UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21910

Claymore Exchange-Traded Fund Trust 2

(Exact name of registrant as specified in charter)

2455 Corporate West Drive, Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Kevin M. Robinson

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant's telephone number, including area code: (630) 505-3700

Date of fiscal year end: August 31

Date of reporting period: September 1, 2011 - August 31, 2012

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

August 31, 2012

GUGGENHEIM FUNDS

ANNUAL REPORT

| ABCS | Guggenheim ABC High Dividend ETF |

| FAA | Guggenheim Airline ETF |

| YAO | Guggenheim China All-Cap ETF |

| CQQQ | Guggenheim China Technology ETF |

| TAN | Guggenheim Solar ETF |

| CGW | Guggenheim S&P Global Water Index ETF |

WWW.GUGGENHEIMFUNDS.COM

... YOUR ROAD TO THE LATEST, MOST UP-TO-DATE INFORMATION

The shareholder report you are reading right now is just the beginning of the story. Online at www.guggenheimfunds.com, you will find:

| · | Daily and historical fund pricing, fund returns, portfolio holdings and characteristics, and distribution history. |

| · | Investor guides and fund fact sheets. |

| · | Regulatory documents including a prospectus and copies of shareholder reports. |

Guggenheim Funds Distributors, LLC is constantly updating and expanding shareholder information services on each Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment.

| | |

| Contents | |

| Dear Shareholder | 3 |

| Economic and Market Overview | 4 |

| Management Discussion of Fund Performance | 6 |

| Fund Summary & Performance | 14 |

| Overview of Fund Expenses | 25 |

| Portfolio of Investments | 27 |

| Statement of Assets and Liabilities | 36 |

| Statement of Operations | 38 |

| Statement of Changes in Net Assets | 40 |

| Financial Highlights | 42 |

| Notes to Financial Statements | 48 |

| Report of Independent Registered Public | |

| Accounting Firm | 56 |

| Supplemental Information | 57 |

| Considerations Regarding Annual Review of the | |

| Investment Advisory Agreements and Investment | |

| Subadvisory Agreement | 59 |

| Trust Information | 63 |

| About the Trust Adviser | Back Cover |

August 31, 2012

DEAR SHAREHOLDER

Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”) is pleased to present the annual shareholder report for six of our exchange-traded funds (“ETFs” or “Funds”).

The Investment Adviser is now a part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

This report covers performance of the following funds for the annual period ended August 31, 2012, with the name of each Fund followed by its NYSE Arca ticker symbol:

| · | Guggenheim ABC High Dividend ETF (ABCS) |

| · | Guggenheim Airline ETF (FAA) |

| · | Guggenheim China All-Cap ETF (YAO) |

| · | Guggenheim China Technology ETF (CQQQ) |

| · | Guggenheim Solar ETF (TAN) |

| · | Guggenheim S&P Global Water Index ETF (CGW) |

Guggenheim Funds Distributors, LLC, the distributor of the Funds, is committed to providing investors with innovative investment solutions; as of the date of this report we offer 44 ETFs with a wide range of domestic and global themes, as well as closed-end funds and unit investment trusts. We have built on the investment management strengths of Guggenheim Investments and worked with a diverse group of index providers to create some of the most distinctive ETFs available.

To learn more about economic and market conditions over the 12 months ending August 2012 and the objective and performance of each ETF, we encourage you to read the Economic and Market Overview section of the report, which follows this letter, and the Management Discussion of Fund Performance for each ETF, which begins on page 6.

Sincerely,

Donald C. Cacciapaglia

Trustee and Chief Executive Officer

Claymore Exchange-Traded Fund Trust 2

September 28, 2012

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 3

| | |

| ECONOMIC AND MARKET OVERVIEW | August 31, 2012 |

A period of self-sustaining economic expansion, driven primarily by the aggressive monetary policy of the U.S. Federal Reserve (the “Fed”), and being reinforced by the European Central Bank (“ECB”), has helped the United States to become the economic locomotive of the global economy. Indeed, as the annual report period ended, the Fed was expected to embark on another round of quantitative easing to keep interest rates low and spur economic activity, responding to an unemployment rate stuck above 8% and U.S. Gross Domestic Product (“GDP”) growth that dropped to 1.3% in the second quarter of 2012 from a 2% rate in the first quarter due largely to anemic levels of consumer spending.

Among the headwinds faced by U.S. investors are a slowing global economy led by a European market in recession and slowing Chinese GDP, as well as uncertainty associated with the U.S. presidential election and approach of the “fiscal cliff” at the end of 2012. The “fiscal cliff” is when the Bush-era tax cuts will expire and $1.2 trillion in spending cuts take effect if Congress cannot agree on a budget. Such events have the potential to push the U.S. into recession. Nevertheless, corporate earnings continue to grow, despite expected third-quarter weakness; the housing market appears to be bottoming-out if not turning around, and private-sector job growth has been better than pre-recession levels. This has given ammunition to investors who disparage the continuing large-scale asset purchases by central banks, both in the U.S. and other major countries, which they contend have increased inflation risks.

Beginning in October 2011, the U.S. stock market moved up fairly consistently, except for a second-quarter pullback caused by lower earnings and slower GDP growth, with the Standard & Poor’s 500 Index (the “S&P 500”) closing on its highest level since early 2008 near the end of the period. (All returns cited are for the 12-month period ended August 31, 2012.) The S&P 500, which is generally regarded as an indicator of the broad U.S. stock market, returned 18.00%. Most foreign equity markets were considerably weaker than the U.S. equity market. The Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East Index (“EAFE”), which is composed of approximately 1,100 companies in 20 developed countries in Europe and the Pacific Basin, returned -0.04%. The MSCI Emerging Market Index, which measures stock market performance in global emerging markets, returned -5.80%.

The search for yield also drove fixed-income investors to the U.S. bond markets, helping performance, with lower-rated bonds outperforming higher-quality issues. The return of the Barclays U.S. Aggregate Bond Index, which is a proxy for the U.S. investment grade bond market, returned 5.78%, while return of the Barclays U.S. Corporate High Yield Index was 14.59%. Reflecting the Fed’s continuing accommodative monetary policy, interest rates on short-term securities remained at their lowest levels in many years; the return of the Barclays 1–3 Month U.S. Treasury Bill Index was 0.05%.

4 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

August 31, 2012

Index Definitions

All indices described below are unmanaged and reflect no expenses. It is not possible to invest directly in any index.

The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

The Barclays U.S. Corporate High Yield Bond Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

The Barclays 1-3 Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury bills with a remaining maturity of one to three months. U.S. Treasury bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury and are generally regarded as being free of any risk of default.

The Dow Jones Global Utilities Index includes those companies in the Dow Jones Global Index associated with generating and distributing electricity through the burning of fossil fuels such as coal, petroleum and natural gas, and through nuclear energy; alternative electricity companies generating and distributing electricity from a renewable source; distributors of gas to end users; and multi-utility and water companies.

The MSCI All Country World Ex-US Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging market countries excluding the United States.

The MSCI China Index is a capitalization weighted index that monitors the performance of stocks from the country of China.

The MSCI EAFE Index is a capitalization weighted measure of stock markets in Europe, Australasia and the Far East.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

The Standard & Poor’s (“S&P”) 500 Index is a capitalization weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

Industry Sectors

Comments about industry sectors in these fund commentaries are based on Bloomberg industry classifications.

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 5

| | |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE | August 31, 2012 |

ABCS Guggenheim ABC High Dividend ETF

Fund Overview

The Guggenheim ABC High Dividend ETF, NYSE Arca ticker: ABCS (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the BNY Mellon ABC Index (the “Index”).

The Index is a rules-based index comprised of, as of August 31, 2012, 30 securities, including common stocks and U.S. exchange-listed American depositary receipts (“ADRs”) of companies from Australia and Brazil and locally-listed companies in Australia and Canada, as defined by Bank of New York Mellon (the “Index Provider”). The depositary receipts included in the Index are sponsored. The Index constituent selection process selects the top ten stocks or ADRs with the highest yield from each country.

The Fund will invest at least 80% of its total assets in common stocks and ADRs that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs included in the Index). The Investment Adviser seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the stocks comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2012.

On a market price basis, the Fund generated a total return of -12.40%, which included a decrease in market price over the period to $18.84 as of August 31, 2012, from $22.72 as of August 31, 2011. On an NAV basis, the Fund generated a total return of -12.10%, which included a decrease in NAV over the period to $18.89 as of August 31, 2012, from $22.70 as of August 31, 2011. At the end of the period, the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time.

For underlying index and international market comparison purposes, the Index returned -11.82% and the MSCI All Country World Ex-US Index returned -1.92% for the 12-month period ended August 31, 2012.

The Fund pays distributions quarterly on the last business day of each calendar quarter to shareholders of record two business days earlier. The following distributions per share were paid during the 12-month period ended August 31, 2012:

| | |

| Payable Date | Amount |

| September 30, 2011 | $0.3810 |

| December 30, 2011 | $0.1900 |

| March 30, 2012 | $0.1820 |

| June 29, 2012 | $0.3180 |

Performance Attribution

For the 12-month period ended August 31, 2012, the utilities sector contributed most significantly to the Fund’s return, followed by the consumer, non-cyclical sector. The communications and basic materials sectors detracted most significantly from the Fund’s return.

Positions that contributed most significantly to the Fund’s return included Ultrapar Participacoes SA, ADR, a Brazilian holding company involved in fuel distribution, chemicals and logistics; Cia Energetica de Minas Gerais, ADR, a Brazilian holding company engaged in the generation, transmission and distribution of electricity; and Cia de Bebidas das Americas, ADR, a Brazilian beverage company (6.6%, 6.1% and 10.4%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included Cia Siderugica Nacional SA, ADR, which primarily operates as an integrated steel producer in Brazil and Latin America; Telefonica Brasil SA, ADR, a telecommunications company which provides services for fixed and mobile telephony, data transmission and VAS, pay TV, among others, and is part of the Telefonica Group, a communication conglomerate with presence in multiple countries; and Vale SA, ADR, a Brazilian metals and mining company (3.6%, 5.1% and 10.1%, respectively, of the Fund’s long-term investments at period end).

6 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | August 31, 2012 |

FAA Guggenheim Airline ETF

Fund Overview

The Guggenheim Airline ETF, NYSE Arca ticker: FAA (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the NYSE Arca Global Airline Index (the “Index”).

The Index is a modified equal-dollar weighted index designed to measure the performance of highly capitalized and liquid U.S. and international passenger airline companies identified as being in the airline industry and listed on developed and emerging global market exchanges. Archipelago Holdings Inc. (“Arca” or the “Index Provider”), an affiliate of NYSE Euronext, Inc., defines “developed markets” as countries with western-style legal systems, transparent financial rules for financial reporting, and sophisticated, liquid and accessible stock exchanges with readily-exchangeable currencies. The Fund will invest at least 80% of its total assets in common stock, American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs and GDRs included in the Index). The Investment Adviser seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2012.

On a market price basis, the Fund generated a total return of 0.13%, which included a decrease in market price over the period to $28.24 as of August 31, 2012, from $28.53 as of August 31, 2011. On an NAV basis, the Fund generated a total return of 0.20%, which included a decrease in NAV over the period to $28.23 as of August 31, 2012, from $28.50 as of August 31, 2011. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and broad global market comparison purposes, the Index returned 1.70% and the MSCI World Index returned 8.12% for the same period.

The Fund made an annual income distribution of $0.3050 per share on December 30, 2011, to shareholders of record on December 28, 2011.

Performance Attribution

All of the Fund’s holdings are classified in the consumer cyclical sector, which had a positive return, contributing to the Fund’s return for the 12-month period ended August 31, 2012. Positions that contributed most significantly to return included Delta Air Lines, Inc., which provides scheduled air transportation for passengers and cargo throughout the United States and around the world; US Airways Group, Inc., which provides airline service under names including US Airways, Piedmont and PSA Airlines from hubs in Charlotte, Philadelphia and Phoenix; and Hawaiian Holdings, Inc., which provides air transportation of passengers, cargo, and mail among the islands of Hawaii and between Hawaii and several West Coast gateway cities and destinations in the South Pacific (15.0%, 3.1% and 3.1%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included AMR Corp., parent of American Airlines, which provides airline service in North America, the Caribbean, Latin America, Europe and Asia (not held in the portfolio at period end); All Nippon Airways Co., Ltd., which provides a variety of air transportation-related services, including air passenger and air courier services, the sale of aircraft parts, travel arrangements and reservation services, and hotel operations (4.5% of the Fund’s long-term investments at period end); and SAS AB, the flag airline carrier of Denmark, Norway and Sweden, and the largest airline in Scandinavia (not held in the portfolio at period end).

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 7

| | |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | August 31, 2012 |

YAO Guggenheim China All-Cap ETF

Fund Overview

The Guggenheim China All-Cap ETF, NYSE Arca ticker: YAO (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China All Cap Index (the “Index”).

The Index is designed to measure and monitor the performance of the investable universe of publicly-traded companies based in mainland China. The Index was created by AlphaShares, LLC (“AlphaShares”) and is maintained by Standard & Poor’s. The Index includes equity securities of companies of all capitalizations, as defined by AlphaShares, subject to certain minimum capitalization requirements. The Fund will invest at least 80% of its total assets in common stock, American depositary receipts (“ADRs”), American depositary shares (“ADSs”), global depositary receipts (“GDRs”) and international depositary receipts (“IDRs”) that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs and IDRs included in the Index). The Investment Adviser seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2012.

On a market price basis, the Fund generated a total return of -10.84%, which included a decrease in market price over the period to $21.76 as of August 31, 2012, from $25.07 as of August 31, 2011. On an NAV basis, the Fund generated a total return of -11.17%, which included a decrease in NAV over the period to $21.66 as of August 31, 2012, from $25.04 as of August 31, 2011. At the end of the period, the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time.

For underlying index and Chinese market comparison purposes, the Index returned -10.57% and the MSCI China Index returned -8.25% for the same period.

The Fund made an annual income distribution of $0.5800 per share on December 30, 2011, to shareholders of record on December 28, 2011.

Performance Attribution

For the 12-month period ended August 31, 2012, the utilities sector made the strongest contribution to the Fund’s return. The financial sector detracted most significantly from the Fund’s return.

Positions that contributed most significantly to the Fund’s return included Tencent Holdings, Ltd., which provides internet, mobile, and telecommunication value-added services in China; Want Want China Holdings, Ltd., which manufactures and trades rice crackers, snack food, beverages, and packing materials; and China Mobile Ltd., a provider of cellular telecommunications and related services in the People’s Republic of China and Hong Kong (5.7%, 1.5% and 5.7%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included Baidu, Inc., ADR, a Chinese-language Internet search provider; Ctrip.com International Ltd., ADR, a travel service provider for hotel accommodations, airline tickets and packaged tours in China; and SINA Corp., an online media company that offers services in the People’s Republic of China and global Chinese communities (4.7%, 0.4% and 0.7%, respectively, of the Fund’s long-term investments at period end).

8 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | August 31, 2012 |

CQQQ Guggenheim China Technology ETF

Fund Overview

The Guggenheim China Technology ETF, NYSE Arca ticker: CQQQ (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China Technology Index (the “Index”).

The Index is designed to measure and monitor the performance of the universe of publicly-traded companies which are based in mainland China, Hong Kong or Macau, are in the Information Technology Sector, as defined by Standard & Poor’s Global Industry Classification Standard, and are open to foreign investment. The Index was created by AlphaShares, LLC (“AlphaShares”) and is maintained by Standard & Poor’s. The Index includes equity securities of companies of all categories of market capitalizations, as defined by AlphaShares (subject to certain minimum capitalization requirements.)

The Index may include Hong Kong-listed securities, including China H-shares and Red Chips. China H-shares are issued by companies incorporated in mainland China and listed on the Hong Kong Stock Exchange. Red Chip shares are issued by companies with controlling Chinese shareholders that are incorporated outside mainland China and listed on the Hong Kong Stock Exchange. The Index may also include N-Shares, which are issued by companies based in mainland China and listed on the NYSE Arca, Inc. or NASDAQ Stock Market. The Index will not include China A-Shares (which are subject to substantial restrictions on foreign investment) or China B-Shares (which offer a generally smaller market and limited liquidity), each of which trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

The Fund will invest at least 80% of its total assets in common stock, American depositary receipts (“ADRs”), American depositary shares (“ADSs”), global depositary receipts (“GDRs”) and international depositary receipts (“IDRs”) that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs and IDRs included in the Index).

The Investment Adviser seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2012.

On a market price basis, the Fund generated a total return of -19.78%, which included a decrease in market price over the period to $19.96 as of August 31, 2012, from $25.57 as of August 31, 2011. On an NAV basis, the Fund generated a total return of -19.10%, which included a decrease in NAV over the period to $20.03 as of August 31, 2012, from $25.44 as of August 31, 2011. At the end of the period, the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time.

For underlying index and broad Chinese market comparison purposes, the Index returned -18.91% and the MSCI China Index returned -8.25% for the same period.

The Fund made an annual income distribution of $0.5650 per share on December 31, 2011, to shareholders of record on December 28, 2011.

Performance Attribution

For the 12-month period ended August 31, 2012, all sectors detracted from return; communications detracted most, while consumer cyclical detracted least. Positions that contributed most significantly to the Fund’s return included Tencent Holdings Ltd., which provides internet, mobile, and telecommunication value-added services in China (10.2% of the Fund’s long-term investments at period end); Alibaba.com Ltd., a provider of software, technology and other services to the online business-to-business marketplace (not held in the portfolio at period end); and AAC Technologies Holdings, Inc., which designs and manufactures miniature acoustic components (4.7% of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included SINA Corp., an online media company; Sohu.com, Inc., a Chinese online media, search, gaming, community and mobile service group; and Baidu, Inc., ADR, a Chinese-language Internet search provider (6.9%, 3.8% and 10.1%, respectively, of the Fund’s long-term investments at period end).

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 9

| | |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | August 31, 2012 |

TAN Guggenheim Solar ETF

Fund Overview

The Guggenheim Solar ETF, NYSE Arca ticker: TAN (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the MAC Global Solar Energy Index (the “Index”).

The Index is comprised of approximately 24 securities selected based on the relative importance of solar power within the company’s business model, as determined by MAC Indexing LLC (the “Index Provider”). As of August 31, 2012, the market capitalization of securities included in the Index ranged from approximately $71 million to $1.2 billion. The Index is designed to track companies within the following business segments of the solar energy industry: companies that produce solar power equipment and products for end-users; companies that produce fabrication products (such as the equipment used by solar cell and module producers to manufacture solar power equipment) or services (such as companies specializing in the solar cell manufacturing or the provision of consulting services to solar cell and module producers) for solar power equipment producers; companies that supply raw materials or components to solar power equipment producers or integrators; companies that derive a significant portion of their business (as defined in the Fund prospectus under “Index Methodology”) from solar power system sales, distribution, installation, integration or financing; and companies that specialize in selling electricity derived from solar power. The Index is generally comprised of equity securities, including American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”), traded in developed markets, as defined by the Index Provider. While the equity securities comprising the Index are traded in developed markets, the issuers of such securities may be located in emerging markets. Emerging market countries are countries that major international financial institutions, such as the World Bank, generally consider to be less economically mature than developed nations. The Fund will invest at least 90% of its total assets in common stock, ADRs and GDRs that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs and GDRs included in the Index).

The Investment Adviser seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. On February 15, 2012, the Fund executed a 1-for-10 reverse split of the shares with the number of shares outstanding declining by a factor of 10 and the market price of the Fund’s shares increasing by a factor of 10. The total market value of the positions held by shareholders was not affected by the reverse split. Share prices cited have been adjusted to reflect this split. This report discusses the annual fiscal period ended August 31, 2012.

On a market price basis, the Fund generated a total return of -66.78%, which included a decrease in market price over the period to $16.71 as of August 31, 2012, from $54.60 as of August 31, 2011. On an NAV basis, the Fund generated a total return of -66.93%, which included a decrease in NAV over the period to $16.74 as of August 31, 2012, from $54.90 as of August 31, 2011. At the end of the period, the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time.

For underlying index and broad international market comparison purposes, the Index returned -69.06% and the MSCI World Index returned 8.12% for the same period.

The Fund made an annual income distribution of $2.110 per share on December 30, 2011, to shareholders of record on December 28, 2011. (The distribution amount has been adjusted to reflect the reverse stock split described above.)

Performance Attribution

The Fund’s holdings are in the basic materials, energy, industrial and technology sectors, all of which had negative returns for the 12-month period ended August 31, 2012, detracting from the Fund’s return. The technology sector detracted most and the basic materials sector detracted least.

Positions that contributed to the Fund’s return included Power-One, Inc., which designs and manufactures power conversion products including solar inverters (7.0% of the Fund’s long-term investments at period end); Conergy AG, a German manufacturer of products for solar power generation (2.7% of the Fund’s long-term investments at period end); and Roth & Rau AG, which manufactures equipment used to produce photovoltaics and to prepare surfaces in manufacturing processes (not held in the portfolio at period end). Positions that detracted most significantly from return included First Solar, Inc., a U.S.-based producer of solar modules and photovoltaic solar power systems; GCL-Poly Energy Holdings Ltd., a Hong Kong company that manufactures polysilicon and wafers for the solar industry and operates power plants; and Suntech Power Holdings Co. Ltd., ADR, which produces solar cells (11.5%, 7.4% and 2.2%, respectively, of the Fund’s long-term investments at period end).

10 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE continued | August 31, 2012 |

CGW Guggenheim S&P Global Water Index ETF

Fund Overview

The Guggenheim S&P Global Water Index ETF, NYSE Arca ticker: CGW (the “Fund”), seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the S&P Global Water Index (the “Index”).

The Index is comprised of approximately 50 equity securities selected, based on investment and other criteria, from a universe of companies listed on global developed market exchanges. Standard & Poor’s Financial Services LLC, a division of The McGraw-Hill Companies (“S&P”), generally defines “developed markets” as the capital markets of those countries with high levels of per capita income and strict market regulation resulting in greater transparency. The universe of companies includes all companies classified by Standard & Poor’s Global Industry Classifications as being associated (in a manner representing a major component of such companies’ business) with the global demand for water, including water utilities, infrastructure, equipment, instruments and materials. Total market capitalization and float-adjusted market capitalization of securities in the Index must be at least $250 million and $100 million, respectively, at the time of each reconstitution, which includes small-, mid-, and large-capitalization securities as defined by S&P. The companies in the universe are selected using criteria as identified by S&P.

The Fund will invest at least 90% of its total assets in common stock and American depositary receipts (“ADRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs included in the Index). The Investment Adviser seeks a correlation over time of 0.95 or better between the Fund’s performance and the performance of the Index. A figure of 1.00 would represent perfect correlation. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2012.

On a market price basis, the Fund generated a total return of 7.25%, which included an increase in market price over the period to $20.98 as of August 31, 2012, from $19.99 as of August 31, 2011. On an NAV basis, the Fund generated a total return of 7.23%, which included an increase in NAV over the period to $21.05 as of August 31, 2012, from $20.06 as of August 31, 2011. At the end of the period, the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time.

For underlying index, broad global market and global utilities market comparison purposes, the Index returned 7.82%, the MSCI World Index returned 8.12%, and the Dow Jones Global Utilities Index returned -3.69% for the same period.

The Fund made an annual income distribution of $0.4110 per share on December 30, 2011, to shareholders of record on December 28, 2011.

Performance Attribution

For the 12-month period ended August 31, 2012, the utilities sector contributed most significantly to the Fund’s return, and the basic materials sector was the only sector that detracted from to the Fund’s return. Positions that contributed most significantly to the Fund’s return included Cia de Saneamento Basico do Estado de Sao Paulo, ADR, which provides water and sewage services to in the State of Sao Paulo, Brazil; American Water Works Co., Inc., a water and wastewater utility company that provides services to 16 million people in 35 states and two Canadian provinces; and Severn Trent PLC, which supplies water, waste, and utility services throughout the United Kingdom, Europe, and the United States (5.3%, 7.1% and 7.2%, respectively, of the Fund’s long-term investments at period end). Positions that detracted most significantly from the Fund’s return included Veolia Environnement SA, a French provider of environmental management services; Suez Environnement Co., a French provider of water and waste removal services; and Kurita Water Industries Ltd., which manufactures, sells, and maintains water treatment equipment and systems (3.1%, 1.8% and 2.3%, respectively, of the Fund’s long-term investments at period end).

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 11

August 31, 2012

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers and Guggenheim Funds Investment Advisors, LLC only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass.

This information does not represent an offer to sell securities of the Funds and it is not soliciting an offer to buy securities of the Funds. An investment in the various Guggenheim Funds ETFs is subject to certain risks and other considerations. Below are some general risks and considerations associated with investing in a Fund, which may cause you to lose money, including the entire principal that you invest. Please refer to the individual ETF prospectus for a more detailed discussion of Fund-specific risks and considerations.

Investment Risk: An investment in a Fund is subject to investment risk, including the possible loss of the entire principal amount that you invest.

Equity Risk: The value of the securities held by each Fund may fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by each Fund participate, or factors relating to specific companies in which such Fund invests.

Foreign Investment Risk: A Fund’s investments in non-U.S. issuers, may involve unique risks compared to investing in securities of U.S. issuers, including, among others, greater market volatility than U.S. securities and less complete financial information than for U.S. issuers. In addition, adverse political, economic or social developments could undermine the value of such Fund’s investments or prevent such Fund from realizing the full value of its investments. Financial reporting standards for companies based in foreign markets differ from those in the U.S. Finally, the value of the currency of the country in which a Fund has invested could decline relative to the value of the U.S. dollar, which may affect the value of the investment to U.S. investors. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities.

Emerging Markets Risk: Investment in securities of issuers based in developing or “emerging market” countries entails all of the risks of investing in securities of non-U.S. issuers, as previously described, but to a heightened degree.

Industry Risk: To the extent that Funds focus their investments in a particular industry of group of related industries, the NAV of the Funds will be more susceptible to factors affecting that industry or sector. Accordingly, the Fund may be subject to more risks than if it were broadly diversified over numerous industries and sectors of the economy.

Micro-, Small- and Medium-Sized Company Risk: Investing in securities of these companies involves greater risk as their stocks may be more volatile and less liquid than investing in more established companies. These stocks may have returns that vary, sometimes significantly, from the overall stock market. Micro-cap companies may be newly formed, less developed and there may be less available information about the company.

Replication Management Risk: The Funds are not “actively” managed. Therefore, a Fund would not necessarily sell a security because the security’s issuer was in financial trouble unless that stock is removed from such Fund’s Index.

Non-Correlation Risk: A Fund’s return may not match the return of such Fund’s index for a number of reasons. For example, the Fund incurs a number of operating expenses not applicable to the Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Index. A Fund may not be fully invested at times, either as a result of cash flows into such Fund or reserves of cash held by a Fund to meet redemptions and expenses. If a Fund utilizes a sampling approach or futures or other derivative positions, its return may not correlate as well with the return on the Index, as would be the case if it purchased all of the securities in the Index with the same weightings as the Index.

Issuer-Specific Changes: The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The value of securities of smaller issuers can be more volatile than that of larger issuers.

Non-Diversified Fund Risk: Non-diversified Funds can invest a greater portion of assets in securities of individual issuers than a diversified fund. Changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Concentration Risk. If the Index concentrates in an industry or group of industries the Fund’s investments will be concentrated accordingly. In such event, the value of the Fund’s shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries.

China Investment Risk (YAO and CQQQ): Investing in securities of Chinese companies involves additional risks, including, but not limited to: the economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources and capital reinvestment, among others; the central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership; and actions of the Chinese central and local government authorities continue to have a substantial effect on economic conditions in China.

The Guggenheim ABC High Dividend ETF is also subject to risks of investing in Australia and Canada including commodity exposure risk, geographic risk and trading partners risk. Commodity exposure risk is exposure related to any negative changes in the agricultural or mining industries which could therefore have an adverse impact on the Australian or Canadian economy, as applicable. Geographic risk is the risk that a natural disaster could occur in Australia or Canada, as applicable. Trading partners risk is due to the

12 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

August 31, 2012

Australian or Canadian economy, as applicable, being heavily dependent upon trading with its key partners. Any reduction in this trading may cause an adverse impact on the economy in which the Fund invests. The Fund is also subject to certain risks of investing in Brazil. Brazil has experienced substantial economic instability resulting from, among other things, periods of very high inflation, persistent structural public sector deficits and significant devaluations of the currency of Brazil, and leading also to a high degree of price volatility in both the Brazilian equity and foreign currency markets. Brazilian companies may also be adversely affected by high interest and unemployment rates, and are particularly sensitive to fluctuations in commodity prices.

Recent Market Developments Risk. Global and domestic financial markets have experienced periods of unprecedented turmoil. Recently, markets have witnessed more stabilized economic activity as expectations for an economic recovery increased. However, risks to a robust resumption of growth persist. Continuing uncertainty as to the status of the euro and the European Monetary Union has created significant volatility in currency and financial markets generally. A return to unfavorable economic conditions or sustained economic slowdown could adversely impact the Funds’ portfolios. Financial market conditions, as well as various social and political tensions in the US and around the world, have contributed to increased market volatility and may have long-term effects on the US and worldwide financial markets and cause further economic uncertainties or deterioration in the US and worldwide. The Investment Adviser does not know how long the financial markets will continue to be affected by these events and cannot predict the effects of these or similar events in the future on the U.S. and global economies and securities markets.

There is no assurance that the requirements of the NYSE Arca necessary to maintain the listing of the Funds will continue to be met or will remain unchanged.

In addition to the risks described, there are certain other risks related to investing in the Funds. These risks are described further in the Prospectus and Statement of Additional Information.

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 13

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) | August 31, 2012 |

ABCS Guggenheim ABC High Dividend ETF

| | | |

| Fund Statistics | | |

| Share Price | | $18.84 |

| Net Asset Value | | $18.89 |

| Premium/Discount to NAV | | -0.26% |

| Net Assets ($000) | | $10,389 |

| | | |

| Total Returns | | |

| | | Since Inception |

| (Inception 6/8/11) | One Year | (Annualized) |

| Guggenheim ABC High | | |

| Dividend ETF | | |

| NAV | -12.10% | -16.77% |

| Market | -12.40% | -16.95% |

| The BNY Mellon ABC Index | -11.82% | -16.39% |

| MSCI All Country World | | |

| Ex-US Index | -1.92% | -9.31% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $25.01 per share for share price returns or initial net asset value (NAV) of $25.01 per share for NAV returns.

The Fund’s annual operating expense ratio of 0.65% is expressed as a unitary fee and covers all expenses of the Fund, except for distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

| | |

| Portfolio Breakdown | % of Net Assets |

| Basic Materials | 23.5% |

| Energy | 15.1% |

| Consumer, Cyclical | 15.0% |

| Utilities | 13.8% |

| Consumer, Non-cyclical | 12.2% |

| Communications | 11.3% |

| Financial | 6.2% |

| Industrial | 1.6% |

| Total Common and Preferred Stocks | 98.7% |

| Investments of Collateral for Securities Loaned | 23.7% |

| Total Investments | 122.4% |

| Liabilities in excess of Other Assets | -22.4% |

| Net Assets | 100.0% |

| | |

| | % of Long-Term |

| Country Breakdown | Investments |

| Brazil | 54.9% |

| Canada | 24.8% |

| Australia | 20.3% |

| | |

| | % of Long-Term |

| Currency Denomination | Investments |

| United States Dollar | 54.9% |

| Canadian Dollar | 24.8% |

| Australian Dollar | 20.3% |

| | |

| | % of Long-Term |

| Top Ten Holdings | Investments |

| Cia de Bebidas das Americas, ADR | 10.4% |

| Vale SA, ADR | 10.1% |

| Ultrapar Participacoes SA, ADR | 6.6% |

| Cia Energetica de Minas Gerais, ADR | 6.1% |

| Telefonica Brasil SA, ADR | 5.1% |

| Banco Santander Brasil SA, ADR | 4.3% |

| Enerplus Corp. | 4.0% |

| Oi SA, ADR | 3.9% |

| Pengrowth Energy Corp. | 3.7% |

| Cia Siderurgica Nacional SA, ADR | 3.6% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

14 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

ABCS Guggenheim ABC High Dividend ETF continued

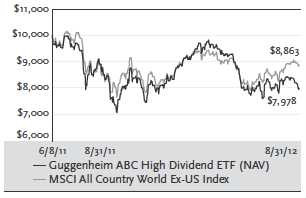

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI All Country World Ex-US Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI All Country World Ex-US Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging market countries excluding the United States. It is not possible to invest directly in the MSCI All Country World Ex-US Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

Distributions to Shareholders &

Annualized Distribution Rate based on Market Price

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 15

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

| | | | |

| FAA Guggenheim Airline ETF | |

| | | |

| Fund Statistics | | | |

| Share Price | | | $28.24 |

| Net Asset Value | | | $28.23 |

| Premium/Discount to NAV | | | 0.04% |

| Net Assets ($000) | | | $15,524 |

| | | | |

| Total Returns | | | |

| | | | Since |

| | One | Three Year | Inception |

| (Inception 1/26/09) | Year | (Annualized) | (Annualized) |

| Guggenheim Airline ETF | | | |

| NAV | 0.20% | 6.45% | 4.93% |

| Market | 0.13% | 5.86% | 4.94% |

| NYSE Arca Global | | | |

| Airline Index | 1.70% | 8.10% | 5.82% |

| MSCI World Index | 8.12% | 7.90% | 15.51% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.04 per share for share price returns or initial net asset value (NAV) of $24.04 per share for NAV returns.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.99%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was determined to be 0.70% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 1.29%. There is a contractual fee waiver currently in place for this Fund through December 31, 2015 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses will be higher than 0.65%. Without this expense cap, actual returns would be lower.

| | |

| Portfolio Breakdown | % of Net Assets |

| Consumer, Cyclical | 99.4% |

| Total Common and Preferred Stocks | 99.4% |

| Investments of Collateral for Securities Loaned | 7.0% |

| Total Investments | 106.4% |

| Liabilities in excess of Other Assets | -6.4% |

| Net Assets | 100.0% |

| | |

| | % of Long-Term |

| Country Breakdown | Investments |

| United States | 70.2% |

| Germany | 4.5% |

| Japan | 4.5% |

| Chile | 4.4% |

| Canada | 1.5% |

| United Kingdom | 1.5% |

| Ireland | 1.5% |

| Panama | 1.5% |

| South Korea | 1.5% |

| Hong Kong | 1.5% |

| Singapore | 1.5% |

| Spain | 1.5% |

| Australia | 1.5% |

| France | 1.5% |

| Brazil | 1.4% |

| | |

| | % of Long-Term |

| Currency Denomination | Investments |

| United States Dollar | 79.1% |

| Euro | 6.0% |

| All other currencies | 14.9% |

| | |

| | % of Long-Term |

| Top Ten Holdings | Investments |

| United Continental Holdings, Inc. | 15.1% |

| Southwest Airlines Co. | 15.1% |

| Delta Air Lines, Inc. | 15.0% |

| Deutsche Lufthansa AG | 4.5% |

| All Nippon Airways Co. Ltd. | 4.5% |

| Latam Airlines Group SA, ADR | 4.4% |

| Spirit Airlines, Inc. | 3.2% |

| SkyWest, Inc. | 3.2% |

| JetBlue Airways Corp. | 3.2% |

| Allegiant Travel Co. | 3.2% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

16 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

FAA Guggenheim Airline ETF continued

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI World Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI World Index is a free float-adjusted market capitalization index that measures global developed market equity performance of the developed market country indices of Europe, Australasia, the Far East, the U.S. and Canada. It is not possible to invest directly in the MSCI World Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 17

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

| | | | |

| YAO Guggenheim China All-Cap ETF | |

| | |

| Fund Statistics | | |

| Share Price | | $21.76 |

| Net Asset Value | | $21.66 |

| Premium/Discount to NAV | | 0.46% |

| Net Assets ($000) | | $49,822 |

| | | |

| Total Returns | | |

| | | | Since |

| | | One | Inception |

| (Inception 10/19/09) | Year | (Annualized) |

| Guggenheim China All-Cap ETF | | |

| NAV | -11.17% | -3.40% |

| Market | -10.84% | -3.24% |

| AlphaShares China All-Cap Index | -10.57% | -2.65% |

| MSCI China Index | -8.25% | -3.86% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.82 per share for share price returns or initial net asset value (NAV) of $24.82 per share for NAV returns.

The Fund’s annual operating expense ratio of 0.70% is expressed as a unitary fee and covers all expenses of the Fund, except for distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

| Portfolio Breakdown | % of Net Assets |

| Financial | 33.0% |

| Communications | 21.7% |

| Energy | 17.9% |

| Consumer, Non-cyclical | 7.5% |

| Industrial | 6.6% |

| Consumer, Cyclical | 5.7% |

| Basic Materials | 3.4% |

| Utilities | 2.5% |

| Technology | 1.0% |

| Diversified | 0.6% |

| Total Common Stocks | 99.9% |

| Investments of Collateral for Securities Loaned | 6.7% |

| Total Investments | 106.6% |

| Liabilities in excess of Other Assets | -6.6% |

| Net Assets | 100.0% |

| | % of Long-Term |

| Country Breakdown | Investments |

| China | 99.5% |

| Singapore | 0.5% |

| | |

| | % of Long-Term |

| Currency Denomination | Investments |

| Hong Kong Dollar | 91.2% |

| United States Dollar | 8.3% |

| Singapore Dollar | 0.5% |

| | |

| | % of Long-Term |

| Top Ten Holdings | Investments |

| China Mobile Ltd. | 5.7% |

| Tencent Holdings Ltd. | 5.7% |

| CNOOC Ltd. | 5.1% |

| China Construction Bank Corp. | 4.7% |

| Baidu, Inc. | 4.7% |

| PetroChina Co. Ltd. | 4.6% |

| Industrial & Commercial Bank of China Ltd. | 4.6% |

| Bank of China Ltd. | 4.0% |

| China Life Insurance Co. Ltd. | 3.6% |

| China Petroleum & Chemical Corp. | 2.9% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

18 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

YAO Guggenheim China All-Cap ETF continued

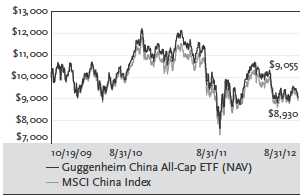

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI China Index is a capitalization-weighted index that monitors the performance of stocks from the country of China. The index is unmanaged. It is not possible to invest directly in the MSCI China Index.Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 19

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

CQQQ Guggenheim China Technology ETF

| | | |

| Fund Statistics | | |

| Share Price | | $19.96 |

| Net Asset Value | | $20.03 |

| Premium/Discount to NAV | | -0.35% |

| Net Assets ($000) | | $17,029 |

| | | |

| Total Returns | | |

| | | Since |

| | One | Inception |

| (Inception 12/8/09) | Year | (Annualized) |

| Guggenheim China Technology ETF | | |

| NAV | -19.10% | -6.80% |

| Market | -19.78% | -6.91% |

| AlphaShares China | | |

| Technology Index | -18.91% | -6.55% |

| MSCI China Index | -8.25% | -5.82% |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $25.06 per share for share price returns or initial net asset value (NAV) of $25.06 per share for NAV returns.

The Fund’s total annual operating expense ratio of 0.70% is expressed as a unitary fee and covers all expenses of the Fund, except for distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

| | |

| Portfolio Breakdown | % of Net Assets |

| Communications | 53.2% |

| Technology | 21.6% |

| Industrial | 12.7% |

| Basic Materials | 4.4% |

| Consumer, Cyclical | 4.3% |

| Energy | 3.4% |

| Total Common Stocks | 99.6% |

| Investments of Collateral for Securities Loaned | 9.6% |

| Total Investments | 109.2% |

| Liabilities in excess of Other Assets | -9.2% |

| Net Assets | 100.0% |

| | % of Long-Term |

| Country Breakdown | Investments |

| China | 100.0% |

| | |

| | % of Long-Term |

| Currency Denomination | Investments |

| Hong Kong Dollar | 64.3% |

| United States Dollar | 35.7% |

| | |

| | % of Long-Term |

| Top Ten Holdings | Investments |

| Tencent Holdings Ltd. | 10.2% |

| Baidu, Inc. | 10.1% |

| Lenovo Group Ltd. | 7.6% |

| SINA Corp. | 6.9% |

| NetEase, Inc. | 6.4% |

| Semiconductor Manufacturing International Corp. | 4.7% |

| AAC Technologies Holdings, Inc. | 4.7% |

| Kingboard Chemical Holdings Ltd. | 4.4% |

| Digital China Holdings Ltd. | 4.3% |

| Sohu.com, Inc. | 3.8% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI China Index is a capitalization-weighted index that monitors the performance of stocks from the country of China. The index is unmanaged. It is not possible to invest directly in the MSCI China Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

20 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

| | | | |

| TAN Guggenheim Solar ETF | | |

| | | |

| Fund Statistics | | | |

| Share Price* | | | $16.71 |

| Net Asset Value* | | | $16.74 |

| Premium/Discount to NAV | | | -0.18% |

| Net Assets ($000) | | | $42,992 |

Total Returns | | | |

| | | | Since |

| | One | Three Year | Inception |

| (Inception 4/15/08) | Year | (Annualized) | (Annualized) |

| Guggenheim Solar ETF | | | |

| NAV | -66.93% | -40.37% | -45.06% |

| Market | -66.78% | -40.21% | -45.08% |

| MAC Global Solar | | | |

| Energy Index | -69.06% | -41.97% | -45.57% |

| MSCI World Index | 8.12% | 7.90% | -0.60% |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $251.30* per share for share price returns or initial net asset value (NAV) of $251.30* per share for NAV returns.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.88%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.70% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 1.01%. There is a contractual fee waiver currently in place for this Fund through December 31, 2015, to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Portfolio Breakdown | % of Net Assets |

| Technology | 40.0% |

| Industrial | 37.3% |

| Energy | 22.3% |

| Total Common Stocks and Right | 99.6% |

| Investments of Collateral for Securities Loaned | 45.7% |

| Total Investments | 145.3% |

| Liabilities in excess of Other Assets | -45.3% |

| Net Assets | 100.0% |

| | % of Long-Term |

| Country Breakdown | Investments |

| United States | 39.5% |

| Cayman Islands | 30.4% |

| Germany | 13.4% |

| Switzerland | 7.0% |

| Norway | 3.7% |

| British Virgin Islands | 3.0% |

| Canada | 3.0% |

| % of Long-Term |

| Currency Denomination | Investments |

| United States Dollar | 64.9% |

| Euro | 13.4% |

| Hong Kong Dollar | 11.1% |

| Swiss Franc | 6.9% |

| Norwegian Krone | 3.7% |

| % of Long-Term |

| Top Ten Holdings | Investments |

| First Solar, Inc. | 11.5% |

| GT Advanced Technologies, Inc. | 8.3% |

| GCL-Poly Energy Holdings Ltd. | 7.4% |

| Power-One, Inc. | 7.0% |

| Meyer Burger Technology AG | 7.0% |

| MEMC Electronic Materials, Inc. | 6.3% |

| SMA Solar Technology AG | 4.5% |

| Trina Solar Ltd. | 4.4% |

| SunPower Corp. | 4.0% |

| Manz AG | 3.4% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

* Reflects 1 for 10 reverse stock split that occurred on February 15, 2012.

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 21

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

TAN Guggenheim Solar ETF continued

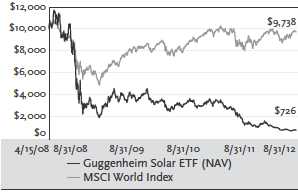

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI World Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. It is not possible to invest directly in the MSCI World Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

22 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

CGW Guggenheim S&P Global Water Index ETF

| Fund Statistics | | | | |

| Share Price | | | | $20.98 |

| Net Asset Value | | | | $21.05 |

| Premium/Discount to NAV | | | -0.33% |

| Net Assets ($000) | | | | $199,547 |

Total Returns | | | | |

| | | | Three | Five | Since |

| | | One | Year | Year | Inception |

| (Inception 5/14/07) | Year | (Annualized) | (Annualized) | (Annualized) |

| Guggenheim S&P | | | | |

| Global Water | | | | |

| Index ETF | | | | |

| NAV | 7.23% | 9.53% | -0.51% | -0.42% |

| Market | 7.25% | 9.30% | -0.80% | -0.49% |

| S&P Global | | | | |

| Water Index | 7.82% | 9.90% | 0.09% | 0.19% |

| MSCI World Index | 8.12% | 7.90% | -1.76% | -1.94% |

| Dow Jones Global | | | | |

| Utilities Index | -3.69% | -1.97% | -6.37% | -6.62% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.guggenheimfunds.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.78 per share for share price returns or initial net asset value (NAV) of $24.78 per share for NAV returns.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.78%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.70% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.76%. There is a contractual fee waiver currently in place for this Fund through December 31, 2015 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Portfolio Breakdown | % of Net Assets |

| Industrial | 51.9% |

| Utilities | 44.6% |

| Basic Materials | 3.3% |

| Total Common Stocks | 99.8% |

| Investments of Collateral for Securities Loaned | 2.4% |

| Total Investments | 102.2% |

| Liabilities in excess of Other Assets | -2.2% |

| Net Assets | 100.0% |

| | % of Long-Term |

| Country Breakdown | Investments |

| United States | 35.3% |

| United Kingdom | 21.6% |

| Switzerland | 11.0% |

| Brazil | 5.3% |

| France | 5.0% |

| Austria | 4.2% |

| Japan | 3.5% |

| Sweden | 2.9% |

| Israel | 2.4% |

| Netherlands | 2.4% |

| Hong Kong | 1.7% |

| Italy | 1.7% |

| Finland | 1.2% |

| Singapore | 0.7% |

| Bermuda | 0.7% |

| Spain | 0.4% |

| | % of Long-Term |

| Currency Denomination | Investments |

| United States Dollar | 40.6% |

| Pound Sterling | 21.6% |

| Euro | 14.8% |

| Swiss Franc | 11.1% |

| Japanese Yen | 3.5% |

| All other currencies | 8.4% |

| % of Long-Term |

| Top Ten Holdings | Investments |

| Geberit AG | 9.4% |

| United Utilities Group PLC | 8.5% |

| Severn Trent PLC | 7.2% |

| American Water Works Co., Inc. | 7.1% |

| Cia de Saneamento Basico do Estado de Sao Paulo, ADR | 5.3% |

| Danaher Corp. | 4.9% |

| Xylem, Inc. | 4.8% |

| Pennon Group PLC | 4.7% |

| Andritz AG | 4.2% |

| Aqua America, Inc. | 3.8% |

Portfolio breakdown is shown as a percentage of net assets. Country breakdown, currency denomination and holdings are shown as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.guggenheimfunds.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 23

| | |

| FUND SUMMARY & PERFORMANCE (Unaudited) continued | August 31, 2012 |

CGW Guggenheim S&P Global Water Index ETF continued

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI World Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI World Index is a free float-adjusted market capitalization index that measures global developed market equity performance of the developed market country indices of Europe, Australasia, the Far East, the U.S. and Canada. It is not possible to invest directly in the MSCI World Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

24 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

| | |

| OVERVIEW OF FUND EXPENSES (Unaudited) | August 31, 2012 |

As a shareholder of Guggenheim ABC High Dividend ETF; Guggenheim Airline ETF; Guggenheim China All-Cap ETF; Guggenheim China Technology ETF; Guggenheim Solar ETF; and Guggenheim S&P Global Water Index ETF, you incur advisory fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire six-month period ended August 31, 2012.

Actual Expense

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or contingent deferred sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Annualized | Expenses |

| | Beginning | Ending | Expense | Paid |

| | Account | Account | Ratio for the | During |

| | Value | Value | Six Months Ended | Period1 |