increase in procedure revenue was attributable to an increase in MAKOplasty procedures performed during the year ended December 31, 2010 as compared with the year ended December 31, 2009. There were 3,485 MAKOplasty procedures performed during the year ended December 31, 2010 compared to 1,602 MAKOplasty procedures performed during the year ended December 31, 2009. The increase in MAKOplasty procedures performed was driven by the continued adoption of knee MAKOplasty, both in terms of utilization per commercial site and total commercial installed base. Revenue for the year ended December 31, 2010 was reduced by $2.2 million, of which $1.2 million related to system sales prior to the fourth quarter, for the deferral of system revenue related to the first year warranty and maintenance services provided by MAKO. This deferred revenue will be recognized in service revenue over a twelve-month period. In accordance with our revenue recognition policy, recognition of revenue on unit sales of our TGS was deferred until delivery of the RIO system, which we commercially released in the first quarter of 2009. We expect our revenue to continue to increase as unit sales of our RIO system increase in future periods and the number of MAKOplasty procedures performed increases in future periods.

We loan instrumentation to our customers, which are used to perform MAKOplasty procedures in conjunction with using the RIO system. These loaned instrument sets, or implant instruments, are comprised of tools and equipment that facilitate the implantation of our implants. Implant instruments loaned to customers are not part of the tangible product sold and title of loaned instrument remains with the Company. To better reflect the economics of the implant instruments and enhance comparability with other companies in our industry, depreciation expense on implant instruments has been reclassified from cost of revenue – procedures to selling, general and administrative expense beginning in the first quarter of 2010. Depreciation expense for implant instruments was $464,000, $250,000 and $134,000 for the years ended December 31, 2010, 2009 and 2008, respectively.

Table of Contents

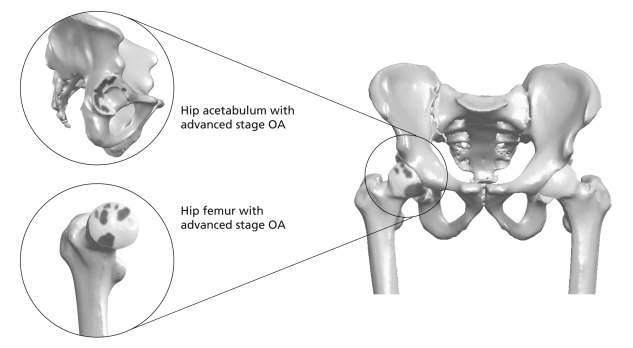

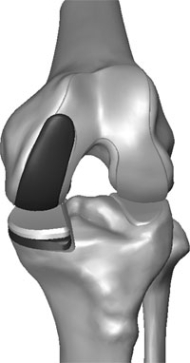

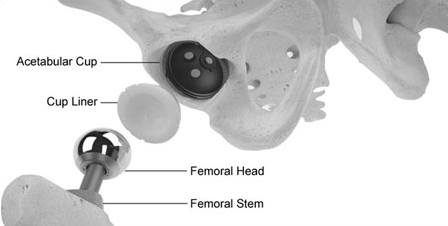

Research and Development. Research and development expense was $15.0 million for the year ended December 31, 2010, compared to $13.1 million for the year ended December 31, 2009. The increase of $1.9 million, or 14%, was primarily due to an increase in research and development activities associated with on-going development of our RIO system, our MAKO implant systems and potential future products, including our hip MAKOplasty application and associated implant systems. We expect our research and development expense to increase as we continue to expand our research and development activities, including the support of existing products and the research of potential future products, including our hip MAKOplasty application and associated implant systems.

Depreciation and Amortization. Depreciation and amortization expense was $3.0 million for the year ended December 31, 2010, compared to $2.0 million for the year ended December 31, 2009. The increase of $1.0 million, or 56%, was primarily due to an increase in depreciation of property and equipment as a result of purchases made during 2010 and 2009 due to the growth in our business, the expansion of our facilities in 2010 to accommodate an increase in employees necessary to support such growth.

Interest and Other Income. Interest and other income was $317,000 for the year ended December 31, 2010, compared to $432,000 for the year ended December 31, 2009. The decrease of $115,000, or 27%, was primarily due to lower yields realized on our cash, cash equivalents and investments for the year ended December 31, 2010 compared with the same period of 2009 which is attributable to a cash investment strategy which emphasizes the security of the principal invested and fulfillment of liquidity needs.

Income Taxes. No federal income taxes were recognized for the year ended December 31, 2010 and 2009, due to net operating losses in each period. State and local income taxes were $68,000 for the year ended December 31, 2010, compared to $56,000 for the year ended December 31, 2009. Income taxes recognized to date have not been significant due to net operating losses we have incurred in each period since our inception in November 2004. In addition, no current or deferred income taxes were recorded for the years ended December 31, 2010 and 2009, as all income tax benefits were fully offset by a valuation allowance against our net deferred income tax assets.

Year Ended December 31, 2009 Compared to the Year Ended December 31, 2008

Revenue. Revenue was $34.2 million for the year ended December 31, 2009, compared to $2.9 million for the year ended December 31, 2008. The increase in revenue of $31.3 million was primarily due to $14.7 million of revenue from 19 unit sales of our RIO system and the recognition of approximately $11.3 million of revenue from 17 previously deferred unit sales of our TGS. In accordance with our revenue recognition policy, recognition of revenue on unit sales of our TGS was deferred until delivery of the RIO system, which we commercially released in the first quarter of 2009. Prior to 2009, recognized revenue was primarily generated from the sale of implants and disposable products utilized in knee MAKOplasty procedures. Total revenue was also positively impacted by a $5.1 million increase in procedure revenue attributable to an increase in knee MAKOplasty procedures performed during the year ended December 31, 2009 as compared with the year ended December 31, 2008. There were 1,602 knee MAKOplasty procedures performed during the year ended December 31, 2009 compared to 601 knee MAKOplasty procedures performed during year ended December 31, 2008.

Cost of Revenue. Cost of revenue was $21.5 million for the year ended December 31, 2009, compared to $3.3 million for the year ended December 31, 2008. The increase in cost of revenue of $18.2 million was primarily due to the cost of revenue from 19 unit sales of our RIO system, the recognition of the direct cost of revenue from 17 previously deferred unit sales of our TGS, including the cost of providing the RIO system upgrades, as described in the “Critical Accounting Policies and Significant Judgments and Estimates” section above, and an increase in knee MAKOplasty procedures performed.

Selling, General and Administrative. Selling, general and administrative expense was $32.1 million for the year ended December 31, 2009, compared to $23.3 million for the year ended December 31, 2008. The increase of $8.8 million, or 38%, was primarily due to an increase in sales, marketing and operations costs

75

Table of Contents

associated with the production and commercialization of our products and an increase in general and administrative costs to support growth and costs associated with operating as a public company. Selling, general and administrative expense for the year ended December 31, 2009 also included $3.3 million of stock-based compensation expense compared to $1.9 million for the year ended December 31, 2008. The increase in stock-based compensation expense was primarily due to additional option and restricted stock grants made in 2009.

Research and Development. Research and development expense was $13.1 million for the year ended December 31, 2009, compared to $12.5 million for the year ended December 31, 2008. The increase of $655,000, or 5%, was primarily due to an increase in research and development activities associated with on-going development of our RIO system, our MAKO implant systems and potential future products. This was partially offset by a nonrecurring charge of $949,000 incurred in the first quarter of 2008 associated with the vesting in full, upon completion of our IPO in February 2008, of restricted common stock issued pursuant to business consultation agreements entered into in December 2004.

Depreciation and Amortization. Depreciation and amortization expense was $2.0 million for the year ended December 31, 2009, compared to $1.8 million for the year ended December 31, 2008. The increase of $123,000, or 7%, was primarily due to an increase in depreciation of property and equipment as a result of purchases made during 2009 and 2008.

Interest and Other Income. Interest and other income was $432,000 for the year ended December 31, 2009, compared to $988,000 for the year ended December 31, 2008. The decrease of $556,000, or 56%, was primarily due to lower yields realized on our cash, cash equivalents and investments for the year ended December 31, 2009 compared with the same period of 2008.

Interest and Other Expense. Interest and other expense was $3,000 for the year ended December 31, 2009, compared to $110,000 for the year ended December 31, 2008. Through February 2008, interest and other expense consisted primarily of the amortization of a $590,000 discount associated with a deferred license fee payment of $4.0 million which had been fully amortized and paid upon the completion of our IPO in February 2008.

Income Taxes. No federal income taxes were recognized for the year ended December 31, 2009 and 2008, due to net operating losses in each period. State and local income taxes were $56,000 for the year ended December 31, 2009. Income taxes recognized to date have not been significant due to net operating losses we have incurred in each period since our inception in November 2004. In addition, no current or deferred income taxes were recorded for the year ended December 31, 2009 and 2008, as all income tax benefits were fully offset by a valuation allowance against our net deferred income tax assets.

Liquidity and Capital Resources

| | | | | | | | | | | | | | | | |

(in thousands) | | | | | | | | | | | | | | | | |

| | 2010 | | Change | | 2009 | | Change | | 2008 | |

Cash and cash equivalents | | $ | 27,108 | | $ | 9,949 | | | 17,159 | | $ | (45,388 | ) | $ | 62,547 | |

Short-term investments | | | 46,401 | | | 1,715 | | | 44,686 | | | 43,609 | | | 1,077 | |

Long-term investments | | | 23,283 | | | 13,915 | | | 9,368 | | | 9,368 | | | ― | |

Total cash, cash equivalents, and investments | | $ | 96,792 | | $ | 25,579 | | $ | 71,213 | | $ | 7,589 | | $ | 63,624 | |

| | | | | | | | | | | | | | | | |

Cash used in operating activities | | $ | (30,292 | ) | $ | 15,280 | | $ | (45,572 | ) | $ | (15,752 | ) | $ | (29,820 | ) |

Cash used in investing activities | | | (20,076 | ) | | 34,104 | | | (54,180 | ) | | (50,631 | ) | | (3,549 | ) |

Cash provided by financing activities | | | 60,317 | | | 5,953 | | | 54,364 | | | (31,937 | ) | | 86,301 | |

Net increase (decrease) in cash and cash equivalents | | $ | 9,949 | | $ | 55,337 | | $ | (45,388 | ) | $ | (98,320 | ) | $ | 52,932 | |

We have incurred net losses and negative cash flow from operating activities for each period since our inception in November 2004. As of December 31, 2010, we had an accumulated deficit of $152.9 million and have financed our operations principally through the sale of our equity securities.

76

Table of Contents

In November 2010, we completed a public offering of our common stock, issuing 6,325,000 shares at a price per share of $9.44, resulting in net proceeds of approximately $59.3 million, after expenses.

As of December 31, 2010, we had approximately $96.8 million in cash, cash equivalents and investments. Our cash and investment balances are held in a variety of interest bearing instruments, including notes and bonds from U.S. government agencies, certificates of deposit and investment grade rated U.S. corporate debt.

Net Cash Used in Operating Activities

Net cash used in operating activities primarily reflects the net loss for those periods, which was reduced in part by depreciation and amortization, stock-based compensation, inventory write-downs and property and equipment write-downs. For the year ended December 31, 2010, inventory write-downs of $1.7 million and property and equipment write-downs of $1.2 million were incurred primarily due to the write-off of excess RESTORIS Classic implants and instrumentation as discussed in “Factors Which May Influence Future Results of Operations” above. Net cash used in operating activities was also affected by changes in operating assets and liabilities. Included in changes in operating assets and liabilities for the year ended December 31, 2010 are approximately $6.1 million of increases to inventory necessitated by increased sales of implants and disposable products to support the growth of knee MAKOplasty and preparation for the anticipated launch of our hip MAKOplasty application, $5.0 million of increases to accounts receivable due to increased sales in 2010, which was partially offset by $4.0 million of increases to other accrued liabilities and accrued compensation and employee benefits. Included in changes in operating assets and liabilities for the year ended December 31, 2009 are approximately $11.0 million and $3.6 million of decreases to the deferred revenue balance and deferred cost of revenue balance, respectively, due to the recognition of 17 previously deferred unit sales of our TGS, $7.4 million of increases in inventory necessitated by the commercial release of the RIO system, the commercial release of the RESTORIS MCK implant system and increased sales of implants and disposable products and $3.8 million of increases in accounts receivable due to increased sales in the fourth quarter of 2009 as compared to the fourth quarter of 2008. In accordance with our revenue recognition policy, recognition of revenue and direct cost of revenue associated with the unit sales of our TGS was deferred until delivery of the RIO system, which we commercially released in the first quarter of 2009.

Net Cash Used in Investing Activities

Net cash used in investing activities for the year ended December 31, 2010 was primarily attributable to the purchase of investments of $65.8 million and purchases of property and equipment of $2.6 million, which was partially offset by proceeds of $49.7 million from sales and maturities of investments. Purchases of investments in 2010 were primarily driven by net proceeds of $59.3 million received in a public offering of our common stock in November 2010. Net cash used in investing activities for the year ended December 31, 2009 was primarily attributable to the purchase of investments of $60.0 million and purchases of property and equipment of $790,000, which was partially offset by proceeds of $6.7 million from sales and maturities of investments.

Net Cash Provided by Financing Activities

Net cash provided by our financing activities for the year ended December 31, 2010 was primarily attributable to net proceeds of $59.3 million received in public offering of our common stock in November 2010. Net cash provided by our financing activities for the year ended December 31, 2009 was primarily attributable to net proceeds of $54.3 million received in connection with our equity financing in August 2009.

Operating Capital and Capital Expenditure Requirements

To date, we have not achieved profitability. We anticipate that we will continue to incur substantial net losses for at least the next two or three years as we expand our sales and marketing capabilities in the orthopedic products market, continue to commercialize our RIO system and RESTORIS MCK multicompartmental knee implant system, continue research and development of existing and future products, including our hip

77

Table of Contents

MAKOplasty application and associated implant systems, and continue development of the corporate infrastructure required to sell and market our products and support operations. We also expect to experience increased cash requirements for inventory and property and equipment in conjunction with the continued commercialization of our RESTORIS MCK multicompartmental knee implant system and our RIO system and introducing other potential future applications, including our hip MAKOplasty application and associated implant systems.

In executing our current business plan, we believe our existing cash, cash equivalents and investment balances, and interest income we earn on these balances will be sufficient to meet our anticipated cash requirements for at least the next twelve months. To the extent our available cash, cash equivalents and investment balances are insufficient to satisfy our operating requirements, we will need to seek additional sources of funds, including selling additional equity, debt or other securities or entering into a credit facility, or modify our current business plan. The sale of additional equity and convertible debt securities may result in dilution to our current stockholders. If we raise additional funds through the issuance of debt securities, these securities may have rights senior to those of our common stock and could contain covenants that could restrict our operations and issuance of dividends. We may also require additional capital beyond our currently forecasted amounts. Any required additional capital, whether forecasted or not, may not be available on reasonable terms, or at all. If we are unable to obtain additional financing, we may be required to reduce the scope of, delay or eliminate some or all of our planned research, development and commercialization activities, which could materially harm our business and results of operations.

Because of the numerous risks and uncertainties associated with the development of medical devices and the current economic situation, we are unable to estimate the exact amounts of capital outlays and operating expenditures necessary to complete the development of our products and successfully deliver commercial products to the market. Our future capital requirements will depend on many factors, including but not limited to the following:

| | |

| • | the revenue generated by sales of our current and future products; |

| | |

| • | the expenses we incur in selling and marketing our products; |

| | |

| • | the costs and timing of regulatory clearance or approvals for upgrades or changes to our existing products as well as future products; |

| | |

| • | the rate of progress, cost and success of on-going product development activities; |

| | |

| • | the emergence of competing or complementary technological developments; |

| | |

| • | the costs of filing, prosecuting, defending and enforcing any patent or license claims and other intellectual property rights, or participating in litigation related activities; |

| | |

| • | the future unknown impact of recently enacted healthcare legislation; |

| | |

| • | the acquisition of businesses, products and technologies, although we currently have no understandings, commitments or agreements relating to any material transaction of this type; and |

| | |

| • | general economic conditions and interest rates. |

Contractual Obligations

The following table summarizes our outstanding contractual obligations as of December 31, 2010 and the effect those obligations are expected to have on our liquidity and cash flows in future periods:

78

Table of Contents

| | | | | | | | | | | | | | | | |

(in thousands) | | Payment Due by Period | |

| | | | December 31, | | After |

| | Total | | 2011 | | 2012-2013 | | 2014-2015 | | 2015 | |

Contractual Obligations | | | | | | | | | | | | | | | | |

Minimum royalty payments – licenses | | $ | 14,150 | | $ | 1,069 | | $ | 3,538 | | $ | 4,068 | | $ | 5,475 | |

Operating lease – real estate | | | 5,823 | | | 290 | | | 689 | | | 1,161 | | | 3,683 | |

Purchase commitments and obligations | | | 8,005 | | | 8,005 | | | ― | | | ― | | | ― | |

Development agreement obligations | | | 1,000 | | | 750 | | | 250 | | | ― | | | ― | |

Total | | $ | 28,978 | | $ | 10,114 | | $ | 4,477 | | $ | 5,229 | | $ | 9,158 | |

Our commitments for minimum royalty payments relate to payments under various licenses and sublicenses as discussed in Item 8, Financial Statements and Supplementary Data, Note 7 to the Financial Statements. Our commitments for operating leases relate to the lease for our headquarters in Fort Lauderdale, Florida. Our commitments for purchase commitments and obligations include an estimate of open purchase orders and contractual obligations in the ordinary course of business, including commitments with contract manufacturers and suppliers, for which we have not received the goods or services. Our commitments for development agreement obligations relate to payments under development agreements as discussed in Item 8, Financial Statements and Supplementary Data, Notes 5 and 7 to the Financial Statements.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

| |

ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Our exposure to market risk is confined to our cash, cash equivalents, investments and exchange rate risk on international sales. The goals of our cash investment policy are the security of the principal invested and fulfillment of liquidity needs, with the need to maximize value being an important consideration. To achieve our goals, we maintain a portfolio of cash equivalents and investments in a variety of securities including notes and bonds from U.S. government agencies, certificates of deposit and investment grade rated U.S. corporate debt. The securities in our investment portfolio are not leveraged and are classified as available-for-sale. We currently do not hedge interest rate exposure or exchange rate risk. We do not believe that a variation in market rates of interest would significantly impact the value of our investment portfolio. We do not believe that a variation in the value of the U.S. dollar relative to foreign currencies would significantly impact our results of operations.

79

Table of Contents

| |

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

MAKO SURGICAL CORP.

Index to the Financial Statements

80

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

MAKO Surgical Corp.

We have audited the accompanying balance sheets of MAKO Surgical Corp. as of December 31, 2010 and 2009, and the related statements of operations, redeemable convertible preferred stock and stockholders’ equity (deficit), and cash flows for each of the three years in the period ended December 31, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of MAKO Surgical Corp. at December 31, 2010 and 2009, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2010, in conformity with U.S. generally accepted accounting principles.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), MAKO Surgical Corp.’s internal control over financial reporting as of December 31, 2010, based on criteria established inInternal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated March 10, 2011 expressed an unqualified opinion thereon.

| |

| /s/ ERNST & YOUNG LLP |

| Certified Public Accountants |

Boca Raton, Florida | |

March 10, 2011 | |

81

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

MAKO Surgical Corp.

We have audited MAKO Surgical Corp.’s internal control over financial reporting as of December 31, 2010, based on criteria established inInternal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the COSO criteria). MAKO Surgical Corp.’s management is responsible for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, MAKO Surgical Corp. maintained, in all material respects, effective internal control over financial reporting as of December 31, 2010, based on the COSO criteria.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the balance sheets of MAKO Surgical Corp. as of December 31, 2010 and 2009, and the related statements of operations, redeemable convertible preferred stock and stockholders’ equity (deficit), and cash flows for each of the three years in the period ended December 31, 2010 of MAKO Surgical Corp. and our report dated March 10, 2011 expressed an unqualified opinion thereon.

| |

| /s/ ERNST & YOUNG LLP |

| Certified Public Accountants |

Boca Raton, Florida | |

March 10, 2011 | |

82

Table of Contents

MAKO SURGICAL CORP.

Balance Sheets

(in thousands, except share and per share data)

| | | | | | | |

| | December 31, | |

| | 2010 | | 2009 | |

ASSETS | | | | | | | |

Current Assets: | | | | | | | |

Cash and cash equivalents | | $ | 27,108 | | $ | 17,159 | |

Short-term investments | | | 46,401 | | | 44,686 | |

Accounts receivable | | | 11,560 | | | 6,536 | |

Inventory | | | 10,504 | | | 10,190 | |

Prepaids and other assets | | | 1,283 | | | 532 | |

Total current assets | | | 96,856 | | | 79,103 | |

Long-term investments | | | 23,283 | | | 9,368 | |

Property and equipment, net | | | 9,212 | | | 6,205 | |

Intangible assets, net | | | 7,530 | | | 4,234 | |

Other assets | | | 198 | | | 193 | |

Total assets | | $ | 137,079 | | $ | 99,103 | |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

Current Liabilities: | | | | | | | |

Accounts payable | | $ | 1,518 | | $ | 1,159 | |

Accrued compensation and employee benefits | | | 5,546 | | | 3,709 | |

Other accrued liabilities | | | 5,064 | | | 2,872 | |

Deferred revenue | | | 3,071 | | | 548 | |

Total current liabilities | | | 15,199 | | | 8,288 | |

| | | | | | | |

Deferred revenue, non-current | | | 109 | | | 21 | |

Total liabilities | | | 15,308 | | | 8,309 | |

| | | | | | | |

Commitments and contingencies (Note 7) | | | ― | | | ― | |

| | | | | | | |

Stockholders’ equity: | | | | | | | |

Preferred stock, $0.001 par value; 27,000,000 authorized; 0 shares issued and outstanding as of December 31, 2010 and 2009 | | | ― | | | ― | |

Common stock, $0.001 par value; 135,000,000 authorized; 39,945,467 and 33,036,378 shares issued and outstanding as of December 31, 2010 and 2009, respectively | | | 40 | | | 33 | |

Additional paid-in capital | | | 274,712 | | | 204,977 | |

Accumulated deficit | | | (152,882 | ) | | (114,195 | ) |

Accumulated other comprehensive loss | | | (99 | ) | | (21 | ) |

Total stockholders’ equity | | | 121,771 | | | 90,794 | |

Total liabilities and stockholders’ equity | | $ | 137,079 | | $ | 99,103 | |

See accompanying notes.

83

Table of Contents

MAKO SURGICAL CORP.

Statements of Operations

(in thousands, except per share data)

| | | | | | | | | | |

| | Years Ended December 31, | |

| | 2010 | | 2009 | | 2008 | |

Revenue: | | | | | | | | | | |

Procedures | | $ | 17,620 | | $ | 7,550 | | $ | 2,457 | |

Systems – RIO | | | 24,928 | | | 14,715 | | | ― | |

Systems – TGS, previously deferred | | | ― | | | 11,297 | | | ― | |

Service and other | | | 1,748 | | | 646 | | | 487 | |

Total revenue | | | 44,296 | | | 34,208 | | | 2,944 | |

Cost of revenue: | | | | | | | | | | |

Procedures | | | 5,960 | | | 3,087 | | | 1,387 | |

Systems – RIO | | | 11,171 | | | 9,032 | | | 1,692 | |

Systems – RIO upgrades | | | ― | | | 5,183 | | | ― | |

Systems – TGS, previously deferred | | | ― | | | 3,606 | | | ― | |

Service and other | | | 1,042 | | | 546 | | | 233 | |

Total cost of revenue | | | 18,173 | | | 21,454 | | | 3,312 | |

Gross profit (loss) | | | 26,123 | | | 12,754 | | | (368 | ) |

Operating costs and expenses: | | | | | | | | | | |

Selling, general and administrative | | | 47,041 | | | 32,072 | | | 23,292 | |

Research and development | | | 14,975 | | | 13,127 | | | 12,472 | |

Depreciation and amortization | | | 3,043 | | | 1,951 | | | 1,828 | |

Total operating costs and expenses | | | 65,059 | | | 47,150 | | | 37,592 | |

Loss from operations | | | (38,936 | ) | | (34,396 | ) | | (37,960 | ) |

Interest and other income | | | 317 | | | 432 | | | 988 | |

Interest and other expenses | | | ― | | | (3 | ) | | (110 | ) |

Loss before income taxes | | | (38,619 | ) | | (33,967 | ) | | (37,082 | ) |

Income tax expense | | | 68 | | | 56 | | | ― | |

Net loss | | | (38,687 | ) | | (34,023 | ) | | (37,082 | ) |

Accretion of preferred stock | | | ― | | | ― | | | (44 | ) |

Dividends on preferred stock | | | ― | | | ― | | | (521 | ) |

Net loss attributable to common stockholders | | $ | (38,687 | ) | $ | (34,023 | ) | $ | (37,647 | ) |

Net loss per share – Basic and diluted attributable to common stockholders | | $ | (1.13 | ) | $ | (1.22 | ) | $ | (2.20 | ) |

Weighted average common shares outstanding – Basic and diluted | | | 34,349 | | | 27,806 | | | 17,096 | |

See accompanying notes.

84

Table of Contents

MAKO SURGICAL CORP.

Statements of Redeemable Convertible Preferred Stock and Stockholders’ Equity (Deficit)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Redeemable

Convertible Preferred | | Common

Shares | | Stock

Amount | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Other

Comprehensive

Income (Loss) | | Total

Stockholders’

Equity (Deficit) | |

| | Shares | | Amount | | | | | | | |

Balance at December 31, 2007 | | | 33,164 | | $ | 59,487 | | | 1,871 | | $ | 2 | | $ | — | | $ | (42,843 | ) | $ | 4 | | $ | (42,837 | ) |

Issuance of common stock in initial public offering | | | — | | | — | | | 5,100 | | | 5 | | | 43,789 | | | — | | | — | | | 43,794 | |

Issuance of common stock in equity financing | | | — | | | — | | | 6,451 | | | 7 | | | 39,726 | | | — | | | — | | | 39,733 | |

Issuance of common stock upon exercise of options | | | — | | | — | | | 62 | | | — | | | 46 | | | — | | | — | | | 46 | |

Stock-based compensation expense | | | — | | | — | | | — | | | — | | | 1,467 | | | — | | | — | | | 1,467 | |

Restricted common stock compensation expense | | | — | | | — | | | 256 | | | — | | | 1,856 | | | — | | | — | | | 1,856 | |

Accretion to redemption value of Series A, B and C redeemable convertible preferred stock | | | — | | | 44 | | | — | | | — | | | (44 | ) | | — | | | — | | | (44 | ) |

Accrued dividends on Series A, B and C redeemable convertible preferred stock | | | — | | | 521 | | | — | | | — | | | (274 | ) | | (247 | ) | | — | | | (521 | ) |

Conversion of Series A, B and C redeemable convertible preferred shares into common shares | | | (33,164 | ) | | (53,667 | ) | | 10,945 | | | 11 | | | 53,656 | | | — | | | — | | | 53,667 | |

Reclassification of accrued dividends on redeemable convertible preferred stock to additional paid-in capital | | | — | | | (6,385 | ) | | — | | | — | | | 6,385 | | | — | | | — | | | 6,385 | |

Change in unrealized gain on available-for-sale securities | | | — | | | — | | | — | | | — | | | — | | | — | | | 50 | | | 50 | |

Net loss | | | — | | | — | | | — | | | — | | | — | | | (37,082 | ) | | — | | | (37,082 | ) |

Total comprehensive loss | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (37,032 | ) |

Balance at December 31, 2008 | | | — | | $ | — | | | 24,685 | | $ | 25 | | $ | 146,607 | | $ | (80,172 | ) | $ | 54 | | $ | 66,514 | |

(continued)

85

Table of Contents

MAKO SURGICAL CORP.

Statements of Redeemable Convertible Preferred Stock and Stockholders’ Equity (Deficit)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Redeemable

Convertible Preferred | | Common

Shares | | Stock

Amount | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Other

Comprehensive

Income (Loss) | | Total

Stockholders’

Equity (Deficit) | |

| | Shares | | Amount | | | | | | | |

Balance at December 31, 2008 | | | — | | $ | — | | | 24,685 | | $ | 25 | | $ | 146,607 | | $ | (80,172 | ) | $ | 54 | | $ | 66,514 | |

Issuance of common stock in equity financing | | | — | | | — | | | 8,050 | | | 8 | | | 54,300 | | | — | | | — | | | 54,308 | |

Issuance of common stock under employee stock purchase plan | | | — | | | — | | | 72 | | | — | | | 455 | | | — | | | — | | | 455 | |

Issuance of common stock upon exercise of options and warrants | | | — | | | — | | | 140 | | | — | | | 149 | | | — | | | — | | | 149 | |

Stock-based compensation expense | | | — | | | — | | | — | | | — | | | 3,032 | | | — | | | — | | | 3,032 | |

Restricted common stock compensation expense | | | — | | | — | | | 145 | | | — | | | 982 | | | — | | | — | | | 982 | |

Receipt of 56,045 shares delivered in payment of payroll taxes | | | — | | | — | | | (56 | ) | | — | | | (492 | ) | | — | | | — | | | (492 | ) |

Equity financing costs | | | — | | | — | | | — | | | — | | | (56 | ) | | — | | | — | | | (56 | ) |

Change in unrealized gain (loss) on available-for-sale securities | | | — | | | — | | | — | | | — | | | — | | | — | | | (75 | ) | | (75 | ) |

Net loss | | | — | | | — | | | — | | | — | | | — | | | (34,023 | ) | | — | | | (34,023 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive loss | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (34,098 | ) |

Balance at December 31, 2009 | | | — | | | — | | | 33,036 | | | 33 | | | 204,977 | | | (114,195 | ) | | (21 | ) | | 90,794 | |

Issuance of common stock in equity financing | | | — | | | — | | | 6,325 | | | 6 | | | 59,277 | | | — | | | — | | | 59,283 | |

Issuance of common stock under employee stock purchase plan | | | — | | | — | | | 86 | | | — | | | 765 | | | — | | | — | | | 765 | |

Issuance of common stock upon exercise of options and warrants | | | — | | | — | | | 199 | | | — | | | 611 | | | — | | | — | | | 611 | |

Stock-based compensation expense | | | — | | | — | | | — | | | — | | | 5,027 | | | — | | | — | | | 5,027 | |

Restricted common stock compensation expense | | | — | | | — | | | 97 | | | — | | | 1,344 | | | — | | | — | | | 1,344 | |

Receipt of 28,307 shares delivered in payment of payroll taxes | | | — | | | — | | | (28 | ) | | — | | | (342 | ) | | — | | | — | | | (342 | ) |

Issuance of stock to a related party for intangible assets | | | — | | | — | | | 230 | | | 1 | | | 3,053 | | | — | | | — | | | 3,054 | |

Change in unrealized loss on available-for-sale securities | | | — | | | — | | | — | | | — | | | — | | | — | | | (78 | ) | | (78 | ) |

Net loss | | | — | | | — | | | — | | | — | | | — | | | (38,687 | ) | | — | | | (38,687 | ) |

Total comprehensive loss | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (38,765 | ) |

Balance at December 31, 2010 | | | — | | $ | — | | | 39,945 | | $ | 40 | | $ | 274,712 | | $ | (152,882 | ) | $ | (99 | ) | $ | 121,771 | |

See accompanying notes.

86

Table of Contents

MAKO SURGICAL CORP.

Statements of Cash Flows

(in thousands)

| | | | | | | | | | |

| | Years Ended December 31, | |

| | 2010 | | 2009 | | 2008 | |

Operating activities: | | | | | | | | | | |

Net loss | | $ | (38,687 | ) | $ | (34,023 | ) | $ | (37,082 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | | | |

Depreciation | | | 2,445 | | | 1,769 | | | 1,502 | |

Amortization of intangible assets | | | 1,070 | | | 682 | | | 660 | |

Stock-based compensation | | | 6,371 | | | 4,014 | | | 3,323 | |

Inventory write-down | | | 1,701 | | | 1,081 | | | 730 | |

Amortization of premium on investment securities | | | 480 | | | 188 | | | ― | |

Loss on asset impairment | | | 1,248 | | | 51 | | | ― | |

Accrued interest expense on deferred license fee | | | ― | | | ― | | | 45 | |

Changes in operating assets and liabilities: | | | | | | | | | | |

Accounts receivable | | | (5,024 | ) | | (3,809 | ) | | (514 | ) |

Inventory | | | (6,087 | ) | | (7,358 | ) | | (7,056 | ) |

Prepaid and other assets | | | (751 | ) | | (49 | ) | | (173 | ) |

Other assets | | | (57 | ) | | (16 | ) | | (7 | ) |

Accounts payable | | | 359 | | | (650 | ) | | 298 | |

Accrued compensation and employee benefits | | | 1,837 | | | 1,371 | | | 1,305 | |

Other accrued liabilities | | | 2,192 | | | (1,411 | ) | | 1,603 | |

Deferred cost of revenue | | | ― | | | 3,608 | | | (2,682 | ) |

Deferred revenue | | | 2,611 | | | (11,020 | ) | | 8,228 | |

Net cash used in operating activities | | | (30,292 | ) | | (45,572 | ) | | (29,820 | ) |

Investing activities: | | | | | | | | | | |

Purchase of investments | | | (65,828 | ) | | (59,961 | ) | | (1,990 | ) |

Proceeds from sales and maturities of investments | | | 49,692 | | | 6,721 | | | 4,047 | |

Acquisition of property and equipment | | | (2,628 | ) | | (790 | ) | | (1,606 | ) |

Acquisition of intangible assets | | | (1,312 | ) | | (150 | ) | | ― | |

Payment of deferred license fee | | | ― | | | ― | | | (4,000 | ) |

Net cash used in investing activities | | | (20,076 | ) | | (54,180 | ) | | (3,549 | ) |

Financing activities: | | | | | | | | | | |

Proceeds from issuance of common stock in equity financing, net of underwriting fees | | | 59,708 | | | 54,861 | | | 40,202 | |

Equity financing costs | | | (425 | ) | | (609 | ) | | (469 | ) |

Proceeds from initial public offering of common stock, net of underwriting fees | | | ― | | | ― | | | 47,430 | |

Initial public offering costs | | | ― | | | ― | | | (908 | ) |

Proceeds from employee stock purchase plan | | | 765 | | | 455 | | | ― | |

Exercise of common stock options and warrants for cash | | | 611 | | | 149 | | | 46 | |

Payment of payroll taxes relating to vesting of restricted stock | | | (342 | ) | | (492 | ) | | ― | |

Net cash provided by financing activities | | | 60,317 | | | 54,364 | | | 86,301 | |

Net increase (decrease) in cash and cash equivalents | | | 9,949 | | | (45,388 | ) | | 52,932 | |

Cash and cash equivalents at beginning of year | | | 17,159 | | | 62,547 | | | 9,615 | |

| | | | | | | | | | |

Cash and cash equivalents at end of year | | $ | 27,108 | | $ | 17,159 | | $ | 62,547 | |

Non-cash investing and financing activities: | | | | | | | | | | |

Receipt of 28,307 and 56,045 shares of common stock delivered in payment of payroll taxes for the years ended December 31, 2010 and 2009, respectively | | $ | 342 | | $ | 492 | | $ | ― | |

Transfers of inventory to property and equipment | | | 2,259 | | | 3,760 | | | 999 | |

Issuance of stock to a related party for intangible assets | | | 3,054 | | | ― | | | ― | |

Accretion of redeemable convertible preferred stock | | | ― | | | ― | | | 44 | |

Accrued dividends on redeemable convertible preferred stock | | | ― | | | ― | | | 521 | |

Conversion of redeemable convertible preferred stock into 10,945,080 common shares | | | ― | | | ― | | | 53,667 | |

Reclassification of accrued dividends on redeemable convertible preferred stock to additional paid-in capital | | | ― | | | ― | | | 6,385 | |

Reclassification of deferred initial public offering costs to additional paid-in capital | | | ― | | | ― | | | 3,636 | |

See accompanying notes.

87

Table of Contents

MAKO SURGICAL CORP.

Notes to Financial Statements

1. Description of the Business

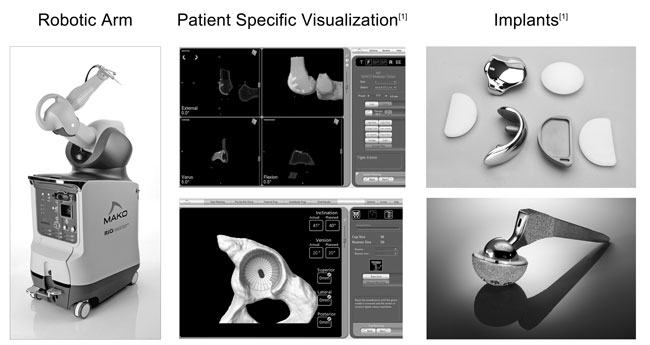

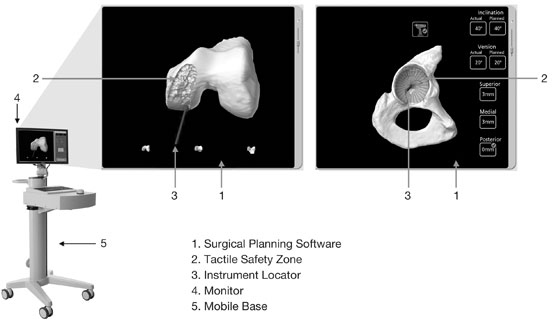

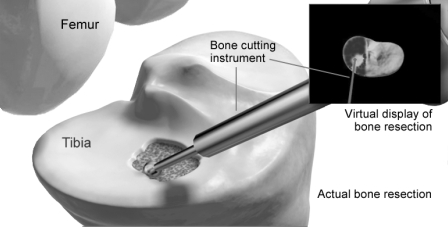

MAKO Surgical Corp. (the “Company” or “MAKO”) is an emerging medical device company that markets its advanced robotic arm solution and orthopedic implants for orthopedic procedures called MAKOplasty®. The Company was incorporated in the State of Delaware on November 12, 2004 and is headquartered in Fort Lauderdale, Florida. The Company’s common stock trades on The NASDAQ Global Select Market under the ticker symbol “MAKO.”

In November 2010, the Company completed a public offering of its common stock, issuing 6,325,000 shares at a price per share of $9.44, resulting in net proceeds of approximately $59.3 million, after expenses.

2. Summary of Significant Accounting Policies

Basis of Presentation and Use of Estimates

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. The accounting estimates that require management’s most significant, difficult and subjective judgments include revenue recognition, allowance for doubtful accounts, inventory valuation, valuation allowance for deferred income tax assets, impairment of long-lived assets and the determination of stock-based compensation. Actual results could differ significantly from these estimates.

Liquidity and Operations

In executing its current business plan, the Company believes its existing cash, cash equivalents and investment balances and interest income earned on these balances will be sufficient to meet its anticipated cash requirements for at least the next twelve months. To the extent the Company’s available cash, cash equivalents and investment balances are insufficient to satisfy its operating requirements, the Company will need to seek additional sources of funds, including selling additional equity, debt or other securities or entering into a credit facility, or modifying its current business plan. The sale of additional equity and convertible debt securities may result in dilution to the Company’s current stockholders. If the Company raises additional funds through the issuance of debt securities, these securities may have rights senior to those of its common stock and could contain covenants that could restrict the Company’s operations and issuance of dividends. The Company may also require additional capital beyond its currently forecasted amounts. Any required additional capital, whether forecasted or not, may not be available on reasonable terms, or at all. If the Company is unable to obtain additional financing, the Company may be required to reduce the scope of, delay or eliminate some or all of its planned research, development and commercialization activities, which could materially harm its business and results of operations.

Concentrations of Credit Risk and Other Risks and Uncertainties

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of cash and cash equivalents, investments, and accounts receivable. The Company’s cash and cash equivalents are held in demand and money market accounts at four large financial institutions. The Company’s investments are held in a variety of interest bearing instruments, including notes and bonds from U.S. government agencies, certificates of deposit and investment grade rated U.S. corporate debt at three large financial institutions. Such deposits are generally in excess of insured limits. The Company has not experienced any historical losses on its deposits of cash and cash equivalents.

88

Table of Contents

The Company may perform credit evaluations of its customers’ financial condition and, generally, requires no collateral from its customers. The Company will provide an allowance for doubtful accounts when collections become doubtful but has not experienced any credit losses to date.

The Company is subject to risks common to emerging companies in the medical device industry including, but not limited to: new technological innovations, dependence on key personnel, dependence on key suppliers, changes in general economic conditions and interest rates, protection of proprietary technology, compliance with changing government regulations and taxes, uncertainty of widespread market acceptance of products, access to credit for capital purchases by our customers, product liability and the need to obtain additional financing. The Company’s products include components subject to rapid technological change. Certain components used in manufacturing have relatively few alternative sources of supply and establishing additional or replacement suppliers for such components cannot be accomplished quickly. The inability of any of these suppliers to fulfill the Company’s supply requirements may negatively impact future operating results. While the Company has ongoing programs to minimize the adverse effect of such uncertainty and considers technological change in estimating the net realizable value of its inventory, uncertainty continues to exist.

The Company expects to derive most of its revenue from capital sales of its RIO system, future applications to the RIO system, including the RIO-enabled hip application, recurring sales of implants and disposable products required for each MAKOplasty procedure, and service plans that are sold with the RIO system. If the Company is unable to achieve commercial acceptance of MAKOplasty or obtain regulatory clearances or approvals for future products, including products to treat other joints of the human body, its revenue would be adversely affected and the Company would not become profitable.

The Company’s current versions of its RIO® Robotic Arm Interactive Orthopedic (“RIO”) system, which is the second generation of its Tactile Guidance System™ (“TGS™”), its RESTORIS ® unicompartmental and RESTORIS MCK multicompartmental knee implant systems and its TGS have been cleared by the U.S. Food and Drug Administration (“FDA”). Certain products currently under development by the Company will require clearance or approval by the FDA or other international regulatory agencies prior to commercial sale. There can be no assurance that the Company’s products will receive the necessary clearances or approvals. If the Company were to be denied such clearance or approval or such clearance or approval were delayed, it could have a material adverse impact on the Company.

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 280,Segment Reporting, establishes standards for reporting information about operating segments. Operating segments are defined as components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker, or decision making group, in deciding how to allocate resources and in assessing performance. The Company’s chief operating decision maker is its CEO. The Company’s CEO reviews financial information presented on an aggregate basis for purposes of allocating resources and evaluating financial performance. The Company has one business activity and there are no segment managers who are held accountable for operations, operating results and plans for products or components below the aggregate Company level. Accordingly, the Company reports as a single operating segment. To date, substantially all of the Company’s revenue is from companies located in the United States. No one customer accounted for more than 10% of the Company’s total revenue for the years ended December 31, 2010 and 2009. The following table presents information about the Company’s revenue by significant customer for the year ended December 31, 2008:

89

Table of Contents

| | | | |

(in thousands) | | Year Ended

December 31, | |

| | 2008 | |

Company A | | $ | 417 | |

Company B | | | 277 | |

Company C | | | 493 | |

Company D | | | 274 | |

Others | | | 996 | |

Net Revenue | | $ | 2,457 | |

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity at date of purchase of 90 days or less to be cash equivalents.

Fair Value of Financial Instruments

Carrying amounts of certain of the Company’s financial instruments, including cash and cash equivalents, investments, accounts receivable and other accrued liabilities approximate fair value due to their short maturities or market rates of interest.

Allowance for Doubtful Accounts

The Company regularly reviews customer balances by considering factors such as historical experience, credit quality, the age of the accounts receivable balances and current economic conditions that may affect a customer’s ability to pay. The Company has not experienced any collectability issues to date and has no allowance for doubtful accounts or write-offs to date in the accompanying financial statements.

Inventory

Inventory is stated at the lower of cost or market value on a first-in, first-out basis. Inventory costs include direct materials, direct labor and manufacturing overhead. The Company reviews its inventory periodically to determine net realizable value and considers product upgrades in its periodic review of realizability. The Company writes down inventory, if required, based on forecasted demand and technological obsolescence. These factors are impacted by market and economic conditions, technology changes and new product introductions and require estimates that may include uncertain elements.

Beginning with the fourth quarter of 2008, manufacturing overhead costs have been capitalized and included in inventory. As of December 31, 2010 and 2009, capitalized manufacturing overhead included in inventory was approximately $1.7 million and $1.1 million, respectively. Prior to 2009, such overhead costs were fully expensed as selling, general and administrative expense as capitalizable amounts were not significant.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Depreciation of property and equipment is computed using the straight-line method over their estimated useful lives of two to seven years. Leasehold improvements are amortized on a straight-line basis over the lesser of their useful life or the term of the lease and are included in depreciation expense in the accompanying statements of operations. Upon retirement or sale, the cost and related accumulated depreciation are removed from the balance sheet and the resulting gain or loss is reflected in operations. Maintenance and repairs are charged to operations as incurred.

The Company loans instrumentation to its customers, who use the instrumentation to perform MAKOplasty procedures in conjunction with using the RIO system. These loaned instrument sets are comprised

90

Table of Contents

of tools and equipment that facilitate the implantation of the Company’s implants (“Implant Instruments”). Implant Instruments loaned to customers are not part of the tangible product sold and title of Implant Instruments remains with the Company. Accordingly, Implant Instruments are classified as a long-lived asset and included as a component of property and equipment. Undeployed Implant Instruments are carried at cost, net of allowances for excess and obsolete instruments. Implant Instruments in the field are carried at cost less accumulated depreciation. Depreciation is computed using the straight-line method based on an estimated useful life of five years. The Company reviews instruments for impairment whenever events or changes in circumstances indicate that the carrying value of an instrument may not be recoverable. To better reflect the economics of the Implant Instruments and enhance comparability with other companies in our industry, depreciation expense on Implant Instruments has been reclassified from cost of revenue – procedures to selling, general and administrative expense beginning in the first quarter of 2010. Depreciation expense for implant instruments was $464,000, $250,000 and $134,000 for the years ended December 31, 2010, 2009 and 2008, respectively.

Prior to 2010, Implant Instruments were included as components of a RIO system sale and undeployed Implant Instruments were classified as inventory. Beginning in the first quarter of 2010, Implant Instruments are no longer included as components of a RIO system sale. To better reflect the economics of the Implant Instruments no longer being sold, undeployed Implant Instruments have been reclassified from inventory to property and equipment. As of December 31, 2010, approximately $1.2 million of undeployed Implant Instruments have been included as property and equipment.

The Company also enters into RIO system consignment arrangements for clinical evaluation and clinical research purposes with terms ranging from one to three years. Under the terms of such arrangements, the Company installs a RIO system at the customer site and retains title to the RIO system, while the customer has use of the RIO system and purchases the Company’s implants and disposables products. Depreciation expense on consigned RIO systems and instruments is classified in selling, general and administrative expense and is computed using the straight-line method based on the estimated useful life of three years. As of December 31, 2010, the Company had three consigned RIO systems.

Service and demonstration RIO systems and instruments consist of RIO systems, associated instrumentation, service tools and equipment, and MAKOplasty procedure models used for sales demonstrations, surgeon training, and temporary RIO system placements at customer sites under warranty and extended warranty agreements. Service and demonstration RIO systems and instruments are classified as a long-lived asset and included as a component of property and equipment. Depreciation expense on service and demonstration RIO systems and instruments is classified in selling, general and administrative expense and is computed using the straight-line method based on an estimated useful life of three years.

Intangible Assets

The Company’s intangible assets are comprised of patents, patent applications and licenses to intellectual property rights. These intangible assets are carried at cost, net of accumulated amortization. Amortization is recorded using the straight-line method over their respective useful lives, which range from 5 to 13 years based on the respective anticipated lives of the underlying patents and patent applications.

Impairment of Long-Lived Assets

The Company evaluates its long-lived assets for indicators of impairment by comparison of the carrying amounts to future net undiscounted cash flows expected to be generated by such assets when events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. Should an impairment exist, the impairment loss would be measured based on the excess carrying value of the asset over the asset’s fair value or estimated discounted future cash flows.

91

Table of Contents

Revenue Recognition

Revenue is generated: from (1) unit sales of the Company’s RIO system, including associated instrumentation, installation services and training; (2) sales of implants and disposable products; and (3) sales of warranty and maintenance services. The Company recognizes revenue in accordance with Accounting Standards Codification (“ASC”) 605-10-S99,Revenue Recognition, when persuasive evidence of an arrangement exists, the fee is fixed or determinable, collection of the fee is probable and delivery has occurred. For all sales, the Company uses either a signed agreement or a binding purchase order as evidence of an arrangement.

The Company’s multiple-element arrangements are generally comprised of the following elements that qualify as separate units of accounting: (1) RIO system sales; (2) sales of implants and disposable products; and (3) warranty and maintenance services on the RIO system hardware. The Company’s revenue recognition policies generally result in revenue recognition at the following points:

| | |

| 1. | RIO system sales: Revenues related to RIO system sales are recognized upon installation of the system and training of at least one surgeon, which typically occurs prior to or concurrent with the RIO system installation. |

| | |

| 2. | Procedure revenue: Revenues from the sale of implants and disposable products utilized in MAKOplasty procedures are recognized at the time of sale (i.e., at the time of the related surgical procedure). |

| | |

| 3. | Service revenue: Revenues from warranty and maintenance services on the RIO system hardware are deferred and recognized ratably over the service period until no further obligation exists. Sales of the Company’s RIO system generally include a one-year warranty and maintenance obligation for services. Upon installation of the RIO system, the Company defers the revenue attributable to the warranty and maintenance obligation and recognizes it ratably over the warranty and maintenance period. Costs associated with providing warranty and maintenance services are expensed to cost of revenue as incurred. |

A portion of the Company’s end-user customers acquire the RIO system through a leasing arrangement with one of a number of qualified third-party leasing companies. In these instances, the Company typically sells the RIO system to the third-party leasing company, and the end-user customer enters into an independent leasing arrangement with the third-party leasing company. The Company recognizes RIO system revenue for a RIO system sale to a third-party leasing company on the same basis as a RIO system sale directly to an end-user customer. The Company sells implants and disposable products utilized in MAKOplasty procedures directly to end-user customers under a separate agreement.

The Company’s sales contracts generally do not provide the customer with a right of return. If such a right is provided, all related revenues would be deferred until such right expires or is waived. In a limited number of RIO system sales, the Company’s agreement with a customer provides for a customer acceptance period, which typically does not exceed three months, following which the customer may either accept or return the RIO system. No system revenue is recognized for these RIO system sales until the customer has unconditionally accepted the RIO system.

Effective January 1, 2010, the Company early adopted the Financial Accounting Standards Board (“FASB”) Accounting Standard Update No. 2009-13,Multiple-Deliverable Revenue Arrangements—a consensus of the FASB Emerging Issues Task Force (“ASU 2009-13”) and Update No. 2009-14,Certain Revenue Arrangements That Include Software Elements, a consensus of the FASB Emerging Issues Task Force (“ASU 2009-14”) on a prospective basis for applicable transactions originating or materially modified after December 31, 2009. In accordance with ASU 2009-13 (as codified under ASC 605-25,Multiple-Element Arrangements) and ASU 2009-14, the Company allocates arrangement consideration to the RIO systems and associated instrumentation, its implants and disposables and its warranty and maintenance services based upon the relative selling-price method. Under this method, revenue is allocated at the time of sale to all deliverables based on their relative selling price using a specific hierarchy. The hierarchy is as follows: vendor-specific objective evidence (“VSOE”) of fair value of the respective elements, third-party evidence of selling price (“TPS”), or best estimate of selling price (“ESP”).

92

Table of Contents

The Company uses ESP for its RIO system, TPS for its implants and disposables and VSOE of fair value for its warranty and maintenance services to allocate arrangement consideration. VSOE of fair value is based on the price charged when the element is sold separately. TPS is established by evaluating largely interchangeable competitor products or services in stand-alone sales. ESP is established by determine the price at which the Company would transact a sale if the product was sold on a stand-alone basis. The Company determines ESP for its systems by considering multiple factors including, but not limited to, geographies, type of customer, and market conditions. The Company regularly reviews ESP and maintains internal controls over the establishment and updates of these estimates.

The Company’s RIO system includes software that is essential to the functionality of the product. Since the RIO system’s software and non-software components function together to deliver the RIO system’s essential functionality, they are considered one deliverable that is excluded from the software revenue recognition guidance under ASU 2009-13 and ASU 2009-14.

Prior to the adoption of ASU 2009-13 and ASU 2009-14, the Company accounted for the sale of the RIO systems and associated instrumentation pursuant to ASC 985-605,Software – Revenue Recognition, which required the Company to allocate arrangement consideration to the RIO systems and associated instrumentation based upon VSOE of fair value of the respective elements. Had the new accounting guidance been applied to revenue at the beginning of 2009, the resultant revenue and net loss for the year ended December 31, 2009 would have been substantially the same.

Subsequent to December 31, 2008, the Company no longer manufactures TGS units, to which associated TGS sales arrangements required it to provide upgrades and enhancements, through and including the delivery of the RIO system. The Company commercially released the RIO system in the first quarter of 2009. Sales arrangements for RIO systems do not require the Company to provide upgrades and enhancements. As a result, revenues related to RIO system sales are generally recognized upon installation of the system and training of at least one surgeon.

For sales of TGS units through December 31, 2008, VSOE of fair value was not established for upgrades and enhancements (through and including delivery of the RIO system), which the TGS sales arrangements required the Company to provide. Accordingly, prior to delivery of the RIO system, sales of TGS units were recorded as deferred revenue and the direct cost of revenue associated with the sale of TGS units was recorded as deferred cost of revenue. Revenue for all previously deferred TGS sales was recognized in the Company’s statement of operations during the year ended December 31, 2009, upon delivery of the RIO system. As of December 31, 2010, the deferred revenue balance consists primarily of deferred service revenue as discussed below.

Costs associated with establishing an accrual for royalties covered by licensing arrangements related to the sale of RIO systems are expensed upon installation and are included in cost of revenue - systems, in the statements of operations.

93

Table of Contents

Deferred Revenue and Deferred Cost of Revenue

Deferred revenue consists of deferred service revenue and deferred system revenue. Deferred service revenue results from the advance payment for services to be delivered over a period of time, usually in one-year increments. Service revenue is recognized ratably over the service period. Deferred system revenue arises from timing differences between the installation of RIO systems and satisfaction of all revenue recognition criteria consistent with the Company’s revenue recognition policy. Deferred revenue expected to be realized within one year is classified as a current liability. The deferred revenue balance as of December 31, 2010 consists primarily of deferred service revenue for warranty and maintenance services on the RIO system hardware.

Foreign Currency Transactions

Gains or losses from foreign currency transactions are included in interest and other income. To date, realized gains and losses recognized from foreign currency transactions were not significant.

Research and Development Costs

Costs related to research, design and development of products are charged to research and development expense as incurred. These costs include direct salary costs for research and development personnel, costs for materials used in research and development activities and costs for outside services.

Shipping and Handling Costs

Costs incurred for shipping and handling are included in cost of revenue at the time the expense is incurred.

Software Development Costs

Software development costs are included in research and development and are expensed as incurred. After technological feasibility is established, material software development costs are capitalized. The capitalized cost is then amortized on a straight-line basis over the estimated product life, or on the ratio of current revenue to total projected product revenue, whichever is greater. To date, the period between achieving technological feasibility, which the Company has defined as the establishment of a working model which typically occurs when the verification and validation testing is complete, and the general availability of such software has been short and software development costs qualifying for capitalization have been insignificant. Accordingly, the Company has not capitalized any software development costs to date.

Stock-Based Compensation

The Company recognizes compensation expense for its stock-based awards in accordance with ASC 718, Compensation-Stock Compensation. ASC 718 requires the recognition of compensation expense, using a fair value based method, for costs related to all stock-based payments including stock options. ASC 718 requires companies to estimate the fair value of stock-based payment awards on the date of grant using an option-pricing model.

The Company accounts for stock-based compensation arrangements with non-employees in accordance with the ASC 505-50, Equity-Based Payments to Non-Employees. The Company records the expense of such services based on the estimated fair value of the equity instrument using the Black-Scholes-Merton pricing model. The value of the equity instrument is charged to expense over the term of the service agreement.

See Note 8 for a detailed discussion of the various stock option plans and related stock-based compensation.

94

Table of Contents

Advertising Costs

Advertising costs are expensed as incurred. Advertising costs were approximately $1.6 million, $1.3 million and $1.4 million for the years ended December 31, 2010, 2009 and 2008, respectively.

Income Taxes

The Company accounts for income taxes under ASC 740, Income Taxes. Deferred income taxes are determined based upon differences between financial reporting and income tax bases of assets and liabilities and are measured using the enacted income tax rates and laws that will be in effect when the differences are expected to reverse. The Company recognizes any interest and penalties related to unrecognized tax benefits as a component of income tax expense.

Due to uncertainty surrounding realization of the deferred income tax assets in future periods, the Company has recorded a 100% valuation allowance against its net deferred tax assets. If it is determined in the future that it is more likely than not that the deferred income tax assets are realizable, the valuation allowance will be reduced.

Operating Leases

Rental payments and incentives are recognized on a straight-line basis over the life of a lease. See Note 7 for further discussion of operating leases.

Net Loss Per Share

The Company calculated net loss per share in accordance with ASC 260, Earnings per Share. Basic earnings per share (“EPS”) is calculated by dividing the net income or loss attributable to common stockholders by the weighted average number of common shares outstanding for the period, without consideration for common stock equivalents. Diluted EPS is computed by dividing the net income or loss attributable to common stockholders by the weighted average number of common shares outstanding for the period and the weighted average number of dilutive common stock equivalents outstanding for the period determined using the treasury stock method. The following table sets forth potential shares of common stock that are not included in the calculation of diluted net loss per share because to do so would be anti-dilutive as of the end of each period presented:

| | | | | | | | | | |

(in thousands) | | December 31, | |

| | 2010 | | 2009 | | 2008 | |

Stock options outstanding | | | 4,405 | | | 3,478 | | | 2,193 | |

Warrants to purchase common stock | | | 2,039 | | | 2,065 | | | 2,076 | |

Unvested restricted stock | | | 503 | | | 222 | | | 267 | |

Reclassifications

Certain reclassifications have been made to the prior periods’ statement of operations to conform to the current period’s presentation. The Company reclassified depreciation expense on its Implant Instruments from cost of revenue – procedures to selling, general and administrative expense as described in greater detail in “Property and Equipment” above. In addition, the Company reclassified its income tax expense from selling, general and administrative expense to income tax expense.

3. Investments

The Company’s investments are classified as available-for-sale. Available-for-sale securities are carried at fair value, with the unrealized gains and losses included in other comprehensive income within stockholders’

95

Table of Contents

equity. Realized gains and losses, interest and dividends, amortization of premium and discount on investment securities and declines in value determined to be other-than-temporary on available-for-sale securities are included in interest and other income. During the years ended December 31, 2010, 2009 and 2008, realized gains and losses recognized on the sale of investments were not significant. The cost of securities sold is based on the specific identification method.

The amortized cost and fair value of short and long-term investments, with gross unrealized gains and losses, were as follows:

As of December 31, 2010

| | | | | | | | | | | | | |

(in thousands) | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value | |

Short-term investments: | | | | | | | | | | | | | |

U.S. government agencies | | $ | 34,483 | | $ | 4 | | $ | (16 | ) | $ | 34,471 | |

Certificates of deposit | | | 10,453 | | | 1 | | | (28 | ) | | 10,426 | |

U.S. corporate debt | | | 1,501 | | | 3 | | | ― | | | 1,504 | |

Long-term investments: | | | | | | | | | | | | | |

U.S. government agencies | | | 17,251 | | | 2 | | | (8 | ) | | 17,245 | |

Certificates of deposit | | | 6,095 | | | ― | | | (57 | ) | | 6,038 | |

Total investments | | $ | 69,783 | | $ | 10 | | $ | (109 | ) | $ | 69,684 | |

As of December 31, 2009

| | | | | | | | | | | | | |

(in thousands) | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value | |

Short-term investments: | | | | | | | | | | | | | |

U.S. government agencies | | $ | 32,860 | | $ | 31 | | $ | (24 | ) | $ | 32,867 | |

Certificates of deposit | | | 10,297 | | | 1 | | | (25 | ) | | 10,273 | |

U.S. corporate debt | | | 1,532 | | | 14 | | | ― | | | 1,546 | |

Long-term investments: | | | | | | | | | | | | | |

U.S. government agencies | | | 5,418 | | | ― | | | (18 | ) | | 5,400 | |

Certificates of deposit | | | 2,462 | | | ― | | | (10 | ) | | 2,452 | |

U.S. corporate debt | | | 1,506 | | | 10 | | | ― | | | 1,516 | |

Total investments | | $ | 54,075 | | $ | 56 | | $ | (77 | ) | $ | 54,054 | |

As of December 31, 2010 and December 31, 2009, all short-term investments had maturity dates of less than one year. As of December 31, 2010 and December 31, 2009, all long-term investments had maturity dates between one and three years.

96

Table of Contents

The fair values of the Company’s investments based on the level of inputs are summarized below:

| | | | | | | | | | | | | |

(in thousands) | | Fair Value Measurements at the Reporting Date Using | |

| | December

31, 2010 | | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

Short-term investments: | | | | | | | | | | | | | |

U.S. government agencies | | $ | 34,471 | | $ | 34,471 | | $ | ― | | $ | ― | |

Certificates of deposit | | | 10,426 | | | 10,426 | | | ― | | | ― | |

U.S. corporate debt | | | 1,504 | | | 1,504 | | | ― | | | ― | |

Long-term investments: | | | | | | | | | | | | | |

U.S. government agencies | | | 17,245 | | | 17,245 | | | ― | | | ― | |

Certificates of deposit | | | 6,038 | | | 6,038 | | | ― | | | ― | |

Total investments | | $ | 69,684 | | $ | 69,684 | | $ | ― | | $ | ― | |

No investments measured at fair value on a recurring basis used Level 3 or significant unobservable inputs for the year ended December 31, 2010. There have been no transfers between Level 1 and Level 2 measurements during the year ended December 31, 2010.

4. Selected Balance Sheet Components

| | | | | | | |

(in thousands) | | December 31, | |

| | 2010 | | 2009 | |

Inventory: | | | | | | | |

Raw materials | | $ | 2,522 | | $ | 2,770 | |

Work-in-process | | | 972 | | | 932 | |

Finished goods | | | 7,010 | | | 6,488 | |

Total inventory | | $ | 10,504 | | $ | 10,190 | |

The Company incurred inventory write-offs totaling approximately $1.7 million and $1.1 million during the years ended December 31, 2010 and 2009, respectively.