Exhibit (c)(5) Preliminary Draft – Not for Reliance; Subject to Change and Further Review Project Atlas – Supplementary Oslo Valuation Materials November 2018Exhibit (c)(5) Preliminary Draft – Not for Reliance; Subject to Change and Further Review Project Atlas – Supplementary Oslo Valuation Materials November 2018

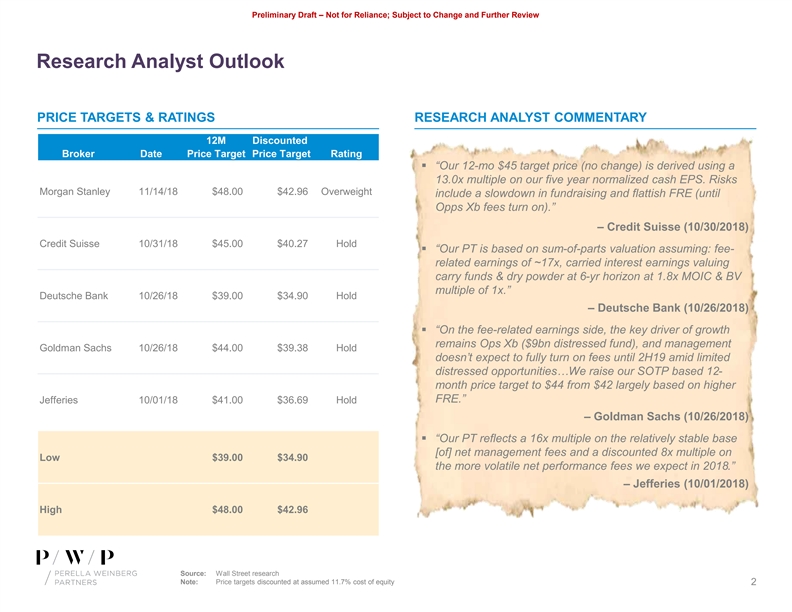

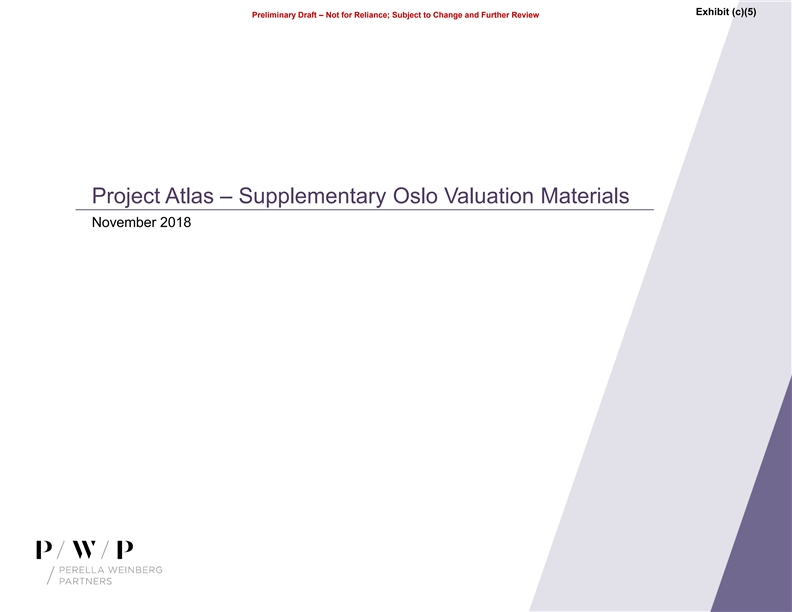

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Research Analyst Outlook PRICE TARGETS & RATINGS RESEARCH ANALYST COMMENTARY 12M Discounted Broker Date Price Target Price Target Rating § “Our 12-mo $45 target price (no change) is derived using a 13.0x multiple on our five year normalized cash EPS. Risks Morgan Stanley 11/14/18 $48.00 $42.96 Overweight include a slowdown in fundraising and flattish FRE (until Opps Xb fees turn on).” – Credit Suisse (10/30/2018) Credit Suisse 10/31/18 $45.00 $40.27 Hold § “Our PT is based on sum-of-parts valuation assuming: fee- related earnings of ~17x, carried interest earnings valuing carry funds & dry powder at 6-yr horizon at 1.8x MOIC & BV multiple of 1x.” Deutsche Bank 10/26/18 $39.00 $34.90 Hold – Deutsche Bank (10/26/2018) § “On the fee-related earnings side, the key driver of growth remains Ops Xb ($9bn distressed fund), and management Goldman Sachs 10/26/18 $44.00 $39.38 Hold doesn’t expect to fully turn on fees until 2H19 amid limited distressed opportunities…We raise our SOTP based 12- month price target to $44 from $42 largely based on higher FRE.” Jefferies 10/01/18 $41.00 $36.69 Hold – Goldman Sachs (10/26/2018) § “Our PT reflects a 16x multiple on the relatively stable base [of] net management fees and a discounted 8x multiple on Low $39.00 $34.90 the more volatile net performance fees we expect in 2018.” – Jefferies (10/01/2018) High $48.00 $42.96 Source: Wall Street research Note: Price targets discounted at assumed 11.7% cost of equity 2Preliminary Draft – Not for Reliance; Subject to Change and Further Review Research Analyst Outlook PRICE TARGETS & RATINGS RESEARCH ANALYST COMMENTARY 12M Discounted Broker Date Price Target Price Target Rating § “Our 12-mo $45 target price (no change) is derived using a 13.0x multiple on our five year normalized cash EPS. Risks Morgan Stanley 11/14/18 $48.00 $42.96 Overweight include a slowdown in fundraising and flattish FRE (until Opps Xb fees turn on).” – Credit Suisse (10/30/2018) Credit Suisse 10/31/18 $45.00 $40.27 Hold § “Our PT is based on sum-of-parts valuation assuming: fee- related earnings of ~17x, carried interest earnings valuing carry funds & dry powder at 6-yr horizon at 1.8x MOIC & BV multiple of 1x.” Deutsche Bank 10/26/18 $39.00 $34.90 Hold – Deutsche Bank (10/26/2018) § “On the fee-related earnings side, the key driver of growth remains Ops Xb ($9bn distressed fund), and management Goldman Sachs 10/26/18 $44.00 $39.38 Hold doesn’t expect to fully turn on fees until 2H19 amid limited distressed opportunities…We raise our SOTP based 12- month price target to $44 from $42 largely based on higher FRE.” Jefferies 10/01/18 $41.00 $36.69 Hold – Goldman Sachs (10/26/2018) § “Our PT reflects a 16x multiple on the relatively stable base [of] net management fees and a discounted 8x multiple on Low $39.00 $34.90 the more volatile net performance fees we expect in 2018.” – Jefferies (10/01/2018) High $48.00 $42.96 Source: Wall Street research Note: Price targets discounted at assumed 11.7% cost of equity 2

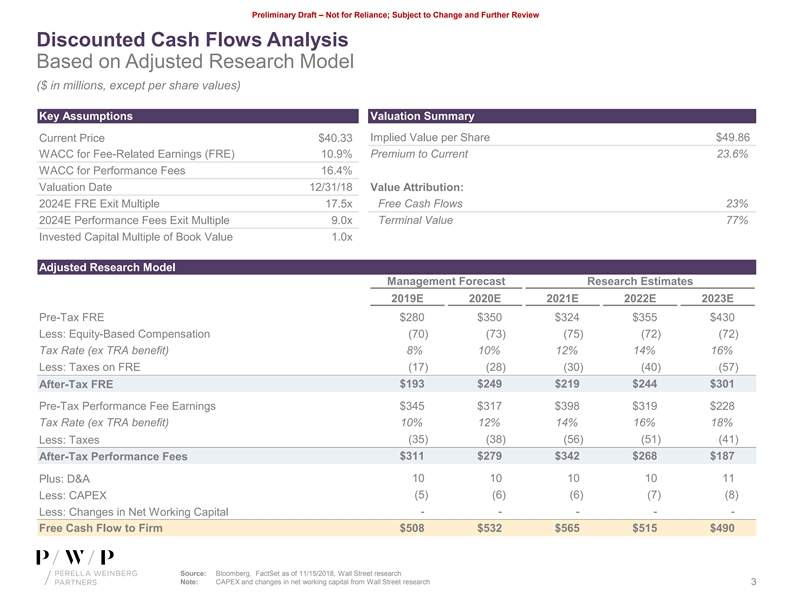

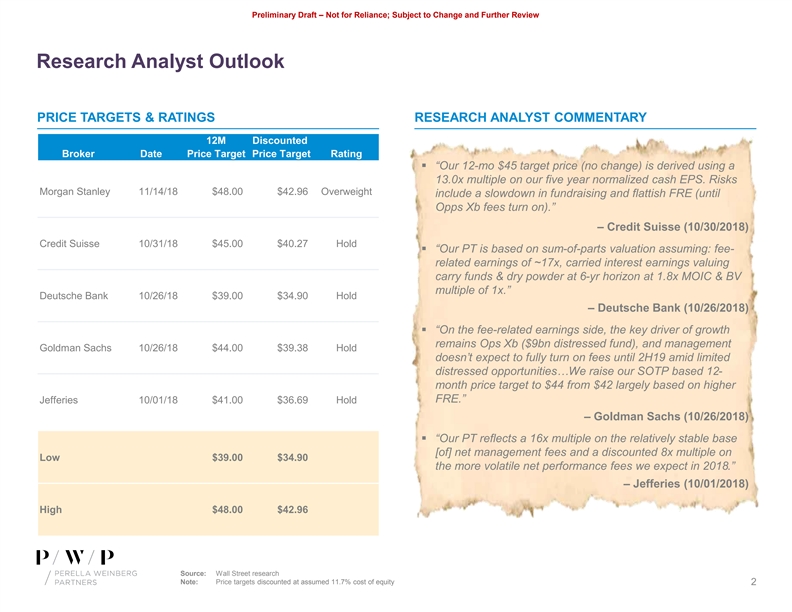

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Discounted Cash Flows Analysis Based on Adjusted Research Model ($ in millions, except per share values) Key Assumptions Valuation Summary Implied Value per Share $49.86 Current Price $40.33 WACC for Fee-Related Earnings (FRE) 10.9% Premium to Current 23.6% WACC for Performance Fees 16.4% Valuation Date 12/31/18 Value Attribution: Free Cash Flows 23% 2024E FRE Exit Multiple 17.5x 2024E Performance Fees Exit Multiple 9.0x Terminal Value 77% Invested Capital Multiple of Book Value 1.0x Adjusted Research Model Management Forecast Research Estimates 2019E 2020E 2021E 2022E 2023E Pre-Tax FRE $280 $350 $324 $355 $430 Less: Equity-Based Compensation (70) (73) (75) (72) (72) Tax Rate (ex TRA benefit) 8% 10% 12% 14% 16% Less: Taxes on FRE (17) (28) (30) (40) (57) After-Tax FRE $193 $249 $219 $244 $301 Pre-Tax Performance Fee Earnings $345 $317 $398 $319 $228 Tax Rate (ex TRA benefit) 10% 12% 14% 16% 18% (35) (38) (56) (51) (41) Less: Taxes After-Tax Performance Fees $311 $279 $342 $268 $187 10 10 10 10 11 Plus: D&A Less: CAPEX (5) (6) (6) (7) (8) - - - - - Less: Changes in Net Working Capital Free Cash Flow to Firm $508 $532 $565 $515 $490 Source: Bloomberg, FactSet as of 11/15/2018, Wall Street research Note: CAPEX and changes in net working capital from Wall Street research 3Preliminary Draft – Not for Reliance; Subject to Change and Further Review Discounted Cash Flows Analysis Based on Adjusted Research Model ($ in millions, except per share values) Key Assumptions Valuation Summary Implied Value per Share $49.86 Current Price $40.33 WACC for Fee-Related Earnings (FRE) 10.9% Premium to Current 23.6% WACC for Performance Fees 16.4% Valuation Date 12/31/18 Value Attribution: Free Cash Flows 23% 2024E FRE Exit Multiple 17.5x 2024E Performance Fees Exit Multiple 9.0x Terminal Value 77% Invested Capital Multiple of Book Value 1.0x Adjusted Research Model Management Forecast Research Estimates 2019E 2020E 2021E 2022E 2023E Pre-Tax FRE $280 $350 $324 $355 $430 Less: Equity-Based Compensation (70) (73) (75) (72) (72) Tax Rate (ex TRA benefit) 8% 10% 12% 14% 16% Less: Taxes on FRE (17) (28) (30) (40) (57) After-Tax FRE $193 $249 $219 $244 $301 Pre-Tax Performance Fee Earnings $345 $317 $398 $319 $228 Tax Rate (ex TRA benefit) 10% 12% 14% 16% 18% (35) (38) (56) (51) (41) Less: Taxes After-Tax Performance Fees $311 $279 $342 $268 $187 10 10 10 10 11 Plus: D&A Less: CAPEX (5) (6) (6) (7) (8) - - - - - Less: Changes in Net Working Capital Free Cash Flow to Firm $508 $532 $565 $515 $490 Source: Bloomberg, FactSet as of 11/15/2018, Wall Street research Note: CAPEX and changes in net working capital from Wall Street research 3

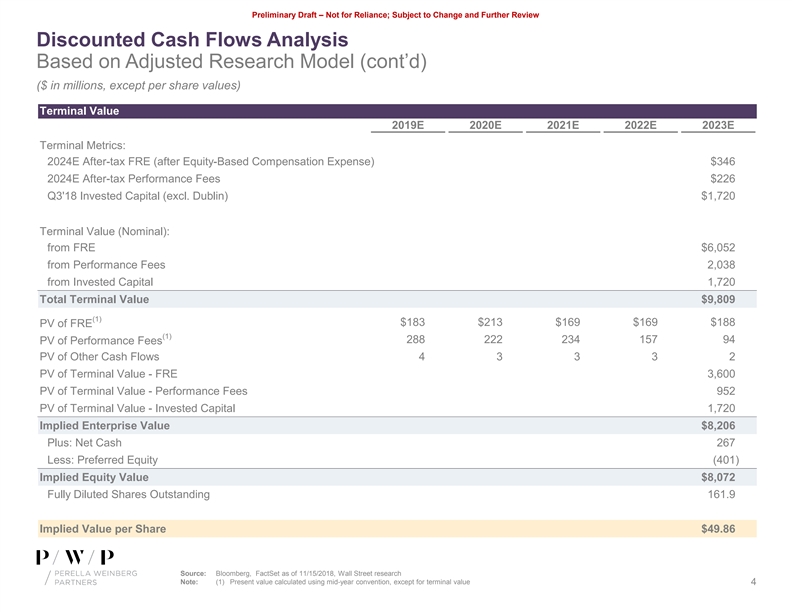

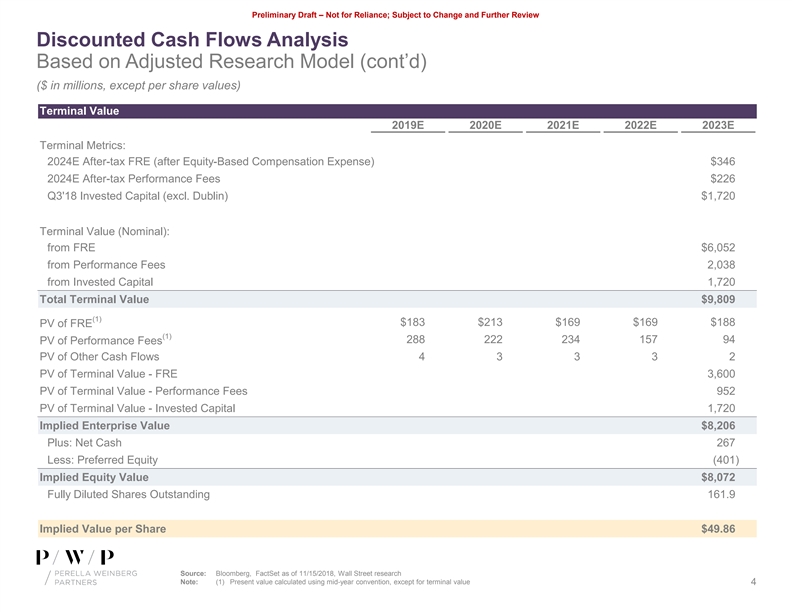

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Discounted Cash Flows Analysis Based on Adjusted Research Model (cont’d) ($ in millions, except per share values) Terminal Value 2019E 2020E 2021E 2022E 2023E Terminal Metrics: 2024E After-tax FRE (after Equity-Based Compensation Expense) $346 2024E After-tax Performance Fees $226 Q3'18 Invested Capital (excl. Dublin) $1,720 Terminal Value (Nominal): from FRE $6,052 from Performance Fees 2,038 from Invested Capital 1,720 Total Terminal Value $9,809 (1) $183 $213 $169 $169 $188 PV of FRE (1) 288 222 234 157 94 PV of Performance Fees PV of Other Cash Flows 4 3 3 3 2 PV of Terminal Value - FRE 3,600 PV of Terminal Value - Performance Fees 952 PV of Terminal Value - Invested Capital 1,720 Implied Enterprise Value $8,206 Plus: Net Cash 267 Less: Preferred Equity (401) Implied Equity Value $8,072 Fully Diluted Shares Outstanding 161.9 Implied Value per Share $49.86 Source: Bloomberg, FactSet as of 11/15/2018, Wall Street research Note: (1) Present value calculated using mid-year convention, except for terminal value 4Preliminary Draft – Not for Reliance; Subject to Change and Further Review Discounted Cash Flows Analysis Based on Adjusted Research Model (cont’d) ($ in millions, except per share values) Terminal Value 2019E 2020E 2021E 2022E 2023E Terminal Metrics: 2024E After-tax FRE (after Equity-Based Compensation Expense) $346 2024E After-tax Performance Fees $226 Q3'18 Invested Capital (excl. Dublin) $1,720 Terminal Value (Nominal): from FRE $6,052 from Performance Fees 2,038 from Invested Capital 1,720 Total Terminal Value $9,809 (1) $183 $213 $169 $169 $188 PV of FRE (1) 288 222 234 157 94 PV of Performance Fees PV of Other Cash Flows 4 3 3 3 2 PV of Terminal Value - FRE 3,600 PV of Terminal Value - Performance Fees 952 PV of Terminal Value - Invested Capital 1,720 Implied Enterprise Value $8,206 Plus: Net Cash 267 Less: Preferred Equity (401) Implied Equity Value $8,072 Fully Diluted Shares Outstanding 161.9 Implied Value per Share $49.86 Source: Bloomberg, FactSet as of 11/15/2018, Wall Street research Note: (1) Present value calculated using mid-year convention, except for terminal value 4

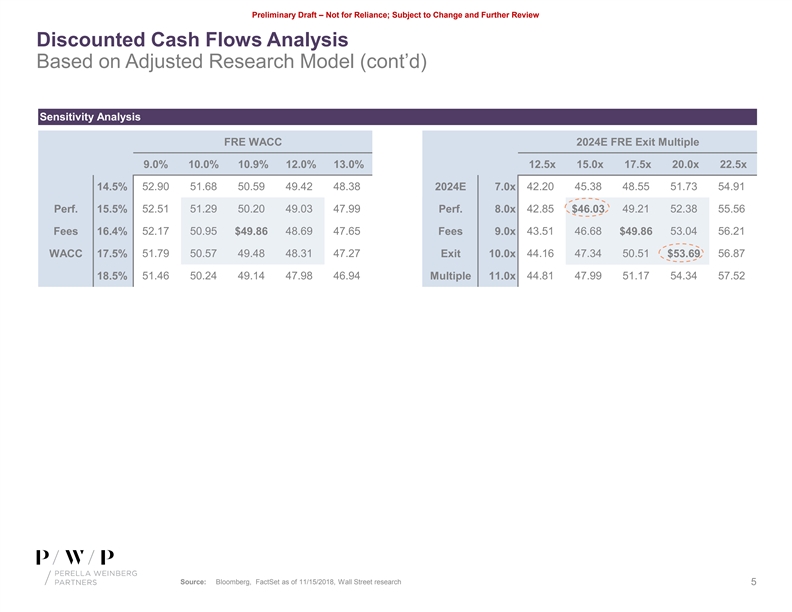

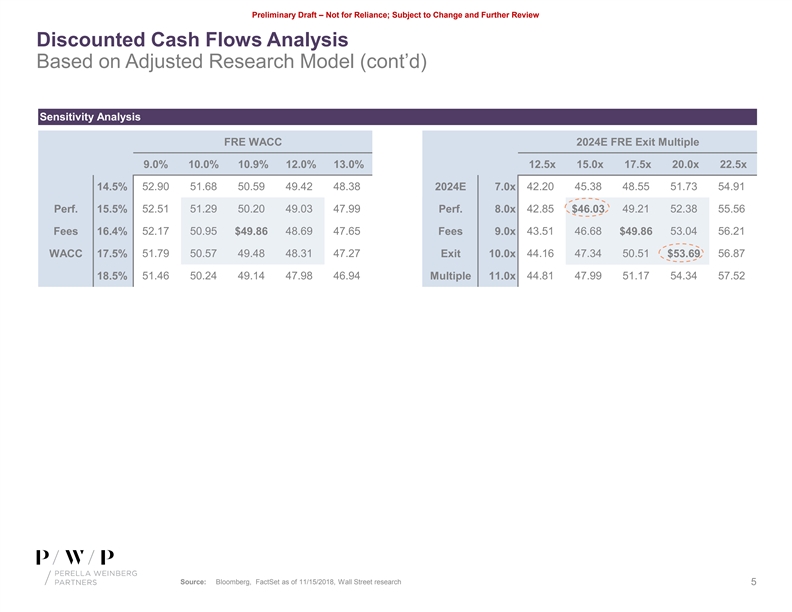

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Discounted Cash Flows Analysis Based on Adjusted Research Model (cont’d) Sensitivity Analysis FRE WACC 2024E FRE Exit Multiple 9.0% 10.0% 10.9% 12.0% 13.0% 12.5x 15.0x 17.5x 20.0x 22.5x 14.5% 52.90 51.68 50.59 49.42 48.38 2024E 7.0x 42.20 45.38 48.55 51.73 54.91 Perf. 15.5% 52.51 51.29 50.20 49.03 47.99 Perf. 8.0x 42.85 $46.03 49.21 52.38 55.56 Fees 16.4% 52.17 50.95 $49.86 48.69 47.65 Fees 9.0x 43.51 46.68 $49.86 53.04 56.21 WACC 17.5% 51.79 50.57 49.48 48.31 47.27 Exit 10.0x 44.16 47.34 50.51 $53.69 56.87 51.46 50.24 49.14 47.98 46.94 44.81 47.99 51.17 54.34 57.52 18.5% Multiple 11.0x Source: Bloomberg, FactSet as of 11/15/2018, Wall Street research 5Preliminary Draft – Not for Reliance; Subject to Change and Further Review Discounted Cash Flows Analysis Based on Adjusted Research Model (cont’d) Sensitivity Analysis FRE WACC 2024E FRE Exit Multiple 9.0% 10.0% 10.9% 12.0% 13.0% 12.5x 15.0x 17.5x 20.0x 22.5x 14.5% 52.90 51.68 50.59 49.42 48.38 2024E 7.0x 42.20 45.38 48.55 51.73 54.91 Perf. 15.5% 52.51 51.29 50.20 49.03 47.99 Perf. 8.0x 42.85 $46.03 49.21 52.38 55.56 Fees 16.4% 52.17 50.95 $49.86 48.69 47.65 Fees 9.0x 43.51 46.68 $49.86 53.04 56.21 WACC 17.5% 51.79 50.57 49.48 48.31 47.27 Exit 10.0x 44.16 47.34 50.51 $53.69 56.87 51.46 50.24 49.14 47.98 46.94 44.81 47.99 51.17 54.34 57.52 18.5% Multiple 11.0x Source: Bloomberg, FactSet as of 11/15/2018, Wall Street research 5

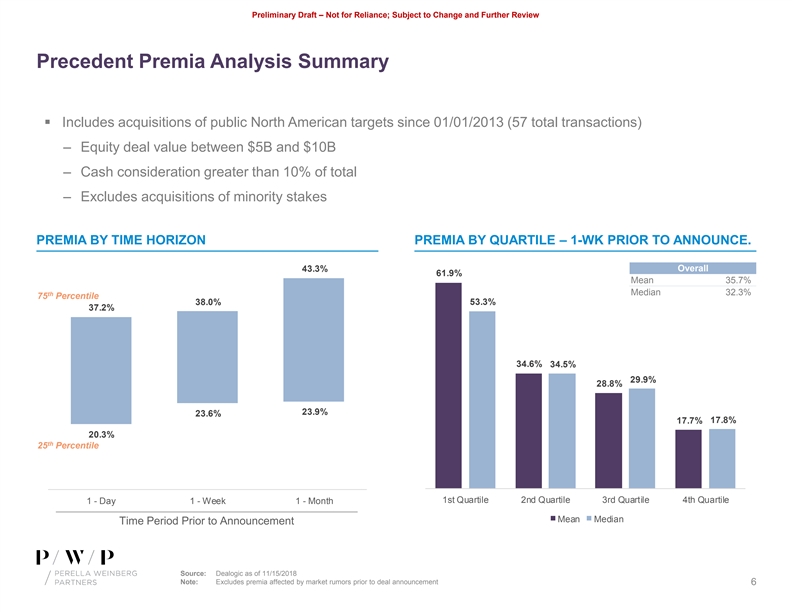

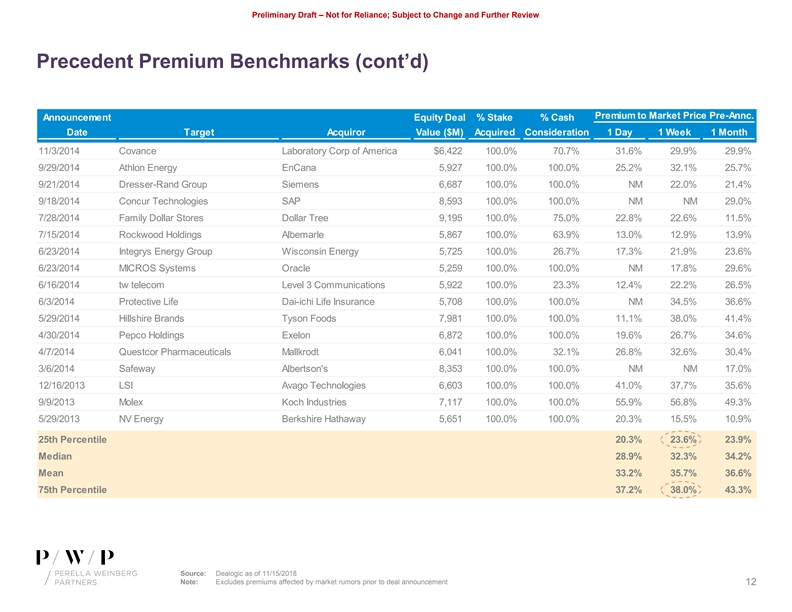

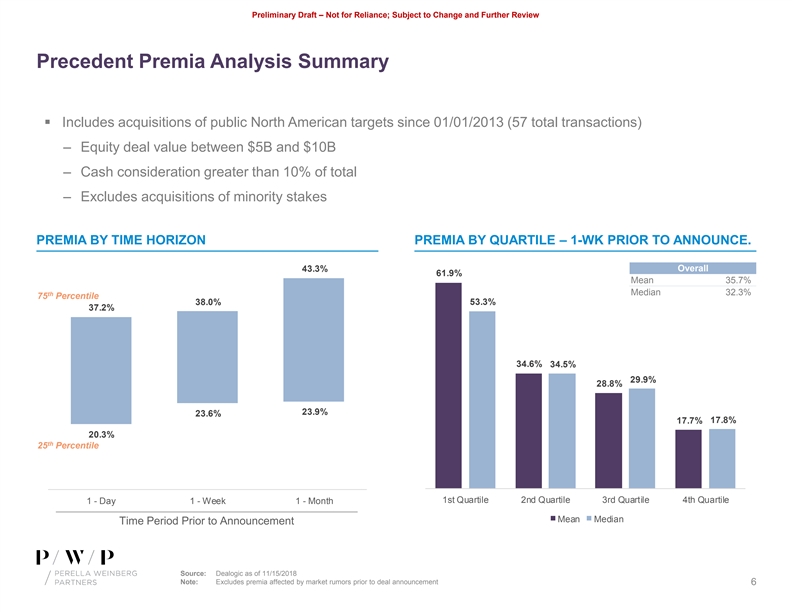

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premia Analysis Summary § Includes acquisitions of public North American targets since 01/01/2013 (57 total transactions) – Equity deal value between $5B and $10B – Cash consideration greater than 10% of total – Excludes acquisitions of minority stakes PREMIA BY TIME HORIZON PREMIA BY QUARTILE – 1-WK PRIOR TO ANNOUNCE. Overall 43.3% 61.9% Mean 35.7% Median 32.3% th 75 Percentile 38.0% 53.3% 37.2% 34.6% 34.5% 29.9% 28.8% 23.9% 23.6% 17.8% 17.7% 20.3% th 25 Percentile 1st Quartile 2nd Quartile 3rd Quartile 4th Quartile 1 - Day 1 - Week 1 - Month Mean Median Time Period Prior to Announcement Source: Dealogic as of 11/15/2018 Note: Excludes premia affected by market rumors prior to deal announcement 6Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premia Analysis Summary § Includes acquisitions of public North American targets since 01/01/2013 (57 total transactions) – Equity deal value between $5B and $10B – Cash consideration greater than 10% of total – Excludes acquisitions of minority stakes PREMIA BY TIME HORIZON PREMIA BY QUARTILE – 1-WK PRIOR TO ANNOUNCE. Overall 43.3% 61.9% Mean 35.7% Median 32.3% th 75 Percentile 38.0% 53.3% 37.2% 34.6% 34.5% 29.9% 28.8% 23.9% 23.6% 17.8% 17.7% 20.3% th 25 Percentile 1st Quartile 2nd Quartile 3rd Quartile 4th Quartile 1 - Day 1 - Week 1 - Month Mean Median Time Period Prior to Announcement Source: Dealogic as of 11/15/2018 Note: Excludes premia affected by market rumors prior to deal announcement 6

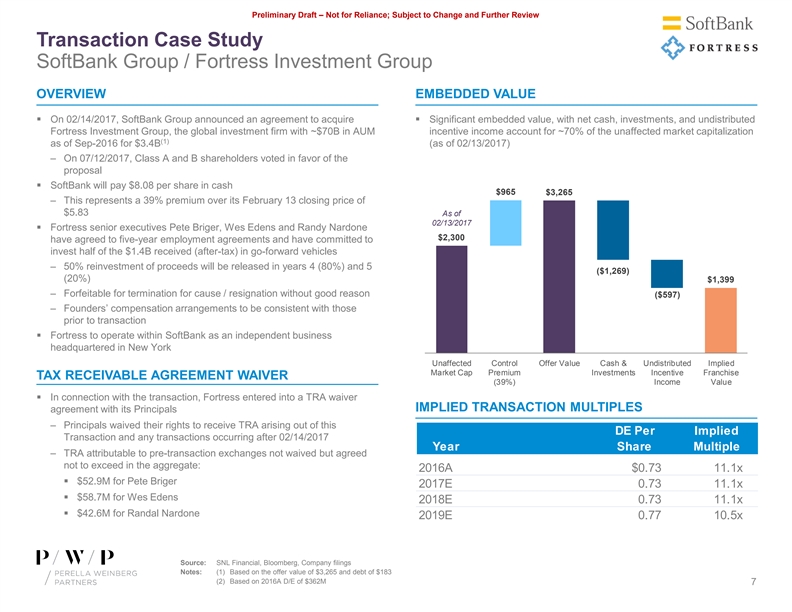

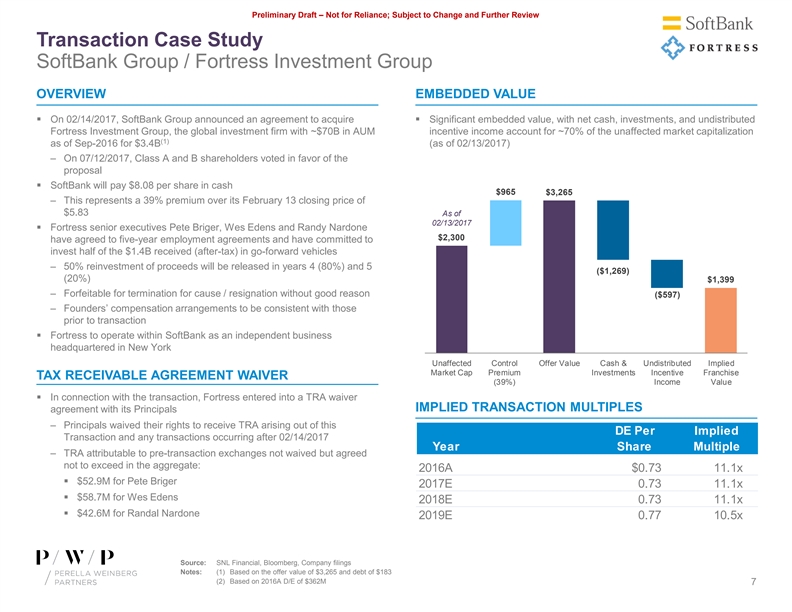

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Transaction Case Study SoftBank Group / Fortress Investment Group OVERVIEW EMBEDDED VALUE § On 02/14/2017, SoftBank Group announced an agreement to acquire § Significant embedded value, with net cash, investments, and undistributed Fortress Investment Group, the global investment firm with ~$70B in AUM incentive income account for ~70% of the unaffected market capitalization (1) as of Sep-2016 for $3.4B (as of 02/13/2017) – On 07/12/2017, Class A and B shareholders voted in favor of the proposal § SoftBank will pay $8.08 per share in cash $965 $3,265 – This represents a 39% premium over its February 13 closing price of $5.83 As of 02/13/2017 § Fortress senior executives Pete Briger, Wes Edens and Randy Nardone $2,300 have agreed to five-year employment agreements and have committed to invest half of the $1.4B received (after-tax) in go-forward vehicles – 50% reinvestment of proceeds will be released in years 4 (80%) and 5 ($1,269) (20%) $1,399 – Forfeitable for termination for cause / resignation without good reason ($597) – Founders’ compensation arrangements to be consistent with those prior to transaction § Fortress to operate within SoftBank as an independent business headquartered in New York Unaffected Control Offer Value Cash & Undistributed Implied Market Cap Premium Investments Incentive Franchise TAX RECEIVABLE AGREEMENT WAIVER (39%) Income Value § In connection with the transaction, Fortress entered into a TRA waiver IMPLIED TRANSACTION MULTIPLES agreement with its Principals – Principals waived their rights to receive TRA arising out of this DE Per Implied Transaction and any transactions occurring after 02/14/2017 Year Share Multiple – TRA attributable to pre-transaction exchanges not waived but agreed not to exceed in the aggregate: 2016A $0.73 11.1x § $52.9M for Pete Briger 2017E 0.73 11.1x § $58.7M for Wes Edens 2018E 0.73 11.1x § $42.6M for Randal Nardone 2019E 0.77 10.5x Source: SNL Financial, Bloomberg, Company filings Notes: (1) Based on the offer value of $3,265 and debt of $183 (2) Based on 2016A D/E of $362M 7Preliminary Draft – Not for Reliance; Subject to Change and Further Review Transaction Case Study SoftBank Group / Fortress Investment Group OVERVIEW EMBEDDED VALUE § On 02/14/2017, SoftBank Group announced an agreement to acquire § Significant embedded value, with net cash, investments, and undistributed Fortress Investment Group, the global investment firm with ~$70B in AUM incentive income account for ~70% of the unaffected market capitalization (1) as of Sep-2016 for $3.4B (as of 02/13/2017) – On 07/12/2017, Class A and B shareholders voted in favor of the proposal § SoftBank will pay $8.08 per share in cash $965 $3,265 – This represents a 39% premium over its February 13 closing price of $5.83 As of 02/13/2017 § Fortress senior executives Pete Briger, Wes Edens and Randy Nardone $2,300 have agreed to five-year employment agreements and have committed to invest half of the $1.4B received (after-tax) in go-forward vehicles – 50% reinvestment of proceeds will be released in years 4 (80%) and 5 ($1,269) (20%) $1,399 – Forfeitable for termination for cause / resignation without good reason ($597) – Founders’ compensation arrangements to be consistent with those prior to transaction § Fortress to operate within SoftBank as an independent business headquartered in New York Unaffected Control Offer Value Cash & Undistributed Implied Market Cap Premium Investments Incentive Franchise TAX RECEIVABLE AGREEMENT WAIVER (39%) Income Value § In connection with the transaction, Fortress entered into a TRA waiver IMPLIED TRANSACTION MULTIPLES agreement with its Principals – Principals waived their rights to receive TRA arising out of this DE Per Implied Transaction and any transactions occurring after 02/14/2017 Year Share Multiple – TRA attributable to pre-transaction exchanges not waived but agreed not to exceed in the aggregate: 2016A $0.73 11.1x § $52.9M for Pete Briger 2017E 0.73 11.1x § $58.7M for Wes Edens 2018E 0.73 11.1x § $42.6M for Randal Nardone 2019E 0.77 10.5x Source: SNL Financial, Bloomberg, Company filings Notes: (1) Based on the offer value of $3,265 and debt of $183 (2) Based on 2016A D/E of $362M 7

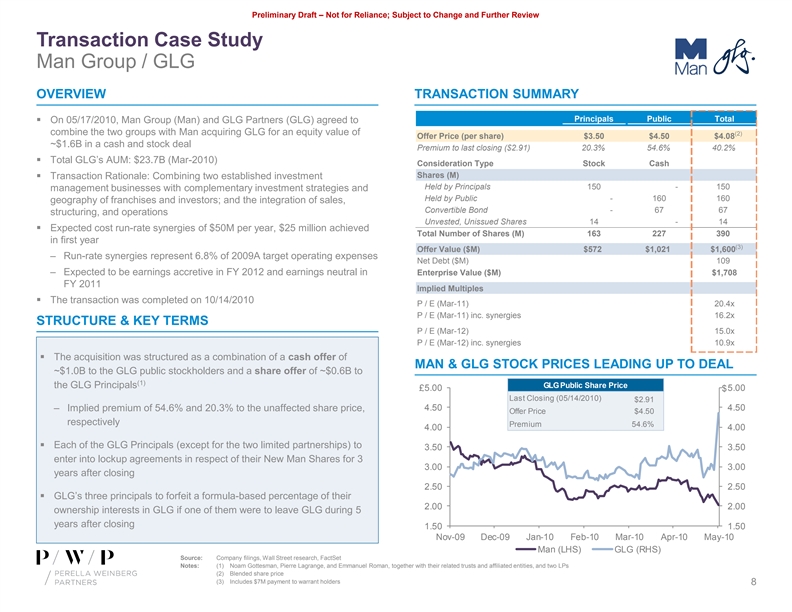

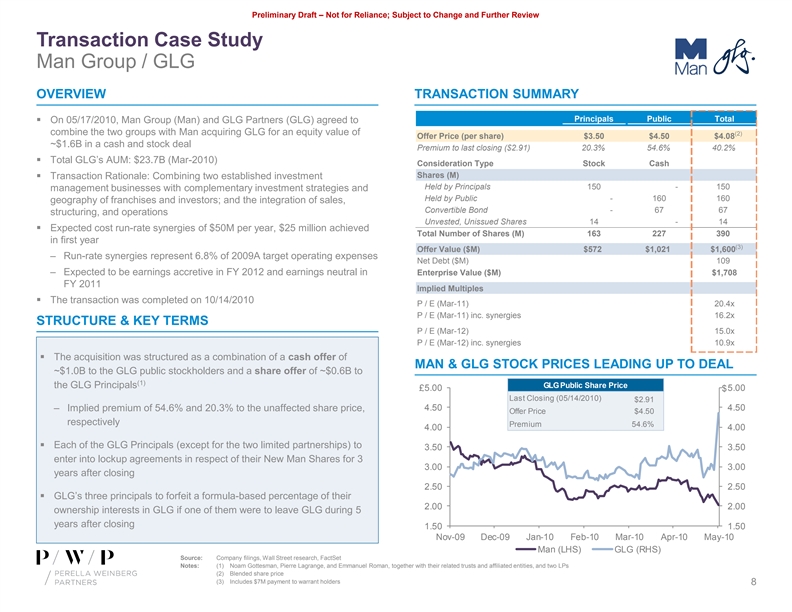

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Transaction Case Study Man Group / GLG OVERVIEW TRANSACTION SUMMARY Principals Public Total § On 05/17/2010, Man Group (Man) and GLG Partners (GLG) agreed to combine the two groups with Man acquiring GLG for an equity value of (2) Offer Price (per share) $3.50 $4.50 $4.08 ~$1.6B in a cash and stock deal Premium to last closing ($2.91) 20.3% 54.6% 40.2% § Total GLG’s AUM: $23.7B (Mar-2010) Consideration Type Stock Cash Shares (M) § Transaction Rationale: Combining two established investment Held by Principals 150 - 150 management businesses with complementary investment strategies and Held by Public - 160 160 geography of franchises and investors; and the integration of sales, Convertible Bond - 67 67 structuring, and operations Unvested, Unissued Shares 14 - 14 § Expected cost run-rate synergies of $50M per year, $25 million achieved Total Number of Shares (M) 163 227 390 in first year (3) Offer Value ($M) $572 $1,021 $1,600 – Run-rate synergies represent 6.8% of 2009A target operating expenses Net Debt ($M) 109 – Expected to be earnings accretive in FY 2012 and earnings neutral in Enterprise Value ($M) $1,708 FY 2011 Implied Multiples § The transaction was completed on 10/14/2010 P / E (Mar-11) 20.4x P / E (Mar-11) inc. synergies 16.2x STRUCTURE & KEY TERMS P / E (Mar-12) 15.0x P / E (Mar-12) inc. synergies 10.9x § The acquisition was structured as a combination of a cash offer of MAN & GLG STOCK PRICES LEADING UP TO DEAL ~$1.0B to the GLG public stockholders and a share offer of ~$0.6B to (1) the GLG Principals GLG Public Share Price £5.00 5.00 $ Last Closing (05/14/2010) $2.91 – Implied premium of 54.6% and 20.3% to the unaffected share price, 4.50 4.50 Offer Price $4.50 respectively Premium 54.6% 4.00 4.00 § Each of the GLG Principals (except for the two limited partnerships) to 3.50 3.50 enter into lockup agreements in respect of their New Man Shares for 3 3.00 3.00 years after closing 2.50 2.50 § GLG’s three principals to forfeit a formula-based percentage of their 2.00 2.00 ownership interests in GLG if one of them were to leave GLG during 5 years after closing 1.50 1.50 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Man (LHS) GLG (RHS) Source: Company filings, Wall Street research, FactSet Notes: (1) Noam Gottesman, Pierre Lagrange, and Emmanuel Roman, together with their related trusts and affiliated entities, and two LPs (2) Blended share price (3) Includes $7M payment to warrant holders 8Preliminary Draft – Not for Reliance; Subject to Change and Further Review Transaction Case Study Man Group / GLG OVERVIEW TRANSACTION SUMMARY Principals Public Total § On 05/17/2010, Man Group (Man) and GLG Partners (GLG) agreed to combine the two groups with Man acquiring GLG for an equity value of (2) Offer Price (per share) $3.50 $4.50 $4.08 ~$1.6B in a cash and stock deal Premium to last closing ($2.91) 20.3% 54.6% 40.2% § Total GLG’s AUM: $23.7B (Mar-2010) Consideration Type Stock Cash Shares (M) § Transaction Rationale: Combining two established investment Held by Principals 150 - 150 management businesses with complementary investment strategies and Held by Public - 160 160 geography of franchises and investors; and the integration of sales, Convertible Bond - 67 67 structuring, and operations Unvested, Unissued Shares 14 - 14 § Expected cost run-rate synergies of $50M per year, $25 million achieved Total Number of Shares (M) 163 227 390 in first year (3) Offer Value ($M) $572 $1,021 $1,600 – Run-rate synergies represent 6.8% of 2009A target operating expenses Net Debt ($M) 109 – Expected to be earnings accretive in FY 2012 and earnings neutral in Enterprise Value ($M) $1,708 FY 2011 Implied Multiples § The transaction was completed on 10/14/2010 P / E (Mar-11) 20.4x P / E (Mar-11) inc. synergies 16.2x STRUCTURE & KEY TERMS P / E (Mar-12) 15.0x P / E (Mar-12) inc. synergies 10.9x § The acquisition was structured as a combination of a cash offer of MAN & GLG STOCK PRICES LEADING UP TO DEAL ~$1.0B to the GLG public stockholders and a share offer of ~$0.6B to (1) the GLG Principals GLG Public Share Price £5.00 5.00 $ Last Closing (05/14/2010) $2.91 – Implied premium of 54.6% and 20.3% to the unaffected share price, 4.50 4.50 Offer Price $4.50 respectively Premium 54.6% 4.00 4.00 § Each of the GLG Principals (except for the two limited partnerships) to 3.50 3.50 enter into lockup agreements in respect of their New Man Shares for 3 3.00 3.00 years after closing 2.50 2.50 § GLG’s three principals to forfeit a formula-based percentage of their 2.00 2.00 ownership interests in GLG if one of them were to leave GLG during 5 years after closing 1.50 1.50 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Man (LHS) GLG (RHS) Source: Company filings, Wall Street research, FactSet Notes: (1) Noam Gottesman, Pierre Lagrange, and Emmanuel Roman, together with their related trusts and affiliated entities, and two LPs (2) Blended share price (3) Includes $7M payment to warrant holders 8

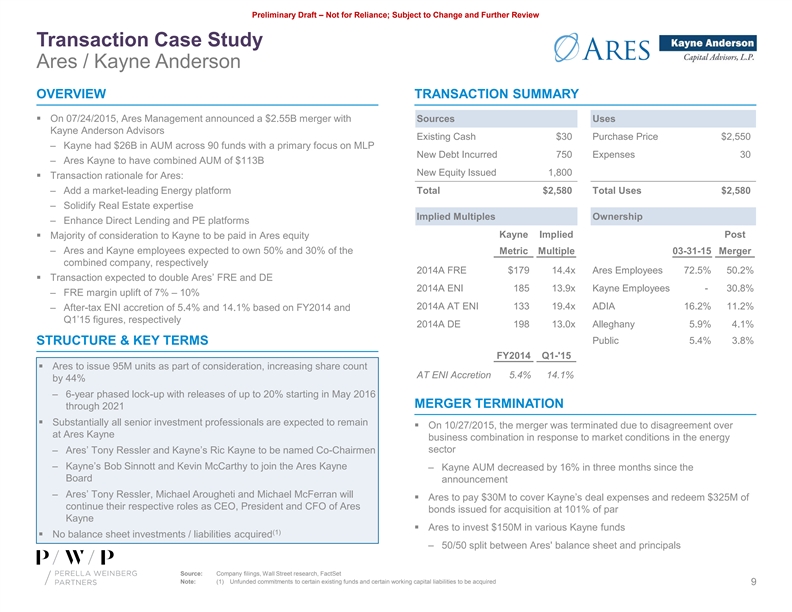

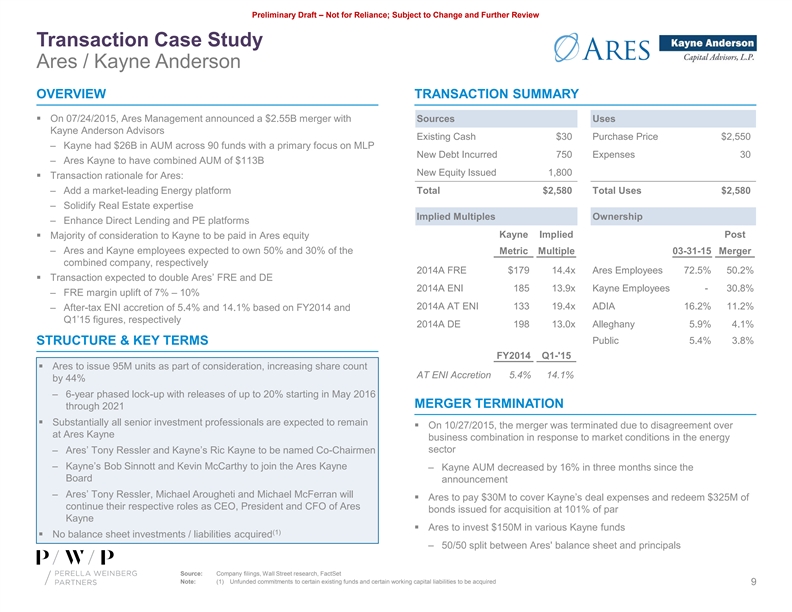

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Transaction Case Study Ares / Kayne Anderson OVERVIEW TRANSACTION SUMMARY § On 07/24/2015, Ares Management announced a $2.55B merger with Sources Uses Kayne Anderson Advisors Existing Cash $30 Purchase Price $2,550 – Kayne had $26B in AUM across 90 funds with a primary focus on MLP New Debt Incurred 750 Expenses 30 – Ares Kayne to have combined AUM of $113B New Equity Issued 1,800 § Transaction rationale for Ares: – Add a market-leading Energy platform Total $2,580 Total Uses $2,580 – Solidify Real Estate expertise Implied Multiples Ownership – Enhance Direct Lending and PE platforms Kayne Implied Post § Majority of consideration to Kayne to be paid in Ares equity – Ares and Kayne employees expected to own 50% and 30% of the Metric Multiple 03-31-15 Merger combined company, respectively 2014A FRE $179 14.4x Ares Employees 72.5% 50.2% § Transaction expected to double Ares’ FRE and DE 2014A ENI 185 13.9x Kayne Employees - 30.8% – FRE margin uplift of 7% – 10% 2014A AT ENI 133 19.4x ADIA 16.2% 11.2% – After-tax ENI accretion of 5.4% and 14.1% based on FY2014 and Q1’15 figures, respectively 2014A DE 198 13.0x Alleghany 5.9% 4.1% Public 5.4% 3.8% STRUCTURE & KEY TERMS FY2014 Q1-'15 § Ares to issue 95M units as part of consideration, increasing share count AT ENI Accretion 5.4% 14.1% by 44% – 6-year phased lock-up with releases of up to 20% starting in May 2016 MERGER TERMINATION through 2021 § Substantially all senior investment professionals are expected to remain § On 10/27/2015, the merger was terminated due to disagreement over at Ares Kayne business combination in response to market conditions in the energy sector – Ares’ Tony Ressler and Kayne’s Ric Kayne to be named Co-Chairmen – Kayne’s Bob Sinnott and Kevin McCarthy to join the Ares Kayne – Kayne AUM decreased by 16% in three months since the Board announcement – Ares’ Tony Ressler, Michael Arougheti and Michael McFerran will § Ares to pay $30M to cover Kayne’s deal expenses and redeem $325M of continue their respective roles as CEO, President and CFO of Ares bonds issued for acquisition at 101% of par Kayne § Ares to invest $150M in various Kayne funds (1) § No balance sheet investments / liabilities acquired – 50/50 split between Ares' balance sheet and principals Source: Company filings, Wall Street research, FactSet Note: (1) Unfunded commitments to certain existing funds and certain working capital liabilities to be acquired 9Preliminary Draft – Not for Reliance; Subject to Change and Further Review Transaction Case Study Ares / Kayne Anderson OVERVIEW TRANSACTION SUMMARY § On 07/24/2015, Ares Management announced a $2.55B merger with Sources Uses Kayne Anderson Advisors Existing Cash $30 Purchase Price $2,550 – Kayne had $26B in AUM across 90 funds with a primary focus on MLP New Debt Incurred 750 Expenses 30 – Ares Kayne to have combined AUM of $113B New Equity Issued 1,800 § Transaction rationale for Ares: – Add a market-leading Energy platform Total $2,580 Total Uses $2,580 – Solidify Real Estate expertise Implied Multiples Ownership – Enhance Direct Lending and PE platforms Kayne Implied Post § Majority of consideration to Kayne to be paid in Ares equity – Ares and Kayne employees expected to own 50% and 30% of the Metric Multiple 03-31-15 Merger combined company, respectively 2014A FRE $179 14.4x Ares Employees 72.5% 50.2% § Transaction expected to double Ares’ FRE and DE 2014A ENI 185 13.9x Kayne Employees - 30.8% – FRE margin uplift of 7% – 10% 2014A AT ENI 133 19.4x ADIA 16.2% 11.2% – After-tax ENI accretion of 5.4% and 14.1% based on FY2014 and Q1’15 figures, respectively 2014A DE 198 13.0x Alleghany 5.9% 4.1% Public 5.4% 3.8% STRUCTURE & KEY TERMS FY2014 Q1-'15 § Ares to issue 95M units as part of consideration, increasing share count AT ENI Accretion 5.4% 14.1% by 44% – 6-year phased lock-up with releases of up to 20% starting in May 2016 MERGER TERMINATION through 2021 § Substantially all senior investment professionals are expected to remain § On 10/27/2015, the merger was terminated due to disagreement over at Ares Kayne business combination in response to market conditions in the energy sector – Ares’ Tony Ressler and Kayne’s Ric Kayne to be named Co-Chairmen – Kayne’s Bob Sinnott and Kevin McCarthy to join the Ares Kayne – Kayne AUM decreased by 16% in three months since the Board announcement – Ares’ Tony Ressler, Michael Arougheti and Michael McFerran will § Ares to pay $30M to cover Kayne’s deal expenses and redeem $325M of continue their respective roles as CEO, President and CFO of Ares bonds issued for acquisition at 101% of par Kayne § Ares to invest $150M in various Kayne funds (1) § No balance sheet investments / liabilities acquired – 50/50 split between Ares' balance sheet and principals Source: Company filings, Wall Street research, FactSet Note: (1) Unfunded commitments to certain existing funds and certain working capital liabilities to be acquired 9

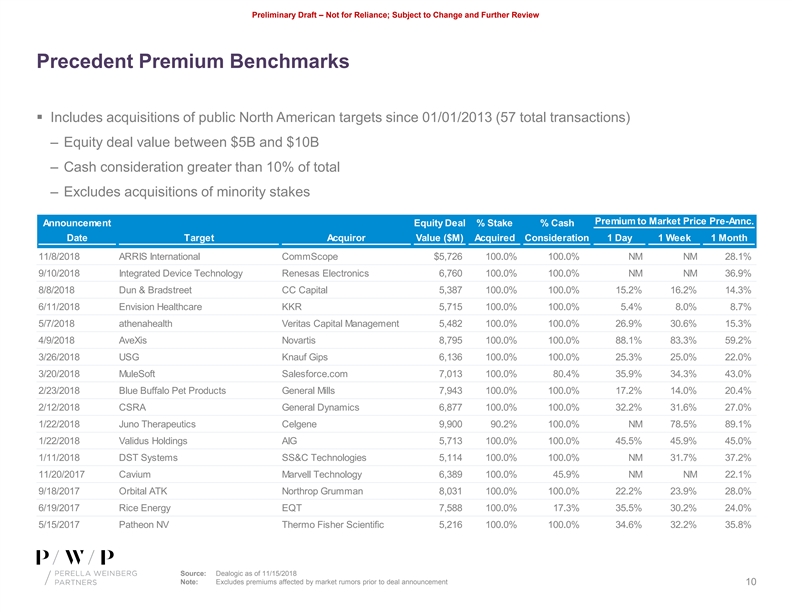

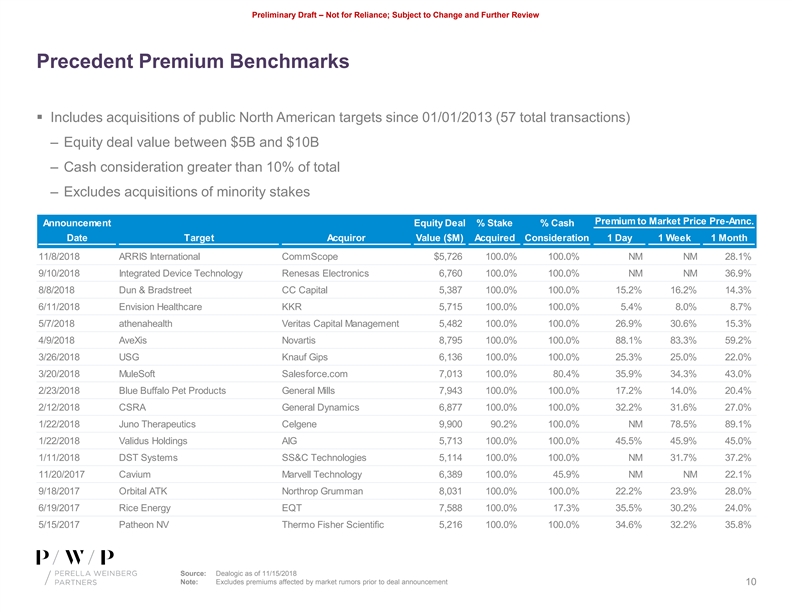

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premium Benchmarks § Includes acquisitions of public North American targets since 01/01/2013 (57 total transactions) – Equity deal value between $5B and $10B – Cash consideration greater than 10% of total – Excludes acquisitions of minority stakes Premium to Market Price Pre-Annc. Announcement Equity Deal % Stake % Cash Date Target Acquiror Value ($M) Acquired Consideration 1 Day 1 Week 1 Month 11/8/2018 ARRIS International CommScope $5,726 100.0% 100.0% NM NM 28.1% 9/10/2018 Integrated Device Technology Renesas Electronics 6,760 100.0% 100.0% NM NM 36.9% 8/8/2018 Dun & Bradstreet CC Capital 5,387 100.0% 100.0% 15.2% 16.2% 14.3% 6/11/2018 Envision Healthcare KKR 5,715 100.0% 100.0% 5.4% 8.0% 8.7% 5/7/2018 athenahealth Veritas Capital Management 5,482 100.0% 100.0% 26.9% 30.6% 15.3% 4/9/2018 AveXis Novartis 8,795 100.0% 100.0% 88.1% 83.3% 59.2% 3/26/2018 USG Knauf Gips 6,136 100.0% 100.0% 25.3% 25.0% 22.0% 3/20/2018 MuleSoft Salesforce.com 7,013 100.0% 80.4% 35.9% 34.3% 43.0% 2/23/2018 Blue Buffalo Pet Products General Mills 7,943 100.0% 100.0% 17.2% 14.0% 20.4% 2/12/2018 CSRA General Dynamics 6,877 100.0% 100.0% 32.2% 31.6% 27.0% 1/22/2018 Juno Therapeutics Celgene 9,900 90.2% 100.0% NM 78.5% 89.1% 1/22/2018 Validus Holdings AIG 5,713 100.0% 100.0% 45.5% 45.9% 45.0% 1/11/2018 DST Systems SS&C Technologies 5,114 100.0% 100.0% NM 31.7% 37.2% 11/20/2017 Cavium Marvell Technology 6,389 100.0% 45.9% NM NM 22.1% 9/18/2017 Orbital ATK Northrop Grumman 8,031 100.0% 100.0% 22.2% 23.9% 28.0% 6/19/2017 Rice Energy EQT 7,588 100.0% 17.3% 35.5% 30.2% 24.0% 5/15/2017 Patheon NV Thermo Fisher Scientific 5,216 100.0% 100.0% 34.6% 32.2% 35.8% Source: Dealogic as of 11/15/2018 Note: Excludes premiums affected by market rumors prior to deal announcement 10Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premium Benchmarks § Includes acquisitions of public North American targets since 01/01/2013 (57 total transactions) – Equity deal value between $5B and $10B – Cash consideration greater than 10% of total – Excludes acquisitions of minority stakes Premium to Market Price Pre-Annc. Announcement Equity Deal % Stake % Cash Date Target Acquiror Value ($M) Acquired Consideration 1 Day 1 Week 1 Month 11/8/2018 ARRIS International CommScope $5,726 100.0% 100.0% NM NM 28.1% 9/10/2018 Integrated Device Technology Renesas Electronics 6,760 100.0% 100.0% NM NM 36.9% 8/8/2018 Dun & Bradstreet CC Capital 5,387 100.0% 100.0% 15.2% 16.2% 14.3% 6/11/2018 Envision Healthcare KKR 5,715 100.0% 100.0% 5.4% 8.0% 8.7% 5/7/2018 athenahealth Veritas Capital Management 5,482 100.0% 100.0% 26.9% 30.6% 15.3% 4/9/2018 AveXis Novartis 8,795 100.0% 100.0% 88.1% 83.3% 59.2% 3/26/2018 USG Knauf Gips 6,136 100.0% 100.0% 25.3% 25.0% 22.0% 3/20/2018 MuleSoft Salesforce.com 7,013 100.0% 80.4% 35.9% 34.3% 43.0% 2/23/2018 Blue Buffalo Pet Products General Mills 7,943 100.0% 100.0% 17.2% 14.0% 20.4% 2/12/2018 CSRA General Dynamics 6,877 100.0% 100.0% 32.2% 31.6% 27.0% 1/22/2018 Juno Therapeutics Celgene 9,900 90.2% 100.0% NM 78.5% 89.1% 1/22/2018 Validus Holdings AIG 5,713 100.0% 100.0% 45.5% 45.9% 45.0% 1/11/2018 DST Systems SS&C Technologies 5,114 100.0% 100.0% NM 31.7% 37.2% 11/20/2017 Cavium Marvell Technology 6,389 100.0% 45.9% NM NM 22.1% 9/18/2017 Orbital ATK Northrop Grumman 8,031 100.0% 100.0% 22.2% 23.9% 28.0% 6/19/2017 Rice Energy EQT 7,588 100.0% 17.3% 35.5% 30.2% 24.0% 5/15/2017 Patheon NV Thermo Fisher Scientific 5,216 100.0% 100.0% 34.6% 32.2% 35.8% Source: Dealogic as of 11/15/2018 Note: Excludes premiums affected by market rumors prior to deal announcement 10

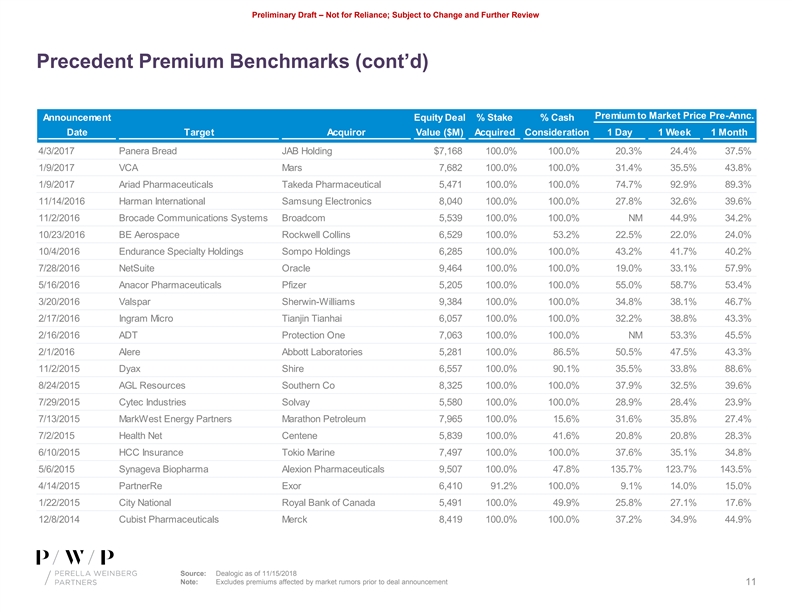

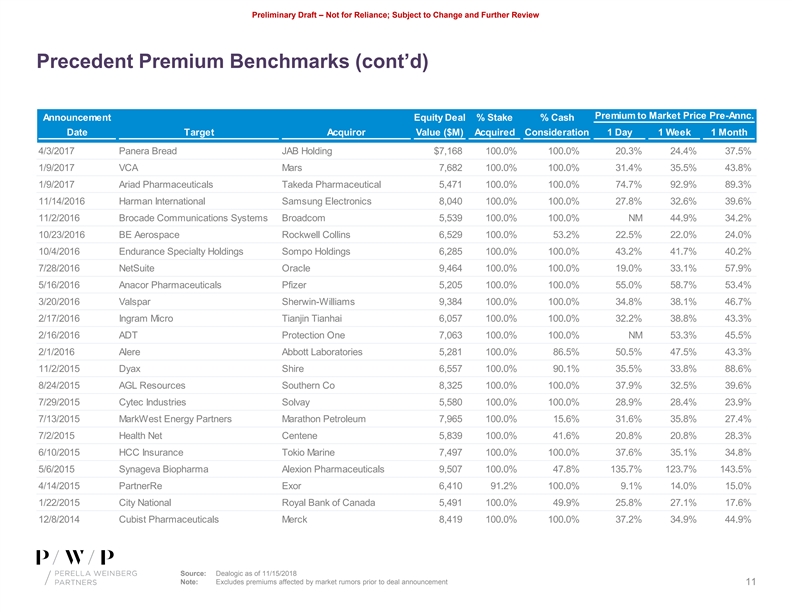

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premium Benchmarks (cont’d) Premium to Market Price Pre-Annc. Announcement Equity Deal % Stake % Cash Date Target Acquiror Value ($M) Acquired Consideration 1 Day 1 Week 1 Month 4/3/2017 Panera Bread JAB Holding $7,168 100.0% 100.0% 20.3% 24.4% 37.5% 1/9/2017 VCA Mars 7,682 100.0% 100.0% 31.4% 35.5% 43.8% 1/9/2017 Ariad Pharmaceuticals Takeda Pharmaceutical 5,471 100.0% 100.0% 74.7% 92.9% 89.3% 11/14/2016 Harman International Samsung Electronics 8,040 100.0% 100.0% 27.8% 32.6% 39.6% 11/2/2016 Brocade Communications Systems Broadcom 5,539 100.0% 100.0% NM 44.9% 34.2% 10/23/2016 BE Aerospace Rockwell Collins 6,529 100.0% 53.2% 22.5% 22.0% 24.0% 10/4/2016 Endurance Specialty Holdings Sompo Holdings 6,285 100.0% 100.0% 43.2% 41.7% 40.2% 7/28/2016 NetSuite Oracle 9,464 100.0% 100.0% 19.0% 33.1% 57.9% 5/16/2016 Anacor Pharmaceuticals Pfizer 5,205 100.0% 100.0% 55.0% 58.7% 53.4% 3/20/2016 Valspar Sherwin-Williams 9,384 100.0% 100.0% 34.8% 38.1% 46.7% 2/17/2016 Ingram Micro Tianjin Tianhai 6,057 100.0% 100.0% 32.2% 38.8% 43.3% 2/16/2016 ADT Protection One 7,063 100.0% 100.0% NM 53.3% 45.5% 2/1/2016 Alere Abbott Laboratories 5,281 100.0% 86.5% 50.5% 47.5% 43.3% 11/2/2015 Dyax Shire 6,557 100.0% 90.1% 35.5% 33.8% 88.6% 8/24/2015 AGL Resources Southern Co 8,325 100.0% 100.0% 37.9% 32.5% 39.6% 7/29/2015 Cytec Industries Solvay 5,580 100.0% 100.0% 28.9% 28.4% 23.9% 7/13/2015 MarkWest Energy Partners Marathon Petroleum 7,965 100.0% 15.6% 31.6% 35.8% 27.4% 7/2/2015 Health Net Centene 5,839 100.0% 41.6% 20.8% 20.8% 28.3% 6/10/2015 HCC Insurance Tokio Marine 7,497 100.0% 100.0% 37.6% 35.1% 34.8% 5/6/2015 Synageva Biopharma Alexion Pharmaceuticals 9,507 100.0% 47.8% 135.7% 123.7% 143.5% 4/14/2015 PartnerRe Exor 6,410 91.2% 100.0% 9.1% 14.0% 15.0% 1/22/2015 City National Royal Bank of Canada 5,491 100.0% 49.9% 25.8% 27.1% 17.6% 12/8/2014 Cubist Pharmaceuticals Merck 8,419 100.0% 100.0% 37.2% 34.9% 44.9% Source: Dealogic as of 11/15/2018 Note: Excludes premiums affected by market rumors prior to deal announcement 11Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premium Benchmarks (cont’d) Premium to Market Price Pre-Annc. Announcement Equity Deal % Stake % Cash Date Target Acquiror Value ($M) Acquired Consideration 1 Day 1 Week 1 Month 4/3/2017 Panera Bread JAB Holding $7,168 100.0% 100.0% 20.3% 24.4% 37.5% 1/9/2017 VCA Mars 7,682 100.0% 100.0% 31.4% 35.5% 43.8% 1/9/2017 Ariad Pharmaceuticals Takeda Pharmaceutical 5,471 100.0% 100.0% 74.7% 92.9% 89.3% 11/14/2016 Harman International Samsung Electronics 8,040 100.0% 100.0% 27.8% 32.6% 39.6% 11/2/2016 Brocade Communications Systems Broadcom 5,539 100.0% 100.0% NM 44.9% 34.2% 10/23/2016 BE Aerospace Rockwell Collins 6,529 100.0% 53.2% 22.5% 22.0% 24.0% 10/4/2016 Endurance Specialty Holdings Sompo Holdings 6,285 100.0% 100.0% 43.2% 41.7% 40.2% 7/28/2016 NetSuite Oracle 9,464 100.0% 100.0% 19.0% 33.1% 57.9% 5/16/2016 Anacor Pharmaceuticals Pfizer 5,205 100.0% 100.0% 55.0% 58.7% 53.4% 3/20/2016 Valspar Sherwin-Williams 9,384 100.0% 100.0% 34.8% 38.1% 46.7% 2/17/2016 Ingram Micro Tianjin Tianhai 6,057 100.0% 100.0% 32.2% 38.8% 43.3% 2/16/2016 ADT Protection One 7,063 100.0% 100.0% NM 53.3% 45.5% 2/1/2016 Alere Abbott Laboratories 5,281 100.0% 86.5% 50.5% 47.5% 43.3% 11/2/2015 Dyax Shire 6,557 100.0% 90.1% 35.5% 33.8% 88.6% 8/24/2015 AGL Resources Southern Co 8,325 100.0% 100.0% 37.9% 32.5% 39.6% 7/29/2015 Cytec Industries Solvay 5,580 100.0% 100.0% 28.9% 28.4% 23.9% 7/13/2015 MarkWest Energy Partners Marathon Petroleum 7,965 100.0% 15.6% 31.6% 35.8% 27.4% 7/2/2015 Health Net Centene 5,839 100.0% 41.6% 20.8% 20.8% 28.3% 6/10/2015 HCC Insurance Tokio Marine 7,497 100.0% 100.0% 37.6% 35.1% 34.8% 5/6/2015 Synageva Biopharma Alexion Pharmaceuticals 9,507 100.0% 47.8% 135.7% 123.7% 143.5% 4/14/2015 PartnerRe Exor 6,410 91.2% 100.0% 9.1% 14.0% 15.0% 1/22/2015 City National Royal Bank of Canada 5,491 100.0% 49.9% 25.8% 27.1% 17.6% 12/8/2014 Cubist Pharmaceuticals Merck 8,419 100.0% 100.0% 37.2% 34.9% 44.9% Source: Dealogic as of 11/15/2018 Note: Excludes premiums affected by market rumors prior to deal announcement 11

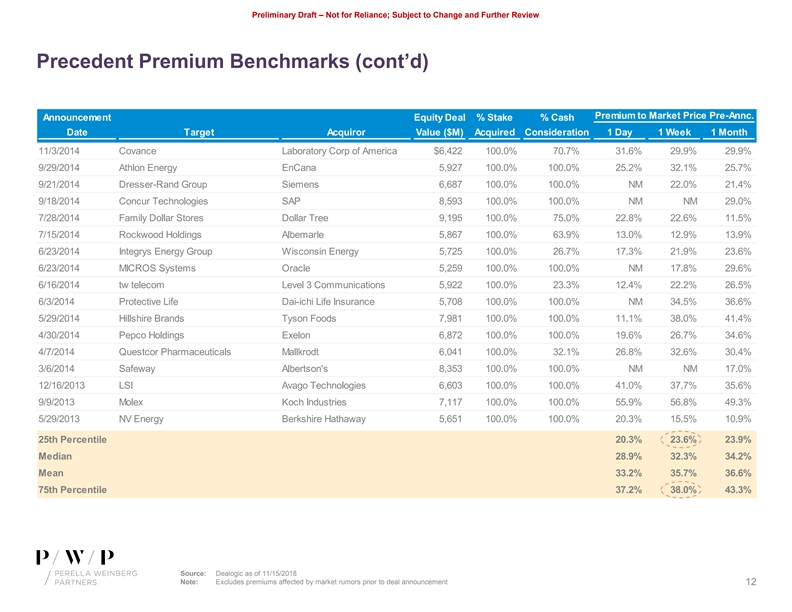

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premium Benchmarks (cont’d) Premium to Market Price Pre-Annc. Announcement Equity Deal % Stake % Cash Date Target Acquiror Value ($M) Acquired Consideration 1 Day 1 Week 1 Month 11/3/2014 Covance Laboratory Corp of America $6,422 100.0% 70.7% 31.6% 29.9% 29.9% 9/29/2014 Athlon Energy EnCana 5,927 100.0% 100.0% 25.2% 32.1% 25.7% 9/21/2014 Dresser-Rand Group Siemens 6,687 100.0% 100.0% NM 22.0% 21.4% 9/18/2014 Concur Technologies SAP 8,593 100.0% 100.0% NM NM 29.0% 7/28/2014 Family Dollar Stores Dollar Tree 9,195 100.0% 75.0% 22.8% 22.6% 11.5% 7/15/2014 Rockwood Holdings Albemarle 5,867 100.0% 63.9% 13.0% 12.9% 13.9% 6/23/2014 Integrys Energy Group Wisconsin Energy 5,725 100.0% 26.7% 17.3% 21.9% 23.6% 6/23/2014 MICROS Systems Oracle 5,259 100.0% 100.0% NM 17.8% 29.6% 6/16/2014 tw telecom Level 3 Communications 5,922 100.0% 23.3% 12.4% 22.2% 26.5% 6/3/2014 Protective Life Dai-ichi Life Insurance 5,708 100.0% 100.0% NM 34.5% 36.6% 5/29/2014 Hillshire Brands Tyson Foods 7,981 100.0% 100.0% 11.1% 38.0% 41.4% 4/30/2014 Pepco Holdings Exelon 6,872 100.0% 100.0% 19.6% 26.7% 34.6% 4/7/2014 Questcor Pharmaceuticals Mallkrodt 6,041 100.0% 32.1% 26.8% 32.6% 30.4% 3/6/2014 Safeway Albertson's 8,353 100.0% 100.0% NM NM 17.0% 12/16/2013 LSI Avago Technologies 6,603 100.0% 100.0% 41.0% 37.7% 35.6% 9/9/2013 Molex Koch Industries 7,117 100.0% 100.0% 55.9% 56.8% 49.3% 5/29/2013 NV Energy Berkshire Hathaway 5,651 100.0% 100.0% 20.3% 15.5% 10.9% 25th Percentile 20.3% 23.6% 23.9% Median 28.9% 32.3% 34.2% Mean 33.2% 35.7% 36.6% 75th Percentile 37.2% 38.0% 43.3% Source: Dealogic as of 11/15/2018 Note: Excludes premiums affected by market rumors prior to deal announcement 12Preliminary Draft – Not for Reliance; Subject to Change and Further Review Precedent Premium Benchmarks (cont’d) Premium to Market Price Pre-Annc. Announcement Equity Deal % Stake % Cash Date Target Acquiror Value ($M) Acquired Consideration 1 Day 1 Week 1 Month 11/3/2014 Covance Laboratory Corp of America $6,422 100.0% 70.7% 31.6% 29.9% 29.9% 9/29/2014 Athlon Energy EnCana 5,927 100.0% 100.0% 25.2% 32.1% 25.7% 9/21/2014 Dresser-Rand Group Siemens 6,687 100.0% 100.0% NM 22.0% 21.4% 9/18/2014 Concur Technologies SAP 8,593 100.0% 100.0% NM NM 29.0% 7/28/2014 Family Dollar Stores Dollar Tree 9,195 100.0% 75.0% 22.8% 22.6% 11.5% 7/15/2014 Rockwood Holdings Albemarle 5,867 100.0% 63.9% 13.0% 12.9% 13.9% 6/23/2014 Integrys Energy Group Wisconsin Energy 5,725 100.0% 26.7% 17.3% 21.9% 23.6% 6/23/2014 MICROS Systems Oracle 5,259 100.0% 100.0% NM 17.8% 29.6% 6/16/2014 tw telecom Level 3 Communications 5,922 100.0% 23.3% 12.4% 22.2% 26.5% 6/3/2014 Protective Life Dai-ichi Life Insurance 5,708 100.0% 100.0% NM 34.5% 36.6% 5/29/2014 Hillshire Brands Tyson Foods 7,981 100.0% 100.0% 11.1% 38.0% 41.4% 4/30/2014 Pepco Holdings Exelon 6,872 100.0% 100.0% 19.6% 26.7% 34.6% 4/7/2014 Questcor Pharmaceuticals Mallkrodt 6,041 100.0% 32.1% 26.8% 32.6% 30.4% 3/6/2014 Safeway Albertson's 8,353 100.0% 100.0% NM NM 17.0% 12/16/2013 LSI Avago Technologies 6,603 100.0% 100.0% 41.0% 37.7% 35.6% 9/9/2013 Molex Koch Industries 7,117 100.0% 100.0% 55.9% 56.8% 49.3% 5/29/2013 NV Energy Berkshire Hathaway 5,651 100.0% 100.0% 20.3% 15.5% 10.9% 25th Percentile 20.3% 23.6% 23.9% Median 28.9% 32.3% 34.2% Mean 33.2% 35.7% 36.6% 75th Percentile 37.2% 38.0% 43.3% Source: Dealogic as of 11/15/2018 Note: Excludes premiums affected by market rumors prior to deal announcement 12

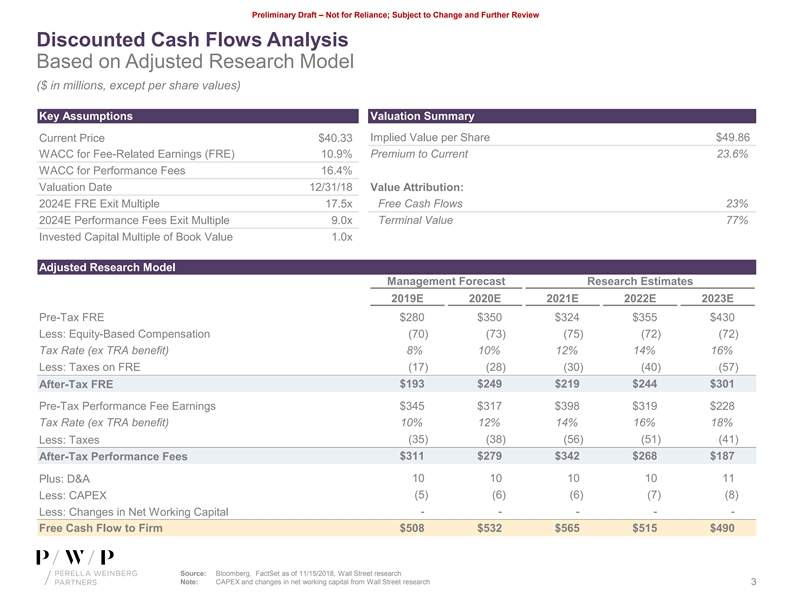

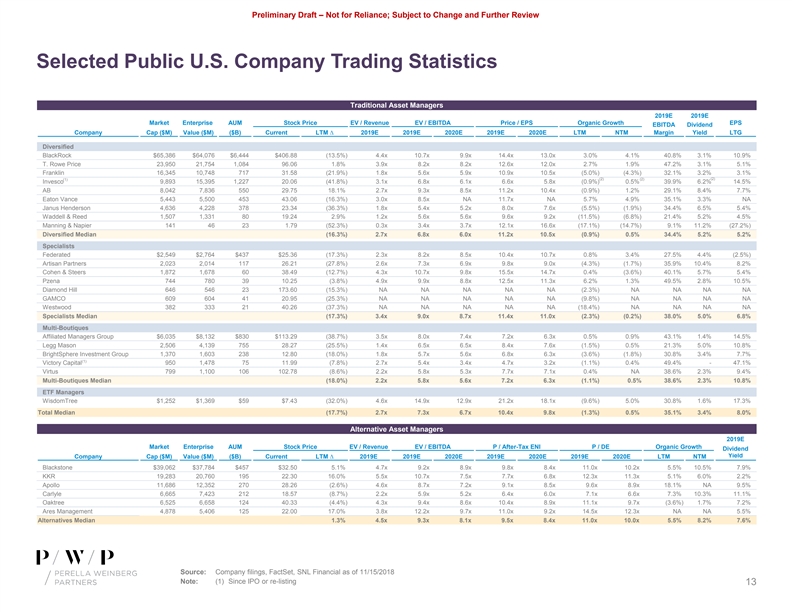

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Selected Public U.S. Company Trading Statistics Traditional Asset Managers 2019E 2019E Market Enterprise AUM Stock Price EV / Revenue EV / EBITDA Price / EPS Organic Growth EPS EBITDA Dividend Company Cap ($M) Value ($M) ($B) Current LTM ∆ 2019E 2019E 2020E 2019E 2020E LTM NTM Margin Yield LTG Diversified BlackRock $65,386 $64,076 $6,444 $406.88 (13.5%) 4.4x 10.7x 9.9x 14.4x 13.0x 3.0% 4.1% 40.8% 3.1% 10.9% T. Rowe Price 23,950 21,754 1,084 96.06 1.8% 3.9x 8.2x 8.2x 12.6x 12.0x 2.7% 1.9% 47.2% 3.1% 5.1% Franklin 16,345 10,748 717 31.58 (21.9%) 1.8x 5.6x 5.9x 10.9x 10.5x (5.0%) (4.3%) 32.1% 3.2% 3.1% (2) (2) (2) (1) Invesco 9,893 15,395 1,227 20.06 (41.8%) 3.1x 6.8x 6.1x 6.6x 5.8x (0.9%) 0.5% 39.9% 6.2% 14.5% AB 8,042 7,836 550 29.75 18.1% 2.7x 9.3x 8.5x 11.2x 10.4x (0.9%) 1.2% 29.1% 8.4% 7.7% Eaton Vance 5,443 5,500 453 43.06 (16.3%) 3.0x 8.5x NA 11.7x NA 5.7% 4.9% 35.1% 3.3% NA Janus Henderson 4,636 4,228 378 23.34 (36.3%) 1.8x 5.4x 5.2x 8.0x 7.6x (5.5%) (1.9%) 34.4% 6.5% 5.4% Waddell & Reed 1,507 1,331 80 19.24 2.9% 1.2x 5.6x 5.6x 9.6x 9.2x (11.5%) (6.8%) 21.4% 5.2% 4.5% Manning & Napier 141 46 23 1.79 (52.3%) 0.3x 3.4x 3.7x 12.1x 16.6x (17.1%) (14.7%) 9.1% 11.2% (27.2%) Diversified Median (16.3%) 2.7x 6.8x 6.0x 11.2x 10.5x (0.9%) 0.5% 34.4% 5.2% 5.2% Specialists Federated $2,549 $2,764 $437 $25.36 (17.3%) 2.3x 8.2x 8.5x 10.4x 10.7x 0.8% 3.4% 27.5% 4.4% (2.5%) Artisan Partners 2,023 2,014 117 26.21 (27.8%) 2.6x 7.3x 6.9x 9.8x 9.0x (4.3%) (1.7%) 35.9% 10.4% 8.2% Cohen & Steers 1,872 1,678 60 38.49 (12.7%) 4.3x 10.7x 9.8x 15.5x 14.7x 0.4% (3.6%) 40.1% 5.7% 5.4% Pzena 744 780 39 10.25 (3.8%) 4.9x 9.9x 8.8x 12.5x 11.3x 6.2% 1.3% 49.5% 2.8% 10.5% Diamond Hill 646 546 23 173.60 (15.3%) NA NA NA NA NA (2.3%) NA NA NA NA GAMCO 609 604 41 20.95 (25.3%) NA NA NA NA NA (9.8%) NA NA NA NA Westwood 382 333 21 40.26 (37.3%) NA NA NA NA NA (18.4%) NA NA NA NA Specialists Median (17.3%) 3.4x 9.0x 8.7x 11.4x 11.0x (2.3%) (0.2%) 38.0% 5.0% 6.8% Multi-Boutiques Affiliated Managers Group $6,035 $8,132 $830 $113.29 (38.7%) 3.5x 8.0x 7.4x 7.2x 6.3x 0.5% 0.9% 43.1% 1.4% 14.5% Legg Mason 2,506 4,139 755 28.27 (25.5%) 1.4x 6.5x 6.5x 8.4x 7.6x (1.5%) 0.5% 21.3% 5.0% 10.8% BrightSphere Investment Group 1,370 1,603 238 12.80 (18.0%) 1.8x 5.7x 5.6x 6.8x 6.3x (3.6%) (1.8%) 30.8% 3.4% 7.7% (1) Victory Capital 950 1,478 75 11.99 (7.8%) 2.7x 5.4x 3.4x 4.7x 3.2x (1.1%) 0.4% 49.4% - 47.1% Virtus 799 1,100 106 102.78 (8.6%) 2.2x 5.8x 5.3x 7.7x 7.1x 0.4% NA 38.6% 2.3% 9.4% Multi-Boutiques Median (18.0%) 2.2x 5.8x 5.6x 7.2x 6.3x (1.1%) 0.5% 38.6% 2.3% 10.8% ETF Managers WisdomTree $1,252 $1,369 $59 $7.43 (32.0%) 4.6x 14.9x 12.9x 21.2x 18.1x (9.6%) 5.0% 30.8% 1.6% 17.3% Total Median (17.7%) 2.7x 7.3x 6.7x 10.4x 9.8x (1.3%) 0.5% 35.1% 3.4% 8.0% Alternative Asset Managers 2019E Market Enterprise AUM Stock Price EV / Revenue EV / EBITDA P / After-Tax ENI P / DE Organic Growth Dividend Yield Company Cap ($M) Value ($M) ($B) Current LTM ∆ 2019E 2019E 2020E 2019E 2020E 2019E 2020E LTM NTM Blackstone $39,062 $37,784 $457 $32.50 5.1% 4.7x 9.2x 8.9x 9.8x 8.4x 11.0x 10.2x 5.5% 10.5% 7.9% KKR 19,283 20,760 195 22.30 16.0% 5.5x 10.7x 7.5x 7.7x 6.8x 12.3x 11.3x 5.1% 6.0% 2.2% Apollo 11,686 12,352 270 28.26 (2.6%) 4.6x 8.7x 7.2x 9.1x 8.5x 9.6x 8.9x 18.1% NA 9.5% Carlyle 6,665 7,423 212 18.57 (8.7%) 2.2x 5.9x 5.2x 6.4x 6.0x 7.1x 6.6x 7.3% 10.3% 11.1% Oaktree 6,525 6,658 124 40.33 (4.4%) 4.3x 9.4x 8.6x 10.4x 8.9x 11.1x 9.7x (3.6%) 1.7% 7.2% Ares Management 4,878 5,406 125 22.00 17.0% 3.8x 12.2x 9.7x 11.0x 9.2x 14.5x 12.3x NA NA 5.5% Alternatives Median 1.3% 4.5x 9.3x 8.1x 9.5x 8.4x 11.0x 10.0x 5.5% 8.2% 7.6% Source: Company filings, FactSet, SNL Financial as of 11/15/2018 Note: (1) Since IPO or re-listing 13Preliminary Draft – Not for Reliance; Subject to Change and Further Review Selected Public U.S. Company Trading Statistics Traditional Asset Managers 2019E 2019E Market Enterprise AUM Stock Price EV / Revenue EV / EBITDA Price / EPS Organic Growth EPS EBITDA Dividend Company Cap ($M) Value ($M) ($B) Current LTM ∆ 2019E 2019E 2020E 2019E 2020E LTM NTM Margin Yield LTG Diversified BlackRock $65,386 $64,076 $6,444 $406.88 (13.5%) 4.4x 10.7x 9.9x 14.4x 13.0x 3.0% 4.1% 40.8% 3.1% 10.9% T. Rowe Price 23,950 21,754 1,084 96.06 1.8% 3.9x 8.2x 8.2x 12.6x 12.0x 2.7% 1.9% 47.2% 3.1% 5.1% Franklin 16,345 10,748 717 31.58 (21.9%) 1.8x 5.6x 5.9x 10.9x 10.5x (5.0%) (4.3%) 32.1% 3.2% 3.1% (2) (2) (2) (1) Invesco 9,893 15,395 1,227 20.06 (41.8%) 3.1x 6.8x 6.1x 6.6x 5.8x (0.9%) 0.5% 39.9% 6.2% 14.5% AB 8,042 7,836 550 29.75 18.1% 2.7x 9.3x 8.5x 11.2x 10.4x (0.9%) 1.2% 29.1% 8.4% 7.7% Eaton Vance 5,443 5,500 453 43.06 (16.3%) 3.0x 8.5x NA 11.7x NA 5.7% 4.9% 35.1% 3.3% NA Janus Henderson 4,636 4,228 378 23.34 (36.3%) 1.8x 5.4x 5.2x 8.0x 7.6x (5.5%) (1.9%) 34.4% 6.5% 5.4% Waddell & Reed 1,507 1,331 80 19.24 2.9% 1.2x 5.6x 5.6x 9.6x 9.2x (11.5%) (6.8%) 21.4% 5.2% 4.5% Manning & Napier 141 46 23 1.79 (52.3%) 0.3x 3.4x 3.7x 12.1x 16.6x (17.1%) (14.7%) 9.1% 11.2% (27.2%) Diversified Median (16.3%) 2.7x 6.8x 6.0x 11.2x 10.5x (0.9%) 0.5% 34.4% 5.2% 5.2% Specialists Federated $2,549 $2,764 $437 $25.36 (17.3%) 2.3x 8.2x 8.5x 10.4x 10.7x 0.8% 3.4% 27.5% 4.4% (2.5%) Artisan Partners 2,023 2,014 117 26.21 (27.8%) 2.6x 7.3x 6.9x 9.8x 9.0x (4.3%) (1.7%) 35.9% 10.4% 8.2% Cohen & Steers 1,872 1,678 60 38.49 (12.7%) 4.3x 10.7x 9.8x 15.5x 14.7x 0.4% (3.6%) 40.1% 5.7% 5.4% Pzena 744 780 39 10.25 (3.8%) 4.9x 9.9x 8.8x 12.5x 11.3x 6.2% 1.3% 49.5% 2.8% 10.5% Diamond Hill 646 546 23 173.60 (15.3%) NA NA NA NA NA (2.3%) NA NA NA NA GAMCO 609 604 41 20.95 (25.3%) NA NA NA NA NA (9.8%) NA NA NA NA Westwood 382 333 21 40.26 (37.3%) NA NA NA NA NA (18.4%) NA NA NA NA Specialists Median (17.3%) 3.4x 9.0x 8.7x 11.4x 11.0x (2.3%) (0.2%) 38.0% 5.0% 6.8% Multi-Boutiques Affiliated Managers Group $6,035 $8,132 $830 $113.29 (38.7%) 3.5x 8.0x 7.4x 7.2x 6.3x 0.5% 0.9% 43.1% 1.4% 14.5% Legg Mason 2,506 4,139 755 28.27 (25.5%) 1.4x 6.5x 6.5x 8.4x 7.6x (1.5%) 0.5% 21.3% 5.0% 10.8% BrightSphere Investment Group 1,370 1,603 238 12.80 (18.0%) 1.8x 5.7x 5.6x 6.8x 6.3x (3.6%) (1.8%) 30.8% 3.4% 7.7% (1) Victory Capital 950 1,478 75 11.99 (7.8%) 2.7x 5.4x 3.4x 4.7x 3.2x (1.1%) 0.4% 49.4% - 47.1% Virtus 799 1,100 106 102.78 (8.6%) 2.2x 5.8x 5.3x 7.7x 7.1x 0.4% NA 38.6% 2.3% 9.4% Multi-Boutiques Median (18.0%) 2.2x 5.8x 5.6x 7.2x 6.3x (1.1%) 0.5% 38.6% 2.3% 10.8% ETF Managers WisdomTree $1,252 $1,369 $59 $7.43 (32.0%) 4.6x 14.9x 12.9x 21.2x 18.1x (9.6%) 5.0% 30.8% 1.6% 17.3% Total Median (17.7%) 2.7x 7.3x 6.7x 10.4x 9.8x (1.3%) 0.5% 35.1% 3.4% 8.0% Alternative Asset Managers 2019E Market Enterprise AUM Stock Price EV / Revenue EV / EBITDA P / After-Tax ENI P / DE Organic Growth Dividend Yield Company Cap ($M) Value ($M) ($B) Current LTM ∆ 2019E 2019E 2020E 2019E 2020E 2019E 2020E LTM NTM Blackstone $39,062 $37,784 $457 $32.50 5.1% 4.7x 9.2x 8.9x 9.8x 8.4x 11.0x 10.2x 5.5% 10.5% 7.9% KKR 19,283 20,760 195 22.30 16.0% 5.5x 10.7x 7.5x 7.7x 6.8x 12.3x 11.3x 5.1% 6.0% 2.2% Apollo 11,686 12,352 270 28.26 (2.6%) 4.6x 8.7x 7.2x 9.1x 8.5x 9.6x 8.9x 18.1% NA 9.5% Carlyle 6,665 7,423 212 18.57 (8.7%) 2.2x 5.9x 5.2x 6.4x 6.0x 7.1x 6.6x 7.3% 10.3% 11.1% Oaktree 6,525 6,658 124 40.33 (4.4%) 4.3x 9.4x 8.6x 10.4x 8.9x 11.1x 9.7x (3.6%) 1.7% 7.2% Ares Management 4,878 5,406 125 22.00 17.0% 3.8x 12.2x 9.7x 11.0x 9.2x 14.5x 12.3x NA NA 5.5% Alternatives Median 1.3% 4.5x 9.3x 8.1x 9.5x 8.4x 11.0x 10.0x 5.5% 8.2% 7.6% Source: Company filings, FactSet, SNL Financial as of 11/15/2018 Note: (1) Since IPO or re-listing 13

Preliminary Draft – Not for Reliance; Subject to Change and Further Review Legal Disclosures This Presentation has been provided to you by Perella Weinberg Partners and its affiliates (collectively “Perella Weinberg Partners” or the “Firm”) and may not be used or relied upon for any purpose without the written consent of Perella Weinberg Partners. The information contained herein (the “Information”) is confidential information. By accepting this Information, you agree that you will, and you will cause your directors, partners, officers, employees, attorney(s), agents and representatives to, use the Information only for your informational purposes and for no other purpose and will not divulge any such Information to any other party. Any reproduction of this Information, in whole or in part, is prohibited. These contents are proprietary information and products of Perella Weinberg Partners. The Information contained herein is not an offer to buy or sell or a solicitation of an offer to buy or sell any corporate advisory services or security or to participate in any corporate advisory services or trading strategy. Any decision regarding corporate advisory services or to invest in the investments described herein should be made after, as applicable, reviewing such definitive offering memorandum, conducting such investigations as you deem necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment or service. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction. Perella Weinberg Partners LP, Tudor, Pickering, Holt & Co. Securities, Inc., and Tudor, Pickering, Holt & Co. Advisors, LLC are each members of FINRA (www.finra.org) and SIPC. 14Preliminary Draft – Not for Reliance; Subject to Change and Further Review Legal Disclosures This Presentation has been provided to you by Perella Weinberg Partners and its affiliates (collectively “Perella Weinberg Partners” or the “Firm”) and may not be used or relied upon for any purpose without the written consent of Perella Weinberg Partners. The information contained herein (the “Information”) is confidential information. By accepting this Information, you agree that you will, and you will cause your directors, partners, officers, employees, attorney(s), agents and representatives to, use the Information only for your informational purposes and for no other purpose and will not divulge any such Information to any other party. Any reproduction of this Information, in whole or in part, is prohibited. These contents are proprietary information and products of Perella Weinberg Partners. The Information contained herein is not an offer to buy or sell or a solicitation of an offer to buy or sell any corporate advisory services or security or to participate in any corporate advisory services or trading strategy. Any decision regarding corporate advisory services or to invest in the investments described herein should be made after, as applicable, reviewing such definitive offering memorandum, conducting such investigations as you deem necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment or service. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction. Perella Weinberg Partners LP, Tudor, Pickering, Holt & Co. Securities, Inc., and Tudor, Pickering, Holt & Co. Advisors, LLC are each members of FINRA (www.finra.org) and SIPC. 14