UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21779

JOHN HANCOCK FUNDS II

- ---------------------------------------------------------

(Exact name of registrant as specified in charter)

601 CONGRESS STREET, BOSTON, MA 02210-2805

-------------------------------------------------------------

(Address of principal executive offices) (Zip code)

GORDON M. SHONE, 601 CONGRESS STREET, BOSTON, MA 02210-2805

- ------------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 663-3000

- --------------

Date of fiscal year end: 12/31

- ------

Date of reporting period: 12/31/06

ITEM 1. REPORTS TO STOCKHOLDERS.

The first report applies to Lifestyle Aggressive Portfolio, the second report applies to Lifestyle Balanced Portfolio, the third report applies to Lifestyle Conservative Portfolio, the fourth report applies to Lifestyle Growth Portfolio and the fifth report applies to Lifestyle Moderate Portfolio

| TABLE OF CONTENTS |

|

| Your fund at a glance |

| page 1 |

|

| Managers’ report |

| page 2 |

|

| A look at performance |

| page 6 |

|

| Your expenses |

| page 8 |

|

| Fund’s investments |

| page 1 0 |

|

| Financial statements |

| page 1 2 |

|

| Notes to financial |

| statements |

| page 2 5 |

|

| Trustees and officers |

| page 3 5 |

|

| For more information |

| page 4 0 |

|

CEO corner

January 2007

To Our Shareholders,

The financial markets surprised many investors in 2006 by beating their expectations. At the beginning of the year, fears abounded about rising inflation – with sky high energy prices – stronger than expected economic growth, a decline in the housing boom and more interest rate hikes from the Federal Reserve. But by June, the economic data suggested the desired “soft landing” for the economy, energy prices stabilized, corporate earnings remained strong and the Fed stopped raising rates. With that, the market took off, producing double-digit returns instead of the single-digit ones originally thought to be the best the market would do. The ascent was widespread and the broad Standard & Poor’s 500 Index returned 15.79% .

The bond market also turned in a solid result, registering its seventh consecutive year of positive performance. Continuing the trend of the last several years, the best performances came from the high yield sector. A healthy corporate earnings environment drove default rates down to near historical low levels and bolstered strong demand from yield-hungry investors. The broad Lehman Brothers Aggregate Bond Index returned 4.33% for the year, while the Merrill Lynch High Yield Master II Index returned 11.74% .

After such a year, we encourage investors to sit back, take stock and set some realistic expectations. While history argues for another good year (since 1945, the S&P 500 Index has always produced positive results in the third year of a presidential term) opinions are divided on the future of this more-than-four-year-old bull market.

We believe it’s wise to work with your financial professional to determine whether changes are now in order to your mix of portfolios. Some stock groups have had long runs of outperformance, such as small-cap stocks, value stocks and real estate investment trusts. Others had truly outsized returns in 2006, such as the telecom and energy sectors, China and emerging markets – not to mention the continued outperformance in general of international markets versus the U.S. Among bonds, the high yield category has become richly valued after such a long run up. These trends argue for a look to determine if these categories now represent a larger stake in your portfolios than prudent diversification would suggest they should, based on your risk profile, investment objectives and time horizons.

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

This commentary reflects the CEO’s views as of December 31, 2006. They are subject to change at any time.

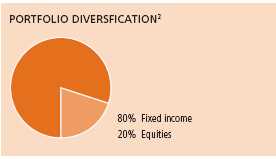

Your portfolio at a glance

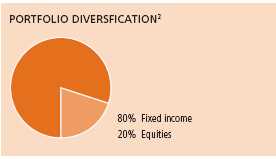

The Portfolio seeks long-term growth of capital. Current income is not a consideration.

To pursue this goal, the Portfolio, which is a fund-of-funds, normally invests 100% of

its assets in affiliated underlying funds that invest primarily in equity securities.

Over the last twelve months

► Stocks representing all market-capitalization ranges and investment styles benefited from a generally positive environment for equities.

► Except for a significant correction in May and June 2006, U.S. and international stock markets rose steadily throughout the year.

► The Portfolio’s exposure to international equity funds was particularly helpful to performance, while several of our domestic large-cap funds detracted.

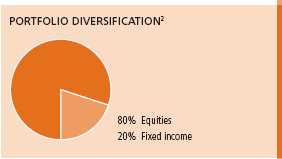

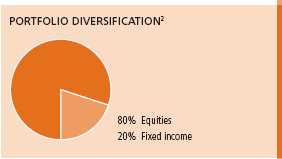

| Asset allocation | |

| | |

| Equity | % of Total |

|

| U.S. Large Cap | 38.0 |

|

| International Large Cap | 24.0 |

|

| U.S. Small Cap | 14.0 |

|

| U.S. Mid Cap | 13.0 |

|

| International Small Cap | 6.0 |

|

| Natural Resources | 5.0 |

|

As a percentage of net assets on December 31, 2006.

1

Managers’ report

John Hancock

Lifestyle Aggressive Portfolio

Recently, the Portfolio’s fiscal year-end changed from August to

December. What follows is a commentary for the 12 months ended

December 31, 2006.

Large and small, value and growth, domestic and international, stocks of all types gained ground against a mostly favorable market backdrop in 2006. Corporate earnings remained strong throughout the year, while consumer spending also held up surprisingly well. Although oil prices rose sharply during the year’s first half, they fell from their summertime peak of nearly $80 per barrel to finish the year closer to $60. Concerns about rising inflation led to a significant stock market correction in May and June. However, better-than-anticipated inflation reports during the year’s second half finally enabled the Federal Reserve Board, in a long-awaited move, to refrain from raising short-term interest rates for the first time in more than two years. Beginning at its August meeting, the Fed left its benchmark federal funds rate alone at 5.25% at each of its subsequent meetings during the year. Against this backdrop, the U.S. stoc k market rose steadily following its summertime decline.

Overall, the S&P 500 Index gained 15.79% during the 12 months ending December 31, 2006. Value stocks in all market-capitalization ranges beat their growth-stock counterparts, while small- and mid-cap stocks generally

SCORECARD

| INVESTMENT | | PERIOD’S PERFORMANCE ... AND WHAT’S BEHIND THE NUMBERS |

| |

| International | ▲ | Benefited from strong stock selection, an underweighting in Japan |

| Value (Franklin | | and currency gains for U.S. investors in European stocks. |

| Templeton) | | |

| | | |

| U.S. Multi Sector | ▼ | Weak individual stock selection — especially in health care and banks |

| (GMO) | | — hurt this fund’s results. |

| | | |

| Capital | ▼ | An overweighting in the information technology sector — and |

| Appreciation | | especially in the semiconductor industry — was a negative. |

| (Jennison) | | |

2

From the MFC Global Investment Management (U.S.A.), LLC’s

Portfolio Management Team

outperformed large caps. International equities did particularly well, with the MSCI EAFE returning an impressive 26.87% . In addition to benefiting from many of the same fundamental trends helping U.S. companies, international stocks were further helped by strength in the euro and British pound relative to the U.S. dollar. Also gaining ground were natural resources stocks, which benefited from rising commodity prices for much of the period and excellent supply/demand fundamentals.

“Large and small, value and growth,

domestic and international,

stocks of all types gained ground

against a mostly favorable market

backdrop in 2006.”

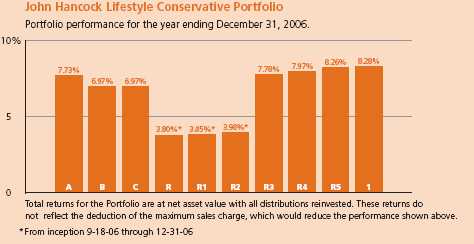

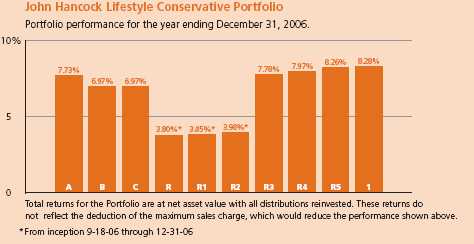

Performance results

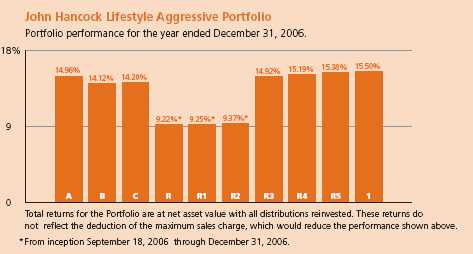

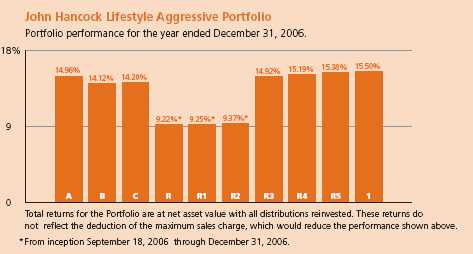

During the 12 months ending December 31, 2006, John Hancock Lifestyle Aggressive Portfolio’s Class A, Class B, Class C, Class R3, Class R4, Class R5 and Class 1 shares produced total returns of 14.96%, 14.12%, 14.20%,14.92%, 15.19%, 15.38% and 15.50%, respectively, at net asset value. Class R, Class R1 and Class R2 shares returned 9.22%, 9.25% and 9.37%, respectively, at net asset value, since beginning operations on September 18, 2006. In comparison, the Portfolio’s benchmark, the S&P 500 Index, returned 15.79% and Morningstar’s average large blend fund returned 14.15% .1 Keep in mind that your net asset value return will be different from the Portfolio’s performance if you were not invested in the Portfolio for the entire period and did not reinvest all distributions. Please see pages six and seven for historical performance information.

International, large-cap value gains

All of the Portfolio’s assets are invested in equity securities. During the period, our allocation to international equities was a significant positive. International Value (Franklin Templeton) — the Portfolio’s best performer

Lifestyle Aggressive Portfolio

3

overall — and International Core (GMO) were two standouts among our large-cap international holdings. International small-cap stocks enjoyed particularly good results, as the Portfolio benefited from positions in International Small Company (Dimensional Fund Advisors) and International Small Cap (Templeton).

Some of the Portfolio’s best performers during the year were U.S. large-cap value funds. In particular, Quantitative Value (MFC Global) and Equity Income (T. Rowe Price) turned in solid performances relative to the S&P 500 Index, thanks in large part to favorable market conditions for large-cap value stocks.

Another notable positive was our 5% position in Natural Resources (Wellington). It is important to remember that while natural resource equities can be relatively volatile on a stand-alone basis, they can be excellent complements to other asset classes within a fully diversified portfolio. This is exactly what happened in 2006.

During the year, a select number of our domestic large-cap blend funds underperformed in relative terms. U.S. Multi Sector (GMO) was an 8% position in the Portfolio and as a result had a relatively meaningful negative impact on performance. Core Equity (Legg Mason) also under-performed, driven largely by poor returns from its Internet holdings and lack of exposure to the energy sector. Large-cap growth fund Capital Appreciation (Jennison) was also a detractor, as was mid-cap blend fund Quantitative Mid Cap (MFC Global). Of final note, although the small-cap asset class provided a modestly favorable impact on performance, select holdings in this part of the market were relative laggards, including Small Company (American Century) and Small Cap (Independence).

Outlook

Global financial markets, and especially certain higher-risk asset classes, have benefited from ample global liquidity. Should that liquidity dry up, we could see a significant market correction, with higher-risk assets beginning to lag, while cash-rich, mega-cap companies could reverse their recent trend of underperformance. The Portfolio is well exposed to both types of stocks, and we believe our emphasis on diversification should position us well if market conditions shift suddenly over the coming months, or if they remain as they have over the last few years.

Lifestyle Aggressive Portfolio

4

As so many investors inevitably discover, trying to time asset class moves based on generalizations often has regrettable consequences and defeats the long-term smoothing effect of diversification. Our focus as portfolio managers is not on the latest quarter or even the past year’s performance. Rather our focus is on designing a portfolio that can compound shareholder wealth over time while evening out some of the inevitable bumps that occur along the way.

“Some of the Portfolio’s best

performers during the year were

U.S. large-cap value funds.”

This commentary reflects the views of the portfolio managers through the end of the Portfolio’s period discussed in this report. The managers’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting. See the prospectus for the risks of investing in small-cap stocks. See the prospectus for the risks of investing in high-yield bonds.

1 Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on December 31, 2006.

Lifestyle Aggressive Portfolio

5

A look at performance

For the periods ending December 31, 2006

| | | | Average annual returns | | | | Cumulative total returns | | |

| | | | with maximum sales charge (POP) | | | | with maximum sales charge (POP) | | |

| | Inception | | | | | Since | | | | | Since |

| Class | date | | 1-year | 5-year | 10-year | inception | | 1-year | 5-year | 10-year | inceptiona |

|

| 1a | 10-15-05 | | 15.50% | — | — | 18.63% | | 15.50% | — | — | 23.04% |

|

| A | 10-18-05 | | 9.25 | — | — | 13.34 | | 9.25 | — | — | 16.29 |

|

| B | 10-18-05 | | 9.12 | — | — | 14.23 | | 9.12 | — | — | 17.39 |

|

| C | 10-18-05 | | 13.20 | — | — | 17.52 | | 13.20 | �� | — | 21.48 |

|

| Ra | 9-18-06 | | — | — | — | — | | — | — | — | 9.22 |

|

| R1a | 9-18-06 | | — | — | — | — | | — | — | — | 9.25 |

|

| R2a | 9-18-06 | | — | — | — | — | | — | — | — | 9.37 |

|

| R3a | 10-18-05 | | 14.92 | — | — | 18.15 | | 14.92 | — | — | 22.27 |

|

| R4a | 10-18-05 | | 15.19 | — | — | 18.43 | | 15.19 | — | — | 22.62 |

|

| R5a | 10-18-05 | | 15.38 | — | — | 18.64 | | 15.38 | — | — | 22.88 |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 shares.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Portfolio’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Portfolio’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Since inception performance is calculated with an opening price (prior day’s close) on inception date.

a For certain types of investors as described in the Portfolio’s Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 share prospectuses.

Lifestyle Aggressive Portfolio

6

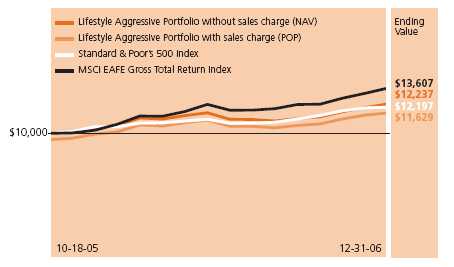

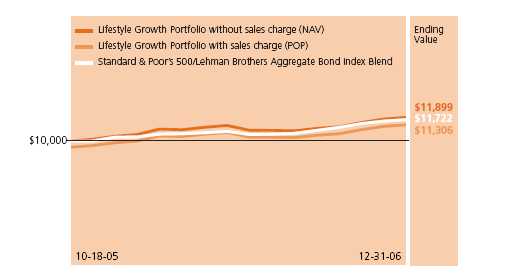

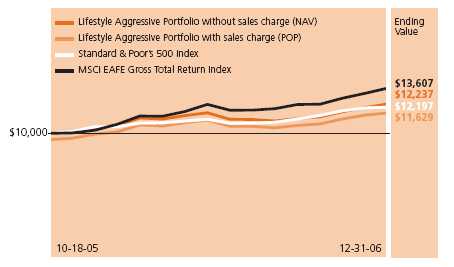

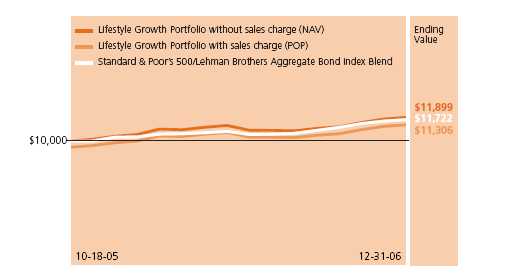

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares

for the period indicated. For comparison, we’ve shown the same investment in two

separate indexes.

| | | Without sales | With maximum | | |

| Class | Period beginning | charge | sales charge | Index 1 | Index 2 |

|

| 11,3 | 10-15-05 | $12,304 | $12,304 | $12,233 | $13,210 |

|

| B1 | 10-18-05 | 12,139 | 11,739 | 12,197 | 13,607 |

|

| C1,2 | 10-18-05 | 12,148 | 12,148 | 12,197 | 13,607 |

|

| R1,3 | 9-18-06 | 10,922 | 10,922 | 10,804 | 11,041 |

|

| R11,3 | 9-18-06 | 10,925 | 10,925 | 10,804 | 11,041 |

|

| R21,3 | 9-18-06 | 10,937 | 10,937 | 10,804 | 11,041 |

|

| R31,3 | 10-18-05 | 12,227 | 12,227 | 12,197 | 13,607 |

|

| R41,3 | 10-18-05 | 12,262 | 12,262 | 12,197 | 13,607 |

|

| R51,3 | 10-18-05 | 12,288 | 12,288 | 12,197 | 13,607 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Portfolio’s Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 shares, respectively, as of December 31, 2006. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Standard & Poor’s 500 Index — Index 1 — is an unmanaged index that includes 500 widely traded common stocks.

MSCI EAFE Gross Total Return Index — Index 1 — (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. As of June 2006 the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

It is not possible to invest directly in an index. Index figures do not reflect sales charges and would be lower if they did.

1 Index 2 figure as of closest month end to inception date.

2 No contingent deferred sales charge applicable.

3 For certain types of investors as described in the Portfolio’s Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 share prospectuses.

Lifestyle Aggressive Portfolio

7

Your expenses

These examples are intended to help you understand your ongoing

operating expenses.

Understanding portfolio expenses

As a shareholder of the Portfolio, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable) and other portfolio expenses.

In addition to the operating expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the operating expenses of the affiliated underlying funds in which the Portfolio invests. Because the affiliated underlying funds have varied operating expenses and transaction costs and the Portfolio may own different proportions of the affiliated underlying funds at different times, the amount of expenses incurred indirectly by the Portfolio will vary. If these indirect expenses were included, your expenses paid during the period would have been higher.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your portfolio’s actual ongoing operating expenses, and is based on your portfolio’s actual return. It assumes an account value of $1,000.00 on July 1, 2006, with the same investment held until December 31, 2006.

| | Account value | Ending value | Expenses paid during period |

| | on 7-1-06 | on 12-31-06 | ended 12-31-06a |

|

| Class A | $1,000.00 | $1,101.80 | $3.44 |

|

| Class B | 1,000.00 | 1,097.80 | 7.14 |

|

| Class C | 1,000.00 | 1,097.70 | 7.14 |

|

| Class R | 1,000.00 | 1,092.20 | 2.83 |

|

| Class R1 | 1,000.00 | 1,092.50 | 2.09 |

|

| Class R2 | 1,000.00 | 1,093.70 | 1.34 |

|

| Class R3 | 1,000.00 | 1,101.40 | 3.76 |

|

| Class R4 | 1,000.00 | 1,103.20 | 2.54 |

|

| Class R5 | 1,000.00 | 1,104.30 | 1.06 |

|

| Class 1 | 1,000.00 | 1,104.60 | 0.53 |

|

Lifestyle Aggressive Portfolio

8

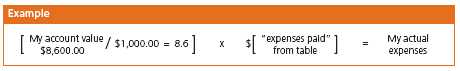

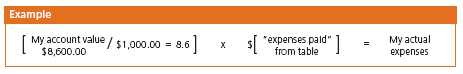

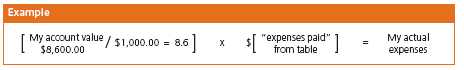

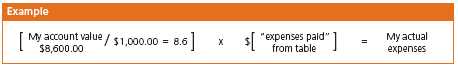

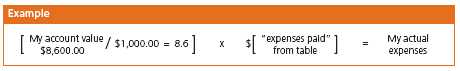

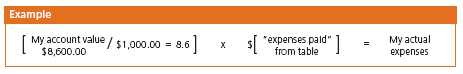

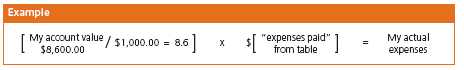

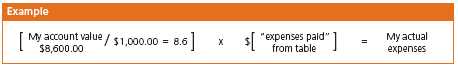

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at December 31, 2006 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

This table allows you to compare your portfolio’s ongoing operating expenses with those of any other portfolio. It provides an example of the Portfolio’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annual return before expenses (which is not your portfolio’s actual return). It assumes an account value of $1,000.00 on July 1, 2006, with the same investment held until December 31, 2006. Look in any other portfolio shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | Account value | Ending value | Expenses paid during period |

| | on 7-1-06 | on 12-31-06 | ended 12-31-06a |

|

| Class A | $1,000.00 | $1,021.93 | $3.31 |

|

| Class B | 1,000.00 | 1,018.40 | 6.87 |

|

| Class C | 1,000.00 | 1,018.40 | 6.87 |

|

| Class R | 1,000.00 | 1,011.54 | 2.72 |

|

| Class R1 | 1,000.00 | 1,012.25 | 2.01 |

|

| Class R2 | 1,000.00 | 1,012.96 | 1.29 |

|

| Class R3 | 1,000.00 | 1,021.63 | 3.62 |

|

| Class R4 | 1,000.00 | 1,022.79 | 2.45 |

|

| Class R5 | 1,000.00 | 1,024.20 | 1.02 |

|

| Class 1 | 1,000.00 | 1,024.70 | 0.51 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different portfolios. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

a Expenses are equal to the Portfolio’s annualized expense ratio of 0.65%, 1.35%, 1.35%, 0.95%, 0.70%, 0.45%, 0.71%, 0.48%, 0.20% and 0.10% for Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1, respectively, multiplied by the average account value over the period, multiplied by the number of days in the period (inception date for Class R, Class R1 and Class R2) /365 or 366 (to reflect the one-half year period).

b Class R, R1 and R2 shares began operations on 9-18-06.

Lifestyle Aggressive Portfolio

9

F I N A N C I A L S T A T E M E N T S

Portfolio’s investments

Securities owned by the Portfolio on 12-31-06

Portfolio of investments, showing all affiliated underlying funds.

| Issuer | Shares | Value |

|

| Investment companies 99.98% | | $2,893,823,572 |

|

| (Cost $2,578,460,454) | | |

| | | |

| John Hancock Funds II 91.97% | | 2,662,103,782 |

|

| All Cap Growth Fund Class NAV | 3,270,836 | 57,926,504 |

|

| All Cap Value Fund Class NAV | 3,577,206 | 57,664,564 |

|

| Blue Chip Growth Fund Class NAV | 7,503,645 | 144,895,377 |

|

| Capital Appreciation Fund Class NAV | 11,312,854 | 115,956,752 |

|

| Core Equity Fund Class NAV | 5,417,429 | 86,787,212 |

|

| Emerging Growth Fund Class NAV | 3,498,404 | 58,073,499 |

|

| Equity-Income Fund Class NAV | 3,077,127 | 57,788,436 |

|

| Fundamental Value Fund Class NAV | 6,800,039 | 115,600,671 |

|

| International Equity Index Fund Class NAV | 7,068,530 | 144,904,862 |

|

| International Opportunities Fund Class NAV | 6,454,539 | 115,988,074 |

|

| International Small Cap Fund Class NAV | 4,172,362 | 87,035,481 |

|

| International Small Company Fund Class NAV | 8,272,786 | 87,029,713 |

|

| International Value Fund Class NAV | 10,849,920 | 202,785,006 |

|

| Large Cap Fund Class NAV | 3,702,322 | 57,793,242 |

|

| Large Cap Value Fund Class NAV | 1,149,067 | 28,761,149 |

|

| Mid Cap Index Fund Class NAV | 5,859,816 | 115,203,989 |

|

| Mid Cap Stock Fund Class NAV | 3,447,720 | 57,714,828 |

|

| Mid Cap Value Equity Fund Class NAV | 2,770,613 | 28,758,959 |

|

| Mid Cap Value Fund Class NAV | 2,879,077 | 57,725,490 |

|

| Natural Resources Fund Class NAV | 4,060,960 | 144,895,069 |

|

| Quantitative Mid Cap Fund Class NAV | 3,782,103 | 57,639,253 |

|

| Quantitative Value Fund Class NAV | 5,018,113 | 87,014,073 |

|

| Small Cap Fund Class NAV | 5,605,832 | 86,441,931 |

|

| Small Cap Index Fund Class NAV | 3,428,771 | 57,809,078 |

|

| Small Company Fund Class NAV | 3,437,117 | 57,743,563 |

|

| Small Company Value Fund Class NAV | 3,452,364 | 86,861,470 |

|

| Special Value Fund Class NAV | 2,662,953 | 57,839,340 |

|

| U.S. Global Leaders Growth Fund Class NAV | 2,133,558 | 28,781,700 |

|

| U.S. Multi Sector Fund Class NAV | 21,083,701 | 231,709,869 |

|

| Value & Restructuring Fund Class NAV | 2,401,870 | 28,894,501 |

|

| Vista Fund Class NAV | 5,015,555 | 58,080,127 |

See notes to financial statements

Lifestyle Aggressive Portfolio

10

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| John Hancock Funds III 8.01% | | $231,719,790 |

|

| International Core Fund Class NAV | $5,433,055 | 231,719,790 |

| |

| Total investments 99.98% | | $2,893,823,572 |

|

| Other assets in excess of liabilities 0.02% | | $527,588 |

|

| Total net assets 100.00% | | $2,894,351,160 |

|

Percentages are stated as a percent of net assets of the Portfolio.

See notes to financial statements

Lifestyle Aggressive Portfolio

11

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 12-31-06

This Statement of Assets and Liabilities is the Portfolio’s balance sheet. It shows the value

of what the Portfolio owns, is due and owes. You’ll also find the net asset value and the

maximum offering price per share.

| Assets | |

|

| Investments in affiliated underlying funds, at value (cost $2,578,460,454) | $2,893,823,572 |

| Receivable for investments sold | 12,807,727 |

| Receivable for fund shares sold | 1,105,762 |

| Receivable from affiliates | 7,687 |

| | |

| Total assets | 2,907,744,748 |

| |

| Liabilities | |

|

| Due to custodian | 376,558 |

| Payable for investments purchased | 107,600 |

| Payable for fund shares repurchased | 12,461,037 |

| Payable to affiliates | |

| Fund administration fees | 76,546 |

| Transfer agent fees | 95,568 |

| Trustees’ fees | 8,823 |

| Investment management fees | 228 |

| Other payables and accrued expenses | 267,228 |

| | |

| Total liabilities | 13,393,588 |

| |

| Net assets | |

|

| Capital paid-in | 2,566,231,412 |

| Accumulated net realized gain on investments | 12,494,002 |

| Net unrealized appreciation on investments in affiliated underlying funds | 315,363,118 |

| Accumulated net investment income | 262,628 |

| | |

| Net assets | $2,894,351,160 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Portfolio has an | |

| unlimited number of shares authorized with no par value. | |

| Class A ($55,913,835 ÷ 3,798,767 shares) | $14.72 |

| Class B ($12,517,682 ÷ 850,169 shares) | $14.72 |

| Class C ($38,920,102 ÷ 2,643,046 shares) | $14.73 |

| Class R ($215,285 ÷ 14,560 shares) | $14.79 |

| Class R1 ($109,263 ÷ 7,402 shares) | $14.76 |

| Class R2 ($118,546 ÷ 8,045 shares) | $14.74 |

| Class R3 ($1,584,810 ÷ 107,667 shares) | $14.72 |

| Class R4 ($2,451,413 ÷ 166,644 shares) | $14.71 |

| Class R5 ($554,940 ÷ 37,726 shares) | $14.71 |

| Class 1 ($2,781,965,284 ÷ 189,485,375 shares) | $14.68 |

| |

| Maximum offering price per share | |

|

| Class A1 ($14.72 ÷ 95%) | $15.49 |

1 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

Lifestyle Aggressive Portfolio

12

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 12-31-06.

This Statement of Operations summarizes the Portfolio’s investment income earned

and expenses incurred in operating the Portfolio. It also shows net gains (losses) for

the period stated.

| | Period | Four months |

| | endeda | endedb |

| | 8-31-06 | 12-31-06 |

| |

| Investment income | | |

|

| Income distributions received from affiliated underlying funds | $11,032,304 | $19,804,944 |

| | | |

| Total investment income | 11,032,304 | 19,804,944 |

| |

| Expenses | | |

|

| Investment management fees (Note 3) | 793,633 | 376,281 |

| Distribution and service fees (Note 3) | 1,087,115 | 626,891 |

| Transfer agent fees (Note 3) | 52,221 | 60,035 |

| Blue sky fees (Note 3) | 99,466 | 47,118 |

| Printing and postage fees (Note 3) | 51,472 | 21,193 |

| Fund administration fees (Note 3) | 166,487 | 63,275 |

| Audit and legal fees | 85,026 | 31,906 |

| Custodian fees | 10,944 | 4,020 |

| Trustees’ fees (Note 3) | 21,991 | 8,357 |

| Registration and filing fees | 70,700 | 26,870 |

| Miscellaneous | 17,551 | 4,756 |

| | | |

| Total expenses | 2,456,606 | 1,270,702 |

| Less expense reductions (Note 3) | (122,636) | (39,656) |

| | | |

| Net expenses | 2,333,970 | 1,231,046 |

| | | |

| Net investment income | 8,698,334 | 18,573,898 |

| |

| Realized and unrealized gain | | |

|

| Net realized and unrealized gain on | | |

| Investments | 54,792,008 | 11,467,280 |

| Capital gain distributions received from affiliated underlying funds | 6,427,198 | 62,425,606 |

| Change in net unrealized appreciation of investments in affiliated | | |

| underlying funds | 160,575,363 | 154,787,755 |

| | | |

| Net realized and unrealized gain | 221,794,569 | 228,680,641 |

| | | |

| Increase in net assets from operations | $230,492,903 | $247,254,539 |

a Period from 10-15-05 (commencement of operations) to 8-31-06.

b Effective 1-18-07, the fiscal year-end changed from August 31 to December 31.

See notes to financial statements

Lifestyle Aggressive Portfolio

13

F I N A N C I A L S T A T E M E N T S

Statement of changes in net assets

These Statements of Changes in Net Assets show how the value of the Portfolio’s net

assets has changed during the last two periods. The difference reflects earnings less

expenses, any investment gains and losses, distributions, if any, paid to shareholders and

the net of Portfolio share transactions.

| | Period | Four months |

| | endeda | endedb |

| | 8-31-06 | 12-31-06 |

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $8,698,334 | $18,573,898 |

| Net realized gain | 61,219,206 | 73,892,886 |

| Change in net unrealized appreciation | 160,575,363 | 154,787,755 |

| | | |

| Increase in net assets resulting from operations | 230,492,903 | 247,254,539 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (10,791) | (1,349,781) |

| Class B | (2,807) | (222,059) |

| Class C | (4,862) | (690,657) |

| Class R | — | (4,634) |

| Class R1 | — | (2,600) |

| Class R2 | — | (3,084) |

| Class R3 | (460) | (37,785) |

| Class R4 | (513) | (64,000) |

| Class R5 | (565) | (15,755) |

| Class1 | (10,836,557) | (81,795,612) |

| From net realized gain | | |

| Class A | — | (1,051,325) |

| Class B | — | (237,454) |

| Class C | — | (738,375) |

| Class R | — | (4,062) |

| Class R1 | — | (2,061) |

| Class R2 | — | (2,227) |

| Class R3 | — | (29,914) |

| Class R4 | — | (46,167) |

| Class R5 | — | (10,422) |

| Class1 | — | (52,688,646) |

| | (10,856,555) | (138,996,620) |

| From Fund share transactions | 2,274,320,405 | 292,136,488 |

| |

| Net assets | | |

|

| Beginning of period | — | $2,493,956,753 |

| End of period | $2,493,956,753 | $2,894,351,160 |

| | | |

| Accumulated net investment income | $4,475,074 | $262,628 |

a Period from 10-15-05 (commencement of operations) to 8-31-06.

b Effective 1-18-07, the fiscal year-end changed from August 31 to December 31.

See notes to financial statements

Lifestyle Aggressive Portfolio

14

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial highlights show how the Portfolio’s net asset value for a share has changed

since the end of the previous period.

| CLASS A SHARES | | |

| |

| Period ended | 8-31-06a | 12-31-06b |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.63 | $14.06 |

| Net investment income (loss) h,v | (0.07) | 0.08 |

| Net realized and unrealized | | |

| gain on investments | 1.56 | 1.24 |

| Total from investment operations | 1.49 | 1.32 |

| Less distributions | | |

| From net investment income | (0.06) | (0.37) |

| From net realized gain | — | (0.29) |

| | (0.06) | (0.66) |

| Net asset value, end of period | $14.06 | $14.72 |

| Total return k,m (%) | 11.85 l | 9.40 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period | | |

| (in millions) | $35 | $56 |

| Ratio of net expenses to average | | |

| net assets q,r (%) | 0.65 | 0.64 |

| Ratio of gross expenses to average | | |

| net assets q,r (%) | 0.84p | 0.65 |

| Ratio of net investment income | | |

| (loss) to average net assets r,v (%) | (0.59) | 1.69 |

| Portfolio turnover m (%) | 23 | 5 |

See notes to financial statements

Lifestyle Aggressive Portfolio

15

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS B SHARES | | |

| |

| Period ended | 8-31-06a | 12-31-06b |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.63 | $14.00 |

| Net investment income (loss) h,v | (0.15) | 0.05 |

| Net realized and unrealized | | |

| gain on investments | 1.56 | 1.23 |

| Total from investment operations | 1.41 | 1.28 |

| Less distributions | | |

| From net investment income | (0.04) | (0.27) |

| From net realized gain | — | (0.29) |

| | (0.04) | (0.56) |

| Net asset value, end of period | $14.00 | $14.72 |

| Total return k,l,m (%) | 11.22 | 9.15 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period | | |

| (in millions) | $8 | $13 |

| Ratio of net expenses to average | | |

| net assets q,r (%) | 1.34 | 1.35 |

| Ratio of gross expenses to average | | |

| net assets p,q,r (%) | 2.00 | 1.54 |

| Ratio of net investment income | | |

| (loss) to average net assets r,v (%) | (1.23) | 1.07 |

| Portfolio turnover m (%) | 23 | 5 |

See notes to financial statements

Lifestyle Aggressive Portfolio

16

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS C SHARES | | |

| |

| Period ended | 8-31-06a | 12-31-06b |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.63 | $14.00 |

| Net investment income (loss) h,v | (0.15) | 0.05 |

| Net realized and unrealized | | |

| gain (loss) on investments | 1.57 | 1.24 |

| Total from investment operations | 1.42 | 1.29 |

| Less distributions | | |

| From net investment income | (0.05) | (0.27) |

| From net realized gain | — | (0.29) |

| | (0.05) | (0.56) |

| Net asset value, end of period | $14.00 | $14.73 |

| Total return k,l,m (%) | 11.22 | 9.22 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period | | |

| (in millions) | $25 | $39 |

| Ratio of net expenses to average | | |

| net assets q,r (%) | 1.34 | 1.35 |

| Ratio of gross expenses to average | | |

| net assets p,q,r (%) | 1.60 | 1.36 |

| Ratio of net investment income | | |

| (loss) to average net assets r,v (%) | (1.27) | 1.10 |

| Portfolio turnover m (%) | 23 | 5 |

See notes to financial statements

Lifestyle Aggressive Portfolio

17

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS R SHARES | |

| |

| Period ended | 12-31-06b,c |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $14.11 |

| Net investment income h,v | 0.13 |

| Net realized and unrealized | |

| gain on investments | 1.17 |

| Total from investment operations | 1.30 |

| Less distributions | |

| From net investment income | (0.33) |

| From net realized gain | (0.29) |

| | (0.62) |

| Net asset value, end of period | $14.79 |

| Total return k,l (%) | 9.22m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets q (%) | 0.95r |

| Ratio of gross expenses to average | |

| net assets p,q (%) | 10.66r |

| Ratio of net investment income | |

| to average net assets v (%) | 2.94r |

| Portfolio turnover (%) | 5m |

See notes to financial statements

Lifestyle Aggressive Portfolio

18

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS R1 SHARES | |

| |

| Period ended | 12-31-06 b,c |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $14.11 |

| Net investment income h,v | 0.08 |

| Net realized and unrealized | |

| gain on investments | 1.23 |

| Total from investment operations | 1.31 |

| Less distributions | |

| From net investment income | (0.37) |

| From net realized gain | (0.29) |

| | (0.66) |

| Net asset value, end of period | $14.76 |

| Total return k,l (%) | 9.25m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets q (%) | 0.70r |

| Ratio of gross expenses to average | |

| net assets p,q (%) | 12.89r |

| Ratio of net investment income | |

| to average net assets v (%) | 1.79r |

| Portfolio turnover (%) | 5m |

See notes to financial statements

Lifestyle Aggressive Portfolio

19

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS R2 SHARES | |

| |

| Period ended | 12-31-06b,c |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $14.11 |

| Net investment income h,v | 0.09 |

| Net realized and unrealized | |

| gain on investments | 1.23 |

| Total from investment operations | 1.32 |

| Less distributions | |

| From net investment income | (0.40) |

| From net realized gain | (0.29) |

| | (0.69) |

| Net asset value, end of period | $14.74 |

| Total return k,l (%) | 9.37m |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period | |

| (in millions) | —i |

| Ratio of net expenses to average | |

| net assets q (%) | 0.45r |

| Ratio of gross expenses to average | |

| net assets p,q (%) | 12.24r |

| Ratio of net investment income | |

| to average net assets v (%) | 2.07r |

| Portfolio turnover (%) | 5m |

See notes to financial statements

Lifestyle Aggressive Portfolio

20

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS R3 SHARES | | |

| |

| Period ended | 8-31-06a | 12-31-06b |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.63 | $14.06 |

| Net investment income h,v (loss) | (0.05) | 0.08 |

| Net realized and unrealized | | |

| gain on investments | 1.54 | 1.24 |

| Total from investment operations | 1.49 | 1.32 |

| Less distributions | | |

| From net investment income | (0.06) | (0.37) |

| From net realized gain | — | (0.29) |

| | (0.06) | (0.66) |

| Net asset value, end of period | $14.06 | $14.72 |

| Total return k,l,m (%) | 11.81 | 9.36 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period | | |

| (in millions) | $1 | $2 |

| Ratio of net expenses to average | | |

| net assets q,r (%) | 0.69 | 0.72 |

| Ratio of gross expenses to average | | |

| net assets p,q,r (%) | 8.07 | 2.21 |

| Ratio of net investment loss | | |

| to average net assets r,v (%) | (0.47) | 1.70 |

| Portfolio turnover m (%) | 23 | 5 |

See notes to financial statements

Lifestyle Aggressive Portfolio

21

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS R4 SHARES | | |

| |

| Period ended | 8-31-06a | 12-31-06b |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.63 | $14.07 |

| Net investment income (loss) h,v | (0.05) | 0.08 |

| Net realized and unrealized | | |

| gain on investments | 1.55 | 1.25 |

| Total from investment operations | 1.50 | 1.33 |

| Less distributions | | |

| From net investment income | (0.06) | (0.40) |

| From net realized gain | — | (0.29) |

| | (0.06) | (0.69) |

| Net asset value, end of period | $14.07 | $14.71 |

| Total return k,l,m (%) | 11.94 | 9.46 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period | | |

| (in millions) | $2 | $2 |

| Ratio of net expenses to average | | |

| net assets q,r (%) | 0.49 | 0.53 |

| Ratio of gross expenses to average | | |

| net assets p,q,r (%) | 4.08 | 1.38 |

| Ratio of net investment income | | |

| (loss) to average net assets r,v (%) | (0.38) | 1.71 |

| Portfolio turnover m (%) | 23 | 5 |

See notes to financial statements

Lifestyle Aggressive Portfolio

22

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS R5 SHARES | | |

| |

| Period ended | 8-31-06a | 12-31-06b |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.63 | $14.09 |

| Net investment income h,v | 0.01 | 0.09 |

| Net realized and unrealized | | |

| gain on investments | 1.52 | 1.26 |

| Total from investment operations | 1.53 | 1.35 |

| Less distributions | | |

| From net investment income | (0.07) | (0.44) |

| From net realized gain | — | (0.29) |

| | (0.07) | (0.73) |

| Net asset value, end of period | $14.09 | $14.71 |

| Total return k,l,m (%) | 12.16 | 9.57 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period | | |

| (in millions) | —i | $1 |

| Ratio of net expenses to average | | |

| net assets q,r (%) | 0.20 | 0.23 |

| Ratio of gross expenses to average | | |

| net assets p,q,r (%) | 8.26 | 4.07 |

| Ratio of net investment income | | |

| to average net assets r,v (%) | 0.05 | 1.90 |

| Portfolio turnover m (%) | 23 | 5 |

See notes to financial statements

Lifestyle Aggressive Portfolio

23

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS 1 SHARES | | |

| |

| Period ended | 8-31-06a | 12-31-06 b |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $12.60 | $14.07 |

| Net investment income h,v | 0.06 | 0.10 |

| Net realized and unrealized | | |

| gain on investments | 1.48 | 1.25 |

| Total from investment operations | 1.54 | 1.35 |

| Less distributions | | |

| From net investment income | (0.07) | (0.45) |

| From net realized gain | — | (0.29) |

| | (0.07) | (0.74) |

| Net asset value, end of period | $14.07 | $14.68 |

| Total return k,m (%) | 12.27 | 9.59 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period | | |

| (in millions) | $2,422 | $2,782 |

| Ratio of net expenses to average | | |

| net assets q,r (%) | 0.11 | 0.11 |

| Ratio of net investment income | | |

| to average net assets r,v (%) | 0.48 | 2.09 |

| Portfolio turnover m (%) | 23 | 5 |

a Class A, Class B, Class C, Class R3, Class R4 and Class R5 shares began operations on 10-18-05, and Class 1 shares began operation on 10-15-05.

b Effective 1-18-07, the fiscal year-end changed from August 31 to December 31.

c Class R, Class R1 and Class R2 shares began operations on 9-18-06.

h Based on the average of the shares outstanding.

i Less than $500,000.

k Assumes dividend reinvestment and does not reflect the effect of sales charges.

l Total returns would have been lower had certain expenses not been reduced during the period shown.

m Not annualized.

p Does not take into consideration expense reductions during the period shown.

q Does not include expenses of the investment companies in which the Portfolio invests.

r Annualized.

v Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests.

See notes to financial statements

Lifestyle Aggressive Portfolio

24

Notes to financial statements

1. Organization

The John Hancock Lifestyle Aggressive Portfolio (the “Portfolio”) is a non-diversified series of John Hancock Funds II (the “Trust”). The Trust was established as a Massachusetts business trust on June 28, 2005. The Trust is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end investment management company.

The Portfolio operates as a “fund of funds”, investing in Class NAV shares of affiliated underlying funds of the Trust and John Hancock Funds III and in other permitted investments. The affiliated underlying funds’ accounting policies are outlined in the shareholder reports, available without charge by calling 1-800-225-5291 or on the Securities & Exchange Commission (“SEC”) Web site at www.sec.gov, File #811-21779, CIK 0001331971. The affiliated underlying funds are not covered by this report.

John Hancock Investment Management Services, LLC (the “Adviser”), a Delaware limited liability company controlled by John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”) serves as investment adviser for the Trust and John Hancock Funds, LLC (the “Distributor”), an affiliate of the Adviser, serves as principal underwriter. John Hancock Life Insurance Company of New York (“John Hancock New York”) is a wholly owned subsidiary of John Hancock USA. John Hancock USA and John Hancock New York are indirect wholly owned subsidiaries of The Manufactures Life Insurance Company (“Manulife”), which in turn is a wholly owned subsidiary of Manulife Financial Corporation (“MFC”), a publicly traded company. MFC and its subsidiaries are known collectively as “Manulife Financial.”

The Portfolio commenced operations after certain separate accounts of John Hancock USA redeemed their interests in portfolios of John Hancock Trust and certain unaffiliated mutual funds of approximately $350 million at the close of business on October 14, 2005, with additional redemption proceeds of approximately $1.5 billion received on October 28, 2005, and invested such proceeds in Class 1 shares of the Portfolio, which in turn invested the proceeds in affiliated underlying funds of the Trust.

The Board of Trustees has authorized the issuance of multiple classes of shares of the Portfolio, including classes designated as Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 shares.

Class A, B and C shares are open to all retail investors. Class 1 shares are sold only to certain exempt separate accounts of John Hancock USA and John Hancock New York. Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans.

The shares of each class represent an interest in the same portfolio of investments of the Portfolio and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the SEC and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

On January 18, 2007, the Board of Trustees approved a change in the fiscal year end of the Portfolio from August 31 to December 31. Accordingly, the Portfolio’s financial statements and related notes include information as of the four-month period ended December 31, 2006 and the period ended August 31, 2006.

Lifestyle Aggressive Portfolio

25

2. Significant accounting policies

In the preparation of the financial statements, the Portfolio follows the policies described below. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results may differ from these estimates.

Securities valuation

The net asset value of the shares of the Portfolio is determined daily as of the close of the New York Stock Exchange, normally at 4:00 p.m. Eastern Time. Investments in the affiliated underlying funds are valued at their respective net asset values each business day, or at fair value as determined in good faith in accordance with procedures approved by the Trustees. Securities in the affiliated underlying funds’ portfolios are valued in accordance with their respective valuation polices, as outlined in the affiliated underlying funds’ financial statements. Short-term debt in vestments that have a remaining maturity of 60 days or less are valued at amortized cost.

Security transactions and related

investment income

Investment security transactions in the affiliated underlying funds are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income and capital gain distributions from the affiliated underlying funds are recorded on the ex-dividend date.

Gains and losses on securities sold are determined on the basis of specific identified cost for both financial and federal income tax reporting purposes.

Multi-class operations

All income, expenses (except for class-specific expenses) and realized and unrealized gains (losses) are allocated to each class of shares based upon the relative net assets of each class. Dividends to shareholders from net investment income are determined at a class level and distributions from capital gains are determined at a Portfolio level.

Expense allocation

Expenses not directly attributable to a particular Portfolio or class of shares are allocated based on the relative share of net assets of the Portfolio at the time the expense was incurred. Class-specific expenses, such as transfer agency fees, blue sky fees, printing and postage fees and distribution and service fees, are accrued daily and charged directly to the respective share classes. Expenses in the Portfolio’s Statements of Operations reflect the expenses of the Portfolio and do not include any indirect expenses related to the affiliated underlying funds. Because the affiliated underlying funds have varied expense levels and the Portfolio may own different proportions of the affiliated underlying funds at different times, the amount of fees and expenses incurred indirectly by the Portfolio will vary.

Federal income taxes

The Portfolio seeks to qualify as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

New accounting pronouncements

In June 2006, Financial Accounting Standards Board (“FASB”) Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the “Interpretation”) was issued, and is effective for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. The Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return, and requires certain expanded disclosures. Management is currently evaluating the application of the Interpretation to the Portfolio, and has not at this time quantified the impact, if any, resulting from the adoption of the Interpretation on the Portfolio’s financial statements. The Portfolio will implement this pronouncement no later than June 29, 2007.

Lifestyle Aggressive Portfolio

26

In September 2006, FASB Standard No. 157, Fair Value Measurements (“FAS 157”) was issued, and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishing a framework for measuring fair value and expands disclosure about fair value measurements. Management is currently evaluating the application of FAS 157 to the Fund, and its impact, if any, resulting from the adoption of FAS 157 on the Fund’s financial statements.

Distribution of income and gains

The Portfolio records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date.

During the period ended August 31, 2006, the tax character of distributions paid was as follows: ordinary income $10,856,555. During the four-month period ended December 31, 2006, the tax character of distributions paid was as follows: ordinary income $138,977,239 and long-term capital gains $19,381. Distributions paid by the Portfolio with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class. Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Portfolio’s financial statements as a return of capital. As of December 31, 2006, the components of distributable earnings on a t ax basis included $1,664,482 of undistributed ordinary income and $11,766,656 of undistributed long-term gain.

Capital accounts

The Portfolio reports the undistributed net investment income and accumulated undistributed net realized gain (loss) accounts on a basis approximating amounts available for future tax distributions (or to offset future taxable realized gains when a capital loss carry-forward is available). Accordingly, the Portfolio may periodically make reclassifications among certain capital accounts, without affecting its net asset value.

3. Investment advisory and

other agreements

Advisory fees

The Trust has entered into an Investment Advisory Agreement with the Adviser. The Adviser is responsible for managing the corporate and business affairs of the Trust and for selecting and compensating subadvisers to handle the investment of the assets of the Portfolio, subject to the supervision of the Board of Trustees. Under the Advisory Agreement, the Portfolio pays a monthly management fee to the Adviser equivalent, on an annual basis, to its pro rata portion of the sum of: (a) 0.05% of the first $7,500,000,000 of the aggregate daily net assets and (b) 0.04% of the aggregate daily net assets in excess of $7,500,000,000 of each of the five Lifestyle Portfolios of the Trust (Lifestyle Aggressive, Lifestyle Growth, Lifestyle Balanced, Lifestyle Moderate and Lifestyle Conservative) and its corresponding funds of the five Lifestyle Portfolios of John Hancock Trust (Lifestyle Aggressive, Lifestyle Growth, Lifestyle Balanced, Lifestyle Moderate and Lifestyle Conservative). The Portfolio is not responsible for payment of the subadvisory fees.

Expense reimbursements

The Adviser has contractually agreed to waive advisory fees or reimburse Portfolio’s expenses for Class A, Class B, Class C, Class R3, Class R, Class R1, Class R2, Class R4 and Class R5 shares to the extent that blue sky fees and printing and postage expenses attributable to each class exceed 0.09% of the average annual net assets attributable to the classes, at least until December 31, 2007, and may thereafter be terminated by the Adviser at any time. Accordingly, the expense reductions related to this expense limitation amounted to $24,863, $22,518, $21,975, $17,405, $17,026 and $17,584 for Class A, Class B, Class C, Class R3, Class R4 and Class R5, respectively, for the period ended August 31, 2006. The expense reductions related to this expense limitation amounted to $358, $6,598, $1,645, $3,641, $3,648, $3,647, $6,269, $5,947 and $6,579 for Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class R5, respectively, for the four-month period ended December 31, 2006.

Lifestyle Aggressive Portfolio

27

Administration fees

The Portfolio has an agreement with the Adviser that requires the Portfolio to reimburse the Adviser for all expenses associated with providing the administrative, financial, accounting and recordkeeping services of the Portfolio, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports.

Distribution plans

The Trust has a Distribution Agreement with the Distributor. The Portfolio has adopted Distribution Plans with respect to Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class 1, pursuant to Rule 12b-1 under the 1940 Act, to reimburse the Distributor for the services it provides as distributor of shares of the Portfolio. Accordingly, the Portfolio makes monthly payments to the Distributor at an annual rate not to exceed 0.30%, 1.00%, 1.00%, 0.75%, 0.50%, 0.25%, 0.50%, 0.25% and 0.05% of the average daily net assets of Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class 1, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Portfolio’s 12b-1 payments could occur under certain circumstances.

The Portfolio has also adopted a Service Plan with respect to Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares (the “Service Plan”). Under the Service Plan, the Fund pays up to 0.25%, 0.25%, 0.25%, 0.15%, 0.10% and 0.05% of average daily net assets of Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares, respectively, for certain other services.

Sales charges

Class A shares are assessed up-front sales charges of up to 5% of the net asset value of such shares. During the four-month period ended December 31, 2006, the Portfolio was informed that the Distributer received net up-front sales charges of $474,296 with regard to sales of Class A shares. Of this amount, $73,196 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $398,348 was paid as sales commissions to unrelated broker-dealers and $2,752 was paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer, an indirect subsidiary of MFC.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to the Distributor and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Portfolio in connection with the sale of Class B and Class C shares. During the four-month period ended December 31, 2006, the Portfolio was informed that CDSCs received by the Distributor amounted to $16,594 for Class B shares and $5,229 for Class C shares.

Transfer agent fees

The Portfolio has a Transfer Agency Agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of MFC. For Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares, the Portfolio pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net assets, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses. Expenses not directly attributable to a particular class of shares are aggregated and allocated to each class on the basis of its relative net asset value.

Signature Services has agreed to limit the transfer agent fees so that such fees do not exceed 0.20% annually of Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 share average daily net assets. This agreement is effective until December 31,

Lifestyle Aggressive Portfolio

28

2007. Signature Services reserves the right to terminate this limitation in the future. In addition, Signature Service has voluntarily agreed to further limit transfer agent fees for Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares so that such fees do not exceed 0.05% annually of each class’s average daily net assets. Accordingly, the transfer agent fees reductions amounted to $304, $638 and $323 for Class R3, Class R4 and Class R5 shares, respectively, during the period ended August 31, 2006. The transfer agent fees reductions amounted to $54, $42, $44, $482, $435 and $267 for Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares, respectively, during the four-month period ended December 31, 2006. Signature Services reserves the right to terminate this limitation at any time.

Expenses under the agreements described above for the period ended August 31, 2006 and the four-month period ended December 31, 2006, were as follows:

| Period ended 8-31-06 | | | | |

| | Distribution and | Transfer | | Printing and |

| Share Class | service fees | agent | Blue sky | postage |

|

| |

| Class A | $39,384 | $26,457 | $17,638 | $19,040 |

| Class B | 34,257 | 6,917 | 16,149 | 9,452 |

| Class C | 84,676 | 17,156 | 17,423 | 12,174 |

| Class R3 | 1,226 | 397 | 15,925 | 1,698 |

| Class R4 | 1,455 | 877 | 15,925 | 1,550 |

| Class R5 | 7 | 417 | 16,406 | 1,379 |

| Class 1 | 926,110 | — | — | 6,179 |

| Total | $1,087,115 | $52,221 | $99,466 | $51,472 |

| |

| Four months ended 12-31-06 | | | | |

| | Distribution and | Transfer | | Printing and |

| Share Class | service fees | agent | Blue sky | postage |

|

| |

| Class A | $45,311 | $29,719 | $6,680 | $7,271 |

| Class B | 34,648 | 6,930 | 6,116 | 3,600 |

| Class C | 106,611 | 21,322 | 6,598 | 4,642 |

| Class R | 282 | 73 | 3,150 | 525 |

| Class R1 | 150 | 57 | 3,150 | 525 |

| Class R2 | 78 | 60 | 3,150 | 525 |

| Class R3 | 2,393 | 709 | 6,030 | 647 |

| Class R4 | 2,457 | 809 | 6,030 | 591 |

| Class R5 | 48 | 356 | 6,214 | 526 |

| Class 1 | 434,913 | — | — | 2,341 |

| Total | $626,891 | $60,035 | $47,118 | $21,193 |

Trustees’ fees

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees’ expenses are allocated based on each portfolio’s average daily net asset value.

4. Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust believes the risk of loss to be remote.

Lifestyle Aggressive Portfolio

29

5. Capital shares

Share activities for the Portfolio during the last two periods were as follows:

| | Period ended 8-31-06a | Four months ended 12-31-06b |

| | Shares | Amount | Shares | Amount |

|

| Class A share | | | | |

|

| Sold | 2,656,426 | $37,105,900 | 1,287,313 | $18,914,525 |

| Distributions reinvested | 739 | 9,867 | 158,685 | 2,343,780 |

| Repurchased | (164,725) | (2,284,281) | (139,671) | (2,069,549) |

| Net increase | 2,492,440 | $34,831,486 | 1,306,327 | $19,188,756 |

| |

| Class B shares | | | | |

|

| Sold | 641,314 | $8,963,149 | 270,496 | $3,963,999 |

| Distributions reinvested | 161 | 2,152 | 29,687 | 438,480 |

| Repurchased | (37,802) | (520,561) | (53,687) | (788,566) |

| Net increase | 603,673 | $8,444,740 | 246,496 | $3,613,913 |

| |

| Class C shares | | | | |

|

| Sold | 1,853,043 | $25,877,041 | 811,127 | $11,860,736 |

| Distributions reinvested | 283 | 3,786 | 91,893 | 1,357,255 |

| Repurchased | (49,020) | (685,074) | (64,280) | (948,858) |

| Net increase | 1,804,306 | $25,195,753 | 838,740 | $12,269,133 |

| |

| Class R shares c | | | | |

|

| Sold | — | — | 13,974 | $204,356 |

| Distributions reinvested | — | — | 586 | 8,697 |

| Repurchased | — | — | — | (3) |

| Net increase | — | — | 14,560 | $213,050 |

| |

| Class R1 shares c | | | | |

|

| Sold | — | — | 7,087 | $100,001 |

| Distributions reinvested | — | — | 315 | 4,660 |

| Repurchased | — | — | — | (1) |

| Net increase | — | — | 7,402 | $104,660 |

| |

| Class R2 shares c | | | | |

|

| Sold | — | — | 7,686 | $108,946 |

| Distributions reinvested | — | — | 359 | 5,311 |

| Repurchased | — | — | — | (1) |

| Net increase | — | — | 8,045 | $114,256 |

| |

| Class R3 shares | | | | |

|

| Sold | 78,517 | $1,063,860 | 42,310 | $622,204 |

| Distributions reinvested | — | — | 4,583 | 67,700 |

| Repurchased | (1,184) | (16,116) | (16,559) | (245,807) |

| Net increase | 77,333 | $1,047,744 | 30,334 | $444,097 |

| |

| Class R4 shares | | | | |

|

| Sold | 125,577 | $1,762,808 | 64,580 | $934,909 |

| Distributions reinvested | — | — | 7,464 | 110,167 |

| Repurchased | (13,355) | (183,449) | (17,622) | (264,501) |

| Net increase | 112,222 | $1,579,359 | 54,422 | $780,575 |

Lifestyle Aggressive Portfolio

30

| | Period ended 8-31-06a | Four months ended 12-31-06b |

| | Shares | Amount | Shares | Amount |

| |

| Class R5 shares | | | | |

|

| Sold | 38,324 | $533,868 | 10,619 | $159,884 |

| Distributions reinvested | — | — | 1,774 | 26,177 |

| Repurchased | (5,050) | (73,349) | (7,941) | (122,198) |

| Net increase | 33,274 | $460,519 | 4,452 | $63,863 |

| |

| Class 1 shares | | | | |

|

| Sold | 173,760,521 | $2,225,676,778 | 9,665,230 | $141,965,510 |

| Distributions reinvested | 812,945 | 10,836,557 | 9,129,956 | 134,484,258 |

| Repurchased | (2,435,942) | (33,752,531) | (1,447,335) | (21,105,583) |

| Net increase | 172,137,524 | $2,202,760,804 | 17,347,851 | $255,344,185 |

|

| Net increase | 177,260,772 | $2,274,320,405 | 19,858,629 | $292,136,488 |

a Class A, Class B, Class C, Class R3, Class R4 and Class R5 share began operations on 10-18-05 and Class 1 shares began operation on 10-15-05.

b Effective 1-18-07, the fiscal year-end changed from August 31 to December 31.

c Class R, Class R1 and Class R2 shares began operations on 9-18-06.

6. Investment transactions

Purchases and sales of the affiliated underlying funds during the four-month period ended December 31, 2006, aggregated $356,840,025 and $122,597,235, respectively.

The cost of investments owned on December 31, 2006, including short-term investments, for federal income tax purposes, was $2,579,134,962. Gross unrealized appreciation and depreciation of investments aggregated $317,028,858 and $2,340,248, respectively, resulting in net unrealized appreciation of $314,688,610.

7. Investment in affiliated

underlying funds

The Portfolio invests primarily in affiliated underlying funds that are managed by affiliates of the Adviser. The Portfolio does not invest in the affiliated underlying funds for the purpose of exercising management or control.

A summary of the Portfolio’s transactions in the securities of affiliated issuers in which the Portfolio’s holdings represent 5% or more of the outstanding voting securities of the issuer, during the four-month period ended December 31, 2006, is set forth below.

Lifestyle Aggressive Portfolio

31

| | Beginning | | | | | |

| Affiliate — | Shares | Shares | Shares | Ending Share | | Ending |

| Class NAV | Amount | Purchased | Sold | Amount | Proceeds | Value |

|

| All Cap Growth | 3,022,333 | 250,328 | 1,825 | 3,270,836 | $32,070 | $57,926,504 |

| All Cap Value | 3,136,053 | 442,838 | 1,685 | 3,577,206 | 27,937 | 57,664,564 |

| Blue Chip Growth | 6,985,892 | 549,634 | 31,881 | 7,503,645 | 592,237 | 144,895,377 |

| Capital Appreciation | 10,532,521 | 948,139 | 167,806 | 11,312,854 | 1,646,640 | 115,956,752 |

| Core Equity | 5,286,718 | 147,502 | 16,791 | 5,417,429 | 249,648 | 86,787,212 |

| Emerging Growth | 2,789,800 | 764,183 | 55,579 | 3,498,404 | 1,046,366 | 58,073,499 |

| Equity-Income | 2,736,026 | 342,715 | 1,614 | 3,077,127 | 31,646 | 57,788,436 |

| Fundamental Value | 6,280,209 | 524,866 | 5,036 | 6,800,039 | 86,307 | 115,600,671 |

| International Core* | 5,057,125 | 544,062 | 168,132 | 5,433,055 | 6,991,707 | 231,719,790 |

| International | | | | | | |

| Equity Index | 6,555,210 | 657,073 | 143,753 | 7,068,530 | 2,939,707 | 144,904,862 |

| International | | | | | | |

| Opportunities | 6,182,381 | 459,253 | 187,095 | 6,454,539 | 3,358,236 | 115,988,074 |

| International | | | | | | |

| Small Cap | 3,557,189 | 747,983 | 132,810 | 4,172,362 | 2,897,275 | 87,035,481 |

| International | | | | | | |

| Small Company | 7,989,553 | 599,035 | 315,802 | 8,272,786 | 3,260,805 | 87,029,713 |

| International Value | 9,755,233 | 1,255,681 | 160,994 | 10,849,920 | 3,057,391 | 202,785,006 |

| Large Cap | 3,379,099 | 325,452 | 2,229 | 3,702,322 | 35,423 | 57,793,242 |

| Large Cap Value | 1,069,803 | 79,849 | 585 | 1,149,067 | 14,542 | 28,761,149 |

| Mid Cap Core | 4,327,223 | 150,976 | 4,478,199 | — | 83,113,684 | — |

| Mid Cap Index | 1,361,218 | 4,501,059 | 2,461 | 5,859,816 | 48,829 | 115,203,989 |

| Mid Cap Stock | 3,170,730 | 279,213 | 2,223 | 3,447,720 | 38,373 | 57,714,828 |

| Mid Cap Value Equity | 2,578,332 | 193,586 | 1,305 | 2,770,613 | 13,505 | 28,758,959 |

| Mid Cap Value | 2,635,211 | 245,319 | 1,453 | 2,879,077 | 29,826 | 57,725,490 |

| Natural Resources | 3,492,935 | 887,425 | 319,400 | 4,060,960 | 11,763,376 | 144,895,069 |

| Quantitative Mid Cap | 3,479,128 | 304,939 | 1,964 | 3,782,103 | 29,992 | 57,639,253 |

| Quantitative Value | 4,497,753 | 534,320 | 13,960 | 5,018,113 | 244,263 | 87,014,073 |

| Small Cap | 5,402,799 | 214,380 | 11,347 | 5,605,832 | 165,841 | 86,441,931 |

| Small Cap Index | 3,174,474 | 256,239 | 1,942 | 3,428,771 | 33,219 | 57,809,078 |

| Small Company | 3,224,770 | 214,384 | 2,037 | 3,437,117 | 33,670 | 57,743,563 |

| Small Company Value | 3,199,392 | 254,723 | 1,751 | 3,452,364 | 44,086 | 86,861,470 |

| Special Value | 2,441,971 | 222,458 | 1,476 | 2,662,953 | 31,963 | 57,839,340 |

| U.S. Global | | | | | | |

| Leaders Growth | 1,958,976 | 175,900 | 1,318 | 2,133,558 | 17,877 | 28,781,700 |

| U.S. Multi Sector | 19,130,584 | 2,010,593 | 57,476 | 21,083,701 | 629,759 | 231,709,869 |

| Value & Restructuring | 2,239,676 | 163,420 | 1,226 | 2,401,870 | 14,758 | 28,894,501 |

| Vista | 4,636,102 | 383,620 | 4,167 | 5,015,555 | 48,125 | 58,080,127 |

*Represents the Portfolio’s investment in John Hancock Funds III International Core Fund.

8. Reclassification of accounts

During the four-month period ended December 31, 2006, the Portfolio reclassified amounts to reflect a decrease in accumulated net realized gain on investments of $61,399,623 and an increase in accumulated net investment income of $61,399,623. This represents the amounts necessary to report these balances on a tax basis, excluding certain temporary differences, as of December 31, 2006. Additional adjustments may be needed in subsequent reporting periods. These reclassifications, which have no impact on the net asset value of the Portfolio, are primarily attributable to certain differences in the computation of distributable income and capital gains under federal tax rules versus accounting principles generally accepted in the United States of America, book and tax differences in accounting for overdistribution. The calculation of net investment income per share in th e Portfolio’s Financial Highlights excludes these adjustments.

Lifestyle Aggressive Portfolio

32

Auditors’ report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of John Hancock Funds II and Shareholders of

John Hancock Lifestyle Aggressive Portfolio: