The table below summarizes the change in unrealized appreciation (depreciation) rec ognized in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category:

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

The Trust has entered into an Investment Advisory Agreement with the Adviser. The Adviser is responsible for managing the corporate and business affairs of the Trust and for selecting and compensating subadvisers to handle the investment of the assets of the Portfolio, subject to the supervision of the Board of Trustees. The advisory fee has two components: (a) a fee on assets invested in affiliated Funds (Affiliated Funds Assets) and (b) a fee on assets not invested in affiliated Funds (Other Assets). Affiliated Funds are any fund of JHF II and JHF III. Under the Advisory Agreement, the Portfolio pays a daily management fee to the Adviser as stated below.

The fee on assets invested in a fund of JHF II or JHF III is stated as an annual percentage of the current value of the aggregate net assets of all the John Hancock LifeCycle Portfolios determined in accordance with the following schedule, and that rate is applied to the Affiliated Fund Assets of each John Hancock LifeCycle Portfolio.

The fee on Other Assets is stated as an annual percentage of the current value of the aggregate net assets of all the John Hancock LifeCycle Portfolios determined in accordance with the following schedule, and that rate is applied to the Other Assets of each John Hancock LifeCycle Portfolio.

MFC Global Investment Management (U.S.A) Limited acts as Subadviser to the Portfolio. The Portfolio is not responsible for the payment of subadvisory fees. The investment management fees incurred for the year ended August 31, 2009, were equivalent to an annual effective rate of 0.12% of the Portfolio’s average daily net assets.

Expense reimbursements

The Adviser has contractually agreed to reimburse for certain Portfolio level expenses (excluding management fees, underlying fund expenses, Rule 12b-1 fees, transfer agency fees, service plan fees, state registration fees, printing and postage fees, taxes, brokerage commissions, interest, litigation and indemnification expenses, other expenses not incurred in the ordinary course of the Portfolio’s business, and fees under any agreement or plans of the Portfolio dealing with services for shareholders and others with beneficial interests in shares of the Portfolio) that exceed 0.09% of the average annual net assets. Also, the Adviser has agreed to reimburse or to make a payment to a specific class of shares of the Portfolio in an amount equal to the amount by which the expenses attributable to such class of shares exceed the percentage of average annual net assets (on an annualized basis) attributable as follows: 0.50% for Class A, 1.20% for Class B, 1.20% for Class C, 1.05% for Class R, 0.80% for Class R1, 0.55% for Class R2, 0.70% for Class R3, 0.40% for Class R4, 0.10% for Class R5, and 0.05% for Class 1 for the Lifecycle funds. These expense reimbursements shall continue in effect until December 31, 2009, and thereafter until terminated by the Adviser on notice to JHF II.

For the year ended August 31, 2009, the expense reductions related to this limitation amounted to $9,017 for Class A, $11,007 for Class B, $13,691 for Class C, $10,366 for Class R, $10,351 for Class R1, $10,770 for Class R2, $10,381 for Class R3, $10,371 for Class R4, $10,515 for Class R5 and $9 for Class 1, and is reflected as a reduction of total expenses in the Statement of Operations.

Accounting and legal services fees

Pursuant to the Service Agreement, the Portfolio will reimburse the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Portfolio, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports. These expenses are allocated based on the relative share of net assets of each John Hancock LifeCycle Portfolio at the time the expense was incurred.

The accounting and legal services fees incurred for the year ended August 31, 2009, were equivalent to an annual effective rate of 0.02% of the Portfolio’s average daily net assets.

Distribution and service plans

The Trust has a Distribution Agreement with the Distributor. The Portfolio has adopted Distribution Plans with respect to Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class 1, pursuant to Rule 12b-1 under the 1940 Act, to reimburse the Distributor for the services it provides as distributor of shares of the Portfolio. Accordingly, the Portfolio makes daily payments to the Distributor at an annual rate not to exceed 0.30%, 1.00%, 1.00%, 0.75%, 0.50%, 0.25%, 0.50%, 0.25% and 0.05% of the average daily net assets of Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class 1, respectively. A maximum of 0.25% of average daily net assets

20

may be service fees, as defined by the Conduct Rules of the Financial Industry Regulatory Authority. Under the Conduct Rules, curtailment of a portion of the Portfolio’s 12b-1 payments could occur under certain circumstances.

The Portfolio has also adopted a Service Plan with respect to Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares (the “Service Plan”). Under the Service Plan, the Portfolio pays up to 0.25%, 0.25%, 0.25%, 0.15%, 0.10% and 0.05% of average daily net assets of Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares, respectively, for certain other services.

Sales charges

Class A shares are assessed up-front sales charges of up to 5% of the net asset value of such shares. During the year ended August 31, 2009 the Distributor received net up-front sales charges of $77,564 with regard to sales of Class A shares. Of this amount, $12,748 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $64,100 was paid as sales commissions to unrelated broker-dealers and $716 was paid as sales commission to affiliated to sales personnel.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to the Distributor and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Portfolio in connection with the sale of Class B and Class C shares. During the year ended August 31, 2009, CDSCs received by the Distributor amounted to $1,987 for Class B shares and $1,037 for Class C shares.

Transfer agent fees

The Portfolios have a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an indirect subsidiary of MFC. The transfer agent fees are made up of three components:

• The Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net assets for all classes;

• a monthly fee based on an annual rate of $16.50 per shareholder account; and

• Signature Services is reimbursed for certain out-of-pocket expenses.

Signature Services has contractually agreed to limit the transfer agent fees so that such fees do not exceed 0.20% annually of Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares average daily net assets. This agreement expired December 31, 2008.

In addition, Signature Services voluntarily agreed to further limit transfer agent fees for Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares so that such fees do not exceed 0.05% annually of each class’s average daily net assets. For the year ended

21

August 31, 2009, the transfer agent voluntary fees reductions amounted to $267 for Class B, $3 for Class R, $21 for Class R1 and $24 for Class R2 and is reflected as a reduction of total expenses in the Statement of Operations.

The Portfolio may receive earnings credits from the transfer agent as a result of uninvested cash balances. These credits are used to reduce a portion of the Portfolio’s transfer agent fees and out of pocket expenses. During the year ended August 31, 2009, there were no earning credits received by the Portfolio.

Class level expenses for the year ended August 31, 2009, were as follows:

| | | | | | | | | | | | | |

| | | | | | | | | State | | | | |

| | | Distribution and | | | Transfer agent | | | registration | | | Printing and | |

Share Class | | | service fees | | | fees | | | fees | | | postage fees | |

Class A | | $ | 23,707 | | $ | 8,502 | | $ | 11,460 | | $ | 4,863 | |

Class B | | | 3,437 | | | 1,575 | | | 10,364 | | | 22 | |

Class C | | | 35,301 | | | 4,792 | | | 10,766 | | | 5,197 | |

Class R | | | 596 | | | 237 | | | 10,370 | | | 2 | |

Class R1 | | | 447 | | | 270 | | | 10,370 | | | 1 | |

Class R2 | | | 450 | | | 416 | | | 10,816 | | | 2 | |

Class R3 | | | 858 | | | 262 | | | 10,370 | | | 1 | |

Class R4 | | | 250 | | | 146 | | | 10,370 | | | 2 | |

Class R5 | | | 2 | | | 137 | | | 10,474 | | | 1 | |

Class 1 | | | 98,746 | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

Total | | $ | 163,794 | | $ | 16,337 | | $ | 95,360 | | $ | 10,091 | |

| | | | | | | | | | | | | |

6. Trustee Fees

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees’ expenses are allocated to each John Hancock LifeCycle Portfolio based on its average daily net asset value.

7. Portfolio share transactions

Share transactions for the Portfolio for the years ended August 31, 2009 and 2008, were as follows:

| | | | | | | | | | | | | |

| | Year ended | | Year ended | |

| | 8/31/09 | | 8/31/08 | |

| | | | | |

| | Shares | | Amount | | Shares | | Amount | |

Class A shares | | | | | | | | | | | | | |

Sold | | | 545,003 | | $ | 3,994,463 | | | 823,146 | | $ | 8,271,824 | |

Distributions reinvested | | | 55,429 | | | 386,973 | | | 26,078 | | | 261,289 | |

Repurchased | | | (779,128 | ) | | (5,539,141 | ) | | (141,454 | ) | | (1,376,430 | ) |

| | | | | | | | | | | | | |

Net increase (decrease) | | | (178,696 | ) | $ | (1,157,705 | ) | | 707,770 | | $ | 7,156,683 | |

| | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

Sold | | | 22,018 | | $ | 165,426 | | | 27,292 | | $ | 280,517 | |

Distributions reinvested | | | 1,151 | | | 8,130 | | | 1,270 | | | 12,810 | |

Repurchased | | | (20,436 | ) | | (135,656 | ) | | (20,551 | ) | | (201,914 | ) |

| | | | | | | | | | | | | |

Net increase | | | 2,733 | | $ | 37,900 | | | 8,011 | | $ | 91,413 | |

| | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

Sold | | | 69,929 | | $ | 548,685 | | | 665,373 | | $ | 6,704,880 | |

Distributions reinvested | | | 26,823 | | | 186,036 | | | 11,420 | | | 114,105 | |

Repurchased | | | (461,577 | ) | | (3,227,062 | ) | | (135,683 | ) | | (1,322,073 | ) |

| | | | | | | | | | | | | |

Net increase (decrease) | | | (364,825 | ) | $ | (2,492,341 | ) | | 541,110 | | $ | 5,496,912 | |

| | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

Sold | | | 38 | | $ | 290 | | | 4,734 | | $ | 45,493 | |

Distributions reinvested | | | 600 | | | 4,127 | | | 394 | | | 3,963 | |

Repurchased | | | (23 | ) | | (164 | ) | | (4,741 | ) | | (45,064 | ) |

| | | | | | | | | | | | | |

Net increase | | | 615 | | $ | 4,253 | | | 387 | | $ | 4,392 | |

| | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

Sold | | | 18,446 | | $ | 121,016 | | | 115 | | $ | 1,135 | |

Distributions reinvested | | | 662 | | | 4,558 | | | 404 | | | 4,064 | |

Repurchased | | | (17,457 | ) | | (108,906 | ) | | — | | | — | |

| | | | | | | | | | | | | |

Net increase | | | 1,651 | | $ | 16,668 | | | 519 | | $ | 5,199 | |

| | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

Sold | | | 66,186 | | $ | 474,889 | | | 10,844 | | $ | 108,356 | |

Distributions reinvested | | | 1,272 | | | 8,752 | | | 531 | | | 5,321 | |

Repurchased | | | (62,136 | ) | | (451,469 | ) | | (5,468 | ) | | (52,471 | ) |

| | | | | | | | | | | | | |

Net increase | | | 5,322 | | $ | 32,172 | | | 5,907 | | $ | 61,206 | |

| | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

Sold | | | 14,471 | | $ | 109,458 | | | 9,187 | | $ | 95,388 | |

Distributions reinvested | | | 1,184 | | | 8,181 | | | 674 | | | 6,767 | |

Repurchased | | | (13,447 | ) | | (88,456 | ) | | (684 | ) | | (6,788 | ) |

| | | | | | | | | | | | | |

Net increase | | | 2,208 | | $ | 29,183 | | | 9,177 | | $ | 95,367 | |

| | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

Sold | | | 5,323 | | $ | 37,453 | | | 97 | | $ | 946 | |

Distributions reinvested | | | 780 | | | 5,387 | | | 440 | | | 4,426 | |

| | | | | | | | | | | | | |

Net increase | | | 6,103 | | $ | 42,840 | | | 537 | | $ | 5,372 | |

| | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

Sold | | | 2,657 | | $ | 18,703 | | | 980 | | $ | 9,618 | |

Distributions reinvested | | | 846 | | | 5,863 | | | 474 | | | 4,769 | |

Repurchased | | | (57 | ) | | (386 | ) | | (1 | ) | | (8 | ) |

| | | | | | | | | | | | | |

Net increase | | | 3,446 | | $ | 24,180 | | | 1,453 | | $ | 14,379 | |

| | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

Sold | | | 15,710,756 | | $ | 112,536,786 | | | 22,765,338 | | $ | 228,178,574 | |

Distributions reinvested | | | 1,724,700 | | | 11,943,271 | | | 565,986 | | | 5,643,203 | |

Repurchased | | | (9,664,087 | ) | | (68,124,832 | ) | | (7,198,772 | ) | | (71,496,368 | ) |

| | | | | | | | | | | | | |

Net increase | | | 7,771,369 | | $ | 56,355,225 | | | 16,132,552 | | $ | 162,325,409 | |

| | | | | | | | | | | | | |

Net increase | | | 7,249,926 | | $ | 52,892,375 | | | 17,407,423 | | $ | 175,256,332 | |

| | | | | | | | | | | | | |

22

8. Purchases and sales of securities

Purchases and proceeds from sales of securities, other than short-term securities, during the year ended August 31, 2009, aggregated $194,518,681 and $149,758,325, respectively.

9. Investment in affiliated underlying funds

The Portfolio invests primarily in underlying funds that are managed by affiliates of the Adviser. The Portfolio does not invest in affiliated underlying funds for the purpose of exercising management or control; however the Portfolio’s investments may represent a significant portion of each underlying fund’s net assets. For the year ended August 31, 2009, the Portfolio held 5% or more of the following underlying fund’s net assets:

| |

Portfolio Affiliate Class NAV | Percentage of Underlying

Funds’ Net Assets |

Investment Quality Bond | 5.49% |

10. Subsequent Events

The Portfolio was terminated and liquidated on October 23, 2009. The termination and liquidation of the Portfilio was approved by the Board of Trustees on June 26, 2009.

23

Auditors report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of John Hancock Funds II:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Lifecycle Retirement Portfolio (the “Portfolio”) at August 31, 2009, the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Trust’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2009 by correspondence with the custodian, transfer agent, and brokers, and the application of alternative auditing procedures where securities purchased confirmations had not been received, provide a reasonable basis for our opinion.

As disclosed in Note 10 to the Financial Statements, the Portfolio was liquidated on October 23, 2009.

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 23, 2009

24

Tax Information (Unaudited)

For federal income tax purposes, the following information is furnished with respect to the distributions of the Portfolio, if any, paid during its taxable year ended August 31, 2009.

The Portfolio has designated distributions to shareholders of $917,579 as a long-term capital gain dividend.

With respect to the ordinary dividends paid by the Portfolios for the year ended August 31, 2009, 17.93% of the dividends qualifies for the corporate dividends-received deduction.

The Portfolio hereby designates the maximum amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. This amount will be reflected on Form 1099-DIV for the calendar year 2009.

Shareholders will be mailed a 2009 U.S. Treasury Department Form 1099-DIV in January 2010. This will reflect the total of all distributions that are taxable for calendar year 2009.

25

John Hancock Funds II

EVALUATION OF ADVISORY AND SUBADVISORY

AGREEMENTS BY THE BOARD OF TRUSTEES

This section describes the evaluation by the Board of Trustees of the Advisory Agreement (the “Advisory Agreement”) and each of the Subadvisory Agreements (the “Subadvisory Agreements”) for each of the portfolios (the “Funds”) of John Hancock Funds II (the “Trust”) discussed in this annual report.

Evaluation by the Board of Trustees

The Board, including the Independent Trustees, is responsible for selecting the Trust’s adviser, John Hancock Investment Management Services, LLC (the “Adviser” or “JHIMS”), approving the Adviser’s selection of subadvisers for each of the portfolios of the Trust and approving the Trust’s advisory and subadvisory (and any sub-subadvisory) agreements, their periodic continuation and any amendments. Consistent with SEC rules, the Board regularly evaluates the Trust’s advisory and subadvisory arrangements, including consideration of the factors listed below. The Board may also consider other factors (including conditions and trends prevailing generally in the economy, the securities markets and the industry) and does not treat any single factor as determinative, and each Trustee may attribute different weights to different factors. The Board is furnished with an analysis of its fiduciary obligations in connection with its evaluation and, throughout the evaluation process, the Board is assisted by counsel for the Trust and the Independent Trustees are also separately assisted by independent legal counsel. The factors considered by the Board are:

| | |

| 1. | the nature, extent and quality of the services to be provided by the Adviser to the Trust and by the subadvisers to the Funds; |

| | |

| 2. | the investment performance of the Funds and their subadvisers; |

| | |

| 3. | the extent to which economies of scale would be realized as a Fund grows and whether fee levels reflect these economies of scale for the benefit of Trust shareholders; |

| | |

| 4. | the costs of the services to be provided and the profits to be realized by the Adviser and its affiliates (including any subadvisers that are affiliated with the Adviser) from the Adviser’s relationship with the Trust; and |

| | |

| 5. | comparative services rendered and comparative advisory and subadvisory fee rates. |

The Board believes that information relating to all of these factors is relevant to its evaluation of the Trust’s advisory agreement. With respect to its evaluation of subadvisory agreements (including any sub-subadvisory agreements) with subadvisers not affiliated with the Adviser, the Board believes that, in view of the Trust’s “manager-of-managers” advisory structure, the costs of the services to be provided and the profits to be realized by those subadvisers that are not affiliated with the Adviser from their relationship with the Trust generally are not a material factor in the Board’s consideration of these subadvisory agreements because such fees are paid by the Adviser and not by the Funds and the Board relies on the ability of the Adviser to negotiate the subadvisory fees at arms-length.

In evaluating subadvisory arrangements, the Board also considers other material business relationships that unaffiliated subadvisers and their affiliates have with the Adviser or its affiliates, including the involvement by certain affiliates of certain subadvisers in the distribution of financial products, including shares of the Trust, offered by the Adviser and other affiliates of the Adviser (“Material Relationships”).

Approval of Advisory Agreement

At its meeting on May 28-29, 2009, the Board, including all the Independent Trustees, approved the Advisory Agreement.

26

In approving the renewal of the Advisory Agreement, and with reference to the factors that it regularly considers, the Board:

(1) -- (a) considered the high value to the Trust of continuing its relationship with JHIMS as the Trust’s adviser, the skills and competency with which JHIMS has in the past managed the Trust’s affairs and its subadvisory relationships, JHIMS’s oversight and monitoring of the subadvisers’ investment performance and compliance programs including its timeliness in responding to performance issues and the qualifications of JHIMS’s personnel,

(b) considered JHIMS’s compliance policies and procedures and its responsiveness to regulatory changes and mutual fund industry developments, and

(c) considered JHIMS’s administrative capabilities, including its ability to supervise the other service providers for the Funds and concluded that JHIMS may reasonably be expected to continue to perform its services under the Advisory Agreement with respect to the Funds;

(2) -- reviewed the investment performance of each of the Funds; the comparative performance of their respective benchmarks, comparable funds (i.e., funds having approximately the same investment objective), if any; and JHIMS’s analysis of such performance and its plans and recommendations regarding the Trust’s subadvisory arrangements generally and with respect to particular Funds; and concluded that each of the Funds has generally performed well or within a range that the Board deemed competitive except as discussed in Appendix A and in such cases, that appropriate action is being taken to address performance, if necessary, or that such performance is reasonable in light of all factors considered, and that JHIMS may reasonably be expected to continue ably to monitor the performance of the Funds and each of their subadvisers;

(3) -- reviewed the Trust’s advisory fee structure and the incorporation therein of any subadvisory fee breakpoints in the advisory fees charged and concluded (i) that to the extent that Funds have subadvisory fees with breakpoints, those breakpoints are reflected as breakpoints in the advisory fees for Funds, (ii) that all Funds with a subadviser that is not affiliated with the Adviser have subadvisory fees which are the product of arms-length negotiations between the Adviser and the subadviser and which in many, but not all, cases contain breakpoints, and (iii) that, although economies of scale cannot be measured with precision, these arrangements permit shareholders of Funds with advisory fee breakpoints to benefit from economies of scale if those Funds grow;

(4) -- (a) reviewed the financial statements of JHIMS and considered (i) an analysis presented by JHIMS regarding the net profitability to JHIMS of each Fund,

(b) reviewed the profitability of the JHIMS’s relationship with each Fund in terms of the total amount of annual advisory fees it received with respect to the Fund and whether JHIMS has the financial ability to continue to provide a high level of services to the Fund,

(c) considered that JHIMS derives reputational and other indirect benefits from providing advisory services to the Funds,

(d) noted that JHIMS pays the subadvisory fees out of the advisory fees JHIMS receives from the Funds and concluded that the advisory fees paid by the Trust with respect to the Funds are not unreasonable in light of such information; and

(e) considered that the Adviser should be entitled to earn a reasonable level of profits in exchange for the level of services it provide to each Fund and the entrepreneurial risk that it assumes as Adviser. Based upon its review, the Board concluded that the Advisor and its affiliates’ anticipated level of profitability from their relationship with each Fund was reasonable and not excessive.

(5) -- reviewed comparative information with respect to the advisory fee rates and concluded that the Trust’s advisory fees are generally within a competitive range of those incurred by other comparable funds. In this regard, the Board took into account management’s discussion with respect to the advisory fee structure. The Board also noted that JHIMS is currently waiving fees and or reimbursing expenses with respect to certain of the Funds and that the Adviser pays the subadvisory fees of the Funds. The Board also took into account the level and quality of services provided by JHIMS with respect to the Funds, as well as the other factors considered.

27

In addition, the Trustees reviewed the advisory fee to be paid to the Adviser for each Fund and concluded that the advisory fee to be paid to the Adviser with respect to each Fund is based on services provided that are in addition to, rather than duplicative of, the services provided pursuant to the advisory agreements for the underlying portfolios of the Fund and that the additional services are necessary because of the differences between the investment policies, strategies and techniques of a Fund and those of its underlying portfolios.

Additional information that the Board considered in approving the Advisory Agreement is set forth in Appendix A.

28

Approval of Subadvisory Agreements

At its meeting on May 28-29, 2009, the Board, including all the Independent Trustees, renewed and approved the Subadvisory Agreements.

In making its determination with respect to the factors that it considers, the Board reviewed:

(1) information relating to each subadviser’s business, which may include information such as: business performance, assets under management and personnel;

(2) the historical and current performance of the Fund and comparative performance information relating to the Fund’s benchmark and comparable funds;

(3) the subadvisory fee for each Fund and comparative fee information; and

(4) information relating to the nature and scope of Material Relationships and their significance to the Trust’s adviser and unaffiliated subadvisers.

The Board noted that in the case of each sub-subadvisory agreement, that the sub-subadvisory fee would be paid by the Subadviser out of the subadvisory fee and would not be an expense of the Fund.

The Board’s decision to approve each Subadvisory Agreement was based on a number of determinations, including the following:

(1) The Subadviser has extensive experience and demonstrated skills as a manager;

(2) Although not without variation, the current and historical performance of each Fund managed by a Subadviser has generally been in line with or outperformed the current and historical performance of comparable funds and the Fund’s respective benchmarks with the exceptions noted in Appendix A (with respect to such exceptions, the Board concluded that appropriate action was being taken to address such Funds’ performance, if necessary, or that performance was reasonable in light of all factors considered);

(3) The subadvisory fees are generally competitive within the range of industry norms and, with respect to each Subadviser that is not affiliated with the Adviser, are a product of arms-length negotiation between the Adviser and the subadviser;

(4) With respect to those Funds that have subadvisory fees that contain breakpoints, such breakpoints are reflected as breakpoints in the advisory fees for the Funds in order to permit shareholders to benefit from economies of scale if those Funds grow; and

(5) The Material Relationships consist of arrangements in which unaffiliated subadvisers or their affiliates provide advisory, distribution or management services in connection with financial products sponsored by the Trust’s adviser or its affiliates, which may include other registered investment companies, a 529 education savings plan, managed separate accounts and exempt group annuity contracts sold to qualified plans, and which in no case contained elements which would cause the Board to conclude that approval of the subadvisory agreement with the subadviser would be inappropriate.

In addition, the Trustees reviewed the subadvisory fee to be paid to the subadviser for each Fund and concluded that the subadvisory fee to be paid to the subadviser with respect to each Fund is based on services provided that are in addition to, rather than duplicative of, the services provided pursuant to the subadvisory agreements for the underlying portfolios of the Fund and that the additional services are necessary because of the differences between the investment policies, strategies and techniques of a Fund and those of its underlying portfolios.

Additional information that the Board considered for a particular Fund is set forth in Appendix A.

29

JOHN HANCOCK FUNDS II

APPENDIX A

LIFECYCLE RETIREMENT PORTFOLIO

PORTFOLIO

(SUBADVISER) | | PERFORMANCE OF

PORTFOLIO,

AS OF MARCH 31, 2009 | | FEES AND EXPENSES | | OTHER

COMMENTS |

JHF II

Lifecycle Retirement

(MFC Global Investment Management (U.S.A.) Limited)*

| | The Fund underperformed the benchmark index over the one- year period.

The Fund underperformed the Morningstar Category Average over the one-year period. | | No subadvisory fee comparative information recorded due to limited size of peer group.

Net management fees for this Fund are higher than the peer group median.

Total expenses for this Fund are slightly higher than the peer group median. | | The Board took into account management’s proposed plan to liquidate the Fund. |

*Deutsche Investment Management America Inc. provides subadvisory consulting services to MFC Global (U.S.A.) in its management of the Portfolio.

30

Trustees and Officers

This chart provides information about the Trustees and Officers who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the Portfolio and execute policies formulated by the Trustees.

Independent Trustees

| | | |

| | | Number of |

Name, Year of Birth | | Trustee | John Hancock |

Position(s) held with Fund | | of Fund | funds overseen |

Principal occupation(s) and other directorships during past 5 years | | since1 | by Trustee |

| | | |

Charles L. Bardelis, Born: 1941 | | 2005 | 212 |

Director, Island Commuter Corp. (Marine Transport). Trustee of John Hancock Trust (since 1988) and former Trustee of John Hancock Funds III (2005–2006). | | | |

| | | |

Peter S. Burgess, Born: 1942 | | 2005 | 212 |

Consultant (financial, accounting and auditing matters) (since 1999); Certified Public Accountant. Partner, Arthur Andersen (independent public accounting firm) (prior to 1999). Director of the following publicly traded companies: PMA Capital Corporation (since 2004) and Lincoln Educational Services Corporation (since 2004). Trustee of John Hancock Trust (since 2005), and former Trustee of John Hancock Funds III (2005–2006). | | | |

| | | |

Theron S. Hoffman,2 Born: 1947 | | 2008 | 212 |

Trustee of John Hancock Trust and John Hancock Funds II (since September 2008); Chief Executive Officer, T. Hoffman Associates, LLC (since 2003); Director, The Todd Organization (since 2003); President, Westport Resources Management (2006–2008); Partner/Operating Head & Senior Managing Director, Putnam Investments (2000–2003). | | | |

| | | |

Hassell H. McClellan, Born: 1945 | | 2005 | 212 |

Associate Professor, The Graduate School of The Wallace E. Carroll School of Management, Boston College. Trustee of John Hancock Trust (since 2005), former Trustee of John Hancock Funds III (2005–2006) and Trustee of Phoenix Edge Series Fund (since 2008). | | | |

| | | |

James M. Oates, Born: 1946 | | 2005 | 212 |

Chairman of the Board of John Hancock Funds II; Managing Director, Wydown Group (finan- cial consulting firm) (since 1994); Chairman, Emerson Investment Management, Inc. (since 2000); Chairman, Hudson Castle Group, Inc. (formerly IBEX Capital Markets, Inc.) (financial services company) (1997–2006). Director of the following publicly traded companies: Stifel Financial (since 1996); Investor Financial Services Corporation (since 1995); and Connecticut River Bancorp, Director (since 1998); Virtus Investment Management (since 2009); and Emerson Investment Management (since 2000). Trustee of John Hancock Trust (since 2004) and former Trustee of John Hancock Funds III (2005–2006). | | | |

| | | |

Steven M. Roberts,2 Born: 1944 | | 2008 | 212 |

Trustee of John Hancock Trust and John Hancock Funds II (since September 2008); Board of Governors Deputy Director, Federal Reserve System (2005–2008); Partner, KPMG (1987–2004). | | | |

| |

1 | Because the Trust does not hold regular annual shareholders meetings, each Trustee holds office for an indefinite term until his/her successor is duly elected and qualified or until he/she dies, retires, resigns, is removed or becomes disqualified. Trustees may be removed (provided the aggregate number of Trustees after such removal shall not be less than one) with cause or without cause, by the action of two-thirds of the remaining Trustees or by action of two-thirds of the outstanding Shares of the Trust. |

| |

2 | Mr. Hoffman and Mr. Roberts were appointed by the Board as Trustees on September 26, 2008. |

31

Annual report | Lifecycle Retirement

| | | |

Trustee Emeritus | | | |

| | | |

| | | Number of |

Name, Year of Birth | | Trustee | John Hancock |

Position(s) held with Fund | | of Fund | funds overseen |

Principal occupation(s) and other directorships during past 5 years | | since | by Trustee |

| | | |

John D. Richardson,1 Born: 1938 | | 2006 | 212 |

Former Trustee of JHT (Retired, December 14, 2006). Former Senior Executive Vice President, Office of the President, MFC, February 2000 to March 2002 (Retired, March 2002); Executive Vice President and General Manager, U.S. Operations, Manulife Financial, January 1995 to January 2000. | | | |

1 Mr. Richardson became a non-voting Trustee Emeritus on December 14, 2006.

Non-Independent Trustees1

| | | |

| | | Number of |

Name, Year of Birth | | Trustee | John Hancock |

Position(s) held with Fund | | of Fund | funds overseen |

Principal occupation(s) and other directorships during past 5 years | | since1,2 | by Trustee |

| | | |

James R. Boyle,2 Born: 1959 | | 2005 | 264 |

Executive Vice President, Manulife Financial Corporation (since 1999); Director and President, John Hancock Variable Life Insurance Company (since 2007); Director and Executive Vice President, John Hancock Life Insurance Company (since 2004); Chairman and Director, John Hancock Advisers, LLC (the Adviser), John Hancock Funds, LLC (John Hancock Funds) and The Berkeley Financial Group, LLC (The Berkeley Group) (holding company) (since 2005); Chairman and Director, John Hancock Investment Management Services, LLC (since 2006); Senior Vice President, The Manufacturers Life Insurance Company (U.S.A.) (until 2004). | | | |

| | | |

Grace K. Fey,3,4 Born: 1946 | | 2008 | 212 |

Trustee of John Hancock Trust and John Hancock Funds II (since September 2008); Chief Executive Officer, Grace Fey Advisors (since 2007); Director & Executive Vice President, Frontier Capital Management Company (1988–2007). | | | |

| |

1 | Because the Trust does not hold regular annual shareholders meetings, each Trustee holds office for an indefinite term until his/her successor is duly elected and qualified or until he/she dies, retires, resigns, is removed or becomes disqualified. Trustees may be removed (provided the aggregate number of Trustees after such removal shall not be less than one) with cause or without cause, by the action of two-thirds of the remaining Trustees or by action of two-thirds of the outstanding Shares of the Trust holds positions with the Fund’s investment adviser, underwriter and certain other affiliates. |

| |

2 | Mr. Boyle is an “interested person” (as defined in the 1940 Act) due to his position with Manulife Financial Corporation (or its affiliates), the ultimate parent of the Adviser. |

| |

3 | Ms. Fey was appointed by the Board as Trustee on September 26, 2008. |

| |

4 | Ms. Fey is an “interested person” (as defined by the 1940 Act) due to a deferred compensation arrangement with her former employer, Frontier Capital Management Company, which is a subadviser of certain funds of John Hancock Funds II and John Hancock Trust. |

32

Lifecycle Retirement | Annual report

| |

Principal officers who are not Trustees | |

| |

Name, age | |

Position(s) held with Portfolio | Officer of |

Principal occupation(s) and | Portfolio |

directorships during past 5 years | since |

| |

Hugh McHaffie, Born: 1959 | 2009 |

President | |

Executive Vice President, John Hancock Wealth Management (since 2006, including prior positions); Senior Vice President, Individual Business Product Management, MetLife, Inc. (1999–2006); Vice President, Annuity Product Management, John Hancock Life Insurance Company (1990–1999). | |

| |

Thomas M. Kinzler, Born: 1955 | 2006 |

Secretary and Chief Legal Officer | |

Vice President and Counsel, John Hancock Life Insurance Company (U.S.A.) (since 2006); Secretary and Chief Legal Officer, John Hancock Funds, John Hancock Funds II and John Hancock Trust (since 2006); Vice President and Associate General Counsel, Massachusetts Mutual Life Insurance Company (1999–2006); Secretary and Chief Legal Counsel, MML Series Investment Fund (2000–2006); Secretary and Chief Legal Counsel, MassMutual Institutional Funds (2000–2004); Secretary and Chief Legal Counsel, MassMutual Select Funds and MassMutual Premier Funds (2004–2006). | |

| |

Francis V. Knox, Jr., Born: 1947 | 2005 |

Chief Compliance Officer | |

Vice President and Chief Compliance Officer, John Hancock Investment Management Services, LLC, the Adviser and MFC Global (U.S.) (since 2005); Chief Compliance Officer, John Hancock Funds, John Hancock Funds II, John Hancock Funds III and John Hancock Trust (since 2005); Vice President and Assistant Treasurer, Fidelity Group of Funds (until 2004); Vice President and Ethics & Compliance Officer, Fidelity Investments (until 2001). | |

| |

Michael J. Leary, Born: 1965 | 2007 |

Treasurer | |

Vice President, John Hancock Life Insurance Company (U.S.A.) and Treasurer for John Hancock Funds, John Hancock Funds II, John Hancock Funds III and John Hancock Trust (since May 2009); Assistant Treasurer, John Hancock Funds, John Hancock Funds II, John Hancock Funds III and John Hancock Trust (2007–2009); Vice President and Director of Fund Administration, JP Morgan (2004–2007); Vice President and Senior Manager of Fund Administration, JP Morgan (1993–2004); Manager, Ernst & Young, LLC (1988–1993). | |

| |

Charles A. Rizzo, Born: 1957 | 2007 |

Chief Financial Officer | |

Chief Financial Officer, John Hancock Funds, John Hancock Funds II, John Hancock Funds III and John Hancock Trust (since 2007); Assistant Treasurer, Goldman Sachs Mutual Fund Complex (registered investment companies) (2005– 2007); Vice President, Goldman Sachs (2005–2007); Managing Director and Treasurer of Scudder Funds, Deutsche Asset Management (2003–2005); Director, Tax and Financial Reporting, Deutsche Asset Management (2002–2003); Vice President and Treasurer, Deutsche Global Fund Services (1999–2002). | |

| |

John G. Vrysen, Born: 1955 | 2007 |

Chief Operating Officer (since 2005) | |

Senior Vice President, Manulife Financial Corporation (since 2006); Director, Executive Vice President and Chief Operating Officer, the Adviser, The Berkeley Group, John Hancock Investment Management Services, LLC and John Hancock Funds, LLC (since 2007); Chief Operating Officer, John Hancock Funds, John Hancock Funds II, John Hancock Funds III and John Hancock Trust (since 2007); Director, John Hancock Signature Services, Inc. (since 2005); Chief Financial Officer, the Adviser, The Berkeley Group, Manulife Financial Corporation Global Investment Management (U.S.), LLC, John Hancock Investment Management Services, LLC, John Hancock Funds, LLC, John Hancock Funds, John Hancock Funds II, John Hancock Funds III and John Hancock Trust (2005–2007); Vice President, Manulife Financial Corporation (until 2006). | |

The business address for all Trustees and Officers is 601 Congress Street, Boston, Massachusetts 02210-2805.

The Statement of Additional Information of the Fund includes additional information about members of the Board of Trustees of the Fund and is available without charge, upon request, by calling 1-800-225-5291.

33

Annual report | Lifecycle Retirement

|

Trustees |

James M. Oates, Chairman** |

James R. Boyle† |

Grace K. Fey† |

Charles L. Bardelis* |

Peter S. Burgess* |

Theron S. Hoffman** |

Hassell H. McClellan** |

Steven M. Roberts* |

John D. Richardson, Trustee Emeritus |

*Member of the Audit Committee |

**Member of the Compliance Committee |

†Non-Independent Trustees |

|

Officers |

Hugh McHaffie |

President |

Thomas M. Kinzler |

Secretary and Chief Legal Officer |

Francis V. Knox, Jr. |

Chief Compliance Officer |

Michael J. Leary |

Treasurer |

Charles A. Rizzo |

Chief Financial Officer |

John G. Vrysen |

Chief Operating Officer |

|

Investment adviser |

John Hancock Investment Management Services, LLC |

|

Investment Subadviser |

MFC Global Investment Management (U.S.A.) Limited |

|

Principal distributor |

John Hancock Funds, LLC |

|

Custodian |

State Street Bank and Trust Company |

|

Transfer agent |

John Hancock Signature Services, Inc. |

|

Legal counsel |

K&L Gates LLP |

The Fund’s proxy voting policies and procedures, as well as the Fund’s proxy voting record for the most recent twelve month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) Website at sec.gov or on our Website.

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form3N-Q. The Fund’s Form N-Q is available on our Website and the SEC’s Website, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 to3receive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our Website www.jhfunds.com or by calling 1-800-225-5291.

| | |

You can also contact us: | | |

1-800-225-5291 | Regular mail: | Express mail: |

jhfunds.com | John Hancock Signature Services, Inc. | John Hancock Signature Services, Inc. |

| P.O. Box 9510 | Mutual Fund Image Operations |

| Portsmouth, NH 03802-9510 | 164 Corporate Drive |

| | Portsmouth, NH 03801 |

Month-end portfolio holdings are available at www.jhfunds.com.

Lifecycle Retirement | Annual report

John Hancock Funds II

Annual Report — Table of Contents

Manager’s Commentary and Fund Performance (See below for each Fund’s page #) | | 3 |

Shareholder Expense Examples | | 63 |

Portfolio of Investments (See below for each Fund’s page #) | | 69 |

Statements of Assets and Liabilities | | 376 |

Statements of Operations | | 388 |

Statements of Changes in Net Assets | | 400 |

Notes to Financial Statements | | 422 |

Report of Independent Registered Public Accounting Firm | | 492 |

Evaluation of Advisory and Subadvisory Agreements by the Board of Trustees | | 495 |

Trustees and Officers Information | | 514 |

Fund

| | | | Manager’s Commentary &

Fund Performance | | Portfolio of

Investments |

|---|

| Active Bond Fund | | | | | 4 | | | | 69 | |

| All Cap Core Fund | | | | | 5 | | | | 87 | |

| All Cap Growth Fund | | | | | 6 | | | | 90 | |

| All Cap Value Fund | | | | | 7 | | | | 92 | |

| Alpha Opportunities Fund | | | | | 8 | | | | 94 | |

| Alternative Asset Allocation Fund | | | | | 9 | | | | 99 | |

| American Diversified Growth & Income Portfolio | | | | | 10 | | | | 99 | |

| American Fundamental Holdings Portfolio | | | | | 11 | | | | 99 | |

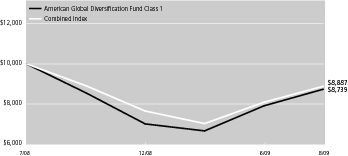

| American Global Diversification Portfolio | | | | | 12 | | | | 100 | |

| Blue Chip Growth Fund | | | | | 13 | | | | 100 | |

| Capital Appreciation Fund | | | | | 14 | | | | 102 | |

| Core Bond Fund | | | | | 15 | | | | 103 | |

| Emerging Markets Value Fund | | | | | 16 | | | | 111 | |

| Emerging Small Company Fund | | | | | 17 | | | | 125 | |

| Equity-Income Fund | | | | | 18 | | | | 127 | |

| Fundamental Value Fund | | | | | 19 | | | | 129 | |

| Global Agribusiness Fund | | | | | 20 | | | | 131 | |

| Global Bond Fund | | | | | 21 | | | | 132 | |

| Global Infrastructure Fund | | | | | 22 | | | | 140 | |

| Global Real Estate Fund | | | | | 23 | | | | 141 | |

| Global Timber Fund | | | | | 24 | | | | 143 | |

| High Income Fund | | | | | 25 | | | | 144 | |

| High Yield Fund | | | | | 26 | | | | 148 | |

| Index 500 Fund | | | | | 27 | | | | 156 | |

| International Equity Index Fund | | | | | 28 | | | | 162 | |

| International Opportunities Fund | | | | | 29 | | | | 180 | |

| International Small Cap Fund | | | | | 30 | | | | 182 | |

| International Small Company Fund | | | | | 31 | | | | 183 | |

| International Value Fund | | | | | 32 | | | | 208 | |

| Investment Quality Bond Fund | | | | | 33 | | | | 209 | |

| Large Cap Fund | | | | | 34 | | | | 220 | |

| Large Cap Value Fund | | | | | 35 | | | | 222 | |

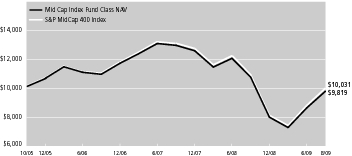

| Mid Cap Index Fund | | | | | 36 | | | | 223 | |

| Mid Cap Stock Fund | | | | | 37 | | | | 229 | |

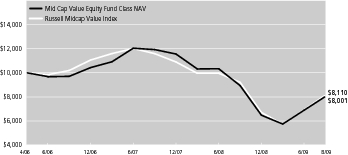

| Mid Cap Value Equity Fund | | | | | 38 | | | | 231 | |

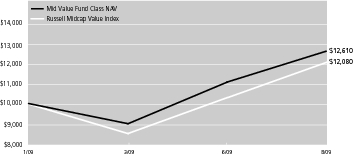

| Mid Value Fund | | | | | 39 | | | | 233 | |

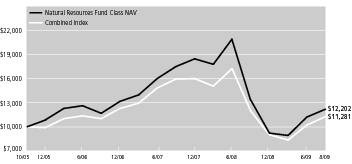

| Natural Resources Fund | | | | | 40 | | | | 236 | |

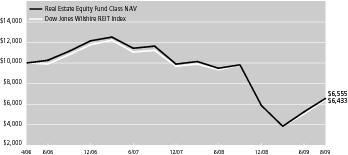

| Real Estate Equity Fund | | | | | 41 | | | | 237 | |

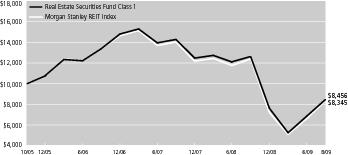

| Real Estate Securities Fund | | | | | 42 | | | | 237 | |

| Real Return Bond Fund | | | | | 43 | | | | 238 | |

| Short Term Government Income Fund | | | | | 44 | | | | 242 | |

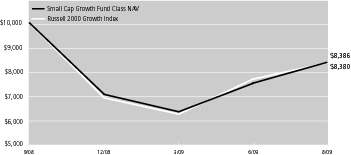

| Small Cap Growth Fund | | | | | 45 | | | | 242 | |

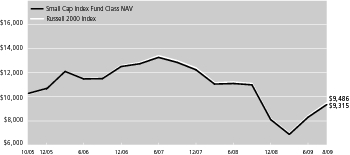

| Small Cap Index Fund | | | | | 46 | | | | 244 | |

| Small Cap Opportunities Fund | | | | | 47 | | | | 263 | |

| Small Cap Value Fund | | | | | 48 | | | | 274 | |

| Small Company Growth Fund | | | | | 49 | | | | 275 | |

| Small Company Value Fund | | | | | 50 | | | | 277 | |

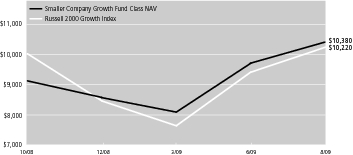

| Smaller Company Growth Fund | | | | | 51 | | | | 280 | |

| Spectrum Income Fund | | | | | 52 | | | | 292 | |

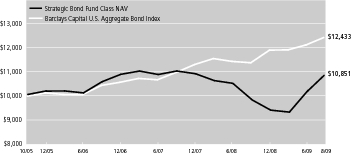

| Strategic Bond Fund | | | | | 53 | | | | 323 | |

| Strategic Income Fund | | | | | 54 | | | | 333 | |

| Total Bond Market Fund | | | | | 55 | | | | 340 | |

| Total Return Fund | | | | | 56 | | | | 348 | |

| U.S. Government Securities Fund | | | | | 57 | | | | 356 | |

| U.S. High Yield Bond Fund | | | | | 58 | | | | 359 | |

| U.S. Multi Sector Fund | | | | | 59 | | | | 365 | |

| Value Fund | | | | | 60 | | | | 370 | |

| Value & Restructuring Fund | | | | | 61 | | | | 371 | |

| Vista Fund | | | | | 62 | | | | 372 | |

2

John Hancock Funds II

Manager’s Commentary and Fund Performance

Fund Performance

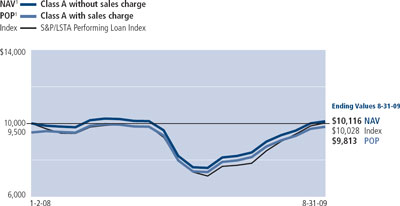

In the following pages we have set forth information regarding the performance of each Fund of the John Hancock Funds II (the Trust). There are several ways to evaluate a Fund’s historical performance. One can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. With respect to all performance information presented, it is important to understand that past performance does not guarantee future results. Return and principal fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Performance Tables

The Performance Tables show two types of total return information: cumulative and average annual total returns. A cumulative total return is an expression of a Fund’s total change in share value in percentage terms over a set period of time — one, five and ten years (or since the Fund’s inception if less than the applicable period). An average annual total return takes the Fund’s cumulative total return for a time period greater than one year and shows what would have happened if the Fund had performed at a constant rate each year. The tables show all cumulative and average annual total returns, net of fees and expenses of the Trust, but do not reflect the insurance (separate account) expenses (including a possible contingent deferred sales charge) that invest in the Fund. If these were included, performance would be lower.

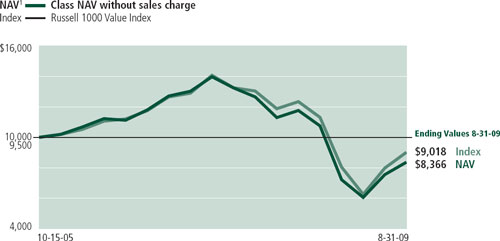

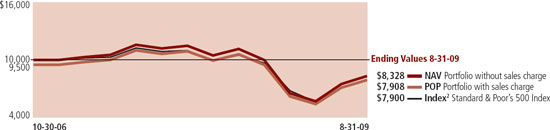

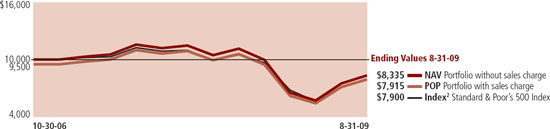

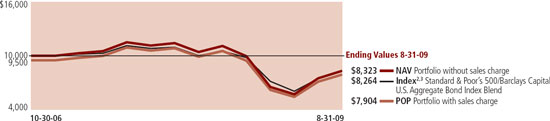

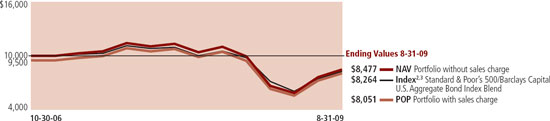

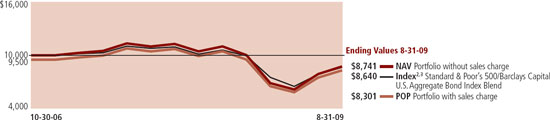

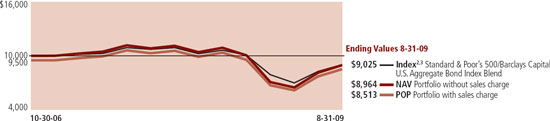

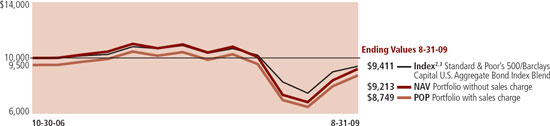

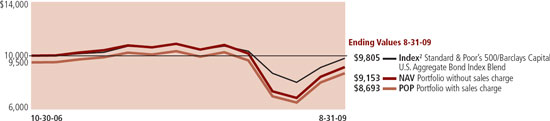

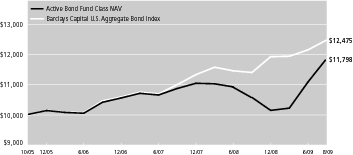

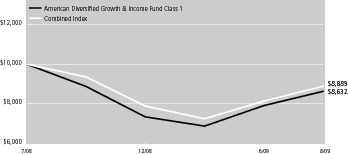

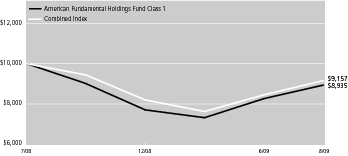

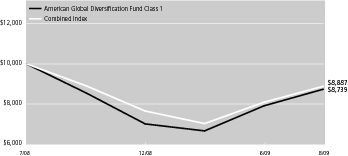

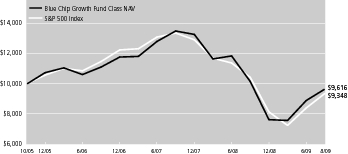

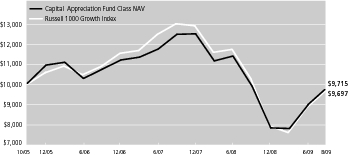

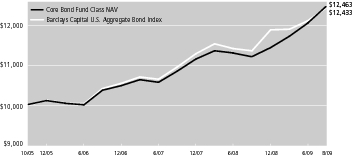

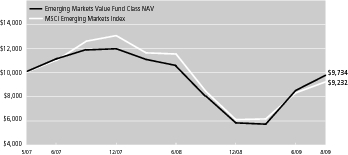

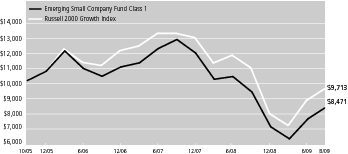

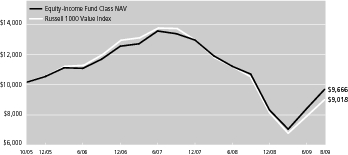

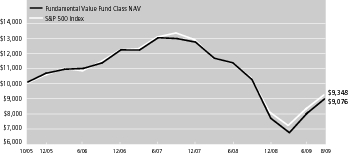

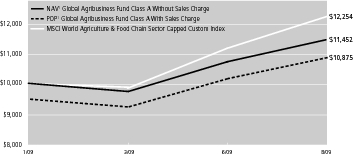

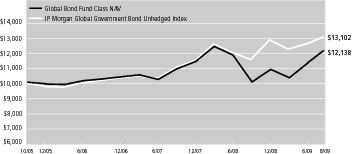

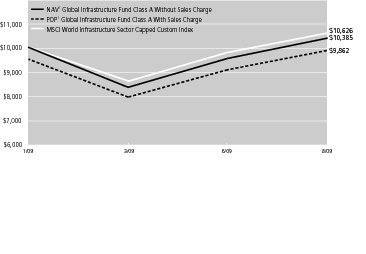

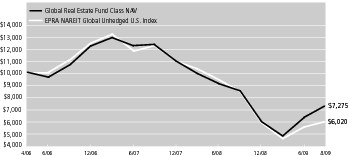

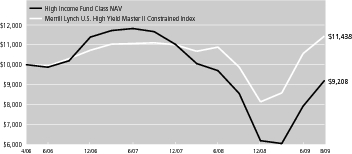

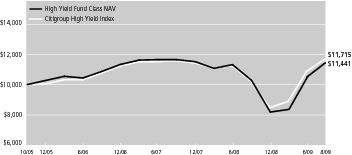

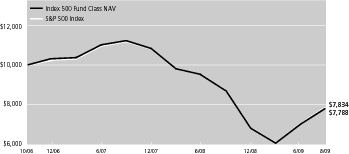

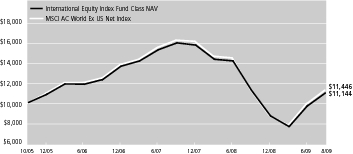

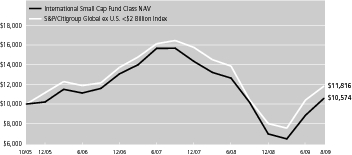

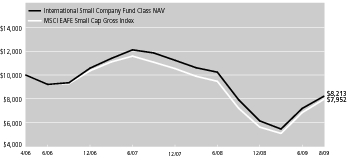

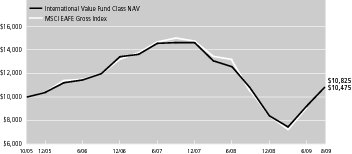

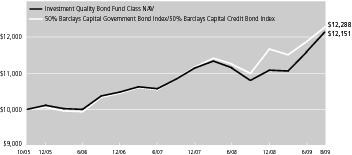

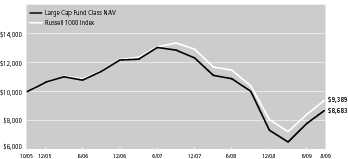

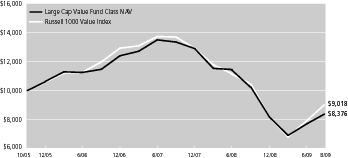

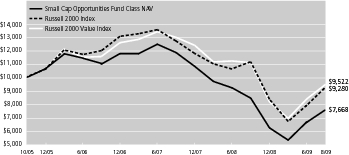

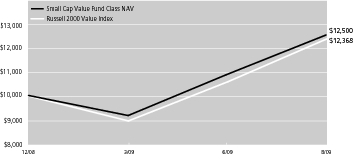

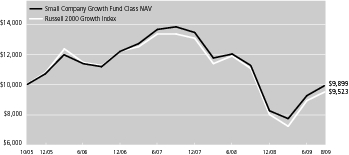

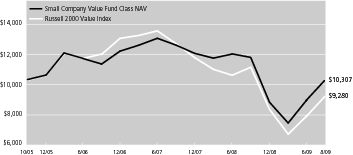

Graph — Change in Value of $10,000 Investment and Comparative Indices

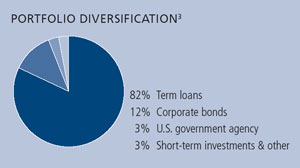

The performance graph for each Fund shows the change in value of a $10,000 investment over the life or ten-year period of each Fund, whichever is shorter. Each Fund’s performance is compared with the performance of one or more broad-based securities indices as a “benchmark.” All performance information includes the reinvestment of dividends and capital gain distributions, as well as the deduction of ongoing management fees and Fund operating expenses. The benchmarks used for comparison are unmanaged and include reinvestment of dividends and capital gains distributions, if any, but do not reflect any fees or expenses. Funds that invest in multiple asset classes are compared with a customized benchmark. This benchmark is comprised of a set percentage allocation from each of the asset classes in which the Fund invests.

Portfolio Manager’s Commentary

Finally, we have provided a commentary by each portfolio manager regarding each Fund’s performance during the period ended August 31, 2009. The views expressed are those of the portfolio manager as of August 31, 2009, and are subject to change based on market and other conditions. Information about a Fund’s holdings, asset allocation or country diversification is historical and is no indication of future fund composition, which will vary. Information provided in this report should not be considered a recommendation to purchase or sell securities. The Funds are not insured by the FDIC, are not a deposit or other obligation of, or guaranteed by banks and are subject to investment risks including loss of principal amount invested. For a more detailed discussion of the risks associated with the Funds, see the Trust prospectus.

“Standard & Poor’s,” “Standard & Poor’s 500,” “S&P 500” and “S&P MidCap 400 Index” are trademarks of The McGraw-Hill Companies, Inc. “Russell 1000,” “Russell 2000,” “Russell 3000” and “Russell Midcap” are trademarks of Frank Russell Company. “Wilshire 5000” is a trademark of Wilshire Associates. “Morgan Stanley European Australian Far East Free”, “EAFE” and “MSCI” are trademarks of Morgan Stanley & Co. Incorporated. “Barclays Capital” is a registered trademark of Barclays Bank PLC. ”Lipper“ is a registered trademark of Reuters S.A. None of the Trusts are sponsored, endorsed, managed, advised, sold or promoted by any of these companies, and none of these companies make any representation regarding the advisability of investing in the Trust.

3

Active Bond Fund

Subadviser: Declaration Management & Research, LLC and MFC Global Investment Management (U.S.), LLC

Portfolio Managers: Peter Farley, James E. Shallcross, Barry Evans, Howard C. Greene and Jeffrey N. Givens

INVESTMENT OBJECTIVE & POLICIES 4 The Fund seeks income and capital appreciation by investing at least 80% of its net assets in a diversified mix of debt securities and instruments.

CHANGE IN VALUE OF $10,000 INVESTMENT AND COMPARATIVE INDICES

Sector Weighting* | % of Total |

Financial | 22.14 |

Federal National Mortgage Association | 20.06 |

Mortgage Securities | 14.85 |

Energy | 7.66 |

Communications | 5.41 |

Utilities | 4.98 |

Consumer, Non-cyclical | 4.70 |

Consumer, Cyclical | 2.79 |

U.S. Treasury Notes | 2.63 |

Industrial | 2.59 |

|

| * | Top Sectors as a percentage of market value. Does not include short-term securities and investments in the John Hancock Collateral

Investment Trust, if applicable. |

PORTFOLIO MANAGERS’ COMMENTARY

Performance 4 For the year ended August 31, 2009, the Active Bond Class NAV returned +8.73%, compared to the +7.94% return of the Barclays Capital U.S. Aggregate Bond Index.

Declaration Commentary:

Market Environment 4 Short-term interest rates fell sharply as the Federal Reserve focused on providing maximum liquidity to combat the financial crisis. Over the course of the year, the market and the economy responded to many historic events: the worst housing market since the Great Depression, the failure of Lehman Brothers, the conservatorship of the Fannie Mae and Freddie Mac, and the bailouts of AIG, Chrysler and General Motors. The government response to the crisis was swift and in most cases effective. The Troubled Asset Relief Program (TARP) stabilized many financial institutions. The Term Asset-Backed Securities Loan Facility (TALF) rejuvenated the market for asset-backed securities and commercial mortgage-backed securities.

The Fed kept the commercial paper market functioning. Equity markets bottomed in March and then recovered half of their losses, finishing down roughly 20% for the 12-month period. The financial crisis has abated now to the point that special Fed liquidity programs are being unwound. It was a very challenging market to navigate, with the credit crisis continuing to unfold and economy shrinking and going through massive job losses, while certain asset classes recovered so strongly that they finished the period at pre-crisis spread levels.

The portfolio outperformed the benchmark as fixed income credit sectors initially sold off, but then rallied later in the period. The portfolio added exposure to corporate credit and commercial mortgage-backed securities at historically wide spread levels, which greatly helped performance. Specifically, adding exposure to bank and finance, insurance and REITS was beneficial. Non-agency mortgage sectors failed to recover fully as the abysmal housing market weighed on performance.

The U.S. economy is expected to transition to a period of sluggish growth from the current recession. Growth will come from business investment, though a rebound in consumer spending is hard to foresee as unemployment remains high. The Fed is expected to leave interest rates on hold until early 2010 though regional reports of recovery are increasing odds of a rate hike. Credit markets have recovered dramatically, though some areas of value remain in corporate bonds and commercial mortgage-backed securities.

MFC Commentary:

Market Environment 4 U.S. bonds posted positive results for the 12-month period despite tremendous market volatility and unprecedented turmoil in the economy and Financial sector. The period began with a severe economic downturn and a liquidity crisis in the credit markets that crippled the financial sector, leading to the bankruptcy or takeover of several major financial institutions. In this environment, Treasury bonds and other high-quality securities posted strong gains amid a substantial flight to quality, while corporate bonds declined sharply as investors shunned riskier securities. In early 2009, however, market conditions changed as the federal government’s efforts to thaw the credit markets, shore up the Financial sector, and stimulate economic growth began to bear fruit. By mid-2009, the U.S. economy was showing signs of stabilization, and liquidity in the credit markets had gradually improved. As a result, bond market leadership shifted — a more positive outlook led to a rally in riskier assets, with corporate bonds posting the best returns, while Treasury securities lagged.

The portfolio’s exposure to corporate bonds hurt performance in the beginning of the period. However, a move to increase corporate bond exposure in late 2008 and early 2009, when corporate bonds were trading at significantly depressed valuations, contributed to the portfolio’s outperformance of its benchmark. At the beginning of the 12-month period, corporate bonds made up about a third of the portfolio, which was low by historical standards. However, as we took advantage of tremendous price dislocations in the corporate bond market, the portfolio’s corporate bond holdings increased to more than half of the portfolio by the end of the period. This strategy proved favorable as corporate bonds outperformed by a substantial margin in the last six months. The fund’s limited exposure to Treasury bonds also added value as these securities underperformed.

We believe that the economy is in a nascent recovery phase that appears to be sustainable, given the enormous amount of federal stimulus in place. However, we expect the recovery to progress at a gradual pace. Despite the rebound in corporate bonds so far in 2009, valuations are comparable to those in late 2002, the peak of the last recession. As a result, we still believe this segment of the bond market is attractively valued.

PERFORMANCE TABLE1

|

|

|

| Average Annual Total Return

|

| Cumulative Total Return

|

|

|---|

Period Ended August 31, 2009 | | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | |

| Active Bond Class 1 (began 10/15/05) | | | | | 8.68 | % | | | — | | | | — | | | | 4.20 | % | | | 8.68 | % | | | — | | | | — | | | | 17.31 | % |

| Active Bond Class NAV (began 10/27/05) | | | | | 8.73 | % | | | — | | | | — | | | | 4.39 | % | | | 8.73 | % | | | — | | | | — | | | | 17.98 | % |

Barclays Capital U.S. Aggregate Bond (10/15/05)2,3,4 | | | | | 7.94 | % | | | — | | | | — | | | | 5.77 | % | | | 7.94 | % | | | — | | | | — | | | | 24.33 | % |

Barclays Capital U.S. Aggregate Bond Index (10/27/05)2,3,4 | | | | | 7.94 | % | | | — | | | | — | | | | 5.92 | % | | | 7.94 | % | | | — | | | | — | | | | 24.75 | % |

| 1 | | Performance does not reflect the deduction of taxes on fund distributions or redemptions of fund shares. Past performance does not predict future performance. |

| 2 | | Since inception returns for the indices may begin on the month-end closest to the actual inception date of the fund. |

| 3 | | Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of dollar-denominated and nonconvertible investment-grade debt issues. |

| 4 | | It is not possible to invest directly in an index. |

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The net expenses equal the gross expenses and are as follows: Class 1 – 0.72% and Class NAV – 0.67%.

4

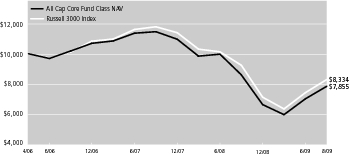

All Cap Core Fund

Subadviser: Deutsche Investment Management Americas Inc.

Portfolio Managers: Robert Wang and James Francis

INVESTMENT OBJECTIVE & POLICIES 4 To seek long-term growth of capital by investing in common stocks and other equity securities within all asset classes primarily in the Russell 3000 Index.

CHANGE IN VALUE OF $10,000 INVESTMENT AND COMPARATIVE INDICES

Sector Weighting* | % of Total |

Consumer, Non-cyclical | 22.06 |

Industrial | 12.16 |

Financial | 11.61 |

Communications | 10.07 |

Energy | 8.70 |

Technology | 7.51 |

Consumer, Cyclical | 5.82 |

Basic Materials | 5.14 |

Utilities | 3.14 |

|

| * | Top Sectors as a percentage of market value. Does not include short-term securities and investments in the John Hancock Collateral

Investment Trust, if applicable. |

PORTFOLIO MANAGERS’ COMMENTARY

Performance 4 For the year ended August 31, 2009, the All Cap Core Class NAV returned –20.07%, compared to the –18.62% return of the Russell 3000 Index.

Market Environment 4 The last 12 months was one of the most extreme periods in recent stock market history. The final four months of 2008 witnessed the collapse of Lehman Brothers and AIG as well as the demise of several major banks including Wachovia and Washington Mutual. 2008 ended on a positive note as the markets rallied in December. However, recovery hopes were dashed after the market swooned in the first quarter. Since March, financial markets have recovered dramatically as it appears the economy is on the mend. The case for recovery has been bolstered by the many Fed-sponsored lending programs that have helped restore liquidity to the market. In addition, several federal programs, including “Cash for Clunkers” and the first-time homebuyer credit, have enticed consumers to resume making big-ticket purchases, a key component of economic growth.

Housing is showing significant improvements as evidenced by the most recent housing report, which showed that new home sales, in line with gains in existing home sales, surged 9.6% in July following an upward revised 9.1% surge in June. The 433,000 annual unit pace is the best since September 2008. The strong sales pulled down new homes on the market to 271,000 versus 280,000 in June and down from 419,000 a year ago. The 271,000 level is the lowest since 1993. Supply at the current sales rate is down to 7.5 months, the lowest level since April 2007 and well down from June’s 8.5 months.

All told, we expect the recovery to continue. However, the levels of growth should be sluggish due to continued job losses and the large amounts of excess productive capacity in the U.S. and around the globe.

The fund underperformed its benchmark during the period. Stocks within the banks, consumer durables and apparel, and materials industry groups contributed most to relative performance. The largest detractors from relative performance were energy, pharmaceuticals and biotechnology, and transportation.

| | | | | | | | | | | | | | | | | | |

|---|

PERFORMANCE TABLE 1

|

|

|

| Average Annual Total Return

|

| Cumulative Total Return

|

|

|---|

Period Ended August 31, 2009 | | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | |

| All Cap Core Class NAV (began 4/28/06) | | | | | –20.07 | % | | | — | | | | — | | | | –6.97 | % | | | –20.07 | % | | | — | | | | — | | | | –21.45 | % |

Russell 3000 Index2,3,4 | | | | | –18.62 | % | | | — | | | | — | | | | –5.31 | % | | | –18.62 | % | | | — | | | | — | | | | –16.66 | % |

| 1 | | Performance does not reflect the deduction of taxes on fund distributions or redemptions of fund shares. Past performance does not predict future performance. |

| 2 | | Since inception returns for the indices may begin on the month-end closest to the actual inception date of the fund. |

| 3 | | Russell 3000 Index is an unmanaged index of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. |

| 4 | | It is not possible to invest directly in an index. |

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. For Class NAV, the net expense equals the gross expense and is 0.80%.

5

All Cap Growth Fund

Subadviser: Invesco AIM Capital Management, Inc.

Portfolio Managers: Robert J. Lloyd & Ryan A. Amerman

INVESTMENT OBJECTIVE & POLICIES 4 To seek long-term capital appreciation by investing the Fund’s assets primarily in common stocks of companies that are believed to benefit from new or innovative products, services or processes as well as those that have experienced above-average, long-term growth in earnings and have excellent prospects for future growth.

CHANGE IN VALUE OF $10,000 INVESTMENT AND COMPARATIVE INDICES

Sector Weighting* | % of Total |

Consumer, Non-cyclical | 26.09 |

Technology | 17.52 |

Industrial | 13.57 |

Consumer, Cyclical | 11.82 |

Communications | 11.04 |

Financial | 6.53 |

Energy | 5.77 |

Basic Materials | 2.70 |

|

| * | Top Sectors as a percentage of market value. Does not include short-term securities and investments in the John Hancock Collateral

Investment Trust, if applicable. |

PORTFOLIO MANAGERS’ COMMENTARY

Performance 4 For the year ended August 31, 2009, the All Cap Growth Class 1 returned –23.94%, compared to the –17.17% return of the Russell 3000 Growth Index.

Market Environment 4 Major U.S. equity markets fell by double digits during the period, as significant problems in the credit markets, weakness in the housing market, rising energy and food prices and a deteriorating outlook for corporate earnings led to a global economic recession. However, global equity markets began to recover some of these losses in early March 2009.

The Fund’s key detractors from relative results versus its benchmark included Energy, Industrials and Materials, driven largely by poor stock selection and an overweight position in late 2008, when many stocks in these sectors were battered by the global economic slowdown. Underperformance in the Information Technology and Consumer Discretionary sectors was driven by stock selection and an underweight position in early 2009 when many stocks in these sectors rallied as the market began to rebound.

Among the Fund’s key contributors to relative performance were Telecommunications and Utilities, driven primarily by good stock selection. Outperformance in the Financials sector was due to stock selection and an underweight position when many of these stocks had weak performance because of the credit crisis.

Early in the period, the portfolio had significant exposure to sectors benefiting from global economic expansion and development, including Energy, Materials and Industrials. During the fourth quarter of 2008, we repositioned the portfolio for an economic recession. We significantly reduced the Fund’s exposure to the Energy, Materials and Industrials sectors, and built overweight positions in more defensive sectors such as Health Care and Consumer Staples. This defensive positioning aided performance as the stock market faltered through early 2009. However, when the market began to recover in March, this defensive positioning hurt performance. We began to reposition the portfolio in April, as the economy showed signs of stabilizing and we identified companies with the potential for sustainable earnings growth in a more stable economic environment. This repositioning included a reduction in the more defensive Health Care and Consumer Staples sectors, and a significant increase in the more economically sensitive sectors, including Information Technology and Consumer Discretionary.

| | | | | | | | | | | | | | | | | | |

|---|

PERFORMANCE TABLE 1

|

|

|

| Average Annual Total Return

|

| Cumulative Total Return

|

|

|---|

Period Ended August 31, 2009 | | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | |

| All Cap Growth Class 1 (began 10/15/05) | | | | | –23.94 | % | | | — | | | | — | | | | –5.10 | % | | | –23.94 | % | | | — | | | | — | | | | –18.37 | % |

Russell 3000 Growth Index2,3,4 | | | | | –17.17 | % | | | — | | | | — | | | | –0.78 | % | | | –17.17 | % | | | — | | | | — | | | | –2.97 | % |

| 1 | | Performance does not reflect the deduction of taxes on fund distributions or redemptions of fund shares. Past performance does not predict future performance. |

| 2 | | Since inception returns for the indices may begin on the month-end closest to the actual inception date of the fund. |

| 3 | | Russell 3000 Growth Index is an unmanaged index that measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The stocks in this index are also members of either the Russell 1000 Growth or the Russell 2000 Growth indexes. |

| 4 | | It is not possible to invest directly in an index. |

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. For Class 1, the net expense equals the gross expense and is 0.98%.

6

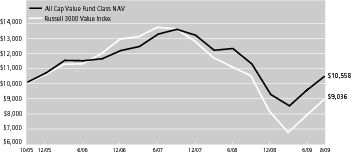

All Cap Value Fund

Subadviser: Lord, Abbett & Co. LLC

Portfolio Managers: Robert P. Fetch and Deepak Khana

INVESTMENT OBJECTIVE & POLICIES 4 To seek capital appreciation by investing in equity securities of U.S. and multinational companies in all capitalization ranges that are believed to be undervalued.

CHANGE IN VALUE OF $10,000 INVESTMENT AND COMPARATIVE INDICES

Sector Weighting* | % of Total |

Financial | 21.84 |

Consumer, Non-cyclical | 19.96 |

Industrial | 14.41 |

Consumer, Cyclical | 13.70 |

Energy | 10.28 |

Technology | 5.35 |

Basic Materials | 3.77 |

Communications | 1.61 |

|

| * | Top Sectors as a percentage of market value. Does not include short-term securities and investments in the John Hancock Collateral

Investment Trust, if applicable. |

PORTFOLIO MANAGERS’ COMMENTARY

Performance 4 For the year ended August 31, 2009, the All Cap Value Class NAV returned –14.34%, compared to the –20.30% return of the Russell 3000 Value Index.

Market Environment 4 The U.S. suffered a substantial slowdown in economic activity during the later half of 2008, marked by continuing weak housing prices, banks reluctant to lend money and a slowing job market. As we moved through 2009, however, we began to see early evidence of a bottoming in overall economic activity.

During the period, large-, mid- and small-cap stocks within the Russell 3000 Value Index all declined by double digits. Within Morningstar’s market capitalization definitions, the portfolio’s weighting in large-cap stocks at period end was 56.5% versus 69.7% for the benchmark. Exposure to mid-cap stocks was 38.3% versus 20.8%, and the small-cap allocation was 3.8% versus 9.5% for the portfolio and benchmark, respectively.

Health Care was the portfolio’s best contributing sector relative to the benchmark Index. Stock selection within the Consumer Staples sector also aided relative performance. An agricultural processor rose sharply in the poor stock market environment of late 2008 following a September quarter earnings result that far surpassed analysts’ expectations. Fears of a margin squeeze evaporated as corn prices fell dramatically in the second half of 2008.

Stock selection within the Energy sector was the largest detractor from performance. Stock selection within Technology also hurt relative performance somewhat.

| | | | | | | | | | | | | | | | | | |

|---|

PERFORMANCE TABLE 1

|

|

|

| Average Annual Total Return

|

| Cumulative Total Return

|

|

|---|

Period Ended August 31, 2009 | | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | | | | 1-year | | | | 5-year | | | | 10-year | | | | Since

inception | |

| All Cap Value Class 1 (began 10/15/05) | | | | | –14.42 | % | | | — | | | | — | | | | 1.36 | % | | | –14.42 | % | | | — | | | | — | | | | 5.40 | % |

| All Cap Value Class NAV (began 10/15/05) | | | | | –14.34 | % | | | — | | | | — | | | | 1.41 | % | | | –14.34 | % | | | — | | | | — | | | | 5.58 | % |

Russell 3000 Value Index2,3,4 | | | | | –20.30 | % | | | — | | | | — | | | | –2.58 | % | | | –20.30 | % | | | — | | | | — | | | | –9.64 | % |

| 1 | | Performance does not reflect the deduction of taxes on fund distributions or redemptions of fund shares. Past performance does not predict future performance. |

| 2 | | Since inception returns for the indices may begin on the month-end closest to the actual inception date of the fund. |

| 3 | | Russell 3000 Value Index is an unmanaged index that measures the performance of those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. The stocks in this index are also members of either the Russell 1000 Value or Russell 2000 Value indices. |

| 4 | | It is not possible to invest directly in an index. |

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The net expenses equal the gross expenses and are as follows: Class 1 – 0.97% and Class NAV – 0.92%.

7

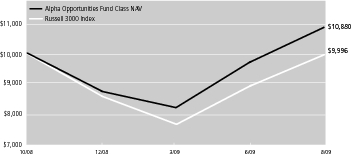

Alpha Opportunities Fund

Subadviser: Wellington Management Company, LLP

Portfolio Managers: Kent Stahl, CFA and Gregg Thomas, CFA

INVESTMENT OBJECTIVE & POLICIES 4 To seek long-term total return by employing a “multiple sleeve structure” which means the Fund has several components that are managed separately in different investment styles. The Fund seeks to obtain its objective by combining these different components into a single fund. For purposes of the Fund, “total return” means growth of capital and investment income (dividends and interest).

CHANGE IN VALUE OF $10,000 INVESTMENT AND COMPARATIVE INDICES

Sector Weighting* | % of Total |

Consumer, Non-cyclical | 16.61 |

Financial | 15.15 |

Consumer, Cyclical | 10.91 |

Industrial | 10.38 |

Technology | 10.06 |

Energy | 9.86 |

Communications | 7.82 |

Basic Materials | 5.43 |

Investment Companies | 1.14 |

Utilities | 0.32 |

|

| * | Top Sectors as a percentage of market value. Does not include short-term securities and investments in the John Hancock Collateral

Investment Trust, if applicable. |

PORTFOLIO MANAGERS’ COMMENTARY

Performance 4 From its inception on October 7, 2008 to August 31, 2009, the Alpha Opportunities Class NAV returned +8.80%, compared to the –0.04% return of the Russell 3000 Index.