UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21779

JOHN HANCOCK FUNDS II

---------------------------------------------------------

(Exact name of registrant as specified in charter)

200 BERKELEY STREET, BOSTON, MASSACHUSETTS 02116

-------------------------------------------------------------

(Address of principal executive offices) (Zip code)

SALVATORE SCHIAVONE, 200 BERKELEY STREET, BOSTON, MASSACHUSETTS 02116

------------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 663-4497

------------------

Date of fiscal year end: 8/31

Date of reporting period: 2/29/20

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared ten semiannual reports to shareholders including thirty-nine funds for the period ended February 29, 2020. The first report applies to Alternative Asset Allocation Fund, the second report applies to Blue Chip Growth Fund, the third report applies to Equity Income Fund, the fourth report applies to Fundamental Global Franchise Fund, the fifth report applies to Global Equity Fund, the sixth report applies to Income Allocation Fund, the seventh report applies to Small Cap Value Fund, the eighth report applies to 11 Multi-Index Lifetime Portfolios, the ninth report applies to 10 Multi-Index Preservation Portfolios, the tenth report applies to 11 Multimanager Lifetime Portfolios of the Registrant.

John Hancock

Alternative Asset Allocation Fund

Semiannual report 2/29/2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling John Hancock Investment Management at 800-225-5291 (Class A and Class C shares) or 888-972-8696 (Class I, Class R2, Class R4, and Class R6 shares) or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform John Hancock Investment Management or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

A message to shareholders

Dear shareholder,

Global financial markets were on pace to deliver strong returns during the 6 months ended February 29, 2020, until heightened fears over the coronavirus (COVID-19) sent the markets skidding during the last week of the period. Prior to the turbulence, investors benefited from a combination of low inflation, accommodative central bank policy, healthy fundamentals, and corporate buybacks of stock. Investors in non-U.S. equities also saw strong gains, fueled in part by similarly supportive monetary policy and some signs of strength in developing markets. In an environment of low inflation and declining interest rates, bonds were also faring well.

However, the COVID-19 pandemic and plummeting oil prices put an end to all that good news. Shortly after period end, the U.S. Federal Reserve lowered interest rates and lawmakers embarked on a plan to launch major fiscal stimulus to support the economy.

After the longest bull market in U.S. history, we're now in bear market territory. Indeed, the spread of COVID-19, trade disputes, rising unemployment, and other geopolitical tensions may continue to create uncertainty among businesses and investors. Your financial professional can helpposition your portfolio so that it's sufficiently diversified to seek to meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management, I'd like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Alternative Asset Allocation Fund

Table of contents

| | | |

| 2 | | Your fund at a glance |

| 3 | | Portfolio summary |

| 4 | | A look at performance |

| 6 | | Your expenses |

| 8 | | Fund's investments |

| 10 | | Financial statements |

| 13 | | Financial highlights |

| 19 | | Notes to financial statements |

| 29 | | More information |

SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 1

INVESTMENT OBJECTIVE

The fund seeks long-term growth of capital.

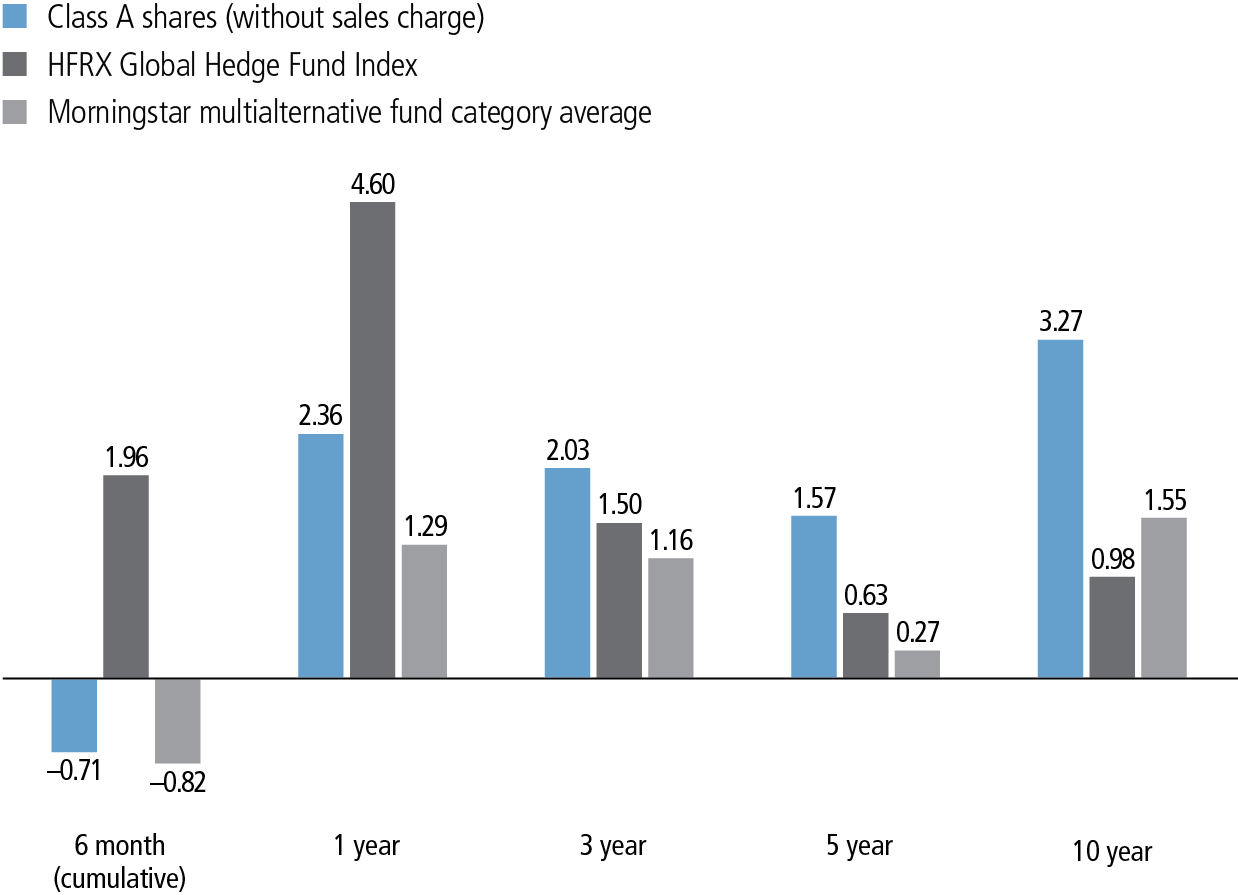

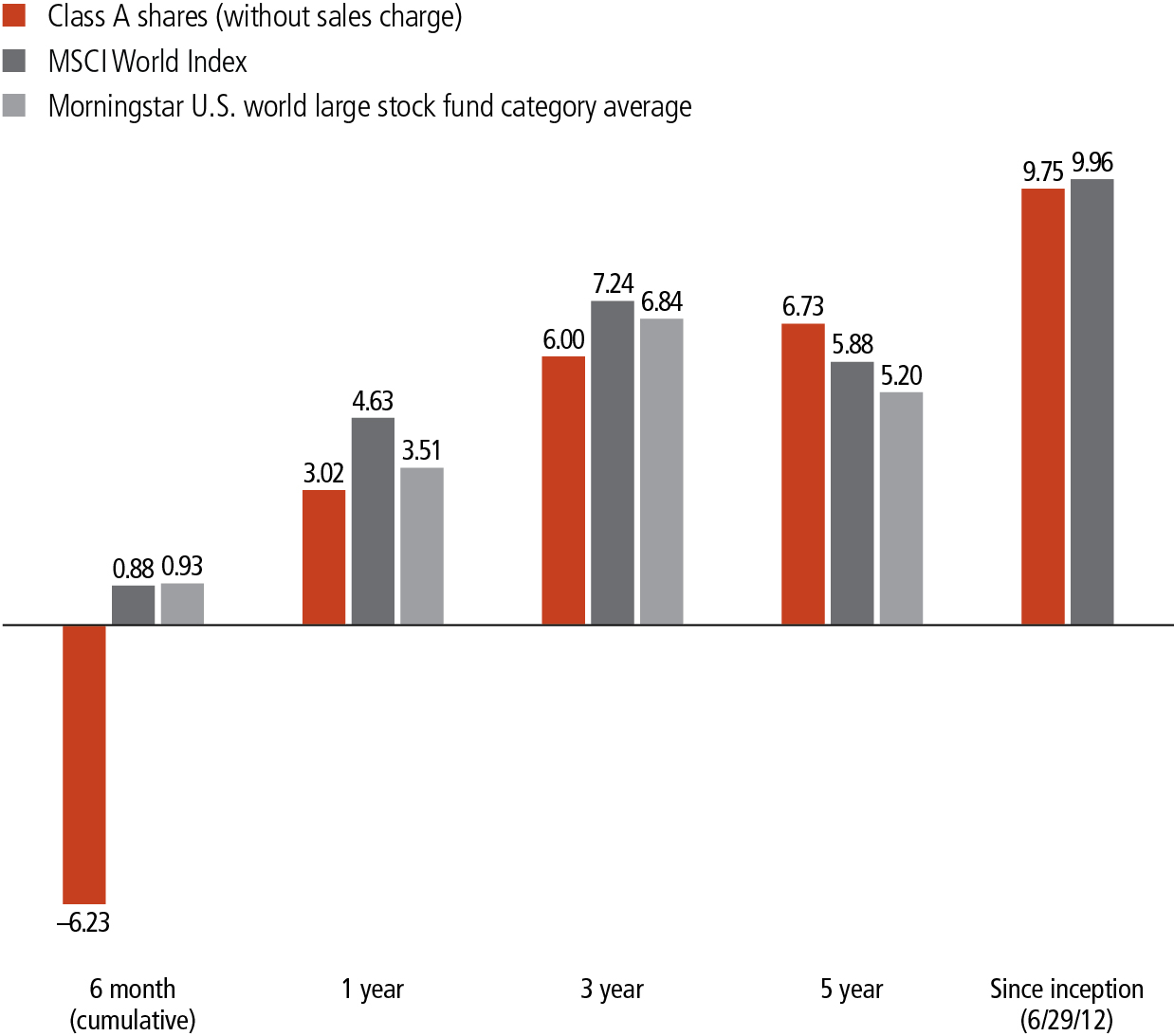

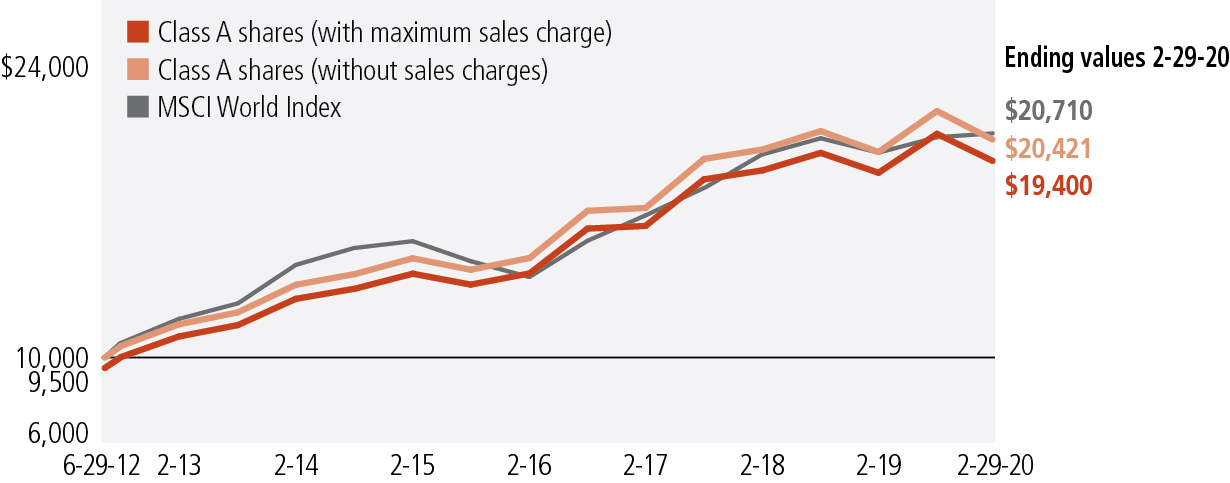

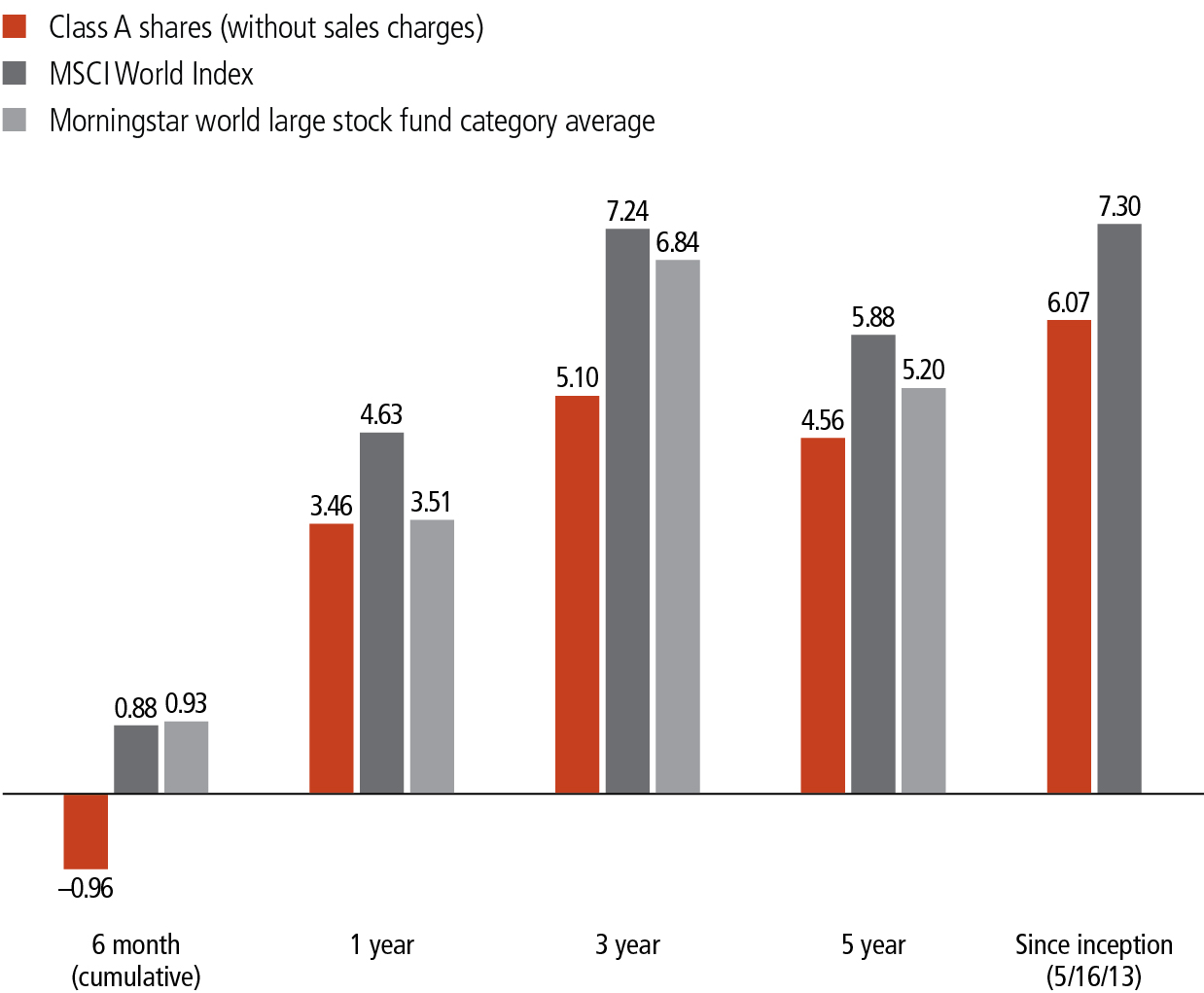

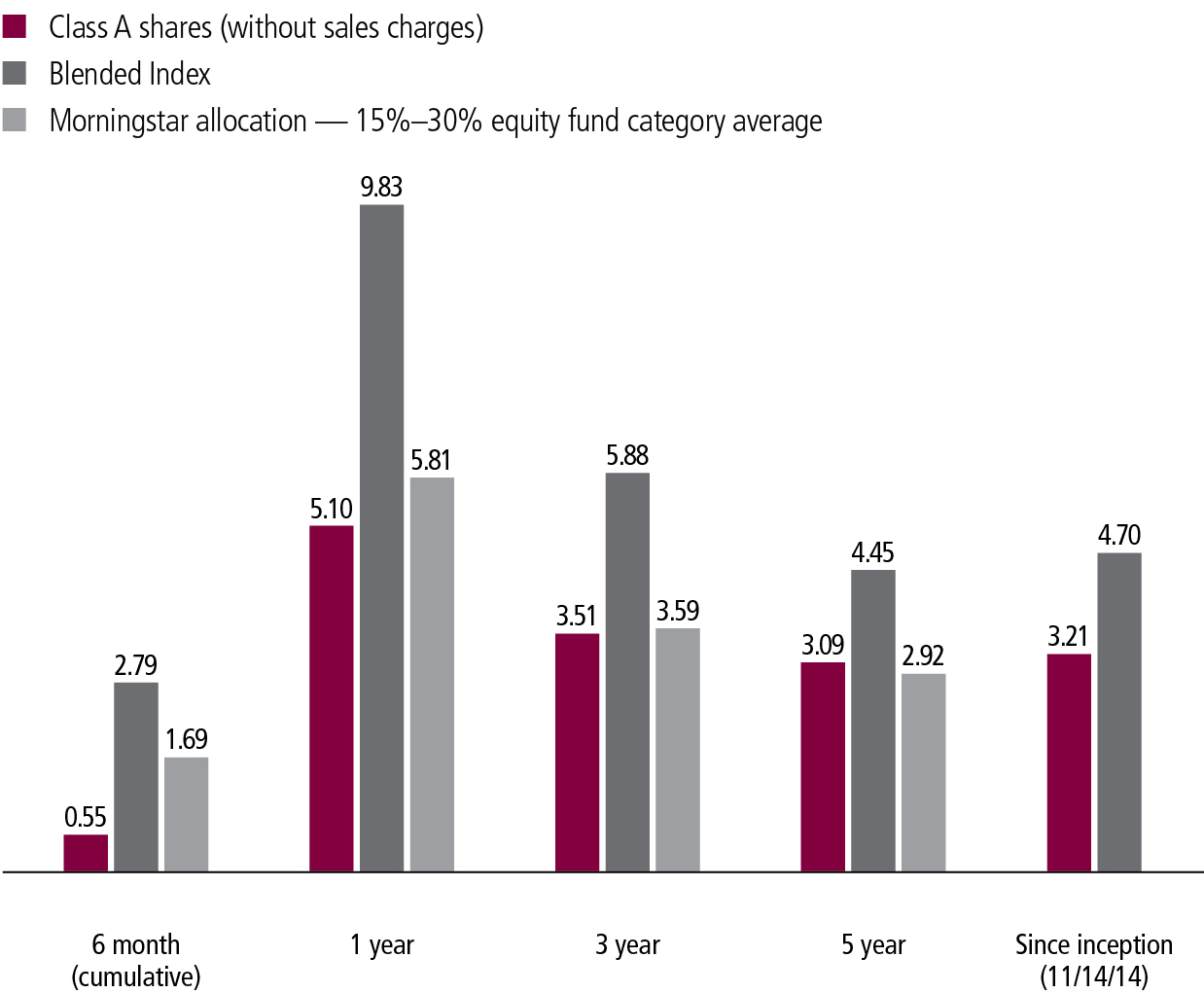

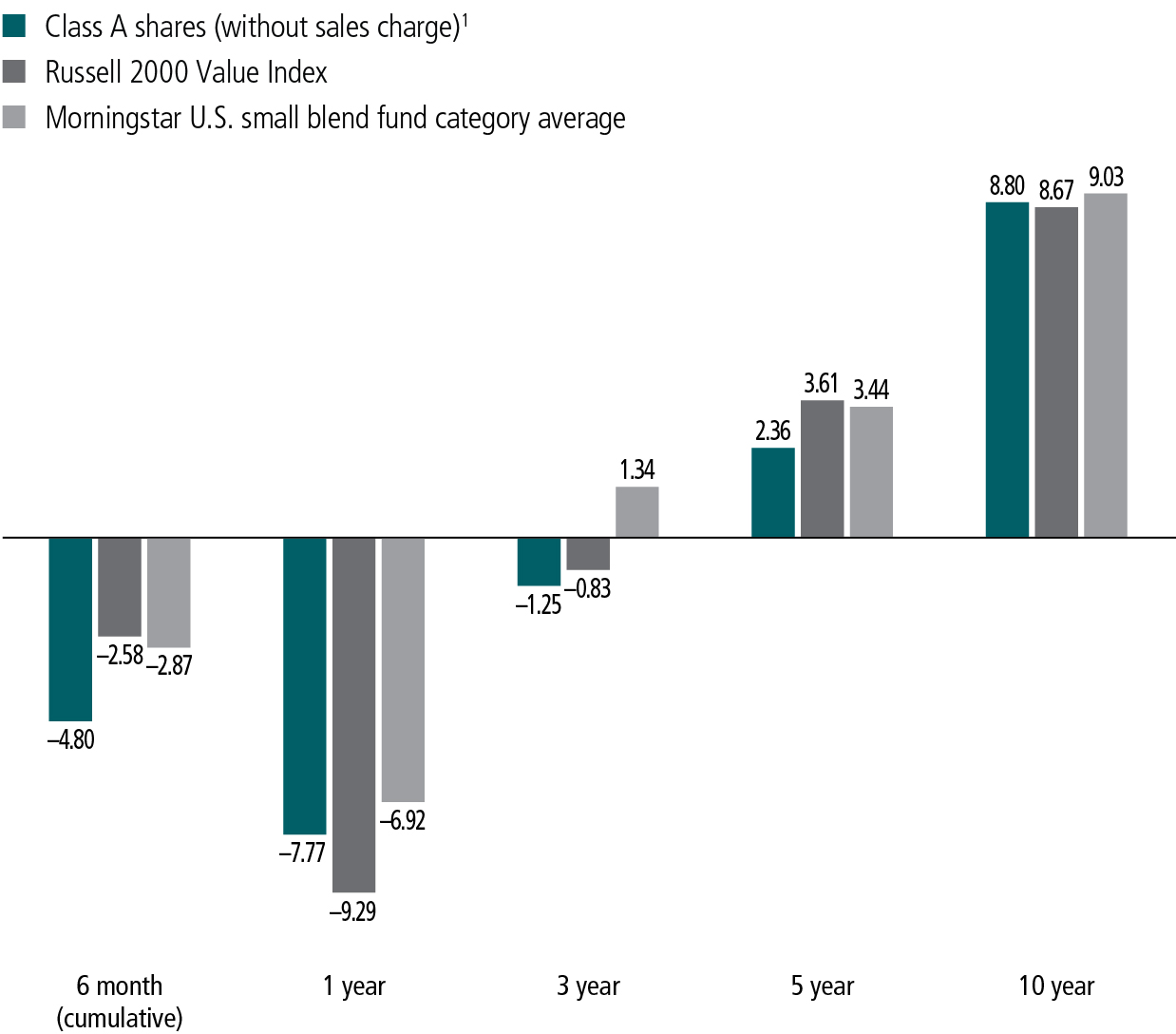

AVERAGE ANNUAL TOTAL RETURNS AS OF 2/29/2020 (%)

The HFRX Global Hedge Fund Index is composed of all eligible hedge fund strategies including four principal strategies: equity hedge, event driven, macro/managed futures, and relative value arbitrage.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower. Since-inception returns for the Morningstar fund category average are not available.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Returns for periods shorter than one year are cumulative. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus. The fund recently experienced negative short-term performance due to market volatility associated with the COVID-19 pandemic.

SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 2

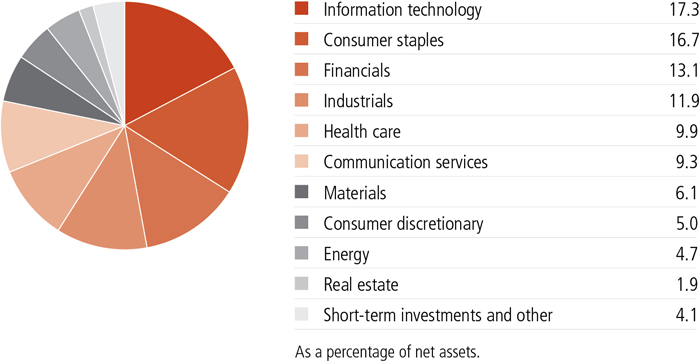

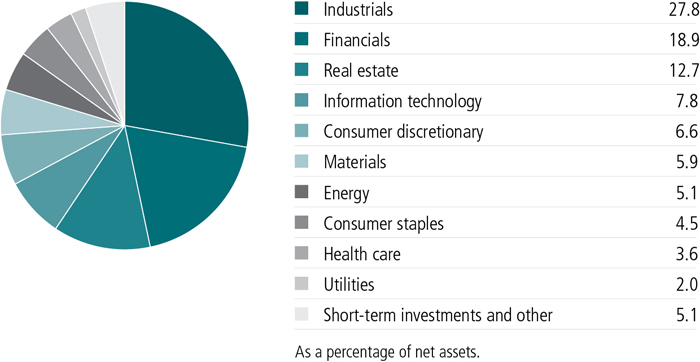

ASSET ALLOCATION AS OF 2/29/2020 (%)

| | | |

| Affiliated investment companies | 72.4 |

| | Alternative investment approaches | 33.5 |

| | Absolute return strategies | 32.5 |

| | Alternative markets | 6.4 |

| Unaffiliated investment companies | 26.5 |

| | Alternative investment approaches | 11.2 |

| | Absolute return strategies | 11.2 |

| | Alternative markets | 4.1 |

| Short-term investments and other | 1.1 |

As a percentage of net assets.

A note about risks

The fund may be subject to various risks as described in the fund's prospectus. For more information, please refer to the "Principal risks" section of the prospectus and "Subsequent events" section in the Notes to financial statements.

SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 3

TOTAL RETURNS FOR THE PERIOD ENDED FEBRUARY 29, 2020

| | | | | | | | |

Average annual total returns (%)

with maximum sales charge | | Cumulative total returns (%)

with maximum sales charge |

| | 1-year | 5-year | 10-year1 | | 6-month | 5-year | 10-year1 |

| Class A | -2.76 | 0.53 | 2.74 | | -5.68 | 2.67 | 31.09 |

| Class C2 | 0.67 | 0.87 | 2.65 | | -2.01 | 4.42 | 29.89 |

| Class I2,3 | 2.73 | 1.89 | 3.59 | | -0.49 | 9.82 | 42.26 |

| Class R22,3 | 2.27 | 1.47 | 3.16 | | -0.73 | 7.58 | 36.54 |

| Class R42,3 | 2.52 | 1.73 | 3.37 | | -0.62 | 8.95 | 39.27 |

| Class R62,3 | 2.84 | 2.00 | 3.62 | | -0.45 | 10.40 | 42.70 |

| Index† | 4.60 | 0.63 | 0.98 | | 1.96 | 3.20 | 10.26 |

Performance figures assume all distributions are reinvested. Figures reflect maximum sales charges on Class A shares of 5% and the applicable contingent deferred sales charge (CDSC) on Class C shares. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R2, Class R4, and Class R6 shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. Net expenses reflect contractual expense limitations in effect until December 31, 2020 and are subject to change. Had the contractual fee waivers and expense limitations not been in place, gross expenses would apply. The following expense ratios include expenses of the affiliated underlying funds in which the fund invests. The expense ratios are as follows:

| | | | | | | |

| | Class A | Class C | Class I | Class R2 | Class R4 | Class R6 |

| Gross (%) | 1.78 | 2.48 | 1.48 | 1.87 | 1.72 | 1.37 |

| Net (%) | 1.70 | 2.40 | 1.40 | 1.79 | 1.54 | 1.29 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the HFRX Global Hedge Fund Index. |

See the following page for footnotes.

SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 4

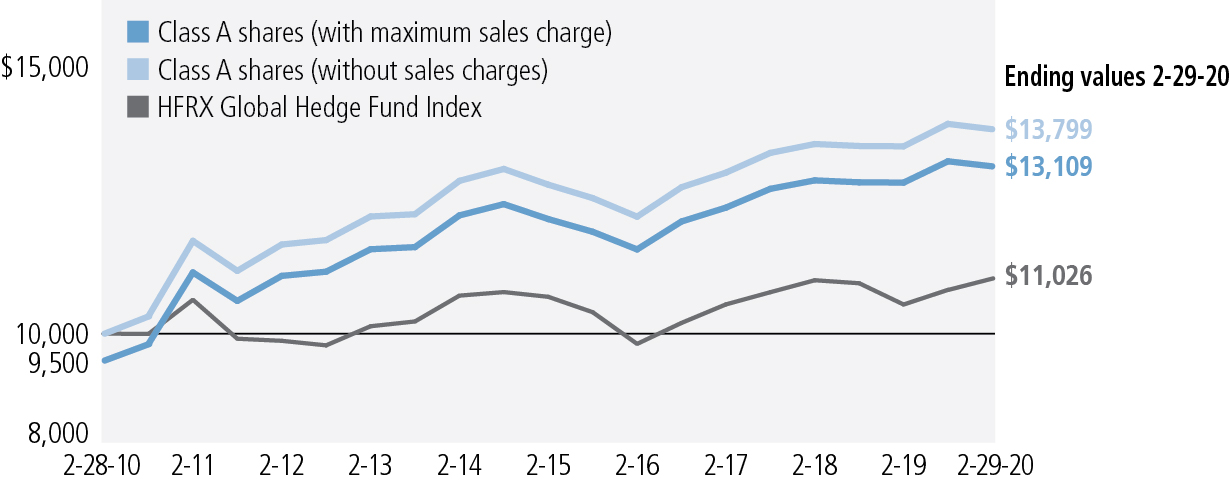

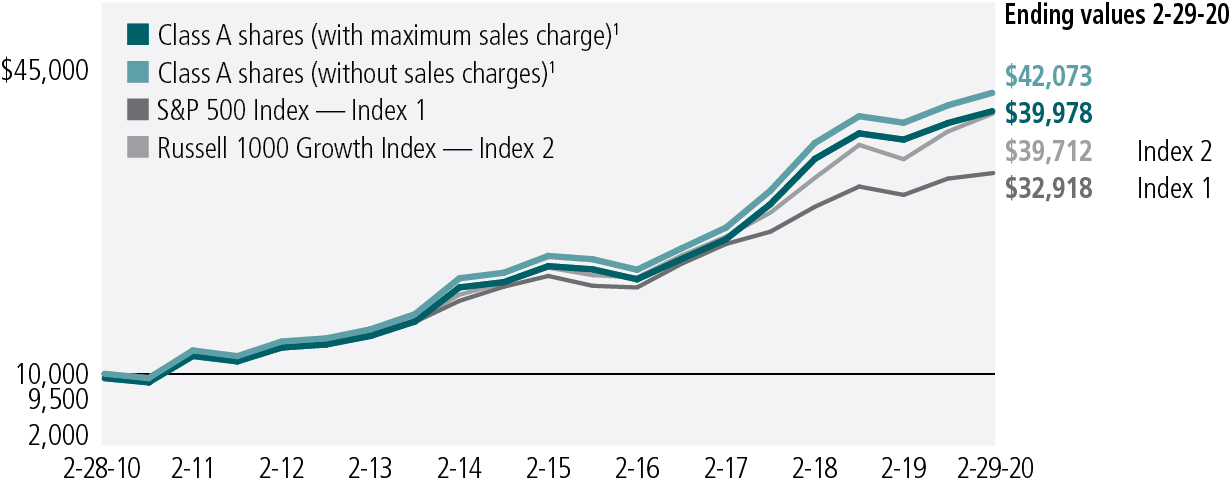

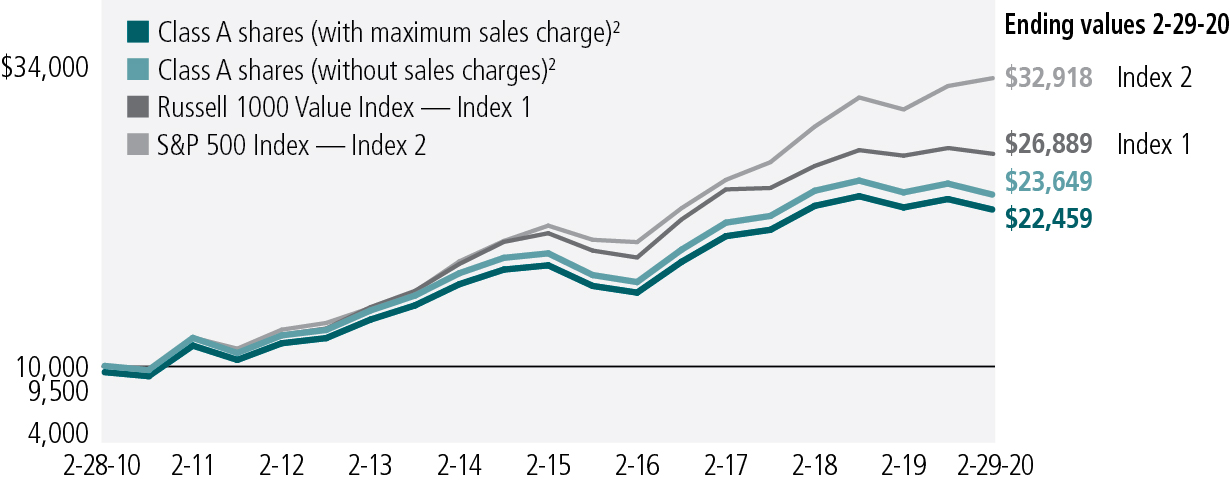

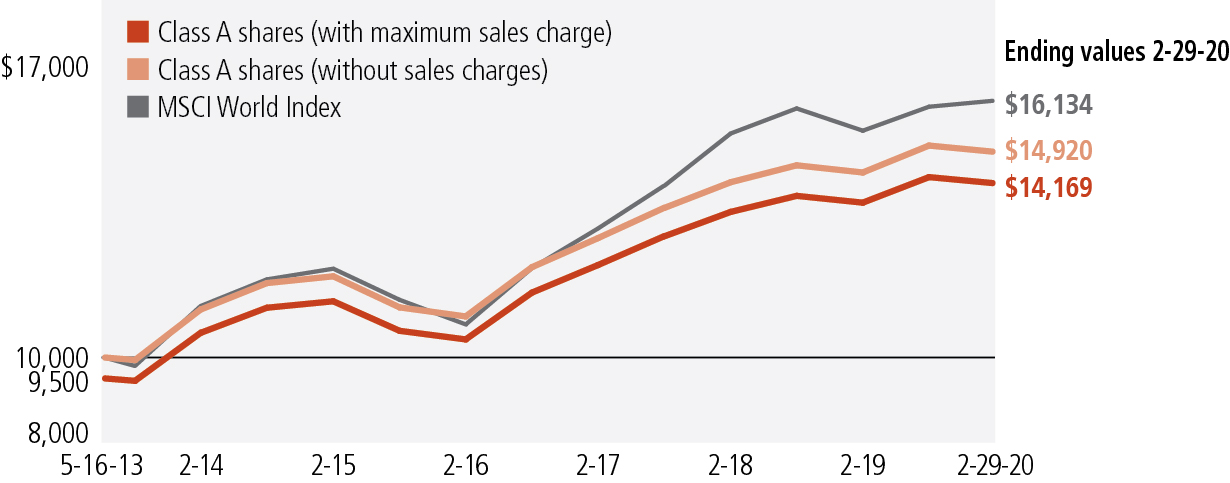

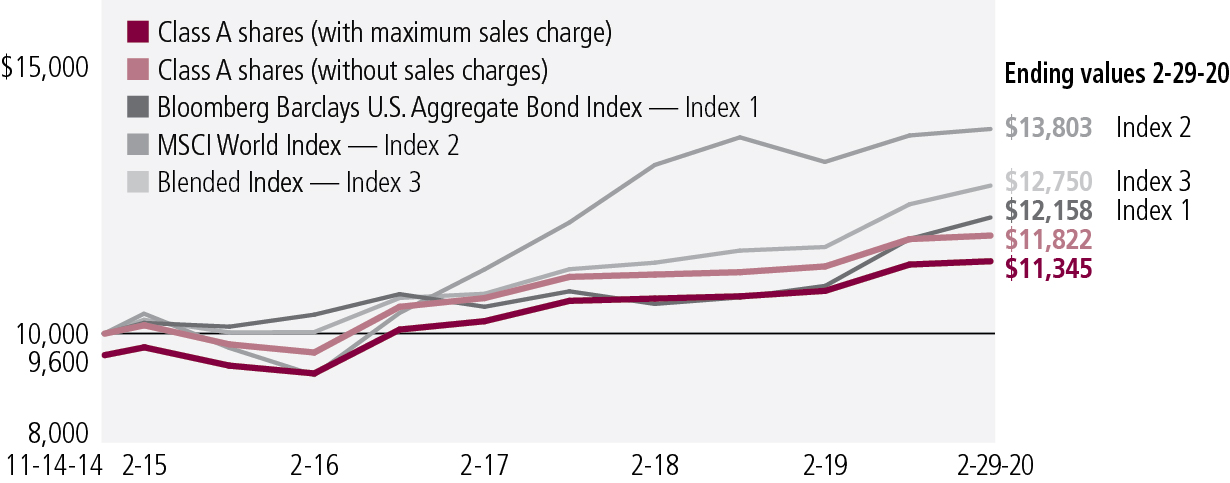

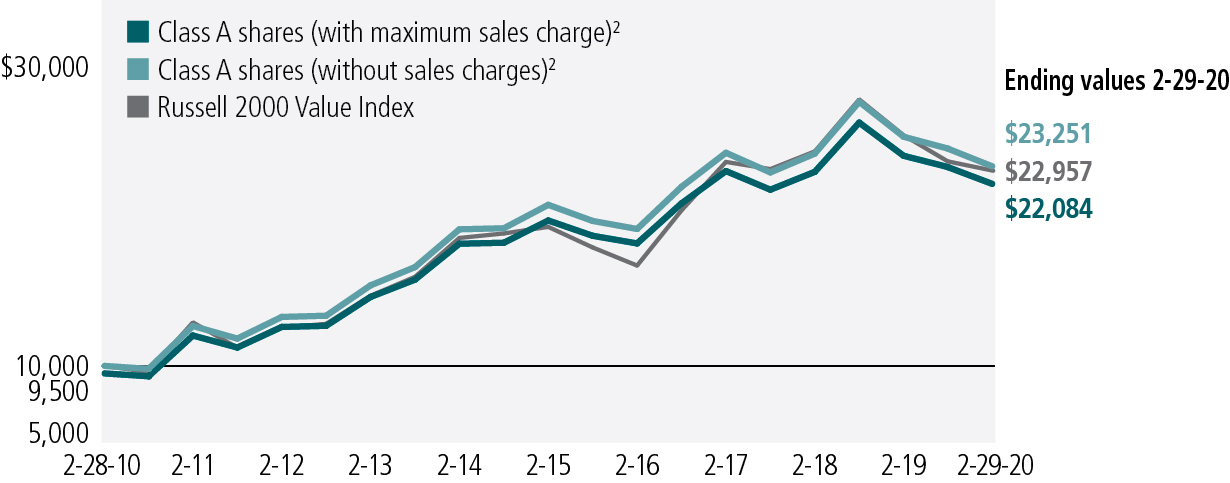

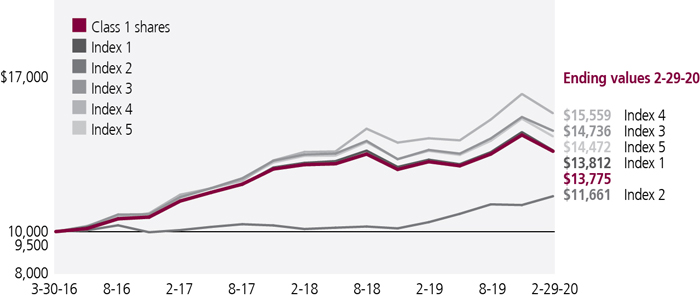

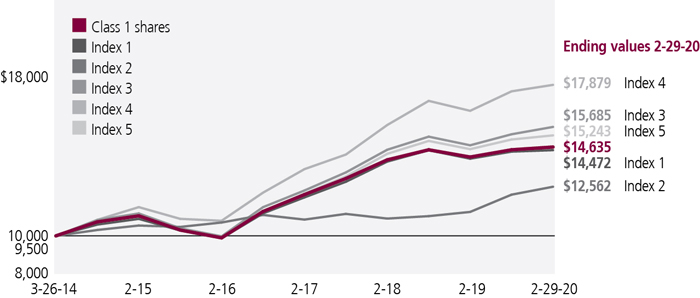

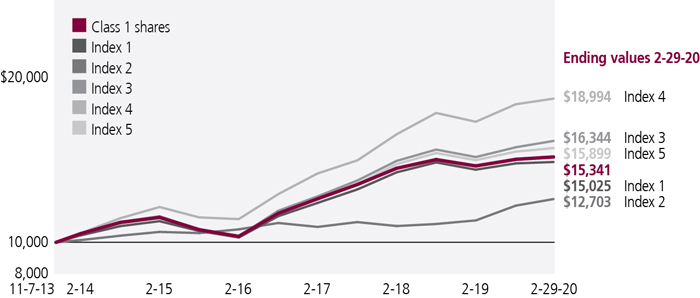

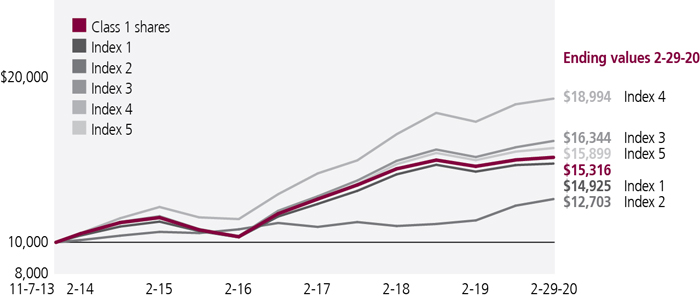

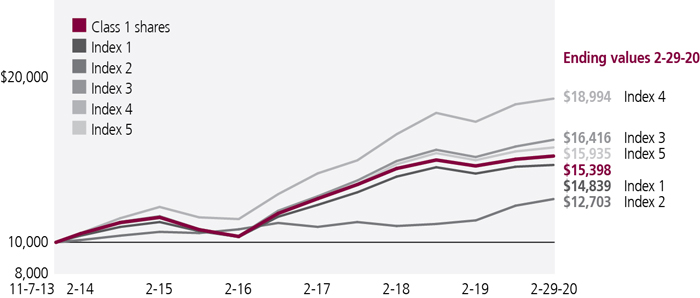

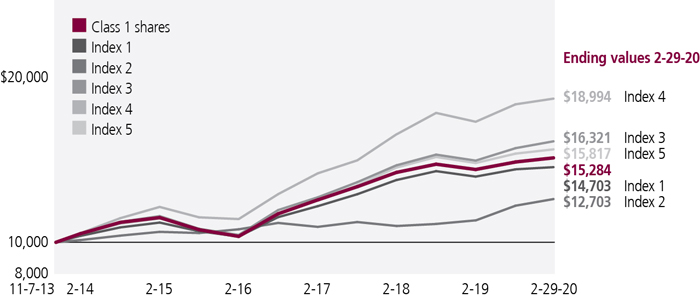

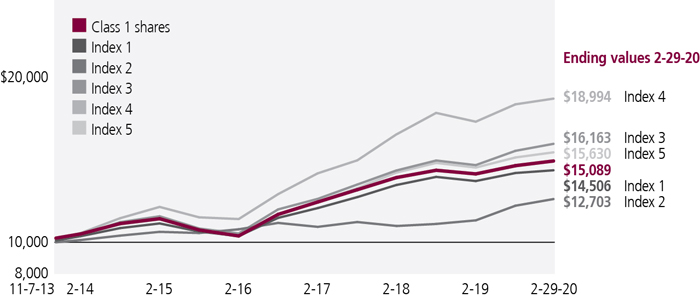

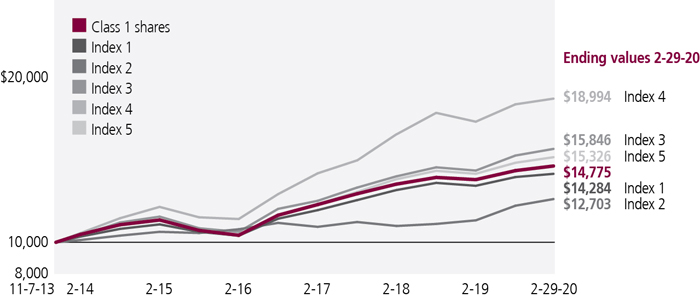

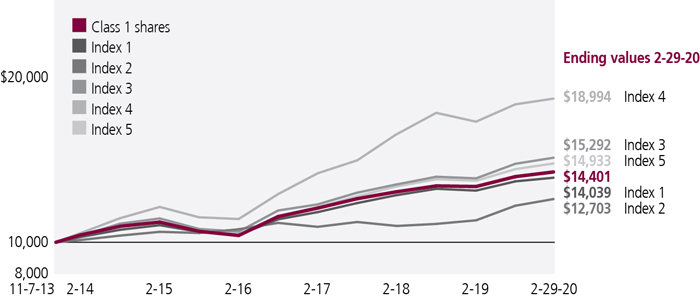

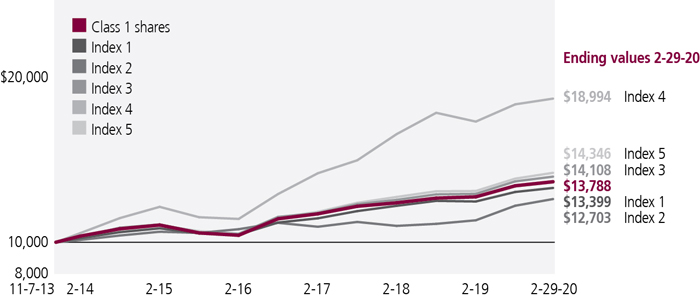

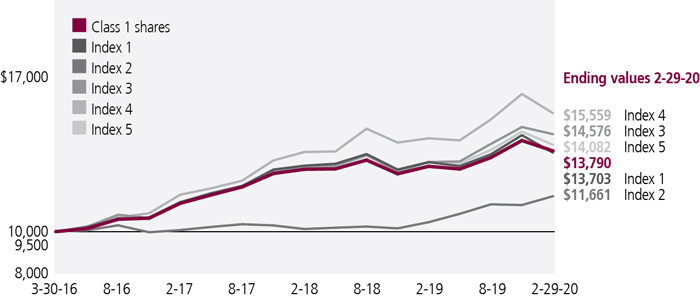

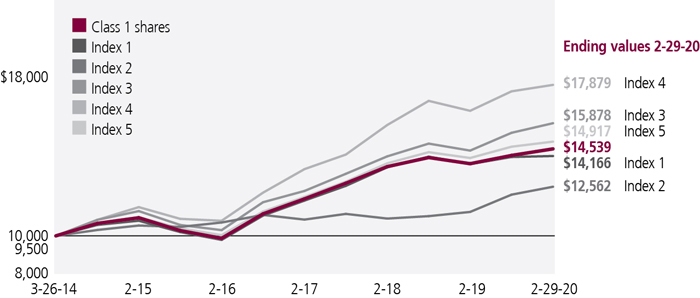

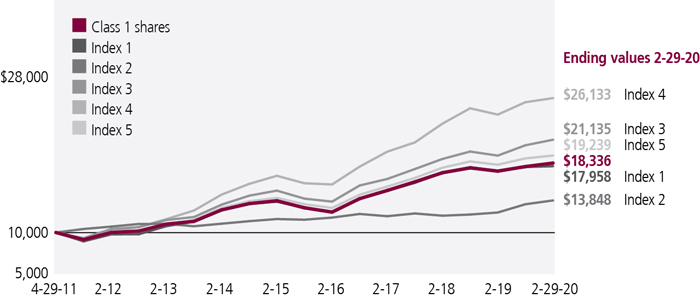

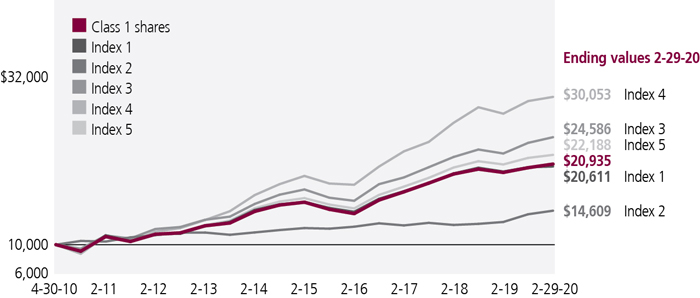

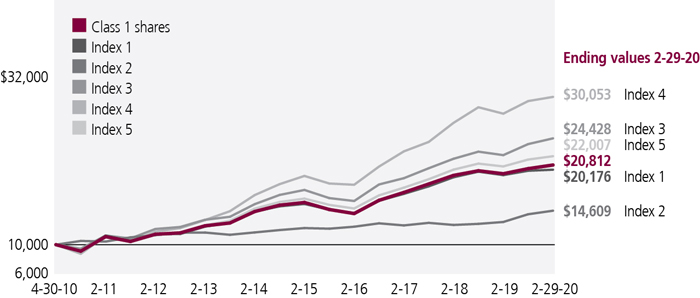

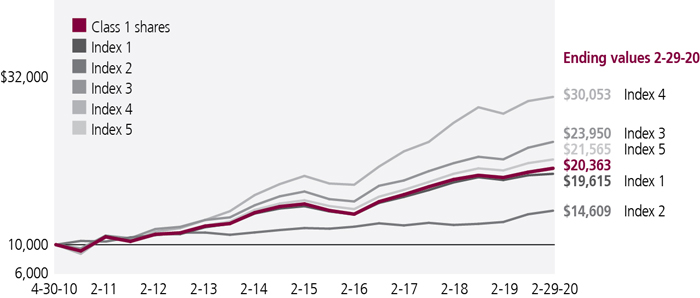

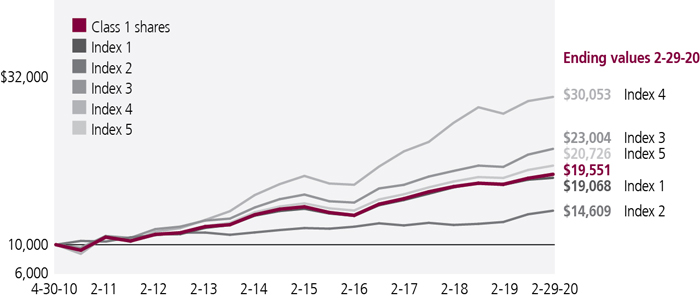

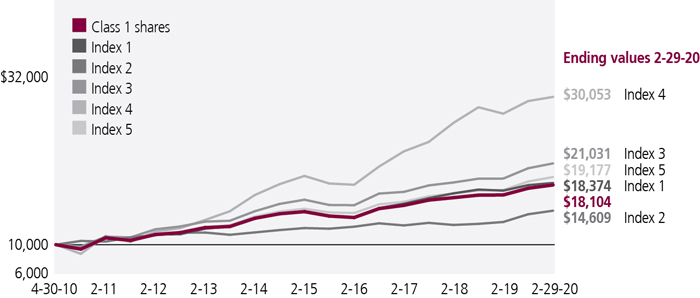

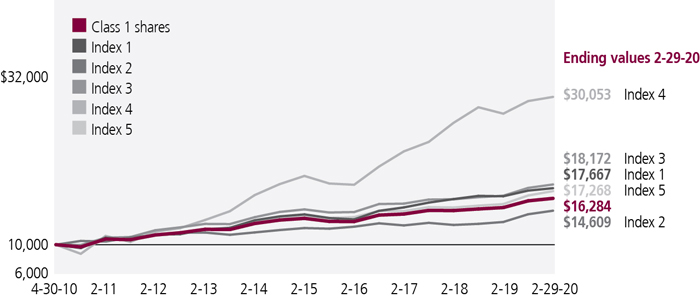

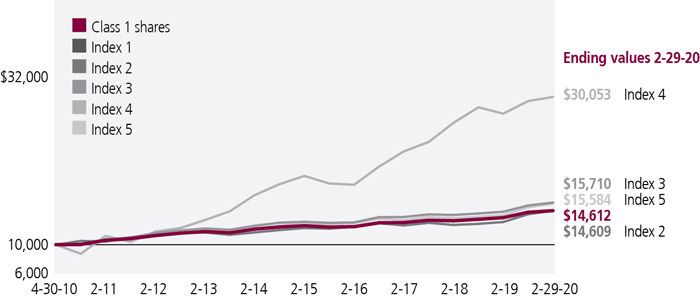

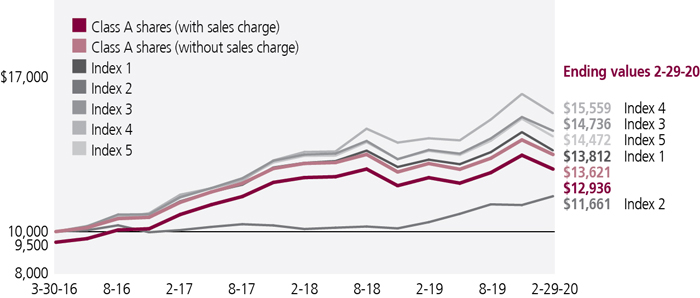

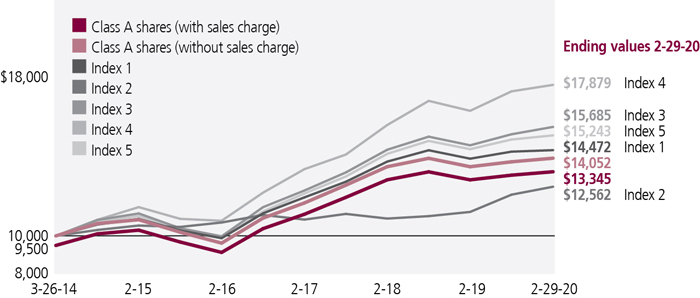

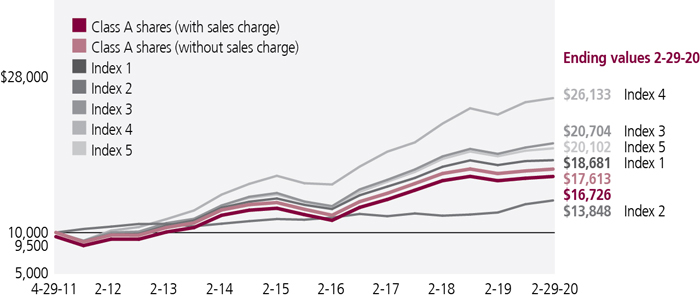

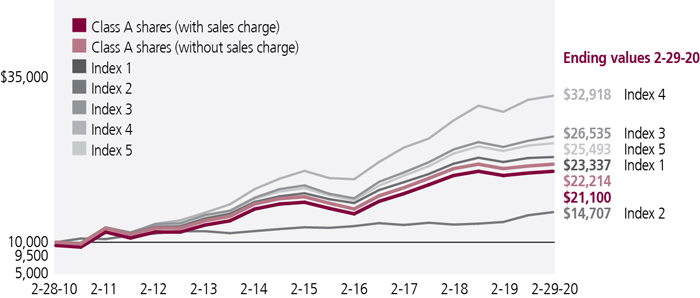

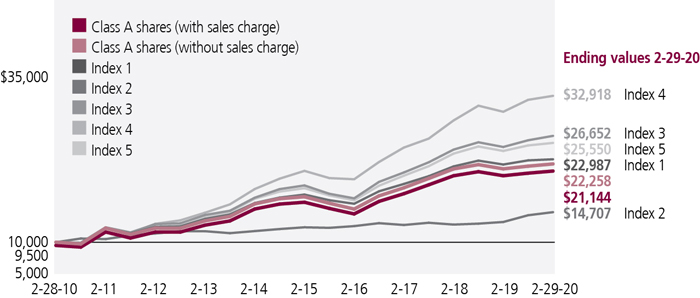

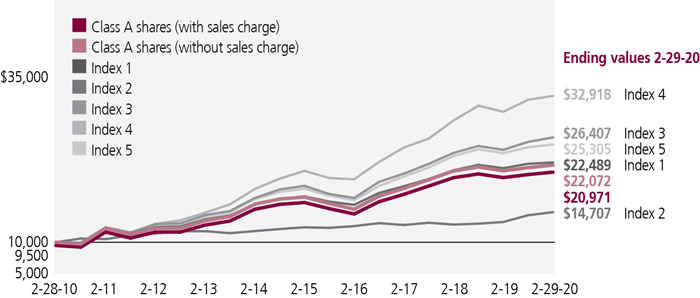

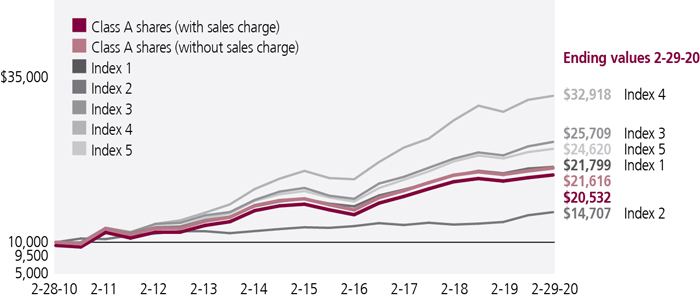

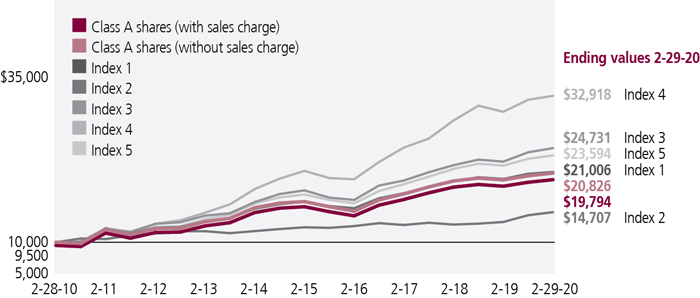

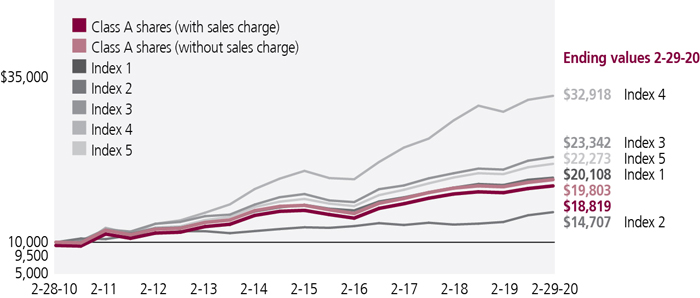

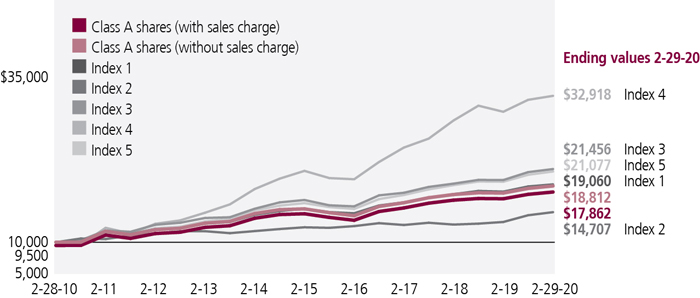

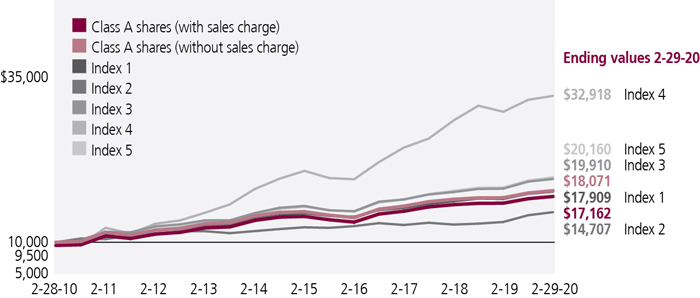

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Alternative Asset Allocation Fund for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the HFRX Global Hedge Fund Index.

| | | | | |

| | Start date | With maximum

sales charge ($) | Without

sales charge ($) | Index ($) |

| Class C2,.4 | 2-28-10 | 12,989 | 12,989 | 11,026 |

| Class I2,3 | 2-28-10 | 14,226 | 14,226 | 11,026 |

| Class R22,3 | 2-28-10 | 13,654 | 13,654 | 11,026 |

| Class R42,3 | 2-28-10 | 13,927 | 13,927 | 11,026 |

| Class R62,3 | 2-28-10 | 14,270 | 14,270 | 11,026 |

The HFRX Global Hedge Fund Index is composed of all eligible hedge fund strategies, including four principal strategies: equity hedge, event driven, macro/managed futures, and relative value arbitrage.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| 1 | Performance information prior to 12-20-10 reflects an allocation to a different mix of underlying funds, and would have been different if the fund's investments had been allocated to its current mix of underlying funds. |

| 2 | Class C shares were first offered on 6-14-11; Class I shares were first offered on 12-31-10; Class R2 shares were first offered on 3-1-12; Class R4 shares were first offered on 6-27-13; Class R6 shares were first offered on 9-1-11. Returns prior to these dates are those of Class A shares that have not been adjusted for class-specific expenses; otherwise, returns would vary. |

| 3 | For certain types of investors, as described in the fund's prospectus. |

| 4 | The contingent deferred sales charge is not applicable. |

SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 5

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

■Transaction costs,which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses.

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

The first line of each share class in the table on the following page is intended to provide information about the fund’s actual ongoing operating expenses, and is based on the fund’s actual return. It assumes an account value of $1,000.00 on September 1, 2019, with the same investment held until February 29, 2020.

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at February 29, 2020, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

The second line of each share class in the table on the following page allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the class’s actual return). It assumes an account value of $1,000.00 on September 1, 2019, with the same investment held until February 29, 2020. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| 6 | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | SEMIANNUAL REPORT | |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

SHAREHOLDER EXPENSE EXAMPLE CHART

| | | Account

value on

9-1-2019 | Ending

value on

2-29-2020 | Expenses

paid during

period ended

2-29-20201 | Annualized

expense

ratio2 |

| Class A | Actual expenses/actual returns | $1,000.00 | $992.90 | $3.27 | 0.66% |

| | Hypothetical example | 1,000.00 | 1,021.60 | 3.32 | 0.66% |

| Class C | Actual expenses/actual returns | 1,000.00 | 989.60 | 6.73 | 1.36% |

| | Hypothetical example | 1,000.00 | 1,018.10 | 6.82 | 1.36% |

| Class I | Actual expenses/actual returns | 1,000.00 | 995.10 | 1.79 | 0.36% |

| | Hypothetical example | 1,000.00 | 1,023.10 | 1.81 | 0.36% |

| Class R2 | Actual expenses/actual returns | 1,000.00 | 992.70 | 3.72 | 0.75% |

| | Hypothetical example | 1,000.00 | 1,021.10 | 3.77 | 0.75% |

| Class R4 | Actual expenses/actual returns | 1,000.00 | 993.80 | 2.48 | 0.50% |

| | Hypothetical example | 1,000.00 | 1,022.40 | 2.51 | 0.50% |

| Class R6 | Actual expenses/actual returns | 1,000.00 | 995.50 | 1.24 | 0.25% |

| | Hypothetical example | 1,000.00 | 1,023.60 | 1.26 | 0.25% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

| 2 | Ratios do not include fees and expenses indirectly incurred by the underlying funds and can vary based on mixed of underlying funds held by the fund. |

| | SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 7 |

AS OF 2-29-20 (unaudited)

| | | | | Shares | Value |

| Affiliated investment companies (A) 72.4% | | | $387,667,674 |

| (Cost $387,159,226) | | | | | |

| Absolute return strategies 32.5% | | | 174,163,387 |

| Absolute Return Currency, Class NAV, JHF II (First Quadrant) | | | | 2,522,368 | 23,382,349 |

| Alternative Risk Premia, Class NAV, JHIT (Unigestion) | | | | 3,378,538 | 32,366,397 |

| Credit Suisse Managed Futures Strategy Fund (B) | | | | 2,656,220 | 24,543,473 |

| Diversified Macro, Class NAV, JHIT (Graham) | | | | 4,554,558 | 41,264,299 |

| Multi-Asset Absolute Return, Class NAV, JHF II (NIMNAI) | | | | 5,755,675 | 52,606,869 |

| Alternative investment approaches 33.5% | | | 179,325,949 |

| Seaport Long/Short, Class NAV, JHIT (Wellington) | | | | 6,538,507 | 75,650,521 |

| Short Duration Credit Opportunities, Class NAV, JHF II (Stone Harbor) | | | | 4,387,528 | 41,813,142 |

| Strategic Income Opportunities, Class NAV, JHF II (MIM US) (C) | | | | 5,792,349 | 61,862,286 |

| Alternative markets 6.4% | | | 34,178,338 |

| Infrastructure, Class NAV, JHIT (Wellington) | | | | 1,952,333 | 25,106,997 |

|

| Invesco DB Gold Fund (B) | | | | 194,372 | 9,071,341 |

| Unaffiliated investment companies 26.5% | | | $142,144,102 |

| (Cost $140,017,264) | | | | | |

| Absolute return strategies 11.2% | | | 59,841,817 |

| IQ Merger Arbitrage ETF (D) | | | | 613,755 | 20,229,365 |

| The Arbitrage Fund, Class I | | | | 2,967,225 | 39,612,452 |

| Alternative investment approaches 11.2% | | | 60,134,602 |

| JPMorgan Hedged Equity Fund | | | | 2,924,835 | 60,134,602 |

| Alternative markets 4.1% | | | 22,167,683 |

| Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF | | | | 1,046,640 | 14,809,956 |

| Vanguard Real Estate ETF | | | | 84,252 | 7,357,727 |

| | Yield* (%) | Maturity date | | Par value^ | Value |

| Short-term investments 1.1% | | | | | $5,689,207 |

| (Cost $5,688,949) | | | | | |

| U.S. Government 1.1% | | | | | 5,629,310 |

| U.S. Treasury Bill | 1.515 | 03-05-20 | | 5,630,000 | 5,629,310 |

| 8 | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | Yield (%) | | Shares | Value |

| Short-term funds 0.0% | | | | | 59,897 |

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 1.5386(E) | | 59,897 | 59,897 |

|

| Total investments (Cost $532,865,439) 100.0% | | | $535,500,983 |

| Other assets and liabilities, net 0.0% | | | | 235,130 |

| Total net assets 100.0% | | | | | $535,736,113 |

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund. |

| ^All par values are denominated in U.S. dollars unless otherwise indicated. |

| Security Abbreviations and Legend |

| JHF II | John Hancock Funds II |

| JHIT | John Hancock Investment Trust |

| (A) | The underlying funds' subadvisor is shown parenthetically. |

| (B) | The fund owns 5% or more of the outstanding voting shares of the issuer and the security is considered an affiliate of the fund. For more information on this security refer to the Notes to financial statements. |

| (C) | The subadvisor is an affiliate of the advisor. |

| (D) | Non-income producing. |

| (E) | The rate shown is the annualized seven-day yield as of 2-29-20. |

| * | Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end. |

At 2-29-20, the aggregate cost of investments for federal income tax purposes was $543,812,299. Net unrealized depreciation aggregated to $8,311,316, of which $5,200,227 related to gross unrealized appreciation and $13,511,543 related to gross unrealized depreciation.

| Subadvisors of Affiliated Underlying Funds | |

| First Quadrant, L.P. | (First Quadrant) |

| Graham Capital Management, L.P. | (Graham) |

| Manulife Investment Management (US) LLC | (MIM US) |

| Nordea Investment Management North America, Inc. | (NIMNAI) |

| Stone Harbor Investment Partners LP | (Stone Harbor) |

| Unigestion (UK) Limited | (Unigestion) |

| Wellington Management Company LLP | (Wellington) |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 9 |

STATEMENT OF ASSETS AND LIABILITIES 2-29-20 (unaudited)

| Assets | |

| Unaffiliated investments, at value (Cost $145,706,213) | $147,833,309 |

| Affiliated investments, at value (Cost $387,159,226) | 387,667,674 |

| Total investments, at value (Cost $532,865,439) | 535,500,983 |

| Dividends and interest receivable | 242,078 |

| Receivable for fund shares sold | 935,787 |

| Receivable for investments sold | 1,139,227 |

| Receivable for securities lending income | 20 |

| Receivable from affiliates | 9,033 |

| Other assets | 67,469 |

| Total assets | 537,894,597 |

| Liabilities | |

| Due to custodian | 63,187 |

| Payable for investments purchased | 241,628 |

| Payable for fund shares repurchased | 1,717,081 |

| Payable to affiliates | |

| Accounting and legal services fees | 13,960 |

| Transfer agent fees | 49,133 |

| Distribution and service fees | 593 |

| Trustees' fees | 1,110 |

| Other liabilities and accrued expenses | 71,792 |

| Total liabilities | 2,158,484 |

| Net assets | $535,736,113 |

| Net assets consist of | |

| Paid-in capital | $590,773,573 |

| Total distributable earnings (loss) | (55,037,460) |

| Net assets | $535,736,113 |

| |

| Net asset value per share | |

| Based on net asset value and shares outstanding - the fund has an unlimited number of shares authorized with no par value | |

| Class A ($67,096,312 ÷ 4,764,204 shares)1 | $14.08 |

| Class C ($36,775,371 ÷ 2,600,800 shares)1 | $14.14 |

| Class I ($409,904,718 ÷ 29,101,632 shares) | $14.09 |

| Class R2 ($1,368,027 ÷ 97,234 shares) | $14.07 |

| Class R4 ($87,730 ÷ 6,223 shares) | $14.10 |

| Class R6 ($20,503,955 ÷ 1,455,569 shares) | $14.09 |

| Maximum offering price per share | |

| Class A (net asset value per share ÷ 95%)2 | $14.82 |

| 1 | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| 2 | On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced. |

| 10 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

STATEMENT OF OPERATIONS For the six months ended 2-29-20 (unaudited)

| Investment income | |

| Income distributions received from affiliated investments | $4,606,637 |

| Dividends | 695,116 |

| Interest | 52,443 |

| Securities lending | 8,916 |

| Total investment income | 5,363,112 |

| Expenses | |

| Investment management fees | 981,422 |

| Distribution and service fees | 310,195 |

| Accounting and legal services fees | 50,541 |

| Transfer agent fees | 330,144 |

| Trustees' fees | 5,171 |

| Custodian fees | 24,675 |

| State registration fees | 45,447 |

| Printing and postage | 39,267 |

| Professional fees | 28,277 |

| Other | 26,952 |

| Total expenses | 1,842,091 |

| Less expense reductions | (549,347) |

| Net expenses | 1,292,744 |

| Net investment income | 4,070,368 |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Unaffiliated investments | 150,321 |

| Affiliated investments | (4,513,541) |

| Capital gain distributions received from unaffiliated investments | 780,190 |

| Capital gain distributions received from affiliated investments | 9,639,956 |

| | 6,056,926 |

| Change in net unrealized appreciation (depreciation) of | |

| Unaffiliated investments | (1,534,710) |

| Affiliated investments | (11,380,879) |

| | (12,915,589) |

| Net realized and unrealized loss | (6,858,663) |

| Decrease in net assets from operations | $(2,788,295) |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 11 |

STATEMENTS OF CHANGES IN NET ASSETS

| | Six months ended

2-29-20

(unaudited) | Year ended

8-31-19 |

| Increase (decrease) in net assets | | |

| From operations | | |

| Net investment income | $4,070,368 | $11,584,852 |

| Net realized gain (loss) | 6,056,926 | (8,139,442) |

| Change in net unrealized appreciation (depreciation) | (12,915,589) | 13,005,662 |

| Increase (decrease) in net assets resulting from operations | (2,788,295) | 16,451,072 |

| Distributions to shareholders | | |

| From earnings | | |

| Class A | (2,347,118) | (1,639,841) |

| Class C | (1,030,673) | (598,120) |

| Class I | (15,281,356) | (9,760,461) |

| Class R2 | (44,843) | (43,758) |

| Class R4 | (1,208) | (4,113) |

| Class R6 | (800,607) | (649,346) |

| Total distributions | (19,505,805) | (12,695,639) |

| From fund share transactions | (9,626,003) | (119,232,261) |

| Total decrease | (31,920,103) | (115,476,828) |

| Net assets | | |

| Beginning of period | 567,656,216 | 683,133,044 |

| End of period | $535,736,113 | $567,656,216 |

| 12 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS A SHARES Period ended | 2-29-201 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 | 8-31-15 |

| Per share operating performance | | | | | | |

| Net asset value, beginning of period | $14.66 | $14.51 | $14.55 | $13.96 | $14.12 | $15.35 |

| Net investment income2,3 | 0.09 | 0.25 | 0.13 | 0.10 | 0.22 | 0.19 |

| Net realized and unrealized gain (loss) on investments | (0.18) | 0.17 | 0.01 | 0.60 | —4 | (0.81) |

| Total from investment operations | (0.09) | 0.42 | 0.14 | 0.70 | 0.22 | (0.62) |

| Less distributions | | | | | | |

| From net investment income | (0.27) | (0.17) | (0.11) | (0.08) | (0.21) | (0.19) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) | (0.42) |

| Total distributions | (0.49) | (0.27) | (0.18) | (0.11) | (0.38) | (0.61) |

| Net asset value, end of period | $14.08 | $14.66 | $14.51 | $14.55 | $13.96 | $14.12 |

| Total return (%)5,6 | (0.71)7 | 3.05 | 0.95 | 5.03 | 1.60 | (4.14) |

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (in millions) | $67 | $73 | $95 | $136 | $278 | $404 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions8 | 0.859 | 0.77 | 0.72 | 0.72 | 0.73 | 0.70 |

| Expenses including reductions8 | 0.669 | 0.64 | 0.59 | 0.59 | 0.59 | 0.56 |

| Net investment income3 | 1.279 | 1.73 | 0.86 | 0.71 | 1.56 | 1.29 |

| Portfolio turnover (%) | 25 | 39 | 18 | 10 | 17 | 45 |

| 1 | Six months ended 2-29-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 4 | Less than $0.005 per share. |

| 5 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 6 | Does not reflect the effect of sales charges, if any. |

| 7 | Not annualized. |

| 8 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 9 | Annualized. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 13 |

| CLASS C SHARES Period ended | 2-29-201 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 | 8-31-15 |

| Per share operating performance | | | | | | |

| Net asset value, beginning of period | $14.67 | $14.51 | $14.56 | $13.97 | $14.12 | $15.35 |

| Net investment income2,3 | 0.04 | 0.15 | 0.02 | —4 | 0.12 | 0.09 |

| Net realized and unrealized gain (loss) on investments | (0.18) | 0.18 | 0.01 | 0.60 | 0.01 | (0.82) |

| Total from investment operations | (0.14) | 0.33 | 0.03 | 0.60 | 0.13 | (0.73) |

| Less distributions | | | | | | |

| From net investment income | (0.17) | (0.07) | (0.01) | — | (0.11) | (0.08) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.01) | (0.17) | (0.42) |

| Total distributions | (0.39) | (0.17) | (0.08) | (0.01) | (0.28) | (0.50) |

| Net asset value, end of period | $14.14 | $14.67 | $14.51 | $14.56 | $13.97 | $14.12 |

| Total return (%)5,6 | (1.04)7 | 2.37 | 0.19 | 4.30 | 0.94 | (4.83) |

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (in millions) | $37 | $42 | $57 | $72 | $99 | $135 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions8 | 1.559 | 1.47 | 1.42 | 1.42 | 1.43 | 1.41 |

| Expenses including reductions8 | 1.369 | 1.34 | 1.29 | 1.29 | 1.29 | 1.26 |

| Net investment income3 | 0.559 | 1.02 | 0.17 | —10 | 0.85 | 0.59 |

| Portfolio turnover (%) | 25 | 39 | 18 | 10 | 17 | 45 |

| 1 | Six months ended 2-29-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 4 | Less than $0.005 per share. |

| 5 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 6 | Does not reflect the effect of sales charges, if any. |

| 7 | Not annualized. |

| 8 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 9 | Annualized. |

| 10 | Less than 0.005%. |

| 14 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS I SHARES Period ended | 2-29-201 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 | 8-31-15 |

| Per share operating performance | | | | | | |

| Net asset value, beginning of period | $14.68 | $14.53 | $14.58 | $13.99 | $14.15 | $15.37 |

| Net investment income2,3 | 0.11 | 0.29 | 0.17 | 0.14 | 0.26 | 0.24 |

| Net realized and unrealized gain (loss) on investments | (0.17) | 0.18 | —4 | 0.60 | —4 | (0.81) |

| Total from investment operations | (0.06) | 0.47 | 0.17 | 0.74 | 0.26 | (0.57) |

| Less distributions | | | | | | |

| From net investment income | (0.31) | (0.22) | (0.15) | (0.12) | (0.25) | (0.23) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) | (0.42) |

| Total distributions | (0.53) | (0.32) | (0.22) | (0.15) | (0.42) | (0.65) |

| Net asset value, end of period | $14.09 | $14.68 | $14.53 | $14.58 | $13.99 | $14.15 |

| Total return (%)5 | (0.49)6 | 3.39 | 1.18 | 5.34 | 1.93 | (3.80) |

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (in millions) | $410 | $423 | $510 | $495 | $433 | $532 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions7 | 0.558 | 0.49 | 0.42 | 0.40 | 0.42 | 0.39 |

| Expenses including reductions7 | 0.368 | 0.35 | 0.30 | 0.28 | 0.28 | 0.24 |

| Net investment income3 | 1.578 | 2.04 | 1.16 | 1.01 | 1.88 | 1.63 |

| Portfolio turnover (%) | 25 | 39 | 18 | 10 | 17 | 45 |

| 1 | Six months ended 2-29-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 4 | Less than $0.005 per share. |

| 5 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 6 | Not annualized. |

| 7 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 8 | Annualized. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 15 |

| CLASS R2 SHARES Period ended | 2-29-201 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 | 8-31-15 |

| Per share operating performance | | | | | | |

| Net asset value, beginning of period | $14.64 | $14.49 | $14.53 | $13.95 | $14.11 | $15.33 |

| Net investment income2,3 | 0.08 | 0.24 | 0.11 | 0.08 | 0.20 | 0.14 |

| Net realized and unrealized gain (loss) on investments | (0.17) | 0.17 | 0.01 | 0.60 | 0.01 | (0.79) |

| Total from investment operations | (0.09) | 0.41 | 0.12 | 0.68 | 0.21 | (0.65) |

| Less distributions | | | | | | |

| From net investment income | (0.26) | (0.16) | (0.09) | (0.07) | (0.20) | (0.15) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) | (0.42) |

| Total distributions | (0.48) | (0.26) | (0.16) | (0.10) | (0.37) | (0.57) |

| Net asset value, end of period | $14.07 | $14.64 | $14.49 | $14.53 | $13.95 | $14.11 |

| Total return (%)4 | (0.73)5 | 2.95 | 0.85 | 4.87 | 1.51 | (4.31) |

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (in millions) | $1 | $2 | $3 | $4 | $7 | $2 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions6 | 0.947 | 0.87 | 0.83 | 0.82 | 0.81 | 1.02 |

| Expenses including reductions6 | 0.757 | 0.74 | 0.70 | 0.69 | 0.67 | 0.69 |

| Net investment income3 | 1.047 | 1.67 | 0.78 | 0.60 | 1.43 | 1.02 |

| Portfolio turnover (%) | 25 | 39 | 18 | 10 | 17 | 45 |

| 1 | Six months ended 2-29-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 5 | Not annualized. |

| 6 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 7 | Annualized. |

| 16 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS R4 SHARES Period ended | 2-29-201 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 | 8-31-15 |

| Per share operating performance | | | | | | |

| Net asset value, beginning of period | $14.69 | $14.54 | $14.58 | $13.99 | $14.15 | $15.36 |

| Net investment income2,3 | 0.05 | 0.27 | 0.15 | 0.12 | 0.14 | 0.20 |

| Net realized and unrealized gain (loss) on investments | (0.13) | 0.18 | 0.01 | 0.60 | 0.10 | (0.80) |

| Total from investment operations | (0.08) | 0.45 | 0.16 | 0.72 | 0.24 | (0.60) |

| Less distributions | | | | | | |

| From net investment income | (0.29) | (0.20) | (0.13) | (0.10) | (0.23) | (0.19) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) | (0.42) |

| Total distributions | (0.51) | (0.30) | (0.20) | (0.13) | (0.40) | (0.61) |

| Net asset value, end of period | $14.10 | $14.69 | $14.54 | $14.58 | $13.99 | $14.15 |

| Total return (%)4 | (0.62)5 | 3.22 | 1.10 | 5.18 | 1.79 | (3.99) |

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (in millions) | $—6 | $—6 | $1 | $5 | $4 | $—6 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions7 | 0.798 | 0.73 | 0.67 | 0.66 | 0.67 | 2.23 |

| Expenses including reductions7 | 0.508 | 0.50 | 0.44 | 0.44 | 0.43 | 0.40 |

| Net investment income3 | 0.658 | 1.76 | 1.05 | 0.85 | 1.00 | 1.44 |

| Portfolio turnover (%) | 25 | 39 | 18 | 10 | 17 | 45 |

| 1 | Six months ended 2-29-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 5 | Not annualized. |

| 6 | Less than $500,000. |

| 7 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 8 | Annualized. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 17 |

| CLASS R6 SHARES Period ended | 2-29-201 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 | 8-31-15 |

| Per share operating performance | | | | | | |

| Net asset value, beginning of period | $14.69 | $14.54 | $14.58 | $13.99 | $14.15 | $15.39 |

| Net investment income2,3 | 0.12 | 0.32 | 0.18 | 0.16 | 0.21 | 0.24 |

| Net realized and unrealized gain (loss) on investments | (0.17) | 0.16 | 0.02 | 0.60 | 0.07 | (0.81) |

| Total from investment operations | (0.05) | 0.48 | 0.20 | 0.76 | 0.28 | (0.57) |

| Less distributions | | | | | | |

| From net investment income | (0.33) | (0.23) | (0.17) | (0.14) | (0.27) | (0.25) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) | (0.42) |

| Total distributions | (0.55) | (0.33) | (0.24) | (0.17) | (0.44) | (0.67) |

| Net asset value, end of period | $14.09 | $14.69 | $14.54 | $14.58 | $13.99 | $14.15 |

| Total return (%)4 | (0.45)5 | 3.49 | 1.34 | 5.45 | 2.05 | (3.74) |

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (in millions) | $21 | $26 | $18 | $15 | $16 | $9 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions6 | 0.447 | 0.37 | 0.32 | 0.31 | 0.32 | 0.34 |

| Expenses including reductions6 | 0.257 | 0.24 | 0.20 | 0.18 | 0.17 | 0.13 |

| Net investment income3 | 1.637 | 2.23 | 1.26 | 1.11 | 1.52 | 1.66 |

| Portfolio turnover (%) | 25 | 39 | 18 | 10 | 17 | 45 |

| 1 | Six months ended 2-29-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 5 | Not annualized. |

| 6 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 7 | Annualized. |

| 18 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Notes to financial statements (unaudited) | |

Note 1—Organization

John Hancock Alternative Asset Allocation Fund (the fund) is a series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the fund is to seek long-term growth of capital.

The fund operates as a “fund of funds", investing in affiliated underlying funds of the Trust, other series of the Trust, other funds in John Hancock group of funds complex, non-John Hancock funds and certain other permitted investments.

The fund may offer multiple classes of shares. The shares currently outstanding are detailed in the Statement of assets and liabilities. Class A and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R2 and Class R4 shares are available only to certain retirement and 529 plans. Class R6 shares are only available to certain retirement plans, institutions and other investors. Class C shares convert to Class A shares ten years after purchase (certain exclusions may apply). Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees for each class may differ.

The accounting policies of the John Hancock underlying funds in which the fund invests are outlined in the underlying funds’ shareholder reports, which include the underlying funds’ financial statements, available without charge by calling 800-344-1029 or visiting jhinvestments.com, on the Securities and Exchange Commission (SEC) website at sec.gov or at the SEC’s public reference room in Washington, D.C. The underlying funds are not covered by this report.

Note 2—Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the scheduled close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing at a time other than the regularly scheduled close, the net asset value (NAV) may be determined as of the regularly scheduled close of the NYSE pursuant to the fund's Valuation Policies and Procedures.

In order to value the securities, the fund uses the following valuation techniques: Equity securities, including exchange-traded or closed-end funds, are typically valued at the last sale price or official closing price on the exchange or principal market where the security trades. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last available bid price. Investments in affiliated underlying funds and/or other open-end management investment companies, other than exchange-traded funds (ETFs), are valued at their respective NAVs each business day. Debt obligations are typically valued based on the evaluated prices provided by an independent pricing vendor. Independent pricing vendors utilize matrix pricing, which takes into account factors such as institutional-size trading in similar groups of securities, yield, quality,

| | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 19 |

coupon rate, maturity, type of issue, trading characteristics and other market data, as well as broker supplied prices. Debt obligations are typically valued based on the evaluated prices provided by an independent pricing vendor. Independent pricing vendors utilize matrix pricing, which takes into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data, as well as broker supplied prices.

In certain instances, the Pricing Committee may determine to value equity securities using prices obtained from another exchange or market if trading on the exchange or market on which prices are typically obtained did not open for trading as scheduled, or if trading closed earlier than scheduled, and trading occurred as normal on another exchange or market.

Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund's Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities, including registered investment companies. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund's own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the values by input classification of the fund's investments as of February 29, 2020, by major security category or type:

| | Total

value at

2-29-20 | Level 1

quoted

price | Level 2

significant

observable

inputs | Level 3

significant

unobservable

inputs |

| Investments in securities: | | | | |

| Assets | | | | |

| Affiliated investment companies | $387,667,674 | $387,667,674 | — | — |

| Unaffiliated investment companies | 142,144,102 | 142,144,102 | — | — |

| Short-term investments | 5,689,207 | 59,897 | $5,629,310 | — |

| Total investments in securities | $535,500,983 | $529,871,673 | $5,629,310 | — |

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily NAV calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off

| 20 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | |

interest receivable when the collection of all or a portion of interest has become doubtful. Income and capital gain distributions from underlying funds are recorded on ex-date. Dividend income is recorded on the ex-date, except for dividends of certain foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Securities lending. The fund may lend its securities to earn additional income. The fund receives collateral from the borrower in an amount not less than the market value of the loaned securities. The fund will invest its cash collateral in John Hancock Collateral Trust (JHCT), an affiliate of the fund, which has a floating NAV and is registered with the SEC as an investment company. JHCT invests in short-term money market investments. The fund will receive the benefit of any gains and bear any losses generated by JHCT with respect to the cash collateral.

The fund has the right to recall loaned securities on demand. If a borrower fails to return loaned securities when due, then the lending agent is responsible and indemnifies the fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in the value of JHCT.

Although the risk of loss on securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification, the fund could experience a delay in recovering securities or could experience a lower than expected return if the borrower fails to return the securities on a timely basis. The fund receives compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Securities lending income received by the fund is net of fees retained by the securities lending agent. Net income received from JHCT is a component of securities lending income as recorded on the Statement of operations. As of February 29, 2020, there were no securities on loan.

Overdraft. The fund may have the ability to borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund's custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the extent of any overdraft, and to the maximum extent permitted by law. Overdrafts at period end are presented under the caption Due to custodian in the Statement of assets and liabilities.

Line of credit. The fund and other affiliated funds have entered into a syndicated line of credit agreement with Citibank, N.A. as the administrative agent that enables them to participate in a $750 million unsecured committed line of credit. Excluding commitments designated for a certain fund and subject to the needs of all other affiliated funds, the fund can borrow up to an aggregate commitment amount of $500 million, subject to asset coverage and other limitations as specified in the agreement. A commitment fee payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund based on a combination of fixed and asset based allocations and is reflected in Other expenses on the Statement of operations. For the six months ended February 29, 2020, the fund had no borrowings under the line of credit. Commitment fees for the six months ended February 29, 2020 were $1,698.

| | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 21 |

Expenses. Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, and transfer agent fees, for all classes, are charged daily at the class level based on the net assets of each class and the specific expense rates applicable to each class.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, as of August 31, 2019, the fund has a short-term capital loss carryforward of $12,132,478 and a long-term capital loss carryforward of $32,016,353 available to offset future net realized capital gains.These carryforwards do not expire.

As of August 31, 2019, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares and pays dividends annually. Capital gain distributions, if any, are typically distributed annually.

Distributions paid by the fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from US GAAP. Distributions in excess of tax basis earnings and profits, if any, are reported in the fund's financial statements as a return of capital. The final determination of tax characteristics of the fund's distribution will occur at the end of the year and will subsequently be reported to shareholders. Short-term gains from underlying funds are treated as ordinary income for tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sale loss deferrals.

Note 3—Guarantees and indemnifications

Under the Trust's organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust, including the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

| 22 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | |

Note 4—Fees and transactions with affiliates

John Hancock Investment Management LLC (the Advisor) serves as investment advisor for the fund. John Hancock Investment Management Distributors LLC (the Distributor), an affiliate of the Advisor, serves as principal underwriter of the fund. The Advisor and the Distributor are indirect, wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The fund pays the Advisor a management fee for its services to the fund. Manulife Investment Management (US) LLC, a division of Manulife Asset Management (US) LLC, acts as the fund’s sole subadvisor. The fund is not responsible for payment of the subadvisory fees.

The management fee has two components: (1) a fee on assets invested in a fund of the Trust or John Hancock Funds III (JHF III); and (2) a fee on assets invested in investments other than a fund of the Trust or JHF III (Other assets).

Management fees are determined in accordance with the following schedule:

| | First $5.0 billion of average net assets | Excess over $5.0 billion of average net assets |

| Assets in a fund of the JHF II or JHF III | 0.100% | 0.075% |

| Other assets | 0.550% | 0.525% |

The Advisor has contractually agreed to reduce its management fee and/or make payment to the fund in an amount equal to the amount by which “Other expenses” of the fund exceed 0.04% of the average net assets of the fund. “Other expenses” means all of the expenses of the fund, excluding: advisory fees, taxes, brokerage commissions, interest expense, litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the fund’s business, class specific expenses, underlying fund expenses (acquired fund fees), and short dividend expense. The current expense limitation agreement expires on December 31, 2020, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time.

The Advisor has contractually agreed to reduce its management fee by 0.05% of the fund’s average daily net assets up to $5 billion, and by 0.025% of the fund’s average daily net assets over $5 billion. The current expense limitation agreement expires on December 31, 2020, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time.

The Advisor has voluntarily agreed to waive its management fee for the fund so that the aggregate advisory fee retained by the Advisor with respect to both the fund and its underlying investments (after payment of subadvisory fees) does not exceed 0.55% of the fund’s first $5 billion of average daily net assets and 0.525% of the fund’s average daily net assets in excess of $5 billion. The Advisor may terminate this voluntary waiver at any time upon notice to the Trust

For the six months ended February 29, 2020, the expense reductions described above amounted to the following:

| Class | Expense reduction |

| Class A | $69,829 |

| Class C | 39,012 |

| Class I | 416,329 |

| Class R2 | 1,588 |

| Class | Expense reduction |

| Class R4 | $142 |

| Class R6 | 22,369 |

| Total | $549,269 |

Expenses waived or reimbursed in the current fiscal period are not subject to recapture in future fiscal periods.

| | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 23 |

The investment management fees, including the impact of the waivers and reimbursements as described above, incurred for the six months ended February 29, 2020, were equivalent to a net annual effective rate of 0.15% of the fund's average daily net assets.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, compliance, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the six months ended February 29, 2020 amounted to an annual rate of 0.02% of the fund's average daily net assets.

Distribution and service plans. The fund has a distribution agreement with the Distributor. The fund has adopted distribution and service plans for certain classes as detailed below pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the fund. In addition, under a service plan for certain classes as detailed below, the fund pays for certain other services. The fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the fund's shares:

| Class | Rule 12b-1 Fee | Service fee |

| Class A | 0.30% | — |

| Class C | 1.00% | — |

| Class R2 | 0.25% | 0.25% |

| Class R4 | 0.25% | 0.10% |

The fund's Distributor has contractually agreed to waive 0.10% of Rule12b-1 fees for Class R4 shares. The current waiver agreement expires on December 31, 2020, unless renewed by mutual agreement of the fund and the Distributor based upon a determination that this is appropriate under the circumstances at the time. This contractual waiver amounted to $78 for Class R4 shares for the six months ended February 29, 2020.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $37,246 for the six months ended February 29, 2020. Of this amount, $5,975 was retained and used for printing prospectuses, advertising, sales literature and other purposes and $31,271 was paid as sales commissions to broker-dealers.

Class A and Class C shares may be subject to contingent deferred sales charges (CDSCs). Certain Class A shares that are acquired through purchases of $1 million or more and are redeemed within one year of purchase are subject to a 1.00% sales charge. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC. CDSCs are applied to the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the six months ended February 29, 2020, CDSCs received by the Distributor amounted to $1,604 and $98 for Class A and Class C shares, respectively.

Transfer agent fees. The John Hancock group of funds has a complex-wide transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Advisor. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. It also includes out-of-pocket expenses, including payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain fees that Signature Services receives in connection with

| 24 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | |

retirement and small accounts. Signature Services Cost is calculated monthly and allocated, as applicable, to five categories of share classes: Retail Share and Institutional Share Classes of Non-Municipal Bond Funds, Class R6 Shares, Retirement Share Classes and Municipal Bond Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the six months ended February 29, 2020 were as follows:

| Class | Distribution and service fees | Transfer agent fees |

| Class A | $106,684 | $43,786 |

| Class C | 199,120 | 24,524 |

| Class I | — | 260,204 |

| Class R2 | 4,118 | 109 |

| Class R4 | 273 | 10 |

| Class R6 | — | 1,511 |

| Total | $310,195 | $330,144 |

Trustee expenses. The fund compensates each Trustee who is not an employee of the Advisor or its affiliates. The costs of paying Trustee compensation and expenses are allocated to the fund based on its net assets relative to other funds within the John Hancock group of funds complex.

Note 5—Fund share transactions

Transactions in fund shares for the six months ended February 29, 2020 and for the year ended August 31, 2019 were as follows:

| | Six Months Ended 2-29-20 | Year Ended 8-31-19 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

| Sold | 254,191 | $3,718,817 | 795,055 | $11,305,156 |

| Distributions reinvested | 154,878 | 2,244,177 | 115,120 | 1,574,839 |

| Repurchased | (647,917) | (9,475,017) | (2,428,928) | (34,635,963) |

| Net decrease | (238,848) | $(3,512,023) | (1,518,753) | $(21,755,968) |

| Class C shares | | | | |

| Sold | 26,153 | $384,098 | 96,697 | $1,388,854 |

| Distributions reinvested | 68,875 | 1,002,820 | 42,160 | 579,700 |

| Repurchased | (385,620) | (5,653,107) | (1,146,343) | (16,394,140) |

| Net decrease | (290,592) | $(4,266,189) | (1,007,486) | $(14,425,586) |

| Class I shares | | | | |

| Sold | 3,263,746 | $47,758,838 | 9,148,547 | $130,782,292 |

| Distributions reinvested | 942,827 | 13,652,128 | 620,211 | 8,484,484 |

| Repurchased | (3,943,947) | (57,633,529) | (16,047,812) | (228,661,790) |

| Net increase (decrease) | 262,626 | $3,777,437 | (6,279,054) | $(89,395,014) |

| | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 25 |

| | Six Months Ended 2-29-20 | Year Ended 8-31-19 |

| | Shares | Amount | Shares | Amount |

| Class R2 shares | | | | |

| Sold | 9,324 | $136,066 | 31,389 | $448,503 |

| Distributions reinvested | 2,864 | 41,474 | 2,947 | 40,280 |

| Repurchased | (74,503) | (1,092,618) | (54,897) | (777,693) |

| Net decrease | (62,315) | $(915,078) | (20,561) | $(288,910) |

| Class R4 shares | | | | |

| Sold | 5,051 | $73,964 | 6,916 | $98,951 |

| Distributions reinvested | 83 | 1,208 | 300 | 4,113 |

| Repurchased | (16,325) | (242,275) | (86,274) | (1,248,855) |

| Net decrease | (11,191) | $(167,103) | (79,058) | $(1,145,791) |

| Class R6 shares | | | | |

| Sold | 198,325 | $2,905,953 | 1,309,202 | $18,559,247 |

| Distributions reinvested | 55,291 | 800,607 | 47,502 | 649,346 |

| Repurchased | (561,751) | (8,249,607) | (801,314) | (11,429,585) |

| Net increase (decrease) | (308,135) | $(4,543,047) | 555,390 | $7,779,008 |

| Total net decrease | (648,455) | $(9,626,003) | (8,349,522) | $(119,232,261) |

Note 6—Purchase and sale of securities

Purchases and sales of securities, other than short-term investments, amounted to $140,777,150 and $155,763,726, respectively, for the six months ended February 29, 2020.

Note 7—Investment in affiliated underlying funds

The fund invests primarily in affiliated underlying funds that are managed by the Advisor and its affiliates. The fund does not invest in the affiliated underlying funds for the purpose of exercising management or control; however, the fund's investment may represent a significant portion of each underlying funds’ net assets. At February 29, 2020, the fund held 5% or more of the net assets of the underlying funds shown below:

| Portfolio | Underlying fund’s net assets |

| JHF Alternative Risk Premia Fund | 22.2% |

| JHF Diversified Macro Fund | 17.4% |

| JHF Seaport Long/Short Fund | 10.3% |

| JHF II Multi-Asset Absolute Return Fund | 9.2% |

| JHF Infrastructure Fund | 5.8% |

| JHF II Short Duration Credit Opportunities Fund | 5.2% |

| JHF II Absolute Return Currency Fund | 5.0% |

Information regarding the fund's fiscal year to date purchases and sales of the affiliated underlying funds as well as income and capital gains earned by the fund, if any, is as follows:

| 26 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | |

| | | | | | | | Dividends and distributions |

| Affiliate | Ending

share

amount | Beginning

value | Cost of

purchases | Proceeds

from shares

sold | Realized

gain

(loss) | Change in

unrealized

appreciation

(depreciation) | Income

distributions

received | Capital gain

distributions

received | Ending

value |

| Absolute Return Currency | 2,522,368 | $40,391,711 | $2,443,781 | $(19,808,530) | $(776,996) | $1,132,383 | $714,019 | — | $23,382,349 |

| Alternative Risk Premia | 3,378,538 | — | 34,774,414 | (993,772) | (2,990) | (1,411,255) | 12,260 | — | 32,366,397 |

| Disciplined Alternative Yield | — | 66,558,006 | 7,831,656 | (69,333,617) | (2,983,177) | (2,072,868) | 604,346 | $7,227,310 | — |

| Diversified Macro | 4,554,558 | 45,326,846 | 3,667,285 | (2,005,400) | 19,617 | (5,744,049) | — | 1,592,220 | 41,264,299 |

| Infrastructure | 1,952,333 | 26,629,522 | 2,692,422 | (3,991,445) | 462,505 | (686,007) | 251,041 | 820,426 | 25,106,997 |

| John Hancock Collateral Trust* | — | 885,879 | 48,485,210 | (49,372,039) | 923 | 27 | 8,916 | — | — |

| Multi-Asset Absolute Return | 5,755,675 | 28,253,887 | 27,484,135 | (2,672,699) | (453,353) | (5,101) | — | — | 52,606,869 |

| Seaport Long/Short | 6,538,507 | 50,138,430 | 26,527,501 | (986,662) | 84,750 | (113,498) | 697,955 | — | 75,650,521 |

| Short Duration Credit Opportunities | 4,387,528 | 62,204,274 | 1,513,642 | (21,975,076) | (1,145,396) | 1,215,698 | 927,839 | — | 41,813,142 |

| Strategic Income Opportunities | 5,792,349 | 74,789,294 | 1,540,397 | (14,550,736) | (151,293) | 234,624 | 774,866 | — | 61,862,286 |

| | | | | | $(4,945,410) | $(7,450,046) | $3,991,242 | $9,639,956 | $354,052,860 |

| * | Refer to the Securities lending note within Note 2 for details regarding this investment. |

| | SEMIANNUAL REPORT | JOHN HANCOCK Alternative Asset Allocation Fund | 27 |

Note 8—Transactions in securities of affiliated issuers

Affiliated issuers, as defiined by the 1940 Act, are those in which the fund's holdings of an issuer represent 5% or more of the outstanding voting securities of the issuer. A summary of the fund's transactions in the securities of these issuers during the six months ended February 29, 2020, is set forth below:

| | | | | | | | Dividends and distributions |

| Affiliate | Ending

share

amount | Beginning

value | Cost of

purchases | Proceeds

from shares

sold | Realized

gain

(loss) | Change in

unrealized

appreciation

(depreciation) | Income

distributions

received | Capital gain

distributions

received | Ending

value |

| | | | | | | | | | |

| Credit Suisse Managed Futures Strategy Fund | 2,656,220 | $24,056,171 | $5,058,784 | $(969,242) | $(49,805) | $(3,552,435) | $428,413 | — | $24,543,473 |

| Invesco DB Gold Fund | 194,372 | 10,651,123 | 979,824 | (2,662,882) | 481,674 | (378,398) | 195,898 | — | 9,071,341 |

| | | | | | $431,869 | $(3,930,833) | $624,311 | — | $33,614,814 |

Note 9—Subsequent events

A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, impact the ability to complete redemptions, and affect fund performance. For example, the novel coronavirus disease (COVID-19) has resulted in significant disruptions to global business activity. The impact of a health crisis and other epidemics and pandemics that may arise in the future, could affect the global economy in ways that cannot necessarily be foreseen at the present time. A health crisis may exacerbate other pre-existing political, social and economic risks. Any such impact could adversely affect the fund's performance, resulting in losses to your investment.

| 28 | JOHN HANCOCK Alternative Asset Allocation Fund | SEMIANNUAL REPORT | |

| | |

Trustees

Hassell H. McClellan,Chairperson

Steven R. Pruchansky,Vice Chairperson

Andrew G. Arnott†

Charles L. Bardelis*

James R. Boyle

Peter S. Burgess*

William H. Cunningham

Grace K. Fey

Marianne Harrison†

Deborah C. Jackson

James M. Oates*

Gregory A. Russo

Officers

Andrew G. Arnott

President

Francis V. Knox, Jr.

Chief Compliance Officer

Charles A. Rizzo

Chief Financial Officer

Salvatore Schiavone

Treasurer

Christopher (Kit) Sechler

Secretary and Chief Legal Officer

| Investment advisor

John Hancock Investment Management LLC

Subadvisor

Manulife Investment Management (US) LLC

Portfolio Managers

Nathan W. Thooft, CFA

Christopher Walsh, CFA

Principal distributor

John Hancock Investment Management Distributors LLC

Custodian

State Street Bank and Trust Company

Transfer agent

John Hancock Signature Services, Inc.

Legal counsel

K&L Gates LLP

|

* Member of the Audit Committee

† Non-Independent Trustee

The fund's proxy voting policies and procedures, as well as the fund proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) website at sec.gov or on our website.

All of the fund's holdings as of the end of the third month of every fiscal quarter are filed with the SEC on Form N-PORT within 60 days of the end of the fiscal quarter. The fund's Form N-PORT filings are available on our website and the SEC's website, sec.gov.

We make this information on your fund, as well asmonthly portfolio holdings, and other fund details available on our website at jhinvestments.com or by calling 800-225-5291.

| | | | |

| | You can also contact us: |

| | 800-225-5291

jhinvestments.com | Regular mail:

John Hancock Signature Services, Inc.

P.O. Box 55913

Boston, MA 02205-5913

| Express mail:

John Hancock Signature Services, Inc.

2000 Crown Colony Drive

Suite 55913

Quincy, MA 02169-0953

|

SEMIANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 29

John Hancock family of funds

| | | |

DOMESTIC EQUITY FUNDS

Blue Chip Growth

Classic Value

Disciplined Value

Disciplined Value Mid Cap

Equity Income

Financial Industries

Fundamental All Cap Core

Fundamental Large Cap Core

New Opportunities

Regional Bank

Small Cap Core

Small Cap Growth

Small Cap Value

U.S. Global Leaders Growth

U.S. Quality Growth

GLOBAL AND INTERNATIONAL EQUITY FUNDS

Disciplined Value International

Emerging Markets

Emerging Markets Equity

Fundamental Global Franchise

Global Equity

Global Shareholder Yield

Global Thematic Opportunities

International Dynamic Growth

International Growth

International Small Company

| | INCOME FUNDS

Bond

California Tax-Free Income

Emerging Markets Debt

Floating Rate Income

Government Income

High Yield

High Yield Municipal Bond

Income

Investment Grade Bond

Money Market

Short Duration Bond

Short Duration Credit Opportunities

Strategic Income Opportunities

Tax-Free Bond

ALTERNATIVE AND SPECIALTY FUNDS

Absolute Return Currency

Alternative Asset Allocation

Alternative Risk Premia

Diversified Macro

Infrastructure

Multi-Asset Absolute Return

Seaport Long/Short

|

A fund's investment objectives, risks, charges, and expenses should be considered carefully before investing. The prospectus contains this and other important information about the fund. To obtain a prospectus, contact your financial professional, call John Hancock Investment Management at 800-225-5291, or visit our website at jhinvestments.com. Please read the prospectus carefully before investing or sending money.

| | | |

ASSET ALLOCATION

Balanced

Income Allocation

Multi-Index Lifetime Portfolios

Multi-Index Preservation Portfolios

Multimanager Lifestyle Portfolios

Multimanager Lifetime Portfolios

Retirement Income 2040

EXCHANGE-TRADED FUNDS

John Hancock Multifactor Consumer Discretionary ETF

John Hancock Multifactor Consumer Staples ETF

John Hancock Multifactor Developed International ETF

John Hancock Multifactor Emerging Markets ETF

John Hancock Multifactor Energy ETF

John Hancock Multifactor Financials ETF

John Hancock Multifactor Healthcare ETF

John Hancock Multifactor Industrials ETF

John Hancock Multifactor Large Cap ETF

John Hancock Multifactor Materials ETF

John Hancock Multifactor Media and

Communications ETF

John Hancock Multifactor Mid Cap ETF

John Hancock Multifactor Small Cap ETF

John Hancock Multifactor Technology ETF

John Hancock Multifactor Utilities ETF