Pat Quarles PRESIDENT, ACETYLS & SUPPLY CHAIN I N V E S T O R D A Y N O V E M B E R 1 3 , 2 0 1 5

2I N V E S T O R D A Y 2 0 1 5 Our global integrated manufacturing footprint is safe, reliable and low-cost Celanese is an integrated manufacturing company > Providing a safe workplace for our employees and contractors > Serving as a reliable partner for our customers > Being a responsible steward of the environment > Being a low-cost operator WE ARE COMMITTED TO:

3I N V E S T O R D A Y 2 0 1 5Note: Safety data relates to Celanese employees only. 2015 YTD as of October 2015. - 1 On stream reliability includes plant controllable at tier 1 facilities. Culture drives operational excellence AWARDS (2013-15 YTD) > Waste minimization, reuse & recycling award > Energy efficiency award > Facility safety awards > Performance Award Winner > Facility Safety Awards > 2 Responsible care awards > 0.18 total recordable injury rate in 2014 > 49% reduction from 2012 to 2014 > Average reduction of process safety incidents 35%/year Improvements from 2012 to 2014 > 16% volatile organic compound intensity reduction > 14% waste intensity reduction > 7% energy intensity reduction > 3% GHG (greenhouse gas) intensity reduction > Safety Merit Award (9 U.S. locations) > Achievement Years (All U.S. locations) > Achievement Hours (8 U.S. locations) > Responsible Care Achievement Award (Singapore) > CEFIC Responsible Care Award for Process Safety Lessons Learned > Excellence in Caring for Texas (Bishop) > Distinguished Service (Bishop) > Zero Incident Rate (Bishop) > ISO-50001 (Energy Management) Certification (3 Germany locations) > 2014 best paper at CCPS congress > Voluntary Protection g55g89g86g78g89g72g84g3g42g76g89g91g80g196g74g72g91g80g86g85g3 (Bishop) Safety Process Safety Environmental Reliability 0.09 0.11 0.04 0.03 2012 2013 2014 2015 YTD 92% 93% 95% 96% 2012 2013 2014 2015 Incident Rate On Stream Reliability1 American Chemistry Council American Fuel & Petrochemical Manufacturers Responsible Care Texas Chemical Council ISO AIChE VPP

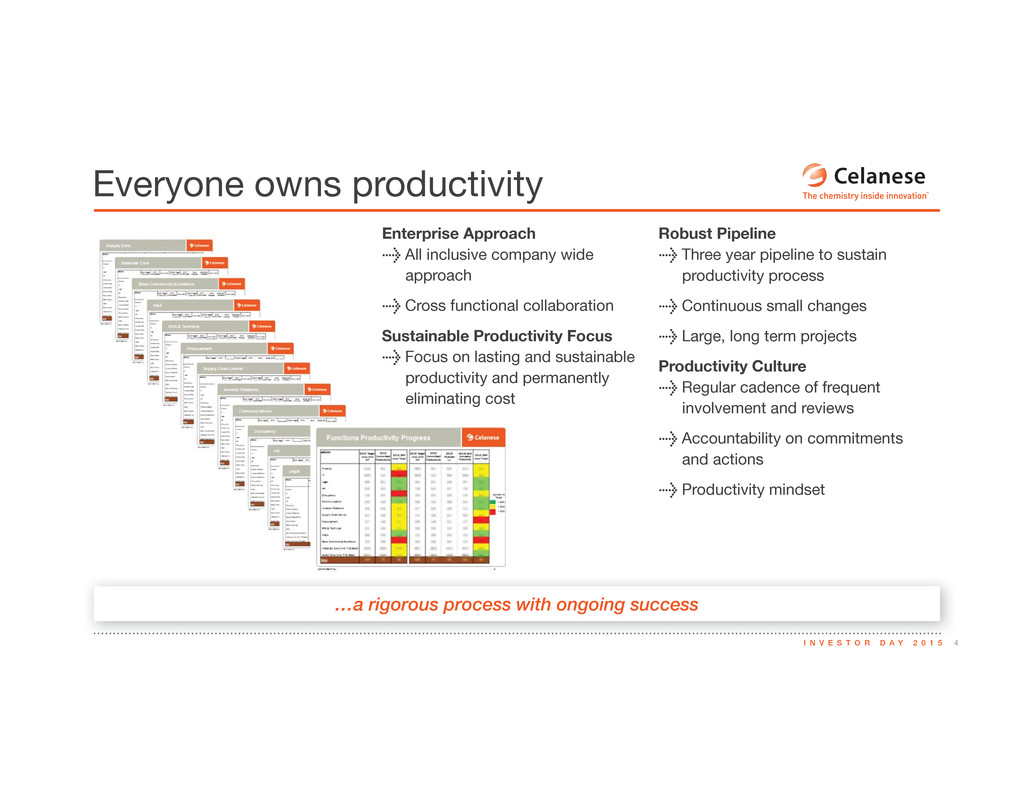

4I N V E S T O R D A Y 2 0 1 5 …a rigorous process with ongoing success Everyone owns productivity Enterprise Approach > All inclusive company wide approach > Cross functional collaboration Sustainable Productivity Focus > Focus on lasting and sustainable productivity and permanently eliminating cost Robust Pipeline > Three year pipeline to sustain productivity process > Continuous small changes > Large, long term projects Productivity Culture > Regular cadence of frequent involvement and reviews > Accountability on commitments and actions > Productivity mindset Functions Productivity Progress

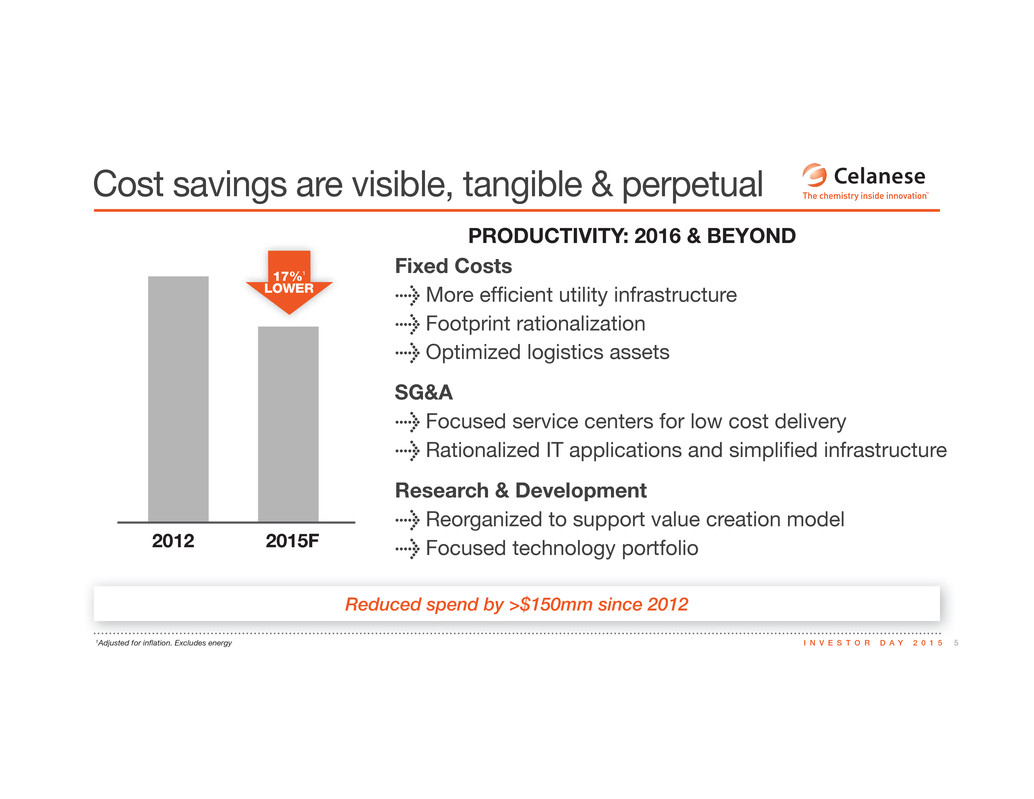

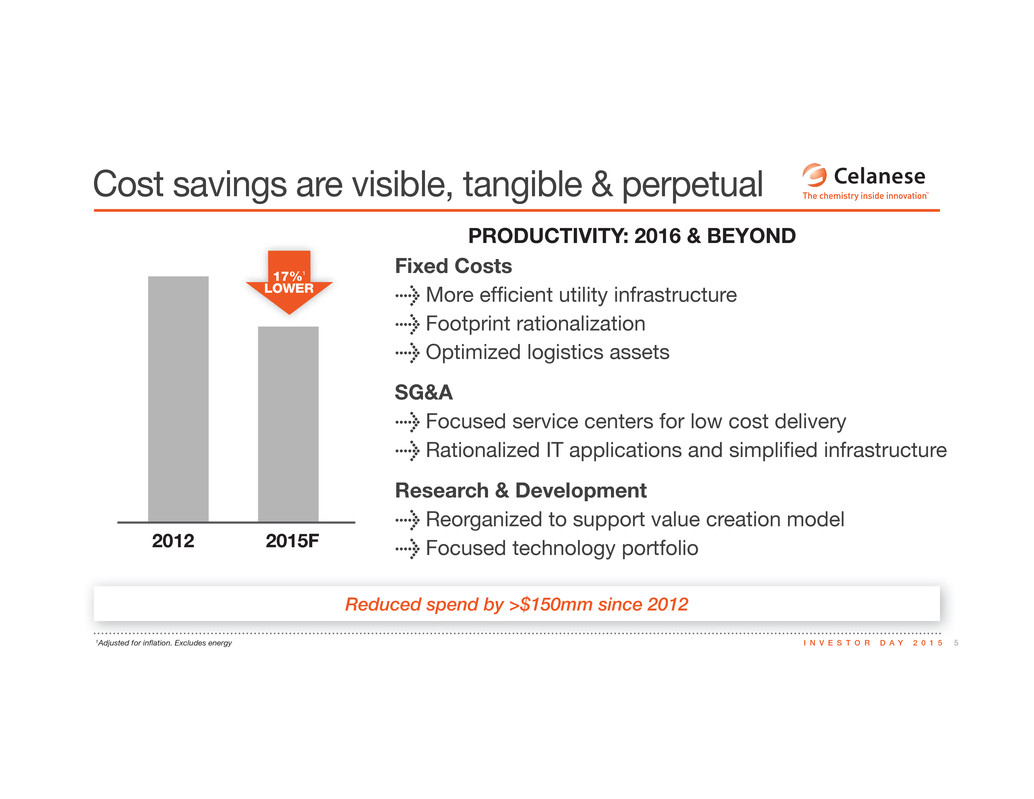

5I N V E S T O R D A Y 2 0 1 51Adjusted for inflation. Excludes energy Reduced spend by >$150mm since 2012 Cost savings are visible, tangible & perpetual Fixed Costs > More efficient utility infrastructure > Footprint rationalization > Optimized logistics assets SG&A > Focused service centers for low cost delivery > Rationalized IT applications and simplified infrastructure Research & Development > Reorganized to support value creation model > Focused technology portfolio2012 2015F 17%1 LOWER PRODUCTIVITY: 2016 & BEYOND

6I N V E S T O R D A Y 2 0 1 5 Expect annual net productivity savings of $50mm to $100mm Multi year productivity planning > Raw material flexibility and yield improvement > Energy efficiency and reduction > Asset utilization and reliability > Raw material and maintenance sourcing > S&OP process improvements > Logistics and network optimization > Reorganization along complementary cores > Asset and footprint rationalization AREAS OF FOCUSFUNCTIONAL AREAS MANUFACTURING SUPPLY CHAIN SHARED SERVICES & ENTERPRISE WIDE GROSS PRODUCTIVITY 2013 2014 2015LE 16LE 17LE 18LE $200mm $150mm TARGET RANGE Pipeline

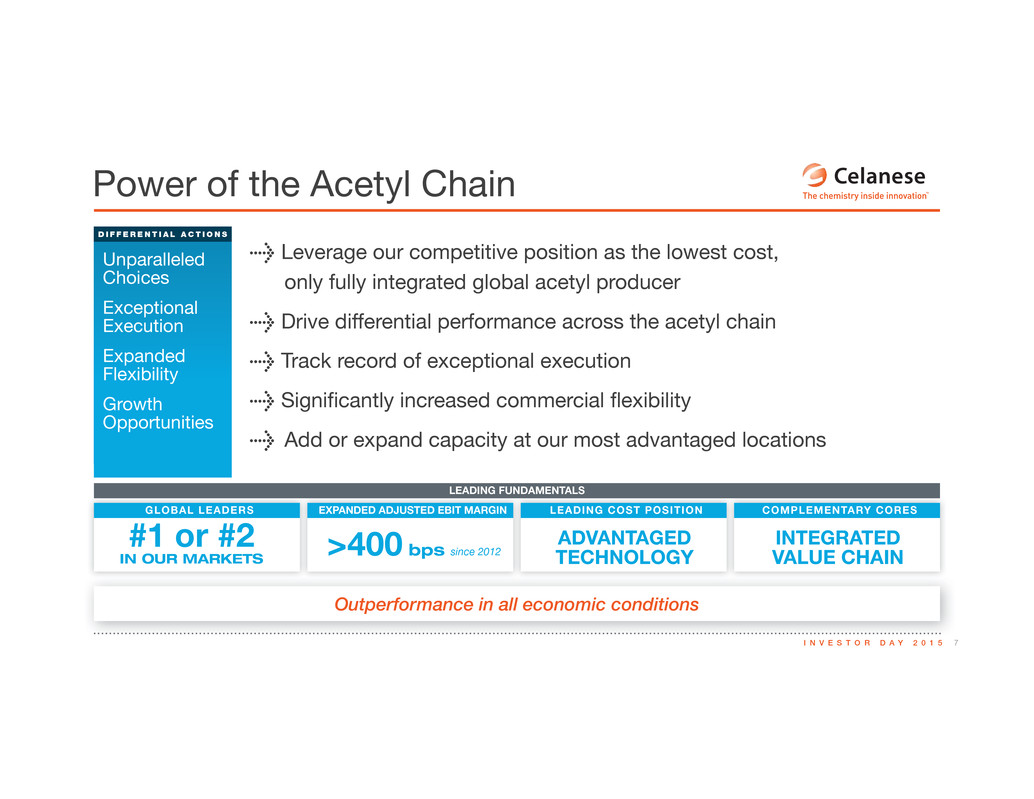

7I N V E S T O R D A Y 2 0 1 5 Outperformance in all economic conditions COMPLEMENTARY CORESGLOBAL LEADERS LEADING COST POSITIONEXPANDED ADJUSTED EBIT MARGIN LEADING FUNDAMENTALS >400 bps ADVANTAGED TECHNOLOGY INTEGRATED VALUE CHAIN#1 or #2 IN OUR MARKETS since 2012 Power of the Acetyl Chain Unparalleled Choices Exceptional Execution Expanded Flexibility Growth Opportunities D I F F E R E N T I A L A C T I O N S > Leverage our competitive position as the lowest cost, only fully integrated global acetyl producer > Drive differential performance across the acetyl chain > Track record of exceptional execution > Significantly increased commercial flexibility > Add or expand capacity at our most advantaged locations

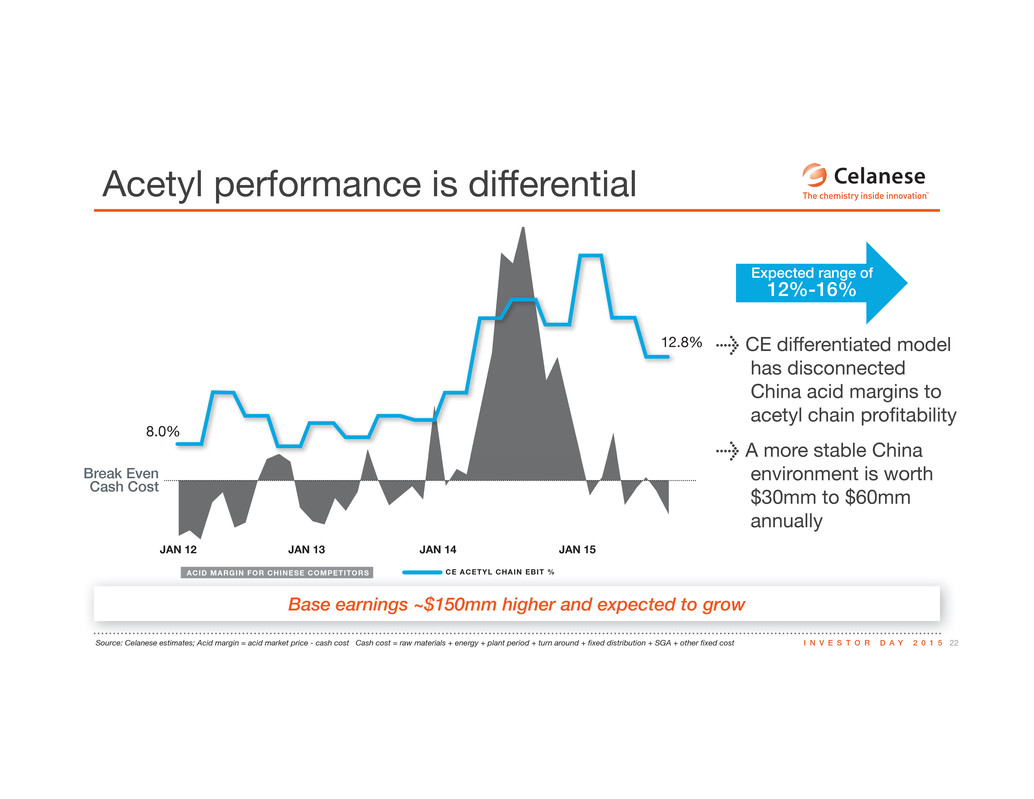

8I N V E S T O R D A Y 2 0 1 5 400 to 500 basis point improvement in margin and ~$150mm in base earnings Acetyl performance is differential 12% $534 $469 $390 $375 $383 $352 $352 $374 $395 $478 $564 $611 $662 $631 $560 11% 9% 9% 9% 9% 9% 10% 11% 13% 14% 16% 16% 15% 10% 8%–10% OLD RANGE 12–16% NEW RANGE Q1 Q2 Q3 Q4 2012 Q1 Q2 Q3 Q4 2014 Q1 Q2 Q3 Q4 2013 Q1 Q2 Q3 2015 LTM ADJ. EBIT LTM ADJ. EBIT MARGIN EBIT MARGIN NORMALIZED RANGE

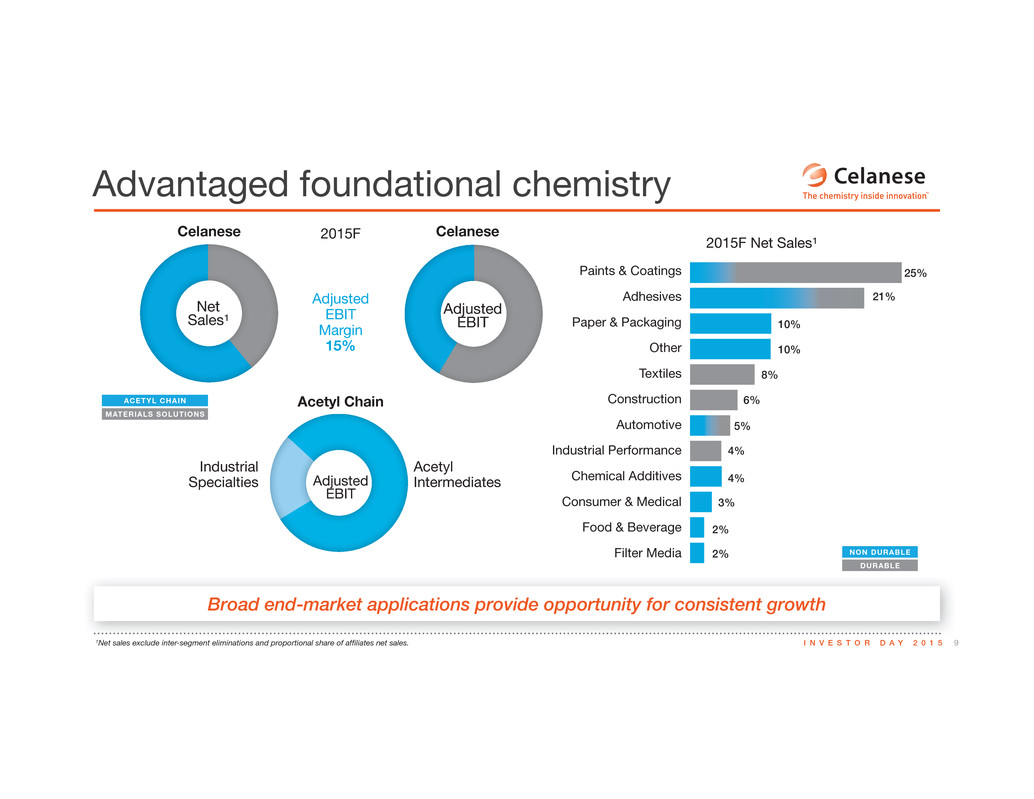

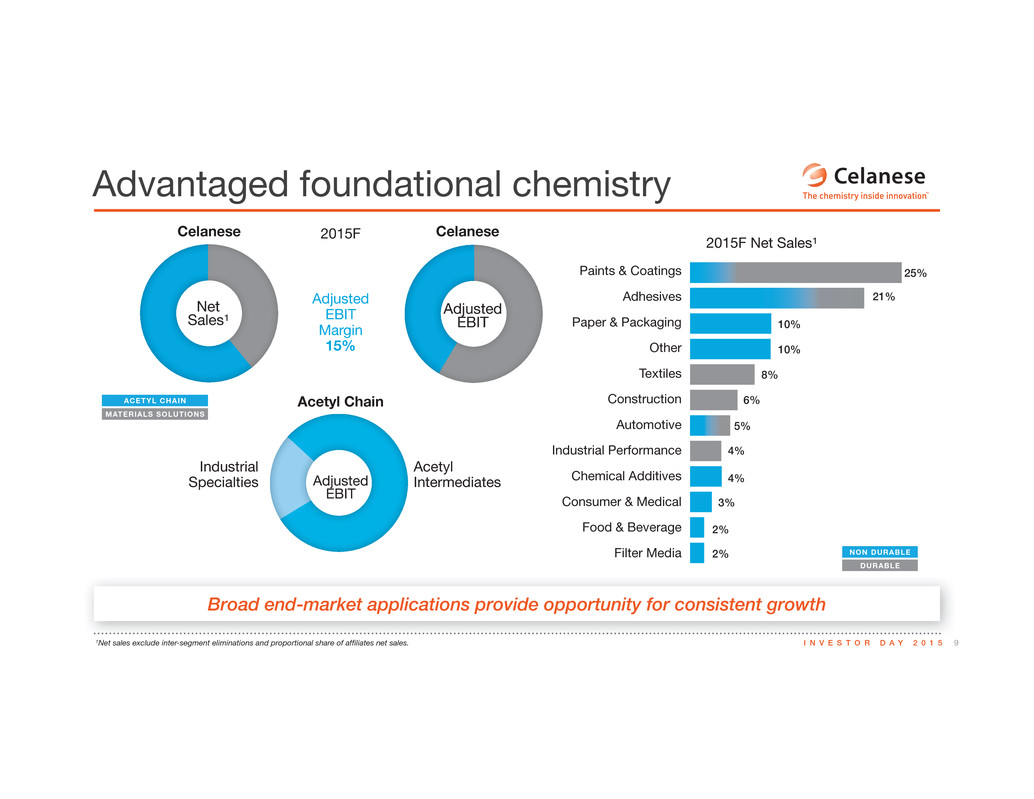

9I N V E S T O R D A Y 2 0 1 51Net sales exclude inter-segment eliminations and proportional share of affiliates net sales. Broad end-market applications provide opportunity for consistent growth Advantaged foundational chemistry Adjusted EBIT Margin 15% Net Sales¹ 2015F Net Sales¹ 2015F Adjusted EBIT Adjusted EBIT Industrial Specialties Acetyl Intermediates ACETYL CHAIN NON DURABLE MATERIALS SOLUTIONS DURABLE Celanese Acetyl Chain Celanese 25% 21% 10% 10% 8% 6% 5% 4% 4% 3% 2% 2% Paints & Coatings Adhesives Paper & Packaging Other Textiles Construction Automotive Industrial Performance Chemical Additives Consumer & Medical Food & Beverage Filter Media

10I N V E S T O R D A Y 2 0 1 5 #1 or #2 position in 85% of Acetyl Chain revenue Global leader across the value chain Estimates of market share, 1includes CE JVs ACID #1 #1 #2 VAM ANHYDRIDE1 VAE #1 GLOBAL POSITION GLOBAL POSITION GLOBAL POSITION GLOBAL POSITION

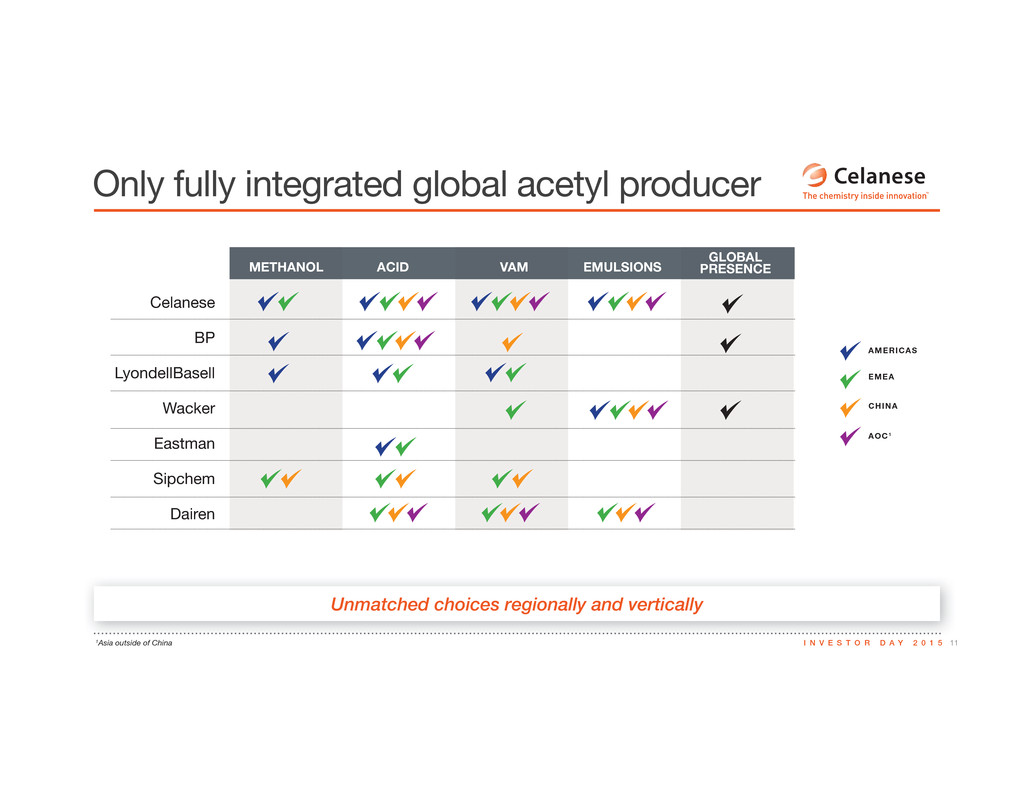

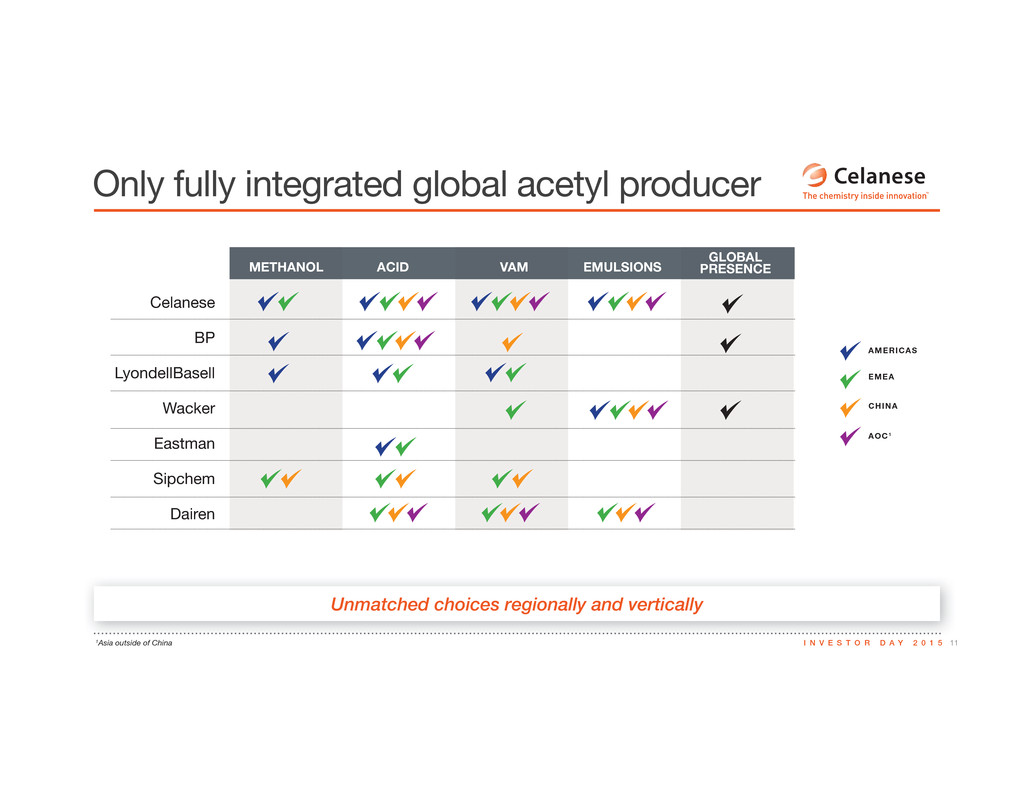

11I N V E S T O R D A Y 2 0 1 51Asia outside of China Unmatched choices regionally and vertically Only fully integrated global acetyl producer Celanese BP LyondellBasell Wacker Eastman Sipchem Dairen METHANOL ACID VAM EMULSIONS GLOBAL PRESENCE AMERICAS EMEA CHINA AOC1

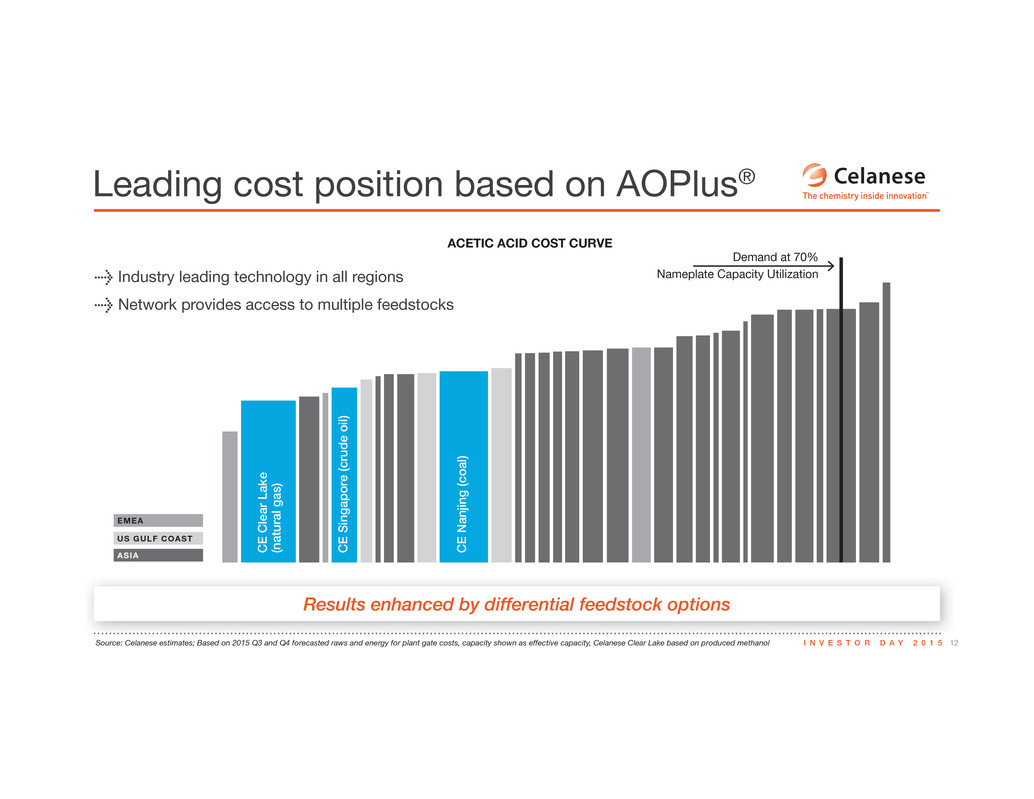

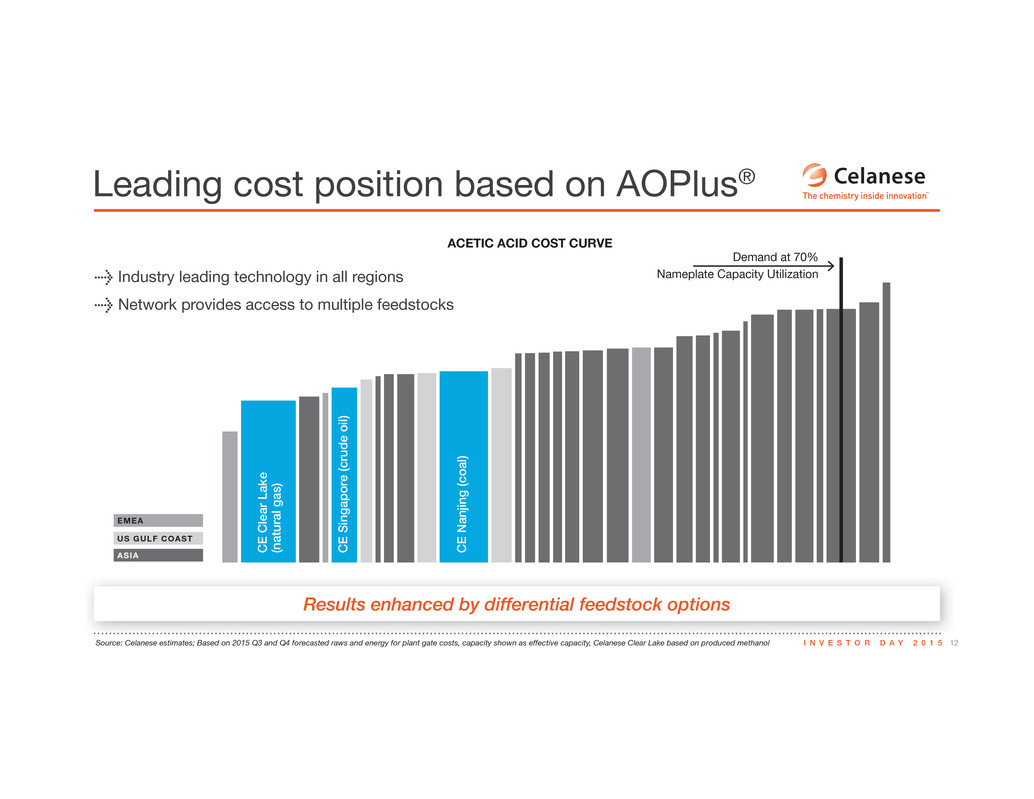

12I N V E S T O R D A Y 2 0 1 5Source: Celanese estimates; Based on 2015 Q3 and Q4 forecasted raws and energy for plant gate costs, capacity shown as effective capacity, Celanese Clear Lake based on produced methanol Results enhanced by differential feedstock options Leading cost position based on AOPlus® > Industry leading technology in all regions > Network provides access to multiple feedstocks Demand at 70% Nameplate Capacity Utilization ACETIC ACID COST CURVE EMEA US GULF COAST ASIA CE Clear Lake (natural gas ) CE Singapo r e (crude oil ) CE Nanjing (coal )

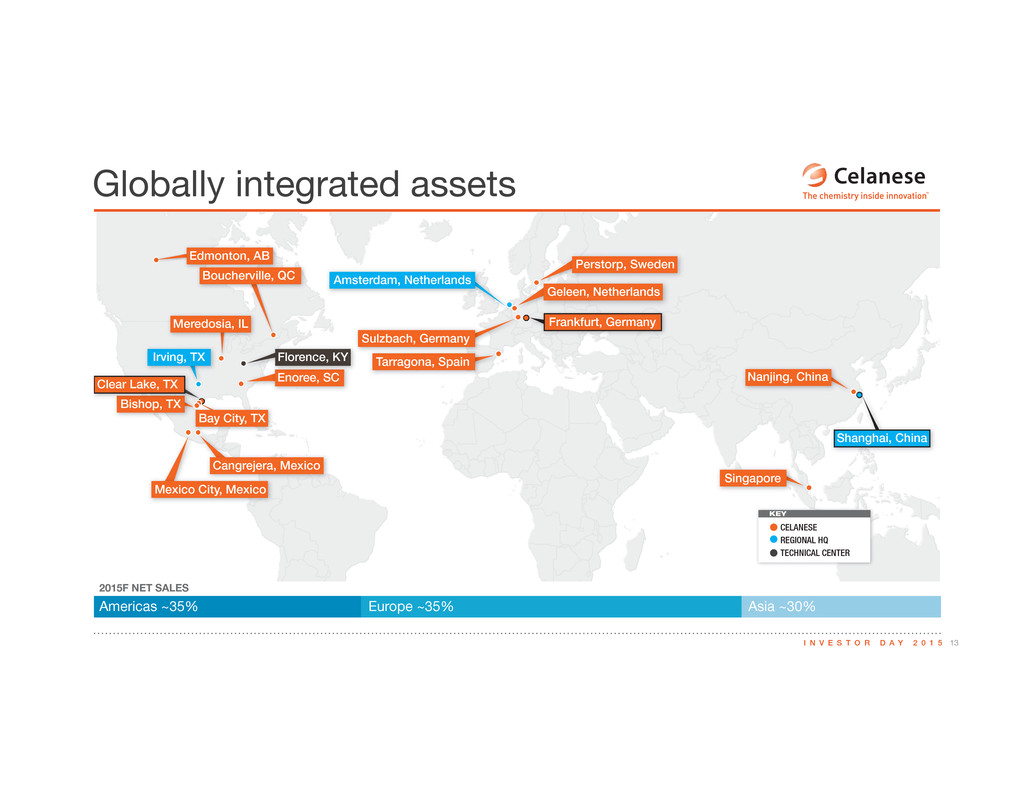

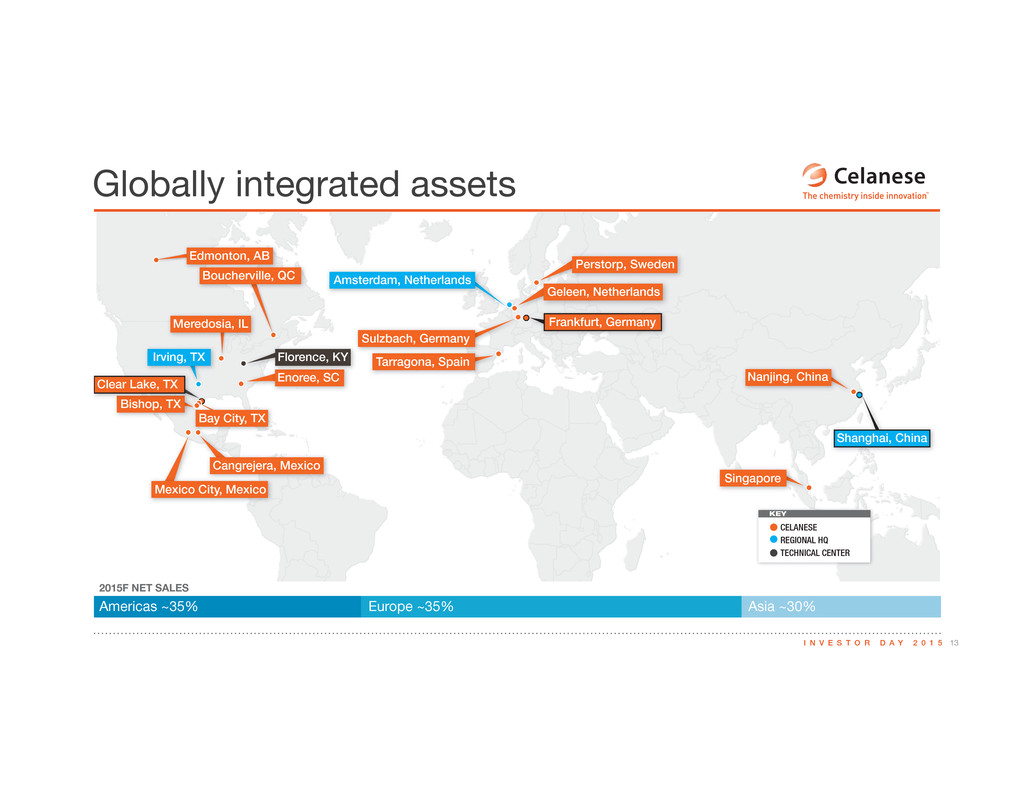

13I N V E S T O R D A Y 2 0 1 5 Globally integrated assets KEY CELANESE REGIONAL HQ TECHNICAL CENTER Amsterdam, Netherlands Sulzbach, Germany Frankfurt, Germany Tarragona, Spain Singapore Irving, TX Meredosia, IL Edmonton, AB Boucherville, QC Enoree, SC Perstorp, Sweden Geleen, Netherlands Bay City, TX Cangrejera, Mexico Mexico City, Mexico Nanjing, China Bishop, TX Clear Lake, TX Shanghai, China Florence, KY Americas ~35% Europe ~35% Asia ~30% 2015F NET SALES

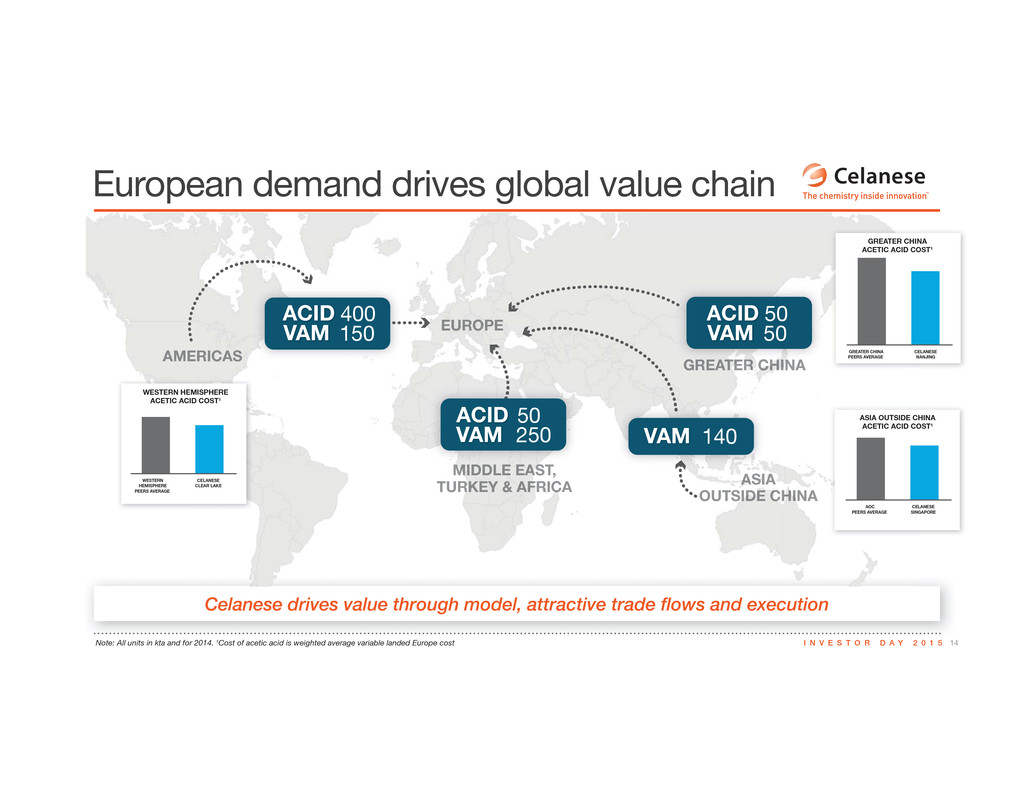

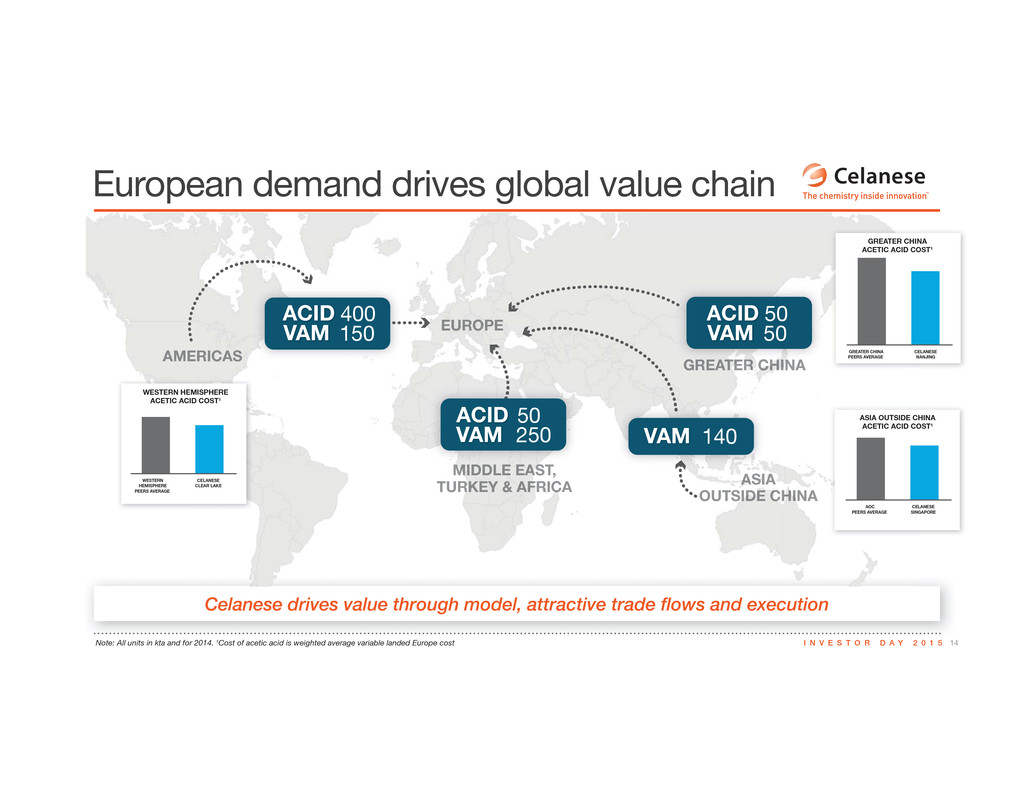

14I N V E S T O R D A Y 2 0 1 5Note: All units in kta and for 2014. 1Cost of acetic acid is weighted average variable landed Europe cost Celanese drives value through model, attractive trade flows and execution ACID AMERICAS EUROPE MIDDLE E AST, TURKEY & AFRICA GREATER CHINA ASIA OUTSIDE CHINA 400ACI VAM 150 ACID 50 VAM 250 GRE ACID 50 VAM 140 ACI VAM 50 European demand drives global value chain WESTERN HEMISPHERE PEERS AVERAGE CELANESE CLEAR LAKE AOC PEERS AVERAGE CELANESE SINGAPORE GREATER CHINA PEERS AVERAGE CELANESE NANJING WESTERN HEMISPHERE ACETIC ACID COST1 ASIA OUTSIDE CHINA ACETIC ACID COST1 GREATER CHINA ACETIC ACID COST1

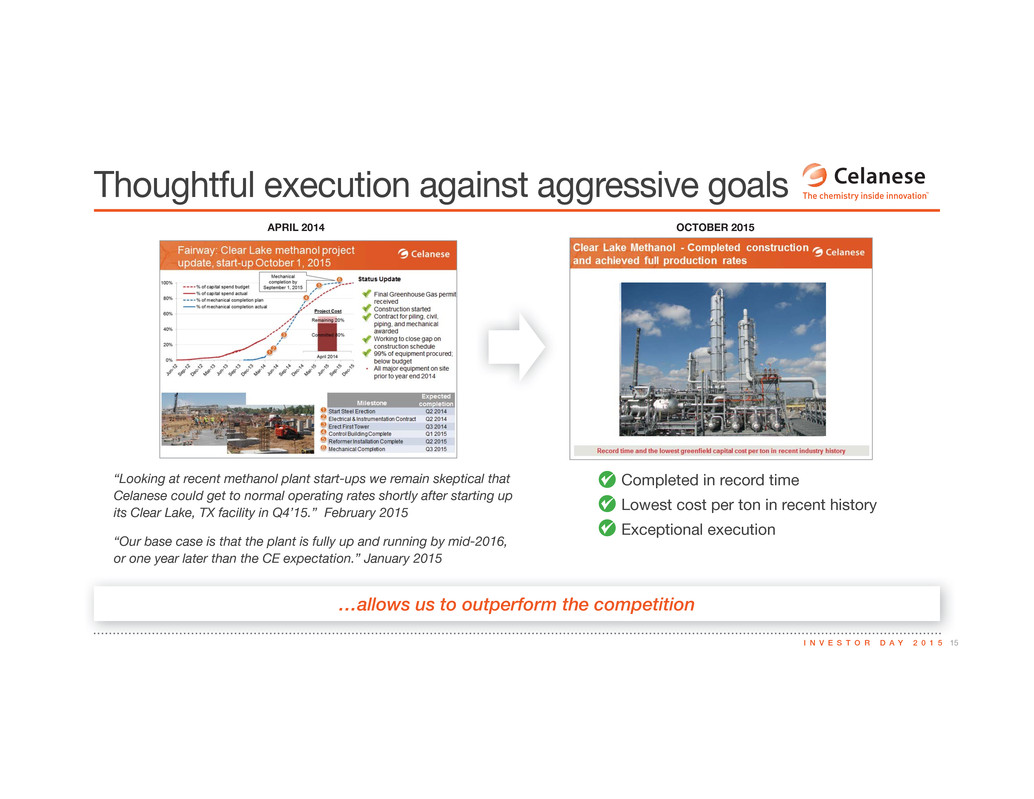

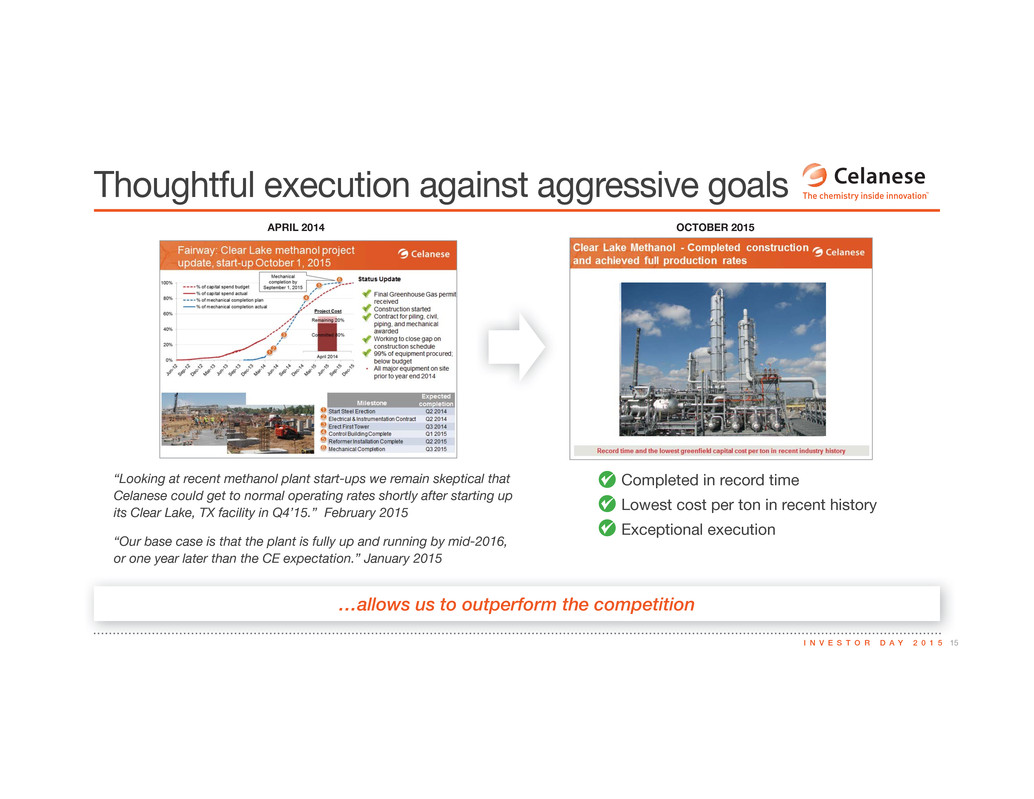

15I N V E S T O R D A Y 2 0 1 5 …allows us to outperform the competition Thoughtful execution against aggressive goals Completed in record time Lowest cost per ton in recent history Exceptional execution “Looking at recent methanol plant start-ups we remain skeptical that Celanese could get to normal operating rates shortly after starting up its Clear Lake, TX facility in Q4’15.” February 2015 “Our base case is that the plant is fully up and running by mid-2016, or one year later than the CE expectation.” January 2015 APRIL 2014 OCTOBER 2015 Fairway: Clear Lake methanol project update, start-up October 1, 2015 Final Greenhouse Gas permit received Construction started Contract for piling, civil, piping, and mechanical awarded Working to close gap on construction schedule 99% of equipment procured; below budget All major equipment on site prior to year Clear Lake Methanol - Completed construction and achieved full production rates end 2014 Start Steel Erection Q2 2014 Electrical & Instrumentation Contract Q2 2014 Erect First Tower Q3 2014 Control Building Complete Q1 2015 Reformer Installation Complete Q2 2015 Mechanical Completion Q3 2015

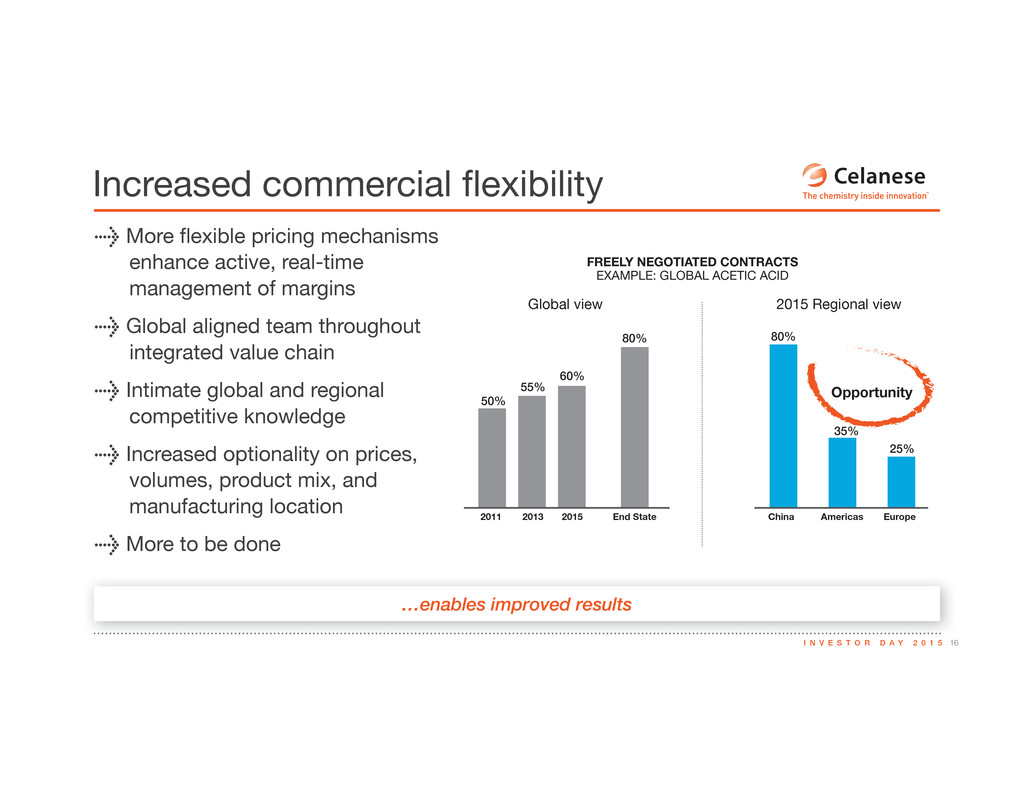

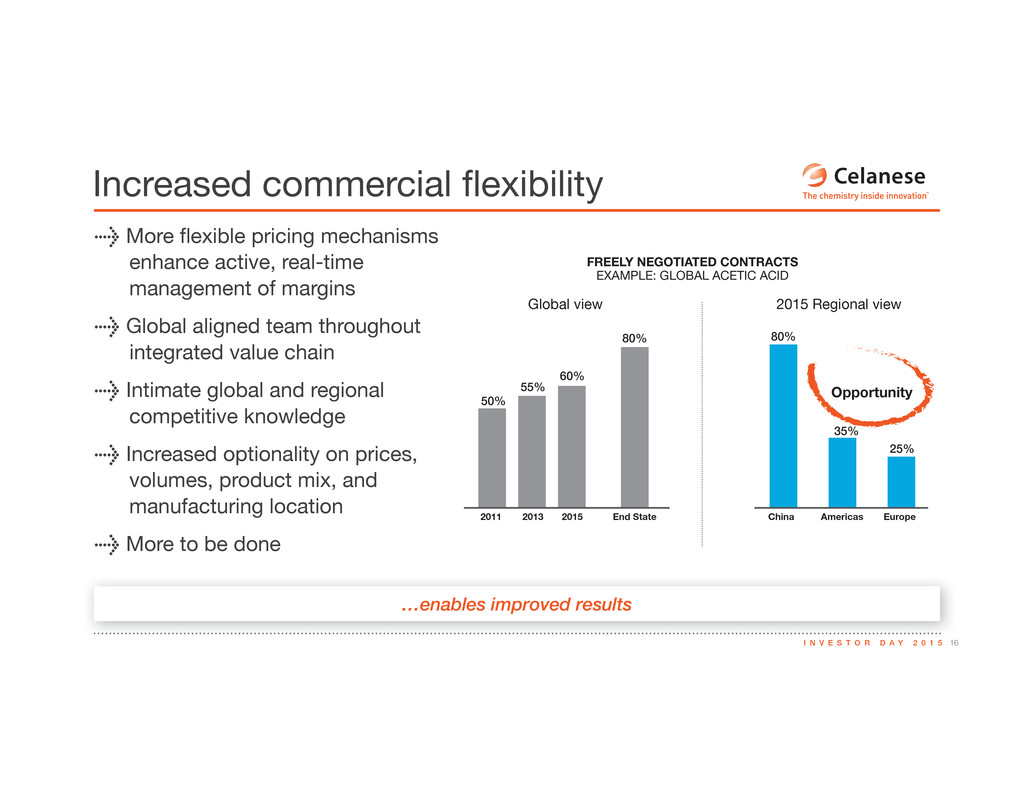

16I N V E S T O R D A Y 2 0 1 5 …enables improved results Increased commercial flexibility > More flexible pricing mechanisms enhance active, real-time management of margins > Global aligned team throughout integrated value chain > Intimate global and regional competitive knowledge > Increased optionality on prices, volumes, product mix, and manufacturing location > More to be done 2011 2013 2015 End State 50% 55% 60% 80% China Americas Europe 80% 35% 25% Opportunity Global view 2015 Regional view FREELY NEGOTIATED CONTRACTS EXAMPLE: GLOBAL ACETIC ACID

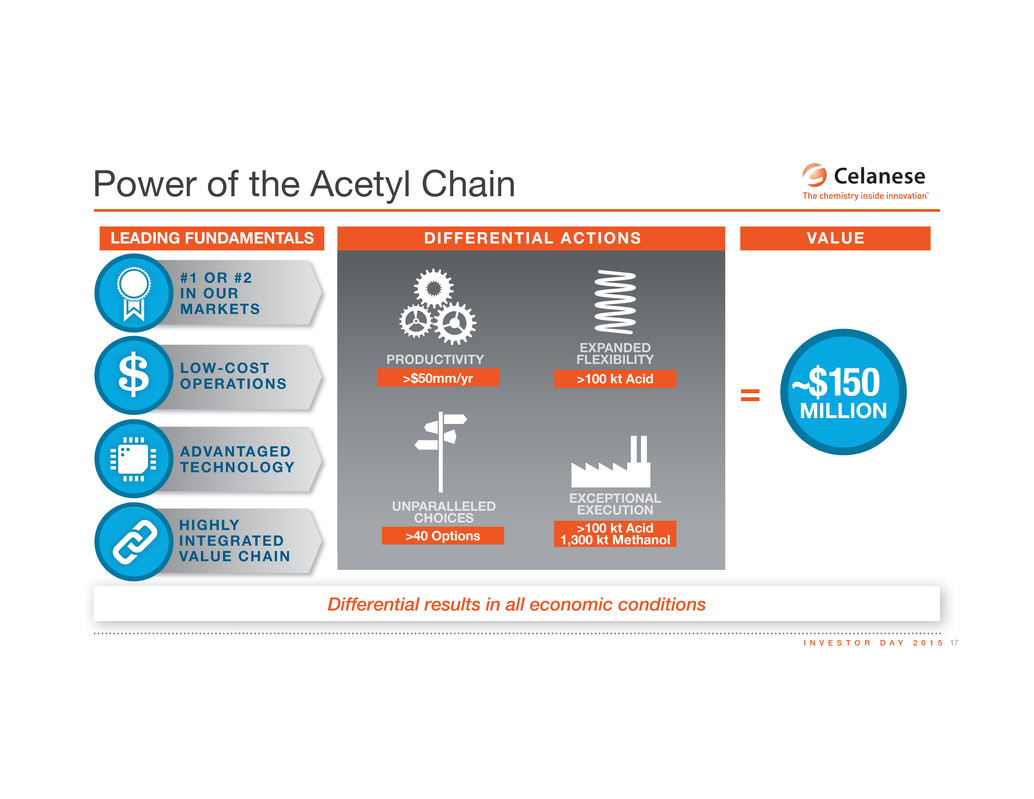

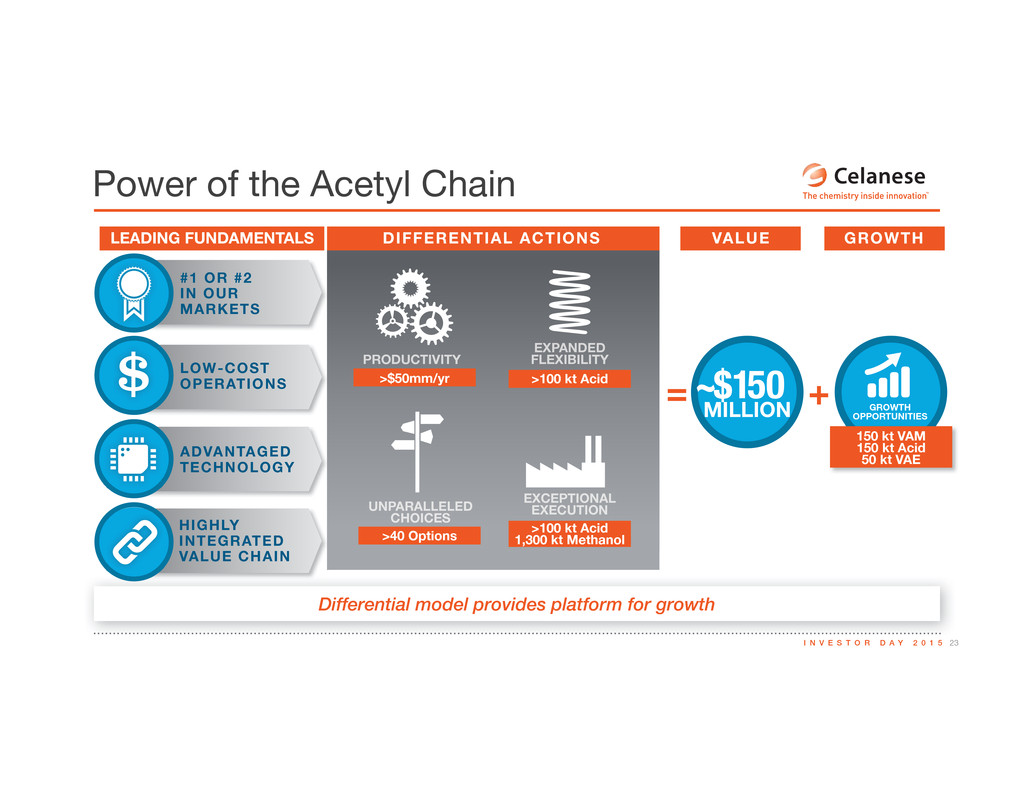

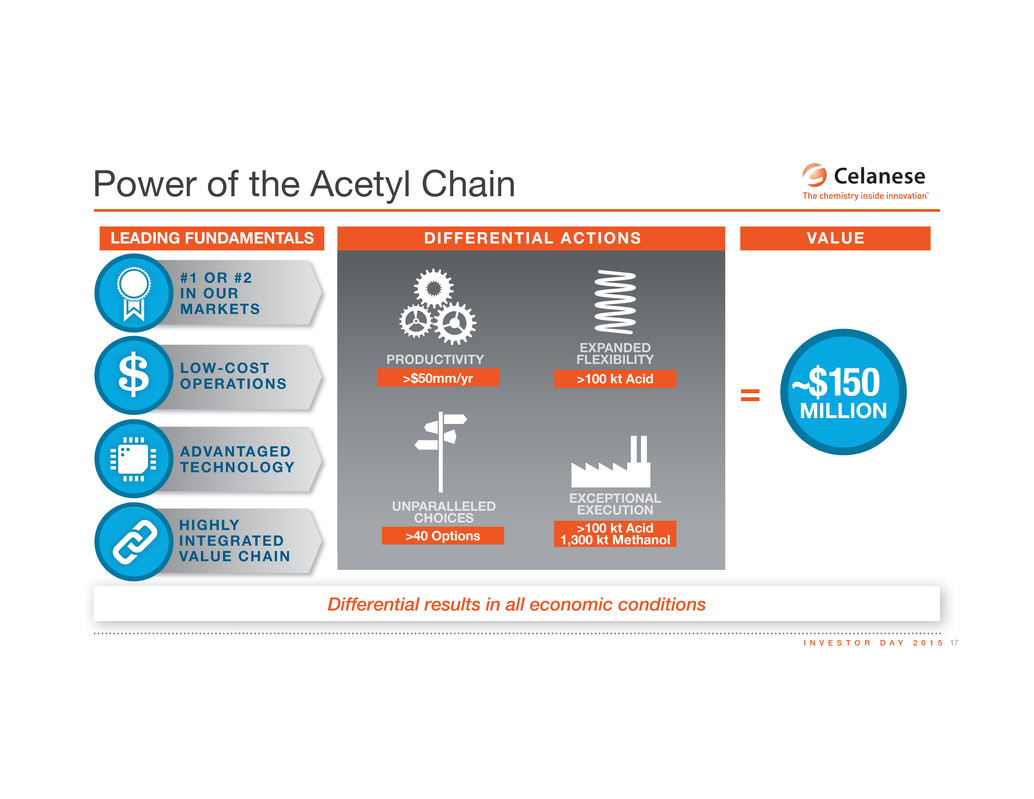

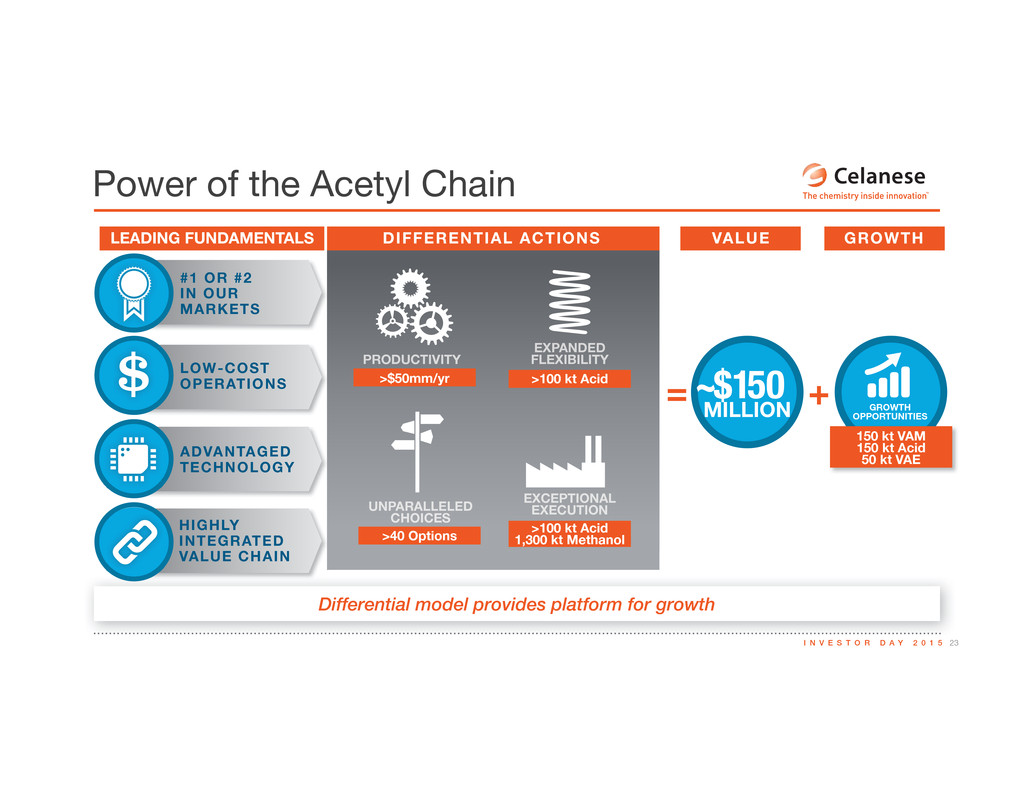

17I N V E S T O R D A Y 2 0 1 5 Power of the Acetyl Chain Differential results in all economic conditions = #1 OR #2 IN OUR MARKETS LOW-COST OPERATIONS ADVANTAGED TECHNOLOGY HIGHLY INTEGRATED VALUE CHAIN DIFFERENTIAL ACTIONS VALUELEADING FUNDAMENTALS PRODUCTIVITY UNPARALLELED CHOICES EXPANDED FLEXIBILITY EXCEPTIONAL EXECUTION >$50mm/yr >40 Options >100 kt Acid1,300 kt Methanol ~$150>100 kt Acid MILLION

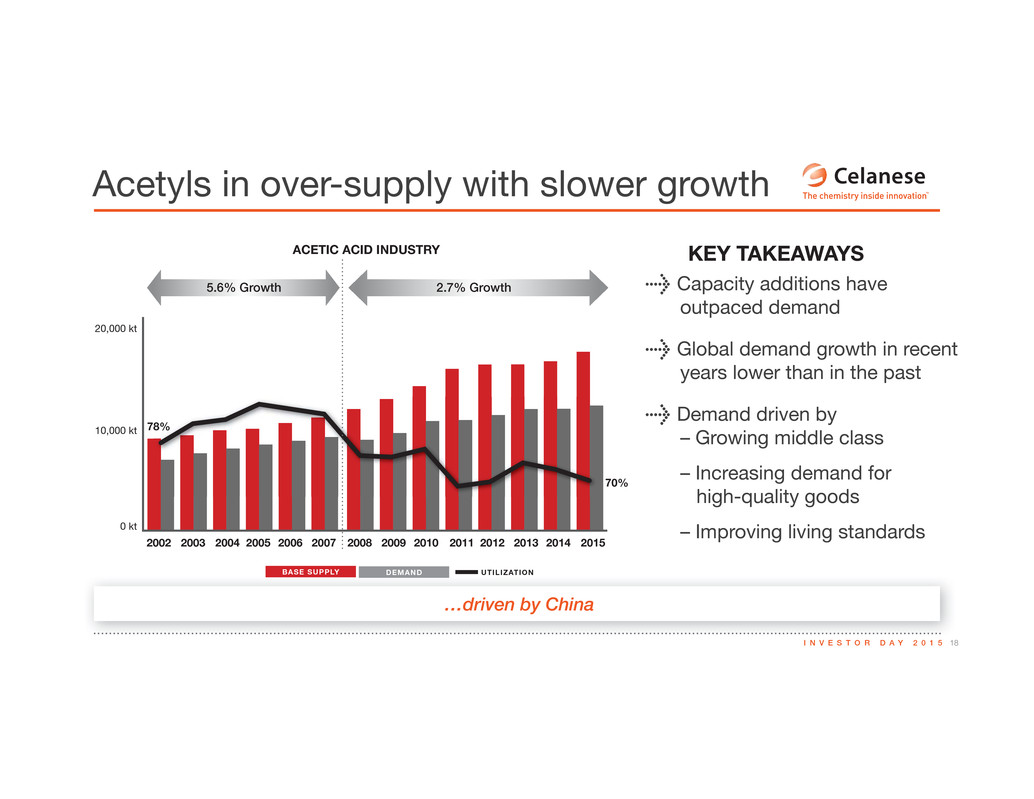

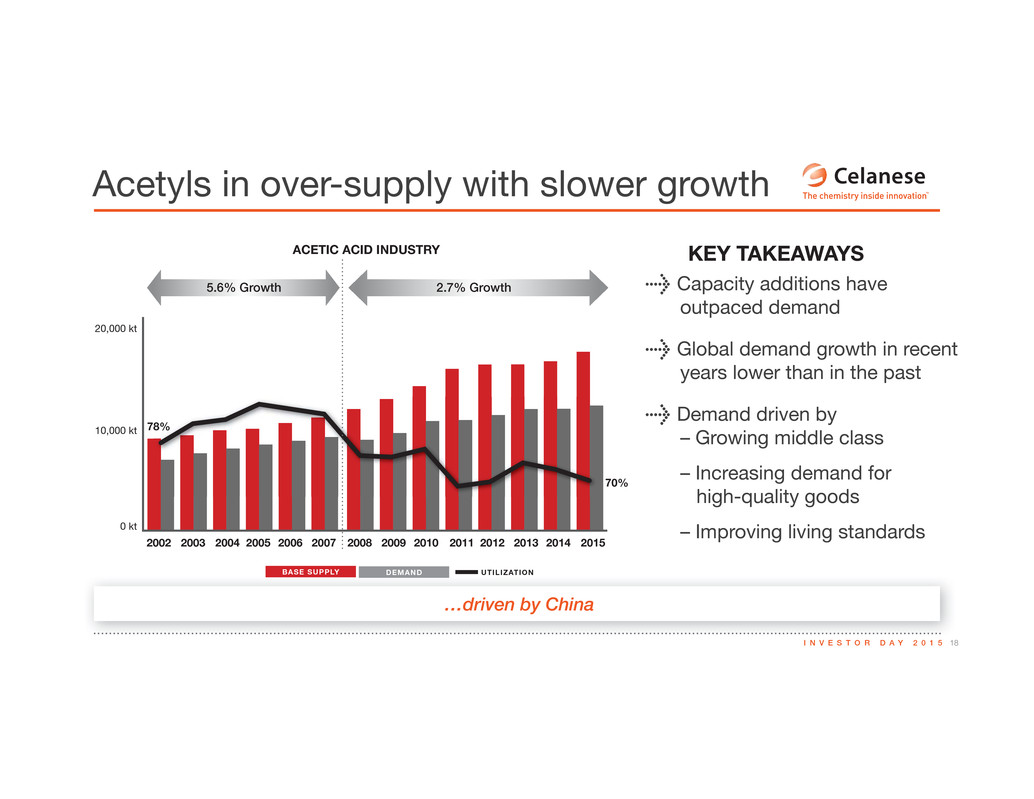

18I N V E S T O R D A Y 2 0 1 5 2012 2013 2014 20152011 20,000 kt 10,000 kt 0 kt 20032002 78% 70% 2004 2005 2006 2007 2008 2009 2010 …driven by China Acetyls in over-supply with slower growth > Capacity additions have outpaced demand > Global demand growth in recent years lower than in the past > Demand driven by – Growing middle class – Increasing demand for high-quality goods – Improving living standards KEY TAKEAWAYSACETIC ACID INDUSTRY 2.7% Growth5.6% Growth BASE SUPPLY DEMAND UTILIZATION

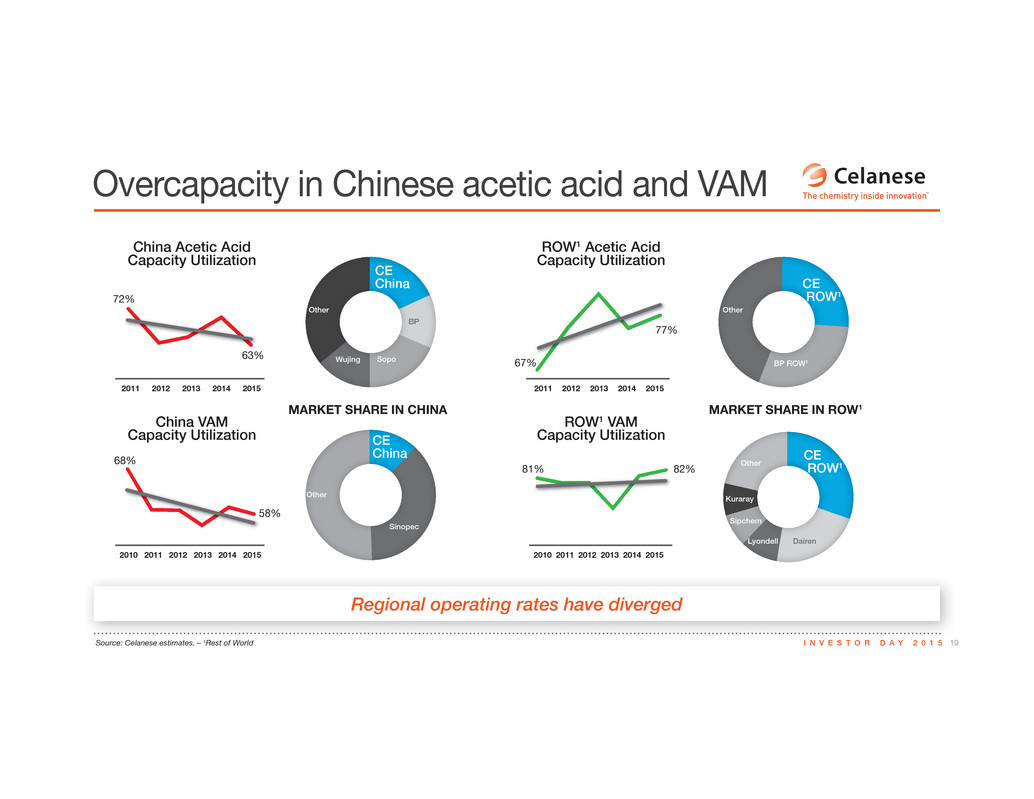

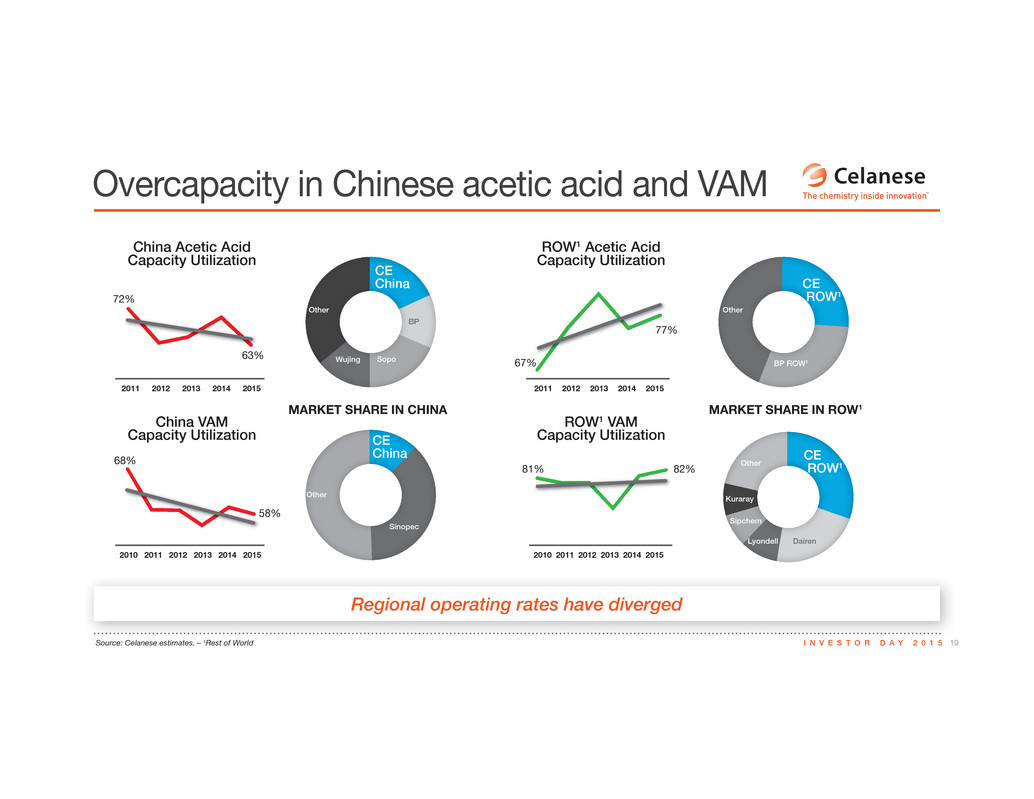

19I N V E S T O R D A Y 2 0 1 5Source: Celanese estimates. – 1Rest of World Regional operating rates have diverged Overcapacity in Chinese acetic acid and VAM 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 20112010 2012 2013 2014 2015 20112010 2012 2013 2014 2015 CE ROW1 CE China CE China CE ROW1 BP ROW1 Dairen BP Lyondell Sipchem Kuraray OtherOther Other Sinopec SopoWujing Other China Acetic Acid Capacity Utilization 72% 67% 81% 82% 68% 58% 63% 77% ROW1 Acetic Acid Capacity Utilization China VAM Capacity Utilization ROW1 VAM Capacity Utilization MARKET SHARE IN ROW1MARKET SHARE IN CHINA

20I N V E S T O R D A Y 2 0 1 5 All acetic acid producers are not created equal Location & logistics are critical for acetic acid CELANESE NANJING COMPETITORS ~$230 ~$190 ~$170 ~$150 ZONE ZONE ZONE ZONE China Capacity by Zone Zone 1 Capacity 53%100% FREIGHT TO EUROPE 4 3 2 1 CE

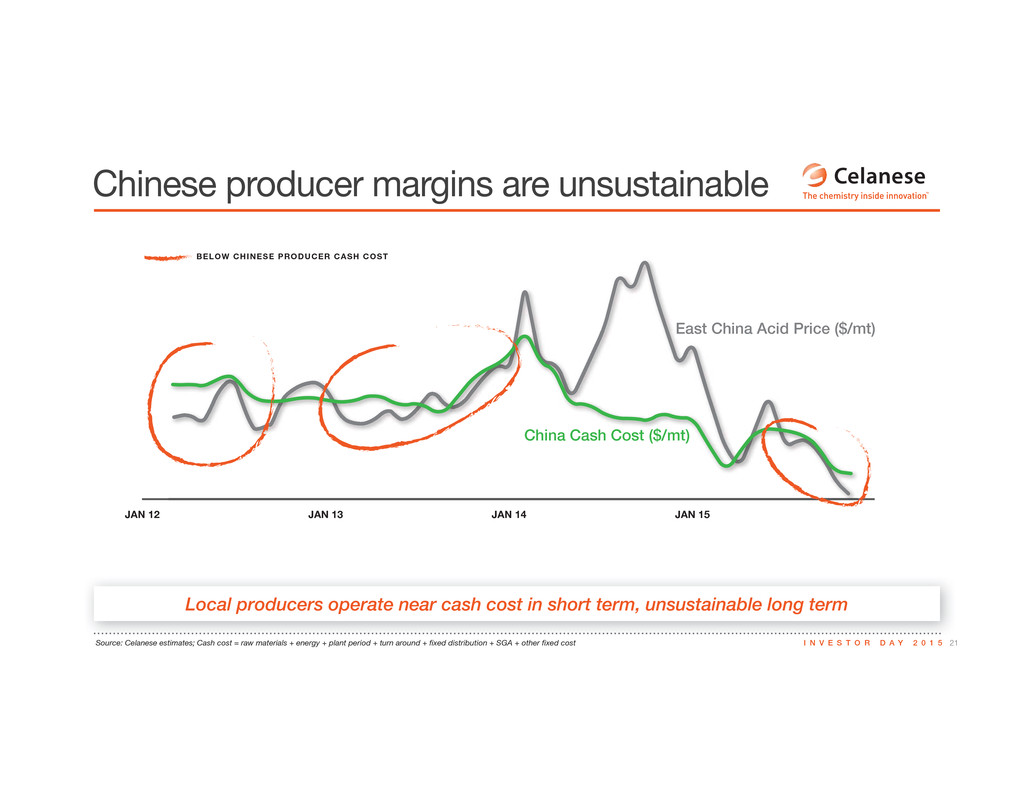

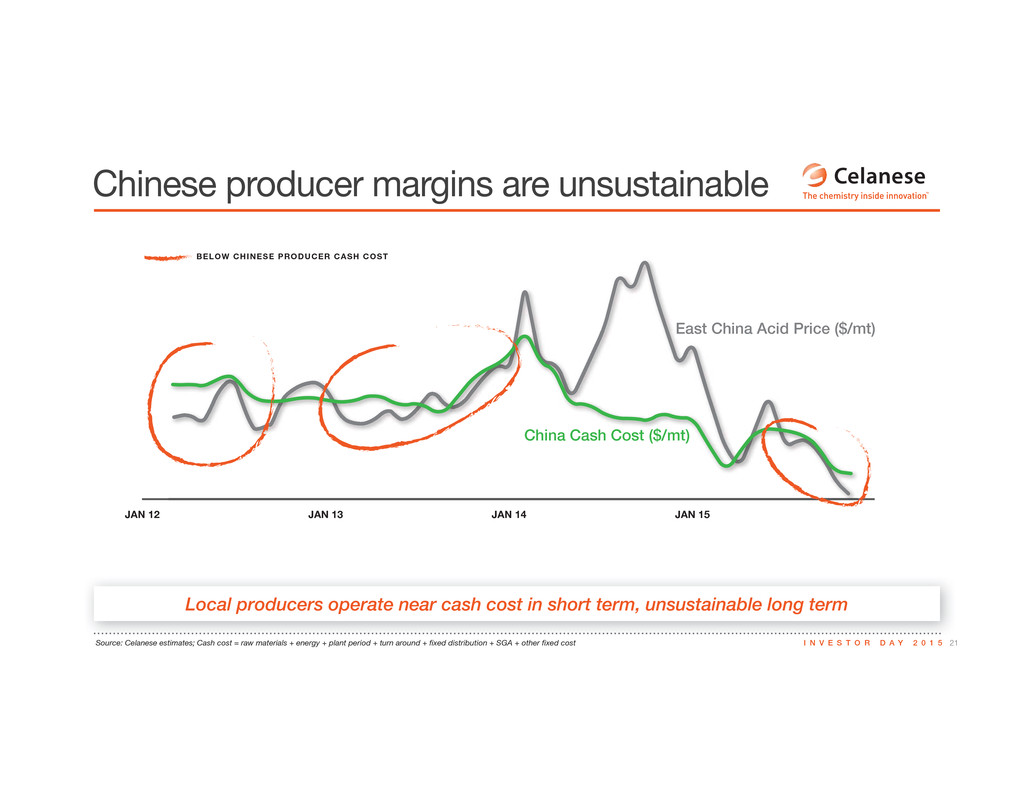

21I N V E S T O R D A Y 2 0 1 5Source: Celanese estimates; Cash cost = raw materials + energy + plant period + turn around + fixed distribution + SGA + other fixed cost Local producers operate near cash cost in short term, unsustainable long term Chinese producer margins are unsustainable JAN 12 JAN 13 JAN 14 JAN 15 East China Acid Price ($/mt) China Cash Cost ($/mt) East China Acid Price ($/m ($/ China Cash Cost ($/mt BELOW CHINESE PRODUCER CASH COST

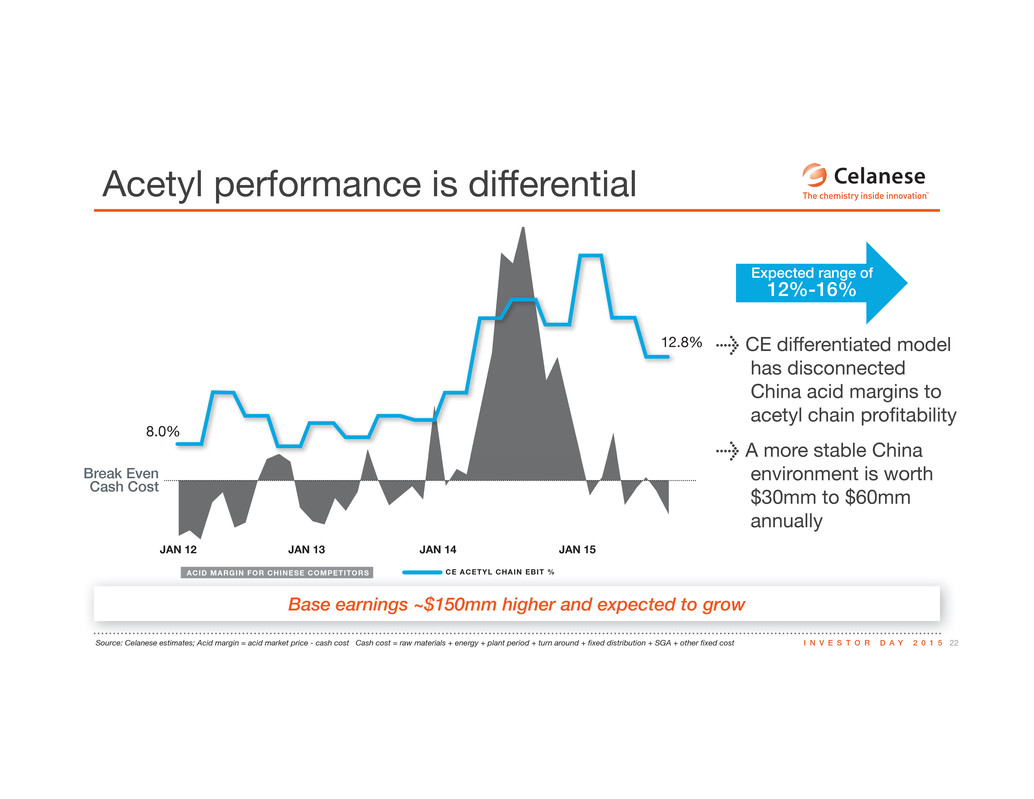

22I N V E S T O R D A Y 2 0 1 5Source: Celanese estimates; Acid margin = acid market price - cash cost Cash cost = raw materials + energy + plant period + turn around + fixed distribution + SGA + other fixed cost Base earnings ~$150mm higher and expected to grow Acetyl performance is differential JAN 12 JAN 13 JAN 14 JAN 15 Break Even Cash Cost 8.0% 12.8% CE ACETYL CHAIN EBIT %ACID MARGIN FOR CHINESE COMPETITORS > CE differentiated model has disconnected China acid margins to acetyl chain profitability > A more stable China environment is worth $30mm to $60mm annually Expected range of 12%-16%

23I N V E S T O R D A Y 2 0 1 5 Power of the Acetyl Chain Differential model provides platform for growth = + DIFFERENTIAL ACTIONS GROWTHVALUE PRODUCTIVITY UNPARALLELED CHOICES EXPANDED FLEXIBILITY EXCEPTIONAL EXECUTION >$50mm/yr >40 Options >100 kt Acid1,300 kt Methanol ~$150>100 kt Acid MILLION GROWTHOPPORTUNITIES LEADING FUNDAMENTALS 150 kt VAM 150 kt Acid 50 kt VAE #1 OR #2 IN OUR MARKETS LOW-COST OPERATIONS ADVANTAGED TECHNOLOGY HIGHLY INTEGRATED VALUE CHAIN

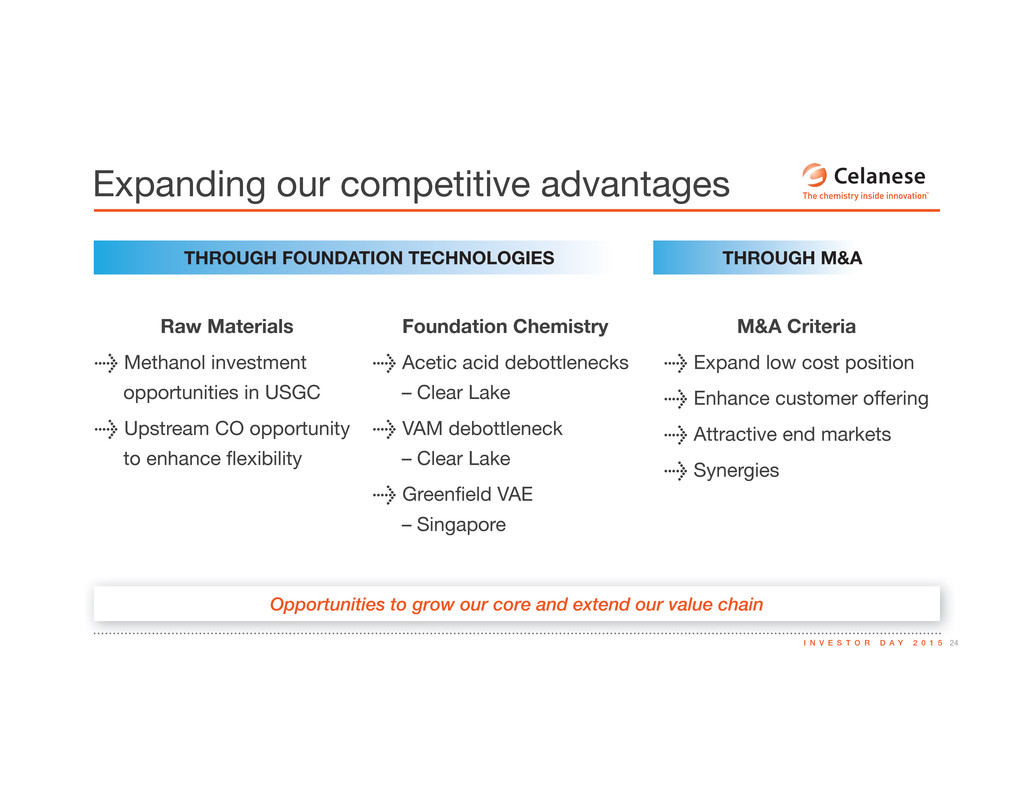

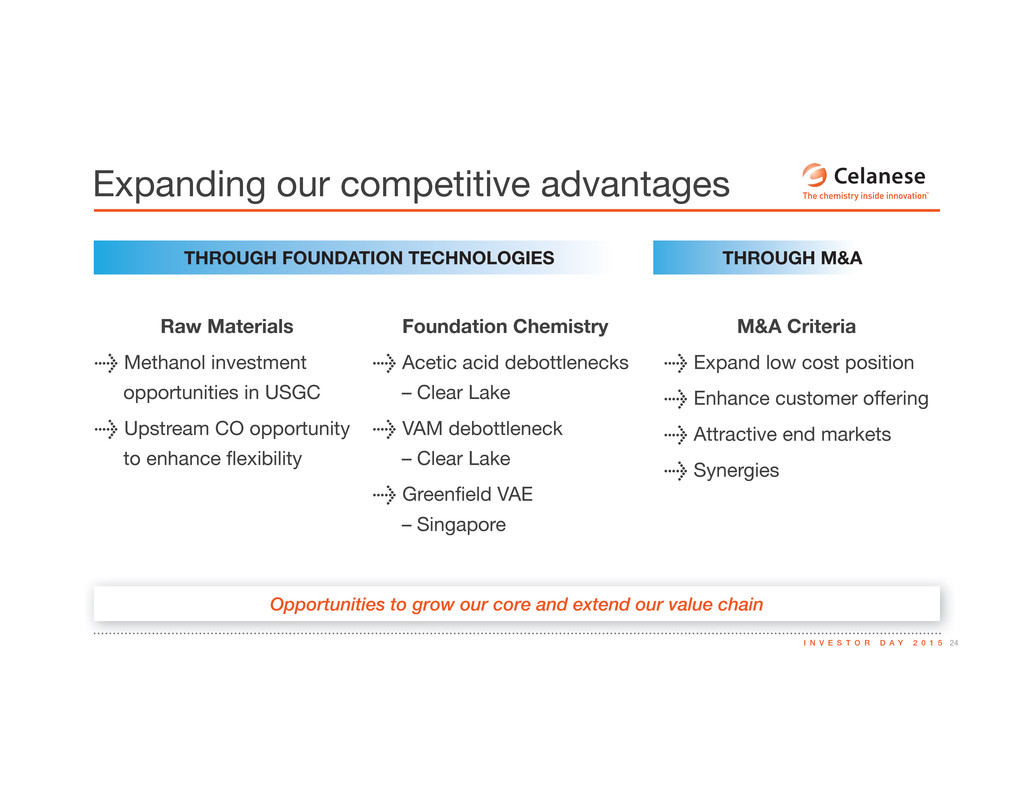

24I N V E S T O R D A Y 2 0 1 5 Opportunities to grow our core and extend our value chain Expanding our competitive advantages Foundation Chemistry > Acetic acid debottlenecks – Clear Lake > VAM debottleneck – Clear Lake > Greenfield VAE – Singapore Raw Materials > Methanol investment opportunities in USGC > Upstream CO opportunity to enhance flexibility M&A Criteria > Expand low cost position > Enhance customer offering > Attractive end markets > Synergies THROUGH FOUNDATION TECHNOLOGIES THROUGH M&A

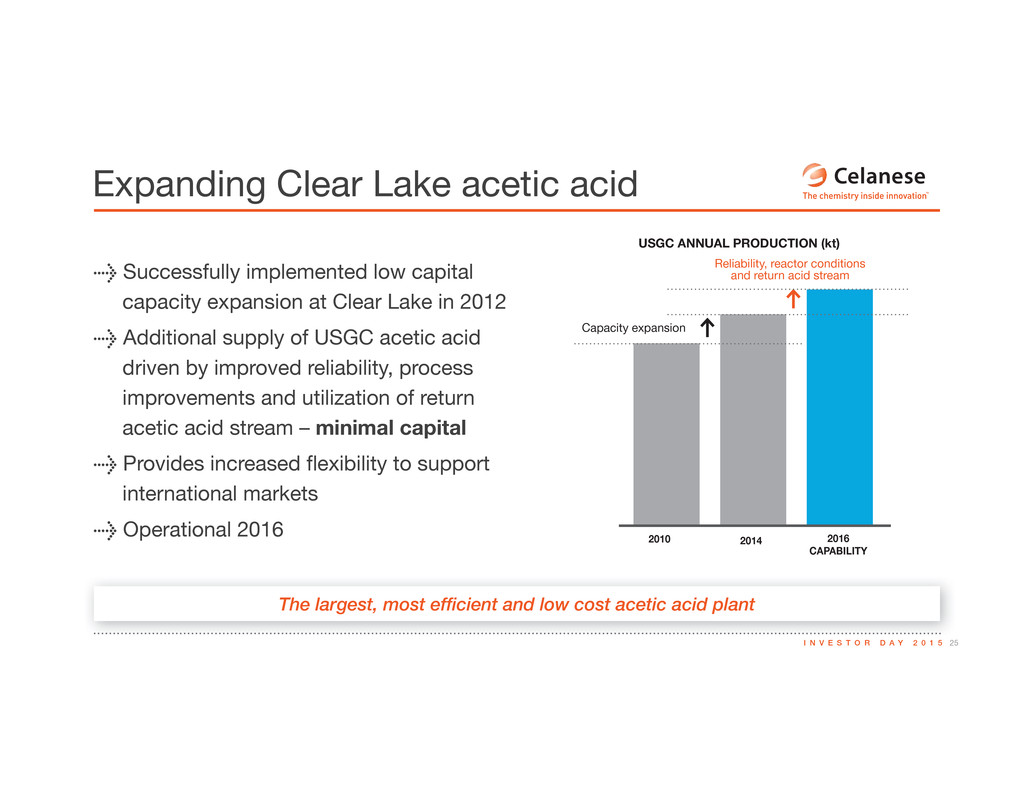

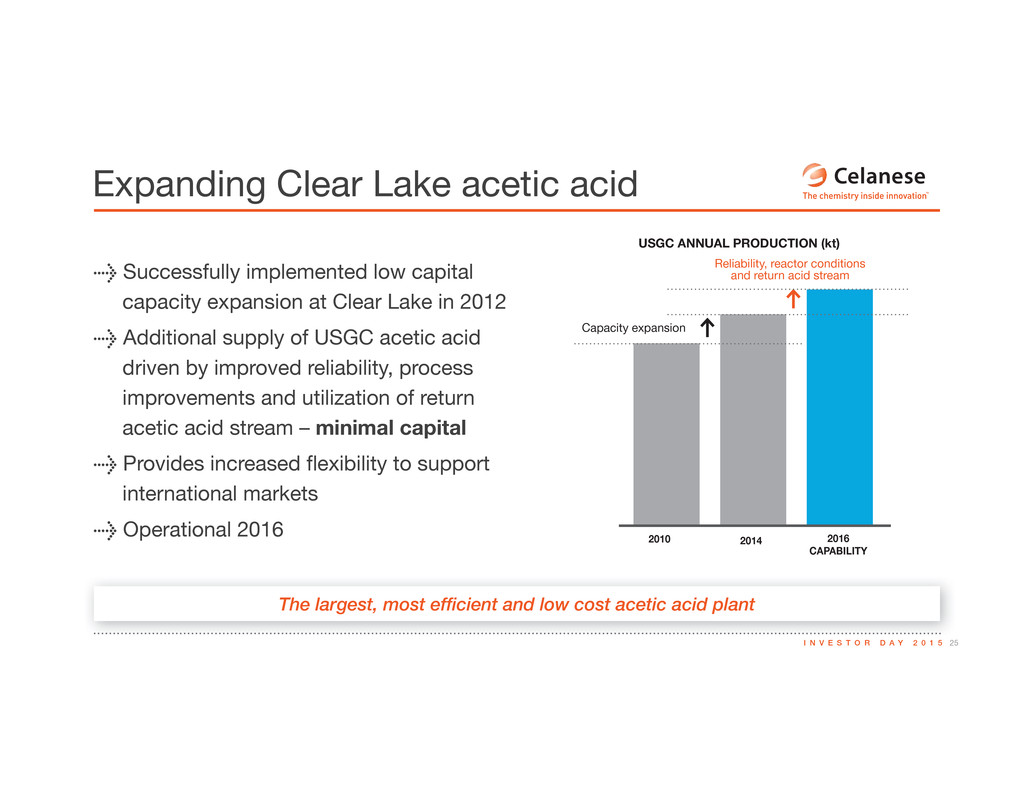

25I N V E S T O R D A Y 2 0 1 5 The largest, most efficient and low cost acetic acid plant Expanding Clear Lake acetic acid > Successfully implemented low capital capacity expansion at Clear Lake in 2012 > Additional supply of USGC acetic acid driven by improved reliability, process improvements and utilization of return acetic acid stream – minimal capital > Provides increased flexibility to support international markets > Operational 2016 2010 2016 CAPABILITY 2014 Capacity expansion Reliability, reactor conditions and return acid stream USGC ANNUAL PRODUCTION (kt)

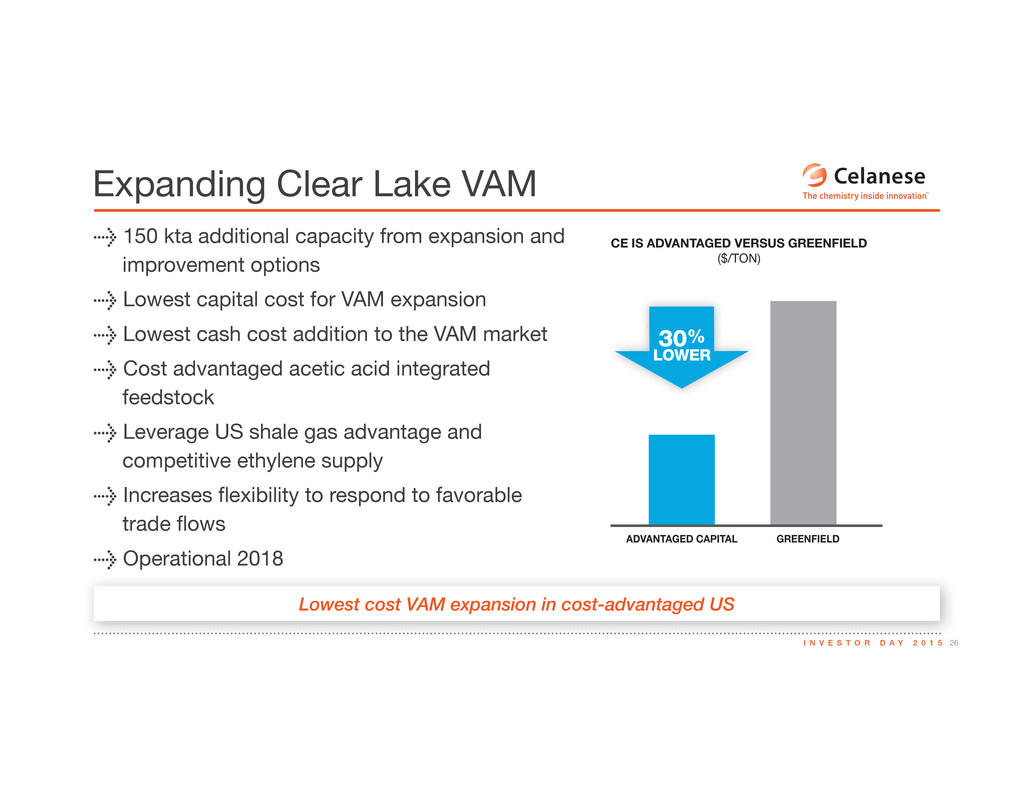

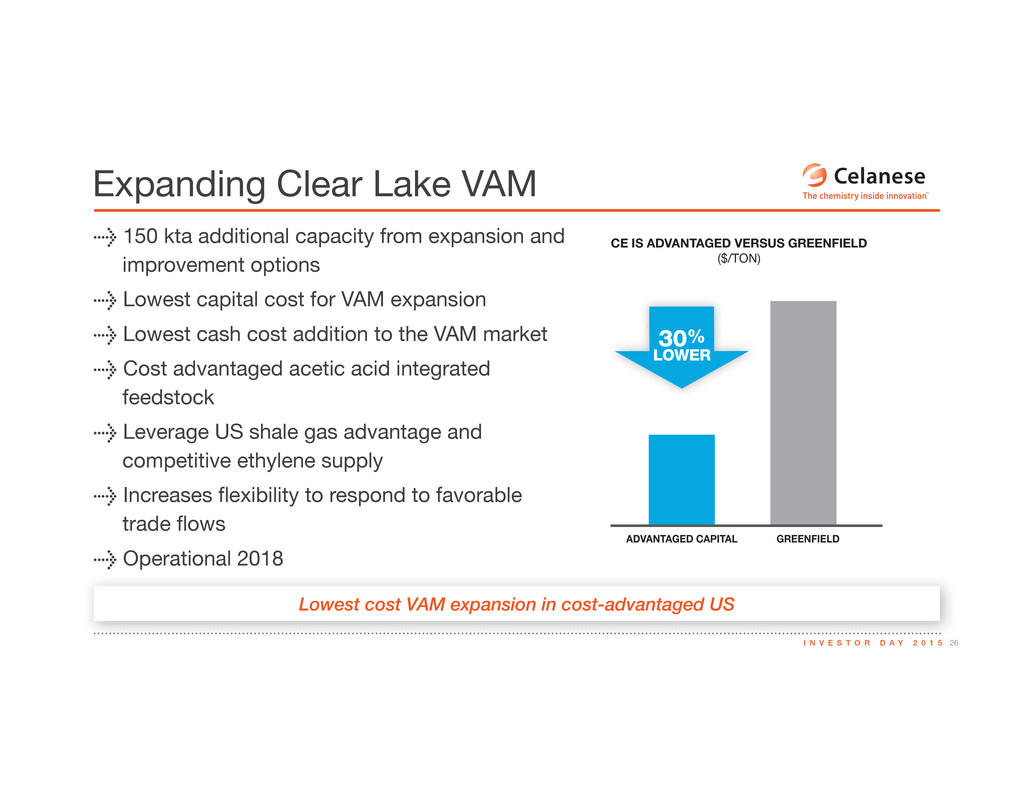

26I N V E S T O R D A Y 2 0 1 5 Lowest cost VAM expansion in cost-advantaged US Expanding Clear Lake VAM > 150 kta additional capacity from expansion and improvement options > Lowest capital cost for VAM expansion > Lowest cash cost addition to the VAM market > Cost advantaged acetic acid integrated feedstock > Leverage US shale gas advantage and competitive ethylene supply > Increases flexibility to respond to favorable trade flows > Operational 2018 ADVANTAGED CAPITAL GREENFIELD 30% LOWER CE IS ADVANTAGED VERSUS GREENFIELD ($/TON)

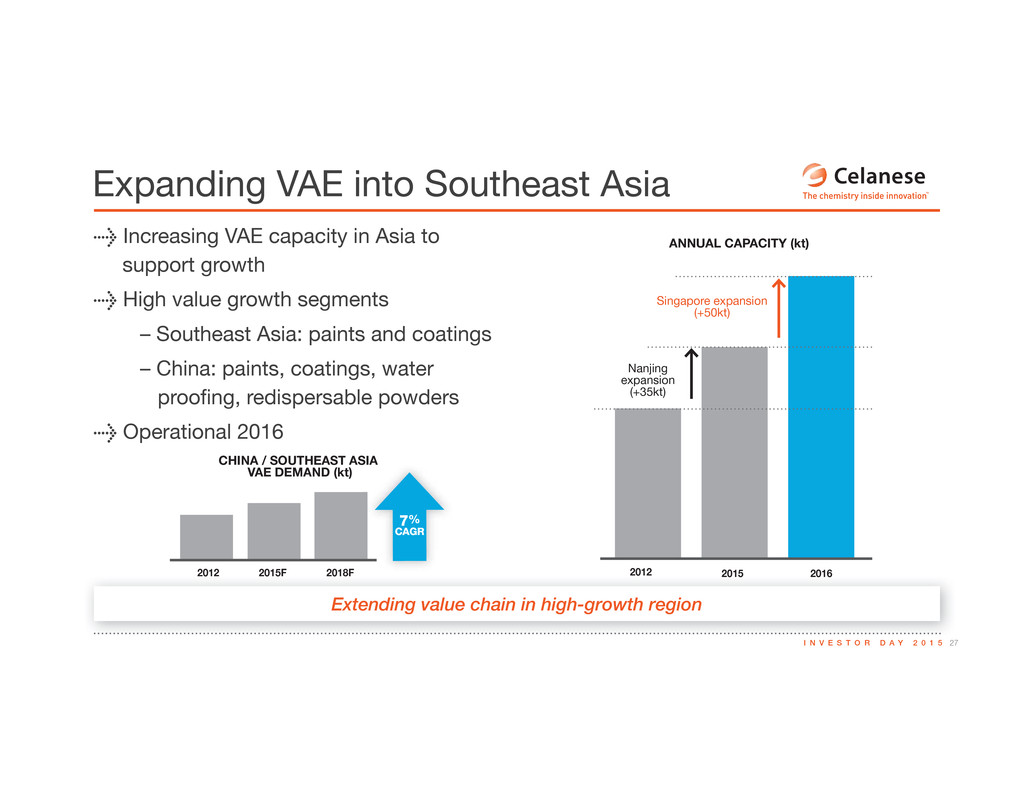

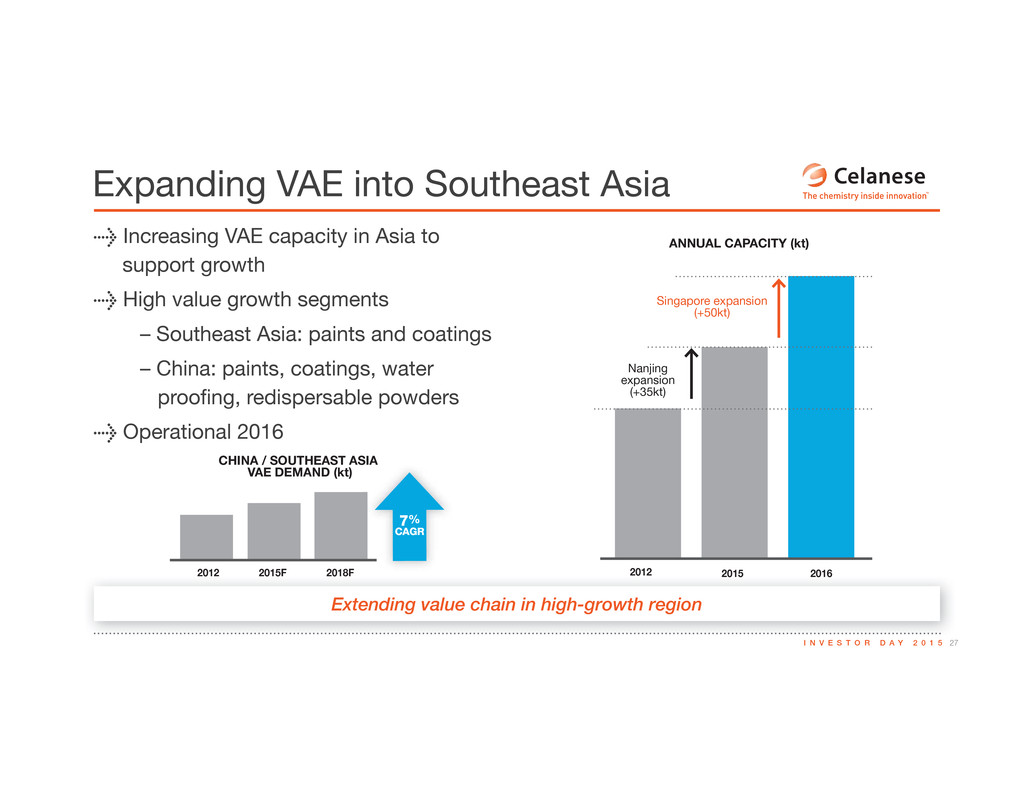

27I N V E S T O R D A Y 2 0 1 5 Extending value chain in high-growth region Expanding VAE into Southeast Asia > Increasing VAE capacity in Asia to support growth > High value growth segments – Southeast Asia: paints and coatings – China: paints, coatings, water proofing, redispersable powders > Operational 2016 2012 2015 20162012 2015F 2018F 7% CAGR Nanjing expansion (+35kt) Singapore expansion (+50kt) ANNUAL CAPACITY (kt) CHINA / SOUTHEAST ASIA VAE DEMAND (kt)

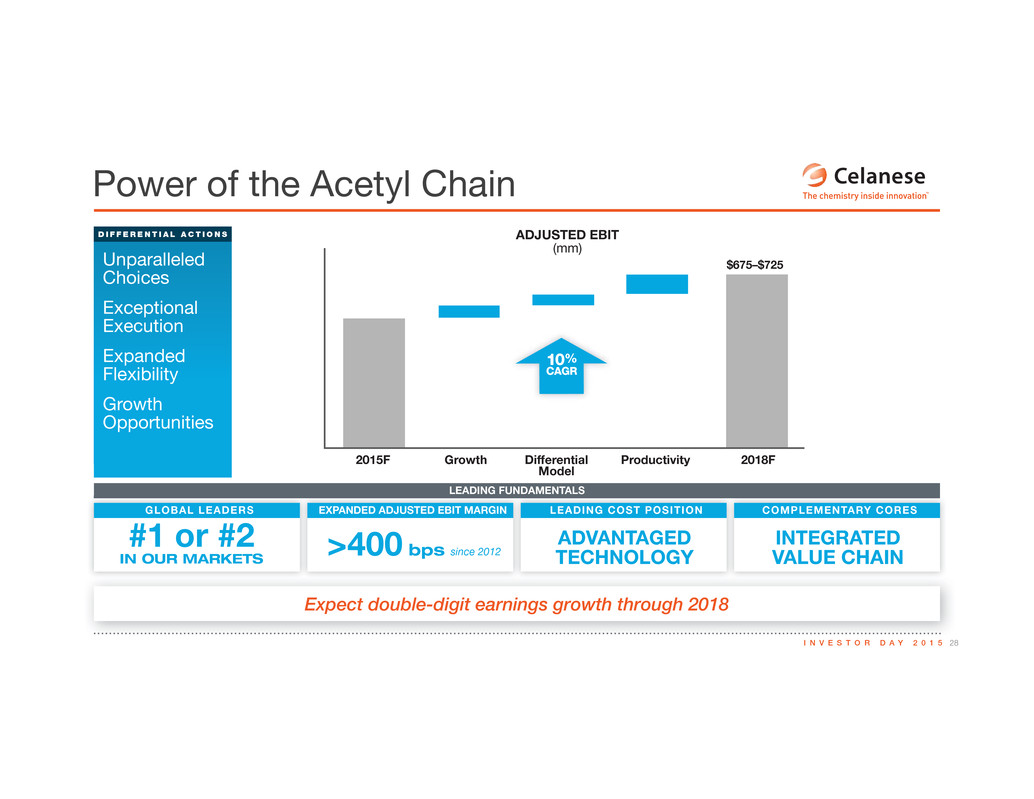

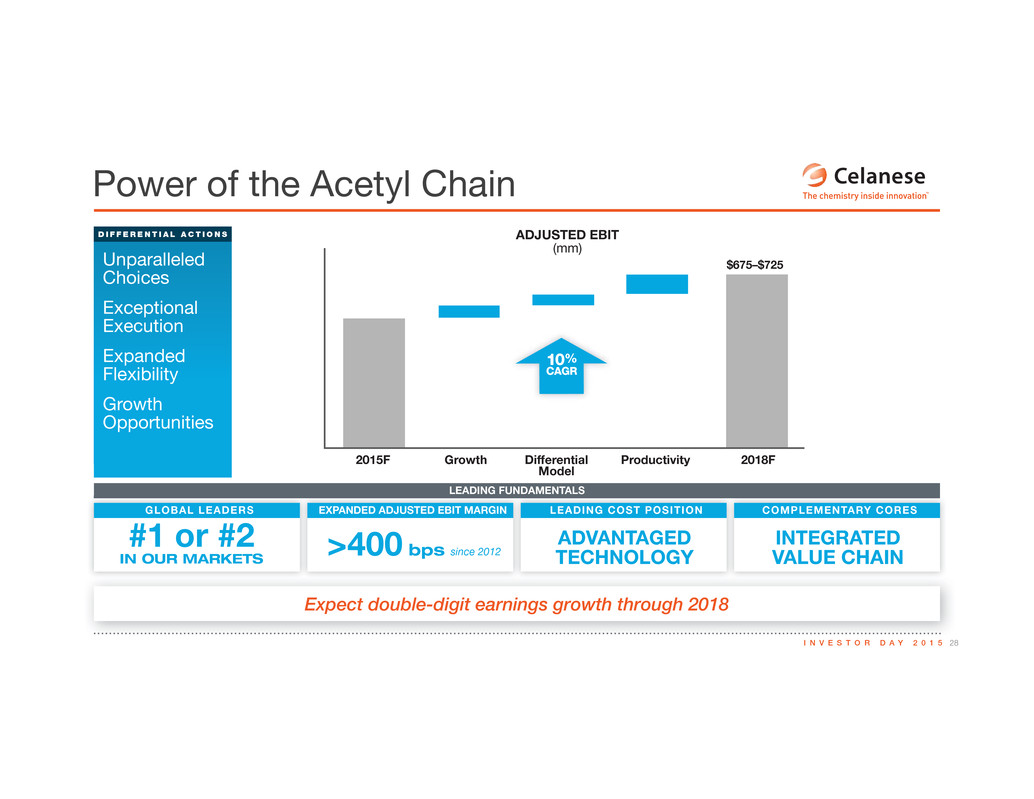

28I N V E S T O R D A Y 2 0 1 5 Expect double-digit earnings growth through 2018 Power of the Acetyl Chain LEADING FUNDAMENTALS Unparalleled Choices Exceptional Execution Expanded Flexibility Growth Opportunities D I F F E R E N T I A L A C T I O N S $675–$725 2015F 2018FProductivityGrowth Differential Model 10% CAGR ADJUSTED EBIT (mm) >400 bps ADVANTAGED TECHNOLOGY INTEGRATED VALUE CHAIN#1 or #2 IN OUR MARKETS since 2012 COMPLEMENTARY CORESGLOBAL LEADERS LEADING COST POSITIONEXPANDED ADJUSTED EBIT MARGIN