | October 1, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 1,143.10 | | | $ | 7.50 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,018.00 | | | | 7.06 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

INTREPID CAPITAL FUND – INSTITUTIONAL CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2011 - | |

| | | October 1, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 1,145.40 | | | $ | 6.17 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,019.25 | | | | 5.81 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

INTREPID SMALL CAP FUND – INVESTOR CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2011 - | |

| | | October 1, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 1,145.40 | | | $ | 7.51 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,018.00 | | | | 7.06 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

Intrepid Funds

EXPENSE EXAMPLE (continued)

March 31, 2012 (Unaudited)

INTREPID SMALL CAP FUND – INSTITUTIONAL CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2011 - | |

| | | October 1, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 1,146.70 | | | $ | 6.17 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,019.25 | | | | 5.81 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

INTREPID INCOME FUND – INVESTOR CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2011 - | |

| | | October 1, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 1,053.60 | | | $ | 5.90 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,019.25 | | | | 5.81 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

INTREPID INCOME FUND – INSTITUTIONAL CLASS

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2011 - | |

| | | October 1, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 1,056.00 | | | $ | 4.63 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,020.50 | | | | 4.55 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.90%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

INTREPID ALL CAP FUND

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During Period* | |

| | | Account Value | | | Account Value | | | October 1, 2011 - | |

| | | October 1, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| Actual | | $ | 1,000.00 | | | $ | 1,198.00 | | | $ | 7.69 | |

| Hypothetical (5% return | | | | | | | | | | | | |

| before expenses) | | | 1,000.00 | | | | 1,018.00 | | | | 7.06 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the period. |

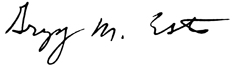

Intrepid Capital Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2012 (Unaudited)

INTREPID CAPITAL FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Common Stocks | | $ | 213,995,453 | |

| Corporate Bonds | | | 85,265,047 | |

| Real Estate Investment Trust | | | 7,340,423 | |

| Convertible Bonds | | | 2,992,465 | |

| Cash* | | | 81,020,930 | |

| | | $ | 390,614,318 | |

* Cash, cash equivalents and other assets less liabilities.

Intrepid Small Cap Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2012 (Unaudited)

INTREPID SMALL CAP FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Information Technology | | $ | 133,266,079 | |

| Consumer Discretionary | | | 88,490,655 | |

| Financials | | | 75,495,681 | |

| Health Care | | | 52,409,599 | |

| Energy | | | 23,225,604 | |

| Industrials | | | 18,374,878 | |

| Consumer Staples | | | 15,734,983 | |

| Materials | | | 10,556,262 | |

| Telecommunication Services | | | 9,227,891 | |

| Cash* | | | 375,362,904 | |

| | | $ | 802,144,536 | |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

* Cash, cash equivalents and other assets less liabilities.

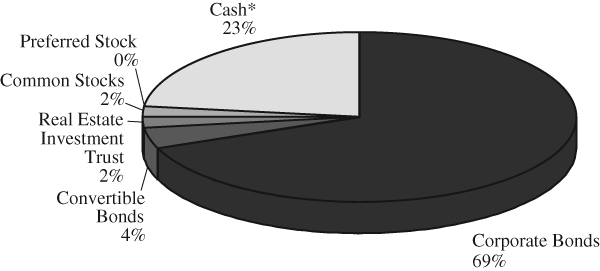

Intrepid Income Fund

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2012 (Unaudited)

INTREPID INCOME FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Corporate Bonds | | $ | 64,982,672 | |

| Convertible Bonds | | | 3,901,495 | |

| Real Estate Investment Trust | | | 1,902,338 | |

| Common Stocks | | | 1,708,665 | |

| Preferred Stock | | | 335,010 | |

| Cash* | | | 22,053,995 | |

| | | $ | 94,884,175 | |

* Cash, cash equivalents and other assets less liabilities.

Intrepid All Cap Fund

SECTOR ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2012 (Unaudited)

INTREPID ALL CAP FUND

(as a % of total net assets)

COMPONENTS OF PORTFOLIO HOLDINGS

| Information Technology | | $ | 9,628,137 | |

| Financials | | | 6,134,777 | |

| Consumer Discretionary | | | 5,918,558 | |

| Health Care | | | 5,283,533 | |

| Consumer Staples | | | 2,522,319 | |

| Telecommunication Services | | | 1,753,914 | |

| Energy | | | 1,326,510 | |

| Materials | | | 458,848 | |

| Cash* | | | 16,655,424 | |

| | | $ | 49,682,020 | |

* Cash, cash equivalents and other assets less liabilities.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 54.78% | | | | | | |

Commercial & Professional Services - 1.80% | | | | | | |

| Securitas AB (a) | | | 730,117 | | | $ | 7,040,942 | |

Consumer Services - 4.79% | | | | | | | | |

| Regis Corp. | | | 557,988 | | | | 10,283,719 | |

| Speedway Motorsports, Inc. | | | 450,314 | | | | 8,411,865 | |

| | | | | | | | 18,695,584 | |

| Diversified Financials - 6.01% | | | | | | | | |

| The Bank Of New York Mellon Corp. | | | 403,000 | | | | 9,724,390 | |

| CoreLogic, Inc. (b) | | | 566,878 | | | | 9,251,449 | |

| Federated Investors, Inc. | | | 201,650 | | | | 4,518,977 | |

| | | | | | | | 23,494,816 | |

| Energy - 2.29% | | | | | | | | |

| Bill Barrett Corp. (b) | | | 344,000 | | | | 8,947,440 | |

Food, Beverage & Tobacco - 3.75% | | | | | | | | |

| Cott Corp. (a)(b) | | | 868,077 | | | | 5,720,628 | |

| Molson Coors Brewing Co. | | | 197,000 | | | | 8,914,250 | |

| | | | | | | | 14,634,878 | |

| Household & Personal Products - 3.21% | | | | | | | | |

| American Greetings Corp. | | | 437,619 | | | | 6,713,075 | |

| Central Garden & Pet Co. - Class A (b) | | | 335,536 | | | | 3,231,212 | |

| Central Garden & Pet Co. - Class B (b) | | | 35,000 | | | | 329,350 | |

| Oil-Dri Corporation of America - Class A (c) | | | 105,847 | | | | 2,253,483 | |

| | | | | | | | 12,527,120 | |

| Insurance - 8.47% | | | | | | | | |

| AMERISAFE, Inc. (b) | | | 176,221 | | | | 4,359,708 | |

| Aspen Insurance Holdings Ltd. (a) | | | 301,914 | | | | 8,435,477 | |

| Baldwin & Lyons, Inc. - Class B | | | 117,804 | | | | 2,636,453 | |

| Berkshire Hathaway, Inc. - Class B (b) | | | 134,000 | | | | 10,874,100 | |

| The Travelers Companies, Inc. | | | 114,556 | | | | 6,781,715 | |

| | | | | | | | 33,087,453 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 54.78% (continued) | | | | | | |

Materials - 4.95% | | | | | | |

| Newmont Mining Corp. | | | 214,630 | | | $ | 11,004,080 | |

| Pan American Silver Corp. (a) | | | 169,600 | | | | 3,741,376 | |

| Royal Gold, Inc. | | | 70,500 | | | | 4,598,010 | |

| | | | | | | | 19,343,466 | |

| Media - 1.77% | | | | | | | | |

| World Wrestling Entertainment, Inc. (c) | | | 777,669 | | | | 6,897,924 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 4.50% | | | | | | | | |

| Bio-Rad Laboratories, Inc. (b) | | | 98,357 | | | | 10,198,637 | |

| Johnson & Johnson | | | 112,200 | | | | 7,400,712 | |

| | | | | | | | 17,599,349 | |

| Software & Services - 9.33% | | | | | | | | |

| Computer Sciences Corp. | | | 172,000 | | | | 5,149,680 | |

| CSG Systems International, Inc. (b)(c) | | | 601,246 | | | | 9,102,864 | |

| DST Systems, Inc. | | | 18,350 | | | | 995,121 | |

| EPIQ Systems, Inc. (c) | | | 433,871 | | | | 5,249,839 | |

| Mantech International Corp. | | | 205,888 | | | | 7,094,901 | |

| Microsoft Corp. | | | 275,000 | | | | 8,868,750 | |

| | | | | | | | 36,461,155 | |

| Technology Hardware & Equipment - 2.98% | | | | | | | | |

| Dell, Inc. (b) | | | 511,890 | | | | 8,497,374 | |

| Tellabs, Inc. | | | 775,000 | | | | 3,138,750 | |

| | | | | | | | 11,636,124 | |

| Telecommunication Services - 0.93% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 156,769 | | | | 3,629,202 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $197,768,257) | | | | | | | 213,995,453 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CONVERTIBLE BONDS - 0.77% | | | | | | |

Food & Staples Retailing - 0.77% | | | | | | |

| Spartan Stores, Inc. | | | | | | |

| 3.375%, 05/15/2027 | | $ | 3,101,000 | | | $ | 2,992,465 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | |

| (Cost $2,825,602) | | | | | | | 2,992,465 | |

| | | | | | | | | |

| CORPORATE BONDS - 21.83% | | | | | | | | |

Capital Goods - 1.39% | | | | | | | | |

| Gibraltar Industries, Inc. | | | | | | | | |

| 8.000%, 12/01/2015 (d) | | | 5,284,000 | | | | 5,416,100 | |

Commercial & Professional Services - 1.36% | | | | | | | | |

| Ashtead Capital, Inc. | | | | | | | | |

| 9.000%, 08/15/2016 | | | 3,312,000 | | | | 3,456,900 | |

| Mobile Mini, Inc. | | | | | | | | |

| 6.875%, 05/01/2015 | | | 1,815,000 | | | | 1,833,150 | |

| | | | | | | | 5,290,050 | |

| Consumer Durables & Apparel - 2.82% | | | | | | | | |

| Hanesbrands, Inc. | | | | | | | | |

| 4.155%, 12/15/2014 (d) | | | 2,290,000 | | | | 2,292,885 | |

| Levi Strauss & Co. | | | | | | | | |

| 8.875%, 04/01/2016 | | | 3,411,000 | | | | 3,521,892 | |

| Smith & Wesson Holding Corp. | | | | | | | | |

| 9.500%, 01/14/2016 | | | 5,089,000 | | | | 5,203,503 | |

| | | | | | | | 11,018,280 | |

| Consumer Services - 0.92% | | | | | | | | |

| Speedway Motorsports, Inc. | | | | | | | | |

| 8.750%, 06/01/2016 | | | 3,285,000 | | | | 3,597,075 | |

Energy - 3.12% | | | | | | | | |

| Bill Barrett Corp. | | | | | | | | |

| 9.875%, 07/15/2016 | | | 4,203,000 | | | | 4,623,300 | |

| Energy Partners Ltd. | | | | | | | | |

| 8.250%, 02/15/2018 | | | 1,176,000 | | | | 1,192,170 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 21.83% (continued) | | | | | | |

Energy - 3.12% (continued) | | | | | | |

| Petroquest Energy, Inc. | | | | | | |

| 10.000%, 09/01/2017 | | $ | 6,182,000 | | | $ | 6,382,915 | |

| | | | | | | | 12,198,385 | |

| Household & Personal Products - 2.53% | | | | | | | | |

| Amscan Holdings, Inc. | | | | | | | | |

| 8.750%, 05/01/2014 | | | 4,489,000 | | | | 4,505,879 | |

| Central Garden & Pet Co. | | | | | | | | |

| 8.250%, 03/01/2018 | | | 5,202,000 | | | | 5,364,562 | |

| | | | | | | | 9,870,441 | |

| Materials - 0.30% | | | | | | | | |

| Silgan Holdings, Inc. | | | | | | | | |

| 7.250%, 08/15/2016 | | | 1,050,000 | | | | 1,179,938 | |

Media - 0.77% | | | | | | | | |

| Scholastic Corp. | | | | | | | | |

| 5.000%, 04/15/2013 | | | 2,977,000 | | | | 3,021,655 | |

Paper Manufacturing - 1.94% | | | | | | | | |

| Intertape Polymer US, Inc. | | | | | | | | |

| 8.500%, 08/01/2014 | | | 7,549,000 | | | | 7,586,745 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 0.49% | | | | | | | | |

| Bio-Rad Laboratories, Inc. | | | | | | | | |

| 8.000%, 09/15/2016 | | | 1,739,000 | | | | 1,930,290 | |

Retailing - 2.89% | | | | | | | | |

| Collective Brands, Inc. | | | | | | | | |

| 8.250%, 08/01/2013 | | | 3,555,000 | | | | 3,581,698 | |

| HSN, Inc. | | | | | | | | |

| 11.250%, 08/01/2016 | | | 4,000,000 | | | | 4,340,040 | |

| PEP Boys-Manny Moe & Jack | | | | | | | | |

| 7.500%, 12/15/2014 | | | 3,312,000 | | | | 3,361,713 | |

| | | | | | | | 11,283,451 | |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 21.83% (continued) | | | | | | |

| Software & Services - 0.88% | | | | | | |

| Computer Sciences Corp. | | | | | | |

| 6.500%, 03/15/2018 | | $ | 3,183,000 | | | $ | 3,445,597 | |

Transportation Equipment | | | | | | | | |

| Manufacturing - 1.27% | | | | | | | | |

| Affinia Group, Inc. | | | | | | | | |

| 10.750%, 08/15/2016 | | | 3,313,000 | | | | 3,627,735 | |

| Oshkosh Corp. | | | | | | | | |

| 8.250%, 03/01/2017 | | | 1,220,000 | | | | 1,323,700 | |

| | | | | | | | 4,951,435 | |

| Truck Transportation - 1.15% | | | | | | | | |

| Quality Distribution LLC / QD Capital Corp. | | | | | | | | |

| 9.875%, 11/01/2018 | | | 4,078,000 | | | | 4,475,605 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $83,684,682) | | | | | | | 85,265,047 | |

| | | | | | | | | |

| | | Shares | | | | | |

| REAL ESTATE INVESTMENT TRUST - 1.88% | | | | | | | | |

Real Estate - 1.88% | | | | | | | | |

| Potlatch Corp. | | | 234,219 | | | | 7,340,423 | |

| TOTAL REAL ESTATE INVESTMENT TRUST | | | | | | | | |

| (Cost $7,448,166) | | | | | | | 7,340,423 | |

Total Investments - 79.26% | | | | | | | | |

| (Cost $291,726,707) | | | | | | | 309,593,388 | |

| Other Assets in Excess of Liabilities - 20.74% | | | | | | | 81,020,930 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 390,614,318 | |

Percentages are stated as a percent of net assets.

| (a) | Foreign issued security. |

| (b) | Non-income producing security. |

| (c) | Affiliated company. See Footnote 7. |

| (d) | Variable rate security. The rate shown is as of March 31, 2012. |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 51.22% | | | | | | |

Commercial & Professional Services - 2.29% | | | | | | |

| Securitas AB (a) | | | 1,905,400 | | | $ | 18,374,878 | |

Consumer Services - 4.19% | | | | | | | | |

| International Speedway Corp. - Class A | | | 315,109 | | | | 8,744,275 | |

| Regis Corp. | | | 629,469 | | | | 11,601,114 | |

| Speedway Motorsports, Inc. | | | 710,098 | | | | 13,264,630 | |

| | | | | | | | 33,610,019 | |

| Diversified Financials - 3.34% | | | | | | | | |

| CoreLogic, Inc. (b) | | | 964,513 | | | | 15,740,852 | |

| Federated Investors, Inc. | | | 492,148 | | | | 11,029,037 | |

| | | | | | | | 26,769,889 | |

| Energy - 2.89% | | | | | | | | |

| Bill Barrett Corp. (b) | | | 892,949 | | | | 23,225,604 | |

Food, Beverage & Tobacco - 1.37% | | | | | | | | |

| Cott Corp. (a)(b) | | | 1,664,695 | | | | 10,970,340 | |

Health Care Equipment & Services - 2.15% | | | | | | | | |

| Teleflex, Inc. | | | 282,697 | | | | 17,286,922 | |

Household & Personal Products - 2.70% | | | | | | | | |

| American Greetings Corp. | | | 1,100,587 | | | | 16,883,005 | |

| Central Garden & Pet Co. - Class A (b) | | | 194,458 | | | | 1,872,630 | |

| Oil-Dri Corporation of America - Class A (c) | | | 135,839 | | | | 2,892,012 | |

| | | | | | | | 21,647,647 | |

| Insurance - 6.05% | | | | | | | | |

| AMERISAFE, Inc. (b) | | | 602,036 | | | | 14,894,371 | |

| Aspen Insurance Holdings Ltd. (a) | | | 600,181 | | | | 16,769,057 | |

| Baldwin & Lyons, Inc. - Class B | | | 259,708 | | | | 5,812,265 | |

| Brown & Brown, Inc. | | | 464,300 | | | | 11,041,054 | |

| | | | | | | | 48,516,747 | |

| Materials - 1.32% | | | | | | | | |

| Pan American Silver Corp. (a) | | | 478,525 | | | | 10,556,262 | |

Media - 1.50% | | | | | | | | |

| World Wrestling Entertainment, Inc. (c) | | | 1,352,429 | | | | 11,996,045 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 51.22% (continued) | | | | | | |

Pharmaceuticals, Biotechnology | | | | | | |

| & Life Sciences - 4.38% | | | | | | |

| Bio-Rad Laboratories, Inc. (b) | | | 229,831 | | | $ | 23,831,176 | |

| ICON PLC - ADR (b) | | | 532,116 | | | | 11,291,502 | |

| | | | | | | | 35,122,678 | |

| Retailing - 3.24% | | | | | | | | |

| Aaron’s, Inc. | | | 388,790 | | | | 10,069,661 | |

| Core-Mark Holding Co., Inc. | | | 227,201 | | | | 9,301,609 | |

| Halfords Group PLC (a) | | | 1,334,602 | | | | 6,630,316 | |

| | | | | | | | 26,001,586 | |

| Software & Services - 11.88% | | | | | | | | |

| Amdocs Ltd. (a)(b) | | | 112,620 | | | | 3,556,540 | |

| Computer Sciences Corp. | | | 375,000 | | | | 11,227,500 | |

| Convergys Corp. (b) | | | 704,276 | | | | 9,402,085 | |

| CSG Systems International, Inc. (b)(c) | | | 1,487,299 | | | | 22,517,707 | |

| EPIQ Systems, Inc. (c) | | | 1,568,655 | | | | 18,980,725 | |

| Global Payments, Inc. | | | 153,654 | | | | 7,293,955 | |

| Mantech International Corp. | | | 575,044 | | | | 19,816,016 | |

| TECMO KOEI HOLDINGS CO., Ltd. (a) | | | 318,500 | | | | 2,520,448 | |

| | | | | | | | 95,314,976 | |

| Technology Hardware & Equipment - 2.77% | | | | | | | | |

| Ingram Micro, Inc. (b) | | | 496,970 | | | | 9,223,763 | |

| Tellabs, Inc. | | | 3,206,540 | | | | 12,986,487 | |

| | | | | | | | 22,210,250 | |

| Telecommunication Services - 1.15% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 398,613 | | | | 9,227,891 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $374,201,062) | | | | | | | 410,831,734 | |

See notes to financial statements.

Intrepid Small Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| REAL ESTATE INVESTMENT TRUST - 1.99% | | | | | | |

Real Estate - 1.99% | | | | | | |

| Potlatch Corp. | | | 508,931 | | | $ | 15,949,898 | |

| TOTAL REAL ESTATE INVESTMENT TRUST | | | | | | | | |

| (Cost $15,459,019) | | | | | | | 15,949,898 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| SHORT-TERM INVESTMENTS - 14.80% | | | | | | | | |

U.S. Treasury Bills - 14.80% | | | | | | | | |

| 0.025%, 04/12/2012 (d) | | $ | 50,000,000 | | | | 49,999,618 | |

| 0.020%, 05/03/2012 (d) | | | 33,750,000 | | | | 33,749,400 | |

| 0.035%, 06/14/2012 (d) | | | 35,000,000 | | | | 34,997,482 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $118,746,500) | | | | | | | 118,746,500 | |

Total Investments - 68.01% | | | | | | | | |

| (Cost $508,406,581) | | | | | | | 545,528,132 | |

| Other Assets in Excess of Liabilities - 31.99% | | | | | | | 256,616,404 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 802,144,536 | |

Percentages are stated as a percent of net assets.

| (a) | Foreign issued security. |

| (b) | Non-income producing security. |

| (c) | Affiliated company. See Footnote 7. |

| (d) | Rate shown is the effective yield based on purchase price. The calculation assumes the security is held to maturity. |

SCHEDULE OF OPEN FORWARD CURRENCY CONTRACTSMarch 31, 2012 (Unaudited)

| | | Amount of | | Amount of | |

| Forward | Currency to | Currency to | Currency to | Currency to | Unrealized |

| Expiration Date | be Received | be Received | be Delivered | be Delivered | Depreciation |

| 7/10/12 | U.S. Dollars | 11,925,287 | Swedish Krona | 83,000,000 | $(570,549) |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 1.80% | | | | | | |

Media - 0.99% | | | | | | |

| World Wrestling Entertainment, Inc. (a) | | | 105,820 | | | $ | 938,623 | |

Retailing - 0.81% | | | | | | | | |

| Halfords Group PLC (b) | | | 155,000 | | | | 770,042 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $1,695,386) | | | | | | | 1,708,665 | |

| | | | | | | | | |

| PREFERRED STOCK - 0.35% | | | | | | | | |

Insurance - 0.35% | | | | | | | | |

| Aspen Insurance Holdings Ltd., 7.401% (b) | | | 13,000 | | | | 335,010 | |

| TOTAL PREFERRED STOCK | | | | | | | | |

| (Cost $298,935) | | | | | | | 335,010 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| CONVERTIBLE BONDS - 4.11% | | | | | | | | |

Food & Staples Retailing - 4.11% | | | | | | | | |

| Spartan Stores, Inc. | | | | | | | | |

| 3.375%, 05/15/2027 | | $ | 4,043,000 | | | | 3,901,495 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | |

| (Cost $3,588,100) | | | | | | | 3,901,495 | |

| | | | | | | | | |

| CORPORATE BONDS - 68.49% | | | | | | | | |

Capital Goods - 3.66% | | | | | | | | |

| Gibraltar Industries, Inc. | | | | | | | | |

| 8.000%, 12/01/2015 (c) | | | 3,391,000 | | | | 3,475,775 | |

Commercial & Professional Services - 6.04% | | | | | | | | |

| Ashtead Capital, Inc. | | | | | | | | |

| 9.000%, 08/15/2016 | | | 2,438,000 | | | | 2,544,662 | |

| FTI Consulting, Inc. | | | | | | | | |

| 7.750%, 10/01/2016 | | | 1,205,000 | | | | 1,239,644 | |

| Mobile Mini, Inc. | | | | | | | | |

| 6.875%, 05/01/2015 | | | 1,928,000 | | | | 1,947,280 | |

| | | | | | | | 5,731,586 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 68.49% (continued) | | | | | | |

Consumer Durables & Apparel - 7.58% | | | | | | |

| Hanesbrands, Inc. | | | | | | |

| 4.146%, 12/15/2014 (c) | | $ | 2,072,000 | | | $ | 2,074,611 | |

| Levi Strauss & Co. | | | | | | | | |

| 8.875%, 04/01/2016 | | | 1,735,000 | | | | 1,791,405 | |

| Smith & Wesson Holding Corp. | | | | | | | | |

| 9.500%, 01/14/2016 | | | 3,256,000 | | | | 3,329,260 | |

| | | | | | | | 7,195,276 | |

| Consumer Services - 3.59% | | | | | | | | |

| Speedway Motorsports, Inc. | | | | | | | | |

| 8.750%, 06/01/2016 | | | 3,113,000 | | | | 3,408,735 | |

Energy - 9.06% | | | | | | | | |

| Bill Barrett Corp. | | | | | | | | |

| 9.875%, 07/15/2016 | | | 2,653,000 | | | | 2,918,300 | |

| Energy Partners Ltd. | | | | | | | | |

| 8.250%, 02/15/2018 | | | 1,874,000 | | | | 1,899,768 | |

| Petroquest Energy, Inc. | | | | | | | | |

| 10.000%, 09/01/2017 | | | 3,662,000 | | | | 3,781,015 | |

| | | | | | | | 8,599,083 | |

| General Merchandise Stores - 2.06% | | | | | | | | |

| Dollar General Corp. | | | | | | | | |

| 11.875%, 07/15/2017 | | | 1,798,000 | | | | 1,950,848 | |

Household & Personal Products - 7.09% | | | | | | | | |

| Amscan Holdings, Inc. | | | | | | | | |

| 8.750%, 05/01/2014 | | | 2,923,000 | | | | 2,933,990 | |

| Central Garden & Pet Co. | | | | | | | | |

| 8.250%, 03/01/2018 | | | 3,683,000 | | | | 3,798,094 | |

| | | | | | | | 6,732,084 | |

| Materials - 0.24% | | | | | | | | |

| Silgan Holdings, Inc. | | | | | | | | |

| 7.250%, 08/15/2016 | | | 200,000 | | | | 224,750 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 68.49% (continued) | | | | | | |

Media - 2.00% | | | | | | |

| Scholastic Corp. | | | | | | |

| 5.000%, 04/15/2013 | | $ | 1,868,000 | | | $ | 1,896,020 | |

Nonmetallic Mineral | | | | | | | | |

| Product Manufacturing - 3.25% | | | | | | | | |

| Libbey Glass, Inc. | | | | | | | | |

| 10.000%, 02/15/2015 | | | 2,881,000 | | | | 3,079,069 | |

Paper Manufacturing - 3.99% | | | | | | | | |

| Intertape Polymer US, Inc. | | | | | | | | |

| 8.500%, 08/01/2014 | | | 3,763,000 | | | | 3,781,815 | |

Pharmaceuticals, Biotechnology | | | | | | | | |

| & Life Sciences - 2.64% | | | | | | | | |

| Bio-Rad Laboratories, Inc. | | | | | | | | |

| 8.000%, 09/15/2016 | | | 2,253,000 | | | | 2,500,830 | |

Retailing - 9.96% | | | | | | | | |

| Collective Brands, Inc. | | | | | | | | |

| 8.250%, 08/01/2013 | | | 2,630,000 | | | | 2,649,751 | |

| HSN, Inc. | | | | | | | | |

| 11.250%, 08/01/2016 | | | 2,904,000 | | | | 3,150,869 | |

| PEP Boys-Manny Moe & Jack | | | | | | | | |

| 7.500%, 12/15/2014 | | | 3,597,000 | | | | 3,650,991 | |

| | | | | | | | 9,451,611 | |

| Software & Services - 1.13% | | | | | | | | |

| Computer Sciences Corp. | | | | | | | | |

| 6.500%, 03/15/2018 | | | 988,000 | | | | 1,069,510 | |

Transportation Equipment | | | | | | | | |

| Manufacturing - 3.89% | | | | | | | | |

| Affinia Group, Inc. | | | | | | | | |

| 10.750%, 08/15/2016 | | | 1,687,000 | | | | 1,847,265 | |

| Oshkosh Corp. | | | | | | | | |

| 8.250%, 03/01/2017 | | | 1,699,000 | | | | 1,843,415 | |

| | | | | | | | 3,690,680 | |

See notes to financial statements.

Intrepid Income Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS - 68.49% (continued) | | | | | | |

Truck Transportation - 2.31% | | | | | | |

| Quality Distribution LLC / QD Capital Corp. | | | | | | |

| 9.875%, 11/01/2018 | | $ | 2,000,000 | | | $ | 2,195,000 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $63,418,081) | | | | | | | 64,982,672 | |

| | | | | | | | | |

| | | Shares | | | | | |

| REAL ESTATE INVESTMENT TRUST - 2.01% | | | | | | | | |

Real Estate - 2.01% | | | | | | | | |

| Potlatch Corp. | | | 60,700 | | | | 1,902,338 | |

| TOTAL REAL ESTATE INVESTMENT TRUST | | | | | | | | |

| (Cost $1,979,858) | | | | | | | 1,902,338 | |

Total Investments - 76.76% | | | | | | | | |

| (Cost $70,980,360) | | | | | | | 72,830,180 | |

| Other Assets in Excess of Liabilities - 23.24% | | | | | | | 22,053,995 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 94,884,175 | |

Percentages are stated as a percent of net assets.

| (a) | Affiliated company. See Footnote 7. |

| (b) | Foreign issued security. |

| (c) | Variable rate security. The rate listed is as of March 31, 2012. |

See notes to financial statements.

Intrepid All Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 64.46% | | | | | | |

Consumer Services - 7.29% | | | | | | |

| International Speedway Corp. - Class A | | | 45,600 | | | $ | 1,265,400 | |

| Regis Corp. | | | 48,176 | | | | 887,884 | |

| Speedway Motorsports, Inc. | | | 78,511 | | | | 1,466,585 | |

| | | | | | | | 3,619,869 | |

| Diversified Financials - 7.18% | | | | | | | | |

| The Bank Of New York Mellon Corp. | | | 83,900 | | | | 2,024,507 | |

| CoreLogic, Inc. (a) | | | 65,841 | | | | 1,074,525 | |

| Federated Investors, Inc. | | | 20,791 | | | | 465,926 | |

| | | | | | | | 3,564,958 | |

| Energy - 2.67% | | | | | | | | |

| Bill Barrett Corp. (a) | | | 51,000 | | | | 1,326,510 | |

Food, Beverage & Tobacco - 5.08% | | | | | | | | |

| Cott Corp. (a)(b) | | | 106,031 | | | | 698,744 | |

| Molson Coors Brewing Co. | | | 40,300 | | | | 1,823,575 | |

| | | | | | | | 2,522,319 | |

| Health Care Equipment & Services - 4.86% | | | | | | | | |

| CR Bard, Inc. | | | 13,270 | | | | 1,310,014 | |

| Teleflex, Inc. | | | 18,100 | | | | 1,106,815 | |

| | | | | | | | 2,416,829 | |

| Household & Personal Products - 1.81% | | | | | | | | |

| American Greetings Corp. | | | 58,711 | | | | 900,627 | |

Insurance - 5.32% | | | | | | | | |

| Aspen Insurance Holdings Ltd. (b) | | | 35,200 | | | | 983,488 | |

| Brown & Brown, Inc. | | | 18,870 | | | | 448,729 | |

| The Travelers Companies, Inc. | | | 20,445 | | | | 1,210,344 | |

| | | | | | | | 2,642,561 | |

| Materials - 0.92% | | | | | | | | |

| Pan American Silver Corp. (b) | | | 20,800 | | | | 458,848 | |

Media - 1.95% | | | | | | | | |

| World Wrestling Entertainment, Inc. (c) | | | 109,169 | | | | 968,329 | |

See notes to financial statements.

Intrepid All Cap Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2012 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 64.46% (continued) | | | | | | |

Pharmaceuticals, Biotechnology | | | | | | |

| & Life Sciences - 5.77% | | | | | | |

| Bio-Rad Laboratories, Inc. (a) | | | 12,021 | | | $ | 1,246,458 | |

| ICON PLC - ADR (a) | | | 24,600 | | | | 522,012 | |

| Johnson & Johnson | | | 16,650 | | | | 1,098,234 | |

| | | | | | | | 2,866,704 | |

| Retailing - 0.86% | | | | | | | | |

| Halfords Group PLC (b) | | | 86,500 | | | | 429,733 | |

Software & Services - 10.66% | | | | | | | | |

| CSG Systems International, Inc. (a)(c) | | | 95,050 | | | | 1,439,057 | |

| EPIQ Systems, Inc. (c) | | | 45,249 | | | | 547,513 | |

| Mantech International Corp. | | | 18,210 | | | | 627,517 | |

| Microsoft Corp. | | | 63,500 | | | | 2,047,875 | |

| SAIC, Inc. | | | 47,900 | | | | 632,280 | |

| | | | | | | | 5,294,242 | |

| Technology Hardware & Equipment - 6.56% | | | | | | | | |

| Dell, Inc. (a) | | | 106,190 | | | | 1,762,754 | |

| Tellabs, Inc. | | | 369,535 | | | | 1,496,617 | |

| | | | | | | | 3,259,371 | |

| Telecommunication Services - 3.53% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 75,763 | | | | 1,753,913 | |

| TOTAL COMMON STOCKS | | | | | | | | |