Scott Richardson CHIEF FINANCIAL OFFICER I N V E S T O R D A Y M A Y 1 , 2 0 1 8

2I n v e s t o r D a y 2 0 1 8 …with a focus on shareholder returns Power of Financial Leadership > Meet commitments to investors > Return-driven capital allocation focused on the highest return opportunities > Constantly improving capital structure and balance sheet > Robust cash flow to support organic growth and bolt-on M&A Growing Free Cash Flow Sustainable Productivity Capital Allocation Capacity for M&A

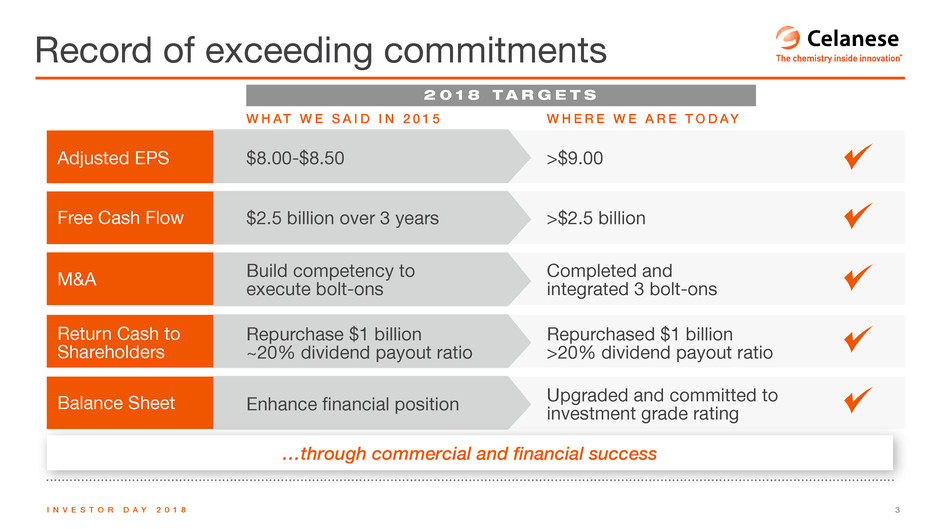

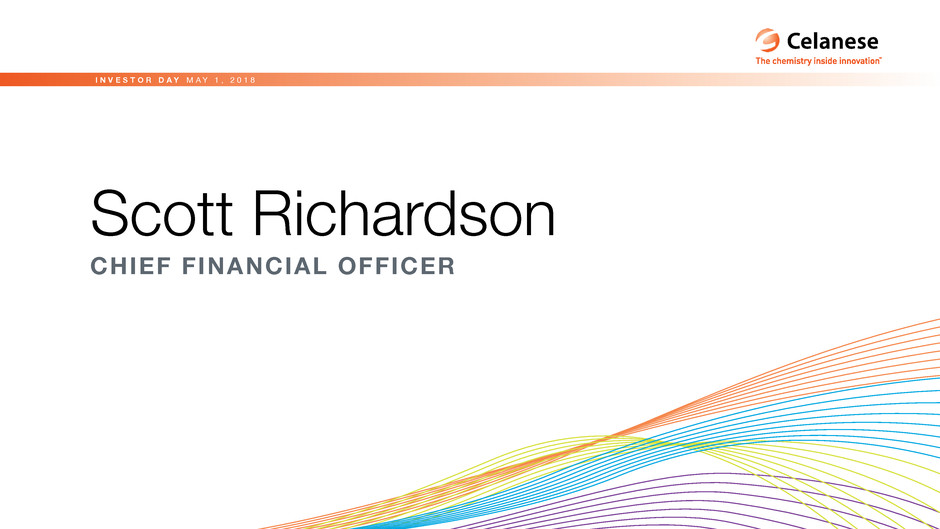

3I n v e s t o r D a y 2 0 1 8 Record of exceeding commitments Adjusted EPS Free Cash Flow M&A Balance Sheet Return Cash to Shareholders W h at W e s a I D I n 2 0 1 5 W h e r e W e a r e t o D ay $8.00-$8.50 >$9.00 $2.5 billion over 3 years >$2.5 billion Build competency to execute bolt-ons Completed and integrated 3 bolt-ons Repurchase $1 billion ~20% dividend payout ratio Repurchased $1 billion >20% dividend payout ratio Enhance financial position Upgraded and committed to investment grade rating 2 0 1 8 T a r g e T s …through commercial and financial success ; ; ; ; ;

4I n v e s t o r D a y 2 0 1 8 Accelerated free cash flow levels to fuel growth Generated record earnings ¹ 2017 free cash flow before $316 million voluntary pension contribution. 2016 free cash flow before $300 million voluntary pension contribution. 2015 free cash flow before $177 million payment related to the termination of an existing supplier agreement 201420132012 $361 $392 $548 $733 $923 $825 ~$950 2015 2016 2017 2018F 18% CAGR 2012-2017 FREE CASH FLOW 1 (in millions) 201420132012 $4.07 $4.50 $5.67 $6.02 $6.61 $7.51 >$9.00 2015 2016 2017 2018F 13% CAGR 2012-2017 ADJUSTED EARNINGS PER SHARE

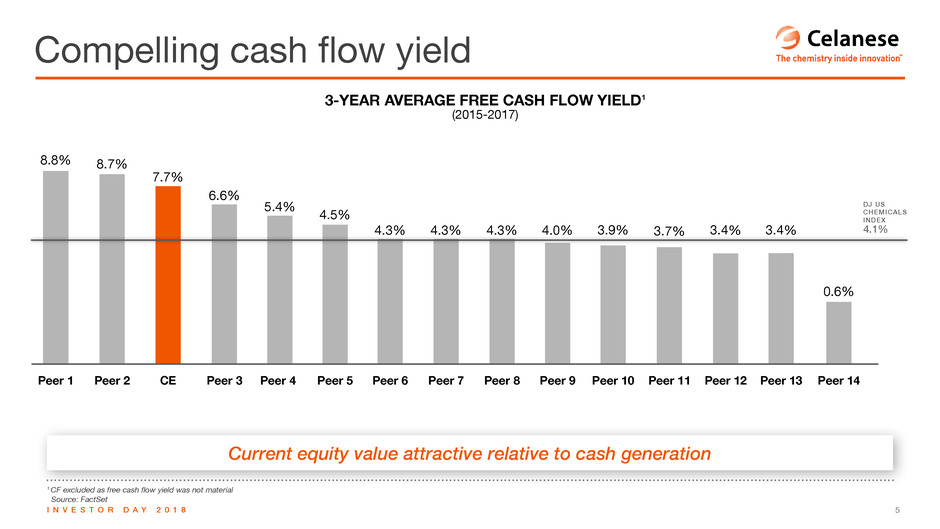

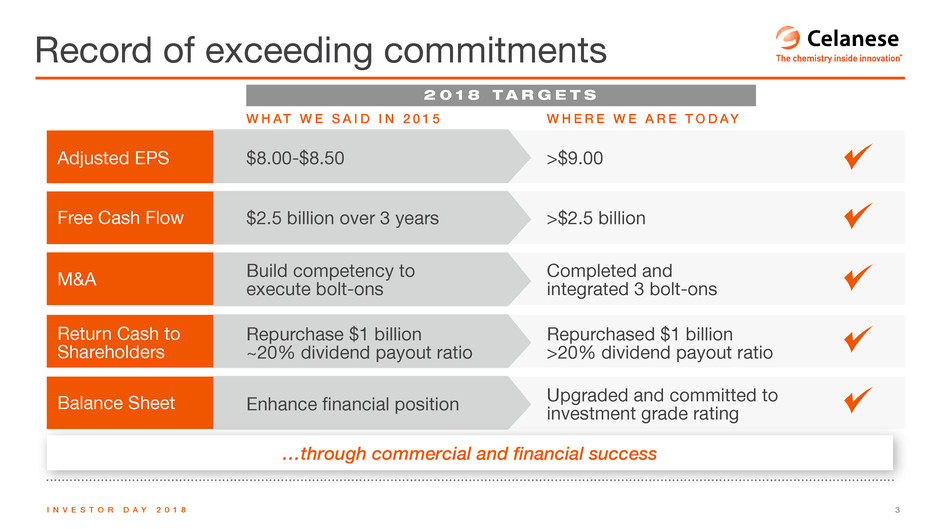

5I N V E S T O R D A Y 2 0 1 8 1 CF excluded as free cash flow yield was not material Source: FactSet Current equity value attractive relative to cash generation Compelling cash flow yield 3-YEAR AVERAgE FREE CASH FLOw YIELD1 (2015-2017) 8.8% 8.7% 7.7% 6.6% 5.4% 4.5% 4.3% 4.3% 4.3% 3.9% DJ US CHEMICALS INDEX 4.1% CE 3.4% Peer 13Peer 8Peer 5Peer 2 Peer 3 3.7% Peer 11Peer 6 Peer 7 3.4% Peer 12 0.6% Peer 14Peer 4 4.0% Peer 9Peer 1 Peer 10

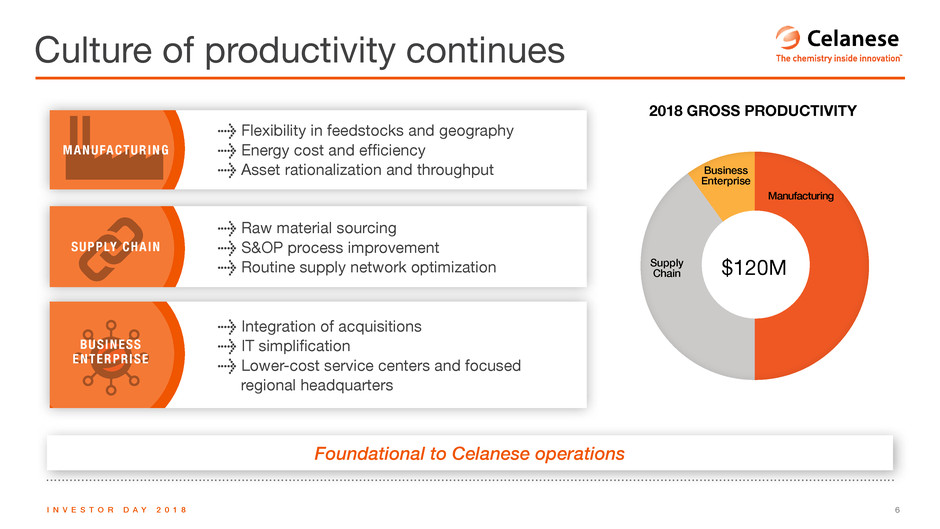

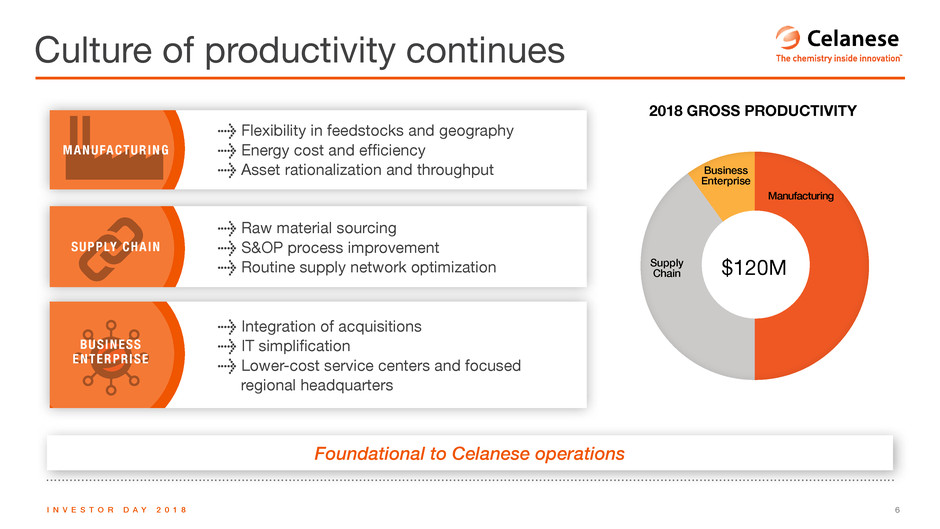

6I n v e s t o r D a y 2 0 1 8 Foundational to Celanese operations Culture of productivity continues 2018 gROSS PRODuCTIVITY Manufacturing 50% Supply Chain 40% Business Enterprises 10% Business enterprise supply Chain Manufacturing $120M > Flexibility in feedstocks and geography > Energy cost and efficiency > Asset rationalization and throughput > Raw material sourcing > S&OP process improvement > Routine supply network optimization > Integration of acquisitions > IT simplification > Lower-cost service centers and focused regional headquarters Manufacturing SuPPLY cHain BuSinESS EntErPriSE

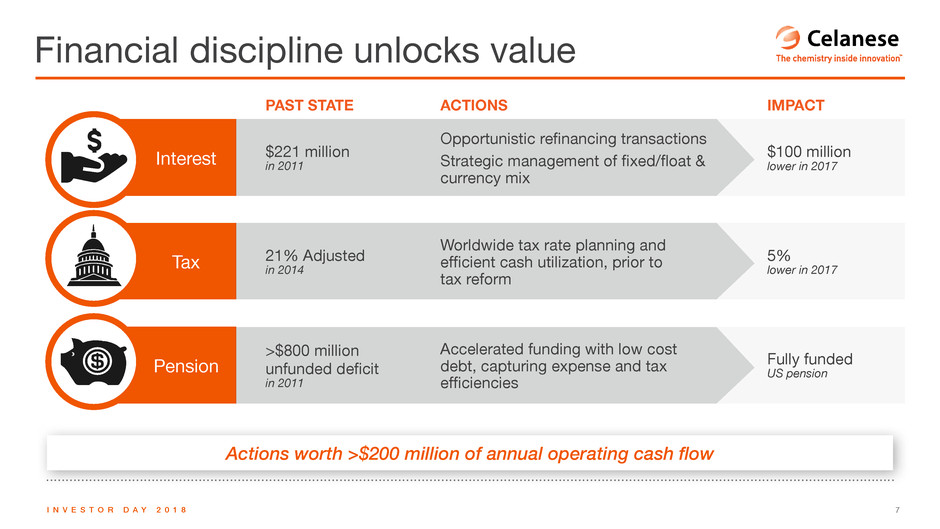

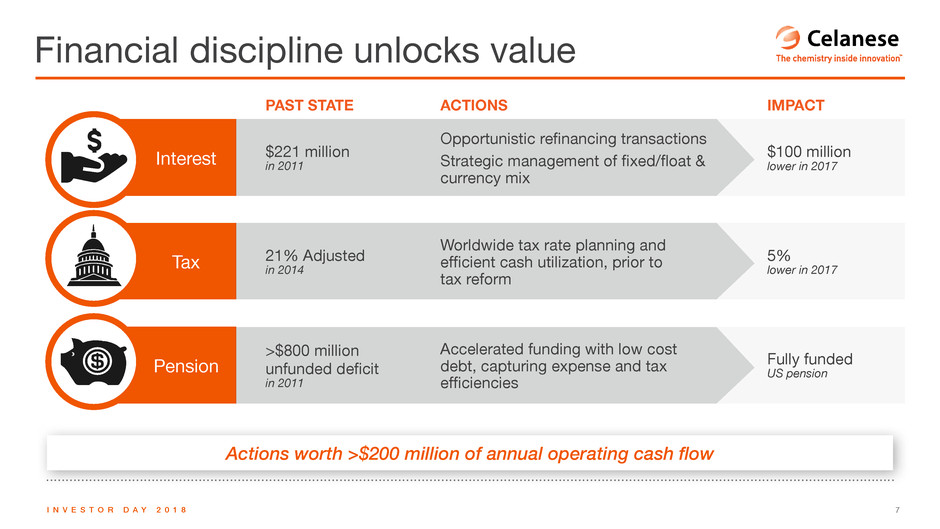

7I n v e s t o r D a y 2 0 1 8 Actions worth >$200 million of annual operating cash flow Financial discipline unlocks value Interest Tax Pension $221 million in 2011 21% Adjusted in 2014 >$800 million unfunded deficit in 2011 Opportunistic refinancing transactions Strategic management of fixed/float & currency mix $100 million lower in 2017 5% lower in 2017 Fully funded US pension Worldwide tax rate planning and efficient cash utilization, prior to tax reform Accelerated funding with low cost debt, capturing expense and tax efficiencies PAST STATE ACTIONS IMPACT

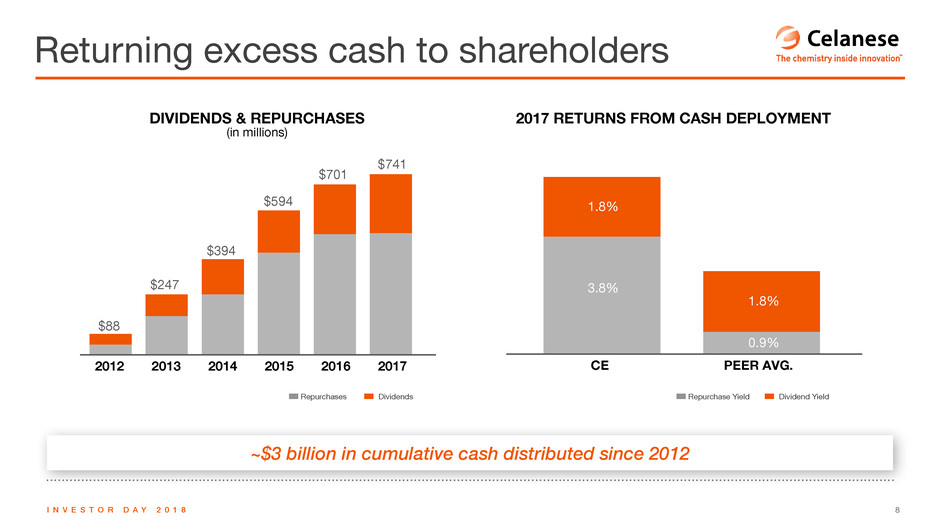

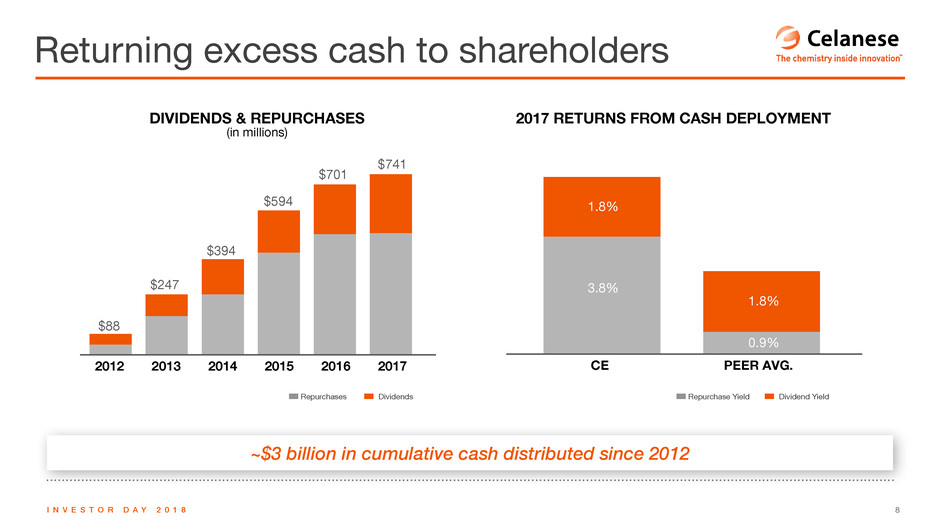

8I n v e s t o r D a y 2 0 1 8 ~$3 billion in cumulative cash distributed since 2012 Returning excess cash to shareholders 201420132012 2015 2016 2017 $741 $701 $594 $394 $247 $88 CE PEER AVG. 1.8% 3.8% 1.8% 0.9% DIVIDENDS & REPURCHASES (in millions) 2017 RETURNS FROM CASH DEPLOYMENT Repurchases Dividends Repurchase Yield Dividend Yield

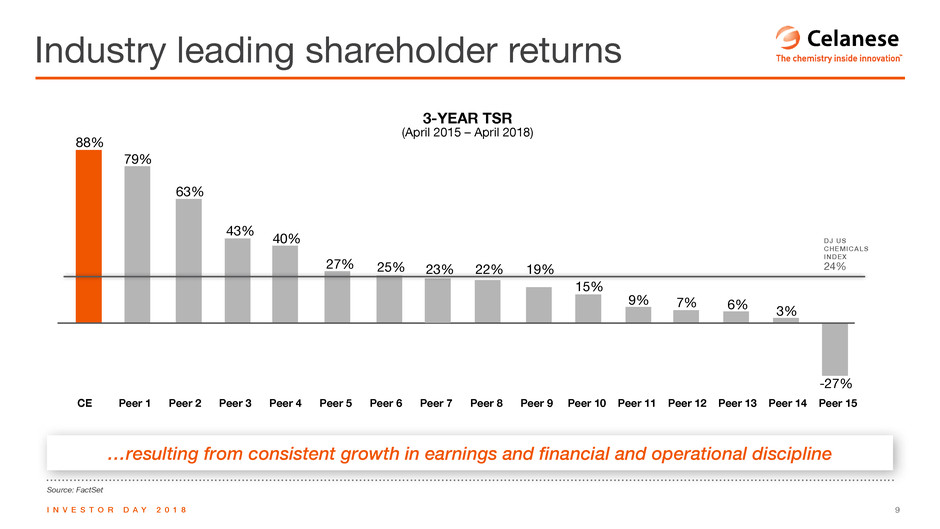

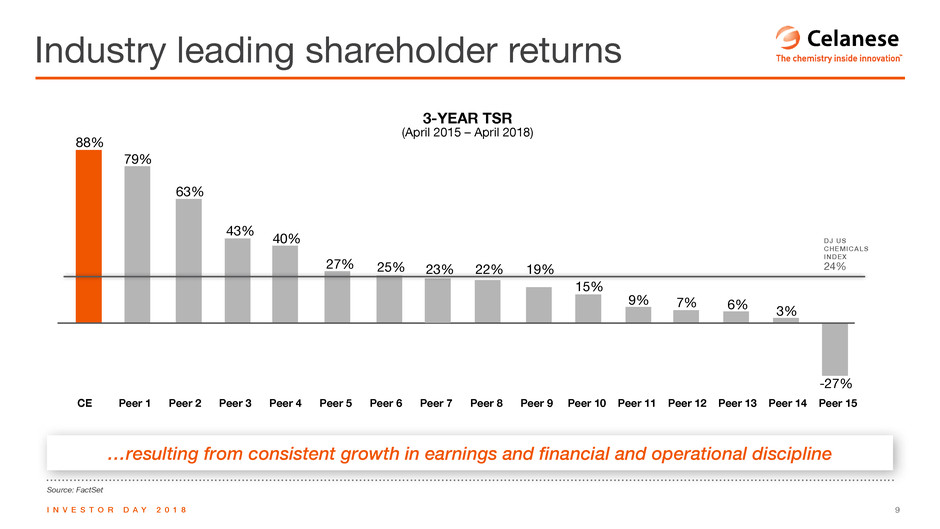

9I N V E S T O R D A Y 2 0 1 8 Source: FactSet …resulting from consistent growth in earnings and financial and operational discipline Industry leading shareholder returns 88% 79% 63% 43% 40% 27% 25% 23% 22% 19% 15% 9% 7% 6% 3% -27% DJ US CHEMICALS INDEX 24% CE Peer 3 Peer 6 Peer 11Peer 4Peer 1 Peer 9 Peer 12 Peer 13Peer 5Peer 2 Peer 10Peer 8Peer 7 Peer 14 Peer 15 3-YEAR TSR (April 2015 – April 2018)

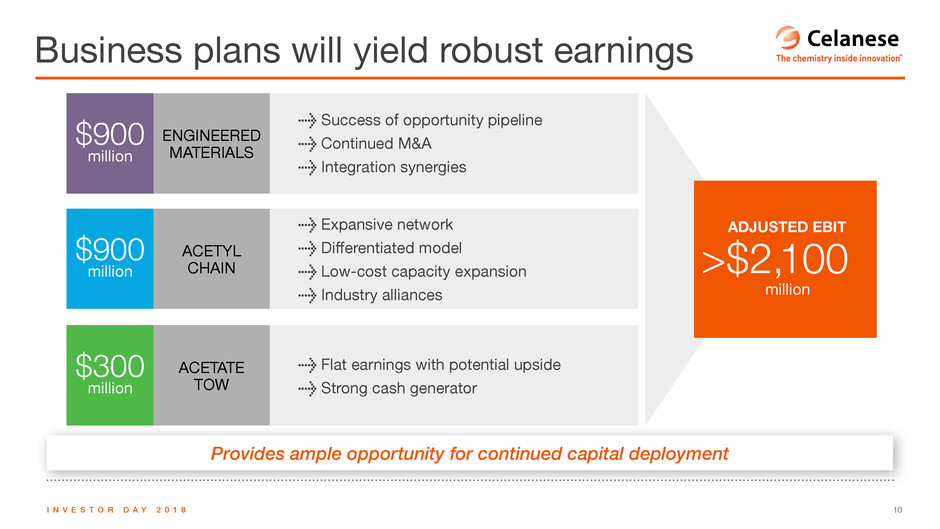

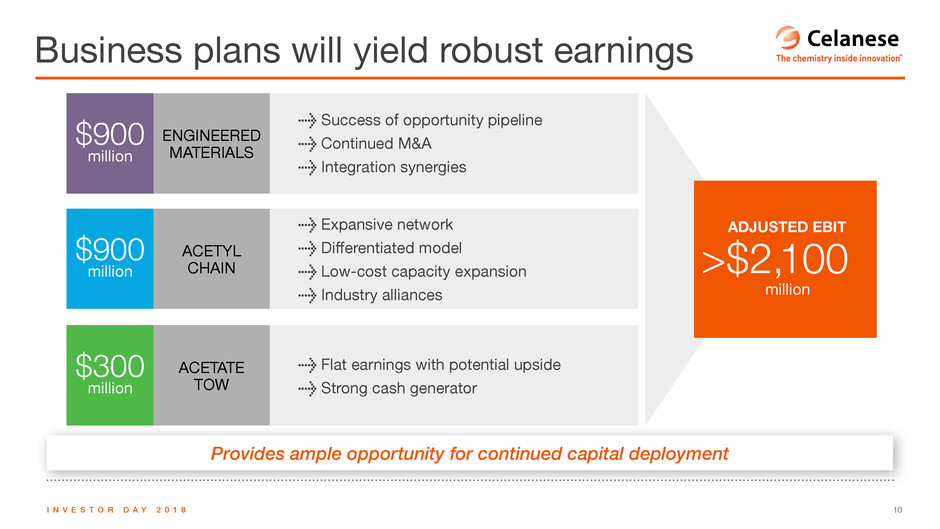

10I n v e s t o r D a y 2 0 1 8 Provides ample opportunity for continued capital deployment Business plans will yield robust earnings > Success of opportunity pipeline > Continued M&A > Integration synergies > Flat earnings with potential upside > Strong cash generator > Expansive network > Differentiated model > Low-cost capacity expansion > Industry alliances >$2,100 ADjuSTED EBIT million $900 $900 $300 million million million EnGInEERED MATERIALS ACETYL ChAIn ACETATE TOW

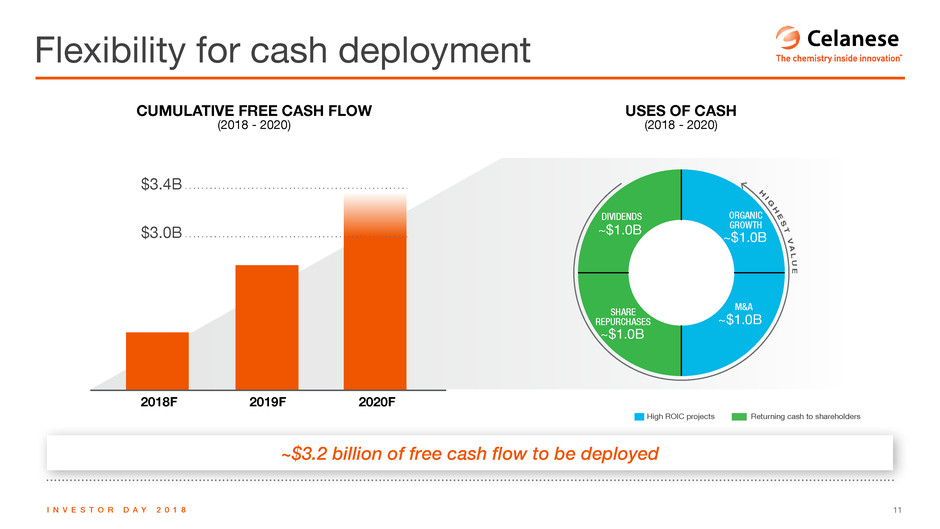

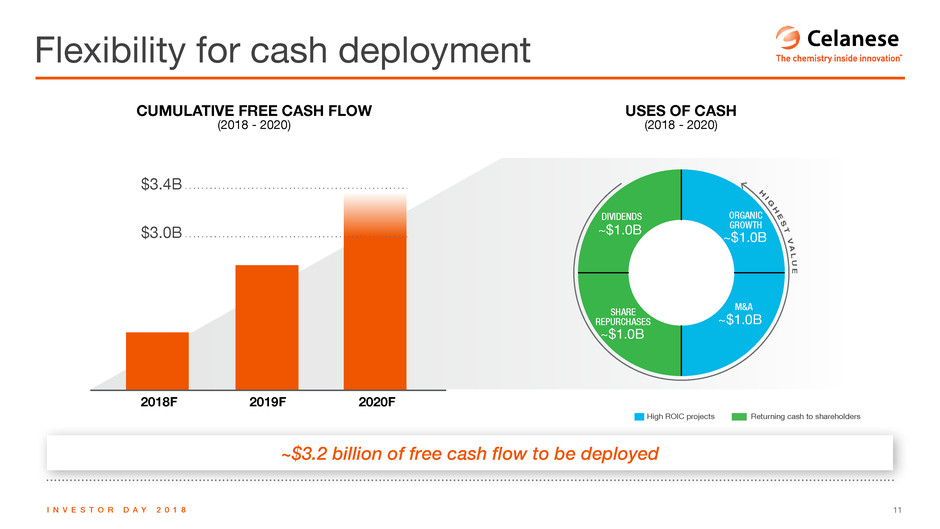

11I n v e s t o r D a y 2 0 1 8 ~$3.2 billion of free cash flow to be deployed Flexibility for cash deployment uSES OF CASH (2018 - 2020) CuMuLATIVE FREE CASH FLOw (2018 - 2020) 2018F 2019F 2020F C U M U L A T I V E C A S H G E N E R A T I O N H I G H E S T V A L U E DIVIDENDS ORGANIC GROWTH M&ASHARE REPURCHASES ~$1.0B ~$1.0B ~$1.0B ~$1.0B high ROIC projects Returning cash to shareholders $3.4B $3.0B

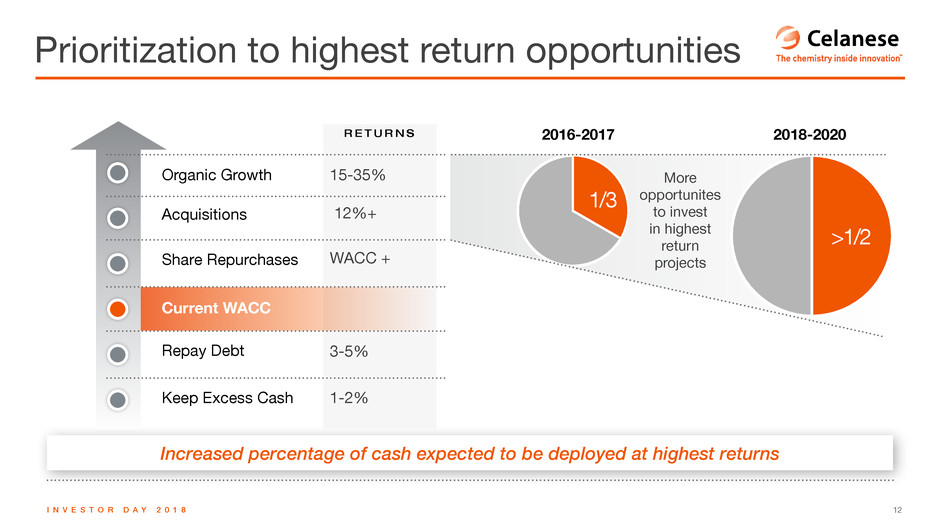

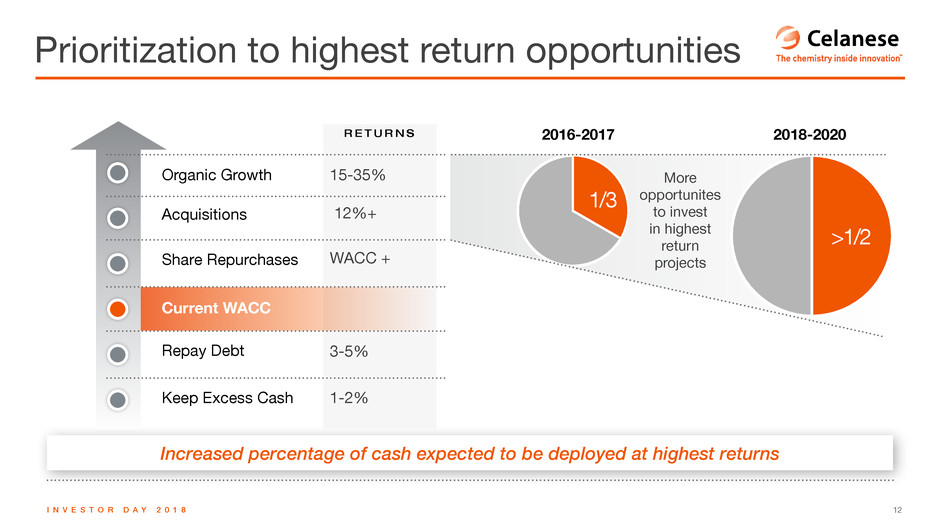

12I n v e s t o r D a y 2 0 1 8 Increased percentage of cash expected to be deployed at highest returns Prioritization to highest return opportunities RetuRns Organic Growth Acquisitions Share Repurchases Repay Debt Keep Excess Cash Current wACC 12%+ 15-35% WACC + 3-5% 1-2% 2016-2017 2018-2020 1/3 >1/2 More opportunites to invest in highest return projects

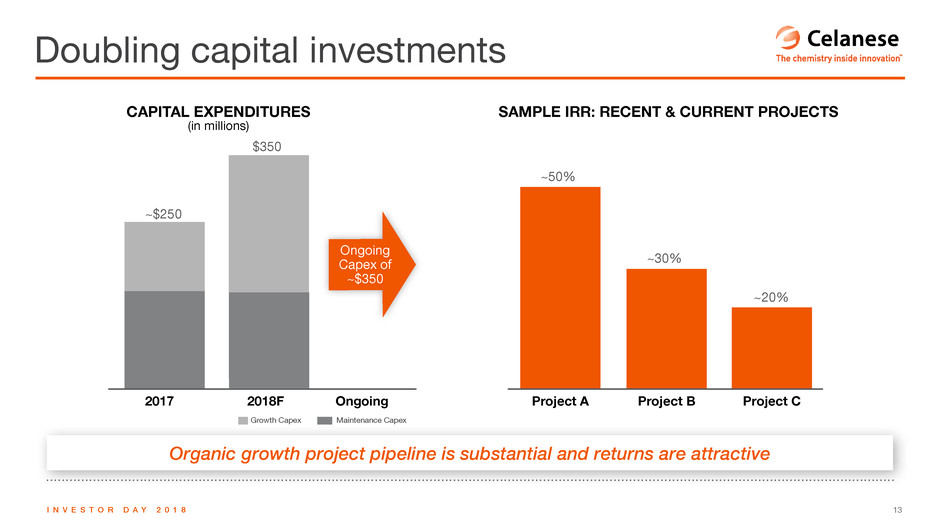

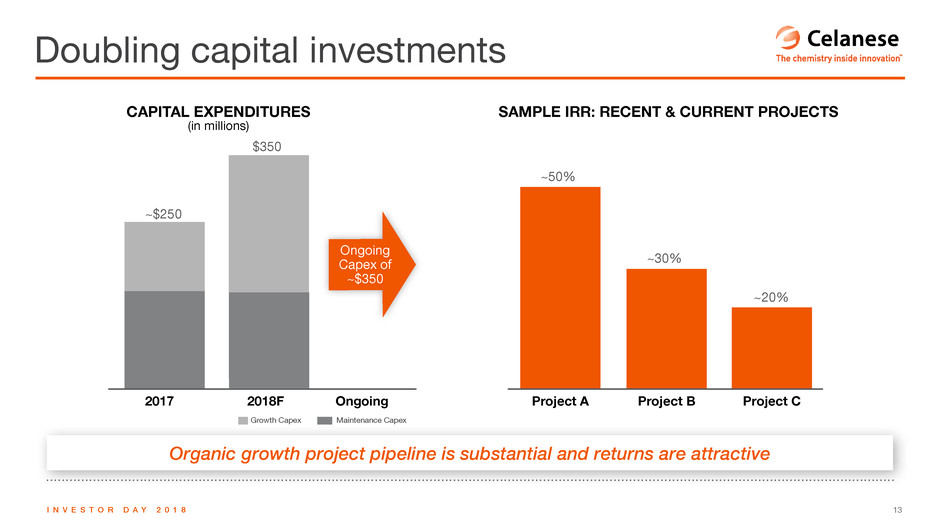

13I n v e s t o r D a y 2 0 1 8 Organic growth project pipeline is substantial and returns are attractive Doubling capital investments CAPITAL ExPENDITuRES (in millions) SAMPLE IRR: RECENT & CuRRENT PROjECTS 2017 Project A2018F Ongoing Project B Project C ~$250 $350 ~50% ~30% ~20% Ongoing Capex of ~$350 Growth Capex Maintenance Capex

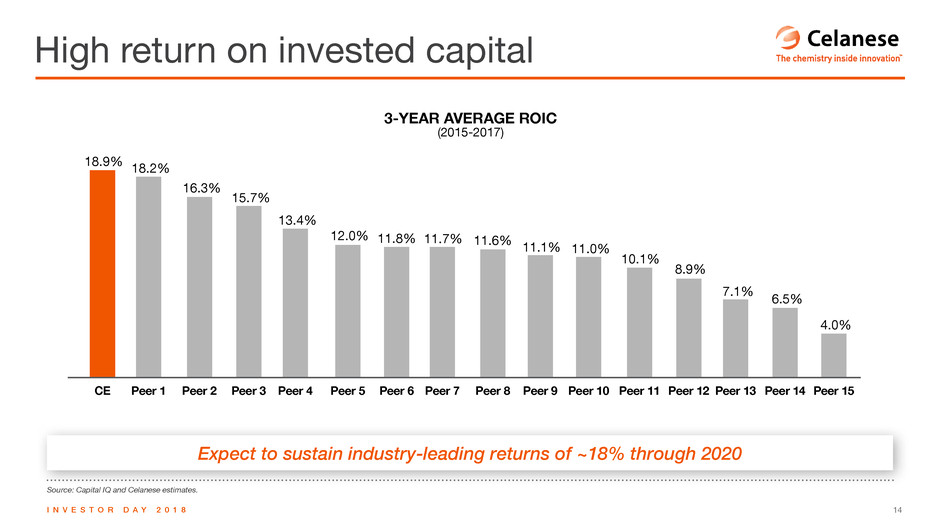

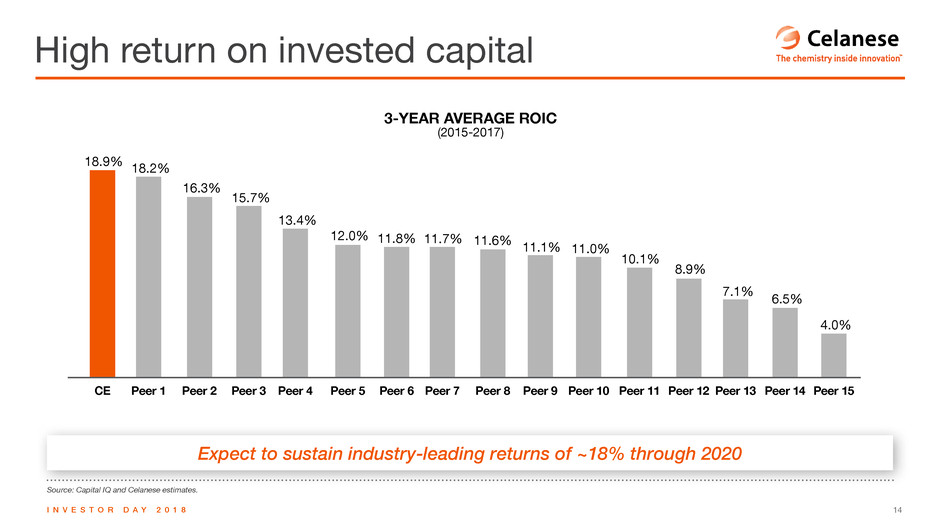

14I n v e s t o r D a y 2 0 1 8 Expect to sustain industry-leading returns of ~18% through 2020 Source: Capital IQ and Celanese estimates. high return on invested capital CE 18.9% Peer 1 18.2% Peer 2 16.3% Peer 4 13.4% Peer 6 11.8% Peer 7 11.7% Peer 8 11.6% Peer 9 11.1% Peer 10 11.0% Peer 11 10.1% Peer 12 8.9% Peer 13 7.1% Peer 14 6.5% Peer 15 4.0% Peer 3 15.7% Peer 5 12.0% 3-YEAR AVERAGE ROIC (2015-2017)

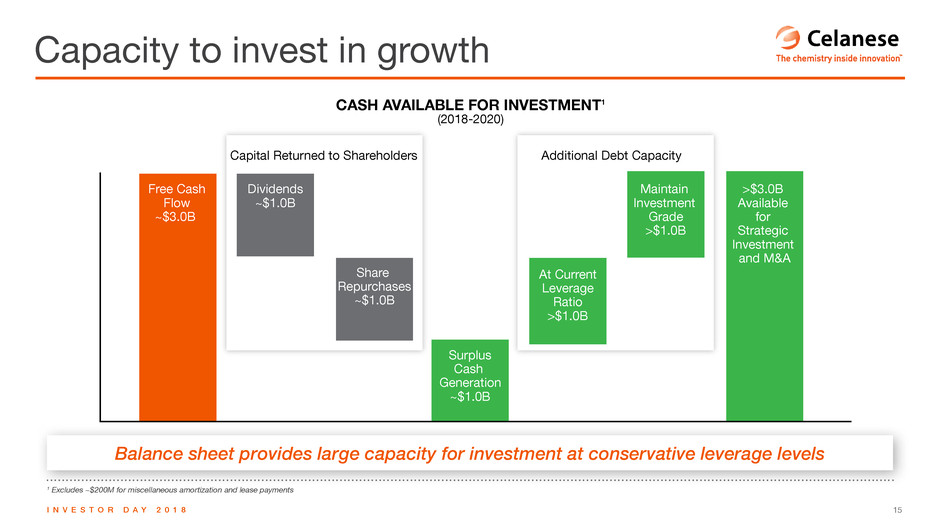

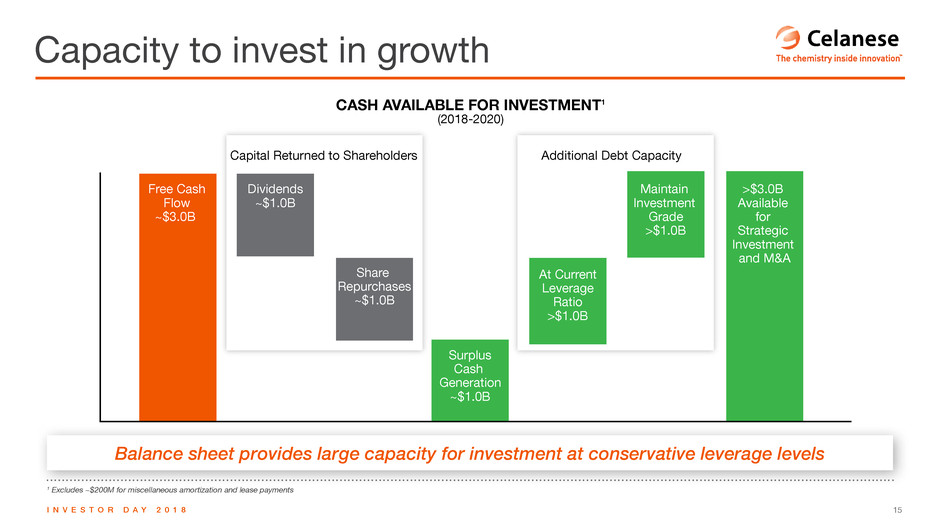

15I n v e s t o r D a y 2 0 1 8 1 Excludes ~$200M for miscellaneous amortization and lease payments Balance sheet provides large capacity for investment at conservative leverage levels Capacity to invest in growth CASH AVAILABLE FOR INVESTMENT1 (2018-2020) Surplus Cash Generation ~$1.0B >$3.0B Available for Strategic Investment and M&A Capital Returned to Shareholders Dividends ~$1.0B Share Repurchases ~$1.0B Additional Debt Capacity Maintain Investment Grade >$1.0B At Current Leverage Ratio >$1.0B Free Cash Flow ~$3.0B

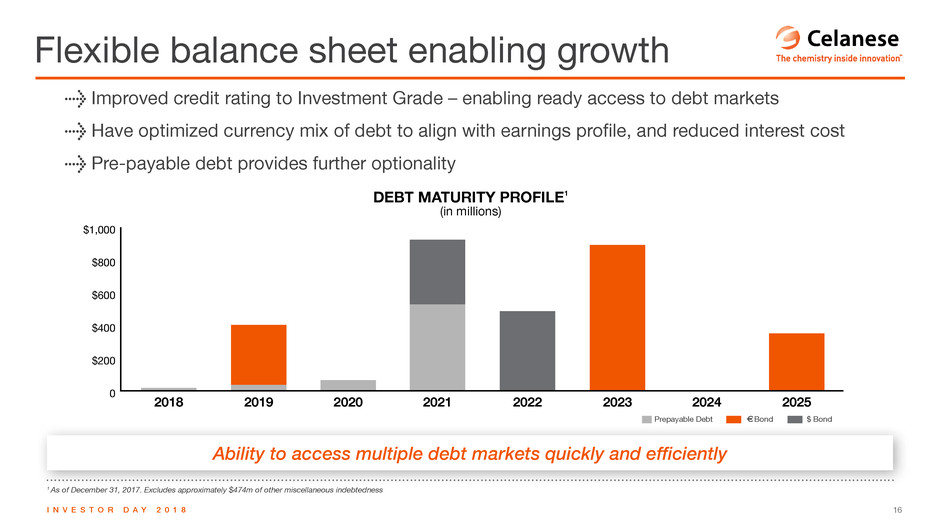

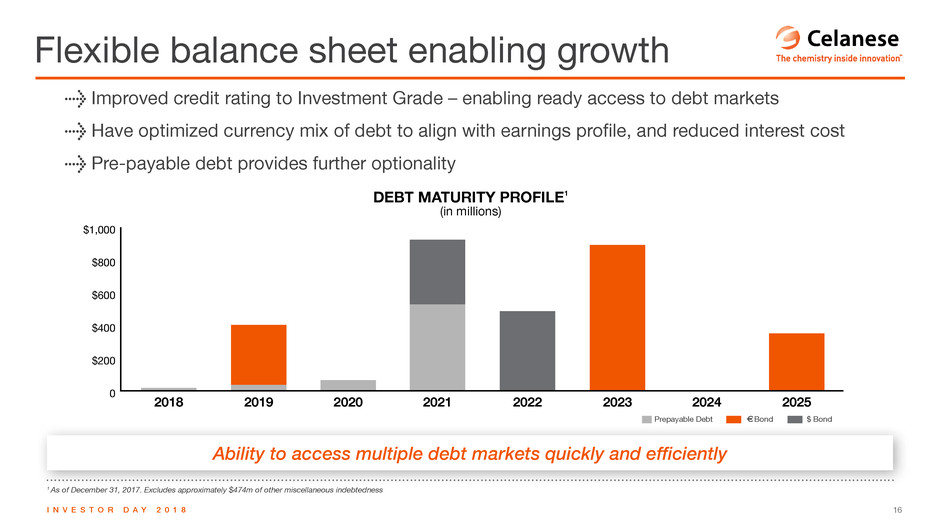

16I n v e s t o r D a y 2 0 1 8 2018 2019 2020 2021 2022 2023 2024 2025 $1,000 $800 $600 $400 $200 0 1 As of December 31, 2017. Excludes approximately $474m of other miscellaneous indebtedness Ability to access multiple debt markets quickly and efficiently Flexible balance sheet enabling growth DEBT MATURITY PROFILE 1 (in millions) > Improved credit rating to Investment Grade – enabling ready access to debt markets > have optimized currency mix of debt to align with earnings profile, and reduced interest cost > Pre-payable debt provides further optionality Prepayable Debt $ Bond Bond

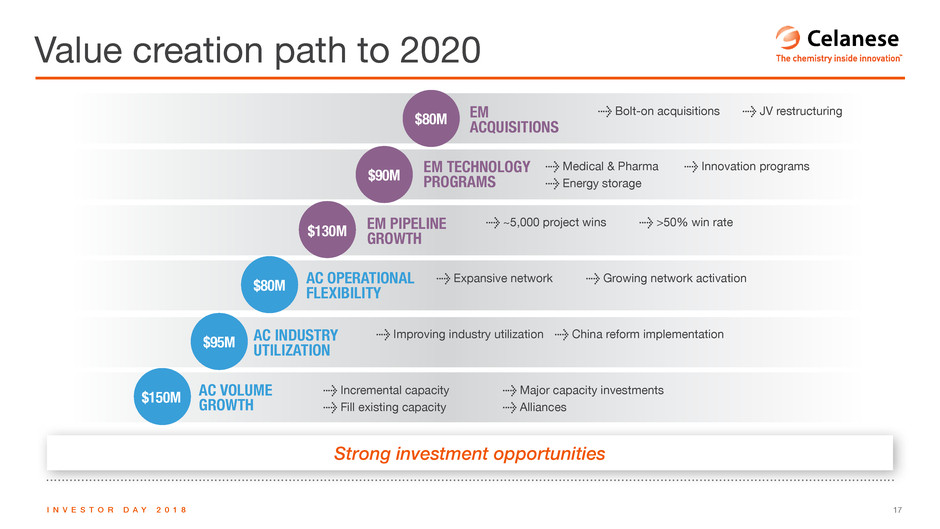

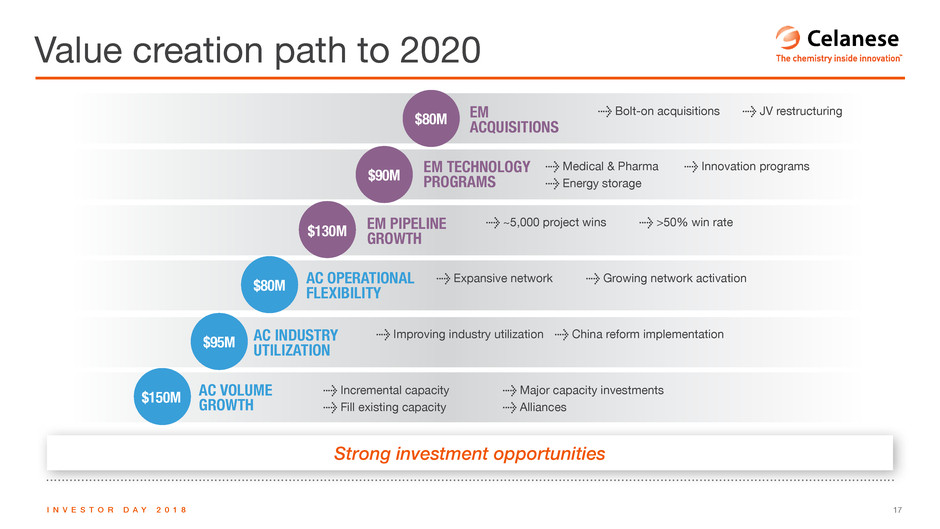

17I n v e s t o r D a y 2 0 1 8 Strong investment opportunities Value creation path to 2020 > ~5,000 project wins > >50% win rate > Incremental capacity > Fill existing capacity > Major capacity investments > Alliances > Medical & Pharma > Energy storage > Improving industry utilization > China reform implementation > Bolt-on acquisitions > Expansive network > Growing network activation EM PiPELinE grOWtH$130M $90M $80M $95M $150M $80M EM acQuiSitiOnS ac inDuStrY utiLiZatiOn ac VOLuME grOWtH ac OPEratiOnaL fLEXiBiLitY EM tEcHnOLOgY PrOgraMS > Innovation programs > JV restructuring

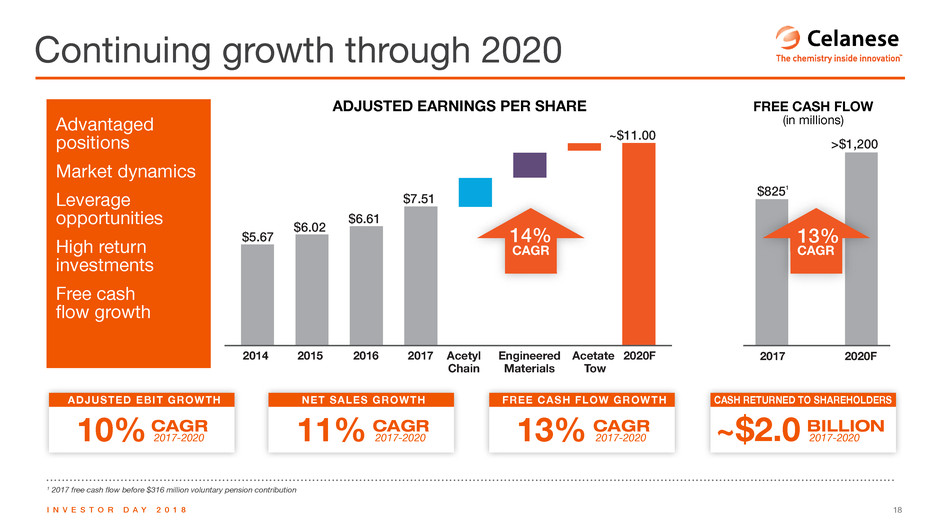

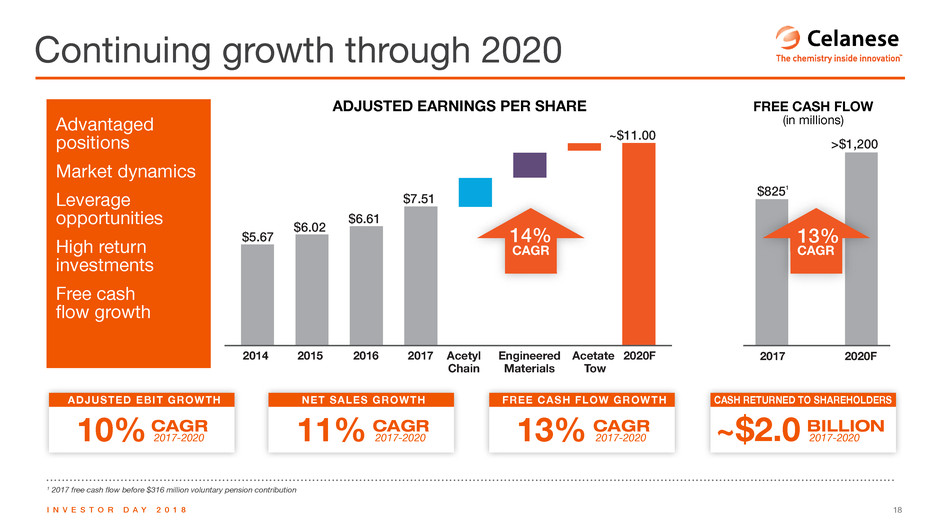

18I n v e s t o r D a y 2 0 1 8 Continuing growth through 2020 1 2017 free cash flow before $316 million voluntary pension contribution ADjuSTED EARNINgS PER SHARE FREE CASH FLOw (in millions)Advantaged positions Market dynamics Leverage opportunities high return investments Free cash flow growth 2014 20162015 2017 2020FAcetyl Chain Acetate Tow Engineered Materials 2017 2020F $5.67 $6.02 $6.61 $7.51 ~$11.00 $8251 >$1,200 13% CAGR 14% CAGR 2014 62015 2017 2020FAcetyl Chain Acetate Tow Engineered Materials 2017 2020F $5.67 $6.02 $6.61 $7.51 ~$11.00 $8251 >$1,200 13% CAGR 14% CAGR CASH RETuRNED TO SHAREHOLDERS 10% ADjuSTED EBIT gROwTH FREE CASH FLOw gROwTHNET SALES gROwTH 2017-2020 CAGR ~$2.0 billion11% 13%2017-2020 2017-2020 2017-2020CAGR CAGR

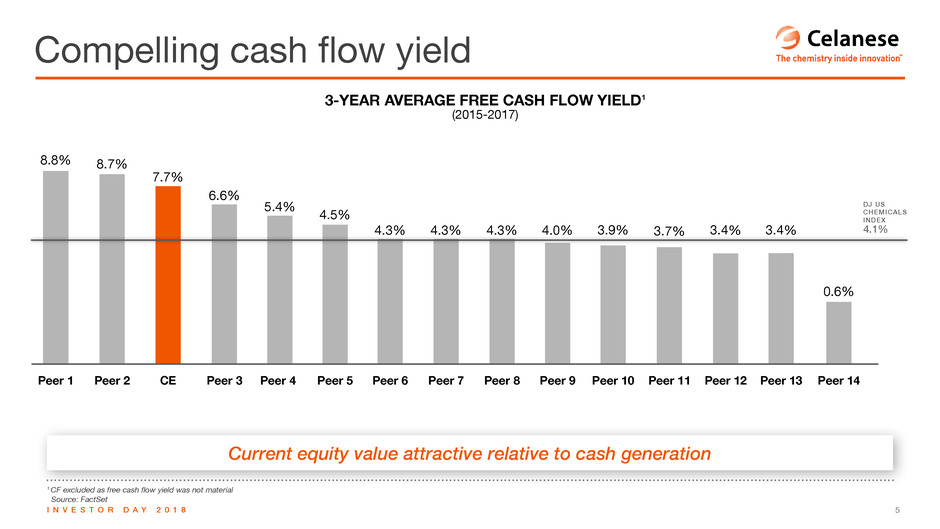

19I n v e s t o r D a y 2 0 1 8 Glossary For Celanese non-GaaP measures, please refer to the non-Us GaaP Financial Measures and supplemental Information documents available under Investor relations/Financial Information/non-GaaP Financial Measures on our website, www.celanese.com. Average Market Cap is the average of quarterly beginning and ending market caps during each measurement period. For instance, 2017 average market cap is the average of market caps of the beginning of Q1, and the ending of Q1, Q2, Q3, and Q4 of 2017. Dividend Payout Ratio is defined as the Q4 dividend rate, annualized, for each respective year, divided by adjusted earnings per share. Dividend Yield is defined as Common Stock Cash Dividends Paid divided by Average Market Cap. (8) IRR is the Internal Rate of Return calculated based on 10-year project cash flow assumptions. (13) Free Cash Flow for peers is defined as Cash Flow from Operations less Capital Expenditures (5); Free Cash Flow for Celanese is per Celanese non-GAAP disclosure. Free Cash Flow Yield is defined as Free Cash Flow divided by Average Market Cap. (5) Peers include ALB, APD, ASh, AXTA, CF, ECL, EMn, FMC, hUn, IFF, MOn, POL, PPG, PX, RPM. (8, 9, 14) Repurchase Yield is defined as Share Repurchases divided by Average Market Cap. (8) ROIC for peers is defined as net Operating Profit After Tax divided by the average Invested Capital at the beginning and ending of each measurement period. ROIC = EBIT * (1 – Effective Tax Rate) / (Total Debt + Preferred Stock + Minority Interest + Book Value of Equity). (14); ROIC for Celanese is per Celanese non-GAAP disclosure.