Exhibit (c)(5)

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Project Osprey

Board of Directors supplemental materials

Confidential

August 29, 2017

PRELIMINARY | SUBJECT TO FURTHER REVIEW AND EVALUATION

These materials may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Credit Suisse Group AG and/or its Affiliates (hereafter “Credit Suisse”).

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

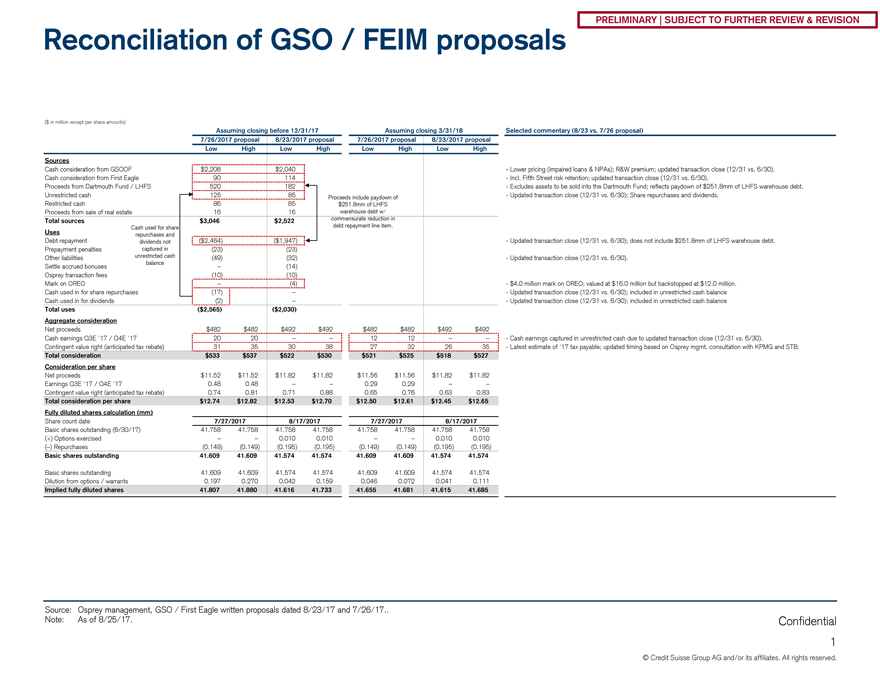

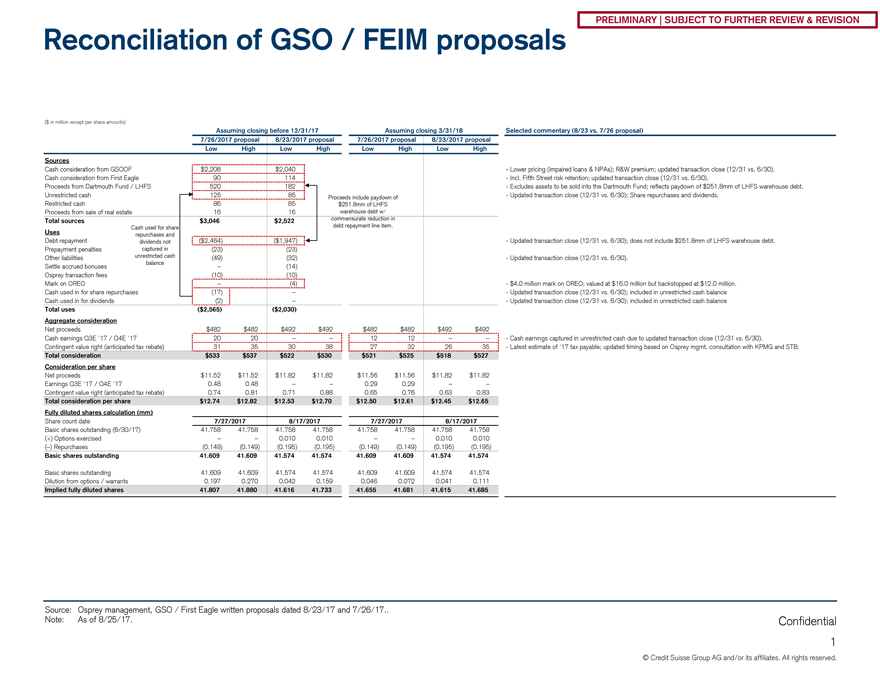

Reconciliation of GSO / FEIM proposals

($ in million except per share amounts)

Assuming closing before 12/31/17 Assuming closing 3/31/18

7/26/2017 proposal 8/23/2017 proposal 7/26/2017 proposal 8/23/2017 proposal Low High Low High Low High Low High Sources

Cash consideration from GSOOF $2,208 $2,040 Cash consideration from First Eagle 90 114 Proceeds from Dartmouth Fund / LHFS 520 182

Unrestricted cash 125 85 Proceeds include paydown of

Restricted cash 86 85 $251.8mm of LHFS Proceeds from sale of real estate 16 16 warehouse debt w/

Total sources $3,046 $2,522 commensurate reduction in Cash used for share debt repayment line item. Uses repurchases and

Debt repayment dividends not ($2,464) ($1,947) Prepayment penalties captured in (23) (23) Other liabilities unrestricted cash (49) (32) balance

Settle accrued bonuses – (14) Osprey transaction fees (10) (10) Mark on OREO – (4) Cash used in for share repurchases (17) –Cash used in for dividends (2) –

Total uses ($2,565) ($2,030) Aggregate consideration

Net proceeds $482 $482 $492 $492 $482 $482 $492 $492 Cash earnings Q3E ‘17 / Q4E ‘17 20 20 – – 12 12 – –Contingent value right (anticipated tax rebate) 31 35 30 38 27 32 26 35

Total consideration $533 $537 $522 $530 $521 $525 $518 $527 Consideration per share

Net proceeds $11.52 $11.52 $11.82 $11.82 $11.56 $11.56 $11.82 $11.82 Earnings Q3E ‘17 / Q4E ‘17 0.48 0.48 – – 0.29 0.29 – –Contingent value right (anticipated tax rebate) 0.74 0.81 0.71 0.88 0.65 0.76 0.63 0.83

Total consideration per share $12.74 $12.82 $12.53 $12.70 $12.50 $12.61 $12.45 $12.65 Fully diluted shares calculation (mm) Share count date 7/27/2017 8/17/2017 7/27/2017 8/17/2017

Basic shares outstanding (6/30/17) 41.758 41.758 41.758 41.758 41.758 41.758 41.758 41.758 (+) Options exercised – – 0.010 0.010 – – 0.010 0.010 (–) Repurchases (0.149) (0.149) (0.195) (0.195) (0.149) (0.149) (0.195) (0.195)

Basic shares outstanding 41.609 41.609 41.574 41.574 41.609 41.609 41.574 41.574

Basic shares outstanding 41.609 41.609 41.574 41.574 41.609 41.609 41.574 41.574 Dilution from options / warrants 0.197 0.270 0.042 0.159 0.046 0.072 0.041 0.111

Implied fully diluted shares 41.807 41.880 41.616 41.733 41.655 41.681 41.615 41.685

Selected commentary (8/23 vs. 7/26 proposal)

- Lower pricing (impaired loans & NPAs); R&W premium; updated transaction close (12/31 vs. 6/30).

- Incl. Fifth Street risk retention; updated transaction close (12/31 vs. 6/30).

- Excludes assets to be sold into the Dartmouth Fund; reflects paydown of $251.8mm of LHFS warehouse debt.

- Updated transaction close (12/31 vs. 6/30); Share repurchases and dividends.

- Updated transaction close (12/31 vs. 6/30); does not include $251.8mm of LHFS warehouse debt.

- Updated transaction close (12/31 vs. 6/30).

- $4.0 million mark on OREO; valued at $16.0 million but backstopped at $12.0 million.

- Updated transaction close (12/31 vs. 6/30); included in unrestricted cash balance

- Updated transaction close (12/31 vs. 6/30); included in unrestricted cash balance

- Cash earnings captured in unrestricted cash due to updated transaction close (12/31 vs. 6/30).

- Latest estimate of ‘17 tax payable; updated timing based on Osprey mgmt. consultation with KPMG and STB.

Source: Osprey management, GSO / First Eagle written proposals dated 8/23/17 and 7/26/17.. Note: As of 8/25/17.

Confidential

1

© Credit Suisse Group AG and/or its affiliates. All rights reserved.

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Credit Suisse does not provide any tax advice. Any tax statement herein regarding any U.S. federal tax is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding any penalties. Any such statement herein was written to support the marketing or promotion of the transaction(s) or matter(s) to which the statement relates. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

These materials have been provided to you by Credit Suisse in connection with an actual or potential mandate or engagement and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Credit Suisse. In addition, these materials may not be disclosed, in whole or in part, or summarized or otherwise referred to except as agreed in writing by Credit Suisse. The information used in preparing these materials was obtained from or through you or your representatives or from public sources. Credit Suisse assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). These materials were designed for use by specific persons familiar with the business and the affairs of your company and Credit Suisse assumes no obligation to update or otherwise revise these materials. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction.

These materials have been prepared by Credit Suisse (“CS”) and its affiliates for use by CS. Accordingly, any information reflected or incorporated herein, or in related materials or in ensuing transactions, may be shared in good faith by CS and its affiliates with employees of CS, its affiliates and agents in any location.

Credit Suisse has adopted policies and guidelines designed to preserve the independence of its research analysts. Credit Suisse’s policies prohibit employees from directly or indirectly offering a favorable research rating or specific price target, or offering to change a research rating or price target, as consideration for or an inducement to obtain business or other compensation. Credit Suisse’s policies prohibit research analysts from being compensated for their involvement in investment banking transactions.

CREDIT SUISSE SECURITIES (USA) LLC

Eleven Madison Avenue New York, NY 10010-3629

+1 212 325 2000 www.credit-suisse.com

Confidential

2

Copyright © 2017 Credit Suisse Group AG and/or its affiliates. All rights reserved.