| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

|

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

|

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael J. Leary |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4490 |

| |

| Date of fiscal year end: | March 31 |

| |

| |

| Date of reporting period: | March 31, 2010 |

ITEM 1. SCHEDULE OF INVESTMENTS

Management’s discussion of

Fund performance

By Rainier investment Management, inc.

In a dramatic rebound, large-company growth stocks generated extremely strong gains during the past year in response to better macroeconomic and fundamental factors, which significantly improved investor demand for equities overall. For the 12 months ended March 31, 2010, John Hancock Rainier Growth Fund’s Class A shares posted a total return of 42.60% at net asset value. In comparison, the average large-cap growth fund returned 48.34%, as tracked by Morningstar, Inc., the Russell 1000 Growth Index, the Fund’s benchmark, returned 49.75% and the Standard & Poor’s 500 Index returned 49.77%.

Technology was the Fund’s biggest contributor both to absolute and relative performance, where our larger-than-benchmark positions in Apple, Inc. and Cognizant Technology Solutions Corp. proved beneficial. Some advantageous picks among energy stocks — namely Devon Energy Corp. and Transocean Ltd. — also helped, as did our decision not to own Exxon Mobil Corp., a major component of the Russell 1000 Growth Index. We sold Devon Energy and Transocean to lock in gains. Industrial and materials companies Precision Castparts Corp. and Freeport-McMoRan Copper & Gold Inc. also topped our list of best performers. The biggest detractor from the Fund’s relative performance was the consumer discretionary sector, within which were some of the best and worst performers. The Fund’s best contributor relative to the benchmark index for the year was Amazon. com, Inc., while other picks — specifically Lowe’s Companies, Inc. and Best Buy C o., Inc., the latter of which we sold — acted as drags. Overall the health care sector was a detractor from performance although results were mixed. On the plus side, holdings in Express Scripts Inc. and Alcon Inc. were among the Fund’s top 10 performers for the year. We took profits and sold Alcon. However, Illumina Inc., St. Jude Medical Inc., Abbott Laboratories and Gilead Sciences Inc. trailed the market. We sold Illumina and St. Jude. Our positioning within the best-performing sector of the market, financial services, also hurt, as did owning global power company The AES Corp.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 6 | Rainier Growth Fund | Annual report |

A look at performance

Total returns for the period ended March 31, 2010

| | | | | | | | | |

| | Average annual returns (%) | | Cumulative returns (%) | |

| | with maximum sales charge (POP) | | | with maximum sales charge (POP) | |

| | 1-year | 5-year | 10-year | Since

inception 1 | | 1-year | 5-year | 10-year | Since

inception 1 |

| |

|

| Class A2 | 35.43 | 2.15 | — | –3.64 | | 35.43 | 11.24 | — | –30.43 |

| Class B2 | 36.52 | 1.70 | — | –4.29 | | 36.52 | 8.79 | — | –34.93 |

| Class C2 | 40.52 | 2.07 | — | –4.29 | | 40.52 | 10.79 | — | –34.93 |

| Class i2,3 | 43.20 | 3.55 | — | –2.83 | | 43.20 | 19.05 | — | –24.47 |

| Class R12,3 | 41.98 | 2.47 | — | –3.92 | | 41.98 | 12.96 | — | –32.37 |

| Class R32,3 | 42.18 | 2.57 | — | –3.82 | | 42.18 | 13.55 | — | –31.68 |

| Class R42,3 | 42.70 | 2.89 | — | –3.52 | | 42.70 | 15.29 | — | –29.63 |

| Class R52,3 | 43.07 | 3.19 | — | –3.24 | | 43.07 | 17.01 | — | –27.54 |

| Class T2,3 | 34.71 | 1.46 | — | –4.31 | | 34.71 | 7.50 | — | –35.03 |

| Class AdV 2,3 | 42.87 | 3.29 | — | –3.07 | | 42.87 | 17.56 | — | –26.31 |

| Class NAV 2,3 | 43.38 | 3.63 | — | –2.74 | | 43.38 | 19.52 | — | –23.81 |

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charge on Class A and Class T shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable for Class I, R1, R3, R4, R5, ADV and NAV shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 7-31-10. The net expenses are as follows: Class A — 1.35%, Class B — 2.10%, Class C — 2.10%, Class R1 — 1.80%, Class R3 — 1.65%, Class R4 —1.35%, Class R5 — 1.05% and Class T — 1.98%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.47%, Class B — 2.82%, Class C — 2.82%, Class R1 — 8.70%, Class R3 — 8.57%, Class R4 — 8.26%, Class R5 — 7.95% and Class T — 2.07%. For other classes, the net expenses equ al the gross expenses and are as follows: Class I — 0.86%, Class ADV —1.14% and Class NAV — 0.83%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

1 From 6-15-00.

2 On 4-25-08, through a reorganization, the Fund acquired all of the assets of the Rainier Large Cap Growth Equity Portfolio (the predecessor fund). On that date, the predecessor fund offered its Original share class and Institutional share class in exchange for Class A and Class I shares, respectively, of the John Hancock Rainier Growth Fund. The inception date for Class A, B, C, I, R1, R3, R4, R5, ADV and NAV shares of the John Hancock Rainier Growth Fund is 4-28-08. The predecessor fund’s Original share class returns have been recalculated to reflect the gross fees and expenses of Class A shares. The returns for Class B, C, I, R1, R3, R4, R5, ADV and NAV prior to 4-28-08 are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class B, C, I, R1, R3, R4, R5, ADV, and NAV, respectively. Class T shares were first offered 10-6-08; the returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class T shares.

3 For certain types of investors, as described in the Fund’s Class I, R1, R3, R4, R5, T, ADV and NAV shares prospectuses.

| |

| Annual report | Rainier Growth Fund | 7 |

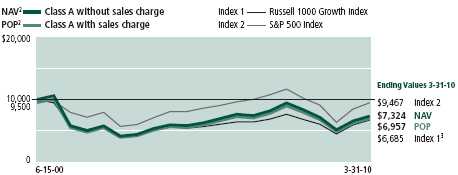

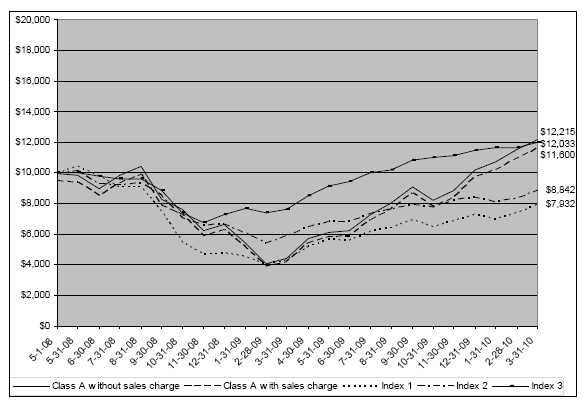

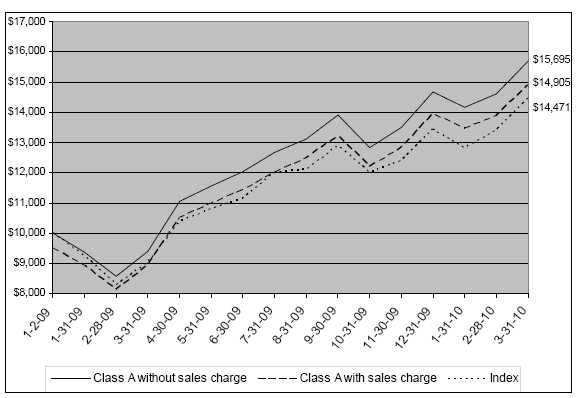

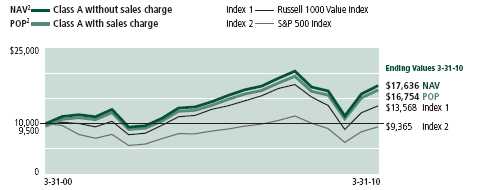

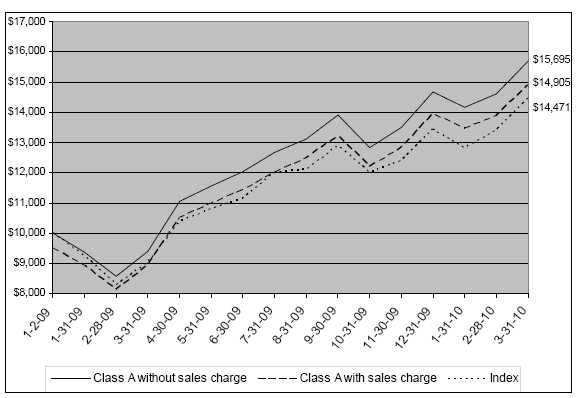

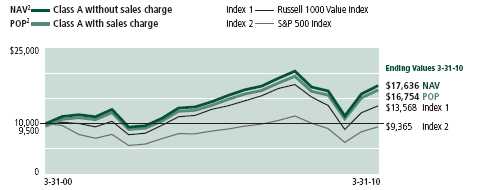

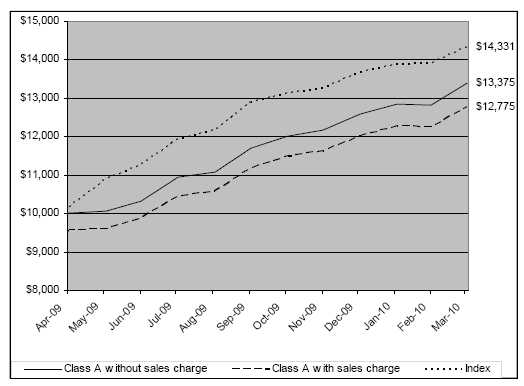

A look at performance

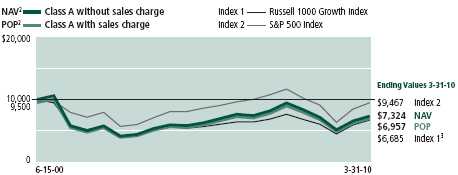

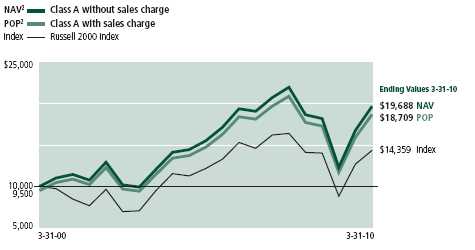

growth of $10,000

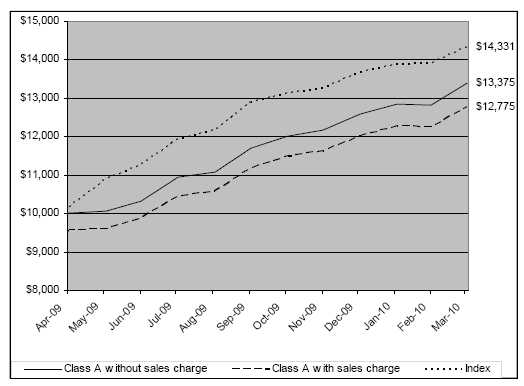

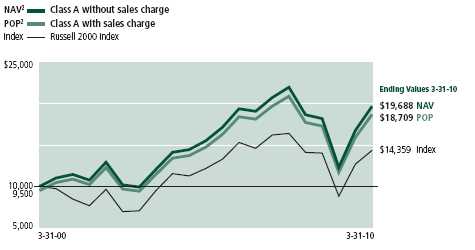

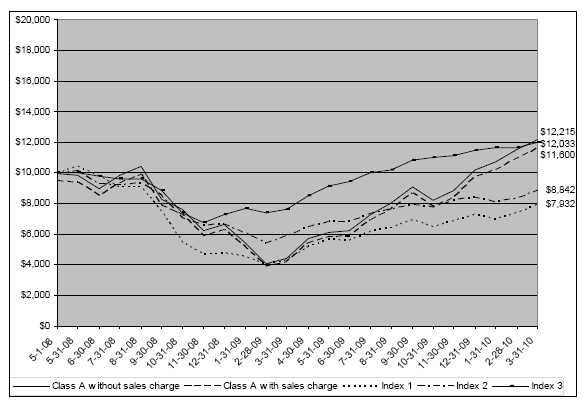

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Rainier Growth Fund Class A1 shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | | | | |

| | | Without sales | With maximum | | |

| | Period beginning | charge | sales charge | Index 13 | Index 2 |

|

| Class B1,4 | 6-15-00 | $6,507 | $6,507 | $6,685 | $9,467 |

|

| Class C1,4 | 6-15-00 | 6,507 | 6,507 | 6,685 | 9,467 |

|

| Class I1,5 | 6-15-00 | 7,553 | 7,553 | 6,685 | 9,467 |

|

| Class R11,5 | 6-15-00 | 6,763 | 6,763 | 6,685 | 9,467 |

|

| Class R31,5 | 6-15-00 | 6,832 | 6,832 | 6,685 | 9,467 |

|

| Class R41,5 | 6-15-00 | 7,037 | 7,037 | 6,685 | 9,467 |

|

| Class R51,5 | 6-15-00 | 7,246 | 7,246 | 6,685 | 9,467 |

|

| Class T1,5 | 6-15-00 | 6,840 | 6,497 | 6,685 | 9,467 |

|

| Class ADV1,5 | 6-15-00 | 7,369 | 7,369 | 6,685 | 9,467 |

|

| Class NAV1,5 | 6-15-00 | 7,619 | 7,619 | 6,685 | 9,467 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, C, I, R1, R3, R4, R5, T, ADV and NAV shares, respectively, as of 3-31-10. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 1000 Growth Index — Index 1 — is an unmanaged index containing those securities in the Russell 1000 Index with a greater-than-average growth orientation.

S&P 500 Index — Index 2 — is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 On 4-25-08, through a reorganization, the Fund acquired all of the assets of the Rainier Large Cap Growth Equity Portfolio (the predecessor fund). On that date, the predecessor fund offered its Original share class and Institutional share class in exchange for Class A and Class I shares, respectively, of the John Hancock Rainier Growth Fund. The inception date for Class A, B, C, I, R1, R3, R4, R5, ADV and NAV shares of the John Hancock Rainier Growth Fund is 4-28-08. The predecessor fund’s Original share class returns have been recalculated to reflect the gross fees and expenses of Class A shares. The returns for Class B, C, I, R1, R3, R4, R5, ADV and NAV prior to 4-28-08 are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class B, C, I, R1, R3, R4, R5, ADV, and NAV, respectively. Class T shares were first offered 10-6-08; the returns prior to this date ar e those of Class A shares that have been recalculated to apply the gross fees and expenses of Class T shares.

2 NAV represents net asset value and POP represents public offering price.

3 Index 1 as of closest month end to fund inception date.

4 The contingent deferred sales charge, if any, is not applicable.

5 For certain types of investors, as described in the Fund’s Class I, R1, R3, R4, R5, T, ADV and NAV shares prospectuses.

| |

| 8 | Rainier Growth Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on October 1, 2009 with the same investment held until March 31, 2010.

| | | |

| | Account value | Ending value | Expenses paid during period |

| | on 10-1-09 | on 3-31-10 | ended 3-31-101 |

|

| Class A | $1,000.00 | $1,117.10 | $7.55 |

|

| Class B | 1,000.00 | 1,113.20 | 11.33 |

|

| Class C | 1,000.00 | 1,113.20 | 12.17 |

|

| Class I | 1,000.00 | 1,119.90 | 4.70 |

|

| Class R1 | 1,000.00 | 1,115.00 | 9.49 |

|

| Class R3 | 1,000.00 | 1,115.40 | 8.70 |

|

| Class R4 | 1,000.00 | 1,117.30 | 7.13 |

|

| Class R5 | 1,000.00 | 1,118.70 | 5.55 |

|

| Class T | 1,000.00 | 1,115.60 | 9.02 |

|

| Class ADV | 1,000.00 | 1,119.00 | 6.02 |

|

| Class NAV | 1,000.00 | 1,120.50 | 4.12 |

|

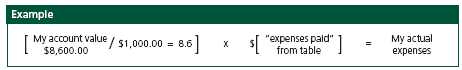

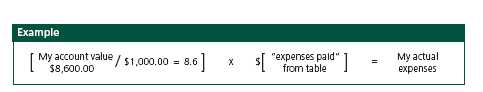

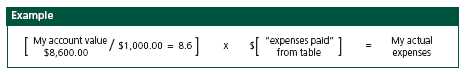

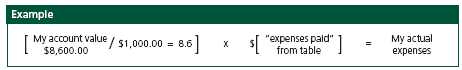

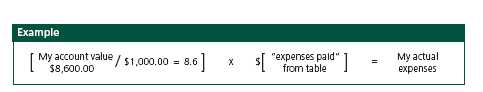

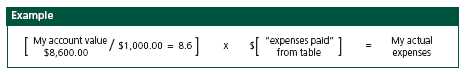

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at March 31, 2010, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | Rainier Growth Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on October 1, 2009, with the same investment held until March 31, 2010. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during period |

| | on 10-1-09 | on 3-31-10 | ended 3-31-101 |

|

| Class A | $1,000.00 | $1,017.80 | $7.19 |

|

| Class B | 1,000.00 | 1,014.20 | 10.80 |

|

| Class C | 1,000.00 | 1,013.40 | 11.60 |

|

| Class I | 1,000.00 | 1,020.50 | 4.48 |

|

| Class R1 | 1,000.00 | 1,016.00 | 9.05 |

|

| Class R3 | 1,000.00 | 1,016.70 | 8.30 |

|

| Class R4 | 1,000.00 | 1,018.20 | 6.79 |

|

| Class R5 | 1,000.00 | 1,019.70 | 5.29 |

|

| Class T | 1,000.00 | 1,016.40 | 8.60 |

|

| Class ADV | 1,000.00 | 1,019.20 | 5.74 |

|

| Class NAV | 1,000.00 | 1,021.00 | 3.93 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.43%, 2.15%, 2.31%, 0.89%, 1.80%, 1.65%, 1.35%, 1.05%, 1.71%, 1.14% and 0.78% for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class T, Class ADV and Class NAV, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| |

| 10 | Rainier Growth Fund | Annual report |

Portfolio summary

| | | | |

| Top 10 Holdings1 | | | | |

|

| Apple, Inc. | 4.2% | | Celgene Corp. | 2.1% |

| |

|

| Cisco Systems, Inc. | 3.2% | | Oracle Corp. | 2.0% |

| |

|

| Google, Inc., Class A | 3.0% | | BlackRock, Inc. | 1.9% |

| |

|

| Microsoft Corp. | 2.8% | | Freeport-McMoRan | |

| | Copper & Gold, Inc. | 1.8% |

| Visa, Inc., Class A | 2.7% | |

|

| | | |

| Amazon.com, Inc. | 2.5% | | | |

| | |

| |

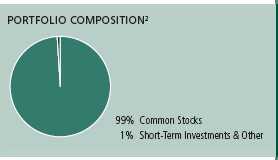

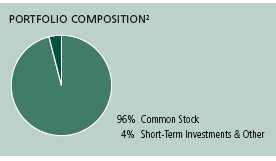

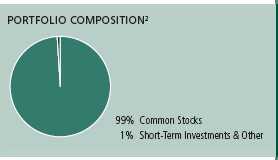

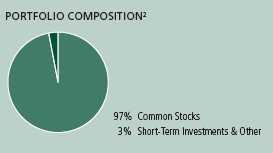

| Sector Composition2,3 | | | | |

|

| Information Technology | 31% | | Materials | 5% |

| |

|

| Consumer Discretionary | 16% | | Energy | 3% |

| |

|

| Health Care | 15% | | Telecommunication Services | 2% |

| |

|

| Industrials | 12% | | Utilities | 1% |

| |

|

| Consumer Staples | 7% | | Short-Term Investments and Other | 1% |

| |

|

| Financials | 7% | | | |

| | |

1 As a percentage of net assets on March 31, 2010. Excludes cash and cash equivalents.

2 As a percentage of net assets on March 31, 2010.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| Annual report | Rainier Growth Fund | 11 |

Fund’s investments

As of 3-31-10

| | |

| | Shares | Value |

| Common Stocks 99.02% | | $1,448,152,255 |

|

| (Cost $1,198,625,245) | | |

| Consumer Discretionary 15.57% | | 227,708,823 |

| | | |

| Hotels, Restaurants & Leisure 3.29% | | |

|

| Carnival Corp. | 383,080 | 14,894,150 |

|

| Marriott International, Inc., Class A | 359,990 | 11,346,885 |

|

| McDonald’s Corp. | 327,415 | 21,845,129 |

| | | |

| Internet & Catalog Retail 2.49% | | |

|

| Amazon.com, Inc. (I) | 268,850 | 36,491,010 |

| | | |

| Media 3.62% | | |

|

| DIRECTV, Class A (I) | 265,225 | 8,967,257 |

|

| Dreamworks Animation SKG, Inc. (I) | 286,470 | 11,284,053 |

|

| The Walt Disney Company | 513,540 | 17,927,681 |

|

| Time Warner, Inc. | 471,175 | 14,733,642 |

| | | |

| Multiline Retail 1.95% | | |

|

| Kohl’s Corp. (I) | 264,790 | 14,505,196 |

|

| Target Corp. | 266,760 | 14,031,576 |

| | | |

| Specialty Retail 3.18% | | |

|

| Limited Brands, Inc. | 644,100 | 15,857,742 |

|

| Lowe’s Companies, Inc. | 664,980 | 16,119,115 |

|

| Tiffany & Company | 306,010 | 14,532,415 |

| | | |

| Textiles, Apparel & Luxury Goods 1.04% | | |

|

| NIKE, Inc., Class B | 206,435 | 15,172,972 |

| | | |

| Consumer Staples 7.45% | | 109,019,313 |

| | | |

| Beverages 1.54% | | |

|

| PepsiCo, Inc. | 339,965 | 22,492,084 |

| | | |

| Food Products 0.98% | | |

|

| General Mills, Inc. | 203,395 | 14,398,332 |

| | | |

| Household Products 2.39% | | |

|

| Church & Dwight Company, Inc. | 192,825 | 12,909,634 |

|

| Colgate-Palmolive Company | 257,690 | 21,970,649 |

| | | |

| Personal Products 0.84% | | |

|

| Avon Products, Inc. | 364,415 | 12,342,736 |

| | | |

| Tobacco 1.70% | | |

|

| Philip Morris International, Inc. | 477,490 | 24,905,878 |

See notes to financial statements

| |

12 | Rainier Growth Fund | Annual report |

| | |

| | Shares | Value |

| Energy 3.02% | | $44,134,864 |

| | |

| Energy Equipment & Services 3.02% | | |

|

| Cameron International Corp. (I) | 514,280 | 22,042,041 |

|

| Halliburton Company | 733,250 | 22,092,823 |

| | | |

| Financials 7.08% | | 103,554,954 |

| | | |

| Diversified Financial Services 7.08% | | |

|

| BlackRock, Inc. | 126,890 | 27,631,566 |

|

| Franklin Resources, Inc. | 159,915 | 17,734,574 |

|

| IntercontinentalExchange, Inc. (I) | 186,965 | 20,973,734 |

|

| JPMorgan Chase & Company | 306,520 | 13,716,770 |

|

| The Goldman Sachs Group, Inc. | 137,715 | 23,498,310 |

| | | |

| Health Care 15.40% | | 225,177,761 |

| | | |

| Biotechnology 5.18% | | |

|

| Alexion Pharmaceuticals, Inc. (I) | 217,580 | 11,829,825 |

|

| Amgen, Inc. (I) | 360,000 | 21,513,600 |

|

| Celgene Corp. (I) | 500,035 | 30,982,171 |

|

| Gilead Sciences, Inc. (I) | 62,805 | 2,856,371 |

|

| Vertex Pharmaceuticals, Inc. (I) | 208,980 | 8,541,013 |

| | | |

| Health Care Equipment & Supplies 1.28% | | |

|

| Medtronic, Inc. | 416,390 | 18,750,042 |

| | | |

| Health Care Providers & Services 2.36% | | |

|

| Aveta, Inc. (I)(S) | 97,210 | 486,050 |

|

| Express Scripts, Inc. (I) | 210,330 | 21,403,181 |

|

| UnitedHealth Group, Inc. | 384,440 | 12,559,655 |

| | | |

| Life Sciences Tools & Services 0.65% | | |

|

| QIAGEN NV (I)(L) | 411,720 | 9,465,443 |

| | | |

| Pharmaceuticals 5.93% | | |

|

| Abbott Laboratories | 387,960 | 20,437,733 |

|

| Allergan, Inc. | 182,455 | 11,917,961 |

|

| Merck & Company, Inc. | 500,870 | 18,707,495 |

|

| Shire PLC, ADR (L) | 213,980 | 14,114,121 |

|

| Teva Pharmaceutical Industries, Ltd., SADR | 342,630 | 21,613,100 |

| | | |

| Industrials 11.61% | | 169,786,067 |

| | | |

| Aerospace & Defense 2.40% | | |

|

| Precision Castparts Corp. | 155,000 | 19,640,050 |

|

| United Technologies Corp. | 210,445 | 15,490,856 |

| | | |

| Air Freight & Logistics 0.69% | | |

|

| Expeditors International of Washington, Inc. (L) | 273,290 | 10,089,867 |

| | | |

| Electrical Equipment 1.57% | | |

|

| ABB, Ltd. SADR (L) | 540,060 | 11,794,910 |

|

| AMETEK, Inc. | 270,110 | 11,198,761 |

| | | |

| Industrial Conglomerates 1.49% | | |

|

| 3M Company | 260,805 | 21,795,474 |

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 13 |

| | |

| | Shares | Value |

| Machinery 4.41% | | |

|

| Cummins, Inc. (L) | 396,800 | $24,581,760 |

|

| Danaher Corp. | 225,870 | 18,049,272 |

|

| Deere & Company | 367,280 | 21,838,469 |

| | | |

| Road & Rail 1.05% | | |

|

| CSX Corp. | 300,720 | 15,306,648 |

| | | |

| Information Technology 31.62% | | 462,379,281 |

| | | |

| Communications Equipment 6.45% | | |

|

| BancTec, Inc. (I)(R) | 197,026 | 1,293,918 |

|

| Cisco Systems, Inc. (I) | 1,770,940 | 46,097,568 |

|

| Juniper Networks, Inc. (I)(L) | 430,535 | 13,208,814 |

|

| QUALCOMM, Inc. | 532,395 | 22,355,266 |

|

| Research In Motion, Ltd. (I) | 153,115 | 11,322,854 |

| | | |

| Computers & Peripherals 6.86% | | |

|

| Apple, Inc. (I) | 264,110 | 62,047,362 |

|

| EMC Corp. (I) | 1,435,785 | 25,901,561 |

|

| NetApp, Inc. (I) | 381,920 | 12,435,315 |

| | | |

| Internet Software & Services 2.95% | | |

|

| Google, Inc., Class A (I) | 76,090 | 43,143,791 |

| | | |

| IT Services 3.31% | | |

|

| Cognizant Technology Solutions Corp., Class A (I) | 177,460 | 9,046,911 |

|

| Visa, Inc., Class A | 431,885 | 39,314,492 |

| | | |

| Semiconductors & Semiconductor Equipment 4.20% | | |

|

| Broadcom Corp., Class A | 355,535 | 11,796,651 |

|

| Intel Corp. | 905,360 | 20,153,314 |

|

| Marvell Technology Group, Ltd. (I) | 1,046,010 | 21,317,684 |

|

| NVIDIA Corp. (I)(L) | 464,775 | 8,077,790 |

| | | |

| Software 7.85% | | |

|

| Adobe Systems, Inc. (I) | 574,700 | 20,327,139 |

|

| Check Point Software Technologies, Ltd. (I) | 413,970 | 14,513,788 |

|

| Citrix Systems, Inc. (I) | 188,840 | 8,964,235 |

|

| Microsoft Corp. | 1,418,110 | 41,508,080 |

|

| Oracle Corp. | 1,150,360 | 29,552,748 |

| | | |

| Materials 4.88% | | 71,427,697 |

| | | |

| Chemicals 2.10% | | |

|

| FMC Corp. | 168,545 | 10,203,714 |

|

| Praxair, Inc. | 248,215 | 20,601,845 |

| | | |

| Metals & Mining 2.78% | | |

|

| Freeport-McMoRan Copper & Gold, Inc. | 310,865 | 25,969,662 |

|

| Walter Energy, Inc. | 158,800 | 14,652,476 |

| | | |

| Telecommunication Services 1.60% | | 23,410,360 |

| | | |

| Wireless Telecommunication Services 1.60% | | |

|

| American Tower Corp., Class A (I) | 549,410 | 23,410,360 |

| | | |

| Utilities 0.79% | | 11,553,135 |

| | | |

| Independent Power Producers & Energy Traders 0.79% | | |

|

| The AES Corp. (I) | 1,050,285 | 11,553,135 |

See notes to financial statements

| |

| 14 | Rainier Growth Fund | Annual report |

| | | |

| | | Par value | Value |

| Short-Term Investments 4.71% | | | $68,844,172 |

|

| (Cost $68,846,187) | | | |

| | | | |

| Repurchase Agreement 0.53% | | | 7,688,000 |

|

| Repurchase Agreement with State Street Corp. dated 3-31-10 | | |

| at 0.00% to be repurchased at $7,688,000 on 4-1-10, collateralized | | |

| by $7,690,000 Federal Home Loan Mortgage Corp., 4.200% | | |

| due 12-10-15 (valued at $7,843,800, including interest) | $7,688,000 | 7,688,000 |

| | | | |

| | | Shares | Value |

| Securities Lending Collateral 4.18% | | | 61,156,172 |

|

| John Hancock Collateral Investment Trust (W) | 0.1970% (Y) | 6,110,240 | 61,156,172 |

|

| Total investments (Cost $1,267,471,432)† 103.73% | $1,516,996,427 |

|

| |

| Other assets and liabilities, net (3.73%) | | | ($54,510,409) |

|

| |

| Total net assets 100.00% | | $1,462,486,018 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

ADR American Depositary Receipts

SADR Sponsored American Depositary Receipts

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of March 31, 2010.

(R) Direct placement securities are restricted to resale and the Fund has limited rights to registration under the Securities Act of 1933.

| | | | |

| | | | Value as a percentage | Value as of |

| Issuer, description | Acquisition date | Acquisition cost | of Fund’s net assets | March 31, 2010 |

|

| |

| BancTec, Inc. | | | | |

| common stock | 06-20-07 | $4,728,640 | 0.09% | $1,293,918 |

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(W) Investment is an affiliate of the Fund, the adviser and/or subadviser and represents the investment of securities lending collateral received.

(Y) The rate shown is the annualized seven-day yield as of March 31, 2010.

† At March 31, 2010, the aggregate cost of investment securities for federal income tax purposes was $1,289,378,817. Net unrealized appreciation aggregated $227,617,610, of which $260,292,729 related to appreciated investment securities and $32,675,119 related to depreciated investment securities.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 3-31-10

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $1,198,625,245) | |

| including $59,614,566 of securities loaned (Note 2) | $1,448,152,255 |

| Investments in affiliated issuers, at value (Cost $61,158,187) (Note 2) | 61,156,172 |

| Repurchase agreements, at value (Cost $7,688,000) (Note 2) | 7,688,000 |

| | |

| Total investments, at value (Cost $1,267,471,432) | 1,516,996,427 |

| Cash | 99 |

| Receivable for investments sold | 6,829,650 |

| Receivable for fund shares sold | 512,565 |

| Dividends and interest receivable | 1,530,109 |

| Receivable for securities lending income | 4,179 |

| Other receivables and prepaid assets | 150,771 |

| | |

| Total assets | 1,526,023,800 |

|

| Liabilities | |

|

| Payable for fund shares repurchased | 1,951,785 |

| Payable upon return of securities loaned (Note 2) | 61,166,612 |

| Payable to affiliates | |

| Accounting and legal services fees | 16,609 |

| Transfer agent fees | 150,036 |

| Distribution and service fees | 1,355 |

| Trustees’ fees | 9,230 |

| Investment management fees | 25,153 |

| Other liabilities and accrued expenses | 217,002 |

| | |

| Total liabilities | 63,537,782 |

|

| Net assets | |

|

| Capital paid-in | $1,960,231,749 |

| Undistributed net investment income | 791,607 |

| Accumulated net realized loss on investments and foreign | |

| currency transactions | (748,062,563) |

| Net unrealized appreciation (depreciation) on investments and translation | |

| of assets and liabilities in foreign currencies | 249,525,225 |

| Net assets | $1,462,486,018 |

See notes to financial statements

| |

| 16 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($384,132,060 ÷ 20,973,718 shares) | $18.31 |

| Class B ($37,399,183 ÷ 2,066,002 shares)1 | $18.10 |

| Class C ($23,677,242 ÷ 1,308,064 shares)1 | $18.10 |

| Class I ($208,333,922 ÷ 11,258,904 shares) | $18.50 |

| Class R1 ($176,974 ÷ 9,706 shares) | $18.23 |

| Class R3 ($81,364 ÷ 4,452.360 shares) | $18.27 |

| Class R4 ($81,835 ÷ 4,452 shares) | $18.38 |

| Class R5 ($82,310 ÷ 4,456 shares) | $18.47 |

| Class T ($82,977,632 ÷ 4,548,776 shares) | $18.24 |

| Class ADV ($17,775,718 ÷ 964,630 shares) | $18.43 |

| Class NAV ($707,767,778 ÷ 38,238,402 shares) | $18.51 |

| |

| Maximum public offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $19.27 |

| Class T (net asset value per share ÷ 95%)2 | $19.20 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 3-31-10

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $13,907,576 |

| Securities lending | 108,357 |

| Interest | 97,806 |

| Less foreign taxes withheld | (171,129) |

| | |

| Total investment income | 13,942,610 |

|

| Expenses | |

|

| Investment management fees (Note 4) | 9,057,057 |

| Distribution and service fees (Note 4) | 1,546,541 |

| Accounting and legal services fees (Note 4) | 126,285 |

| Transfer agent fees (Note 4) | 1,845,113 |

| Trustees’ fees (Note 4) | 124,719 |

| State registration fees (Note 4) | 133,080 |

| Printing and postage fees (Note 4) | 171,044 |

| Professional fees | 57,603 |

| Custodian fees | 136,426 |

| Registration and filing fees | 147,065 |

| Proxy fees | 284,982 |

| Other | 47,266 |

| | |

| Total expenses | 13,677,181 |

| Less expense reductions (Note 4) | (572,014) |

| | |

| Net expenses | 13,105,167 |

| | |

| Net investment income | 837,443 |

|

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | (35,590,560) |

| Investments in affiliated issuers | (3,413) |

| Foreign currency transactions | 494 |

| | (35,593,479) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 446,161,529 |

| Investments in affiliated issuers | (2,015) |

| Translation of assets and liabilities in foreign currencies | 193 |

| | 446,159,707 |

| Net realized and unrealized gain | 410,566,228 |

| Increase in net assets from operations | $411,403,671 |

See notes to financial statements

| |

| 18 | Rainier Growth Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 3-31-10 | 3-31-09 |

|

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $837,443 | $679,905 |

| Net realized loss | (35,593,479) | (310,987,326) |

| Change in net unrealized appreciation (depreciation) | 446,159,707 | (143,822,280) |

| | | |

| Increase (decrease) in net assets resulting from operations | 411,403,671 | (454,129,701) |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class I | (8,940) | (128,337) |

| Class R5 | (1) | (43) |

| Class NAV | (33,551) | (498,835) |

| | | |

| Total distributions | (42,492) | (627,215) |

| | | |

| From Fund share transactions (Note 5) | 194,788,353 | 1,010,863,775 |

| | | |

| Total increase | 606,149,532 | 556,106,859 |

|

| Net assets | | |

|

| Beginning of year | 856,336,486 | 300,229,627 |

| | | |

| End of year | $1,462,486,018 | $856,336,486 |

| Undistributed net investment income | $791,607 | $36,984 |

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 19 |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | |

| CLASS A SHARES Period ended | 3-31-10 | 3-31-091 | 3-31-082 | 3-31-072 | 3-31-062 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of year | $12.84 | $20.91 | $20.44 | $19.07 | $15.64 |

| Net investment loss | (0.03)3 | (0.01)3 | (0.02) | (0.04) | (0.07)3 |

| Net realized and unrealized gain (loss) on investments | 5.50 | (8.06) | 0.49 | 1.41 | 3.50 |

| Total from investment operations | 5.47 | (8.07) | 0.47 | 1.37 | 3.43 |

| Net asset value, end of year | $18.31 | $12.84 | $20.91 | $20.44 | $19.07 |

| Total return (%)4,5 | 42.60 | (38.59) | 2.30 | 7.18 | 21.93 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of year (in millions) | $384 | $193 | $164 | $33 | $15 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.45 | 1.47 | 1.176 | 1.30 | 1.72 |

| Expenses net of fee waivers | 1.38 | 1.18 | 1.196 | 1.19 | 1.19 |

| Expenses net of fee waivers and credits | 1.34 | 1.18 | 1.196 | 1.19 | 1.19 |

| Net investment loss | (0.18) | (0.04) | (0.27) | (0.38) | (0.42) |

| Portfolio turnover (%) | 102 | 101 | 86 | 101 | 96 |

| |

1 After the close of business on April 25, 2008, holders of Original Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class A shares of the John Hancock Rainier Growth Fund. These shares were first offered on April 28, 2008. Additionally, the accounting and performance history of the Original Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class A.

2 Audited by previous independent registered public accounting firm.

3 Based on the average daily shares outstanding.

4 Assumes dividend reinvestment (if applicable).

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Prior to the reorganization (Note 7), the Fund was subject to a contractual expense reimbursement and recoupment plan.

| | | | | |

| CLASS B SHARES Period ended | | | | 3-31-10 | 3-31-091 |

|

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.79 | $22.46 |

| Net investment loss2 | | | | (0.15) | (0.09) |

| Net realized and unrealized gain (loss) on investments | | | | 5.46 | (9.58) |

| Total from investment operations | | | | 5.31 | (9.67) |

| Net asset value, end of period | | | | $18.10 | $12.79 |

| Total return (%)3,4 | | | | 41.52 | (43.05)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | $37 | $27 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 2.45 | 2.826 |

| Expenses net of fee waivers | | | | 2.11 | 2.056 |

| Expenses net of fee waivers and credits | | | | 2.09 | 2.046 |

| Net investment loss | | | | (0.94) | (0.75)6 |

| Portfolio turnover (%) | | | | 102 | 1017 |

| | | | |

1 The inception date for Class B shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 20 | Rainier Growth Fund | Annual report |

| | | | | |

| CLASS C SHARES Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.79 | $22.46 |

| Net investment loss2 | | | | (0.15) | (0.09) |

| Net realized and unrealized gain (loss) on investments | | | | 5.46 | (9.58) |

| Total from investment operations | | | | 5.31 | (9.67) |

| Net asset value, end of period | | | | $18.10 | $12.79 |

| Total return (%)3,4 | | | | 41.52 | (43.05)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | $24 | $15 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 2.34 | 2.826 |

| Expenses net of fee waivers | | | | 2.21 | 2.056 |

| Expenses net of fee waivers and credits | | | | 2.09 | 2.046 |

| Net investment loss | | | | (0.93) | (0.77)6 |

| Portfolio turnover (%) | | | | 102 | 1017 |

| | | | |

1 The inception date for Class C shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | | | | |

| CLASS I SHARES Period ended | | 3-31-10 | 3-31-091 | 3-31-082 | 3-31-072,3 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | $12.92 | $20.98 | $20.44 | $20.94 |

| Net investment income4 | | 0.04 | 0.04 | —5 | —5 |

| Net realized and unrealized gain (loss) on investments | | 5.54 | (8.09) | 0.54 | (0.50) |

| Total from investment operations | | 5.58 | (8.05) | 0.54 | (0.50) |

| Less distributions | | | | | |

| From net investment income | | —5 | (0.01) | — | — |

| Net asset value, end of period | | $18.50 | $12.92 | $20.98 | $20.44 |

| Total return (%)6 | | 43.20 | (38.36) | 2.64 | (2.39)7,8 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | $208 | $133 | $136 | $537 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | 0.90 | 0.86 | 0.929 | 1.0010 |

| Expenses net of fee waivers | | 0.90 | 0.86 | 0.949 | 0.9410 |

| Expenses net of fee waivers and credits | | 0.90 | 0.86 | 0.949 | 0.9410 |

| Net investment income (loss) | | 0.26 | 0.22 | (0.02) | 0.1510 |

| Portfolio turnover (%) | | 102 | 101 | 86 | 10111 |

| | |

1 After the close of business on April 25, 2008, holders of Institutional Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class I shares of the John Hancock Rainier Growth Fund. These shares were first offered on April 28, 2008. Additionally, the accounting and performance history of the Institutional Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class I.

2 Audited by previous independent registered public accounting firm.

3 The inception date for Class I shares is 2-20-07.

4 Based on the average daily shares outstanding.

5 Less than ($0.005) per share.

6 Assumes dividend reinvestment (if applicable).

7 Total returns would have been lower had certain expenses not been reduced during the periods shown.

8 Not annualized.

9 Prior to the reorganization (Note 7), the Fund was subject to a contractual expense reimbursement and recoupment plan.

10 Annualized.

11 Annualized based on investments held for a full year.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 21 |

| | | | | |

| CLASS R1 SHARES Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.84 | $22.46 |

| Net investment loss2 | | | | (0.11) | (0.08) |

| Net realized and unrealized gain (loss) on investments | | | | 5.50 | (9.54) |

| Total from investment operations | | | | 5.39 | (9.62) |

| Net asset value, end of period | | | | $18.23 | $12.84 |

| Total return (%)3,4 | | | | 41.98 | (42.83)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | —6 | —6 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 13.91 | 8.707 |

| Expenses net of fee waivers | | | | 1.78 | 1.647 |

| Expenses net of fee waivers and credits | | | | 1.78 | 1.647 |

| Net investment loss | | | | (0.65) | (0.50)7 |

| Portfolio turnover (%) | | | | 102 | 1018 |

| | | | |

1 The inception date for Class R1 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | | | | |

| CLASS R3 SHARES Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.85 | $22.46 |

| Net investment loss2 | | | | (0.07) | (0.06) |

| Net realized and unrealized gain (loss) on investments | | | | 5.49 | (9.55) |

| Total from investment operations | | | | 5.42 | (9.61) |

| Net asset value, end of period | | | | $18.27 | $12.85 |

| Total return (%)3,4 | | | | 42.18 | (42.79)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | —6 | —6 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 13.68 | 8.577 |

| Expenses net of fee waivers | | | | 1.62 | 1.547 |

| Expenses net of fee waivers and credits | | | | 1.62 | 1.547 |

| Net investment loss | | | | (0.46) | (0.40)7 |

| Portfolio turnover (%) | | | | 102 | 1018 |

| | | | |

1 The inception date for Class R3 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 22 | Rainier Growth Fund | Annual report |

| | | | | |

| CLASS R4 SHARES Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.88 | $22.46 |

| Net investment loss2 | | | | (0.03) | (0.02) |

| Net realized and unrealized gain (loss) on investments | | | | 5.53 | (9.56) |

| Total from investment operations | | | | 5.50 | (9.58) |

| Net asset value, end of period | | | | $18.38 | $12.88 |

| Total return (%)3,4 | | | | 42.70 | (42.65)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | —6 | —6 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 13.33 | 8.267 |

| Expenses net of fee waivers | | | | 1.32 | 1.247 |

| Expenses net of fee waivers and credits | | | | 1.32 | 1.247 |

| Net investment loss | | | | (0.16) | (0.10)7 |

| Portfolio turnover (%) | | | | 102 | 1018 |

| | | | |

1 The inception date for Class R4 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | | | | |

| CLASS R5 SHARES Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.91 | $22.46 |

| Net investment income2 | | | | 0.02 | 0.03 |

| Net realized and unrealized gain (loss) on investments | | | | 5.54 | (9.57) |

| Total from investment operations | | | | 5.56 | (9.54) |

| Less distributions | | | | | |

| From net investment income | | | | —3 | (0.01) |

| Net asset value, end of period | | | | $18.47 | $12.91 |

| Total return (%)4,5 | | | | 43.07 | (42.48)6 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | —7 | —7 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 12.97 | 7.958 |

| Expenses net of fee waivers | | | | 1.02 | 0.948 |

| Expenses net of fee waivers and credits | | | | 1.02 | 0.948 |

| Net investment income | | | | 0.14 | 0.208 |

| Portfolio turnover (%) | | | | 102 | 1019 |

| | | | |

1 The inception date for Class R5 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Assumes dividend reinvestment (if applicable).

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Less than $500,000.

8 Annualized.

9 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 23 |

| | | | | |

| CLASS T SHARES Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.86 | $16.59 |

| Net investment loss2 | | | | (0.11) | (0.05) |

| Net realized and unrealized gain (loss) on investments | | | | 5.49 | (3.68) |

| Total from investment operations | | | | 5.38 | (3.73) |

| Net asset value, end of period | | | | $18.24 | $12.86 |

| Total return (%)3 | | | | 41.84 | (22.48) |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | $83 | $72 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 1.84 | 2.076 |

| Expenses net of fee waivers | | | | 1.84 | 1.996 |

| Expenses net of fee waivers and credits | | | | 1.84 | 1.986 |

| Net investment loss | | | | (0.69) | (0.74)6 |

| Portfolio turnover (%) | | | | 102 | 1017 |

| | | | |

1 The inception date for Class T shares is 10-6-08.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

| | | | | |

| CLASS ADV SHARES Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.90 | $22.46 |

| Net investment income (loss)2 | | | | —3 | (0.01) |

| Net realized and unrealized gain (loss) on investments | | | | 5.53 | (9.55) |

| Total from investment operations | | | | 5.53 | (9.56) |

| Net asset value, end of period | | | | $18.43 | $12.90 |

| Total return (%)4 | | | | 42.875 | (42.56)6 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | $18 | $17 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 1.25 | 1.147 |

| Expenses net of fee waivers | | | | 1.14 | 1.147 |

| Expenses net of fee waivers and credits | | | | 1.14 | 1.147 |

| Net investment income (loss) | | | | 0.01 | (0.04)7 |

| Portfolio turnover (%) | | | | 102 | 1018 |

| | | | |

1 The inception date for Class ADV shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Assumes dividend reinvestment (if applicable).

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Annualized.

8 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| 24 | Rainier Growth Fund | Annual report |

| | | | | |

| CLASS NAV Period ended | | | | 3-31-10 | 3-31-091 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $12.91 | $22.46 |

| Net investment income2 | | | | 0.05 | 0.04 |

| Net realized and unrealized gain (loss) on investments | | | | 5.55 | (9.57) |

| Total from investment operations | | | | 5.60 | (9.53) |

| Less distributions | | | | | |

| From net investment income | | | | —3 | (0.02) |

| Net asset value, end of period | | | | $18.51 | $12.91 |

| Total return (%)4 | | | | 43.38 | (42.44)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | $708 | $400 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 0.82 | 0.836 |

| Expenses net of fee waivers | | | | 0.82 | 0.836 |

| Expenses net of fee waivers and credits | | | | 0.82 | 0.836 |

| Net investment income | | | | 0.33 | 0.266 |

| Portfolio turnover (%) | | | | 102 | 1017 |

| | | | |

1 The inception date for Class NAV shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Assumes dividend reinvestment (if applicable).

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from April 1, 2008 to March 31, 2009.

See notes to financial statements

| |

| Annual report | Rainier Growth Fund | 25 |

Notes to financial statements

Note 1 — Organization

John Hancock Rainier Growth Fund (the Fund) is a diversified series of John Hancock Funds III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek to maximize long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A, Class B and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R1, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Class T and Class ADV shares are closed to new investors. Class NAV shares are sold to John Hancock affiliated funds of funds. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, transfer agent fees, printing and postage and state registration fees for each class may differ. Class B shares convert to Class A shares eight years after purchase. Effective at the close of business on August 21, 2009, Class R2 converted into Class A and Class R converted into Class R1.

Affiliates of the Fund owned 92%, 100%, 100% and 100% of shares of beneficial interest of Class R1, Class R3, Class R4 and Class R5 shares, respectively, on March 31, 2010.

The Fund is the accounting and performance successor of the Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund). On April 28, 2008, the Fund acquired substantially all the assets and assumed the liabilities of the Predecessor Fund pursuant to an agreement and plan of reorganization, in exchange for Class A and Class I shares of the Fund.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes significant unobservable inpu ts when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the values by input classification of the Fund’s investments as of March 31, 2010, by major security category or type:

| |

| 26 | Rainier Growth Fund | Annual report |

| | | | |

| | | | LEVEL 2 | LEVEL 3 |

| | TOTAL MARKET | | SIGNIFICANT | SIGNIFICANT |

| | VALUE AT | LEVEL 1 | OBSERVABLE | UNOBSERVABLE |

| INVESTMENTS IN SECURITIES | 3-31-10 | QUOTED PRICE | INPUTS | INPUTS |

|

| Common stocks | | | | |

| Consumer Discretionary | $227,708,823 | $227,708,823 | — | — |

| Consumer Staples | 109,019,313 | 109,019,313 | — | — |

| Energy | 44,134,864 | 44,134,864 | — | — |

| Financials | 103,554,954 | 103,554,954 | — | — |

| Health Care | 225,177,761 | 224,691,711 | — | $486,050 |

| Industrials | 169,786,067 | 169,786,067 | — | — |

| Information Technology | 462,379,281 | 461,085,363 | — | 1,293,918 |

| Materials | 71,427,697 | 71,427,697 | — | — |

| Telecommunication | 23,410,360 | 23,410,360 | — | — |

| Services | | | | |

| Utilities | 11,553,135 | 11,553,135 | — | — |

| Short-Term Investments | 68,844,172 | 61,156,172 | $7,688,000 | — |

| |

|

| Total Investments in | | | | |

| Securities | $1,516,996,427 | $1,507,528,459 | $7,688,000 | $1,779,968 |

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | |

| INVESTMENTS IN SECURITIES | HEALTH CARE | INFORMATION TECHNOLOGY |

|

| Balance as of March 31, 2009 | $178,416 | $1,582,227 |

| Accrued discounts/premiums | — | — |

| Realized gain (loss) | (1,166,717) | (2,241,887) |

| Change in unrealized appreciation (depreciation) | 1,474,351 | 1,953,578 |

| Net purchases (sales) | — | — |

| Transfers in and/or out of Level 3 | — | — |

| Balance as of March 31, 2010 | $486,050 | $1,293,918 |

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. John Hancock Collateral Investment Trust (JHCIT), an affiliate of the Fund, is valued at its closing net asset value. JHCIT is a floating rate fund investing in short-term investments as part of a s ecurities lending program.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of non-U.S. securities, used in computing the net asset value of the Fund’s shares, are generally determined at these times. Significant market events that affect the values of non-U.S. securities may occur after the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees.

Repurchase agreements. The Fund may enter into repurchase agreements. When a Fund enters into a repurchase agreement it receives collateral which is held in a segregated account by the

| |

| Annual report | Rainier Growth Fund | 27 |

Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date except for certain foreign dividends where the ex-date may have passed, which are recorded when the Fund becomes aware of the dividends.

Securities lending. A Fund may lend its securities to earn additional income. It receives and maintains cash collateral received from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, which is a floating rate fund. As a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral. Income received from JHCIT is a component of securities lending income as recorded on the Statement of Operations.

Foreign currency translation. Assets, including investments and liabilities denominated in foreign currencies, are translated into U.S. dollar values each day at the prevailing exchange rate. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized securities gains and losses is reflected as a component of securities gains and losses.

Funds that invest internationally generally carry more risk than funds that invest strictly in U.S. securities. Funds investing in a single country or in a limited geographic region tend to be riskier than funds that invest more broadly. Risks can result from differences in economic and political conditions, regulations, market practices (including higher transaction costs) and accounting standards. Foreign investments are also subject to a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to a Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with the custodian which enables them to participate in a $150 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis based on their relative average net assets. For the year ended March 31, 2010, there were no significant borrowings under the line of credit by the Fund. Effective March 31, 2010, the amount of the line of credit changed to $100 million.

| |

| 28 | Rainier Growth Fund | Annual report |

Expenses. The majority of expenses are directly attributable to an individual Fund. Expenses that are not readily attributable to a specific fund are allocated among all Funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the Funds’ relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses, and realized and unrealized gains (losses) are determined at the Fund level and allocated daily to each class of shares based on the net asset value of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage fees, for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has a capital loss carryforward of $726,155,178 available to offset future net realized capital gains. Availability of a certain amount of the loss carryforward, which was acquired in mergers, may be limited in a given year. The following table details the capital loss carryforward available as of March 31, 2010.

At March 31, 2010, capital loss carryforward available to offset future realized gains is as follows:

| | | | |

| CAPITAL LOSS CARRYFORWARD EXPIRING AT MARCH 31 | | | |

| 2011 | 2012 | 2016 | 2017 | 2018 |

|

| $260,334,070 | $86,800,122 | $25,380,418 | $113,554,715 | $240,085,853 |

It is estimated that $304,466,160 of the loss carryforward, which was acquired on October 3, 2008, in mergers with John Hancock Core Equity Fund, John Hancock Growth Trends Fund, and John Hancock Technology Fund, as well as the carryforward acquired October 2, 2009, in a merger with John Hancock Health Sciences Fund, will likely expire unused because of limitations.

As of March 31, 2010, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. The Fund generally declares and pays dividends and capital gains distributions, if any, at least annually. The tax character of distributions for the years ended March 31, 2010 and March 31, 2009 was as follows:

| | | | |

| | MARCH 31, 2010 | MARCH 31, 2009 | | |

| | |

| Ordinary Income | $42,492 | $627,215 | | |

Distributions paid by the Fund with respect to each series of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class. As of March 31, 2010, the components of distributable earnings on a tax basis included $842,466 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

| |

| Annual report | Rainier Growth Fund | 29 |

Capital accounts within financial statements are adjusted for permanent book/tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book/ tax differences will reverse in a subsequent period. Permanent book/tax differences are primarily attributable to expiration of capital loss carryforward in the amount of $500,226,008 and merger related transactions.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management Fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser based on the aggregate net assets of the Fund and John Hancock Growth Equity Trust (Growth Equity). Growth Equity is a series of John Hancock Trust, an affiliate of the Fund, managed by the Adviser. The management fee is equivalent, on an annual basis, to the sum of: (a) 0.750% of the first $3,000,000,000 of the Fund’s aggregate net assets; (b) 0.725% of the next $3,000,000,000 of the Fund’s aggregate net assets; and (c) 0.700% of the Fund’s aggregate net assets in excess of $6,000,000,000. The Adviser has a subadvisory agreement with Rainier Investment Management, Inc. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the year ended March 31, 2010 were equivalent to an annual effective rate of 0.75% of the Fund’s average daily net assets.

Effective August 1, 2009, the Adviser agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business and shareholder service fees. The reimbursements and limits are such that these expenses will not exceed 1.35% for Class A, 2.10% for Class B, 2.10% for Class C, 0.92% for Class I, 1.80% for Class R1, 1.65% for Class R3, 1.35% for Class R4, 1.05% for Class R5, 1.98% for Class T and 1.14% for Class ADV. The expense reimbursements and limits will continue in effect until July 31, 2010, and thereafter until terminated by the Adviser on notice to the Trust.

Prior to July 31, 2009, the Adviser agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business and shareholder service fees. The reimbursements and limits are such that these expenses will not exceed 1.32% for Class A, 2.04% for Class B, 2.04% for Class C, 0.89% for Class I, 1.64% for Class R1, 1.54% for Class R3, 1.24% for Class R4, 0.94% for Class R5, 1.98% for Class T and 1.14% for Class ADV. Prior to April 30, 2009, the reimbursements and limits was 1.19% for Class A.

Accordingly, the expense reductions or reimbursements related to these agreements were $199,431, $112,468, $27,273, $1,879, $14,955, $2,004, $8,570, $8,569, $8,569 and $19,033 for Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class ADV, respectively, for the year ended March 31, 2010.

| |

| 30 | Rainier Growth Fund | Annual report |

Accounting and legal services. Pursuant to the Service Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports amongst other services. These expenses are allocated to each share class based on relative net assets at the time the expense was incurred. The accounting and legal services fees incurred for year ended March 31, 2010, amounted to an approximate annual rate of 0.01% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class T and Class ADV shares pursuant to Rule 12b-1 of the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. In addition, under a service plan for Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares, the Fund pays for certain other services. The Fund may pay up to the following contractual rates of distribution fees and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares.

| | | | |

| Class | 12b-1 Fees | Service Fee | | |

| | |

| Class A | 0.30% | — | | |

| Class B | 1.00% | — | | |

| Class C | 1.00% | — | | |

| Class R | 0.75% | 0.25% | | |

| Class R1 | 0.50% | 0.25% | | |

| Class R2 | 0.25% | 0.25% | | |

| Class R3 | 0.50% | 0.15% | | |

| Class R4 | 0.25% | 0.10% | | |

| Class R5 | — | 0.05% | | |

| Class T | 0.30% | — | | |

| Class ADV | 0.25% | — | | |

For the year ended March 31, 2010, the Board of Trustees has authorized only 0.25% to be charged to Class A for 12b-1 fees.

Sales charges. Class A and Class T shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $104,923 and $55,602 for Class A and Class T shares, respectively, for the year ended March 31, 2010. Of those amounts, $14,473 and $8,212 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $69,350 and $32,773 was paid as sales commissions to broker-dealers and $21,100 and $14,617 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a broker-dealer affiliate of the Adviser for Class A and T shares, respectively.

Class B and Class C shares are subject to contingent deferred sales charges (CDSC). Class B shares that are redeemed within six years of purchase are subject to CDSC, at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC on the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the year ended March 31, 2010, CDSCs amounts received by the Distributor amounted to $47,828 and $1,383 for Class B and Class C shares, respectively.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services or Transfer Agent), an affiliate of the Adviser. The transfer agent fees are made up of three components:

| |

| Annual report | Rainier Growth Fund | 31 |

• The Fund pays a monthly transfer agent fee at an annual rate of 0.05% for Classes A, B, C, R, R1, R2, R3, R4, R5, T and ADV shares and 0.04% for Class I shares, based on each class’s average daily net assets.

• The Fund pays a monthly fee based on an annual rate of $15.00 per shareholder account for Class A, R, R1, R2, R3, R4 and R5 shares and $16.50 per shareholder account for Class B, C and T shares. During the year ended March 31, 2010, there were no monthly fee assessed for Class I and ADV.

• Signature Services is reimbursed for certain out-of-pocket expenses.

• Additionally, Class NAV shares do not pay transfer agent fees.