Scott Sutton CHIEF OPERATING OFFICER I N V E S T O R D A Y M A Y 1 , 2 0 1 8

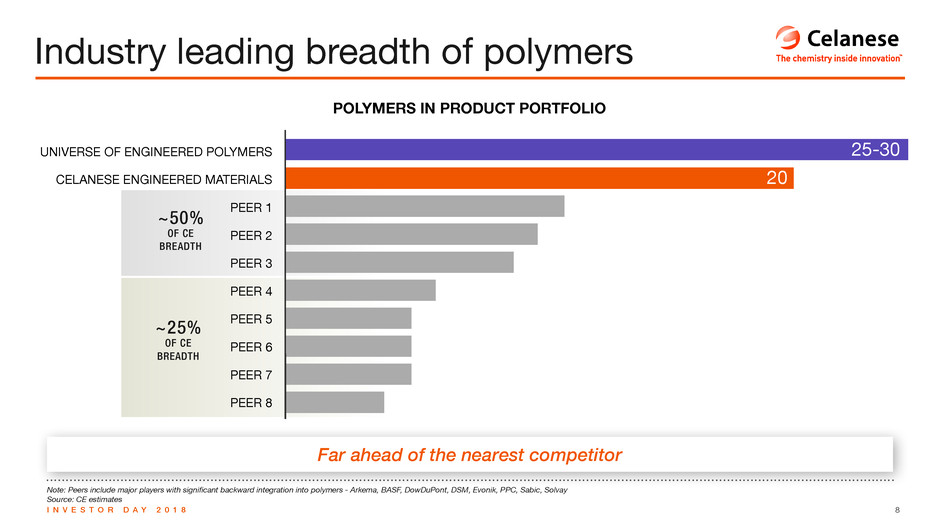

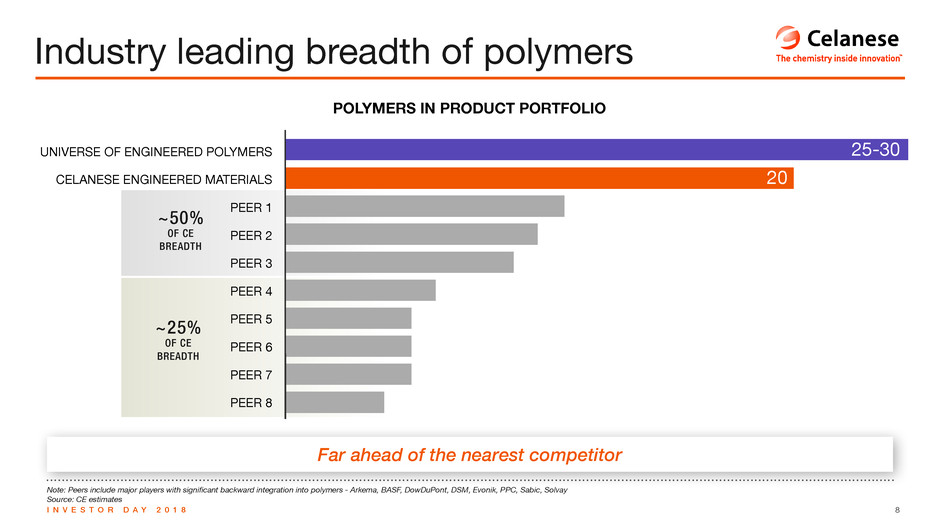

2I N V E S T O R D A Y 2 0 1 8 Engineered Materials storyline 2020 > The demand growth for solutions across all markets is robust > Celanese has unassailable positions in its solution set. The nearest competitor has half of our breadth > Model cannot be replicated by others. We are market and product agnostic and deliver solutions broadly > Clear growth initiatives, both organic and inorganic, provide future runway

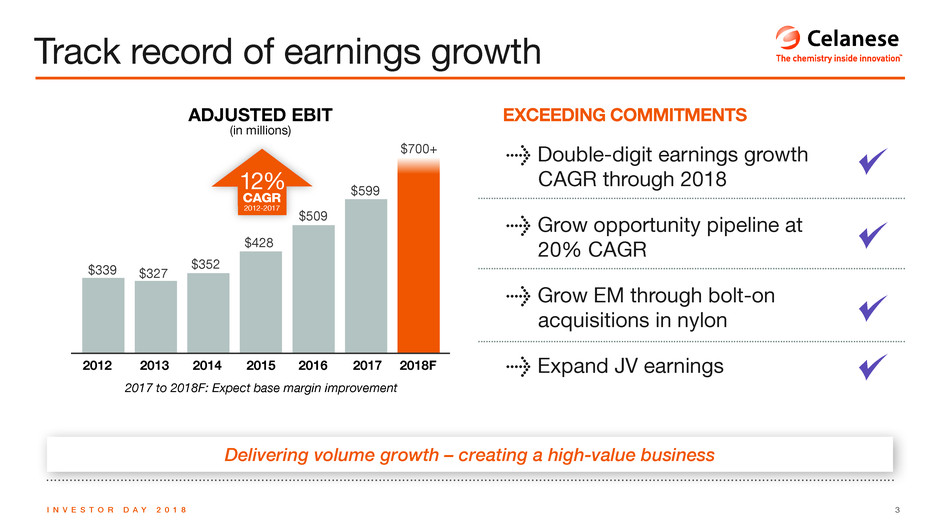

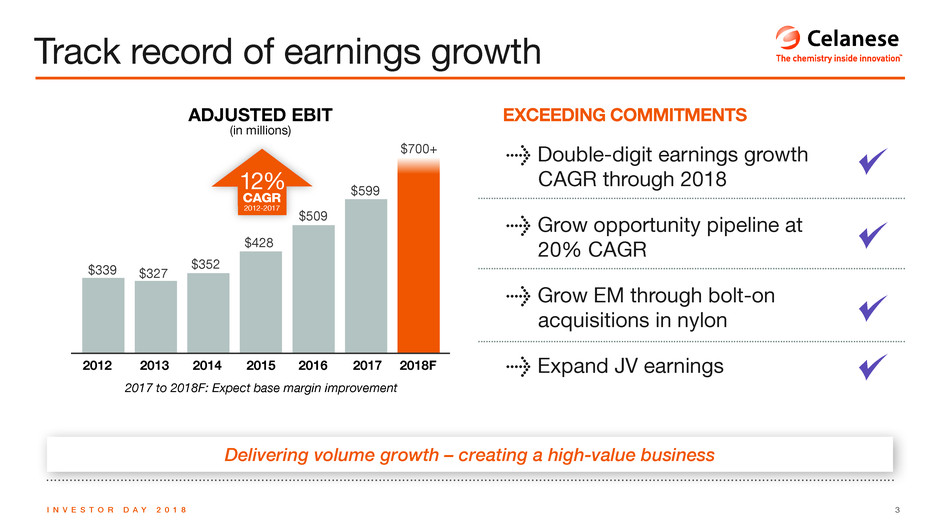

3I N V E S T O R D A Y 2 0 1 8 Track record of earnings growth Delivering volume growth – creating a high-value business > Double-digit earnings growth CAGR through 2018 > Grow opportunity pipeline at 20% CAGR > Grow EM through bolt-on acquisitions in nylon > Expand JV earnings ; ; ; ;201420132012 $339 $599 $700+ $428 $509 2015 2016 2017 2018F $327 $352 12% CAGR 2012-2017 2017 to 2018F: Expect base margin improvement ADJUSTED EBIT (in millions) EXCEEDING COMMITMENTS

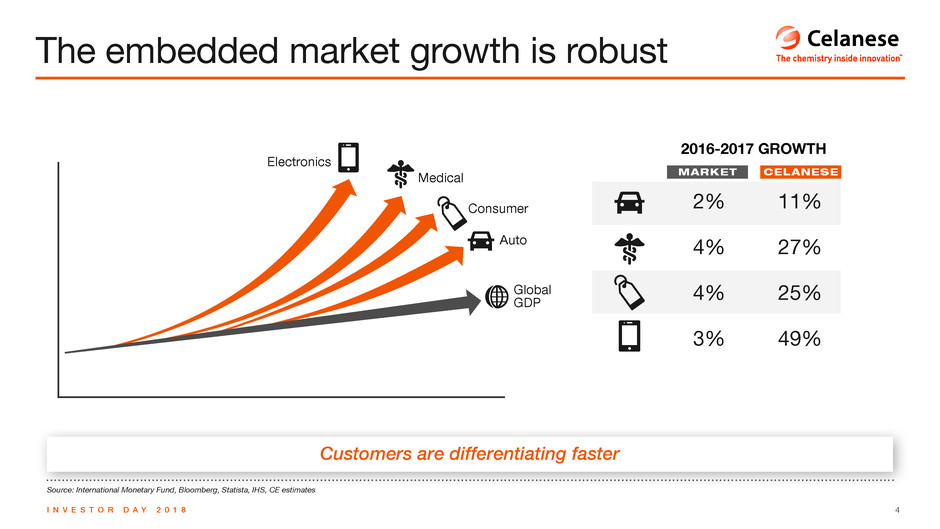

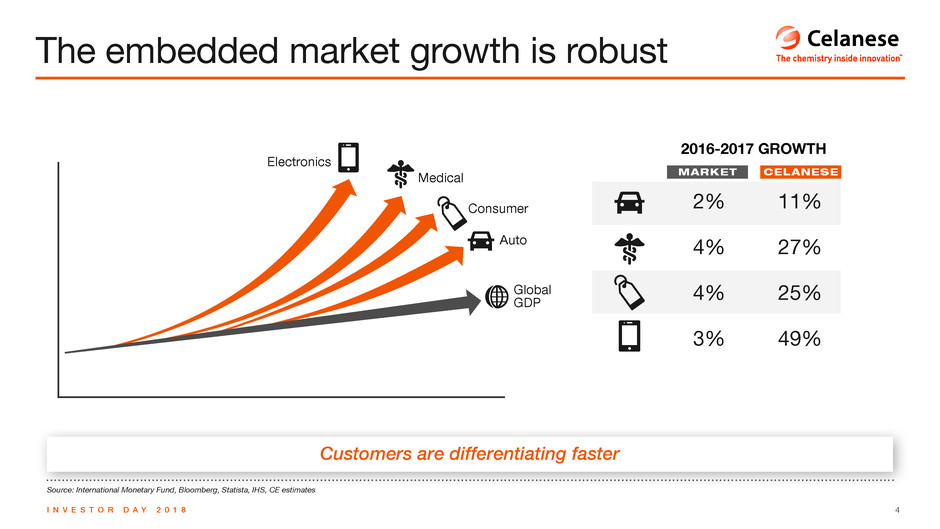

4I N V E S T O R D A Y 2 0 1 8 Source: International Monetary Fund, Bloomberg, Statista, IHS, CE estimates Customers are differentiating faster The embedded market growth is robust 2% 4% 4% 3% 11% 27% 25% 49% 2016-2017 GROWTH CELANESEMARKET Auto Global GDP Electronics Consumer Medical

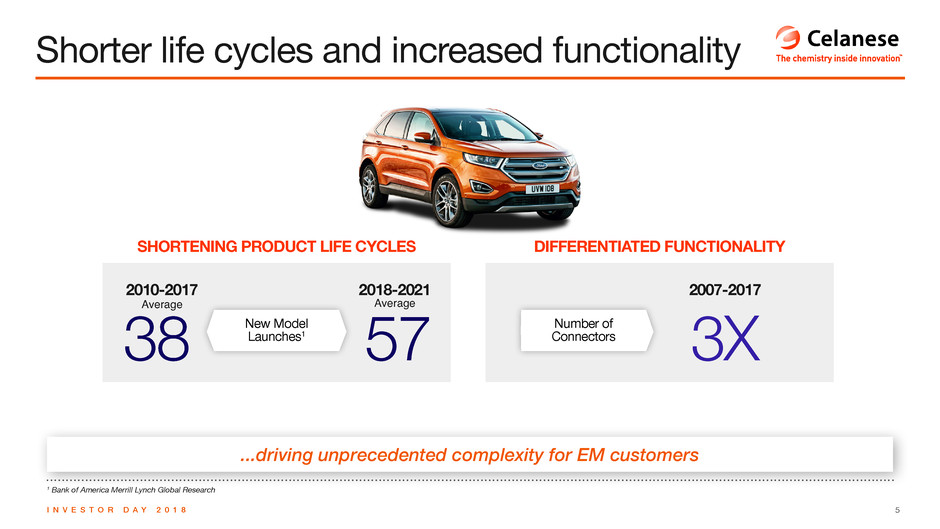

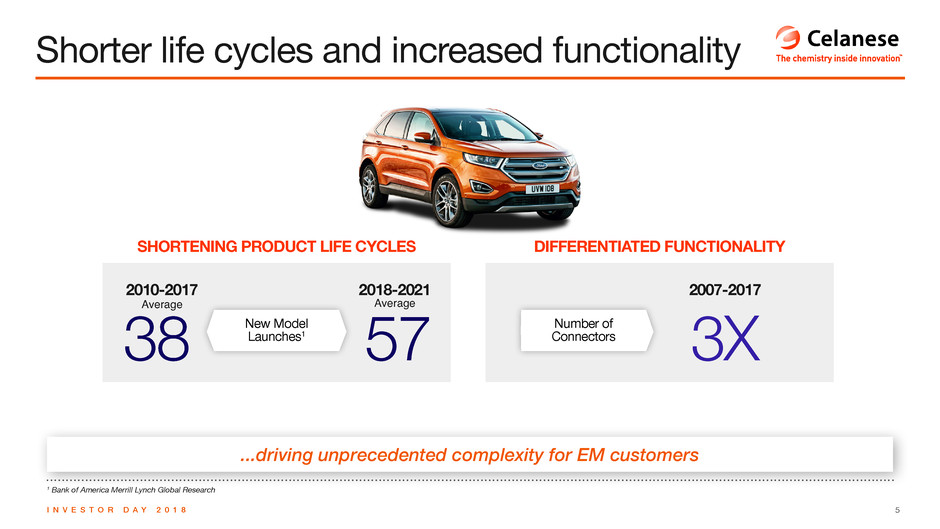

5I N V E S T O R D A Y 2 0 1 8 1 Bank of America Merrill Lynch Global Research ...driving unprecedented complexity for EM customers Shorter life cycles and increased functionality SHORTENING PRODUCT LIFE CYCLES DIFFERENTIATED FUNCTIONALITY 2010-2017 Average 2007-20172018-2021 Average Number of Connectors New Model Launches138 57 3X

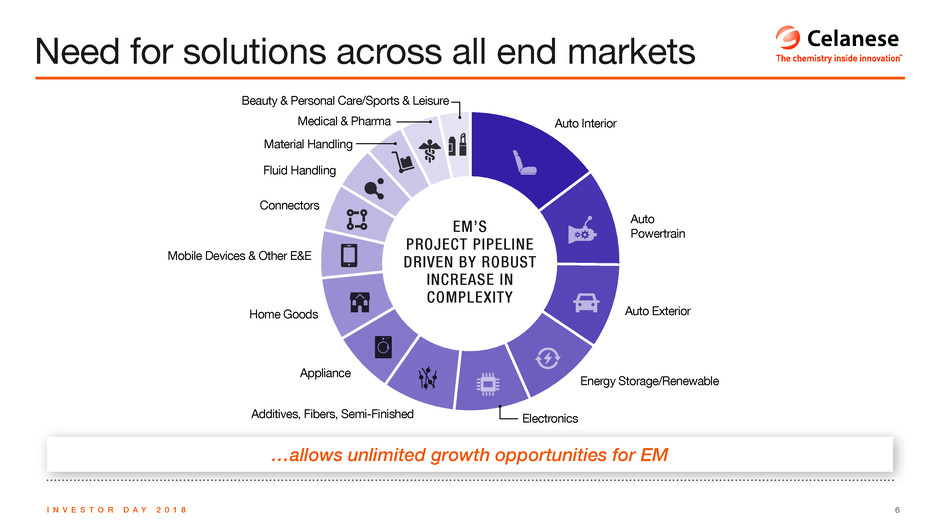

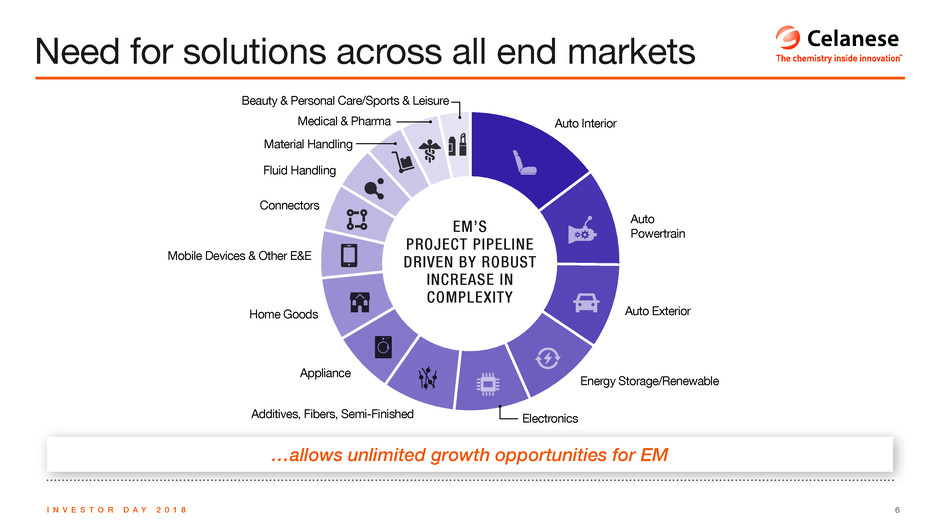

6I N V E S T O R D A Y 2 0 1 8 …allows unlimited growth opportunities for EM Auto Interior Auto Powertrain Auto Exterior Energy Storage/Renewable ElectronicsAdditives, Fibers, Semi-Finished Fluid Handling Appliance Material Handling Home Goods Medical & Pharma Mobile Devices & Other E&E Connectors Beauty & Personal Care/Sports & Leisure EM’S PROJECT PIPELINE DRIVEN BY ROBUST INCREASE IN COMPLEXITY Need for solutions across all end markets

7I N V E S T O R D A Y 2 0 1 8 ...allows EM to uniquely multiply more customer challenges to projects CUSTOMER ENABLING COMPETENCIES EXTENSIVE FUNCTIONALITY OF POLYMERS BREADTH OF POLYMERS The broadest set of solutions…

8I N V E S T O R D A Y 2 0 1 8 Note: Peers include major players with significant backward integration into polymers - Arkema, BASF, DowDuPont, DSM, Evonik, PPC, Sabic, Solvay Source: CE estimates Far ahead of the nearest competitor Industry leading breadth of polymers POLYMERS IN PRODUCT PORTFOLIO UNIVERSE OF ENGINEERED POLYMERS CELANESE ENGINEERED MATERIALS PEER 1 PEER 2 PEER 3 PEER 4 PEER 5 PEER 6 PEER 7 PEER 8 20 25-30 ~50% OF CE BREADTH ~25% OF CE BREADTH

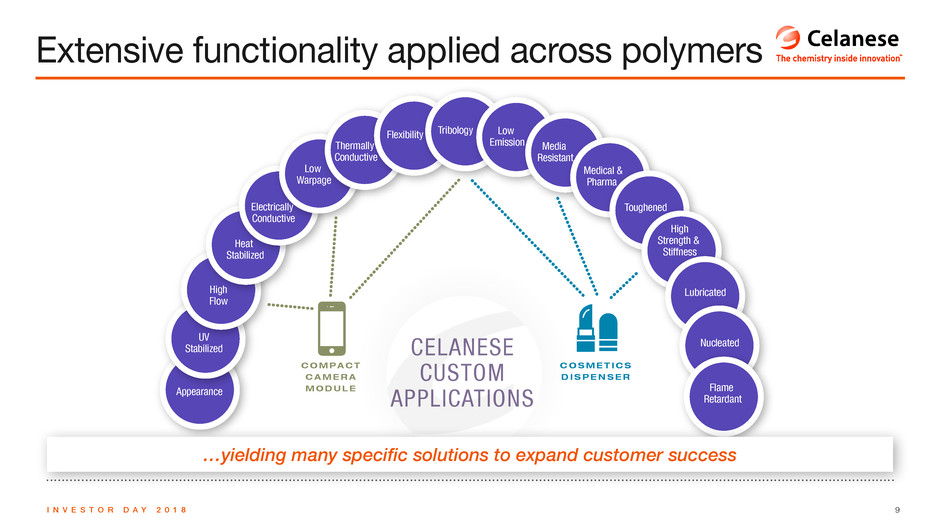

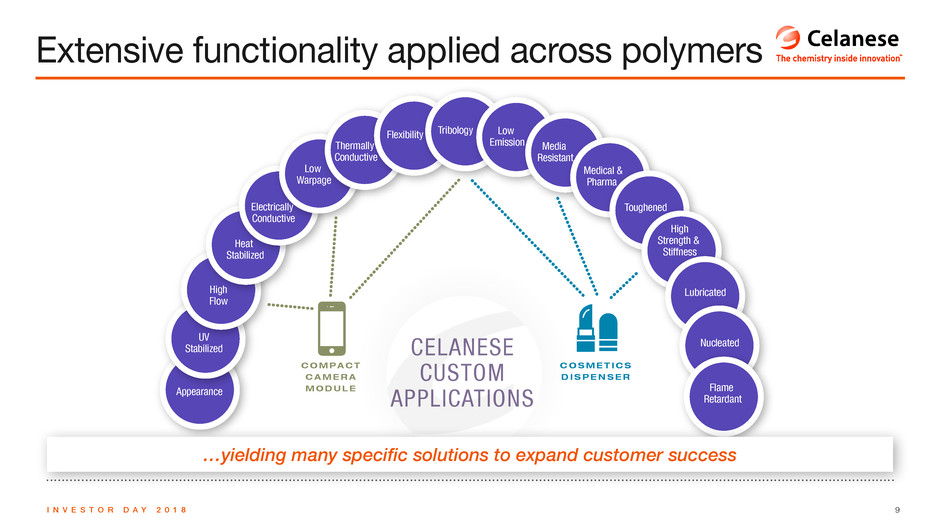

9I N V E S T O R D A Y 2 0 1 8 Extensive functionality applied across polymers High Strength & Stiffness Media Resistant Tribology COMPACT CAMERA MODULE COSMET ICS D ISPENSER Compliant Anti- microbial Appearance UV Stabilized Electrically Conductive Heat Stabilized Low Emission High Flow Low Warpage Flexibility Flame Retardant Thermally Conductive Toughened Lubricated Nucleated Medical & Pharma CELANESE CUSTOM APPLICATI ONS …yielding many specific solutions to expand customer success

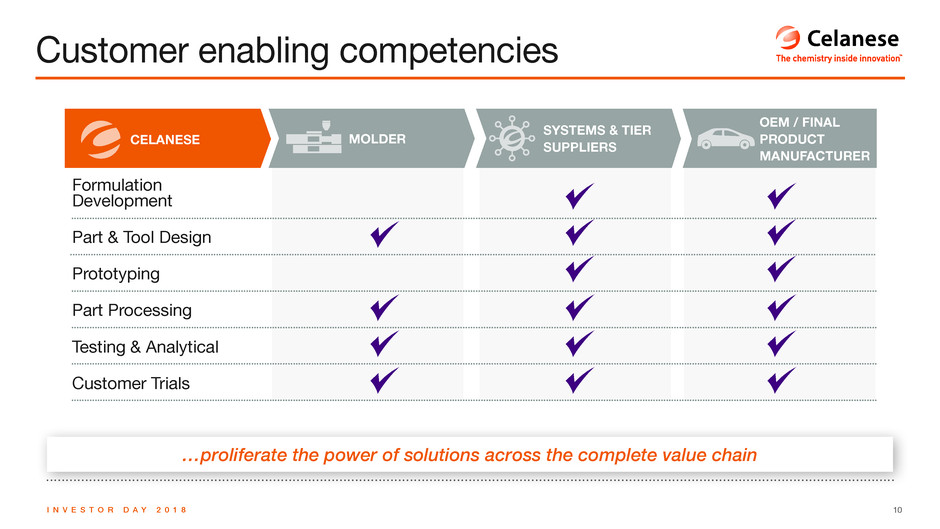

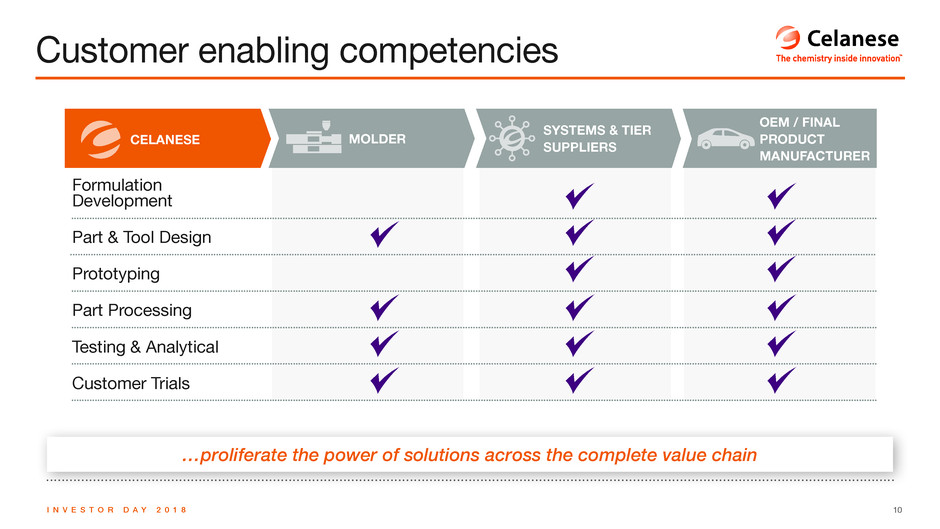

10I N V E S T O R D A Y 2 0 1 8 …proliferate the power of solutions across the complete value chain Customer enabling competencies CELANESE MOLDER OEM / FINAL PRODUCT MANUFACTURER SYSTEMS & TIER SUPPLIERS Formulation Development Part & Tool Design Prototyping Part Processing Testing & Analytical Customer Trials ; ; ; ; ; ; ; ; ; ; ; ; ; ; ; ;

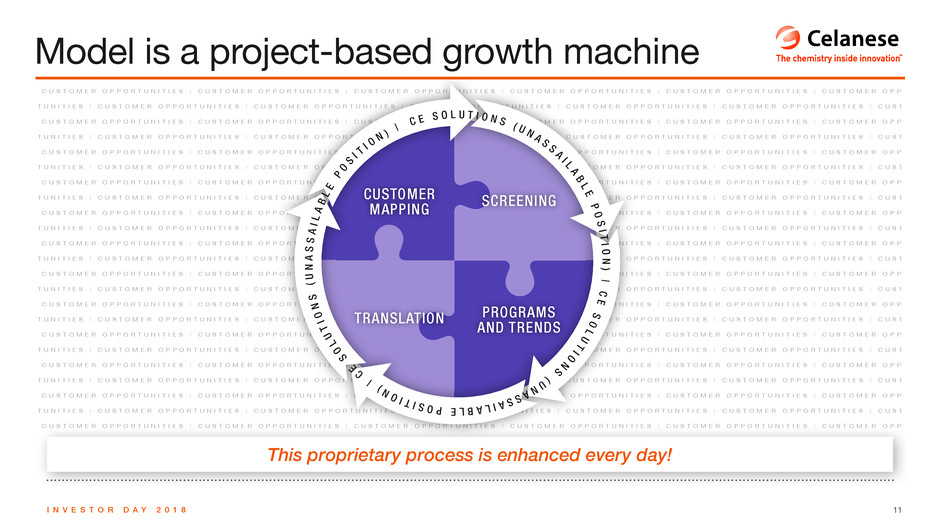

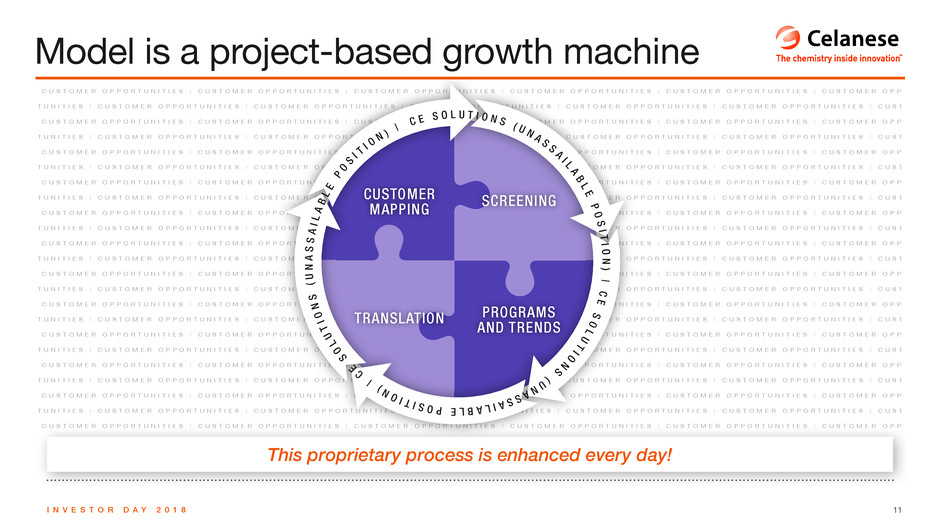

11I N V E S T O R D A Y 2 0 1 8 This proprietary process is enhanced every day! Model is a project-based growth machine C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | C U S T O M E R O P P O R T U N I T I E S | CUSTOMER MAPPING TRAN LATION SCREENING PROGRAMS AND TRENDS C E S O L U T I O N S ( U N A S S A I L A B L E P O S I T I O N ) | C E S O L U TIO NS (UNASSAILABLE POSI TIO N) | CE S O LU T IO N S ( U N A S S A I L A B L E P O S I T I O N ) |

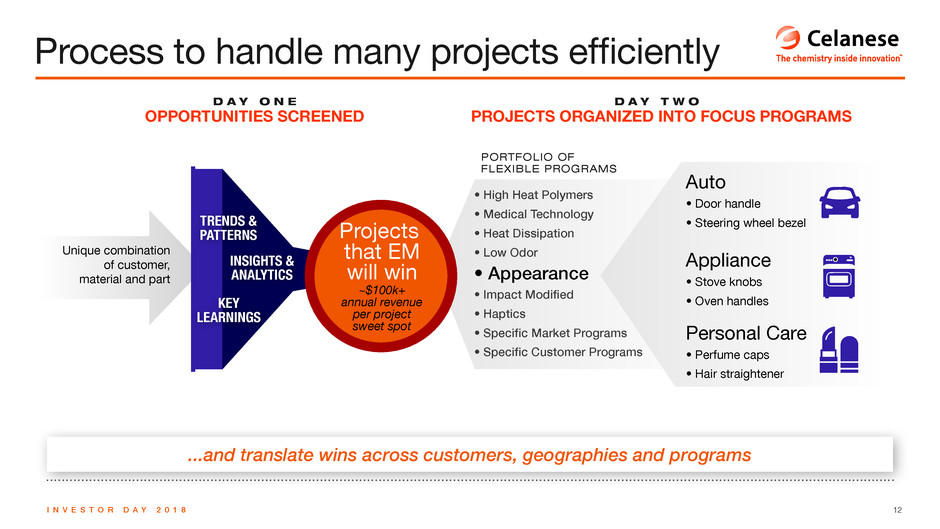

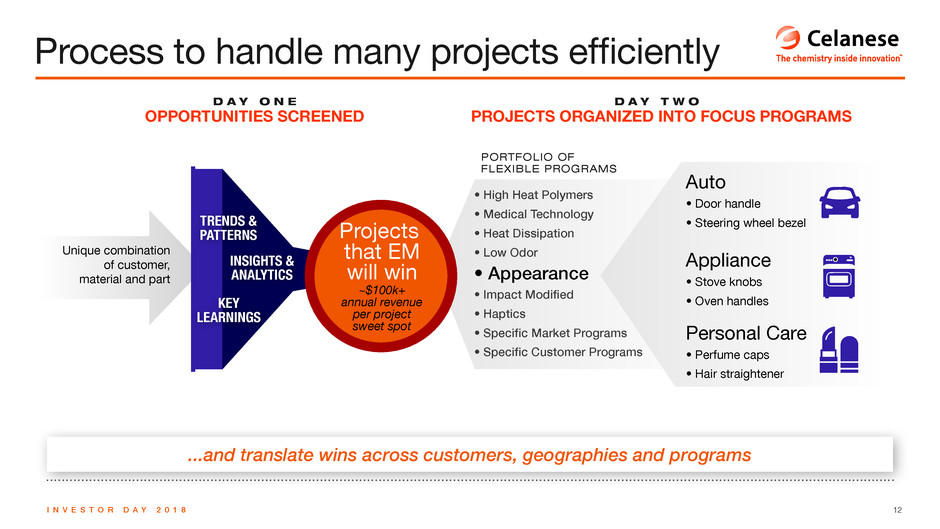

12I N V E S T O R D A Y 2 0 1 8 ...and translate wins across customers, geographies and programs Process to handle many projects efficiently OPPORTUNITIES SCREENED PROJECTS ORGANIZED INTO FOCUS PROGRAMS TRENDS & PATTERNS INSIGHTS & ANALYTICS KEY LEARNINGS Unique combination of customer, material and part • High Heat Polymers • Medical Technology • Heat Dissipation • Low Odor • Appearance • Impact Modified • Haptics • Specific Market Programs • Specific Customer Programs Auto • Door handle • Steering wheel bezel Appliance • Stove knobs • Oven handles Personal Care • Perfume caps • Hair straightener Projects that EM will win ~$100k+ annual revenue per project sweet spot PORTFOLIO OF FLEXIBLE PROGRAMS D A Y O N E D A Y T W O

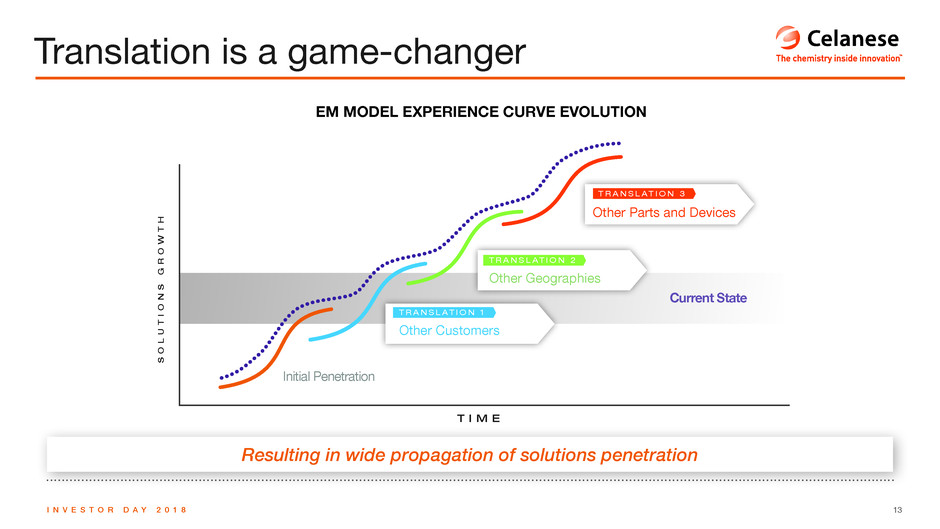

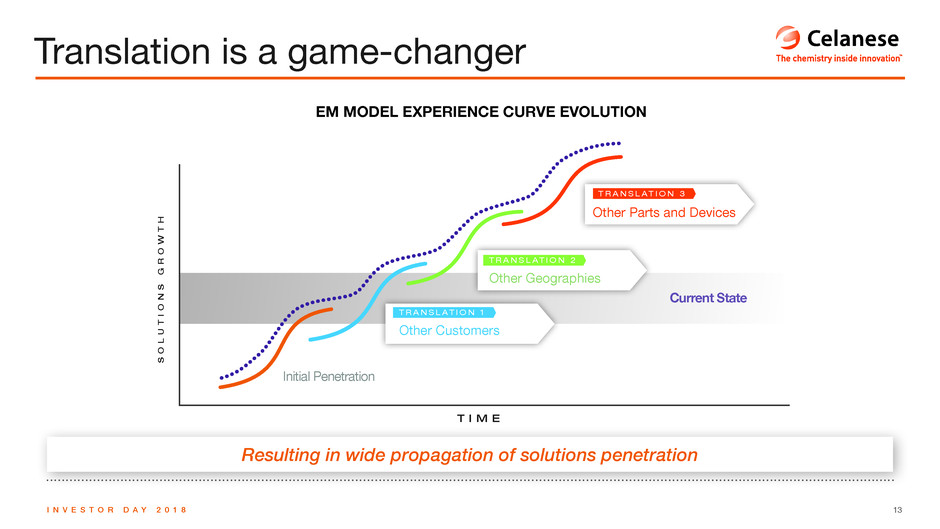

13I N V E S T O R D A Y 2 0 1 8 Resulting in wide propagation of solutions penetration Translation is a game-changer S O L U T I O N S G R O W T H T I M E EM MODEL EXPERIENCE CURVE EVOLUTION Current State Initial Penetration Other Parts and Devices T R A N S L AT I O N 3 Other Geographies T R A N S L AT I O N 2 Other Customers T R A N S L AT I O N 1

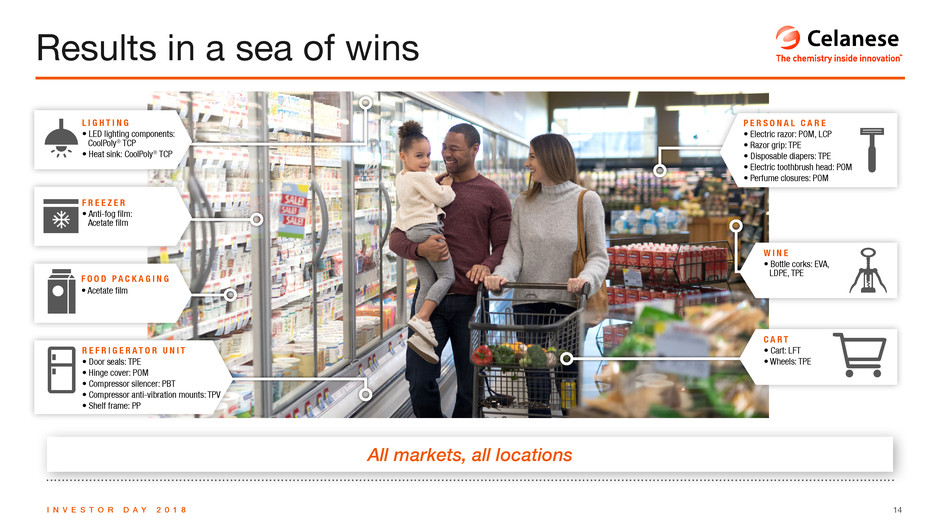

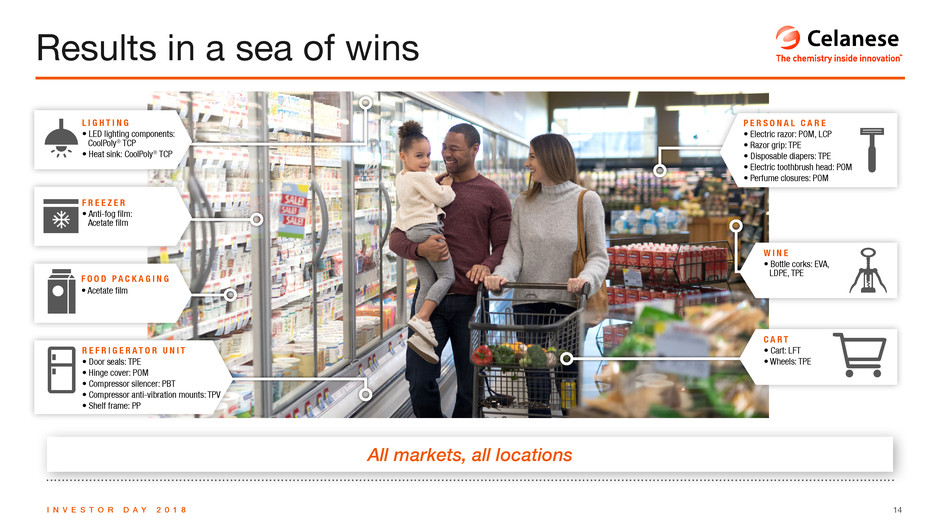

14I N V E S T O R D A Y 2 0 1 8 All markets, all locations Results in a sea of wins R E F R I G E R A T O R U N I T • Door seals: TPE • Hinge cover: POM • Compressor silencer: PBT • Compressor anti-vibration mounts: TPV • Shelf frame: PP F R E E Z E R • Anti-fog film: Acetate film L I G H T I N G • LED lighting components: CoolPoly® TCP • Heat sink: CoolPoly® TCP C A R T • Cart: LFT • Wheels: TPE W I N E • Bottle corks: EVA, LDPE, TPE P E R S O N A L C A R E • Electric razor: POM, LCP • Razor grip: TPE • Disposable diapers: TPE • Electric toothbrush head: POM • Perfume closures: POM • Acetate film F O O D P A C K A G I N G

15I N V E S T O R D A Y 2 0 1 8 ...continue to improve our efficiency Scale the model SCALIN G THE PIPELIN E MODE L EX P ANDEDIN G OUR PROJEC T CA P ACIT Y GROWIN G ORGANI C VOLUM E 2015 2016 2017 2018F 2020F ??? ??????1??1?? WIN RATE 35% WIN RATE 45% WIN RATE >50% Projects managed Projects won +0% +11% +13% +6-9% +6-9% EM 1.0 EM 2.0700TEAM MEMBERS 800 TEAM MEMBERS Implement New Model Leverage Model Debottleneck Model Supercharge Processes Run Model Hard

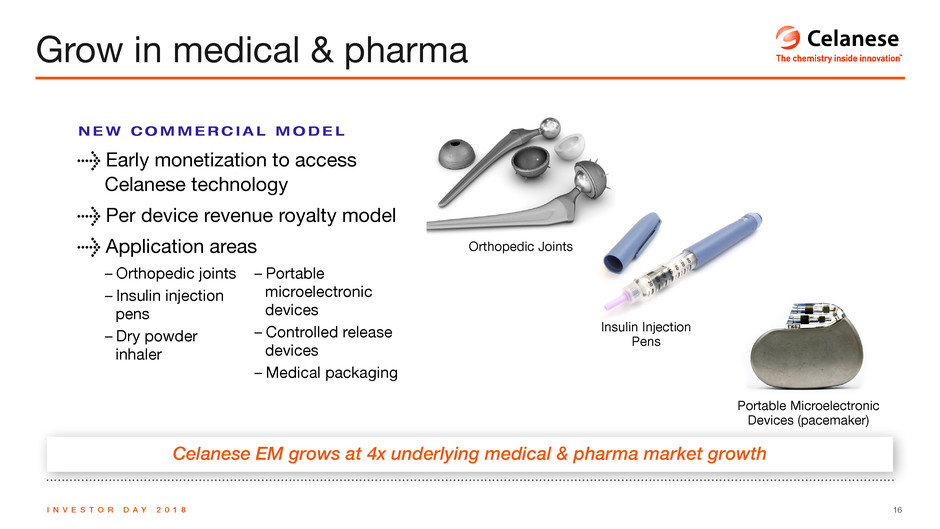

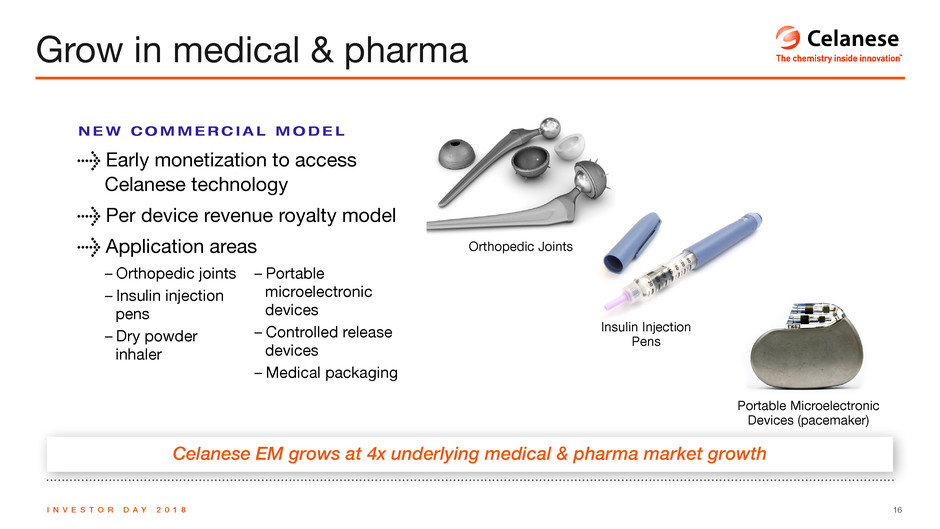

16I N V E S T O R D A Y 2 0 1 8 Insulin Injection Pens Grow in medical & pharma Celanese EM grows at 4x underlying medical & pharma market growth N E W C O M M E R C I A L M O D E L > Early monetization to access Celanese technology > Per device revenue royalty model > Application areas Orthopedic Joints Portable Microelectronic Devices (pacemaker) – Orthopedic joints – Insulin injection pens – Dry powder inhaler – Portable microelectronic devices – Controlled release devices – Medical packaging

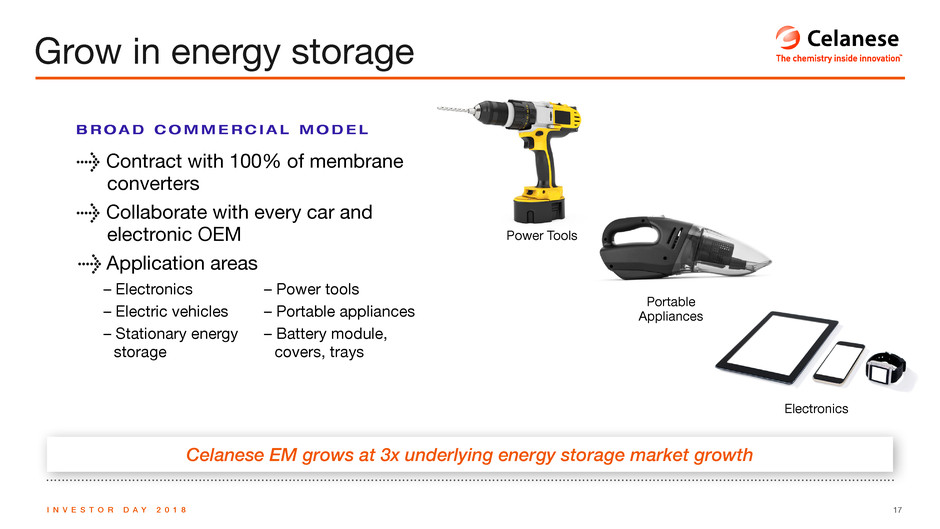

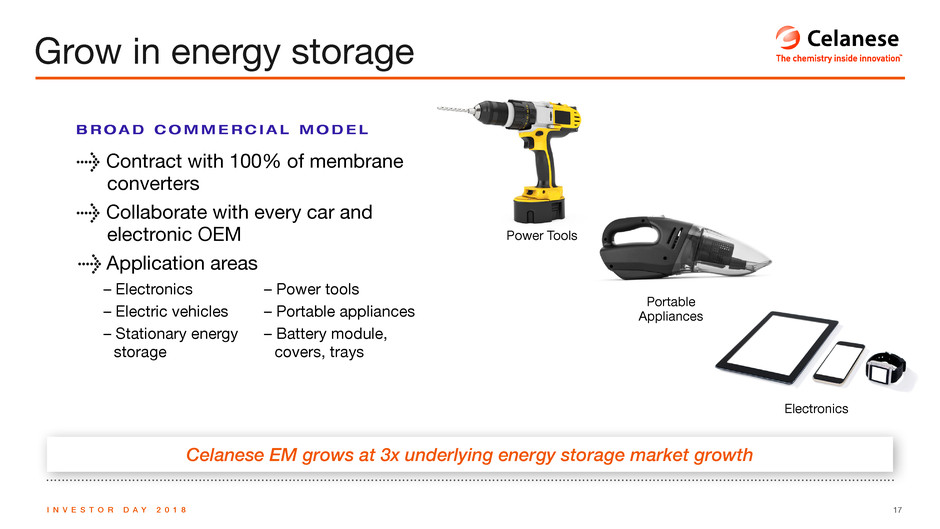

17I N V E S T O R D A Y 2 0 1 8 Portable Appliances B R O A D C O M M E R C I A L M O D E L > Contract with 100% of membrane converters > Collaborate with every car and electronic OEM > Application areas Celanese EM grows at 3x underlying energy storage market growth Electronics Power Tools – Electronics – Electric vehicles – Stationary energy storage – Power tools – Portable appliances – Battery module, covers, trays Grow in energy storage

18I N V E S T O R D A Y 2 0 1 8 Best-in-industry product development provides a foundation for growth Expand through novel technology Oven-to-Freezer Plastic Cookware Low Friction Plastics for High Wear Environments > Lightweight food tray/pan for cooking, freezing, serving and reusing > Applications in food service > Lubricant free conveyor chain belts > Applications in industrial lines, mining, etc. C U S T O M E R C H A L L E N G E S O LV E D C U S T O M E R C H A L L E N G E S O LV E D

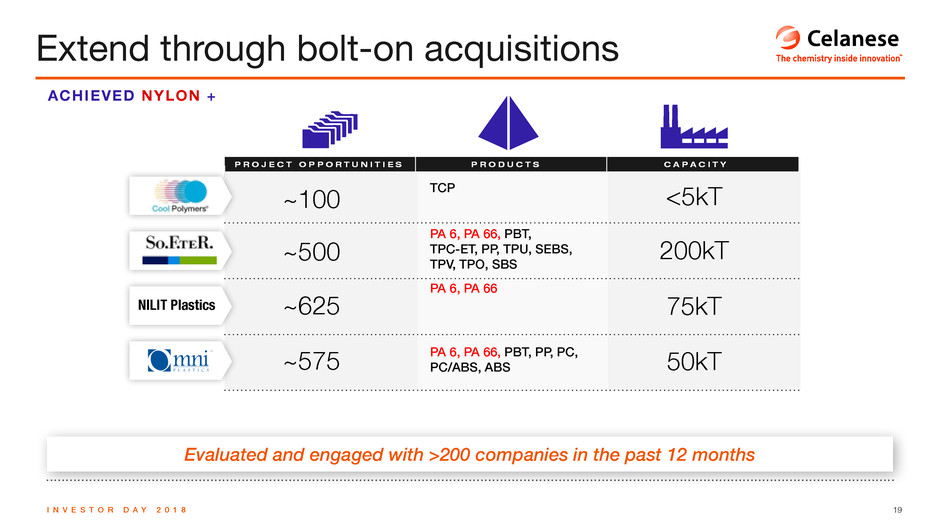

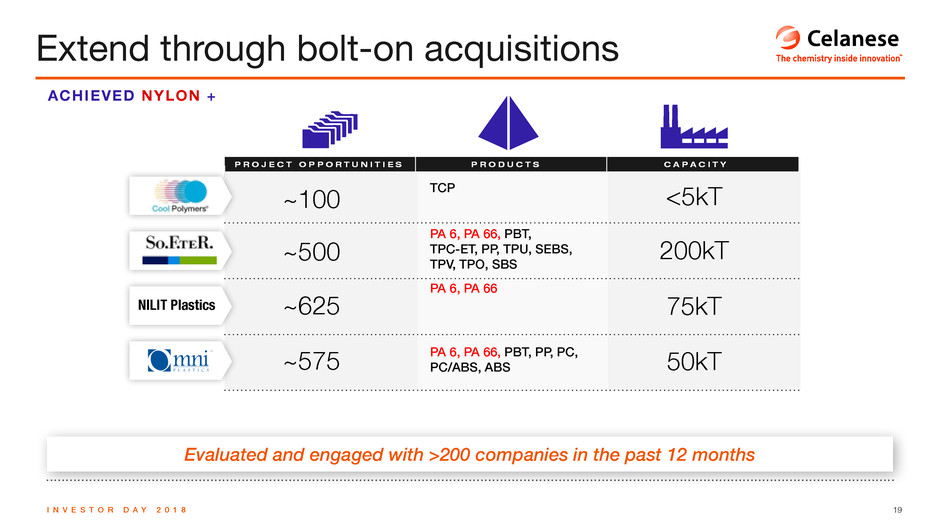

19I N V E S T O R D A Y 2 0 1 8 Extend through bolt-on acquisitions P R O J E C T O P P O R T U N I T I E S P R O D U C T S C A P A C I T Y TCP PA 6, PA 66, PBT, TPC-ET, PP, TPU, SEBS, TPV, TPO, SBS PA 6, PA 66, PBT, PP, PC, PC/ABS, ABS PA 6, PA 66 ~100 200kT <5kT 75kT 50kT ~500 ~625 ~575 ACHIEVED NYLON + Evaluated and engaged with >200 companies in the past 12 months NILIT Plastics

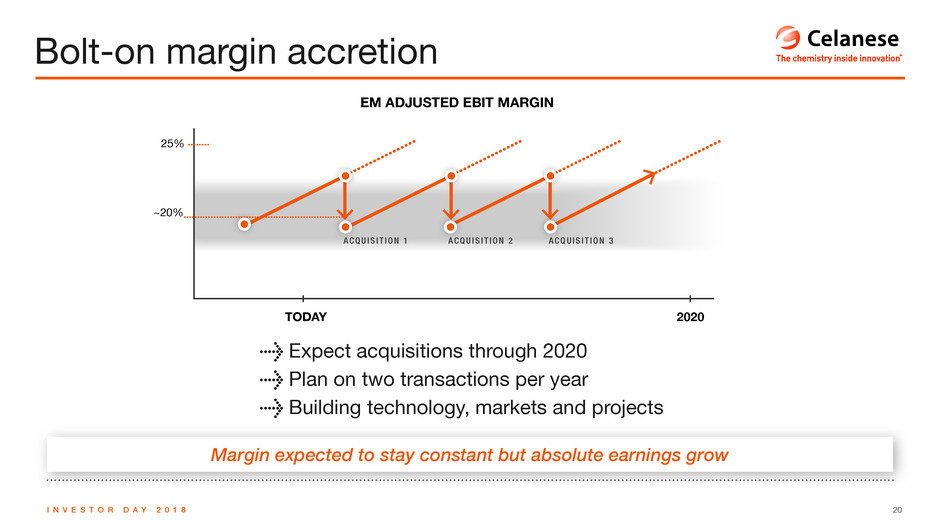

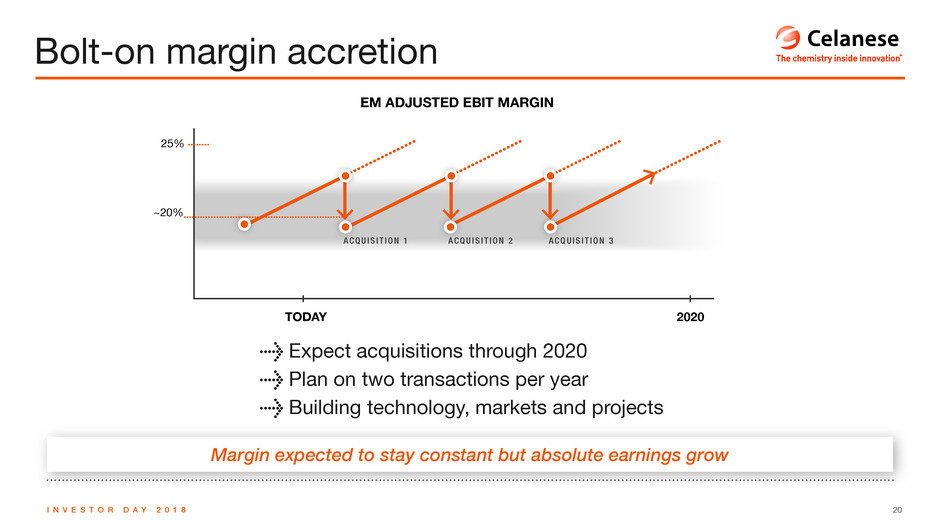

20I N V E S T O R D A Y 2 0 1 8 Margin expected to stay constant but absolute earnings grow Bolt-on margin accretion % M A R G I N Bolt-on 25% 1 Bolt-on 2 Bolt-on 3 Stand-alone base business margin trajectory TODAY 2020 A C Q U I S I T I O N 1 A C Q U I S I T I O N 2 A C Q U I S I T I O N 3 ~20% EM ADJUSTED EBIT MARGIN > Expect acquisitions through 2020 > Plan on two transactions per year > Building technology, markets and projects

21I N V E S T O R D A Y 2 0 1 8 ...focus areas designed to extend polymer, application and market positions in EM Acquisition opportunities ahead MORE SOLUTIONS IN GROWTH APPLICATIONS NEW AND HIGH GROWTH GEOGRAPHIES POLYMER PORTFOLIO EXPANSION ADDITIVE MANUFACTURING Growth in key applications (medical, energy storage) Focus on high growth regions Expand into differentiated polymers Gain customer enabling competencies – e.g. additive manufacturing

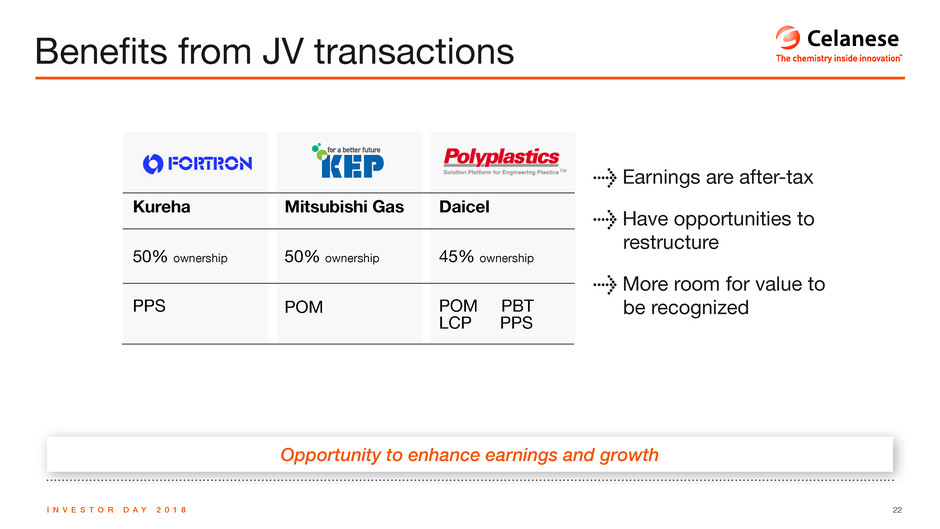

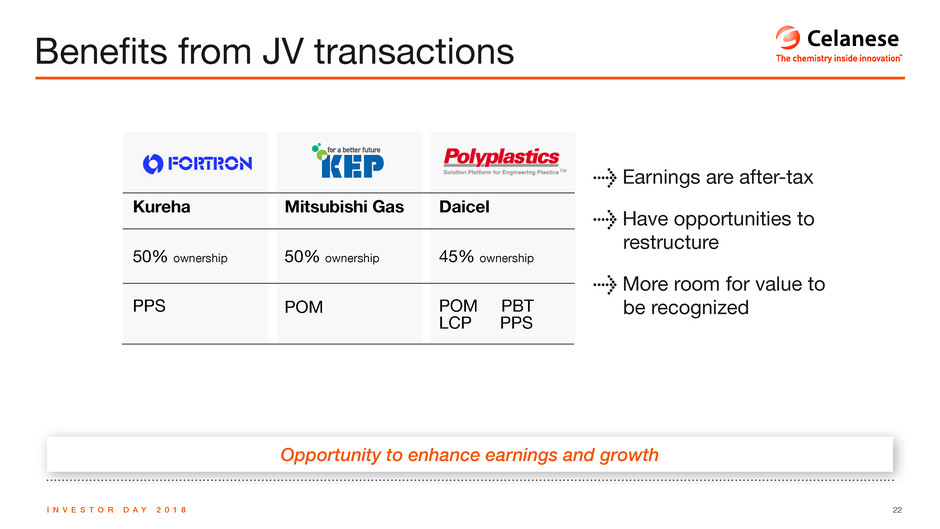

22I N V E S T O R D A Y 2 0 1 8 Opportunity to enhance earnings and growth Benefits from JV transactions Kureha 50% ownership PPS Mitsubishi Gas 50% ownership POM Daicel 45% ownership POM PBT LCP PPS > Earnings are after-tax > Have opportunities to restructure > More room for value to be recognized

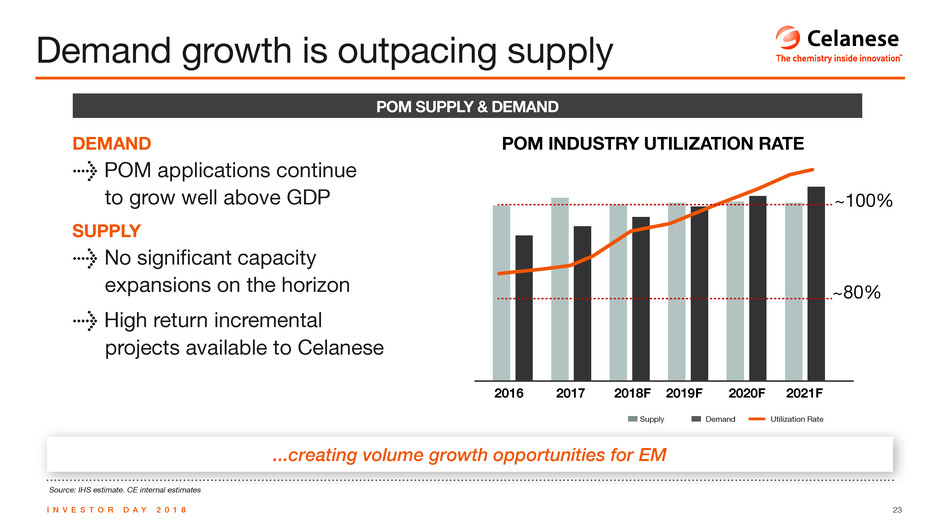

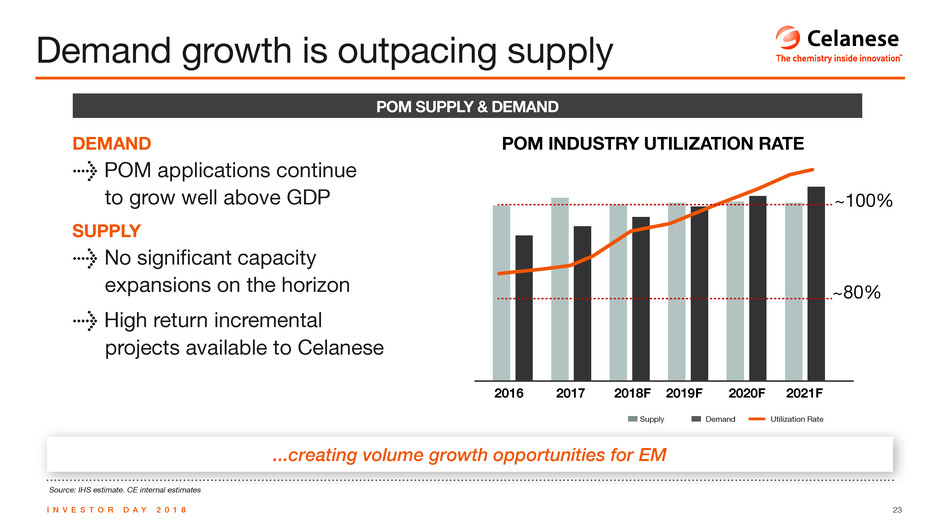

23I N V E S T O R D A Y 2 0 1 8 Source: IHS estimate. CE internal estimates ...creating volume growth opportunities for EM Demand growth is outpacing supply POM SUPPLY & DEMAND DEMAND > POM applications continue to grow well above GDP SUPPLY > No significant capacity expansions on the horizon > High return incremental projects available to Celanese ~100% 2016 2017 2018F 2019F 2020F 2021F ~80% Supply Demand Utilization Rate POM INDUSTRY UTILIZATION RATE

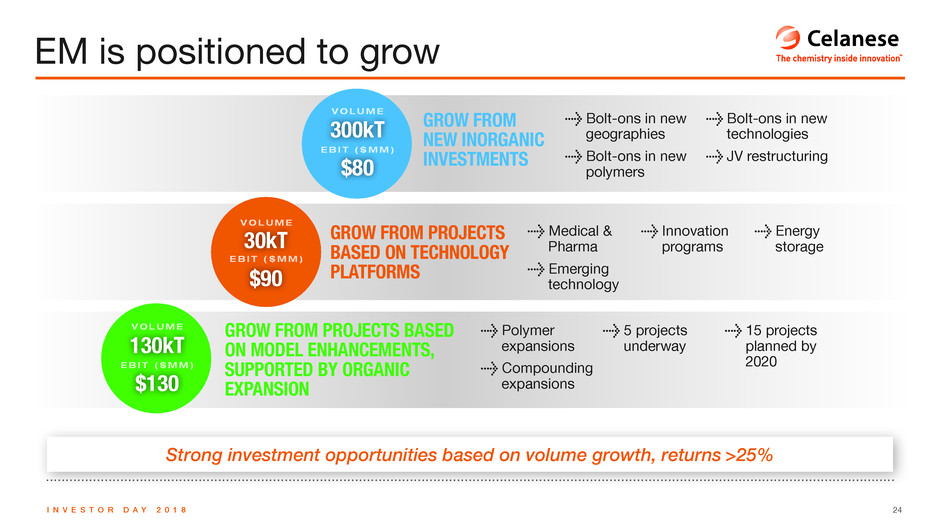

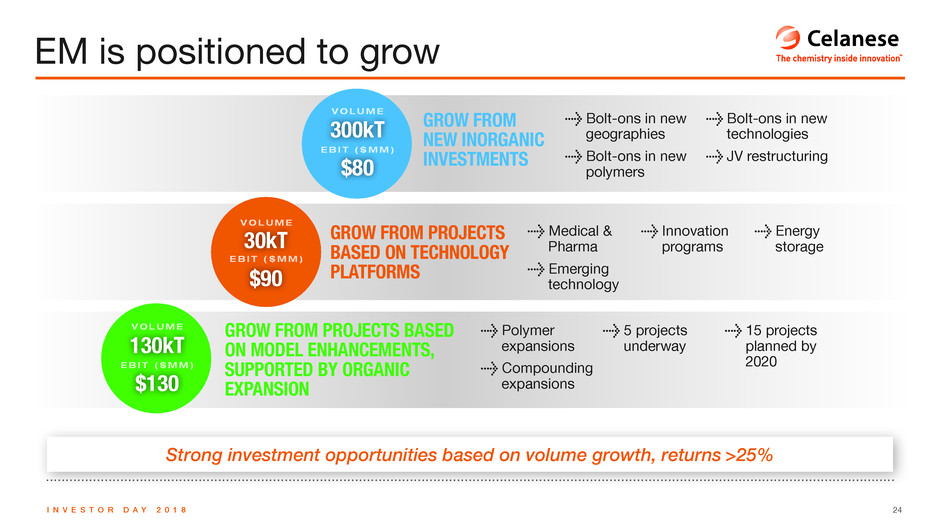

24I N V E S T O R D A Y 2 0 1 8 Strong investment opportunities based on volume growth, returns >25% EM is positioned to grow > Bolt-ons in new geographies > Bolt-ons in new polymers > Bolt-ons in new technologies > JV restructuring > Medical & Pharma > Emerging technology > Innovation programs > Energy storage > Polymer expansions > Compounding expansions > 5 projects underway > 15 projects planned by 2020 130kT $130 30kT $90 300kT $80 GROW FROM NEW INORGANIC INVESTMENTS GROW FROM PROJECTS BASED ON MODEL ENHANCEMENTS, SUPPORTED BY ORGANIC EXPANSION GROW FROM PROJECTS BASED ON TECHNOLOGY PLATFORMS VOLUME VOLUME VOLUME E ? ? ? MM ? E ? ? ? MM ? E ? ? ? MM ?

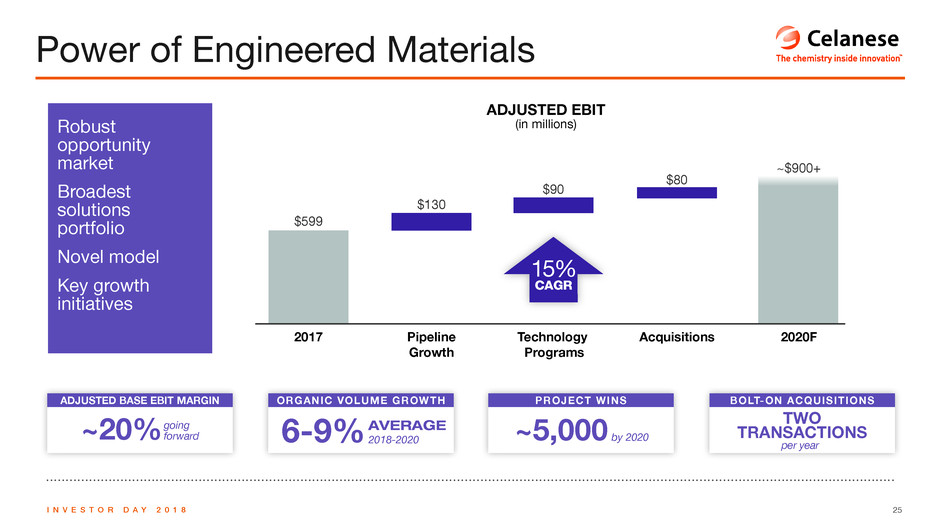

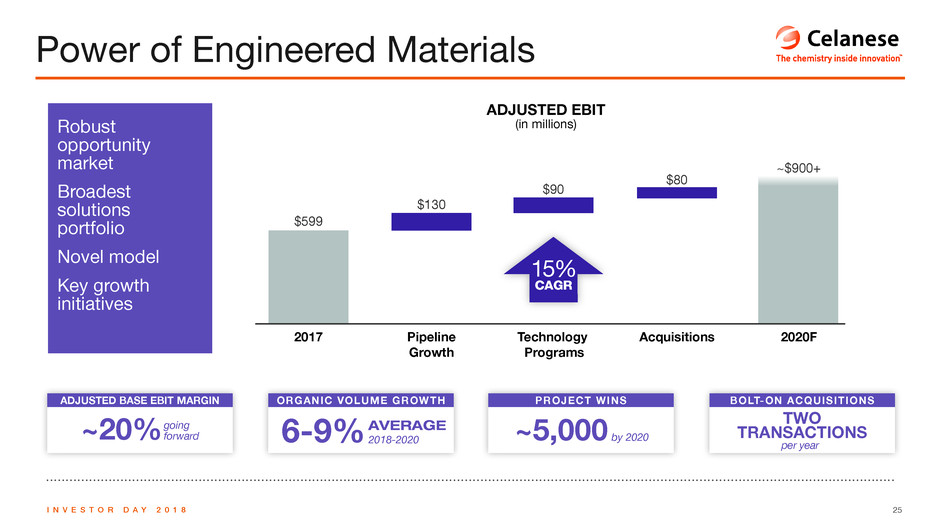

25I N V E S T O R D A Y 2 0 1 8 Power of Engineered Materials ADJUSTED EBIT (in millions)Robust opportunity market Broadest solutions portfolio Novel model Key growth initiatives 2017 Pipeline Growth Technology Programs Acquisitions 2020F $599 $130 $90 $80 ~$900+ 15% CAGR TWO TRANSACTIONS ADJUSTED BASE EBIT MARGIN PROJECT WINS BOLT-ON ACQUISITIONSORGANIC VOLUME GROWTH ~20%going forward ~5,000 by 2020 per year 6-9% 2018-2020AVERAGE