Exhibit (c)(18) Presentation to the Special Committee of the Board of Directors of OSLO Strictly Private & Confidential February 19, 2019Exhibit (c)(18) Presentation to the Special Committee of the Board of Directors of OSLO Strictly Private & Confidential February 19, 2019

GENERAL INFORMATION AND LIMITATIONS This presentation, and the oral or video presentation that supplements it, have been developed by and are proprietary to Sandler O'Neill & Partners, L.P. and were prepared exclusively for the benefit and internal use of the recipient. Neither the printed presentation nor the oral or video presentation that supplements it, nor any of their contents, may be reproduced, distributed or used for any other purpose without the prior written consent of Sandler O'Neill & Partners, L.P. The analyses contained herein rely upon information obtained from the recipient or from public sources, the accuracy of which has not been verified, and cannot be assured, by Sandler O'Neill & Partners, L.P. Moreover, many of the projections and financial analyses herein are based on estimated financial performance prepared by or in consultation with the recipient and are intended only to suggest estimated ranges of results. Finally, the printed presentation is incomplete without the oral or video presentation that supplements it. Sandler O’Neill & Partners, L.P. prohibits employees from offering, directly or indirectly, favorable research, a specific rating or a specific price target, or offering or threatening to change research, a rating or a price target to a company as consideration or inducement for the receipt of business or compensation. The Firm also prohibits research analysts from being compensated for their involvement in, or based upon, specific investment banking transactions. Sandler O'Neill & Partners, L.P. is a limited partnership, the sole general partner of which is Sandler O'Neill & Partners Corp., a New York corporation. Sandler O'Neill & Partners, L.P. is a registered broker-dealer and a member of the Financial Industry Regulatory Authority. Sandler O'Neill Mortgage Finance L.P. is an indirect subsidiary of Sandler O'Neill & Partners Corp. This material is protected under applicable copyright laws and does not carry any rights of publication or disclosure.GENERAL INFORMATION AND LIMITATIONS This presentation, and the oral or video presentation that supplements it, have been developed by and are proprietary to Sandler O'Neill & Partners, L.P. and were prepared exclusively for the benefit and internal use of the recipient. Neither the printed presentation nor the oral or video presentation that supplements it, nor any of their contents, may be reproduced, distributed or used for any other purpose without the prior written consent of Sandler O'Neill & Partners, L.P. The analyses contained herein rely upon information obtained from the recipient or from public sources, the accuracy of which has not been verified, and cannot be assured, by Sandler O'Neill & Partners, L.P. Moreover, many of the projections and financial analyses herein are based on estimated financial performance prepared by or in consultation with the recipient and are intended only to suggest estimated ranges of results. Finally, the printed presentation is incomplete without the oral or video presentation that supplements it. Sandler O’Neill & Partners, L.P. prohibits employees from offering, directly or indirectly, favorable research, a specific rating or a specific price target, or offering or threatening to change research, a rating or a price target to a company as consideration or inducement for the receipt of business or compensation. The Firm also prohibits research analysts from being compensated for their involvement in, or based upon, specific investment banking transactions. Sandler O'Neill & Partners, L.P. is a limited partnership, the sole general partner of which is Sandler O'Neill & Partners Corp., a New York corporation. Sandler O'Neill & Partners, L.P. is a registered broker-dealer and a member of the Financial Industry Regulatory Authority. Sandler O'Neill Mortgage Finance L.P. is an indirect subsidiary of Sandler O'Neill & Partners Corp. This material is protected under applicable copyright laws and does not carry any rights of publication or disclosure.

Table of Contents I. Transaction Overview II. Preliminary OSLO Financial Analyses III. Preliminary BERLIN Financial Analyses IV. BERLIN Stock-Related Data V. Proposed Future Liquidity for Management's/Founders’ Retained Equity VI. AppendixTable of Contents I. Transaction Overview II. Preliminary OSLO Financial Analyses III. Preliminary BERLIN Financial Analyses IV. BERLIN Stock-Related Data V. Proposed Future Liquidity for Management's/Founders’ Retained Equity VI. Appendix

I. Transaction OverviewI. Transaction Overview

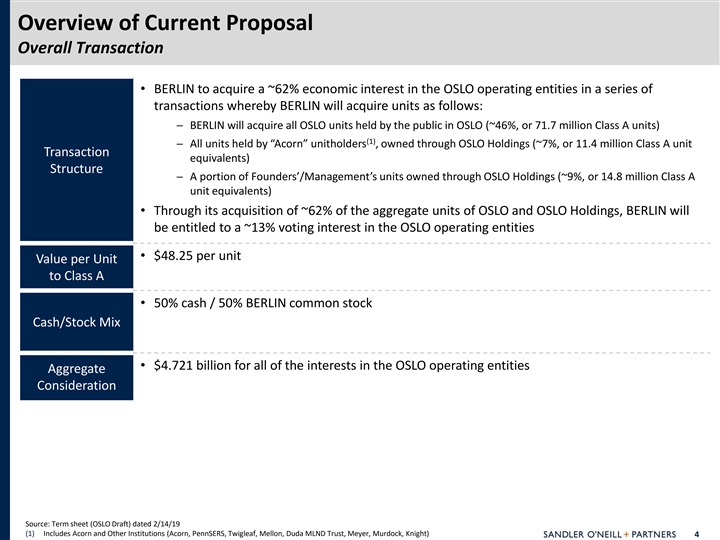

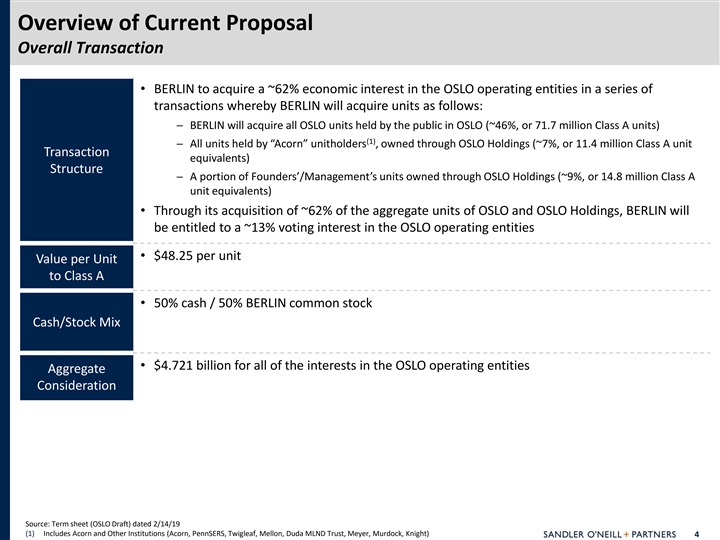

Overview of Current Proposal Overall Transaction • BERLIN to acquire a ~62% economic interest in the OSLO operating entities in a series of transactions whereby BERLIN will acquire units as follows: - BERLIN will acquire all OSLO units held by the public in OSLO (~46%, or 71.7 million Class A units) (1) - All units held by “Acorn” unitholders , owned through OSLO Holdings (~7%, or 11.4 million Class A unit Transaction equivalents) Structure - A portion of Founders’/Management’s units owned through OSLO Holdings (~9%, or 14.8 million Class A unit equivalents) • Through its acquisition of ~62% of the aggregate units of OSLO and OSLO Holdings, BERLIN will be entitled to a ~13% voting interest in the OSLO operating entities • $48.25 per unit Value per Unit to Class A • 50% cash / 50% BERLIN common stock Cash/Stock Mix • $4.721 billion for all of the interests in the OSLO operating entities Aggregate Consideration Source: Term sheet (OSLO Draft) dated 2/14/19 (1) Includes Acorn and Other Institutions (Acorn, PennSERS, Twigleaf, Mellon, Duda MLND Trust, Meyer, Murdock, Knight) 4Overview of Current Proposal Overall Transaction • BERLIN to acquire a ~62% economic interest in the OSLO operating entities in a series of transactions whereby BERLIN will acquire units as follows: - BERLIN will acquire all OSLO units held by the public in OSLO (~46%, or 71.7 million Class A units) (1) - All units held by “Acorn” unitholders , owned through OSLO Holdings (~7%, or 11.4 million Class A unit Transaction equivalents) Structure - A portion of Founders’/Management’s units owned through OSLO Holdings (~9%, or 14.8 million Class A unit equivalents) • Through its acquisition of ~62% of the aggregate units of OSLO and OSLO Holdings, BERLIN will be entitled to a ~13% voting interest in the OSLO operating entities • $48.25 per unit Value per Unit to Class A • 50% cash / 50% BERLIN common stock Cash/Stock Mix • $4.721 billion for all of the interests in the OSLO operating entities Aggregate Consideration Source: Term sheet (OSLO Draft) dated 2/14/19 (1) Includes Acorn and Other Institutions (Acorn, PennSERS, Twigleaf, Mellon, Duda MLND Trust, Meyer, Murdock, Knight) 4

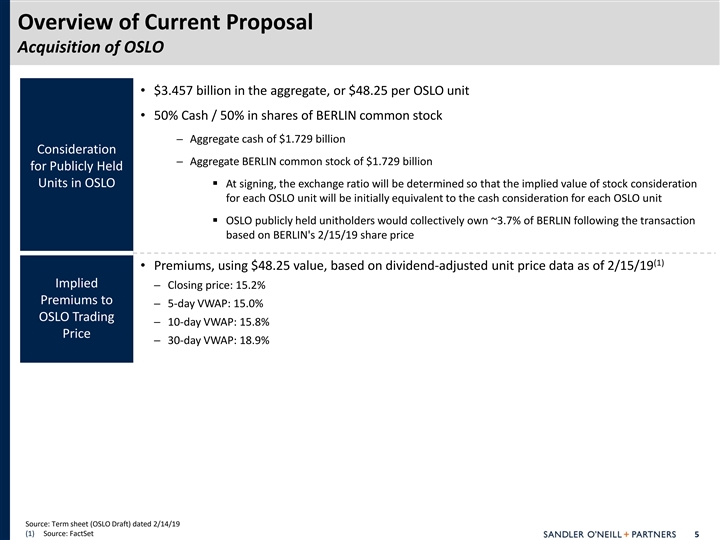

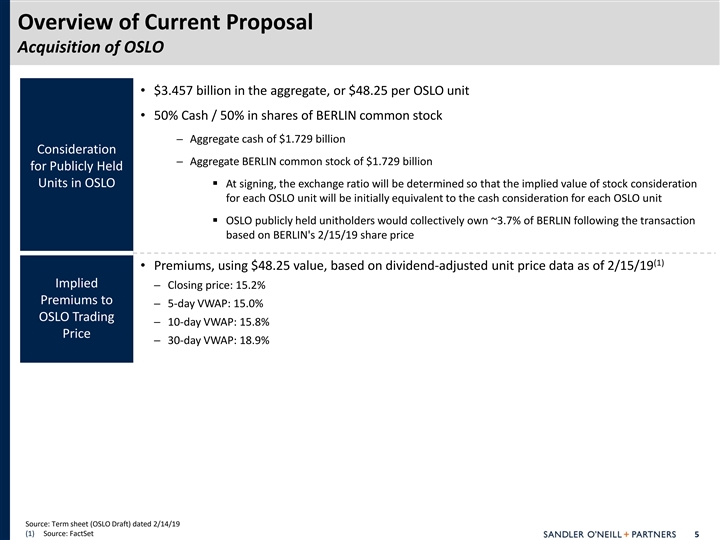

Overview of Current Proposal Acquisition of OSLO • $3.457 billion in the aggregate, or $48.25 per OSLO unit • 50% Cash / 50% in shares of BERLIN common stock - Aggregate cash of $1.729 billion Consideration - Aggregate BERLIN common stock of $1.729 billion for Publicly Held Units in OSLO § At signing, the exchange ratio will be determined so that the implied value of stock consideration for each OSLO unit will be initially equivalent to the cash consideration for each OSLO unit § OSLO publicly held unitholders would collectively own ~3.7% of BERLIN following the transaction based on BERLIN's 2/15/19 share price (1) • Premiums, using $48.25 value, based on dividend-adjusted unit price data as of 2/15/19 Implied - Closing price: 15.2% Premiums to - 5-day VWAP: 15.0% OSLO Trading - 10-day VWAP: 15.8% Price - 30-day VWAP: 18.9% Source: Term sheet (OSLO Draft) dated 2/14/19 (1) Source: FactSet 5Overview of Current Proposal Acquisition of OSLO • $3.457 billion in the aggregate, or $48.25 per OSLO unit • 50% Cash / 50% in shares of BERLIN common stock - Aggregate cash of $1.729 billion Consideration - Aggregate BERLIN common stock of $1.729 billion for Publicly Held Units in OSLO § At signing, the exchange ratio will be determined so that the implied value of stock consideration for each OSLO unit will be initially equivalent to the cash consideration for each OSLO unit § OSLO publicly held unitholders would collectively own ~3.7% of BERLIN following the transaction based on BERLIN's 2/15/19 share price (1) • Premiums, using $48.25 value, based on dividend-adjusted unit price data as of 2/15/19 Implied - Closing price: 15.2% Premiums to - 5-day VWAP: 15.0% OSLO Trading - 10-day VWAP: 15.8% Price - 30-day VWAP: 18.9% Source: Term sheet (OSLO Draft) dated 2/14/19 (1) Source: FactSet 5

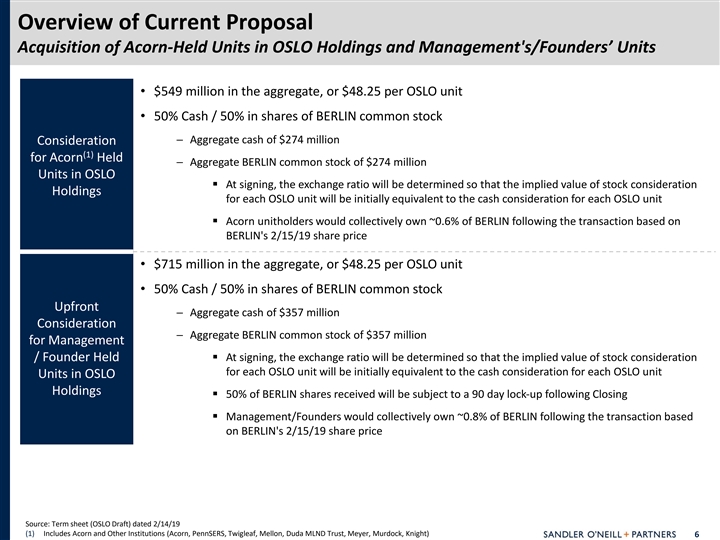

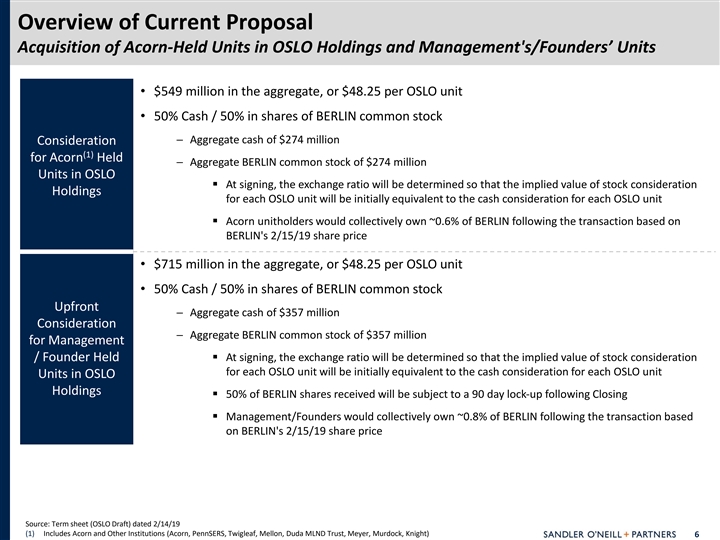

Overview of Current Proposal Acquisition of Acorn-Held Units in OSLO Holdings and Management's/Founders’ Units • $549 million in the aggregate, or $48.25 per OSLO unit • 50% Cash / 50% in shares of BERLIN common stock - Aggregate cash of $274 million Consideration (1) for Acorn Held - Aggregate BERLIN common stock of $274 million Units in OSLO § At signing, the exchange ratio will be determined so that the implied value of stock consideration Holdings for each OSLO unit will be initially equivalent to the cash consideration for each OSLO unit § Acorn unitholders would collectively own ~0.6% of BERLIN following the transaction based on BERLIN's 2/15/19 share price • $715 million in the aggregate, or $48.25 per OSLO unit • 50% Cash / 50% in shares of BERLIN common stock Upfront - Aggregate cash of $357 million Consideration - Aggregate BERLIN common stock of $357 million for Management / Founder Held § At signing, the exchange ratio will be determined so that the implied value of stock consideration for each OSLO unit will be initially equivalent to the cash consideration for each OSLO unit Units in OSLO Holdings § 50% of BERLIN shares received will be subject to a 90 day lock‐up following Closing § Management/Founders would collectively own ~0.8% of BERLIN following the transaction based on BERLIN's 2/15/19 share price Source: Term sheet (OSLO Draft) dated 2/14/19 (1) Includes Acorn and Other Institutions (Acorn, PennSERS, Twigleaf, Mellon, Duda MLND Trust, Meyer, Murdock, Knight) 6Overview of Current Proposal Acquisition of Acorn-Held Units in OSLO Holdings and Management's/Founders’ Units • $549 million in the aggregate, or $48.25 per OSLO unit • 50% Cash / 50% in shares of BERLIN common stock - Aggregate cash of $274 million Consideration (1) for Acorn Held - Aggregate BERLIN common stock of $274 million Units in OSLO § At signing, the exchange ratio will be determined so that the implied value of stock consideration Holdings for each OSLO unit will be initially equivalent to the cash consideration for each OSLO unit § Acorn unitholders would collectively own ~0.6% of BERLIN following the transaction based on BERLIN's 2/15/19 share price • $715 million in the aggregate, or $48.25 per OSLO unit • 50% Cash / 50% in shares of BERLIN common stock Upfront - Aggregate cash of $357 million Consideration - Aggregate BERLIN common stock of $357 million for Management / Founder Held § At signing, the exchange ratio will be determined so that the implied value of stock consideration for each OSLO unit will be initially equivalent to the cash consideration for each OSLO unit Units in OSLO Holdings § 50% of BERLIN shares received will be subject to a 90 day lock‐up following Closing § Management/Founders would collectively own ~0.8% of BERLIN following the transaction based on BERLIN's 2/15/19 share price Source: Term sheet (OSLO Draft) dated 2/14/19 (1) Includes Acorn and Other Institutions (Acorn, PennSERS, Twigleaf, Mellon, Duda MLND Trust, Meyer, Murdock, Knight) 6

Overview of Current Proposal Overview of Consideration ($Millions, except per unit data) OSLO Mgmt / Total Public Acorn Founders OSLO Units (mm) 157.1 71.7 11.4 74.1 % Acquired 62% 100% 100% 20% OSLO Units Acquired by BERLIN (mm) 97.8 71.7 11.4 14.8 % of Total OSLO Units 62% 46% 7% 9% Consideration Breakdown Cash 50% 50% 50% 50% BERLIN Common Stock 50% 50% 50% 50% Total Consideration Cash Consideration $ 2,360 $ 1,729 $ 274 $ 357 BERLIN Common Stock Consideration 2 ,360 1 ,729 274 357 Total Consideration $ 4,721 $ 3,457 $ 549 $ 715 Value Per Unit $ 48.25 $ 48.25 $ 48.25 $ 4 8.25 Note: Consideration is based on OSLO and BERLIN closing price data as of 2/15/19 7Overview of Current Proposal Overview of Consideration ($Millions, except per unit data) OSLO Mgmt / Total Public Acorn Founders OSLO Units (mm) 157.1 71.7 11.4 74.1 % Acquired 62% 100% 100% 20% OSLO Units Acquired by BERLIN (mm) 97.8 71.7 11.4 14.8 % of Total OSLO Units 62% 46% 7% 9% Consideration Breakdown Cash 50% 50% 50% 50% BERLIN Common Stock 50% 50% 50% 50% Total Consideration Cash Consideration $ 2,360 $ 1,729 $ 274 $ 357 BERLIN Common Stock Consideration 2 ,360 1 ,729 274 357 Total Consideration $ 4,721 $ 3,457 $ 549 $ 715 Value Per Unit $ 48.25 $ 48.25 $ 48.25 $ 4 8.25 Note: Consideration is based on OSLO and BERLIN closing price data as of 2/15/19 7

II. Preliminary OSLO Financial AnalysesII. Preliminary OSLO Financial Analyses

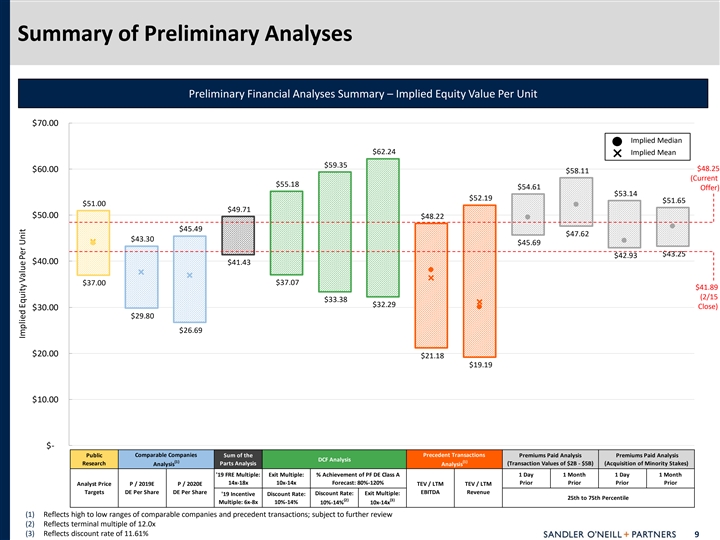

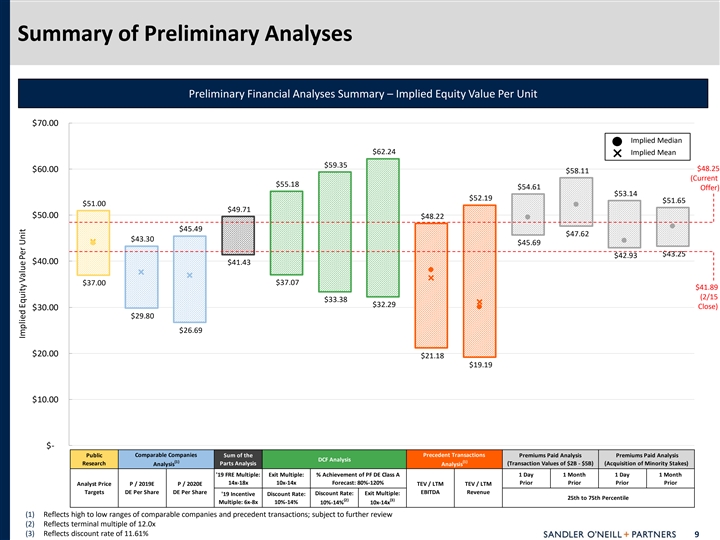

Summary of Preliminary Analyses Preliminary Financial Analyses Summary – Implied Equity Value Per Unit $70.00 Implied Median $62.24 Implied Mean $59.35 $48.25 $60.00 $58.11 (Current $55.18 $54.61 Offer) $53.14 $52.19 $51.65 $51.00 $49.71 $50.00 $48.22 $45.49 $47.62 $43.30 $45.69 $43.25 $42.93 $40.00 $41.43 $37.00 $37.07 $41.89 (2/15 $33.38 $32.29 Close) $30.00 $29.80 $26.69 $20.00 $21.18 $19.19 $10.00 $- Public Comparable Companies Sum of the Precedent Transactions Premiums Paid Analysis Premiums Paid Analysis DCF Analysis (1) (1) Research Parts Analysis (Transaction Values of $2B - $5B) (Acquisition of Minority Stakes) Analysis Analysis '19 FRE Multiple: Exit Multiple: % Achievement of PF DE Class A 1 Day 1 Month 1 Day 1 Month 14x-18x 10x-14x Forecast: 80%-120% Prior Prior Prior Prior Analyst Price P / 2019E P / 2020E TEV / LTM TEV / LTM Targets DE Per Share DE Per Share EBITDA Revenue Discount Rate: Exit Multiple: '19 Incentive Discount Rate: 25th to 75th Percentile (2) (3) Multiple: 6x-8x 10%-14% 10%-14% 10x-14x (1) Reflects high to low ranges of comparable companies and precedent transactions; subject to further review (2) Reflects terminal multiple of 12.0x (3) Reflects discount rate of 11.61% 9 Implied Equity Value Per UnitSummary of Preliminary Analyses Preliminary Financial Analyses Summary – Implied Equity Value Per Unit $70.00 Implied Median $62.24 Implied Mean $59.35 $48.25 $60.00 $58.11 (Current $55.18 $54.61 Offer) $53.14 $52.19 $51.65 $51.00 $49.71 $50.00 $48.22 $45.49 $47.62 $43.30 $45.69 $43.25 $42.93 $40.00 $41.43 $37.00 $37.07 $41.89 (2/15 $33.38 $32.29 Close) $30.00 $29.80 $26.69 $20.00 $21.18 $19.19 $10.00 $- Public Comparable Companies Sum of the Precedent Transactions Premiums Paid Analysis Premiums Paid Analysis DCF Analysis (1) (1) Research Parts Analysis (Transaction Values of $2B - $5B) (Acquisition of Minority Stakes) Analysis Analysis '19 FRE Multiple: Exit Multiple: % Achievement of PF DE Class A 1 Day 1 Month 1 Day 1 Month 14x-18x 10x-14x Forecast: 80%-120% Prior Prior Prior Prior Analyst Price P / 2019E P / 2020E TEV / LTM TEV / LTM Targets DE Per Share DE Per Share EBITDA Revenue Discount Rate: Exit Multiple: '19 Incentive Discount Rate: 25th to 75th Percentile (2) (3) Multiple: 6x-8x 10%-14% 10%-14% 10x-14x (1) Reflects high to low ranges of comparable companies and precedent transactions; subject to further review (2) Reflects terminal multiple of 12.0x (3) Reflects discount rate of 11.61% 9 Implied Equity Value Per Unit

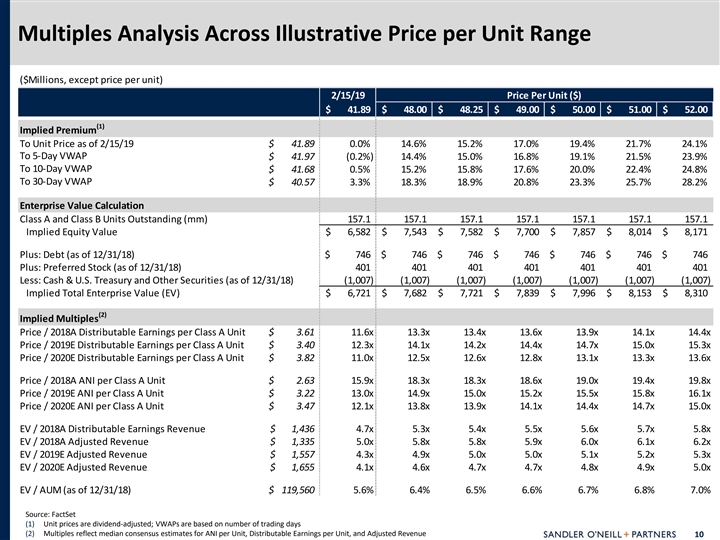

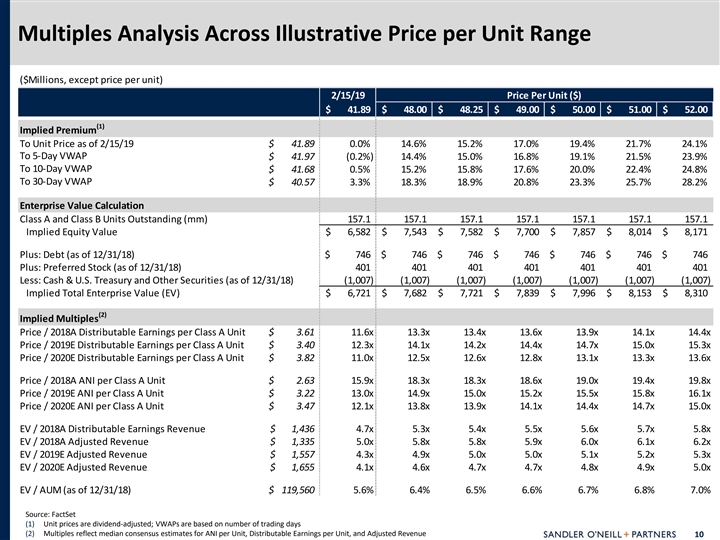

Multiples Analysis Across Illustrative Price per Unit Range ($Millions, except price per unit) 2/15/19 Price Per Unit ($) $ 4 1.89 $ 4 8.00 $ 4 8.25 $ 49.00 $ 5 0.00 $ 51.00 $ 52.00 (1) Implied Premium To Unit Price as of 2/15/19 $ 41.89 0.0% 14.6% 15.2% 17.0% 19.4% 21.7% 24.1% To 5-Day VWAP $ 41.97 (0.2%) 14.4% 15.0% 16.8% 19.1% 21.5% 23.9% To 10-Day VWAP $ 41.68 0.5% 15.2% 15.8% 17.6% 20.0% 22.4% 24.8% To 30-Day VWAP $ 40.57 3.3% 18.3% 18.9% 20.8% 23.3% 25.7% 28.2% Enterprise Value Calculation Class A and Class B Units Outstanding (mm) 1 57.1 1 57.1 157.1 157.1 157.1 1 57.1 1 57.1 Implied Equity Value $ 6,582 $ 7,543 $ 7,582 $ 7 ,700 $ 7,857 $ 8,014 $ 8,171 Plus: Debt (as of 12/31/18) $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 Plus: Preferred Stock (as of 12/31/18) 401 401 401 401 401 401 401 Less: Cash & U.S. Treasury and Other Securities (as of 12/31/18) (1,007) (1,007) (1,007) (1,007) ( 1,007) (1,007) (1,007) Implied Total Enterprise Value (EV) $ 6 ,721 $ 7 ,682 $ 7 ,721 $ 7 ,839 $ 7 ,996 $ 8,153 $ 8,310 (2) Implied Multiples Price / 2018A Distributable Earnings per Class A Unit $ 3.61 11.6x 13.3x 13.4x 13.6x 13.9x 14.1x 14.4x Price / 2019E Distributable Earnings per Class A Unit $ 3.40 12.3x 14.1x 14.2x 14.4x 14.7x 15.0x 15.3x Price / 2020E Distributable Earnings per Class A Unit $ 3.82 11.0x 12.5x 12.6x 12.8x 13.1x 13.3x 13.6x Price / 2018A ANI per Class A Unit $ 2.63 15.9x 18.3x 18.3x 18.6x 19.0x 19.4x 19.8x Price / 2019E ANI per Class A Unit $ 3.22 13.0x 14.9x 15.0x 15.2x 15.5x 15.8x 16.1x Price / 2020E ANI per Class A Unit $ 3.47 12.1x 13.8x 13.9x 14.1x 14.4x 14.7x 15.0x EV / 2018A Distributable Earnings Revenue $ 1,436 4.7x 5.3x 5.4x 5.5x 5.6x 5.7x 5.8x EV / 2018A Adjusted Revenue $ 1,335 5.0x 5.8x 5.8x 5.9x 6.0x 6.1x 6.2x EV / 2019E Adjusted Revenue $ 1,557 4.3x 4.9x 5.0x 5.0x 5.1x 5.2x 5.3x EV / 2020E Adjusted Revenue $ 1,655 4.1x 4.6x 4.7x 4.7x 4.8x 4.9x 5.0x EV / AUM (as of 12/31/18) $ 119,560 5.6% 6.4% 6.5% 6.6% 6.7% 6.8% 7.0% Source: FactSet (1) Unit prices are dividend-adjusted; VWAPs are based on number of trading days (2) Multiples reflect median consensus estimates for ANI per Unit, Distributable Earnings per Unit, and Adjusted Revenue 10Multiples Analysis Across Illustrative Price per Unit Range ($Millions, except price per unit) 2/15/19 Price Per Unit ($) $ 4 1.89 $ 4 8.00 $ 4 8.25 $ 49.00 $ 5 0.00 $ 51.00 $ 52.00 (1) Implied Premium To Unit Price as of 2/15/19 $ 41.89 0.0% 14.6% 15.2% 17.0% 19.4% 21.7% 24.1% To 5-Day VWAP $ 41.97 (0.2%) 14.4% 15.0% 16.8% 19.1% 21.5% 23.9% To 10-Day VWAP $ 41.68 0.5% 15.2% 15.8% 17.6% 20.0% 22.4% 24.8% To 30-Day VWAP $ 40.57 3.3% 18.3% 18.9% 20.8% 23.3% 25.7% 28.2% Enterprise Value Calculation Class A and Class B Units Outstanding (mm) 1 57.1 1 57.1 157.1 157.1 157.1 1 57.1 1 57.1 Implied Equity Value $ 6,582 $ 7,543 $ 7,582 $ 7 ,700 $ 7,857 $ 8,014 $ 8,171 Plus: Debt (as of 12/31/18) $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 Plus: Preferred Stock (as of 12/31/18) 401 401 401 401 401 401 401 Less: Cash & U.S. Treasury and Other Securities (as of 12/31/18) (1,007) (1,007) (1,007) (1,007) ( 1,007) (1,007) (1,007) Implied Total Enterprise Value (EV) $ 6 ,721 $ 7 ,682 $ 7 ,721 $ 7 ,839 $ 7 ,996 $ 8,153 $ 8,310 (2) Implied Multiples Price / 2018A Distributable Earnings per Class A Unit $ 3.61 11.6x 13.3x 13.4x 13.6x 13.9x 14.1x 14.4x Price / 2019E Distributable Earnings per Class A Unit $ 3.40 12.3x 14.1x 14.2x 14.4x 14.7x 15.0x 15.3x Price / 2020E Distributable Earnings per Class A Unit $ 3.82 11.0x 12.5x 12.6x 12.8x 13.1x 13.3x 13.6x Price / 2018A ANI per Class A Unit $ 2.63 15.9x 18.3x 18.3x 18.6x 19.0x 19.4x 19.8x Price / 2019E ANI per Class A Unit $ 3.22 13.0x 14.9x 15.0x 15.2x 15.5x 15.8x 16.1x Price / 2020E ANI per Class A Unit $ 3.47 12.1x 13.8x 13.9x 14.1x 14.4x 14.7x 15.0x EV / 2018A Distributable Earnings Revenue $ 1,436 4.7x 5.3x 5.4x 5.5x 5.6x 5.7x 5.8x EV / 2018A Adjusted Revenue $ 1,335 5.0x 5.8x 5.8x 5.9x 6.0x 6.1x 6.2x EV / 2019E Adjusted Revenue $ 1,557 4.3x 4.9x 5.0x 5.0x 5.1x 5.2x 5.3x EV / 2020E Adjusted Revenue $ 1,655 4.1x 4.6x 4.7x 4.7x 4.8x 4.9x 5.0x EV / AUM (as of 12/31/18) $ 119,560 5.6% 6.4% 6.5% 6.6% 6.7% 6.8% 7.0% Source: FactSet (1) Unit prices are dividend-adjusted; VWAPs are based on number of trading days (2) Multiples reflect median consensus estimates for ANI per Unit, Distributable Earnings per Unit, and Adjusted Revenue 10

OSLO Unit Price Performance As of 2/15/19 One-Year Adjusted Unit Price Performance 50.00 45.00 $41.89 6.6% 40.00 35.00 30.00 25.00 20.00 Feb-18 Apr-18 May-18 Jul-18 Sep-18 Nov-18 Dec-18 Feb-19 Three-Year Adjusted Unit Price Performance 50.00 45.00 $41.89 12.3% 40.00 35.00 30.00 25.00 20.00 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 Feb-19 Note: Unit prices are presented on a dividend-adjusted basis 11 Adjusted Unit Price ($) Adjusted Unit Price ($)OSLO Unit Price Performance As of 2/15/19 One-Year Adjusted Unit Price Performance 50.00 45.00 $41.89 6.6% 40.00 35.00 30.00 25.00 20.00 Feb-18 Apr-18 May-18 Jul-18 Sep-18 Nov-18 Dec-18 Feb-19 Three-Year Adjusted Unit Price Performance 50.00 45.00 $41.89 12.3% 40.00 35.00 30.00 25.00 20.00 Feb-16 Aug-16 Feb-17 Aug-17 Feb-18 Aug-18 Feb-19 Note: Unit prices are presented on a dividend-adjusted basis 11 Adjusted Unit Price ($) Adjusted Unit Price ($)

OSLO Analyst Estimates OSLO Analyst Recommendations and Price Targets ($Millions, except per unit data) As of Current Current Adjusted Revenue ANI / Unit DE / Unit Date Rating Price Target 2019E 2020E 2019E 2020E 2019E 2020E Autonomous 2/5/19 Hold $ 4 4.00 n/a n/a n/a n/a n/a n/a Bank of America Merrill Lynch 2/5/19 Hold 44.00 1,573 1,680 3.51 3.94 3.47 4.18 Credit Suisse 2/5/19 Hold 43.00 1 ,405 1,533 2.46 2 .93 3.31 3.80 Deutsche Bank 2/5/19 Hold 37.00 1,352 1 ,059 2.71 1.87 3.26 2.30 Goldman Sachs 2/6/19 Hold 43.00 1,642 1,655 3.81 4.07 3.73 4.01 Jefferies 2/8/19 Hold 43.00 1,481 1,535 n/a n/a 3.60 3.84 JP Morgan 2/6/19 Hold 51.00 1 ,618 1,685 3.31 3.56 3 .26 3 .43 Keefe, Bruyette & Woods 2/5/19 Hold 45.00 1,557 1,681 2.99 3.40 3.40 3.81 Morgan Stanley 2/11/19 Buy 4 9.00 1,648 1 ,637 3.37 3.21 3.41 3.38 Oppenheimer 2/5/19 Hold n/a n/a n/a 3 .22 3.47 3 .66 3 .89 Wells Fargo 2/5/19 Hold 4 4.00 1 ,512 1 ,672 2.95 3.65 3.27 4.06 High $ 51.00 $ 1,648 $ 1 ,685 $ 3.81 $ 4.07 $ 3.73 $ 4.18 Low $ 3 7.00 $ 1,352 $ 1,059 $ 2.46 $ 1.87 $ 3.26 $ 2.30 Mean $ 4 4.30 $ 1,532 $ 1,571 $ 3.15 $ 3.35 $ 3.44 $ 3.67 Median $ 44.00 $ 1 ,557 $ 1 ,655 $ 3.22 $ 3.47 $ 3.40 $ 3.82 $ 4 1.89 OSLO (2/15/19 closing price) Source: Analyst research reports, Company materials, FactSet 12OSLO Analyst Estimates OSLO Analyst Recommendations and Price Targets ($Millions, except per unit data) As of Current Current Adjusted Revenue ANI / Unit DE / Unit Date Rating Price Target 2019E 2020E 2019E 2020E 2019E 2020E Autonomous 2/5/19 Hold $ 4 4.00 n/a n/a n/a n/a n/a n/a Bank of America Merrill Lynch 2/5/19 Hold 44.00 1,573 1,680 3.51 3.94 3.47 4.18 Credit Suisse 2/5/19 Hold 43.00 1 ,405 1,533 2.46 2 .93 3.31 3.80 Deutsche Bank 2/5/19 Hold 37.00 1,352 1 ,059 2.71 1.87 3.26 2.30 Goldman Sachs 2/6/19 Hold 43.00 1,642 1,655 3.81 4.07 3.73 4.01 Jefferies 2/8/19 Hold 43.00 1,481 1,535 n/a n/a 3.60 3.84 JP Morgan 2/6/19 Hold 51.00 1 ,618 1,685 3.31 3.56 3 .26 3 .43 Keefe, Bruyette & Woods 2/5/19 Hold 45.00 1,557 1,681 2.99 3.40 3.40 3.81 Morgan Stanley 2/11/19 Buy 4 9.00 1,648 1 ,637 3.37 3.21 3.41 3.38 Oppenheimer 2/5/19 Hold n/a n/a n/a 3 .22 3.47 3 .66 3 .89 Wells Fargo 2/5/19 Hold 4 4.00 1 ,512 1 ,672 2.95 3.65 3.27 4.06 High $ 51.00 $ 1,648 $ 1 ,685 $ 3.81 $ 4.07 $ 3.73 $ 4.18 Low $ 3 7.00 $ 1,352 $ 1,059 $ 2.46 $ 1.87 $ 3.26 $ 2.30 Mean $ 4 4.30 $ 1,532 $ 1,571 $ 3.15 $ 3.35 $ 3.44 $ 3.67 Median $ 44.00 $ 1 ,557 $ 1 ,655 $ 3.22 $ 3.47 $ 3.40 $ 3.82 $ 4 1.89 OSLO (2/15/19 closing price) Source: Analyst research reports, Company materials, FactSet 12

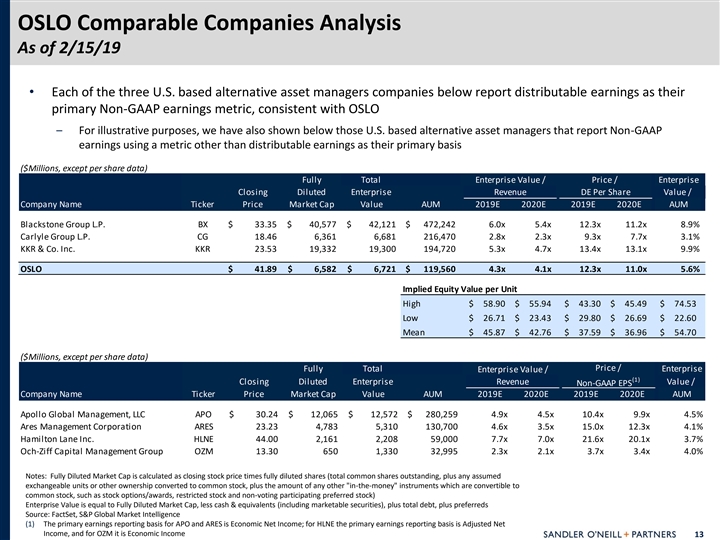

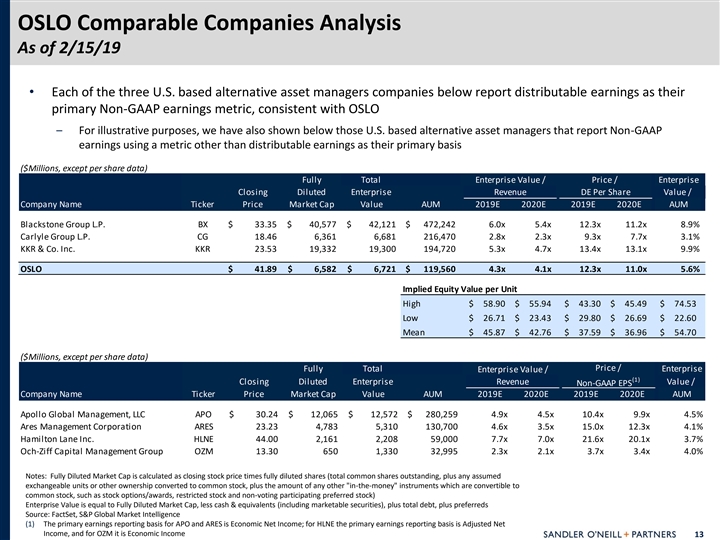

OSLO Comparable Companies Analysis As of 2/15/19 • Each of the three U.S. based alternative asset managers companies below report distributable earnings as their primary Non-GAAP earnings metric, consistent with OSLO – For illustrative purposes, we have also shown below those U.S. based alternative asset managers that report Non-GAAP earnings using a metric other than distributable earnings as their primary basis ($Millions, except per share data) Fully Total Enterprise Value / Price / Enterprise Closing Diluted Enterprise Revenue DE Per Share Value / Company Name Ticker Price Market Cap Value AUM 2019E 2020E 2019E 2020E AUM Blackstone Group L.P. BX $ 33.35 $ 40,577 $ 4 2,121 $ 472,242 6.0x 5.4x 12.3x 11.2x 8.9% Carlyle Group L.P. CG 18.46 6 ,361 6 ,681 2 16,470 2.8x 2.3x 9.3x 7.7x 3.1% KKR & Co. Inc. KKR 2 3.53 1 9,332 19,300 194,720 5.3x 4.7x 13.4x 13.1x 9.9% OSLO $ 41.89 $ 6,582 $ 6,721 $ 119,560 4.3x 4.1x 12.3x 11.0x 5.6% Implied Equity Value per Unit High $ 58.90 $ 55.94 $ 43.30 $ 45.49 $ 74.53 Low $ 26.71 $ 23.43 $ 29.80 $ 26.69 $ 22.60 Mean $ 45.87 $ 42.76 $ 37.59 $ 36.96 $ 54.70 ($Millions, except per share data) Price / Fully Total Enterprise Value / Enterprise (1) Closing Diluted Enterprise Revenue Value / Non-GAAP EPS Company Name Ticker Price Market Cap Value AUM 2019E 2020E 2019E 2020E AUM Apollo Global Management, LLC APO $ 3 0.24 $ 1 2,065 $ 1 2,572 $ 2 80,259 4.9x 4.5x 10.4x 9.9x 4.5% Ares Management Corporation ARES 23.23 4 ,783 5 ,310 130,700 4.6x 3.5x 15.0x 12.3x 4.1% Hamilton Lane Inc. HLNE 44.00 2,161 2,208 59,000 7.7x 7.0x 21.6x 20.1x 3.7% Och-Ziff Capital Management Group OZM 1 3.30 650 1,330 3 2,995 2.3x 2.1x 3.7x 3.4x 4.0% Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock) Enterprise Value is equal to Fully Diluted Market Cap, less cash & equivalents (including marketable securities), plus total debt, plus preferreds Source: FactSet, S&P Global Market Intelligence (1) The primary earnings reporting basis for APO and ARES is Economic Net Income; for HLNE the primary earnings reporting basis is Adjusted Net Income, and for OZM it is Economic Income 13OSLO Comparable Companies Analysis As of 2/15/19 • Each of the three U.S. based alternative asset managers companies below report distributable earnings as their primary Non-GAAP earnings metric, consistent with OSLO – For illustrative purposes, we have also shown below those U.S. based alternative asset managers that report Non-GAAP earnings using a metric other than distributable earnings as their primary basis ($Millions, except per share data) Fully Total Enterprise Value / Price / Enterprise Closing Diluted Enterprise Revenue DE Per Share Value / Company Name Ticker Price Market Cap Value AUM 2019E 2020E 2019E 2020E AUM Blackstone Group L.P. BX $ 33.35 $ 40,577 $ 4 2,121 $ 472,242 6.0x 5.4x 12.3x 11.2x 8.9% Carlyle Group L.P. CG 18.46 6 ,361 6 ,681 2 16,470 2.8x 2.3x 9.3x 7.7x 3.1% KKR & Co. Inc. KKR 2 3.53 1 9,332 19,300 194,720 5.3x 4.7x 13.4x 13.1x 9.9% OSLO $ 41.89 $ 6,582 $ 6,721 $ 119,560 4.3x 4.1x 12.3x 11.0x 5.6% Implied Equity Value per Unit High $ 58.90 $ 55.94 $ 43.30 $ 45.49 $ 74.53 Low $ 26.71 $ 23.43 $ 29.80 $ 26.69 $ 22.60 Mean $ 45.87 $ 42.76 $ 37.59 $ 36.96 $ 54.70 ($Millions, except per share data) Price / Fully Total Enterprise Value / Enterprise (1) Closing Diluted Enterprise Revenue Value / Non-GAAP EPS Company Name Ticker Price Market Cap Value AUM 2019E 2020E 2019E 2020E AUM Apollo Global Management, LLC APO $ 3 0.24 $ 1 2,065 $ 1 2,572 $ 2 80,259 4.9x 4.5x 10.4x 9.9x 4.5% Ares Management Corporation ARES 23.23 4 ,783 5 ,310 130,700 4.6x 3.5x 15.0x 12.3x 4.1% Hamilton Lane Inc. HLNE 44.00 2,161 2,208 59,000 7.7x 7.0x 21.6x 20.1x 3.7% Och-Ziff Capital Management Group OZM 1 3.30 650 1,330 3 2,995 2.3x 2.1x 3.7x 3.4x 4.0% Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock) Enterprise Value is equal to Fully Diluted Market Cap, less cash & equivalents (including marketable securities), plus total debt, plus preferreds Source: FactSet, S&P Global Market Intelligence (1) The primary earnings reporting basis for APO and ARES is Economic Net Income; for HLNE the primary earnings reporting basis is Adjusted Net Income, and for OZM it is Economic Income 13

OSLO Sum of the Parts Analysis Economic Net Income Basis ($Millions) Value 2019E Multiple of Fees Fee Related Earnings Fee related earnings, less equity based compensation $ 216.7 Less: Portion attributable to OCGH non- controlling interest (117.9) Less: Non-Operating Group income / (expense) (2.0) Less: Income taxes - Class A (14.5) Fee related earnings - Class A $ 82.4 16.0x $ 1,317.8 Incentives Created, Net Incentives created, net $ 311.0 Less: Portion attributable to OCGH non- controlling interest (169.2) Less: Income taxes - Class A (9.9) Incentives created - Class A $ 131.9 7.0x $ 9 23.5 Sub-Total $ 214.3 $ 2,241.2 (1) Add: NAV of Balance Sheet (as of 12/31/18) 9 83.4 Add: Deferred Tax Assets (as of 12/31/18) 2 29.1 Less: Due to Affiliates (as of 12/31/18) ( 188.4) Total Value $ 3,265.4 Class A Units (mm) 71.7 Value Per Class A Unit $ 4 5.57 2/15/19 OSLO Unit Price $ 41.89 Value Per Class A Unit Sensitivity Fee Related Earnings (FRE) Multiple 14.0x 15.0x 16.0x 17.0x 18.0x 6.0x $ 41.43 $ 42.58 $ 43.73 $ 44.88 $ 46.03 6.5x $ 42.35 $ 43.50 $ 44.65 $ 45.80 $ 46.95 7.0x $ 43.28 $ 44.42 $ 45.57 $ 46.72 $ 47.87 7.5x $ 44.20 $ 45.35 $ 46.50 $ 47.64 $ 48.79 8.0x $ 45.12 $ 46.27 $ 47.42 $ 48.57 $ 49.71 Source: OSLO 5-Year Plan, as provided by OSLO management, subject to further discussion with OSLO management; public filings Note: Multiple ranges based on methodologies utilized in published analyst research reports and Sandler O'Neill's professional judgement (1) NAV of Balance Sheet is equal to Class A Unitholders’ proportionate share of principal investments ($1,771M, less $43M DoubleLine carrying value), plus tax-affected accrued net carry ($812M, less taxes of 7%, less 25% risk discount), less debt obligations ($746M), less preferred ($401M), plus cash & cash equivalents ($461M) and U.S. Treasury and other securities ($547M) 14 Incentive Income MultipleOSLO Sum of the Parts Analysis Economic Net Income Basis ($Millions) Value 2019E Multiple of Fees Fee Related Earnings Fee related earnings, less equity based compensation $ 216.7 Less: Portion attributable to OCGH non- controlling interest (117.9) Less: Non-Operating Group income / (expense) (2.0) Less: Income taxes - Class A (14.5) Fee related earnings - Class A $ 82.4 16.0x $ 1,317.8 Incentives Created, Net Incentives created, net $ 311.0 Less: Portion attributable to OCGH non- controlling interest (169.2) Less: Income taxes - Class A (9.9) Incentives created - Class A $ 131.9 7.0x $ 9 23.5 Sub-Total $ 214.3 $ 2,241.2 (1) Add: NAV of Balance Sheet (as of 12/31/18) 9 83.4 Add: Deferred Tax Assets (as of 12/31/18) 2 29.1 Less: Due to Affiliates (as of 12/31/18) ( 188.4) Total Value $ 3,265.4 Class A Units (mm) 71.7 Value Per Class A Unit $ 4 5.57 2/15/19 OSLO Unit Price $ 41.89 Value Per Class A Unit Sensitivity Fee Related Earnings (FRE) Multiple 14.0x 15.0x 16.0x 17.0x 18.0x 6.0x $ 41.43 $ 42.58 $ 43.73 $ 44.88 $ 46.03 6.5x $ 42.35 $ 43.50 $ 44.65 $ 45.80 $ 46.95 7.0x $ 43.28 $ 44.42 $ 45.57 $ 46.72 $ 47.87 7.5x $ 44.20 $ 45.35 $ 46.50 $ 47.64 $ 48.79 8.0x $ 45.12 $ 46.27 $ 47.42 $ 48.57 $ 49.71 Source: OSLO 5-Year Plan, as provided by OSLO management, subject to further discussion with OSLO management; public filings Note: Multiple ranges based on methodologies utilized in published analyst research reports and Sandler O'Neill's professional judgement (1) NAV of Balance Sheet is equal to Class A Unitholders’ proportionate share of principal investments ($1,771M, less $43M DoubleLine carrying value), plus tax-affected accrued net carry ($812M, less taxes of 7%, less 25% risk discount), less debt obligations ($746M), less preferred ($401M), plus cash & cash equivalents ($461M) and U.S. Treasury and other securities ($547M) 14 Incentive Income Multiple

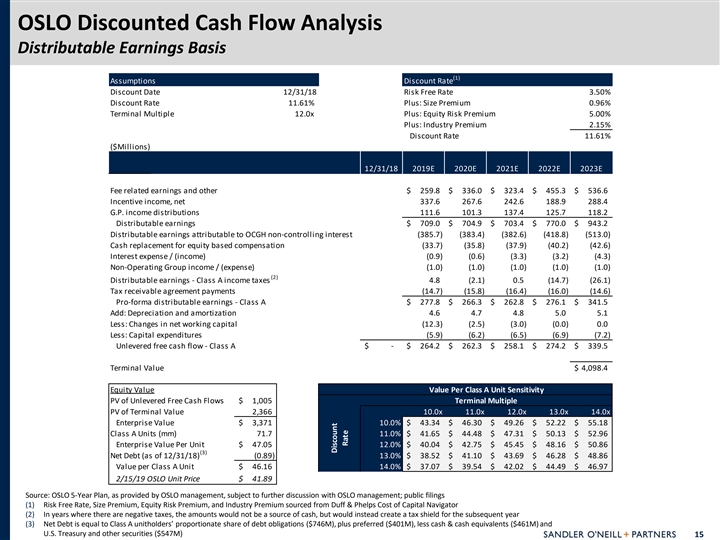

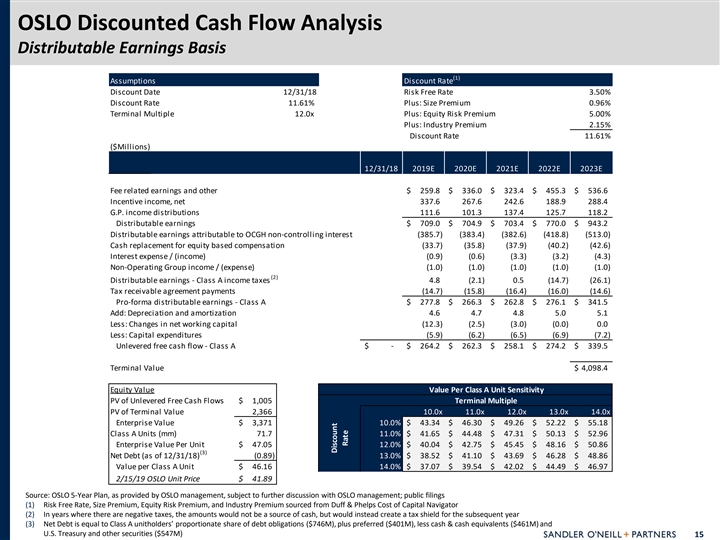

OSLO Discounted Cash Flow Analysis Distributable Earnings Basis (1) Assumptions Discount Rate Discount Date 12/31/18 Risk Free Rate 3.50% Discount Rate 11.61% Plus: Size Premium 0.96% Terminal Multiple 12.0x Plus: Equity Risk Premium 5.00% Plus: Industry Premium 2.15% Discount Rate 11.61% ($Millions) 12/31/18 2019E 2020E 2021E 2022E 2023E Fee related earnings and other $ - $ 259.8 $ 336.0 $ 323.4 $ 455.3 $ 536.6 Incentive income, net 3 37.6 2 67.6 242.6 188.9 2 88.4 G.P. income distributions 111.6 1 01.3 137.4 125.7 1 18.2 Distributable earnings $ - $ 709.0 $ 704.9 $ 703.4 $ 770.0 $ 943.2 Distributable earnings attributable to OCGH non-controlling interest (385.7) (383.4) (382.6) (418.8) (513.0) Cash replacement for equity based compensation (33.7) ( 35.8) ( 37.9) ( 40.2) (42.6) Interest expense / (income) (0.9) (0.6) (3.3) (3.2) (4.3) Non-Operating Group income / (expense) (1.0) (1.0) (1.0) (1.0) (1.0) (2) Distributable earnings - Class A income taxes 4.8 (2.1) 0.5 ( 14.7) ( 26.1) Tax receivable agreement payments ( 14.7) (15.8) ( 16.4) ( 16.0) (14.6) Pro-forma distributable earnings - Class A $ 277.8 $ 266.3 $ 262.8 $ 276.1 $ 341.5 Add: Depreciation and amortization 4.6 4.7 4.8 5.0 5.1 Less: Changes in net working capital (12.3) (2.5) (3.0) (0.0) 0.0 Less: Capital expenditures (5.9) (6.2) (6.5) (6.9) (7.2) Unlevered free cash flow - Class A $ - $ 264.2 $ 262.3 $ 258.1 $ 274.2 $ 339.5 Terminal Value $ - $ - $ - $ - $ - $ 4,098.4 Equity Value Value Per Class A Unit Sensitivity PV of Unlevered Free Cash Flows $ 1,005 Terminal Multiple PV of Terminal Value 2,366 10.0x 11.0x 12.0x 13.0x 14.0x Enterprise Value $ 3,371 10.0% $ 43.34 $ 46.30 $ 49.26 $ 52.22 $ 55.18 Class A Units (mm) 71.7 11.0% $ 41.65 $ 44.48 $ 47.31 $ 50.13 $ 52.96 Enterprise Value Per Unit $ 47.05 12.0% $ 40.04 $ 42.75 $ 45.45 $ 48.16 $ 50.86 (3) Net Debt (as of 12/31/18) (0.89) 13.0% $ 38.52 $ 41.10 $ 43.69 $ 46.28 $ 48.86 Value per Class A Unit $ 46.16 14.0% $ 37.07 $ 39.54 $ 42.02 $ 44.49 $ 46.97 2/15/19 OSLO Unit Price $ 41.89 Source: OSLO 5-Year Plan, as provided by OSLO management, subject to further discussion with OSLO management; public filings (1) Risk Free Rate, Size Premium, Equity Risk Premium, and Industry Premium sourced from Duff & Phelps Cost of Capital Navigator (2) In years where there are negative taxes, the amounts would not be a source of cash, but would instead create a tax shield for the subsequent year (3) Net Debt is equal to Class A unitholders’ proportionate share of debt obligations ($746M), plus preferred ($401M), less cash & cash equivalents ($461M) and U.S. Treasury and other securities ($547M) 15 Discount RateOSLO Discounted Cash Flow Analysis Distributable Earnings Basis (1) Assumptions Discount Rate Discount Date 12/31/18 Risk Free Rate 3.50% Discount Rate 11.61% Plus: Size Premium 0.96% Terminal Multiple 12.0x Plus: Equity Risk Premium 5.00% Plus: Industry Premium 2.15% Discount Rate 11.61% ($Millions) 12/31/18 2019E 2020E 2021E 2022E 2023E Fee related earnings and other $ - $ 259.8 $ 336.0 $ 323.4 $ 455.3 $ 536.6 Incentive income, net 3 37.6 2 67.6 242.6 188.9 2 88.4 G.P. income distributions 111.6 1 01.3 137.4 125.7 1 18.2 Distributable earnings $ - $ 709.0 $ 704.9 $ 703.4 $ 770.0 $ 943.2 Distributable earnings attributable to OCGH non-controlling interest (385.7) (383.4) (382.6) (418.8) (513.0) Cash replacement for equity based compensation (33.7) ( 35.8) ( 37.9) ( 40.2) (42.6) Interest expense / (income) (0.9) (0.6) (3.3) (3.2) (4.3) Non-Operating Group income / (expense) (1.0) (1.0) (1.0) (1.0) (1.0) (2) Distributable earnings - Class A income taxes 4.8 (2.1) 0.5 ( 14.7) ( 26.1) Tax receivable agreement payments ( 14.7) (15.8) ( 16.4) ( 16.0) (14.6) Pro-forma distributable earnings - Class A $ 277.8 $ 266.3 $ 262.8 $ 276.1 $ 341.5 Add: Depreciation and amortization 4.6 4.7 4.8 5.0 5.1 Less: Changes in net working capital (12.3) (2.5) (3.0) (0.0) 0.0 Less: Capital expenditures (5.9) (6.2) (6.5) (6.9) (7.2) Unlevered free cash flow - Class A $ - $ 264.2 $ 262.3 $ 258.1 $ 274.2 $ 339.5 Terminal Value $ - $ - $ - $ - $ - $ 4,098.4 Equity Value Value Per Class A Unit Sensitivity PV of Unlevered Free Cash Flows $ 1,005 Terminal Multiple PV of Terminal Value 2,366 10.0x 11.0x 12.0x 13.0x 14.0x Enterprise Value $ 3,371 10.0% $ 43.34 $ 46.30 $ 49.26 $ 52.22 $ 55.18 Class A Units (mm) 71.7 11.0% $ 41.65 $ 44.48 $ 47.31 $ 50.13 $ 52.96 Enterprise Value Per Unit $ 47.05 12.0% $ 40.04 $ 42.75 $ 45.45 $ 48.16 $ 50.86 (3) Net Debt (as of 12/31/18) (0.89) 13.0% $ 38.52 $ 41.10 $ 43.69 $ 46.28 $ 48.86 Value per Class A Unit $ 46.16 14.0% $ 37.07 $ 39.54 $ 42.02 $ 44.49 $ 46.97 2/15/19 OSLO Unit Price $ 41.89 Source: OSLO 5-Year Plan, as provided by OSLO management, subject to further discussion with OSLO management; public filings (1) Risk Free Rate, Size Premium, Equity Risk Premium, and Industry Premium sourced from Duff & Phelps Cost of Capital Navigator (2) In years where there are negative taxes, the amounts would not be a source of cash, but would instead create a tax shield for the subsequent year (3) Net Debt is equal to Class A unitholders’ proportionate share of debt obligations ($746M), plus preferred ($401M), less cash & cash equivalents ($461M) and U.S. Treasury and other securities ($547M) 15 Discount Rate

OSLO Discounted Cash Flow Analysis Illustrative Forecast Achievement Sensitivities • The illustrative analysis below shows the implied price per unit based on (a) various levels of annual achievement of forecasted Distributable Earnings attributable to the Class A units, ranging from 80% to 120%, (b) a range of terminal multiples applied to the forecasted Distributable Earnings attributable to the Class A units, and (c) a range of discount rates Pro-Forma Distributable Earnings – Class A ($Millions) % Achievement 2019E 2020E 2021E 2022E 2023E 80.0% $ 222.3 $ 213.0 $ 210.2 $ 220.9 $ 273.2 90.0% 250.1 2 39.6 2 36.5 2 48.5 3 07.4 100.0% 277.8 2 66.3 2 62.8 276.1 341.5 110.0% 3 05.6 2 92.9 289.1 303.7 375.7 120.0% 333.4 319.5 3 15.4 3 31.3 409.8 (1) (2) Value Per Class A Unit Sensitivity Value Per Class A Unit Sensitivity Annual Achievement of Pro-Forma Distributable Earnings - Class A Annual Achievement of Pro-Forma Distributable Earnings - Class A 80.0% 90.0% 100.0% 110.0% 120.0% 80.0% 90.0% 100.0% 110.0% 120.0% 10.0% $ 39.17 $ 44.21 $ 49.26 $ 54.30 $ 59.35 10.0x $ 32.29 $ 36.48 $ 40.66 $ 44.85 $ 49.03 11.0% $ 37.61 $ 42.46 $ 47.31 $ 52.16 $ 57.00 11.0x $ 34.49 $ 38.95 $ 43.41 $ 47.87 $ 52.33 12.0% $ 36.13 $ 40.79 $ 45.45 $ 50.12 $ 54.78 12.0x $ 36.69 $ 41.43 $ 46.16 $ 50.90 $ 55.63 13.0% $ 34.72 $ 39.20 $ 43.69 $ 48.18 $ 52.66 13.0x $ 38.90 $ 43.91 $ 48.92 $ 53.93 $ 58.94 14.0% $ 33.38 $ 37.70 $ 42.02 $ 46.34 $ 50.65 14.0x $ 41.10 $ 46.38 $ 51.67 $ 56.95 $ 62.24 Source: OSLO 5-Year Plan, as provided by OSLO management, subject to further discussion with OSLO management; public filings (1) Reflects terminal multiple of 12.0x (2) Reflects discount rate of 11.61% 16 Discount Rate Terminal MultipleOSLO Discounted Cash Flow Analysis Illustrative Forecast Achievement Sensitivities • The illustrative analysis below shows the implied price per unit based on (a) various levels of annual achievement of forecasted Distributable Earnings attributable to the Class A units, ranging from 80% to 120%, (b) a range of terminal multiples applied to the forecasted Distributable Earnings attributable to the Class A units, and (c) a range of discount rates Pro-Forma Distributable Earnings – Class A ($Millions) % Achievement 2019E 2020E 2021E 2022E 2023E 80.0% $ 222.3 $ 213.0 $ 210.2 $ 220.9 $ 273.2 90.0% 250.1 2 39.6 2 36.5 2 48.5 3 07.4 100.0% 277.8 2 66.3 2 62.8 276.1 341.5 110.0% 3 05.6 2 92.9 289.1 303.7 375.7 120.0% 333.4 319.5 3 15.4 3 31.3 409.8 (1) (2) Value Per Class A Unit Sensitivity Value Per Class A Unit Sensitivity Annual Achievement of Pro-Forma Distributable Earnings - Class A Annual Achievement of Pro-Forma Distributable Earnings - Class A 80.0% 90.0% 100.0% 110.0% 120.0% 80.0% 90.0% 100.0% 110.0% 120.0% 10.0% $ 39.17 $ 44.21 $ 49.26 $ 54.30 $ 59.35 10.0x $ 32.29 $ 36.48 $ 40.66 $ 44.85 $ 49.03 11.0% $ 37.61 $ 42.46 $ 47.31 $ 52.16 $ 57.00 11.0x $ 34.49 $ 38.95 $ 43.41 $ 47.87 $ 52.33 12.0% $ 36.13 $ 40.79 $ 45.45 $ 50.12 $ 54.78 12.0x $ 36.69 $ 41.43 $ 46.16 $ 50.90 $ 55.63 13.0% $ 34.72 $ 39.20 $ 43.69 $ 48.18 $ 52.66 13.0x $ 38.90 $ 43.91 $ 48.92 $ 53.93 $ 58.94 14.0% $ 33.38 $ 37.70 $ 42.02 $ 46.34 $ 50.65 14.0x $ 41.10 $ 46.38 $ 51.67 $ 56.95 $ 62.24 Source: OSLO 5-Year Plan, as provided by OSLO management, subject to further discussion with OSLO management; public filings (1) Reflects terminal multiple of 12.0x (2) Reflects discount rate of 11.61% 16 Discount Rate Terminal Multiple

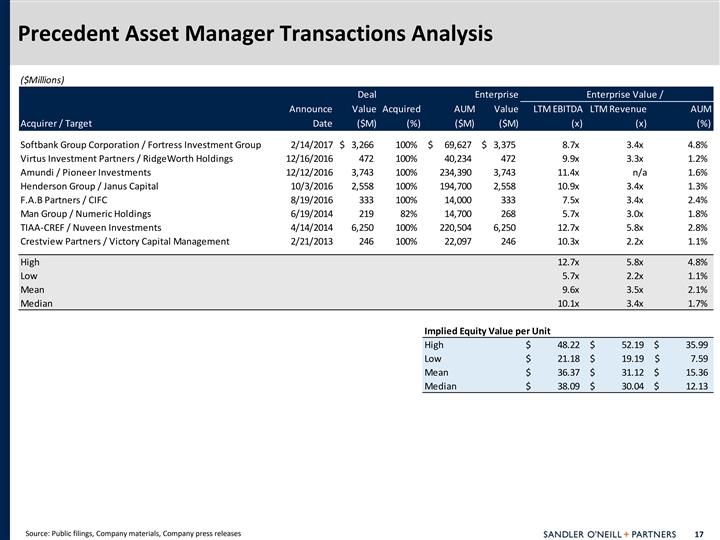

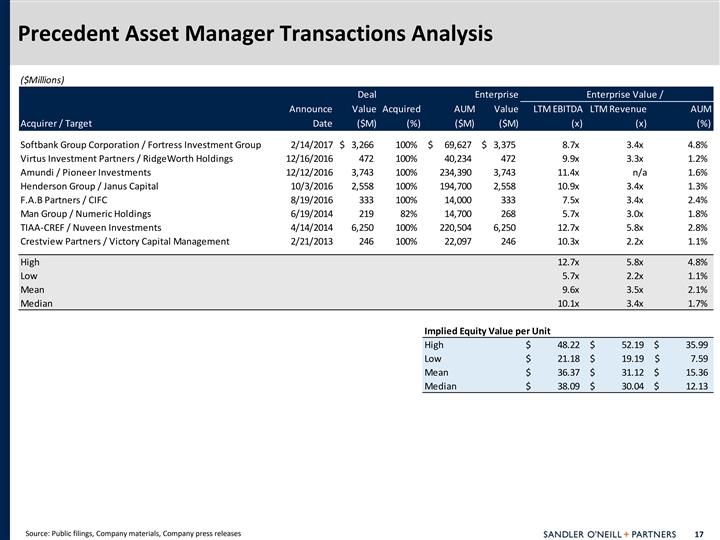

Precedent Asset Manager Transactions Analysis ($Millions) Deal Enterprise Enterprise Value / Announce Value Acquired AUM Value LTM EBITDA LTM Revenue AUM Acquirer / Target Date ($M) (%) ($M) ($M) (x) (x) (%) Softbank Group Corporation / Fortress Investment Group 2/14/2017 $ 3,266 100% $ 69,627 $ 3,375 8.7x 3.4x 4.8% Virtus Investment Partners / RidgeWorth Holdings 12/16/2016 472 100% 4 0,234 472 9.9x 3.3x 1.2% Amundi / Pioneer Investments 12/12/2016 3,743 100% 234,390 3,743 11.4x n/a 1.6% Henderson Group / Janus Capital 10/3/2016 2,558 100% 194,700 2,558 10.9x 3.4x 1.3% F.A.B Partners / CIFC 8/19/2016 333 100% 14,000 333 7.5x 3.4x 2.4% Man Group / Numeric Holdings 6/19/2014 219 82% 14,700 268 5.7x 3.0x 1.8% TIAA-CREF / Nuveen Investments 4/14/2014 6,250 100% 220,504 6,250 12.7x 5.8x 2.8% Crestview Partners / Victory Capital Management 2/21/2013 246 100% 2 2,097 246 10.3x 2.2x 1.1% High 12.7x 5.8x 4.8% Low 5.7x 2.2x 1.1% Mean 9.6x 3.5x 2.1% Median 10.1x 3.4x 1.7% Implied Equity Value per Unit High $ 48.22 $ 5 2.19 $ 35.99 Low $ 2 1.18 $ 1 9.19 $ 7.59 Mean $ 3 6.37 $ 31.12 $ 15.36 Median $ 3 8.09 $ 30.04 $ 1 2.13 Source: Public filings, Company materials, Company press releases 17Precedent Asset Manager Transactions Analysis ($Millions) Deal Enterprise Enterprise Value / Announce Value Acquired AUM Value LTM EBITDA LTM Revenue AUM Acquirer / Target Date ($M) (%) ($M) ($M) (x) (x) (%) Softbank Group Corporation / Fortress Investment Group 2/14/2017 $ 3,266 100% $ 69,627 $ 3,375 8.7x 3.4x 4.8% Virtus Investment Partners / RidgeWorth Holdings 12/16/2016 472 100% 4 0,234 472 9.9x 3.3x 1.2% Amundi / Pioneer Investments 12/12/2016 3,743 100% 234,390 3,743 11.4x n/a 1.6% Henderson Group / Janus Capital 10/3/2016 2,558 100% 194,700 2,558 10.9x 3.4x 1.3% F.A.B Partners / CIFC 8/19/2016 333 100% 14,000 333 7.5x 3.4x 2.4% Man Group / Numeric Holdings 6/19/2014 219 82% 14,700 268 5.7x 3.0x 1.8% TIAA-CREF / Nuveen Investments 4/14/2014 6,250 100% 220,504 6,250 12.7x 5.8x 2.8% Crestview Partners / Victory Capital Management 2/21/2013 246 100% 2 2,097 246 10.3x 2.2x 1.1% High 12.7x 5.8x 4.8% Low 5.7x 2.2x 1.1% Mean 9.6x 3.5x 2.1% Median 10.1x 3.4x 1.7% Implied Equity Value per Unit High $ 48.22 $ 5 2.19 $ 35.99 Low $ 2 1.18 $ 1 9.19 $ 7.59 Mean $ 3 6.37 $ 31.12 $ 15.36 Median $ 3 8.09 $ 30.04 $ 1 2.13 Source: Public filings, Company materials, Company press releases 17

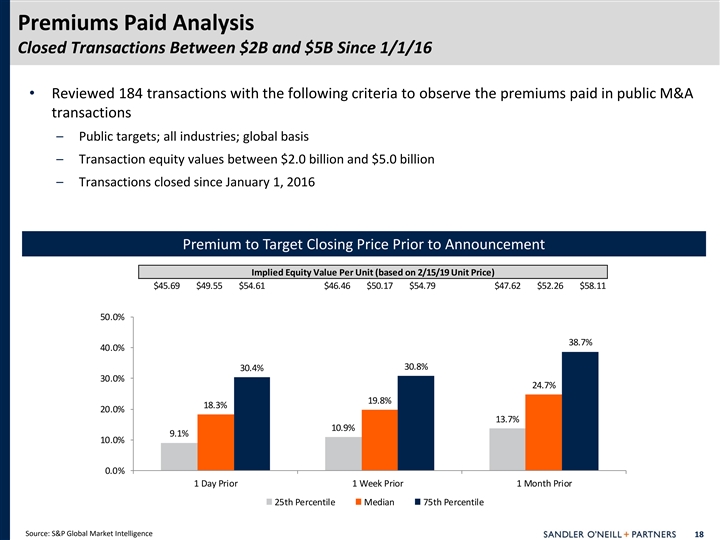

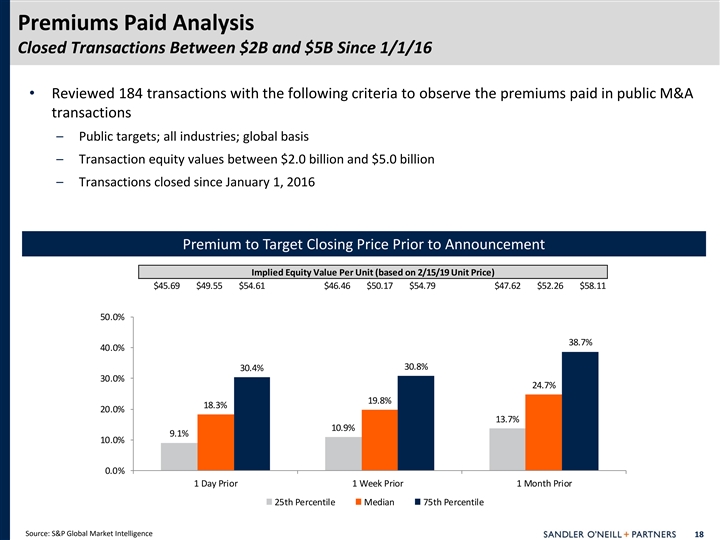

Premiums Paid Analysis Closed Transactions Between $2B and $5B Since 1/1/16 • Reviewed 184 transactions with the following criteria to observe the premiums paid in public M&A transactions – Public targets; all industries; global basis – Transaction equity values between $2.0 billion and $5.0 billion – Transactions closed since January 1, 2016 Premium to Target Closing Price Prior to Announcement Implied Equity Value Per Unit (based on 2/15/19 Unit Price) $45.69 $49.55 $54.61 $46.46 $50.17 $54.79 $47.62 $52.26 $58.11 50.0% 38.7% 40.0% 30.8% 30.4% 30.0% 24.7% 19.8% 18.3% 20.0% 13.7% 10.9% 9.1% 10.0% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior 25th Percentile Median 75th Percentile Source: S&P Global Market Intelligence 18Premiums Paid Analysis Closed Transactions Between $2B and $5B Since 1/1/16 • Reviewed 184 transactions with the following criteria to observe the premiums paid in public M&A transactions – Public targets; all industries; global basis – Transaction equity values between $2.0 billion and $5.0 billion – Transactions closed since January 1, 2016 Premium to Target Closing Price Prior to Announcement Implied Equity Value Per Unit (based on 2/15/19 Unit Price) $45.69 $49.55 $54.61 $46.46 $50.17 $54.79 $47.62 $52.26 $58.11 50.0% 38.7% 40.0% 30.8% 30.4% 30.0% 24.7% 19.8% 18.3% 20.0% 13.7% 10.9% 9.1% 10.0% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior 25th Percentile Median 75th Percentile Source: S&P Global Market Intelligence 18

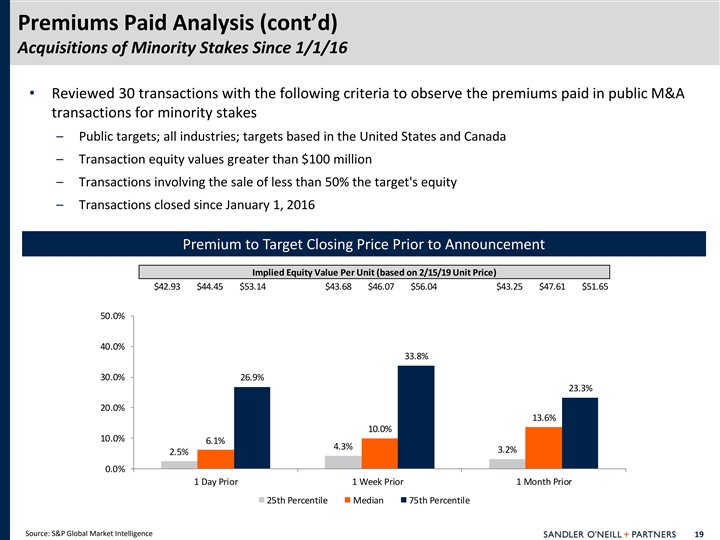

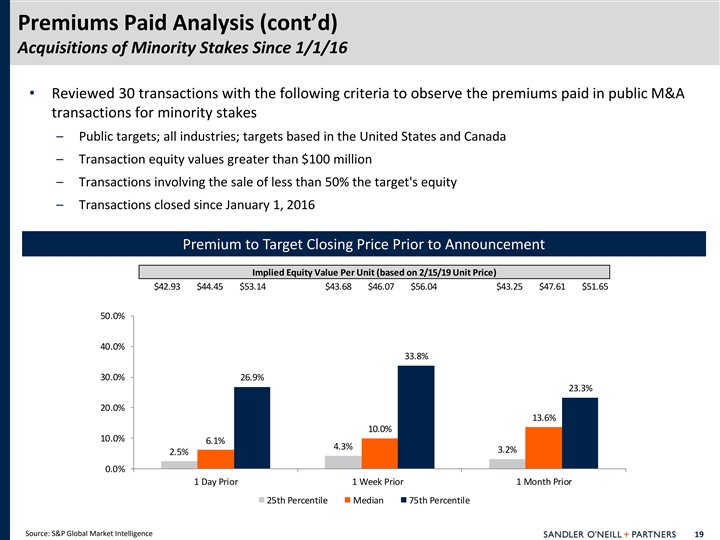

Premiums Paid Analysis (cont’d) Acquisitions of Minority Stakes Since 1/1/16 • Reviewed 30 transactions with the following criteria to observe the premiums paid in public M&A transactions for minority stakes – Public targets; all industries; targets based in the United States and Canada – Transaction equity values greater than $100 million – Transactions involving the sale of less than 50% the target's equity – Transactions closed since January 1, 2016 Premium to Target Closing Price Prior to Announcement Implied Equity Value Per Unit (based on 2/15/19 Unit Price) $42.93 $44.45 $53.14 $43.68 $46.07 $56.04 $43.25 $47.61 $51.65 50.0% 40.0% 33.8% 30.0% 26.9% 23.3% 20.0% 13.6% 10.0% 10.0% 6.1% 4.3% 3.2% 2.5% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior 25th Percentile Median 75th Percentile Source: S&P Global Market Intelligence 19Premiums Paid Analysis (cont’d) Acquisitions of Minority Stakes Since 1/1/16 • Reviewed 30 transactions with the following criteria to observe the premiums paid in public M&A transactions for minority stakes – Public targets; all industries; targets based in the United States and Canada – Transaction equity values greater than $100 million – Transactions involving the sale of less than 50% the target's equity – Transactions closed since January 1, 2016 Premium to Target Closing Price Prior to Announcement Implied Equity Value Per Unit (based on 2/15/19 Unit Price) $42.93 $44.45 $53.14 $43.68 $46.07 $56.04 $43.25 $47.61 $51.65 50.0% 40.0% 33.8% 30.0% 26.9% 23.3% 20.0% 13.6% 10.0% 10.0% 6.1% 4.3% 3.2% 2.5% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior 25th Percentile Median 75th Percentile Source: S&P Global Market Intelligence 19

III. Preliminary BERLIN Financial AnalysesIII. Preliminary BERLIN Financial Analyses

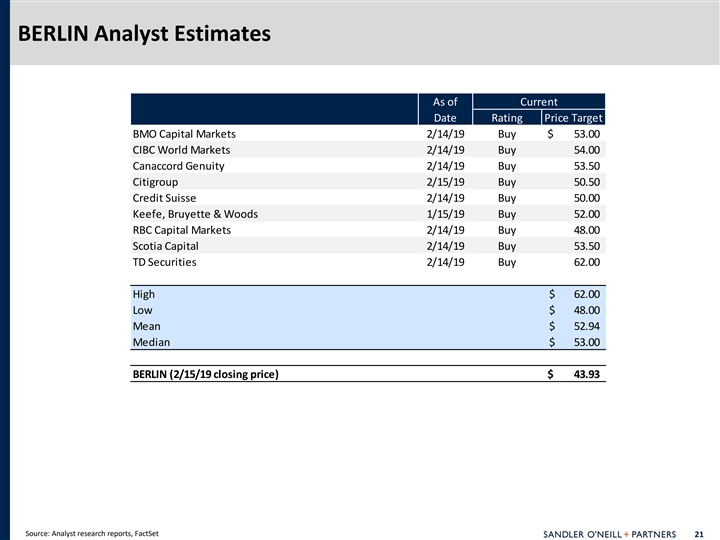

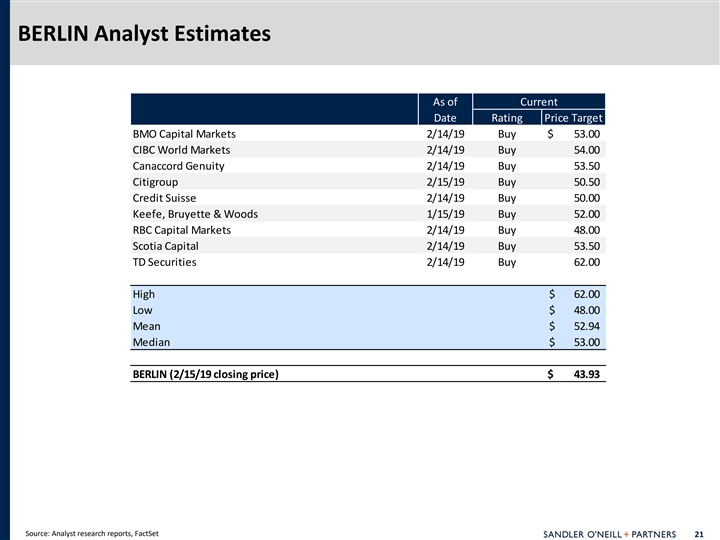

BERLIN Analyst Estimates As of Current Date Rating Price Target BMO Capital Markets 2/14/19 Buy $ 53.00 CIBC World Markets 2/14/19 Buy 5 4.00 Canaccord Genuity 2/14/19 Buy 53.50 Citigroup 2/15/19 Buy 50.50 Credit Suisse 2/14/19 Buy 5 0.00 Keefe, Bruyette & Woods 1/15/19 Buy 52.00 RBC Capital Markets 2/14/19 Buy 4 8.00 Scotia Capital 2/14/19 Buy 5 3.50 TD Securities 2/14/19 Buy 6 2.00 High $ 6 2.00 Low $ 48.00 Mean $ 52.94 Median $ 53.00 BERLIN (2/15/19 closing price) $ 43.93 Source: Analyst research reports, FactSet 21BERLIN Analyst Estimates As of Current Date Rating Price Target BMO Capital Markets 2/14/19 Buy $ 53.00 CIBC World Markets 2/14/19 Buy 5 4.00 Canaccord Genuity 2/14/19 Buy 53.50 Citigroup 2/15/19 Buy 50.50 Credit Suisse 2/14/19 Buy 5 0.00 Keefe, Bruyette & Woods 1/15/19 Buy 52.00 RBC Capital Markets 2/14/19 Buy 4 8.00 Scotia Capital 2/14/19 Buy 5 3.50 TD Securities 2/14/19 Buy 6 2.00 High $ 6 2.00 Low $ 48.00 Mean $ 52.94 Median $ 53.00 BERLIN (2/15/19 closing price) $ 43.93 Source: Analyst research reports, FactSet 21

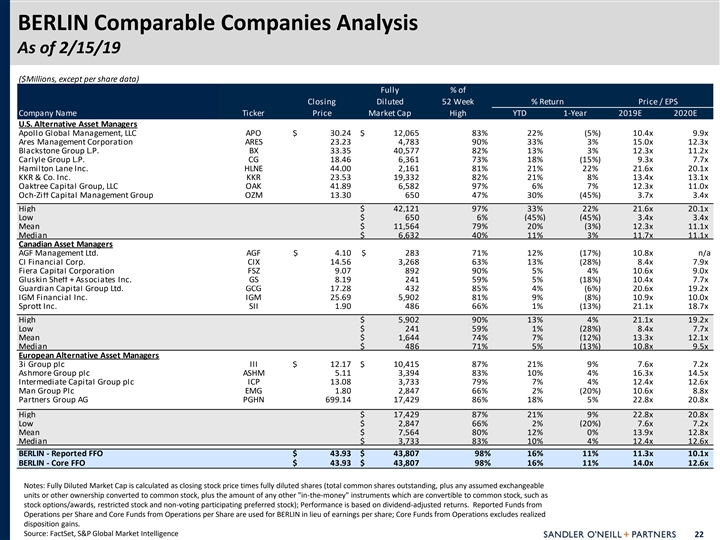

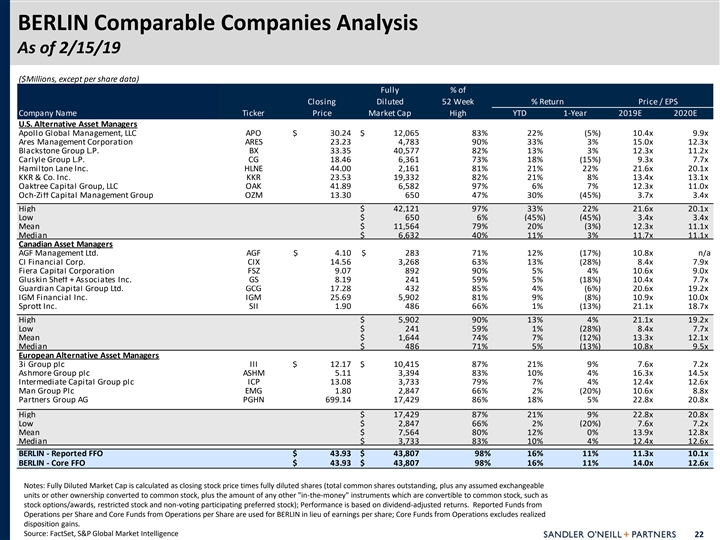

BERLIN Comparable Companies Analysis As of 2/15/19 ($Millions, except per share data) Fully % of Closing Diluted 52 Week % Return Price / EPS Company Name Ticker Price Market Cap High YTD 1-Year 2019E 2020E U.S. Alternative Asset Managers (1) (2) Apollo Global Management, LLC APO $ 3 0.24 $ 1 2,065 83% 22% (5%) 10.4x 9.9x Ares Management Corporation ARES 2 3.23 4,783 90% 33% 3% 15.0x 12.3x Blackstone Group L.P. BX 3 3.35 40,577 82% 13% 3% 12.3x 11.2x Carlyle Group L.P. CG 1 8.46 6,361 73% 18% (15%) 9.3x 7.7x Hamilton Lane Inc. HLNE 44.00 2,161 81% 21% 22% 21.6x 20.1x KKR & Co. Inc. KKR 2 3.53 19,332 82% 21% 8% 13.4x 13.1x Oaktree Capital Group, LLC OAK 41.89 6,582 97% 6% 7% 12.3x 11.0x Och-Ziff Capital Management Group OZM 13.30 650 47% 30% (45%) 3.7x 3.4x High $ 42,121 97% 33% 22% 21.6x 20.1x Low $ 650 6% (45%) (45%) 3.4x 3.4x Mean $ 11,564 79% 20% (3%) 12.3x 11.1x Median $ 6,632 40% 11% 3% 11.7x 11.1x Canadian Asset Managers AGF Management Ltd. AGF $ 4 .10 $ 283 71% 12% (17%) 10.8x n/a CI Financial Corp. CIX 1 4.56 3,268 63% 13% (28%) 8.4x 7.9x Fiera Capital Corporation FSZ 9.07 892 90% 5% 4% 10.6x 9.0x Gluskin Sheff + Associates Inc. GS 8.19 241 59% 5% (18%) 10.4x 7.7x Guardian Capital Group Ltd. GCG 17.28 432 85% 4% (6%) 20.6x 19.2x IGM Financial Inc. IGM 25.69 5 ,902 81% 9% (8%) 10.9x 10.0x Sprott Inc. SII 1 .90 486 66% 1% (13%) 21.1x 18.7x High $ 5,902 90% 13% 4% 21.1x 19.2x Low $ 241 59% 1% (28%) 8.4x 7.7x Mean $ 1,644 74% 7% (12%) 13.3x 12.1x Median $ 486 71% 5% (13%) 10.8x 9.5x European Alternative Asset Managers 3i Group plc III $ 12.17 $ 10,415 87% 21% 9% 7.6x 7.2x Ashmore Group plc ASHM 5 .11 3 ,394 83% 10% 4% 16.3x 14.5x Intermediate Capital Group plc ICP 13.08 3 ,733 79% 7% 4% 12.4x 12.6x Man Group Plc EMG 1.80 2,847 66% 2% (20%) 10.6x 8.8x Partners Group AG PGHN 699.14 1 7,429 86% 18% 5% 22.8x 20.8x High $ 17,429 87% 21% 9% 22.8x 20.8x Low $ 2,847 66% 2% (20%) 7.6x 7.2x Mean $ 7,564 80% 12% 0% 13.9x 12.8x Median $ 3,733 83% 10% 4% 12.4x 12.6x BERLIN - Reported FFO $ 4 3.93 $ 43,807 98% 16% 11% 11.3x 10.1x BERLIN - Core FFO $ 4 3.93 $ 43,807 98% 16% 11% 14.0x 12.6x Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock); Performance is based on dividend-adjusted returns. Reported Funds from Operations per Share and Core Funds from Operations per Share are used for BERLIN in lieu of earnings per share; Core Funds from Operations excludes realized disposition gains. Source: FactSet, S&P Global Market Intelligence 22BERLIN Comparable Companies Analysis As of 2/15/19 ($Millions, except per share data) Fully % of Closing Diluted 52 Week % Return Price / EPS Company Name Ticker Price Market Cap High YTD 1-Year 2019E 2020E U.S. Alternative Asset Managers (1) (2) Apollo Global Management, LLC APO $ 3 0.24 $ 1 2,065 83% 22% (5%) 10.4x 9.9x Ares Management Corporation ARES 2 3.23 4,783 90% 33% 3% 15.0x 12.3x Blackstone Group L.P. BX 3 3.35 40,577 82% 13% 3% 12.3x 11.2x Carlyle Group L.P. CG 1 8.46 6,361 73% 18% (15%) 9.3x 7.7x Hamilton Lane Inc. HLNE 44.00 2,161 81% 21% 22% 21.6x 20.1x KKR & Co. Inc. KKR 2 3.53 19,332 82% 21% 8% 13.4x 13.1x Oaktree Capital Group, LLC OAK 41.89 6,582 97% 6% 7% 12.3x 11.0x Och-Ziff Capital Management Group OZM 13.30 650 47% 30% (45%) 3.7x 3.4x High $ 42,121 97% 33% 22% 21.6x 20.1x Low $ 650 6% (45%) (45%) 3.4x 3.4x Mean $ 11,564 79% 20% (3%) 12.3x 11.1x Median $ 6,632 40% 11% 3% 11.7x 11.1x Canadian Asset Managers AGF Management Ltd. AGF $ 4 .10 $ 283 71% 12% (17%) 10.8x n/a CI Financial Corp. CIX 1 4.56 3,268 63% 13% (28%) 8.4x 7.9x Fiera Capital Corporation FSZ 9.07 892 90% 5% 4% 10.6x 9.0x Gluskin Sheff + Associates Inc. GS 8.19 241 59% 5% (18%) 10.4x 7.7x Guardian Capital Group Ltd. GCG 17.28 432 85% 4% (6%) 20.6x 19.2x IGM Financial Inc. IGM 25.69 5 ,902 81% 9% (8%) 10.9x 10.0x Sprott Inc. SII 1 .90 486 66% 1% (13%) 21.1x 18.7x High $ 5,902 90% 13% 4% 21.1x 19.2x Low $ 241 59% 1% (28%) 8.4x 7.7x Mean $ 1,644 74% 7% (12%) 13.3x 12.1x Median $ 486 71% 5% (13%) 10.8x 9.5x European Alternative Asset Managers 3i Group plc III $ 12.17 $ 10,415 87% 21% 9% 7.6x 7.2x Ashmore Group plc ASHM 5 .11 3 ,394 83% 10% 4% 16.3x 14.5x Intermediate Capital Group plc ICP 13.08 3 ,733 79% 7% 4% 12.4x 12.6x Man Group Plc EMG 1.80 2,847 66% 2% (20%) 10.6x 8.8x Partners Group AG PGHN 699.14 1 7,429 86% 18% 5% 22.8x 20.8x High $ 17,429 87% 21% 9% 22.8x 20.8x Low $ 2,847 66% 2% (20%) 7.6x 7.2x Mean $ 7,564 80% 12% 0% 13.9x 12.8x Median $ 3,733 83% 10% 4% 12.4x 12.6x BERLIN - Reported FFO $ 4 3.93 $ 43,807 98% 16% 11% 11.3x 10.1x BERLIN - Core FFO $ 4 3.93 $ 43,807 98% 16% 11% 14.0x 12.6x Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock); Performance is based on dividend-adjusted returns. Reported Funds from Operations per Share and Core Funds from Operations per Share are used for BERLIN in lieu of earnings per share; Core Funds from Operations excludes realized disposition gains. Source: FactSet, S&P Global Market Intelligence 22

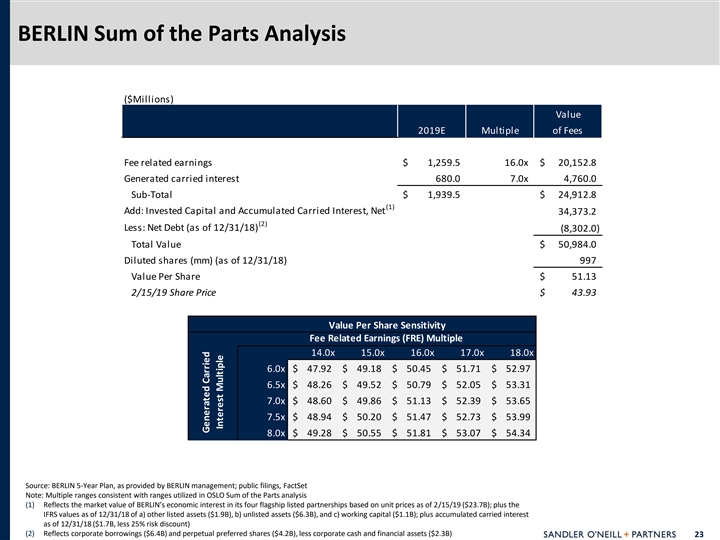

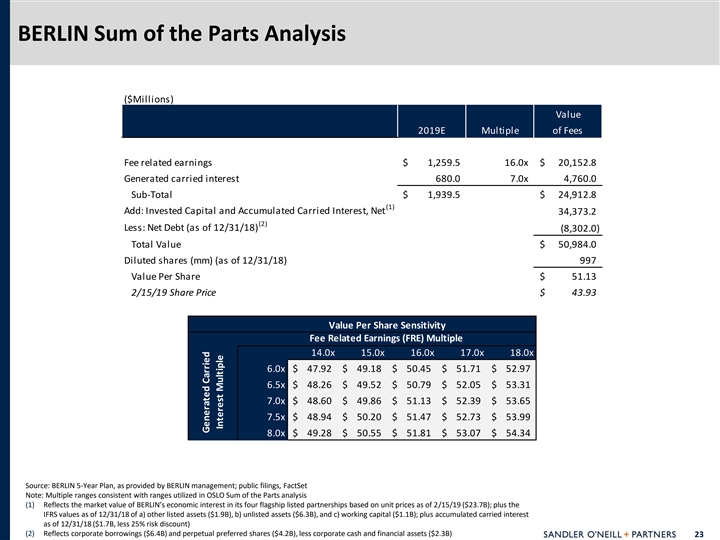

BERLIN Sum of the Parts Analysis ($Millions) Value 2019E Multiple of Fees Fee related earnings $ 1 ,259.5 16.0x $ 20,152.8 Generated carried interest 680.0 7.0x 4,760.0 Sub-Total $ 1,939.5 $ 24,912.8 (1) Add: Invested Capital and Accumulated Carried Interest, Net 3 4,373.2 (2) Less: Net Debt (as of 12/31/18) (8,302.0) Total Value $ 50,984.0 Diluted shares (mm) (as of 12/31/18) 997 Value Per Share $ 51.13 2/15/19 Share Price $ 43.93 Value Per Share Sensitivity Fee Related Earnings (FRE) Multiple 14.0x 15.0x 16.0x 17.0x 18.0x 6.0x $ 47.92 $ 49.18 $ 50.45 $ 51.71 $ 52.97 6.5x $ 48.26 $ 49.52 $ 50.79 $ 52.05 $ 53.31 7.0x $ 48.60 $ 49.86 $ 51.13 $ 52.39 $ 53.65 7.5x $ 48.94 $ 50.20 $ 51.47 $ 52.73 $ 53.99 8.0x $ 49.28 $ 50.55 $ 51.81 $ 53.07 $ 54.34 Source: BERLIN 5-Year Plan, as provided by BERLIN management; public filings, FactSet Note: Multiple ranges consistent with ranges utilized in OSLO Sum of the Parts analysis (1) Reflects the market value of BERLIN’s economic interest in its four flagship listed partnerships based on unit prices as of 2/15/19 ($23.7B); plus the IFRS values as of 12/31/18 of a) other listed assets ($1.9B), b) unlisted assets ($6.3B), and c) working capital ($1.1B); plus accumulated carried interest as of 12/31/18 ($1.7B, less 25% risk discount) (2) Reflects corporate borrowings ($6.4B) and perpetual preferred shares ($4.2B), less corporate cash and financial assets ($2.3B) 23 Generated Carried Interest MultipleBERLIN Sum of the Parts Analysis ($Millions) Value 2019E Multiple of Fees Fee related earnings $ 1 ,259.5 16.0x $ 20,152.8 Generated carried interest 680.0 7.0x 4,760.0 Sub-Total $ 1,939.5 $ 24,912.8 (1) Add: Invested Capital and Accumulated Carried Interest, Net 3 4,373.2 (2) Less: Net Debt (as of 12/31/18) (8,302.0) Total Value $ 50,984.0 Diluted shares (mm) (as of 12/31/18) 997 Value Per Share $ 51.13 2/15/19 Share Price $ 43.93 Value Per Share Sensitivity Fee Related Earnings (FRE) Multiple 14.0x 15.0x 16.0x 17.0x 18.0x 6.0x $ 47.92 $ 49.18 $ 50.45 $ 51.71 $ 52.97 6.5x $ 48.26 $ 49.52 $ 50.79 $ 52.05 $ 53.31 7.0x $ 48.60 $ 49.86 $ 51.13 $ 52.39 $ 53.65 7.5x $ 48.94 $ 50.20 $ 51.47 $ 52.73 $ 53.99 8.0x $ 49.28 $ 50.55 $ 51.81 $ 53.07 $ 54.34 Source: BERLIN 5-Year Plan, as provided by BERLIN management; public filings, FactSet Note: Multiple ranges consistent with ranges utilized in OSLO Sum of the Parts analysis (1) Reflects the market value of BERLIN’s economic interest in its four flagship listed partnerships based on unit prices as of 2/15/19 ($23.7B); plus the IFRS values as of 12/31/18 of a) other listed assets ($1.9B), b) unlisted assets ($6.3B), and c) working capital ($1.1B); plus accumulated carried interest as of 12/31/18 ($1.7B, less 25% risk discount) (2) Reflects corporate borrowings ($6.4B) and perpetual preferred shares ($4.2B), less corporate cash and financial assets ($2.3B) 23 Generated Carried Interest Multiple

BERLIN Discounted Cash Flow Analysis (1) Assumptions Discount Rate Discount Date 12/31/18 Risk Free Rate 3.50% Discount Rate 10.65% Plus: Size Premium 0.00% Terminal Multiple 12.0x Plus: Equity Risk Premium 5.00% Plus: Industry Premium 2.15% Discount Rate 10.65% ($Millions) 12/31/18 2019E 2020E 2021E 2022E 2023E Fee related earnings $ - $ 1 ,260 $ 1 ,440 $ 1 ,650 $ 1 ,930 $ 2,160 Realized carried interest 200 290 240 390 1,030 Unlevered free cash flows $ - $ 1,460 $ 1 ,730 $ 1 ,890 $ 2 ,320 $ 3 ,190 Terminal Value $ - $ - $ - $ - $ - $ 38,286 Equity Value NPV Per Share Sensitivity Terminal Multiple PV of Unlevered Free Cash Flows $ 7 ,596 PV of Terminal Value 2 3,076 10.0x 11.0x 12.0x 13.0x 14.0x Sub-Total $ 30,672 7.0% $ 56.13 $ 58.41 $ 60.70 $ 6 2.98 $ 65.26 (2) Invested Capital 3 3,074 8.0% $ 5 4.85 $ 57.02 $ 59.20 $ 6 1.38 $ 63.55 Enterprise Value $ 63,747 9.0% $ 5 3.62 $ 55.70 $ 57.78 $ 59.86 $ 6 1.94 Shares (mm) (as of 12/31/18) 997 10.0% $ 5 2.46 $ 5 4.45 $ 5 6.44 $ 5 8.42 $ 60.41 Enterprise Value Per Share $ 6 3.93 11.0% $ 51.37 $ 53.26 $ 55.16 $ 5 7.06 $ 5 8.96 (3) Net Debt (as of 12/31/18) (8.33) (1) Value Per Share $ 55.60 NPV Per Share Sensitivity 2/15/19 Share Price $ 43.93 Annual Achievement of Unlevered Free Cash Flows Source: BERLIN 5-Year Plan, as provided by BERLIN management; public filings, FactSet Note: Capital expenditures and depreciation & amortization largely relate to technology costs which are generally expensed as incurred and included within corporate cost expenses (fee related earnings is net of these costs), per BERLIN management; net working capital assumed to be flat over the forecast period, per BERLIN management (1) Risk Free Rate, Size Premium, Equity Risk Premium, and Industry Premium sourced from Duff & Phelps Cost of Capital Navigator (2) Reflects the market value of BERLIN’s economic interest in its four flagship listed partnerships based on unit prices as of 2/15/19 ($23.7B); plus the IFRS values as of 12/31/18 of a) other listed assets ($1.9B), b) unlisted assets ($6.3B), and c) working capital ($1.1B) (3) Reflects corporate borrowings ($6.4B) and perpetual preferred shares ($4.2B), less corporate cash and financial assets ($2.3B) 24 Discount RateBERLIN Discounted Cash Flow Analysis (1) Assumptions Discount Rate Discount Date 12/31/18 Risk Free Rate 3.50% Discount Rate 10.65% Plus: Size Premium 0.00% Terminal Multiple 12.0x Plus: Equity Risk Premium 5.00% Plus: Industry Premium 2.15% Discount Rate 10.65% ($Millions) 12/31/18 2019E 2020E 2021E 2022E 2023E Fee related earnings $ - $ 1 ,260 $ 1 ,440 $ 1 ,650 $ 1 ,930 $ 2,160 Realized carried interest 200 290 240 390 1,030 Unlevered free cash flows $ - $ 1,460 $ 1 ,730 $ 1 ,890 $ 2 ,320 $ 3 ,190 Terminal Value $ - $ - $ - $ - $ - $ 38,286 Equity Value NPV Per Share Sensitivity Terminal Multiple PV of Unlevered Free Cash Flows $ 7 ,596 PV of Terminal Value 2 3,076 10.0x 11.0x 12.0x 13.0x 14.0x Sub-Total $ 30,672 7.0% $ 56.13 $ 58.41 $ 60.70 $ 6 2.98 $ 65.26 (2) Invested Capital 3 3,074 8.0% $ 5 4.85 $ 57.02 $ 59.20 $ 6 1.38 $ 63.55 Enterprise Value $ 63,747 9.0% $ 5 3.62 $ 55.70 $ 57.78 $ 59.86 $ 6 1.94 Shares (mm) (as of 12/31/18) 997 10.0% $ 5 2.46 $ 5 4.45 $ 5 6.44 $ 5 8.42 $ 60.41 Enterprise Value Per Share $ 6 3.93 11.0% $ 51.37 $ 53.26 $ 55.16 $ 5 7.06 $ 5 8.96 (3) Net Debt (as of 12/31/18) (8.33) (1) Value Per Share $ 55.60 NPV Per Share Sensitivity 2/15/19 Share Price $ 43.93 Annual Achievement of Unlevered Free Cash Flows Source: BERLIN 5-Year Plan, as provided by BERLIN management; public filings, FactSet Note: Capital expenditures and depreciation & amortization largely relate to technology costs which are generally expensed as incurred and included within corporate cost expenses (fee related earnings is net of these costs), per BERLIN management; net working capital assumed to be flat over the forecast period, per BERLIN management (1) Risk Free Rate, Size Premium, Equity Risk Premium, and Industry Premium sourced from Duff & Phelps Cost of Capital Navigator (2) Reflects the market value of BERLIN’s economic interest in its four flagship listed partnerships based on unit prices as of 2/15/19 ($23.7B); plus the IFRS values as of 12/31/18 of a) other listed assets ($1.9B), b) unlisted assets ($6.3B), and c) working capital ($1.1B) (3) Reflects corporate borrowings ($6.4B) and perpetual preferred shares ($4.2B), less corporate cash and financial assets ($2.3B) 24 Discount Rate

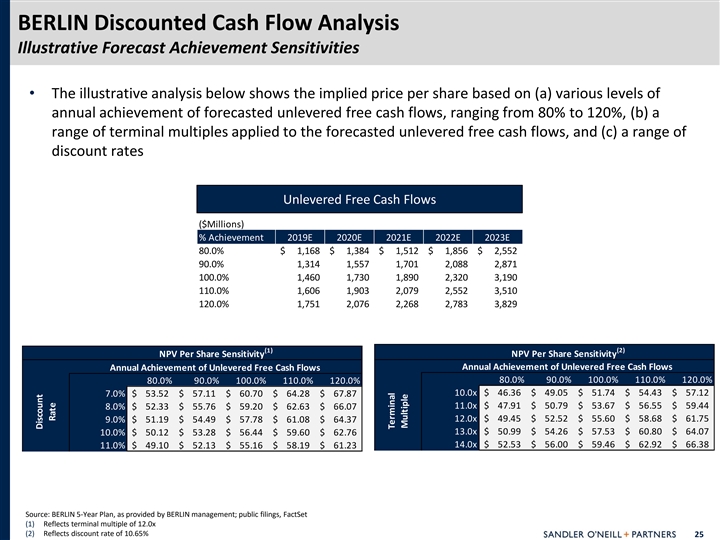

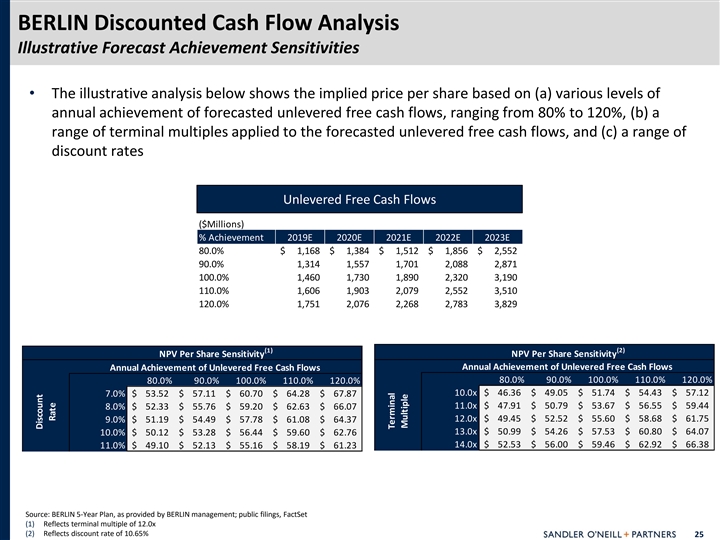

BERLIN Discounted Cash Flow Analysis Illustrative Forecast Achievement Sensitivities • The illustrative analysis below shows the implied price per share based on (a) various levels of annual achievement of forecasted unlevered free cash flows, ranging from 80% to 120%, (b) a range of terminal multiples applied to the forecasted unlevered free cash flows, and (c) a range of discount rates Unlevered Free Cash Flows ($Millions) % Achievement 2019E 2020E 2021E 2022E 2023E 80.0% $ 1,168 $ 1,384 $ 1,512 $ 1,856 $ 2,552 90.0% 1,314 1,557 1,701 2,088 2,871 100.0% 1,460 1,730 1,890 2,320 3,190 110.0% 1,606 1,903 2,079 2,552 3,510 120.0% 1,751 2,076 2,268 2,783 3,829 (2) (1) NPV Per Share Sensitivity NPV Per Share Sensitivity Annual Achievement of Unlevered Free Cash Flows Annual Achievement of Unlevered Free Cash Flows 80.0% 90.0% 100.0% 110.0% 120.0% 80.0% 90.0% 100.0% 110.0% 120.0% 10.0x $ 46.36 $ 49.05 $ 51.74 $ 54.43 $ 57.12 7.0% $ 53.52 $ 57.11 $ 60.70 $ 64.28 $ 67.87 11.0x $ 47.91 $ 50.79 $ 53.67 $ 56.55 $ 59.44 8.0% $ 52.33 $ 55.76 $ 59.20 $ 62.63 $ 66.07 12.0x $ 49.45 $ 52.52 $ 55.60 $ 58.68 $ 61.75 9.0% $ 51.19 $ 54.49 $ 57.78 $ 61.08 $ 64.37 13.0x $ 50.99 $ 54.26 $ 57.53 $ 60.80 $ 64.07 10.0% $ 50.12 $ 53.28 $ 56.44 $ 59.60 $ 62.76 14.0x $ 52.53 $ 56.00 $ 59.46 $ 62.92 $ 66.38 11.0% $ 49.10 $ 52.13 $ 55.16 $ 58.19 $ 61.23 Source: BERLIN 5-Year Plan, as provided by BERLIN management; public filings, FactSet (1) Reflects terminal multiple of 12.0x (2) Reflects discount rate of 10.65% 25 Discount Rate Terminal MultipleBERLIN Discounted Cash Flow Analysis Illustrative Forecast Achievement Sensitivities • The illustrative analysis below shows the implied price per share based on (a) various levels of annual achievement of forecasted unlevered free cash flows, ranging from 80% to 120%, (b) a range of terminal multiples applied to the forecasted unlevered free cash flows, and (c) a range of discount rates Unlevered Free Cash Flows ($Millions) % Achievement 2019E 2020E 2021E 2022E 2023E 80.0% $ 1,168 $ 1,384 $ 1,512 $ 1,856 $ 2,552 90.0% 1,314 1,557 1,701 2,088 2,871 100.0% 1,460 1,730 1,890 2,320 3,190 110.0% 1,606 1,903 2,079 2,552 3,510 120.0% 1,751 2,076 2,268 2,783 3,829 (2) (1) NPV Per Share Sensitivity NPV Per Share Sensitivity Annual Achievement of Unlevered Free Cash Flows Annual Achievement of Unlevered Free Cash Flows 80.0% 90.0% 100.0% 110.0% 120.0% 80.0% 90.0% 100.0% 110.0% 120.0% 10.0x $ 46.36 $ 49.05 $ 51.74 $ 54.43 $ 57.12 7.0% $ 53.52 $ 57.11 $ 60.70 $ 64.28 $ 67.87 11.0x $ 47.91 $ 50.79 $ 53.67 $ 56.55 $ 59.44 8.0% $ 52.33 $ 55.76 $ 59.20 $ 62.63 $ 66.07 12.0x $ 49.45 $ 52.52 $ 55.60 $ 58.68 $ 61.75 9.0% $ 51.19 $ 54.49 $ 57.78 $ 61.08 $ 64.37 13.0x $ 50.99 $ 54.26 $ 57.53 $ 60.80 $ 64.07 10.0% $ 50.12 $ 53.28 $ 56.44 $ 59.60 $ 62.76 14.0x $ 52.53 $ 56.00 $ 59.46 $ 62.92 $ 66.38 11.0% $ 49.10 $ 52.13 $ 55.16 $ 58.19 $ 61.23 Source: BERLIN 5-Year Plan, as provided by BERLIN management; public filings, FactSet (1) Reflects terminal multiple of 12.0x (2) Reflects discount rate of 10.65% 25 Discount Rate Terminal Multiple

IV. BERLIN Stock-Related DataIV. BERLIN Stock-Related Data

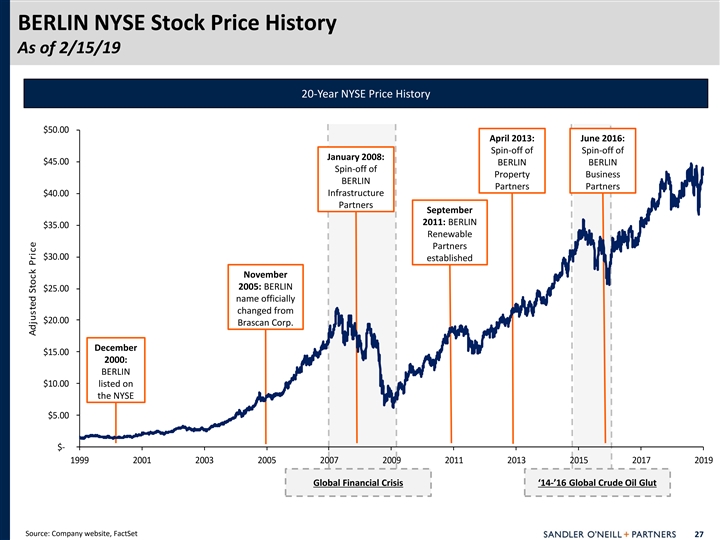

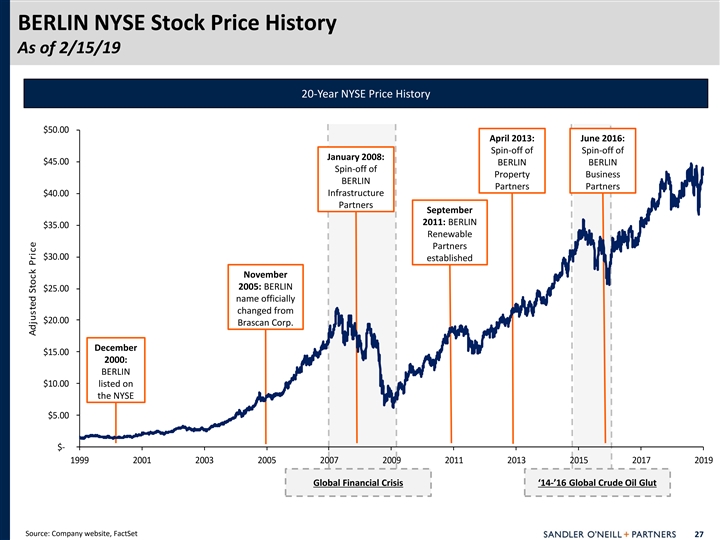

BERLIN NYSE Stock Price History As of 2/15/19 20-Year NYSE Price History $50.00 April 2013: June 2016: Spin-off of Spin-off of January 2008: $45.00 BERLIN BERLIN Spin-off of Property Business BERLIN Partners Partners $40.00 Infrastructure Partners September 2011: BERLIN $35.00 Renewable Partners $30.00 established November 2005: BERLIN $25.00 name officially changed from $20.00 Brascan Corp. December $15.00 2000: BERLIN $10.00 listed on the NYSE $5.00 $- 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 Global Financial Crisis ‘14-’16 Global Crude Oil Glut Source: Company website, FactSet 27 Adjusted Stock PriceBERLIN NYSE Stock Price History As of 2/15/19 20-Year NYSE Price History $50.00 April 2013: June 2016: Spin-off of Spin-off of January 2008: $45.00 BERLIN BERLIN Spin-off of Property Business BERLIN Partners Partners $40.00 Infrastructure Partners September 2011: BERLIN $35.00 Renewable Partners $30.00 established November 2005: BERLIN $25.00 name officially changed from $20.00 Brascan Corp. December $15.00 2000: BERLIN $10.00 listed on the NYSE $5.00 $- 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 Global Financial Crisis ‘14-’16 Global Crude Oil Glut Source: Company website, FactSet 27 Adjusted Stock Price

BERLIN Stock Price Performance As of 2/15/19 One-Year Stock Price Performance 30.0% BERLIN OSLO Canadian Asset Managers U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 20.0% 10.6% European Alternative Asset Managers 6.6% 10.0% 3.6% 1.2% 0.0% (1.4)% (1.9)% (10.0%) (11.0)% (20.0%) (30.0%) Feb-18 Apr-18 May-18 Jul-18 Sep-18 Nov-18 Dec-18 Feb-19 Three-Year Stock Price Performance 160.0% BERLIN OSLO Canadian Asset Managers 140.0% U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 120.0% European Alternative Asset Managers 103.0% 100.0% 77.8% 80.0% 75.4% 60.0% 57.9% 55.6% 40.0% 28.6% 20.0% 12.3% 0.0% (20.0%) Note: Canadian Asset Managers includes AGF, CI Financial, Fiera, Gluskin Sheff, Guardian Capital, IGM Financial, and Sprott. U.S. Alternative Asset Managers includes Apollo, Ares, Blackstone, Carlyle, Hamilton Lane, KKR, Oaktree, Och-Ziff. European Alternative Asset Managers includes 3i, Ashmore, Intermediate Capital, Man Group, and Partners Group; stock price returns are dividend-adjusted Source: FactSet 28BERLIN Stock Price Performance As of 2/15/19 One-Year Stock Price Performance 30.0% BERLIN OSLO Canadian Asset Managers U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 20.0% 10.6% European Alternative Asset Managers 6.6% 10.0% 3.6% 1.2% 0.0% (1.4)% (1.9)% (10.0%) (11.0)% (20.0%) (30.0%) Feb-18 Apr-18 May-18 Jul-18 Sep-18 Nov-18 Dec-18 Feb-19 Three-Year Stock Price Performance 160.0% BERLIN OSLO Canadian Asset Managers 140.0% U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 120.0% European Alternative Asset Managers 103.0% 100.0% 77.8% 80.0% 75.4% 60.0% 57.9% 55.6% 40.0% 28.6% 20.0% 12.3% 0.0% (20.0%) Note: Canadian Asset Managers includes AGF, CI Financial, Fiera, Gluskin Sheff, Guardian Capital, IGM Financial, and Sprott. U.S. Alternative Asset Managers includes Apollo, Ares, Blackstone, Carlyle, Hamilton Lane, KKR, Oaktree, Och-Ziff. European Alternative Asset Managers includes 3i, Ashmore, Intermediate Capital, Man Group, and Partners Group; stock price returns are dividend-adjusted Source: FactSet 28

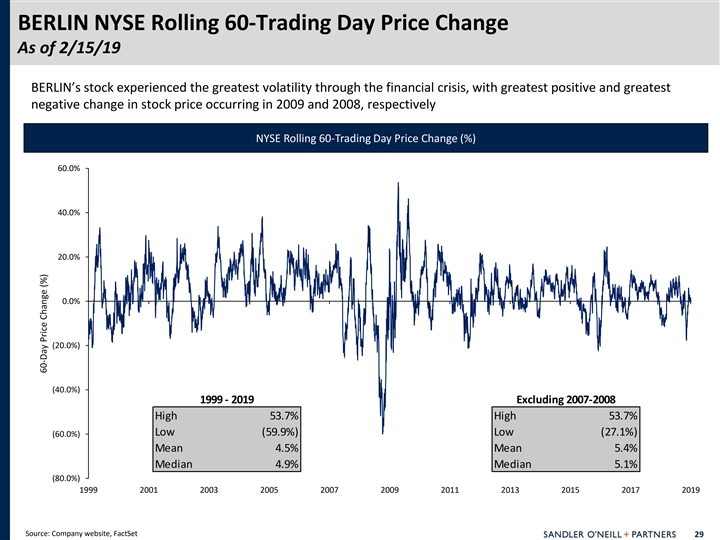

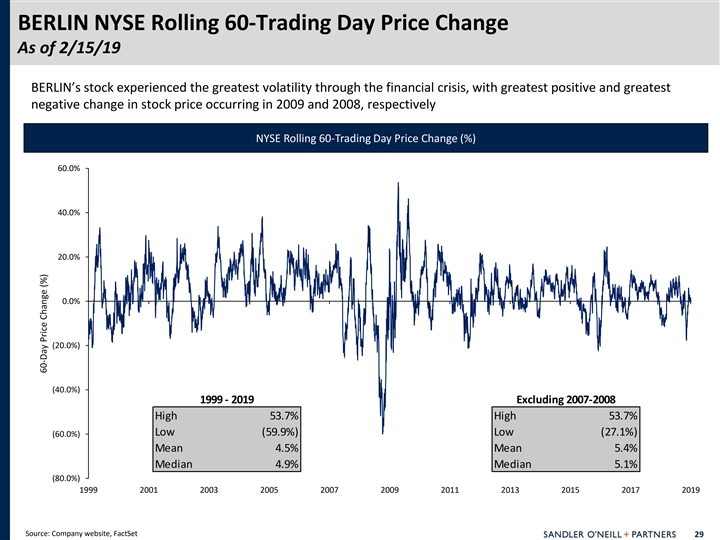

BERLIN NYSE Rolling 60-Trading Day Price Change As of 2/15/19 BERLIN’s stock experienced the greatest volatility through the financial crisis, with greatest positive and greatest negative change in stock price occurring in 2009 and 2008, respectively NYSE Rolling 60-Trading Day Price Change (%) 60.0% 40.0% 20.0% 0.0% (20.0%) (40.0%) 1999 - 2019 Excluding 2007-2008 High 53.7% High 53.7% Low (59.9%) Low (27.1%) (60.0%) Mean 4.5% Mean 5.4% Median 4.9% Median 5.1% (80.0%) 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 Source: Company website, FactSet 29 60-Day Price Change (%)BERLIN NYSE Rolling 60-Trading Day Price Change As of 2/15/19 BERLIN’s stock experienced the greatest volatility through the financial crisis, with greatest positive and greatest negative change in stock price occurring in 2009 and 2008, respectively NYSE Rolling 60-Trading Day Price Change (%) 60.0% 40.0% 20.0% 0.0% (20.0%) (40.0%) 1999 - 2019 Excluding 2007-2008 High 53.7% High 53.7% Low (59.9%) Low (27.1%) (60.0%) Mean 4.5% Mean 5.4% Median 4.9% Median 5.1% (80.0%) 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 Source: Company website, FactSet 29 60-Day Price Change (%)

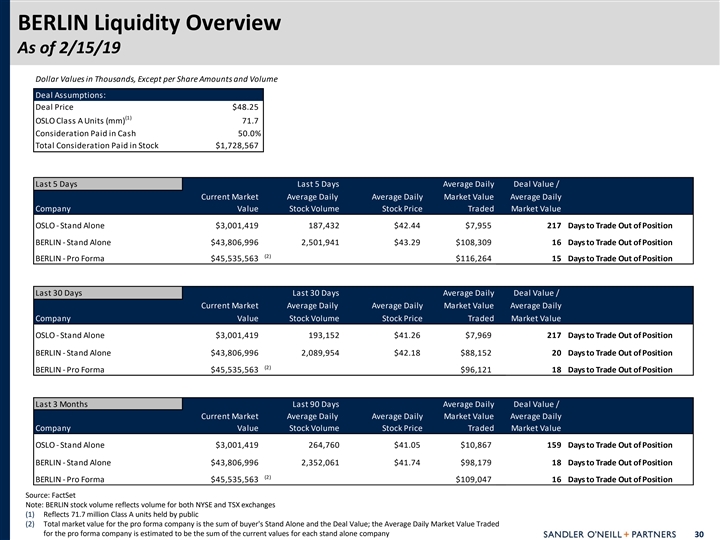

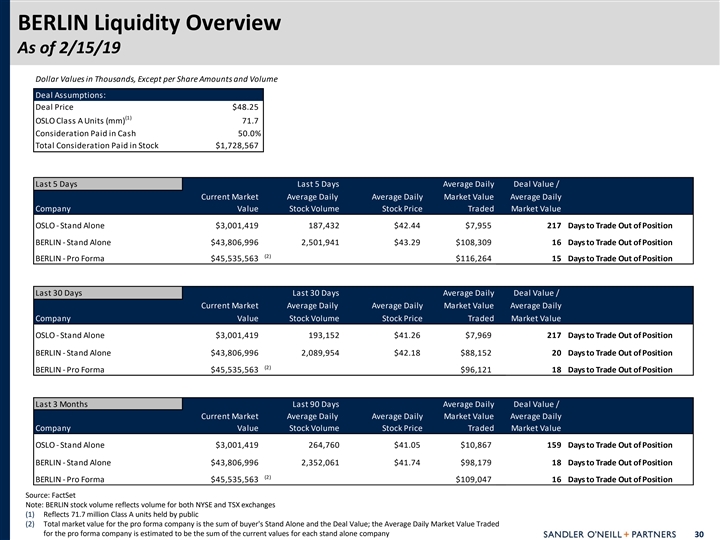

BERLIN Liquidity Overview As of 2/15/19 Dollar Values in Thousands, Except per Share Amounts and Volume Deal Assumptions: Deal Price $48.25 (1) OSLO Class A Units (mm) 71.7 Consideration Paid in Cash 50.0% Total Consideration Paid in Stock $1,728,567 Last 5 Days Last 5 Days Average Daily Deal Value / Current Market Average Daily Average Daily Market Value Average Daily Company Value Stock Volume Stock Price Traded Market Value OSLO - Stand Alone $3,001,419 1 87,432 $42.44 $7,955 217 Days to Trade Out of Position BERLIN - Stand Alone $43,806,996 2 ,501,941 $43.29 $108,309 16 Days to Trade Out of Position (2) BERLIN - Pro Forma $45,535,563 $116,264 15 Days to Trade Out of Position Last 30 Days Last 30 Days Average Daily Deal Value / Current Market Average Daily Average Daily Market Value Average Daily Company Value Stock Volume Stock Price Traded Market Value OSLO - Stand Alone $3,001,419 193,152 $41.26 $7,969 217 Days to Trade Out of Position BERLIN - Stand Alone $43,806,996 2 ,089,954 $42.18 $88,152 20 Days to Trade Out of Position (2) BERLIN - Pro Forma $45,535,563 $96,121 18 Days to Trade Out of Position Last 3 Months Last 90 Days Average Daily Deal Value / Current Market Average Daily Average Daily Market Value Average Daily Company Value Stock Volume Stock Price Traded Market Value OSLO - Stand Alone $3,001,419 264,760 $41.05 $10,867 159 Days to Trade Out of Position BERLIN - Stand Alone $43,806,996 2 ,352,061 $41.74 $98,179 18 Days to Trade Out of Position (2) BERLIN - Pro Forma $45,535,563 $109,047 16 Days to Trade Out of Position Source: FactSet Note: BERLIN stock volume reflects volume for both NYSE and TSX exchanges (1) Reflects 71.7 million Class A units held by public (2) Total market value for the pro forma company is the sum of buyer's Stand Alone and the Deal Value; the Average Daily Market Value Traded for the pro forma company is estimated to be the sum of the current values for each stand alone company 30BERLIN Liquidity Overview As of 2/15/19 Dollar Values in Thousands, Except per Share Amounts and Volume Deal Assumptions: Deal Price $48.25 (1) OSLO Class A Units (mm) 71.7 Consideration Paid in Cash 50.0% Total Consideration Paid in Stock $1,728,567 Last 5 Days Last 5 Days Average Daily Deal Value / Current Market Average Daily Average Daily Market Value Average Daily Company Value Stock Volume Stock Price Traded Market Value OSLO - Stand Alone $3,001,419 1 87,432 $42.44 $7,955 217 Days to Trade Out of Position BERLIN - Stand Alone $43,806,996 2 ,501,941 $43.29 $108,309 16 Days to Trade Out of Position (2) BERLIN - Pro Forma $45,535,563 $116,264 15 Days to Trade Out of Position Last 30 Days Last 30 Days Average Daily Deal Value / Current Market Average Daily Average Daily Market Value Average Daily Company Value Stock Volume Stock Price Traded Market Value OSLO - Stand Alone $3,001,419 193,152 $41.26 $7,969 217 Days to Trade Out of Position BERLIN - Stand Alone $43,806,996 2 ,089,954 $42.18 $88,152 20 Days to Trade Out of Position (2) BERLIN - Pro Forma $45,535,563 $96,121 18 Days to Trade Out of Position Last 3 Months Last 90 Days Average Daily Deal Value / Current Market Average Daily Average Daily Market Value Average Daily Company Value Stock Volume Stock Price Traded Market Value OSLO - Stand Alone $3,001,419 264,760 $41.05 $10,867 159 Days to Trade Out of Position BERLIN - Stand Alone $43,806,996 2 ,352,061 $41.74 $98,179 18 Days to Trade Out of Position (2) BERLIN - Pro Forma $45,535,563 $109,047 16 Days to Trade Out of Position Source: FactSet Note: BERLIN stock volume reflects volume for both NYSE and TSX exchanges (1) Reflects 71.7 million Class A units held by public (2) Total market value for the pro forma company is the sum of buyer's Stand Alone and the Deal Value; the Average Daily Market Value Traded for the pro forma company is estimated to be the sum of the current values for each stand alone company 30

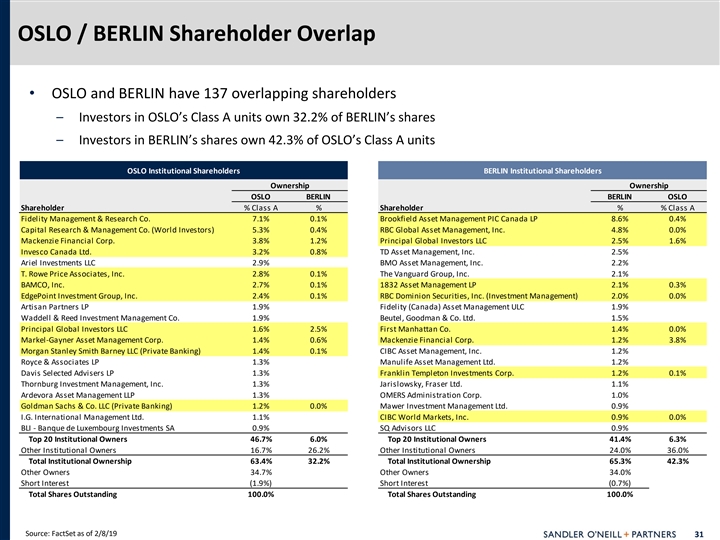

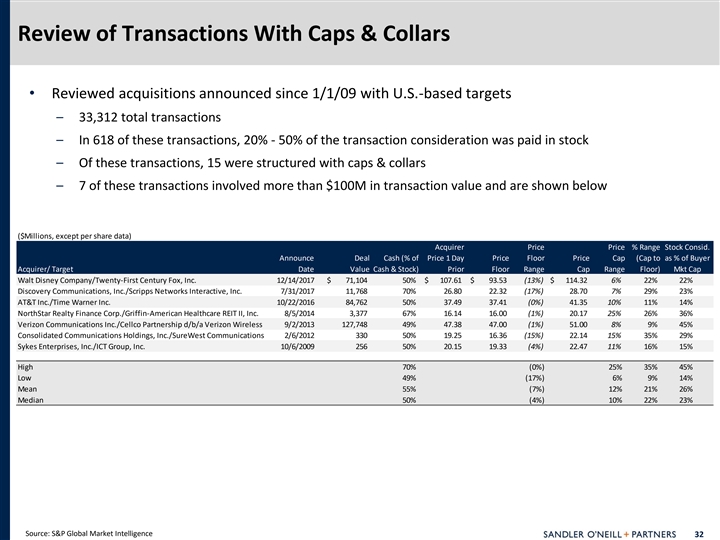

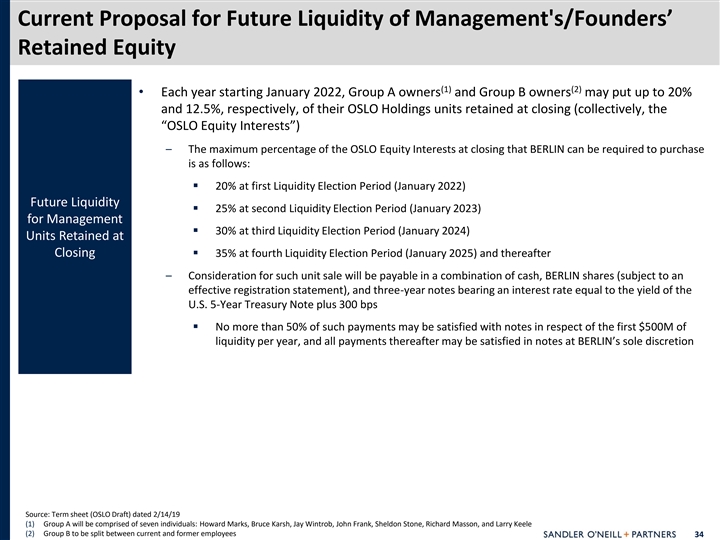

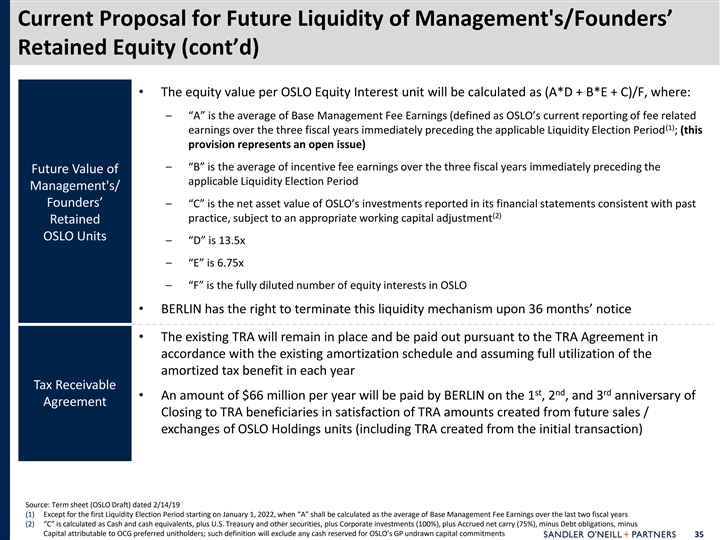

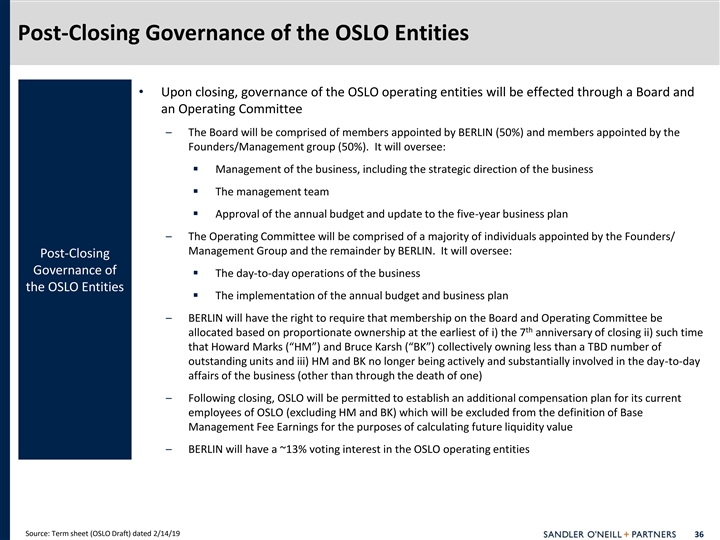

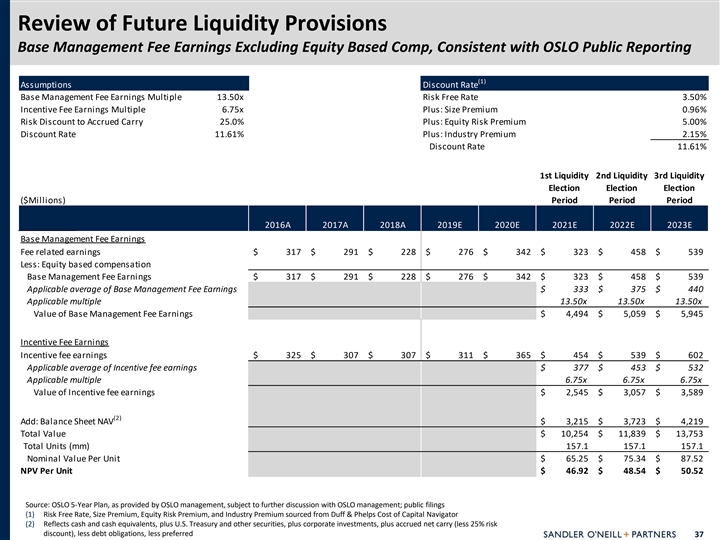

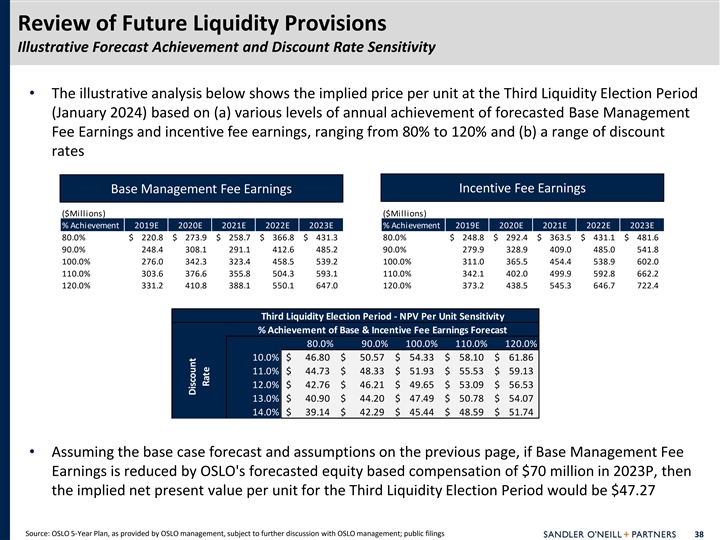

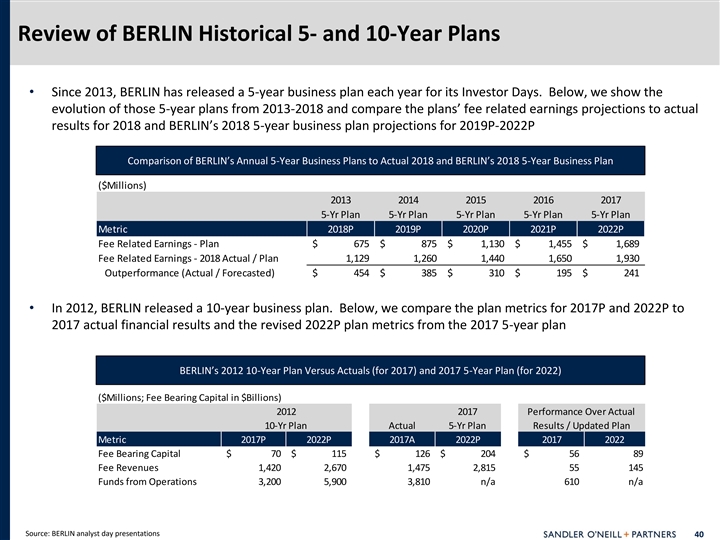

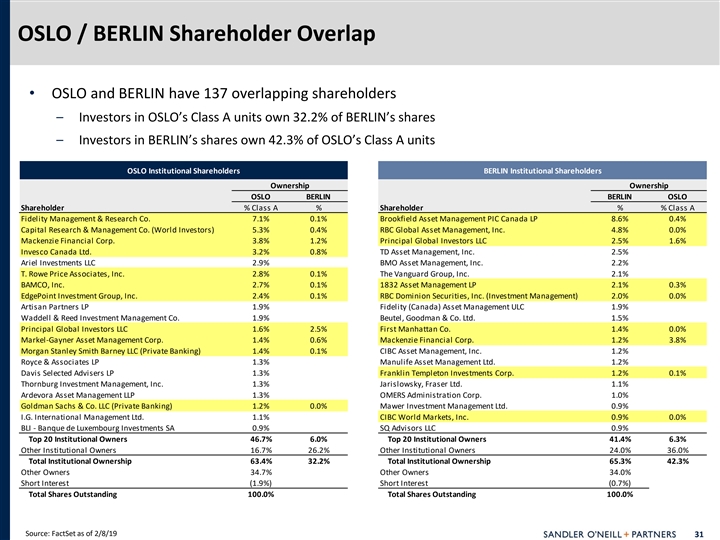

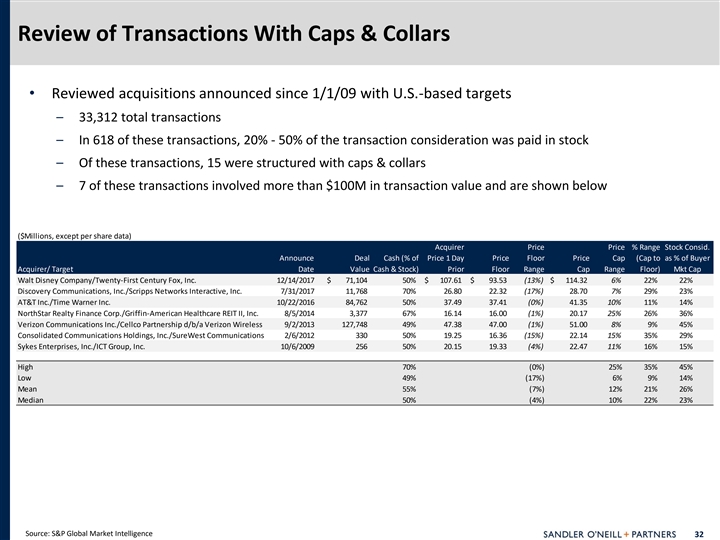

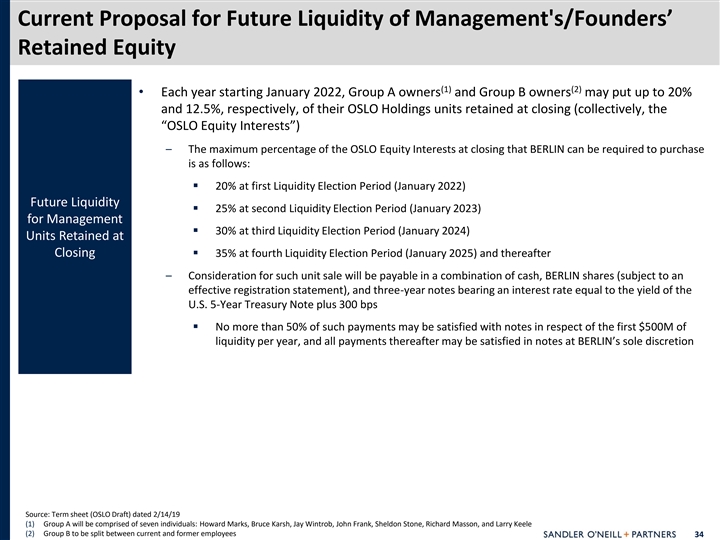

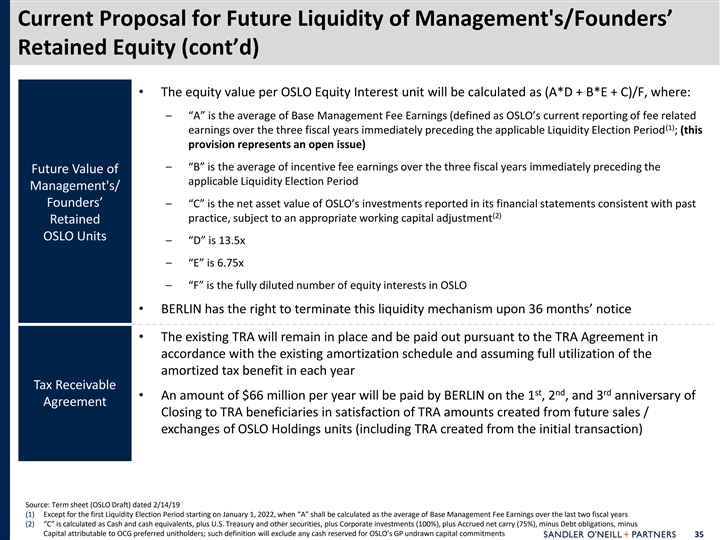

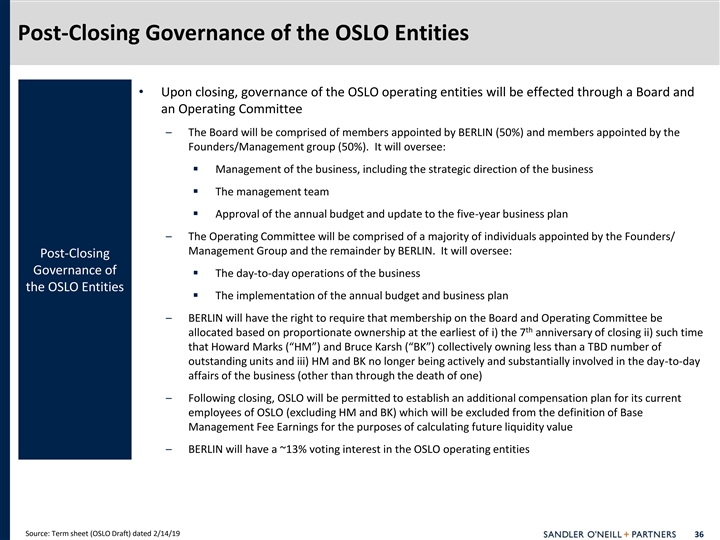

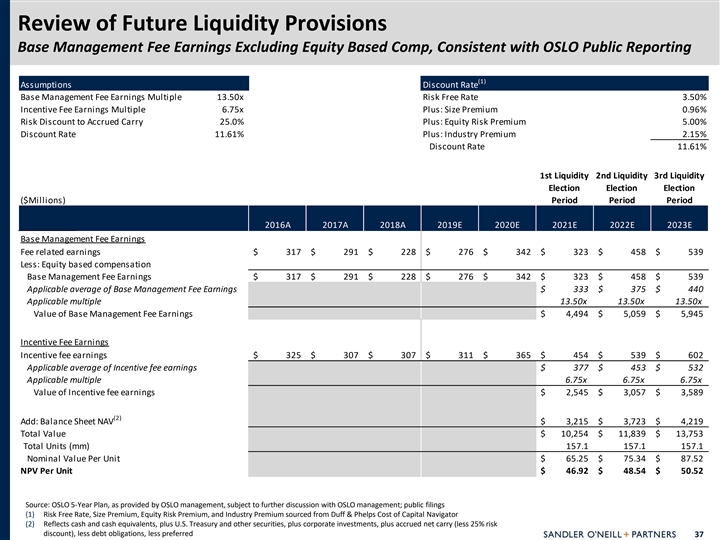

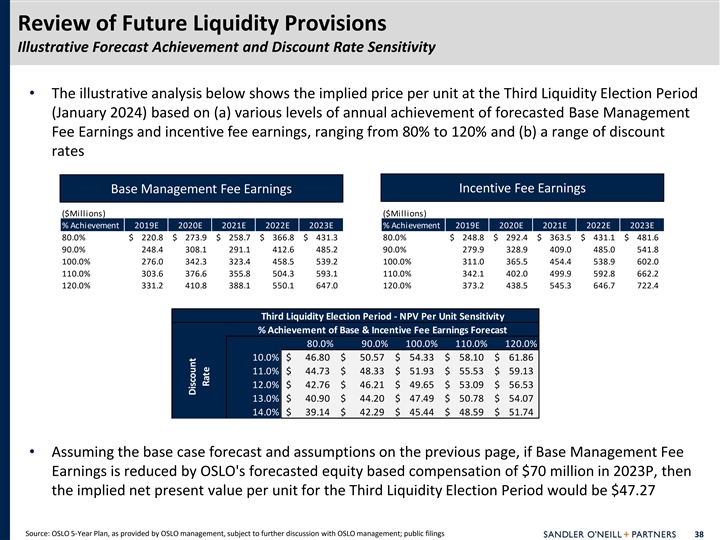

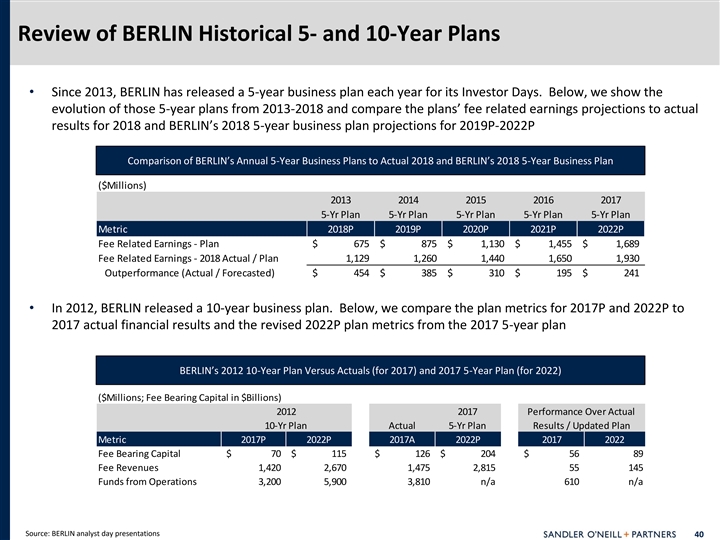

OSLO / BERLIN Shareholder Overlap • OSLO and BERLIN have 137 overlapping shareholders – Investors in OSLO’s Class A units own 32.2% of BERLIN’s shares – Investors in BERLIN’s shares own 42.3% of OSLO’s Class A units OSLO Institutional Shareholders BERLIN Institutional Shareholders Ownership Ownership OSLO BERLIN BERLIN OSLO Shareholder % Class A % Shareholder % % Class A Fidelity Management & Research Co. 7.1% 0.1% Brookfield Asset Management PIC Canada LP 8.6% 0.4% Capital Research & Management Co. (World Investors) 5.3% 0.4% RBC Global Asset Management, Inc. 4.8% 0.0% Mackenzie Financial Corp. 3.8% 1.2% Principal Global Investors LLC 2.5% 1.6% Invesco Canada Ltd. 3.2% 0.8% TD Asset Management, Inc. 2.5% Ariel Investments LLC 2.9% BMO Asset Management, Inc. 2.2% T. Rowe Price Associates, Inc. 2.8% 0.1% The Vanguard Group, Inc. 2.1% BAMCO, Inc. 2.7% 0.1% 1832 Asset Management LP 2.1% 0.3% EdgePoint Investment Group, Inc. 2.4% 0.1% RBC Dominion Securities, Inc. (Investment Management) 2.0% 0.0% Artisan Partners LP 1.9% Fidelity (Canada) Asset Management ULC 1.9% Waddell & Reed Investment Management Co. 1.9% Beutel, Goodman & Co. Ltd. 1.5% Principal Global Investors LLC 1.6% 2.5% First Manhattan Co. 1.4% 0.0% Markel-Gayner Asset Management Corp. 1.4% 0.6% Mackenzie Financial Corp. 1.2% 3.8% Morgan Stanley Smith Barney LLC (Private Banking) 1.4% 0.1% CIBC Asset Management, Inc. 1.2% Royce & Associates LP 1.3% Manulife Asset Management Ltd. 1.2% Davis Selected Advisers LP 1.3% Franklin Templeton Investments Corp. 1.2% 0.1% Thornburg Investment Management, Inc. 1.3% Jarislowsky, Fraser Ltd. 1.1% Ardevora Asset Management LLP 1.3% OMERS Administration Corp. 1.0% Goldman Sachs & Co. LLC (Private Banking) 1.2% 0.0% Mawer Investment Management Ltd. 0.9% I.G. International Management Ltd. 1.1% CIBC World Markets, Inc. 0.9% 0.0% BLI - Banque de Luxembourg Investments SA 0.9% SQ Advisors LLC 0.9% Top 20 Institutional Owners 46.7% 6.0% Top 20 Institutional Owners 41.4% 6.3% Other Institutional Owners 16.7% 26.2% Other Institutional Owners 24.0% 36.0% Total Institutional Ownership 63.4% 32.2% Total Institutional Ownership 65.3% 42.3% Other Owners 34.7% Other Owners 34.0% Short Interest (1.9%) Short Interest (0.7%) Total Shares Outstanding 100.0% Total Shares Outstanding 100.0% Source: FactSet as of 2/8/19 31OSLO / BERLIN Shareholder Overlap • OSLO and BERLIN have 137 overlapping shareholders – Investors in OSLO’s Class A units own 32.2% of BERLIN’s shares – Investors in BERLIN’s shares own 42.3% of OSLO’s Class A units OSLO Institutional Shareholders BERLIN Institutional Shareholders Ownership Ownership OSLO BERLIN BERLIN OSLO Shareholder % Class A % Shareholder % % Class A Fidelity Management & Research Co. 7.1% 0.1% Brookfield Asset Management PIC Canada LP 8.6% 0.4% Capital Research & Management Co. (World Investors) 5.3% 0.4% RBC Global Asset Management, Inc. 4.8% 0.0% Mackenzie Financial Corp. 3.8% 1.2% Principal Global Investors LLC 2.5% 1.6% Invesco Canada Ltd. 3.2% 0.8% TD Asset Management, Inc. 2.5% Ariel Investments LLC 2.9% BMO Asset Management, Inc. 2.2% T. Rowe Price Associates, Inc. 2.8% 0.1% The Vanguard Group, Inc. 2.1% BAMCO, Inc. 2.7% 0.1% 1832 Asset Management LP 2.1% 0.3% EdgePoint Investment Group, Inc. 2.4% 0.1% RBC Dominion Securities, Inc. (Investment Management) 2.0% 0.0% Artisan Partners LP 1.9% Fidelity (Canada) Asset Management ULC 1.9% Waddell & Reed Investment Management Co. 1.9% Beutel, Goodman & Co. Ltd. 1.5% Principal Global Investors LLC 1.6% 2.5% First Manhattan Co. 1.4% 0.0% Markel-Gayner Asset Management Corp. 1.4% 0.6% Mackenzie Financial Corp. 1.2% 3.8% Morgan Stanley Smith Barney LLC (Private Banking) 1.4% 0.1% CIBC Asset Management, Inc. 1.2% Royce & Associates LP 1.3% Manulife Asset Management Ltd. 1.2% Davis Selected Advisers LP 1.3% Franklin Templeton Investments Corp. 1.2% 0.1% Thornburg Investment Management, Inc. 1.3% Jarislowsky, Fraser Ltd. 1.1% Ardevora Asset Management LLP 1.3% OMERS Administration Corp. 1.0% Goldman Sachs & Co. LLC (Private Banking) 1.2% 0.0% Mawer Investment Management Ltd. 0.9% I.G. International Management Ltd. 1.1% CIBC World Markets, Inc. 0.9% 0.0% BLI - Banque de Luxembourg Investments SA 0.9% SQ Advisors LLC 0.9% Top 20 Institutional Owners 46.7% 6.0% Top 20 Institutional Owners 41.4% 6.3% Other Institutional Owners 16.7% 26.2% Other Institutional Owners 24.0% 36.0% Total Institutional Ownership 63.4% 32.2% Total Institutional Ownership 65.3% 42.3% Other Owners 34.7% Other Owners 34.0% Short Interest (1.9%) Short Interest (0.7%) Total Shares Outstanding 100.0% Total Shares Outstanding 100.0% Source: FactSet as of 2/8/19 31