|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT |

| COMPANIES |

| Investment Company Act file number 811-21779 |

| |

| JOHN HANCOCK FUNDS II |

| --------------------------------------------------------- |

| (Exact name of registrant as specified in charter) |

| |

| 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------- |

| (Address of principal executive offices) (Zip code) |

| |

| GORDON M. SHONE, 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------------------------------------ |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (617) 663-3000 |

| -------------- |

|

| Date of fiscal year end: 12/31 |

| ------ |

| |

| Date of reporting period: 12/31/07 |

| ------- |

| |

| ITEM 1. REPORTS TO STOCKHOLDERS. |

John Hancock

Lifestyle Aggressive Portfolio

Goal and strategy

The Portfolio seeks long-term growth of capital. Current income is not a consideration. To pursue this goal, the Portfolio, which is a fund-of-funds, normally invests 100% of its assets in affiliated underlying funds that invest primarily in equity securities.

Target Asset Allocation

| Equity | % of Total |

|

| U.S. Large Cap | 40% |

|

| U.S. Mid Cap | 13% |

|

| U.S. Small Cap | 12% |

|

| Foreign Small Cap | 12% |

|

| Foreign Large Cap | 8% |

|

| Foreign Mid Cap | 8% |

|

| Natural Resources | 4% |

|

| Emerging Markets | 3% |

|

As a percentage of net assets on December 31, 2007.

Performance review

For the 12 months ended December 31, 2007, John Hancock Lifestyle Aggressive Portfolio’s Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 shares returned 8.00%, 7.23%, 7.21%, 7.48%, 7.92%, 8.13%, 7.85%, 8.13%, 8.42% and 8.54%, respectively, at net asset value. In comparison, the Portfolio’s benchmark index — the S&P 500 Index — returned 5.49% during the same period.

Outperformance

The Portfolio benefited significantly from its international allocations. International Core (GMO), with an 8% position in the Portfolio, performed well, helped by positions in the German consumer discretionary sector and in United Kingdom telecommunications stocks. Also contributing to the Portfolio was a 3% position we initiated in May to Emerging Markets Value (DFA). Emerging markets as an asset class benefited from strong economic growth across a variety of developing nations. Natural Resources (Wellington), a 4% stake in the Portfolio, finished the year with exceptional gains fueled by strength in crude oil prices, industrial metals and other commodities. Excellent stock selection in both the energy, and metals and mining segments helped the fund significantly beat its benchmark.

One of the Portfolio’s largest holdings and best contributors was Blue Chip Growth (T. Rowe Price). This large-cap growth fund benefited from a combination of excellent stock picks in the energy sector and an overweighting in technology, one of the stronger sectors in 2007. Two mid-cap growth funds, Vista (American Century) and Mid Cap Stock (Wellington), also added to the Portfolio’s performance. Both funds benefited from their materials and industrial holdings and from excellent security selection in the consumer discretionary sector.

One holding that detracted from performance was Quantitative Value (MFC Global U.S.A.), a large-cap value strategy that was hurt by its exposure to the troubled financials sector. Likewise, Core Equity (Legg Mason), run by well-known value manager Bill Miller, suffered because of its relatively high exposure to stocks linked to housing. Poor security selection in telecommunications and an underweight to the energy sector also hurt performance.

Over the course of the year, in addition to the move into emerging-market equities, we made a small shift from small caps to mid caps. Additionally, toward the end of the year, we began a reallocation from small- and mid-cap holdings into large-caps. We believe large caps have greater potential to outperform during periods of slower economic growth.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

SCORECARD

| | |

| INVESTMENT | | PERIOD’S PERFORMANCE . . . AND WHAT’S BEHIND THE NUMBERS |

| |

| Natural Resources | ▲ | Robust commodity prices |

| (Wellington) | | |

| |

| Emerging Markets | ▲ | Dynamic growth in developing nations |

| Value (DFA) | | |

| |

| Core Equity | ▼ | Exposure to housing, underweight to energy |

| (Legg Mason) | | |

Lifestyle Portfolios | Annual report

4

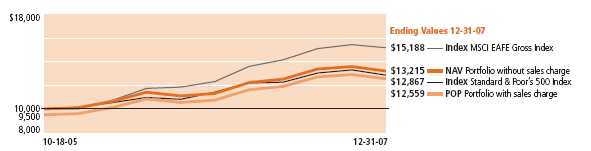

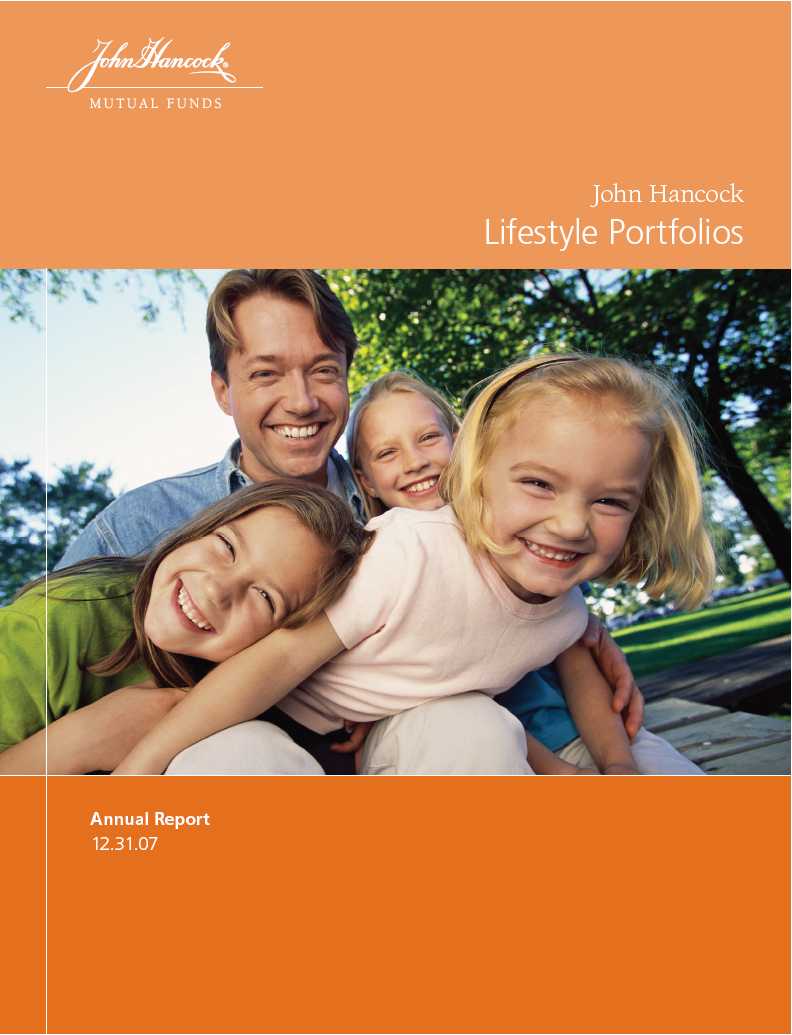

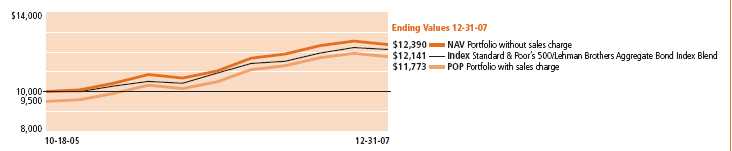

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in two comparable indices.

| | | | | | | | | |

| | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 |

|

| Period beginning | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 |

|

| Without sales charge | 13,017 | 13,023 | 11,739 | 11,790 | 11,826 | 13,187 | 13,249 | 13,323 | 13,355 |

|

| With maximum sales charge | 12,717 | 13,023 | 11,739 | 11,790 | 11,826 | 13,187 | 13,249 | 13,323 | 13,355 |

|

| S&P 500 Index | 12,867 | 12,867 | 11,398 | 11,398 | 11,398 | 12,867 | 12,867 | 12,867 | 12,906 |

|

| MSCI EAFE Gross Index2 | 15,188 | 15,188 | 12,324 | 12,324 | 12,324 | 15,188 | 15,188 | 15,188 | 14,745 |

|

Performance chart

Cumulative total returns with maximum sales charge (POP) for the period ending December 31, 2007

| | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 |

|

| Inception | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 |

|

| Since inception | 25.59% | 27.17% | 30.23% | 17.39% | 17.90% | 18.26% | 31.87% | 32.49% | 33.23% | 33.55% |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 shares.

The expense ratios of the Portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 5-1-08. The following expense ratios include expenses of the underlying affiliated funds in which the Portfolio invests. The net expenses are as follows: Class A — 1.55%, Class B — 2.26%, Class C — 2.26%, Class R — 1.86%, Class R1 — 1.61%, Class R2 — 1.36%, Class R3 — 1.63%, Class R4 — 1.44%, Class R5 — 1.14% . Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.56%, Class B — 2.45%, Class C — 2.27%, Class R — 11.57%, Class R1 — 13.80%, Class R2 — 13.15%, Class R3 — 3.12%, Class R4 — 2.29%, Class R5 — 4.98% . The net expenses equal the gross expenses and are as follows: Class 1 — 1.02% .

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Portfolio’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Since inception performance is calculated with an opening price (prior day’s close) on inception date.

1 For certain types of investors as described in the Portfolio’s Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 share prospectuses.

2 Index as of closest month end to inception date.

Annual report | Lifestyle Portfolios

5

John Hancock

Lifestyle Growth Portfolio

Goal and strategy

The Portfolio seeks long-term growth of capital. Current income is also a consideration. To pursue this goal, the Portfolio, which is a fund-of-funds, normally invests approximately 80% of its assets in affiliated underlying funds that invest primarily in equity securities and approximately 20% of its assets in affiliated underlying funds that invest primarily in fixed-income securities.

| |

| Target Asset Allocation |

| | |

| Equity | % of Total |

|

| U.S. Large Cap | 40% |

|

| U.S. Mid Cap | 8% |

|

| Foreign Small Cap | 7% |

|

| Foreign Mid Cap | 6% |

|

| Foreign Large Cap | 6% |

|

| U.S. Small Cap | 6% |

|

| Natural Resources | 3% |

|

| Emerging Markets | 2% |

|

| Real Estate | 2% |

|

| | |

| Fixed Income | % of Total |

|

| High Yield Bond | 7% |

|

| Intermediate-term bond | 4% |

|

| Multi-sector bond | 4% |

|

| Treasury Inflation | |

| Protected Securities | 3% |

|

| Global bond | 2% |

|

As a percentage of net assets on December 31, 2007.

Note to shareholders

In September 2007, shareholders of John Hancock Allocation Growth + Value Portfolio approved the merger of their portfolio into John Hancock Lifestyle Growth Portfolio.

Performance review

For the 12 months ended December 31, 2007, John Hancock Lifestyle Growth Portfolio’s Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 shares returned 6.96%, 6.14%, 6.19%, 6.47%, 6.75%, 6.91%, 6.69%, 6.95%, 7.31%, 7.44% and 7.42%, respectively, at net asset value. In comparison, the Portfolio’s benchmark index — a blended index combining 80% S&P 500 Index and 20% Lehman Brothers U.S. Aggregate Index — returned 5.88% during the same period.

Outperformance

The Portfolio benefited significantly from the strong performance of international funds. International Opportunities (Marsico), with a 4% position in the Portfolio, performed exceptionally well, helped by positions in Hong Kong telecommunications and Canadian materials. Also contributing to the Portfolio was a 2% position we initiated in May to Emerging Markets Value (DFA). Emerging markets as an asset class benefited from strong economic growth across a variety of developing nations. Natural Resources (Wellington), a 3% stake in the Portfolio, finished the year with exceptional gains fueled by strength in crude oil prices, industrial metals and other commodities. Excellent stock selection in both the energy, and metals and mining segments helped the fund significantly beat its benchmark.

Another solid contributor to the Portfolio was Blue Chip Growth (T. Rowe Price). This large-cap growth fund benefited from a combination of excellent stock picks in the energy equipment and services segment as well as an overweighting in technology, one of the stronger sectors in 2007. Two mid-cap growth funds, Vista (American Century) and Mid Cap Stock (Wellington), also added to the Portfolio’s performance.

One holding that detracted from performance was Quantitative Value (MFC Global U.S.A.), a large-cap value strategy that was hurt by its exposure to the troubled financials sector. Likewise, Core Equity (Legg Mason), run by well-known value manager Bill Miller, suffered because of its relatively high exposure to stocks linked to housing. Poor security selection in telecommunications and an underweight to the energy sector also hurt performance. The Portfolio’s performance also was weighed down by its real estate exposure. Both Real Estate Equity (T. Rowe Price) and Global Real Estate (Deutsche) struggled, as real estate markets sold off after a good year in 2006.

Our 20% allocation to fixed income hurt performance, specifically, our allocation to high yield. Partially offsetting this allocation were the strong returns from Real Return Bond (PIMCO) and Global Bond (PIMCO), which benefited from the flight to quality that occurred during the year, and exposure to non-U.S. currencies, respectively. Over the course of the year, in addition to the move into emerging market equities, we made a small shift from small caps to mid caps. Additionally, toward the end of year, we began a reallocation from small- and mid-cap holdings into large caps.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

SCORECARD

| | |

| INVESTMENT | | PERIOD’S PERFORMANCE . . . AND WHAT’S BEHIND THE NUMBERS |

| | | |

| Natural Resources | ▲ | Robust commodity prices |

| (Wellington) | | |

| | | |

| Emerging Markets | ▲ | Dynamic growth in developing nations |

| Value (DFA) | | |

| | | |

| Real estate funds | ▼ | Global real estate market selloff |

Lifestyle Portfolios | Annual report

6

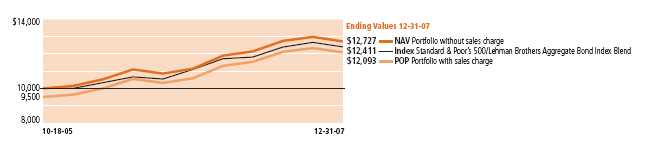

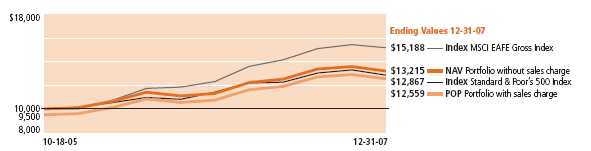

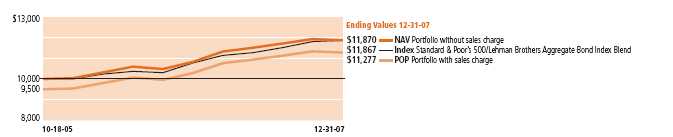

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in a blended Index.

| | | | | | | | | | |

| | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 | Class 51 |

|

| Period beginning | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 7-3-06 |

|

| Without sales charge | 12,533 | 12,535 | 11,460 | 11,503 | 11,525 | 12,673 | 12,741 | 12,821 | 12,853 | 11,805 |

|

| With maximum sales charge | 12,233 | 12,535 | 11,460 | 11,503 | 11,525 | 12,673 | 12,741 | 12,821 | 12,853 | 11,805 |

|

| Index 2,3 | 12,411 | 12,411 | 11,180 | 11,180 | 11,180 | 12,411 | 12,411 | 12,411 | 12,226 | 11,771 |

|

Performance chart

Cumulative total returns with maximum sales charge (POP) for the period ending December 31, 2007

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 | Class 51 |

|

| Inception | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 7-3-06 |

|

| Since inception | 20.93% | 22.33% | 25.35% | 14.60% | 15.03% | 15.25% | 26.73% | 27.41% | 28.21% | 28.53% | 18.05% |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 shares.

The expense ratios of the Portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 5-1-08. The following expense ratios include expenses of the underlying affiliated funds in which the Portfolio invests. The net expenses are as follows: Class B — 2.22%, Class R — 1.82%, Class R1 — 1.56%, Class R2 — 1.32%, Class R3 — 1.58%, Class R4 — 1.40%, Class R5 — 1.07% . Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class B — 2.27%, Class R — 13.28%, Class R1 — 13.82%, Class R2 — 13.61%, Class R3 —2.22%, Class R4 — 1.67%, Cla ss R5 — 2.27% . The net expenses equal the gross expenses and are as follows: Class A — 1.45%, Class C — 2.16%, Class 1 — 0.98%, Class 5 — 0.93% .

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Portfolio’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Since inception performance is calculated with an opening (prior day’s close) on the inception date.

1 For certain types of investors as described in the Portfolio’s Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 share prospectuses.

2 Index as of closest month end to inception date.

3 The blended index is comprised of 80% of the Standard & Poor’s 500 Index and 20% of the Lehman Brothers Aggregate Bond Index.

Annual report | Lifestyle Portfolios

7

John Hancock

Lifestyle Balanced Portfolio

Goal and strategy

The Portfolio seeks a balance between a high level of current income and growth of capital, with greater emphasis on growth of capital. To pursue this goal, the Portfolio, which is a fund-of-funds, normally invests approximately 60% of its assets in affiliated underlying funds that invest primarily in equity securities and approximately 40% of its assets in affiliated underlying funds that invest primarily in fixed-income securities.

| |

| Target Asset Allocation |

| | |

| Equity | % of Total |

|

| U.S. Large Cap | 37% |

|

| Foreign Small Cap | 5% |

|

| Foreign Mid Cap | 4% |

|

| Real Estate | 4% |

|

| Natural Resources | 3% |

|

| Emerging Markets | 2% |

|

| U.S. Mid Cap | 2% |

|

| Foreign Large Cap | 2% |

|

| U.S. Small Cap | 2% |

|

| | |

| Fixed Income | % of Total |

|

| High Yield Bond | 13% |

|

| Intermediate-term bond | 9% |

|

| Multi-sector bond | 9% |

|

| Treasury Inflation | |

| Protected Securities | 5% |

|

| Global bond | 3% |

|

As a percentage of net assets on December 31, 2007.

Note to shareholders

In September 2007, shareholders of John Hancock Allocation Core Portfolio approved the merger of their portfolio into John Hancock Lifestyle Balanced Portfolio.

Performance review

For the 12 months ended December 31, 2007, John Hancock Lifestyle Balanced Portfolio’s Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 shares returned 5.90%, 5.02%, 5.10%, 5.31%, 5.58%, 5.77%, 5.65%, 5.91%, 6.18%, 6.30% and 6.35%, respectively, at net asset value. In comparison, the Portfolio’s benchmark index — a blended index combining 60% S&P 500 Index and 40% Lehman Brothers U.S. Aggregate Index — returned 6.22% during the same period.

Competitive returns

The Portfolio benefited significantly from the strong performance of international funds, including a new 2% allocation to Emerging Markets Value (DFA). A 3% stake in Natural Resources (Wellington) also aided the Portfolio. The fund finished the year with solid gains due to strength in the prices of crude oil, industrial metals and other commodities. An allocation to Blue Chip Growth (T. Rowe Price) also helped performance. This large-cap growth fund benefited from a combination of excellent stock picks in the energy sector and an overweighting in technology, one of the stronger sectors in 2007. In the fixed-income area, Real Return Bond (PIMCO) and Global Bond (PIMCO) delivered strong returns. Real Return Bond benefited from the flight to quality that occurred during the year while Global Bond benefited from its exposure to non-U.S. currencies.

Conversely, the Portfolio’s 4% exposure to real estate weighed heavily on overall performance. At approximately 3% of assets, Global Real Estate (Deutsche) declined 10%, while Real Estate Equity (T. Rowe Price), investing exclusively in U.S. REITs, fared even worse. Our dedicated exposure to high yield (a 13% allocation) also weighed on results. Among our equity funds, Core Equity (Legg Mason) suffered from its relatively high exposure to stocks linked to housing and from an underweight to the energy sector.

Over the course of the year, in addition to the move into emerging-market equities, we made a small shift from small caps to mid caps. Additionally, toward the end of year, we began a reallocation from small- and mid-cap holdings into large caps. We feel large caps have greater potential to outperform during periods of slower economic growth.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

SCORECARD

| | |

| INVESTMENT | | PERIOD’S PERFORMANCE . . . AND WHAT’S BEHIND THE NUMBERS |

| | | |

| Real estate funds | ▼ | Global real estate market selloff |

| |

| Natural Resources | ▲ | Robust commodity prices |

| (Wellington) | | |

| | | |

| Real Return Bond | ▲ | Flight to quality |

| (PIMCO) | | |

Lifestyle Portfolios | Annual report

8

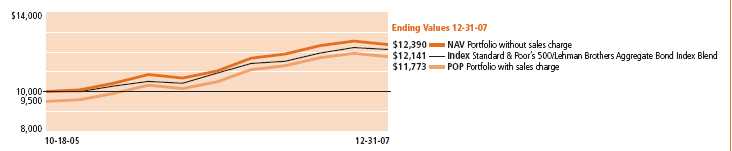

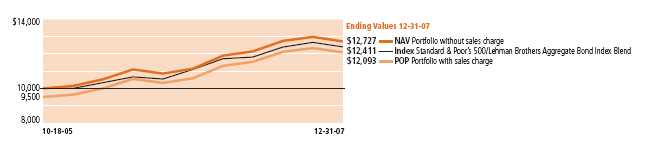

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in a blended index.

| | | | | | | | | | |

| | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 | Class 51 |

|

| Period beginning | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 7-3-06 |

|

| Without sales charge | 12,184 | 12,211 | 11,246 | 11,281 | 11,307 | 12,340 | 12,406 | 12,475 | 12,499 | 11,679 |

|

| With maximum sales charge | 11,884 | 12,211 | 11,246 | 11,281 | 11,307 | 12,340 | 12,406 | 12,475 | 12,499 | 11,679 |

|

| Index2,3 | 12,141 | 12,141 | 11,100 | 11,100 | 11,100 | 12,141 | 12,141 | 12,141 | 11,981 | 11,647 |

|

Performance chart

Cumulative total returns with maximum sales charge (POP) for the period ending December 31, 2007

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 | Class 51 |

|

| Inception | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 7-3-06 |

|

| Since inception | 17.73% | 18.84% | 22.11% | 12.46% | 12.81% | 13.07% | 23.40% | 24.06% | 24.75% | 24.99% | 16.79% |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5% and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 shares.

The expense ratios of the Portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 5-1-08. The following expense ratios include expenses of the underlying affiliated funds in which the Portfolio invests. The net expenses are as follows: Class B — 2.20%, Class R — 1.81%, Class R1 — 1.56%, Class R2 — 1.31%, Class R3 — 1.58%, Class R4 — 1.38%, Class R5 — 1.06% . Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class B — 2.27%, Class R — 9.27%, Class R1 — 13.92%, Class R2 — 13.56%, Class R3 — 2.10%, Class R4 — 1.56%, Cla ss R5 — 2.55% . The net expenses equal the gross expenses and are as follows: Class A — 1.41%, Class C — 2.11%, Class 1 — 0.97%, Class 5 — 0.92% .

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Portfolio’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Since inception performance is calculated with an opening price (prior day’s close) on the inception date.

1 For certain types of investors as described in the Portfolio’s Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 share prospectuses.

2 Index as of closest month end to inception date.

3 The blended index is comprised of 60% of the Standard & Poor’s 500 Index and 40% of the Lehman Brothers Aggregate Bond Index.

Annual report | Lifestyle Portfolios

9

John Hancock

Lifestyle Moderate Portfolio

Goal and strategy

The Portfolio seeks a balance between a high level of current income and growth of capital, with a greater emphasis on income. To pursue this goal, the Portfolio, which is a fund-of-funds, normally invests approximately 60% of its assets in affiliated underlying funds that invest primarily in fixed-income securities and approximately 40% of its assets in affiliated underlying funds that invest primarily in equity securities.

| |

| Target Asset Allocation |

| | |

| Equity | % of Total |

|

| U.S. Large Cap | 22% |

|

| Foreign Mid Cap | 5% |

|

| Real Estate | 3% |

|

| Foreign Small Cap | 3% |

|

| Foreign Large Cap | 3% |

|

| U.S. Small Cap | 3% |

|

| U.S. Mid Cap | 1% |

|

| | |

| Fixed Income | % of Total |

|

| Intermediate-term bond | 22% |

|

| Multi-sector bond | 14% |

|

| High Yield Bond | 12% |

|

| Global bond | 6% |

|

| Treasury Inflation | |

| Protected Securities | 4% |

|

| Long-term Bond | 2% |

|

As a percentage of net assets on December 31, 2007.

Performance review

For the 12 months ended December 31, 2007, John Hancock Lifestyle Moderate Portfolio’s Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 shares returned 4.78%, 3.97%, 4.05%, 4.28%, 4.63%, 4.89%, 4.61%, 4.87%, 5.15%, 5.25% and 5.39%, respectively, at net asset value. In comparison, the Portfolio’s benchmark index — a blended index combining 40% S&P 500 Index and 60% Lehman Brothers U.S. Aggregate Index — returned 6.52% during the same period.

Performance explained

The Portfolio’s largest holding at roughly 12% of assets, Total Return (PIMCO), was a solid contributor to the Portfolio. This fund benefited from its concentration in investment-grade bonds against the backdrop of the subprime meltdown. Another PIMCO-managed fund, Global Bond, also contributed positively to the Portfolio as its return was boosted by the weak dollar. Our 4% position in Real Return Bond (PIMCO) helped as well. This fund invests in Treasury Inflation Protected Securities (TIPS), which benefited from the flight to the safety of U.S. government issues.

Blue Chip Growth (T. Rowe Price) was a solid equity performer. This large-cap growth fund benefited from a combination of excellent stock picks in the energy equipment and services segment. An overweighting in technology, one of the stronger sectors in 2007, also helped performance.

The Portfolio’s performance was weighed down by its real estate exposure. At approximately 2% of assets, Global Real Estate (Deutsche) declined 10%, while Real Estate Equity (T. Rowe Price), investing exclusively in U.S. real estate investment trusts (REITs), fared even worse. Both managers also trailed their respective benchmarks. Our 12% allocation to high yield also detracted from results, with all three managers trailing the Lehman Brothers U.S. Aggregate Index. Among our equity funds, a negative contributor for the year was Core Equity (Legg Mason), which suffered due to its relatively high exposure to stocks linked to housing and from an underweight to the energy sector.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

SCORECARD

| | |

| INVESTMENT | | PERIOD’S PERFORMANCE . . . AND WHAT’S BEHIND THE NUMBERS |

| | | |

| Real estate funds | ▼ | Global real estate market selloff |

| | | |

| Total Return | ▲ | Investment-grade bonds outperformed |

| (PIMCO) | | |

| | | |

| Global Bond | ▲ | Weak U.S. dollar relative to world’s major currencies |

| (PIMCO) | | |

Lifestyle Portfolios | Annual report

10

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in a blended index.

| | | | | | | | | | |

| | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 | Class 51 |

|

| Period beginning | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 7-3-06 |

|

| Without sales charge | 11,672 | 11,689 | 10,989 | 11,032 | 11,064 | 11,839 | 11,887 | 11,963 | 11,979 | 11,417 |

|

| With maximum sales charge | 11,372 | 11,689 | 10,989 | 11,032 | 11,064 | 11,839 | 11,887 | 11,963 | 11,979 | 11,417 |

|

| Index2,3 | 11,867 | 11,867 | 11,015 | 11,015 | 11,015 | 11,867 | 11,867 | 11,867 | 11,732 | 11,516 |

|

Performance chart

Cumulative total returns with maximum sales charge (POP) for the period ending December 31, 2007

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 | Class 51 |

|

| Inception | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 7-3-06 |

|

| Since inception | 12.77% | 13.72% | 16.89% | 9.89% | 10.32% | 10.64% | 18.39% | 18.87% | 19.63% | 19.79% | 14.17% |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 shares.

The expense ratios of the Portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 5-1-08. The following expense ratios include expenses of the underlying affiliated funds in which the Portfolio invests. The net expenses are as follows: Class A — 1.39%, Class B — 2.18%, Class C — 2.11%, Class R — 1.78%, Class R1 — 1.53%, Class R2 — 1.28%, Class R3 — 1.61%, Class R4 — 1.35%, Class R5 — 1.03% . Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.40%, Class B — 2.49%, Class C &# 151; 2.15%, Class R — 14.23%, Class R1 — 13.97%, Class R2 — 13.70%, Class R3 —3.96%, Class R4 — 2.36%, Class R5 — 3.66% . The net expenses equal the gross expenses and are as follows: Class 1 — 0.94%, Class 5 — 0.89% .

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Portfolio’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Since inception performance is calculated with an opening price (prior day’s close) on the inception date.

1 For certain types of investors as described in the Portfolio’s Class R, Class R1, Class R2, Class R3, Class R4, Class R5, Class 1 and Class 5 share prospectuses.

2 Index as of closest month end to inception date.

3 The blended index is comprised of 40% of the Standard & Poor’s 500 Index and 60% of the Lehman Brothers Aggregate Bond Index.

Annual report | Lifestyle Portfolios

11

John Hancock

Lifestyle Conservative Portfolio

Goal and strategy

The Portfolio seeks a balance between a high level of current income and growth of capital, with a greater emphasis on income. To pursue this goal, the Portfolio, which is a fund-of-funds, normally invests approximately 80% of its assets in affiliated underlying funds that invest primarily in fixed-income securities and approximately 20% of its assets in affiliated underlying funds that invest primarily in equity securities.

| |

| Target Asset Allocation |

| | |

| Equity | % of Total |

|

| U.S. Large Cap | 11% |

|

| Real Estate | 4% |

|

| Foreign Small Cap | 3% |

|

| Foreign Mid Cap | 2% |

|

| | |

| Fixed Income | % of Total |

|

| Intermediate-term bond | 28% |

|

| Multi-sector bond | 16% |

|

| Short-term bond | 11% |

|

| High yield bond | 8% |

|

| Global bond | 8% |

|

| Long-term bond | 5% |

|

| Treasury Inflation | |

| Protected Securities | 4% |

|

As a percentage of net assets on December 31, 2007.

Performance review

For the 12 months ended December 31, 2007, John Hancock Lifestyle Conservative Portfolio’s Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 shares returned 4.89%, 4.11%, 4.22%, 4.49%, 4.83%, 4.93%, 4.81%, 4.97%, 5.27% and 5.38%, respectively, at net asset value. In comparison, the Portfolio’s benchmark index — a blended index combining 20% S&P 500 Index and 80% Lehman Brothers U.S. Aggregate Index — returned 6.77% during the same period.

Performance explained

The Portfolio’s largest holding at roughly 16% of assets, Total Return (PIMCO), was a solid contributor to performance. This fund benefited from its concentration in investment-grade bonds against the backdrop of the subprime meltdown. Another PIMCO-managed fund, Global Bond, also contributed positively to the Portfolio as its return was boosted by the weak dollar. Our 4% position in Real Return Bond (PIMCO) helped as well. This fund benefited from the flight to the safety of U.S. government issues. In the equity sector, one significant contributor was Value and Restructuring (Excelsior), a large-cap value fund that benefited from an overweight in the energy and materials sectors.

The Portfolio’s performance was weighed down by its real estate exposure. At approximately 3% of assets, Global Real Estate (Deutsche) declined 10%, while Real Estate Equity (T. Rowe Price), investing exclusively in U.S. real estate investment trusts (REITs), fared even worse. Our 8% allocation to high yield also detracted from results, with all three managers trailing the Lehman Brothers U.S Aggregate Index.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

SCORECARD

| | |

| INVESTMENT | | PERIOD’S PERFORMANCE . . . AND WHAT’S BEHIND THE NUMBERS |

| | | |

| Real estate funds | ▼ | Global real estate market selloff |

| | | |

| Total Return | ▲ | Investment-grade bonds outperformed |

| (PIMCO) | | |

| | | |

| Global Bond | ▲ | Weak U.S. dollar relative to world’s major currencies |

| (PIMCO) | | |

Lifestyle Portfolios | Annual report

12

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in a blended index.

| | | | | | | | | |

| | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 |

|

| Period beginning | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 |

|

| Without sales charge | 11,341 | 11,345 | 10,846 | 10,887 | 10,911 | 11,498 | 11,541 | 11,619 | 11,635 |

|

| With maximum sales charge | 11,041 | 11,345 | 10,846 | 10,887 | 10,911 | 11,498 | 11,541 | 11,619 | 11,635 |

|

| Index2,3 | 11,593 | 11,593 | 10,924 | 10,924 | 10,924 | 11,593 | 11,593 | 11,593 | 11,481 |

|

Performance chart

Cumulative total returns with maximum sales charge (POP) for the period ending December 31, 2007

| | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R11 | Class R21 | Class R31 | Class R41 | Class R51 | Class 11 |

|

| Inception | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 9-18-06 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 |

|

| Since inception | 9.49% | 10.41% | 13.45% | 8.46% | 8.87% | 9.11% | 14.98% | 15.41% | 16.19% | 16.35% |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 shares.

The expense ratios of the Portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 5-1-08. The following expense ratios include expenses of the underlying affiliated funds in which the Portfolio invests. The net expenses are as follows: Class A — 1.35%, Class B — 2.12%, Class C — 2.08%, Class R — 1.74%, Class R1 — 1.49%, Class R2 — 1.24%, Class R3 — 1.56%, Class R4 — 1.30%, Class R5 — 0.99% . Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.43%, Class B — 2.67%, Class C — 2.20%, Class R — 14.28%, Class R1 — 14.03%, Class R2 — 13.77%, Class R3 — 7.02%, Class R4 — 3.66%, Class R5 — 7.16% . The net expenses equal the gross expenses and are as follows: Class 1 — 0.90% .

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Portfolio’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Since inception performance is calculated with an opening price (prior day’s close) on the inception date.

1 For certain types of investors as described in the Portfolio’s Class R, Class R1, Class R2, Class R3, Class R4, Class R5 and Class 1 share prospectuses.

2 Index as of closest month end to inception date.

3 The blended index is comprised of 20% of the Standard & Poor’s 500 Index and 80% of the Lehman Brothers Aggregate Bond Index.

Annual report | Lifestyle Portfolios

13

Your expenses

As a shareholder of John Hancock Funds II Lifestyle Portfolios, you incur two types of costs:

(1) transaction costs, including sales charges (loads) on certain purchase and redemption fees on certain exchanges and redemptions, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Portfolio expenses. In addition to the operating expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the operating expenses of the affiliated underlying funds in which the Portfolio invests. Because the affiliated underlying funds have varied operating expenses and transaction costs and the Portfolio may own different proportions of the underlying funds at different times, the amount of expenses incurred indirectly by the Portfolio will vary. Had these indirect expenses been reflected in the following analysis, total expenses would have been higher than the amounts shown.

This example is intended to help you understand your ongoing costs (in dollars) of investing in the portfolios so you can compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the period and held for the entire period (July 1, 2007, through December 31, 2007).

Actual expenses:

The first line of each share class in the table on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes:

The second line of each share class in the table on the following pages provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio for the share class and an assumed annualized rate of return of 5% per year before expenses, which is not the actual return of the share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs and insurance-related charges. Therefore, the second line of each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Lifestyle Portfolios | Annual report

14

Shareholder expense example chart

| | | | | |

| | | Beginning | Ending | Expenses Paid | |

| | | Account Value | Account Value | During Period1 | Annualized |

| | | 7-1-07 | 12-31-07 | 7-1-07–12-31-07 | Expense Ratio2,3 |

| Lifestyle Aggressive | | | | |

|

| Class A | Actual | $1,000.00 | $987.40 | $2.91 | 0.58% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.28 | 2.96 | 0.58% |

|

| Class B | Actual | 1,000.00 | 983.47 | 6.75 | 1.35% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.40 | 6.87 | 1.35% |

|

| Class C | Actual | 1,000.00 | 983.27 | 6.55 | 1.31% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.60 | 6.67 | 1.31% |

|

| Class R | Actual | 1,000.00 | 984.28 | 5.60 | 1.12% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.56 | 5.70 | 1.12% |

|

| Class R1 | Actual | 1,000.00 | 986.31 | 3.60 | 0.72% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.58 | 3.67 | 0.72% |

|

| Class R2 | Actual | 1,000.00 | 988.15 | 2.71 | 0.54% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.48 | 2.75 | 0.54% |

|

| Class R3 | Actual | 1,000.00 | 986.07 | 4.21 | 0.84% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.97 | 4.28 | 0.84% |

|

| Class R4 | Actual | 1,000.00 | 987.31 | 2.81 | 0.56% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.38 | 2.85 | 0.56% |

|

| Class R5 | Actual | 1,000.00 | 988.75 | 1.20 | 0.24% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.00 | 1.22 | 0.24% |

|

| Class 1 | Actual | 1,000.00 | 989.69 | 0.55 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.65 | 0.56 | 0.11% |

| |

| Lifestyle Growth | | | | |

|

| Class A | Actual | $1,000.00 | $997.73 | $2.67 | 0.53% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.53 | 2.70 | 0.53% |

|

| Class B | Actual | 1,000.00 | 993.91 | 6.33 | 1.26% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.85 | 6.41 | 1.26% |

|

| Class C | Actual | 1,000.00 | 993.71 | 6.23 | 1.24% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.95 | 6.31 | 1.24% |

|

| Class R | Actual | 1,000.00 | 994.76 | 5.63 | 1.12% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.56 | 5.70 | 1.12% |

|

| Class R1 | Actual | 1,000.00 | 996.66 | 3.72 | 0.74% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.48 | 3.77 | 0.74% |

|

| Class R2 | Actual | 1,000.00 | 996.72 | 3.22 | 0.64% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.98 | 3.26 | 0.64% |

|

| Class R3 | Actual | 1,000.00 | 996.47 | 4.23 | 0.84% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.97 | 4.28 | 0.84% |

|

| Class R4 | Actual | 1,000.00 | 997.65 | 2.82 | 0.56% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.38 | 2.85 | 0.56% |

|

| Class R5 | Actual | 1,000.00 | 999.10 | 1.11 | 0.22% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.10 | 1.12 | 0.22% |

|

| Class 1 | Actual | 1,000.00 | 1,000.06 | 0.55 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.65 | 0.56 | 0.11% |

|

| Class 5 | Actual | 1,000.00 | 999.89 | 0.30 | 0.06% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.90 | 0.31 | 0.06% |

|

Annual report | Lifestyle Portfolios

15

Shareholder expense example chart, continued

| | | | | |

| | | Beginning | Ending | Expenses Paid | |

| | | Account Value | Account Value | During Period1 | Annualized |

| | | 7-1-07 | 12-31-07 | 7-1-07–12-31-07 | Expense Ratio2,3 |

| Lifestyle Balanced | | | | |

|

| Class A | Actual | $1,000.00 | $1,004.55 | $2.48 | 0.49% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.74 | 2.50 | 0.49% |

|

| Class B | Actual | 1,000.00 | 1,000.67 | 6.40 | 1.27% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.80 | 6.46 | 1.27% |

|

| Class C | Actual | 1,000.00 | 1,000.72 | 6.10 | 1.21% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.11 | 6.16 | 1.21% |

|

| Class R | Actual | 1,000.00 | 1,001.85 | 5.75 | 1.14% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.46 | 5.80 | 1.14% |

|

| Class R1 | Actual | 1,000.00 | 1,003.11 | 4.09 | 0.81% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.12 | 4.13 | 0.81% |

|

| Class R2 | Actual | 1,000.00 | 1,003.61 | 3.08 | 0.61% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.13 | 3.11 | 0.61% |

|

| Class R3 | Actual | 1,000.00 | 1,003.71 | 3.94 | 0.78% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.27 | 3.97 | 0.78% |

|

| Class R4 | Actual | 1,000.00 | 1,004.81 | 2.68 | 0.53% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.53 | 2.70 | 0.53% |

|

| Class R5 | Actual | 1,000.00 | 1,006.13 | 1.06 | 0.21% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.15 | 1.07 | 0.21% |

|

| Class 1 | Actual | 1,000.00 | 1,006.16 | 0.56 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.65 | 0.56 | 0.11% |

|

| Class 5 | Actual | 1,000.00 | 1,007.18 | 0.30 | 0.06% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.90 | 0.31 | 0.06% |

| |

| Lifestyle Moderate | | | | |

|

| Class A | Actual | $1,000.00 | $1,013.00 | $2.64 | 0.52% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.58 | 2.65 | 0.52% |

|

| Class B | Actual | 1,000.00 | 1,008.37 | 6.83 | 1.35% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.40 | 6.87 | 1.35% |

|

| Class C | Actual | 1,000.00 | 1,008.46 | 6.23 | 1.23% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.00 | 6.26 | 1.23% |

|

| Class R | Actual | 1,000.00 | 1,009.69 | 5.57 | 1.10% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.66 | 5.60 | 1.10% |

|

| Class R1 | Actual | 1,000.00 | 1,011.74 | 3.65 | 0.72% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.58 | 3.67 | 0.72% |

|

| Class R2 | Actual | 1,000.00 | 1,012.86 | 2.33 | 0.46% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.89 | 2.35 | 0.46% |

|

| Class R3 | Actual | 1,000.00 | 1,011.50 | 4.46 | 0.88% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.77 | 4.48 | 0.88% |

|

| Class R4 | Actual | 1,000.00 | 1,012.64 | 2.94 | 0.58% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.28 | 2.96 | 0.58% |

|

| Class R5 | Actual | 1,000.00 | 1,014.70 | 1.07 | 0.21% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.15 | 1.07 | 0.21% |

|

| Class 1 | Actual | 1,000.00 | 1,014.68 | 0.56 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.65 | 0.56 | 0.11% |

|

| Class 5 | Actual | 1,000.00 | 1,015.81 | 0.30 | 0.06% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.90 | 0.31 | 0.06% |

|

Lifestyle Portfolios | Annual report

16

Shareholder expense example chart, continued

| | | | | |

| | | Beginning | Ending | Expenses Paid | |

| | | Account Value | Account Value | During Period1 | Annualized |

| | | 7-1-07 | 12-31-07 | 7-1-07–12-31-07 | Expense Ratio2,3 |

| Lifestyle Conservative | | | | |

|

| Class A | Actual | $1,000.00 | $1,030.05 | $2.76 | 0.54% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.48 | 2.75 | 0.54% |

|

| Class B | Actual | 1,000.00 | 1,025.77 | 6.79 | 1.33% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.50 | 6.77 | 1.33% |

|

| Class C | Actual | 1,000.00 | 1,026.86 | 6.54 | 1.28% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.75 | 6.51 | 1.28% |

|

| Class R | Actual | 1,000.00 | 1,027.72 | 5.42 | 1.06% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.86 | 5.40 | 1.06% |

|

| Class R1 | Actual | 1,000.00 | 1,029.66 | 3.63 | 0.71% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.63 | 3.62 | 0.71% |

|

| Class R2 | Actual | 1,000.00 | 1,030.01 | 2.97 | 0.58% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.28 | 2.96 | 0.58% |

|

| Class R3 | Actual | 1,000.00 | 1,029.47 | 4.35 | 0.85% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.92 | 4.33 | 0.85% |

|

| Class R4 | Actual | 1,000.00 | 1,030.35 | 2.71 | 0.53% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.53 | 2.70 | 0.53% |

|

| Class R5 | Actual | 1,000.00 | 1,031.89 | 1.13 | 0.22% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.10 | 1.12 | 0.22% |

|

| Class 1 | Actual | 1,000.00 | 1,032.67 | 0.61 | 0.12% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.60 | 0.61 | 0.12% |

|

1 Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period (184) and divided by 365 (to reflect the one-half year period).

2 Lifestyle Portfolios’ expense ratios do not include fees and expenses indirectly incurred by Portfolios from the underlying funds.

3 Ratios do not include expenses indirectly incurred from underlying portfolios whose expense ratios can vary between 0.79% and 0.91% based on the mix of underlying portfolios held by the portfolio.

Annual report | Lifestyle Portfolios

17

F I N A N C I A L S T A T E M E N T S

Portfolio’s investments

| |

| Investment companies | |

| | |

| Underlying Funds’ Subadviser | |

| |

| AIM Capital Management, Inc. | (AIM) |

| | |

| American Century Management, Inc. | (American Century) |

| BlackRock Investment Management, LLC | (BlackRock) |

| (formerly Mercury Advisors) | |

| |

| Davis Advisors | (Davis) |

| | |

| Declaration Management / | (Declaration) |

| John Hancock Advisers | |

| | |

| Deutsche Asset Management | (Deutsche) |

| | |

| Dimensional Fund Advisors, Inc. | (DFA) |

| | |

| Franklin®Templeton® | (Templeton) |

| | |

| Grantham, Mayo, Van Otterloo & Co. | (GMO) |

| | |

| Independence Investments LLC | (Independence) |

| | |

| Jennison Associates LLC | (Jennison) |

| | |

| Legg Mason Funds Management, Inc | (Legg Mason) |

| | |

| Lord Abbett | (Lord Abbett) |

| | |

| Marsico Capital Management, LLC | (Marsico) |

| | |

| MFC Global Investment Management | (MFC Global U.S.A.) |

| (U.S.A.) Limited | |

| | |

| MFC Global Investment Management | (MFC Global U.S.) |

| (U.S.), LLC | |

| | |

| Munder Capital Management | (Munder) |

| | |

| Pacific Investment Management Company | (PIMCO) |

| | |

| RiverSource Investments, LLC | (RiverSource) |

| | |

| SSgA Funds Management, Inc. | (SSgA) |

| | |

| Sustainable Growth Advisers, L.P. | (Sustainable Growth) |

| | |

| T. Rowe Price Associates, Inc. | (T. Rowe Price) |

| | |

| UBS Global Asset | |

| Management (Americas) Inc. | (UBS) |

| | |

| UST Advisers, Inc. | (UST) |

| |

| Wellington Management Company, LLP | (Wellington) |

| | |

| Wells Capital Management, Inc. | (Wells Capital) |

| | |

| Western Asset Management Company | (WAMCO) |

Lifestyle Aggressive Portfolio

Securities owned by the Portfolio on 12-31-07

| | |

| | Shares or | |

| | Principal | |

| Issuer | Amount | Value |

| |

| Investment companies 99.99% | | |

|

| John Hancock Funds 2.00% | | |

|

| Small Cap Intrinsic Value (MFC Global U.S.) (f) | 4,942,009 | $73,388,841 |

| | | |

| John Hancock Funds II 89.96% | | |

|

| All Cap Core (Deutsche) (f) | 4,647,003 | 47,817,662 |

|

| All Cap Value (Lord Abbett) (f) | 6,201,765 | 73,490,915 |

|

| Blue Chip Growth (T. Rowe Price) (f) | 10,556,975 | 227,819,518 |

|

| Capital Appreciation (Jennison) (f) | 16,296,370 | 185,941,584 |

|

| Core Equity (Legg Mason) (f) | 9,969,608 | 146,952,029 |

|

| Emerging Growth (MFC Global U.S.) (f) | 4,580,476 | 73,150,204 |

|

| Emerging Markets Value (DFA) (f) | 9,283,334 | 108,893,511 |

|

| Equity-Income (T. Rowe Price) (f) | 4,030,687 | 73,116,653 |

|

| Fundamental Value (Davis) (f) | 8,482,063 | 147,503,070 |

|

| International Equity Index (SSgA) (f) | 6,559,872 | 147,662,712 |

|

| International Opportunities (Marsico) (f) | 7,791,225 | 147,409,969 |

|

| International Small Cap (Templeton) (f) | 4,821,699 | 92,576,625 |

|

| International Small Company (DFA) (f) | 9,074,822 | 92,563,180 |

|

| International Value (Templeton) (f) | 13,571,373 | 258,263,222 |

|

| Large Cap (UBS) (f) | 4,789,888 | 72,997,887 |

|

| Large Cap Value (BlackRock) (f) | 1,469,985 | 36,984,823 |

|

| Mid Cap Index (MFC Global U.S.A.) (f) | 4,576,932 | 87,877,097 |

|

| Mid Cap Intersection (Wellington) (f) | 15,785,758 | 146,965,407 |

|

| Mid Cap Stock (Wellington) (f) | 3,835,628 | 74,027,612 |

|

| Mid Cap Value (Lord Abbett) (f) | 3,840,733 | 73,127,552 |

|

| Mid Cap Value Equity (RiverSource) (f) | 3,277,623 | 36,643,820 |

|

| Natural Resources (Wellington) (f) | 3,679,650 | 141,997,702 |

|

| Quantitative Value (MFC Global U.S.A.) (f) | 7,344,829 | 109,952,092 |

|

| Small Cap (Independence) (f) | 5,450,867 | 72,878,086 |

|

| Small Cap Index (MFC Global U.S.A.) (f) | 3,857,786 | 51,308,552 |

|

| Small Company (American Century) (f) | 4,286,999 | 63,276,108 |

|

| Small Company Value (T. Rowe Price) (f) | 4,632,848 | 109,844,827 |

|

| U.S. Global Leaders Growth | | |

| (Sustainable Growth) (f) | 2,449,530 | 33,999,476 |

|

| U.S. Multi Sector (GMO) (f) | 23,994,380 | 257,939,582 |

|

| Value & Restructuring (UST) (f) | 2,840,935 | 37,045,795 |

|

| Vista (American Century) (f) | 4,961,760 | 74,029,459 |

|

| | | 3,304,056,731 |

| John Hancock Funds III 8.03% | | |

|

| International Core (GMO) (f) | 6,861,655 | 295,119,767 |

| | | |

| Total investment companies | | |

| (Cost $3,404,593,047) | | $3,672,565,339 |

| | | |

| Total investments | | |

| (Cost $3,404,593,047) 99.99% | | $3,672,565,339 |

| | |

| Other assets in excess of liabilities 0.01% | 302,675 |

|

| Total net assets 100.00% | | $3,672,868,014 |

Percentages are stated as a percent of net assets.

(f) The underlying fund’s subadviser.

See notes to financial statements

Lifestyle Portfolios | Annual report

18

F I N A N C I A L S T A T E M E N T S

Lifestyle Growth Portfolio

Securities owned by the Portfolio on 12-31-07

| | |

| | Shares or | |

| | Principal | |

| Issuer | Amount | Value |

| |

| Investment companies 99.99% | | |

|

| John Hancock Funds 0.99% | | |

|

| Small Cap Intrinsic Value (MFC Global U.S.) (f) | 6,874,164 | $102,081,329 |

| | | |

| John Hancock Funds II 92.99% | | |

|

| All Cap Core (Deutsche) (f) | 38,161,537 | 392,682,218 |

|

| All Cap Growth (AIM) (f) | 5,662,950 | 104,991,101 |

|

| Blue Chip Growth (T. Rowe Price) (f) | 22,424,649 | 483,923,926 |

|

| Capital Appreciation (Jennison) (f) | 36,973,561 | 421,868,328 |

|

| Core Equity (Legg Mason) (f) | 21,203,704 | 312,542,593 |

|

| Emerging Markets Value (DFA) (f) | 17,531,672 | 205,646,513 |

|

| Equity-Income (T. Rowe Price) (f) | 17,246,089 | 312,844,055 |

|

| Floating Rate Income (WAMCO) (f) | 1,734,000 | 17,340,000 |

|

| Fundamental Value (Davis) (f) | 24,077,822 | 418,713,317 |

|

| Global Bond (PIMCO) (f) | 13,911,650 | 208,674,753 |

|

| Global Real Estate (Deutsche) (f) | 10,472,060 | 102,835,626 |

|

| High Income (MFC Global U.S.) (f) | 10,895,731 | 102,528,827 |

|

| High Yield (WAMCO) (f) | 53,261,680 | 506,518,579 |

|

| Index 500 (MFC Global USA) (f) | 9,722,589 | 104,226,158 |

|

| International Equity Index (SSgA) (f) | 9,155,375 | 206,087,490 |

|

| International Opportunities (Marsico) (f) | 21,986,513 | 415,984,822 |

|

| International Small Cap (Templeton) (f) | 8,121,347 | 155,929,860 |

|

| International Small Company (DFA) (f) | 15,212,848 | 155,171,052 |

|

| International Value (Templeton) (f) | 21,833,764 | 415,496,528 |

|

| Large Cap (UBS) (f) | 6,725,562 | 102,497,566 |

|

| Large Cap Value (BlackRock) (f) | 4,187,432 | 105,355,781 |

|

| Mid Cap Index (MFC Global U.S.A.) (f) | 8,029,535 | 154,167,080 |

|

| Mid Cap Intersection (Wellington) (f) | 22,116,454 | 205,904,189 |

|

| Mid Cap Stock (Wellington) (f) | 10,797,452 | 208,390,815 |

|

| Mid Cap Value (Lord Abbett) (f) | 5,424,884 | 103,289,797 |

|

| Mid Cap Value Equity (RiverSource) (f) | 9,273,710 | 103,680,078 |

|

| Natural Resources (Wellington) (f) | 7,815,291 | 301,592,093 |

|

| Quantitative Value (MFC Global U.S.A.) (f) | 27,868,977 | 417,198,581 |

|

| Real Estate Equity (T. Rowe Price) (f) | 8,360,094 | 70,224,790 |

|

| Real Return Bond (PIMCO) (f) | 22,907,641 | 312,460,218 |

|

| Small Cap (Independence) (f) | 7,608,636 | 101,727,464 |

|

| Small Cap Opportunities (Munder) (f) | 8,150,023 | 177,344,503 |

|

| Small Company Growth (AIM) (f) | 7,925,307 | 102,157,213 |

|

| Small Company Value (T. Rowe Price) (f) | 4,298,591 | 101,919,596 |

|

| Spectrum Income (T. Rowe Price) (f) | 20,012,316 | 208,328,212 |

|

| Strategic Bond (WAMCO) (f) | 9,045,056 | 102,842,287 |

|

| Strategic Income (MFC Global U.S.) (f) | 10,169,431 | 104,236,666 |

|

| Total Return (PIMCO) (f) | 29,747,453 | 416,166,864 |

|

| U.S. Global Leaders Growth | | |

| (Sustainable Growth) (f) | 10,709,400 | 148,646,466 |

|

| U.S. High Yield Bond (Wells Capital) (f) | 8,224,694 | 103,713,388 |

|

| U.S. Multi Sector (GMO) (f) | 68,084,023 | 731,903,249 |

|

| Value & Restructuring (UST) (f) | 8,083,134 | 105,404,070 |

|

| Vista (American Century) (f) | 7,027,732 | 104,853,765 |

|

| | | 9,638,010,477 |

| John Hancock Funds III 6.01% | | |

|

| International Core (GMO) (f) | 14,489,994 | 623,214,653 |

| | | |

| Total investment companies | | |

| (Cost $9,745,136,447) | | $10,363,306,459 |

| | | |

| Total Investments 99.99% | | |

| (Cost $9,745,136,447) | | $10,363,306,459 |

| | |

| Other assets in excess of liabilities 0.01% | 1,136,870 |

|

| |

| Total net assets 100.00% | | $10,364,443,329 |

Percentages are stated as a percent of net assets.

(f) The underlying fund’s subadviser.

Lifestyle Balanced Portfolio

Securities owned by the Portfolio on 12-31-07

| | |

| | Shares or | |

| | Principal | |

| Issuer | Amount | Value |

| |

| Investment companies 99.99% | | |

| | | |

| John Hancock Funds II 95.98% | | |

|

| Active Bond (MFC Global U.S./Declaration) (f) | 20,236,402 | $192,650,544 |

|

| All Cap Core (Deutsche) (f) | 18,910,811 | 194,592,244 |

|

| Blue Chip Growth (T. Rowe Price) (f) | 40,573,018 | 875,565,735 |

|

| Core Bond (Wells Capital) (f) | 15,280,380 | 192,991,205 |

|

| Core Equity (Legg Mason) (f) | 19,638,992 | 289,478,745 |

|

| Emerging Markets Value (DFA) (f) | 16,228,956 | 190,365,656 |

|

| Equity-Income (T. Rowe Price) (f) | 16,058,780 | 291,306,263 |

|

| Floating Rate Income (WAMCO) (f) | 1,600,000 | 16,000,000 |

|

| Fundamental Value (Davis) (f) | 16,755,608 | 291,380,025 |

|

| Global Bond (PIMCO) (f) | 19,270,641 | 289,059,618 |

|

| Global Real Estate (Deutsche) (f) | 29,408,451 | 288,790,985 |

|

| High Income (MFC Global U.S.) (f) | 20,303,178 | 191,052,902 |

|

| High Yield (WAMCO) (f) | 90,980,889 | 865,228,257 |

|

| Index 500 (MFC Global USA) (f) | 8,724,405 | 93,525,623 |

|

| International Opportunities (Marsico) (f) | 10,105,813 | 191,201,977 |

|

| International Small Cap (Templeton) (f) | 7,519,527 | 144,374,918 |

|

| International Value (Templeton) (f) | 17,712,241 | 337,063,949 |

|

| Large Cap (UBS) (f) | 12,591,369 | 191,892,460 |

|

| Large Cap Value (BlackRock) (f) | 11,585,552 | 291,492,495 |

|

| Mid Cap Index (MFC Global U.S.A.) (f) | 4,958,885 | 95,210,584 |

|

| Mid Cap Stock (Wellington) (f) | 5,024,463 | 96,972,135 |

|

| Natural Resources (Wellington) (f) | 7,481,275 | 288,702,383 |

|

| Quantitative Value (MFC Global U.S.A.) (f) | 12,820,466 | 191,922,378 |

|

| Real Estate Equity (T. Rowe Price) (f) | 12,796,159 | 107,487,737 |

|

| Real Return Bond (PIMCO) (f) | 34,761,923 | 474,152,634 |

|

| Small Company Growth (AIM) (f) | 7,314,366 | 94,282,183 |

|

| Small Company Value (T. Rowe Price) (f) | 3,967,203 | 94,062,373 |

|

| Spectrum Income (T. Rowe Price) (f) | 46,212,781 | 481,075,052 |

|

| Strategic Bond (WAMCO) (f) | 16,844,776 | 191,525,101 |

|

| Strategic Income (MFC Global U.S.) (f) | 18,773,387 | 192,427,220 |

|

| Total Return (PIMCO) (f) | 34,392,492 | 481,150,968 |

|

| U.S. Global Leaders Growth | | |

| (Sustainable Growth) (f) | 10,608,400 | 147,244,596 |

|

| U.S. High Yield Bond (Wells Capital) (f) | 15,185,176 | 191,485,065 |

|

| U.S. Multi Sector (GMO) (f) | 45,105,839 | 484,887,772 |

|

| Value & Restructuring (UST) (f) | 14,942,914 | 194,855,595 |

|

| | | 9,225,457,377 |

| John Hancock Funds III 4.01% | | |

|

| International Core (GMO) (f) | 8,954,741 | 385,143,390 |

| | | |

| Total investment companies | | |

| (Cost $9,162,380,630) | | $9,610,600,767 |

| | | |

| Total investments | | |

| (Cost $9,162,380,630) 99.99% | | $9,610,600,767 |

| | | |

| Other assets in excess of liabilities | 0.01% | 828,116 |

|

| Total net assets 100.00% | | $9,611,428,883 |

Percentages are stated as a percent of net assets.

(f) The underlying fund’s subadviser.

See notes to financial statements

Annual report | Lifestyle Portfolios

19

F I N A N C I A L S T A T E M E N T S

Lifestyle Moderate Portfolio

Securities owned by the Portfolio on 12-31-07

| | |

| | Shares or | |

| | Principal | |

| Issuer | Amount | Value |

| |

| Investment companies 99.97% | | |

|

| John Hancock Funds II 94.98% | | |

|

| Active Bond (MFC Global U.S./Declaration) (f) | 21,116,017 | $ 201,024,484 |

|

| Blue Chip Growth (T. Rowe Price) (f) | 6,066,500 | 130,915,080 |

|

| Core Bond (Wells Capital) (f) | 3,987,178 | 50,358,058 |

|

| Core Equity (Legg Mason) (f) | 7,088,208 | 104,480,182 |

|

| Equity-Income (T. Rowe Price) (f) | 2,871,815 | 52,094,730 |

|

| Floating Rate Income (WAMCO) (f) | 1,245,000 | 12,450,000 |

|

| Fundamental Value (Davis) (f) | 6,024,652 | 104,768,702 |

|

| Global Bond (PIMCO) (f) | 10,054,173 | 150,812,596 |

|

| Global Real Estate (Deutsche) (f) | 5,127,695 | 50,353,966 |

|

| High Income (MFC Global U.S.) (f) | 8,019,959 | 75,467,817 |

|

| High Yield (WAMCO) (f) | 15,466,156 | 147,083,147 |

|

| International Equity Index (SSgA) (f) | 2,224,578 | 50,075,251 |

|

| International Opportunities (Marsico) (f) | 1,307,961 | 24,746,613 |

|

| International Value (Templeton) (f) | 3,963,239 | 75,420,446 |

|

| Investment Quality Bond (Wellington) (f) | 4,260,398 | 50,357,905 |

|

| Mid Cap Index (MFC Global U.S.A.) (f) | 1,298,664 | 24,934,342 |

|

| Real Estate Equity (T. Rowe Price) (f) | 3,359,278 | 28,217,933 |

|

| Real Return Bond (PIMCO) (f) | 7,184,588 | 97,997,779 |

|

| Small Company (American Century) (f) | 1,681,036 | 24,812,097 |

|

| Small Company Growth (AIM) (f) | 1,916,802 | 24,707,574 |

|

| Small Company Value (T. Rowe Price) (f) | 1,042,946 | 24,728,245 |

|

| Spectrum Income (T. Rowe Price) (f) | 19,310,466 | 201,021,954 |

|

| Strategic Bond (WAMCO) (f) | 6,637,478 | 75,468,123 |

|

| Strategic Income (MFC Global U.S.) (f) | 7,362,785 | 75,468,550 |

|

| Total Return (PIMCO) (f) | 21,511,729 | 300,949,094 |

|

| U.S. High Yield Bond (Wells Capital) (f) | 5,984,829 | 75,468,693 |

|

| U.S. Multi Sector (GMO) (f) | 9,745,009 | 104,758,849 |

|

| Value & Restructuring (UST) (f) | 4,022,680 | 52,455,745 |

|

| | | 2,391,397,955 |

| John Hancock Funds III 4.99% | | |

|

| International Core (GMO) (f) | 2,922,458 | 125,694,903 |

| | | |

| Total investment companies | | |

| (Cost $2,428,313,932) | | $2,517,092,858 |

| | | |

| Total investments | | |

| (Cost $2,428,313,932) 99.97% | | $2,517,092,858 |

| | |

| Other assets in excess of liabilities 0.03% | 738,952 |

|

| Total net assets 100.00% | | $2,517,831,810 |

Percentages are stated as a percent of net assets.

(f) The underlying fund’s subadviser.

Lifestyle Conservative Portfolio

Securities owned by the Portfolio on 12-31-07

| | |

| | Shares or | |

| | Principal | |

| Issuer | Amount | Value |

| |

| Investment companies 99.98% | | |

|

| John Hancock Funds II 97.98% | | |

|

| Active Bond (MFC Global U.S./Declaration) (f) | 15,805,583 | $ 150,469,149 |

|

| Blue Chip Growth (T. Rowe Price) (f) | 1,517,487 | 32,747,366 |

|

| Core Bond (Wells Capital) (f) | 2,383,617 | 30,105,084 |

|

| Equity-Income (T. Rowe Price) (f) | 1,808,734 | 32,810,431 |

|

| Floating Rate Income (WAMCO) (f) | 733,000 | 7,330,000 |

|

| Fundamental Value (Davis) (f) | 1,888,585 | 32,842,501 |

|

| Global Bond (PIMCO) (f) | 8,025,991 | 120,389,863 |

|

| Global Real Estate (Deutsche) (f) | 4,597,805 | 45,150,450 |

|

| High Income (MFC Global U.S.) (f) | 3,199,214 | 30,104,605 |

|

| High Yield (WAMCO) (f) | 6,329,724 | 60,195,678 |

|

| International Value (Templeton) (f) | 2,372,571 | 45,150,024 |

|

| Investment Quality Bond (Wellington) (f) | 6,365,634 | 75,241,797 |

|

| Real Estate Equity (T. Rowe Price) (f) | 1,952,543 | 16,401,361 |

|

| Real Return Bond (PIMCO) (f) | 4,268,780 | 58,226,153 |

|

| Spectrum Income (T. Rowe Price) (f) | 11,563,676 | 120,377,870 |

|

| Strategic Bond (WAMCO) (f) | 5,294,256 | 60,195,695 |

|

| Strategic Income (MFC Global U.S.) (f) | 5,872,770 | 60,195,891 |

|

| Total Return (PIMCO) (f) | 17,208,364 | 240,745,013 |

|

| U.S. Government Securities (WAMCO) (f) | 12,116,864 | 161,638,968 |

|

| U.S. High Yield Bond (Wells Capital) (f) | 2,387,367 | 30,104,697 |

|

| U.S. Multi Sector (GMO) (f) | 3,040,960 | 32,690,322 |

|

| Value & Restructuring (UST) (f) | 2,518,600 | 32,842,545 |

|

| | | 1,475,955,463 |

| John Hancock Funds III 2.00% | | |

|

| International Core (GMO) (f) | 700,057 | 30,109,438 |

| | | |

| Total investment companies | | |

| (Cost $1,475,748,473) | | $1,506,064,901 |

| | | |

| Total investments | | |

| | | |

| (Cost $1,475,748,473) 99.98% | | $1,506,064,901 |

| | |

| Other assets in excess of liabilities 0.02% | 282,799 |

|

| Total net assets 100.00% | | $1,506,347,700 |

Percentages are stated as a percent of net assets.