Investor Day MAY 1, 2018

Mark Rohr CHAIRMAN AND CHIEF EXECUTIVE OFFICER I N V E S T O R D A Y M A Y 1 , 2 0 1 8

2I N V E S T O R D A Y 2 0 1 8 Disclosures Forward Looking Statements This presentation, and statements made in connection with this presentation, contain “forward-looking statements,” which include information concerning the Company’s plans, objectives, goals, strategies, future revenues, synergies, or performance, capital expenditures, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize any or all of these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained herein. These risks and uncertainties include, among other things, various factors discussed from time to time in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for 2017 (filed with the SEC on February 9, 2018), and those listed in the Company’s press release dated May 1, 2018 issued in connection with this presentation, which are available under Investor Relations on the Company’s website at www.celanese.com. Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this presentation, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year. Presentation This presentation presents the Company’s four business segments, Engineered Materials, Acetate Tow, Industrial Specialties and Acetyl Intermediates, with one subtotal reflecting our core, the Acetyl Chain, which is based on similarities among customers, business models and technical processes. The Acetyl Chain includes the Company’s Acetyl Intermediates segment and Industrial Specialties segment. Non-GAAP Financial Measures This presentation, and statements made in connection with this presentation, contain references to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the Company and referenced in this presentation, including definitions and reconciliations with comparable GAAP financial measures, as well as prior period information, please refer to the Non-US GAAP Financial Measures and Supplemental Information documents available under Investor Relations/Financial Information/Non-GAAP Financial Measures on our website, www.celanese.com.

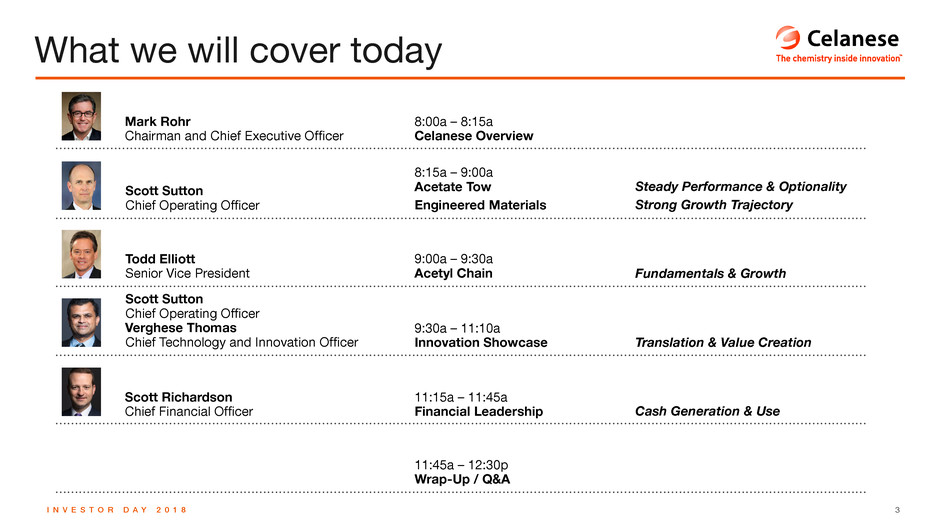

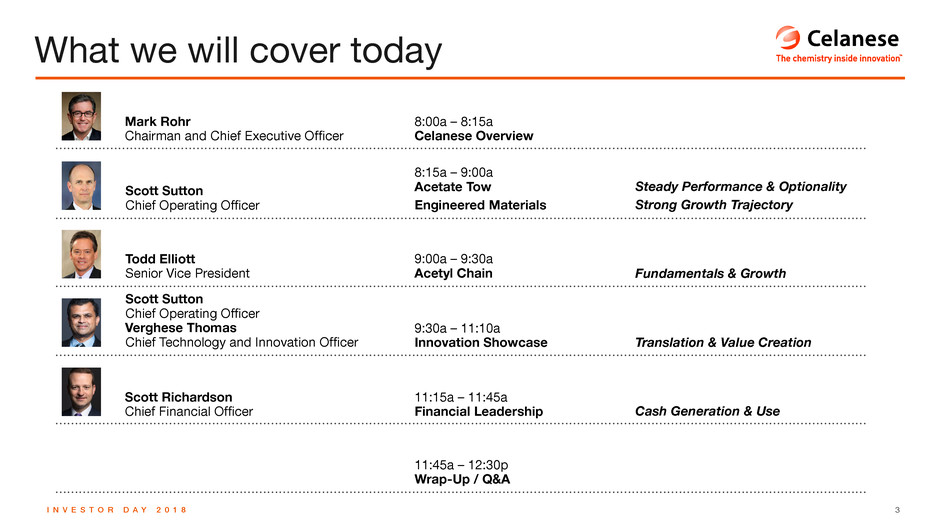

3I N V E S T O R D A Y 2 0 1 8 What we will cover today Mark Rohr Chairman and Chief Executive Officer Scott Richardson Chief Financial Officer Scott Sutton Chief Operating Officer Todd Elliott Senior Vice President Scott Sutton Chief Operating Officer Verghese Thomas Chief Technology and Innovation Officer 8:00a – 8:15a Celanese Overview 9:30a – 11:10a Innovation Showcase 11:15a – 11:45a Financial Leadership 11:45a – 12:30p Wrap-Up / Q&A 8:15a – 9:00a Acetate Tow Engineered Materials 9:00a – 9:30a Acetyl Chain Steady Performance & Optionality Strong Growth Trajectory Fundamentals & Growth Translation & Value Creation Cash Generation & Use

4I N V E S T O R D A Y 2 0 1 8 ...actions benefit all shareholders and improve our business Celanese one hundred years > Being a good corporate citizen and giving back to the community > Leading safety and environmental stewardship > Support of employees, their growth and opportunities > Respectful workplace for all employees, suppliers and customers > Serving customers through innovation and quality WE ARE COMMITTED TO:

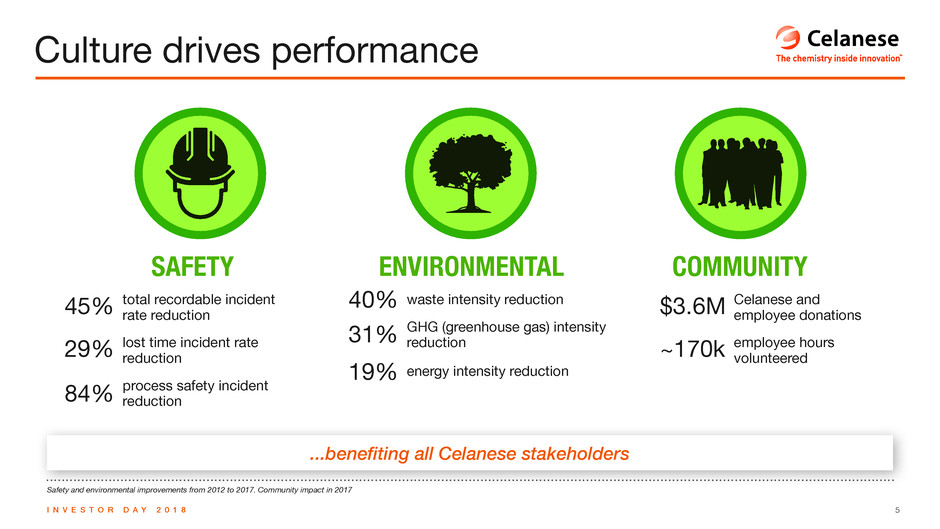

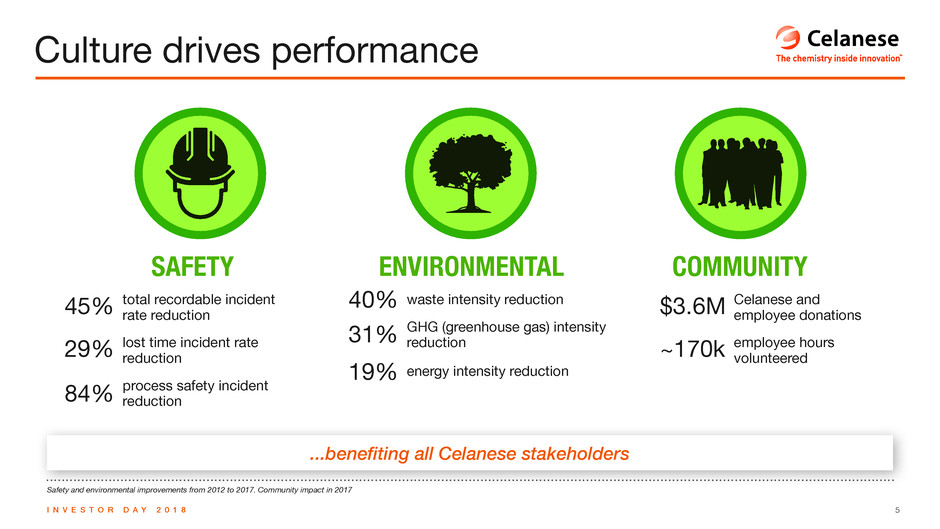

5I N V E S T O R D A Y 2 0 1 8 Safety and environmental improvements from 2012 to 2017. Community impact in 2017 Culture drives performance ...benefiting all Celanese stakeholders SAFETY ENVIRONMENTAL COMMUNITY Celanese and employee donations employee hours volunteered total recordable incident rate reduction lost time incident rate reduction process safety incident reduction 45% 29% 84% waste intensity reduction GHG (greenhouse gas) intensity reduction energy intensity reduction 40% 31% 19% $3.6M ~170k

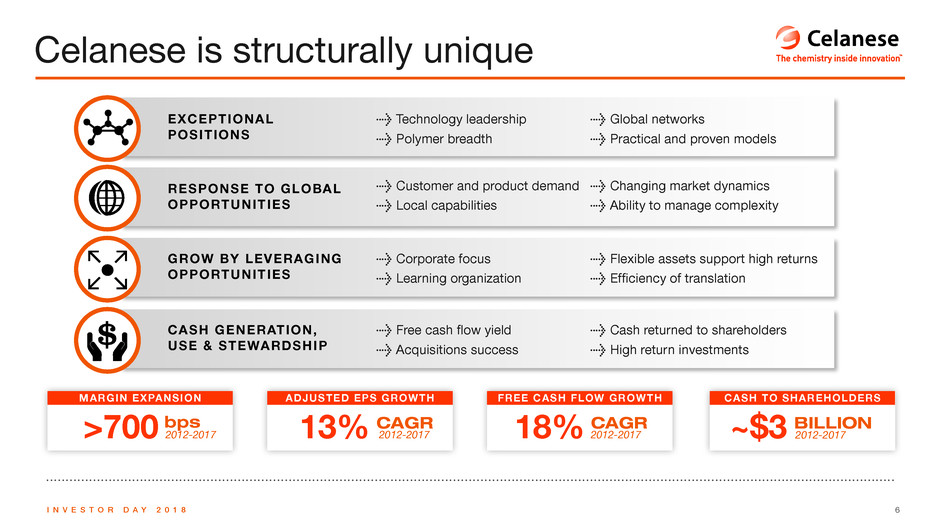

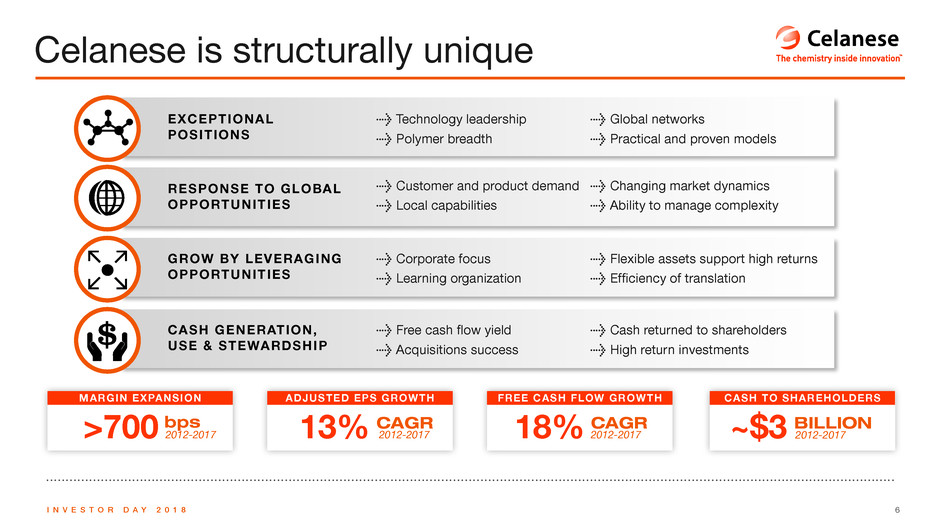

6I N V E S T O R D A Y 2 0 1 8 Celanese is structurally unique EXCEPTIONAL POSITIONS RESPONSE TO GLOBAL OPPORTUNITIES GROW BY LEVERAGING OPPORTUNITIES CASH GENERATION, USE & STEWARDSHIP >700 MARGIN EXPANSION 18% FREE CASH FLOW GROWTH ~$3 CASH TO SHAREHOLDERS 13% ADJUSTED EPS GROWTH bps > Corporate focus > Learning organization > Free cash flow yield > Acquisitions success > Technology leadership > Polymer breadth > Customer and product demand > Local capabilities > Flexible assets support high returns > Efficiency of translation > Cash returned to shareholders > High return investments > Global networks > Practical and proven models > Changing market dynamics > Ability to manage complexity 2012-2017 BILLION 2012-2017 2012-2017 2012-2017 CAGR CAGR

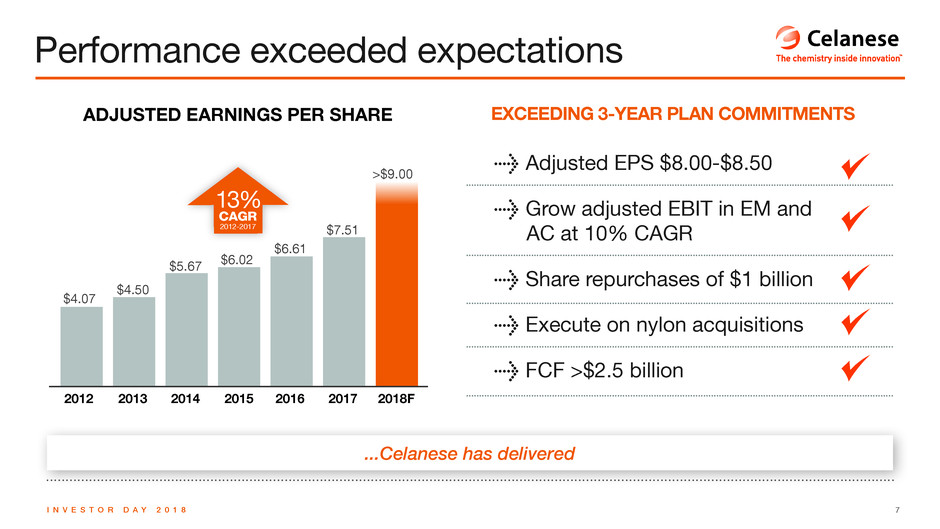

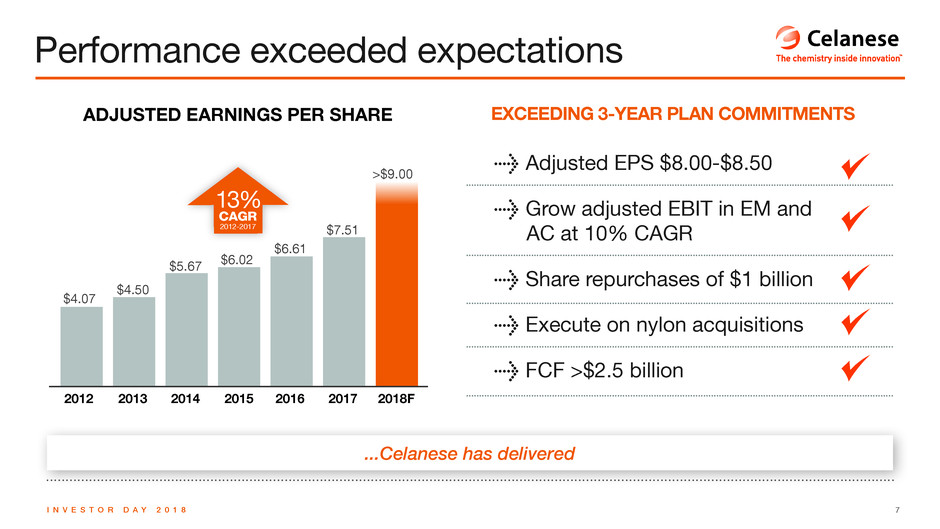

7I N V E S T O R D A Y 2 0 1 8 Performance exceeded expectations ...Celanese has delivered 201420132012 $4.07 $4.50 $5.67 $6.02 $6.61 $7.51 >$9.00 2015 2016 2017 2018F 13% CAGR 2012-2017 ADJUSTED EARNINGS PER SHARE EXCEEDING 3-YEAR PLAN COMMITMENTS > Adjusted EPS $8.00-$8.50 > Grow adjusted EBIT in EM and AC at 10% CAGR > Share repurchases of $1 billion > Execute on nylon acquisitions > FCF >$2.5 billion ; ; ; ; ;

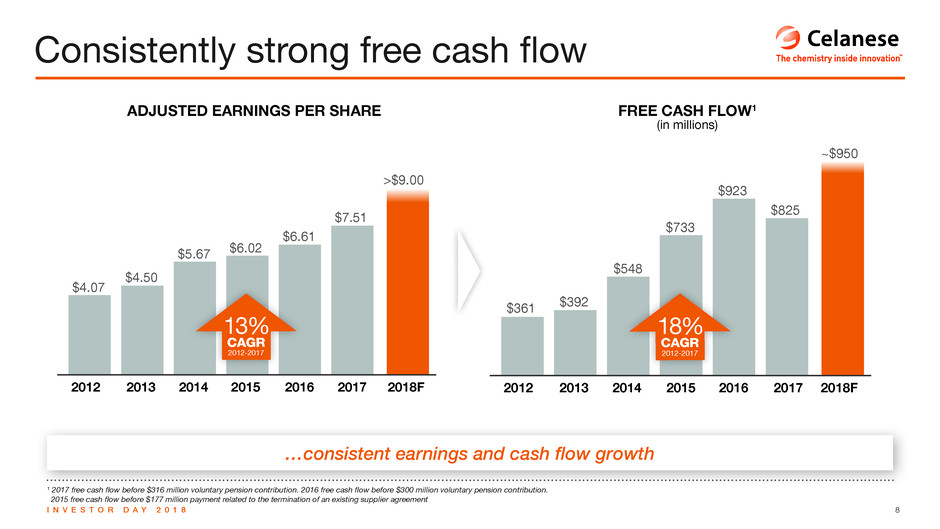

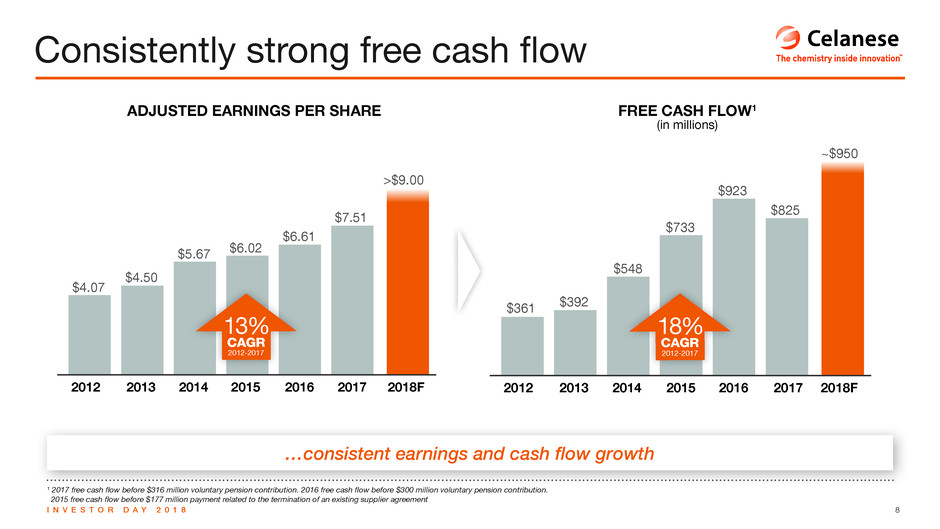

8I N V E S T O R D A Y 2 0 1 8 …consistent earnings and cash flow growth Consistently strong free cash flow ¹ 2017 free cash flow before $316 million voluntary pension contribution. 2016 free cash flow before $300 million voluntary pension contribution. 2015 free cash flow before $177 million payment related to the termination of an existing supplier agreement 201420132012 $361 $392 $548 $733 $923 $825 ~$950 2015 2016 2017 2018F 18% CAGR 2012-2017 FREE CASH FLOW 1 (in millions) 201420132012 $4.07 $4.50 $5.67 $6.02 $6.61 $7.51 >$9.00 2015 2016 2017 2018F 13% CAGR 2012-2017 ADJUSTED EARNINGS PER SHARE

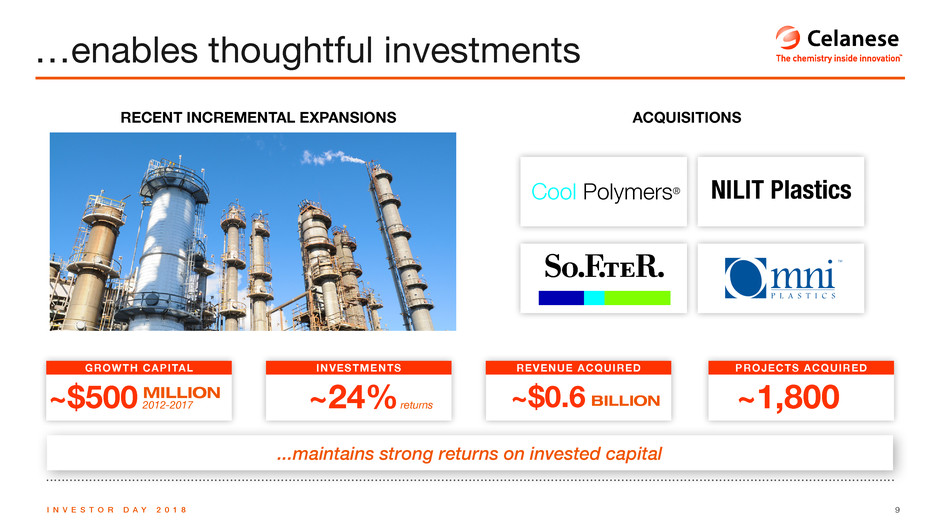

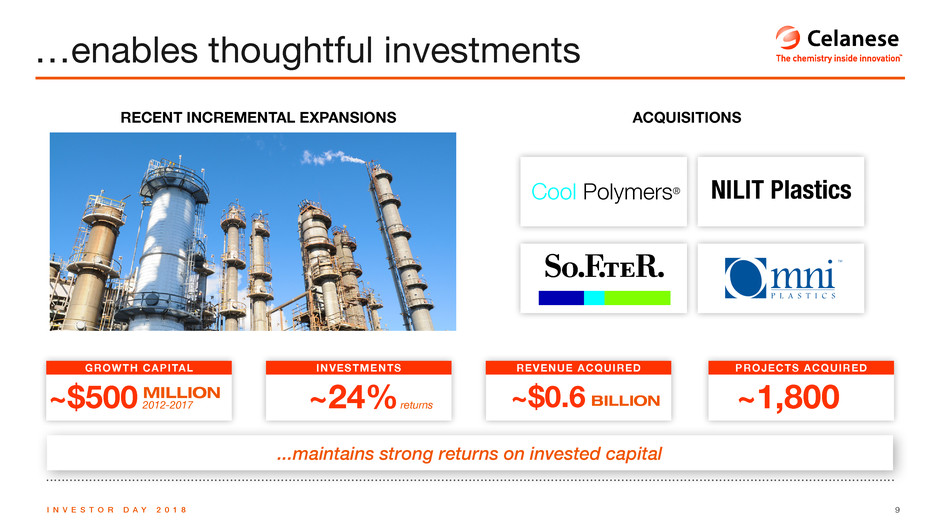

9I N V E S T O R D A Y 2 0 1 8 ...maintains strong returns on invested capital …enables thoughtful investments ACQUISITIONSRECENT INCREMENTAL EXPANSIONS NILIT PlasticsCool Polymers® Marchio pantoni Marchio quadricromia GROWTH CAPITAL ~$0.6 REVENUE ACQUIRED ~$500 ~1,800 PROJECTS ACQUIRED ~24% INVESTMENTS MILLION BILLION2012-2017 returns

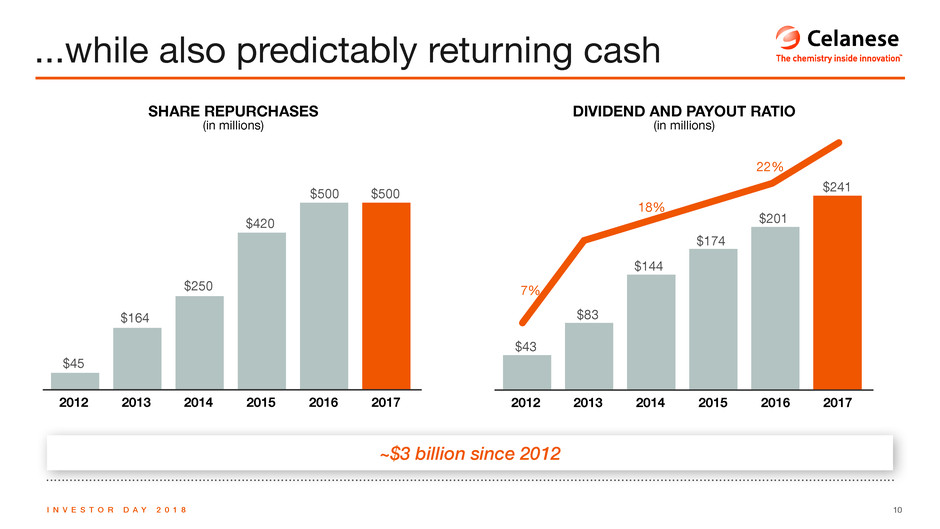

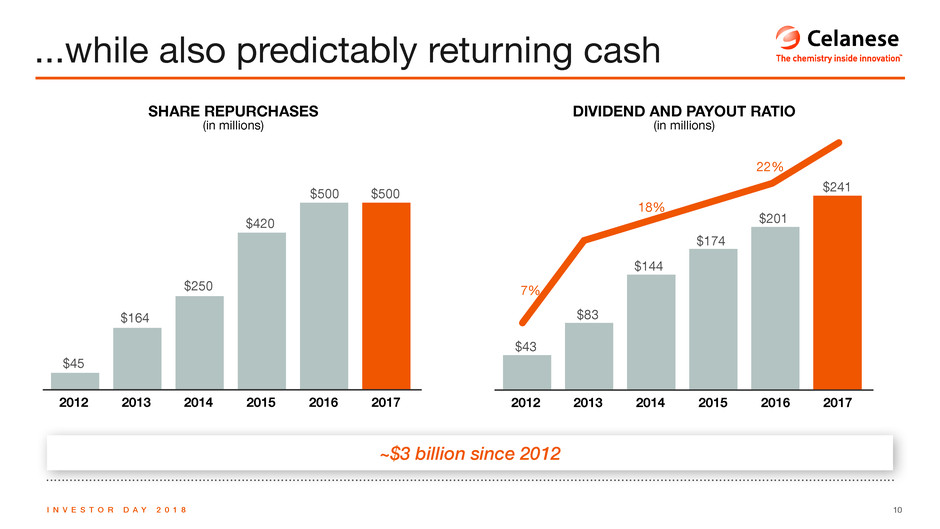

10I N V E S T O R D A Y 2 0 1 8 ~$3 billion since 2012 ...while also predictably returning cash DIVIDEND AND PAYOUT RATIO (in millions) SHARE REPURCHASES (in millions) 201420132012 $43 $83 $144 $174 $201 $241 2015 2016 2017 7% 18% 22% 201420132012 $45 $164 $250 $420 $500 $500 2015 2016 2017

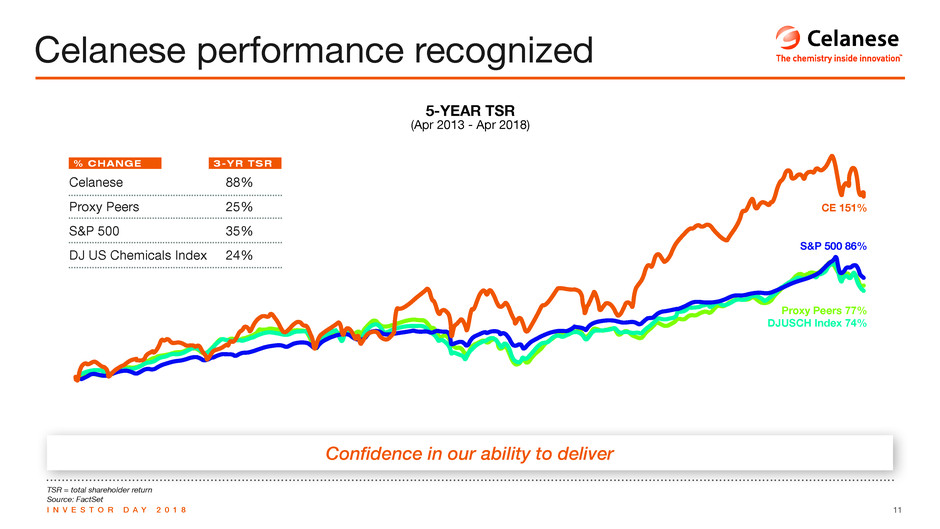

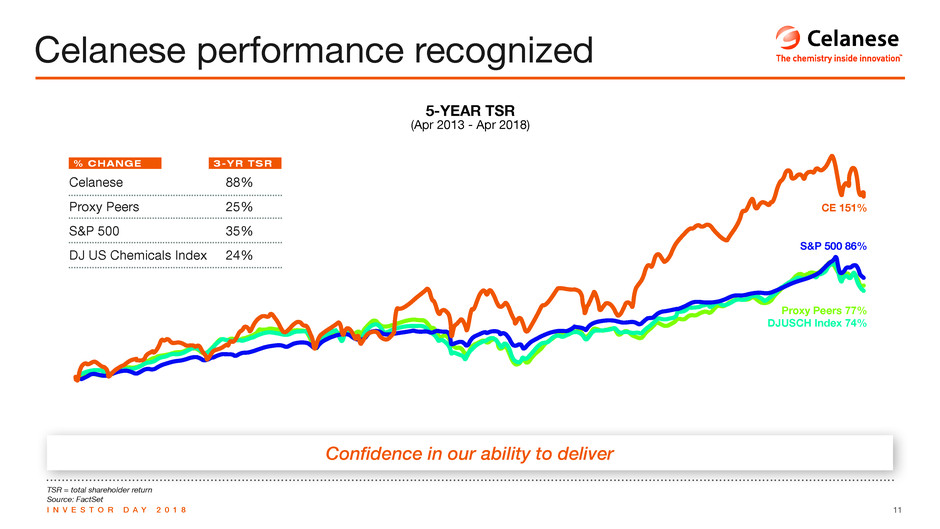

11I N V E S T O R D A Y 2 0 1 8 CE 151% Proxy Peers 77% DJUSCH Index 74% S&P 500 86% TSR = total shareholder return Source: FactSet Confidence in our ability to deliver Celanese performance recognized Celanese Proxy Peers S&P 500 DJ US Chemicals Index 88% 25% 35% 24% % CHANGE 3-YR TSR 5-YEAR TSR (Apr 2013 - Apr 2018)

12I N V E S T O R D A Y 2 0 1 8 Each element reinforces consistent value creation for shareholders Celanese positioned for continued success > Escalating need for solutions > Increased customer complexity > Broadest set of solutions > Global presence > Project-based model > Customized service > Bolt-on acquisitions > Low-cost organic expansion > Demand outgrowing supply > China landscape > Expansive network > Production optionality > Network maximizes value > Agility and global reach > Low-cost organic expansion > Alliances and ventures ENGINEERED MATERIALS ACETYL CHAIN WORLD DYNAMICS GROWTH OPTIONALITY POSITIONS UNASSAILABLE MODEL NOT REPLICATED

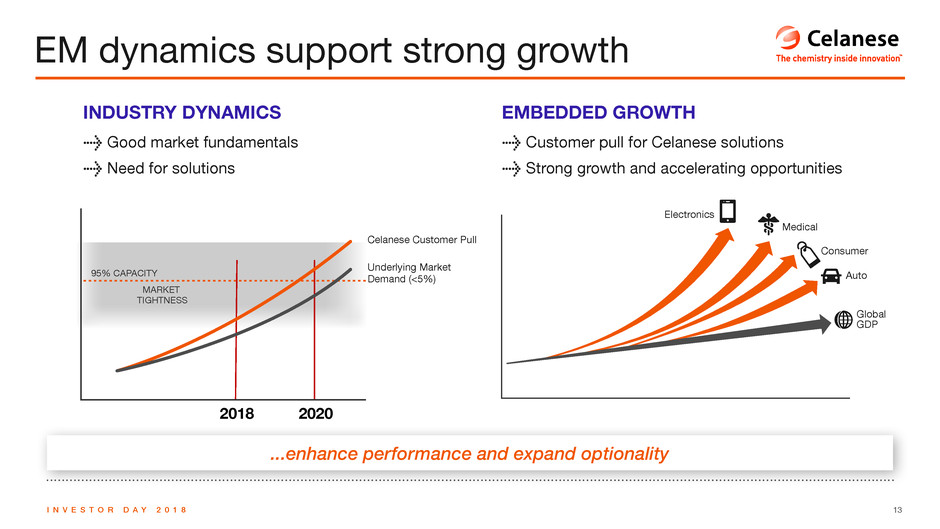

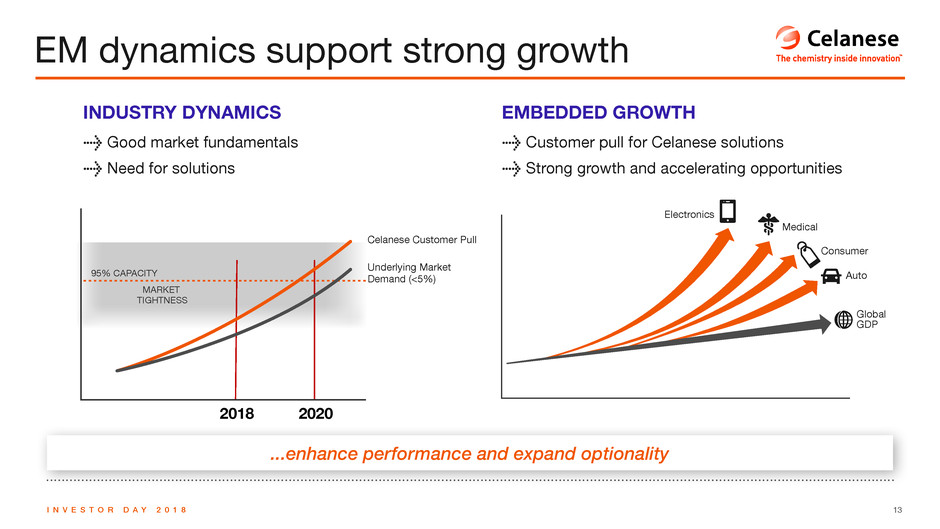

13I N V E S T O R D A Y 2 0 1 8 2020201820202018 MARKET TIGHTNESS 95% CAPACITYMARKET TIGHTNESS 85% CAPACITY ...enhance performance and expand optionality EM dynamics support strong growth INDUSTRY DYNAMICS > Good market fundamentals > Need for solutions EMBEDDED GROWTH > Customer pull for Celanese solutions > Strong growth and accelerating opportunities Auto Global GDP Electronics Celanese Customer Pull Underlying Market Demand (<5%) Consumer Medical

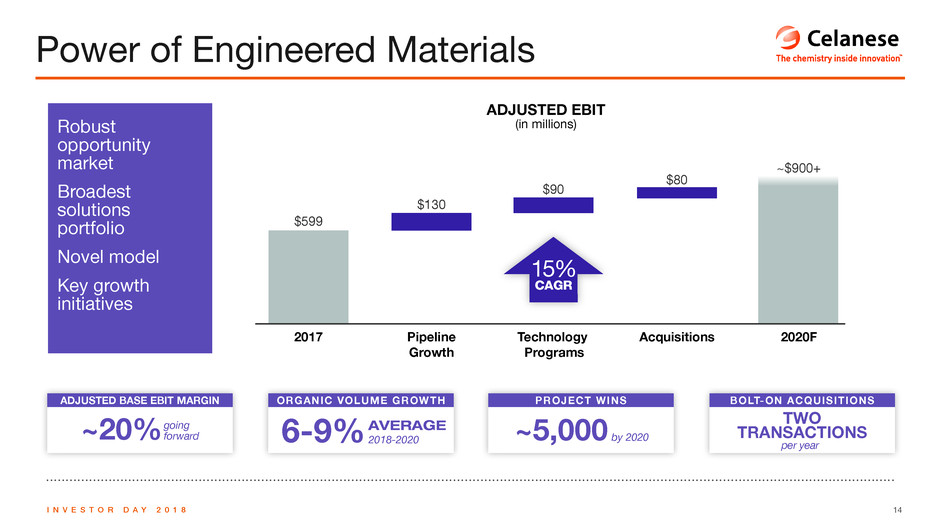

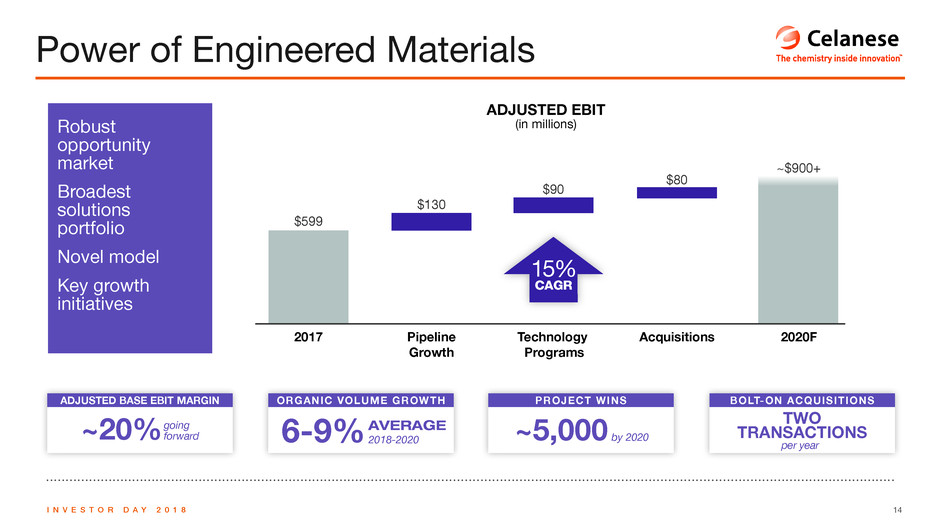

14I N V E S T O R D A Y 2 0 1 8 Power of Engineered Materials ADJUSTED EBIT (in millions)Robust opportunity market Broadest solutions portfolio Novel model Key growth initiatives 2017 Pipeline Growth Technology Programs Acquisitions 2020F $599 $130 $90 $80 ~$900+ 15% CAGR TWO TRANSACTIONS ADJUSTED BASE EBIT MARGIN PROJECT WINS BOLT-ON ACQUISITIONSORGANIC VOLUME GROWTH ~20%going forward ~5,000 by 2020 per year 6-9% 2018-2020AVERAGE

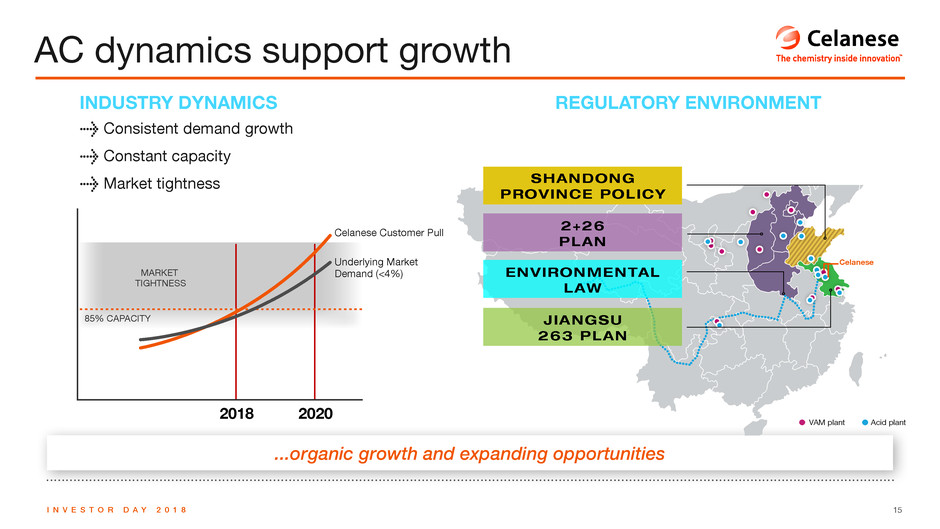

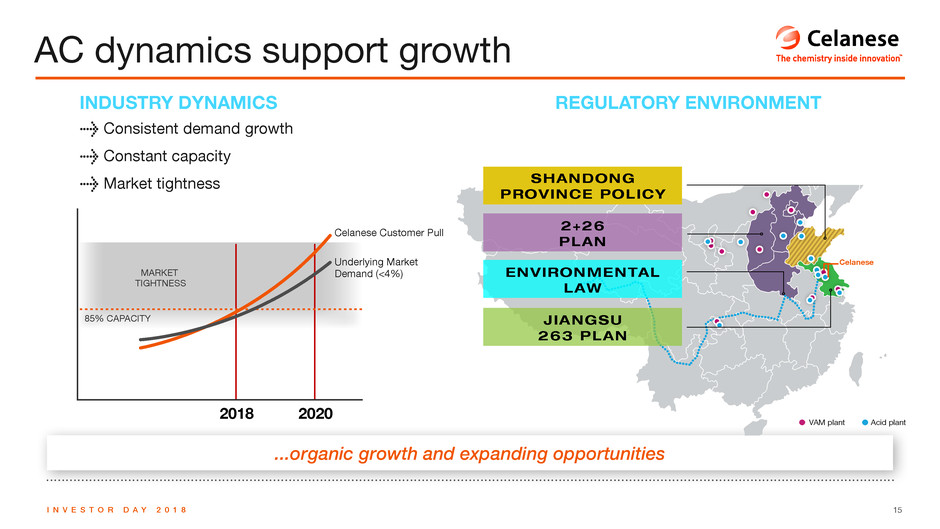

15I N V E S T O R D A Y 2 0 1 8 Celanese ...organic growth and expanding opportunities AC dynamics support growth 2+26 PLAN ENVIRONMENTAL LAW JIANGSU 263 PLAN SHANDONG PROVINCE POLICY VAM plant Acid plant INDUSTRY DYNAMICS > Consistent demand growth > Constant capacity > Market tightness 2020201820202018 MARKET TIGHTNESS 95% CAPACITYMARKET TIGHTNESS 85% CAPACITY Celanese Customer Pull Underlying Market Demand (<4%) REGULATORY ENVIRONMENT

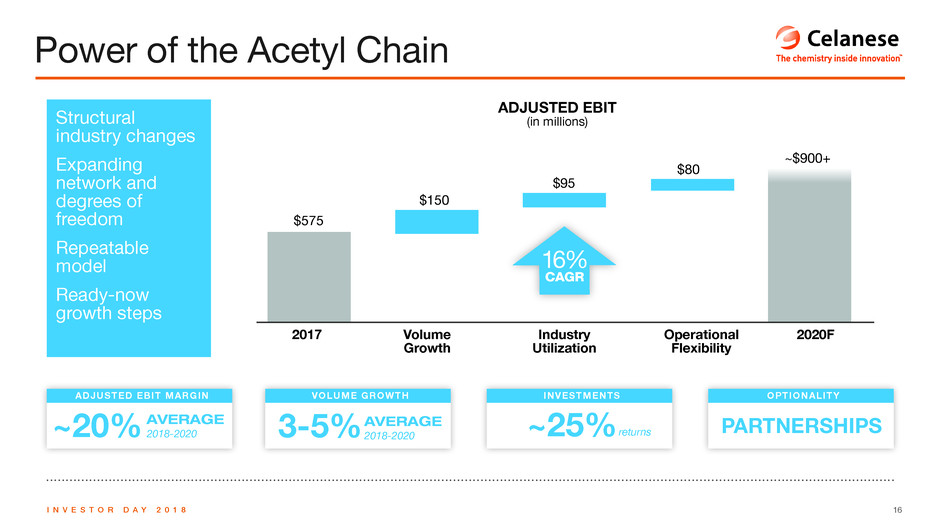

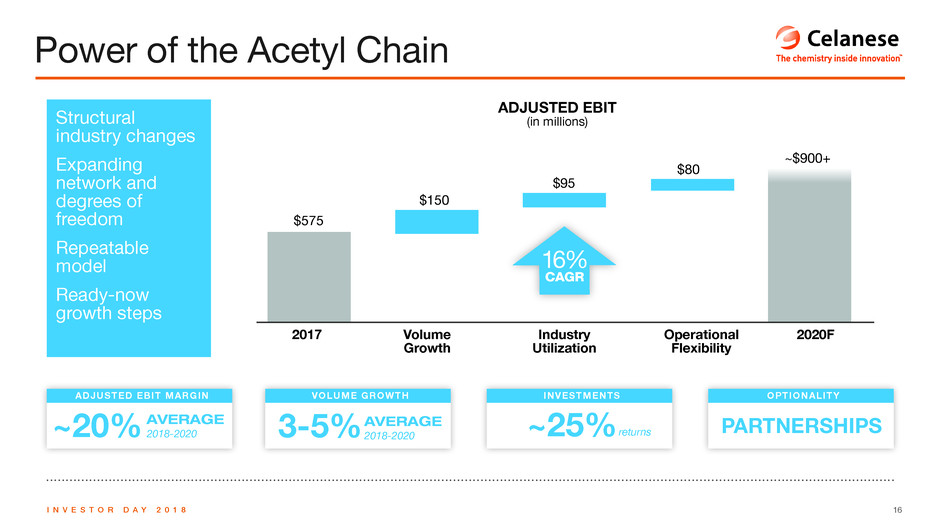

16I N V E S T O R D A Y 2 0 1 8 Power of the Acetyl Chain ADJUSTED EBIT (in millions) 2017 Volume Growth Industry Utilization Operational Flexibility 2020F $575 $80 $95 $150 ~$900+ 16% CAGR Structural industry changes Expanding network and degrees of freedom Repeatable model Ready-now growth steps PARTNERSHIPS OPTIONALITY INVESTMENTS 3-5% VOLUME GROWTH ~20% ADJUSTED EBIT MARGIN returns~25%2018-2020AVERAGE 2018-2020AVERAGE

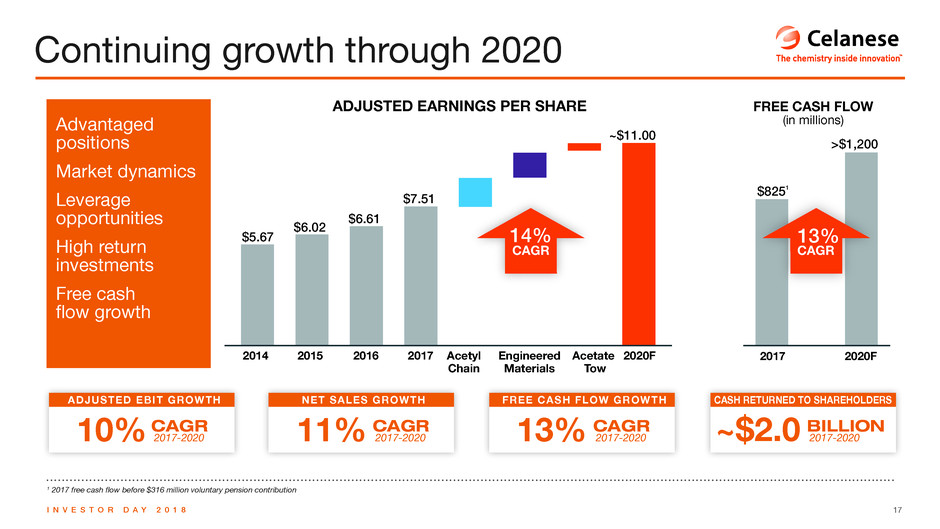

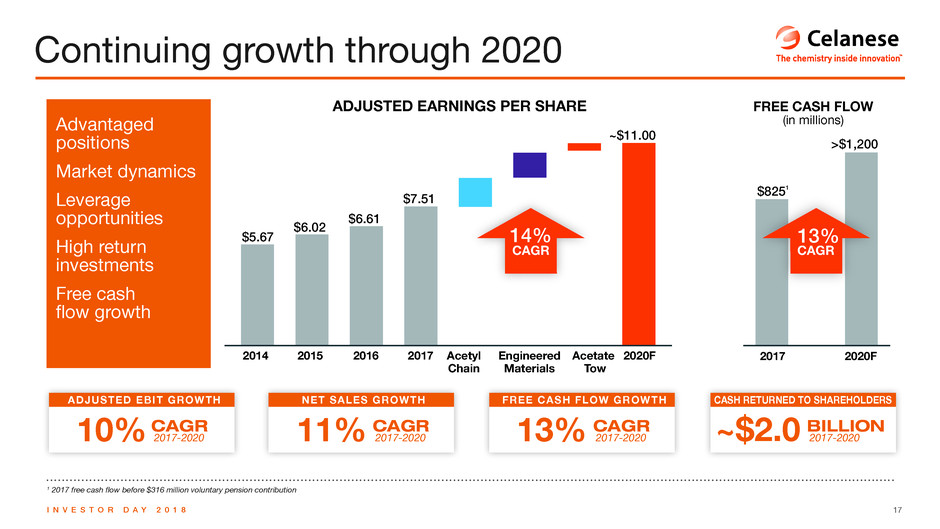

17I N V E S T O R D A Y 2 0 1 8 1 2017 free cash flow before $316 million voluntary pension contribution Continuing growth through 2020 ADJUSTED EARNINGS PER SHARE FREE CASH FLOW (in millions)Advantaged positions Market dynamics Leverage opportunities High return investments Free cash flow growth 2014 20162015 2017 2020FAcetyl Chain Acetate Tow Engineered Materials 2017 2020F $5.67 $6.02 $6.61 $7.51 ~$11.00 $8251 >$1,200 13% CAGR 14% CAGR 2014 62015 2017 2020FAcetyl Chain Acetate Tow Engineered Materials 2017 2020F $5.67 $6.02 $6.61 $7.51 ~$11.00 $8251 >$1,200 13% CAGR 14% CAGR CASH RETURNED TO SHAREHOLDERS 10% ADJUSTED EBIT GROWTH FREE CASH FLOW GROWTHNET SALES GROWTH 2017-2020 CAGR ~$2.0 BILLION11% 13%2017-2020 2017-2020 2017-2020CAGR CAGR