UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22037 | ||||||||

| |||||||||

Stone Harbor Investment Funds | |||||||||

(Exact name of registrant as specified in charter) | |||||||||

| |||||||||

1290 Broadway, Suite 1100 Denver, CO |

| 80203 | |||||||

(Address of principal executive offices) |

| (Zip code) | |||||||

| |||||||||

Adam J. Shapiro, Esq. | |||||||||

(Name and address of agent for service) | |||||||||

| |||||||||

With copies To: | |||||||||

| |||||||||

John M. Loder, Esq. | |||||||||

| |||||||||

Registrant’s telephone number, including area code: | (303) 623-2577 |

| |||||||

| |||||||||

Date of fiscal year end: | May 31 |

| |||||||

| |||||||||

Date of reporting period: | June 1, 2008 - November 30, 2008 |

| |||||||

Item 1. Report to Stockholders.

2 | |

5 | |

6 | |

7 | |

| |

8 | |

15 | |

33 | |

34 | |

| |

35 | |

36 | |

| |

37 | |

38 | |

39 | |

46 | |

48 |

January 15, 2009

Dear Shareholder,

We appreciate your confidence in the Stone Harbor Investment Funds as we steer through this latest credit cycle and identify opportunities within the financial markets. While we have witnessed extremes in the marketplace over the past year, our goal is to produce long-term returns that exceed our benchmarks, and maintain risk levels comparable to, or less than, the relevant level of market risk. As always, we will try to keep you well informed about your investment in our Funds. Please feel free to call us at 212-548-1200 if you have any questions.

MARKET OVERVIEW

Shocks from the credit crunch accelerated during 2008. The unwinding of lax lending practices of 2006 and 2007, particularly within the housing sector, led to extremely tight credit conditions in all major credit markets. As a result, financial institutions took massive write-offs in their credit portfolios, consumer and investor confidence plummeted, and the Federal Reserve was left with no choice but to intervene. In 2008, the Fed aggressively lowered its overnight funds target rate by 225 basis points to 0.25%. In March, the US central bank forced a bailout of Bear Stearns, and gave investment banks unprecedented access to the discount window. Historical events in September intensified market concerns. Following the government takeover of Fannie Mae and Freddie Mac, Lehman Brothers filed for bankruptcy, and Merrill Lynch and Washington Mutual were absorbed by Bank of America and JP Morgan, respectively. In turn, Goldman Sachs and Morgan Stanley sold significant stakes in their businesses, and converted to bank holding companies. Aggressive steps taken by the Fed and the US Treasury were aimed at reducing systemic risk. Nonetheless, unprecedented write-offs severely impaired banking system capital and investor confidence, precipitating a tide of deleveraging. In response, the Fed directly injected capital into banks, guaranteed future bank bond issuance, increased depositor guarantees, and implemented over $1.5 trillion in government-sponsored financial relief programs. Congress simultaneously made progress on an auto bailout plan for the Big Three (GM, Chrysler, Ford) intended to avoid further deterioration in the economy, while the incoming next President provided more clarity on his stimulus package for 2009. Since mid-December 2008, credit markets managed to show signs of stabilization despite expectations for further corporate earnings shortfalls.

Against this challenging backdrop, navigating the credit market waters was difficult. Investors favored the safety of U.S. government debt and credit risk was approached with great caution. Credit spreads versus governments in all major fixed income asset classes were quite volatile as investors remained concerned about US economic prospects. Massive spread widening during the year drove spreads on US investment grade corporates and high yield debt to all-time highs. Spreads on US investment grade credits, as represented by the Barclays Capital US Credit Index, reached a record wide at 545 bps over US Treasuries on December 4, with the Financial sector reaching a spread of 707 bps. On the same day, credit spreads in the high yield market, as measured by the Citigroup High Yield Market Capped Index, also widened to an all-time high, reaching 1850 bps. During the period in review, spreads for the emerging markets debt dollar-denominated benchmark, the JP Morgan EMBI Global Diversified Index, widened to a cyclical high of 891 bps on October 24.

The market has maintained its focus on global economic and financial market conditions as global central banks continue to create what they hope will be enough stimulus to prevent a prolonged recession. We believe our portfolios are well-positioned for this period of uncertainty and to take advantage of the opportunities that lie in the year ahead.

Sincerely,

![]()

Thomas W. Brock

Chairman of the Board of Trustees

2

Stone Harbor Emerging Markets Debt Fund

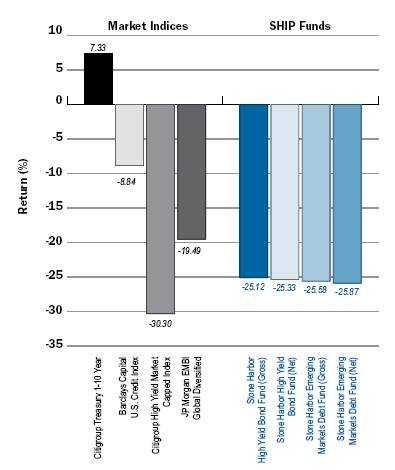

Fund performance over the six months ended November 30, 2008 was -25.87% net of expenses (-25.58% gross of expenses), relative to a benchmark return of -19.49% on the JP Morgan Emerging Market Global Diversified Index. The Fund maintained its focus on identifying improving emerging market credits but ran into headwinds of substantial risk aversion and deleveraging following the bankruptcy of Lehman Brothers in mid-September. In the weeks that followed this event, investors sold bonds from emerging markets indiscriminately, including bonds whose credit quality were fundamentally sound. Key drivers of market underperformance from country selection were the Fund’s overweight positions in Argentina and Iraq, as well as its underweights to China, Chile, Mexico and Poland. The Fund continues to underweight these credits based on Stone Harbor’s belief that their lack of value relative to investment grade debt in the developed world. The Fund’s overweight in Argentina is based on the view that the government’s strong ability to pay its debts and its need to garner debt holders’ support for financing requirements in 2009 favors owning Argentine bonds, particularly at currently distressed market prices. In addition, the Fund maintained an underweight in Lebanon based on our opinion that the country’s political risk and weak fundamentals did not justify by current bond prices; this position was a negative factor in performance. The significant steepening of the US yield curve detracted 25 basis points from performance. Issue and sector selection were also sources of underperformance versus the Index. The portfolio’s allocation to local currency bonds in Brazil and Colombia were the primary contributors to weakness in security selection.

Stone Harbor High Yield Bond Fund

The Fund outperformed its benchmark for the 6 months ended November 30, 2008, returning -25.33% net of expenses (-25.12% gross of expenses), 497 bps above the Citigroup High Yield Market Capped Index, which returned -30.30%. Investor risk aversion, which began in earnest at the start of the period under review, continued through the six months amid record high volatility, driving high yield spreads to all-time highs. The US economic recession which began in December 2007 weighed heavily on consumer confidence. Bank write-downs continued while a wide range of corporate earnings disappointed. Following Lehman Brothers’ collapse in September, technical pressures were accelerated by hedge and mutual fund deleveraging. Aggressive steps taken by the Fed and US Treasury were aimed at reducing systemic risk, but were not enough to stem the tide of liquidations as accounts were forced to delever or meet redemptions. Poor economic data weighed on consumer and investor sentiment, particularly US auto sales, unemployment, ISM manufacturing, and housing starts. Positive news such as the definitive presidential election, the lowest LIBOR rates since 2004, and aggressive monetary and fiscal policy were not enough to offset these fundamental stresses. Falling oil prices did not compensate for pressures on the consumer, mainly the negative wealth effect from falling stock and home prices. By the end of November, headwinds persisted for the high yield market: constrained borrowing, ratings downgrades, corporate earnings shortfalls, and declining investor confidence. Focus was on the fate of the Big Three (GM, Chrysler, Ford), distressed debt exchanges and the imminent Fed Funds rate decision in mid-December. Stone Harbor’s high yield strategy during the six month period was to overweight defensive sectors such as Utilities, Cable & Media, Energy, Healthcare, and Telecommunications; underweight consumer- related industries such as Financials and Homebuilders, and maintain a slightly higher credit quality. Issue selection, particularly in Services (Other) and Gaming contributed positively to performance.

3

The Citigroup US Treasury 1-10 Year Benchmark (On-The-Run) Index measures total returns for the current ten year on-the-run Treasuries that have been in existence for the entire month.

The Barclarys Capital U.S. Credit Index is comprised of publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. To qualify, bonds must be SEC-registered.

The Citigroup High Yield Market Capped Index represents a modified version of the High Yield Market Index by delaying the entry of “fallen angel” issues (corporate or municipal bonds that were investment-grade when issued but have since been downgraded) and capping the par value of individual issuers at US $5 billion par amount outstanding.

The JP Morgan Emerging Bond Index Global Diversified is a uniquely-weighted version of the EMBI Global Index, which tracks total returns for U.S.-dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities such as: Brady bonds, loans and Eurobonds. Currently, the EMBI Global Index covers 196 instruments across 28 countries. It limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible debt outstanding. The countries covered in the EMBI Global Diversified are identical to those covered by the EMBI Global Index.

4

November 30, 2008 (Unaudited)

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and/or redemption fees (if applicable) and (2) ongoing costs, including management fees and other Fund expenses. The below examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on June 1, 2008 and held until November 30, 2008.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transaction fees, such as redemption fees, sales charges (loads) or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction fees were included, your costs would have been higher.

|

| Beginning |

| Ending |

|

|

| Expenses |

| |||

|

| Account Value |

| Account Value |

| Expense |

| Paid During |

| |||

|

| 06/01/2008 |

| 11/30/2008 |

| Ratio(a) |

| Period(b) |

| |||

STONE HARBOR EMERGING MARKETS DEBT FUND |

|

|

|

|

|

|

|

|

| |||

Institutional Class |

|

|

|

|

|

|

|

|

| |||

Actual |

| $ | 1,000.00 |

| $ | 740.40 |

| 0.75 | % | $ | 3.27 |

|

Hypothetical |

| $ | 1,000.00 |

| $ | 1,021.31 |

| 0.75 | % | $ | 3.80 |

|

|

|

|

|

|

|

|

|

|

| |||

STONE HARBOR HIGH YIELD BOND FUND |

|

|

|

|

|

|

|

|

| |||

Institutional Class |

|

|

|

|

|

|

|

|

| |||

Actual |

| $ | 1,000.00 |

| $ | 746.70 |

| 0.55 | % | $ | 2.41 |

|

Hypothetical |

| $ | 1,000.00 |

| $ | 1,022.31 |

| 0.55 | % | $ | 2.79 |

|

(a) |

| Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

(b) |

| Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 365. Note this expense example is typically based on a six-month period. |

5

November 30, 2008 (Unaudited)

Under SEC Rules, all funds are required to include in their annual and semi-annual shareholder reports a presentation of portfolio holdings in a table, chart or graph by reasonably identifiable categories. The following tables which present holdings as a percent of total net assets (“TNA”) are provided in compliance with such requirements.

EMERGING MARKETS DEBT FUND

Country Breakout |

| % of TNA |

|

Argentina |

| 4.80 | % |

Brazil |

| 13.43 | % |

Bulgaria |

| 0.15 | % |

Chile |

| 0.37 | % |

Colombia |

| 6.21 | % |

Ecuador |

| 0.08 | % |

El Salvador |

| 2.45 | % |

Gabon |

| 0.75 | % |

Ghana |

| 0.82 | % |

Great Britain |

| 0.50 | % |

Indonesia |

| 4.86 | % |

Iraq |

| 2.68 | % |

Ireland |

| 0.51 | % |

Kazakhstan |

| 0.60 | % |

Luxembourg |

| 0.64 | % |

Malaysia |

| 3.80 | % |

Mexico |

| 1.64 | % |

Netherlands |

| 0.25 | % |

Panama |

| 4.36 | % |

Peru |

| 3.13 | % |

Philippines |

| 6.57 | % |

Russia |

| 11.76 | % |

Singapore |

| 0.02 | % |

South Africa |

| 0.63 | % |

Tunisia |

| 0.46 | % |

Turkey |

| 4.48 | % |

Ukraine |

| 3.07 | % |

United States |

| 3.91 | % |

Uruguay |

| 2.37 | % |

Venezuela |

| 11.14 | % |

Vietnam |

| 0.38 | % |

Total |

| 96.82 | % |

Other Assets in Excess of Liabilities |

| 3.18 | % |

Total Net Assets |

| 100.00 | % |

HIGH YIELD BOND FUND

Industry Breakout |

| % of TNA |

|

Advertising |

| 1.53 | % |

Aerospace - Defense |

| 4.38 | % |

Agriculture |

| 1.43 | % |

Apparel |

| 0.62 | % |

Auto Manufacturers |

| 0.99 | % |

Beverages |

| 1.35 | % |

Building Materials |

| 0.36 | % |

Building Products |

| 0.71 | % |

Chemicals |

| 3.31 | % |

Coal |

| 1.27 | % |

Commercial Services |

| 5.33 | % |

Communications |

| 0.77 | % |

Distribution - Wholesale |

| 0.33 | % |

Diversified Financial Services |

| 6.20 | % |

Electric |

| 5.55 | % |

Electrical Components & Equipment |

| 0.48 | % |

Entertainment |

| 4.33 | % |

Environmental Control |

| 0.86 | % |

Exploration & Production |

| 0.10 | % |

Food |

| 1.58 | % |

Forest Products & Paper |

| 1.93 | % |

Healthcare-Products |

| 1.89 | % |

Healthcare-Services |

| 6.31 | % |

Holding Companies-Diversified |

| 0.16 | % |

Home Furnishings |

| 0.27 | % |

Hotels & Motels |

| 0.08 | % |

Internet |

| 0.16 | % |

Iron/Steel |

| 0.94 | % |

Lodging |

| 0.68 | % |

Machinery - Construction & Mining |

| 0.58 | % |

Media |

| 6.34 | % |

Miscellaneous Manufacturers |

| 1.75 | % |

Money Market Mutual Funds |

| 6.87 | % |

Office-Business Equipment |

| 1.31 | % |

Office Furnishings |

| 0.34 | % |

Oil & Gas |

| 5.00 | % |

Oil & Gas Services |

| 1.10 | % |

Packaging & Containers |

| 2.21 | % |

Pipelines |

| 4.85 | % |

Radio & TV/Other |

| 0.15 | % |

Real Estate Investment Trusts |

| 1.59 | % |

Research Services |

| 0.28 | % |

Retail |

| 1.28 | % |

Semiconductors |

| 0.25 | % |

Telecommunications |

| 8.85 | % |

Transportation |

| 0.80 | % |

Total |

| 97.45 | % |

Other Assets in Excess of Liabilities |

| 2.55 | % |

Total Net Assets |

| 100.00 | % |

6

Growth of a $10,000 Investment

November 30, 2008 (Unaudited)

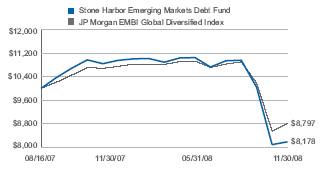

STONE HARBOR EMERGING MARKETS DEBT FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Debt Fund and the JP Morgan Emerging Bond Index Global Diversified

The JP Morgan Emerging Bond Index Global Diversified is a uniquely-weighted version of the EMBI Global Index, which tracks total returns for U.S.-dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities such as: Brady bonds, loans and Eurobonds. Currently, the EMBI Global Index covers 196 instruments across 28 countries. It limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible debt outstanding. The countries covered in the EMBI Global Diversified are identical to those covered by the EMBI Global Index.

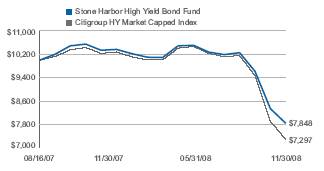

STONE HARBOR HIGH YIELD BOND FUND

Comparison of Change in Value of $10,000 Investment in Stone Harbor High Yield Bond Fund and the Citigroup High Yield Market Capped Index

The Citigroup High Yield Market Capped Index represents a modified version of the High Yield Market Index by delaying the entry of “fallen angel” issues (corporate or municipal bonds that were investment-grade when issued but have since been downgraded) and capping the par value of individual issuers at US $5 billion par amount outstanding.

7

November 30, 2008 (Unaudited)

|

|

|

| Principal |

| Market Value |

| ||

Interest Rate/Maturity Date |

| Currency |

| Amount* |

| (Expressed in U.S. $) |

| ||

|

|

|

|

|

|

|

| ||

SOVEREIGN DEBT OBLIGATIONS - 84.33% |

|

|

|

|

|

|

| ||

Argentina - 4.80% |

|

|

|

|

|

|

| ||

Republic of Argentina |

|

|

|

|

|

|

| ||

10.500%, 11/14/2002(1) |

| EUR |

| $ | 2,165,000 |

| $ | 188,099 |

|

8.750%, 02/04/2003(1) |

| EUR |

| 57,000 |

| 11,044 |

| ||

7.000%, 03/18/2004(1) |

| EUR |

| 88,000 |

| 10,990 |

| ||

1.985%, 03/29/2005(1)(2) |

|

|

| 154,000 |

| 26,180 |

| ||

9.000%, 05/24/2005(1) |

| EUR |

| 191,000 |

| 35,187 |

| ||

9.000%, 04/26/2006(1) |

| EUR |

| 58,000 |

| 10,869 |

| ||

10.000%, 01/03/2007(1) |

| ITL |

| 140,000,000 |

| 14,468 |

| ||

10.250%, 01/26/2007(1) |

| EUR |

| 661,000 |

| 132,269 |

| ||

8.000%, 02/26/2008(1) |

| EUR |

| 243,000 |

| 45,924 |

| ||

7.000%, 09/12/2013 |

|

|

| 130,000 |

| 38,253 |

| ||

7.820%, 12/31/2033 |

| EUR |

| 167,830 |

| 51,175 |

| ||

8.280%, 12/31/2033(3) |

|

|

| 1,766,416 |

| 547,588 |

| ||

1.985%, 12/15/2035 IO(2)(4) |

| EUR |

| 1,800,000 |

| 90,333 |

| ||

2.280%, 12/15/2035(2) |

|

|

| 3,785,000 |

| 169,379 |

| ||

1.330%, 12/31/2038(5) |

|

|

| 1,385,000 |

| 249,299 |

| ||

|

|

|

|

|

| 1,621,057 |

| ||

Brazil - 12.00% |

|

|

|

|

|

|

| ||

Nota Do Tesouro Nacional |

|

|

|

|

|

|

| ||

Series F, 10.000%, 01/01/2014 |

| BRL |

| 1,080,000 |

| 363,096 |

| ||

Series F, 10.000%, 01/01/2017 |

| BRL |

| 2,890,000 |

| 876,082 |

| ||

Republic of Brazil |

|

|

|

|

|

|

| ||

6.000%, 01/17/2017 |

|

|

| 100,000 |

| 93,500 |

| ||

8.000%, 01/15/2018 |

|

|

| 1,440,000 |

| 1,490,400 |

| ||

8.750%, 02/04/2025 |

|

|

| 265,000 |

| 288,850 |

| ||

10.125%, 05/15/2027 |

|

|

| 230,000 |

| 279,450 |

| ||

12.250%, 03/06/2030 |

|

|

| 20,000 |

| 27,300 |

| ||

8.250%, 01/20/2034 |

|

|

| 130,000 |

| 136,500 |

| ||

11.000%, 08/17/2040 |

|

|

| 420,000 |

| 494,025 |

| ||

|

|

|

|

|

| 4,049,203 |

| ||

Bulgaria - 0.15% |

|

|

|

|

|

|

| ||

Republic of Bulgaria |

|

|

|

|

|

|

| ||

8.250%, 01/15/2015 |

|

|

| 53,000 |

| 50,350 |

| ||

|

|

|

|

|

|

|

| ||

Colombia - 6.21% |

|

|

|

|

|

|

| ||

Republic of Colombia |

|

|

|

|

|

|

| ||

6.364%, 03/17/2013(2) |

|

|

| 55,000 |

| 51,150 |

| ||

8.250%, 12/22/2014 |

|

|

| 85,000 |

| 85,850 |

| ||

8

|

|

|

| Principal |

| Market Value |

| ||

Interest Rate/Maturity Date |

| Currency |

| Amount* |

| (Expressed in U.S. $) |

| ||

|

|

|

|

|

|

|

| ||

Republic of Colombia (continued) |

|

|

|

|

|

|

| ||

3.949%, 11/16/2015(2) |

|

|

| $ | 100,000 |

| $ | 84,500 |

|

7.375%, 01/27/2017 |

|

|

| 100,000 |

| 92,750 |

| ||

11.750%, 02/25/2020 |

|

|

| 385,000 |

| 462,000 |

| ||

9.850%, 06/28/2027 |

| COP |

| 824,000,000 |

| 288,079 |

| ||

10.375%, 01/28/2033 |

|

|

| 35,000 |

| 38,850 |

| ||

7.375%, 09/18/2037 |

|

|

| 1,190,000 |

| 993,650 |

| ||

|

|

|

|

|

| 2,096,829 |

| ||

Ecuador - 0.08% |

|

|

|

|

|

|

| ||

Republic of Ecuador |

|

|

|

|

|

|

| ||

9.375%, 12/15/2015 |

|

|

| 85,000 |

| 26,350 |

| ||

|

|

|

|

|

|

|

| ||

El Salvador - 2.45% |

|

|

|

|

|

|

| ||

Republic of El Salvador |

|

|

|

|

|

|

| ||

7.750%, 01/24/2023 |

|

|

| 73,000 |

| 63,510 |

| ||

8.250%, 04/10/2032 |

|

|

| 290,000 |

| 181,250 |

| ||

7.650%, 06/15/2035 |

|

|

| 993,000 |

| 580,905 |

| ||

|

|

|

|

|

| 825,665 |

| ||

Gabon - 0.75% |

|

|

|

|

|

|

| ||

Republic of Gabonese |

|

|

|

|

|

|

| ||

8.200%, 12/12/2017(6) |

|

|

| 395,000 |

| 252,800 |

| ||

|

|

|

|

|

|

|

| ||

Ghana - 0.82% |

|

|

|

|

|

|

| ||

Republic of Ghana |

|

|

|

|

|

|

| ||

8.500%, 10/04/2017 |

|

|

| 460,000 |

| 276,000 |

| ||

|

|

|

|

|

|

|

| ||

Indonesia - 4.86% |

|

|

|

|

|

|

| ||

Republic of Indonesia |

|

|

|

|

|

|

| ||

6.750%, 03/10/2014 |

|

|

| 525,000 |

| 420,000 |

| ||

6.625%, 02/17/2037 |

|

|

| 55,000 |

| 32,175 |

| ||

7.750%, 01/17/2038 |

|

|

| 1,760,000 |

| 1,188,000 |

| ||

|

|

|

|

|

| 1,640,175 |

| ||

Iraq - 2.68% |

|

|

|

|

|

|

| ||

Republic of Iraq |

|

|

|

|

|

|

| ||

5.800%, 01/15/2028 |

|

|

| 2,010,000 |

| 904,500 |

| ||

|

|

|

|

|

|

|

| ||

Mexico - 1.64% |

|

|

|

|

|

|

| ||

United Mexican States |

|

|

|

|

|

|

| ||

5.625%, 01/15/2017 |

|

|

| 106,000 |

| 96,195 |

| ||

8.000%, 09/24/2022 |

|

|

| 445,000 |

| 458,350 |

| ||

|

|

|

|

|

| 554,545 |

| ||

9

|

| Principal |

| Market Value |

| ||

Interest Rate/Maturity Date |

| Amount* |

| (Expressed in U.S. $) |

| ||

|

|

|

|

|

| ||

Panama - 4.36% |

|

|

|

|

| ||

Republic of Panama |

|

|

|

|

| ||

9.375%, 01/16/2023 |

| $ | 25,000 |

| $ | 24,875 |

|

9.375%, 04/01/2029 |

| 1,310,000 |

| 1,310,000 |

| ||

6.700%, 01/26/2036 |

| 175,000 |

| 137,375 |

| ||

|

|

|

| 1,472,250 |

| ||

Peru - 3.13% |

|

|

|

|

| ||

Republic of Peru |

|

|

|

|

| ||

9.875%, 02/06/2015 |

| 5,000 |

| 5,463 |

| ||

8.375%, 05/03/2016 |

| 120,000 |

| 123,300 |

| ||

7.350%, 07/21/2025 |

| 175,000 |

| 158,813 |

| ||

8.750%, 11/21/2033 |

| 165,000 |

| 165,825 |

| ||

6.550%, 03/14/2037 |

| 765,000 |

| 604,349 |

| ||

|

|

|

| 1,057,750 |

| ||

Philippines - 6.57% |

|

|

|

|

| ||

Republic of Philippines |

|

|

|

|

| ||

8.250%, 01/15/2014 |

| 207,000 |

| 203,895 |

| ||

8.875%, 03/17/2015 |

| 58,000 |

| 58,290 |

| ||

8.000%, 01/15/2016 |

| 340,000 |

| 328,100 |

| ||

9.375%, 01/18/2017 |

| 825,000 |

| 849,750 |

| ||

7.500%, 09/25/2024 |

| 145,000 |

| 126,875 |

| ||

10.625%, 03/16/2025 |

| 315,000 |

| 349,650 |

| ||

9.500%, 02/02/2030 |

| 30,000 |

| 31,950 |

| ||

7.750%, 01/14/2031 |

| 195,000 |

| 181,350 |

| ||

6.375%, 01/15/2032 |

| 100,000 |

| 87,500 |

| ||

|

|

|

| 2,217,360 |

| ||

Russia - 11.76% |

|

|

|

|

| ||

Russian Federation |

|

|

|

|

| ||

12.750%, 06/24/2028 |

| 90,000 |

| 104,400 |

| ||

7.500%, 03/31/2030 |

| 4,629,520 |

| 3,865,649 |

| ||

|

|

|

| 3,970,049 |

| ||

South Africa - 0.63% |

|

|

|

|

| ||

Republic of South Africa |

|

|

|

|

| ||

6.500%, 06/02/2014 |

| 218,000 |

| 191,840 |

| ||

8.500%, 06/23/2017 |

| 20,000 |

| 19,100 |

| ||

|

|

|

| 210,940 |

| ||

10

|

| Principal |

| Market Value |

| ||

Interest Rate/Maturity Date |

| Amount* |

| (Expressed in U.S. $) |

| ||

|

|

|

|

|

| ||

Turkey - 4.48% |

|

|

|

|

| ||

Republic of Turkey |

|

|

|

|

| ||

7.250%, 03/15/2015 |

| $ | 1,020,000 |

| $ | 938,400 |

|

7.000%, 03/11/2019 |

| 275,000 |

| 228,250 |

| ||

7.375%, 02/05/2025 |

| 100,000 |

| 83,500 |

| ||

6.875%, 03/17/2036 |

| 360,000 |

| 262,800 |

| ||

|

|

|

| 1,512,950 |

| ||

Ukraine - 3.07% |

|

|

|

|

| ||

Ukraine Government |

|

|

|

|

| ||

6.450%, 08/05/2009(2)(6) |

| 100,000 |

| 82,500 |

| ||

6.450%, 08/05/2009(2) |

| 275,000 |

| 226,875 |

| ||

6.875%, 03/04/2011(6) |

| 110,000 |

| 70,400 |

| ||

6.385%, 06/26/2012 |

| 200,000 |

| 108,000 |

| ||

7.650%, 06/11/2013 |

| 630,000 |

| 340,200 |

| ||

6.580%, 11/21/2016 |

| 100,000 |

| 43,500 |

| ||

6.750%, 11/14/2017 |

| 390,000 |

| 165,750 |

| ||

|

|

|

| 1,037,225 |

| ||

Uruguay - 2.37% |

|

|

|

|

| ||

Republic of Uruguay |

|

|

|

|

| ||

8.000%, 11/18/2022 |

| 935,000 |

| 752,675 |

| ||

7.875%, 01/15/2033(3) |

| 800 |

| 588 |

| ||

7.625%, 03/21/2036 |

| 65,000 |

| 46,475 |

| ||

|

|

|

| 799,738 |

| ||

Venezuela - 11.14% |

|

|

|

|

| ||

Republic of Venezuela |

|

|

|

|

| ||

5.375%, 08/07/2010 |

| 1,145,000 |

| 921,725 |

| ||

5.059%, 04/20/2011(2) |

| 635,000 |

| 403,225 |

| ||

10.750%, 09/19/2013 |

| 330,000 |

| 227,700 |

| ||

8.500%, 10/08/2014 |

| 140,000 |

| 81,200 |

| ||

5.750%, 02/26/2016 |

| 60,000 |

| 27,750 |

| ||

7.000%, 12/01/2018 |

| 75,000 |

| 35,250 |

| ||

6.000%, 12/09/2020 |

| 85,000 |

| 36,125 |

| ||

7.650%, 04/21/2025 |

| 2,580,000 |

| 1,186,800 |

| ||

9.375%, 01/13/2034 |

| 165,000 |

| 85,800 |

| ||

9.000%, 05/07/2023 |

| 45,000 |

| 22,500 |

| ||

9.250%, 05/07/2028 |

| 1,460,000 |

| 730,000 |

| ||

|

|

|

| 3,758,075 |

| ||

11

|

|

|

| Principal |

| Market Value |

| ||

Interest Rate/Maturity Date |

| Currency |

| Amount* |

| (Expressed in U.S. $) |

| ||

|

|

|

|

|

|

|

| ||

Vietnam - 0.38% |

|

|

|

|

|

|

| ||

Republic of Vietnam |

|

|

|

|

|

|

| ||

6.875%, 01/15/2016 |

|

|

| $ | 160,000 |

| $ | 129,600 |

|

|

|

|

|

|

|

|

| ||

TOTAL SOVEREIGN DEBT OBLIGATIONS |

|

|

|

|

| 28,463,411 |

| ||

(Amortized Cost $36,362,600) |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||

CORPORATE BONDS - 8.86% |

|

|

|

|

|

|

| ||

Brazil - 1.43% |

|

|

|

|

|

|

| ||

GTL Trade Finance, Inc. |

|

|

|

|

|

|

| ||

7.250%, 10/20/2017(6) |

|

|

| 310,000 |

| 259,913 |

| ||

National Development Co. |

|

|

|

|

|

|

| ||

6.369%, 06/16/2018(6) |

|

|

| 260,000 |

| 222,300 |

| ||

|

|

|

|

|

| 482,213 |

| ||

Chile - 0.37% |

|

|

|

|

|

|

| ||

Codelco, Inc. |

|

|

|

|

|

|

| ||

6.375%, 11/30/2012(6) |

|

|

| 125,000 |

| 125,885 |

| ||

|

|

|

|

|

|

|

| ||

Great Britain - 0.50% |

|

|

|

|

|

|

| ||

Vedanta Resources PLC |

|

|

|

|

|

|

| ||

9.500%, 07/18/2018(6) |

|

|

| 340,000 |

| 170,000 |

| ||

|

|

|

|

|

|

|

| ||

Ireland - 0.51% |

|

|

|

|

|

|

| ||

VIP Finance Ireland Ltd. for OJSC Vimpel Communications |

|

|

|

|

|

|

| ||

8.375%, 04/30/2013(6) |

|

|

| 300,000 |

| 171,000 |

| ||

|

|

|

|

|

|

|

| ||

Kazakhstan - 0.60% |

|

|

|

|

|

|

| ||

KazMunaiGaz Finance Sub BV |

|

|

|

|

|

|

| ||

9.125%, 07/02/2018(6) |

|

|

| 305,000 |

| 204,350 |

| ||

|

|

|

|

|

|

|

| ||

Luxembourg - 0.64% |

|

|

|

|

|

|

| ||

VTB Capital SA |

|

|

|

|

|

|

| ||

6.875%, 05/29/2018(6) |

|

|

| 345,000 |

| 214,763 |

| ||

|

|

|

|

|

|

|

| ||

Malaysia - 3.80% |

|

|

|

|

|

|

| ||

Petroliam Nasional BHD |

|

|

|

|

|

|

| ||

7.750%, 08/15/2015 |

|

|

| 335,000 |

| 345,248 |

| ||

Petronas Capital Ltd. |

|

|

|

|

|

|

| ||

7.000%, 05/22/2012 |

|

|

| 200,000 |

| 205,778 |

| ||

7.875%, 05/22/2022 |

|

|

| 675,000 |

| 730,462 |

| ||

|

|

|

|

|

| 1,281,488 |

| ||

12

|

| Principal |

| Market Value |

| ||

Interest Rate/Maturity Date |

| Amount/Shares* |

| (Expressed in U.S. $) |

| ||

|

|

|

|

|

| ||

Netherlands - 0.25% |

|

|

|

|

| ||

HSBK Europe BV |

|

|

|

|

| ||

9.250%, 10/16/2013(6) |

| $ | 110,000 |

| $ | 85,800 |

|

|

|

|

|

|

| ||

Singapore - 0.02% |

|

|

|

|

| ||

DBS Bank Ltd. |

|

|

|

|

| ||

5.000%, 11/15/2019(2)(6) |

| 10,000 |

| 7,098 |

| ||

|

|

|

|

|

| ||

Tunisia - 0.46% |

|

|

|

|

| ||

Banque Centrale de Tunisie |

|

|

|

|

| ||

7.375%, 04/25/2012 |

| 155,000 |

| 153,838 |

| ||

|

|

|

|

|

| ||

United States - 0.28% |

|

|

|

|

| ||

TransCapitalInvest Ltd. for OJSC AK Transneft |

|

|

|

|

| ||

8.700%, 08/07/2018(6) |

| 160,000 |

| 96,000 |

| ||

|

|

|

|

|

| ||

TOTAL CORPORATE BONDS |

|

|

| 2,992,435 |

| ||

(Amortized Cost $3,829,453) |

|

|

|

|

| ||

|

|

|

|

|

| ||

MONEY MARKET MUTUAL FUNDS - 3.63% |

|

|

|

|

| ||

Dreyfus Cash Advantage Plus Fund (1.73% 7-day yield) |

| 1,223,121 |

| 1,223,121 |

| ||

|

|

|

|

|

| ||

TOTAL MONEY MARKET MUTUAL FUNDS |

|

|

| 1,223,121 |

| ||

(Cost $1,223,121) |

|

|

|

|

| ||

|

|

|

|

|

| ||

Total Investments - 96.82% |

|

|

| $ | 32,678,967 |

| |

(Amortized Cost $41,415,174) |

|

|

|

|

| ||

|

|

|

|

|

| ||

Other Assets In Excess of Liabilities - 3.18% |

|

|

| 1,073,335 |

| ||

|

|

|

|

|

| ||

Net Assets - 100% |

|

|

| $ | 33,752,302 |

| |

13

* |

| The principal/contract amount of each security is stated in the currency in which the bond is denominated (U.S. Dollar unless otherwise notated). See below. | |

|

|

| |

|

| BRL | Brazilian Real |

|

| COP | Colombian Peso |

|

| EUR | Euro Currency |

|

| ITL | Italian Lira |

|

|

| |

(1) |

| Security is currently in default/non-income producing. | |

|

|

| |

(2) |

| Floating or variable rate security. Interest rate disclosed is that which is in effect at November 30, 2008. | |

|

|

| |

(3) |

| Pay-in-kind securities. | |

|

|

| |

(4) |

| IO - Interest Only. | |

|

|

| |

(5) |

| Step Bond. Coupon increases periodically based upon a predetermined schedule. Interest rate disclosed is the stated rate at a set date in the future. | |

|

|

| |

(6) |

| Security exempt from registration under Rule 144A of the Securities Act of 1933. Under procedures approved by the Board of Trustees, such securities have been determined to be liquid by the Investment Advisor and may be resold, normally to qualified buyers in transactions exempt from registration. Total market value of Rule 144A securities amounts to $1,962,809, which represents approximately 5.82% of net assets as of November 30, 2008. | |

Common Abbreviations:

|

| BHD - Berhad is the Malaysian term for public limited company. BV - Besloten Vennootschap a Dutch private limited liability company. OJSC - Open Joint Stock Company. PLC - Public Limited Co. SA - Generally designates corporations in various countries, mostly those employing the civil law. |

See Notes to Financial Statements

OUTSTANDING FORWARD FOREIGN CURRENCY CONTRACTS

|

|

|

|

|

|

|

|

|

|

|

| Unrealized |

| |||

Contract |

| Contracted |

| Purchase/Sale |

| Expiration |

| Value on |

| Current |

| Appreciation/ |

| |||

Description |

| Amount |

| Contract |

| Date |

| Settlement Date |

| Value |

| Depreciation |

| |||

EUR |

| 387,895 (EUR | ) | Purchase |

| 01/16/2009 |

| $ | 550,376 |

| $ | 492,627 |

| $ | (57,749 | ) |

EUR |

| 737,370 (EUR | ) | Sale |

| 01/16/2009 |

| $ | 1,132,511 |

| $ | 936,462 |

| $ | 196,049 |

|

14

Statement of Investments

November 30, 2008 (Unaudited)

|

| Principal |

|

|

| ||

Interest Rate/Maturity Date |

| Amount |

| Market Value |

| ||

|

|

|

|

|

| ||

CORPORATE BONDS - 85.18% |

|

|

|

|

| ||

Advertising - 1.53% |

|

|

|

|

| ||

Interep National Radio Sales, Inc. |

|

|

|

|

| ||

Series B, 10.000%, 07/01/2008(1)(2) |

| $ | 4,000 |

| $ | 1,600 |

|

Lamar Media Corp. |

|

|

|

|

| ||

6.625%, 08/15/2015 |

| 710,000 |

| 518,300 |

| ||

Series B, 6.625%, 08/15/2015 |

| 780,000 |

| 569,400 |

| ||

Series C, 6.625%, 08/15/2015 |

| 200,000 |

| 146,000 |

| ||

RH Donnelley Corp. |

|

|

|

|

| ||

Series A-1, 6.875%, 01/15/2013 |

| 250,000 |

| 33,750 |

| ||

Series A-2, 6.875%, 01/15/2013 |

| 25,000 |

| 3,375 |

| ||

Series A-3, 8.875%, 01/15/2016 |

| 380,000 |

| 51,300 |

| ||

Series WI, 8.875%, 10/15/2017 |

| 1,800,000 |

| 243,000 |

| ||

|

|

|

| 1,566,725 |

| ||

Aerospace - Defense - 4.12% |

|

|

|

|

| ||

Alliant Techsystems, Inc. |

|

|

|

|

| ||

6.750%, 04/01/2016 |

| 640,000 |

| 550,400 |

| ||

DRS Technologies, Inc. |

|

|

|

|

| ||

6.875%, 11/01/2013 |

| 175,000 |

| 174,563 |

| ||

Esterline Technologies Corp. |

|

|

|

|

| ||

7.750%, 06/15/2013 |

| 325,000 |

| 281,125 |

| ||

6.625%, 03/01/2017 |

| 275,000 |

| 226,875 |

| ||

L-3 Communications Corp. |

|

|

|

|

| ||

7.625%, 06/15/2012 |

| 1,531,000 |

| 1,420,002 |

| ||

6.125%, 01/15/2014 |

| 475,000 |

| 401,375 |

| ||

Series B, 6.375%, 10/15/2015 |

| 400,000 |

| 334,000 |

| ||

Moog, Inc. |

|

|

|

|

| ||

6.250%, 01/15/2015 |

| 435,000 |

| 341,475 |

| ||

TransDigm, Inc. |

|

|

|

|

| ||

7.750%, 07/15/2014 |

| 625,000 |

| 478,125 |

| ||

|

|

|

| 4,207,940 |

| ||

Agriculture - 1.43% |

|

|

|

|

| ||

Reynolds American, Inc. |

|

|

|

|

| ||

7.250%, 06/01/2013 |

| 625,000 |

| 543,103 |

| ||

7.625%, 06/01/2016 |

| 1,155,000 |

| 914,072 |

| ||

|

|

|

| 1,457,175 |

| ||

Apparel - 0.62% |

|

|

|

|

| ||

Levi Strauss & Co. |

|

|

|

|

| ||

9.750%, 01/15/2015 |

| 1,045,000 |

| 632,225 |

| ||

15

|

| Principal |

|

|

| ||

Interest Rate/Maturity Date |

| Amount |

| Market Value |

| ||

|

|

|

|

|

| ||

Auto Manufacturers - 0.77% |

|

|

|

|

| ||

Ford Motor Co. |

|

|

|

|

| ||

7.450%, 07/16/2031 |

| $ | 1,560,000 |

| $ | 397,800 |

|

8.900%, 01/15/2032 |

| 25,000 |

| 5,875 |

| ||

General Motors Corp. |

|

|

|

|

| ||

8.375%, 07/15/2033 |

| 1,685,000 |

| 379,125 |

| ||

|

|

|

| 782,800 |

| ||

Beverages - 1.31% |

|

|

|

|

| ||

Constellation Brands, Inc. |

|

|

|

|

| ||

8.375%, 12/15/2014 |

| 675,000 |

| 590,625 |

| ||

7.250%, 09/01/2016 |

| 845,000 |

| 705,575 |

| ||

7.250%, 05/15/2017 |

| 50,000 |

| 41,750 |

| ||

|

|

|

| 1,337,950 |

| ||

Building Materials - 0.36% |

|

|

|

|

| ||

Interline Brands, Inc. |

|

|

|

|

| ||

8.125%, 06/15/2014 |

| 400,000 |

| 302,000 |

| ||

Nortek, Inc. |

|

|

|

|

| ||

8.500%, 09/01/2014 |

| 150,000 |

| 46,500 |

| ||

NTK Holdings, Inc. |

|

|

|

|

| ||

10.750%, 03/01/2014(3) |

| 75,000 |

| 17,625 |

| ||

|

|

|

| 366,125 |

| ||

Chemicals - 3.15% |

|

|

|

|

| ||

Airgas, Inc. |

|

|

|

|

| ||

6.250%, 07/15/2014 |

| 425,000 |

| 350,625 |

| ||

7.125%, 10/01/2018(4) |

| 75,000 |

| 60,188 |

| ||

Hercules, Inc. |

|

|

|

|

| ||

6.750%, 10/15/2029 |

| 475,000 |

| 497,563 |

| ||

Lyondell Chemical Co. |

|

|

|

|

| ||

8.375%, 08/15/2015(4) |

| 945,000 |

| 148,838 |

| ||

MacDermid, Inc. |

|

|

|

|

| ||

9.500%, 04/15/2017(4) |

| 650,000 |

| 354,250 |

| ||

Nalco Co. |

|

|

|

|

| ||

7.750%, 11/15/2011 |

| 375,000 |

| 334,688 |

| ||

8.875%, 11/15/2013 |

| 530,000 |

| 426,650 |

| ||

NewMarket Corp. |

|

|

|

|

| ||

7.125%, 12/15/2016 |

| 405,000 |

| 317,925 |

| ||

Nova Chemicals Corp. |

|

|

|

|

| ||

6.500%, 01/15/2012 |

| 1,045,000 |

| 731,499 |

| ||

|

|

|

| 3,222,226 |

| ||

16

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Coal - 1.27% |

|

|

|

|

| ||

Arch Western Finance LLC |

|

|

|

|

| ||

6.750%, 07/01/2013(5) |

| $ | 625,000 |

| $ | 506,250 |

|

Peabody Energy Corp. |

|

|

|

|

| ||

Series B, 6.875%, 03/15/2013 |

| 750,000 |

| 641,250 |

| ||

5.875%, 04/15/2016 |

| 75,000 |

| 58,125 |

| ||

7.875%, 11/01/2026 |

| 125,000 |

| 96,875 |

| ||

|

|

|

| 1,302,500 |

| ||

Commercial Services - 4.91% |

|

|

|

|

| ||

ARAMARK Corp. |

|

|

|

|

| ||

6.693%, 02/01/2015(5) |

| 65,000 |

| 45,825 |

| ||

8.500%, 02/01/2015 |

| 955,000 |

| 797,425 |

| ||

Cadmus Communications Corp. |

|

|

|

|

| ||

8.375%, 06/15/2014 |

| 550,000 |

| 320,375 |

| ||

Cenveo Corp. |

|

|

|

|

| ||

7.875%, 12/01/2013 |

| 100,000 |

| 50,625 |

| ||

10.500%, 08/15/2016(4) |

| 250,000 |

| 193,125 |

| ||

Corrections Corp. of America |

|

|

|

|

| ||

7.500%, 05/01/2011 |

| 10,000 |

| 9,550 |

| ||

6.250%, 03/15/2013 |

| 999,000 |

| 884,115 |

| ||

6.750%, 01/31/2014 |

| 325,000 |

| 292,500 |

| ||

Deluxe Corp. |

|

|

|

|

| ||

7.375%, 06/01/2015 |

| 395,000 |

| 242,925 |

| ||

Education Management, LLC |

|

|

|

|

| ||

8.750%, 06/01/2014 |

| 600,000 |

| 438,000 |

| ||

10.250%, 06/01/2016 |

| 195,000 |

| 136,500 |

| ||

The Geo Group, Inc. |

|

|

|

|

| ||

8.250%, 07/15/2013 |

| 575,000 |

| 500,250 |

| ||

Iron Mountain, Inc. |

|

|

|

|

| ||

8.625%, 04/01/2013 |

| 25,000 |

| 22,688 |

| ||

7.750%, 01/15/2015 |

| 575,000 |

| 485,875 |

| ||

8.750%, 07/15/2018 |

| 360,000 |

| 307,800 |

| ||

8.000%, 06/15/2020 |

| 375,000 |

| 290,625 |

| ||

|

|

|

| 5,018,203 |

| ||

Communications - 0.77 |

|

|

|

|

| ||

Intelsat Jackson Holdings Ltd. |

|

|

|

|

| ||

9.500%, 06/15/2016(4) |

| 350,000 |

| 297,500 |

| ||

11.250%, 06/15/2016 |

| 600,000 |

| 486,000 |

| ||

|

|

|

| 783,500 |

| ||

17

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Distribution - Wholesale - 0.33% |

|

|

|

|

| ||

Baker & Taylor, Inc. |

|

|

|

|

| ||

11.500%, 07/01/2013(4) |

| $ | 670,000 |

| $ | 338,350 |

|

|

|

|

|

|

| ||

Diversified Financial Services - 6.00% |

|

|

|

|

| ||

Ford Motor Credit Co. LLC |

|

|

|

|

| ||

5.800%, 01/12/2009 |

| 225,000 |

| 200,510 |

| ||

7.375%, 10/28/2009 |

| 475,000 |

| 290,064 |

| ||

9.875%, 08/10/2011 |

| 1,075,000 |

| 505,500 |

| ||

8.000%, 12/15/2016 |

| 1,385,000 |

| 584,306 |

| ||

Fox Acquisition Sub LLC |

|

|

|

|

| ||

13.375%, 07/15/2016(4) |

| 540,000 |

| 283,500 |

| ||

Global Cash Access LLC |

|

|

|

|

| ||

8.750%, 03/15/2012 |

| 600,000 |

| 471,000 |

| ||

GMAC LLC |

|

|

|

|

| ||

5.850%, 01/14/2009 |

| 450,000 |

| 375,684 |

| ||

5.625%, 05/15/2009 |

| 224,000 |

| 154,358 |

| ||

7.250%, 03/02/2011 |

| 125,000 |

| 51,066 |

| ||

6.875%, 09/15/2011 |

| 375,000 |

| 144,167 |

| ||

6.000%, 12/15/2011 |

| 150,000 |

| 53,463 |

| ||

7.000%, 02/01/2012 |

| 600,000 |

| 212,801 |

| ||

6.625%, 05/15/2012 |

| 105,000 |

| 36,835 |

| ||

8.000%, 11/01/2031 |

| 30,000 |

| 7,896 |

| ||

Hughes Network Systems LLC |

|

|

|

|

| ||

9.500%, 04/15/2014 |

| 160,000 |

| 132,800 |

| ||

Petroplus Finance Ltd. |

|

|

|

|

| ||

6.750%, 05/01/2014(4) |

| 485,000 |

| 315,250 |

| ||

7.000%, 05/01/2017(4) |

| 550,000 |

| 343,750 |

| ||

Pinnacle Foods Finance LLC |

|

|

|

|

| ||

9.250%, 04/01/2015 |

| 475,000 |

| 315,875 |

| ||

Rainbow National Services LLC |

|

|

|

|

| ||

8.750%, 09/01/2012(4) |

| 200,000 |

| 177,000 |

| ||

Sensus Metering Systems, Inc. |

|

|

|

|

| ||

8.625%, 12/15/2013 |

| 600,000 |

| 471,000 |

| ||

Southern Star Central Corp. |

|

|

|

|

| ||

6.750%, 03/01/2016 |

| 75,000 |

| 61,125 |

| ||

6.750%, 03/01/2016(4) |

| 575,000 |

| 468,625 |

| ||

Vanguard Health Holding Co. II LLC |

|

|

|

|

| ||

9.000%, 10/01/2014 |

| 590,000 |

| 474,950 |

| ||

|

|

|

| 6,131,525 |

| ||

18

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Electric - 5.55% |

|

|

|

|

| ||

The AES Corp. |

|

|

|

|

| ||

7.750%, 03/01/2014 |

| $ | 650,000 |

| $ | 479,375 |

|

8.000%, 10/15/2017 |

| 850,000 |

| 590,750 |

| ||

Edison Mission Energy |

|

|

|

|

| ||

7.500%, 06/15/2013 |

| 55,000 |

| 45,100 |

| ||

7.200%, 05/15/2019 |

| 665,000 |

| 488,775 |

| ||

7.625%, 05/15/2027 |

| 960,000 |

| 657,600 |

| ||

Mirant Americas Generation LLC |

|

|

|

|

| ||

8.500%, 10/01/2021 |

| 175,000 |

| 123,375 |

| ||

Mirant North America LLC |

|

|

|

|

| ||

7.375%, 12/31/2013 |

| 915,000 |

| 796,050 |

| ||

NRG Energy, Inc. |

|

|

|

|

| ||

7.250%, 02/01/2014 |

| 425,000 |

| 347,438 |

| ||

7.375%, 02/01/2016 |

| 1,090,000 |

| 888,350 |

| ||

Texas Competitive Electric Holdings Co. LLC |

|

|

|

|

| ||

10.250%, 11/01/2015(4) |

| 1,950,000 |

| 1,257,749 |

| ||

|

|

|

| 5,674,562 |

| ||

Electrical Components & Equipment - 0.48% |

|

|

|

|

| ||

Belden, Inc. |

|

|

|

|

| ||

7.000%, 03/15/2017 |

| 655,000 |

| 491,250 |

| ||

|

|

|

|

|

| ||

Entertainment - 4.22% |

|

|

|

|

| ||

AMC Entertainment, Inc. |

|

|

|

|

| ||

8.000%, 03/01/2014 |

| 50,000 |

| 31,250 |

| ||

11.000%, 02/01/2016 |

| 565,000 |

| 403,975 |

| ||

Cinemark, Inc. |

|

|

|

|

| ||

9.750%, 03/15/2014(3) |

| 1,260,000 |

| 1,039,500 |

| ||

Great Canadian Gaming Corp. |

|

|

|

|

| ||

7.250%, 02/15/2015(4) |

| 630,000 |

| 437,850 |

| ||

Marquee Holdings, Inc. |

|

|

|

|

| ||

12.000%, 08/15/2014(3) |

| 615,000 |

| 350,550 |

| ||

Penn National Gaming, Inc. |

|

|

|

|

| ||

6.875%, 12/01/2011 |

| 650,000 |

| 588,250 |

| ||

Pinnacle Entertainment, Inc. |

|

|

|

|

| ||

8.250%, 03/15/2012 |

| 425,000 |

| 312,375 |

| ||

8.750%, 10/01/2013 |

| 175,000 |

| 133,875 |

| ||

7.500%, 06/15/2015 |

| 855,000 |

| 474,525 |

| ||

Seneca Gaming Corp. |

|

|

|

|

| ||

7.250%, 05/01/2012 |

| 695,000 |

| 469,125 |

| ||

Series B, 7.250%, 05/01/2012 |

| 105,000 |

| 70,875 |

| ||

|

|

|

| 4,312,150 |

| ||

19

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Environmental Control - 0.86% |

|

|

|

|

| ||

Allied Waste North America, Inc. |

|

|

|

|

| ||

7.250%, 03/15/2015 |

| $ | 900,000 |

| $ | 798,750 |

|

Series B, 7.125%, 05/15/2016 |

| 50,000 |

| 44,250 |

| ||

Browning-Ferris Industries, Inc. |

|

|

|

|

| ||

9.250%, 05/01/2021 |

| 35,000 |

| 32,375 |

| ||

Safety-Kleen Services, Inc. |

|

|

|

|

| ||

9.250%, 06/01/2008(6) |

| 50,000 |

| 10 |

| ||

|

|

|

| 875,385 |

| ||

Food - 1.58% |

|

|

|

|

| ||

American Stores Co. |

|

|

|

|

| ||

7.900%, 05/01/2017(2) |

| 550,000 |

| 539,000 |

| ||

Del Monte Corp. |

|

|

|

|

| ||

8.625%, 12/15/2012 |

| 625,000 |

| 568,750 |

| ||

Dole Food Co., Inc. |

|

|

|

|

| ||

8.625%, 05/01/2009 |

| 300,000 |

| 270,000 |

| ||

7.250%, 06/15/2010 |

| 325,000 |

| 230,750 |

| ||

Pilgrim’s Pride Corp. |

|

|

|

|

| ||

9.250%, 11/15/2013(1) |

| 100,000 |

| 6,375 |

| ||

|

|

|

| 1,614,875 |

| ||

Forest Products & Paper - 1.39% |

|

|

|

|

| ||

Appleton Papers, Inc. |

|

|

|

|

| ||

8.125%, 06/15/2011 |

| 470,000 |

| 305,500 |

| ||

Series B, 9.750%, 06/15/2014 |

| 200,000 |

| 109,000 |

| ||

Buckeye Technologies, Inc. |

|

|

|

|

| ||

8.000%, 10/15/2010 |

| 91,000 |

| 83,265 |

| ||

8.500%, 10/01/2013 |

| 525,000 |

| 451,500 |

| ||

International Paper Co. |

|

|

|

|

| ||

7.950%, 06/15/2018 |

| 600,000 |

| 471,680 |

| ||

|

|

|

| 1,420,945 |

| ||

Healthcare-Products - 1.89% |

|

|

|

|

| ||

Accellent, Inc. |

|

|

|

|

| ||

10.500%, 12/01/2013 |

| 630,000 |

| 444,150 |

| ||

Advanced Medical Optics, Inc. |

|

|

|

|

| ||

7.500%, 05/01/2017 |

| 675,000 |

| 374,625 |

| ||

Boston Scientific Corp. |

|

|

|

|

| ||

6.000%, 06/15/2011 |

| 900,000 |

| 792,000 |

| ||

5.450%, 06/15/2014 |

| 100,000 |

| 78,500 |

| ||

6.400%, 06/15/2016 |

| 50,000 |

| 39,500 |

| ||

7.000%, 11/15/2035 |

| 300,000 |

| 205,500 |

| ||

|

|

|

| 1,934,275 |

| ||

20

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Healthcare-Services - 5.06% |

|

|

|

|

| ||

Community Health Systems, Inc. |

|

|

|

|

| ||

8.875%, 07/15/2015 |

| $ | 900,000 |

| $ | 726,750 |

|

DaVita, Inc. |

|

|

|

|

| ||

7.250%, 03/15/2015 |

| 1,245,000 |

| 1,083,150 |

| ||

HCA, Inc. |

|

|

|

|

| ||

9.250%, 11/15/2016 |

| 1,525,000 |

| 1,242,874 |

| ||

9.625%, 11/15/2016(7) |

| 750,000 |

| 541,875 |

| ||

Healthsouth Corp. |

|

|

|

|

| ||

10.750%, 06/15/2016 |

| 550,000 |

| 489,500 |

| ||

Psychiatric Solutions, Inc. |

|

|

|

|

| ||

7.750%, 07/15/2015 |

| 755,000 |

| 551,150 |

| ||

United Surgical Partners International, Inc. |

|

|

|

|

| ||

8.875%, 05/01/2017 |

| 125,000 |

| 82,500 |

| ||

9.250%, 05/01/2017(7) |

| 745,000 |

| 450,725 |

| ||

|

|

|

| 5,168,524 |

| ||

Holding Companies-Diversified - 0.16% |

|

|

|

|

| ||

AMH Holdings, Inc. |

|

|

|

|

| ||

11.250%, 03/01/2014(3) |

| 130,000 |

| 66,950 |

| ||

Atlantic Broadband Finance LLC |

|

|

|

|

| ||

9.375%, 01/15/2014 |

| 135,000 |

| 97,200 |

| ||

|

|

|

| 164,150 |

| ||

Home Furnishings - 0.27% |

|

|

|

|

| ||

Norcraft Cos LP |

|

|

|

|

| ||

9.000%, 11/01/2011 |

| 35,000 |

| 31,675 |

| ||

Norcraft Holdings LP |

|

|

|

|

| ||

9.750%, 09/01/2012(3) |

| 300,000 |

| 241,500 |

| ||

|

|

|

| 273,175 |

| ||

Iron/Steel - 0.94% |

|

|

|

|

| ||

RathGibson, Inc. |

|

|

|

|

| ||

11.250%, 02/15/2014 |

| 400,000 |

| 246,000 |

| ||

Steel Dynamics, Inc. |

|

|

|

|

| ||

7.375%, 11/01/2012 |

| 750,000 |

| 558,750 |

| ||

6.750%, 04/01/2015 |

| 250,000 |

| 155,000 |

| ||

|

|

|

| 959,750 |

| ||

Lodging - 0.68% |

|

|

|

|

| ||

Caesars Entertainment, Inc. |

|

|

|

|

| ||

7.875%, 03/15/2010 |

| 325,000 |

| 170,625 |

| ||

21

|

| Principal |

|

|

| ||

Interest Rate/Maturity Date |

| Amount |

| Market Value |

| ||

|

|

|

|

|

| ||

MGM Mirage |

|

|

|

|

| ||

8.500%, 09/15/2010 |

| $ | 550,000 |

| $ | 314,875 |

|

8.375%, 02/01/2011 |

| 75,000 |

| 36,563 |

| ||

13.000%, 11/15/2013(4) |

| 75,000 |

| 63,000 |

| ||

Station Casinos, Inc. |

|

|

|

|

| ||

6.000%, 04/01/2012 |

| 60,000 |

| 18,900 |

| ||

7.750%, 08/15/2016 |

| 300,000 |

| 93,000 |

| ||

|

|

|

| 696,963 |

| ||

Machinery - Construction & Mining - 0.58% |

|

|

|

|

| ||

Terex Corp. |

|

|

|

|

| ||

8.000%, 11/15/2017 |

| 825,000 |

| 594,000 |

| ||

|

|

|

|

|

| ||

Media - 5.94% |

|

|

|

|

| ||

Bonten Media Acquisition Co. |

|

|

|

|

| ||

9.000%, 06/01/2015(4)(7) |

| 425,000 |

| 150,875 |

| ||

Cablevision Systems Corp. |

|

|

|

|

| ||

Series B, 8.334%, 04/01/2009(5) |

| 300,000 |

| 294,750 |

| ||

CanWest MediaWorks, Inc. |

|

|

|

|

| ||

8.000%, 09/15/2012 |

| 700,000 |

| 276,500 |

| ||

CCH I Holdings LLC |

|

|

|

|

| ||

9.920%, 04/01/2014 |

| 275,000 |

| 38,500 |

| ||

10.000%, 05/15/2014 |

| 25,000 |

| 3,500 |

| ||

11.000%, 10/01/2015 |

| 1,365,000 |

| 368,550 |

| ||

CCH I Holdings LLC |

|

|

|

|

| ||

11.750%, 05/15/2014(3) |

| 230,000 |

| 31,050 |

| ||

12.125%, 01/15/2015(3) |

| 25,000 |

| 3,375 |

| ||

CCO Holdings LLC |

|

|

|

|

| ||

8.750%, 11/15/2013 |

| 200,000 |

| 115,000 |

| ||

CSC Holdings, Inc. |

|

|

|

|

| ||

Series B, 7.625%, 04/01/2011 |

| 675,000 |

| 600,750 |

| ||

6.750%, 04/15/2012 |

| 350,000 |

| 294,875 |

| ||

Dex Media, Inc. |

|

|

|

|

| ||

8.000%, 11/15/2013 |

| 20,000 |

| 2,700 |

| ||

9.000%, 11/15/2013(3) |

| 375,000 |

| 50,625 |

| ||

Dex Media West LLC |

|

|

|

|

| ||

Series B, 8.500%, 08/15/2010 |

| 20,000 |

| 12,500 |

| ||

Series B, 9.875%, 08/15/2013 |

| 44,000 |

| 9,790 |

| ||

Echostar DBS Corp. |

|

|

|

|

| ||

7.000%, 10/01/2013 |

| 25,000 |

| 18,875 |

| ||

6.625%, 10/01/2014 |

| 650,000 |

| 466,375 |

| ||

7.750%, 05/31/2015 |

| 75,000 |

| 55,500 |

| ||

7.125%, 02/01/2016 |

| 660,000 |

| 471,899 |

| ||

22

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Idearc, Inc. |

|

|

|

|

| ||

8.000%, 11/15/2016 |

| $ | 1,265,000 |

| $ | 110,687 |

|

Radio One, Inc. |

|

|

|

|

| ||

Series B, 8.875%, 07/01/2011 |

| 865,000 |

| 421,688 |

| ||

The Reader’s Digest Association, Inc. |

|

|

|

|

| ||

9.000%, 02/15/2017 |

| 470,000 |

| 111,038 |

| ||

Rogers Cable, Inc. |

|

|

|

|

| ||

8.750%, 05/01/2032 |

| 175,000 |

| 165,414 |

| ||

Salem Communications Holding Corp. |

|

|

|

|

| ||

7.750%, 12/15/2010 |

| 445,000 |

| 278,125 |

| ||

Shaw Communications, Inc. |

|

|

|

|

| ||

7.250%, 04/06/2011 |

| 325,000 |

| 310,375 |

| ||

7.200%, 12/15/2011 |

| 200,000 |

| 189,000 |

| ||

Univision Communications, Inc. |

|

|

|

|

| ||

9.750%, 03/15/2015(4)(7) |

| 1,075,000 |

| 142,438 |

| ||

Videotron Ltee |

|

|

|

|

| ||

6.875%, 01/15/2014 |

| 920,000 |

| 772,799 |

| ||

6.375%, 12/15/2015 |

| 185,000 |

| 143,375 |

| ||

9.125%, 04/15/2018(4) |

| 175,000 |

| 154,875 |

| ||

|

|

|

| 6,065,803 |

| ||

Miscellaneous Manufacturers - 1.75% |

|

|

|

|

| ||

Koppers, Inc. |

|

|

|

|

| ||

9.875%, 10/15/2013 |

| 575,000 |

| 537,625 |

| ||

Koppers Holdings, Inc. |

|

|

|

|

| ||

9.875%, 11/15/2014(3) |

| 425,000 |

| 331,500 |

| ||

RBS Global, Inc. |

|

|

|

|

| ||

9.500%, 08/01/2014 |

| 635,000 |

| 447,675 |

| ||

SPX Corp. |

|

|

|

|

| ||

7.625%, 12/15/2014(4) |

| 575,000 |

| 469,344 |

| ||

|

|

|

| 1,786,144 |

| ||

Office-Business Equipment - 1.31% |

|

|

|

|

| ||

Xerox Capital Trust I |

|

|

|

|

| ||

8.000%, 02/01/2027 |

| 1,820,000 |

| 1,338,555 |

| ||

|

|

|

|

|

| ||

Office Furnishings - 0.21% |

|

|

|

|

| ||

Interface, Inc. |

|

|

|

|

| ||

9.500%, 02/01/2014 |

| 265,000 |

| 213,325 |

| ||

|

|

|

|

|

| ||

Oil & Gas - 5.00% |

|

|

|

|

| ||

Chaparral Energy, Inc. |

|

|

|

|

| ||

8.500%, 12/01/2015 |

| 625,000 |

| 234,375 |

| ||

8.875%, 02/01/2017(3) |

| 145,000 |

| 54,375 |

| ||

23

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Chesapeake Energy Corp. |

|

|

|

|

| ||

7.625%, 07/15/2013 |

| $ | 575,000 |

| $ | 462,875 |

|

7.000%, 08/15/2014 |

| 50,000 |

| 38,250 |

| ||

6.375%, 06/15/2015 |

| 275,000 |

| 193,875 |

| ||

6.250%, 01/15/2018 |

| 585,000 |

| 386,100 |

| ||

7.250%, 12/15/2018 |

| 550,000 |

| 387,750 |

| ||

EXCO Resources, Inc. |

|

|

|

|

| ||

7.250%, 01/15/2011 |

| 1,025,000 |

| 794,375 |

| ||

Hilcorp Energy I LP |

|

|

|

|

| ||

7.750%, 11/01/2015(4) |

| 270,000 |

| 194,400 |

| ||

9.000%, 06/01/2016(4) |

| 334,000 |

| 240,480 |

| ||

Newfield Exploration Co. |

|

|

|

|

| ||

7.125%, 05/15/2018 |

| 500,000 |

| 357,500 |

| ||

Pioneer Natural Resources Co. |

|

|

|

|

| ||

6.650%, 03/15/2017 |

| 950,000 |

| 666,515 |

| ||

Quicksilver Resources, Inc. |

|

|

|

|

| ||

8.250%, 08/01/2015 |

| 625,000 |

| 406,250 |

| ||

SandRidge Energy, Inc. |

|

|

|

|

| ||

8.000%, 06/01/2018(4) |

| 575,000 |

| 370,875 |

| ||

Stone Energy Corp. |

|

|

|

|

| ||

8.250%, 12/15/2011 |

| 425,000 |

| 316,625 |

| ||

|

|

|

| 5,104,620 |

| ||

Oil & Gas Services - 1.10% |

|

|

|

|

| ||

Complete Production Services, Inc. |

|

|

|

|

| ||

8.000%, 12/15/2016 |

| 600,000 |

| 381,000 |

| ||

Dresser-Rand Group, Inc. |

|

|

|

|

| ||

7.375%, 11/01/2014 |

| 955,000 |

| 740,125 |

| ||

|

|

|

| 1,121,125 |

| ||

Packaging & Containers - 2.21% |

|

|

|

|

| ||

Crown Americas LLC |

|

|

|

|

| ||

7.625%, 11/15/2013 |

| 175,000 |

| 162,750 |

| ||

7.750%, 11/15/2015 |

| 430,000 |

| 391,300 |

| ||

Graphic Packaging International, Inc. |

|

|

|

|

| ||

8.500%, 08/15/2011 |

| 410,000 |

| 338,250 |

| ||

9.500%, 08/15/2013 |

| 460,000 |

| 319,700 |

| ||

Owens Brockway Glass Container, Inc. |

|

|

|

|

| ||

8.250%, 05/15/2013 |

| 500,000 |

| 472,500 |

| ||

Series $, 6.750%, 12/01/2014 |

| 425,000 |

| 371,875 |

| ||

Owens-Illinois, Inc. |

|

|

|

|

| ||

7.500%, 05/15/2010 |

| 100,000 |

| 96,500 |

| ||

24

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Packaging Dynamics Finance Corp. |

|

|

|

|

| ||

10.000%, 05/01/2016(4) |

| $ | 225,000 |

| $ | 104,625 |

|

Radnor Holdings Corp. |

|

|

|

|

| ||

11.000%, 03/15/2010(2)(6) |

| 25,000 |

| 3 |

| ||

|

|

|

| 2,257,503 |

| ||

Pipelines - 4.85% |

|

|

|

|

| ||

ANR Pipeline Co. |

|

|

|

|

| ||

7.375%, 02/15/2024 |

| 60,000 |

| 55,352 |

| ||

7.000%, 06/01/2025 |

| 10,000 |

| 8,869 |

| ||

Atlas Pipeline Partners LP |

|

|

|

|

| ||

8.125%, 12/15/2015 |

| 600,000 |

| 393,000 |

| ||

8.750%, 06/15/2018(4) |

| 25,000 |

| 16,125 |

| ||

Copano Energy LLC |

|

|

|

|

| ||

7.750%, 06/01/2018(4) |

| 675,000 |

| 445,500 |

| ||

Dynegy Holdings, Inc. |

|

|

|

|

| ||

8.375%, 05/01/2016 |

| 920,000 |

| 644,000 |

| ||

7.125%, 05/15/2018 |

| 500,000 |

| 297,500 |

| ||

7.750%, 06/01/2019 |

| 235,000 |

| 157,450 |

| ||

7.625%, 10/15/2026 |

| 25,000 |

| 11,125 |

| ||

El Paso Corp. |

|

|

|

|

| ||

7.000%, 05/15/2011 |

| 100,000 |

| 85,828 |

| ||

7.250%, 06/01/2018 |

| 175,000 |

| 122,500 |

| ||

7.800%, 08/01/2031 |

| 800,000 |

| 511,950 |

| ||

7.750%, 01/15/2032 |

| 150,000 |

| 95,250 |

| ||

MarkWest Energy Partners LP |

|

|

|

|

| ||

Series B, 8.750%, 04/15/2018 |

| 575,000 |

| 365,125 |

| ||

Targa Resources, Inc. |

|

|

|

|

| ||

8.500%, 11/01/2013 |

| 855,000 |

| 474,525 |

| ||

Tennessee Gas Pipeline Co. |

|

|

|

|

| ||

8.375%, 06/15/2032 |

| 150,000 |

| 123,081 |

| ||

Transcontinental Gas Pipe Line Corp. |

|

|

|

|

| ||

6.400%, 04/15/2016 |

| 50,000 |

| 45,375 |

| ||

Williams Cos, Inc. |

|

|

|

|

| ||

7.875%, 09/01/2021 |

| 1,000,000 |

| 761,361 |

| ||

8.750%, 03/15/2032 |

| 473,000 |

| 345,981 |

| ||

|

|

|

| 4,959,897 |

| ||

Real Estate Investment Trusts - 1.55% |

|

|

|

|

| ||

Felcor Lodging LP |

|

|

|

|

| ||

8.500%, 06/01/2011 |

| 525,000 |

| 366,188 |

| ||

4.803%, 12/01/2011(5) |

| 90,000 |

| 52,650 |

| ||

25

Interest Rate/Maturity Date |

| Principal |

| Market Value |

| ||

|

|

|

|

|

| ||

Host Hotels & Resorts LP |

|

|

|

|

| ||

Series M, 7.000%, 08/15/2012 |

| $ | 275,000 |

| $ | 207,625 |

|