Chris Jensen CHIEF FINANCIAL OFFICER I N V E S T O R D A Y N O V E M B E R 1 3 , 2 0 1 5

2I N V E S T O R D A Y 2 0 1 5 Expect to drive double-digit earnings and cash flow growth through 2018 Power of Financial Leadership > Significant and growing free cash flow generation driven by financial performance and decreasing capital expenditure needs > Capital allocation focused on highest-return opportunities > Commitment to return significantly more cash to shareholders > Strong financial position from which to invest in organic growth and disciplined M&A Growing Free Cash Flow Sustainable Productivity Capital Allocation Capacity for M&A

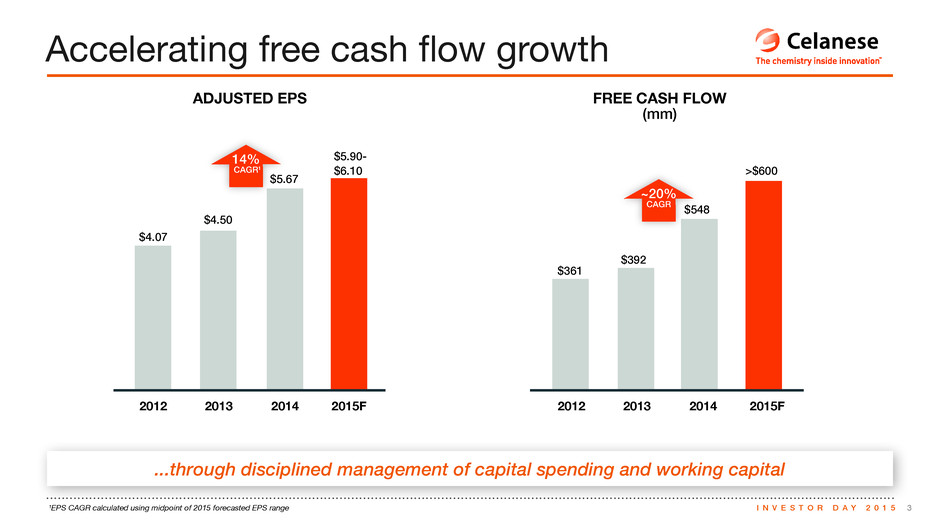

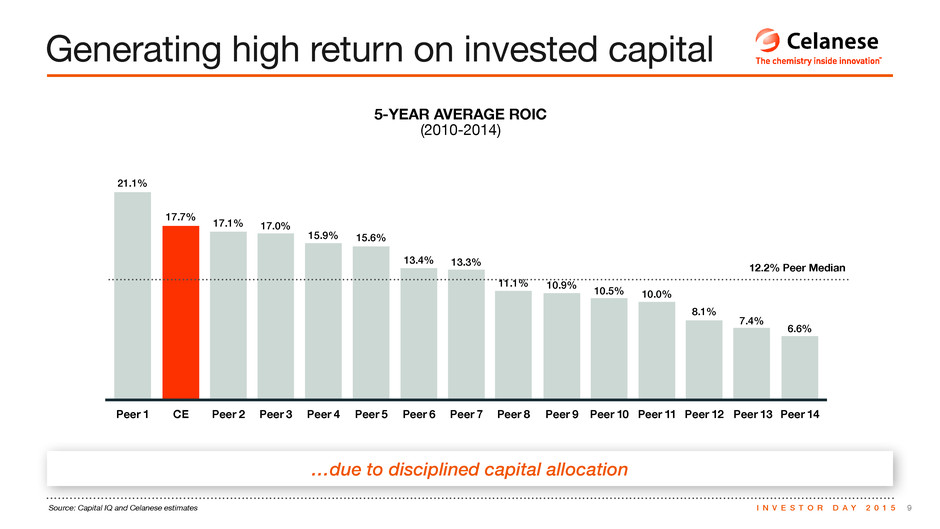

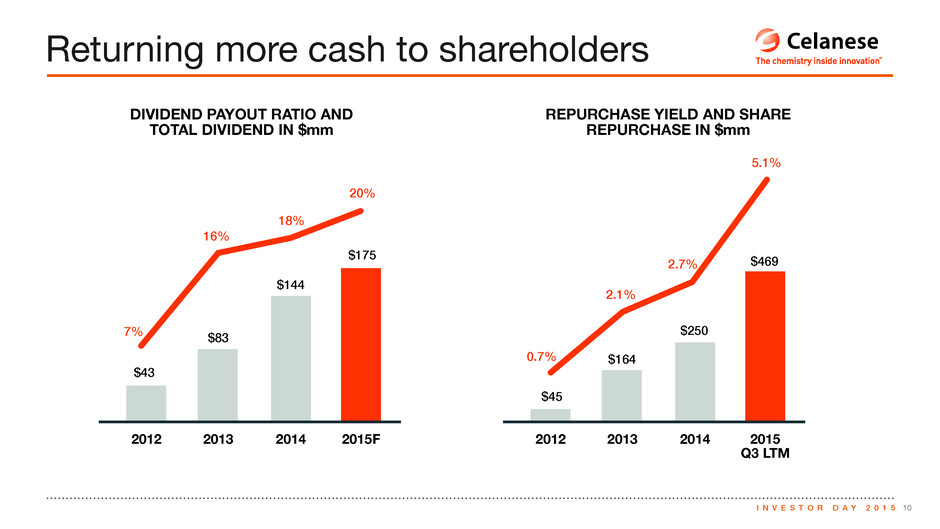

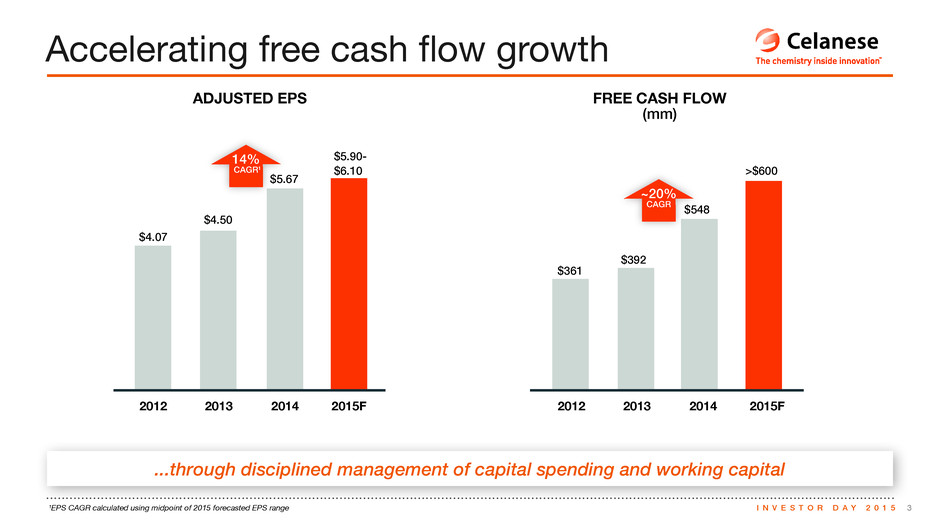

3I N V E S T O R D A Y 2 0 1 5¹EPS CAGR calculated using midpoint of 2015 forecasted EPS range ...through disciplined management of capital spending and working capital Accelerating free cash flow growth 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5% 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% 1 3 4 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 3 Peer 4 Peer 5 Peer 7 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 P er 2 P er 3 Peer 4 P er 5 P er 6 Peer 7 P er 8 P er 9 P er 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10 ADJUSTED EPS FREE CASH FLOW ( mm)

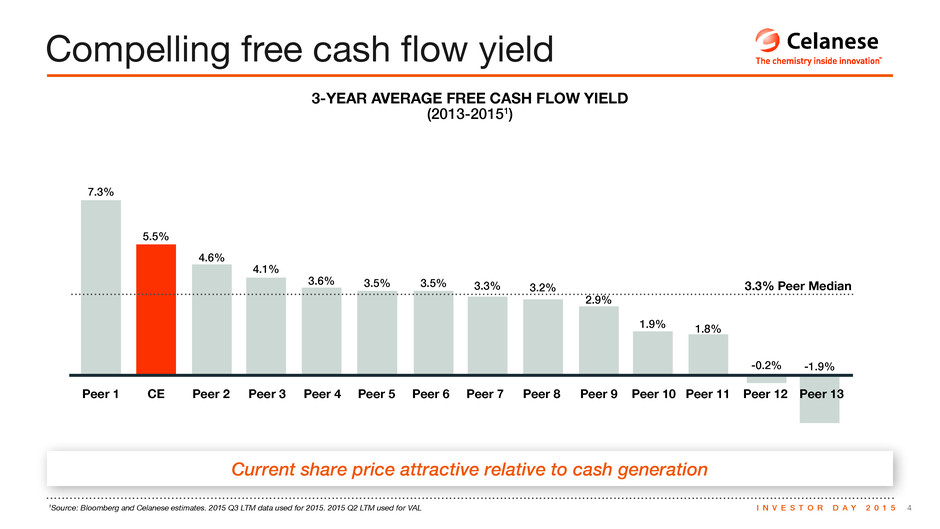

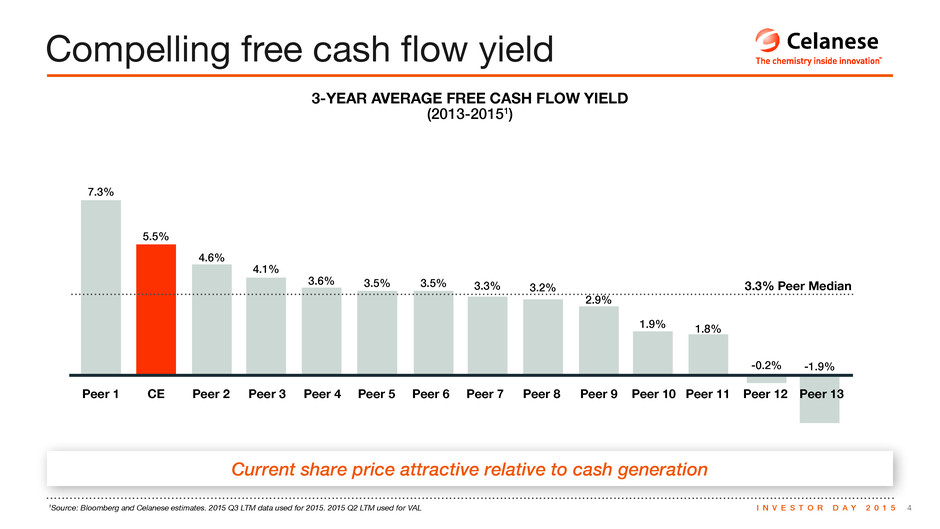

4I N V E S T O R D A Y 2 0 1 51Source: Bloomberg and Celanese estimates. 2015 Q3 LTM data used for 2015. 2015 Q2 LTM used for VAL Current share price attractive relative to cash generation Compelling free cash flow yield 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5% 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10 3-YEAR AVERAGE FREE CASH FLOW YIELD (2013-2015 1)

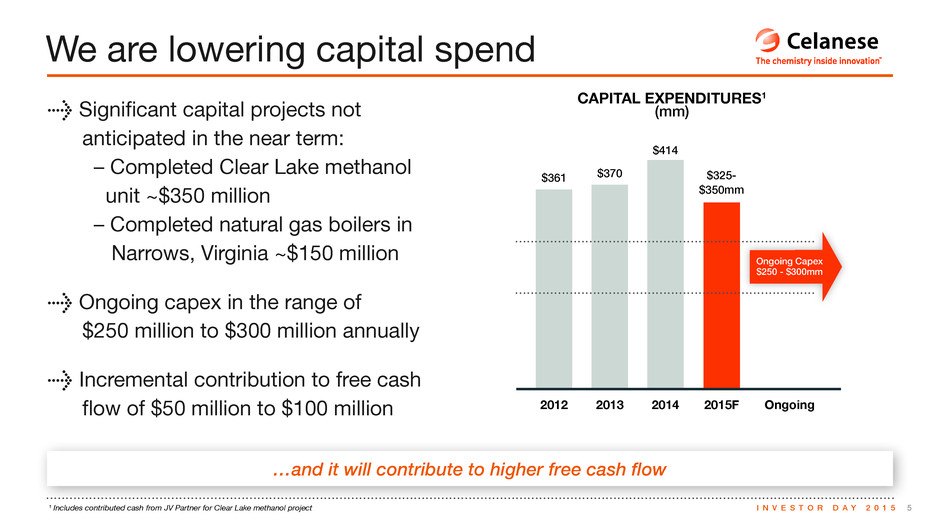

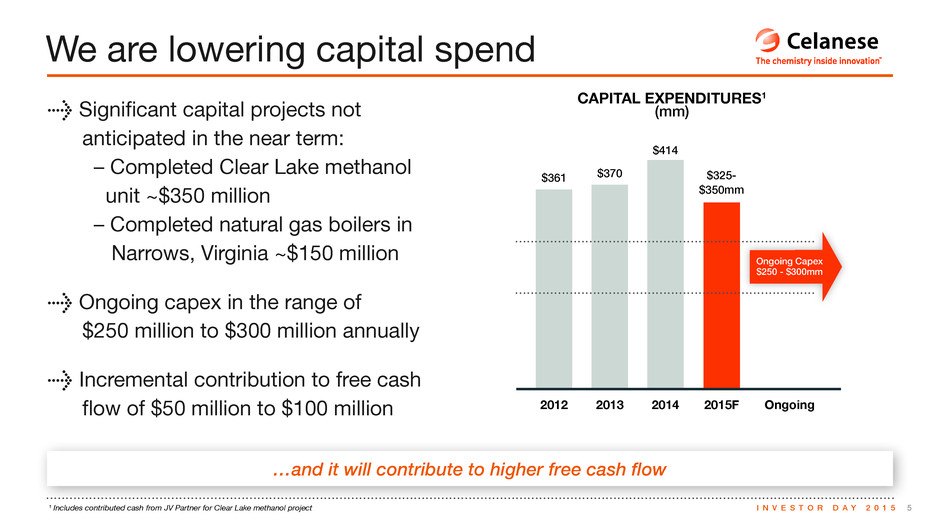

5I N V E S T O R D A Y 2 0 1 5¹ Includes contributed cash from JV Partner for Clear Lake methanol project …and it will contribute to higher free cash flow We are lowering capital spend > Significant capital projects not anticipated in the near term: – Completed Clear Lake methanol unit ~$350 million – Completed natural gas boilers in Narrows, Virginia ~$150 million > Ongoing capex in the range of $250 million to $300 million annually > Incremental contribution to free cash flow of $50 million to $100 million2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5% 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10 CAPITAL EXPENDITURES 1 ( mm)

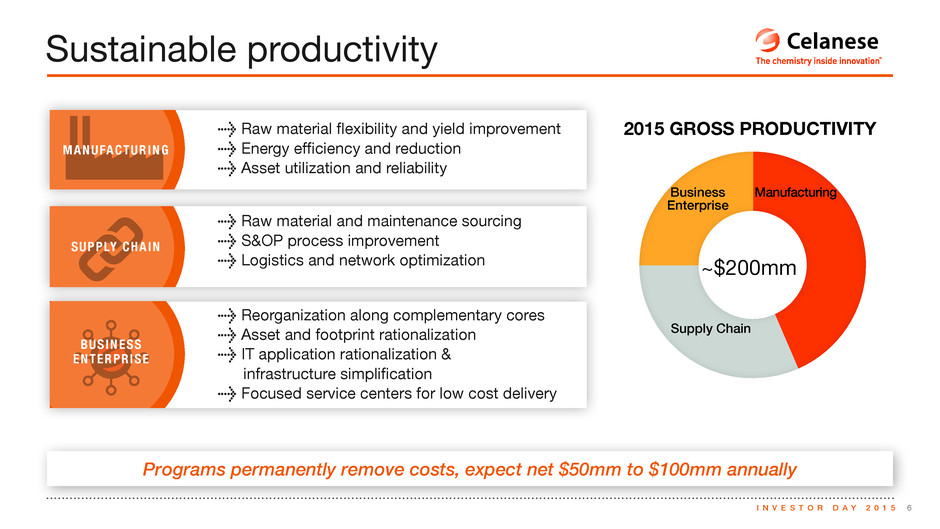

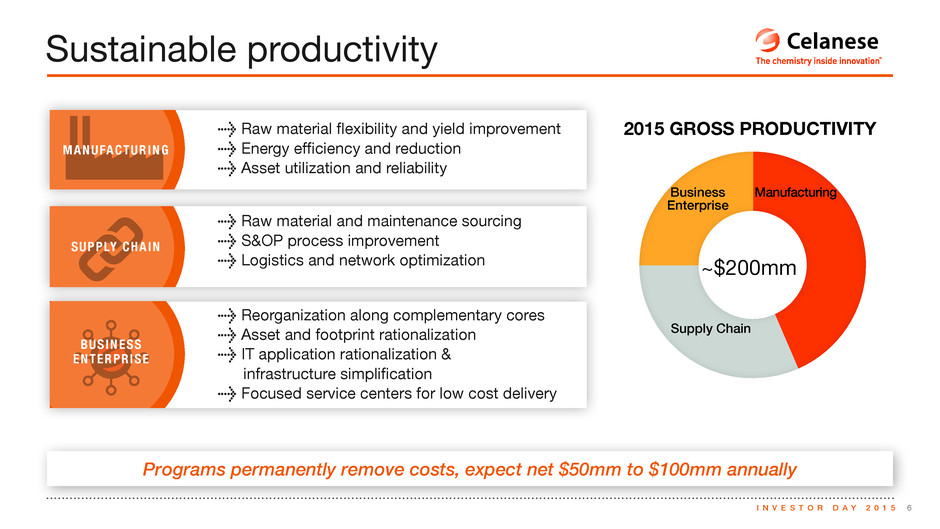

6I N V E S T O R D A Y 2 0 1 5 Programs permanently remove costs, expect net $50mm to $100mm annually Sustainable productivity 2015 GROSS PRODUCTIVITY Business Enterprise Supply Chain Manufacturing ~$200mm > Raw material flexibility and yield improvement > Energy efficiency and reduction > Asset utilization and reliability > Raw material and maintenance sourcing > S&OP process improvement > Logistics and network optimization > Reorganization along complementary cores > Asset and footprint rationalization > IT application rationalization & infrastructure simplification > Focused service centers for low cost delivery MANUFACTURING SUPPLY CHAIN BUSINESS ENTERPRISE

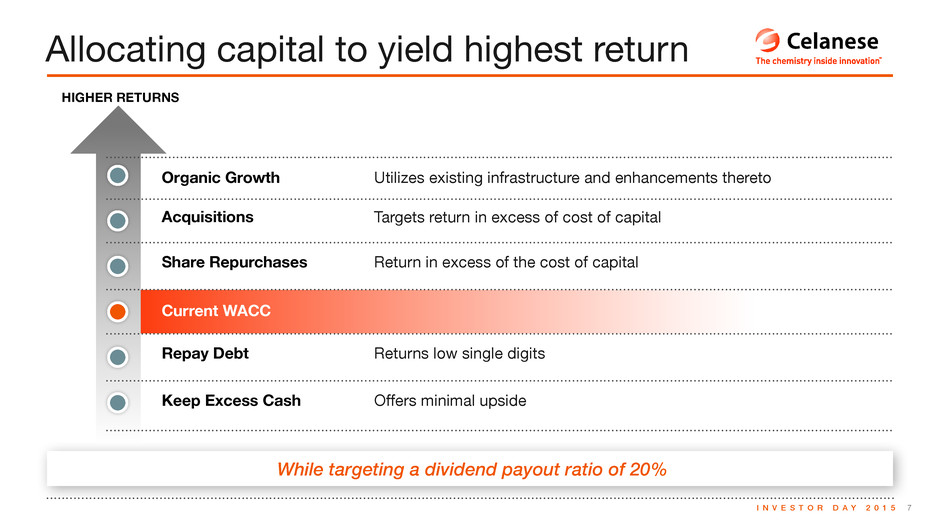

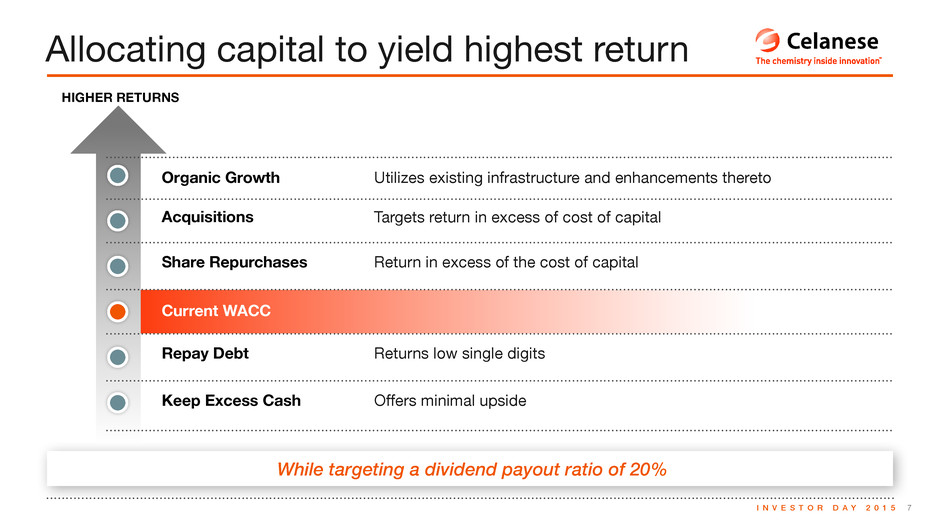

7I N V E S T O R D A Y 2 0 1 5 While targeting a dividend payout ratio of 20% Allocating capital to yield highest return HIGHER RETURNS Organic Growth Acquisitions Share Repurchases Repay Debt Keep Excess Cash Current WACC Utilizes existing infrastructure and enhancements thereto Targets return in excess of cost of capital Return in excess of the cost of capital Returns low single digits Offers minimal upside

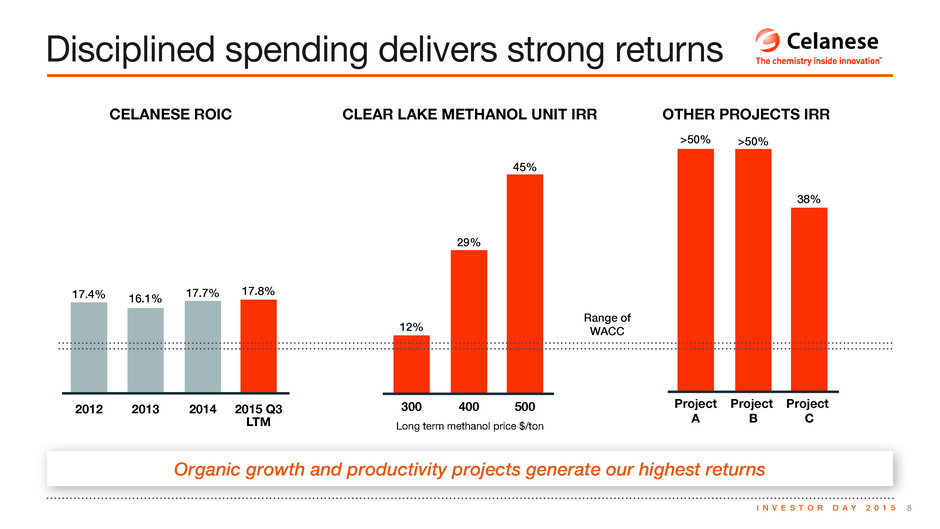

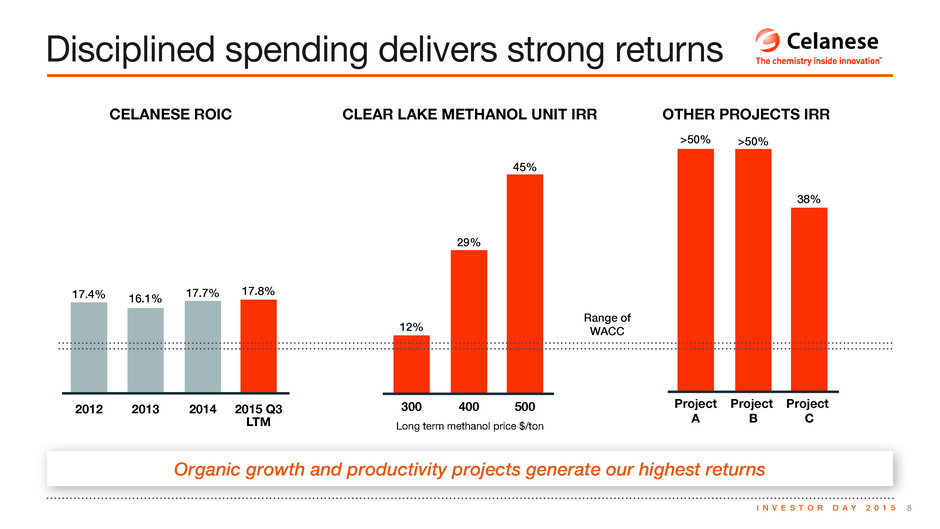

8I N V E S T O R D A Y 2 0 1 5 Organic growth and productivity projects generate our highest returns Disciplined spending delivers strong returns CELANESE ROIC CLEAR LAKE METHANOL UNIT IRR OTHER PROJECTS IRR 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5% 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10 Long term methanol price $/ton

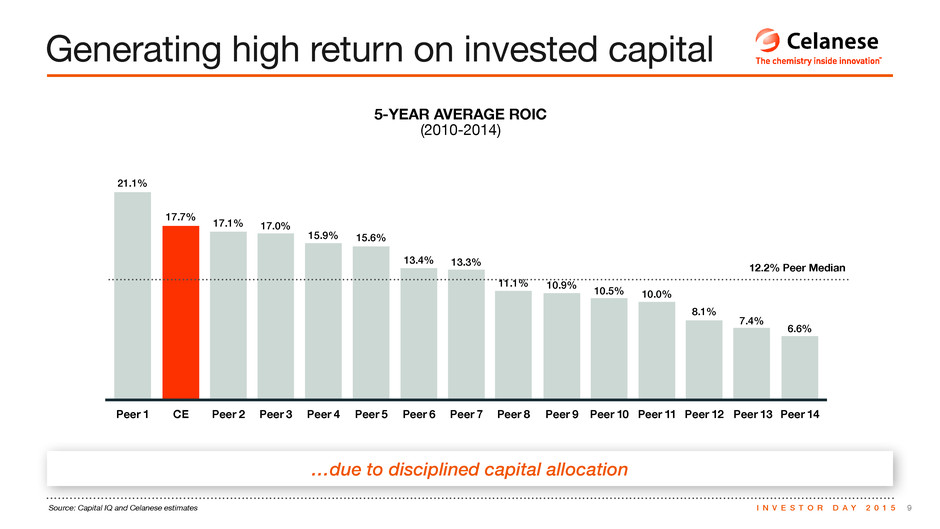

9I N V E S T O R D A Y 2 0 1 5Source: Capital IQ and Celanese estimates …due to disciplined capital allocation Generating high return on invested capital 5-YEAR AVERAGE ROIC (2010-2014) 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5% 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10 12.2% Peer Median

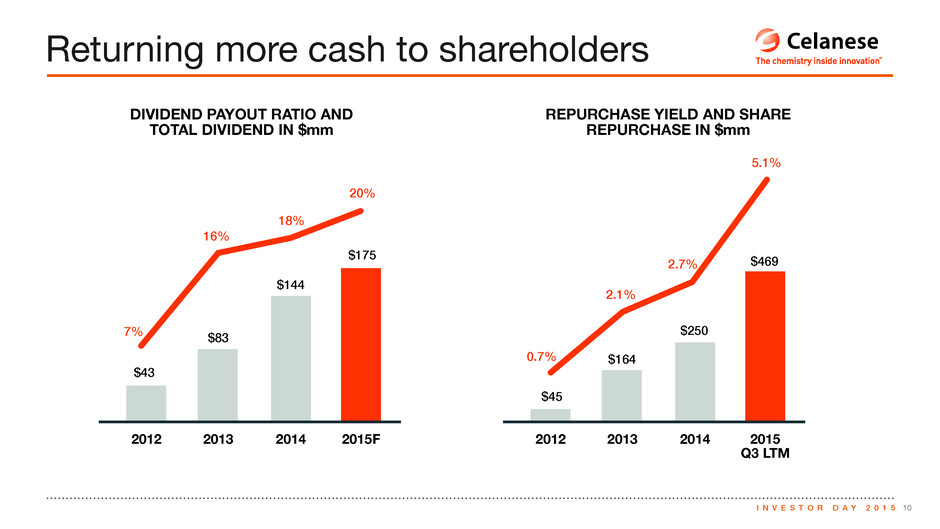

10I N V E S T O R D A Y 2 0 1 5 Returning more cash to shareholders DIVIDEND PAYOUT RATIO AND TOTAL DIVIDEND IN $mm REPURCHASE YIELD AND SHARE REPURCHASE IN $mm 2012 2013 2014 2015F 2012 2013 2014 2015F $4.07 $361 $392 $548 >$600 $4.50 $5.67 $5.90- $6.10 14% CAGR1 ~20% CAGR PAGE 3 PAGE 4 3.3% Peer Median 7.3% 5.5% 4.6% 4.1% 3.6% 3.5% 3.5% 3.3% 3.2% 2.9% 1.9% 1.8% -0.2% -1.9% Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8Peer 6Peer 2 Peer 9 Peer 11Peer 10 Peer 12 Peer 13CE Peer 1 Peer 3 Peer 4 Peer 5 Peer 7 Peer 8 Peer 6 Peer 2 Peer 9 Peer 11 Peer 10 Peer 12 Peer 13CE PAGE 5 2012 2013 2014 2015F Ongoing $361 $370 $414 $325- $350mm $250 - $300mm Ongoing Capex PAGE 9 21.1% 17.7% 17.1% 17.0% 15.9% 15.6% 13.4% 13.3% 11.1% 10.9% 10.5% 10.0% 8.1% 7.4% 6.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14CE PAGE 8 2012 2013 2014 2015 Q3 LTM 17.4% 16.1% 17.7% 17.8% Project A Project B Project C 38% >50% >50% 300 400 500 12% 29% 45% Range of WACC 2012 2013 2014 2015F 2012 2013 2014 2015 Q3 LTM 7% $43 $83 $175 16% 18% 20% 0.7% 2.1% 2.7% 5.1% $45 $164 $250 $469 $144 PAGE 10

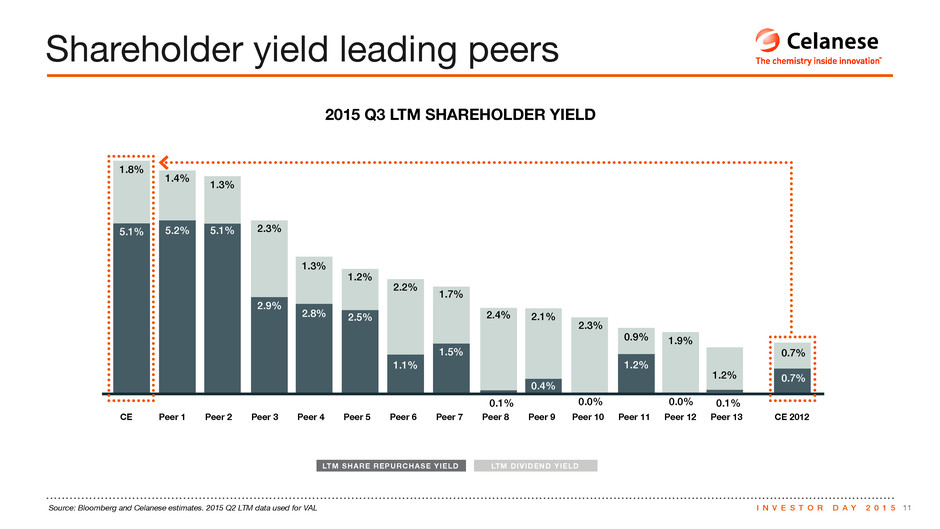

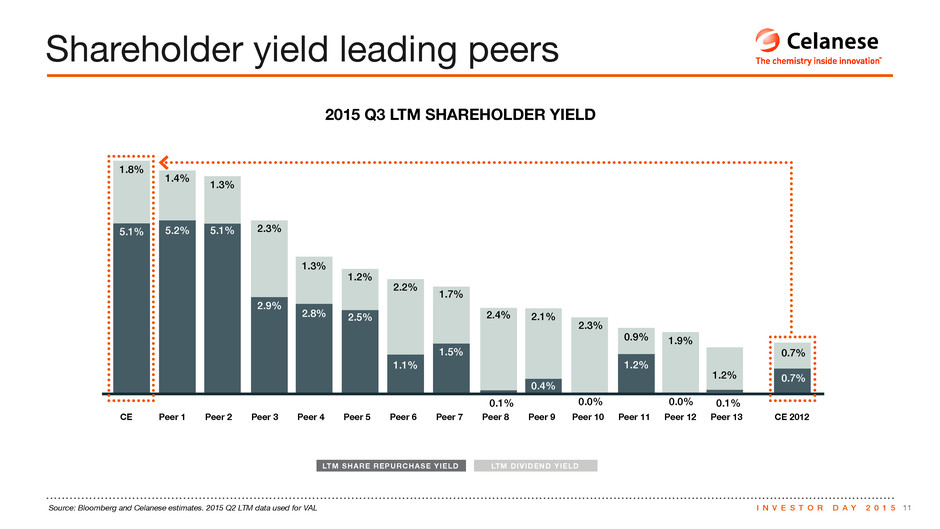

11I N V E S T O R D A Y 2 0 1 5Source: Bloomberg and Celanese estimates. 2015 Q2 LTM data used for VAL Shareholder yield leading peers 2015 Q3 LTM SHAREHOLDER YIELD PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2% 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 CE 2012 Share repurpose yield Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 16.3x Peer Median Peer 12 Peer 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 10% 15% CAGR CAGR Bolt-on M&A Capacity LTM SHARE REPURCHASE YIELD LTM DIVIDEND YIELD

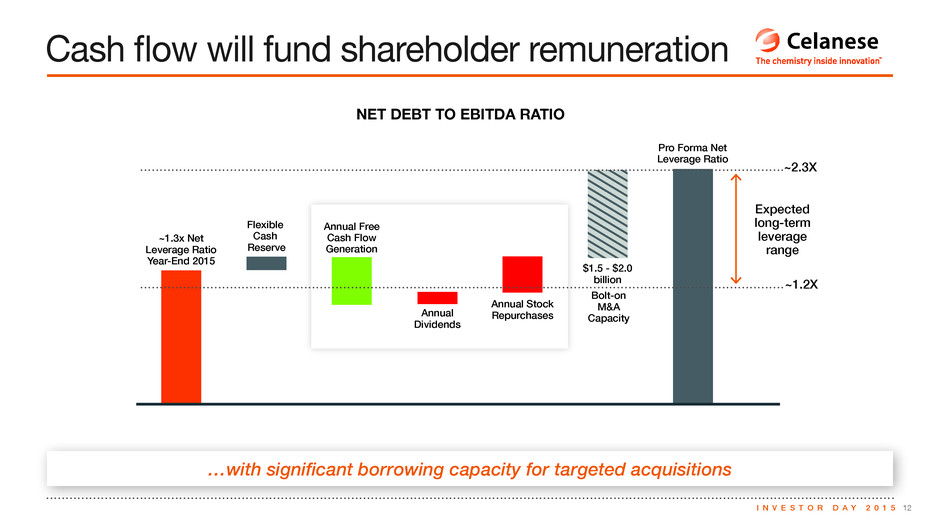

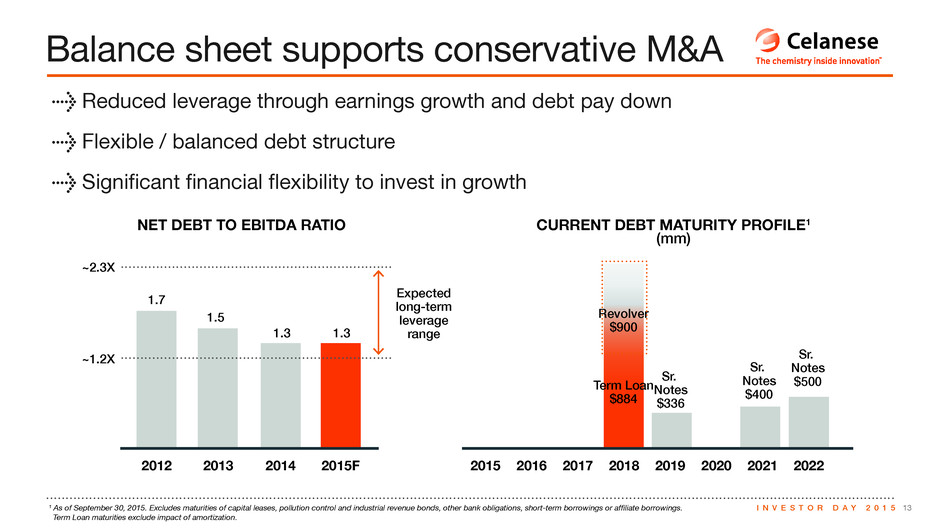

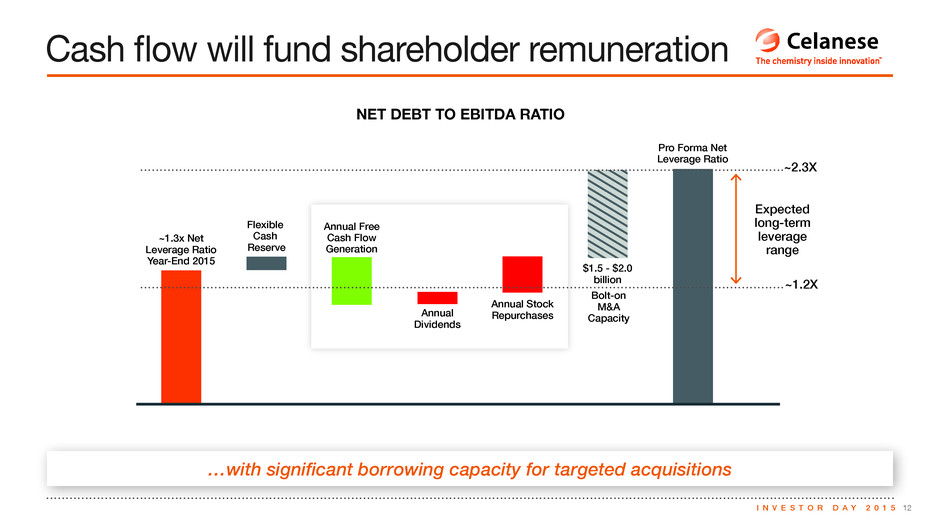

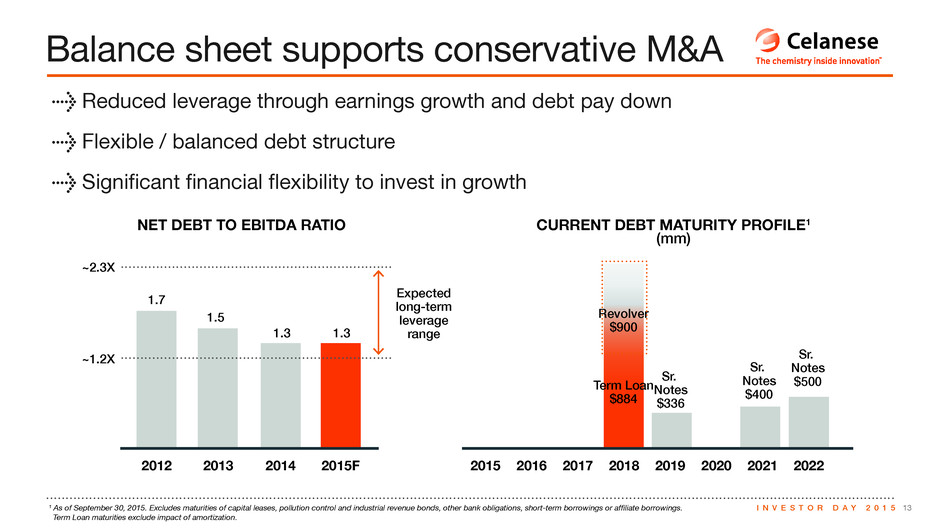

12I N V E S T O R D A Y 2 0 1 5 PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2% 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 CE 2012 Share repurpose yield Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 16.3x Peer Median Peer 12 Peer 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 10% 15% CAGR CAGR Bolt-on M&A Capacity …with significant borrowing capacity for targeted acquisitions Cash flow will fund shareholder remuneration NET DEBT TO EBITDA RATIO

13I N V E S T O R D A Y 2 0 1 5 PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2% 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 CE 2012 Share repurpose yield Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 16.3x Peer Median Peer 12 Peer 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 10% 15% CAGR CAGR Bolt-on M&A Capacity ¹ As of September 30, 2015. Excludes maturities of capital leases, pollution control and industrial revenue bonds, other bank obligations, short-term borrowings or affiliate borrowings. Term Loan maturities exclude impact of amortization. Balance sheet supports conservative M&A > Reduced leverage through earnings growth and debt pay down > Flexible / balanced debt structure > Significant financial flexibility to invest in growth NET DEBT TO EBITDA RATIO CURRENT DEBT MATURITY PROFILE 1 ( mm)

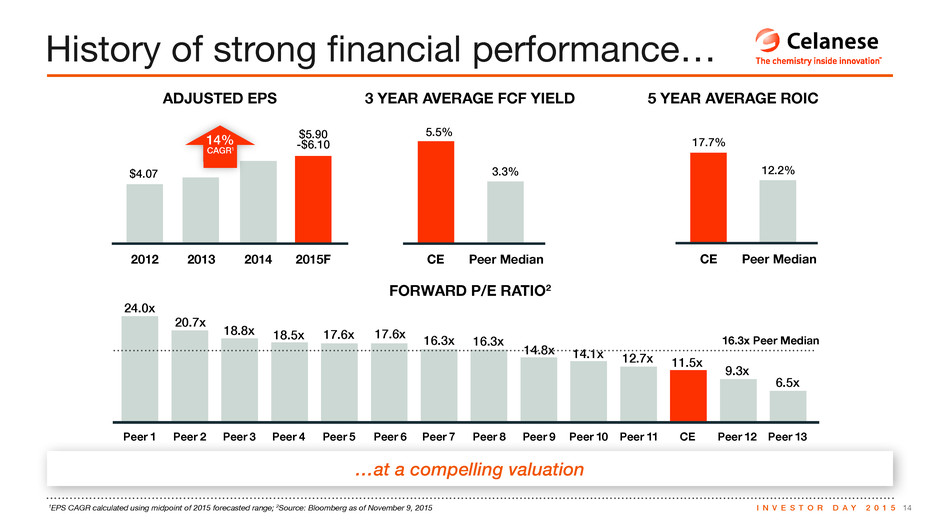

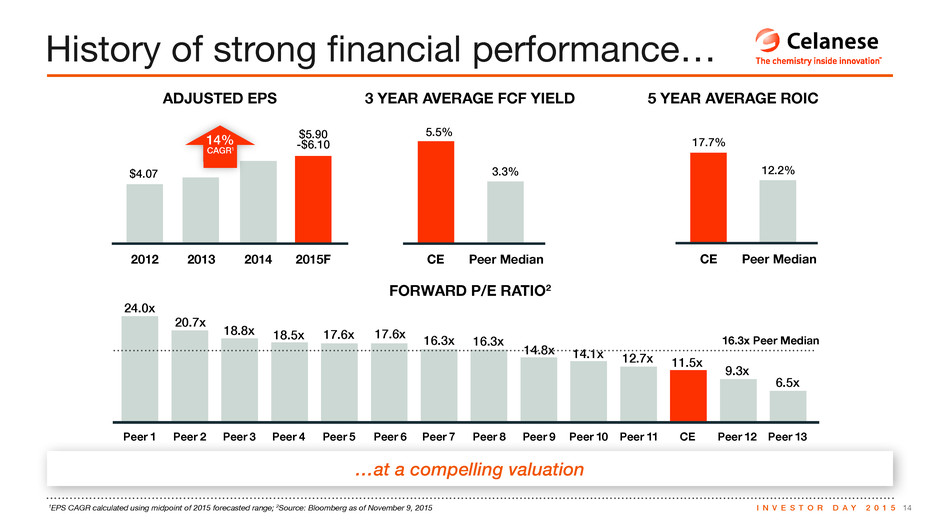

14I N V E S T O R D A Y 2 0 1 5 …at a compelling valuation 1EPS CAGR calculated using midpoint of 2015 forecasted range; 2Source: Bloomberg as of November 9, 2015 History of strong financial performance… ADJUSTED EPS 3 YEAR AVERAGE FCF YIELD 5 YEAR AVERAGE ROIC PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2% 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 CE 2012 Share repurpose yield Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 16.3x Peer Median Peer 12 Peer 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 10% 15% CAGR CAGR Bolt-on M&A Capacity PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2% 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 CE 2012 Share repurpose yield Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 16.3x Peer Median Peer 12 Peer 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 10% 15% CAGR CAGR Bolt-on M&A Capacity PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2% 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 CE 2012 Share repurpose yield Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Pe r 1 Pe r 2 Pe r 3 Pe r 4 Pe r 5 Pe r 6 Pe r 7 Pe r 8 Pe r 9 Pe r 10 Pe r 11 16.3x Pe r Median Pe r 12 Pe r 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 10% 15% CAGR CAGR Bolt-on M&A Capacity PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 3 CE 2012 Share repurpose yiel Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 16.3x Peer Median Peer 12 Peer 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1,000 10% 15% CAGR CAGR Bolt-on M&A Capacity FORWARD P/E RATIO2

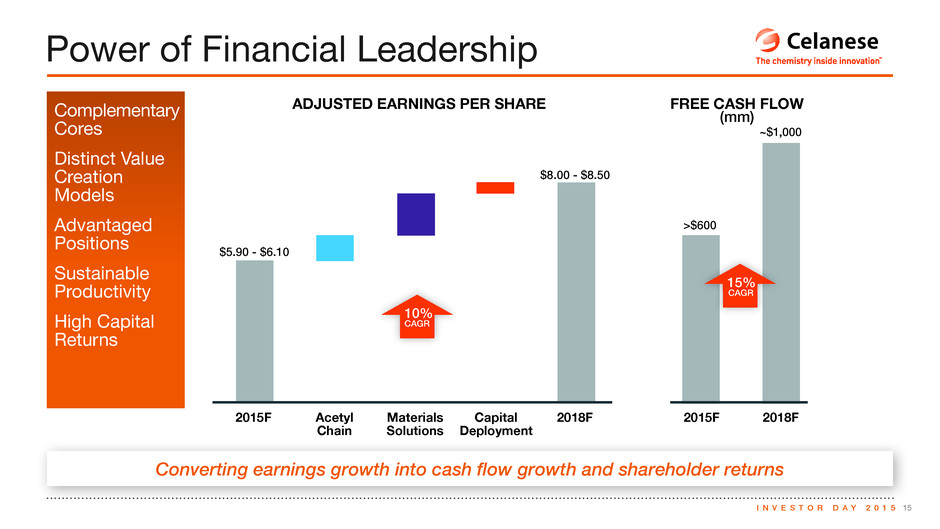

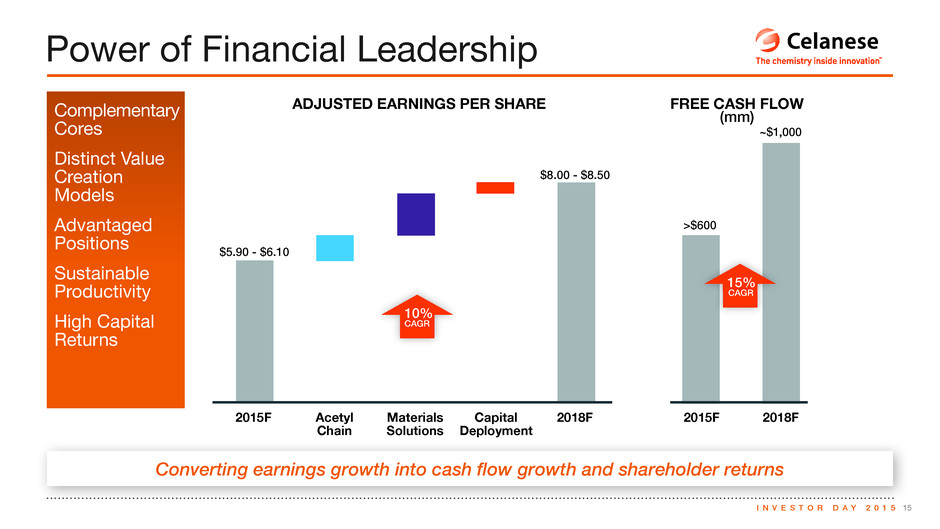

15I N V E S T O R D A Y 2 0 1 5 Converting earnings growth into cash flow growth and shareholder returns Power of Financial Leadership Complementary Cores Distinct Value Creation Models Advantaged Positions Sustainable Productivity High Capital Returns ADJUSTED EARNINGS PER SHARE FREE CASH FLOW (mm) PAGE 11 1.8% 1.4% 1.3% 5.1% 5.1% 2.9% 2.8% 0.0% 2.1% 2.3% 0.0% 0.9% 1.9% 1.2% 0.7% 0.7% 2.3% 1.3% 1.2% 2.2% 1.1% 1.5% 0.4% 1.2% 0.1% 0.1% 1.7% 2.4%2.5% 5.2% CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 CE 2012 Share repurpose yield Dividend yield PAGE 12 ~1.3x Net Leverage Ratio Year-End 2015 Flexible Cash Reserve Annual Free Cash Flow Generation Annual Dividends Annual Stock Repurchases $1.5 - $2.0 billion Pro Forma Net Leverage Ratio ~1.2X ~2.3X Expected long-term leverage range 2012 2013 2014 2015F 2015 2016 2017 2018 2019 2020 2021 2022 1.7 1.5 1.31.3 Term Loan $884 Sr. Notes $336 Sr. Notes $400 Sr. Notes $500 Revolver $900 PAGE 13 2015F Acetyl Chain Materials Solutions Capital Deployment 2018F 2015F 2018F ~1.2X ~2.3X Expected long-term leverage range PAGE 14 20.7x 18.8x 18.5x 17.6x 17.6x 16.3x 16.3x 14.8x 14.1x 12.7x 11.5x 9.3x 6.5x 24.0x Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 16.3x Peer Median Peer 12 Peer 13CE 2012 2013 2014 2015F Peer MedianCE Peer MedianCE 14% CAGR1 $4.07 $5.90 -$6.10 5.5% 3.3% 17.7% 12.2% PAGE 15 $5.90 - $6.10 $8.00 - $8.50 >$600 ~$1 ,000 10% 15% CAGR CAGR Bolt-on M&A Capacity

16I N V E S T O R D A Y 2 0 1 5 Glossary For Celanese Non-GAAP measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information documents available under Investor Relations/Financial Information/Non-GAAP Financial Measures on our website, www.celanese.com. > Average Market Cap is the average of quarterly beginning and ending market caps during each measurement period. For instance, 2014 average market cap is the average of market caps of the beginning of Q1, and the ending of Q1, Q2, Q3, and Q4 of 2014. > Dividend Payout Ratio is defined as the last reported quarterly dividend per share, annualized, divided by Adjusted Earnings Per Share for each measurement period. (10) > Dividend Yield is defined as Common Stock Cash Dividends Paid divided by Average Market Cap. (11) > IRR is the Internal Rate of Return calculated based on 15-year project cash flow assumptions for Clear Lake Methanol Project and 10-year project cash flow assumptions for other projects. (8) > Forward P/E Ratio is defined as Stock price divided by Bloomberg consensus Earnings Per Share for upcoming 4 quarters. (14) > Free Cash Flow for proxy peers is defined as Cash Flow from Operations less Capital Expenditures (4); Free Cash Flow for Celanese is per Celanese non- GAAP disclosure. > Free Cash Flow Yield is defined as Free Cash Flow divided by Average Market Cap. (4, 14) > Net Debt to EBITDA Ratio is defined as Total Debt minus Cash then divided by Operating EBITDA. (12, 13) > Proxy Peers include ALB, APD, ASH, CYT, ECL, EMN, FMC, HUN, MON, PPG, PX, ROC, RPM, VAL. (4, 9, 11, 14) Note: ROC was acquired by ALB in January 2015. > Repurchase Yield is defined as Share Repurchases divided by Average Market Cap. (10, 11) > ROIC for proxy peers is defined as Net Operating Profit After Tax divided by the average Invested Capital at the beginning and ending of each measurement period. ROIC = EBIT * (1 – Effective Tax Rate) / (Total Debt + Preferred Stock + Minority Interest + Book Value of Equity). (8, 9, 14); ROIC for Celanese is per Celanese non-GAAP disclosure.