| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number 811-21777 |

|

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

|

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

|

| Michael J. Leary |

| Treasurer |

|

| 601 Congress Street |

|

| Boston, Massachusetts 02210 |

| | |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4490 |

| |

| Date of fiscal year end: | February 28 |

| |

| |

| Date of reporting period: | February 28, 2010 |

ITEM 1. REPORT TO SHAREHOLDERS.

Management’s discussion of

Fund performance

By Grantham, Mayo, Van Otterloo & Co. LLC

U.S. stocks posted exceptionally strong gains during the 12 months ended February 28, 2010, with mid- and small-cap stocks leading the way. The government’s stimulative fiscal and monetary policies helped push the market sharply higher in the first half of the period. Upward momentum waned thereafter, as investors took some profits and waited to see whether the economic recovery would gain traction. While healthy economic growth later in 2009 helped bolster investors’ confidence, unemployment remained persistently high and home prices continued to decline. Additionally, credit concerns about Greece briefly spooked the market late in the period. During the period, John Hancock Value Opportunities Fund’s benchmark, the Russell 2500 Value Index, delivered a robust 69.33% return.

During the past year, the Fund’s Class A shares returned 45.86% at net asset value, trailing its benchmark and lagging the 68.94% mark of the Morningstar, Inc. mid-cap value funds average. Performance was curbed by stock selection in the consumer discretionary sector, which was only partially offset by a large overweighting in that outperforming group. Lackluster stock picking in information technology and health care also hurt. Conversely, a sizable underweighting in the utilities sector bolstered our results. At the stock level, for-profit education holdings ITT Educational Services, Inc. and Career Education Corp. disappointed us. Other detractors included Advance Auto Parts, Inc., Affiliated Computer Services Inc., which was acquired by Xerox, and SAIC Inc., a provider of technical services to the U.S. military. Pharmaceutical services holding Omnicare, Inc. also detracted. We sold all six of these stocks. Contributors included mortgage insurance p rovider Genworth Financial, Inc., which benefited from the gradually improving prospects for the housing market. Also adding value were computer hard-disk drive makers Seagate Technology LLC and Western Digital Corp., as well as consumer electronics retailer RadioShack Corp., mattress maker Tempur-Pedic International, Inc. and media and marketing holding Valassis Communications, Inc.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 6 | Value Opportunities Fund | Annual report |

A look at performance

For the period ended February 28, 2010

| | | | | | | | | | |

| | | Average annual returns (%) | | | Cumulative total returns (%) | |

| | | with maximum sales charge (POP) | | | with maximum sales charge (POP) | |

| | |

| |

|

| | | 1-year | 5-year | 10-year | inception Since1 | | 1-year | 5-year | 10-year | inception Since1 |

|

| Class A | | 38.61 | — | — | –7.11 | | 38.61 | — | — | –24.01 |

|

| Class B | | 39.82 | — | — | –7.20 | | 39.82 | — | — | –24.30 |

|

| Class C | | 43.77 | — | — | –6.47 | | 43.77 | — | — | –22.04 |

|

| Class I2 | | 46.41 | — | — | –5.43 | | 46.41 | — | — | –18.76 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B shares and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable for Class I shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until June 30, 2010. The net expenses are as follows: Class A — 1.39%, Class B — 2.09%, Class C — 2.09% and Class I — 0.91%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.85%, Class B — 9.77%, Class C — 4.94% and Class I — 20.87%. .

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses increase and results would have been less favorable.

1 From June 12, 2006.

2 For certain types of investors, as described in the Fund’s Class I share prospectus.

| |

| Annual report | Value Opportunities Fund | 7 |

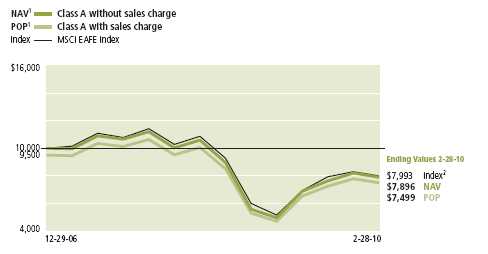

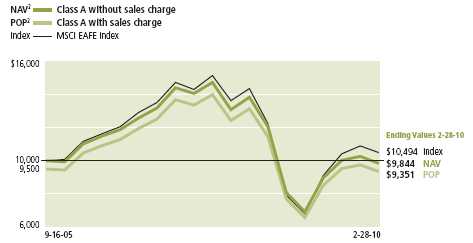

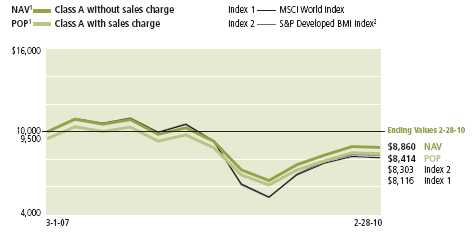

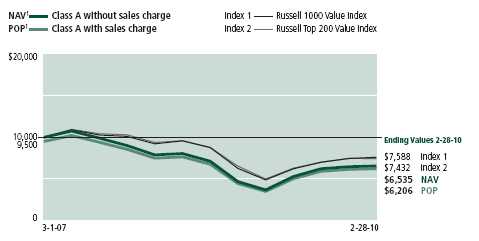

A look at performance

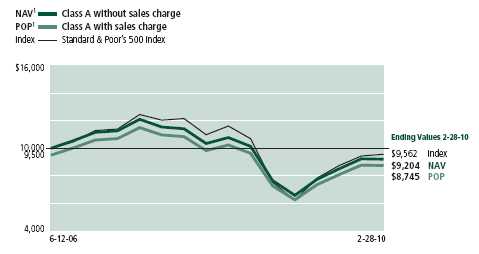

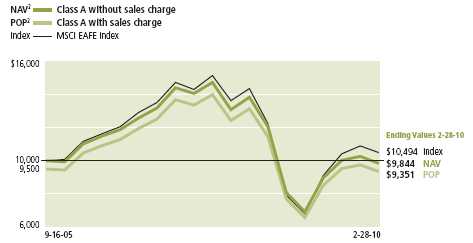

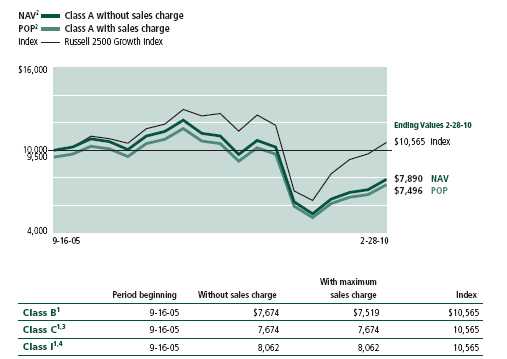

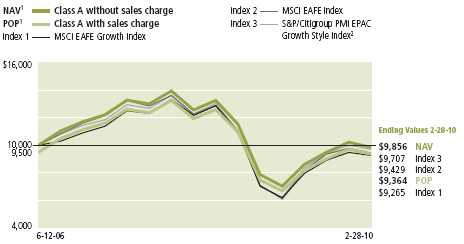

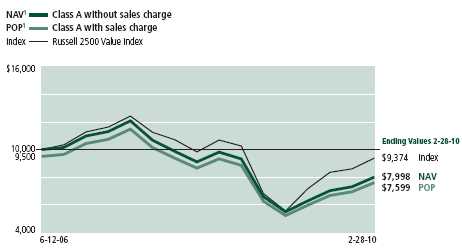

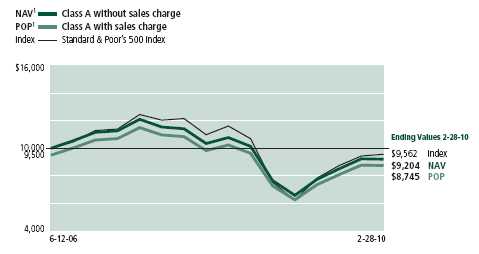

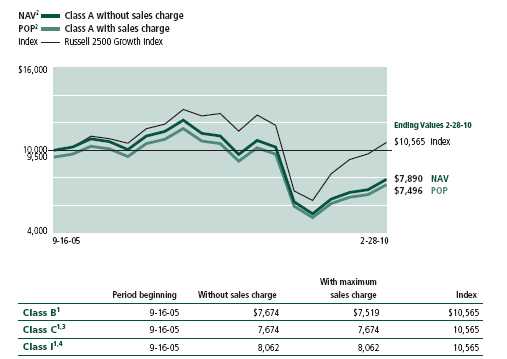

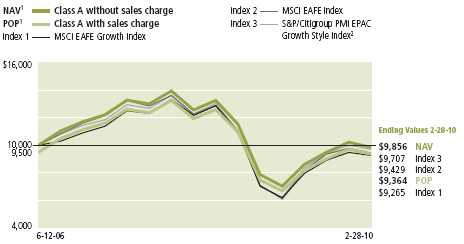

Growth of $10,000

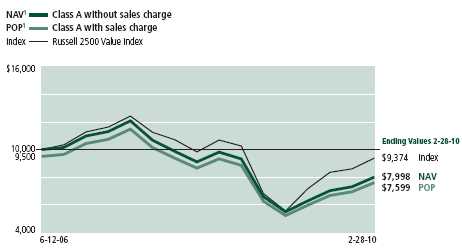

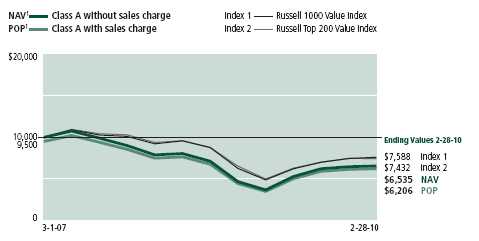

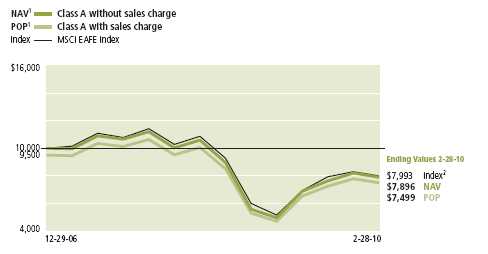

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Value Opportunities Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Russell 2500 Value Index.

| | | | |

| | Period | Without sales | With maximum | |

| | beginning | charge | sales charge | Index |

|

| Class B | 6-12-06 | $7,790 | $7,570 | $9,374 |

|

| Class C2 | 6-12-06 | 7,796 | 7,796 | 9,374 |

|

| Class I3 | 6-12-06 | 8,124 | 8,124 | 9,374 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C and Class I shares, respectively, as of February 28, 2010. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 2500 Value Index is an unmanaged index containing those securities in the Russell 2500 Index with a less-than-average growth orientation.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 The contingent deferred sales charge, if any, is not applicable.

3 For certain types of investors, as described in the Fund’s Class I share prospectus.

| |

| 8 | Value Opportunities Fund | Annual report |

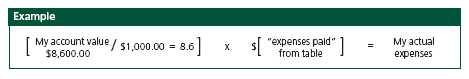

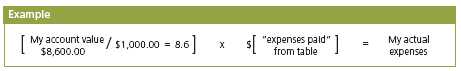

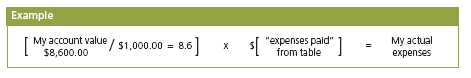

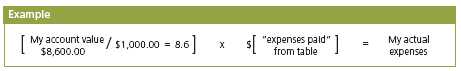

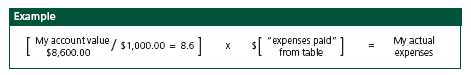

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on September 1, 2009 with the same investment held until February 28, 2010.

| | | |

| | Account value | Ending value | Expenses paid during period |

| | on 9-1-09 | on 2-28-10 | ended 2-28-101 |

|

| Class A | $1,000.00 | $1,140.30 | $7.43 |

|

| Class B | 1,000.00 | 1,137.20 | 11.92 |

|

| Class C | 1,000.00 | 1,137.10 | 12.29 |

|

| Class I | 1,000.00 | 1,143.10 | 4.84 |

|

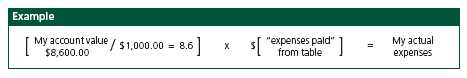

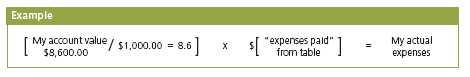

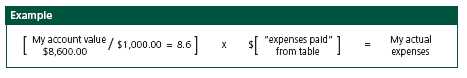

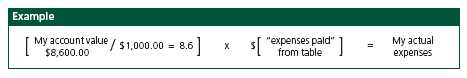

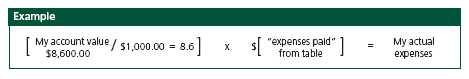

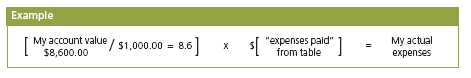

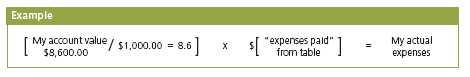

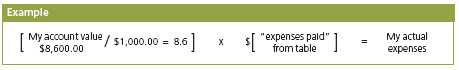

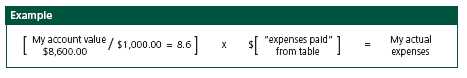

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at February 28, 2010, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | Value Opportunities Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on September 1, 2009, with the same investment held until February 28, 2010. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during period |

| | on 9-1-09 | on 2-28-10 | ended 2-28-101 |

|

| Class A | $1,000.00 | $1,017.90 | 7.00 |

|

| Class B | 1,000.00 | 1,014.40 | 11.23 |

|

| Class C | 1,000.00 | 1,014.40 | 11.58 |

|

| Class I | 1,000.00 | 1,020.30 | 4.56 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.40%, 2.25%, 2.32%, 0.91%, for Class A, Class B, Class C, and Class I, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| |

| 10 | Value Opportunities Fund | Annual report |

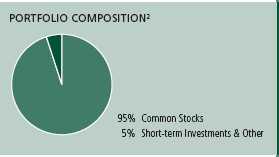

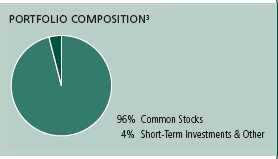

Portfolio summary

| | | | |

| Top 10 Holdings1 | | | | |

|

| Genworth Financial, Inc., Class A | 1.9% | | Oshkosh Corp. | 1.0% |

| |

|

| Lubrizol Corp. | 1.3% | | PepsiAmericas, Inc. | 1.0% |

| |

|

| Tiffany & Company | 1.3% | | Autoliv, Inc. | 1.0% |

| |

|

| Wyndham Worldwide Corp. | 1.2% | | Coventry Health Care, Inc. | 0.9% |

| |

|

| Gannett Company, Inc. | 1.2% | | Kinetic Concepts, Inc. | 0.9% |

| |

|

| |

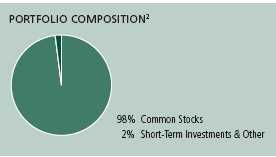

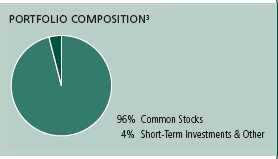

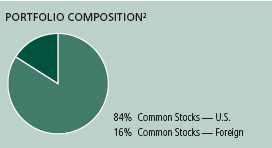

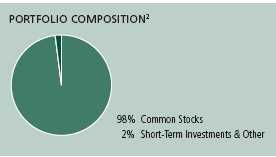

| Sector Composition2,3 | | | | |

|

| Consumer Discretionary | 35% | | Consumer Staples | 6% |

| |

|

| Financials | 14% | | Materials | 5% |

| |

|

| Health Care | 14% | | Energy | 1% |

| |

|

| Industrials | 11% | | Telecommunication Services | 1% |

| |

|

| Information Technology | 11% | | Short-Term Investments & Other | 2% |

| |

|

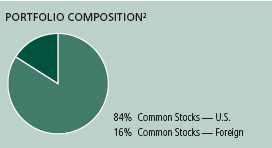

1 As a percentage of net assets on February 28, 2010. Excludes cash and cash equivalents.

2 As a percentage of net assets on February 28, 2010.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| Annual report | Value Opportunities Fund | 11 |

Fund’s investments

As of 2-28-10

| | |

| | Shares | Value |

|

| Common Stocks 97.97% | | $10,035,948 |

|

| (Cost $7,855,780) | | |

| | | |

| Consumer Discretionary 34.98% | | 3,583,447 |

| | | |

| Auto Components 2.93% | | |

|

| ArvinMeritor, Inc. (I)(L) | 2,000 | 23,320 |

|

| Autoliv, Inc. (I) | 2,200 | 98,142 |

|

| Dana Holding Corp. (I) | 3,800 | 43,206 |

|

| Dorman Products, Inc. (I) | 400 | 7,220 |

|

| Modine Manufacturing Company (I) | 800 | 7,520 |

|

| Standard Motor Products, Inc. | 700 | 5,677 |

|

| Tenneco, Inc. (I) | 1,600 | 32,256 |

|

| TRW Automotive Holdings Corp. (I) | 3,100 | 83,297 |

| | | |

| Automobiles 0.44% | | |

|

| Harley-Davidson, Inc. (L) | 300 | 7,383 |

|

| Thor Industries, Inc. | 1,100 | 37,323 |

| | | |

| Distributors 0.06% | | |

|

| Core-Mark Holding Company, Inc. (I) | 200 | 6,408 |

| | | |

| Diversified Consumer Services 1.08% | | |

|

| CPI Corp. | 300 | 3,771 |

|

| Pre-Paid Legal Services, Inc. (I) | 200 | 8,328 |

|

| Service Corp. International | 5,000 | 40,300 |

|

| Steiner Leisure, Ltd. (I) | 400 | 17,188 |

|

| Weight Watchers International, Inc. | 1,600 | 41,152 |

| | | |

| Hotels, Restaurants & Leisure 2.96% | | |

|

| AFC Enterprises, Inc. (I) | 700 | 5,670 |

|

| Ambassadors Group, Inc. | 400 | 4,516 |

|

| Carrols Restaurant Group, Inc. (I) | 800 | 5,080 |

|

| Cheesecake Factory, Inc. (I) | 800 | 18,920 |

|

| Cracker Barrel Old Country Store, Inc. | 700 | 30,576 |

|

| DineEquity, Inc. (I) | 500 | 14,670 |

|

| O’Charley’s, Inc. (I) | 700 | 5,663 |

|

| Royal Caribbean Cruises, Ltd. (I)(L) | 2,500 | 70,675 |

|

| Ruby Tuesday, Inc. (I) | 2,000 | 16,180 |

|

| Steak N Shake Company (I) | 20 | 6,842 |

|

| Wyndham Worldwide Corp. | 5,400 | 124,146 |

See notes to financial statements

| |

| 12 | Value Opportunities Fund | Annual report |

| | |

| | Shares | Value |

| Household Durables 4.34% | | |

|

| American Greetings Corp., Class A | 1,300 | $24,791 |

|

| Blyth, Inc. | 200 | 5,768 |

|

| Furniture Brands International, Inc. (I) | 1,100 | 6,028 |

|

| Harman International Industries, Inc. (I) | 1,200 | 51,768 |

|

| Jarden Corp. | 2,600 | 83,356 |

|

| La-Z-Boy, Inc. (I) | 1,300 | 16,393 |

|

| Newell Rubbermaid, Inc. | 4,400 | 60,500 |

|

| Sealy Corp. (I) | 3,100 | 10,726 |

|

| Tempur-Pedic International, Inc. (I) | 1,200 | 34,080 |

|

| Tupperware Brands Corp. | 1,800 | 84,114 |

|

| Whirlpool Corp. | 800 | 67,328 |

| | | |

| Internet & Catalog Retail 1.58% | | |

|

| Expedia, Inc. | 2,000 | 44,480 |

|

| HSN, Inc. (I) | 2,000 | 43,320 |

|

| Liberty Media Corp.—Interactive A (I) | 5,100 | 64,209 |

|

| NutriSystem, Inc. (L) | 500 | 9,675 |

| | | |

| Leisure Equipment & Products 0.57% | | |

|

| Polaris Industries, Inc. (L) | 1,000 | 45,740 |

|

| RC2 Corp. (I) | 900 | 12,699 |

| | | |

| Media 4.08% | | |

|

| Belo Corp., Class A | 2,700 | 18,171 |

|

| Carmike Cinemas, Inc. (I) | 600 | 5,460 |

|

| CTC Media, Inc. | 1,700 | 29,070 |

|

| Entercom Communications Corp. (I) | 1,600 | 16,272 |

|

| EW Scripps Company (I) | 1,300 | 9,906 |

|

| Gannett Company, Inc. | 7,900 | 119,685 |

|

| Harte-Hanks, Inc. | 1,900 | 22,591 |

|

| Journal Communications, Inc. (I) | 1,700 | 6,358 |

|

| Lee Enterprises, Inc. (I) | 2,800 | 10,724 |

|

| LIN TV Corp. (I) | 1,800 | 9,198 |

|

| LodgeNet Entertainment Corp. (I) | 400 | 2,496 |

|

| McClatchy Company, Class A (L) | 2,600 | 12,532 |

|

| Media General, Inc., Class A (I) | 900 | 7,362 |

|

| Meredith Corp. (L) | 1,300 | 39,936 |

|

| New York Times Company, Class A (I) | 2,400 | 26,256 |

|

| Scholastic Corp. | 1,100 | 32,340 |

|

| Sinclair Broadcast Group, Inc., Class A (I) | 1,800 | 9,036 |

|

| Valassis Communications, Inc. (I) | 1,600 | 40,992 |

| | | |

| Multiline Retail 1.17% | | |

|

| Big Lots, Inc. (I) | 900 | 30,150 |

|

| Dillard’s, Inc., Class A (L) | 2,200 | 37,114 |

|

| Nordstrom, Inc. | 1,000 | 36,940 |

|

| Retail Ventures, Inc. (I) | 800 | 7,152 |

|

| Tuesday Morning Corp. (I) | 1,400 | 7,994 |

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 13 |

| | |

| | Shares | Value |

| Specialty Retail 11.14% | | |

|

| Abercrombie & Fitch Company, Class A | 2,400 | $87,408 |

|

| Aeropostale, Inc. (I) | 700 | 24,752 |

|

| American Eagle Outfitters, Inc. | 2,500 | 42,175 |

|

| Americas Car Mart, Inc. (I) | 500 | 13,220 |

|

| AnnTaylor Stores Corp. (I)(L) | 1,500 | 25,815 |

|

| Asbury Automotive Group, Inc. (I) | 1,100 | 12,793 |

|

| AutoNation, Inc. (I)(L) | 2,900 | 51,475 |

|

| Big 5 Sporting Goods Corp. | 900 | 13,752 |

|

| Books-A–Million, Inc. | 600 | 3,774 |

|

| Borders Group, Inc. (I)(L) | 1,700 | 2,414 |

|

| Brown Shoe Company, Inc. | 800 | 11,064 |

|

| Cabela’s, Inc. (I)(L) | 900 | 13,914 |

|

| Charming Shoppes, Inc. (I) | 3,000 | 17,850 |

|

| Chico’s FAS, Inc. | 4,500 | 60,975 |

|

| Collective Brands, Inc. (I) | 1,200 | 27,120 |

|

| Finish Line, Inc. | 700 | 8,463 |

|

| Genesco, Inc. (I) | 300 | 7,179 |

|

| Group 1 Automotive, Inc. (I) | 700 | 19,439 |

|

| Guess?, Inc. | 1,200 | 48,948 |

|

| Gymboree Corp. (I) | 800 | 34,800 |

|

| Jo-Ann Stores, Inc. (I) | 400 | 15,140 |

|

| Jos. A. Bank Clothiers, Inc. (I) | 500 | 22,365 |

|

| Limited Brands, Inc. | 800 | 17,688 |

|

| Lithia Motors, Inc., Class A (I) | 400 | 2,552 |

|

| MarineMax, Inc. (I) | 800 | 8,464 |

|

| Office Depot, Inc. (I) | 7,900 | 57,038 |

|

| OfficeMax, Inc. (I) | 2,300 | 36,731 |

|

| Pacific Sunwear of California, Inc. (I) | 1,400 | 6,272 |

|

| Penske Auto Group, Inc. (I)(L) | 2,400 | 34,920 |

|

| RadioShack Corp. | 4,200 | 82,152 |

|

| Shoe Carnival, Inc. (I) | 400 | 7,292 |

|

| Sonic Automotive, Inc. (I)(L) | 1,600 | 16,480 |

|

| Stein Mart, Inc. (I) | 1,600 | 13,072 |

|

| Systemax, Inc. | 600 | 9,780 |

|

| Talbots, Inc. (I)(L) | 1,300 | 14,092 |

|

| The Men’s Wearhouse, Inc. | 1,400 | 29,904 |

|

| Tiffany & Company | 3,000 | 133,170 |

|

| Tractor Supply Company (I) | 700 | 38,304 |

|

| Williams-Sonoma, Inc. | 3,200 | 68,672 |

| | | |

| Textiles, Apparel & Luxury Goods 4.63% | | |

|

| Columbia Sportswear Company | 600 | 27,504 |

|

| Crocs, Inc. (I) | 2,400 | 16,920 |

|

| Deckers Outdoor Corp. (I) | 210 | 25,242 |

|

| Fossil, Inc. (I) | 2,200 | 79,750 |

|

| Fuqi International, Inc. (I)(L) | 400 | 7,380 |

|

| G-III Apparel Group, Ltd. (I) | 400 | 8,388 |

|

| Hanesbrands, Inc. (I) | 1,300 | 33,709 |

|

| Jones Apparel Group, Inc. | 2,800 | 47,208 |

See notes to financial statements

| |

| 14 | Value Opportunities Fund | Annual report |

| | |

| | Shares | Value |

| Textiles, Apparel & Luxury Goods (continued) | | |

|

| Liz Claiborne, Inc. (I)(L) | 2,100 | $14,511 |

|

| Maidenform Brands, Inc. (I) | 500 | 8,610 |

|

| Oxford Industries, Inc. | 600 | 11,676 |

|

| Perry Ellis International, Inc. (I) | 600 | 11,742 |

|

| Phillips-Van Heusen Corp. | 1,600 | 69,632 |

|

| Skechers U.S.A., Inc., Class A (I) | 700 | 21,511 |

|

| Steven Madden, Ltd. (I) | 500 | 21,005 |

|

| True Religion Apparel, Inc. (I) | 600 | 14,736 |

|

| Unifirst Corp. | 300 | 15,768 |

|

| Wolverine World Wide, Inc. | 1,400 | 38,598 |

| | | |

| Consumer Staples 6.02% | | 616,205 |

| | | |

| Beverages 0.97% | | |

|

| PepsiAmericas, Inc. | 3,300 | 98,934 |

| | | |

| Food & Staples Retailing 0.93% | | |

|

| Great Atlantic & Pacific Tea Company, Inc. (I) | 900 | 6,543 |

|

| Whole Foods Market, Inc. (I)(L) | 2,500 | 88,725 |

| | | |

| Food Products 1.53% | | |

|

| Chiquita Brands International, Inc. (I)(L) | 1,100 | 16,016 |

|

| Del Monte Foods Company | 5,900 | 69,148 |

|

| J.M. Smucker Company | 1,000 | 59,680 |

|

| Pilgrim’s Pride Corp. (I) | 1,300 | 11,726 |

| | | |

| Personal Products 2.59% | | |

|

| Bare Escentuals, Inc. (I) | 900 | 16,362 |

|

| Elizabeth Arden, Inc. (I) | 500 | 9,010 |

|

| Herbalife, Ltd. | 1,900 | 76,095 |

|

| Inter Parfums, Inc. | 1,100 | 14,938 |

|

| NBTY, Inc. (I) | 2,000 | 90,800 |

|

| Nu Skin Enterprises, Inc., Class A | 1,700 | 45,424 |

|

| Revlon, Inc. (I) | 300 | 4,497 |

|

| USANA Health Sciences, Inc. (I) | 300 | 8,307 |

| | | |

| Energy 1.42% | | 145,196 |

| | | |

| Energy Equipment & Services 0.81% | | |

|

| Complete Production Services, Inc. (I) | 1,000 | 13,960 |

|

| Oil States International, Inc. (I) | 1,600 | 68,832 |

| | | |

| Oil, Gas & Consumable Fuels 0.61% | | |

|

| Ship Finance International, Ltd. (L) | 1,100 | 17,490 |

|

| World Fuel Services Corp. | 1,700 | 44,914 |

| | | |

| Financials 14.00% | | 1,434,102 |

| | | |

| Capital Markets 1.03% | | |

|

| Allied Capital Corp. (I) | 4,300 | 17,888 |

|

| American Capital, Ltd. (I) | 3,200 | 13,760 |

|

| Ares Capital Corp. | 2,600 | 33,982 |

|

| Calamos Asset Management, Inc. | 500 | 6,670 |

|

| Hercules Technology Growth Capital, Inc. | 800 | 7,872 |

|

| International Assets Holding Corp. (I) | 800 | 12,488 |

|

| MCG Capital Corp. (I) | 2,600 | 13,312 |

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 15 |

| | |

| | Shares | Value |

| Commercial Banks 0.09% | | |

|

| Oriental Financial Group, Inc. | 800 | $8,832 |

| | | |

| Consumer Finance 1.53% | | |

|

| Advance America Cash Advance Centers, Inc. | 2,000 | 12,540 |

|

| AmeriCredit Corp. (I)(L) | 2,900 | 64,525 |

|

| Cash America International, Inc. | 400 | 15,332 |

|

| Nelnet, Inc., Class A | 1,400 | 22,008 |

|

| SLM Corp. (I) | 1,900 | 21,242 |

|

| World Acceptance Corp. (I) | 500 | 20,895 |

| | | |

| Diversified Financial Services 0.19% | | |

|

| Encore Capital Group, Inc. (I) | 600 | 10,824 |

|

| Primus Guaranty, Ltd. (I) | 2,000 | 8,220 |

| | | |

| Insurance 8.16% | | |

|

| Allied World Assurance Company Holdings, Ltd. | 1,000 | 46,100 |

|

| American Equity Investment Life Holding Company | 1,000 | 8,800 |

|

| American Financial Group, Inc. | 1,700 | 43,979 |

|

| American International Group, Inc. (I)(L) | 500 | 12,385 |

|

| CNA Financial Corp. (I) | 600 | 14,754 |

|

| Conseco, Inc. (I) | 6,800 | 33,864 |

|

| Delphi Financial Group, Inc. | 800 | 17,064 |

|

| Endurance Specialty Holdings, Ltd. | 1,600 | 61,536 |

|

| FBL Financial Group, Inc., Class A | 700 | 14,224 |

|

| Genworth Financial, Inc., Class A (I) | 12,000 | 191,280 |

|

| Hartford Financial Services Group, Inc. | 2,200 | 53,614 |

|

| Horace Mann Educators Corp. | 600 | 8,064 |

|

| Lincoln National Corp. | 900 | 22,662 |

|

| Maiden Holdings, Ltd. | 1,200 | 8,424 |

|

| National Financial Partners Corp. (I) | 1,200 | 13,788 |

|

| Protective Life Corp. | 2,300 | 42,228 |

|

| Reinsurance Group of America, Inc. | 1,100 | 52,283 |

|

| StanCorp Financial Group, Inc. | 1,100 | 47,278 |

|

| Torchmark Corp. | 1,300 | 60,450 |

|

| Transatlantic Holdings, Inc. | 800 | 39,760 |

|

| Universal Insurance Holdings, Inc. | 1,500 | 9,075 |

|

| Validus Holdings, Ltd. | 1 | 28 |

|

| XL Capital, Ltd. | 1,900 | 34,713 |

| | | |

| Real Estate Investment Trusts 2.90% | | |

|

| Agree Realty Corp. | 300 | 6,618 |

|

| American Capital Agency Corp. | 700 | 17,724 |

|

| Ashford Hospitality Trust, Inc. (I)(L) | 2,200 | 12,056 |

|

| Developers Diversified Realty Corp. | 3,400 | 36,074 |

|

| FelCor Lodging Trust, Inc. (I) | 1,600 | 6,032 |

|

| General Growth Properties, Inc. | 2,839 | 37,219 |

|

| Glimcher Realty Trust | 2,000 | 8,600 |

|

| Gramercy Capital Corp. (I) | 2,100 | 8,022 |

|

| Hatteras Financial Corp. | 900 | 23,373 |

|

| Hospitality Properties Trust | 1,500 | 32,955 |

|

| HRPT Properties Trust | 6,100 | 42,822 |

See notes to financial statements

| |

| 16 | Value Opportunities Fund | Annual report |

| | |

| | Shares | Value |

| Real Estate Investment Trusts (continued) | | |

|

| NorthStar Realty Finance Corp. | 1,600 | $6,832 |

|

| Resource Capital Corp. | 1,200 | 7,596 |

|

| SL Green Realty Corp. | 1,000 | 51,060 |

| | | |

| Thrifts & Mortgage Finance 0.10% | | |

|

| First Defiance Financial Corp. | 400 | 3,936 |

|

| PMI Group, Inc. (I)(L) | 2,300 | 6,440 |

| | | |

| Health Care 13.94% | | 1,428,234 |

| | | |

| Health Care Equipment & Supplies 3.08% | | |

|

| American Medical Systems Holdings, Inc. (I) | 700 | 12,684 |

|

| ArthroCare Corp. (I) | 400 | 10,628 |

|

| Beckman Coulter, Inc. | 1,100 | 72,116 |

|

| Cooper Companies, Inc. | 900 | 36,054 |

|

| Hill-Rom Holdings, Inc. | 1,800 | 47,232 |

|

| Invacare Corp. (L) | 700 | 19,096 |

|

| Kinetic Concepts, Inc. (I) | 2,200 | 92,224 |

|

| Orthofix International NV (I) | 500 | 17,045 |

|

| Young Innovations, Inc. | 300 | 8,040 |

| | | |

| Health Care Providers & Services 6.73% | | |

|

| Amedisys, Inc. (I) | 400 | 23,060 |

|

| BioScrip, Inc. (I) | 1,100 | 8,129 |

|

| Community Health Systems, Inc. (I) | 2,000 | 68,540 |

|

| Coventry Health Care, Inc. (I) | 4,100 | 95,038 |

|

| Health Management Associates, Inc. (I) | 7,800 | 56,862 |

|

| Health Net, Inc. (I) | 2,900 | 66,961 |

|

| Healthspring, Inc. | 1,200 | 22,092 |

|

| Healthways, Inc. | 700 | 10,514 |

|

| Henry Schein, Inc. (I)(L) | 700 | 39,781 |

|

| inVentiv Health, Inc. (I) | 800 | 11,744 |

|

| Lincare Holdings, Inc. (I) | 1,700 | 68,272 |

|

| MEDNAX, Inc. (I) | 1,500 | 80,250 |

|

| Odyssey HealthCare, Inc. (I) | 800 | 14,024 |

|

| Patterson Companies, Inc. (I) | 2,200 | 65,296 |

|

| Providence Service Corp. (I) | 600 | 7,266 |

|

| PSS World Medical, Inc. (I) | 200 | 4,218 |

|

| Universal American Financial Corp. (I) | 900 | 12,969 |

|

| WellCare Health Plans, Inc. (I) | 1,300 | 34,710 |

| | | |

| Health Care Technology 0.09% | | |

|

| MedQuist, Inc. | 1,200 | 9,432 |

| | | |

| Life Sciences Tools & Services 1.05% | | |

|

| Life Technologies Corp. (I) | 1,400 | 71,064 |

|

| Mettler-Toledo International, Inc. (I) | 80 | 7,953 |

|

| PerkinElmer, Inc. | 1,300 | 28,873 |

| | | |

| Pharmaceuticals 2.99% | | |

|

| Endo Pharmaceutical Holdings, Inc. (I) | 1,700 | 38,675 |

|

| K-V Pharmaceutical Company, Class A (I) | 1,900 | 6,004 |

|

| King Pharmaceuticals, Inc. (I) | 5,700 | 64,125 |

|

| Medicis Pharmaceutical Corp., Class A | 1,500 | 33,750 |

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 17 |

| | |

| | Shares | Value |

| Pharmaceuticals (continued) | | |

|

| Mylan, Inc. (I)(L) | 4,300 | $91,762 |

|

| Par Pharmaceutical Companies, Inc. (I) | 800 | 20,024 |

|

| Watson Pharmaceuticals, Inc. (I) | 1,300 | 51,727 |

| | | |

| Industrials 11.09% | | 1,135,928 |

| | | |

| Air Freight & Logistics 0.07% | | |

|

| Air Transport Services Group, Inc. (I) | 2,600 | 6,604 |

| | | |

| Commercial Services & Supplies 2.85% | | |

|

| Acco Brands Corp. (I) | 1,500 | 10,755 |

|

| Avery Dennison Corp. | 1,500 | 47,400 |

|

| Bowne & Company, Inc. | 1,100 | 12,243 |

|

| Consolidated Graphics, Inc. (I) | 300 | 13,362 |

|

| Deluxe Corp. | 1,600 | 28,720 |

|

| Ennis Business Forms, Inc. | 1,000 | 15,370 |

|

| HNI Corp. (L) | 1,300 | 30,901 |

|

| M & F Worldwide Corp. (I) | 500 | 16,195 |

|

| R.R. Donnelley & Sons Company | 3,600 | 71,604 |

|

| United Stationers, Inc. (I) | 800 | 45,688 |

| | | |

| Electrical Equipment 0.60% | | |

|

| Hubbell, Inc. | 1,300 | 60,905 |

| | | |

| Industrial Conglomerates 0.71% | | |

|

| Carlisle Companies, Inc. | 1,300 | 44,590 |

|

| Textron, Inc. (L) | 1,400 | 27,888 |

| | | |

| Machinery 4.27% | | |

|

| Bucyrus International, Inc. | 1,100 | 68,816 |

|

| Crane Company | 1,400 | 44,338 |

|

| John Bean Technologies Corp. | 300 | 4,905 |

|

| Joy Global, Inc. | 1,000 | 50,800 |

|

| Manitowoc Company, Inc. (L) | 2,400 | 27,984 |

|

| NACCO Industries, Inc., Class A | 190 | 8,892 |

|

| Oshkosh Corp. (I) | 2,800 | 106,736 |

|

| Stanley Works (L) | 1,600 | 91,600 |

|

| Toro Company | 600 | 26,412 |

|

| TriMas Corp. (I) | 1,200 | 7,308 |

| | | |

| Marine 0.04% | | |

|

| Horizon Lines, Inc. (L) | 1,100 | 4,444 |

| | | |

| Professional Services 1.48% | | |

|

| COMSYS IT Partners, Inc. (I) | 800 | 13,984 |

|

| Corporate Executive Board Company | 600 | 13,728 |

|

| Kforce, Inc. (I) | 1,000 | 13,320 |

|

| Manpower, Inc. | 1,300 | 66,976 |

|

| School Specialty, Inc. (I) | 400 | 8,540 |

|

| SFN Group, Inc. (I) | 1,500 | 11,805 |

|

| TrueBlue, Inc. (I) | 1,100 | 14,597 |

|

| Volt Information Sciences, Inc. (I) | 400 | 4,260 |

|

| VSE Corp. | 100 | 4,253 |

See notes to financial statements

| |

18 | Value Opportunities Fund | Annual report |

| | |

| | Shares | Value |

| Road & Rail 0.60% | | |

|

| Avis Budget Group, Inc. (I)(L) | 3,300 | $34,716 |

|

| Dollar Thrifty Automotive Group, Inc. (I) | 900 | 27,036 |

| | | |

| Trading Companies & Distributors 0.38% | | |

|

| Aircastle, Ltd. | 2,200 | 21,406 |

|

| WESCO International, Inc. (I) | 600 | 17,334 |

| | | |

| Transportation Infrastructure 0.09% | | |

|

| Macquarie Infrastructure Company LLC (I) | 700 | 9,513 |

| | | |

| Information Technology 10.80% | | 1,106,473 |

| | | |

| Communications Equipment 0.28% | | |

|

| Plantronics, Inc. | 1,000 | 28,430 |

| | | |

| Computers & Peripherals 2.16% | | |

|

| Lexmark International, Inc. (I) | 1,500 | 50,565 |

|

| QLogic Corp. (I) | 2,300 | 41,860 |

|

| Quantum Corp. (I) | 4,300 | 10,664 |

|

| Seagate Technology (I) | 4,400 | 87,604 |

|

| Western Digital Corp. (I) | 800 | 30,904 |

| | | |

| Electronic Equipment, Instruments & Components 3.03% | | |

|

| Brightpoint, Inc. (I) | 1,900 | 13,547 |

|

| Ingram Micro, Inc., Class A (I) | 4,100 | 72,570 |

|

| Insight Enterprises, Inc. (I) | 1,500 | 19,185 |

|

| Jabil Circuit, Inc. | 4,600 | 69,782 |

|

| Sanmina-SCI Corp. (I) | 1,000 | 16,540 |

|

| Smart Modular Technologies (WWH), Inc. (I) | 1,500 | 9,600 |

|

| SYNNEX Corp. (I) | 1,100 | 31,504 |

|

| Tech Data Corp. (I) | 1,700 | 72,828 |

|

| Technitrol, Inc. | 1,000 | 4,400 |

| | | |

| Internet Software & Services 0.32% | | |

|

| Earthlink, Inc. | 1,700 | 14,178 |

|

| United Online, Inc. | 2,300 | 14,398 |

|

| Web.com Group, Inc. (I) | 800 | 3,808 |

| | | |

| IT Services 1.29% | | |

|

| Convergys Corp. (I) | 2,700 | 33,318 |

|

| CSG Systems International, Inc. (I) | 500 | 10,060 |

|

| Global Cash Access, Inc. (I) | 900 | 6,741 |

|

| Heartland Payment Systems, Inc. | 400 | 6,116 |

|

| infoGROUP, Inc. (I) | 1,600 | 12,848 |

|

| MoneyGram International, Inc. (I) | 900 | 2,493 |

|

| TeleTech Holdings, Inc. (I)(L) | 1,100 | 19,239 |

|

| Unisys Corp. (I) | 1,200 | 41,892 |

| | | |

| Semiconductors & Semiconductor Equipment 0.18% | | |

|

| Entegris, Inc. (I) | 2,700 | 12,096 |

|

| Photronics, Inc. (I) | 1,500 | 6,600 |

| | | |

| Software 3.54% | | |

|

| Actuate Corp. (I) | 1,200 | 6,432 |

|

| Blackbaud, Inc. | 600 | 13,968 |

|

| Bottomline Technologies, Inc. (I) | 400 | 6,356 |

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 19 |

| | |

| | Shares | Value |

| Software (continued) | | |

|

| Deltek, Inc. (I) | 800 | $6,152 |

|

| Dynamics Research Corp. (I) | 500 | 5,150 |

|

| ePlus, Inc. (I) | 400 | 6,560 |

|

| Fair Isaac Corp. | 1,100 | 25,256 |

|

| Jack Henry & Associates, Inc. | 900 | 20,322 |

|

| JDA Software Group, Inc. (I) | 900 | 25,470 |

|

| Manhattan Associates, Inc. (I) | 500 | 12,635 |

|

| MICROS Systems, Inc. (I) | 400 | 12,016 |

|

| MicroStrategy, Inc., Class A (I) | 300 | 26,607 |

|

| Progress Software Corp. (I) | 600 | 16,812 |

|

| Quest Software, Inc. (I) | 2,200 | 37,070 |

|

| Radiant Systems, Inc. (I) | 1,100 | 12,287 |

|

| Smith Micro Software, Inc. (I) | 600 | 5,256 |

|

| Sonic Solutions (I) | 1,000 | 9,090 |

|

| SonicWALL, Inc. (I) | 1,300 | 10,413 |

|

| Sybase, Inc. (I)(L) | 1,200 | 53,268 |

|

| THQ, Inc. (I)(L) | 1,400 | 8,484 |

|

| TIBCO Software, Inc. (I) | 4,700 | 43,099 |

| | | |

| Materials 4.76% | | 487,525 |

| | | |

| Chemicals 3.84% | | |

|

| Ashland, Inc. | 1,800 | 84,744 |

|

| Cytec Industries, Inc. | 600 | 25,602 |

|

| Hawkins, Inc. (L) | 200 | 3,990 |

|

| Innospec, Inc. | 500 | 5,325 |

|

| Lubrizol Corp. | 1,700 | 134,317 |

|

| NewMarket Corp. | 190 | 16,920 |

|

| RPM International, Inc. | 3,100 | 59,675 |

|

| Spartech Corp. | 500 | 5,095 |

|

| W.R. Grace & Company (I) | 2,000 | 57,920 |

| | | |

| Containers & Packaging 0.21% | | |

|

| AEP Industries, Inc. (I) | 200 | 6,980 |

|

| Boise, Inc. (I) | 2,000 | 9,500 |

|

| Bway Holding Company (I) | 300 | 4,521 |

| | | |

| Metals & Mining 0.52% | | |

|

| Reliance Steel & Aluminum Company | 1,200 | 53,208 |

| | | |

| Paper & Forest Products 0.19% | | |

|

| Clearwater Paper Corp. | 200 | 9,652 |

|

| KapStone Paper and Packaging Corp. (I) | 1,100 | 10,076 |

| | | |

| Telecommunication Services 0.96% | | 98,838 |

| | | |

| Diversified Telecommunication Services 0.96% | | |

|

| Atlantic Tele-Network, Inc. | 300 | 13,163 |

|

| CenturyTel, Inc. | 2,500 | 85,675 |

See notes to financial statements

| |

20 | Value Opportunities Fund | Annual report |

| | |

| Short-Term Investments 10.60% | | $1,086,110 |

|

| (Cost $1,085,667) | | |

| |

| | Par value | Value |

| Repurchase Agreement 2.45% | | 251,000 |

| Repurchase Agreement with State Street Corp. dated 2-26-10 | | |

| at 0.010% to be repurchased at $251,000 on 3-1-10, | | |

| collateralized by $255,000 Federal Home Loan Mortgage Corp., | | |

| 2.250% due 8-24-12 (valued at $256,244, including interest). | $251,000 | 251,000 |

| | | |

| | | Shares | Value |

| Securities Lending Collateral 8.15% | | | 835,110 |

| John Hancock Collateral Investment Trust (W) | 0.1869% (Y) | 83,427 | 835,110 |

|

| Total investments (Cost $8,941,447)† 108.57% | | $11,122,058 |

|

| Other assets and liabilities, net (8.57%) | | ($877,992) |

|

| Total net assets 100.00% | | | $10,244,066 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of February 28, 2010.

(W) Investment is an affiliate of the Fund, the adviser and/or subadviser and represents the investment of securities lending collateral received.

(Y) The rate shown is the annualized seven-day yield as of February 28, 2010.

† At February 28, 2010, the aggregate cost of investment securities for federal income tax purposes was $9,084,872. Net unrealized appreciation aggregated $2,037,186, of which $2,283,024 related to appreciated investment securities and $245,838 related to depreciated investment securities.

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 21 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 2-28-10

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $7,855,780) including | |

| $820,717 of securities loaned (Note 2) | $10,035,948 |

| Investments in affiliated issuers, at value (Cost $834,667) (Note 2) | 835,110 |

| Repurchase agreements, at value (Cost $251,000) (Note 2) | 251,000 |

| | |

| Total investments, at value (Cost $8,941,447) | 11,122,058 |

| Cash | 53 |

| Cash held at broker for futures contracts | 20,000 |

| Receivable for fund shares sold | 386 |

| Dividends and interest receivable | 7,671 |

| Receivable for securities lending income | 339 |

| | |

| Total assets | 11,150,507 |

| |

| Liabilities | |

|

| Payable upon return of securities loaned (Note 2) | 834,550 |

| Payable for futures variation margin | 20 |

| Payable to affiliates | |

| Accounting and legal services fees | 123 |

| Transfer agent fees | 1,402 |

| Distribution and service fees | 62 |

| Trustees’ fees | 269 |

| Investment management fees | 10,446 |

| Other liabilities and accrued expenses | 59,569 |

| | |

| Total liabilities | 906,441 |

| |

| Net assets | |

|

| Capital paid-in | $16,602,816 |

| Accumulated distributions in excess of income | (2,008) |

| Accumulated net realized loss on investments and futures contracts | (8,535,653) |

| Net unrealized appreciation on investments and futures contracts | 2,178,911 |

| | |

| Net assets | $10,244,066 |

See notes to financial statements

| |

| 22 | Value Opportunities Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($9,542,719 ÷ 647,672 shares) | $14.73 |

| Class B ($182,267 ÷ 12,427 shares)1 | $14.67 |

| Class C ($449,351 ÷ 30,614 shares)1 | $14.68 |

| Class I ($69,729 ÷ 4,731 shares) | $14.74 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $15.51 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 23 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 2-28-10

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $207,262 |

| Securities lending | 4,461 |

| Interest | 153 |

| Less foreign taxes withheld | (10) |

| | |

| Total investment income | 211,866 |

|

| Expenses | |

|

| Investment management fees (Note 5) | 98,960 |

| Distribution and service fees (Note 5) | 40,743 |

| Accounting and legal services fees (Note 5) | 932 |

| Transfer agent fees (Note 5) | 18,708 |

| Trustees’ fees (Note 5) | 974 |

| State registration fees (Note 5) | 44,901 |

| Printing and postage fees | 9,673 |

| Professional fees | 35,618 |

| Custodian fees | 30,414 |

| Registration and filing fees | 27,651 |

| Proxy fees | 4,083 |

| Other | 898 |

| | |

| Total expenses | 313,555 |

| Less expense reductions (Note 5) | (138,148) |

| | |

| Net expenses | 175,407 |

| | |

| Net investment income | 36,459 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | (3,566,788) |

| Investments in affiliated issuers | 118 |

| Futures contracts (Note 3) | 91,461 |

| | (3,475,209) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 8,059,251 |

| Investments in affiliated issuers | 443 |

| Futures contracts (Note 3) | 34,443 |

| | 8,094,137 |

| Net realized and unrealized gain | 4,618,928 |

| | |

| Increase in net assets from operations | $4,655,387 |

See notes to financial statements

| |

| 24 | Value Opportunities Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 2-28-10 | 2-28-09 |

|

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $36,459 | $101,853 |

| Net realized loss | (3,475,209) | (3,717,979) |

| Change in net unrealized appreciation (depreciation) | 8,094,137 | (3,610,530) |

| | | |

| Increase (decrease) in net assets resulting from operations | 4,655,387 | (7,226,656) |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (57,822) | (108,166) |

| Class B | — | (28) |

| Class C | — | (98) |

| Class I | (933) | (688) |

| Class R1 | — | (693) |

| | | |

| Total distributions | (58,755) | (109,673) |

| | | |

| From Fund share transactions (Note 6) | (4,922,172) | (283,575) |

| | | |

| Total decrease | (325,540) | (7,619,904) |

| |

| Net assets | | |

|

| Beginning of year | 10,569,606 | 18,189,510 |

| | | |

| End of year | $10,244,066 | $10,569,606 |

| | | |

| Accumulated distributions in excess of income | ($2,008) | ($119) |

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 25 |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | |

| CLASS A SHARES Period ended | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

| |

| Per share operating performance | | | | |

|

| Net asset value, beginning of year | $10.14 | $17.00 | $22.36 | $20.00 |

| Net investment income2 | 0.04 | 0.10 | 0.12 | 0.073 |

| Net realized and unrealized gain (loss) on investments | 4.61 | (6.84) | (4.41) | 2.53 |

| | | | | |

| Total from investment operations | 4.65 | (6.74) | (4.29) | 2.60 |

| | | | | |

| Less distributions | | | | |

| From net investment income | (0.06) | (0.12) | (0.11) | (0.08) |

| From net realized gain | — | — | (0.96) | (0.16) |

| | | | | |

| Total distributions | (0.06) | (0.12) | (1.07) | (0.24) |

| |

| Net asset value, end of year | $14.73 | $10.14 | $17.00 | $22.36 |

| | | | | |

| Total return (%)4,5 | 45.86 | (39.79) | (19.45) | 13.066 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of year (in millions) | $10 | $10 | $16 | $20 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 2.187 | 2.03 | 2.04 | 2.138 |

| Expenses net of fee waivers | 1.397 | 1.39 | 1.39 | 1.388 |

| Expenses net of fee waivers and credits | 1.397 | 1.39 | 1.39 | 1.388 |

| Net investment income | 0.33 | 0.69 | 0.56 | 0.473,8 |

| Portfolio turnover (%) | 178 | 80 | 68 | 30 |

| |

1 The inception date for Class A shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.09% of average net assets.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment (if applicable).

6 Not annualized.

7 Includes the impact of proxy expenses, which amounted to 0.03% of average net assets.

8 Annualized.

See notes to financial statements

| |

| 26 | Value Opportunities Fund | Annual report |

| | | | |

| CLASS B SHARES Period ended | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of year | $10.13 | $16.94 | $22.33 | $20.00 |

| Net investment loss2 | (0.05) | (0.01) | (0.03) | (0.01)3 |

| Net realized and unrealized gain (loss) on investments | 4.59 | (6.80) | (4.40) | 2.51 |

| | | | | |

| Total from investment operations | 4.54 | (6.81) | (4.43) | 2.50 |

| | | | | |

| Less distributions | | | | |

| From net investment income | — | —4 | — | (0.01) |

| From net realized gain | — | — | (0.96) | (0.16) |

| | | | | |

| Total distributions | — | —4 | (0.96) | (0.17) |

| | | |

| Net asset value, end of year | $14.67 | $10.13 | $16.94 | $22.33 |

| | | | | |

| Total return (%)5,6 | 44.82 | (40.19) | (20.08) | 12.547 |

|

| Ratios and supplemental data | | | | |

|

| Net assets, end of year (in millions) | —8 | —8 | $—8 | $—8 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 10.379 | 9.95 | 6.82 | 11.3110 |

| Expenses net of fee waivers | 2.189 | 2.63 | 2.10 | 2.0810 |

| Expenses net of fee waivers and credits | 2.099 | 2.09 | 2.09 | 2.0810 |

| Net investment loss | (0.43) | (0.02) | (0.14) | (0.07)3,10 |

| Portfolio turnover (%) | 178 | 80 | 68 | 30 |

1 The inception date for Class B shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.10% of average net assets.

4 Less than $0.01 per share.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Assumes dividend reinvestment (if applicable).

7 Not annualized.

8 Less than $500,000.

9 Includes the impact of proxy expenses, which amounted to 0.03% of average net assets.

10 Annualized.

| | | | |

| CLASS C SHARES Period ended | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of year | $10.14 | $16.95 | $22.33 | $20.00 |

| Net investment loss2 | (0.05) | (0.01) | (0.03) | (0.01)3 |

| Net realized and unrealized gain (loss) on investments | 4.59 | (6.80) | (4.39) | 2.51 |

| | | |

| Total from investment operations | 4.54 | (6.81) | (4.42) | 2.50 |

| From net investment income | — | —4 | — | (0.01) |

| rom net realized gain | — | — | (0.96) | (0.16) |

| | | |

| Total distributions | — | —4 | (0.96) | (0.17) |

| | | |

| Net asset value, end of year | $14.68 | $10.14 | $16.95 | $22.33 |

| | | | | |

| Total return (%)5,6 | 44.77 | (40.17) | (20.03) | 12.547 |

|

| Ratios and supplemental data | | | | |

|

| Net assets, end of year (in millions) | —8 | —8 | $1 | $1 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 5.799 | 5.1210 | 3.88 | 5.09 |

| Expenses net of fee waivers | 2.219 | 2.40 | 2.10 | 2.0810 |

| Expenses net of fee waivers and credits | 2.099 | 2.09 | 2.09 | 2.0810 |

| Net investment loss | (0.41) | (0.03) | (0.14) | (0.07)3,10 |

| Portfolio turnover (%) | 178 | 80 | 68 | 30 |

1 The inception date for Class C shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.10% of average net assets.

4 Less than $0.01 per share.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Assumes dividend reinvestment (if applicable).

7 Not annualized.

8 Less than $500,000.

9 Includes the impact of proxy expenses, which amounted to 0.04% of average net assets.

10 Annualized.

See notes to financial statements

| |

| Annual report | Value Opportunities Fund | 27 |

| | | | |

| CLASS I SHARES Period ended | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

|

| Per share operating performance | | | | |

|

| Net asset value, beginning of year | $10.15 | $17.02 | $22.39 | $20.00 |

| Net investment income2 | 0.09 | 0.17 | 0.18 | 0.153 |

| Net realized and unrealized gain (loss) on investments | 4.62 | (6.86) | (4.41) | 2.53 |

| | | | | |

| Total from investment operations | 4.71 | (6.69) | (4.23) | 2.68 |

| | | |

| Less distributions | | | | |

| From net investment income | (0.12) | (0.18) | (0.18) | (0.13) |

| From net realized gain | — | — | (0.96) | (0.16) |

| | | |

| Total distributions | (0.12) | (0.18) | (1.14) | (0.29) |

| | | |

| Net asset value, end of year | $14.74 | $10.15 | $17.02 | $22.39 |

| | | | | |

| Total return (%)4,5 | 46.41 | (39.48) | (19.16) | 13.426 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of year (in millions) | —7 | —7 | —7 | —7 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 11.398 | 21.05 | 8.80 | 12.639 |

| Expenses net of fee waivers | 0.948 | 0.99 | 0.99 | 0.999 |

| Expenses net of fee waivers and credits | 0.948 | 0.99 | 0.99 | 0.999 |

| Net investment income | 0.74 | 1.11 | 0.86 | 0.963,9 |

| Portfolio turnover (%) | 178 | 80 | 68 | 30 |

| |

1 The inception date for Class I shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Net investment loss per share and ratio of net investment loss to average net assets reflects a special dividend received by the Fund, which amounted to $0.02 per share and 0.10% of average net assets.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Assumes dividend reinvestment (if applicable).

6 Not annualized.

7 Less than $500,000.

8 Includes the impact of proxy expenses, which amounted to 0.01% of average net assets.

9 Annualized.

See notes to financial statements

| |

| 28 | Value Opportunities Fund | Annual report |

Notes to financial statements

Note 1 — Organization

John Hancock Value Opportunities Fund (the Fund) is a diversified series of John Hancock Funds III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A, Class B and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees and transfer agent fees for each class may differ. Class B shares convert to Class A shares eight years after purchase. Effective at the close of business on August 21, 2009, Class R1 shares converted into Class A shares.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of the regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes significant unobservable input s when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the values by input classification of the Fund’s investments as of February 28, 2010, by major security category or type:

| | | | |

| | | | LEVEL 2 | LEVEL 3 |

| | TOTAL MARKET | | SIGNIFICANT | SIGNIFICANT |

| INVESTMENTS | VALUE AT | LEVEL 1 | OBSERVABLE | UNOBSERVABLE |

| IN SECURITIES | 2-28-10 | QUOTED PRICE | INPUTS | INPUTS |

|

| Common Stocks | | | | |

| Consumer Discretionary | $3,583,447 | $3,583,447 | — | — |

| Consumer Staples | 616,205 | 616,205 | — | — |

| Energy | 145,196 | 145,196 | — | — |

| Financials | 1,434,102 | 1,434,102 | — | — |

| Health Care | 1,428,234 | 1,428,234 | — | — |

| Industrials | 1,135,928 | 1,135,928 | — | — |

| |

| Annual report | Value Opportunities Fund | 29 |

| | | | |

| | | | LEVEL 2 | LEVEL 3 |

| | TOTAL MARKET | | SIGNIFICANT | SIGNIFICANT |

| INVESTMENTS | VALUE AT | LEVEL 1 | OBSERVABLE | UNOBSERVABLE |

| IN SECURITIES | 2-28-10 | QUOTED PRICE | INPUTS | INPUTS |

|

| Information Technology | $1,106,473 | $1,106,473 | — | — |

| Materials | 487,525 | 487,525 | — | — |

| Telecommunication | | | | |

| Services | 98,838 | 98,838 | — | — |

| Short-Term Investments | 1,086,110 | 835,110 | $251,000 | |

| |

|

| Total Investments in | | | | |

| Securities | $11,122,058 | $10,871,058 | $251,000 | — |

| Other Financial | | | | |

| Instruments | (1,700) | (1,700) | — | — |

| Totals | $11,120,358 | $10,869,358 | $251,000 | — |

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. John Hancock Collateral Investment Trust (JHCIT), an affiliate of the Fund, is valued at its closing net asset value. JHCIT is a non stable value fund investing in short-term investments as part of a securities lending program.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of non-U.S. securities, used in computing the net asset value of the Fund’s shares, are generally determined at these times. Significant market events that affect the values of non-U.S. securities may occur after the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees.

Repurchase agreements. The Fund may enter into repurchase agreements. When a Fund enters into a repurchase agreement it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date.

Securities lending. A Fund may lend its securities to earn additional income. It receives and maintains cash collateral received from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, which is not a stable value fund. As a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the

| |

| 30 | Value Opportunities Fund | Annual report |

securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral. Income received from JHCIT is a component of securities lending income as recorded on the Statement of Operations.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to a Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with the custodian which enables them to participate in a $150 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis based on their relative average net assets. For the year ended February 28, 2010, there were no significant borrowings under the line of credit by the Fund. Effective March 31, 2010, the amount of the line of credit changed to $100 million.

Expenses. The majority of expenses are directly attributable to an individual Fund. Expenses that are not readily attributable to a specific fund are allocated among all Funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the Funds’ relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses, and realized and unrealized gains (losses) are determined at the Fund level and allocated daily to each class of shares based on the net asset value of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage fees, for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has a capital loss carryforward of $8,395,553 available to offset future net realized capital gains. The following table details the capital loss carryforward available as of February 28, 2010.

At February 28, 2010, capital loss carryforward available to offset future realized gains was as follows:

| | | |

| CAPITAL LOSS CARRYFORWARD | | |

| EXPIRING AT FEBRUARY 28 | | | |

| | |

| 2017 | 2018 | | |

| | |

| $2,899,971 | $5,495,582 | | |

As of February 28, 2010, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. The Fund generally declares and pays dividends and capital gain distributions, if any, at least annually. The tax character of distributions for the years ended February 28, 2010 and February 28, 2009 was as follows:

| |

| Annual report | Value Opportunities Fund | 31 |

| | | | |

| | FEBRUARY 28, 2010 | FEBRUARY 28, 2009 | | |

| | |

| Ordinary Income | $58,755 | $109,673 | | |

Distributions paid by the Fund with respect to each series of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of expenses that may be applied differently to each class. As of February 28, 2010, the Fund has no distributable earnings on a tax basis.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within financial statements are adjusted for permanent book/tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book/ tax differences will reverse in a subsequent period. Permanent book/tax differences are primarily attributable to foreign currency transactions, net operating losses, pay-downs, defaulted bonds, derivative transactions, partnerships, amortization and accretion on debt securities, tender fees and investments in passive foreign investment companies.

Note 3 — Derivative instruments

The Fund may invest in derivatives, including futures contracts in order to meet its investment objectives. The Fund may use derivatives to gain exposure to securities or indices and enhance potential gains.

The use of derivatives may involve risks different from, or potentially greater than, the risks associated with investing directly in securities. Specifically, derivatives expose a Fund to the risk that the counterparty to an over-the-counter (OTC) derivatives contract will be unable or unwilling to make timely settlement payments or otherwise honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction. If the counterparty defaults, the Fund will have contractual remedies, but there is no assurance that the counterparty will meet its contractual obligations or the Fund will succeed in enforcing them.

For more information regarding the Fund’s use of derivatives, please refer to the Fund’s Prospectuses and Statement of Additional Information.

Futures. A future is a contractual agreement to buy or sell a particular commodity, currency, or financial instrument at a pre-determined price in the future. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values and/or interest rates and potential losses in excess of the fund’s initial investment.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. Upon entering into a futures contract, the Fund is required to deposit initial margin with the broker in the form of cash or securities. The amount of required margin is generally based on a percentage of the contract value; this amount is the initial margin for the trade. The margin deposit must then be maintained at the established level over the life of the contract. Futures contracts are marked to market daily and an appropriate payable or receivable for the change in value (“variation margin”) is recorded by the Fund.

| |

| 32 | Value Opportunities Fund | Annual report |

During the year ended February 28, 2010, the Fund used futures contracts to maintain diversity and liquidity of the portfolio. The following table summarizes the contracts held at February 28, 2010. The range of futures contracts notional amounts held by the Fund during the year ended February 28, 2010 was $210,000 to $311,000.

| | | | | |

| | | | | | UNREALIZED |

| OPEN | NUMBER OF | | | | APPRECIATION |

| CONTRACTS | CONTRACTS | POSITION | EXPIRATION DATE | NOTIONAL VALUE | (DEPRECIATION) |

|

| Russell 2000 Mini | | | | | |

| Index Futures | 1 | Long | Mar 2010 | $62,790 | ($966) |

| S&P Midcap 400 | | | | | |

| E-Mini Index Futures | 2 | Long | Mar 2010 | 147,540 | (734) |

|

| | | | | $210,330 | ($1,700) |

Fair value of derivative instruments by risk category. The table below summarizes the fair value of derivatives held by the Fund at February 28, 2010 by risk category:

| | | | | | |

| | | | FINANCIAL | ASSET | | LIABILITY |

| | STATEMENT OF ASSETS AND | | INSTRUMENT | DERIVATIVES | | DERIVATIVES |

| RISK | LIABILITIES LOCATION | | LOCATION | FAIR VALUE | | FAIR VALUE |

|

| | Receivable/Payable | | | | | |

| | for futures variation | | | | | |

| | margin; Net unrealized | | | | | |

| | (appreciation) | | | | | |

| | depreciation on | | | | | |

| Equity contracts | investments | | Futures | — | | ($1,700)† |

| |

| Total | | | | — | | ($1,700) |

† Reflects cumulative appreciation/depreciation of futures as disclosed in Note 3. Only the period end variation margin is separately disclosed on the Statement of Assets and Liabilities.

Effect of derivative instruments on the Statements of Operations. The table below summarizes the net realized gain (loss) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the year ended February 28, 2010:

| | | |

| RISK | STATEMENT OF OPERATIONS LOCATION | | FUTURES |

|

| | | | Futures contracts |

| Equity contracts | Net realized gain (loss) | | $91,461 |

| Total | | | $91,461 |

The table below summarizes the net change in unrealized appreciation (depreciation) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the year ended February 28, 2010:

| | | |

| RISK | STATEMENT OF OPERATIONS LOCATION | | FUTURES |

|

| | | | Futures contracts |

| Equity contracts | Change in unrealized | | $34,443 |

| | apppreciation (depreciation) | | |

| Total | | | $34,443 |

Note 4 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is

| |

| Annual report | Value Opportunities Fund | 33 |

unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

Note 5 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management Fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.80% of the first $500,000,000 of the Fund’s average daily net assets; (b) 0.78% of the next $500,000,000 of the Fund’s average daily net assets; (c) 0.77% of the next $1,500,000,000 of the Fund’s average daily net assets; and (d) 0.76% of the Fund’s average daily net assets in excess of $2,500,000,000. The Adviser has a subadvisory agreement with Grantham, Mayo, Van Otterloo & Co. LLC. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the year ended February 28, 2010 were equivalent to an annual effective rate of 0.80% of the Fund’s average daily net assets.

Effective July 1, 2009, the Adviser has agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, fees incurred under any agreement or plans of the Fund dealing with services for the shareholders and others with beneficial interest in shares of the Fund, are excluded. The reimbursements and limits are such that these expenses will not exceed 1.39% for Class A shares, 2.09% for Class B, 2.09% for Class C and 0.91% for Class I. The expense reimbursements and limits will continue in effect until June 30, 2010 and thereafter until terminated by the Adviser on notice to the Trust.

Prior to June 30, 2009, the Adviser contractually agreed to reimburse or limit certain Fund level expenses to 0.09% of the Fund’s average annual net assets which are allocated pro rata to all share classes. This agreement excluded taxes, portfolio brokerage commissions, interest, advisory fees, distribution and service fees, transfer agent fees, state registration fees, printing and postage fees, litigation and indemnification expenses, and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, fees incurred under any agreement or plans of the Fund dealing with services for the shareholders and others with beneficial interest in shares of the Fund, were excluded.

In addition, the Adviser agreed to reimburse or limit certain expenses for each share class. This agreement excludes taxes, portfolio brokerage commissions, interest and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, fees incurred under any agreement or plans of the Fund dealing with services for the shareholders and others with beneficial interest in shares of the Fund, are excluded. The reimbursements and limits were such that these expenses will not exceed 1.39% for Class A shares, 2.09% for Class B, 2.09% for Class C, 0.99% for Class I and 1.49% for Class R1.

Accordingly, the expense reductions or reimbursements related to these agreements $91,276, $11,801, $14,657, $11,309 and $8,083 for Class A, Class B, Class C, Class I and Class R1, respectively, for the year ended February 28, 2010.

Accounting and legal services. Pursuant to the Service Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, periodic

| |

| 34 | Value Opportunities Fund | Annual report |