UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-21624

Allianz Variable Insurance Products Fund of Funds Trust

(Exact name of registrant as specified in charter)

5701 Golden Hills Drive, Minneapolis,

MN 55416-1297

(Address of principal executive offices) (Zip code)

Citi Fund Services Ohio, Inc.,

4400 Easton Commons, Suite 200, Columbus,

OH 43219-8000

(Name and address of agent for service)

Registrant’s telephone number, including area code:800-624-0197

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Item 1. Reports to Stockholders.

AZL® Balanced Index Strategy Fund

Annual Report

December 31, 2019

Management Discussion and Analysis

Page 1

Expense Examples and Portfolio Composition

Page 3

Schedule of Portfolio Investments

Page 4

Statement of Assets and Liabilities

Page 5

Page 5

Statements of Changes in Net Assets

Page 6

Page 7

Notes to the Financial Statements

Page 8

Report of Independent Registered Public Accounting Firm

Page 12

Other Federal Income Tax Information

Page 13

Page 14

Approval of Investment Advisory Agreement

Page 15

Information about the Board of Trustees and Officers

Page 17

This report is submitted for the general information of the shareholder of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus, which contains details concerning the sales charges and other pertinent information.

AZL® Balanced Index Strategy Fund Review (Unaudited)

Allianz Investment Management LLC serves as the Manager for the AZL® Balanced Index Strategy Fund.

What factors affected the Fund’s performance during the year ended December 31, 2019?

For the year ended December 31, 2019, the AZL® Balanced Index Strategy Fund (the “Fund”) had a total return of 17.24%. That compared to a 31.49%, 8.72% and 19.82% total return for its benchmarks, the S&P 500 Index1, the Bloomberg Barclays U.S. Aggregate Bond Index1, and the Balanced Composite Index1, respectively.

The Fund is a fund of funds that pursues broad diversification across four equitysub-portfolios and one fixed-incomesub-portfolio. The four equitysub-portfolios pursue passive strategies that aim to achieve, before fees, returns similar to the S&P 500 Index, the S&P 400 Index2, the S&P 600 Index3 and the MSCI EAFE Index4, which represents shares of large companies in developed foreign markets. The fixed-incomesub-portfolio is an enhanced bond index strategy that seeks to achieve a return that exceeds that of the Bloomberg Barclays Capital U.S. Aggregate Bond Index. Generally, the Fund allocates 40% to 60% of its assets to the underlying equity index funds and between 40% and 60% to the underlying bond index fund.*

U.S. equities gained 13.65% (S&P 500) in the first quarter of 2019. Stocks rebounded in reaction to the dovish stance taken by the Federal Reserve Board (the Fed), indicating a shift away from its rate hiking cycle stretching back to 2015. U.S. equities gained in each of the four quarters under for the12-month period under review amid an encouraging earnings environment and the Fed’s ongoing dovish stance. These gains came despite fears of international trade tensions and stagnating global growth. The S&P 500 returned 31.49% for the year, while the S&P 400 returned 26.20% and the S&P 600 returned 22.78%. Continuing a longer-term trend, growth stocks outperformed value stocks for the year.

International developed market equities, as measured by the MSCI EAFE, returned 22.01% for the year, underperforming U.S. equities. International equities failed to keep pace with U.S. equities, grappling with trade tensions and slowing global growth.

U.S. bonds gained during the year, as the Bloomberg Barclays U.S. Aggregate Bond Index returned 8.72%. Yields fell throughout most of the year. In September,10-year Treasury yields fell to levels last seen in July 2016. The Fed remained dovish throughout the year, cutting rates three times. Although the Treasury yield curve was partially inverted at the beginning of the year, the curve flattened during the first three quarters, and steepened in the fourth quarter. Meanwhile, credit spreads tightened, leading corporate bonds and other credit-sensitive bonds to outperform U.S. Government bonds.

The Fund, which invests in both U.S. and international markets, underperformed its blended benchmark in 2019. The Fund’s strategic allocation to developed international equities was the primary detractor compared to its blended benchmark, as U.S. equities outperformed during the year. In addition, a strategic allocation tomid- andsmall-cap U.S. equities detracted, as these stocks underperformedlarge-cap equities.*

Within the Fund’s fixed income holdings, an underweight allocation to duration kept the Fund from fully benefiting from the decline in interest rates during the year. As a result, the Fund’s fixed income allocation modestly lagged its fixed income benchmark.*

Past performance does not guarantee future results.

| * | The Fund’s portfolio composition is subject to change. There is no guarantee that any sectors mentioned will continue to perform well or that securities in such sectors will be held by the Fund in the future. The information contained in this commentary is for informational purposes only and should not be construed as a recommendation to purchase or sell securities in the sector mentioned. The Fund’s holdings and weightings are as of December 31, 2019. |

| 1 | For a complete description of the Fund’s performance benchmarks please refer to page 2 of this report. |

| 2 | The Standard & Poor’s MidCap 400 Index (“S&P 400”) is the most widely used index formid-sized companies. The S&P 400 covers 7% of the U.S. equities market, and is part of a series of S&P U.S. indexes that can be used as building blocks for portfolio composition. |

| 3 | The Standard & Poor’s SmallCap 600 Index (“S&P 600”) covers approximately 3% of the domestic equities market. Measuring thesmall-cap segment of the market that is typically renowned for poor trading liquidity and financial instability, the index is designed to be an efficient portfolio of companies that meet specific inclusion criteria to ensure that they are investable and financially viable. |

| 4 | The Morgan Stanley Capital International, Europe, Australasia and Far East (“MSCI EAFE”) Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. |

The indexes defined above are unmanaged. Investors cannot invest directly in an index.

1

AZL® Balanced Index Strategy Fund Review (Unaudited)

Fund Objective

The Fund’s investment objective is to seek long-term capital appreciation with preservation of capital as an important consideration. This objective may be changed by the Trustees of the Fund without shareholder approval. The Fund seeks to achieve its objective by investing in a combination of Index Strategy Underlying Funds that represent different classes in the Fund’s asset allocation.

Investment Concerns

The Fund invests in underlying funds, so its investment performance is directly related to the performance of those underlying funds. Before investing, investors should assess the risks associated with and types of investments made by each of the underlying funds in which the Fund invests.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Small- tomid-capitalization companies typically have a higher risk of failure and historically have experienced a greater degree of volatility.

The performance of the Fund is expected to be lower than that of the Indexes because of Fund fees and expenses. Securities in which the Fund will invest may involve substantial risk and may be subject to sudden severe price declines.

Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss.

Debt securities held by the Fund may decline in value due to rising interest rates.

For a complete description of these and other risks associated with investing in a mutual Fund, please refer to the Fund’s prospectus.

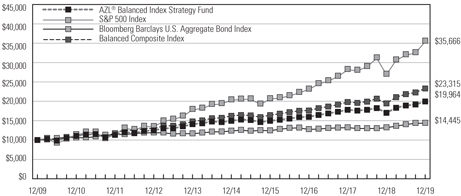

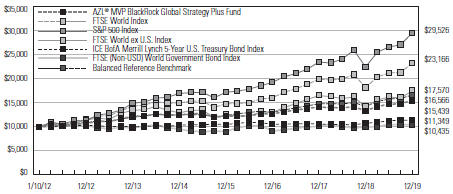

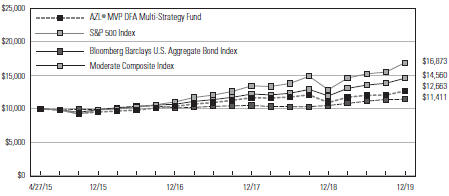

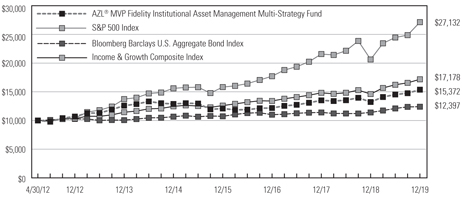

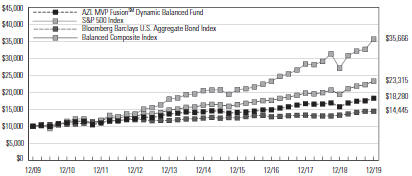

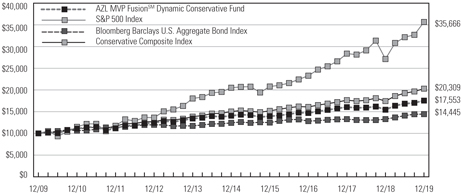

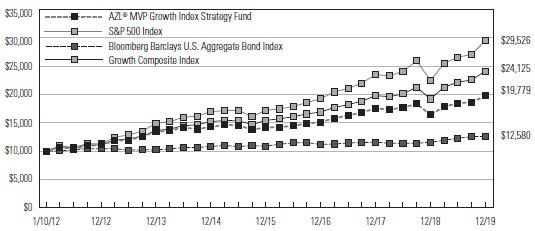

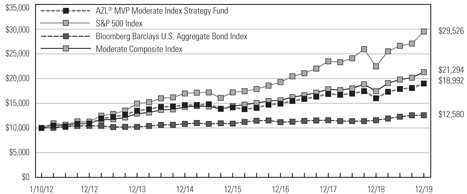

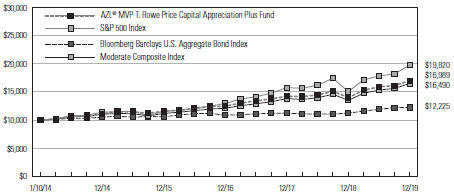

Growth of $10,000 Investment

The chart above represents a comparison of a hypothetical investment in the Fund versus a similar investment in the Fund’s benchmarks and represents the reinvestment of dividends and capital gains in the Fund.

Average Annual Total Returns as of December 31, 2019

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

AZL®Balanced Index Strategy Fund | 17.24 | % | 7.73 | % | 5.95 | % | 7.16 | % | ||||||||

S&P 500 Index | 31.49 | % | 15.27 | % | 11.70 | % | 13.56 | % | ||||||||

Bloomberg Barclays U.S. Aggregate Bond Index | 8.72 | % | 4.03 | % | 3.05 | % | 3.75 | % | ||||||||

Balanced Composite Index | 19.82 | % | 9.77 | % | 7.49 | % | 8.83 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.Allianzlife.com.

Expense Ratio | Gross | |||

AZL®Balanced Index Strategy Fund | 0.68 | % | ||

The above expense ratio is based on the current Fund prospectus dated April 29, 2019. The Manager and the Fund have entered into a written contract limiting operating expenses, excluding certain expenses (such as interest expense and acquired fund fees and expenses), to 0.20% through April 30, 2021. Additional information pertaining to the December 31, 2019 expense ratio can be found in the Financial Highlights.

Acquired fund fees and expenses are incurred indirectly by the Fund through the valuation of the Fund’s investments in the Permitted Underlying Funds. Accordingly, acquired fund fees and expenses affect the Fund’s total returns. Because these fees and expenses are not included in the Fund’s financial highlights, the Fund’s total annual fund operating expenses, as shown in the current prospectus, do not correlate to the ratios of expenses to average net assets shown in the Financial Highlights. Without acquired fund fees and expenses the Fund’s gross expense ratio would be 0.08%.

The total return of the Fund does not reflect the effect of any insurance charges, the annual maintenance fee or the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Such charges, fees and tax payments would reduce the performance quoted.

The Fund’s performance is measured against the Standard & Poor’s 500 Index (“S&P 500”), the Bloomberg Barclays U.S. Aggregate Bond Index and the Balanced Composite Index (“Composite”). The S&P 500 is representative of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is a measure of the U.S. Stock market as a whole. The Bloomberg Barclays U.S. Aggregate Bond Index is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The Composite is a blended index comprised of (50%) S&P 500 and (50%) Bloomberg Barclays U.S. Aggregate Bond Index. These indexes are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for services provided to the Fund. Investors cannot invest directly in an index.

2

AZL Balanced Index Strategy Fund

(Unaudited)

As a shareholder of the AZL Balanced Index Strategy Fund (the “Fund”), you incur ongoing costs, including management fees, distribution fees, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Please note that the expenses shown in each table do not reflect expenses that apply to the subaccount or the insurance contract. If the expenses that apply to the subaccount of the insurance contract were included, your costs would have been higher.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the periods presented below.

TheActual Expense table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| Beginning Account Value 7/1/19 | Ending Account Value 12/31/19 | Expenses Paid During Period 7/1/19 - 12/31/19* | Annualized Expense Ratio During Period 7/1/19 - 12/31/19 | |||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 1,000.00 | $ | 1,055.50 | $ | 0.47 | 0.09 | % | ||||||||||||

TheHypothetical Expense table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| Beginning Account Value 7/1/19 | Ending Account Value 12/31/19 | Expenses Paid During Period 7/1/19 - 12/31/19* | Annualized Expense Ratio During Period 7/1/19 - 12/31/19 | |||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 1,000.00 | $ | 1,024.75 | $ | 0.46 | 0.09 | % | ||||||||||||

| * | Expenses are equal to the average account value multiplied by the Fund’s annualized expense ratio multiplied by 184/365 (the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year). |

Portfolio Composition

(Unaudited)

| Investments | Percent of Net Assets | ||||

Fixed Income Funds | 49.5 | % | |||

Domestic Equity Funds | 37.9 | ||||

International Equity Funds | 12.6 | ||||

|

| ||||

Total Investment Securities | 100.0 | ||||

Net other assets (liabilities) | — | † | |||

|

| ||||

Net Assets | 100.0 | % | |||

|

| ||||

| † | Represents less than 0.05%. |

3

AZL Balanced Index Strategy Fund

Schedule of Portfolio Investments

December 31, 2019

| Shares | Fair Value | |||||||

| Affiliated Investment Companies (100.0%): | ||||||||

| Domestic Equity Funds (37.9%): | ||||||||

| 1,380,743 | AZL Mid Cap Index Fund, Class 2 | $ | 30,252,069 | |||||

| 5,703,117 | AZL S&P 500 Index Fund, Class 2 | 104,024,862 | ||||||

| 1,225,115 | AZL Small Cap Stock Index Fund, Class 2 | 16,208,268 | ||||||

|

| |||||||

| 150,485,199 | ||||||||

|

| |||||||

| Fixed Income Funds (49.5%): | ||||||||

| 17,560,176 | AZL Enhanced Bond Index Fund | 196,849,569 | ||||||

|

| |||||||

| International Equity Funds (12.6%): | ||||||||

| 2,990,911 | AZL International Index Fund, Class 2 | 50,217,390 | ||||||

|

| |||||||

Total Affiliated Investment Companies (Cost $295,010,690) | 397,552,158 | |||||||

|

| |||||||

Total Investment Securities | 397,552,158 | |||||||

Net other assets (liabilities) — (0.0%†) | (149,798 | ) | ||||||

|

| |||||||

Net Assets — 100.0% | $ | 397,402,360 | ||||||

|

| |||||||

Percentages indicated are based on net assets as of December 31, 2019.

| (a) | See Federal Tax Information listed in the Notes to the Financial Statements. |

| † | Represents less than 0.05%. |

See accompanying notes to the financial statements.

4

AZL Balanced Index Strategy Fund

Statement of Assets and Liabilities

December 31, 2019

Assets: | |||||

Investments in affiliates, at cost | $ | 295,010,690 | |||

|

| ||||

Investments in affiliates, at value | $ | 397,552,158 | |||

Interest and dividends receivable | 16 | ||||

Receivable for affiliated investments sold | 274,024 | ||||

Prepaid expenses | 1,372 | ||||

|

| ||||

Total Assets | 397,827,570 | ||||

|

| ||||

Liabilities: | |||||

Cash overdraft | 274,024 | ||||

Payable for capital shares redeemed | 112,847 | ||||

Manager fees payable | 16,808 | ||||

Administration fees payable | 5,219 | ||||

Custodian fees payable | 823 | ||||

Administrative and compliance services fees payable | 1,425 | ||||

Transfer agent fees payable | 940 | ||||

Trustee fees payable | 351 | ||||

Other accrued liabilities | 12,773 | ||||

|

| ||||

Total Liabilities | 425,210 | ||||

|

| ||||

Net Assets | $ | 397,402,360 | |||

|

| ||||

Net Assets Consist of: | |||||

Paid in capital | $ | 274,991,108 | |||

Total distributable earnings | 122,411,252 | ||||

|

| ||||

Net Assets | $ | 397,402,360 | |||

|

| ||||

Shares of beneficial interest (unlimited number of shares authorized, no par value) | 24,144,261 | ||||

Net Asset Value (offering and redemption price per share) | $ | 16.46 | |||

|

|

For the Year Ended December 31, 2019

Investment Income: | |||||

Dividends from affiliates | $ | 7,761,835 | |||

Dividends fromnon-affiliates | 365 | ||||

|

| ||||

Total Investment Income | 7,762,200 | ||||

|

| ||||

Expenses: | |||||

Manager fees | 198,616 | ||||

Administration fees | 62,697 | ||||

Custodian fees | 5,950 | ||||

Administrative and compliance services fees | 6,991 | ||||

Transfer agent fees | 5,506 | ||||

Trustee fees | 22,132 | ||||

Professional fees | 18,513 | ||||

Shareholder reports | 9,524 | ||||

Other expenses | 8,380 | ||||

|

| ||||

Total expenses | 338,309 | ||||

|

| ||||

Net Investment Income/(Loss) | 7,423,891 | ||||

|

| ||||

Net realized and Change in net unrealized gains/losses on investments: | |||||

Net realized gains/(losses) on affiliated underlying funds | 7,039,719 | ||||

Net realized gains/(losses) on securities | 151 | ||||

Net realized gains distributions from affiliated underlying funds | 6,909,336 | ||||

Change in net unrealized appreciation/depreciation on affiliated underlying funds | 41,704,814 | ||||

|

| ||||

Net realized and Change in net unrealized gains/losses on investments | 55,654,020 | ||||

|

| ||||

Change in Net Assets Resulting From Operations | $ | 63,077,911 | |||

|

|

See accompanying notes to the financial statements.

5

AZL Balanced Index Strategy Fund

Statements of Changes in Net Assets

| For the Year Ended December 31, 2019 | For the Year Ended December 31, 2018 | |||||||||

Change In Net Assets: | ||||||||||

Operations: | ||||||||||

Net investment income/(loss) | $ | 7,423,891 | $ | 7,720,384 | ||||||

Net realized gains/(losses) on investments | 13,949,206 | 14,710,890 | ||||||||

Change in unrealized appreciation/depreciation on investments | 41,704,814 | (40,203,778 | ) | |||||||

|

|

|

| |||||||

Change in net assets resulting from operations | 63,077,911 | (17,772,504 | ) | |||||||

|

|

|

| |||||||

Distributions to Shareholders: | ||||||||||

Distributions | (22,295,760 | ) | (19,383,356 | ) | ||||||

|

|

|

| |||||||

Change in net assets resulting from distributions to shareholders | (22,295,760 | ) | (19,383,356 | ) | ||||||

|

|

|

| |||||||

Capital Transactions: | ||||||||||

Proceeds from shares issued | 8,205,982 | 8,361,288 | ||||||||

Proceeds from dividends reinvested | 22,295,760 | 19,383,356 | ||||||||

Value of shares redeemed | (60,070,127 | ) | (52,781,680 | ) | ||||||

|

|

|

| |||||||

Change in net assets resulting from capital transactions | (29,568,385 | ) | (25,037,036 | ) | ||||||

|

|

|

| |||||||

Change in net assets | 11,213,766 | (62,192,896 | ) | |||||||

Net Assets: | ||||||||||

Beginning of period | 386,188,594 | 448,381,490 | ||||||||

|

|

|

| |||||||

End of period | $ | 397,402,360 | $ | 386,188,594 | ||||||

|

|

|

| |||||||

Share Transactions: | ||||||||||

Shares issued | 508,792 | 526,619 | ||||||||

Dividends reinvested | 1,421,017 | 1,252,155 | ||||||||

Shares redeemed | (3,724,340 | ) | (3,282,281 | ) | ||||||

|

|

|

| |||||||

Change in shares | (1,794,531 | ) | (1,503,507 | ) | ||||||

|

|

|

| |||||||

See accompanying notes to the financial statements.

6

AZL Balanced Index Strategy Fund

(Selected data for a share of beneficial interest outstanding throughout the periods indicated)

| Year Ended December 31, | |||||||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 14.89 | $ | 16.34 | $ | 15.75 | $ | 15.44 | $ | 15.91 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Investment Activities: | |||||||||||||||||||||||||

Net Investment Income/(Loss) | 0.30 | (a) | 0.31 | 0.15 | 0.30 | 0.34 | |||||||||||||||||||

Net Realized and Unrealized Gains/(Losses) on Investments | 2.22 | (0.99 | ) | 1.62 | 0.73 | (0.34 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total from Investment Activities | 2.52 | (0.68 | ) | 1.77 | 1.03 | — | (b) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Distributions to Shareholders From: | |||||||||||||||||||||||||

Net Investment Income | (0.38 | ) | (0.16 | ) | (0.38 | ) | (0.43 | ) | (0.17 | ) | |||||||||||||||

Net Realized Gains | (0.57 | ) | (0.61 | ) | (0.80 | ) | (0.29 | ) | (0.30 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total Dividends | (0.95 | ) | (0.77 | ) | (1.18 | ) | (0.72 | ) | (0.47 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net Asset Value, End of Period | $ | 16.46 | $ | 14.89 | $ | 16.34 | $ | 15.75 | $ | 15.44 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total Return(c) | 17.24 | % | (4.36 | )% | 11.50 | % | 6.75 | % | 0.01 | % | |||||||||||||||

Ratios to Average Net Assets/Supplemental Data: | |||||||||||||||||||||||||

Net Assets, End of Period (000’s) | $ | 397,402 | $ | 386,189 | $ | 448,381 | $ | 438,300 | $ | 432,536 | |||||||||||||||

Net Investment Income/(Loss) | 1.87 | % | 1.82 | % | 0.78 | % | 1.83 | % | 2.14 | % | |||||||||||||||

Expenses Before Reductions*(d) | 0.09 | % | 0.08 | % | 0.08 | % | 0.08 | % | 0.08 | % | |||||||||||||||

Expenses Net of Reductions* | 0.09 | % | 0.08 | % | 0.08 | % | 0.08 | % | 0.08 | % | |||||||||||||||

Portfolio Turnover Rate | 5 | % | 5 | % | 6 | % | 12 | % | 11 | % | |||||||||||||||

| * | The expense ratios exclude the impact of fees/expenses paid by each underlying fund. |

| (a) | Calculated using the average shares method. |

| (b) | Represents less than $0.005. |

| (c) | The returns include reinvested dividends and fund level expenses, but exclude insurance contract charges. If these charges were included, the returns would have been lower. |

| (d) | Excludes fee reductions. If such fee reductions had not occurred, the ratios would have been as indicated. |

See accompanying notes to the financial statements.

7

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2019

1. Organization

The Allianz Variable Insurance Products Fund of Funds Trust (the “Trust”) was organized as a Delaware statutory trust on June 16, 2004. The Trust is a diversifiedopen-end management investment company registered under the Investment Company Act of 1940, as amended, (the “1940 Act”) and thus is determined to be an investment company, and follows the investment company accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 “Financial Services — Investment Companies”. The Trust consists of 12 separate investment portfolios (collectively, the “Funds”), of which one is included in this report, the AZL Balanced Index Strategy Fund (the “Fund”), and 11 are presented in separate reports.

The Fund is a “fund of funds”, which means that the Fund invests primarily in other mutual funds (the “Underlying Funds”). Underlying Funds invest in stock, bonds, and other securities and reflect varying amounts of potential investment risk and reward. The Underlying Funds record their investments at fair value. Periodically, the Fund will adjust its asset allocation as it seeks to achieve its investment objective.

The Trust is authorized to issue an unlimited number of shares of the Fund without par value. Shares of the Fund are available through the variable annuity contracts offered through the separate accounts of participating insurance companies. Currently, the Fund only offers its shares to separate accounts of Allianz Life Insurance Company of North America and Allianz Life Insurance Company of New York, affiliates of the Trust and the Manager, as defined below.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform with U.S. generally accepted accounting principles (“U.S. GAAP”). The preparation of financial statements requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation

The Fund records its investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants at the measurement date. The valuation techniques used to determine fair value are further described in Note 4 below.

Investment Transactions and Investment Income

Investment transactions are accounted for on trade date. Net realized gains and losses on investments sold and on foreign currency transactions are recorded on the basis of identified cost. Interest income is recorded on the accrual basis and includes, where applicable, the amortization of premiums or accretion of discounts. Dividend income is recorded on theex-dividend date except in the case of foreign securities, in which case dividends are recorded as soon as such information becomes available.

Distributions to Shareholders

Distributions to shareholders are recorded on theex-dividend date. The Fund distributes its dividends from net investment income and net realized capital gains, if any, on an annual basis. The amount of distributions from net investment income and from net realized gains is determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., return of capital, net operating loss, reclassification of certain market discounts, gain/loss, paydowns, and distributions), such amounts are reclassified within the composition of net assets based on their federaltax-basis treatment; temporary differences (e.g., wash sales and differing treatment on certain investments) do not require reclassification. Distributions to shareholders that exceed net investment income and net realized gains for tax purposes are reported as distributions of capital.

Expense Allocation

Expenses directly attributable to the Fund are charged directly to the Fund, while expenses attributable to more than one Fund are allocated among the respective Funds based upon relative net assets or some other reasonable method. Expenses which are attributable to more than one Trust are allocated across the Allianz Variable Insurance Products and Allianz Variable Insurance Products Fund of Funds Trusts based upon relative net assets or another reasonable basis. Allianz Investment Management LLC (the “Manager”), serves as the investment manager for the Trust and the Allianz Variable Insurance Products Trust.

Affiliated Securities Transactions

Pursuant to Rule17a-7 under the 1940 Act (the “Rule”), the Fund may engage in securities transactions with affiliated investment companies and advisory accounts managed by the Manager and Subadviser. Any such purchase or sale transaction must be effected without a brokerage commission or other remuneration, except for customary transfer fees. The transaction must be effected at the current market price, which is either the security’s last sale price on an exchange or, if there are no transactions in the security that day, at the average of the highest bid and lowest asked price. During the year ended December 31, 2019, the Fund did not engage in any Rule17a-7 transactions under the Rule.

3. Fees and Transactions with Affiliates and Other Parties

The Manager provides investment advisory and management services for the Fund. The Manager has contractually agreed to waive fees and reimburse the Fund to limit the annual expenses, excluding interest expense (e.g., cash overdraft fees), taxes, brokerage commissions, acquired fund fees and expenses, other expenditures that are capitalized in

8

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2019

accordance with U.S. GAAP and other extraordinary expenses not incurred in the ordinary course of the Fund’s business, based on the daily net assets of the Fund, through April 30, 2020. Expenses incurred for investment advisory and management services are reflected on the Statement of Operations as “Manager fees.”

For the year ended December 31, 2019, the annual rate due to the Manager and the annual expense limit were as follows:

| Annual Rate | Annual Expense Limit | |||||||||

AZL Balanced Index Strategy Fund | 0.05 | % | 0.20 | % | ||||||

Any amounts contractually waived or reimbursed by the Manager in a particular fiscal year will be subject to repayment by the Fund to the Manager to the extent that from time to time through the next three fiscal years the repayment will not cause the Fund’s expenses to exceed the lesser of the stated limit at the time of the waiver or the current stated limit. Any amounts recouped by the Manager during the year are reflected on the Statement of Operations as “Recoupment of prior expenses reimbursed by the Manager.” At December 31, 2019, there were no remaining contractual reimbursements that are subject to repayment by the Fund in subsequent years.

In addition, the Manager may voluntarily waive or reimburse additional fees in order to maintain more competitive expense ratios. Any voluntary waivers or reimbursements are not subject to repayment in subsequent years. Information on the total amount waived/reimbursed by the Manager or repaid to the Manager by the Fund during the year can be found on the Statement of Operations. During the year ended December 31, 2019, there were no voluntary waivers.

The Manager or an affiliate of the Manager serves as the investment adviser of certain underlying funds in which the Fund invests. At December 31, 2019, these underlying funds are noted as Affiliated Investment Companies in the Fund’s Schedule of Portfolio Investments. Additional information, including financial statements, about these Funds is available at www.allianzlife.com. The Manager or an affiliate of the Manager is paid a separate fee from the underlying funds for such services. A summary of the Fund’s investments in affiliated investment companies for the year ended December 31, 2019 is as follows:

| Fair Value 12/31/2018 | Purchases at Cost | Proceeds from Sales | Net Realized Gains (Losses) | Change in Net Unrealized Appreciation/ Depreciation | Fair Value 12/31/2019 | Shares as of 12/31/2019 | Dividend Income | Net Realized Gains Distributions from Affiliated Underlying Funds | |||||||||||||||||||||||||||||||||||||

AZL Enhanced Bond Index Fund | $ | 201,992,298 | $ | 7,877,105 | $ | (24,581,382 | ) | $ | 386,594 | $ | 11,174,954 | $ | 196,849,569 | 17,560,176 | $ | 4,575,832 | $ | — | |||||||||||||||||||||||||||

AZL International Index Fund, Class 2 | 47,746,626 | 1,747,460 | (7,553,366 | ) | 439,211 | 7,837,459 | 50,217,390 | 2,990,911 | 1,159,164 | 296,492 | |||||||||||||||||||||||||||||||||||

AZL Mid Cap Index Fund, Class 2 | 26,638,665 | 2,902,200 | (3,598,025 | ) | 68,738 | 4,240,491 | 30,252,069 | 1,380,743 | 315,395 | 1,978,261 | |||||||||||||||||||||||||||||||||||

AZL S&P 500 Index Fund, Class 2 | 96,443,706 | 6,939,968 | (22,574,927 | ) | 6,222,559 | 16,993,556 | 104,024,862 | 5,703,117 | 1,561,046 | 3,103,464 | |||||||||||||||||||||||||||||||||||

AZL Small Cap Stock Index Fund, Class 2 | 13,778,376 | 2,172,498 | (1,123,577 | ) | (77,383 | ) | 1,458,354 | 16,208,268 | 1,225,115 | 150,398 | 1,531,119 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

| $ | 386,599,671 | $ | 21,639,231 | $ | (59,431,277 | ) | $ | 7,039,719 | $ | 41,704,814 | $ | 397,552,158 | 28,860,062 | $ | 7,761,835 | $ | 6,909,336 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Pursuant to separate agreements between the Funds and the Manager, the Manager provides a Chief Compliance Officer (“CCO”) and certain compliance oversight and regulatory filing services to the Trust. Under these agreements the Manager is entitled to an amount equal to a portion of the compensation and certain other expenses related to the individuals performing the CCO and compliance oversight services, as well as $100 per hour for time incurred in connection with the preparation and filing of certain documents with the SEC. The fees are paid to the Manager on a quarterly basis. The total expenses incurred by the Fund for these services are reflected on the Statement of Operations as “Administrative and compliance services fees.”

Citi Fund Services Ohio, Inc. (“Citi” or the “Administrator”), a wholly owned subsidiary of Citigroup, Inc., with which an officer of the Trust is affiliated, serves as the Trust’s administrator and fund accountant, and assists the Trust in all aspects of its administration and operation. The Administrator is entitled to a fee, accrued daily and paid monthly. The Administrator is entitled to an annual fee for each additional class of shares of any Fund, certain annual fees in supporting fair values services, and a Trust-wide annual fee for providing infrastructure and support in implementing the written policies and procedures comprising the Fund’s compliance program. The Administrator is also reimbursed for certain expenses incurred. The total expenses incurred by the Fund for these services are reflected on the Statement of Operations as “Administration fees.”

FIS Investor Services LLC (“FIS”) serves as the Fund’s transfer agent. Under the Transfer Agent Agreement, the Trust pays FIS a fee for its services and reimburses FIS for all of their reasonableout-of-pocket expenses incurred in providing these services.

The Bank of New York Mellon (“BNY Mellon” or the “Custodian”) serves as the Trust’s custodian and securities lending agent. For these services as custodian, the Funds pay BNY Mellon a fee based on a percentage of assets held on behalf of the Funds, plus certainout-of-pocket charges.

Allianz Life Financial Services, LLC (“ALFS”), an affiliate of the Manager, serves as distributor of the Fund. ALFS receives an annual Trust-wide annual fee of $7,500, paid by the Manager from its profits and not by the Trust, for recordkeeping and reporting services.

In addition, certain legal fees and expenses are paid to a law firm, Dorsey & Whitney LLP, of which the Secretary of the Fund is Senior Counsel. During the year ended December 31, 2019, $4,742 was paid from the Fund relating to these fees and expenses.

Certain Officers and Trustees of the Trust are affiliated with the Manager or the Administrator. Such Officers (except for the Trust’s CCO as noted above) and Trustees receive no compensation from the Trust for serving in their respective roles. For their service to the Trust and to the Allianz Variable Insurance Products Trust, eachnon-interested Trustee receives a $182,500 annual Board retainer, the Lead Director receives an additional $45,625 annually, the Chair of the Nominating and Corporate Governance Committee receives an additional $10,000 annually and the Chair of the Audit Committee receives an additional $10,000 annually. In addition, the Trustees are reimbursed for certain expenses associated with attending Board meetings. Compensation to the Trustees is allocated between the Trust and the Allianz Variable Insurance Products Trust in proportion to the assets under management of each trust. During the year ended December 31, 2019, actual Trustee compensation was $1,343,125 in total for both trusts.

9

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2019

4. Investment Valuation Summary

The valuation techniques employed by the Fund, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund’s investments are summarized in the three broad levels listed below:

| ● | Level 1 — quoted prices in active markets for identical assets |

| ● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayments speeds, credit risk, etc.) |

| ● | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments.

Investments in other investment companies are valued at their published net asset value (“NAV”). Security prices are generally provided by an independent third party pricing service approved by the Trust’s Board of Trustees (the “Board” or “Trustees”) as of the close of the New York Stock Exchange (“NYSE”) (generally 4:00 pm Eastern Time). The investments utilizing Level 1 valuations represent investments inopen-end investment companies.

The following is a summary of the valuation inputs used as of December 31, 2019 in valuing the Fund’s investments based upon the three levels defined above:

| Investment Securities: | Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||

Affiliated Investment Companies | $ | 397,552,158 | $ | — | $ | — | $ | 397,552,158 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Total Investments | $ | 397,552,158 | $ | — | $ | — | $ | 397,552,158 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

5. Security Purchases and Sales

For the year ended December 31, 2019, cost of purchases and proceeds from sales of securities (excluding securities maturing less than one year from acquisition) were as follows:

| Purchases | Sales | |||||||||

AZL Balanced Index Strategy Fund | $ | 21,639,231 | $ | 59,431,277 | ||||||

6. Investment Risks

Derivatives Risk: The Fund may invest directly or through affiliated or unaffiliated mutual funds or unregistered investment pools in derivative instruments such as futures, options, and options on futures. A derivative is a financial contract whose value depends on, or is derived from, the value of an underlying asset, reference rate, or risk. Use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of other risks, such as liquidity risk, interest rate risk, market risk, credit risk, and selection risk. Derivatives also involve the risk of mispricing or improper valuation and the risk that changes in the value may not correlate perfectly with the underlying asset, rate, or index. Using derivatives may result in losses, possibly in excess of the principal amount invested. Also, suitable derivative transactions may not be available in all circumstances. The other party to a derivatives contract could default. During the year ended December 31, 2019, the Fund did not directly invest in derivatives.

Fund of Fund Risk: The Fund, as a shareholder of the underlying funds, indirectly bears its proportionate share of any investment management fees and other expenses of the underlying funds. Further due to the fees and expenses paid by the Fund, as well as small variations in the Fund’s actual allocations to the underlying funds and any futures and cash held in the Fund’s portfolio, the performance and income distributions of the Fund will not be the same as the performance and income distributions of the underlying funds.

7. Federal Tax Information

It is the policy of the Fund to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined under Subchapter M of the Internal Revenue Code, and to make distributions of net investment income and net realized gains sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provisions for federal income taxes are required in the financial statements.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last four tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Cost of securities, including derivatives and short positions as applicable, for federal income tax purposes at December 31, 2019 is $296,367,198. The gross unrealized appreciation/(depreciation) on a tax basis is as follows:

Unrealized appreciation | $ | 101,184,960 | ||

Unrealized (depreciation) | — | |||

|

| |||

Net unrealized appreciation/(depreciation) | $ | 101,184,960 | ||

|

|

10

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2019

The tax character of dividends paid to shareholders during the year ended December 31, 2019 was as follows:

| Ordinary Income | Net Long-Term | Total Distributions(a) | |||||||||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 8,970,236 | $ | 13,325,524 | $ | 22,295,760 | |||||||||||||||||||

| (a) | Total distributions paid may differ from the Statements of Changes in Net Assets because dividends are recognized when actually paid for tax purposes. |

The tax character of dividends paid to shareholders during the year ended December 31, 2018 was as follows:

| Ordinary Income | Net Long-Term | Total Distributions(a) | |||||||||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 3,957,710 | $ | 15,425,646 | $ | 19,383,356 | |||||||||||||||||||

| (a) | Total distributions paid may differ from the Statements of Changes in Net Assets because dividends are recognized when actually paid for tax purposes. |

At December 31, 2019, the components of accumulated earnings on a tax basis were as follows:

| Undistributed Ordinary Income | Undistributed Long-Term Capital Gains | Accumulated Capital and Other Losses | Unrealized Appreciation/ Depreciation(a) | Total Accumulated Earnings/ (Deficit) | |||||||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 7,606,113 | $ | 13,620,179 | $ | — | $ | 101,184,960 | $ | 122,411,252 | |||||||||||||||

| (a) | The difference between book-basis andtax-basis unrealized appreciation/depreciation is attributable primarily to tax deferral of losses on wash sales. |

8. Ownership and Principal Holders

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumptions of control of the fund, under section 2 (a)(9) of the 1940 Act. As of December 31, 2019, the Fund had an individual shareholder account which is affiliated with the Manager representing ownership [in excess] of 90% of the Fund. Investment activities of these shareholders could have a material impact to the Fund.

9. Subsequent Events

Management of the Fund has evaluated the need for additional disclosures or adjustments resulting from events through the date the financial statements were issued. Based on this evaluation, there were no subsequent events to report that would have material impact on the Fund’s financial statements.

11

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TotheBoard of Trustees of Allianz Variable Insurance Products Fund of Funds Trust and Shareholders of AZL Balanced Index Strategy Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of portfolio investments, of AZL Balanced Index Strategy Fund (one of the funds constituting Allianz Variable Insurance Products Fund of Funds Trust, referred to hereafter as the “Fund”) as of December 31, 2019, the related statement of operations for the year ended December 31, 2019, the statements of changes in net assets for the years ended December 31, 2019 and 2018, including the related notes, and the financial highlights for the years ended December 31, 2019 and 2018 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2019, and the results of its operations for the year ended December 31, 2019, the changes in its net assets and the financial highlights for the years ended December 31, 2019 and 2018 in conformity with accounting principles generally accepted in the United States of America.

The financial statements of the Fund as of and for the year ended December 31, 2017 and the financial highlights for each of the periods ended on or prior to December 31, 2017 (not presented herein, other than the financial highlights) were audited by other auditors whose report dated February 23, 2018 expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019 by correspondence with the custodian and transfer agent. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

New York, New York

February 21, 2020

We have served as the auditor of one or more investment companies in the Allianz Variable Insurance Products complex since 2018.

12

Other Federal Income Tax Information (Unaudited)

For the year ended December 31, 2019, 22.42% of the total ordinary income dividends paid by the Fund qualify for the corporate dividends received deductions available to corporate shareholders.

During the year ended December 31, 2019, the Fund declared net long-term capital gain distributions of $13,325,524.

13

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request, by visiting the Securities and Exchange Commission’s (‘‘Commission’’) website at www.sec.gov, or by calling 800-624-0197.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available (i) without charge, upon request, by calling 800-624-0197; (ii) on the Allianz Variable Insurance Products Fund of Funds Trust’s website at https://www.allianzlife.com; and (iii) on the Commission’s website at http://www.sec.gov.

The Fund files complete Schedules of Portfolio Holdings with the Commission for the first and third quarters of each fiscal year on Form N-PORT. Schedules of Portfolio Holdings for the Fund in this report are available without charge on the Commission’s website at http://www.sec.gov, or may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

14

Approval of Investment Advisory Agreement (Unaudited)

Subject to the general supervision of the Board of Trustees (the “Board”) and in accordance with the investment objectives and restrictions of each separate series (together, the “Funds”) of the Allianz Variable Insurance Products Fund of Funds Trust (the “Trust”), investment advisory services are provided to the Funds by Allianz Investment Management LLC (the “Manager”). As used in this section, “Fund” refers to any of the Funds. The Manager manages each Fund pursuant to an investment management agreement (the “Management Agreement”) with the Trust in respect of each such Fund. The Management Agreement provides that the Manager, subject to the supervision and approval of the Board, is responsible for the management of each Fund. For management services, each Fund pays the Manager an investment advisory fee based upon each Fund’s average daily net assets. The Manager has contractually agreed to limit the expenses of each Fund by reimbursing the Fund if and when total Fund operating expenses exceed certain amounts until at least April 30, 2021 (the “Expense Limitation Agreement”).

In reviewing the services provided by the Manager and the terms of the Management Agreement, the Board receives and reviews information related to the Manager’s experience and expertise in the variable insurance marketplace. Currently, the Funds are offered only through variable annuities and variable life insurance policies, and not in the retail fund market. In addition, the Board receives information regarding the Manager’s expertise with regard to portfolio diversification and asset allocation requirements within variable insurance products issued by Allianz Life Insurance Company of North America (“Allianz Life”) and its subsidiary, Allianz Life Insurance Company of New York (“Allianz of New York”). Currently, the Funds are offered only through Allianz Life and Allianz of New York variable products.

As required by the Investment Company Act of 1940 (the “1940 Act”), the Board has reviewed and approved the Management Agreement with the Manager. The Board’s decision to approve this contract reflects the exercise of its business judgment on whether to approve new arrangements and continue the existing arrangements. During its review of the contract, the Board considered many factors, among the most material of which are: the Fund’s investment objectives and long-term performance; the Manager’s management philosophy, personnel, processes and investment performance, including its compliance history and the adequacy of its compliance processes; the preferences and expectations of Fund shareholders (and underlying contract owners) and their relative sophistication; the continuing state of competition in the mutual fund industry; and comparable fees in the mutual fund industry.

The Board also considered the compensation and benefits received by the Manager. This includes fees received for services provided to a Fund by employees of the Manager or of affiliates of the Manager and research services received by the Manager from brokers that execute Fund trades, as well as advisory fees. The Board considered the fact that: (1) the Manager and the Trust are parties to an Administrative Services Agreement and a Compliance Services Agreement, under which the Manager is compensated by the Trust for performing certain administrative and compliance services including providing an employee of the Manager or one of its affiliates to act as the Trust’s Chief Compliance Officer; and (2) Allianz Life Financial Services, LLC, an affiliated person of the Manager, is a registered securities broker-dealer and received (along with its affiliated persons) payments made by certain underlying funds pursuant toRule 12b-1.

The Board is aware that various courts have interpreted provisions of the 1940 Act and have indicated in their decisions that the following factors may be relevant to an adviser’s compensation: the nature and quality of the services provided by the adviser, including the performance of the fund; the adviser’s cost of providing the services; the extent to which the adviser may realize “economies of scale” as the fund grows larger; any indirect benefits that may accrue to the adviser and its affiliates as a result of the adviser’s relationship with the fund; performance and expenses of comparable funds; the profitability of acting as adviser to the fund; and the extent to which the independent Board members, who are not “interested persons” of a fund as defined by the 1940 Act, are fully informed about all facts bearing on the adviser’s services and fees. The Board is aware of these factors and takes them into account in its review of the Management Agreement for the Funds.

The Board considered and weighed these circumstances in light of its experience in governing the Trust, and is assisted in its deliberations by the advice of independent legal counsel to the independent Trustees (“Independent Trustee Counsel”). In this regard, the Board requests and receives a significant amount of information about the Funds and the Manager. Some of this information is provided at each regular meeting of the Board; additional information is provided in connection with the particular meetings at which the Board’s formal review of an advisory contract occurs. In between regularly scheduled meetings, the Board may receive information on particular matters as the need arises. Thus, the Board’s evaluation of the Management Agreement is informed by reports covering such matters as: the Manager’s investment philosophy, personnel and processes, and the Fund’s investment performance (in absolute terms as well as in relationship to its benchmark). In connection with comparing the performance of each Fund versus its benchmark, the Board receives reports on the extent to which the Fund’s performance may be attributed to various applicable factors, such as asset class allocation decisions and volatility management strategies, the performance of the underlying funds, rebalancing decisions, and the impact of cash positions and Fund fees and expenses. The Board also receives reports on the Funds’ expenses (including the advisory fee itself and the overall expense structure of the Funds, both in absolute terms and relative to similar and/or competing funds, with due regard for the Expense Limitation Agreement and additional voluntary expense limitations); the use and allocation of any brokerage commissions derived from trading the Funds’ portfolio securities; the nature and extent of the advisory and other services provided to the Fund by the Manager and its affiliates; compliance and audit reports concerning the Funds and the companies that service them; and relevant developments in the mutual fund industry and how the Funds and/or the Manager are responding to them.

The Board also receives financial information about the Manager, including reports on the compensation and benefits the Manager derives from its relationships with the Funds. These reports cover not only the fees under the Management Agreement, but also fees, if any, received for providing other services to the Funds. The reports also discuss any indirect or “fall out” benefits the Manager or its affiliates may derive from its relationship with the Funds.

The Management Agreement was most recently considered at Board meetings held in the summer and fall of 2019. Information relevant to the approval of the Management Agreement was considered atin-person Board meetings held June 18, 2019, and September 18, 2019, as well as at various telephonic Board meetings preceding the twoin-person meetings.. The Management Agreement was approved at the Board meeting on September 18, 2019. At such meeting the Board also approved the Expense Limitation Agreement between the Manager and the Trust for the period ending April 30, 2021. In connection with such meetings, the Trustees requested and evaluated extensive materials from the Manager, including performance and expense information for other investment companies with similar investment objectives derived from data compiled by an independent third party provider and other sources believed to be reliable by the Manager and the Trustees. Prior to voting, the Trustees reviewed the proposed approval/continuance of the Agreement with management and with Independent Trustee Counsel and received a memorandum from such counsel discussing the legal standards for their consideration of the proposed approvals/continuances. The independent Trustees also discussed the proposed approvals/continuances in a private session with Independent Trustee Counsel at which no representatives of the Manager were present. In reaching its determinations relating to the approval and/or continuance of the Agreement, in respect of each Fund, the Board considered all factors it believed relevant. The Board based its decision to approve the Management Agreement on the totality of the circumstances and relevant factors, and with a view to past and future long-term considerations. Not all of the factors and considerations discussed above and below are necessarily relevant to every Fund, and the Board did not assign relative weights to factors discussed herein or deem any one or group of them to be controlling in and of themselves.

An SEC rule requires that shareholder reports include a discussion of certain factors relating to the selection of the investment adviser and the approval of the advisory fee. The “factors” enumerated by the SEC are set forth below in italics, as well as the Board’s conclusions regarding such factors:

(1) The nature, extent and quality of services provided by the Manager. The Trustees noted that the Manager, subject to the control of the Board, administers each Fund’s business and other affairs. The Trustees noted that the Manager also provides the Trust and each Fund with such administrative and other services (exclusive of, and in addition to, any such services provided by any others retained by the Trust on behalf of the Funds) and executive and other personnel as are necessary for the operation of the Trust and the Funds. Except for the Trust’s Chief Compliance Officer and certain compliance staff, the Manager pays all of the compensation of Trustees and officers of the Trust who are employees of the Manager or its affiliates.

15

The Board considered the scope and quality of services provided by the Manager and noted that the scope of such services provided has continued to expand as a result of regulatory and other developments. The Board noted that, for example, the Manager is responsible for maintaining and monitoring its own compliance program, and this compliance program has been continuously refined and enhanced in light of new regulatory requirements. The Board considered the capabilities and resources which the Manager has dedicated to performing services on behalf of the Trust and its Funds. The quality of administrative and other services, including the Manager’s role in coordinating the activities of the Trust’s other service providers, also were considered. The Board concluded that, overall, they were satisfied with the nature, extent and quality of services provided (and expected to be provided) to the Trust and to each of the Funds under the Management Agreement.

(2) The investment performance of the Funds and the Manager. In connection with everyin-person quarterly Board meeting and the summer and fall 2019 contract review process, Trustees received extensive information on the performance results of each Fund. This included, for example, performance information on absolute total return, performance versus the appropriate benchmark(s), the contribution to performance of the Manager’s asset class allocation decisions and volatility management strategies, the performance of the underlying funds, and the impact on performance of rebalancing decisions, cash and Fund fees. This included Lipper performance information on the Funds for the previous quarter,year-to-date, and previousone-, three- and five-year periods, to the extent the Funds were in existence for such periods. (For Funds that have been in existence for less than five years, the Board received performance information on shorter time periods to the extent available.) For example, in connection with the Board meetings held June 18 and September 18, 2019, the Manager reported that for the five Funds for which performance information for the five year period ended December 31, 2018 was available, three were in the top 40%, two were in the middle 20%, and none was in the bottom 40%. None of these Funds was in the bottom 40% for the three- orone-year periods. The Manager reported that for the three-year period ended December 31, 2018, for the eight Funds for which three-year performance information was available, four Funds were in the top 40%, three Funds were in the middle 20%, and one Fund was in the bottom 40%. For the 12 Funds for whichone-year performance information was available, for theone-year period ended December 31, 2018, four Funds were in the top 40%, seven Funds were in the middle 20%, and one Fund was in the bottom 40% against peers.

At the Board meetings held June 18 and September 18, 2019, the Manager also reported upon the performance of the MVP Funds compared to custom managed-volatility peer groups. For the six Funds for which five-year performance information was available, for the five-year period ended December 31, 2018, five Funds were in the top 40% and one Fund was in the bottom 20%. For the eight Funds for which three-year performance information was available, for the three-year period ended December 31, 2018, five Funds were in the top 40%, two Funds were in the middle 20%, and one was in the bottom 40%. For the 10 Funds for whichone-year performance was available, for theone-year period ended December 31, 2018, five Funds were in the top 40%, four Funds were in the middle 20%, and one Fund was in the bottom 40%.

At the Board meeting held September 18, 2019, the Trustees determined that the investment performance of the Funds was acceptable.

(3) The costs of services to be provided and profits to be realized by the Manager and its affiliates from the relationship with the Funds.The Board considered that the Manager receives an advisory fee from each of the Funds. The Manager reported that for the three MVP Fusion Dynamic Funds the advisory fee paid put these Funds in the 48th percentile of the customized peer group. The Manager reported that for three MVP Index Strategy Funds the advisory fee paid put them in the 18th percentile of the customized peer group, and for the AZL Balanced Index Strategy Fund the advisory fee paid put it in the 7th percentile of the customized peer group. The Manager reported that for the AZL DFA Multi-Strategy Fund, the advisory fee paid was in the 6th percentile. The Manager reported that for the AZL MVP Global Balanced Index Strategy (formerly, AZL MVP BlackRock Global Strategy Plus), AZL MVP DFA Multi-Strategy, AZL MVP FIAM Multi-Strategy, and AZL MVP T. Rowe Price Capital Appreciation Plus Funds, the advisory fee paid was in the 10th percentile. (A lower percentile reflects lower fund fees and is better for fund shareholders.) Trustees were provided with information on the total expense ratios of the Funds and other funds in the customized peer groups, and the Manager reported upon the challenges in making peer group comparisons for the Funds.

The Manager provided information concerning the profitability of the Manager’s investment advisory activities for the period from 2016 through December 31, 2018. The Board recognized that it is difficult to make comparisons of profitability from investment company advisory agreements because comparative information is not generally publicly available and is affected by numerous factors, including the structure of the particular adviser, the types of funds it manages, its business mix, numerous assumptions regarding allocation of expenses and the adviser’s capital structure and cost of capital. In considering profitability information, the Board considered the possible effect of certainfall-out benefits to the Manager and its affiliates. The Board focused on profitability of the Manager’s relationships with the Funds before taxes and distribution expenses. The Board recognized that the Manager should earn a reasonable level of profits for the services it provides to each Fund.

The Board also considered that Wilshire Funds Management (“Wilshire”) serves as a consultant to the Manager in preparing statistical and other factual information for use in the creation and maintenance of the asset allocation models for the AZL MVP Fusion Dynamic Funds, pursuant to an agreement between the Manager and Wilshire. Wilshire serves as a consultant to the Manager with respect to selecting the AZL MVP Fusion Dynamic Funds’ underlying funds and the asset allocations among the underlying funds. The Manager, not any Fund, pays a consultant fee to Wilshire.

(4) and (5) The extent to which economies of scale would be realized as the Funds grow, and whether fee levels reflect these economies of scale. The Board noted that the advisory fee schedules for the Funds do not contain breakpoints that reduce the fee rate on assets above specified levels. The Board recognized that breakpoints may be an appropriate way for the Manager to share its economies of scale, if any, with Funds that have substantial assets. The Board found there was no uniform methodology for establishing breakpoints that give effect to Fund-specific services provided by the Manager. The Board noted that in the fund industry as a whole, as well as among funds similar to the Funds, there is no uniformity or pattern in the fees and asset levels at which breakpoints (if any) apply. Depending on the age, size, and other characteristics of a particular fund and its manager’s cost structure, different conclusions can be drawn as to whether there are economies of scale to be realized at any particular level of assets, notwithstanding the intuitive conclusion that such economies exist, or will be realized at some level of total assets. Moreover, because different managers have different cost structures and service models, it is difficult to draw meaningful conclusions from the breakpoints that may have been adopted by other funds. The Board also noted that the advisory agreements for many funds do not have breakpoints at all, or if breakpoints exist, they may be at asset levels significantly greater than those of the individual Funds. The Board also noted that the total assets in all of the Funds, as of December 31, 2018, were approximately $9.8 billion and that the largest Fund, the AZL MVP Growth Index Strategy Fund, had assets of approximately $2.4 billion.

The Board noted that the Manager has agreed to temporarily limit Fund expenses under the Expense Limitation Agreement, which has the same effect of reducing expenses similar to implementation of advisory fee breakpoints. The Manager has committed to continue to consider the continuation of expense limits and/or advisory fee breakpoints as the Funds grow larger. The Board receives quarterly reports on the level of Fund assets. The Board expects to continue to consider: (a) the extent to which economies of scale have been realized, and (b) whether the advisory fee should be modified, either in connection with the next renewal of the Agreements or by modifying the Expense Limitation Agreement, to reflect such economies of scale, if any.

Having taken these factors into account, the Board concluded that the absence of breakpoints in the Funds’ advisory fee rate schedules was acceptable under each Fund’s circumstances.

In conclusion, after full consideration of the above factors, as well as such other factors as each member of the Board considered instructive in evaluating the Management Agreement, the Board concluded that the advisory fees were reasonable, and that the continuation of the Management Agreement was in the best interest of the Funds.

16

Information about the Board of Trustees and Officers (Unaudited)

The Trust is managed by the Trustees in accordance with the laws of the state of Delaware governing business trusts. There are currently seven Trustees, one of whom is an “interested person” of the Trust within the meaning of that term under the 1940 Act. The Trustees and Officers of the Trust, and their addresses, ages, positions held with the Trust, terms of office with the Trust and length of time served, principal occupation(s) during the past five years, the number of portfolios in the Trust they oversee, and other directorships held during the past five years are as follows:

Non-Interested Trustees(1)

| Name, Address, and Year of Birth | Positions Held with Allianz VIP and VIP FOF Trust | Term of Office(2)/Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios Overseen for Allianz VIP and VIP FOF Trust | Other AZL Fund Complex | |||||

| Peter R. Burnim (1947) 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 2/07 | Consultant/Chair, various companies: Chairman, Emrys Analytics and subsidiaries, July 2015 to present; Chairman, Argus Investment Strategies Fund Ltd., February 2013 to 2017; Managing Director, iQ Venture Advisors, LLC, 2005 to present; Chair, Northstar Group Holdings Ltd. Bermuda, 2011 to present; Chair Sterling Bank & Trust (Bahamas) Ltd., 2016 to present, and Expert Witness, Massachusetts Department of Revenue, 2011 to 2016. | 33 | Argus Group Holdings and Subsidiaries; Northstar Group Holdings; Sterling Trust (Cayman) Ltd.; Sterling Bank & Trust Limited (Bahamas); Emrys Analytics; EGB Insurance. Sterling National Bank Advisory Board, Stellar Energy Foundation. | |||||

| Peggy L. Ettestad (1957) 5701 Golden Hills Drive Minneapolis, MN 55416 | Lead Independent Trustee | Since 10/14 (Trustee since 2/07) | Managing Director, Red Canoe Management Consulting LLC, 2008 to present | 33 | Luther College | |||||

| Tamara Lynn Fagely (1958) 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 12/17 | Retired; Chief Operations Officer, Hartford Funds, March 2012 to December 2013 | 33 | Diamond Hill Funds (13 funds) | |||||

| Richard H. Forde (1953) 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 12/17 | Member of the Board and Chairman of the Finance and Investment Committee, Connecticut Water Service, Inc., October 2013 to present; Senior Vice President and Chief Investment Officer, CIGNA, 2004 to 2012 | 33 | Connecticut Water Service, Inc. | |||||

| Claire R. Leonardi (1955) 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 2/04 | Chief Executive Officer, Health eSense Inc., 2015 to Present; CEO, Connecticut Innovations, Inc., 2012 to 2015 | 33 | reSet Social Enterprise Investment Fund | |||||

| Dickson W. Lewis (1948) 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 2/04 | Retired; Vice President/General Manager, Yearbooks & Canada-Lifetouch National School Studios, 2006 to 2014 | 33 | None | |||||

Interested Trustees(3)

| Name, Address, and Year of Birth | Positions Held with Allianz VIP and VIP FOF Trust | Term of Office(2)/Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios Overseen for Allianz VIP and VIP FOF Trust | Other AZL Fund Complex | |||||

Brian Muench (1970) 5701 Golden Hills Drive | Trustee | Since 6/11 | President, Allianz Investment Management LLC, November 2010 to present; Vice President, Allianz Life, April 2011 to present | 33 | None | |||||

17

Officers

| Name, Address, and Age | Positions Held with Allianz VIP and VIP FOF Trust | Term of Office(2)/ Length of Time Served | Principal Occupation(s) During Past 5 Years | |||

Brian Muench (1970) 5701 Golden Hills Drive | President | Since 11/10 | President, Allianz Investment Management LLC, November 2010 to present; Vice President, Allianz Life, April 2011 to present. | |||

| Michael Radmer (1945) Dorsey & Whitney LLP, Suite 1500 50 South Sixth Street Minneapolis, MN55402-1498 | Secretary | Since 02/02 | Senior Counsel (previously, Partner), Dorsey and Whitney LLP since 1976. | |||

| Bashir C. Asad (1963) Citi Fund Services Ohio, Inc. 4400 Easton Commons, Suite 200 Columbus, OH 43219 | Treasurer, Principal Accounting Officer and Principal Financial Officer | Since 06/16 | Senior Vice President, Citi Fund Services Ohio, Inc. | |||

| Chris R. Pheiffer (1968) 5701 Golden Hills Drive Minneapolis, MN 55416 | Chief Compliance Officer(4) and Anti-Money Laundering Compliance Officer | Since 02/14 | Chief Compliance Officer of the VIP Trust and the FOF Trust, February 2014 to present. | |||

| (1) | Member of the Audit Committee. |

| (2) | Indefinite. |

| (3) | Is an “interested person”, as defined by the 1940 Act, due to employment by Allianz. |

| (4) | The Manager and the Trust are parties to a Chief Compliance Officer Agreement under which the Manager is compensated by the Trust for providing an employee of the Manager or one of its affiliates to act as the Trust’s Chief Compliance Officer. The Chief Compliance Officer and Anti-Money Laundering Compliance Officer is not considered a corporate officer or executive employee of the Trust. |

18

| The Allianz VIP Fund of Funds are distributed by Allianz Life Financial Services, LLC. These Funds are not FDIC Insured. | ANNRPT1219 2/20 |

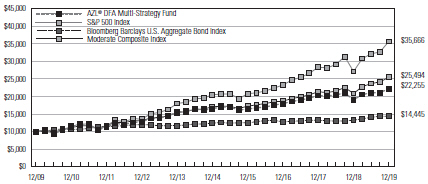

AZL® DFA Multi-Strategy Fund

Annual Report

December 31, 2019

Management Discussion and Analysis

Page 1

Expense Examples and Portfolio Composition

Page 3

Schedule of Portfolio Investments

Page 4

Statement of Assets and Liabilities

Page 5

Page 5

Statements of Changes in Net Assets

Page 6

Page 7

Notes to the Financial Statements

Page 8

Report of Independent Registered Public Accounting Firm

Page 12

Other Federal Income Tax Information