Preliminary Confidential Draft – Not for Reliance; Subject to Change and Further Review Exhibit (c)(13) Oslo Response to Berlin Proposal January 2019Preliminary Confidential Draft – Not for Reliance; Subject to Change and Further Review Exhibit (c)(13) Oslo Response to Berlin Proposal January 2019

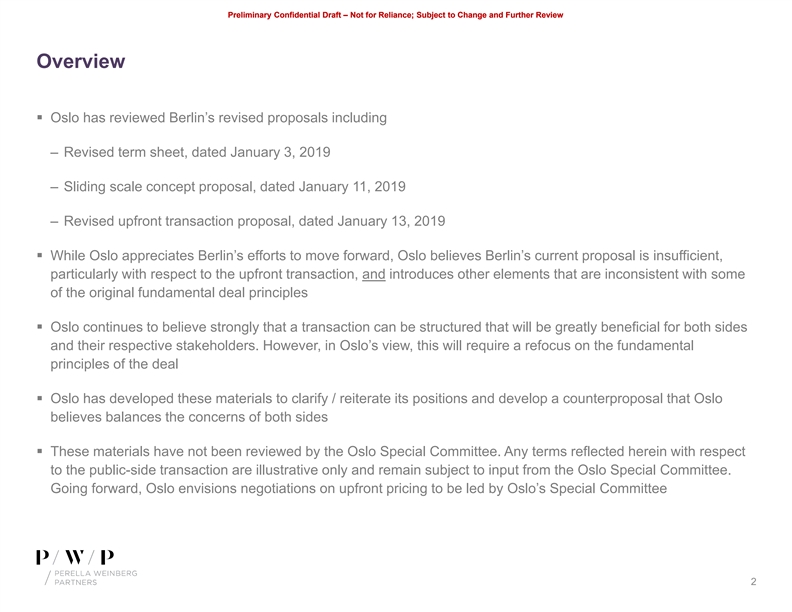

Pr Preliminar eliminary y Con Confid fident ential ial Draft Draft – – Not Not fo for Relia r Relianc nce; e; Subject Subject to to Chan Change ge and and Fu Further rther Rev Reviiew ew Overview § Oslo has reviewed Berlin’s revised proposals including – Revised term sheet, dated January 3, 2019 – Sliding scale concept proposal, dated January 11, 2019 – Revised upfront transaction proposal, dated January 13, 2019 § While Oslo appreciates Berlin’s efforts to move forward, Oslo believes Berlin’s current proposal is insufficient, particularly with respect to the upfront transaction, and introduces other elements that are inconsistent with some of the original fundamental deal principles § Oslo continues to believe strongly that a transaction can be structured that will be greatly beneficial for both sides and their respective stakeholders. However, in Oslo’s view, this will require a refocus on the fundamental principles of the deal § Oslo has developed these materials to clarify / reiterate its positions and develop a counterproposal that Oslo believes balances the concerns of both sides § These materials have not been reviewed by the Oslo Special Committee. Any terms reflected herein with respect to the public-side transaction are illustrative only and remain subject to input from the Oslo Special Committee. Going forward, Oslo envisions negotiations on upfront pricing to be led by Oslo’s Special Committee 2Pr Preliminar eliminary y Con Confid fident ential ial Draft Draft – – Not Not fo for Relia r Relianc nce; e; Subject Subject to to Chan Change ge and and Fu Further rther Rev Reviiew ew Overview § Oslo has reviewed Berlin’s revised proposals including – Revised term sheet, dated January 3, 2019 – Sliding scale concept proposal, dated January 11, 2019 – Revised upfront transaction proposal, dated January 13, 2019 § While Oslo appreciates Berlin’s efforts to move forward, Oslo believes Berlin’s current proposal is insufficient, particularly with respect to the upfront transaction, and introduces other elements that are inconsistent with some of the original fundamental deal principles § Oslo continues to believe strongly that a transaction can be structured that will be greatly beneficial for both sides and their respective stakeholders. However, in Oslo’s view, this will require a refocus on the fundamental principles of the deal § Oslo has developed these materials to clarify / reiterate its positions and develop a counterproposal that Oslo believes balances the concerns of both sides § These materials have not been reviewed by the Oslo Special Committee. Any terms reflected herein with respect to the public-side transaction are illustrative only and remain subject to input from the Oslo Special Committee. Going forward, Oslo envisions negotiations on upfront pricing to be led by Oslo’s Special Committee 2

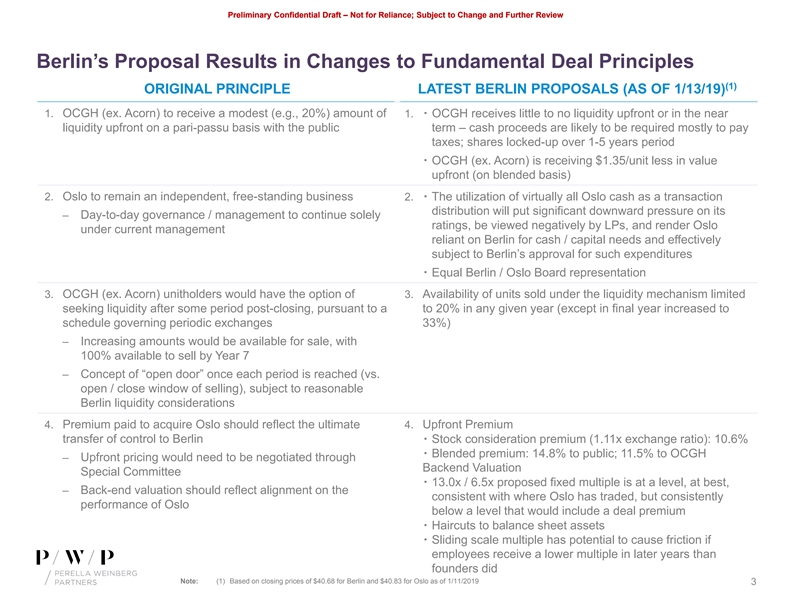

Pr Preliminar eliminary y Con Confid fident ential ial Draft Draft – – Not Not fo for Relia r Relianc nce; e; Subject Subject to to Chan Change ge and and Fu Further rther Rev Reviiew ew Berlin’s Proposal Results in Changes to Fundamental Deal Principles (1) ORIGINAL PRINCIPLE LATEST BERLIN PROPOSALS (AS OF 1/13/19) 1. OCGH (ex. Acorn) to receive a modest (e.g., 20%) amount of 1.▪ OCGH receives little to no liquidity upfront or in the near liquidity upfront on a pari-passu basis with the public term – cash proceeds are likely to be required mostly to pay taxes; shares locked-up over 1-5 years period ▪ OCGH (ex. Acorn) is receiving $1.35/unit less in value upfront (on blended basis) 2. Oslo to remain an independent, free-standing business 2.▪ The utilization of virtually all Oslo cash as a transaction distribution will put significant downward pressure on its ‒ Day-to-day governance / management to continue solely ratings, be viewed negatively by LPs, and render Oslo under current management reliant on Berlin for cash / capital needs and effectively subject to Berlin’s approval for such expenditures ▪ Equal Berlin / Oslo Board representation 3. OCGH (ex. Acorn) unitholders would have the option of 3. Availability of units sold under the liquidity mechanism limited seeking liquidity after some period post-closing, pursuant to a to 20% in any given year (except in final year increased to schedule governing periodic exchanges 33%) ‒ Increasing amounts would be available for sale, with 100% available to sell by Year 7 ‒ Concept of “open door” once each period is reached (vs. open / close window of selling), subject to reasonable Berlin liquidity considerations 4. Premium paid to acquire Oslo should reflect the ultimate 4. Upfront Premium transfer of control to Berlin▪ Stock consideration premium (1.11x exchange ratio): 10.6% ▪ Blended premium: 14.8% to public; 11.5% to OCGH ‒ Upfront pricing would need to be negotiated through Backend Valuation Special Committee ▪ 13.0x / 6.5x proposed fixed multiple is at a level, at best, ‒ Back-end valuation should reflect alignment on the consistent with where Oslo has traded, but consistently performance of Oslo below a level that would include a deal premium ▪ Haircuts to balance sheet assets ▪ Sliding scale multiple has potential to cause friction if employees receive a lower multiple in later years than founders did Note: (1) Based on closing prices of $40.68 for Berlin and $40.83 for Oslo as of 1/11/2019 3Pr Preliminar eliminary y Con Confid fident ential ial Draft Draft – – Not Not fo for Relia r Relianc nce; e; Subject Subject to to Chan Change ge and and Fu Further rther Rev Reviiew ew Berlin’s Proposal Results in Changes to Fundamental Deal Principles (1) ORIGINAL PRINCIPLE LATEST BERLIN PROPOSALS (AS OF 1/13/19) 1. OCGH (ex. Acorn) to receive a modest (e.g., 20%) amount of 1.▪ OCGH receives little to no liquidity upfront or in the near liquidity upfront on a pari-passu basis with the public term – cash proceeds are likely to be required mostly to pay taxes; shares locked-up over 1-5 years period ▪ OCGH (ex. Acorn) is receiving $1.35/unit less in value upfront (on blended basis) 2. Oslo to remain an independent, free-standing business 2.▪ The utilization of virtually all Oslo cash as a transaction distribution will put significant downward pressure on its ‒ Day-to-day governance / management to continue solely ratings, be viewed negatively by LPs, and render Oslo under current management reliant on Berlin for cash / capital needs and effectively subject to Berlin’s approval for such expenditures ▪ Equal Berlin / Oslo Board representation 3. OCGH (ex. Acorn) unitholders would have the option of 3. Availability of units sold under the liquidity mechanism limited seeking liquidity after some period post-closing, pursuant to a to 20% in any given year (except in final year increased to schedule governing periodic exchanges 33%) ‒ Increasing amounts would be available for sale, with 100% available to sell by Year 7 ‒ Concept of “open door” once each period is reached (vs. open / close window of selling), subject to reasonable Berlin liquidity considerations 4. Premium paid to acquire Oslo should reflect the ultimate 4. Upfront Premium transfer of control to Berlin▪ Stock consideration premium (1.11x exchange ratio): 10.6% ▪ Blended premium: 14.8% to public; 11.5% to OCGH ‒ Upfront pricing would need to be negotiated through Backend Valuation Special Committee ▪ 13.0x / 6.5x proposed fixed multiple is at a level, at best, ‒ Back-end valuation should reflect alignment on the consistent with where Oslo has traded, but consistently performance of Oslo below a level that would include a deal premium ▪ Haircuts to balance sheet assets ▪ Sliding scale multiple has potential to cause friction if employees receive a lower multiple in later years than founders did Note: (1) Based on closing prices of $40.68 for Berlin and $40.83 for Oslo as of 1/11/2019 3

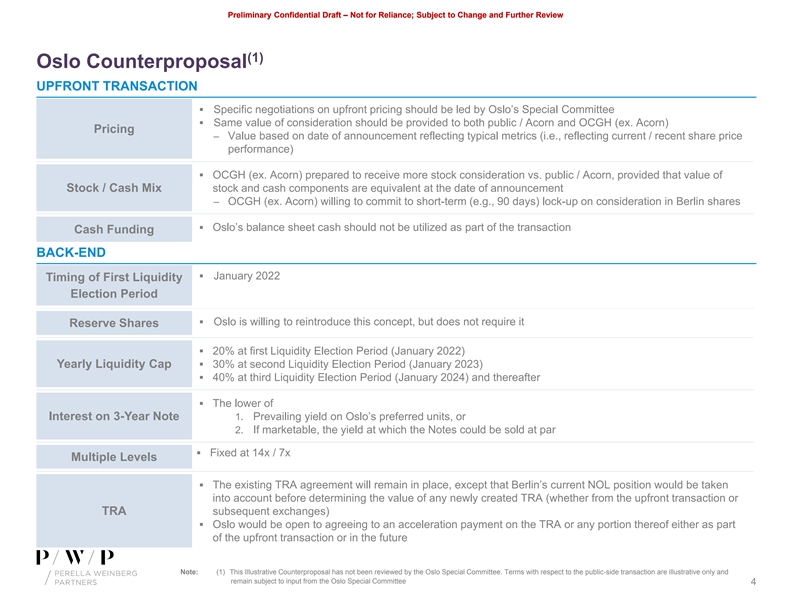

Pr Preliminar eliminary y Con Confid fident ential ial Draft Draft – – Not Not fo for Relia r Relianc nce; e; Subject Subject to to Chan Change ge and and Fu Further rther Rev Reviiew ew (1) Oslo Counterproposal UPFRONT TRANSACTION § Specific negotiations on upfront pricing should be led by Oslo’s Special Committee § Same value of consideration should be provided to both public / Acorn and OCGH (ex. Acorn) Pricing ‒ Value based on date of announcement reflecting typical metrics (i.e., reflecting current / recent share price performance) § OCGH (ex. Acorn) prepared to receive more stock consideration vs. public / Acorn, provided that value of Stock / Cash Mix stock and cash components are equivalent at the date of announcement ‒ OCGH (ex. Acorn) willing to commit to short-term (e.g., 90 days) lock-up on consideration in Berlin shares § Oslo’s balance sheet cash should not be utilized as part of the transaction Cash Funding BACK-END § January 2022 Timing of First Liquidity Election Period § Oslo is willing to reintroduce this concept, but does not require it Reserve Shares § 20% at first Liquidity Election Period (January 2022) Yearly Liquidity Cap§ 30% at second Liquidity Election Period (January 2023) § 40% at third Liquidity Election Period (January 2024) and thereafter § The lower of Interest on 3-Year Note 1. Prevailing yield on Oslo’s preferred units, or 2. If marketable, the yield at which the Notes could be sold at par § Fixed at 14x / 7x Multiple Levels § The existing TRA agreement will remain in place, except that Berlin’s current NOL position would be taken into account before determining the value of any newly created TRA (whether from the upfront transaction or TRA subsequent exchanges) § Oslo would be open to agreeing to an acceleration payment on the TRA or any portion thereof either as part of the upfront transaction or in the future Note: (1) This Illustrative Counterproposal has not been reviewed by the Oslo Special Committee. Terms with respect to the public-side transaction are illustrative only and remain subject to input from the Oslo Special Committee 4Pr Preliminar eliminary y Con Confid fident ential ial Draft Draft – – Not Not fo for Relia r Relianc nce; e; Subject Subject to to Chan Change ge and and Fu Further rther Rev Reviiew ew (1) Oslo Counterproposal UPFRONT TRANSACTION § Specific negotiations on upfront pricing should be led by Oslo’s Special Committee § Same value of consideration should be provided to both public / Acorn and OCGH (ex. Acorn) Pricing ‒ Value based on date of announcement reflecting typical metrics (i.e., reflecting current / recent share price performance) § OCGH (ex. Acorn) prepared to receive more stock consideration vs. public / Acorn, provided that value of Stock / Cash Mix stock and cash components are equivalent at the date of announcement ‒ OCGH (ex. Acorn) willing to commit to short-term (e.g., 90 days) lock-up on consideration in Berlin shares § Oslo’s balance sheet cash should not be utilized as part of the transaction Cash Funding BACK-END § January 2022 Timing of First Liquidity Election Period § Oslo is willing to reintroduce this concept, but does not require it Reserve Shares § 20% at first Liquidity Election Period (January 2022) Yearly Liquidity Cap§ 30% at second Liquidity Election Period (January 2023) § 40% at third Liquidity Election Period (January 2024) and thereafter § The lower of Interest on 3-Year Note 1. Prevailing yield on Oslo’s preferred units, or 2. If marketable, the yield at which the Notes could be sold at par § Fixed at 14x / 7x Multiple Levels § The existing TRA agreement will remain in place, except that Berlin’s current NOL position would be taken into account before determining the value of any newly created TRA (whether from the upfront transaction or TRA subsequent exchanges) § Oslo would be open to agreeing to an acceleration payment on the TRA or any portion thereof either as part of the upfront transaction or in the future Note: (1) This Illustrative Counterproposal has not been reviewed by the Oslo Special Committee. Terms with respect to the public-side transaction are illustrative only and remain subject to input from the Oslo Special Committee 4

Preliminary Confidential Draft – Not for Reliance; Subject to Change and Further Review Legal Disclosures This document, and the information contained herein (this “Information”), is being delivered on behalf of Oaktree Capital Group, LLC (the “Company”), to you in connection with your consideration of a potential transaction with the Company (the “Potential Transaction”) by Perella Weinberg Partner LP (“Perella Weinberg Partners” and together with its affiliates, the “Firm”) which has been engaged as financial advisor to the Company in connection with the Potential Transaction. The Information, together with any information which may be provided orally by the Firm in connection herewith, is confidential and is being provided subject to, and is governed by, your confidentiality agreement with the Company (the “Confidentiality Agreement”). The purpose and permitted use of the Information is solely to assist you in deciding whether you proceed with a further investigation of the Potential Transaction (the “Specified Purpose”). Except as provided in the Confidentiality Agreement, this Information may not be distributed or reproduced without the express written consent of the Company and the Firm, and shall not be used for any purpose other than the Specified Purpose. This Information does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities, businesses or assets of the Company in any jurisdiction (and any such offer with respect to securities (if any) will be made only in accordance with applicable securities laws and only in jurisdictions where such offer and sale is permitted). The Information, which does not purport to be comprehensive or contain all of the information that may be required to evaluate all of the factors that would be relevant to your consideration of the Potential Transaction. This information has been furnished or approved for inclusion herein by the Company but has not been independently verified by the Firm. No responsibility or liability is or will be accepted by the Company, any affiliate of the Company, the Firm or by any of their respective directors, managers, members, stockholders, investors, officers, employees, brokers, agents, accountants, counsel, advisors or other representatives (collectively, “Representatives”) with respect to the accuracy or completeness of the Information or any other written or oral information made available to you or your affiliates or Representatives, any such responsibility or liability being expressly disclaimed. In particular, but without limiting the foregoing, no representation or warranty is given as to the achievability or reasonableness of any future projections, management estimates, prospects, opportunities or returns contained herein or in any other information provided (whether in writing or orally) to you or any other person. You acknowledge and agree that the information set forth herein has not be independently verified by either the Company, the Firm or their respective affiliates or Representatives and that no person has (or is held out as having) any authority to give any statement, representation, warranty or undertaking on behalf of the Company, the Firm or any of their respective affiliates or Representatives in connection with the Potential Transaction. No information provided or referred to herein shall form the basis of any contract, commitment, agreement, arrangement, understanding or obligation by or among the Company or its affiliates or Representatives, on the one hand, and you or your affiliates and Representatives, on the other hand. If the parties enter into a definitive agreement to proceed with the Potential Transaction, such definitive agreement will contain, among other things, an express acknowledgement by you (on behalf of yourself and your affiliates and Representatives) that you have not relied on, or been induced to enter into such an agreement by, any representation or warranty except for those representations and warranties expressly set forth in such definitive agreement. You should not assume that the information contained herein or any additional information (which may or may not be provided to you, in the Company’s sole discretion) is current as of any date other than as of their respective dates, regardless of their time of delivery. The Company’s business, assets, financial condition, liquidity, results of operations, opportunities and/or prospects may have changed since those dates. Neither the Company nor the Firm undertakes any obligation (express or implied) to update any such information or advise you of any changes or errors or inaccuracies. Furthermore, this Information, and any such additional information, may contain statements related to future results, beliefs, expectations, forecasts or predictions for the future. Such forward-looking statements are not historical facts, speak only as of the date on which the statements were made, and are not a guarantee of future performance. You are urged to conduct your own investigation and analysis of the Company and the Potential Transaction in consultation with your own professional advisors. Unless and until a definitive agreement has been duly executed and delivered by the Company and/or its stockholders (as the case may be), neither the Company nor any of its affiliates or Representatives (nor any other person) shall have any obligation to negotiate or proceed with the Potential Transaction or any other transaction. 5Preliminary Confidential Draft – Not for Reliance; Subject to Change and Further Review Legal Disclosures This document, and the information contained herein (this “Information”), is being delivered on behalf of Oaktree Capital Group, LLC (the “Company”), to you in connection with your consideration of a potential transaction with the Company (the “Potential Transaction”) by Perella Weinberg Partner LP (“Perella Weinberg Partners” and together with its affiliates, the “Firm”) which has been engaged as financial advisor to the Company in connection with the Potential Transaction. The Information, together with any information which may be provided orally by the Firm in connection herewith, is confidential and is being provided subject to, and is governed by, your confidentiality agreement with the Company (the “Confidentiality Agreement”). The purpose and permitted use of the Information is solely to assist you in deciding whether you proceed with a further investigation of the Potential Transaction (the “Specified Purpose”). Except as provided in the Confidentiality Agreement, this Information may not be distributed or reproduced without the express written consent of the Company and the Firm, and shall not be used for any purpose other than the Specified Purpose. This Information does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities, businesses or assets of the Company in any jurisdiction (and any such offer with respect to securities (if any) will be made only in accordance with applicable securities laws and only in jurisdictions where such offer and sale is permitted). The Information, which does not purport to be comprehensive or contain all of the information that may be required to evaluate all of the factors that would be relevant to your consideration of the Potential Transaction. This information has been furnished or approved for inclusion herein by the Company but has not been independently verified by the Firm. No responsibility or liability is or will be accepted by the Company, any affiliate of the Company, the Firm or by any of their respective directors, managers, members, stockholders, investors, officers, employees, brokers, agents, accountants, counsel, advisors or other representatives (collectively, “Representatives”) with respect to the accuracy or completeness of the Information or any other written or oral information made available to you or your affiliates or Representatives, any such responsibility or liability being expressly disclaimed. In particular, but without limiting the foregoing, no representation or warranty is given as to the achievability or reasonableness of any future projections, management estimates, prospects, opportunities or returns contained herein or in any other information provided (whether in writing or orally) to you or any other person. You acknowledge and agree that the information set forth herein has not be independently verified by either the Company, the Firm or their respective affiliates or Representatives and that no person has (or is held out as having) any authority to give any statement, representation, warranty or undertaking on behalf of the Company, the Firm or any of their respective affiliates or Representatives in connection with the Potential Transaction. No information provided or referred to herein shall form the basis of any contract, commitment, agreement, arrangement, understanding or obligation by or among the Company or its affiliates or Representatives, on the one hand, and you or your affiliates and Representatives, on the other hand. If the parties enter into a definitive agreement to proceed with the Potential Transaction, such definitive agreement will contain, among other things, an express acknowledgement by you (on behalf of yourself and your affiliates and Representatives) that you have not relied on, or been induced to enter into such an agreement by, any representation or warranty except for those representations and warranties expressly set forth in such definitive agreement. You should not assume that the information contained herein or any additional information (which may or may not be provided to you, in the Company’s sole discretion) is current as of any date other than as of their respective dates, regardless of their time of delivery. The Company’s business, assets, financial condition, liquidity, results of operations, opportunities and/or prospects may have changed since those dates. Neither the Company nor the Firm undertakes any obligation (express or implied) to update any such information or advise you of any changes or errors or inaccuracies. Furthermore, this Information, and any such additional information, may contain statements related to future results, beliefs, expectations, forecasts or predictions for the future. Such forward-looking statements are not historical facts, speak only as of the date on which the statements were made, and are not a guarantee of future performance. You are urged to conduct your own investigation and analysis of the Company and the Potential Transaction in consultation with your own professional advisors. Unless and until a definitive agreement has been duly executed and delivered by the Company and/or its stockholders (as the case may be), neither the Company nor any of its affiliates or Representatives (nor any other person) shall have any obligation to negotiate or proceed with the Potential Transaction or any other transaction. 5