united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21720

Northern Lights Fund Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Ste 450, Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2633

Date of fiscal year end: 10/31

Date of reporting period: 10/31/23

Item 1. Reports to Stockholders.

| Navigator® Equity Hedged Fund |

| K. Sean Clark, CFA — Chief Investment Officer |

| October 31, 2023 (unaudited) |

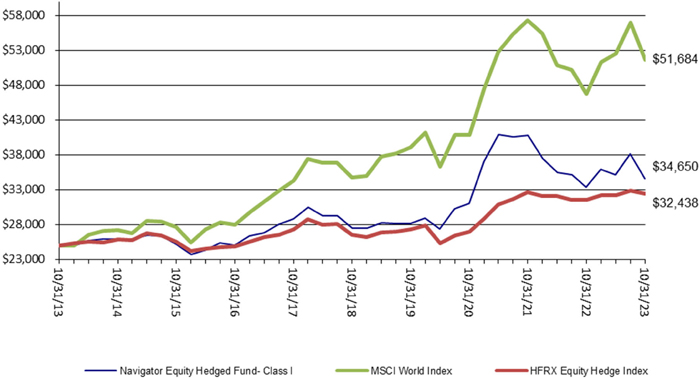

For the fiscal year ending October 31st, 2023 the Navigator Equity Hedged Fund (the “Fund”) institutional shares gained 3.85%, compared to the MSCI World Index 10.48% gain and the HFRX Equity Hedged Index gain of 2.89%.

| ● | The Fund overweighted U.S. versus International throughout the fiscal year, which was a net positive contributor to performance as geopolitical issues continue weighing more heavily on Europe than domestically. |

| ● | After 525 basis points of rate hikes it appears the Fed is now in a wait and see phase. The last Fed hike was in July 2023. Yields across the U.S. Treasury curve continued their relentless move higher. 2-Year and 10-Year Treasury Yields hit their highest levels since 2006 and 2007, respectively. |

The economy has remained much stronger than most expected while inflation has moderated. Increased dysfunction in Washington DC adds to an already challenging fiscal outlook. In addition, the credit rating agencies have previously expressed concern over the political landscape in DC. This certainly adds a level of risk at a time when the market is growing increasingly uncomfortable with higher amounts of Treasury supply, hence the higher interest rates as inflation continue to moderate.

Third quarter GDP came in at 5.2%, which likely marks the peak growth rate of this cycle. We expect the economy to continue growing into 2024 but at a more moderate pace as the long and variable lags of the Fed’s 525 basis point rate hikes to date continue to filter through the economy.

Performance as of 10/31/2023

| Inception Date | Name | 1 Year | 3 Year | 5 Year | 7 Year | 10 Year | Since Inception |

| 12/28/2010 | Navigator Equity Hedged I | 3.85 | 3.72 | 4.72 | 4.74 | 3.32 | 2.43 |

| 3/31/1986 | MSCI World NR USD | 10.48 | 8.14 | 8.27 | 9.16 | 7.53 | 8.22 |

| Total Annual Fund Operating Expenses | |

| A Shares | 0.95% |

| I Shares | 0.69% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment

1

return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call 1-800-766-2264.

Disclosures

Clark Capital Management Group, Inc. (Clark Capital) is an investment advisor registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Clark Capital is a closely held, mostly employee-owned C Corporation with all significant owners currently employed by the firm in key management capacities. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request.

The opinions expressed are those of the Clark Capital Management Group Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investment portfolio. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security, sector or industry. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. It should not be assumed that any of the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across all 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country.

HFRX Equity Hedged Index constituents are comprised of private hedge funds. Equity Hedge strategies maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. Equity Hedge managers would typically maintain at least 50%, and may in some cases be substantially entirely invested in equities, both long and short.

The Bloomberg Barclays US Treasury: 7-10 Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 7-9.9999 years to maturity. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index.

Past performance does not guarantee future returns. Investors should carefully consider the investment objectives, risks, charges and expenses of the Navigator Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 1-800-766-2264. The prospectus should be read carefully before investing. The Navigator® Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Clark Capital Management Group and Northern Lights Distributors LLC are not affiliated entities.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

9052-NLD 12/20/2023

2

| Navigator® Tactical Fixed Income Fund |

| K. Sean Clark, CFA — Chief Investment Officer |

| October 31, 2023 (unaudited) |

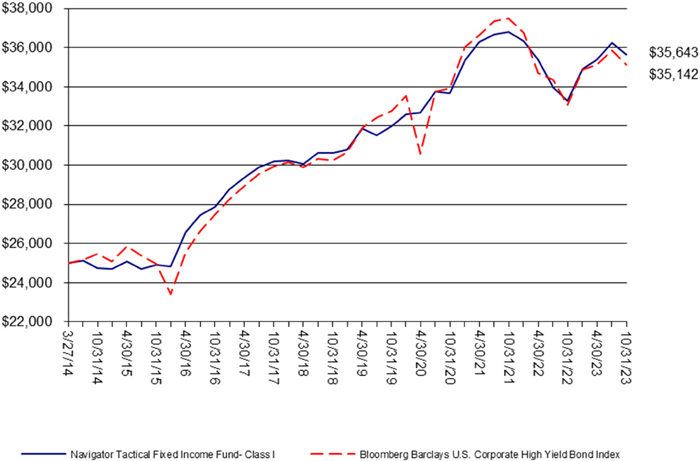

For the fiscal year ended October 31st, 2023 the Navigator Tactical Fixed Income Fund Class I shares (the “Fund”) gained 7.05%, compared to the Bloomberg Barclays US Corporate High Yield Index gain of 6.23% and the Bloomberg Barclays US Aggregate Bond Index gain of 0.36%. The primary driver of performance in the Fund has always been the Fund’s sector exposure and the modeling processes that drives the allocation between High Yield Bonds, US Treasuries, and cash equivalents.

| ● | A big driver of performance throughout the period was the increase in interest rates. Credit remained firm even in the face of higher interest rates. This is evidenced by credit spreads. The high yield credit spread began the annual period at 464 basis points and ended the period on October 31, 2023 at 437 basis points. |

| ● | After 525 basis points of rate hikes it appears the Fed is now in a wait and see phase. The last Fed hike was in July, 2023. Yields across the U.S. Treasury curve continued their relentless move higher. 2-Year and 10-Year Treasury Yields hit their highest levels since 2006 and 2007 respectively. |

| ● | The rise in yields has kept the Fund between risk-on in High Yield and risk-off is Cash Equivalents, while spending only a limited amount of time allocated to Treasuries. |

| ● | Fixed income volatility, measured by the ICE BofA MOVE Index, remained elevated throughout the quarter, and reached its highest level in March since the Global Financial Crisis in 2008. |

The economy has remained much stronger than most expected while inflation has moderated. Increased dysfunction in Washington DC adds to an already challenging fiscal outlook. In addition, the credit rating agencies have previously expressed concern over the political landscape in DC. This certainly adds a level of risk at a time when the market is growing increasingly uncomfortable with higher amounts of Treasury supply, hence the higher interest rates as inflation continue to moderate.

Third quarter GDP came in at 5.2%, which likely marks the peak growth rate of this cycle. We expect the economy to continue growing into 2024 but at a more moderate pace as the long and variable lags of the Fed’s 525 basis point rate hikes to date continue to filter through the economy.

3

Performance as of 10/31/2023

| Inception Date | Name | 1 Year | 3 Year | 5 Year | 7 Year | Since Inception |

| 3/27/2014 | Navigator Tactical Fixed Income I | 7.05 | 1.91 | 3.09 | 3.58 | 3.76 |

| 1/1/1986 | Bloomberg US Corporate High Yield TR USD | 6.23 | 1.19 | 3.05 | 3.57 | 3.60 |

| Total Annual Fund Operating Expenses | |

| A Shares | 1.30% |

| I Shares | 1.05% |

| C Shares | 2.05% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call 1-800-766-2264.

Disclosures

Clark Capital Management Group, Inc. (Clark Capital) is an investment advisor registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Clark Capital is a closely held, mostly employee-owned C Corporation with all significant owners currently employed by the firm in key management capacities. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request.

The opinions expressed are those of the Clark Capital Management Group Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investment portfolio. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security, sector or industry. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. It should not be assumed that any of the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption

4

before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

The Bloomberg Barclays Capital U.S. Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented. Municipal bonds, and Treasury inflation-protected securities are excluded, due to tax treatment issues. The index includes Treasury securities, government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S.

The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Barclays EM country definition, are excluded.

The Bloomberg Barclays US Treasury: 7-10 Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 7-9.9999 years to maturity. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index.

ICE BofA MOVE Index calculates the implied volatility of U.S. Treasury options using a weighted average of option prices on Treasury futures across multiple maturities (2, 5, 10, and 30 years). By capturing the expected fluctuations in interest rates, the index serves as a proxy for the bond market’s overall sentiment regarding future interest rate movements.

Past performance does not guarantee future returns. Investors should carefully consider the investment objectives, risks, charges and expenses of the Navigator Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 1-800-766-2264. The prospectus should be read carefully before investing. The Navigator® Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Clark Capital Management Group and Northern Lights Distributors LLC are not affiliated entities.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute

9053-NLD 12/20/2023

5

| Navigator® Tactical Investment Grade Bond Fund |

| K. Sean Clark, CFA — Chief Investment Officer |

| October 31, 2023 (unaudited) |

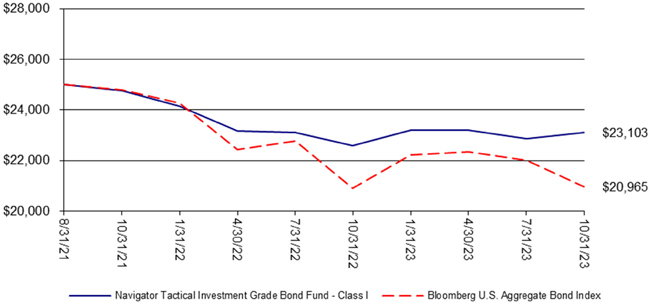

For the fiscal year ended October 31st, 2023 the Navigator Tactical Investment Grade Bond Fund Class I shares (the “Fund”) gained 2.33% compared to the Bloomberg Barclays US Aggregate Bond Index gain of 0.36%. The primary driver of performance in the Fund is its sector exposure and the modeling processes that drives the allocation between Investment Grade Bonds, US Treasuries, and cash equivalents.

| ● | The Fund’s alpha is driven by the Credit Risk Management models that determine its allocation. When risk-on, the Fund will invest in Investment Grade Corporate Bonds; when risk-off, the Fund will invest in U.S. Treasuries or T-bills. |

| ● | After 525 basis points of rate hikes it appears the Fed is now in a wait and see phase. The last Fed hike was in July 2023. Yields across the U.S. Treasury curve continued their relentless move higher. 2-Year and 10-Year Treasury Yields hit their highest levels since 2006 and 2007 respectively. |

| ● | Fixed income volatility, measured by the ICE BofA MOVE Index, remained elevated throughout the quarter, and reached its highest level in March 2023 since the Global Financial Crisis in 2008. |

| ● | The largest driver of the Fund performance during the period were its allocation to Cash Equivalents from May 19, 2023 through the end of the period. During that period T-bills returned 2.43%, while the 7-10 Year Treasury Index declined 7.01% and the ICE BofA BBB Index declined 2.99%. |

The economy has remained much stronger than most expected while inflation has moderated. Increased dysfunction in Washington DC adds to an already challenging fiscal outlook. In addition, the credit rating agencies have previously expressed concern over the political landscape in DC. This certainly adds a level of risk at a time when the market is growing increasingly uncomfortable with higher amounts of Treasury supply, hence the higher interest rates as inflation continue to moderate.

Third quarter GDP came in at 5.2%, which likely marks the peak growth rate of this cycle. We expect the economy to continue growing into 2024 but at a more moderate pace as the long and variable lags of the Fed’s 525 basis point rate hikes to date continue to filter through the economy.

6

Performance as of 10/31/2023

| Inception Date | Name | 1 Year | Since Inception |

| 8/31/2021 | Navigator Tactical Investment Grd Bd I | 2.33 | -3.58 |

| Bloomberg US Agg Bond TR USD | 0.36 | -7.80 |

| Total Annual Fund Operating Expenses | |

| I Shares | 1.19% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call 1-800-766-2264.

Disclosures

Clark Capital Management Group, Inc. (Clark Capital) is an investment advisor registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Clark Capital is a closely held, mostly employee-owned C Corporation with all significant owners currently employed by the firm in key management capacities. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request.

The opinions expressed are those of the Clark Capital Management Group Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investment portfolio. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security, sector or industry. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. It should not be assumed that any of the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Alpha: A measure of the difference between a portfolio’s actual returns and its expected performance, given its level of risk as measured by beta. A positive alpha figure indicates the portfolio has performed better than its beta would predict. In contrast, a negative alpha indicates the portfolio has underperformed, given the expectations established by beta. Alpha is calculated by taking the excess average monthly return of the investment over the risk free rate and subtracting beta times the excess average monthly return of the benchmark over the risk free rate.

7

The Bloomberg Barclays Capital U.S. Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented. Municipal bonds, and Treasury inflation-protected securities are excluded, due to tax treatment issues. The index includes Treasury securities, government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S.

The Bloomberg Barclays US Treasury: 7-10 Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 7-9.9999 years to maturity. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index.

ICE BofA MOVE Index calculates the implied volatility of U.S. Treasury options using a weighted average of option prices on Treasury futures across multiple maturities (2, 5, 10, and 30 years). By capturing the expected fluctuations in interest rates, the index serves as a proxy for the bond market’s overall sentiment regarding future interest rate movements.

Past performance does not guarantee future returns. Investors should carefully consider the investment objectives, risks, charges and expenses of the Navigator Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 1-800-766-2264. The prospectus should be read carefully before investing. The Navigator® Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Clark Capital Management Group and Northern Lights Distributors LLC are not affiliated entities.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute

9049-NLD 12/20/2023

8

| Navigator® Tactical U.S. Allocation Fund |

| K. Sean Clark, CFA — Chief Investment Officer |

| October 31, 2023 (unaudited) |

For the fiscal year ended October 31st, 2023 the Navigator Tactical U.S. Allocation Fund Class I shares (the “Fund”) gained 11.36% compared to the S&P 500 Index gain of 10.14%. The primary driver of performance in the Fund is its allocation exposure and the modeling processes that drives the allocation between U.S. Equities, US Treasuries, and cash equivalents.

| ● | The primary driver of the Fund over time is its macro allocations that are driven by our relative strength Credit Risk Management Models. Those models dictate the Fund’s allocation to U.S. Equities, US Treasuries, and cash equivalents. |

| ● | The cyclical bull market is stocks began on October 12, 2022. A large portion of the Fund’s return was generated by its allocation to U.S. Equities. From October 31, 2022 to February 16, 2023 the Fund was allocated risk-on in U.S. Equities. The S&P 500 gained 6.22% while the 7-10 Year Treasury Index gained 2.64%. In addition, the Fund was allocated risk-on to U.S. Equities from April 13, 2023 to October 4, 2023. During that period the S&P 500 gained 3.60% while the 7-10 Year Treasury Index lost 7.59%. |

| ● | The Fund ended the annual period in cash equivalents, with the models edging closer to turning risk-on. |

The economy has remained much stronger than most expected while inflation has moderated. Increased dysfunction in Washington DC adds to an already challenging fiscal outlook. In addition, the credit rating agencies have previously expressed concern over the political landscape in DC. This certainly adds a level of risk at a time when the market is growing increasingly uncomfortable with higher amounts of Treasury supply, hence the higher interest rates as inflation continue to moderate.

Third quarter GDP came in at 5.2%, which likely marks the peak growth rate of this cycle. We expect the economy to continue growing into 2024 but at a more moderate pace as the long and variable lags of the Fed’s 525 basis point rate hikes to date continue to filter through the economy.

| Inception Date | Name | 1 Year | Since Inception |

| 6/11/2021 | Navigator Tactical US Allocation I | 11.36 | 0.49 |

| 1/30/1970 | S&P 500 TR USD | 10.14 | 0.52 |

| C | |

| I Shares | 1.28% |

9

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call 1-800-766-2264.

Disclosures

Clark Capital Management Group, Inc. (Clark Capital) is an investment advisor registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Clark Capital is a closely held, mostly employee-owned C Corporation with all significant owners currently employed by the firm in key management capacities. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request.

The opinions expressed are those of the Clark Capital Management Group Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investment portfolio. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security, sector or industry. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. It should not be assumed that any of the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities.

Past performance does not guarantee future returns. Investors should carefully consider the investment objectives, risks, charges and expenses of the Navigator Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 1-800-766-2264. The prospectus should be read carefully before investing. The Navigator® Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Clark Capital Management Group and Northern Lights Distributors LLC are not affiliated entities.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

9051-NLD 12/20/2023

10

| Navigator Ultra Short Bond Fund |

| Robert S. Bennett, Jr. – Senior Portfolio Manager |

| October 31, 2023 (unaudited) |

For the fiscal period ending October 31st, 2023, the Navigator Ultra Short Bond Fund (“the Fund”) Class I shares returned 5.39%, compared to the Bloomberg Barclays U.S Treasury Bellwethers 1 Year Index return of 4.46%. The duration of the Fund continues to be shorter than the benchmark and the Fund was invested in a mix of floating and fixed rate debt during the fiscal period.

The Federal Reserve continued where it left off last fiscal year with tightening conditions in pursuit of their long-term goals of maximum employment and taming inflation. During the fiscal year ending October 31, 2023, the Fed Committee met eight times on policy and raised the target range of the fed funds rate in six of the eight meetings. The only meetings where the Fed did not raise the target range of the fed funds rate were in the June and September 2023 meetings. The reporting period started with the target range of the fed funds rate at 300 basis points in the lower bound and 325 basis points in the upper bound. We ended the reporting period with the target range of the fed funds rate at 525 basis points in the lower bound and 550 basis points in the upper bound. Moreover, this move in the target ranges amounted to an increase of 225 basis points in the fed funds rate in the six meetings where they hiked. We will continue to monitor the markets and any new developments from the Federal Reserve.

Performance as of 10/31/2023

| Inception Date | Name | 1 Year | 3 Year | Since Inception |

| 3/21/2019 | Navigator Ultra Short Term Bond I | 5.39 | 2.06 | 2.07 |

| 1/31/2019 | Benchmark - U.S. Treasury Bellwethers: 1 Y | 4.45 | 1.17 | 1.61 |

| Total Annual Fund Operating Expenses | |

| A Shares | 0.95% |

| I Shares | 0.69% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call 1-800-766-2264.

Disclosures

Clark Capital Management Group, Inc. (Clark Capital) is an investment advisor registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request.

11

The opinions expressed are those of the Clark Capital Management Group Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investment portfolio. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

The Bloomberg Barclays US Treasury Bellweathers 1 Year Index measures the performance of U.S. Treasury securities that have a remaining maturity of at least one (1) year and less than three (3) years.

Past performance does not guarantee future returns. Investors should carefully consider the investment objectives, risks, charges and expenses of the Navigator Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 1-800-766-2264. The prospectus should be read carefully before investing. The Navigator® Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC.

Clark Capital Management Group and Northern Lights Distributors LLC are not affiliated entities.

9050-NLD 12/20/2023

12

| Navigator Equity Hedged Fund |

| PORTFOLIO REVIEW (Unaudited) |

The Fund’s performance figures for the periods ended October 31, 2023, compared to its benchmarks:

Comparison of change in value of $25,000 Investment

| Annualized | ||||

| One Year | Five Year | Ten Year | Since Inception* | |

| Navigator Equity Hedged Fund: | ||||

| Class A | 3.48% | 4.44% | 3.06% | 2.15% |

| Class A with load of 5.50% | (2.18)% | 3.27% | 2.49% | 1.70% |

| Class C | 2.72% | 3.68% | 2.29% | 1.39% |

| Class I | 3.85% | 4.72% | 3.32% | 2.41% |

| MSCI World Index | 10.48% | 8.27% | 7.53% | 8.25% |

| HFRX Equity Hedge Index | 2.89% | 4.11% | 2.64% | 1.51% |

| * | Fund commenced operations on December 28, 2010. |

The “MSCI World Index” is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance consisting of 23 developed market country indices. Investors cannot invest directly in an index or benchmark.

The HFRX Equity Hedge Index is designed to be representative of equity hedge strategies which maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. The referenced index is shown for general market comparisons and is not meant to represent the Fund. Investors cannot invest directly in an index or benchmark; unmanaged index returns do not reflect any fees, expenses or sales charges.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The chart does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. Per the fee table in the Fund’s February 28, 2023 prospectus, the total annual operating expenses before fee waivers are 2.05%, 2.80% and 1.80% for the Fund’s Class A, Class C and Class I shares, respectively. Class A shares are subject to a maximum sales charge of 5.50% imposed on purchases. For performance information current to the most recent month-end, please call 1-877-766-2264.

13

| Navigator Equity Hedged Fund |

| PORTFOLIO REVIEW (Unaudited)(Continued) |

PORTFOLIO COMPOSITION+ (Unaudited)

| Exchange Traded Funds | 86.0 | % | Options* | 2.6 | % | |||||

| Equity Funds | 86.0 | % | Short-Term Investments | 11.4 | % | |||||

| 100.0 | % |

| + | Based on Schedule of Investments Market Value as of October 31, 2023. Please refer to the Fund’s Schedule of Investments in the report for a detailed listing of the Fund’s holdings. |

| * | Options purchased percentage is netted with options written. |

14

| Navigator Tactical Fixed Income Fund |

| PORTFOLIO REVIEW (Unaudited) |

The Fund’s performance figures for the periods ended October 31, 2023, compared to its benchmark:

Comparison of change in value of $25,000 Investment

| Annualized | |||

| One Year | Five Years | Since Inception* | |

| Navigator Tactical Fixed Income Fund: | |||

| Class A | 6.78% | 2.83% | 3.49% |

| Class A with load of 3.75% | 2.80% | 2.05% | 3.08% |

| Class C | 5.99% | 2.06% | 2.73% |

| Class I | 7.05% | 3.09% | 3.76% |

| Bloomberg Barclays U.S. Corporate High Yield Bond Index | 6.23% | 3.05% | 3.61% |

| * | Fund commenced operations on March 27, 2014. |

The Bloomberg Barclays U.S. Corporate High Yield Bond Index is a market value-weighted index which covers the U.S. non-investment grade fixed- rate debt market. Investors cannot invest directly in an index or benchmark.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The chart does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. Per the fee table in the Fund’s February 28, 2023 prospectus, the total annual operating expenses before fee waivers are 1.30%, 2.05% and 1.05% for the Fund’s Class A, Class C and Class I shares, respectively. Class A shares are subject to a maximum sales charge of 3.75% imposed on purchases. For performance information current to the most recent month-end, please call 1-877-766-2264.

15

| Navigator Tactical Fixed Income Fund |

| PORTFOLIO REVIEW (Unaudited)(Continued) |

PORTFOLIO COMPOSITION+ (Unaudited)

| U.S. Government & Agencies | 63.7 | % | ||

| Corporate Bonds | 19.4 | % | ||

| Open-End Funds | 1.5 | % | ||

| Certificate of Deposit | 0.6 | % | ||

| Exchange Traded Fund | 0.1 | % | ||

| Commercial Paper | 0.1 | % | ||

| Collateral for Securities Loaned | 0.1 | % | ||

| Short-Term Investments | 14.5 | % | ||

| 100.0 | % |

| + | Based on Schedule of Investments Market Value as of October 31, 2023. Please refer to the Fund’s Schedule of Investments in the report for a detailed listing of the Fund’s holdings. |

16

| Navigator Tactical Investment Grade Bond Fund |

| PORTFOLIO REVIEW (Unaudited) |

The Fund’s performance figures for the period ended October 31, 2023, compared to its benchmark:

Comparison of change in value of $25,000 Investment

| Annualized Since | ||

| One Year | Inception* | |

| Navigator Tactical Investment Grade Bond Fund: | ||

| Class I | 2.33% | (3.57)% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 0.36% | (7.80)% |

| * | Fund commenced operations on August 31, 2021. |

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities. Investors cannot invest directly in an index.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The chart does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. Per the fee table in the Fund’s February 28, 2023, prospectus, the total annual operating expenses before fee waivers are 1.44% and 1.19% for the Fund’s Class A and Class I shares, respectively. Class A shares are subject to a maximum sales charge of 3.75% imposed on purchases. For performance information current to the most recent month-end, please call 1-877-766-2264.

PORTFOLIO COMPOSITION+ (Unaudited)

| U.S. Government & Agencies | 91.9 | % | ||

| Short-Term Investments | 8.1 | % | ||

| 100.0 | % |

| + | Based on Schedule of Investments Market Value as of October 31, 2023. Please refer to the Fund’s Schedule of Investments in the report for a detailed listing of the Fund’s holdings. |

17

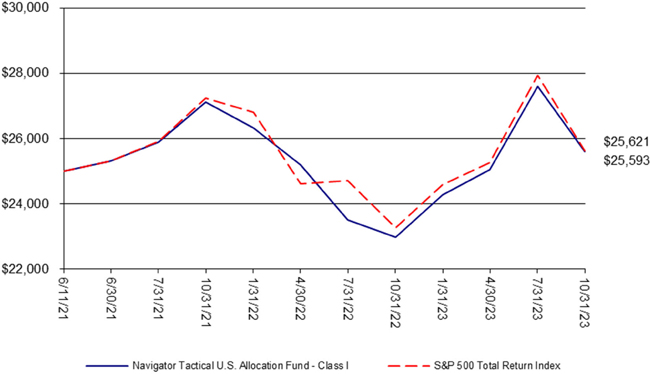

| Navigator Tactical U.S. Allocation Fund |

| PORTFOLIO REVIEW (Unaudited) |

The Fund’s performance figures for the period ended October 31, 2023, compared to its benchmark:

Comparison of change in value of $25,000 Investment

| Annualized | ||

| One Year | Since Inception* | |

| Navigator Tactical U.S. Allocation Fund: | ||

| Class I | 11.36% | 0.99% |

| S&P 500 Total Return Index | 10.14% | 1.03% |

| * | Fund commenced operations on June 11, 2021. |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The chart does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. Per the fee table in the Fund’s February 28, 2023, prospectus, the total annual operating expenses before fee waivers are 1.53% and 1.28% for the Fund’s Class A and Class I shares, respectively. Class A shares are subject to a maximum sales charge of 3.75% imposed on purchases. For performance information current to the most recent month-end, please call 1-877-766-2264.

PORTFOLIO COMPOSITION+ (Unaudited)

| Corporate Bonds | 60.0 | % | ||

| U.S. Government & Agencies | 3.7 | % | ||

| Commercial Paper | 2.9 | % | ||

| Certificate of Deposit | 1.8 | % | ||

| Short-Term Investments | 31.6 | % | ||

| 100.0 | % |

| + | Based on Schedule of Investments Market Value as of October 31, 2023. Please refer to the Fund’s Schedule of Investments in the report for a detailed listing of the Fund’s holdings. |

18

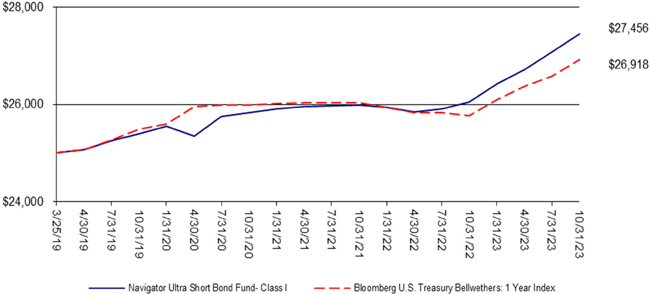

| Navigator Ultra Short Bond Fund |

| PORTFOLIO REVIEW (Unaudited) |

The Fund’s performance figures for the periods ended October 31, 2023, compared to its benchmark:

Comparison of change in value of $25,000 Investment

| Annualized | |||

| One Year | Three Year | Since Inception* | |

| Navigator Ultra Short Bond Fund: | |||

| Class A | 5.14% | 1.83% | 2.20% |

| Class A with load of 3.75% | 1.21% | 0.56% | 1.36% |

| Class I | 5.39% | 2.06% | 2.06% |

| Bloomberg Barclays U.S. Treasury Bellwethers: 1 Year Index | 4.46% | 1.17% | 1.62% |

| * | Fund commenced operations on March 21, 2019. Start of performance is March 25, 2019. |

Bloomberg Barclays U.S. Treasury Bellwethers: 1 Year Index measures the performance of the U.S. government bond market and includes public obligations of the U.S. Treasury with a maturity of up to a year. Investors cannot invest directly in an index or benchmark.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The chart does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. Per the fee table in the Fund’s February 28, 2023, prospectus, the total annual operating expenses are 0.95% and 0.69% for the Fund’s Class A and Class I shares, respectively. Class A shares are subject to a maximum sales charge of 3.75% imposed on purchases. For performance information current to the most recent month-end, please call 1-877-766-2264.

PORTFOLIO COMPOSITION+ (Unaudited)

| Corporate Bonds | 86.3 | % | ||

| U.S. Government & Agencies | 3.2 | % | ||

| Commercial Paper | 3.2 | % | ||

| Certificate of Deposit | 3.2 | % | ||

| Municipal Bond | 1.2 | % | ||

| Short-Term Investments | 2.9 | % | ||

| 100.0 | % |

| + | Based on Schedule of Investments Market Value as of October 31, 2023. Please refer to the Fund’s Schedule of Investments in the report for a detailed listing of the Fund’s holdings. |

19

| NAVIGATOR EQUITY HEDGED FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2023 |

| Shares | Fair Value | |||||||||||||||||

| EXCHANGE-TRADED FUNDS — 84.8% | ||||||||||||||||||

| EQUITY - 84.8% | ||||||||||||||||||

| 75,468 | Invesco International BuyBack Achievers ETF | $ | 2,525,159 | |||||||||||||||

| 7,292 | iShares Core S&P 500 ETF USD Class | 3,062,203 | ||||||||||||||||

| 3,734 | iShares Expanded Tech-Software Sector ETF | 1,260,038 | ||||||||||||||||

| 54,273 | iShares MSCI EAFE Value ETF | 2,563,314 | ||||||||||||||||

| 30,816 | iShares MSCI USA Quality Factor ETF | 4,001,149 | ||||||||||||||||

| 24,804 | iShares Russell Top 200 Growth ETF | 3,780,626 | ||||||||||||||||

| 12,287 | iShares US Aerospace & Defense ETF | 1,349,850 | ||||||||||||||||

| 26,144 | SPDR Portfolio S&P 500 Growth ETF | 1,512,169 | ||||||||||||||||

| 30,949 | SPDR S&P Insurance ETF | 1,321,832 | ||||||||||||||||

| 9,127 | SPDR S&P Oil & Gas Exploration & Production ETF | 1,325,423 | ||||||||||||||||

| 21,533 | Vanguard Energy ETF | 2,582,668 | ||||||||||||||||

| 25,284,431 | ||||||||||||||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost $26,190,646) | 25,284,431 | |||||||||||||||||

| SHORT-TERM INVESTMENTS — 11.3% | ||||||||||||||||||

| MONEY MARKET FUNDS - 11.3% | ||||||||||||||||||

| 179,595 | Dreyfus Money Market Fund, Service Shares, 4.56%(a) | 179,595 | ||||||||||||||||

| 3,182,676 | Dreyfus Treasury Obligations Cash Management Fund, Institutional Class, 5.23%(a) | 3,182,676 | ||||||||||||||||

| TOTAL MONEY MARKET FUNDS (Cost $3,362,271) | 3,362,271 | |||||||||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $3,362,271) | 3,362,271 | |||||||||||||||||

| Contracts(b) | Expiration Date | Exercise Price | Notional Value | |||||||||||||||

| INDEX OPTIONS PURCHASED(c) - 3.5% | ||||||||||||||||||

| PUT OPTIONS PURCHASED - 3.5% | ||||||||||||||||||

| 86 | S&P 500 Index | 11/24/2023 | $ | 4,290.00 | $ | 36,066,680 | $ | 1,046,190 | ||||||||||

| TOTAL PUT OPTIONS PURCHASED (Cost - $448,685) | ||||||||||||||||||

| TOTAL INDEX OPTIONS PURCHASED (Cost - $448,685) | 1,046,190 | |||||||||||||||||

The accompanying notes are an integral part of these financial statements.

20

| NAVIGATOR EQUITY HEDGED FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| Contracts(b) | Expiration Date | Exercise Price | Notional Value | Fair Value | ||||||||||||||

| EQUITY OPTIONS PURCHASED(c) - 0.4% | ||||||||||||||||||

| CALL OPTIONS PURCHASED - 0.4% | ||||||||||||||||||

| 2,000 | iPath Series B S&P 500 ETN | 11/10/2023 | $ | 26.00 | $ | 3,626,000 | $ | 118,000 | ||||||||||

| TOTAL CALL OPTIONS PURCHASED (Cost - $481,920) | ||||||||||||||||||

| TOTAL EQUITY OPTIONS PURCHASED (Cost - $481,920) | 118,000 | |||||||||||||||||

| TOTAL INVESTMENTS - 100.0% (Cost $30,483,522) | $ | 29,810,892 | ||||||||||||||||

| CALL OPTIONS WRITTEN - (0.6)% (Premiums Received - $620,016) | (184,000 | ) | ||||||||||||||||

| PUT OPTIONS WRITTEN - (0.8)% (Premiums Received - $144,629) | (233,490 | ) | ||||||||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES - 1.4% | 424,416 | |||||||||||||||||

| NET ASSETS - 100.0% | �� | $ | 29,817,818 | |||||||||||||||

| Contracts(b) | ||||||||||||||||||

| WRITTEN EQUITY OPTIONS(c) - (0.6)% | ||||||||||||||||||

| WRITTEN EQUITY CALL OPTIONS - (0.6)% | ||||||||||||||||||

| 2,000 | iPath Series B S&P 500 ETN | 11/10/2023 | $ | 24.50 | $ | 3,626,000 | $ | 184,000 | ||||||||||

| TOTAL WRITTEN EQUITY CALL OPTIONS (Premiums Received - $620,016) | $ | 184,000 | ||||||||||||||||

| TOTAL WRITTEN EQUITY CALL OPTIONS (Premiums Received - $620,016) | $ | 184,000 | ||||||||||||||||

| WRITTEN INDEX OPTIONS(c) - (0.8)% | ||||||||||||||||||

| PUT OPTIONS WRITTEN - (0.8)% | ||||||||||||||||||

| 86 | S&P 500 Index | 11/24/2023 | $ | 4,050.00 | $ | 36,066,680 | $ | 233,490 | ||||||||||

| TOTAL PUT OPTIONS WRITTEN (Premiums Received - $144,629) | $ | 233,490 | ||||||||||||||||

| TOTAL INDEX OPTIONS WRITTEN (Premiums Received - $144,629) | $ | 233,490 | ||||||||||||||||

| EAFE | - Europe, Australasia and Far East |

| ETF | - Exchange-Traded Fund |

| ETN | - Exchange-Traded Note |

| MSCI | - Morgan Stanley Capital International |

| SPDR | - Standard & Poor’s Depositary Receipt |

| (a) | Rate disclosed is the seven-day effective yield as of October 31, 2023. |

| (b) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

| (c) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

21

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2023 |

| Shares | Fair Value | |||||||||||||

| EXCHANGE-TRADED FUND — 0.1% | ||||||||||||||

| FIXED INCOME - 0.1% | ||||||||||||||

| 96,302 | iShares iBoxx High Yield Corporate Bond ETF(j) | $ | 6,988,636 | |||||||||||

| TOTAL EXCHANGE-TRADED FUND (Cost $7,097,459) | 6,988,636 | |||||||||||||

| OPEN-END FUNDS — 1.6% | ||||||||||||||

| FIXED INCOME - 0.8% | ||||||||||||||

| 5,202,847 | Navigator Ultra Short Bond Fund, Class I(h) | 52,444,702 | ||||||||||||

| MIXED ALLOCATION - 0.8% | ||||||||||||||

| 5,612,489 | Navigator Tactical US Allocation Fund, Class I(h) | 51,185,904 | ||||||||||||

| TOTAL OPEN-END FUNDS (Cost $108,024,781) | 103,630,606 | |||||||||||||

| Principal | ||||||||||||||

| Amount ($) | Spread | Coupon Rate (%) | Maturity | |||||||||||

| CORPORATE BONDS — 20.8% | ||||||||||||||

| AEROSPACE & DEFENSE — 0.1% | ||||||||||||||

| 3,647,000 | Raytheon Technologies Corporation | 3.7000 | 12/15/23 | 3,637,583 | ||||||||||

| ASSET MANAGEMENT — 0.7% | ||||||||||||||

| 45,530,000 | Charles Schwab Corporation(a) | SOFRRATE + 0.500% | 5.8260 | 03/18/24 | 45,473,810 | |||||||||

| AUTOMOTIVE — 2.3% | ||||||||||||||

| 15,000,000 | American Honda Finance Corporation(a) | SOFRINDX + 0.700% | 6.0090 | 11/22/24 | 15,008,610 | |||||||||

| 40,000,000 | American Honda Finance Corporation(a) | SOFRRATE + 0.670% | 5.9870 | 01/10/25 | 40,008,213 | |||||||||

| 24,000,000 | American Honda Finance Corporation(a) | SOFRINDX + 0.780% | 6.0880 | 04/23/25 | 24,006,648 | |||||||||

| 45,000,000 | Toyota Motor Credit Corporation(a) | SOFRINDX + 0.650% | 5.9720 | 12/29/23 | 45,029,101 | |||||||||

| 28,345,000 | Toyota Motor Credit Corporation(a) | SOFRRATE + 0.380% | 5.6880 | 02/22/24 | 28,348,708 | |||||||||

| 152,401,280 | ||||||||||||||

The accompanying notes are an integral part of these financial statements.

22

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| Principal | ||||||||||||||

| Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 20.8% (Continued) | ||||||||||||||

| BANKING — 5.5% | ||||||||||||||

| 15,000,000 | Bank of Montreal(a) | SOFRINDX + 0.710% | 6.0380 | 03/08/24 | $ | 15,011,851 | ||||||||

| 8,500,000 | Bank of Nova Scotia(a) | SOFRINDX + 0.960% | 6.2880 | 03/11/24 | 8,512,754 | |||||||||

| 5,000,000 | Bank of Nova Scotia | 0.7000 | 04/15/24 | 4,883,546 | ||||||||||

| 9,803,000 | Bank of Nova Scotia(a) | SOFRRATE + 0.380% | 5.6910 | 07/31/24 | 9,806,684 | |||||||||

| 47,000,000 | Citibank NA(a) | SOFRRATE + 0.805% | 6.1270 | 09/29/25 | 47,029,176 | |||||||||

| 41,508,000 | Credit Suisse A.G.(a) | SOFRINDX + 0.390% | 5.7350 | 02/02/24 | 41,423,225 | |||||||||

| 55,814,000 | Credit Suisse A.G. | 3.6250 | 09/09/24 | 54,481,251 | ||||||||||

| 15,341,000 | HSBC Holdings plc(a) | TSFR3M + 1.473% | 3.8030 | 03/11/25 | 15,180,825 | |||||||||

| 14,789,000 | KeyBank NA(a) | SOFRRATE + 0.320% | 5.6460 | 06/14/24 | 14,429,548 | |||||||||

| 32,000,000 | Morgan Stanley Bank NA(a) | SOFRRATE + 0.780% | 6.0910 | 07/16/25 | 32,010,196 | |||||||||

| 15,000,000 | Royal Bank of Canada(a) | SOFRINDX + 0.300% | 5.6090 | 01/19/24 | 14,993,266 | |||||||||

| 72,000,000 | Royal Bank of Canada(a) | SOFRINDX + 0.360% | 5.6710 | 07/29/24 | 71,918,268 | |||||||||

| 31,100,000 | Toronto-Dominion Bank(a) | SOFRRATE + 0.355% | 5.6860 | 03/04/24 | 31,095,087 | |||||||||

| 360,775,677 | ||||||||||||||

| BIOTECH & PHARMA — 0.0%(c) | ||||||||||||||

| 200,000 | Takeda Pharmaceutical Company Ltd. | 4.4000 | 11/26/23 | 199,784 | ||||||||||

| CABLE & SATELLITE — 0.0%(c) | ||||||||||||||

| 1,200,000 | Cequel Communications Holdings I, LLC / Cequel(d) | 7.5000 | 04/01/28 | 774,000 | ||||||||||

| ELECTRIC UTILITIES — 0.9% | ||||||||||||||

| 2,540,000 | American Electric Power Company, Inc. | 0.7500 | 11/01/23 | 2,540,000 | ||||||||||

| 15,000,000 | CenterPoint Energy, Inc.(a) | SOFRRATE + 0.650% | 5.9870 | 05/13/24 | 14,995,980 | |||||||||

| 34,000,000 | Florida Power & Light Company(a) | SOFRINDX + 0.380% | 5.6940 | 01/12/24 | 34,000,545 | |||||||||

| 9,578,000 | Public Service Enterprise Group, Inc. | 2.8750 | 06/15/24 | 9,385,973 | ||||||||||

| 60,922,498 | ||||||||||||||

| ELECTRICAL EQUIPMENT — 0.2% | ||||||||||||||

| 10,461,000 | Lennox International, Inc. | 3.0000 | 11/15/23 | 10,448,660 | ||||||||||

The accompanying notes are an integral part of these financial statements.

23

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| Principal | ||||||||||||||

| Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 20.8% (Continued) | ||||||||||||||

| FOOD — 0.7% | ||||||||||||||

| 46,000,000 | Danone S.A.(d) | 2.5890 | 11/02/23 | $ | 46,000,000 | |||||||||

| HEALTH CARE FACILITIES & SERVICES — 0.5% | ||||||||||||||

| 11,033,000 | Cardinal Health, Inc. | 3.0790 | 06/15/24 | 10,837,613 | ||||||||||

| 3,799,000 | Cencora, Inc. | 3.4000 | 05/15/24 | 3,747,383 | ||||||||||

| 18,349,000 | Cigna Group | 0.6130 | 03/15/24 | 17,987,810 | ||||||||||

| 32,572,806 | ||||||||||||||

| INSTITUTIONAL FINANCIAL SERVICES — 0.4% | ||||||||||||||

| 7,400,000 | Bank of New York Mellon Corporation | 0.5000 | 04/26/24 | 7,211,063 | ||||||||||

| 28,000,000 | Coinbase Global, Inc.(d) | 3.6250 | 10/01/31 | 19,062,125 | ||||||||||

| 26,273,188 | ||||||||||||||

| INSURANCE — 0.2% | ||||||||||||||

| 12,925,000 | Willis North America, Inc. | 3.6000 | 05/15/24 | 12,743,408 | ||||||||||

| LEISURE FACILITIES & SERVICES — 0.5% | ||||||||||||||

| 35,035,000 | Starbucks Corporation(a) | SOFRINDX + 0.420% | 5.7570 | 02/14/24 | 35,035,590 | |||||||||

| MACHINERY — 0.7% | ||||||||||||||

| 47,500,000 | Caterpillar Financial Services Corporation(a) | SOFRRATE + 0.450% | 5.7870 | 11/13/23 | 47,504,448 | |||||||||

| MEDICAL EQUIPMENT & DEVICES — 0.0%(c) | ||||||||||||||

| 2,936,000 | Becton Dickinson & Company | 3.8750 | 05/15/24 | 2,904,704 | ||||||||||

| OIL & GAS PRODUCERS — 2.9% | ||||||||||||||

| 5,180,000 | Enable Midstream Partners, L.P. | 3.9000 | 05/15/24 | 5,117,584 | ||||||||||

| 13,000,000 | Enbridge, Inc. | 2.1500 | 02/16/24 | 12,845,271 | ||||||||||

| 36,373,000 | Enbridge, Inc.(a) | SOFRINDX + 0.630% | 5.9660 | 02/16/24 | 36,398,470 | |||||||||

| 30,062,000 | Kinder Morgan Energy Partners, L.P. | 4.1500 | 02/01/24 | 29,904,940 | ||||||||||

| 26,659,000 | Kinder Morgan Energy Partners, L.P. | 4.3000 | 05/01/24 | 26,420,698 | ||||||||||

| 5,000,000 | Kinder Morgan, Inc.(d) | 5.6250 | 11/15/23 | 4,998,265 | ||||||||||

The accompanying notes are an integral part of these financial statements.

24

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| Principal | ||||||||||||||

| Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 20.8% (Continued) | ||||||||||||||

| OIL & GAS PRODUCERS — 2.9% (Continued) | ||||||||||||||

| 14,977,000 | Phillips 66 | 0.9000 | 02/15/24 | $ | 14,747,287 | |||||||||

| 18,320,000 | Spectra Energy Partners, L.P. | 4.7500 | 03/15/24 | 18,234,072 | ||||||||||

| 44,023,000 | Williams Companies, Inc. | 4.5500 | 06/24/24 | 43,572,382 | ||||||||||

| 192,238,968 | ||||||||||||||

| REAL ESTATE INVESTMENT TRUSTS — 0.6% | ||||||||||||||

| 5,850,000 | Host Hotels & Resorts, L.P. | 3.8750 | 04/01/24 | 5,782,987 | ||||||||||

| 3,500,000 | Kimco Realty OP, LLC | 4.4500 | 01/15/24 | 3,485,006 | ||||||||||

| 25,116,000 | Public Storage(a) | SOFRRATE + 0.470% | 5.7780 | 04/23/24 | 25,113,480 | |||||||||

| 6,070,000 | VICI Properties, L.P. / VICI Note Company, Inc.(d) | 5.6250 | 05/01/24 | 6,032,644 | ||||||||||

| 40,414,117 | ||||||||||||||

| SEMICONDUCTORS — 0.3% | ||||||||||||||

| 16,245,000 | Microchip Technology, Inc. | 0.9720 | 02/15/24 | 16,007,410 | ||||||||||

| SPECIALTY FINANCE — 1.4% | ||||||||||||||

| 60,000,000 | AerCap Ireland Capital DAC / AerCap Global | 1.6500 | 10/29/24 | 57,221,502 | ||||||||||

| 35,000,000 | American Express Company(a) | SOFRINDX + 0.720% | 6.0600 | 05/03/24 | 35,030,660 | |||||||||

| 92,252,162 | ||||||||||||||

| TECHNOLOGY HARDWARE — 0.5% | ||||||||||||||

| 35,000,000 | Hewlett Packard Enterprise Company B | 5.9000 | 10/01/24 | 34,997,649 | ||||||||||

| TECHNOLOGY SERVICES — 0.1% | ||||||||||||||

| 5,485,000 | International Business Machines Corporation | 3.6250 | 02/12/24 | 5,452,244 | ||||||||||

| TELECOMMUNICATIONS — 0.7% | ||||||||||||||

| 45,743,000 | Sprint Corporation | 7.1250 | 06/15/24 | 46,020,477 | ||||||||||

| TOBACCO & CANNABIS — 0.9% | ||||||||||||||

| 55,772,000 | Altria Group, Inc. | 4.0000 | 01/31/24 | 55,442,270 | ||||||||||

| TRANSPORTATION & LOGISTICS — 0.1% | ||||||||||||||

| 6,500,000 | Ryder System, Inc. | 3.8750 | 12/01/23 | 6,489,297 | ||||||||||

The accompanying notes are an integral part of these financial statements.

25

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| Principal | ||||||||||||||

| Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 20.8% (Continued) | ||||||||||||||

| TRANSPORTATION EQUIPMENT — 0.6% | ||||||||||||||

| 25,000,000 | Daimler Trucks Finance North America, LLC(a),(d) | SOFRRATE + 1.000% | 6.3190 | 04/07/24 | $ | 25,030,922 | ||||||||

| 11,170,000 | Westinghouse Air Brake Technologies Corporation | 4.1500 | 03/15/24 | 11,093,289 | ||||||||||

| 36,124,211 | ||||||||||||||

| TOTAL CORPORATE BONDS (Cost $1,363,136,143) | 1,363,106,241 | |||||||||||||

| U.S. GOVERNMENT & AGENCIES — 68.4% | ||||||||||||||

| GOVERNMENT SPONSORED — 0.7% | ||||||||||||||

| 28,000,000 | Federal Farm Credit Banks Funding Corporation(a) | SOFRRATE + 0.075% | 5.3820 | 09/03/24 | 27,987,313 | |||||||||

| 20,000,000 | Federal Farm Credit Banks Funding Corporation(a) | FEDL01 + 0.100% | 5.4300 | 01/24/25 | 20,001,453 | |||||||||

| 47,988,766 | ||||||||||||||

| U.S. TREASURY BILLS — 67.7% | ||||||||||||||

| 200,000,000 | United States Treasury Bill(e) | 4.7500 | 11/09/23 | 199,765,838 | ||||||||||

| 100,000,000 | United States Treasury Bill(e) | 5.0200 | 11/16/23 | 99,780,625 | ||||||||||

| 200,000,000 | United States Treasury Bill(e) | 5.1500 | 11/24/23 | 199,325,334 | ||||||||||

| 400,000,000 | United States Treasury Bill(e) | 5.2000 | 11/30/23 | 398,299,068 | ||||||||||

| 200,000,000 | United States Treasury Bill(e) | 5.2000 | 12/07/23 | 198,946,500 | ||||||||||

| 200,000,000 | United States Treasury Bill(e) | 5.2700 | 12/14/23 | 198,737,294 | ||||||||||

| 200,000,000 | United States Treasury Bill(e) | 5.3000 | 12/21/23 | 198,529,166 | ||||||||||

| 100,000,000 | United States Treasury Bill(e) | 5.3400 | 12/28/23 | 99,158,854 | ||||||||||

| 1,000,000,000 | United States Treasury Bill(e) | 5.3400 | 01/11/24 | 989,566,940 | ||||||||||

| 200,000,000 | United States Treasury Bill(e) | 5.3700 | 01/18/24 | 197,701,600 | ||||||||||

| 500,000,000 | United States Treasury Bill(e) | 5.3900 | 01/25/24 | 493,734,005 | ||||||||||

| 500,000,000 | United States Treasury Bill(e) | 5.4000 | 02/01/24 | 493,211,380 | ||||||||||

| 200,000,000 | United States Treasury Bill(e) | 5.4100 | 02/15/24 | 196,880,362 | ||||||||||

| 470,000,000 | United States Treasury Floating Rate Note(a) | USBMMY3M + 0.125% | 5.5070 | 07/31/25 | 469,957,432 | |||||||||

| 4,433,594,398 | ||||||||||||||

| TOTAL U.S. GOVERNMENT & AGENCIES (Cost $4,481,166,258) | 4,481,583,164 | |||||||||||||

The accompanying notes are an integral part of these financial statements.

26

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| Principal | ||||||||||||||

| Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CERTIFICATE OF DEPOSIT — 0.7% | ||||||||||||||

| BANKING - 0.7% | ||||||||||||||

| 20,000,000 | Toronto-Dominion Bank | 5.9560 | 09/18/24 | $ | 20,021,234 | |||||||||

| 24,000,000 | Toronto-Dominion Bank | 5.9800 | 03/25/24 | 24,032,648 | ||||||||||

| TOTAL CERTIFICATE OF DEPOSIT (Cost $44,000,000) | 44,053,882 | |||||||||||||

| COMMERCIAL PAPER — 0.1% | ||||||||||||||

| COMMERCIAL PAPER - 0.1% | ||||||||||||||

| 9,000,000 | Hilltop Securities Incorporated | 6.2500 | 11/15/23 | 8,976,935 | ||||||||||

| TOTAL COMMERCIAL PAPER (Cost $8,976,935) | 8,976,935 | |||||||||||||

| Shares | ||||||||||||||

| SHORT-TERM INVESTMENTS — 15.6% | ||||||||||||||

| MONEY MARKET FUNDS - 15.6% | ||||||||||||||

| 10,010,001 | BlackRock Liquidity Funds TempFund Portfolio, Institutional Class, 5.38%(f) | 10,015,006 | ||||||||||||

| 970,162,635 | Dreyfus Treasury Obligations Cash Management Fund, Institutional Class, 5.23%(f) | 970,162,635 | ||||||||||||

| 10,000,000 | Federated Hermes Institutional Prime Obligations, Institutional Class, 5.45%(f) | 10,003,000 | ||||||||||||

| 10,000,001 | Goldman Sachs Financial Square Money Market Fund, Institutional Class, 5.36%(f) | 10,002,001 | ||||||||||||

| 10,000,000 | JPMorgan Prime Money Market Fund, Capital Class, 5.43%(f) | 10,003,000 | ||||||||||||

| 10,000,000 | Morgan Stanley Institutional Liquidity Funds - Prime Portfolio, Institutional Class, 5.46%(f) | 9,999,000 | ||||||||||||

| TOTAL MONEY MARKET FUNDS (Cost $1,020,177,636) | 1,020,184,642 | |||||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,020,177,636) | 1,020,184,642 | |||||||||||||

The accompanying notes are an integral part of these financial statements.

27

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| Contracts(g) | Expiration Date | Exercise Price | Notional Value | Fair Value | ||||||||||||||

| FUTURE OPTIONS PURCHASED(i) - 0.0%(c) | ||||||||||||||||||

| CALL OPTIONS PURCHASED - 0.0%(c) | ||||||||||||||||||

| 554 | S&P500 E-Mini Option Index | 12/15/2023 | $ | 5,000.00 | $ | 116,679,325 | $ | 4,155 | ||||||||||

| TOTAL CALL OPTIONS PURCHASED (Cost - $505,525) | ||||||||||||||||||

| PUT OPTIONS PURCHASED - 0.0%(c) | ||||||||||||||||||

| 1,104 | U.S. 5 Years Futures Option | 12/15/2023 | $ | 100.00 | $ | 115,345,920 | 11 | |||||||||||

| 5,000 | U.S. 5 Years Futures Option | 12/15/2023 | 95.00 | 522,400,000 | 50 | |||||||||||||

| 4,000 | U.S. 5 Years Futures Option | 12/15/2023 | 96.00 | 417,920,000 | 40 | |||||||||||||

| TOTAL PUT OPTIONS PURCHASED (Cost - $200,529) | 101 | |||||||||||||||||

| TOTAL FUTURE OPTIONS PURCHASED (Cost - $706,054) | 4,256 | |||||||||||||||||

| Shares | ||||||||||||||||||

| COLLATERAL FOR SECURITIES LOANED – 0.1% | ||||||||||||||||||

| 6,464,122 | Goldman Sachs Financial Square Government Fund, Institutional Class, 5.26% (f),(k) | 6,464,122 | ||||||||||||||||

| TOTAL COLLATERAL FOR SECURITIES LOANED (Cost -$6,464,122) | ||||||||||||||||||

| TOTAL INVESTMENTS - 107.4% (Cost $7,039,749,388) | $ | 7,034,992,484 | ||||||||||||||||

| PUT OPTIONS WRITTEN - 0.0% (Premiums Received - $77,109) | (61,813 | ) | ||||||||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (7.4)% | (484,329,896 | ) | ||||||||||||||||

| NET ASSETS - 100.0% | $ | 6,550,600,775 | ||||||||||||||||

| Contracts(g) | Expiration Date | Exercise Price | Notional Value | |||||||||||||||

| WRITTEN FUTURE OPTIONS(i) - 0.0% (c) | ||||||||||||||||||

| PUT OPTIONS WRITTEN - 0.0%(c) | ||||||||||||||||||

| 184 | U.S. 5 Years Future Option | 12/15/2023 | $ | 104 | $ | 19,224,320 | $ | 61,813 | ||||||||||

| TOTAL PUT OPTIONS WRITTEN (Premiums Received - $77,109) | ||||||||||||||||||

| TOTAL FUTURE OPTIONS WRITTEN (Premiums Received - $77,109) | $ | 61,813 | ||||||||||||||||

| OPEN FUTURES CONTRACTS | ||||||||||||||

| Number of | ||||||||||||||

| Contracts | Open Short Futures Contracts | Expiration | Notional Amount | Unrealized Appreciation | ||||||||||

| 225 | CBOT 5 Year US Treasury Note | 12/29/2023 | $ | 23,507,227 | $ | 128,326 | ||||||||

| 970 | CME E-Mini Standard & Poor’s 500 Index Futures | 12/15/2023 | 204,294,125 | 4,175,650 | ||||||||||

| TOTAL FUTURES CONTRACTS | $ | 4,303,976 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

28

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

| ETF | - Exchange-Traded Fund |

| LLC | - Limited Liability Company |

| LP | - Limited Partnership |

| LTD | - Limited Company |

| PLC | - Public Limited Company |

| REIT | - Real Estate Investment Trust |

| S/A | - Société Anonyme |

| GS | Goldman Sachs |

| MS | Morgan Stanley |

| FEDL01 | Federal Funds Rate |

| SOFRINDX | Secured Overnight Financing Rate Index |

| SOFRRATE | United States SOFR Secured Overnight Financing Rate |

| TSFR3M | 3-Month CME Term SOFR |

| USBMMY3M | US Treasury 3 Month Bill Money Market Yield |

| (a) | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| (b) | Variable rate security; the rate shown represents the rate on October 31, 2023. |

| (c) | Percentage rounds to less than 0.1%. |

| (d) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of October 31, 2023 the total market value of 144A securities is 101,897,956 or 1.6% of net assets. |

| (e) | Zero coupon bond; rate disclosed is the effective yield as of October 31, 2023. |

| (f) | Rate disclosed is the seven-day effective yield as of October 31, 2023. |

| (g) | Each contract is equivalent to one futures contract. |

| (h) | Affiliated Security. |

| (i) | Non-income producing security. |

| (j) | All or a portion of the security is on loan. Total loaned securities had a value of $6,322,610 at October 31, 2023. Security purchase with cash proceeds of securities lending collateral value of $6,464,122. |

| (k) | Security purchased with cash proceeds of securities lending collateral. |

The accompanying notes are an integral part of these financial statements.

29

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2023 |

OPEN CREDIT DEFAULT SWAP AGREEMENTS (1)

OPEN CREDIT DEFAULT SWAP AGREEMENTS - SELL PROTECTION (2)

| Unrealized | ||||||||||||||||||||||

| Termination | Interest Rate | Notional Value at | Upfront | Appreciation/ | ||||||||||||||||||

| Reference Entity | Counterparty | Date | Payable | October 31, 2023 | Value | Premiums Paid | (Depreciation) | |||||||||||||||

| Bank of America Corporation | GS | 6/20/2024 | 1.00% | $ | 60,000,000 | $ | 263,740 | $ | 34,128 | $ | 229,612 | |||||||||||

| CDX North American High Yield Series 37 | GS | 12/20/2026 | 5.00% | 100,000,000 | 3,373,890 | 854,188 | 2,519,702 | |||||||||||||||

| CDX North American High Yield Series 40 | GS | 6/20/2028 | 5.00% | 1,113,350,000 | 9,736,617 | 25,072,869 | (15,336,252 | ) | ||||||||||||||

| CDX North American High Yield Series 40 | MS | 6/20/2028 | 5.00% | 58,400,000 | 510,728 | 760,039 | (249,311 | ) | ||||||||||||||

| Ford Motor Company | GS | 12/20/2023 | 5.00% | 10,000,000 | 116,163 | 38,246 | 77,917 | |||||||||||||||

| General Motors Company | GS | 12/20/2023 | 5.00% | 10,000,000 | 120,573 | 53,572 | 67,001 | |||||||||||||||

| Verizon Communications, Inc. | GS | 12/20/2023 | 1.00% | 25,000,000 | 46,442 | 8,216 | 38,226 | |||||||||||||||

| TOTAL | $ | 14,168,153 | $ | 26,821,258 | $ | (12,653,105 | ) | |||||||||||||||

OPEN CREDIT DEFAULT SWAP AGREEMENTS - BUY PROTECTION (3)

| Termination | Interest Rate | Notional Value at | Upfront | Unrealized | ||||||||||||||||||

| Reference Entity | Counterparty | Date | Payable | October 31, 2023 | Value | Premiums Paid | (Depreciation) | |||||||||||||||

| CDX North American High Yield Series 41 | GS | 12/20/2028 | 5.00% | $ | 634,300,000 | $ | (345,271 | ) | $ | 2,069,796 | $ | (2,415,067 | ) | |||||||||

| CDX North American High Yield Series 41 | MS | 12/20/2028 | 5.00% | 150,000,000 | (81,650 | ) | 581,629 | (663,279 | ) | |||||||||||||

| TOTAL | $ | (426,921 | ) | $ | 2,651,425 | $ | (3,078,346 | ) | ||||||||||||||

| TOTAL OPEN CREDIT DEFAULT SWAP | $ | 13,741,232 | $ | 29,472,683 | $ | (15,731,451 | ) | |||||||||||||||

GS - Goldman Sachs

MS - Morgan Stanley

| (1) | For centrally cleared swaps, the notional amounts represent the maximum potential the Fund may pay/receive as a seller/buyer of credit protection if a credit event occurs, as defined under the terms of the swap contract, for each security included in the reference entity. |

| (2) | For centrally cleared swaps, when a credit event occurs as defined under the terms of the swap contract, the Fund as a seller of credit protection will either (i) pay a net amount equal to the par value of the defaulted reference entity and take delivery of the reference entity or (ii) pay a net amount equal to the par value of the defaulted reference entity less its recovery value. |

| (3) | For centrally cleared swaps, when a credit event occurs as defined under the terms of the swap contract, the Fund as a buyer of credit protection will either (i) receive a net amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receive a net amount equal to the par value of the defaulted reference entity more its recovery value. |

The accompanying notes are an integral part of these financial statements.

30

| NAVIGATOR TACTICAL INVESTMENT GRADE BOND FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2023 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| U.S. GOVERNMENT & AGENCIES — 91.8% | ||||||||||||

| U.S. TREASURY BILLS — 91.8% | ||||||||||||

| 300,000,000 | United States Treasury Bill(a) | 5.1500 | 11/24/23 | $ | 298,988,001 | |||||||

| 100,000,000 | United States Treasury Bill(a) | 5.2000 | 11/30/23 | 99,574,767 | ||||||||

| 250,000,000 | United States Treasury Bill(a) | 5.3000 | 12/21/23 | 248,161,458 | ||||||||

| 150,000,000 | United States Treasury Bill(a) | 5.3400 | 12/28/23 | 148,738,281 | ||||||||

| 200,000,000 | United States Treasury Bill(a) | 5.3900 | 01/25/24 | 197,493,602 | ||||||||

| 992,956,109 | ||||||||||||

| TOTAL U.S. GOVERNMENT & AGENCIES (Cost $992,935,139) | 992,956,109 | |||||||||||