united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22153

Dunham Funds

(Exact name of registrant as specified in charter)

10251 Vista Sorrento Pkwy, Ste. 200, San Diego, CA 92121

(Address of principal executive offices) (Zip code)

James Ash

Gemini Fund Services, LLC., 80 Arkay Drive, Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 10/31

Date of reporting period: 4/30/16

Item 1. Reports to Stockholders.

This Semi-Annual Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements also include those preceded by, followed by or that include the words “believes”, “expects”, “anticipates” or similar expressions. Such statements should be viewed with caution. Actual results or experience could differ materially from the forward-looking statements as a result of many factors. Each Fund makes no commitments to disclose any revisions to forward-looking statements, or any facts, events or circumstances after the date hereof that may bear upon forward-looking statements. In addition, prospective purchasers of the Funds should consider carefully the information set forth herein and the applicable fund’s prospectus. Other factors and assumptions not identified above may also have been involved in the derivation of these forward-looking statements, and the failure of these other assumptions to be realized may also cause actual results to differ materially from those projected.

Dunham Floating Rate Bond Fund

Message from the Sub-Adviser (Newfleet Asset Management, LLC)

Despite a December increase in interest rates by the U.S. Federal Reserve for the first time in nearly a decade, interest rates decreased over the first half of the fiscal year ended April 30, 2016. While there was a slight increase towards the beginning of the fiscal period, interest rates generally declined thereafter. The yield on 10-year Treasuries began the fiscal year at 2.14 percent, rose to a high of 2.34 in early November, and ended the first fiscal quarter at 1.92 percent. The beginning of the second fiscal quarter saw interest rates hit a low of 1.66 percent in early February, before finishing the fiscal six-month period at 1.83 percent. The performance of bank loans, as measured by the S&P/LSTA Leveraged Loan Index, generally followed interest rates downward during the first half of the fiscal six-month period, but subsequently reversed course while interest rates continued to decline. Bank loans gained 1.6 percent over the fiscal period, after falling 1.8 percent over the prior fiscal six-month period. Although interest rates fell, the London Interbank Offered Rate (“LIBOR”) rose over the fiscal period. Three-month LIBOR began the fiscal period at 0.33 percent, hit a low of 0.33 percent in early November, then began a steady increase, hitting a high of 0.64 percent in mid-March, before ending the fiscal six-month period at 0.64 percent, nearly 91 percent higher than it began the fiscal period.

There were two quite different stories for U.S. stocks between the first and second halves of the fiscal six-month period, and bank loan returns generally mirrored both plots. The first half of the fiscal year saw a decline in U.S. stocks and bank loans, as investors sold risk. The second half of the fiscal year began with a generally flat February for both U.S. stocks and bank loans before turning sharply positive as investors bought risk. At the beginning of the fiscal period, the average bank loan in the Fund had a price of $96.79. By the middle of the fiscal period, the average bank loan price dropped to $94.50, before rebounding to $96.72 by the end of the fiscal six-month period. The Sub-Adviser remains optimistic about the asset class’ potential as interest rates rise and investor sentiment towards the loan space allows the price to continue to increase. At the beginning of the fiscal six-month period, approximately 36 bank loans in the Fund had a price lower than $95, which represented approximately 13 percent of the bank loans in the Fund. By the end of the fiscal six-month period, the Fund held approximately 29 bank loans with a price below $95, which represented approximately 11 percent of the bank loans in the Fund.

The yields on bank loans, as measured by the S&P / LSTA Leveraged Loan 100 Index, generally moved in the opposite direction from broader Treasury yield movements for the majority of the fiscal period, although they still ended slightly lower by the end. Bank loans, in general, began the fiscal six-month period with a yield-to-maturity of 5.9 percent, approximately 1.7 percent less than their traditional high-yield bond counterparts, as measured by the BofA Merrill Lynch High-Yield Bond Cash Pay Index. Bank loans outperformed traditional high-yield bonds over the first half of fiscal period by 3.7 percent, but trailed by 4.8 percent over the second half of the fiscal six-month period. Over the entire period, bank loans underperformed traditional high-yield bonds by 0.7 percent. The yield gap between the bank loans and traditional high-yield bonds saw an overall expansion over the fiscal period. At the end of the fiscal six months, the yields on bank loans stood at 5.8 percent and traditional high-yield bonds ended at 7.7 percent. The Fund held approximately 4.5 percent of its assets in traditional high-yield bonds which, from an allocation perspective, enhanced relative performance during the fiscal period.

The Sub-Adviser continued to focus on higher rated first lien loans within the bank loan space, limiting its exposure to bank loans rated CCC and lower. The exposure to lower-rated loans, second lien loans, and traditional bonds has been limited to instances where the Sub-Adviser has determined that the additional reward is expected to significantly outweigh the additional risk. However, with the significant increase in lower-rated securities over the second half of the six-month period, some of the Fund’s bonds also benefitted. For example, the Fund held the CCC-rated traditional bonds issued by Beverage Packaging Holdings Luxembourg I SA (08783AAC7) (holding percentage*: 0.15 percent), a joint issuer of debt that operates as a dual issuer of senior notes. The company is a subsidiary of Reynolds Group Holdings Limited, which is a leading global manufacturer and supplier of consumer beverage and foodservice packaging products, based in Auckland, New Zealand. The Beverage Packaging Holdings bonds increased 2.7 percent on a total return basis over the six-month period. In addition, the Fund held the traditional CCC-rated bond issued by iHeartCommunications, Inc. (184502BL5) (holding percentage*: 0.08 percent), a mobile and on-demand entertainment and information services provider. Over the first half of the six-month period the company’s bonds took a hit, losing a painful 15.6 percent on a total return basis. The second half of the six-month period saw a reversal, however, with the company’s bonds gaining 15.9 percent on a total return basis. On a net basis, the bonds were down 2.1 percent over the entire six-month period. As oil prices fell over the first half of the six-month period, so did many energy-related issuers in the Fund. However, as oil prices rallied from their January lows, these same issuers saw substantial increases in their bank loans. One such issuer was MEG Energy Corporation (BL0932949) (holding percentage*: 0.28 percent), an oil and gas company that is primarily involved in oil sands development and leases. Over the first fiscal quarter, the MED Energy Corp. bank loan saw a price decrease of 17 percent, but saw a rebound of 11.8 percent over the second fiscal quarter, paring overall losses for the six-month period to 4.5 percent.

The Sub-Adviser also analyzes recovery expectations for bank loans that are issued by companies proceeding through restructurings or defaults. For example, the Fund continued to hold the Caesars Entertainment Operating Co., Inc. bank loan (BL1302209) (holding percentage*: 0.15 percent), a casino, restaurant, and convention-space operator, which defaulted on its debt over a year ago. The bank loan was priced at $89.71 at the beginning of the six-month period, but rebounded by the end of the period to a price to just below $94.50.

The Sub-Adviser remains optimistic that interest rates, in general, will eventually rise and that bank loan investors may benefit from a highly-correlated increase in LIBOR. Although the Federal Open Market Committee’s planned four interest rate increases have been reduced to two for 2016, the Sub-Adviser believes we are in the late innings of the credit cycle. They are, however, incrementally dialing up risk in the Fund, albeit cautiously. The Sub-Adviser remains encouraged by the historically low default rates combined with the floating rate feature offered by bank loans.

| * | Holdings percentage(s) as of 4/30/2016. |

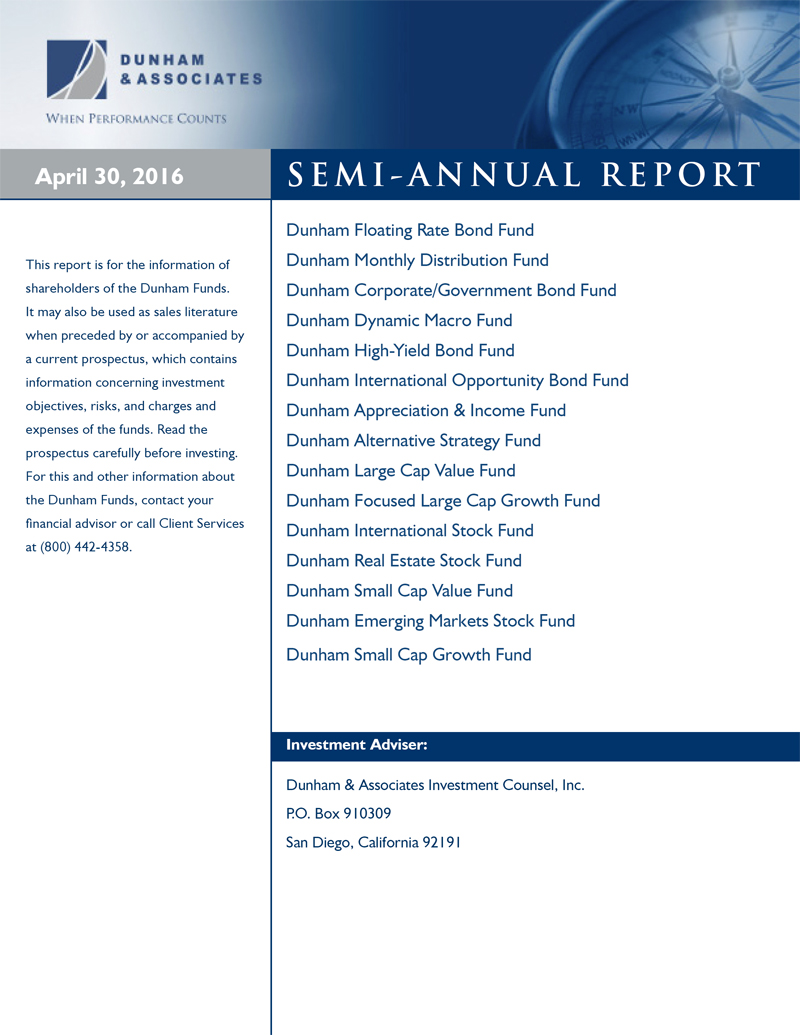

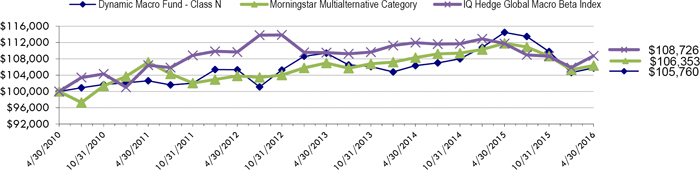

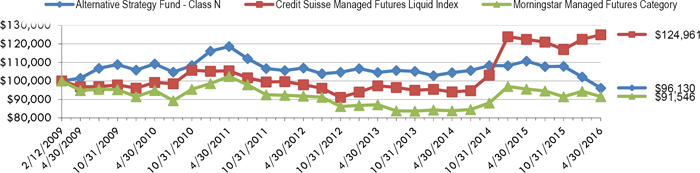

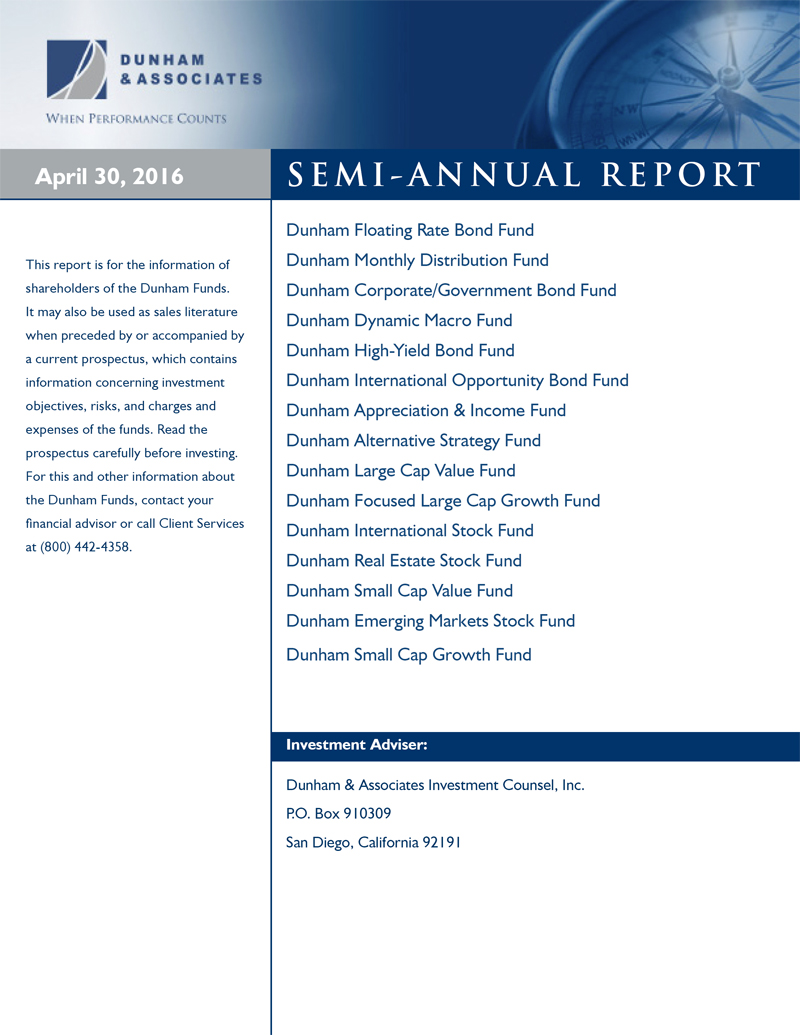

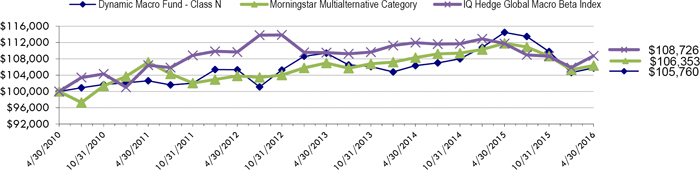

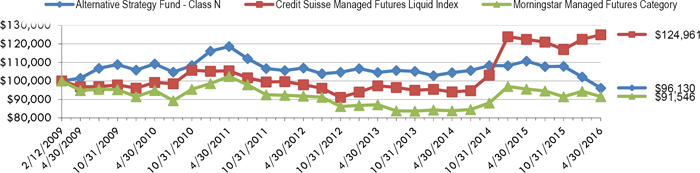

Growth of $100,000 Investment - (Unaudited)

Total Returns as of April 30, 2016

| | | | Annualized |

| | Six | One | Since Inception |

| | Months | Year | (11/1/13) |

| Class N | 1.58% | 0.21% | 1.41% |

| Class C | 1.21% | (0.53)% | 0.65% |

| Class A with load of 4.50% | (2.99)% | (4.48)% | (0.68)% |

| Class A without load | 1.57% | 0.07% | 1.17% |

| S&P/LSTA Leverage Loan Index | 1.88% | (0.07)% | 2.31% |

| Morningstar Bank Loan Category | 0.96% | (0.88)% | 1.35% |

The S&P/LSTA U.S. Leveraged Loan 100 Index is designed to reflect the performance of the largest facilities in the leveraged loan market. Investors cannot invest directly in an index or benchmark.

The Morningstar Bank Loan Category is generally representative of mutual funds that primarily invest in floating-rate bank loans instead of bonds. These bank loans generally offer interest payments that typically float above a common short-term benchmark such as the London interbank offered rate, or LIBOR.

As disclosed in the Trust’s latest registration statement, the Fund’s total annual operating expenses, including cost of underlying funds, are 1.27% for Class N, 2.02% for Class C and 1.52% for Class A. Class A shares are subject to a sales load of 4.50% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of fund shares or fund distributions. For performance information current to the most recent month-end, please call 1-800-442-4358 or visit our website www.dunham.com

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| BANK LOANS - 92.7% | | | | | | | | | | | | | | |

| CONSUMER DISCRETIONARY - 26.0% | | | | | | | | | | | | | | |

| Acosta Holdco, Inc. | | $ | 239,761 | | | | 4.2500 | % | | 9/26/2021 | | $ | 237,864 | |

| Advantage Sales & Marketing, Inc. | | | 97,000 | | | | 7.5000 | | | 7/24/2022 | | | 92,150 | |

| Allison Transmission, Inc. | | | 583,827 | | | | 3.5000 | | | 8/24/2019 | | | 585,508 | |

| Aristocrat International Property | | | 366,000 | | | | 4.7500 | | | 10/20/2021 | | | 368,353 | |

| Boyd Gaming Corp. | | | 467,297 | | | | 4.0000 | | | 8/14/2020 | | | 469,049 | |

| Caesars Entertainment Operating Co., Inc.* | | | 203,234 | | | | 10.2500 | | | 2/28/2017 | | | 190,024 | |

| Caesars Entertainment Operating Co., Inc.* | | | 137,310 | | | | 13.2500 | | | 2/28/2017 | | | 129,700 | |

| Caesars Entertainment Resort Properties, Inc. | | | 272,860 | | | | 7.0000 | | | 10/12/2020 | | | 258,622 | |

| Caesars Growth Properties Holdings, LLC | | | 152,026 | | | | 6.2500 | | | 5/8/2021 | | | 136,824 | |

| CBAC Borrower LLC | | | 99,750 | | | | 8.2500 | | | 7/2/2020 | | | 93,516 | |

| CCO Safari III LLC | | | 138,000 | | | | 3.2500 | | | 8/24/2021 | | | 138,421 | |

| CCO Safari III LLC | | | 708,000 | | | | 3.5000 | | | 1/24/2023 | | | 712,174 | |

| CDS US Intermediate Holdings | | | 175,120 | | | | 5.0000 | | | 7/8/2022 | | | 170,013 | |

| Charter Communications Operations, LLC | | | 326,812 | | | | 3.0000 | | | 6/30/2020 | | | 326,684 | |

| CityCenter Holdings LLC | | | 301,249 | | | | 4.2500 | | | 10/16/2020 | | | 302,605 | |

| Clear Channel Communications | | | 480,000 | | | | 7.3866 | | | 1/30/2019 | | | 360,468 | |

| CS Intermediate Holdco 2 LLC | | | 410,689 | | | | 4.0000 | | | 4/4/2021 | | | 411,333 | |

| CSC Holdings LLC | | | 723,149 | | | | 3.1366 | | | 4/16/2020 | | | 722,550 | |

| CSC Holdings LLC | | | 620,000 | | | | 5.0000 | | | 10/8/2022 | | | 624,005 | |

| Delta, Inc. | | | 310,000 | | | | 4.7500 | | | 7/30/2021 | | | 305,128 | |

| Eldorado Resorts, Inc. | | | 129,025 | | | | 4.2500 | | | 7/24/2022 | | | 129,186 | |

| Federal-Mogul Holdings Corp. | | | 293,261 | | | | 4.7500 | | | 4/16/2021 | | | 279,771 | |

| Gates Global LLC | | | 318,003 | | | | 4.2500 | | | 7/6/2021 | | | 305,623 | |

| Graton Economic Development Authority | | | 137,622 | | | | 4.7500 | | | 8/31/2022 | | | 137,966 | |

| Hilton Worldwide Finance LLC | | | 1,575,784 | | | | 3.5000 | | | 10/26/2020 | | | 1,583,490 | |

| Hudson’s Bay Co | | | 250,000 | | | | 4.7500 | | | 9/30/2022 | | | 251,563 | |

| Ineos Group Holdings Ltd | | | 327,265 | | | | 4.2500 | | | 12/14/2022 | | | 327,756 | |

| Infiltrator Systems Integrated | | | 78,408 | | | | 5.2500 | | | 5/28/2022 | | | 78,604 | |

| Intelsat Jackson Holdings S.A. | | | 200,000 | | | | 3.7500 | | | 6/30/2019 | | | 188,178 | |

| KAR Auction Services, Inc. | | | 311,188 | | | | 3.9375 | | | 3/12/2021 | | | 312,873 | |

| KAR Auction Services, Inc. | | | 75,000 | | | | 4.2500 | | | 3/8/2023 | | | 75,438 | |

| Laureate Education, Inc. | | | 476,428 | | | | 5.0000 | | | 6/16/2018 | | | 443,674 | |

| Leslie’s Poolmart, Inc. | | | 266,262 | | | | 4.2500 | | | 10/16/2019 | | | 265,932 | |

| Libbey Glass, Inc. | | | 258,609 | | | | 3.7500 | | | 4/8/2021 | | | 258,664 | |

| LTF Merger Sub, Inc. | | | 221,116 | | | | 4.2500 | | | 6/10/2022 | | | 220,357 | |

| Mattress Holding Corp. | | | 288,000 | | | | 6.2500 | | | 10/20/2021 | | | 289,080 | |

| MCC Georgia LLC | | | 299,738 | | | | 3.2500 | | | 1/28/2021 | | | 299,988 | |

| MCC Georgia LLC | | | 61,898 | | | | 3.7500 | | | 6/30/2021 | | | 61,975 | |

| MCC Georgia LLC | | | 155,630 | | | | 3.5000 | | | 6/30/2021 | | | 156,020 | |

| MGM Growth Properties Operating, LLC | | | 377,000 | | | | 4.0000 | | | 4/24/2023 | | | 379,631 | |

| Michaels Stores, Inc. | | | 531,529 | | | | 3.7500 | | | 1/28/2020 | | | 532,999 | |

| Mohegan Tribal Gaming Authority | | | 325,917 | | | | 5.5000 | | | 6/16/2018 | | | 324,830 | |

| MPG Holdco I, Inc. | | | 286,885 | | | | 3.7500 | | | 10/20/2021 | | | 285,604 | |

| Neiman Marcus Group LTD, Inc. | | | 270,000 | | | | 4.2500 | | | 10/24/2020 | | | 257,850 | |

| Numericable US LLC | | | 143,000 | | | | 4.7500 | | | 2/10/2023 | | | 143,409 | |

| Numericable US LLC | | | 325,000 | | | | 5.0000 | | | 1/16/2024 | | | 327,200 | |

| Party City Holdings, Inc. | | | 434,232 | | | | 4.2500 | | | 8/20/2022 | | | 433,720 | |

| Penn National Gaming, Inc. | | | 455,789 | | | | 3.2500 | | | 10/30/2020 | | | 456,358 | |

| Petsmart, Inc. | | | 541,905 | | | | 4.2500 | | | 3/12/2022 | | | 541,252 | |

| Scientific Games International, Inc. | | | 681,732 | | | | 6.0000 | | | 9/30/2021 | | | 673,105 | |

| ServiceMasterCo.LLC/The | | | 897,233 | | | | 4.2500 | | | 6/30/2021 | | | 902,002 | |

| SInc.lair Television Group, Inc. | | | 372,188 | | | | 3.5000 | | | 7/30/2021 | | | 372,031 | |

| Six Flags Theme Parks, Inc. | | | 397,254 | | | | 3.5006 | | | 6/30/2022 | | | 400,150 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund (Continued)

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| CONSUMER DISCRETIONARY (Continued) - 26.0% | | | | | | | | | | | | | | |

| SRAM Corporation | | $ | 282,400 | | | | 4.0124 | % | | 4/10/2020 | | $ | 249,218 | |

| Staples, Inc. | | | 945,000 | | | | 4.7500 | | | 2/2/2022 | | | 949,134 | |

| Station Casinos LLC | | | 247,370 | | | | 4.2500 | | | 3/2/2020 | | | 248,220 | |

| TI Group Automotive Systems LLC | | | 181,464 | | | | 4.5000 | | | 6/30/2022 | | | 181,692 | |

| Transtar Holding Co | | | 34,213 | | | | 7.7500 | | | 10/8/2018 | | | 23,493 | |

| Tribune Co | | | 368,952 | | | | 3.7500 | | | 12/28/2020 | | | 369,626 | |

| Univision Communications, Inc. | | | 262,667 | | | | 4.0000 | | | 2/29/2020 | | | 263,314 | |

| Univision Communications, Inc. | | | 1,331,185 | | | | 4.0000 | | | 2/29/2020 | | | 1,330,955 | |

| US Farathane LLC | | | 154,791 | | | | 6.7500 | | | 12/24/2021 | | | 155,371 | |

| Ziggo BV | | | 154,941 | | | | 3.6519 | | | 1/16/2022 | | | 154,622 | |

| Ziggo BV | | | 99,847 | | | | 3.6478 | | | 1/16/2022 | | | 99,641 | |

| Ziggo BV | | | 164,212 | | | | 3.6013 | | | 1/16/2022 | | | 163,874 | |

| | | | | | | | | | | | | | 22,520,430 | |

| CONSUMER STAPLES - 7.3% | | | | | | | | | | | | | | |

| Albertson’s Holdings LLC | | | 278,190 | | | | 5.5000 | | | 8/24/2021 | | | 279,614 | |

| Albertsons LLC | | | 252,368 | | | | 5.5000 | | | 12/20/2022 | | | 253,665 | |

| ARAMARK Corp. | | | 800,682 | | | | 3.2500 | | | 2/24/2021 | | | 802,684 | |

| Coty, Inc. | | | 102,976 | | | | 3.7500 | | | 10/28/2022 | | | 103,877 | |

| Dole Food Co, Inc. | | | 557,688 | | | | 4.5020 | | | 10/31/2018 | | | 558,087 | |

| Galleria Co | | | 205,952 | | | | 3.7500 | | | 1/26/2023 | | | 206,564 | |

| Hostess Brands LLC | | | 319,395 | | | | 4.1366 | | | 8/4/2022 | | | 321,059 | |

| Hostess Brands LLC | | | 235,000 | | | | 8.5000 | | | 8/4/2023 | | | 231,769 | |

| Kronos, Inc./MA | | | 60,875 | | | | 9.7500 | | | 4/30/2020 | | | 61,839 | |

| Kronos, Inc./MA | | | 820,590 | | | | 4.5000 | | | 10/30/2019 | | | 820,417 | |

| Oak Tea, Inc. | | | 59,901 | | | | 4.2500 | | | 7/2/2022 | | | 60,225 | |

| Pinnacle Foods Finance LLC | | | 802,277 | | | | 3.0000 | | | 4/28/2020 | | | 802,610 | |

| Pinnacle Foods Finance LLC | | | 22,943 | | | | 3.7500 | | | 1/12/2023 | | | 23,094 | |

| Prestige Brands, Inc. | | | 635,634 | | | | 3.5218 | | | 9/4/2021 | | | 638,151 | |

| Reynolds Group Holdings, Inc. | | | 445,370 | | | | 4.5000 | | | 11/30/2018 | | | 447,157 | |

| Rite Aid Corp. | | | 430,000 | | | | 4.8750 | | | 6/20/2021 | | | 431,479 | |

| Spectrum Brands, Inc. | | | 280,321 | | | | 3.5000 | | | 6/24/2022 | | | 281,828 | |

| | | | | | | | | | | | | | 6,324,119 | |

| ENERGY - 1.4% | | | | | | | | | | | | | | |

| Chelsea Petroleum | | | 199,179 | | | | 5.2500 | | | 10/28/2022 | | | 194,199 | |

| Chief Exploration & Development LLC | | | 172,000 | | | | 7.5000 | | | 5/16/2021 | | | 130,505 | |

| Drillships Financing Holding Inc. | | | 141,366 | | | | 6.0000 | | | 4/1/2021 | | | 69,269 | |

| Drillships Ocean Ventures, Inc. | | | 110,040 | | | | 5.5000 | | | 7/24/2021 | | | 65,611 | |

| Fieldwood Energy LLC | | | 215,850 | | | | 8.3750 | | | 9/30/2020 | | | 59,089 | |

| Jonah Energy LLC | | | 243,000 | | | | 7.5000 | | | 5/12/2021 | | | 164,835 | |

| MEG Energy Corp. | | | 276,394 | | | | 3.7500 | | | 4/1/2020 | | | 248,983 | |

| Paragon Offshore Finance Co | | | 174,258 | | | | 5.2500 | | | 7/16/2021 | | | 47,268 | |

| Seadrill Operating LP | | | 492,086 | | | | 4.0000 | | | 2/20/2021 | | | 246,043 | |

| | | | | | | | | | | | | | 1,225,802 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund (Continued)

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| FINANCIALS - 5.2% | | | | | | | | | | | | | | |

| Alixpartners LLP | | $ | 515,410 | | | | 4.5000 | % | | 7/28/2022 | | $ | 518,201 | |

| Asurion LLC | | | 82,794 | | | | 5.0000 | | | 5/24/2019 | | | 82,639 | |

| Asurion LLC | | | 189,120 | | | | 5.0000 | | | 8/4/2022 | | | 188,157 | |

| Capital Automotive L.P. | | | 93,064 | | | | 4.0000 | | | 4/10/2019 | | | 93,541 | |

| Capital Automotive LP | | | 197,005 | | | | 6.0000 | | | 4/30/2020 | | | 198,359 | |

| Delos Finance | | | 381,000 | | | | 3.5000 | | | 3/6/2021 | | | 383,000 | |

| DTZ US Borrower LLC | | | 595,499 | | | | 4.2500 | | | 11/4/2021 | | | 595,747 | |

| Realogy Group LLC | | | 773,336 | | | | 3.7500 | | | 3/4/2020 | | | 774,384 | |

| Starwood Property Trust, Inc. | | | 476,516 | | | | 3.5000 | | | 4/16/2020 | | | 474,729 | |

| TransUnion LLC | | | 892,339 | | | | 3.5000 | | | 4/8/2021 | | | 889,884 | |

| Walter Investment Management Corp. | | | 373,471 | | | | 4.7500 | | | 12/18/2020 | | | 328,772 | |

| | | | | | | | | | | | | | 4,527,413 | |

| HEALTHCARE - 16.7% | | | | | | | | | | | | | | |

| 21st Century Oncology, Inc. | | | 208,425 | | | | 6.5000 | | | 4/30/2022 | | | 186,019 | |

| Acadia Healthcare Co, Inc. | | | 226,433 | | | | 4.5000 | | | 2/16/2023 | | | 228,449 | |

| Akorn, Inc. | | | 258,134 | | | | 6.0000 | | | 4/16/2021 | | | 259,103 | |

| Alere, Inc. | | | 172,038 | | | | 4.2500 | | | 6/20/2022 | | | 170,774 | |

| American Renal Holdings Co, Inc. | | | 134,000 | | | | 4.7500 | | | 8/20/2019 | | | 134,084 | |

| Amneal Pharmaceuticals LLC | | | 344,403 | | | | 4.5007 | | | 10/31/2019 | | | 344,546 | |

| Amsurg Corp. | | | 101,197 | | | | 3.5000 | | | 7/16/2021 | | | 101,667 | |

| Ardent Legacy Acquisitions, Inc. | | | 194,025 | | | | 6.5000 | | | 8/4/2021 | | | 194,995 | |

| Capsugel Holdings US, Inc. | | | 410,809 | | | | 4.0000 | | | 8/1/2021 | | | 412,029 | |

| CHG Buyer Corp. | | | 397,008 | | | | 4.2500 | | | 11/20/2019 | | | 397,957 | |

| CHS/Community Health Systems Inc. | | | 282,504 | | | | 3.7500 | | | 1/1/2020 | | | 278,846 | |

| CHS/Community Health Systems Inc. | | | 519,800 | | | | 4.0000 | | | 1/28/2021 | | | 513,126 | |

| CHS/Community Health Systems Inc. | | | 218,666 | | | | 3.8855 | | | 1/1/2019 | | | 218,096 | |

| Concordia Healthcare Corp. | | | 149,625 | | | | 5.2500 | | | 10/20/2021 | | | 148,652 | |

| ConvaTec, Inc. | | | 10,800 | | | | 4.2500 | | | 6/16/2020 | | | 10,826 | |

| DaVita, Inc. | | | 748,589 | | | | 3.5000 | | | 6/24/2021 | | | 753,549 | |

| DJO Finance LLC | | | 158,800 | | | | 4.2500 | | | 6/8/2020 | | | 154,979 | |

| Emdeon, Inc. | | | 43,446 | | | | 3.7500 | | | 11/2/2018 | | | 43,746 | |

| Emdeon, Inc. | | | 492,500 | | | | 3.7500 | | | 11/2/2018 | | | 492,810 | |

| Emergency Medical Svcs Corp. | | | 190,010 | | | | 4.2500 | | | 5/24/2018 | | | 190,560 | |

| Endo Luxembourg Finance ICo. | | | 620,445 | | | | 3.7500 | | | 9/26/2022 | | | 619,437 | |

| Envision Healthcare Corp. | | | 161,595 | | | | 4.5000 | | | 10/28/2022 | | | 162,330 | |

| FHC Health Systems, Inc. | | | 247,500 | | | | 5.0000 | | | 12/24/2021 | | | 244,406 | |

| Greatbatch Ltd | | | 100,748 | | | | 5.2500 | | | 10/28/2022 | | | 101,393 | |

| HCA, Inc. | | | 203,925 | | | | 3.8866 | | | 3/16/2023 | | | 205,653 | |

| Horizon Pharma, Inc. | | | 131,010 | | | | 4.5000 | | | 5/8/2021 | | | 128,062 | |

| IASIS Healthcare LLC | | | 299,227 | | | | 4.5000 | | | 5/4/2018 | | | 299,351 | |

| IMS Health, Inc. | | | 450,311 | | | | 3.5000 | | | 3/16/2021 | | | 451,275 | |

| inVentiv Health, Inc. | | | 233,269 | | | | 7.7500 | | | 5/16/2018 | | | 234,291 | |

| Kinetic Concepts, Inc. | | | 417,411 | | | | 4.5000 | | | 5/4/2018 | | | 417,978 | |

| Mallinckrodt International Finance | | | 154,840 | | | | 3.2500 | | | 3/20/2021 | | | 151,744 | |

| Mallinckrodt International Finance | | | 225,074 | | | | 3.5000 | | | 3/20/2021 | | | 222,635 | |

| MJ Acquisition Corp. | | | 230,260 | | | | 4.0004 | | | 5/31/2022 | | | 229,397 | |

| MPH Acquisition Holdings LLC | | | 245,417 | | | | 3.7500 | | | 4/1/2021 | | | 244,711 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund (Continued)

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| HEALTHCARE (Continued) - 16.7% | | | | | | | | | | | | | | |

| National Mentor Holdings, Inc. | | $ | 266,797 | | | | 4.2500 | % | | 2/1/2021 | | $ | 266,397 | |

| National Surgical Hospitals Inc. | | | 117,115 | | | | 4.5000 | | | 5/31/2022 | | | 116,676 | |

| NBTY, Inc. | | | 56,000 | | | | 5.0000 | | | 4/26/2023 | | | 56,251 | |

| NVA Holdings, Inc. | | | 92,000 | | | | 8.0000 | | | 8/14/2022 | | | 90,006 | |

| NVA Holdings, Inc. | | | 115,000 | | | | 5.5000 | | | 8/14/2021 | | | 115,431 | |

| Onex Schumacher Finance LP | | | 223,875 | | | | 5.0000 | | | 7/28/2022 | | | 223,409 | |

| Ortho-Clinical Diag Holdings | | | 335,878 | | | | 4.7500 | | | 6/30/2021 | | | 318,934 | |

| Pharmaceutical Product Development | | | 294,335 | | | | 4.2500 | | | 8/18/2022 | | | 294,275 | |

| PRA Holdings, Inc. | | | 367,438 | | | | 4.5000 | | | 9/24/2020 | | | 369,826 | |

| Quintiles Transnational Corp. | | | 122,078 | | | | 3.2500 | | | 5/12/2022 | | | 122,535 | |

| Quorum Health Corp. | | | 226,000 | | | | 6.7500 | | | 4/12/2022 | | | 226,318 | |

| RegionalCare Hospital Partners | | | 313,762 | | | | 6.7500 | | | 4/23/2019 | | | 314,351 | |

| RPI Finance Trust | | | 296,992 | | | | 3.5000 | | | 11/8/2020 | | | 298,755 | |

| Select Medical Corp. | | | 255,000 | | | | 6.0000 | | | 3/4/2021 | | | 256,275 | |

| Sterigenics-Nordion Holdings LLC | | | 119,400 | | | | 4.2500 | | | 5/16/2022 | | | 119,400 | |

| Surgery Center Holdings, Inc. | | | 46,412 | | | | 5.2500 | | | 11/4/2020 | | | 46,572 | |

| Surgery Center Holdings, Inc. | | | 164,000 | | | | 5.2500 | | | 11/4/2020 | | | 164,564 | |

| Surgical Care Affiliates LLC | | | 270,776 | | | | 4.2500 | | | 3/16/2022 | | | 271,115 | |

| Team Health, Inc. | | | 243,390 | | | | 4.5000 | | | 11/24/2022 | | | 245,520 | |

| US Renal Care, Inc. | | | 354,113 | | | | 5.2500 | | | 12/30/2022 | | | 355,497 | |

| Valeant Pharmaceuticals International | | | 296,703 | | | | 4.7500 | | | 8/4/2020 | | | 292,359 | |

| Valeant Pharmaceuticals International | | | 409,899 | | | | 5.0000 | | | 3/31/2022 | | | 397,250 | |

| Valeant Pharmaceuticals International | | | 654,744 | | | | 4.5000 | | | 2/12/2019 | | | 637,286 | |

| | | | | | | | | | | | | | 14,546,478 | |

| INDUSTRIALS - 12.3% | | | | | | | | | | | | | | |

| Air Canada | | | 400,905 | | | | 4.0000 | | | 9/26/2019 | | | 403,244 | |

| Allied Security Holdings LLC | | | 302,473 | | | | 4.2500 | | | 2/12/2021 | | | 300,583 | |

| Allied Security Holdings LLC | | | 38,479 | | | | 8.0000 | | | 8/12/2021 | | | 37,686 | |

| American Airlines, Inc. | | | 436,545 | | | | 3.2500 | | | 6/28/2020 | | | 434,910 | |

| American Airlines, Inc. | | | 89,000 | | | | 3.5000 | | | 4/28/2023 | | | 88,722 | |

| Brickman Group Holdings, Inc. | | | 491,179 | | | | 4.0000 | | | 12/18/2020 | | | 489,134 | |

| Brickman Group Holdings, Inc. | | | 249,000 | | | | 7.5000 | | | 12/16/2021 | | | 244,954 | |

| Brock Holdings III, Inc. | | | 214,562 | | | | 6.0000 | | | 3/16/2017 | | | 208,393 | |

| Builders FirstSource, Inc. | | | 271,749 | | | | 6.0000 | | | 7/28/2022 | | | 272,258 | |

| DynCorp International, Inc. | | | 227,868 | | | | 6.2500 | | | 7/8/2016 | | | 221,602 | |

| Filtration Group, Inc. | | | 20,950 | | | | 8.2500 | | | 11/22/2021 | | | 20,701 | |

| Filtration Group, Inc. | | | 162,260 | | | | 4.2500 | | | 11/24/2020 | | | 162,178 | |

| Gardner Denver, Inc. | | | 265,000 | | | | 4.2500 | | | 7/30/2020 | | | 248,619 | |

| Harland Clarke Holdings Corp. | | | 173,518 | | | | 7.0000 | | | 5/22/2018 | | | 172,087 | |

| Harland Clarke Holdings Corp. | | | 65,119 | | | | 6.0000 | | | 8/4/2019 | | | 64,012 | |

| HD Supply, Inc. | | | 546,691 | | | | 3.7500 | | | 8/12/2021 | | | 547,990 | |

| Headwaters, Inc. | | | 422,660 | | | | 4.5000 | | | 3/24/2022 | | | 425,830 | |

| Husky Injection Molding | | | 171,490 | | | | 4.2500 | | | 6/30/2021 | | | 170,704 | |

| McJunkin Red Man Corp. | | | 139,284 | | | | 4.7500 | | | 11/8/2019 | | | 135,918 | |

| Navistar, Inc. | | | 61,845 | | | | 6.5000 | | | 8/8/2020 | | | 58,598 | |

| Nortek, Inc. | | | 606,433 | | | | 3.5000 | | | 10/30/2020 | | | 597,588 | |

| PQ Corp. | | | 93,000 | | | | 5.7500 | | | 10/28/2022 | | | 93,614 | |

| Prime Security Services | | | 39,000 | | | | 5.5000 | | | 5/2/2022 | | | 39,225 | |

| Quikrete Co, Inc. | | | 384,342 | | | | 4.0000 | | | 9/28/2020 | | | 384,583 | |

| Rexnord LLC | | | 655,325 | | | | 4.0000 | | | 8/20/2020 | | | 652,846 | |

| Science Applications International | | | 308,130 | | | | 3.7500 | | | 5/4/2022 | | | 309,672 | |

| Sedgwick, Inc. | | | 677,102 | | | | 3.7500 | | | 2/28/2021 | | | 666,665 | |

| Sedgwick, Inc. | | | 195,000 | | | | 6.7500 | | | 2/28/2022 | | | 186,225 | |

| SiteOne Landscape Supply Holdings | | | 176,000 | | | | 6.5000 | | | 4/28/2022 | | | 176,660 | |

| Spin Holdco, Inc. | | | 283,261 | | | | 4.2500 | | | 11/14/2019 | | | 278,421 | |

| TransDigm, Inc. | | | 815,831 | | | | 3.7500 | | | 2/28/2020 | | | 816,340 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund (Continued)

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| INDUSTRIALS (Continued) - 12.3% | | | | | | | | | | | | | | |

| TransDigm, Inc. | | $ | 81,547 | | | | 3.7500 | % | | 6/4/2021 | | $ | 81,267 | |

| TransDigm, Inc. | | | 396,192 | | | | 3.5000 | | | 5/16/2022 | | | 392,797 | |

| United Airlines, Inc. | | | 518,409 | | | | 3.5000 | | | 9/16/2021 | | | 519,612 | |

| US Airways, Inc. | | | 504,700 | | | | 3.5000 | | | 5/24/2019 | | | 505,490 | |

| Waste Industries USA, Inc. | | | 294,629 | | | | 4.2500 | | | 2/28/2020 | | | 295,917 | |

| | | | | | | | | | | | | | 10,705,045 | |

| INFORMATION TECHNOLOGY - 8.9% | | | | | | | | | | | | | | |

| Allflex Holdings III, Inc. | | | 282,750 | | | | 4.2500 | | | 7/16/2020 | | | 282,220 | |

| Applied Systems, Inc. | | | 221,058 | | | | 4.2605 | | | 1/24/2021 | | | 219,037 | |

| Applied Systems, Inc. | | | 158,197 | | | | 7.5000 | | | 1/24/2022 | | | 157,878 | |

| Avago Technologies Cayman Ltd. | | | 705,000 | | | | 4.2500 | | | 1/31/2023 | | | 706,449 | |

| Blue Coat Systems, Inc. | | | 263,340 | | | | 4.5000 | | | 5/20/2022 | | | 262,462 | |

| CCC Holdings,, Inc. | | | 335,409 | | | | 4.0000 | | | 12/20/2019 | | | 334,152 | |

| CDW LLC | | | 1,062,140 | | | | 3.2500 | | | 4/28/2020 | | | 1,063,287 | |

| Deltek, Inc. | | | 126,852 | | | | 5.0000 | | | 6/24/2022 | | | 127,328 | |

| Deltek, Inc. | | | 94,000 | | | | 9.5000 | | | 6/26/2023 | | | 93,530 | |

| Ensemble S Merger Sub, Inc. | | | 318,400 | | | | 4.7500 | | | 9/30/2022 | | | 318,333 | |

| First Data Corp. | | | 198,000 | | | | 4.3839 | | | 7/8/2022 | | | 198,421 | |

| First Data Corp. | | | 1,209,841 | | | | 4.6339 | | | 3/24/2021 | | | 1,214,626 | |

| Infinity Acquisition, LLC | | | 305,982 | | | | 4.0000 | | | 8/6/2021 | | | 292,787 | |

| Infor US, Inc. | | | 243,327 | | | | 3.7500 | | | 6/4/2020 | | | 239,069 | |

| Infor US, Inc. | | | 306,676 | | | | 3.7500 | | | 6/4/2020 | | | 300,288 | |

| Mitchell International, Inc. | | | 369,375 | | | | 4.5000 | | | 10/12/2020 | | | 368,220 | |

| Mitchell International, Inc. | | | 221,000 | | | | 8.5000 | | | 10/12/2021 | | | 206,083 | |

| MKS Instruments, Inc. | | | 91,000 | | | | 4.7500 | | | 4/30/2023 | | | 91,417 | |

| NXP BV | | | 237,405 | | | | 3.7500 | | | 12/8/2020 | | | 238,414 | |

| ON Semiconductor Corp. | | | 139,000 | | | | 5.2500 | | | 4/1/2023 | | | 139,840 | |

| Presidio, Inc. | | | 202,554 | | | | 5.2500 | | | 2/2/2022 | | | 201,896 | |

| SS&C European Holdings SARL | | | 25,225 | | | | 3.3866 | | | 7/8/2020 | | | 25,036 | |

| SS&C European Holdings SARL | | | 39,125 | | | | 3.3866 | | | 7/8/2020 | | | 38,831 | |

| SS&C Technologies, Inc. | | | 277,489 | | | | 4.0000 | | | 7/8/2022 | | | 278,790 | |

| SS&C Technologies, Inc. | | | 40,224 | | | | 4.0000 | | | 7/8/2022 | | | 40,412 | |

| Western Digital Corp. | | | 290,000 | | | | 6.2500 | | | 4/28/2023 | | | 283,656 | |

| | | | | | | | | | | | | | 7,722,462 | |

| MATERIALS- 7.3% | | | | | | | | | | | | | | |

| American Builders & Contractor Supply Co., Inc. | | | 553,612 | | | | 3.5000 | | | 4/16/2020 | | | 555,549 | |

| Anchor Glass Container Corp. | | | 428,352 | | | | 4.2500 | | | 6/30/2022 | | | 430,094 | |

| Ardagh Holdings USA, Inc. | | | 260,513 | | | | 4.0000 | | | 12/16/2019 | | | 260,553 | |

| Berlin Packaging LLC | | | 291,062 | | | | 4.5000 | | | 9/30/2021 | | | 291,971 | |

| Berry Plastics Corp. | | | 147,971 | | | | 4.0000 | | | 10/4/2022 | | | 152,474 | |

| Berry Plastics Group, Inc. | | | 238,843 | | | | 3.5000 | | | 2/8/2020 | | | 239,132 | |

| Berry Plastics Group, Inc. | | | 417,784 | | | | 3.7500 | | | 1/6/2021 | | | 414,999 | |

| CPG International, Inc. | | | 277,863 | | | | 4.7500 | | | 9/30/2020 | | | 276,821 | |

| Fortescue Metals Group Ltd | | | 700,929 | | | | 4.2500 | | | 6/30/2019 | | | 662,476 | |

| Huntsman International LLC | | | 485,870 | | | | 3.7500 | | | 9/30/2021 | | | 487,896 | |

| Huntsman International LLC | | | 112,000 | | | | 4.2500 | | | 3/31/2023 | | | 112,911 | |

| Ineos Group Holdings Ltd | | | 625,220 | | | | 3.7500 | | | 12/16/2020 | | | 620,140 | |

| Ineos US Finance LLC | | | 395,702 | | | | 4.2500 | | | 4/1/2022 | | | 394,220 | |

| Owens-Brockway Glass Container | | | 286,870 | | | | 3.5000 | | | 8/31/2022 | | | 287,825 | |

| Royal Holdings, Inc./IN | | | 236,215 | | | | 4.5000 | | | 6/20/2022 | | | 234,850 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund (Continued)

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| MATERIALS (Continued) - 7.3% | | | | | | | | | | | | | | |

| Solenis International LP | | $ | 153,660 | | | | 4.2500 | % | | 8/1/2021 | | $ | 152,508 | |

| Summit Materials | | | 390,053 | | | | 4.0000 | | | 7/18/2022 | | | 390,499 | |

| Univar, Inc. | | | 300,490 | | | | 4.2500 | | | 6/30/2022 | | | 297,646 | |

| WR Grace & Co | | | 111,773 | | | | 2.7500 | | | 2/4/2021 | | | 111,513 | |

| | | | | | | | | | | | | | 6,374,077 | |

| TELECOMMUNICATION SERVICES - 4.2% | | | | | | | | | | | | | | |

| Global Tel*Link Corp. | | | 302,023 | | | | 5.0000 | | | 5/24/2020 | | | 282,344 | |

| Level 3 Financing Inc | | | 355,000 | | | | 4.0000 | | | 1/16/2020 | | | 356,731 | |

| Level 3 Financing, Inc. | | | 986,000 | | | | 3.5000 | | | 6/1/2022 | | | 988,204 | |

| Sable International Finance Lt | | | 165,550 | | | | 5.5000 | | | 12/2/2022 | | | 166,533 | |

| Sable International Finance Lt | | | 135,450 | | | | 5.5000 | | | 12/2/2022 | | | 136,254 | |

| SBA Senior Finance II LLC | | | 210,255 | | | | 3.2500 | | | 3/24/2021 | | | 210,367 | |

| SBA Senior Finance II LLC | | | 159,793 | | | | 3.2500 | | | 6/10/2022 | | | 159,464 | |

| Securus Technologies Holdings | | | 141,376 | | | | 4.7500 | | | 4/30/2020 | | | 134,859 | |

| Securus Technologies Holdings | | | 84,788 | | | | 5.2500 | | | 4/30/2020 | | | 80,880 | |

| T-Mobile USA, Inc. | | | 199,500 | | | | 3.5000 | | | 11/8/2022 | | | 200,947 | |

| Virgin Media Investment Holdings | | | 445,962 | | | | 3.6519 | | | 6/30/2023 | | | 445,683 | |

| West Corporation | | | 232,707 | | | | 3.2500 | | | 6/30/2018 | | | 231,601 | |

| XO Communications LLC | | | 259,700 | | | | 4.2500 | | | 3/20/2021 | | | 259,917 | |

| | | | | | | | | | | | | | 3,653,784 | |

| UTILITIES - 3.4% | | | | | | | | | | | | | | |

| APLP Holdings LP | | | 445,000 | | | | 6.0000 | | | 4/12/2023 | | | 443,888 | |

| Calpine Construction Finance Co., LP | | | 470,708 | | | | 3.0000 | | | 5/4/2020 | | | 465,120 | |

| Calpine Construction Finance Co., LP | | | 258,836 | | | | 3.2500 | | | 2/1/2022 | | | 256,138 | |

| Calpine Corp. | | | 230,673 | | | | 4.0000 | | | 10/8/2019 | | | 231,366 | |

| Calpine Corp. | | | 618,328 | | | | 3.5000 | | | 5/28/2022 | | | 615,953 | |

| NRG Energy, Inc. | | | 723,690 | | | | 2.7500 | | | 6/30/2018 | | | 723,173 | |

| Texas Comp Elec Hold LLC | | | 635,000 | | | | 5.1291 | | | 10/10/2017 | | | 218,048 | |

| | | | | | | | | | | | | | 2,953,686 | |

| | | | | | | | | | | | | | | |

| TOTAL BANK LOANS (Cost - $81,956,720) | | | | | | | | | | | | | 80,553,296 | |

| | | | | | | | | | | | | | | |

| BONDS & NOTES - 4.6% | | | | | | | | | | | | | | |

| AIRLINES - 0.2% | | | | | | | | | | | | | | |

| Air Canada - 144A | | | 75,000 | | | | 6.7500 | | | 10/1/2019 | | | 78,750 | |

| American Airlines Group, Inc. - 144A | | | 45,000 | | | | 4.6250 | | | 3/1/2020 | | | 44,381 | |

| | | | | | | | | | | | | | 123,131 | |

| BUILDING MATERIALS - 0.0% | | | | | | | | | | | | | | |

| Standard Industries, Inc./NJ - 144A | | | 5,000 | | | | 5.1250 | | | 2/15/2021 | | | 5,225 | |

| | | | | | | | | | | | | | | |

| CHEMICALS - 0.1% | | | | | | | | | | | | | | |

| Hexion, Inc. | | | 150,000 | | | | 6.6250 | | | 4/15/2020 | | | 126,375 | |

| | | | | | | | | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES - 0.5% | | | | | | | | | | | | | | |

| Ally Financial, Inc. | | | 80,000 | | | | 3.2500 | | | 2/13/2018 | | | 80,200 | |

| Ally Financial, Inc. | | | 50,000 | | | | 4.1250 | | | 2/13/2022 | | | 50,875 | |

| International Lease Finance Corp | | | 120,000 | | | | 3.8750 | | | 4/15/2018 | | | 122,100 | |

| Springleaf Finance Corp. | | | 170,000 | | | | 5.2500 | | | 12/15/2019 | | | 161,925 | |

| | | | | | | | | | | | | | 415,100 | |

| ELECTRIC - 0.1% | | | | | | | | | | | | | | |

| Talen Energy Supply LLC | | | 100,000 | | | | 4.6250 | | | 7/15/2019 | | | 93,500 | |

| | | | | | | | | | | | | | | |

| ENTERTAINMENT - 0.1% | | | | | | | | | | | | | | |

| GLP Capital LP | | | 50,000 | | | | 4.8750 | | | 11/1/2020 | | | 53,000 | |

| GLP Capital LP . | | | 10,000 | | | | 4.3750 | | | 4/15/2021 | | | 10,250 | |

| | | | | | | | | | | | | | 63,250 | |

| FOOD - 0.1% | | | | | | | | | | | | | | |

| Dole Food Co., Inc. - 144A | | | 70,000 | | | | 7.2500 | | | 5/1/2019 | | | 70,525 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund (Continued)

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| HEALTHCARE-PRODUCTS - 0.8% | | | | | | | | | | | | | | |

| Kinetic Concepts, Inc. - 144A | | $ | 10,000 | | | | 7.8750 | % | | 2/15/2021 | | $ | 10,838 | |

| Centene Corp. - 144A | | | 75,000 | | | | 5.6250 | | | 2/15/2021 | | | 79,125 | |

| CHS/Community Health Systems, Inc. | | | 75,000 | | | | 5.1250 | | | 8/15/2018 | | | 76,125 | |

| HCA, Inc. | | | 200,000 | | | | 3.7500 | | | 3/15/2019 | | | 206,000 | |

| Surgery Center Holdings, Inc. - 144A | | | 130,000 | | | | 8.8750 | | | 4/15/2021 | | | 130,325 | |

| Tenet Healthcare Corp. - 144A | | | 25,000 | | | | 5.0000 | | | 3/1/2019 | | | 24,875 | |

| Tenet Healthcare Corp. | | | 75,000 | | | | 6.0000 | | | 10/1/2020 | | | 79,875 | |

| Tenet Healthcare Corp. | | | 80,000 | | | | 3.7841 | | | 6/15/2020 | | | 80,500 | |

| | | | | | | | | | | | | | 687,663 | |

| HOLDING COMPANIES - DIVERSIFICATION - 0.2% | | | | | | | | | | | | | | |

| Argos Merger Sub, Inc. - 144A ^ | | | 140,000 | | | | 7.1250 | | | 3/15/2023 | | | 143,500 | |

| | | | | | | | | | | | | | | |

| HOME BUILDERS - 0.1% | | | | | | | | | | | | | | |

| TRI Pointe Group, Inc. | | | 70,000 | | | | 4.3750 | | | 6/15/2019 | | | 70,525 | |

| | | | | | | | | | | | | | | |

| LODGING - 0.0% | | | | | | | | | | | | | | |

| Boyd Gaming Corp. | | | 40,000 | | | | 6.8750 | | | 5/15/2023 | | | 41,700 | |

| | | | | | | | | | | | | | | |

| MEDIA - 1.1% | | | | | | | | | | | | | | |

| Altice Financing SA - 144A | | | 200,000 | | | | 6.6250 | | | 2/15/2023 | | | 198,510 | |

| CCO Safari II LLC - 144A | | | 300,000 | | | | 3.5790 | | | 7/23/2020 | | | 311,658 | |

| Cequel Capital Corp - 144A | | | 50,000 | | | | 6.3750 | | | 9/15/2020 | | | 51,377 | |

| iHeartCommunications, Inc. | | | 95,000 | | | | 9.0000 | | | 12/15/2019 | | | 73,981 | |

| Numericable-SFR SA - 144A | | | 200,000 | | | | 6.0000 | | | 5/15/2022 | | | 201,010 | |

| RCN Telecom Services LLC - 144A | | | 110,000 | | | | 8.5000 | | | 8/15/2020 | | | 111,788 | |

| | | | | | | | | | | | | | 948,324 | |

| MINING - 0.1% | | | | | | | | | | | | | | |

| Vedanta Resources PLC - 144A | | | 100,000 | | | | 9.5000 | | | 7/18/2018 | | | 93,750 | |

| | | | | | | | | | | | | | | |

| OIL & GAS SERVICES - 0.1% | | | | | | | | | | | | | | |

| FTS International, Inc. - 144A | | | 50,000 | | | | 6.2500 | | | 5/1/2022 | | | 8,025 | |

| FTS International, Inc. | | | 120,000 | | | | 8.1182 | | | 6/15/2020 | | | 87,643 | |

| | | | | | | | | | | | | | 95,668 | |

| PACKAGING & CONTAINERS - 0.4% | | | | | | | | | | | | | | |

| Ardagh Holdings USA, Inc. - 144A | | | 200,000 | | | | 6.2500 | | | 1/31/2019 | | | 205,500 | |

| Beverage Packaging Holdings Luxembourg II SA - 144A | | | 130,000 | | | | 6.0000 | | | 6/15/2017 | | | 129,838 | |

| Reynolds Group Issuer, Inc. ^ | | | 50,000 | | | | 5.7500 | | | 10/15/2020 | | | 52,000 | |

| | | | | | | | | | | | | | 387,338 | |

| PHARMACEUTICALS - 0.2% | | | | | | | | | | | | | | |

| Capsugel SA - 144A | | | 19,000 | | | | 7.0000 | | | 5/15/2019 | | | 19,143 | |

| Quintiles Transnational Corp. - 144A | | | 40,000 | | | | 4.8750 | | | 5/15/2023 | | | 41,150 | |

| Valeant Pharmaceuticals International, Inc | | | 70,000 | | | | 5.3750 | | | 3/15/2020 | | | 62,344 | |

| | | | | | | | | | | | | | 122,637 | |

| PRIVATE EQUITY - 0.0% | | | | | | | | | | | | | | |

| Icahn Enterprises LP | | | 10,000 | | | | 4.8750 | | | 3/15/2019 | | | 9,975 | |

| | | | | | | | | | | | | | | |

| REITS - 0.2% | | | | | | | | | | | | | | |

| iStar, Financial, Inc. | | | 30,000 | | | | 4.8750 | | | 7/1/2018 | | | 29,362 | |

| iStar, Financial, Inc. | | | 60,000 | | | | 5.0000 | | | 7/1/2019 | | | 58,500 | |

| iStar, Financial, Inc. | | | 100,000 | | | | 4.0000 | | | 11/1/2017 | | | 99,000 | |

| | | | | | | | | | | | | | 186,862 | |

| SOFTWARE - 0.1% | | | | | | | | | | | | | | |

| First Data Corp. - 144A | | | 90,000 | | | | 5.0000 | | | 1/15/2024 | | | 91,238 | |

| First Data Corp. - 144A | | | 25,000 | | | | 5.7500 | | | 1/15/2024 | | | 25,469 | |

| | | | | | | | | | | | | | 116,707 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Floating Rate Bond Fund (Continued)

April 30, 2016

| | | Principal | | | Interest | | | Maturity | | | |

| Security | | Amount | | | Rate | | | Date | | Value | |

| TELECOMMUNICATIONS - 0.2% | | | | | | | | | | | | | | |

| Frontier Communications Corp. | | $ | 155,000 | | | | 6.2500 | % | | 9/15/2021 | | $ | 144,924 | |

| Intelsat Jackson Holdings SA | | | 85,000 | | | | 6.6250 | | | 12/15/2022 | | | 55,355 | |

| | | | | | | | | | | | | | 200,279 | |

| | | | | | | | | | | | | | | |

| TOTAL BONDS & NOTES (Cost - $4,153,334) | | | | | | | | | | | | | 4,002,034 | |

| | | | | | | | | | | | | | | |

| ASSET BACKED SECURITIES - 1.6% | | | | | | | | | | | | | | |

| Drive Auto Receivables Trust 2016-A | | | 250,000 | | | | 2.1100 | | | 5/15/2019 | | | 251,375 | |

| Flagship Credit Auto Trust 2016-1 | | | 281,227 | | | | 2.7700 | | | 12/15/2020 | | | 282,448 | |

| Hertz Vehicle Financing LLC 2016-1 | | | 250,000 | | | | 2.3200 | | | 3/25/2020 | | | 250,214 | |

| Home Equity Loan Trust 2007-HSA3 | | | 125,083 | | | | 6.1100 | | | 6/25/2037 | | | 123,263 | |

| JP Morgan Chase Commercial Mortgage Securities Trust 2007-LDP10 | | | 192,000 | | | | 5.4640 | | | 1/15/2049 | | | 189,587 | |

| OneMain Financial Issuance Trust 2015-1 | | | 250,000 | | | | 3.1900 | | | 3/18/2026 | | | 250,916 | |

| | | | | | | | | | | | | | | |

| TOTAL ASSET BACKED SECURITIES (Cost - $1,345,176) | | | | | | | | | | | | | 1,347,803 | |

| | | | | | | | | | | | | | | |

| | | Shares | | | | | | | | | | | |

| SHORT-TERM INVESTMENT - 3.6% | | | | | | | | | | | | | | |

| MONEY MARKET FUND - 3.6% | | | | | | | | | | | | | | |

| Fidelity Institutional Money Market Funds - Government Portfolio | | | 3,122,938 | | | | 0.0100 | + | | | | | 3,122,938 | |

| TOTAL SHORT-TERM INVESTMENT - (Cost - $3,122,938) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| COLLATERAL FOR SECURITIES LOANED - 0.1% | | | | | | | | | | | | | | |

| Mount Vernon Prime Portfolio + (Cost - $105,750) | | | 105,750 | | | | 0.51 | % | | | | | 105,750 | |

| | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 102.6% (Cost - $90,683,918) | | | | | | | | | | | | $ | 89,131,821 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (2.6)% | | | | | | | | | | | | | (2,226,757 | ) |

| NET ASSETS - 100.0% | | | | | | | | | | | | $ | 86,905,064 | |

REITS - Real Estate Investment Trusts.

| ^ | All or a portion of these securities are on loan. Total loaned securities had a value of $103,583 at April 30, 2016. |

| + | Variable rate security. Interest rate is as of April 30, 2016. |

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| Portfolio Composition * - (Unaudited) |

| Bank Loans | | | 90.4 | % | | Diversified Financial Services | | | 0.5 | % |

| Asset Backed Securities | | | 3.5 | % | | Packaging & Containers | | | 0.4 | % |

| Short-Term Investment | | | 1.5 | % | | Pharmaceuticals | | | 0.2 | % |

| Media | | | 1.1 | % | | Telecommunications | | | 0.2 | % |

| Healthcare-Products | | | 0.8 | % | | Other ** | | | 1.4 | % |

| | | | | | | Total | | | 100.0 | % |

| * | Based on total value of investments as of April 30, 2016. |

| ** | Groupings less than 0.20% of holdings. |

Percentage may differ from Schedule of Investments which are based on Fund net assets.

See accompanying notes to financial statements.

Dunham Monthly Distribution Fund

Message from the Sub-Adviser (Westchester Capital Management, LLC)

While “higher” market volatility has been a prominent theme across the past few periods, there have been relatively short periods that have experienced significant spikes. For example, market volatility, as measured by the CBOE Volatility Index (“VIX”) ended the first three months of the six-month period 34 percent higher than it began. At one point during this period, the VIX nearly doubled, while equity market prices widely tumbled. Generally, large increases in the VIX coincide with sizeable declines in the equity markets. Equity markets rallied during the fourth and fifth months of the six-month period as volatility generally subsided. The VIX decreased 30.9 percent over this time period. In the final month of the six-month period ended April 30, 2016, the VIX spiked once again, albeit less than the previous spike. The VIX increased 12.5 percent in the month of April. After the higher volatility levels during the first three months generally continued to result in investors attempting to reduce risk and making indiscriminate sell decisions, the decrease in volatility in the most recent fiscal quarter may have increased investor optimism. Event-driven strategies, as measured by the Credit Suisse Event Driven Index, decreased 2.3 percent, while market-neutral strategies, as measured by the IQ Hedge Market Neutral Beta Index, increased 1.5 percent.

Similar to the previous periods, merger arbitrage strategies, as measured by the Credit Suisse Merger Arbitrage Index, provided a slight positive contribution to absolute performance during the final three months of the six-month fiscal period. Merger arbitrage strategies increased 1.0 percent in this period and increased 0.6 percent in the first three months of the fiscal six-month period. Although the broad merger arbitrage space experienced a slight positive return, many merger spreads saw significant widening during the period. However, deals continued to close during this volatility. For example, the cash and stock acquisition of Jarden Corporation (JAH) (holding percentage*: 3.59 percent) by Newell Rubbermaid Inc. (NWL) (holding percentage*: -0.76 percent) began the most recent fiscal quarter with a 2.6 percent spread and completed towards the end of the six-month period. These significant spreads on deals that ultimately proved to successfully close helps to illustrate how this ongoing volatility significantly impacted deal spreads within the event driven space.

As volatility peaked during the first three months of the period, many deal spreads widened substantially. For example, the cash and stock acquisition of Baker Hughes Inc. (BHI) (holding percentage**: 0.06 percent) by Halliburton Co. (HAL) (holding percentage**: -0.03 percent) continued to experience its deal spread widen. At the start of the period, the spread stood at 17.7 percent and by the end of the first three months, it had widened further to a spread of 25.5 percent. Even though volatility generally subsided, the spread did not improve during the final three months. The deal completion date was pushed back to midsummer due regulatory request from the U.S. government and European Commission. The Sub-Adviser believed the risk present in the position no longer warranted a place in the Fund and sold out of the position on March 3, 2016. The Justice Department denied the approval of this acquisition on April 6, 2016. Conversely, as volatility generally subsided during the final three months of the fiscal period many spreads tightened. The cash and stock acquisition of Time Warner Cable Inc. (TWC) (holding percentage*: 1.31 percent) by Charter Communications, Inc. (CHTR) (holding percentage*: -2.84 percent) saw its deal spread tighten from 7.3 percent at the end of October to slightly less than 1.2 percent at the end of April.

The Sub-Adviser generally implements risk-reversals, a risk-management technique using call and put options, on event-driven opportunities outside of the merger arbitrage strategy. The Sub-Adviser does this in order to help keep the risk within what it believes are acceptable bounds. A special situation event example that has spanned multiple periods included Hertz Global Holdings, Inc.’s (HTZ) (holding percentage*: 2.09 percent) spin-off of its equipment rental business. In this particular example, HTZ experienced a substantial decline during the first three months of the six-month period, primarily due to concerns over the company’s leverage and its growing competition from smart-phone oriented ride-hailing companies. However, the Sub-Adviser’s implementation of the risk reversals during this time served well to offset a meaningful amount of the downturn. The risk reversal detracted slightly in the final three months of the period as HTZ increased 2.0 percent. During the six-month period, buy/write strategies, as measured by the CBOE S&P 500 Buy/Write Index, declined 0.6 percent. The difference in utilizing a risk-reversal instead of a buy/write strategy is that it uses the majority of the proceeds of the written call to purchase protective put options. Therefore, in the declining periods during the first three months of the period, the risk-reversal generally helped to reduce the downside (leaving less to be recovered).

The Sub-Adviser continued to maintain a small position in credit opportunities during the most recent six-month period. Similar to the prior fiscal period, the strategy as a whole generally contributed positively to Fund performance during the most recent six-month period. During this period, corporate bonds in general, as measured by the Bank of America Merrill Lynch Corporate Bond Master Index, increased 4.2 percent. Fund holdings such as the corporate bond issued by U.S. Foods Inc. (90290MAA9) (holding percentage*: 1.20 percent) aided positive performance. The U.S Foods Inc. bond price increased 3.6 percent over the fiscal period.

The Sub-Adviser believes that the increased volatility across the markets has generally increased the potential rewards from many of these event-driven opportunities. However, while the core tenets for many of these events have not substantially changed, the Sub-Adviser is optimistic that the overall risk-reward profile has improved. The Sub-Adviser continues to implement its disciplined risk controls while taking advantage of these perceived opportunities going forward.

*Holdings percentage(s) as of 4/30/2016.

**Holdings percentage(s) as of the date prior to the sale of the security.

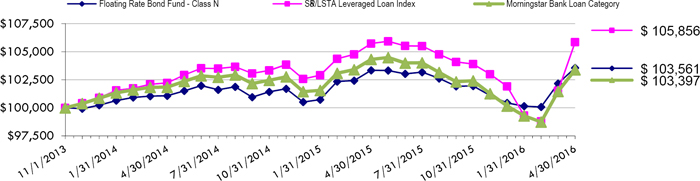

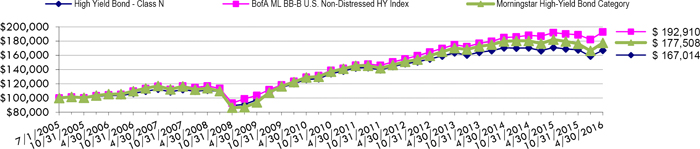

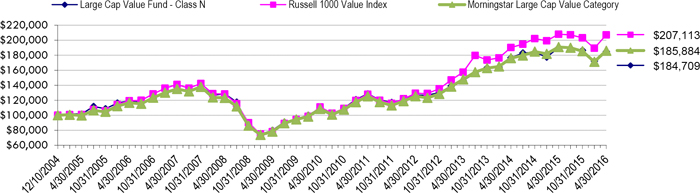

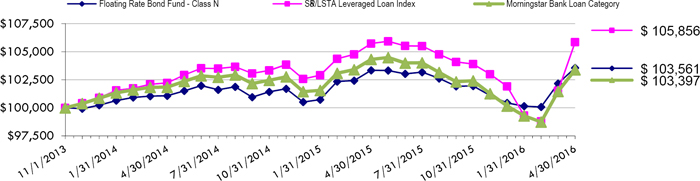

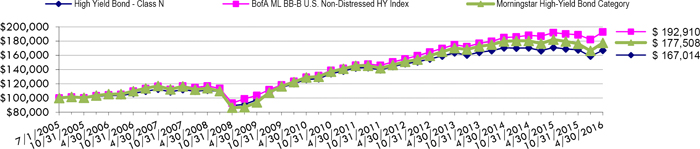

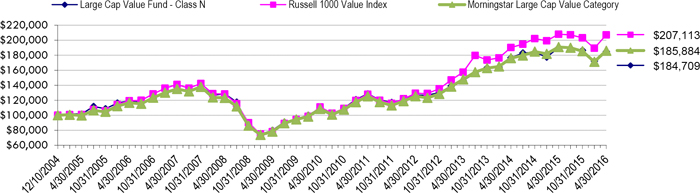

Growth of $10,000 Investment - (Unaudited)

Total Returns as of April 30, 2016

| | Six | | Annualized | Annualized | Annualized Since |

| | Months | One Year | Three Years | Five Years | Inception (8/1/08)* |

| Class N | (0.32)% | (4.40)% | 0.92% | 2.51% | 4.06%** |

| Class C | (0.86)% | (5.40)% | (0.09)% | 1.48% | 2.04% |

| Class A with load of 5.75% | (6.15)% | (10.13)% | (1.30)% | 1.04% | (0.40)% |

| Class A without load | (0.44)% | (4.65)% | 0.66% | 2.25% | 2.82% |

| IQ Hedge Market Neutral Beta Index | (0.88)% | 1.88% | 2.44% | 1.52% | 2.50% |

| Morningstar Multialternative Category | (2.12)% | (4.82)% | (0.18)% | (0.14)% | 0.37% |

| * | Westchester Capital Management, Inc. was named Sub-Adviser to the Fund on August 1, 2008. Prior to August 1, 2008, the Fund was named Kelmoore Strategy Liberty Fund and was managed under a different adviser. |

| ** | Class N commenced operations on September 29, 2008. |

IQ Hedge Market Neutral Beta Index is a benchmark index designed to replicate the risk-adjusted return characteristics of the collective hedge funds using a market neutral investment style. Investors cannot invest directly in an index or benchmark.

The Morningstar Multialternative Category is generally representative of mutual funds with static allocations to alternative strategies and mutual funds that tactically allocate among alternative strategies and asset classes. The gross short exposure in these mutual funds is generally greater than 20%.

As disclosed in the Trust’s latest registration statement, the Fund’s total annual operating expenses before any fee waiver, including the cost of underlying funds, are 2.11% for Class N, 3.11% for Class C and 2.36% for Class A. Class A shares are subject to a sales load of 5.75% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of fund shares or fund distributions. For performance information current to the most recent month-end, please call 1-800-442-4358 or visit our website www.dunham.com.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Monthly Distribution Fund

April 30, 2016

| Security | | Shares | | | | | | Value | |

| COMMON STOCK - 84.3% | | | | | | | | | | | | |

| AIRLINES - 0.0% | | | | | | | | | | | | |

| American Airlines Group, Inc. | | | 101,283 | | | | | | | $ | 84,065 | |

| | | | | | | | | | | | | |

| AUTO MANUFACTURERS - 0.9% | | | | | | | | | | | | |

| General Motors Co. | | | 72,000 | | | | | | | | 2,289,600 | |

| | | | | | | | | | | | | |

| BUILDING MATERIALS - 2.0% | | | | | | | | | | | | |

| West China Cement Ltd. | | | 24,035,911 | | | | | | | | 5,081,784 | |

| | | | | | | | | | | | | |

| CHEMICALS - 12.0% | | | | | | | | | | | | |

| Airgas, Inc. # | | | 63,076 | | | | | | | | 8,984,545 | |

| Dow Chemical Co. # | | | 88,648 | | | | | | | | 4,663,771 | |

| EI du Pont de Nemours & Co. # | | | 105,752 | | | | | | | | 6,970,114 | |

| Syngenta AG - ADR | | | 37,350 | | | | | | | | 3,009,290 | |

| Valspar Corp. # | | | 57,909 | | | | | | | | 6,178,311 | |

| | | | | | | | | | | | 29,806,031 | |

| COMMERCIAL SERVICES - 3.8% | | | | | | | | | | | | |

| ADT Corp. | | | 102,413 | | | | | | | | 4,299,298 | |

| Global Payments, Inc. | | | 89 | | | | | | | | 6,419 | |

| Hertz Global Holdings, Inc. # | | | 561,800 | | | | | | | | 5,202,268 | |

| SFX Entertainment, Inc. # | | | 536,171 | | | | | | | | 13,404 | |

| | | | | | | | | | | | 9,521,389 | |

| COMPUTERS - 6.1% | | | | | | | | | | | | |

| EMC Corp./MA # | | | 417,394 | | | | | | | | 10,898,157 | |

| SanDisk Corp. # | | | 56,155 | | | | | | | | 4,218,925 | |

| | | | | | | | | | | | 15,117,082 | |

| DISTRIBUTION / WHOLESALE - 3.3% | | | | | | | | | | | | |

| Ingram Micro, Inc. # | | | 233,589 | | | | | | | | 8,163,936 | |

| | | | | | | | | | | | | |

| ELECTRONICS - 2.9% | | | | | | | | | | | | |

| Tyco International PLC # | | | 188,088 | | | | | | | | 7,245,150 | |

| | | | | | | | | | | | | |

| ENVIRONMENTAL CONTROL - 0.4% | | | | | | | | | | | | |

| Progressive Waste Solutions Ltd. | | | 31,774 | | | | | | | | 1,023,441 | |

| | | | | | | | | | | | | |

| FOOD - 2.6% | | | | | | | | | | | | |

| ConAgra Foods, Inc. # | | | 143,000 | | | | | | | | 6,372,080 | |

| | | | | | | | | | | | | |

| HEALTHCARE-PRODUCTS - 3.0% | | | | | | | | | | | | |

| Alere, Inc. # | | | 110,629 | | | | | | | | 4,314,531 | |

| Baxter International, Inc. | | | 44,800 | | | | | | | | 1,981,056 | |

| St Jude Medical, Inc. | | | 16,162 | | | | | | | | 1,231,544 | |

| | | | | | | | | | | | 7,527,131 | |

| HEALTHCARE-SERVICES - 2.6% | | | | | | | | | | | | |

| Centene Corp. | | | 1 | | | | | | | | 57 | |

| Humana, Inc. # | | | 36,997 | | | | | | | | 6,551,059 | |

| | | | | | | | | | | | 6,551,116 | |

| HOLDING COMPANIES-DIVERSIFICATION - 0.9% | | | | | | | | | | | | |

| Hennessy Capital Acquisition Corp. II | | | 104,074 | | | | | | | | 1,027,210 | |

| Pacific Special Acquisition Corp. | | | 105,552 | | | | | | | | 1,062,909 | |

| | | | | | | | | | | | 2,090,119 | |

| HOUSEHOLD PRODUCTS / WARES - 3.5% | | | | | | | | | | | | |

| Jarden Corp. | | | 148,157 | | | | | | | | 8,736,818 | |

| | | | | | | | | | | | | |

| INSURANCE - 0.3% | | | | | | | | | | | | |

| American International Group, Inc. | | | 13,200 | | | | | | | | 736,824 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Monthly Distribution Fund (Continued)

April 30, 2016

| Security | | Shares | | | | | | Value | |

| INTERNET - 4.7% | | | | | | | | | | | | |

| Qihoo 360 Technology Co., Ltd. # | | | 16,319 | | | | | | | $ | 1,239,265 | |

| Yahoo!, Inc. # | | | 288,544 | | | | | | | | 10,560,710 | |

| | | | | | | | | | | | 11,799,975 | |

| LODGING - 9.0% | | | | | | | | | | | | |

| Hilton Worldwide Holdings, Inc. | | | 118,800 | | | | | | | | 2,619,540 | |

| MGM Resorts International | | | 239,000 | | | | | | | | 5,090,700 | |

| Starwood Hotels & Resorts Worldwide, Inc. # | | | 178,867 | | | | | | | | 14,645,630 | |

| | | | | | | | | | | | 22,355,870 | |

| MEDIA - 8.5% | | | | | | | | | | | | |

| Cablevision Systems Corp. # | | | 97,079 | | | | | | | | 3,241,468 | |

| CBS Corp. # | | | 74,139 | | | | | | | | 4,145,111 | |

| Liberty Braves Group | | | 21,240 | | | | | | | | 332,198 | |

| Liberty Media Group | | | 53,100 | | | | | | | | 971,744 | |

| Liberty SiriusXM Group | | | 212,403 | | | | | | | | 6,960,446 | |

| Markit Ltd. # | | | 12,422 | | | | | | | | 433,404 | |

| Media General, Inc. # | | | 107,359 | | | | | | | | 1,860,531 | |

| Time Warner Cable, Inc. | | | 15,353 | | | | | | | | 3,256,525 | |

| | | | | | | | | | | | 21,201,427 | |

| MINING - 1.3% | | | | | | | | | | | | |

| Alcoa, Inc. | | | 292,000 | | | | | | | | 3,261,640 | |

| Freeport-McMoRan, Inc. | | | 1 | | | | | | | | 14 | |

| | | | | | | | | | | | 3,261,654 | |

| MISCELLANEOUS MANUFACTURING - 1.7% | | | | | | | | | | | | |

| General Electric Co. # | | | 136,300 | | | | | | | | 4,191,225 | |

| | | | | | | | | | | | | |

| OIL & GAS - 1.0% | | | | | | | | | | | | |

| Northern Tier Energy LP # | | | 109,406 | | | | | | | | 2,499,927 | |

| | | | | | | | | | | | | |

| PHARMACEUTICALS - 4.1% | | | | | | | | | | | | |

| Allergan PLC # | | | 135 | | | | | | | | 29,236 | |

| Baxalta, Inc. # | | | 216,379 | | | | | | | | 9,077,099 | |

| Mylan NV | | | 463 | | | | | | | | 19,312 | |

| Pfizer, Inc. # | | | 35,600 | | | | | | | | 1,164,476 | |

| | | | | | | | | | | | 10,290,123 | |

| PIPELINES - 0.3% | | | | | | | | | | | | |

| Williams Cos, Inc. # | | | 41,925 | | | | | | | | 812,926 | |

| | | | | | | | | | | | | |

| REITS - 3.6% | | | | | | | | | | | | |

| Blackstone Mortgage Trust, Inc. # | | | 4,944 | | | | | | | | 135,862 | |

| CYS Investments, Inc. | | | 9,500 | | | | | | | | 77,046 | |

| NorthStar Realty Finance Corp. # | | | 118,000 | | | | | | | | 1,509,220 | |

| Starwood Property Trust, Inc. # | | | 247,078 | | | | | | | | 4,783,430 | |

| Wheeler Real Estate Investment Trust, Inc. | | | 850,746 | | | | | | | | 1,199,552 | |

| Winthrop Realty Trust # | | | 102,617 | | | | | | | | 1,305,288 | |

| | | | | | | | | | | | 9,010,398 | |

| RETAIL - 0.0% | | | | | | | | | | | | |

| Restaurant Brands International, Inc. | | | 1 | | | | | | | | 43 | |

| | | | | | | | | | | | | |

| SAVINGS & LOANS - 1.7% | | | | | | | | | | | | |

| First Niagara Financial Group, Inc. # | | | 406,657 | | | | | | | | 4,294,298 | |

| | | | | | | | | | | | | |

| SEMICONDUCTORS - 3.9% | | | | | | | | | | | | |

| KLA-Tencor Corp. # | | | 137,343 | | | | | | | | 9,605,769 | |

| Microchip Technology, Inc. | | | 2 | | | | | | | | 97 | |

| | | | | | | | | | | | 9,605,866 | |

| TELECOMMUNICATIONS - 0.2% | | | | | | | | | | | | |

| T-Mobile US, Inc. | | | 15,190 | | | | | | | | 596,663 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCK (Cost - $221,693,465) | | | | | | | | | | | 210,266,961 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Monthly Distribution Fund (Continued)

April 30, 2016

| Security | | | | | Shares | | | | | Value | |

| RIGHTS - 0.0% | | | | | | | | | | | | | | |

| Leap Wireless International, Inc. * | | | | | | | 4,071 | | | | | $ | 13,231 | |

| Pacific Special Acquisition Corp. | | | | | | | 105,552 | | | | | | 17,727 | |

| Safeway Casa Ley CVR * | | | | | | | 90,955 | | | | | | 4,548 | |

| Safeway PDC, LLC CVR * | | | | | | | 90,955 | | | | | | 40,930 | |

| TOTAL RIGHTS (Cost - $125,879) | | | | | | | | | | | | | 76,436 | |

| | | | | | | | | | | | | | | |

| WARRANTS - 0.0% | | | | | | | | | | | | | | |

| Hennessy Capital Acquisition Corp. II | | | | | | | 104,074 | | | | | | 29,141 | |

| Pacific Special Acquisition Corp. | | | | | | | 105,552 | | | | | | 9,500 | |

| TOTAL WARRANTS (Cost - $32,028) | | | | | | | | | | | | | 38,641 | |

| | | | | | | | | | | | | | | |

| CLOSED-END FUNDS - 3.9% | | | | | | | | | | | | | | |

| BlackRock Floating Rate Income Strategies Fund, Inc. | | | | | | | 103,341 | | | | | | 1,368,235 | |

| DoubleLine Income Solutions Fund # | | | | | | | 73,612 | | | | | | 1,295,571 | |

| Eaton Vance Floating-Rate Income Trust | | | | | | | 104,551 | | | | | | 1,376,937 | |

| First Trust Senior Floating Rate Income Fund II ^ | | | | | | | 67,775 | | | | | | 869,553 | |

| Invesco Senior Income Trust # | | | | | | | 703,160 | | | | | | 2,868,893 | |

| Voya Prime Rate Trust # | | | | | | | 275,084 | | | | | | 1,389,174 | |

| Western Asset High Income Opportunity Fund, Inc. | | | | | | | 106,644 | | | | | | 506,559 | |

| TOTAL CLOSED-END FUNDS (Cost - $9,913,936) | | | | | | | | | | | | | 9,674,922 | |

| | | | | | | | | | | | | | | |

| | | | | | | Dividend | | | | | | | |

| | | Shares | | | Rate | | | | | | | |

| PREFERRED STOCK - 2.3% | | | | | | | | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES - 0.8% | | | | | | | | | | | | | | |

| Kinder Morgan GP, Inc. - 144A # | | | 2,000 | | | | 4.5157 | % | | | | | 1,825,000 | |

| | | | | | | | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS - 1.5% | | | | | | | | | | | | | | |

| Equity CommonWealth # | | | 150,000 | | | | 7.2500 | | | | | | 3,750,000 | |

| | | | | | | | | | | | | | | |

| TOTAL PREFERRED STOCK (Cost - $5,739,425) | | | | | | | | | | | | | 5,575,000 | |

| | | | | | | | | | | | | | | |

| | | Principal | | | Interest | | | Maturity | | | | |

| | Amount | | | Rate | | | Date | | | | |

| BONDS & NOTES - 4.9% | | | | | | | | | | | | |

| COMMERCIAL SERVICES - 0.8% | | | | | | | | | | | | | | |

| ADT Corp. | | $ | 1,834,000 | | | | 4.125 | % | | 4/15/2019 | | | 1,969,258 | |

| | | | | | | | | | | | | | | |

| ENGINEERING & CONSTRUCTION - 0.1% | | | | | | | | | | | | | | |

| Aeropuertos Dominicanos Siglo XXI SA | | | 192,000 | | | | 9.2500 | | | 11/13/2019 | | | 204,960 | |

| | | | | | | | | | | | | | | |

| ELECTRIC - 2.0% | | | | | | | | | | | | | | |

| Energy Future Intermediate Holding Co. LLC - 144A | | | 4,761,350 | | | | 11.7500 | | | 3/1/2022 | | | 5,106,548 | |

| | | | | | | | | | | | | | | |

| MEDIA - 0.8% | | | | | | | | | | | | | | |

| LIN Television Corp. | | | 2,000,000 | | | | 5.8750 | | | 11/15/2022 | | | 2,050,000 | |

| | | | | | | | | | | | | | | |

| FOOD - 1.2% | | | | | | | | | | | | | | |

| US Foods, Inc. | | | 2,887,000 | | | | 8.5000 | | | 6/30/2019 | | | 2,973,610 | |

| | | | | | | | | | | | | | | |

| TOTAL BONDS & NOTES (Cost - $12,495,890) | | | | | | | | | | | | | 12,304,376 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | Contracts** | | Value | |

| PURCHASED PUT OPTIONS - 0.9% | | | | | | | | | | | | | | |

| Alcoa Inc, Expiration June 2016, Exercise Price $6 | | | | | | | | | | 2,374 | | | 2,374 | |

| Alcoa Inc., Expiration May 2016, Exercise Price $7 | | | | | | | | | | 546 | | | 540 | |

| Allergan Public, Expiration May 2016, Exercise Price $240 | | | | | | | | | | 31 | | | 77,500 | |

| American Intl Group, Expiration May 2016, Exercise Price $47.5 | | | | | | | | | | 125 | | | 1,187 | |

| AIG, Expiration June 2016, Exercise Price $45 | | | | | | | | | | 211 | | | 3,165 | |

| AIG, Expiration June 2016, Exercise Price $50 | | | | | | | | | | 274 | | | 11,371 | |

| BAX, Expiration August 2016, Exercise Price $55 | | | | | | | | | | 448 | | | 504,000 | |

| BAY, Expiration June 2016, Exercise Price $92 | | | | | | | | | | 196 | | | 40,173 | |

| CAG, Expiration June 2016, Exercise Price $40 | | | | | | | | | | 1,430 | | | 35,750 | |

| CBS Corp, Expiration June 2016, Exercise Price $40 | | | | | | | | | | 741 | | | 12,228 | |

| Dow Chemical Co., Expiration June 2016, Exercise Price $43 | | | | | | | | | | 1,356 | | | 16,273 | |

| VIVENDI, Expiration June 2016, Exercise Price $15 | | | | | | | | | | 1,259 | | | 34,599 | |

| General Electric Co., Expiration May 2016, Exercise Price $28 | | | | | | | | | | 1,227 | | | 3,069 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Monthly Distribution Fund (Continued)

April 30, 2016

| Security | | | | | | | | Contracts** | | Value | |

| PURCHASED PUT OPTIONS - 0.9% (Continued) | | | | | | | | | | | | | | |

| General Motors Co., Expiration June 2016, Exercise Price $27 | | | | | | | | | | 1,438 | | $ | 24,446 | |

| HLT, Expiration July 2016, Exercise Price $19 | | | | | | | | | | 1,188 | | | 32,670 | |

| Starwood Hotels & Resorts Worldwide, Inc., Expiration May 2016, Exercise Price $55 | | | | | | | | | | 283 | | | 284 | |

| HTZ, Expiration June 2016, Exercise Price $8 | | | | | | | | | | 5,182 | | | 168,415 | |

| Huntsman Corp, Expiration May 2016, Exercise Price $8 | | | | | | | | | | 447 | | | 1,342 | |

| iShares iBoxx High Yield, Expiration June 2016, Exercise Price $75 | | | | | | | | | | 263 | | | 2,630 | |

| iShares iBoxx High Yield, Expiration June 2016, Exercise Price $77 | | | | | | | | | | 520 | | | 7,280 | |

| MGM, Expiration June 2016, Exercise Price $16 | | | | | | | | | | 2,390 | | | 22,705 | |

| NRF, Expiration June 2016, Exercise Price $12 | | | | | | | | | | 1,180 | | | 76,700 | |

| Pfizer, Expiration June 2016, Exercise Price $27 | | | | | | | | | | 267 | | | 1,335 | |

| SPY, Expiration May 2016, Exercise Price $206 | | | | | | | | | | 105 | | | 26,040 | |

| SPY, Expiration June 2016, Exercise Price $184 | | | | | | | | | | 210 | | | 24,360 | |

| SPY, Expiration May 2016, Exercise Price $204 | | | | | | | | | | 610 | | | 116,510 | |

| SPY, Expiration June 2016, Exercise Price $204 | | | | | | | | | | 210 | | | 94,710 | |

| T-Mobile, Inc., Expiration May 2016, Exercise Price $31 | | | | | | | | | | 1,167 | | | 12,837 | |

| Vmware, Inc., Expiration September 2016, Exercise Price $95 | | | | | | | | | | 290 | | | 1,133,900 | |

| TOTAL PURCHASED PUT OPTIONS (Cost - $3,473,288) | | | | | | | | | | | | | 2,488,393 | |

| | | | | | | | | | | | | | | |

| SHORT-TERM INVESTMENT - 11.9% | | | | | | | | | | Interest | | | | |

| MONEY MARKET FUND - 11.9% | | Shares | | | | | | | Rate | | Value | |

| First American Government Obligations Fund | | | 29,646,669 | | | | | | | 0.21 | %+ | $ | 29,646,669 | |

| TOTAL SHORT-TERM INVESTMENT (Cost - $29,646,669) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| COLLATERAL FOR SECURITIES LOANED - 3.7% | | | | | | | | | | | | | | |

| Mount Vernon Prime Portfolio + (Cost - $9,209,035) | | | 9,209,035 | | | | | | | 0.51 | %+ | | 9,209,035 | |

| | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 111.9% (Cost - $292,329,615) | | | | | | | | | | | | $ | 279,280,433 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (11.9)% | | | | | | | | | | | | | (29,827,617 | ) |

| NET ASSETS - 100.0% | | | | | | | | | | | | $ | 249,452,816 | |

| * | Non-Income producing security. |

| ** | Each Purchased Option contract allows the Fund to sell 100 shares of the underlying security at the exercise price. |

| *** | Issuer in default on interest payments, non-interest producing security. |

REITS - Real Estate Investment Trusts

ADR- American Depositary Receipt.

| + | Variable rate security. Interest rate is as of April 30, 2016. |

| ++ | Each Written Call/Put Option contract allows the holder to purchase/sell 100 shares of the underlying security from/to the Fund at the stated exercise price. |

| ^ | All or a portion of these securities are on loan. Total loaned securities had a value of $8,949,290 at April 30, 2016. |

| # | All or a portion of the security is segregated as collateral for securities sold short and/or options purchased/written at April 30, 2016. Total collateral had a value of $49,627,303 at April 30, 2016. |

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| Security | | Contracts ++ | | | Value | |

| WRITTEN CALL OPTIONS - (2.5)% | | | | | | | | |

| Alcoa Inc., Expiration June 2016, Exercise Price $8 | | | 546 | | | $ | 170,352 | |

| Alcoa Inc., Expiration May 2016, Exercise Price $8 | | | 2,374 | | | | 759,680 | |

| Allergan, Expiration May 2016, Exercise Price $265 | | | 8 | | | | 64 | |

| Allergan, Expiration May 2016, Exercise Price $275 | | | 57 | | | | 570 | |

| American Intl Group, Expiration May 2016, Exercise Price $45 | | | 421 | | | | 151,560 | |

| American Intl Group, Expiration May 2016, Exercise Price $55 | | | 125 | | | | 27,125 | |

| AIG, Expiration June 2016, Exercise Price $52.5 | | | 307 | | | | 336,933 | |

| AIG, Expiration June 2016, Exercise Price $55 | | | 260 | | | | 48,620 | |

| Alere Inc, Expiration May 2016, Exercise Price $60 | | | 51 | | | | 255 | |

| BAX, Expiration August 2016, Exercise Price $55 | | | 448 | | | | 2,688 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

Dunham Monthly Distribution Fund (Continued)

April 30, 2016

| Security | | Contracts ++ | | | Value | |

| WRITTEN CALL OPTIONS (Continued) - (2.5)% | | | | | | | | |

| CAG, Expiration June 2016, Exercise Price $44 | | | 867 | | | $ | 130,050 | |

| CAG, Expiration June 2016, Exercise Price $45 | | | 563 | | | | 56,300 | |

| CBS Corp, Expiration June 2016, Exercise Price $50 | | | 741 | | | | 463,125 | |

| Dow Chemical, Expiration June 2016, Exercise Price $48 | | | 1,507 | | | | 768,570 | |

| General Electric Co., Expiration May 2016, Exercise Price $30 | | | 1,363 | | | | 122,670 | |

| General Motors Co., Expiration June 2016, Exercise Price $33 | | | 62 | | | | 1,674 | |

| GM, Expiration June 2016, Exercise Price $34 | | | 2,187 | | | | 102,789 | |

| HLT, Expiration July 2016, Exercise Price $21 | | | 1,188 | | | | 204,930 | |

| Starwood Hotels & Resorts Worldwide, Inc., Expiration May 2016, Exercise Price $60 | | | 83 | | | | 182,808 | |

| Starwood Hotels & Resorts Worldwide, Inc., Expiration May 2016, Exercise Price $67.5 | | | 284 | | | | 433,810 | |

| HTZ, Expiration June 2016, Exercise Price $9 | | | 5,618 | | | | 500,002 | |

| Humana Inc, Expiration May 2016, Exercise Price $170 | | | 148 | | | | 148,740 | |

| Humana Inc, Expiration May 2016, Exercise Price $175 | | | 125 | | | | 76,250 | |

| Huntsman Corp, Expiration May 2016, Exercise Price $10 | | | 447 | | | | 252,555 | |

| MAR, Expiration June 2016, Exercise Price $70 | | | 77 | | | | 17,710 | |

| MGM, Expiration June 2016, Exercise Price $19 | | | 2,390 | | | | 651,275 | |

| NRF, Expiration June 2016, Exercise Price $14 | | | 1,180 | | | | 41,300 | |

| Pfizer Inc, Expiration June 2016, Exercise Price $30 | | | 356 | | | | 97,188 | |

| SIRI, Expiration June 2016, Exercise Price $4 | | | 937 | | | | 6,559 | |

| T-Mobile Inc, Expiration May 2016, Exercise Price $36 | | | 1,297 | | | | 450,708 | |

| WRITTEN CALL OPTIONS - (Premiums Received - $5,732,588) | | | | | | | 6,206,860 | |

| | | | | | | | | |

| WRITTEN PUT OPTIONS - (0.1)% | | | | | | | | |

| BAY, Expiration June 2016, Exercise Price $98 | | | 196 | | | | 81,468 | |

| iShares iBoxx High Yield, Expiration June 2016, Exercise Price $71 | | | 288 | | | | 2,160 | |

| iShares iBoxx High Yield, Expiration June 2016, Exercise Price $72 | | | 520 | | | | 3,900 | |

| SPY, Expiration May 2016, Exercise Price $196 | | | 715 | | | | 38,610 | |

| SPY, Expiration June 2016, Exercise Price $194 | | | 420 | | | | 89,880 | |

| VIVENDI, Expiration June 2016, Exercise Price $17 | | | 1,259 | | | | 131,187 | |

| TOTAL WRITTEN PUT OPTIONS - (Premiums Received - $475,993) | | | | | | | 347,205 | |

| | | | | | | | | |

| | | Shares | | | | | |

| SECURITIES SOLD SHORT * - (28.8)% | | | | | | | | |

| Abbott Laboratories | | | 14,073 | | | | 547,440 | |

| Aetna, Inc. | | | 7,700 | | | | 864,479 | |

| Alibaba Group Holding Ltd. - ADR | | | 115,210 | | | | 8,864,257 | |

| American Airlines Group, Inc. | | | 5,300 | | | | 183,857 | |