Washington, D.C. 20549

Kevin M. Robinson

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

WWW.GUGGENHEIMFUNDS.COM

. . . YOUR ROAD TO THE LATEST, MOST UP - TO - DATE INFORMATION

| Contents | |

| | |

| Dear Shareholder | 3 |

| | |

| Economic and Market Overview | 4 |

| | |

| Management Discussion of Fund Performance | 6 |

| | |

| Fund Summary & Performance | 15 |

| | |

| Overview of Fund Expenses | 29 |

| | |

| Portfolio of Investments | 31 |

| | |

| Statement of Assets and Liabilities | 44 |

| | |

| Statement of Operations | 46 |

| | |

| Statement of Changes in Net Assets | 48 |

| | |

| Financial Highlights | 52 |

| | |

| Notes to Financial Statements | 60 |

| | |

| Report of Independent Registered Public Accounting Firm | 68 |

| | |

| Supplemental Information | 69 |

| | |

| Considerations Regarding Annual Review of the | |

| Investment Advisory Agreements and | |

| Investment Subadvisory Agreement | 72 |

| | |

| Trust Information | 75 |

| | |

| About the Trust Adviser | Back Cover |

The shareholder report you are reading right now is just the beginning of the story. Online at www.guggenheimfunds.com, you will find:

| • | Daily and historical fund pricing, fund returns, portfolio holdings and characteristics, and distribution history. |

| | |

| • | Investor guides and fund fact sheets. |

| | |

| • | Regulatory documents including a prospectus and copies of shareholder reports. |

Guggenheim Funds Distributors, LLC is constantly updating and expanding shareholder information services on each Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment.

DEAR SHAREHOLDER

Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”) is pleased to present the annual shareholder report for eight of our exchange-traded funds (“ETFs” or “Funds”), including the Guggenheim Yuan Bond ETF, a new Fund introduced in 2011.

The Investment Adviser is now a part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

This report covers performance of the following eight Funds for the annual fiscal period ended May 31, 2012, with the name of each Fund followed by its NYSE Arca ticker symbol:

| - | Guggenheim Canadian Energy Income ETF (ENY) |

| | |

| - | Guggenheim China Real Estate ETF (TAO) |

| | |

| - | Guggenheim China Small Cap ETF (HAO) |

| | |

| - | Guggenheim Frontier Markets ETF (FRN) |

| | |

| - | Guggenheim International Multi-Asset Income ETF (HGI) |

| | |

| - | Guggenheim Shipping ETF (SEA) |

| | |

| - | Guggenheim Timber ETF (CUT) |

| | |

| - | Guggenheim Yuan Bond ETF (RMB) |

Guggenheim Funds Distributors, LLC, the distributor of the Funds, is committed to providing investors with innovative investment solutions; as of the date of this report we offer 44 ETFs with a wide range of domestic and global themes, as well as closed-end funds and unit investment trusts. We have built on the investment management strengths of Guggenheim Investments and worked with a diverse group of index providers to create some of the most distinctive ETFs available.

To learn more about economic and market conditions over the last year and the objective and performance of each ETF, we encourage you to read the Economic and Market Overview section of the report, which follows this letter, and the Management Discussion of Fund Performance for each ETF, which begins on page 6.

Sincerely,

Donald Cacciapaglia

Chief Executive Officer

Claymore Exchange-Traded Fund Trust 2

June 30, 2012

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 3 |

| ECONOMIC AND MARKET OVERVIEW | May 31, 2012 |

Securities markets exhibited considerable volatility over the past 12 months, driven largely by concerns about sovereign debt in several European nations, a fledgling U.S. economic recovery and the sustainability of economic growth in Asia. Risk aversion in fall 2011 and again in May 2012 drove investors toward dollar-denominated assets, sending rates on U.S. Treasury bonds to near historic lows. Fixed income securities generally provided positive returns over the period, including riskier bonds, while returns from equities were generally negative.

Weak economic reports in May 2012 indicated that the world’s major economies were beginning to slip in unison, and both the Organization for Economic Cooperation and Development and the International Monetary Fund forecast lower global growth for 2012. This was in spite of recent efforts from leading central bankers to recharge the global economy, including a restructuring of Greece’s debt that enabled a new international bailout earlier in 2012, and an injection of liquidity from the European Central Bank in December that lessened financial stresses across the continent and contributed to improvement in global financial markets. However, manufacturing gauges in March 2012 indicated that the eurozone was entering a period of economic contraction, meaning that policy makers may need to do more to revive growth across the region and keep the problem from infecting other countries.

Although the U.S. was stronger economically than many countries, slowing growth and job creation late in the period indicated the economy is having difficulty gaining traction. In May 2012, U.S. gross domestic product (GDP) was reported to have grown at an annualized 1.9% pace in the first quarter of 2012, compared with estimates of more than 2.0%, and a 3.0% rate in the fourth quarter of 2011. But the GDP report did show that the lower first quarter growth was partly a result of less inventory building. As companies replenish stocks later in the year, the economy could get a boost. Many firms have been cautious in spending and hiring, even though corporate profits have continued to rise, although at a pace lower than in recent quarters. Economists say many companies are near the limit of what they produce without adding staff and equipment.

To foster growth, the U.S. Federal Reserve (the “Fed”) has said it will leave its key interest rate close to zero at least through 2014, despite arguments by some Fed officials and investors that the Fed may have to consider raising rates much earlier than that to prevent inflation. For now, the Fed’s leadership appears to be committed to keeping rates low, thus reducing borrowing costs for businesses and consumers, and seems prepared to sustain quantitative easing if the employment and growth picture worsens.

For the 12-month period ended May 31, 2012, the Standard & Poor’s 500 Index (the “S&P”), which is generally regarded as an indicator of the broader U.S. stock market, returned -0.41%, with periods of decline last summer and again near the end of the period. Most foreign markets were much weaker: the Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East Index (“EAFE”) Index, which is composed of approximately 1,100 companies in 20 developed countries in Europe and the Pacific Basin, returned -20.49%. The return of the MSCI Emerging Market Index, which measures market performance in global emerging markets, returned -20.32%. The MSCI China Index, which measures performance of the broad Chinese equity market, returned -20.79% for the 12-month period ended May 31, 2012.

In the bond market, higher quality issues performed better than lower-rated bonds, as investors sought to avoid risk. The return of the Barclays Capital U.S. Aggregate Bond Index, which is a proxy for the U.S. investment grade bond market, posted a 7.12% return for the period, while the Barclays Capital U.S. Corporate High Yield Index returned 4.14%. Reflecting the Fed’s continuing accommodative monetary policy, interest rates on short-term securities remained at their lowest levels in many years. The return of the Barclays Capital 1–3 Month U.S. Treasury Bill Index was 0.04% for the 12-month period.

| 4 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

Index Definitions

All indices described below are unmanaged and reflect no expenses. It is not possible to invest directly in any index.

The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

The Barclays Capital U.S. Corporate High Yield Bond Index: measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

The Barclays Capital 1-3 Month U.S. Treasury Bill Index: tracks the performance of U.S. Treasury bills with a remaining maturity of one to three months. U.S. Treasury bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury and are generally regarded as being free of any risk of default.

The Dow Jones Global Forestry & Paper Index is a float-adjusted market capitalization weighted index that provides a broad measure of the world forestry and paper markets. According to Dow Jones, the index consists of owners and operators of timber tracts, forest tree nurseries and sawmills excluding providers of finished wood products such as wooden beams, which are classified under Building Materials & Fixtures.

The MSCI China index is a capitalization weighted index that monitors the performance of stocks from the country of China.

The MSCI EAFE Index is a capitalization weighted measure of stock markets in Europe, Australasia and the Far East.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

The Bank of China Hong Kong Offshore RMB Bond Index tracks the total return performance of offshore RMB denominated bonds which are issued outside the Mainland of China and fulfill a set of pre-specified and transparent criteria for eligibility.

The Standard & Poor’s (“S&P”) 500 Index is a capitalization weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of U.S. stock market.

The S&P/TSX Composite Index is a capitalization weighted index. The index is designed to measure performance of the broad Canadian economy through changes in the aggregate market value of stocks representing all major industries.

The STOXX Europe Total Market Forestry & Paper Index represents the European forestry and paper industry as defined by the market standards of ICB (Industry Classification Benchmark).

Industry Sectors

Comments about industry sectors in these fund commentaries are based on Bloomberg industry classifications.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 5 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE | May 31, 2012 |

ENY Guggenheim Canadian Energy Income ETF

Fund Overview

The Guggenheim Canadian Energy Income ETF, NYSE Arca ticker: ENY

(the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Sustainable Canadian Energy Income Index (the “Index”).

The Index is comprised of approximately 30 stocks selected, based on investment and other criteria, from a universe of companies listed on the Toronto Stock Exchange (the “TSX”), NYSE AMEX, Nasdaq Stock Market or New York Stock Exchange. The universe of companies includes approximately 200 TSX-listed oil and gas sector securities including royalty trusts and approximately 25 oil sands resource producers that are classified as oil and gas producers. The companies in the universe are selected using criteria as identified by Sustainable Wealth Management, Ltd. (the “Index Provider”).

The Fund will invest at least 90% of its total assets in securities that comprise the Index. Guggenheim Funds Investment Advisors, LLC, the Fund’s investment adviser, seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the stocks comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited – whether based on net asset value (“NAV”) or market price – assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2012.

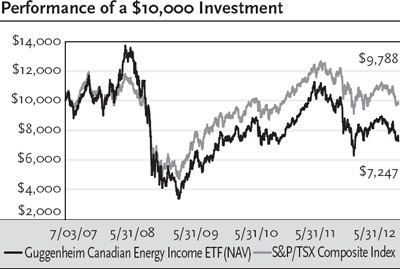

On a market price basis, the Fund generated a total return of -31.00%, which included a decrease in market price over the period to $14.73 as of May 31, 2012, from $22.06 on May 31, 2011. On an NAV basis, the Fund generated a total return of -30.45%, which included a decrease in NAV over the period to $14.83 as of May 31, 2012, from $22.03 on May 31, 2011.

At the end of the period the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time.

For underlying index and broad Canadian equity market comparison purposes, the Index returned -29.41% and the S&P/TSX Composite Index (“S&P/TSX”) returned -19.54% for the 12-month period ended May 31, 2012.

The Fund made quarterly distributions per share of $0.105 on June 30, 2011; $0.106 on September 30, 2011; $0.141 on December 30, 2011; and $0.118 on March 30, 2012.

In addition, the Fund made a supplemental distribution of $0.086 per share on December 30, 2011, which was characterized as ordinary income.

Performance Attribution

Since more than 90% of the Fund’s portfolio is invested in the energy sector, the return of this sector was the main determinant of the Fund’s return, and it was the major source of the Fund’s negative return for the 12-month period ended May 31, 2012. The Fund also has positions in the utilities and industrial sectors, which had minimal impact on the Fund’s return.

Positions that contributed most significantly to the Fund’s return included Sinopec Daylight Energy Ltd., which is engaged in oil and gas exploration, exploitation, development and production in Alberta and British Columbia (not held in the Fund’s portfolio at period end); PetroBakken Energy Ltd., Class A, which explores for and produces light oil in Canada (0.9% of the Fund’s long-term investments at period end); and Provident Energy Ltd., which owns and operates a natural gas liquids midstream services and marketing business (not held in the Fund’s portfolio at period end). Positions that detracted most significantly included Connacher Oil & Gas Ltd., an integrated energy company (not held in the Fund’s portfolio at period end); BlackPearl Resources, Inc., an oil and gas exploration company (4.6% of the Fund’s long-term investments at period end) and Petrobank Energy & Resources Ltd., which explores for and develops oil and natural gas in Alberta, Canada (4.3% of the Fund’s long-term investments at period end).

| 6 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | May 31, 2012 |

TAO Guggenheim China Real Estate ETF

Fund Overview

The Guggenheim China Real Estate ETF, NYSE Arca ticker: TAO (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China Real Estate Index (the “Index”).

The Index is designed to measure and monitor the performance of the investable universe of publicly-traded companies and real estate investment trusts (REITs) which are open to foreign ownership and derive a majority of their revenues from real estate development, management and/or ownership of property in China or the Special Administrative Regions of China, such as Hong Kong and Macau. The Index was created by AlphaShares, LLC and is maintained by Standard & Poor’s.

The Fund will invest at least 90% of its total assets in common stock, American Depositary Receipts (ADRs), American Depositary Shares (ADSs), Global Depositary Receipts (GDRs) and International Depositary Receipts (IDRs) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs, ADSs, GDRs and IDRs included in the Index). Guggenheim Funds Investment Advisors, LLC, the Fund’s investment adviser, seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2012.

On a market price basis, the Fund generated a total return of -15.49%, which included a decrease in market price over the period to $16.74 as of May 31, 2012, from $20.07 on May 31, 2011. On an NAV basis, the Fund generated a total return of -15.90%, which included a decrease in NAV over the period to $16.72 as of May 31, 2012, from $20.14 on May 31, 2011. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and market comparison purposes, the Index returned -15.52% and the MSCI China Index, which measures performance of the Chinese equity market, returned

-20.79% for the same period.

The Fund made an annual distribution on December 30, 2011, of $0.193 per share, which was characterized as ordinary income.

Performance Attribution

Nearly all of the Fund’s investments are in the real estate holding and development businesses and are classified in the financial and diversified sectors. For the 12-month period ended May 31, 2012, both sectors detracted from the Fund’s return. The top-three contributors to return were in the financial sector. They were Link Real Estate Investment Trust, a real estate investment trust (REIT) based in Hong Kong that invests mainly in retail and car park facilities; China Resources Land Ltd., which through its subsidiaries develops and invests in properties and provides corporate financing and electrical engineering services; and China Overseas Land & Investment Ltd., which through its subsidiaries develops and invests in properties, constructs buildings and invests in Treasury securities and infrastructure projects (4.6%, 4.0% and 5.3%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included Wharf Holdings Ltd., an investment holding company based in Hong Kong; Hongkong Land Holdings Ltd., a property investment, management and development group; and Cheung Kong Holdings Ltd., a Hong Kong-based company that invests in and manages property development and investment projects and hotel and serviced suite operations (5.1%, 5.3% and 4.5%, respectively, of the Fund’s long-term investments at period end).

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 7 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | May 31, 2012 |

HAO Guggenheim China Small Cap ETF

Fund Overview

The Guggenheim China Small Cap ETF, NYSE Arca ticker: HAO (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China Small Cap Index (the “Index”).

The Index is designed to measure and monitor the performance of publicly-traded mainland China-based small capitalization companies. The Index was created by AlphaShares, LLC (“AlphaShares”) and is maintained by Standard & Poor’s. For inclusion in the Index, AlphaShares defines small-capitalization companies as those companies with a maximum $1.5 billion float-adjusted market capitalization.

The Fund will invest at least 90% of its total assets in common stock, American Depositary Receipts (“ADRs”), American Depositary Shares (“ADSs”), Global Depositary Receipts (“GDRs”) and International Depositary receipts (“IDRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs, ADSs, GDRs and IDRs included in the Index).

Guggenheim Funds Investment Advisors, LLC, the Fund’s investment adviser, seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2012.

On a market price basis, the Fund generated a total return of -29.15%, which included a decrease in market price over the period to $20.01 as of May 31, 2012, from $29.15 on May 31, 2011. On an NAV basis, the Fund generated a total return of -29.50%, which included a decrease in NAV over the period to $19.97 as of May 31, 2012, from $29.23 on May 31, 2011. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and broad market comparison purposes, the Index returned -28.56% and the MSCI China Index, which measures performance of the broad Chinese equity market, returned -20.79% for 12-month period ending May 31, 2012.

The Fund made an annual distribution of $0.620 per share on December 30, 2011, which was characterized as ordinary income.

Performance Attribution

For the 12-month period ended May 31, 2012, none of the sectors represented in the Fund contributed positively to the Fund’s return, with the consumer cyclical sector detracting most and utilities detracting least. Positions that contributed most significantly to the Fund’s return included Alibaba.com Ltd., which is a business-to-business e-commerce company that operates an English-language marketplace for global importers and exporters, as well as a Chinese-language marketplace for domestic China trade and a Japanese-language marketplace facilitating trade to and from Japan; Zoomlion Heavy Industry Science and Technology Co. Ltd., which manufactures and markets construction machinery, environmental machinery and satellite navigation products; and Shimao Property Holdings Ltd., which develops real estate projects in China (1.9%, 1.7% and 1.4%, respectively, of the Fund’s common stocks at period end). Positions that detracted most significantly from the Fund’s return included Renhe Commercial Holdings Co. Ltd., which develops underground shopping centers in China; Zhaojin Mining Industry Co. Ltd., which explores, mines, and produces gold; and Semiconductor Manufacturing International Corp., which manufactures, trades, packages, tests, and provides computer-aided design integrated circuits (0.3%, 0.8% and 0.5%, respectively, of the Fund’s common stocks at period end).

| 8 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | May 31, 2012 |

FRN Guggenheim Frontier Markets ETF

Fund Overview

The Guggenheim Frontier Markets ETF, NYSE Arca ticker: FRN (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the BNY Mellon New Frontier DR Index (the “Frontier Index”).

The Frontier Index is composed of and tracks the performance of all liquid, as defined by BNY Mellon, the Fund’s index provider (the “Index Provider”), American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) that trade on the London Stock Exchange (“LSE”), New York Stock Exchange (“NYSE”), NYSE Arca, Inc. (“NYSE Arca”), NYSE AMEX and Nasdaq Stock Market (“NASDAQ”) of Frontier Market countries, as defined by the Index Provider. The Index Provider defines Frontier Market countries based upon an evaluation of gross domestic product growth, per capita income growth, experienced and expected inflation rates, privatization of infrastructure and social inequalities. The countries currently are: Argentina, Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, United Arab Emirates, Egypt, Ghana, Kenya, Malawi, Mauritius, Morocco, Nigeria, Tunisia, Zimbabwe, Bulgaria, Croatia, Czech Republic, Estonia, Georgia, Kazakhstan, Latvia, Lithuania, Poland, Romania, Slovak Republic, Slovenia, Ukraine, Bangladesh, Pakistan, Papua New Guinea, Sri Lanka, Vietnam, Peru, Chile, Colombia, Ecuador, Jamaica, Panama, Trinidad and Tobago. An ADR or GDR is determined to be liquid based upon an assessment of trading volume and market capitalization.

The Fund will invest at least 80% of its total assets in ADRs and GDRs that comprise the Index or in the stocks underlying such ADRs and GDRs. The Fund also will invest at least 80% of its total assets in securities of issuers from Frontier Market countries (whether directly or through ADRs or GDRs), as defined by the Index Provider. Guggenheim Funds Investment Advisors, LLC, the Fund’s investment adviser, seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the stocks comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2012.

On a market price basis, the Fund generated a total return of -12.27%, which included a decrease in market price over the period to $19.26 as of May 31, 2012, from $22.95 on May 31, 2011. On an NAV basis, the Fund generated a total return of -14.16%, which included a decrease in NAV over the period to $19.08 as of May 31, 2012, from $23.23 on May 31, 2011.

At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and broad emerging market comparison purposes, the Frontier Index returned -12.59% and the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index returned -20.32% for the 12-month period ending May 31, 2012.

The Fund made an annual distribution of $0.824 per share on December 30, 2011, which was characterized as ordinary income.

Performance Attribution

For the 12-month period ending May 31, 2012, all sectors but one in which the Fund was invested had negative returns, detracting from the Fund’s return. The energy sector made a slight contribution to return, and the financial sector detracted most. Positions that contributed most significantly to the Fund’s return included Ecopetrol SA, ADR, an integrated oil company that owns interests in oil producing fields, refineries, ports and a transportation network throughout Colombia; Cia Cervecerias Unidas SA, ADR, a beer brewer and distributor of non-alcoholic beverages in Chile and Argentina; and Banco de Chile ADR, a deposit-gathering bank that offers retail and commercial banking services (11.3%, 2.0% and 3.9%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included YPF SA, which explores for, develops, and produces oil and natural gas in South America, the United States, and Indonesia; Enersis SA, a Chilean company that generates and distributes electric energy; and Telecom Argentina SA, which provides telecommunications services in Argentina (1.1%, 5.8% and 1.4%, respectively, of the Fund’s long-term investments at period end).

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 9 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | May 31, 2012 |

HGI Guggenheim International Multi-Asset Income ETF

Fund Overview

The Guggenheim International Multi-Asset Income ETF, NYSE Arca ticker: HGI (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an index called the Zacks International Multi-Asset Income Index (the “Index”).

The Index is comprised of approximately 150 securities selected, based on investment and other criteria, from a universe of international companies, global real estate investment trusts (“REITs”), master limited partnerships (“MLPs”), Canadian royalty trusts, and American Depositary Receipts (“ADRs”) of emerging market companies and U.S. listed closed-end funds that invest in international companies, and at all times is comprised of at least 40% non-U.S. securities. The companies in the universe are selected using a proprietary strategy developed by Zacks Investment Research, Inc.

The Fund will invest at least 90% of its total assets in securities that comprise the Index and underlying securities representing the ADRs included in the Index. Guggenheim Funds Investment Advisors, LLC, the Fund’s investment adviser, seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2012.

On a market price basis, the Fund generated a total return of -20.81%, which included a decrease in market price over the period to $15.09 as of May 31, 2012, from $20.02 on May 31, 2011. On an NAV basis, the Fund generated a total return of -20.86%, which included a decrease in NAV over the period to $15.05 as of May 31, 2012, from $19.98 on May 31, 2011. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and broad market comparison purposes, the Index returned -19.88% and the Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index, an index designed to reflect the movements of stock markets in developed countries of Europe and the Pacific Basin, returned -20.49% for the same period.

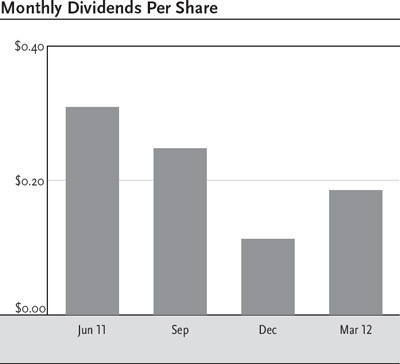

The Fund made quarterly distributions per share of $0.309 on June 30, 2011, $0.247 on September 30, 2011, $0.113 on December 30, 2011 and $0.185 on March 30, 2012.

Performance Attribution

For the 12-month period ended May 31, 2012, all but one sector in which the Fund was invested had negative returns, detracting from the Fund’s return. The utilities sector contributed slightly to the Fund’s return, while the financial sector detracted most. Positions that contributed most significantly to the Fund’s return included Huaneng Power International, Inc., ADR, which builds and operates power plants in China; SandRidge Mississippian Trust I, which owns royalty interests in producing and developing oil wells in the Mississippian formation in Oklahoma; and Ecopetrol SA, ADR, an integrated oil company that owns interests in oil producing fields, refineries, ports and a transportation network throughout Colombia (1.1%, 2.2% and 0.8%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included Alon Holdings Blue Square Israel Ltd., an Israeli company that operates retail stores and commercial real estate properties (not held in the Fund’s portfolio at period end); Enerplus Corp., a Canadian oil and gas exploration and production company that owns a large, diversified portfolio of income generating crude oil and natural gas properties (1.8% of the Fund’s long-term investments at period end); and Penn West Petroleum Ltd., an oil and natural gas producer based in Alberta, Canada (1.9% of the Fund’s long-term investments at period end).

| 10 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | May 31, 2012 |

SEA Guggenheim Shipping ETF

Fund Overview

The Guggenheim Shipping ETF, NYSE Arca ticker: SEA (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Dow Jones Global Shipping IndexSM (the “Index”).

The Index is designed to measure the performance of high dividend-paying companies in the global shipping industry. CME Group Index Services LLC (the “Index Provider”) uses a rules-based methodology to rank companies by yield that are involved in the shipping industry globally that primarily transport goods and materials. The Index Provider considers a company to be in the shipping industry if its revenues are derived primarily from shipping activities (excluding companies solely involved in transporting passengers). The Index Provider determines whether a company is “high-dividend paying” by ranking it relative to other companies in the shipping industry based upon indicated annual yield (most recent distribution annualized and divided by the current share price). Prior to July 27, 2011, the Fund sought to replicate, before the Fund’s fees and expenses, the performance of the Delta Global Shipping Index.

The Fund will at all times invest at least 90% of its total assets in common stock, American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”) and master limited partnerships (“MLPs”) that comprise the Index and the underlying stocks in respect of the ADRs and GDRs in the Index. Guggenheim Funds Investment Advisors, LLC, the Fund’s investment adviser, seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2012.

On a market price basis, the Fund generated a total return of -32.10%, which included a decrease in market price over the period to $15.99 as of May 31, 2012, from $24.67 on May 31, 2011. On an NAV basis, the Fund generated a total return of -31.98%, which included a decrease in NAV over the period to $16.03 as of May 31, 2012, from $24.69 on May 31, 2011. At the end of the period the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time.

For underlying index and broad market comparison purposes, the Index returned -27.61% and the MSCI World Index, an index designed to measure the equity market performance of developed markets, returned -11.02% for the same period.

The Fund made quarterly distributions per share of $0.684 on June 30, 2011, $0.077 on September 30, 2011, $0.092 on December 30, 2011 and $0.103 on March 30, 2012.

Performance Attribution

Most of the Fund’s portfolio is invested in the industrial sector, and it was the largest detractor from return. The non-cyclical consumer sector was the only contributor to return. Positions that contributed most to the Fund’s return included Teekay LNG Partners, LP, a provider of marine transportation services to producers of liquefied natural gas, liquefied petroleum gas and crude oil; Alexander & Baldwin, Inc., which includes a subsidiary that is engaged in real estate and agricultural businesses that develop real property in Hawaii and the mainland, and grows sugar cane and coffee; and Seaspan Corp., which operates a fleet of containerships (4.7%, 6.1% and 3.6%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included three Japanese marine transportation companies: Mitsui OSK Lines Ltd.; Nippon Yusen KK; and Kawasaki Kisen Kaisha Ltd. (8.8%, 9.6% and 4.4%, respectively, of the Fund’s long-term investments at period end).

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 11 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | May 31, 2012 |

CUT Guggenheim Timber ETF

Fund Overview

The Guggenheim Timber ETF, NYSE Arca ticker: CUT (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Beacon Global Timber Index (the “Index”).

All securities in the Index are selected from the universe of global timber companies. Beacon Indexes LLC (“Beacon” or the “Index Provider”) defines global timber companies as firms who own or lease forested land and harvest the timber from such forested land for commercial use and sale of wood-based products, including lumber, pulp or other processed or finished goods such as paper and packaging.

The Fund will invest at least 90% of its total assets in common stock, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs and GDRs included in the Index). Guggenheim Funds Investment Advisors, LLC, the Fund’s investment adviser, seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2012.

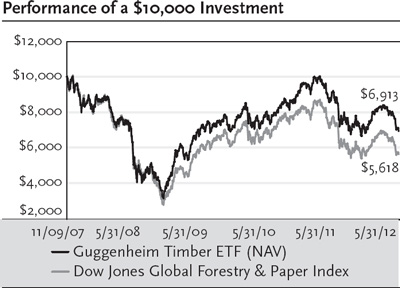

On a market price basis, the Fund generated a total return of -27.98%, which included a decrease in market price over the period to $15.75 as of May 31, 2012, from $22.38 on May 31, 2011. On an NAV basis, the Fund generated a total return of -28.20%, which included a decrease in NAV over the period to $15.71 as of May 31, 2012, from $22.39 on May 31, 2011. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and broad world market comparison purposes, the Index returned -27.36%; the Dow Jones Global Forestry & Paper Index returned -31.94%; and the MSCI World Index, an index designed to measure the equity market performance of developed markets, returned -11.02% for the same period.

The Fund made an annual distribution of $0.387 per share on December 30, 2011, which was characterized as ordinary income.

Performance Attribution

Since approximately 70% of the Fund’s portfolio is invested in the basic materials sector, return of this sector is the main determinant of the Fund’s return, and it was the major detractor from the Fund’s return for the 12-month period ended May 31, 2012. The Fund also has positions in the energy, financial and industrial sectors, all of which detracted from the Fund’s return.

Positions that contributed most significantly to the Fund’s return included American paper manufacturer Wausau Paper Corp. (not held in the Fund’s portfolio at period end); Weyerhaeuser Co., an integrated forest products company (5.0% of the Fund’s long-term investments at period end); and Rayonier Inc. REIT, an international forestry products company (5.2% of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included Fibria Celulose SA, a Brazilian company involved in the renewable forest business (4.1% of the Fund’s long-term investments at period end); Smurfit Kappa Group PLC, one of the world’s largest integrated manufacturers of paper-based packaging products, with operations in Europe and Latin America (3.5% of the Fund’s long-term investments at period end); and Sino-Forest Corporation, a commercial forest plantation operator in the People’s Republic of China (not held in the Fund’s portfolio at period end).

| 12 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | May 31, 2012 |

RMB Guggenheim Yuan Bond ETF

Fund Overview

The Guggenheim Yuan Bond ETF, NYSE Arca ticker: RMB (the “Fund”) seeks to replicate, before the Fund’s fees and expenses, the performance of the AlphaShares China Yuan Bond Index (the “Index”). The Index is a rules-based index comprised of, as of December 2, 2011, approximately 44 securities. The securities in the Index are bonds that are eligible for investment by U.S. and other foreign investors and denominated in Chinese Yuan, whether issued by Chinese or non-Chinese issuers and traded in the secondary market, a market commonly referred to as the “Dim Sum” bond market. The Fund will not invest in securities traded in mainland China. The Index includes bonds issued by mainland Chinese entities with a minimum of Yuan 1 billion outstanding par value, as well as bonds issued by non-mainland Chinese entities (which have no minimum outstanding par value requirement). All of the bond issues or issuers must have an investment grade rating by Moody’s Investors Service, Standard & Poor’s Ratings Services and/or Fitch Ratings. Bonds must have a minimum of one year maturity for inclusion in the Index. Only bonds that pay a fixed periodic coupon, that delay coupon payments until maturity, zero coupon bonds or floating rate bonds are eligible for inclusion in the Index. The interest rates of the floating rate bonds in the Index typically adjust based upon the then-current Shanghai Interbank Offered Rate on a quarterly basis. The Chinese Yuan-denominated debt securities in which the Fund invests are currently not listed on a stock exchange or a primary securities market where trading is conducted on a regular basis. The Index was created by AlphaShares, LLC and is maintained by Interactive Data Corporation.

The Fund will invest at least 80% of its total assets in fixed income securities that comprise the Index. Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”), J.P. Morgan Investment Management, Inc. (“JPMIM”) and JF International Management Inc. (“JFIMI,” together with JPMIM, the “Investment Sub-Advisers”) seek a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation.

The Fund uses a sampling approach in seeking to achieve its investment objective. Sampling means that the Investment Adviser and Investment Sub-Advisers use quantitative analysis to select securities from the Index universe to obtain a representative sample of securities that resemble the Index in terms of key risk factors, performance attributes and other characteristics. These characteristics include maturity, credit quality, duration and other financial characteristics of fixed income securities.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the abbreviated annual fiscal period from the Fund’s inception date of September 22, 2011, through May 31, 2012.

On a market price basis, the Fund generated a total return of 1.29%, which included an increase in market price over the period to $25.16 as of May 31, 2012, from $25.00 at inception. On an NAV basis, the Fund generated a total return of -0.31%, which included a decrease in NAV over the period to $24.76 as of May 31, 2012, from $25.00 at inception. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and Chinese bond market comparison purposes, the Index returned 0.17% and the Bank of China Hong Kong Offshore RMB Bond Index, which also measures the performance of the Dim Sum bond market, but includes both investment grade and below investment grade rated securities, returned -0.22% for the period from the Fund’s inception date through May 31, 2012.

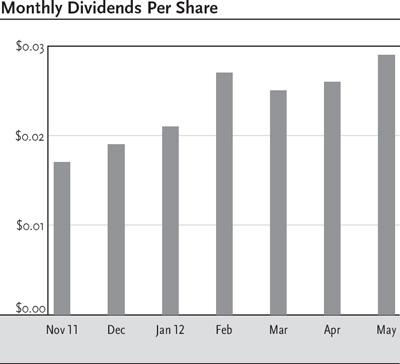

The Fund made the following monthly distributions per share during the abbreviated annual period ended May 31, 2012, all of which were characterized as ordinary income.

| Month | Distribution per Share |

| November 2011 | $ | 0.017 |

| December | $ | 0.019 |

| January 2012 | $ | 0.021 |

| February | $ | 0.027 |

| March | $ | 0.025 |

| April | $ | 0.026 |

| May | $ | 0.029 |

Performance Attribution

For the period since inception through May 31, 2012, the sovereign sector made the largest contribution to return, followed by the auto manufacturers sector. The food and diversified holding companies sectors detracted most from the Fund’s return. Positions that contributed most significantly to the Fund’s return included 1.8% coupon 2015 bonds issued by the Government of China; 2.15% coupon 2016 bonds issued by Volkswagen International Finance NV, which provides financing of and participation in companies belonging to Volkswagen AG group; and two series of bonds issued by the Government of China: 1.4% coupon 2016 bonds and 0.6% coupon 2014 bonds (7.9%, 3.1%, 6.2% and 3.1% of the Fund’s total investments at period end). Positions that detracted most significantly from the Fund’s return included 2.7% coupon 2013 bonds issued by China Development Bank Corp. (9.9% of the Fund’s total investments at period end); 1.0% coupon 2013 bonds issued by the Hong Kong Ministry of Finance (not held in the Fund’s portfolio at period end); and 1.1% coupon 2014 bonds issued by Fonterra Cooperative Group Ltd., a New Zealand dairy cooperative (not held in the Fund’s portfolio at period end).

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 13 |

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers and Guggenheim Funds Investment Advisors, LLC only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass.

This information does not represent an offer to sell securities of the Funds and it is not soliciting an offer to buy securities of the Funds. An investment in the various Guggenheim Funds ETFs is subject to certain risks and other considerations. Below are some general risks and considerations associated with investing in a Fund, which may cause you to lose money, including the entire principal that you invest. Please refer to the individual ETF prospectus for a more detailed discussion of Fund-specific risks and considerations.

Equity Risk: The value of the securities held by the Funds will fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Funds participate, or factors relating to specific companies in which the Funds invest.

Foreign Investment Risk: Investing in non-U.S. issuers may involve unique risks such as currency, political, and economic risk, as well as less market liquidity, generally greater market volatility and less complete financial information than for U.S. issuers.

Small and Medium-Sized Company Risk: Investing in securities of these companies involves greater risk as their stocks may be more volatile and less liquid than investing in more established companies. These stocks may have returns that vary, sometimes significantly, from the overall stock market.

Non-Correlation Risk: The Funds’ return may not match the return of the Index including, but not limited to, operating expenses and costs in buying and selling securities to reflect changes in the Index. The Fund may not be fully invested at times. If the Fund utilizes a sampling approach or futures or other derivative positions, its return may not correlate with the Index return, as would be the case if it purchased all of the stocks with the same weightings as the Index.

Replication Management Risk: The Funds are not “actively” managed. Therefore, it would not necessarily sell a stock because the stock’s issuer was in financial trouble unless that stock is removed from the Index.

Issuer-Specific Changes: The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The value of securities of smaller issuers can be more volatile than that of larger issuers.

Non-Diversified Fund Risk: The Funds can invest a greater portion of assets in securities of individual issuers than a diversified fund. Changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Industry Risk: If the Index is comprised of issuers in a particular industry or sector, the Fund would therefore be focused in that industry or sector. Accordingly, the Fund may be subject to more risks than if it were broadly diversified over numerous industries and sectors of the economy.

Emerging Markets Risk (CUT, FRN, HGI, TAO, HAO, RMB): Investment in securities of issuers based in developing or “emerging market” countries entails all of the risks of investing in securities of non-U.S. issuers, as previously described, but to a heightened degree.

Canadian Risk (ENY and HGI): Investing in Canadian royalty trusts and stocks listed on the TSX are subject to: Commodity Exposure Risk, Reliance on Exports Risk, U.S. Economic Risk and Structural Risk (Political Risk).

Master Limited Partnership (MLP) Risk (FRN and HGI): Investments in securities of MLPs involve risks that differ from an investment in common stock. Holders of the units of MLPs have more limited control and limited rights to vote on matters affecting the partnership. There are also certain tax risks associated with an investment in units of MLPs.

China Investment Risk (HAO, TAO and RMB): Investing in securities of Chinese companies involves additional risks, including, but not limited to: the economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources and capital reinvestment, among others; the central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership; and actions of the Chinese central and local government authorities continue to have a substantial effect on economic conditions in China. See prospectus for more information.

REIT Risk (CUT, HGI and TAO): Investments in securities of real estate companies involve risks. These risks include, among others, adverse changes in national, state or local real estate conditions; obsolescence of properties; changes in the availability, cost and terms of mortgage funds; and the impact of changes in environmental laws.

Risks of Investing In Other Investment Companies (HGI): Investments in these securities involve risks, including, among others, that shares of other investment companies are subject to the management fees and other expenses of those companies, and the purchase of shares of some investment companies (in the case of closed-end investment companies) may sometimes require the payment of substantial premiums above the value of such companies’ portfolio securities or net asset values.

Risks of Investing in Frontier Securities (FRN): Investment in securities in emerging market countries involves risks not associated with investments in securities in developed countries, including risks associated with expropriation and/or nationalization, political or social instability, armed conflict, the impact on the economy as a result of civil war, religious or ethnic unrest and the withdrawal or non-renewal of any license enabling the Fund to trade in securities of a particular country, confiscatory taxation, restrictions on transfers of assets, lack of uniform accounting, auditing and financial reporting standards, less publicly available financial and other information, diplomatic development which could affect U.S. investments in those countries and potential difficulties in enforcing contractual obligations. Frontier countries generally have smaller economies or less developed capital markets than traditional emerging markets, and, as a result, the risk of investing in emerging market countries are magnified in frontier countries. As of the date of this prospectus, a significant percentage of the Index is comprised of securities of companies from Poland, Chile and Egypt. To the extent that the index is focused on securities of any one country, including Poland, Chile or Egypt, the value of the index will be especially affected by adverse developments in such country, including the risks described above. Please note: the above risks are a broad overview of the potential risks associated with investing in the Frontier markets. Investing in securities of Frontier countries involves significant risk. The prospectus contains a more detailed discussion of these individual risks and should be evaluated when determining an investor’s risk tolerance.

Foreign Issuers Risk (RMB): Investments in Chinese Yuan-denominated bonds of foreign corporations, governments, agencies and instrumentalities are supranational agencies which have different risks than investing in U.S. companies.

Currency Risk (RMB): Changes in currency exchange rates and the relative value of the Chinese Yuan will affect the value of the Fund’s investment and the value of your Shares. Because the Fund’s net asset value (“NAV”) is determined on the basis of U.S. dollars, the U.S. dollar value of your investment in the Fund may go down if the value of the Chinese Yuan depreciates against the U.S. dollar.

Securities Lending Risk: Although each Fund will receive collateral in connection with all loans of its securities holdings, the Fund would be exposed to a risk of loss should a borrower default on its obligation to return the borrowed securities (e.g., the loaned securities may have appreciated beyond the value of the collateral held by the Fund). In addition, the Funds will bear the risk of loss of any cash collateral that they invest.

In addition to the risks described, there are certain other risks related to investing in the Funds. These risks are described further in the Prospectus and Statement of Additional Information.

| 14 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| FUND SUMMARY & PERFORMANCE (Unaudited) | May 31, 2012 |

ENY Guggenheim Canadian Energy Income ETF

| | | | | |

| Fund Statistics | | | | |

| Share Price | | $ | 14.73 | |

| Net Asset Value | | $ | 14.83 | |

| Premium/Discount to NAV | | | -0.67 | % |

| Net Assets ($000) | | $ | 90,015 | |

| Total Returns | | | | | | | | | | |

| | | | | | | Three | | Since |

| | | | One | | Year | | Inception |

| (Inception 7/3/07) | | | Year | | (Annualized) | | (Annualized) |

| Guggenheim Canadian | | | | | | | | | | |

| Energy Income ETF | | | | | | | | | | |

| NAV | | | -30.45 | % | | 5.13 | % | | -6.35 | % |

| Market | | | -31.00 | % | | 4.21 | % | | -6.49 | % |

| Sustainable Canadian | | | | | | | | | | |

| Energy Income Index | | | -29.41 | % | | 6.70 | % | | -4.67 | % |

| S&P/TSX Composite Index | | | -19.54 | % | | 8.40 | % | | -0.43 | % |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $25.05 per share for share price returns or initial net asset value (NAV) of $25.05 per share for NAV returns. Returns for periods of less than one year are not annualized.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.84%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.70% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.79%. There is a contractual fee waiver currently in place for this Fund through December 31, 2014 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Portfolio Breakdown | % of Net Assets |

| Energy | 97.5% |

| Utilities | 1.2% |

| Industrial | 1.2% |

| Total Long-Term Investments | 99.9% |

| Investments of Collateral for Securities Loaned | 30.5% |

| Total Investments | 130.4% |

| Liabilities in excess of Other Assets | -30.4% |

| Net Assets | 100.0% |

| | % of Long-Term |

| Country Breakdown | Investments |

| Canada | 100.0% |

| | % of Long-Term |

| Currency Denomination | Investments |

| Canadian Dollar | 100.0% |

| | % of Long-Term |

| Top Ten Holdings | Investments |

| Imperial Oil Ltd. | 7.3% |

| Suncor Energy, Inc. | 7.2% |

| Canadian Oil Sands Ltd. | 7.2% |

| Cenovus Energy, Inc. | 6.5% |

| Southern Pacific Resource Corp. | 6.2% |

| Canadian Natural Resources Ltd. | 5.3% |

| MEG Energy Corp. | 5.0% |

| BlackPearl Resources, Inc. | 4.6% |

| Baytex Energy Corp. | 4.5% |

| Athabasca Oil Corp. | 4.5% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the Standard and Poor’s Toronto Stock Exchange Composite Index (S&P/TSX Composite Index). Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The S&P/TSX Composite Index is a capitalization-weighted index. The index is designed to measure performance of the broad Canadian economy through changes in the aggregate market value of stocks representing all major industries. It is not possible to invest directly in the S&P/TSX Composite Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 15 |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | May 31, 2012 |

TAO Guggenheim China Real Estate ETF

| | | | | |

| Fund Statistics | | | | |

| Share Price | | $ | 16.74 | |

| Net Asset Value | | $ | 16.72 | |

| Premium/Discount to NAV | | | 0.12 | % |

| Net Assets ($000) | | $ | 18,558 | |

| Total Returns | | | | | | | | | | |

| | | | | | | Three | | Since |

| | | | One | | Year | | Inception |

| (Inception 12/18/07) | | | Year | | (Annualized) | | (Annualized) |

| Guggenheim China | | | | | | | | | | |

| Real Estate ETF | | | | | | | | | | |

| NAV | | | -15.90 | % | | 1.42 | % | | -5.53 | % |

| Market | | | -15.49 | % | | 0.68 | % | | -5.53 | % |

| AlphaShares China | | | | | | | | | | |

| Real Estate Index | | | -15.52 | % | | 2.16 | % | | -4.68 | % |

| MSCI China Index | | | -20.79 | % | | 2.23 | % | | -6.71 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $23.50 per share for share price returns or initial net asset value (NAV) of $23.50 per share for NAV returns. Returns for periods of less than one year are not annualized.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 1.02%. In the Financial Highlights section of the Annual Report, the Fund’s annualized net operating expense ratio was 0.70%, while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 1.35%. There is a contractual fee waiver currently in place for this Fund through December 31, 2014 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Portfolio Breakdown | % of Net Assets |

| Financials/Real Estate | 88.1% |

| Diversified | 11.2% |

| Total Common Stocks | 99.3% |

| Investments of Collateral for Securities Loaned | 6.7% |

| Total Investments | 106.0% |

| Liabilities in excess of Other Assets | -6.0% |

| Net Assets | 100.0% |

| | % of Long-Term |

| Country Breakdown | Investments |

| China | 98.8% |

| Singapore | 1.2% |

| | % of Long-Term |

| Currency Denomination | Investments |

| Hong Kong Dollar | 93.7% |

| United States Dollar | 5.8% |

| Singapore Dollar | 0.5% |

| | % of Long-Term |

| Top Ten Holdings | Investments |

| China Overseas Land & Investment Ltd. | 5.3% |

| Hongkong Land Holdings Ltd. | 5.3% |

| Wharf Holdings Ltd. | 5.1% |

| Hang Lung Properties Ltd. | 4.9% |

| Sino Land Co. Ltd. | 4.7% |

| Henderson Land Development Co. Ltd. | 4.7% |

| Link Real Estate Investment Trust, REIT | 4.6% |

| Cheung Kong Holdings Ltd. | 4.5% |

| Hang Lung Group Ltd. | 4.4% |

| Sun Hung Kai Properties Ltd. | 4.1% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI China Index is a capitalization weighted index that monitors the performance of stocks from the country of China. The index is unmanaged. It is not possible to invest directly in the MSCI China Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| 16 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | May 31, 2012 |

HAO Guggenheim China Small Cap ETF

| | | | | |

| Fund Statistics | | | | |

| Share Price | | $ | 20.01 | |

| Net Asset Value | | $ | 19.97 | |

| Premium/Discount to NAV | | | 0.20 | % |

| Net Assets ($000) | | $ | 164,773 | |

| Total Returns | | | | | | | | | | |

| | | | | | | Three | | Since |

| | | | One | | Year | | Inception |

| (Inception 1/30/08) | | | Year | | (Annualized) | | (Annualized) |

| Guggenheim China | | | | | | | | | | |

| Small Cap ETF | | | | | | | | | | |

| NAV | | | -29.50 | % | | 0.37 | % | | -3.26 | % |

| Market | | | -29.15 | % | | -0.38 | % | | -3.21 | % |

| AlphaShares China | | | | | | | | | | |

| Small Cap Index | | | -28.56 | % | | 1.47 | % | | -2.06 | % |

| MSCI China Index | | | -20.79 | % | | 2.23 | % | | -3.88 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.34 per share for share price returns or initial net asset value (NAV) of $24.34 per share for NAV returns. Returns for periods of less than one year are not annualized.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.89%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.75% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.92%. There is a contractual fee waiver currently in place for this Fund through December 31, 2014 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.70% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.70%. Without this expense cap, actual returns would be lower.

| Portfolio Breakdown | % of Net Assets |

| Industrial | 26.0% |

| Financial | 18.1% |

| Consumer, Cyclical | 16.4% |

| Consumer, Non-cyclical | 15.6% |

| Basic Materials | 9.9% |

| Communications | 4.8% |

| Utilities | 4.5% |

| Technology | 1.8% |

| Energy | 1.7% |

| Diversified | 0.4% |

| Total Long-Term Investments | 99.2% |

| Investments of Collateral for Securities Loaned | 23.4% |

| Total Investments | 122.6% |

| Liabilities in excess of Other Assets | -22.6% |

| Net Assets | 100.0% |

| | |

| | % of Long-Term |

| Country Breakdown | Investments |

| China | 99.3% |

| Singapore | 0.7% |

| | |

| | % of Long-Term |

| Currency Denomination | Investments |

| Hong Kong Dollar | 95.5% |

| United States Dollar | 3.2% |

| Singapore Dollar | 1.3% |

| | |

| | % of Long-Term |

| Top Ten Holdings | Investments |

| Alibaba.com Ltd. | 1.9% |

| Zoomlion Heavy Industry Science and Technology Co. Ltd. | 1.7% |

| Longfor Properties Co. Ltd. | 1.5% |

| Tsingtao Brewery Co. Ltd. | 1.5% |

| Shimao Property Holdings Ltd. | 1.4% |

| Guangdong Investment Ltd. | 1.3% |

| China Shanshui Cement Group Ltd. | 1.2% |

| Agile Property Holdings Ltd. | 1.2% |

| China Railway Group Ltd. | 1.2% |

| Sino-Ocean Land Holdings Ltd. | 1.2% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

| |

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 17 |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | May 31, 2012 |

HAO Guggenheim China Small Cap ETF (continued)

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI China Index is a capitalization-weighted index that monitors the performance of stocks from the country of China. The index is unmanaged. It is not possible to invest directly in the MSCI China Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| |

| 18 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | May 31, 2012 |

FRN Guggenheim Frontier Markets ETF

| | | | | |

| Fund Statistics | | | | |

| Share Price | | $ | 19.26 | |

| Net Asset Value | | $ | 19.08 | |

| Premium/Discount to NAV | | | 0.94 | % |

| Net Assets ($000) | | $ | 133,397 | |

| | | | | | | | | | | |

| Total Returns | | | | | | | | | | |

| | | | | | | Three | | Since |

| | | | One | | Year | | Inception |

| (Inception 6/12/08) | | | Year | | (Annualized) | | (Annualized) |

| Guggenheim Frontier | | | | | | | | | | |

| Markets ETF | | | | | | | | | | |

| NAV | | | -14.16 | % | | 12.20 | % | | -4.10 | % |

| Market | | | -12.27 | % | | 12.58 | % | | -3.87 | % |

| BNY Mellon New | | | | | | | | | | |

| Frontier DR Index | | | -12.59 | % | | 13.46 | % | | -3.23 | % |

| MSCI Emerging | | | | | | | | | | |

| Markets Index | | | -20.32 | % | | 7.88 | % | | -3.13 | % |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.34 per share for share price returns or initial net asset value (NAV) of $24.34 per share for NAV returns. Returns for periods of less than one year are not annualized.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.80%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.70% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.81%. There is a contractual fee waiver currently in place for this Fund through December 31, 2014 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

| | % of Long-Term |

| Country Breakdown | Investments |

| Chile | 37.3% |

| Colombia | 17.9% |

| Egypt | 10.7% |

| Peru | 8.6% |

| Argentina | 6.7% |

| Kazakhstan | 4.9% |

| Lebanon | 4.4% |

| Nigeria | 4.3% |

| Oman | 1.8% |

| Ukraine | 1.3% |

| United States | 1.1% |

| Isle of Man | 1.0% |

| | % of Long-Term |

| Currency Denomination | Investments |

| United States | 100.0% |

| Portfolio Breakdown | % of Net Assets |

| Financial | 33.7% |

| Energy | 18.0% |

| Basic Materials | 14.1% |

| Utilities | 13.0% |

| Consumer, Non-cyclical | 6.3% |

| Communications | 4.8% |

| Industrial | 4.5% |

| Consumer, Cyclical | 4.0% |

| Total Common Stocks and Preferred Stocks | 98.4% |

| Exchange Traded Fund | 1.1% |

| Investments of Collateral for Securities Loaned | 13.6% |

| Total Investments | 113.1% |

| Liabilities in excess of Other Assets | -13.1% |

| Net Assets | 100.0% |

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 19 |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | May 31, 2012 |

FRN Guggenheim Frontier Markets ETF (continued)

| | % of Long-Term |

| Top Ten Holdings | Investments |

| Ecopetrol SA, ADR | 11.3% |

| Cia de Minas Buenaventura SA, ADR | 8.1% |

| Empresa Nacional de Electricidad SA, ADR | 6.8% |

| BanColombia SA, ADR | 6.6% |

| Sociedad Quimica y Minera de Chile SA, ADR | 6.1% |

| Enersis SA, ADR | 5.8% |

| Guaranty Trust Bank PLC, GDR | 4.3% |

| KazMunaiGas Exploratin Production JSC, GDR | 4.2% |

| Banco Santander Chile, ADR | 4.0% |

| Lan Airlines SA, ADR | 4.0% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI Emerging Markets Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. It is not possible to invest directly in the MSCI Emerging Market Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| |

| 20 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | May 31, 2012 |

HGI Guggenheim International Multi-Asset Income ETF

| | | | | |

| Fund Statistics | | | | |

| Share Price | | $ | 15.09 | |

| Net Asset Value | | $ | 15.05 | |

| Premium/Discount to NAV | | | 0.27 | % |

| Net Assets ($000) | | $ | 102,306 | |

| Total Returns | | | | | | | | | | |

| | | | | | | Three | | Since |

| | | | One | | Year | | Inception |

| (Inception 7/11/07) | | | Year | | (Annualized) | | (Annualized) |

| Guggenheim International | | | | | | | | | | |

| Multi-Asset Income ETF | | | | | | | | | | |

| NAV | | | -20.86 | % | | 6.23 | % | | -5.61 | % |

| Market | | | -20.81 | % | | 6.00 | % | | -5.57 | % |

| Zacks International | | | | | | | | | | |

| Multi-Asset | | | | | | | | | | |

| Income Index | | | -19.88 | % | | 6.99 | % | | -5.01 | % |

| MSCI EAFE Index | | | -20.49 | % | | 3.39 | % | | -7.89 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in the market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.98 per share for share price returns or initial net asset value (NAV) of $24.98 per share for NAV returns. Returns for periods of less than one year are not annualized.