| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

|

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

|

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

|

| Michael J. Leary |

| Treasurer |

|

| 601 Congress Street |

|

| Boston, Massachusetts 02210 |

| | |

| (Name and address of agent for service) |

|

| Registrant's telephone number, including area code: 617-663-4490 |

| |

| Date of fiscal year end: | March 31 |

| |

| |

| Date of reporting period: | March 31, 2009 |

ITEM 1. REPORT TO SHAREHOLDERS.

Discussion of Fund performance

By Rainier Investment Management, Inc.

During the fiscal year, shareholders in three John Hancock funds — Core Equity Fund, Growth Trends Fund and Technology Fund — approved the merger of their funds into John Hancock Rainier Growth Fund. The merger occurred after the close of business on October 3, 2008.

Despite a late-period surge, large-company growth stocks posted severe losses during the 12 months ended March 31, 2009. They came under pressure due to the lack of credit needed to help businesses operate and expand, extreme worries about an increasingly fragile financial system and rapidly deteriorating economic conditions. For the 12 months ended March 31, 2009, John Hancock Rainier Growth Fund’s Class A shares returned –38.59% at net asset value. That return compared with the –35.94% return of the average large growth fund as tracked by Morningstar, Inc. and the –34.28% return of the Russell 1000 Growth Index.

Our overweighted stake early in the period in energy stocks versus the Russell index was the biggest drag on its performance as energy prices slumped. Energy services company McDermott International, which we sold during the period, suffered steep declines in anticipation of declining demand. Independent oil and gas producer Devon Energy Corp. was another big detractor. In contrast, our navigation through the volatile financial sector proved beneficial, with relatively good stock selection in the group. Our larger-than-index stakes in Visa, Inc. and Charles Schwab Corp., while still posting losses, performed far better than the financial group as a whole. We also were helped by not owning some of the major components of the Russell index that fared the worst. State Street Corp., which we eliminated, was the biggest detractor, due to worries about it being under-capitalized. Elsewhere, our underweighting in Wal-Mart Stores, Inc., hurt because it was a top performer. Alcon , Inc., was hurt by slowing prescriptions and the decline of major foreign currencies relative to the U.S. dollar. Among our best performers were Teva Pharmaceutical Industries, Ltd., online retailer Amazon.com, Inc., restaurant chain McDonald’s Corp. and DIRECTV.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 6 | Rainier Growth Fund | Annual report |

A look at performance

For the period ended March 31, 2009

| | | | | | | | | |

| | | Average annual returns (%) | | Cumulative total returns (%) | | |

| | | with maximum sales charge (POP) | with maximum sales charge (POP) | | |

| |

|

|

| | Inception | | | | Since | | | | Since |

| Class | date | 1-year | 5-year | 10-year | inception | 1-year | 5-year | 10-year | inception |

|

| A2 | 6-15-00 | –41.66 | –3.83 | — | –7.84 | –41.66 | –17.75 | — | –51.22 |

|

| B2 | 6-15-00 | –42.16 | –4.42 | — | –8.46 | –42.16 | –20.23 | — | –54.02 |

|

| C2 | 6-15-00 | –39.72 | –4.01 | — | –8.46 | –39.72 | –18.50 | — | –54.02 |

|

| I1,2 | 6-15-00 | –38.36 | –2.54 | — | –7.02 | –38.36 | –12.07 | — | –47.26 |

|

| R1,2 | 6-15-00 | –39.00 | –3.86 | — | –8.32 | –39.00 | –17.88 | — | –53.40 |

|

| R11,2 | 6-15-00 | –38.85 | –3.62 | — | –8.09 | –38.85 | –16.85 | — | –52.36 |

|

| R21,2 | 6-15-00 | –38.70 | –3.38 | — | –7.86 | –38.70 | –15.81 | — | –51.30 |

|

| R31,2 | 6-15-00 | –38.80 | –3.53 | — | –8.00 | –38.80 | –16.45 | — | –51.95 |

|

| R41,2 | 6-15-00 | –38.64 | –3.25 | — | –7.73 | –38.64 | –15.23 | — | –50.69 |

|

| R51,2 | 6-15-00 | –38.44 | –2.96 | — | –7.45 | –38.44 | –13.93 | — | –49.35 |

|

| T2 | 6-15-00 | –42.10 | –4.52 | — | –8.50 | –42.10 | –20.64 | — | –54.20 |

|

| ADV1,2 | 6-15-00 | –38.53 | –2.79 | — | –7.25 | –38.53 | –13.18 | — | –48.42 |

|

| NAV1,2 | 6-15-00 | –38.38 | –2.47 | — | –6.94 | –38.38 | –11.75 | — | –46.86 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charge on Class A and Class T shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class ADV and Class NAV shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until April 28, 2009 for Class A, Class I, and Class ADV, and at least until July 31, 2009 for Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, and Class R5. The net expenses are as follows:, Class B — 2.04%, Class C — 2.04%, Class R — 1.89%, Class R1 — 1.64%, Class R2 — 1.39%, Class R3 — 1.54%, Class R4 — 1.24% and Class R5 — 0.94%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows:Class B — 2.50%, Class C — 2.50%, Class R — 2.35%, Class R1 —2.10%, Class R2 — 1.85%, Class R3 — 2.00%, Class R4 — 1.70% and Class R5 — 1.40%. For the other classes, the net expenses equal the gross expenses and are as follows: Class A — 1.19%, Class I — limit of 0.89% until 4-28-09, Class T — 1.90%, Class ADV — 1.15% and Class NAV — 0.80%. The Fund’s expenses for the current fiscal year may be higher than the expenses listed above, for some of the following reasons: i) a significant decrease in average net assets may result in a higher advisory fee rate; ii) a significant decrease in average net assets may result in an increase in the expense ratio; and iii) the termination or expiration of expense cap reimbursements.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors, as described in the Fund’s Class I, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class ADV and Class NAV prospectuses.

2 On April 25, 2008, through a reorganization, the Fund acquired all of the assets of the Rainier Large Cap Growth Equity Portfolio (the predecessor fund). On that date, the predecessor fund offered its Original share class and Institutional share class in exchange for Class A and Class I shares, respectively, of the John Hancock Rainier Growth Fund. Classes A, B, C, I, R, R1, R2, R3, R4, R5, ADV and NAV of the John Hancock Rainier Growth Fund were first offered on April 28, 2008. The returns prior to April 28, 2008 are those of the predecessor fund’s Original share class that have been recalculated to apply the gross fees and expenses of Class A, B, C, I, R, R1, R2, R3, R4, R5, ADV, and NAV. Class T shares were first offered October 6, 2008; the returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class T shares.

| |

| Annual report | Rainier Growth Fund | 7 |

A look at performance

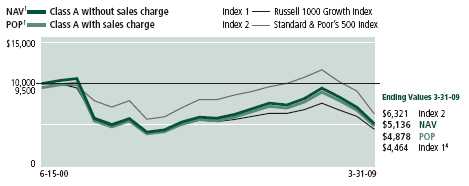

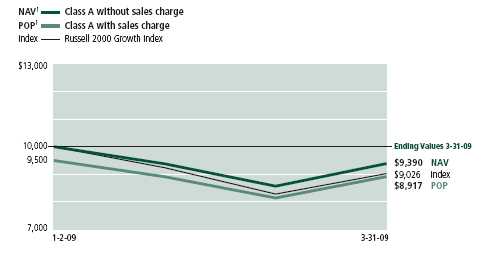

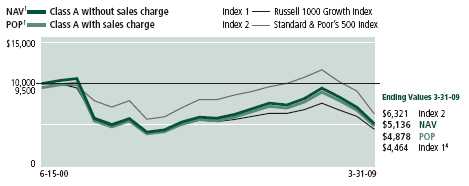

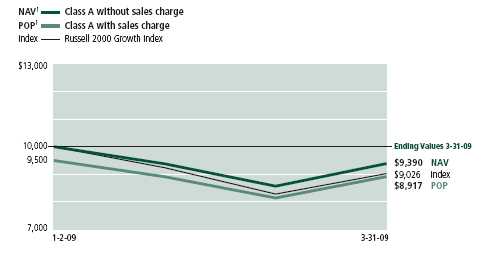

Growth of $10,000

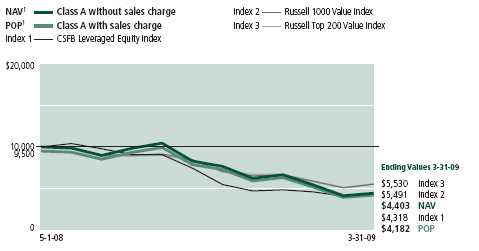

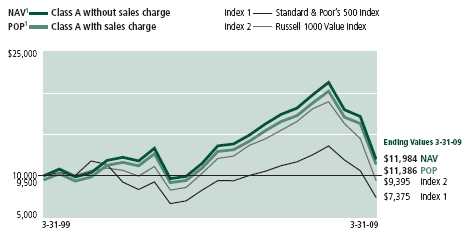

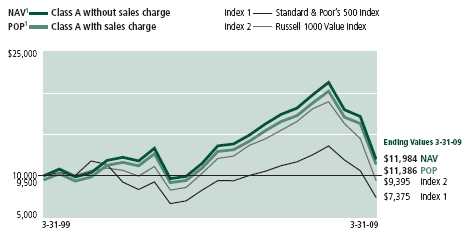

This chart shows what happened to a hypothetical $10,000 investment in Rainier Growth Fund Class A5 shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | | | | |

| | | Without sales | With maximum | | |

| Class | Period beginning | charge | sales charge | Index 1 | Index 2 |

|

| B2,4,5 | 6-15-00 | $4,598 | $4,598 | $4,464 | $6,321 |

|

| C2,4,5 | 6-15-00 | 4,598 | 4,598 | 4,464 | 6,321 |

|

| I3,4,5 | 6-15-00 | 5,274 | 5,274 | 4,464 | 6,321 |

|

| R3,4,5 | 6-15-00 | 4,660 | 4,660 | 4,464 | 6,321 |

|

| R13,4,5 | 6-15-00 | 4,764 | 4,764 | 4,464 | 6,321 |

|

| R23,4,5 | 6-15-00 | 4,870 | 4,870 | 4,464 | 6,321 |

|

| R33,4,5 | 6-15-00 | 4,805 | 4,805 | 4,464 | 6,321 |

|

| R43,4,5 | 6-15-00 | 4,931 | 4,931 | 4,464 | 6,321 |

|

| R53,4,5 | 6-15-00 | 5,065 | 5,065 | 4,464 | 6,321 |

|

| T4,5 | 6-15-00 | 4,822 | 4,580 | 4,464 | 6,321 |

|

| ADV3,4,5 | 6-15-00 | 5,158 | 5,158 | 4,464 | 6,321 |

|

| NAV3,4,5 | 6-15-00 | 5,314 | 5,314 | 4,464 | 6,321 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C, Class I, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV shares, respectively, as of March 31, 2009. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 1000 Growth Index — Index 1 — is an unmanaged index of the 1,000 largest companies in the Russell 3,000 Index.

Standard & Poor’s 500 Index — Index 2 — is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

3 For certain types of investors, as described in the Fund’s Class I, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class ADV and Class NAV share prospectuses.

4 Index 1 as of closest month end to fund inception date.

5 On April 25, 2008, through a reorganization, the Fund acquired all of the assets of the Rainier Large Cap Growth Equity Portfolio (the predecessor fund). On that date, the predecessor fund offered its Original share class and Institutional share class in exchange for Class A and Class I shares, respectively, of the John Hancock Rainier Growth Fund. Classes A, B, C, I, R, R1, R2, R3, R4, R5, ADV and NAV of the John Hancock Rainier Growth Fund were first offered on April 28, 2008. The returns prior to April 28, 2008 are those of the predecessor fund’s Original share class that have been recalculated to apply the gross fees and expenses of Class A, B, C, I, R, R1, R2, R3, R4, R5, ADV, and NAV. Class T shares were first offered October 6, 2008; the returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class T shares.

| |

| 8 | Rainier Growth Fund | Annual report |

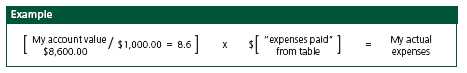

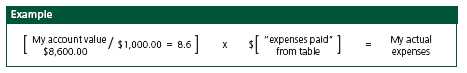

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on October 1, 2008 with the same investment held until March 31, 2009.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 10-1-08 | on 3-31-09 | period ended on 3-31-091 |

|

| Class A | $1,000.00 | $720.10 | $5.10 |

|

| Class B | 1,000.00 | 717.70 | 8.74 |

|

| Class C | 1,000.00 | 717.70 | 8.74 |

|

| Class I | 1,000.00 | 721.70 | 3.82 |

|

| Class R | 1,000.00 | 718.00 | 8.10 |

|

| Class R1 | 1,000.00 | 718.90 | 7.03 |

|

| Class R2 | 1,000.00 | 719.80 | 5.96 |

|

| Class R3 | 1,000.00 | 719.10 | 6.60 |

|

| Class R4 | 1,000.00 | 720.00 | 5.32 |

|

| Class R5 | 1,000.00 | 721.40 | 4.03 |

|

| Class ADV | 1,000.00 | 720.70 | 4.93 |

|

| Class NAV | 1,000.00 | 721.40 | 3.65 |

|

For Class T noted below, the example assumes an acccount value of $1,000 on October 6, 2008 with the same investment held until March 31, 2009.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 10-6-08 | on 3-31-09 | period ended on 3-31-091 |

|

| Class T | 1,000.00 | $775.20 | $8.52 |

|

| |

| Annual report | Rainier Growth Fund | 9 |

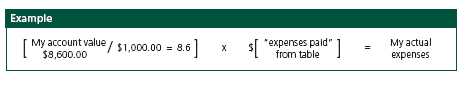

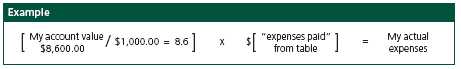

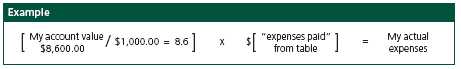

Your expenses

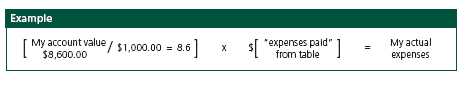

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at March 31, 2009, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on October 1, 2008, with the same investment held until March 31, 2009. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 10-1-08 | on 3-31-09 | period ended on 3-31-091 |

|

| Class A | $1,000.00 | $1,019.90 | $5.99 |

|

| Class B | 1,000.00 | 1,014.80 | 10.25 |

|

| Class C | 1,000.00 | 1,014.80 | 10.25 |

|

| Class I | 1,000.00 | 1,020.50 | 4.48 |

|

| Class R | 1,000.00 | 1,015.50 | 9.50 |

|

| Class R1 | 1,000.00 | 1,016.80 | 8.25 |

|

| Class R2 | 1,000.00 | 1,018.00 | 6.99 |

|

| Class R3 | 1,000.00 | 1,017.30 | 7.75 |

|

| Class R4 | 1,000.00 | 1,018.70 | 6.24 |

|

| Class R5 | 1,000.00 | 1,020.20 | 4.73 |

|

| Class T | 1,000.00 | 1,015.10 | 9.95 |

|

| Class ADV | 1,000.00 | 1,019.20 | 5.79 |

|

| Class NAV | 1,000.00 | 1,020.70 | 4.28 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.19%, 2.04%, 2.04%, 0.89%, 1.89%, 1.64%, 1.39%, 1.54%, 1.24%, 0.94%, 1.98%, 1.15% and 0.85% for Class A, Class B, Class C, Class I, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| |

| 10 | Rainier Growth Fund | Annual report |

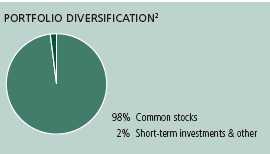

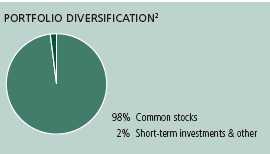

Portfolio summary

| | | | |

| Top 10 holdings1 | | | | |

|

| Monsanto Co. | 3.3% | | Cisco Systems, Inc. | 2.7% |

| |

|

| Google, Inc. (Class A) | 3.1% | | NIKE, Inc. (Class B) | 2.7% |

| |

|

| Apple, Inc. | 2.9% | | Oracle Corp. | 2.7% |

| |

|

| Transocean, Ltd. | 2.7% | | Gilead Sciences, Inc. | 2.6% |

| |

|

| QUALCOMM, Inc. | 2.7% | | Visa, Inc. (Class A) | 2.6% |

| |

|

| |

| Sector distribution2,3 | | | | |

|

| Information technology | 31% | | Financials | 6% |

| |

|

| Health care | 14% | | Energy | 6% |

|

| |

|

| Consumer discretionary | 13% | | Materials | 5% |

|

| |

|

| Consumer staples | 11% | | Telecommunication services | 2% |

|

| |

|

| Industrials | 10% | | Short-term investments & other | 2% |

|

| |

|

1 As a percentage of net assets on March 31, 2009, excluding cash and cash equivalents.

2 As a percentage of net assets on March 31, 2009.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| Annual report | Rainier Growth Fund | 11 |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 3-31-09

| | |

| Issuer | Shares | Value |

|

| Common stocks 98.05% | | $839,658,220 |

|

| (Cost $1,035,474,754) | | |

| | | |

| Aerospace & Defense 5.19% | | 44,427,100 |

|

| Boeing Co. | 83,025 | 2,954,030 |

|

| Precision Castparts Corp. | 249,175 | 14,925,582 |

|

| Raytheon Co. | 301,650 | 11,746,251 |

|

| United Technologies Corp. | 344,375 | 14,801,237 |

| | | |

| Air Freight & Logistics 2.47% | | 21,118,333 |

|

| Expeditors International of Washington, Inc. | 368,825 | 10,434,059 |

|

| Fedex Corp. | 240,150 | 10,684,274 |

| | | |

| Asset Management & Custody Banks 1.85% | | 15,810,745 |

|

| BlackRock, Inc. | 76,675 | 9,970,817 |

|

| Northern Trust Corp. | 97,625 | 5,839,928 |

| | | |

| Biotechnology 5.87% | | 50,249,248 |

|

| Celgene Corp. (I) | 338,725 | 15,039,390 |

|

| Cephalon, Inc. (I) | 92,550 | 6,302,655 |

|

| Genzyme Corp. (I) | 108,450 | 6,440,845 |

|

| Gilead Sciences, Inc. (I) | 485,025 | 22,466,358 |

| | | |

| Cable & Satellite 1.89% | | 16,227,620 |

|

| DIRECTV Group, Inc. (I) | 712,050 | 16,227,620 |

| | | |

| Coal & Consumable Fuels 0.80% | | 6,819,848 |

|

| Consol Energy, Inc. | 270,200 | 6,819,848 |

| | | |

| Communications Equipment 5.91% | | 50,643,717 |

|

| BancTec, Inc. (B)(I)(K) | 197,026 | 1,582,227 |

|

| Cisco Systems, Inc. (I) | 1,361,200 | 22,827,324 |

|

| QUALCOMM, Inc. | 592,675 | 23,060,984 |

|

| Research In Motion, Ltd. (I) | 73,675 | 3,173,182 |

| | | |

| Computer & Electronics Retail 0.92% | | 7,844,199 |

|

| Gamestop Corp. (Class A) (I) | 279,950 | 7,844,199 |

| | | |

| Computer Hardware 5.11% | | 43,798,807 |

|

| Apple, Inc. (I) | 240,275 | 25,257,708 |

|

| Hewlett-Packard Co. | 578,325 | 18,541,099 |

| | | |

| Computer Storage & Peripherals 1.21% | | 10,376,850 |

|

| EMC Corp. (I) | 910,250 | 10,376,850 |

| | | |

| Construction & Engineering 0.43% | | 3,676,562 |

|

| Foster Wheeler AG (I) | 210,450 | 3,676,562 |

See notes to financial statements

| |

| 12 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| | | |

| Construction & Farm Machinery & Heavy Trucks 0.29% | | $2,500,450 |

|

| Bucyrus International, Inc. (Class A) | 164,720 | 2,500,450 |

| | | |

| Consumer Finance 2.56% | | 21,916,130 |

|

| Visa, Inc. (Class A) | 394,175 | 21,916,130 |

| | | |

| Data Processing & Outsourced Services 1.15% | | 9,872,946 |

|

| Mastercard, Inc. (Class A) (L) | 58,950 | 9,872,946 |

| | | |

| Department Stores 1.50% | | 12,852,584 |

|

| Kohl’s Corp. (I) | 303,700 | 12,852,584 |

| | | |

| Drug Retail 1.96% | | 16,794,328 |

|

| CVS Caremark Corp. | 610,925 | 16,794,328 |

| | | |

| Electrical Components & Equipment 0.54% | | 4,591,377 |

|

| Emerson Electric Co. | 160,650 | 4,591,377 |

| | | |

| Electronic Components 0.96% | | 8,188,026 |

|

| Amphenol Corp. (Class A) | 287,400 | 8,188,026 |

| | | |

| Fertilizers & Agricultural Chemicals 3.30% | | 28,249,845 |

|

| Monsanto Co. | 339,950 | 28,249,845 |

| | | |

| Food Retail 1.22% | | 10,430,691 |

|

| Kroger Co. | 491,550 | 10,430,691 |

| | | |

| Footwear 2.66% | | 22,775,645 |

|

| NIKE, Inc. (Class B) | 485,725 | 22,775,645 |

| | | |

| Health Care Equipment 0.70% | | 6,011,256 |

|

| Becton, Dickinson & Co. | 89,400 | 6,011,256 |

|

| SerOptix, Inc. (B)(I)(K) | 491,800 | — |

| | | |

| Health Care Services 1.25% | | 10,708,638 |

|

| Aveta, Inc. (B)(I)(S) | 97,210 | 178,415 |

|

| Express Scripts, Inc. (I) | 228,075 | 10,530,223 |

| | | |

| Health Care Supplies 0.48% | | 4,109,132 |

|

| Alcon, Inc. | 45,200 | 4,109,132 |

| | | |

| Heavy Electrical Equipment 0.74% | | 6,295,653 |

|

| ABB, Ltd., SADR | 451,625 | 6,295,653 |

| | | |

| Home Improvement Retail 1.76% | | 15,085,450 |

|

| Lowe’s Cos., Inc. | 826,600 | 15,085,450 |

| | | |

| Household Products 3.44% | | 29,478,211 |

|

| Colgate-Palmolive Co. | 234,350 | 13,821,963 |

|

| Procter & Gamble Co. | 332,475 | 15,656,248 |

| | | |

| Hypermarkets & Super Centers 2.09% | | 17,891,140 |

|

| Wal-Mart Stores, Inc. | 343,400 | 17,891,140 |

| | | |

| Industrial Gases 1.97% | | 16,859,509 |

|

| Praxair, Inc. | 250,550 | 16,859,509 |

| | | |

| Industrial Machinery 0.89% | | 7,639,125 |

|

| SPX Corp. | 162,500 | 7,639,125 |

| | | |

| Internet Retail 2.07% | | 17,717,400 |

|

| Amazon.com, Inc. (I) | 241,250 | 17,717,400 |

| | | |

| Internet Software & Services 3.08% | | 26,400,351 |

|

| Gomez, Inc. (B)(I)(K) | 328 | — |

|

| Google, Inc. (Class A) (I) | 75,850 | 26,400,351 |

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 13 |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

|

| Investment Banking & Brokerage 2.43% | | $20,810,451 |

|

| Charles Schwab Corp. | 828,375 | 12,839,812 |

|

| Morgan Stanley | 350,050 | 7,970,639 |

| | | |

| IT Consulting & Other Services 1.29% | | 11,062,359 |

|

| Cognizant Technology Solutions Corp. (Class A) (I) | 532,100 | 11,062,359 |

| | | |

| Managed Health Care 0.85% | | 7,308,732 |

|

| Aetna, Inc. | 300,400 | 7,308,732 |

| | | |

| Oil & Gas Drilling 2.73% | | 23,367,306 |

|

| Transocean, Ltd. (I) | 397,133 | 23,367,306 |

| | | |

| Oil & Gas Exploration & Production 2.01% | | 17,187,774 |

|

| Devon Energy Corp. | 384,600 | 17,187,774 |

| | | |

| Personal Products 0.69% | | 5,924,763 |

|

| Avon Products, Inc. | 308,100 | 5,924,763 |

| | | |

| Pharmaceuticals 5.17% | | 44,299,146 |

|

| Abbott Laboratories | 399,250 | 19,044,225 |

|

| Allergan, Inc. | 228,950 | 10,934,652 |

|

| Teva Pharmaceutical Industries, Ltd., SADR | 317,875 | 14,320,269 |

| | | |

| Restaurants 2.58% | | 22,116,285 |

|

| Darden Restaurants, Inc. | 204,650 | 7,011,309 |

|

| McDonald’s Corp. | 276,800 | 15,104,976 |

| | | |

| Semiconductors 4.83% | | 41,358,158 |

|

| Broadcom Corp. (Class A) (I) | 650,900 | 13,004,982 |

|

| Intel Corp. | 1,170,775 | 17,620,164 |

|

| Intersil Corp. (Class A) | 213,025 | 2,449,787 |

|

| Taiwan Semiconductor Manufacturing Co., Ltd., SADR | 925,500 | 8,283,225 |

| | | |

| Soft Drinks 2.14% | | 18,319,158 |

|

| PepsiCo, Inc. | 355,850 | 18,319,158 |

| | | |

| Specialized Finance 0.56% | | 4,764,218 |

|

| IntercontinentalExchange, Inc. (I) | 63,975 | 4,764,218 |

| | | |

| Systems Software 4.97% | | 42,604,543 |

|

| Check Point Software Technologies, Ltd. (I) | 299,700 | 6,656,337 |

|

| McAfee, Inc. (I) | 200,400 | 6,713,400 |

|

| Microsoft Corp. | 354,725 | 6,516,298 |

|

| Oracle Corp. | 1,257,250 | 22,718,508 |

| | | |

| Wireless Telecommunication Services 1.54% | | 13,174,411 |

|

| America Movil SAB de CV, Ser L, ADR | 160,175 | 4,337,539 |

|

| American Tower Corp. (Class A) (I) | 290,400 | 8,836,872 |

| |

| |

| Issuer, description | Shares | Value |

|

| Preferred stocks 0.00% | | $1 |

|

| (Cost $1,230,942) | | |

| | | |

| Health Care Equipment 0.00% | | 1 |

|

| SerOptix, Inc., Ser A (B)(I)(K) | 500,000 | — |

|

| SerOptix, Inc., Ser B (B)(I)(K) | 500,000 | 1 |

| | | |

| Internet Software & Services 0.00% | | 0 |

|

| Gomez, Inc. (B)(I)(K) | 6,427 | — |

See notes to financial statements

| |

| 14 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| | | |

| | | Principal | |

| Issuer, description, maturity date | | amount | Value |

| |

| Short-term investments 1.99% | | | $17,033,000 |

|

| (Cost $17,033,000) | | | |

| | | | |

| Repurchase Agreement 1.48% | | | 12,704,000 |

|

| Repurchase Agreement with State Street Corp. dated 3/31/2009 | | |

| at 0.10% to be repurchased at $12,704,035 on 4/1/2009, | | | |

| collateralized by $12,370,000 Federal Home Loan Mortgage Corp., | | |

| 4.375% due 9/17/2010 (valued at $12,958,812, including interest) | $12,704,000 | 12,704,000 |

| |

| |

| | Interest | | |

| Issuer, description | rate | Shares | Value |

| | | | |

| Cash Equivalents 0.51% | | | $4,329,000 |

|

| John Hancock Cash Investment Trust (T)(W) | 0.7795% (Y) | 4,329,000 | 4,329,000 |

|

| Total investments (Cost $1,053,738,696)† 100.04% | | | $856,691,221 |

|

| |

| Other assets and liabilities, net (0.04%) | | | ($354,735) |

|

| |

| Total net assets 100.00% | | | $856,336,486 |

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

ADR American Depositary Receipts

SADR Sponsored American Depositary Receipts

(B) These securities are fair valued in good faith under procedures established by the Board of Trustees.

(I) Non-income producing security.

(K) Direct placement securities are restricted to resale. The Fund may be unable to sell a direct placement security and it may be more difficult to determine a market value for a direct placement security. Moreover, if adverse market conditions were to develop during the period between the Fund’s decision to sell a direct placement security and the point at which the Fund is permitted or able to sell such security, the Fund might obtain a price less favorable than the price that prevailed when it decided to sell. This investment practice, therefore, could have the effect of increasing the level of illiquidity of the Fund. The Fund has limited rights to registration under the Securities Act of 1933 with respect to these restricted securities.

Additional information on these securities is shown below:

| | | | |

| | | | Value as a percentage | Value as of |

| Issuer, description | Acquisition date | Acquisition cost | of Fund’s net assets | March 31, 2009 |

|

|

| BancTec, Inc. | | | | |

| common stock | 06-20-07 | $4,728,640 | 0.18% | $1,582,227 |

|

| Gomez, Inc | | | | |

| common stock | 09-10-02 | 2,177,612 | 0.00 | 0 |

| preferred stock. | 01-23-06 | 64,275 | 0.00 | 0 |

|

| SerOptix, Inc. | | | | |

| common stock | 01-12-98 | 50 | 0.00 | 0 |

| preferred stock, Ser A | 01-12-98 | 500,000 | 0.00 | 0 |

| preferred stock, Ser B | 04-05-00 | 666,667 | 0.00 | 1 |

|

| Total | | | 0.18% | $1,582,228 |

(L) All or a portion of this security is on loan as of March 31, 2009.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(T) Represents investment of securities lending collateral.

(W) Issuer is an affiliate of John Hancock Advisers, LLC.

(Y) Represents current yield as of March 31, 2009.

† At March 31, 2009, the aggregate cost of investment securities for federal income tax purposes was $1,094,468,380. Net unrealized depreciation aggregated $237,777,159, of which $10,349,538 related to appreciated investment securities and $248,126,697 related to depreciated investment securities.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 3-31-09

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $1,036,705,696) | |

| including $4,354,480 of securities loaned (Note 2) | $839,658,221 |

| Repurchase agreement, at value (Cost $12,704,000) (Note 2) | 12,704,000 |

| Investments in affiliated issuers, at value (Cost $4,329,000) (Note 2) | 4,329,000 |

| | |

| Total investments, at value (Cost $1,053,738,696) | 856,691,221 |

| Cash | 1,636 |

| Receivable for investments sold | 5,713,512 |

| Receivable for fund shares sold | 649,574 |

| Dividends and interest receivable | 411,077 |

| Receivable for security lending income | 696 |

| Receivable due from adviser | 23,215 |

| Receivable from affiliates | 112,406 |

| Other assets | 140,583 |

| | |

| Total assets | 863,743,920 |

| |

| Liabilities | |

|

| Payable for investments purchased | 1,947,211 |

| Payable for fund shares repurchased | 392,661 |

| Payable upon return of securities loaned (Note 2) | 4,329,000 |

| Payable to affiliates | |

| Fund administration fees | 3,846 |

| Transfer agent fees | 247,335 |

| Distribution and service fees | 724 |

| Trustees fees | 57,598 |

| Other payables and accrued expenses | 429,059 |

| | |

| Total liabilities | 7,407,434 |

| |

| Net assets | |

|

| Capital paid-in | $2,246,970,419 |

| Undistributed net investment income | 36,984 |

| Accumulated net realized loss on investments and foreign currency transactions | (1,193,623,479) |

| Net unrealized depreciation on investments and translation of assets and | |

| liabilities in foreign currencies | (197,047,438) |

| | |

| Net assets | $856,336,486 |

See notes to financial statements

| |

| 16 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($192,740,994 ÷ 15,010,774 shares) | $12.84 |

| Class B ($27,393,276 ÷ 2,142,209 shares)1 | $12.79 |

| Class C ($14,857,674 ÷ 1,162,011 shares)1 | $12.79 |

| Class I ($132,954,391 ÷ 10,293,323 shares) | $12.92 |

| Class R ($59,791 ÷ 4,669 shares) | $12.81 |

| Class R1 ($59,097 ÷ 4,604 shares) | $12.84 |

| Class R2 ($57,284 ÷ 4,452 shares) | $12.87 |

| Class R3 ($57,204 ÷ 4,452 shares) | $12.85 |

| Class R4 ($57,364 ÷ 4,452 shares) | $12.88 |

| Class R5 ($57,524 ÷ 4,456 shares) | $12.91 |

| Class T ($71,544,028 ÷ 5,565,242 shares) | $12.86 |

| Class ADV ($16,553,048 ÷ 1,283,663 shares) | $12.90 |

| Class NAV ($399,944,811 ÷ 30,973,055 shares) | $12.91 |

| |

| Maximum public offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $13.52 |

| Class T (net asset value per share ÷ 95%)2 | $13.54 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 3-31-09

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $8,584,006 |

| Interest | 232,807 |

| Securities lending | 81,950 |

| Income from affiliated issuers | 2,387 |

| Less foreign taxes withheld | (76,368) |

| | |

| Total investment income | 8,824,782 |

| |

| Expenses | |

|

| Investment management fees (Note 5) | 5,933,984 |

| Distribution and service fees (Note 5) | 922,503 |

| Transfer agent fees (Note 5) | 1,322,535 |

| State registration fees (Note 5) | 46,695 |

| Fund administration fees (Note 5) | 84,588 |

| Printing and postage fees (Note 5) | 75,141 |

| Professional fees | 257,343 |

| Custodian fees | 80,329 |

| Registration and filing fees | 128,853 |

| Trustees’ fees (Note 6) | 40,418 |

| Miscellaneous | 20,842 |

| | |

| Total expenses | 8,913,231 |

| Less expense reductions (Note 5) | (768,354) |

| | |

| Net expenses | 8,144,877 |

| | |

| Net investment income | 679,905 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized loss on | |

| Investments in unaffiliated issuers | (310,987,081) |

| Foreign currency transactions | (245) |

| | (310,987,326) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | (143,822,317) |

| Translation of assets and liabilities in foreign currencies | 37 |

| | (143,822,280) |

| Net realized and unrealized loss | (454,809,606) |

| | |

| Decrease in net assets from operations | ($454,129,701) |

See notes to financial statements

| |

| 18 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 3-31-09 | 3-31-08 |

|

| Increase (decrease) in net assets | | |

| | | |

| From operations | | |

| Net investment income (loss) | $679,905 | ($245,270) |

| Net realized loss | (310,987,326) | (10,598,963) |

| Change in net unrealized appreciation (depreciation) | (143,822,280) | (9,639,351) |

| | | |

| Decrease in net assets resulting from operations | (454,129,701) | (20,483,584) |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class I | (128,337) | — |

| Class R5 | (43) | — |

| Class NAV | (498,835) | — |

| | | |

| Total distributions | (627,215) | — |

| | | |

| From Fund share transactions (Note 7) | 1,010,863,775 | 287,074,666 |

| | | |

| Total increase | 556,106,859 | 266,591,082 |

|

| Net assets | | |

| Beginning of year | 300,229,627 | 33,638,545 |

| | | |

| End of year | $856,336,486 | $300,229,627 |

| | | |

| Undistributed (distributions in excess of) | | |

| net investment income | $36,984 | ($15,461) |

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 19 |

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | |

| CLASS A SHARES Period ended | 3-31-091 | 3-31-082 | 3-31-072 | 3-31-062 | 3-31-052 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning | | | | | |

| of period | $20.91 | $20.44 | $19.07 | $15.64 | $14.83 |

| Net investment loss | (0.01)3 | (0.02) | (0.04) | (0.07)3 | (0.06) |

| Net realized and unrealized gain | | | | | |

| (loss) on investments | (8.06) | 0.49 | 1.41 | 3.50 | 0.87 |

| Total from investment operations | (8.07) | 0.47 | 1.37 | 3.43 | 0.81 |

| Net asset value, end of period | $12.84 | $20.91 | $20.44 | $19.07 | $15.64 |

| Total return (%)4,5 | (38.59) | 2.30 | 7.18 | 21.93 | 5.46 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $193 | $164 | $33 | $15 | $7 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.47 | 1.176 | 1.30 | 1.72 | 2.19 |

| Expenses net of fee waivers | 1.18 | 1.196 | 1.19 | 1.19 | 1.19 |

| Expenses net of all fee waivers and credits | 1.18 | 1.196 | 1.19 | 1.19 | 1.19 |

| Net investment loss | (0.04) | (0.27) | (0.38) | (0.42) | (0.43) |

| Portfolio turnover (%) | 1017 | 86 | 101 | 96 | 119 |

| |

1 After the close of business on April 25, 2008, holders of Original Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class A shares of the John Hancock Rainier Growth Fund. These shares were first offered on April 28, 2008. Additionally, the accounting and performance history of the Original Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class A.

2 Audited by previous Independent Registered Public Accounting Firm.

3 Based on the average of the shares outstanding.

4 Assumes dividend reinvestment and does not reflect the effect of sales charges.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Prior to the reorganization (see Note 9), the Fund was subject to a contractual expense reimbursement and recoupment plan. See Note 5 for more information on this plan.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 20 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| |

| CLASS B SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment loss2 | (0.09) |

| Net realized and unrealized loss on investments | (9.58) |

| Total from investment operations | (9.67) |

| Net asset value, end of period | $12.79 |

| Total return (%)3,4 | (43.05)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $27 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 2.826 |

| Expenses net of fee waivers | 2.056 |

| Expenses net of all fee waivers and credits | 2.046 |

| Net investment loss | (0.75)6 |

| Portfolio turnover (%) | 1017 |

| | |

1 Class B shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| |

| CLASS C SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning | |

| of period | $22.46 |

| Net investment loss2 | (0.09) |

| Net realized and unrealized loss on investments | (9.58) |

| Total from investment operations | (9.67) |

| Net asset value, end of period | $12.79 |

| Total return (%) 3,4 | (43.05)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $15 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 2.826 |

| Expenses net of fee waivers | 2.056 |

| Expenses net of all fee waivers and credits | 2.046 |

| Net investment loss | (0.77)6 |

| Portfolio turnover (%) | 1017 |

| |

1 Class C shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 21 |

F I N A N C I A L S T A T E M E N T S

| | | |

| CLASS I SHARES Period ended | 3-31-091 | 3-31-082 | 3-31-072,3 |

| |

| Per share operating performance | | | |

|

| Net asset value, beginning of period | $20.98 | $20.44 | $20.94 |

| Net investment income4 | 0.04 | —5 | —5 |

| Net realized and unrealized gain (loss) on investments | (8.09) | 0.54 | (0.50) |

| Total from investment operations | (8.05) | 0.54 | (0.50) |

| Less distributions | | | |

| From net investment income | (0.01) | — | — |

| Net asset value, end of period | $12.92 | $20.98 | $20.44 |

| Total return (%)6 | (38.36) | 2.64 | (2.39)7 |

| |

| Ratios and supplemental data | | | |

|

| Net assets, end of period (in millions) | $133 | $136 | $537 |

| Ratios (as a percentage of average net assets): | | | |

| Expenses before reductions | 0.86 | 0.928 | 1.009 |

| Expenses net of fee waivers | 0.86 | 0.948 | 0.949 |

| Expenses net of all fee waivers and credits | 0.86 | 0.948 | 0.949 |

| Net investment income (loss) | 0.22 | (0.02) | 0.159 |

| Portfolio turnover (%) | 10111 | 86 | 10110 |

| | |

1 After the close of business on April 25, 2008, holders of Institutional Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class I shares of the John Hancock Rainier Growth Fund. These shares were first offered on April 28, 2008. Additionally, the accounting and performance history of the Institutional Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class I.

2 Audited by previous Independent Registered Public Accounting Firm.

3 Class I shares began operations on 2-20-07.

4 Based on the average of the shares outstanding.

5 Less than (0.01) per share.

6 Assumes dividend reinvestment.

7 Total returns would have been lower had certain expenses not been reduced during the periods shown.

8 Prior to the reorganization (see Note 9), the Fund was subject to a contractual expense reimbursement and recoupment plan. See Note 5 for more information on this plan.

9 Annualized.

10 Annualized based on investments held for a full year.

11 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| |

| CLASS R SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment loss2 | (0.12) |

| Net realized and unrealized loss on investments | (9.53) |

| Total from investment operations | (9.65) |

| Net asset value, end of period | $12.81 |

| Total return (%)3,4 | (42.97)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | —6 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 8.827 |

| Expenses net of fee waivers | 1.897 |

| Expenses net of all fee waivers and credits | 1.897 |

| Net investment loss | (0.75)7 |

| Portfolio turnover (%) | 1018 |

| | |

1 Class R shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 22 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| |

| CLASS R1 SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment loss2 | (0.08) |

| Net realized and unrealized loss on investments | (9.54) |

| Total from investment operations | (9.62) |

| Net asset value, end of period | $12.84 |

| Total return (%)3,4 | (42.83)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | —6 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 8.707 |

| Expenses net of fee waivers | 1.647 |

| Expenses net of all fee waivers and credits | 1.647 |

| Net investment loss | (0.50)7 |

| Portfolio turnover (%) | 1018 |

| | |

1 Class R1 shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| |

| CLASS R2 SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment loss2 | (0.04) |

| Net realized and unrealized loss on investments | (9.55) |

| Total from investment operations | (9.59) |

| Net asset value, end of period | $12.87 |

| Total return (%)3,4 | (42.70)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | —6 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 8.427 |

| Expenses net of fee waivers | 1.397 |

| Expenses net of all fee waivers and credits | 1.397 |

| Net investment loss | (0.25)7 |

| Portfolio turnover (%) | 1018 |

| | |

1 Class R2 shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 23 |

F I N A N C I A L S T A T E M E N T S

| |

| CLASS R3 SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment loss2 | (0.06) |

| Net realized and unrealized loss on investments | (9.55) |

| Total from investment operations | (9.61) |

| Net asset value, end of period | $12.85 |

| Total return (%)3,4 | (42.79)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | —6 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 8.577 |

| Expenses net of fee waivers | 1.547 |

| Expenses net of all fee waivers and credits | 1.547 |

| Net investment loss | (0.40)7 |

| Portfolio turnover (%) | 1018 |

| |

1 Class R3 shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| |

| CLASS R4 SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment loss2 | (0.02) |

| Net realized and unrealized loss on investments | (9.56) |

| Total from investment operations | (9.58) |

| Net asset value, end of period | $12.88 |

| Total return (%)3,4 | (42.65)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | —6 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 8.267 |

| Expenses net of fee waivers | 1.247 |

| Expenses net of all fee waivers and credits | 1.247 |

| Net investment loss | (0.10)7 |

| Portfolio turnover (%) | 1018 |

| | |

1 Class R4 shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 24 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| |

| CLASS R5 SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment income2 | 0.03 |

| Net realized and unrealized loss on investments | (9.57) |

| Total from investment operations | (9.54) |

| Less distributions | |

| From net investment income | (0.01) |

| Net asset value, end of period | $12.91 |

| Total return (%)3,4 | (42.48)5 |

|

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | —6 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 7.957 |

| Expenses net of fee waivers | 0.947 |

| Expenses net of all fee waivers and credits | 0.947 |

| Net investment income | 0.207 |

| Portfolio turnover (%) | 1018 |

| | |

1 Class R5 shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| |

| CLASS T SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $16.59 |

| Net investment loss2 | (0.05) |

| Net realized and unrealized loss on investments | (3.68) |

| Total from investment operations | (3.73) |

| Net asset value, end of period | $12.86 |

| Total return (%)3,4 | (22.48)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $72 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 2.076 |

| Expenses net of fee waivers | 1.996 |

| Expenses net of all fee waivers and credits | 1.986 |

| Net investment loss | (0.74)6 |

| Portfolio turnover (%) | 1017 |

| | |

1 Class T shares began operations on 10-6-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 25 |

F I N A N C I A L S T A T E M E N T S

| |

| CLASS ADV SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment loss2 | (0.01) |

| Net realized and unrealized loss on investments | (9.55) |

| Total from investment operations | (9.56) |

| Net asset value, end of period | $12.90 |

| Total return (%)3 | (42.56)4 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $17 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 1.145 |

| Expenses net of fee waivers | 1.145 |

| Expenses net of all fee waivers and credits | 1.145 |

| Net investment loss | (0.04)5 |

| Portfolio turnover (%) | 1016 |

| |

1 Class ADV shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Not annualized.

5 Annualized.

6 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| |

| CLASS NAV SHARES Period ended | 3-31-091 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $22.46 |

| Net investment gain2 | 0.04 |

| Net realized and unrealized loss on investments | (9.57) |

| Total from investment operations | (9.53) |

| Less distributions | |

| From net investment income | (0.02) |

| Net asset value, end of period | $12.91 |

| Total return (%)3 | (42.44)4 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $400 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 0.835 |

| Expenses net of fee waivers | 0.835 |

| Expenses net of all fee waivers and credits | 0.835 |

| Net investment income | 0.265 |

| Portfolio turnover (%) | 1016 |

| | |

1 Class NAV shares began operations on 4-28-08.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment.

4 Not annualized.

5 Annualized.

6 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 26 | Rainier Growth Fund | Annual report |

Notes to financial statements

Note 1

Organization

John Hancock Rainier Growth Fund (the Fund) is a diversified series of John Hancock Funds III (the Trust). The Trust was established as a Massachusetts business trust on June 9, 2005. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end investment management company. The investment objective of the Fund is to seek to maximize long-term capital appreciation.

John Hancock Life Insurance Company (U.S.A.) (John Hancock USA) is an indirect wholly owned subsidiary of Manulife Financial Corporation (MFC), a publicly traded company. MFC and its subsidiaries are known collectively as “Manulife Financial.”

John Hancock Investment Management Services, LLC (the Adviser), a Delaware limited liability company controlled by John Hancock USA, serves as investment adviser for the Trust and John Hancock Funds, LLC (the Distributor), a Delaware limited liability company, an affiliate of the Adviser, serves as principal underwriter.

The Board of Trustees has authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B, Class C, Class I, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV shares. Class A, Class B and Class C shares are open to all retail investors. Class I shares are offered without any sales charge to various institutional and certain individual investors. Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Class T shares are available to investors who acquired Class T shares as a result of the reorganization of the John Hancock Technology Fund into the Fund or such other investors as permitted by the fund, in the fund’s sole discretion as it deems appropriate. Class ADV shares are available to investors who acquired Class A shares as a result of the reorganization of the Rainier Large Cap Growth

Equity Portfolio (the Predecessor Fund) into the Fund or such other investors as permitted by the fund, in the fund’s sole discretion as it deems appropriate. Class NAV shares are sold to affiliated funds of funds, which are funds of funds within the John Hancock funds complex. The shares of each class represent an interest in the same portfolio of investments of the Fund, and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Board of Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bear distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

The Fund is the accounting and performance successor to the Predecessor Fund. On April 28, 2008, the Fund acquired substantially all the assets and assumed the liabilities of the Predecessor Fund pursuant to an agreement and plan of reorganization, in exchange for Class A and Class I shares of the Fund.

The Adviser and other affiliates of John Hancock USA owned 4,452, 4,452, 4,452, 4,452, 4,452, and 4,456 shares of beneficial interest of Class R, Class R1, Class R2, Class R3, Class R4 and Class R5, respectively, of the Fund on March 31, 2009.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

| |

| Annual report | Rainier Growth Fund | 27 |

Security valuation

Investments are stated at value as of the close of the regular trading on New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. Equity securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated price if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Equity and debt obligations, for which there are no prices available from an independent pricing service, are valued based on broker quotes or fair valued as described below. Short-term debt investments that have a remaining maturity of 60 days or less are valued at amortized cost, and thereafter assume a constant amortization to maturity of any discount or premium, which approximates market value. John Hancock Cash Investment Trust (JHCIT), an affiliate of the Adviser, is valued at its net asset value each business day.

Other portfolio securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Fund’s Pricing Committee in accordance with procedures adopted by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of the Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic and market conditions, interest rates, investor perceptions and market liquidity.

The Fund adopted Statement of Financial Accounting Standards No. 157 (FAS 157), Fair Value Measurements, effective with the beginning of the Fund’s fiscal year. FAS 157 established a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Prices determined using other significant observable inputs. Observable inputs are inputs that other market participants would use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others.

Level 3 – Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity for an investment, unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| |

| 28 | Rainier Growth Fund | Annual report |

The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2009:

| | |

| | INVESTMENTS IN | OTHER FINANCIAL |

| VALUATION INPUTS | SECURITIES | INSTRUMENTS* |

|

| Level 1 — Quoted Prices | $842,226,578 | $— |

|

| Level 2 — Other Significant Observable Inputs | 12,704,000 | — |

|

| Level 3 — Significant Unobservable Inputs | 1,760,643 | — |

| Total | $856,691,221 | $— |

*Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures, forwards and swap contracts, which are stated at value based upon futures’ settlement prices, foreign currency exchange forward rates and swap prices.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | |

| | INVESTMENTS IN | OTHER FINANCIAL |

| | SECURITIES | INSTRUMENTS |

|

| Balance as of March 31, 2008 | $— | $— |

|

| Accrued discounts/premiums | — | — |

|

| Realized gain (loss) | (16) | — |

|

| Change in unrealized appreciation (depreciation) | (7,688,919) | — |

|

| Net purchases (sales) | — | — |

|

| Acquired from mergers (see Note 9) | 9,449,578 | — |

| Balance as of March 31, 2009 | $1,760,643 | $— |

Security transactions and related investment income

Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-date or when the Fund becomes aware of the dividends from cash collections. Discounts/premiums are accreted/ amortized for financial reporting purposes. Non-cash dividends are recorded at the fair market value of the securities received. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful, based upon consistently applied procedures. The Fund uses identified cost method for determining realized gain or loss on inves tments for both financial statement and federal income tax reporting purposes.

Securities lending

The Fund may lend portfolio securities from time to time in order to earn additional income. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends paid by the issuer of securities and to participate in any changes in their value. On the settlement date of the loan, the Fund receives cash collateral against the loaned securities and maintain the cash collateral in an amount not less than 102% of the market value of the loaned securities for U.S. equity and corporate securities and 105% for foreign equity and corporate securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required cash collateral is delivered to the Fund on the next business day. Cash collateral received is invested in JHCIT. The Fund may receive compensation for lending its securities either in the form of fees and/or by retaining a portion of interest on the investment of any cash received as collateral. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund could experience delays and costs in recovering the securities

| |

| Annual report | Rainier Growth Fund | 29 |

loaned or in gaining access to the collateral. The Fund bears the risk in the event that invested collateral is not sufficient to meet obligations due on loans.

Line of credit

The Fund has entered into an agreement which enables it to participate in a $150 million unsecured committed line of credit with State Street Corporation. Borrowings will be made solely to temporarily finance the repurchase of capital shares. Interest is charged to the Fund based on its borrowings at a rate per annum equal to the Federal Funds rate plus 0.50%. In addition, a commitment fee of 0.08% per annum, payable at the end of each calendar quarter, based on the average daily-unused portion of the line of credit, is charged to the Fund on a prorated basis based on average net assets. Prior to February 19, 2009, the commitment fee was 0.05% per annum. For the year ended March 31, 2009, there were no borrowings under the line of credit.

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft, including any costs or expenses associated with the overdraft. The Custodian has a lien, security interest or security entitlement in any Fund property, that is not segregated, to the maximum extent permitted by law to the extent of any overdraft.

Repurchase agreements

The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement through its custodian, it receives delivery of securities, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the market value is generally at least 102% of the repurchase amount. The Fund will take constructive receipt of all securities underlying the repurchase agreements it has entered into until such agreements expire. If the seller defaults, the Fund would suffer a loss to the extent that proceeds from the sale of underlying securities were less than the repurchase amount. The Fund may enter into repurchase agreements maturing within seven days with domestic dealers, banks or other financial institutions deemed to be creditworthy by the Adviser. Collateral for certain tri-party repurchase agreements is held at the custodian bank in a segregated account for the benefi t of the Fund and the counterparty.

Expenses

The majority of expenses are directly identifiable to an individual fund. Trust expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage fees for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Foreign currency translation

The books and records of the Fund are maintained in U.S. Dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the disposition of forward foreign currency exchange contracts and foreign currencies, and the difference between the amount of net investment income accrued and the U.S.

| |

| 30 | Rainier Growth Fund | Annual report |

dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

The Fund may be subject to capital gains and repatriation taxes imposed by certain countries in which it invests. Such taxes are generally based upon income and/or capital gains earned or repatriated. Taxes are accrued based upon net investment income, net realized gains and net unrealized appreciation.

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has $967,402,549 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforward expires as follows: March 31, 2010 — $499,103,584, March 31, 2011 — $260,334,070, March 31, 2012 — $86,800,122, March 31, 2016 — $25,380,418 and March 31, 2017 —$95,784,355. We estimate that $803,569,744 of the loss carryforwards, which were acquired on October 3, 2008, in mergers with John Hancock Core Equity Fund, John Hancock Growth Trends Fund and John Hancock Technology Fund, will likely expire unused because of limitations.

Net capital losses of $185,491,246 that are attributable to security transactions incurred after October 31, 2008, are treated as arising on April 1, 2009, the first day of the Fund’s next taxable year.

As of March 31, 2009, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. Each of the Fund’s federal tax returns filed in the 3-year period ended March 31, 2009 remains subject to examination by the Internal Revenue Service.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Fund generally declares and pays dividends and capital gains distributions, if any, annually. There were no distributions during the year ended March 31, 2008. During the year ended March 31, 2009, the tax character of distributions paid was as follows: ordinary income $627,215. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

As of March 31, 2009, the components of distributable earnings on a tax basis included $42,366 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period. Permanent book-tax differences are primarily attributable to expiration of capital loss carryforwards and merger related transactions.

New accounting pronouncements