United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21904

(Investment Company Act File Number)

Federated MDT Series

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 07/31/2012

Date of Reporting Period: 07/31/2012

Item 1. Reports to Stockholders

Annual Shareholder Report

July 31, 2012

| Share Class | Ticker |

| A | QAACX |

| C | QCACX |

| R | QKACX |

| Institutional | QIACX |

Federated MDT All Cap Core Fund

Fund Established 2002

A Portfolio of Federated MDT Series

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from August 1, 2011 through July 31, 2012. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings, performance information and financial statements along with other important fund information.

In addition, our website, FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools. We invite you to register to take full advantage of its capabilities.

Thank you for investing with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Not FDIC Insured • May Lose Value • No Bank Guarantee

Management's Discussion of Fund Performance (unaudited)

The Fund's total return, based on net asset value, for the 12-month reporting period ended July 31, 2012 was 2.00% for Class A Shares, 1.16% for Class C Shares, 1.45% for Class R Shares and 2.23% for Institutional Shares. The total return of the Russell 3000® Index (Russell 3000®),1 a broad-based securities market index, was 7.33% for the same period. The Fund's total return for the fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of the Russell 3000®.

Market Overview

During the reporting period, domestic equity market performance was favorable as evidenced by the 7.33% return on the Russell 3000®. Large-cap stocks led the way during the reporting period, as demonstrated by the 10.41% return of the Russell Top 200® Index,2 exceeding by far the 2.28% and 0.19% results for the Russell Midcap® Index,3 representing the mid-cap stocks, and the Russell 2000® Index,4 representing small-cap stocks, respectively. Growth stocks outperformed value stocks slightly during the year with the Russell 3000 Growth® Index,5 returning 7.55% as compared to 7.09% for the Russell 3000 Value® Index.6

The best performing sectors in the Russell 3000®, during the reporting period were Telecommunications (+27.07%), Consumer Staples (+17.96%), Public Utilities (+17.67%) and Health Care (+14.36%). Underperforming sectors included Energy (-7.20%), Materials (-5.76%) and Financials (+2.74%).

Fund Performance

The most significant positive factors in the Fund's performance for this period relative to the Russell 3000® were the Consumer Discretionary and Public Utilities sectors. The stock selection in each of these sectors was favorable, and there was a significant overweight in the Consumer Discretionary sector which did outperform the benchmark. The most significant negative factor in the Fund's performance was poor stock selection in the Information Technology sector, where Hewlett Packard was the single stock that detracted the most from the Fund's performance and NetApp, Agilent, Ingram Micro and Dell underperformed as well. The Energy sector was a secondary factor contributing to underperformance. That sector was the worst performing sector in the benchmark and although it was underweighted in the Fund which offset some of that poor performance, holdings in Murphy Oil and Carbo Ceramics detracted from Fund performance.

Individual stocks enhancing the Fund's performance included Wal-Mart Stores, Home Depot, MasterCard and Verizon Communications.

Individual stocks detracting from the Fund's performance included Hewlett-Packard, Caterpillar, Lincoln National and Wynn Resorts Limited.

Annual Shareholder Report

| 1 | The Russell 3000® offers investors access to the broad U.S. equity universe representing approximately 98% of the U.S. market. The Russell 3000® is constructed to provide a comprehensive, unbiased and stable barometer of the broad market and is completely reconstituted annually to ensure that new and growing equities are reflected. The index is unmanaged, and it is not possible to invest directly in an index. |

| 2 | Russell Top 200® Index measures the performance of the 200 largest companies in the Russell 1000® Index and represents approximately 66% of the total market capitalization of the Russell 1000® Index. The index is unmanaged, and it is not possible to invest directly in an index. |

| 3 | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index and represents approximately 27% of the total market capitalization of the Russell 1000® Index. The index is unmanaged, and it is not possible to invest directly in an index. |

| 4 | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index and represents approximately 7% of the total market capitalization of the Russell 3000® Index. The index is unmanaged, and it is not possible to invest directly in an index. |

| 5 | The Russell 3000 Growth® Index measures the performance of those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The stocks in this index are also members of either the Russell 1000 Growth® or the Russell 2000 Growth® indexes. The index is unmanaged, and it is not possible to invest directly in an index. |

| 6 | The Russell 3000 Value® Index measures the performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The stocks in this index are also members of either the Russell 1000 Value® or the Russell 2000 Value® indexes. The index is unmanaged, and it is not possible to invest directly in an index. |

Annual Shareholder Report

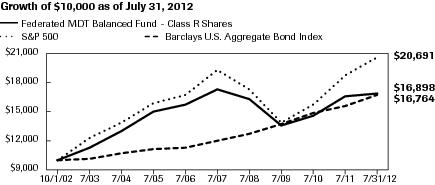

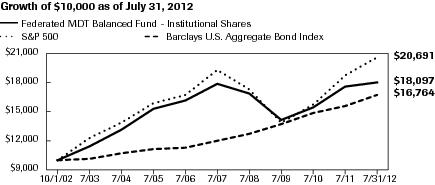

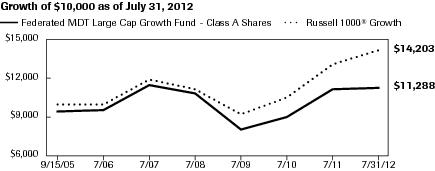

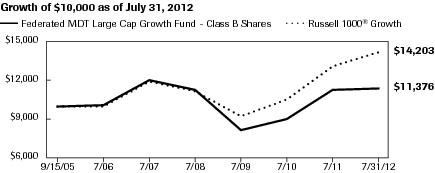

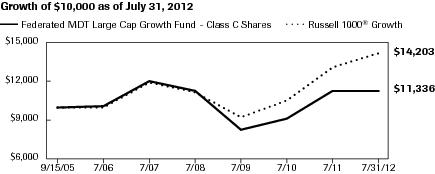

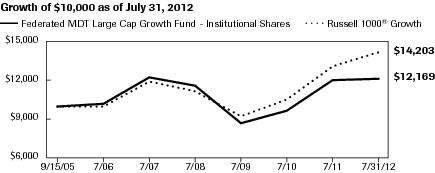

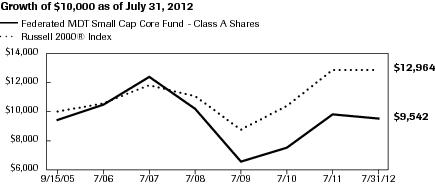

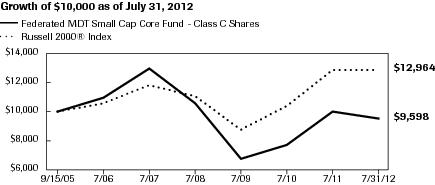

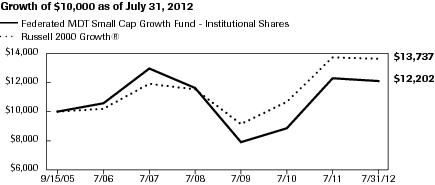

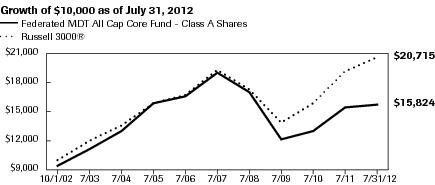

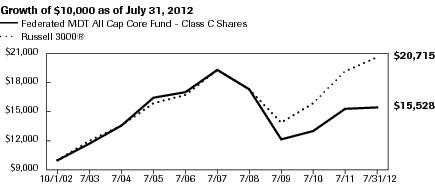

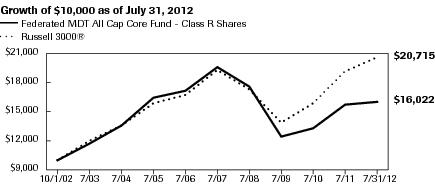

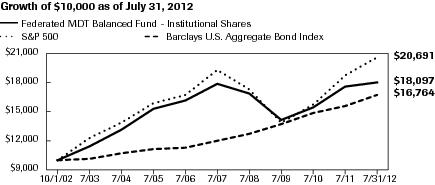

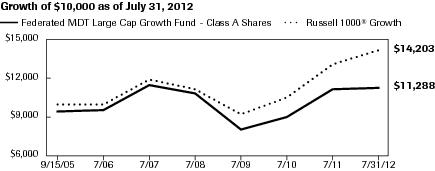

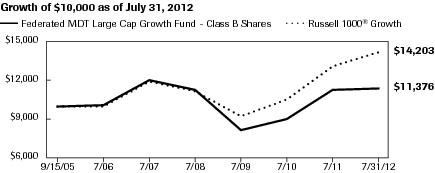

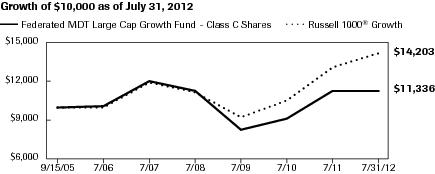

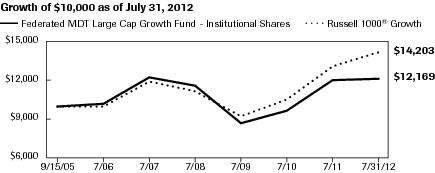

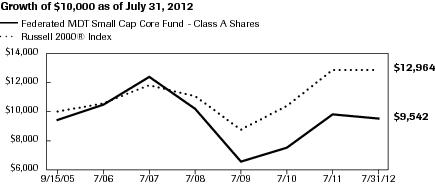

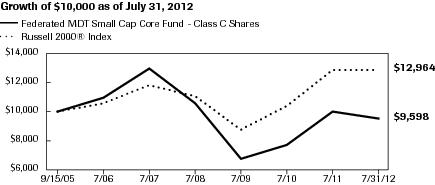

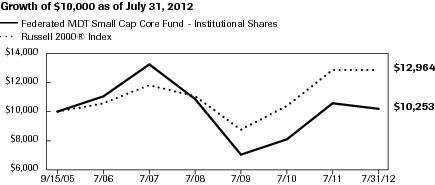

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

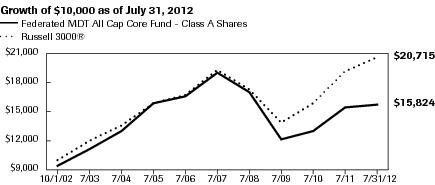

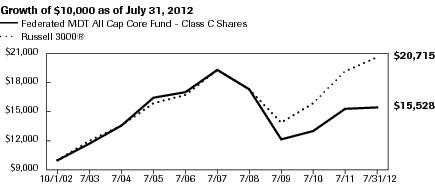

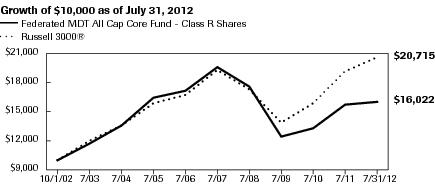

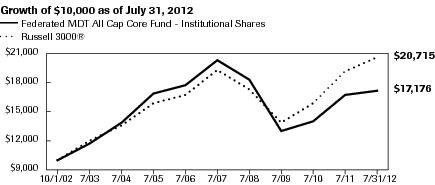

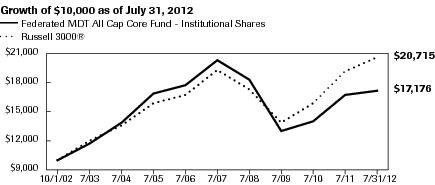

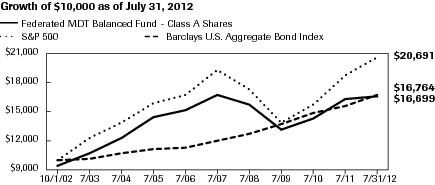

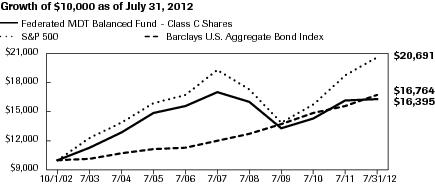

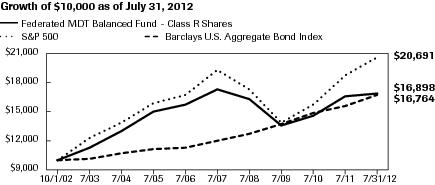

The start of performance date for the Fund's Class A Shares, Class C Shares and Class R Shares was October 1, 2002. Class A Shares, Class C Shares and Class R Shares commenced operations on February 12, 2003, September 15, 2005 and December 12, 2006, respectively. Performance results shown before those dates are for the Fund's Institutional Shares and have been adjusted for the maximum sales charge, maximum contingent deferred sales charge and total annual operating expenses applicable to each class. The Fund's Institutional Shares commenced operations on October 1, 2002. Subject to the expense adjustments described above, the Class A Shares, Class C Shares and Class R Shares annual returns would be substantially similar to those of the Institutional Shares because Shares of each class are invested in the same portfolio of securities. The Average Annual Total Return table below shows returns for each class averaged over the stated periods. The graphs below illustrate the hypothetical investment of $10,0001 in the Federated MDT All Cap Core Fund2 (the “Fund”) from October 1, 2002 (start of performance) to July 31, 2012, compared to the Russell 3000® Index (Russell 3000®).3

Average Annual Total Returns for the Period Ended 7/31/2012

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| Share Class | 1 Year | 5 Years | Start of

Performance* |

| Class A Shares | -3.63% | -4.74% | 4.78% |

| Class C Shares | 0.16% | -4.42% | 4.58% |

| Class R Shares | 1.45% | -4.11% | 4.91% |

| Institutional Shares | 2.23% | -3.39% | 5.65% |

| * | The Fund's start of performance date was October 1, 2002. |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Annual Shareholder Report

Growth of a $10,000 Investment–Class A Shares

| Federated MDT All Cap Core Fund - Class A Shares | C000035043 | Russell 3000® |

| 10/1/2002 | 9,450 | 10,000 |

| 7/31/2003 | 11,108 | 12,016 |

| 7/31/2004 | 13,056 | 13,615 |

| 7/31/2005 | 15,900 | 15,917 |

| 7/31/2006 | 16,629 | 16,735 |

| 7/31/2007 | 19,069 | 19,426 |

| 7/31/2008 | 17,166 | 17,421 |

| 7/31/2009 | 12,176 | 13,900 |

| 7/31/2010 | 13,051 | 15,959 |

| 7/31/2011 | 15,514 | 19,301 |

| 7/31/2012 | 15,824 | 20,715 |

41 graphic description end -->

| ■ | Total returns shown include the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450). |

Growth of a $10,000 Investment–Class C Shares

| Federated MDT All Cap Core Fund - Class C Shares | C000035044 | Russell 3000® |

| 10/1/2002 | 10,000 | 10,000 |

| 7/31/2003 | 11,681 | 12,016 |

| 7/31/2004 | 13,628 | 13,615 |

| 7/31/2005 | 16,473 | 15,917 |

| 7/31/2006 | 17,107 | 16,735 |

| 7/31/2007 | 19,469 | 19,426 |

| 7/31/2008 | 17,387 | 17,421 |

| 7/31/2009 | 12,233 | 13,900 |

| 7/31/2010 | 13,007 | 15,959 |

| 7/31/2011 | 15,350 | 19,301 |

| 7/31/2012 | 15,528 | 20,715 |

41 graphic description end -->

| ■ | Total returns shown include the maximum contingent deferred sales charge of 1.00%, as applicable. |

Annual Shareholder Report

Growth of a $10,000 Investment–Class R Shares

| Federated MDT All Cap Core Fund - Class R Shares | C000043497 | Russell 3000® |

| 10/1/2002 | 10,000 | 10,000 |

| 7/31/2003 | 11,703 | 12,016 |

| 7/31/2004 | 13,682 | 13,615 |

| 7/31/2005 | 16,587 | 15,917 |

| 7/31/2006 | 17,262 | 16,735 |

| 7/31/2007 | 19,765 | 19,426 |

| 7/31/2008 | 17,722 | 17,421 |

| 7/31/2009 | 12,508 | 13,900 |

| 7/31/2010 | 13,347 | 15,959 |

| 7/31/2011 | 15,793 | 19,301 |

| 7/31/2012 | 16,022 | 20,715 |

41 graphic description end -->

Growth of a $10,000 Investment–Institutional shares

| Federated MDT All Cap Core Fund - Institutional Shares | C000035045 | Russell 3000® |

| 10/1/2002 | 10,000 | 10,000 |

| 7/31/2003 | 11,775 | 12,016 |

| 7/31/2004 | 13,869 | 13,615 |

| 7/31/2005 | 16,939 | 15,917 |

| 7/31/2006 | 17,761 | 16,735 |

| 7/31/2007 | 20,411 | 19,426 |

| 7/31/2008 | 18,429 | 17,421 |

| 7/31/2009 | 13,113 | 13,900 |

| 7/31/2010 | 14,102 | 15,959 |

| 7/31/2011 | 16,800 | 19,301 |

| 7/31/2012 | 17,176 | 20,715 |

41 graphic description end -->

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for Class C Shares a 1.00% contingent deferred sales charge would be applied on any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The Russell 3000® has been adjusted to reflect reinvestment of dividends of securities in the index. |

| 2 | The Fund is the successor to the MDT All Cap Core Fund pursuant to a reorganization that was completed on or about the close of business on December 8, 2006. Prior to that date, the Fund had no investment operations. Accordingly, the performance information shown for periods prior to that date for Class A Shares, Class C Shares and Class R Shares is historical information for the MDT All Cap Core Fund. The MDT All Cap Core Fund was managed by MDT Advisers and had similar investment objectives and strategies as the Fund. |

| 3 | The Russell 3000® offers investors access to the broad U.S. equity universe representing approximately 98% of the U.S. market. The Russell 3000® is constructed to provide a comprehensive, unbiased and stable barometer of the broad market and is completely reconstituted annually to ensure that new and growing equities are reflected. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. The Russell 3000® is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund's performance. |

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At July 31, 2012, the Fund's industry composition1 was as follows:

| Industry Composition | Percentage of

Total Net Assets |

| Specialty Retailing | 6.5% |

| Regional Banks | 5.5% |

| Discount Department Stores | 4.6% |

| Integrated Domestic Oil | 4.6% |

| Money Center Bank | 4.4% |

| Services to Medical Professionals | 4.3% |

| Property Liability Insurance | 4.2% |

| Multi-Line Insurance | 4.1% |

| Department Stores | 3.8% |

| Personal Loans | 3.5% |

| Financial Services | 3.2% |

| Ethical Drugs | 3.1% |

| Broadcasting | 2.7% |

| Diversified Leisure | 2.2% |

| Hotels | 2.1% |

| Auto Manufacturing | 1.8% |

| Computers - Midrange | 1.8% |

| Cable & Wireless Television | 1.7% |

| Computer Stores | 1.6% |

| Cosmetics & Toiletries | 1.6% |

| Life Insurance | 1.6% |

| Drug Store | 1.5% |

| Semiconductor Distribution | 1.4% |

| Building Supply Stores | 1.3% |

| Oil Refiner | 1.3% |

| Specialty Chemicals | 1.2% |

| Soft Drinks | 1.1% |

| Airline - Regional | 1.0% |

| Diversified Oil | 1.0% |

| Other2 | 19.7% |

| Cash Equivalents3 | 1.4% |

| Other Assets and Liabilities—Net4 | 0.2% |

| TOTAL | 100.0% |

Annual Shareholder Report

| 1 | Except for Cash Equivalents and Other Assets and Liabilities, industry classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

| 2 | For purposes of this table, industry classifications which constitute less than 1.0% of the Fund's total net assets have been aggregated under the designation “Other.” |

| 3 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 4 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

|

Annual Shareholder Report

Portfolio of Investments

July 31, 2012

| Shares | | | Value |

| | COMMON STOCKS—98.4% | |

| | Agricultural Chemicals—0.1% | |

| 2,500 | | Scotts Miracle-Gro Co. | $99,750 |

| | Agricultural Machinery—0.1% | |

| 1,800 | | Lindsay Manufacturing Co. | 127,620 |

| | Airline - Regional—1.0% | |

| 28,534 | 1 | Alaska Air Group, Inc. | 994,410 |

| | Aluminum—0.2% | |

| 4,400 | | Kaiser Aluminum Corp. | 239,976 |

| | Apparel—0.8% | |

| 8,800 | 1 | Carter's, Inc. | 445,896 |

| 2,300 | | Guess ?, Inc. | 69,230 |

| 2,500 | 1 | Warnaco Group, Inc. | 106,650 |

| 4,400 | 1 | Zumiez, Inc. | 159,852 |

| | TOTAL | 781,628 |

| | AT&T Divestiture—0.2% | |

| 5,200 | | Verizon Communications, Inc. | 234,728 |

| | Auto Manufacturing—1.8% | |

| 26,800 | | Ford Motor Co. | 247,632 |

| 62,000 | 1 | General Motors Co. | 1,222,020 |

| 6,600 | 1 | TRW Automotive Holdings Corp. | 259,380 |

| | TOTAL | 1,729,032 |

| | Auto Original Equipment Manufacturers—0.2% | |

| 6,700 | | Johnson Controls, Inc. | 165,155 |

| 2,200 | 1 | Tenneco Automotive, Inc. | 64,438 |

| | TOTAL | 229,593 |

| | Auto Part Replacement—0.6% | |

| 8,600 | | Genuine Parts Co. | 550,658 |

| | Auto Rentals—0.1% | |

| 1,400 | 1 | Dollar Thrifty Automotive Group | 104,160 |

| | Broadcasting—2.7% | |

| 52,889 | 1 | DIRECTV Group, Inc., Class A | 2,626,468 |

| | Building Materials—0.2% | |

| 7,100 | 1 | Fortune Brands Home & Security, Inc. | 157,052 |

| 1,800 | | Lennox International, Inc. | 78,606 |

| | TOTAL | 235,658 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Building Supply Stores—1.3% | |

| 49,400 | | Lowe's Cos., Inc. | $1,253,278 |

| | Cable & Wireless Television—1.7% | |

| 19,200 | | Time Warner Cable, Inc. | 1,630,656 |

| | Cable TV—0.3% | |

| 3,700 | 1 | Charter Communications, Inc. | 284,604 |

| | Carpets—0.3% | |

| 3,900 | 1 | Mohawk Industries, Inc. | 259,077 |

| | Clothing Stores—0.9% | |

| 1,700 | 1 | Children's Place Retail Stores, Inc. | 86,360 |

| 22,200 | | Gap (The), Inc. | 654,678 |

| 3,000 | 1 | Hanesbrands, Inc. | 90,060 |

| | TOTAL | 831,098 |

| | Commodity Chemicals—0.4% | |

| 3,000 | | PPG Industries, Inc. | 328,380 |

| 3,000 | | RPM International, Inc. | 79,500 |

| | TOTAL | 407,880 |

| | Computer Peripherals—0.1% | |

| 3,700 | | Lexmark International Group, Class A | 64,713 |

| | Computer Services—0.6% | |

| 1,300 | 1 | CACI International, Inc., Class A | 73,385 |

| 11,134 | 1 | Synnex Corp. | 376,663 |

| 1,500 | | Syntel, Inc. | 87,195 |

| | TOTAL | 537,243 |

| | Computer Stores—1.6% | |

| 6,500 | | GameStop Corp. | 104,130 |

| 46,849 | 1 | Ingram Micro, Inc., Class A | 702,267 |

| 2,100 | 1 | Insight Enterprises, Inc. | 35,196 |

| 13,862 | 1 | Tech Data Corp. | 694,486 |

| | TOTAL | 1,536,079 |

| | Computers - Low End—0.6% | |

| 46,400 | | Dell, Inc. | 551,232 |

| | Computers - Midrange—1.8% | |

| 96,300 | | Hewlett-Packard Co. | 1,756,512 |

| | Construction Machinery—0.4% | |

| 12,700 | | Trinity Industries, Inc. | 355,600 |

| | Cosmetics & Toiletries—1.6% | |

| 5,700 | | Avon Products, Inc. | 88,293 |

| 14,400 | | Estee Lauder Cos., Inc., Class A | 754,272 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Cosmetics & Toiletries—continued | |

| 7,900 | 1 | Ulta Salon Cosmetics & Fragrance, Inc. | $670,552 |

| | TOTAL | 1,513,117 |

| | Crude Oil & Gas Production—0.1% | |

| 2,100 | 1 | PDC Energy, Inc. | 55,020 |

| | Defense Aerospace—0.2% | |

| 1,800 | 1 | Transdigm Group, Inc. | 222,048 |

| | Department Stores—3.8% | |

| 1,500 | | Dillards, Inc., Class A | 97,845 |

| 14,900 | | Kohl's Corp. | 740,828 |

| 16,600 | | Macy's, Inc. | 594,944 |

| 8,400 | | Penney (J.C.) Co., Inc. | 189,084 |

| 200 | 1 | Sears Holdings Corp. | 9,898 |

| 32,400 | | Target Corp. | 1,965,060 |

| | TOTAL | 3,597,659 |

| | Discount Department Stores—4.6% | |

| 16,000 | 1 | Dollar Tree, Inc. | 805,440 |

| 4,200 | | Family Dollar Stores, Inc. | 277,536 |

| 45,200 | | Wal-Mart Stores, Inc. | 3,364,236 |

| | TOTAL | 4,447,212 |

| | Diversified Leisure—2.2% | |

| 4,500 | 1 | Bally Technologies, Inc. | 196,695 |

| 52,800 | | Carnival Corp. | 1,757,184 |

| 200 | 1 | Coinstar, Inc. | 9,498 |

| 5,800 | | Royal Caribbean Cruises Ltd. | 144,884 |

| | TOTAL | 2,108,261 |

| | Diversified Oil—1.0% | |

| 18,600 | | Murphy Oil Corp. | 998,076 |

| | Drug Store—1.5% | |

| 39,600 | | Walgreen Co. | 1,439,856 |

| | Education & Training Services—0.4% | |

| 11,000 | 1 | Apollo Group, Inc., Class A | 299,200 |

| 2,100 | | DeVRY, Inc. | 41,223 |

| 1,500 | 1 | ITT Educational Services, Inc. | 58,230 |

| | TOTAL | 398,653 |

| | Electrical Equipment—0.1% | |

| 1,400 | 1 | WESCO International, Inc. | 77,994 |

| | Electronic Instruments—0.3% | |

| 6,700 | 1 | Trimble Navigation Ltd. | 296,542 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Electronic Test/Measuring Equipment—0.1% | |

| 1,800 | 1 | Itron, Inc. | $70,146 |

| | Ethical Drugs—3.1% | |

| 60,200 | | Eli Lilly & Co. | 2,650,606 |

| 10,200 | 1 | Forest Laboratories, Inc., Class A | 342,210 |

| | TOTAL | 2,992,816 |

| | Financial Services—3.2% | |

| 10,300 | | Ameriprise Financial, Inc. | 532,716 |

| 7,600 | | SLM Corp. | 121,524 |

| 18,500 | | Visa, Inc., Class A | 2,387,795 |

| | TOTAL | 3,042,035 |

| | Food Wholesaling—0.9% | |

| 29,700 | | Sysco Corp. | 872,883 |

| | Gas Distributor—0.1% | |

| 1,400 | | Southwest Gas Corp. | 62,524 |

| | Grocery Chain—0.9% | |

| 1,500 | 1 | Fresh Market, Inc. | 88,335 |

| 25,700 | | Kroger Co. | 569,769 |

| 13,700 | | Safeway, Inc. | 213,035 |

| | TOTAL | 871,139 |

| | Health Care Equipment & Supplies—0.1% | |

| 2,200 | | Hill-Rom Holdings, Inc. | 57,530 |

| | Home Building—0.1% | |

| 5,400 | | D. R. Horton, Inc. | 95,202 |

| | Home Products—0.8% | |

| 4,100 | | Energizer Holdings, Inc. | 318,857 |

| 3,100 | | Jarden Corp. | 140,120 |

| 5,200 | | Newell Rubbermaid, Inc. | 91,780 |

| 3,400 | | Tupperware Brands Corp. | 178,228 |

| | TOTAL | 728,985 |

| | Hospitals—0.1% | |

| 2,700 | 1 | Community Health Systems, Inc. | 66,447 |

| | Hotels—2.1% | |

| 26,300 | | Marriott International, Inc., Class A | 957,846 |

| 20,400 | | Wyndham Worldwide Corp. | 1,061,820 |

| | TOTAL | 2,019,666 |

| | Household Appliances—0.6% | |

| 1,800 | 1 | Middleby Corp. | 176,256 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Household Appliances—continued | |

| 6,100 | | Whirlpool Corp. | $412,116 |

| | TOTAL | 588,372 |

| | Household Durables—0.7% | |

| 10,500 | | Stanley Black & Decker, Inc. | 702,345 |

| | Insurance Brokerage—0.4% | |

| 4,900 | | Aspen Insurance Holdings Ltd. | 140,826 |

| 500 | 1 | Markel Corp. | 216,030 |

| | TOTAL | 356,856 |

| | Integrated Domestic Oil—4.6% | |

| 62,000 | | ConocoPhillips | 3,375,280 |

| 3,500 | | Hess Corp. | 165,060 |

| 33,300 | | Marathon Oil Corp. | 881,451 |

| | TOTAL | 4,421,791 |

| | Integrated International Oil—0.9% | |

| 7,500 | | Chevron Corp. | 821,850 |

| | Life Insurance—1.6% | |

| 18,200 | | Protective Life Corp. | 507,962 |

| 20,100 | | Prudential Financial, Inc. | 970,428 |

| 5,400 | | Symetra Financial Corp. | 62,802 |

| | TOTAL | 1,541,192 |

| | Lumber Products—0.2% | |

| 18,300 | 1 | Louisiana-Pacific Corp. | 188,856 |

| | Mail Order—0.1% | |

| 2,200 | | HSN, Inc. | 93,192 |

| | Maritime—0.1% | |

| 7,000 | | Ship Finance International Ltd. | 101,360 |

| | Meat Packing—0.5% | |

| 28,300 | 1 | Smithfield Foods, Inc. | 523,550 |

| | Medical Supplies—0.2% | |

| 3,900 | 1 | Align Technology, Inc. | 132,444 |

| 1,400 | 1 | CareFusion Corp. | 34,174 |

| | TOTAL | 166,618 |

| | Medical Technology—0.1% | |

| 2,600 | | St. Jude Medical, Inc. | 97,136 |

| | Metal Fabrication—0.2% | |

| 2,800 | | Reliance Steel & Aluminum Co. | 144,144 |

| 1,900 | | Timken Co. | 68,780 |

| | TOTAL | 212,924 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Miscellaneous Communications—0.1% | |

| 800 | 1 | Equinix, Inc. | $142,544 |

| | Miscellaneous Components—0.5% | |

| 14,297 | 1 | Fairchild Semiconductor International, Inc., Class A | 198,157 |

| 27,428 | 1 | Vishay Intertechnology, Inc. | 270,714 |

| | TOTAL | 468,871 |

| | Miscellaneous Food Products—0.2% | |

| 6,000 | | Fresh Del Monte Produce, Inc. | 147,000 |

| | Miscellaneous Machinery—0.4% | |

| 7,600 | | Nordson Corp. | 389,576 |

| | Money Center Bank—4.4% | |

| 98,100 | | JPMorgan Chase & Co. | 3,531,600 |

| 1,600 | | Northern Trust Corp. | 72,640 |

| 16,200 | | State Street Corp. | 654,156 |

| | TOTAL | 4,258,396 |

| | Mortgage and Title—0.0% | |

| 2,500 | | Fidelity National Financial, Inc., Class A | 46,550 |

| | Multi-Industry Capital Goods—0.5% | |

| 17,500 | | Textron, Inc. | 455,875 |

| | Multi-Line Insurance—4.1% | |

| 50,600 | | Allstate Corp. | 1,735,580 |

| 54,900 | 1 | American International Group, Inc. | 1,716,723 |

| 6,200 | | CNA Financial Corp. | 161,882 |

| 10,200 | | Montpelier Re Holdings Ltd. | 206,652 |

| 200 | | White Mountains Insurance Group, Inc. | 102,118 |

| | TOTAL | 3,922,955 |

| | Newspaper Publishing—0.1% | |

| 200 | | Washington Post Co., Class B | 67,700 |

| | Office Equipment—0.1% | |

| 5,600 | | Pitney Bowes, Inc. | 74,816 |

| | Office Supplies—0.1% | |

| 4,500 | | Avery Dennison Corp. | 138,555 |

| | Oil Refiner—1.3% | |

| 9,400 | | Marathon Petroleum Corp. | 444,620 |

| 9,000 | 1 | Tesoro Petroleum Corp. | 248,850 |

| 18,500 | | Valero Energy Corp. | 508,750 |

| | TOTAL | 1,202,220 |

| | Oil Service, Explore & Drill—0.1% | |

| 4,400 | 1 | Helix Energy Solutions Group, Inc. | 78,672 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Other Communications Equipment—0.1% | |

| 3,100 | | Harris Corp. | $129,115 |

| | Paint & Related Materials—0.1% | |

| 600 | | Sherwin-Williams Co. | 80,610 |

| | Paper Products—0.0% | |

| 5,700 | 1 | Boise, Inc. | 42,180 |

| | Personal & Household—0.1% | |

| 1,100 | | Nu Skin Enterprises, Inc., Class A | 56,111 |

| | Personal Loans—3.5% | |

| 59,700 | | Capital One Financial Corp. | 3,372,453 |

| | Personnel Agency—0.3% | |

| 4,500 | | Manpower, Inc. | 160,110 |

| 3,400 | | Robert Half International, Inc. | 91,834 |

| | TOTAL | 251,944 |

| | Printed Circuit Boards—0.1% | |

| 3,500 | 1 | Benchmark Electronics, Inc. | 55,160 |

| 4,200 | 1 | Sanmina-SCI Corp. | 35,868 |

| | TOTAL | 91,028 |

| | Printing—0.1% | |

| 4,800 | | Donnelley (R.R.) & Sons Co. | 58,176 |

| | Property Liability Insurance—4.2% | |

| 2,700 | | Everest Re Group Ltd. | 274,590 |

| 7,100 | | ProAssurance Corp. | 635,947 |

| 49,100 | | The Travelers Cos., Inc. | 3,076,115 |

| | TOTAL | 3,986,652 |

| | Regional Banks—5.5% | |

| 16,400 | | BB&T Corp. | 514,468 |

| 1,700 | | City National Corp. | 83,776 |

| 7,300 | | Comerica, Inc. | 220,533 |

| 1,100 | | Commerce Bancshares, Inc. | 43,318 |

| 13,600 | | Fifth Third Bancorp | 187,952 |

| 17,200 | | Huntington Bancshares, Inc. | 106,898 |

| 8,400 | | KeyCorp | 67,032 |

| 17,600 | | SunTrust Banks, Inc. | 416,240 |

| 105,900 | | Wells Fargo & Co. | 3,580,479 |

| 3,700 | | Zions Bancorp | 67,340 |

| | TOTAL | 5,288,036 |

| | Rental & Leasing Services—0.1% | |

| 3,200 | | Rent-A-Center, Inc. | 113,792 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Restaurants—0.3% | |

| 1,800 | 1 | Panera Bread Co. | $283,482 |

| | Semiconductor Distribution—1.4% | |

| 25,913 | 1 | Arrow Electronics, Inc. | 874,564 |

| 14,515 | 1 | Avnet, Inc. | 457,222 |

| | TOTAL | 1,331,786 |

| | Semiconductor Manufacturing—0.1% | |

| 6,500 | 1 | Omnivision Technologies, Inc. | 91,130 |

| | Services to Medical Professionals—4.3% | |

| 13,800 | | Aetna, Inc. | 497,628 |

| 3,600 | | Coventry Health Care, Inc. | 119,988 |

| 2,900 | 1 | Henry Schein, Inc. | 216,949 |

| 1,500 | | Humana, Inc. | 92,400 |

| 2,300 | | Omnicare, Inc. | 72,243 |

| 41,400 | | UnitedHealth Group, Inc. | 2,115,126 |

| 19,273 | | Wellpoint, Inc. | 1,027,058 |

| | TOTAL | 4,141,392 |

| | Soft Drinks—1.1% | |

| 14,400 | | Coca-Cola Enterprises, Inc. | 422,208 |

| 13,800 | | Dr. Pepper Snapple Group, Inc. | 629,004 |

| | TOTAL | 1,051,212 |

| | Software Packaged/Custom—0.8% | |

| 6,000 | | CA, Inc. | 144,420 |

| 7,300 | | Computer Sciences Corp. | 179,726 |

| 6,800 | 1 | Electronic Arts, Inc. | 74,936 |

| 22,200 | 1 | Symantec Corp. | 349,650 |

| | TOTAL | 748,732 |

| | Specialty Chemicals—1.2% | |

| 5,300 | | Airgas, Inc. | 420,396 |

| 11,900 | | Cabot Corp. | 464,100 |

| 5,900 | | Rockwood Holdings, Inc. | 260,898 |

| | TOTAL | 1,145,394 |

| | Specialty Retailing—6.5% | |

| 8,000 | | Abercrombie & Fitch Co., Class A | 270,400 |

| 5,100 | | Advance Auto Parts, Inc. | 357,765 |

| 3,600 | 1 | Ascena Retail Group, Inc. | 66,024 |

| 6,300 | 1 | AutoNation, Inc. | 248,409 |

| 2,900 | 1 | Big Lots, Inc. | 117,479 |

| 47,587 | | CVS Caremark Corp. | 2,153,312 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Specialty Retailing—continued | |

| 1,600 | 1 | Cabela's, Inc., Class A | $73,504 |

| 8,600 | | Expedia, Inc. | 490,114 |

| 5,400 | | Foot Locker, Inc. | 178,308 |

| 12,700 | | GNC Acquisition Holdings, Inc. | 489,331 |

| 3,600 | 1 | Mattress Firm Holding Corp. | 104,976 |

| 10,800 | | Nordstrom, Inc. | 584,712 |

| 3,900 | | Signet Jewelers Ltd. | 171,288 |

| 16,300 | | Staples, Inc. | 207,662 |

| 2,900 | | Tractor Supply Co. | 263,523 |

| 3,600 | 1 | Vitamin Shoppe Industries, Inc. | 197,712 |

| 6,100 | | Williams-Sonoma, Inc. | 211,975 |

| | TOTAL | 6,186,494 |

| | Telecommunication Equipment & Services—0.2% | |

| 1,200 | 1 | Anixter International, Inc. | 68,292 |

| 4,000 | 1 | TW Telecom, Inc. | 100,520 |

| | TOTAL | 168,812 |

| | Tools and Hardware—0.2% | |

| 2,700 | | Snap-On, Inc. | 183,006 |

| | Toys & Games—0.4% | |

| 9,500 | | Hasbro, Inc. | 340,290 |

| | Truck Manufacturing—0.1% | |

| 3,500 | 1 | Navistar International Corp. | 86,100 |

| | Uniforms—0.3% | |

| 6,500 | | Cintas Corp. | 257,595 |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $89,504,226) | 94,150,758 |

| | MUTUAL FUND—1.4% | |

| 1,319,746 | 2,3 | Federated Prime Value Obligations Fund, Institutional Shares, 0.22%

(AT NET ASSET VALUE) | 1,319,746 |

| | TOTAL INVESTMENTS—99.8%

(IDENTIFIED COST $90,823,972)4 | 95,470,504 |

| | OTHER ASSETS AND LIABILITIES - NET—0.2%5 | 154,296 |

| | TOTAL NET ASSETS—100% | $95,624,800 |

| 1 | Non-income producing security. |

| 2 | Affiliated holding. |

| 3 | 7-Day net yield. |

| 4 | The cost of investments for federal tax purposes amounts to $91,167,688. |

| 5 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

Note: The categories of investments are shown as a percentage of total net assets at July 31, 2012.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities, including investment companies with daily net asset values, if applicable.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of July 31, 2012, all investments of the Fund utilized Level 1 inputs in valuing the Fund's assets carried at fair value.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $12.48 | $10.54 | $9.91 | $14.05 | $16.74 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.061 | 0.031 | 0.051 | 0.061 | 0.06 |

| Net realized and unrealized gain (loss) on investments | 0.19 | 1.96 | 0.67 | (4.15) | (1.56) |

| TOTAL FROM INVESTMENT OPERATIONS | 0.25 | 1.99 | 0.72 | (4.09) | (1.50) |

| Less Distributions: | | | | | |

| Distributions from net investment income | — | (0.05) | (0.09) | (0.05) | — |

| Distributions from net realized gain on investments | — | — | — | — | (1.19) |

| TOTAL DISTRIBUTIONS | — | (0.05) | (0.09) | (0.05) | (1.19) |

| Net Asset Value, End of Period | $12.73 | $12.48 | $10.54 | $9.91 | $14.05 |

| Total Return2 | 2.00% | 18.87% | 7.18% | (29.07)% | (9.98)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.35% | 1.34% | 1.29% | 1.34% | 1.29% |

| Net investment income | 0.48% | 0.21% | 0.44% | 0.64% | 0.43% |

| Expense waiver/reimbursement3 | 0.40% | 0.31% | 0.25% | 0.14% | 0.00%4 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $29,365 | $40,227 | $54,437 | $81,898 | $194,867 |

| Portfolio turnover | 164% | 154% | 135% | 290% | 199% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

| 4 | Represents less than 0.01%. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $12.12 | $10.27 | $9.66 | $13.73 | $16.51 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.04)1 | (0.07)1 | (0.04)1 | (0.02)1 | (0.04) |

| Net realized and unrealized gain (loss) on investments | 0.18 | 1.92 | 0.65 | (4.05) | (1.55) |

| TOTAL FROM INVESTMENT OPERATIONS | 0.14 | 1.85 | 0.61 | (4.07) | (1.59) |

| Less Distributions: | | | | | |

| Distributions from net investment income | — | — | (0.00)2 | — | — |

| Distributions from net realized gain on investments | — | — | — | — | (1.19) |

| TOTAL DISTRIBUTIONS | — | — | (0.00)2 | — | (1.19) |

| Net Asset Value, End of Period | $12.26 | $12.12 | $10.27 | $9.66 | $13.73 |

| Total Return3 | 1.16% | 18.01% | 6.33% | (29.64)% | (10.69)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.15% | 2.13% | 2.08% | 2.14% | 2.08% |

| Net investment income (loss) | (0.32)% | (0.59)% | (0.36)% | (0.17)% | (0.36)% |

| Expense waiver/reimbursement4 | 0.36% | 0.29% | 0.24% | 0.17% | 0.00%5 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $24,440 | $31,129 | $39,524 | $52,546 | $96,601 |

| Portfolio turnover | 164% | 154% | 135% | 290% | 199% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Represents less than $0.01. |

| 3 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

| 5 | Represents less than 0.01%. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class R Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $12.44 | $10.52 | $9.91 | $14.10 | $16.86 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.00)1,2 | (0.04)1 | (0.01)1 | 0.011 | (0.00)2 |

| Net realized and unrealized gain (loss) on investments | 0.18 | 1.97 | 0.68 | (4.16) | (1.57) |

| TOTAL FROM INVESTMENT OPERATIONS | 0.18 | 1.93 | 0.67 | (4.15) | (1.57) |

| Less Distributions: | | | | | |

| Distributions from net investment income | — | (0.01) | (0.06) | (0.04) | — |

| Distributions from net realized gain on investments | — | — | — | — | (1.19) |

| TOTAL DISTRIBUTIONS | — | (0.01) | (0.06) | (0.04) | (1.19) |

| Net Asset Value, End of Period | $12.62 | $12.44 | $10.52 | $9.91 | $14.10 |

| Total Return3 | 1.45% | 18.33% | 6.71% | (29.42)% | (10.34)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.85% | 1.83% | 1.75% | 1.80% | 1.75% |

| Net investment income (loss) | (0.02)% | (0.31)% | (0.09)% | 0.15% | (0.00)%4 |

| Expense waiver/reimbursement5 | 0.25% | 0.19% | 0.18% | 0.11% | 0.00%4 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $2,718 | $2,973 | $2,300 | $1,937 | $1,393 |

| Portfolio turnover | 164% | 154% | 135% | 290% | 199% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Represents less than $0.01. |

| 3 | Based on net asset value. |

| 4 | Represents less than 0.01%. |

| 5 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Institutional Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended July 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $12.61 | $10.66 | $10.02 | $14.22 | $16.88 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.091 | 0.051 | 0.081 | 0.091 | 0.10 |

| Net realized and unrealized gain (loss) on investments | 0.19 | 1.99 | 0.68 | (4.20) | (1.57) |

| TOTAL FROM INVESTMENT OPERATIONS | 0.28 | 2.04 | 0.76 | (4.11) | (1.47) |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.02) | (0.09) | (0.12) | (0.09) | — |

| Distributions from net realized gain on investments | — | — | — | — | (1.19) |

| TOTAL DISTRIBUTIONS | (0.02) | (0.09) | (0.12) | (0.09) | (1.19) |

| Net Asset Value, End of Period | $12.87 | $12.61 | $10.66 | $10.02 | $14.22 |

| Total Return2 | 2.23% | 19.14% | 7.54% | (28.84)% | (9.71)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.10% | 1.08% | 1.01% | 1.06% | 1.01% |

| Net investment income | 0.73% | 0.45% | 0.69% | 0.90% | 0.72% |

| Expense waiver/reimbursement3 | 0.27% | 0.19% | 0.20% | 0.12% | 0.00%4 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $39,101 | $43,197 | $41,958 | $50,031 | $86,681 |

| Portfolio turnover | 164% | 154% | 135% | 290% | 199% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

| 4 | Represents less than 0.01%. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and Liabilities

July 31, 2012

| Assets: | | |

| Total investment in securities, at value including $1,319,746 of investment in an affiliated holding (Note 5) (identified cost $90,823,972) | | $95,470,504 |

| Income receivable | | 74,870 |

| Receivable for investments sold | | 1,017,697 |

| Receivable for shares sold | | 29,088 |

| TOTAL ASSETS | | 96,592,159 |

| Liabilities: | | |

| Payable for investments purchased | $557,102 | |

| Payable for shares redeemed | 279,363 | |

| Payable for transfer and dividend disbursing agent fees and expenses | 44,121 | |

| Payable for Directors'/Trustees' fees | 407 | |

| Payable for auditing fees | 23,400 | |

| Payable for distribution services fee (Note 5) | 16,817 | |

| Payable for shareholder services fee (Note 5) | 11,582 | |

| Accrued expenses | 34,567 | |

| TOTAL LIABILITIES | | 967,359 |

| Net assets for 7,554,409 shares outstanding | | $95,624,800 |

| Net Assets Consist of: | | |

| Paid-in capital | | $218,466,398 |

| Net unrealized appreciation of investments | | 4,646,532 |

| Accumulated net realized loss on investments | | (127,855,828) |

| Undistributed net investment income | | 367,698 |

| TOTAL NET ASSETS | | $95,624,800 |

Annual Shareholder Report

Statement of Assets and Liabilities–continued

| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class A Shares: | | |

| Net asset value per share ($29,365,462 ÷ 2,307,256 shares outstanding), no par value, unlimited shares authorized | | $12.73 |

| Offering price per share (100/94.50 of $12.73) | | $13.47 |

| Redemption proceeds per share | | $12.73 |

| Class C Shares: | | |

| Net asset value per share ($24,440,419 ÷ 1,994,176 shares outstanding), no par value, unlimited shares authorized | | $12.26 |

| Offering price per share | | $12.26 |

| Redemption proceeds per share (99.00/100 of $12.26) | | $12.14 |

| Class R Shares: | | |

| Net asset value per share ($2,717,730 ÷ 215,405 shares outstanding), no par value, unlimited shares authorized | | $12.62 |

| Offering price per share | | $12.62 |

| Redemption proceeds per share | | $12.62 |

| Institutional Shares: | | |

| Net asset value per share ($39,101,189 ÷ 3,037,572 shares outstanding), no par value, unlimited shares authorized | | $12.87 |

| Offering price per share | | $12.87 |

| Redemption proceeds per share | | $12.87 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Operations

Year Ended July 31, 2012

| Investment Income: | | | |

Dividends (including $3,364 received from an affiliated

holding (Note 5)) | | | $1,875,813 |

| Expenses: | | | |

| Investment adviser fee (Note 5) | | $765,989 | |

| Administrative fee (Note 5) | | 270,000 | |

| Custodian fees | | 22,124 | |

Transfer and dividend disbursing agent fees and

expenses (Note 2) | | 214,935 | |

| Directors'/Trustees' fees | | 2,733 | |

| Auditing fees | | 23,376 | |

| Legal fees | | 7,939 | |

| Portfolio accounting fees | | 80,079 | |

| Distribution services fee (Note 5) | | 211,047 | |

| Shareholder services fee (Note 5) | | 147,805 | |

| Account administration fee (Note 2) | | 181 | |

| Share registration costs | | 49,735 | |

| Printing and postage | | 39,738 | |

| Insurance premiums | | 4,040 | |

| Miscellaneous | | 9,708 | |

| TOTAL EXPENSES | | 1,849,429 | |

| Waivers and Reimbursements: | | | |

| Waiver/reimbursement of investment adviser fee (Note 5) | $(198,934) | | |

| Waiver of administrative fee (Note 5) | (53,977) | | |

| Waiver of distribution services fee (Note 5) | (175) | | |

| Reimbursement of transfer and dividend disbursing agent fees and expenses (Note 2) and (Note 5) | (88,236) | | |

| TOTAL WAIVERS AND REIMBURSEMENTS | | (341,322) | |

| Net expenses | | | 1,508,107 |

| Net investment income | | | 367,706 |

| Realized and Unrealized Gain (Loss) on Investments: | | | |

| Net realized gain on investments | | | 2,904,136 |

| Net change in unrealized appreciation of investments | | | (2,143,917) |

| Net realized and unrealized gain on investments | | | 760,219 |

| Change in net assets resulting from operations | | | $1,127,925 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| Year Ended July 31 | 2012 | 2011 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $367,706 | $68,486 |

| Net realized gain on investments | 2,904,136 | 21,524,570 |

| Net change in unrealized appreciation/depreciation of investments | (2,143,917) | 824,024 |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 1,127,925 | 22,417,080 |

| Distributions to Shareholders: | | |

| Distributions from net investment income | | |

| Class A Shares | — | (193,416) |

| Class R Shares | — | (1,842) |

| Institutional Shares | (67,721) | (276,596) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (67,721) | (471,854) |

| Share Transactions: | | |

| Proceeds from sale of shares | 7,857,700 | 22,465,156 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 65,854 | 434,830 |

| Cost of shares redeemed | (30,884,509) | (65,538,863) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | (22,960,955) | (42,638,877) |

| Change in net assets | (21,900,751) | (20,693,651) |

| Net Assets: | | |

| Beginning of period | 117,525,551 | 138,219,202 |

| End of period (including undistributed net investment income of $367,698 and $67,713, respectively) | $95,624,800 | $117,525,551 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

July 31, 2012

1. ORGANIZATION

Federated MDT Series (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of five portfolios. The financial statements included herein are only those of Federated MDT All Cap Core Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers four classes of shares: Class A Shares, Class C Shares, Class R Shares and Institutional Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is long-term capital appreciation.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

| ■ | Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market. |

| ■ | Shares of other mutual funds are valued based upon their reported NAVs. |

| ■ | Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Fund's Board of Trustees (the “Trustees”). |

| ■ | Fixed-income securities acquired with remaining maturities of 60 days or less are valued at their cost (adjusted for the accretion of any discount or amortization of any premium), which approximates market value. |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the purchase price of the security, information obtained by contacting the issuer, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded and public trading in similar securities of the issuer or comparable issuers. |

Annual Shareholder Report

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Fair Valuation and Significant Events Procedures

The Trustees have appointed a Valuation Committee comprised of officers of the Fund, Federated MDTA LLC (“Adviser”) or an affiliated adviser, and others to determine fair value of securities and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing service evaluations including periodic reviews of third-party pricing services' policies, procedures and valuation methods (including key inputs and assumptions), transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for other types of fixed-income securities and OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

| ■ | With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures or options contracts; |

| ■ | With respect to price evaluations of fixed-income securities determined before the close of regular trading on the NYSE, actions by the Federal Reserve Open Market Committee and other significant trends in U.S. fixed-income markets; |

Annual Shareholder Report

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and |

| ■ | Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

The Trustees have approved the use of a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment using another method approved by the Trustees.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income are declared and paid annually. Non-cash dividends included in dividend income, if any, are recorded at fair value. Investment income, realized and unrealized gains and losses and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that

Annual Shareholder Report

Class A Shares, Class C Shares, Class R Shares and Institutional Shares may bear distribution services fees, shareholder services fees, account administration fees and certain transfer and dividend disbursing agent fees unique to those classes. For the year ended July 31, 2012, transfer and dividend disbursing agent fees and account administration fees for the Fund were as follows:

| Transfer and

Dividend

Disbursing

Agent Fees

Incurred | Transfer and

Dividend

Disbursing

Agent Fees

Reimbursed | Account

Administration

Fees Incurred |

| Class A Shares | $86,120 | $(50,788) | $181 |

| Class C Shares | 70,435 | (29,915) | — |

| Class R Shares | 10,012 | — | — |

| Institutional Shares | 48,368 | (7,533) | — |

| TOTAL | $214,935 | $(88,236) | $181 |

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Premium and Discount Amortization

All premiums and discounts on fixed-income securities are amortized/accreted using the effective interest rate method.

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended July 31, 2012, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of July 31, 2012, tax years 2009 through 2012 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

When-Issued and Delayed Delivery Transactions

The Fund may engage in when-issued or delayed delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Annual Shareholder Report

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ from those estimated.

3. SHARES OF BENEFICIAL INTEREST

The following tables summarize share activity:

| Year Ended July 31 | 2012 | 2011 |

| Class A Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 174,952 | $2,147,251 | 328,142 | $4,029,120 |

| Shares issued to shareholders in payment of distributions declared | — | — | 15,294 | 183,529 |

| Shares redeemed | (1,090,509) | (13,285,030) | (2,285,365) | (27,236,700) |

| NET CHANGE RESULTING FROM CLASS A SHARE TRANSACTIONS | (915,557) | $(11,137,779) | (1,941,929) | $(23,024,051) |

| Year Ended July 31 | 2012 | 2011 |

| Class C Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 246,589 | $2,944,629 | 355,709 | $4,287,880 |

| Shares redeemed | (821,569) | (9,611,299) | (1,633,873) | (18,969,226) |

| NET CHANGE RESULTING FROM CLASS C SHARE TRANSACTIONS | (574,980) | $(6,666,670) | (1,278,164) | $(14,681,346) |

| Year Ended July 31 | 2012 | 2011 |

| Class R Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 94,213 | $1,129,971 | 125,054 | $1,537,837 |

| Shares issued to shareholders in payment of distributions declared | — | — | 153 | 1,842 |

| Shares redeemed | (117,870) | (1,436,974) | (104,836) | (1,281,271) |

| NET CHANGE RESULTING FROM CLASS R SHARE TRANSACTIONS | (23,657) | $(307,003) | 20,371 | $258,408 |

| Year Ended July 31 | 2012 | 2011 |

| Institutional Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 136,805 | $1,635,849 | 971,643 | $12,610,319 |

| Shares issued to shareholders in payment of distributions declared | 5,447 | 65,854 | 20,599 | 249,459 |

| Shares redeemed | (529,245) | (6,551,206) | (1,504,407) | (18,051,666) |

| NET CHANGE RESULTING FROM INSTITUTIONAL SHARE TRANSACTIONS | (386,993) | $(4,849,503) | (512,165) | $(5,191,888) |

| NET CHANGE RESULTING FROM TOTAL FUND SHARE TRANSACTIONS | (1,901,187) | $(22,960,955) | (3,711,887) | $(42,638,877) |

Annual Shareholder Report

4. FEDERAL TAX INFORMATION

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended July 31, 2012 and 2011, was as follows:

| 2012 | 2011 |

| Ordinary income | $67,721 | $471,854 |

As of July 31, 2012, the components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income | $367,698 |

| Net unrealized appreciation | $4,302,816 |

| Capital loss carryforwards | $(127,512,112) |

The difference between book-basis and tax-basis net unrealized appreciation/depreciation is attributable to differing treatments for the deferral of losses on wash sales.

At July 31, 2012, the cost of investments for federal tax purposes was $91,167,688. The net unrealized appreciation of investments for federal tax purposes was $4,302,816. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $9,283,190 and net unrealized depreciation from investments for those securities having an excess of cost over value of $4,980,374.

At July 31, 2012, the Fund had a capital loss carryforward of $127,512,112 which will reduce the Fund's taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code, thereby reducing the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income tax. Pursuant to the Code, a net capital loss incurred in taxable years beginning on or before December 22, 2010, is characterized as short-term and may be carried forward for a maximum of eight tax years (“Carryforward Limit”), whereas a net capital loss incurred in taxable years beginning after December 22, 2010, retains its character as either short-term or long-term, does not expire and is required to be utilized prior to the losses which have a Carryforward Limit.

The following schedule summarizes the Fund's capital loss carryforwards and expiration years:

| Expiration Year | Short-Term | Long-Term | Total |

| 2016 | $13,181 | NA | $13,181 |

| 2017 | $57,908,050 | NA | $57,908,050 |

| 2018 | $69,590,881 | NA | $69,590,881 |

As a result of the tax-free transfer of assets from Federated MDT Tax Aware/All Cap Core Fund, the use of certain capital loss carryforwards listed above may be limited.

The Fund used capital loss carryforwards of $2,992,524 to offset taxable capital gains realized during the year ended July 31, 2012.

Annual Shareholder Report

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The advisory agreement between the Fund and the Adviser provides for an annual fee equal to 0.75% of the Fund's average daily net assets. Subject to the terms described in the Expense Limitation note, the Adviser may voluntarily choose to waive any portion of its fee. For the year ended July 31, 2012, the Adviser waived $196,951 of its fee. In addition, an affiliate of the Adviser reimbursed $88,236 of transfer and dividend disbursing agent fees and expenses.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. The fee paid to FAS is based on the average aggregate daily net assets of certain Federated funds as specified below:

| Administrative Fee | Average Aggregate Daily Net Assets

of the Federated Funds |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |

The administrative fee received during any fiscal year shall be at least $150,000 per portfolio and $40,000 per each additional class of Shares. Subject to the terms described in the Expense Limitation note, FAS may voluntarily choose to waive any portion of its fee. For the year ended July 31, 2012, FAS waived $53,977 of its fee. The net fee paid to FAS was 0.212% of average daily net assets of the Fund. The Fund is currently being charged the minimum administrative fee; therefore the fee as a percentage of average daily net assets is greater than the amounts presented in the chart above.

Distribution Services Fee

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. Under the terms of the Plan, the Fund will compensate Federated Securities Corp. (FSC), the principal distributor, from the daily net assets of the Fund's Class A Shares, Class C Shares and Class R Shares to finance activities intended to result in the sale of these shares. The Plan provides that the Fund may incur distribution expenses at the following percentages of average daily net assets annually, to compensate FSC:

| Share Class Name | Percentage of Average Daily

Net Assets of Class |

| Class A Shares | 0.05% |

| Class C Shares | 0.75% |

| Class R Shares | 0.50% |

Annual Shareholder Report

Subject to the terms described in the Expense Limitation note, FSC may voluntarily choose to waive any portion of its fee. For the year ended July 31, 2012, distribution services fees for the Fund were as follows:

| Distribution

Services Fees

Incurred | Distribution

Services Fees

Waived |

| Class C Shares | $197,062 | $— |

| Class R Shares | 13,985 | (175) |

| TOTAL | $211,047 | $(175) |

When FSC receives fees, it may pay some or all of them to financial intermediaries whose customers purchase shares. For the year ended July 31, 2012, FSC retained $9,699 of fees paid by the Fund. For the year ended July 31, 2012, the Fund's Class A Shares did not incur a distribution services fee; however, it may begin to incur this fee upon approval of the Trustees.

Sales Charges

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. They are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. For the year ended July 31, 2012, FSC retained $1,279 in sales charges from the sale of Class A Shares. FSC also retained $485 of CDSC relating to redemptions of Class C Shares.

Shareholder Services Fee

The Fund may pay fees (“Service Fees”) up to 0.25% of the average daily net assets of the Fund's Class A Shares and Class C Shares to financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to shareholders and maintaining shareholder accounts. Subject to the terms described in the Expense Limitation note, FSSC may voluntarily reimburse the Fund for Service Fees. For the year ended July 31, 2012, Service Fees for the Fund were as follows:

| Service Fees

Incurred |

| Class A Shares | $82,118 |

| Class C Shares | 65,687 |

| TOTAL | $147,805 |

For the year ended July 31, 2012, FSSC did not receive any fees paid by the Fund.

Expense Limitation

The Adviser and its affiliates (which may include FSC, FAS and FSSC) have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (as shown in the financial highlights) paid by the Fund's Class A Shares, Class C Shares, Class R Shares and Institutional Shares (after the voluntary waivers and reimbursements) will not exceed 1.35%, 2.15%, 1.85% and 1.10% (the “Fee Limit”), respectively, up to but not including the later of (the “Termination Date”): (a) October 1, 2013; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Trustees.

Annual Shareholder Report

General

Certain Officers and Trustees of the Trust are Officers and Directors or Trustees of the above companies.

Transactions Involving Affiliated Holdings

Affiliated holdings are mutual funds which are managed by the Adviser or an affiliate of the Adviser. The Adviser has agreed to reimburse the Fund for certain investment adviser fees as a result of transactions in other affiliated mutual funds. For the year ended July 31, 2012, the Adviser reimbursed $1,983. Transactions involving the affiliated holding during the year ended July 31, 2012, were as follows:

| Federated

Prime Value

Obligations Fund,

Institutional Shares |

| Balance of Shares Held 7/31/2011 | 2,027,952 |

| Purchases/Additions | 17,620,937 |

| Sales/Reductions | 18,329,143 |

| Balance of Shares Held 7/31/2012 | 1,319,746 |

| Value | $1,319,746 |

| Dividend Income | $3,364 |

6. Investment TRANSACTIONS

Purchases and sales of investments, excluding long-term U.S. government securities and short-term obligations, for the year ended July 31, 2012, were as follows:

| Purchases | $166,684,378 |

| Sales | $189,138,124 |

7. LINE OF CREDIT

The Fund participates in a $100,000,000 unsecured, uncommitted revolving line of credit (LOC) agreement with PNC Bank. The LOC was made available for extraordinary or emergency purposes, primarily for financing redemption payments. Borrowings are charged interest at a rate offered to the Fund by PNC Bank at the time of the borrowing. As of July 31, 2012, there were no outstanding loans. During the year ended July 31, 2012, the Fund did not utilize the LOC.

8. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund, along with other funds advised by subsidiaries of Federated Investors, Inc., may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from other participating affiliated funds. As of July 31, 2012, there were no outstanding loans. During the year ended July 31, 2012, the program was not utilized.

Annual Shareholder Report

9. Subsequent events

On August 15, 2012, the Trustees approved the elimination of minimum administrative personnel and services fees effective September 1, 2012. Prior to this date, the administrative fee received during any fiscal year was at least $150,000 per portfolio and $40,000 per each additional class of Shares.

Management has evaluated subsequent events through the date the financial statements were issued, and determined that no additional events have occurred that require disclosure.

10. FEDERAL TAX INFORMATION (UNAUDITED)

For the fiscal year ended July 31, 2012, 100.0% of total income distributions made by the Fund are qualifying dividends which may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Act of 2003. Complete information is reported in conjunction with the reporting of your distributions on Form 1099-DIV.

Of the ordinary income distributions made by the Fund during the year ended July 31, 2012, 100.0% qualify for the dividend received deduction available to corporate shareholders.

Annual Shareholder Report

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF trustees OF Federated MDt series AND SHAREHOLDERS OF federated mdt all cap core fund:

We have audited the accompanying statement of assets and liabilities of Federated MDT All Cap Core Fund (the “Fund”) (one of the portfolios constituting Federated MDT Series), including the portfolio of investments, as of July 31, 2012, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of July 31, 2012 by correspondence with the custodian and others, or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Federated MDT All Cap Core Fund, a portfolio of Federated MDT Series, at July 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

September 24, 2012

Annual Shareholder Report

Shareholder Expense Example (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase or redemption payments; and (2) ongoing costs, including management fees and to the extent applicable, distribution (12b-1) fees and/or shareholder services fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from February 1, 2012 to July 31, 2012.

ACTUAL EXPENSES