Scott Sutton PRESIDENT, MATERIALS SOLUTIONS I N V E S T O R D A Y N O V E M B E R 1 3 , 2 0 1 5

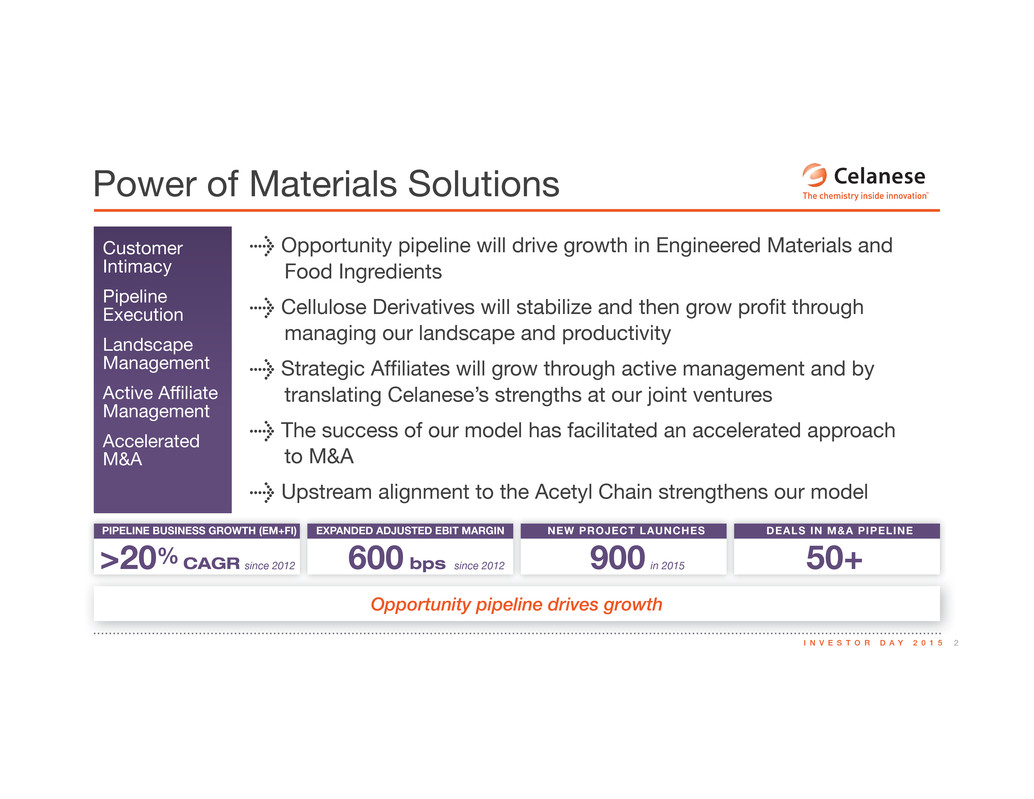

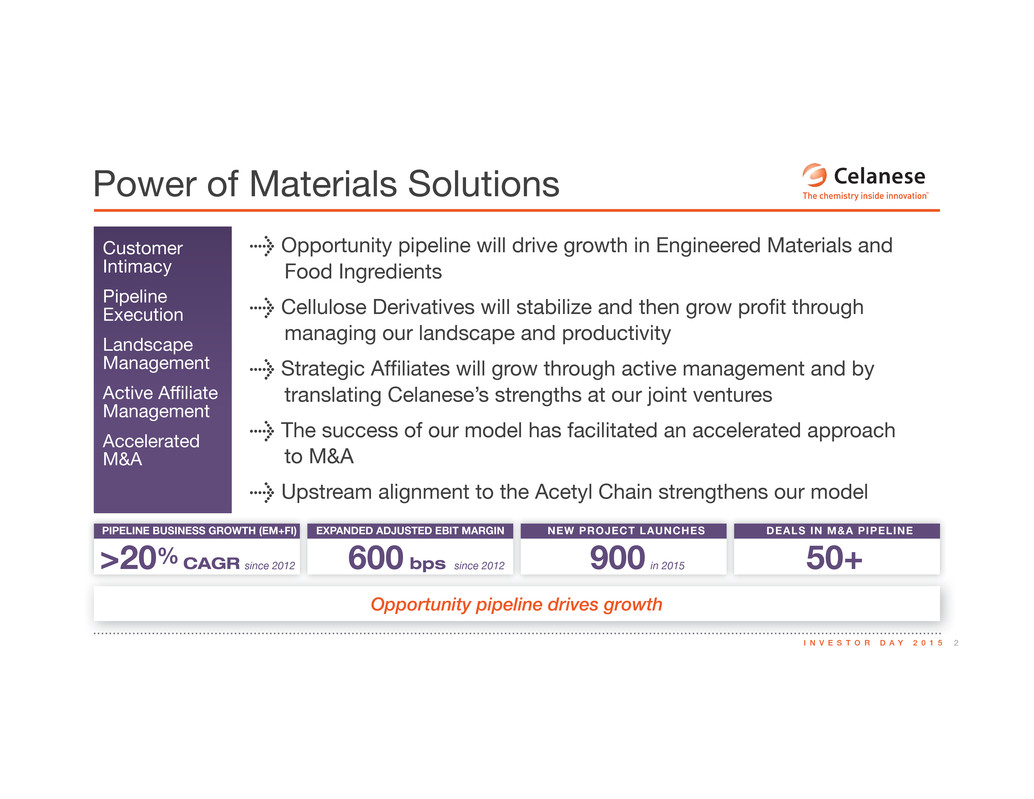

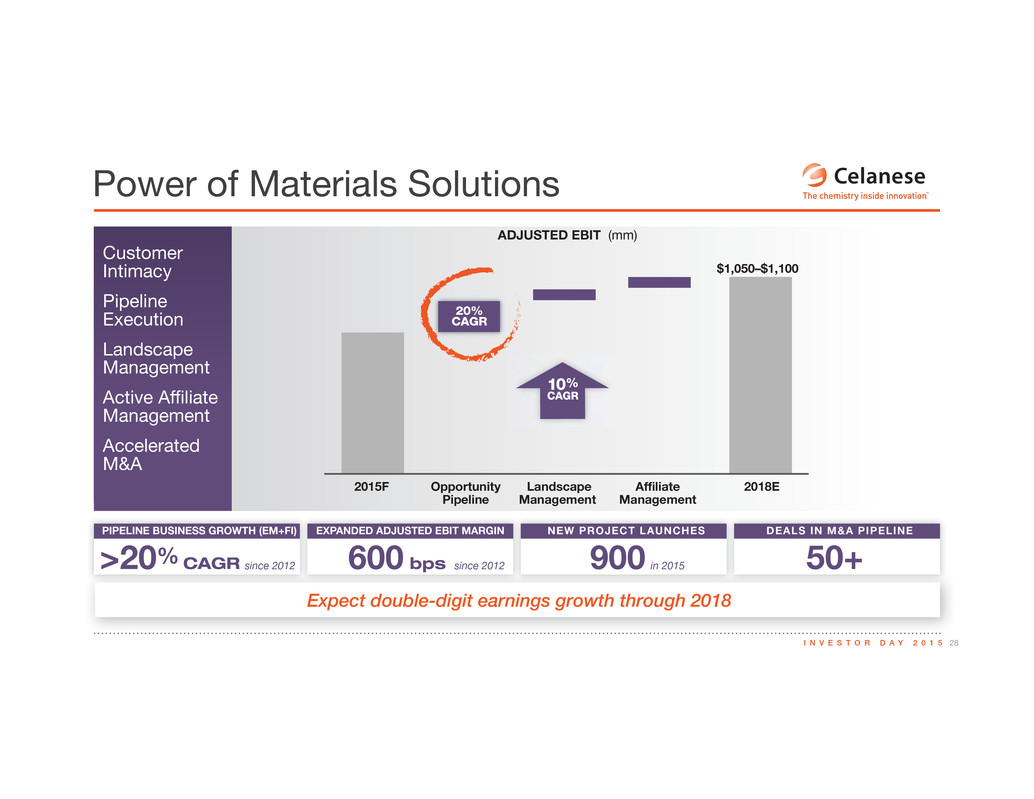

2I N V E S T O R D A Y 2 0 1 5 Power of Materials Solutions Customer Intimacy Pipeline Execution Landscape Management g40g74g91g80g93g76g3g40g585g83g80g72g91g76g3 Management Accelerated M&A > Opportunity pipeline will drive growth in Engineered Materials and Food Ingredients > Cellulose Derivatives will stabilize and then grow profit through managing our landscape and productivity > Strategic Affiliates will grow through active management and by translating Celanese’s strengths at our joint ventures > The success of our model has facilitated an accelerated approach to M&A > Upstream alignment to the Acetyl Chain strengthens our model PIPELINE BUSINESS GROWTH (EM+FI) DEALS IN M&A PIPELINE NEW PROJECT LAUNCHES EXPANDED ADJUSTED EBIT MARGIN 50+900600 bps>20% CAGR in 2015 Opportunity pipeline drives growth since 2012 since 2012

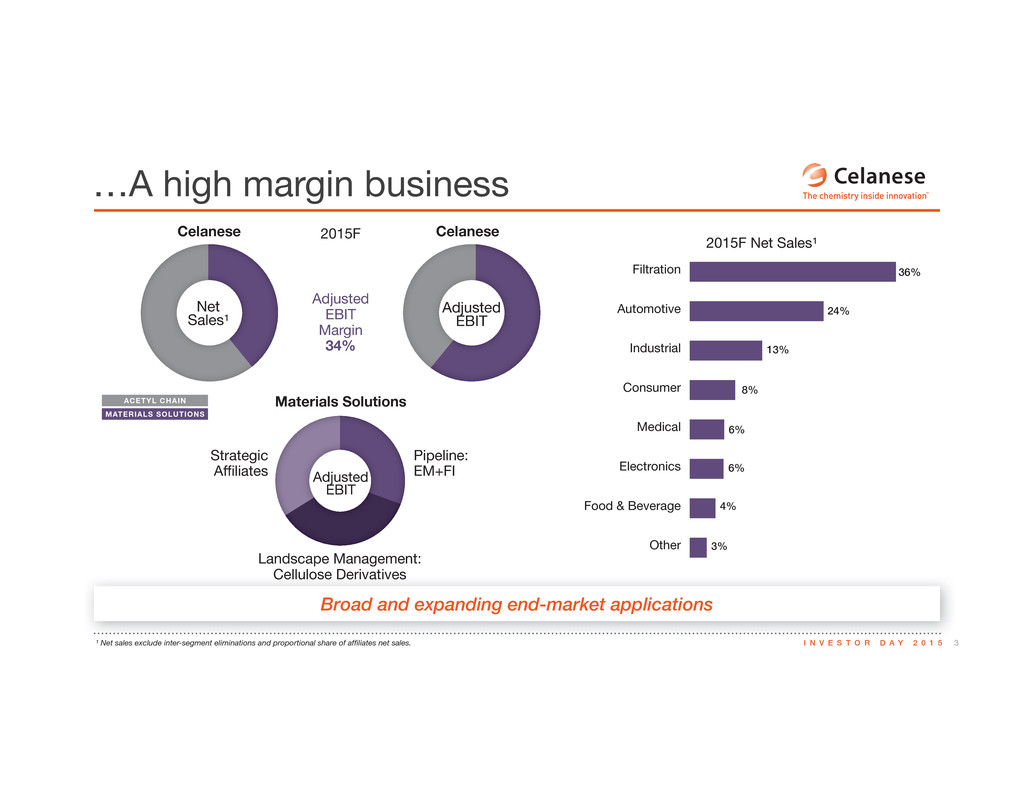

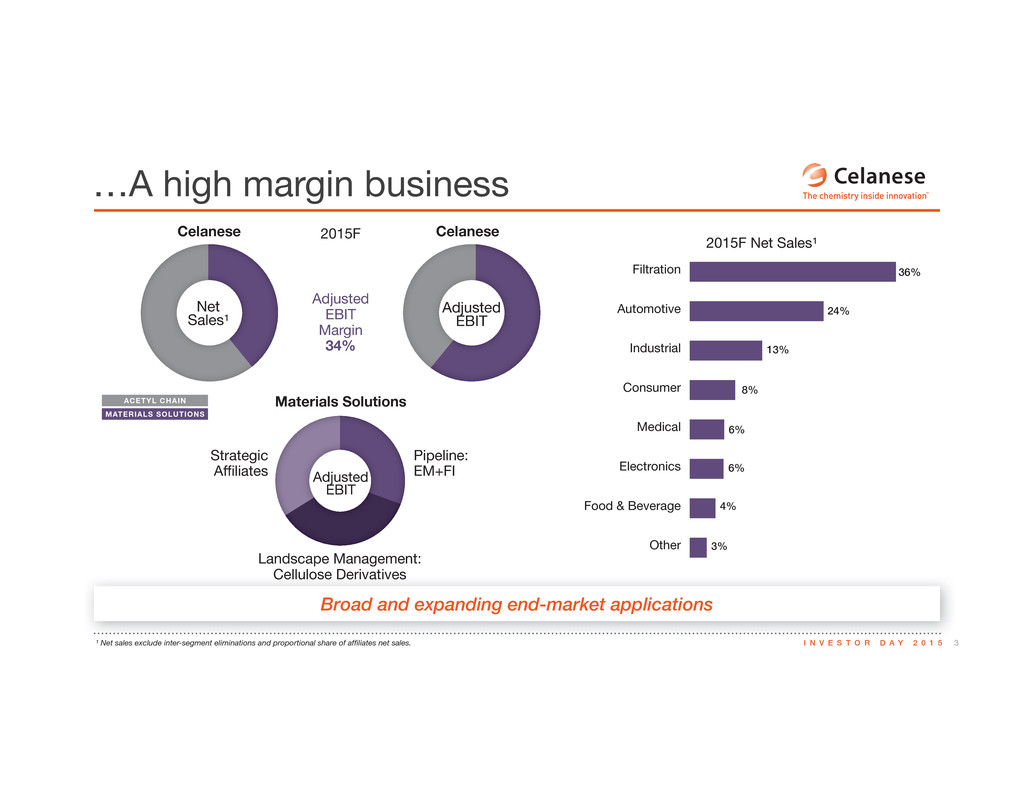

3I N V E S T O R D A Y 2 0 1 5 …A high margin business Adjusted EBIT Margin 34% Net Sales¹ 2015F Net Sales¹ 2015F Adjusted EBIT Adjusted EBIT Strategic g40g585g83g80g72g91g76g90 Pipeline: EM+FI Landscape Management: Cellulose Derivatives ¹ Net sales exclude inter-segment eliminations and proportional share of affiliates net sales. ACETYL CHAIN MATERIALS SOLUTIONS Cellulose Derivative Broad and expanding end-market applications Celanese Materials Solutions Celanese Filtration Automotive Industrial Consumer Medical Electronics Food & Beverage Other 36% 24% 13% 8% 6% 6% 4% 3%

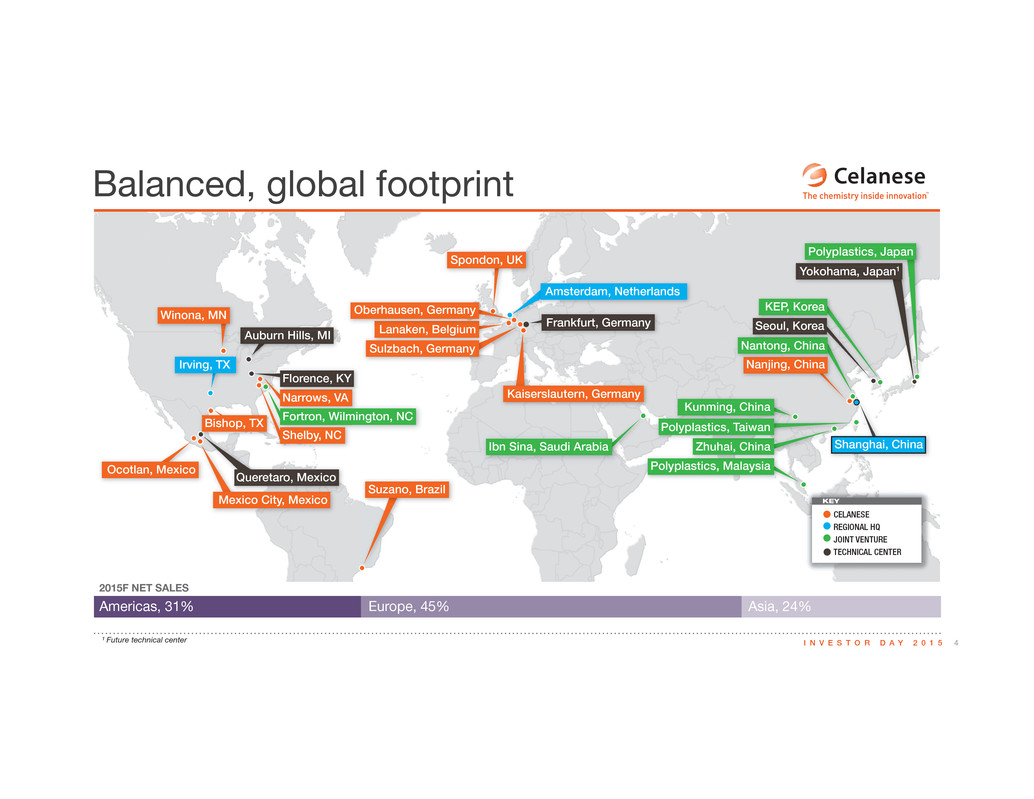

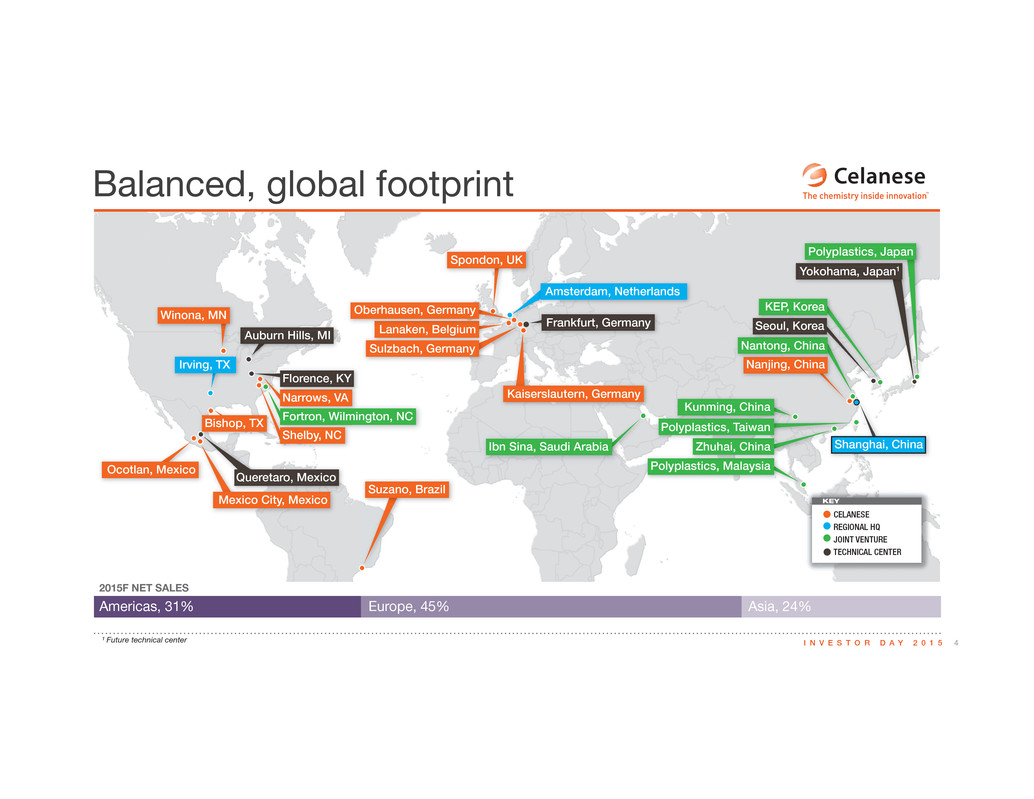

4I N V E S T O R D A Y 2 0 1 5 Balanced, global footprint KEY CELANESE REGIONAL HQ JOINT VENTURE TECHNICAL CENTER Spondon, UK Amsterdam, Netherlands Lanaken, Belgiuml Oberhausen, Germany Kaiserslautern, Germany g Sulzbach, Germany Frankfurt, Germany Polyplastics, Japan Yokohama, Japan1 Polyplastics, Malaysiai M l i Zhuhai, China Polyplastics, Taiwan Winona, MN Irving, TX Narrows, VA Florence, KY Auburn Hills, MI Fortron, Wilmington, NC Shelby, NC Suzano, Brazil Bishop, TX Mexico City, Mexico Ocotlan, Mexico Queretaro, Mexico Kunming, China Ibn Sina, Saudi Arabia Shanghai, China Nanjing, ChinaCh Nantong, China KEP, Korea N Chi Seoul, Korea Americas, 31% Europe, 45% Asia, 24% ¹ Future technical center 2015F NET SALES

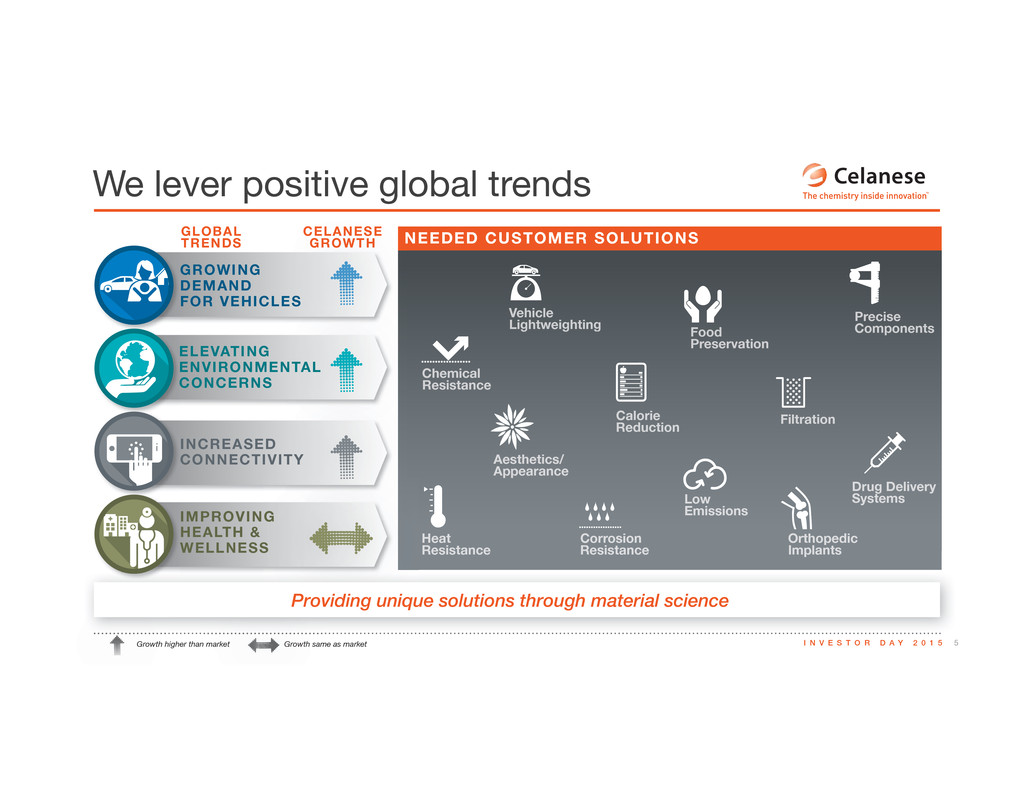

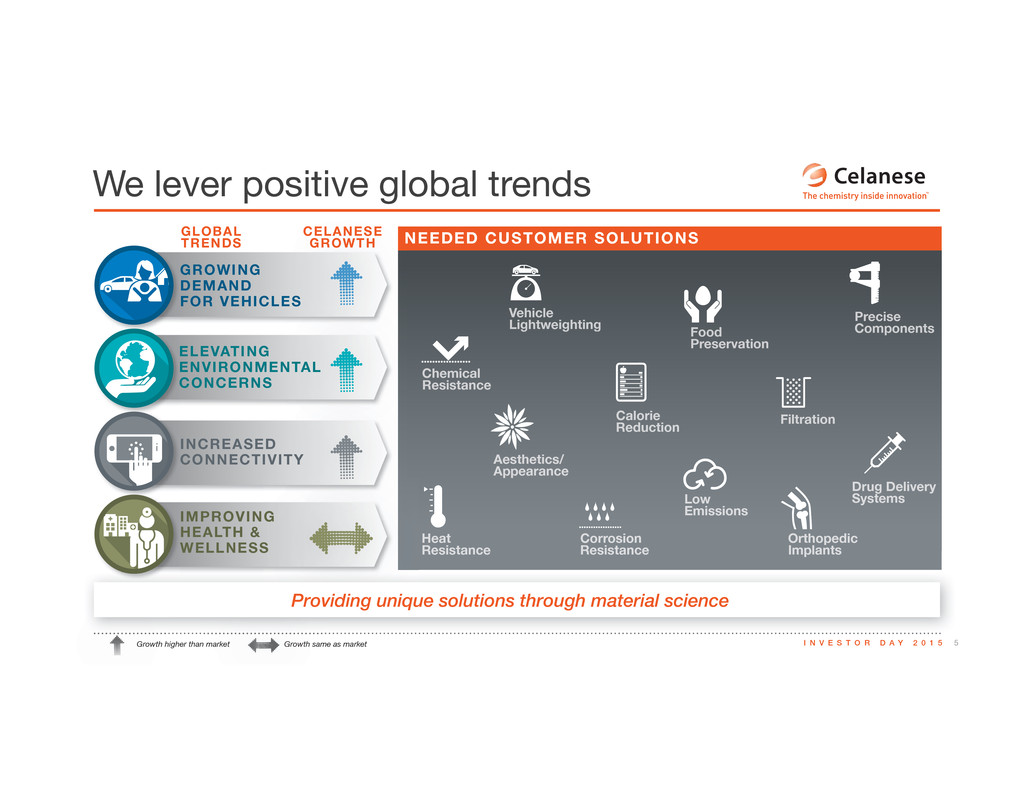

5I N V E S T O R D A Y 2 0 1 5 We lever positive global trends GLOBAL TRENDS CELANESE GROWTH GROWING DEMAND FOR VEHICLES INCREASED CONNECTIVITY IMPROVING HEALTH & WELLNESS ELEVATING ENVIRONMENTAL CONCERNS NEEDED CUSTOMER SOLUTIONS Vehicle Lightweighting Food Preservation Calorie Reduction Corrosion Resistance Orthopedic Implants Low Emissions Drug Delivery Systems g Filtration Precise Components Chemical Resistance Aesthetics/ Appearance Heat Resistance Growth higher than market Growth same as market Providing unique solutions through material science

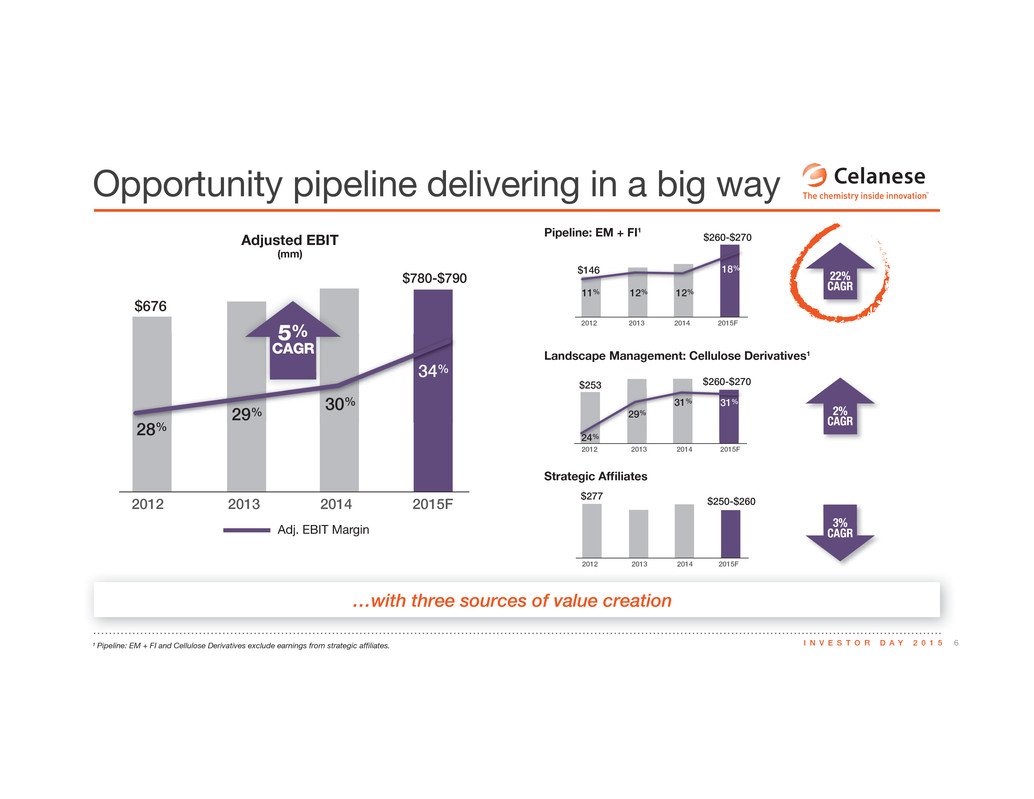

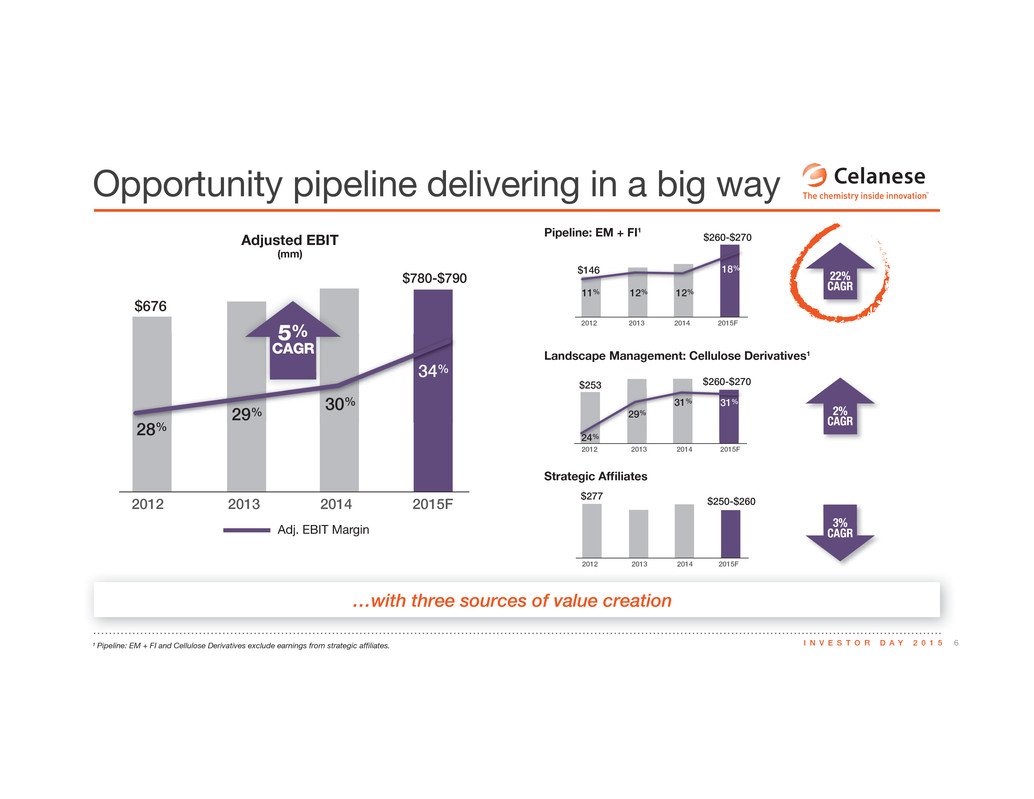

6I N V E S T O R D A Y 2 0 1 5 Opportunity pipeline delivering in a big way ¹ Pipeline: EM + FI and Cellulose Derivatives exclude earnings from strategic affiliates. 2012 2013 2014 2015F $676 28% 29% 30 % 34% $780-$790 5% CAGR 2012 2013 2014 2015F $146 $260-$270 11% 12% 12% 18%$14 2012 2013 2014 2015F $260-$270$253 24% 29% 31% 31% $250-$260 2012 2013 2014 2015F $277 Adjusted EBIT (mm) Pipeline: EM + FI1 Landscape Management: Cellulose Derivatives1 Strategic Affiliates …with three sources of value creation Adj. EBIT Margin 22% CAGR 2% CAGR 3% CAGR

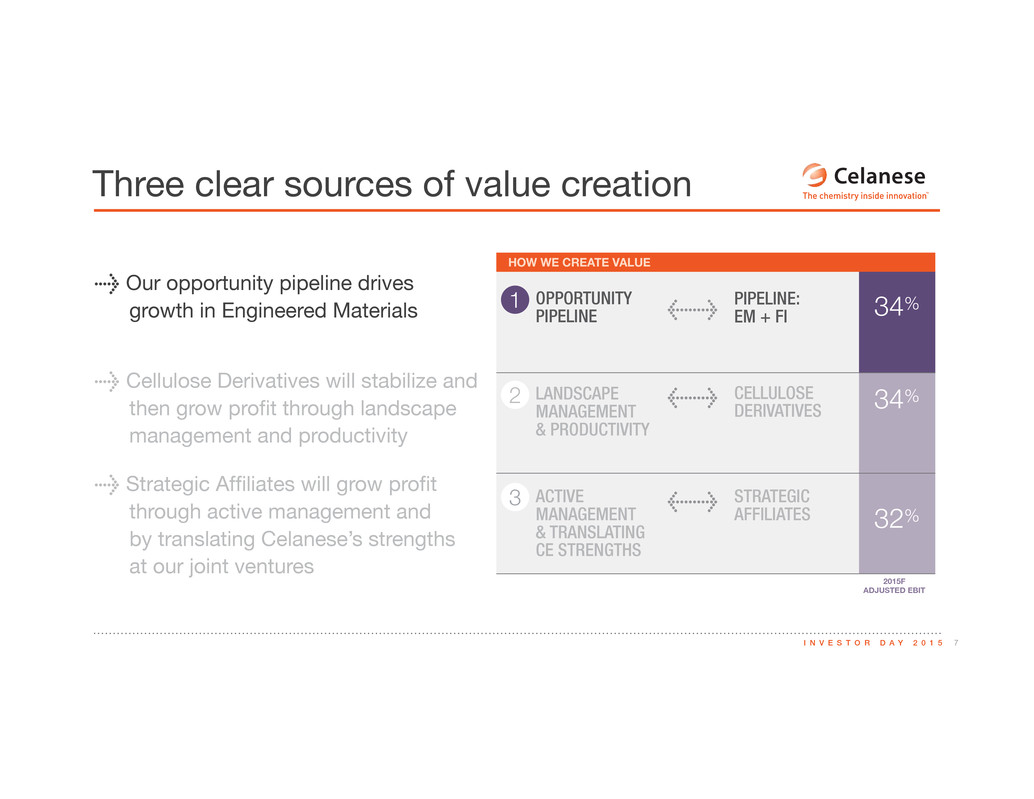

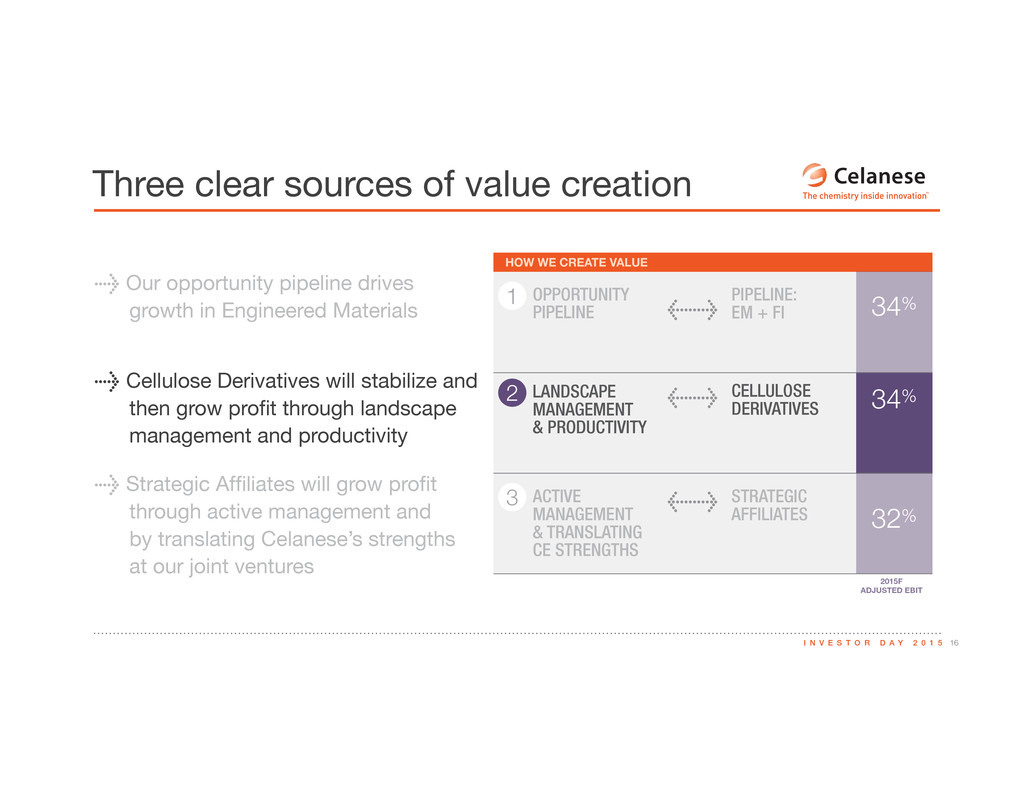

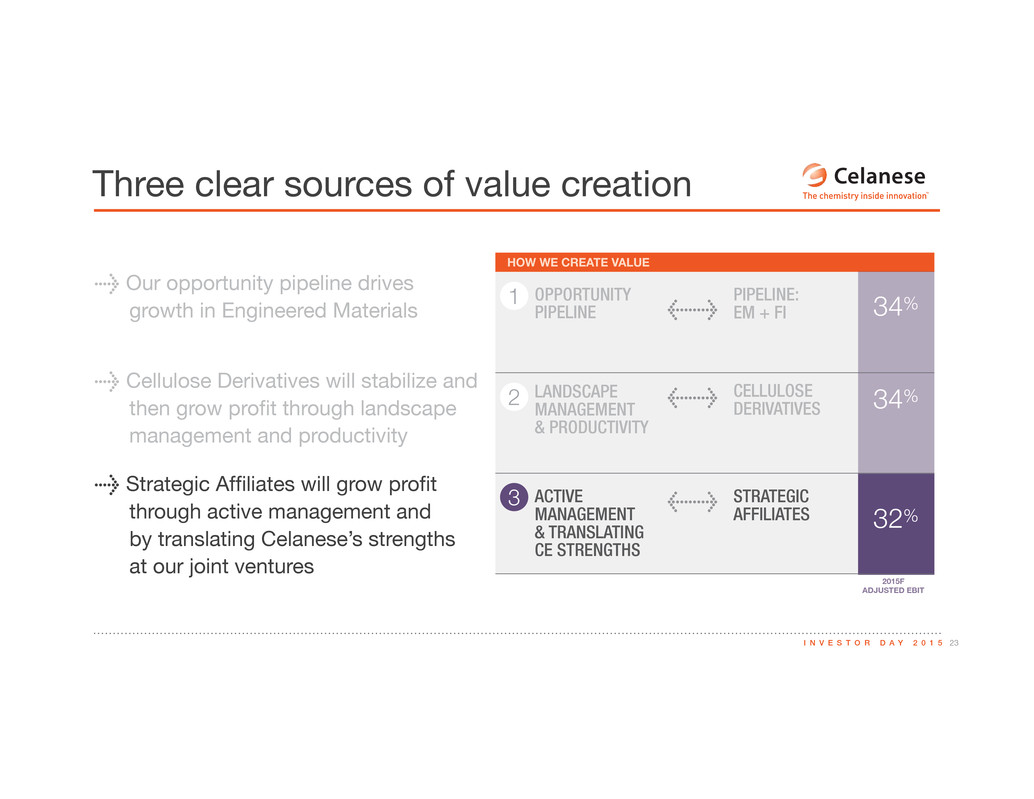

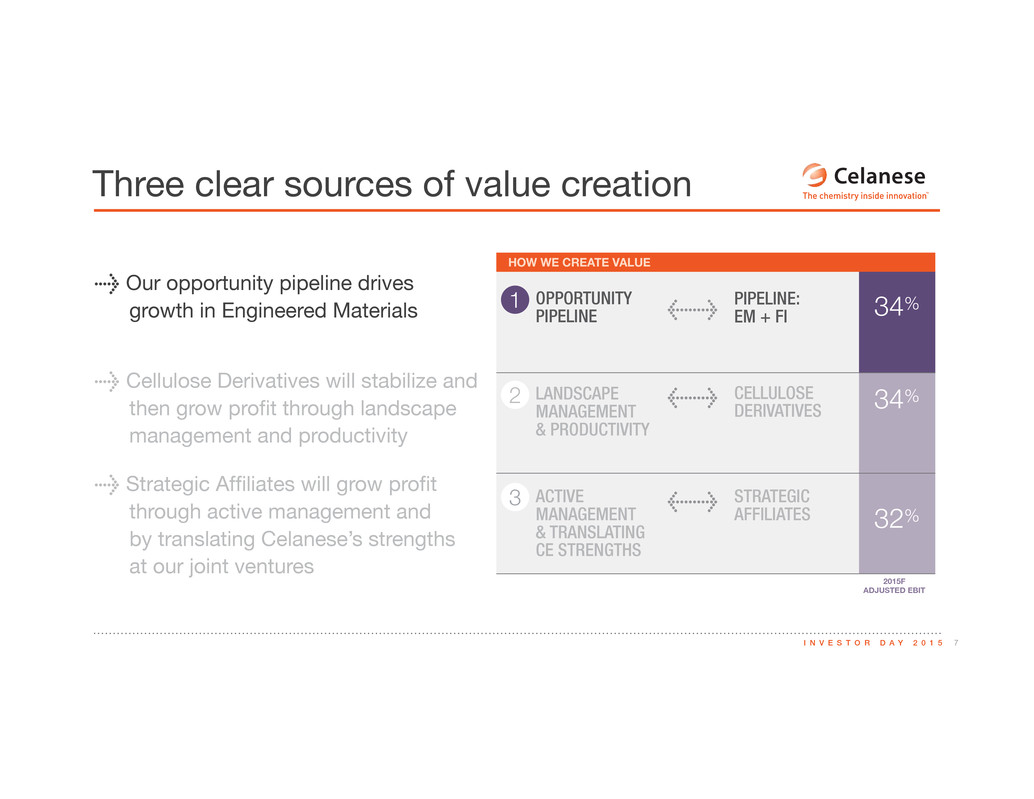

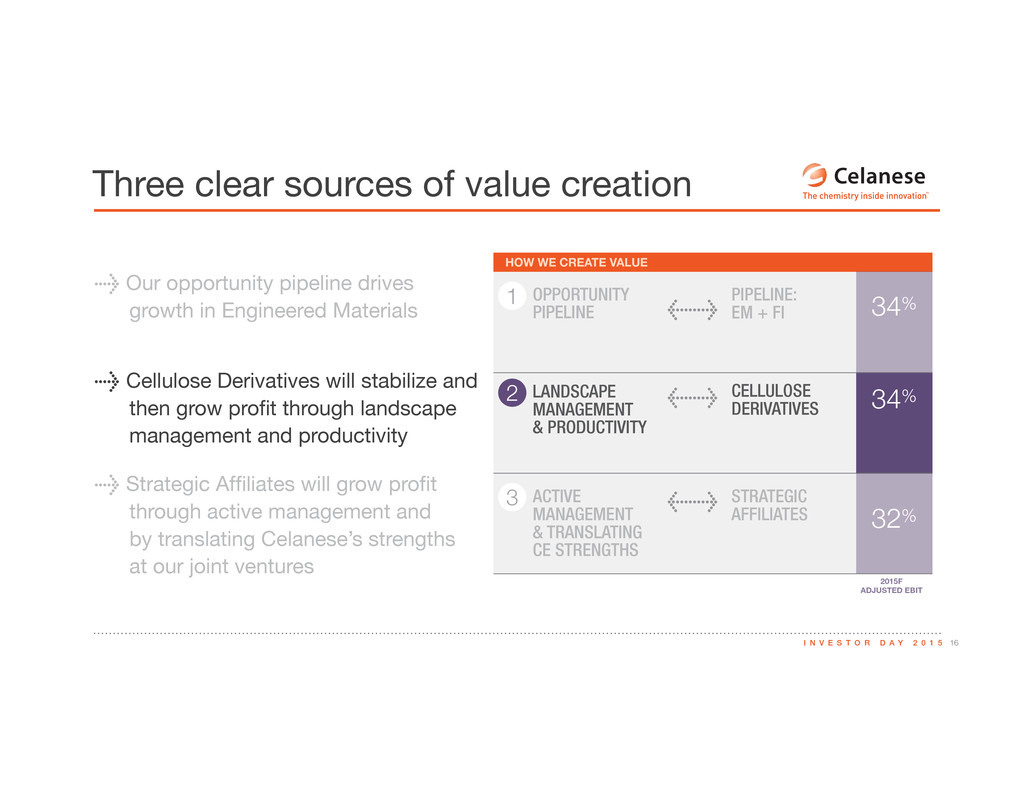

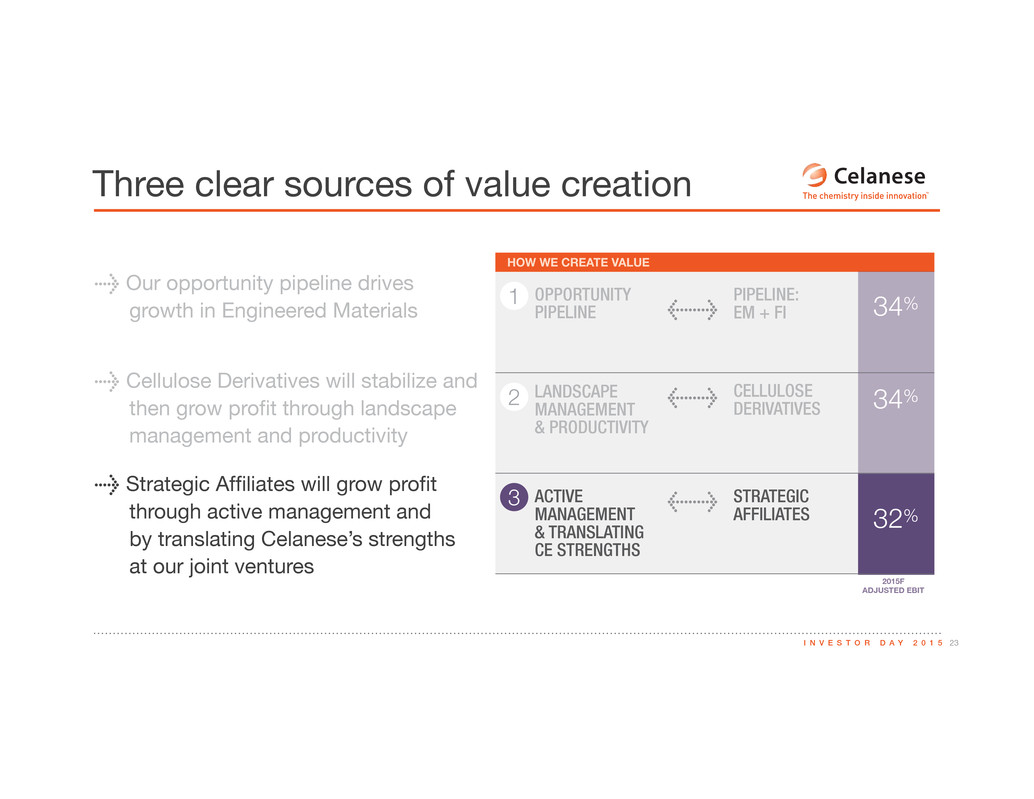

7I N V E S T O R D A Y 2 0 1 5 Three clear sources of value creation 2015F ADJUSTED EBIT PIPELINE: EM + FI OPPORTUNITY PIPELINE CELLULOSE DERIVATIVES LANDSCAPE MANAGEMENT & PRODUCTIVITY STRATEGIC AFFILIATES ACTIVE MANAGEMENT & TRANSLATING CE STRENGTHS 1 2 3 HOW WE CREATE VALUE > Strategic Affiliates will grow profit through active management and by translating Celanese’s strengths at our joint ventures > > > 34% 34% 32% > Our opportunity pipeline drives growth in Engineered Materials > Cellulose Derivatives will stabilize and then grow profit through landscape management and productivity Strategic Affiliates will g ough active management and by translating Celanese engths at our joint ventu Cellulose Derivatives will stabilize and then g ofit th ough landscape management and p

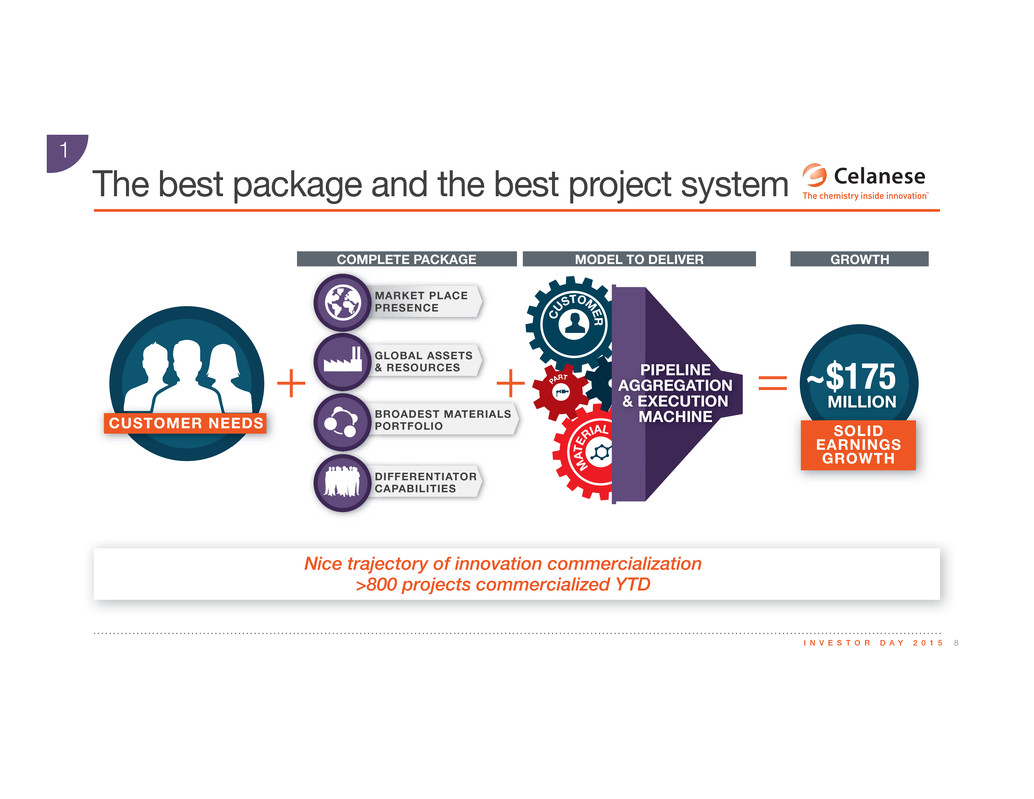

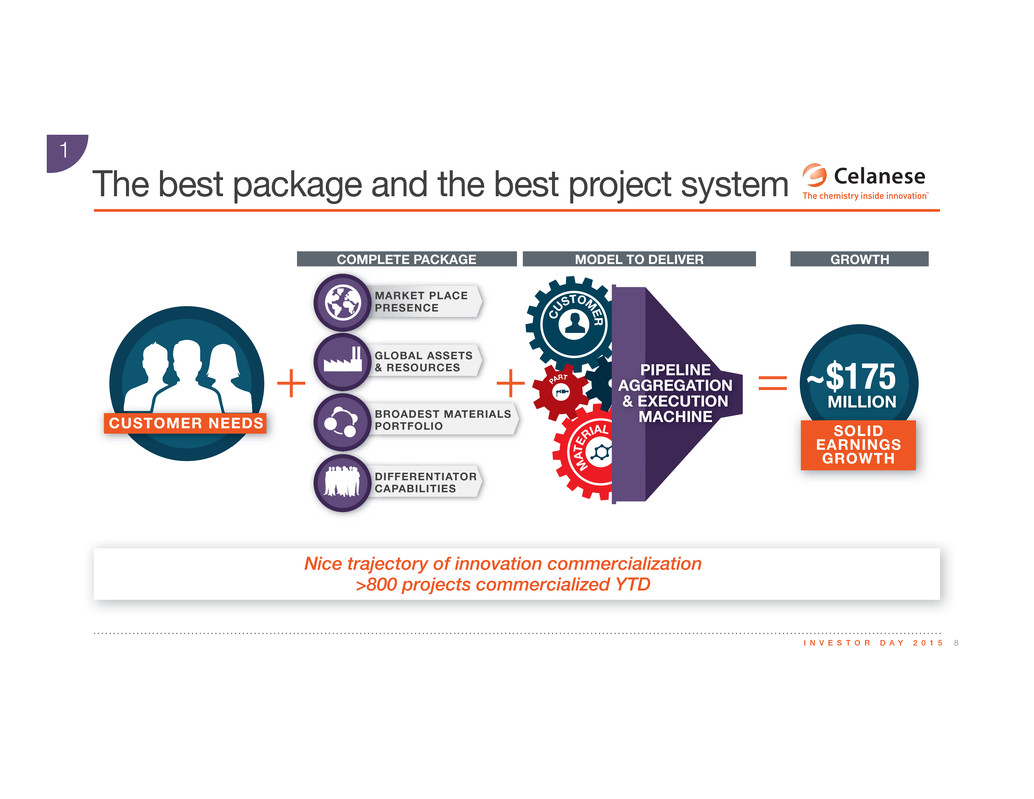

8I N V E S T O R D A Y 2 0 1 5 The best package and the best project system C US TOMER M AT ER IAL PA RT GLOBAL ASSETS & RESOURCES MARKET PLACE PRESENCE DIFFERENTIATOR CAPABILITIES BROADEST MATERIALS PORTFOLIO PIPELINE AGGREGATION & EXECUTION MACHINE MILLION + + = SOLID EARNINGS GROWTH CUSTOMER NEEDS ~$175 Nice trajectory of innovation commercialization >800 projects commercialized YTD 1 COMPLETE PACKAGE MODEL TO DELIVER GROWTH

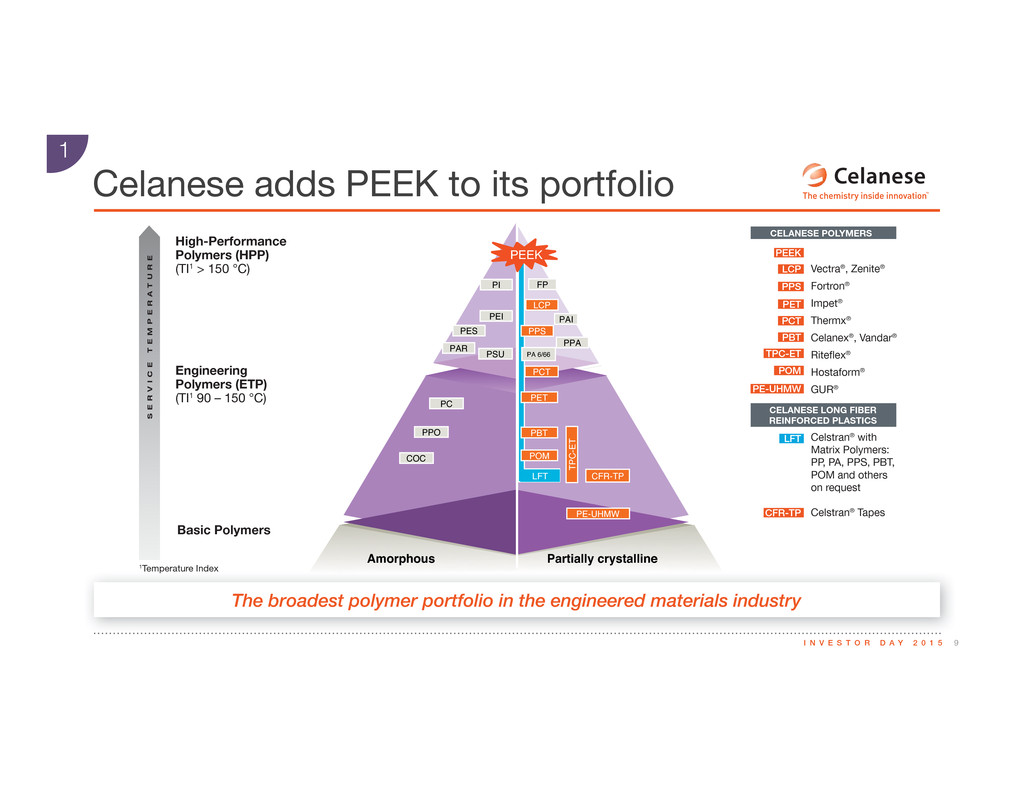

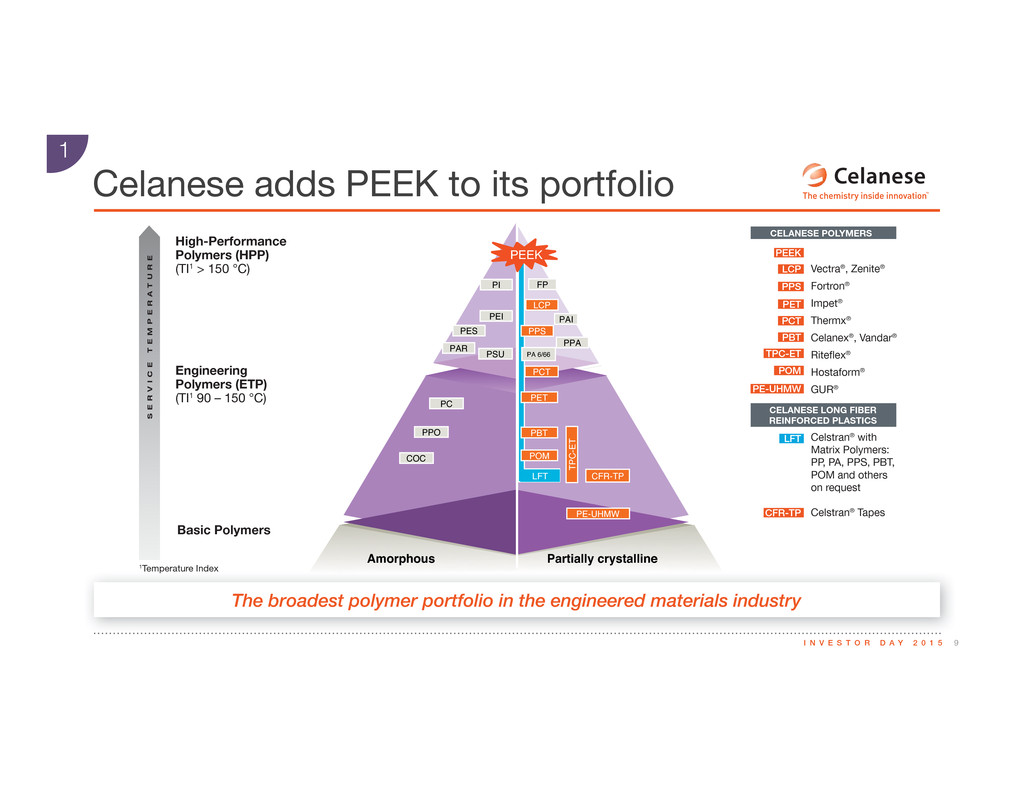

9I N V E S T O R D A Y 2 0 1 5 Celanese adds PEEK to its portfolio 1 Amorphousg1 Partially crystallineg1 PE-UHMWg1 PSUg1 PPAg1 PAIg1 PIg1 PESg1 PARg1 PPOg1 PCg1 COCg1 PEIg1 TPC-ET g1 FPg1 CFR-TPg1LFTg1 LCPg1 PPSg1 PA 6/66g1 PCTg1 PETg1 PBTg1 POMg1 LFTg1 PEEK CFR-TPg1 S E R V I C E T E M P E R A T U R E High-Performance Polymers (HPP) (TI1 > 150 °C) Engineering Polymers (ETP) (TI1 90 – 150 °C) Basic Polymers 1Temperature Index Celstran® with Matrix Polymers: PP, PA, PPS, PBT, POM and others on request Celstran® Tapes CELANESE POLYMERS CELANESE LONG FIBER REINFORCED PLASTICS Vectra®, Zenite® Fortron® Impet® Thermx® Celanex®, Vandar® Riteflex® Hostaform® GUR® PEEK LCP PPS PET PCT PBT TPC-ET CFR-TP POM LFT PE-UHMW p The broadest polymer portfolio in the engineered materials industry

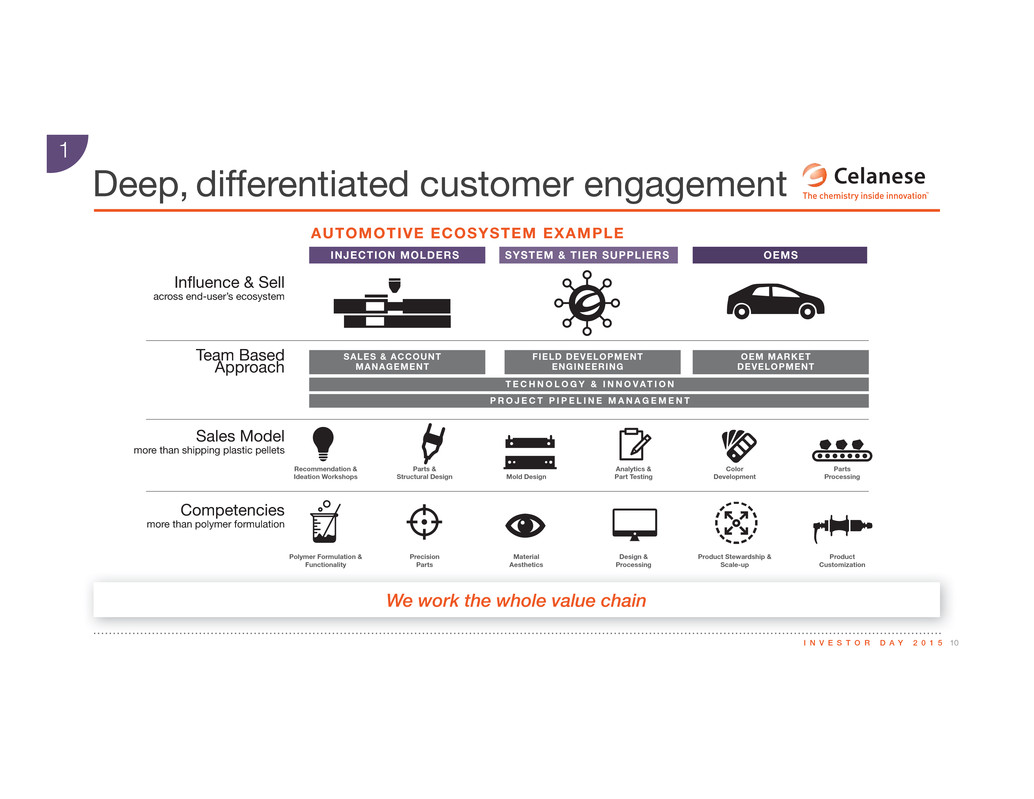

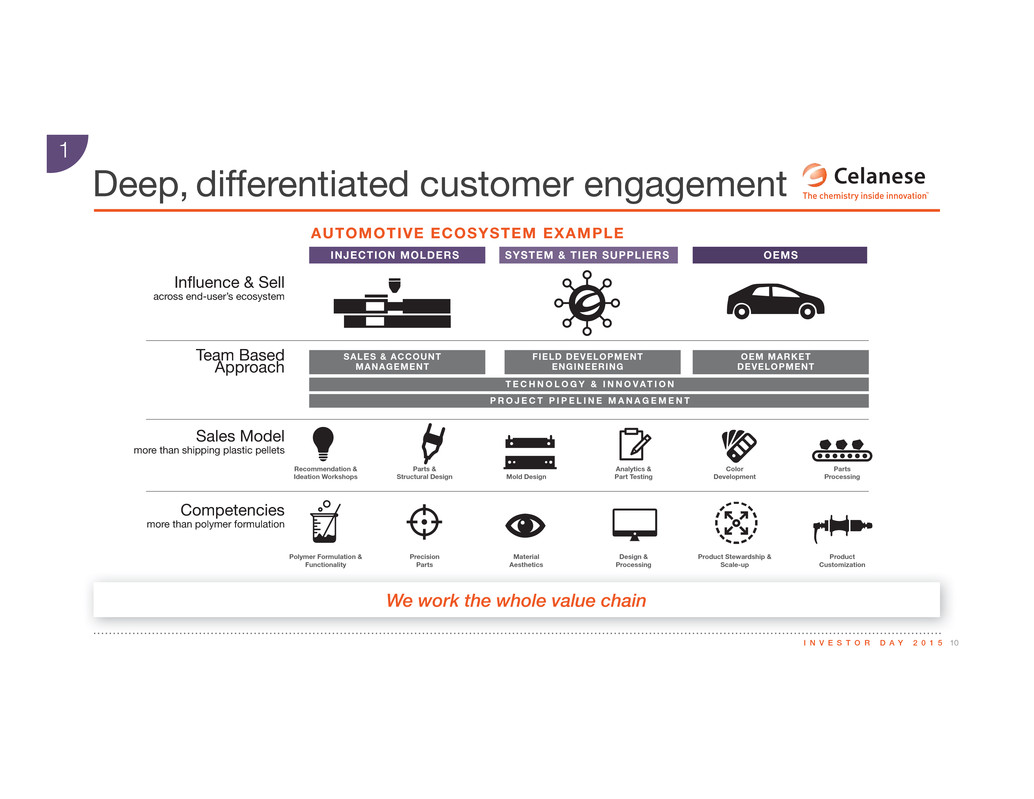

10I N V E S T O R D A Y 2 0 1 5 Deep, differentiated customer engagement g48g85g197g92g76g85g74g76g3g13g3g58g76g83g83 across end-user’s ecosystem Sales Model more than shipping plastic pellets Competencies more than polymer formulation Team Based Approach INJECTION MOLDERS OEMSSYSTEM & TIER SUPPLIERS SALES & ACCOUNT MANAGEMENT T E C H N O L O G Y & I N N O V AT I O N P R O J E C T P I P E L I N E M A N A G E M E N T FIELD DEVELOPMENT ENGINEERING OEM MARKET DEVELOPMENT Recommendation & Ideation Workshops Polymer Formulation & Functionality Parts & Structural Design Precision Parts Analytics & Part Testing Design & Processing Color Development Product Stewardship & Scale-up Parts Processing Product Customization Mold Design Material Aesthetics AUTOMOTIVE ECOSYSTEM EXAMPLE 1 We work the whole value chain

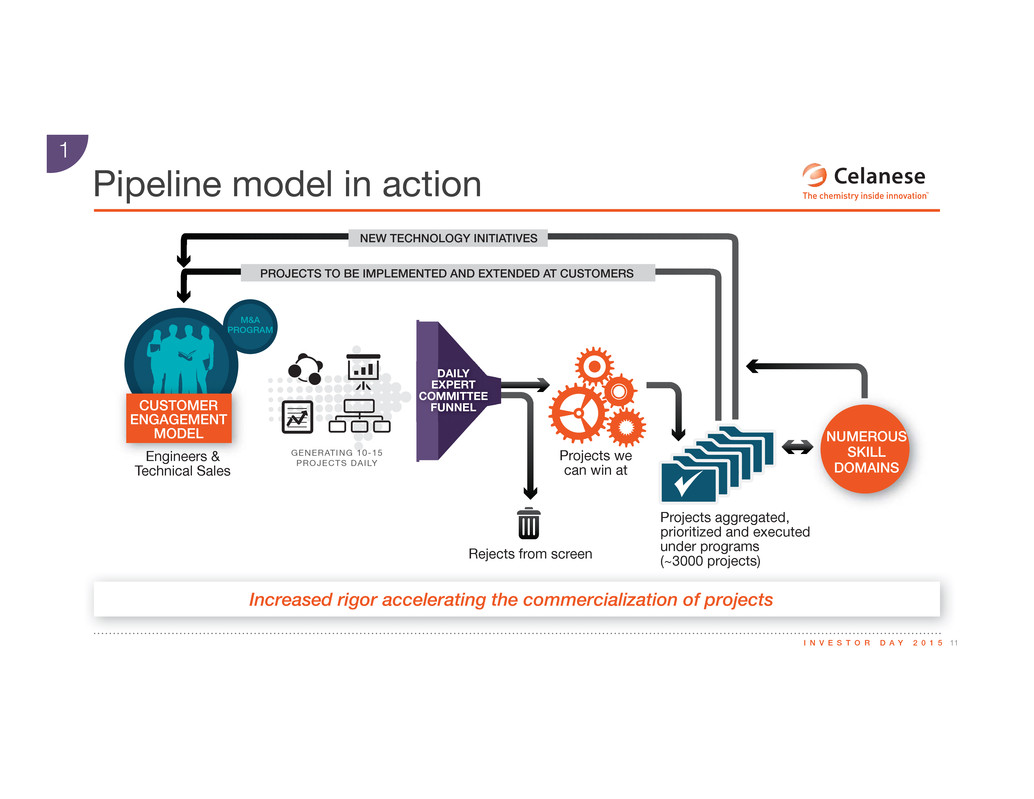

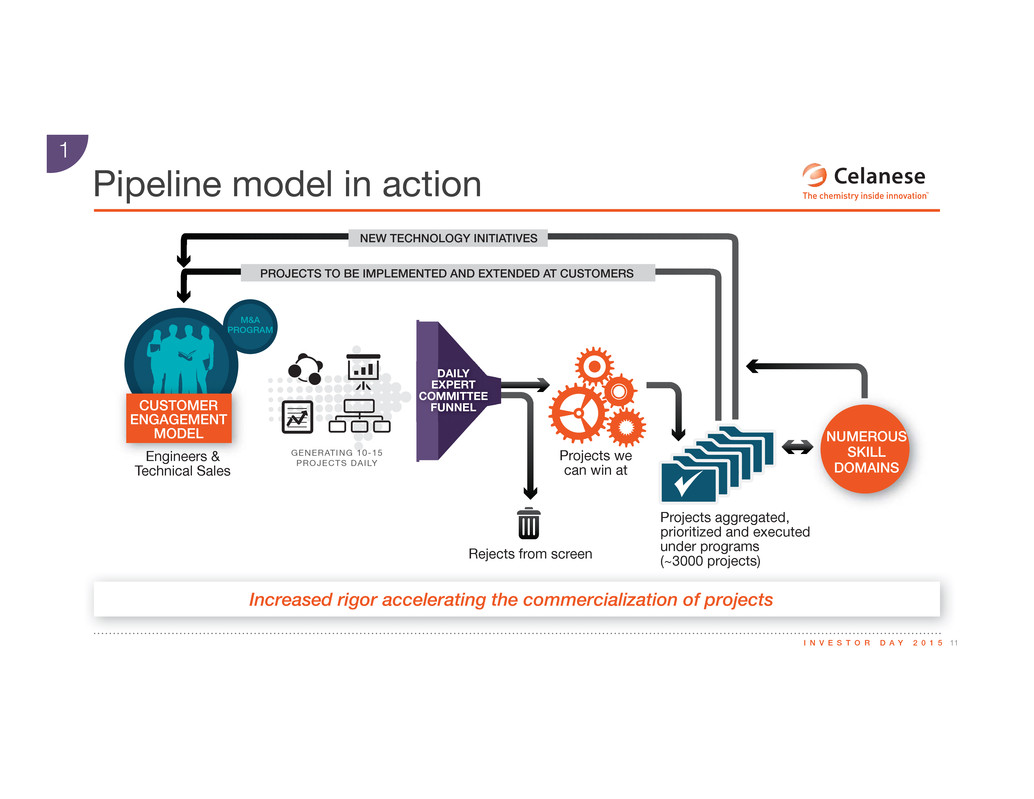

11I N V E S T O R D A Y 2 0 1 5 Pipeline model in action 1 M&A PROGRAM CUSTOMER ENGAGEMENT MODEL Engineers & Technical Sales Rejects from screen GENERATING 10-15 PROJECTS DAILY Projects we can win at Projects aggregated, prioritized and executed under programs (~3000 projects) NUMEROUS SKILL DOMAINS PROJECTS TO BE IMPLEMENTED AND EXTENDED AT CUSTOMERS NEW TECHNOLOGY INITIATIVES DAILY EXPERT COMMITTEE FUNNEL Increased rigor accelerating the commercialization of projects

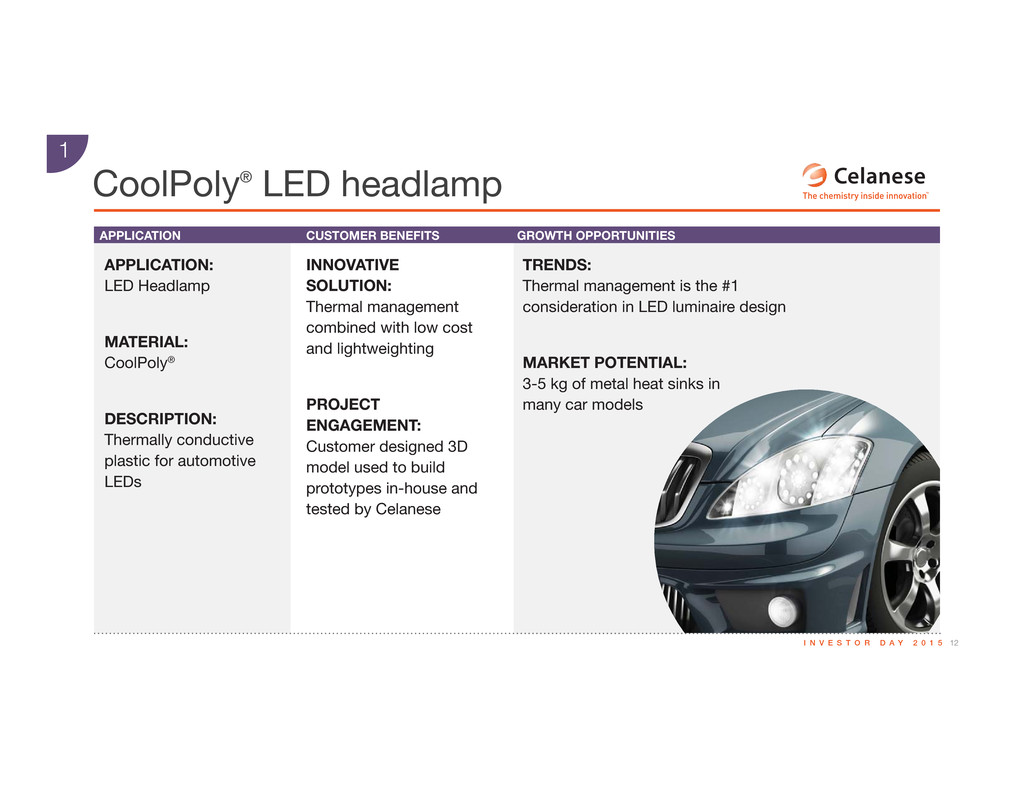

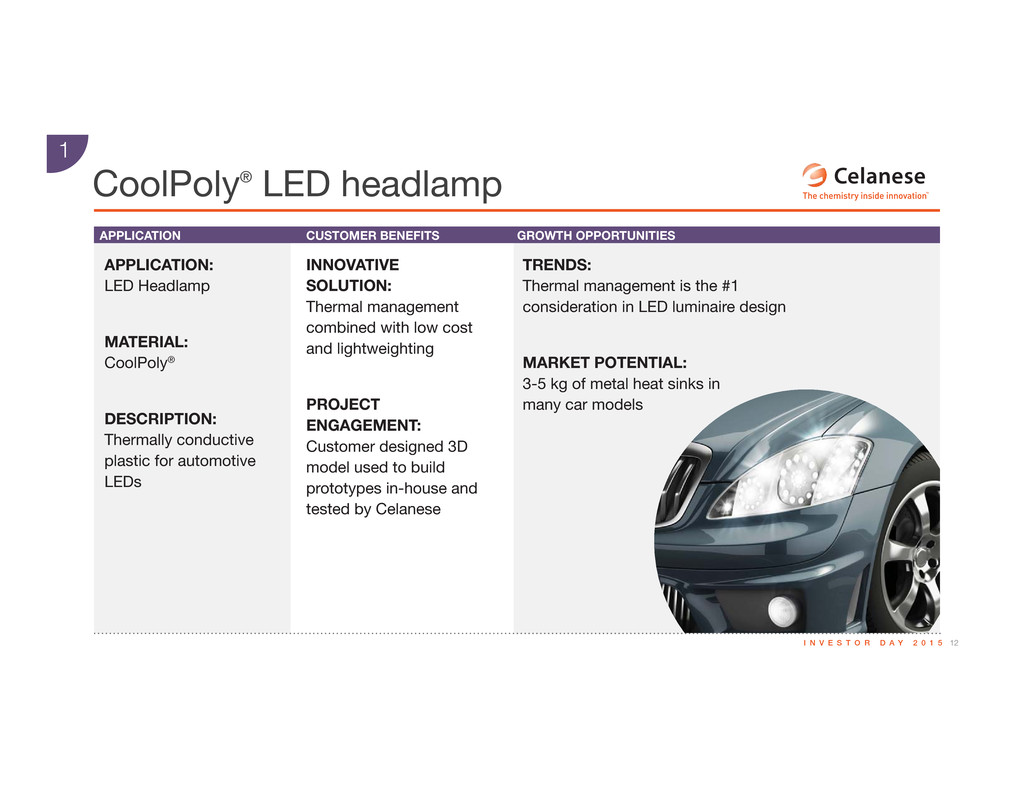

12I N V E S T O R D A Y 2 0 1 5 CoolPoly® LED headlamp APPLICATION CUSTOMER BENEFITS GROWTH OPPORTUNITIES APPLICATION: LED Headlamp MATERIAL: CoolPoly® DESCRIPTION: Thermally conductive plastic for automotive LEDs INNOVATIVE SOLUTION: Thermal management combined with low cost and lightweighting PROJECT ENGAGEMENT: Customer designed 3D model used to build prototypes in-house and tested by Celanese TRENDS: Thermal management is the #1 consideration in LED luminaire design MARKET POTENTIAL: 3-5 kg of metal heat sinks in many car models 1

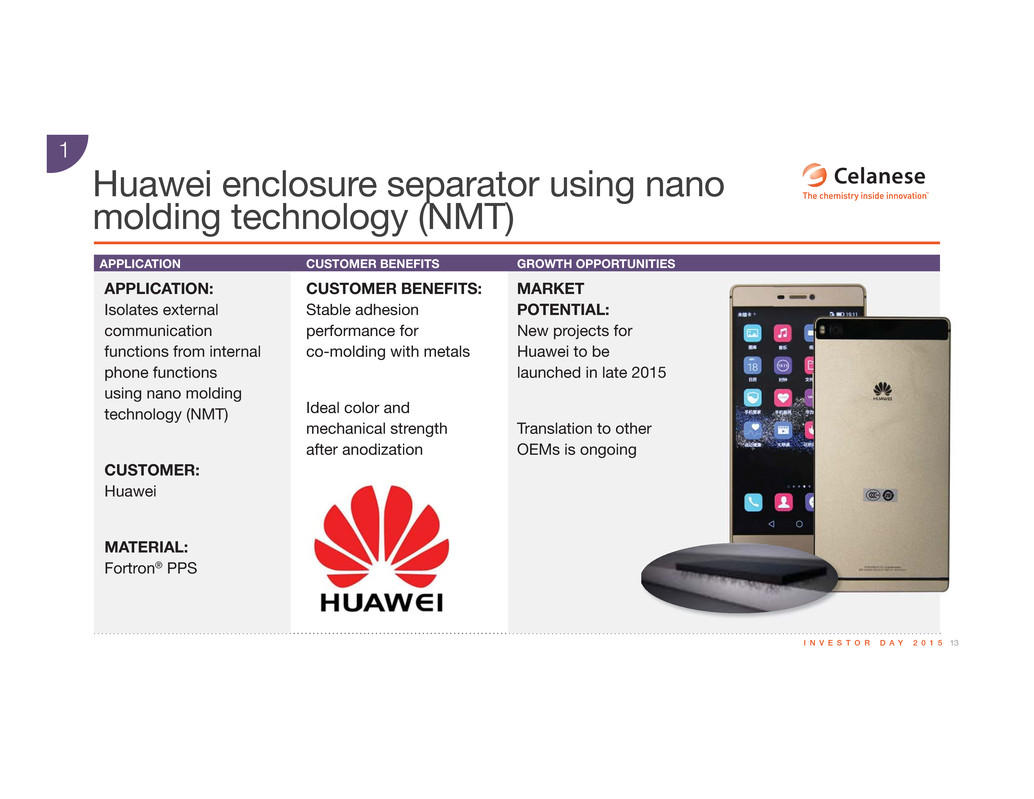

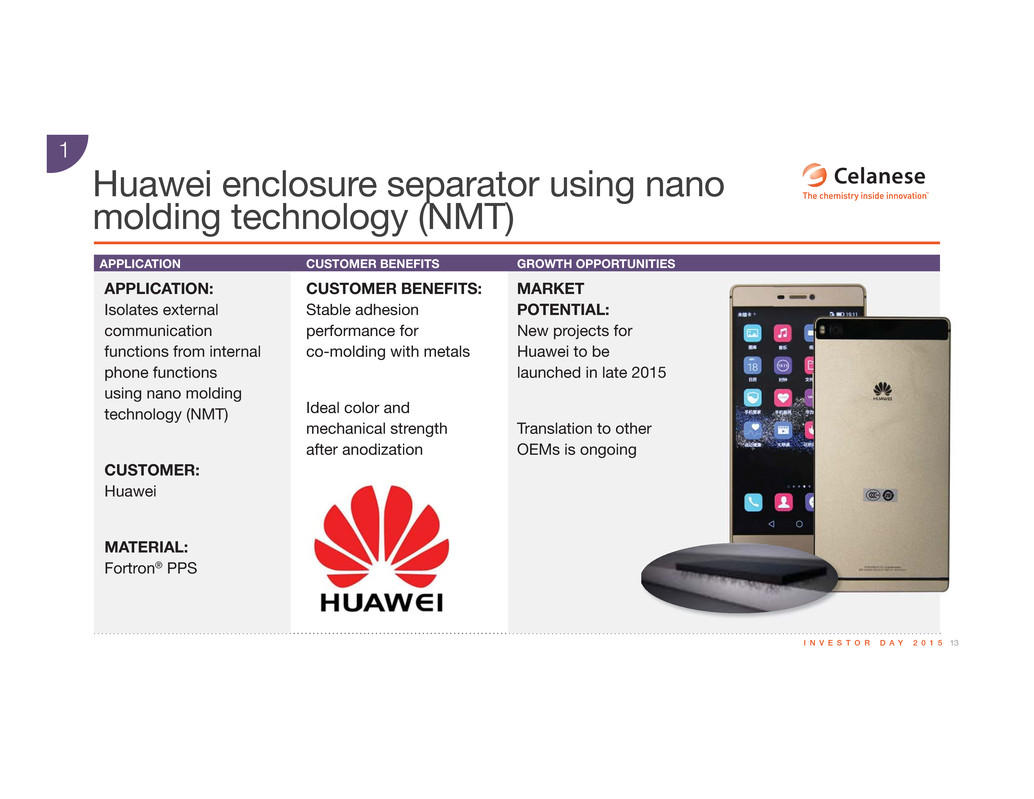

13I N V E S T O R D A Y 2 0 1 5 Huawei enclosure separator using nano molding technology (NMT) 1 APPLICATION CUSTOMER BENEFITS GROWTH OPPORTUNITIES APPLICATION: Isolates external communication functions from internal phone functions using nano molding technology (NMT) CUSTOMER: Huawei MATERIAL: Fortron® PPS MARKET POTENTIAL: New projects for Huawei to be launched in late 2015 Translation to other OEMs is ongoing CUSTOMER BENEFITS: Stable adhesion performance for co-molding with metals Ideal color and mechanical strength after anodization

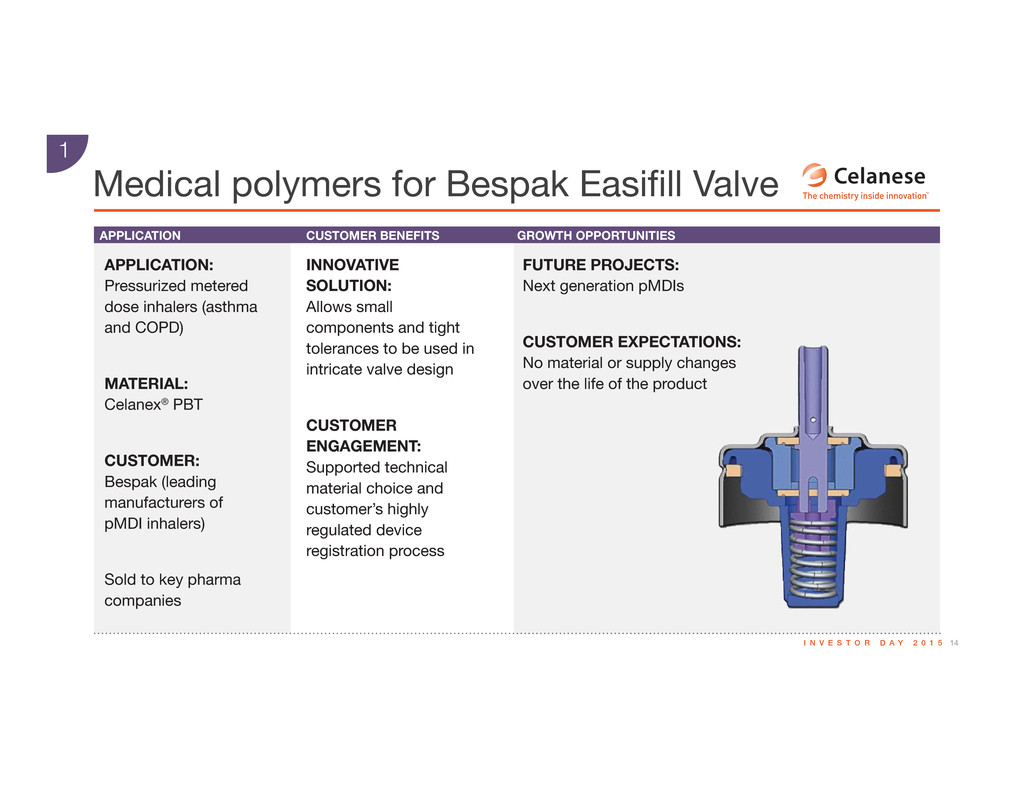

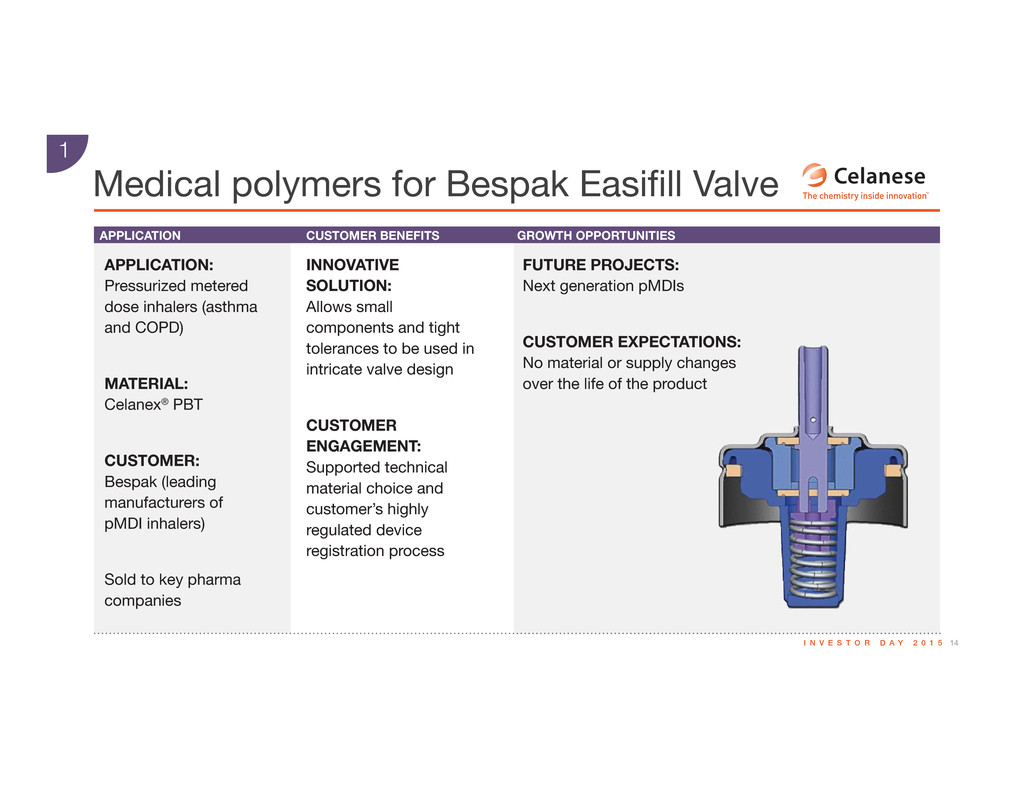

14I N V E S T O R D A Y 2 0 1 5 Medical polymers for Bespak Easifill Valve APPLICATION CUSTOMER BENEFITS GROWTH OPPORTUNITIES APPLICATION: Pressurized metered dose inhalers (asthma and COPD) MATERIAL: Celanex® PBT CUSTOMER: Bespak (leading manufacturers of pMDI inhalers) Sold to key pharma companies INNOVATIVE SOLUTION: Allows small components and tight tolerances to be used in intricate valve design CUSTOMER ENGAGEMENT: Supported technical material choice and customer’s highly regulated device registration process FUTURE PROJECTS: Next generation pMDIs CUSTOMER EXPECTATIONS: No material or supply changes over the life of the product 1

15I N V E S T O R D A Y 2 0 1 5 Celanese Innovation Showcase Tangible examples of the Celanese value creation model Growth Acetyl Chain: Organizational New Performance CoolPoly Thermally Conductive Polymers Model Freely Increasing Lightweight Solutions New Product PEEK: Ultra High Performance Polymer Model Strategic M&A Framework Pipeline Model in Action Functionalized POM productivity: It's in Celanese's DNA Pipeline Model: Opportunities Cellulose Derivatives Clarifoil

16I N V E S T O R D A Y 2 0 1 5 Three clear sources of value creation 2015F ADJUSTED EBIT PIPELINE: EM + FI OPPORTUNITY PIPELINE CELLULOSE DERIVATIVES LANDSCAPE MANAGEMENT & PRODUCTIVITY STRATEGIC AFFILIATES ACTIVE MANAGEMENT & TRANSLATING CE STRENGTHS 1 2 3 HOW WE CREATE VALUE 34% 34% 32% > Strategic Affiliates will grow profit through active management and by translating Celanese’s strengths at our joint ventures > Our opportunity pipeline drives growth in Engineered Materials > Cellulose Derivatives will stabilize and then grow profit through landscape management and productivity Strategic Affiliates will g ough active management and by translating Celanese engths at our joint ventu Our opportunity pipeline drives owth in Enginee ed Material > > >

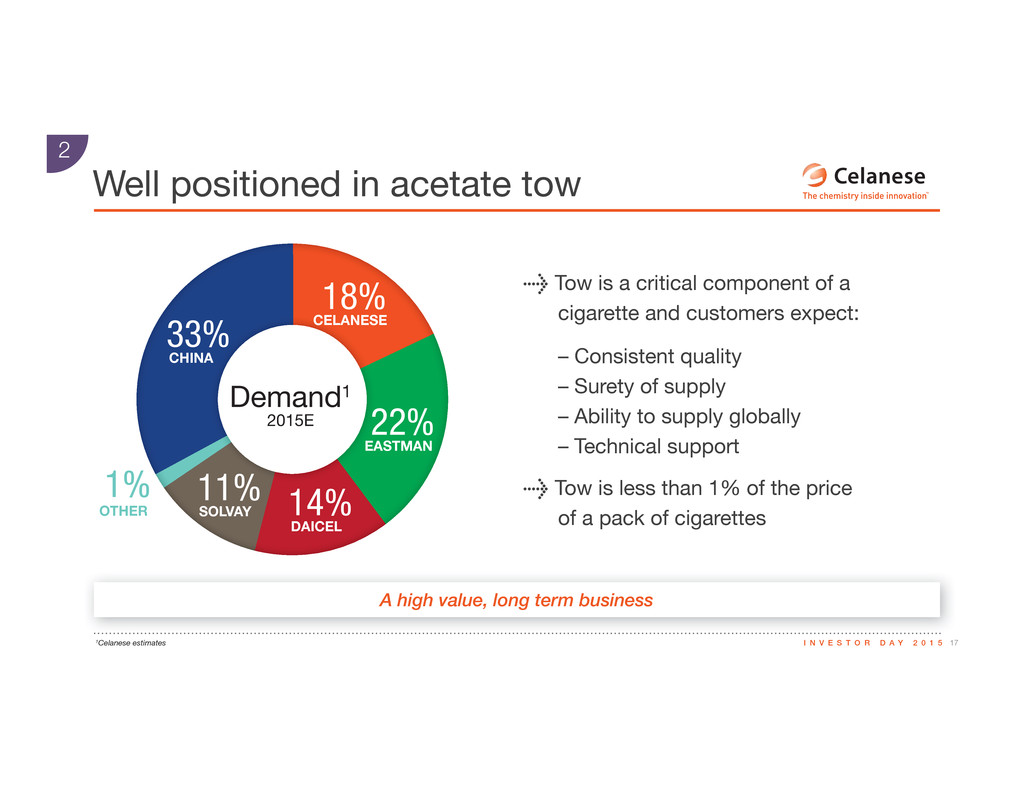

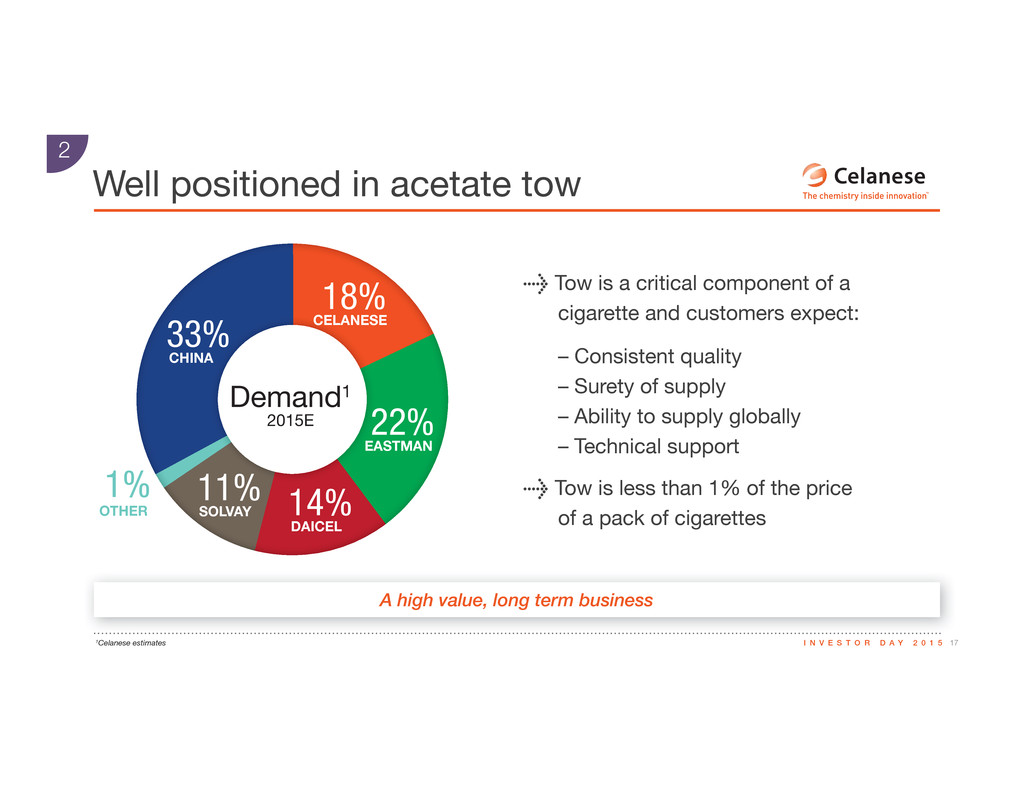

17I N V E S T O R D A Y 2 0 1 5 Well positioned in acetate tow 1Celanese estimates Demand1 2015E 33% 18% 22% 14%11%1% CHINA CELANESE EASTMAN DAICEL SOLVAYOTHER 2 > Tow is a critical component of a cigarette and customers expect: – Consistent quality – Surety of supply – Ability to supply globally – Technical support > Tow is less than 1% of the price of a pack of cigarettes A high value, long term business

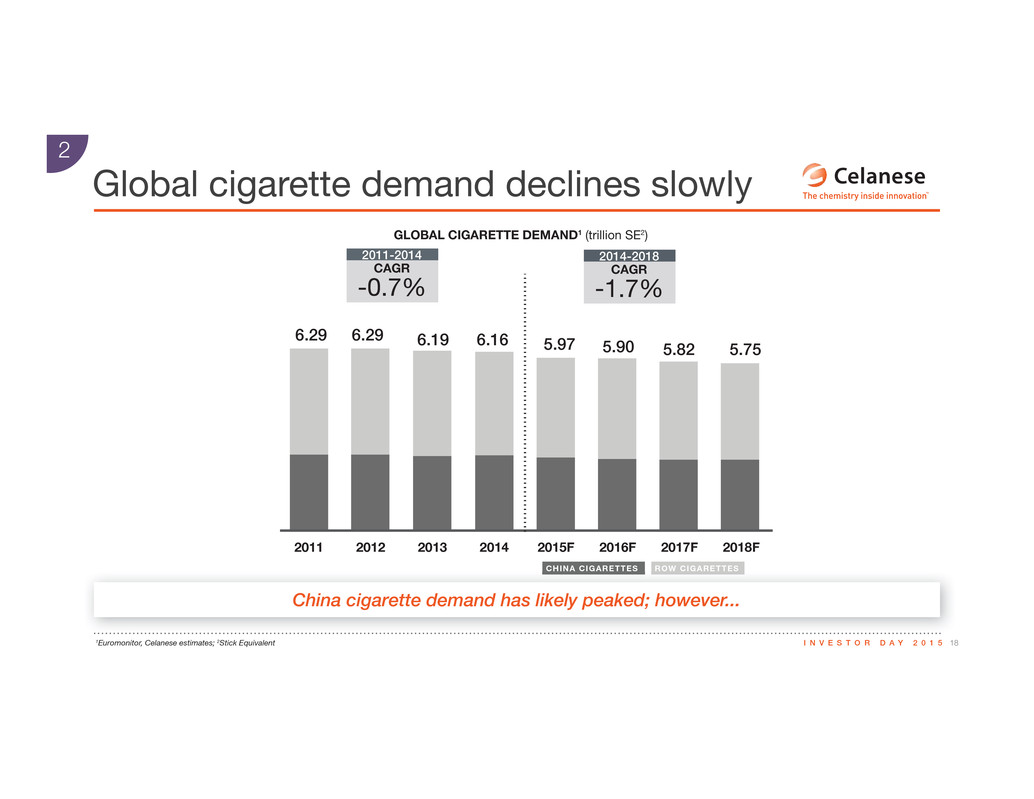

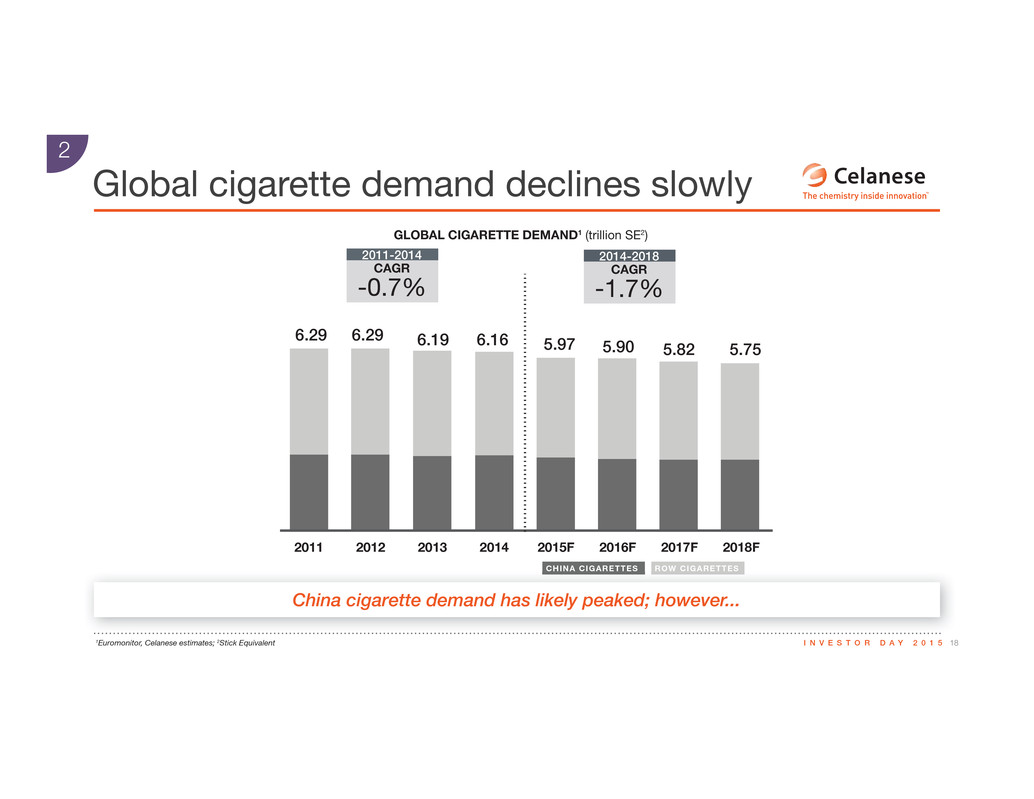

18I N V E S T O R D A Y 2 0 1 5 Global cigarette demand declines slowly 2 2012 2013 2014 2015F 2016F 2017F 2018F 6.29 6.29 6.19 6.16 5.97 5.90 5.82 5.75 2011 GLOBAL CIGARETTE DEMAND1 (trillion SE2) 2011-2014 2014-2018 CHINA CIGARETTES ROW CIGARETTES CAGR CAGR -0.7% -1.7% 1Euromonitor, Celanese estimates; 2Stick Equivalent China cigarette demand has likely peaked; however...

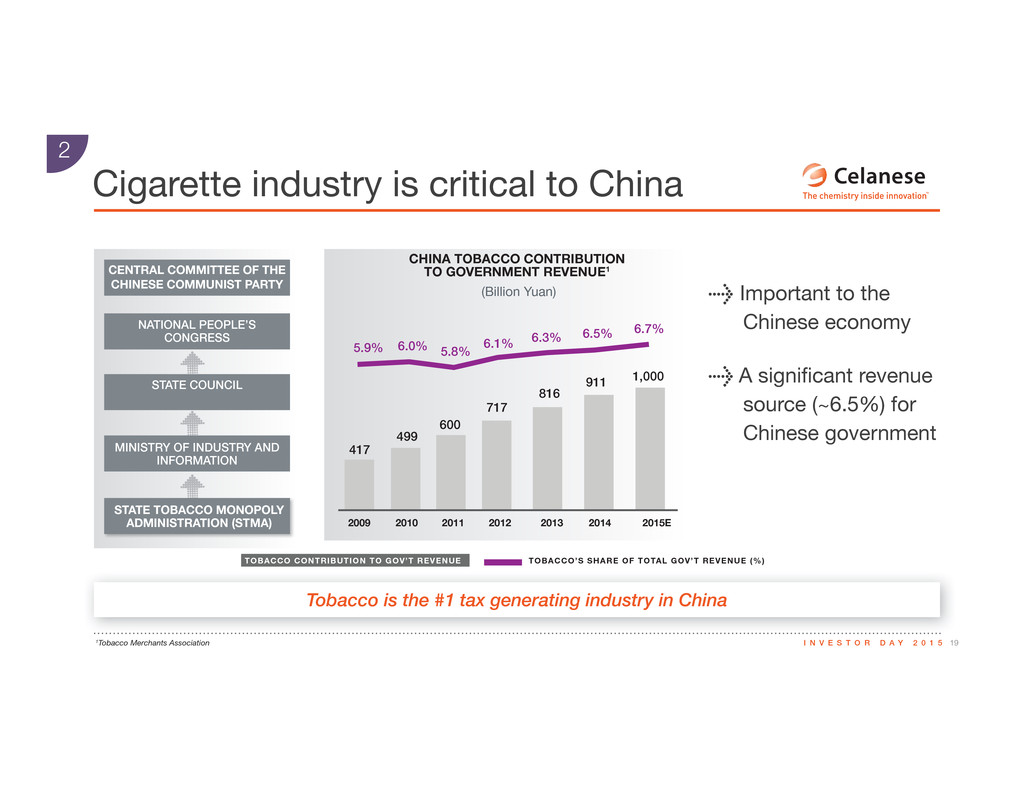

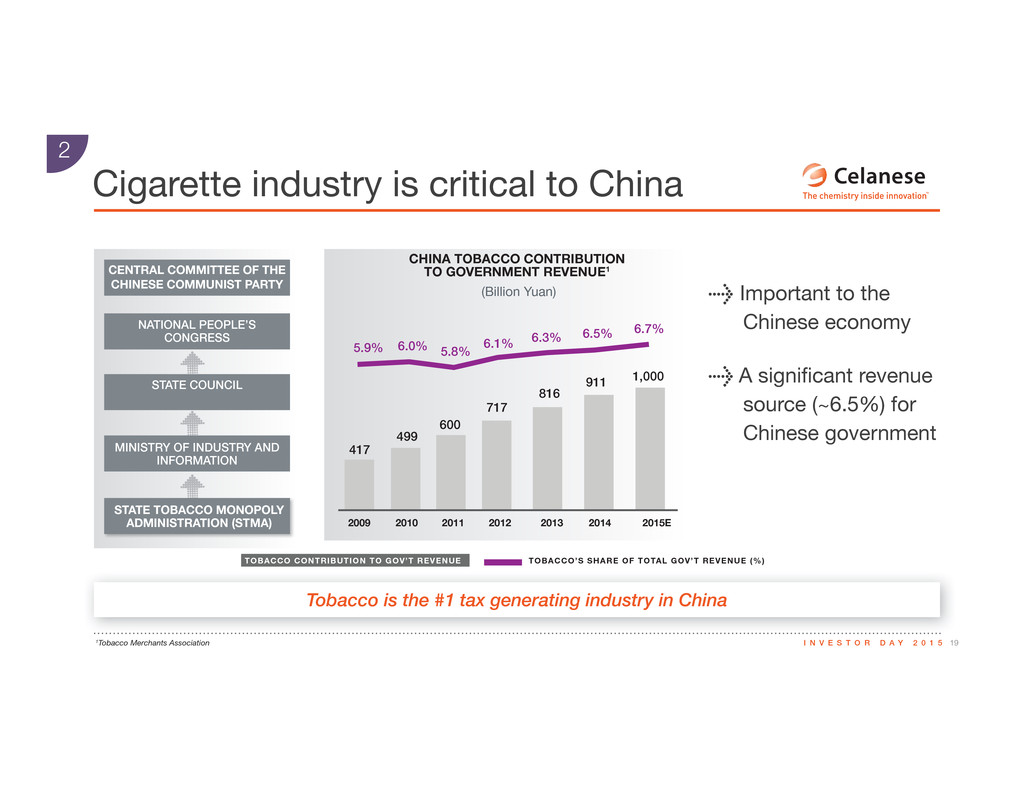

19I N V E S T O R D A Y 2 0 1 5 Cigarette industry is critical to China 2 1Tobacco Merchants Association Tobacco is the #1 tax generating industry in China > Important to the Chinese economy > A significant revenue source (~6.5%) for Chinese government CENTRAL COMMITTEE OF THE CHINESE COMMUNIST PARTY NATIONAL PEOPLE’S CONGRESS STATE COUNCIL MINISTRY OF INDUSTRY AND INFORMATION STATE TOBACCO MONOPOLY ADMINISTRATION (STMA) CHINA TOBACCO CONTRIBUTION TO GOVERNMENT REVENUE1 TOBACCO CONTRIBUTION TO GOV’T REVENUE TOBACCO’S SHARE OF TOTAL GOV’T REVENUE (%) 2009 2010 2011 2012 2013 2014 2015E 417 5.9% 6.0% 5.8% 6.1% 6.3% 6.5% 6.7% 499 600 717 816 911 1,000 (Billion Yuan)

20I N V E S T O R D A Y 2 0 1 5 A perfect storm of events 2 > Customer tow inventory correction outside of China > Customer tow inventory correction inside China > Cigarette inventory correction inside of China > China increased the sales and production taxes on cigarettes > China tow capacity increases materialized which reduced imports > China T&E spending reduced > Some smoking restrictions being enforced in China > Middle East demand suppressed due to conflicts TEMPORARY TEMPORARY TEMPORARY PERMANENT PERMANENT TEMPORARY PERMANENT TEMPORARY Resulting in unique dynamics during 2015 and 2016…

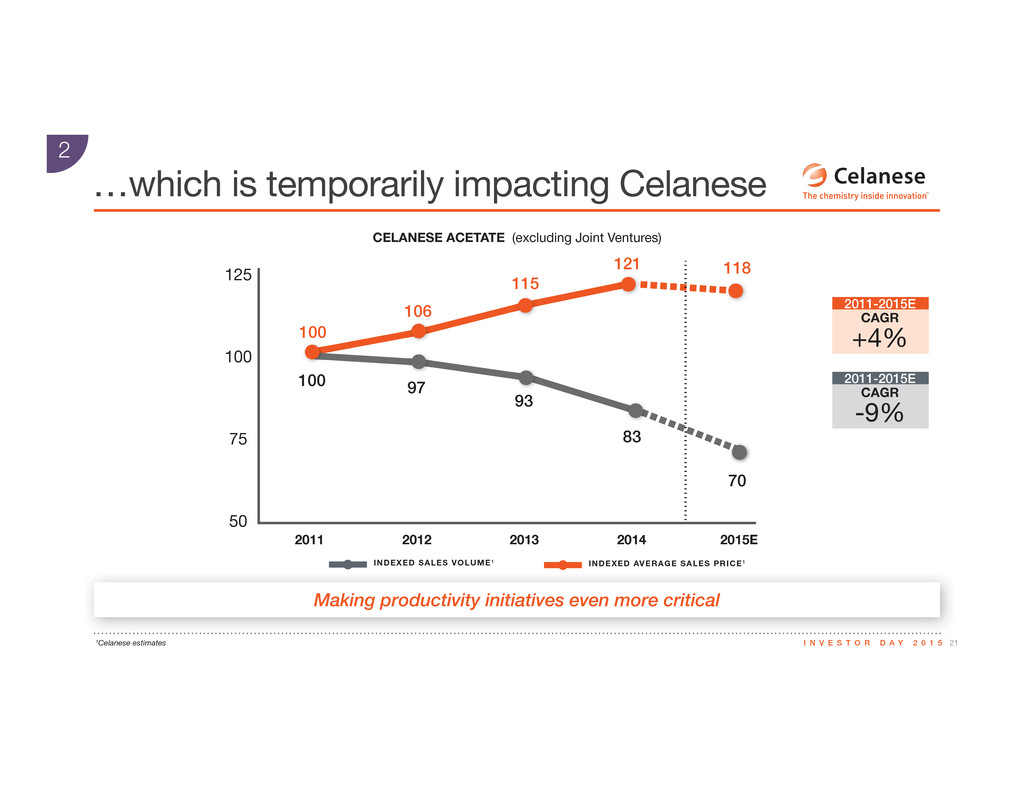

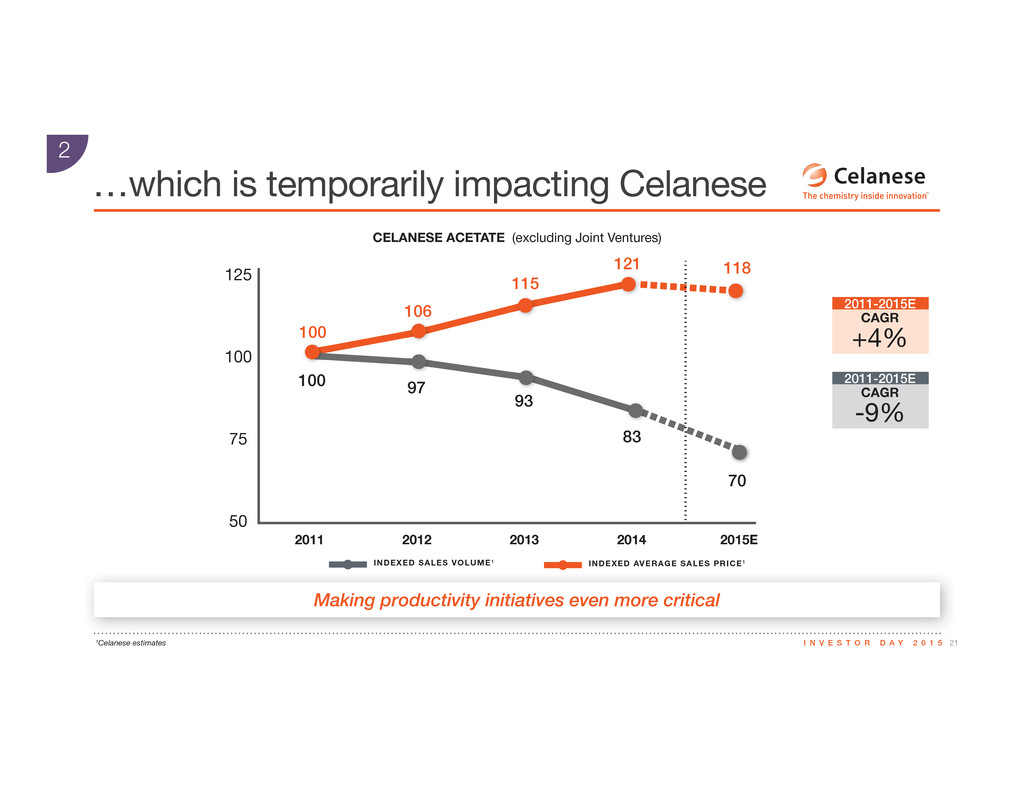

21I N V E S T O R D A Y 2 0 1 5 …which is temporarily impacting Celanese 2 2011 2012 2013 2014 2015E 125 100 75 50 100 97 93 83 70 118121 115 106 100 INDEXED AVERAGE SALES PRICE1INDEXED SALES VOLUME1 CELANESE ACETATE (excluding Joint Ventures) 1Celanese estimates 2011-2015E 2011-2015E CAGR CAGR +4% -9% Making productivity initiatives even more critical

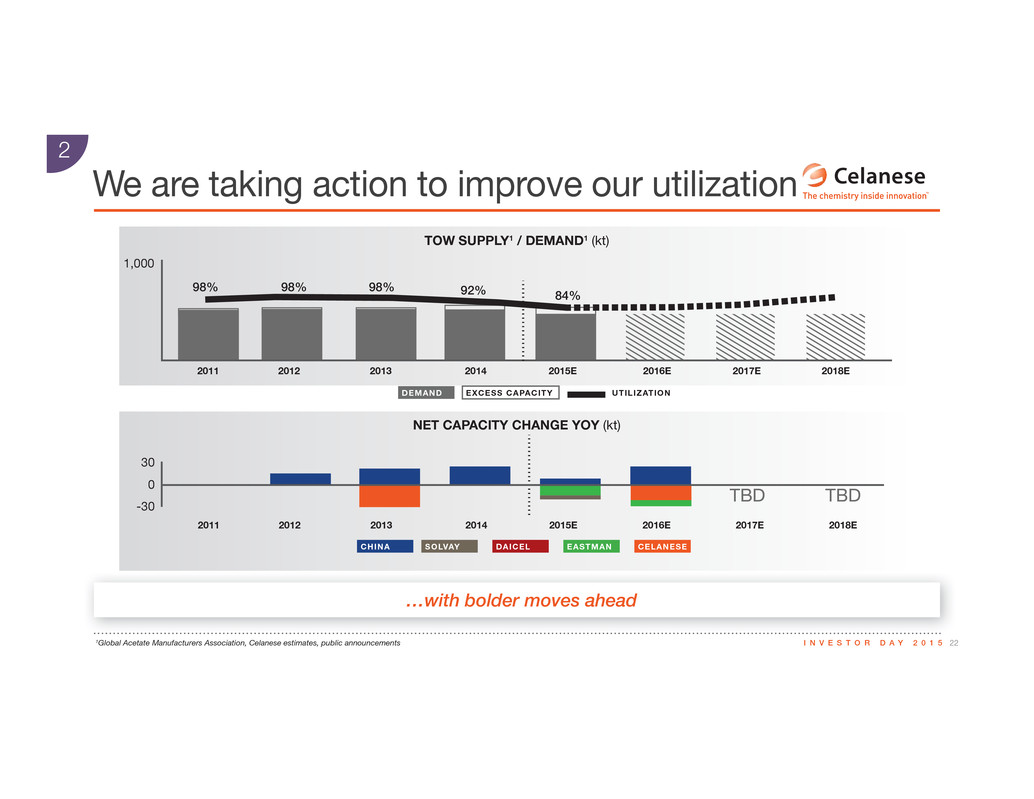

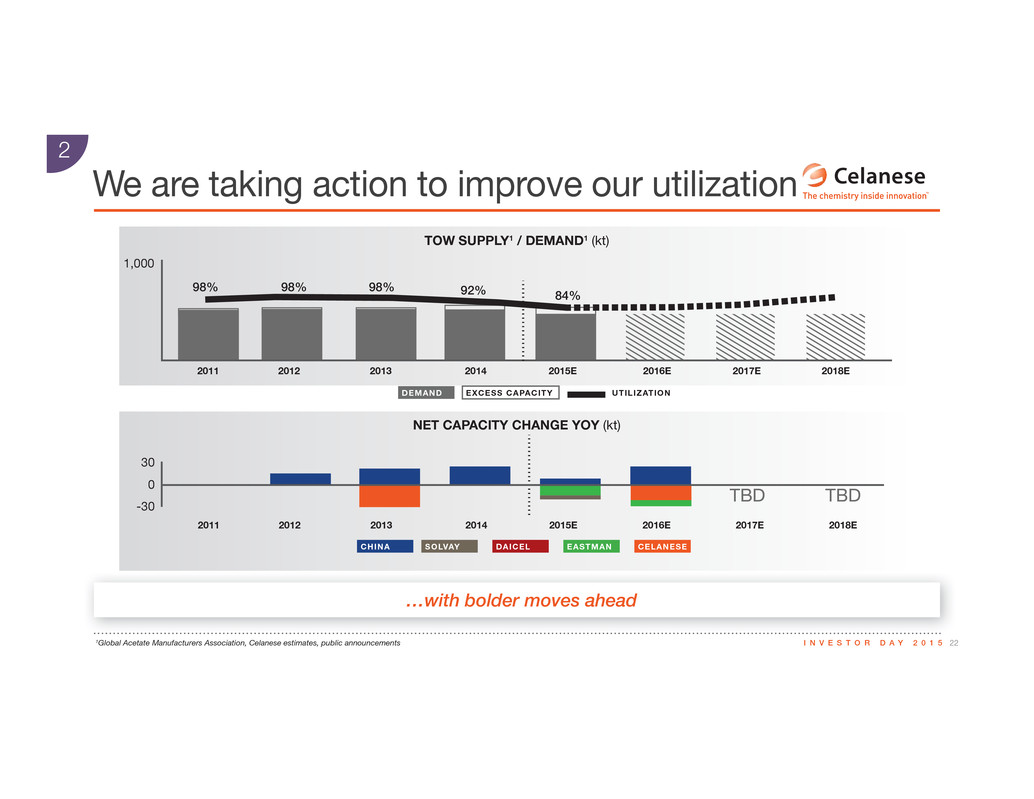

22I N V E S T O R D A Y 2 0 1 5 We are taking action to improve our utilization 2 …with bolder moves ahead 1Global Acetate Manufacturers Association, Celanese estimates, public announcements DEMAND CHINA SOLVAY DAICEL EASTMAN CELANESE EXCESS CAPACITY UTILIZATION 2012 2013 2014 2015E 2016E 2017E 2018E 98% 98% 98% 92% 84% 2011 1,000 2012 2013 2014 2015E 2016E 2017E 2018E TBDTBD 2011 30 0 -30 TOW SUPPLY1 / DEMAND1 (kt) NET CAPACITY CHANGE YOY (kt)

23I N V E S T O R D A Y 2 0 1 5 Three clear sources of value creation 2015F ADJUSTED EBIT PIPELINE: EM + FI OPPORTUNITY PIPELINE CELLULOSE DERIVATIVES LANDSCAPE MANAGEMENT & PRODUCTIVITY STRATEGIC AFFILIATES ACTIVE MANAGEMENT & TRANSLATING CE STRENGTHS 1 3 2 HOW WE CREATE VALUE 34% 34% 32% > Strategic Affiliates will grow profit through active management and by translating Celanese’s strengths at our joint ventures > Our opportunity pipeline drives growth in Engineered Materials > Cellulose Derivatives will stabilize and then grow profit through landscape management and productivity Our opportunity pipeline drives owth in Enginee ed Material Cellulose Derivatives will stabilize and then g ofit th ough landscape management and p > > >

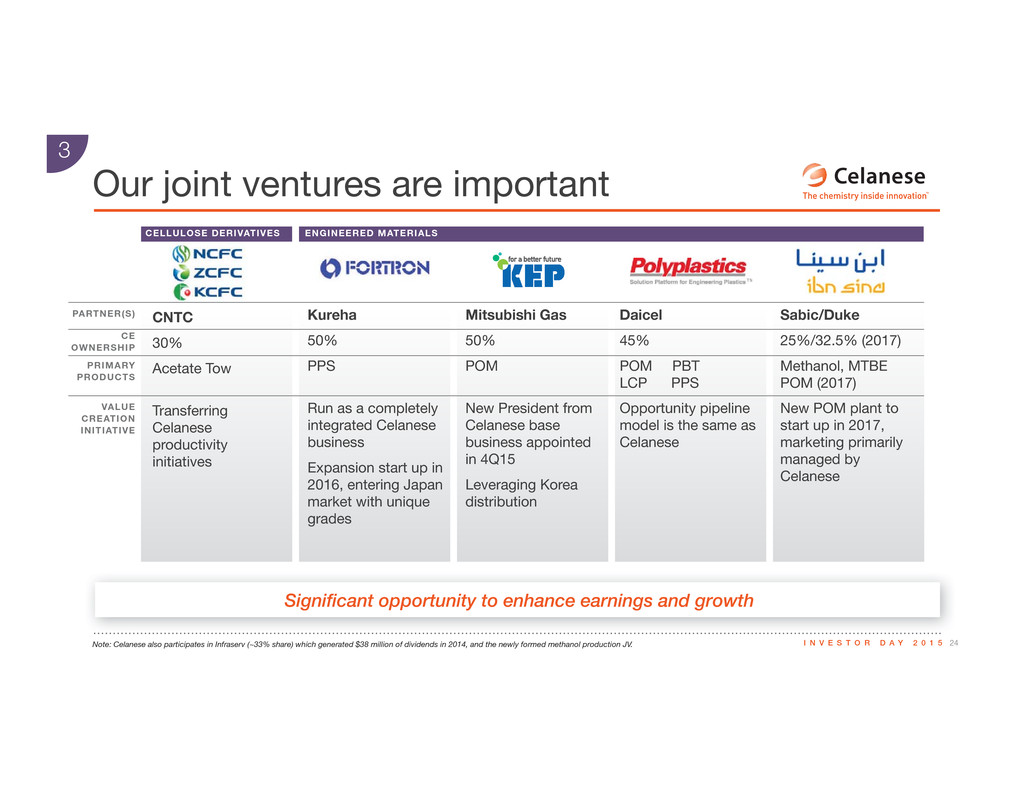

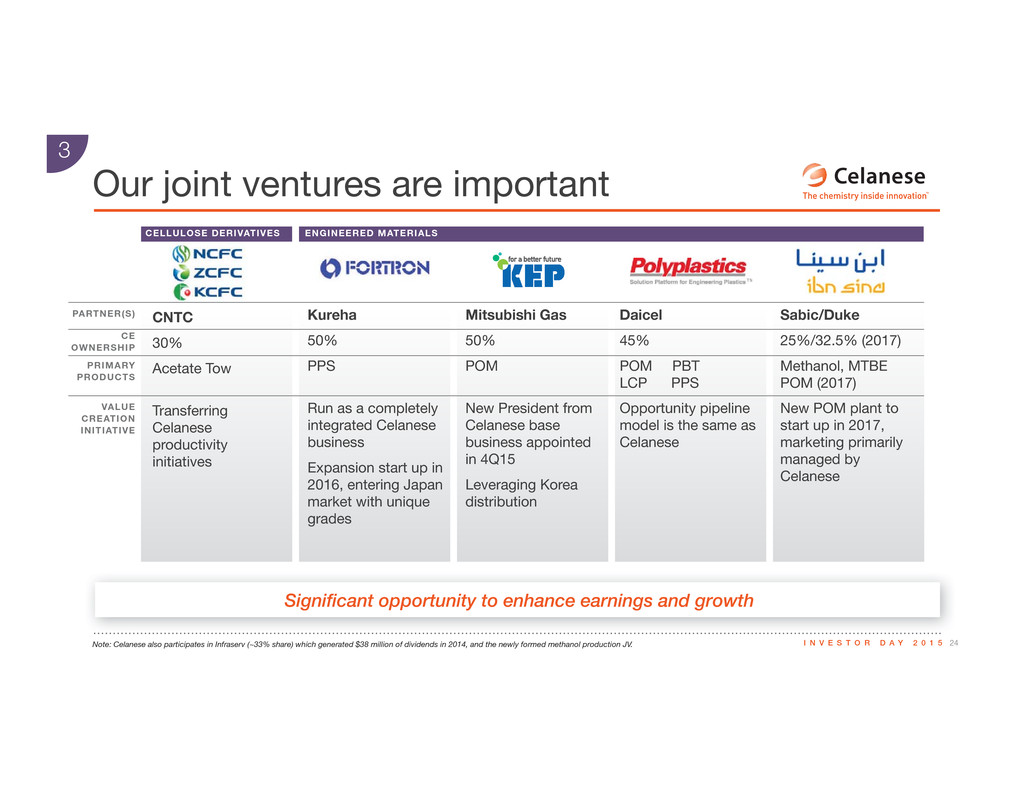

24I N V E S T O R D A Y 2 0 1 5 Our joint ventures are important CELLULOSE DERIVATIVES ENGINEERED MATERIALS VALUE CREATION INITIATIVE CNTC 30% Acetate Tow Transferring Celanese productivity initiatives Kureha 50% PPS Run as a completely integrated Celanese business Expansion start up in 2016, entering Japan market with unique grades Mitsubishi Gas 50% POM New President from Celanese base business appointed in 4Q15 Leveraging Korea distribution Daicel 45% POM PBT LCP PPS Opportunity pipeline model is the same as Celanese Sabic/Duke 25%/32.5% (2017) Methanol, MTBE POM (2017) New POM plant to start up in 2017, marketing primarily managed by Celanese PARTNER(S) CE OWNERSHIP PRIMARY PRODUCTS Note: Celanese also participates in Infraserv (~33% share) which generated $38 million of dividends in 2014, and the newly formed methanol production JV. Significant opportunity to enhance earnings and growth 3 NCFC ZCFC KCFC Fortron KEP Polyplastics ibn sina

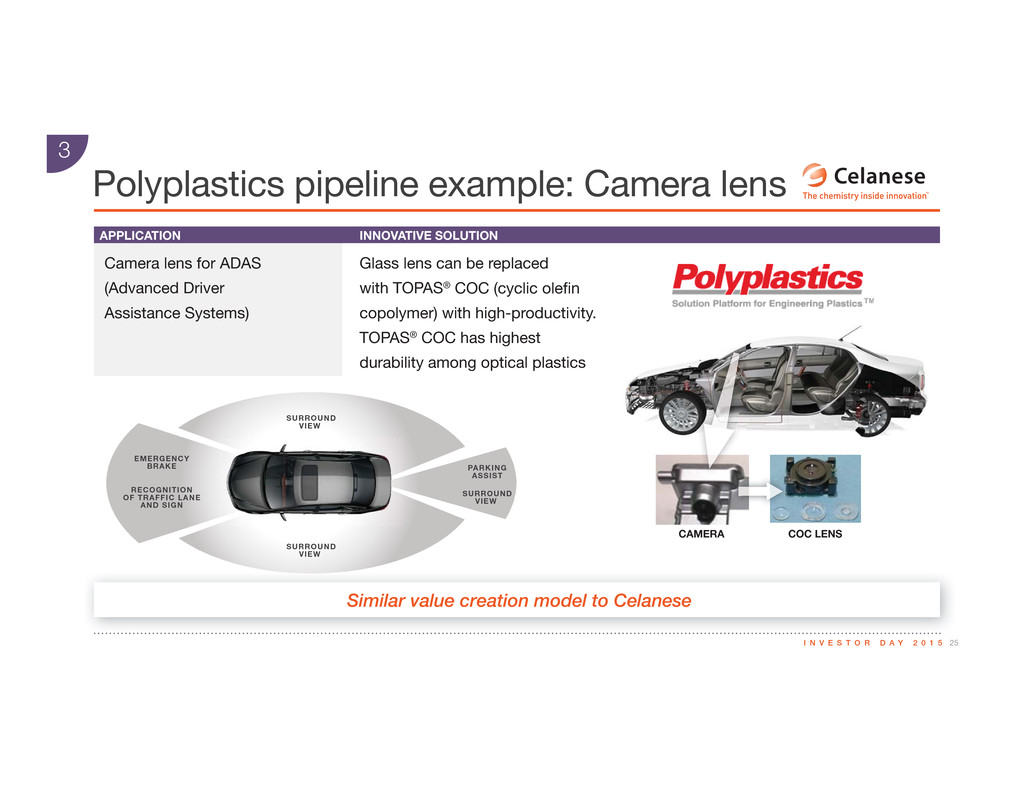

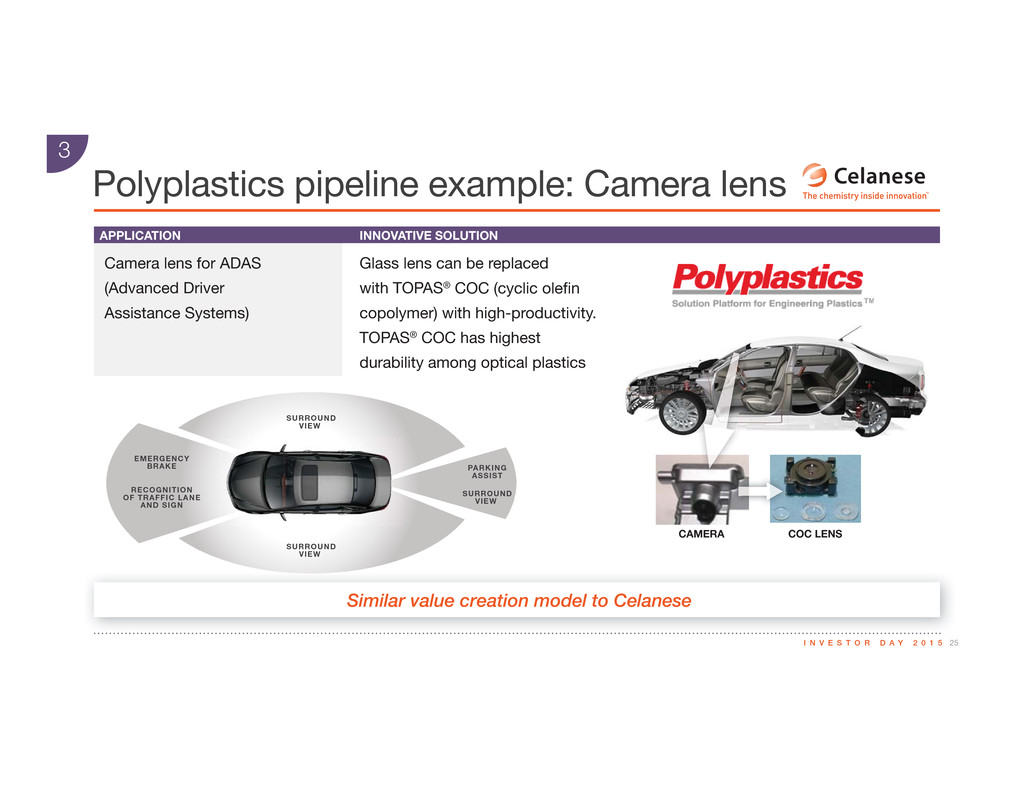

25I N V E S T O R D A Y 2 0 1 5 CAMERA COC LENS Polyplastics pipeline example: Camera lens 3 APPLICATION INNOVATIVE SOLUTION Camera lens for ADAS (Advanced Driver Assistance Systems) Glass lens can be replaced with TOPAS®g3g42g54g42g3g15g74g96g74g83g80g74g3g86g83g76g196g85g3 copolymer) with high-productivity. TOPAS® COC has highest durability among optical plastics Similar value creation model to Celanese EMERGENCY BRAKE RECOGNITION OF TRAFFIC LANE AND SIGN SURROUND VIEW SURROUND VIEW SURROUND VIEW PARKING ASSIST

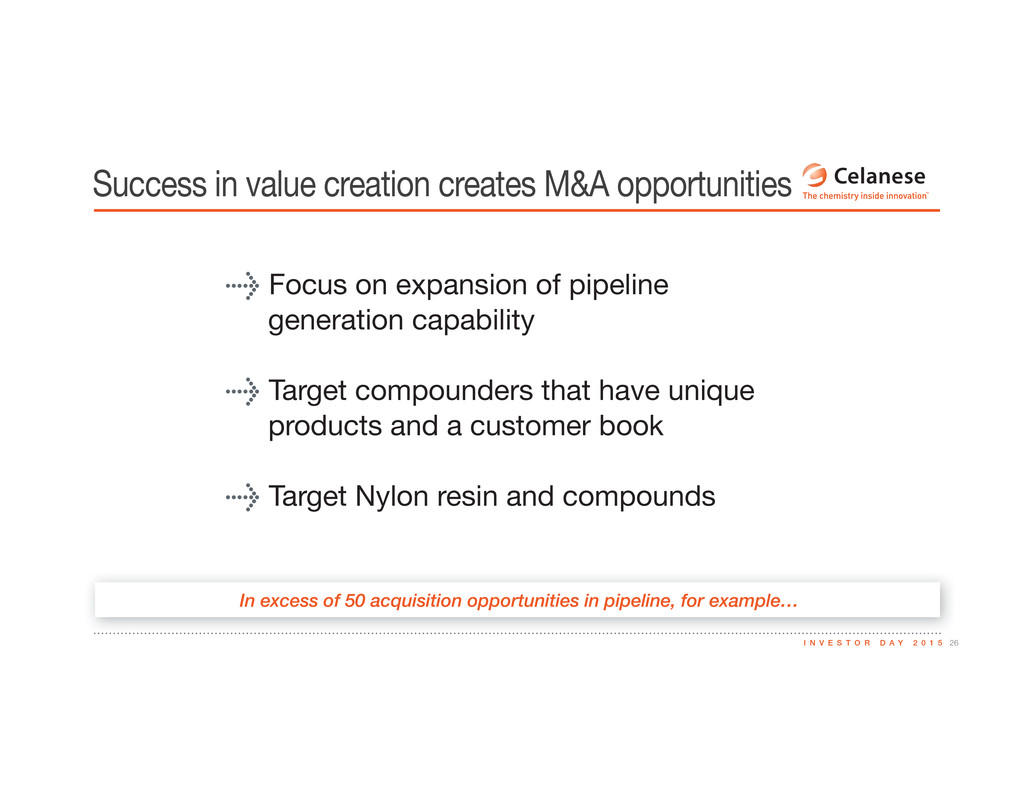

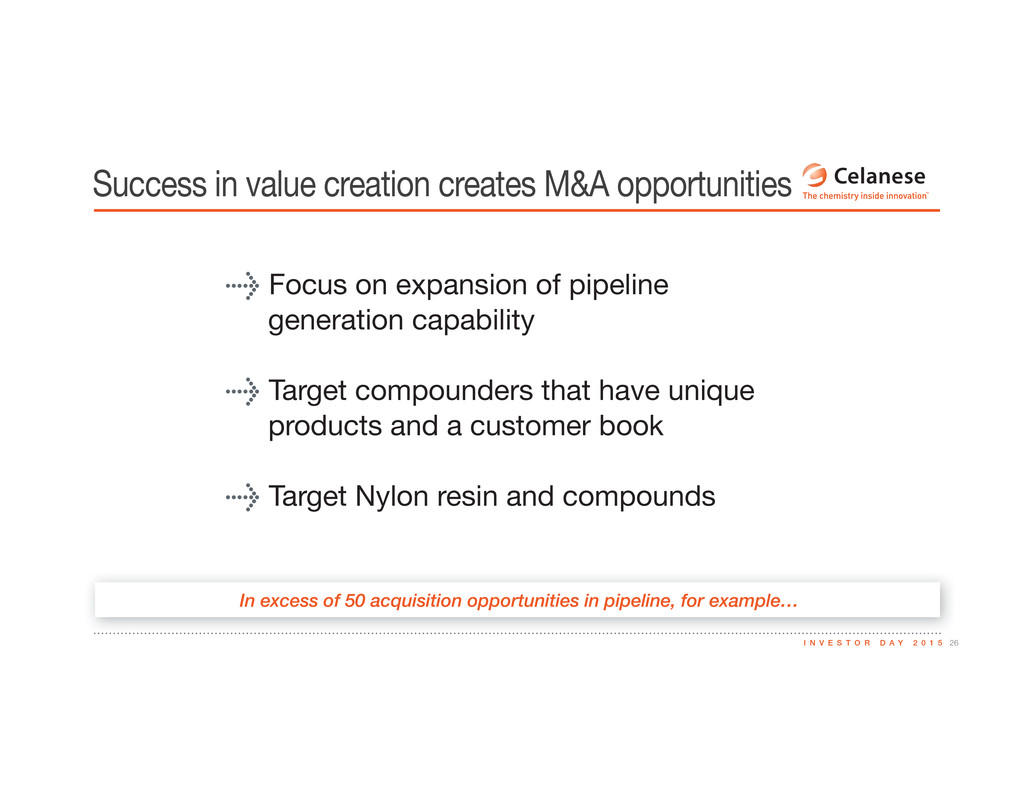

26I N V E S T O R D A Y 2 0 1 5 Success in value creation creates M&A opportunities > Focus on expansion of pipeline generation capability > Target compounders that have unique products and a customer book > Target Nylon resin and compounds In excess of 50 acquisition opportunities in pipeline, for example…

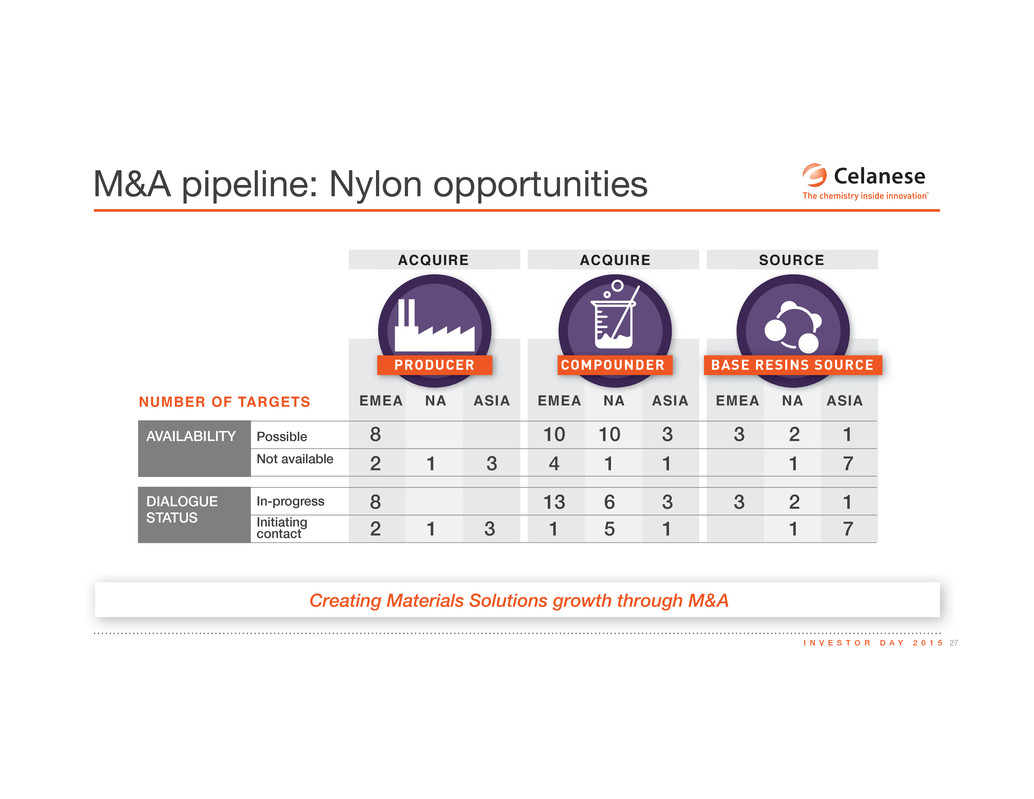

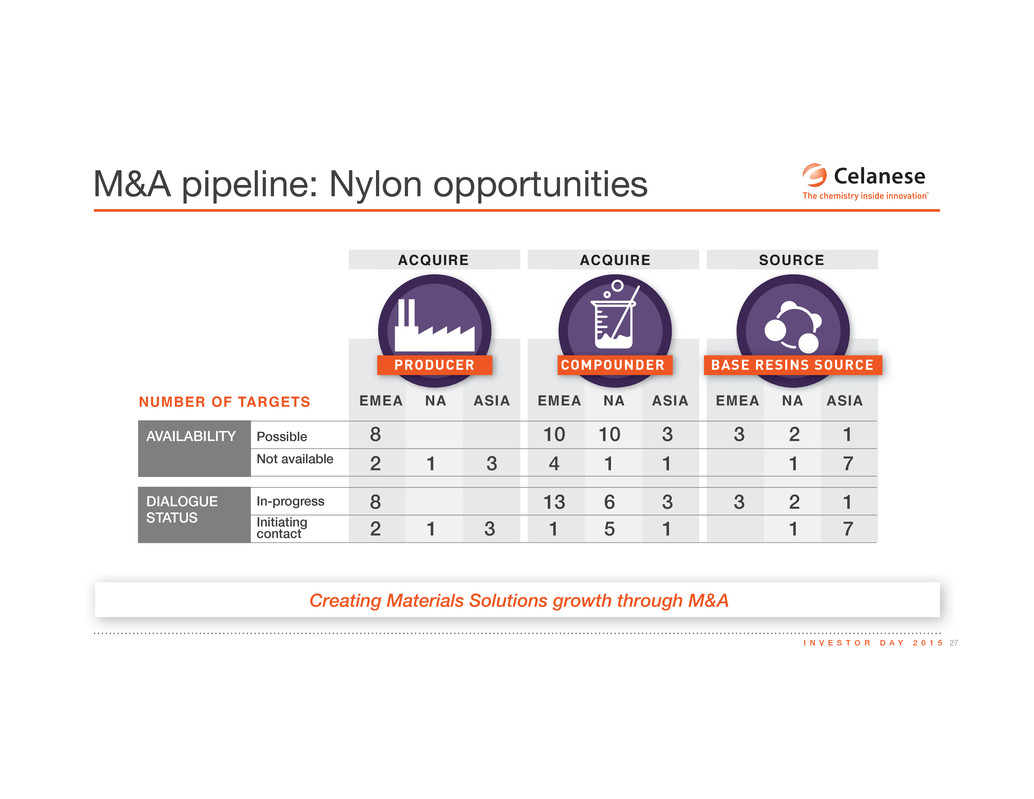

27I N V E S T O R D A Y 2 0 1 5 M&A pipeline: Nylon opportunities EMEA NA ASIA EMEA NA ASIA EMEA NA ASIA PRODUCER COMPOUNDER BASE RESINS SOURCE NUMBER OF TARGETS AVAILABILITY Possible Not available 8 2 8 1 3 10 4 10 1 3 1 3 2 1 3 2 1 1 7 1 7 13 6 3 1 5 12 1 3 In-progress Initiating contact DIALOGUE STATUS ACQUIRE ACQUIRE SOURCE Creating Materials Solutions growth through M&A

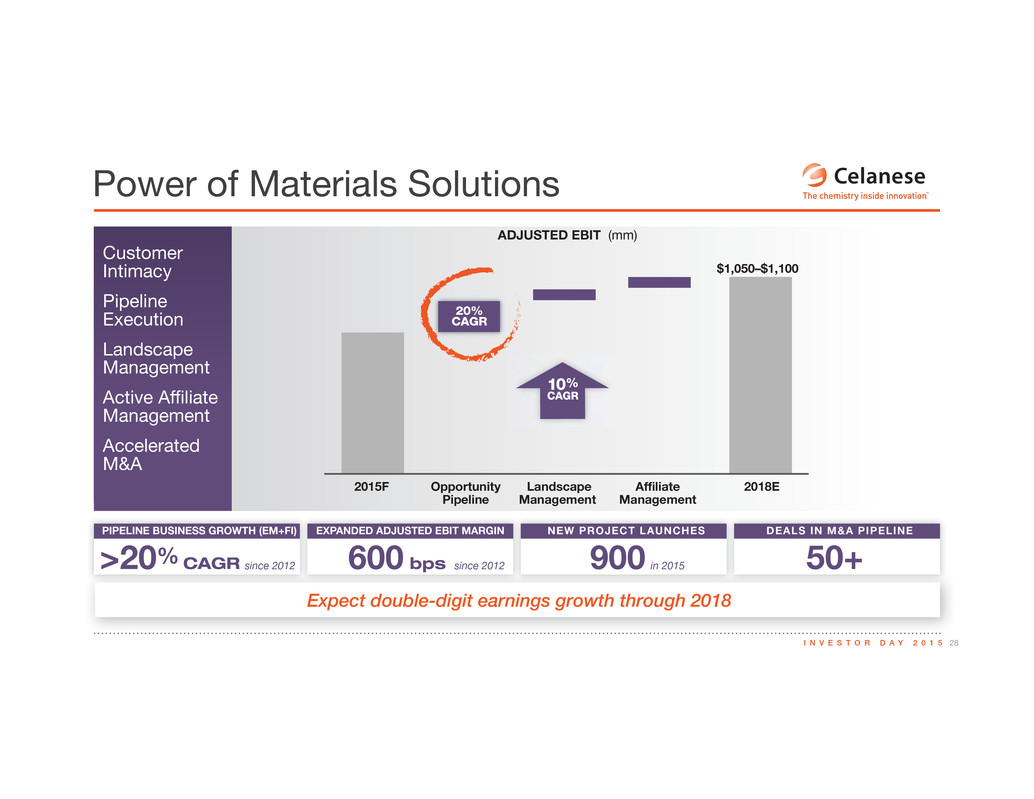

28I N V E S T O R D A Y 2 0 1 5 $1,050–$1,100 2015F 2018E 20% CAGR Affiliate Management Opportunity Pipeline Landscape Management 10% CAGR Power of Materials Solutions Customer Intimacy Pipeline Execution Landscape Management g40g74g91g80g93g76g3g40g585g83g80g72g91g76g3 Management Accelerated M&A ADJUSTED EBIT (mm) Expect double-digit earnings growth through 2018 PIPELINE BUSINESS GROWTH (EM+FI) DEALS IN M&A PIPELINE NEW PROJECT LAUNCHES EXPANDED ADJUSTED EBIT MARGIN 50+900600 bps>20% CAGR in 2015since 2012 since 2012

29I N V E S T O R D A Y 2 0 1 5 Next Up: Celanese Innovation Showcase Tangible examples of the Celanese value creation model Growth Acetyl Chain: Organizational New Performance CoolPoly Thermally Conductive Polymers Model Freely Increasing Lightweight Solutions New Product PEEK: Ultra High Performance Polymer Model Strategic M&A Framework Pipeline Model in Action Functionalized POM productivity: It's in Celanese's DNA Pipeline Model: Opportunities Cellulose Derivatives Clarifoil