UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21667

Fidelity Central Investment Portfolios LLC

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | September 30 |

Date of reporting period: | September 30, 2022 |

Item 1.

Reports to Stockholders

Contents

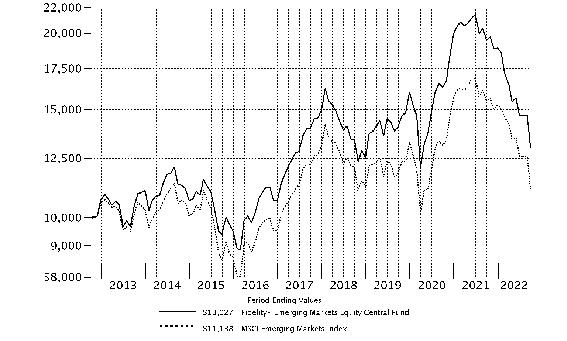

| Average Annual Total Returns | |||

Periods ended September 30, 2022 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Floating Rate Central Fund | -1.98% | 3.38% | 4.14% |

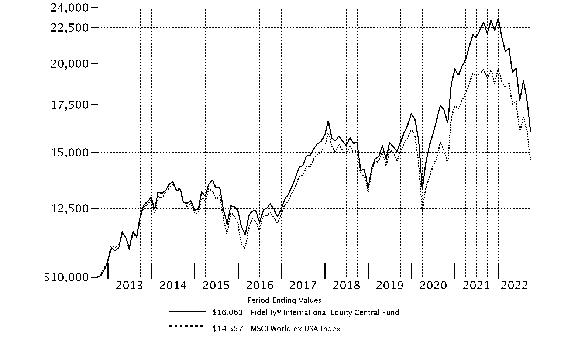

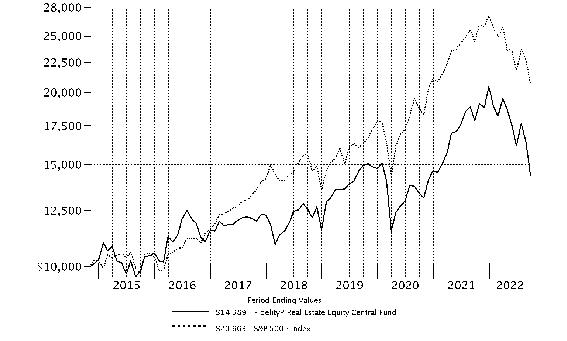

| $10,000 Over 10 Years |

Let's say hypothetically that $10,000 was invested in Fidelity® Floating Rate Central Fund on September 30, 2012. The chart shows how the value of your investment would have changed, and also shows how the Morningstar® LSTA® US Performing Loans performed over the same period. |

|

| Top Bond Issuers (% of Fund's net assets) | ||

(with maturities greater than one year) | ||

| Bass Pro Group LLC | 2.8 | |

| Asurion LLC | 1.9 | |

| Caesars Resort Collection LLC | 1.3 | |

| Intelsat Jackson Holdings SA | 1.2 | |

| TransDigm, Inc. | 1.0 | |

| Athenahealth Group, Inc. | 1.0 | |

| Fertitta Entertainment LLC NV | 0.9 | |

| HUB International Ltd. | 0.9 | |

| Ultimate Software Group, Inc. | 0.9 | |

| Peraton Corp. | 0.8 | |

| 12.8 | ||

| Market Sectors (% of Fund's net assets) | ||

| Technology | 15.5 | |

| Services | 8.7 | |

| Telecommunications | 5.2 | |

| Healthcare | 5.0 | |

| Gaming | 4.9 | |

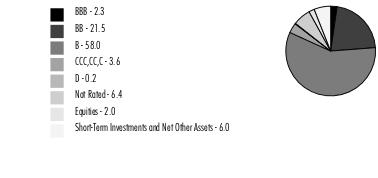

Quality Diversification (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

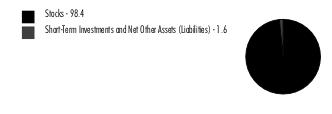

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 9% |

| Bank Loan Obligations - 88.1% | |||

Principal Amount (a) | Value ($) | ||

| Aerospace - 1.1% | |||

| ADS Tactical, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.750% 8.8019% 3/19/26 (b)(c)(d) | 4,440,000 | 4,054,297 | |

| Gemini HDPE LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 5.81% 12/31/27 (b)(c)(d) | 2,030,966 | 1,939,573 | |

| TransDigm, Inc.: | |||

| Tranche E 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.9241% 5/30/25 (b)(c)(d) | 3,058,823 | 2,930,475 | |

| Tranche F 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.9241% 12/9/25 (b)(c)(d) | 12,181,485 | 11,652,078 | |

| Tranche G 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.9241% 8/22/24 (b)(c)(d) | 8,139,553 | 7,921,983 | |

TOTAL AEROSPACE | 28,498,406 | ||

| Air Transportation - 1.7% | |||

| AAdvantage Loyalty IP Ltd. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.4599% 4/20/28 (b)(c)(d) | 6,475,000 | 6,261,325 | |

| Air Canada Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.421% 8/11/28 (b)(c)(d) | 3,491,250 | 3,313,580 | |

| Dynasty Acquisition Co., Inc.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 4/8/26 (b)(c)(d) | 2,369,401 | 2,180,347 | |

| Tranche B2 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 4/4/26 (b)(c)(d) | 1,273,872 | 1,172,229 | |

| Echo Global Logistics, Inc.: | |||

| 1LN, term loan 3 month U.S. LIBOR + 4.750% 7.4057% 11/23/28 (b)(c)(d)(e) | 4,800,000 | 4,624,000 | |

| 2LN, term loan 3 month U.S. LIBOR + 8.000% 10.6429% 11/23/29 (b)(c)(d)(e) | 900,000 | 867,000 | |

| Mileage Plus Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.250% 8.7771% 7/2/27 (b)(c)(d) | 5,301,000 | 5,313,298 | |

| SkyMiles IP Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 6.4599% 10/20/27 (b)(c)(d) | 6,705,000 | 6,710,230 | |

| STG Logistics, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 6.000% 9.1341% 3/24/28 (b)(c)(d) | 1,492,500 | 1,425,338 | |

| United Airlines, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.533% 4/21/28 (b)(c)(d) | 9,879,550 | 9,411,655 | |

| WestJet Airlines Ltd. 1LN, term loan 3 month U.S. LIBOR + 3.000% 5.9934% 12/11/26 (b)(c)(d) | 1,117,004 | 980,450 | |

TOTAL AIR TRANSPORTATION | 42,259,452 | ||

| Automotive & Auto Parts - 1.7% | |||

| Adient U.S. LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 4/8/28 (b)(c)(d) | 2,567,500 | 2,418,277 | |

| American Trailer World Corp. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 6.3053% 3/5/28 (b)(c)(d) | 5,878,792 | 5,317,838 | |

| Avis Budget Car Rental LLC 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 6.6341% 3/16/29 (b)(c)(d) | 1,169,125 | 1,121,390 | |

| Clarios Global LP Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 4/30/26 (b)(c)(d) | 4,562,298 | 4,305,669 | |

| CWGS Group LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.3406% 6/3/28 (b)(c)(d) | 9,030,864 | 7,920,790 | |

| Driven Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 3.5169% 11/17/28 (b)(c)(d)(e) | 1,238,775 | 1,189,224 | |

| Les Schwab Tire Centers Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.5799% 11/2/27 (b)(c)(d) | 3,993,863 | 3,810,824 | |

| PECF USS Intermediate Holding III Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.3653% 12/17/28 (b)(c)(d) | 4,118,875 | 3,504,462 | |

| Power Stop LLC 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.8196% 1/26/29 (b)(c)(d) | 3,154,150 | 2,334,071 | |

| Rough Country LLC: | |||

| 2LN, term loan 1 month U.S. LIBOR + 6.500% 10.1741% 7/28/29 (b)(c)(d) | 1,585,000 | 1,499,806 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 7.1741% 7/28/28 (b)(c)(d) | 2,693,799 | 2,518,702 | |

| RVR Dealership Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 6.8684% 2/8/28 (b)(c)(d) | 1,930,000 | 1,695,988 | |

| Thor Industries, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.125% 2/1/26 (b)(c)(d) | 442,047 | 435,231 | |

| Truck Hero, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 1/29/28 (b)(c)(d) | 4,919,729 | 4,276,081 | |

TOTAL AUTOMOTIVE & AUTO PARTS | 42,348,353 | ||

| Banks & Thrifts - 0.8% | |||

| Citadel Securities LP Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6486% 2/27/28 (b)(c)(d) | 6,812,498 | 6,606,420 | |

| Deerfield Dakota Holding LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 6.7841% 4/9/27 (b)(c)(d) | 3,072,426 | 2,893,212 | |

| LHS Borrower LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.750% 7.8841% 2/18/29 (b)(c)(d) | 5,407,825 | 4,380,338 | |

| Novae LLC 1LN, term loan CME Term SOFR 1 Month Index + 5.000% 7.7267% 12/22/28 (b)(c)(d) | 3,119,325 | 2,885,376 | |

| Superannuation & Investments U.S. LLC 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 12/1/28 (b)(c)(d) | 1,791,463 | 1,747,572 | |

| Walker & Dunlop, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.250% 5.3841% 12/16/28 (b)(c)(d)(e) | 1,801,388 | 1,747,346 | |

TOTAL BANKS & THRIFTS | 20,260,264 | ||

| Broadcasting - 2.1% | |||

| AppLovin Corp.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.6741% 10/25/28 (b)(c)(d) | 2,487,500 | 2,384,891 | |

| Tranche B, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 8/15/25 (b)(c)(d) | 8,351,471 | 8,062,677 | |

| Diamond Sports Group LLC: | |||

| 1LN, term loan CME Term SOFR 1 Month Index + 8.000% 10.6955% 5/25/26 (b)(c)(d) | 2,361,194 | 2,257,892 | |

| 2LN, term loan CME Term SOFR 1 Month Index + 3.250% 5.9455% 8/24/26 (b)(c)(d) | 19,373,871 | 3,694,791 | |

| Dotdash Meredith, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 6.6121% 12/1/28 (b)(c)(d)(e) | 10,058,875 | 8,952,399 | |

| Entercom Media Corp. Tranche B 2LN, term loan 1 month U.S. LIBOR + 2.500% 5.6131% 11/17/24 (b)(c)(d) | 2,395,807 | 1,980,829 | |

| Gray Television, Inc. Tranche D 1LN, term loan 1 month U.S. LIBOR + 3.000% 5.564% 12/1/28 (b)(c)(d) | 3,662,325 | 3,549,196 | |

| Nexstar Broadcasting, Inc. Tranche B, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 9/19/26 (b)(c)(d) | 4,537,309 | 4,467,615 | |

| Sinclair Television Group, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.62% 9/30/26 (b)(c)(d) | 2,349,515 | 2,220,292 | |

| Springer Nature Deutschland GmbH Tranche B18 1LN, term loan 1 month U.S. LIBOR + 3.500% 5.5239% 8/14/26 (b)(c)(d) | 3,155,852 | 3,056,442 | |

| Univision Communications, Inc. Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.250% 5.7739% 3/24/26 (b)(c)(d) | 4,823,092 | 4,569,108 | |

| 1 month U.S. LIBOR + 3.250% 6.3653% 1/31/29 (b)(c)(d) | 9,339,309 | 8,910,262 | |

TOTAL BROADCASTING | 54,106,394 | ||

| Building Materials - 2.4% | |||

| Acproducts Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.3247% 5/17/28 (b)(c)(d) | 6,729,061 | 4,939,333 | |

| APi Group DE, Inc. Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 2.500% 3.1153% 10/1/26 (b)(c)(d) | 2,250,491 | 2,190,290 | |

| 1 month U.S. LIBOR + 2.750% 5.8653% 1/3/29 (b)(c)(d) | 3,646,792 | 3,544,974 | |

| Beacon Roofing Supply, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.3653% 5/19/28 (b)(c)(d) | 2,034,250 | 1,957,966 | |

| DiversiTech Holdings, Inc.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4241% 12/22/28 (b)(c)(d) | 2,168,247 | 2,027,311 | |

| Tranche B-DD 1LN, term loan 1 month U.S. LIBOR + 3.750% 12/22/28 (c)(d)(f) | 450,857 | 421,551 | |

| Hunter Douglas, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 6.3399% 2/25/29 (b)(c)(d) | 19,745,513 | 16,161,702 | |

| Ingersoll-Rand Services Co. Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.8841% 2/28/27 (b)(c)(d) | 3,441,725 | 3,333,449 | |

| Installed Building Products, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.3653% 12/14/28 (b)(c)(d) | 697,194 | 682,957 | |

| Oscar AcquisitionCo LLC 1LN, term loan CME Term SOFR 1 Month Index + 4.500% 8.1532% 4/29/29 (b)(c)(d) | 4,525,000 | 4,136,619 | |

| Smyrna Ready Mix LLC Tranche B 1lN, term loan CME Term SOFR 1 Month Index + 4.250% 7.3841% 4/1/29 (b)(c)(d)(e) | 1,755,600 | 1,672,209 | |

| SRS Distribution, Inc. Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.500% 6.3059% 6/4/28 (b)(c)(d) | 6,855,550 | 6,312,796 | |

| CME Term SOFR 1 Month Index + 3.500% 6.1767% 6/2/28 (b)(c)(d) | 3,109,375 | 2,851,297 | |

| Standard Industries, Inc./New Jersey Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 6.6751% 9/22/28 (b)(c)(d) | 2,575,816 | 2,494,523 | |

| Traverse Midstream Partners Ll Tranche B, term loan CME Term SOFR 1 Month Index + 4.250% 5.9499% 9/27/24 (b)(c)(d) | 1,652,860 | 1,611,538 | |

| USIC Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 5/7/28 (b)(c)(d) | 2,791,800 | 2,609,160 | |

| White Capital Buyer LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 6.7841% 10/19/27 (b)(c)(d) | 3,669,871 | 3,426,742 | |

TOTAL BUILDING MATERIALS | 60,374,417 | ||

| Cable/Satellite TV - 2.6% | |||

| Charter Communication Operating LLC Tranche B2 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.87% 2/1/27 (b)(c)(d) | 16,860,513 | 16,200,087 | |

| Coral-U.S. Co.-Borrower LLC: | |||

| Tranche B, term loan 1 month U.S. LIBOR + 2.250% 5.0677% 1/31/28 (b)(c)(d) | 7,240,000 | 6,948,590 | |

| Tranche B6 1LN, term loan 1 month U.S. LIBOR + 3.000% 5.8177% 10/15/29 (b)(c)(d) | 1,940,000 | 1,859,975 | |

| CSC Holdings LLC: | |||

| Tranche B 5LN, term loan 1 month U.S. LIBOR + 2.500% 5.3177% 4/15/27 (b)(c)(d) | 8,405,747 | 7,843,655 | |

| Tranche B3 1LN, term loan 3 month U.S. LIBOR + 2.250% 5.0677% 1/15/26 (b)(c)(d) | 1,930,000 | 1,802,138 | |

| DIRECTV Financing LLC 1LN, term loan 1 month U.S. LIBOR + 5.000% 8.1153% 8/2/27 (b)(c)(d) | 8,662,322 | 8,048,423 | |

| LCPR Loan Financing LLC 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.5677% 9/25/28 (b)(c)(d) | 1,910,000 | 1,843,150 | |

| Neptune Finco Corp. Tranche B, term loan 3 month U.S. LIBOR + 2.250% 5.0677% 7/17/25 (b)(c)(d) | 4,691,366 | 4,459,753 | |

| Numericable LLC: | |||

| Tranche B 11LN, term loan 3 month U.S. LIBOR + 2.750% 5.5559% 7/31/25 (b)(c)(d) | 6,006,533 | 5,465,945 | |

| Tranche B 12LN, term loan 3 month U.S. LIBOR + 3.680% 6.1995% 1/31/26 (b)(c)(d) | 1,476,555 | 1,336,282 | |

| Tranche B 13LN, term loan 3 month U.S. LIBOR + 4.000% 6.9051% 8/14/26 (b)(c)(d) | 5,775,000 | 5,226,375 | |

| Virgin Media Bristol LLC Tranche N, term loan 1 month U.S. LIBOR + 2.500% 5.3177% 1/31/28 (b)(c)(d) | 5,373,792 | 5,120,041 | |

TOTAL CABLE/SATELLITE TV | 66,154,414 | ||

| Capital Goods - 0.6% | |||

| Ali Group North America Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.1486% 7/23/29 (b)(c)(d) | 2,160,219 | 2,078,130 | |

| CPM Holdings, Inc.: | |||

| 2LN, term loan 3 month U.S. LIBOR + 8.250% 10.814% 11/15/26 (b)(c)(d) | 514,697 | 488,962 | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 6.064% 11/15/25 (b)(c)(d) | 2,054,927 | 1,977,867 | |

| Griffon Corp. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.750% 5.4899% 1/24/29 (b)(c)(d) | 5,049,900 | 4,843,713 | |

| MHI Holdings LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 8.1153% 9/20/26 (b)(c)(d) | 3,127,731 | 3,069,086 | |

| TNT Crane & Rigging LLC 2LN, term loan 3 month U.S. LIBOR + 8.750% 11.0271% 4/16/25 (b)(c)(d)(e) | 1,612,880 | 1,520,139 | |

TOTAL CAPITAL GOODS | 13,977,897 | ||

| Chemicals - 2.8% | |||

| ARC Falcon I, Inc.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 9/30/28 (b)(c)(d) | 5,871,933 | 5,404,645 | |

| Tranche B 2LN, term loan 1 month U.S. LIBOR + 7.000% 10.1153% 9/22/29 (b)(c)(d)(e) | 930,000 | 874,200 | |

| Tranche DD 1LN, term loan 1 month U.S. LIBOR + 3.750% 9/30/28 (c)(d)(f) | 863,694 | 794,961 | |

| Aruba Investment Holdings LLC: | |||

| 2LN, term loan 1 month U.S. LIBOR + 7.750% 10.834% 11/24/28 (b)(c)(d) | 1,575,000 | 1,425,375 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.084% 11/24/27 (b)(c)(d) | 3,983,389 | 3,659,738 | |

| Avient Corp. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 6.2969% 8/29/29 (b)(c)(d) | 1,925,000 | 1,916,184 | |

| Bakelite U.S. Holding Ltd. 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 7.669% 5/27/29 (b)(c)(d) | 2,763,075 | 2,567,366 | |

| Cimpress U.S.A., Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 5/17/28 (b)(c)(d) | 993,736 | 909,269 | |

| Consolidated Energy Finance SA: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.3633% 5/7/25 (b)(c)(d)(e) | 1,560,100 | 1,489,896 | |

| Tranche B, term loan 3 month U.S. LIBOR + 2.500% 5.2929% 5/7/25 (b)(c)(d) | 2,645,250 | 2,526,214 | |

| Discovery Purchaser Corp. 1LN, term loan CME Term SOFR 1 Month Index + 4.370% 8/3/29 (c)(d) | 5,250,000 | 4,790,625 | |

| Element Solutions, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.1153% 1/31/26 (b)(c)(d) | 2,378,708 | 2,357,394 | |

| Groupe Solmax, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 8.3919% 5/27/28 (b)(c)(d) | 3,912,492 | 3,452,774 | |

| Herens U.S. Holdco Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.6741% 7/3/28 (b)(c)(d) | 2,236,815 | 1,985,173 | |

| Hexion Holdings Corp. 1LN, term loan CME Term SOFR 1 Month Index + 4.500% 7.4125% 3/15/29 (b)(c)(d) | 7,980,000 | 6,775,020 | |

| Hexion, Inc. 2LN, term loan CME Term SOFR 1 Month Index + 7.000% 10.5559% 2/9/30 (b)(c)(d)(e) | 2,105,000 | 1,705,050 | |

| ICP Group Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4241% 12/29/27 (b)(c)(d) | 1,851,800 | 1,436,682 | |

| INEOS U.S. Petrochem LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 1/20/26 (b)(c)(d) | 6,386,033 | 5,941,693 | |

| Manchester Acquisition Sub LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.750% 8.8467% 12/1/26 (b)(c)(d) | 3,478,713 | 2,991,693 | |

| Messer Industries U.S.A., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 6.1741% 3/1/26 (b)(c)(d) | 1,773,633 | 1,692,720 | |

| Olympus Water U.S. Holding Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4375% 11/9/28 (b)(c)(d) | 5,478,600 | 4,985,526 | |

| Oxea Corp. Tranche B2, term loan 3 month U.S. LIBOR + 3.250% 5.9375% 10/11/24 (b)(c)(d) | 2,073,157 | 1,871,024 | |

| Starfruit U.S. Holdco LLC Tranche B, term loan 1 month U.S. LIBOR + 3.000% 5.8653% 10/1/25 (b)(c)(d) | 4,602,086 | 4,308,703 | |

| The Chemours Co. LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 1.750% 4.87% 4/3/25 (b)(c)(d) | 2,262,819 | 2,111,210 | |

| Valcour Packaging LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 5.2199% 10/4/28 (b)(c)(d) | 482,588 | 442,171 | |

| W.R. Grace Holding LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 7.4375% 9/22/28 (b)(c)(d) | 2,230,581 | 2,082,805 | |

TOTAL CHEMICALS | 70,498,111 | ||

| Consumer Products - 2.2% | |||

| 19Th Holdings Golf LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 5.6955% 2/7/29 (b)(c)(d)(e) | 4,179,525 | 3,866,061 | |

| BCPE Empire Holdings, Inc.: | |||

| 1LN, term loan: | |||

CME Term SOFR 1 Month Index + 4.000% 7.1153% 6/11/26 (b)(c)(d) | 1,698,574 | 1,610,809 | |

CME Term SOFR 1 Month Index + 4.620% 7.7591% 6/11/26 (b)(c)(d) | 1,467,613 | 1,397,901 | |

| Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 7.1153% 6/11/26 (b)(c)(d) | 2,967,525 | 2,836,450 | |

| Bombardier Recreational Products, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.1153% 5/23/27 (b)(c)(d) | 1,368,939 | 1,307,337 | |

| CNT Holdings I Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.2475% 11/8/27 (b)(c)(d) | 3,989,250 | 3,793,338 | |

| Conair Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4241% 5/17/28 (b)(c)(d) | 3,054,363 | 2,558,029 | |

| Diamond BC BV Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.5552% 9/29/28 (b)(c)(d) | 4,113,913 | 3,782,743 | |

| Gloves Buyer, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.1153% 1/6/28 (b)(c)(d) | 2,073,302 | 1,948,904 | |

| Knowlton Development Corp., Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 12/21/25 (b)(c)(d) | 3,695,766 | 3,480,192 | |

| Kronos Acquisition Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8196% 12/22/26 (b)(c)(d) | 5,399,061 | 4,988,138 | |

| Mattress Firm, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 8.4327% 9/24/28 (b)(c)(d) | 3,884,428 | 3,394,990 | |

| Michaels Companies, Inc. 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.9241% 4/15/28 (b)(c)(d) | 9,073,355 | 7,276,830 | |

| Petco Health & Wellness Co., Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.9241% 3/4/28 (b)(c)(d) | 2,221,175 | 2,092,769 | |

| Runner Buyer, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.500% 8.5696% 10/20/28 (b)(c)(d) | 2,482,525 | 1,655,025 | |

| Sweetwater Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.375% 8/5/28 (b)(c)(d) | 4,470,074 | 4,067,768 | |

| TGP Holdings III LLC: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 6/29/28 (b)(c)(d) | 1,581,129 | 1,238,229 | |

| Tranche DD 1LN, term loan 1 month U.S. LIBOR + 3.250% 4.0288% 6/29/28 (b)(c)(d)(f) | 208,482 | 163,269 | |

| TKC Holdings, Inc. 1LN, term loan 1 month U.S. LIBOR + 5.500% 7% 5/3/28 (b)(c)(d) | 2,312,914 | 1,964,820 | |

| Woof Holdings LLC: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.3153% 12/21/27 (b)(c)(d) | 3,220,403 | 3,035,230 | |

| Tranche B 2LN, term loan 1 month U.S. LIBOR + 7.250% 10.8153% 12/21/28 (b)(c)(d) | 605,000 | 577,775 | |

TOTAL CONSUMER PRODUCTS | 57,036,607 | ||

| Containers - 1.8% | |||

| AOT Packaging Products AcquisitionCo LLC 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 3/3/28 (b)(c)(d) | 5,009,727 | 4,695,367 | |

| Berlin Packaging, LLC Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.250% 5.916% 3/11/28 (b)(c)(d) | 581,168 | 546,008 | |

| 1 month U.S. LIBOR + 3.750% 6.3817% 3/11/28 (b)(c)(d) | 6,870,126 | 6,475,094 | |

| Berry Global, Inc. Tranche Z 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.1776% 7/1/26 (b)(c)(d) | 4,302,210 | 4,160,065 | |

| BWAY Holding Co. Tranche B, term loan 3 month U.S. LIBOR + 3.250% 5.814% 4/3/24 (b)(c)(d) | 1,421,250 | 1,320,881 | |

| Canister International Group, Inc. 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.8653% 12/21/26 (b)(c)(d) | 1,218,750 | 1,194,375 | |

| Charter NEX U.S., Inc. 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.5559% 12/1/27 (b)(c)(d) | 3,852,666 | 3,648,012 | |

| Graham Packaging Co., Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 8/4/27 (b)(c)(d) | 4,467,793 | 4,246,816 | |

| Kloeckner Pentaplast of America, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 8.2592% 2/9/26 (b)(c)(d) | 2,137,450 | 1,806,145 | |

| Pregis TopCo Corp. 1LN, term loan: | |||

| 1 month U.S. LIBOR + 4.000% 6.8059% 7/31/26 (b)(c)(d) | 2,178,040 | 2,069,138 | |

| 1 month U.S. LIBOR + 4.000% 6.8059% 8/1/26 (b)(c)(d) | 495,000 | 469,013 | |

| Proampac PG Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.4591% 11/18/25 (b)(c)(d) | 1,492,174 | 1,392,198 | |

| Reynolds Consumer Products LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 1/30/27 (b)(c)(d) | 5,239,014 | 5,035,164 | |

| Reynolds Group Holdings, Inc. Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.250% 6.3653% 2/5/26 (b)(c)(d) | 3,070,313 | 2,931,596 | |

| 1 month U.S. LIBOR + 3.500% 6.6153% 9/24/28 (b)(c)(d) | 4,113,450 | 3,933,487 | |

| Ring Container Technologies Group LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 8/12/28 (b)(c)(d) | 3,069,269 | 2,951,624 | |

TOTAL CONTAINERS | 46,874,983 | ||

| Diversified Financial Services - 2.2% | |||

| ACNR Holdings, Inc. term loan 19.084% 9/16/25 (b)(d)(e) | 516,616 | 516,616 | |

| AlixPartners LLP Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 2/4/28 (b)(c)(d) | 3,959,700 | 3,795,650 | |

| AVSC Holding Corp.: | |||

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 6.6441% 3/1/25 (b)(c)(d) | 1,947,963 | 1,700,416 | |

| Tranche B2 1LN, term loan 3 month U.S. LIBOR + 5.500% 8.6441% 10/15/26 (b)(c)(d) | 2,970,876 | 2,619,956 | |

| BCP Renaissance Parent LLC Tranche B3 1LN, term loan U.S. Secured Overnight Fin. Rate (SOFR) Index + 3.500% 7.0532% 10/31/26 (b)(c)(d) | 3,040,557 | 2,910,238 | |

| Broadstreet Partners, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 1/27/27 (b)(c)(d) | 1,782,000 | 1,683,990 | |

| Eagle 4 Ltd. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.9241% 7/12/28 (b)(c)(d) | 1,180,766 | 1,135,897 | |

| Finco I LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 6/27/25 (b)(c)(d) | 1,562,530 | 1,543,982 | |

| Focus Financial Partners LLC: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 6/24/28 (b)(c)(d) | 3,680,166 | 3,555,960 | |

| Tranche B3 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.1153% 7/3/24 (b)(c)(d) | 1,070,365 | 1,042,418 | |

| GT Polaris, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.5559% 9/24/27 (b)(c)(d) | 2,254,923 | 2,119,628 | |

| HarbourVest Partners LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 4.762% 3/1/25 (b)(c)(d) | 4,418,343 | 4,255,438 | |

| Hightower Holding LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 6.7317% 4/21/28 (b)(c)(d) | 4,930,200 | 4,557,378 | |

| KREF Holdings X LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.3125% 9/1/27 (b)(c)(d)(e) | 2,615,324 | 2,523,788 | |

| Nexus Buyer LLC: | |||

| 2LN, term loan 1 month U.S. LIBOR + 6.250% 9.3653% 11/5/29 (b)(c)(d) | 2,500,000 | 2,354,175 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 11/8/26 (b)(c)(d) | 2,969,466 | 2,845,134 | |

| Recess Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.750% 6.5511% 9/29/24 (b)(c)(d) | 573,455 | 552,909 | |

| TransUnion LLC: | |||

| Tranche B5 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 11/16/26 (b)(c)(d) | 5,322,791 | 5,125,848 | |

| Tranche B6 1LN, term loan 1 month U.S. LIBOR + 2.250% 4.7739% 12/1/28 (b)(c)(d) | 3,123,691 | 3,020,234 | |

| UFC Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.52% 4/29/26 (b)(c)(d) | 3,856,044 | 3,698,602 | |

| WH Borrower LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.500% 8.422% 2/9/27 (b)(c)(d) | 5,855,325 | 5,547,920 | |

TOTAL DIVERSIFIED FINANCIAL SERVICES | 57,106,177 | ||

| Diversified Media - 1.1% | |||

| Advantage Sales & Marketing, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.500% 7.0534% 10/28/27 (b)(c)(d) | 6,948,737 | 6,178,609 | |

| Allen Media LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.500% 9.2032% 2/10/27 (b)(c)(d) | 11,433,005 | 9,846,676 | |

| Terrier Media Buyer, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 12/17/26 (b)(c)(d) | 14,122,915 | 13,193,203 | |

TOTAL DIVERSIFIED MEDIA | 29,218,488 | ||

| Energy - 2.8% | |||

| Apro LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8949% 11/14/26 (b)(c)(d) | 2,569,315 | 2,440,849 | |

| Array Technologies, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.2077% 10/14/27 (b)(c)(d) | 7,761,891 | 7,289,735 | |

| Brazos Delaware II LLC Tranche B, term loan 3 month U.S. LIBOR + 4.000% 7.0139% 5/21/25 (b)(c)(d) | 2,664,462 | 2,563,213 | |

| BW Gas & Convenience Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 3/17/28 (b)(c)(d)(e) | 1,881,188 | 1,787,128 | |

| Citgo Petroleum Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 6.250% 9.3653% 3/28/24 (b)(c)(d) | 694,835 | 694,488 | |

| CQP Holdco LP / BIP-V Chinook Holdco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4241% 6/4/28 (b)(c)(d) | 18,480,863 | 17,803,170 | |

| Delek U.S. Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 5.3653% 3/30/25 (b)(c)(d) | 1,498,207 | 1,446,893 | |

| EG America LLC Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 4.250% 7.9241% 3/10/26 (b)(c)(d) | 1,326,696 | 1,236,043 | |

| 3 month U.S. LIBOR + 4.000% 7.6741% 2/6/25 (b)(c)(d) | 3,642,578 | 3,389,892 | |

| EG Finco Ltd. Tranche B, term loan 3 month U.S. LIBOR + 4.000% 7.6741% 2/6/25 (b)(c)(d) | 3,131,222 | 2,914,009 | |

| Epic Crude Services LP Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 7.08% 3/1/26 (b)(c)(d) | 1,726,167 | 1,419,772 | |

| Esdec Solar Group BV Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 8.9199% 8/27/28 (b)(c)(d)(e) | 3,198,724 | 2,990,807 | |

| GIP II Blue Holding LP Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.500% 8.1741% 9/29/28 (b)(c)(d) | 7,357,381 | 7,232,305 | |

| GIP III Stetson I LP Tranche B, term loan 3 month U.S. LIBOR + 4.250% 7.3653% 7/18/25 (b)(c)(d) | 6,019,059 | 5,729,422 | |

| Granite Acquisition, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 6.4241% 3/25/28 (b)(c)(d) | 3,189,426 | 3,041,117 | |

| Natgasoline LLC Tranche B, term loan 3 month U.S. LIBOR + 3.500% 6.625% 11/14/25 (b)(c)(d)(e) | 4,018,438 | 3,837,608 | |

| Rockwood Service Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.3653% 1/23/27 (b)(c)(d) | 4,197,114 | 4,071,201 | |

| WaterBridge Operating LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.750% 9.1274% 6/21/26 (b)(c)(d) | 915,141 | 881,583 | |

TOTAL ENERGY | 70,769,235 | ||

| Entertainment/Film - 0.2% | |||

| AP Core Holdings II LLC: | |||

| Tranche B1 1LN, term loan 1 month U.S. LIBOR + 5.500% 8.6153% 9/1/27 (b)(c)(d) | 1,090,844 | 1,007,667 | |

| Tranche B2 1LN, term loan 1 month U.S. LIBOR + 5.500% 8.6153% 9/1/27 (b)(c)(d) | 3,430,000 | 3,168,463 | |

| SMG U.S. Midco 2, Inc. 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 1/23/25 (b)(c)(d) | 1,359,368 | 1,293,669 | |

TOTAL ENTERTAINMENT/FILM | 5,469,799 | ||

| Environmental - 0.7% | |||

| Clean Harbors, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.1153% 10/8/28 (b)(c)(d) | 1,975,025 | 1,955,690 | |

| Covanta Holding Corp.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 11/30/28 (b)(c)(d) | 3,938,692 | 3,811,393 | |

| Tranche C 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.0239% 11/30/28 (b)(c)(d) | 296,516 | 286,932 | |

| Madison IAQ LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.8153% 6/21/28 (b)(c)(d) | 7,562,714 | 6,972,519 | |

| The Brickman Group, Ltd. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 6.2841% 4/14/29 (b)(c)(d) | 3,280,929 | 3,145,590 | |

| TRC Companies, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 11/17/28 (b)(c)(d) | 155,447 | 144,825 | |

| WTG Holdings III Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.625% 4/1/28 (b)(c)(d) | 1,194,875 | 1,163,510 | |

TOTAL ENVIRONMENTAL | 17,480,459 | ||

| Food & Drug Retail - 0.5% | |||

| 8th Avenue Food & Provisions, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.2739% 10/1/25 (b)(c)(d) | 1,257,300 | 1,104,324 | |

| Cardenas Merger Sub, LLC 1LN, term loan CME Term SOFR 1 Month Index + 6.750% 9.7949% 8/1/29 (b)(c)(d) | 2,335,000 | 2,253,275 | |

| Froneri U.S., Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.3653% 1/29/27 (b)(c)(d) | 3,487,225 | 3,284,094 | |

| GOBP Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 10/22/25 (b)(c)(d) | 1,289,787 | 1,260,766 | |

| JP Intermediate B LLC Tranche B, term loan 3 month U.S. LIBOR + 5.500% 8.3059% 11/20/25 (b)(c)(d) | 5,714,124 | 4,239,880 | |

| PetIQ, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.0677% 4/13/28 (b)(c)(d)(e) | 1,649,594 | 1,517,627 | |

TOTAL FOOD & DRUG RETAIL | 13,659,966 | ||

| Food/Beverage/Tobacco - 1.4% | |||

| 8th Avenue Food & Provisions, Inc.: | |||

| 2LN, term loan 3 month U.S. LIBOR + 7.750% 10.8653% 10/1/26 (b)(c)(d) | 410,000 | 338,763 | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 6.8653% 10/1/25 (b)(c)(d) | 1,553,832 | 1,355,237 | |

| Bengal Debt Merger Sub LLC: | |||

| 1LN, term loan CME TERM SOFR 3 MONTH INDEX + 3.250% 6.9032% 1/24/29 (b)(c)(d) | 6,109,675 | 5,587,787 | |

| 2LN, term loan CME Term SOFR 1 Month Index + 6.000% 9.6532% 1/24/30 (b)(c)(d) | 2,185,000 | 1,977,425 | |

| Chobani LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 10/23/27 (b)(c)(d) | 4,772,600 | 4,334,141 | |

| Del Monte Foods, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.250% 7.3684% 5/16/29 (b)(c)(d) | 7,135,000 | 6,819,847 | |

| Shearer's Foods, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 9/23/27 (b)(c)(d) | 3,505,653 | 3,246,480 | |

| Triton Water Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 7.1741% 3/31/28 (b)(c)(d) | 9,060,211 | 8,110,158 | |

| U.S. Foods, Inc. 1LN, term loan 3 month U.S. LIBOR + 2.000% 5.1153% 9/13/26 (b)(c)(d) | 2,778,970 | 2,692,711 | |

TOTAL FOOD/BEVERAGE/TOBACCO | 34,462,549 | ||

| Gaming - 4.4% | |||

| Bally's Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 5.9349% 10/1/28 (b)(c)(d) | 8,925,038 | 8,038,692 | |

| Caesars Resort Collection LLC: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 7/20/25 (b)(c)(d) | 7,847,778 | 7,721,036 | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 5.8653% 12/22/24 (b)(c)(d) | 25,190,075 | 24,562,842 | |

| Cypress Intermediate Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.250% 4.3653% 9/21/28 (b)(c)(d) | 1,732,409 | 1,671,774 | |

| Fertitta Entertainment LLC NV Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 7.0341% 1/27/29 (b)(c)(d) | 25,745,220 | 23,841,103 | |

| Flutter Financing B.V. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 7/4/28 (c)(d) | 1,360,000 | 1,325,782 | |

| Golden Entertainment, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 6.09% 10/20/24 (b)(c)(d) | 7,386,160 | 7,297,526 | |

| GVC Holdings Gibraltar Ltd. Tranche B4 1LN, term loan 1 month U.S. LIBOR + 2.250% 6.1741% 3/16/27 (b)(c)(d) | 2,947,576 | 2,862,833 | |

| J&J Ventures Gaming LLC 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.6741% 4/26/28 (b)(c)(d) | 2,796,750 | 2,644,691 | |

| PCI Gaming Authority 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 5/29/26 (b)(c)(d) | 3,284,152 | 3,185,628 | |

| Playtika Holding Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 3/11/28 (b)(c)(d) | 1,170,330 | 1,118,730 | |

| Scientific Games Corp. 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 5.9062% 4/7/29 (b)(c)(d) | 5,586,000 | 5,415,627 | |

| Scientific Games Holdings LP term loan CME Term SOFR 1 Month Index + 3.500% 5.6165% 4/4/29 (b)(c)(d) | 6,095,000 | 5,631,536 | |

| Stars Group Holdings BV Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.8919% 7/16/26 (b)(c)(d) | 7,856,329 | 7,547,968 | |

| Station Casinos LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.37% 2/7/27 (b)(c)(d) | 8,906,573 | 8,503,907 | |

TOTAL GAMING | 111,369,675 | ||

| Healthcare - 5.0% | |||

| Accelerated Health Systems LLC Tranche B1 LN, term loan CME Term SOFR 1 Month Index + 4.250% 7.9532% 2/2/29 (b)(c)(d) | 2,064,825 | 1,842,856 | |

| AHP Health Partners, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 8/23/28 (b)(c)(d) | 3,238,460 | 3,079,581 | |

| Avantor Funding, Inc. Tranche B5 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.3653% 11/6/27 (b)(c)(d) | 5,523,712 | 5,365,789 | |

| Charlotte Buyer, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.250% 7.9803% 2/12/28 (b)(c)(d) | 2,000,000 | 1,870,000 | |

| Da Vinci Purchaser Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.4639% 12/13/26 (b)(c)(d) | 7,252,456 | 6,805,197 | |

| Elanco Animal Health, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.314% 8/1/27 (b)(c)(d) | 8,848,358 | 8,400,455 | |

| Electron BidCo, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 11/1/28 (b)(c)(d) | 3,283,500 | 3,105,830 | |

| Embecta Corp. Tranche B 1LN, term loan CME TERM SOFR 3 MONTH INDEX + 3.000% 6.5532% 3/31/29 (b)(c)(d) | 2,757,664 | 2,674,934 | |

| Gainwell Acquisition Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 6.2504% 10/1/27 (b)(c)(d) | 16,945,355 | 16,110,796 | |

| HAH Group Holding Co. LLC: | |||

| 1LN, term loan 1 month U.S. LIBOR + 5.000% 8.71% 10/29/27 (b)(c)(d) | 777,841 | 738,949 | |

| Tranche DD 1LN, term loan 1 month U.S. LIBOR + 5.000% 8.71% 10/29/27 (b)(c)(d) | 98,423 | 93,502 | |

| Horizon Pharma U.S.A., Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.875% 3/15/28 (b)(c)(d) | 2,826,950 | 2,708,586 | |

| ICU Medical, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.500% 5.8859% 1/6/29 (b)(c)(d) | 3,636,725 | 3,538,242 | |

| Insulet Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 5/4/28 (b)(c)(d) | 7,598,813 | 7,389,845 | |

| Jazz Financing Lux SARL Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 5/5/28 (b)(c)(d) | 8,248,121 | 7,959,437 | |

| Mamba Purchaser, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.5519% 10/14/28 (b)(c)(d) | 6,901 | 6,530 | |

| Maravai Intermediate Holdings LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 5.5532% 10/19/27 (b)(c)(d) | 4,213,012 | 4,073,477 | |

| MED ParentCo LP: | |||

| 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.3653% 8/31/26 (b)(c)(d) | 3,434,834 | 2,879,525 | |

| 2LN, term loan 1 month U.S. LIBOR + 8.250% 11.3653% 8/30/27 (b)(c)(d) | 1,310,000 | 1,110,225 | |

| Mozart Borrower LP Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 10/23/28 (b)(c)(d) | 2,276,031 | 2,088,964 | |

| National Mentor Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.1795% 3/2/28 (b)(c)(d) | 1,747,487 | 1,238,531 | |

| Organon & Co. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1875% 6/2/28 (b)(c)(d) | 8,056,967 | 7,855,542 | |

| Packaging Coordinators Midco, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 7.4241% 11/30/27 (b)(c)(d) | 4,060,017 | 3,850,236 | |

| Pathway Vet Alliance LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4241% 3/31/27 (b)(c)(d) | 5,300,723 | 4,644,758 | |

| Phoenix Newco, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 5.7739% 11/15/28 (b)(c)(d) | 11,743,469 | 11,185,654 | |

| Pluto Acquisition I, Inc. term loan 1 month U.S. LIBOR + 4.000% 6.0757% 6/20/26 (b)(c)(d) | 3,844,563 | 3,344,770 | |

| PRA Health Sciences, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.9375% 7/3/28 (b)(c)(d) | 3,021,411 | 2,948,898 | |

| Surgery Center Holdings, Inc. 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.51% 8/31/26 (b)(c)(d) | 540,347 | 511,979 | |

| U.S. Anesthesia Partners, Inc.: | |||

| 2LN, term loan 1 month U.S. LIBOR + 7.500% 10.064% 10/1/29 (b)(c)(d) | 775,000 | 730,438 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 6.814% 10/1/28 (b)(c)(d) | 6,138,000 | 5,754,375 | |

| U.S. Radiology Specialists, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.250% 8.9241% 12/15/27 (b)(c)(d) | 2,153,675 | 1,893,447 | |

| Upstream Newco, Inc. 1LN, term loan 1 month U.S. LIBOR + 4.250% 8.0648% 11/20/26 (b)(c)(d) | 2,160,773 | 1,998,715 | |

TOTAL HEALTHCARE | 127,800,063 | ||

| Homebuilders/Real Estate - 0.7% | |||

| DTZ U.S. Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 8/21/25 (b)(c)(d) | 7,440,138 | 7,097,371 | |

| Fluidra Finco SL Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.000% 5.1341% 1/27/29 (b)(c)(d) | 3,220,613 | 3,112,497 | |

| Lightstone Holdco LLC: | |||

| Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.750% 8.7841% 1/30/27 (b)(c)(d) | 4,226,029 | 3,847,208 | |

| Tranche C 1LN, term loan CME Term SOFR 1 Month Index + 5.750% 8.7841% 1/30/27 (b)(c)(d) | 239,022 | 217,596 | |

| Ryan Specialty Group LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1341% 9/1/27 (b)(c)(d)(e) | 4,527,600 | 4,369,134 | |

TOTAL HOMEBUILDERS/REAL ESTATE | 18,643,806 | ||

| Hotels - 2.2% | |||

| Aimbridge Acquisition Co., Inc.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.7434% 2/1/26 (b)(c)(d) | 936,736 | 833,695 | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.750% 6.8653% 2/1/26 (b)(c)(d) | 2,783,976 | 2,442,939 | |

| ASP LS Acquisition Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.500% 7.3769% 4/30/28 (b)(c)(d) | 2,018,278 | 1,694,102 | |

| BRE/Everbright M6 Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.000% 8.0519% 9/9/26 (b)(c)(d) | 2,987,425 | 2,892,813 | |

| Carnival Finance LLC Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.000% 5.8769% 6/30/25 (b)(c)(d) | 3,511,693 | 3,178,082 | |

| 1 month U.S. LIBOR + 3.250% 6.1269% 10/18/28 (b)(c)(d) | 7,198,088 | 6,274,357 | |

| Four Seasons Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.000% 5.1206% 11/30/23 (b)(c)(d) | 6,575,981 | 6,537,248 | |

| Hilton Grand Vacations Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 8/2/28 (b)(c)(d) | 14,978,512 | 14,468,344 | |

| Hilton Worldwide Finance LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.834% 6/21/26 (b)(c)(d) | 2,792,849 | 2,697,417 | |

| Marriott Ownership Resorts, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 8/31/25 (b)(c)(d) | 3,381,280 | 3,212,216 | |

| Oravel Stays Singapore Pte Ltd. Tranche B 1LN, term loan 1 month U.S. LIBOR + 8.250% 11.86% 6/23/26 (b)(c)(d) | 2,054,000 | 1,810,950 | |

| Travelport Finance Luxembourg SARL 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.750% 12.4241% 2/28/25 (b)(c)(d) | 3,766,754 | 3,721,251 | |

| 3 month U.S. LIBOR + 6.750% 10.4241% 5/30/26 (b)(c)(d) | 4,646,956 | 3,231,958 | |

| Wyndham Hotels & Resorts, Inc. Tranche B, term loan 3 month U.S. LIBOR + 1.750% 4.8653% 5/30/25 (b)(c)(d) | 2,687,597 | 2,612,721 | |

TOTAL HOTELS | 55,608,093 | ||

| Insurance - 4.6% | |||

| Acrisure LLC: | |||

| Tranche B 1LN, term loan: | |||

1 month U.S. LIBOR + 3.500% 6.6153% 2/13/27 (b)(c)(d) | 13,396,066 | 12,218,284 | |

1 month U.S. LIBOR + 4.250% 7.3653% 2/15/27 (b)(c)(d) | 2,560,650 | 2,400,609 | |

| Tranche B-2 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 2/15/27 (b)(c)(d) | 831,600 | 759,875 | |

| Alliant Holdings Intermediate LLC: | |||

| Tranche B, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 5/10/25 (b)(c)(d) | 4,573,706 | 4,375,756 | |

| Tranche B-2 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 5/9/25 (b)(c)(d) | 967,500 | 925,975 | |

| Tranche B3 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.4934% 11/12/27 (b)(c)(d) | 6,172,538 | 5,840,764 | |

| AmWINS Group, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 4.7739% 2/19/28 (b)(c)(d) | 6,228,874 | 5,947,142 | |

| AssuredPartners, Inc. Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.500% 6.6153% 2/13/27 (b)(c)(d) | 192,563 | 181,972 | |

| 1 month U.S. LIBOR + 3.500% 6.6153% 2/13/27 (b)(c)(d) | 6,045,432 | 5,712,933 | |

| Asurion LLC: | |||

| Tranche B 7LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 11/3/24 (b)(c)(d) | 6,702,500 | 6,256,784 | |

| Tranche B3 2LN, term loan 1 month U.S. LIBOR + 5.250% 8.3653% 1/31/28 (b)(c)(d) | 15,975,000 | 11,981,250 | |

| Tranche B4 2LN, term loan 1 month U.S. LIBOR + 5.250% 8.3653% 1/20/29 (b)(c)(d) | 19,820,000 | 15,063,200 | |

| Tranche B8 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 12/23/26 (b)(c)(d) | 9,247,572 | 7,820,025 | |

| Tranche B9 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 7/31/27 (b)(c)(d) | 4,971,184 | 4,183,251 | |

| HUB International Ltd.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 5.9817% 4/25/25 (b)(c)(d) | 14,480,596 | 13,928,596 | |

| Tranche B, term loan 1 month U.S. LIBOR + 3.000% 5.7663% 4/25/25 (b)(c)(d) | 9,901,928 | 9,507,930 | |

| USI, Inc.: | |||

| 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.9241% 12/2/26 (b)(c)(d) | 2,851,924 | 2,740,214 | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.000% 6.4241% 5/16/24 (b)(c)(d) | 7,048,918 | 6,849,222 | |

TOTAL INSURANCE | 116,693,782 | ||

| Leisure - 3.1% | |||

| Alterra Mountain Co. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 8/17/28 (b)(c)(d) | 4,344,815 | 4,203,608 | |

| Arcis Golf LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.3653% 11/24/28 (b)(c)(d)(e) | 1,865,625 | 1,809,656 | |

| City Football Group Ltd. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.484% 7/21/28 (b)(c)(d) | 11,637,063 | 11,045,551 | |

| Crown Finance U.S., Inc.: | |||

| 1LN, term loan CME Term SOFR 1 Month Index + 10.000% 9/9/23 (c)(d) | 4,080,337 | 4,152,885 | |

| Tranche B 1LN, term loan: | |||

1 month U.S. LIBOR + 2.500% 3.9997% 2/28/25 (b)(c)(d) | 5,645,675 | 2,375,192 | |

1 month U.S. LIBOR + 2.750% 4.2497% 9/30/26 (b)(c)(d) | 2,315,581 | 958,072 | |

1 month U.S. LIBOR + 8.250% 10.0763% 5/23/24 (b)(c)(d) | 731,517 | 780,895 | |

15.25% 5/23/24 (d) | 1,214,798 | 1,439,232 | |

| Tranche DD 1LN, term loan CME Term SOFR 1 Month Index + 10.000% 9/9/23 (c)(d) | 342,885 | 348,982 | |

| Delta 2 SARL Tranche B, term loan 3 month U.S. LIBOR + 2.500% 5.6153% 2/1/24 (b)(c)(d) | 15,394,747 | 15,183,069 | |

| Equinox Holdings, Inc.: | |||

| Tranche 2LN, term loan 3 month U.S. LIBOR + 7.000% 10.6741% 9/8/24 (b)(c)(d) | 1,000,000 | 658,980 | |

| Tranche B-1, term loan 3 month U.S. LIBOR + 3.000% 6.6741% 3/8/24 (b)(c)(d) | 5,640,729 | 4,256,381 | |

| Hayward Industries, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 5/28/28 (b)(c)(d) | 2,755,125 | 2,593,261 | |

| Herschend Entertainment Co. LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.88% 8/27/28 (b)(c)(d) | 1,816,650 | 1,767,837 | |

| Lids Holdings, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 5.500% 8.9904% 12/14/26 (b)(c)(d)(e) | 6,769,688 | 6,634,294 | |

| MajorDrive Holdings IV LLC 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.125% 5/12/28 (b)(c)(d) | 3,432,110 | 3,157,542 | |

| SeaWorld Parks & Entertainment, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.125% 8/25/28 (b)(c)(d) | 2,593,576 | 2,484,438 | |

| SP PF Buyer LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 7.6153% 12/21/25 (b)(c)(d) | 4,513,797 | 3,696,799 | |

| Topgolf Callaway Brands Corp. Tranche B, term loan 3 month U.S. LIBOR + 4.500% 7.6153% 1/4/26 (b)(c)(d) | 2,684,938 | 2,663,673 | |

| United PF Holdings LLC: | |||

| 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.6741% 12/30/26 (b)(c)(d) | 7,886,612 | 6,910,644 | |

| 2LN, term loan 3 month U.S. LIBOR + 8.500% 12.1741% 12/30/27 (b)(c)(d) | 750,000 | 716,250 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 8.500% 12.1741% 12/30/26 (b)(c)(d)(e) | 940,800 | 898,464 | |

TOTAL LEISURE | 78,735,705 | ||

| Paper - 0.8% | |||

| Ahlstrom-Munksjo OYJ 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4241% 2/4/28 (b)(c)(d) | 2,536,616 | 2,335,792 | |

| Clydesdale Acquisition Holdings, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 4.170% 7.3091% 4/13/29 (b)(c)(d) | 18,698,138 | 17,610,093 | |

| Journey Personal Care Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.9241% 3/1/28 (b)(c)(d) | 1,658,208 | 1,041,902 | |

TOTAL PAPER | 20,987,787 | ||

| Publishing/Printing - 0.7% | |||

| Cengage Learning, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.8144% 7/14/26 (b)(c)(d) | 746,860 | 674,392 | |

| Harland Clarke Holdings Corp.: | |||

| 1LN, term loan 1 month U.S. LIBOR + 7.750% 11.4241% 6/16/26 (b)(c)(d) | 2,945,221 | 2,037,121 | |

| Tranche B 7LN, term loan 3 month U.S. LIBOR + 4.750% 8.4241% 11/3/23 (b)(c)(d) | 482,595 | 333,898 | |

| Learning Care Group (U.S.) No 2, Inc. Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 8.500% 11.4273% 3/13/25 (b)(c)(d)(e) | 2,380,213 | 2,332,608 | |

| 3 month U.S. LIBOR + 3.250% 6.0698% 3/13/25 (b)(c)(d) | 2,253,188 | 2,126,446 | |

| MJH Healthcare Holdings LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 6.6341% 1/28/29 (b)(c)(d) | 2,388,000 | 2,241,735 | |

| Recorded Books, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.0753% 8/29/25 (b)(c)(d) | 2,288,077 | 2,196,554 | |

| RLG Holdings LLC: | |||

| 2LN, term loan 1 month U.S. LIBOR + 7.500% 10.6153% 7/2/29 (b)(c)(d) | 590,000 | 560,500 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.1153% 7/8/28 (b)(c)(d) | 2,347,263 | 2,202,507 | |

| Scripps (E.W.) Co. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 1/7/28 (b)(c)(d) | 2,385,000 | 2,302,384 | |

TOTAL PUBLISHING/PRINTING | 17,008,145 | ||

| Railroad - 0.8% | |||

| AIT Worldwide Logistics Holdings, Inc. 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.0429% 4/6/28 (b)(c)(d) | 4,552,678 | 4,148,628 | |

| Echo Global Logistics, Inc. 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 11/23/28 (b)(c)(d) | 487,538 | 456,823 | |

| Einstein Merger Sub, Inc. 2LN, term loan 3 month U.S. LIBOR + 7.000% 9.8059% 11/23/29 (b)(c)(d)(e) | 2,095,000 | 2,084,525 | |

| First Student Bidco, Inc.: | |||

| Tranche B 1LN, term loan: | |||

1 month U.S. LIBOR + 3.000% 6.6419% 7/21/28 (b)(c)(d) | 2,989,998 | 2,762,490 | |

CME Term SOFR 1 Month Index + 4.000% 6.1544% 7/21/28 (b)(c)(d) | 1,313,766 | 1,242,337 | |

| Tranche C 1LN, term loan: | |||

1 month U.S. LIBOR + 3.000% 6.6419% 7/21/28 (b)(c)(d) | 1,112,283 | 1,027,650 | |

CME Term SOFR 1 Month Index + 4.000% 6.1544% 7/21/28 (b)(c)(d) | 91,234 | 86,273 | |

| Genesee & Wyoming, Inc. 1LN, term loan 3 month U.S. LIBOR + 2.000% 5.6741% 12/30/26 (b)(c)(d) | 3,443,705 | 3,342,735 | |

| Worldwide Express, Inc.: | |||

| 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.6741% 7/22/28 (b)(c)(d) | 4,629,963 | 4,197,339 | |

| Tranche B 2LN, term loan 1 month U.S. LIBOR + 7.000% 9.2504% 7/22/29 (b)(c)(d) | 1,295,000 | 1,165,500 | |

TOTAL RAILROAD | 20,514,300 | ||

| Restaurants - 0.8% | |||

| Burger King Worldwide, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.8706% 11/19/26 (b)(c)(d) | 2,906,477 | 2,773,099 | |

| Dave & Buster's, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.000% 8.1875% 6/29/29 (b)(c)(d) | 2,835,000 | 2,759,391 | |

| Flynn Restaurant Group LP Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.3653% 11/22/28 (b)(c)(d) | 1,714,506 | 1,592,776 | |

| KFC Holding Co. Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.7434% 3/15/28 (b)(c)(d) | 664,719 | 656,689 | |

| Pacific Bells LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.500% 8.3148% 10/20/28 (b)(c)(d) | 2,074,487 | 1,929,273 | |

| PFC Acquisition Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.500% 9.5696% 3/1/26 (b)(c)(d) | 3,498,125 | 3,078,350 | |

| Whatabrands LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 7/21/28 (b)(c)(d) | 8,730,839 | 8,060,747 | |

TOTAL RESTAURANTS | 20,850,325 | ||

| Services - 8.5% | |||

| ABG Intermediate Holdings 2 LLC: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 9/27/24 (b)(c)(d) | 2,847,127 | 2,775,237 | |

| Tranche B 2LN, term loan CME Term SOFR 1 Month Index + 6.000% 9.1341% 12/20/29 (b)(c)(d) | 2,355,000 | 2,207,813 | |

| Tranche B1 LN, term loan CME Term SOFR 1 Month Index + 3.500% 6.6341% 12/21/28 (b)(c)(d) | 10,463,775 | 9,988,510 | |

| Adtalem Global Education, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.0519% 8/12/28 (b)(c)(d) | 2,885,076 | 2,854,436 | |

| AEA International Holdings Luxembourg SARL Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4375% 9/7/28 (b)(c)(d)(e) | 2,106,544 | 2,048,614 | |

| All-Star Bidco AB: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.0696% 11/16/28 (b)(c)(d) | 2,481,250 | 2,360,289 | |

| Tranche B1 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.5696% 11/16/28 (b)(c)(d) | 2,427,750 | 2,291,189 | |

| Allied Universal Holdco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 5/14/28 (b)(c)(d) | 9,444,600 | 8,282,914 | |

| APX Group, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.2443% 7/9/28 (b)(c)(d) | 4,355,197 | 4,107,865 | |

| Aramark Services, Inc. Tranche B 3LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 3/11/25 (b)(c)(d) | 4,726,300 | 4,560,880 | |

| Ascend Learning LLC: | |||

| 2LN, term loan 1 month U.S. LIBOR + 5.750% 8.8653% 12/10/29 (b)(c)(d) | 3,705,000 | 3,207,159 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 12/10/28 (b)(c)(d) | 8,838,213 | 8,139,994 | |

| Asurion LLC 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 7.1341% 8/17/28 (b)(c)(d) | 2,055,008 | 1,745,893 | |

| Brand Energy & Infrastructure Services, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.250% 6.9468% 6/21/24 (b)(c)(d) | 13,534,055 | 11,745,936 | |

| Cast & Crew Payroll LLC Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.500% 6.6153% 2/7/26 (b)(c)(d) | 5,999,586 | 5,834,597 | |

| CME Term SOFR 1 Month Index + 3.750% 6.7841% 12/30/28 (b)(c)(d) | 2,411,775 | 2,330,378 | |

| CHG Healthcare Services, Inc. 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 9/30/28 (b)(c)(d) | 1,971,518 | 1,889,779 | |

| Citadel Securities LP Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 6.1486% 2/2/28 (b)(c)(d) | 1,505,000 | 1,484,306 | |

| CoreLogic, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.625% 6/2/28 (b)(c)(d) | 10,182,150 | 7,611,157 | |

| EAB Global, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.3052% 8/16/28 (b)(c)(d) | 2,406,788 | 2,250,346 | |

| EmployBridge LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 8.4241% 7/19/28 (b)(c)(d) | 7,128,000 | 6,330,591 | |

| Ensemble RCM LLC 1LN, term loan 3 month U.S. LIBOR + 3.750% 6.5559% 8/1/26 (b)(c)(d) | 4,140,918 | 4,034,827 | |

| Filtration Group Corp.: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 10/21/28 (b)(c)(d) | 5,222,250 | 4,945,889 | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.000% 6.1153% 3/29/25 (b)(c)(d) | 208,147 | 199,497 | |

| Finastra U.S.A., Inc.: | |||

| Tranche 2LN, term loan 3 month U.S. LIBOR + 7.250% 10.6207% 6/13/25 (b)(c)(d) | 2,340,000 | 1,888,099 | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 6.8707% 6/13/24 (b)(c)(d) | 2,178,609 | 1,882,318 | |

| Flexera Software LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.39% 3/3/28 (b)(c)(d) | 1,835,640 | 1,747,786 | |

| Franchise Group, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 7.5625% 3/10/26 (b)(c)(d) | 4,646,789 | 4,329,274 | |

| Galaxy U.S. Opco, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 4.750% 7.7841% 4/29/29 (b)(c)(d) | 3,405,000 | 3,192,188 | |

| Gateway Merger Sub 2021, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.250% 8.1699% 6/30/28 (b)(c)(d) | 1,866,150 | 1,707,527 | |

| GEMS MENASA Cayman Ltd. Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.000% 8.5664% 7/30/26 (b)(c)(d) | 5,756,119 | 5,576,240 | |

| Greeneden U.S. Holdings II LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.1153% 12/1/27 (b)(c)(d) | 4,319,225 | 4,101,709 | |

| Indy U.S. Bidco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 3/5/28 (b)(c)(d) | 2,275,465 | 2,035,586 | |

| Ion Trading Finance Ltd. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 8.4241% 3/26/28 (b)(c)(d) | 8,250,363 | 7,639,836 | |

| KNS Acquisitions, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 6.250% 10.4199% 4/21/27 (b)(c)(d) | 1,798,875 | 1,677,451 | |

| KUEHG Corp.: | |||

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 8.250% 11.3652% 8/22/25 (b)(c)(d) | 1,000,000 | 969,000 | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.750% 6.8653% 2/21/25 (b)(c)(d) | 6,812,039 | 6,423,208 | |

| Lakeshore Intermediate LLC 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.1333% 10/1/28 (b)(c)(d) | 1,447,155 | 1,374,797 | |

| Maverick Purchaser Sub LLC: | |||

| Tranche B 1LN, term loan: | |||

1 month U.S. LIBOR + 4.000% 7.7977% 1/23/27 (b)(c)(d) | 4,655,708 | 4,430,698 | |

CME Term SOFR 1 Month Index + 4.000% 7.3925% 2/16/29 (b)(c)(d) | 4,339,125 | 4,133,017 | |

| Tranche B 2LN, term loan 1 month U.S. LIBOR + 8.750% 12.9199% 1/31/28 (b)(c)(d)(e) | 4,060,000 | 3,694,600 | |

| Pilot Travel Centers LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.1341% 8/4/28 (b)(c)(d) | 7,556,107 | 7,217,442 | |

| PowerTeam Services LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 7.1741% 3/6/25 (b)(c)(d) | 2,740,313 | 2,218,283 | |

| Sabert Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.500% 7.625% 12/10/26 (b)(c)(d)(e) | 4,396,373 | 4,198,536 | |

| Sabre GLBL, Inc.: | |||

| Tranche B-1 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 12/17/27 (b)(c)(d) | 555,789 | 496,275 | |

| Tranche B-2 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 12/17/27 (b)(c)(d) | 885,961 | 791,092 | |

| Signal Parent, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 4/3/28 (b)(c)(d) | 6,706,929 | 4,921,209 | |

| Sitel Worldwide Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.87% 8/27/28 (b)(c)(d) | 2,427,919 | 2,345,977 | |

| Spin Holdco, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.1441% 3/4/28 (b)(c)(d) | 15,358,026 | 13,435,048 | |

| SuperMoose Borrower LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 7.4241% 8/29/25 (b)(c)(d) | 2,017,011 | 1,759,842 | |

| The GEO Group, Inc. Tranche 1B 1LN, term loan CME Term SOFR 1 Month Index + 7.120% 10.2403% 3/23/27 (b)(c)(d) | 1,905,463 | 1,875,299 | |

| Uber Technologies, Inc. Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.500% 6.5696% 4/4/25 (b)(c)(d) | 5,907,692 | 5,769,866 | |

| 1 month U.S. LIBOR + 3.500% 6.5696% 2/25/27 (b)(c)(d) | 5,875,159 | 5,715,708 | |

| Vaco Holdings LLC 1LN, term loan CME Term SOFR 1 Month Index + 5.000% 8.7032% 1/21/29 (b)(c)(d) | 3,379,463 | 3,269,630 | |

| WMB Holdings, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 8/9/29 (c)(d) | 1,750,000 | 1,704,063 | |

TOTAL SERVICES | 215,749,700 | ||

| Specialty Retailing - 0.2% | |||

| New SK Holdco Sub LLC 1LN, term loan CME Term SOFR 1 Month Index + 6.750% 11.1954% 6/30/27 (b)(c)(d) | 4,851,958 | 4,366,762 | |

| Steel - 0.2% | |||

| Atkore International, Inc. Tranche B1LN, term loan 1 month U.S. LIBOR + 2.000% 6.1875% 5/26/28 (b)(c)(d) | 2,079,475 | 2,063,879 | |

| JMC Steel Group, Inc. 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.6039% 1/24/27 (b)(c)(d) | 2,895,578 | 2,773,964 | |

| Tiger Acquisition LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 6/1/28 (b)(c)(d) | 1,465,000 | 1,351,463 | |

TOTAL STEEL | 6,189,306 | ||

| Super Retail - 4.3% | |||

| Academy Ltd. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.314% 11/6/27 (b)(c)(d) | 4,255,429 | 4,156,149 | |

| Ambience Merger Sub, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 6.2771% 7/24/28 (b)(c)(d) | 4,080,421 | 3,123,807 | |

| Bass Pro Group LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 3/5/28 (b)(c)(d) | 76,688,871 | 70,668,780 | |

| BJ's Wholesale Club, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 4.7731% 2/3/24 (b)(c)(d) | 2,743,975 | 2,740,051 | |

| Empire Today LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.000% 7.6849% 4/1/28 (b)(c)(d) | 4,652,892 | 3,678,112 | |

| Harbor Freight Tools U.S.A., Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 10/19/27 (b)(c)(d) | 9,586,181 | 8,651,528 | |

| LBM Acquisition LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.1207% 12/18/27 (b)(c)(d) | 1,213,612 | 1,056,450 | |

| Red Ventures LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 11/8/24 (b)(c)(d) | 3,328,714 | 3,199,727 | |

| RH: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 10/20/28 (b)(c)(d) | 5,591,192 | 4,941,216 | |

| Tranche B2 1LN, term loan CME Term SOFR 1 Month Index + 3.250% 6.3841% 10/20/28 (b)(c)(d) | 7,940,000 | 7,208,011 | |

TOTAL SUPER RETAIL | 109,423,831 | ||

| Technology - 15.4% | |||

| A&V Holdings Midco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.370% 9.5378% 3/10/27 (b)(c)(d)(e) | 3,460,879 | 3,374,357 | |

| Acuris Finance U.S., Inc. 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 7.7032% 2/16/28 (b)(c)(d) | 3,631,771 | 3,471,973 | |

| Alliance Laundry Systems LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 5.9551% 10/8/27 (b)(c)(d) | 1,629,046 | 1,559,127 | |

| Anastasia Parent LLC Tranche B, term loan 3 month U.S. LIBOR + 3.750% 7.4241% 8/10/25 (b)(c)(d) | 10,460,730 | 8,266,174 | |

| Applied Systems, Inc. Tranche B, term loan 1 month U.S. LIBOR + 3.000% 6.6741% 9/19/24 (b)(c)(d) | 2,000,000 | 1,947,760 | |

| Aptean, Inc. 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.3196% 4/23/26 (b)(c)(d) | 4,294,444 | 4,093,164 | |

| Arches Buyer, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 12/4/27 (b)(c)(d) | 2,599,280 | 2,331,243 | |

| Athenahealth Group, Inc.: | |||

| Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 6.5756% 2/15/29 (b)(c)(d) | 24,875,843 | 22,239,004 | |

| Tranche DD 1LN, term loan CME Term SOFR 1 Month Index + 3.500% 2/15/29 (c)(d)(f) | 4,226,812 | 3,778,770 | |

| AZZ, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.250% 7.085% 5/13/29 (b)(c)(d) | 2,612,380 | 2,538,371 | |

| Camelot Finance SA: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 10/31/26 (b)(c)(d) | 7,054,026 | 6,807,135 | |

| Tranche B, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 10/31/26 (b)(c)(d) | 8,138,118 | 7,860,445 | |

| Central Parent, Inc. 1LN, term loan CME Term SOFR 1 Month Index + 4.500% 6.6095% 7/6/29 (b)(c)(d) | 11,065,000 | 10,638,776 | |

| Ceridian HCM Holding, Inc. Tranche B, term loan 1 month U.S. LIBOR + 2.500% 5.6153% 4/30/25 (b)(c)(d) | 1,648,868 | 1,563,951 | |

| Coherent Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 5.314% 7/1/29 (b)(c)(d) | 8,805,000 | 8,511,529 | |

| CommScope, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 6.3653% 4/4/26 (b)(c)(d) | 9,440,326 | 8,696,901 | |

| ConnectWise LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 7.1741% 9/30/28 (b)(c)(d) | 6,347,038 | 5,918,612 | |

| Constant Contact, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 6.423% 2/10/28 (b)(c)(d) | 2,039,703 | 1,800,038 | |

| DCert Buyer, Inc.: | |||

| 1LN, term loan 3 month U.S. LIBOR + 4.000% 6.9027% 10/16/26 (b)(c)(d) | 8,983,060 | 8,548,909 | |

| Tranche B 2LN, term loan 1 month U.S. LIBOR + 7.000% 9.9027% 2/19/29 (b)(c)(d) | 5,713,409 | 5,307,757 | |

| DG Investment Intermediate Holdings, Inc.: | |||

| 2LN, term loan 1 month U.S. LIBOR + 6.750% 9.8653% 3/31/29 (b)(c)(d) | 630,000 | 583,802 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 3/31/28 (b)(c)(d) | 2,750,279 | 2,557,759 | |

| Emerald TopCo, Inc. 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 7/25/26 (b)(c)(d) | 248,993 | 225,961 | |

| Entegris, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 5.6836% 7/6/29 (b)(c)(d) | 7,680,000 | 7,611,725 | |

| Eos U.S. Finco LLC 1LN, term loan CME Term SOFR 1 Month Index + 6.000% 8/3/29 (c)(d) | 1,500,000 | 1,415,625 | |

| Epicor Software Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 7/31/27 (b)(c)(d) | 3,518,661 | 3,288,857 | |

| Global IID Parent LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.500% 8.1741% 12/16/28 (b)(c)(d) | 2,059,438 | 1,951,317 | |

| Go Daddy Operating Co. LLC: | |||

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.000% 5.1153% 8/10/27 (b)(c)(d) | 3,787,813 | 3,665,504 | |

| Tranche B, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 2/15/24 (b)(c)(d) | 3,684,426 | 3,640,213 | |

| Hunter U.S. Bidco, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.9241% 8/19/28 (b)(c)(d) | 3,279,431 | 3,090,864 | |

| Hyland Software, Inc.: | |||

| 2LN, term loan 1 month U.S. LIBOR + 6.250% 9.3653% 7/10/25 (b)(c)(d) | 602,800 | 590,744 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 7/1/24 (b)(c)(d) | 4,403,512 | 4,254,365 | |

| Icon Luxembourg Sarl Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.9375% 7/3/28 (b)(c)(d) | 12,126,847 | 11,835,802 | |

| Imprivata, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 12/1/27 (b)(c)(d) | 3,314,525 | 3,190,230 | |

| MA FinanceCo. LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 7.4179% 6/5/25 (b)(c)(d) | 1,195,016 | 1,172,239 | |

| Maxar Technologies, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.250% 6.8053% 6/9/29 (b)(c)(d) | 1,201,988 | 1,128,366 | |

| McAfee Corp. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 6.3621% 3/1/29 (b)(c)(d) | 1,915,200 | 1,741,798 | |

| MH Sub I LLC: | |||

| 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 9/15/24 (b)(c)(d) | 5,414,466 | 5,146,450 | |

| Tranche B 2LN, term loan 1 month U.S. LIBOR + 6.250% 8.7053% 2/23/29 (b)(c)(d) | 3,030,000 | 2,830,535 | |

| Tranche B, term loan 3 month U.S. LIBOR + 3.750% 6.8653% 9/15/24 (b)(c)(d) | 9,062,295 | 8,619,058 | |

| MKS Instruments, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.750% 5.8684% 8/17/29 (b)(c)(d) | 8,400,000 | 8,175,300 | |

| Motus Group LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.1153% 12/10/28 (b)(c)(d) | 1,626,825 | 1,508,880 | |

| NAVEX TopCo, Inc.: | |||

| 2LN, term loan 3 month U.S. LIBOR + 7.000% 9.53% 9/4/26 (b)(c)(d) | 415,000 | 398,400 | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 6.37% 9/5/25 (b)(c)(d) | 1,569,681 | 1,526,515 | |

| NortonLifeLock, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.000% 4.8475% 9/12/29 (b)(c)(d) | 11,995,000 | 11,509,203 | |

| Osmosis Debt Merger Sub, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 6.3455% 7/30/28 (b)(c)(d) | 3,261,825 | 3,023,320 | |

| Park Place Technologies LLC 1LN, term loan 1 month U.S. LIBOR + 5.000% 8.1341% 11/10/27 (b)(c)(d) | 4,969,808 | 4,704,768 | |

| Peraton Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 2/1/28 (b)(c)(d) | 21,107,106 | 19,967,322 | |

| PointClickCare Technologies, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 5.9375% 12/29/27 (b)(c)(d) | 1,615,400 | 1,538,669 | |

| Polaris Newco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.6741% 6/2/28 (b)(c)(d) | 9,904,950 | 9,118,101 | |

| Project Boost Purchaser LLC: | |||

| 1LN, term loan 3 month U.S. LIBOR + 3.500% 6.6153% 5/30/26 (b)(c)(d) | 2,187,417 | 2,072,578 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.6153% 5/30/26 (b)(c)(d) | 2,019,600 | 1,908,522 | |

| Proofpoint, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3196% 8/31/28 (b)(c)(d) | 10,484,769 | 9,825,067 | |

| Rackspace Technology Global, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.6167% 2/15/28 (b)(c)(d) | 9,050,813 | 6,416,664 | |

| RealPage, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 4/22/28 (b)(c)(d) | 7,658,635 | 7,162,968 | |

| Red Planet Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 9/30/28 (b)(c)(d) | 3,605,092 | 2,280,221 | |

| Renaissance Holdings Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 6.3653% 5/31/25 (b)(c)(d) | 5,330,235 | 5,057,060 | |

| Seattle Spinco, Inc.: | |||

| Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 4.000% 7.1465% 3/1/27 (b)(c)(d)(e) | 10,231,678 | 10,001,466 | |

| Tranche B 3LN, term loan 3 month U.S. LIBOR + 2.750% 5.8653% 6/21/24 (b)(c)(d) | 9,513,033 | 9,275,207 | |

| Sophia LP Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 7.1741% 10/7/27 (b)(c)(d) | 5,256,776 | 5,046,505 | |

| SS&C Technologies, Inc.: | |||

| Tranche B 3LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 4/16/25 (b)(c)(d) | 4,849,999 | 4,684,565 | |

| Tranche B 4LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 4/16/25 (b)(c)(d) | 3,937,207 | 3,802,909 | |

| Tranche B 5LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 4/16/25 (b)(c)(d) | 3,769,508 | 3,651,711 | |

| STG-Fairway Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 1/31/27 (b)(c)(d) | 2,274,231 | 2,198,431 | |

| Tempo Acquisition LLC: | |||

| 1LN, term loan U.S. Secured Overnight Fin. Rate (SOFR) Index + 3.000% 6.0341% 8/31/28 (b)(c)(d) | 7,239,356 | 7,038,464 | |

| Tranche B, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 5/1/24 (b)(c)(d) | 653,552 | 645,383 | |

| TTM Technologies, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.500% 5.064% 9/28/24 (b)(c)(d) | 2,662,361 | 2,609,114 | |

| UKG, Inc. 1LN, term loan 3 month U.S. LIBOR + 3.750% 6.8653% 5/4/26 (b)(c)(d) | 6,169,200 | 5,868,452 | |

| Ultimate Software Group, Inc.: | |||

| 1LN, term loan 1 month U.S. LIBOR + 3.250% 5.5351% 5/3/26 (b)(c)(d) | 15,547,691 | 14,757,402 | |

| 2LN, term loan 1 month U.S. LIBOR + 5.250% 7.5351% 5/3/27 (b)(c)(d) | 7,170,000 | 6,739,800 | |

| Verscend Holding Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.1153% 8/27/25 (b)(c)(d) | 6,543,742 | 6,331,070 | |

| VFH Parent LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 3.000% 6.1184% 1/13/29 (b)(c)(d) | 4,785,000 | 4,574,173 | |

| Virgin Pulse, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 7.1153% 4/6/28 (b)(c)(d) | 4,026,330 | 3,496,183 | |

| VM Consolidated, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.1269% 3/27/28 (b)(c)(d) | 5,098,925 | 4,961,254 | |

| VS Buyer LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 2/28/27 (b)(c)(d) | 3,549,000 | 3,429,221 | |

| Weber-Stephen Products LLC Tranche B 1LN, term loan: | |||

| 1 month U.S. LIBOR + 3.250% 6.3653% 10/30/27 (b)(c)(d) | 2,407,164 | 1,944,531 | |

| CME Term SOFR 1 Month Index + 4.250% 6.8053% 10/30/27 (b)(c)(d)(e) | 1,442,750 | 1,154,200 | |

| Zelis Payments Buyer, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.064% 9/30/26 (b)(c)(d) | 4,846,448 | 4,660,151 | |

TOTAL TECHNOLOGY | 390,858,960 | ||

| Telecommunications - 4.4% | |||

| Altice Financing SA Tranche B, term loan: | |||

| 3 month U.S. LIBOR + 2.750% 5.262% 7/15/25 (b)(c)(d) | 4,247,267 | 3,985,338 | |

| 3 month U.S. LIBOR + 2.750% 5.262% 1/31/26 (b)(c)(d) | 1,590,144 | 1,484,797 | |

| Cablevision Lightpath LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.0677% 11/30/27 (b)(c)(d) | 1,506,041 | 1,439,218 | |

| Connect U.S. Finco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.62% 12/12/26 (b)(c)(d) | 1,823,746 | 1,692,673 | |

| Consolidated Communications, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 6.625% 10/2/27 (b)(c)(d) | 1,902,823 | 1,638,806 | |

| Crown Subsea Communications Holding, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.314% 4/27/27 (b)(c)(d) | 1,438,459 | 1,384,517 | |

| Frontier Communications Holdings LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 7.4375% 5/1/28 (b)(c)(d) | 11,659,993 | 10,814,644 | |

| GTT Communications, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.750% 10% 5/31/25 (b)(c)(d) | 5,343,847 | 3,792,475 | |

| Intelsat Jackson Holdings SA 1LN, term loan CME Term SOFR 1 Month Index + 4.250% 7.4449% 2/1/29 (b)(c)(d) | 26,609,967 | 24,913,582 | |

| Level 3 Financing, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 1.750% 4.8653% 3/1/27 (b)(c)(d) | 3,540,504 | 3,357,389 | |

| Lumen Technologies, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.250% 5.3653% 3/15/27 (b)(c)(d) | 2,769,982 | 2,514,202 | |

| Northwest Fiber LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.7434% 4/30/27 (b)(c)(d) | 6,748,661 | 6,450,573 | |

| Patagonia Holdco LLC Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.750% 8.386% 8/1/29 (b)(c)(d) | 5,220,000 | 4,176,000 | |

| Radiate Holdco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 9/25/26 (b)(c)(d) | 7,864,082 | 7,257,604 | |

| SBA Senior Finance II, LLC Tranche B, term loan 1 month U.S. LIBOR + 1.750% 4.87% 4/11/25 (b)(c)(d) | 3,329,210 | 3,233,496 | |

| Securus Technologies Holdings Tranche B, term loan: | |||

| 3 month U.S. LIBOR + 4.500% 8.1741% 11/1/24 (b)(c)(d) | 9,338,348 | 8,169,560 | |

| 3 month U.S. LIBOR + 8.250% 11.0559% 11/1/25 (b)(c)(d) | 7,055,000 | 5,820,375 | |

| Windstream Services LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 6.250% 9.3653% 9/21/27 (b)(c)(d) | 3,684,310 | 3,315,879 | |

| Zayo Group Holdings, Inc. 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 3/9/27 (b)(c)(d) | 18,838,135 | 15,685,196 | |

TOTAL TELECOMMUNICATIONS | 111,126,324 | ||

| Textiles/Apparel - 1.2% | |||

| Byju's Alpha, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.500% 8.9797% 11/24/26 (b)(c)(d) | 5,044,070 | 3,592,084 | |

| Canada Goose, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.500% 7.1419% 10/7/27 (b)(c)(d) | 1,753,829 | 1,657,369 | |

| Crocs, Inc. Tranche B1 LN, term loan CME Term SOFR 1 Month Index + 3.500% 7.6511% 2/17/29 (b)(c)(d) | 16,086,375 | 15,101,085 | |

| Fanatics Commerce Intermediate Holdco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.0559% 11/23/28 (b)(c)(d)(e) | 3,161,575 | 3,043,016 | |

| Jo-Ann Stores LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.750% 7.5163% 7/7/28 (b)(c)(d) | 3,644,489 | 2,358,677 | |

| Samsonite IP Holdings SARL Tranche B2 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 4/25/25 (b)(c)(d) | 979,213 | 955,780 | |

| Tory Burch LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.1153% 4/14/28 (b)(c)(d) | 2,913,125 | 2,650,944 | |

| Victoria's Secret & Co. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3941% 8/2/28 (b)(c)(d) | 1,529,188 | 1,427,880 | |

TOTAL TEXTILES/APPAREL | 30,786,835 | ||

| Transportation Ex Air/Rail - 0.1% | |||

| ASP LS Acquisition Corp. 2LN, term loan 1 month U.S. LIBOR + 7.500% 10.3769% 5/7/29 (b)(c)(d)(e) | 2,500,000 | 1,900,000 | |

| Utilities - 2.0% | |||

| Brookfield WEC Holdings, Inc.: | |||

| 1LN, term loan CME Term SOFR 1 Month Index + 3.750% 6.8653% 8/1/25 (b)(c)(d) | 2,145,000 | 2,087,686 | |

| Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.8653% 8/1/25 (b)(c)(d) | 13,990,207 | 13,349,455 | |

| ExGen Renewables IV, LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 5.57% 12/15/27 (b)(c)(d) | 2,359,278 | 2,305,605 | |

| Granite Generation LLC 1LN, term loan 1 month U.S. LIBOR + 3.750% 6.8653% 11/1/26 (b)(c)(d) | 1,761,000 | 1,681,755 | |

| Limetree Bay Terminals LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 8.8148% 2/15/24 (b)(c)(d) | 4,459,914 | 3,005,670 | |

| Luxembourg Investment Co. 428 SARL Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 5.000% 8.5532% 1/3/29 (b)(c)(d)(e) | 2,065,000 | 1,693,300 | |

| Osmose Utilities Services, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6.3653% 6/17/28 (b)(c)(d) | 1,801,688 | 1,648,544 | |

| PG&E Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.125% 6/23/25 (b)(c)(d) | 8,727,130 | 8,330,045 | |

| Pike Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 6.12% 1/21/28 (b)(c)(d) | 3,598,630 | 3,486,173 | |

| Vertiv Group Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.750% 5.3034% 3/2/27 (b)(c)(d) | 7,071,698 | 6,715,567 | |

| Vistra Operations Co. LLC Tranche B 3LN, term loan 1 month U.S. LIBOR + 1.750% 4.8411% 12/31/25 (b)(c)(d) | 7,024,556 | 6,773,077 | |

TOTAL UTILITIES | 51,076,877 | ||

| TOTAL BANK LOAN OBLIGATIONS (Cost $2,419,008,982) | 2,240,246,247 | ||

| Nonconvertible Bonds - 3.6% | |||

Principal Amount (a) | Value ($) | ||

| Aerospace - 0.2% | |||

| TransDigm, Inc.: | |||

| 6.25% 3/15/26 (g) | 4,000,000 | 3,880,000 | |

| 8% 12/15/25 (g) | 385,000 | 390,471 | |

TOTAL AEROSPACE | 4,270,471 | ||

| Air Transportation - 0.1% | |||

| American Airlines, Inc. / AAdvantage Loyalty IP Ltd. 5.5% 4/20/26 (g) | 1,105,000 | 1,037,783 | |

| Delta Air Lines, Inc. / SkyMiles IP Ltd. 4.5% 10/20/25 (g) | 815,000 | 791,085 | |

TOTAL AIR TRANSPORTATION | 1,828,868 | ||

| Automotive & Auto Parts - 0.7% | |||

| Rivian Holdco & Rivian LLC & Rivian Automotive LLC 6 month U.S. LIBOR + 5.620% 7.1766% 10/15/26 (b)(c)(g) | 17,605,000 | 16,548,700 | |

| Broadcasting - 0.0% | |||

| Univision Communications, Inc. 6.625% 6/1/27 (g) | 1,205,000 | 1,137,174 | |

| Building Materials - 0.0% | |||

| SRS Distribution, Inc. 4.625% 7/1/28 (g) | 160,000 | 137,438 | |

| Cable/Satellite TV - 0.1% | |||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp. 3 month U.S. LIBOR + 1.650% 4.4323% 2/1/24 (b)(c) | 1,750,000 | 1,759,273 | |

| Radiate Holdco LLC/Radiate Financial Service Ltd. 4.5% 9/15/26 (g) | 2,130,000 | 1,747,090 | |

TOTAL CABLE/SATELLITE TV | 3,506,363 | ||

| Chemicals - 0.0% | |||

| Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc. 5% 12/31/26 (g) | 40,000 | 35,102 | |

| Containers - 0.1% | |||

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc. 4.125% 8/15/26 (g) | 2,945,000 | 2,429,625 | |

| Trivium Packaging Finance BV 5.5% 8/15/26 (g) | 1,085,000 | 970,453 | |

TOTAL CONTAINERS | 3,400,078 | ||

| Energy - 0.4% | |||

| Citgo Petroleum Corp.: | |||

| 6.375% 6/15/26 (g) | 5,000,000 | 4,667,559 | |

| 7% 6/15/25 (g) | 1,050,000 | 1,003,307 | |

| New Fortress Energy, Inc.: | |||

| 6.5% 9/30/26 (g) | 2,000,000 | 1,847,800 | |

| 6.75% 9/15/25 (g) | 535,000 | 506,752 | |

| Transocean Poseidon Ltd. 6.875% 2/1/27 (g) | 997,500 | 912,713 | |

TOTAL ENERGY | 8,938,131 | ||

| Gaming - 0.5% | |||

| Affinity Gaming LLC 6.875% 12/15/27 (g) | 1,700,000 | 1,385,840 | |

| Fertitta Entertainment LLC / Fertitta Entertainment Finance Co., Inc. 4.625% 1/15/29 (g) | 10,240,000 | 8,473,600 | |

| Golden Entertainment, Inc. 7.625% 4/15/26 (g) | 1,065,000 | 1,050,250 | |

| Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp. 5.875% 5/15/25 (g) | 1,367,000 | 1,264,519 | |

| VICI Properties LP / VICI Note Co.: | |||

| 3.5% 2/15/25 (g) | 240,000 | 221,846 | |

| 4.25% 12/1/26 (g) | 345,000 | 311,395 | |