UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

811-22175

ALPS ETF TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Tané T. Tyler, Esq.

ALPS ETF Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: (303) 623-2577

Date of fiscal year end: November 30

Date of reporting period: December 1, 2011 – November 30, 2012

| Item 1. | Reports to Stockholders. |

| | |

| | TABLE OF CONTENTS |

| | |

| | | | |

| | | | 1 |

| Annual | | November 30, 2012 | |

| | |

| | SHAREHOLDER LETTER |

| | November 30, 2012 (Unaudited) |

Dear Shareholders:

When ALPS launched its ETF(1) Trust in 2008 our goal was to bring innovative solutions to the ETF industry that provide investors with access to a unique market segment or strategy. Our first portfolio – the Cohen & Steers Global Real Estate ETF – is one of the first ETFs to provide investors with access to a diversified portfolio of global real estate securities. US real estate, while already a mainstream asset class, only represents 1/3 of the global real estate universe. Furthermore, the global market is growing at a rapid pace as foreign countries continue to securitize their private real estate holdings. As a result, a global real estate fund can provide investors with a wider range of opportunities than a purely domestic fund while preserving the diversification and income benefits of US REITs.

By partnering with Cohen & Steers, we have secured a best in breed real estate manager with a great track record and reputation. Furthermore, the transparency(2), low cost and tax efficiency of the ETF structure provides access to global real estate in a very efficient manner. We believe access to global real estate, the benefits of the ETF structure, and the expertise of Cohen & Steers make for a powerful investment combination that will allow investors to build better portfolios.

In the pages that follow our Fund managers have provided a performance overview. We thank you for your investment and for being a GRI shareholder.

Thomas A. Carter*

President, ALPS ETF Trust

| * | Registered representative of ALPS Distributors, Inc. |

| (1) | Exchange Traded Fund (“ETF”). |

| (2) | ETFs are considered transparent because their portfolio holdings are disclosed daily. |

Ordinary brokerage commissions apply.

| | | | | | |

2 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | PERFORMANCE OVERVIEW |

| | November 30, 2012 (Unaudited) |

FUND DESCRIPTION

The Cohen & Steers Global Realty Majors ETF (the “Fund”) seeks investment results that correspond generally to the performance (before the Fund’s fees and expenses) of an equity index called the Cohen & Steers Global Realty Majors Index (the “Index”). The Shares of the Fund are listed and trade on the NYSE Arca under the ticker symbol “GRI.” The Fund will normally invest substantially all of its assets in the 75 stocks that comprise the Cohen & Steers Global Realty Majors Index. The Fund began trading on May 9, 2008.

The Index is a free-float, market-cap-weighted total return index of selected real estate equity securities maintained by Cohen & Steers. It is quoted intraday on a realtime basis by the Chicago Mercantile Exchange under the symbol GRM. The Index’s free-float market capitalization approach and qualitative screening process emphasize companies that the Cohen & Steers Index Committee believes are leading the securitization of real estate globally.

PERFORMANCE OVERVIEW

After three years of underperforming US REITs, Global real estate securities rebounded strongly in 2012, significantly outperforming their US counterparts. For the 11 months ended November 30, 2012 the Cohen & Steers Global Realty Majors Index advanced 24.51% vs. 18.8% for US REITs. Stabilizing growth rates and attractive valuations catapulted Asian real estate securities nearly 40% in 2012, making them the best performing region. Despite continued fiscal challenges in Europe, real estate stocks also performed well, rising 26%. US REITs rose in value for the fourth year in a row, and benefited generally from strong access to capital and low borrowing costs.

While US REITs underperformed international real estate securities during 2012, they still generated strong total returns, rising more than 18% in value. Ready access to capital allowed US REITs to solidify their balance sheets and issue debt and equity and historically low rates. Improved balance sheets also allowed REITs to pursue accretive acquisitions of both public and private real estate assets. Industrial REITs were the best performing sector, followed by retail, which was buoyed primarily by performance of Class A properties. Apartment REITs were the worst performing sector of the market, followed by the Office sector, which continued to underperform on a relative basis. The Healthcare and Self-storage REITs delivered performance that was in-line with the overall market.

The European real estate market performed well in 2012 despite fiscal issues and the continued overhang of continent-wide austerity measures. Prime locations continued to outperform, particularly in the central business district of Paris and London’s West End. France was the best performing country in 2012 and was lead by the retail sector and continued strength in Paris’s prime locations. The UK was the 2nd best performing country and benefited from strong property development fundamentals and a positive trend in office and retail segments. The Netherlands was the worst performing country and was impacted negatively by uncertainty of the tax treatment of mortgage interest, which dampened housing market demand and consumer sentiment.

Property stocks in Asia reversed their decline in 2011 and became the best performing region in 2012. Singapore was the best performing sector, rising more than 50%. Property companies benefited from surprising acceleration in certain export industries and those with operations in China generally fared better than their domestic-oriented counterparts. The Hong Kong property market rallied on the confirmation of improv-

| | | | |

| | | | 3 |

| Annual | | November 30, 2012 | |

| | |

| | PERFORMANCE OVERVIEW |

| | November 30, 2012 (Unaudited) |

ing growth trends in China, particularly in the commercial sector as investors favored income-producing stocks. Japanese property stocks also fared very well despite slowing exports. Real estate securities outperformed generic Japanese equities due to their potential to outperform in a reflationary environment. Australia was the worst performing sector of the group, but still managed to advance more than 25% due to its exposure to China and continued demand from foreign investors for quality commercial real estate.

For the year ended November 30, 2012 the Fund’s market price increased 22.47% and the Fund’s net asset value (“NAV”) increased 24.50%. Over the same time period the Fund’s benchmark increased 25.40%.

Average Annual Total Return as of November 30, 2012

| | | | | | | | | | | | | | | | | | | | | | |

| | | 6 Months | | 1 Year | | 3 Year | | Since Inception* | | |

Fund Performance | | | | | | | | | | | | | | | | | | | | | | |

NAV | | | | 15.07 | % | | | | 24.50 | % | | | | 46.56 | % | | | | -1.00 | % | | |

Market Price** | | | | 14.74 | % | | | | 22.47 | % | | | | 46.90 | % | | | | -1.00 | % | | |

Index Performance | | | | | | | | | | | | | | | | | | | | | | |

Cohen & Steers Global Realty Majors Portfolio Index | | | | 15.42 | % | | | | 25.40 | % | | | | 49.73 | % | | | | -0.15 | % | | |

FTSE EPRA/NAREIT Developed Real Estate Index | | | | 14.47 | % | | | | 25.06 | % | | | | 45.57 | % | | | | -0.22 | % | | |

S&P 500® Total Return Index | | | | 9.32 | % | | | | 16.13 | % | | | | 37.67 | % | | | | 2.65 | % | | |

Total Expense Ratio (per the current prospectus) 0.55%.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For most current month-end performance data please visit www.alpsfunds.com.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| ** | Market Price is based on the midpoint of the bid/ask spread at 4p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. |

Cohen & Steers Global Realty Majors® Portfolio Index: A free-float adjusted, modified market capitalization-weighted index of global real estate equities. The modified market capitalization weighting approach and qualitative screening process emphasize those companies that, in the opinion of the Cohen & Steers investment committee, are leading the securitization of real estate globally.

FTSE EPRA/NAREIT Developed Real Estate Index: An unmanaged market-weighted total return index that consists of many companies from developed markets whose floats are larger than $100 million and which derive more than half of their revenue from property-related activities.

S&P 500® Index: The Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

An investor cannot invest directly in an index.

| | | | | | |

4 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | PERFORMANCE OVERVIEW |

| | November 30, 2012 (Unaudited) |

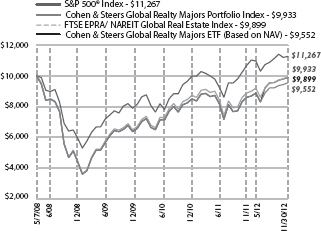

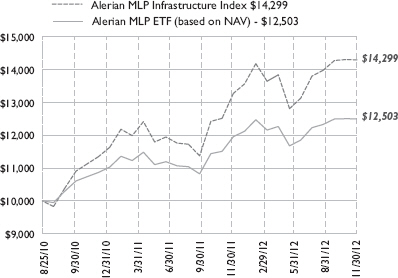

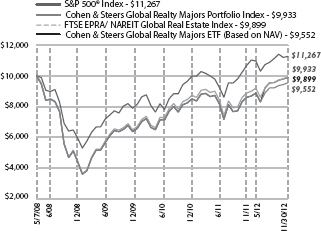

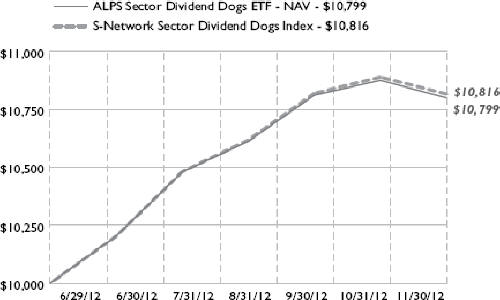

GROWTH OF $10K as of November 30, 2012

Comparison of Change in Value of $10,000 Investment in Cohen & Steers Global Realty Majors ETF and Cohen & Steers Global Realty Majors Index.

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the life of the Fund. Performance calculations are as of the end of each month. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

TOP 10 HOLDINGS (as a % of Net Assets)* as of November 30, 2012

| | | | |

| |

Simon Property Group, Inc. | | | 3.91 | % |

| |

Mitsubishi Estate Co., Ltd. | | | 3.73 | |

| |

Westfield Group | | | 3.68 | |

| |

Sun Hung Kai Properties, Ltd. | | | 3.61 | |

| |

Unibail-Rodamco | | | 3.50 | |

| |

HCP, Inc. | | | 3.31 | |

| |

Public Storage | | | 3.31 | |

| | | | |

| |

Ventas, Inc. | | | 3.06 | % |

| |

Mitsui Fudosan Co., Ltd. | | | 2.98 | |

| |

Equity Residential | | | 2.72 | |

| |

Percent of Net Assets in Top Ten Holdings: | | | 33.81 | % |

| * | Future holdings are subject to change. |

GEOGRAPHIC BREAKDOWN**

| | | | |

| |

United States | | | 45.16 | % |

| |

Hong Kong | | | 14.58 | |

| |

Japan | | | 9.89 | |

| |

Australia | | | 9.63 | |

| |

United Kingdom | | | 6.07 | |

| |

France | | | 4.94 | |

| |

Singapore | | | 4.10 | |

| | | | |

| |

Canada | | | 2.31 | |

| |

Brazil | | | 0.95 | |

| |

Netherlands | | | 0.94 | |

| |

Switzerland | | | 0.58 | |

| |

Germany | | | 0.46 | |

| |

Sweden | | | 0.39 | |

| |

** % of Total Investments | | | | |

| | | | |

| | | | 5 |

| Annual | | November 30, 2012 | |

| | |

| | DISCLOSURE OF FUND EXPENSES |

| | For the period ended November 30, 2012 (Unaudited) |

Shareholder Expense Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs which may include creation and redemption fees or brokerage charges, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. It is based on an investment of $1,000 invested at the beginning of the (six month) period and held through November 30, 2012.

Actual Return: The first line of the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses attributable to your investment during this period.

Hypothetical 5% Return: The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect any transaction costs, such as creation and redemption fees, or brokerage charges. Therefore, the second line is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | Beginning

Account Value

06/01/12 | | Ending

Account Value

11/30/12 | | Expense

Ratio (a) | | | Expenses Paid

During the Period 06/01/12-11/30/12 (b) |

Actual | | $ 1,000.00 | | $ 1,150.70 | | | 0.55% | | | $ 2.96 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,022.25 | | | 0.55% | | | $ 2.78 |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), then divided by 366. |

| | | | | | |

6 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| | |

To the Board of Trustees and Shareholders of ALPS ETF Trust:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Cohen & Steers Global Realty Majors ETF, one of the portfolios constituting the ALPS ETF Trust (the “Trust”) as of November 30, 2012, and the related statement of operations for the year then ended, the statements of changes in net assets for the year ended November 30, 2012, for the period January 1, 2011 to November 30, 2011, and for the year ended December 31, 2010, and the financial highlights for the periods presented. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2012, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Cohen & Steers Global Realty Majors ETF of the ALPS ETF Trust as of November 30, 2012, the results of its operations for the year then ended, the changes in its net assets for the year ended November 30, 2012, for the period January 1, 2011 to November 30, 2011, and for the year ended December 31, 2010, and the financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Denver, Colorado

January 24, 2013

| | | | |

| | | | 7 |

| Annual | | November 30, 2012 | |

| | |

| | SCHEDULE OF INVESTMENTS |

| | November 30, 2012 |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

COMMON STOCKS (99.69%) | | | | | | | | |

Australia (9.60%) | | | | | | | | |

CFS Retail Property Trust | | | 276,112 | | | $ | 558,825 | |

Dexus Property Group | | | 569,016 | | | | 596,594 | |

Goodman Group | | | 175,491 | | | | 845,834 | |

GPT Group | | | 189,016 | | | | 688,196 | |

Mirvac Group | | | 401,603 | | | | 615,889 | |

Stockland Trust Group | | | 257,395 | | | | 910,308 | |

Westfield Group | | | 241,203 | | | | 2,622,037 | |

| | | | | | | | |

| | | | | | | 6,837,683 | |

| | | | | | | | |

Brazil (0.95%) | | | | | | | | |

BR Malls Participacoes SA | | | 52,100 | | | | 678,437 | |

| | | | | | | | |

Canada (2.30%) | | | | | | | | |

Boardwalk Real Estate Investment Trust | | | 4,608 | | | | 299,020 | |

Dundee Real Estate Investment Trust | | | 11,654 | | | | 424,699 | |

RioCan Real Estate Investment Trust | | | 33,812 | | | | 918,015 | |

| | | | | | | | |

| | | | | | | 1,641,734 | |

| | | | | | | | |

France (4.93%) | | | | | | | | |

Gecina SA | | | 3,072 | | | | 339,573 | |

ICADE | | | 2,692 | | | | 243,159 | |

Klepierre | | | 11,250 | | | | 431,344 | |

Unibail-Rodamco | | | 10,639 | | | | 2,496,901 | |

| | | | | | | | |

| | | | | | | 3,510,977 | |

| | | | | | | | |

Germany (0.46%) | | | | | | | | |

Deutsche Wohnen AG | | | 17,048 | | | | 329,707 | |

| | | | | | | | |

| | |

Hong Kong (14.53%) | | | | | | | | |

China Overseas Land & Investment, Ltd. | | | 444,000 | | | | 1,314,805 | |

China Resources Land, Ltd. | | | 214,500 | | | | 572,919 | |

Hang Lung Properties, Ltd. | | | 224,000 | | | | 820,846 | |

Henderson Land Development Co., Ltd. | | | 111,000 | | | | 790,601 | |

Hongkong Land Holdings, Ltd. | | | 136,000 | | | | 889,440 | |

The Link Real Estate Investment Trust | | | 264,664 | | | | 1,436,006 | |

Sino Land Co., Ltd. | | | 334,000 | | | | 603,351 | |

Sun Hung Kai Properties, Ltd. | | | 176,000 | | | | 2,575,261 | |

The Wharf Holdings, Ltd. | | | 175,700 | | | | 1,352,315 | |

| | | | | | | | |

| | | | | | | 10,355,544 | |

| | | | | | | | |

Japan (9.86%) | | | | | | | | |

Mitsubishi Estate Co., Ltd. | | | 138,000 | | | | 2,658,931 | |

Mitsui Fudosan Co., Ltd. | | | 102,000 | | | | 2,126,082 | |

Nippon Building Fund, Inc. | | | 71 | | | | 742,973 | |

Sumitomo Realty & Development Co., Ltd. | | | 55,000 | | | | 1,495,877 | |

| | | | | | | | |

| | | | | | | 7,023,863 | |

| | | | | | | | |

| | | | | | |

8 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | SCHEDULE OF INVESTMENTS |

| | November 30, 2012 |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | |

Netherlands (0.93%) | | | | | | | | |

Corio N.V. | | | 11,208 | | | $ | 502,255 | |

Eurocommercial Properties N.V. | | | 4,201 | | | | 163,805 | |

| | | | | | | | |

| | | | | | | 666,060 | |

| | | | | | | | |

Singapore (4.09%) | | | | | | | | |

Ascendas Real Estate Investment Trust | | | 215,066 | | | | 422,925 | |

CapitaLand, Ltd. | | | 296,000 | | | | 856,143 | |

CapitaMall Trust | | | 281,347 | | | | 477,191 | |

City Developments, Ltd. | | | 52,000 | | | | 499,357 | |

Global Logistic Properties, Ltd. | | | 285,000 | | | | 656,192 | |

| | | | | | | | |

| | | | | | | 2,911,808 | |

| | | | | | | | |

Sweden (0.39%) | | | | | | | | |

Castellum AB | | | 20,227 | | | | 275,518 | |

| | | | | | | | |

| | |

Switzerland (0.58%) | | | | | | | | |

PSP Swiss Property AG | | | 4,402 | | | | 411,975 | |

| | | | | | | | |

| | |

United Kingdom (6.05%) | | | | | | | | |

British Land Co. Plc | | | 104,346 | | | | 919,765 | |

Capital Shopping Centres Group Plc | | | 70,408 | | | | 389,860 | |

Derwent London Plc | | | 9,907 | | | | 327,869 | |

Great Portland Estates Plc | | | 36,855 | | | | 277,904 | |

Hammerson Plc | | | 82,944 | | | | 626,367 | |

Land Securities Group Plc | | | 91,147 | | | | 1,180,299 | |

Segro Plc | | | 87,417 | | | | 331,053 | |

Shaftesbury Plc | | | 29,442 | | | | 261,642 | |

| | | | | | | | |

| | | | | | | 4,314,759 | |

| | | | | | | | |

United States (45.02%) | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 7,287 | | | | 494,933 | |

American Campus Communities, Inc. | | | 11,912 | | | | 521,746 | |

AvalonBay Communities, Inc. | | | 11,273 | | | | 1,485,669 | |

Boston Properties, Inc. | | | 17,493 | | | | 1,795,307 | |

Brookfield Office Properties, Inc. | | | 28,843 | | | | 468,410 | |

Camden Property Trust | | | 9,675 | | | | 635,647 | |

Corporate Office Properties Trust | | | 9,283 | | | | 229,104 | |

Digital Realty Trust, Inc. | | | 14,064 | | | | 907,691 | |

Douglas Emmett, Inc. | | | 14,757 | | | | 335,131 | |

Equity Residential | | | 34,968 | | | | 1,941,074 | |

Essex Property Trust, Inc. | | | 4,263 | | | | 598,909 | |

Federal Realty Investment Trust | | | 7,396 | | | | 769,480 | |

| | | | |

| | | | 9 |

| Annual | | November 30, 2012 | |

| | |

| | SCHEDULE OF INVESTMENTS |

| | November 30, 2012 |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | |

United States (continued) | | | | | | | | |

General Growth Properties, Inc. | | | 52,087 | | | $ | 1,008,925 | |

HCP, Inc. | | | 52,433 | | | | 2,362,107 | |

Health Care REIT, Inc. | | | 29,574 | | | | 1,741,613 | |

Host Hotels & Resorts, Inc. | | | 83,807 | | | | 1,231,125 | |

Kimco Realty Corp. | | | 47,158 | | | | 908,263 | |

Liberty Property Trust | | | 13,603 | | | | 473,792 | |

The Macerich Co. | | | 15,417 | | | | 871,061 | |

ProLogis | | | 53,476 | | | | 1,814,975 | |

Public Storage | | | 16,763 | | | | 2,357,548 | |

Regency Centers Corp. | | | 10,500 | | | | 491,925 | |

Simon Property Group, Inc. | | | 18,295 | | | | 2,783,218 | |

SL Green Realty Corp. | | | 10,480 | | | | 789,982 | |

Tanger Factory Outlet Centers | | | 11,009 | | | | 361,976 | |

UDR, Inc. | | | 29,214 | | | | 672,214 | |

Ventas, Inc. | | | 34,258 | | | | 2,180,522 | |

Vornado Realty Trust | | | 19,639 | | | | 1,501,009 | |

Weingarten Realty Investors | | | 12,710 | | | | 345,458 | |

| | | | | | | | |

| | | | | | | 32,078,814 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $61,487,699) | | | | | | | 71,036,879 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (99.69%) | | | | | | | | |

(Cost $61,487,699) | | | | | | | 71,036,879 | |

| |

NET OTHER ASSETS AND LIABILITIES (0.31%) | | | | 221,384 | |

| | | | | | | | |

| | |

NET ASSETS (100.00%) | | | | | | $ | 71,258,263 | |

| | | | | | | | |

| | |

| Common Abbreviations: |

AB - | | Aktiebolag is the Swedish equivalent of the term corporation. |

AG - | | Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

Ltd. - | | Limited. |

N.V. - | | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

Plc - | | Public Limited Co. |

REIT - | | Real Estate Investment Trust. |

SA - | | Generally designated corporations in various countries, mostly those employing the civil law. |

See Notes to Financial Statements.

| | | | | | |

10 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | STATEMENT OF ASSETS & LIABILITIES |

| | November 30, 2012 |

| | | | |

ASSETS: | | | | |

Investments, at value | | $ | 71,036,879 | |

Cash | | | 80,029 | |

Foreign currency, at value (Cost $13,793) | | | 13,795 | |

Foreign tax reclaims | | | 11,878 | |

Dividends receivable | | | 147,214 | |

Total Assets | | | 71,289,795 | |

| |

LIABILITIES: | | | | |

Payable to advisor | | | 31,532 | |

Total Liabilities | | | 31,532 | |

NET ASSETS | | $ | 71,258,263 | |

| | | | | |

| |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 65,487,431 | |

Overdistributed net investment income | | | (314,538 | ) |

Accumulated net realized loss on investments and foreign currency transactions | | | (3,462,147 | ) |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 9,547,517 | |

NET ASSETS | | $ | 71,258,263 | |

| | | | | |

| |

INVESTMENTS, AT COST | | $ | 61,487,699 | |

| |

PRICING OF SHARES | | | | |

Net Assets | | $ | 71,258,263 | |

Shares of beneficial interest outstanding (Unlimited number of shares authorized,par value $0.01 per share) | | | 1,800,000 | |

Net Asset Value, offering and redemption price per share | | $ | 39.59 | |

| | | | |

See Notes to Financial Statements. | | 11 |

| Annual | | November 30, 2012 | |

| | |

| | STATEMENT OF OPERATIONS |

| | |

| | | | |

| | | For theYear

Ended

November 30,

2012 | |

INVESTMENT INCOME: | | | | |

Dividends(a) | | $ | 1,904,085 | |

Total Investment Income | | | 1,904,085 | |

| |

EXPENSES: | | | | |

Investment advisory fee | | | 346,232 | |

Total Expenses | | | 346,232 | |

NET INVESTMENT INCOME | | | 1,557,853 | |

| |

Net realized gain on investments | | | 1,516,427 | |

Net realized loss on foreign currency transactions | | | (578 | ) |

Net change in unrealized appreciation on investments | | | 9,938,234 | |

Net change in unrealized (depreciation) on translation of assets and liabilities in foreign currencies | | | (1,202 | ) |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 11,452,881 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 13,010,734 | |

| | | | | |

| (a) | Net of foreign withholding tax of $90,866. |

| | | | | | |

12 | | See Notes to Financial Statements. | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | STATEMENTS OF CHANGES IN NET ASSETS |

| | |

| | | | | | | | | | | | |

| | | For the Year

Ended

November 30,

2012 | | | For the Period

January 1, 2011

to November

30, 2011(a) | | | For theYear

Ended

December31,

2010 | |

OPERATIONS: | | | | | | | | | | | | |

| | | |

Net investment income | | $ | 1,557,853 | | | $ | 1,436,252 | | | $ | 1,104,720 | |

Net realized gain/(loss) on investments and foreign currency transactions | | | 1,515,849 | | | | 772,135 | | | | (961,629 | ) |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency | | | 9,937,032 | | | | (5,848,292 | ) | | | 5,070,740 | |

Net increase/(decrease) in net assets resulting from operations | | | 13,010,734 | | | | (3,639,905 | ) | | | 5,213,831 | |

| | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | |

From net investment income | | | (1,417,294 | ) | | | (1,593,186 | ) | | | (1,865,795 | ) |

Total distributions | | | (1,417,294 | ) | | | (1,593,186 | ) | | | (1,865,795 | ) |

| | | |

SHARE TRANSACTIONS: | | | | | | | | | | | | |

Proceeds from sale of shares | | | 18,618,717 | | | | 19,906,094 | | | | 26,743,914 | |

Cost of shares redeemed | | | (9,371,914 | ) | | | (6,881,318 | ) | | | (68,866 | ) |

Net increase from share transactions | | | 9,246,803 | | | | 13,024,776 | | | | 26,675,048 | |

Net increase in net assets | | | 20,840,243 | | | | 7,791,685 | | | | 30,023,084 | |

| | | |

NET ASSETS: | | | | | | | | | | | | |

Beginning of year | | | 50,418,020 | | | | 42,626,335 | | | | 12,603,251 | |

End of period* | | $ | 71,258,263 | | | $ | 50,418,020 | | | $ | 42,626,335 | |

| | | | | | | | | | | | | |

| | | |

*Including accumulated net investment loss of: | | $ | (314,538 | ) | | $ | (728,017 | ) | | $ | (1,044,296) | |

| | | |

Other Information: | | | | | | | | | | | | |

SHARE TRANSACTIONS: | | | | | | | | | | | | |

Beginning shares | | | 1,550,000 | | | | 1,200,000 | | | | 402,000 | |

Shares sold | | | 500,000 | | | | 550,000 | | | | 800,000 | |

Shares redeemed | | | (250,000 | ) | | | (200,000 | ) | | | (2,000 | ) |

Shares outstanding, end of period | | | 1,800,000 | | | | 1,550,000 | | | | 1,200,000 | |

| | | | | | | | | | | | | |

| (a) | Effective March 7, 2011, the Board approved changing the fiscal year end of the Fund from December 31 to November 30. |

| | | | |

See Notes to Financial Statements. | | 13 |

| Annual | | November 30, 2012 | |

| | | | |

| | | For the Year Ended November 30, 2012 | |

| |

| |

NET ASSETVALUE, BEGINNING OF PERIOD | | $ | 32.53 | |

| |

INCOME/(LOSS) FROM OPERATIONS: | | | | |

Net investment income | | | 0.91 | (b) |

Net realized and unrealized gain/(loss) on investments | | | 6.97 | |

Total from Investment Operations | | | 7.88 | |

| |

LESS DISTRIBUTIONS: | | | | |

From net investment income | | | (0.82) | |

Total Distributions | | | (0.82) | |

NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 7.06 | |

NET ASSET VALUE, END OF PERIOD | | $ | 39.59 | |

| | | | | |

TOTAL RETURN(c) | | | 24.50 | % |

| |

RATIOS/ SUPPLEMENTAL DATA: | | | | |

Net assets, end of period (in 000s) | | $ | 71,258 | |

| |

RATIOS TO AVERAGE NET ASSETS: | | | | |

Net investment income | | | 2.47 | % |

Operating expenses | | | 0.55 | % |

PORTFOLIO TURNOVER RATE(e) | | | 4 | % |

| (a) | Effective March 7, 2011, the Board approved changing the fiscal year end of the Fund from December 31 to November 30. |

| (b) | Calculated using average shares outstanding. |

| (c) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of the period and redemption at the net asset value on the last day of the period and assuming all distributions are reinvested at actual reinvestment prices. Total return calculated for a period of less than one year is not annualized. |

| (e) | Portfolio turnover is not annualized and does not include securities received or delivered from processing creations or redemptions. |

| | | | | | |

14 | | See Notes to Financial Statements. | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | | FINANCIAL HIGHLIGHTS |

| | For a Share Outstanding Throughout the Periods Presented |

| | | | | | | | | | | | | | |

For the Period January 1, 2011 to November 30, 2011(a) | | | For the Year Ended December 31, 2010 | | | For the Year Ended December 31, 2009 | | | For the Period May 7, 2008 (Inception) through December 31, 2008 | |

| $ | 35.52 | | | $ | 31.35 | | | $ | 25.06 | | | $ | 50.00 | |

| | | |

| | | | | | | | | | | | | | | |

| | 0.97 | (b) | | | 1.43 | (b) | | | 0.98 | | | | 0.47 | |

| | (2.87 | ) | | | 4.68 | | | | 7.00 | | | | (24.92 | ) |

| | (1.90 | ) | | | 6.11 | | | | 7.98 | | | | (24.45 | ) |

| | | |

| | | | | | | | | | | | | | | |

| | (1.09 | ) | | | (1.94 | ) | | | (1.69 | ) | | | (0.49 | ) |

| | (1.09 | ) | | | (1.94 | ) | | | (1.69 | ) | | | (0.49 | ) |

| | (2.99 | ) | | | 4.17 | | | | 6.29 | | | | (24.94 | ) |

| $ | 32.53 | | | $ | 35.52 | | | $ | 31.35 | | | $ | 25.06 | |

| | | |

| | (5.53 | )% | | | 19.91 | % | | | 32.51 | % | | | (48.90 | )% |

| | | |

| | | | | | | | | | | | | | | |

| $ | 50,418 | | | $ | 42,626 | | | $ | 12,603 | | | $ | 5,063 | |

| | | |

| | | | | | | | | | | | | | | |

| | 3.02 | %(d) | | | 4.33 | % | | | 3.24 | % | | | 3.49 | %(d) |

| | 0.55 | %(d) | | | 0.55 | % | | | 0.55 | % | | | 0.55 | %(d) |

| | 15 | % | | | 14 | % | | | 18 | % | | | 18 | % |

| | | | |

| | | | 15 |

| Annual | | November 30, 2012 | |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | November 30, 2012 |

The ALPS ETF Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As of November 30, 2012, the Trust consists of five separate portfolios. Each portfolio represents a separate series of the Trust. This report pertains solely to the Cohen & Steers Global Realty Majors ETF (the “Fund”). The investment objective of the Fund is to seek investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of the Cohen & Steers Global Realty Majors Index.

The Fund’s Shares (“Shares”) are listed on the New York Stock Exchange (“NYSE”) Arca. The Fund issues and redeems Shares at Net Asset Value (“NAV”) in blocks of 50,000 Shares, each of which is called a “Creation Unit.” Creation Units are issued and redeemed principally in-kind for securities included in a specified index. Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates.

A. Portfolio Valuation

The Fund’s NAV is determined daily, as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time, on each day the NYSE is open for trading. The NAV is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

Portfolio securities listed on any exchange other than the National Association of Securities Dealer Automated Quotation (“NASDAQ”) exchange are valued at the last sale price on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and asked prices on such day. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Short-term investments that mature in less than 60 days are valued at amortized cost, which approximates market value.

| | | | | | |

16 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | |

The Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by theTrust’s Board ofTrustees (the “Board”). When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Fund may be valued in good faith by or under the direction of the Board. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre-established primary pricing source or the pricing source is not willing to provide a price; a security with respect to which an event has occurred that is most likely to materially affect the value of the security after the market has closed but before the calculation of the Fund’s NAV or make it difficult or impossible to obtain a reliable market quotation; or a security whose price, as provided by the pricing service, does not reflect the security’s “fair value” due to the security being de-listed from a national exchange or the security’s primary trading market is temporarily closed at a time when, under normal conditions, it would be open. As a general principle, the current “fair value” of a security would be the amount which the owner might reasonably expect to receive from the closing sale prices on the applicable exchange and fair value prices may not reflect the actual value of a security. A variety of factors may be considered in determining the fair value of such securities.

B. Foreign Currency Translation and Foreign Investments

The Fund invests in foreign securities which may involve a number of risk factors and special considerations not present with investments in securities of U.S. corporations.

Investment in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers. These risks may include, but are not limited to: (i) less information about non-U.S. issuers or markets may be available due to less rigorous disclosure, accounting standards or regulatory practices; (ii) many non-U.S. markets are smaller, less liquid and more volatile thus, in a changing market, the advisers may not be able to sell the Fund’s portfolio securities at times, in amounts and at prices they consider reasonable; (iii) currency exchange rates or controls may adversely affect the value of the Fund��s investments; (iv) the economies of non-U.S. countries may grow at slower rates than expected or may experience downturns or recessions; and, (v) withholdings and other non-U.S. taxes may decrease the Fund’s return.

The accounting records of the Fund are maintained in U.S. dollars. Portfolio securities and other assets and liabilities denominated in a foreign currency are translated to U.S. dollars at the prevailing rates of exchange at period end. Amounts related to the purchases and sales of securities and investment income are translated into U.S. dollars at the prevailing exchange rate on the respective dates of transactions. The effects of changes in foreign currency exchange rates on portfolio investments are included in the net realized and unrealized gains and losses on investments. Net gains and losses on foreign currency transactions include disposition of foreign currencies, and currency

| | | | |

| | | | 17 |

| Annual | | November 30, 2012 | |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | November 30, 2012 |

gains and losses between the accrual and receipt dates of portfolio investment income and between the trade and settlement dates of portfolio investment transactions.

C. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded on the highest cost basis. Dividend income is recorded on the ex-dividend date. Interest income, if any, is recorded on the accrual basis.

D. Dividends and Distributions to Shareholders

Dividends from net investment income of the Fund, if any, are declared and paid quarterly or as the Board may determine from time to time. Distributions of net realized capital gains earned by the Fund, if any, are distributed at least annually.

E. Federal Tax and Tax Basis Information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP. Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations.

For the year ended November 30, 2012, permanent book and tax differences resulting primarily from differing treatment of foreign currency and in-kind transactions were identified and reclassified among the components of the Fund’s net assets as follows:

| | | | |

Undistributed Net Investment Income | | Accumulated Net Realized Loss | | Paid-in Capital |

| | |

$272,920 | | $(1,670,993) | | $1,398,073 |

Net investment income and net realized (loss), as disclosed on the Statement of Operations, and net assets were not affected by this reclassification.

Under the Regulated Investment Company Modernization Act of 2010 (“the Modernization Act”), net capital losses recognized in tax years beginning after December 22, 2010 may be carried forward indefinitely, and the character of the losses is retained as short-term and/or long-term. Under the law in effect prior to the Modernization Act, net capital losses were carried forward for eight years and treated as short-term. As a transition rule, the Modernization Act requires that post-enactment net capital losses be used before pre-enactment net capital losses. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term losses rather than being considered all short-term as under previous law.

| | | | | | |

18 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | |

At November 30, 2012, the Fund had available for tax purposes unused pre-enactment capital loss carryforwards as follows:

| | | | | | |

Year of Expiration | | |

| 2016 | | 2017 | | 2018 | | Total |

$176,692 | | $809,982 | | $187,815 | | $1,174,489 |

At November 30, 2012, the Fund had available for tax purposes unused post-enactment capital loss carryforwards as follows:

Distributions from net investment income and capital gains are determined in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund.

The tax character of the distributions paid was as follows:

| | | | | | | | | | | | |

| | | For the Year Ended November 30, 2012 | | | For the Period Ended November 30, 2011 | | | For the Year Ended December 31, 2010 | |

| | | |

| | | |

| | | |

Distributions paid from: | | | | | | | | | | | | |

Ordinary income | | $ | 1,417,294 | | | $ | 1,593,186 | | | $ | 1,865,795 | |

| |

Total | | $ | 1,417,294 | | | $ | 1,593,186 | | | $ | 1,865,795 | |

| |

As of November 30, 2012, the components of distributable earnings on a tax basis for the Fund were as follows:

| | | | |

Undistributed net investment income | | $ | 2,515,895 | |

Accumulated net realized loss on investmentsand foreign currency transactions | | | (2,198,761) | |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 5,453,656 | |

Other Cumulative Effect of Timing Differences | | | 42 | |

| |

Total | | $ | 5,770,832 | |

| |

The differences between book-basis and tax-basis are primarily due to Passive Foreign Investment Company (“PFIC”) adjustments and the differing treatment of certain other investments.

| | | | |

| | | | 19 |

| Annual | | November 30, 2012 | |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | November 30, 2012 |

As of November 30, 2012, the costs of investments for federal income tax purposes and accumulated net unrealized appreciation/(depreciation) on investments were as follows:

| | | | | | |

Cost of investment for income tax purposes | | $ | 65,581,560 | | | |

|

| | |

Gross Appreciation (excess of value over tax cost) | | $ | 6,987,873 | �� | | |

Gross Depreciation (excess of tax cost over value) | | | (1,532,554 | ) | | |

Net Depreciation of Foreign Currency Derivatives | | | (1,663 | ) | | |

Net Unrealized Appreciation | | $ | 5,453,656 | | | |

|

F. Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax returns to determine whether these positions meet a “morelikely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

Management of the Fund analyzes all open tax years, as defined by the Statute of Limitations, for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the fiscal year ended November 30, 2012, the Fund did not have a liability for any unrecognized tax benefits. The Fund will file income tax returns in the U.S. federal jurisdiction and Colorado. For the years ended December 31, 2009 through November 30, 2012, the Fund’s returns are still open to examination by the appropriate taxing authority.

G. Fair Value Measurements

The Fund discloses the classification of its fair value measurements following a threetier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair

| | | | | | |

20 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | |

value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | |

Level 1 – | | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| |

Level 2 – | | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| |

Level 3 – | | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used to value the Funds investment November 30, 2012:

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value* | | Level 1- Unadjusted Quoted Prices | | | Level 2- Other Significant Observable Inputs | | | Level 3- Significant Unobservable Inputs | | | Total | |

Common Stocks | | $ | 71,036,879 | | | $ | – | | | $ | – | | | $ | 71,036,879 | |

TOTAL | | $ | 71,036,879 | | | $ | – | | | $ | – | | | $ | 71,036,879 | |

| | | | | | | | | | | | | | | | | |

*For a detailed geographical breakdown, see the accompanying Schedule of Investments.

The Fund recognizes transfers between levels as of the end of the fiscal year. For the year ended November 30, 2012, the Fund did not have any transfers between Level 1 and Level 2 securities. The Fund did not have any securities which used significant unobservable inputs (Level 3) in determining fair value.

| 3. | INVESTMENT ADVISORY FEE AND OTHER AFFILIATED TRANSACTIONS |

ALPS Advisors, Inc. (the “Investment Adviser”) acts as the Fund’s investment adviser pursuant to an Advisory Agreement with theTrust on behalf of the Fund (the “Advisory Agreement”). Pursuant to the Advisory Agreement, the Fund pays the Investment Adviser a unitary fee for the services and facilities it provides payable on a monthly basis at the annual rate of 0.55% of the Fund’s average daily net assets. From time to time, the Investment Adviser may waive all or a portion of its fee.

Out of the unitary management fee, the Investment Adviser pays substantially all expenses of the Fund, including the licensing fee of the Index provider, and the cost

| | | | |

| | | | 21 |

| Annual | | November 30, 2012 | |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | November 30, 2012 |

of transfer agency, custody, fund administration, legal, audit and other services, except for interest expenses, distribution fees or expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of the Fund’s business. In addition, the Investment Adviser’s unitary management fee is designed to compensate the Investment Adviser for providing services for the Fund.

ALPS Fund Services, Inc. (“ALPS”), an affiliate of the Investment Adviser, is the administrator of the Fund.

The Bank of New York Mellon is the custodian, fund accounting agent and transfer agent for the Fund.

Each Trustee who is not an officer or employee of the Investment Adviser, any subadviser or any of their affiliates (“Independent Trustees”) is paid a quarterly retainer of $5,000, $3,750 for each regularly scheduled Board meeting attended and $1,500 for each special meeting held outside of regularly scheduled meetings.

| 4. | PURCHASES AND SALES OF SECURITIES |

For the year ended November 30, 2012, the cost of purchases and proceeds from sales of investment securities, excluding in-kind transactions and short-term investments, were as follows:

| | |

| Purchases | | Sales |

| $3,718,804 | | $2,539,859 |

For the year ended November 30, 2012, the cost of in-kind purchases and proceeds from in-kind sales were as follows:

| | |

| Purchases | | Sales |

$13,849,272 | | $5,403,955 |

Gains on in-kind transactions are not considered taxable for federal income tax purposes.

| 5. | CAPITAL SHARE TRANSACTIONS |

Shares are created and redeemed by the Fund only in Creation Unit size aggregations of 50,000 shares. Only broker-dealers or large institutional investors with creation and redemption agreements called Authorized Participants (“AP”) are permitted to purchase or redeem Creation Units from the Fund. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the net asset value per unit of the Fund on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery, not eligible for trading by the AP or as a result of other market circumstances.

| | | | | | |

22 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | NOTES TO FINANCIAL STATEMENTS |

| | |

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

| | | | |

| | | | 23 |

| Annual | | November 30, 2012 | |

| | |

| | ADDITIONAL INFORMATION |

| | November 30, 2012 (Unaudited) |

PROXY VOTING POLICIES AND PROCEDURES

A description of the Fund’s proxy voting policies and procedures used in determining how to vote for proxies and information regarding how the Fund voted proxies related to portfolio securities during the most recent 12-month period ended June 30th is available without charge, (1) on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov; (2) upon request, by calling (toll-free) 1-866-513-5856; and (3) on the Trust’s website located at http://www.alpsfunds.com.

PORTFOLIO HOLDINGS

The Trust will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Form N-Q will be available (1) on the SEC’s website at http://www.sec.gov; (2) by calling (toll-free) 1-866-513-5856; (3) on the Trust’s website located at http://www.alpsfunds. com; and (4) for review and copying at the SEC’s Public Reference Room (“PRR”) in Washington D.C. Information regarding the operation of the PRR may be obtained by calling (toll-free) 1-800-732-0330.

TAX DESIGNATIONS

The Fund designates the following as a percentage of taxable ordinary income distributions for the calendar year ended December 31, 2011:

| | | | |

Qualified Dividend Income: | | | 10.54 | % |

Dividend Received Deduction: | | | 0.00 | % |

| | | | | | |

24 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | TRUSTEES AND OFFICERS |

| | November 30, 2012 (Unaudited) |

INDEPENDENT TRUSTEES

| | | | | | | | | | |

Name, Address and Age of Management Trustee* | | Position(s)

Held

with Trust | | Term of Office and Length of Time Served** | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustees*** | | Other Directorships Held by Trustees |

Mary K. Anstine, age 72 | | Trustee | | Since March 2008 | | Ms. Anstine was President/ Chief Executive Officer of HealthONE Alliance, Denver, Colorado, and former Executive Vice President of First Interstate Bank of Denver. Ms. Anstine is also Trustee/ Director of the following: AV Hunter Trust; Colorado Uplift Board. Ms. Anstine was formerly a Director of the Trust Bank of Colorado (later purchased and now known as Northern Trust Bank), HealthONE and Denver Area Council of the Boy Scouts of America and a member of the American Bankers Association Trust Executive Committee. | | 21 | | Ms. Anstine is a Trustee of Financial Investors Variable Insurance Trust (5 funds); Financial Investors Trust (25 funds); Reaves Utility Income Fund; and Westcore Trust (12 funds). |

Jeremy W. Deems, age 36 | | Trustee | | Since March 2008 | | Mr. Deems is the Co-Founder, Chief Operations Officer and Chief Financial Officer of Green Alpha Advisors, LLC. Prior to joining Green Alpha Advisors, Mr. Deems was CFO and Treasurer of Forward Management, LLC, ReFlow Management Co., LLC, ReFlow Fund, LLC, a private investment fund, and Sutton Place Management, LLC, an administrative services company, from 2004 to June 2007. Prior to this, Mr. Deems served as Controller of Forward Management, LLC, ReFlow Management Co., LLC, ReFlow Fund, LLC and Sutton Place Management, LLC. | | 21 | | Mr. Deems is a Trustee of Financial Investors Trust (25 funds); Financial Investors Variable Insurance Trust (5 funds); and Reaves Utility Income Fund. |

| | | | |

| | | | 25 |

| Annual | | November 30, 2012 | |

| | |

| | TRUSTEES AND OFFICERS |

| | November 30, 2012 (Unaudited) |

INDEPENDENT TRUSTEES Continued

| | | | | | | | | | |

Name, Address

and Age of

Management

Trustee* | | Position(s)

Held

with Trust | | Term of Office and Length of Time Served** | | Principal Occupation(s) During Past 5 Years | | Number of

Portfolios in Fund Complex

Overseen

by Trustees*** | | Other Directorships Held by Trustees |

| Rick A. Pederson, age 60 | | Trustee | | Since March 2008 | | President, Foundation Properties, Inc. (a real estate investment management company), 1994 - present; Partner, Western Capital Partners (a prime lending company), 2000 - present; Partner, Bow River Capital Partners (investment manager), 2003 - present; Principal, The Pauls Corporation (real estate development), 2008 - present; Director, Guaranty Bank and Trust (a community bank), 1999 – 2007; Winter Park Recreational Association (an entity that operates, maintains and develops Winter Park Resort), 2002 – 2008; Neenan Co. (an integrated real estate development, architecture and construction company), 2002 – present; NexCore Properties LLC (a real estate investment company), 2004 – present; Urban Land Conservancy (a not-for-profit organization), 2004 – present. | | 5 | | Mr. Pederson is Trustee of Westcore Trust (12 funds) |

| * | The business address of the Trustee is c/o ALPS Advisors, Inc., 1290 Broadway, Suite 1100, Denver, Colorado 80203. |

| ** | This is the period for which the Trustee began serving the Trust. Each Trustee serves an indefinite term, until his successor is elected. |

| *** | The Fund Complex includes all series of the Trust and any other investment companies for which ALPS Advisors, Inc. provides investment advisory services. |

| | | | | | |

26 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

| | |

| | TRUSTEES AND OFFICERS |

| | November 30, 2012 (Unaudited) |

INTERESTED TRUSTEE***

| | | | | | | | | | |

Name, Address

and Age of

Management

Trustee* | | Position(s)

Held

with Trust | | Term of Office and Length of Time Served** | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustees**** | | Other Directorships Held by Trustees |

Thomas A. Carter, age 46 | | Trustee

and

President | | Since March 2008 | | Mr. Carter joined ALPS Fund Services, Inc. (“ALPS”) in 1994 and is currently President and Director of ALPS Advisors, Inc. (“AAI”), ALPS Distributors, Inc. (“ADI”) and ALPS Portfolio Solutions Distributors, Inc. (“APSD”) and Executive Vice President and Director of ALPS and ALPS Holdings, Inc. (“AHI”). Because of his position with AHI, ALPS, ADI, APSD and AAI, Mr. Carter is deemed an affiliate of the Fund as defined under the 1940 Act. Before joining ALPS, Mr. Carter was with Deloitte & Touché LLP, where he worked with a diverse group of clients, primarily within the financial services industry. Mr. Carter is a Certified Public Accountant and received his Bachelor of Science in Accounting from the University of Colorado at Boulder. | | 10 | | Mr. Carter is a Trustee of Financial Investors Variable Insurance Trust (5 funds) |

| * | The business address of the Trustee is c/o ALPS Advisors, Inc., 1290 Broadway, Suite 1100, Denver, Colorado 80203. |

| ** | This is the period for which the Trustee began serving the Trust. Each Trustee serves an indefinite term, until his successor is elected. |

| *** | Mr. Carter is an interested person of the Trust because of his affiliation with ALPS. |

| **** | The Fund Complex includes all series of the Trust and any other investment companies for which ALPS Advisors, Inc. provides investment advisory services. |

| | | | |

| | | | 27 |

| Annual | | November 30, 2012 | |

| | |

| | TRUSTEES AND OFFICERS |

| | November 30, 2012 (Unaudited) |

OFFICERS

| | | | | | |

Name,Address and Age of

Executive Officer* | | Position(s) Held withTrust | | Length of Time Served** | | Principal Occupation(s) During Past 5 Years |

Melanie Zimdars, age 36 | | Chief Compliance Officer (“CCO”) | | Since December 2009 | | Ms. Zimdars currently serves as a Deputy Chief Compliance Officer with ALPS. Prior to joining ALPS in September 2009, Ms. Zimdars served as Principal Financial Officer, Treasurer and Secretary for the Wasatch Funds from February 2007 to December 2008. From November 2006 to February 2007, she served as Assistant Treasurer for the Wasatch Funds and served as a Senior Compliance Officer for Wasatch Advisors, Inc. since 2005. Because of her position with ALPS, Ms. Zimdars is deemed an affiliate of the Trust as defined under the 1940 Act. Ms. Zimdars is also the CCO of EGA Emerging Global Shares Trust, Financial Investors Variable Insurance Trust, Liberty All-Star Growth Fund, Inc., Liberty All-Star Equity Fund and BPV Family of Funds. |

Patrick D. Buchanan, age 40 | | Treasurer | | Since June 2012 | | Mr. Buchanan is Vice President of ALPS. Mr. Buchanan joined ALPS in 2007 and because of his position with ALPS, he is deemed an affiliate of the Trust as defined under the 1940 Act. |

William Parmentier, age 60 | | Vice President | | Since March 2008 | | Mr. Parmentier is Chief Investment Officer, ALPS Advisors, Inc. (since 2006); President of the Liberty All-Star Funds (since April 1999); SeniorVice President (2005-2006), Banc of America Investment Advisors, Inc. |

Tané T. Tyler, age 47 | | Secretary | | Since December 2008 | | Ms.Tyler is Senior Vice President, General Counsel and Assistant Secretary of ALPS. Ms.Tyler joined ALPS in 2004. She served as Secretary, Reaves Utility Income Fund from December 2004–2007; Secretary, Westcore Funds from February 2005–2007; Secretary, First Funds from November 2004 to January 2007; Secretary, Financial Investors Variable Insurance Trust from December 2004–December 2006; Vice President and Associate Counsel, Oppenheimer Funds from January 2004 to August 2004; Vice President and Assistant General Counsel, INVESCO Funds from September 1991 to December 2003. Ms. Tyler also serves as Secretary, Liberty All-Star Equity Fund and Liberty All-Star Growth Fund. |

| * | The business address of each Officer is c/o ALPS Advisors, Inc., 1290 Broadway, Suite 1100, Denver, Colorado 80203. |

| ** | This is the period for which the Officer began serving the Trust. Each Officer serves an indefinite term, until his successor is elected. |

| | | | | | |

28 | | | | | | |

| | An ALPS Advisors, Inc. Solution | | www.alpsfunds.com | | 866.513.5856 |

|

|

| ALPS Equal Sector Weight ETF |

| | | | |

| | | | |

| | | | ALPS Equal Sector Weight ETF | www.alpsfunds.com |

| | | | |

| | |

| |

|

| | Shareholder Letter (Unaudited) |

Dear Shareholders:

When ALPS launched its ETF(1) Trust in 2008 our goal was to bring innovative solutions to the ETF industry that provide investors with access to a unique market segment or strategy. The ALPS Equal Sector Weight ETF is the world’s first ETF to provide access to an Equal Sector Strategy.

Sectors are one of the most important drivers of risk and return in a portfolio. An equal sector strategy can minimize the negative impact of any one sector on the entire portfolio. At the same time by offering meaningful exposure to each sector of the market, it allows investors the ability to participate in market rallies regardless of where they occur. We believe the consistency of the historical returns delivered by an equal sector strategy combined with its transparency(2) and simplicity make it a viable alternative for US large-cap investing.

In the pages that follow our Fund managers have provided a performance overview. We thank you for your investment and for being a EQL shareholder.

Thomas A. Carter*

President, ALPS ETF Trust

| * | Registered representative of ALPS Distributors, Inc. |

| (1) | Exchange Traded Fund (“ETF”). |

| (2) | ETFs are considered transparent because their portfolio holdings are disclosed daily. |

Ordinary brokerage commissions apply.

| | | | |

| | | | |

| Annual Report | November 30, 2012 | | 2 | |  |

| | | | |

|

|

Performance Overview November 30, 2012 (Unaudited) |

INVESTMENT OBJECTIVE

The Fund seeks investment results that replicate as closely as possible, before fees and expenses, the performance of the Banc of America Securities – Merrill Lynch Equal Sector Weight Index (the “Underlying Index”). The Fund’s investment objective is not fundamental and may be changed by the Board of Trustees without shareholder approval.

PRIMARY INVESTMENT STRATEGIES

The Adviser will seek to match the performance of the Underlying Index. The Underlying Index is an index of indexes comprised in equal proportions of the nine Select Sector SPDR Indexes (“The Underlying Sector Indexes”). In order to track the securities in the Underlying Index, the Fund will use a “fund of funds” approach, and seek to achieve its investment objective by investing at least 90% of its total assets in the shares of Select Sector SPDR exchange-traded funds (each, an “Underlying Sector ETF” and collectively the “Underlying Sector ETFs”) that track the Underlying Sector indexes of which the Underlying Index is comprised.

PERFORMANCE OVERVIEW

For the fiscal year ended November 30, 2012 the Fund generated a total return of 14.35%. Over the same time period the S&P 500® gained 16.13%. Almost all of the gains for the year occurred in the first calendar quarter when the S&P 500® advanced 12.59%. For the fiscal year, every sector of the market generated a positive return, with cyclical sectors leading the way. The best performing sector was Financials (25.32%) followed by Consumer Discretionary (24.65%). Healthcare stocks (21.29%) also performed well, buoyed by increased profits in the biotech segment.

Energy stocks were weighed down by lackluster earnings growth and were the worst performing sector, rising just 2.00% in the 2012 fiscal year. Utilities, also a strong performer in 2011, reversed course in 2012 gaining 4.42%. Weak commodity prices and fears of a global Gross Domestic Product (“GDP”) slowdown weighed down Materials sector as well, ranking it 7th with a total return of 8.60%. The Technology sector was driven largely by Apple, racing forward nearly 20% in the first four months of year only to give back a quarter of its gains for a total return of 15.48%, 5th overall in the sector rankings. Industrials and Consumer Staples generated returns throughout the year that were mostly in line with the market, finishing the fiscal year with gains of 12.04% and 16.21%, respectively.

Compared to the S&P 500® the fund benefited from being underweight the Energy sector, as well as its slight overweights in the Consumer Discretionary and Health Care sectors. The Fund was negatively impacted by its overweight in Utilities sector and its underweight to Technology. Overall, the Fund’s sector weights relative to the S&P 500® resulted in positive out-performance above the index in 5 of the 9 sectors.

| | | | |

| | | | |

| | 3 | | ALPS Equal Sector Weight ETF | www.alpsfunds.com |

| | | | |

| | |

| |

|

| | Performance Overview November 30, 2012 (Unaudited) |

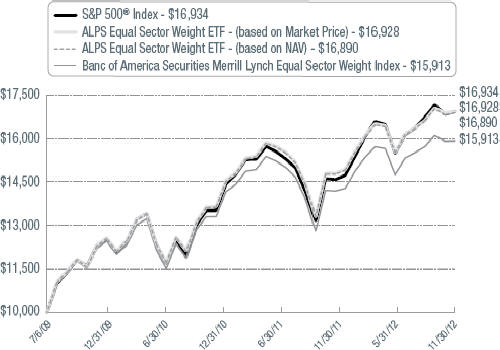

PERFORMANCE as of November 30, 2012

| | | | | | | | | | |

| Average Annual Total Return | | 6 Month | | YTD | | 1 Year | | 3 Year | | Since

Inception

Annualized* |

ALPS Equal Sector Weight ETF | | | | | | | | | | |

NAV (Net Asset Value) | | 8.96% | | 13.33% | | 14.35% | | 11.18% | | 16.65% |

Market Price** | | 9.07% | | 13.39% | | 14.37% | | 11.19% | | 16.73% |

Banc of America Securities Merrill Lynch Equal

Sector Weight Index | | 7.93% | | 11.44% | | 12.16% | | 9.24% | | 14.63% |

S&P 500® Total Return Index | | 9.32% | | 14.96% | | 16.13% | | 11.25% | | 16.74% |

Total Expense Ratio (per the current Prospectus) | | 0.55% | | | | | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be higher or lower than actual data quoted. Call 1.866.675.2639 or visit www.alpsfunds.com for current month end performance. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| * | The Fund commenced Investment Operations on July 06, 2009 with an Inception Date, the first day of trading on the Exchange, of July 7, 2009. |

| ** | Market Price is based on the midpoint of the bid/ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. |

Banc of America Securities Merrill Lynch Equal Sector Weight Index: a U.S. equity index comprised, in equal weights, of nine sub-indices, and is a price-return index.

S&P 500® Index: the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

An investor cannot invest directly in an index.

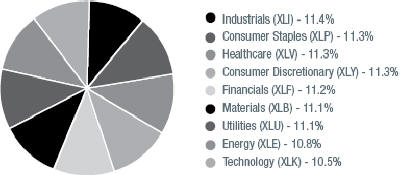

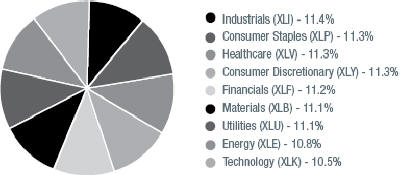

The following table shows the sector weights of both the Fund and the S&P 500® as of November 30, 2012:

SECTOR WEIGHTING COMPARISON as of November 30, 2012

| | | | |

| | | EQL | | S&P 500® |

Industrials (XLI) | | 11.4% | | 10.1% |

Consumer Staples (XLP) | | 11.3 | | 11.1 |

Healthcare (XLV) | | 11.3 | | 12.2 |

Consumer Discretionary (XLY) | | 11.3 | | 11.4 |

Financials (XLF) | | 11.2 | | 15.0 |

Materials (XLB) | | 11.1 | | 3.5 |

Utilities (XLU) | | 11.1 | | 3.4 |

Energy (XLE) | | 10.8 | | 11.0 |

Technology (XLK) | | 10.5 | | 22.3 |

Source: S&P 500®. | | | | |

| | | | |

| | | | |

| Annual Report | November 30, 2012 | | 4 | |  |

| | | | |

|

|

Performance Overview November 30, 2012 (Unaudited) |

SECTOR ALLOCATION as of November 30, 2012

Sector weights and allocations subject to change.

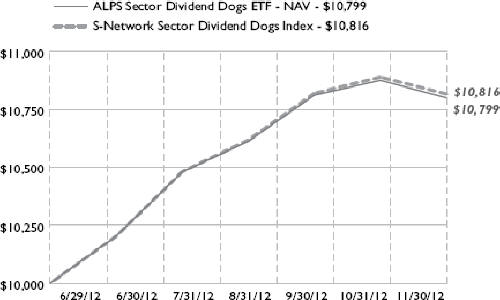

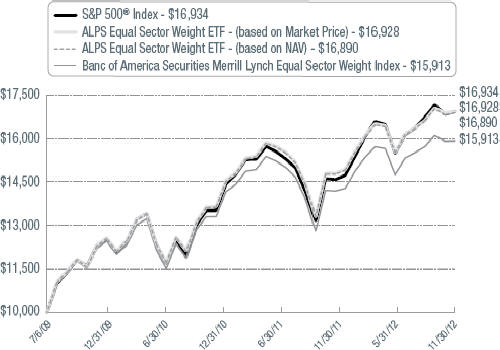

GROWTH OF $10,000 as of November 30, 2012

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the life of the Fund. Performance calculations are as of the end of each month. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | |

| | | | |

| | 5 | | ALPS Equal Sector Weight ETF | www.alpsfunds.com |

| | | | |

| | |

| |

|

| | Disclosure of Fund Expenses For the Six Months Ended November 30, 2012 (Unaudited) |

Shareholder Expense Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs which may include creation and redemption fees or brokerage charges, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the (six month) period and held through November 30, 2012.

Actual Return: The first line of the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses attributable to your investment during this period.

Hypothetical 5% Return: The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect any transaction costs, such as creation and redemption fees, or brokerage charges. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| | | | | | | | |

| | | Beginning

Account

Value

06/01/12 | | Ending

Account

Value

11/30/12 | | Expense

Ratio(a) | | Expenses

Paid During

the Period(b)

06/01/12-

11/30/12 |

Actual | | $1,000.00 | | $1,089.60 | | 0.34% | | $1.78 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,023.30 | | 0.34% | | $1.72 |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), then divided by 366. |

| | | | |

| | | | |

| Annual Report | November 30, 2012 | | 6 | |  |

| | | | |

|

|

| Report of Independent Registered Public Accounting Firm |

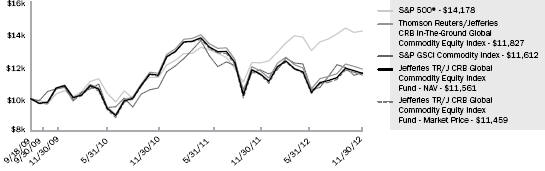

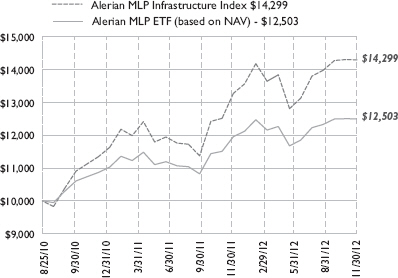

To the Board of Trustees and Shareholders of ALPS ETF Trust: