united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21872

Mutual Fund Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

CT CORPORATION SYSTEM

1300 EAST NINTH STREET, CLEVELAND, OH 44114

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 6/30

Date of reporting period: 6/30/2023

ITEM 1. REPORTS TO SHAREHOLDERS.

| Annual Report | June 30, 2023 |

| | |

| | |

| | Eventide Core Bond Fund Eventide Dividend Opportunities Fund Eventide Exponential Technologies Fund Eventide Gilead Fund Eventide Healthcare & Life Sciences Fund Eventide Large Cap Focus Fund Eventide Limited-Term Bond Fund Eventide Multi-Asset Income Fund |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Eventide Asset Management, LLC One International Place, Suite 4210 Boston, MA 02110 1-877-771-3836 |

| | |

| | |

| | |

| | |

| A N N U A L R E P O R T | June 30, 2023 |

| Annual Shareholder Letter 2023 (Unaudited) |

PREAMBLE

Both in investing and in other aspects of life, it can be easier to act virtuously when circumstances are smooth than when they are difficult or unpredictable. You often see someone’s true character in how they handle difficult times more than in how they act when things are easy. The past three years have tested the character of many investors as each quarter has been marked by a sensational headline encouraging dramatic investor behavior.

Something about our human nature seems to draw us to sensational headlines— and currently, it seems apparent that we’re especially drawn to negative sensational headlines. As humans, we long to feel something and it can be easier to create headlines that cause others to feel fearful, envious, or angry than it is to encourage them to feel hopeful, confident, or joyful.

At Eventide, we consider this in how we promote ourselves and our investing process. Our recent cultural environment has been polarized by hot takes. In our view, it’s cheap and easy to gain a following by inciting a group of people to become judgmental and angry at another group of people. It’s a way to prey on our complex desires as humans and exploit some of our ugly inclinations.

On the other hand, it’s also easy to retreat from the conversation completely and take a “to each their own” approach, even on very consequential topics. While this approach appeals to our virtuous desires for peace, it can become a crutch to not speak about injustices impacting vulnerable people.

We started Eventide with strong convictions about how we wanted to impact other people. We have a belief that businesses should be blessings to their customers, employees, suppliers, their communities, the environment, and society as a whole. Being a blessing includes valuing all human lives at any stage, promoting strong families and communities, addressing injustices to any people group, and caring for the environment.

Along with this conviction about what businesses should be doing comes a strong conviction about what they should not be doing: they shouldn’t be harming people, they shouldn’t be exploiting people’s addictions, they shouldn’t be creating products that are mainly used for the destruction of life and they shouldn’t be encouraging people through their products or messaging to pursue a path that leads to a life that isn’t flourishing.

Our impact not only comes from us doing what we believe is right and good but encouraging others to join us. This leaves us with a difficult question: Since we know that hot takes gain attention and a “to each their own” passivity keeps us out of the negative press, how do we faithfully pursue our mission in a way that appeals to the brighter side of our human nature?

In a polarized climate, marked by anger and fear, we seek to be both bold and inspiring.

Being bold involves having strong convictions based on enduring values, and being willing to voice our convictions even when they aren’t popular. Being inspiring means being deeply empathetic to those who may not agree with us and being winsome in our actions and communications with a goal of bringing people together rather than tearing them apart.

| A N N U A L R E P O R T | June 30, 2023 |

Just like a volatile market tests the character of investors—forcing them to choose between remaining faithful to their guiding virtues or abandoning them to respond to the fear or greed enticed by headlines, so it is that a polarized cultural climate tests the character of all of us engaged with our society— it forces us to choose between gaining a following with quick, easy, and angry hot-takes, completely retreating, or being faithfully bold and inspirational.

Thank you for your trust.

Robin John

Finny Kuruvilla, MD, PhD

Dolores Bamford, CFA

Anant Goel

Chris Grogan, CFA

Andrew Singer, CFA

| To stay tuned in throughout the year to bold, inspiring stories of what your investments are doing in the world, subscribe to Eventide. |

| A N N U A L R E P O R T | June 30, 2023 |

| Fund Returns (Unaudited) | | | | | | | | |

| as of 6/30/2023 | | | | | | | | |

| Eventide Core Bond Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 1.89 | -0.44 | -0.67 | — | — | — | -5.07 | 07/31/2020 |

| Class A without load | 1.78 | -0.62 | -0.90 | — | — | — | -5.31 | 07/31/2020 |

| Class A with 5.75% load | -4.12 | -6.39 | -6.55 | — | — | — | -7.21 | 07/31/2020 |

| Class C | 1.51 | -0.71 | -1.67 | — | — | — | -5.97 | 07/31/2020 |

| Class N | 1.92 | -0.49 | -0.89 | — | — | — | -5.26 | 07/31/2020 |

| Benchmark | | | | | | | | |

| Bloomberg U.S. Aggregate Bond Index | 2.09 | -0.84 | -0.94 | — | — | — | -4.56 | 07/31/2020 |

| | | | | | | | |

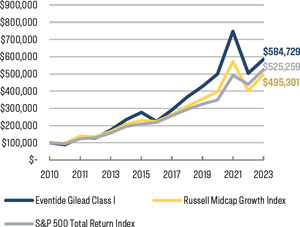

| Eventide Dividend Opportunities Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 8.44 | 5.78 | 10.87 | 12.59 | 10.77 | — | 8.98 | 09/29/2017 |

| Class A without load | 8.39 | 5.71 | 10.68 | 12.39 | 10.55 | — | 8.73 | 09/29/2017 |

| Class A with 5.75% load | 2.14 | -0.38 | 4.31 | 10.20 | 9.24 | — | 7.61 | 09/29/2017 |

| Class C | 7.94 | 5.52 | 9.78 | 11.46 | 9.67 | — | 7.91 | 09/29/2017 |

| Class N | 8.34 | 5.73 | 10.66 | 12.37 | 10.56 | — | 8.76 | 09/29/2017 |

| Benchmarks | | | | | | | | |

| Russell Midcap Index | 9.01 | 4.76 | 14.92 | 12.50 | 8.46 | — | 8.86 | 09/29/2017 |

| Russell Midcap Value Index | 5.23 | 3.86 | 10.50 | 15.04 | 6.84 | — | 6.88 | 09/29/2017 |

| | | | | | | | | |

| Eventide Exponential Technologies Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 21.77 | 9.32 | 10.12 | 7.01 | — | — | 7.01 | 06/30/2020 |

| Class A without load | 21.58 | 9.29 | 9.79 | 6.78 | — | — | 6.78 | 06/30/2020 |

| Class A with 5.75% load | 14.61 | 3.00 | 3.45 | 4.69 | — | — | 4.69 | 06/30/2020 |

| Class C | 21.28 | 9.11 | 9.01 | 6.00 | — | — | 6.00 | 06/30/2020 |

| Class N | 21.58 | 9.29 | 9.89 | 6.78 | — | — | 6.78 | 06/30/2020 |

| Benchmarks | | | | | | | | |

| S&P North American Technology Sector Index | 40.57 | 15.74 | 33.71 | 13.05 | — | — | 13.05 | 06/30/2020 |

| S&P 500 Total Return Index | 16.89 | 8.74 | 19.59 | 14.60 | — | — | 14.60 | 06/30/2020 |

| | | | | | | | | |

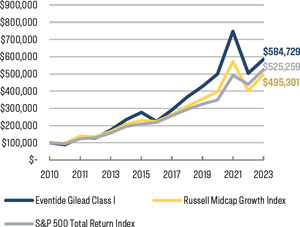

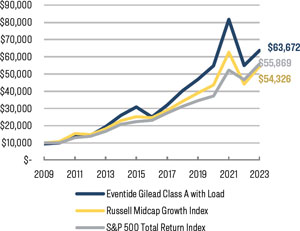

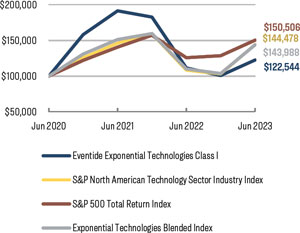

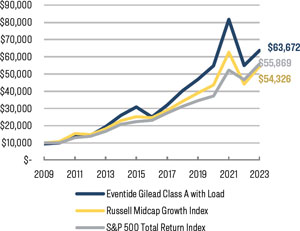

| Eventide Gilead Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 17.56 | 8.15 | 16.00 | 5.44 | 9.83 | 12.92 | 14.08 | 02/02/2010 |

| Class A without load | 17.42 | 8.09 | 15.73 | 5.19 | 9.57 | 12.65 | 15.00 | 10/28/2009 |

| Class A with 5.75% load | 10.67 | 1.86 | 9.08 | 3.14 | 8.27 | 11.99 | 14.50 | 10/28/2009 |

| Class C | 16.98 | 7.91 | 14.87 | 4.38 | 8.73 | 11.79 | 14.12 | 10/28/2009 |

| Class N | 17.45 | 8.12 | 15.77 | 5.23 | 9.61 | 12.69 | 13.44 | 07/08/2008 |

| Benchmarks | | | | | | | | |

| Russell Midcap Growth Index | 15.94 | 6.23 | 23.13 | 7.63 | 9.71 | 11.53 | 10.46 | 07/08/2008 |

| S&P 500 Total Return Index | 16.89 | 8.74 | 19.59 | 14.60 | 12.31 | 12.86 | 10.93 | 07/08/2008 |

| A N N U A L R E P O R T | June 30, 2023 |

| Fund Returns (Unaudited) (Continued) | | | | | | | | |

| as of 6/30/2023 | | | | | | | | |

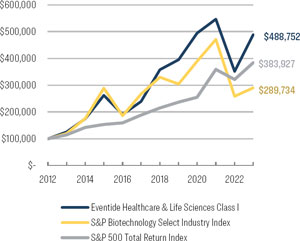

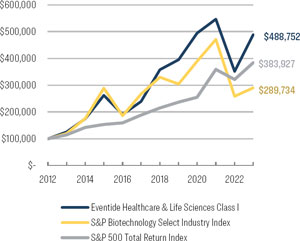

| Eventide Healthcare & Life Sciences Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 13.08 | 14.90 | 39.11 | -0.39 | 6.46 | 14.61 | 16.30 | 12/27/2012 |

| Class A without load | 12.92 | 14.83 | 38.71 | -0.64 | 6.19 | 14.31 | 16.00 | 12/27/2012 |

| Class A with 5.75% load | 6.42 | 8.22 | 30.74 | -2.58 | 4.94 | 13.64 | 15.35 | 12/27/2012 |

| Class C | 12.47 | 14.62 | 37.71 | -1.39 | 5.39 | 13.46 | 15.14 | 12/27/2012 |

| Class N | 12.95 | 14.85 | 38.83 | -0.58 | 6.25 | 14.38 | 16.08 | 12/27/2012 |

| Benchmarks | | | | | | | | |

| S&P Biotechnology Select Industry Index | 0.08 | 9.61 | 12.13 | -9.33 | -2.55 | 9.26 | 10.66 | 12/27/2012 |

| S&P 500 Total Return Index | 16.89 | 8.74 | 19.59 | 14.60 | 12.31 | 12.86 | 13.66 | 12/27/2012 |

| | | | | | | | | |

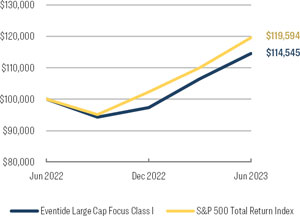

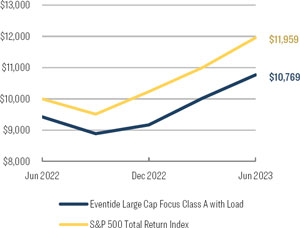

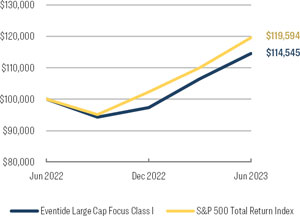

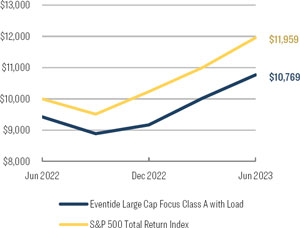

| Eventide Large Cap Focus Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 17.66 | 7.52 | 14.55 | — | — | — | 14.55 | 6/30/2022 |

| Class A without load | 17.40 | 7.43 | 14.26 | — | — | — | 14.26 | 6/30/2022 |

| Class A with 5.75% load | 10.69 | 1.24 | 7.69 | — | — | — | 7.69 | 6/30/2022 |

| Class C | 17.11 | 7.37 | 13.60 | — | — | — | 13.60 | 6/30/2022 |

| Class N | 17.60 | 7.52 | 14.43 | — | — | — | 14.43 | 6/30/2022 |

| Benchmarks | | | | | | | | |

| S&P Biotechnology Select Industry Index | 16.89 | 8.74 | 19.59 | — | — | — | 19.59 | 6/30/2022 |

| | | | | | | | | |

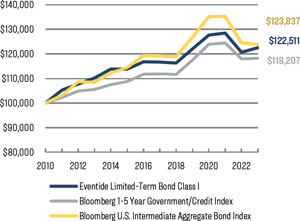

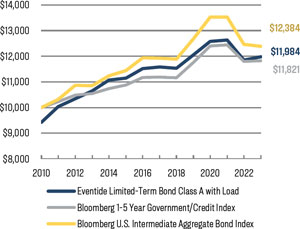

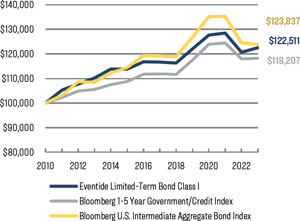

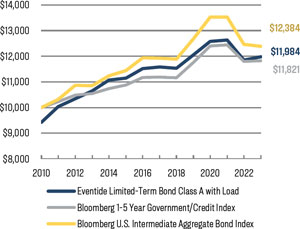

| Eventide Limited-Term Bond Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 1.69 | 0.17 | 1.46 | -1.36 | 1.04 | 1.06 | 1.58 | 07/28/2010 |

| Class A without load | 1.61 | 0.11 | 1.14 | -1.60 | 0.78 | 1.18 | 1.88 | 07/28/2010 |

| Class A with 5.75% load | -4.25 | -5.61 | -4.64 | -3.52 | -0.40 | 0.58 | 1.41 | 07/28/2010 |

| Class C | 1.23 | -0.08 | 0.49 | -2.33 | — | — | 0.11 | 12/14/2018 |

| Class N | 1.63 | 0.12 | 1.29 | -1.56 | — | — | 0.91 | 12/14/2018 |

| Benchmarks | | | | | | | | |

| Bloomberg 1-5 Year Government/Credit Index | 1.19 | -0.62 | 0.19 | -1.57 | 1.15 | 1.14 | 1.30 | 07/28/2010 |

| Bloomberg U.S. Intermediate Aggregate Bond Index | 1.62 | -0.75 | -0.60 | -2.89 | 0.83 | 1.33 | 1.67 | 7/28/2010 |

| | | | | | | | | |

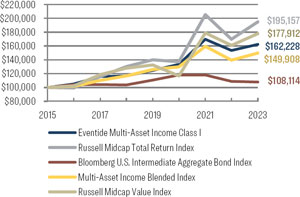

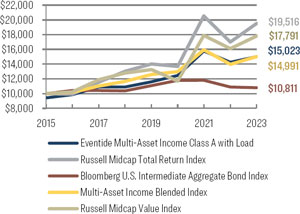

| Eventide Multi-Asset Income Fund | YTD | 3-month | 1-year | 3-year | 5-year | 10-year | Inception | Inception Date |

| Class I | 5.06 | 2.62 | 5.57 | 6.71 | 6.83 | — | 6.27 | 07/15/2015 |

| Class A without load | 4.92 | 2.47 | 5.29 | 6.50 | 6.63 | — | 6.03 | 07/15/2015 |

| Class A with 5.75% load | -1.11 | -3.39 | -0.76 | 4.43 | 5.38 | — | 5.24 | 07/15/2015 |

| Class C | 4.56 | 2.38 | 4.54 | 5.66 | 5.79 | — | 5.22 | 07/15/2015 |

| Class N | 4.95 | 2.57 | 5.35 | 6.50 | 6.63 | — | 6.06 | 07/15/2015 |

| Benchmark | | | | | | | | |

| Multi-Asset Income Blend | 5.41 | 2.07 | 7.34 | 4.92 | 5.14 | — | 5.22 | 07/15/2015 |

| Benchmark Components | | | | | | | | |

| Russell Midcap Total Return Index | 9.01 | 4.76 | 14.92 | 12.50 | 8.46 | — | 8.76 | 07/15/2015 |

| Bloomberg U.S. Intermediate Aggregate Bond Index | 1.62 | -0.75 | -0.60 | -2.89 | 0.83 | — | 0.98 | 07/15/2015 |

| A N N U A L R E P O R T | June 30, 2023 |

EXPENSES AND DISCLOSURES (UNAUDITED)

Performance is historical and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the data quoted. Investors cannot directly invest in an index, and unmanaged index returns do not reflect any fees, expenses, or sales charges. The volatility of an index may be materially different than that of the Fund, and investors should not expect the Fund to achieve the same results as a listed index. Performance data current to the most recent month-end may be obtained by calling 1-877-771-EVEN (3836).

Eventide Core Bond Fund

Expenses: Class I, Gross Expenses 0.74%, Net Expenses 0.58%; Class A, Gross Expenses 0.99%, Net Expenses 0.83%; Class C, Gross Expenses 1.74%, Net Expenses 1.58%; Class N, Gross Expenses 0.94%, Net Expenses 0.78%. The adviser has contractually agreed to waive fees and/or reimburse expenses of the Fund through 10/31/2023. The agreement may be terminated by the Fund’s Board of Trustees only on 60 days’ written notice. Class A is subject to a maximum sales charge of 5.75% and a maximum deferred sales charge of 1.00%. The Bloomberg U.S. Aggregate Bond Index is a broad based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage backed securities, asset-backed securities and collateralized mortgage-backed securities. The benchmark is not an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Eventide Dividend Opportunities Fund

Expenses: Class I, Gross Expenses 0.95%, Net Expenses 0.95%; Class A, Gross Expenses 1.20%, Net Expenses 1.20%; Class C, Gross Expenses 1.95%, Net Expenses 1.95%; Class N, Gross Expenses 1.15%, Net Expenses 1.15%. The adviser has contractually agreed to waive fees and/or reimburse expenses of the Fund through 10/31/2023. The agreement may be terminated by the Fund’s Board of Trustees only on 60 days’ written notice. Class A is subject to a maximum sales charge of 5.75% and a maximum deferred sales charge of 1.00%. The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Value Index measures the performance of the U.S. equity mid-cap value segment. Neither benchmark is an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

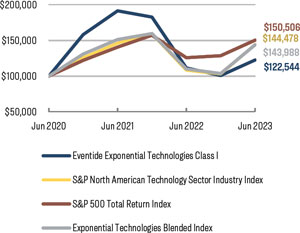

Eventide Exponential Technologies Fund

Expenses: Class I, Gross Expenses 1.43%, Net Expenses 1.43%; Class A, Gross Expenses 1.68%, Net Expenses 1.68%; Class C, Gross Expenses 2.43%, Net Expenses 2.43%; Class N, Gross Expenses 1.63%, Net Expenses 1.63%. Class A is subject to a maximum sales charge of 5.75% and a maximum deferred sales charge of 1.00%. The S&P North American Technology Sector Index represents U.S. securities classified under the GICS® information technology sector as well as the internet & direct marketing retail, interactive home entertainment, and interactive media & services sub-industries. The S&P 500 is an index created by Standard & Poor’s of American stocks with the largest market capitalization. Neither benchmark is an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Eventide Gilead Fund

Total annual fund operating expenses: Class I: 1.11%; Class A: 1.36%; Class C: 2.11%; Class N: 1.31%. Class A is subject to a maximum sales charge of 5.75% and a maximum deferred sales charge of 1.00%. The Fund’s share classes have different inception dates. Class N has an inception date of 07/08/2008. Class A and Class C have an inception date of 10/28/2009. Class I has an inception date of 02/02/2010. The indices assume an inception date of 07/08/2008. The Russell Midcap Growth Index measures the performance of the U.S. equity mid-cap growth segment. The S&P 500 is an index created by Standard & Poor’s of American stocks with the largest market capitalization. Neither benchmark is an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Eventide Healthcare & Life Sciences Fund

Total annual fund operating expenses: Class I: 1.31%; Class A: 1.56%; Class C: 2.31%; Class N: 1.51%. Class A is subject to a maximum sales charge of 5.75% and a maximum deferred sales charge of 1.00%. The S&P Biotechnology Select Industry Index represents the biotechnology sub-industry portion of the S&P Total Markets Index. The S&P 500 is an index created by Standard & Poor’s of American stocks with the largest market capitalization. Neither benchmark is an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

| A N N U A L R E P O R T | June 30, 2023 |

EXPENSES AND DISCLOSURES (UNAUDITED) (CONTINUED)

Eventide Large Cap Focus Fund

Expenses: Class I, Gross Expenses 1.21%, Net Expenses 0.94%; Class A, Gross Expenses 1.46%, Net Expenses 1.19%; Class C, Gross Expenses 2.21%, Net Expenses 1.94%; Class N, Gross Expenses 1.41%, Net Expenses 1.14%. The adviser has contractually agreed to waive fees and/or reimburse expenses of the Fund through 10/31/2023. The agreement may be terminated by the Fund’s Board of Trustees only on 60 days’ written notice. The S&P 500 is an index created by Standard & Poor’s of American stocks with the largest market capitalization. The benchmark is not an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Eventide Limited-Term Bond Fund

Expenses: Class I, Gross Expenses 0.62%, Net Expenses 0.55%; Class A, Gross Expenses 0.87%, Net Expenses 0.80%; Class C, Gross Expenses 1.62%, Net Expenses 1.55%; Class N, Gross Expenses 0.82%, Net Expenses 0.75%. The adviser has contractually agreed to waive fees and/or reimburse expenses of the Fund through 10/31/2023. The agreement may only be terminated by the Fund’s Board of Trustees on 60 days’ written notice. Class A is subject to a maximum sales charge of 5.75% and a maximum deferred sales charge of 1.00%. The Fund acquired the assets and liabilities of the Epiphany FFV Strategic Income Fund (“Predecessor Fund”) on 12/14/2018. The Predecessor Fund’s Class A shares were reclassified from Class N shares on 06/01/2015 and its Class I shares were reclassified from Class C shares on 05/30/2017, and the fee structure was different. The Fund’s share classes have different inception dates. Annualized since inception returns assume the Predecessor Fund’s inception date of 07/28/2010 unless otherwise noted. The Bloomberg 1-5 Year Government/Credit Index includes investment-grade, U.S. dollar-denominated, fixed-rate treasuries, government-related and corporate securities that have a remaining maturity of greater than or equal to one year and less than five years. The Bloomberg U.S. Intermediate Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S.-traded investment-grade bonds are represented. Municipal bonds and Treasury Inflation-Protected Securities are excluded. The index includes Treasury securities, Government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in the U.S. Neither benchmark is an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Eventide Multi-Asset Income Fund

Expenses: Class I, Gross Expenses 0.82%, Net Expenses 0.82%; Class A, Gross Expenses 1.07%, Net Expenses 1.07%; Class C, Gross Expenses 1.82%, Net Expenses 1.82%; Class N, Gross Expenses 1.02%, Net Expenses 1.02%. The adviser has contractually agreed to waive fees and/or reimburse expenses of the Fund through 10/31/2023. The agreement may be terminated by the Fund’s Board of Trustees only on 60 days’ written notice. Class A is subject to a maximum sales charge of 5.75% and a maximum deferred sales charge of 1.00%. The Multi-Asset Income Blend is a proprietary Eventide benchmark composed of 50% Russell Midcap Index and 50% Bloomberg U.S. Intermediate Aggregate Bond Index. Prior to 12/30/2022, it was composed of 50% Russell Midcap Value Index and 50% Bloomberg U.S. Intermediate Aggregate Bond Index. The benchmark’s composition was updated because the Fund’s Adviser believes it is more reflective of the Fund’s portfolio. The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Bloomberg U.S. Intermediate Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S.-traded investment-grade bonds are represented. Municipal bonds and Treasury Inflation-Protected Securities are excluded. The index includes Treasury securities, Government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in the U.S. The Russell Midcap Value Index measures the performance of the U.S. equity mid-cap value segment. Please refer to the Fund’s Prospectus for additional index details. The benchmark is not an investment product. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Core Bond Fund

The Eventide Core Bond Fund (Class I) posted a total return of -0.67% for the 12 months ended 06/30/2023 compared to the Bloomberg U.S. Aggregate Bond Index of -0.94%.

Interest rates experienced heightened volatility for the period as the capital markets continued to anticipate and react to Federal Open Market Committee (“FOMC”) interest rate policy action. As the FOMC began to downshift the pace of interest rates hikes and macroeconomic data began to show the deflationary effects of previous hikes, credit spreads remained very resilient which benefited the portfolio’s positions in both investment grade and high yield credit sectors.

Interest rate volatility is expected to remain elevated, despite a resolution to the debt ceiling and stabilization in the banking sector. The market’s focus has now turned to the resiliency of the economy, stickiness of inflation, and the response from the Federal Reserve (“Fed”). While the yield curve could flatten further over the near term, a steepening trend may emerge later this year as the FOMC likely nears the end of their tightening cycle. Corporate bonds have been resilient in the face of a highly uncertain economic outlook. While we recognize the recent spread tightening tilts the risk/reward profile somewhat less favorably looking forward, we are reluctant to reduce corporate exposure further as recession odds have become milder than previously thought. Our preference on the security selection side is centered on credit exposures more at the front end of the curve with a greater emphasis on higher quality and lower beta in intermediate and longer-term maturities. We have become more constructive on the agency mortgage-backed sector given its underperformance over the last few years. The relative cheapness of the sector combined with limited origination may offset the bank-related selling pressures and the fact that the Fed is no longer an indiscriminate buyer of mortgages.

Eventide Dividend Opportunities Fund

The Eventide Dividend Opportunities Fund (Class I) reported a total return of 10.87% for the 12-month period ended 06/30/2023, leading the Russell Midcap® Value Index (+10.50%) and lagging the Russell Midcap Index (+14.92%).

The Fund’s trailing 12-month performance relative to the Russell Midcap Index derived largely from underperformance among higher-quality and interest rate-sensitive stocks amid unprecedented policy tightening and surging interest rates over the past year. The Fund’s higher-quality, dividend-growth positioning helped the Fund outperform its secondary benchmark, the Russell Midcap Value Index during this period. Among sectors for the 12-month period, the Fund enjoyed particularly strong relative results in the Information Technology, Industrials, and Materials sectors, partially offset by underperformance, as mentioned, in more interest rate sensitive sectors, as Utilities and Financials. Overweights to Semiconductors, Software, Industrials, and Energy positioned the Fund well in relationship to key secular growth themes in technology, electrification, supply chain resiliency, energy efficiency, and energy infrastructure. The Fund avoids areas with high leverage, high and rising costs of financing, and high exposure to external financing. The Fund remains focused on pursuing companies we see as resilient, well-managed, and well-positioned in long-term secular growth themes of human flourishing. The resilience we seek includes generation of robust free cash flow, self-financing, attractive dividend growth, and strong execution through volatile macroeconomic and market environments. For the Eventide Dividend Opportunities Fund, we continue to see many opportunities for investing in companies that we believe have this resilience to ride out the macro and market storms and can achieve attractive long-term

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Dividend Opportunities Fund (Continued)

capital appreciation and dividend growth for our clients, and have a positive impact on the world and well-being. The Fund’s 3-year and 5-year performance ended 6/30/2023 remains strong at 12.59%and 10.77% versus 12.50% and 8.46% for its primary benchmark, the Russell Midcap Index.

Contributors

nVent Electric plc,1 a company that offers electrical connection and protection solutions, outperformed due to strong trends in electrification for data centers, utilities, and industrials. Palo Alto Networks Inc.,2 a company that provides integrated cloud and network security solutions, benefited from continued demand for cybersecurity solutions, coupled with customers consolidating spending to platforms over solutions built to solve a single problem. Trane Technologies plc,3 a company that supplies HVAC systems for energy efficiency and reduced greenhouse emissions, reported strong results in its commercial HVAC business. KLA Corporation,4 a company that provides semiconductors and semiconductor assembly solutions, benefitted from the increasing importance of semiconductor fabrication at new technology nodes as well as a likely bottoming of the business cycle. Old Dominion Freight Line, Inc.,5 an inter-regional and multi-regional motor carrier known for exceptional employment practices, gained market share–despite a soft freight market–because of its strong customer service and ability to hire drivers.

Detractors

Baxter International Inc.,6 a company that provides essential healthcare products such as dialysis therapies and infusion devices, posted disappointing results due to supply chain pressures. Crown Castle International Corp.,7 a company that provides wireless infrastructure in the U.S., was negatively impacted by a slowdown in tower leasing activity and services. NextEra Energy Partners, LP,8 a company that contracts clean energy projects, including wind and solar, was negatively impacted by higher financing costs and a financing structure that was not well received by investors. Royalty Pharma plc,9 a leader in acquiring royalty interests in late-stage biopharmaceutical products, was negatively impacted by a higher cost of capital and selling by pre-IPO investors. First Republic Bank,10 a commercial bank offering private banking and wealth management, was negatively impacted by margin pressure from higher interest rates and contagion from the regional banking crisis.

Eventide Exponential Technologies Fund

The Eventide Exponential Technologies Fund (Class I) posted a total return of 10.12% for the 12-month period ended 06/30/2023, compared with the S&P North American Technology Sector Index return of 33.71% and the S&P 500 Total Return Index return of 19.59%.

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Exponential Technologies Fund (Continued)

The Fund underperformed its benchmark largely due to its greater-than benchmark exposures to small- and mid-cap high-growth stocks. Indeed, our data shows that for Q2 2023, five mega-cap stocks accounted for roughly 25% of the S&P market capitalization. Further, for the first half of 2023, roughly 90% of the S&P 500’s return was attributable to the S&P’s top seven stocks, with a similar dynamic seen for the NASDAQ. We note this to put Fund performance in context.

The past year continued to see unprecedented challenges for small- and mid-cap growth investing. This has been particularly evident in the technology space where the spread between the largest and smaller companies reached historical levels. This meant that the Fund lagged popular technology benchmarks and peers in the technology category that invest the vast majority of their funds in the largest technology companies. The market saw challenges like continued persistence of higher inflation led by sticky wage growth in a resilient labor market, expectations of higher for longer interest rates, the regional banking crisis, quantitative tightening, and de-globalization trends for economic self-sufficiency. These multifaceted factors have limited historical proxies, and the uncertainty led the market to sell small- and mid-cap growth technology companies versus their large-cap peers. Looking forward, we have now been able to upgrade the portfolio to include what we believe to be the best growth Business 360® investment opportunities. We believe these companies are in attractive industries, possess strong and growing moats, are well capitalized, have longer-term-focused, stakeholder-oriented, and high-quality-incentivized management teams who are likely to take advantage of the economic turbulence to improve their competitive positions. While these types of sell-offs can lead to significant short-termism among investors, history has shown that patient longer-term-oriented investors will likely be rewarded positively over time when owning portfolios of outstanding companies. We are excited for the journey ahead.

Contributors

Palo Alto Networks Inc.,11 a company that provides integrated cloud and network security solutions, benefited from continued demand for cybersecurity solutions, coupled with customers consolidating spending to platforms over solutions built to solve a single problem. Flywire Corporation,12 a company that offers global payments enablement software focusing on education and healthcare, benefited from resilient demand and profitability improvement trends as a key payments solutions provider to the education, healthcare, and business services sectors. Lattice Semiconductor Corporation,13 a company that designs semiconductor devices, benefitted from significant new product ramps, relative end market resilience, and industry cyclicality. Synopsys, Inc.,14 a company that provides design technologies to creators of electronic systems, benefitted from a significant surge in demand custom silicon to support applications such as Artificial Intelligence (“AI”). Lam Research Corporation,15 a company that supplies semiconductor wafer fabrication equipment, benefitted from the increasing importance of semiconductor fabrication at new technology nodes as well as a likely bottoming of the business cycle.

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Exponential Technologies Fund (Continued)

Detractors

MongoDB, Inc.,16 a company that develops database software, saw challenges in consumption trends as the company experienced a slowdown in demand across their platform in 2022. Bill.com Holdings, Inc.,17 a company that provides small and midsize business (SMB) back-office software to enable digital bill and expense management, saw challenges in SMB spend in 2022, which hurt revenue growth and profitability. Five9, Inc.,18 a company that provides cloud-based contact center software, saw investor sentiment tilt negatively as contact center software was generally classified as an AI-loser; this perception has since changed. Xometry Inc,19 a company that offers an AI-enabled marketplace for on-demand manufacturing, suffered through faulty execution in Q4 which hurt top and bottom line and had investors questioning their business model; we believe this perception should change over the coming quarters. dLocal Ltd20, a company that serves a worldwide customer base with a payment solutions platform, suffered from multiple short report attacks that hurt the stock price, which we believe provides compelling opportunity, should they continue clean execution over the coming quarters.

Eventide Gilead Fund

The Eventide Gilead Fund (Class I) posted a total return of 16.00% for the 12-month period ended 06/30/2023, while the Russell Midcap Growth Index returned 23.13% and the S&P 500 Total Return Index, 19.59%.

Underperformance relative to the primary benchmark was primarily due to weak stock selection within the Information Technology, Utilities, and Consumer Discretionary sectors. Cash allocation was also a drag on relative returns. These weaknesses were largely offset by strong performance from the Fund’s investments in the Healthcare sector, with Biotechnology stocks leading to the upside after emerging from a period of weak performance. Many of the detractors from relative performance in the last half of 2022 became relative performance contributors in the first half of 2023 as market dynamics and industry leadership shifted. Despite concerns of stock market valuation and concentration, looking forward we are finding opportunities to invest in companies whose valuations remain depressed, particularly within the small and mid-cap areas of the market.

Contributors

Palo Alto Networks Inc.,21 a company that provides integrated cloud and network security solutions, benefited from continued demand for cybersecurity solutions, coupled with customers consolidating spending to platforms over solutions built to solve a single problem. Exact Sciences Corporation,22 a molecular diagnostics company that provides non-invasive molecular screening for colorectal cancer, benefited from end-market cancer

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Gilead Fund (Continued)

screening tailwinds and profitability inflection. Global-E Online Ltd.,23 a company that develops end-to-end cross-border platforms for eBusiness, benefited from continued growth of their best-in-class cross-border e-commerce platform despite consumer macro headwinds. Old Dominion Freight Line, Inc.,24 an inter-regional and multi-regional motor carrier known for exceptional employment practices, gained market share–despite a soft freight market–because of its strong customer service and ability to hire drivers. HubSpot, Inc.,25 a company that offers an inbound marketing, sales, and customer service software platform, benefited from continued share gains through consolidation of spend across key platforms like Hubspot.

Detractors

MongoDB, Inc.,26 a company that develops database software, saw challenges in consumption trends as the company experienced a slowdown in demand across their platform in 2022. ZoomInfo Technologies Inc.,27 a company that provides marketing solutions to customers worldwide, saw challenges in churn and upsell. Their seat-based platform experienced headwinds to growth as 40% of their customer base was in software-based businesses that had sales count reductions near year-end 2022. Five9, Inc.,28 a company that provides cloud-based contact center software, saw investor sentiment tilt negatively as contact center software was generally classified as an AI-loser; this perception has since changed. Xometry Inc,29 a company that offers an AI-enabled marketplace for on-demand manufacturing, suffered through faulty execution in Q4 which hurt top and bottom line and had investors questioning their business model; we believe this perception should change over the coming quarters. dLocal Ltd,30 a company that serves a worldwide customer base with a payment solutions platform, suffered from multiple short report attacks that hurt the stock price, which we believe provides compelling opportunity, should they continue clean execution over the coming quarters.

Eventide Healthcare and Life Sciences Fund

The Eventide Healthcare and Life Sciences Fund (Class I) posted a total return of 39.11% for the 12-month period ended 06/30/2023, compared with the S&P Biotechnology Select Industry Index of 12.13% and the S&P 500 Total Return Index total return of 19.59%.

The Fund’s outperformance compared to the primary benchmark was primarily due to strong stock selection within the Biotechnology and Medical Technology sector. This was during a period when there was a high degree of performance disparity between the winners and losers within the benchmark. M&A activity continued to pick up during the period, which benefited the portfolio as multiple investments experienced outsized price appreciation due to M&A. The field also benefited from higher-profile approvals in Alzheimer’s disease and greater investor attention in large markets like diabetes and obesity. Looking forward, we believe that there are

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Healthcare and Life Sciences Fund (Continued)

many opportunities to invest in high quality assets with depressed valuations. As macro fears subside, generalist attention could return to the space and cause valuations to normalize.

Contributors

Prometheus Biosciences,31 a biopharma company focused on gastroenterology and autoimmune diseases, benefited from exceptional Phase 2 data in ulcerative colitis. It was ultimately acquired during the year by Merck for ~$11B. Immunovant, Inc.,32 a biotech company developing drugs for patients with autoimmune diseases, benefited from positive tailwinds surrounding its novel mechanism of action for the treatment of various autoimmune diseases. Exact Sciences Corporation,33 a molecular diagnostics company providing non-invasive molecular screening for colorectal cancer, benefited from end market cancer screening tailwinds and profitability inflection. Karuna Therapeutics, Inc.,34 a clinical-stage biopharmaceutical company developing novel therapies for disabling neuropsychiatric disorders and pain, benefited from positive Phase 3 trials for the treatment of schizophrenia. VectivBio Holding AG,35 a global biotechnology company focused on rare diseases, was acquired by Ironwood Pharmaceuticals.

Detractors

Amylyx Pharmaceuticals Inc,36 a biopharmaceutical company marketing a novel drug for Lou Gehrig’s disease and developing novel therapies for rare neurological disorders, was negatively impacted following an adverse approval decision from Europe’s Committee for Medicinal Products for Human Use (CHMP), despite a strong US launch. ADC Therapeutics SA,37 a clinical stage biotechnology company focused on oncology drug discovery and development, was negatively impacted as the market ascribed lower valuations across oncology over the course of the last year. FibroGen, Inc,38 a biopharmaceutical company developing medicines for the treatment of anemia, fibrotic disease, and cancer, was negatively impacted by a Phase 3 trial failure in fibrotic lung disease. GoldFinch Bio,39 a biopharma company focused on kidney disease treatments, was negatively impacted by mixed Phase 2 trial data that forced the company to stop development and divest its lead asset to Karuna Therapeutics. 908 Devices Inc.,40 a medical device manufacturer for chemical and biomolecular analysis, was negatively impacted by bioprocessing headwinds and rotation away from small cap, technical life science tools.

Eventide Large Cap Focus Fund

The Eventide Large Cap Focus Fund (Class I) posted a total return of 14.55% for the 12-month period ended 06/30/2023, compared with the S&P 500 Total Return Index result of 19.59%.

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Large Cap Focus Fund (Continued)

The underperformance relative to the primary benchmark was primarily from stock selection, where not owning megacaps such as Apple, Microsoft, and Meta proved to be a headwind, while we also saw some negative selection effects in financials and information technology (partly due to this lack of exposure). This was partially offset by positive stock selection in consumer discretionary and an overweight in information technology.

The Fund seeks high active share and is a concentrated portfolio of high conviction holdings. We seek to invest in companies that can achieve or sustain leadership in secular growth industries, while also creating compelling value for society. Examples of themes we invest in include cybersecurity, life sciences innovation, and energy efficiency.

We are confident that our portfolio companies are well-positioned for the long-term, with strong fundamentals and attractive valuations. Even in a volatile economic environment, we believe that our companies create intrinsic (long-term) value every day by providing innovative products and services to solve their customers’ most challenging problems and by creating a strong culture for employees. As the stock market has continued to concentrate the large cap space into a few megacap names, we are excited to provide our investors with a large cap fund that contains high quality companies that fit our Business 360® framework, while also being high conviction, concentrated, and high active share without owning most of the well-known megacaps.

Contributors

Palo Alto Networks Inc.,41 a company that provides integrated cloud and network security solutions, benefited from continued demand for cybersecurity solutions, coupled with customers consolidating spending to platforms over solutions built to solve a single problem. Workday, Inc.,42 a company that serves enterprises with human capital and financial management software, benefited from continued demand for its critical enterprise solutions. Constellation Software Inc.,43 a company that provides mission-critical software for use in various industries, benefitted from end market resilience as well as continued execution as the acquirer of choice for owner-operated vertical market software. NVIDIA Corporation,44 a company that designs and supplies specialized processors and software for AI and graphics visualization, benefitted from a significant surge in demand to support AI applications such as those based on large language models. Synopsys, Inc.,45 a company that provides design technologies to creators of electronic systems, benefitted from a significant surge in demand for custom silicon to support applications such as AI.

Detractors

CrowdStrike Holdings, Inc.,46 a technology company offering an enterprise cybersecurity platform to prevent endpoint attacks, was negatively impacted during a period where the market was skeptical around the company’s

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Large Cap Focus Fund (Continued)

competitive position, which has since reversed. Royalty Pharma plc,47 a leader in acquiring royalty interests in late-stage biopharmaceutical products, was negatively impacted by a higher cost of capital and selling by pre-IPO investors. ZoomInfo Technologies Inc.,48 a company that provides marketing solutions to customers worldwide, saw challenges in churn and upsell. Their seat-based platform experienced headwinds to growth as 40% of their customer base was in software-based businesses that had sales count reductions near year-end 2022. First Republic Bank,49 a commercial bank offering private banking and wealth management, was negatively impacted by margin pressure from higher interest rates and contagion from the regional banking crisis. dLocal Ltd,50 a company that serves a worldwide customer base with a payment solutions platform, suffered from multiple short report attacks that hurt the stock price, which we believe provides compelling opportunity, should they continue clean execution over the coming quarters.

Eventide Limited-Term Bond Fund

The Eventide Limited-Term Bond Fund (Class I) posted a total return of 1.46% for the 12-month period ended 06/30/2023 compared to the Bloomberg 1-5 Year Government/Credit Index of 0.19% and the Bloomberg U.S. Intermediate Aggregate Bond Index of -0.60%.

Interest rates experienced heightened volatility for the period as the capital markets continued to anticipate and react to FOMC interest rate policy action. As the FOMC began to downshift the pace of interest rates hikes and macroeconomic data began to show the deflationary effects of previous hikes, credit spreads remained very resilient which benefited the portfolio’s positions in both investment grade and high yield credit sectors.

Interest rate volatility is expected to remain elevated, despite a resolution to the debt ceiling and stabilization in the banking sector. The market’s focus has now turned to the resiliency of the economy, stickiness of inflation, and the response from the Fed. While the yield curve could flatten further over the near term, a steepening trend may emerge later this year as the FOMC likely nears the end of their tightening cycle. Corporate bonds have been resilient in the face of a highly uncertain economic outlook. While we recognize the recent spread tightening tilts the risk/reward profile somewhat less favorably looking forward, we are reluctant to reduce corporate exposure further as recession odds have become milder than previously thought. Our preference on the security selection side is centered on credit exposures more at the front end of the curve with a greater emphasis on higher quality and lower beta in intermediate and longer-term maturities. We have become more constructive on the agency mortgage-backed sector given its underperformance over the last few years. The relative cheapness of the sector combined with limited origination may offset the bank-related selling pressures and the fact that the Fed is no longer an indiscriminate buyer of mortgages.

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Multi-Asset Income Fund

The Eventide Multi-Asset Income Fund (Class I) reported a total return of 5.57% for the 12-month period ended 06/30/2023, compared with the 7.34% gain of its 50/50 custom Multi-Asset Income Blend benchmark.

The Fund’s fixed income positions posted strong outperformance compared to its fixed income benchmark for the 12-month period ended 6/30/2023. The Fund’s fixed income outperformance was primarily due to both an overweight allocation to corporate bonds and positive selection within credit sectors. Within the benchmark, corporate bonds outperformed treasuries as both high yield and investment grade credit spreads stabilized during this period after rising sharply off of the lows of 2021.

The Fund’s equity positions trailed their equity benchmark, Russell Midcap Index, largely from underperformance among higher-quality and interest rate-sensitive stocks amid unprecedented policy tightening and surging interest rates over the past year. Among sectors for the 12-month period, the Fund enjoyed particularly strong relative results in the Information Technology, Industrials, and Materials sectors, partially offset by underperformance, as mentioned, in more interest rate sensitive sectors, such as Utilities and Financials. Overweights to Semiconductors, Software, Industrials, and Energy positioned the Fund well in relationship to key secular growth themes in technology, electrification, supply chain resiliency, energy efficiency, and energy infrastructure. The Fund avoids areas with high leverage, high and rising costs of financing, and high exposure to external financing. The Fund remains focused on pursuing companies we see as resilient, well-managed, and well-positioned in long-term secular growth themes of human flourishing. The resilience we seek includes generation of robust free cash flow, self-financing, attractive dividend growth, and strong execution through volatile macroeconomic and market environments. For the Eventide Multi-Asset Income Fund, we continue to see many opportunities for investing in companies that we believe have this resilience to ride out the macro and market storms, can achieve attractive long-term capital appreciation and income for our clients, and have a positive impact on the world and well-being. The Fund’s 3-year and 5-year performance ending 6/30/2023 remains strong at 6.71% and 6.83% versus 4.92% and 5.14% for its custom 50%/50% equity/fixed income benchmark.

Contributors

nVent Electric plc,51 a company that provides electrical connection and protection solutions, outperformed due to strong trends in electrification for data centers, utilities, and industrials. Palo Alto Networks Inc.,52 a company that provides integrated cloud and network security solutions, benefited from continued demand for cybersecurity solutions, coupled with customers consolidating spending to platforms over solutions built to solve a single problem. KLA Corporation,53 a company that provides semiconductors and semiconductor assembly solutions, benefitted from the increasing importance of semiconductor fabrication at new technology nodes as well as a likely bottoming of the cycle. Trane Technologies plc,54 a company that supplies HVAC systems for

| A N N U A L R E P O R T | June 30, 2023 |

FUND REVIEWS (UNAUDITED)

Eventide Multi-Asset Income Fund (Continued)

energy efficiency and reduced greenhouse emissions, reported strong results in its commercial HVAC business. Old Dominion Freight Line, Inc.,55 an inter-regional and multi-regional motor carrier known for exceptional employment practices, gained market share–despite a soft freight market–because of its strong customer service and ability to hire drivers.

Detractors

EQT Corporation,56 the USA’s largest natural gas producer serving customers in the USA and oversees, was negatively impacted by rapidly falling natural gas prices in the U.S. Royalty Pharma plc,57 a leader in acquiring royalty interests in late-stage biopharmaceutical products, was negatively impacted by a higher cost of capital and selling by pre-IPO investors. NextEra Energy Partners, LP,58 a utility company that contracts clean energy projects including wind and solar, was negatively impacted by higher financing costs and a financing structure that was not well received by investors. Crown Castle International Corp.,59 a company that provides wireless infrastructure in the U.S., was negatively impacted by a slowdown in tower leasing activity and services. First Republic Bank,60 a commercial bank offering private banking and wealth management, was negatively impacted by margin pressure from higher interest rates and contagion from the regional banking crisis.

CIO OUTLOOK (UNAUDITED)

Several quarters of recession calls from economists and market pundits have caused many investors to be too defensively postured in a surprisingly strong market. The economy and stock market have been more resilient than anticipated in the face of higher Fed interest rates, a regional bank crisis, and weak leading indicators. The weaker leading indicators have manifested as a set of “rolling recessions” rather than a single, broad-based recession. As the Fed has successfully cooled inflation, markets remain uncertain if there is “another shoe to drop” or if there is a light at the end of the tunnel. A few strategies we’ve employed to weather this environment are investing into companies that are currently pricing in a slowdown or recession and thus offer a potential margin of safety, or investing in companies whose outcomes are less or not macro-sensitive. While mega cap tech-stocks have been the most recent beneficiaries of this perceived change in regime, they have become expensive. In contrast, there are many attractive valuations in small and mid-cap stocks. When fears subside, we believe these companies should do well.

While there is much to consider on the macro front, we do not use our macro view as a market timing tool, but rather as another lens to view our companies as we work to build our long-term conviction from a bottom-up perspective. We seek to be long-term investors in companies that create compelling value for their stakeholders, operate in attractive industries, exhibit excellent management teams, and trade at reasonable valuations. We believe this approach will produce strong returns for our clients over the long-term.

| A N N U A L R E P O R T | June 30, 2023 |

CIO OUTLOOK (UNAUDITED) (CONTINUED)

Many of the headwinds we had experienced heading into 2023 have now become short-term tailwinds for the themes, sectors, industries, and styles we invest in. However, this does not deter us from seeking to find companies that have resilient, self-funding business models or companies whose outcome is less dependent on capital markets, especially as the risk of an economic slowdown remains. Our investments in the Biotechnology sector are a prime example of companies whose stock prices had suffered in recent years because of the market environment, but whose outcomes are less macro-sensitive but tied to the success of their drugs and therapies.

We would like to thank our investors who have participated with us through strong markets and weak markets. It is during weak markets like we have recently experienced where investment conviction is often tested. We believe our disciplined approach, informed by value creation, helps fight the tendency to make poor investment decisions informed by emotion. It is our hope that our investors are encouraged as we humbly continue to seek to invest in a way that makes the world rejoice!

DISCLAIMERS (UNAUDITED)

The opinions expressed herein are those of the Fund’s portfolio management team as of 06/30/2023 and are subject to change. There is no guarantee that such views are correct or that the outlook opinions will come to pass. Specific companies mentioned are for performance attribution informational purposes only and should not be construed as buy or sell advice. Reliance upon the views expressed herein is at the sole discretion of the reader. Mutual funds involve risk including the possible loss of principal. Past performance does not guarantee future results. The Fund’s ethical values screening criteria could cause it to under-perform similar funds that do not have such screening criteria.

Investors in the Eventide Core Bond Fund should be aware that interest rates may change at any time based on government policy. In general, the price of a fixed income security falls when interest rates rise. Longer term securities may be more sensitive to changes in interest rates. A rise in interest rates may result in volatility and increased redemptions, which in turn could result in the Fund being forced to liquidate portfolio securities at disadvantageous prices. Interest rates are sensitive to changes in inflation, and investing in bonds exposes investors to inflation risk. Bonds may be subject to default, causing loss of invested capital. Fixed income investments may be of any maturity or credit quality, but the Fund’s weighted average effective portfolio duration will be between three years and nine years. The Fund may invest, directly or indirectly, in “junk bonds.” Such securities are speculative investments that carry greater risks than higher quality debt securities. The Fund can invest in smaller-sized companies which may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies. There are unique risks associated with asset backed securities, convertible securities, credit, duration, extension, foreign securities, income, mortgage back securities, municipal bonds, preferred stocks, pre-payment securities, sovereign debt, and U.S. Agency securities that are covered in the Fund’s prospectus and SAI. The Fund has no history of operations prior to its inception date.

The Eventide Dividend Opportunities Fund can have risk related to option investing. Companies in the Utilities sector are subject to interest rate risk and cash flow risk. Companies in the technology industries have different risks including but not limited to products becoming obsolete, and entrance of competing products. Companies in the Industrial Sector carry various risks including, but not limited to, risk related to debt loads, intense competition, and sensitivity to economic cycles. The Fund can invest in smaller-sized companies which may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies. There are unique risks associated with convertible securities, foreign securities, hedging, MLPs, preferred stocks, REITs, securities, and yieldcos that are covered in the Fund’s prospectus and SAI.

The Eventide Exponential Technologies Fund typically invests at least 80% of its net assets in companies that the Adviser believes are participating in and benefiting from technologies, innovations, technology themes, or technology trends which can include information technology, e-commerce discretionary, internet media and services, healthcare technology, healthcare devices, or transaction & payment processing services industries. The term “exponential” means the potential for accelerated advancements in underlying technologies that can positively impact capabilities and development cycles of a company’s products and services. Not every company in the Fund’s portfolio will experience exponential growth, and the

| A N N U A L R E P O R T | June 30, 2023 |

DISCLAIMERS (UNAUDITED) (CONTINUED)

Fund is not expected to deliver exponential returns. The Fund can invest in smaller-sized companies which may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies. The Fund may experience higher volatility than the general market due to being concentrated in the technology industries. Companies in the technology industries have different risks including but not limited to products becoming obsolete, and entrance of competing products. Communications companies may underperform due to legislative or increased competition. Internet and Direct Marketing Retail companies may underperform due to legislative or increased government supervision. Healthcare Technology and Devices Companies may be heavily dependent on clinical trials with uncertain outcomes and decisions made by the governments and regulatory authorities. Further, these companies are dependent on patent protection. The Fund has non-diversification risk as a high percentage of Fund assets may be invested in a limited number of companies. The Fund can have risk related to option investing. There are special risks associated with investments in foreign companies including exposure to currency fluctuations, less efficient trading markets, political instability and differing auditing and legal standards. The Fund can invest in private companies. Private investments include various risks including but not limited to lack of liquidity, capital commitment risk, and valuation risk. Private companies may not be financially profitable and have uncertain futures, subjecting them to additional risks. The Fund has no history of operations prior to its inception date.

The Eventide Gilead Fund can invest in smaller-sized companies which may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies. The Fund can have risk associated with the biotechnology and pharmaceutical industry in which these companies may be heavily dependent on clinical trials with uncertain outcomes and decisions made by the U.S. Food and Drug Administration.

Companies in the technology industries have different risks including but not limited to products becoming obsolete, and entrance of competing products. Companies in the Industrial Sector carry various risks including, but not limited to, risk related to debt loads, intense competition, and sensitivity to economic cycles. The Fund can have risk related to option investing. There are special risks associated with investments in foreign companies including exposure to currency fluctuations, less efficient trading markets, political instability and differing auditing and legal standards. The Fund can invest in private companies. Private investments include various risks including but not limited to lack of liquidity, capital commitment risk, and valuation risk. Private companies may not be financially profitable and have uncertain futures, subjecting them to additional risks.

The Eventide Healthcare & Life Sciences Fund can invest in smaller-sized companies which may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies. The Fund can have risk associated with the biotechnology and pharmaceutical industry in which these companies may be heavily dependent on clinical trials with uncertain outcomes and decisions made by the U.S. Food and Drug Administration. The Fund can have risk related to option investing. There are special risks associated with investments in foreign companies including exposure to currency fluctuations, less efficient trading markets, political instability and differing auditing and legal standards. The Fund can invest in private companies. Private investments include various risks including but not limited to lack of liquidity, capital commitment risk, and valuation risk. Private companies may not be financially profitable and have uncertain futures, subjecting them to additional risks.

Investors in the Eventide Limited-Term Bond Fund should be aware that interest rates may change at any time based on government policy. In general, the price of a fixed income security falls when interest rates rise. A rise in interest rates may result in volatility and increased redemptions, which in turn could result in the Fund being forced to liquidate portfolio securities at disadvantageous prices. Longer term securities may be more sensitive to changes in interest rates. Interest rates are sensitive to changes in inflation, and investing in bonds exposes investors to inflation risk. Bonds may be subject to default, causing loss of invested capital. Fixed income investments may be of any maturity or credit quality, but the Fund’s weighted average effective portfolio duration will not exceed five years. The Fund may invest, directly or indirectly, in “junk bonds.” Such securities are speculative investments that carry greater risks than higher quality debt securities. The Fund can invest in smaller-sized companies which may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies. There are unique risks associated with asset-backed securities, convertible securities, credit, foreign securities, income, interest rates, mortgage-backed securities, municipal bonds, preferred stocks, prepayment, securities, sovereign debt, and U.S. Agency securities that are covered in the Fund’s prospectus and SAI.

| A N N U A L R E P O R T | June 30, 2023 |

DISCLAIMERS (UNAUDITED) (CONTINUED)

The Eventide Multi-Asset Income Fund can have risk related to option investing. Investors in the Fund should be aware that interest rates may change at any time based on government policy. In general, the price of a fixed income security falls when interest rates rise. Longer term securities may be more sensitive to changes in interest rates. The intermediate-term bond portion of the Fund’s portfolio may represent 0% to 100% of the Fund’s portfolio with an average duration of between two and eight years. The Fund may invest, directly or indirectly, in “junk bonds.” Such securities are speculative investments that carry greater risks than higher quality debt securities. The Fund can invest in smaller-sized companies which may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies. There are unique risks associated with asset-backed securities, convertible securities, credit, foreign securities, hedging, income, MLPs, mortgage-backed securities, preferred stocks, prepayment, REITs, securities, U.S. Agency securities, and yieldcos that are covered in the Fund’s prospectus and SAI.

Investors should consider a fund’s investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information can be found in the prospectus, which can be obtained at https://www.eventidefunds.com/prospectus or by calling 1-877-771-EVEN (3836). Please read the prospectus carefully before investing. Eventide Mutual Funds are distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC, which is not affiliated with Eventide Asset Management, LLC.

5579-NLD-7/31/2023

| A N N U A L R E P O R T | June 30, 2023 |

| Eventide Core Bond Fund | |

| Portfolio Review (Unaudited) | June 30, 2023 |

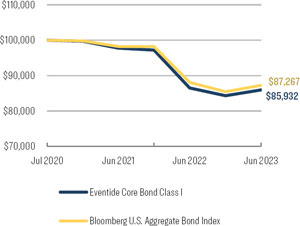

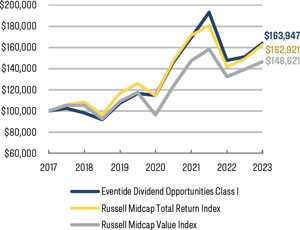

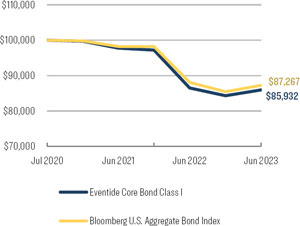

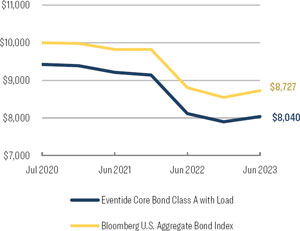

Average Annual Total Return through June 30, 20231, as compared to its benchmark:

| | | Since |

| | 1 Year Return | Inception 3 |

| Class N | -0.89% | -5.26% |

| Class A without load | -0.90% | -5.31% |

| Class A with 5.75% load | -6.55% | -7.21% |

| Class C | -1.67% | -5.97% |

| Class I | -0.67% | -5.07% |

| Bloomberg U.S. Aggregate Bond Index 2 | -0.94% | -4.56% |

| 1. | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Total returns would have been lower absent the manager’s fee waiver. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 0.83%, 1.58%, 0.78% and 0.58% for Class A shares, Class C shares, Class N shares and Class I shares, respectively, through October 31, 2023. Per the Fund’s most recent prospectus as supplemented, total annual Fund expenses before waiver are 0.99%, 1.74%, 0.94% and 0.74% for Class A shares, Class C shares, Class N shares and Class I shares, respectively. Class A shares are subject to a maximum sales charge of 5.75% imposed on purchases and have a maximum deferred sales charge of 1.00% on purchases of $1 million or more made without an initial sales charge and applies to shares sold within 18 months. Class C shares are subject to a maximum deferred sales charge of 1.00% on shares sold within 12 months. A $15 fee may be charged for redemptions made by wire. For performance information current to the most recent month-end, please call toll-free 1-877-771-3836. |

| 2. | The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency). Investors cannot invest directly in an index. |

| 3. | Eventide Core Bond Fund commenced operations on July 31, 2020. |

| Comparison of the Change in Value of a $100,000 Investment | | Comparison of the Change in Value of a $10,000 Investment |

| | | |

| |  |

| A N N U A L R E P O R T | June 30, 2023 |

| Eventide Core Bond Fund | |

| Portfolio Review (Unaudited) (Continued) | June 30, 2023 |

| Holdings by Industry or Asset Class | | % of Net Assets | |

| Agency Fixed Rate | | | 23.6 | % |

| Electric Utilities | | | 14.5 | % |

| Government Sponsored | | | 11.6 | % |

| Banking | | | 5.4 | % |

| Real Estate Investment Trusts | | | 3.8 | % |

| Institutional Financial Services | | | 3.5 | % |

| Engineering & Construction | | | 3.2 | % |

| Auto Loan | | | 2.8 | % |

| Oil & Gas Producers | | | 2.5 | % |

| Insurance | | | 2.5 | % |

| Other / Cash & Cash Equivalents | | | 26.6 | % |

| | | | 100.0 | % |

| | | | | |

| Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings. |

| A N N U A L R E P O R T | June 30, 2023 |

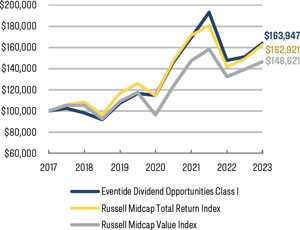

| Eventide Dividend Opportunities Fund | |

| Portfolio Review (Unaudited) | June 30, 2023 |

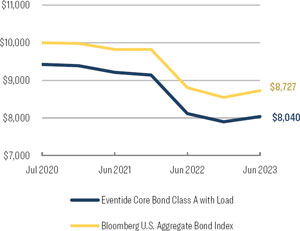

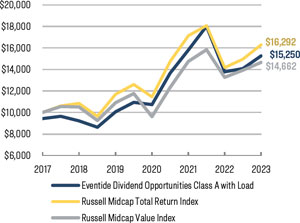

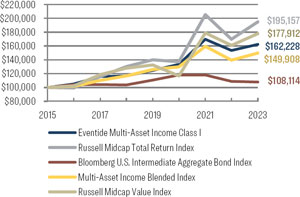

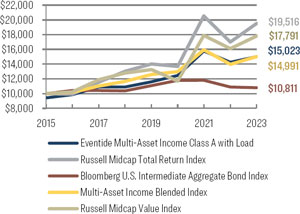

Average Annual Total Return through June 30, 20231, as compared to its benchmarks:

| | | | Since |

| | 1 Year Return | 5 Year Return | Inception 4 |

| Class N | 10.66% | 10.56% | 8.76% |

| Class A without load | 10.68% | 10.55% | 8.73% |

| Class A with 5.75% load | 4.31% | 9.24% | 7.61% |

| Class C | 9.78% | 9.67% | 7.91% |

| Class I | 10.87% | 10.77% | 8.98% |

| Russell Midcap Total Return Index 2 | 14.92% | 8.46% | 8.86% |

| Russell Midcap Value Index 3 | 10.50% | 6.84% | 6.88% |

| 1. | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 1.20%, 1.95%, 1.15% and 0.95% for Class A shares, Class C shares, Class N shares and Class I shares, respectively, through October 31, 2023. Class A shares are subject to a maximum sales charge of 5.75% imposed on purchases and have a maximum deferred sales charge of 1.00% on purchases of $1 million or more made without an initial sales charge and applies to shares sold within 18 months. Class C shares are subject to a maximum deferred sales charge of 1.00% on shares sold within 12 months. A $15 fee may be charged for redemptions made by wire. For performance information current to the most recent month-end, please call toll-free 1-877-771-3836. |

| 2. | The Russell Midcap Total Return Index measures the performance of the mid-cap segment of the US equity universe. It is a subset of the Russell 1000 Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership, representing approximately 31% of the total market capitalization of the Russell 1000 companies. It is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap opportunity set. Investors cannot invest directly in an index. |

| 3. | The Russell Midcap Value Index measures the performance of the mid-capitalization U.S. equities that exhibit value characteristics. It includes those Russell Midcap Index companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years). Investors cannot invest directly in an index. |

| 4. | Eventide Dividend Opportunities Fund commenced operations on September 29, 2017. |

| Comparison of the Change in Value of a $100,000 Investment | | Comparison of the Change in Value of a $10,000 Investment |

| | | |

| |  |

| A N N U A L R E P O R T | June 30, 2023 |

| Eventide Dividend Opportunities Fund | |

| Portfolio Review (Unaudited) (Continued) | June 30, 2023 |

| Holdings by Industry or Asset Class | | % of Net Assets | |

| Electrical Equipment | | | 15.0 | % |

| Oil & Gas Producers | | | 10.0 | % |

| Technology Services | | | 8.0 | % |

| Medical Equipment & Devices | | | 7.4 | % |

| Software | | | 7.0 | % |

| Chemicals | | | 5.2 | % |

| Semiconductors | | | 4.9 | % |

| Electric Utilities | | | 4.4 | % |

| Industrial REIT | | | 4.0 | % |

| Retail - Discretionary | | | 3.2 | % |

| Transportation & Logistics | | | 3.2 | % |

| Other / Cash & Cash Equivalents | | | 27.7 | % |

| | | | 100.0 | % |

| | | | | |

| Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings. |

| A N N U A L R E P O R T | June 30, 2023 |

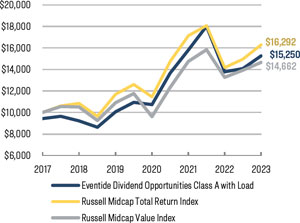

| Eventide Exponential Technologies Fund | |

| Portfolio Review (Unaudited) | June 30, 2023 |

Average Annual Total Return through June 30, 20231, as compared to its benchmarks:

| | | Since |

| | 1 Year Return | Inception 5 |

| Class N | 9.89% | 6.78% |

| Class A without load | 9.79% | 6.78% |

| Class A with 5.75% load | 3.45% | 4.69% |

| Class C | 9.01% | 6.00% |

| Class I | 10.12% | 7.01% |

| S&P North American Technology Sector Industry Index 2 | 33.71% | 13.05% |

| S&P 500 Total Return Index 3 | 19.59% | 14.60% |

| Exponential Technologies Blended Index 4 | 33.37% | 12.92% |

| 1. | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 1.68%, 2.43%, 1.63% and 1.43% for Class A shares, Class C shares, Class N shares and Class I shares, respectively, through October 31, 2023. Per the Fund’s most recent prospectus, total annual Fund expenses before waiver are 1.68%, 2.43%, 1.63% and 1.43% for Class A shares, Class C shares, Class N shares and Class I shares, respectively. Class A shares are subject to a maximum sales charge of 5.75% imposed on purchases and have a maximum deferred sales charge of 1.00% on purchases of $1 million or more made without an initial sales charge and applies to shares sold within 18 months. Class C shares are subject to a maximum deferred sales charge of 1.00% on shares sold within 12 months. Redemptions within 180 days of purchase were subject to a redemption fee of 1.00%, effective until June 26, 2023. A $15 fee may be charged for redemptions made by wire. For performance information current to the most recent month-end, please call toll-free 1-877-771-3836. |

| 2. | The S&P North American Technology Sector Industry Index provides investors with a benchmark that represents U.S. securities classified under the GICS® information technology sector as well as the internet & direct marketing retail, interactive home entertainment, and interactive media & services sub-industries. Investors cannot invest directly in an index. |

| 3. | The S&P 500 Total Return Index, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |