UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22077

Prospector Funds, Inc.

(Exact name of registrant as specified in charter)

370 Church St., Guilford, CT 06437

(Address of principal executive offices) (Zip code)

Prospector Partners Asset Management, LLC, 370 Church St., Guilford, CT 06437

(Name and address of agent for service)

(203) 458-1500

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2009

Date of reporting period: December 31, 2009

Item 1. Report to Stockholders.

Prospector Capital Appreciation Fund

Prospector Opportunity Fund

Annual Report

www.prospectorfunds.com | December 31, 2009 |

February 1, 2010

To the Shareholders of the Prospector Capital Appreciation Fund and Prospector Opportunity Fund:

2009 was a pretty darn good year, despite interest rates near zero and a decade of less than zero stock market returns. It just never felt that good. In painful 2008, there was no place to hide; nearly every asset class – and a huge preponderance of individual securities – had miserable declines. In 2009, all that reversed. Despite these gains, most investors, individuals and professionals remain significantly underwater due to the fact that consecutive returns of minus 50 percent and plus 50 percent generate an unpleasant combined minus 25 percent. Nevertheless, for those not constrained by poor balance sheets, faint-hearted regulators or their own queasy stomachs, 2009 was very good indeed.

Performance

The Prospector Capital Appreciation Fund gained 30.74% for the year ended December 31, 2009 bringing the average annual return since inception (September 28, 2007) to -1.99%. The Prospector Opportunity Fund was up 26.10% for the year ended December 31, 2009 resulting in an average annual return of 0.91% since inception (September 28, 2007). This compares to the S&P 500 Index, the Russell 2000 Index, and the Russell Midcap Index which were up 26.46%, 27.17% and 40.48% for the same one year and -11.03%, -9.65% and -9.85% since the funds’ inception on 9/28/07, respectively.

The unmanaged S&P 500, Russell 2000, and Russell Midcap indices need to rise from their current levels (as of December 31, 2009) by 37%, 29%, and 32%, respectively to reach their September 30, 2007 levels; while the Capital Appreciation Fund needs less than 5% and the Opportunity Fund has already recovered.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-734-7862.

The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. The Funds’ net expense ratios are 1.50% while the gross expense ratios are 3.52% for the Prospector Capital Appreciation Fund and 4.13% for the Prospector Opportunity Fund. Performance data does not reflect the redemption fee. If it had, return would be reduced.

Portfolio Highlights – Capital Appreciation Fund

The majority of full-year and fourth-quarter top contributors had one thing in common – they hurt us in 2008. While Domtar, Nexen, DuPont, Calpine, Meredith, Post Properties and Tootsie Roll all recovered nicely, they don’t deserve excessive praise. However, we are maintaining these positions, anticipating eventual significant profits from our purchase price. We are also maintaining major positions in Cimarex Energy and CMS which have been real winners since purchase.

Contributors, such as Mead Westvaco, Huntsman Chemical and Petro Canada, have been profitably eliminated. Other eliminations include Conseco, Eastman Kodak, and the common stocks of Cabot and Hewlett Packard. Happily, all these were profitable, although the first two in particular engendered “anxious moments.”

Recycling sales proceeds into attractive new positions has been challenging, largely due to the strong market uptrend. Allegheny Energy common (an electric utility) and the convertible bond of USEC (a nuclear fuel supplier) were our largest 4Q purchases. Smaller common stock positions established included Comcast, Telephone and Data Systems, and Sara Lee. Trinity Industries and Penn Virginia were convertible initiations.

Generally we are moving the portfolio to a higher quality focus, both in asset mix and within the common stock holdings. So far this has modestly hurt our results and our glacial speed has been appropriate.

Portfolio Highlights – Opportunity Fund

In many ways the rally from March through December 2009 was a mirror image of the market decline of the prior eight month period from July 2008 through February 2009, just on a half scale. During the 2009 rally, the weaker the balance sheet and the more cyclical the revenue stream, the better the underlying equity performed. As confirmation, the high yield bond market and the leveraged bank loan market, each populated with leveraged balance sheets, also climbed sharply during this period. Conversely, the less risky balance sheets, steadier revenue models, and consistent free cash flow generators (exactly the types of companies that we look for and comprise your portfolio) lagged the sharp upward move in the market. Not surprisingly, these companies had held up better in the 2008 selloff. Exceptions include certain financials such as the property & casualty stocks which were clobbered in 2008, despite their low leverage and low exposure to the deep recession. Despite this selloff, these stocks significantly lagged the market in the sharp rally. As a result they sit today at extremely low valuations in a market that has rallied off its lows. Platinum Underwriters, Aspen Holdings, Cincinnati Financial and Aon Corp. are representative holdings.

Contributors to Opportunity Fund performance include Franklin Resources, Merck (from Schering Plough), and Nexen which bounced back from poor 2008 performance. We are also maintaining large positions in NVR, Mastercard, and Netapp which have been significant winners since purchase last year. These companies generated consistent, strong free cash flow in 2009 and we anticipate continued progress in 2010.

Other major purchases or additions to existing positions during 2009 include Church and Dwight, Murphy Oil, Allegheny Energy, and Biogen. We remain upbeat about their prospects.

Drugs and Thugs

No, we are not talking about the National Football League, but rather our very own Federal government. The drug is the nearly free money showering our economy, plus all kinds of other stimulants. At some point (and it may already be too late), this spending will have to be curtailed or we’ll have some nasty unintended consequences. We are fast becoming addicted to this easy money, and withdrawal will have to be done carefully in order to avoid aborting the economic recovery. The task looks impossibly complex to us. Our politicians and their minions have unlimited hubris – they’ll confidently proceed, but will they succeed?

As for thugs, did you ever think our government would force employment contract abrogation? How has AIG held together with many of their key people suffering from the equivalent of modern day tar and feathering? (AIG’s dire outlook contributes to our property/casualty insurance bullishness.) One would hope that, in an effort to avoid repeating the mistakes of the recent past, Washington’s condescension and finger-pointing would give way to sensible policy-making.

Do Buy or Dubai?

While greed and fear remain investing constants, every cycle takes on its own flavor. The late ‘08/early ‘09 low was unique – macro issues largely overpowered superior security selection. The excesses needing correction were not corporate (okay, some banks/financials were out of control), but rather consumer/housing and, less importantly, government budget related. In fact, most corporations entered the financial distress period in fairly good shape. Certainly some stocks were overpriced – but that’s always the case. Balance sheets, particularly of industrial firms, were not dangerously stretched. All this remains true ten months after the March ‘09 bottom; equity has been raised and near-term debt maturities have been aggressively refinanced. In the context of a strong stock market the question we must ask ourselves is: have the excesses that plunged us into this mess been corrected? And the answer is a resounding … somewhat.

If home prices haven’t finished going down, then at least they are unlikely to continue a dramatic negative. Affordability indices are reasonable. Stabilized employment and the gradual absorption of excess supply over time should put this problem behind us. The continuing macro issue of significant concern is the financial position of state, local and national governments around the world. The sudden financial embarrassment of tiny, nearly oil-less, Dubai – debt of over $80 billion – could easily be the harbinger of worse things to come. Portugal, Ireland, Greece and Spain are all particularly vulnerable (acronym anyone?). We all assume that tottering states like New York will be partially bailed out by Uncle Sam, but with California credit default insurance more expensive than Vietnam’s, are we sure? And by the way, it’s cheaper to insure Chevron debt than the U.S. government’s. Financial stress resembles geologic stress. It may seem contained, but eventually it finds its way to weak points where damage can be sudden and severe.

Okay, so now we’re scared; what should we do? This time we are confident of our answer … don’t over bet. A financial crisis associated with a major country (even the United States) or currency is possible. But that doesn’t mean cash is the preferred asset. None of us would hold pesos as a store of wealth, but the United States’ finances don’t look much better than Mexico’s. The excess liquidity flooding our financial system could turn into horrible inflation that would ravage bond investors, or it could be drained too fast devastating equity prices. Predictions concerning the future are always difficult. What we do know is that the equity market is probably in a reasonable trading range (S&P 500 say 950 to 1350) and that if you can benefit from the superior returns that stocks historically provide versus other financial investments why wouldn’t you? We also sense that a correction is overdue, causing us to gradually become more defensive as well as prepare for possible extreme macro outcomes. If the next bear market is exactly like the last one, it’s likely we could outperform the S&P 500 while losing money and feeling miserable. If it’s like all the others we’ve experienced previously, we should be in pretty good shape. If inflation runs wild, we could have stellar returns, but wouldn’t particularly enjoy them.

On that somber note, we close with the timeless advice of motor racing’s A.J. Foyt: “To finish first, you must first finish.”

Respectfully yours,

| John D. Gillespie | Richard P. Howard | Kevin R. O’Brien |

Performance data quoted represents past performance; past performance does not guarantee future results.

Opinions expressed are those of the Funds and are subject to change, are not guaranteed, and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds invest in smaller and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may hold restricted securities purchased through private placements. Such securities can be difficult to sell without experiencing delays or additional costs. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. These risks are fully disclosed in the prospectus.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. You cannot invest directly in an index. Free cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Fund holdings and/or security allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see the Schedule of Investments section in this report for a full listing of the Funds holdings. Current and future portfolio holdings are subject to risk.

The Advisor has contractually agreed to waive a portion of its fees and / or pay Fund expenses through September 28, 2010 in order to limit the net annual operating expenses to 1.50%.

Prospector Funds, Inc. are distributed by Quasar Distributors, LLC (2/10).

Capital Appreciation Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%)

| | One Year Ended | Since Inception(1) to |

| | December 31, 2009 | December 31, 2009 |

| Capital Appreciation Fund | 30.74% | -1.99% |

S&P 500 Index(2) | 26.46% | -11.03% |

| (2) | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

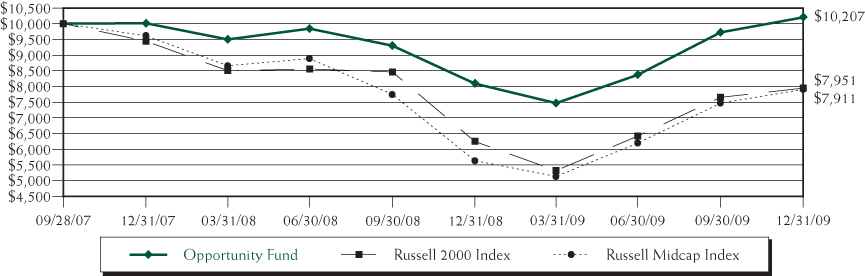

Opportunity Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%)

| | One Year Ended | Since Inception(1) to |

| | December 31, 2009 | December 31, 2009 |

| Opportunity Fund | 26.10% | 0.91% |

Russell 2000 Index(2) | 27.17% | -9.65% |

Russell Midcap Index(3) | 40.48% | -9.85% |

| (2) | An unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. This index cannot be invested in directly. |

| (3) | An unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. This index cannot be invested in directly. |

Expense Example

December 31, 2009

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, redemption fees, wire transfer fees, maintenance fee (IRA accounts), and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2009 – December 31, 2009).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. The example below includes, but is not limited to, management fees, shareholder servicing fees and other Fund expenses. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (07/01/09) | Value (12/31/09) | (07/01/09 to 12/31/09) |

Capital Appreciation Actual(2) | $1,000.00 | $1,230.30 | $8.43 |

| Capital Appreciation Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,017.64 | 7.63 |

| | | | |

Opportunity Actual(2) | 1,000.00 | 1,218.50 | 8.39 |

| Opportunity Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,017.64 | 7.63 |

| (1) | Expenses are equal to the fund’s annualized expense ratio for the most recent six-month period of 1.50% and 1.50% for Capital Appreciation Fund and Opportunity Fund, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year/365 (to reflect the one-half year period). |

| (2) | Based on the actual returns for the six-month period ended December 31, 2009 of 23.03% and 21.85% for Capital Appreciation Fund and Opportunity Fund, respectively. |

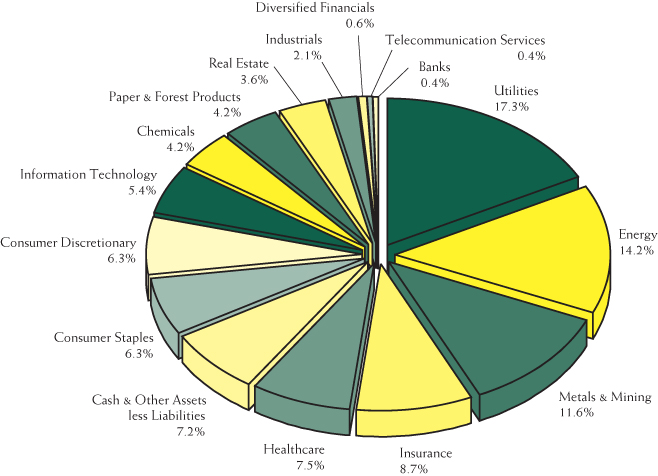

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2009(1)(2)

Capital Appreciation Fund

Top 10 Holdings (% of net assets)

as of December 31, 2009(1)(3)

Capital Appreciation Fund

| CMS Energy, 2.875%, 12/01/2024 | 4.0% |

| Nexen | 3.7% |

| E.I. Du Pont de Nemours | 3.7% |

| Mirant | 3.6% |

| Barrick Gold | 3.2% |

| Gold Fields - ADR | 2.8% |

| Post Properties | 2.5% |

| Newmont Mining | 2.5% |

| Domtar | 2.5% |

| Automatic Data Processing | 2.3% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Sector allocation includes all investment types. |

| (3) | AIM Short-Term Treasury Portfolio excluded from top 10 holdings. |

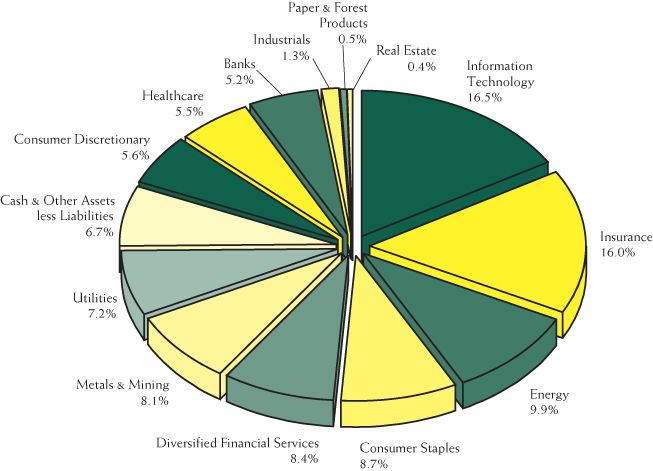

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2009(1)(2)

Opportunity Fund

Top 10 Holdings (% of net assets)

as of December 31, 2009(1)(3)

Opportunity Fund

| Platinum Underwriters Holdings | 4.1% |

| Newmont Mining | 3.4% |

| Church & Dwight | 2.9% |

| Franklin Resources | 2.7% |

| Hess | 2.1% |

| MasterCard, Class A | 2.0% |

| Leucadia National | 2.0% |

| NVR | 1.9% |

| Merck & Co. | 1.8% |

| Nexen | 1.8% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Sector allocation includes all investment types. |

| (3) | AIM Short-Term Treasury Portfolio excluded from top 10 holdings. |

Schedule of Investments

December 31, 2009

Capital Appreciation Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 69.7% | | | | | | |

| | | | | | | |

| Banks – 0.4% | | | | | | |

| Charter Financial | | | 7,400 | | | $ | 74,000 | |

| Investors Bancorp* | | | 1,000 | | | | 10,940 | |

| Rockville Financial | | | 1,400 | | | | 14,700 | |

| Waterstone Financial* | | | 6,400 | | | | 13,120 | |

| | | | | | | | 112,760 | |

| Chemicals – 4.2% | | | | | | | | |

| E.I. Du Pont de Nemours | | | 32,500 | | | | 1,094,275 | |

| Huntsman | | | 1,400 | | | | 15,806 | |

| International Flavors & Fragrances | | | 3,400 | | | | 139,876 | |

| | | | | | | | 1,249,957 | |

| Consumer Discretionary – 5.9% | | | | | | | | |

| Comcast, Class A | | | 13,900 | | | | 222,539 | |

| Fortune Brands | | | 6,800 | | | | 293,760 | |

| H&R Block | | | 23,600 | | | | 533,832 | |

| Meredith | | | 16,300 | | | | 502,855 | |

| New York Times, Class A* | | | 9,900 | | | | 122,364 | |

| Walt Disney | | | 2,200 | | | | 70,950 | |

| | | | | | | | 1,746,300 | |

| Consumer Staples – 5.3% | | | | | | | | |

| Campbell Soup | | | 5,600 | | | | 189,280 | |

| Coca-Cola | | | 2,000 | | | | 114,000 | |

| Coca-Cola Enterprises | | | 11,600 | | | | 245,920 | |

| Sara Lee | | | 11,200 | | | | 136,416 | |

| SUPERVALU | | | 11,700 | | | | 148,707 | |

| Tootsie Roll Industries | | | 18,407 | | | | 503,984 | |

| Viterra* | | | 5,500 | | | | 51,905 | |

| Walgreen | | | 4,900 | | | | 179,928 | |

| | | | | | | | 1,570,140 | |

| Energy – 11.6% | | | | | | | | |

| Cimarex Energy | | | 11,400 | | | | 603,858 | |

| Clayton Williams Energy* | | | 8,300 | | | | 290,832 | |

| El Paso | | | 10,700 | | | | 105,181 | |

| Hess | | | 4,500 | | | | 272,250 | |

| Marathon Oil | | | 11,200 | | | | 349,664 | |

| McMoRan Exploration* | | | 19,400 | | | | 155,588 | |

| Nexen | | | 46,300 | | | | 1,107,959 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Capital Appreciation Fund

| Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 69.7% (Continued) | | | | | | |

| | | | | | | |

| Energy – 11.6% (Continued) | | | | | | |

| OPTI - Canada* | | | 56,800 | | | $ | 110,249 | |

| Repsol YPF - ADR | | | 13,300 | | | | 354,578 | |

| San Juan Basin Royalty Trust | | | 4,900 | | | | 84,476 | |

| | | | | | | | 3,434,635 | |

| Healthcare – 1.7% | | | | | | | | |

| Pfizer | | | 28,300 | | | | 514,777 | |

| | | | | | | | | |

| Industrials – 0.7% | | | | | | | | |

| Tyco International | | | 5,600 | | | | 199,808 | |

| | | | | | | | | |

| Information Technology – 3.7% | | | | | | | | |

| Automatic Data Processing | | | 16,300 | | | | 697,966 | |

| Xerox | | | 46,800 | | | | 395,928 | |

| | | | | | | | 1,093,894 | |

| Insurance – 8.7% | | | | | | | | |

| Arch Capital Group* | | | 3,400 | | | | 243,270 | |

| Arthur J. Gallagher | | | 4,200 | | | | 94,542 | |

| Berkshire Hathaway, Class B* | | | 207 | | | | 680,202 | |

| Donegal Group, Class A | | | 3,300 | | | | 51,282 | |

| Loews | | | 17,000 | | | | 617,950 | |

| Max Capital Group | | | 12,500 | | | | 278,750 | |

| Mercer Insurance Group | | | 2,800 | | | | 50,876 | |

| Platinum Underwriters Holdings | | | 5,800 | | | | 222,082 | |

| State Auto Financial | | | 19,600 | | | | 362,600 | |

| | | | | | | | 2,601,554 | |

| Metals & Mining – 9.4% | | | | | | | | |

| AngloGold Ashanti - ADR | | | 2,500 | | | | 100,450 | |

| Barrick Gold | | | 24,300 | | | | 956,934 | |

| Gold Fields - ADR | | | 64,000 | | | | 839,040 | |

| Newmont Mining | | | 15,600 | | | | 738,036 | |

| Northgate Minerals* | | | 37,000 | | | | 113,960 | |

| RTI International Metals* | | | 1,400 | | | | 35,238 | |

| | | | | | | | 2,783,658 | |

| Paper & Forest Products – 3.4% | | | | | | | | |

| Domtar* | | | 13,250 | | | | 734,182 | |

| Graphic Packaging* | | | 26,300 | | | | 91,261 | |

| Neenah Paper | | | 14,100 | | | | 196,695 | |

| | | | | | | | 1,022,138 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Capital Appreciation Fund

| Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 69.7% (Continued) | | | | | | |

| | | | | | | |

| Real Estate – 3.6% | | | | | | |

| Forestar Group* | | | 14,200 | | | $ | 312,116 | |

| Post Properties | | | 38,000 | | | | 744,800 | |

| Thomas Properties Group | | | 6,900 | | | | 20,424 | |

| | | | | | | | 1,077,340 | |

| Telecommunication Services – 0.4% | | | | | | | | |

| Telephone & Data Systems | | | 3,700 | | | | 125,504 | |

| | | | | | | | | |

| Utilities – 10.7% | | | | | | | | |

| Allegheny Energy | | | 23,200 | | | | 544,736 | |

| Calpine* | | | 57,188 | | | | 629,068 | |

| Calpine - Escrow Shares* | | | 1,075,000 | | | | 61,812 | |

| El Paso Electric* | | | 1,800 | | | | 36,504 | |

| Mirant* | | | 70,700 | | | | 1,079,589 | |

| NV Energy | | | 38,900 | | | | 481,582 | |

| Unisource Energy | | | 10,900 | | | | 350,871 | |

| | | | | | | | 3,184,162 | |

| Total Common Stocks | | | | | | | | |

| (Cost $22,391,622) | | | | | | | 20,716,627 | |

| | | | | | | | | |

| | | Par | | | | | |

| CONVERTIBLE CORPORATE BONDS – 22.0% | | | | | | | | |

| Amgen | | | | | | | | |

| 0.125%, 02/01/2011 | | $ | 550,000 | | | | 543,125 | |

| Anixter International | | | | | | | | |

| 1.000%, 02/15/2013 | | | 375,000 | | | | 360,938 | |

| Archer Daniels | | | | | | | | |

| 0.875%, 02/15/2014 | | | 200,000 | | | | 209,500 | |

| Carnival | | | | | | | | |

| 2.000%, 04/15/2021 | | | 125,000 | | | | 128,906 | |

| Century Aluminum | | | | | | | | |

| 1.750%, 08/01/2024 | | | 200,000 | | | | 191,250 | |

| Charles River Laboratories International | | | | | | | | |

| 2.250%, 06/15/2013 | | | 100,000 | | | | 97,250 | |

| CMS Energy | | | | | | | | |

| 2.875%, 12/01/2024 | | | 975,000 | | | | 1,196,813 | |

| 5.500%, 06/15/2029 | | | 125,000 | | | | 152,812 | |

| Dominion Resources, Series C | | | | | | | | |

| 2.125%, 12/15/2023 | | | 125,000 | | | | 144,375 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Capital Appreciation Fund

| Description | | Par | | | Value | |

| | | | | | | |

CONVERTIBLE CORPORATE BONDS – 22.0% (CONTINUED) | | | | | | |

| EMC | | | | | | |

| 1.750%, 12/01/2011 | | $ | 125,000 | | | $ | 151,875 | |

| Kinross Gold | | | | | | | | |

| 1.750%, 03/15/2028 | | | 50,000 | | | | 52,062 | |

| 1.750%, 03/15/2028 (a) | | | 175,000 | | | | 182,219 | |

| Medtronic | | | | | | | | |

| 1.500%, 04/15/2011 | | | 425,000 | | | | 431,375 | |

| Millipore | | | | | | | | |

| 3.750%, 06/01/2026 | | | 625,000 | | | | 644,531 | |

| Newmont Mining | | | | | | | | |

| 1.250%, 07/15/2014 | | | 150,000 | | | | 187,125 | |

| NovaGold Resources | | | | | | | | |

| 5.500%, 05/01/2015 | | | 50,000 | | | | 46,188 | |

| Penn Virginia | | | | | | | | |

| 4.500%, 11/15/2012 | | | 225,000 | | | | 213,188 | |

| PHH | | | | | | | | |

| 4.000%, 04/15/2012 | | | 150,000 | | | | 156,480 | |

| Smithfield Foods | | | | | | | | |

| 4.000%, 06/30/2013 | | | 100,000 | | | | 98,375 | |

| Trinity Industries | | | | | | | | |

| 3.875%, 06/01/2036 | | | 275,000 | | | | 205,562 | |

| UAL | | | | | | | | |

| 5.000%, 02/01/2021 | | | 225,000 | | | | 204,750 | |

| Unisource Energy | | | | | | | | |

| 4.500%, 03/01/2035 | | | 425,000 | | | | 423,938 | |

| USEC | | | | | | | | |

| 3.000%, 10/01/2014 | | | 775,000 | | | | 503,750 | |

| Total Convertible Corporate Bonds | | | | | | | | |

| (Cost $5,905,737) | | | | | | | 6,526,387 | |

| | | | | | | | | |

| | | Shares | | | | | |

| STAPLED UNIT – 0.8% | | | | | | | | |

| | | | | | | | | |

| Paper & Forest Products – 0.8% | | | | | | | | |

| TimberWest Forest* | | | | | | | | |

| (Cost $443,686) | | | 54,300 | | | | 225,331 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Capital Appreciation Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| CONVERTIBLE PREFERRED STOCK – 0.2% | | | | | | |

| | | | | | | |

| Energy – 0.2% | | | | | | |

| El Paso Energy Capital Trust | | | | | | |

| (Cost $60,343) | | | 2,000 | | | $ | 73,100 | |

| | | | | | | | | |

| WARRANT – 0.1% | | | | | | | | |

| | | | | | | | | |

| Utilities – 0.1% | | | | | | | | |

| Mirant* | | | | | | | | |

| (Cost $199,579) | | | 47,700 | | | | 32,913 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 7.8% | | | | | | | | |

| AIM Short-Term Treasury Portfolio, 0.020% | | | | | | | | |

| (Cost $2,312,740) | | | 2,312,740 | | | | 2,312,740 | |

| | | | | | | | | |

| Total Investments – 100.6% | | | | | | | | |

| (Cost $31,313,707) | | | | | | | 29,887,098 | |

| Other Assets and Liabilities, Net – (0.6)% | | | | | | | (163,286 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 29,723,812 | |

| * | Non-income producing security. |

| (a) | Security purchased within the terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of December 31, 2009, the value of these investments was $182,219 or 0.6% of total net assets. |

ADR – American Depository Receipt

Schedule of Investments

December 31, 2009

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 88.8% | | | | | | |

| | | | | | | |

| Banks – 5.2% | | | | | | |

| Abington Bancorp | | | 6,500 | | | $ | 44,785 | |

| AJS Bancorp | | | 2,000 | | | | 24,000 | |

| Brooklyn Federal Bancorp | | | 5,700 | | | | 57,228 | |

| Chicopee Bancorp* | | | 9,900 | | | | 123,552 | |

| First Horizon National | | | 6,912 | | | | 92,620 | |

| Fox Chase Bancorp* | | | 11,600 | | | | 110,432 | |

| Northern Trust | | | 2,400 | | | | 125,760 | |

| Ocean Shore Holding | | | 4,572 | | | | 41,148 | |

| OceanFirst Financial | | | 11,700 | | | | 132,210 | |

| Oritani Financial | | | 10,400 | | | | 142,792 | |

| Roma Financial | | | 6,804 | | | | 84,098 | |

| Territorial Bancorp* | | | 7,900 | | | | 142,595 | |

| UMB Financial | | | 2,500 | | | | 98,375 | |

| United Financial Bancorp | | | 3,100 | | | | 40,641 | |

| Westfield Financial | | | 11,400 | | | | 94,050 | |

| | | | | | | | 1,354,286 | |

| Consumer Discretionary – 5.3% | | | | | | | | |

| Brinker International | | | 12,600 | | | | 187,992 | |

| Fortune Brands | | | 3,600 | | | | 155,520 | |

| H&R Block | | | 6,200 | | | | 140,244 | |

| NVR* | | | 690 | | | | 490,390 | |

| Toll Brothers* | | | 7,800 | | | | 146,718 | |

| Yum! Brands | | | 7,600 | | | | 265,772 | |

| | | | | | | | 1,386,636 | |

| Consumer Staples – 8.7% | | | | | | | | |

| Alberto-Culver | | | 14,300 | | | | 418,847 | |

| Church & Dwight | | | 12,350 | | | | 746,558 | |

| Clorox | | | 6,800 | | | | 414,800 | |

| General Mills | | | 4,300 | | | | 304,483 | |

| H.J. Heinz | | | 6,600 | | | | 282,216 | |

| Viterra* | | | 10,600 | | | | 100,035 | |

| | | | | | | | 2,266,939 | |

| Diversified Financial Services – 7.6% | | | | | | | | |

| CME Group | | | 480 | | | | 161,256 | |

| Cowen Group* | | | 10,423 | | | | 61,704 | |

| Franklin Resources | | | 6,600 | | | | 695,310 | |

| Invesco | | | 12,300 | | | | 288,927 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 88.8% (CONTINUED) | | | | | | |

| | | | | | | |

| Diversified Financial Services – 7.6% (Continued) | | | | | | |

| Leucadia National* | | | 21,700 | | | $ | 516,243 | |

| PICO Holdings* | | | 7,900 | | | | 258,567 | |

| | | | | | | | 1,982,007 | |

| Energy – 9.9% | | | | | | | | |

| Cimarex Energy | | | 8,600 | | | | 455,542 | |

| Hess | | | 8,900 | | | | 538,450 | |

| Hugoton Royalty Trust | | | 27,200 | | | | 437,376 | |

| Murphy Oil | | | 7,600 | | | | 411,920 | |

| Nexen | | | 19,800 | | | | 473,814 | |

| San Juan Basin Royalty Trust | | | 16,000 | | | | 275,840 | |

| | | | | | | | 2,592,942 | |

| Healthcare – 5.5% | | | | | | | | |

| Aetna | | | 6,700 | | | | 212,390 | |

| Biogen Idec* | | | 6,200 | | | | 331,700 | |

| Facet Biotech* | | | 4,700 | | | | 82,626 | |

| Henry Schein* | | | 1,600 | | | | 84,160 | |

| Merck & Co. | | | 13,148 | | | | 480,428 | |

| WellPoint* | | | 4,300 | | | | 250,647 | |

| | | | | | | | 1,441,951 | |

| Industrials – 1.3% | | | | | | | | |

| Tyco International | | | 9,200 | | | | 328,256 | |

| | | | | | | | | |

| Information Technology – 14.0% | | | | | | | | |

| Affiliated Computer Services, Class A* | | | 2,000 | | | | 119,380 | |

| CA | | | 11,300 | | | | 253,798 | |

| CACI International* | | | 2,140 | | | | 104,539 | |

| EMC* | | | 11,100 | | | | 193,917 | |

| Emulex* | | | 23,400 | | | | 255,060 | |

| F5 Networks* | | | 1,500 | | | | 79,470 | |

| Lexmark International, Class A* | | | 2,900 | | | | 75,342 | |

| MasterCard, Class A | | | 2,020 | | | | 517,080 | |

| NetApp* | | | 12,900 | | | | 443,631 | |

| Qlogic* | | | 8,300 | | | | 156,621 | |

| Symantec* | | | 16,400 | | | | 293,396 | |

| Synopsys* | | | 10,800 | | | | 240,624 | |

| Teradata* | | | 7,500 | | | | 235,725 | |

| Xerox | | | 16,000 | | | | 135,360 | |

| Xilinx | | | 12,500 | | | | 313,250 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 88.8% (CONTINUED) | | | | | | |

| | | | | | | |

| Information Technology – 14.0% (Continued) | | | | | | |

| Xyratex* | | | 17,330 | | | $ | 230,662 | |

| | | | | | | | 3,647,855 | |

| Insurance – 16.0% | | | | | | | | |

| Alleghany* | | | 122 | | | | 33,672 | |

| AON | | | 8,400 | | | | 322,056 | |

| Arch Capital Group* | | | 4,500 | | | | 321,975 | |

| Aspen Insurance Holdings | | | 11,000 | | | | 279,950 | |

| Assurant | | | 11,700 | | | | 344,916 | |

| Cincinnati Financial | | | 3,900 | | | | 102,336 | |

| Hanover Insurance Group | | | 3,400 | | | | 151,062 | |

| Lancashire Holdings | | | 47,300 | | | | 339,974 | |

| Max Capital Group | | | 9,100 | | | | 202,930 | |

| Penn Millers Holding* | | | 11,105 | | | | 122,155 | |

| Platinum Underwriters Holdings | | | 27,900 | | | | 1,068,291 | |

| Progressive | | | 11,700 | | | | 210,483 | |

| RenaissanceRe Holdings | | | 3,300 | | | | 175,395 | |

| Wesco Financial Group | | | 427 | | | | 146,461 | |

| Zenith National Insurance | | | 11,900 | | | | 354,144 | |

| | | | | | | | 4,175,800 | |

| Metals & Mining – 7.2% | | | | | | | | |

| Gold Fields - ADR | | | 17,400 | | | | 228,114 | |

| Horsehead Holding* | | | 3,070 | | | | 39,142 | |

| Kinross Gold | | | 24,000 | | | | 441,600 | |

| Newmont Mining | | | 18,800 | | | | 889,428 | |

| Pan American Silver* | | | 1,900 | | | | 45,239 | |

| RTI International Metals* | | | 9,200 | | | | 231,564 | |

| | | | | | | | 1,875,087 | |

| Paper & Forest Products – 0.5% | | | | | | | | |

| Domtar* | | | 758 | | | | 42,001 | |

| Neenah Paper | | | 4,500 | | | | 62,775 | |

| TimberWest Forest* | | | 6,900 | | | | 28,633 | |

| | | | | | | | 133,409 | |

| Real Estate – 0.4% | | | | | | | | |

| Forestar Group* | | | 3,600 | | | | 79,128 | |

| Thomas Properties Group | | | 12,700 | | | | 37,592 | |

| | | | | | | | 116,720 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 88.8% (CONTINUED) | | | | | | |

| | | | | | | |

| Utilities – 7.2% | | | | | | |

| Allegheny Energy | | | 11,800 | | | $ | 277,064 | |

| Calpine - Escrow Shares* | | | 125,000 | | | | 7,188 | |

| CMS Energy | | | 21,000 | | | | 328,860 | |

| Empire District Electric | | | 12,600 | | | | 235,998 | |

| Mirant* | | | 27,100 | | | | 413,817 | |

| NV Energy | | | 29,400 | | | | 363,972 | |

| Pure Cycle* | | | 3,000 | | | | 8,550 | |

| TransAlta | | | 8,500 | | | | 190,830 | |

| Unisource Energy | | | 1,400 | | | | 45,066 | |

| | | | | | | | 1,871,345 | |

| Total Common Stocks | | | | | | | | |

| (Cost $21,358,949) | | | | | | | 23,173,233 | |

| | | | | | | | | |

| | | Par | | | | | |

| CONVERTIBLE BONDS – 2.8% | | | | | | | | |

| Ciena | | | | | | | | |

| 0.250%, 05/01/2013 | | $ | 225,000 | | | | 169,875 | |

| Kinross Gold | | | | | | | | |

| 1.750%, 03/15/2028 (a) | | | 150,000 | | | | 156,187 | |

| 1.750%, 03/15/2028 | | | 75,000 | | | | 78,094 | |

| Maxtor | | | | | | | | |

| 6.800%, 04/30/2010 | | | 175,000 | | | | 176,750 | |

| Symantec | | | | | | | | |

| 0.750%, 06/15/2011 | | | 125,000 | | | | 135,937 | |

| Total Convertible Bonds | | | | | | | | |

| (Cost $654,798) | | | | | | | 716,843 | |

| | | | | | | | | |

| CORPORATE BONDS – 1.7% | | | | | | | | |

| Broadridge Financial Solutions | | | | | | | | |

| 6.125%, 06/01/2017 | | | 175,000 | | | | 170,212 | |

| Leucadia National | | | | | | | | |

| 7.000%, 08/15/2013 | | | 200,000 | | | | 200,750 | |

| Mohawk Industries | | | | | | | | |

| 6.500%, 01/15/2011 | | | 75,000 | | | | 76,875 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $390,031) | | | | | | | 447,837 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2009

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| WARRANTS – 0.0% | | | | | | |

| | | | | | | |

| Utilities – 0.0% | | | | | | |

| Mirant* | | | | | | |

| (Cost $27,363) | | | 6,000 | | | $ | 4,140 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 6.3% | | | | | | | | |

| AIM Short-Term Treasury Portfolio, 0.020% | | | | | | | | |

| (Cost $1,636,574) | | | 1,636,574 | | | | 1,636,574 | |

| | | | | | | | | |

| Total Investments – 99.6% | | | | | | | | |

| (Cost $24,067,715) | | | | | | | 25,978,627 | |

| Other Assets and Liabilities, Net – 0.4% | | | | | | | 103,590 | |

| Total Net Assets – 100.0% | | | | | | $ | 26,082,217 | |

| * | Non-income producing security |

| (a) | Security purchased within the terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of December 31, 2009, the value of these investment was $156,187 or 0.6% of total net assets. |

ADR – American Depository Receipt

Statements of Assets and Liabilities

December 31, 2009

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| ASSETS: | | | | | | |

| Investments, at market value | | | | | | |

| (Cost $31,313,707 and $24,067,715 respectively) | | $ | 29,887,098 | | | $ | 25,978,627 | |

| Cash | | | 380,878 | | | | 2,416 | |

| Receivable for investment securities sold | | | 10,175 | | | | 98,203 | |

| Receivable for dividends and interest | | | 63,908 | | | | 92,068 | |

| Receivable for capital shares sold | | | 5,662 | | | | 68,309 | |

| Prepaid expenses | | | 16,679 | | | | 15,184 | |

| Total assets | | | 30,364,400 | | | | 26,254,807 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payable for investment securities purchased | | | 571,118 | | | | 110,510 | |

| Payable for capital shares redeemed | | | 683 | | | | 1,083 | |

| Payable to adviser, net | | | 12,274 | | | | 8,356 | |

| Accrued distribution fees | | | 4,360 | | | | 3,711 | |

| Accrued expenses and other liabilities | | | 52,153 | | | | 48,930 | |

| Total liabilities | | | 640,588 | | | | 172,590 | |

| | | | | | | | | |

| NET ASSETS | | $ | 29,723,812 | | | $ | 26,082,217 | |

| | | | | | | | | |

| COMPOSITION OF NET ASSETS: | | | | | | | | |

| Portfolio capital | | $ | 31,200,454 | | | $ | 25,239,615 | |

| Distributions in excess of net investment income | | | (31,083 | ) | | | (3,732 | ) |

| Accumulated net realized loss on investments | | | (18,962 | ) | | | (1,064,615 | ) |

| Net unrealized appreciation (depreciation) of investments | | | (1,426,597 | ) | | | 1,910,949 | |

| Total net assets | | $ | 29,723,812 | | | $ | 26,082,217 | |

| | | | | | | | | |

CAPITAL STOCK, $0.0001 par value | | | | | | | | |

| Authorized | | | 500,000,000 | | | | 500,000,000 | |

| Issued and outstanding | | | 2,130,396 | | | | 1,727,817 | |

| | | | | | | | | |

| NET ASSET VALUE, REDEMPTION PRICE, | | | | | | | | |

| AND OFFERING PRICE PER SHARE | | $ | 13.95 | | | $ | 15.10 | |

See Notes to the Financial Statements

Statements of Operations

For the Year Ended December 31, 2009

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| INVESTMENT INCOME: | | | | | | |

| Interest income | | $ | 532,908 | | | $ | 87,755 | |

| Dividend income | | | 337,675 | | | | 347,679 | |

| Less: Foreign taxes withheld | | | (5,045 | ) | | | (1,700 | ) |

| Total investment income | | | 865,538 | | | | 433,734 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 260,869 | | | | 212,756 | |

| Directors’ fees | | | 55,810 | | | | 44,517 | |

| Administration fees | | | 48,250 | | | | 47,193 | |

| Fund accounting fees | | | 41,173 | | | | 39,223 | |

| Audit fees | | | 29,658 | | | | 29,658 | |

| Transfer agent fees | | | 28,304 | | | | 25,810 | |

| Legal fees | | | 27,020 | | | | 23,310 | |

| Distribution fees | | | 22,643 | | | | 19,605 | |

| Registration fees | | | 18,953 | | | | 19,028 | |

| Other expenses | | | 16,346 | | | | 11,093 | |

| Custodian fees | | | 10,946 | | | | 8,500 | |

| Postage and printing fees | | | 4,932 | | | | 4,191 | |

| Total expenses | | | 564,904 | | | | 484,884 | |

| Less: Fee waivers | | | (209,174 | ) | | | (194,762 | ) |

| Total net expenses | | | 355,730 | | | | 290,122 | |

| NET INVESTMENT INCOME | | | 509,808 | | | | 143,612 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | | | | | |

| Net realized gain (loss) on investments | | | 501,382 | | | | (284,138 | ) |

| Net change in unrealized appreciation of investments | | | 5,498,306 | | | | 4,791,653 | |

| Net gain on investments | | | 5,999,688 | | | | 4,507,515 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 6,509,496 | | | $ | 4,651,127 | |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Capital Appreciation Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2009 | | | December 31, 2008 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 509,808 | | | $ | 148,246 | |

| Net realized gain (loss) on investments | | | 501,382 | | | | (552,140 | ) |

| Net change in unrealized depreciation of investments | | | 5,498,306 | | | | (6,860,410 | ) |

| Net increase (decrease) resulting from operations | | | 6,509,496 | | | | (7,264,304 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 7,663,277 | | | | 23,743,136 | |

| Proceeds from reinvestment of distributions | | | 487,535 | | | | 182,415 | |

| Payments for shares redeemed | | | (4,536,906 | ) | | | (4,566,416 | ) |

| Redemption fees | | | 7,179 | | | | 16,988 | |

| Net increase from capital share transactions | | | 3,621,085 | | | | 19,376,123 | |

| | | | | | | | | |

| DISTRIBUTIONS PAID FROM: | | | | | | | | |

| Net investment income | | | (498,151 | ) | | | (166,867 | ) |

| Net realized gains | | | — | | | | (21,567 | ) |

| Total distributions to shareholders | | | (498,151 | ) | | | (188,434 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 9,632,430 | | | | 11,923,385 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 20,091,382 | | | | 8,167,997 | |

| End of period (including distributions | | | | | | | | |

| in excess of net investment income | | | | | | | | |

| of $(31,083) and $(25,412), respectively) | | $ | 29,723,812 | | | $ | 20,091,382 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 631,668 | | | | 1,694,655 | |

| Shares issued in reinvestment of distributions | | | 34,651 | | | | 17,176 | |

| Shares redeemed | | | (387,533 | ) | | | (406,802 | ) |

| Net increase | | | 278,786 | | | | 1,305,029 | |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Opportunity Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2009 | | | December 31, 2008 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 143,612 | | | $ | 71,163 | |

| Net realized loss on investments | | | (284,138 | ) | | | (764,416 | ) |

| Net change in unrealized appreciation or depreciation | | | | | | | | |

| of investments | | | 4,791,653 | | | | (2,846,430 | ) |

| Net increase (decrease) resulting from operations | | | 4,651,127 | | | | (3,539,683 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 9,039,886 | | | | 16,344,630 | |

| Proceeds from reinvestment of distributions | | | 141,283 | | | | 73,907 | |

| Payments for shares redeemed | | | (3,639,425 | ) | | | (2,683,607 | ) |

| Redemption fees | | | 6,991 | | | | 7,947 | |

| Net increase from capital share transactions | | | 5,548,735 | | | | 13,742,877 | |

| | | | | | | | | |

| DISTRIBUTIONS PAID FROM: | | | | | | | | |

| Net investment income | | | (142,261 | ) | | | (74,309 | ) |

| Net realized gains | | | — | | | | — | |

| Total distributions to shareholders | | | (142,261 | ) | | | (74,309 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 10,057,601 | | | | 10,128,885 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 16,024,616 | | | | 5,895,731 | |

| End of period (including distributions | | | | | | | | |

| in excess of net investment | | | | | | | | |

| income of $(3,732) and $(3,958), respectively) | | $ | 26,082,217 | | | $ | 16,024,616 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 681,323 | | | | 1,152,108 | |

| Shares issued in reinvestment of distributions | | | 9,289 | | | | 6,226 | |

| Shares redeemed | | | (294,001 | ) | | | (221,322 | ) |

| Net increase | | | 396,611 | | | | 937,012 | |

See Notes to the Financial Statements

Financial Highlights

| | | Capital Appreciation Fund | |

| | | Year Ended | | | Year Ended | | | September 28, 2007(1) | |

| | | December 31, | | | December 31, | | | through | |

| | | 2009 | | | 2008 | | | December 31, 2007 | |

| For a Fund share outstanding | | | | | | | | | |

| throughout the period | | | | | | | | | |

| | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | |

| Beginning of period | | $ | 10.85 | | | $ | 14.94 | | | $ | 15.00 | |

| | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | |

| Net investment income | | | 0.25 | | | | 0.08 | | | | 0.01 | |

| Net realized and unrealized | | | | | | | | | | | | |

| gain (loss) on investments | | | 3.09 | | | | (4.08 | ) | | | (0.06 | ) |

| Total from operations | | | 3.34 | | | | (4.00 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | |

| From net investment income | | | (0.24 | ) | | | (0.09 | ) | | | (0.01 | ) |

| From net realized gains | | | — | | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.24 | ) | | | (0.10 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | (4) | | | 0.01 | | | | — | |

| | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | |

| End of period | | $ | 13.95 | | | $ | 10.85 | | | $ | 14.94 | |

| | | | | | | | | | | | | |

| TOTAL RETURN | | | 30.74 | % | | | (26.67 | )% | | | (0.32 | )%(2) |

| | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 29,724 | | | $ | 20,091 | | | $ | 8,168 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | |

| Before expense reimbursement | | | 2.38 | % | | | 3.51 | % | | | 11.28 | %(3) |

| After expense reimbursement | | | 1.50 | % | | | 1.50 | % | | | 1.50 | %(3) |

| Ratio of net investment | | | | | | | | | | | | |

| income (loss) to average net assets: | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.27 | % | | | (1.07 | )% | | | (9.38 | )%(3) |

| After expense reimbursement | | | 2.15 | % | | | 0.94 | % | | | 0.40 | %(3) |

| Portfolio turnover rate | | | 41 | % | | | 21 | % | | | 5 | %(2) |

| (1) | Inception date of the fund. |

| (4) | Less than $0.01 per share. |

See Notes to the Financial Statements

Financial Highlights

| | | Opportunity Fund | |

| | | Year Ended | | | Year Ended | | | September 28, 2007(1) | |

| | | December 31, | | | December 31, | | | through | |

| | | 2009 | | | 2008 | | | December 31, 2007 | |

| For a Fund share outstanding | | | | | | | | | |

| throughout the period | | | | | | | | | |

| | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | |

| Beginning of period | | $ | 12.04 | | | $ | 14.96 | | | $ | 15.00 | |

| | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | |

| Net investment income | | | 0.08 | | | | 0.05 | | | | 0.02 | |

| Net realized and unrealized | | | | | | | | | | | | |

| gain (loss) on investments | | | 3.06 | | | | (2.92 | ) | | | (0.01 | ) |

| Total from operations | | | 3.14 | | | | (2.87 | ) | | | 0.01 | |

| | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | |

| From net investment income | | | (0.08 | ) | | | (0.06 | ) | | | (0.02 | ) |

| From net realized gains | | | — | | | | — | | | | (0.03 | ) |

| Total distributions | | | (0.08 | ) | | | (0.06 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | (4) | | | 0.01 | | | | — | |

| | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | |

| End of period | | $ | 15.10 | | | $ | 12.04 | | | $ | 14.96 | |

| | | | | | | | | | | | | |

| TOTAL RETURN | | | 26.10 | % | | | (19.14 | )% | | | 0.11 | %(2) |

| | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 26,082 | | | $ | 16,025 | | | $ | 5,896 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | |

| Before expense reimbursement | | | 2.51 | % | | | 4.11 | % | | | 14.50 | %(3) |

| After expense reimbursement | | | 1.50 | % | | | 1.50 | % | | | 1.50 | %(3) |

| Ratio of net investment | | | | | | | | | | | | |

| income (loss) to average net assets: | | | | | | | | | | | | |

| Before expense reimbursement | | | (0.27 | )% | | | (1.96 | )% | | | (12.27 | )%(3) |

| After expense reimbursement | | | 0.74 | % | | | 0.65 | % | | | 0.73 | %(3) |

| Portfolio turnover rate | | | 51 | % | | | 66 | % | | | 18 | %(2) |

| (1) | Inception date of the fund. |

| (4) | Less than $0.01 per share. |

See Notes to the Financial Statements

Notes to the Financial Statements

December 31, 2009

1. ORGANIZATION

Prospector Funds, Inc. (the “Corporation”) was organized as a Maryland corporation on June 6, 2007 and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end diversified management investment company. The Corporation issues its shares in series, each series representing a distinct portfolio with its own investment objectives and policies. There are two series presently authorized, the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (individually a “Fund” and collectively the “Funds”). The Funds commenced operations on September 28, 2007.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by each Fund:

Security Valuation – Portfolio securities which are traded on an exchange are valued at the last sales price reported by the exchange on which the securities are primarily traded on the day of valuation. If there are no sales on a given day for securities traded on an exchange or for securities not traded or dealt on any securities exchange for which over-the-counter market quotations are readily available, the latest bid quotation will be used. Debt securities with remaining maturities of 60 days or less may be valued on an amortized cost basis, which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium, regardless of the impact of fluctuating rates on the market value of the instrument. Any securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by Prospector Partners Asset Management, LLC (the “Adviser” or “Investment Manager”) pursuant to procedures established under the general supervision and responsibility of the Funds’ Board of Directors.

Generally accepted accounting principles (“GAAP”) require disclosures regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or technique. These principles establish a three-tier hierarchy for inputs used in measuring fair value. Fair value inputs are summarized in the three broad levels listed below:

| Level 1 – | Quoted prices in active markets for identical securities. |

| | |

| Level 2 – | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | |

| Level 3 – | Significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments). |

Notes to the Financial Statements – Continued

December 31, 2009

As of December 31, 2009, each fund’s investments in securities were classified as follows:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Capital Appreciation Fund | | | | | | | | | | | | |

| Common Stocks | | $ | 20,654,815 | | | $ | — | | | $ | 61,812 | | | $ | 20,716,627 | |

| Convertible Bonds | | | — | | | | 6,369,907 | | | | 156,480 | | | | 6,526,387 | |

| Stapled Units | | | 225,331 | | | | — | | | | — | | | | 225,331 | |

| Convertible Preferred Stocks | | | 73,100 | | | | — | | | | — | | | | 73,100 | |

| Warrants | | | 32,913 | | | | — | | | | — | | | | 32,913 | |

| Short-Term Investments | | | 2,312,740 | | | | — | | | | — | | | | 2,312,740 | |

| Total Investments | | $ | 23,298,899 | | | $ | 6,369,907 | | | $ | 218,292 | | | $ | 29,887,098 | |

| | | | | | | | | | | | | | | | | |

| Opportunity Fund | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 23,166,045 | | | $ | — | | | $ | 7,188 | | | $ | 23,173,233 | |

| Convertible Bonds | | | — | | | | 716,843 | | | | — | | | | 716,843 | |

| Corporate Bonds | | | — | | | | 447,837 | | | | — | | | | 447,837 | |

| Warrants | | | 4,140 | | | | — | | | | — | | | | 4,140 | |

| Short-Term Investments | | | 1,636,574 | | | | — | | | | — | | | | 1,636,574 | |

| Total Investments | | $ | 24,806,759 | | | $ | 1,164,680 | | | $ | 7,188 | | | $ | 25,978,627 | |

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | | Capital | | | Opportunity | |

| | | Appreciation Fund | | | Fund | |

| | | Common | | | | | | Common | | | | |

| | | Stocks - | | | Convertible | | | Stocks - | | | Convertible | |

| | | Utilities | | | Bonds | | | Utilities | | | Bonds | |

| Balance as of 12/31/2008 | | $ | 31,000 | | | $ | — | | | $ | 5,000 | | | $ | — | |

| Accrued discounts | | | — | | | | (18 | ) | | | — | | | | (4 | ) |

| Realized gain | | | — | | | | 10,861 | | | | — | | | | 2,420 | |

| Change in net unrealized | | | | | | | | | | | | | | | | |

| appreciation (depreciation) | | | 20,312 | | | | (428 | ) | | | 2,188 | | | | — | |

| Net purchases (sales) | | | 10,500 | | | | 146,065 | | | | — | | | | (2,416 | ) |

| Transfers in and/or out of Level 3 | | | — | | | | — | | | | — | | | | — | |

| Balance as of 12/31/2009 | | $ | 61,812 | | | $ | 156,480 | | | $ | 7,188 | | | $ | — | |

| Net unrealized appreciation (depreciation) | | | | | | | | | | | | | | | | |

| of Level 3 securities as of December 31, 2009 | | $ | (24,313 | ) | | $ | (428 | ) | | $ | 7,188 | | | $ | — | |

The Funds may invest in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. The Funds’ investment objectives allow the Funds to enter into various types of derivative contracts, including, but not limited to, futures contracts, forward foreign exchange contracts, and purchased and written options. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements which may expose the funds to gains or losses in excess of the amounts shown on the Statements of Assets and Liabilities. As of and for the fiscal year ended December 31, 2009, the Funds held no derivative instruments.

Notes to the Financial Statements – Continued

December 31, 2009

Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. The character of distributions made during the period from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. All short-term capital gains are included in ordinary income for tax purposes.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds intend to meet the requirements of subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is required. As of December 31, 2009, the Funds did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. Generally, tax authorities can examine all the tax returns filed for the last three years.

Reclassification of Capital Accounts – GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the fiscal year ended December 31, 2009, the following reclassifications were made on the Statements of Assets and Liabilities:

| | Undistributed Net | Accumulated Net | | |

| | Investment Income | Realized Gain | | Portfolio Capital |

| Capital Appreciation Fund | $(17,328) | $17,328 | | $ — |

| Opportunity Fund | (1,125) | (558 | ) | 1,683 |

Foreign Currency Translation – The books and records relating to the Funds’ non-U.S. dollar denominated investments are maintained in U.S. dollars on the following bases: (1) market value of investment securities, assets, and liabilities are translated at the current rate of exchange; and (2) purchases and sales of investment securities, income, and expenses are translated at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate the portion of gains and losses on investments in equity securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. The Funds report certain foreign currency-related transactions as components of realized gains for financial reporting purposes, whereas such components are treated as ordinary income for federal income tax purposes.

Expenses – Expenses directly attributable to a Fund are charged to that Fund, while expenses attributable to more than one Fund are allocated among the respective Funds based on relative net assets or another appropriate basis.

Other – Investment and shareholder transactions are recorded on the trade date. Each Fund determines the gain or loss realized from the investment transactions on the basis of identified cost. Dividend income is recognized on the ex-dividend date. Interest income, including amortization of bond premium and discount, is recognized on an accrual basis.

Notes to the Financial Statements – Continued

December 31, 2009

3. INVESTMENT TRANSACTIONS

During the fiscal year ended December 31, 2009, purchases of securities and proceeds from sales of securities, other than temporary investments in short-term securities, were as follows:

| | Purchases | Sales |

| Capital Appreciation Fund | $11,103,598 | $9,386,604 |

| Opportunity Fund | 14,018,423 | 9,016,740 |

There were no purchases or sales of long-term U.S. Government securities.

The aggregate gross unrealized appreciation and depreciation of securities held by the Funds and the total cost of securities for federal income tax purposes at December 31, 2009, were as follows:

| | Aggregate | Aggregate | | | | Federal |

| | Gross | Gross | | | | Income |

| | Appreciation | Depreciation | | Net | | Tax Cost |

| Capital Appreciation Fund | $3,076,562 | $(4,612,487) | | $(1,535,925 | ) | $31,423,035 |

| Opportunity Fund | 3,546,710 | (1,673,854) | | 1,872,856 | | 24,105,808 |

At December 31, 2009, the Funds’ most recently completed fiscal year-end, components of accumulated earnings (deficit) on a tax-basis were as follows:

| | Undistributed | Other | Unrealized | | Total | |

| | Ordinary | Accumulated | Appreciation | | Accumulated | |

| | Income | Losses | (Depreciation) | | Earnings (Deficit) | |

| Capital Appreciation Fund | $78,238 | $(18,955) | $(1,535,925 | ) | $(1,476,642 | ) |

| Opportunity Fund | 489 | (1,030,743) | 1,872,856 | | 842,602 | |

As of December 31, 2009, Opportunity Fund had capital loss carryovers of $1,015,488, which if not offset by subsequent capital gains, $311,833 will expire in 2016 and $703,655 will expire in 2017. As of December 31, 2009, Capital Appreciation Fund and Opportunity Fund had $0 and $0, respectively, of deferred, on a tax basis, post-October losses.

The tax character of distributions paid during the fiscal year ended December 31, 2009 were as follows:

| | Ordinary | Long Term | |

| | Income | Capital Gains | Total |

| Capital Appreciation Fund | $498,151 | $ — | $498,151 |

| Opportunity Fund | 142,261 | — | 142,261 |

Notes to the Financial Statements – Continued

December 31, 2009

The tax character of distributions paid during the fiscal year ended December 31, 2008 were as follows:

| | Ordinary | Return of | Long Term | |

| | Income | Capital | Capital Gains | Total |

| Capital Appreciation Fund | $180,221 | $8,213 | $ — | $188,434 |

| Opportunity Fund | 72,626 | 1,683 | — | 74,309 |

4. AGREEMENTS

The Funds have entered into an Investment Advisory Agreement with the Adviser, with whom certain directors and officers of the Corporation are affiliated, to furnish investment advisory services to the Funds. Pursuant to this Agreement, the Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 1.10% as applied to each Fund’s daily net assets.

The Adviser has contractually agreed to waive, through September 28, 2010 its management fee and/or reimburse each Fund’s other expenses to the extent necessary to ensure that each Fund’s operating expenses do not exceed 1.50% of its average daily net assets. Any such waiver or reimbursement may be subject to later adjustment to allow the Adviser to recoup amounts waived or reimbursed to the extent actual fees and expenses for a fiscal year are less than the respective expense cap limitations, provided, however, that the Adviser shall only be entitled to recoup such amounts for a period of three years from the date such amount was waived or reimbursed. Waived/reimbursed fees and expenses subject to potential recovery by year of expiration are as follows:

| Expiration | | Capital Appreciation Fund | | | Opportunity Fund | |

| 12/31/10 | | $ | 156,132 | | | $ | 156,522 | |

| 12/31/11 | | | 316,194 | | | | 287,941 | |

| 12/31/12 | | | 209,174 | | | | 194,762 | |

| Total | | $ | 681,500 | | | $ | 639,225 | |

As of December 31, 2009, it was possible, but not probable, those amounts would be recovered by the Adviser. At the end of each fiscal year in the future, the Funds will continue to assess the potential recovery of waived/reimbursed fees and expenses for financial reporting purposes.

Quasar Distributors, LLC (“Quasar”), a subsidiary of U.S. Bancorp, serves as distributor of the Funds’ shares pursuant to a Distribution Agreement with the Corporation. Each Fund’s shares are sold on a no-load basis and, therefore, Quasar receives no sales commission or sales load for providing services to the Funds. The Corporation has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which authorizes the Corporation to reimburse Quasar and certain financial intermediaries who assist in distributing each Fund’s shares or who provide shareholder services to Fund shareholders a distribution and/or shareholder servicing fee of up to 0.25% of each Fund’s average daily net assets (computed on an annual basis). All or a portion of the fee may be used by the Funds or Quasar to pay the Fund’s distribution fees and costs of printing reports and prospectuses for potential investors and the costs of other distribution and shareholder services expenses. During the fiscal year ended December 31, 2009, Capital Appreciation Fund and Opportunity Fund incurred expenses of $22,643 and $19,605, respectively, pursuant to the 12b-1 Plan.

Notes to the Financial Statements – Continued

December 31, 2009

U.S. Bancorp Fund Services, LLC serves as transfer agent, administrator and fund accountant for the Funds. U.S. Bank, N.A. serves as custodian for the Funds.

5. INDEMNIFICATIONS

The Funds enter into contracts that contain a variety of indemnifications. The Funds’ maximum exposure under these arrangements is unknown. However, the Funds have not had prior claims or losses pursuant to these contracts and expect the risk of loss to be remote

6. SUBSEQUENT EVENTS

Management has evaluated fund related events and transactions that occurred subsequent to December 31, 2009, through February 23, 2010, the date of issuance of the Funds’ financial statements. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Funds’ financial statements.

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of Prospector Funds, Inc.:

We have audited the accompanying statements of assets and liabilities, including the schedule of investments, of Prospector Funds, Inc., comprised of, the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (the Funds) as of December 31, 2009, and the related statements of operations for the year then ended, the statements of changes in net assets for the two years in the period then ended, and financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2009, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Funds at December 31, 2009, the results of their operations for the year then ended, the changes in their net assets for the two years in the period then ended, and the financial highlights for the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

Minneapolis, Minnesota

February 23, 2010

Additional Information (Unaudited)

December 31, 2009

Board Approval of Investment Advisory Agreement

The Corporation’s independent directors (the “directors”) unanimously approved the continuance of the Investment Advisory Agreement (the “Advisory Agreement”) between the Funds and the Investment Manager at a Board of Director’s meeting held on September 3, 2009.

In preparation for the meeting, the directors had requested from the Investment Manager and evaluated a memorandum providing certain information requested by the Board pursuant to Section 15(c) of the 1940 Act, including (i) expense, compliance and other information as it relates to the Investment Manager; (ii) performance of other accounts managed by its affiliate Prospector Partners, LLC with similar investment objectives derived from data compiled by the Investment Manager and (iii) expense and other information for other registered investment companies with similar investment objectives derived from data compiled by the Investment Manager. Prior to voting, the directors reviewed the proposed approval of the Advisory Agreement with management and with counsel to the Corporation and reviewed a memorandum from such counsel discussing the legal standards for their consideration of the proposed approval. In reaching their determinations relating to approval of the continuance of the Advisory Agreement, the directors considered all factors they believed relevant including the following:

| 1. | the nature, extent and quality of investment, and other services to be rendered by the Investment Manager; |

| 2. | payments to be received by the Investment Manager from all sources in respect of the Funds; |

| 3. | comparative fee and expense data for the Funds and other investment companies with similar investment objectives; |

| 4. | the extent to which economies of scale may be realized as the Funds grow and whether fee levels reflect these economies of scale for the benefit of investors; |

| 5. | the Investment Manager’s policies and practices regarding allocation of portfolio transactions of the Funds, including the extent to which the Investment Manager may benefit from soft dollar arrangements; |

| 6. | fall-out benefits which the Investment Manager and its affiliates may receive from their relationships to the Funds; |

| 7. | information about fees charged by the Investment Manager to other clients with similar investment objectives; |

| 8. | the professional experience and qualifications of the Funds’ portfolio managers and other senior personnel of the Investment Manager; |

| 9. | profitability of the Investment manager; and |

| 10. | the terms of the Advisory Agreement. |

The directors also considered their overall confidence in the integrity and competence of the Investment Manager and the portfolio managers. In their deliberations, the directors did not identify any particular information that was all-important or controlling, and each director attributed different weights to the various factors. The directors determined that the overall arrangements between the Funds and the Investment Manager, as provided in the Advisory Agreement, were fair and reasonable in light of the services performed, expenses expected to be incurred and such other matters as the directors considered relevant in the exercise of their reasonable judgment.

Additional Information (Unaudited) – Continued

December 31, 2009

The material factors and conclusions that formed the basis for the directors reaching their determinations to approve the continuance of the Advisory Agreement (including their determinations that the Investment Manager should be the investment adviser for the Funds, and that the fees payable to the Investment Manager pursuant to the Advisory Agreement are appropriate) were separately discussed by the directors.

Nature, extent and quality of services provided by the Investment Manager