UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21779

| JOHN HANCOCK FUNDS II |

| (Exact name of registrant as specified in charter) |

| 200 BERKELEY STREET, BOSTON, MA 02216 |

| (Address of principal executive offices) (Zip code) |

| SALVATORE SCHIAVONE, 200 BERKELEY STREET, BOSTON, MA 02216 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (617) 663-4497 |

Date of fiscal year end: 7/31

Date of reporting period: 1/31/20

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared five semiannual reports to shareholders for the period ended January 31, 2020. The first report applies to Short Duration Credit Opportunities Fund, the second report applies to Absolute Return Currency Fund, the third report applies to Fundamental All Cap Core Fund, the fourth report applies to Diversified Strategies Fund, and the fifth report applies to Multi-Asset Absolute Return Fund.

John Hancock

Short Duration Credit Opportunities Fund

Semiannual report 1/31/2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling John Hancock Investment Management at 800-225-5291 (Class A and Class C shares) or 888-972-8696 (Class I, Class R2, Class R4, Class R6, and Class NAV shares) or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform John Hancock Investment Management or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

A message to shareholders

Dear shareholder,

The bond markets posted positive performance during the 6 months ended January 31, 2020, with strong gains coming in the investment-grade corporate and high-yield segments of the market. U.S. Treasuries and tax-exempt municipal bonds also registered gains. Fixed-income investors have benefited from a combination of declining interest rates, low inflation, and accommodative central bank policy.

After a strong period of positive returns, investors are prudent to consider the risks to future gains. Growth has slowed in the United States, with some negative data in manufacturing reflecting concerns over international trade and wavering business confidence. Additionally, the spread of the coronavirus, trade disputes, and other geopolitical tensions may continue to create uncertainty among businesses and skepticism among investors. Your financial advisor can helpposition your portfolio so that it's sufficiently diversified to meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management, I'd like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Short Duration Credit Opportunities Fund

Table of contents

| | | |

| 2 | | Your fund at a glance |

| 3 | | Portfolio summary |

| 5 | | A look at performance |

| 7 | | Your expenses |

| 9 | | Fund's investments |

| 46 | | Financial statements |

| 50 | | Financial highlights |

| 55 | | Notes to financial statements |

| 70 | | More information |

SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 1

INVESTMENT OBJECTIVE

The fund seeks to maximize total return, which consists of income on its investments and capital appreciation.

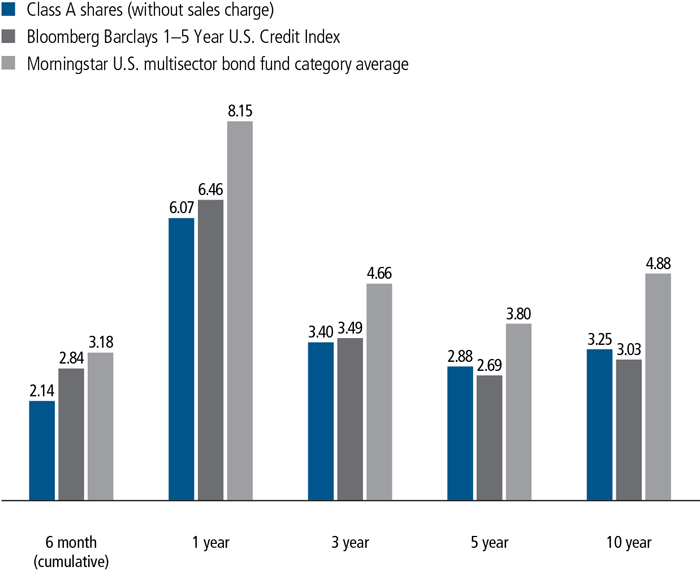

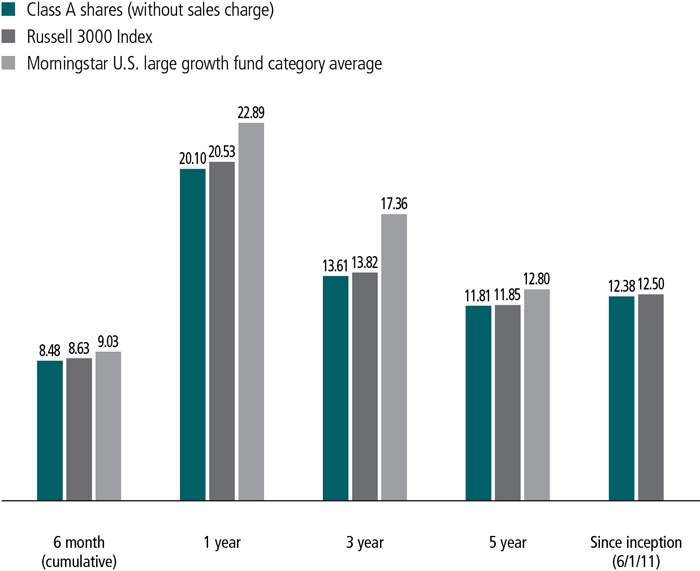

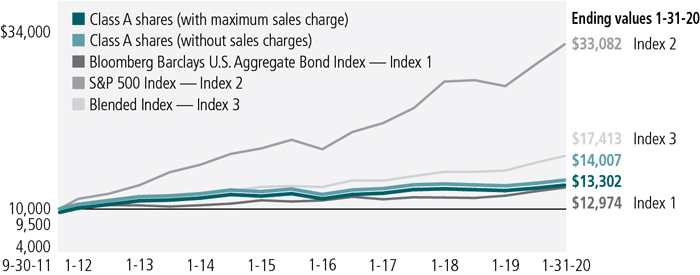

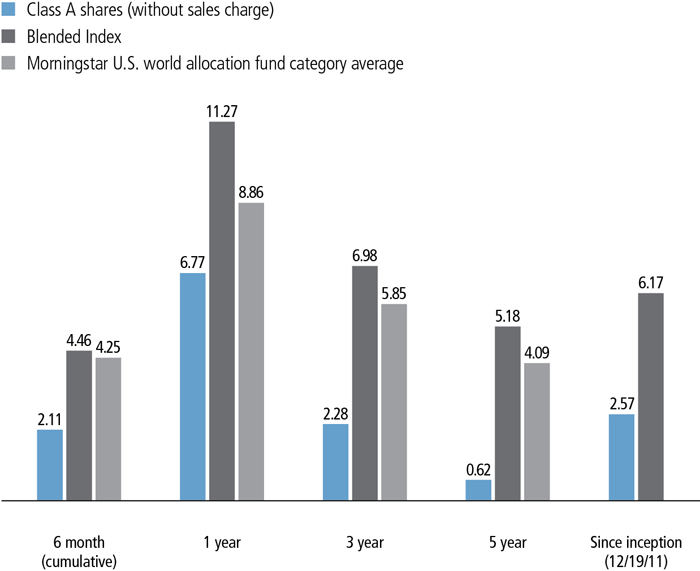

AVERAGE ANNUAL TOTAL RETURNS AS OF 1/31/2020 (%)

The Bloomberg Barclays 1 - 5 Year U.S. Credit Index includes investment-grade corporate and international U.S. dollar-denominated bonds with maturities of 1 to 5 years.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower. Since-inception returns for the Morningstar fund category average are not available.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Returns for periods shorter than one year are cumulative. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 2

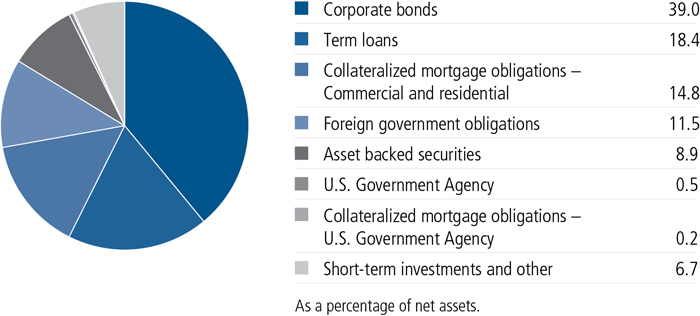

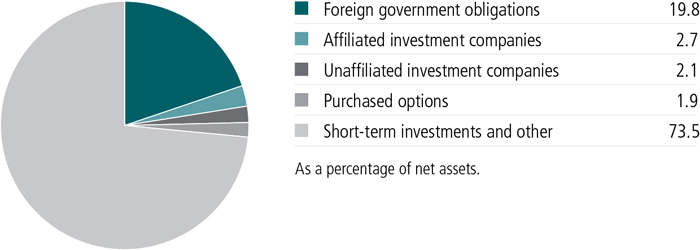

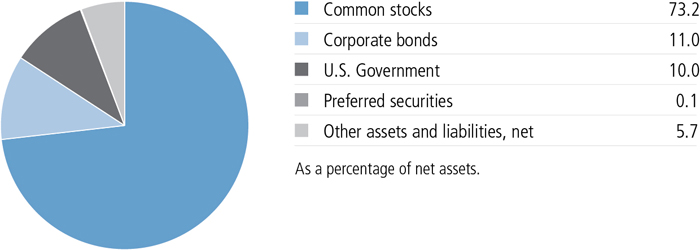

PORTFOLIO COMPOSITION AS OF 1/31/2020 (%)

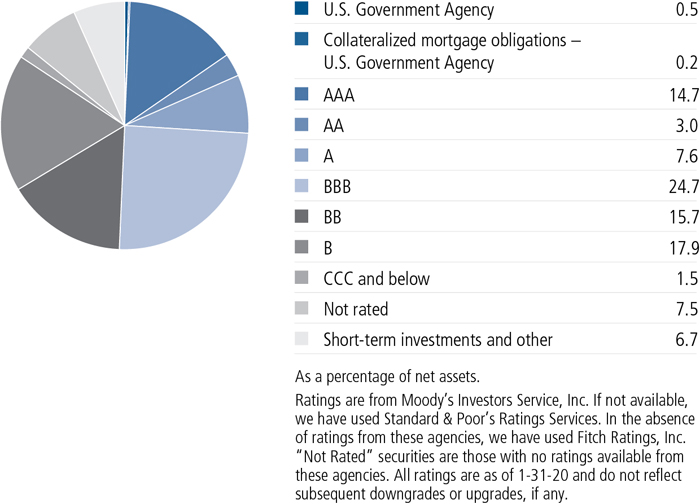

QUALITY COMPOSITION AS OF 1/31/2020 (%)

SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 3

COUNTRY COMPOSITION AS OF 1/31/2020 (%)

| | |

| United States | 74.3 |

| United Kingdom | 2.4 |

| Ireland | 1.5 |

| Netherlands | 1.3 |

| Mexico | 1.3 |

| France | 1.2 |

| Indonesia | 1.0 |

| Canada | 1.0 |

| Other countries | 16.0 |

| TOTAL | 100.0 |

| As a percentage of net assets. | |

A note about risks

The fund is subject to various risks as described in the fund's prospectus. For more information, please refer to the "Principal risks" section of the prospectus.

SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 4

TOTAL RETURNS FOR THE PERIOD ENDED JANUARY 31, 2020

| | | | | | | | | | | | |

Average annual

total returns (%)

with maximum sales charge | | Cumulative total

returns (%)

with maximum sales charge | | SEC 30-day

yield (%)

subsidized | | SEC 30-day

yield (%)

unsubsidized1 |

| | 1-year | 5-year | 10-year | | 6-month | 5-year | 10-year | | as of

1-31-20 | | as of

1-31-20 |

| Class A | 3.43 | 2.37 | 2.99 | | -0.46 | 12.40 | 34.28 | | 2.62 | | 2.62 |

| Class C2 | 4.34 | 2.17 | 2.85 | | 0.78 | 11.32 | 32.43 | | 2.00 | | 2.00 |

| Class I3 | 6.29 | 3.19 | 3.55 | | 2.18 | 17.00 | 41.77 | | 3.00 | | 2.99 |

| Class R62,3 | 6.51 | 3.31 | 3.47 | | 2.35 | 17.69 | 40.66 | | 3.11 | | 3.10 |

| Class NAV3 | 6.41 | 3.31 | 3.72 | | 2.25 | 17.68 | 44.10 | | 3.13 | | 3.12 |

| Index† | 6.46 | 2.69 | 3.03 | | 2.84 | 14.22 | 34.73 | | — | | — |

Performance figures assume all distributions are reinvested. Figures reflect maximum sales charges on Class A shares of 2.5% and the applicable contingent deferred sales charge (CDSC) on Class C shares. The returns for Class A shares have been adjusted to reflect the reduction in the maximum sales charge from 4.5% to 2.5%, effective 2-3-14. Class C shares sold within one year of purchase are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R6, and Class NAV shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. Net expenses reflect contractual expense limitations in effect until July 31, 2021 and are subject to change. Had the contractual fee waivers and expense limitations not been in place, gross expenses would apply. The expense ratios are as follows:

| | | | | | |

| | Class A | Class C | Class I | Class R6 | Class NAV |

| Gross (%) | 1.21 | 1.91 | 0.91 | 0.80 | 0.79 |

| Net (%) | 1.20 | 1.90 | 0.90 | 0.79 | 0.78 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the Bloomberg Barclays 1-5 Year U.S. Credit Index. |

See the following page for footnotes.

SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 5

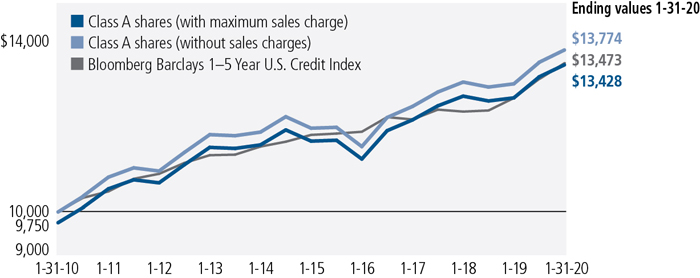

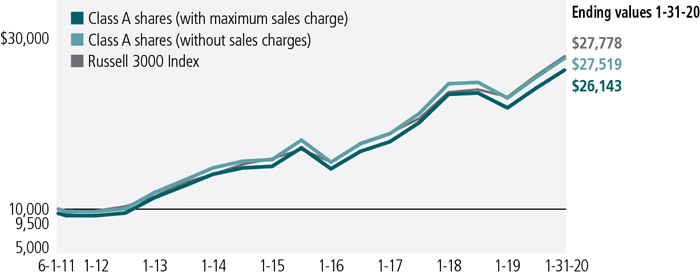

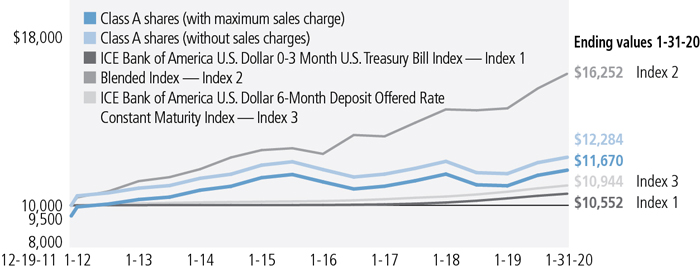

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Short Duration Credit Opportunities Fund for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the Bloomberg Barclays 1-5 Year U.S. Credit Index.

| | | | | |

| | Start date | With maximum

sales charge ($) | Without

sales charge ($) | Index ($) |

| Class C2,4 | 1-31-10 | 13,243 | 13,243 | 13,473 |

| Class I3 | 1-31-10 | 14,177 | 14,177 | 13,473 |

| Class R62,3 | 1-31-10 | 14,066 | 14,066 | 13,473 |

| Class NAV3 | 1-31-10 | 14,410 | 14,410 | 13,473 |

The values shown in the chart for "Class A with maximum sales charge" have been adjusted to reflect the reduction in the Class A maximum sales charge from 4.5% to 2.5%, which became effective on 2-3-14.

The Bloomberg Barclays 1-5 Year U.S. Credit Index includes investment-grade corporate and international U.S. dollar-denominated bonds with maturities of 1 to 5 years.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| 1 | Unsubsidized yield reflects what the yield would have been without the effects of waivers and reimbursements. |

| 2 | Class C shares were first offered on 6-27-14; Class R6 shares were first offered on 3-27-15. Returns prior to these dates are those of Class A shares (first offered on 11-2-09) that have not been adjusted for class-specific expenses; otherwise, returns would vary. |

| 3 | For certain types of investors as described in the fund's prospectuses. |

| 4 | The contingent deferred sales charge is not applicable. |

SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 6

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

■Transaction costs,which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses.

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

The first line of each share class in the table on the following page is intended to provide information about the fund’s actual ongoing operating expenses, and is based on the fund’s actual return. It assumes an account value of $1,000.00 on August 1, 2019, with the same investment held until January 31, 2020.

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at January 31, 2020, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

The second line of each share class in the table on the following page allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the class’s actual return). It assumes an account value of $1,000.00 on August 1, 2019, with the same investment held until January 31, 2020. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 7 |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectuses for details regarding transaction costs.

SHAREHOLDER EXPENSE EXAMPLE CHART

| | | Account

value on

8-1-2019 | Ending

value on

1-31-2020 | Expenses

paid during

period ended

1-31-20201 | Annualized

expense

ratio |

| Class A | Actual expenses/actual returns | $1,000.00 | $1,021.40 | $6.10 | 1.20% |

| | Hypothetical example | 1,000.00 | 1,019.10 | 6.09 | 1.20% |

| Class C | Actual expenses/actual returns | 1,000.00 | 1,017.80 | 9.64 | 1.90% |

| | Hypothetical example | 1,000.00 | 1,015.60 | 9.63 | 1.90% |

| Class I | Actual expenses/actual returns | 1,000.00 | 1,021.80 | 4.57 | 0.90% |

| | Hypothetical example | 1,000.00 | 1,020.60 | 4.57 | 0.90% |

| Class R6 | Actual expenses/actual returns | 1,000.00 | 1,023.50 | 4.02 | 0.79% |

| | Hypothetical example | 1,000.00 | 1,021.20 | 4.01 | 0.79% |

| Class NAV | Actual expenses/actual returns | 1,000.00 | 1,022.50 | 3.97 | 0.78% |

| | Hypothetical example | 1,000.00 | 1,021.20 | 3.96 | 0.78% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| 8 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | |

AS OF 1-31-20 (unaudited)

| | Rate (%) | Maturity date | | Par value^ | Value |

| U.S. Government and Agency obligations 0.5% | | | | $3,605,671 |

| (Cost $3,599,388) | | | | | |

| U.S. Government Agency 0.5% | | | 3,605,671 |

| Federal Home Loan Mortgage Corp. | | | |

| 30 Yr Pass Thru (12 month LIBOR + 1.625%) (A) | 2.721 | 04-01-46 | | 996,525 | 1,017,352 |

| 30 Yr Pass Thru (12 month LIBOR + 1.650%) (A) | 3.639 | 12-01-42 | | 414,349 | 428,379 |

| 30 Yr Pass Thru (12 month LIBOR + 1.743%) (A) | 4.031 | 01-01-37 | | 47,997 | 50,373 |

| 30 Yr Pass Thru (12 month LIBOR + 1.619%) (A) | 4.390 | 05-01-43 | | 220,926 | 228,106 |

| Federal National Mortgage Association | | | |

| 30 Yr Pass Thru (12 month LIBOR + 1.600%) (A) | 2.287 | 08-01-45 | | 185,778 | 189,248 |

| 30 Yr Pass Thru (12 month LIBOR + 1.582%) (A) | 2.841 | 12-01-44 | | 769,648 | 786,528 |

| 30 Yr Pass Thru (12 month LIBOR + 1.778%) (A) | 4.039 | 04-01-44 | | 350,428 | 364,764 |

| 30 Yr Pass Thru (1 Year CMT + 2.227%) (A) | 4.399 | 01-01-37 | | 215,343 | 227,240 |

| 30 Yr Pass Thru (12 month LIBOR + 1.765%) (A) | 4.740 | 10-01-38 | | 115,433 | 121,568 |

| Government National Mortgage Association | | | |

| 30 Yr Pass Thru | 4.500 | 01-15-40 | | 93,973 | 103,153 |

|

| 30 Yr Pass Thru | 6.000 | 08-15-35 | | 77,908 | 88,960 |

| Foreign government obligations 11.5% | | | $94,416,805 |

| (Cost $91,615,036) | | | | | |

| Angola 0.3% | | | 2,814,789 |

| Republic of Angola | | | | | |

| Bond (6 month LIBOR + 4.500%) (A) | 6.388 | 12-07-23 | | 168,000 | 163,800 |

| Bond (B) | 9.125 | 11-26-49 | | 928,000 | 978,233 |

| Bond (B) | 9.375 | 05-08-48 | | 187,000 | 202,552 |

| Bond (6 month LIBOR + 7.500%) (A) | 9.412 | 07-01-23 | | 1,048,462 | 1,136,921 |

| Bond | 9.500 | 11-12-25 | | 285,000 | 333,283 |

| Argentina 0.4% | | | 3,268,630 |

| Republic of Argentina | | | | | |

| Bond | 3.375 | 01-15-23 | EUR | 423,000 | 207,459 |

| Bond | 5.000 | 01-15-27 | EUR | 107,000 | 49,591 |

| Bond | 6.625 | 07-06-28 | | 451,000 | 200,249 |

| Bond | 6.875 | 01-26-27 | | 450,000 | 201,600 |

| Bond | 7.820 | 12-31-33 | EUR | 4,439,675 | 2,609,731 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 9 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Azerbaijan 0.0% | | | $307,680 |

| Republic of Azerbaijan | | | | | |

| Bond (B) | 3.500 | 09-01-32 | | 306,000 | 307,680 |

| Bahrain 0.1% | | | 627,025 |

| Kingdom of Bahrain | | | | | |

| Bond (B) | 6.000 | 09-19-44 | | 140,000 | 145,342 |

| Bond (B) | 7.000 | 10-12-28 | | 408,000 | 481,683 |

| Belarus 0.1% | | | 512,922 |

| Republic of Belarus | | | | | |

| Bond | 6.200 | 02-28-30 | | 200,000 | 218,246 |

| Bond | 7.625 | 06-29-27 | | 255,000 | 294,676 |

| Benin 0.1% | | | 490,242 |

| Republic of Benin | | | | | |

| Bond (B) | 5.750 | 03-26-26 | EUR | 428,000 | 490,242 |

| Bolivia 0.0% | | | 212,007 |

| Plurinational State of Bolivia | | | | | |

| Bond | 4.500 | 03-20-28 | | 218,000 | 212,007 |

| Brazil 0.8% | | | 6,444,878 |

| Brazil Minas SPE | | | | | |

| Bond | 5.333 | 02-15-28 | | 1,183,500 | 1,275,233 |

| Bond (B) | 5.333 | 02-15-28 | | 107,100 | 115,401 |

| Federative Republic of Brazil | | | | | |

| Bill (C) | 3.987 | 07-01-20 | BRL | 480,000 | 110,246 |

| Bond | 4.500 | 05-30-29 | | 208,000 | 225,890 |

| Bond | 4.625 | 01-13-28 | | 8,000 | 8,820 |

| Bond | 4.750 | 01-14-50 | | 774,000 | 797,994 |

| Bond | 5.000 | 01-27-45 | | 753,000 | 812,306 |

| Note | 10.000 | 01-01-21 | BRL | 5,350,000 | 1,320,148 |

| Note | 10.000 | 01-01-23 | BRL | 1,490,000 | 391,331 |

| Note | 10.000 | 01-01-25 | BRL | 1,410,000 | 383,519 |

| Note | 10.000 | 01-01-27 | BRL | 2,740,000 | 765,388 |

| Note | 10.000 | 01-01-29 | BRL | 695,000 | 198,261 |

| Note | 10.000 | 01-01-31 | BRL | 140,000 | 40,341 |

| Cameroon 0.0% | | | 107,091 |

| Republic of Cameroon | | | | | |

| Bond (B) | 9.500 | 11-19-25 | | 94,000 | 107,091 |

| Chile 0.1% | | | 636,955 |

| Republic of Chile | | | | | |

| Bond | 4.500 | 03-01-26 | CLP | 225,000,000 | 311,340 |

| Bond (B) | 4.700 | 09-01-30 | CLP | 230,000,000 | 325,615 |

| Colombia 0.6% | | | 4,907,054 |

| Bogota Distrito Capital | | | | | |

| Bond | 9.750 | 07-26-28 | COP | 427,000,000 | 141,896 |

| 10 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Colombia (continued) | | | |

| Republic of Colombia | | | | | |

| Bond | 3.875 | 04-25-27 | | 95,000 | $102,078 |

| Bond | 4.375 | 03-21-23 | COP | 2,800,000,000 | 801,050 |

| Bond | 4.500 | 01-28-26 | | 325,000 | 358,277 |

| Bond | 4.500 | 03-15-29 | | 628,000 | 708,742 |

| Bond | 5.000 | 06-15-45 | | 143,000 | 173,602 |

| Bond | 5.200 | 05-15-49 | | 568,000 | 713,408 |

| Bond | 8.125 | 05-21-24 | | 312,000 | 385,713 |

| Bond | 9.850 | 06-28-27 | COP | 2,888,000,000 | 1,068,450 |

| Bond | 10.375 | 01-28-33 | | 278,000 | 453,838 |

| Costa Rica 0.0% | | | 201,600 |

| Republic of Costa Rica | | | | | |

| Bond | 4.375 | 04-30-25 | | 200,000 | 201,600 |

| Czech Republic 0.1% | | | 1,105,235 |

| Czech Republic | | | | | |

| Bond | 0.250 | 02-10-27 | CZK | 9,020,000 | 362,744 |

| Bond | 0.950 | 05-15-30 | CZK | 8,470,000 | 352,582 |

| Bond | 1.000 | 06-26-26 | CZK | 2,620,000 | 111,450 |

| Bond | 2.750 | 07-23-29 | CZK | 930,000 | 45,361 |

| Bond | 4.200 | 12-04-36 | CZK | 3,800,000 | 233,098 |

| Dominican Republic 0.3% | | | 2,722,184 |

| Government of Dominican Republic | | | | | |

| Bond (B) | 4.500 | 01-30-30 | | 200,000 | 199,752 |

| Bond | 5.500 | 01-27-25 | | 202,000 | 216,142 |

| Bond (B) | 5.875 | 04-18-24 | | 93,000 | 99,627 |

| Bond (B) | 5.875 | 01-30-60 | | 396,000 | 395,802 |

| Bond | 5.950 | 01-25-27 | | 290,000 | 318,640 |

| Bond | 6.600 | 01-28-24 | | 347,000 | 385,607 |

| Bond | 6.875 | 01-29-26 | | 347,000 | 395,583 |

| Bond (B) | 7.450 | 04-30-44 | | 595,000 | 711,031 |

| Ecuador 0.3% | | | 2,720,119 |

| Republic of Ecuador | | | | | |

| Bond | 7.875 | 03-27-25 | | 446,000 | 381,330 |

| Bond (B) | 7.875 | 01-23-28 | | 237,000 | 197,599 |

| Bond | 7.875 | 01-23-28 | | 272,000 | 221,003 |

| Bond | 8.875 | 10-23-27 | | 305,000 | 258,106 |

| Bond (B) | 10.750 | 01-31-29 | | 1,834,000 | 1,662,081 |

| Egypt 0.5% | | | 3,981,839 |

| Arab Republic of Egypt | | | | | |

| Bond (B) | 4.750 | 04-16-26 | EUR | 125,000 | 148,404 |

| Bond (B) | 5.577 | 02-21-23 | | 192,000 | 201,730 |

| Bond (B) | 5.625 | 04-16-30 | EUR | 1,251,000 | 1,455,098 |

| Bond (B) | 6.125 | 01-31-22 | | 609,000 | 639,108 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 11 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Egypt (continued) | | | |

| Bond (B) | 6.375 | 04-11-31 | EUR | 226,000 | $272,583 |

| Bond (B) | 8.150 | 11-20-59 | | 181,000 | 197,950 |

| Bond (B) | 8.500 | 01-31-47 | | 693,000 | 792,835 |

| Bond | 14.400 | 09-10-29 | EGP | 1,840,000 | 119,892 |

| Bond | 15.600 | 08-06-26 | EGP | 2,270,000 | 154,239 |

| El Salvador 0.1% | | | 959,986 |

| Republic of El Salvador | | | | | |

| Bond | 7.650 | 06-15-35 | | 456,000 | 530,105 |

| Bond | 8.250 | 04-10-32 | | 189,000 | 230,864 |

| Bond | 8.625 | 02-28-29 | | 162,000 | 199,017 |

| Ghana 0.2% | | | 1,272,416 |

| Republic of Ghana | | | | | |

| Bond (B) | 7.875 | 03-26-27 | | 167,000 | 178,490 |

| Bond (B) | 8.125 | 01-18-26 | | 48,000 | 53,340 |

| Bond (B) | 8.627 | 06-16-49 | | 177,000 | 177,404 |

| Bond (B) | 8.950 | 03-26-51 | | 223,000 | 227,781 |

| Bond (B) | 10.750 | 10-14-30 | | 494,000 | 635,401 |

| Hungary 0.0% | | | 317,883 |

| Republic of Hungary | | | | | |

| Bond | 5.375 | 03-25-24 | | 59,000 | 67,196 |

| Bond | 7.625 | 03-29-41 | | 149,000 | 250,687 |

| Indonesia 0.8% | | | 6,714,373 |

| Republic of Indonesia | | | | | |

| Bond | 2.850 | 02-14-30 | | 402,000 | 406,964 |

| Bond | 3.700 | 10-30-49 | | 295,000 | 307,090 |

| Bond (B) | 3.850 | 07-18-27 | | 1,339,000 | 1,443,675 |

| Bond (B) | 4.350 | 01-08-27 | | 20,000 | 22,131 |

| Bond | 5.250 | 01-17-42 | | 673,000 | 832,110 |

| Bond (B) | 5.250 | 01-08-47 | | 52,000 | 65,154 |

| Bond | 7.500 | 08-15-32 | IDR | 1,000,000,000 | 74,634 |

| Bond | 7.500 | 05-15-38 | IDR | 2,889,000,000 | 211,075 |

| Bond | 8.250 | 05-15-36 | IDR | 8,904,000,000 | 700,337 |

| Bond | 8.375 | 03-15-24 | IDR | 13,640,000,000 | 1,085,511 |

| Bond | 8.375 | 09-15-26 | IDR | 8,028,000,000 | 649,265 |

| Bond | 8.375 | 03-15-34 | IDR | 9,130,000,000 | 734,746 |

| Bond | 8.375 | 04-15-39 | IDR | 1,902,000,000 | 151,976 |

| Bond | 9.000 | 03-15-29 | IDR | 356,000,000 | 29,705 |

| Ivory Coast 0.1% | | | 1,113,030 |

| Republic of Ivory Coast | | | | | |

| Bond (B) | 5.875 | 10-17-31 | EUR | 598,000 | 702,570 |

| Bond | 6.125 | 06-15-33 | | 400,000 | 410,460 |

| 12 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Jamaica 0.1% | | | $529,044 |

| Government of Jamaica | | | | | |

| Bond | 7.875 | 07-28-45 | | 389,000 | 529,044 |

| Jordan 0.1% | | | 567,848 |

| Kingdom of Jordan | | | | | |

| Bond (B) | 5.750 | 01-31-27 | | 531,000 | 567,848 |

| Kenya 0.1% | | | 1,020,333 |

| Republic of Kenya | | | | | |

| Bond | 6.875 | 06-24-24 | | 339,000 | 367,687 |

| Bond (B) | 7.000 | 05-22-27 | | 211,000 | 224,109 |

| Bond (B) | 8.000 | 05-22-32 | | 185,000 | 201,272 |

| Bond | 8.250 | 02-28-48 | | 211,000 | 227,265 |

| Lebanon 0.0% | | | 362,572 |

| Republic of Lebanon | | | | | |

| Bond | 6.650 | 04-22-24 | | 475,000 | 178,360 |

| Bond | 6.750 | 11-29-27 | | 500,000 | 184,212 |

| Malaysia 0.1% | | | 1,094,540 |

| Government of Malaysia | | | | | |

| Bond | 3.502 | 05-31-27 | MYR | 416,000 | 104,079 |

| Bond | 3.620 | 11-30-21 | MYR | 180,000 | 44,533 |

| Bond | 3.733 | 06-15-28 | MYR | 450,000 | 114,496 |

| Bond | 3.885 | 08-15-29 | MYR | 979,000 | 253,607 |

| Bond | 3.899 | 11-16-27 | MYR | 347,000 | 89,143 |

| Bond | 3.906 | 07-15-26 | MYR | 1,410,000 | 361,388 |

| Bond | 4.498 | 04-15-30 | MYR | 470,000 | 127,294 |

| Mexico 0.7% | | | 5,525,124 |

| Government of Mexico | | | | | |

| Bond | 3.250 | 04-16-30 | | 295,000 | 300,163 |

| Bond | 4.350 | 01-15-47 | | 67,000 | 73,399 |

| Bond | 4.500 | 04-22-29 | | 1,422,000 | 1,591,943 |

| Bond | 4.750 | 03-08-44 | | 128,000 | 147,008 |

| Bond | 5.750 | 03-05-26 | MXN | 9,530,000 | 482,983 |

| Bond | 6.500 | 06-10-21 | MXN | 1,660,000 | 87,601 |

| Bond | 7.500 | 06-03-27 | MXN | 14,140,000 | 786,281 |

| Bond | 7.750 | 11-13-42 | MXN | 12,180,000 | 702,580 |

| Bond | 10.000 | 12-05-24 | MXN | 22,396,500 | 1,353,166 |

| Mozambique 0.1% | | | 618,031 |

| Republic of Mozambique | | | | | |

| Bond (B) | 5.000 | 09-15-31 | | 646,000 | 618,031 |

| Nigeria 0.3% | | | 2,028,819 |

| Federal Republic of Nigeria | | | | | |

| Bond (B) | 6.500 | 11-28-27 | | 1,078,000 | 1,110,163 |

| Bond (B) | 7.143 | 02-23-30 | | 495,000 | 510,045 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 13 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Nigeria (continued) | | | |

| Bond (B) | 7.625 | 11-28-47 | | 268,000 | $260,957 |

| Bond (B) | 7.875 | 02-16-32 | | 141,000 | 147,654 |

| Oman 0.3% | | | 2,047,761 |

| Sultanate of Oman | | | | | |

| Bond | 3.625 | 06-15-21 | | 521,000 | 523,472 |

| Bond (B) | 3.875 | 03-08-22 | | 296,000 | 298,960 |

| Bond (B) | 4.875 | 02-01-25 | | 10,000 | 10,313 |

| Bond (B) | 5.375 | 03-08-27 | | 831,000 | 859,655 |

| Bond (B) | 6.000 | 08-01-29 | | 340,000 | 355,361 |

| Pakistan 0.1% | | | 756,664 |

| Republic of Pakistan | | | | | |

| Bond | 6.875 | 12-05-27 | | 716,000 | 756,664 |

| Panama 0.2% | | | 1,662,661 |

| Republic of Panama | | | | | |

| Bond | 3.160 | 01-23-30 | | 1,573,000 | 1,662,661 |

| Papua New Guinea 0.1% | | | 1,183,173 |

| Independent State of Papua New Guinea | | | | | |

| Bond (B) | 8.375 | 10-04-28 | | 1,093,000 | 1,183,173 |

| Paraguay 0.1% | | | 857,465 |

| Republic of Paraguay | | | | | |

| Bond (B) | 5.400 | 03-30-50 | | 318,000 | 372,461 |

| Bond (B) | 6.100 | 08-11-44 | | 388,000 | 485,004 |

| Peru 0.2% | | | 1,702,938 |

| Republic of Peru | | | | | |

| Bond (B) | 5.400 | 08-12-34 | PEN | 540,000 | 171,655 |

| Bond | 5.625 | 11-18-50 | | 170,000 | 260,525 |

| Bond (B) | 5.940 | 02-12-29 | PEN | 510,000 | 173,182 |

| Bond (B) | 6.150 | 08-12-32 | PEN | 2,491,000 | 853,976 |

| Bond | 6.550 | 03-14-37 | | 160,000 | 243,600 |

| Poland 0.3% | | | 2,558,867 |

| Republic of Poland | | | | | |

| Bond | 2.000 | 04-25-21 | PLN | 420,000 | 109,184 |

| Bond | 2.500 | 04-25-24 | PLN | 930,000 | 247,079 |

| Bond | 2.500 | 07-25-26 | PLN | 3,316,000 | 879,933 |

| Bond | 2.750 | 04-25-28 | PLN | 1,480,000 | 398,862 |

| Bond | 4.000 | 10-25-23 | PLN | 1,290,000 | 359,939 |

| Bond | 5.750 | 09-23-22 | PLN | 1,976,000 | 563,870 |

| Qatar 0.4% | | | 3,048,725 |

| State of Qatar | | | | | |

| Bond (B) | 4.000 | 03-14-29 | | 1,258,000 | 1,418,463 |

| Bond | 4.000 | 03-14-29 | | 235,000 | 265,378 |

| 14 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Qatar (continued) | | | |

| Bond (B) | 4.500 | 04-23-28 | | 199,000 | $230,664 |

| Bond (B) | 5.103 | 04-23-48 | | 658,000 | 869,833 |

| Bond | 5.103 | 04-23-48 | | 200,000 | 264,387 |

| Romania 0.2% | | | 1,316,378 |

| Government of Romania | | | | | |

| Bond | 3.875 | 10-29-35 | EUR | 526,000 | 695,245 |

| Bond | 4.125 | 03-11-39 | EUR | 70,000 | 93,706 |

| Bond (B) | 4.625 | 04-03-49 | EUR | 136,000 | 193,063 |

| Bond | 5.000 | 02-12-29 | RON | 1,365,000 | 334,364 |

| Russia 0.8% | | | 6,880,796 |

| Government of Russia | | | | | |

| Bond | 4.250 | 06-23-27 | | 200,000 | 221,163 |

| Bond | 4.750 | 05-27-26 | | 800,000 | 904,760 |

| Bond | 4.875 | 09-16-23 | | 200,000 | 219,023 |

| Bond | 5.100 | 03-28-35 | | 800,000 | 977,680 |

| Bond | 5.250 | 06-23-47 | | 1,000,000 | 1,310,028 |

| Bond | 7.050 | 01-19-28 | RUB | 51,960,000 | 862,892 |

| Bond | 7.400 | 12-07-22 | RUB | 39,800,000 | 653,202 |

| Bond | 7.700 | 03-23-33 | RUB | 29,600,000 | 521,099 |

| Bond | 7.750 | 09-16-26 | RUB | 25,710,000 | 440,513 |

| Bond | 7.950 | 10-07-26 | RUB | 21,710,000 | 375,475 |

| Bond | 8.150 | 02-03-27 | RUB | 22,520,000 | 394,961 |

| Saudi Arabia 0.3% | | | 2,081,540 |

| Kingdom of Saudi Arabia | | | | | |

| Bond (B) | 3.625 | 03-04-28 | | 263,000 | 282,844 |

| Bond (B) | 4.375 | 04-16-29 | | 117,000 | 133,492 |

| Bond (B) | 4.500 | 04-17-30 | | 106,000 | 123,437 |

| Bond | 4.500 | 10-26-46 | | 866,000 | 991,032 |

| Bond (B) | 4.625 | 10-04-47 | | 212,000 | 246,880 |

| KSA Sukuk, Ltd. | | | | | |

| Bond (B) | 3.628 | 04-20-27 | | 282,000 | 303,855 |

| Senegal 0.1% | | | 598,018 |

| Republic of Senegal | | | | | |

| Bond (B) | 6.250 | 05-23-33 | | 560,000 | 598,018 |

| South Africa 0.5% | | | 3,958,899 |

| Republic of South Africa | | | | | |

| Bond | 4.665 | 01-17-24 | | 56,000 | 58,660 |

| Bond | 4.875 | 04-14-26 | | 207,000 | 217,182 |

| Bond | 5.000 | 10-12-46 | | 55,000 | 51,461 |

| Bond | 5.750 | 09-30-49 | | 400,000 | 393,484 |

| Bond | 5.875 | 06-22-30 | | 164,000 | 178,632 |

| Bond | 6.250 | 03-31-36 | ZAR | 22,600,000 | 1,077,403 |

| Bond | 6.300 | 06-22-48 | | 78,000 | 83,070 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 15 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| South Africa (continued) | | | |

| Bond | 7.000 | 02-28-31 | ZAR | 10,650,000 | $602,732 |

| Bond | 8.875 | 02-28-35 | ZAR | 2,340,000 | 145,395 |

| Bond | 10.500 | 12-21-26 | ZAR | 15,320,000 | 1,150,880 |

| Sri Lanka 0.2% | | | 1,512,899 |

| Republic of Sri Lanka | | | | | |

| Bond (B) | 5.750 | 04-18-23 | | 139,000 | 139,133 |

| Bond | 6.200 | 05-11-27 | | 196,000 | 186,489 |

| Bond | 6.250 | 07-27-21 | | 477,000 | 486,621 |

| Bond (B) | 6.750 | 04-18-28 | | 624,000 | 602,205 |

| Bond (B) | 7.850 | 03-14-29 | | 97,000 | 98,451 |

| Thailand 0.2% | | | 1,444,921 |

| Kingdom of Thailand | | | | | |

| Bond | 2.875 | 12-17-28 | THB | 16,330,000 | 592,705 |

| Bond | 3.775 | 06-25-32 | THB | 21,160,000 | 852,216 |

| Tunisia 0.0% | | | 323,277 |

| Banque Centrale de Tunisia | | | | | |

| Bond | 5.625 | 02-17-24 | EUR | 294,000 | 323,277 |

| Turkey 0.6% | | | 4,601,559 |

| Hazine Mustesarligi Varlik Kiralama AS | | | | | |

| Bond (B) | 5.800 | 02-21-22 | | 119,000 | 124,374 |

| Republic of Turkey | | | | | |

| Bond | 5.125 | 02-17-28 | | 75,000 | 75,204 |

| Bond | 5.750 | 03-22-24 | | 100,000 | 106,000 |

| Bond | 5.750 | 05-11-47 | | 305,000 | 294,478 |

| Bond | 6.000 | 03-25-27 | | 165,000 | 174,697 |

| Bond | 6.125 | 10-24-28 | | 389,000 | 412,904 |

| Bond | 6.250 | 09-26-22 | | 946,000 | 1,010,756 |

| Bond | 6.875 | 03-17-36 | | 469,000 | 521,497 |

| Bond | 7.375 | 02-05-25 | | 521,000 | 589,342 |

| Bond | 7.625 | 04-26-29 | | 197,000 | 229,211 |

| Bond | 8.000 | 03-12-25 | TRY | 3,510,000 | 544,850 |

| Bond | 10.700 | 02-17-21 | TRY | 1,080,000 | 182,083 |

| Bond | 10.700 | 08-17-22 | TRY | 490,000 | 83,594 |

| Bond | 11.000 | 02-24-27 | TRY | 1,426,000 | 252,569 |

| Ukraine 0.3% | | | 2,310,123 |

| Republic of Ukraine | | | | | |

| Bond (B) | 4.375 | 01-27-30 | EUR | 273,000 | 300,558 |

| Bond (B) | 6.750 | 06-20-26 | EUR | 301,000 | 386,856 |

| Bond (B) | 7.375 | 09-25-32 | | 189,000 | 208,845 |

| Bond (B) | 7.750 | 09-01-26 | | 248,000 | 280,860 |

| Bond (B) | 7.750 | 09-01-27 | | 157,000 | 177,759 |

| Bond (B) | 8.994 | 02-01-24 | | 564,000 | 646,485 |

| Bond (B) | 9.750 | 11-01-28 | | 248,000 | 308,760 |

| 16 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| United Arab Emirates 0.0% | | | $294,664 |

| Abu Dhabi Government | | | | | |

| Bond (B) | 4.125 | 10-11-47 | | 248,000 | 294,664 |

| Uruguay 0.2% | | | 1,553,172 |

| Republic of Uruguay | | | | | |

| Bond | 4.125 | 11-20-45 | | 197,000 | 223,103 |

| Bond | 4.975 | 04-20-55 | | 171,000 | 211,828 |

| Bond | 5.100 | 06-18-50 | | 848,865 | 1,067,456 |

| Bond (B) | 8.500 | 03-15-28 | UYU | 2,160,000 | 50,785 |

| Venezuela 0.0% | | | 168,315 |

| Republic of Venezuela | | | | | |

| Bond (D) | 7.750 | 10-13-19 | | 1,374,000 | 168,315 |

| Zambia 0.0% | | | 369,741 |

| Republic of Zambia | | | | | |

| Bond (B) | 5.375 | 09-20-22 | | 126,000 | 86,965 |

|

| Bond (B) | 8.500 | 04-14-24 | | 414,000 | 282,776 |

| Corporate bonds 39.0% | | | $320,197,872 |

| (Cost $304,006,235) | | | | | |

| Communication services 4.7% | | 38,353,740 |

| Diversified telecommunication services 1.0% | | |

| Altice France SA (B) | 7.375 | 05-01-26 | | 845,000 | 898,911 |

| AT&T, Inc. | 4.350 | 03-01-29 | | 1,950,000 | 2,201,707 |

| Axtel SAB de CV (B) | 6.375 | 11-14-24 | | 214,000 | 226,040 |

| CenturyLink, Inc. (B) | 4.000 | 02-15-27 | | 411,000 | 412,878 |

| Level 3 Financing, Inc. (B) | 4.625 | 09-15-27 | | 632,000 | 649,393 |

| Midcontinent Communications (B) | 5.375 | 08-15-27 | | 230,000 | 243,225 |

| UPCB Finance IV, Ltd. (B) | 5.375 | 01-15-25 | | 485,000 | 496,650 |

| Verizon Communications, Inc. | 4.329 | 09-21-28 | | 1,900,000 | 2,198,708 |

| Zayo Group LLC (B) | 5.750 | 01-15-27 | | 639,000 | 652,515 |

| Ziggo BV (B) | 5.500 | 01-15-27 | | 510,000 | 540,600 |

| Entertainment 0.3% | | |

| Lions Gate Capital Holdings LLC (B) | 6.375 | 02-01-24 | | 590,000 | 592,950 |

| Live Nation Entertainment, Inc. (B) | 4.750 | 10-15-27 | | 480,000 | 493,824 |

| Netflix, Inc. | 4.875 | 04-15-28 | | 690,000 | 738,300 |

| Netflix, Inc. (B) | 4.875 | 06-15-30 | | 424,000 | 442,285 |

| Interactive media and services 0.3% | | |

| Tencent Holdings, Ltd. (B) | 3.595 | 01-19-28 | | 2,075,000 | 2,214,254 |

| Twitter, Inc. (B) | 3.875 | 12-15-27 | | 236,000 | 236,295 |

| Media 2.5% | | |

| AMC Networks, Inc. | 4.750 | 08-01-25 | | 424,000 | 428,062 |

| Cablevision Systems Corp. | 5.875 | 09-15-22 | | 515,000 | 553,625 |

| CCO Holdings LLC (B) | 5.125 | 05-01-27 | | 520,000 | 543,400 |

| CCO Holdings LLC (B) | 5.375 | 06-01-29 | | 495,000 | 529,056 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 17 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | | |

| Media (continued) | | |

| CCO Holdings LLC (B) | 5.500 | 05-01-26 | | 410,000 | $428,450 |

| Charter Communications Operating LLC | 6.484 | 10-23-45 | | 2,675,000 | 3,470,293 |

| Comcast Corp. | 3.969 | 11-01-47 | | 2,000,000 | 2,295,543 |

| Cox Communications, Inc. (B) | 3.350 | 09-15-26 | | 2,050,000 | 2,174,964 |

| CSC Holdings LLC (B) | 7.500 | 04-01-28 | | 1,185,000 | 1,348,175 |

| Discovery Communications LLC | 5.000 | 09-20-37 | | 2,200,000 | 2,556,554 |

| DISH DBS Corp. | 7.750 | 07-01-26 | | 614,000 | 644,700 |

| Lamar Media Corp. (B) | 4.000 | 02-15-30 | | 463,000 | 466,473 |

| Sirius XM Radio, Inc. (B) | 4.625 | 07-15-24 | | 260,000 | 269,588 |

| Sirius XM Radio, Inc. (B) | 5.000 | 08-01-27 | | 855,000 | 897,750 |

| TEGNA, Inc. (B) | 4.625 | 03-15-28 | | 478,000 | 480,390 |

| Telenet Finance Luxembourg Notes Sarl (B) | 5.500 | 03-01-28 | | 600,000 | 636,327 |

| Terrier Media Buyer, Inc. (B) | 8.875 | 12-15-27 | | 333,000 | 342,990 |

| The Interpublic Group of Companies, Inc. | 4.650 | 10-01-28 | | 2,150,000 | 2,486,881 |

| Wireless telecommunication services 0.6% | | |

| Millicom International Cellular SA (B) | 6.250 | 03-25-29 | | 139,000 | 153,220 |

| Sprint Corp. | 7.625 | 02-15-25 | | 1,192,000 | 1,240,860 |

| T-Mobile USA, Inc. | 5.375 | 04-15-27 | | 555,000 | 592,463 |

| T-Mobile USA, Inc. | 6.500 | 01-15-26 | | 325,000 | 346,596 |

| Vodafone Group PLC | 5.000 | 05-30-38 | | 1,850,000 | 2,228,845 |

| Consumer discretionary 4.1% | | 33,517,930 |

| Auto components 0.3% | | |

| Dana Financing Luxembourg Sarl (B) | 6.500 | 06-01-26 | | 335,000 | 355,100 |

| Lear Corp. | 5.250 | 05-15-49 | | 1,175,000 | 1,288,525 |

| Panther BF Aggregator 2 LP (B) | 6.250 | 05-15-26 | | 495,000 | 530,938 |

| Panther BF Aggregator 2 LP (B) | 8.500 | 05-15-27 | | 287,000 | 308,525 |

| Automobiles 0.8% | | |

| Ford Motor Credit Company LLC | 4.271 | 01-09-27 | | 2,100,000 | 2,132,868 |

| General Motors Financial Company, Inc. | 4.350 | 01-17-27 | | 2,000,000 | 2,147,338 |

| Hyundai Capital America (B) | 3.000 | 10-30-20 | | 925,000 | 932,245 |

| Hyundai Capital America (B) | 3.250 | 09-20-22 | | 1,175,000 | 1,208,378 |

| Diversified consumer services 0.1% | | |

| Prime Security Services Borrower LLC (B) | 6.250 | 01-15-28 | | 313,000 | 310,066 |

| WW International, Inc. (B) | 8.625 | 12-01-25 | | 605,000 | 632,225 |

| Hotels, restaurants and leisure 0.9% | | |

| Boyd Gaming Corp. | 6.000 | 08-15-26 | | 220,000 | 233,750 |

| Churchill Downs, Inc. (B) | 5.500 | 04-01-27 | | 425,000 | 448,375 |

| International Game Technology PLC (B) | 6.250 | 01-15-27 | | 502,000 | 563,495 |

| NCL Corp., Ltd. (B) | 3.625 | 12-15-24 | | 472,000 | 468,460 |

| 18 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer discretionary (continued) | | |

| Hotels, restaurants and leisure (continued) | | |

| New Red Finance, Inc. (B) | 3.875 | 01-15-28 | | 180,000 | $181,143 |

| New Red Finance, Inc. (B) | 4.375 | 01-15-28 | | 435,000 | 436,044 |

| Royal Caribbean Cruises, Ltd. | 2.650 | 11-28-20 | | 2,150,000 | 2,161,036 |

| Sands China, Ltd. | 4.600 | 08-08-23 | | 2,100,000 | 2,222,619 |

| Station Casinos LLC (B) | 5.000 | 10-01-25 | | 480,000 | 491,256 |

| Household durables 0.2% | | |

| KB Home | 4.800 | 11-15-29 | | 275,000 | 285,313 |

| PulteGroup, Inc. | 5.000 | 01-15-27 | | 464,000 | 512,720 |

| TopBuild Corp. (B) | 5.625 | 05-01-26 | | 535,000 | 557,738 |

| Internet and direct marketing retail 0.9% | | |

| Alibaba Group Holding, Ltd. | 4.000 | 12-06-37 | | 2,000,000 | 2,272,223 |

| Amazon.com, Inc. | 3.875 | 08-22-37 | | 1,900,000 | 2,230,784 |

| Expedia Group, Inc. (B) | 3.250 | 02-15-30 | | 3,300,000 | 3,252,987 |

| Leisure products 0.1% | | |

| Diamond Sports Group LLC (B) | 5.375 | 08-15-26 | | 482,000 | 480,121 |

| Diamond Sports Group LLC (B)(E) | 6.625 | 08-15-27 | | 317,000 | 296,395 |

| Multiline retail 0.3% | | |

| Dollar Tree, Inc. | 4.000 | 05-15-25 | | 2,050,000 | 2,220,301 |

| Specialty retail 0.3% | | |

| AutoZone, Inc. | 3.750 | 04-18-29 | | 2,000,000 | 2,181,734 |

| Party City Holdings, Inc. (B) | 6.625 | 08-01-26 | | 493,000 | 350,030 |

| Textiles, apparel and luxury goods 0.2% | | |

| Hanesbrands, Inc. (B) | 4.625 | 05-15-24 | | 575,000 | 602,313 |

| Hanesbrands, Inc. (B) | 4.875 | 05-15-26 | | 206,000 | 217,073 |

| Levi Strauss & Company | 5.000 | 05-01-25 | | 555,000 | 572,416 |

| The William Carter Company (B) | 5.625 | 03-15-27 | | 407,000 | 433,396 |

| Consumer staples 1.1% | | 9,159,145 |

| Beverages 0.1% | | |

| Cott Holdings, Inc. (B) | 5.500 | 04-01-25 | | 610,000 | 632,875 |

| Food and staples retailing 0.3% | | |

| Albertsons Companies, Inc. (B) | 4.875 | 02-15-30 | | 463,000 | 475,733 |

| Albertsons Companies, Inc. (B) | 5.875 | 02-15-28 | | 225,000 | 240,188 |

| Albertsons Companies, Inc. | 6.625 | 06-15-24 | | 575,000 | 598,000 |

| Ingles Markets, Inc. | 5.750 | 06-15-23 | | 509,000 | 517,694 |

| The Kroger Company | 4.450 | 02-01-47 | | 1,075,000 | 1,173,560 |

| Food products 0.4% | | |

| Adecoagro SA (B) | 6.000 | 09-21-27 | | 295,000 | 295,738 |

| Chobani LLC (B)(E) | 7.500 | 04-15-25 | | 460,000 | 457,525 |

| JBS USA LUX SA (B) | 6.500 | 04-15-29 | | 860,000 | 963,209 |

| Pilgrim's Pride Corp. (B) | 5.750 | 03-15-25 | | 375,000 | 385,313 |

| Pilgrim's Pride Corp. (B) | 5.875 | 09-30-27 | | 330,000 | 350,031 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 19 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer staples (continued) | | |

| Food products (continued) | | |

| Post Holdings, Inc. (B) | 5.000 | 08-15-26 | | 445,000 | $459,463 |

| Post Holdings, Inc. (B) | 5.500 | 03-01-25 | | 345,000 | 357,361 |

| Food, beverage and tobacco 0.3% | | |

| Imperial Brands Finance PLC (B) | 3.500 | 07-26-26 | | 2,175,000 | 2,252,455 |

| Energy 5.9% | | 48,261,786 |

| Energy equipment and services 0.2% | | |

| Apergy Corp. | 6.375 | 05-01-26 | | 405,000 | 429,300 |

| Archrock Partners LP (B) | 6.250 | 04-01-28 | | 380,000 | 390,925 |

| Inkia Energy, Ltd. (B) | 5.875 | 11-09-27 | | 223,000 | 235,267 |

| SESI LLC | 7.750 | 09-15-24 | | 425,000 | 264,609 |

| Transocean, Inc. (B) | 8.000 | 02-01-27 | | 407,000 | 378,836 |

| Oil, gas and consumable fuels 5.7% | | |

| Abu Dhabi Crude Oil Pipeline LLC (B) | 3.650 | 11-02-29 | | 518,000 | 563,973 |

| Abu Dhabi Crude Oil Pipeline LLC (B) | 4.600 | 11-02-47 | | 665,000 | 781,375 |

| AI Candelaria Spain SLU (B) | 7.500 | 12-15-28 | | 326,000 | 371,902 |

| Alta Mesa Holdings LP (D) | 7.875 | 12-15-24 | | 460,000 | 5,750 |

| Antero Midstream Partners LP (B) | 5.750 | 03-01-27 | | 996,000 | 776,830 |

| Antero Midstream Partners LP (B) | 5.750 | 01-15-28 | | 344,000 | 267,529 |

| Antero Resources Corp. | 5.000 | 03-01-25 | | 600,000 | 395,880 |

| Apache Corp. | 5.100 | 09-01-40 | | 2,150,000 | 2,173,307 |

| Boardwalk Pipelines LP | 5.950 | 06-01-26 | | 2,125,000 | 2,441,268 |

| Cheniere Corpus Christi Holdings LLC | 5.125 | 06-30-27 | | 1,825,000 | 2,033,485 |

| Concho Resources, Inc. | 3.750 | 10-01-27 | | 2,100,000 | 2,217,079 |

| DCP Midstream Operating LP | 5.125 | 05-15-29 | | 545,000 | 574,975 |

| Diamondback Energy, Inc. | 2.875 | 12-01-24 | | 2,175,000 | 2,211,668 |

| Empresa Nacional del Petroleo | 3.750 | 08-05-26 | | 210,000 | 219,066 |

| Enterprise Products Operating LLC (4.875% to 8-16-22, then 3 month LIBOR + 2.986%) | 4.875 | 08-16-77 | | 2,125,000 | 2,126,084 |

| Genesis Energy LP | 6.000 | 05-15-23 | | 435,000 | 437,045 |

| Genesis Energy LP | 7.750 | 02-01-28 | | 276,000 | 278,285 |

| Geopark, Ltd. (B)(E) | 6.500 | 09-21-24 | | 245,000 | 258,230 |

| Hilcorp Energy I LP (B) | 5.750 | 10-01-25 | | 832,000 | 752,269 |

| Holly Energy Partners LP (B) | 5.000 | 02-01-28 | | 439,000 | 445,998 |

| KazMunayGas National Company JSC (B) | 4.750 | 04-24-25 | | 407,000 | 449,125 |

| KazMunayGas National Company JSC | 5.375 | 04-24-30 | | 514,000 | 611,111 |

| KazMunayGas National Company JSC (B) | 5.750 | 04-19-47 | | 306,000 | 379,391 |

| KazMunayGas National Company JSC (B) | 6.375 | 10-24-48 | | 545,000 | 727,435 |

| KazTransGas JSC (B) | 4.375 | 09-26-27 | | 547,000 | 586,482 |

| Kinder Morgan Energy Partners LP | 5.500 | 03-01-44 | | 975,000 | 1,165,663 |

| 20 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Energy (continued) | | |

| Oil, gas and consumable fuels (continued) | | |

| Kosmos Energy, Ltd. (B) | 7.125 | 04-04-26 | | 58,000 | $58,653 |

| Marathon Petroleum Corp. | 3.800 | 04-01-28 | | 1,025,000 | 1,096,092 |

| Marathon Petroleum Corp. | 5.125 | 12-15-26 | | 1,000,000 | 1,151,978 |

| Murphy Oil Corp. | 5.750 | 08-15-25 | | 375,000 | 386,018 |

| Murphy Oil Corp. | 5.875 | 12-01-27 | | 411,000 | 421,275 |

| Murphy Oil USA, Inc. | 4.750 | 09-15-29 | | 420,000 | 438,900 |

| NAK Naftogaz Ukraine (B) | 7.625 | 11-08-26 | | 299,000 | 318,307 |

| Oasis Petroleum, Inc. (B)(E) | 6.250 | 05-01-26 | | 150,000 | 114,375 |

| Oasis Petroleum, Inc. | 6.875 | 03-15-22 | | 475,000 | 456,000 |

| Pertamina Persero PT (B) | 3.650 | 07-30-29 | | 320,000 | 333,600 |

| Pertamina Persero PT | 5.250 | 05-23-21 | | 242,000 | 251,081 |

| Pertamina Persero PT (B) | 5.625 | 05-20-43 | | 513,000 | 601,984 |

| Pertamina Persero PT | 6.450 | 05-30-44 | | 363,000 | 470,677 |

| Petroamazonas EP (B) | 4.625 | 02-16-20 | | 91,667 | 91,593 |

| Petroamazonas EP (B) | 4.625 | 11-06-20 | | 166,667 | 165,837 |

| Petrobras Global Finance BV | 6.900 | 03-19-49 | | 456,000 | 556,480 |

| Petroleos de Venezuela SA (D) | 5.375 | 04-12-27 | | 64,000 | 5,120 |

| Petroleos de Venezuela SA (D) | 6.000 | 05-16-24 | | 3,771,996 | 301,760 |

| Petroleos de Venezuela SA (D) | 6.000 | 11-15-26 | | 1,826,000 | 146,080 |

| Petroleos de Venezuela SA (D) | 9.750 | 05-17-35 | | 3,459,000 | 276,720 |

| Petroleos del Peru SA | 4.750 | 06-19-32 | | 640,000 | 716,800 |

| Petroleos del Peru SA (B) | 4.750 | 06-19-32 | | 177,000 | 198,240 |

| Petroleos del Peru SA | 5.625 | 06-19-47 | | 628,000 | 756,941 |

| Petroleos Mexicanos | 5.350 | 02-12-28 | | 254,000 | 257,658 |

| Petroleos Mexicanos (B) | 5.950 | 01-28-31 | | 194,000 | 195,310 |

| Petroleos Mexicanos (B) | 6.490 | 01-23-27 | | 600,000 | 651,000 |

| Petroleos Mexicanos | 6.500 | 03-13-27 | | 367,000 | 397,890 |

| Petroleos Mexicanos | 6.500 | 01-23-29 | | 279,000 | 297,944 |

| Petroleos Mexicanos (B) | 6.840 | 01-23-30 | | 339,000 | 367,307 |

| Petroleos Mexicanos | 7.190 | 09-12-24 | MXN | 4,586,400 | 223,617 |

| Petroleos Mexicanos | 7.470 | 11-12-26 | MXN | 2,300,000 | 108,074 |

| Petroleos Mexicanos | 7.470 | 11-12-26 | MXN | 11,000 | 517 |

| Petroleos Mexicanos (B) | 7.690 | 01-23-50 | | 1,162,000 | 1,278,769 |

| Petroleos Mexicanos | 9.500 | 09-15-27 | | 97,000 | 116,255 |

| Petronas Capital, Ltd. (B) | 4.500 | 03-18-45 | | 452,000 | 567,749 |

| QEP Resources, Inc. | 5.250 | 05-01-23 | | 455,000 | 436,800 |

| Sabine Pass Liquefaction LLC | 5.000 | 03-15-27 | | 1,975,000 | 2,203,805 |

| Saudi Arabian Oil Company | 2.875 | 04-16-24 | | 484,000 | 497,292 |

| Saudi Arabian Oil Company (B) | 4.250 | 04-16-39 | | 150,000 | 166,220 |

| Sinopec Group Overseas Development 2016, Ltd. | 2.750 | 09-29-26 | | 223,000 | 227,511 |

| Sinopec Group Overseas Development 2017, Ltd. | 3.625 | 04-12-27 | | 753,000 | 803,669 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 21 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Energy (continued) | | |

| Oil, gas and consumable fuels (continued) | | |

| SM Energy Company | 6.125 | 11-15-22 | | 275,000 | $272,250 |

| Targa Resources Partners LP | 6.500 | 07-15-27 | | 1,021,000 | 1,112,890 |

| The Oil and Gas Holding Company BSCC (B) | 7.625 | 11-07-24 | | 324,000 | 379,120 |

| Tullow Oil PLC (B) | 7.000 | 03-01-25 | | 245,000 | 198,149 |

| Unit Corp. | 6.625 | 05-15-21 | | 515,000 | 225,570 |

| Western Midstream Operating LP | 5.300 | 03-01-48 | | 975,000 | 865,395 |

| Western Midstream Operating LP | 5.450 | 04-01-44 | | 1,375,000 | 1,251,738 |

| Whiting Petroleum Corp. | 6.625 | 01-15-26 | | 825,000 | 461,959 |

| WPX Energy, Inc. | 4.500 | 01-15-30 | | 430,000 | 432,675 |

| Financials 8.0% | | 65,938,976 |

| Banks 5.5% | | |

| Banco Mercantil del Norte SA (6.750% to 9-27-24, then 5 Year CMT + 4.967%) (B)(F) | 6.750 | 09-27-24 | | 187,000 | 203,400 |

| Banco Mercantil del Norte SA (7.500% to 6-27-29, then 10 Year CMT + 5.470%) (B)(F) | 7.500 | 06-27-29 | | 124,000 | 140,431 |

| Banco Nacional de Comercio Exterior SNC (3.800% to 8-11-21, then 5 Year CMT + 3.000%) (B) | 3.800 | 08-11-26 | | 233,000 | 235,915 |

| Banco Nacional de Comercio Exterior SNC (3.800% to 8-11-21, then 5 Year CMT + 3.000%) | 3.800 | 08-11-26 | | 115,000 | 116,439 |

| Bank of America Corp. | 3.950 | 04-21-25 | | 3,550,000 | 3,846,876 |

| Bank of America Corp. (4.078% to 4-23-39, then 3 month LIBOR + 1.320%) | 4.078 | 04-23-40 | | 2,400,000 | 2,814,560 |

| Barclays PLC | 4.836 | 05-09-28 | | 1,000,000 | 1,114,182 |

| Barclays PLC | 5.250 | 08-17-45 | | 875,000 | 1,109,483 |

| Brazil Loan Trust 1 (B) | 5.477 | 07-24-23 | | 140,814 | 147,151 |

| CIT Group, Inc. | 6.125 | 03-09-28 | | 180,000 | 214,300 |

| Citigroup, Inc. | 4.400 | 06-10-25 | | 4,025,000 | 4,438,916 |

| Citigroup, Inc. (2.876% to 7-24-22, then 3 month LIBOR + 0.950%) | 2.876 | 07-24-23 | | 75,000 | 76,574 |

| Deutsche Bank AG | 3.700 | 05-30-24 | | 2,325,000 | 2,407,525 |

| Fifth Third Bancorp | 3.650 | 01-25-24 | | 2,150,000 | 2,287,974 |

| HSBC Holdings PLC (3.950% to 5-18-23, then 3 month LIBOR + 0.987%) | 3.950 | 05-18-24 | | 2,000,000 | 2,117,998 |

| Intesa Sanpaolo SpA (B) | 4.000 | 09-23-29 | | 3,150,000 | 3,334,959 |

| JPMorgan Chase & Co. | 3.625 | 12-01-27 | | 2,100,000 | 2,261,691 |

| KeyBank NA | 3.900 | 04-13-29 | | 2,150,000 | 2,379,016 |

| Mizuho Financial Group, Inc. (2.721% to 7-16-22, then 3 month LIBOR + 0.840%) | 2.721 | 07-16-23 | | 2,125,000 | 2,162,899 |

| 22 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Financials (continued) | | |

| Banks (continued) | | |

| Santander Holdings USA, Inc. (B) | 3.244 | 10-05-26 | | 2,175,000 | $2,229,238 |

| Societe Generale SA (B) | 2.625 | 10-16-24 | | 5,550,000 | 5,633,726 |

| Standard Chartered PLC (2.819% to 1-30-25, then 3 month LIBOR + 1.209%) (B) | 2.819 | 01-30-26 | | 2,150,000 | 2,177,061 |

| Sumitomo Mitsui Financial Group, Inc. | 3.202 | 09-17-29 | | 1,375,000 | 1,444,313 |

| The Royal Bank of Scotland Group PLC | 6.100 | 06-10-23 | | 1,975,000 | 2,193,451 |

| Ukreximbank | 9.625 | 04-27-22 | | 151,250 | 160,567 |

| Capital markets 1.3% | | |

| 1MDB Global Investments, Ltd. | 4.400 | 03-09-23 | | 1,000,000 | 991,549 |

| Credit Suisse Group AG (4.207% to 6-12-23, then 3 month LIBOR + 1.240%) (B) | 4.207 | 06-12-24 | | 2,000,000 | 2,135,483 |

| MDGH - GMTN BV (B) | 2.875 | 11-07-29 | | 160,000 | 162,600 |

| MDGH - GMTN BV (B) | 4.500 | 11-07-28 | | 601,000 | 688,265 |

| MSCI, Inc. (B) | 4.000 | 11-15-29 | | 395,000 | 403,394 |

| MV24 Capital BV (B) | 6.748 | 06-01-34 | | 268,208 | 289,209 |

| State Street Corp. (3.031% to 11-1-29, then SOFR + 1.490%) | 3.031 | 11-01-34 | | 1,625,000 | 1,683,851 |

| The Goldman Sachs Group, Inc. (2.905% to 7-24-22, then 3 month LIBOR + 0.990%) | 2.905 | 07-24-23 | | 2,100,000 | 2,147,216 |

| UBS Group AG (B) | 3.491 | 05-23-23 | | 2,075,000 | 2,146,769 |

| Consumer finance 0.8% | | |

| Ally Financial, Inc. | 8.000 | 11-01-31 | | 153,000 | 215,816 |

| Capital One Financial Corp. | 3.750 | 03-09-27 | | 3,075,000 | 3,329,307 |

| Springleaf Finance Corp. | 7.125 | 03-15-26 | | 475,000 | 544,991 |

| Synchrony Financial | 3.700 | 08-04-26 | | 2,125,000 | 2,235,436 |

| Diversified financial services 0.3% | | |

| GE Capital International Funding Company Unlimited Company | 3.373 | 11-15-25 | | 2,325,000 | 2,464,531 |

| Insurance 0.1% | | |

| Acrisure LLC (B) | 7.000 | 11-15-25 | | 304,000 | 297,920 |

| Acrisure LLC (B) | 8.125 | 02-15-24 | | 415,000 | 443,531 |

| Alliant Holdings Intermediate LLC (B) | 6.750 | 10-15-27 | | 485,000 | 510,463 |

| Health care 2.3% | | 18,496,828 |

| Biotechnology 0.4% | | |

| AbbVie, Inc. (B) | 2.950 | 11-21-26 | | 3,150,000 | 3,253,851 |

| Health care equipment and supplies 0.1% | | |

| Hologic, Inc. (B) | 4.375 | 10-15-25 | | 370,000 | 376,782 |

| Health care providers and services 1.3% | | |

| Centene Corp. (B) | 4.250 | 12-15-27 | | 471,000 | 492,195 |

| CVS Health Corp. | 4.300 | 03-25-28 | | 2,125,000 | 2,357,578 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 23 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Health care (continued) | | |

| Health care providers and services (continued) | | |

| CVS Health Corp. | 4.780 | 03-25-38 | | 125,000 | $146,038 |

| Encompass Health Corp. | 4.500 | 02-01-28 | | 180,000 | 185,407 |

| HCA, Inc. | 5.250 | 06-15-49 | | 1,925,000 | 2,233,990 |

| HCA, Inc. | 5.375 | 09-01-26 | | 595,000 | 669,405 |

| HCA, Inc. | 5.625 | 09-01-28 | | 700,000 | 809,410 |

| Tenet Healthcare Corp. | 4.625 | 07-15-24 | | 675,000 | 691,875 |

| Tenet Healthcare Corp. (B) | 4.875 | 01-01-26 | | 225,000 | 234,000 |

| Tenet Healthcare Corp. (B) | 6.250 | 02-01-27 | | 515,000 | 544,664 |

| UnitedHealth Group, Inc. | 3.875 | 08-15-59 | | 2,075,000 | 2,305,504 |

| Life sciences tools and services 0.1% | | |

| Charles River Laboratories International, Inc. (B) | 4.250 | 05-01-28 | | 90,000 | 91,312 |

| Charles River Laboratories International, Inc. (B) | 5.500 | 04-01-26 | | 720,000 | 765,900 |

| Pharmaceuticals 0.4% | | |

| Bausch Health Companies, Inc. (B) | 6.125 | 04-15-25 | | 975,000 | 1,002,905 |

| Bausch Health Companies, Inc. (B) | 7.000 | 01-15-28 | | 615,000 | 666,131 |

| Catalent Pharma Solutions, Inc. (B) | 5.000 | 07-15-27 | | 465,000 | 489,482 |

| Endo DAC (B) | 6.000 | 02-01-25 | | 505,000 | 349,713 |

| IQVIA, Inc. (B) | 5.000 | 05-15-27 | | 580,000 | 611,923 |

| Par Pharmaceutical, Inc. (B) | 7.500 | 04-01-27 | | 215,000 | 218,763 |

| Industrials 2.4% | | 19,860,092 |

| Aerospace and defense 0.3% | | |

| Bombardier, Inc. (B) | 6.000 | 10-15-22 | | 833,000 | 816,340 |

| Moog, Inc. (B) | 4.250 | 12-15-27 | | 124,000 | 127,119 |

| Signature Aviation US Holdings, Inc. (B) | 4.000 | 03-01-28 | | 274,000 | 271,005 |

| TransDigm, Inc. (B) | 6.250 | 03-15-26 | | 875,000 | 943,688 |

| Air freight and logistics 0.5% | | |

| FedEx Corp. | 4.400 | 01-15-47 | | 2,300,000 | 2,422,256 |

| Gol Finance SA (B)(E) | 7.000 | 01-31-25 | | 310,000 | 314,805 |

| Park-Ohio Industries, Inc. | 6.625 | 04-15-27 | | 535,000 | 543,095 |

| XPO Logistics, Inc. (B) | 6.125 | 09-01-23 | | 200,000 | 206,750 |

| XPO Logistics, Inc. (B) | 6.750 | 08-15-24 | | 225,000 | 243,844 |

| Building products 0.2% | | |

| Advanced Drainage Systems, Inc. (B) | 5.000 | 09-30-27 | | 550,000 | 567,875 |

| American Woodmark Corp. (B) | 4.875 | 03-15-26 | | 640,000 | 658,400 |

| Griffon Corp. | 5.250 | 03-01-22 | | 690,000 | 689,227 |

| Commercial services and supplies 0.3% | | |

| ACCO Brands Corp. (B) | 5.250 | 12-15-24 | | 605,000 | 626,175 |

| Covanta Holding Corp. | 5.875 | 07-01-25 | | 655,000 | 679,358 |

| GFL Environmental, Inc. (B) | 5.125 | 12-15-26 | | 148,000 | 152,418 |

| GFL Environmental, Inc. (B) | 8.500 | 05-01-27 | | 540,000 | 588,600 |

| 24 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Industrials (continued) | | |

| Commercial services and supplies (continued) | | |

| Waste Pro USA, Inc. (B) | 5.500 | 02-15-26 | | 425,000 | $436,626 |

| Construction and engineering 0.0% | | |

| IHS Netherlands Holdco BV (B) | 8.000 | 09-18-27 | | 92,000 | 99,360 |

| Machinery 0.1% | | |

| Mueller Water Products, Inc. (B) | 5.500 | 06-15-26 | | 475,000 | 497,563 |

| SPX FLOW, Inc. (B) | 5.625 | 08-15-24 | | 700,000 | 728,000 |

| Road and rail 0.3% | | |

| Ryder System, Inc. | 3.650 | 03-18-24 | | 2,000,000 | 2,128,776 |

| Trading companies and distributors 0.6% | | |

| Air Lease Corp. | 3.625 | 12-01-27 | | 2,150,000 | 2,264,749 |

| Beacon Roofing Supply, Inc. (B) | 4.500 | 11-15-26 | | 285,000 | 292,838 |

| GATX Corp. | 4.550 | 11-07-28 | | 1,775,000 | 2,005,637 |

| United Rentals North America, Inc. | 6.500 | 12-15-26 | | 625,000 | 678,906 |

| Transportation infrastructure 0.1% | | |

| Aeropuerto Internacional de Tocumen SA | 5.625 | 05-18-36 | | 411,000 | 494,232 |

| Aeropuerto Internacional de Tocumen SA (B) | 6.000 | 11-18-48 | | 262,000 | 330,940 |

| Rumo Luxembourg Sarl (B) | 7.375 | 02-09-24 | | 48,000 | 51,510 |

| Information technology 1.8% | | 14,759,980 |

| Communications equipment 0.2% | | |

| Hughes Satellite Systems Corp. | 6.625 | 08-01-26 | | 600,000 | 661,500 |

| ViaSat, Inc. (B) | 5.625 | 04-15-27 | | 545,000 | 570,833 |

| IT services 0.6% | | |

| Broadridge Financial Solutions, Inc. | 2.900 | 12-01-29 | | 1,700,000 | 1,743,877 |

| Fiserv, Inc. | 3.200 | 07-01-26 | | 2,125,000 | 2,244,021 |

| The Western Union Company | 2.850 | 01-10-25 | | 1,300,000 | 1,331,315 |

| Semiconductors and semiconductor equipment 0.7% | | |

| Broadcom, Inc. (B) | 4.250 | 04-15-26 | | 2,075,000 | 2,243,870 |

| Entegris, Inc. (B) | 4.625 | 02-10-26 | | 560,000 | 578,200 |

| Qorvo, Inc. | 5.500 | 07-15-26 | | 520,000 | 549,900 |

| Xilinx, Inc. | 2.950 | 06-01-24 | | 2,100,000 | 2,181,406 |

| Software 0.2% | | |

| Fair Isaac Corp. (B) | 4.000 | 06-15-28 | | 533,000 | 542,328 |

| Nuance Communications, Inc. | 5.625 | 12-15-26 | | 600,000 | 638,250 |

| SS&C Technologies, Inc. (B) | 5.500 | 09-30-27 | | 560,000 | 592,368 |

| Technology hardware, storage and peripherals 0.1% | | |

| Seagate HDD Cayman | 4.875 | 06-01-27 | | 816,000 | 882,112 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 25 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Materials 3.4% | | $28,328,167 |

| Chemicals 1.1% | | |

| Axalta Coating Systems LLC (B) | 4.875 | 08-15-24 | | 450,000 | 463,500 |

| CF Industries, Inc. | 5.150 | 03-15-34 | | 595,000 | 687,225 |

| CNAC HK Finbridge Company, Ltd. | 5.125 | 03-14-28 | | 863,000 | 989,634 |

| Element Solutions, Inc. (B) | 5.875 | 12-01-25 | | 675,000 | 697,694 |

| ENN Clean Energy International Investment, Ltd. | 7.500 | 02-27-21 | | 200,000 | 205,893 |

| GCP Applied Technologies, Inc. (B) | 5.500 | 04-15-26 | | 450,000 | 468,000 |

| Huntsman International LLC | 4.500 | 05-01-29 | | 2,075,000 | 2,262,431 |

| Nutrien, Ltd. | 5.000 | 04-01-49 | | 1,850,000 | 2,294,673 |

| OCI NV (B) | 6.625 | 04-15-23 | | 810,000 | 840,814 |

| The Chemours Company (E) | 7.000 | 05-15-25 | | 392,000 | 375,144 |

| Construction materials 0.4% | | |

| American Builders & Contractors Supply Company, Inc. (B) | 4.000 | 01-15-28 | | 280,000 | 282,307 |

| U.S. Concrete, Inc. | 6.375 | 06-01-24 | | 555,000 | 574,425 |

| Vulcan Materials Company | 4.500 | 06-15-47 | | 1,975,000 | 2,287,737 |

| Containers and packaging 0.3% | | |

| Ardagh Packaging Finance PLC (B) | 4.125 | 08-15-26 | | 170,000 | 174,888 |

| Berry Global, Inc. | 5.125 | 07-15-23 | | 170,000 | 172,978 |

| Crown Americas LLC | 4.750 | 02-01-26 | | 500,000 | 519,375 |

| WRKCo, Inc. | 3.900 | 06-01-28 | | 1,600,000 | 1,737,797 |

| Metals and mining 1.3% | | |

| Anglo American Capital PLC (B) | 4.000 | 09-11-27 | | 2,025,000 | 2,167,056 |

| ArcelorMittal SA | 4.550 | 03-11-26 | | 2,150,000 | 2,318,285 |

| Corp. Nacional del Cobre de Chile (B) | 3.000 | 09-30-29 | | 55,000 | 55,744 |

| Corp. Nacional del Cobre de Chile (B) | 3.625 | 08-01-27 | | 114,000 | 121,313 |

| Corp. Nacional del Cobre de Chile (B) | 4.375 | 02-05-49 | | 1,143,000 | 1,281,080 |

| Corp. Nacional del Cobre de Chile (B) | 4.500 | 09-16-25 | | 709,000 | 783,289 |

| Corp. Nacional del Cobre de Chile | 5.625 | 10-18-43 | | 136,000 | 177,611 |

| First Quantum Minerals, Ltd. (B) | 6.875 | 03-01-26 | | 120,000 | 115,200 |

| First Quantum Minerals, Ltd. (B) | 7.500 | 04-01-25 | | 120,000 | 118,200 |

| FMG Resources August 2006 Pty, Ltd. (B) | 4.500 | 09-15-27 | | 455,000 | 461,256 |

| Freeport-McMoRan, Inc. | 4.550 | 11-14-24 | | 460,000 | 485,300 |

| Freeport-McMoRan, Inc. | 5.000 | 09-01-27 | | 450,000 | 466,313 |

| Indonesia Asahan Aluminium Persero PT (B) | 5.710 | 11-15-23 | | 195,000 | 215,272 |

| Kaiser Aluminum Corp. (B) | 4.625 | 03-01-28 | | 475,000 | 484,500 |

| Metinvest BV (B) | 7.750 | 10-17-29 | | 252,000 | 265,265 |

| Metinvest BV | 8.500 | 04-23-26 | | 200,000 | 218,739 |

| Newmont Corp. | 6.250 | 10-01-39 | | 975,000 | 1,360,678 |

| Paper and forest products 0.3% | | |

| Boise Cascade Company (B) | 5.625 | 09-01-24 | | 645,000 | 669,188 |

| 26 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Materials (continued) | | |

| Paper and forest products (continued) | | |

| Flex Acquisition Company, Inc. (B) | 6.875 | 01-15-25 | | 340,000 | $341,275 |

| Louisiana-Pacific Corp. | 4.875 | 09-15-24 | | 580,000 | 598,125 |

| Norbord, Inc. (B) | 6.250 | 04-15-23 | | 545,000 | 589,963 |

| Real estate 1.9% | | 15,781,822 |

| Equity real estate investment trusts 1.9% | | |

| American Homes 4 Rent LP | 4.250 | 02-15-28 | | 2,000,000 | 2,190,271 |

| Boston Properties LP | 2.900 | 03-15-30 | | 1,100,000 | 1,134,987 |

| Crown Castle International Corp. | 3.800 | 02-15-28 | | 2,000,000 | 2,178,288 |

| Equinix, Inc. | 2.625 | 11-18-24 | | 2,150,000 | 2,172,984 |

| MGM Growth Properties Operating Partnership LP | 5.750 | 02-01-27 | | 430,000 | 478,375 |

| Office Properties Income Trust | 4.250 | 05-15-24 | | 2,050,000 | 2,160,658 |

| SBA Communications Corp. (B) | 3.875 | 02-15-27 | | 288,000 | 291,960 |

| SITE Centers Corp. | 4.250 | 02-01-26 | | 2,125,000 | 2,298,483 |

| VICI Properties LP (B) | 4.125 | 08-15-30 | | 445,000 | 451,675 |

| WEA Finance LLC (B) | 2.875 | 01-15-27 | | 2,125,000 | 2,175,806 |

| Real estate management and development 0.0% | | |

| Wanda Properties International Company, Ltd. | 7.250 | 01-29-24 | | 247,000 | 248,335 |

| Utilities 3.4% | | 27,739,406 |

| Electric utilities 1.8% | | |

| Electricite de France SA (B) | 4.500 | 09-21-28 | | 1,950,000 | 2,227,612 |

| Enel Finance International NV (B) | 4.625 | 09-14-25 | | 2,975,000 | 3,308,515 |

| Entergy Texas, Inc. | 3.550 | 09-30-49 | | 1,375,000 | 1,507,106 |

| Eskom Holdings SOC, Ltd. (B) | 6.750 | 08-06-23 | | 470,000 | 475,570 |

| Eskom Holdings SOC, Ltd. (B) | 7.125 | 02-11-25 | | 178,000 | 180,451 |

| Eskom Holdings SOC, Ltd. (B) | 8.450 | 08-10-28 | | 270,000 | 290,304 |

| FirstEnergy Corp. | 4.850 | 07-15-47 | | 1,800,000 | 2,223,211 |

| Georgia Power Company | 4.300 | 03-15-42 | | 1,100,000 | 1,272,975 |

| Vistra Operations Company LLC (B) | 5.000 | 07-31-27 | | 220,000 | 225,786 |

| Vistra Operations Company LLC (B) | 5.625 | 02-15-27 | | 645,000 | 670,800 |

| Xcel Energy, Inc. | 3.500 | 12-01-49 | | 2,000,000 | 2,117,749 |

| Gas utilities 0.6% | | |

| Dominion Energy Gas Holdings LLC | 3.000 | 11-15-29 | | 1,425,000 | 1,464,199 |

| Dominion Energy, Inc. | 2.715 | 08-15-21 | | 2,150,000 | 2,172,740 |

| Southern Gas Corridor CJSC (B) | 6.875 | 03-24-26 | | 167,000 | 199,998 |

| Southern Gas Corridor CJSC | 6.875 | 03-24-26 | | 860,000 | 1,029,896 |

| Independent power and renewable electricity producers 0.5% | | |

| Calpine Corp. (B) | 4.500 | 02-15-28 | | 525,000 | 522,375 |

| Exelon Generation Company LLC | 5.600 | 06-15-42 | | 2,050,000 | 2,419,216 |

| Minejesa Capital BV (B) | 5.625 | 08-10-37 | | 33,000 | 35,892 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 27 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Utilities (continued) | | |

| Independent power and renewable electricity producers (continued) | | |

| Mong Duong Finance Holdings BV (B) | 5.125 | 05-07-29 | | 214,000 | $220,834 |

| NRG Energy, Inc. | 5.750 | 01-15-28 | | 645,000 | 694,214 |

| Multi-utilities 0.5% | | |

| ACWA Power Management and Investments One, Ltd. (B) | 5.950 | 12-15-39 | | 773,000 | 840,207 |

| CenterPoint Energy, Inc. | 4.250 | 11-01-28 | | 1,950,000 | 2,193,113 |

| Cometa Energia SA de CV (B) | 6.375 | 04-24-35 | | 199,614 | 228,598 |

|

| Sempra Energy | 4.000 | 02-01-48 | | 1,100,000 | 1,218,045 |

| Term loans (G) 18.4% | | | $151,374,737 |

| (Cost $154,127,812) | | | | | |

| Communication services 2.6% | 21,632,442 |

| Diversified telecommunication services 1.2% | | |

| Altice France SA, USD Term Loan B11 (1 month LIBOR + 2.750%) | 4.395 | 07-31-25 | | 1,502,095 | 1,486,143 |

| Consolidated Communications, Inc., 2016 Term Loan B (1 month LIBOR + 3.000%) | 4.650 | 10-04-23 | | 1,760,653 | 1,697,111 |

| Conterra Ultra Broadband Holdings, Inc., 1st Lien Term Loan (1 month LIBOR + 4.500%) | 6.150 | 04-30-26 | | 895,500 | 894,381 |

| Frontier Communications Corp., 2017 Term Loan B1 (1 month LIBOR + 3.750%) | 5.400 | 06-15-24 | | 1,579,921 | 1,593,081 |

| Intelsat Jackson Holdings SA, 2017 Term Loan B3 (6 month LIBOR + 3.750%) | 5.682 | 11-27-23 | | 835,000 | 831,351 |

| Iridium Satellite LLC, Term Loan B (1 month LIBOR + 3.750%) | 5.395 | 11-04-26 | | 1,180,000 | 1,186,879 |

| Level 3 Financing, Inc., 2019 Term Loan B (1 month LIBOR + 1.750%) | 3.395 | 03-01-27 | | 650,368 | 648,905 |

| Telesat LLC, Term Loan B5 (3 month LIBOR + 2.750%) | 4.630 | 12-07-26 | | 1,455,000 | 1,460,093 |

| Entertainment 0.1% | | |

| UFC Holdings LLC, 2019 Term Loan (1 month LIBOR + 3.250%) | 4.900 | 04-29-26 | | 1,112,201 | 1,114,803 |

| Interactive media and services 0.2% | | |

| MH Sub I LLC, 2017 1st Lien Term Loan (1 month LIBOR + 3.750%) | 5.395 | 09-13-24 | | 1,337,440 | 1,335,768 |

| Media 0.7% | | |

| Charter Communications Operating LLC, 2019 Term Loan B1 (1 month LIBOR + 1.750%) | 3.400 | 04-30-25 | | 1,106,856 | 1,111,870 |

| Cogeco Communications USA II LP, 2017 1st Lien Term Loan (1 month LIBOR + 2.250%) | 3.895 | 01-03-25 | | 1,024,599 | 1,024,947 |

| 28 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | |

| Media (continued) | | |

| CSC Holdings LLC, 2017 1st Lien Term Loan (1 month LIBOR + 2.250%) | 3.926 | 07-17-25 | | 1,507,627 | $1,508,698 |

| Cumulus Media New Holdings, Inc., Term Loan B (1 month LIBOR + 3.750%) | 5.395 | 03-31-26 | | 314,213 | 316,164 |

| Hubbard Radio LLC, 2015 Term Loan B (1 month LIBOR + 3.500%) | 5.150 | 03-28-25 | | 714,095 | 713,502 |

| Terrier Media Buyer, Inc., Term Loan B (3 month LIBOR + 4.250%) | 6.148 | 12-17-26 | | 1,120,000 | 1,128,120 |

| Wireless telecommunication services 0.4% | | |

| SBA Senior Finance II LLC, 2018 Term Loan B (1 month LIBOR + 1.750%) | 3.400 | 04-11-25 | | 1,427,656 | 1,428,555 |

| Sprint Communications, Inc., 1st Lien Term Loan B (1 month LIBOR + 2.500%) | 4.188 | 02-02-24 | | 1,411,222 | 1,379,469 |

| Syniverse Holdings, Inc., 2018 1st Lien Term Loan (6 month LIBOR + 5.000%) | 6.873 | 03-09-23 | | 846,687 | 772,602 |

| Consumer discretionary 2.5% | 20,814,475 |

| Auto components 0.1% | | |

| Panther BF Aggregator 2 LP, USD Term Loan B (1 month LIBOR + 3.500%) | 5.160 | 04-30-26 | | 798,000 | 802,589 |

| Diversified consumer services 0.5% | | |

| PCI Gaming Authority, Term Loan (1 month LIBOR + 2.500%) | 4.145 | 05-29-26 | | 610,397 | 612,918 |

| Prime Security Services Borrower LLC, 2019 Term Loan B1 (1 month LIBOR + 3.250%) | 5.013 | 09-23-26 | | 1,090,810 | 1,090,810 |

| Whatabrands LLC, Term Loan B (1 month LIBOR + 3.250%) | 4.984 | 08-02-26 | | 738,150 | 739,493 |

| WW International, Inc., 2017 Term Loan B (3 month LIBOR + 4.750%) | 6.720 | 11-29-24 | | 1,464,075 | 1,463,167 |

| Hotels, restaurants and leisure 0.9% | | |

| Alterra Mountain Company, Term Loan B1 (1 month LIBOR + 2.750%) | 4.395 | 07-31-24 | | 1,492,162 | 1,497,131 |

| Aramark Services, Inc., 2019 Term Loan B4 (3 month LIBOR + 1.750%) | 3.470 | 01-15-27 | | 500,000 | 500,625 |

| Boyd Gaming Corp., Term Loan B3 (1 week LIBOR + 2.250%) | 3.811 | 09-15-23 | | 949,193 | 951,272 |

| Caesars Resort Collection LLC, 2017 1st Lien Term Loan B (1 month LIBOR + 2.750%) | 4.395 | 12-23-24 | | 1,407,793 | 1,406,343 |

| Golden Nugget LLC, 2017 Incremental Term Loan B (1 month LIBOR + 2.750%) | 4.401 | 10-04-23 | | 1,523,285 | 1,525,341 |

| Motion Finco LLC, USD Term Loan B1 (3 month LIBOR + 3.250%) | 5.151 | 11-13-26 | | 816,667 | 824,017 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 29 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer discretionary (continued) | |

| Hotels, restaurants and leisure (continued) | | |

| New Red Finance, Term Loan B4 (1 month LIBOR + 1.750%) | 3.395 | 11-19-26 | | 864,545 | $863,033 |

| Leisure products 0.3% | | |

| Diamond Sports Group LLC, Term Loan (1 month LIBOR + 3.250%) | 4.910 | 08-24-26 | | 951,615 | 950,130 |

| Hayward Industries, Inc., 1st Lien Term Loan (1 month LIBOR + 3.500%) | 5.145 | 08-05-24 | | 1,578,612 | 1,560,189 |

| Multiline retail 0.1% | | |

| JC Penney Corp., Inc., 2016 Term Loan B (3 month LIBOR + 4.250%) | 6.159 | 06-23-23 | | 1,105,500 | 981,131 |

| Specialty retail 0.6% | | |

| Bass Pro Group LLC, Term Loan B (1 month LIBOR + 5.000%) | 6.645 | 09-25-24 | | 1,483,853 | 1,477,057 |

| Nascar Holdings LLC, Term Loan B (1 month LIBOR + 2.750%) | 4.408 | 10-19-26 | | 938,899 | 944,767 |

| Party City Holdings, Inc., 2018 Term Loan B (1 month LIBOR + 2.500%) | 4.150 | 08-19-22 | | 686,732 | 641,669 |

| Petco Animal Supplies, Inc., 2017 Term Loan B (3 month LIBOR + 3.250%) | 5.027 | 01-26-23 | | 1,115,732 | 941,198 |

| PetSmart, Inc., Consenting Term Loan (1 month LIBOR + 4.000%) | 5.670 | 03-11-22 | | 1,044,855 | 1,041,595 |

| Consumer staples 2.3% | 18,994,819 |

| Beverages 0.2% | | |

| Refresco Group BV, USD Term Loan B (H) | TBD | 01-29-25 | | 140,000 | 139,825 |

| Refresco Holding BV, USD Term Loan B3 (3 month LIBOR + 3.250%) | 5.160 | 03-28-25 | | 1,530,950 | 1,529,036 |

| Food and staples retailing 0.1% | | |

| Albertson's LLC, 2019 Term Loan B7 (1 month LIBOR + 2.750%) | 4.395 | 11-17-25 | | 751,954 | 751,954 |

| Food products 1.2% | | |

| Atkins Nutritionals Holdings, Inc., 2017 Term Loan B (1 month LIBOR + 3.750%) | 5.434 | 07-07-24 | | 600,927 | 606,936 |

| Chobani LLC, 2017 Term Loan B (1 month LIBOR + 3.500%) | 5.145 | 10-10-23 | | 1,091,386 | 1,090,022 |

| Dole Food Company, Inc., 2017 Term Loan B (1 month LIBOR + 2.750%) | 4.404 | 04-06-24 | | 1,399,396 | 1,396,430 |

| Froneri US, Inc., 2020 USD Term Loan (H) | TBD | 01-31-27 | | 1,495,000 | 1,498,738 |

| Hostess Brands LLC, 2019 Term Loan (1, 2, and 3 month LIBOR + 2.500%) | 3.986 | 08-03-25 | | 1,959,606 | 1,960,214 |

| JBS USA LUX SA, 2019 Term Loan B (1 month LIBOR + 2.000%) | 3.645 | 05-01-26 | | 858,513 | 862,118 |

| 30 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer staples (continued) | |

| Food products (continued) | | |

| Nomad Foods Lux Sarl, 2017 USD Term Loan B4 (3 month LIBOR + 2.250%) | 3.926 | 05-15-24 | | 1,719,423 | $1,719,423 |

| Upfield USA Corp., 2018 USD Term Loan B2 (3 month LIBOR + 3.000%) | 4.909 | 07-02-25 | | 651,085 | 647,556 |

| Household products 0.1% | | |

| Diamond BC BV, USD Term Loan (1 and 3 month LIBOR + 3.000%) | 4.777 | 09-06-24 | | 648,346 | 628,896 |

| Energizer Holdings, Inc., 2018 Term Loan B (1 month LIBOR + 2.250%) | 4.063 | 12-17-25 | | 477,000 | 477,797 |

| Personal products 0.7% | | |

| Edgewell Personal Care Company, Term Loan B (H) | TBD | 09-18-26 | | 930,000 | 930,000 |

| Prestige Brands, Inc., Term Loan B4 (1 month LIBOR + 2.000%) | 3.645 | 01-26-24 | | 1,042,683 | 1,048,387 |

| Revlon Consumer Products Corp., 2016 Term Loan B (3 month LIBOR + 3.500%) | 5.409 | 09-07-23 | | 3,401,327 | 2,658,715 |

| Sunshine Luxembourg VII Sarl, USD Term Loan B1 (3 month LIBOR + 4.250%) | 6.195 | 10-01-26 | | 1,045,000 | 1,048,772 |

| Energy 0.7% | 5,926,794 |

| Energy equipment and services 0.2% | | |

| Apergy Corp., 2018 1st Lien Term Loan (1 month LIBOR + 2.500%) | 4.188 | 05-09-25 | | 807,053 | 808,570 |

| Covia Holdings Corp., Term Loan (3 month LIBOR + 4.000%) | 5.874 | 06-01-25 | | 1,426,282 | 1,138,886 |

| Oil, gas and consumable fuels 0.5% | | |

| Buckeye Partners LP, 2019 Term Loan B (1 month LIBOR + 2.750%) | 4.531 | 11-01-26 | | 1,230,000 | 1,239,742 |

| Granite Acquisition, Inc., Term Loan B (3 month LIBOR + 3.500%) | 5.445 | 12-19-21 | | 2,004,293 | 2,008,462 |

| Prairie ECI Acquiror LP, Term Loan B (3 month LIBOR + 4.750%) | 6.695 | 03-11-26 | | 739,767 | 731,134 |

| Financials 1.1% | 9,203,276 |

| Capital markets 0.2% | | |