UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22077

Prospector Funds, Inc.

(Exact name of registrant as specified in charter)

370 Church St., Guilford, CT 06437

(Address of principal executive offices) (Zip code)

Prospector Partners Asset Management, LLC, 370 Church St., Guilford, CT 06437

(Name and address of agent for service)

(203) 458-1500

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2012

Date of reporting period: December 31, 2012

Item 1. Report to Stockholders.

Prospector Capital Appreciation Fund

Prospector Opportunity Fund

| | Annual Report |

| | |

| www.prospectorfunds.com | December 31, 2012 |

January 31, 2013

Dear Shareholders of the Prospector Capital Appreciation Fund and Prospector Opportunity Fund,

The global economy slowed in 2012. Europe slipped into recession and China decelerated as policymakers chose to temper inflation. The US chugged along fairly well, receiving a boost from the housing sector which rebounded after 4 years in the doldrums. Central bankers in the US, Europe, and Japan continue to support financial asset prices through unprecedented liquidity creation policies. These central bank policies have comforted the financial markets and largely removed concern about macro “tail” risks. Financial asset performance was terrific in 2012, largely driven by this unsustainable central bank-provided liquidity. The US equity markets were particularly strong as the unmanaged S&P 500 index rose 16.0% in 2012. “Risk on” sectors such as consumer discretionary, money center banks, as well as several large technology stocks (including Apple Inc.), drove the market averages higher. Not surprisingly given our preference for low risk, low volatility investing, we trailed the market in 2012. Fixed income markets were strong as well, out earning their coupons across the board. Spread products such as high yield, corporate investment grade, and commercial mortgages outperformed. Despite the fact that the Federal Reserve balance sheet has ballooned since the financial crisis of 2008, Treasury Bonds continued to rally across the curve in 2012.

We have witnessed Europe’s leaders bungle the euro crisis for the past two years, each time choosing a short-term band-aid solution to one deadline or another while never addressing the problem with a long-term strategy. So now that US politicians finally have a chance to show the Europeans how to properly deal with long-term imbalances of a ballooning federal balance sheet and operating deficit, we resort to the same inadequate political maneuvering. We only focus on a solution that takes us to the next looming deadline, rather than take on the real issue at hand, which is that our revenues are several GDP percentage points BELOW equilibrium, while our spending rate is several GDP percentage points ABOVE equilibrium levels. This is different than Europe’s problem of rolling debt refinancings of member states. The midnight deal between Joe Biden and Mitch McConnell averts the draconian combination of tax increases and automatic spending cuts which was estimated at 5% of GDP (read: immediate recession). The bad news is the automatic cuts have only been temporarily postponed, and we are only weeks away from hitting the debt ceiling once again. Hence, we have set more draconian deadlines in the coming weeks. The real issue of the growing gap between tax revenues and unsustainable entitlement spending promises (think healthcare and pensions) is ignored by this midnight deal.

The worst offense is that our leaders will not engage in an honest debate over the real issue. Instead our politicians attack each other’s calculations and pretend that a solution could possibly involve:

| 1. | No cuts for Social Security or Medicare (Democrats). |

| 2. | No tax increases and unspecified spending cuts (Republicans). |

We are lucky in the US that we don’t face an imminent debt crisis like Europe, but the preconditions are in place and getting worse. At least the markets are forcing the Europeans to address retirement ages and pension obligations to a certain extent now. Maybe their brand of bungling is superior to ours?

Prospector Capital Appreciation Fund Highlights

Our approach to portfolio positioning and trading emphasizes “gradualism.” Annualized turnover remains about 15%, with over three quarters of our holdings having purchase or sale activity during the last six months. Murphy Oil and ConocoPhillips were our biggest purchases, funded largely by sales of two highly successful past oil investments, Nexen and Marathon. Our long held Marathon position has been eliminated now that other investors have recognized the value of its corporate restructuring.

We continued purchasing shares of consumer staples companies, including Energizer Holdings, and Hillshire Brands, believing them to be cheap and advantageously positioned for a period of sluggish worldwide growth. We prefer investing in established brands, as they tend to be powerful, long lasting and valuable. When we suffer a scrape, don’t we all reach for a Johnson & Johnson “Band-Aid,” rather than an “adhesive bandage”? Additionally, the value inherent in these brands, and the consistent cash flows they generate, often make for attractive acquisition metrics, particularly in low interest rate environments. While we don’t own America’s oldest brand (Kraft’s Baker’s Chocolate, 1780), we do own some American classics - Jim Beam (1795), Campbell’s Soup (1869), and Tootsie Roll (1896) to name a few.

While the dramatic slowdown in mergers and acquisition (M&A) activity has been a headwind (our focus on private-market value often depends on M&A as a catalyst to realize value), we did benefit from the announced acquisition of two of our holdings. On July 23, Nexen agreed to be purchased by CNOOC, the Chinese national oil company, for $27.50 in cash, a 60% premium to the prior day’s closing price. Also in July, it was announced that GenOn Energy was being acquired at a significant premium. Nexen and GenOn led the top performance contributors in the second half of 2012.

Prospector Opportunity Fund Highlights

The Opportunity Fund’s top performance contributors in the second half of 2012 included energy stocks which rebounded, awakening from a long slumber. These shares had languished over the past couple of years as the oil price trended lower. Aggressive capital management, corporate actions, and consistent cash flow generation helped to reverse the trend for large portfolio holdings in Nexen, Hess Oil, and Murphy Oil. Significant additions to our Hess Oil and Murphy Oil positions were funded by sales of Nexen shares after the deal was announced.

Another area of significant portfolio strength was financial companies such as: the reinsurer Platinum Underwriters Holdings, money managers Franklin Resources and Invesco, investment banking institutions such as JP Morgan and Greenhill, and regional banks such as Fifth Third, HomeTrust, and Oritani Financial. These companies collectively are recovering from below- average valuations and a rebound in investor sentiment towards the sector.

Portfolio additions in the consumer area, driven by attractive free cash flows, included: Hillshire Brands, Jack in the Box, and Church & Dwight. In technology we added significantly to our Symantec position following a management change.

Outlook

The economy remains in a choppy, slow growth recovery mode since the financial crisis ended in 2009. Wounds of that great recession are gradually healing. The biggest malefactors - banks (recovering smartly) and housing (recovering sluggishly) have become economic contributors. The Fed has done what needed doing. The softer patch experienced in the second half of 2012 is behind us as China slowly accelerates, Europe continues to bounce along the bottom without getting worse and the US picks up. We are comforted by the historical pattern that serious recessions are precipitated by tight monetary conditions, and we couldn’t be further away from that scenario.

Corporate earnings remain solid so far, but margins are already at the high end and unlikely to further expand, limiting future earnings potential much beyond revenue growth. Interest and mortgage rates continue to fall to record low levels. Employment is stable to improving. The US energy revolution of low cost natural gas due to fracking is real, and has driven down the price of that commodity, aiding both consumers and the international competitiveness of America’s industries.

Our best guess is that interest rates will be materially higher in five years. This would be undoubtedly bad for bond investors. The outlook for equities in a higher interest rate scenario is less certain. Higher rates will likely accompany better economic conditions and possibly higher inflation, both of which are relative positives for equities compared to bonds.

Equity valuations are in a reasonable range as well. Furthermore, equities look extraordinarily inexpensive when comparing earnings yields of stocks to Treasury or even corporate bond yields. Money flows out of equity mutual funds in 2012 were substantial, and we’re not aware of any overheated investment theme beyond “reaching for yield.”

Merger and acquisition activity is poised for an uptick in 2013 after a slow 2012. Corporations have terrific balance sheets and are accumulating excess cash and capital. Private equity is poised as well with dry powder in hand. We are not sure exactly what the catalyst will be to energize M&A activity, but we are confident it will ensue. Perhaps the uncertain macro environment will move towards resolution, and when that happens, the values inherent in your portfolio will attract acquirers and other investors. In the meantime we view equities as a superior asset allocation alternative in the longer term.

Steadfast, we remain committed to making you money while protecting your wealth.

Respectfully submitted,

| | | |

| John D. Gillespie | Richard P. Howard | Kevin R. O’Brien |

Performance data quoted represents past performance; past performance does not guarantee future results.

Opinions expressed are those of the Funds and are subject to change, are not guaranteed, and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds invest in smaller and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may hold restricted securities purchased through private placements. Such securities can be difficult to sell without experiencing delays or additional costs. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. These risks are fully disclosed in the prospectus.

Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index.

Book value: The total value of the company's assets that shareholders would theoretically receive if a company were liquidated.

Cash flow: A revenue or expense stream that changes a cash account over a given period.

Free cash flow: A measure of financial performance calculated as operating cash flow minus capital expenditures.

Fund holdings and/or security allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see the Schedule of Investments section in this report for a full listing of the Fund’s holdings.

Prospector Funds, Inc. are distributed by Quasar Distributors, LLC.

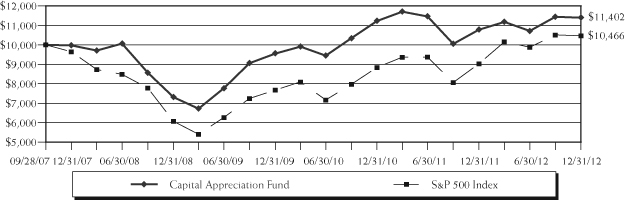

Capital Appreciation Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%)

| | | | | Since Inception(1) to |

| | One Year | Three Year | Five Year | December 31, 2012 |

| Capital Appreciation Fund | 5.76% | 6.06% | 2.72% | 2.53% |

S&P 500 Index(2) | 16.00% | 10.87% | 1.66% | 0.87% |

| (2) | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

Opportunity Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%)

| | | | | Since Inception(1) to |

| | One Year | Three Year | Five Year | December 31, 2012 |

| Opportunity Fund | 14.63% | 10.18% | 6.40% | 6.10% |

Russell 2000 Index(2) | 16.35% | 12.25% | 3.56% | 2.26% |

Russell Midcap Index(3) | 17.28% | 13.15% | 3.57% | 2.63% |

| (2) | An unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. This index cannot be invested in directly. |

| (3) | An unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. This index cannot be invested in directly. |

Expense Example

December 31, 2012

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, redemption fees, wire transfer fees, maintenance fee (IRA accounts), and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2012 – December 31, 2012).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. The example below includes, but is not limited to, management fees, shareholder servicing fees and other Fund expenses. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (07/01/2012) | Value (12/31/2012) | (07/01/2012 to 12/31/2012) |

Capital Appreciation Actual(2) | $1,000.00 | $1,064.80 | $6.75 |

| Capital Appreciation Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.60 | 6.60 |

| | | | |

Opportunity Actual(2) | 1,000.00 | 1,083.00 | 6.81 |

| Opportunity Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.60 | 6.60 |

| (1) | Expenses are equal to the fund’s annualized expense ratio for the most recent six-month period of 1.30% and 1.30% for Capital Appreciation Fund and Opportunity Fund, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year/366 (to reflect the one-half year period). |

| (2) | Based on the actual returns for the six-month period ended December 31, 2012 of 6.48% and 8.30% for Capital Appreciation Fund and Opportunity Fund, respectively. |

PROSPECTOR FUNDS, INC.

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2012(1)(2)

Capital Appreciation Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2012(1)

Capital Appreciation Fund

| | Automatic Data Processing | | | 3.8 | % | |

| | Platinum Underwriters Holdings | | | 3.5 | % | |

| | E.I. Du Pont de Nemours | | | 3.4 | % | |

| | Nexen | | | 3.3 | % | |

| | Hess | | | 3.3 | % | |

| | Gold Fields – ADR | | | 3.1 | % | |

| | Johnson & Johnson | | | 2.9 | % | |

| | Pfizer | | | 2.8 | % | |

| | Domtar | | | 2.7 | % | |

| | Loews | | | 2.5 | % | |

| | (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| | (2) | Sector allocation includes all investment types. |

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2012(1)(2)

Opportunity Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2012(1)(3)

Opportunity Fund

| | Franklin Resources | | | 3.2 | % | |

| | Hess | | | 3.1 | % | |

| | Platinum Underwriters Holdings | | | 3.0 | % | |

| | Murphy Oil | | | 2.5 | % | |

| | Newmont Mining | | | 2.5 | % | |

| | CNA Financial | | | 2.1 | % | |

| | Invesco | | | 2.0 | % | |

| | Leucadia National | | | 1.9 | % | |

| | Lancaster Colony | | | 1.8 | % | |

| | Hillshire Brands | | | 1.7 | % | |

| | (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| | (2) | Sector allocation includes all investment types. |

| | (3) | Invesco Treasury Portfolio excluded from top 10 holdings. |

Schedule of Investments

December 31, 2012

Capital Appreciation Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 78.9% | | | | | | |

| | | | | | | |

| Banks – 0.2% | | | | �� | | |

| Charter Financial | | | 3,400 | | | $ | 36,040 | |

| Waterstone Financial* | | | 3,800 | | | | 29,640 | |

| | | | | | | | 65,680 | |

| Chemicals – 3.4% | | | | | | | | |

| E.I. Du Pont de Nemours | | | 29,700 | | | | 1,335,609 | |

| | | | | | | | | |

| Consumer Discretionary – 1.4% | | | | | | | | |

| Cablevision Systems, Class A | | | 18,000 | | | | 268,920 | |

| DreamWorks Animation SKG, Class A* | | | 16,000 | | | | 265,120 | |

| | | | | | | | 534,040 | |

| Consumer Staples – 12.1% | | | | | | | | |

| Beam | | | 10,200 | | | | 623,118 | |

| Campbell Soup | | | 15,600 | | | | 544,284 | |

| Coca Cola Enterprises | | | 14,700 | | | | 466,431 | |

| Energizer Holdings | | | 5,200 | | | | 415,896 | |

| Hillshire Brands | | | 7,980 | | | | 224,557 | |

| SUPERVALU | | | 11,000 | | | | 27,170 | |

| Sysco | | | 8,400 | | | | 265,944 | |

| Tootsie Roll Industries | | | 25,822 | | | | 669,306 | |

| Walgreen | | | 20,800 | | | | 769,808 | |

| Wal-Mart Stores | | | 10,400 | | | | 709,592 | |

| | | | | | | | 4,716,106 | |

| Diversified Financial Services – 0.1% | | | | | | | | |

| CIT Group* | | | 1,500 | | | | 57,960 | |

| | | | | | | | | |

| Energy – 11.8% | | | | | | | | |

| Clayton Williams Energy* | | | 9,200 | | | | 368,000 | |

| ConocoPhillips | | | 11,400 | | | | 661,086 | |

| Hess | | | 24,300 | | | | 1,286,928 | |

| Murphy Oil | | | 11,700 | | | | 696,735 | |

| Nexen | | | 48,000 | | | | 1,293,120 | |

| Repsol YPF – ADR | | | 11,500 | | | | 240,350 | |

| Talisman Energy | | | 6,000 | | | | 67,980 | |

| | | | | | | | 4,614,199 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2012

Capital Appreciation Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 78.9% (Continued) | | | | | | |

| | | | | | | |

| Healthcare – 7.7% | | | | | | |

| Abbott Laboratories | | | 9,200 | | | $ | 602,600 | |

| Hospira* | | | 6,700 | | | | 209,308 | |

| Johnson & Johnson | | | 16,000 | | | | 1,121,600 | |

| Pfizer | | | 43,300 | | | | 1,085,964 | |

| | | | | | | | 3,019,472 | |

| Industrials – 1.4% | | | | | | | | |

| Curtiss-Wright | | | 12,400 | | | | 407,092 | |

| Fortune Brands Home & Security* | | | 5,400 | | | | 157,788 | |

| | | | | | | | 564,880 | |

| Information Technology – 6.2% | | | | | | | | |

| Automatic Data Processing | | | 26,400 | | | | 1,505,064 | |

| Corning | | | 45,600 | | | | 575,472 | |

| Microsoft | | | 3,400 | | | | 90,882 | |

| Xerox | | | 37,700 | | | | 257,114 | |

| | | | | | | | 2,428,532 | |

| Insurance – 13.3% | | | | | | | | |

| Alterra Capital Holdings | | | 10,100 | | | | 284,719 | |

| American International Group* | | | 6,900 | | | | 243,570 | |

| Arch Capital Group* | | | 4,400 | | | | 193,688 | |

| Aspen Insurance Holdings | | | 6,600 | | | | 211,728 | |

| Berkshire Hathaway, Class B* | | | 4,500 | | | | 403,650 | |

| CNA Financial | | | 7,800 | | | | 218,478 | |

| Donegal Group, Class A | | | 7,900 | | | | 110,916 | |

| First American Financial | | | 13,100 | | | | 315,579 | |

| Loews | | | 23,700 | | | | 965,775 | |

| Montpelier Re Holdings | | | 17,200 | | | | 393,192 | |

| Platinum Underwriters Holdings | | | 29,500 | | | | 1,357,000 | |

| State Auto Financial | | | 32,700 | | | | 488,538 | |

| | | | | | | | 5,186,833 | |

| Metals & Mining – 8.6% | | | | | | | | |

| AngloGold Ashanti – ADR | | | 12,100 | | | | 379,577 | |

| AuRico Gold* | | | 1,700 | | | | 13,906 | |

| Barrick Gold | | | 23,500 | | | | 822,735 | |

| Gold Fields – ADR | | | 97,300 | | | | 1,215,277 | |

| Kinross Gold | | | 900 | | | | 8,748 | |

| Newmont Mining | | | 19,500 | | | | 905,580 | |

| | | | | | | | 3,345,823 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments – Continued

December 31, 2012

Capital Appreciation Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 78.9% (Continued) | | | | | | |

| | | | | | | |

| Paper & Forest Products – 3.1% | | | | | | |

| Domtar | | | 12,701 | | | $ | 1,060,788 | |

| Neenah Paper | | | 4,900 | | | | 139,503 | |

| | | | | | | | 1,200,291 | |

| Real Estate – 2.6% | | | | | | | | |

| Forestar Group* | | | 24,200 | | | | 419,386 | |

| Post Properties | | | 12,000 | | | | 599,400 | |

| | | | | | | | 1,018,786 | |

| Telecommunication Services – 1.3% | | | | | | | | |

| Telephone & Data Systems | | | 22,200 | | | | 491,508 | |

| | | | | | | | | |

| Utilities – 5.7% | | | | | | | | |

| FirstEnergy | | | 10,354 | | | | 432,383 | |

| NRG Energy | | | 29,901 | | | | 687,427 | |

| Public Service Enterprise Group | | | 18,600 | | | | 569,160 | |

| TECO Energy | | | 14,000 | | | | 234,640 | |

| UNS Energy | | | 7,658 | | | | 324,852 | |

| | | | | | | | 2,248,462 | |

| Total Common Stocks | | | | | | | | |

| (Cost $29,088,269) | | | | | | | 30,828,181 | |

| | | Par | | | | | |

| CONVERTIBLE BONDS – 18.1% | | | | | | | | |

| Consumer Staples – 3.0% | | | | | | | | |

| Archer Daniels | | | | | | | | |

| 0.875%, 02/15/2014 | | $ | 725,000 | | | | 725,453 | |

| Chiquita Brands | | | | | | | | |

| 4.250%, 08/15/2016 | | | 150,000 | | | | 130,500 | |

| Smithfield Foods | | | | | | | | |

| 4.000%, 06/30/2013 | | | 300,000 | | | | 317,813 | |

| | | | | | | | 1,173,766 | |

| Diversified Financial Services – 2.0% | | | | | | | | |

| Janus Capital Group | | | | | | | | |

| 3.250%, 07/15/2014 | | | 175,000 | | | | 181,781 | |

| PHH | | | | | | | | |

| 4.000%, 09/01/2014 | | | 550,000 | | | | 614,969 | |

| | | | | | | | 796,750 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2012

Capital Appreciation Fund

| Description | | Par | | | Value | |

| | | | | | | |

| CONVERTIBLE BONDS – 18.1% (CONTINUED) | | | | | | |

| | | | | | | |

| Energy – 2.4% | | | | | | |

| InterOil | | | | | | |

| 2.750%, 11/15/2015 | | $ | 25,000 | | | $ | 21,797 | |

| USEC | | | | | | | | |

| 3.000%, 10/01/2014 | | | 2,375,000 | | | | 902,500 | |

| | | | | | | | 924,297 | |

| Healthcare – 5.2% | | | | | | | | |

| Amgen | | | | | | | | |

| 0.375%, 02/01/2013 | | | 150,000 | | | | 167,906 | |

| Charles River Laboratories International | | | | | | | | |

| 2.250%, 06/15/2013 | | | 575,000 | | | | 576,438 | |

| Chemed | | | | | | | | |

| 1.875%, 05/15/2014 | | | 275,000 | | | | 286,516 | |

| Greatbatch | | | | | | | | |

| 2.250%, 06/15/2013 | | | 700,000 | | | | 700,875 | |

| Hologic | | | | | | | | |

| 2.000%, 12/15/2037 | | | 125,000 | | | | 124,609 | |

| 2.000%, 12/15/2037 | | | 150,000 | | | | 167,250 | |

| | | | | | | | 2,023,594 | |

| Industrials – 2.5% | | | | | | | | |

| Alliant Techsystems | | | | | | | | |

| 3.000%, 08/15/2024 | | | 175,000 | | | | 184,844 | |

| L-3 Communications | | | | | | | | |

| 3.000%, 08/01/2035 | | | 125,000 | | | | 126,563 | |

| Trinity Industries | | | | | | | | |

| 3.875%, 06/01/2036 | | | 600,000 | | | | 670,874 | |

| | | | | | | | 982,281 | |

| Information Technology – 1.8% | | | | | | | | |

| Anixter International | | | | | | | | |

| 1.000%, 02/15/2013 | | | 425,000 | | | | 485,031 | |

| Comtech Telecommunications | | | | | | | | |

| 3.000%, 05/01/2029 | | | 225,000 | | | | 229,219 | |

| | | | | | | | 714,250 | |

| Metals & Mining – 1.2% | | | | | | | | |

| Horsehead Holding | | | | | | | | |

| 3.800%, 07/01/2017 | | | 50,000 | | | | 48,375 | |

| | | | | | | | | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2012

Capital Appreciation Fund

| Description | | Par | | | Value | |

| | | | | | | |

| CONVERTIBLE BONDS – 18.1% (CONTINUED) | | | | | | |

| | | | | | | |

| Metals & Mining – 1.2% (Continued) | | | | | | |

| Kinross Gold | | | | | | |

| 1.750%, 03/15/2028 | | $ | 100,000 | | | $ | 99,938 | |

| Northgate Minerals | | | | | | | | |

| 3.500%, 10/01/2016 | | | 50,000 | | | | 54,219 | |

| RTI International | | | | | | | | |

| 3.000%, 12/01/2015 | | | 250,000 | | | | 271,405 | |

| | | | | | | | 473,937 | |

| Total Convertible Bonds | | | | | | | | |

| (Cost $7,994,364) | | | | | | | 7,088,875 | |

| | | | | | | | | |

| CORPORATE BONDS – 1.5% | | | | | | | | |

| Utilities – 1.5% | | | | | | | | |

| Edison Mission Energy | | | | | | | | |

| 7.750%, 06/15/2016 (a) | | | 200,000 | | | | 106,000 | |

| 7.000%, 05/15/2017 (a) | | | 925,000 | | | | 490,250 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $928,378) | | | | | | | 596,250 | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENT – 1.5% | | | | | | | | |

| Invesco Treasury Portfolio, 0.020%^ | | | | | | | | |

| (Cost $574,940) | | | 574,940 | | | | 574,940 | |

| | | | | | | | | |

| Total Investments – 100.0% | | | | | | | | |

| (Cost $38,585,951) | | | | | | | 39,088,246 | |

| Other Assets and Liabilities, Net – 0.0% | | | | | | | 15,308 | |

| Total Net Assets – 100.0% | | | | | | $ | 39,103,554 | |

| * | Non-income producing security |

ADR – American Depository Receipt

| ^ | Variable Rate Security – the rate shown is the annualized seven-day effective yield as of December 31, 2012. |

See Notes to the Financial Statements

Schedule of Investments

December 31, 2012

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 90.8% | | | | | | |

| | | | | | | |

| Banks – 15.4% | | | | | | |

| AJS Bancorp* (a) | | | 8,958 | | | $ | 89,580 | |

| Cape Bancorp | | | 10,900 | | | | 94,721 | |

| Central Pacific Financial* | | | 31,800 | | | | 495,762 | |

| Chicopee Bancorp* | | | 26,200 | | | | 416,318 | |

| City National | | | 6,500 | | | | 321,880 | |

| Clifton Savings Bancorp | | | 27,200 | | | | 306,544 | |

| Fifth Third Bancorp | | | 71,000 | | | | 1,078,490 | |

| First Connecticut Bancorp | | | 35,600 | | | | 489,500 | |

| First Defiance Financial | | | 29,000 | | | | 556,510 | |

| Fox Chase Bancorp | | | 25,902 | | | | 431,268 | |

| Greenhill & Co. | | | 9,700 | | | | 504,303 | |

| HomeTrust Bancshares* | | | 68,800 | | | | 929,488 | |

| Metro Bancorp* | | | 18,780 | | | | 248,272 | |

| Ocean Shore Holding | | | 25,072 | | | | 371,066 | |

| OceanFirst Financial | | | 47,500 | | | | 653,125 | |

| OmniAmerican Bancorp* | | | 10,500 | | | | 242,865 | |

| Oritani Financial | | | 66,750 | | | | 1,022,610 | |

| PacWest Bancorp | | | 18,100 | | | | 448,518 | |

| Peoples Federal Bancshares | | | 10,680 | | | | 185,725 | |

| United Financial Bancorp | | | 37,100 | | | | 583,212 | |

| Virginia Commerce Bancorp* | | | 35,700 | | | | 319,515 | |

| Washington Trust Bancorp | | | 8,500 | | | | 223,635 | |

| West Coast Bancorp | | | 11,300 | | | | 250,295 | |

| Westfield Financial | | | 89,000 | | | | 643,470 | |

| | | | | | | | 10,906,672 | |

| Chemicals – 2.0% | | | | | | | | |

| H.B. Fuller | | | 19,000 | | | | 661,580 | |

| RPM International | | | 24,500 | | | | 719,320 | |

| | | | | | | | 1,380,900 | |

| Consumer Discretionary – 4.6% | | | | | | | | |

| Caribou Coffee* | | | 26,100 | | | | 422,559 | |

| Gentex | | | 12,000 | | | | 225,840 | |

| Home Depot | | | 16,800 | | | | 1,039,080 | |

| Hyatt Hotels, Class A* | | | 18,300 | | | | 705,831 | |

| Jack in the Box* | | | 12,700 | | | | 363,220 | |

| Matthews International, Class A | | | 15,300 | | | | 491,130 | |

| | | | | | | | 3,247,660 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2012

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 90.8% (Continued) | | | | | | |

| | | | | | | |

| Consumer Staples – 9.9% | | | | | | |

| Church & Dwight | | | 12,400 | | | $ | 664,268 | |

| De Master Blenders* | | | 49,800 | | | | 573,134 | |

| Hillshire Brands | | | 42,260 | | | | 1,189,196 | |

| J & J Snack Foods | | | 13,400 | | | | 856,796 | |

| Lancaster Colony | | | 18,000 | | | | 1,245,420 | |

| PepsiCo | | | 11,800 | | | | 807,474 | |

| Post Holdings* | | | 20,400 | | | | 698,700 | |

| Wal-Mart Stores | | | 13,800 | | | | 941,574 | |

| | | | | | | | 6,976,562 | |

| Containers & Packaging – 1.0% | | | | | | | | |

| Silgan Holdings | | | 16,700 | | | | 694,553 | |

| | | | | | | | | |

| Diversified Financial Services – 9.5% | | | | | | | | |

| Citigroup | | | 16,370 | | | | 647,597 | |

| Franklin Resources | | | 18,100 | | | | 2,275,170 | |

| Invesco | | | 53,200 | | | | 1,387,988 | |

| JPMorgan Chase | | | 16,400 | | | | 721,108 | |

| Leucadia National | | | 55,000 | | | | 1,308,450 | |

| PICO Holdings* | | | 17,500 | | | | 354,725 | |

| | | | | | | | 6,695,038 | |

| Energy – 6.4% | | | | | | | | |

| Clayton Williams Energy* | | | 5,300 | | | | 212,000 | |

| Hess | | | 41,800 | | | | 2,213,728 | |

| Marathon Oil | | | 10,900 | | | | 334,194 | |

| Murphy Oil | | | 29,600 | | | | 1,762,680 | |

| | | | | | | | 4,522,602 | |

| Healthcare – 4.1% | | | | | | | | |

| Haemonetics* | | | 7,800 | | | | 318,552 | |

| Johnson & Johnson | | | 9,000 | | | | 630,900 | |

| Merck & Co. | | | 7,548 | | | | 309,015 | |

| Molina Healthcare* | | | 10,850 | | | | 293,601 | |

| Pfizer | | | 23,200 | | | | 581,856 | |

| WellPoint | | | 12,300 | | | | 749,316 | |

| | | | | | | | 2,883,240 | |

| Industrials – 4.5% | | | | | | | | |

| Alliant Techsystems | | | 7,600 | | | | 470,896 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2012

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 90.8% (CONTINUED) | | | | | | |

| | | | | | | |

| | | | | | | |

| Industrials – 4.5% (Continued) | | | | | | |

| Celadon Group | | | 54,300 | | | $ | 981,201 | |

| CIRCOR International | | | 21,240 | | | | 840,892 | |

| Tyco International | | | 29,300 | | | | 857,025 | |

| | | | | | | | 3,150,014 | |

| Information Technology – 9.0% | | | | | | | | |

| BMC Software* | | | 16,500 | | | | 654,390 | |

| Cisco Systems | | | 17,700 | | | | 347,805 | |

| EMC* | | | 17,400 | | | | 440,220 | |

| Global Cash Access Holdings* | | | 65,200 | | | | 511,168 | |

| Maxim Integrated Products | | | 23,900 | | | | 702,660 | |

| Microsoft | | | 26,700 | | | | 713,691 | |

| NetApp* | | | 24,400 | | | | 818,620 | |

| Symantec* | | | 59,500 | | | | 1,119,195 | |

| VeriSign* | | | 4,800 | | | | 186,336 | |

| Xilinx | | | 23,800 | | | | 854,420 | |

| | | | | | | | 6,348,505 | |

| Insurance – 15.0% | | | | | | | | |

| Arthur J. Gallagher | | | 27,200 | | | | 942,480 | |

| Aspen Insurance Holdings | | | 23,100 | | | | 741,048 | |

| Axis Capital Holdings | | | 32,400 | | | | 1,122,336 | |

| Catlin Group | | | 29,427 | | | | 240,688 | |

| Chubb | | | 10,800 | | | | 813,456 | |

| CNA Financial | | | 51,900 | | | | 1,453,719 | |

| Endurance Specialty Holdings | | | 8,800 | | | | 349,272 | |

| MetLife | | | 12,500 | | | | 411,750 | |

| Montpelier Re Holdings | | | 24,100 | | | | 550,926 | |

| Platinum Underwriters Holdings | | | 45,500 | | | | 2,093,000 | |

| Progressive | | | 43,000 | | | | 907,300 | |

| W.R. Berkley | | | 8,400 | | | | 317,016 | |

| XL Group | | | 25,500 | | | | 639,030 | |

| | | | | | | | 10,582,021 | |

| Metals & Mining – 3.8% | | | | | | | | |

| Gold Fields – ADR | | | 39,800 | | | | 497,102 | |

| Kinross Gold | | | 42,600 | | | | 414,072 | |

| Newmont Mining | | | 37,900 | | | | 1,760,076 | |

| Victoria Gold* | | | 96,500 | | | | 22,002 | |

| | | | | | | | 2,693,252 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

December 31, 2012

Opportunity Fund

| Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 90.8% (CONTINUED) | | | | | | |

| | | | | | | |

| Paper & Forest Products – 0.6% | | | | | | |

| Domtar | | | 5,400 | | | $ | 451,008 | |

| | | | | | | | | |

| Real Estate – 1.4% | | | | | | | | |

| Forestar Group* | | | 21,300 | | | | 369,129 | |

| Howard Hughes* | | | 3,300 | | | | 240,966 | |

| Thomas Properties Group | | | 74,700 | | | | 404,127 | |

| | | | | | | | 1,014,222 | |

| Utilities – 3.6% | | | | | | | | |

| Empire District Electric | | | 22,000 | | | | 448,360 | |

| NV Energy | | | 14,900 | | | | 270,286 | |

| Public Service Enterprise Group | | | 20,000 | | | | 612,000 | |

| TECO Energy | | | 45,800 | | | | 767,608 | |

| UIL Holdings | | | 11,800 | | | | 422,558 | |

| | | | | | | | 2,520,812 | |

| Total Common Stocks | | | | | | | | |

| (Cost $57,088,113) | | | | | | | 64,067,061 | |

| | | Par | | | | | |

| CONVERTIBLE BOND – 0.5% | | | | | | | | |

| Industrials – 0.5% | | | | | | | | |

| Alliant Techsystems | | | | | | | | |

| 3.000%, 08/15/2024 | | | | | | | | |

| (Cost $340,148) | | $ | 325,000 | | | | 343,281 | |

| | | | | | | | | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENT – 9.7% | | | | | | | | |

| Invesco Treasury Portfolio, 0.020%^ | | | | | | | | |

| (Cost $6,874,945) | | | 6,874,945 | | | | 6,874,945 | |

| | | | | | | | | |

| Total Investments – 101.0% | | | | | | | | |

| (Cost $64,303,206) | | | | | | | 71,285,287 | |

| Other Assets and Liabilities, Net – (1.0%) | | | | | | | (736,240 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 70,549,047 | |

| * | Non-income producing security |

| (a) | Illiquid Security – A security is considered illiquid if it may not be sold or disposed of in the ordinary course of business within seven days at approximately the price at which it is valued. As of December 31, 2012, the fair value of this investment was $89,580 or 0.1% of total net assets. See note 2 in Notes to Financial Statements. |

ADR – American Depository Receipt

| ^ | Variable Rate Security – the rate shown is the annualized seven-day effective yield as of December 31, 2012. |

See Notes to the Financial Statements

Statements of Assets and Liabilities

December 31, 2012

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| ASSETS: | | | | | | |

| Investments, at market value | | | | | | |

| (Cost $38,585,951 and $64,303,206, respectively) | | $ | 39,088,246 | | | $ | 71,285,287 | |

| Cash | | | 22,039 | | | | 9,167 | |

| Receivable for investment securities sold | | | 78,441 | | | | — | |

| Receivable for dividends and interest | | | 78,038 | | | | 43,200 | |

| Receivable for capital shares sold | | | 8,223 | | | | 357,314 | |

| Prepaid expenses | | | 14,978 | | | | 17,841 | |

| Total assets | | | 39,289,965 | | | | 71,712,809 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payable for investment securities purchased | | | 81,553 | | | | 1,009,716 | |

| Payable for capital shares redeemed | | | 6,145 | | | | 24,074 | |

| Payable to adviser, net | | | 28,103 | | | | 48,980 | |

| Accrued distribution fees | | | 7,289 | | | | 8,663 | |

| Accrued expenses and other liabilities | | | 63,321 | | | | 72,329 | |

| Total liabilities | | | 186,411 | | | | 1,163,762 | |

| | | | | | | | | |

| NET ASSETS | | $ | 39,103,554 | | | $ | 70,549,047 | |

| | | | | | | | | |

| COMPOSITION OF NET ASSETS: | | | | | | | | |

| Portfolio capital | | $ | 39,141,931 | | | $ | 62,961,215 | |

| Distributions in excess of net investment income | | | (227,611 | ) | | | (11,546 | ) |

| Accumulated net realized gain (loss) on investments | | | (313,061 | ) | | | 617,297 | |

| Net unrealized appreciation of investments | | | 502,295 | | | | 6,982,081 | |

| Total net assets | | $ | 39,103,554 | | | $ | 70,549,047 | |

CAPITAL STOCK, $0.0001 par value | | | | | | | | |

| Authorized | | | 500,000,000 | | | | 500,000,000 | |

| Issued and outstanding | | | 2,574,432 | | | | 3,907,784 | |

| | | | | | | | | |

| NET ASSET VALUE, REDEMPTION PRICE, | | | | | | | | |

| AND OFFERING PRICE PER SHARE | | $ | 15.19 | | | $ | 18.05 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Statements of Operations

For the Year Ended December 31, 2012

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| INVESTMENT INCOME: | | | | | | |

| Interest income | | $ | 430,319 | | | $ | 37,989 | |

| Dividend income | | | 914,620 | | | | 1,596,340 | |

| Less: Foreign taxes withheld | | | (12,562 | ) | | | (2,619 | ) |

| Total investment income | | | 1,332,377 | | | | 1,631,710 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 511,039 | | | | 725,210 | |

| Directors’ fees | | | 52,797 | | | | 51,852 | |

| Administration fees | | | 51,973 | | | | 67,713 | |

| Fund accounting fees | | | 41,055 | | | | 40,009 | |

| Transfer agent fees | | | 32,050 | | | | 38,694 | |

| Audit fees | | | 29,459 | | | | 29,459 | |

| Distribution fees | | | 26,870 | | | | 37,232 | |

| Registration fees | | | 25,172 | | | | 25,310 | |

| Legal fees | | | 19,238 | | | | 30,819 | |

| Other expenses | | | 16,169 | | | | 16,655 | |

| Custodian fees | | | 11,895 | | | | 8,160 | |

| Postage and printing fees | | | 5,654 | | | | 7,261 | |

| Total expenses | | | 823,371 | | | | 1,078,374 | |

| Less: Fee waivers | | | (186,758 | ) | | | (183,148 | ) |

| Total net expenses | | | 636,613 | | | | 895,226 | |

| NET INVESTMENT INCOME | | | 695,764 | | | | 736,484 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS | | | | | | | | |

| Net realized gain on investments | | | 240,751 | | | | 3,339,487 | |

| Net change in unrealized appreciation | | | | | | | | |

| or depreciation of investments | | | 1,014,133 | | | | 4,749,162 | |

| Net gain on investments | | | 1,254,884 | | | | 8,088,649 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 1,950,648 | | | $ | 8,825,133 | |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Capital Appreciation Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2012 | | | December 31, 2011 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 695,764 | | | $ | 467,793 | |

| Net realized gain on investments | | | 240,751 | | | | 1,136,387 | |

| Net change in unrealized appreciation of investments | | | 1,014,133 | | | | (4,027,600 | ) |

| Net increase (decrease) resulting from operations | | | 1,950,648 | | | | (2,423,420 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 2,999,727 | | | | 20,818,037 | |

| Proceeds from reinvestment of distributions | | | 1,377,580 | | | | 1,324,588 | |

| Payments for shares redeemed | | | (19,566,364 | ) | | | (8,165,386 | ) |

| Redemption fees | | | 3,419 | | | | 1,463 | |

| Net increase (decrease) from capital share transactions | | | (15,185,638 | ) | | | 13,978,702 | |

| | | | | | | | | |

| DISTRIBUTIONS PAID FROM: | | | | | | | | |

| Net investment income | | | (856,862 | ) | | | (598,607 | ) |

| Net realized gains | | | (541,416 | ) | | | (754,823 | ) |

| Total distributions to shareholders | | | (1,398,278 | ) | | | (1,353,430 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (14,633,268 | ) | | | 10,201,852 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 53,736,822 | | | | 43,534,970 | |

| | | | | | | | | |

| End of period (including distributions | | | | | | | | |

| in excess of net investment income | | | | | | | | |

| of $(227,611) and $(193,063), respectively) | | $ | 39,103,554 | | | $ | 53,736,822 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 195,862 | | | | 1,306,362 | |

| Shares issued in reinvestment of distributions | | | 91,839 | | | | 88,661 | |

| Shares redeemed | | | (1,319,605 | ) | | | (523,639 | ) |

| Net increase (decrease) | | | (1,031,904 | ) | | | 871,384 | |

| | | | | | | | | |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Opportunity Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2012 | | | December 31, 2011 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 736,484 | | | $ | 217,478 | |

| Net realized gain on investments | | | 3,339,487 | | | | 2,550,201 | |

| Net change in unrealized appreciation | | | | | | | | |

| or depreciation of investments | | | 4,749,162 | | | | (3,229,445 | ) |

| Net increase (decrease) resulting from operations | | | 8,825,133 | | | | (461,766 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 12,426,328 | | | | 27,510,295 | |

| Proceeds from reinvestment of distributions | | | 3,503,375 | | | | 2,590,150 | |

| Payments for shares redeemed | | | (10,246,036 | ) | | | (4,754,057 | ) |

| Redemption fees | | | 621 | | | | 1,095 | |

| Net increase from capital share transactions | | | 5,684,288 | | | | 25,347,483 | |

| | | | | | | | | |

| DISTRIBUTIONS PAID FROM: | | | | | | | | |

| Net investment income | | | (735,643 | ) | | | (177,445 | ) |

| Net realized gains | | | (2,939,377 | ) | | | (2,568,958 | ) |

| Total distributions to shareholders | | | (3,675,020 | ) | | | (2,746,403 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 10,834,401 | | | | 22,139,314 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 59,714,646 | | | | 37,575,332 | |

| | | | | | | | | |

| End of period (including distributions | | | | | | | | |

| in excess of net investment income | | | | | | | | |

| of $(11,546) and $(12,696), respectively) | | $ | 70,549,047 | | | $ | 59,714,646 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 690,660 | | | | 1,558,575 | |

| Shares issued in reinvestment of distributions | | | 197,040 | | | | 155,471 | |

| Shares redeemed | | | (573,799 | ) | | | (272,964 | ) |

| Net increase | | | 313,901 | | | | 1,441,082 | |

See Notes to the Financial Statements

Financial Highlights

| | | Capital Appreciation Fund | |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the period | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of period | | $ | 14.90 | | | $ | 15.92 | | | $ | 13.95 | | | $ | 10.85 | | | $ | 14.94 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.31 | | | | 0.15 | | | | 0.14 | | | | 0.25 | | | | 0.08 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.54 | | | | (0.79 | ) | | | 2.30 | | | | 3.09 | | | | (4.08 | ) |

| Total from operations | | | 0.85 | | | | (0.64 | ) | | | 2.44 | | | | 3.34 | | | | (4.00 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.34 | ) | | | (0.17 | ) | | | (0.16 | ) | | | (0.24 | ) | | | (0.09 | ) |

| From net realized gains | | | (0.22 | ) | | | (0.21 | ) | | | (0.31 | ) | | | — | | | | (0.01 | ) |

| Total distributions | | | (0.56 | ) | | | (0.38 | ) | | | (0.47 | ) | | | (0.24 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | (1) | | | — | (1) | | | — | (1) | | | — | (1) | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of period | | $ | 15.19 | | | $ | 14.90 | | | $ | 15.92 | | | $ | 13.95 | | | $ | 10.85 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 5.76 | % | | | (4.00 | )% | | | 17.52 | % | | | 30.74 | % | | | (26.67 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 39,104 | | | $ | 53,737 | | | $ | 43,535 | | | $ | 29,724 | | | $ | 20,091 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.77 | % | | | 1.70 | % | | | 2.01 | % | | | 2.38 | % | | | 3.51 | % |

| After expense reimbursement | | | 1.37 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.10 | % | | | 0.63 | % | | | 0.55 | % | | | 1.27 | % | | | (1.07 | )% |

| After expense reimbursement | | | 1.50 | % | | | 0.83 | % | | | 1.06 | % | | | 2.15 | % | | | 0.94 | % |

| Portfolio turnover rate | | | 15 | % | | | 24 | % | | | 27 | % | | | 41 | % | | | 21 | % |

| (1) | Less than $0.01 per share. |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Financial Highlights

| | | Opportunity Fund | |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the period | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of period | | $ | 16.62 | | | $ | 17.45 | | | $ | 15.10 | | | $ | 12.04 | | | $ | 14.96 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.20 | | | | 0.07 | | | | 0.09 | | | | 0.08 | | | | 0.05 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 2.22 | | | | (0.11 | ) | | | 2.47 | | | | 3.06 | | | | (2.92 | ) |

| Total from operations | | | 2.42 | | | | (0.04 | ) | | | 2.56 | | | | 3.14 | | | | (2.87 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.20 | ) | | | (0.05 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.06 | ) |

| From net realized gains | | | (0.79 | ) | | | (0.74 | ) | | | (0.09 | ) | | | — | | | | — | |

| Total distributions | | | (0.99 | ) | | | (0.79 | ) | | | (0.21 | ) | | | (0.08 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | (1) | | | — | (1) | | | — | (1) | | | — | (1) | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of period | | $ | 18.05 | | | $ | 16.62 | | | $ | 17.45 | | | $ | 15.10 | | | $ | 12.04 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 14.63 | % | | | (0.21 | )% | | | 16.94 | % | | | 26.10 | % | | | (19.14 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 70,549 | | | $ | 59,715 | | | $ | 37,575 | | | $ | 26,082 | | | $ | 16,025 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.64 | % | | | 1.70 | % | | | 2.05 | % | | | 2.51 | % | | | 4.11 | % |

| After expense reimbursement | | | 1.36 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 0.84 | % | | | 0.20 | % | | | 0.04 | % | | | (0.27 | )% | | | (1.96 | )% |

| After expense reimbursement | | | 1.12 | % | | | 0.40 | % | | | 0.59 | % | | | 0.74 | % | | | 0.65 | % |

| Portfolio turnover rate | | | 43 | % | | | 45 | % | | | 45 | % | | | 51 | % | | | 66 | % |

| (1) | Less than $0.01 per share. |

See Notes to the Financial Statements

Notes to the Financial Statements

December 31, 2012

1. ORGANIZATION

Prospector Funds, Inc. (the “Corporation”) was organized as a Maryland corporation on June 6, 2007 and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end diversified management investment company. The Corporation issues its shares in series, each series representing a distinct portfolio with its own investment objectives and policies. There are two series presently authorized, the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (individually a “Fund” and collectively the “Funds”). The Funds commenced operations on September 28, 2007.

2. FAIR VALUE MEASUREMENT

The following is a summary of significant accounting policies consistently followed by each Fund:

Security Valuation – The Fund has adopted fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

On May 11, 2011, the Financial Accounting Standards Board (FASB) issued an Accounting Standard Update (ASU) No. 2011-04 modifying FASB Accounting Standards Codification (ASC) Topic 820, Fair Value Measurements and Disclosures. At the same time, the International Accounting Standards Board (IASB) issued International Financial Reporting Standard (IFRS) 13, Fair Value Measurement. The objective of the FASB and IASB is convergence of their guidance on fair value measurements and disclosures. Specifically, the ASU requires reporting entities to disclose i) the amounts of any transfers between Level 1 and Level 2 and the reasons for the transfers, and (ii) for Level 3 fair value measurements, a) quantitative information about significant unobservable inputs used, b) a description of the valuation process used by the reporting entity and c) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of the ASU is for interim and annual periods beginning after December 15, 2011. Management evaluated the implications of this guidance and concluded the ASU has no material impact on the Funds.

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Notes to the Financial Statements – Continued

December 31, 2012

Common stock – Securities that are primarily traded on a national securities exchange shall be valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the last bid price on the day of valuation. For securities not traded or dealt on any securities exchange for which over-the-counter quotations are readily available, the latest bid quotation will be used. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Convertible and Corporate Bonds – Convertible and corporate bonds, including listed issues, are valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Convertible and corporate bonds are generally categorized in Level 2 of the fair value hierarchy.

Investment Companies – Investments in other mutual funds, including money market funds, are valued at their net asset value per share and are categorized in Level 1 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board of Directors. These procedures consider many factors, including the type of security, size of holding, trading volume and news events. There can be no assurance that the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines their net asset values per share.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of December 31, 2012, each Fund’s investments in securities were classified as follows:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Capital Appreciation Fund | | | | | | | | | | | | |

| Common Stocks | | $ | 30,828,181 | | | $ | — | | | $ | — | | | $ | 30,828,181 | |

| Convertible Bonds | | | — | | | | 7,088,875 | | | | — | | | | 7,088,875 | |

| Corporate Bonds | | | — | | | | 596,250 | | | | — | | | | 596,250 | |

| Short-Term Investment | | | 574,940 | | | | — | | | | — | | | | 574,940 | |

| Total Investments | | $ | 31,403,121 | | | $ | 7,685,125 | | | $ | — | | | $ | 39,088,246 | |

| | | | | | | | | | | | | | | | | |

| Opportunity Fund | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 63,977,481 | | | $ | 89,580 | | | $ | — | | | $ | 64,067,061 | |

| Convertible Bond | | | — | | | | 343,281 | | | | — | | | | 343,281 | |

| Short-Term Investment | | | 6,874,945 | | | | — | | | | — | | | | 6,874,945 | |

| Total Investments | | $ | 70,852,426 | | | $ | 432,861 | | | $ | — | | | $ | 71,285,287 | |

Refer to each Fund’s Schedule of Investments for further sector breakout.

Transfers between levels are recognized at the beginning of the reporting period. During the year ended December 31, 2012, one security in the amount of $89,580 was transferred from Level 1 to Level 2 investments. This transfer relates to a security that is not actively traded or priced by the Fund’s third party pricing vendor. A bid price was obtained from an alternate pricing source in accordance with the Fund’s Valuation Procedures. The Funds did not invest in any Level 3 investments during the period.

Notes to the Financial Statements – Continued

December 31, 2012

The Funds may invest in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. The Funds’ investment objectives allow the Funds to enter into various types of derivative contracts, including, but not limited to, futures contracts, forward foreign exchange contracts, and purchased and written options. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements which may expose the funds to gains or losses in excess of the amounts shown on the Statements of Assets and Liabilities. As of and for the year ended December 31, 2012, the Funds held no derivative instruments.

3. SIGNIFICANT ACCOUNTING POLICIES

Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. The character of distributions made during the period from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. All short-term capital gains are included in ordinary income for tax purposes.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds intend to meet the requirements of subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is required. As of December 31, 2012, the Funds did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. Generally, tax authorities can examine all the tax returns filed for the last three years.

Reclassification of Capital Accounts – GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the fiscal year ended December 31, 2012, the following reclassifications were made on the Statements of Assets and Liabilities:

| | | Undistributed | | | Accumulated | | | | |

| | | Net Investment | | | Net Realized | | | | |

| | | Income | | | Gain (Loss) | | | Portfolio Capital | |

| | | | | | | | | | | | | |

| Capital Appreciation Fund | | $ | 126,550 | | | $ | (126,550 | ) | | $ | — | |

| Opportunity Fund | | | 309 | | | | (309 | ) | | | — | |

Foreign Currency Translation – The books and records relating to the Funds’ non-U.S. dollar denominated investments are maintained in U.S. dollars on the following bases: (1) market value of investment securities, assets, and liabilities are translated at the current rate of exchange; and (2) purchases and sales of investment securities, income, and expenses are translated at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate the portion of gains and losses on investments in equity securities that is due to changes

Notes to the Financial Statements – Continued

December 31, 2012

in the foreign exchange rates from that which is due to changes in market prices of equity securities. The Funds report certain foreign currency-related transactions as components of realized gains for financial reporting purposes, whereas such components are treated as ordinary income for federal income tax purposes.

Illiquid or Restricted Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Fund. Illiquid securities may be valued under methods approved by the Funds’ board of directors as reflecting fair value. Each Fund intends to invest no more than 15% of its total assets in illiquid securities. Certain restricted securities may be considered illiquid. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Funds’ board of directors as reflecting fair value. Certain restricted securities eligible for resale to qualified institutional investors, including Rule 144A securities, are not subject to the limitation on a Fund’s investment in illiquid securities if they are determined to be liquid in accordance with procedures adopted by the Funds’ board of directors. At December 31, 2012, Prospector Opportunity Fund had investments in illiquid securities with a total value of $89,580 or 0.1% of total net assets.

Information concerning illiquid securities is as follows:

| Prospector Opportunity Fund | Shares | Dates Acquired | Cost Basis |

| AJS Bancorp | 8,958 | 8/08 – 1/11 | $119,698 |

Expenses – Expenses directly attributable to a Fund are charged to that Fund, while expenses attributable to more than one Fund are allocated among the respective Funds based on relative net assets or another appropriate basis.

Other – Investment and shareholder transactions are recorded on the trade date. Each Fund determines the gain or loss realized from the investment transactions on the basis of identified cost. Dividend income is recognized on the ex-dividend date. Interest income, including amortization of bond premium and discount, is recognized on an accrual basis.

Subsequent Events – Management has evaluated fund related events and transactions that occurred subsequent to December 31, 2012, through the date of issuance of the Funds’ financial statements. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Funds’ financial statements.

4. INVESTMENT TRANSACTIONS

During the year ended December 31, 2012, purchases of securities and proceeds from sales of securities, other than temporary investments in short-term securities, were as follows:

| | | Purchases | | | Sales | |

| | | | | | | | | |

| Capital Appreciation Fund | | $ | 6,768,198 | | | $ | 20,950,873 | |

| Opportunity Fund | | | 27,710,137 | | | | 25,714,452 | |

There were no purchases or sales of long-term U.S. Government securities.

Notes to the Financial Statements – Continued

December 31, 2012

The aggregate gross unrealized appreciation and depreciation of securities held by the Funds and the total cost of securities for federal income tax purposes at December 31, 2012, were as follows:

| | | Aggregate | | | Aggregate | | | | | | Federal | |

| | | Gross | | | Gross | | | | | | Income | |

| | | Appreciation | | | Depreciation | | | Net | | | Tax Cost | |

| | | | | | | | | | | | | | | | | |

| Capital Appreciation Fund | | $ | 4,413,604 | | | $ | (4,326,659 | ) | | $ | 86,945 | | | $ | 39,001,301 | |

| Opportunity Fund | | | 8,722,053 | | | | (1,741,167 | ) | | | 6,980,886 | | | | 64,304,401 | |

At December 31, 2012, components of accumulated earnings (deficit) on a tax-basis were as follows:

| | | | | | | | | | | | | | | Total | |

| | | Undistributed | | | Undistributed | | | Other | | | | | | Accumulated | |

| | | Ordinary | | | Long-Term | | | Accumulated | | | Unrealized | | | Earnings | |

| | | Income | | | Capital Gains | | | Losses | | | Appreciation | | | (Deficit) | |

| | | | | | | | | | | | | | | | | | | | | |

| Capital Appreciation Fund | | $ | 29,414 | | | $ | — | | | $ | (154,736 | ) | | $ | 86,945 | | | $ | (38,377 | ) |

| Opportunity Fund | | | 4,653 | | | | 613,940 | | | | (11,647 | ) | | | 6,980,886 | | | | 7,587,832 | |

As of December 31, 2012, the Funds did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31. For the taxable year ended December 31, 2012, the Capital Appreciation Fund deferred on a tax basis, long-term post-October losses (“late year losses”) of $(140,266). The Opportunity Fund does not plan to defer any late year losses.

The tax character of distributions paid during the fiscal year ended December 31, 2012 were as follows:

| | | Ordinary | | | Long Term | | | | |

| | | Income | | | Capital Gains | | | Total | |

| | | | | | | | | | | | | |

| Capital Appreciation Fund | | $ | 934,926 | | | $ | 463,352 | | | $ | 1,398,278 | |

| Opportunity Fund | | | 950,064 | | | | 2,724,956 | | | | 3,675,020 | |

The tax character of distributions paid during the fiscal year ended December 31, 2011 were as follows:

| | | Ordinary | | | Long Term | | | | |

| | | Income | | | Capital Gains | | | Total | |

| | | | | | | | | | | | | |

| Capital Appreciation Fund | | $ | 738,372 | | | $ | 615,058 | | | $ | 1,353,430 | |

| Opportunity Fund | | | 177,445 | | | | 2,568,958 | | | | 2,746,403 | |

5. AGREEMENTS

The Funds have entered into an Investment Advisory Agreement with Prospector Partners Asset Management, LLC (the “Adviser”), with whom certain directors and officers of the Corporation are affiliated, to furnish investment advisory services to the Funds. Pursuant to this Agreement, the Adviser is entitled to receive a management fee, calculated daily and payable monthly, at the annual rate of 1.10% as applied to each Fund’s daily net assets.

Notes to the Financial Statements – Continued

December 31, 2012

The Adviser has contractually agreed to waive, through September 30, 2014 its management fee and/or reimburse each Fund’s other expenses to the extent necessary to ensure that each Fund’s operating expenses do not exceed 1.30% of its average daily net assets. Prior to April 18, 2012, this ratio was 1.50% of each Fund’s average daily net assets. Any such waiver or reimbursement may be subject to later adjustment to allow the Adviser to recoup amounts waived or reimbursed to the extent actual fees and expenses for a fiscal year are less than the respective expense cap limitations, provided, however, that the Adviser shall only be entitled to recoup such amounts for a period of three years from the date such amount was waived or reimbursed. Waived/reimbursed fees and expenses subject to potential recovery by year of expiration are as follows:

| Expiration | | Capital Appreciation Fund | | | Opportunity Fund | |

| | | | | | | | | |

| 12/31/13 | | $ | 177,007 | | | $ | 171,081 | |

| 12/31/14 | | | 114,442 | | | | 105,613 | |

| 12/31/15 | | | 186,758 | | | | 183,148 | |

| Total | | $ | 478,207 | | | $ | 459,842 | |

As of December 31, 2012, it was possible, but not probable, those amounts would be recovered by the Adviser. At the end of each fiscal year in the future, the Funds will continue to assess the potential recovery of waived/reimbursed fees and expenses for financial reporting purposes.

Quasar Distributors, LLC (“Quasar”), a subsidiary of U.S. Bancorp, serves as distributor of the Funds’ shares pursuant to a Distribution Agreement with the Corporation. Each Fund’s shares are sold on a no-load basis and, therefore, Quasar receives no sales commission or sales load for providing services to the Funds. The Corporation has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which authorizes the Corporation to reimburse Quasar and certain financial intermediaries who assist in distributing each Fund’s shares or who provide shareholder services to Fund shareholders a distribution and/or shareholder servicing fee of up to 0.25% of each Fund’s average daily net assets (computed on an annual basis). All or a portion of the fee may be used by the Funds or Quasar to pay the Fund’s distribution fees and costs of printing reports and prospectuses for potential investors and the costs of other distribution and shareholder services expenses. During the year ended December 31, 2012, Capital Appreciation Fund and Opportunity Fund incurred expenses of $26,870 and $37,232, respectively, pursuant to the 12b-1 Plan.

U.S. Bancorp Fund Services, LLC serves as transfer agent, administrator and fund accountant for the Funds. U.S. Bank, N.A. serves as custodian for the Funds.

6. INDEMNIFICATIONS

The Funds enter into contracts that contain a variety of indemnifications. The Funds’ maximum exposure under these arrangements is unknown. However, the Funds have not had prior claims or losses pursuant to these contracts and expect the risk of loss to be remote.

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

Prospector Funds, Inc.:

We have audited the accompanying statements of assets and liabilities, including the schedule of investments, of Prospector Funds, Inc., comprised of, the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (the Funds) as of December 31, 2012, and the related statements of operations for the year then ended, the statements of changes in net assets for the two years in the period then ended, and financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2012, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.