united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21720

Northern Lights Fund Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2023

Item 1. Reports to Stockholders.

Institutional Short Duration

Government Bond Fund

TWSGX

Annual Report

December 31, 2023

Advised by: TransWestern Capital Advisors, LLC 37 Bellevue Avenue Newport, RI 02840 (303) 864-1213

Subadvised by: Loomis, Sayles & Company, L.P. One Financial Center Boston, MA 02111 |

Tel. (800) 997-0718

www.TransWesternFunds.com

Market Conditions:

2023 Annual Shareholder Letter (Unaudited):

The bond market finished 2023 with positive total returns, but the favorable end result obscures the elevated volatility that occurred along the way. For most of the year, bonds were under pressure from concerns about persistent inflation and the US Federal Reserve’s (the “Fed”) continued interest rate increases. As late as October, the headline US investment-grade bond indexes were in negative territory on a year-to-date basis amid worries that the Fed would have to keep interest rates “higher for longer.”

This backdrop changed considerably in November and December, as the concerns that had weighed on the market throughout 2023 dissipated rapidly. Inflation continued to decline unabated, despite concerns from rising oil prices in the third quarter. In November, the headline Consumer Price Index came in at inflation rates not seen since early 2021. With inflation receding, the markets grew comfortable with the idea that the Fed was finished raising rates. In December, Fed Chairman Jerome Powell added to the upbeat tone with comments suggesting that rate cuts could begin as early as the first half of 2024. Bond prices took another leg higher in response, erasing all of the previous losses and helping the fixed-income market close with solid gains for the full year. Income also made a meaningful contribution to total returns thanks to the increase in yields over the past two years.

US Treasurys registered gains on the year, albeit with unusually high volatility brought about by the shifting interest-rate outlook. The yield on the two-year note, which came into 2023 at 4.41%, rose as high as 5.19% in mid-October before falling sharply to finish December at 4.23%. The ten-year issue took a similar path, moving from 3.88% at the end of 2022 to 4.99% in October and ultimately closing at the same 3.88% level where it began. The yield curve remained inverted for all of 2023, meaning that short-term debt offered higher yields than longer-term issues – an unusual condition that is often seen as a precursor to a recession. However, the extent of the inversion gradually receded from its July high over the remainder of the year.

Securitized assets produced largely positive total returns in 2023. Headwinds facing the commercial real estate sector emerged in the first half of 2023, negatively impacting non-agency commercial mortgage-backed securities’ performance for the full year. Generally, the higher-yielding securitized credit sectors performed best. A challenging supply-and-demand backdrop negatively impacted agency mortgage-backed securities (MBS) as elevated levels of interest-rate volatility continued and historically large buyers of agency MBS (banks and the US Federal Reserve) pulled back from the market. Still, agency MBS outperformed US Treasuries for the year

Performance Results:

During the year ended December 31, 2023, the TransWestern Institutional Short Duration Government Bond Fund (the “Fund”) returned 4.40% which was approximately 77 basis points lower than its benchmark, the 50% Barclays Short Treasury 50% Barclays MBS Index, which returned 5.17% over the same period.

Explanation of Fund Performance:

Yield curve effects had a positive impact on 2023 performance, while bond selection and sector allocation decisions detracted.

1

Our underweight allocation to Agency MBS detracted the most from excess return. Both sector allocation and security selection detracted in this space. Security selection within Agency CMBS and CMOs were both positive. The Fund’s slight overweight to US Treasurys as compared to its benchmark detracted.

Outlook:

The Federal Reserve elected to hold the fed funds rates steady at 5.25% throughout the fourth quarter, although forward guidance shifted from a hawkish to a dovish tone, as inflation surprised to the downside and softer economic data increased the odds of achieving the elusive “soft landing”. In our view, the shift in tone caused market sentiment to dramatically reverse course; yields fell sharply while spreads tightened. Yields on the 10-year Treasury peaked at just over 5% in late-October before falling over 110 bps to 3.88% by year-end. Market expectations for any additional hikes seemingly disappeared, while expectations for easing monetary policy rose and were pulled forward into early 2024. Current pricing reflects 150 bps of anticipated cuts in the next 12 months, equivalent to three additional hikes on top of what is reflected in the Fed’s Summary of Economic Projections. The yield curve steepened but remained inverted during the quarter, with higher yields on shorter maturity Treasurys relative to longer-dated notes and bonds.

We continue to hold the view that we are in the late expansion phase of the credit cycle, with a significant probability of either a softer landing or more meaningful slowdown (i.e. downturn) sometime over the next 6-9 months. Corporate balance sheets have deteriorated, but from a very strong starting point; profit margins could continue to be pressured amid higher input costs, tighter credit conditions, and a slowdown in de-leveraging trends. We believe a relatively healthy middle class consumer and resilient labor market should prevent the economy from entering into a severe recession in this cycle.

We remain concerned about the lagged effects of significant monetary tightening, globally. This has come through traditional monetary policy tightening, including some central bank asset sales and/or balance sheet run-off, and covers many developed and emerging economies across the globe. Notable exceptions on the policy tightening side include the Bank of Japan, where policy remains very accommodative, and the Bank of China, where weakness in the Chinese property sector in particular remains a concern. We also remain concerned about potential exogenous shocks to growth, possibly emanating from the ongoing conflict in the Middle East.

We continue to favor spread sectors, such as securitized mortgage assets.

While the strategy continues to hold commercial mortgage backed securities (CMBS), the exposure is typically on the low end of our risk range relative to benchmark. When opportunities arise within CMBS we tend to favor senior parts of the capital stack.

This commentary is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P., or any portfolio manager. Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy. The information is subject to change at any time without notice. Indexes are unmanaged and do not incur fees, and you may not invest directly in an index.

Past Performance is no guarantee of future results.

2

| TransWestern Institutional Short Duration Government Bond Fund |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2023 |

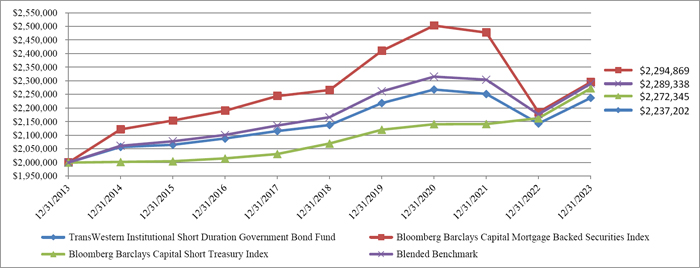

The Fund’s performance figures* for the periods ended December 31, 2023, compared to its benchmarks:

| Annualized | ||||

| One Year | Five Year | Ten Year | Since Inception ** | |

| TransWestern Institutional Short Duration Government Bond Fund | 4.40% | 0.92% | 1.13% | 1.17% |

| Bloomberg Capital Mortgage Backed Securities Index *** | 5.05% | 0.25% | 1.38% | 1.63% |

| Bloomberg Capital Short Treasury Index **** | 5.09% | 1.89% | 1.28% | 1.03% |

| Blended Benchmark Index ***** | 5.17% | 1.11% | 1.36% | 1.35% |

Comparison of the Change in Value of a $2,000,000 Investment

| * | The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Returns greater than 1 year are annualized. The Fund may assess a redemption fee of 0.25% of the total redemption amount if shareholders sell their shares after holding them for less than 30 days. Per the fee table in the Fund’s May 1, 2023 prospectus, the total annual operating expenses are 0.74% before fee waivers. For performance information current to the most recent month-end, please call 1-855-881-2380. |

| ** | Inception date is January 3, 2011. |

| *** | The Bloomberg Barclays Capital Mortgage Backed Securities Index is an unmanaged market capitalization index which measures the performance of investment grade fixed-rate mortgage-backed pass through securities of Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). Investors may not invest in the Index directly. Unlike the Fund’s returns, Index returns do not reflect any fees or expenses. |

| **** | The Bloomberg Barclays Capital Short Treasury Index measures the performance of United States Treasury Securities with a remaining maturity between 1 to 12 months. The index is unmanaged and its results do not reflect the effect of sales charges, commissions, account fees, expenses or taxes. Investors cannot invest directly in an index. Unlike the Fund’s returns, Index returns do not reflect any fees or expenses. |

| ***** | The Blended Benchmark Index represents a blend of 50% Bloomberg Capital Short Treasury Index and 50% Bloomberg Capital Mortgage Backed Securities Index. The index is unmanaged and its results do not reflect the effect of sales charges, commissions, account fees, expenses or taxes. Investors cannot invest directly in an index. |

| Portfolio Composition as of December 31, 2023 (Unaudited) | ||||

| Holdings By Investment Type | % of Net Assets | |||

| U.S. Government & Agencies | 60.2 | % | ||

| U.S. Treasury Notes | 31.5 | % | ||

| Short-Term Investments and Liabilities in Excess of Other Assets | 8.3 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this report for a detailed listing of the Fund’s holdings.

3

| TRANSWESTERN INSTITUTIONAL SHORT DURATION GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2023 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| U.S. GOVERNMENT & AGENCIES — 60.2% | ||||||||||||||

| FEDERAL HOME LOAN MORTGAGE CORP. — 19.1%(a) | ||||||||||||||

| 67,995 | Freddie Mac Gold Pool Series G08448 | 5.0000 | 05/01/41 | $ | 69,213 | |||||||||

| 512,240 | Freddie Mac Gold Pool Series Q18571 | 3.5000 | 05/01/43 | 483,318 | ||||||||||

| 307,062 | Freddie Mac Gold Pool Series Q20545 | 3.5000 | 07/01/43 | 290,361 | ||||||||||

| 99,354 | Freddie Mac Gold Pool Series U92432 | 4.0000 | 02/01/44 | 96,842 | ||||||||||

| 1,331,842 | Freddie Mac Multifamily Structured Pass Through Series KJ20 A2 | 3.7990 | 12/25/25 | 1,306,572 | ||||||||||

| 795,757 | Freddie Mac Multifamily Structured Pass Through Series KF60 A (b) | SOFR30A + 0.604% | 5.9350 | 02/25/26 | 795,890 | |||||||||

| 1,512,157 | Freddie Mac Multifamily Structured Pass Through Series KJ21 A2 | 3.7000 | 09/25/26 | 1,479,164 | ||||||||||

| 976,029 | Freddie Mac Multifamily Structured Pass Through Series KF72 A (b) | SOFR30A + 0.614% | 5.9450 | 11/25/26 | 973,177 | |||||||||

| 957,324 | Freddie Mac Multifamily Structured Pass Through Series KF77 AL (b) | SOFR30A + 0.814% | 6.1450 | 02/25/27 | 959,144 | |||||||||

| 591,881 | Freddie Mac Multifamily Structured Pass Through Series KF82 AS (b) | SOFR30A + 0.420% | 5.7510 | 06/25/30 | 586,779 | |||||||||

| 887,822 | Freddie Mac Multifamily Structured Pass Through Series KF82 AL (b) | SOFR30A + 0.484% | 5.8150 | 06/25/30 | 881,933 | |||||||||

| 779,878 | Freddie Mac Multifamily Structured Pass Through Series KF80 AS (b) | SOFR30A + 0.510% | 5.8410 | 06/25/30 | 776,463 | |||||||||

| 2,580,000 | Freddie Mac Multifamily Structured Pass Through Series KJ42 A2 | 4.1180 | 11/25/32 | 2,496,997 | ||||||||||

| 198,483 | Freddie Mac Multifamily Structured Pass Through Series Q008 A (b) | SOFR30A + 0.504% | 5.8350 | 10/25/45 | 197,736 | |||||||||

| 1,291,415 | Freddie Mac Multifamily Structured Pass Through Series Q016 APT1 (c) | 1.2420 | 05/25/51 | 1,202,765 | ||||||||||

| 575 | Freddie Mac Non Gold Pool Series 845830(b) | RFUCCT6M + 1.633% | 5.4480 | 07/01/24 | 571 | |||||||||

| 287,602 | Freddie Mac Non Gold Pool Series 780722(b) | H15T1Y + 2.220% | 6.2200 | 08/01/33 | 290,578 | |||||||||

| 54,858 | Freddie Mac Non Gold Pool Series 972132(b) | H15T1Y + 2.225% | 6.3500 | 11/01/33 | 56,050 | |||||||||

| 85,005 | Freddie Mac Non Gold Pool Series 1B2025(b) | RFUCCT1Y + 1.862% | 4.9500 | 06/01/34 | 87,025 | |||||||||

| 64,019 | Freddie Mac Non Gold Pool Series 1Q0160(b) | RFUCCT1Y + 1.765% | 6.0150 | 09/01/35 | 64,311 | |||||||||

| 123,661 | Freddie Mac Non Gold Pool Series 1L1358(b) | H15T1Y + 2.500% | 5.9280 | 05/01/36 | 127,034 | |||||||||

| 313,969 | Freddie Mac Non Gold Pool Series 848690(b) | H15T1Y + 2.249% | 5.8700 | 03/01/37 | 321,177 | |||||||||

| 20,751 | Freddie Mac Non Gold Pool Series 848565(b) | RFUCCT1Y + 1.750% | 5.8020 | 12/01/37 | 20,691 | |||||||||

| 40,578 | Freddie Mac Non Gold Pool Series 848568(b) | H15T1Y + 2.203% | 5.7690 | 09/01/38 | 40,268 | |||||||||

| 816,560 | Freddie Mac Non Gold Pool Series 848949(b) | H15T1Y + 2.248% | 6.2010 | 09/01/38 | 836,660 | |||||||||

| 19,540 | Freddie Mac Non Gold Pool Series 1Q0647(b) | RFUCCT1Y + 1.771% | 5.4710 | 11/01/38 | 19,367 | |||||||||

| 54,173 | Freddie Mac Non Gold Pool Series 1Q1302(b) | RFUCCT1Y + 1.703% | 5.8850 | 11/01/38 | 53,935 | |||||||||

| 244,432 | Freddie Mac Non Gold Pool Series 849046(b) | RFUCCT1Y + 1.897% | 5.2750 | 09/01/41 | 242,461 | |||||||||

| 402,014 | Freddie Mac Pool Series SB8031 | 2.5000 | 02/01/35 | 373,373 | ||||||||||

| 15,487 | Freddie Mac REMICS Series 2903 Z (d) | 5.0000 | 12/15/24 | 14,959 | ||||||||||

| 9,283 | Freddie Mac REMICS Series 3104 DH (d) | 5.0000 | 01/15/26 | 8,899 | ||||||||||

See accompanying notes to financial statements.

4

| TRANSWESTERN INSTITUTIONAL SHORT DURATION GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| U.S. GOVERNMENT & AGENCIES — 60.2% (Continued) | ||||||||||||||

| FEDERAL HOME LOAN MORTGAGE CORP. — 19.1%(a) (Continued) | ||||||||||||||

| 31,760 | Freddie Mac REMICS Series 2102 PE (d) | 6.5000 | 12/15/28 | $ | 31,498 | |||||||||

| 22,358 | Freddie Mac REMICS Series 2131 ZB (d) | 6.0000 | 03/15/29 | 21,590 | ||||||||||

| 10,997 | Freddie Mac REMICS Series 2412 OF (b),(d) | SOFR30A + 1.064% | 6.4030 | 12/15/31 | 10,828 | |||||||||

| 5,675 | Freddie Mac REMICS Series 2450 FW (b),(d) | SOFR30A + 0.614% | 5.9530 | 03/15/32 | 5,507 | |||||||||

| 21,159 | Freddie Mac REMICS Series 2448 FV (b),(d) | SOFR30A + 1.114% | 6.4530 | 03/15/32 | 20,788 | |||||||||

| 31,189 | Freddie Mac REMICS Series 2581 FD (b),(d) | SOFR30A + 0.864% | 6.2030 | 12/15/32 | 30,434 | |||||||||

| 10,473 | Freddie Mac REMICS Series 2557 WF (b),(d) | SOFR30A + 0.514% | 5.8530 | 01/15/33 | 10,133 | |||||||||

| 26,648 | Freddie Mac REMICS Series 2768 PW (d) | 4.2500 | 03/15/34 | 25,105 | ||||||||||

| 151,869 | Freddie Mac REMICS Series 2978 JG (d) | 5.5000 | 05/15/35 | 152,962 | ||||||||||

| 230,839 | Freddie Mac REMICS Series 3036 NE (d) | 5.0000 | 09/15/35 | 230,076 | ||||||||||

| 128,572 | Freddie Mac REMICS Series 3620 AT (b),(d) | 3.8910 | 12/15/36 | 127,583 | ||||||||||

| 117,075 | Freddie Mac REMICS Series 3412 AY (d) | 5.5000 | 02/15/38 | 116,522 | ||||||||||

| 110,898 | Freddie Mac REMICS Series 3561 W (c),(d) | 2.5610 | 06/15/48 | 105,592 | ||||||||||

| 16,042,331 | ||||||||||||||

| FEDERAL NATIONAL MORTGAGE ASSOCIATION — 26.2%(a) | ||||||||||||||

| 793 | Fannie Mae Pool Series 303212(b) | RFUCCT6M + 2.170% | 5.4200 | 02/01/25 | 787 | |||||||||

| 2,040,000 | Fannie Mae Pool Series BL0481 | 3.5800 | 01/01/26 | 1,999,492 | ||||||||||

| 17,381 | Fannie Mae Pool Series 684842(b) | H15T1Y + 2.436% | 4.2670 | 01/01/30 | 17,026 | |||||||||

| 17,995 | Fannie Mae Pool Series 642012(b) | H15T1Y + 2.265% | 5.2650 | 05/01/32 | 17,982 | |||||||||

| 53,722 | Fannie Mae Pool Series 699985(b) | H15T1Y + 2.211% | 5.2110 | 04/01/33 | 53,747 | |||||||||

| 104,964 | Fannie Mae Pool Series 555375 | 6.0000 | 04/01/33 | 109,816 | ||||||||||

| 43,544 | Fannie Mae Pool Series 721424(b) | H15T1Y + 2.287% | 5.9330 | 06/01/33 | 43,478 | |||||||||

| 20,205 | Fannie Mae Pool Series 725052(b) | H15T1Y + 2.165% | 4.2900 | 07/01/33 | 19,650 | |||||||||

| 15,168 | Fannie Mae Pool Series 732087(b) | H15T1Y + 2.440% | 6.2660 | 08/01/33 | 15,144 | |||||||||

| 311,208 | Fannie Mae Pool Series AD0541(b) | H15T1Y + 2.185% | 6.2190 | 11/01/33 | 318,752 | |||||||||

| 21,425 | Fannie Mae Pool Series 725392(b) | H15T1Y + 2.196% | 4.7400 | 04/01/34 | 21,166 | |||||||||

| 7,294 | Fannie Mae Pool Series 783245(b) | 12MTA + 1.200% | 6.1290 | 04/01/34 | 7,046 | |||||||||

| 288,259 | Fannie Mae Pool Series AL1270(b) | H15T1Y + 2.216% | 5.4050 | 10/01/34 | 295,054 | |||||||||

| 43,178 | Fannie Mae Pool Series 813844(b) | RFUCCT6M + 1.546% | 7.0810 | 01/01/35 | 43,824 | |||||||||

| 13,287 | Fannie Mae Pool Series 995552(b) | H15T1Y + 2.189% | 5.3480 | 05/01/35 | 13,221 | |||||||||

| 46,235 | Fannie Mae Pool Series 735667 | 5.0000 | 07/01/35 | 47,049 | ||||||||||

| 109,792 | Fannie Mae Pool Series 889822(b) | RFUCCT1Y + 1.558% | 5.4650 | 07/01/35 | 110,696 | |||||||||

| 53,161 | Fannie Mae Pool Series AL0361(b) | H15T1Y + 2.223% | 6.1370 | 07/01/35 | 53,172 | |||||||||

See accompanying notes to financial statements.

5

| TRANSWESTERN INSTITUTIONAL SHORT DURATION GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| U.S. GOVERNMENT & AGENCIES — 60.2% (Continued) | ||||||||||||||

| FEDERAL NATIONAL MORTGAGE ASSOCIATION — 26.2%(a) (Continued) | ||||||||||||||

| 20,934 | Fannie Mae Pool Series 995269(b) | RFUCCT6M + 1.545% | 7.2590 | 07/01/35 | $ | 21,264 | ||||||||

| 82,795 | Fannie Mae Pool Series 838948(b) | RFUCCT6M + 1.510% | 7.0070 | 08/01/35 | 83,798 | |||||||||

| 8,491 | Fannie Mae Pool Series 844532(b) | 12MTA + 1.770% | 6.7050 | 11/01/35 | 8,348 | |||||||||

| 177,638 | Fannie Mae Pool Series 813637(b) | H15T1Y + 2.185% | 4.3100 | 01/01/36 | 178,868 | |||||||||

| 31,492 | Fannie Mae Pool Series 863729(b) | H15T1Y + 2.268% | 4.3930 | 01/01/36 | 31,121 | |||||||||

| 110,812 | Fannie Mae Pool Series 846749(b) | RFUCCT6M + 2.428% | 5.6780 | 01/01/36 | 110,689 | |||||||||

| 79,712 | Fannie Mae Pool Series 880373(b) | RFUCCT1Y + 1.523% | 4.2410 | 02/01/36 | 81,529 | |||||||||

| 11,798 | Fannie Mae Pool Series 880366(b) | RFUCCT6M + 1.430% | 7.0790 | 02/01/36 | 11,874 | |||||||||

| 115,873 | Fannie Mae Pool Series 920847(b) | H15T1Y + 2.500% | 5.4780 | 08/01/36 | 119,827 | |||||||||

| 19,150 | Fannie Mae Pool Series 886376(b) | 12MTA + 2.361% | 7.2700 | 08/01/36 | 19,253 | |||||||||

| 6,423 | Fannie Mae Pool Series 879683(b) | H15T1Y + 2.145% | 5.9340 | 09/01/36 | 6,415 | |||||||||

| 11,214 | Fannie Mae Pool Series 995949(b) | 12MTA + 2.366% | 7.2850 | 09/01/36 | 11,222 | |||||||||

| 138,580 | Fannie Mae Pool Series 900197(b) | RFUCCT1Y + 2.075% | 6.3250 | 10/01/36 | 140,186 | |||||||||

| 37,799 | Fannie Mae Pool Series 995008(b) | 12MTA + 2.180% | 7.1070 | 10/01/36 | 36,898 | |||||||||

| 45,289 | Fannie Mae Pool Series AE0870(b) | RFUCCT1Y + 1.677% | 5.3440 | 11/01/36 | 45,583 | |||||||||

| 157,625 | Fannie Mae Pool Series 889819(b) | RFUCCT1Y + 1.550% | 5.0990 | 04/01/37 | 160,612 | |||||||||

| 18,617 | Fannie Mae Pool Series 748848(b) | H15T1Y + 2.270% | 6.0200 | 06/01/37 | 18,855 | |||||||||

| 63,650 | Fannie Mae Pool Series AB5688 | 3.5000 | 07/01/37 | 59,956 | ||||||||||

| 37,621 | Fannie Mae Pool Series AL0920 | 5.0000 | 07/01/37 | 38,283 | ||||||||||

| 32,152 | Fannie Mae Pool Series 888628(b) | RFUCCT1Y + 1.828% | 5.1810 | 07/01/37 | 31,878 | |||||||||

| 1,385 | Fannie Mae Pool Series 899633 | 5.5000 | 07/01/37 | 1,414 | ||||||||||

| 75,420 | Fannie Mae Pool Series AD0959(b) | RFUCCT6M + 2.064% | 5.8330 | 07/01/37 | 76,555 | |||||||||

| 125,100 | Fannie Mae Pool Series AL1288(b) | RFUCCT1Y + 1.585% | 5.7720 | 09/01/37 | 124,694 | |||||||||

| 9,269 | Fannie Mae Pool Series AL0883(b) | RFUCCT1Y + 1.323% | 5.3620 | 01/01/38 | 9,162 | |||||||||

| 70,808 | Fannie Mae Pool Series 964760(b) | RFUCCT1Y + 1.616% | 5.8660 | 08/01/38 | 70,207 | |||||||||

| 4,515 | Fannie Mae Pool Series 725320(b) | H15T1Y + 2.252% | 5.4850 | 08/01/39 | 4,533 | |||||||||

| 42,182 | Fannie Mae Pool Series AC2472 | 5.0000 | 06/01/40 | 42,467 | ||||||||||

| 1,858,952 | Fannie Mae Pool Series BM1078(b) | H15T1Y + 2.174% | 5.4960 | 12/01/40 | 1,900,148 | |||||||||

See accompanying notes to financial statements.

6

| TRANSWESTERN INSTITUTIONAL SHORT DURATION GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| U.S. GOVERNMENT & AGENCIES — 60.2% (Continued) | ||||||||||||||

| FEDERAL NATIONAL MORTGAGE ASSOCIATION — 26.2%(a) (Continued) | ||||||||||||||

| 7,572 | Fannie Mae Pool Series AL2559(b) | RFUCCT1Y + 1.807% | 5.2670 | 07/01/41 | $ | 7,532 | ||||||||

| 273,978 | Fannie Mae Pool Series AJ0875(b) | RFUCCT1Y + 1.800% | 6.0500 | 10/01/41 | 280,819 | |||||||||

| 377,538 | Fannie Mae Pool Series AO4163 | 3.5000 | 06/01/42 | 355,589 | ||||||||||

| 230,889 | Fannie Mae Pool Series AB5519 | 3.5000 | 07/01/42 | 217,467 | ||||||||||

| 2,157,746 | Fannie Mae Pool Series AO8169 | 3.5000 | 09/01/42 | 2,032,285 | ||||||||||

| 292,939 | Fannie Mae Pool Series AB7016 | 4.0000 | 11/01/42 | 285,051 | ||||||||||

| 541,802 | Fannie Mae Pool Series AQ6238 | 3.5000 | 12/01/42 | 510,301 | ||||||||||

| 374,040 | Fannie Mae Pool Series AQ9715 | 3.0000 | 01/01/43 | 342,004 | ||||||||||

| 398,794 | Fannie Mae Pool Series MA1404 | 3.5000 | 04/01/43 | 375,601 | ||||||||||

| 125,589 | Fannie Mae Pool Series AB9096 | 4.0000 | 04/01/43 | 122,243 | ||||||||||

| 21,921 | Fannie Mae Pool Series 803338(b) | 12MTA + 1.200% | 6.1290 | 09/01/44 | 21,213 | |||||||||

| 221,364 | Fannie Mae Pool Series MA3536 | 4.0000 | 12/01/48 | 213,173 | ||||||||||

| 3,086,749 | Fannie Mae Pool Series CB2846 | 2.0000 | 02/01/52 | 2,530,807 | ||||||||||

| 2,920,613 | Fannie Mae Pool Series MA4562 | 2.0000 | 03/01/52 | 2,389,565 | ||||||||||

| 1,243 | Fannie Mae REMICS Series 2005-100 BQ (d) | 5.5000 | 11/25/25 | 1,199 | ||||||||||

| 1 | Fannie Mae REMICS Series 1999-57 FC (b),(d) | SOFR30A + 0.364% | 5.7030 | 11/17/29 | 1 | |||||||||

| 52,043 | Fannie Mae REMICS Series 2000-45 FG (b),(d) | SOFR30A + 0.664% | 6.0030 | 12/18/30 | 50,546 | |||||||||

| 75,875 | Fannie Mae REMICS Series 2000-45 FD (b),(d) | SOFR30A + 0.664% | 6.0030 | 12/18/30 | 73,692 | |||||||||

| 35,087 | Fannie Mae REMICS Series 2002-30 FB (b),(d) | SOFR30A + 1.114% | 6.4520 | 08/25/31 | 34,410 | |||||||||

| 18,798 | Fannie Mae REMICS Series 2002-16 VF (b),(d) | SOFR30A + 0.664% | 6.0020 | 04/25/32 | 17,891 | |||||||||

| 7,139 | Fannie Mae REMICS Series 2002-71 AP (d) | 5.0000 | 11/25/32 | 6,824 | ||||||||||

| 1,937 | Fannie Mae REMICS Series 2003-35 FG (b),(d) | SOFR30A + 0.414% | 5.7520 | 05/25/33 | 1,868 | |||||||||

| 23,944 | Fannie Mae REMICS Series 2005-29 WQ (d) | 5.5000 | 04/25/35 | 24,081 | ||||||||||

| 77,966 | Fannie Mae REMICS Series 2009-50 PT (c),(d) | 5.5530 | 05/25/37 | 75,491 | ||||||||||

| 67,400 | Fannie Mae REMICS Series 2008-86 LA (c),(d) | 3.4940 | 08/25/38 | 65,509 | ||||||||||

| 298,753 | Fannie Mae REMICS Series 2010-60 HB (d) | 5.0000 | 06/25/40 | 297,059 | ||||||||||

| 81,312 | Fannie Mae REMICS Series 2013-63 YF (b),(d) | SOFR30A + 1.114% | 5.0000 | 06/25/43 | 72,209 | |||||||||

| 1,419,024 | Fannie Mae REMICS Series 2020-35 FA (b),(d) | SOFR30A + 0.614% | 5.5730 | 06/25/50 | 1,396,926 | |||||||||

| 1,483,854 | Fannie Mae-Aces Series 2017-M3 A2 (c) | 2.4650 | 12/25/26 | 1,406,522 | ||||||||||

| 2,186,409 | Fannie Mae-Aces Series 2017-M14 A2 (c) | 2.8620 | 11/25/27 | 2,071,853 | ||||||||||

| 21,912,472 | ||||||||||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION — 14.9% | ||||||||||||||

| 39,879 | Ginnie Mae II Pool Series 891616(b) | H15T1Y + 1.400% | 6.8600 | 06/20/58 | 39,925 | |||||||||

See accompanying notes to financial statements.

7

| TRANSWESTERN INSTITUTIONAL SHORT DURATION GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| U.S. GOVERNMENT & AGENCIES — 60.2% (Continued) | ||||||||||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION — 14.9% (Continued) | ||||||||||||||

| 1,114 | Ginnie Mae II Pool Series 751387(c) | 4.7420 | 01/20/61 | $ | 1,098 | |||||||||

| 14,032 | Ginnie Mae II Pool Series 710065(c) | 4.8100 | 02/20/61 | 13,843 | ||||||||||

| 15,926 | Ginnie Mae II Pool Series 751408(c) | 4.8170 | 06/20/61 | 15,850 | ||||||||||

| 10,653 | Ginnie Mae II Pool Series 710084(c) | 4.7000 | 08/20/61 | 10,587 | ||||||||||

| 23,497 | Ginnie Mae II Pool Series 894704(b) | H15T1Y + 0.792% | 6.2500 | 10/20/61 | 23,423 | |||||||||

| 1,349 | Ginnie Mae II Pool Series 773437(c) | 4.4850 | 02/20/62 | 1,293 | ||||||||||

| 156 | Ginnie Mae II Pool Series 757339(c) | 4.8620 | 02/20/62 | 154 | ||||||||||

| 3,925 | Ginnie Mae II Pool Series 759745(c) | 4.8150 | 05/20/62 | 3,869 | ||||||||||

| 158 | Ginnie Mae II Pool Series 757348(c) | 4.8490 | 06/20/62 | 155 | ||||||||||

| 247,336 | Ginnie Mae II Pool Series 897906(b) | H15T1Y + 0.836% | 6.2940 | 06/20/62 | 246,701 | |||||||||

| 390,695 | Ginnie Mae II Pool Series 896363(b) | H15T1Y + 0.662% | 6.1190 | 07/20/62 | 388,834 | |||||||||

| 1,315 | Ginnie Mae II Pool Series 766556(c) | 4.7550 | 08/20/62 | 1,293 | ||||||||||

| 6,468 | Ginnie Mae II Pool Series 777432(c) | 4.5990 | 10/20/62 | 6,351 | ||||||||||

| 94,808 | Ginnie Mae II Pool Series 899072(b) | RFUCCT1M + 2.063% | 7.4690 | 10/20/62 | 97,133 | |||||||||

| 4,078 | Ginnie Mae II Pool Series 765229(c) | 4.5530 | 11/20/62 | 3,911 | ||||||||||

| 548,555 | Ginnie Mae II Pool Series 899633(b) | RFUCCT1M + 1.879% | 7.2840 | 01/20/63 | 557,123 | |||||||||

| 142,516 | Ginnie Mae II Pool Series 898433(b) | RFUCCT1M + 2.177% | 7.5830 | 01/20/63 | 144,013 | |||||||||

| 327,596 | Ginnie Mae II Pool Series 899650(b) | RFUCCT1M + 1.890% | 7.2960 | 02/20/63 | 332,933 | |||||||||

| 349,782 | Ginnie Mae II Pool Series 899765(b) | RFUCCT1M + 1.912% | 7.3270 | 02/20/63 | 354,661 | |||||||||

| 110,801 | Ginnie Mae II Pool Series 898436(b) | RFUCCT1M + 2.157% | 7.5400 | 02/20/63 | 112,247 | |||||||||

| 155,389 | Ginnie Mae II Pool Series 899651(b) | RFUCCT1M + 2.331% | 7.7400 | 02/20/63 | 158,434 | |||||||||

| 18,392 | Ginnie Mae II Pool Series AE9606(b) | H15T1Y + 1.140% | 6.6000 | 08/20/64 | 18,394 | |||||||||

| 7,116 | Ginnie Mae II Pool Series AG8190(b) | H15T1Y + 1.135% | 6.5930 | 09/20/64 | 7,108 | |||||||||

| 18,457 | Ginnie Mae II Pool Series AG8209(b) | H15T1Y + 0.871% | 6.3170 | 10/20/64 | 18,407 | |||||||||

| 11,323 | Ginnie Mae II Pool Series AG8275(b) | H15T1Y + 1.136% | 6.5950 | 03/20/65 | 11,314 | |||||||||

| 1 | Government National Mortgage Association Series 2012-124 HT (c),(d) | 6.5000 | 07/20/32 | 1 | ||||||||||

| 36,030 | Government National Mortgage Association Series 2003-72 Z (c) | 5.4140 | 11/16/45 | 35,094 | ||||||||||

| 3,688 | Government National Mortgage Association Series 2011-H23 HA (d) | 3.0000 | 12/20/61 | 3,395 | ||||||||||

| 1,436,620 | Government National Mortgage Association Series 2014-H12 HZ (c),(d) | 4.5750 | 06/20/64 | 1,370,311 | ||||||||||

| 756 | Government National Mortgage Association Series 2015-H09 HA (d) | 1.7500 | 03/20/65 | 682 | ||||||||||

See accompanying notes to financial statements.

8

| TRANSWESTERN INSTITUTIONAL SHORT DURATION GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| U.S. GOVERNMENT & AGENCIES — 60.2% (Continued) | ||||||||||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION — 14.9% (Continued) | ||||||||||||||

| 2,083,307 | Government National Mortgage Association Series 2018-H16 FA (b),(d) | TSFR1M + 0.534% | 5.8570 | 09/20/68 | $ | 2,043,825 | ||||||||

| 2,761,175 | Government National Mortgage Association Series 2020-H04 FP (b),(d) | TSFR1M + 0.614% | 5.9370 | 06/20/69 | 2,743,340 | |||||||||

| 3,720,457 | Government National Mortgage Association Series 2020-H02 FG (b),(d) | TSFR1M + 0.714% | 6.0370 | 01/20/70 | 3,701,932 | |||||||||

| 12,467,634 | ||||||||||||||

| TOTAL U.S. GOVERNMENT & AGENCIES (Cost $52,225,387) | 50,422,437 | |||||||||||||

| U.S. TREASURY NOTES — 31.5% | ||||||||||||||

| 4,410,000 | United States Treasury Note | 5.0000 | 08/31/25 | 4,451,774 | ||||||||||

| 4,485,000 | United States Treasury Note | 4.2500 | 12/31/25 | 4,485,350 | ||||||||||

| 1,000,000 | United States Treasury Note | 4.1250 | 06/15/26 | 1,000,274 | ||||||||||

| 815,000 | United States Treasury Note | 4.6250 | 11/15/26 | 828,339 | ||||||||||

| 2,250,000 | United States Treasury Note | 3.6250 | 03/31/28 | 2,227,676 | ||||||||||

| 4,090,000 | United States Treasury Note | 4.1250 | 07/31/28 | 4,136,332 | ||||||||||

| 500,000 | United States Treasury Note | 3.7500 | 12/31/28 | 498,242 | ||||||||||

| 5,505,000 | United States Treasury Note | 4.1250 | 11/15/32 | 5,607,144 | ||||||||||

| 235,000 | United States Treasury Note | 3.5000 | 02/15/33 | 228,377 | ||||||||||

| 2,940,000 | United States Treasury Note | 3.8750 | 08/15/33 | 2,942,756 | ||||||||||

| TOTAL U.S. TREASURY NOTES (Cost $26,242,782) | 26,406,264 | |||||||||||||

| SHORT-TERM INVESTMENTS — 14.9% | ||||||||||||||

| U.S. TREASURY BILLS — 9.6% | ||||||||||||||

| 2,040,000 | United States Treasury Bill | 2.6600 | 01/02/24 | 2,039,703 | ||||||||||

| 3,275,000 | United States Treasury Bill | 4.3300 | 01/09/24 | 3,271,506 | ||||||||||

| 2,740,000 | United States Treasury Bill | 5.0900 | 02/08/24 | 2,725,175 | ||||||||||

| 8,036,384 | ||||||||||||||

| AGENCY DISCOUNT NOTES – 5.3% | ||||||||||||||

| 4,475,000 | Fannie Mae Discount Notes | 2.6500 | 01/02/24 | 4,474,351 | ||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $12,510,297) | 12,510,735 | |||||||||||||

See accompanying notes to financial statements.

9

| TRANSWESTERN INSTITUTIONAL SHORT DURATION GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Fair Value | ||||||||

| TOTAL INVESTMENTS - 106.6% (Cost $90,978,466) | $ | 89,339,436 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (6.6)% | (5,559,848 | ) | ||||||

| NET ASSETS - 100.0% | $ | 83,779,588 | ||||||

| SOFR30A | United States 30 Day Average SOFR Secured Overnight Financing Rate |

| RFUCCT6M | Refinitiv USD IBOR Consumer Cash Fallbacks 6 Month Term |

| H15T1Y | US Treasury Yield Curve Rate T Note Constant Maturity 1 Year |

| RFUCCT1Y | Refinitiv USD IBOR Consumer Cash Fallbacks 1 Year Term |

| 12MTA | Federal Reserve US 12 Month Cumulative Avg 1 Year CMT |

| REMIC | Real Estate Mortgage Investment Conduit |

| RFUCCT1M | Refinitiv USD IBOR Consumer Cash Fallbacks 1 Month Term |

| TSFR1M | Term Secured Overnight Financing Rate |

| (a) | Issuer operates under a Congressional charter; its securities are neither issued nor guaranteed by the U.S. government. The Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation currently operate under a federal conservatorship. |

| (b) | Variable rate security; the rate shown represents the rate on December 31, 2023. |

| (c) | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| (d) | Collateralized mortgage obligation (CMO). |

See accompanying notes to financial statements.

10

| TransWestern Institutional Short Duration Government Bond Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2023 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 90,978,466 | ||

| At value | $ | 89,339,436 | ||

| Cash | 588,414 | |||

| Receivable for securities sold | 2,026,446 | |||

| Principal paydown receivable | 30,981 | |||

| Interest receivable | 410,467 | |||

| Prepaid expenses and other assets | 5,109 | |||

| TOTAL ASSETS | 92,400,853 | |||

| LIABILITIES | ||||

| Payable for investments purchased | 8,522,832 | |||

| Distributions payable | 30,354 | |||

| Investment advisory fees payable | 19,213 | |||

| Payable to related parties | 10,476 | |||

| Distribution (12b-1) fees payable | 7,051 | |||

| Trustee fees payable | 435 | |||

| Accrued expenses and other liabilities | 30,904 | |||

| TOTAL LIABILITIES | 8,621,265 | |||

| NET ASSETS | $ | 83,779,588 | ||

| Net Assets Consist Of: | ||||

| Paid in capital | 116,788,874 | |||

| Accumulated deficit | (33,009,286 | ) | ||

| NET ASSETS | $ | 83,779,588 | ||

| Net Asset Value Per Share: | ||||

| Shares of beneficial interest outstanding [$0 par value, unlimited shares authorized] | 9,148,016 | |||

| Net asset value (Net Assets divided by Shares Outstanding), offering price and redemption price per share (a) | $ | 9.16 | ||

| (a) | Redemptions made within 30 days of purchase may be assessed a redemption fee of 0.25%. |

See accompanying notes to financial statements.

11

| TransWestern Institutional Short Duration Government Bond Fund |

| STATEMENT OF OPERATIONS |

| Year Ended December 31, 2023 |

| INVESTMENT INCOME | ||||

| Interest | $ | 3,408,349 | ||

| EXPENSES | ||||

| Investment advisory fees | 394,007 | |||

| Distribution (12b-1) fees | 87,557 | |||

| Administrative services fees | 91,191 | |||

| Accounting services fees | 30,689 | |||

| Compliance officer fees | 29,931 | |||

| Transfer agent fees | 25,506 | |||

| Audit fees | 20,261 | |||

| Trustees’ fees and expenses | 20,108 | |||

| Custodian fees | 17,668 | |||

| Legal fees | 16,119 | |||

| Printing and postage expenses | 7,501 | |||

| Insurance expense | 2,476 | |||

| Registration fees | 1,104 | |||

| Other expenses | 14 | |||

| TOTAL EXPENSES | 744,132 | |||

| Less: Fees waived by the Advisor | (175,104 | ) | ||

| NET EXPENSES | 569,028 | |||

| NET INVESTMENT INCOME | 2,839,321 | |||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | ||||

| Net realized loss from investments | (767,915 | ) | ||

| Net change in unrealized appreciation/(depreciation) on investments | 1,533,397 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 765,482 | |||

| NET INCREASE IN NET ASSETS FROM OPERATIONS | $ | 3,604,803 | ||

See accompanying notes to financial statements.

12

| TransWestern Institutional Short Duration Government Bond Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| Year Ended | Year Ended | |||||||

| December 31, 2023 | December 31, 2022 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 2,839,321 | $ | 2,028,539 | ||||

| Net realized loss from investments and securities sold short | (767,915 | ) | (10,424,336 | ) | ||||

| Net change in unrealized appreciation/(depreciation) on investments | 1,533,397 | (4,727,695 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 3,604,803 | (13,123,492 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM EARNINGS | ||||||||

| Total distributions paid | (3,189,379 | ) | (2,491,353 | ) | ||||

| Net decrease in net assets from distributions to shareholders | (3,189,379 | ) | (2,491,353 | ) | ||||

| FROM BENEFICIAL INTEREST TRANSACTIONS: | ||||||||

| Proceeds from shares sold | 10,000,000 | 5,000,000 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 2,795,384 | 2,269,534 | ||||||

| Payments for shares redeemed | (18,425,151 | ) | (228,204,931 | ) | ||||

| Net decrease in net assets from shares of beneficial interest | (5,629,767 | ) | (220,935,397 | ) | ||||

| TOTAL DECREASE IN NET ASSETS | (5,214,343 | ) | (236,550,242 | ) | ||||

| NET ASSETS | ||||||||

| Beginning of year | 88,993,931 | 325,544,173 | ||||||

| End of year | $ | 83,779,588 | $ | 88,993,931 | ||||

| SHARE ACTIVITY | ||||||||

| Shares sold | 1,114,827 | 520,725 | ||||||

| Shares reinvested | 308,328 | 245,134 | ||||||

| Shares redeemed | (2,053,740 | ) | (24,489,373 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (630,585 | ) | (23,723,514 | ) | ||||

See accompanying notes to financial statements.

13

| TransWestern Institutional Short Duration Government Bond Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year |

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| December 31, | December 31, | December 31, | December 31, | December 31, | ||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 9.10 | $ | 9.72 | $ | 9.82 | $ | 9.68 | $ | 9.57 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (1) | 0.29 | 0.10 | 0.01 | 0.03 | 0.13 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.10 | (0.57 | ) | (0.08 | ) | 0.19 | 0.23 | |||||||||||||

| Total from investment operations | 0.39 | (0.47 | ) | (0.07 | ) | 0.22 | 0.36 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.33 | ) | (0.15 | ) | (0.03 | ) | (0.08 | ) | (0.25 | ) | ||||||||||

| Total from distributions | (0.33 | ) | (0.15 | ) | (0.03 | ) | (0.08 | ) | (0.25 | ) | ||||||||||

| Net Asset Value, End of Year | $ | 9.16 | $ | 9.10 | $ | 9.72 | $ | 9.82 | $ | 9.68 | ||||||||||

| Total return (2) | 4.40 | % | (4.82 | )% | (0.72 | )% | 2.24 | % | 3.78 | % | ||||||||||

| Net assets, end of year (000s) | $ | 83,780 | $ | 88,994 | $ | 325,544 | $ | 397,181 | $ | 161,140 | ||||||||||

| Ratio of gross expenses to average net assets | 0.85 | % | 0.74 | % | 0.70 | % | 0.69 | % | 0.72 | % | ||||||||||

| Ratio of net expenses to average net assets | 0.65 | % | 0.65 | % | 0.64 | % (4) | 0.64 | % (4) | 0.65 | % | ||||||||||

| Ratio of net investment income to average net assets | 3.24 | % | 1.05 | % | 0.11 | % | 0.26 | % | 1.32 | % | ||||||||||

| Portfolio Turnover Rate | 222 | % | 218 | % (3) | 317 | % (3) | 433 | % | 431 | % | ||||||||||

| (1) | Per share amounts calculated using the average share method, which appropriately presents the per share data for the year. |

| (2) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends, and capital gain distributions, if any, and exclude the effect of applicable sales loads. Had the Advisor not waived a portion of its fees, total returns would have been lower. |

| (3) | The portfolio turnover rate excludes dollar roll transactions for the years ended December 31, 2022, and December 31, 2021. If these were included in the calculation the turnover percentage would be 237%, and 320%, respectively. The fund had no dollar rolls for the years ended December 31, 2019, December 31, 2020 or December 31, 2023. |

| (4) | During the years ended December 31, 2021 and December 31, 2020, the Advisor voluntarily waived a portion of the advisory fee. Without this waiver, the net expense ratio would have been 0.65%. |

See accompanying notes to financial statements.

14

| TransWestern Institutional Short Duration Government Bond Fund |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2023 |

| 1. | ORGANIZATION |

The TransWestern Institutional Short Duration Government Bond Fund (the “Fund”) is a separate diversified series of shares of beneficial interest of Northern Lights Fund Trust (the “Trust”). The Trust is organized under the laws of the State of Delaware, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund’s investment objective is to seek to provide income consistent with liquidity, and limited credit and interest rate risk. The Fund commenced operations on January 3, 2011 and is offered at net asset value (“NAV”) without a sales charge.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies” including Accounting Standards update 2013-08.

Securities Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale, such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Board of Trustees of the Trust (the “Board”) based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type, indications as to values from dealers, and general market conditions or market quotations from a major market maker in the securities. The independent pricing service does not distinguish between smaller-sized bond positions known as “odd lots” and larger institutional-sized bond positions known as “round lots”. The Fund may fair value a particular bond if the advisor does not believe that the round lot value provided by the independent pricing service reflects fair value of the Fund’s holding. Short-term debt obligations, having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities are valued using the “fair value” procedures approved by the Board. The Board has designated the adviser as its valuation designee (the “Valuation Designee”) to execute these procedures. The Board may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, approval of which shall be based upon whether the Valuation Designee followed the valuation procedures established by the Board.

Fair Valuation Process – The applicable investments are valued by the Valuation Designee pursuant to valuation procedures established by the Board. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the Valuation Designee, the prices or values available do not represent the fair value of the instrument; factors which may cause the Valuation Designee to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that affects the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed

15

| TransWestern Institutional Short Duration Government Bond Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| December 31, 2023 |

futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If a current bid from such independent dealers or other independent parties is unavailable, the Valuation Designee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of December 31, 2023, for the Fund’s investments measured at fair value:

| Assets * | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| U.S. Government & Agencies | $ | — | $ | 50,422,437 | $ | — | $ | 50,422,437 | ||||||||

| U.S. Treasury Notes | — | 26,406,264 | — | 26,406,264 | ||||||||||||

| Short-Term Investments | — | 12,510,735 | — | 12,510,735 | ||||||||||||

| Total | $ | — | $ | 89,339,436 | $ | — | $ | 89,339,436 | ||||||||

The Fund did not hold any Level 3 securities during the year.

| * | Refer to the Schedule of Investments for industry classification. |

16

| TransWestern Institutional Short Duration Government Bond Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| December 31, 2023 |

Security Transactions and Related Income – Security transactions are accounted for on trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities using the effective interest method. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and Distributions to Shareholders – Dividends from net investment income are declared daily and paid monthly. Distributable net realized capital gains, if any, are declared and distributed annually. Dividends from net investment income and distributions from net realized gains are recorded on the ex-dividend date and are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (e.g., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Any such reclassifications will have no effect on net assets, results of operations, or net asset value per share of the Fund.

Federal Income Tax – It is the Fund’s policy to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code of 1986 as amended, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended December 31, 2020 to December 31, 2022 or expected to be taken in the Fund’s December 31, 2023 year-end tax returns. The Fund identifies its major tax jurisdictions as U.S. federal and Ohio (Nebraska in prior years), and foreign jurisdictions where the Fund makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

When-Issued and Delayed-Delivery Transactions – The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Dollar Roll Transactions – A mortgage dollar roll transaction involves a sale by the Fund of mortgage related securities that it holds with an agreement by the Fund to repurchase similar securities at an agreed upon price and date. The securities purchased will bear the same interest rate as those sold, but generally will be collateralized by pools of mortgages with different prepayment histories than those securities sold. The Fund accounts for mortgage dollar rolls as purchases and sales transactions. There were no dollar roll transactions during the year ended December 31, 2023.

Short Sales – A short sale is a transaction in which the Fund sells a security it does not own but has borrowed in anticipation that the market price of that security will decline. The Fund is obligated to replace the security borrowed by purchasing it on the open market at a later date. If the price of the security sold short increases between the time of the short sale and the time the Fund replaces the borrowed security, the Fund will incur a loss. Conversely, if the price declines, the Fund will realize a gain. There were no short sales transactions during the year ended December 31, 2023.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses, which are not readily identifiable to a specific fund, are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

17

| TransWestern Institutional Short Duration Government Bond Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| December 31, 2023 |

Cash – The Fund considers its investment in an FDIC insured interest bearing savings account to be cash. The Fund maintains cash balances, which, at times, may exceed federally insured limits. The Fund maintains these balances with a high-quality financial institution.

| 3. | INVESTMENT TRANSACTIONS |

For the year ended December 31, 2023, the cost of purchases and proceeds from sales of U.S. government securities, other than short-term investments, amounted to $185,135,343 and $192,902,233, respectively.

| 4. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

TransWestern Capital Advisors, LLC serves as the Fund’s investment advisor (the “Advisor”) and Loomis, Sayles & Company, L.P. serves as the Fund’s sub-advisor (the “Sub-Advisor”). Pursuant to an advisory agreement between the Advisor and the Trust, on behalf of the Fund, the Advisor, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Advisor, the Fund pays the Advisor a management fee, computed and accrued daily and paid monthly, at an annual rate of 0.45% of the Fund’s average daily net assets. Subject to the authority of the Board and oversight by the Advisor, the Sub-Advisor is responsible for day-to-day execution of the Fund’s strategy and management of the Fund’s investment portfolio according to the Fund’s investment objective, policies and restrictions. The Sub-Advisor is paid by the Advisor, not the Fund. During the year ended December 31, 2023, the Fund incurred $394,007 in advisory fees.

Pursuant to an expense limitation agreement between the Advisor and the Trust, on behalf of the Fund, (the “Expense Limitation Agreement”), the Advisor has contractually agreed, at least until April 30, 2024, to waive a portion of its advisory fee and has agreed to reimburse the Fund for other expenses to the extent necessary so that the total expenses incurred by the Fund (exclusive of any front end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, fees and expenses associated with instruments in other collective investment vehicles or derivative instruments (including for example options and swap fees and expenses) borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers other than the Advisor will not exceed 0.65% per annum of the Fund’s average daily net assets. During the year ended December 31, 2023, the Advisor waived fees of $175,104.

If the Advisor waives any fee or reimburses any expense pursuant to the expense limitation agreement, and the Fund’s operating expenses are subsequently less than 0.65% of average daily net assets, the Advisor shall be entitled to reimbursement by the Fund for such waived fees or reimbursed expenses provided that such reimbursement does not cause the Fund’s expenses to exceed 0.65% of average daily net assets. If the Fund’s operating expenses subsequently exceed 0.65% per annum of the Fund’s average daily net assets, the reimbursements shall be suspended. The Advisor may seek reimbursement only for expenses waived or paid by it during the three fiscal years prior to such reimbursement; provided, however, that such expenses may only be reimbursed to the extent they were waived or paid after the date of the Expense Limitation Agreement (or any similar agreement). As of December 31, 2023, fee waivers subject to recapture by the Advisor were as follows:

| Year of Expiration | ||||

| December 31, 2024 | $ | 164,660 | ||

| December 31, 2025 | $ | 173,594 | ||

| December 31, 2026 | $ | 175,104 | ||

As of December 31, 2023, $133,788 in previously waived fees expired unrecouped.

Effective September 30, 2020, the Advisor agreed to voluntarily waive a portion of the advisory fee to support an annualized yield. The Advisor can amend or terminate this voluntary waiver at any time. For the year ended December 31, 2023, the Advisor voluntarily waived $0 of advisory fees. The voluntary waiver is not subject to recapture by the Advisor.

18

| TransWestern Institutional Short Duration Government Bond Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| December 31, 2023 |

The Trust, with respect to the Fund, has adopted the Trust’s Master Distribution and Shareholder Servicing Plan (the “12b-1 Plan” or “Plan”). Pursuant to the Plan, the Fund pays the Advisor an annual fee for distribution and shareholder servicing expenses of up to 0.10% of the Fund’s average daily net assets. During the year ended December 31, 2023, pursuant to the Plan, the Advisor received $87,557 of fees.

Pursuant to a separate servicing agreement with Ultimus Fund Solutions, LLC (“UFS”), the Fund pays UFS fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Trust are also officers of UFS, and are not paid any fees directly by the Fund for serving in such capacities.

In addition, certain affiliates of UFS provide ancillary services to the Fund as follows:

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of UFS, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund.

Blu Giant, LLC (“Blu Giant”), an affiliate of UFS, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives fees from the Fund.

| 5. | REDEMPTION FEE |

The Fund may assess a short-term redemption fee of 0.25% of the total redemption amount if shareholders sell their shares after holding them for less than 30 days. The redemption fee is paid directly to the Fund. For the year ended December 31, 2023, the Fund did not assess any redemption fees.

| 6. | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS |

The identified cost of investments in securities owned by the Fund for federal income tax purposes (including securities sold short), and its respective gross unrealized appreciation and depreciation at December 31, 2023, were as follows:

| Net Unrealized | ||||||||||||||

| Cost | Appreciation | Depreciation | Depreciation | |||||||||||

| $ | 91,010,352 | $ | 422,090 | $ | (2,093,006 | ) | $ | (1,670,916 | ) | |||||

| 7. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of Fund distributions paid during the years ended December 31, 2023 and December 31, 2022 was as follows:

| Fiscal Year Ended | Fiscal Year Ended | |||||||

| December 31, 2023 | December 31, 2022 | |||||||

| Ordinary Income | $ | 3,189,379 | $ | 2,491,353 | ||||

| $ | 3,189,379 | $ | 2,491,353 | |||||

As of December 31, 2023, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Undistributed | Undistributed | Post October Loss | Capital Loss | Other | Total | |||||||||||||||||||||

| Ordinary | Long-Term | and | Carry | Book/Tax | Unrealized | Accumulated | ||||||||||||||||||||

| Income | Gains | Late Year Loss | Forwards | Differences | Depreciation | Deficit | ||||||||||||||||||||

| $ | 29,026 | $ | — | $ | — | $ | (31,337,042 | ) | $ | (30,354 | ) | $ | (1,670,916 | ) | $ | (33,009,286 | ) | |||||||||

The difference between book basis and tax basis undistributed net investment income/(loss and other book/tax adjustments is primarily attributable to the tax deferral of losses on wash sales and adjustments for accrued dividends payable.

19

| TransWestern Institutional Short Duration Government Bond Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| December 31, 2023 |

At December 31, 2023, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains as follows:

| Non-Expiring | Non-Expiring | |||||||||

| Short-Term | Long-Term | Total | ||||||||

| $ | 10,344,151 | $ | 20,992,891 | $ | 31,337,042 | |||||

| 8. | BENEFICIAL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of December 31, 2023, Crest Forest Realty Corporation held 63.23% of the voting securities of the Fund.

| 9. | RECENT REGULATORY UPDATES |

On January 24, 2023, the SEC adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will not appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. At this time, management is evaluating the impact of these amendments on the shareholder reports for the Fund.

| 10. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

20

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of TransWestern Institutional Short Duration Government Bond Fund and

Board of Trustees of Northern Lights Fund Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of TransWestern Institutional Short Duration Government Bond Fund (the “Fund”), a series of the Northern Lights Fund Trust, as of December 31, 2023, the related statement of operations and changes in net assets, the related notes, and the financial highlights for the year ended December 31, 2023 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, the results of its operations, the changes in net assets, and financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial statement and financial highlights for the years ended December 31, 2022, and prior, were audited by other auditors whose report dated February 28, 2023, expressed an unqualified opinion on those financial statement and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2023.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

February 27, 2024

COHEN & COMPANY, LTD.

800.229.1099 | 866.818.4538 fax | cohencpa.com

Registered with the Public Company Accounting Oversight Board

21

| TransWestern Institutional Short Duration Government Bond Fund |

| EXPENSE EXAMPLES |

| December 31, 2023 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees; (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2023 to December 31, 2023.

Actual Expenses

The “Actual” line in the table below provides information about actual account values and actual expenses. You may use the information below; together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized | Beginning | Ending | Expenses Paid | |

| Expense | Account Value | Account Value | During Period * | |

| Actual | Ratio | 7/1/23 | 12/31/23 | 7/1/23 – 12/31/23 |

| TransWestern | 0.65% | $1,000.00 | $1,030.60 | $3.33 |

| Annualized | Beginning | Ending | Expenses Paid | |

| Hypothetical | Expense | Account Value | Account Value | During Period * |

| (5% return before expenses) | Ratio | 7/1/23 | 12/31/23 | 7/1/23 – 12/31/23 |

| TransWestern | 0.65% | $1,000.00 | $1,021.93 | $3.31 |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the number of days in the period (184) divided by the number of days in the fiscal year (365). |

22

| Transwestern Institutional Short Duration Government Bond Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| December 31, 2023 |

Transwestern Advisors-Advisor to TransWestern Institutional Short Duration Government Bond Fund*

In connection with the regular meeting held on December 13-14, 2023 of the Board of Trustees (the “Trustees” or the “Board”) of the Northern Lights Fund Trust (the “Trust”), including a majority of the Trustees who are not “interested persons,” as that term is defined in the Investment Company Act of 1940, as amended, discussed the renewal of an investment advisory agreement (the “Advisory Agreement”) between TransWestern Capital Advisers, LLC (“TCA” or the “Adviser”) and the Trust, with respect to the TransWestern Institutional Short Duration Government Bond Fund (the “Fund”). In considering the renewal of the Advisory Agreement, the Board received materials specifically relating to the Advisory Agreement.

Nature, Extent and Quality of Services. The Board noted that TCA was founded in 2005 and managed approximately $118 million in total assets. The Board acknowledged that the adviser’s conservative strategy was focused on short duration government bonds, the management of credit and interest rate risk, and receiving favorable treatment on a financial institution’s balance sheet. The Board noted that TCA had delegated the Fund’s day-to-day management to a sub-adviser, Loomis, Sayles, according to strict parameters set by TCA, and that TCA continuously monitored and evaluated the sub-adviser’s performance as well as daily review of duration, average coupon, and other portfolio characteristics. The Board observed that the Adviser confirmed there were no reported cybersecurity incidents, material litigation or compliance issues since the last renewal of the Advisory Agreement. The Board noted that the Adviser had the necessary expertise to oversee this specialty strategy and concluded that TCA was expected to continue to provide high quality service to the Fund and its shareholders.

Performance. The Board considered the Fund’s performance, noting that the Fund was rated 4-stars by Morningstar. The Board noted that, relative to its category, the Fund’s performance was in the 12th percentile over the since inception period and was in the 32nd percentile over the prior one-year period. The Board further considered that the Fund’s performance was equal to its blended index over the prior one-year period and was slightly stronger than the blended index over the prior three-year period. The Board concluded that the performance of the Fund was satisfactory given the Fund’s specific investment strategy.

Fees and Expenses. The Board observed that the Adviser charged an advisory fee of 0.45%, noting that such advisory fee was above the Fund’s category average and median. They further noted that Fund’s gross expense ratio of 0.85% was in the 80th percentile of the Fund’s category. The Board considered the Adviser’s position that the fee was reasonable in light of the complexity of the Fund’s investment strategy and the process required to operate such strategy. They discussed the sub-advisory fee and the allocation of duties, the sub-advisory fee breakpoint, and whether a similar breakpoint on the advisory fee would be reasonable in the future. The Board concluded that the advisory fee was not unreasonable.

Profitability. The Board assessed TCA’s profitability analysis, considering the Adviser’s profits in absolute dollars and as a percentage of revenue, included among the Meeting Materials in light of the service provided by the Adviser to the Fund. The Board noted that the Adviser reported a net loss over the past year. The Board agreed that the profitability from TCA’s relationship to the Fund was not excessive.