The fee on Affiliated Fund Assets is stated as an annual percentage of the current value of the aggregate net assets of all the Portfolios determined in accordance with the following schedule, and that rate is applied to the Affiliated Fund Assets of each Portfolio.

The fee on Other Assets is stated as an annual percentage of the current value of the aggregate net assets of all the Portfolios determined in accordance with the following schedule, and that rate is applied to the Other Assets of each Portfolio.

The Portfolios are not responsible for the payment of sub-advisory fees.

MFC Global Investment Management (U.S.A.) Limited acts as Sub-adviser to the Lifecycle Portfolios.

The investment management fees incurred for the year ended August 31, 2008, were equivalent to an annual effective rate of the Portfolio’s average daily net assets as follows:

The Adviser has contractually agreed to reimburse for certain Portfolio level expenses for the period January 1, 2008 to December 31, 2008 (excluding management fees, underlying fund expenses, Rule 12b-1 fees, transfer agency fees, service plan fees, blue sky fees, printing and postage fees, taxes, Portfolio brokerage commissions, interest, litigation and indemnification expenses, other expenses not incurred in the ordinary course of the Portfolios’ business, and fees under any agreement or plans of the Portfolios dealing with services for shareholders and others with beneficial interests in shares of the Portfolio) that exceed 0.09% of the average annual net assets. Also, the Adviser has agreed to reimburse or to make a payment to a specific class of shares of the Portfolios in an amount equal to the amount by which the expenses attributable to such class of shares exceed the percentage of average annual net assets (on an annualized basis) attributable as follows: 0.50% for Class A, 1.20% for Class B, 1.20% for Class C, 1.05% for Class R, 0.80% for Class R1, 0.55% for Class R2, 0.70% for Class R3, 0.40% for Class R4 and 0.10% for Class R5, and 0.05% for Class 1 for the Lifecycle funds. These expense reimbursements shall continue in effect until December 31, 2008, and thereafter until terminated by the Adviser on notice to JHF II.

For the period September 1, 2007 to December 31, 2007, the Adviser had agreed to reimburse or to make a payment to a specific class of shares of the Portfolios in an amount equal to the amount by which the expenses attributable to such class of shares exceed the percentage of average annual net assets (on an annualized basis) attributable as follows: 0.65% for Class A, 1.35% for Class B, 1.35% for Class C, 1.20% for Class R, 0.95% for Class R1, 0.70% for Class R2, 0.85% for Class R3, 0.55% for Class R4 and 0.25% for Class R5, for Lifecycle 2045, Lifecycle 2040, Lifecycle 2035, Lifecycle 2030, Lifecycle 2025, Lifecycle 2020, Lifecycle 2015 and Lifecycle 2010 and 0.69% for Class A, 1.39% for Class B, 1.39% for Class C, 1.24% for Class R, 0.99% for Class R1, 0.74% for Class R2, 0.89% for Class R3, 0.59% for Class R4, 0.29% for Class R5 for Lifecycle Retirement.

For the year ended August 31, 2008, the expense reductions amounted to the following and are reflected as a reduction of total expenses in the Statements of Operations:

Fund administration fees

Pursuant to the Advisory Agreement, the Portfolios reimburse the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Portfolios, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports. These expenses are allocated based on the relative share of net assets of each Portfolio at the time the expense was incurred.

The fund administration fees incurred for the year ended August 31, 2008, were equivalent to an annual effective rate of 0.01% of each Portfolio’s average daily net assets.

Distribution and service plans

The Trust has a Distribution Agreement with the Distributor. The Portfolios have adopted Distribution Plans with respect to Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class 1, pursuant to Rule 12b-1 under the 1940 Act, to reimburse the Distributor for the services it provides as distributor of shares of the Portfolios. Accordingly, the Portfolios make daily payments to the Distributor at an annual rate up to 0.30%, 1.00%, 1.00%, 0.75%, 0.50%, 0.25%, 0.50%, 0.25% and 0.05% of the average daily net assets of Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class 1, respectively. A maximum of 0.25% of average daily net assets may be service fees, as defined by the Conduct Rules of the Financial Industry Regulatory Authority (formerly, National Association of Securities Dealers). Under the Conduct Rules, curtailment of a portion of the Portfolio’s 12b-1 payments could occur under certain circumstances.

The Portfolios have also adopted a Service Plan with respect to Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares (the “Service Plan”). Under the Service Plan, the Portfolios pay up to 0.25%, 0.25%, 0.25%, 0.15%, 0.10% and 0.05% of average daily net assets of Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares.

Sales charges

Class A shares are assessed up-front sales charges of up to 5% of the net asset value of such shares. The following summarizes the net up-front sales charges received by the Distributor during the year ended August 31, 2008:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Lifecycle

2045 | | Lifecycle

2040 | | Lifecycle

2035 | | Lifecycle

2030 | | Lifecycle

2025 | | Lifecycle

2020 | | Lifecycle

2015 | | Lifecycle

2010 | | Lifecycle

Retirement | |

| | | | | | | | | | | | | | | | | | | | |

Net sales charges | | $ | 18,555 | | $ | 17,244 | | $ | 22,278 | | $ | 33,914 | | $ | 66,083 | | $ | 71,324 | | $ | 49,329 | | $ | 26,693 | | $ | 186,434 | |

|

Retained for printing

prospectuses, advertising and sales literature | | | 2,760 | | | 2,761 | | | 3,413 | | | 5,263 | | | 10,855 | | | 11,519 | | | 8,359 | | | 4,248 | | | 32,051 | |

|

Sales commission to

unrelated broker-dealers | | | 15,408 | | | 14,483 | | | 18,567 | | | 28,607 | | | 53,231 | | | 59,704 | | | 40,970 | | | 22,399 | | | 152,801 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sales commission to

affiliated sales personnel | | | 387 | | | — | | | 298 | | | 44 | | | 1,997 | | | 101 | | | — | | | 46 | | | 1,582 | |

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to the Distributor and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Portfolios in connection with the sale of Class B and Class C shares. During the year ended August 31, 2008, CDSCs received by the Distributor amounted to $32, $718, $1,643, $139, $1,287, $1,256, $479 and $53 for Lifecycle 2045, Lifecycle 2040, Lifecycle 2035, Lifecycle 2030, Lifecycle 2025, Lifecycle 2020, Lifecycle 2015 and Lifecycle Retirement, respectively, for Class B shares. There were no CDSCs received by the Distributor for Lifecycle 2010 and Lifecycle Retirement for Class B shares. CDSCs received by the Distributor amounted to $148, $372, $1,195, $246, $167, $525, $530 and $1,526 for Lifecycle 2040, Lifecycle 2035, Lifecycle 2030, Lifecycle 2025, Lifecycle 2020, Lifecycle 2015, Lifecycle 2010 and Lifecycle Retirement, respectively, for Class C shares. There were no CDSCs received by the Distributor for Lifecycle 2045 for Class C shares.

Transfer agent fees

The Portfolios have a Transfer Agency Agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of MFC. For Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares, the Portfolio pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net assets, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses. Expenses not directly attributable to a particular class of shares are aggregated and allocated to each class on the basis of its relative net asset value. Lifecycle Portfolios pay a monthly fee which is based on an annual rate of $15.00 for each Class A shareholder account, $17.50 for each class B shareholder account, $16.50 for each Class C shareholder account and $15.00 for each Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shareholder account.

| |

60 | Lifecycle Portfolios | Annual report |

Signature Services has contractually agreed to limit the transfer agent fees so that such fees do not exceed 0.20% annually of Class A, Class B, Class C, Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares average daily net assets. This agreement is effective until December 31, 2008.

In addition, Signature Services has voluntarily agreed to further limit transfer agent fees for Class R, Class R1, Class R2, Class R3, Class R4 and Class R5 shares so that such fees do not exceed 0.05% annually of each class’s average daily net assets. This voluntary agreement was terminated on June 1, 2008. For period ended June 30, 2008, the transfer agent voluntary fee reductions amounted to the following and are reflected as a reductions of total expenses in the Statement of Operations:

| | | | | | | | | | | | | |

| | Transfer agent fee reduction by class | | | | | | | |

| | | | | | | | | | | | | |

Portfolio | | Class R | | Class R1 | | Class R2 | | Class R3 | | Class R4 | | Class R5 | |

| | | | | | | | | | | | | | |

|

Lifecycle 2045 | | $ 91 | | $ 98 | | $ 106 | | $ 95 | | $ 23 | | $ 51 | |

Lifecycle 2040 | | 108 | | 92 | | 91 | | 130 | | 31 | | 65 | |

Lifecycle 2035 | | 83 | | 108 | | 113 | | 90 | | 25 | | 63 | |

Lifecycle 2030 | | 132 | | 106 | | 84 | | 121 | | 22 | | 50 | |

Lifecycle 2025 | | 97 | | 102 | | 104 | | 91 | | 31 | | 68 | |

Lifecycle 2020 | | 117 | | 107 | | 97 | | 134 | | 25 | | 71 | |

Lifecycle 2015 | | 94 | | 114 | | 104 | | 101 | | 34 | | 73 | |

Lifecycle 2010 | | 55 | | 70 | | 56 | | 136 | | 30 | | 44 | |

Lifecycle Retirement | | 34 | | 55 | | 65 | | 58 | | 31 | | 35 | |

Signature Services reserves the right to terminate this limitation at any time.

In August 2007, the Fund began receiving earnings credits from its transfer agent as a result of uninvested cash balances. These credits are used to reduce a portion of the Fund’s transfer agent fees and out of pocket expenses. During the year ended August 31, 2008, the Fund’s transfer agent fees and out of pocket expenses were reduced by the following amount for transfer agent credits earned.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Lifecycle

2045 | | Lifecycle

2040 | | Lifecycle

2035 | | Lifecycle

2030 | | Lifecycle

2025 | | Lifecycle

2020 | | Lifecycle

2015 | | Lifecycle

2010 | | Lifecycle

Retirement | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Transfer agent

earning credit | | $ | 52 | | $ | 53 | | $ | 58 | | $ | 76 | | $ | 69 | | $ | 92 | | $ | 67 | | $ | 41 | | $ | 109 | |

Class level expenses for the year ended August 31, 2008, were as follows:

| | | | | | | | | | | | | | | |

Portfolio | | Share class | | Distribution and

service fees | | Transfer

agent fees | | Blue sky fees | | Printing and

postage fees | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Lifecycle 2045 | | Class A | | $ | 4,784 | | $ | 3,213 | | $ | 13,727 | | $ | 906 | |

| | Class B | | | 2,254 | | | 460 | | | 13,587 | | | 194 | |

| | Class C | | | 1,861 | | | 379 | | | 13,587 | | | 108 | |

| | Class R | | | 1,092 | | | 182 | | | 16,116 | | | 147 | |

| | Class R1 | | | 696 | | | 192 | | | 16,116 | | | 103 | |

| | Class R2 | | | 465 | | | 232 | | | 16,116 | | | 155 | |

| | Class R3 | | | 838 | | | 203 | | | 16,116 | | | 92 | |

| | Class R4 | | | 297 | | | 87 | | | 16,116 | | | 86 | |

| | Class R5 | | | — | | | 130 | | | 16,116 | | | 95 | |

| | Class 1 | | | 28,888 | | | — | | | — | | | — | |

| | Total | | $ | 41,175 | | $ | 5,078 | | $ | 137,597 | | $ | 1,886 | |

| | | | | | | | | | | | | | | | |

|

Lifecycle 2040 | | Class A | | $ | 2,894 | | | 1,949 | | $ | 13,727 | | $ | 563 | |

| | Class B | | | 2,262 | | | 463 | | | 13,727 | | | 187 | |

| | Class C | | | 1,857 | | | 378 | | | 13,828 | | | 109 | |

| | Class R | | | 952 | | | 195 | | | 16,116 | | | 131 | |

| | Class R1 | | | 934 | | | 201 | | | 16,116 | | | 147 | |

| | Class R2 | | | 881 | | | 291 | | | 16,116 | | | 346 | |

| | Class R3 | | | 1,745 | | | 387 | | | 16,116 | | | 185 | |

| | Class R4 | | | 363 | | | 111 | | | 16,116 | | | 111 | |

| | Class R5 | | | — | | | 204 | | | 16,116 | | | 148 | |

| | Class 1 | | | 33,751 | | | — | | | — | | | — | |

| | Total | | $ | 45,639 | | $ | 4,179 | | $ | 137,978 | | $ | 1,927 | |

| | | | | | | | | | | | | | | | |

| |

Annual report | Lifecycle Portfolios | 61 |

| | | | | | | | | | | | | | | |

Portfolio | | Share class | | Distribution and

service fees | | Transfer

agent fees | | Blue sky fees | | Printing and

postage fees | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Lifecycle 2035 | | Class A | | $ | 3,759 | | $ | 2,529 | | $ | 13,749 | | $ | 687 | |

| | Class B | | | 4,864 | | | 984 | | | 13,609 | | | 455 | |

| | Class C | | | 3,047 | | | 619 | | | 13,749 | | | 172 | |

| | Class R | | | 854 | | | 150 | | | 16,139 | | | 119 | |

| | Class R1 | | | 844 | | | 213 | | | 16,139 | | | 133 | |

| | Class R2 | | | 866 | | | 341 | | | 16,139 | | | 273 | |

| | Class R3 | | | 885 | | | 203 | | | 16,138 | | | 100 | |

| | Class R4 | | | 385 | | | 108 | | | 16,138 | | | 118 | |

| | Class R5 | | | — | | | 148 | | | 16,138 | | | 112 | |

| | Class 1 | | | 50,241 | | | — | | | — | | | — | |

| | Total | | $ | 65,745 | | $ | 5,295 | | $ | 137,938 | | $ | 2,169 | |

| | | | | | | | | | | | | | | | |

|

Lifecycle 2030 | | Class A | | $ | 6,494 | | $ | 4,360 | | $ | 13,727 | | $ | 1,414 | |

| | Class B | | | 3,910 | | | 798 | | | 13,588 | | | 322 | |

| | Class C | | | 5,435 | | | 1,101 | | | 13,882 | | | 419 | |

| | Class R | | | 1,342 | | | 236 | | | 16,116 | | | 192 | |

| | Class R1 | | | 1,063 | | | 259 | | | 16,116 | | | 165 | |

| | Class R2 | | | 803 | | | 318 | | | 16,116 | | | 235 | |

| | Class R3 | | | 2,330 | | | 381 | | | 16,116 | | | 314 | |

| | Class R4 | | | 282 | | | 85 | | | 16,116 | | | 82 | |

| | Class R5 | | | — | | | 224 | | | 16,116 | | | 158 | |

| | Class 1 | | | 66,271 | | | — | | | — | | | — | |

| | Total | | $ | 87,930 | | $ | 7,762 | | $ | 137,893 | | $ | 3,301 | |

| | | | | | | | | | | | | | | | |

|

Lifecycle 2025 | | Class A | | $ | 5,331 | | $ | 3,583 | | $ | 14,388 | | $ | 984 | |

| | Class B | | | 4,559 | | | 925 | | | 13,587 | | | 375 | |

| | Class C | | | 4,310 | | | 874 | | | 13,727 | | | 233 | |

| | Class R | | | 971 | | | 184 | | | 16,116 | | | 130 | |

| | Class R1 | | | 1,065 | | | 248 | | | 16,116 | | | 168 | |

| | Class R2 | | | 793 | | | 410 | | | 16,116 | | | 229 | |

| | Class R3 | | | 1,756 | | | 328 | | | 16,116 | | | 239 | |

| | Class R4 | | | 359 | | | 131 | | | 16,116 | | | 107 | |

| | Class R5 | | | — | | | 215 | | | 16,116 | | | 165 | |

| | Class 1 | | | 87,259 | | | — | | | — | | | — | |

| | Total | | $ | 106,403 | | $ | 6,898 | | $ | 138,398 | | $ | 2,630 | |

| | | | | | | | | | | | | | | | |

|

Lifecycle 2020 | | Class A | | $ | 9,011 | | $ | 6,043 | | $ | 14,240 | | $ | 1,860 | |

| | Class B | | | 10,449 | | | 2,112 | | | 13,699 | | | 952 | |

| | Class C | | | 9,018 | | | 1,823 | | | 13,907 | | | 657 | |

| | Class R | | | 1,345 | | | 238 | | | 16,189 | | | 195 | |

| | Class R1 | | | 911 | | | 234 | | | 16,189 | | | 138 | |

| | Class R2 | | | 1,289 | | | 510 | | | 16,189 | | | 442 | |

| | Class R3 | | | 2,543 | | | 499 | | | 16,189 | | | 341 | |

| | Class R4 | | | 303 | | | 105 | | | 16,189 | | | 90 | |

| | Class R5 | | | — | | | 288 | | | 16,189 | | | 63 | |

| | Class 1 | | | 85,432 | | | — | | | — | | | — | |

| | Total | | $ | 120,301 | | $ | 11,852 | | $ | 138,980 | | $ | 4,738 | |

| | | | | | | | | | | | | | | | |

|

Lifecycle 2015 | | Class A | | $ | 5,502 | | $ | 3,703 | | $ | 13,659 | | $ | 1,150 | |

| | Class B | | | 6,662 | | | 1,345 | | | 13,659 | | | 557 | |

| | Class C | | | 4,347 | | | 875 | | | 13,658 | | | 258 | |

| | Class R | | | 1,022 | | | 183 | | | 16,116 | | | 139 | |

| | Class R1 | | | 1,005 | | | 245 | | | 16,116 | | | 165 | |

| | Class R2 | | | 848 | | | 390 | | | 16,116 | | | 282 | |

| | Class R3 | | | 1,496 | | | 347 | | | 16,116 | | | 176 | |

| | Class R4 | | | 333 | | | 124 | | | 16,116 | | | 101 | |

| | Class R5 | | | — | | | 305 | | | 16,116 | | | 272 | |

| | Class 1 | | | 70,133 | | | — | | | — | | | — | |

| | Total | | $ | 91,348 | | $ | 7,517 | | $ | 137,672 | | $ | 3,100 | |

| | | | | | | | | | | | | | | | |

| |

62 | Lifecycle Portfolios | Annual report |

| | | | | | | | | | | | | | | |

Portfolio | | Share class | | Distribution and

service fees | | Transfer

agent fees | | Blue sky fees | | Printing and

postage fees | |

| | | | | | | | | | | | | | | | |

|

Lifecycle 2010 | | Class A | | $ | 4,611 | | $ | 3,090 | | $ | 13,758 | | $ | 832 | |

| | Class B | | | 2,045 | | | 413 | | | 13,658 | | | 168 | |

| | Class C | | | 7,845 | | | 1,578 | | | 13,958 | | | 532 | |

| | Class R | | | 793 | | | 121 | | | 16,116 | | | 112 | |

| | Class R1 | | | 573 | | | 147 | | | 16,116 | | | 79 | |

| | Class R2 | | | 1,363 | | | 530 | | | 16,116 | | | 346 | |

| | Class R3 | | | 2,580 | | | 510 | | | 16,116 | | | 346 | |

| | Class R4 | | | 342 | | | 129 | | | 16,116 | | | 101 | |

| | Class R5 | | | — | | | 188 | | | 16,258 | | | 98 | |

| | Class 1 | | | 38,738 | | | — | | | — | | | — | |

| | Total | | $ | 58,890 | | $ | 6,706 | | $ | 138,212 | | $ | 2,614 | |

| | | | | | | | | | | | | | | | |

|

Lifecycle Retirement | | Class A | | $ | 24,114 | | $ | 11,373 | | $ | 14,107 | | $ | 5,348 | |

| | Class B | | | 4,483 | | | 905 | | | 13,648 | | | 362 | |

| | Class C | | | 45,036 | | | 7,261 | | | 13,768 | | | 703 | |

| | Class R | | | 851 | | | 97 | | | 16,128 | | | 118 | |

| | Class R1 | | | 529 | | | 117 | | | 16,128 | | | 74 | |

| | Class R2 | | | 367 | | | 151 | | | 16,127 | | | 123 | |

| | Class R3 | | | 813 | | | 150 | | | 16,127 | | | 101 | |

| | Class R4 | | | 265 | | | 89 | | | 16,127 | | | 82 | |

| | Class R5 | | | — | | | 95 | | | 16,127 | | | 77 | |

| | Class 1 | | | 77,232 | | | — | | | — | | | — | |

| | Total | | $ | 153,690 | | $ | 20,238 | | $ | 138,287 | | $ | 6,988 | |

| | | | | | | | | | | | | | | | |

5. Trustees’ fees

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees’ expenses are allocated to each Portfolio based on its average daily net asset value.

6. Custody overdraft

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft, including any costs or expenses associated with the overdraft. The Custodian has a lien and security interest in any Fund property to the extent of any overdraft.

| |

Annual report | Lifecycle Portfolios | 63 |

7. Portfolio share transactions

Share activities for the Portfolios for the periods ended August 31, 2008, and August 31, 2007, were as follows:

Lifecycle 2045 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| |

Class A shares | | | | | | | | | | | | | |

| |

Sold | | | 98,037 | | $ | 1,018,036 | | | 124,259 | | $ | 1,386,752 | |

Distributions reinvested | | | 2,858 | | | 30,538 | | | 235 | | | 2,410 | |

Repurchased | | | (27,860 | ) | | (285,948 | ) | | (1,362 | ) | | (15,519 | ) |

Net increase | | | 73,035 | | $ | 762,626 | | | 123,132 | | $ | 1,373,643 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 28,315 | | $ | 293,920 | | | 13,076 | | $ | 134,159 | |

Distributions reinvested | | | 316 | | | 3,363 | | | 223 | | | 2,290 | |

Repurchased | | | (12,813 | ) | | (127,822 | ) | | — | | | — | |

Net increase | | | 15,818 | | $ | 169,461 | | | 13,299 | | $ | 136,449 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 6,278 | | $ | 66,271 | | | 13,755 | | $ | 139,477 | |

Distributions reinvested | | | 292 | | | 3,103 | | | 224 | | | 2,290 | |

Repurchased | | | (560 | ) | | (5,554 | ) | | (2 | ) | | (20 | ) |

Net increase | | | 6,010 | | $ | 63,820 | | | 13,977 | | $ | 141,747 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 7,021 | | $ | 71,102 | | | 10,833 | | $ | 109,197 | |

Distributions reinvested | | | 232 | | | 2,465 | | | 222 | | | 2,282 | |

Repurchased | | | (11 | ) | | (109 | ) | | (2 | ) | | (21 | ) |

Net increase (decrease) | | | 7,242 | | $ | 73,458 | | | 11,053 | | $ | 111,458 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 8,488 | | $ | 85,788 | | | 10,116 | | $ | 101,285 | |

Distributions reinvested | | | 214 | | | 2,286 | | | 227 | | | 2,325 | |

Repurchased | | | (65 | ) | | (633 | ) | | (2 | ) | | (20 | ) |

Net increase | | | 8,637 | | $ | 87,441 | | | 10,341 | | $ | 103,590 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 43,295 | | $ | 431,933 | | | 10,429 | | $ | 104,746 | |

Distributions reinvested | | | 314 | | | 3,359 | | | 231 | | | 2,368 | |

Repurchased | | | (11,469 | ) | | (114,671 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 32,140 | | $ | 320,621 | | | 10,658 | | $ | 107,092 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 21,803 | | $ | 217,375 | | | 10,529 | | $ | 105,905 | |

Distributions reinvested | | | 295 | | | 3,144 | | | 229 | | | 2,342 | |

Repurchased | | | (3,120 | ) | | (31,851 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 18,978 | | $ | 188,668 | | | 10,756 | | $ | 108,225 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 5,216 | | $ | 52,001 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 216 | | | 2,312 | | | 233 | | | 2,393 | |

Repurchased | | | (872 | ) | | (8,736 | ) | | — | | | — | |

Net increase | | | 4,560 | | $ | 45,577 | | | 10,233 | | $ | 102,393 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 6,695 | | $ | 68,210 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 225 | | | 2,408 | | | 238 | | | 2,444 | |

Repurchased | | | (391 | ) | | (3,782 | ) | | — | | | — | |

Net increase | | | 6,529 | | $ | 66,836 | | | 10,238 | | $ | 102,444 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 7,983,512 | | $ | 82,402,161 | | | 2,141,873 | | $ | 23,604,482 | |

Distributions reinvested | | | 78,533 | | | 841,091 | | | 1,110 | | | 11,381 | |

Repurchased | | | (11,424 | ) | | (126,806 | ) | | (29,626 | ) | | (325,498 | ) |

Net increase | | | 8,050,621 | | $ | 83,116,446 | | | 2,113,357 | | $ | 23,290,365 | |

| | | | | | | | | | | | | | |

Net increase | | | 8,223,570 | | $ | 84,894,954 | | | 2,327,044 | | $ | 25,577,406 | |

| | | | | | | | | | | | | | |

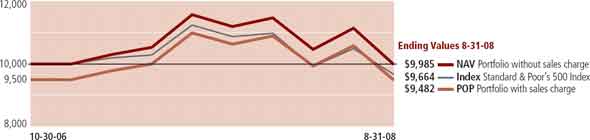

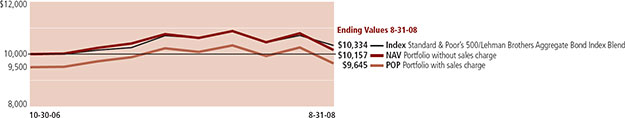

1 Period from 10-30-06 (commencement of operations) to 8-31-07.

| |

64 | Lifecycle Portfolios | Annual report |

Lifecycle 2040 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 118,633 | | $ | 1,239,743 | | | 53,068 | | $ | 571,474 | |

Distributions reinvested | | | 1,861 | | | 19,890 | | | 218 | | | 2,240 | |

Repurchased | | | (42,305 | ) | | (422,298 | ) | | — | | | — | |

Net increase | | | 78,189 | | $ | 837,335 | | | 53,286 | | $ | 573,714 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 23,684 | | $ | 251,706 | | | 14,639 | | $ | 150,579 | |

Distributions reinvested | | | 439 | | | 4,680 | | | 206 | | | 2,121 | |

Repurchased | | | (12,894 | ) | | (129,491 | ) | | (468 | ) | | (4,938 | ) |

Net increase | | | 11,229 | | $ | 126,895 | | | 14,377 | | $ | 147,762 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 25,422 | | $ | 260,996 | | | 11,420 | | $ | 115,887 | |

Distributions reinvested | | | 323 | | | 3,444 | | | 206 | | | 2,121 | |

Repurchased | | | (12,536 | ) | | (125,786 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 13,209 | | $ | 138,654 | | | 11,624 | | $ | 117,987 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 4,253 | | $ | 43,142 | | | 10,337 | | $ | 103,722 | |

Distributions reinvested | | | 222 | | | 2,371 | | | 206 | | | 2,112 | |

Repurchased | | | (79 | ) | | (750 | ) | | (2 | ) | | (21 | ) |

Net increase (decrease) | | | 4,396 | | $ | 44,763 | | | 10,541 | | $ | 105,813 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 20,931 | | $ | 215,989 | | | 10,032 | | $ | 100,352 | |

Distributions reinvested | | | 294 | | | 3,141 | | | 210 | | | 2,155 | |

Repurchased | | | (10,475 | ) | | (99,534 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 10,750 | | $ | 119,596 | | | 10,240 | | $ | 102,486 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 62,292 | | $ | 616,164 | | | 24,799 | | $ | 261,681 | |

Distributions reinvested | | | 582 | | | 6,223 | | | 214 | | | 2,198 | |

Repurchased | | | (13,108 | ) | | (131,647 | ) | | (5 | ) | | (53 | ) |

Net increase | | | 49,766 | | $ | 490,740 | | | 25,008 | | $ | 263,826 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 128,579 | | $ | 1,248,512 | | | 12,679 | | $ | 130,104 | |

Distributions reinvested | | | 489 | | | 5,218 | | | 211 | | | 2,172 | |

Repurchased | | | (18,094 | ) | | (178,830 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 110,974 | | $ | 1,074,900 | | | 12,888 | | $ | 132,254 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 11,713 | | $ | 118,813 | | | 10,002 | | $ | 100,020 | |

Distributions reinvested | | | 224 | | | 2,393 | | | 216 | | | 2,223 | |

Repurchased | | | (4,073 | ) | | (42,234 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 7,864 | | $ | 78,972 | | | 10,216 | | $ | 102,221 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 85,659 | | $ | 842,514 | | | 10,269 | | $ | 102,858 | |

Distributions reinvested | | | 239 | | | 2,561 | | | 221 | | | 2,275 | |

Repurchased | | | (30,558 | ) | | (297,549 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 55,340 | | $ | 547,526 | | | 10,488 | | $ | 105,111 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 9,191,245 | | $ | 95,022,350 | | | 2,375,526 | | $ | 26,086,277 | |

Distributions reinvested | | | 93,889 | | | 1,006,487 | | | 1,157 | | | 11,882 | |

Repurchased | | | (20,936 | ) | | (234,174 | ) | | (15,090 | ) | | (158,719 | ) |

Net increase | | | 9,264,198 | | $ | 95,794,663 | | | 2,361,593 | | $ | 25,939,440 | |

| | | | | | | | | | | | | | |

Net increase | | | 9,605,915 | | $ | 99,254,044 | | | 2,520,261 | | $ | 27,590,614 | |

| | | | | | | | | | | | | | |

1 Period from 10-30-06 (commencement of operations) to 8-31-07.

| |

Annual report | Lifecycle Portfolios | 65 |

Lifecycle 2035 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 196,006 | | $ | 2,041,324 | | | 61,634 | | $ | 679,752 | |

Distributions reinvested | | | 1,672 | | | 17,849 | | | 156 | | | 1,608 | |

Repurchased | | | (31,220 | ) | | (324,132 | ) | | (6,467 | ) | | (69,755 | ) |

Net increase | | | 166,458 | | $ | 1,735,041 | | | 55,323 | | $ | 611,605 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 40,058 | | $ | 425,469 | | | 35,972 | | $ | 385,605 | |

Distributions reinvested | | | 874 | | | 9,356 | | | 144 | | | 1,488 | |

Repurchased | | | (18,788 | ) | | (199,268 | ) | | (63 | ) | | (665 | ) |

Net increase | | | 22,144 | | $ | 235,557 | | | 36,053 | | $ | 386,428 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 25,658 | | $ | 279,939 | | | 22,044 | | $ | 230,444 | |

Distributions reinvested | | | 536 | | | 5,740 | | | 144 | | | 1,488 | |

Repurchased | | | (13,968 | ) | | (150,848 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 12,226 | | $ | 134,831 | | | 22,186 | | $ | 231,911 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 19,880 | | $ | 201,125 | | | 10,258 | | $ | 102,858 | |

Distributions reinvested | | | 229 | | | 2,452 | | | 143 | | | 1,480 | |

Repurchased | | | (22,220 | ) | | (227,053 | ) | | (2 | ) | | (21 | ) |

Net increase (decrease) | | | (2,111 | ) | $ | (23,476 | ) | | 10,399 | | $ | 104,317 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 18,677 | | $ | 191,534 | | | 10,056 | | $ | 100,617 | |

Distributions reinvested | | | 217 | | | 2,332 | | | 147 | | | 1,522 | |

Repurchased | | | (10,610 | ) | | (101,427 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 8,284 | | $ | 92,439 | | | 10,201 | | $ | 102,118 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 142,396 | | $ | 1,398,517 | | | 13,697 | | $ | 141,109 | |

Distributions reinvested | | | 306 | | | 3,297 | | | 152 | | | 1,565 | |

Repurchased | | | (12,781 | ) | | (129,019 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 129,921 | | $ | 1,272,795 | | | 13,847 | | $ | 142,652 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 29,045 | | $ | 298,140 | | | 10,002 | | $ | 100,021 | |

Distributions reinvested | | | 285 | | | 3,058 | | | 149 | | | 1,539 | |

Repurchased | | | (10,473 | ) | | (100,269 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 18,857 | | $ | 200,929 | | | 10,149 | | $ | 101,538 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 18,345 | | $ | 182,548 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 224 | | | 2,407 | | | 154 | | | 1,591 | |

Repurchased | | | (5,947 | ) | | (56,797 | ) | | — | | | — | |

Net increase | | | 12,622 | | $ | 128,158 | | | 10,154 | | $ | 101,591 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 15,402 | | $ | 159,749 | | | 10,622 | | $ | 106,656 | |

Distributions reinvested | | | 250 | | | 2,698 | | | 159 | | | 1,642 | |

Repurchased | | | (10,996 | ) | | (110,754 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 4,656 | | $ | 51,693 | | | 10,779 | | $ | 108,276 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 13,037,246 | | $ | 136,162,654 | | | 3,619,334 | | $ | 39,775,763 | |

Distributions reinvested | | | 144,091 | | | 1,554,738 | | | 2,233 | | | 23,067 | |

Repurchased | | | (104,135 | ) | | (1,123,302 | ) | | (32,200 | ) | | (353,406 | ) |

Net increase | | | 13,077,202 | | $ | 136,594,090 | | | 3,589,367 | | $ | 39,445,424 | |

| | | | | | | | | | | | | | |

Net increase | | | 13,450,259 | | $ | 140,422,057 | | | 3,768,458 | | $ | 41,335,860 | |

| | | | | | | | | | | | | | |

1 Period from 10-30-06 (commencement of operations) to 8-31-07.

| |

66 | Lifecycle Portfolios | Annual report |

Lifecycle 2030 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 289,702 | | $ | 3,012,936 | | | 104,649 | | $ | 1,154,412 | |

Distributions reinvested | | | 2,865 | | | 30,623 | | | 209 | | | 2,144 | |

Repurchased | | | (47,030 | ) | | (492,880 | ) | | (766 | ) | | (8,094 | ) |

Net increase | | | 245,537 | | $ | 2,550,679 | | | 104,092 | | $ | 1,148,462 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 47,041 | | $ | 478,082 | | | 27,333 | | $ | 287,630 | |

Distributions reinvested | | | 396 | | | 4,233 | | | 197 | | | 2,024 | |

Repurchased | | | (19,905 | ) | | (208,883 | ) | | (39 | ) | | (437 | ) |

Net increase | | | 27,532 | | $ | 273,432 | | | 27,491 | | $ | 289,217 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 31,099 | | $ | 324,051 | | | 50,632 | | $ | 529,920 | |

Distributions reinvested | | | 578 | | | 6,169 | | | 197 | | | 2,024 | |

Repurchased | | | (31,005 | ) | | (323,375 | ) | | — | | | — | |

Net increase | | | 672 | | $ | 6,845 | | | 50,829 | | $ | 531,944 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 12,120 | | $ | 122,761 | | | 11,832 | | $ | 120,346 | |

Distributions reinvested | | | 221 | | | 2,357 | | | 196 | | | 2,016 | |

Repurchased | | | (274 | ) | | (2,721 | ) | | (2 | ) | | (21 | ) |

Net increase (decrease) | | | 12,067 | | $ | 122,397 | | | 12,026 | | $ | 122,341 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 34,528 | | $ | 347,211 | | | 10,080 | | $ | 100,887 | |

Distributions reinvested | | | 208 | | | 2,217 | | | 201 | | | 2,059 | |

Repurchased | | | (11,401 | ) | | (112,864 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 23,335 | | $ | 236,564 | | | 10,279 | | $ | 102,925 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 144,745 | | $ | 1,413,285 | | | 12,892 | | $ | 131,544 | |

Distributions reinvested | | | 331 | | | 3,534 | | | 205 | | | 2,102 | |

Repurchased | | | (18,261 | ) | | (179,343 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 126,815 | | $ | 1,237,476 | | | 13,095 | | $ | 133,624 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 78,378 | | $ | 829,159 | | | 10,079 | | $ | 100,857 | |

Distributions reinvested | | | 932 | | | 9,945 | | | 202 | | | 2,076 | |

Repurchased | | | (18,674 | ) | | (198,780 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 60,636 | | $ | 640,324 | | | 10,279 | | $ | 102,911 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 2,214 | | $ | 22,031 | | | 10,002 | | $ | 100,020 | |

Distributions reinvested | | | 210 | | | 2,244 | | | 207 | | | 2,127 | |

Repurchased | | | (629 | ) | | (6,325 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 1,795 | | $ | 17,950 | | | 10,207 | | $ | 102,125 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 149,048 | | $ | 1,451,436 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 241 | | | 2,567 | | | 212 | | | 2,178 | |

Repurchased | | | (54,791 | ) | | (530,702 | ) | | — | | | — | |

Net increase | | | 94,498 | | $ | 923,301 | | | 10,212 | | $ | 102,178 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 18,232,119 | | $ | 187,652,703 | | | 4,625,239 | | $ | 50,428,286 | |

Distributions reinvested | | | 187,107 | | | 1,996,434 | | | 3,380 | | | 34,640 | |

Repurchased | | | (49,768 | ) | | (528,520 | ) | | (46,270 | ) | | (488,058 | ) |

Net increase | | | 18,369,458 | | $ | 189,120,617 | | | 4,582,349 | | $ | 49,974,868 | |

| | | | | | | | | | | | | | |

Net increase | | | 18,962,345 | | $ | 195,129,585 | | | 4,830,859 | | $ | 52,610,595 | |

| | | | | | | | | | | | | | |

1 Period from 10-30-06 (commencement of operations) to 8-31-07.

| |

Annual report | Lifecycle Portfolios | 67 |

Lifecycle 2025 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 361,450 | | $ | 3,703,251 | | | 60,756 | | $ | 647,664 | |

Distributions reinvested | | | 1,640 | | | 17,449 | | | 191 | | | 1,958 | |

Repurchased | | | (47,605 | ) | | (488,900 | ) | | — | | | — | |

Net increase | | | 315,485 | | $ | 3,231,800 | | | 60,947 | | $ | 649,622 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 60,998 | | $ | 632,404 | | | 23,983 | | $ | 250,457 | |

Distributions reinvested | | | 322 | | | 3,416 | | | 179 | | | 1,838 | |

Repurchased | | | (15,122 | ) | | (157,598 | ) | | (370 | ) | | (3,914 | ) |

Net increase | | | 46,198 | | $ | 478,222 | | | 23,792 | | $ | 248,381 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 63,029 | | $ | 658,808 | | | 21,270 | | $ | 220,502 | |

Distributions reinvested | | | 344 | | | 3,655 | | | 179 | | | 1,838 | |

Repurchased | | | (12,783 | ) | | (133,371 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 50,590 | | $ | 529,092 | | | 21,447 | | $ | 222,319 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 4,088 | | $ | 41,973 | | | 10,312 | | $ | 103,398 | |

Distributions reinvested | | | 185 | | | 1,963 | | | 178 | | | 1,830 | |

Repurchased | | | (7 | ) | | (66 | ) | | — | | | — | |

Net increase (decrease) | | | 4,266 | | $ | 43,870 | | | 10,490 | | $ | 105,228 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 32,763 | | $ | 329,022 | | | 10,040 | | $ | 100,442 | |

Distributions reinvested | | | 232 | | | 2,456 | | | 183 | | | 1,873 | |

Repurchased | | | (13,265 | ) | | (126,697 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 19,730 | | $ | 204,781 | | | 10,221 | | $ | 102,294 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 178,139 | | $ | 1,738,279 | | | 10,622 | | $ | 106,772 | |

Distributions reinvested | | | 391 | | | 4,146 | | | 187 | | | 1,915 | |

Repurchased | | | (10,732 | ) | | (113,356 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 167,798 | | $ | 1,629,069 | | | 10,807 | | $ | 108,665 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 54,594 | | $ | 577,342 | | | 16,965 | | $ | 178,186 | |

Distributions reinvested | | | 855 | | | 9,067 | | | 184 | | | 1,890 | |

Repurchased | | | (24,749 | ) | | (248,136 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 30,700 | | $ | 338,273 | | | 17,147 | | $ | 180,054 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 11,846 | | $ | 119,032 | | | 10,002 | | $ | 100,021 | |

Distributions reinvested | | | 220 | | | 2,339 | | | 189 | | | 1,941 | |

Repurchased | | | (594 | ) | | (6,004 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 11,472 | | $ | 115,367 | | | 10,189 | | $ | 101,940 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 30,069 | | $ | 309,143 | | | 10,190 | | $ | 102,021 | |

Distributions reinvested | | | 254 | | | 2,694 | | | 194 | | | 1,993 | |

Repurchased | | | (10,901 | ) | | (108,814 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 19,422 | | $ | 203,023 | | | 10,382 | | $ | 103,992 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 22,895,610 | | $ | 235,338,535 | | | 6,225,701 | | $ | 67,419,547 | |

Distributions reinvested | | | 269,249 | | | 2,856,733 | | | 4,892 | | | 50,143 | |

Repurchased | | | (45,102 | ) | | (470,040 | ) | | (57,570 | ) | | (609,992 | ) |

Net increase | | | 23,119,757 | | $ | 237,725,228 | | | 6,173,023 | | $ | 66,859,698 | |

| | | | | | | | | | | | | | |

Net increase | | | 23,785,418 | | $ | 244,498,725 | | | 6,348,445 | | $ | 68,682,193 | |

| | | | | | | | | | | | | | |

1 Period from 10-30-06 (commencement of operations) to 8-31-07.

| |

68 | Lifecycle Portfolios | Annual report |

Lifecycle 2020 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 346,873 | | $ | 3,614,886 | | | 142,559 | | $ | 1,542,872 | |

Distributions reinvested | | | 4,411 | | | 46,760 | | | 173 | | | 1,775 | |

Repurchased | | | (45,096 | ) | | (464,080 | ) | | (4,755 | ) | | (51,607 | ) |

Net increase | | | 306,188 | | $ | 3,197,566 | | | 137,977 | | $ | 1,493,040 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 101,666 | | $ | 1,062,506 | | | 57,441 | | $ | 611,012 | |

Distributions reinvested | | | 1,050 | | | 11,135 | | | 161 | | | 1,655 | |

Repurchased | | | (26,115 | ) | | (267,174 | ) | | (1,092 | ) | | (11,726 | ) |

Net increase | | | 76,601 | | $ | 806,467 | | | 56,510 | | $ | 600,941 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 79,442 | | $ | 833,142 | | | 56,913 | | $ | 602,495 | |

Distributions reinvested | | | 837 | | | 8,877 | | | 161 | | | 1,655 | |

Repurchased | | | (19,431 | ) | | (201,977 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 60,848 | | $ | 640,042 | | | 57,072 | | $ | 604,129 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 20,925 | | $ | 221,867 | | | 10,928 | | $ | 110,016 | |

Distributions reinvested | | | 383 | | | 4,053 | | | 161 | | | 1,647 | |

Repurchased | | | (10,349 | ) | | (103,704 | ) | | (2 | ) | | (21 | ) |

Net increase (decrease) | | | 10,959 | | $ | 122,216 | | | 11,087 | | $ | 111,642 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 30,910 | | $ | 311,811 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 205 | | | 2,165 | | | 165 | | | 1,690 | |

Repurchased | | | (15,236 | ) | | (146,814 | ) | | — | | | — | |

Net increase | | | 15,879 | | $ | 167,162 | | | 10,165 | | $ | 101,690 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 156,560 | | $ | 1,552,843 | | | 19,640 | | $ | 202,008 | |

Distributions reinvested | | | 418 | | | 4,418 | | | 169 | | | 1,732 | |

Repurchased | | | (18,955 | ) | | (192,751 | ) | | (3 | ) | | (37 | ) |

Net increase | | | 138,023 | | $ | 1,364,510 | | | 19,806 | | $ | 203,703 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 102,114 | | $ | 1,086,512 | | | 11,529 | | $ | 116,807 | |

Distributions reinvested | | | 1,002 | | | 10,614 | | | 167 | | | 1,707 | |

Repurchased | | | (28,981 | ) | | (303,910 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 74,135 | | $ | 793,216 | | | 11,694 | | $ | 118,492 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 4,387 | | $ | 44,331 | | | 10,002 | | $ | 100,021 | |

Distributions reinvested | | | 230 | | | 2,435 | | | 172 | | | 1,758 | |

Repurchased | | | (439 | ) | | (4,410 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 4,178 | | $ | 42,356 | | | 10,172 | | $ | 101,757 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 64,772 | | $ | 632,997 | | | 24,951 | | $ | 257,900 | |

Distributions reinvested | | | 378 | | | 4,002 | | | 177 | | | 1,809 | |

Repurchased | | | (11,818 | ) | | (123,740 | ) | | — | | | — | |

Net increase | | | 53,332 | | $ | 513,259 | | | 25,128 | | $ | 259,709 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 22,479,297 | | $ | 232,024,606 | | | 6,122,505 | | $ | 66,015,343 | |

Distributions reinvested | | | 268,281 | | | 2,841,099 | | | 4,746 | | | 48,643 | |

Repurchased | | | (164,608 | ) | | (1,816,093 | ) | | (131,757 | ) | | (1,382,850 | ) |

Net increase | | | 22,582,970 | | $ | 233,049,612 | | | 5,995,494 | | $ | 64,681,136 | |

| | | | | | | | | | | | | | |

Net increase | | | 23,323,113 | | $ | 240,696,406 | | | 6,335,105 | | $ | 68,276,239 | |

| | | | | | | | | | | | | | |

| |

1 | Period from 10-30-06 (commencement of operations) to 8-31-07. |

| |

Annual report | Lifecycle Portfolios | 69 |

Lifecycle 2015 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 256,050 | | $ | 2,615,937 | | | 78,279 | | $ | 826,395 | |

Distributions reinvested | | | 2,745 | | | 28,683 | | | 176 | | | 1,794 | |

Repurchased | | | (49,748 | ) | | (505,001 | ) | | (11 | ) | | (114 | ) |

Net increase | | | 209,047 | | $ | 2,139,619 | | | 78,444 | | $ | 828,075 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 69,878 | | $ | 711,535 | | | 43,663 | | $ | 461,767 | |

Distributions reinvested | | | 783 | | | 8,177 | | | 164 | | | 1,674 | |

Repurchased | | | (19,999 | ) | | (206,216 | ) | | (589 | ) | | (6,260 | ) |

Net increase | | | 50,662 | | $ | 513,496 | | | 43,238 | | $ | 457,181 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 72,676 | | $ | 739,069 | | | 24,475 | | $ | 255,866 | |

Distributions reinvested | | | 452 | | | 4,728 | | | 164 | | | 1,674 | |

Repurchased | | | (18,472 | ) | | (192,134 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 54,656 | | $ | 551,663 | | | 24,637 | | $ | 257,518 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 7,380 | | $ | 75,071 | | | 10,245 | | $ | 102,635 | |

Distributions reinvested | | | 222 | | | 2,314 | | | 163 | | | 1,666 | |

Repurchased | | | (383 | ) | | (3,724 | ) | | — | | | — | |

Net increase (decrease) | | | 7,219 | | $ | 73,661 | | | 10,408 | | $ | 104,301 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 21,618 | | $ | 223,188 | | | 10,006 | | $ | 100,060 | |

Distributions reinvested | | | 391 | | | 4,081 | | | 167 | | | 1,708 | |

Repurchased | | | (10,670 | ) | | (102,139 | ) | | — | | | — | |

Net increase | | | 11,339 | | $ | 125,130 | | | 10,173 | | $ | 101,768 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 121,562 | | $ | 1,195,474 | | | 15,897 | | $ | 162,466 | |

Distributions reinvested | | | 510 | | | 5,315 | | | 171 | | | 1,751 | |

Repurchased | | | (12,505 | ) | | (124,199 | ) | | (909 | ) | | (9,417 | ) |

Net increase | | | 109,567 | | $ | 1,076,590 | | | 15,159 | | $ | 154,800 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 71,912 | | $ | 731,743 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 321 | | | 3,353 | | | 169 | | | 1,725 | |

Repurchased | | | (10,414 | ) | | (99,769 | ) | | — | | | — | |

Net increase | | | 61,819 | | $ | 635,327 | | | 10,169 | | $ | 101,725 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 8,080 | | $ | 80,771 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 261 | | | 2,726 | | | 174 | | | 1,777 | |

Repurchased | | | (706 | ) | | (7,076 | ) | | — | | | — | |

Net increase | | | 7,635 | | $ | 76,421 | | | 10,174 | | $ | 101,777 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 61,469 | | $ | 625,889 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 288 | | | 3,004 | | | 179 | | | 1,828 | |

Repurchased | | | (23,994 | ) | | (240,340 | ) | | — | | | — | |

Net increase | | | 37,763 | | $ | 388,553 | | | 10,179 | | $ | 101,828 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 17,158,243 | | $ | 176,378,050 | | | 5,361,809 | | $ | 57,250,879 | |

Distributions reinvested | | | 254,558 | | | 2,660,134 | | | 2,570 | | | 26,262 | |

Repurchased | | | (251,331 | ) | | (2,535,009 | ) | | (146,622 | ) | | (1,540,356 | ) |

Net increase | | | 17,161,470 | | $ | 176,503,175 | | | 5,217,757 | | $ | 55,736,785 | |

| | | | | | | | | | | | | | |

Net increase | | | 17,711,177 | | $ | 182,083,635 | | | 5,430,338 | | $ | 57,945,758 | |

| | | | | | | | | | | | | | |

| |

1 | Period from 10-30-06 (commencement of operations) to 8-31-07. |

| |

70 | Lifecycle Portfolios | Annual report |

Lifecycle 2010 Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 206,150 | | $ | 2,112,391 | | | 92,090 | | $ | 965,714 | |

Distributions reinvested | | | 2,495 | | | 25,819 | | | 151 | | | 1,540 | |

Repurchased | | | (60,209 | ) | | (603,338 | ) | | (29,153 | ) | | (309,869 | ) |

Net increase | | | 148,436 | | $ | 1,534,872 | | | 63,088 | | $ | 657,385 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 23,018 | | $ | 235,563 | | | 12,327 | | $ | 124,735 | |

Distributions reinvested | | | 280 | | | 2,904 | | | 139 | | | 1,421 | |

Repurchased | | | (12,596 | ) | | (126,151 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 10,702 | | $ | 112,316 | | | 12,464 | | $ | 126,135 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 100,254 | | $ | 1,040,588 | | | 39,409 | | $ | 405,423 | |

Distributions reinvested | | | 1,147 | | | 11,884 | | | 139 | | | 1,421 | |

Repurchased | | | (38,965 | ) | | (403,306 | ) | | (2 | ) | | (22 | ) |

Net increase | | | 62,436 | | $ | 649,166 | | | 39,546 | | $ | 406,822 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 174 | | $ | 1,776 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 211 | | | 2,182 | | | 139 | | | 1,413 | |

Repurchased | | | — | | | — | | | — | | | — | |

Net increase (decrease) | | | 385 | | $ | 3,958 | | | 10,139 | | $ | 101,413 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 2,725 | | $ | 27,217 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 238 | | | 2,456 | | | 143 | | | 1,455 | |

Repurchased | | | (25 | ) | | (258 | ) | | — | | | — | |

Net increase | | | 2,938 | | $ | 29,415 | | | 10,143 | | $ | 101,455 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 311,738 | | $ | 3,064,593 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 264 | | | 2,730 | | | 147 | | | 1,498 | |

Repurchased | | | (87,280 | ) | | (881,776 | ) | | — | | | — | |

Net increase | | | 224,722 | | $ | 2,185,547 | | | 10,147 | | $ | 101,498 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 97,370 | | $ | 1,016,704 | | | 10,027 | | $ | 100,273 | |

Distributions reinvested | | | 1,055 | | | 10,914 | | | 144 | | | 1,473 | |

Repurchased | | | (26,359 | ) | | (266,281 | ) | | — | | | — | |

Net increase | | | 72,066 | | $ | 761,337 | | | 10,171 | | $ | 101,746 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 16,708 | | $ | 166,308 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 264 | | | 2,730 | | | 149 | | | 1,523 | |

Repurchased | | | (5,964 | ) | | (57,706 | ) | | — | | | — | |

Net increase | | | 11,008 | | $ | 111,332 | | | 10,149 | | $ | 101,523 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 57,081 | | $ | 557,654 | | | 10,000 | | $ | 100,000 | |

Distributions reinvested | | | 290 | | | 3,005 | | | 154 | | | 1,574 | |

Repurchased | | | (16,191 | ) | | (158,353 | ) | | — | | | — | |

Net increase | | | 41,180 | | $ | 402,306 | | | 10,154 | | $ | 101,574 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 10,300,472 | | $ | 105,648,006 | | | 2,520,127 | | $ | 26,611,731 | |

Distributions reinvested | | | 147,202 | | | 1,523,542 | | | 965 | | | 9,843 | |

Repurchased | | | (368,067 | ) | | (3,737,100 | ) | | (115,877 | ) | | (1,235,555 | ) |

Net increase | | | 10,079,607 | | $ | 103,434,448 | | | 2,405,215 | | $ | 25,386,019 | |

| | | | | | | | | | | | | | |

Net increase | | | 10,653,480 | | $ | 109,224,697 | | | 2,581,216 | | $ | 27,185,570 | |

| | | | | | | | | | | | | | |

| |

1 | Period from 10-30-06 (commencement of operations) to 8-31-07. |

| |

Annual report | Lifecycle Portfolios | 71 |

Lifecycle Retirement Portfolio

| | | | | | | | | | | | | |

| | Shares | | Year ended 8-31-08

Amount | | Shares | | Period ended 8-31-07

Amount | 1 |

| | | | | | | | | | |

Class A shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 823,146 | | $ | 8,271,824 | | | 426,231 | | $ | 4,425,214 | |

Distributions reinvested | | | 26,078 | | | 261,289 | | | 1,672 | | | 17,355 | |

Repurchased | | | (141,454 | ) | | (1,376,430 | ) | | (14,393 | ) | | (150,201 | ) |

Net increase | | | 707,770 | | $ | 7,156,683 | | | 413,510 | | $ | 4,292,368 | |

| | | | | | | | | | | | | | |

Class B shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 27,292 | | $ | 280,517 | | | 38,650 | | $ | 399,558 | |

Distributions reinvested | | | 1,270 | | | 12,810 | | | 313 | | | 3,206 | |

Repurchased | | | (20,551 | ) | | (201,914 | ) | | (1,449 | ) | | (15,078 | ) |

Net increase | | | 8,011 | | $ | 91,413 | | | 37,514 | | $ | 387,686 | |

| | | | | | | | | | | | | | |

Class C shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 665,373 | | $ | 6,704,880 | | | 133,397 | | $ | 1,381,684 | |

Distributions reinvested | | | 11,420 | | | 114,105 | | | 456 | | | 4,700 | |

Repurchased | | | (135,683 | ) | | (1,322,073 | ) | | (2,165 | ) | | (22,143 | ) |

Net increase | | | 541,110 | | $ | 5,496,912 | | | 131,688 | | $ | 1,364,241 | |

| | | | | | | | | | | | | | |

Class R shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 4,734 | | $ | 45,493 | | | 10,002 | | $ | 100,020 | |

Distributions reinvested | | | 394 | | | 3,963 | | | 238 | | | 2,426 | |

Repurchased | | | (4,741 | ) | | (45,064 | ) | | (2 | ) | | (20 | ) |

Net increase (decrease) | | | 387 | | $ | 4,392 | | | 10,238 | | $ | 102,426 | |

| | | | | | | | | | | | | | |

Class R1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 115 | | $ | 1,135 | | | 10,002 | | $ | 100,020 | |

Distributions reinvested | | | 404 | | | 4,064 | | | 255 | | | 2,601 | |

Repurchased | | | — | | | — | | | (2 | ) | | (20 | ) |

Net increase | | | 519 | | $ | 5,199 | | | 10,255 | | $ | 102,601 | |

| | | | | | | | | | | | | | |

Class R2 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 10,844 | | $ | 108,356 | | | 10,360 | | $ | 103,687 | |

Distributions reinvested | | | 531 | | | 5,321 | | | 272 | | | 2,777 | |

Repurchased | | | (5,468 | ) | | (52,471 | ) | | (1 | ) | | (14 | ) |

Net increase | | | 5,907 | | $ | 61,206 | | | 10,631 | | $ | 106,450 | |

| | | | | | | | | | | | | | |

Class R3 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 9,187 | | $ | 95,388 | | | 10,007 | | $ | 100,073 | |

Distributions reinvested | | | 674 | | | 6,767 | | | 259 | | | 2,645 | |

Repurchased | | | (684 | ) | | (6,788 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 9,177 | | $ | 95,367 | | | 10,264 | | $ | 102,697 | |

| | | | | | | | | | | | | | |

Class R4 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 97 | | $ | 946 | | | 10,002 | | $ | 100,020 | |

Distributions reinvested | | | 440 | | | 4,426 | | | 278 | | | 2,843 | |

Repurchased | | | — | | | — | | | (2 | ) | | (21 | ) |

Net increase | | | 537 | | $ | 5,372 | | | 10,278 | | $ | 102,842 | |

| | | | | | | | | | | | | | |

Class R5 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 980 | | $ | 9,618 | | | 10,002 | | $ | 100,020 | |

Distributions reinvested | | | 474 | | | 4,769 | | | 298 | | | 3,040 | |

Repurchased | | | (1 | ) | | (8 | ) | | (2 | ) | | (21 | ) |

Net increase | | | 1,453 | | $ | 14,379 | | | 10,298 | | $ | 103,039 | |

| | | | | | | | | | | | | | |

Class 1 shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Sold | | | 22,765,338 | | $ | 228,178,574 | | | 7,847,983 | | $ | 80,813,062 | |

Distributions reinvested | | | 565,986 | | | 5,643,203 | | | 54,521 | | | 563,991 | |

Repurchased | | | (7,198,772 | ) | | (71,496,368 | ) | | (1,541,863 | ) | | (15,951,117 | ) |

Net increase | | | 16,132,552 | | $ | 162,325,409 | | | 6,360,641 | | $ | 65,425,936 | |

| | | | | | | | | | | | | | |

Net increase | | | 17,407,423 | | $ | 175,256,332 | | | 7,005,317 | | $ | 72,090,286 | |

| | | | | | | | | | | | | | |

| |

1 | Period from 10-30-06 (commencement of operations) to 8-31-07. |

| |

72 | Lifecycle Portfolios | Annual report |

8. Purchases and sales of securities

The following summarizes the Portfolios’ purchases and sales of the affiliated and unaffiliated underlying funds for the year ended August 31, 2008:

| | | | | | | | | | | |

| | Purchases | | Sales and Maturities | |

Portfolio | | U.S. Government | | Other Issuers | | U.S. Government | | Other Issuers | |

| | | | | | | | | | | | |

|

Lifecycle 2045 | | — | | $ | 96,134,388 | | — | | $ | 9,945,437 | |

Lifecycle 2040 | | — | | | 112,315,925 | | — | | | 11,529,931 | |

Lifecycle 2035 | | — | | | 157,485,206 | | — | | | 14,863,856 | |

Lifecycle 2030 | | — | | | 211,886,773 | | — | | | 14,060,967 | |

Lifecycle 2025 | | — | | | 264,877,062 | | — | | | 16,957,704 | |

Lifecycle 2020 | | — | | | 262,473,426 | | — | | | 18,124,090 | |

Lifecycle 2015 | | — | | | 200,156,586 | | — | | | 14,860,078 | |

Lifecycle 2010 | | — | | | 122,325,229 | | — | | | 11,165,401 | |

Lifecycle Retirement | | — | | | 258,604,955 | | — | | | 89,047,328 | |

9. Investment in affiliated underlying funds

The Portfolios invest primarily in affiliated underlying funds that are managed by affiliates of the Adviser. The Portfolios do not invest in affiliated underlying funds for the purpose of exercising management or control; however, the Portfolios’ investments may represent a significant portion of each underlying funds’ net assets. As of August 31, 2008, the following Portfolios held 5% or more of the underlying funds’ net assets:

| | | | | |

Portfolio | | Affiliate—Class NAV | | Percent of Underlying Funds’ Net Assets |

| | | | | | |

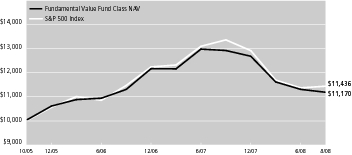

Lifecycle 2045 | | Value | | 7.99% | |

| | | | | |

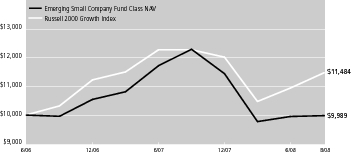

Lifecycle 2040 | | Emerging Small Company | | 5.43% | |

| | Value | | 9.18% | |

| | | | | |

Lifecycle 2035 | | Emerging Small Company | | 7.76% | |

| | Value | | 13.06% | |

| | | | | |

Lifecycle 2030 | | Emerging Small Company | | 10.64% | |

| | Index 500 | | 5.19% | |

| | International Equity Index | | 5.09% | |

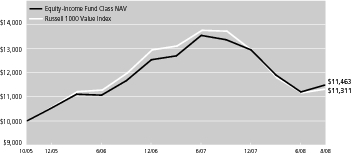

| | Value | | 17.94% | |

| | | | | |

Lifecycle 2025 | | Emerging Small Company | | 11.54% | |

| | Index 500 | | 6.88% | |

| | International Equity Index | | 6.45% | |

| | Total Bond Market | | 9.89% | |

| | Value | | 11.37% | |

| | | | | |

Lifecycle 2020 | | Emerging Small Company | | 7.64% | |

| | Index 500 | | 7.08% | |

| | International Equity Index | | 5.82% | |

| | Total Bond Market | | 9.66% | |

| | Value | | 11.21% | |

| | | | | |

Lifecycle 2015 | | Index 500 | | 5.20% | |

| | Total Bond Market | | 18.83% | |

| | Value | | 8.76% | |

| | | | | |

Lifecycle 2010 | | Total Bond Market | | 21.59% | |

| | | | | |

Lifecycle Retirement | | Total Bond Market | | 15.90% | |

| |

Annual report | Lifecycle Portfolios | 73 |

Report of Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

To the Board of Trustees and Shareholders of John Hancock Funds II,

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Funds (identified in Note 1) which are part of John Hancock Funds II (the “Trust”) at August 31, 2008, the results of each of their operations, the changes in each of their net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Trust’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2008 by correspondence with the custodian, transfer agent, and brokers, and the application of alternative auditing procedures where securities purchased had not been received, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 30, 2008

| |

74 | Lifecycle Portfolios | Annual report |

|

| |

Tax information |

|

Unaudited |

For federal income tax purposes, the following information is furnished with respect to the distributions of the Portfolios, if any, paid during its taxable year ended August 31, 2008.

Long Term Capital Gains The Portfolios below have designated the following amounts as capital gain dividends paid during the year.

| | | | |

Portfolio | | Capital Gain | |

| | | | | |

|

Lifecycle 2045 | | $ | 64,011 | |

Lifecycle 2040 | | | 72,022 | |

Lifecycle 2035 | | | 45,027 | |

Lifecycle 2030 | | | — | |

Lifecycle 2025 | | | — | |

Lifecycle 2020 | | | — | |

Lifecycle 2015 | | | — | |

Lifecycle 2010 | | | — | |

Lifecycle Retirement | | | 108,827 | |

Dividend Received Deduction Corporate shareholders are generally entitled to take the dividend received deduction on the portion of a Portfolio’s dividend distribution that qualifies under tax law. The percentage of the Portfolio’s fiscal 2008 ordinary income dividends that qualifies for the corporate dividend received deduction is set forth below.

| | | | |

Portfolio | | Dividend Received

Deduction | |

| | | | | |

|

Lifecycle 2045 | | | 32.25 | % |

Lifecycle 2040 | | | 31.87 | |

Lifecycle 2035 | | | 31.05 | |

Lifecycle 2030 | | | 27.64 | |

Lifecycle 2025 | | | 22.34 | |

Lifecycle 2020 | | | 18.05 | |

Lifecycle 2015 | | | 13.51 | |

Lifecycle 2010 | | | 13.90 | |

Lifecycle Retirement | | | 9.26 | |

Qualified Dividend Income The Portfolio hereby designates the maximum amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. This amount will be reflected on Form 1099-DIV for the calendar year 2008.

Shareholders will be mailed a 2008 U.S. Treasury Department Form 1099-DIV in January 2009. This will reflect the total of all distributions that are taxable for the calendar year 2008.

| |

Annual report | Lifecycle Portfolios | 75 |

EVALUATION OF ADVISORY AND SUBADVISORY AGREEMENTS BY THE BOARD OF TRUSTEES

This section describes the evaluation by the Board of Trustees of the Advisory Agreement (the “Advisory Agreement”) and each of the Subadvisory Agreements and the Sub-Subadvisory Agreements (collectively, the “Subadvisory Agreements”) for each of the portfolios (the “Funds”) of John Hancock Funds II (the “Trust”) discussed in this annual report.

EVALUATION BY THE BOARD OF TRUSTEES

The Board, including the Independent Trustees, is responsible for selecting the Trust’s adviser, John Hancock Investment Management Services, LLC (the “Adviser” or “JHIMS”), approving the Adviser’s selection of subadvisers for each of the portfolios of the Trust and approving the Trust’s advisory and subadvisory (and any sub-subadvisory) agreements, their periodic continuation and any amendments. Consistent with SEC rules, the Board regularly evaluates the Trust’s advisory and subadvisory arrangements, including consideration of the factors listed below. The Board may also consider other factors (including conditions and trends prevailing generally in the economy, the securities markets and the industry) and does not treat any single factor as determinative, and each Trustee may attribute different weights to different factors. The Board is furnished with an analysis of its fiduciary obligations in connection with its evaluation and, throughout the evaluation process, the Board is assisted by counsel for the Trust and the Independent Trustees are also separately assisted by independent legal counsel. The factors considered by the Board are:

| | |

| 1. | the nature, extent and quality of the services to be provided by the Adviser to the Trust and by the subadvisers to the Funds; |

| | |

| 2. | the investment performance of the Funds and their subadvisers; |

| | |

| 3. | the extent to which economies of scale would be realized as a Fund grows and whether fee levels reflect these economies of scale for the benefit of Trust shareholders; |

| | |

| 4. | the costs of the services to be provided and the profits to be realized by the Adviser and its affiliates (including any subadvisers that are affiliated with the Adviser) from the Adviser’s relationship with the Trust; and |

| | |

| 5. | comparative services rendered and comparative advisory and subadvisory fee rates. |

The Board believes that information relating to all of these factors is relevant to its evaluation of the Trust’s advisory agreement. With respect to its evaluation of subadvisory agreements (including any sub-subadvisory agreements) with subadvisers not affiliated with the Adviser, the Board believes that, in view of the Trust’s “manager-of-managers” advisory structure, the costs of the services to be provided and the profits to be realized by those subadvisers that are not affiliated with the Adviser from their relationship with the Trust generally are not a material factor in the Board’s consideration of these subadvisory agreements because such fees are paid by the Adviser and not by the Funds and the Board relies on the ability of the Adviser to negotiate the subadvisory fees at arm’s-length.

In evaluating subadvisory arrangements, the Board also considers other material business relationships that unaffiliated subadvisers and their affiliates have with the Adviser or its affiliates, including the involvement by certain affiliates of certain subadvisers in the distribution of financial products, including shares of the Trust, offered by the Adviser and other affiliates of the Adviser (“Material Relationships”).

APPROVAL OF ADVISORY AGREEMENT

At its meeting on May 30, 2008, the Board, including all the Independent Trustees, approved the Advisory Agreement.

In approving the renewal of the Advisory Agreement, and with reference to the factors that it regularly considers, the Board:

| |

(1) | (a) considered the high value to the Trust of continuing its relationship with JHIMS as the Trust’s adviser, the skills and competency with which JHIMS has in the past managed the Trust’s affairs and its subadvisory relationships, JHIMS’s oversight and monitoring of the subadvisers’ investment performance and compliance programs, including its timeliness in responding to performance issues and the qualifications of JHIMS’s personnel, |

| |

| (b) considered JHIMS’s compliance policies and procedures and its responsiveness to regulatory changes and mutual fund industry developments, and |

| |

| (c) considered JHIMS’s administrative capabilities, including its ability to supervise the other service providers for the Funds and concluded that JHIMS may reasonably be expected to continue to perform its services under the Advisory Agreement with respect to the Funds; |

| |

(2) | reviewed the investment performance of each of the Funds; the comparative performance of their respective benchmarks, comparable funds as included in a report prepared by an independent third party (i.e., funds having approximately the same investment objective), if any; and JHIMS’s analysis of such performance and its plans and recommendations regarding the Trust’s subadvisory arrangements generally and with respect to particular Funds; and concluded that each of the Funds has generally performed well or within a range that the Board deemed competitive except as discussed in Appendix A and in such cases, that appropriate action is being taken to address performance, if necessary, or that such performance is reasonable in light of all factors considered, and that JHIMS may reasonably be expected to continue ably to monitor the performance of the Funds and each of their subadvisers; |

| |

(3) | (a) reviewed the advisory and other fee waivers and expense reimbursements with respect to certain of the Funds, |

| |

| (b) reviewed the Trust’s advisory fee structure and the incorporation therein of any subadvisory fee breakpoints in the advisory fees charged and concluded (i) that to |

| |

76 | Lifecycle Portfolios | Annual report |

| |

| the extent that Funds have subadvisory fees with breakpoints, those breakpoints are reflected as breakpoints in the advisory fees for Funds, (ii) that all Funds with a subadviser that is not affiliated with the Adviser have subadvisory fees which are the product of arm’s-length negotiations between the Adviser and the subadviser and which in many, but not all, cases contain breakpoints, and (iii) that, although economies of scale cannot be measured with precision, these arrangements permit shareholders of Funds with advisory fee breakpoints to benefit from economies of scale if those Funds grow; |

| |

(4) | (a) reviewed the financial statements of JHIMS and considered (i) an analysis presented by JHIMS regarding the net profitability to JHIMS of each Fund, |

| |

| (b) reviewed and considered an analysis presented by JHIMS regarding the profitability of the JHIMS’s relationship with each Fund and whether JHIMS has the financial ability to continue to provide a high level of services to the Fund, |

| |

| (c) considered that in the case of Class 1 shares the John Hancock insurance companies that are affiliates of JHIMS, as shareholders of Class 1 shares of the Trust directly or through their separate accounts, receive certain tax credits or deductions relating to foreign taxes paid and dividends received by certain Funds of the Trust and noted that these tax benefits, which are not available to contract owners under applicable income tax law, are reflected in the profitability analysis reviewed by the Board. |

| |

| (d) considered that JHIMS derives reputational and other indirect benefits from providing advisory services to the Funds, and |

| |