Mark Rohr CHAIRMAN & CHIEF EXECUTIVE OFFICER I N V E S T O R D A Y N O V E M B E R 1 3 , 2 0 1 5

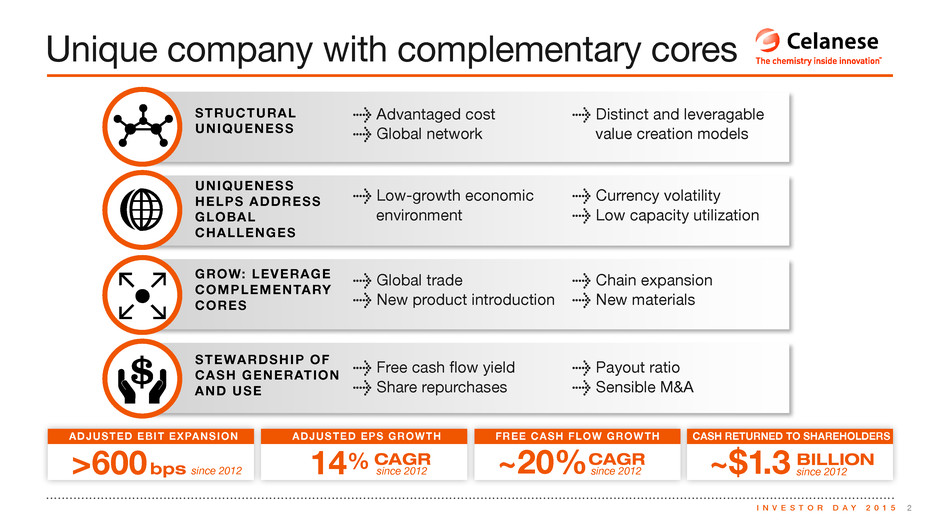

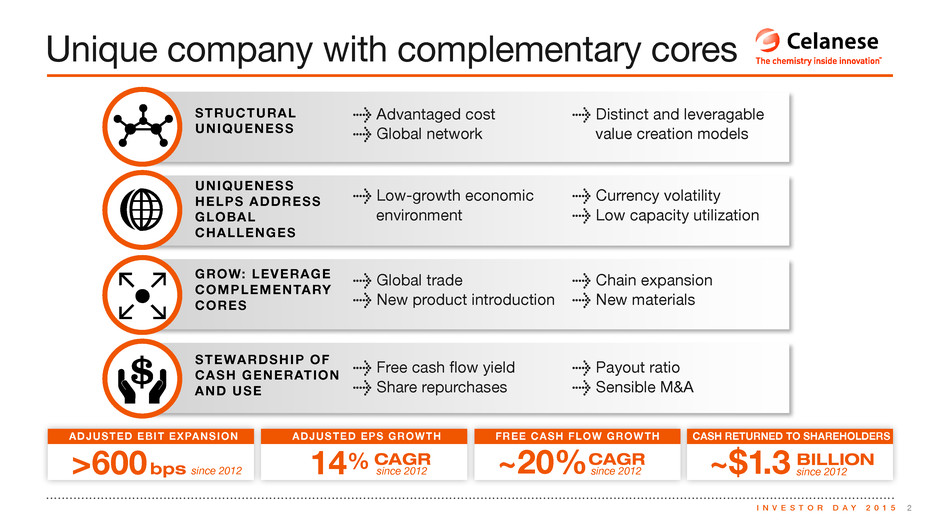

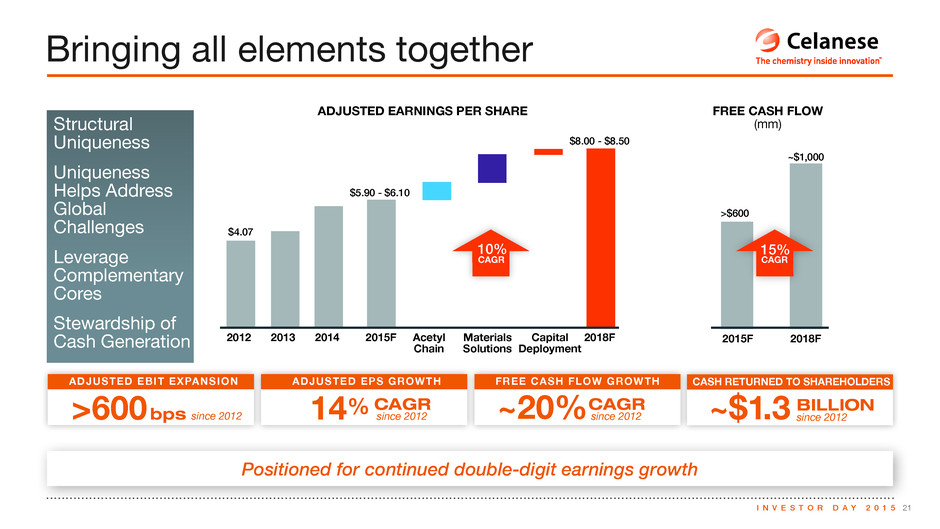

2I N V E S T O R D A Y 2 0 1 5 Unique company with complementary cores ADJUSTED EPS GROWTH CASH RETURNED TO SHAREHOLDERSADJUSTED EBIT EXPANSION FREE CASH FLOW GROWTH >600 bps ~$1.3~20%14% since 2012since 2012 since 2012since 2012CAGR CAGR > Advantaged cost > Global network > Distinct and leveragable value creation models > Low-growth economic environment > Currency volatility > Low capacity utilization > Global trade > New product introduction > Chain expansion > New materials > Free cash flow yield > Share repurchases > Payout ratio > Sensible M&A STRUCTURAL UNIQUENESS UNIQUENESS HELPS ADDRESS GLOBAL CHALLENGES GROW: LEVERAGE COMPLEMENTARY CORES STEWARDSHIP OF CASH GENERATION AND USE BILLION

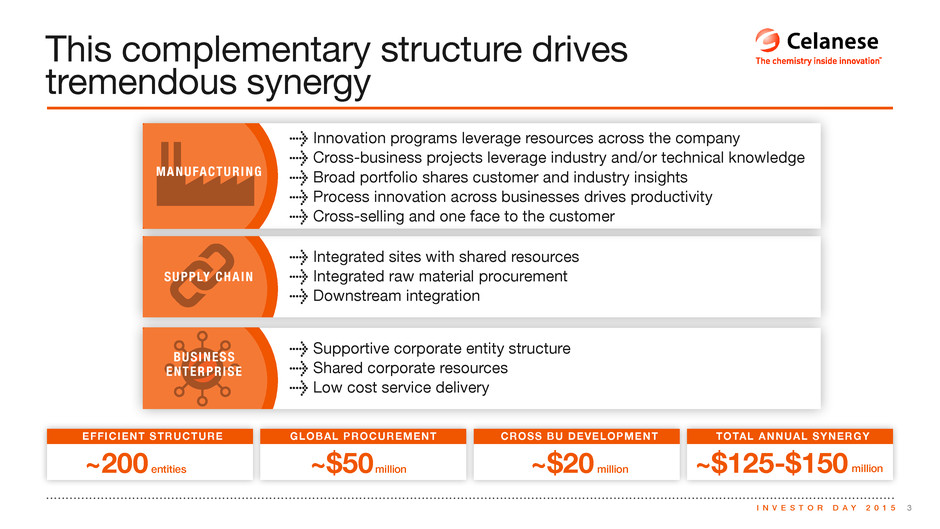

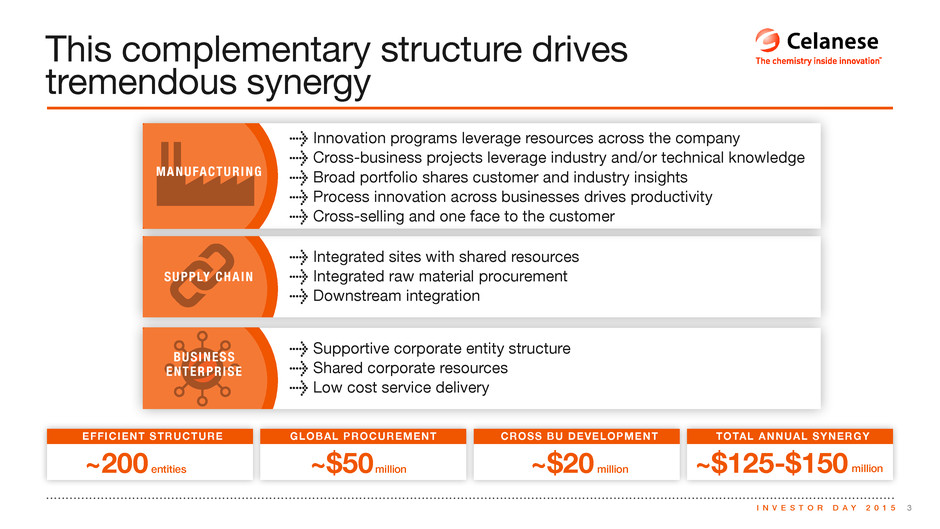

3I N V E S T O R D A Y 2 0 1 5 This complementary structure drives tremendous synergy > Innovation programs leverage resources across the company > Cross-business projects leverage industry and/or technical knowledge > Broad portfolio shares customer and industry insights > Process innovation across businesses drives productivity > Cross-selling and one face to the customer > Integrated sites with shared resources > Integrated raw material procurement > Downstream integration > Supportive corporate entity structure > Shared corporate resources > Low cost service delivery EFFICIENT STRUCTURE TOTAL ANNUAL SYNERGYCROSS BU DEVELOPMENTGLOBAL PROCUREMENT ~200 ~$50 ~$125-$150~$20entities million million million MANUFACTURING SUPPLY CHAIN BUSINESS ENTERPRISE

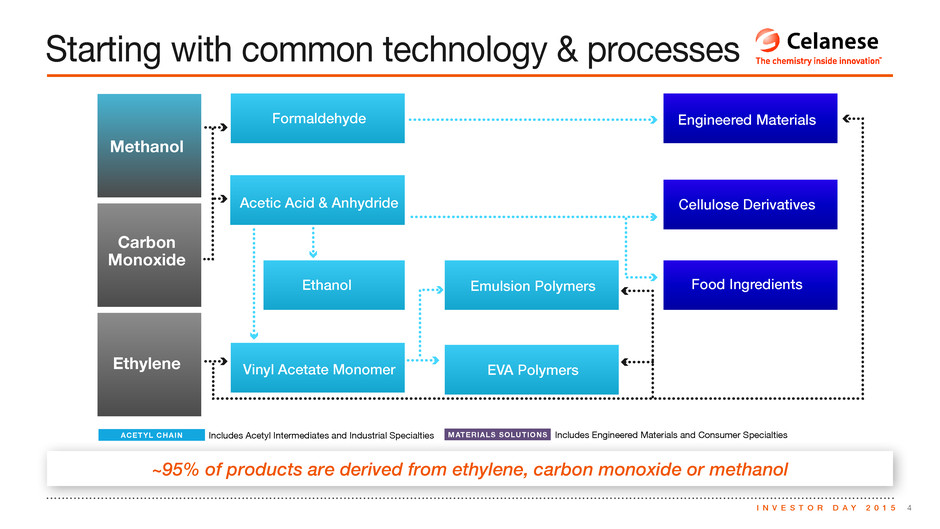

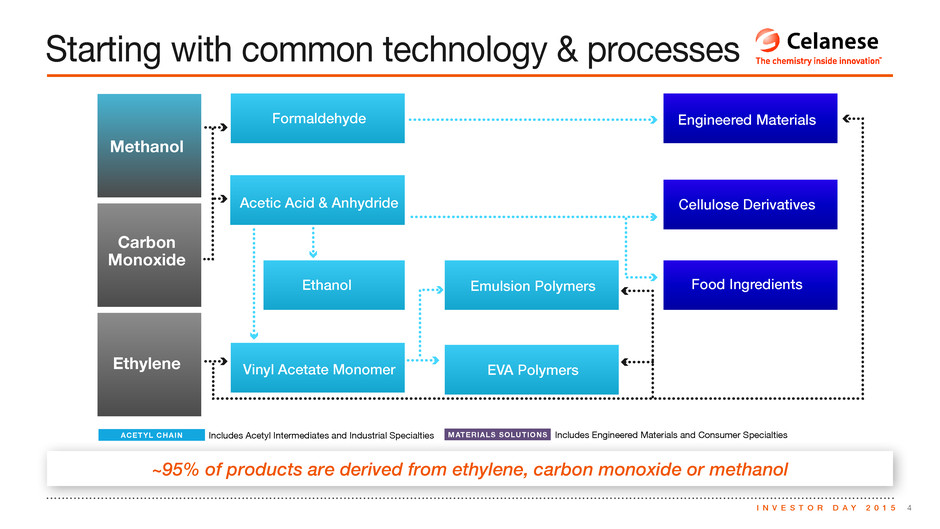

4I N V E S T O R D A Y 2 0 1 5 Starting with common technology & processes ~95% of products are derived from ethylene, carbon monoxide or methanol Formaldehyde Acetic Acid & Anhydride Ethanol Vinyl Acetate Monomer Emulsion Polymers EVA Polymers Engineered Materials Cellulose Derivatives Food Ingredients Methanol Ethylene Carbon Monoxide Acetyl Chain: Includes Acetyl Intermediates and Industrial Specialties Materials Solutions: Includes Engineered Materials and Consumer Specialties ACETYL CHAIN MATERIALS SOLUTIONSIncludes Acetyl Intermediates and Industrial Specialties Includes Engineered Materials and Consumer Specialties

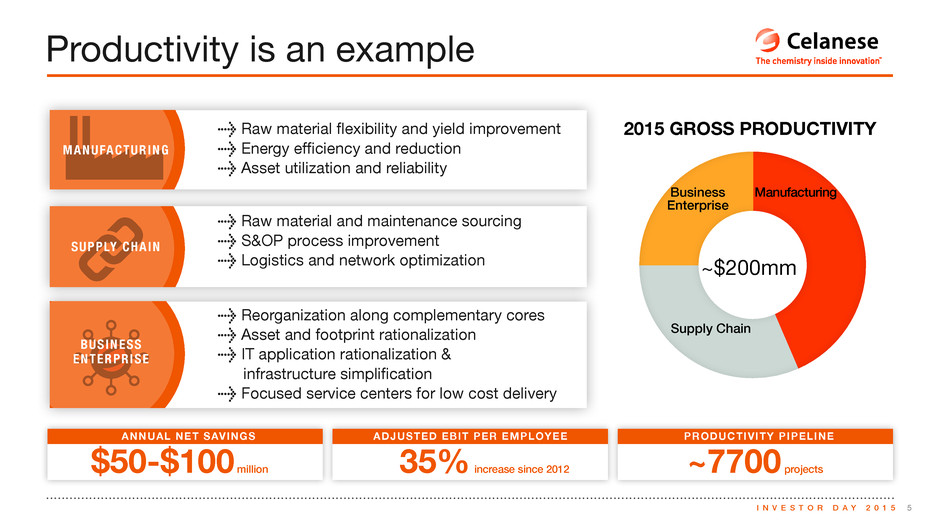

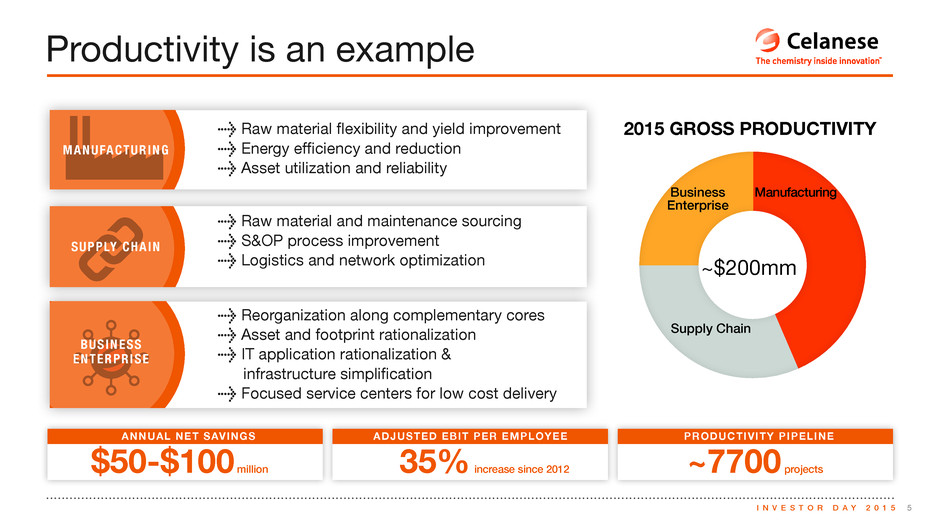

5I N V E S T O R D A Y 2 0 1 5 Productivity is an example > Raw material flexibility and yield improvement > Energy efficiency and reduction > Asset utilization and reliability 2015 GROSS PRODUCTIVITY ANNUAL NET SAVINGS PRODUCTIVITY PIPELINEADJUSTED EBIT PER EMPLOYEE $50-$100 35% ~7700 million increase since 2012 projects > Raw material and maintenance sourcing > S&OP process improvement > Logistics and network optimization > Reorganization along complementary cores > Asset and footprint rationalization > IT application rationalization & infrastructure simplification > Focused service centers for low cost delivery MANUFACTURING SUPPLY CHAIN BUSINESS ENTERPRISE Business Enterprise Supply Chain Manufacturing ~$200mm

6I N V E S T O R D A Y 2 0 1 5 …Helping us manage global economic volatility Model provides opportunity to benefit from global trends > Continued growth > Feedstock advantage > Low-cost export base > Celanese driving productivity > Celanese investing in growth > Modest growth > Euro depreciation > Celanese driving productivity > Celanese investing in growth > Lower GDP growth > Higher consumer growth > Tremendous overcapacity > Celanese driving productivity > Exploring partnerships > Consumer growth > Low-cost energy & labor > Celanese investing in growth

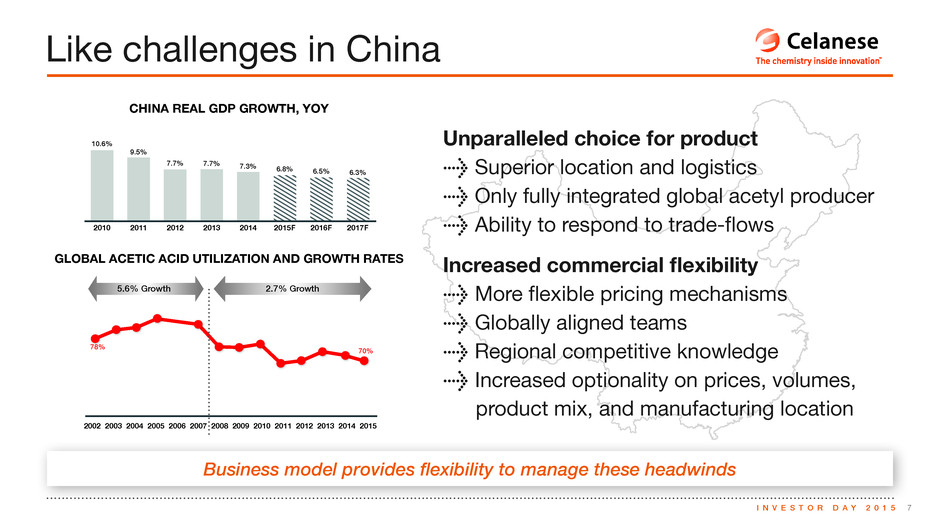

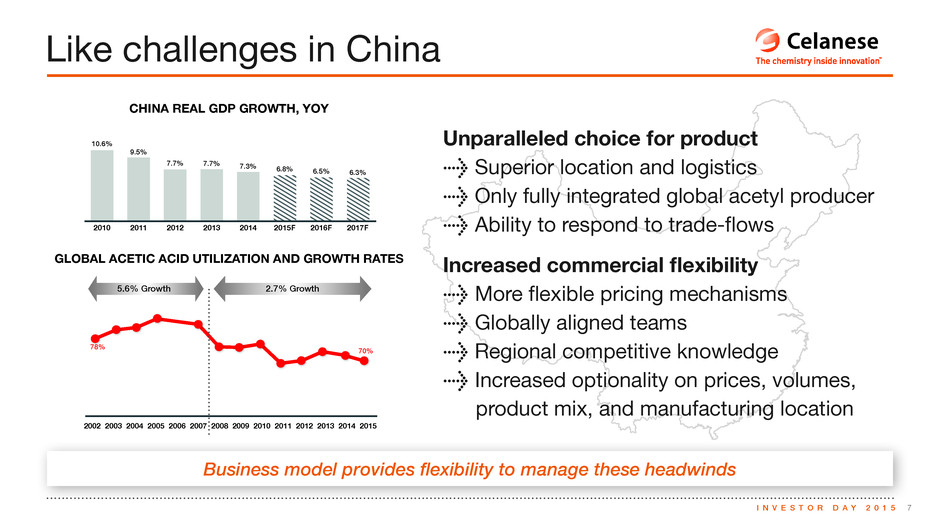

7I N V E S T O R D A Y 2 0 1 5 Business model provides flexibility to manage these headwinds Like challenges in China Unparalleled choice for product > Superior location and logistics > Only fully integrated global acetyl producer > Ability to respond to trade-flows Increased commercial flexibility > More flexible pricing mechanisms > Globally aligned teams > Regional competitive knowledge > Increased optionality on prices, volumes, product mix, and manufacturing location 2010 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015F 2016F 2017F 10.6% 9.5% 7.7% 7.7% 7.3% 6.8% 6.5% 6.3% PAGE 10 PAGE 11 PAGE 17 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 5.6% >11% >$600$5.90 - $6.10 70%78% 2012 China Americas Europe2013 2014 2015F 2016F 2010 2011 2012 2013 2014 2015F 2016F 2017F 18.6 19.1% 18.1% 15.2% 13.6% 11.9% 10.6% 10.7% 10.9% 2010 2011 2012 2013 2014 2015F 2016F 2017F 8.2% 8.4% 7.5% 7.7% 7.7% 8.0% 8.0% 11.0% 21.3 0.5-1.0 2-3 3-4 23.0 23.3 24.2 Global average 14% CAGR1 ~20% CAGR 2010 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015F 2016F 2017F 10.6% 9.5% 7.7% 7.7% 7.3% 6.8% 6.5% 6.3% PAGE 10 PAGE 11 PAGE 17 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 5.6% >11% >$600$5.90 - $6.10 70%78% 2012 China Americas Europe2013 2014 2015F 2016F 2010 2011 2012 2013 2014 2015F 2016F 2017F 18.6 19.1% 18.1% 15.2% 13.6% 11.9% 10.6% 10.7% 10.9% 2010 2011 2012 2013 2014 2015F 2016F 2017F 8.2% 8.4% 7.5% 7.7% 7.7% 8.0% 8.0% 11.0% 21.3 0.5-1.0 2-3 3-4 23.0 23.3 24.2 Global average 14% CAGR1 ~20% CAGR CHINA REAL GDP GROWTH, YOY GLOBAL ACETIC ACID UTILIZATION AND GROWTH RATES 5.6% Growth 2.7% Growth

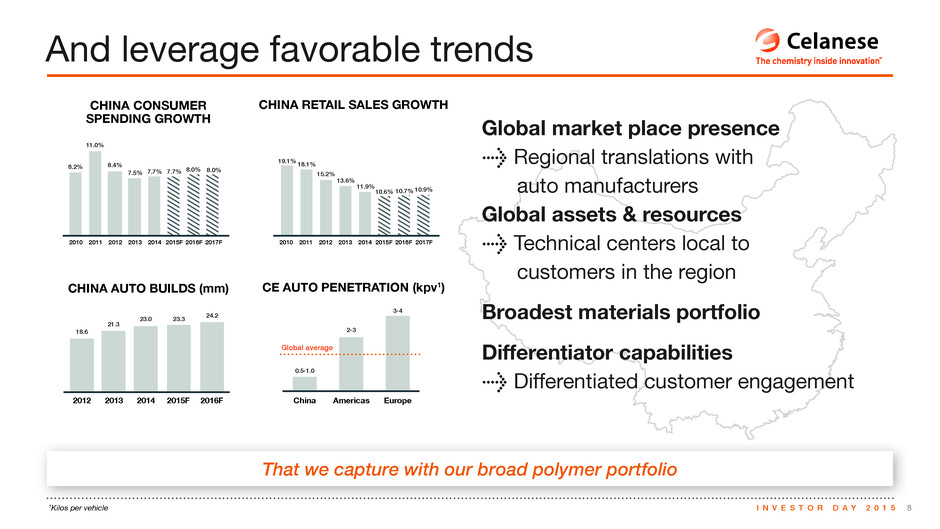

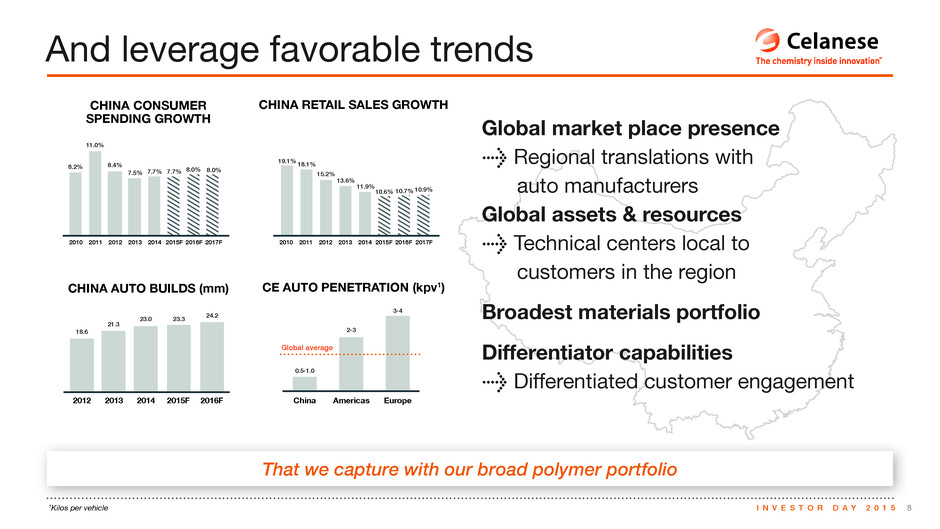

8I N V E S T O R D A Y 2 0 1 51Kilos per vehicle That we capture with our broad polymer portfolio And leverage favorable trends Global market place presence > Regional translations with auto manufacturers Global assets & resources > Technical centers local to customers in the region Broadest materials portfolio Differentiator capabilities > Differentiated customer engagement CHINA CONSUMER SPENDING GROWTH CHINA AUTO BUILDS (mm) CE AUTO PENETRATION (kpv1) CHINA RETAIL SALES GROWTH 2010 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015F 2016F 2017F 10.6% 9.5% 7.7% 7.7% 7.3% 6.8% 6.5% 6.3% PAGE 10 PAGE 11 PAGE 17 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 5.6% >11% >$600$5.90 - $6.10 70%78% 2012 China Americas Europe2013 2014 2015F 2016F 2010 2011 2012 2013 2014 2015F 2016F 2017F 18.6 19.1% 18.1% 15.2% 13.6% 11.9% 10.6% 10.7% 10.9% 2010 2011 2012 2013 2014 2015F 2016F 2017F 8.2% 8.4% 7.5% 7.7% 7.7% 8.0% 8.0% 11.0% 21.3 0.5-1.0 2-3 3-4 23.0 23.3 24.2 Global average 14% CAGR1 ~20% CAGR 2010 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015F 2016F 2017F 10.6% 9.5% 7.7% 7.7% 7.3% 6.8% 6.5% 6.3% PAGE 10 PAGE 11 PAGE 17 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 5.6% >11% >$600$5.90 - $6.10 70%78% 2012 China Americas Europe2013 2014 2015F 2016F 2010 2011 2012 2013 2014 2015F 2016F 2017F 18.6 19.1% 18.1% 15.2% 13.6% 11.9% 10.6% 10.7% 10.9% 2010 2011 2012 2013 2014 2015F 2016F 2017F 8.2% 8.4% 7.5% 7.7% 7.7% 8.0% 8.0% 11.0% 21.3 0.5-1.0 2-3 3-4 23.0 23.3 24.2 Global average 14% CAGR1 ~20% CAGR

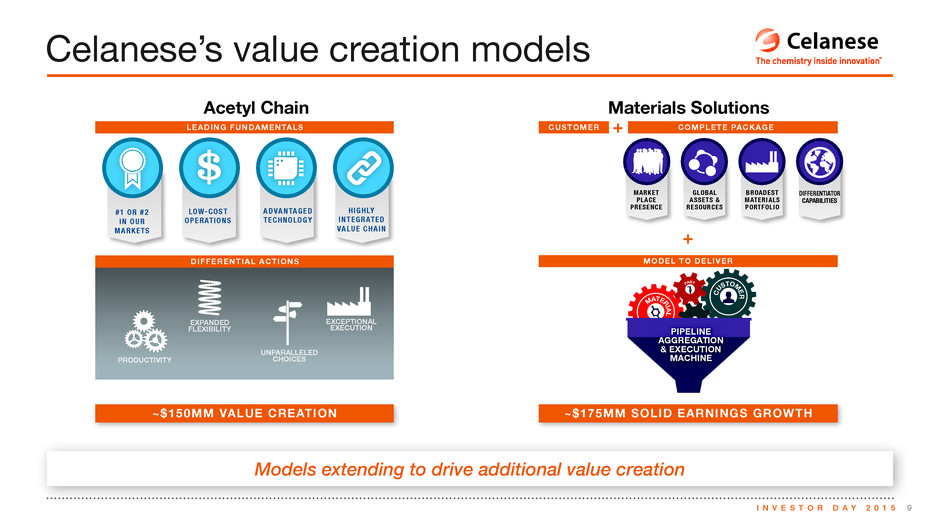

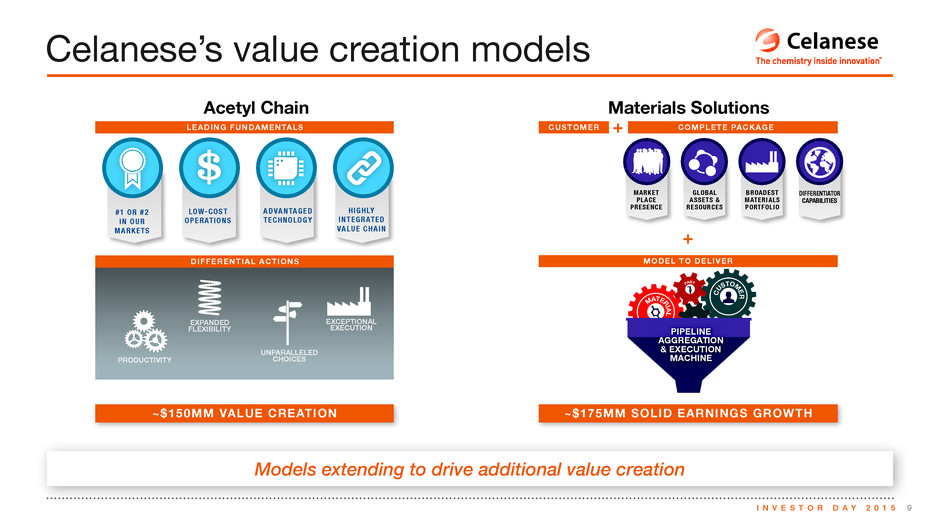

9I N V E S T O R D A Y 2 0 1 5 Models extending to drive additional value creation Celanese’s value creation models Acetyl Chain Materials Solutions + + #1 OR #2 IN OUR MARKETS LOW-COST OPERATIONS ADVANTAGED TECHNOLOGY HIGHLY INTEGRATED VALUE CHAIN MARKET PLACE PRESENCE GLOBAL ASSETS & RESOURCES BROADEST MATERIALS PORTFOLIO DIFFERENTIATOR CAPABILITIES LEADING FUNDAMENTALS COMPLETE PACKAGECUSTOMER MODEL TO DELIVERDIFFERENTIAL ACTIONS PRODUCTIVITY UNPARALLELED CHOICES EXPANDED FLEXIBILITY EXCEPTIONAL EXECUTION C US TOMER MATERIA L PART PIPELINE AGGREGATION & EXECUTION MACHINE ~$175MM SOLID EARNINGS GROWTH~$150MM VALUE CREATION

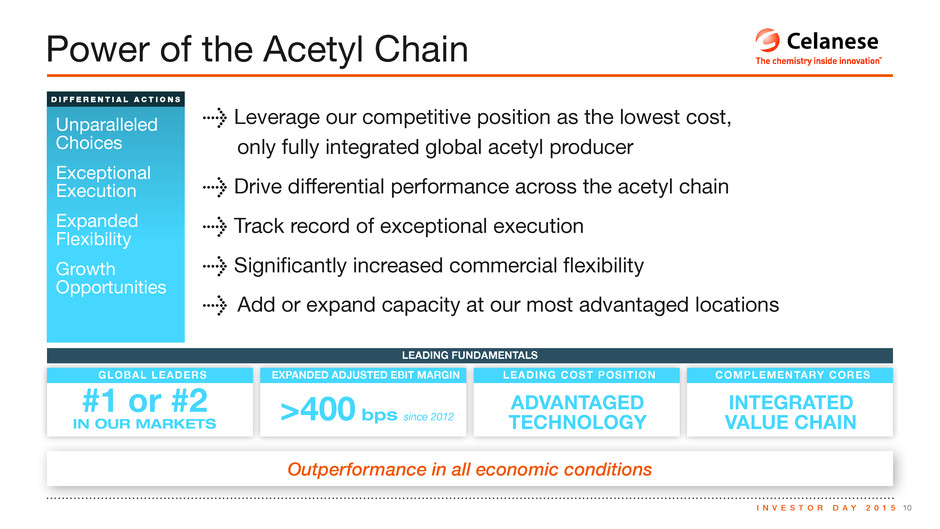

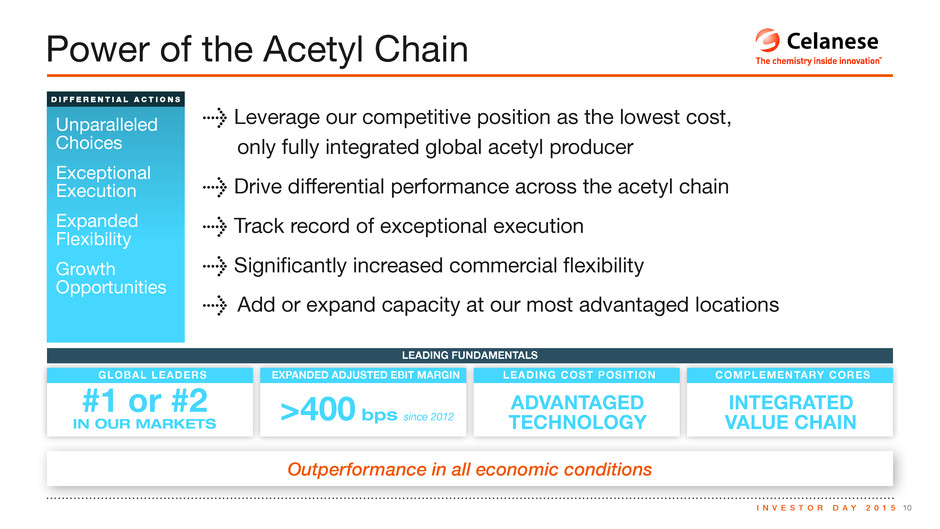

10I N V E S T O R D A Y 2 0 1 5 Power of the Acetyl Chain Outperformance in all economic conditions COMPLEMENTARY CORESGLOBAL LEADERS LEADING COST POSITIONEXPANDED ADJUSTED EBIT MARGIN LEADING FUNDAMENTALS >400 bps ADVANTAGED TECHNOLOGY INTEGRATED VALUE CHAIN#1 or #2 IN OUR MARKETS since 2012 Unparalleled Choices Exceptional Execution Expanded Flexibility Growth Opportunities D I F F E R E N T I A L A C T I O N S > Leverage our competitive position as the lowest cost, only fully integrated global acetyl producer > Drive differential performance across the acetyl chain > Track record of exceptional execution > Significantly increased commercial flexibility > Add or expand capacity at our most advantaged locations

11I N V E S T O R D A Y 2 0 1 5 Acetyl Model: Opportunity & Execution Operating Rates Strategic Purchases Demand Optimization Freight Arbitrage Swaps Model best netback on acetic acid molecule 3 Optimize operating rates across production network 4 Execute 5 Repeat 6 2 Daily competitive intelligence (90 days forward) 1 Assess regional product dynamics

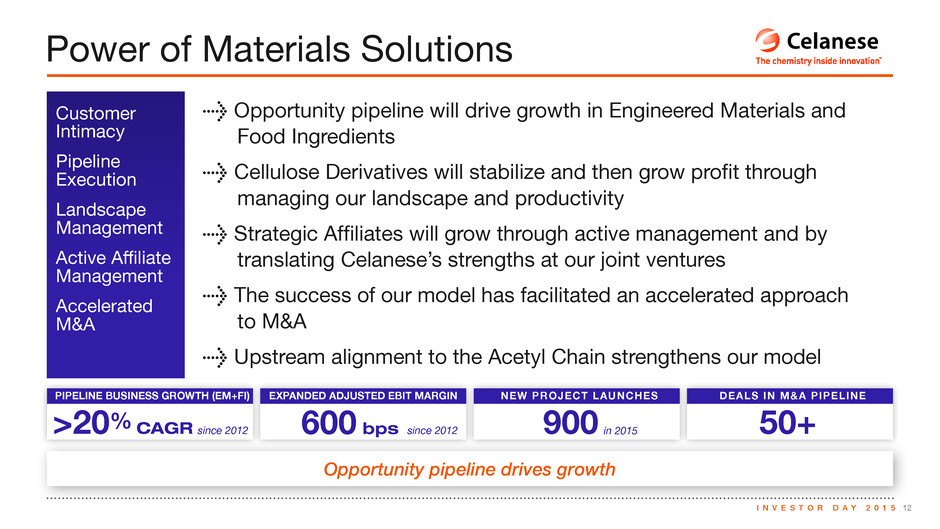

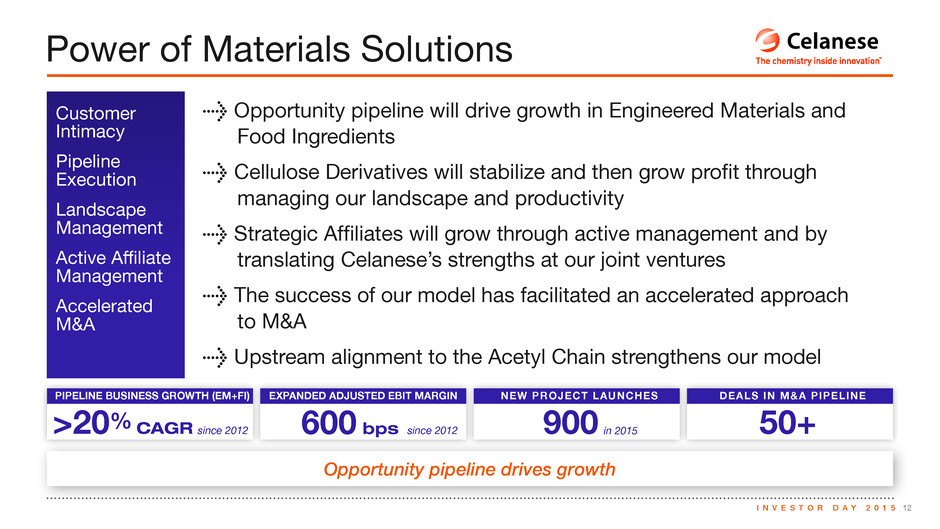

12I N V E S T O R D A Y 2 0 1 5 Power of Materials Solutions Opportunity pipeline drives growth Customer Intimacy Pipeline Execution Landscape Management Active Affiliate Management Accelerated M&A > Opportunity pipeline will drive growth in Engineered Materials and Food Ingredients > Cellulose Derivatives will stabilize and then grow profit through managing our landscape and productivity > Strategic Affiliates will grow through active management and by translating Celanese’s strengths at our joint ventures > The success of our model has facilitated an accelerated approach to M&A > Upstream alignment to the Acetyl Chain strengthens our model PIPELINE BUSINESS GROWTH (EM+FI) DEALS IN M&A PIPELINE NEW PROJECT LAUNCHES EXPANDED ADJUSTED EBIT MARGIN 50+900600 bps>20% CAGR in 2015since 2012 since 2012

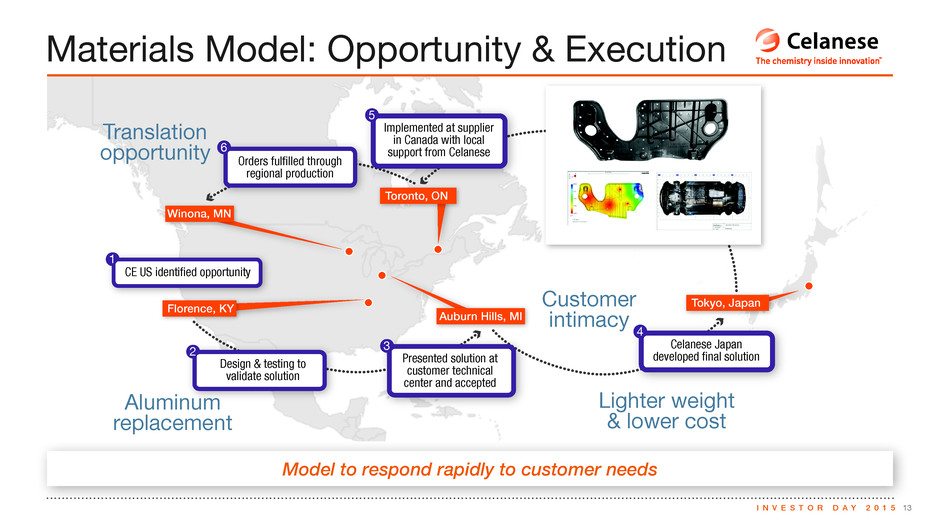

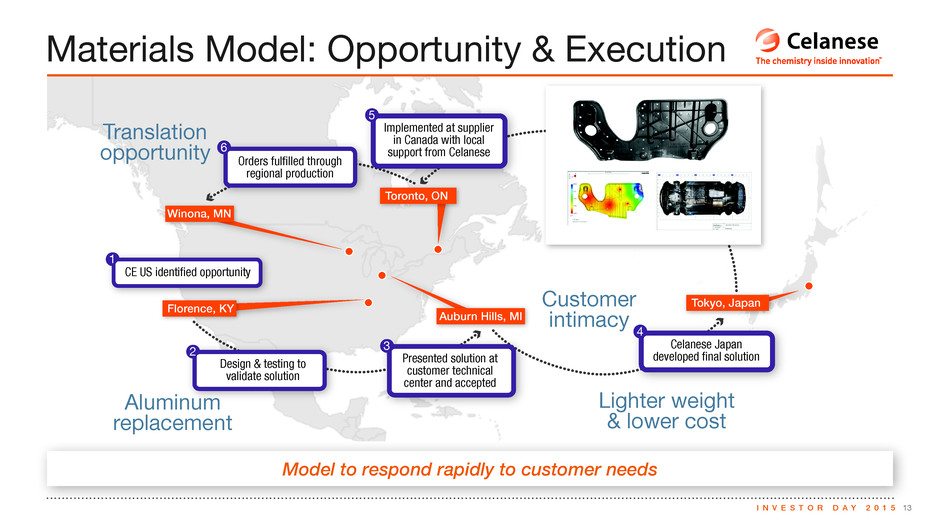

13I N V E S T O R D A Y 2 0 1 5 Model to respond rapidly to customer needs Materials Model: Opportunity & Execution Winona, MN Winona, MN Toronto, ON Auburn Hills, MI Florence, KY CE US identified opportunity 3 Presented solution at customer technical center and accepted Celanese Japan developed final solution Implemented at supplier in Canada with local support from Celanese Tokyo, Japan Translation opportunity Aluminum replacement Lighter weight & lower cost Customer intimacy 4 3 1 5 Orders fulfilled through regional production Design & testing to validate solution 2 6

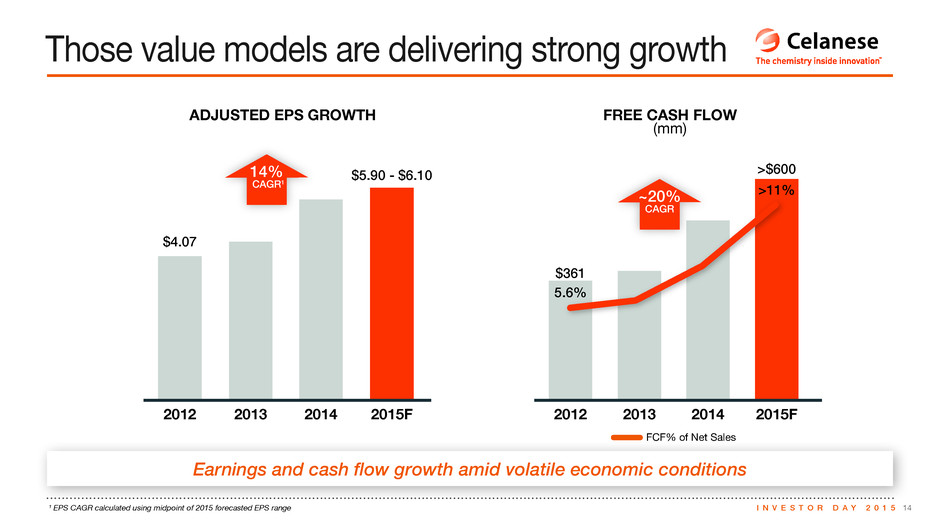

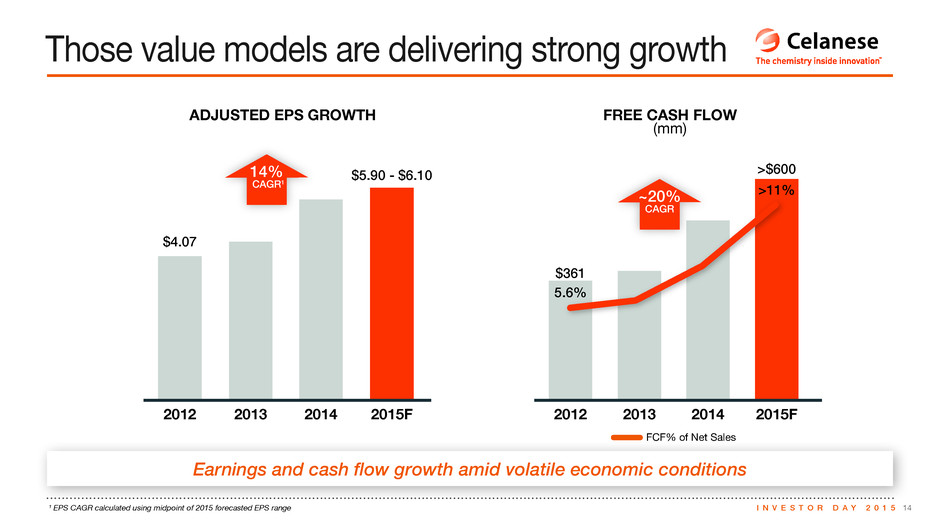

14I N V E S T O R D A Y 2 0 1 5¹ EPS CAGR calculated using midpoint of 2015 forecasted EPS range Earnings and cash flow growth amid volatile economic conditions Those value models are delivering strong growth FREE CASH FLOW (mm) ADJUSTED EPS GROWTH 2010 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015F 2016F 2017F 10.6% 9.5% 7.7% 7.7% 7.3% 6.8% 6.5% 6.3% PAGE 10 PAGE 11 PAGE 17 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 5.6% >11% >$600$5.90 - $6.10 70%78% 2012 China Americas Europe2013 2014 2015F 2016F 2010 2011 2012 2013 2014 2015F 2016F 2017F 18.6 19.1% 18.1% 15.2% 13.6% 11.9% 10.6% 10.7% 10.9% 2010 2011 2012 2013 2014 2015F 2016F 2017F 8.2% 8.4% 7.5% 7.7% 7.7% 8.0% 8.0% 11.0% 21.3 0.5-1.0 2-3 3-4 23.0 23.3 24.2 Global average 14% CAGR1 ~20% CAGR 2010 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015F 2016F 2017F 10.6% 9.5% 7.7% 7.7% 7.3% 6.8% 6.5% 6.3% 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 5.6% >11% >$600$5.90 - $6.10 70%78% 2012 China Americas Europe2013 2014 2015F 2016F 2010 2011 2012 2013 2014 2015F 2016F 2017F 18.6 19.1% 18.1% 15.2% 13.6% 11.9% 10.6% 10.7% 10.9% 2010 2011 2012 2013 2014 2015F 2016F 2017F 8.2% 8.4% 7.5% 7.7% 7.7% 8.0% 8.0% 11.0% 21.3 0.5-1.0 2-3 3-4 23.0 23.3 24.2 Global average 14 CAGR1 ~20 CAGR FCF% of Net Sales

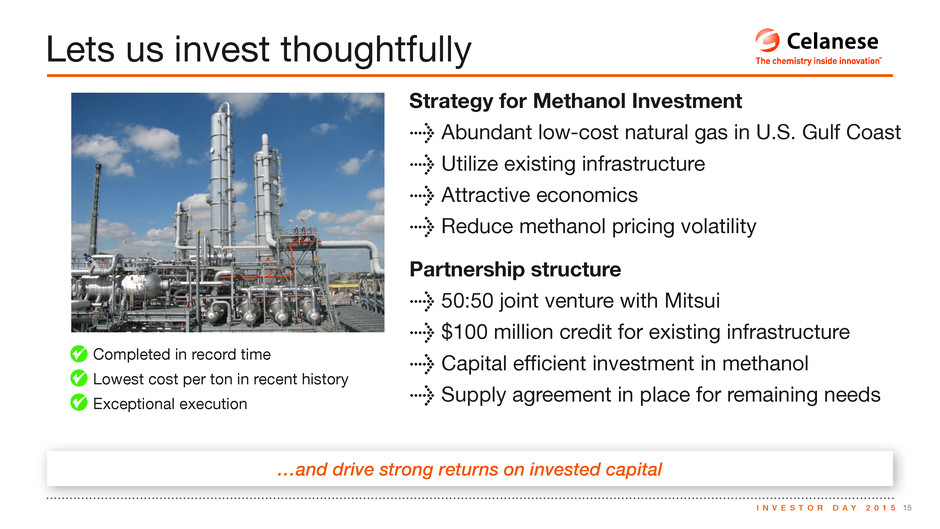

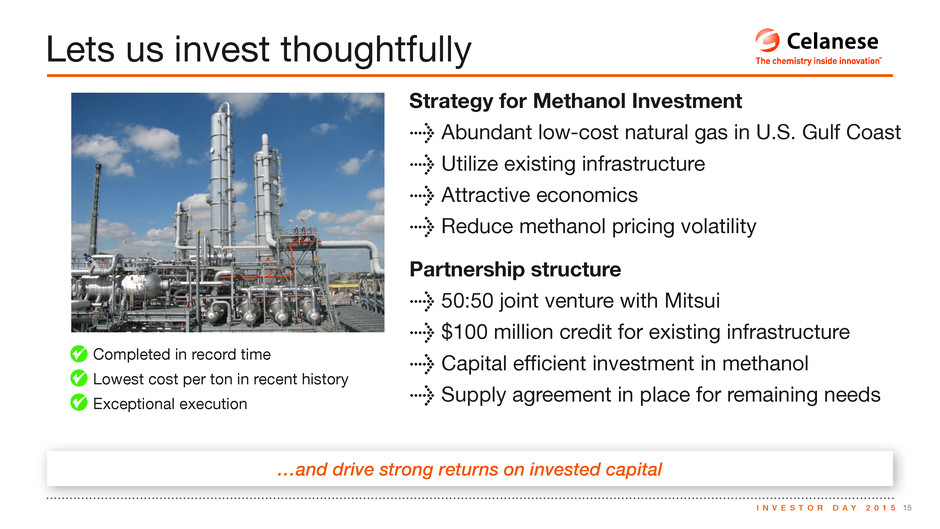

15I N V E S T O R D A Y 2 0 1 5 …and drive strong returns on invested capital Lets us invest thoughtfully Strategy for Methanol Investment > Abundant low-cost natural gas in U.S. Gulf Coast > Utilize existing infrastructure > Attractive economics > Reduce methanol pricing volatility Partnership structure > 50:50 joint venture with Mitsui > $100 million credit for existing infrastructure > Capital efficient investment in methanol > Supply agreement in place for remaining needs Completed in record time Lowest cost per ton in recent history Exceptional execution

16I N V E S T O R D A Y 2 0 1 5Source: Capital IQ and Celanese estimates. Refer to Glossary in CFO presentation for proxy peers Top quartile ROIC versus peers Delivering strong returns on investment 5-YEAR AVERAGE ROIC (2010-2014) 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5% 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10 12.2% Peer Median

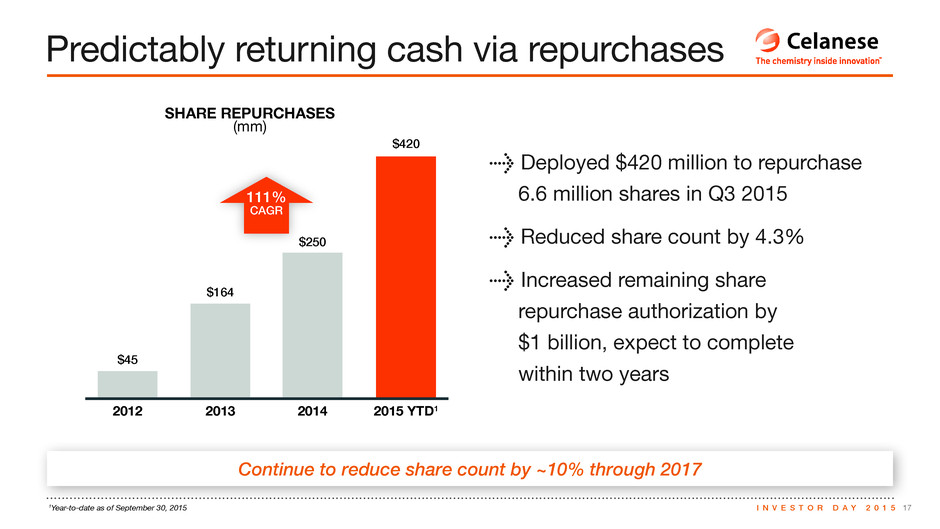

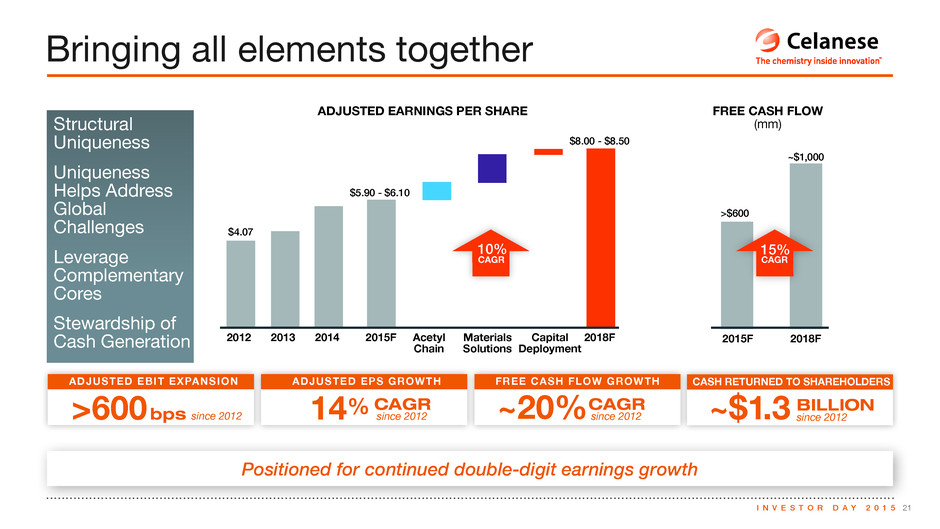

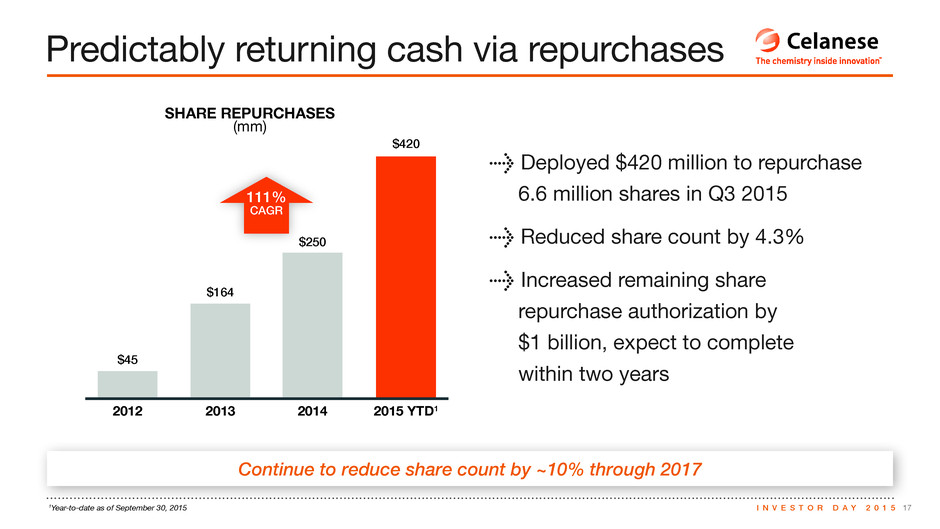

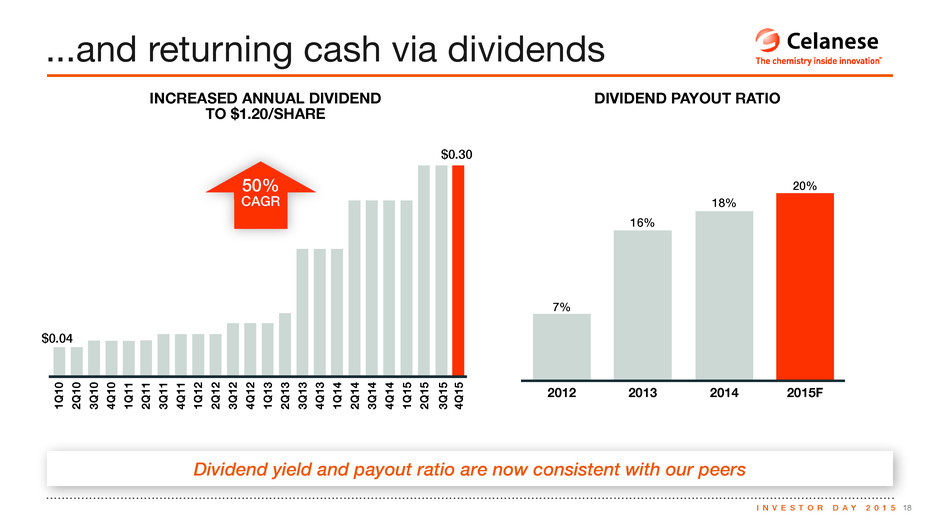

17I N V E S T O R D A Y 2 0 1 51Year-to-date as of September 30, 2015 Continue to reduce share count by ~10% through 2017 Predictably returning cash via repurchases SHARE REPURCHASES (mm) > Deployed $420 million to repurchase 6.6 million shares in Q3 2015 > Reduced share count by 4.3% > Increased remaining share repurchase authorization by $1 billion, expect to complete within two years PAGE 21 PAGE 19 21.1% 17.5% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 12.2% Peer Median Peer 12 Peer 13 Peer 14 PAGE 25 PAGE 20 2012 2013 2014 2015 YTD1 $45 $164 $250 $420 111% CAGR CE 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 $0.04 $0.30 50% CAGR 2012 2013 2014 2015F 7% 16% 18% 20% 2012 20142013 2015F 2018FAcetyl Chain Capital Deployment Materials Solutions 2015F 2018F $4.07 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 15% CAGR 10% CAGR

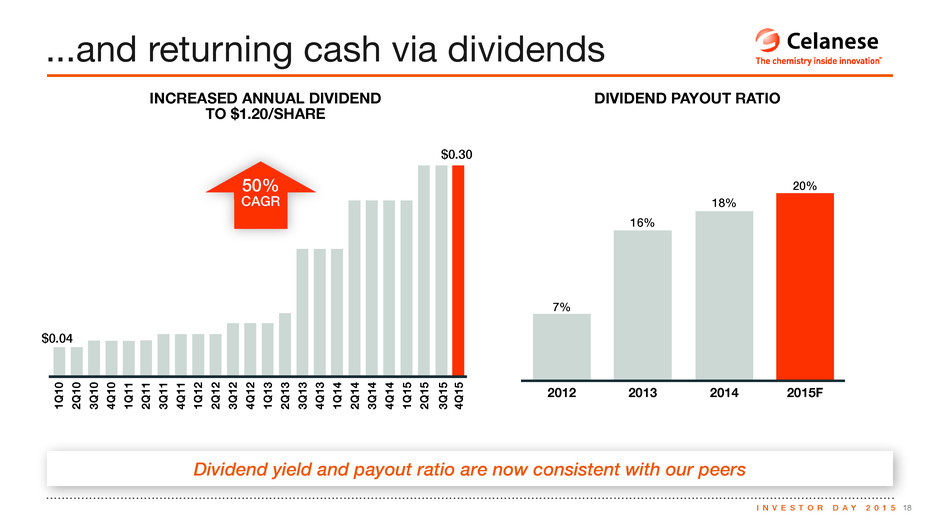

18I N V E S T O R D A Y 2 0 1 5 Dividend yield and payout ratio are now consistent with our peers ...and returning cash via dividends INCREASED ANNUAL DIVIDEND TO $1.20/SHARE DIVIDEND PAYOUT RATIO PAGE 21 PAGE 19 21.1% 17.5% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 12.2% Peer Median Peer 12 Peer 13 Peer 14 PAGE 25 PAGE 20 2012 2013 2014 2015 YTD1 $45 $164 $250 $420 111% CAGR CE 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 $0.04 $0.30 50% CAGR 2012 2013 2014 2015F 7% 16% 18% 20% 2012 20142013 2015F 2018FAcetyl Chain Capital Deployment Materials Solutions 2015F 2018F $4.07 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 15% CAGR 10% CAGR PAGE 21 PAGE 19 21.1% 17.5 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 12.2% Peer Median Peer 12 Peer 13 Peer 14 PAGE 25 PAGE 20 2012 2013 2014 2015 YTD1 $45 $164 $250 $420 111% CAGR CE 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 $0.04 $0.30 50% CAGR 2012 2013 2014 2015F 7% 16% 18% 20% 2012 20142013 2015F 2018FAcetyl Chain Capital Deployment Materials Solutions 2015F 2018F $4.07 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 15% CAGR 10% CAGR

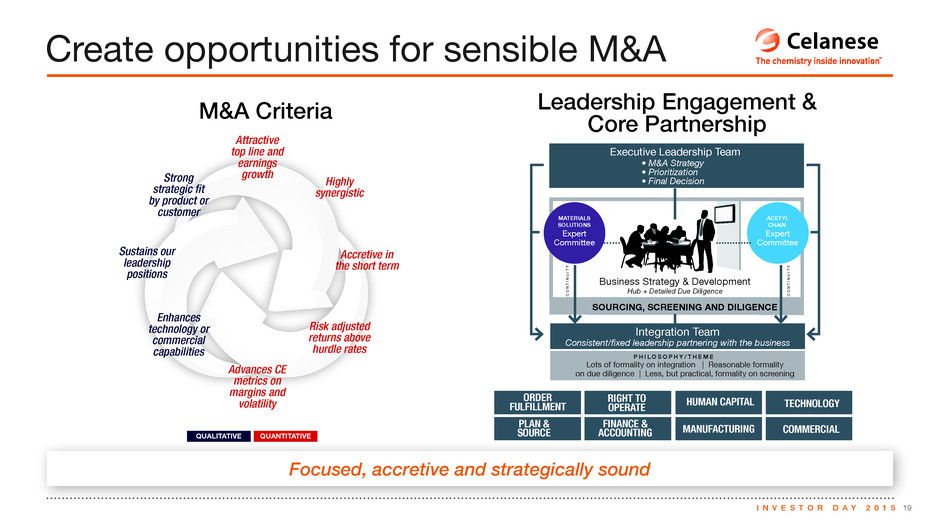

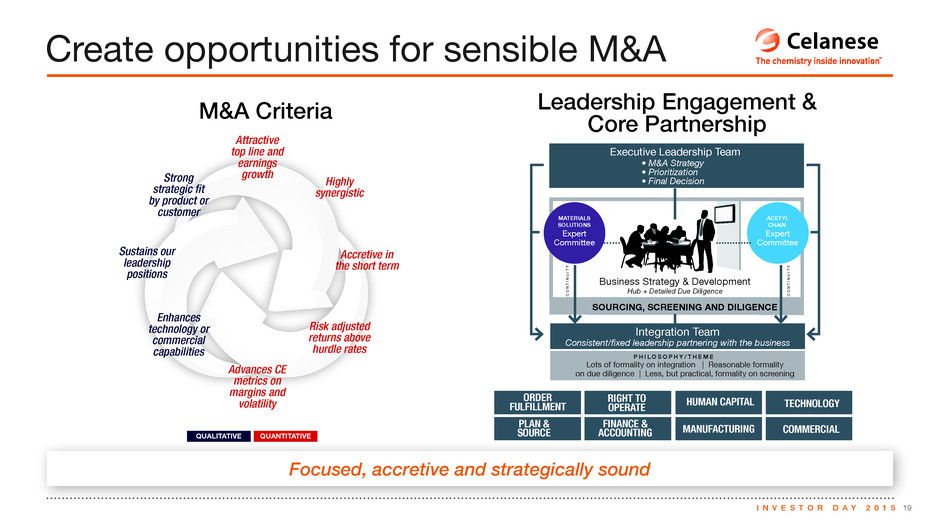

19I N V E S T O R D A Y 2 0 1 5 Focused, accretive and strategically sound Create opportunities for sensible M&A M&A Criteria Leadership Engagement & Core Partnership Attractive top line and earnings growth Highly synergistic Accretive in the short term Sustains our leadership positions Risk adjusted returns above hurdle rates Enhances technology or commercial capabilities Strong strategic fit by product or customer Advances CE metrics on margins and volatility QUALITATIVE QUANTITATIVE MATERIALS SOLUTIONS P H I L O S O P H Y / T H E M E C O N T IN U IT Y C O N T IN U IT Y Expert Committee ACETYL CHAIN Expert Committee Executive Leadership Team Integration Team Consistent/fixed leadership partnering with the business • M&A Strategy • Prioritization • Final Decision Lots of formality on integration | Reasonable formality on due diligence | Less, but practical, formality on screening Business Strategy & Development Hub + Detailed Due Diligence SOURCING, SCREENING AND DILIGENCE ORDER FULFILLMENT RIGHT TO OPERATE FINANCE & ACCOUNTING HUMAN CAPITAL PLAN & SOURCE TECHNOLOGY MANUFACTURING COMMERCIAL

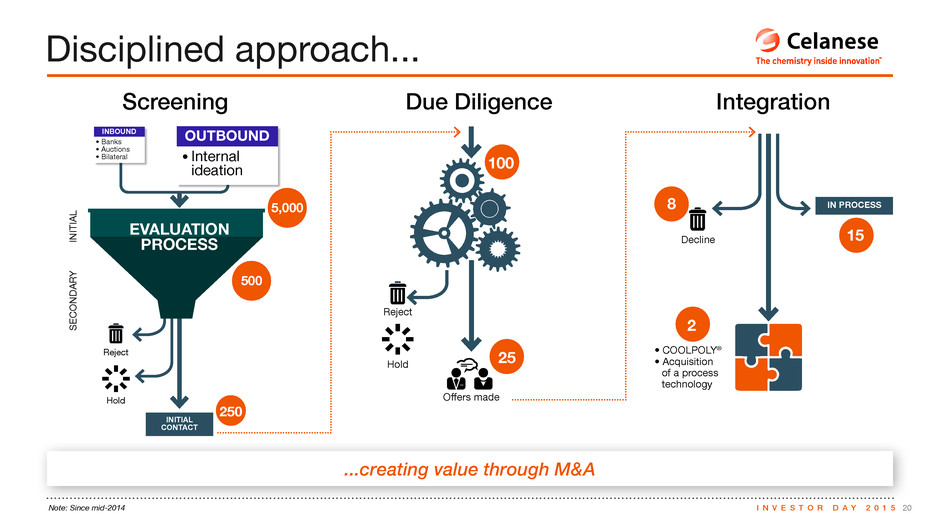

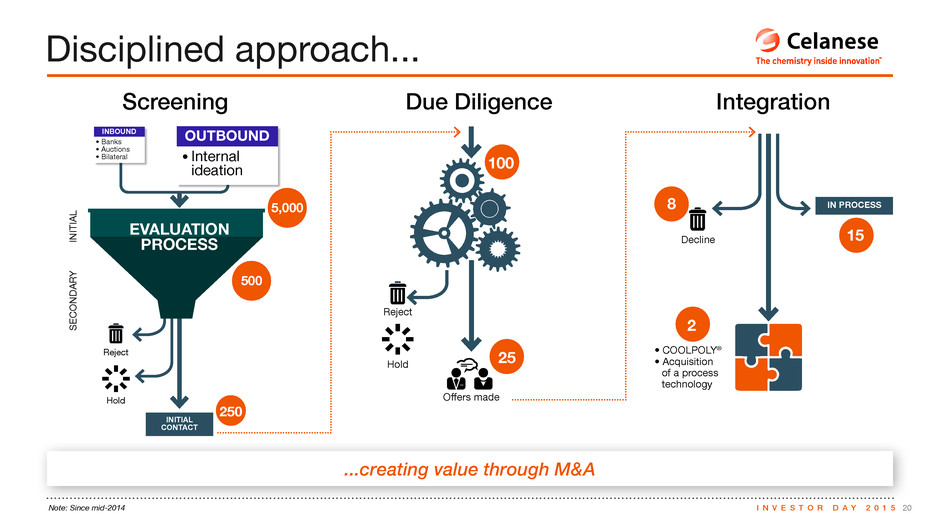

20I N V E S T O R D A Y 2 0 1 5 Disciplined approach... Note: Since mid-2014 ...creating value through M&A Screening Due Diligence Integration EVALUATION PROCESS Reject ?? INBOUND OUTBOUND• Banks • Auctions • Bilateral ????? ???? • ?te??? ? ???e??? 5,000 500 250 INITIAL CONTACT Reject ?????e ?? 25 100 ?c?? • COOLPOLY ? • Acquisition of a process technology 2 8 15 IN PROCESS

21I N V E S T O R D A Y 2 0 1 5 Bringing all elements together Positioned for continued double-digit earnings growth Structural Uniqueness Uniqueness Helps Address Global Challenges Leverage Complementary Cores Stewardship of Cash Generation PAGE 21 PAGE 19 21.1% 17.5% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 12.2% Peer Median Peer 12 Peer 13 Peer 14 PAGE 25 PAGE 20 2012 2013 2014 2015 YTD1 $45 $164 $250 $420 111% CAGR CE 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 $0.04 $0.30 50% CAGR 2012 2013 2014 2015F 7% 16% 18% 20% 2012 20142013 2015F 2018FAcetyl Chain Capital Deployment Materials Solutions 2015F 2018F $4.07 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 15% CAGR 10% CAGR PAGE 21 PAGE 19 21.1% 17.5% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 12.2% Peer Median Peer 12 Peer 13 Peer 14 PAGE 25 PAGE 20 2012 2013 2014 2015 YTD1 $45 $164 $250 $420 111% CAGR CE 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 $0.04 $0.30 50% CAGR 2012 2013 2014 2015F 7% 16% 18% 20% 2012 20142013 2015F 2018FAcetyl Chain Capital Deployment Materials Solutions 2015F 2018F $4.07 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 15% CAGR 10% CAGR ADJUSTED EARNINGS PER SHARE FREE CASH FLOW (mm) ADJUSTED EPS GROWTH ADJUSTED EBIT EXPANSION FREE CASH FLOW GROWTH >600 bps ~20%14% since 2012since 2012 since 2012CAGR CAGR CASH RETURNED TO SHAREHOLDERS ~$1.3 since 2012BILLION