UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21777

John Hancock Funds III

(Exact name of registrant as specified in charter)

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Gordon M. Shone

Treasurer

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-3000

| Date of fiscal year end: | February | 28 |

| | | |

| Date of reporting period: | February | 28, 2007 |

ITEM 1. REPORT TO SHAREHOLDERS.

| TABLE OF CONTENTS |

|

| Your fund at a glance |

| page 1 |

|

| Managers’ report |

| page 2 |

|

| A look at performance |

| page 6 |

|

| Your expenses |

| page 8 |

|

| Fund’s investments |

| page 10 |

|

| Financial statements |

| page 17 |

|

| Notes to financial |

| statements |

| page 26 |

|

| Trustees and officers |

| page 36 |

|

| For more information |

| page 40 |

|

CEO corner

To Our Shareholders,

The U.S. financial markets turned in strong results over the last 12 months, as earlier concerns of rising inflation, a housing slowdown and high energy prices gave way to news of slower, but still resilient, economic growth, stronger than expected corporate earnings and dampened inflation fears and energy costs. This environment also led the Federal Reserve Board to hold short-term interest rates steady. Even with a sharp decline in the last days of the period, the broad stock market returned 11.97% for the year ended February 28, 2007, as measured by the S&P 500 Index. With interest rates remaining relatively steady, fixed-income securities also produced positive results.

But after a remarkably long period of calm, the financial markets were rocked at the end of the period by a dramatic sell-off in China’s stock market, which had ripple effects on financial markets worldwide. In the United States, for example, the Dow Jones Industrial Average had its steepest one-day percentage decline in nearly four years on February 27, 2007. The event served to jog investors out of their seemingly casual attitude toward risk and remind them of the simple fact that stock markets move in two directions — down as well as up.

It was also a good occasion to bring to mind several important investment principles that we believe are at the foundation of successful investing. First, keep a long-term approach to investing, avoiding emotional reactions to daily market moves. Second, maintain a well-diversified portfolio that is appropriate for your goals, risk profile and time horizons.

After the market’s moves of the last year, we encourage investors to sit back, take stock and set some realistic expectations. While history bodes well for the U.S. market in 2007 (since 1939, the S&P 500 Index has always produced positive results in the third year of a presidential term), there are no guarantees, and opinions are divided on the future of this more-than-four-year-old bull market. The recent downturn bolsters this uncertainty, although we believe it was a healthy correction for which we were overdue.

The recent volatility could also be a wake-up call to contact your financial professional to determine whether changes are in order to your investment mix. Some asset groups have had long runs of outperformance. Others had truly outsized returns in 2006. These trends argue for a look to determine if these categories now represent a larger stake in your portfolios than prudent diversification would suggest they should. After all, we believe investors with a well-balanced portfolio and a marathon — not a sprint — approach to investing, stand a better chance of weathering the market’s short-term twists and turns, and reaching their long-term goals.

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

This commentary reflects the CEO’s views as of February 28, 2007. They are subject to change at any time.

Your fund at a glance

The Fund seeks long-term capital growth by typically investing in U.S. companies that issue stocks included in the Russell 1000 Index, and in companies with size and growth characteristics similar to those of companies with stocks in the Index.

Since inception

► The Fund generated double-digit gains against a backdrop of rising share prices and investors’ preference for cheap stocks.

► The market's rally was fueled in part by the Fed’s decision to keep short-term interest rates steady and by falling energy prices.

► Market volatility was evident at the beginning of the period, diminished to near-record-low levels during the rally and returned as the period came to a close.

| Top 10 holdings | | | | |

| | | | | |

| Exxon Mobil Corp. | 5.8% | | Merck & Company, Inc. | 3.8% |

| |

|

| Pfizer, Inc. | 5.4% | | Home Depot, Inc. | 2.6% |

| |

|

| Citigroup, Inc. | 4.6% | | Wal-Mart Stores, Inc. | 2.4% |

| |

|

| Verizon Communications, Inc. | 4.5% | | Bank of America Corp. | 2.3% |

| |

|

| AT&T, Inc. | 4.2% | | Morgan Stanley | 2.1% |

| |

|

As a percentage of net assets on February 28, 2007.

1

Managers’ report

John Hancock

Intrinsic Value Fund

U.S. stocks enjoyed solid performance during the review period, which began in June 2006 in the midst of a market correction triggered by the Federal Reserve Board’s hawkish comments about inflation and fears of a longer-than-anticipated cycle of interest rate hikes. Rising energy prices were another factor adding to the negative investor sentiment early in the period.

As the summer progressed, however, the prospects for both interest rates and energy prices improved. Inflationary pressures eased a bit and more data emerged indicating a slowing U.S. economy, prompting the Fed to leave interest rates unchanged in August after 17 consecutive 0.25% increases. At subsequent meetings in September, November, December and January, the Fed reaffirmed its stand-pat position. At the same time, energy prices registered substantial declines. In response, the market embarked on a rally that began in July and continued almost through the end of February.

The rally was characterized by extremely low share price volatility and investors’ preference for stocks with low price-to-book value (P/B) or price-to-earnings (P/E) ratios, as evidenced by the dramatic outperformance of the Fund’s benchmark, the Russell 1000 Value Index, over the Russell 1000 Growth Index. Corporate profits continued to grow at a healthy pace and, while short-term interest rates were higher than they had been prior to the Fed’s tightening moves, access to capital

SCORECARD

| INVESTMENT | | PERIOD’S PERFORMANCE ... AND WHAT’S BEHIND THE NUMBERS |

| | | |

| Merck | ▲ | Undervalued; controversy over Vioxx fading |

| | | |

| AT&T | ▲ | Improving profitability; synergies from Bell South acquisition |

| | | |

| Exxon Mobil | ▼ | Underweighting hurts as stock advances amid record profits |

2

From the Grantham, Mayo, Van Otterloo & Co. LLC (GMO)

Portfolio Management Team

remained relatively unhindered. However, on the second-to-last trading day of the period, volatility returned with a vengeance, as the Dow Jones Industrial Average and the Russell 1000 Value Index each fell by more than 3%. It was the Dow’s worst one-day percentage loss since 2003, leaving many investors wondering if the long run of benign market conditions had come to an end.

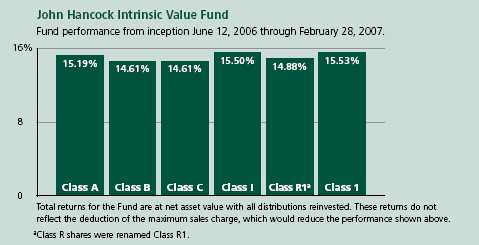

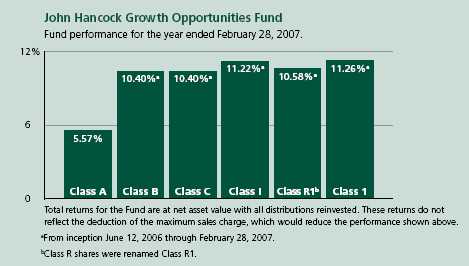

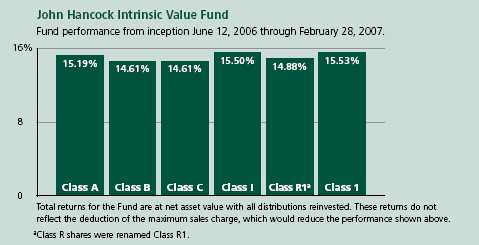

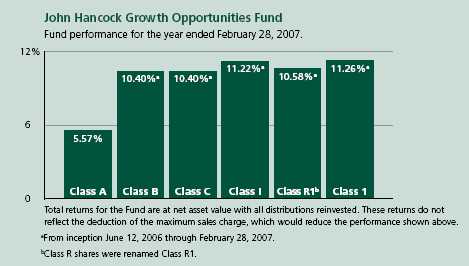

Looking at performance

From their inception on June 12, 2006, through February 28, 2007, John Hancock Intrinsic Value Fund’s Class A, Class B, Class C, Class I, Class R1 and Class 1 shares returned 15.19%, 14.61%, 14.61%, 15.50%, 14.88% and 15.53%, respectively, at net asset value. By comparison, the Russell 1000 Value Index returned 16.32%, while the average large value fund monitored by Morningstar, Inc. gained 15.95% .a Keep in mind that your returns will differ from those listed above if you were not invested in the Fund for the entire period or did not reinvest all distributions.

“U.S. stocks enjoyed solid

performance during the review

period…”

The market environment proved challenging to both of our primary stock selection tools — valuation and momentum. Valuation, which determines the positioning for the majority of this Fund’s assets, accounted for most of the performance shortfall. During the period, investors wanted cheap stocks on a P/B or P/E basis, whereas our valuation discipline seeks out stocks selling at a significant discount from their intrinsic value. The difference is that our methodology encompasses various yardsticks of quality, such as stability of earnings, leverage and long-term profitability. Over the longer term, the market has rewarded an emphasis on quality stocks acquired at a discount, but over shorter periods of time investors

Intrinsic Value Fund

3

sometimes spurn quality in favor of low prices, concept stocks or other fads.

Our momentum criteria are designed to identify stocks that have performed well recently and appear poised to continue outperforming. That said, although the broader earnings environment was favorable and the market rose for most of the period, our momentum strategy rotated out of low P/B and low P/E stocks after they plummeted during the market’s early summer correction. Consequently, the strategy underperformed when the market shifted back toward these stocks as the market recovered.

Oil and gas, construction and retail limit gains

The oil and gas sector had the biggest negative impact on the Fund’s results versus the benchmark and included the Fund’s biggest individual detractor, Exxon Mobil Corp. Although this company enjoyed record profitability, the Fund’s underweighted position detracted from performance. The drag on performance from the retail group was caused largely by two stocks, Wal-Mart Stores, Inc. and Home Depot, Inc. Concerns about decelerating growth hampered Wal-Mart, while Home Depot was hurt by speculation that its profits could be curtailed by a weak homebuilding market. In our view, both companies remained capable of generating solid earnings growth in a wide variety of economic environments, and both stocks were trading at discounts to their true economic values. Drug holding Pfizer, Inc. further limited the Fund’s gains. After a strong run during the late summer and early fall, Pfizer shares suffered a setback in Decemb er when the company announced that it was abandoning the development of a cholesterol drug that had been seen as a potential core product for the future. Computer maker Dell, Inc. was a detractor as well.

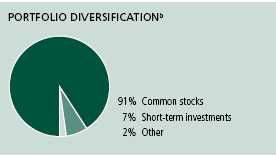

| SECTOR DISTRIBUTIONb | |

| | |

| Financial | 24% |

| Consumer, non-cyclical | 23% |

| Consumer, cyclical | 15% |

| Communications | 13% |

| Energy | 8% |

| Industrial | 5% |

| Technology | 3% |

| Government | 2% |

| Mortgage securities | 2% |

| Basic materials | 1% |

Utilities, health care and financial add value

On the positive side, the utility, health care and financial sectors made contributions to performance. In particular, our valuation and momentum screens signaled opportunity in pharmaceutical stocks, which had been beaten down due to controversies surrounding the safety of various patent medications. Merck & Company, Inc. had been one of the downtrodden and as investors began to realize its inherent

Intrinsic Value Fund

4

value, the stock responded with a strong gain. Also adding value were telecommunication services providers AT&T, Inc. and Verizon Communications, Inc., two stocks we owned for both their compelling valuations and strong momentum. In the financial sector, not owning Wells Fargo & Co. proved rewarding, as the stock slumped near the end of the period on concerns about the company’s subprime lending exposure. Lastly, we were well served by not holding General Electric, whose shares failed to keep pace with the benchmark during the period.

“…the utility, health care

and financial sectors made

contributions to performance.”

Outlook

The plunge in share prices near the end of the period raises the possibility that the era of low volatility might be coming to an end. Likewise, the mean-reverting nature of corporate profitability and access to capital indicate that challenges in those areas could lie in the market’s future. Against this backdrop, we believe the Fund’s emphasis on buying quality stocks below their intrinsic value — together with its focus on momentum opportunities — positions it well to face the remainder of 2007 and beyond.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect its own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

a Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

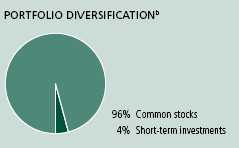

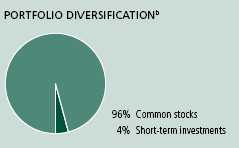

b As a percentage of net assets on February 28, 2007.

Intrinsic Value Fund

5

A look at performance

For the period ended February 28, 2007

| | | Cumulative total returns |

| | | with maximum sales charge (POP) |

|

| | Inception | Since |

| Class | date | inception |

|

| A | 6-12-06 | 9.44% |

|

| B | 6-12-06 | 9.61 |

|

| C | 6-12-06 | 13.61 |

|

| Ia | 6-12-06 | 15.50 |

|

| R1a | 6-12-06 | 14.88 |

|

| 1a | 6-12-06 | 15.53 |

|

Performance figures assume all distributions are reinvested. POP (Public Offering Price) figures reflect maximum sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I, Class R1 and Class 1 shares.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses increase and results would have been less favorable.

Performance is calculated with an opening price (prior day’s close) on the inception date.

a For certain types of investors as described in the Fund’s Class I, Class R1 and Class 1 share prospectuses.

Intrinsic Value Fund

6

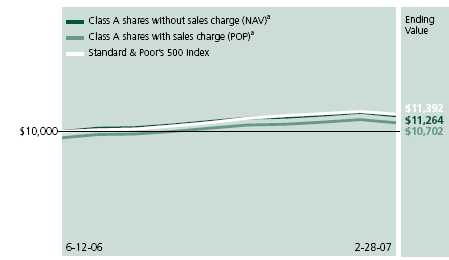

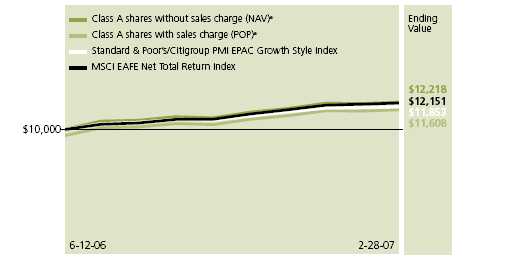

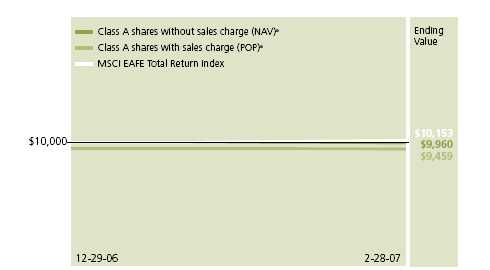

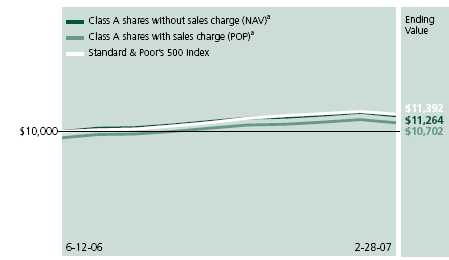

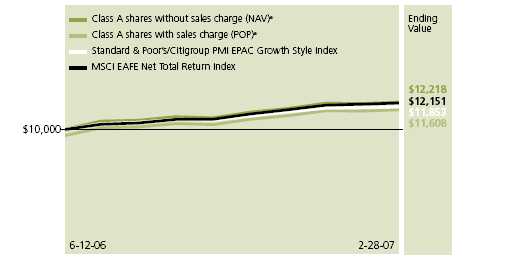

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Intrinsic Value Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Russell 1000 Value Index.

| | | | With maximum | |

| Class | Period beginning | Without sales charge | sales charge | Index |

|

| B | 6-12-06 | $11,461 | $10,961 | $11,632 |

|

| C | 6-12-06 | 11,461 | 11,361 | 11,632 |

|

| Ib | 6-12-06 | 11,550 | 11,550 | 11,632 |

|

| R1b | 6-12-06 | 11,488 | 11,488 | 11,632 |

|

| 1b | 6-12-06 | 11,553 | 11,553 | 11,632 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C, Class I, Class R1 and Class 1 shares, respectively, as of February 28, 2007. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 1000 Value Index is an unmanaged index containing those securities in the Russell 1000 Index with a less-than-average growth orientation.

It is not possible to invest directly in an index. Index figures do not reflect sales charges which would have resulted in lower values if they did.

a NAV represents net asset value and POP represents public offering price.

b For certain types of investors as described in the Fund’s Class I, Class R1 and Class 1 share prospectuses.

Intrinsic Value Fund

7

Your expenses

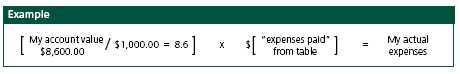

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable) and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your Fund’s actual ongoing operating expenses, and is based on your Fund’s actual return. It assumes an account value of $1,000.00 on September 1, 2006, with the same investment held until February 28, 2007.

| | Account value | Ending value | Expenses paid during period |

| | on 9-1-06 | on 2-28-07 | ended 2-28-07a |

|

| Class A | $1,000.00 | $1,077.04 | $6.95 |

|

| Class B | 1,000.00 | 1,072.65 | 10.54 |

|

| Class C | 1,000.00 | 1,073.15 | 10.54 |

|

| Class I | 1,000.00 | 1,078.97 | 4.90 |

|

| Class R1 | 1,000.00 | 1,074.69 | 8.74 |

|

| Class 1 | 1,000.00 | 1,078.71 | 4.64 |

|

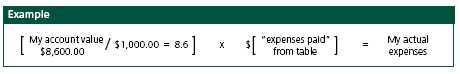

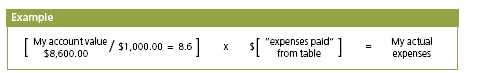

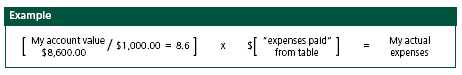

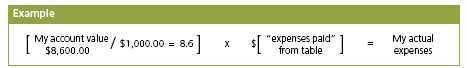

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at February 28, 2007 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Intrinsic Value Fund

8

Hypothetical example for comparison purposes

This table allows you to compare your Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’ actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on September 1, 2006, with the same investment held until February 28, 2007. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | Account value | Ending value | Expenses paid during period |

| | on 9-1-06 | on 2-28-07 | ended 2-28-07a |

|

| Class A | $1,000.00 | $1,018.10 | $6.76 |

|

| Class B | 1,000.00 | 1,014.63 | 10.24 |

|

| Class C | 1,000.00 | 1,014.63 | 10.24 |

|

| Class I | 1,000.00 | 1,020.08 | 4.76 |

|

| Class R1 | 1,000.00 | 1,016.36 | 8.50 |

|

| Class 1 | 1,000.00 | 1,020.33 | 4.51 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

a Expenses are equal to the Fund’s annualized expense ratio of 1.35%, 2.05%, 2.05%, 0.95%, 1.70% and 0.90% for Class A, Class B, Class C, Class I, Class R1 and Class 1, respectively, multiplied by the average account value over the period, multiplied by the number of days in the inception period/365 or 366 (to reflect the one-half year period).

Intrinsic Value Fund

9

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 2-28-07

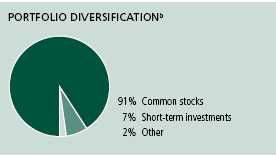

This schedule is divided into two main categories: common stocks and repurchase agreements. Common stocks are further broken down by industry group.

| Issuer | Shares | Value |

| | | |

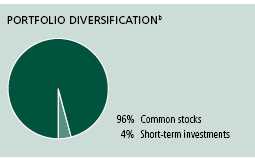

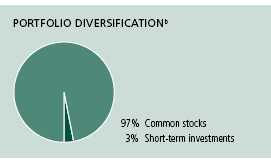

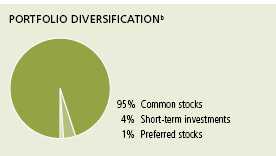

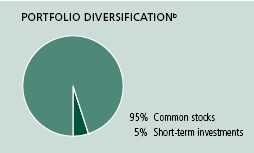

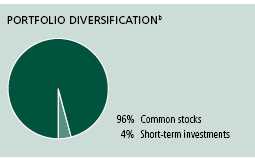

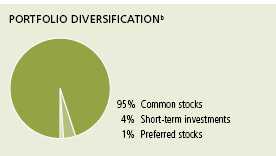

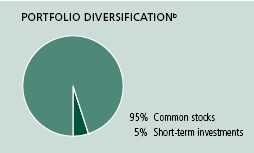

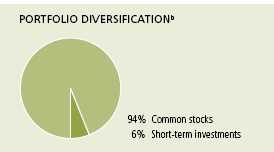

| Common stocks 95.84% | | $19,466,127 |

|

| (Cost $17,743,676) | | |

| | | |

| Aerospace 0.68% | | 137,627 |

|

| General Dynamics Corp. | 300 | 22,937 |

|

| Northrop Grumman Corp. | 1,000 | 71,850 |

|

| Raytheon Company | 800 | 42,840 |

| | | |

| Agriculture 0.36% | | 72,198 |

|

| Archer-Daniels-Midland Company | 2,100 | 72,198 |

| | | |

| Aluminum 0.38% | | 76,843 |

|

| Alcoa, Inc. | 2,300 | 76,843 |

| | | |

| Apparel & Textiles 1.18% | | 238,849 |

|

| Jones Apparel Group, Inc. | 1,400 | 46,088 |

|

| Liz Claiborne, Inc. | 1,200 | 54,000 |

|

| Mohawk Industries, Inc. * | 400 | 35,008 |

|

| VF Corp. | 1,300 | 103,753 |

| | | |

| Auto Parts 0.63% | | 127,952 |

|

| AutoZone, Inc. * | 200 | 25,058 |

|

| Johnson Controls, Inc. | 600 | 56,280 |

|

| O’Reilly Automotive, Inc. * | 1,000 | 34,430 |

|

| TRW Automotive Holdings Corp. * | 400 | 12,184 |

| | | |

| Auto Services 0.29% | | 59,292 |

|

| AutoNation, Inc. * | 2,700 | 59,292 |

| | | |

| Automobiles 1.84% | | 373,535 |

|

| Ford Motor Company | 22,600 | 178,992 |

|

| General Motors Corp. | 3,700 | 118,104 |

|

| PACCAR, Inc. | 1,100 | 76,439 |

| | | |

| Banking 6.67% | | 1,354,946 |

|

| Bank of America Corp. | 9,200 | 468,004 |

|

| Bank of New York Company, Inc. | 1,500 | 60,930 |

|

| BB&T Corp. | 1,600 | 67,968 |

|

| Comerica, Inc. | 2,000 | 120,780 |

|

| Fifth Third Bancorp | 1,100 | 44,308 |

|

| First Horizon National Corp. | 800 | 34,520 |

|

| Huntington Bancshares, Inc. | 1,000 | 23,150 |

See notes to financial statements

Intrinsic Value Fund

10

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Banking (continued) | | |

|

| KeyCorp | 2,500 | $94,350 |

|

| National City Corp. | 9,200 | 348,220 |

|

| US Bancorp | 2,600 | 92,716 |

| | | |

| Broadcasting 0.91% | | 184,112 |

|

| CBS Corp., Class B | 2,800 | 84,980 |

|

| News Corp. | 4,400 | 99,132 |

| | | |

| Building Materials & Construction 0.52% | | 104,776 |

|

| American Standard Companies, Inc. | 400 | 21,196 |

|

| Masco Corp. | 2,800 | 83,580 |

| | | |

| Business Services 1.19% | | 242,736 |

|

| Affiliated Computer Services, Inc., Class A * | 700 | 36,379 |

|

| Computer Sciences Corp. * | 700 | 37,051 |

|

| Convergys Corp. * | 1,300 | 33,436 |

|

| First Data Corp. | 1,200 | 30,636 |

|

| Manpower, Inc. | 600 | 44,580 |

|

| Moody’s Corp. | 200 | 12,944 |

|

| Pitney Bowes, Inc. | 1,000 | 47,710 |

| | | |

| Cable and Television 1.30% | | 263,489 |

|

| Comcast Corp., Class A * | 7,950 | 204,474 |

|

| Time Warner, Inc. | 2,900 | 59,015 |

| | | |

| Chemicals 0.75% | | 151,702 |

|

| Air Products & Chemicals, Inc. | 400 | 29,928 |

|

| E.I. Du Pont De Nemours & Company | 600 | 30,450 |

|

| Eastman Chemical Company | 200 | 11,824 |

|

| PPG Industries, Inc. | 1,200 | 79,500 |

| | | |

| Colleges & Universities 0.07% | | 14,790 |

|

| Career Education Corp. * | 500 | 14,790 |

| | | |

| Computers & Business Equipment 1.77% | | 358,678 |

|

| CDW Corp. | 200 | 12,416 |

|

| Cisco Systems, Inc. * | 2,200 | 57,068 |

|

| Dell, Inc. * | 4,900 | 111,965 |

|

| Ingram Micro, Inc., Class A * | 1,600 | 31,088 |

|

| International Business Machines Corp. | 900 | 83,709 |

|

| Lexmark International, Inc. * | 600 | 36,336 |

|

| Tech Data Corp. * | 700 | 26,096 |

| | | |

| Construction Materials 0.06% | | 12,384 |

|

| Louisiana-Pacific Corp. | 600 | 12,384 |

| | | |

| Cosmetics & Toiletries 0.17% | | 34,055 |

|

| Kimberly-Clark Corp. | 500 | 34,055 |

| | | |

| Crude Petroleum & Natural Gas 0.68% | | 138,773 |

|

| Apache Corp. | 400 | 27,412 |

|

| Devon Energy Corp. | 500 | 32,855 |

|

| Occidental Petroleum Corp. | 1,700 | 78,506 |

See notes to financial statements

Intrinsic Value Fund

11

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Electrical Utilities 0.10% | | $19,740 |

|

| Entergy Corp. | 200 | 19,740 |

| | | |

| Financial Services 14.09% | | 2,861,943 |

|

| AmeriCredit Corp. * | 600 | 14,652 |

|

| Bear Stearns Companies, Inc. | 200 | 30,448 |

|

| Citigroup, Inc. | 18,400 | 927,360 |

|

| Countrywide Financial Corp. | 1,300 | 49,764 |

|

| Federal Home Loan Mortgage Corp. | 5,400 | 346,572 |

|

| Federal National Mortgage Association | 6,400 | 363,072 |

|

| Fiserv, Inc. * | 400 | 21,184 |

|

| Goldman Sachs Group, Inc. | 500 | 100,800 |

|

| IndyMac Bancorp, Inc. | 300 | 10,299 |

|

| JPMorgan Chase & Company | 4,100 | 202,540 |

|

| Knight Capital Group, Inc. * | 600 | 9,486 |

|

| Mellon Financial Corp. | 500 | 21,715 |

|

| Merrill Lynch & Company, Inc. | 1,100 | 92,048 |

|

| Morgan Stanley | 5,800 | 434,536 |

|

| PNC Financial Services Group, Inc. | 1,300 | 95,303 |

|

| Washington Mutual, Inc. | 3,300 | 142,164 |

| | | |

| Food & Beverages 2.49% | | 506,518 |

|

| Campbell Soup Company | 300 | 12,249 |

|

| Coca-Cola Enterprises, Inc. | 600 | 12,054 |

|

| ConAgra Foods, Inc. | 1,500 | 37,845 |

|

| General Mills, Inc. | 300 | 16,908 |

|

| H.J. Heinz Company | 1,000 | 45,870 |

|

| Kraft Foods, Inc., Class A | 4,800 | 153,216 |

|

| Pepsi Bottling Group, Inc. | 700 | 21,700 |

|

| PepsiAmericas, Inc. | 500 | 10,655 |

|

| Sara Lee Corp. | 3,800 | 62,548 |

|

| The Coca-Cola Company | 1,100 | 51,348 |

|

| Tyson Foods, Inc., Class A | 4,500 | 82,125 |

| | | |

| Healthcare Products 0.74% | | 150,379 |

|

| Biomet, Inc. | 400 | 16,932 |

|

| Johnson & Johnson | 1,100 | 69,355 |

|

| Patterson Companies, Inc. * | 300 | 10,014 |

|

| Stryker Corp. | 600 | 37,212 |

|

| Zimmer Holdings, Inc. * | 200 | 16,866 |

| | | |

| Healthcare Services 2.91% | | 591,108 |

|

| Cardinal Health, Inc. | 2,200 | 154,198 |

|

| Caremark Rx, Inc. | 200 | 12,318 |

|

| Express Scripts, Inc. * | 600 | 45,246 |

|

| Lincare Holdings, Inc. * | 600 | 23,430 |

|

| McKesson Corp. | 3,400 | 189,584 |

|

| Quest Diagnostics, Inc. | 600 | 30,612 |

|

| UnitedHealth Group, Inc. | 2,600 | 135,720 |

See notes to financial statements

Intrinsic Value Fund

12

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Homebuilders 0.67% | | $136,308 |

|

| Centex Corp. | 700 | 32,452 |

|

| KB Home | 400 | 19,840 |

|

| Lennar Corp., Class A | 600 | 29,544 |

|

| M.D.C. Holdings, Inc. | 400 | 20,424 |

|

| Pulte Homes, Inc. | 500 | 14,780 |

|

| Ryland Group, Inc. | 400 | 19,268 |

| | | |

| Hotels & Restaurants 0.58% | | 117,551 |

|

| Brinker International, Inc. | 1,300 | 44,213 |

|

| McDonald’s Corp. | 900 | 39,348 |

|

| Starbucks Corp. * | 1,100 | 33,990 |

| | | |

| Household Appliances 0.26% | | 52,926 |

|

| Whirlpool Corp. | 600 | 52,926 |

| | | |

| Household Products 0.08% | | 17,184 |

|

| Energizer Holdings, Inc. * | 200 | 17,184 |

| | | |

| Industrial Machinery 0.69% | | 139,477 |

|

| AGCO Corp. * | 700 | 25,375 |

|

| Cummins, Inc. | 200 | 26,936 |

|

| Deere & Company | 500 | 54,210 |

|

| Parker-Hannifin Corp. | 400 | 32,956 |

| | | |

| Insurance 6.95% | | 1,410,729 |

|

| Aetna, Inc. | 1,200 | 53,124 |

|

| AFLAC, Inc. | 2,900 | 136,880 |

|

| Allstate Corp. | 3,400 | 204,204 |

|

| Ambac Financial Group, Inc. | 800 | 70,112 |

|

| American International Group, Inc. | 3,700 | 248,270 |

|

| CIGNA Corp. | 200 | 28,500 |

|

| Commerce Group, Inc. | 400 | 11,468 |

|

| Conseco, Inc. * | 600 | 11,970 |

|

| First American Corp. | 700 | 33,005 |

|

| Hartford Financial Services Group, Inc. | 200 | 18,912 |

|

| Lincoln National Corp. | 500 | 34,075 |

|

| MBIA, Inc. | 1,300 | 86,411 |

|

| MGIC Investment Corp. | 600 | 36,210 |

|

| Nationwide Financial Services, Inc., Class A | 400 | 21,440 |

|

| Old Republic International Corp. | 1,600 | 35,712 |

|

| PMI Group, Inc. | 1,000 | 46,870 |

|

| Progressive Corp. | 2,100 | 48,153 |

|

| Protective Life Corp. | 400 | 17,764 |

|

| Radian Group, Inc. | 800 | 45,960 |

|

| SAFECO Corp. | 200 | 13,344 |

|

| The Travelers Companies, Inc. * | 800 | 40,608 |

|

| Torchmark Corp. | 700 | 44,744 |

See notes to financial statements

Intrinsic Value Fund

13

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Insurance (continued) | | |

|

| Transatlantic Holdings, Inc. | 200 | $13,220 |

|

| UnumProvident Corp. | 3,300 | 70,653 |

|

| W.R. Berkley Corp. | 1,200 | 39,120 |

| | | |

| International Oil 7.35% | | 1,492,331 |

|

| Anadarko Petroleum Corp. | 2,000 | 80,460 |

|

| Chevron Corp. | 2,500 | 171,525 |

|

| ConocoPhillips | 1,100 | 71,962 |

|

| Exxon Mobil Corp. | 16,300 | 1,168,384 |

| | | |

| Leisure Time 0.78% | | 157,596 |

|

| Walt Disney Company | 4,600 | 157,596 |

| | | |

| Liquor 0.34% | | 68,712 |

|

| Anheuser-Busch Companies, Inc. | 1,400 | 68,712 |

| | | |

| Manufacturing 1.04% | | 211,172 |

|

| Danaher Corp. | 400 | 28,656 |

|

| Eaton Corp. | 600 | 48,606 |

|

| Harley-Davidson, Inc. | 600 | 39,540 |

|

| Illinois Tool Works, Inc. | 800 | 41,360 |

|

| Snap-on, Inc. | 500 | 25,050 |

|

| SPX Corp. | 400 | 27,960 |

| | | |

| Medical-Hospitals 0.09% | | 18,441 |

|

| Tenet Healthcare Corp. * | 2,700 | 18,441 |

| | | |

| Metal & Metal Products 0.16% | | 31,962 |

|

| Reliance Steel & Aluminum Company | 700 | 31,962 |

| | | |

| Office Furnishings & Supplies 0.10% | | 20,760 |

|

| OfficeMax, Inc. | 400 | 20,760 |

| | | |

| Paper 0.19% | | 39,611 |

|

| International Paper Company | 1,100 | 39,611 |

| | | |

| Pharmaceuticals 11.30% | | 2,295,350 |

|

| Abbott Laboratories | 1,300 | 71,006 |

|

| AmerisourceBergen Corp. | 2,800 | 147,476 |

|

| Barr Pharmaceuticals, Inc. * | 200 | 10,600 |

|

| Bristol-Myers Squibb Company | 2,900 | 76,531 |

|

| Forest Laboratories, Inc. * | 1,500 | 77,640 |

|

| King Pharmaceuticals, Inc. * | 2,500 | 46,625 |

|

| Merck & Company, Inc. | 17,600 | 777,216 |

|

| Pfizer, Inc. | 43,600 | 1,088,256 |

| | | |

| Photography 0.22% | | 45,372 |

|

| Eastman Kodak Company | 1,900 | 45,372 |

| | | |

| Publishing 0.98% | | 199,345 |

|

| Gannett Company, Inc. | 2,700 | 165,402 |

|

| McGraw-Hill Companies, Inc. | 200 | 12,922 |

|

| Tribune Company | 700 | 21,021 |

See notes to financial statements

Intrinsic Value Fund

14

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Railroads & Equipment 0.58% | | $117,815 |

|

| Burlington Northern Santa Fe Corp. | 500 | 39,595 |

|

| CSX Corp. | 400 | 15,068 |

|

| Norfolk Southern Corp. | 500 | 23,700 |

|

| Union Pacific Corp. | 400 | 39,452 |

| | | |

| Retail Grocery 2.21% | | 449,806 |

|

| Safeway, Inc. | 5,500 | 190,135 |

|

| SUPERVALU, Inc. | 1,400 | 51,744 |

|

| The Kroger Company | 8,100 | 207,927 |

| | | |

| Retail Trade 8.69% | | 1,764,994 |

|

| Bed Bath & Beyond, Inc. * | 800 | 31,912 |

|

| Best Buy Company, Inc. | 300 | 13,941 |

|

| Big Lots, Inc. * | 500 | 12,515 |

|

| BJ’s Wholesale Club, Inc. * | 900 | 29,052 |

|

| Circuit City Stores, Inc. | 500 | 9,515 |

|

| Costco Wholesale Corp. | 800 | 44,712 |

|

| Dillard’s, Inc., Class A | 400 | 13,360 |

|

| Dollar General Corp. | 1,500 | 25,320 |

|

| Dollar Tree Stores, Inc. * | 1,700 | 57,987 |

|

| Family Dollar Stores, Inc. | 1,700 | 49,249 |

|

| Foot Locker, Inc. | 500 | 11,360 |

|

| Gap, Inc. | 1,400 | 26,866 |

|

| Home Depot, Inc. | 13,300 | 526,680 |

|

| Kohl’s Corp. * | 200 | 13,798 |

|

| Lowe’s Companies, Inc. | 7,400 | 240,944 |

|

| NBTY, Inc. * | 600 | 29,208 |

|

| Rent-A-Center, Inc. * | 500 | 14,160 |

|

| Staples, Inc. | 700 | 18,214 |

|

| Target Corp. | 700 | 43,071 |

|

| The TJX Companies, Inc. | 1,100 | 30,250 |

|

| Walgreen Company | 1,000 | 44,710 |

|

| Wal-Mart Stores, Inc. | 9,900 | 478,170 |

| | | |

| Sanitary Services 0.22% | | 45,588 |

|

| Allied Waste Industries, Inc. * | 900 | 11,538 |

|

| Waste Management, Inc. | 1,000 | 34,050 |

| | | |

| Semiconductors 0.45% | | 92,280 |

|

| Intel Corp. | 4,000 | 79,400 |

|

| Novellus Systems, Inc. * | 400 | 12,880 |

| | | |

| Software 0.34% | | 68,144 |

|

| Intuit, Inc. * | 400 | 11,804 |

|

| Microsoft Corp. | 2,000 | 56,340 |

| | | |

| Telecommunications Equipment & Services 0.13% | | 25,520 |

|

| Polycom, Inc. * | 800 | 25,520 |

See notes to financial statements

Intrinsic Value Fund

15

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Telephone 8.99% | | $1,825,426 |

|

| AT&T, Inc. | 23,327 | 858,434 |

|

| CenturyTel, Inc. | 1,200 | 53,700 |

|

| Verizon Communications, Inc. | 24,400 | 913,292 |

| | | |

| Tires & Rubber 0.07% | | 14,772 |

|

| Goodyear Tire & Rubber Company * | 600 | 14,772 |

| | | |

| Tobacco 0.93% | | 188,860 |

|

| Altria Group, Inc. | 1,400 | 117,992 |

|

| Reynolds American, Inc. | 400 | 24,420 |

|

| UST, Inc. | 800 | 46,448 |

| | | |

| Toys, Amusements & Sporting Goods 0.38% | | 76,569 |

|

| Hasbro, Inc. | 500 | 14,145 |

|

| Mattel, Inc. | 2,400 | 62,424 |

| | | |

| Transportation 0.13% | | 27,404 |

|

| C.H. Robinson Worldwide, Inc. | 300 | 15,288 |

|

| Overseas Shipholding Group, Inc. | 200 | 12,116 |

| | | |

| Travel Services 0.17% | | 35,563 |

|

| Sabre Holdings Corp. | 1,100 | 35,563 |

| | | |

| Trucking & Freight 0.99% | | 202,134 |

|

| Fedex Corp. | 1,500 | 171,270 |

|

| Ryder Systems, Inc. | 600 | 30,864 |

| |

| | Principal | |

| Issuer, description, maturity date | amount | Value |

| |

| Repurchase agreements 4.01% | | $814,000 |

|

| (Cost $814,000) | | |

|

| Repurchase Agreement with State Street Corp. dated 2/28/2007 at | | |

| 4.60% to be repurchased at $814,104 on 3/1/2007, collateralized | | |

| by $850,000 Federal Home Loan Bank, 4.625% due 09/11/2020 | | |

| (Valued at $834,063, including interest) (c) | $814,000 | 814,000 |

|

| Total investments (Cost $18,557,676) 99.85% | | $20,280,127 |

|

| |

| Other assets in excess of liabilities 0.15% | | 31,103 |

|

| |

| Total net assets 100.00% | | $20,311,230 |

* Non-income producing.

(c) Investment is an affiliate of the Trust’s subadvisor or custodian bank.

See notes to financial statements

Intrinsic Value Fund

16

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 2-28-07

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| Assets | |

|

| Investments, at value (Cost $17,743,676) | $19,466,127 |

| Repurchase agreement, at value (Cost $814,000) | 814,000 |

| Cash | 770 |

| Cash segregated for futures contracts | 40,000 |

| Receivable for fund shares sold | 33,409 |

| Dividends and interest receivable | 36,107 |

| Receivable for futures variation margin | 3,400 |

| Other assets | 1,515 |

| Total assets | 20,395,328 |

| |

| Liabilities | |

|

| Payable for fund shares repurchased | 1,902 |

| Payable to affiliates | |

| Fund administration fees | 3,137 |

| Transfer agent fees | 4,180 |

| Investment management fees | 9,181 |

| Service fees | 196 |

| Accrued expenses | 65,502 |

| Total liabilities | 84,098 |

| |

| Net assets | |

|

| Capital paid-in | 18,211,979 |

| Undistributed net investment income | 43,586 |

| Accumulated undistributed net realized gain on investments and futures contracts | 336,571 |

| Net unrealized appreciation on investments and futures contracts | 1,719,094 |

| Net assets | $20,311,230 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — The Fund has an | |

| unlimited number of shares authorized with no par value. | |

| Class A ($19,197,111 ÷ 846,602 shares) | $22.68 |

| Class B ($467,931 ÷ 20,668 shares)a | $22.64 |

| Class C ($286,915 ÷ 12,673 shares)a | $22.64 |

| Class I ($128,129 ÷ 5,645 shares) | $22.70 |

| Class R1 ($115,618 ÷ 5,109 shares) | $22.63 |

| Class 1 ($115,526 ÷ 5,090 shares) | $22.70 |

| |

| Maximum offering price per share | |

|

| Class Ab ($22.68 ÷ 95%) | $23.87 |

a Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

b On single retail sales of less than $50,000. On sales of $50,000 and on group sales the offering price is reduced.

See notes to financial statements

Intrinsic Value Fund

17

F I N A N C I A L S T A T E M E N T S

Statement of operations For the period ended 2-28-07a

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

|

| Dividends | $289,416 |

| Interest | 30,745 |

| Total investment income | 320,161 |

| |

| Expenses | |

|

| Investment management fees (Note 3) | 100,631 |

| Distribution and service fees (Note 3) | 41,511 |

| Transfer agent fees (Note 3) | 9,006 |

| Fund administration fees (Note 3) | 4,800 |

| Blue sky fees (Note 3) | 70,630 |

| Audit and legal fees | 49,276 |

| Custodian fees | 21,189 |

| Printing and postage fees (Note 3) | 10,124 |

| Registration and filing fees | 2,996 |

| Trustees’ fees (Note 3) | 90 |

| Miscellaneous | 280 |

| | |

| Total expenses | 310,533 |

| Less expense reductions (Note 3) | (133,882) |

| | |

| Net expenses | 176,651 |

| | |

| Net investment income | 143,510 |

| |

| Realized and unrealized gain | |

|

| Net realized gain on | |

| Investments | 469,129 |

| Futures contracts | 56,932 |

| | |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | 1,722,451 |

| Futures contracts | (3,357) |

| | |

| Net realized and unrealized gain | 2,245,155 |

| | |

| Increase in net assets from operations | $2,388,665 |

a Period from 6-12-06 (commencement of operations) to 2-28-07.

See notes to financial statements

Intrinsic Value Fund

18

F I N A N C I A L S T A T E M E N T S

Statement of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed since inception. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | Period |

| | ended |

| | 2-28-07a |

|

| Increase (decrease) in net assets | |

| From operations | |

| Net investment income | $143,510 |

| Net realized gain | 526,061 |

| Change in net unrealized appreciation (depreciation) | 1,719,094 |

| | |

| Increase in net assets resulting from operations | 2,388,665 |

| | |

| Distributions to shareholders | |

| From net investment income | |

| Class A | (108,035) |

| Class B | (1,017) |

| Class C | (762) |

| Class I | (985) |

| Class R1 | (620) |

| Class 1 | (914) |

| From net realized gain | |

| Class A | (179,361) |

| Class B | (3,802) |

| Class C | (2,850) |

| Class I | (1,241) |

| Class R1 | (1,118) |

| Class 1 | (1,118) |

| Total distributions | (301,823) |

| | |

| From Fund share transactions | 18,224,388 |

| |

| Net assets | |

|

| Beginning of period | — |

| | |

| End of periodb | $20,311,230 |

a Period from 6-12-06 (commencement of operations) to 2-28-07.

b Includes undistributed net investment income of $43,586.

See notes to financial statements

Intrinsic Value Fund

19

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since inception.

| CLASS A SHARES | |

| |

| Period ended | 2-28-07a |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $20.00 |

| Net investment incomeh | 0.18 |

| Net realized and unrealized | |

| gain on investments | 2.85 |

| Total from investment operations | 3.03 |

| Less distributions | |

| From net investment income | (0.13) |

| From net realized gain | (0.22) |

| | (0.35) |

| Net asset value, end of period | $22.68 |

| Total return (%) | 15.19k,l,m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $19 |

| Ratio of net expenses to average | |

| net assets (%) | 1.34r |

| Ratio of gross expenses to average | |

| net assets (%) | 1.94p,r |

| Ratio of net investment income | |

| to average net assets (%) | 1.13r |

| Portfolio turnover (%) | 32m |

See notes to financial statements

Intrinsic Value Fund

20

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS B SHARES | |

| |

| Period ended | 2-28-07a |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $20.00 |

| Net investment incomeh | 0.07 |

| Net realized and unrealized | |

| gain on investments | 2.85 |

| Total from investment operations | 2.92 |

| Less distributions | |

| From net investment income | (0.06) |

| From net realized gain | (0.22) |

| | (0.28) |

| Net asset value, end of period | $22.64 |

| Total return (%) | 14.61k,l,m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets (%) | 2.04r |

| Ratio of gross expenses to average | |

| net assets (%) | 9.00p,r |

| Ratio of net investment income | |

| to average net assets (%) | 0.42r |

| Portfolio turnover (%) | 32m |

See notes to financial statements

Intrinsic Value Fund

21

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS C SHARES | |

| |

| Period ended | 2-28-07a |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $20.00 |

| Net investment incomeh | 0.06 |

| Net realized and unrealized | |

| gain on investments | 2.86 |

| Total from investment operations | 2.92 |

| Less distributions | |

| From net investment income | (0.06) |

| From net realized gain | (0.22) |

| | (0.28) |

| Net asset value, end of period | $22.64 |

| Total return (%) | 14.61k,l,m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets (%) | 2.04r |

| Ratio of gross expenses to average | |

| net assets (%) | 10.08p,r |

| Ratio of net investment income | |

| to average net assets (%) | 0.37r |

| Portfolio turnover (%) | 32m |

See notes to financial statements

Intrinsic Value Fund

22

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS I SHARES | |

| |

| Period ended | 2-28-07a |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $20.00 |

| Net investment incomeh | 0.24 |

| Net realized and unrealized | |

| gain on investments | 2.86 |

| Total from investment operations | 3.10 |

| Less distributions | |

| From net investment income | (0.18) |

| From net realized gain | (0.22) |

| | (0.40) |

| Net asset value, end of period | $22.70 |

| Total return (%) | 15.50k,l,m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets (%) | 0.95r |

| Ratio of gross expenses to average | |

| net assets (%) | 17.60p,r |

| Ratio of net investment income | |

| to average net assets (%) | 1.53r |

| Portfolio turnover (%) | 32m |

See notes to financial statements

Intrinsic Value Fund

23

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS R1 SHARES | |

| |

| Period ended | 2-28-07a |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $20.00 |

| Net investment incomeh | 0.12 |

| Net realized and unrealized | |

| gain on investments | 2.85 |

| Total from investment operations | 2.97 |

| Less distributions | |

| From net investment income | (0.12) |

| From net realized gain | (0.22) |

| | (0.34) |

| Net asset value, end of period | $22.63 |

| Total return (%) | 14.88k,l,m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets (%) | 1.69r |

| Ratio of gross expenses to average | |

| net assets (%) | 20.85p,r |

| Ratio of net investment income | |

| to average net assets (%) | 0.78r |

| Portfolio turnover (%) | 32m |

See notes to financial statements

Intrinsic Value Fund

24

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS 1 SHARES | |

| |

| Period ended | 2-28-07a |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $20.00 |

| Net investment incomeh | 0.25 |

| Net realized and unrealized | |

| gain on investments | 2.85 |

| Total from investment operations | 3.10 |

| Less distributions | |

| From net investment income | (0.18) |

| From net realized gain | (0.22) |

| | (0.40) |

| Net asset value, end of period | $22.70 |

| Total return (%) | 15.53k,l,m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets (%) | 0.90r |

| Ratio of gross expenses to average | |

| net assets (%) | 1.44p,r |

| Ratio of net investment income | |

| to average net assets (%) | 1.58r |

| Portfolio turnover (%) | 32m |

a Class A, Class B, Class C, Class I, Class R1 and Class 1 shares began operations on 6-12-06.

h Based on the average of the shares outstanding.

i Less than $500,000.

k Assumes dividend reinvestment.

l Total returns would have been lower had certain expenses not been reduced during the period shown.

m Not annualized.

p Does not take into consideration expense reductions during the periods shown.

r Annualized.

See notes to financial statements

Intrinsic Value Fund

25

Notes to financial statements

1. Organization

John Hancock Intrinsic Value Fund (the “Fund”) is a newly organized non-diversified series of John Hancock Funds III (the “Trust”). The Trust was established as a Massachusetts business trust on June 9, 2005. The Trust is registered under the Investment Company Act of 1940 as amended, (the “1940 Act”), as an open-end investment management company. The investment objective of the Fund is to seek long-term capital growth.

John Hancock Life Insurance Company of New York (“John Hancock New York”) is a wholly owned subsidiary of John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”). John Hancock USA and John Hancock New York are indirect wholly owned subsidiaries of The Manufacturers Life Insurance Company (“Manulife”), which in turn is a wholly owned subsidiary of Manulife Financial Corporation (“MFC”), a publicly traded company. MFC and its subsidiaries are known collectively as “Manulife Financial.”

John Hancock Investment Management Services, LLC (the “Adviser”), a Delaware limited liability company controlled by John Hancock USA, serves as investment adviser for the Trust and John Hancock Funds, LLC (the “Distributor”), a Delaware limited liability company, an affiliate of the Adviser, serves as principal underwriter.

The Board of Trustees has authorized the issuance of multiple classes of shares of the Fund, including classes designated as Class A, Class B, Class C, Class I, Class R1, Class 1, Class 3 and Class NAV shares. The shares of each class represent an interest in the same portfolio of investments of the Fund, and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Board of Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bear distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Effective November 6, 2006, the Board of Trustees elected to change the name of Class R to Class R1.

Class 1 shares are sold only to certain exempt separate accounts of John Hancock USA and John Hancock New York. Class NAV shares are sold to affiliated funds of funds, which are funds of funds within the John Hancock funds complex

2. Significant accounting policies

In the preparation of the financial statements, the Fund follows the policies described below. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results may differ from these estimates.

Security valuation

The net asset value of the shares of the Fund is determined daily as of the close of the New York Stock Exchange, normally at 4:00 p.m., Eastern Time. Short-term debt instruments with remaining maturities of 60 days or less are valued at amortized cost, and thereafter assume a constant amortization to maturity of any discount or premium, which approximates market value. All other securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) as of the close of business on a principal securities exchange (domestic or foreign) on which

Intrinsic Value Fund

26

they trade or, lacking any sales, at the closing bid price. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Fund securities for which there are no such quotations, principally debt securities, are valued based on the valuation provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques.

Other assets and securities for which no such quotations are readily available are valued at their fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the New York Stock Exchange. The values of such securities used in computing the net asset value of a Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the New York Stock Exchange. Upon such an occurrence, these securities will then be valued at their fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

In deciding whether to make a fair value adjustment to the price of a security, the Board of Trustees or their designee may review a variety of factors, including, developments in foreign markets, the performance of U.S. securities markets and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The Fund may also fair value securities in other situations, for example, when a particular foreign market is closed, but the Fund is calculating the net asset value. In view of these factors, it is likely that a fund investing significant amounts of assets in securities in foreign markets will be fair valued more frequently than a fund investing significant amounts of assets in frequently traded, U.S. exchange listed securities of large capitalization U.S. issuers.

For purposes of determining when fair value adjustments may be appropriate with respect to the Fund investing in securities in foreign markets that close prior to the New York Stock Exchange, the Fund will, on an ongoing basis, monitor for “significant market events.” A significant market event may be a certain percentage change in the value of an index or of certain Exchange Traded Funds (“ETFs”) that track foreign markets in which the Fund has significant investments. If a significant market event occurs due to a change in the value of the index or of ETFs, the pricing for the Fund will promptly be reviewed and potential adjustments to the net asset value will be recommended to the Trust’s Pricing Committee, where applicable.

Fair value pricing of securities is intended to help ensure that the net asset value of the Fund’s shares reflects the value of the Fund’s securities as of the close of the New York Stock Exchange (as opposed to a value which is no longer accurate as of such close), thus limiting the opportunity for aggressive traders to purchase shares of the Fund at deflated prices, reflecting stale security valuations, and to promptly sell such shares at a gain. However, a security’s valuation may differ depending on the method used for determining value and no assurance can be given that fair value pricing of securities will successfully eliminate all potential opportunities for such trading gains.

Repurchase agreements

The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement through its custodian, it receives delivery of securities, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the market value is generally at least 102% of the repurchase amount. The Fund will take constructive receipt of all securities underlying the repurchase agreements it has entered into until such agreements expire. If the seller defaults, the Fund would suffer a loss to the extent that proceeds from the sale of underlying securities were less than the repurchase amount. The Fund may enter into repurchase agreements maturing within seven

Intrinsic Value Fund

27

days with domestic dealers, banks or other financial institutions deemed to be credit-worthy by the Adviser. Collateral for certain tri-party repurchase agreements is held at the custodian bank in a segregated account for the benefit of the Fund and the counterparty.

Security transactions and

related investment income

Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Foreign dividends are recorded on the ex-date or as soon after the ex-date that the Fund becomes aware of such dividends, net of all taxes. Discounts/premiums are accreted/amortized for financial reporting purposes. Non-cash dividends are recorded at the fair market value of the securities received. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful, based upon consistently applied procedures.

From time to time, the Fund may invest in Real Estate Investment Trusts (“REITs”) and as a result, will estimate the components of distributions from these securities. Distributions from REITs received in excess of income are recorded as a reduction of cost of investments and/or as a realized gain.

The Fund uses the First In, First Out method for fixed income securities and Highest Cost, First Out for all other securities for determining realized gain or loss on investments for both financial and federal income tax reporting purposes.

Multi-class operations

All income, expenses (except for class-specific expenses) and realized and unrealized gains (losses) are allocated to each class of shares based upon the relative net assets of each class.

Dividends to shareholders from net investment income are determined at a class level and distributions from capital gains are determined at a Fund level.

Expense allocation

Expenses are allocated based on the relative share of net assets of the Fund at the time the expense was incurred. Class-specific expenses, such as distribution (Rule 12b-1) fees, are accrued daily and charged directly to the respective share classes.

Futures

The Fund may purchase and sell financial futures contracts and options on those contracts. The Fund invests in contracts based on financial instruments such as U.S. Treasury Bonds or Notes or on securities indices such as the Standard & Poor’s 500 Index (the “S&P 500 Index”), in order to hedge against a decline in the value of securities owned by the Fund.

Upon entering into futures contracts, the Fund is required to deposit with a broker an amount, termed the initial margin, which typically represents a certain percentage of the purchase price indicated in the futures contract. Payments to and from the broker, known as variation margin, are required to be made on a daily basis as the price of the futures contract fluctuates, making the long or short positions in the contract more or less valuable. If the position is closed out by taking an opposite position prior to the settlement date of the futures contract, a final determination of variation margin is made, cash is required to be paid to or released by the broker and the Fund realizes a gain or loss.

When the Fund sells a futures contract based on a financial instrument, the Fund becomes obligated to deliver that kind of instrument at an agreed upon date for a specified price. The Fund realizes a gain or loss depending on whether the price of an offsetting purchase is less or more than the price of the initial sale or on whether the price of an offsetting sale is more or less than the price of the initial purchase. The Fund could be exposed to risks if it could not close out futures positions because of an illiquid secondary market or the inability of counterparties to meet the terms of their contracts. Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade.

Intrinsic Value Fund

28

The following is a summary of open futures contracts on February 28, 2007:

| | NUMBER OF | | | UNREALIZED |

| OPEN CONTRACTS | CONTRACTS | POSITION | EXPIRATION | DEPRECIATION |

|

| S&P 500 Index | 1 | Long | Mar 2007 | ($3,357) |

Federal income taxes

The Fund qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income. Therefore, no federal income tax provision is required.

New accounting pronouncements

In June 2006, Financial Accounting Standards Board (“FASB”) Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the “Interpretation”) was issued, and is effective for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. This Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return, and requires certain expanded disclosures. Management is currently evaluating the application of the Interpretation to the Fund and has not at this time quantified the impact, if any, resulting from the adoption of this Interpretation on the Fund’s financial statements. The Fund will implement this pronou ncement no later than August 31, 2007.

In September 2006, FASB Standard No. 157, Fair Value Measurements (“FAS 157”), was issued and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishing a framework for measuring fair value and expands disclosure about fair value measurements. Management is currently evaluating the application of FAS 157 to the Fund and its impact, if any, resulting from the adoption of FAS 157 on the Fund’s financial statements.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. During the period ended February 28, 2007, the tax character of distributions paid was as follows: ordinary income $270,360 and long-term capital gains $31,463. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class. Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capit al.

As of February 28, 2007, the components of distributable earnings on a tax basis included $377,374 of undistributed ordinary income and $682 of undistributed long-term gain.

Capital accounts

The Fund reports the undistributed net investment income and accumulated undistributed net realized gain (loss) accounts on a basis approximating amounts available for future tax distributions (or to offset future taxable realized gains when a capital loss carryforward is available). Accordingly, the Fund may periodically make reclassifications among certain capital accounts without affecting its net asset value.

3. Investment advisory and other agreements

Advisory fees

The Trust has entered into an Investment Advisory Agreement with the Adviser. The Adviser is responsible for managing the corporate and business affairs of the Trust and for selecting and compensating subadvisers to handle the investment of the assets of the Fund, subject to the supervision of the Trust’s Board of Trustees. Under the Advisory Agreement, the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.78% of the first $500,000,000 of the Fund’s aggregate daily net assets; (b) 0.76% of the next $500,000,000 of the Fund’s aggregate daily net

Intrinsic Value Fund

29

assets; (c) 0.75% of the next $1,500,000,000 of the Fund’s aggregate daily net assets; and (d) 0.74% of the Fund’s aggregate daily net assets in excess of $2,500,000,000. Aggregate net assets include the net assets of the Fund and Intrinsic Value Trust, a series of John Hancock Trust. John Hancock Trust is an open-end investment company advised by the Adviser and distributed by John Hancock Distributors, LLC. The Adviser has a subadvisory agreement with Grantham, Mayo, Van Otterloo & Co. LLC. The Fund is not responsible for payment of the subadvisory fees.

Expense reimbursements

The Adviser has agreed contractually to reimburse for certain fund level expenses that exceed 0.08% of the average annual net assets, or to make a payment to a specific class of shares of the Fund in an amount equal to the amount by which the expenses attributable to such class of shares (excluding taxes, portfolio brokerage commissions, interest, litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business and fees under any agreement or plans of the Fund dealing with services for shareholders and others with beneficial interests in shares of the Fund) exceed the percentage of average annual net assets (on an annualized basis) attributable as follows: 1.35% for Class A, 2.05% for Class B, 2.05% for Class C, 0.95% for Class I, 1.45% for Class R1 and 0.90% for Class 1. Accordingly, the expense reductions related to this expense limitation amounted to $72,538, $15,706, $15,412, $14,603, $15,192 and $431 for Class A, Class B, Class C, Class I, Class R1 and Class 1, respectively, for the period ended February 28, 2007. This expense reimbursement shall continue in effect until June 30, 2007 and thereafter until terminated by the Adviser on notice to the Trust.

Administration fees

The Fund has an agreement with the Adviser that requires the Fund to reimburse the Adviser for all expenses associated with providing the administrative, financial, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports. These expenses are allocated based on the relative shares of net assets of each fund at the time the expense was incurred.

Distribution plan

The Trust has a Distribution Agreement with the Distributor. The Fund has adopted Distribution Plans with respect to Class A, Class B, Class C, Class R1 and Class 1, pursuant to Rule 12b-1 under the 1940 Act, to reimburse the Distributor for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to the Distributor at an annual rate not to exceed 0.30%, 1.00%, 1.00%, 0.50% and 0.05% of average daily net asset value of Class A, Class B, Class C, Class R1 and Class 1, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances. In addition, under a Service Plan for Class R1 shares, the Fund pays up to 0.25% of Class R1 average daily net asset value for certain other serv ices.

Sales charges

Class A shares are assessed up-front sales charges of up to 5.00% of net asset value of such shares. During the period ended February 28, 2007, the Fund was informed that the Distributor received net up-front sales charges of $73,651 with regard to sales of Class A shares. Of this amount, $9,376 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $63,595 was paid as sales commissions to unrelated broker-dealers and $680 was paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer, an indirect subsidiary of MFC.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed

Intrinsic Value Fund

30

within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to the Distributor and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the period ended February 28, 2007, CDSCs received by JH Funds amounted to $5 for Class B shares.

Transfer agent fees

The Fund has a Transfer Agency Agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of MFC. For Class A, Class B, Class C, Class I and Class R1 shares, the Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’ average daily net assets, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses. Expenses not directly attributable to a particular class of shares are aggregated and allocated to each class on the basis of its relative net asset value.

Signature Services has agreed to limit the transfer agent fees so that such fees do not exceed 0.20% annually of Class A, Class B, Class C, Class I and Class R1 share average daily net assets. This agreement is effective until December 31, 2007. Signature Services reserves the right to terminate this limitation in the future. Accordingly, there were no transfer agent fee reductions for Class A, Class B, Class C, Class I and Class R1 shares, respectively, during the period ended February 28, 2007.

Expenses under the agreements described above for the period ended February 28, 2007, were as follows:

| | Distribution and | Transfer | | Printing and |

| Share class | service fees | agent | Blue sky | postage |

|

| |

| Class A | $36,720 | $8,089 | $14,320 | $8,743 |

| Class B | 2,249 | 450 | 14,078 | 431 |

| Class C | 1,911 | 382 | 14,078 | 134 |

| Class I | — | 44 | 14,077 | 92 |

| Class R1a | 591 | 41 | 14,077 | 723 |

| Class 1 | 40 | — | — | 1 |

| Total | $41,511 | $9,006 | $70,630 | $10,124 |

a Effective 11-6-06, the Board of Trustees elected to change the name of Class R to Class R1.

Trustees’ fees

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees’ expenses are allocated to the Fund based on its average daily net asset value.

4. Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust believes the risk of loss to be remote.

5. Line of credit

The Fund has entered into an agreement which enables it to participate in a $100 million unsecured committed line of credit with State Street Corporation. Borrowings will be made solely to temporarily finance the repurchase of capital shares. Interest is charged to the Fund based on its borrowings at a rate per annum equal to the Federal Funds rate

Intrinsic Value Fund

31

plus 0.50% . In addition, a commitment fee of 0.07% per annum, payable at the end of each calendar quarter, based on the average daily-unused portion of the line of credit, is charged to the Fund on a prorated basis based on average net assets. For the period ended February 28, 2007, there were no borrowings under the line of credit.

6. Capital shares

Share activities for the Fund for the period ended February 28, 2007, were as follows:

| | | Period ended 2-28-07a |

| | Shares | Amount |

| |

| Class A shares | | |

|

| Sold | 838,725 | $17,032,947 |

| Distributions reinvested | 12,374 | 281,144 |

| Repurchased | (4,497) | (101,945) |

| Net increase | 846,602 | $17,212,146 |

| |

| Class B shares | | |

|

| Sold | 25,686 | $554,475 |

| Distributions reinvested | 201 | 4,563 |

| Repurchased | (5,219) | (119,072) |

| Net increase | 20,668 | $439,966 |

| |

| Class C shares | | |

|

| Sold | 23,486 | $503,103 |

| Distributions reinvested | 135 | 3,064 |

| Repurchased | (10,948) | (251,638) |

| Net increase | 12,673 | $254,529 |

| |

| Class I shares | | |

|

| Sold | 5,547 | $111,000 |

| Distributions reinvested | 98 | 2,226 |

| Net increase | 5,645 | $113,226 |

| |

| Class R1 shares | | |

|

| Sold | 5,033 | $100,750 |

| Distributions reinvested | 76 | 1,738 |

| Net increase | 5,109 | $102,488 |

| |

| Class 1 shares | | |

|

| Sold | 5,000 | $100,000 |

| Distributions reinvested | 90 | 2,033 |

| Net increase | 5,090 | $102,033 |

| |

| Net increase | 895,787 | $18,224,388 |

|

aPeriod from 6-12-06 (commencement of operations) to 2-28-07.

Intrinsic Value Fund

32

7. Investment transactions

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the period ended February 28, 2007, aggregated $22,828,172 and $5,553,625, respectively.

The cost of investments owned on February 28, 2007, including short-term investments, for federal income tax purposes, was $18,558,932. Gross unrealized appreciation and depreciation of investments aggregated $1,859,355 and $138,160, respectively, resulting in net unrealized appreciation of $1,721,195.

8. Federal income tax information

Federal income tax regulations may differ from generally accepted accounting principles and income and capital gain distributions determined in accordance with tax regulations may differ from net investment income and realized gains recognized for financial reporting purposes.

9. Reclassification of accounts