| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D. C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

| |

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Gordon M. Shone |

| Treasurer |

| |

| 601 Congress Street |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-3000 |

| | |

| Date of fiscal year end: | February 29 |

| |

| |

| Date of reporting period: | February 29, 2008 |

ITEM 1. REPORT TO SHAREHOLDERS.

Discussion of Fund performance

By Grantham, Mayo, Van Otterloo & Co. LLC (GMO)

U.S. stocks went on a wild ride during the 12-month period, highlighted both by record highs for broad market indexes and conditions deemed poor enough to warrant numerous interventions by the Federal Reserve. For the period in full the S&P 500 Index returned –3.60%, a modest move that belied its frequent violent gyrations. Growth stocks outpaced value stocks during the period. Financials and consumer discretionary were the worst-performing sectors in the Russell 1000 Value Index, while energy stocks performed the best.

"U.S. stocks went on a wild ride

during the 12-month review

period…"

For the year ended February, 29, 2008, John Hancock Intrinsic Value Fund’s Class A, Class B, Class C, Class I, Class R1 and Class 1 shares returned –12.52%, –13.13%, –13.13%, –12.18%, –12.60% and –12.13%, respectively, at net asset value while the Russell 1000 Value Index returned –7.91% and the average large value fund monitored by Morningstar, Inc. returned –6.64% .

Sector selection added to relative returns while stock selection detracted. Sector weightings adding to relative returns included an underweight in financials, while sector weightings detracting from relative returns included an overweight in consumer discretionary. Stock selections in information technology added to relative returns, while picks in consumer discretionary and financials detracted. Individual names adding to returns versus the benchmark included overweight positions in Exxon Mobil Corp., Wal-Mart Stores, Inc. and Merck & Company, Inc., while overweight positions detracting from relative returns included Citigroup, Inc., Fannie Mae and Home Depot, Inc.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Intrinsic Value Fund | Annual report

6

A look at performance

For the periods ended February 29, 2008

| | | | | | | | | | | |

| | | | Average annual returns | | | | Cumulative total returns | | |

| | | | with maximum sales charge (POP) | | | with maximum sales charge (POP) | | |

| | |

| |

|

| | Inception | | | | | Since | | | | | Since |

| Class | date | | 1-year | 5-year | 10-year | inception | | 1-year | 5-year | 10-year | inception |

|

| A | 6-12-06 | | –16.88% | — | — | –2.50% | | –16.88% | — | — | –4.26% |

|

| B | 6-12-06 | | –17.14 | — | — | –2.38 | | –17.14 | — | — | –4.07 |

|

| C | 6-12-06 | | –13.93 | — | — | –0.25 | | –13.93 | — | — | –0.44 |

|

| I 1 | 6-12-06 | | –12.18 | — | — | 0.83 | | –12.18 | — | — | 1.44 |

|

| R11 | 6-12-06 | | –12.60 | — | — | 0.24 | | –12.60 | — | — | 0.41 |

|

| 1 1 | 6-12-06 | | –12.13 | — | — | 0.88 | | –12.13 | — | — | 1.52 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I, Class R1 and Class 1 shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 6-30-08. The net expenses are as follows: Class A — 1.34%, Class B — 2.04%, Class C — 2.04%, Class I — 0.95%, Class R1 — 1.69%, Class 1 — 0.90% . Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.94%, Class B — 9.00%, Class C — 10.08%, Class I —17.60%, Class R1 — 20.85%, Class 1 — 1.44% .

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses increase and results would have been less favorable.

Performance is calculated with an opening price (prior day’s close) on the inception date.

1 For certain types of investors as described in the Fund’s Class I, Class R1 and Class 1 share prospectuses.

Annual report | Intrinsic Value Fund

7

A look at performance

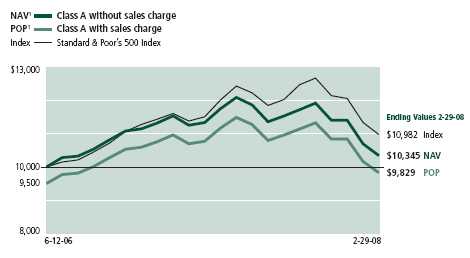

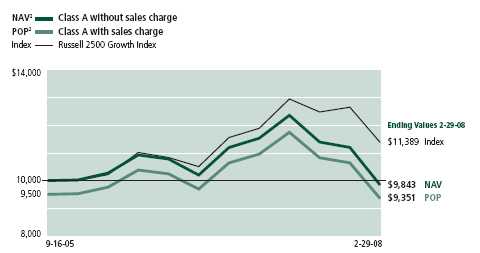

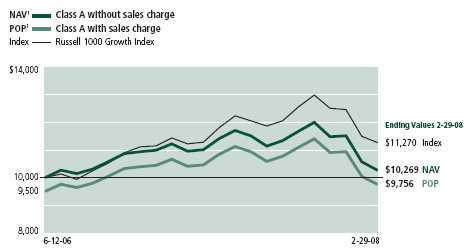

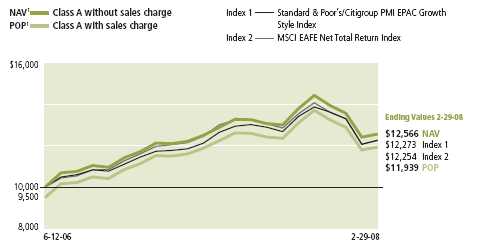

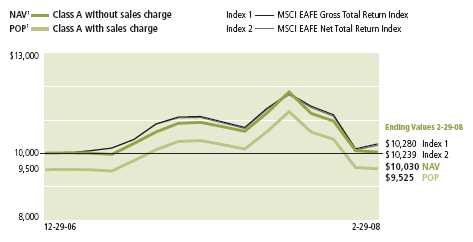

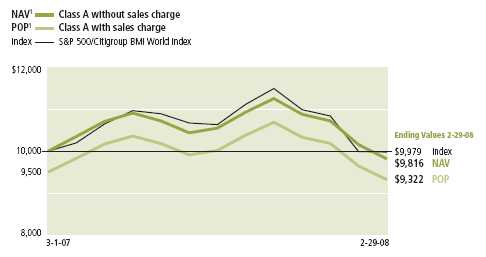

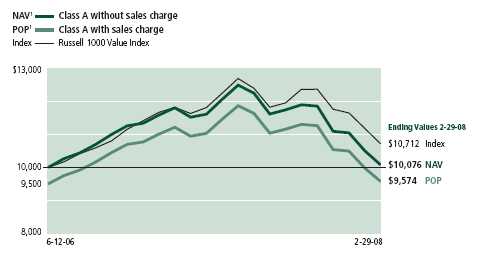

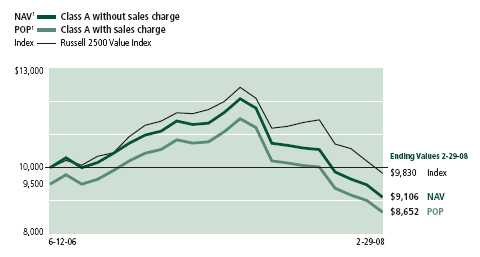

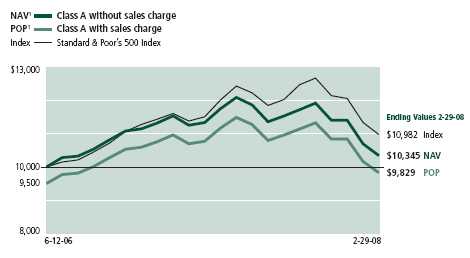

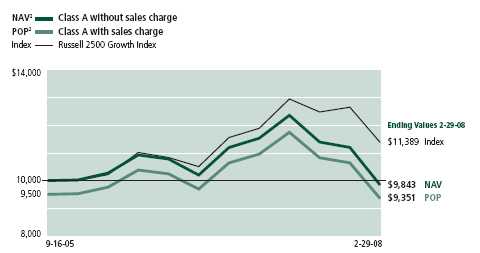

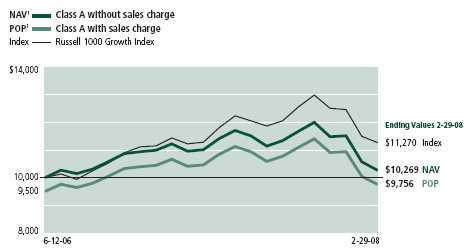

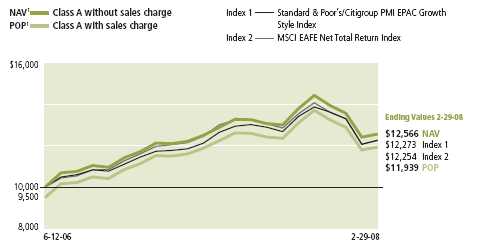

Growth of $10,000

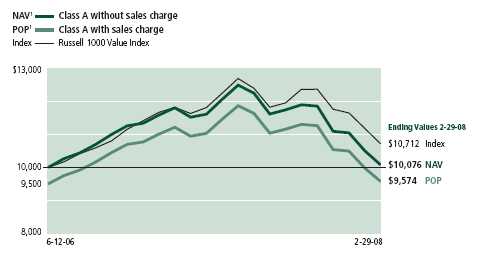

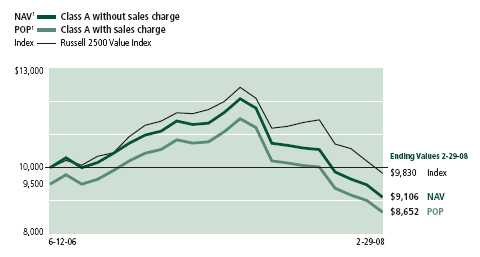

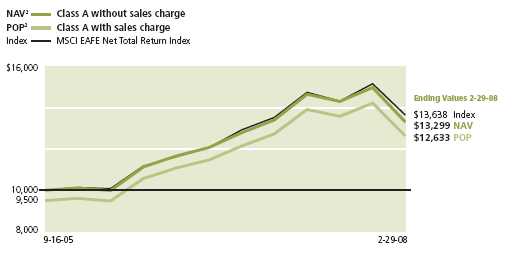

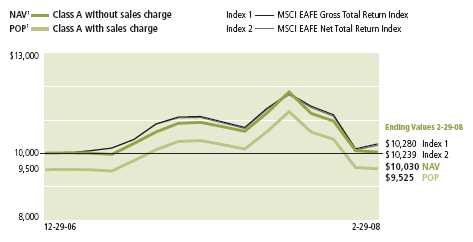

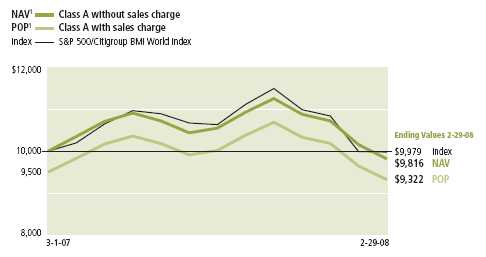

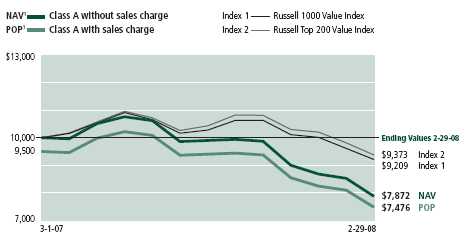

This chart shows what happened to a hypothetical $10,000 investment in Intrinsic Value Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Russell 1000 Value Index.

| | | | |

| | | | With maximum | |

| Class | Period beginning | Without sales charge | sales charge | Index |

|

| B | 6-12-06 | $9,957 | $9,593 | $10,712 |

|

| C 2 | 6-12-06 | 9,956 | 9,956 | 10,712 |

|

| I 3 | 6-12-06 | 10,144 | 10,144 | 10,712 |

|

| R13 | 6-12-06 | 10,041 | 10,041 | 10,712 |

|

| 1 3 | 6-12-06 | 10,152 | 10,152 | 10,712 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C, Class I, Class R1 and Class 1 shares, respectively, as of February 29, 2008. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 1000 Value Index is an unmanaged index containing those securities in the Russell 1000 Index with a less-than-average growth orientation.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

3 For certain types of investors as described in the Fund’s Class I, Class R1 and Class 1 share prospectuses.

Intrinsic Value Fund | Annual report

8

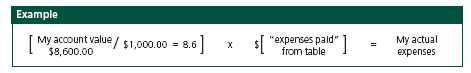

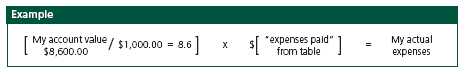

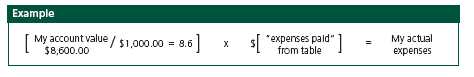

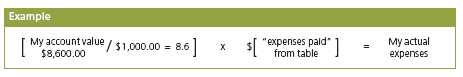

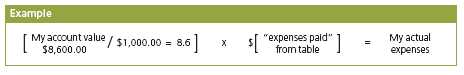

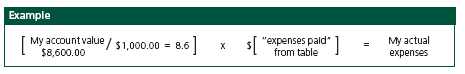

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on September 1, 2007, with the same investment held until February 29, 2008.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 9-1-07 | on 2-29-08 | period on 2-29-081 |

|

| Class A | $1,000.00 | $858.12 | $6.24 |

|

| Class B | 1,000.00 | 854.75 | 9.45 |

|

| Class C | 1,000.00 | 854.74 | 9.50 |

|

| Class I | 1,000.00 | 859.68 | 4.39 |

|

| Class R1 | 1,000.00 | 858.80 | 5.45 |

|

| Class 1 | 1,000.00 | 859.77 | 4.16 |

|

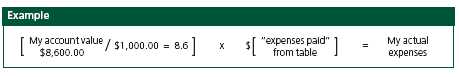

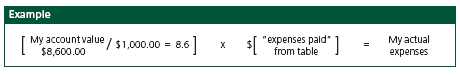

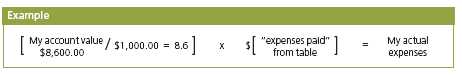

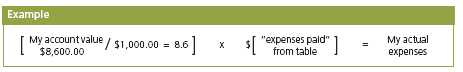

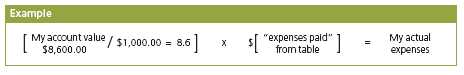

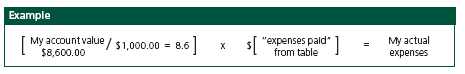

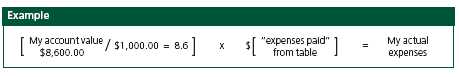

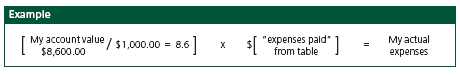

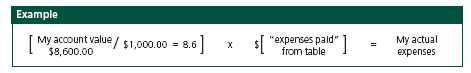

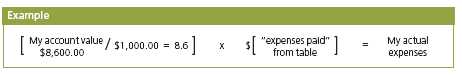

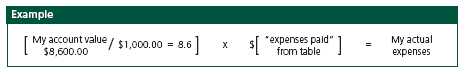

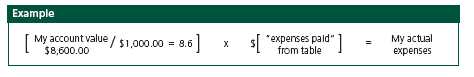

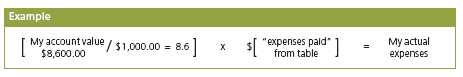

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at February 29, 2008, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Annual report | Intrinsic Value Fund

9

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on September 1, 2007, with the same investment held until February 29, 2008. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value on | Ending value on | Expenses paid during |

| | 9-1-07 | 2-29-08 | period on 2-29-081 |

|

| Class A | $1,000.00 | $1,018.15 | $6.77 |

|

| Class B | 1,000.00 | 1,014.67 | 10.27 |

|

| Class C | 1,000.00 | 1,014.62 | 10.32 |

|

| Class I | 1,000.00 | 1,020.14 | 4.77 |

|

| Class R1 | 1,000.00 | 1,019.00 | 5.92 |

|

| Class 1 | 1,000.00 | 1,020.39 | 4.52 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.35%, 2.05%, 2.06%, 0.95%, 1.18% and 0.90% for Class A, Class B, Class C, Class I, Class R1 and Class 1, respectively, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half year/366 (to reflect the one-half year period).

Intrinsic Value Fund | Annual report

10

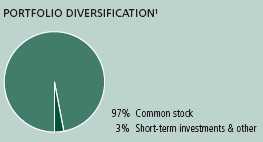

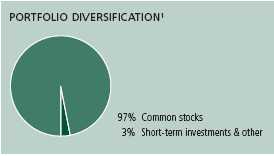

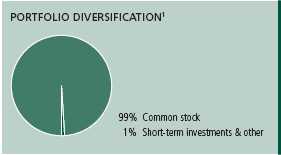

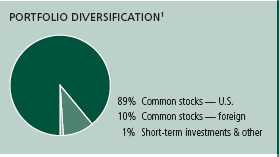

Portfolio summary

| | | | |

| Top 10 holdings1 | | | | |

|

| Exxon Mobil Corp. | 7.9% | | Citigroup, Inc. | 2.8% |

| |

|

| Chevron Corp. | 5.7% | | Home Depot, Inc. | 2.4% |

| |

|

| ConocoPhillips | 3.4% | | UnitedHealth Group, Inc. | 2.2% |

| |

|

| Wal-Mart Stores, Inc. | 3.4% | | The Coca-Cola Company | 2.0% |

| |

|

| Pfizer, Inc. | 2.9% | | Merck & Company, Inc. | 2.0% |

| |

|

| |

| Sector distribution1 | | | | |

|

| Consumer non-cyclical | 23% | | Technology | 6% |

| |

|

| Energy | 22% | | Communications | 6% |

| |

|

| Financial | 15% | | Basic materials | 2% |

| |

|

| Consumer cyclical | 14% | | Utilities | 2% |

| |

|

| Industrial | 7% | | Other | 3% |

| |

|

1 As a percentage of net assets on February 29, 2008.

Annual report | Intrinsic Value Fund

11

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 2-29-08

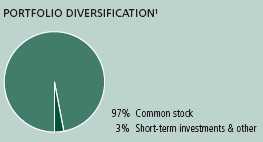

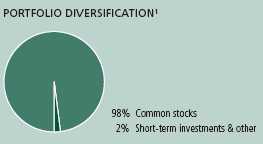

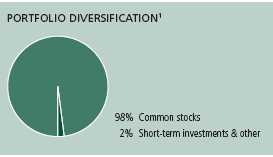

This schedule is divided into three main categories: common stocks, short-term investments and repurchase agreements. Common stocks are further broken down by industry group. Repurchase agreements, which represent the Fund’s cash position, are listed last.

| | |

| Issuer | Shares | Value |

| |

| Common stocks 96.51% | | $17,953,838 |

|

| (Cost $19,713,761) | | |

| | | |

| Aerospace 0.83% | | 154,226 |

|

| Alliant Techsystems, Inc. * | 100 | 10,494 |

|

| General Dynamics Corp. | 500 | 40,925 |

|

| Goodrich Corp. | 200 | 11,846 |

|

| Northrop Grumman Corp. | 200 | 15,722 |

|

| Rockwell Collins, Inc. | 200 | 11,780 |

|

| United Technologies Corp. | 900 | 63,459 |

| | | |

| Aluminum 0.36% | | 66,852 |

|

| Alcoa, Inc. | 1,800 | 66,852 |

| | | |

| Apparel & Textiles 0.71% | | 132,976 |

|

| Coach, Inc. * | 1,100 | 33,352 |

|

| Jones Apparel Group, Inc. | 800 | 11,288 |

|

| Liz Claiborne, Inc. | 1,100 | 19,558 |

|

| Mohawk Industries, Inc. * | 200 | 14,282 |

|

| NIKE, Inc. , Class B | 400 | 24,080 |

|

| VF Corp. | 400 | 30,416 |

| | | |

| Auto Parts 0.79% | | 147,016 |

|

| Autoliv, Inc. | 100 | 4,990 |

|

| AutoZone, Inc. * | 200 | 23,016 |

|

| BorgWarner, Inc. | 400 | 17,244 |

|

| Johnson Controls, Inc. | 2,500 | 82,150 |

|

| O’Reilly Automotive, Inc. * | 400 | 10,784 |

|

| TRW Automotive Holdings Corp. * | 400 | 8,832 |

| | | |

| Auto Services 0.24% | | 45,343 |

|

| AutoNation, Inc. * | 1,700 | 24,769 |

|

| Avis Budget Group, Inc. * | 1,800 | 20,574 |

| | | |

| Automobiles 0.97% | | 180,604 |

|

| Ford Motor Company * | 11,300 | 73,789 |

|

| General Motors Corp. | 1,700 | 39,576 |

|

| PACCAR, Inc. | 1,550 | 67,239 |

See notes to financial statements

Intrinsic Value Fund | Annual report

12

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| Banking 3.11% | | $578,854 |

|

| Bank of America Corp. | 8,100 | 321,894 |

|

| BB&T Corp. | 1,400 | 43,582 |

|

| Comerica, Inc. | 1,100 | 39,864 |

|

| Fifth Third Bancorp | 600 | 13,740 |

|

| First Horizon National Corp. | 800 | 12,992 |

|

| National City Corp. | 3,400 | 53,924 |

|

| U. S. Bancorp | 2,900 | 92,858 |

| | | |

| Biotechnology 0.58% | | 107,166 |

|

| Amgen, Inc. * | 700 | 31,864 |

|

| Biogen Idec, Inc. * | 800 | 46,688 |

|

| Charles River Laboratories International, Inc. * | 200 | 11,716 |

|

| Invitrogen Corp. * | 200 | 16,898 |

| | | |

| Broadcasting 0.18% | | 33,850 |

|

| Discovery Holding Company * | 1,000 | 22,570 |

|

| Liberty Global, Inc. , Class A * | 300 | 11,280 |

| | | |

| Building Materials & Construction 0.16% | | 29,982 |

|

| Lennox International, Inc. | 300 | 11,292 |

|

| Masco Corp. | 1,000 | 18,690 |

| | | |

| Business Services 0.67% | | 125,305 |

|

| Affiliated Computer Services, Inc. , Class A * | 500 | 25,375 |

|

| Cadence Design Systems, Inc. * | 700 | 7,434 |

|

| FactSet Research Systems, Inc. | 200 | 10,528 |

|

| Fiserv, Inc. * | 900 | 47,358 |

|

| NCR Corp. * | 700 | 15,512 |

|

| R. R. Donnelley & Sons Company | 600 | 19,098 |

| | | |

| Cellular Communications 0.05% | | 9,380 |

|

| Telephone & Data Systems, Inc. | 200 | 9,380 |

| | | |

| Chemicals 0.55% | | 102,268 |

|

| Air Products & Chemicals, Inc. | 200 | 18,266 |

|

| Celanese Corp. , Series A | 300 | 11,670 |

|

| Dow Chemical Company | 1,000 | 37,690 |

|

| FMC Corp. | 200 | 11,322 |

|

| Lubrizol Corp. | 400 | 23,320 |

| | | |

| Colleges & Universities 0.06% | | 11,880 |

|

| Career Education Corp. * | 800 | 11,880 |

| | | |

| Commercial Services 0.07% | | 12,876 |

|

| Shaw Group, Inc. * | 200 | 12,876 |

| | | |

| Computers & Business Equipment 3.89% | | 722,770 |

|

| Cisco Systems, Inc. * | 9,200 | 224,204 |

|

| Dell, Inc. * | 5,600 | 111,160 |

|

| EMC Corp. * | 5,700 | 88,578 |

|

| Foundry Networks, Inc. * | 600 | 7,122 |

|

| Hewlett-Packard Company | 1,000 | 47,770 |

See notes to financial statements

Annual report | Intrinsic Value Fund

13

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| Computers & Business Equipment (continued) | | |

|

| Ingram Micro, Inc. , Class A * | 1,000 | $15,270 |

|

| International Business Machines Corp. | 1,300 | 148,018 |

|

| Juniper Networks, Inc. * | 600 | 16,092 |

|

| Lexmark International, Inc. * | 500 | 16,515 |

|

| Tech Data Corp. * | 700 | 23,345 |

|

| Western Digital Corp. * | 800 | 24,696 |

| | | |

| Construction & Mining Equipment 0.07% | | 12,093 |

|

| Rowan Companies, Inc. | 300 | 12,093 |

| | | |

| Construction Materials 0.10% | | 18,020 |

|

| Trane, Inc. | 400 | 18,020 |

| | | |

| Cosmetics & Toiletries 0.94% | | 174,641 |

|

| Colgate-Palmolive Company | 300 | 22,827 |

|

| Kimberly-Clark Corp. | 400 | 26,072 |

|

| Procter & Gamble Company | 1,900 | 125,742 |

| | | |

| Crude Petroleum & Natural Gas 2.77% | | 515,272 |

|

| Apache Corp. | 1,000 | 114,710 |

|

| Cimarex Energy Company | 300 | 15,810 |

|

| Devon Energy Corp. | 500 | 51,360 |

|

| Forest Oil Corp. * | 200 | 9,866 |

|

| Hess Corp. | 400 | 37,272 |

|

| Occidental Petroleum Corp. | 3,200 | 247,584 |

|

| Patterson-UTI Energy, Inc. | 600 | 14,238 |

|

| Sunoco, Inc. | 400 | 24,432 |

| | | |

| Drugs & Health Care 0.26% | | 47,982 |

|

| Wyeth | 1,100 | 47,982 |

| | | |

| Educational Services 0.22% | | 41,118 |

|

| Apollo Group, Inc. , Class A * | 400 | 24,552 |

|

| ITT Educational Services, Inc. * | 300 | 16,566 |

| | | |

| Electrical Utilities 1.46% | | 271,731 |

|

| American Electric Power Company, Inc. | 800 | 32,736 |

|

| Constellation Energy Group, Inc. | 400 | 35,340 |

|

| Edison International | 800 | 39,520 |

|

| Entergy Corp. | 300 | 30,822 |

|

| FPL Group, Inc. | 500 | 30,145 |

|

| Mirant Corp. * | 300 | 11,100 |

|

| PPL Corp. | 200 | 9,076 |

|

| Public Service Enterprise Group, Inc. | 1,200 | 52,920 |

|

| Quanta Services, Inc. * | 400 | 9,552 |

|

| Reliant Energy, Inc. * | 900 | 20,520 |

| | | |

| Electronics 0.62% | | 115,612 |

|

| Arrow Electronics, Inc. * | 400 | 13,044 |

|

| Avnet, Inc. * | 600 | 20,226 |

|

| L-3 Communications Holdings, Inc. | 600 | 63,774 |

|

| Synopsys, Inc. * | 800 | 18,568 |

See notes to financial statements

Intrinsic Value Fund | Annual report

14

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| Energy 0.09% | | $16,508 |

|

| NRG Energy, Inc. * | 400 | 16,508 |

| | | |

| Financial Services 4.30% | | 799,169 |

|

| Citigroup, Inc. | 21,900 | 519,249 |

|

| Countrywide Financial Corp. (a) | 1,400 | 8,834 |

|

| Federal Home Loan Mortgage Corp. | 300 | 7,554 |

|

| Federal National Mortgage Association | 7,200 | 199,080 |

|

| Janus Capital Group, Inc. | 400 | 9,688 |

|

| Leucadia National Corp. | 300 | 13,578 |

|

| T. Rowe Price Group, Inc. (c) | 200 | 10,106 |

|

| Washington Mutual, Inc. | 2,100 | 31,080 |

| | | |

| Food & Beverages 3.55% | | 659,767 |

|

| Coca-Cola Enterprises, Inc. | 400 | 9,772 |

|

| Kraft Foods, Inc. , Class A | 1,222 | 38,090 |

|

| PepsiAmericas, Inc. | 500 | 12,650 |

|

| PepsiCo, Inc. | 2,700 | 187,812 |

|

| Pilgrim’s Pride Corp. (a) | 300 | 7,038 |

|

| The Coca-Cola Company | 6,400 | 374,144 |

|

| Tyson Foods, Inc. , Class A | 2,100 | 30,261 |

| | | |

| Forest Products 0.16% | | 30,600 |

|

| Weyerhaeuser Company | 500 | 30,600 |

| | | |

| Healthcare Products 3.27% | | 608,596 |

|

| Johnson & Johnson | 5,400 | 334,584 |

|

| Medtronic, Inc. | 1,100 | 54,296 |

|

| Patterson Companies, Inc. * | 600 | 21,120 |

|

| Stryker Corp. | 1,200 | 78,132 |

|

| Zimmer Holdings, Inc. * | 1,600 | 120,464 |

| | | |

| Healthcare Services 5.55% | | 1,032,455 |

|

| Cardinal Health, Inc. | 1,400 | 82,796 |

|

| Coventry Health Care, Inc. * | 900 | 46,683 |

|

| Express Scripts, Inc. * | 1,100 | 65,010 |

|

| McKesson Corp. | 3,000 | 176,280 |

|

| Medco Health Solutions, Inc. * | 2,000 | 88,620 |

|

| Quest Diagnostics, Inc. | 600 | 28,602 |

|

| UnitedHealth Group, Inc. | 9,000 | 418,320 |

|

| WellPoint, Inc. * | 1,800 | 126,144 |

| | | |

| Holdings Companies/Conglomerates 1.71% | | 318,144 |

|

| General Electric Company | 9,600 | 318,144 |

| | | |

| Homebuilders 0.45% | | 84,043 |

|

| Centex Corp. | 600 | 13,314 |

|

| D. R. Horton, Inc. | 1,500 | 21,045 |

|

| KB Home (a) | 300 | 7,179 |

|

| Lennar Corp. , Class A (a) | 700 | 13,027 |

|

| M. D. C. Holdings, Inc. | 400 | 16,752 |

|

| Toll Brothers, Inc. * | 600 | 12,726 |

See notes to financial statements

Annual report | Intrinsic Value Fund

15

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| Hotels & Restaurants 0.58% | | $108,220 |

|

| McDonald’s Corp. | 2,000 | 108,220 |

| | | |

| Household Products 0.10% | | 18,566 |

|

| Energizer Holdings, Inc. * | 200 | 18,566 |

| | | |

| Industrial Machinery 1.51% | | 280,648 |

|

| AGCO Corp. * | 200 | 12,972 |

|

| Cummins, Inc. | 400 | 20,152 |

|

| Deere & Company | 1,600 | 136,336 |

|

| Ingersoll-Rand Company, Ltd. , Class A | 600 | 25,116 |

|

| ITT Corp. | 300 | 16,872 |

|

| Kennametal, Inc. | 400 | 12,148 |

|

| Pall Corp. | 300 | 11,811 |

|

| Parker-Hannifin Corp. | 700 | 45,241 |

| | | |

| Insurance 7.87% | | 1,464,450 |

|

| ACE, Ltd. | 1,100 | 61,864 |

|

| Aetna, Inc. | 1,500 | 74,400 |

|

| AFLAC, Inc. | 1,300 | 81,133 |

|

| Allstate Corp. | 5,100 | 243,423 |

|

| Ambac Financial Group, Inc. (a) | 800 | 8,912 |

|

| American International Group, Inc. | 6,200 | 290,532 |

|

| Aon Corp. | 800 | 33,288 |

|

| Chubb Corp. | 1,200 | 61,080 |

|

| CIGNA Corp. | 800 | 35,664 |

|

| Commerce Group, Inc. | 400 | 14,496 |

|

| Everest Re Group, Ltd. | 100 | 9,688 |

|

| First American Corp. | 700 | 24,381 |

|

| Hartford Financial Services Group, Inc. | 500 | 34,950 |

|

| HCC Insurance Holdings, Inc. | 400 | 9,624 |

|

| MBIA, Inc. (a) | 800 | 10,376 |

|

| MGIC Investment Corp. (a) | 800 | 11,848 |

|

| Nationwide Financial Services, Inc. , Class A | 400 | 16,500 |

|

| Old Republic International Corp. | 1,600 | 21,952 |

|

| Progressive Corp. * | 2,600 | 47,658 |

|

| Protective Life Corp. | 400 | 15,436 |

|

| Prudential Financial, Inc. | 900 | 65,673 |

|

| SAFECO Corp. | 500 | 23,130 |

|

| The Travelers Companies, Inc. | 3,300 | 153,153 |

|

| Torchmark Corp. | 700 | 42,182 |

|

| Transatlantic Holdings, Inc. | 200 | 13,480 |

|

| UnumProvident Corp. | 2,100 | 48,111 |

|

| W. R. Berkley Corp. | 400 | 11,516 |

See notes to financial statements

Intrinsic Value Fund | Annual report

16

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| International Oil 17.68% | | $3,288,176 |

|

| Anadarko Petroleum Corp. | 1,100 | 70,114 |

|

| Chevron Corp. | 12,200 | 1,057,252 |

|

| ConocoPhillips | 7,700 | 636,867 |

|

| Exxon Mobil Corp. | 16,900 | 1,470,469 |

|

| Murphy Oil Corp. | 200 | 16,076 |

|

| Noble Corp. | 200 | 9,830 |

|

| Weatherford International, Ltd. * | 400 | 27,568 |

| | | |

| Internet Content 0.25% | | 47,118 |

|

| Google, Inc. , Class A * | 100 | 47,118 |

| | | |

| Internet Retail 0.44% | | 82,637 |

|

| eBay, Inc. * | 2,700 | 71,172 |

|

| Expedia, Inc. * | 500 | 11,465 |

| | | |

| Internet Software 0.22% | | 41,301 |

|

| McAfee, Inc. * | 300 | 9,981 |

|

| VeriSign, Inc. * | 900 | 31,320 |

| | | |

| Leisure Time 0.03% | | 4,887 |

|

| Brunswick Corp. | 300 | 4,887 |

| | | |

| Life Sciences 0.05% | | 9,928 |

|

| PerkinElmer, Inc. | 400 | 9,928 |

| | | |

| Liquor 0.13% | | 23,545 |

|

| Anheuser-Busch Companies, Inc. | 500 | 23,545 |

| | | |

| Manufacturing 1.87% | | 348,626 |

|

| 3M Company | 1,600 | 125,440 |

|

| Danaher Corp. | 700 | 51,905 |

|

| Eaton Corp. | 200 | 16,126 |

|

| Harley-Davidson, Inc. | 800 | 29,728 |

|

| Honeywell International, Inc. | 1,000 | 57,540 |

|

| Illinois Tool Works, Inc. | 200 | 9,814 |

|

| Pentair, Inc. | 300 | 9,786 |

|

| SPX Corp. | 100 | 10,230 |

|

| Tyco International, Ltd. | 950 | 38,057 |

| | | |

| Metal & Metal Products 0.09% | | 16,638 |

|

| Reliance Steel & Aluminum Company | 300 | 16,638 |

| | | |

| Office Furnishings & Supplies 0.04% | | 7,959 |

|

| Office Depot, Inc. * | 700 | 7,959 |

| | | |

| Paper 0.06% | | 11,491 |

|

| Smurfit-Stone Container Corp. * | 1,100 | 8,745 |

|

| Temple-Inland, Inc. | 200 | 2,746 |

| | | |

| Petroleum Services 1.10% | | 203,766 |

|

| Helmerich & Payne, Inc. | 300 | 13,449 |

|

| Tidewater, Inc. | 200 | 11,230 |

|

| Valero Energy Corp. | 3,100 | 179,087 |

See notes to financial statements

Annual report | Intrinsic Value Fund

17

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| Pharmaceuticals 6.73% | | $1,252,532 |

|

| Abbott Laboratories | 1,400 | 74,970 |

|

| AmerisourceBergen Corp. | 1,700 | 70,924 |

|

| Bristol-Myers Squibb Company | 900 | 20,349 |

|

| Eli Lilly & Company | 1,200 | 60,024 |

|

| Forest Laboratories, Inc. * | 1,300 | 51,701 |

|

| Gilead Sciences, Inc. * | 600 | 28,392 |

|

| King Pharmaceuticals, Inc. * | 1,400 | 14,840 |

|

| Merck & Company, Inc. | 8,400 | 372,120 |

|

| Pfizer, Inc. | 24,600 | 548,088 |

|

| Watson Pharmaceuticals, Inc. * | 400 | 11,124 |

| | | |

| Publishing 0.43% | | 79,687 |

|

| Gannett Company, Inc. | 2,100 | 63,315 |

|

| McGraw-Hill Companies, Inc. | 400 | 16,372 |

| | | |

| Railroads & Equipment 0.27% | | 49,904 |

|

| Union Pacific Corp. | 400 | 49,904 |

| | | |

| Real Estate 0.15% | | 27,810 |

|

| Annaly Capital Management, Inc. , REIT | 1,000 | 20,690 |

|

| Thornburg Mortgage, Inc. , REIT | 800 | 7,120 |

| | | |

| Retail Grocery 0.34% | | 62,825 |

|

| SUPERVALU, Inc. | 1,100 | 28,875 |

|

| The Kroger Company | 1,400 | 33,950 |

| | | |

| Retail Trade 9.84% | | 1,830,925 |

|

| Abercrombie & Fitch Company, Class A | 400 | 31,012 |

|

| Advance Auto Parts, Inc. | 300 | 10,062 |

|

| American Eagle Outfitters, Inc. | 600 | 12,822 |

|

| Bed Bath & Beyond, Inc. * | 1,100 | 31,174 |

|

| Best Buy Company, Inc. | 200 | 8,602 |

|

| BJ’s Wholesale Club, Inc. * | 600 | 18,936 |

|

| Costco Wholesale Corp. | 200 | 12,384 |

|

| CVS Caremark Corp. | 900 | 36,342 |

|

| Dollar Tree Stores, Inc. * | 1,300 | 34,879 |

|

| Family Dollar Stores, Inc. | 700 | 13,405 |

|

| Home Depot, Inc. | 16,800 | 446,040 |

|

| Kohl’s Corp. * | 1,100 | 48,884 |

|

| Lowe’s Companies, Inc. | 10,600 | 254,082 |

|

| Staples, Inc. | 2,100 | 46,725 |

|

| Target Corp. | 2,300 | 121,003 |

|

| Tiffany & Company | 400 | 15,056 |

|

| Walgreen Company | 1,500 | 54,765 |

|

| Wal-Mart Stores, Inc. | 12,800 | 634,752 |

| | | |

| Semiconductors 0.42% | | 78,718 |

|

| Cypress Semiconductor Corp. * | 400 | 8,696 |

|

| Intel Corp. | 1,600 | 31,920 |

See notes to financial statements

Intrinsic Value Fund | Annual report

18

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| Semiconductors (continued) | | |

|

| Intersil Corp. , Class A | 400 | $9,308 |

|

| KLA-Tencor Corp. | 400 | 16,804 |

|

| Teradyne, Inc. * | 1,000 | 11,990 |

| | | |

| Software 2.57% | | 478,487 |

|

| CA, Inc. | 800 | 18,304 |

|

| Compuware Corp. * | 1,700 | 13,532 |

|

| Intuit, Inc. * | 400 | 10,624 |

|

| Microsoft Corp. | 12,100 | 329,362 |

|

| Novell, Inc. * | 1,700 | 12,665 |

|

| Oracle Corp. * | 5,000 | 94,000 |

| | | |

| Telecommunications Equipment & Services 2.33% | | 432,684 |

|

| ADC Telecommunications, Inc. * | 700 | 9,569 |

|

| QUALCOMM, Inc. | 3,900 | 165,243 |

|

| Verizon Communications, Inc. | 7,100 | 257,872 |

| | | |

| Telephone 0.62% | | 115,312 |

|

| AT&T, Inc. | 3,127 | 108,913 |

|

| Sprint Nextel Corp. | 900 | 6,399 |

| | | |

| Tobacco 1.38% | | 255,990 |

|

| Altria Group, Inc. | 3,500 | 255,990 |

| | | |

| Toys, Amusements & Sporting Goods 0.23% | | 42,513 |

|

| Hasbro, Inc. | 900 | 23,193 |

|

| Mattel, Inc. | 1,000 | 19,320 |

| | | |

| Transportation 0.07% | | 12,544 |

|

| Overseas Shipholding Group, Inc. | 200 | 12,544 |

| | | |

| Trucking & Freight 0.37% | | 68,852 |

|

| FedEx Corp. | 400 | 35,252 |

|

| United Parcel Service, Inc. , Class B | 400 | 28,096 |

|

| YRC Worldwide, Inc. * | 400 | 5,504 |

See notes to financial statements

Annual report | Intrinsic Value Fund

19

F I N A N C I A L S T A T E M E N T S

| | |

| | Principal | |

| Issuer, description, maturity date | amount | Value |

| |

| Short-term investments 0.36% | | $66,544 |

|

| (Cost $66,544) | | |

|

| John Hancock Cash Investment Trust, 3.5681% (c)(f) | $66,544 | $66,544 |

| |

| Repurchase agreements 3.30% | | $614,000 |

|

| (Cost $614,000) | | |

|

| Repurchase Agreement with State Street Corp. dated 2-29-08 at | | |

| 2.35% to be repurchased at $614,120 on 3-3-08, | | |

| collateralized by $635,000 Federal National Mortgage | | |

| Association, 5.57%, due 7-14-28 (valued at $627,856, | | |

| including interest) | $614,000 | $614,000 |

| |

| Total investments (cost $20,394,305)† 100.17% | | $18,634,382 |

|

| |

| Liabilities in excess of other assets (0.17%) | | (31,753) |

|

| |

| Total net assets 100.00% | | $18,602,629 |

|

Percentages are stated as a percent of net assets.

REIT Real Estate Investment Trust

* Non-income producing.

(a) All or a portion of this security was out on loan.

(c) Investment is an affiliate of the Trust’s adviser or subadviser.

(f) John Hancock Cash Investment Trust is managed by MFC Global Investment Management (U.S.), LLC. The rate shown is the seven-day effective yield at period end.

† At February 29, 2008, the aggregate cost of investment securities for federal income tax purposes was $20,445,250. Net unrealized depreciation aggregated $1,810,868, of which $821,067 related to appreciated investment securities and $2,631,935 related to depreciated investment securities.

See notes to financial statements

Intrinsic Value Fund | Annual report

20

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 2-29-08

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (cost $19,713,761) including | |

| $65,239 of securities loaned (Note 2) | $17,953,838 |

| Repurchase agreement, at value (cost $614,000) (Note 2) | 614,000 |

| Investments in affiliated issuers, at value (cost $66,544) (Note 2) | 66,544 |

| | |

| Total investments, at value (cost $20,394,305) | 18,634,382 |

| Cash | 795 |

| Cash collateral at broker for futures contracts | 45,360 |

| Receivable for fund shares sold | 14,248 |

| Dividends and interest receivable (net of tax) | 41,399 |

| Receivable due from adviser | 3,880 |

| Other assets | 96 |

| | |

| Total assets | 18,740,160 |

| |

| Liabilities | |

|

| Payable for fund shares repurchased | 8,899 |

| Payable upon return of securities loaned (Note 2) | 66,544 |

| Payable for futures variation margin | 10,350 |

| Payable to affiliates | |

| Fund administration fees | 193 |

| Transfer agent fees | 2,816 |

| Distribution and service fees | 195 |

| Trustees’ fees | 73 |

| Other payables and accrued expenses | 48,461 |

| | |

| Total liabilities | 137,531 |

| |

| Net assets | |

|

| Capital paid-in | $20,812,480 |

| Undistributed net investment income | 26,236 |

| Accumulated undistributed net realized gain (loss) on investments and futures contracts | (464,411) |

| Net unrealized appreciation (depreciation) on investments and futures contracts | (1,771,676) |

| | |

| Net assets | $18,602,629 |

See notes to financial statements

Annual report | Intrinsic Value Fund

21

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| The Funds have an unlimited number of shares authorized with no par value. | |

| Net asset value is calculated by dividing the net assets of each class of shares | |

| by the number of outstanding shares in the class. | |

| | |

| Class A | |

| Net assets | $17,554,568 |

| Shares outstanding | 964,495 |

| Net asset value and redemption price per share | $18.20 |

| | |

| Class B1 | |

| Net assets | $289,866 |

| Shares outstanding | 15,942 |

| Net asset value and offering price per share | $18.18 |

| | |

| Class C1 | |

| Net assets | $413,575 |

| Shares outstanding | 22,744 |

| Net asset value and offering price per share | $18.18 |

| | |

| Class I | |

| Net assets | $134,704 |

| Shares outstanding | 7,396 |

| Net asset value, offering price and redemption price per share | $18.21 |

| | |

| Class R1 | |

| Net assets | $108,385 |

| Shares outstanding | 5,968 |

| Net asset value, offering price and redemption price per share | $18.16 |

| | |

| Class 1 | |

| Net assets | $101,531 |

| Shares outstanding | 5,575 |

| Net asset value, offering price and redemption price per share | $18.21 |

| |

| Maximum public offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $19.16 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

Intrinsic Value Fund | Annual report

22

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 2-29-08

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $470,439 |

| Interest | 32,387 |

| Securities lending | 849 |

| Income from affiliated issuers | 205 |

| | |

| Total investment income | 503,880 |

| |

| Expenses | |

|

| Investment management fees (Note 3) | 163,557 |

| Distribution and service fees (Note 3) | 68,124 |

| Transfer agent fees (Note 3) | 18,272 |

| Fund administration fees (Note 3) | 9,581 |

| Blue sky fees (Note 3) | 76,510 |

| Audit and legal fees | 66,930 |

| Printing and postage fees (Note 3) | 7,298 |

| Custodian fees | 27,821 |

| Trustees’ fees (Note 3) | 1,535 |

| Registration and filing fees | 24,473 |

| Miscellaneous | 295 |

| | |

| Total expenses | 464,396 |

| Less expense reductions (Note 3) | (176,615) |

| | |

| Net expenses | 287,781 |

| | |

| Net investment income | 216,099 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | 628,405 |

| Futures contracts | (11,356) |

| | 617,049 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | (3,482,374) |

| Futures contracts | (8,396) |

| | (3,490,770) |

| | |

| Net realized and unrealized gain (loss) | (2,873,721) |

| | |

| Increase (decrease) in net assets from operations | ($2,657,622) |

See notes to financial statements

Annual report | Intrinsic Value Fund

23

F I N A N C I A L S T A T E M E N T S

Statement of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 2-28-071 | 2-29-08 |

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $143,510 | $216,099 |

| Net realized gain (loss) | 526,061 | 617,049 |

| Change in net unrealized appreciation (depreciation) | 1,719,094 | (3,490,770) |

| | | |

| Increase (decrease) in net assets resulting from operations | 2,388,665 | (2,657,622) |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (108,035) | (224,181) |

| Class B | (1,017) | (1,449) |

| Class C | (762) | (2,335) |

| Class I | (985) | (2,359) |

| Class R1 | (620) | (1,273) |

| Class 1 | (914) | (1,843) |

| From net realized gain | | |

| Class A | (179,361) | (1,330,407) |

| Class B | (3,802) | (23,393) |

| Class C | (2,850) | (37,862) |

| Class I | (1,241) | (10,289) |

| Class R1 | (1,118) | (8,307) |

| Class 1 | (1,118) | (7,782) |

| | | |

| Total distributions | (301,823) | (1,651,480) |

| | | |

| From Fund share transactions (Note 6) | 18,224,388 | 2,600,501 |

| | | |

| Total increase (decrease) | 20,311,230 | (1,708,601) |

| |

| Net assets | | |

|

| Beginning of year | — | 20,311,230 |

| | | |

| End of year | $20,311,230 | $18,602,629 |

| | | |

| Undistributed net investment income | $43,586 | $26,236 |

1 Period from 6-12-06 (commencement of operations) to 2-28-07.

See notes to financial statements

Intrinsic Value Fund | Annual report

24

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

CLASS A SHARES

| | |

| Period ended | 2-28-07 1 | 2-29-08 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $20.00 | $22.68 |

| Net investment income (loss)2 | 0.18 | 0.24 |

| Net realized and unrealized gain | | |

| (loss) on investments | 2.85 | (2.93) |

| Total from investment operations | 3.03 | (2.69) |

| Less distributions | | |

| From net investment income | (0.13) | (0.26) |

| From net realized gain | (0.22) | (1.53) |

| | (0.35) | (1.79) |

| Net asset value, end of period | $22.68 | $18.20 |

| Total return3,4 (%) | 15.19 5 | (12.52) |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $19 | $18 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 1.94 6 | 1.89 |

| Expenses net of fee waivers, if any | 1.34 6 | 1.35 |

| Expenses net of all fee waivers and credits | 1.34 6 | 1.35 |

| Net investment income (loss) | 1.13 6 | 1.05 |

| Portfolio turnover (%) | 32 5 | 72 |

1 Class A shares began operations on 6-12-06.

2 Based on the average of the shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Assumes dividend reinvestment.

5 Not annualized.

6 Annualized.

See notes to financial statements

Annual report | Intrinsic Value Fund

25

F I N A N C I A L S T A T E M E N T S

Financial highlights

CLASS B SHARES

| | |

| Period ended | 2-28-07 1 | 2-29-08 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $20.00 | $22.64 |

| Net investment income (loss)2 | 0.07 | 0.08 |

| Net realized and unrealized gain | | |

| (loss) on investments | 2.85 | (2.92) |

| Total from investment operations | 2.92 | (2.84) |

| Less distributions | | |

| From net investment income | (0.06) | (0.09) |

| From net realized gain | (0.22) | (1.53) |

| | (0.28) | (1.62) |

| Net asset value, end of period | $22.64 | $18.18 |

| Total return3,4 (%) | 14.61 5 | (13.13) |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | — 6 | — 6 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 9.00 7 | 6.13 |

| Expenses net of fee waivers, if any | 2.04 7 | 2.06 |

| Expenses net of all fee waivers and credits | 2.04 7 | 2.05 |

| Net investment income (loss) | 0.42 7 | 0.35 |

| Portfolio turnover (%) | 32 5 | 72 |

1 Class B shares began operations on 6-12-06.

2 Based on the average of the shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Assumes dividend reinvestment.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

See notes to financial statements

Intrinsic Value Fund | Annual report

26

F I N A N C I A L S T A T E M E N T S

Financial highlights

CLASS C SHARES

| | |

| Period ended | 2-28-07 1 | 2-29-08 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $20.00 | $22.64 |

| Net investment income (loss)2 | 0.06 | 0.08 |

| Net realized and unrealized gain | | |

| (loss) on investments | 2.86 | (2.92) |

| Total from investment operations | 2.92 | (2.84) |

| Less distributions | | |

| From net investment income | (0.06) | (0.09) |

| From net realized gain | (0.22) | (1.53) |

| | (0.28) | (1.62) |

| Net asset value, end of period | $22.64 | $18.18 |

| Total return3,4 (%) | 14.61 5 | (13.13) |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | — 6 | — 6 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 10.08 7 | 6.21 |

| Expenses net of fee waivers, if any | 2.04 7 | 2.06 |

| Expenses net of all fee waivers and credits | 2.04 7 | 2.05 |

| Net investment income (loss) | 0.37 7 | 0.36 |

| Portfolio turnover (%) | 32 5 | 72 |

1 Class C shares began operations on 6-12-06.

2 Based on the average of the shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Assumes dividend reinvestment.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

See notes to financial statements

Annual report | Intrinsic Value Fund

27

F I N A N C I A L S T A T E M E N T S

Financial highlights

CLASS I SHARES

| | |

| Period ended | 2-28-07 1 | 2-29-08 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $20.00 | $22.70 |

| Net investment income (loss)2 | 0.24 | 0.32 |

| Net realized and unrealized gain | | |

| (loss) on investments | 2.86 | (2.93) |

| Total from investment operations | 3.10 | (2.61) |

| Less distributions | | |

| From net investment income | (0.18) | (0.35) |

| From net realized gain | (0.22) | (1.53) |

| | (0.40) | (1.88) |

| Net asset value, end of period | $22.70 | $18.21 |

| Total return3,4 (%) | 15.50 5 | (12.18) |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | — 6 | — 6 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 17.60 7 | 13.79 |

| Expenses net of fee waivers, if any | 0.95 7 | 0.95 |

| Expenses net of all fee waivers and credits | 0.95 7 | 0.95 |

| Net investment income (loss) | 1.53 7 | 1.45 |

| Portfolio turnover (%) | 32 5 | 72 |

1 Class I shares began operations on 6-12-06.

2 Based on the average of the shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Assumes dividend reinvestment.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

See notes to financial statements

Intrinsic Value Fund | Annual report

28

F I N A N C I A L S T A T E M E N T S

Financial highlights

CLASS R1 SHARES

| | |

| Period ended | 2-28-07 1 | 2-29-08 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $20.00 | $22.63 |

| Net investment income (loss)2 | 0.12 | 0.21 |

| Net realized and unrealized gain | | |

| (loss) on investments | 2.85 | (2.92) |

| Total from investment operations | 2.97 | (2.71) |

| Less distributions | | |

| From net investment income | (0.12) | (0.23) |

| From net realized gain | (0.22) | (1.53) |

| | (0.34) | (1.76) |

| Net asset value, end of period | $22.63 | $18.16 |

| Total return3,4 (%) | 14.88 5 | (12.60) |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | — 6 | — 6 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 20.85 7 | 15.27 |

| Expenses net of fee waivers, if any | 1.69 7 | 1.45 |

| Expenses net of all fee waivers and credits | 1.69 7 | 1.45 |

| Net investment income (loss) | 0.78 7 | 0.95 |

| Portfolio turnover (%) | 32 5 | 72 |

1 Class R1 shares began operations on 6-12-06.

2 Based on the average of the shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Assumes dividend reinvestment.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

See notes to financial statements

Annual report | Intrinsic Value Fund

29

F I N A N C I A L S T A T E M E N T S

Financial highlights

CLASS 1 SHARES

| | |

| Period ended | 2-28-07 1 | 2-29-08 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $20.00 | $22.70 |

| Net investment income (loss)2 | 0.25 | 0.34 |

| Net realized and unrealized gain | | |

| (loss) on investments | 2.85 | (2.94) |

| Total from investment operations | 3.10 | (2.60) |

| Less distributions | | |

| From net investment income | (0.18) | (0.36) |

| From net realized gain | (0.22) | (1.53) |

| | (0.40) | (1.89) |

| Net asset value, end of period | $22.70 | $18.21 |

| Total return3,4 (%) | 15.53 5 | (12.13) |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | — 6 | — 6 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions | 1.44 7 | 1.47 |

| Expenses net of fee waivers, if any | 0.90 7 | 0.90 |

| Expenses net of all fee waivers and credits | 0.90 7 | 0.90 |

| Net investment income (loss) | 1.58 7 | 1.50 |

| Portfolio turnover (%) | 32 5 | 72 |

1 Class 1 shares began operations on 6-12-06.

2 Based on the average of the shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Assumes dividend reinvestment.

5 Not annualized.

6 Less than $500,000.

7 Annualized

See notes to financial statements

Intrinsic Value Fund | Annual report

30

Notes to financial statements

1. Organization

John Hancock Intrinsic Value Fund (the Fund) is a non-diversified series of John Hancock Funds III (the Trust). The Trust was established as a Massachusetts business trust on June 9, 2005. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end investment management company. The investment objective of the Fund is to seek long-term capital growth.

John Hancock Life Insurance Company of New York (John Hancock New York) is a wholly owned subsidiary of John Hancock Life Insurance Company (U.S.A.) (John Hancock USA). John Hancock USA and John Hancock New York are indirect wholly owned subsidiaries of The Manufacturers Life Insurance Company (Manulife), which in turn is a wholly owned subsidiary of Manulife Financial Corporation (MFC), a publicly traded company. MFC and its subsidiaries are known collectively as “Manulife Financial.”

John Hancock Investment Management Services, LLC (the Adviser), a Delaware limited liability company controlled by John Hancock USA, serves as investment adviser for the Trust and John Hancock Funds, LLC (the Distributor), a Delaware limited liability company, an affiliate of the Adviser, serves as principal underwriter.

The Board of Trustees have authorized the issuance of multiple classes of shares of the Fund, including classes designated as Class A, Class B, Class C, Class I, Class R1 and Class 1 shares. Class A, Class B and Class C shares are open to all retail investors. Class I shares are offered without any sales charge to various institutional and certain individual investors. Class R1 shares are available only to certain retirement plans. Class 1 shares are sold only to certain exempt separate accounts of John Hancock USA and John Hancock New York. The shares of each class represent an interest in the same portfolio of investments of the Fund, and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Board of Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission (SEC) and the Interna l Revenue Service. Shareholders of a class that bear distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

The Adviser and other affiliates of John Hancock USA owned 802,790, 5,571, 5,529 and 5,575 shares of beneficial interest of Class A, Class I, Class R1 and Class 1, respectively, on February 29, 2008.

2. Significant accounting policies

In the preparation of the financial statements, the Fund follows the policies described below. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results may differ from these estimates.

Security valuation

The net asset value of the shares of the Fund is determined daily as of the close of the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. Short-term debt investments that have a remaining maturity of 60 days or less are valued at amortized cost, and thereafter assume a constant amortization to maturity of any discount or premium, which approximates market value. Investments in John Hancock Cash Investment Trust (JHCIT),

Annual report | Intrinsic Value Fund

31

an affiliate of the John Hancock Advisers, LLC (JHA), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of MFC, are valued at their net asset value each business day. All other securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade or, lacking any sales, at the closing bid price. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Securities for which there are no such quotations, principally debt securities, are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data.

Other assets and securities for which no such quotations are readily available are valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of a Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

In deciding whether to make a fair value adjustment to the price of a security, the Board of Trustees or their designee may review a variety of factors, including developments in foreign markets, the performance of U.S. securities markets and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The Fund may also fair value securities in other situations, for example, when a particular foreign market is closed, but the Fund is calculating the net asset value. In view of these factors, it is likely that Funds investing significant amounts of assets in securities in foreign markets will be fair valued more frequently than Funds investing significant amounts of assets in frequently traded, U.S. exchange listed securities of large-capitalization U.S. issuers.

For purposes of determining when fair value adjustments may be appropriate with respect to Funds that invest in securities in foreign markets that close prior to the NYSE, the Funds will, on an ongoing basis, monitor for “significant market events.” A significant market event may be a certain percentage change in the value of an index or of certain Exchange Traded Funds that track foreign markets in which Funds have significant investments. If a significant market event occurs due to a change in the value of the index or of Exchange Traded Funds, the pricing for the Fund will promptly be reviewed and potential adjustments to the net asset value of the Fund will be recommended to the Trust’s Pricing Committee when applicable.

Fair value pricing of securities is intended to help ensure that the net asset value of the Fund’s shares reflects the value of the Fund’s securities as of the close of the NYSE (as opposed to a value which is no longer accurate as of such close), thus limiting the opportunity for aggressive traders to purchase shares of the Fund at deflated prices, reflecting stale security valuations, and to promptly sell such shares at a gain. However, a security’s valuation may differ depending on the method used for determining value and no assurance can be given that fair value pricing of securities will successfully eliminate all potential opportunities for such trading gains.

New accounting pronouncements

In September 2006, Financial Accounting Standards Board (FASB) Standard No. 157, Fair Value Measurements (FAS 157), was issued and is effective for fiscal years beginning after

Intrinsic Value Fund | Annual report

32

November 15, 2007. FAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosure about fair value measurements. As of February 29, 2008, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements; however, additional disclosures regarding pricing sources will be required about the inputs used to develop the measurements of fair value and the related realized and unrealized gain/loss for certain securities valued by significant unobservable market inputs.

In March 2008, FASB No. 161 (FAS 161), Disclosures about Derivative Instruments and Hedging Activities , an amendment of FASB Statement No. 133 (FAS 133), was issued and is effective for fiscal years beginning after November 15, 2008. FAS 161 amends and expands the disclosure requirements of FAS 133 in order to provide financial statement users an understanding of a company’s use of derivative instruments, how derivative instruments are accounted for under FAS 133 and related interpretations and how these instruments affect a company’s financial position, performance, and cash flows. FAS 161 requires companies to disclose information detailing the objectives and strategies for using derivative instruments, the level of derivative activity entered into by the company, and any credit risk-related contingent features of the agreements. Management is currently evaluating the adoption of FAS 161 on the Fund’s financial statement disclosures.

Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

Repurchase agreements

The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement through its custodian, it receives delivery of securities, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the market value is generally at least 102% of the repurchase amount. The Fund will take constructive receipt of all securities underlying the repurchase agreements it has entered into until such agreements expire. If the seller defaults, the Fund would suffer a loss to the extent that proceeds from the sale of underlying securities were less than the repurchase amount. The Fund may enter into repurchase agreements maturing within seven days with domestic dealers, banks or other financial institutions deemed to be creditworthy by the Adviser. Collateral for certain tri-party repurchase agreements is held at the custodian bank in a segregated account for the benefi t of the Fund and the counterparty.

Security transactions and related investment income

Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-date or when the Fund becomes aware of the dividends from cash collections. Discounts/premiums are accreted/ amortized for financial reporting purposes. Non-cash dividends are recorded at the fair market value of the securities received. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful, based upon consistently applied procedures.

From time to time, the Fund may invest in Real Estate Investment Trusts (REITs) and, as a result, will estimate the components of distributions from these securities. Distributions from REITs received in excess of income are recorded as a reduction of cost of investments and/or as a realized gain.

Annual report | Intrinsic Value Fund

33

The Fund uses the specific identification method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Allocations of income and expenses

All income, expenses (except class-specific expenses), and realized and unrealized gain/ loss are allocated to each class of shares based upon the relative net assets of each class. Dividends to shareholders from net investment income are determined at a class level and distributions from capital gains are determined at a Fund level.

Expenses not directly attributable to the Fund or share classes are allocated based on the relative share of net assets of the Fund or share class at the time the expense was incurred. Class-specific expenses, as detailed in Note 3, are accrued daily and charged directly to the respective share classes.

Securities lending

The Fund may lend portfolio securities from time to time in order to earn additional income. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends paid by the issuer of securities and to participate in any changes in their value. On the settlement date of the loan, the Fund receives collateral against the loaned securities and maintain collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. Any cash collateral received is invested in the JHCIT. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collat eral. The Fund receives compensation for lending its securities either in the form of fees, guarantees, and/or by retaining a portion of interest on the investment of any cash received as collateral.

The Fund has entered into an agreement with Morgan Stanley & Co. Incorporated and MS Securities Services Inc. (collectively, Morgan Stanley), which permits the Fund to lend securities to Morgan Stanley on a principal basis. Morgan Stanley is the primary borrower of fund securities of the Fund. The risk of having one primary borrower of securities (as opposed to several borrowers in an agency relationship) is that should Morgan Stanley fail financially, all securities lent will be affected by the failure and by any delays in recovery of the securities (or in the rare event, loss of rights in the collateral).

Prior to May 8, 2007, cash collateral was invested in the State Street Navigator Securities Lending Portfolio. At February 29, 2008, the Fund loaned securities having a market value of $65,239 collateralized by securities in the amount of $66,544.

Futures

The Fund may purchase and sell financial futures contracts and options on those contracts. The Fund invests in contracts based on financial instruments, such as U.S. Treasury Bonds or Notes, or on securities indices such as the Standard & Poor’s 500 Index, in order to hedge against a decline in the value of securities owned by the Fund.

Initial margin deposits required upon entering into futures contracts are satisfied by the delivery of specific securities or cash as collateral to the broker (the Fund’s agent in acquiring the futures position). If the position is closed out by taking an opposite position prior to the settlement date of the futures contract, a final determination of variation margin is made, cash is required to be paid to or released by the broker and the Fund realizes a gain or loss.

When the Fund sells a futures contract based on a financial instrument, the Fund becomes obligated to deliver that kind of instrument at an agreed upon date for a specified price. The Fund realizes a gain or loss depending on whether the price of an offsetting purchase is less or more than the price of the initial sale or on whether the price of an offsetting sale is more or less than the price of the initial purchase. The Fund could be exposed to risks if it could not close out futures positions because of an illiquid secondary market or the inability

Intrinsic Value Fund | Annual report

34

of counterparties to meet the terms of their contracts. Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade.

The following is a summary of open futures contracts on February 29, 2008:

| | | | | |

| | | | | | UNREALIZED |

| | NUMBER OF | | EXPIRATION | NOTIONAL | APPRECIATION |

| OPEN CONTRACTS | CONTRACTS | POSITION | DATE | AMOUNT | (DEPRECIATION) |

|

| S&P Mini 500 Index Futures | 6 | Long | Mar 2008 | $399,390 | ($11,753) |

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. Net capital losses of $425,219 that are attributable to security transactions incurred after October 31, 2007, are treated as arising on March 1, 2008, the first day of the Fund’s next taxable year.

The Fund has adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes , an interpretation of FASB Statement 109 (FIN 48), at the beginning of the Fund’s fiscal year. FIN 48 prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not have a material impact on the Fund’s financial statements. Each of the Fund’s federal tax returns for the prior fiscal years remains subject to examination by the Internal Revenue Service.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. During the year ended February 28, 2007, the tax character of distributions paid was as follows: ordinary income $270,360 and long-term capital gain $31,463. During the year ended February 29, 2008, the tax character of distributions paid was as follows: ordinary income $1,019,233 and long-term capital gain $632,247. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

As of February 29, 2008, the components of distributable earnings on a tax basis included $26,236 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within financial statements are adjusted for permanent book/tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book/tax differences will reverse in a subsequent period. Permanent book/tax differences are primarily attributable to derivative transactions.

3. Investment advisory and

other agreements

The Trust has entered into an Investment Advisory Agreement with the Adviser. The Adviser is responsible for managing the corporate and business affairs of the Trust and for selecting and compensating subadvisers to handle the investment of the assets of the Fund, subject to the supervision of the Trust’s Board of Trustees. As compensation for its services, the Adviser receives an advisory fee from the Trust. Under the Advisory Agreement, the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.78% of the first $500,000,000 of the Fund’s aggregate daily net assets; (b) 0.76% of the next $500,000,000 of the Fund’s aggregate daily net assets; (c) 0.75% of the Fund’s next $1,500,000,000 of the Fund’s aggregate daily net assets; and (d) 0.74% of the Fund’s aggregate daily net assets in excess of $2,500,000,000. Aggregate net assets include

Annual report | Intrinsic Value Fund

35

the net assets of the Fund and Intrinsic Value Trust, a series of John Hancock Trust and Intrinsic Value Fund, a series of John Hancock Funds II. The Adviser has a subadvisory agreement with Grantham, Mayo, Van Otterloo & Co. LLC. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the year ended February 29, 2008, were equivalent to an annual effective rate of 0.78% of the Fund’s average daily net assets.

Expense reimbursements

The Adviser has contractually agreed to reimburse or limit certain Fund level expenses to 0.08% of the Fund’s average annual net assets which are allocated pro rata to all share classes. This agreement excludes taxes, portfolio brokerage commissions, interest, advisory fees, Rule 12b-1 fees, transfer agency fees, blue sky fees, printing and postage and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, fees incurred under any agreement or plans of the Fund dealing with services for the shareholders and others with beneficial interest in shares of the Fund, are excluded.

In addition, the Adviser has agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, fees incurred under any agreement or plans of the Fund dealing with services for the shareholders and others with beneficial interest in shares of the Fund, are excluded. The reimbursements and limits are such that these expenses will not exceed 1.35% for Class A shares, 2.05% for Class B, 2.05% for Class C, 0.95% for Class I, 1.45% for Class R1 and 0.90% for Class 1. Accordingly, the expense reductions or reimbursements related to this agreement were $107,537, $16,704, $16,870, $18,453, $16,037 and $664 for Class A, Class B, Class C, Class I, Class R1 and Class 1, respectively for the year ended February 29, 2008. The expense reimbursements and limits will continue in effect until June 30, 2008 and thereafter until terminated by the Adviser on notice to the Trust.

Fund administration fees

Pursuant to the Advisory Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports. These expenses are allocated based on the relative share of net assets of each class at the time the expense was incurred.

The fund administration fees incurred for the year ended February 29, 2008, were $9,581 with an annual effective rate of 0.05% of the Fund’s average daily net assets.

Distribution and shareholder servicing fees

The Trust has a Distribution Agreement with the Distributor. The Fund has adopted Distribution Plans with respect to Class A, Class B, Class C, Class R1 and Class 1, pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to the Distributor at an annual rate not to exceed 0.30%, 1.00%, 1.00%, 0.50% and 0.05% of average daily net asset value of Class A, Class B, Class C, Class R1 and Class 1, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of Financial Industry Regulatory Authority (formerly the National Association of Securities Dealers). Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

In addition, the Fund has also adopted a Service Plan for Class R1 shares. Under the Service Plan, the Fund may pay up to 0.25% of Class R1 average daily net asset value for certain other services. There were no Service Plan fees incurred for the year ended February 29, 2008.

Sales charges

Class A shares are assessed up-front sales charges of up to 5.00% of net asset value of such shares. During the year ended

Intrinsic Value Fund | Annual report

36

February 29, 2008, the Fund was informed that the Distributor received net up-front sales charges of $22,389 with regard to sales of Class A shares. Of this amount, $3,598 was retained and used for printing prospectuses, advertising, sales literature and other purposes; $18,738 was paid as sales commissions to unrelated broker-dealers; and $53 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a related broker-dealer, an indirect subsidiary of MFC.