| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT |

| COMPANIES |

| Investment Company Act file number 811-21779 |

| |

| JOHN HANCOCK FUNDS II |

| --------------------------------------------------------- |

| (Exact name of registrant as specified in charter) |

| |

| 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------- |

| (Address of principal executive offices) (Zip code) |

| |

| MICHAEL J. LEARY, 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------------------------------------ |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (617) 663-4490 |

| -------------- |

| Date of fiscal year end: 7/31 |

| ------ | |

| |

| Date of reporting period: 7/31/10 |

| ------- | |

| |

| ITEM 1. REPORTS TO STOCKHOLDERS. |

The Registrant prepared three annual reports to shareholders for the year ended July 31, 2010 for series of John Hancock Funds with July 31 fiscal year end. The first report applies to the Technical Opportunities Fund, the second report applies to the Global High Yield Fund and the third report applies to Multi Sector Bond Fund. All three funds began operations during the fiscal year ended July 31, 2010.

Management’s discussion of

Fund performance

By Wellington Management Company, LLP

Global equities rallied in 2009 and throughout the early part of 2010 against a strengthening economic backdrop. During the period ended July 31, 2010, the U.S. economy showed signs of life as it emerged from a deep and difficult recession. Markets reacted to the momentum and trended positive. The positive trend eroded toward the end of the period, shifting from a reflection of hopeful optimism early in the period to one of cautious fear as concerns about a global growth slowdown resurfaced. Sovereign debt and solvency troubles in the Eurozone, slowing economic expansion in China and the U.S., and uncertainty about the sustainability of corporate earnings growth combined to send global equities down later in the period.

For the 12 months ended July 31, 2010, the Fund’s Class A shares returned –1.40% at net asset value, underperforming both the 11.61% return of the MSCI All Country World Index and the 11.40% average return of its Morningstar, Inc. world stock fund peer group. Stock selection in the energy, materials, financials and industrials sectors drove underperformance during the period. An overweight to cash in periods when the market rallied also caused the Fund to lag its benchmark index. Detractors from absolute results included energy and mining company PT Bumi Resources and oil and gas production company Sandridge Energy. We bought PT Bumi given the stock’s ability to respond positively to important price supports. After the trend broke down toward the end of the period, our sell discipline had us exit the stock. After establishing a period of stability, Sandridge Energy tracked sideways for several months then broke down. We sold the stock at the end of 2009. The biggest contributions came from the information technology sector. Top performers included server virtualization software leader VMware, Inc. and consumer electronics company Apple, Inc. Earlier in 2009, VMware had emerged from a period of stability into a positive trend that continued throughout the period. With the launch of the iPad and iPhone 4, Apple’s stock price has maintained a positive trend structure.

This commentary reflects the views of the portfolio manager through the end of the Fund’s period discussed in this report. The manager’s statements reflect his own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting. These risks are more significant in emerging markets. Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors. The Fund is non-diversified, which generally means that it may invest a greater percentage of its total assets in the securities of fewer issuers than a diversified fund. As a result, credit, market and other risks associated with the Fund’s investment strategies or techniques may be more pronounced for the Fund than for funds that are diversified.

| |

| 6 | Technical Opportunities Fund | Annual report |

A look at performance

For the period ended July 31, 2010

| | | | | | | | | |

| | Average annual returns (%) | | | Cumulative total returns (%) | |

| | with maximum sales charge (POP) | | | with maximum sales charge (POP) | |

| |

|

| | | | | Since | | | | | Since |

| | 1-year | 5-year | 10-year | inception1 | | 1-year | 5-year | 10-year | inception1 |

|

| Class A | –6.36 | — | — | –6.36 | | –6.36 | — | — | –6.36 |

|

| Class I2 | –1.10 | — | — | –1.10 | | –1.10 | — | — | –1.10 |

|

| Class NAV2 | –1.00 | — | — | –1.00 | | –1.00 | — | — | –1.00 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 5.00%.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual for Class A. The net expenses are as follows: Class A — 2.05%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 2.28%. For the other classes, the net expenses equal the gross expenses and are as follows: Class I — 1.50% and Class NAV — 1.40%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

1 From 8-3-09.

2 For certain types of investors, as described in the Fund’s Class I and Class NAV shares prospectuses.

| |

| Annual report | Technical Opportunities Fund | 7 |

A look at performance

Growth of $10,000

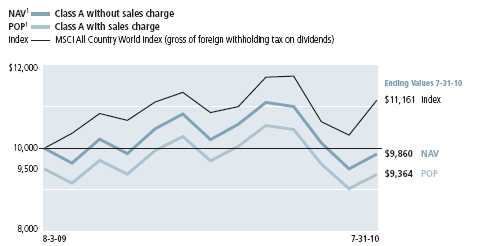

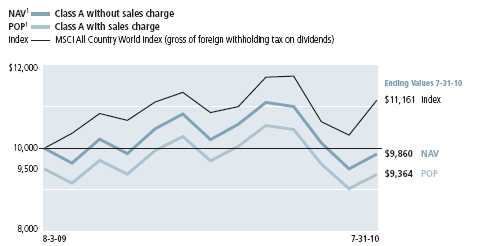

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Technical Opportunities Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the MSCI All Country World Index.

| | | | |

| | | | With maximum | |

| | Period beginning | Without sales charge | sales charge | Index |

|

| Class I2,3 | 8-3-09 | $9,890 | $9,890 | $11,161 |

|

| Class NAV2,3 | 8-3-09 | 9,900 | 9,900 | 11,161 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class I and Class NAV shares, respectively, as of 7-31-10.

MSCI All Country World Index (gross of foreign withholding tax on dividends) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

It is not possible to invest directly in an index. Index figures do not reflect expenses, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charges applicable.

3 For certain types of investors, as described in the Fund’s Class I and Class NAV shares prospectuses.

| |

| 8 | Technical Opportunities Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on February 1, 2010 with the same investment held until July 31, 2010.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 2-1-10 | on 7-31-10 | period ended 7-31-101 |

|

| Class A | $1,000.00 | $965.70 | $9.11 |

|

| Class I | 1,000.00 | 966.80 | 7.36 |

|

| Class NAV | 1,000.00 | 966.80 | 6.68 |

|

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at July 31, 2010, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | Technical Opportunities Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on February 1, 2010, with the same investment held until July 31, 2010. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 2-1-10 | on 7-31-10 | period ended 7-31-101 |

|

| Class A | $1,000.00 | $1,015.50 | $9.35 |

|

| Class I | 1,000.00 | 1,017.30 | 7.55 |

|

| Class NAV | 1,000.00 | 1,018.00 | 6.85 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.87%, 1.51% and 1.37% for Class A, Class I and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| |

| 10 | Technical Opportunities Fund | Annual report |

Portfolio summary

| | | | |

| Top 10 Holdings1 | | | | |

|

| EMC Corp. | 2.9% | | Eli Lilly & Company | 2.5% |

| |

|

| Xilinx, Inc. | 2.9% | | Bristol-Myers Squibb Company | 2.5% |

| |

|

| Baidu, Inc. | 2.8% | | Salesforce.com, Inc. | 2.4% |

| |

|

| Broadcom Corp., Class A | 2.8% | | American Tower Corp., Class A | 2.2% |

| |

|

| NetApp, Inc. | 2.5% | | Apple, Inc. | 2.0% |

| |

|

| |

| Sector Composition2,3,4 | | | | |

|

| Information Technology | 39% | | Consumer Staples | 4% |

| |

|

| Consumer Discretionary | 12% | | Financials | 3% |

| |

|

| Industrials | 7% | | Energy | 2% |

| |

|

| Health Care | 6% | | Materials | 1% |

| |

|

| Telecommunication Services | 5% | | Short-Term Investments & Other | 21% |

| |

|

| |

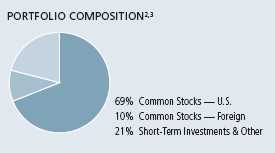

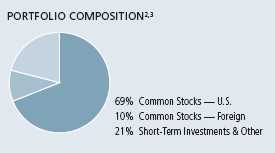

| Country Composition2,3 | | | | |

|

| United States | 69% | | Hong Kong | 1% |

| |

|

| China | 4% | | Argentina | 1% |

| |

|

| South Korea | 2% | | Indonesia | 1% |

| |

|

| Mexico | 1% | | Short-Term Investments & Other | 21% |

| |

|

1 As a percentage of net assets on 7-31-10. Excludes cash and cash equivalents.

2 As a percentage of net assets on 7-31-10.

3 International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting. Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

4 The Fund may invest up to 100% of its assets in cash.

| |

| Annual report | Technical Opportunities Fund | 11 |

Fund’s investments

As of 7-31-10

| | |

| | Shares | Value |

|

| Common Stocks 79.16% | | $469,009,554 |

|

| (Cost $435,471,129) | | |

| | |

| Consumer Discretionary 11.86% | | 70,281,993 |

| | |

| Auto Components 1.74% | | |

|

| Cooper Tire & Rubber Company (L) | 55,500 | 1,199,355 |

|

| TRW Automotive Holdings Corp. (I) | 258,800 | 9,081,292 |

| | | |

| Automobiles 1.03% | | |

|

| Ford Motor Company (I)(L) | 478,400 | 6,109,168 |

| | | |

| Hotels, Restaurants & Leisure 3.95% | | |

|

| Las Vegas Sands Corp. (I)(L) | 316,500 | 8,501,190 |

|

| Starbucks Corp. (L) | 207,800 | 5,163,830 |

|

| Starwood Hotels & Resorts Worldwide, Inc. | 60,700 | 2,940,915 |

|

| Wendy’s/Arby’s Group, Inc., Class A | 1,563,211 | 6,815,600 |

| | | |

| Media 3.39% | | |

|

| CBS Corp., Class B | 107,900 | 1,594,762 |

|

| Comcast Corp., Class A | 382,000 | 7,437,540 |

|

| Time Warner Cable, Inc. | 75,300 | 4,304,901 |

|

| Virgin Media, Inc. (L) | 313,300 | 6,745,349 |

| | | |

| Textiles, Apparel & Luxury Goods 1.75% | | |

|

| Under Armour, Inc., Class A (I)(L) | 133,400 | 5,010,504 |

|

| XTEP International Holdings | 7,493,500 | 5,377,587 |

| | | |

| Consumer Staples 4.11% | | 24,326,645 |

| | | |

| Beverages 0.95% | | |

|

| Dr. Pepper Snapple Group, Inc. | 149,700 | 5,621,235 |

| | | |

| Food Products 0.41% | | |

|

| The J.M. Smucker Company | 5,300 | 325,579 |

|

| Tingyi (Cayman Islands) Holding Corp. | 822,000 | 2,095,469 |

| | | |

| Household Products 0.99% | | |

|

| Clorox Company | 90,400 | 5,865,152 |

| | | |

| Tobacco 1.76% | | |

|

| Altria Group, Inc. | 345,200 | 7,649,632 |

|

| Reynolds American, Inc. | 47,900 | 2,769,578 |

| | | |

| Energy 1.52% | | 9,028,610 |

| | | |

| Energy Equipment & Services 0.39% | | |

|

| CARBO Ceramics, Inc. | 29,300 | 2,349,860 |

| | | |

| Oil, Gas & Consumable Fuels 1.13% | | |

|

| EOG Resources, Inc. | 68,500 | 6,678,750 |

| | |

| 12 | Technical Opportunities Fund | Annual report | See notes to financial statements |

| | |

| | Shares | Value |

| Financials 3.54% | | $20,969,158 |

|

| Commercial Banks 0.55% | | |

|

| Bank Rakyat Indonesia Tbk PT | 2,949,000 | 3,257,408 |

| | | |

| Real Estate Investment Trusts 2.99% | | |

|

| AvalonBay Communities, Inc. | 27,600 | 2,900,484 |

|

| HCP, Inc. (L) | 167,200 | 5,930,584 |

|

| Ventas, Inc. (L) | 116,500 | 5,908,880 |

|

| Vornado Realty Trust | 35,900 | 2,971,802 |

| | | |

| Health Care 6.30% | | 37,304,810 |

| | | |

| Life Sciences Tools & Services 0.40% | | |

|

| Pharmaceutical Product Development, Inc. | 97,900 | 2,375,054 |

| | | |

| Pharmaceuticals 5.90% | | |

|

| Allergan, Inc. | 82,600 | 5,043,556 |

|

| Bristol-Myers Squibb Company | 599,000 | 14,927,080 |

|

| Eli Lilly & Company | 420,200 | 14,959,120 |

| | | |

| Industrials 6.87% | | 40,712,054 |

| | | |

| Aerospace & Defense 2.30% | | |

|

| BE Aerospace, Inc. (I) | 192,000 | 5,644,800 |

|

| Cubic Corp. | 197,501 | 8,002,741 |

| | | |

| Airlines 1.36% | | |

|

| US Airways Group, Inc. (I)(L) | 742,600 | 8,057,210 |

| | | |

| Commercial Services & Supplies 1.01% | | |

|

| Republic Services, Inc. | 187,500 | 5,973,750 |

| | | |

| Industrial Conglomerates 0.92% | | |

|

| Beijing Enterprises Holdings, Ltd. | 829,000 | 5,474,505 |

| | | |

| Machinery 1.28% | | |

|

| Deere & Company | 91,800 | 6,121,224 |

|

| Pall Corp. | 37,600 | 1,437,824 |

| | | |

| Information Technology 38.69% | | 229,225,014 |

| | | |

| Communications Equipment 3.25% | | |

|

| F5 Networks, Inc. (I)(L) | 137,000 | 12,032,710 |

|

| Riverbed Technology, Inc. (I)(L) | 194,237 | 7,204,250 |

| | | |

| Computers & Peripherals 8.58% | | |

|

| Apple, Inc. (I) | 47,100 | 12,116,475 |

|

| EMC Corp. (I) | 879,300 | 17,401,347 |

|

| NetApp, Inc. (I)(L) | 356,000 | 15,058,800 |

|

| SanDisk Corp. (I) | 143,300 | 6,262,210 |

| | | |

| Electronic Equipment, Instruments & Components 1.42% | | |

|

| National Instruments Corp. | 27,300 | 870,870 |

|

| Samsung SDI Company, Ltd. | 52,852 | 7,571,014 |

| | | |

| Internet Software & Services 3.77% | | |

|

| Alibaba.com, Ltd. | 511,000 | 1,055,183 |

|

| Baidu, Inc., SADR (I) | 205,300 | 16,713,473 |

|

| MercadoLibre, Inc. (I)(L) | 75,400 | 4,561,700 |

| | | |

| IT Services 1.72% | | |

|

| Cognizant Technology Solutions Corp., Class A (I) | 186,900 | 10,197,264 |

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 13 |

| | |

| | Shares | Value |

| Semiconductors & Semiconductor Equipment 13.14% | | |

|

| Broadcom Corp., Class A | 453,000 | $16,321,590 |

|

| Cavium Networks, Inc. (I)(L) | 191,800 | 5,145,994 |

|

| Cree, Inc. (I)(L) | 126,000 | 8,925,840 |

|

| Netlogic Microsystems, Inc. (I) | 134,600 | 3,978,776 |

|

| OmniVision Technologies, Inc. (I)(L) | 478,900 | 10,684,259 |

|

| Samsung Electronics Company, Ltd. | 6,928 | 4,754,940 |

|

| Skyworks Solutions, Inc. (I)(L) | 631,500 | 11,070,195 |

|

| Xilinx, Inc. (L) | 607,400 | 16,958,608 |

| | | |

| Software 6.81% | | |

|

| Citrix Systems, Inc. (I) | 163,700 | 9,006,774 |

|

| Rovi Corp. (I) | 177,700 | 7,907,650 |

|

| Salesforce.com, Inc. (I)(L) | 142,400 | 14,090,480 |

|

| VMware, Inc., Class A (I)(L) | 120,400 | 9,334,612 |

| | | |

| Materials 1.02% | | 6,056,315 |

| | | |

| Chemicals 1.02% | | |

|

| The Mosaic Company | 127,100 | 6,056,315 |

| | | |

| Telecommunication Services 5.25% | | 31,104,955 |

| | | |

| Wireless Telecommunication Services 5.25% | | |

|

| America Movil SAB de CV, Series L, ADR | 173,900 | 8,627,179 |

|

| American Tower Corp., Class A (I) | 279,600 | 12,928,704 |

|

| Crown Castle International Corp. (I) | 149,200 | 5,894,892 |

|

| SBA Communications Corp., Class A (I) | 101,000 | 3,654,180 |

| | Par value | Value |

| |

| Short-Term Investments 39.08% | | $231,557,292 |

|

| (Cost $231,531,433) | | |

| | | |

| Repurchase Agreement 23.63% | | 140,000,000 |

| Bank of America Tri-Party Repurchase Agreement dated 7-30-10 at | | |

| 0.210% to be repurchased at $69,501,216 on 8-2-10, collateralized by | | |

| $181,429,255 Federal National Mortgage Association, 5.713%–5.864% | | |

| due 8-01-37 – 11-01-37 (valued at $69,806,824, including interest) | $69,500,000 | 69,500,000 |

|

| BNP Paribas Tri-Party Repurchase Agreement dated 7-30-10 at 0.210% to | | |

| be repurchased at $70,501,234 on 8-2-10, collateralized by $81,317,645 | | |

| Federal National Mortgage Association, 3.500%–7.500% due 12-1-17 – | | |

| 6-1-48 (valued at $51,624,618 including interest), $45,879,234 Federal | | |

| Home Loan Mortgage Corp., 4.000%–7.000% due 4-1-18 – 7-1-40 | | |

| (valued at $17,435,406 including interest) and $1,643,677 Government | | |

| National Mortgage Association, 5.750% due 10-15-50 (valued at | | |

| $1,721,583, including interest) | 70,500,000 | 70,500,000 |

| | | |

| Securities Lending Collateral 15.45% | | 91,557,292 |

| | | |

| John Hancock Collateral Investment Trust, 0.3385% (W)(Y) | 9,146,217 | 91,557,292 |

| |

| Total investments (Cost $667,002,562)† 118.24% | | $700,566,846 |

|

| Other assets and liabilities, net (18.24%) | | ($108,084,707) |

|

| Total net assets 100.00% | | $592,482,139 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

| | |

| 14 | Technical Opportunities Fund | Annual report | See notes to financial statements |

Notes to Schedule of Investments

ADR American Depositary Receipts

SADR Sponsored American Depositary Receipts

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of 7-31-10.

(W) Investment is an affiliate of the Fund, the adviser and/or subadviser. Also, it represents the investment of securities lending collateral received.

(Y) The rate shown is the annualized seven-day yield as of 7-31-10.

† At 7-31-10, the aggregate cost of investment securities for federal income tax purposes was $672,799,677. Net unrealized appreciation aggregated $27,767,169, of which $38,696,785 related to appreciated investment securities and $10,929,616 related to depreciated investment securities.

The Fund had the following country concentration as a percentage of net assets on 7-31-10:

| | | |

| United States | 69% | | |

| China | 4% | | |

| South Korea | 2% | | |

| Mexico | 1% | | |

| Hong Kong | 1% | | |

| Argentina | 1% | | |

| Indonesia | 1% | | |

| Short-Term Investments & Other | 21% | | |

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 7-31-10

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $435,471,129) including | |

| $89,240,839 of securities loaned (Note 2) | $469,009,554 |

| Investments in affiliated issuers, at value (Cost $91,531,433) (Note 2) | 91,557,292 |

| Repurchase agreements, at value (Cost $140,000,000) (Note 2) | 140,000,000 |

| | |

| Total investments, at value (Cost $667,002,562) | 700,566,846 |

| Cash | 58,459 |

| Receivable for investments sold | 18,793,189 |

| Receivable for fund shares sold | 1,394,382 |

| Dividends and interest receivable | 60,697 |

| Receivable for securities lending income | 23,017 |

| Other receivables and prepaid assets | 57,970 |

| | |

| Total assets | 720,954,560 |

| |

| Liabilities | |

|

| Payable for investments purchased | 36,262,588 |

| Payable for fund shares repurchased | 509,481 |

| Payable upon return of securities loaned (Note 2) | 91,554,178 |

| Payable to affiliates | |

| Accounting and legal services fees | 8,498 |

| Transfer agent fees | 32,839 |

| Trustees’ fees | 205 |

| Other liabilities and accrued expenses | 104,632 |

| | |

| Total liabilities | 128,472,421 |

|

| Net assets | |

|

| Capital paid-in | $608,841,124 |

| Accumulated net realized loss on investments and foreign | |

| currency transactions | (49,923,135) |

| Net unrealized appreciation (depreciation) on investments and translation | |

| of assets and liabilities in foreign currencies | 33,564,150 |

| | |

| Net assets | $592,482,139 |

|

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($164,732,297 ÷ 16,711,324 shares) | $9.86 |

| Class I ($79,242,237 ÷ 8,008,894 shares) | $9.89 |

| Class NAV ($348,507,605 ÷ 35,185,499 shares) | $9.90 |

|

| Maximum offering price per share | |

| Class A (net asset value per share ÷ 95%)1 | $10.38 |

1 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| | |

| 16 | Technical Opportunities Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T SStatement of operations For the period ended 7-31-101

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $3,142,758 |

| Interest | 125,794 |

| Securities lending | 89,387 |

| Less foreign taxes withheld | (58,465) |

| |

| Total investment income | 3,299,474 |

| |

| Expenses | |

|

| Investment management fees (Note 4) | 6,632,512 |

| Distribution and service fees (Note 4) | 374,516 |

| Accounting and legal services fees (Note 4) | 73,652 |

| Transfer agent fees (Note 4) | 270,840 |

| Trustees’ fees (Note 4) | 5,020 |

| State registration fees (Note 4) | 23,503 |

| Printing and postage fees (Note 4) | 10,677 |

| Professional fees | 44,066 |

| Custodian fees | 194,299 |

| Registration and filing fees | 10,300 |

| Other | 6,087 |

| | |

| Total expenses | 7,645,472 |

| Less expense reductions and amounts recaptured (Note 4) | (5,857) |

| | |

| Net expenses | 7,639,615 |

| | |

| Net investment loss | (4,340,141) |

|

| Realized and unrealized gain (loss) | |

|

| Net realized loss on | |

| Investments in unaffiliated issuers | (49,900,390) |

| Investments in affiliated issuers | (22,745) |

| Foreign currency transactions | (86,663) |

| | (50,009,798) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 33,538,425 |

| Investments in affiliated issuers | 25,859 |

| Translation of assets and liabilities in foreign currencies | (134) |

| | 33,564,150 |

| Net realized and unrealized loss | (16,445,648) |

| | |

| Decrease in net assets from operations | ($20,785,789) |

1 Period from 8-3-09 (inception date) to 7-31-10.

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 17 |

F I N A N C I A L S T A T E M E N T SStatement of changes in net assets

This Statement of Changes in Net Assets shows how the value of the Fund’s net assets has changed during the period.

| |

| | Period |

| | ended |

| | 7-31-101 |

|

| Increase (decrease) in net assets | |

|

| From operations | |

| Net investment loss | ($4,340,141) |

| Net realized loss | (50,009,798) |

| Change in net unrealized appreciation (depreciation) | 33,564,150 |

| |

| Decrease in net assets resulting from operations | (20,785,789) |

| |

| From Fund share transactions (Note 5) | 613,267,928 |

| |

| Total increase | 592,482,139 |

| |

| Net assets | |

|

| Beginning of period | — |

| |

| End of period | $592,482,139 |

1 Period from 8-3-09 (inception date) to 7-31-10.

| | |

| 18 | Technical Opportunities Fund | Annual report | See notes to financial statements |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the beginning of the period.

| |

| CLASS A SHARES Period ended | 7-31-101 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $10.00 |

| Net investment loss2 | (0.13) |

| Net realized and unrealized loss on investments | (0.01) |

| Total from investment operations | (0.14) |

| Net asset value, end of period | $9.86 |

| Total return (%)3,4 | (1.40)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $165 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions and amounts recaptured | 1.876 |

| Expenses including reductions and amounts recaptured | 1.876 |

| Net investment loss | (1.23)6 |

| Portfolio turnover (%) | 389 |

| |

1 Period from 8-3-09 (inception date) to 7-31-10.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Annualized.

| |

| CLASS I SHARES Period ended | 7-31-101 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $10.00 |

| Net investment loss2 | (0.09) |

| Net realized and unrealized loss on investments | (0.02) |

| Total from investment operations | (0.11) |

| Net asset value, end of period | $9.89 |

| Total return (%)3,4 | (1.10)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $79 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions and amounts recaptured | 1.526 |

| Expenses including reductions and amounts recaptured | 1.526 |

| Net investment loss | (0.89)6 |

| Portfolio turnover (%) | 389 |

1 Period from 8-3-09 (inception date) to 7-31-10.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Annualized.

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 19 |

| |

| CLASS NAV SHARES Period ended | 7-31-101 |

| |

| Per share operating performance | |

|

| Net asset value, beginning of period | $10.00 |

| Net investment loss2 | (0.07) |

| Net realized and unrealized loss on investments | (0.03) |

| Total from investment operations | (0.10) |

| Net asset value, end of period | $9.90 |

| Total return (%)3,4 | (1.00)5 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $349 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions and amounts recaptured | 1.396 |

| Expenses including reductions and amounts recaptured | 1.396 |

| Net investment loss | (0.72)6 |

| Portfolio turnover (%) | 389 |

1 Period from 8-3-09 (inception date) to 7-31-10.

2 Based on the average daily shares outstanding.

3 Assumes dividend reinvestment (if applicable).

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Not annualized.

6 Annualized.

| | |

| 20 | Technical Opportunities Fund | Annual report | See notes to financial statements |

Notes to financial statements

Note 1 — Organization

John Hancock Technical Opportunities Fund (the Fund) is a non-diversified series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek long-term capital appreciation. The Fund commenced operations on August 3, 2009.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class NAV shares are sold to John Hancock affiliated funds of funds. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, transfer agent fees, registration fees and printing and postage fees for each class may differ.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes significant unobservable inpu ts when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the values by input classification of the Fund’s investments as of July 31, 2010, by major security category or type:

| |

| Annual report | Technical Opportunities Fund | 21 |

| | | | |

| | | | | LEVEL 3 |

| | | | LEVEL 2 | SIGNIFICANT |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | VALUE AT 7-31-10 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Common Stocks | | | | |

|

| Consumer Discretionary | $70,281,993 | $64,904,406 | $5,377,587 | — |

|

| Consumer Staples | 24,326,645 | 22,231,176 | 2,095,469 | — |

|

| Energy | 9,028,610 | 9,028,610 | — | — |

|

| Financials | 20,969,158 | 17,711,750 | 3,257,408 | — |

|

| Health Care | 37,304,810 | 37,304,810 | — | — |

|

| Industrials | 40,712,054 | 35,237,549 | 5,474,505 | — |

|

| Information Technology | 229,225,014 | 215,843,877 | 13,381,137 | — |

|

| Materials | 6,056,315 | 6,056,315 | — | — |

| Telecommunication | | | | |

| Services | 31,104,955 | 31,104,955 | — | — |

|

| Short-Term Investments | 231,557,292 | 91,557,292 | 140,000,000 | — |

| |

|

| Total Investments in | | | | |

| Securities | $700,566,846 | $530,980,740 | $169,586,106 | — |

During the period ended July 31, 2010, there were no significant transfers in or out of Level 1 or Level 2 assets.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. John Hancock Collateral Investment Trust (JHCIT), an affiliate of the Fund, is valued at its closing net asset value. JHCIT has a floating net asset value and invests in short-term investments as pa rt of a securities lending program.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. Significant market events that affect the values of non-U.S. securities may occur after the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees. The Fund may use a fair valuation model to value non-U.S. securities in order to adjust for events which may occur between the close of foreign exchanges and the close of the NYSE.

Repurchase agreements. The Fund may enter into repurchase agreements. When a Fund enters into a repurchase agreement, it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline. Collateral for certain tri-party repurchase agreements is held at a third-party custodian bank in a segregated account for the benefit of the Fund.

| |

| 22 | Technical Opportunities Fund | Annual report |

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-date except for certain foreign dividends where the ex-date may have passed, which are recorded when the Fund becomes aware of the dividends.

Securities lending. The Fund may lend its securities to earn additional income. It receives and maintains cash collateral received from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, as a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Income received from JHCIT is a component of securities lending income as re corded on the Statement of Operations.

Foreign currency translation. Assets, including investments and liabilities denominated in foreign currencies, are translated into U.S. dollar values each day at the prevailing exchange rate. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on securities is reflected as a component of the realized and unrealized gains (losses) on investments.

Funds that invest internationally generally carry more risk than funds that invest strictly in U.S. securities. Funds investing in a single country or in a limited geographic region tend to be riskier than funds that invest more broadly. Risks can result from differences in economic and political conditions, regulations, market practices (including higher transaction costs) and accounting standards. Foreign investments are also subject to a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with the custodian which enables them to participate in a $200 million unsecured committed line of credit. Prior to March 31, 2010, the amount of the line of credit was $300 million. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis based on their relative average net assets. At July 31, 2010, the Fund did not have an outstanding balance from the line of credit.

Expenses. The majority of expenses are directly attributable to an individual fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative assets. Expense estimates are accrued in the year to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses, and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net asset value

| |

| Annual report | Technical Opportunities Fund | 23 |

of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage fees, for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund had a capital loss carryforward of $1,124,489 available to offset future net realized capital gains which expires on July 31, 2018. Net capital losses of $43,001,531, that are a result of security transactions occurring after October 31, 2009 are treated as occurring on August 1, 2010, the first day of the Fund’s next taxable year.

As of July 31, 2010, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, at least annually.

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class. As of July 31, 2010, the Fund has no distributable earnings on a tax basis.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within financial statements are adjusted for permanent book/tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book/tax differences, if any, will reverse in a subsequent period. Permanent book/tax differences are primarily attributable to net operating losses.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Fund. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Fund. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the

| |

| 24 | Technical Opportunities Fund | Annual report |

sum of: a) 1.35% of the first $250,000,000 of the Fund’s average daily net assets, b) 1.30% of the next $250,000,000 and c) 1.25% of the Fund’s average daily net assets in excess of $500,000,000. The Adviser has a subadvisory agreement with Wellington Management Company, LLP. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the period ended July 31, 2010 were equivalent to an annual effective rate of 1.32% of the Fund’s average daily net assets.

Effective January 1, 2010, the Adviser contractually agreed to waive a portion of the management fee for certain funds of the Trust. The waiver equals, on an annualized basis 0.01% of that portion of the aggregate net assets of all the participating funds that exceeds $85 billion. The amount of the reimbursement is calculated daily and allocated among all the funds in proportion of the daily net assets of each Fund.

The Adviser had contractually agreed to waive fees and/or reimburse certain expenses for each share class of the Fund. This agreement excluded taxes, portfolio brokerage commissions, interest, overdraft, litigation and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. For the period discussed in this report, the fee waivers and/or reimbursements were such that these expenses will not exceed 2.05% and 1.55% for Class A and Class I shares, respectively. Such fee waivers and/or reimbursements have been lowered subsequent to the period. In addition, the Adviser voluntarily waived certain other expenses.

Additionally, the Adviser has voluntarily agreed to waive other fund level expenses excluding advisory fees, 12b-1 fees, service fees, transfer agent fees, blue sky fees, taxes, brokerage commissions, interest expenses, acquired fund fees, litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of business. The waivers are such that these expenses will not exceed 0.20% of average net assets.

Accordingly, these expense reductions described above amounted to $2,405, $614 and $2,838 for Class A, Class I and Class NAV shares, respectively, for the period ended July 31, 2010.

Accounting and legal services. Pursuant to the Service Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. The accounting and legal services fees incurred for the period ended July 31, 2010 amounted to an annual rate of 0.01% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. Accordingly, the Fund may pay up to 0.30% for Class A shares for distribution and service fees, expressed as an annual percentage of average daily net assets.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $2,645,764 for the period ended July 31, 2010. Of this amount, $414,293 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $2,231,037 was paid as sales commissions to broker-dealers and $434 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a broker-dealer affiliate of the Adviser.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services or Transfer Agent), an affiliate of the Adviser. Class NAV shares do not pay transfer agent fees. Prior to July 1, 2010, the transfer agent fees were made up of three components:

| |

| Annual report | Technical Opportunities Fund | 25 |

• The Fund paid a monthly transfer agent fee at an annual rate of 0.05% and 0.04% for Class A and Class I shares, respectively, based on each class’s average daily net assets.

• The Fund paid a monthly fee based on an annual rate of $16.50 per shareholder account for Class A and Class I shares.

• In addition, Signature Services was reimbursed for certain out-of-pocket expenses.

Effective July 1, 2010, the transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost is comprised of a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain revenues that Signature Services received in connection with the performance of the service they provide to the funds. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the period ended July 31, 2010 were:

| | | | |

| | DISTRIBUTION | TRANSFER | STATE | PRINTING AND |

| CLASS | AND SERVICE FEES | AGENT FEES | REGISTRATION FEES | POSTAGE FEES |

|

| Class A | $374,516 | $210,299 | $16,963 | $7,682 |

|

| Class I | — | 60,541 | 6,540 | 2,995 |

| | | | | |

| Total | $374,516 | $270,840 | $23,503 | $10,677 |

Trustee expenses. The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. The costs of paying Trustee compensation and expenses are allocated to each Fund based on its average daily net assets.

Note 5 — Fund share transactions

Transactions in Fund shares for the period ended July 31, 2010 were as follows:

| | |

| | Period ended 7-31-10 |

| | Shares | Amount |

| Class A shares | | |

|

| Sold | 22,796,591 | $240,781,737 |

| Repurchased | (6,085,267) | (62,239,897) |

| Net increase | 16,711,324 | $178,541,840 |

| |

| Class I shares | | |

|

| Sold | 10,412,153 | $110,650,156 |

| Repurchased | (2,403,259) | (24,891,985) |

| Net increase | 8,008,894 | $85,758,171 |

| |

| Class NAV shares | | |

|

| Sold | 35,772,158 | $355,210,980 |

| Repurchased | (586,659) | (6,243,063) |

| Net increase | 35,185,499 | $348,967,917 |

| |

| Net increase | 59,905,717 | $613,267,928 |

|

26 Technical Opportunities Fund | Annual report

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, aggregated $2,186,463,721 and $1,701,043,736, respectively, for the period ended July 31, 2010.

Note 7 — Investment by affiliated funds

Certain investors in the Fund are affiliated funds and are managed by the Adviser and its affiliates. The affiliated funds do not invest in the Fund for the purpose of exercising management or control; however, this investment may represent a significant portion of the Fund’s net assets. For the period ended July 31, 2010, the following funds had an affiliate ownership concentration of 5% or more of the Fund’s net assets:

| | | |

| | AFFILIATE | | |

| FUND | CONCENTRATION | | |

| | |

| Lifestyle Aggressive Portfolio | 8.5% | | |

| | |

| Lifestyle Balanced Portfolio | 25.4% | | |

| | |

| Lifestyle Growth Portfolio | 24.6% | | |

| |

| Annual report | Technical Opportunities Fund | 27 |

Auditors’ report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of John Hancock Funds II and Shareholders of

John Hancock Technical Opportunities Fund:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Technical Opportunities Fund (the “Fund”) at July 31, 2010, and the results of its operations, the changes in its net assets and the financial highlights for the period August 3, 2009 (commencement of operations) through July 31, 2010, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standa rds of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at July 31, 2010 by correspondence with the custodian and brokers and the application of alternative auditing procedures where securities purchased confirmations had not been received, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

September 20, 2010

| |

| 28 | Technical Opportunities Fund | Annual report |

Trustees and Officers

This chart provides information about the Trustees and Officers of John Hancock Funds II who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the Portfolio and execute policies formulated by the Trustees.

| | |

| Independent Trustees | | |

| | | |

| Name, Year of Birth | | Number of |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Trust | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| |

| Charles L. Bardelis, Born: 1941 | 2005 | 210 |

|

| Director, Island Commuter Corp. (Marine Transport). Trustee of John Hancock Trust (since 1988), |

| John Hancock Funds II (since 2005) and former Trustee of John Hancock Funds III (2005–2006). |

|

| |

| Peter S. Burgess, Born: 1942 | 2005 | 210 |

|

| Consultant (financial, accounting and auditing matters) (since 1999); Certified Public Accountant. |

| Partner, Arthur Andersen (independent public accounting firm) (prior to 1999). Director of the |

| following publicly traded companies: PMA Capital Corporation (since 2004) and Lincoln Educational |

| Services Corporation (since 2004). Trustee of John Hancock Trust (since 2005), John Hancock Funds II |

| (since 2005), and former Trustee of John Hancock Funds III (2005–2006). | | |

|

| |

| Theron S. Hoffman, Born: 1947 | 2008 | 210 |

|

| Chief Executive Officer, T. Hoffman Associates, LLC (since 2003); Director, The Todd Organization |

| (since 2003); President, Westport Resources Management (2006–2008); Partner/Operating Head & |

| Senior Managing Director, Putnam Investments (2000–2003); Executive Vice President, Thomson |

| Corp. (1997–2000) (financial information publishing). Trustee of John Hancock Trust (since 2008) and |

| John Hancock Funds II (since 2008). | | |

|

| |

| Hassell H. McClellan, Born: 1945 | 2005 | 210 |

|

| Associate Professor, The Graduate School of The Wallace E. Carroll School of Management, Boston |

| College (since 1984). Trustee of John Hancock Trust (since 2005), John Hancock Funds II (since 2005) |

| and Trustee of Phoenix Edge Series Funds (since 2008). | | |

|

| |

| James M. Oates, Born: 1946 | 2005 | 210 |

|

| Managing Director, Wydown Group (financial consulting firm) (since 1994); Chairman, Emerson |

| Investment Management, Inc. (since 2000); Chairman, Hudson Castle Group, Inc. (formerly IBEX Capital |

| Markets, Inc.) (financial services company) (since 1997) (Independent Chairman, 1997–2006). Director |

| of the following publicly traded companies: Stifel Financial (since 1996); Investor Financial Services |

| Corporation (1995–2007); and Connecticut River Bancorp (since 1998); Director of the following |

| Mutual Funds: Phoenix Mutual Funds (1988–2008); Virtus Funds (since 2008); and Emerson Investment |

| Management (since 2000). Chairman of the Boards of John Hancock Trust and John Hancock Funds II |

| (since 2005). Trustee of John Hancock Trust (since 2004), John Hancock Funds II (since 2005) and former |

| Trustee of John Hancock Funds III (2005–2006). | | |

| |

| Annual report | Technical Opportunities Fund | 29 |

| | |

| Independent Trustees (continued) | | |

| |

| Name, Year of Birth | | Number of |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Trust | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

|

| Steven M. Roberts, Born: 1944 | 2008 | 210 |

|

| Board of Governors Deputy Director Division of Banking Supervision and Regulation, Federal Reserve |

| System (2005–2008); Partner, KPMG (1987–2004). Trustee of John Hancock Trust (since 2008) and |

| John Hancock Funds II (since September 2008). | | |

| |

| Non-Independent Trustees2 | | |

| | |

| Name, Year of Birth | | Number of |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Trust | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| |

| James R. Boyle,3 Born: 1959 | 2005 | 210 |

|

| President, John Hancock Financial Services (since 2010); Chairman and Director, John Hancock Advisers, |

| LLC, John Hancock Funds, LLC, and John Hancock Investment Management Services, LLC (until 2010); |

| Trustee, John Hancock Trust, John Hancock Funds II, and John Hancock retail funds (since 2005). |

|

| |

| Grace K. Fey,4 Born: 1946 | 2008 | 210 |

|

| Chief Executive Officer, Grace Fey Advisors (since 2007); Director & Executive Vice President, Frontier |

| Capital Management Company (1988–2007); Director, Fiduciary Trust (since 2009). Trustee of |

| John Hancock Trust (since 2008) and John Hancock Funds II (since 2008). | | |

1 Because the Trust does not hold regular annual shareholders meetings, each Trustee holds office for an indefinite term until his/her successor is duly elected and qualified or until he/she dies, retires, resigns, is removed or becomes disqualified. Trustees may be removed (provided the aggregate number of Trustees after such removal shall not be less than one) with cause or without cause, by the action of two-thirds of the remaining Trustees or by action of two-thirds of the outstanding Shares of the Trust.

2 Non-Independent Trustees hold positions or are affiliated with the Fund’s investment adviser, subadviser, underwriter or their affiliates.

3 Mr. Boyle is an “interested person” (as defined in the 1940 Act) due to his position with Manulife Financial Corporation (or its affiliates), the ultimate parent of the Adviser.

4 Ms. Fey is an “interested person” (as defined by the 1940 Act) due to a deferred compensation arrangement with her former employer, Frontier Capital Management Company, which is a subadviser of certain funds of John Hancock Funds II and John Hancock Trust.

| |

| Principal officers who are not Trustees | |

| | |

| Name, Year of Birth | |

| Position(s) held with Fund | Officer |

| Principal occupation(s) and other | of Trust |

| directorships during past 5 years | since |

|

| Hugh McHaffie, Born: 1959 | 2009 |

|

| President | |

| Executive Vice President, John Hancock Financial Services (since 2006); Director, John Hancock | |

| Investment Management Services, LLC, John Hancock Advisers, LLC and John Hancock Funds, LLC |

| (since 2010); President, John Hancock Trust and John Hancock Funds II (since 2009); Senior | |

| Vice President, Individual Business Product Management, MetLife, Inc. (1999–2006). | |

| |

| 30 | Technical Opportunities Fund | Annual report |

| |

| Principal officers who are not Trustees (continued) | |

| |

| Name, Year of Birth | |

| Position(s) held with Fund | Officer |

| Principal occupation(s) and other | of Trust |

| directorships during past 5 years | since |

| |

| Thomas M. Kinzler, Born: 1955 | 2009 |

|

| Secretary and Chief Legal Officer | |

| Vice President, John Hancock Financial Services (since 2006); Secretary and Chief Legal Officer, | |

| John Hancock retail funds, John Hancock Funds II and John Hancock Trust (since 2006); Secretary and |

| Chief Legal Counsel, John Hancock Advisers, LLC, John Hancock Investment Management Services, |

| LLC and John Hancock Funds, LLC (since 2007); Vice President and Associate General Counsel, | |

| Massachusetts Mutual Life Insurance Company (1999–2006); Secretary and Chief Legal Counsel, MML |

| Series Investment Fund (2000–2006); Secretary and Chief Legal Counsel, MassMutual Select Funds and |

| MassMutual Premier Funds (2004–2006). | |

|

| |

| Francis V. Knox, Jr., Born: 1947 | 2009 |

|

| Chief Compliance Officer | |

| Vice President, John Hancock Financial Services (since 2005); Chief Compliance Officer, John Hancock |

| retail funds, John Hancock Funds II, John Hancock Trust, Chief Compliance Officer, John Hancock | |

| Advisers, LLC and John Hancock Investment Management Services, LLC (since 2005); Vice President and |

| Chief Compliance Officer, MFC Global Investment Management (U.S.), LLC (2005–2008). | |

|

| |

| Michael J. Leary, Born: 1965 | 2009 |

|

| Treasurer | |

| Assistant Vice President, John Hancock Financial Services (since 2007); Treasurer, John Hancock retail |

| funds, John Hancock Funds II and John Hancock Trust (since 2009); Vice President, John Hancock | |

| Advisers, LLC and John Hancock Investment Management Services, LLC (since 2007); Assistant | |

| Treasurer, John Hancock retail funds, John Hancock Funds II and John Hancock Trust (2007–2009); |

| Vice President and Director of Fund Administration, JP Morgan (2004–2007). | |

|

| |

| Charles A. Rizzo, Born: 1957 | 2009 |

|

| Chief Financial Officer | |

| Vice President, John Hancock Financial Services (since 2008); Chief Financial Officer, John Hancock retail |

| funds, John Hancock Funds II and John Hancock Trust (since 2007); Senior Vice President, John Hancock |

| Advisers, LLC and John Hancock Investment Management Services, LLC (since 2008); Assistant Treasurer, |

| Goldman Sachs Mutual Fund Complex (2005–2007); Vice President, Goldman Sachs (2005–2007); | |

| Managing Director and Treasurer, Scudder Funds, Deutsche Asset Management (2003–2005). | |

|

| |

| John G. Vrysen, Born: 1955 | 2009 |

|

| Chief Operating Officer | |

| Senior Vice President, John Hancock Financial Services (since 2006); Director, Executive Vice President |

| and Chief Operating Officer, John Hancock Advisers, LLC, John Hancock Investment Management |

| Services, LLC and John Hancock Funds, LLC (since 2005); Chief Operating Officer, John Hancock | |

| Funds II and John Hancock Trust (since 2007); Chief Operating Officer, John Hancock retail funds (until |

| 2009); Trustee, John Hancock retail funds (since 2009). | |

The business address for all Trustees and Officers is 601 Congress Street, Boston, Massachusetts 02210-2805.

The Statement of Additional Information of the Fund includes additional information about members of the Board of Trustees of the Fund and is available without charge, upon request, by calling 1-800-225-5291.

| |

| Annual report | Technical Opportunities Fund | 31 |

More information

| | |

| Trustees | Investment adviser |

| James M. Oates, Chairman | John Hancock Investment Management |

| James R. Boyle† | Services, LLC |

| Grace K. Fey† | |

| Charles L. Bardelis* | Subadviser |

| Peter S. Burgess* | Wellington Management Company, LLC |

| Theron S. Hoffman | |

| Hassell H. McClellan | Principal distributor |

| Steven M. Roberts* | John Hancock Funds, LLC |

| | |

| Officers | Custodian |

| Hugh McHaffie | State Street Bank and Trust Company |

| President | |

| | Transfer agent |

| Thomas M. Kinzler | John Hancock Signature Services, Inc. |

| Secretary and Chief Legal Officer | |

| | Legal counsel |

| Francis V. Knox, Jr. | K&L Gates LLP |

| Chief Compliance Officer | |

| Independent registered |

| Michael J. Leary | public accounting firm |

| Treasurer | PricewaterhouseCoopers LLP |

| |

| Charles A. Rizzo |

| |

| Chief Financial Officer | The report is certified under the Sarbanes-Oxley |

| Act, which requires mutual funds and other public |

| John G. Vrysen | companies to affirm that, to the best of their |

| Chief Operating Officer | knowledge, the information in their financial reports |

| | is fairly and accurately stated in all material respects. |

| *Member of the Audit Committee |

| |

| †Non-Independent Trustee | |

| | |

The Fund’s proxy voting policies and procedures, as well as the Fund’s proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) Web site at www.sec.gov or on our Web site.

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available on our Web site and the SEC’s Web site, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 to receive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our Web site www.jhfunds.com or by calling 1-800-225-5291.

| | |

| You can also contact us: | | |

| 1-800-225-5291 | Regular mail: | Express mail: |

| jhfunds.com | John Hancock Signature Services, Inc. | John Hancock Signature Services, Inc. |

| | P.O. Box 55913 | Mutual Fund Image Operations |

| | Boston, MA 02205-5913 | 30 Dan Road |

| | | Canton, MA 02021 |

|

| |

| 32 | Technical Opportunities Fund | Annual report |

1-800-225-5291

1-800-554-6713 TDD

1-800-338-8080 EASI-Line

www.jhfunds.com

Now available: electronic delivery

www.jhfunds.com/edelivery

| |

| This report is for the information of the shareholders of John Hancock Technical Opportunities Fund. | 3470A 7/10 |

| It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. | 9/10 |

| |

| |

| |

| |

| |

| |

| | John Hancock |

| | Global High Yield Fund |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

| |

| |

| Annual Report | |

| 7.31.10 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | |

| John Hancock Global High Yield Fund | | | | |

| |

| Table of Contents | | | | |

| | | | |

| Management’s Discussion of Fund Performance | | | | Page 2 |

| | | | |

| A look at performance | | | | Page 3 |

| | | | |

| Your expenses | | | | Page 5 |

| | | | |

| Portfolio Summary | | | | Page 6 |

| | | | |

| Portfolio of Investments | | | | Page 7 |

| | | | |

| Financial Statements | | | | Page 18 |

| | | | |

| Financial Highlights | | | | Page 21 |

| | | | |

| Notes to Financial Statements | | | | Page 24 |

| | | | |

| Trustees and Officers | | | | Page 35 |

| | | | |

| More information | | | | Page 42 |

John Hancock Global High Yield Fund

Management’s Discussion of Fund Performance

By Stone Harbor Investment Partners LP

The positive momentum within risk assets, such as high-yield bonds, that began at the start of 2009 picked up speed in the latter half, leading to significant spread contraction as the U.S. and global economy showed signs of stabilization. Better-than-expected economic indicators, as well as continued monetary and fiscal stimulus out of Washington, buoyed investor sentiment. Constructive earnings and improvement in domestic manufacturing and global production sustained strong inflows into these asset classes at the end of the first quarter of 2010. Yet despite just over a year of strong performance, concerns over the stability of U.S. and global growth led to wider risk premiums. Market focus shifted overseas as developments regarding a sovereign debt crisis in Greece, EU efforts to limit its spread to other European countries and a pullback on Chinese growth challenged the viability of a synchronized global recovery. Tracking equity volatility, a sharp dec line across risk assets in May reflected investor unease and uncertainty regarding the negative impact of global events on U.S. growth. High-yield and emerging-markets debt remained resilient during this period of volatility, rallying in July.

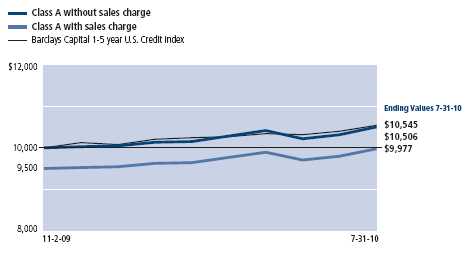

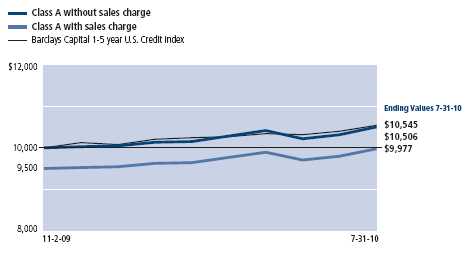

From the Fund’s inception on November 2, 2009 through July 31, 2010, John Hancock Global High Yield Fund’s Class A, Class I and Class NAV shares posted total returns of 9.66%, 9.89% and 9.96%, respectively, at net asset value. The Fund’s return compares with the 10.15% return of the Fund’s benchmark, the Bank of America Merrill Lynch Global High Yield and Emerging Markets Plus Index, the 12.16% return of a blended index – 50% Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index/50% JPMorgan Global EMBI Global Diversified Index – and the 3.75% average return of the world bond funds tracked by Morningstar, Inc. The benefits of holding a large stake in high-yield assets were more than offset by issue selection decisions in sectors such as cable and media and utilities. An underweight allocation to financials also detracted from relative returns. Within the high-yield bond universe, we have focused on mid-quali ty investments, which, despite strong absolute returns, lagged the broader market indexes until the May-June period of volatility. The Fund’s relative performance was helped by its stake in strong-performing emerging-markets debt, especially by an allocation to Argentina. The country benefited from a debt exchange for previously defaulted bonds, an event that was viewed favorably as the country’s capacity to borrow in the capital markets was restored. Other high beta (higher volatility) credits such as Ukraine also outperformed. As evidence of a global economic turnaround became more entrenched, we increased the portfolio’s exposure to local currency debt in Brazil, Colombia and Mexico, which also boosted performance.

This commentary reflects the views of the portfolio managers through the end of the Fund’s period discussed in this report. The managers' statements reflect their own opinions. As such, they are in no way guarantees of future events, and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results. The major factors in this Fund's performance are interest rate and credit risk. When interest rates rise, bond prices usually fall. Generally, an increase in the Fund's average maturity will make it more sensitive to interest-rate risk. International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting. Higher-yielding bonds are riskier than lower-yielding bonds, and their value may fluctuate more in response to market conditions. The Fund may not be appropriate for all investors. Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

A look at Performance

Global High Yield Fund

For the period ended July 31, 2010

| | | | | | | | |

| | Average annual total return (%) | | Cumulative total returns (%) | |