UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21653

DOMINI ADVISOR TRUST

(Exact Name of Registrant as Specified in Charter)

536 Broadway, 7th Floor, New York, New York 10012

(Address of Principal Executive Offices)

Amy L. Domini

Domini Social Investments LLC

536 Broadway, 7th Floor

New York, New York 10012

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 212-217-1100

Date of Fiscal Year End: July 31

Date of Reporting Period: January 31, 2006

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 follows.

Table of Contents

| 2 | Letter from the President | ||||

| Domini Social Equity Portfolio | |||||

| 4 | Performance Commentary | ||||

| 7 | Expense Example | ||||

| 9 | Social Profiles | ||||

| 13 | Portfolio of Investments | ||||

| Domini European Social Equity Portfolio | |||||

| 20 | Performance Commentary | ||||

| 23 | Expense Example | ||||

| 25 | Social Profiles | ||||

| 27 | Portfolio of Investments | ||||

| Financial Statements | |||||

| 31 | Domini Social Index Trust | ||||

| 37 | Domini Social Equity Portfolio | ||||

| 44 | Domini European Social Equity Trust | ||||

| 52 | Domini European Social Equity Portfolio | ||||

| 59 | Board of Trustees' Consideration of Management and Submanagement Agreements | ||||

| 66 | Proxy Voting Information | ||||

| 66 | Quarterly Portfolio Schedule Information | ||||

| Back Cover | For More Information |

Letter from the President

Dear Fellow Shareholders:

As I reflect on the second half of last year, I am haunted by the anguished faces of the survivors of Hurricane Katrina in New Orleans. The virtual abandonment of the survivors — especially the many residents of poor African American neighborhoods who lacked the resources to escape the flooding — prompted shame and anger, and was seen as a national disgrace. The cost of neglecting the needs and opinions of minorities has also emerged in other parts of the world. Riots in France and elsewhere in Europe, for example, made it clear that Muslims are far from integrated into many societies.

A commitment to diversity, including attention to the rights of women and minorities, is one of the key areas of corporate behavior that Domini considers when evaluating its investments. In this year's Semi-Annual Report, we focus on diversity in the Social Profiles for each of our mutual funds.

We have long believed that by including women and ethnic minorities in their leadership and workforce, companies may enhance not only their bottom line but also provide long-term benefits to the economy and society.

We believe that shareholders can benefit when a company draws on diverse viewpoints to understand a rapidly changing marketplace, and that corporate governance can improve when a company's management and board of directors include the voices of women and minorities. Employees are stimulated by new ideas and new points of view, and female and minority employees do their best work in an environment that supports them.

By creating opportunities for women and minorities, diversity can also alleviate the concentration of power and wealth in society and therefore help safeguard basic civil rights and democracy itself.

Progress may come as attitudes evolve in a society, as women and minorities press for their rights through protest and through the courts, and as companies recognize that women and minorities can provide leadership as effective and innovative as that of white men. In this Semi-Annual Report, we profile six U.S. companies with notable records in diversity. We also profile three companies in Norway, where a new law requires companies to have at least 40% of their board represented by women within two years — an interesting example of progress by government mandate.

In 1994, according to KLD Research & Analytics, Inc., approximately 25.6% of the companies in the S&P 500 had no women on their board of directors or among senior level managers. Ten years later that percentage had dropped to 11.4%. We consider this figure still too high.

2

Boards should nominate the most qualified people to serve, and when we see an all-white, all-male board we can reasonably question whether the board has sought the most qualified candidates. To emphasize this point, we withhold our proxy votes from non-diverse boards, and write to the company to explain why. From time to time, more proactive steps are called for. For example, for the 2006 proxy voting season, we filed shareholder resolutions challenging Monster Worldwide to diversify its board, which appears to be entirely white and male based on publicly available information, and calling on Home Depot to disclose its Equal Employment Opportunity data.

Sometimes diversity may have unexpected benefits. In 1971, General Motors responded to a shareholder resolution by appointing the Rev. Leon Sullivan to its board: one of the first African Americans to serve on the board of a major U.S. corporation. During his tenure on the board, Sullivan created the famous Sullivan Principles, a code of conduct for foreign corporations that wished to do business in apartheid South Africa.

By holding corporations to a higher standard and pressing them to disclose the details of their employment practices, the Sullivan Principles became a critical tool for changing corporate behavior, produced a wealth of information for investors, and contributed to the downfall of the apartheid regime. One small step taken to help level inequality — in this case, putting an African American man on the board of what was one of America's most powerful and successful corporations — can help change the world.

Diversity is an ever-present consideration when we evaluate and interact with corporations, though it does not mean that we will only invest in companies run by women, or companies with diverse boards. The birth of social investing did not change the world overnight. We therefore must invest in imperfect companies, with a goal of improving their social and environmental performance through responsible ownership.

As a Domini shareholder, you are part of a community of social investors who are working toward the ultimate goal of creating a more just and sustainable economic system. We thank you for joining us in this important effort. Advancing diversity is only one of the many ways in which you help ensure not only that the American economy continues to generate prosperity into the future, but that prosperity is enjoyed by more than a few.

Very truly yours,

Amy Domini

amy@domini.com

3

Domini Social Equity Portfolio

PERFORMANCE COMMENTARY

Despite the devastating impact of Hurricane Katrina and the spike in oil prices that followed, stocks posted gains during the six-month period ended January 31, 2006. After trending downward for the first three months of the period, positive performance for the next three months caused the period to end with an increase of 4.67% for the large-cap S&P 500 index and 8.53% for the small-cap Russell 2000 index.

Economic growth continued during the period, but with signs that we may be nearing the end of the cycle of expansion. Growth in gross domestic product (GDP) for the last two quarters of 2005 was reported to be 4.1% and 1.6%, respectively. The decline in the fourth quarter was largely attributed to Katrina. Corporate earnings showed surprising strength in 2005, increasing approximately 14% over 2004, but Standard & Poor's expected earnings to decrease in 2006. A slowdown in earnings is consistent with the later stages of economic expansions.

Comments by the Federal Reserve Board after its latest interest rate increase in January suggested that the Fed believed economic expansion would continue and that it was concerned about the potential for inflation due to higher energy prices and higher use of manufacturing capacity. January data showed an increase of 193,000 in nonfarm jobs, helping to continue a trend in the decline of the unemployment rate to 4.7%. The number of discouraged workers (those not looking for work because they believe no jobs are available) declined to 396,000, a decrease of 119,000 over the previous year.

The effect of Hurricane Katrina on oil prices heightened awareness that oil prices will remain vulnerable to production interruptions. After peaking at approximately $70 a barrel, oil prices declined, only to increase again in late 2005 and early 2006 because of speculation about the interruption of oil supplies due to diplomatic uncertainties over Iran's potential to develop nuclear weapons.

For the six months ended January 31, the Fund underperformed the Standard & Poor's 500 Index (S&P 500) by 1.95%. The performance of the Fund relative to the S&P 500 was hurt in part by its underweighting to the energy sector, although positive return due to stock selection partially offset this effect. The relative performance of the Fund was also hurt by its overweighting to the information technology sector. Negative return due to stock selection contributed to this effect. The Fund was hurt in particular by its overweighting to Dell and Intel.

The relative performance of the Fund was helped in part by its underweighting to the industrials and utilities sectors. The Fund added positive return due to stock selection within the industrials sector, in

4

particular by its avoidance of General Electric, excluded because of the company's involvement in military weapons and nuclear power.

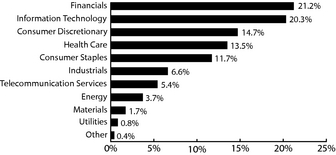

The Domini Social Equity Portfolio invests in the Domini Social Index Trust. The table and the bar chart below provide information, as of January 31, 2006, about the ten largest holdings of the Domini Social Index Trust and its portfolio holdings by industry sector:

TEN LARGEST HOLDINGS

| COMPANY | % OF NET ASSETS | COMPANY | % OF NET ASSETS | ||||||||

| Microsoft Corporation | 4.30 | Cisco Systems Inc. | 1.90 | ||||||||

| Procter & Gamble Co. | 3.31 | Wells Fargo & Co. | 1.74 | ||||||||

| Johnson & Johnson | 2.86 | AT&T Inc. | 1.69 | ||||||||

| JP Morgan Chase & Co. | 2.32 | Pepsico Inc. | 1.58 | ||||||||

| Intel Corp | 2.14 | Verizon Communications Inc | 1.54 |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

The holdings mentioned above are described in the Domini Social Index Trust (DSIT) Portfolio of Investments at January 31, 2006, included herein. The composition of the DSIT is subject to change.

Domini Social Equity Portfolio — Performance Commentary 5

AVERAGE ANNUAL TOTAL RETURNS

WITH MAXIMUM 4.75% SALES CHARGE

| Domini Social Equity Portfolio (DSEP) | S&P 500 | ||||||||||||||||||

| As of 12-31-05 | 1 Year(1) | −3.58 | % | 4.91 | % | ||||||||||||||

| 5 Year(1) | −1.53 | % | 0.54 | % | |||||||||||||||

| 10 Year(1) | 7.84 | % | 9.07 | % | |||||||||||||||

| Since Inception(1) | 9.35 | % | 10.49 | % | |||||||||||||||

| As of 1-31-06 | 1 Year(1) | 1.42 | % | 10.38 | % | ||||||||||||||

| 5 Year(1) | −2.00 | % | 0.37 | % | |||||||||||||||

| 10 Year(1) | 7.74 | % | 8.99 | % | |||||||||||||||

| Since Inception(1) | 9.44 | % | 10.62 | % | |||||||||||||||

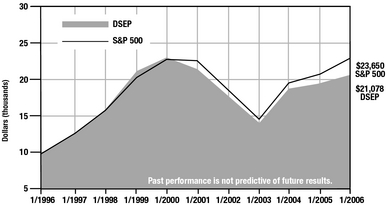

Comparison of $10,000 Investment With Sales Charge in the

Domini Social Equity Portfolio and S&P 500

Past performance is no guarantee of future results. The Fund's returns quoted above represent past performance after all expenses and sales charges. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 60 days after the settlement of purchase or acquisition through exchange, with certain exceptions. See the Fund's prospectus for further information.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund's net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund's average annual total returns would have been lower had these not been waived.

The Standard & Poor's 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

(1)

The Domini Social Equity Portfolio, which commenced operations on May 1, 2005, invests all of its assets in the Domini Social Index Trust (DSIT), which has the same investment objectives as the Fund. The DSIT commenced operations on June 3, 1991. Performance prior to the Fund's commencement of operations is the performance of the DSIT adjusted for expenses of the Fund.

This material must be preceded or accompanied by the Fund's current prospectus. DSIL Investment Services LLC, Distributor. 03/06

6 Domini Social Equity Portfolio — Performance Commentary

Domini Social Equity Portfolio

Expense Example

As a shareholder of the Domini Social Equity Portfolio, you incur two types of costs:

•

Transaction costs such as sales charges (loads) on purchases and redemption fees deducted from any redemption or exchange proceeds if you sell or exchange shares of the Fund after holding them less than 60 days

•

Ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses

This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on August 1, 2005, and held through January 31, 2006.

Actual Expenses

The line of the table captioned "Actual Expenses" below provides information about actual account value and actual expenses. You may use the information in this line, together with the amount invested, to estimate the expenses that you paid over the period as follows:

•

Divide your account value by $1,000.

•

Multiply your result in step 1 by the number in the first line under the heading "Expenses Paid During Period" in the table.

•

The result equals the estimated expenses you paid on your account during the period.

7

Hypothetical Expenses

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's return. The hypothetical account values and expenses may not be used to estimate actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical example that appears in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Domini Social Equity Portfolio | Beginning Account Value as of 8/1/2005 | Ending Account Value as of 1/31/2006 | Expenses Paid During Period* 8/1/2005 – 1/31/2006 | ||||||||||||||||||||

| Actual Expenses | $ | 1,000.00 | $ | 1,027.20 | $ | 4.85 | |||||||||||||||||

| Hypothetical Expenses (5% return before expenses) | $ | 1,000.00 | $ | 1,020.42 | $ | 4.84 | |||||||||||||||||

*

Expenses are equal to the Fund's annualized expense ratio of 0.95% multiplied by average account value over the period, multiplied by 184, and divided by 365. The example reflects the aggregate expenses of the Fund and the Domini Social Index Trust, the underlying portfolio in which the Fund invests.

8 Domini Social Equity Portfolio — Expense Example

Domini Social Equity Portfolio

Social Profiles

Diversity

In this year's Semi-Annual Report we discuss several companies in the Fund's portfolio that are headed by women or minorities and that have a particularly strong commitment to diversity. (Of the companies in the Domini 400 Social Index, 39 or 9.8% have CEOs who are women or minorities, versus 28 or 5.6% for the S&P 500.) The CEOs of Radio One and WGL Holdings are African American, the CEO of Cathay General Bancorp is Asian American, the CEO of Molina Healthcare is Latino, and the CEOs of Claire's Stores and eBay are women.

Radio One

| Ticker: ROIA | Website:www.radio-one.com | ||||

| Market Capitalization: $136 Million |

Catherine L. Hughes is the first African American woman to head a publicly traded company. As of 2005, the company she founded included 70 radio stations with more than 13.5 million listeners. Radio One's CEO is Ms. Hughes' son, Alfred C. Liggins III. In 2004, he launched TV One, a cable and satellite network aimed at an African American audience. In 2005, he bought a 51% interest in Reach Media, which sponsors the Tom Joyner Morning Show, a syndicated radio show broadcast on about 115 radio stations.

Interviewed in 2005, Catherine Hughes said that about 70% of Radio One's 1,800 employees are African American. "Nobody in the broadcasting business has given or continues to give more opportunity to African Americans than Radio One and now, TV One. Given the very small number of African Americans in the entire broadcasting business, our numbers are staggeringly high."

As of September 2004, one woman (Ms. Hughes) and five minorities (including Ms. Hughes and her son, Alfred C. Liggins, III) served on the company's seven-member board of directors.

WGL Holdings

| Ticker: WGL | Website: www.wglholdings.com | ||||

| Market Capitalization: $1.52 Billion |

WGL Holdings, which distributes natural gas in Washington, D.C., serves a city that is primarily African American, and it is one of the few public utilities to be led by an African American CEO.

9

In 1983, Washington Gas established the Washington Area Fuel Fund, which helps pay for fuel to heat the homes of people in financial need. The Fund is administered by the Salvation Army, while Washington Gas pays all of its administrative expenses. According to the company, the Fund has raised more than $15.8 million and helped more than 187,000 people.

WGL has shown a strong commitment to supporting minority-owned and women-owned businesses through its purchases of goods and services. WGL is unusual in having hired minority-owned investment firms as agents for the sale of its taxable medium-term notes.

As of January 2005, the eight-member board of WGL Holdings included two women and four minorities, including CEO James H. DeGraffenreidt Jr.

Cathay General Bancorp

| Ticker: CATY | Website: www.cathaybank.com | ||||

| Market Capitalization: $1.79 Billion |

Cathay General Bancorp is the holding company of Cathay Bank, founded in 1962, which is the oldest Chinese American commercial bank in the country.

Many of Cathay General Bancorp's employees speak both English and either Vietnamese or one or more Chinese dialects, and are therefore able to serve the bank's customers more effectively. In January 2005, Cathay announced that the Cathay Bank Foundation would donate $50,000 to the American Red Cross to help victims of the December 2004 tsunami.

The company exceeds federal maternity leave requirements by granting additional weeks of maternity leave beyond the federal government's mandate of 12 weeks of unpaid leave. In 2002, the company told KLD that it prohibits discrimination based on sexual orientation.

As of March 2005, the eleven-member board of Cathay included ten Asian Americans, including CEO Dunson Cheng. As of March 2005, the four top officers of the company were all Asian American.

Molina Healthcare

| Ticker: MOH | Website:www.molinahealthcare.com | ||||

| Market Capitalization: $527 Million |

Molina Healthcare was founded by Dr. C. David Molina, the father of the company's current CEO, Dr. J. Mario Molina. The senior Dr. Molina started the company specifically to treat low-income patients. He met opposition from medical colleagues, including the reluctance of specialists

10 Domini Social Equity Portfolio — Social Profiles

to accept referrals for Medicaid patients. Now the company has health plans in six states and operates 21 primary care clinics in California.

Molina Healthcare has been commended for being one of the first companies to hire a cultural anthropologist to deal with the variety of languages and cultures where it operates. Although Latinos account for 40% of the company's clientele, it also serves large numbers of Vietnamese, Cambodian, and Russian patients. In 2004, Molina Healthcare received a $10,000 Innovation Award from the nonprofit Center for Health Care Strategies for increasing immunization rates among African Americans in its Michigan division.

As of March 2005, two women (Sally Richardson and Ronna Romney) and two minorities (J. Mario Molina and John Molina) served on the company's seven-member board of directors.

Claire's Stores

| Ticker: CLE | Website: www.clairestores.com | ||||

| Market Capitalization: $3.15 Billion |

Claire's Stores, which operates mall-based stores that sell fashion jewelry targeted towards teenagers, has not one but two female CEOs. In November 2003, when company founder Rowland Schaefer retired, his daughters Bonnie and Marla Schaefer were appointed co-chairs and co-CEOs. In 2005, Marla Schaefer was quoted as saying, "Our goal is to keep the business healthy, keep inventories in line and keep moving forward.... We don't run the business for Wall Street. We run it for our shareholders and employees and customers."

As of January 2006, three women (including Bonnie and Marla Schaefer) served on the company's seven-member board of directors, and four of the six top officers were women. As of January 2006, according to the Human Rights Campaign, Claire's includes sexual orientation in its written nondiscrimination policy.

eBay

| Ticker: EBAY | Website: www.ebay.com | ||||

| Market Capitalization: $49.26 Billion |

From 1997, the year before Meg Whitman became CEO of eBay, to the end of 2005, the company's revenues grew from $5.7 million to $4.6 billion — making it one of the fastest-growing companies in history.

eBay has been recognized as a leader in creating online, person-to-person auctions. In 2000, the company was awarded a Computerworld Smithsonian Award for "creating a new global marketplace and trading

Domini Social Equity Portfolio — Social Profiles 11

community." As of 2004, according to Fortune magazine, an estimated 430,000 people earned all or most of their income selling on eBay's website. A case study on eBay's innovations was added to the permanent research collection at the Smithsonian National Museum of American History. Whitman and her team have been praised for creating a "company of tomorrow" that combines a small staff and a high profit margin.

As of March 2004, two women (including Ms. Whitman) served on the company's nine-member board of directors.

The Fund invests in a portfolio designed to replicate the Domini 400 Social Index.SM All companies in the Fund's portfolio are measured against multiple standards of corporate accountability. We seek to avoid companies that manufacture alcohol, tobacco, or firearms, derive revenues from gambling operations, own or operate nuclear power plants, or earn significant revenues from weapons contracting. Before investing in any company, KLD Research & Analytics, Inc. (KLD) evaluates its social profile by weighing both strengths and weaknesses in the areas of community impact, diversity, employee relations, the environment, human rights, and product safety and usefulness. KLD is responsible for maintaining the Domini 400 Social Index and developing and applying its social and environmental standards. Special thanks to KLD for allowing us to reproduce portions of its research in these pages.

For extensive information about how we use social and environmental standards to choose our investments, including brief social profiles of every company in the Fund's portfolio, visit www.domini.com.

Unlike other mutual funds, the Domini Social Equity Portfolio seeks to achieve its investment objective by investing all of its investable assets in a separate portfolio with an identical investment objective called the Domini Social Index Trust (DSIT). The companies discussed above can be found in the DSIT's Portfolio of Investments at January 31, 2006, included herein. The composition of the DSIT is subject to change.

The preceding profiles should not be deemed an offer to sell or a solicitation of an offer to buy the stock of any of the companies noted, or a recommendation concerning the merits of any of these companies as an investment.

Domini 400 Social IndexSM is a service mark of KLD Research & Analytics, Inc. (KLD), which is used under license. KLD is the owner of the Domini 400 Social Index. KLD determines the composition of the Index but is not the manager of the Domini Social Index Trust, the Domini Social Equity Fund, the Domini Institutional Social Equity Fund and the Domini Social Equity Portfolio. Certain portions of these social profiles are copyright © 2006 by KLD and are reprinted here by permission. 03/06

12 Domini Social Equity Portfolio — Social Profiles

Domini Social Index Trust

Portfolio of Investments

January 31, 2006 (unaudited)

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 follows.

| Security | Shares | Value | ||||||||||||||

| Consumer Discretionary 14.7% | ||||||||||||||||

| American Greetings Corporation, Class A | 16,300 | $ | 332,683 | |||||||||||||

| AutoZone, Inc. (a) | 14,231 | 1,391,080 | ||||||||||||||

| Bandag, Inc. | 2,400 | 107,088 | ||||||||||||||

| Bed Bath & Beyond (a) | 76,400 | 2,858,124 | ||||||||||||||

| Best Buy Co., Inc. | 105,200 | 5,329,432 | ||||||||||||||

| Black & Decker Corp. | 20,200 | 1,743,260 | ||||||||||||||

| Bright Horizons Family Solutions, Inc. (a) | 6,400 | 250,112 | ||||||||||||||

| Centex Corporation | 32,600 | 2,327,314 | ||||||||||||||

| Champion Enterprises, Inc. (a) | 20,200 | 276,942 | ||||||||||||||

| Charming Shoppes, Inc. (a) | 24,400 | 296,704 | ||||||||||||||

| Circuit City Stores, Inc. | 39,400 | 993,274 | ||||||||||||||

| Claire's Stores, Inc. | 26,000 | 823,160 | ||||||||||||||

| Comcast Corporation, Class A (a) | 556,058 | 15,469,534 | ||||||||||||||

| Cooper Tire and Rubber Company | 17,400 | 260,826 | ||||||||||||||

| Dana Corporation | 39,500 | 192,365 | ||||||||||||||

| Darden Restaurants, Inc. | 33,100 | 1,345,846 | ||||||||||||||

| DeVry, Inc. (a) | 15,000 | 344,850 | ||||||||||||||

| Disney (Walt) Company (The) | 492,300 | 12,460,113 | ||||||||||||||

| Dollar General Corporation | 81,551 | 1,378,212 | ||||||||||||||

| Dow Jones & Company | 15,400 | 585,354 | ||||||||||||||

| eBay Inc. (a) | 292,572 | 12,609,853 | ||||||||||||||

| Emmis Communications Corporation, Class A (a) | 8,860 | 157,619 | ||||||||||||||

| Family Dollar Stores Inc. | 40,500 | 969,975 | ||||||||||||||

| Foot Locker, Inc. | 40,600 | 922,432 | ||||||||||||||

| Gaiam, Inc. (a) | 2,200 | 31,350 | ||||||||||||||

| Gap Inc. | 146,897 | 2,657,367 | ||||||||||||||

| Genuine Parts Company | 44,700 | 1,901,091 | ||||||||||||||

| Harley-Davidson, Inc. | 70,400 | 3,768,512 | ||||||||||||||

| Harman International Industries, Inc. | 16,920 | 1,861,200 | ||||||||||||||

| Hartmarx Corporation (a) | 8,500 | 72,420 | ||||||||||||||

| Home Depot, Inc. (The) | 544,144 | 22,065,039 | ||||||||||||||

| Horton (D.R.), Inc. | 70,133 | 2,617,364 | ||||||||||||||

| Interface, Inc., Class A (a) | 11,400 | 107,160 | ||||||||||||||

| Johnson Controls, Inc. | 49,400 | 3,420,456 | ||||||||||||||

| Consumer Discretionary (Continued) | ||||||||||||||||

| KB Home | 20,300 | $ | 1,546,860 | |||||||||||||

| Lee Enterprises, Inc. | 10,900 | 383,571 | ||||||||||||||

| Leggett & Platt, Incorporated | 46,300 | 1,139,906 | ||||||||||||||

| Limited Brands | 89,630 | 2,120,646 | ||||||||||||||

| Liz Claiborne, Inc. | 28,000 | 972,160 | ||||||||||||||

| Lowe's Companies, Inc. | 200,200 | 12,722,710 | ||||||||||||||

| Mattel, Inc. | 103,985 | 1,715,753 | ||||||||||||||

| Maytag Corporation | 18,700 | 322,014 | ||||||||||||||

| McDonald's Corporation | 322,100 | 11,276,721 | ||||||||||||||

| McGraw-Hill Companies | 96,400 | 4,920,256 | ||||||||||||||

| Media General, Inc., Class A | 5,600 | 267,960 | ||||||||||||||

| Men's Wearhouse, Inc. (a) | 13,050 | 445,919 | ||||||||||||||

| Meredith Corporation | 10,200 | 558,552 | ||||||||||||||

| Modine Manufacturing Company | 8,700 | 235,770 | ||||||||||||||

| New York Times Company, Class A | 36,800 | 1,041,440 | ||||||||||||||

| Newell Rubbermaid, Inc. | 70,978 | 1,677,920 | ||||||||||||||

| NIKE, Inc., Class B | 49,100 | 3,974,645 | ||||||||||||||

| Nordstrom, Inc. | 55,800 | 2,327,976 | ||||||||||||||

| Office Depot (a) | 79,400 | 2,632,110 | ||||||||||||||

| Omnicom Group, Inc. | 46,000 | 3,762,340 | ||||||||||||||

| Penney (J.C.) Company, Inc. | 59,500 | 3,320,100 | ||||||||||||||

| Pep Boys – Manny, Moe & Jack | 14,000 | 218,400 | ||||||||||||||

| Phillips-Van Heusen Corporation | 9,300 | 336,009 | ||||||||||||||

| Pixar (a) | 14,000 | 808,920 | ||||||||||||||

| Pulte Homes, Inc. | 55,200 | 2,202,480 | ||||||||||||||

| Radio One, Inc. (a) | 5,800 | 63,104 | ||||||||||||||

| RadioShack Corporation | 33,700 | 748,140 | ||||||||||||||

| Ruby Tuesday, Inc. | 15,800 | 452,038 | ||||||||||||||

| Russell Corporation | 8,300 | 126,824 | ||||||||||||||

| Scholastic Corporation (a) | 9,700 | 291,485 | ||||||||||||||

| Scripps (E.W.) Company (The), Class A | 21,400 | 1,034,476 | ||||||||||||||

| Snap-On Incorporated | 15,050 | 603,957 | ||||||||||||||

| Spartan Motors, Inc. | 3,100 | 32,922 | ||||||||||||||

| Stanley Works | 18,200 | 892,528 | ||||||||||||||

13

Domini Social Index Trust / Portfolio of Investments (Continued)

January 31, 2006 (unaudited)

| Security | Shares | Value | ||||||||||||||

| Consumer Discretionary (Continued) | ||||||||||||||||

| Staples, Inc. | 186,784 | $ | 4,428,649 | |||||||||||||

| Starbucks Corporation (a) | 196,514 | 6,229,494 | ||||||||||||||

| Stride Rite Corporation | 10,800 | 156,276 | ||||||||||||||

| Target Corporation | 225,000 | 12,318,750 | ||||||||||||||

| Tiffany & Co. | 36,100 | 1,360,970 | ||||||||||||||

| Timberland Company (The) (a) | 13,400 | 468,464 | ||||||||||||||

| Time Warner, Inc. | 1,194,520 | 20,939,936 | ||||||||||||||

| TJX Companies, Inc. | 118,600 | 3,027,858 | ||||||||||||||

| Tribune Company | 66,756 | 1,936,592 | ||||||||||||||

| Tupperware Corporation | 12,400 | 275,280 | ||||||||||||||

| Univision Communications, Inc., Class A (a) | 57,200 | 1,821,248 | ||||||||||||||

| Valassis Communications Inc. (a) | 12,300 | 343,170 | ||||||||||||||

| Value Line, Inc. | 900 | 31,275 | ||||||||||||||

| Visteon Corporation | 34,000 | 178,500 | ||||||||||||||

| Washington Post Company, Class B | 1,500 | 1,144,469 | ||||||||||||||

| Wendy's International, Inc. | 30,100 | 1,774,394 | ||||||||||||||

| Whirlpool Corporation | 17,500 | 1,411,899 | ||||||||||||||

| 224,951,947 | ||||||||||||||||

| Consumer Staples 11.7% | ||||||||||||||||

| Alberto-Culver Company, Class B | 19,750 | 874,925 | ||||||||||||||

| Albertson's, Inc. | 93,400 | 2,349,010 | ||||||||||||||

| Avon Products, Inc. | 117,000 | 3,313,440 | ||||||||||||||

| Campbell Soup Company | 48,500 | 1,451,605 | ||||||||||||||

| Chiquita Brands International, Inc. | 10,800 | 195,588 | ||||||||||||||

| Church & Dwight Co., Inc. | 15,600 | 574,080 | ||||||||||||||

| Clorox Company | 38,400 | 2,298,240 | ||||||||||||||

| Coca-Cola Company | 530,400 | 21,947,952 | ||||||||||||||

| Colgate-Palmolive Company | 132,500 | 7,272,925 | ||||||||||||||

| Costco Wholesale Corporation | 121,230 | 6,048,165 | ||||||||||||||

| CVS Corporation | 209,700 | 5,821,272 | ||||||||||||||

| Estée Lauder Companies, Inc. (The), Class A | 27,200 | 991,984 | ||||||||||||||

| General Mills Incorporated | 91,400 | 4,442,954 | ||||||||||||||

| Consumer Staples (Continued) | ||||||||||||||||

| Green Mountain Coffee, Inc. (a) | 1,800 | $ | 68,940 | |||||||||||||

| Hain Celestial Group, Inc. (The) (a) | 8,700 | 202,797 | ||||||||||||||

| Heinz (H.J.) Company | 86,200 | 2,925,628 | ||||||||||||||

| Hershey Foods Corporation | 46,600 | 2,385,920 | ||||||||||||||

| Kellogg Company | 66,100 | 2,835,690 | ||||||||||||||

| Kimberly-Clark Corporation | 120,264 | 6,869,480 | ||||||||||||||

| Kroger Company (a) | 185,700 | 3,416,880 | ||||||||||||||

| Longs Drug Stores Corporation | 6,200 | 216,938 | ||||||||||||||

| McCormick & Company, Inc. | 34,900 | 1,054,329 | ||||||||||||||

| Nature's Sunshine Products, Inc. | 3,990 | 70,463 | ||||||||||||||

| PepsiAmericas, Inc. | 16,400 | 401,636 | ||||||||||||||

| PepsiCo, Inc. | 425,070 | 24,305,503 | ||||||||||||||

| Procter & Gamble Company | 859,516 | 50,909,133 | ||||||||||||||

| Safeway Inc. | 115,700 | 2,712,008 | ||||||||||||||

| Smucker (J.M.) Company | 15,105 | 657,068 | ||||||||||||||

| SUPERVALU, Inc. | 35,800 | 1,143,094 | ||||||||||||||

| Sysco Corporation | 159,700 | 4,899,596 | ||||||||||||||

| Tootsie Roll Industries, Inc. | 6,638 | 192,834 | ||||||||||||||

| United Natural Foods, Inc. (a) | 10,000 | 323,300 | ||||||||||||||

| Walgreen Company | 259,000 | 11,209,520 | ||||||||||||||

| Whole Foods Market, Inc. | 35,200 | 2,600,224 | ||||||||||||||

| Wild Oats Markets, Inc. (a) | 6,550 | 79,189 | ||||||||||||||

| Wrigley (Wm.) Jr. Company | 45,900 | 2,935,763 | ||||||||||||||

| 179,998,073 | ||||||||||||||||

| Energy 3.7% | ||||||||||||||||

| Anadarko Petroleum Corporation | 60,685 | 6,543,057 | ||||||||||||||

| Apache Corporation | 84,824 | 6,406,757 | ||||||||||||||

| Chesapeake Energy Corp | 75,700 | 2,652,528 | ||||||||||||||

| Cooper Cameron Corp. (a) | 28,400 | 1,374,276 | ||||||||||||||

| Devon Energy Corporation | 113,644 | 7,751,657 | ||||||||||||||

| EOG Resources, Inc. | 62,200 | 5,258,388 | ||||||||||||||

| Helmerich & Payne, Inc. | 13,000 | 1,018,680 | ||||||||||||||

14

Domini Social Index Trust / Portfolio of Investments (Continued)

January 31, 2006 (unaudited)

| Security | Shares | Value | ||||||||||||||

| Energy (Continued) | ||||||||||||||||

| Kinder Morgan, Inc. | 27,100 | $ | 2,608,375 | |||||||||||||

| National Oilwell Varco, Inc. (a) | 44,900 | 3,415,543 | ||||||||||||||

| Noble Energy, Inc. | 45,000 | 2,082,600 | ||||||||||||||

| Pioneer Natural Resources Company | 32,700 | 1,736,370 | ||||||||||||||

| Rowan Companies, Inc. | 28,700 | 1,286,621 | ||||||||||||||

| Smith International | 51,600 | 2,322,000 | ||||||||||||||

| Sunoco, Inc. | 34,800 | 3,312,960 | ||||||||||||||

| Williams Companies, Inc. | 146,800 | 3,499,712 | ||||||||||||||

| XTO Energy Inc. | 93,100 | 4,569,348 | ||||||||||||||

| 55,838,872 | ||||||||||||||||

| Financials 21.2% | ||||||||||||||||

| AFLAC, Inc. | 128,800 | 6,047,160 | ||||||||||||||

| Allied Capital Corporation | 34,600 | 986,446 | ||||||||||||||

| AMBAC Financial Group, Inc. | 27,000 | 2,073,870 | ||||||||||||||

| American Express Company | 318,000 | 16,679,100 | ||||||||||||||

| AmSouth Bancorporation | 88,900 | 2,454,529 | ||||||||||||||

| BB&T Corporation | 139,500 | 5,446,080 | ||||||||||||||

| Capital One Financial Corporation | 77,100 | 6,422,430 | ||||||||||||||

| Cathay General Bancorp | 12,790 | 456,731 | ||||||||||||||

| Chittenden Corporation | 11,920 | 338,170 | ||||||||||||||

| Chubb Corporation | 51,500 | 4,859,025 | ||||||||||||||

| Cincinnati Financial Corporation | 45,017 | 2,050,074 | ||||||||||||||

| Comerica Incorporated | 42,500 | 2,357,475 | ||||||||||||||

| Edwards (A.G.), Inc. | 19,187 | 912,726 | ||||||||||||||

| Equity Office Properties Trust | 104,600 | 3,328,372 | ||||||||||||||

| Fannie Mae | 247,865 | 14,361,298 | ||||||||||||||

| Fifth Third Bancorp | 142,911 | 5,369,166 | ||||||||||||||

| First Horizon National Corporation | 32,800 | 1,242,136 | ||||||||||||||

| FirstFed Financial Corp. (a) | 4,500 | 282,150 | ||||||||||||||

| Franklin Resources, Inc. | 38,100 | 3,752,850 | ||||||||||||||

| Freddie Mac | 176,800 | 11,997,648 | ||||||||||||||

| General Growth Properties | 61,434 | 3,169,994 | ||||||||||||||

| Golden West Financial | 65,500 | 4,625,610 | ||||||||||||||

| Hartford Financial Services Group (The) | 77,300 | 6,356,379 | ||||||||||||||

| Heartland Financial USA, Inc. | 3,000 | 64,860 | ||||||||||||||

| Janus Capital Group Inc. | 54,226 | 1,132,781 | ||||||||||||||

| Financials (Continued) | ||||||||||||||||

| Jefferson-Pilot Corporation | 34,025 | $ | 1,984,678 | |||||||||||||

| KeyCorp | 104,600 | 3,701,794 | ||||||||||||||

| Lincoln National Corporation | 44,600 | 2,432,038 | ||||||||||||||

| M&T Bank Corp. | 20,400 | 2,209,320 | ||||||||||||||

| Maguire Properties Inc. | 7,900 | 267,020 | ||||||||||||||

| Marsh & McLennan Companies, Inc. | 140,100 | 4,257,639 | ||||||||||||||

| MBIA, Inc. | 34,500 | 2,123,820 | ||||||||||||||

| Medallion Financial Corp. | 4,300 | 49,149 | ||||||||||||||

| Mellon Financial Corporation | 107,300 | 3,784,471 | ||||||||||||||

| Merrill Lynch & Co., Inc. | 235,392 | 17,670,877 | ||||||||||||||

| MGIC Investment Corporation | 23,100 | 1,524,831 | ||||||||||||||

| Moody's Corporation | 63,200 | 4,001,824 | ||||||||||||||

| Morgan (J.P.) Chase & Co. | 896,992 | 35,655,432 | ||||||||||||||

| National City Corporation | 140,500 | 4,802,290 | ||||||||||||||

| Northern Trust Corporation | 47,800 | 2,495,638 | ||||||||||||||

| PNC Financial Services Group | 75,000 | 4,864,500 | ||||||||||||||

| Popular Inc. | 69,896 | 1,419,588 | ||||||||||||||

| Principal Financial Group, Inc. | 72,100 | 3,400,236 | ||||||||||||||

| Progressive Corporation (The) | 50,800 | 5,336,032 | ||||||||||||||

| Regions Financial Corp. (New) | 117,700 | 3,905,286 | ||||||||||||||

| SAFECO Corporation | 32,200 | 1,682,450 | ||||||||||||||

| Schwab (Charles) Corporation | 263,400 | 3,895,686 | ||||||||||||||

| SLM Corporation | 107,500 | 6,015,700 | ||||||||||||||

| Sovereign Bancorp | 91,000 | 1,983,800 | ||||||||||||||

| St. Paul Travelers Companies, Inc. (The) | 177,164 | 8,039,702 | ||||||||||||||

| State Street Corporation | 83,600 | 5,054,456 | ||||||||||||||

| SunTrust Banks, Inc. | 92,400 | 6,601,980 | ||||||||||||||

| Synovus Financial Corporation | 81,150 | 2,245,421 | ||||||||||||||

| T. Rowe Price Group, Inc. | 33,100 | 2,529,833 | ||||||||||||||

| TradeStation Group, Inc. (a) | 5,100 | 90,219 | ||||||||||||||

| U.S. Bancorp | 465,021 | 13,908,778 | ||||||||||||||

15

Domini Social Index Trust / Portfolio of Investments (Continued)

January 31, 2006 (unaudited)

| Security | Shares | Value | ||||||||||||||

| Financials (Continued) | ||||||||||||||||

| UnumProvident Corporation | 75,800 | $ | 1,541,014 | |||||||||||||

| Wachovia Corporation | 398,043 | 21,824,698 | ||||||||||||||

| Wainwright Bank & Trust Co. | 2,625 | 27,038 | ||||||||||||||

| Washington Mutual, Inc. | 252,442 | 10,683,345 | ||||||||||||||

| Wells Fargo & Company | 428,606 | 26,727,870 | ||||||||||||||

| Wesco Financial Corporation | 400 | 155,017 | ||||||||||||||

| 325,660,530 | ||||||||||||||||

| Health Care 13.5% | ||||||||||||||||

| Affymetrix Inc (a) | 16,700 | 637,606 | ||||||||||||||

| Allergan, Inc. | 33,905 | 3,946,542 | ||||||||||||||

| Amgen, Inc. (a) | 316,153 | 23,044,392 | ||||||||||||||

| Bard (C.R.), Inc. | 27,000 | 1,712,340 | ||||||||||||||

| Bausch & Lomb Incorporated | 13,600 | 918,680 | ||||||||||||||

| Baxter International, Inc. | 159,400 | 5,873,890 | ||||||||||||||

| Becton Dickinson and Company | 64,800 | 4,199,040 | ||||||||||||||

| Biogen Idec Inc. (a) | 86,950 | 3,891,013 | ||||||||||||||

| Biomet, Inc. | 64,100 | 2,423,621 | ||||||||||||||

| Boston Scientific Corporation (a) | 151,400 | 3,311,118 | ||||||||||||||

| CIGNA Corporation | 32,100 | 3,903,360 | ||||||||||||||

| Cross Country Healthcare, Inc. (a) | 3,800 | 75,088 | ||||||||||||||

| Dionex Corporation (a) | 5,600 | 296,968 | ||||||||||||||

| Fisher Scientific International (a) | 31,800 | 2,126,466 | ||||||||||||||

| Forest Laboratories, Inc. (a) | 86,700 | 4,012,476 | ||||||||||||||

| Genzyme Corporation (a) | 66,500 | 4,717,510 | ||||||||||||||

| Guidant Corporation | 85,438 | 6,288,237 | ||||||||||||||

| Hillenbrand Industries, Inc. | 15,500 | 762,910 | ||||||||||||||

| Humana, Inc. (a) | 41,900 | 2,336,763 | ||||||||||||||

| IMS Health, Inc. | 59,613 | 1,466,480 | ||||||||||||||

| Invacare Corporation | 7,700 | 266,343 | ||||||||||||||

| Invitrogen Corporation (a) | 13,300 | 916,104 | ||||||||||||||

| Johnson & Johnson | 762,780 | 43,890,361 | ||||||||||||||

| King Pharmaceuticals Inc. (a) | 63,500 | 1,190,625 | ||||||||||||||

| Manor Care, Inc. | 19,800 | 774,180 | ||||||||||||||

| McKesson HBOC, Inc. | 79,120 | 4,193,360 | ||||||||||||||

| Health Care (Continued) | ||||||||||||||||

| MedImmune, Inc. (a) | 63,400 | $ | 2,163,208 | |||||||||||||

| Medtronic, Inc. | 309,800 | 17,494,406 | ||||||||||||||

| Merck & Co., Inc. | 560,200 | 19,326,900 | ||||||||||||||

| Millipore Corporation (a) | 13,700 | 942,286 | ||||||||||||||

| Molina Healthcare Inc. (a) | 5,300 | 140,238 | ||||||||||||||

| Mylan Laboratories, Inc. | 55,975 | 1,102,708 | ||||||||||||||

| Quest Diagnostics Incorporated | 42,700 | 2,110,661 | ||||||||||||||

| St. Jude Medical, Inc. (a) | 94,300 | 4,632,959 | ||||||||||||||

| Stryker Corporation | 75,100 | 3,747,490 | ||||||||||||||

| Synovis Life Technologies, Inc. (a) | 2,600 | 26,260 | ||||||||||||||

| Thermo Electron Corporation (a) | 41,800 | 1,406,152 | ||||||||||||||

| UnitedHealth Group Incorporated | 349,434 | 20,763,368 | ||||||||||||||

| Waters Corporation (a) | 28,000 | 1,174,600 | ||||||||||||||

| Watson Pharmaceuticals (a) | 26,300 | 870,267 | ||||||||||||||

| Zimmer Holdings, Inc. (a) | 63,600 | 4,385,219 | ||||||||||||||

| 207,462,195 | ||||||||||||||||

| Industrials 6.6% | ||||||||||||||||

| 3M Company | 194,600 | 14,157,150 | ||||||||||||||

| Alaska Air Group, Inc. (a) | 6,900 | 220,317 | ||||||||||||||

| American Power Conversion | 43,400 | 1,028,580 | ||||||||||||||

| AMR Corporation (a) | 35,200 | 799,040 | ||||||||||||||

| Apogee Enterprises, Inc. | 7,400 | 136,604 | ||||||||||||||

| Avery Dennison Corporation | 28,300 | 1,690,642 | ||||||||||||||

| Baldor Electric Company | 6,000 | 179,280 | ||||||||||||||

| Banta Corporation | 6,550 | 334,836 | ||||||||||||||

| Brady Corporation, Class A | 12,000 | 477,240 | ||||||||||||||

| CLARCOR, Inc. | 12,900 | 439,632 | ||||||||||||||

| Cooper Industries, Inc., Class A | 23,300 | 1,902,445 | ||||||||||||||

| Cummins, Inc. | 12,200 | 1,187,060 | ||||||||||||||

| Deere & Company | 61,900 | 4,441,944 | ||||||||||||||

| Deluxe Corporation | 13,100 | 350,818 | ||||||||||||||

| Donaldson Company, Inc. | 16,900 | 583,895 | ||||||||||||||

| Donnelley (R.R.) & Sons Company | 56,000 | 1,825,600 | ||||||||||||||

| Emerson Electric Company | 105,000 | 8,132,250 | ||||||||||||||

16

Domini Social Index Trust / Portfolio of Investments (Continued)

January 31, 2006 (unaudited)

| Security | Shares | Value | ||||||||||||||

| Industrials (Continued) | ||||||||||||||||

| Fastenal Company | 32,400 | $ | 1,236,060 | |||||||||||||

| FedEx Corporation | 77,500 | 7,839,125 | ||||||||||||||

| GATX Corporation | 12,600 | 500,346 | ||||||||||||||

| Graco, Inc. | 17,952 | 721,311 | ||||||||||||||

| Grainger (W.W.), Inc. | 19,800 | 1,404,414 | ||||||||||||||

| Granite Construction Incorporated | 7,725 | 312,708 | ||||||||||||||

| Herman Miller, Inc. | 17,300 | 524,190 | ||||||||||||||

| HNI Corporation | 14,100 | 813,570 | ||||||||||||||

| Hubbell Incorporated, Class B | 15,060 | 676,947 | ||||||||||||||

| Ikon Office Solutions | 32,800 | 387,696 | ||||||||||||||

| Illinois Tool Works, Inc. | 52,700 | 4,442,083 | ||||||||||||||

| JetBlue Airways Corporation (a) | 38,550 | 502,692 | ||||||||||||||

| Kadant Inc. (a) | 3,700 | 71,188 | ||||||||||||||

| Kansas City Southern Industries, Inc. (a) | 18,900 | 491,022 | ||||||||||||||

| Kelly Services, Inc. | 5,075 | 135,909 | ||||||||||||||

| Lawson Products, Inc. | 400 | 16,896 | ||||||||||||||

| Lincoln Electric Holdings, Inc. | 11,000 | 489,610 | ||||||||||||||

| Masco Corporation | 109,300 | 3,240,745 | ||||||||||||||

| Milacron, Inc. (a) | 12,633 | 17,181 | ||||||||||||||

| Monster Worldwide (a) | 31,200 | 1,330,992 | ||||||||||||||

| Nordson Corporation | 8,000 | 363,360 | ||||||||||||||

| Norfolk Southern Corporation | 104,200 | 5,193,328 | ||||||||||||||

| Pall Corp. | 31,100 | 895,680 | ||||||||||||||

| Pitney Bowes, Inc. | 58,200 | 2,487,468 | ||||||||||||||

| Robert Half International, Inc. | 44,300 | 1,618,279 | ||||||||||||||

| Ryder System, Inc. | 15,800 | 706,260 | ||||||||||||||

| Smith (A.O.) Corporation | 5,200 | 224,068 | ||||||||||||||

| Southwest Airlines Co. | 179,662 | 2,957,237 | ||||||||||||||

| SPX Corporation | 17,230 | 822,043 | ||||||||||||||

| Standard Register Company | 4,700 | 85,305 | ||||||||||||||

| Steelcase, Inc. | 13,300 | 224,105 | ||||||||||||||

| Tennant Company | 2,300 | 124,660 | ||||||||||||||

| Thomas & Betts Corporation (a) | 12,800 | 571,520 | ||||||||||||||

| Toro Company | 10,800 | 477,468 | ||||||||||||||

| Trex Company, Inc. (a) | 3,700 | 92,426 | ||||||||||||||

| United Parcel Service, Inc., Class B | 282,633 | 21,172,038 | ||||||||||||||

| YRC Worldwide Inc. (a) | 14,780 | 736,635 | ||||||||||||||

| 101,793,898 | ||||||||||||||||

| Information Technology 20.3% | ||||||||||||||||

| 3Com Corporation (a) | 103,000 | $ | 470,710 | |||||||||||||

| Adaptec, Inc. (a) | 27,400 | 149,056 | ||||||||||||||

| ADC Telecommunications (a) | 30,028 | 761,510 | ||||||||||||||

| Adobe Systems Incorporated | 154,800 | 6,148,656 | ||||||||||||||

| Advanced Micro Devices, Inc. (a) | 103,500 | 4,332,510 | ||||||||||||||

| Advent Software, Inc. (a) | 4,200 | 110,292 | ||||||||||||||

| Analog Devices, Inc. | 93,900 | 3,734,403 | ||||||||||||||

| Andrew Corporation (a) | 43,800 | 568,086 | ||||||||||||||

| Apple Computer, Inc. (a) | 215,800 | 16,295,058 | ||||||||||||||

| Applied Materials, Inc. | 414,700 | 7,900,035 | ||||||||||||||

| Arrow Electronics, Inc. (a) | 31,000 | 1,065,160 | ||||||||||||||

| Autodesk, Inc. | 59,800 | 2,427,282 | ||||||||||||||

| Automatic Data Processing, Inc. | 148,474 | 6,523,948 | ||||||||||||||

| BMC Software, Inc. (a) | 55,400 | 1,224,340 | ||||||||||||||

| CDW Corporation | 16,500 | 924,000 | ||||||||||||||

| Ceridian Corporation (a) | 38,300 | 945,244 | ||||||||||||||

| Cisco Systems, Inc. (a) | 1,574,414 | 29,236,868 | ||||||||||||||

| Coherent, Inc. (a) | 7,700 | 238,392 | ||||||||||||||

| Compuware Corporation (a) | 98,800 | 814,112 | ||||||||||||||

| Convergys Corp. (a) | 35,500 | 610,600 | ||||||||||||||

| Dell Inc. (a) | 602,786 | 17,667,658 | ||||||||||||||

| Electronic Arts Inc. (a) | 76,800 | 4,191,744 | ||||||||||||||

| Electronic Data Systems Corporation | 134,300 | 3,383,017 | ||||||||||||||

| EMC Corporation (a) | 611,200 | 8,190,080 | ||||||||||||||

| Entegris, Inc. (a) | 20,000 | 210,000 | ||||||||||||||

| Gerber Scientific, Inc. (a) | 5,700 | 63,384 | ||||||||||||||

| Hewlett-Packard Company | 733,910 | 22,883,314 | ||||||||||||||

| Imation Corporation | 9,100 | 412,503 | ||||||||||||||

| Intel Corporation | 1,545,555 | 32,873,955 | ||||||||||||||

| Lexmark International Group, Inc. (a) | 30,300 | 1,471,671 | ||||||||||||||

| LSI Logic Corporation (a) | 102,300 | 936,045 | ||||||||||||||

| Lucent Technologies, Inc. (a) | 1,144,492 | 3,021,459 | ||||||||||||||

| Merix Corporation (a) | 3,750 | 30,563 | ||||||||||||||

17

Domini Social Index Trust / Portfolio of Investments (Continued)

January 31, 2006 (unaudited)

| Security | Shares | Value | ||||||||||||||||||||

| Information Technology (Continued) | ||||||||||||||||||||||

| Micron Technology, Inc. (a) | 159,100 | $ | 2,335,588 | |||||||||||||||||||

| Microsoft Corporation | 2,346,030 | 66,040,745 | ||||||||||||||||||||

| Molex Incorporated | 36,946 | 1,117,617 | ||||||||||||||||||||

| National Semiconductor Corporation | 87,700 | 2,474,017 | ||||||||||||||||||||

| Novell, Inc. (a) | 100,000 | 974,000 | ||||||||||||||||||||

| Novellus Systems, Inc. (a) | 34,300 | 972,405 | ||||||||||||||||||||

| Palm Inc. (a) | 11,604 | 458,126 | ||||||||||||||||||||

| Paychex, Inc. | 85,900 | 3,122,465 | ||||||||||||||||||||

| Plantronics Inc. | 11,000 | 385,000 | ||||||||||||||||||||

| Polycom Inc. (a) | 24,300 | 470,934 | ||||||||||||||||||||

| Qualcomm, Inc. | 421,200 | 20,200,752 | ||||||||||||||||||||

| Red Hat, Inc. (a) | 40,700 | 1,178,265 | ||||||||||||||||||||

| Salesforce.com, Inc. (a) | 17,500 | 718,375 | ||||||||||||||||||||

| Sapient Corporation (a) | 15,500 | 102,300 | ||||||||||||||||||||

| Scientific-Atlanta, Inc. | 39,000 | 1,667,640 | ||||||||||||||||||||

| Solectron Corporation (a) | 235,200 | 898,464 | ||||||||||||||||||||

| Sun Microsystems, Inc. (a) | 876,300 | 3,943,350 | ||||||||||||||||||||

| Symantec Corporation (a) | 278,400 | 5,116,992 | ||||||||||||||||||||

| Tektronix, Inc. | 22,100 | 651,950 | ||||||||||||||||||||

| Tellabs, Inc. (a) | 113,700 | 1,454,223 | ||||||||||||||||||||

| Texas Instruments, Inc. | 414,178 | 12,106,422 | ||||||||||||||||||||

| Xerox Corporation (a) | 246,200 | 3,523,121 | ||||||||||||||||||||

| Xilinx, Inc. | 88,900 | 2,503,423 | ||||||||||||||||||||

| 312,231,829 | ||||||||||||||||||||||

| Materials 1.7% | ||||||||||||||||||||||

| Air Products & Chemicals, Inc. | 56,800 | 3,503,992 | ||||||||||||||||||||

| Airgas, Inc. | 17,800 | 690,284 | ||||||||||||||||||||

| Aleris International, Inc. (a) | 7,900 | 328,798 | ||||||||||||||||||||

| Bemis Company, Inc. | 28,000 | 854,560 | ||||||||||||||||||||

| Cabot Corporation | 16,300 | 639,286 | ||||||||||||||||||||

| Calgon Carbon Corporation | 10,100 | 73,326 | ||||||||||||||||||||

| Caraustar Industries, Inc. (a) | 7,200 | 78,336 | ||||||||||||||||||||

| Crown Holdings, Inc. (a) | 43,200 | 808,272 | ||||||||||||||||||||

| Ecolab, Inc. | 46,800 | 1,675,908 | ||||||||||||||||||||

| Engelhard Corporation | 31,400 | 1,265,420 | ||||||||||||||||||||

| Fuller (H.B.) Company | 7,300 | 275,867 | ||||||||||||||||||||

| Lubrizol Corporation | 18,100 | 827,894 | ||||||||||||||||||||

| MeadWestvaco Corp. | 45,812 | 1,222,722 | ||||||||||||||||||||

| Materials (Continued) | ||||||||||||||||||||||

| Minerals Technologies, Inc. | 5,300 | $ | 296,111 | |||||||||||||||||||

| Nucor Corporation | 40,100 | 3,377,623 | ||||||||||||||||||||

| Praxair, Inc. | 82,900 | 4,367,172 | ||||||||||||||||||||

| Rock-Tenn Company, Class A | 9,000 | 125,820 | ||||||||||||||||||||

| Rohm & Haas Company | 36,587 | 1,862,278 | ||||||||||||||||||||

| Schnitzer Steel Industries Inc., Class A | 5,800 | 193,952 | ||||||||||||||||||||

| Sealed Air Corporation (a) | 21,000 | 1,160,670 | ||||||||||||||||||||

| Sigma-Aldrich Corporation | 17,000 | 1,102,960 | ||||||||||||||||||||

| Sonoco Products Company | 25,645 | 794,226 | ||||||||||||||||||||

| Valspar Corporation | 26,200 | 713,164 | ||||||||||||||||||||

| Wausau-Mosinee Paper Corporation | 10,500 | 133,875 | ||||||||||||||||||||

| Wellman, Inc. | 4,400 | 31,240 | ||||||||||||||||||||

| Worthington Industries, Inc. | 17,100 | 352,773 | ||||||||||||||||||||

| 26,756,529 | ||||||||||||||||||||||

| Telecommunication Services 5.4% | ||||||||||||||||||||||

| AT&T Inc. | 1,001,167 | 25,980,284 | ||||||||||||||||||||

| BellSouth Corporation | 469,300 | 13,501,761 | ||||||||||||||||||||

| Citizens Communications Company | 86,767 | 1,064,631 | ||||||||||||||||||||

| Sprint Nextel Corporation | 756,800 | 17,323,152 | ||||||||||||||||||||

| Telephone and Data Systems, Inc. | 26,000 | 931,580 | ||||||||||||||||||||

| Verizon Communications | 748,622 | 23,701,372 | ||||||||||||||||||||

| 82,502,780 | ||||||||||||||||||||||

| Utilities 0.8% | ||||||||||||||||||||||

| AGL Resources, Inc. | 20,600 | 737,068 | ||||||||||||||||||||

| Cascade Natural Gas Corporation | 2,900 | 58,406 | ||||||||||||||||||||

| Cleco Corporation | 12,200 | 267,546 | ||||||||||||||||||||

| Energen Corporation | 19,400 | 756,988 | ||||||||||||||||||||

| Equitable Resources, Inc. | 30,700 | 1,132,830 | ||||||||||||||||||||

| IDACORP, Inc. | 11,300 | 357,758 | ||||||||||||||||||||

| KeySpan Corporation | 44,800 | 1,609,216 | ||||||||||||||||||||

| MGE Energy, Inc. | 4,400 | 151,844 | ||||||||||||||||||||

18

Domini Social Index Trust / Portfolio of Investments (Continued)

January 31, 2006 (unaudited)

| Security | Shares | Value | ||||||||||||||

| Utilities (Continued) | ||||||||||||||||

| National Fuel Gas Company | 21,800 | $ | 717,220 | |||||||||||||

| NICOR, Inc. | 11,400 | 466,260 | ||||||||||||||

| NiSource, Inc. | 71,347 | 1,464,754 | ||||||||||||||

| Northwest Natural Gas Company | 6,500 | 231,335 | ||||||||||||||

| OGE Energy Corporation | 24,200 | 657,030 | ||||||||||||||

| Peoples Energy Corporation | 9,400 | 349,868 | ||||||||||||||

| Pepco Holdings, Inc. | 49,500 | 1,138,995 | ||||||||||||||

| Utilities (Continued) | ||||||||||||||||

| Questar Corporation | 22,000 | $ | 1,792,560 | |||||||||||||

| Southern Union Company (a) | 25,521 | 643,129 | ||||||||||||||

| WGL Holdings | 12,600 | 392,868 | ||||||||||||||

| 12,925,675 | ||||||||||||||||

| Total Investments — 99.6% | ||||||||||||||||

| (Cost $1,223,232,958)(b) | 1,530,122,328 | |||||||||||||||

| Other Assets, less liabilities — 0.4% | 6,183,253 | |||||||||||||||

| Net Assets — 100.0% | $ | 1,536,305,581 | ||||||||||||||

(a)

Non-income producing security.

(b)

The aggregate cost for federal income tax purposes is $1,332,211,911. The aggregate gross unrealized appreciation is $424,058,756 and the aggregate gross unrealized depreciation is $226,148,339, resulting in net unrealized appreciation of $197,910,417.

Copyright in the Domini 400 Social IndexSM is owned by KLD Research & Analytics, Inc., and the Index is reproduced here by permission. No portion of the Index may be reproduced or distributed by any means or in any medium without the express written consent of the copyright owner.

SEE NOTES TO FINANCIAL STATEMENTS

19

Domini European Social Equity PORTFOLIO

PERFORMANCE COMMENTARY

The Domini European Social Equity Portfolio was launched in the fourth quarter of 2005. However, our market analysis covers the six-month period ended January 31, 2006.

The Fund's share price is denominated in U.S. dollars and generally will be exposed to European currency movements. In addition to other risks, the Fund will benefit when European currencies strengthen against the dollar and will be hurt when European currencies weaken against the dollar.

For the six-month period ended January 31, 2006, European equity markets and currency value generally moved in opposite directions. European stocks performed well, while the euro declined against the dollar. January was an exception to the rule, with both stock markets and the euro increasing in value. For the six-month period, the MSCI Europe index was up 11.13% in European currency terms and 11.49% in U.S. dollar terms. The broader international MSCI World index was up 10.42% in international currency terms and 10.32% in U.S. dollar terms.

The European economy grew at a slow but gradually increasing rate in 2005. The European region saw unemployment decline to a three-year low, and German investor confidence improve to its best level in two years. The European Central Bank anticipated a moderate increase in gross domestic product for 2006.

Despite economic and political uncertainty generated by the French and Dutch "no" vote against a European Constitution, followed by an indecisive German election in which no party won a majority of the parliament, the European Central Bank raised interest rates 0.25% in December, to 2.25%. This rate increase helped keep the gap between U.S. and European rates from increasing. Historically, the more U.S. interest rates exceed European rates, the more likely the U.S. dollar will gain in value against other currencies. While a stronger dollar reduces European stock returns for U.S. investors, it may benefit the European economy by making European exports more affordable for U.S. consumers.

The Domini European Social Equity Portfolio's inception date was October 3, 2005. The Fund's performance for the month of October was influenced by the process of initially investing the portfolio.

For the month of November 2005, the Fund outperformed the MSCI Europe index by 0.99%. The performance of the Fund relative to the MSCI Europe was helped in part by its overweighting to the financials sector, which outperformed the index, and its underweighting to the telecommunication services sector, which underperformed the index. The Fund's relative performance was helped in particular by its overweighting

20

to Man Group (United Kingdom:

Financials) and its underweighting

to Vodafone Group (United

Kingdom: Telecommunication

Services), which had a negative

return for the period.

| Total Return Since Inception (10/3/05)* | |||||||||

| Domini European Social Equity Portfolio | 12.16 | % | |||||||

| MSCI | 9.14 | % | |||||||

* Does not reflect sales commission

The relative performance of the Fund was not significantly hurt by its sector weighting. The Fund's relative performance was hurt in particular by its overweighting to Dampskibssel Torm (Denmark: Energy), Fresenius (Germany: Health Care), and Celesio (Germany: Health Care).

For the month of December 2005, the Fund outperformed the MSCI Europe index by 1.18%. The performance of the Fund relative to the MSCI Europe was helped in part by its underweighting to the energy sector and its overweighting to the consumer discretionary sector. The Fund's relative performance was helped in particular by its avoidance of BP (United Kingdom: Energy), which had a negative return for the period, and its overweighting to Taylor Woodrow (United Kingdom: Consumer Discretionary).

The relative performance of the Fund was not significantly hurt by its sector weighting. The Fund's relative performance was hurt in particular by its overweighting to National Express Group (United Kingdom: Industrials) and Corporación Mapfre (Spain: Financials) and by its avoidance of Siemens (Germany: Industrials).

For the month of January 2006, the Fund outperformed the MSCI Europe index by 1.78%. The performance of the Fund relative to the MSCI Europe was helped in part by its stock selection within the healthcare sector. The Fund's relative performance was helped in particular by its overweighting to Merck KGaG (Germany: Pharmaceuticals). The Fund was also helped by stock selection in the materials sector, primarily by Arcelor (Luxembourg: Materials), which returned 41.7% following the announcement of a takeover bid by Mittal Steel (Netherlands: Materials).

The relative performance of the Fund was hurt in part by stock selection in the utilities and information technology sectors. The Fund was hurt by its avoidance of BP (United Kingdom: Energy) and Royal Dutch Shell (United Kingdom: Energy).

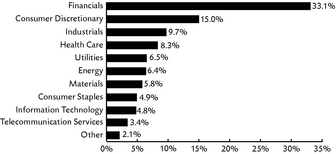

The Domini European Social Equity Portfolio invests in the Domini European Equity Trust. The table and the bar chart below provide information as of January 31, 2006, about the ten largest holdings of the

Domini European Social Equity Portfolio — Performance Commentary 21

Domini European Social Equity Trust and its portfolio holdings by industry sector and by country.

TEN LARGEST HOLDINGS

| COMPANY | % OF NET ASSETS | COMPANY | % OF NET ASSETS | ||||||||

| Statoil ASA | 3.7 | Nokia Oyj. | 2.7 | ||||||||

| Arcelor | 3.2 | Aegon N.V. | 2.4 | ||||||||

| BNP Paribas | 3.1 | Societe Generale | 2.4 | ||||||||

| Unilever NV | 3.0 | Allianz AG | 2.3 | ||||||||

| National Grid PLC | 2.8 | Koninkijke (Royal) KPN NV | 2.1 |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

The holdings mentioned above are described in the Domini European Social Equity Trust's Portfolio of Investments at January 31, 2006, included herein. The composition of the DESET is subject to change.

22 Domini European Social Equity Portfolio — Performance Commentary

Domini European Social Equity Portfolio

Expense Example

As a shareholder of the Domini European Social Equity Portfolio, you incur two types of costs:

•

Transaction costs such as sales charges (loads) on purchases and redemption fees deducted from any redemption or exchange proceeds if you sell or exchange shares of the Fund after holding them less than 60 days

•

Ongoing costs, including management fees, distribution (12b-1) fees, and other Fund expenses

This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on October 3, 2005 (commencement of operations), and held through January 31, 2006.

Actual Expenses

The line of the table captioned "Actual Expenses" below provides information about actual account value and actual expenses. You may use the information in this line, together with the amount invested, to estimate the expenses that you paid over the period as follows:

•

Divide your account value by $1,000.

•

Multiply your result in step 1 by the number in the first line under the heading "Expenses Paid During Period" in the table.

•

The result equals the estimated expenses you paid on your account during the period.

23

Hypothetical Expenses

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's return. The hypothetical account values and expenses may not be used to estimate actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical example that appears in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges and redemption fees. Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Domini European Social Equity Portfolio | Beginning Account Value as of 10/3/2005 | Ending Account Value as of 1/31/2006 | Expenses Paid During Period* 10/3/2005 − 1/31/2006 | ||||||||||||||||||||

| Actual Expenses | $ | 1,000.00 | $ | 1,121.60 | $ | 5.63 | |||||||||||||||||

| Hypothetical Expenses (5% return before expenses) | $ | 1,000.00 | $ | 1,011.27 | $ | 5.33 | |||||||||||||||||

*

Expenses are equal to the Fund's annualized expense ratio of 1.60%, multiplied by average account value over the period, multiplied by 121, and divided by 365. The example reflects the aggregate expenses of the Fund and the Domini European Social Equity Trust, the underlying portfolio in which the Fund invests.

24 Domini European Social Equity Portfolio — Expense Example

Domini European Social Equity Portfolio

Social Profiles

Diversity

Norway provides an interesting example of how government can promote diversity in corporations. A new law, which took effect on January 1, 2006, requires large publicly traded Norwegian companies to reach a target of 40% women on their boards within two years. Companies have reportedly been improving their records on diversity for some time in anticipation of the law.

Below we discuss how three of the Norwegian companies in our portfolio — DNB Nor, Hafslund, and Statoil — are meeting the challenge of increased representation for women.

DNB Nor

| Industry: Banks | Website:www.dnbnor.com | ||||

| Market Capitalization: $14.96 Billion |

DNB Nor is Norway's largest financial services group, reporting more than 2.2 million customers and 9,963 full-time employees. The company includes a leading life insurance company and a leading real estate broker.

At the end of 2004, the company reported that 21.5% of managers in its top four management levels were women. The company has set a goal of increasing this to 25% by the end of 2006 and 30% by the end of 2009. Five of the eleven members of the company's board are women.

Among the equal-opportunity measures that the company has announced are flexible working hours, computers for telecommuting, announcing all job vacancies internally, and preparing annual reports on the number of women at different management levels. The company said it will seek gender balance in recruiting trainees and will ensure 50% female participation in mentoring programs, and implement a separate program for women candidates for senior executive positions.

Hafslund

| Industry: Energy | Website: www.hafslund.no | ||||

| Market Capitalization: $2.47 Billion |

Beginning in 1898, Hafslund has generated and distributed electricity from hydropower plants on the lower Glomma River. Today, the company's nine hydroelectric plants generate an estimated 2,900 million kilowatt-hours of power each year. Hafslund reports that it is now Norway's largest home

25

alarm company and a leading transporter of valuables and provider of guards and security systems.

In its annual report for 2004, Hafslund stated its belief that "diversity leads to better decision-making and boosts innovative ability." The company reported that in 2004 the proportion of women among its top 50 or so leaders increased to 25%, with non-Norwegian managers making up 14% of the group. In June 2004, the company received an award from the foundation Ledelse, Likestilling og Mangfold (management, equality, and diversity) honoring it for its efforts to recruit more women to its board and top management. As of 2006, three of Hafslund's eight board members were women.

Statoil

| Industry: Energy | Website: www.statoil.com | ||||

| Market Capitalization: $60.19 Billion |

Statoil, an oil company that is about 70% owned by the Norwegian government, is a leader in reporting and reducing CO2 emissions from its operations, and a leading developer of carbon sequestration technology. The Norwegian government takes a share of the revenues from North Sea oil extracted by Statoil and other companies. This money is managed in a fund that recently adopted social responsibility guidelines.

Statoil also has a strong record on diversity. According to the company, 26% of Statoil managers are women and 27% of the overall workforce is female. The company has a policy of having at least 20% of managers be women at all times. Statoil offers flexible hours and telecommuting when possible. For women on maternity leave, the company pays the difference between state maternity benefits and the employee's regular salary.

As of 2006, four out of nine of Statoil's board directors were women. Kaci Kullmann Five, the deputy chair of the board, was a member of the Norwegian Parliament from 1981 to 1997 and leader of the Norwegian Conservative Party from 1991 to 1994. She currently serves as a member of the Norwegian Nobel Committee, which awards the Nobel Peace Prize.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The companies discussed above can be found in the Domini European Social Equity Trust's Portfolio of Investments at January 31, 2006, included herein. The composition of the DESET is subject to change.

The preceding profiles should not be deemed an offer to sell or a solicitation of an offer to buy the stock of any of the companies noted, or a recommendation concerning the merits of any of these companies as an investment.

26 Domini European Social Equity Portfolio — Social Profiles

Domini European Social Equity Trust

Portfolio of Investments

January 31, 2006 (Unaudited)

| Country/ Security | Industry | Shares | Value | |||||||||||||||||||

| AUSTRIA – 1.1% | ||||||||||||||||||||||

| OMV AG | Energy | 3,723 | $ | 262,887 | ||||||||||||||||||

| 262,887 | ||||||||||||||||||||||

| BELGIUM – 0.9% | ||||||||||||||||||||||

| Fortis | Diversified Financials | 5,829 | 202,648 | |||||||||||||||||||

| 202,648 | ||||||||||||||||||||||

| DENMARK – 2.4% | ||||||||||||||||||||||

| A/S Dampskibsselskabet Torm A/S | Energy | 6,273 | 308,195 | |||||||||||||||||||

| Danske Bank A/S | Banks | 7,456 | 261,698 | |||||||||||||||||||

| 569,893 | ||||||||||||||||||||||

| FINLAND – 5.3% | ||||||||||||||||||||||

| Kesko Oyj | Food & Staples Retailing | 5,865 | 173,774 | |||||||||||||||||||

| Nokia Oyj | Technology Hardware & Equipment | 34,035 | 621,997 | |||||||||||||||||||

| Sampo Oyj | Insurance | 10,236 | 199,370 | |||||||||||||||||||

| TietoEnator Oyj | Software & Services | 3,860 | 149,990 | |||||||||||||||||||

| Uponor Oyj | Capital Goods | 4,406 | 108,716 | |||||||||||||||||||

| 1,253,847 | ||||||||||||||||||||||

| FRANCE – 12.6% | ||||||||||||||||||||||

| Assurances Generales de France | Insurance | 2,203 | 227,919 | |||||||||||||||||||

| BNP Paribas | Banks | 8,046 | 717,137 | |||||||||||||||||||

| Ciments Francais SA | Materials | 1,252 | 174,075 | |||||||||||||||||||

| CNP Assurances | Insurance | 3,342 | 290,161 | |||||||||||||||||||

| Natexis Banques Populaires | Banks | 899 | 168,224 | |||||||||||||||||||

| Neopost SA | Technology Hardware & Equipment | 1,018 | 102,292 | |||||||||||||||||||

| Sanofi-Aventis | Pharmaceuticals & Biotechnology | 5,101 | 467,639 | |||||||||||||||||||

| Societe Generale | Banks | 4,227 | 557,940 | |||||||||||||||||||

| Vivendi Universal SA | Media | 8,161 | 255,477 | |||||||||||||||||||

| 2,960,864 | ||||||||||||||||||||||

| GERMANY – 11.9% | ||||||||||||||||||||||

| Adidas-Salomon AG | Consumer Durables & Apparel | 748 | 156,318 | |||||||||||||||||||

| Allianz AG | Insurance | 3,298 | 531,232 | |||||||||||||||||||

| Celesio AG | Health Care Equipment & Services | 1,942 | 181,697 | |||||||||||||||||||

| Continental AG | Automobiles & Components | 2,030 | 197,449 | |||||||||||||||||||

| Deutsche Post AG | Transportation | 3,312 | 93,264 | |||||||||||||||||||

| Douglas Holding AG | Retailing | 6,580 | 291,958 | |||||||||||||||||||

| Fresenius AG | Health Care Equipment & Services | 3,130 | 471,294 | |||||||||||||||||||

| Linde AG | Materials | 2,921 | 237,505 | |||||||||||||||||||

| Merck KGaA | Pharmaceuticals & Biotechnology | 3,495 | 374,908 | |||||||||||||||||||

| Schering AG | Pharmaceuticals & Biotechnology | 3,611 | 246,866 | |||||||||||||||||||

| 2,782,491 | ||||||||||||||||||||||

| IRELAND – 0.9% | ||||||||||||||||||||||

| Bank of Ireland | Banks | 11,100 | 190,320 | |||||||||||||||||||

| Depfa Bank plc | Banks | 1,217 | 20,822 | |||||||||||||||||||

| 211,142 | ||||||||||||||||||||||

27

Domini European Social Equity Trust / Portfolio of Investments (Continued)

January 31, 2006 (Unaudited)

| Country/ Security | Industry | Shares | Value | |||||||||||||||||||

| ITALY – 3.9% | ||||||||||||||||||||||

| Banche Popolari Unite Scpa (a) | Banks | 8,095 | $ | 189,714 | ||||||||||||||||||

| Fiat S.p.A. (a) | Automobiles & Components | 40,237 | 394,299 | |||||||||||||||||||

| Italcementi S.p.A. | Materials | 3,484 | 66,378 | |||||||||||||||||||

| Seat Pagine Gialle S.p.A (a) | Media | 511,383 | 266,397 | |||||||||||||||||||

| 916,788 | ||||||||||||||||||||||

| LUXEMBOURG – 3.2% | ||||||||||||||||||||||

| Arcelor | Materials | 21,208 | 744,258 | |||||||||||||||||||

| 744,258 | ||||||||||||||||||||||

| NETHERLANDS – 11.7% | ||||||||||||||||||||||

| ABN AMRO Holding NV | Banks | 12,368 | 343,172 | |||||||||||||||||||

| Aegon N.V. | Insurance | 34,961 | 564,627 | |||||||||||||||||||

| ING Groep N.V. | Diversified Financials | 13,221 | 471,514 | |||||||||||||||||||

| Koninklijke (Royal) KPN NV | Telecommunication Services | 51,392 | 496,122 | |||||||||||||||||||

| Oce N.V. | Technology Hardware & Equipment | 6,095 | 107,465 | |||||||||||||||||||

| Unilever NV | Food Beverage & Tobacco | 10,115 | 709,323 | |||||||||||||||||||

| Wolters Kluwer NV | Media | 2,806 | 62,081 | |||||||||||||||||||

| 2,754,304 | ||||||||||||||||||||||

| NORWAY – 6.1% | ||||||||||||||||||||||

| DNB Nor ASA | Banks | 14,750 | 165,057 | |||||||||||||||||||

| Hafslund ASA | Utilities | 1,907 | 23,918 | |||||||||||||||||||

| Norsk Hydro ASA | Energy | 293 | 35,934 | |||||||||||||||||||

| Orkla ASA | Food Beverage & Tobacco | 7,004 | 278,790 | |||||||||||||||||||

| Statoil ASA | Energy | 31,324 | 861,021 | |||||||||||||||||||

| Telenor ASA | Telecommunication Services | 7,578 | 75,979 | |||||||||||||||||||

| 1,440,699 | ||||||||||||||||||||||

| SPAIN – 1.7% | ||||||||||||||||||||||

| Corporacion Financiera Alba, S.A. | Diversified Financials | 1,325 | 63,586 | |||||||||||||||||||

| Corporacion Mapfre S.A. | Insurance | 10,659 | 191,042 | |||||||||||||||||||

| Sacyr Vallehermoso S.A. | Capital Goods | 5,644 | 143,718 | |||||||||||||||||||

| 398,346 | ||||||||||||||||||||||

| SWEDEN – 6.4% | ||||||||||||||||||||||

| AB SKF (a) | Capital Goods | 1,720 | 24,055 | |||||||||||||||||||

| Atlas Copco AB (a) | Capital Goods | 1,016 | 21,480 | |||||||||||||||||||

| Electrolux AB | Consumer Durables & Apparel | 2,600 | 69,310 | |||||||||||||||||||

| Eniro AB | Media | 3,900 | 50,703 | |||||||||||||||||||

| ForeningsSparbanken AB | Banks | 10,488 | 298,178 | |||||||||||||||||||

| Nordea Bank AB | Banks | 46,072 | 494,594 | |||||||||||||||||||

| Scania AB | Capital Goods | 3,245 | 127,838 | |||||||||||||||||||

| Skanska AB | Capital Goods | 7,988 | 123,778 | |||||||||||||||||||

| SSAB Svenskt Stal AB | Materials | 2,200 | 95,192 | |||||||||||||||||||

| Svenska Handelsbanken AB | Banks | 7,755 | 190,435 | |||||||||||||||||||

| 1,495,563 | ||||||||||||||||||||||

28

Domini European Social Equity Trust / Portfolio of Investments (Continued)

January 31, 2006 (Unaudited)

| Country/ Security | Industry | Shares | Value | |||||||||||||||||||

| SWITZERLAND – 3.2% | ||||||||||||||||||||||