UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21653

DOMINI ADVISOR TRUST

(Exact Name of Registrant as Specified in Charter)

536 Broadway, 7th Floor, New York, New York 10012

(Address of Principal Executive Offices)

Amy L. Domini

Domini Social Investments LLC

536 Broadway, 7th Floor

New York, New York 10012

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 212-217-1100

Date of Fiscal Year End: July 31

Date of Reporting Period: January 31, 2007

Item 1.

Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 follows.

SEMI-ANNUAL REPORT 2007 | JANUARY 31, 2007 |

| (UNAUDITED) |

CLASS A SHARES DOMINI EUROPEAN SOCIAL EQUITY PORTFOLIOSM CLASS A SHARES DOMINI PACASIA SOCIAL EQUITY PORTFOLIOSM CLASS A SHARES DOMINI EUROPACIFIC SOCIAL EQUITY PORTFOLIOSM CLASS A SHARES | |

THIS PAGE INTENTIONALLY LEFT BLANK

TABLE OF CONTENTS

| ||

| ||

| ||

| ||

|

| Fund Performance and Holdings |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| Domini Social Equity Trust |

|

| Domini European Social Equity Trust |

|

| Domini PacAsia Social Equity Trust |

|

| Domini EuroPacific Social Equity Trust |

| ||

|

| Domini Social Equity Portfolio |

|

| Domini European Social Equity Portfolio |

|

| Domini PacAsia Social Equity Portfolio |

|

| Domini EuroPacific Social Equity Portfolio |

| Board of Trustees’ Consideration of Management and | |

| ||

|

THE WAY YOU INVEST MATTERS |

Dear Fellow Shareholders:

With the launch of two more international funds in 2006, Domini Social Investments moved decisively into assessing corporate social responsibility at a global level. Our European and PacAsia funds are the only socially responsible regional funds offered by a U.S. investment advisor. Designing them has enabled us to address war, poverty, and environmental degradation — themes that are integrated throughout our Global Investment Standards — on a scale we have never before faced.

Social investing has always had an international dimension. In the 1980s, during the anti-apartheid movement, concerned investors pressed U.S. companies to report on their activities in South Africa. By applying clear behavior standards to the companies in their portfolios, investors played a key role in bringing about freedom for the South African majority. But the issues facing us now are myriad and complex.

Today we are called to action by the horrors of the ongoing genocide in Sudan. In a recent column, Nicholas Kristof of the New York Times encouraged readers to ask whether their investments are “helping finance the janjaweed militias that throw babies into bonfires in Darfur and Chad.” Though not usually a supporter of economic sanctions, Kristof argued that Sudan is “a rare instance where narrowly focused divestment makes practical as well as moral sense.”

We at Domini first spoke out on the Darfur genocide in early 2005. We sent out an Action Alert asking shareholders to join us in supporting economic sanctions and diplomatic initiatives to put pressure on the Sudanese government.* Like you, we do not wish to own companies that support or profit from unspeakable abuses of human dignity.

But social investing is not just about standing up against abuses. It is also about helping to create opportunities. By encouraging companies to offer fair wages, pay their fair share of taxes, work in partnership with community organizations, and take other initiatives, we can make a difference.

For example, a few years ago we learned that families of coffee growers in many countries were facing starvation because coffee prices had plunged. We began dialogue with one of the world’s largest coffee roasters. Eventually they agreed to begin buying Fair Trade Certified® coffee, paying growers a guaranteed minimum price for their crop. This shields farmers and their families from the fluctuations of the market, allows them to plan for the future, and helps make the coffee industry more sustainable. By investing internationally we will be able to find new ways of using our influence to make people’s lives better.

Direct community investing offers some of the most concrete and inspiring examples of investors’ power to transform lives and neighborhoods. In 2006, microfinance — one of the most targeted and effective forms of

2

THE WAY YOU INVEST MATTERS |

community investing — finally came to worldwide attention when Muhammad Yunus and Grameen Bank of Bangladesh won the Nobel Peace Prize. In his Nobel acceptance speech, Yunus said, “Once the poor can unleash their energy and creativity, poverty will disappear very quickly.”

In this report, we highlight companies in the Domini Funds that work to expand their business opportunities by drawing on that energy and creativity. The results are helping to alleviate poverty and encouraging sustainable economic development worldwide.

As a Domini shareholder, you are doing your part to help realize this vision. Thank you for your trust in us, and for your commitment to creating a better future for everyone.

Very truly yours,

![]()

Amy Domini

amy@domini.com

______________

* | To receive Action Alerts, visit www.domini.com, go to the “About Domini” section, and select “Domini Updates.” |

THE DARFUR CRISIS |

Perhaps the most urgent humanitarian crisis in the world is taking place in the Darfur region of Sudan. The genocidal violence by government-backed militias has included the mass murder of women and children, the destruction of villages, and the displacement of hundreds of thousands of Sudanese.

Domini’s Global Investment Standards express our fundamental commitment to building a world that values and protects human dignity. The Darfur crisis obliges us and other investors to look closely at not just whether, but also how, a company may pursue business activities in Sudan. In our evaluation, we consider the nature and extent of a company’s activities, whether it operates primarily outside government stronghold areas, whether the company has supported the efforts of humanitarian organizations working to address human rights abuses in Sudan, and whether the company has been transparent about its operations and their impact.

Our investment decisions are grounded in our standards and based upon our own research. We seek to avoid investing in companies whose activities provide direct or substantial indirect benefits to the Sudanese government, or that are complicit in human rights abuses in Sudan. To learn more about Domini’s policies, visit www.domini.com. For information on other ways you can help, visit www.savedarfur.org and www.sudandivestment.org.

3

THE WAY YOU INVEST MATTERS |

Domini Named as World-Changing Company: Plenty magazine, in its February 2007 issue, honored Domini as one of 20 companies that are changing the world, citing our use of social and environmental investment standards, and our activism work with such companies as Coca-Cola, Dell, and JPMorgan Chase.

Domini Among “Most Activist”: Domini was one of only four fund families rated “most activist” in a comprehensive study of the proxy voting activity of 45 mutual fund families, conducted by The Corporate Library, a respected corporate governance expert. In 2001, Domini petitioned the SEC for the rule that now requires funds to disclose their votes, making such studies possible.

Active Management Strategy: On November 30, 2006, the Domini Social Equity Portfolio, formerly an index fund, transitioned to an active management strategy, combining Domini’s social and environmental research with Wellington Management’s quantitative stock selection and portfolio construction.

First Anniversary for European Fund: The Domini European Social Equity Portfolio completed its first year on October 3, 2006, and gained attention from Money magazine (January 2007) and the Wall Street Journal (January 4, 2007) for strong 2006 performance.

New International Funds: Domini launched two new international funds: Domini PacAsia Social Equity Portfolio and Domini EuroPacific Social Equity Portfolio. Domini is the only investment advisor in the U.S. to offer regional mutual funds that include social and environmental as well as financial standards.

Past performance is no guarantee of future results. The returns referenced above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Certain fees payable during the period were waived, and the Fund’s total return would have been lower had these not been waived. Current performance may be lower or higher than the performance data referenced. For performance information current to the most recent month-end, call 1-800-762-6814 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 60 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data referenced above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information. The Domini Funds are subject to market risks and are not insured. You may lose money.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

4

THE WAY YOU INVEST MATTERS |

THE WAY YOU INVEST MATTERS: POVERTY

In a world where more than a billion workers earn less than two dollars a day, alleviating poverty is the key to addressing sickness, malnutrition, illiteracy, and other critical and interrelated challenges.

Corporations, through their core business activities, can help lift people out of poverty in a number of ways: by avoiding harmful practices that impoverish struggling communities, by providing employment at a fair wage and products at a fair price, and by helping to enrich the communities on which they depend for their staff and their customers. Additional ways of supporting communities can include building partnerships with community organizations, engaging in creative philanthropy, working honestly and transparently with government, and paying a fair share of taxes.

In this section, we profile companies that are making notable contributions to alleviating poverty in the U.S. and around the world. Whether by providing low-cost loans, insurance, or medicine, or by creating jobs where employment is scarce, each is helping provide poor people with greater opportunities.

Several of the profiled companies participate in an innovative type of finance that has become a global phenomenon. Beginning in 1974, an economics professor named Muhammad Yunus found that by lending small amounts of money to the poor — usually to women — he could help them support themselves by buying a dairy cow, making bamboo stools, or starting other small businesses. Grameen Bank, Yunus’s creation, has now loaned more than $5.3 billion to almost seven million borrowers. In 2006, after social entrepreneurs in dozens of companies worldwide emulated this innovative model, Yunus and Grameen Bank were honored with the Nobel Peace Prize.

As we have said many times, the social and environmental performance of large companies is often mixed and complex. Weighing the positives and negatives, Domini assesses corporate conduct across a broad range of issues, and engages with companies when we believe their behavior needs improvement.

Allianz

Domini European Social Equity Portfolio

Domini EuroPacific Social Equity Portfolio

Just as small loans, as pioneered by Grameen Bank, can offer poor people opportunity to develop new businesses, small insurance policies can help prevent families from being driven back into poverty by death, illness, or natural disaster.

The German insurance company Allianz introduced “microinsurance” in India through its subsidiary Allianz Bajaj Life Insurance. The company’s

5

THE WAY YOU INVEST MATTERS |

first life insurance product was launched in 2003, and by 2006 it covered more than 100,000 customers. Also in 2006, Allianz and CARE partnered to offer small insurance policies to people of Tamil Nadu, a state in southern India, who were affected by the December 2004 tsunami. The insurance is designed for coastal people who work in fishing, agriculture, and plantations.

An Allianz pilot project in Indonesia offers a product called Payung Keluarga or Family Umbrella, The policy covers the outstanding balance of a loan if the borrower dies, and the borrower’s family receives twice the original loan amount as an additional payout.

Through these innovative ventures, Allianz is developing new ways to extend its core business into new markets and at the same time provide vital financial services in historically underserved communities.

Gilead Sciences

Domini Social Equity Portfolio

Along with the devastating human toll of HIV/AIDS comes a severe impact on the economic life of families and of countries. The vast majority of people living with AIDS are aged 15 to 49, in what would ordinarily be their prime working years. When breadwinners become sick or die, families sink into poverty. When a devastating disease becomes epidemic, widespread poverty follows in its path.

The U.S. pharmaceutical company Gilead Sciences has based its business model on creating and manufacturing drugs that treat infectious diseases, including AIDS and hepatitis, that disproportionately afflict developing countries. Doing business in developing markets is complex, however, and controversies can develop over issues such as the pricing of drugs and the conduct of clinical trials with weak government oversight.

In 97 developing countries, including every country in Africa, Gilead makes its primary HIV drugs, Truvada and Viread, available at no-profit prices. The company granted eight Indian drug companies the right to produce and sell generic versions of Viread. Gilead has also worked with the Bill and Melinda Gates Foundation and the Centers for Disease Control and Prevention to develop clinical trials of Viread for potential use as a preventive drug.

Procter & Gamble

Domini Social Equity Portfolio

In 2003, the price of coffee was near a 30-year low, and small coffee farmers could not earn the money they needed to feed their families, send their children to school, buy essential medicines, and stay on their land. After an intensive dialogue that Domini helped lead, Procter & Gamble, one of the world’s largest coffee roasters, began to sell Fair Trade Certified® coffee. The Fair Trade certification system helps to alleviate poverty and hardship by guaranteeing farmers a minimum price per pound

6 | The Way You Invest Matters: Poverty |

THE WAY YOU INVEST MATTERS |

for their crop, and by supporting democratically managed cooperatives and more environmentally sound farming techniques.

Total Fair Trade coffee imports to the U.S. have increased from under 10 million pounds in 2002 to more than 60 million pounds in 2005, when imports reached a total retail value of about half a billion dollars. These imports have translated into more than $60 million in cumulative additional income to coffee farmers.

Procter & Gamble has also addressed poverty by promoting better health. Working with the Centers for Disease Control and Prevention, the company developed an easy-to-use water treatment system called PUR, which packages the chemicals used in municipal water systems into small packets or “sachets.” PUR has been used in Bangladesh, Botswana, Haiti, Iran, and Malawi — and in refugee camps in Chad for people fleeing genocide in Sudan.

Telenor

Domini European Social Equity Portfolio

As Muhammad Yunus proved through his work with Grameen Bank, by giving a woman in a developing country a small loan to buy a cow, she can sell milk to repay the loan, make a profit, and become a small entrepreneur. Iqbal Quadir, who grew up in a wealthy family in Bangladesh, realized in 1993 that a mobile telephone could fight poverty as effectively as a cow. He searched for a partner in his project but was rejected repeatedly until he asked the Norwegian telecommunications company Telenor, then a state-owned phone provider.

The Norwegian government was then laying fiber optic cable along railway lines in Bangladesh — a good start toward a system of mobile transmission towers. Telenor agreed to help Quadir found GrameenPhone in 1997. According to then-CEO Tormod Hermansen, “I’m interested in bottom-up development and saw in this an effective way to help a population to move forward.” Muhammad Yunus has criticized Telenor for its majority ownership of GrameenPhone, arguing that the company should be owned by the people of Bangladesh. We are following this controversy, but believe that it does not detract from GrameenPhone’s remarkable achievements.

As of 2006, GrameenPhone had more than 10 million customers. More than 260,000 “phone lady” entrepreneurs were doing business in more than 50,000 villages throughout Bangladesh, providing a stable livelihood for their families and vital communication services to previously isolated villages. The Village Phone Program has been replicated in countries including Uganda and Rwanda.

Unilever

Domini EuroPacific Social Equity Portfolio

With headquarters in the Netherlands, Unilever is an international food and personal care company. Project Shakti, a small pilot project launched

The Way You Invest Matters: Poverty | 7 |

THE WAY YOU INVEST MATTERS |

by Unilever’s Indian subsidiary Hindustan Lever and the government of Andhra Pradesh state, helps train women to sell Hindustan Lever products such as soap, toothpaste, and shampoo.

As of 2005, about 13,000 poor women were selling the company’s products in 50,000 villages. This accounted for about 15% of the company’s rural sales in 12 Indian states. Through this program, Unilever is expanding its business in a growing part of the world, providing useful products to the poor, and providing business opportunities for Indian women.

CARE India has approached the company to promote other small rural businesses. In one state, Hindustan Lever agreed to help create packaging and branding for pickles and spices made by a local group of small-scale entrepreneurs working with CARE.

Westpac Banking Corporation

Domini PacAsia Social Equity Portfolio

Beginning in 2001, the Australian bank Westpac has helped provide much-needed financial services to the indigenous people of Australia’s Cape York Peninsula. The 12,000 people in this isolated region suffer from extreme poverty, unemployment, and substance abuse.

Working with the Balkanu Cape York Development Corporation, the bank sends employees to the region and supports a “business hubs” program that provides small enterprise loans and other services for indigenous ventures. As of 2004, five successful start-up businesses had been launched, including a company that offers rainforest walking tours, with another forty being incubated. In December 2006, Westpac reported having assessed plans for a cattle station, a camping ground, and a crocodile watching cruise.

Westpac has also partnered with the nonprofit Opportunity International Australia to provide microfinance and enterprise development services to people in Tamil Nadu, India, who were affected by the tsunami of December 2004.

Unlike other mutual funds, the Domini Social Equity Portfolio, Domini European Social Equity Portfolio, Domini PacAsia Social Equity Portfolio, and Domini EuroPacific Social Equity Portfolio seek to achieve their investment objectives by investing all of their investable assets, respectively, in separate portfolios with identical investment objectives called the Domini Social Equity Trust, the Domini European Social Equity Trust, the Domini PacAsia Social Equity Trust, and the Domini EuroPacific Social Equity Trust. References to each Domini Fund include the applicable Domini Trust, unless the context otherwise requires.

The holdings discussed above can be found in the portfolios of the Domini Funds, included herein. The composition of the Funds’ portfolios is subject to change.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The preceding profiles should not be deemed an offer to sell or a solicitation of an offer to buy the stock of any of the companies noted, or a recommendation concerning the merits of any of these companies as an investment.

8 | The Way You Invest Matters: Poverty |

THE WAY YOU INVEST MATTERS |

THE WAY YOU INVEST MATTERS: ACTIVISM

As Domini shareholders, you make a difference in the world. By applying social and environmental standards to our holdings, Domini and its shareholders create accountability, encourage transparency, spur demand for more information, and reshape the way the world thinks about corporations and their role in our lives. By engaging in dialogue with the companies we invest in, filing shareholder resolutions, and actively voting our proxies, we make our voices heard on a wide range of issues. By investing in underserved communities, we help low-income people buy homes, start businesses, and revitalize their neighborhoods.

Here are a few recent highlights of Domini’s shareholder activism, which each year includes meetings with dozens of companies on a wide range of important issues. (For more information, visit our website, www.domini.com.)

Climate Change: As part of our work with the Carbon Disclosure Project, we contacted more than 200 U.S. and European companies, asking them to disclose their greenhouse gas emissions and climate change policies. Following Domini’s shareholder resolution, Devon Energy, the largest U.S-based independent oil and gas producer, committed to measure and publicly report its greenhouse gas emissions.

Forestry Practices: Greenpeace has charged Kimberly-Clark with buying wood fiber that is cut from old-growth forests in British Columbia. After meetings with Domini, the company commissioned a study to evaluate the feasibility of phasing out its use of wood fiber from sources not certified by the Forest Stewardship Council (FSC). The FSC certifies that wood is produced in a way that does not destroy habitat, pollute water, displace indigenous people, or harm wildlife.

Freedom of Expression on the Internet: Domini joined a multi-stakeholder group that is developing policies on Internet privacy and freedom of expression. The group includes Google, Microsoft, Vodafone, and Yahoo!, as well as human rights organizations and academics. Domini achieved a significant vote of 29% for a resolution (co-filed with Boston Common Asset Management) calling on Cisco Systems to address Internet censorship and surveillance under repressive regimes.

Political Contributions: Domini believes that shareholders have a right to know how the companies they own are influencing the political system. After a 33% vote for a resolution filed by Domini, Verizon committed to annual public disclosure of its political contributions. Hewlett-Packard also agreed to disclose its contributions, in exchange for withdrawal of our resolution (co-filed with Trillium Asset Management).

9

FUND PERFORMANCE AND HOLDINGS

ECONOMIC AND MARKET BACKGROUND

United States Markets Financial markets in the U.S. were generally strong in the six months ended January 31, 2007, with the S&P 500 Index returning 13.75%.

At least in part, this performance reflects a renewed focus by investors on corporate results. During the third quarter of 2006, more than 70% of the companies in the S&P 500 reported earnings above consensus expectations. The six-month period also saw a reversal in the long rise of crude oil prices, in part because of unusually warm weather in the U.S. and Europe, resulting in underperformance for energy stocks.

After five years of economic growth without a sustained increase in wages, the share of U.S. economic production going to workers’ pay and benefits has fallen to its lowest level in 40 years. Recent hopeful signs of change, however, have included an uptick in wages and a likely increase in the federal minimum wage. And excessive CEO compensation attracted more attention, with the sudden departures of highly paid CEOs at Home Depot and Pfizer and the introduction of improved disclosure requirements and a bill that would require a shareholder advisory vote on executive compensation.

In recent months, housing starts dropped to their lowest number since 2000. This may point to a softening of home prices, with homeowners less able (or less willing) to borrow against the value of their homes. Since mortgage and home equity loan borrowings have been fueling consumer spending, which in turn has been an important economic driver, there could be a negative impact on economic growth during 2007.

European Markets The European stock market had strong returns for this six-month period, with the MSCI Europe Index returning 16.74%. For U.S.-based investors, total return was improved by the strengthening of European currencies against the dollar.

Underlying Europe’s strong markets was accelerating economic growth. Economic, business, and consumer confidence indicators continue to point to the best conditions since 2001. European exports, however, are vulnerable to the declining dollar, which raises the price of European products sold in the U.S. For this reason, consumption and trade within Europe — particularly consumer spending — is an increasingly important factor for the region’s continued economic vitality.

The benefits of growth in Europe have not entirely bypassed workers and the middle class. In October, the jobless rate in the euro zone fell to 7.6%, its lowest level in over five years. This appears to be increasing wage levels and buoying consumer spending. German steelworkers, for instance,

10

recently negotiated their biggest wage increase in a decade, following five years of job cuts in Germany. A survey of German retailers indicated that a planned increase in the country’s value added tax may dampen consumer spending less than expected.

Asian Markets The Domini PacAsia Social Equity Portfolio and Domini EuroPacific Social Equity Portfolio were launched on December 27, 2006, toward the end of this six-month period.

The decline in commodity prices over recent months was among the notable factors affecting the Asian markets as of early 2007. In January, Japan saw a sell-off in commodities sector stocks, and zinc prices suffered their biggest one-day drop since September 11, 2001. The Asian markets are particularly sensitive to fluctuations in the commodities markets, largely due to the purchasing practices of China and India.

In Japan, the region’s largest market, a new law caused share price declines for consumer finance companies. The legislation reduces the maximum rate companies can charge for consumer loans from 29% to 20%, and limits the total amount a person can borrow to one-third of the borrower’s annual income. Domini carefully examines the lending practices of Japanese financial companies due to the prevalence of predatory lending. The top four consumer lenders in Japan do not meet Domini’s standards.

Recent Developments In late February, after the end of the period covered by this report, stock markets in the U.S., Europe, and Asia declined, in volatility driven not by a specific event but by concern over a variety of risks. At the time of writing, it remains unclear whether this will be a brief interruption within a persistent bull market or the beginning of a meaningful correction. As always, the Funds’ manager and submanager continue to monitor market developments closely, focusing on the Funds’ long-term investment objectives.

Economic and Market Background | 11 |

DOMINI SOCIAL EQUITY PORTFOLIO

PERFORMANCE COMMENTARY

For the six months ended January 31, 2007, the Fund returned 15.11%, excluding sales charges, outperforming the S&P 500 Index return of 13.75%. Because a significant transition in the Fund’s management approach occurred during the period, we will divide our discussion of performance into two parts.

During the four months ended November 29, 2006, the Fund was managed as an index fund. In this period, the Fund’s performance was helped by its underweighting to the energy sector, which underperformed as oil and gas prices declined, and its overweighting to the information technology sector. Stocks that helped performance included Microsoft and Cisco Systems, which returned 22.9% and 50.5%, respectively, for the period. In the same four-month period, the Fund’s performance was hurt by an overweighting in the consumer staples sector and by stock selection within the financials sector.

On November 30, 2006, the Fund transitioned to an active investment strategy, and Wellington Management Company became the Fund’s submanager. During December, the Fund’s performance of 1.52%, excluding sales charges, outpaced that of the S&P 500, which returned 1.40%. The Fund’s outperformance continued with a total return of 2.28% in January, excluding sales charges, versus 1.51% for the index.

In December and January, as in many recent periods, the energy sector played a key role in Fund performance. Starting in 2002, the price of crude oil rose dramatically from under $20 per barrel to a high in mid-2006 of nearly $80 a barrel. Oil stocks, many of which are ineligible for Fund investment, performed extremely well as a result. More recently, however, oil prices have come back down to $50-$60 a barrel. During this two-month period, energy was the only sector in the S&P to produce a negative total return, and the Fund’s performance was helped by its underweighting to the sector (now based on an active investment decision rather than on index construction), including the omission of ExxonMobil for social and environmental reasons. Under the Fund’s new strategy, stock selection helped performance in other sectors, including industrials (where Navistar and Cummins were particularly strong) and consumer staples (where Kroger and Estee Lauder were notable).

Holdings that hurt performance during this two-month period included technology companies like Symantec, Lexmark, and Motorola.

12

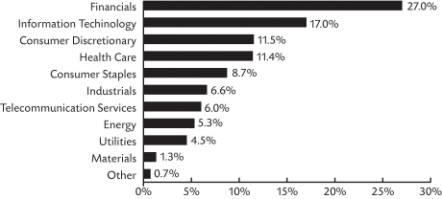

The Domini Social Equity Portfolio invests in the Domini Social Equity Trust. The table and bar chart below provide information as of January 31, 2007, about the ten largest holdings of the Domini Social Equity Trust and its portfolio holdings by industry sector:

TEN LARGEST HOLDINGS

COMPANY |

| % NET |

Citigroup Inc |

| 4.35% |

AT&T Inc |

| 4.18% |

Bank of America Corporation |

| 3.73% |

Johnson & Johnson |

| 3.62% |

Intl Business Machines Corp |

| 3.47% |

JP Morgan Chase & Co. |

| 3.35% |

Hewlett-Packard Company |

| 2.94% |

Goldman Sachs Group Inc |

| 2.77% |

Merck & Co. Inc. |

| 2.67% |

Microsoft Corp |

| 2.38% |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

______________

The holdings mentioned above are described in the Domini Social Equity Trust’s Portfolio of Investments at January 31, 2007, included herein. The composition of the Trust’s portfolio is subject to change.

Domini Social Equity Portfolio — Performance Commentary | 13 |

AVERAGE ANNUAL TOTAL RETURNS

|

|

|

| Domini Social Equity |

| Domini Social Equity |

| S&P 500 |

|

|

| 1 year |

| 6.95% |

| 12.28% |

| 15.79% |

|

As of |

| 5 year |

| 3.68% |

| 4.70% |

| 6.19% |

|

12-31-06 |

| 10 year |

| 7.02% |

| 7.54% |

| 8.42% |

|

|

| Since Inception(1) |

| 9.57% |

| 9.92% |

| 10.82% |

|

|

| 1 year |

| 7.29% |

| 12.64% |

| 14.51% |

|

As of |

| 5 year |

| 4.24% |

| 5.26% |

| 6.82% |

|

1-31-07 |

| 10 year |

| 6.50% |

| 7.02% |

| 7.92% |

|

|

| Since Inception(1) |

| 9.68% |

| 10.02% |

| 10.87% |

|

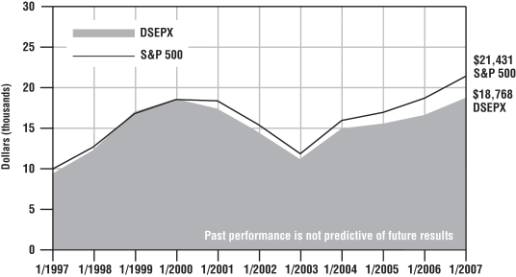

COMPARISON OF $10,000 INVESTMENT IN THE

DOMINI SOCIAL EQUITY PORTFOLIO (WITH 4.75% MAXIMUM SALES CHARGE) AND S&P 500

Past performance is no guarantee of future results. The fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 60 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the fund’s prospectus for further information.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini Social Equity Portfolio is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived. The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

______________

(1) | The Domini Social Equity Portfolio, which commenced operations on May 1, 2005, invests all of its assets in the Domini Social Equity Trust (DSET), which has the same investment objectives as the Fund. The DSET commenced operations on June 3, 1991. Performance prior to the Fund’s commencement of operations is the performance of the DSET adjusted for expenses of the Fund. |

This material must be preceded or accompanied by the Fund’s current prospectus. DSIL Investment Services LLC, Distributor. 03/07

14 | Domini Social Equity Portfolio — Performance Commentary |

DOMINI SOCIAL EQUITY TRUST

PORTFOLIO OF INVESTMENTS

JANUARY 31, 2007 (UNAUDITED)

SECURITY |

| SHARES |

| VALUE |

| |

Consumer Discretionary – 11.5% |

|

|

|

|

|

|

American Eagle Outfitters Inc. |

| 375,750 |

| $ | 12,166,785 |

|

AutoZone, Inc. (a) |

| 54,047 |

|

| 6,789,925 |

|

Best Buy Co., Inc. |

| 858 |

|

| 43,243 |

|

Bright Horizons Family Solutions, Inc. (a) |

| 443 |

|

| 17,352 |

|

CBS Corporation, Class B |

| 989,200 |

|

| 30,833,364 |

|

Comcast Corporation, Class A (a) |

| 112,700 |

|

| 4,994,864 |

|

Disney (Walt) Company (The) |

| 5,337 |

|

| 187,702 |

|

Family Dollar Stores Inc. |

| 123,071 |

|

| 3,987,500 |

|

Gap Inc. |

| 2,187 |

|

| 41,925 |

|

Home Depot, Inc. (The) |

| 3,344 |

|

| 136,235 |

|

Horton (D.R.), Inc. |

| 1,975 |

|

| 57,394 |

|

Interface, Inc., Class A (a) |

| 1,268 |

|

| 19,299 |

|

Johnson Controls, Inc. |

| 818 |

|

| 75,632 |

|

Kohl’s Corporation (a) |

| 385,100 |

|

| 27,307,441 |

|

Limited Brands |

| 868 |

|

| 24,252 |

|

Lowe’s Companies, Inc. |

| 2,686 |

|

| 90,545 |

|

McDonald’s Corporation |

| 168,474 |

|

| 7,471,822 |

|

McGraw-Hill Companies |

| 1,512 |

|

| 101,425 |

|

Meredith Corporation |

| 623 |

|

| 36,732 |

|

NIKE, Inc., Class B |

| 1,194 |

|

| 117,979 |

|

Nordstrom, Inc. |

| 403,603 |

|

| 22,484,723 |

|

Penney (J.C.) Company, Inc. |

| 111,417 |

|

| 9,051,517 |

|

Pulte Homes, Inc. |

| 1,594 |

|

| 54,738 |

|

Radio One, Inc. (a) |

| 2,279 |

|

| 16,682 |

|

Scholastic Corporation (a) |

| 310,022 |

|

| 10,959,278 |

|

Staples, Inc. (a) |

| 1,858 |

|

| 47,788 |

|

Starbucks Corporation (a) |

| 2,378 |

|

| 83,087 |

|

Target Corporation |

| 1,736 |

|

| 106,521 |

|

Time Warner, Inc. |

| 9,376 |

|

| 205,053 |

|

Washington Post Company, Class B |

| 95 |

|

| 72,457 |

|

Wendy’s International, Inc. |

| 1,823 |

|

| 61,909 |

|

Whirlpool Corporation |

| 222,063 |

|

| 20,303,220 |

|

|

|

|

|

| 157,948,389 |

|

Consumer Staples – 8.7% |

|

|

|

|

|

|

Avon Products, Inc. |

| 1,706 |

|

| 58,669 |

|

Campbell Soup Company |

| 703,695 |

|

| 27,078,184 |

|

Church & Dwight Co., Inc. |

| 585 |

| $ | 26,506 |

|

Coca-Cola Company |

| 327,684 |

|

| 15,689,510 |

|

Colgate-Palmolive Company |

| 1,796 |

|

| 122,667 |

|

CVS Corporation |

| 1,905 |

|

| 64,103 |

|

Estée Lauder Companies, Inc. (The), Class A |

| 619,149 |

|

| 29,409,578 |

|

Green Mountain Coffee, Inc. (a) |

| 322 |

|

| 19,034 |

|

Hershey Foods Corporation |

| 1,736 |

|

| 88,605 |

|

Kimberly-Clark Corporation |

| 1,456 |

|

| 101,046 |

|

Kroger Company |

| 1,228,977 |

|

| 31,461,811 |

|

PepsiCo, Inc. |

| 4,153 |

|

| 270,942 |

|

Procter & Gamble Company |

| 233,101 |

|

| 15,121,262 |

|

Smucker (J.M.) Company |

| 1,241 |

|

| 58,935 |

|

SunOpta Inc. (a) |

| 2,500 |

|

| 27,150 |

|

United Natural Foods, Inc. (a) |

| 732 |

|

| 24,185 |

|

Walgreen Company |

| 1,964 |

|

| 88,969 |

|

Wild Oats Markets, Inc. (a) |

| 1,259 |

|

| 18,294 |

|

|

|

|

|

| 119,729,450 |

|

Energy – 5.3% |

|

|

|

|

|

|

Anadarko Petroleum Corporation |

| 4,618 |

|

| 202,038 |

|

Apache Corporation |

| 5,462 |

|

| 398,562 |

|

Devon Energy Corporation |

| 3,970 |

|

| 278,257 |

|

EOG Resources, Inc. |

| 3,008 |

|

| 207,943 |

|

Metretek Technologies, Inc. (a) |

| 1,700 |

|

| 22,100 |

|

Noble Energy, Inc. |

| 101,183 |

|

| 5,404,184 |

|

Overseas Shipholding Group, Inc. |

| 335,900 |

|

| 20,869,467 |

|

Unit Corporation (a) |

| 494,200 |

|

| 23,958,816 |

|

XTO Energy Inc. |

| 427,716 |

|

| 21,586,827 |

|

|

|

|

|

| 72,928,194 |

|

Financials – 27.0% |

|

|

|

|

|

|

Allstate Life Insurance Company |

| 58,200 |

|

| 3,501,312 |

|

American Express Company |

| 3,876 |

|

| 225,661 |

|

Assurant, Inc. |

| 218,600 |

|

| 12,149,788 |

|

15

DOMINI SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

SECURITY |

| SHARES |

| VALUE |

| |

Financials (Continued) |

|

|

|

|

|

|

Bank of America Corporation |

| 979,600 |

| $ | 51,507,368 |

|

Chubb Corporation |

| 191,666 |

|

| 9,974,299 |

|

Citigroup Inc. |

| 1,087,400 |

|

| 59,948,361 |

|

Fannie Mae |

| 336,116 |

|

| 19,000,637 |

|

FirstFed Financial Corp. (a) |

| 94,000 |

|

| 6,481,300 |

|

Freddie Mac |

| 2,222 |

|

| 144,274 |

|

Goldman Sachs Group, Inc. (The) |

| 180,300 |

|

| 38,252,448 |

|

Hartford Financial Services Group (The) |

| 104,738 |

|

| 9,940,684 |

|

Heartland Financial USA, Inc. |

| 498 |

|

| 14,238 |

|

KeyCorp. |

| 89,592 |

|

| 3,419,727 |

|

Lehman Brothers Holdings Inc. |

| 2,000 |

|

| 164,480 |

|

Medallion Financial Corp. |

| 1,275 |

|

| 14,395 |

|

Morgan (J.P.) Chase & Co. |

| 906,630 |

|

| 46,174,666 |

|

Nationwide Financial Services, Inc., Class A |

| 441,000 |

|

| 24,100,650 |

|

PMI Group, Inc. (The) |

| 342,500 |

|

| 16,378,350 |

|

Popular Inc. |

| 4,111 |

|

| 75,067 |

|

Principal Financial Group, Inc. |

| 321,360 |

|

| 19,798,990 |

|

Prudential Financial, Inc. |

| 3,200 |

|

| 285,216 |

|

St. Paul Travelers Companies, Inc. (The) |

| 447,852 |

|

| 22,773,273 |

|

SunTrust Banks, Inc. |

| 323,626 |

|

| 26,893,320 |

|

U.S. Bancorp |

| 5,163 |

|

| 183,803 |

|

Wachovia Corporation |

| 4,083 |

|

| 230,690 |

|

Washington Mutual, Inc. |

| 4,331 |

|

| 193,119 |

|

Wells Fargo & Company |

| 6,826 |

|

| 245,190 |

|

|

|

|

|

| 372,071,306 |

|

Health Care – 11.4% |

|

|

|

|

|

|

Amgen, Inc. (a) |

| 150,766 |

|

| 10,609,403 |

|

Applera Corp.-Applied Biosystems Group |

| 136,000 |

|

| 4,727,360 |

|

Baxter International, Inc. |

| 425,322 |

|

| 21,121,491 |

|

Becton Dickinson and Company |

| 2,202 |

|

| 169,422 |

|

Conceptus, Inc. (a) |

| 1,100 |

|

| 25,509 |

|

Forest Laboratories, Inc. (a) |

| 69,586 |

|

| 3,904,470 |

|

Genentech, Inc. (a) |

| 1,600 |

|

| 139,792 |

|

Gilead Sciences (a) |

| 77,605 |

|

| 4,991,554 |

|

Invacare Corporation |

| 1,260 |

|

| 27,203 |

|

Johnson & Johnson |

| 747,024 |

| $ | 49,901,203 |

|

Medtronic, Inc. |

| 3,455 |

|

| 184,670 |

|

Merck & Co., Inc. |

| 823,602 |

|

| 36,856,190 |

|

Thermo Fisher Scientific (a) |

| 246,581 |

|

| 11,798,901 |

|

Zimmer Holdings, Inc. (a) |

| 146,743 |

|

| 12,358,695 |

|

|

|

|

|

| 156,815,863 |

|

Industrials – 6.6% |

|

|

|

|

|

|

3M Company |

| 2,664 |

|

| 197,935 |

|

Baldor Electric Company |

| 1,190 |

|

| 42,031 |

|

Brady Corporation, Class A |

| 654 |

|

| 24,492 |

|

Cooper Industries, Inc., Class A |

| 1,193 |

|

| 109,028 |

|

Cummins, Inc. |

| 199,916 |

|

| 26,900,697 |

|

Donnelley (R.R.) & Sons Company |

| 2,118 |

|

| 78,578 |

|

Emerson Electric Company |

| 4,408 |

|

| 198,228 |

|

Evergreen Solar, Inc (a) |

| 1,700 |

|

| 14,264 |

|

FedEx Corporation |

| 628 |

|

| 69,331 |

|

Fuel Tech, Inc. (a) |

| 700 |

|

| 20,153 |

|

FuelCell Energy, Inc. (a) |

| 2,600 |

|

| 17,186 |

|

Granite Construction Incorporated |

| 737 |

|

| 39,474 |

|

Herman Miller, Inc. |

| 896 |

|

| 33,690 |

|

Illinois Tool Works, Inc. |

| 2,800 |

|

| 142,772 |

|

JetBlue Airways Corporation (a) |

| 2,293 |

|

| 31,368 |

|

Kadant Inc. (a) |

| 627 |

|

| 17,148 |

|

Monster Worldwide (a) |

| 835 |

|

| 41,257 |

|

Navistar International Corporation (a) |

| 263,000 |

|

| 11,635,120 |

|

PACCAR Inc. |

| 146,700 |

|

| 9,809,829 |

|

Pitney Bowes, Inc. |

| 1,457 |

|

| 69,747 |

|

Ryder System, Inc. |

| 479,584 |

|

| 26,156,511 |

|

Southwest Airlines Co. |

| 3,478 |

|

| 52,518 |

|

Tennant Company |

| 1,296 |

|

| 40,072 |

|

Trex Company, Inc. (a) |

| 888 |

|

| 23,763 |

|

United Parcel Service, Inc., Class B |

| 1,873 |

|

| 135,380 |

|

YRC Worldwide Inc. (a) |

| 344,779 |

|

| 15,290,949 |

|

|

|

|

|

| 91,191,521 |

|

Information Technology – 17.0% |

|

|

|

|

|

|

Alliance Data Systems Corporation (a) |

| 89,100 |

|

| 6,052,563 |

|

Apple Computer, Inc. (a) |

| 1,312 |

|

| 112,478 |

|

Applied Materials, Inc. |

| 740,100 |

|

| 13,121,973 |

|

16

DOMINI SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

SECURITY |

| SHARES |

| VALUE |

| |

Information Technology (Continued) |

|

|

|

|

|

|

Cisco Systems, Inc. (a) |

| 8,816 |

| $ | 234,417 |

|

Dell Inc. (a) |

| 4,184 |

|

| 101,462 |

|

eBay Inc. (a) |

| 2,176 |

|

| 70,481 |

|

Google Inc., Class A (a) |

| 300 |

|

| 150,390 |

|

Hewlett-Packard Company |

| 935,847 |

|

| 40,503,458 |

|

Intel Corporation |

| 10,039 |

|

| 210,417 |

|

International Business Machines Corporation |

| 482,800 |

|

| 47,869,619 |

|

Itron, Inc. (a) |

| 445 |

|

| 25,650 |

|

Jabil Circuit, Inc. |

| 1,500 |

|

| 35,985 |

|

Juniper Networks, Inc. (a) |

| 1,900 |

|

| 34,428 |

|

LAM Research Corporation (a) |

| 338,900 |

|

| 15,525,009 |

|

Lexmark International Group, Inc. (a) |

| 353,850 |

|

| 22,303,166 |

|

MEMC Electronic Materials, Inc. (a) |

| 93,000 |

|

| 4,873,200 |

|

Micron Technology, Inc. (a) |

| 1,283,052 |

|

| 16,615,523 |

|

Microsoft Corporation |

| 1,065,852 |

|

| 32,892,193 |

|

Motorola, Inc. |

| 5,000 |

|

| 99,250 |

|

Power Integrations, Inc. (a) |

| 600 |

|

| 13,608 |

|

Qualcomm, Inc. |

| 3,434 |

|

| 129,324 |

|

SunPower Corporation (a) |

| 400 |

|

| 17,720 |

|

Symantec Corporation (a) |

| 1,276,846 |

|

| 22,612,943 |

|

Texas Instruments, Inc. |

| 3,628 |

|

| 113,157 |

|

Western Digital Corporation (a) |

| 526,800 |

|

| 10,325,280 |

|

Xerox Corporation (a) |

| 3,698 |

|

| 63,606 |

|

|

|

|

|

| 234,107,300 |

|

Materials – 1.3% |

|

|

|

|

|

|

Airgas, Inc. |

| 1,159 |

|

| 48,238 |

|

Ecolab, Inc. |

| 1,757 |

|

| 77,132 |

|

International Paper Company |

| 3,000 |

|

| 101,100 |

|

MeadWestvaco Corp. |

| 2,666 |

| $ | 80,353 |

|

Nucor Corporation |

| 156,016 |

|

| 10,069,272 |

|

Rock-Tenn Company, Class A |

| 592 |

|

| 19,370 |

|

Rohm & Haas Company |

| 1,510 |

|

| 78,611 |

|

Schnitzer Steel Industries Inc., Class A |

| 1,269 |

|

| 48,857 |

|

Sonoco Products Company |

| 1,260 |

|

| 48,510 |

|

Valspar Corporation |

| 320,998 |

|

| 9,045,724 |

|

|

|

|

|

| 19,617,167 |

|

Telecommunication Services – 6.0% |

|

|

|

|

|

|

Alltel Corporation |

| 74,900 |

|

| 4,590,621 |

|

AT&T Inc. |

| 1,531,204 |

|

| 57,619,206 |

|

CenturyTel, Inc. |

| 451,900 |

|

| 20,263,196 |

|

Sprint Corp. – FON Group |

| 5,159 |

|

| 91,985 |

|

Verizon Communications |

| 5,138 |

|

| 197,916 |

|

|

|

|

|

| 82,762,924 |

|

Utilities – 4.5% |

|

|

|

|

|

|

Energen Corporation |

| 363,147 |

|

| 16,806,443 |

|

OGE Energy Corporation |

| 430,182 |

|

| 16,656,647 |

|

ONEOK, Inc. |

| 294,500 |

|

| 12,636,995 |

|

UGI Corporation |

| 563,800 |

|

| 15,453,758 |

|

WGL Holdings |

| 8,577 |

|

| 271,291 |

|

|

|

|

|

| 61,825,134 |

|

Total Investments — 99.3% |

|

|

|

|

|

|

(Cost $1,215,349,476) |

|

|

|

| 1,368,997,248 |

|

Other Assets, less liabilities — 0.7% |

|

|

|

| 10,193,118 |

|

Net Assets — 100.0% |

|

|

| $ | 1,379,190,366 |

|

______________

(a) | Non-income producing security. |

(b) | The aggregate cost for federal income tax purposes is $1,330,674,418. The aggregate gross unrealized appreciation is $53,931,600 and the aggregate gross unrealized depreciation is $15,608,770, resulting in net unrealized appreciation of $38,322,830. |

SEE NOTES TO FINANCIAL STATEMENTS

17

DOMINI EUROPEAN SOCIAL EQUITY PORTFOLIO

PERFORMANCE COMMENTARY

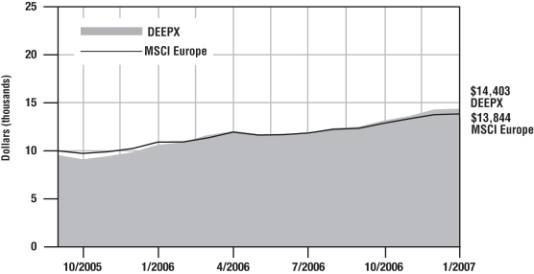

For the six months ended January 31, 2007, the Fund continued to perform well, returning 21.20%, excluding sales charges, compared with the MSCI Europe Index return of 16.74%.

The energy sector played a key role in Fund performance during the period. Crude oil prices, which peaked at nearly $80 per barrel early in the period, receded to the $50-$60 range, and energy stocks weakened as a result. Energy was the only sector in the MSCI Europe Index to put in a negative result for the six-month period. The Fund avoids many oil companies for environmental reasons, and its underweighting to the sector was helpful for performance.

Particularly important for relative performance were the exclusion of U.K.-based oil companies BP and Royal Dutch Shell, whose stocks were down by 11.4% and 5.0%, respectively. Both companies are ineligible for investment by the Fund for social and environmental reasons. BP, one of the largest stocks in the index, experienced several high-profile safety problems in 2005 and 2006, including an explosion at its refinery in Texas City and a pipeline rupture in Alaska. Statoil, an industry leader in responding to climate change, announced that it will acquire Norsk Hydro’s oil and gas assets. Both Norwegian energy companies are held by the Fund, and both positions hurt performance as the sector generally underperformed.

Individual stocks in a number of other sectors were helpful for performance, including British equipment rental firm Aggreko, Italian auto maker Fiat, and Rieter Holding, a Swiss manufacturer of textile equipment.

The Fund’s performance was hurt by its position in French pharmaceutical maker Sanofi-Aventis, which was down by 13.3% during the time it was held by the Fund. Despite the company’s recent financial performance, Domini views it as having a generally positive social and environmental profile. Sanofi-Aventis has substantial research programs on the treatment of malaria, and is a major company in the vaccine industry. After this six-month period came to an end, the company introduced a malaria medicine called ASAQ, which it developed as part of an initiative by Doctors Without Borders. Sanofi will not patent the medicine, allowing it to be produced as a generic product, and it plans to sell the pill at cost to international health agencies. A course of treatment with the new pill will cost less than a dollar for an adult and less than fifty cents for a child, a potentially momentous development in the world’s battle against malaria.

18

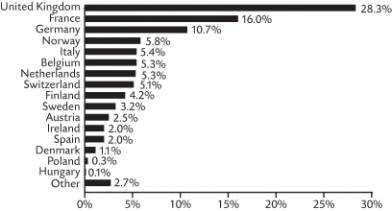

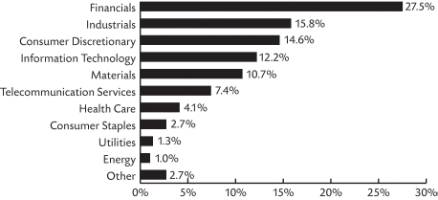

The Domini European Social Equity Portfolio invests in the Domini European Social Equity Trust. The table and bar chart below provide information as of January 31, 2007, about the ten largest holdings of the Domini European Social Equity Trust and its portfolio holdings by industry sector and by country:

TEN LARGEST HOLDINGS

COMPANY |

| % NET |

|

Vivendi SA |

| 3.14% |

|

Statoil ASA |

| 2.85% |

|

ING Groep NV-CVA |

| 2.69% |

|

National Grid PLC |

| 2.60% |

|

Muenchener Rueckver AG -Reg |

| 2.43% |

|

BNP Paribas |

| 2.36% |

|

Royal Bank of Scotland Group |

| 2.34% |

|

Barclays PLC |

| 2.32% |

|

GlaxoSmithKline PLC |

| 2.30% |

|

Societe Generale |

| 2.20% |

|

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

|

|

______________

The holdings mentioned above are described in the Domini European Social Equity Trust’s Portfolio of Investments at January 31, 2007, included herein. The composition of the Trust’s portfolio is subject to change.

Domini European Social Equity Portfolio — Performance Commentary | 19 |

AVERAGE ANNUAL TOTAL RETURNS

|

|

|

| Domini European Social |

| Domini European Social |

| MSCI Europe |

|

As of 12-31-06 |

| 1 Year |

| 37.97% |

| 44.85% |

| 34.36% |

|

| Since Inception(1) |

| 33.21% |

| 38.53% |

| 29.26% |

| |

As of 1-31-07 |

| 1 Year |

| 28.42% |

| 34.82% |

| 26.85% |

|

| Since Inception(1) |

| 31.59% |

| 36.50% |

| 27.73% |

|

COMPARISON OF $10,000 INVESTMENT IN THE

DOMINI EUROPEAN SOCIAL EQUITY PORTFOLIO

(WITH 4.75% MAXIMUM SALES CHARGE) AND MSCI EUROPE

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 60 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini European Social Equity Portfolio is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Morgan Stanley Capital International Europe Index (MSCI Europe) is an unmanaged index of common stocks. Investors cannot invest directly in the MSCI Europe.

______________

(1) | Since October 3, 2005 |

This material must be preceded or accompanied by the Fund’s current prospectus. DSIL Investment Services LLC, Distributor. 03/07

20 | Domini European Social Equity Portfolio — Performance Commentary |

DOMINI EUROPEAN SOCIAL EQUITY TRUST

PORTFOLIO OF INVESTMENTS

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Austria – 2.5% |

|

|

|

|

|

|

|

|

Immoeast AG (a) |

| Real Estate |

| 21,431 |

| $ | 320,258 |

|

Immofinanz AG (a) |

| Real Estate |

| 51,163 |

|

| 774,536 |

|

OMV AG (a) |

| Energy |

| 2,399 |

|

| 128,031 |

|

Voestalpine AG (a) |

| Materials |

| 26,200 |

|

| 1,511,624 |

|

|

|

|

|

|

|

| 2,734,449 |

|

Belgium – 5.3% |

|

|

|

|

|

|

|

|

Bekaert NV |

| Capital Goods |

| 1,417 |

|

| 173,176 |

|

Belgacom SA |

| Telecommunication Services |

| 41,267 |

|

| 1,862,912 |

|

Fortis |

| Diversified Financials |

| 56,680 |

|

| 2,373,094 |

|

Omega Pharma SA (a) |

| Health Care Equipment & Services |

| 19,098 |

|

| 1,529,962 |

|

|

|

|

|

|

|

| 5,939,144 |

|

Denmark – 1.1% |

|

|

|

|

|

|

|

|

Dampskibsselskabet Torm AS (a) |

| Energy |

| 14,326 |

|

| 917,517 |

|

Danske Bank A/S (a) |

| Banks |

| 7,856 |

|

| 360,756 |

|

|

|

|

|

|

|

| 1,278,273 |

|

Finland – 4.2% |

|

|

|

|

|

|

|

|

Kesko OYJ – B shares (a) |

| Food & Staples Retailing |

| 37,695 |

|

| 2,003,395 |

|

Nokia OYJ (a) |

| Technology Hardware & Equipment |

| 63,202 |

|

| 1,378,926 |

|

Rautaruukki OYJ (a) |

| Materials |

| 26,846 |

|

| 1,055,272 |

|

Sampo Insurance Co – A shares |

| Insurance |

| 10,454 |

|

| 284,323 |

|

|

|

|

|

|

|

| 4,721,916 |

|

France – 16.0% |

|

|

|

|

|

|

|

|

AGF – Assur Gen De France (a) |

| Insurance |

| 12,227 |

|

| 1,990,813 |

|

Air France – KLM (a) |

| Transportation |

| 17,310 |

|

| 776,475 |

|

BNP Paribas (a) |

| Banks |

| 23,573 |

|

| 2,620,562 |

|

CNP Assurances |

| Insurance |

| 7,311 |

|

| 834,600 |

|

Lafarge SA (a) |

| Materials |

| 10,873 |

|

| 1,660,148 |

|

Michelin (CGDE) – B (a) |

| Automobiles & Components |

| 5,884 |

|

| 536,747 |

|

Sanofi – Aventis (a) |

| Pharma, Biotech & Life Sciences |

| 11,540 |

|

| 1,010,707 |

|

Schneider Electric SA |

| Capital Goods |

| 630 |

|

| 75,848 |

|

Societe Generale (a) |

| Banks |

| 13,880 |

|

| 2,443,928 |

|

Ste Des Ciments Francais – A (a) |

| Materials |

| 3,576 |

|

| 784,385 |

|

Vinci S.A. |

| Capital Goods |

| 11,533 |

|

| 1,579,583 |

|

Vivendi SA (a) |

| Media |

| 85,013 |

|

| 3,488,647 |

|

|

|

|

|

|

|

| 17,802,443 |

|

Germany – 10.7% |

|

|

|

|

|

|

|

|

Allianz SE – Reg (a) |

| Insurance |

| 891 |

|

| 177,146 |

|

Celesio AG (a) |

| Health Care Equipment & Services |

| 28,907 |

|

| 1,644,141 |

|

Continental AG |

| Automobiles & Components |

| 4,491 |

|

| 541,915 |

|

Deutsche Lufthansa – Reg (a) |

| Transportation |

| 47,766 |

|

| 1,332,012 |

|

Deutsche Telekom AG – Reg |

| Telecommunication Services |

| 72,037 |

|

| 1,263,714 |

|

Epcos AG |

| Technology Hardware & Equipment |

| 63,738 |

|

| 1,167,823 |

|

Fresenius AG |

| Health Care Equipment & Services |

| 9,479 |

|

| 1,904,653 |

|

Linde AG |

| Materials |

| 3,975 |

|

| 424,486 |

|

21

DOMINI EUROPEAN SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Germany (continued) |

|

|

|

|

|

|

|

|

Muenchener Rueckver AG – Reg (a) |

| Insurance |

| 17,158 |

| $ | 2,697,812 |

|

ProSieben Sat.1 Media AG |

| Media |

| 21,065 |

|

| 707,042 |

|

|

|

|

|

|

|

| 11,860,744 |

|

Hungary – 0.1% |

|

|

|

|

|

|

|

|

MOL Magyar Olaj – es Gazipari |

| Energy |

| 1,003 |

|

| 102,980 |

|

|

|

|

|

|

|

| 102,980 |

|

Ireland – 2.0% |

|

|

|

|

|

|

|

|

Bank Of Ireland |

| Banks |

| 55,046 |

|

| 1,226,016 |

|

Fyffes PLC |

| Food & Staples Retailing |

| 683,198 |

|

| 976,560 |

|

|

|

|

|

|

|

| 2,202,576 |

|

Italy – 5.4% |

|

|

|

|

|

|

|

|

Banca Popolare Emilia Romagna (a) |

| Banks |

| 20,412 |

|

| 546,402 |

|

Banche Popolari Unite Scrl (a) |

| Banks |

| 40,539 |

|

| 1,144,175 |

|

Banco Popolare Di Verona E N (a) |

| Banks |

| 24,241 |

|

| 759,779 |

|

Benetton Group SPA (a) |

| Consumer Durables & Apparel |

| 56,546 |

|

| 975,062 |

|

Fiat SPA (a) |

| Automobiles & Components |

| 76,275 |

|

| 1,648,292 |

|

Pirelli & Co. |

| Capital Goods |

| 843,562 |

|

| 870,356 |

|

|

|

|

|

|

|

| 5,944,066 |

|

Netherlands – 5.3% |

|

|

|

|

|

|

|

|

Aegon NV |

| Insurance |

| 43,095 |

|

| 842,797 |

|

Fugro NV – CVA |

| Energy |

| 16,079 |

|

| 761,372 |

|

ING Groep NV – CVA |

| Diversified Financials |

| 68,544 |

|

| 2,988,282 |

|

Koninkijke KPN NV |

| Telecommunication Services |

| 87,899 |

|

| 1,262,135 |

|

|

|

|

|

|

|

| 5,854,586 |

|

Norway – 5.8% |

|

|

|

|

|

|

|

|

Bergesen Worldwide Gas ASA |

| Energy |

| 36,200 |

|

| 434,929 |

|

DNB Nor ASA (a) |

| Banks |

| 13,665 |

|

| 204,434 |

|

Norsk Hydro ASA (a) |

| Energy |

| 50,628 |

|

| 1,630,828 |

|

Petroleum Geo – Services (a) |

| Energy |

| 5,067 |

|

| 117,914 |

|

Statoil ASA (a) |

| Energy |

| 118,967 |

|

| 3,162,601 |

|

Tandberg ASA (a) |

| Technology Hardware & Equipment |

| 25,104 |

|

| 416,850 |

|

Telenor ASA (a) |

| Telecommunication Services |

| 23,978 |

|

| 484,292 |

|

|

|

|

|

|

|

| 6,451,848 |

|

Poland – 0.3% |

|

|

|

|

|

|

|

|

Polska Grupa Farmaceutyczna |

| Health Care Equipment & Services |

| 8,317 |

|

| 208,950 |

|

PROKOM Software SA |

| Software & Services |

| 2,768 |

|

| 151,125 |

|

|

|

|

|

|

|

| 360,075 |

|

Spain — 2.0% |

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argenta |

| Banks |

| 68,825 |

|

| 1,703,730 |

|

Corporacion Financiera Alba |

| Diversified Financials |

| 4,480 |

|

| 309,997 |

|

Telefonica SA |

| Telecommunication Services |

| 10,472 |

|

| 227,931 |

|

|

|

|

|

|

|

| 2,241,658 |

|

Sweden – 3.2% |

|

|

|

|

|

|

|

|

Axfood AB (a) |

| Food & Staples Retailing |

| 31,620 |

|

| 1,184,465 |

|

Electrolux AB – Ser B (a) |

| Consumer Durables & Apparel |

| 11,500 |

|

| 217,042 |

|

22

DOMINI EUROPEAN SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Sweden (continued) |

|

|

|

|

|

|

| |

Industrivarden AB – C shares |

| Diversified Financials |

| 17,400 |

| $ | 668,025 |

|

Investor AB – B shares |

| Diversified Financials |

| 13,400 |

| 323,098 |

| |

Nordea AB (a) |

| Banks |

| 61,223 |

| 954,255 |

| |

SSAB Svenskt Stal AB – Ser A (a) |

| Materials |

| 7,050 |

| 170,494 |

| |

|

|

|

|

|

| 3,517,379 |

| |

Switzerland – 5.1% |

|

|

|

|

|

|

| |

Baloise Holding – AG (a) |

| Insurance |

| 8,673 |

| 875,085 |

| |

Novartis AG – Reg Shs (a) |

| Pharma, Biotech & Life Sciences |

| 26,924 |

| 1,543,847 |

| |

Rieter Holding AG (a) |

| Automobiles & Components |

| 2,895 |

| 1,654,219 |

| |

Roche Holding AG (a) |

| Pharma, Biotech & Life Sciences |

| 3,515 |

| 658,323 |

| |

Swisscom AG – Reg (a) |

| Telecommunication Services |

| 2,376 |

| 884,478 |

| |

|

|

|

|

|

| 5,615,952 |

| |

United Kingdom – 28.3% |

|

|

|

|

|

|

| |

3i Group PLC |

| Diversified Financials |

| 43,411 |

| 896,462 |

| |

Aggreko PLC |

| Commercial Services & Supplies |

| 170,621 |

| 1,482,008 |

| |

Alliance Boots PLC |

| Food & Staples Retailing |

| 15,165 |

| 239,550 |

| |

Arriva PLC |

| Transportation |

| 47,675 |

| 670,964 |

| |

Aviva PLC |

| Insurance |

| 63,993 |

| 1,028,384 |

| |

Barclays PLC |

| Banks |

| 177,780 |

| 2,575,100 |

| |

Barratt Developments PLC |

| Consumer Durables & Apparel |

| 56,469 |

| 1,306,493 |

| |

Bellway PLC |

| Consumer Durables & Apparel |

| 11,578 |

| 319,545 |

| |

BG Group PLC |

| Energy |

| 38,952 |

| 509,695 |

| |

Bradford and Bingley |

| Banks |

| 57,614 |

| 515,657 |

| |

BT Group PLC |

| Telecommunication Services |

| 263,647 |

| 1,579,152 |

| |

Firstgroup PLC |

| Transportation |

| 169,611 |

| 1,807,721 |

| |

GlaxoSmithKline PLC |

| Pharma, Biotech & Life Sciences |

| 95,715 |

| 2,557,362 |

| |

HSBC Holdings PLC |

| Banks |

| 47,643 |

| 862,622 |

| |

Inchcape PLC |

| Retailing |

| 21,282 |

| 220,368 |

| |

Man Group PLC |

| Diversified Financials |

| 147,075 |

| 1,539,463 |

| |

Marks & Spencer Group PLC |

| Retailing |

| 58,277 |

| 771,123 |

| |

National Grid PLC |

| Utilities |

| 191,882 |

| 2,884,530 |

| |

Next PLC |

| Retailing |

| 26,289 |

| 1,004,976 |

| |

Northern Rock PLC |

| Banks |

| 8,586 |

| 197,305 |

| |

Resolution PLC |

| Insurance |

| 38,860 |

| 495,941 |

| |

Royal Bank Of Scotland Group |

| Banks |

| 64,856 |

| 2,596,109 |

| |

Scottish Power PLC |

| Utilities |

| 112,199 |

| 1,640,549 |

| |

Severn Trent PLC |

| Utilities |

| 49,950 |

| 1,383,476 |

| |

Standard Life PLC (a) |

| Insurance |

| 151,181 |

| 870,010 |

| |

Taylor Woodrow PLC |

| Consumer Durables & Apparel |

| 15,247 |

| 121,467 |

| |

Whitbread PLC (a) |

| Consumer Services |

| 7,826 |

| 248,315 |

| |

George Wimpey PLC |

| Consumer Durables & Apparel |

| 100,048 |

| 1,053,587 |

| |

|

|

|

|

|

| 31,377,934 |

| |

Total Investments – 97.3% (Cost $91,005,011) (b) |

|

|

| 108,006,023 |

| |||

Other Assets, less liabilities – 2.7% |

|

|

|

|

| 3,001,325 |

| |

Net Assets – 100.0% |

|

|

|

|

| $ | 111,007,348 |

|

______________

(a) | Non-income producing security. |

(b) | The aggregate cost for federal income tax purposes is $91,030,355. The aggregate gross unrealized appreciation is $17,405,297 and the aggregate gross unrealized depreciation is $429,629, resulting in net unrealized appreciation of $16,975,668. |

SEE NOTES TO FINANCIAL STATEMENTS

23

DOMINI PACASIA SOCIAL EQUITY PORTFOLIO

PERFORMANCE COMMENTARY

From the Fund’s inception on December 27, 2006, through January 31, 2007, the Fund returned 0.90%, excluding sales charges, underperforming the MSCI All Country Asia Pacific Index return of 1.37%. The Fund’s performance for the period was influenced by the process of initially investing the portfolio.

Stock selection was the most important factor in the Fund’s performance during this brief period. Three Japanese companies helped performance: packaging firm Toyo Seikan Kaisha, information technology company Seiko Epson, and financial services company SBI Holdings. SBI Holdings’ stock price increased after it announced a $4 billion property financing arrangement with Merrill Lynch to build large-scale residential developments in Japan.

Positions that hurt performance included Australia-based mining company Zinifex and Japanese steelmaker Tokyo Steel. Zinifex’s stock declined after a sharp drop in the market price of zinc, an industrial metal that is used for environmentally positive purposes such as corrosion prevention and batteries. Korea Zinc, Korea Telecom, and Japanese technology producer Konica Minolta also made negative contributions to the Fund’s returns.

24

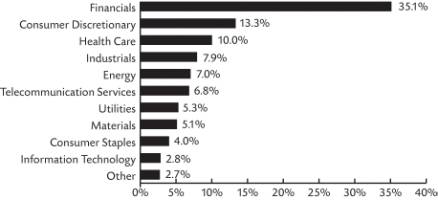

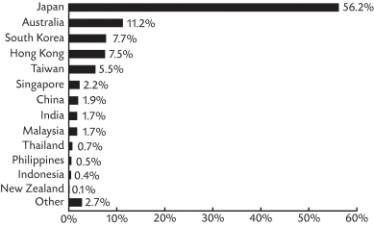

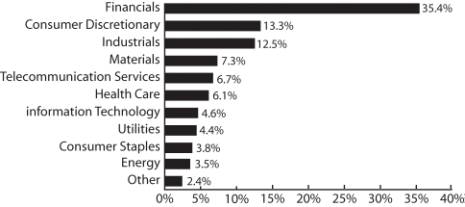

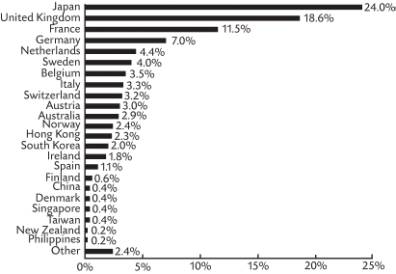

The Domini PacAsia Social Equity Portfolio invests in the Domini PacAsia Social Equity Trust. The table and bar chart below provide information as of January 31, 2007, about the ten largest holdings of the Domini PacAsia Social Equity Trust and its portfolio holdings by industry sector and by country:

TEN LARGEST HOLDINGS

COMPANY |

| % NET |

Honda Motor Co Ltd |

| 3.79 |

Fuji Film Holdings Corp |

| 3.10 |

Nippon Telegraph & Telephone |

| 2.98 |

Dai Nippon Printing Co Ltd |

| 2.54 |

QBE Insurance Group Ltd |

| 2.53 |

Resona Holdings Inc |

| 2.34 |

Toppan Printing Company Ltd |

| 2.31 |

Mediceo Paltac Holding Co |

| 2.22 |

Denso Corporation |

| 2.19 |

Zinifex Ltd |

| 2.18 |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

______________

The holdings mentioned above are described in the Domini PacAsia Social Equity Trust’s Portfolio of Investments at January 31, 2007, included herein. The composition of the Trust’s portfolio is subject to change.

Domini PacAsia Social Equity Portfolio — Performance Commentary | 25 |

Total Return Since Inception (12/27/2006) | |

Domini PacAsia Social Equity Portfolio (with 4.75% Maximum Sales Charge) | -3.89% |

Domino PacAsia Social Equity Portfolio (without Sales Charge) | 0.90% |

MSCI AC Asia Pacific | 1.37% |

Past performance is no guarantee of future results. The fund’s return quoted above represents past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 60 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the fund’s prospectus for further information.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.