Todd Elliott SENIOR VICE PRESIDENT, ACETYL CHAIN I N V E S T O R D A Y M A Y 1 , 2 0 1 8

2I N V E S T O R D A Y 2 0 1 8 Acetyl Chain storyline 2020 > Improving fundamentals and structural reform in China > Margins enhanced by Acetyl Chain’s (AC) repeatable model > Network positions with greatest flexibility > Multiple growth opportunities will lift volume and revenue

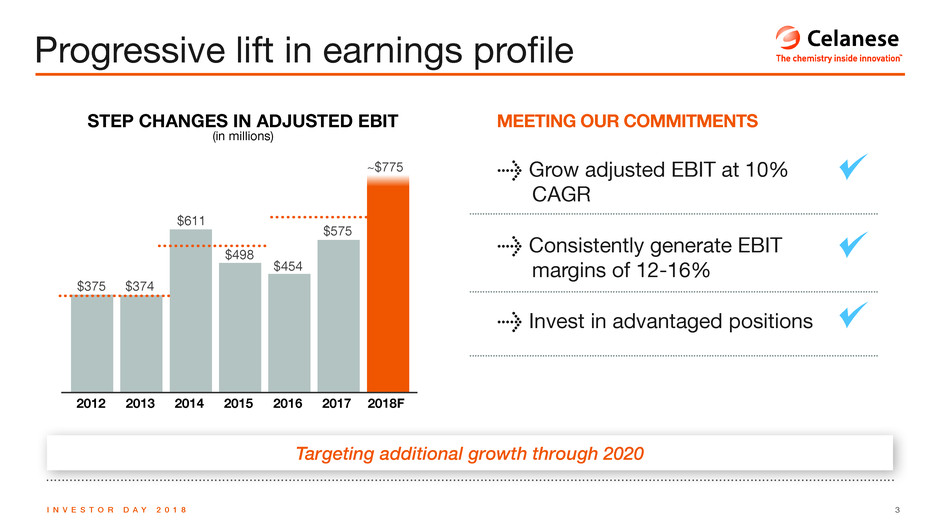

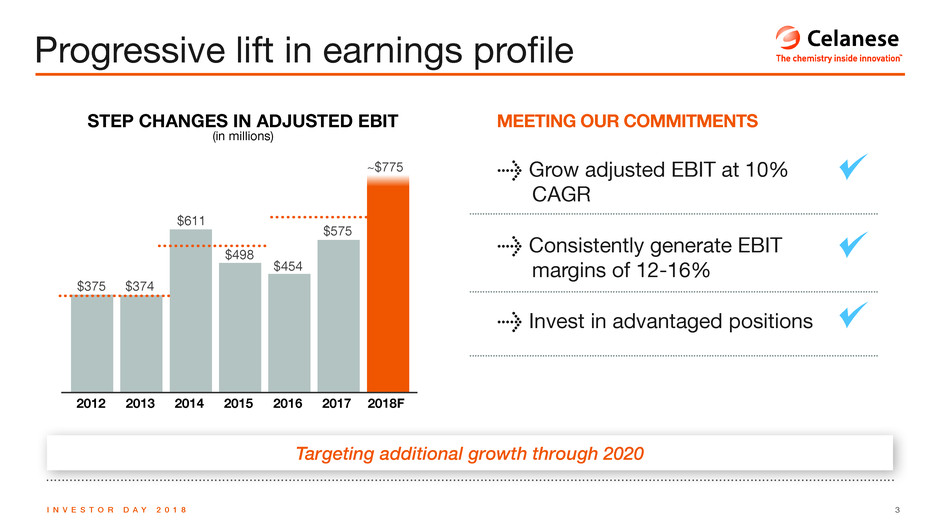

3I N V E S T O R D A Y 2 0 1 8 Progressive lift in earnings profile STEP CHANGES IN ADJUSTED EBIT (in millions) 201420132012 $375 $374 $611 $498 $454 $575 ~$775 2015 2016 2017 2018F Targeting additional growth through 2020 MEETING OUR COMMITMENTS > Grow adjusted EBIT at 10% CAGR > Consistently generate EBIT margins of 12-16% > Invest in advantaged positions ; ; ;

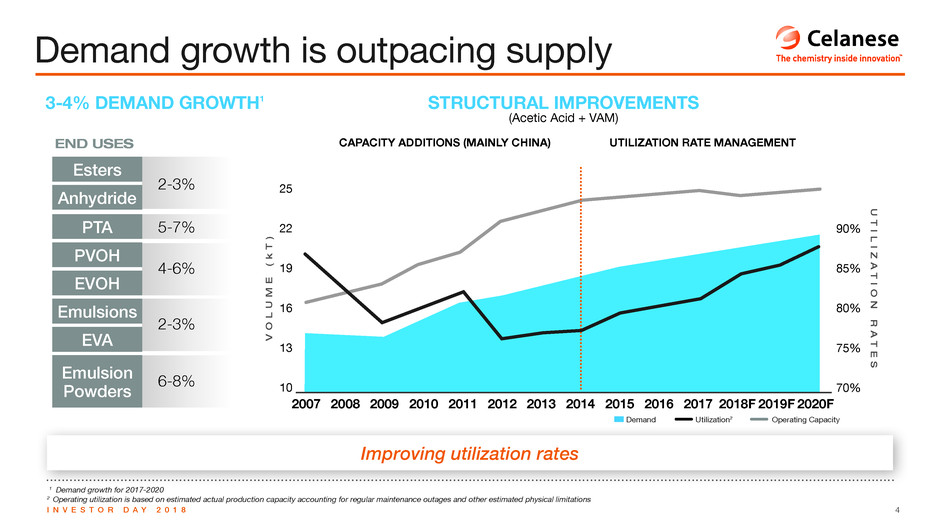

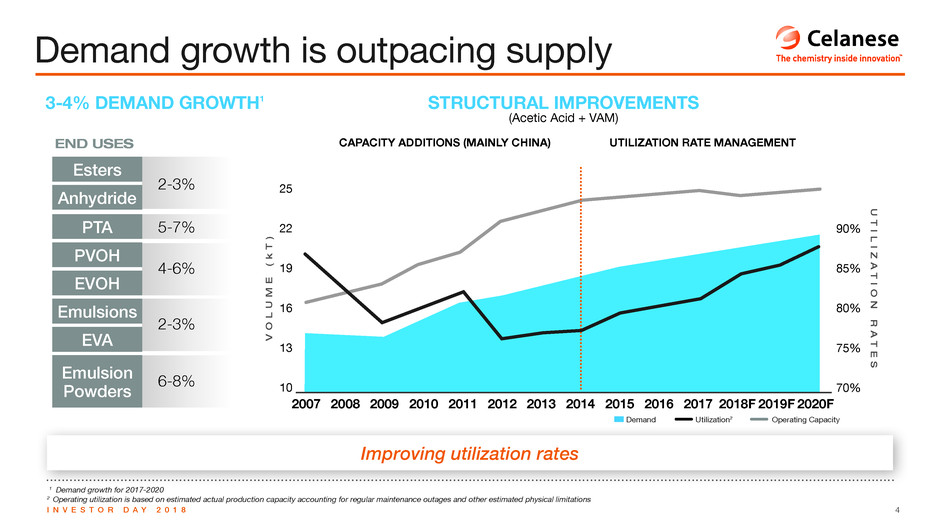

4I N V E S T O R D A Y 2 0 1 8 1 Demand growth for 2017-2020 2 Operating utilization is based on estimated actual production capacity accounting for regular maintenance outages and other estimated physical limitations Improving utilization rates Demand growth is outpacing supply Esters PTA EVOH EVA Anhydride PVOH Emulsions Emulsion Powders 2-3% 2-3% 6-8% 4-6% 5-7% 3-4% DEMAND GROWTH1 CAPACITY ADDITIONS (MAINLY CHINA) UTILIZATION RATE MANAGEMENTEND USES STRUCTURAL IMPROVEMENTS (Acetic Acid + VAM) Demand Utilization2 Operating Capacity 20142013201220112010200920082007 2015 2016 2017 2018F 2019F 2020F 25 22 19 16 13 10 U T I L I Z A T I O N R A T E S V O L U M E ( k T ) 90% 85% 80% 75% 70%

5I N V E S T O R D A Y 2 0 1 8 Already seeing industry impact from reforms China reforms impacting acetyls landscape INCREASE IN ENVIRONMENTAL REFORM IMPLEMENTATION > Environmental concerns have been a focus > New local policies reinforcing central government policies > Requirement to improve economic returns 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Beijing Olympics Measures Action Plan Coal Reform 2+26 Plan Air Pollution Act Environmental Tax Law Environmental Protection Law Ethanol Mandate PM2.5 Added Tightened Coal Emissions Jiangsu 263 Plan 11th Five Year Plan Shandong Province Policy

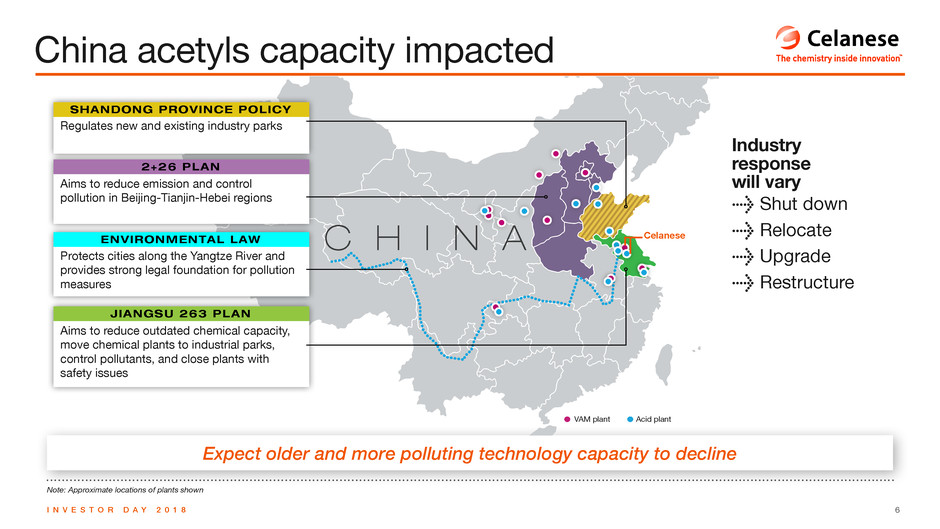

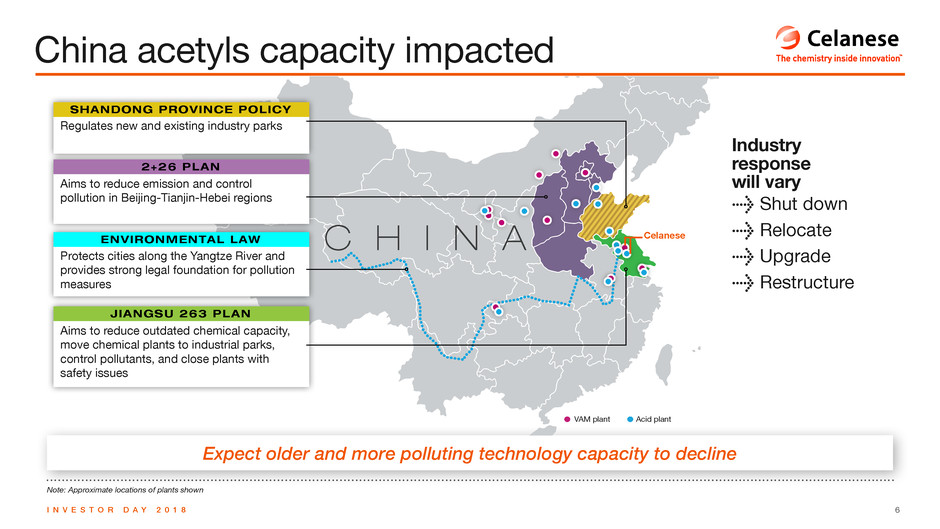

6I N V E S T O R D A Y 2 0 1 8 C H I N A Celanese Note: Approximate locations of plants shown Expect older and more polluting technology capacity to decline China acetyls capacity impacted Industry response will vary > Shut down > Relocate > Upgrade > Restructure 2+26 PLAN ENVIRONMENTAL LAW J IANGSU 263 PLAN SHANDONG PROVINCE POLI C Y Aims to reduce emission and control pollution in Beijing-Tianjin-Hebei regions Protects cities along the Yangtze River and provides strong legal foundation for pollution measures Aims to reduce outdated chemical capacity, move chemical plants to industrial parks, control pollutants, and close plants with safety issues Regulates new and existing industry parks VAM plant Acid plant

7I N V E S T O R D A Y 2 0 1 8 Though variation will continue, expect a structurally better industry Changes in China affect utilization GLOBAL ACETIC ACID & VAM SUPPLY & DEMAND WITH FORECASTED REGULATORY IMPACT 2016 2017 2018F 2019F 2020F U T I L I Z A T I O N V O L U M E ( k T ) 95% 90% 85% 80% 75% 70% 25 22 19 16 13 10 2018F Net Demand China Impact 83% 2020F +6-8% Operating Capacity Operating Utilization W IT H C H INA RE DU CTION Operating CapacityDemand Operating Utilization W IT HOUT C H INA RE DU CTION

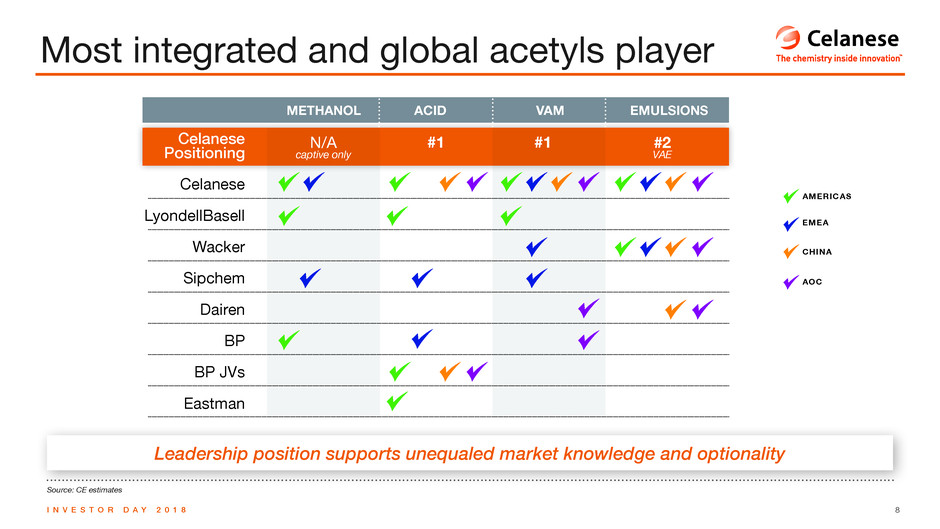

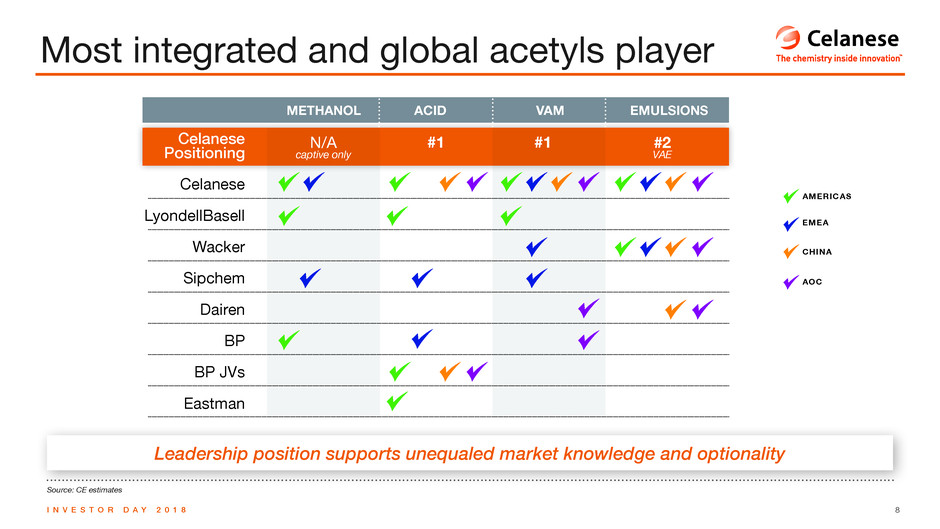

8I N V E S T O R D A Y 2 0 1 8 Source: CE estimates Leadership position supports unequaled market knowledge and optionality Most integrated and global acetyls player Celanese Positioning Celanese LyondellBasell Wacker Sipchem Dairen BP BP JVs Eastman METHANOL ACID VAM EMULSIONS AMERICAS EMEA CHINA AOC N/A captive only #2 VAE #1 #1

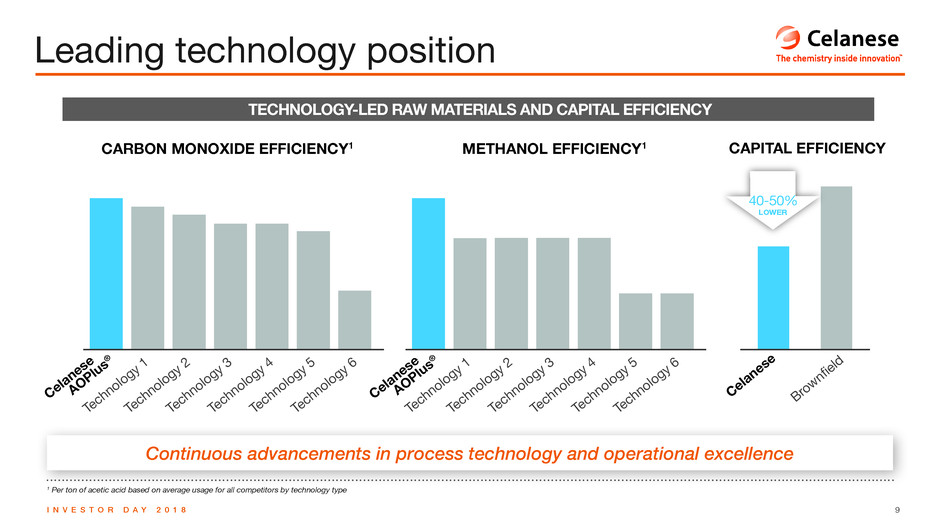

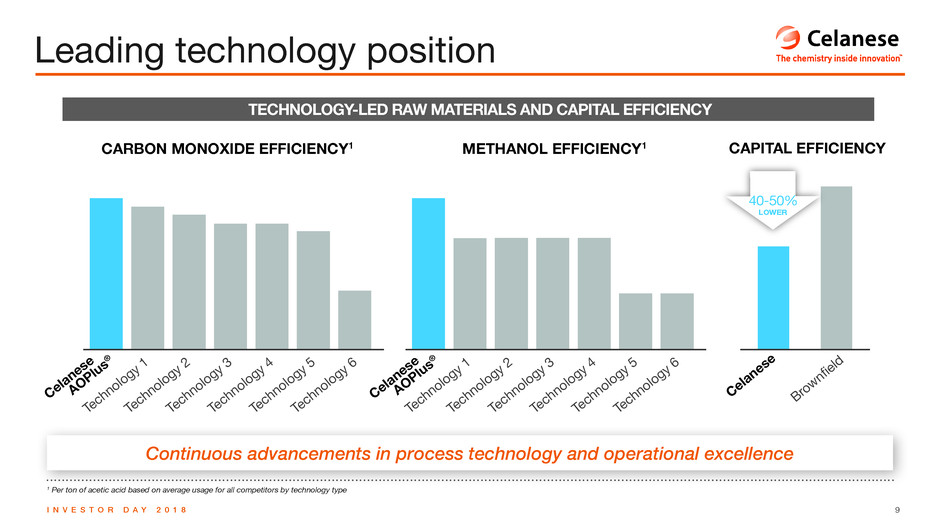

9I N V E S T O R D A Y 2 0 1 8 Continuous advancements in process technology and operational excellence 1 Per ton of acetic acid based on average usage for all competitors by technology type Leading technology position TECHNOLOGY-LED RAW MATERIALS AND CAPITAL EFFICIENCY Celanese AOPlu s® Celanese AOPlu s® Technology 1 Technology 2 Technology 3 Technology 4 Technology 5 Technology 6 Technology 1 Technology 2 Technology 3 Technology 4 Technology 5 Technology 6 Celanes e Br ownfiel d LOWER 40-50% CARBON MONOXIDE EFFICIENCY1 METHANOL EFFICIENCY1 CAPITAL EFFICIENCY

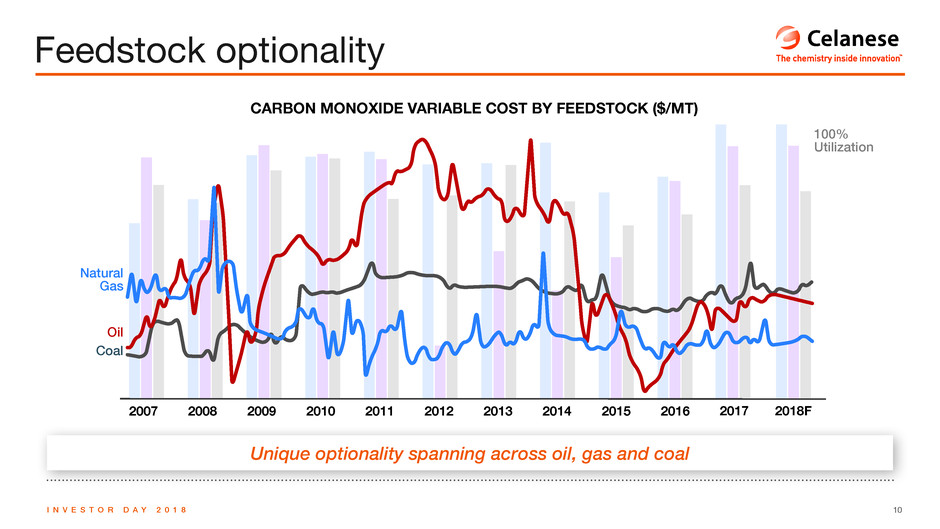

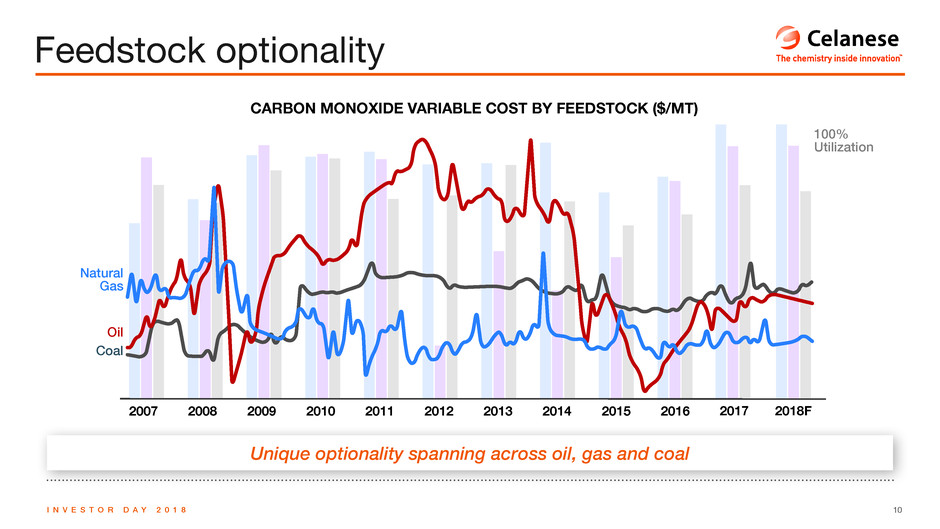

10I N V E S T O R D A Y 2 0 1 8 Unique optionality spanning across oil, gas and coal Feedstock optionality CARBON MONOXIDE VARIABLE COST BY FEEDSTOCK ($/MT) 2013201220112010200920082007 20152014 2016 2017 2018F Oil Coal Natural Gas 100% Utilization

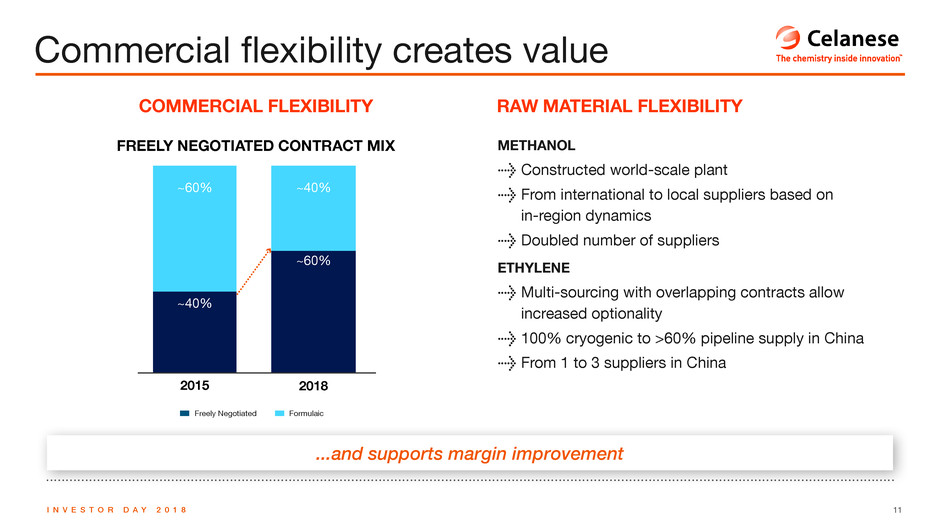

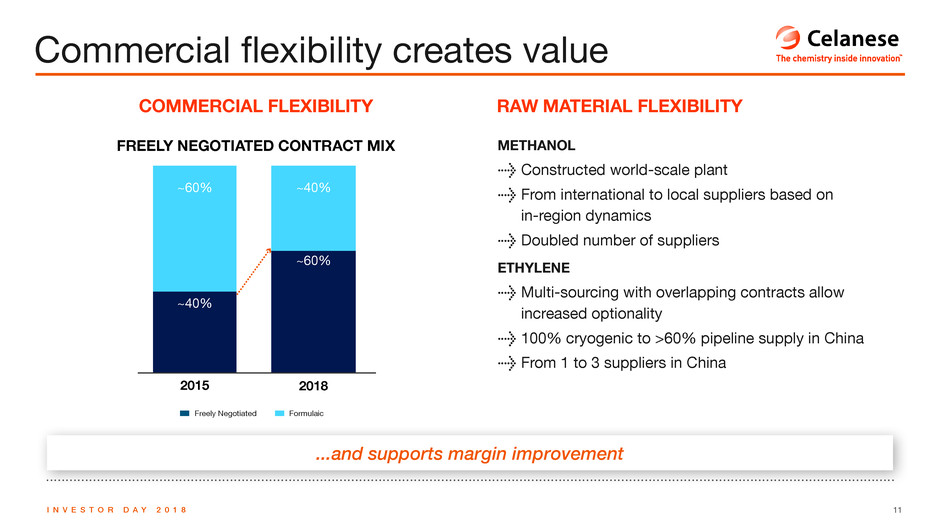

11I N V E S T O R D A Y 2 0 1 8 ...and supports margin improvement Commercial flexibility creates value METHANOL > Constructed world-scale plant > From international to local suppliers based on in-region dynamics > Doubled number of suppliers ETHYLENE > Multi-sourcing with overlapping contracts allow increased optionality > 100% cryogenic to >60% pipeline supply in China > From 1 to 3 suppliers in China COMMERCIAL FLEXIBILITY RAW MATERIAL FLEXIBILITY FREELY NEGOTIATED CONTRACT MIX 2015 2018 ~40% ~60% ~60% ~40% FormulaicFreely Negotiated

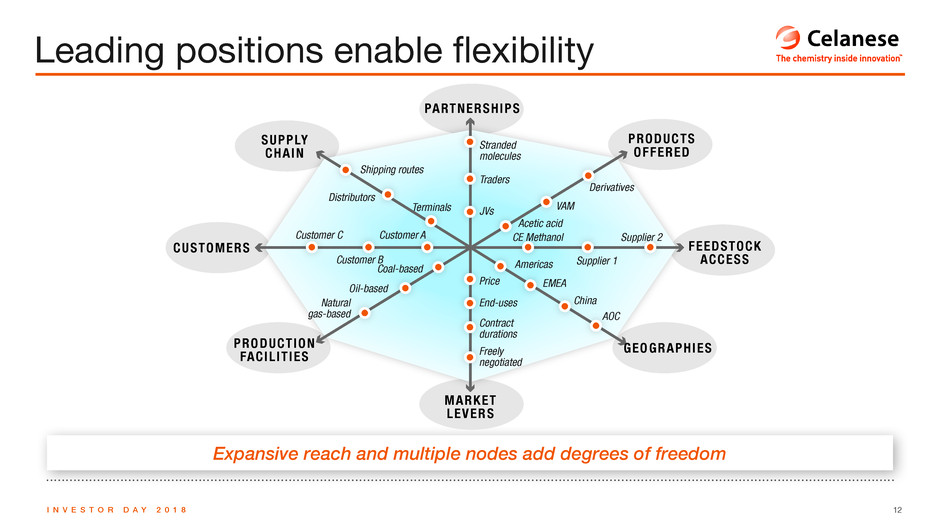

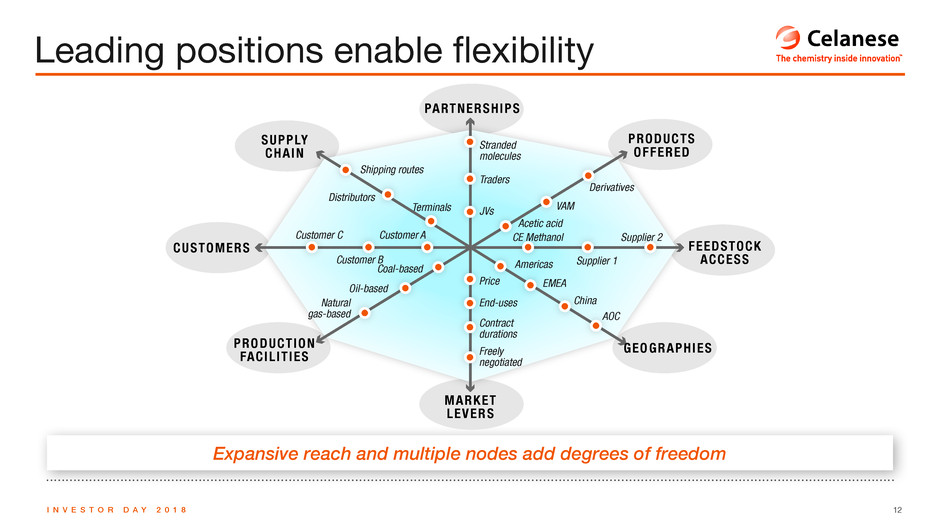

12I N V E S T O R D A Y 2 0 1 8 Expansive reach and multiple nodes add degrees of freedom Leading positions enable flexibility PARTNERSHIPS PRODUCTS OFFERED FEEDSTOCK ACCESS GEOGRAPHIES MARKET LEVERS PRODUCTION FACILITIES CUSTOMERS SUPPLY CHAIN Shipping routes Stranded molecules Derivatives VAM Acetic acid Americas Price CE Methanol Supplier 2 End-uses Contract durations Freely negotiated EMEA China AOC Supplier 1 Traders JVs Distributors Terminals Customer A Coal-based Oil-based Natural gas-based Customer B Customer C

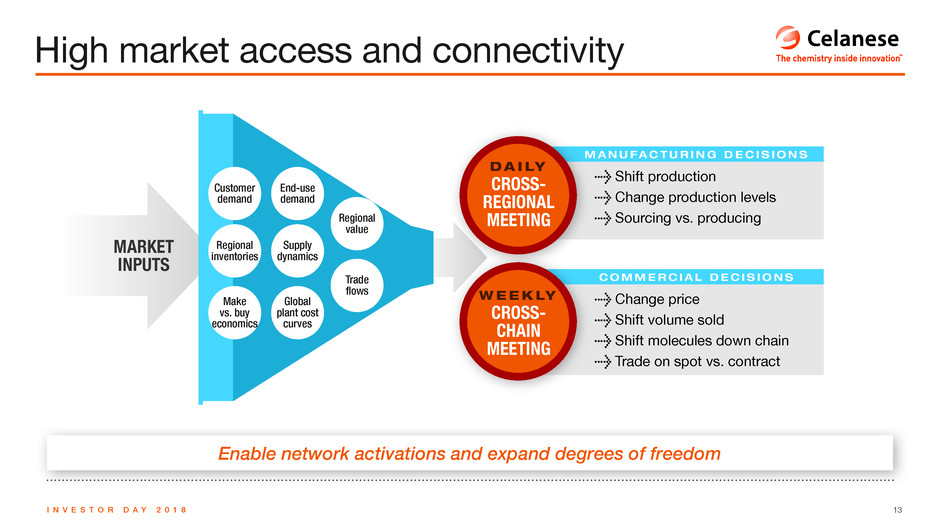

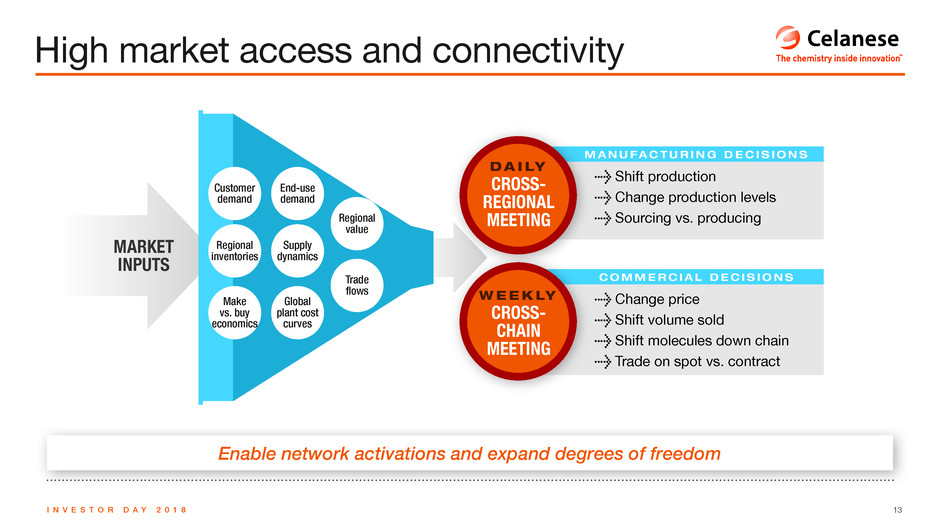

13I N V E S T O R D A Y 2 0 1 8 Enable network activations and expand degrees of freedom High market access and connectivity MARKET INPUTS Customer demand End-use demand Supply dynamics Regional value Global plant cost curves Make vs. buy economics Trade flows Regional inventories > Shift production > Change production levels > Sourcing vs. producing M A N U FA C T U R I N G D E C I S I O N S > Change price > Shift volume sold > Shift molecules down chain > Trade on spot vs. contract C O M M E R C I A L D E C I S I O N S CROSS- REGIONAL MEETING DA ILY CROSS- CHAIN MEETING W E E K LY

14I N V E S T O R D A Y 2 0 1 8 > Change production rates in different geographies > Add terminals …to leverage Celanese degrees of freedom and optionality Increasing network activations INCREASES THROUGH: > Commercial flexibility > Partnerships & alliances > Supply network expansion 50% INCREASE YEAR-OVER-YEAR 2017 2020F2016 +50% NETWORK ACTIVATIONS > Insights captured from new data > A decision made based on insights – More than one option to choose E X A M P L E S

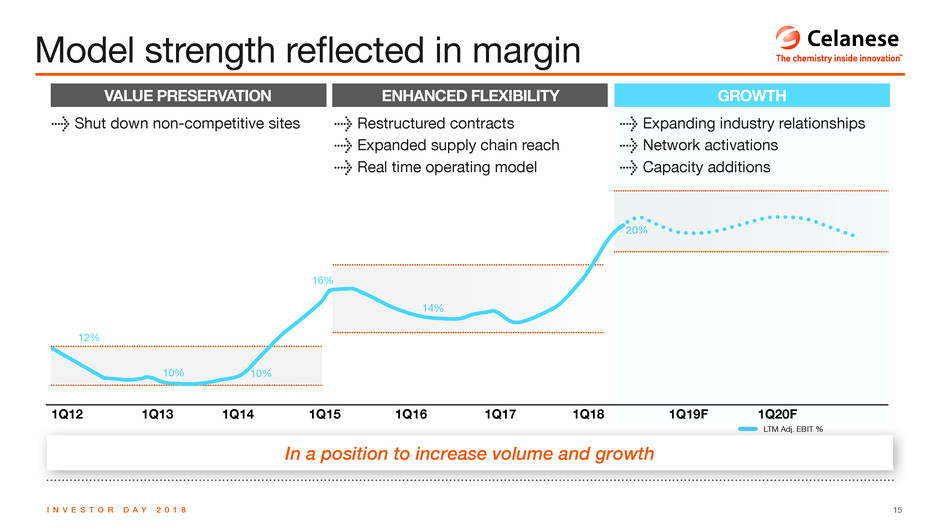

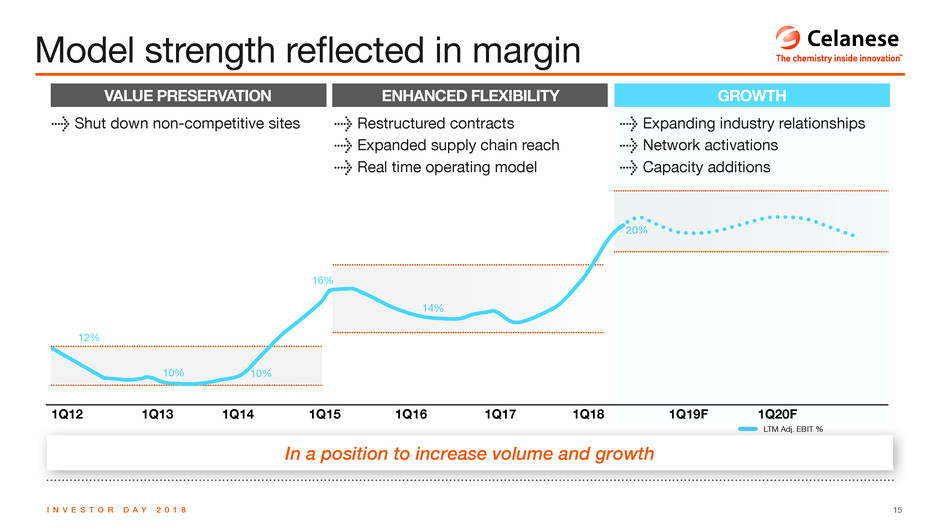

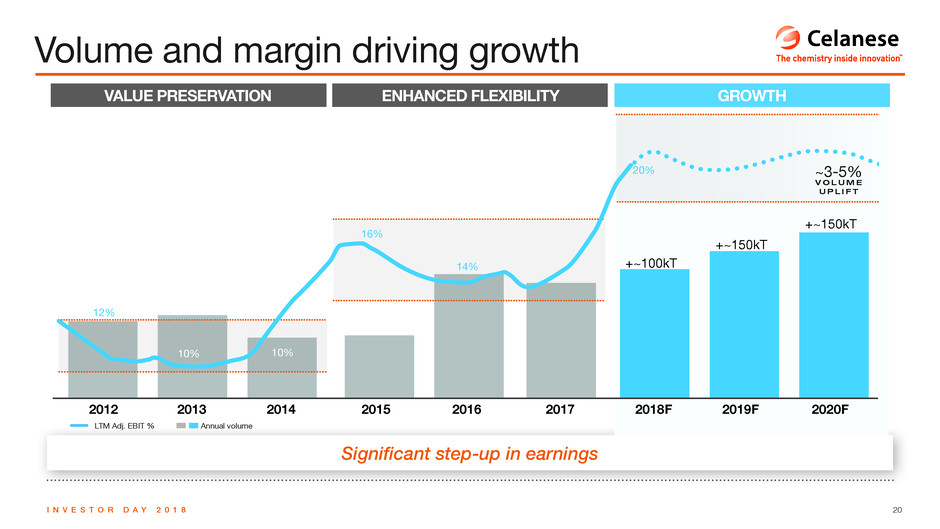

15I N V E S T O R D A Y 2 0 1 8 In a position to increase volume and growth Model strength reflected in margin VALUE PRESERVATION ENHANCED FLEXIBILITY GROWTH > Shut down non-competitive sites > Restructured contracts > Expanded supply chain reach > Real time operating model > Expanding industry relationships > Network activations > Capacity additions 1Q12 1Q13 1Q14 1Q15 1Q16 1Q17 1Q18 1Q19F 1Q20F ?? 1? 1? 1? 1? 1? LTM Adj. EBIT %

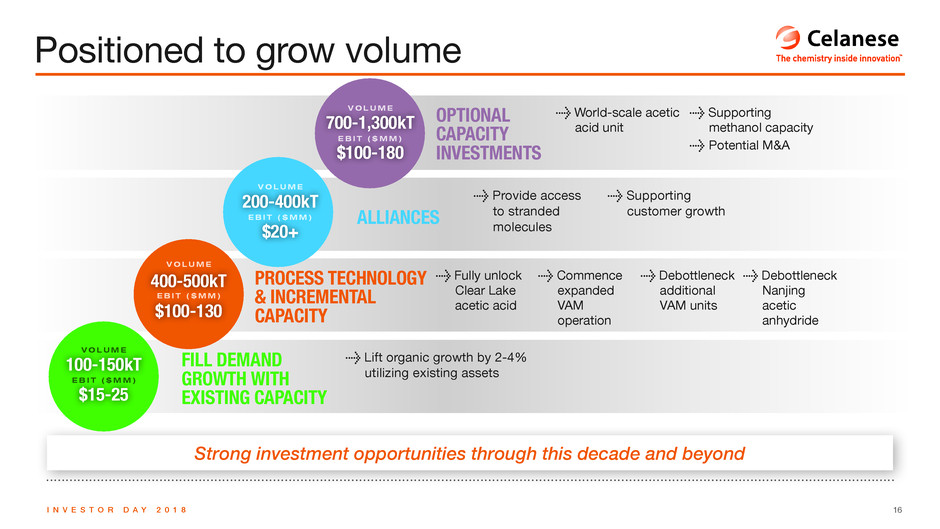

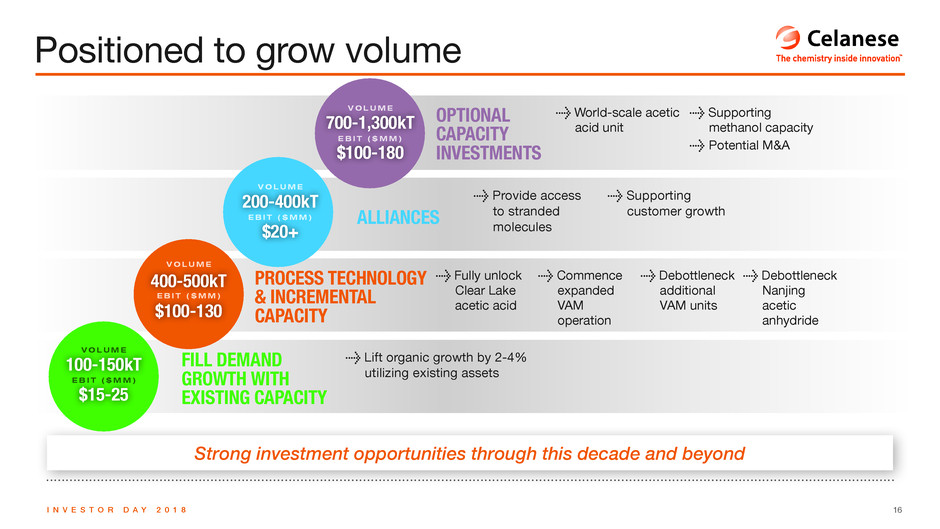

16I N V E S T O R D A Y 2 0 1 8 Positioned to grow volume Strong investment opportunities through this decade and beyond > World-scale acetic acid unit > Supporting methanol capacity > Potential M&A > Provide access to stranded molecules > Supporting customer growth > Lift organic growth by 2-4% utilizing existing assets > Fully unlock Clear Lake acetic acid > Commence expanded VAM operation > Debottleneck additional VAM units > Debottleneck Nanjing acetic anhydride OPTIONAL CAPACITY INVESTMENTS ALLIANCES FILL DEMAND GROWTH WITH EXISTING CAPACITY PROCESS TECHNOLOGY & INCREMENTAL CAPACITY 700-1,300kT $100-180 VOLUME E ? ? ? MM ? 200-400kT $20+ VOLUME E ? ? ? MM ? E ? ? ? MM ? 400-500kT $100-130 VOLUME 100-150kT $15-25 VOLUME E ? ? ? MM ?

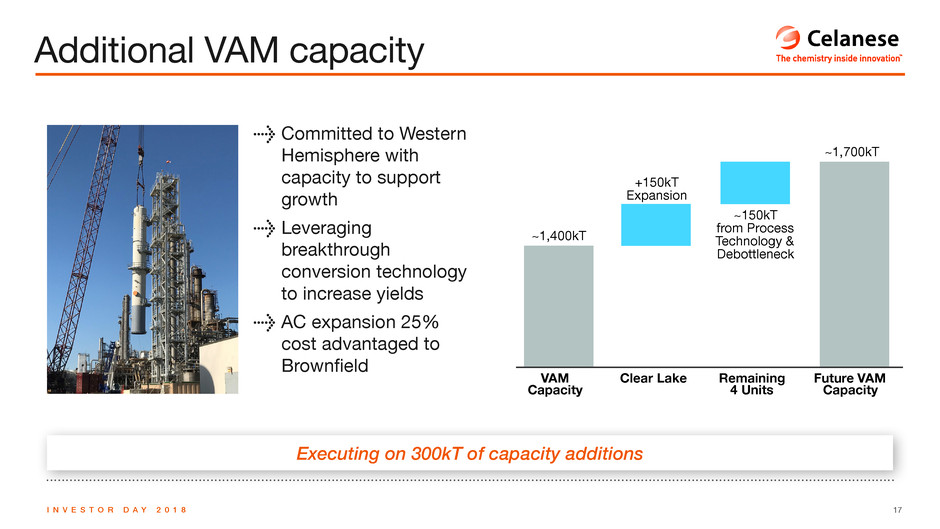

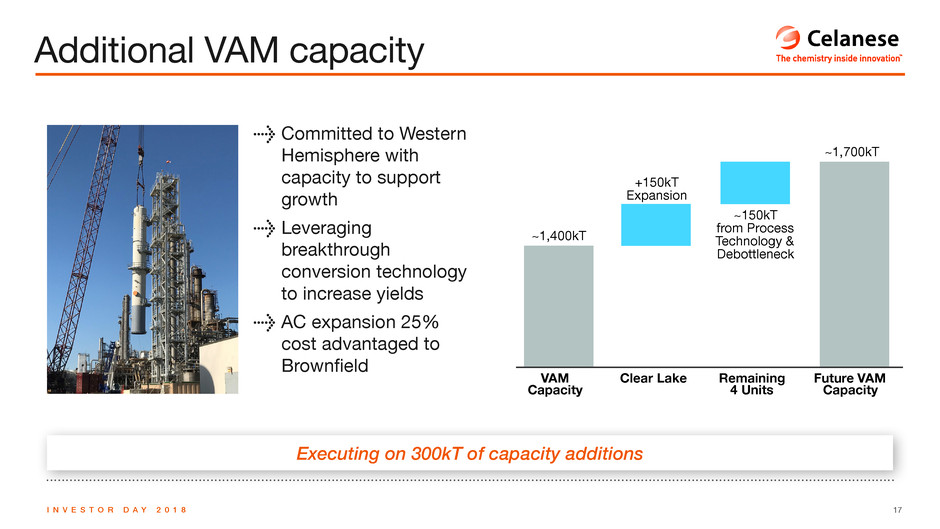

17I N V E S T O R D A Y 2 0 1 8 Executing on 300kT of capacity additions Additional VAM capacity VAM Capacity Remaining 4 Units Clear Lake ~1,400kT +150kT Expansion ~150kT from Process Technology & Debottleneck ~1,700kT Future VAM Capacity > Committed to Western Hemisphere with capacity to support growth > Leveraging breakthrough conversion technology to increase yields > AC expansion 25% cost advantaged to Brownfield

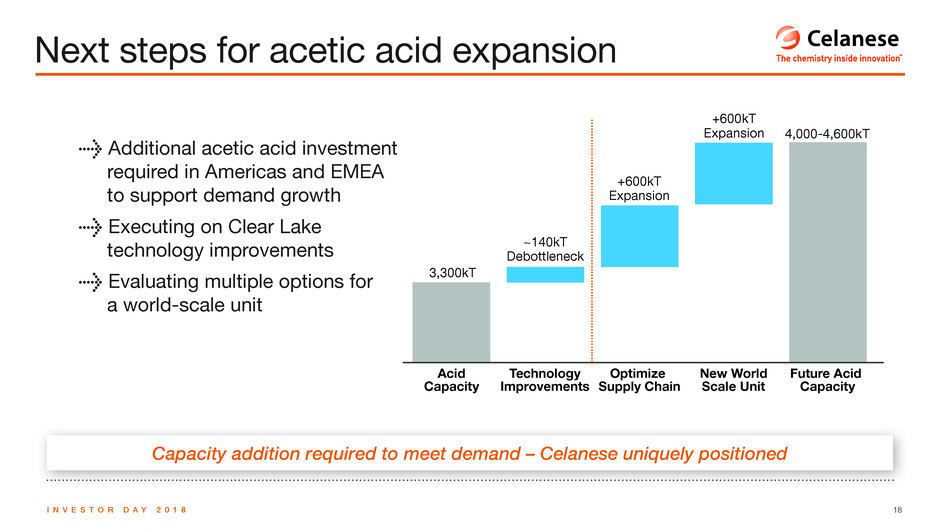

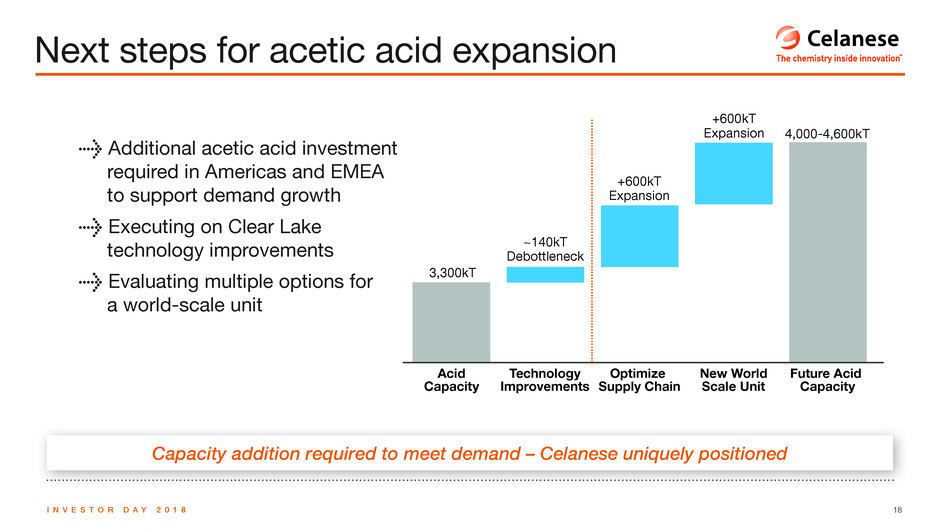

18I N V E S T O R D A Y 2 0 1 8 Capacity addition required to meet demand – Celanese uniquely positioned Next steps for acetic acid expansion > Additional acetic acid investment required in Americas and EMEA to support demand growth > Executing on Clear Lake technology improvements > Evaluating multiple options for a world-scale unit Acid Capacity Technology Improvements New World Scale Unit Optimize Supply Chain Future Acid Capacity 3,300kT ~140kT Debottleneck +600kT Expansion +600kT Expansion 4,000-4,600kT

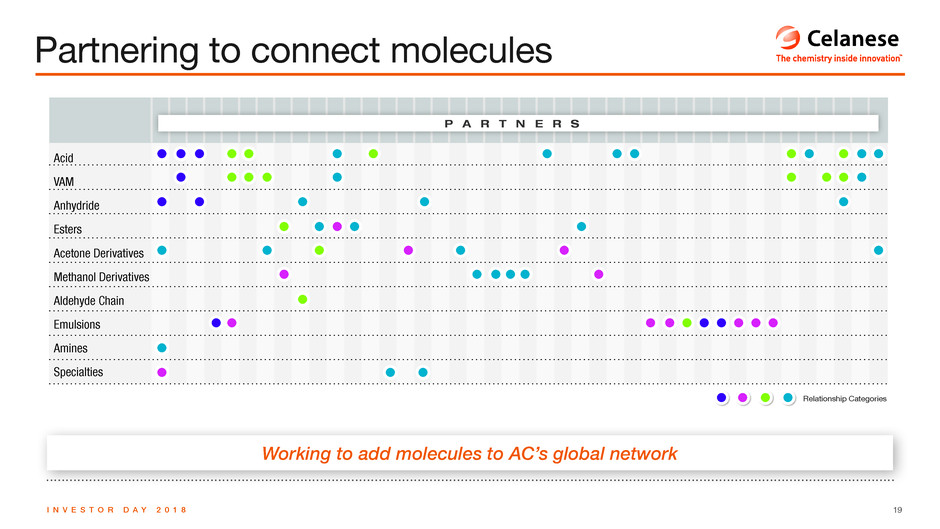

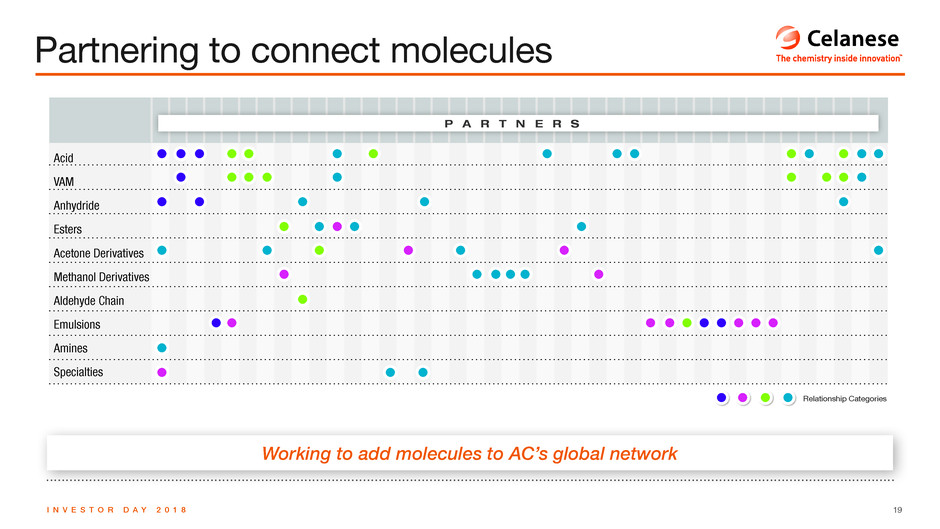

19I N V E S T O R D A Y 2 0 1 8 Partnering to connect molecules Acid VAM Anhydride Esters Acetone Derivatives Methanol Derivatives Aldehyde Chain Emulsions Amines Specialties P A R T N E R S Working to add molecules to AC’s global network Relationship Categories

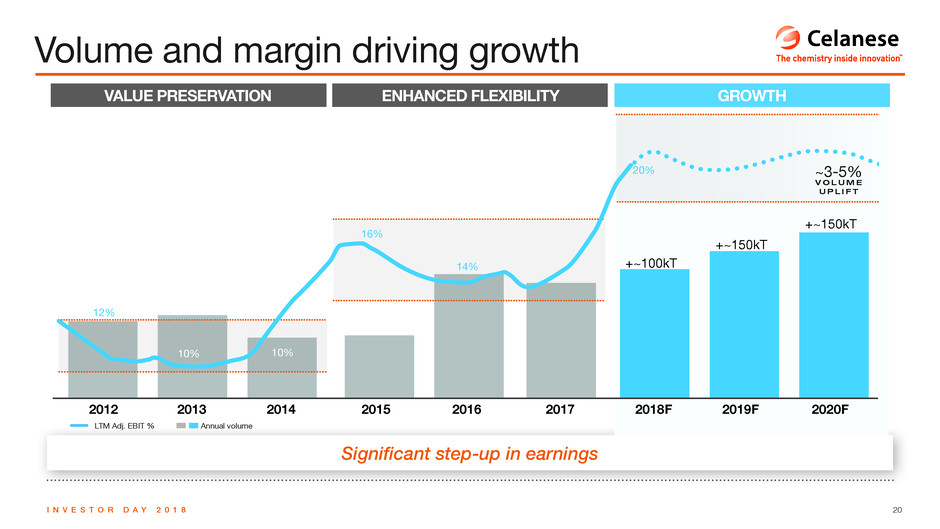

20I N V E S T O R D A Y 2 0 1 8 Significant step-up in earnings Volume and margin driving growth 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F +~100kT +~150kT +~150kT 20% 12% 14% 16% 10% 10% Annual volumeLTM Adj. EBIT % VALUE PRESERVATION ENHANCED FLEXIBILITY GROWTH ~3-5% V O L U M E U P L I F T

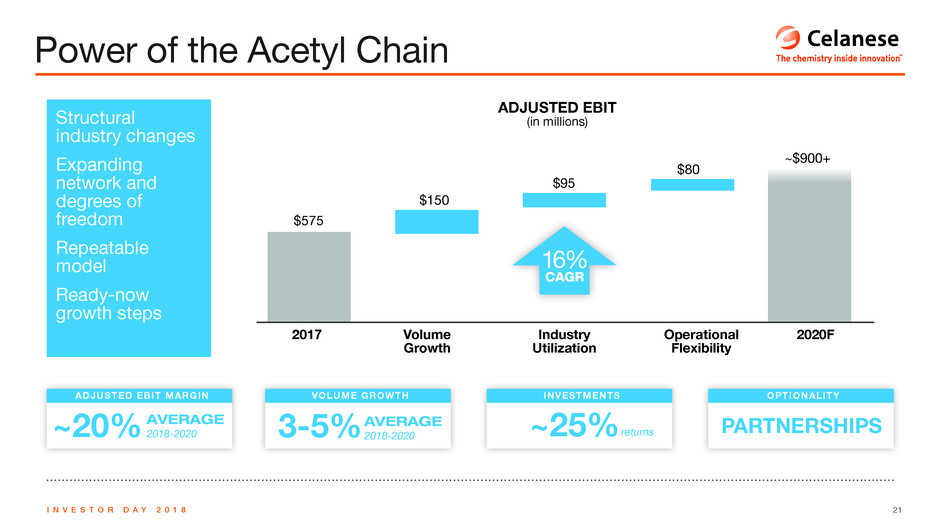

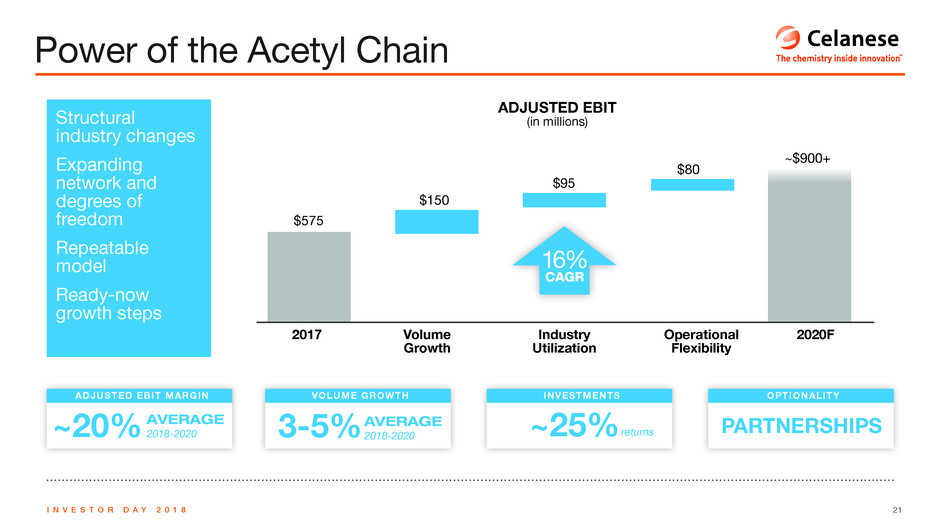

21I N V E S T O R D A Y 2 0 1 8 ADJUSTED EBIT (in millions) 2017 Volume Growth Industry Utilization Operational Flexibility 2020F $575 $80 $95 $150 ~$900+ 16% CAGR Structural industry changes Expanding network and degrees of freedom Repeatable model Ready-now growth steps PARTNERSHIPS OPTIONALITY INVESTMENTS 3-5% VOLUME GROWTH ~20% ADJUSTED EBIT MARGIN returns~25%2018-2020AVERAGE 2018-2020AVERAGE Power of the Acetyl Chain

22I N V E S T O R D A Y 2 0 1 8 Next Up: Celanese Innovation Showcase Tangible examples of the Celanese value creation model