UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21779

JOHN HANCOCK FUNDS II

---------------------------------------------------------

(Exact name of registrant as specified in charter)

601 CONGRESS STREET, BOSTON, MA 02210-2805

-------------------------------------------------------------

(Address of principal executive offices) (Zip code)

GORDON M. SHONE, 601 CONGRESS STREET, BOSTON, MA 02210-2805

------------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 663-3000

--------------

Date of fiscal year end: 8/31

------

Date of reporting period: 8/31/06

-------

ITEM 1. REPORTS TO STOCKHOLDERS.

The first report applies to Lifestyle Aggressive Portfolio, the second report applies to Lifestyle Balanced Portfolio, the third report applies to Lifestyle Conservative Portfolio, the fourth report applies to Lifestyle Growth Portfolio, the fifth report applies to Lifestyle Moderate Portfolio and the sixth report applies to 56 of the Registrant’s portfolios

CEO corner

| TABLE OF CONTENTS |

|

| |

| Managers' report |

| page 2 |

|

| |

| A look at performance |

| page 6 |

|

| |

| Your expenses |

| page 8 |

|

| |

| Portfolio’s investments |

| page 10 |

|

| |

| Financial statements |

| page 12 |

|

| |

| Trustees and officers |

| page 31 |

|

| |

| For more information |

| page 36 |

|

To Our Shareholders,

The future has arrived at John Hancock Funds.

We have always been firm believers in the powerful role the Internet can play in providing fund information to our shareholders and prospective investors. Recently, we launched a redesigned, completely overhauled Web site that is more visually pleasing, easier to navigate and, most importantly, provides more fund information and learning tools without overwhelming the user.

Not long after we embarked on this major project, a study was released by the Investment Company Institute, the mutual fund industry’s main trade group, which found that an overwhelming majority of shareholders consider the Internet the “wave of the future” for accessing fund information.

Our new site sports fresher and faster ways to access account information. New innovations allow investors to view funds by risk level, track the performance of the John Hancock funds of their choice or sort funds by Morningstar, Inc.’s star ratings. Investors who own a John Hancock fund through a qualified retirement plan and don’t pay sales charges when making a purchase have the option of sorting by a “Load Waived” Morningstar Rating, thereby creating an apples-to-apples comparison with no-load funds that may also be available in their retirement plan.

The new site also has more educational tools and interactive modules to educate and assist investors with their financial goals, from college savings to retirement planning. A new “I want to…” feature allows investors to check performance, invest more money, update personal information or download prospectuses and forms quickly and easily.

In another of our ongoing efforts to provide our shareholders with top-notch service, we also redesigned our shareholder reports, as you may have noticed with this report. We hope the larger size, more colorful cover and redesigned presentation of the commentary and data tables will draw you in and make them easier to read.

After you’ve read your shareholder report, we encourage you to visit our new Web site — www.jhfunds.com — and take a tour. It’s easy, fast and fun and allows you to be in control of what you see and do. In short, it’s the wave of the future!

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

This commentary reflects the CEO’s views as of August 31, 2006. They are subject to change at any time.

Your portfolio at a glance

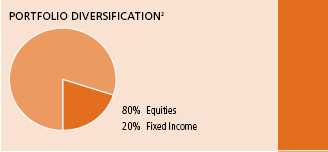

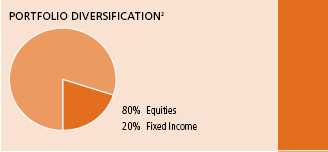

The Portfolio seeks long-term growth of capital. Current income is not a consideration. To pursue this goal, the Portfolio, which is a fund-of-funds, normally invests 100% of its assets in underlying funds that invest primarily in equity securities.

Since inception*

► Across all asset classes, financial markets gained ground during the period, with nearly all of the Portfolio’s underlying funds performing positively.

► The Portfolio’s allocation to international and natural resources funds was a big positive, while U.S. large-cap growth and core funds lagged the S&P 500 Index.

► While there were relatively few management changes to the Portfolio, we did add a new international small-cap stock fund to broaden our exposure to that asset class.

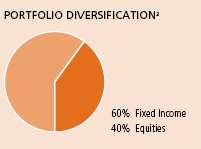

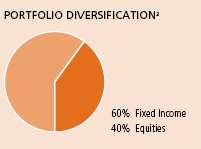

| Target Asset Allocation | |

| Equity | % of Total |

|

| U.S. Large Cap | 38.0 |

|

| International | 24.0 |

|

| U.S. Small Cap | 14.0 |

|

| U.S. Mid Cap | 13.0 |

|

| International Small Cap | 6.0 |

|

| Natural Resources | 5.0 |

|

1

Managers’ report

John Hancock

Lifestyle Aggressive Portfolio

The Portfolio’s broad diversification across multiple asset classes and fund managers was very valuable during a volatile market environment. Just about every investment type ended the reporting period in positive territory for the period beginning October 15, 2005 (the Portfolio’s inception date), through August 31, 2006.

The broad U.S. equity market turned in a respectable performance during the reporting period, as the S&P 500 Index gained 11.44% . These results came despite a sharp May/June downturn, which resulted from worries about slowing corporate earnings, fears of rising inflation and the expectation for further rate hikes from the U.S. Federal Reserve. However, strong rallies both early and late in the period helped overcome prior losses and gave stocks some much-needed upward momentum.

Continuing the trend of the past several years, large-capitalization U.S. stocks again lagged their mid-cap counterparts, which in turn underperformed small caps — although the performance gap between large and small stocks finally began to narrow during the period. Once again, one trend that remained the same across all U.S. market-capitalization ranges: value stocks continued to outshine growth stocks, despite several brief periods during which growth took the lead.

SCORECARD

| INVESTMENT | | PERIOD’S PERFORMANCE... AND WHAT’S BEHIND THE NUMBERS |

| Natural Resources | ▲ | Continued to benefit from steadily rising commodity prices. |

| (Wellington) | | |

| International | ▲ | Strong international stock performance and favorable currency |

| Opportunities (Marsico) | | movements added to results. |

| U.S. Multi-Sector | ▼ | Emphasis on certain higher-quality, large-cap growth stocks |

| (GMO) | | detracted from performance. |

2

From the MFC Global Investment Management (U.S.A.), LLC’s Portfolio Management Team

“One big reason for the

Portfolio’s solid relative

performance was our large

weighting in international

equities, approximately 30%

of assets.”

International stocks were particularly strong performers during the period, as indicated by the 23.02% return of the MSCI EAFE Index. Equities abroad benefited from continued relative weakness in the U.S. dollar and greater uncertainty about the direction of interest rates in the United States. Another asset class that did very well was natural resources, which was helped by continued economic expansion boosting demand for commodities, coupled with relatively tight supplies. Energy stocks did particularly well, as oil prices rose further. Excellent supply/demand fundamentals also helped companies in the metals and mining and the paper and forest products industries.

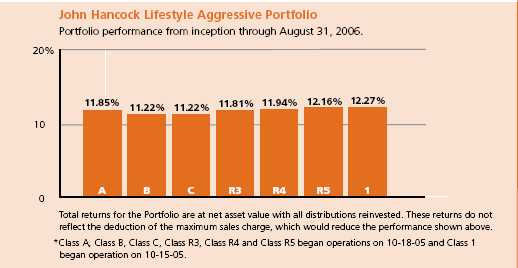

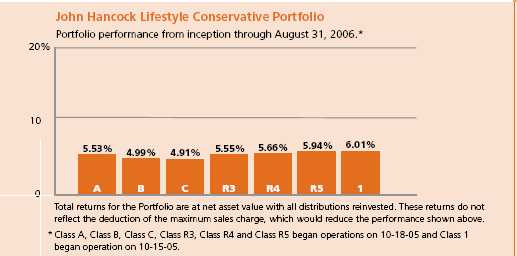

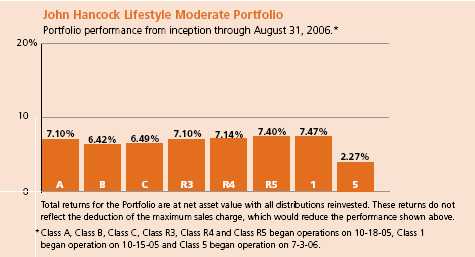

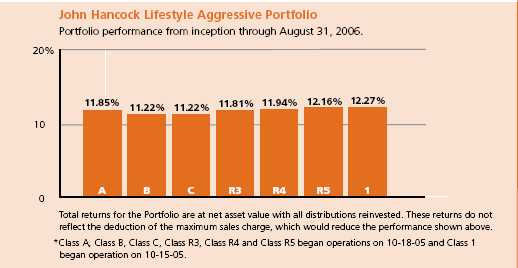

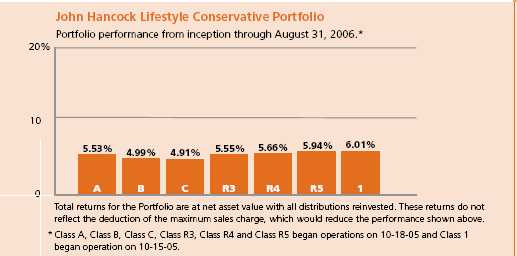

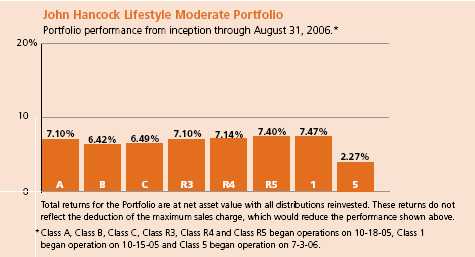

Performance results

John Hancock Lifestyle Aggressive Portfolio’s Class A, Class B, Class C, Class R3, Class R4 and Class R5, which began operations on October 18, 2005, producd total returns of 11.85%, 11.22%, 11.22%, 11.81%, 11.94% and 12.16%, respectively, at net asset value through August 31, 2006. Class 1 shares returned 12.27% at net asset value since beginning operation October 15, 2005. In comparison, the Portfolio’s benchmark, the S&P 500 Index, returned 11.44% and Morningstar’s average large blend fund returned 11.41% .1 Keep in mind that your net asset value return will be different from the Portfolio’s performance if you were not invested in the Portfolio for the entire period and did not reinvest all distributions. Please see pages six and seven for historical performance information.

Lifestyle Aggressive Portfolio

3

International gains

One big reason for the Portfolio’s solid relative performance was our large weighting in international equities, approximately 30% of assets. Particularly strong results came from International Core (+22.19%, GMO), one of our two largest allocations at 8% of the Portfolio at period end. Another big help was our position in International Opportunities (+23.51%, Marsico), in which we held a 4% stake.

In addition, we benefited significantly from our exposure to the natural resources asset class through a 5% position in Natural Resources (+24.62%, Wellington). The Portfolio’s overweighting in natural resources has declined somewhat relative to our benchmark, as these stocks have performed well and grown to occupy a larger portion of the index.

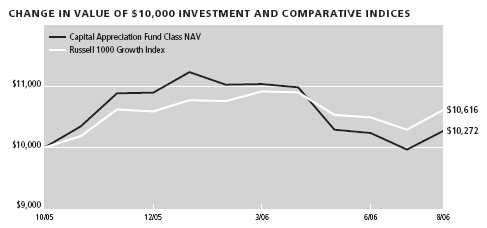

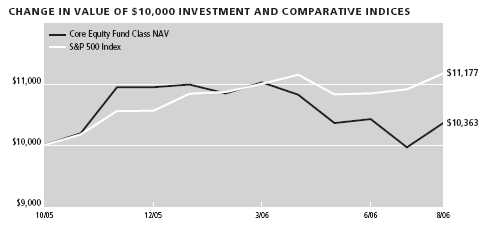

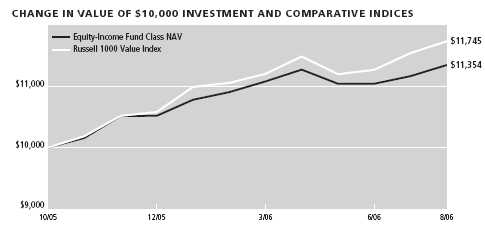

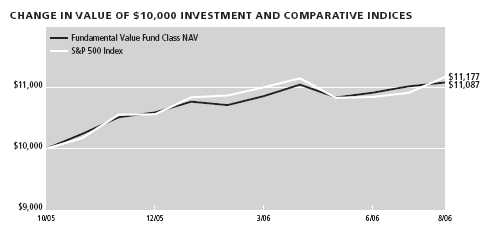

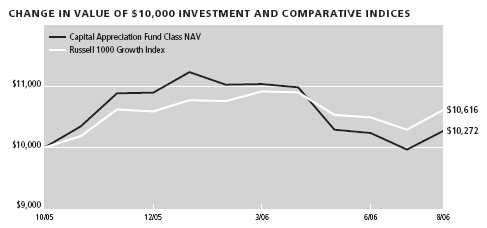

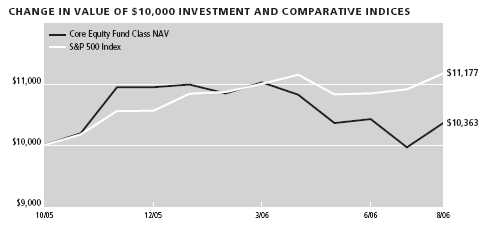

On the Portfolio’s domestic equity side, we were most helped by a number of our large-cap value-oriented investments. For example, Quantitative Value (+17.98%, MFC Global Investment Management (U.S.A.), LLC) enjoyed very strong results, while Large Cap Value (+13.43%, Mercury) and Equity Income (+13.54%, T. Rowe Price) also generated solid gains. By contrast, the Portfolio’s large-cap core and growth-oriented investments tended to lag in a market environment that continued to favor value and small-cap stocks. Capital Appreciation, managed by Jennison, turned in a modestly positive return of 2.72%, while the GMO-managed U.S. Multi-Sector — at 8% our other largest weighting — gained 4.25% . Core Equity (+3.63%, Legg Mason) also failed to keep pace with the S&P 500 Index.

Broader small-cap exposure

We initiated relatively few meaningful asset allocation shifts during the period. In May, we did establish a new position in a new international small-cap fund, International Small Company, managed by Dimensional Fund Advisors (DFA). This fund was added to complement our existing holdings in International Small Cap, managed by Templeton. The DFA offering provides us with two important benefits — added exposure to the smaller end of the international small-cap spectrum, and enough capacity to maintain our desired exposure to this important asset class.

Lifestyle Aggressive Portfolio

4

Outlook

We have maintained the Portfolio’s relatively neutral weighting in international markets. On the positive side, there are some good pockets of growth around the world, particularly in Japan. However, higher valuations in many markets along with the potential for rising interest rates are some reasons to be cautious.

“On the Portfolio’s domestic equity

side, we were most helped by a

number of our large-cap value-

oriented investments.”

We believe the stage may be set for high-quality, large-cap stocks to finally take the lead over their mid- and small-cap counterparts. We have positioned the Portfolio to benefit from such a scenario, maintaining a slight overweight in funds that own high-quality, large-cap stocks, such as T. Rowe Price’s Blue Chip Growth. Added exposure to this group comes from funds such as U.S. Multi Sector, whose management team also has prepared for a high-quality large-cap shift and has tilted its portfolio accordingly. Although we are expecting large caps to take the lead, we can’t predict when such a reversal will take place. If, however, investors continue their preference for higher-risk, lower-quality asset classes, we believe our broadly diversified Portfolio can help capture these performance gains while effectively managing volatility for our shareholders.

This commentary reflects the views of the portfolio managers through the end of the Portfolio’s period discussed in this report. The managers’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting. See the prospectus for the risks of investing in small-cap stocks. See the prospectus for the risks of investing in high-yield bonds.

1 Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on August 31, 2006.

Lifestyle Aggressive Portfolio

5

A look at performance

| For the period ending August 31, 2006 | |

| |

| | | Cumulative total returns |

| | | with maximum sales charge (POP) |

|

| | Inception | Since |

| Class | date | Inceptiona |

|

| A | 10-18-05 | 6.30% |

|

| B | 10-18-05 | 6.22 |

|

| C | 10-18-05 | 10.22 |

|

| R3b | 10-18-05 | 11.81 |

|

| R4b | 10-18-05 | 11.94 |

|

| R5b | 10-18-05 | 12.16 |

|

| 1b | 10-15-05 | 12.27 |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class R3, Class R4, Class R5 and Class 1 shares.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Portfolio’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Portfolio’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Since inception performance is calculated with an opening price (prior day’s close) on inception date.

a Class A, Class B, Class C, Class R3, Class R4 and Class R5 shares began operations on 10-18-05 and Class 1 shares began operation on 10-15-05.

b For certain types of investors as described in the Portfolio’s Class R3, Class R4, Class R5 and Class 1 share prospectuses.

Lifestyle Aggressive Portfolio

6

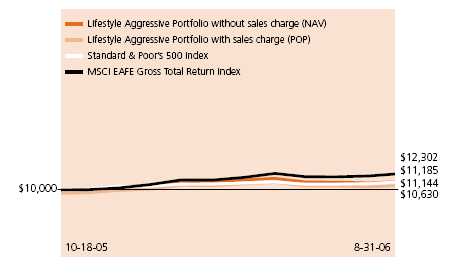

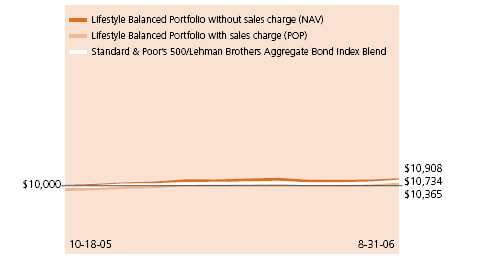

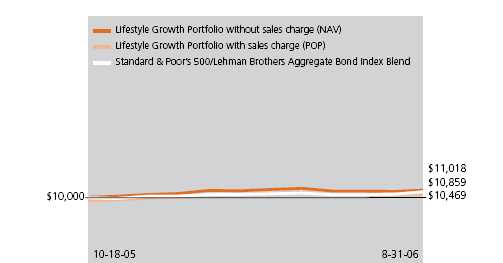

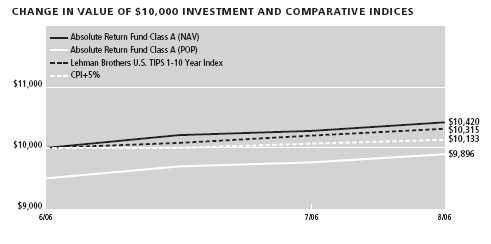

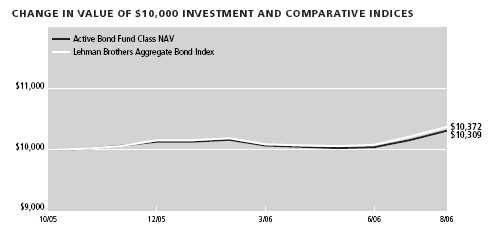

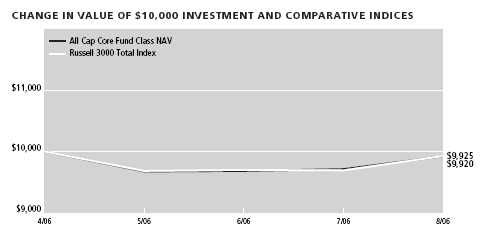

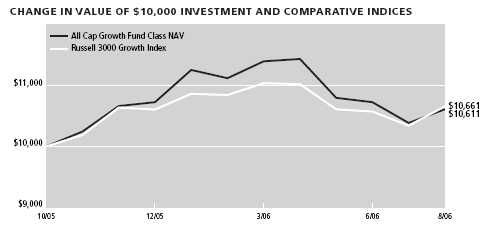

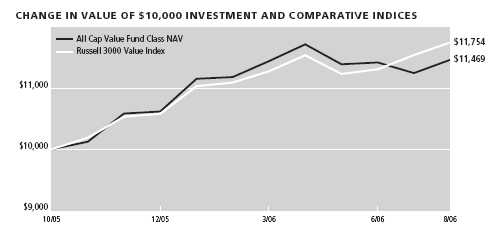

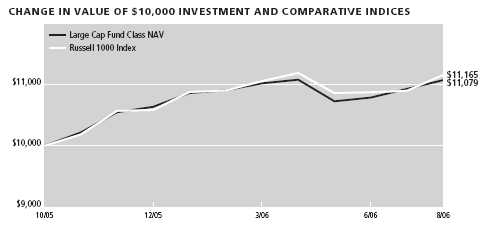

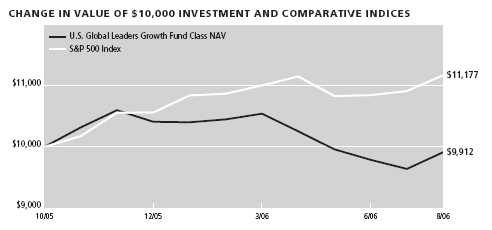

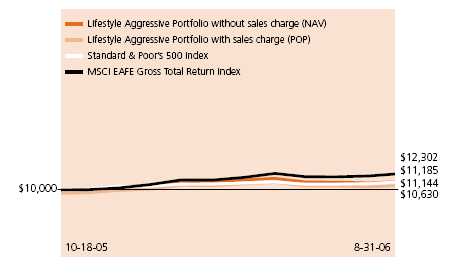

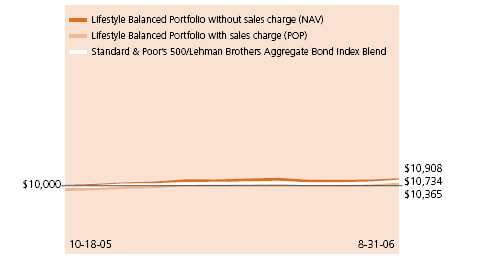

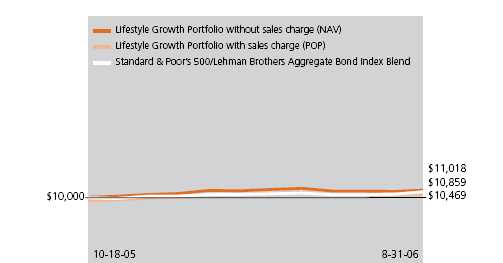

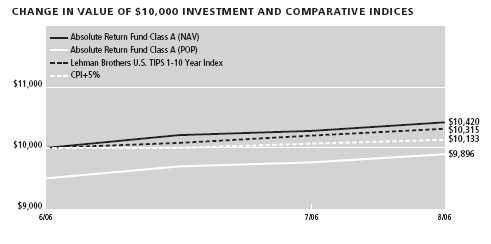

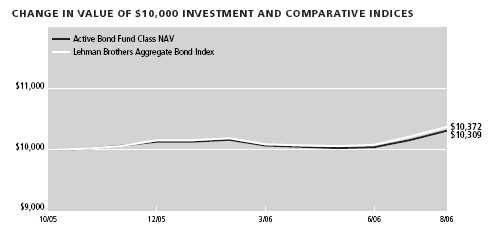

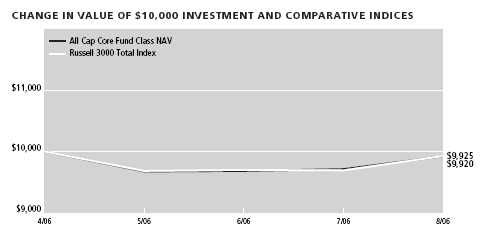

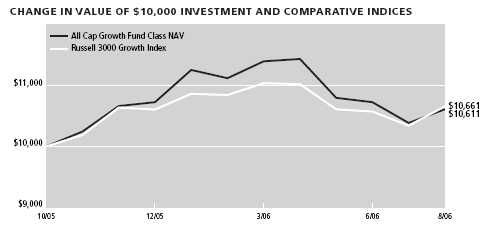

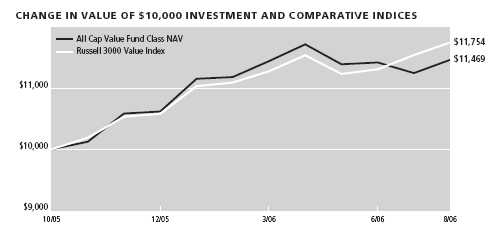

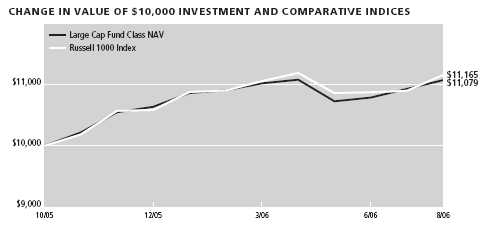

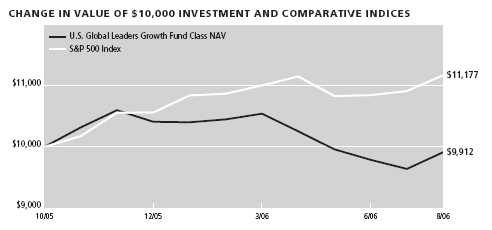

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | | Without sales | With maximum | | |

| Class | Period beginning | charge | sales charge | Index 1 | Index 2 |

|

| B1 | 10-18-05 | $11,122 | $10,622 | $11,144 | $12,302 |

|

| C1 | 10-18-05 | 11,122 | 11,022 | 11,144 | 12,302 |

|

| R31,3 | 10-18-05 | 11,181 | 11,181 | 11,144 | 12,302 |

|

| R41,3 | 10-18-05 | 11,194 | 11,194 | 11,144 | 12,302 |

|

| R51,3 | 10-18-05 | 11,216 | 11,216 | 11,144 | 12,302 |

|

| 12,3 | 10-15-05 | 11,227 | 11,227 | 11,177 | 11,944 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Portfolio’s Class B, Class C, Class R3, Class R4, Class R5 and Class 1 shares, respectively, as of August 31, 2006. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Index 1 — Standard & Poor’s 500 Index is an unmanaged index that includes 500 widely traded common stocks.

Index 2 — MSCI EAFE Gross Total Return Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. As of June 2006 the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

It is not possible to invest directly in an index. Index figures do not reflect sales charges and would be lower if they did.

1 Index 2 figure from 10/31/05.

2 Index 2 figure from 9/30/05.

3 For certain types of investors as described in the Portfolio’s Class R3, Class R4, Class R5 and Class 1 share prospectuses.

7

Lifestyle Aggressive Portfolio

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding portfolio expenses

As a shareholder of the Portfolio, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable) and other Portfolio expenses.

In addition to the operating expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the operating expenses of the underlying funds in which the Portfolio invests. Because the underlying funds have varied operating expenses and transaction costs and the Portfolio may own different proportions of the underlying funds at different times, the amount of expenses incurred indirectly by the Portfolio will vary. If these indirect expenses were included, your expenses paid during the period would have been higher.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your portfolio’s actual ongoing operating expenses, and is based on your portfolio’s actual return. It assumes an account value of $1,000.00 on March 1, 2006, with the same investment held until August 31, 2006.

| | Account value | Ending value | Expenses paid during period |

| | on 3-1-06 | on 8-31-06 | ended 8-31-06 a |

|

| Class A | $1,000.00 | $1,004.30 | $3.28 |

|

| Class B | 1,000.00 | 1,000.70 | 6.81 |

|

| Class C | 1,000.00 | 1,000.70 | 6.81 |

|

| Class R3 | 1,000.00 | 1,005.00 | 3.44 |

|

| Class R4 | 1,000.00 | 1,005.00 | 2.48 |

|

| Class R5 | 1,000.00 | 1,006.40 | 0.96 |

|

| Class 1 | 1,000.00 | 1,007.20 | 0.56 |

|

8

Lifestyle Aggressive Portfolio

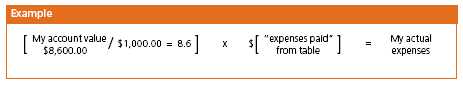

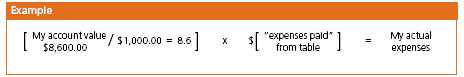

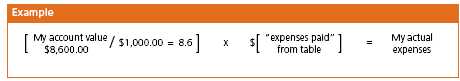

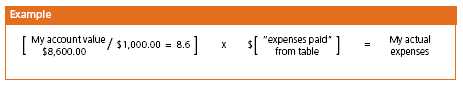

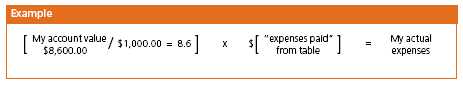

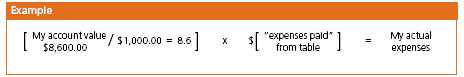

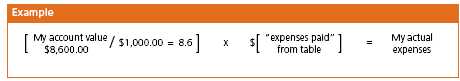

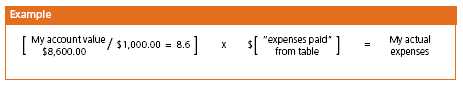

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at August 31, 2006 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

This table allows you to compare your portfolio’s ongoing operating expenses with those of any other fund. It provides an example of the Portfolio’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annual return before expenses (which is not your portfolio’s actual return). It assumes an account value of $1,000.00 on March 1, 2006, with the same investment held until August 31, 2006. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | Account value | Ending value | Expenses paid during period |

| | on 3-1-06 | on 8-31-06 | ended 8-31-06 a |

|

| Class A | $1,000.00 | $1,021.93 | $3.31 |

|

| Class B | 1,000.00 | 1,018.40 | 6.87 |

|

| Class C | 1,000.00 | 1,018.40 | 6.87 |

|

| Class R3 | 1,000.00 | 1,021.78 | 3.47 |

|

| Class R4 | 1,000.00 | 1,022.74 | 2.50 |

|

| Class R5 | 1,000.00 | 1,024.25 | 0.97 |

|

| Class 1 | 1,000.00 | 1,024.65 | 0.56 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

a Expenses are equal to the Portfolio's annualized expense ratio of 0.65%, 1.35%, 1.35%, 0.68%, 0.49%, 0.19% and 0.11% for Class A, Class B, Class C, Class R3, Class R4, Class R5 and Class 1, respectively, multiplied by the average account value over the period, multiplied by the number of days in the period /365 or 366 (to reflect the one-half year period). The expense ratios do not include fees and expenses incurred by the Portfolio from the underlying funds.

Lifestyle Aggressive Portfolio

9

F I N A N C I A L S T A T E M E N T SPortfolio’s investments

Securities owned by the Portfolio on 8-31-06

Portfolio of investments, showing all underlying funds.

| Issuer | Shares | Value |

|

| Investment companies 99.97% | | $2,493,325,747 |

| (Cost $2,332,750,384) | | |

| John Hancock Funds II | | |

|

| All Cap Growth Fund Class NAV | 3,022,333 | $49,717,383 |

|

| All Cap Value Fund Class NAV | 3,136,053 | 49,549,643 |

|

| Blue Chip Growth Fund Class NAV | 6,985,892 | 124,348,875 |

|

| Capital Appreciation Fund Class NAV | 10,532,521 | 99,532,325 |

|

| Core Equity Fund Class NAV | 5,286,718 | 75,441,459 |

|

| Emerging Growth Fund Class NAV | 2,789,800 | 51,164,930 |

|

| Equity-Income Fund Class NAV | 2,736,026 | 49,549,424 |

|

| Fundamental Value Fund Class NAV | 6,280,209 | 99,415,710 |

|

| International Equity Index Fund Class NAV | 6,555,210 | 124,352,333 |

|

| International Opportunities Fund Class NAV | 6,182,381 | 99,907,280 |

|

| International Small Cap Fund Class NAV | 3,557,189 | 74,523,111 |

|

| International Small Company Fund Class NAV | 7,989,553 | 74,542,530 |

|

| International Value Fund Class NAV | 9,755,233 | 174,423,566 |

|

| Large Cap Fund Class NAV | 3,379,099 | 49,571,376 |

|

| Large Cap Value Fund Class NAV | 1,069,803 | 24,616,172 |

|

| Mid Cap Core Fund Class NAV | 4,327,223 | 74,687,869 |

|

| Mid Cap Index Fund Class NAV | 1,361,218 | 25,005,575 |

|

| Mid Cap Stock Fund Class NAV | 3,170,730 | 50,192,653 |

|

| Mid Cap Value Equity Fund Class NAV | 2,578,332 | 24,880,903 |

|

| Mid Cap Value Fund Class NAV | 2,635,211 | 49,700,071 |

|

| Natural Resources Fund Class NAV | 3,492,935 | 124,348,487 |

|

| Quantitative Mid Cap Fund Class NAV | 3,479,128 | 49,821,116 |

|

| Quantitative Value Fund Class NAV | 4,497,753 | 74,482,795 |

|

| Small Cap Fund Class NAV | 5,402,799 | 75,855,305 |

|

| Small Cap Index Fund Class NAV | 3,174,474 | 50,632,853 |

|

| Small Company Fund Class NAV | 3,224,770 | 49,790,455 |

|

| Small Company Value Fund Class NAV | 3,199,392 | 75,601,641 |

|

| Special Value Fund Class NAV | 2,441,971 | 50,109,240 |

|

| U.S. Global Leaders Growth Fund Class NAV | 1,958,976 | 24,839,817 |

|

| U.S. Multi Sector Fund Class NAV | 19,130,584 | 199,149,379 |

|

| Value & Restructuring Fund Class NAV | 2,239,676 | 24,815,609 |

|

| Vista Fund Class NAV | 4,636,102 | 49,606,288 |

See notes to financial statements

Lifestyle Aggressive Portfolio

10

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

|

| John Hancock Funds III | | |

|

| International Core Fund Class NAV | 5,057,125 | $199,149,574 |

|

| Total investments 99.97% | | $2,493,325,747 |

|

| Other assets in excess of liabilities 0.03% | | $631,006 |

|

| Total net assets 100.00% | | $2,493,956,753 |

| | | |

| Percentages are stated as a percent of net assets of the Portfolio. | | |

See notes to financial statements

Lifestyle Aggressive Portfolio

11

F I N A N C I A L S T A T E M E N T SFinancial statements

Statement of assets and liabilities 8-31-06

This Statement of Assets and Liabilities is the Portfolio’s balance sheet. It shows the value of what the Portfolio owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| Assets | |

|

| Investments in affiliated funds, at value (cost $2,332,750,384) | $2,493,325,747 |

| Receivable for fund shares sold | 2,917,687 |

| Other assets | 7,767 |

| Total assets | 2,496,251,201 |

|

| Liabilities | |

|

| Payable for investments purchased | 1,954,062 |

| Payable for fund shares repurchased | 68,176 |

| Payable to affiliates | |

| Fund administration fees | 46,274 |

| Transfer agent fees | 36,857 |

| Trustees’ fees | 515 |

| Due to adviser | 22,540 |

| Other payables and accrued expenses | 166,024 |

| Total liabilities | 2,294,448 |

|

| Net assets | |

|

| Capital paid-in | 2,274,094,924 |

| Accumulated net realized gain on investments | 54,811,392 |

| Net unrealized appreciation on investments | 160,575,363 |

| Accumulated net investment income | 4,475,074 |

| Net assets | $2,493,956,753 |

|

| Net asset value per share | |

|

| Based on net asset values and shares outstanding | |

| — the Portfolio has an unlimited number of shares authorized with no par value | |

| Class A ($35,037,913 ÷ 2,492,440 shares) | $14.06 |

| Class B ($8,453,392 ÷ 603,673 shares) | $14.00 |

| Class C ($25,269,023 ÷ 1,804,306 shares) | $14.00 |

| Class R3 ($1,087,135 ÷ 77,333 shares) | $14.06 |

| Class R4 ($1,579,009 ÷ 112,222 shares) | $14.07 |

| Class R5 ($468,879 ÷ 33,274 shares) | $14.09 |

| Class 1 ($2,422,061,402 ÷ 172,137,524 shares) | $14.07 |

|

| Maximum offering price per share | |

|

| Class A1 ($14.06 ÷ 95%) | $14.80 |

1 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

Lifestyle Aggressive Portfolio

12

F I N A N C I A L S T A T E M E N T SStatement of operations For the period ended 8-31-06a

This Statement of Operations summarizes the Portfolio’s investment income earned and expenses incurred in operating the Portfolio. It also shows net gains (losses) for the period stated.

| Investment income | |

|

| Income distributions received from affiliated underlying funds | 11,032,304 |

| Total investment income | 11,032,304 |

|

| Expenses | |

|

| Investment management fees (Note 3) | 793,633 |

| Distribution and service fees (Note 3) | 1,087,115 |

| Transfer agent fees (Note 3) | 52,221 |

| Blue sky fees (Note 3) | 99,466 |

| Printing and postage fees (Note 3) | 51,472 |

| Fund administration fees (Note 3) | 166,487 |

| Audit and legal fees | 85,026 |

| Custodian fees | 10,944 |

| Trustees’ fees (Note 3) | 21,991 |

| Registration and filing fees | 70,700 |

| Miscellaneous | 17,551 |

| Total expenses | 2,456,606 |

| Less expense reductions (Note 3) | (122,636) |

| Net expenses | 2,333,970 |

| Net investment income | 8,698,334 |

| |

| Realized and unrealized gain | |

|

| Net realized gain on investments | 54,792,008 |

| Capital gain distributions received from affiliated underlying funds | 6,427,198 |

| Change in net unrealized appreciation of investments | 160,575,363 |

| Net realized and unrealized gain | 221,794,569 |

| Increase in net assets from operations | $230,492,903 |

a Period from 10-15-06 (commencement of operatons) to 8-31-06.

See notes to financial statements

Lifestyle Aggressive Portfolio

13

F I N A N C I A L S T A T E M E N T SStatement of changes in net assets

This Statement of Changes in Net Assets shows how the value of the Portfolio’s net assets has changed during the period. It reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Portfolio share transactions.

| | Period |

| | ended a |

| | 8-31-06 |

|

| Increase (decrease) in net assets | |

|

| From operations | |

| Net investment income | $8,698,334 |

| Net realized gain | 61,219,206 |

| Change in net unrealized appreciation | 160,575,363 |

| Increase in net assets resulting from operations | 230,492,903 |

| Distributions to shareholders | |

| From net investment income | |

| Class A | (10,791) |

| Class B | (2,807) |

| Class C | (4,862) |

| Class R3 | (460) |

| Class R4 | (513) |

| Class R5 | (565) |

| Class 1 | (10,836,557) |

| | (10,856,555) |

| From Fund share transactions | 2,274,320,405 |

|

| Net assets | |

|

| End of period | $2,493,956,753 |

| Accumulated net investment income | $4,475,074 |

a Period from 10-15-05 (commencement of operations) to 8-31-06.

See notes to financial statements

Lifestyle Aggressive Portfolio

14

F I N A N C I A L S T A T E M E N T SFinancial highlights

The Financial highlights show how the Portfolio’s net asset value for a share has changed since the beginning of the period.

| CLASS A SHARES | |

| |

| Period ended | 8-31-06a |

|

| Per share operating performance | |

| |

| Net asset value, beginning of period | $12.63 |

| Net investment loss h,v | (0.07) |

| Net realized and unrealized | |

| gain on investments | 1.56 |

| Total from investment operations | 1.49 |

| Less distributions | |

| From net investment income | (0.06) |

| | (0.06) |

| Net asset value, end of period | $14.06 |

| Total return k,l (%) | 11.85 m |

|

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $35 |

| Ratio of net expenses | |

| to average net assets q (%) | 0.65 r |

| Ratio of gross expenses | |

| to average net assets p,q (%) | 0.84 r |

| Ratio of net investment loss | |

| to average net assets v (%) | (0.59) r |

| Portfolio turnover (%) | 23 m |

See notes to financial statements

Lifestyle Aggressive Portfolio

15

F I N A N C I A L S T A T E M E N T SFinancial highlights

| CLASS B SHARES | |

| |

| Period ended | 8-31-06a |

|

| Per share operating performance | |

|

| Net asset value, beginning of period | $12.63 |

| Net investment loss h,v | (0.15) |

| Net realized and unrealized | |

| gain on investments | 1.56 |

| Total from investment operations | 1.41 |

| Less distributions | |

| From net investment income | (0.04) |

| | (0.04) |

| Net asset value, end of period | $14.00 |

| Total return k,l (%) | 11.22m |

|

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $8 |

| Ratio of net expenses | |

| to average net assets q (%) | 1.34r |

| Ratio of gross expenses | |

| to average net assets p,q (%) | 2.00r |

| Ratio of net investment loss | |

| to average net assets v (%) | (1.23)r |

| Portfolio turnover (%) | 23m |

See notes to financial statements

Lifestyle Aggressive Portfolio

16

F I N A N C I A L S T A T E M E N T SFinancial highlights

| CLASS C SHARES | |

| |

| Period ended | 8-31-06a |

|

| Per share operating performance | |

|

| Net asset value, beginning of period | $12.63 |

| Net investment loss h,v | (0.15) |

| Net realized and unrealized | |

| gain on investments | 1.57 |

| Total from investment operations | 1.42 |

| Less distributions | |

| From net investment income | (0.05) |

| | (0.05) |

| Net asset value, end of period | $14.00 |

| Total return k,l (%) | 11.22m |

|

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $25 |

| Ratio of net expenses | |

| to average net assets q (%) | 1.34r |

| Ratio of gross expenses | |

| to average net assets p,q (%) | 1.60r |

| Ratio of net investment loss | |

| to average net assets v (%) | (1.27)r |

| Portfolio turnover (%) | 23m |

See notes to financial statements

Lifestyle Aggressive Portfolio

17

F I N A N C I A L S T A T E M E N T S

| Financial highlights | |

| |

| |

| |

| |

| CLASS R3 SHARES | |

| |

| Period ended | 8-31-06a |

|

| Per share operating performance | |

|

| Net asset value, beginning of period | $12.63 |

| Net investment loss h,v | (0.05) |

| Net realized and unrealized | |

| gain on investments | 1.54 |

| Total from investment operations | 1.49 |

| Less distributions | |

| From net investment income | (0.06) |

| | (0.06) |

| Net asset value, end of period | $14.06 |

| Total return k,l (%) | 11.81m |

|

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $1 |

| Ratio of net expenses | |

| to average net assets q (%) | 0.69r |

| Ratio of gross expenses | |

| to average net assets p,q (%) | 8.07r |

| Ratio of net investment loss | |

| to average net assets v (%) | (0.47)r |

| Portfolio turnover (%) | 23m |

See notes to financial statements

Lifestyle Aggressive Portfolio

18

F I N A N C I A L S T A T E M E N T SFinancial highlights

| CLASS R4 SHARES | |

| |

| Period ended | 8-31-06a |

|

| Per share operating performance | |

|

| Net asset value, beginning of period | $12.63 |

| Net investment loss h,v | (0.05) |

| Net realized and unrealized | |

| gain on investments | 1.55 |

| Total from investment operations | 1.50 |

| Less distributions | |

| From net investment income | (0.06) |

| | (0.06) |

| Net asset value, end of period | $14.07 |

| Total return k,l (%) | 11.94m |

|

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $2 |

| Ratio of net expenses | |

| to average net assets q (%) | 0.49r |

| Ratio of gross expenses | |

| to average net assets p,q (%) | 4.08r |

| Ratio of net investment loss | |

| to average net assets v (%) | (0.38)r |

| Portfolio turnover (%) | 23m |

See notes to financial statements

Lifestyle Aggressive Portfolio

19

F I N A N C I A L S T A T E M E N T SFinancial highlights

| CLASS R5 SHARES | |

| |

| Period ended | 8-31-06a |

|

| Per share operating performance | |

|

| Net asset value, beginning of period | $12.63 |

| Net investment income h,v | 0.01 |

| Net realized and unrealized | |

| gain on investments | 1.52 |

| Total from investment operations | 1.53 |

| Less distributions | |

| From net investment income | (0.07) |

| | (0.07) |

| Net asset value, end of period | $14.09 |

| Total return k,l (%) | 12.16m |

|

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $—i |

| Ratio of net expenses | |

| to average net assets q (%) | 0.20r |

| Ratio of gross expenses | |

| to average net assets p,q (%) | 8.26r |

| Ratio of net investment income | |

| to average net assets v (%) | 0.05r |

| Portfolio turnover (%) | 23m |

See notes to financial statements

Lifestyle Aggressive Portfolio

20

F I N A N C I A L S T A T E M E N T SFinancial highlights

| CLASS 1 SHARES | |

| |

| Period ended | 8-31-06a |

|

| Per share operating performance | |

|

| Net asset value, beginning of period | $12.60 |

| Net investment income h,v | 0.06 |

| Net realized and unrealized | |

| gain on investments | 1.48 |

| Total from investment operations | 1.54 |

| Less distributions | |

| From net investment income | (0.07) |

| | (0.07) |

| Net asset value, end of period | $14.07 |

| Total return k (%) | 12.27m |

|

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | $2,422 |

| Ratio of net expenses | |

| to average net assets q (%) | 0.11r |

| Ratio of net investment income | |

| to average net assets v (%) | 0.48r |

| Portfolio turnover (%) | 23m |

a Class A, Class B, Class C, Class R3, Class R4 and Class R5 shares began operations on 10-18-05, and Class 1 shares began operation on 10-15-05.

h Based on the average of the shares outstanding.

i Less than $500,000.

k Assumes dividend reinvestment and does not reflect the effect of sales charges.

l Total returns would have been lower had certain expenses not been reduced during the period shown.

m Not annualized.

p Does not take into consideration expense reductions during the period shown.

q Does not include expenses of the investment companies in which the Portfolio invests.

r Annualized.

v Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests.

See notes to financial statements

Lifestyle Aggressive Portfolio

21

Notes to financial statements

1. Organization

The John Hancock Lifestyle Aggressive Portfolio (the “Portfolio”) is a newly organized non-diversified series of John Hancock Funds II (the “Trust”). The Trust was established as a Massachusetts business trust on June 28, 2005. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end investment management company.

The Portfolio operates as a “fund of funds”, investing in Class NAV shares of underlying funds of the Trust and John Hancock Funds III and in other permitted investments.

John Hancock Investment Management Services, LLC (the “Adviser”), a Delaware limited liability company controlled by John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”) serves as investment adviser for the Trust and John Hancock Funds, LLC (the “Distributor”), an affiliate of the Adviser, serves as principal underwriter. John Hancock Life Insurance Company of New York (“John Hancock New York”) is a wholly owned subsidiary of John Hancock USA. John Hancock USA and John Hancock New York are indirect wholly owned subsidiaries of The Manufactures Life Insurance Company (“Manulife”), which in turn is a wholly owned subsidiary of Manulife Financial Corporation (“MFC”), a publicly traded company. MFC and its subsidiaries are known collectively as “Manulife Financial.”

The Portfolio commenced operations after certain separate accounts of John Hancock USA redeemed their interests in portfolios of John Hancock Trust and certain unaffiliated mutual funds of approximately $350 million at the close of business on October 14, 2005, with additional redemption proceeds of approximately $1.5 billion received on October 28, 2005, and invested such proceeds in Class 1 shares of the Portfolio, which in turn invested the proceeds in underlying funds of the Trust.

The Board of Trustees has authorized the issuance of multiple classes of shares of the Portfolio, including classes designated as Class A, Class B, Class C, Class R3, Class R4, Class R5 and Class 1 shares.

Class A, B, and C shares are open to all retail investors. Class 1 shares are sold only to certain exempt separate accounts of John Hancock USA and John Hancock New York. Class R3, R4 and R5 shares are available only to certain retirement plans.

The shares of each class represent an interest in the same portfolio of investments of the Portfolio, and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the SEC and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

2. Significant accounting policies

In the preparation of the financial statements, the Portfolio follows the policies described below. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results may differ from these estimates.

Lifestyle Aggressive Portfolio

22

Securities valuation

The net asset value of the shares of the Portfolio is determined daily as of the close of the New York Stock Exchange, normally at 4:00 p.m. Eastern Time. Investments in underlying funds are valued at their respective net asset values each business day, or at fair value as determined in good faith in accordance with procedures approved by the Trustees. Securities in the underlying funds’ portfolios are valued in accordance with their respective valuation polices, as outlined in the underlying funds’ financial statements. Short-term debt investments that have a remaining maturity of 60 days or less are valued at amortized cost.

Security transactions and related investment income

Investment security transactions in the underlying funds are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income and capital gain distributions are recorded on the ex-dividend date.

Gains and losses on securities sold are determined on the basis of specific identi-fied cost for both financial and federal income tax reporting purposes.

Multi-class operations

All income, expenses (except for class-specific expenses) and realized and unrealized gains (losses) are allocated to each class of shares based upon the relative net assets of each class. Dividends to shareholders from net investment income are determined at a class level and distributions from capital gains are determined at a Portfolio level.

Expense allocation

Expenses not directly attributable to a particular Portfolio or class of shares are allocated based on the relative share of net assets of the Portfolio at the time the expense was incurred. Class-specific expenses, such as transfer agency fees, blue sky fees, printing and postage fees and distribution and service fees, are accrued daily and charged directly to the respective share classes. Expenses in the Portfolio’s Statement of Operations reflect the expenses of the Portfolio and do not include any indirect expenses related to the underlying funds. Because the underlying funds have varied expense levels and the Portfolio may own different proportions of the underlying funds at different times, the amount of fees and expenses incurred indirectly by the Portfolio will vary.

Federal income taxes

The Portfolio qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

New accounting pronouncement

In June 2006, Financial Accounting Standards Board (FASB) Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the “Interpretation”) was issued and is effective for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. This Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return, and requires certain expanded disclosures. Management is currently evaluating the application of the Interpretation to the Portfolio and has not at this time quantified the impact, if any, resulting from the adoption of this Interpretation on the Portfolio’s financial statements.

In September 2006, FASB Standard No. 157, Fair Value Measurements (“FAS 157”) was issued, and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishing a framework for measuring fair value and expands disclosure about fair value measurements. Management is currently evaluating the application of FAS 157 to the Portfolio, and its impact, if any, resulting from the adoption of FAS 157 on the Portfolio’s financial statements.

Distribution of income and gains

The Portfolio records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date.

Lifestyle Aggressive Portfolio

23

During the period ended August 31, 2006, the tax character of distributions paid was as follows: ordinary income $10,856,555. Distributions paid by the Portfolio with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class. Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Portfolio’s financial statements as a return of capital. As of August 31, 2006, the components of distributable earnings on a tax basis included $59,267,085 of undistributed ordinary income and $19,381 of undistributed long-term gain.

Capital accounts

The Portfolio reports the undistributed net investment income and accumulated undistributed net realized gain (loss) accounts on a basis approximating amounts available for future tax distributions (or to offset future taxable realized gains when a capital loss carry-forward is available). Accordingly, the Portfolio may periodically make reclassifications among certain capital accounts, without affecting its net asset value.

3. Investment advisory and

other agreements

Advisory fees

The Trust has entered into an Investment Advisory Agreement with the Adviser. The Adviser is responsible for managing the corporate and business affairs of the Trust and for selecting and compensating subadvisers to handle the investment and reinvestment of the assets of the Portfolio, subject to the supervision of the Board of Trustees. Under the Advisory Agreement, the Portfolio pays a monthly management fee to the Adviser equivalent, on an annual basis, to its pro rata portion of the sum of: (a) 0.05% of the first $7,500,000,000 of the aggregate daily net assets and (b) 0.04% of the aggregate daily net assets in excess of $7,500,000,000 of the five Lifestyle Portfolios of the Trust (Lifestyle Aggressive, Lifestyle Growth, Lifestyle Balanced, Lifestyle Moderate and Lifestyle Conservative) and the five Lifestyle Portfolios of John Hancock Trust (Lifestyle Aggressive, Lifestyle Growth, Lifestyle Balanced, Lifestyle Moderate and Lifestyle Co nservative). The Portfolio is not responsible for payment of the subadvisory fees.

Expense reimbursements

The Adviser has contractually agreed to waive advisory fees or reimburse the Portfolio’s expenses for Class A, Class B, Class C, Class R3, Class R4 and Class R5 shares to the extent that blue sky fees and printing and postage expenses attributable to each class exceed 0.09% of the average annual net assets attributable to the classes, at least until November 1, 2006, and may thereafter be terminated by the Adviser at any time. Accordingly, the expense reductions related to this expense limitation amounted to $24,863, $22,518, $21,975, $17,405, $17,026 and $17,584 for Class A, Class B, Class C, Class R3, Class R4 and Class R5, respectively, for the period ended August 31, 2006.

Administration fees

The Portfolio has an agreement with the Adviser that requires the Portfolio to reimburse the Adviser for all expenses associated with providing the administrative, financial, accounting and recordkeeping services of the Portfolio, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports.

Distribution plans

The Trust has a Distribution Agreement with the Distributor. The Portfolio has adopted Distribution Plans with respect to Class A, Class B, Class C, Class R3, Class R4 and Class 1, pursuant to Rule 12b-1 under the 1940 Act, to reimburse the Distributor for the services it provides as distributor of shares of the Portfolio. Accordingly, the Portfolio makes monthly payments to the Distributor at an annual rate not to exceed 0.30%, 1.00%, 1.00%, 0.50%, 0.25% and 0.05% of the

Lifestyle Aggressive Portfolio

24

average daily net assets of Class A, Class B, Class C, Class R3, Class R4 and Class 1, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Portfolio’s 12b-1 payments could occur under certain circumstances.

The Portfolio has also adopted a Service Plan with respect to Class R3, Class R4 and Class R5 shares (the “Service Plan”). Under the Service Plan, the Portfolio pays up to 0.15%, 0.10% and 0.05% of the average daily net assets of Class R3, Class R4 and Class R5 shares, respectively, for certain other services.

Sales charges

Class A shares are assessed up-front sales charges of up to 5% of the net asset value of such shares. During the period ended August 31, 2006, the Portfolio was informed that the Distributor received net up-front sales charges of $800,789 with regard to sales of Class A shares. Of this amount, $128,706 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $664,228 was paid as sales commissions to unrelated broker-dealers and $7,855 was paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer, an indirect subsidiary of MFC.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed.

Proceeds from the CDSCs are paid to the Distributor and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Portfolio in connection with the sale of Class B and Class C shares. During the period ended August 31, 2006, the Portfolio was informed that CDSCs received by the Distributor amounted to $5,977 for Class B shares and $3,815 for Class C shares.

Transfer agent fees

The Portfolio has a Transfer Agency Agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of MFC. For Class A, Class B, Class C, Class R3, Class R4 and Class R5 shares, the Portfolio pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net assets, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses. Expenses not directly attributable to a particular class of shares are aggregated and allocated to each class on the basis of its relative net asset value.

Signature Services has agreed to limit the transfer agent fees so that such fees do not exceed 0.20% annually of each of Class A, Class B, Class C, Class R3, Class R4 and Class R5 share average daily net assets. This agreement is effective until December 31, 2006. Signature Services reserves the right to terminate this limitation in the future. In addition, Signature Services has voluntarily agreed to further limit transfer agent fees for Class R3, Class R4 and Class R5 shares so that such fees do not exceed 0.05% annually of each class’s average daily net assets. Accordingly, the transfer agent fees reductions amounted to $304, $638 and $323 for Class R3, Class R4 and Class R5 shares, respectively, during the period ended August 31, 2006. Signature Services reserves the right to terminate this limitation at any time.

Lifestyle Aggressive Portfolio

25

Expenses under the agreements described above for the period ended August 31, 2006, were as follows:

| | Distribution and | Transfer | | Printing and |

| Share Class | service fees | agent | Blue sky | postage |

|

| |

| Class A | $39,384 | $26,457 | $17,638 | $19,040 |

| Class B | 34,257 | 6,917 | 16,149 | 9,452 |

| Class C | 84,676 | 17,156 | 17,423 | 12,174 |

| Class R3 | 1,226 | 397 | 15,925 | 1,698 |

| Class R4 | 1,455 | 877 | 15,925 | 1,550 |

| Class R5 | 7 | 417 | 16,406 | 1,379 |

| Class 1 | 926,110 | — | — | 6,179 |

| Total | $1,087,115 | $52,221 | $99,466 | $51,472 |

Trustees’ fees

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees’ expenses are allocated based on each portfolio’s average daily net asset value.

4. Guarantees and Indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust believes the risk of loss to be remote.

5. Capital shares

Share activities for the Portfolio for the period ended August 31, 2006 were as follows:

| | Period ended 8-31-06a |

| | Shares | Amount |

|

| Class A shares | | |

| |

| Sold | 2,656,426 | $37,105,900 |

| Distributions reinvested | 739 | 9,867 |

| Repurchased | (164,725) | (2,284,281) |

| Net increase | 2,492,440 | $34,831,486 |

|

| |

| Class B shares | | |

| |

| Sold | 641,314 | $8,963,149 |

| Distributions reinvested | 161 | 2,152 |

| Repurchased | (37,802) | (520,561) |

| Net increase | 603,673 | $8,444,740 |

|

| |

| |

| Class C shares | | |

| |

| Sold | 1,853,043 | $25,877,041 |

| Distributions reinvested | 283 | 3,786 |

| Repurchased | (49,020) | (685,074) |

| Net increase | 1,804,306 | $25,195,753 |

Lifestyle Aggressive Portfolio

26

| | Period ended 8-31-06a |

| | Shares | Amount |

|

| Class R3 shares | | |

| |

| Sold | 78,517 | $1,063,860 |

| Repurchased | (1,184) | (16,116) |

| Net increase | 77,333 | $1,047,744 |

|

| |

| Class R4 shares | | |

| |

| Sold | 125,577 | $1,762,808 |

| Repurchased | (13,355) | (183,449) |

| Net increase | 112,222 | $1,579,359 |

|

| |

| Class R5 shares | | |

| |

| Sold | 38,324 | $533,868 |

| Repurchased | (5,050) | (73,349) |

| Net increase | 33,274 | $460,519 |

|

| |

| Class 1 shares | | |

| |

| Sold | 173,760,521 | $2,225,676,778 |

| Distributions reinvested | 812,945 | 10,836,557 |

| Repurchased | (2,435,942) | (33,752,531) |

| Net increase | 172,137,524 | $2,202,760,804 |

|

| |

| Net increase | 177,260,772 | $2,274,320,405 |

a Class A, Class B, Class C, Class R3, Class R4 and Class R5 shares began operations on 10-18-05, and Class 1 shares began operation on 10-15-05.

6. Investment transactions

Purchases and sales of the underlying funds during the period ended August 31, 2006, aggregated $2,782,373,375 and $504,414,999, respectively.

The cost of investments owned on August 31, 2006, including short-term investments, for federal income tax purposes, was $2,332,750,384. Gross unrealized appreciation and depreciation of investments aggregated $173,885,053 and $13,309,690, respectively, resulting in net unrealized appreciation of $160,575,363.

7. Investment in affiliated underlying funds

The Portfolio invests primarily in the underlying funds that are managed by affiliates of the Adviser. The Portfolio does not invest in the underlying funds for the purpose of exercising management or control.

A summary of the Portfolio’s transactions in the securities of affiliated issuers in which the Portfolio’s holdings represent 5% or more of the outstanding voting securities of the issuer, during the period ended August 31, 2006 is set forth below.

Lifestyle Aggressive Portfolio

27

| Affiliate — | Shares | Shares | Ending Share | | Ending |

| Class NAV | Purchased | Sold | Amount | Proceeds | Value |

|

| All Cap Growth | 3,022,915 | 582 | 3,022,333 | $9,704 | $49,717,383 |

| All Cap Value | 3,136,588 | 535 | 3,136,053 | 8,328 | 49,549,643 |

| Blue Chip Growth | 6,993,440 | 7,548 | 6,985,892 | 132,497 | 124,348,875 |

| Capital Appreciation | 10,634,630 | 102,109 | 10,532,521 | 980,546 | 99,532,325 |

| Core Equity | 5,379,463 | 92,745 | 5,286,718 | 1,395,241 | 75,441,459 |

| Emerging Growth | 2,849,165 | 59,365 | 2,789,800 | 1,092,545 | 51,164,930 |

| Emerging Small Company | 252,226 | 252,226 | — | 7,052,232 | — |

| Equity-Income | 4,051,280 | 1,315,254 | 2,736,026 | 23,659,779 | 49,549,424 |

| Fundamental Value | 6,326,518 | 46,309 | 6,280,209 | 730,650 | 99,415,710 |

| International Core * | 5,057,125 | — | 5,057,125 | — | 199,149,574 |

| International Equity Index | 6,643,725 | 88,515 | 6,555,210 | 1,653,856 | 124,352,333 |

| International | | | | | |

| Opportunities | 6,500,950 | 318,569 | 6,182,381 | 4,890,687 | 99,907,280 |

| International Small Cap | 6,972,659 | 3,415,470 | 3,557,189 | 74,920,265 | 74,523,111 |

| International Small Company | 8,003,632 | 14,079 | 7,989,553 | 130,062 | 74,542,530 |

| International Stock | 15,376,049 | 15,376,049 | — | 210,898,404 | — |

| International Value | 11,382,320 | 1,627,087 | 9,755,233 | 28,832,080 | 174,423,566 |

| Large Cap | 3,379,943 | 844 | 3,379,099 | 12,124 | 49,571,376 |

| Large Cap Value | 1,070,611 | 808 | 1,069,803 | 17,033 | 24,616,172 |

| Mid Cap Core | 5,625,095 | 1,297,872 | 4,327,223 | 23,244,140 | 74,687,869 |

| Mid Cap Index | 1,361,298 | 80 | 1,361,218 | 1,452 | 25,005,575 |

| Mid Cap Stock | 3,186,155 | 15,425 | 3,170,730 | 231,280 | 50,192,653 |

| Mid Cap Value Equity | 2,578,534 | 202 | 2,578,332 | 1,916 | 24,880,903 |

| Mid Cap Value | 3,849,395 | 1,214,184 | 2,635,211 | 23,542,159 | 49,700,071 |

| Natural Resources | 4,622,763 | 1,129,828 | 3,492,935 | 36,288,093 | 124,348,487 |

| Quantitative Mid Cap | 3,479,631 | 503 | 3,479,128 | 7,484 | 49,821,116 |

| Quantitative Value | 4,584,366 | 86,613 | 4,497,753 | 1,426,897 | 74,482,795 |

| Small Cap | 5,465,472 | 62,673 | 5,402,799 | 976,051 | 75,855,305 |

| Small Cap Index | 3,174,671 | 197 | 3,174,474 | 3,049 | 50,632,853 |

| Small Cap Opportunities | 1,890,213 | 1,890,213 | — | 48,025,547 | — |

| Small Company | 3,230,032 | 5,262 | 3,224,770 | 81,705 | 49,790,455 |

| Small Company Value | 3,243,700 | 44,308 | 3,199,392 | 1,106,036 | 75,601,641 |

| Special Value | 2,461,043 | 19,072 | 2,441,971 | 406,574 | 50,109,240 |

| U.S. Global Leaders | | | | | |

| Growth | 2,789,786 | 830,810 | 1,958,976 | 10,875,171 | 24,839,817 |

| U.S. Multi Sector | 19,227,030 | 96,446 | 19,130,584 | 986,469 | 199,149,379 |

| Value & Restructuring | 2,239,885 | 209 | 2,239,676 | 2,274 | 24,815,609 |

| Vista | 4,703,770 | 67,668 | 4,636,102 | 792,670 | 49,606,288 |

*Represents the Portfolio’s investment in John Hancock Funds III International Core Fund

8. Reclassification of accounts

During the period ended August 31, 2006, the Portfolio reclassified amounts to reflect a decrease in accumulated net realized gain on investments of $6,407,814, an increase in accumulated net investment income of $6,633,295 and a decrease in capital paid-in of $225,481. This represents the amounts necessary to report these balances on a tax basis, excluding certain temporary differences, as of August 31, 2006. Additional adjustments may be needed in subsequent reporting periods. These reclassifications, which have no impact on the net asset value of the Portfolio, are primarily attributable to certain differences in the computation of distributable income and capital gains under federal tax rules versus accounting principles generally accepted in the United States of America and book and tax differences in accounting for non-deductible organizational costs. The calculation of net investment income per share in the Portfolio’s Financial Highlights excludes these adjustments.

Lifestyle Aggressive Portfolio

28

Auditors’ report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of John Hancock Funds II and Shareholders of John Hancock Lifestyle Aggressive Portfolio:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of securities owned, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Lifestyle Aggressive Portfolio (the “Portfolio”) at August 31, 2006, and the results of its operations, the changes in its net assets, and the financial highlights for the period October 15, 2005 (commencement of operations) through August 31, 2006, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Portfolio’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at August 31, 2006, by correspondence with the transfer agent, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 26, 2006

29

Tax information

Unaudited

For federal income tax purposes, the following information is furnished with respect to the distributions of the Portfolio, if any, paid during its taxable year ended August 31, 2006.

With respect to the ordinary dividends paid by the Portfolio for the fiscal period ended August 31, 2006, 24.82% of the dividends qualify for the corporate dividends-received deduction.

The Portfolio hereby designates the maximum amount allowable of its net taxable income as qualified diviend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. This amount will be reflected on Form 1099-DIV for the calendar year 2006.

Shareholders will be mailed a 2006 U.S. Treasury Department Form 1099-DIV in January 2007. This will reflect the total of all distributions that are taxable for calendar year 2006.

30

Trustees and Officers

This chart provides information about the Trustees and Officers who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the Portfolio and execute policies formulated by the Trustees.

| Independent Trustees | | |

| |

| Name, age | | Number of |

| Position(s) held with Portfolio | Trustee of | John Hancock |

| Principal occupation(s) and other | Portfolio | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

|

| Charles L. Bardelis, Born: 1941 | 2005 | 209 |

|

| President and Executive Officer, Island Commuter Corp. (Marine Transport). | | |

| Trustee of John Hancock Trust (since 1988) and John Hancock Funds III (since 2005). | |

|

| |

| Peter S. Burgess, Born: 1942 | 2005 | 209 |

|

| Consultant (financial, accounting and auditing matters (since 1999); | | |

| Certified Public Accountant; Partner, Arthur Andersen (prior to 1999). | | |

| Director of the following publicly traded companies: PMA Capital Corporation | | |

| (since 2004) and Lincoln Educational Services Corporation (since 2004). | | |

| Trustee of John Hancock Trust (since 2005), John Hancock Funds III (since 2005). | |

|

| |

| Elizabeth G. Cook, Born: 1937 | 2005 | 209 |

|

| Expressive Arts Therapist, Massachusetts General Hospital (September 2001 | | |

| to present); Expressive Arts Therapist, Dana Farber Cancer Institute | | |

| (September 2000 to January 2004); President, The Advertising Club of Greater Boston. | |

| Trustee of John Hancock Trust (since 2005) and John Hancock Funds III (since 2005). | |

|

| |

| William H. Cunningham, Born: 1944 | 2005 | 160 |

|

| Former Chancellor, University of Texas System and former President of the | | |

| University of Texas, Austin, Texas; Chairman and CEO, IBT Technologies | | |

| (until 2001); Director of the following: Hire.com (until 2004), STC Broadcasting, | |

| Inc. and Sunrise Television Corp. (until 2001), Symtx, Inc. (electronic manufacturing) | |

| (since 2001), Adorno/Rogers Technology, Inc. (until 2004), Pinnacle Foods | | |

| Corporation (until 2003), rateGenius (until 2003), Lincoln National Corporation | |

| (insurance) (since 2006), Jefferson-Pilot Corporation (diversified life insurance | | |

| company) (until 2006), New Century Equity Holdings (formerly Billing Concepts) | |

| (until 2001), eCertain (until 2001), ClassMap.com (until 2001), Agile Ventures | | |

| (until 2001), AskRed.com (until 2001), Southwest Airlines, Introgen and Viasystems | |

| Group, Inc. (electronic manufacturer) (until 2003); Advisory Director, Interactive | |

| Bridge, Inc. (college fundraising) (until 2001); Advisory Director, Q Investments | | |

| (until 2003); Advisory Director, JP Morgan Chase Bank (formerly Texas Commerce | |

| Bank - Austin), LIN Television (since 2002), WilTel Communications (until 2003) | |

| and Hayes Lemmerz International, Inc. (diversified automotive parts supply | | |

| company) (since 2003). Trustee of John Hancock Funds (since 2005) and | | |

| John Hancock Funds III (since 2005). | | |

31

| Independent Trustees (continued) | | |

| |

| Name, age | | Number of |

| Position(s) held with Portfolio | Trustee of | John Hancock |

| Principal occupation(s) and other | Portfolio | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

|

| Charles L. Ladner, Born: 1938 | 2005 | 160 |

|

| Chairman and Trustee, Dunwoody Village, Inc. (retirement services) (until 2003); | |

| Senior Vice President and Chief Financial Officer, UGI Corporation (public utility | |

| holding company) (retired 1998); Vice President and Director for AmeriGas, Inc. | |

| (retired 1998); Director of AmeriGas Partners, L.P. (until 1997)(gas distribution); | |

| Director, EnergyNorth, Inc. (until 1995); Director, Parks and History Association | |

| (since 2007). Trustee of John Hancock Funds (since 2004) and John Hancock | | |

| Funds III (since 2005). | | |

|

| |

| Hassell H. McClellan, Born: 1945 | 2005 | 209 |

|

| Associate Professor, The Wallace E. Carroll School of Management, Boston College. | |

| Trustee of John Hancock Trust (since 2005), John Hancock Funds III (since 2005). | |

|

| |

| James. M. Oates, Born: 1946 | 2005 | 209 |

|

| Managing Director, Wydown Group (financial consulting firm)(since 1994); | | |

| Chairman, Emerson Investment Management, Inc. (since 2000); Chairman, | | |

| Hudson Castle Group, Inc. (formerly IBEX Capital Markets, Inc.) (financial services | |

| company) (since 1997). Director of the following publicly traded companies: | | |

| Stifel Financial (since 1996); Investor Financial Services Corporation (since 1995); | |

| and Connecticut River Bancorp, Director (since 1998). Director, Phoenix Mutual | |

| Funds (since 1988; overseeing 20 portfolios). Trustee of John Hancock Trust | | |

| (since 2004) and John Hancock Funds III (since 2005). | | |

1 Because the Trust does not hold regular annual shareholders meetings, each Trustee holds office for an indefinite term until his/her successor is duly elected and qualified or until he/she dies, retires, resigns, is removed or becomes disqualified.

32

| Non-Independent Trustee3 | | |

| |

| Name, age | | Number of |

| Position(s) held with Portfolio | Trustee of | John Hancock |

| Principal occupation(s) and other | Portfolio | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

|

| James R. Boyle, Born: 1959 | 2005 | 262 |

|

| Chairman and Director, John Hancock Advisers, LLC (the “Adviser”), The Berkeley Financial Group, LLC |

| (“The Berkeley Group”) (holding company) and John Hancock Funds, LLC (since 2005); President, John |

| Hancock Annuities; Executive Vice President, John Hancock Life Insurance Company (since June, 2004); |

| President U.S. Annuities; Senior Vice President, The Manufacturers Life Insurance Company (U.S.A) (prior |

| to 2004). | | |

| |

| |

| Principal officers who are not Trustees | | |

| |

| Name, age | | |

| Position(s) held with Portfolio | | Officer of |

| Principal occupation(s) and | | Portfolio |

| directorships during past 5 years | | since |

|

| Keith Hartstein2, Born: 1956 | | 2005 |

|

| President and Chief Executive Officer | | |

| Senior Vice President, Manulife Financial Corporation (since 2004); Director, President and Chief |

| Executive Officer, the Adviser and The Berkeley Group, John Hancock Funds, LLC (since 2005); |

| Director, MFC Global Investment Management (U.S.), LLC (“MFC Global (U.S.)”) (since 2005); |

| Director, John Hancock Signature Services, Inc. (since 2005); President and Chief Executive |

| Officer, John Hancock Investment Management Services, LLC (since 2006); President and Chief |

| Executive Officer, John Hancock Funds, John Hancock Funds II, John Hancock Funds III, John |

| Hancock Trust,; Director, Chairman and President, NM Capital Management, Inc. (since 2005); |

| Chairman, Investment Company Institute Sales Force Marketing Committee (since 2003); |

| Director, President and Chief Executive Officer, MFC Global (U.S.) (2005-2006); Executive Vice |

| President, John Hancock Funds, LLC (until 2005). | | |

|

| |

| John Vrysen2, Born: 1955 | | 2005 |

|

| Chief Financial Officer | | |

| Director, Executive Vice President and Chief Financial Officer, the Adviser, The Berkeley Group and |

| John Hancock Funds, LLC (since 2005); Executive Vice President and Chief Financial Officer, John |

| Hancock Investment Management Services, LLC (since 2005), Vice President and Chief Financial |

| Officer, MFC Global (U.S.) (since 2005); Director, John Hancock Signature Services, Inc. (since |

| 2005); Chief Financial Officer, John Hancock Funds, John Hancock Funds II, John Hancock Funds III, |

| John Hancock Trust (since 2005); Vice President and General Manager, Fixed Annuities, U.S. Wealth |

| Management (until 2005); Vice President, Operations Manulife Wood Logan (2000-2004). |

|

| |

| Francis V. Knox2, Jr., Born: 1947 | | 2005 |

|

| Vice President and Chief Compliance Officer, John Hancock Investment Management Services, |

| LLC, the Adviser and MFC Global (U.S.) (since 2005); Chief Compliance Officer, John Hancock |

| Funds, John Hancock Funds II, John Hancock Funds III and John Hancock Trust (since 2005); Vice |

| President and Assistant Treasurer, Fidelity Group of Funds (until 2004); Vice President and Ethics |

| & Compliance Officer, Fidelity Investments (until 2001). | | |

33

| Principal officers who are not Trustees (continued) | |

| |

| Name, age | |

| Position(s) held with Portfolio | Officer of |

| Principal occupation(s) and | Portfolio |

| directorships during past 5 years | since |

|

| Gordon Shone2, Born: 1956 | 2005 |

|

| Treasurer, John Hancock Funds (since 2006); John Hancock Funds II, John Hancock Funds III and John |

| Hancock Trust (since 2005); Vice President and Chief Financial Officer, John Hancock Trust (2003-2005); |

| Senior Vice President, John Hancock Life Insurance Company (U.S.A.) (since 2001); Vice President, John |

| Hancock Investment Management Services, Inc. and John Hancock Advisers, LLC (since 2006), The |

| Manufacturers Life Insurance Company (U.S.A.) (1998 to 2000). | |

|

| |

| Thomas M. Kinzler2, Born: 1955 | 2006 |

|

| Vice President and Counsel for John Hancock Life Insurance Company (U.S.A.) (since 2006); |

| Secretary and Chief Legal Officer, John Hancock Funds, John Hancock Funds II, John Hancock |

| Funds III and John Hancock Trust (since 2006); Vice President and Associate General Counsel for |

| Massachusetts Mutual Life Insurance Company (1999-2006); Secretary and Chief Legal Counsel |

| for MML Series Investment Fund (2000-2006); Secretary and Chief Legal Counsel for MassMutual |

| Institutional Funds (2000-2004); Secretary and Chief Legal Counsel for MassMutual Select Funds |

| and MassMutual Premier Funds (2004-2006). | |

1 Because the Trust does not hold regular annual shareholders meetings, each Trustee holds office for an indefinite term until his successor is duly elected and qualified or until he dies, retires, resigns, is removed or becomes disqualified.

2Affiliated with the investment adviser.

3 Non-Independent Trustee: holds positions with the Fund’s investment adviser, underwriter, and/ or certain other affiliates.

34

For more information

The Portfolio’s proxy voting policies, procedures and records are available without charge, upon request:

| By phone | On the Portfolio’s Web site | On the SEC’s Web site |

| 1-800-225-5291 | www.jhfunds.com/proxy | www.sec.gov |

|

| |

| Investment adviser | Custodian | Legal counsel |

| John Hancock Investment | State Street Bank & Trust Co. | Kirkpatrick & Lockhart |

| Management Services, LLC | 2 Avenue de Lafayette | Nicholson Graham LLP |

| 601 Congress Street | Boston, MA 02111 | 1 Lincoln Street |

| Boston, MA 02210-2805 | | Boston, MA 02111 |

| | Transfer agent | |

| Principal distributor | John Hancock Signature | Independent registered |