UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21732

Mercer Funds

(Exact Name of Registrant as Specified in Charter)

99 High Street

Boston, MA 02110

(Address of Principal Executive Offices)(Zip Code)

Colin J. Dean, Esq.

Mercer Investment Management, Inc.

99 High Street

Boston, MA 02110

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: (617) 747-9500

Date of Fiscal Year End: March 31, 2018

Date of Reporting Period: March 31, 2018

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Mercer Funds™

Annual Report

Mercer US Large Cap Equity Fund

Mercer US Small/Mid Cap Equity Fund

Mercer Non-US Core Equity Fund

Mercer Core Fixed Income Fund

Mercer Opportunistic Fixed Income Fund

Mercer Emerging Markets Equity Fund

Mercer Global Low Volatility Equity Fund

This report has been prepared for Mercer Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Mercer Funds prospectus. The prospectus contains more complete information about the Funds’ investment objectives, risks, and expenses. Investors are reminded to read the prospectus carefully before investing.

March 31, 2018

MERCER FUNDS

TABLE OF CONTENTS

Mercer US Large Cap Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the Russell 1000 Index.

Investment Strategy

The Fund invests principally in equity securities (such as common stock) issued by large capitalization U.S. companies. The Fund employs a “core equity” investment strategy by investing in both growth and value oriented equity securities. The Fund may invest in derivative instruments to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs.

Performance

For the fiscal year ended March 31, 2018, the Fund’s Y-3 share class performance was 17.26% compared to its benchmark, the Russell 1000 Index, return of 13.98%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2018, the Fund employed six subadvisors: HS Management Partners, LLC (HS), Columbia Management Investment Advisers (Columbia), Parametric Portfolio Associates LLC (Parametric), AJO LP (AJO), Brandywine Global Investment Management, LLC (Brandywine), and O’Shaughnessy Asset Management, LLC (OSAM).

AJO is a quantitative manager that relies on a combination of value, management, momentum, and sentiment factors to evaluate securities. Columbia is an aggressive growth manager, following a high conviction, concentrated strategy that focuses on financially strong companies that are growing earnings faster than the broader equity market. HS is a growth manager that invests in quality businesses with strong management that trade at attractive valuations. Brandywine, a deep value manager, focuses on cheap stocks that trade at a significant discount to intrinsic value, that have strong free cash flows and quality balance sheets. OSAM is a yield focused quantitative value manager that seeks stocks that are ranked high based on valuation, quality and shareholder yield. Parametric utilizes exchange-traded futures to generate exposure corresponding to the Fund’s benchmark, the Russell 1000 Index.

Market Commentary and Fund Performance

For the 12-month-period ended March 31, 2018, the U.S. equity market, as measured by the Russell 3000 Index, increased 13.63%. In 2017, strength in the U.S. equity market was supported by strong corporate earnings results, relatively benign inflation, low volatility, falling unemployment, steady wage gains and rising consumer and business sentiment. From a style perspective, growth meaningfully outperformed value across the market capitalization spectrum. Despite some negative headlines, including geopolitical tension, political uncertainty and concerns over the economic impacts of the devastating hurricanes in August and September of 2017, the U.S. equity market continued its slow and steady march forward. Tax reform took center stage at the end of 2017, when the new tax bill was signed into law, which boosted investor optimism, giving further support to equity prices. The Federal Reserve raised rates three times over the course of the Fund’s fiscal year and announced plans for further modest increases throughout 2018.

After a strong start to 2018, markets were jolted in February by fears of rising interest rates, inflation, and wages weighing on equity markets. During this period, market volatility, as measured by the CBOE Volatility Index (VIX), increased, reaching a high of 37.32 on February 5, 2018, as compared to a low of 9.15 on January 3, 2018. From a style perspective growth stocks continued to lead the market in the first quarter of 2018, outperforming

1

Mercer US Large Cap Equity Fund

value stocks across market capitalization ranges. However, unlike in 2017, smaller capitalization stocks outperformed larger capitalization stocks for the first quarter 2018.

Within the Russell 1000 Index, the Fund’s benchmark, the best performing sectors for the fiscal year were information technology, financials, and consumer discretionary, with returns of 28.0%, 17.8%, and 16.4% respectively. Telecommunication services was the laggard with returns of -5.3%. The best performing industries were internet & direct marketing, personal products, and aerospace & defense, with returns of 55.3%, 45.3%, and 42.0% respectively.

The Mercer U.S. Large Cap Equity Fund outperformed the Russell 1000 Index for the period. Strong contributions from growth managers, as well as the Fund’s exposure to momentum were the primary contributors to the Fund’s outperformance. From a sector perspective, security selection in the information technology, consumer staples and energy sectors drove performance. Detracting from performance was poor security selection within industrials and health care.

Columbia outperformed its benchmark for the period. Results were driven by strong stock selection within information technology, particularly among software and internet service names. HS underperformed its benchmark for the period. Large overweight allocations to consumer sectors, and stock selection within the consumer discretionary sector caused performance to lag. AJO outperformed for the period, despite its value style. Exposure to momentum and quality factors, as well as strong stock selection within energy and technology were among the largest contributors to AJO’s performance. Brandywine outperformed its benchmark for the period due to strong stock selection within the information technology and energy sectors. Sector positioning also benefitted Brandywine’s strategy, particularly its underweight allocations to real estate, utilities, and telecommunication services, and its overweight allocations to financials and consumer discretionary stocks. O’Shaughnessy outperformed for the period, with positive returns being driven by helpful interaction effects between its quality, momentum, valuation and yield selection criteria. From a sector perspective, this drove positive effects from positioning and O’Shaughnessy’s stock selection in the energy, industrials, and consumer discretionary sectors. Parametric utilizes exchange-traded futures replicating the Fund’s benchmark to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, creating positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

Risk Considerations

The Fund invests in both growth stocks and value stocks. Growth stocks may be particularly sensitive to market conditions. Investing in value stocks involves the risk that an investment made in undervalued securities may not appreciate in value as anticipated or remain undervalued for long periods of time.

The Fund may invest in derivative instruments such as exchange-listed equity futures contracts, which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

2

Mercer Funds

March 31, 2018

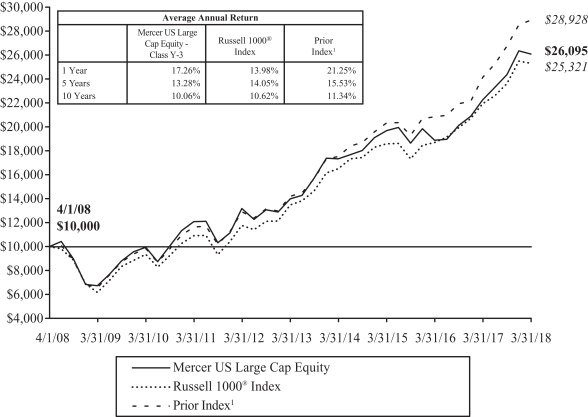

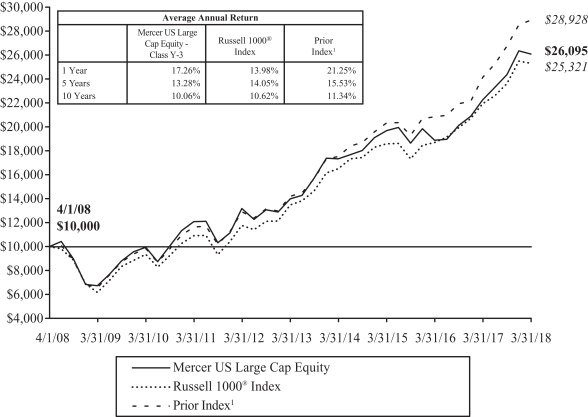

Comparison of Change in Value of a $10,000 Investment in

Mercer US Large Cap Equity Shares vs. the

Russell 1000® Index and the Fund’s Prior Index1

As of March 31, 2018

This graph shows the performance of the Mercer US Large Cap Equity Fund Class Y-3 shares versus the Russell 1000® Index and the Fund’s Prior Index1 from April 1, 2008 through March 31, 2018. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

1 Effective as of June 27, 2016, the Fund changed its primary benchmark from the Russell 1000® Growth Index to the Russell 1000® Index in connection with a change to the Fund’s principal investment strategies because it was determined that this index is more reflective of the Fund’s current investment style.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-866-658-9896 for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

3

Mercer US Small/Mid Cap Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, comprised primarily of capital appreciation. The benchmark for the Fund is the Russell 2500 Index.

Investment Strategy

The Fund invests principally in equity securities issued by small-to-medium capitalization U.S. companies. The Fund employs a “core equity” investment strategy by investing in both growth and value oriented equity securities. The Fund may invest in derivative instruments to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs.

Performance

For the fiscal year ended March 31, 2018, the Fund’s Y-3 share class performance was 12.64% compared to its benchmark, the Russell 2500 Index, return of 12.31%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2018, the Fund employed six sub-advisors: Westfield Capital Management Company (Westfield), Parametric Portfolio Associates LLC (Parametric), GW&K Investment Management, LLC (GW&K), Loomis, Sayles & Company L.P. (Loomis), LSV Asset Management (LSV) and BNY Mellon Asset Management North America Corporation. GW&K uses a bottom-up fundamental research process in order to identify companies with sustainable long-term earnings growth rates. Westfield, a traditional growth manager, employs a fundamental, bottom-up approach which seeks to identify reasonably priced stocks with high earnings growth potential. Loomis looks to provide a lower volatility approach to high growth investing by seeking companies with high quality business models that have differentiated and sustainable growth opportunities. LSV, a quantitative value manager, seeks deep value, out-of-favor companies with recent momentum. LSV avoids introducing any judgmental biases or behavioral weaknesses into their investment process. BNY Mellon Asset Management North America, a fundamental intrinsic value manager, focuses on purchasing companies that are at a large discount, underappreciated and temporarily dislocated (contrarian view). BNY Mellon Asset Management North America was added as a sub-advisor to the Fund in February 2018, replacing NWQ Investment Management Company, LLC (NWQ). Parametric utilizes exchange traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

For the 12-month-period ended March 31, 2018, the U.S. equity market, as measured by the Russell 3000 Index, increased 13.63%. In 2017, strength in the U.S. equity market was supported by strong corporate earnings results, relatively benign inflation, low volatility, falling unemployment, steady wage gains and rising consumer and business sentiment. From a style perspective, growth meaningfully outperformed value across the market capitalization spectrum. Despite some negative headlines, including geopolitical tension, political uncertainty and concerns over the economic impacts of the devastating hurricanes in August and September of 2017, the U.S. equity market continued its slow and steady march forward. Tax reform took center stage at the end of 2017, when the new tax bill was signed into law, which boosted investor optimism, giving further support to equity prices. The Federal Reserve raised rates three times over the course of the Fund’s fiscal year and announced plans for further modest increases throughout 2018.

After a strong start to 2018, markets were jolted in February by fears of rising interest rates, inflation, and wages, which weighed on equity markets. During this period, market volatility, as measured by the CBOE Volatility

4

Mercer US Small/Mid Cap Equity Fund

Index (VIX), increased, reaching a high of 37.32 on February 5, 2018 as compared to a low of 9.15 on January 3, 2018. From a style perspective growth stocks continued to lead the market outperforming value stocks across market capitalization ranges in the first quarter of 2018. However, unlike in 2017, smaller capitalization stocks outperformed larger capitalization stocks for the first quarter of 2018.

Within the Russell 2500 Index, the Fund’s benchmark, the best performing sectors for the fiscal year were information technology and health care with positive returns of 24.42% and 22.34%, respectively. Underperforming sectors for the fiscal year were energy and real estate, with negative returns of -15.56% and -3.18%, respectively. The top performing industries for the fiscal year were air freight & logistics and internet software & services with positive returns of 58.41% and 54.36%, respectively. The underperforming industries for the fiscal year were transportation infrastructure and energy equipment & services with negative returns of -49.70% and -30.92%, respectively.

The Mercer U.S. Small/Mid Cap Equity Fund outperformed the Russell 2500 Index for the period. The Fund’s exposure to momentum, coupled with strong security selection, were the primary drivers to the Fund’s outperformance. Specifically, strong security selection in the industrials and energy sectors drove performance for the fiscal year despite poor security selection in the consumer staples and real estate sectors.

Westfield outperformed for the fiscal year due to its strong security selection in the industrials and consumer discretionary sectors. In addition, their underweight in the materials and energy sectors from an allocation standpoint helped drive their outperformance. Loomis outperformed for the fiscal year due to its strong security selection in the consumer discretionary, industrials and information technology sectors. GW&K‘s outperformance was attributed to its security selection in the information technology and consumer discretionary sectors. In addition, GW&K’s underweight in the energy sector and overweight in the information technology sector helped contribute to its outperformance. For the period that NWQ was a subadvisor in the fund, its outperformance was driven by its allocation decisions. In particular, NWQ’s underweight to the real estate sector and overweight within the information technology and materials sectors drove its outperformance. LSV’s underperformance for the period was driven by its security selection in the information technology, real estate and health care sectors. BNY Mellon Asset Management North America underperformed for the short period that it was a subadvisor to the Fund during the Fund’s fiscal year 2018. In particular, the strategy’s underperformance was driven by its underweight to the real estate and utilities sectors. In addition, BNY Mellon Asset Management North America’s security selection within the financials and consumer discretionary sectors detracted from performance. Parametric utilizes exchange-traded futures replicating the Fund’s benchmark to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, creating positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

Risk Considerations

The Fund invests in both growth stocks and value stocks. Growth stocks may be particularly sensitive to market conditions. Investing in value stocks involves the risk that an investment made in undervalued securities may not appreciate in value as anticipated or remain undervalued for long periods of time. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund may invest in derivative instruments such as exchange-listed equity futures contracts, which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

5

Mercer Funds

March 31, 2018

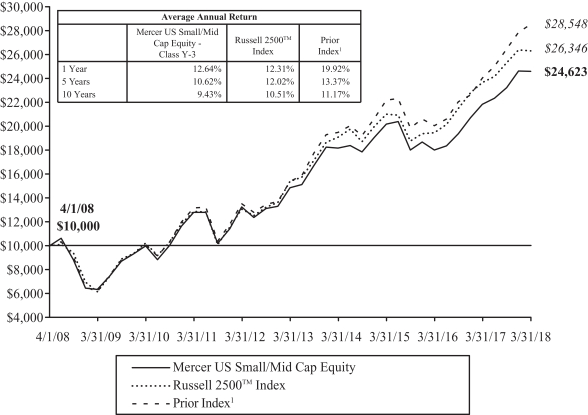

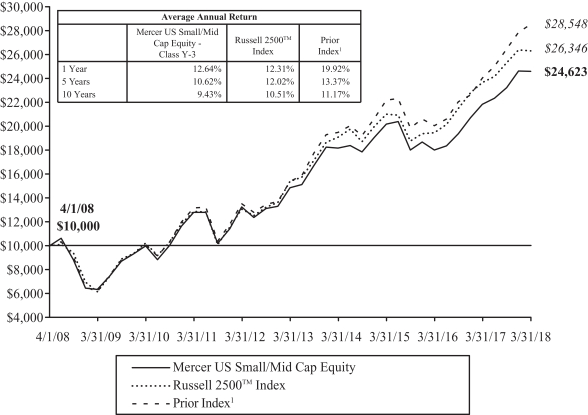

Comparison of Change in Value of a $10,000 Investment in

Mercer US Small/Mid Cap Equity Shares vs. the

Russell 2500™ Index and the Fund’s Prior Index1

As of March 31, 2018

This graph shows the performance of the Mercer US Small/Mid Cap Equity Fund Class Y-3 shares versus the Russell 2500™ Index and the Fund’s Prior Index1 from April 1, 2008 through March 31, 2018. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

1 Effective as of June 27, 2016, the Fund changed its primary benchmark from the Russell 2500TM Growth Index to the Russell 2500TM Index in connection with a change to the Fund’s principal investment strategies because it was determined that this index is more reflective of the Fund’s current investment style.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-866-658-9896 for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

6

Mercer Non-US Core Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the MSCI EAFE Index.

Investment Strategy

The Fund invests principally in equity securities issued by non-U.S. companies of any capitalization, located in the world’s developed and emerging capital markets. The Fund employs a “core equity” investment strategy that seeks to meet the Fund’s investment objective by investing in both growth- and value-oriented equity securities.

Performance

For the fiscal year ended March 31, 2018, the Fund’s Y-3 share class performance was 18.80% compared to its benchmark return of 14.80%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2018, the Fund employed five sub-advisors: Arrowstreet Capital, Limited Partnership (Arrowstreet), American Century Investment Management, Inc. (American Century), MFS Investment Management (MFS), LSV Asset Management (LSV) and Parametric Portfolio Associates LLC (Parametric).

Arrowstreet’s strategy seeks to outperform international equity benchmarks through a risk-controlled core approach. Arrowstreet combines sound investment intuition and research with rigorous quantitative tools to identify mispriced stocks around the world. Arrowstreet believes that the key to generating return in excess of the benchmark involves evaluating the prospects of a security considering both the characteristics of the stock itself (direct effects) as well as the characteristics of other related stocks (indirect effects). American Century manages its portfolio based on an investment philosophy that companies exhibiting improving or accelerating growth will outperform the market over time. American Century constructs its portfolio through bottom-up stock selection within a risk aware framework. American Century’s thorough research process seeks to identify companies that are exhibiting an improvement or acceleration in growth where it believes that growth is sustainable but that the earnings power of the company is generally underestimated. American Century will invest primarily in equity securities of companies located in Non-U.S. developed markets. MFS manages a value portfolio, which focuses on stocks whose long-term value they believe is not adequately reflected in the stock price. MFS invests opportunistically in emerging markets. LSV utilizes a quantitative approach which seeks deep value stocks that have fallen out of favor with the market, but have recent momentum, either in terms of price or earnings. LSV believes that long-term results are achieved through systematic exploitation of judgmental biases and behavioral weaknesses that influence investor decisions. LSV aims to exploit these biases through the disciplined application of quantitative techniques to drive bottom-up security selection. Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

The MSCI EAFE Index (the Fund’s benchmark) returned 14.8% for the 12-month period ended March 31, 2018. Generally, global equity markets performed well, as measured by the MSCI World Index, which rose 13.6% during the period. U.S. equities rallied, with the Russell 1000 Index up 14.0% for the fiscal year. Emerging markets also performed well, as the MSCI Emerging Markets Index returned 24.9%, over the period.

Global equity markets rose steadily from the end of the first quarter of 2017 until late January 2018. Since the recent peak in January 2018, global equity markets dropped over 9% (measured by the MSCI All Country World Index) by the end of the first quarter of 2018.

7

Mercer Non-US Core Equity Fund

Over the year ended March 31, 2018, global equity markets were boosted by synchronized global growth, unusually subdued volatility and strong corporate earnings growth. Growth outside the U.S. was also helped by the continued easy monetary policies of the European Central Bank and the Bank of Japan. Developed international equity markets (MSCI EAFE Index) rose by almost 15% during this period and Emerging markets (MSCI Emerging Markets Index) delivered even greater gains (25%), though there was a wide disparity in returns across countries.

Despite these strong returns, equity market investors had a number of reasons to worry including: rising tensions with North Korea, risk of rising protectionism, uncertainty resulting from European elections, the Catalan independence movement in Spain, struggles in the German parliament to form a coalition government, Brexit negotiations, monetary tightening by the Federal Reserve and a rise in both inflation and global bond rates.

The recent losses suffered by global equity markets, which began at the end of January 2018, have been attributed to investor concerns around rising inflation, a drop in global economic surprise indexes (Citigroup Economic Surprise Indices), concerns that imposition of tariffs could negatively impact growth, and a loss in positive momentum for some of the largest technology companies, which had outperformed in the prior year.

In this environment, the Mercer Non-US Core Equity Fund outperformed the MSCI EAFE Index by 4.00% for the 12-month period ended March 31, 2018. During this period, the Fund’s outperformance was driven by positive stock selection in all 11 sectors. The Fund’s overall overweight to the technology sector was also beneficial to relative returns.

American Century provides the growth allocation for the Fund. Stock selection in Information technology, financials, industrials, consumer discretionary and consumer staples generated excess returns. Growth stocks outperformed value stocks during the period which was a tailwind to performance. The American Century portfolio may make opportunistic, off-benchmark bets in Emerging Market companies which helped generate outperformance over this time period. Stock selection in Europe generated strong relative returns, while investments in Emerging Market technology stocks also added to results.

MFS, a manager that has outperformed significantly over the last few years, continued this trend over the period. Similar to the American Century strategy, much of the outperformance generated by MFS came from the technology sector. The MFS portfolio also holds a sizeable overweight to the consumer staples sector. Despite the underperformance of the consumer staples sector versus the benchmark, MFS was able to make up some of the drag on performance caused by an overweight to this sector through positive stock selection.

Arrowstreet beat the Fund’s benchmark during this period through stock selection and an overweight to the technology sector. The biggest contributor to Arrowstreet’s outperformance was stock selection in the materials and technology sectors.

LSV is the dedicated value manager in the Fund. Value stocks underperformed growth stocks during this period. Despite this headwind, the LSV portfolio generated outperformance from positive stock selection in 8 out of 11 sectors. LSV’s underweight to the consumer staples sector was also beneficial to relative returns.

Parametric utilizes exchange-traded futures replicating the Fund’s benchmark to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, creating positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

8

Mercer Non-US Core Equity Fund

Risk Considerations

The Fund invests in foreign and emerging market securities which involves certain risks such as currency volatility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund may invest in derivative instruments such as exchange-listed equity futures contracts, which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

9

Mercer Funds

March 31, 2018

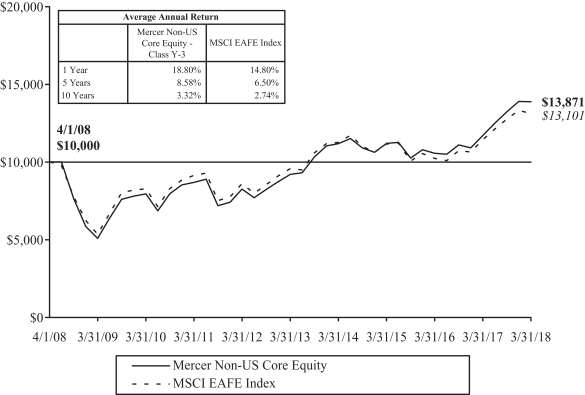

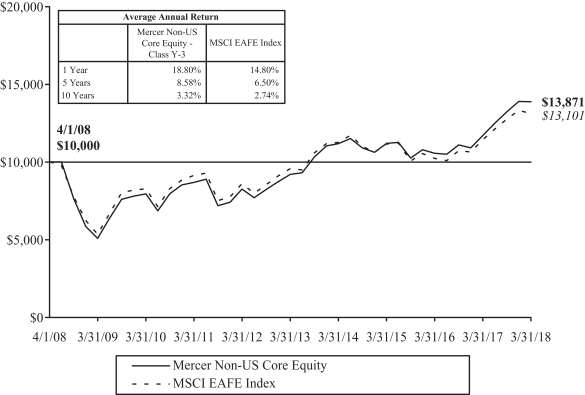

Comparison of Change in Value of a $10,000 Investment in

Mercer Non-US Core Equity Shares vs. the

MSCI EAFE Index

As of March 31, 2018

This graph shows the performance of the Mercer Non-US Core Equity Fund Class Y-3 shares versus the MSCI EAFE Index from April 1, 2008 through March 31, 2018. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-866-658-9896 for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

10

Mercer Core Fixed Income Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide total return, consisting of both current income and capital appreciation. The benchmark for the Fund is the Bloomberg Barclays U.S. Aggregate Bond™ Index.

Investment Strategy

The Fund invests principally in investment grade fixed income securities, including government securities, corporate bonds and securitized bonds such as mortgage and asset-backed securities. The Fund may also invest in non-investment grade bonds, non-U.S. dollar denominated bonds, bonds issued by issuers located in emerging capital markets, and certain derivative instruments. The Fund may invest in derivative instruments, such as options, futures, and swap agreements. The Fund may engage in transactions in derivatives for a variety of purposes, including changing the investment characteristics of its portfolio, enhancing total returns or as a substitute for taking a position in an underlying asset.

Performance

For the fiscal year ended March 31, 2018, the Fund’s Y-3 share class performance was 1.80% compared to its benchmark return of 1.20%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2018, the Fund employed three sub-advisors, Manulife Asset Management (Manulife), Income Research & Management (IR&M) and Prudential Fixed Income, a business unit of PGIM, Inc. (Prudential).

Manulife manages its allocated portion of the Fund by seeking to produce superior results by anticipating shifts in the business cycle and moderating risk relative to the direction of interest rates. The investment team capitalizes on these shifts by using a research-driven process to identify attractive sectors as well as mispriced securities within those sectors. IR&M manages its allocated portion based on the belief that careful security selection and higher portfolio income provide superior returns over the long term. Portfolios are constructed using a disciplined, bottom-up investment approach to select attractive securities from the U.S fixed income universe. Prudential manages its allocated portion of the Fund by seeking to maximize excess return opportunities from sustainable alpha sources such as sector allocation and bottom up security selection. This process is coupled with a diligent daily portfolio risk evaluation and monitoring process. Research-based security selection is a major source of added value and incorporates both fundamental analysis as well as proprietary models that identify relative value and detailed technical review of issuers across both benchmark and non-benchmark sectors, with an emphasis on credit-oriented sectors.

Market Commentary and Fund Performance

For the 12 month period ended March 31, 2018, U.S. fixed income market returns, as measured by the Bloomberg Barclays U.S. Aggregate index, were positive. Generally, price increases of fixed income securities that are not backed by a U.S. Government Guarantee (including Corporate Bonds, Asset Backed Securities, and Commercial Mortgage Backed Securities) more than offset the general drop in prices of U.S. Government securities resulting from rising interest rates. Intermediate U.S. Treasury rates increased 0.64% while longer term interest rates decreased -0.05% year-over-year (with some interim volatility). Yields for the two year Treausry Note, also referred to as the short end of the Treasury curve, rose year-over-year by 1.01% as the Federal Reserve raised short term interest rates three times over the period. 2017 confounded many of the initial expectations of a bear market for bonds and turned out to be yet another solid year for fixed income with broad benchmarks generally outperforming cash and, as expected, the higher-yielding sectors putting in particularly impressive

11

Mercer Core Fixed Income Fund

performances. U.S. economic growth accelerated from 1.5% in 2016 to an estimated 2.3% in 2017. Encouragingly, in 2017 a significant source of growth was stronger investment by businesses — a trend that the tax reform package, which passed in December 2017, is likely to continue to foster in 2018. In addition, a rebound in corporate profits, a weakening dollar, and broad-based, synchronized growth among U.S. trading partners contributed to the improvement in growth in 2017. Strong consumer spending, meanwhile, has been supported by a drop in the household saving rate over the past two years and a modest pick-up in borrowing. Proposed tax cuts for an estimated 60% of households are expected to continue supporting consumption in 2018. Despite volatility during the first 2 quarters of the period ended March 31, 2018, interest rates moved steadily higher in the latter 2 quarters as the Fed announced that it would begin the balance sheet normalization process. Foreign purchases of U.S. Treasuries continued at a strong pace, and this helped to temper the effect of the rise in interest rates, especially in the 10 year and longer portion of the Treasury curve, also referred to as the long end of the curve.

Returns from fixed income securities that are not backed by a U.S. Government guarantee (including corporate bonds, asset backed securities, and commercial mortgage backed securities) were generally positive, as these securities benefitted from strong demand for higher yields. Lower credit quality rated corporate bonds (i.e., high yield or “junk” bonds) tended to provide greater excess returns during the 12-month period than the higher credit quality rated corporate bonds (i.e., investment-grade bonds). Investment-grade corporate bond issuers continued to issue record amounts of new bonds to take advantage of low interest rates, once again exceeding the record breaking issuance of the prior year.

With Treasury rates rising so significantly during the 12-month period, positive total return was driven almost entirely from outperformance of the spread sectors (i.e., non-Treasury securities). Spread sectors provided higher returns in relation to similar-duration Treasuries while registering moderate gains in absolute terms. The Fund’s return was positive in absolute terms and it also outperformed in relation to the Bloomberg Barclays U.S. Aggregate Bond Index for the fiscal year ended March 31, 2018. The Fund was helped by its strategic overweight to spread sectors, including an allocation to high yield.

The respective performance results of each Sub-advisor correlated with their risk posture, as more risk translated into more returns in this “risk-on” period. Manulife has the largest share of the risk allocation within the Fund. Manulife’s bias towards corporate credit and its approximate 15% allocation to relatively “higher quality” high yield bonds, led it to have the strongest returns among the Fund’s Sub-Advisors for the 2018 fiscal year. Manulife had an overweight to the long end of the yield curve and an underweight to the middle, or two to ten year portion of the yield curve, which was also a driver of returns over the period as the long end yields fell slightly and prices for those bonds went up in value, while the yields in the middle of the curve rose significantly, and prices for those bonds declined. Manulife carried an underweight to securities issued by utility companies, which detracted from returns over the year.

Prudential had a less aggressive allocation to spread sectors than Manulife, but it was nonetheless overweight to the spread sectors as spreads tightened, which helped it outperform the index. Prudential also had similar curve positioning to Manulife, with an overweight to the long end of the curve, and an underweight to the middle which added to outperformance. Prudential also had a large overweight to commercial mortgage backed securities, an asset class that had strong performance over the period.

Similarly, IR&M’s overall underweight to Treasury bonds over the period was beneficial to the Fund, as the spread sector outperformed Treasuries. IR&M’s underweight to agency mortgage backed securities, coupled with security selection within that sector, was also a major contributor to its outperformance of the index. IR&M’s bias towards higher quality corporate bonds helped it outperform the index, but to a lesser extent than the other two managers who held more lower-quality bonds. IR&M’s investment in Small Business Administration loans detracted from returns over the year.

12

Mercer Core Fixed Income Fund

Risk Considerations

The Fund is subject to the risks that the underlying bonds in its portfolio are subject to, including credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline. The Fund may invest in foreign securities, which may expose the Fund to currency and exchange rate fluctuations, derivatives (such as futures, options, or swaps) and high yield bonds (also known as “junk” bonds). These investments may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

13

Mercer Funds

March 31, 2018

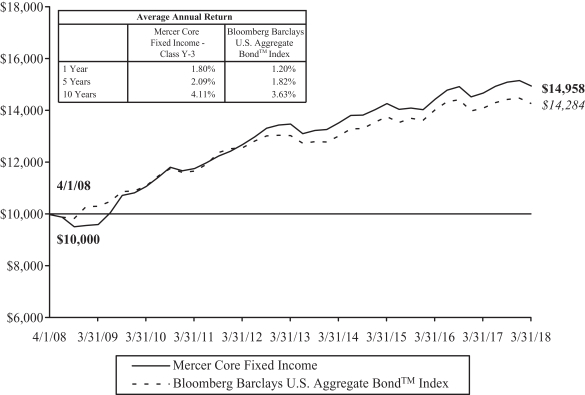

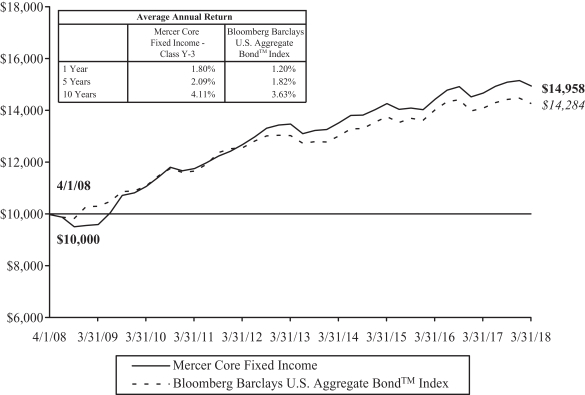

Comparison of Change in Value of a $10,000 Investment in

Mercer Core Fixed Income Shares vs. the

Bloomberg Barclays U.S. Aggregate Bond™ Index

As of March 31, 2018

This graph shows the performance of the Mercer Core Fixed Income Fund Class Y-3 shares versus the Bloomberg Barclays U.S. Aggregate Bond™ Index from April 1, 2008 through March 31, 2018. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-866-658-9896 for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

14

Mercer Opportunistic Fixed Income Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The Fund’s primary benchmark is the Bank of America Merrill Lynch Global High Yield 2.0% Constrained Index Unhedged. The Fund’s secondary benchmark is a blended benchmark consisting of 50% JP Morgan Government Bond Index — Emerging Markets Global Diversified and 50% Bank of America Merrill Lynch Global High Yield 2.0% Constrained Index Unhedged.

Investment Strategy

The Fund invests principally in fixed income securities of U.S. and non-U.S. issuers, including those in emerging and frontier markets. The Fund invests in various strategic and tactical global bond market opportunities without limitations in geography, issuer type, quality and currency denomination. The Fund may invest in derivatives such as futures (including among others, interest rate futures), swaps (currency, interest rate, credit default and total return), forwards, options, and credit-linked notes. The Fund may engage in transactions in derivatives for a variety of purposes, including hedging, risk management, efficient portfolio management, enhance total returns, or as a substitute for taking position in the underlying asset.

Performance

For the fiscal year ended March 31, 2018, the Fund’s Y-3 share class performance was 9.42% compared to its primary benchmark return of 6.67% and secondary benchmark return of 9.82%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2018, the Fund employed two sub-advisors, Franklin Advisers, Inc. (Franklin) and Investec Asset Management Limited (Investec).

In managing its allocated portion of the Fund’s portfolio, Franklin typically invests in non-investment grade securities issued globally. Franklin is a research driven, fundamental investor that relies on a team of analysts to provide in-depth industry expertise, using both qualitative and quantitative analysis to evaluate issuers. Although bottom-up security selection forms the core part of Franklin’s process, it uses industry attractiveness when selecting investments.

In managing its allocated portion of the Fund’s portfolio, Investec invests in public sector, sovereign and corporate bonds issued by emerging market borrowers and those denominated in local emerging market currencies. Investec’s portfolio construction process promotes allocation to countries and currencies identified based on economic fundamentals, valuations and market price behavior.

Market Commentary and Fund Performance

For the 12-month period ended March 31, 2018, U.S. and global fixed income markets experienced a volatile period driven by a few broad underlying factors: a recovery in the physical commodities markets; stable economic growth in China; a weak U.S. dollar versus developed and emerging market currencies; and significant oil price recovery, which created mixed effects on energy importer and exporter economies. Towards the end of the period, the Trump administration’s protectionist trade policies and escalating trade tensions between the U.S. and China contributed to volatility in global financial markets.

The passage of the U.S. tax reform bill in December 2017, along with expectations for stronger U.S. economic growth and higher inflation, pressured total returns for U.S. Treasury securities and boosted total returns for

15

Mercer Opportunistic Fixed Income Fund

lower rated corporate bonds (i.e., high yield or “junk” bonds) and for non-U.S. dollar-denominated bonds. After rising early in the period, U.S. Treasury securities prices generally moved lower. U.S. Treasury yields reached highs for the period in February 2018 as a result of market perception that President Trump’s pro-growth agenda and the U.S. tax reform bill could lead to an overheating in the U.S. economy, which could in turn lead to the U.S. Federal Reserve to raise interest rates at a faster-than-expected pace. The Bank of America Merrill Lynch Global High Yield 2% Constrained Index Unhedged experienced a tightening in its yield spread (i.e., the difference in yield of the securities comprising the index over U.S. Treasuries, which is a measure of risk premium), ending the Fund’s fiscal year with a yield spread of 361 basis points and an overall effective yield of 5.69%. Additionally, rising oil prices and a weak U.S. dollar positively influenced global bond prices. Low corporate default rates, stable business fundamentals and the perception of a synchronized global economic growth provided positive momentum, which led high yield bonds to outperform investment-grade bonds in a rising rate environment.

Unhedged emerging markets (“EM”) local currency bonds produced a solid positive return over the year, supported by falling bond yields and rising EM currency markets (relative to the U.S. dollar). On the bond side, generally falling EM inflation numbers and supportive valuations helped drive yields lower (bond prices higher) as they attracted strong inflows into the asset class. Rising commodity prices, more balanced current accounts and positive political developments in key EM countries were supportive of currency returns relative to the U.S. dollar.

During the 12-month period ended March 31, 2018, The Fund was tactically overweight to emerging market debt (“EMD”) compared to global high yield (55% to 45%). This contributed to the Fund’s performance as the absolute return for EMD was 12.52% versus 6.67% for global high yield over the period. During the period, Investec outperformed the JPMorgan Global Bond Index — Emerging Markets Global Diversified. The Fund benefited materially from Investec’s overweight position in the Malaysian ringgit. The Fund’s currency exposure had a positive impact during the second half of the period, due to a combination of booming economic activity data, a material trade surplus, and rising oil & gas prices. An off-benchmark position in unhedged Egyptian treasury bills also added to the Fund’s positive performance. These securities benefited from a mild strengthening in the spot price, their high carry return, and Egypt’s successful implementation of an International Monetary Fund reform program, which includes adopting the value-added tax as well allowing the exchange rate to be determined by market forces. Gains were partly offset by positions in Mexico, both from being underweight when Mexican securities generally outperformed and from being overweight when Mexican securities generally underperformed. Franklin underperformed the ICE Bank of America Merrill Lynch Global High Yield 2% Constrained Index Unhedged. This underperformance was driven primarily by security selection within the health care, retailers, metals, and mining sectors. Quality allocation was another detractor, particularly within the energy-related portion of the portfolio. Franklin’s exposure to foreign currencies also weighed on performance over the period, primarily from the Fund’s underweighted exposure to the euro and British pound sterling. In contrast, industry allocation contributed to performance, driven primarily by underweight positioning in the wired and wireless communication sectors and an overweight positioning in utilities.

Risk Considerations

The Fund invests in non-investment grade and emerging market fixed income securities which involves certain risks such as higher volatility, currency fluctuation, political and social instability and reduced market liquidity. The Fund is subject to the risks that the underlying bonds in its portfolio are subject to, including credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline. The Fund may invest in foreign securities, which may expose the Fund to currency and exchange rate fluctuations, derivatives (such as futures, options, or swaps) and high yield bonds (also known as “junk” bonds). These investments may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

16

Mercer Funds

March 31, 2018

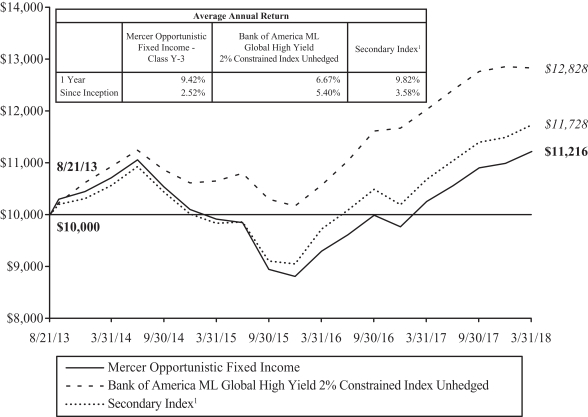

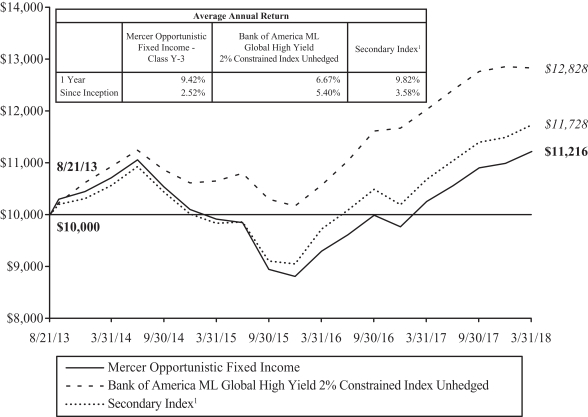

Comparison of Change in Value of a $10,000 Investment in

Mercer Opportunistic Fixed Income Shares vs. the

Bank of America ML Global High Yield 2% Constrained Index Unhedged and the Fund’s Secondary Index1

As of March 31, 2018

This graph shows the performance of the Mercer Opportunistic Fixed Income Fund Class Y-3 shares versus the Bank of America ML Global High Yield 2% Constrained Index Unhedged and the Fund’s Secondary Index1 from August 21, 2013, which is the inception date of the Fund, through March 31, 2018. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

1 The Mercer Opportunistic Fixed Income Fund’s Secondary Index is a blended benchmark consisting of 50% JP Morgan Government Bond Index — Emerging Markets Global Diversified USD Unhedged and 50% Bank of America ML Global High Yield 2% Constrained Index Unhedged.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-866-658-9896 for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

17

Mercer Emerging Markets Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the MSCI Emerging Markets Index.

Investment Strategy

The Fund invests principally in equity securities of large, medium and small capitalization companies, located in emerging markets, other investments that are tied economically to emerging markets, as well as in American, European and Global Depository receipts. Stock index futures and various types of swaps may be used to implement the country selection component of the Fund’s investment strategy. Currency forwards may be used to make stock-selection and country allocation decisions independently of the underlying currency.

Performance

For the fiscal year ended March 31, 2018, the Fund’s Y-3 share class performance was 22.92% compared to its benchmark return of 24.93%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2018, the Fund employed seven sub-advisors: AQR Capital Management, LLC (AQR), Dimensional Fund Advisors (DFA), Janus Henderson Investors (Janus Henderson), Mondrian Investment Partners Limited (Mondrian), Copper Rock Capital Partners LLC (Copper Rock), William Blair Investment Management, LLC (William Blair) and Parametric Portfolio Associates LLC (Parametric). DFA and Janus Henderson were added to the Fund in March 2018. The addition of these two new managers added more quality and broad value exposure to the portfolio. Investec and KBI were terminated in March 2018.

AQR employs a systematic, research-driven investment approach focused on generating excess return relative to the benchmark from currency, country and security selection strategies. AQR’s proprietary investment process uses fundamental factors, such as value, momentum and quality within its models. AQR uses quantitative tools to construct optimized portfolios based on this diversified set of fundamental factors, along with estimates of risk and transactions costs. DFA benefits from a robust research platform, which includes close ties to academia, its clear and long-standing focus on exploiting risk premiums, most notably value and size, along with the new addition profitability, and a systematic approach to building and trading its portfolios. DFA’s process is repeatable and results in broad consistent exposures to the risk premiums. Janus Henderson’s emerging markets strategy is based on the importance of limiting the potential for permanent loss of capital by investing with businesses and management teams that have a track record of generating value for shareholders. The strategy is managed with a long-term, unconstrained, absolute return mind-set, and singular focus on identifying and investing in companies with sustainable, enduring business models. Copper Rock specializes in small cap equity investing using a blend of quantitative and fundamental analyses to identify companies with superior growth relative to their peers. Copper Rock’s portfolio typically exhibits factor exposures to growth, momentum and quality. Mondrian is an experienced value manager that uses a Dividend Discount Model to analyze and find attractive companies focused on the domestic oriented growth of emerging markets. Along with emerging market domiciled companies, Mondrian’s management team will also consider any company globally that generates at least 25% of revenues/profits from emerging/frontier markets. William Blair has a quality growth philosophy and process focused on finding those companies that can achieve a higher growth rate for a longer period of time than the market expects. William Blair looks for companies with experienced and motivated management teams, unique business models and attractive financial characteristics. Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

18

Mercer Emerging Markets Equity Fund

Market Commentary and Fund Performance

The MSCI Emerging Markets Index (the Fund’s benchmark) returned 24.9% for the 12-month period ended March 31, 2018. Generally, global equity markets performed well, as measured by the MSCI World Index, which rose 13.6% during the 12-month period ended March 31, 2018. U.S. equities rallied, with the Russell 1000 Index up 14.0% for the fiscal year. International developed markets also performed well, as the MSCI EAFE Index returned 14.8% over the period.

Global equity markets rose steadily from the end of the first quarter of 2017 until late January 2018. Since the recent peak in January 2018, global equity markets dropped over 9% (measured by the MSCI All Country World Index) by the end of the first quarter of 2018.

Over the year ended March 31, 2018, global equity markets were boosted by synchronized global growth, unusually subdued volatility and strong corporate earnings growth. Growth outside the US was also helped by the continued easy monetary policies of the European Central Bank and the Bank of Japan. Developed international equity markets (MSCI EAFE Index) rose by almost 15% during this period and Emerging markets (MSCI Emerging Markets Index) delivered even greater gains (25%), though there was a wide disparity in returns across countries.

Despite these strong returns, equity market investors had a number of reasons to worry including: rising tensions with North Korea, risk of rising protectionism, uncertainty resulting from European elections, the Catalan independence movement in Spain, struggles in the German parliament to form a coalition government, Brexit negotiations, monetary tightening by the Federal Reserve and a rise in both inflation and global bond rates.

The recent losses suffered by global equity markets, which began at the end of January 2018, have been attributed to investor concerns around rising inflation, a drop in global economic surprise indexes (Citigroup Economic Surprise Indices), concerns that imposition of tariffs could negatively impact growth, and a loss in positive momentum for some of the largest technology companies, which had outperformed in the prior year.

In this environment, the Mercer Emerging Markets Equity Fund underperformed the MSCI Emerging Markets Index by 2.0% for the 12-month period ended March 31, 2018. Underperformance during the period can be attributed primarily to the Fund’s smaller allocation to specific Chinese and South Korean technology stocks.

Intentionally, the Mercer Emerging Markets Equity Fund holds a greater weighting to value stocks compared with its benchmark. Value stocks have tended to outperform growth stocks historically. At the very basic level, value managers, and managers that use valuation criteria as a material part of their investment processes, focus on investing in stocks that sell at lower prices compared to their peers.

During the period ended March 31, 2018, much of the strong performance by the MSCI Emerging Markets Index was attributable to a small number of stocks with large index weights. A handful of technology companies were selling at higher valuations than the Fund’s sub-advisors considered justified. Due to their large weighting within the benchmark, the Fund’s underweight to a few of these technology stocks was the biggest source of underperformance over the period.

In addition, the Fund’s relative performance was also negatively affected by stock selection within the telecommunications sector. Collectively, the sub-advisors in the Fund generated positive returns through stock selection in the majority of sectors. However, these returns were not great enough to offset the relative losses taken in the technology sector.

Among the sub-advisors, AQR, William Blair and CopperRock generated positive relative returns over the period. Mondrian trailed the Index.

19

Mercer Emerging Markets Equity Fund

AQR beat the MSCI Emerging Markets Index for the period. AQR’s strategy outperformance versus the benchmark was driven by positive performance generated by its momentum focus and positive performance in stock selection within the consumer discretionary sector.

William Blair’s outperformance was due to broad positive stock selection. William Blair generated positive selection in 8 out of 11 sectors. The strategy also benefitted from an overweight to the technology sector.

The largest detractor at the sub advisor level was Mondrian. Mondrian’s focus on value stocks was a headwind to relative performance. Mondrian did not hold the top performing technology companies in the MSCI Emerging Markets Index, and it was 15% underweight to the technology sector overall, which was the best performing sector in the Index during this timeframe.

CopperRock, contributed positively to the Fund’s relative performance as a result of positive stock selection, particularly in the consumer and materials sectors. CopperRock is the dedicated small market capitalization sub-advisor for the Fund.

Prior to their removal from the Fund, KBI underperformed during the period as their focus on undervalued companies led to them not investing in many of the strongest performing Chinese technology companies during this period.

Prior to their removal from the Fund, Investec outperformed during this period as their focus on earnings revision momentum kept them invested in many of the top performing technology stocks.

Parametric utilizes exchange-traded futures replicating the Fund’s benchmark to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, creating positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

Risk Considerations

The Fund invests in emerging market securities which involves certain risks such as currency volatility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund may invest in derivatives (such as futures, forwards, options, or swaps), which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

20

Mercer Funds

March 31, 2018

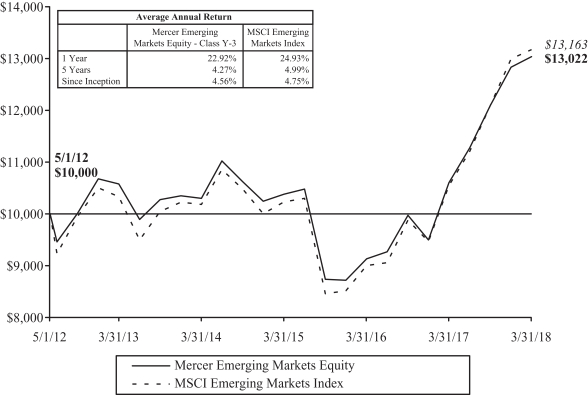

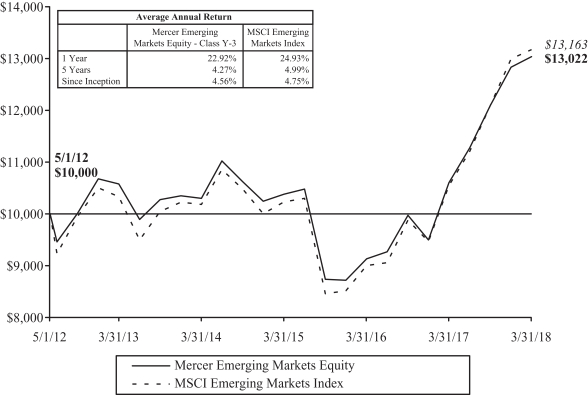

Comparison of Change in Value of a $10,000 Investment in

Mercer Emerging Markets Equity Shares vs. the

MSCI Emerging Markets Index

As of March 31, 2018

This graph shows the performance of the Mercer Emerging Markets Equity Fund Class Y-3 shares versus the MSCI Emerging Markets Index from May 1, 2012, which is the inception date of the Fund, through March 31, 2018. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-866-658-9896 for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

21

Mercer Global Low Volatility Equity Fund

Investment Objective and Benchmark

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. The benchmark for the Fund is the MSCI World Index.

Investment Strategy

The Fund invests principally in equity securities of U.S. and foreign issuers, of large, medium and small capitalization companies. Stock index futures and various types of swaps may be used to implement the equity security selection component of the Fund’s investment strategy. Currency forwards may be used to make stock-selection and country allocation decisions independently of the underlying currency.

Performance

For the fiscal year ended March 31, 2018, the Fund’s Y-3 share class performance was 12.47% compared to its benchmark return of 13.59%. Performance for the Fund is reported net of fees and operating expenses while the benchmark returns do not include expenses of any kind as indexes are unmanaged.

The Sub-Advisors

As of March 31, 2018, the Fund employed four sub-advisors, Acadian Asset Management LLC (Acadian), MFG Asset Management (MFG), Martingale Asset Management, L.P. (Martingale) and Parametric Portfolio Associates LLC (Parametric).

Acadian’s process uses both risk analysis and stock forecasts to build the portfolio. The process uses a risk model to determine the systematic risk and the level of volatility of each stock in the investable universe. Once a stock’s risk is determined, Acadian uses its stock forecast model as an overlay to determine the optimal mix of securities. Acadian’s security return forecasting model incorporates five categories including value, growth, risk, macroeconomic, and technical factors.

MFG screens the universe of investable global stocks to identify high quality companies based on key quality criteria: the sustainability of a company’s competitive advantages; the predictability and reliability of future cash flows and earnings; the extent to which management will act in the best interest of shareholders; and re-investment potential. MFG then evaluates investment opportunities quantitatively incorporating both long-term intrinsic value and three-year forecast total shareholder returns using MFG’s proprietary forecasts. MFG determines portfolio construction by each stock’s ranking based on the qualitative assessment of the key criteria, the quantitative assessment driven by valuation, and detailed macroeconomic research within a robust risk management framework. From time to time, MFG may hold up to 20% of its portion of the Fund in cash if warranted by its assessment of the macro environment.

Martingale’s approach to low volatility investing is built around a risk-adjusted market index methodology which promotes broad and stable diversification combined with a valuation overlay that favors low risk companies with stronger fundamentals. Martingale’s systematic stock evaluation incorporates measures of relative valuation, growth and quality, along with each security’s risk properties.

Parametric utilizes exchange-traded futures to generate market exposure corresponding to the Fund’s benchmark.

Market Commentary and Fund Performance

Global equity markets, as measured by the MSCI World Index (the Fund’s benchmark), rose 13.59% during the 12-month period ended March 31, 2018. U.S. equities rallied with the S&P 500 Index up 14.10% for the fiscal year. The MSCI EAFE Index and MSCI Emerging Markets Index returned 14.80% and 24.93%, respectively, over the same time period.

22

Mercer Global Low Volatility Equity Fund

Markets rose steadily from the end of the first quarter of 2017 until late January 2018. Performance was boosted by synchronized global growth, unusually subdued volatility and strong corporate earnings growth. The US tax reform package, which was signed into law at the end of 2017, boosted investor optimism. Growth outside the US was also helped by the continued easy monetary policies of the European Central Bank and the Bank of Japan. The best performers over the period were growth technology stocks. Value and defensive stocks significantly lagged behind.

The recent losses suffered by global equity markets, which began at the end of January 2018, have been attributed to investor concerns around rising inflation, concerns that imposition of tariffs could negatively impact growth, and a loss in positive momentum for some of the largest technology companies, which had outperformed in the prior year.

The Mercer Global Low Volatility Equity Fund returned 12.47%, underperforming the MSCI World Index by 1.12% for the 12-month period ended March 31, 2018. The Fund’s defensive posture — lower risk and volatility — was a negative contributor to performance for the Fund as these factors underperformed. Additionally, being underweight the euro in the period when it appreciated significantly versus the US dollar was one of the main drags on the Fund’s performance. Another detractor to the Fund’s performance was its allocation to cash.

While Martingale and Acadian, which employ defensive strategies, struggled to beat their respective benchmarks, MFG showed solid outperformance.

The main driver for MFG’s outperformance was overweight to the technology sector, which was one of the strongest performing sectors for the period ended March 31, 2018. Significant underweight to the euro and MFG’s allocation to cash in the portfolio were its main performance detractors.

The Martingale strategy, which provides U.S. large cap exposure for the Fund, trailed the Russell 1000 Index primarily due to sector allocation. The strategy generally holds overweight allocations to consumer staples, utilities and real estate investment trusts (REITs), as these sectors tend to be lower volatility sectors. These three sectors were among the worst performing sectors during the period. In addition, the Martingale strategy was also underweight the technology sector, which performed well during the period. Having only a minimal allocation to energy, however, helped the strategy’s performance.

The Acadian strategy, which provides international equity exposure for the Fund, underperformed compared to the MSCI EAFE Index, mainly as a result of an overweight allocation to under-performing sectors. While stock selection was positive during the period, Acadian held overweight positions in consumer staples, utilities, telecom and pharmaceuticals, which trailed the stronger performance of the technology, consumer discretionary and industrials sectors. Holding higher weights in underperforming sectors caused Acadian’s portfolio to trail the MSCI EAFE Index.

Parametric utilizes exchange-traded futures replicating the Fund’s benchmark to provide broad, passive, equity market exposure to the Fund’s liquidity sleeve, creating positive returns on assets that would have otherwise been earning cash or cash equivalent returns. Performance differences versus the benchmark are largely a result of cash flow effects related to daily subscription/redemption activity and through financing costs of futures relative to interest earned on cash.

Risk Considerations

The Fund invests in foreign and emerging market securities which involves certain risks such as currency volatility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. The Fund may invest in derivatives (such as futures, forwards, options,

23

Mercer Global Low Volatility Equity Fund

or swaps), which may cause the Fund to experience greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify the risk of loss for the Fund. The Fund may experience high portfolio turnover which may result in higher transaction costs and capital gains.

24

Mercer Funds

March 31, 2018

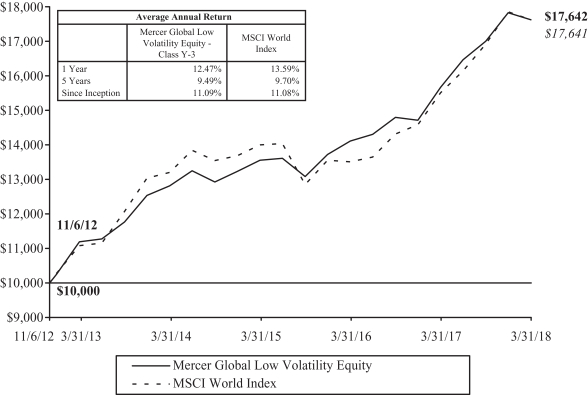

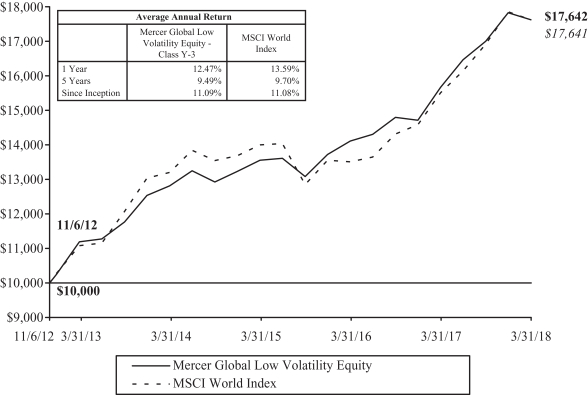

Comparison of Change in Value of a $10,000 Investment in

Mercer Global Low Volatility Equity Shares vs. the

MSCI World Index

As of March 31, 2018

This graph shows the performance of the Mercer Global Low Volatility Equity Fund Class Y-3 shares versus the MSCI World Index from November 6, 2012, which is the inception date of the Fund, through March 31, 2018. The performance of other classes, when launched, will vary from the performance of the class shown based on the difference in fees and expenses paid by shareholders investing in different share classes. The Fund may charge a 2% redemption fee on shares owned less than 30 days.

The table and graph assume reinvestment of dividends and capital gains, but do not reflect a deduction of taxes an investor might pay on fund distributions or upon redemption of fund shares. Performance shown reflects a fee waiver and/or expense reimbursement. Without this waiver/reimbursement, returns would have been lower.

The data quoted represents past performance and does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Please call 1-866-658-9896 for the Fund’s most recent month-end performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased.

25

Mercer US Large Cap Equity Fund

Schedule of Investments

(showing percentage of net assets)

March 31, 2018

| | | | | | | | | | |

| Shares | | | | | Description | | Value ($) | |

| | |

| | | | | | COMMON STOCKS — 95.4% | |

| | |

| | | | | | Aerospace & Defense — 1.4% | |

| | | |

| | 10,391 | | | | | Boeing Co. (The) | | | 3,407,001 | |

| | 1,550 | | | | | Lockheed Martin Corp. | | | 523,791 | |

| | 4,688 | | | | | Northrop Grumman Corp. | | | 1,636,675 | |

| | 10,272 | | | | | Spirit AeroSystems Holdings, Inc. Class A | | | 859,766 | |

| | 6,702 | | | | | United Technologies Corp. | | | 843,246 | |

| | | | | | | | | | |

| | | | | | | | | 7,270,479 | |

| | | | | | | | | | |

| | |

| | | | | | Agriculture — 0.3% | |

| | | |

| | 13,982 | | | | | Altria Group, Inc. | | | 871,358 | |

| | 6,032 | | | | | Philip Morris International, Inc. | | | 599,581 | |

| | | | | | | | | | |

| | | | | | | | | 1,470,939 | |

| | | | | | | | | | |

| | |

| | | | | | Airlines — 2.5% | |

| | | |

| | 81,875 | | | | | American Airlines Group, Inc. | | | 4,254,225 | |

| | 67,476 | | | | | Delta Air Lines, Inc. | | | 3,698,360 | |

| | 35,093 | | | | | Southwest Airlines Co. | | | 2,010,127 | |

| | 38,079 | | | | | United Continental Holdings, Inc.* | | | 2,645,348 | |

| | | | | | | | | | |

| | | | | | | | | 12,608,060 | |

| | | | | | | | | | |

| | |

| | | | | | Apparel — 1.4% | |

| | | |

| | 33,600 | | | | | Hanesbrands, Inc.‡ | | | 618,912 | |

| | 42,850 | | | | | LVMH Moet Hennessy Louis Vuitton SE, ADR‡ | | | 2,641,702 | |

| | 15,003 | | | | | Michael Kors Holdings, Ltd.* | | | 931,386 | |

| | 34,966 | | | | | NIKE, Inc. Class B | | | 2,323,141 | |

| | 1,541 | | | | | Ralph Lauren Corp. | | | 172,284 | |

| | 5,141 | | | | | VF Corp. | | | 381,051 | |

| | | | | | | | | | |

| | | | | | | | | 7,068,476 | |

| | | | | | | | | | |

| | |

| | | | | | Auto Manufacturers — 1.0% | |

| | | |

| | 39,424 | | | | | Fiat Chrysler Automobiles NV | | | 808,981 | |

| | 115,262 | | | | | General Motors Co. | | | 4,188,621 | |

| | | | | | | | | | |

| | | | | | | | | 4,997,602 | |

| | | | | | | | | | |

| | |

| | | | | | Auto Parts & Equipment — 1.3% | |

| | | |

| | 43,700 | | | | | Goodyear Tire & Rubber Co. (The) | | | 1,161,546 | |

| | 14,125 | | | | | Lear Corp. | | | 2,628,521 | |

| | 48,602 | | | | | Magna International, Inc. Class A | | | 2,738,723 | |

| | | | | | | | | | |

| | | | | | | | | 6,528,790 | |

| | | | | | | | | | |

| | |

| | | | | | Banks — 5.5% | |

| | | |

| | 157,563 | | | | | Bank of America Corp. | | | 4,725,314 | |

| | 23,900 | | | | | BNP Paribas SA, ADR | | | 890,156 | |

| | 8,691 | | | | | CIT Group, Inc. | | | 447,587 | |

| | 121,773 | | | | | Citigroup, Inc. | | | 8,219,677 | |

| | 44,282 | | | | | Citizens Financial Group, Inc. | | | 1,858,958 | |

| | 60,716 | | | | | Fifth Third Bancorp | | | 1,927,733 | |

| | 24,179 | | | | | First Republic Bank | | | 2,239,217 | |

| | | | | | |

| 26 | | See accompanying Notes to the Financial Statements. | | | | |

Mercer US Large Cap Equity Fund

Schedule of Investments (Continued)

(showing percentage of net assets)

March 31, 2018

| | | | | | | | | | |

| Shares | | | | | Description | | Value ($) | |

| | |

| | | | | | Banks — continued | |

| | | |

| | 3,078 | | | | | Goldman Sachs Group (The), Inc. | | | 775,225 | |

| | 37,209 | | | | | JPMorgan Chase & Co. | | | 4,091,874 | |

| | 16,612 | | | | | Morgan Stanley | | | 896,384 | |

| | 129,478 | | | | | Regions Financial Corp. | | | 2,405,701 | |

| | | | | | | | | | |

| | | | | | | | | 28,477,826 | |

| | | | | | | | | | |

| | |

| | | | | | Beverages — 4.7% | |

| | | |

| | 31,425 | | | | | Anheuser-Busch InBev SA, ADR | | | 3,454,864 | |

| | 156,225 | | | | | Coca-Cola Co. (The) | | | 6,784,852 | |

| | 31,780 | | | | | Diageo Plc, ADR | | | 4,303,647 | |

| | 69,550 | | | | | Heineken NV, ADR | | | 3,745,963 | |

| | 15,100 | | | | | Molson Coors Brewing Co. Class B | | | 1,137,483 | |

| | 36,203 | | | | | Monster Beverage Corp.* | | | 2,071,174 | |

| | 26,191 | | | | | PepsiCo, Inc. | | | 2,858,748 | |

| | | | | | | | | | |

| | | | | | | | | 24,356,731 | |

| | | | | | | | | | |

| | |

| | | | | | Biotechnology — 2.5% | |

| | | |

| | 16,538 | | | | | Alexion Pharmaceuticals, Inc.* | | | 1,843,325 | |

| | 3,314 | | | | | Biogen, Inc.* | | | 907,439 | |

| | 27,474 | | | | | Celgene Corp.* | | | 2,450,956 | |

| | 32,459 | | | | | Gilead Sciences, Inc. | | | 2,447,084 | |