united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22153

Dunham Funds

(Exact name of registrant as specified in charter)

6256 Greenwich Dr. Ste. 550, San Diego, CA 92122

(Address of principal executive offices) (Zip code)

Timothy Burdick

Ultimus Fund Solutions LLC., 4221 N 203rd St., Suite 100, Elkhorn, NE 68022

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 10/31

Date of reporting period: 4/30/24

Item 1. Reports to Stockholders.

| |

| April 30, 2024 | SEMI - ANNUAL REPORT |

| This report is for the information of shareholders of the Dunham Funds. It may also be used as sales literature when preceded by or accompanied by a current prospectus, which contains information concerning investment objectives, risks, and charges and expenses of the funds. Read the prospectus carefully before investing. For this and other information about the Dunham Funds, contact your financial advisor or call Client Services at (800) 442-4358. | BOND FUNDS Dunham Corporate/Government Bond Fund Dunham Floating Rate Bond Fund Dunham High-Yield Bond Fund Dunham International Opportunity Bond Fund U.S. VALUE FUNDS Dunham Large Cap Value Fund Dunham Small Cap Value Fund U.S. GROWTH FUNDS Dunham Focused Large Cap Growth Fund Dunham Small Cap Growth Fund INTERNATIONAL EQUITY FUNDS Dunham Emerging Markets Stock Fund Dunham International Stock Fund ALTERNATIVE FUNDS Dunham Dynamic Macro Fund Dunham Long/Short Credit Fund Dunham Monthly Distribution Fund Dunham Real Estate Stock Fund Dunham U.S. Enhanced Market Fund |

| Investment Adviser: | |

Dunham & Associates Investment Counsel, Inc. P.O. Box 910309 San Diego, California 92191 | |

| This Semi-Annual Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements also include those preceded by, followed by or that include the words “believes”, “expects”, “anticipates” or similar expressions. Such statements should be viewed with caution. Actual results or experience could differ materially from the forward-looking statements as a result of many factors. Each Fund makes no commitments to disclose any revisions to forward-looking statements, or any facts, events or circumstances after the date hereof that may bear upon forward-looking statements. In addition, prospective purchasers of the Funds should consider carefully the information set forth herein and the applicable fund’s prospectus. Other factors and assumptions not identified above may also have been involved in the derivation of these forward-looking statements, and the failure of these other assumptions to be realized may also cause actual results to differ materially from those projected. |

Shareholder Letter (Unaudited)

Dear Fellow Shareholders:

As the Federal Open Market Committee (Fed) is quarrelling with the timing of pivoting toward easing monetary policy, market participants across the spectrum of bonds to stocks have seen much of their overall price movement impacted as the rhetoric shifts. The timing and magnitude of interest rate decreases changed from the beginning of this fiscal year when many market participants expected multiple rate decreases in 2024, to now many participants expecting only one decrease. As the Fed has reiterated that its timing on rate decreases is dependent on economic data improving, particularly on inflation cooling to its target rate, economic releases and their interpretation have been even more impactful to bond and equity price movements.

While investors anticipate the path to long-term average interest rates, the yield curve has remained inverted. With short-term interest rates higher than intermediate-term and long-term interest rates, the discussion of a potential recession has continued. However, the markets do not appear to be pricing in such an adverse outcome, with the S&P 500 Index setting a new all-time high as recent as March. Clearly, greed and euphoria can drive markets upward just as easily as fear and market contagion can see dramatic declines. The VIX Index, also known as the market’s fear-gauge, remained fairly low for most of the six-month period, near levels not seen since before the 2020 pandemic. This indicated that concern for volatility in the markets was relatively low, despite the Fed still struggling to rein in inflation while simultaneously avoiding a recession.

Even if the Fed clarifies its timing and magnitude for interest rate cuts, US markets will still face another uncertainty – who will win the US election. While over the long-term the political party in power may have little impact on market performance, this uncertainty and the direction of important factors such as tax regulations may coincide with some additional volatility. Outside of the United States, other central banks are also working to navigate their own economies to avoid recessions or even promote the next wave of growth. It is unlikely that all of these efforts will be successful, which may result in meaningful dispersion between countries and asset classes. We believe that it is important to maintain a diverse array of tools to navigate this environment and to avoid emotional investing decisions.

I continue to personally invest alongside you, and I remain confident that you can continue to rely on us to apply a rational and unemotional approach. We thank you for your continued trust and the confidence you have placed in us. We take that trust very seriously. We look forward to servicing the investment needs for you and your family for generations to come.

Sincerely,

Jeffrey A. Dunham

President

Dunham & Associates

April 30, 2024

1

Dunham Corporate/Government Bond Fund (Unaudited)

Message from the Sub-Adviser (Virtus Fixed Income Advisers, LLC)

Asset Class Recap

Over the first half of the fiscal year, ended April 30, 2024, investment grade bonds, as measured by the Bloomberg U.S. Aggregate Bond Index rose 5.0 percent. During the period, strong economic reports on the labor market and sticky inflation led to unpredictable interest rates and mostly positive returns in the fixed income markets. Leaving the Federal Reserve (“Fed”) with a challenging decision on their rate cut path. To begin the year market participants priced in the possibility of six 25 basis point rate cuts in 2024. Now as the Feds tone around inflation has evolved the likelihood of rate reductions at that pace have diminished, adversely impacting those who leaned into duration and made the decision to heavily weight U.S. Treasuries on the longer end of the curve during the most recent fiscal quarter. However, the bond rally that took place in November and December was enough to keep most fixed income markets in positive territory. For the six-month period, U.S. longer dated maturities, as measured by ICE BofA current 30-Year US Treasury Index increased 6.6 percent. While the shorter dated 2-year US Treasuries with less interest rate volatility rose only 1.9 percent for the fiscal quarter, as measured by the ICE BofA current 2-Year US Treasury Index. However High Yield bonds, as measured by the ICE BofA US High Yield Index increased 8.9 percent during the period. Showing that investors who hung on to the more risky but higher coupon paying investments were rewarded for it.

Allocation Review

More than half of the U.S. investment-grade bonds in the benchmark index are represented by Treasury and agency mortgage-backed securities. Just those two sectors alone make up nearly 68 percent of the index. So, the majority of returns in the benchmark are dictated by U.S. government related securities, and agency MBS. Far less performance is reflected from investment grade corporate debt, and non-agency mortgage-backed securities. For the period, the Funds slight overweight to investment grade corporate debt positively contributed to the Funds relative performance from both an allocation and security selection standpoint. Another sector that outperformed for the period was the exposure to corporate high-yield bonds. The Sub-Adviser’s roughly 5 percent overweight to the sector enhanced Fund performance. The Funds exposure to U.S. Treasuries was another sector that contributed to positive relative performance. The largest detractors from Fund performance came from the exposure to asset backed securities. Much of the negative contribution was due to the duration exposure the Fund had within this sector relative to the benchmark.

Holdings Insights

Treasuries, specifically with longer dated maturities, outperformed for the period, as rates decreased. The same goes for the two 5 and 6 percent Freddie Mac mortgage pools, as spreads tightened from an attractive basis versus U.S Treasury alternatives. One specific position that positively contributed to the Fund’s performance was Broward County FL Water & Sewer Utility Revenue 4.00%, due 10/01/2047 (115117NJ8) (holding weight**: 0.21 percent), a municipal bond which rose 16.7 percent from a price return perspective, in addition to duration, municipals have rallied since the October lows. Another investment grade corporate bond that outperformed was Bank of America Corporation 2.687%, due 04/22/2032 (06051GJT7) (holding weight*: 0.45 percent). Bank of America 2032 bonds spreads tightened over the six-month period, from 179 basis points to 112 basis points. The credit performance was likely due to net interest margins improving with rising rates, and unlike some of their peers, Bank of America did not have deposit pressure during the Silicon Valley Bank (SBV) (not held) failure. Over the period the holding increased 7.9 percent. Lastly, MDC Holdings Inc. 3.966%, due 08/06/2061 (552676AV0) (holding weight**: 0.46 percent) increased 23.3 percent, after a Japanese homebuilder announced an offering to acquire MDC.

When looking at individual holdings, Del Monte Foods, Inc. Floating Rate, due 05/16/2029 (BL3847425) (holding weight*: 0.08 percent) acted as a detractor to Fund performance. For the period the position fell 12.7 percent, after Del Monte Foods reported weak earnings, and has been facing cost inflation. Additionally, the demand for their products have started to normalize since the pandemic. Roche Holdings, Inc. 5.218%, due 03/08/2054 (771196CM2) (holding weight*: 0.18 percent) was another position that underperformed, falling 4.8 percent. This bonds decline was largely due to the duration impact, and because the Sub-Adviser entered the position in March, they did not receive a full half year of coupon payments to provide any meaningful offset for returns. Similarly, Northen Natural Gas Company 5.625%, due 02/01/2054 (665501AN2) (holding weight*: 0.21 percent) was down 4.5 percent, mostly because of unfortunate timing, right before long term rates started rising.

Sub-Adviser Outlook

The Sub-Adviser recognizes that rate cuts are on the horizon this year, but patience is key, modestly adding to duration throughout the period and making sure the Fund is fairly compensated for the duration risk assumed. The Sub-Adviser believes valuations in the investment-grade corporate bond space may not currently fully reflect the risks and volatility that may persist. Interest rates remain the main story as fundamentals and valuations may not be revisited as performance drivers until there is a better sense for the timing and severity of the Federal Reserve’s interest rate decisions. As yields are currently near 10-year highs, there have been more discussions about how both high quality and low-quality companies may refinance their debt that is maturing over the next year. The Sub-Adviser is optimistic that it can capitalize on dislocated valuations during spikes in volatility within the fixed income markets.

| * | Holdings percentage(s) of total investments, cash and unsettled trades excluding collateral for securities loaned as of 04/30/2024. |

| ** | Holdings percentage(s) as of the date prior to the sale of the security. |

2

| Dunham Corporate/Government Bond Fund |

| PORTFOLIO REVIEW (Unaudited) |

| April 30, 2024 |

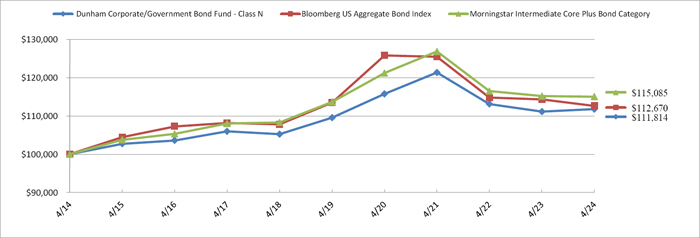

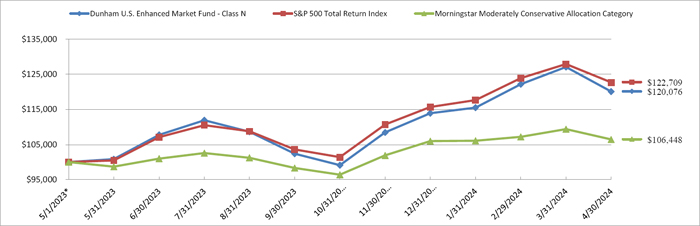

The Fund’s performance figures* for each of the periods ended April 30, 2024, compared to its benchmarks:

| Annualized | Annualized | |||

| 6 Month Return | 1 Year Return | 5 Year Return | 10 Year Return | |

| Class N | 5.94% | 0.58% | 0.41% | 1.12% |

| Class A with Load 4.50% | 1.00% | (4.15)% | (0.75)% | 0.40% |

| Class A without load | 5.73% | 0.33% | 0.16% | 0.87% |

| Class C | 5.52% | (0.16)% | (0.34)% | 0.37% |

| Bloomberg US Aggregate Bond Index (a) | 4.97% | (1.47)% | (0.16)% | 1.20% |

| Morningstar Intermediate Core Plus Bond Category (b) | 5.83% | (0.13)% | 0.25% | 1.41% |

| * | Total Returns are calculated based on traded NAVs. As disclosed in the Trust’s latest registration statement, the Fund’s total annual operating expenses, including underlying funds, are 1.17% for Class N, 1.92% for Class C and 1.42% for Class A. Class A shares are subject to a sales load of 4.50% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of Fund shares or Fund distributions. For performance information current to the most recent month-end, please call 1-800-442-4358 or visit our website www.dunham.com. |

| (a) | The Bloomberg US Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark. |

| (b) | The Morningstar Intermediate Core Plus Bond Category is generally representative of intermediate-term bond mutual funds that primarily invest in corporate and other investment-grade U.S. fixed-income securities and typically have durations of 3.5 to 6.0 years. Funds in this category also invest in high-yield and foreign bonds. |

Comparison of the Change in Value of a $100,000 Investment

| Portfolio Composition * (Unaudited) | ||||

| Corporate Bonds | 32.2 | % | ||

| Asset Backed Securities | 31.0 | % | ||

| U.S. Government & Agencies | 24.0 | % | ||

| Term Loans | 6.6 | % | ||

| Short-Term Investments | 2.4 | % | ||

| Collateral for Securities Loaned | 1.8 | % | ||

| Non U.S. Government & Agencies | 1.8 | % | ||

| Municipal Bonds | 0.2 | % | ||

| Common Stocks | 0.0 | % | ||

| Total | 100.0 | % | ||

* Based on total value of investments as of April 30, 2024. Does not include derivative holdings.

Percentage may differ from Schedule of Investments which are based on Fund net assets.

Please refer to the Schedule of Investments for a more detailed listing of the Fund’s holdings.

3

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| April 30, 2024 |

| Shares | Fair Value | |||||||||||||

| COMMON STOCKS — 0.0%(a) | ||||||||||||||

| HEALTH CARE EQUIPMENT & SUPPLIES - 0.0%(a) | ||||||||||||||

| 436 | Endo, Inc. | $ | 12,418 | |||||||||||

| TOTAL COMMON STOCKS (Cost $24,533) | 12,418 | |||||||||||||

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | |||||||||||

| ASSET BACKED SECURITIES — 31.5% | ||||||||||||||

| AUTO LOAN — 7.4% | ||||||||||||||

| 220,000 | American Credit Acceptance Receivables Trust Series 2022-1 D(b) | 2.4600 | 03/13/28 | 214,771 | ||||||||||

| 230,000 | AmeriCredit Automobile Receivables Trust Series 2020-3 C | 1.0600 | 08/18/26 | 224,742 | ||||||||||

| 446,000 | Arivo Acceptance Auto Loan Receivables Trust Series 1A B(b) | 6.8700 | 06/17/30 | 443,387 | ||||||||||

| 155,000 | Avis Budget Rental Car Funding AESOP, LLC Series 2019-3A A(b) | 2.3600 | 03/20/26 | 151,428 | ||||||||||

| 317,000 | CarNow Auto Receivables Trust Series 2023-1A C(b) | 7.2400 | 09/15/26 | 316,710 | ||||||||||

| 225,000 | Carvana Auto Receivables Trust Series 2021-P3 B | 1.4200 | 08/10/27 | 202,238 | ||||||||||

| 54,844 | Carvana Auto Receivables Trust Series 2021-N1 C | 1.3000 | 01/10/28 | 52,052 | ||||||||||

| 68,395 | Carvana Auto Receivables Trust Series 2021-N2 C | 1.0700 | 03/10/28 | 64,214 | ||||||||||

| 410,000 | Carvana Auto Receivables Trust Series 2023-N1 C(b) | 5.9200 | 07/10/29 | 406,908 | ||||||||||

| 330,000 | Carvana Auto Receivables Trust Series 2023-N4 C(b) | 6.5900 | 02/11/30 | 334,688 | ||||||||||

| 495,000 | Carvana Auto Receivables Trust Series 2024-N1 B(b) | 5.6300 | 05/10/30 | 492,654 | ||||||||||

| 115,732 | CPS Auto Receivables Trust Series 2019-D E(b) | 3.8600 | 10/15/25 | 115,601 | ||||||||||

| 430,000 | CPS Auto Receivables Trust Series 2024-A C(b) | 5.7400 | 04/15/30 | 427,196 | ||||||||||

| 302,000 | Credit Acceptance Auto Loan Trust Series 1A A(b) | 5.6800 | 03/15/34 | 300,549 | ||||||||||

| 529,000 | DT Auto Owner Trust Series 2023-1A B(b) | 5.1900 | 10/16/28 | 525,259 | ||||||||||

| 195,000 | DT Auto Owner Trust Series 2023-3A C(b) | 6.4000 | 05/15/29 | 193,162 | ||||||||||

| 410,000 | Exeter Automobile Receivables Trust Series 2023-1A B | 5.7200 | 04/15/27 | 409,534 | ||||||||||

| 500,000 | Exeter Automobile Receivables Trust Series 2024-2A C | 5.7400 | 05/15/29 | 496,636 | ||||||||||

| 229,231 | FHF Trust Series 2023-1A A2(b) | 6.5700 | 06/15/28 | 230,043 | ||||||||||

| 84,306 | Flagship Credit Auto Trust Series 2020-4 C(b) | 1.2800 | 02/16/27 | 83,016 | ||||||||||

| 330,000 | Flagship Credit Auto Trust Series 2024-1 C(b) | 5.7900 | 02/15/30 | 327,545 | ||||||||||

| 180,000 | Foursight Capital Automobile Receivables Trust Series 2022-1 B(b) | 2.1500 | 05/17/27 | 174,078 | ||||||||||

| 315,000 | Foursight Capital Automobile Receivables Trust Series 2023-1 A3(b) | 5.3900 | 12/15/27 | 313,001 | ||||||||||

| 417,035 | GLS Auto Receivables Issuer Trust Series 2019-4A D(b) | 4.0900 | 08/17/26 | 416,178 | ||||||||||

| 345,000 | Hertz Vehicle Financing III, LLC Series 2022-1A C(b) | 2.6300 | 06/25/26 | 332,107 | ||||||||||

| 239,144 | LAD Auto Receivables Trust Series 2022-1A A(b) | 5.2100 | 06/15/27 | 238,474 | ||||||||||

| 339,000 | LAD Auto Receivables Trust Series 2023-4A C(b) | 6.7600 | 03/15/29 | 343,711 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

4

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 31.5% (Continued) | ||||||||||||||

| AUTO LOAN — 7.4% (Continued) | ||||||||||||||

| 81,776 | Lendbuzz Securitization Trust Series 2022-1A A(b) | 4.2200 | 05/17/27 | $ | 80,512 | |||||||||

| 425,000 | Lendbuzz Securitization Trust Series 2024-2A A2(b) | 5.9900 | 05/15/29 | 424,995 | ||||||||||

| 231,744 | Lobel Financial Corporation Series 1 A(b) | 6.9700 | 07/15/26 | 232,121 | ||||||||||

| 318,000 | Merchants Fleet Funding, LLC Series 1A A(b) | 7.2100 | 05/20/36 | 319,351 | ||||||||||

| 140,000 | OneMain Direct Auto Receivables Trust Series 2021-1A B(b) | 1.2600 | 07/14/28 | 129,348 | ||||||||||

| 164,443 | Santander Drive Auto Receivables Trust Series 2020-2 D | 2.2200 | 09/15/26 | 163,705 | ||||||||||

| 20,149 | Santander Drive Auto Receivables Trust Series 2021-3 C | 0.9500 | 09/15/27 | 20,112 | ||||||||||

| 370,000 | Santander Drive Auto Receivables Trust Series 2023-1 B | 4.9800 | 02/15/28 | 366,958 | ||||||||||

| 195,000 | Santander Drive Auto Receivables Trust Series 2022-5 C | 4.7400 | 10/15/28 | 192,295 | ||||||||||

| 276,000 | SBNA Auto Receivables Trust Series 2024-A C(b) | 5.5900 | 01/15/30 | 271,871 | ||||||||||

| 362,000 | Tricolor Auto Securitization Trust Series 2023-1 B(b) | 6.8400 | 11/16/26 | 362,649 | ||||||||||

| 307,679 | United Auto Credit Securitization Trust Series 2023-1 B(b) | 5.9100 | 07/10/28 | 307,263 | ||||||||||

| 146,000 | Veros Auto Receivables Trust Series 2022-1 B(b) | 4.3900 | 08/16/27 | 144,905 | ||||||||||

| 230,251 | Westlake Automobile Receivables Trust Series 2022-1A B(b) | 2.7500 | 03/15/27 | 229,418 | ||||||||||

| 446,000 | Westlake Automobile Receivables Trust Series 1A B(b) | 5.5500 | 11/15/27 | 442,883 | ||||||||||

| 415,000 | Westlake Automobile Receivables Trust Series 2023-1A C(b) | 5.7400 | 08/15/28 | 411,322 | ||||||||||

| 11,929,590 | ||||||||||||||

| CLO — 0.3% | ||||||||||||||

| 515,000 | GoldentTree Loan Management US CLO 1 Ltd. Series 9A AR(b),(c) | TSFR3M + 1.500% | 6.8250 | 04/20/37 | 515,739 | |||||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS — 12.6% | ||||||||||||||

| 720,224 | AJAX Mortgage Loan Trust Series 2021-A A1(b),(d) | 1.0650 | 09/25/65 | 622,010 | ||||||||||

| 69,558 | Angel Oak Mortgage Trust Series 2020-R1 A2(b),(d) | 1.2470 | 12/26/24 | 64,387 | ||||||||||

| 59,574 | Angel Oak Mortgage Trust Series 2021-8 A1(b),(d) | 1.8200 | 11/25/66 | 50,687 | ||||||||||

| 112,013 | Angel Oak Mortgage Trust Series 2022-5 A1(b),(e) | 4.5000 | 05/25/67 | 107,725 | ||||||||||

| 90,832 | Angel Oak Mortgage Trust Series 2023-1 A1(b),(e) | 4.7500 | 09/26/67 | 87,292 | ||||||||||

| 76,468 | Arroyo Mortgage Trust Series 2019-1 A1(b),(d) | 3.8050 | 01/25/49 | 71,288 | ||||||||||

| 80,641 | Arroyo Mortgage Trust Series 2019-2 A1(b),(d) | 3.3470 | 04/25/49 | 75,767 | ||||||||||

| 229,123 | Bunker Hill Loan Depositary Trust Series 2019-2 A1(b),(e) | 2.8790 | 07/25/49 | 214,757 | ||||||||||

| 31,469 | Chase Mortgage Finance Corporation Series 2016-SH2 M2(b),(d) | 3.7500 | 02/25/44 | 27,749 | ||||||||||

| 40,895 | Chase Mortgage Finance Corporation Series 2016-SH1 M2(b),(d) | 3.7500 | 04/25/45 | 36,232 | ||||||||||

| 351,061 | CIM TRUST Series 2022-R2 A1(b),(d) | 3.7500 | 12/25/61 | 319,429 | ||||||||||

| 56,662 | COLT Funding, LLC Series 2021-3R A1(b),(d) | 1.0510 | 12/25/64 | 49,002 | ||||||||||

| 1,413,147 | COLT Mortgage Loan Trust Series 2022-4 A1(b),(d) | 4.3010 | 03/25/67 | 1,353,328 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

5

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 31.5% (Continued) | ||||||||||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS — 12.6% (Continued) | ||||||||||||||

| 617,220 | COLT Mortgage Loan Trust Series 2022-5 A1(b),(d) | 4.5500 | 04/25/67 | $ | 601,067 | |||||||||

| 995,523 | COLT Mortgage Loan Trust Series 2023-4 A1(b),(e) | 7.1630 | 10/25/68 | 1,003,209 | ||||||||||

| 129,116 | CSMC Trust Series 2020-RPL4 A1(b),(d) | 2.0000 | 01/25/60 | 111,542 | ||||||||||

| 18,969 | CSMC Trust Series 2020-NQM1 A1(b),(e) | 1.2080 | 05/25/65 | 17,142 | ||||||||||

| 248,663 | Deephaven Residential Mortgage Trust Series 2022-1 A1(b),(d) | 2.2050 | 01/25/67 | 220,298 | ||||||||||

| 293,011 | Ellington Financial Mortgage Trust Series 2019-2 A3(b),(d) | 3.0460 | 11/25/59 | 274,036 | ||||||||||

| 20,916 | Flagstar Mortgage Trust Series 2017-1 1A3(b),(d) | 3.5000 | 03/25/47 | 18,482 | ||||||||||

| 8,326 | Galton Funding Mortgage Trust Series 2018-1 A23(b),(d) | 3.5000 | 11/25/57 | 7,273 | ||||||||||

| 244,155 | Imperial Fund Mortgage Trust Series 2022-NQM3 A1(b),(e) | 4.3800 | 05/25/67 | 232,667 | ||||||||||

| 18,645 | JP Morgan Mortgage Trust Series 2017-5 A1(b),(d) | 4.2570 | 12/15/47 | 18,656 | ||||||||||

| 801,610 | JP Morgan Mortgage Trust Series 2017-4 A3(b),(d) | 3.5000 | 11/25/48 | 698,826 | ||||||||||

| 100,000 | METLIFE S.E.CURITIZATION TRUST Series 2017-1A M1(b),(d) | 3.4700 | 04/25/55 | 85,720 | ||||||||||

| 27,550 | METLIFE S.E.CURITIZATION TRUST Series 2019-1A A1A(b),(d) | 3.7500 | 04/25/58 | 26,598 | ||||||||||

| 558,463 | MFA Trust Series 2022-INV2 A1(b),(e) | 4.9500 | 07/25/57 | 541,706 | ||||||||||

| 1,166,570 | MFA Trust Series 2022-INV1 A1(b),(e) | 3.9070 | 04/25/66 | 1,105,318 | ||||||||||

| 703,319 | MFA Trust Series 2022-NQM2 A1(b),(e) | 4.0000 | 05/25/67 | 657,923 | ||||||||||

| 195,334 | Mill City Mortgage Loan Trust Series 2017-3 M2(b),(d) | 3.2500 | 01/25/61 | 177,929 | ||||||||||

| 199,632 | Mill City Mortgage Loan Trust Series 2019-1 M2(b),(d) | 3.5000 | 10/25/69 | 173,692 | ||||||||||

| 159,422 | New Residential Mortgage Loan Trust Series 2022-RTL1 A1F(b) | 4.3360 | 12/25/26 | 158,780 | ||||||||||

| 131,776 | New Residential Mortgage Loan Trust Series 2014-3A AFX3(b),(d) | 3.7500 | 11/25/54 | 121,196 | ||||||||||

| 137,298 | New Residential Mortgage Loan Trust Series 2016-3A B1(b),(d) | 4.0000 | 09/25/56 | 126,230 | ||||||||||

| 33,115 | New Residential Mortgage Loan Trust Series 2016-4A A1(b),(d) | 3.7500 | 11/25/56 | 30,264 | ||||||||||

| 641,474 | New Residential Mortgage Loan Trust Series 2017-2A A3(b),(d) | 4.0000 | 03/25/57 | 597,991 | ||||||||||

| 453,167 | New Residential Mortgage Loan Trust Series 2018-1A A1A(b),(d) | 4.0000 | 12/25/57 | 423,640 | ||||||||||

| 35,410 | New Residential Mortgage Loan Trust Series 2021-NQ2R A1(b),(d) | 0.9410 | 09/25/58 | 31,951 | ||||||||||

| 215,000 | New Residential Mortgage Loan Trust Series 2019-RPL2 M2(b),(d) | 3.7500 | 02/25/59 | 182,127 | ||||||||||

| 688,784 | New Residential Mortgage Loan Trust Series 2022-NQM2 A1(b),(d) | 3.0790 | 03/27/62 | 614,665 | ||||||||||

| 425,223 | NYMT Loan Trust Series 2024-CP1 A1(b) | 3.7500 | 02/25/68 | 385,055 | ||||||||||

| 824,385 | OBX Trust Series 2023-NQM9 A1(b),(e) | 7.1590 | 10/25/63 | 835,782 | ||||||||||

| 435,917 | OBX Trust Series 2024-NQM3 A1(b),(e) | 6.1290 | 12/25/63 | 435,844 | ||||||||||

| 92,248 | Palisades Mortgage Loan Trust Series 2021-RTL1 A1(b),(e) | 3.4870 | 06/25/26 | 92,254 | ||||||||||

| 28,304 | Provident Funding Mortgage Loan Trust Series 2019-1 A2(b),(d) | 3.0000 | 12/25/49 | 23,360 | ||||||||||

| 800,044 | PRPM, LLC Series 2024-RPL1 A1(b),(d) | 4.2000 | 12/25/64 | 760,630 | ||||||||||

| 551,512 | RCKT Mortgage Trust Series 2023-CES1 A1A(b),(d) | 6.5150 | 06/25/43 | 550,529 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

6

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 31.5% (Continued) | ||||||||||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS — 12.6% (Continued) | ||||||||||||||

| 51,673 | RCKT Mortgage Trust Series 2020-1 A1(b),(d) | 3.0000 | 02/25/50 | $ | 42,651 | |||||||||

| 296 | Residential Mortgage Loan Trust Series 2019-2 A1(b),(d) | 2.9130 | 05/25/59 | 295 | ||||||||||

| 41,067 | Residential Mortgage Loan Trust Series 2020-1 A1(b),(d) | 2.3760 | 01/26/60 | 39,186 | ||||||||||

| 60,352 | Starwood Mortgage Residential Trust Series 2020-1 A1(b),(d) | 2.2750 | 02/25/50 | 56,348 | ||||||||||

| 707,897 | Towd Point Mortgage Trust Series 2017-1 A2(b),(d) | 3.5000 | 10/25/56 | 693,584 | ||||||||||

| 265,000 | Towd Point Mortgage Trust Series 2019-HY2 M1(b),(c) | TSFR1M + 1.714% | 7.0310 | 05/25/58 | 277,966 | |||||||||

| 365,000 | Towd Point Mortgage Trust Series 2021-1 A2(b),(d) | 2.7500 | 11/25/61 | 288,023 | ||||||||||

| 507,935 | Towd Point Mortgage Trust Series 2024-1 A1(b),(d) | 4.2120 | 03/25/64 | 502,131 | ||||||||||

| 65,822 | Verus Securitization Trust Series 2019-INV2 A1(b),(d) | 3.9130 | 07/25/59 | 63,334 | ||||||||||

| 135,545 | Verus Securitization Trust Series 2020-1 A1(b),(e) | 3.4170 | 01/25/60 | 128,921 | ||||||||||

| 572,618 | Verus Securitization Trust Series 2022-6 A1(b),(e) | 4.9100 | 06/25/67 | 557,114 | ||||||||||

| 498,995 | Verus Securitization Trust Series 2022-6 A3(b),(e) | 4.9100 | 06/25/67 | 479,114 | ||||||||||

| 925,389 | Verus Securitization Trust Series 2022-7 A1(b),(e) | 5.1520 | 07/25/67 | 911,519 | ||||||||||

| 1,506,236 | Verus Securitization Trust Series 2023-1 A1(b),(e) | 5.8500 | 12/25/67 | 1,492,461 | ||||||||||

| 457,704 | Verus Securitization Trust Series 2023-8 A1(b),(e) | 6.2590 | 12/25/68 | 456,503 | ||||||||||

| 150,006 | Wells Fargo Mortgage Backed Securities Series 2020-4 A1(b),(d) | 3.0000 | 07/25/50 | 123,571 | ||||||||||

| 20,534,756 | ||||||||||||||

| CREDIT CARD — 0.4% | ||||||||||||||

| 400,000 | Discover Card Execution Note Trust Series A2 A | 4.9300 | 06/15/28 | 396,148 | ||||||||||

| 316,000 | Mercury Financial Credit Card Master Trust Series 2023-1A A(b) | 8.0400 | 09/20/27 | 318,877 | ||||||||||

| 715,025 | ||||||||||||||

| NON AGENCY CMBS — 2.6% | ||||||||||||||

| 111,238 | Angel Oak SB Commercial Mortgage Trust Series 2020-SBC1 A1(b),(d) | 2.0680 | 05/25/50 | 101,086 | ||||||||||

| 280,000 | BBCMS Mortgage Trust Series 2018-TALL(b),(c) | TSFR1M + 0.919% | 6.2400 | 03/15/37 | 266,367 | |||||||||

| 160,000 | Benchmark Mortgage Trust Series 2023-B38 A2 | 5.6260 | 04/15/56 | 156,634 | ||||||||||

| 610,000 | BPR Trust Series 2022-OANA A(b),(c) | TSFR1M + 1.898% | 7.2190 | 04/15/37 | 613,604 | |||||||||

| 360,000 | BX Trust Series 2022-CLS A(b) | 5.7600 | 10/13/27 | 354,081 | ||||||||||

| 445,000 | BX Trust Series 2019-OC11 B(b) | 3.6050 | 12/09/41 | 388,242 | ||||||||||

| 410,000 | BX Trust Series 2019-OC11 D(b),(d) | 4.0750 | 12/09/41 | 354,845 | ||||||||||

| 280,000 | COMM Mortgage Trust Series 2013-300P A1(b) | 4.3530 | 08/10/30 | 258,955 | ||||||||||

| 150,000 | COMM Mortgage Trust Series 2020-CBM B(b) | 3.0990 | 02/10/37 | 144,253 | ||||||||||

| 191,994 | Extended Stay America Trust Series 2021-ESH C(b),(c) | TSFR1M + 1.814% | 7.1350 | 07/15/38 | 191,818 | |||||||||

| 305,000 | GCT Commercial Mortgage Trust Series 2021-GCT A(b),(c) | TSFR1M + 0.914% | 6.2350 | 02/15/38 | 256,058 | |||||||||

| 419,000 | JP Morgan Chase Commercial Mortgage Securities Series C13 E(b),(d) | 3.9860 | 01/15/46 | 371,234 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

7

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 31.5% (Continued) | ||||||||||||||

| NON AGENCY CMBS — 2.6% (Continued) | ||||||||||||||

| 325,000 | MIRA Trust Series 2023-Mile A(b) | 6.7550 | 06/06/28 | $ | 331,256 | |||||||||

| 364,000 | ORL Trust Series 2023-GLKS A(b),(c) | TSFR1M + 2.350% | 7.6710 | 10/15/28 | 365,894 | |||||||||

| 62,000 | WFRBS Commercial Mortgage Trust Series 2014-C24 AS | 3.9310 | 11/15/47 | 59,866 | ||||||||||

| 4,214,193 | ||||||||||||||

| OTHER ABS — 7.1% | ||||||||||||||

| 382,635 | ACHV A.B.S TRUST Series 2024-1PL A(b) | 5.9000 | 04/25/31 | 382,032 | ||||||||||

| 336,000 | Affirm Asset Securitization Trust Series 2023-B A(b) | 6.8200 | 09/15/28 | 339,593 | ||||||||||

| 1,530,305 | American Homes 4 Rent Series 2015-SFR1 A(b) | 3.4670 | 04/17/52 | 1,496,632 | ||||||||||

| 220,000 | American Homes 4 Rent Trust Series 2015-SFR2 C(b) | 4.6910 | 10/17/45 | 215,153 | ||||||||||

| 175,000 | AMSR Trust Series 2020-SFR1 B(b) | 2.1200 | 04/17/37 | 168,325 | ||||||||||

| 250,000 | AMSR Trust Series 2020-SFR2 C(b) | 2.5330 | 07/17/37 | 238,902 | ||||||||||

| 100,000 | AMSR Trust Series 2020-SFR2 D(b) | 3.2820 | 07/17/37 | 96,130 | ||||||||||

| 341,356 | Amur Equipment Finance Receivables XII, LLC Series 1A A2(b) | 6.0900 | 12/20/29 | 342,562 | ||||||||||

| 38,401 | Aqua Finance Trust Series 2017-A A(b) | 3.7200 | 11/15/35 | 38,334 | ||||||||||

| 49,057 | Aqua Finance Trust Series 2019-A A(b) | 3.1400 | 07/16/40 | 45,994 | ||||||||||

| 189,896 | Aqua Finance Trust Series 2019-A C(b) | 4.0100 | 07/16/40 | 172,056 | ||||||||||

| 270,000 | Aqua Finance Trust Series 2020-AA B(b) | 2.7900 | 07/17/46 | 244,716 | ||||||||||

| 220,000 | CCG Receivables Trust Series 2021-1 C(b) | 0.8400 | 06/14/27 | 217,329 | ||||||||||

| 103,437 | CF Hippolyta, LLC Series 2020-1 A1(b) | 1.6900 | 07/15/60 | 97,003 | ||||||||||

| 285,706 | CLI Funding VI, LLC Series 2020-1A A(b) | 2.0800 | 09/18/45 | 254,361 | ||||||||||

| 30,725 | Corevest American Finance Trust Series 2020-1 A1(b) | 1.8320 | 03/15/50 | 30,031 | ||||||||||

| 100,000 | Corevest American Finance Trust Series 2019-3 C(b) | 3.2650 | 10/15/52 | 86,703 | ||||||||||

| 135,448 | Corevest American Finance Trust Series 2020-4 A(b) | 1.1740 | 12/15/52 | 126,636 | ||||||||||

| 393,381 | Dext A.B.S, LLC Series 2023-1 A2(b) | 5.9900 | 03/15/32 | 390,058 | ||||||||||

| 262,708 | Elara HGV Timeshare Issuer, LLC Series 2023-A A(b) | 6.1600 | 02/25/38 | 263,686 | ||||||||||

| 130,000 | FirstKey Homes Trust Series 2021-SFR1 D(b) | 2.1890 | 08/17/28 | 117,846 | ||||||||||

| 375,000 | FirstKey Homes Trust Series 2020-SFR2 B(b) | 1.5670 | 10/19/37 | 350,551 | ||||||||||

| 32,137 | Foundation Finance Trust Series 2019-1A A(b) | 3.8600 | 11/15/34 | 32,011 | ||||||||||

| 334,419 | Foundation Finance Trust Series 2023-2A A(b) | 6.5300 | 06/15/49 | 336,933 | ||||||||||

| 63,115 | HIN Timeshare Trust Series 2020-A C(b) | 3.4200 | 10/09/39 | 59,331 | ||||||||||

| 129,025 | Jersey Mike’s Funding Series 2019-1A A2(b) | 4.4330 | 02/15/50 | 122,415 | ||||||||||

| 733,550 | Kubota Credit Owner Trust Series 2023-1A A2(b) | 5.4000 | 02/17/26 | 732,697 | ||||||||||

| 40,733 | MVW, LLC Series 2020-1A A(b) | 1.7400 | 10/20/37 | 38,080 | ||||||||||

| 278,145 | MVW, LLC Series 2023-1A B(b) | 5.4200 | 10/20/40 | 274,070 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

8

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 31.5% (Continued) | ||||||||||||||

| OTHER ABS — 7.1% (Continued) | ||||||||||||||

| 265,000 | Octane Receivables Trust Series 2023-1A C(b) | 6.3700 | 09/20/29 | $ | 262,743 | |||||||||

| 320,181 | PowerPay Issuance Trust Series 2024-1A A(b) | 6.5300 | 02/18/39 | 317,417 | ||||||||||

| 265,000 | Progress Residential Series 2021-SFR3 D(b) | 2.2880 | 05/17/26 | 242,190 | ||||||||||

| 201,000 | Progress Residential Series 2021-SFR1 C(b) | 1.5550 | 04/17/38 | 183,813 | ||||||||||

| 577,415 | Progress Residential Trust Series 2020-SFR1 A(b) | 1.7320 | 04/17/37 | 555,469 | ||||||||||

| 550,000 | Progress Residential Trust Series 2020-SFR2 E(b) | 5.1150 | 06/17/37 | 539,754 | ||||||||||

| 480,000 | Purchasing Power Funding Series A B(b) | 6.4300 | 08/15/28 | 477,053 | ||||||||||

| 220,434 | Regional Management Issuance Trust Series 2021-1 A(b) | 1.6800 | 03/17/31 | 214,353 | ||||||||||

| 30,614 | Sierra Timeshare Receivables Funding, LLC Series 2020-2A B(b) | 2.3200 | 07/20/37 | 29,419 | ||||||||||

| 212,194 | Sierra Timeshare Receivables Funding, LLC Series 2023-2A B(b) | 6.2800 | 04/20/40 | 214,739 | ||||||||||

| 200,625 | Taco Bell Funding, LLC Series 2016-1A A23(b) | 4.9700 | 05/25/46 | 196,863 | ||||||||||

| 200,000 | Tricon American Homes Trust Series 2020-SFR2 D(b) | 2.2810 | 11/17/27 | 174,491 | ||||||||||

| 165,000 | Tricon American Homes Trust Series 2019-SFR1 C(b) | 3.1490 | 03/17/38 | 155,963 | ||||||||||

| 160,000 | Tricon Residential Trust Series 2021-SFR1 B(b) | 2.2440 | 07/17/38 | 147,080 | ||||||||||

| 460,000 | Verizon Master Trust Series 1 A1A | 5.0000 | 12/20/28 | 457,256 | ||||||||||

| 11,478,773 | ||||||||||||||

| RESIDENTIAL MORTGAGE — 1.1% | ||||||||||||||

| 72,378 | Ajax Mortgage Loan Trust Series 2019-D A1(b),(e) | 2.9560 | 09/25/65 | 66,720 | ||||||||||

| 104,605 | Pretium Mortgage Credit Partners, LLC Series 2021-NPL1 A1(b),(e) | 5.2400 | 09/27/60 | 103,432 | ||||||||||

| 135,000 | Towd Point Mortgage Trust Series 2016-4 B1(b),(d) | 4.0150 | 07/25/56 | 125,392 | ||||||||||

| 115,000 | Towd Point Mortgage Trust Series 2017-1 M1(b),(d) | 3.7500 | 10/25/56 | 109,087 | ||||||||||

| 460,000 | Towd Point Mortgage Trust Series 2017-4 A2(b),(d) | 3.0000 | 06/25/57 | 412,436 | ||||||||||

| 160,000 | Towd Point Mortgage Trust Series 2017-6 A2(b),(d) | 3.0000 | 10/25/57 | 145,571 | ||||||||||

| 140,000 | Towd Point Mortgage Trust Series 2018-6 A1B(b),(d) | 3.7500 | 03/25/58 | 130,045 | ||||||||||

| 300,000 | Towd Point Mortgage Trust Series 2018-6 A2(b),(d) | 3.7500 | 03/25/58 | 260,718 | ||||||||||

| 255,000 | Towd Point Mortgage Trust Series 2019-2 A2(b),(d) | 3.7500 | 12/25/58 | 220,536 | ||||||||||

| 235,000 | Towd Point Mortgage Trust Series 2019-4 A2(b),(d) | 3.2500 | 10/25/59 | 202,643 | ||||||||||

| 33,845 | VCAT, LLC Series 2021-NPL2 A1(b),(e) | 5.1150 | 03/27/51 | 33,199 | ||||||||||

| 1,809,779 | ||||||||||||||

| TOTAL ASSET BACKED SECURITIES (Cost $52,374,155) | 51,197,855 | |||||||||||||

See accompanying notes which are an integral part of these financial statements.

9

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% | ||||||||||||||

| AEROSPACE & DEFENSE — 0.4% | ||||||||||||||

| 200,000 | Boeing Company (The) | 5.8050 | 05/01/50 | $ | 177,022 | |||||||||

| 303,000 | Boeing Company (The) | 5.9300 | 05/01/60 | 265,236 | ||||||||||

| 185,000 | TransDigm, Inc.(b) | 6.6250 | 03/01/32 | 184,835 | ||||||||||

| 627,093 | ||||||||||||||

| APPAREL & TEXTILE PRODUCTS — 0.2% | ||||||||||||||

| 260,000 | Tapestry, Inc. | 7.8500 | 11/27/33 | 271,701 | ||||||||||

| ASSET MANAGEMENT — 2.3% | ||||||||||||||

| 235,000 | Apollo Debt Solutions BDC(b) | 6.9000 | 04/13/29 | 232,985 | ||||||||||

| 435,000 | BlackRock Funding, Inc. | 5.2500 | 03/14/54 | 411,204 | ||||||||||

| 157,000 | Blackstone Private Credit Fund | 2.6250 | 12/15/26 | 142,550 | ||||||||||

| 65,000 | Blackstone Private Credit Fund(b) | 7.3000 | 11/27/28 | 66,820 | ||||||||||

| 128,000 | Blue Owl Credit Income Corporation | 4.7000 | 02/08/27 | 121,026 | ||||||||||

| 120,000 | Blue Owl Credit Income Corporation(b) | 6.6500 | 03/15/31 | 115,546 | ||||||||||

| 555,000 | Blue Owl Finance, LLC(b) | 3.1250 | 06/10/31 | 456,018 | ||||||||||

| 410,000 | Brookfield Finance, Inc. | 6.3500 | 01/05/34 | 421,672 | ||||||||||

| 125,000 | Charles Schwab Corporation (The)(c) | SOFRRATE + 2.010% | 6.1360 | 08/24/34 | 126,761 | |||||||||

| 305,000 | Charles Schwab Corporation (The)(c) | H15T10Y + 3.079% | 4.0000 | 03/01/69 | 248,636 | |||||||||

| 250,000 | Drawbridge Special Opportunities Fund, L.P. /(b) | 3.8750 | 02/15/26 | 235,765 | ||||||||||

| 220,000 | Icahn Enterprises, L.P. / Icahn Enterprises | 5.2500 | 05/15/27 | 201,959 | ||||||||||

| 340,000 | Nuveen, LLC(b) | 5.8500 | 04/15/34 | 335,406 | ||||||||||

| 355,000 | UBS Group A.G.(b),(c) | H15T1Y + 2.400% | 4.9880 | 08/05/33 | 331,787 | |||||||||

| 35,000 | UBS Group A.G.(b),(c) | H15T5Y + 4.758% | 9.2500 | 05/13/72 | 38,501 | |||||||||

| 294,000 | United Airlines Class A Pass Through Trust Series 2023-1(f) | 5.8000 | 07/15/36 | 293,142 | ||||||||||

| 3,779,778 | ||||||||||||||

| AUTOMOTIVE — 0.3% | ||||||||||||||

| 70,000 | Ford Motor Company | 4.7500 | 01/15/43 | 55,073 | ||||||||||

| 200,000 | Ford Motor Credit Company, LLC | 6.8000 | 05/12/28 | 204,181 | ||||||||||

| 190,000 | Nissan Motor Acceptance Company, LLC(b) | 7.0500 | 09/15/28 | 195,207 | ||||||||||

| 454,461 | ||||||||||||||

| BANKING — 5.1% | ||||||||||||||

| 287,000 | Banco de Credito del Peru S.A.(b),(c) | H15T5Y + 3.000% | 3.1250 | 07/01/30 | 272,976 | |||||||||

| 290,000 | Banco de Credito e Inversiones S.A.(c) | H15T5Y + 4.944% | 8.7500 | 02/08/74 | 297,402 | |||||||||

See accompanying notes which are an integral part of these financial statements.

10

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| BANKING — 5.1% (Continued) | ||||||||||||||

| 200,000 | Banco Mercantil del Norte S.A.(b),(c) | H15T10Y + 5.034% | 6.6250 | 01/24/70 | $ | 176,090 | ||||||||

| 920,000 | Bank of America Corporation(c) | SOFRRATE + 1.320% | 2.6870 | 04/22/32 | 758,548 | |||||||||

| 390,000 | Bank of America Corporation(c) | H15T5Y + 1.200% | 2.4820 | 09/21/36 | 304,919 | |||||||||

| 400,000 | Barclays plc(c) | H15T1Y + 3.500% | 7.4370 | 11/02/33 | 432,959 | |||||||||

| 200,000 | BBVA Bancomer S.A.(b),(c) | H15T5Y + 2.650% | 5.1250 | 01/18/33 | 182,804 | |||||||||

| 250,000 | BPCE S.A.(b),(c) | SOFRRATE + 2.590% | 7.0030 | 10/19/34 | 263,226 | |||||||||

| 280,000 | Citigroup, Inc.(c) | TSFR3M + 1.600% | 3.9800 | 03/20/30 | 259,350 | |||||||||

| 320,000 | Citigroup, Inc.(c) | SOFRRATE + 2.338% | 6.2700 | 11/17/33 | 328,632 | |||||||||

| 229,000 | Citigroup, Inc.(c) | SOFRRATE + 2.661% | 6.1740 | 05/25/34 | 227,476 | |||||||||

| 250,000 | Citizens Bank NA | 2.2500 | 04/28/25 | 241,389 | ||||||||||

| 185,000 | Citizens Financial Group, Inc.(c) | SOFRRATE + 2.010% | 5.8410 | 01/23/30 | 181,101 | |||||||||

| 250,000 | Fifth Third Bancorp(c) | SOFRRATE + 1.660% | 4.3370 | 04/25/33 | 221,373 | |||||||||

| 280,000 | Huntington Bancshares, Inc. | 2.5500 | 02/04/30 | 233,480 | ||||||||||

| 710,000 | JPMorgan Chase & Company(d) | 1.9530 | 02/04/32 | 563,857 | ||||||||||

| 420,000 | JPMorgan Chase & Company(c),(f) | SOFRRATE + 2.580% | 5.7170 | 09/14/33 | 418,054 | |||||||||

| 82,000 | JPMorgan Chase & Company Series HH(c) | SOFRRATE + 3.125% | 4.6000 | 08/01/68 | 80,567 | |||||||||

| 390,000 | KeyCorporation(c) | SOFRRATE + 2.420% | 6.4010 | 03/06/35 | 383,701 | |||||||||

| 310,000 | NatWest Group plc(c) | H15T5Y + 2.200% | 6.4750 | 06/01/34 | 311,321 | |||||||||

| 375,000 | Societe Generale S.A.(b),(c) | H15T1Y + 2.100% | 6.0660 | 01/19/35 | 366,520 | |||||||||

| 200,000 | Texas Capital Bancshares, Inc.(c) | H15T5Y + 3.150% | 4.0000 | 05/06/31 | 178,440 | |||||||||

| 285,000 | Toronto-Dominion Bank (The)(c) | H15T5Y + 4.075% | 8.1250 | 10/31/82 | 293,732 | |||||||||

| 90,000 | Truist Financial Corporation(c) | SOFRRATE + 1.922% | 5.7110 | 01/24/35 | 87,376 | |||||||||

| 400,000 | Truist Financial Corporation(c) | H15T10Y + 4.349% | 5.1000 | 03/01/69 | 365,734 | |||||||||

| 280,000 | Wells Fargo & Company(c) | SOFRRATE + 2.100% | 4.8970 | 07/25/33 | 262,961 | |||||||||

| 285,000 | Wells Fargo & Company(c) | SOFRRATE + 2.060% | 6.4910 | 10/23/34 | 296,747 | |||||||||

| 330,000 | Wells Fargo & Company Series BB(c) | H15T5Y + 3.453% | 3.9000 | 03/15/69 | 312,869 | |||||||||

| 8,303,604 | ||||||||||||||

See accompanying notes which are an integral part of these financial statements.

11

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| BEVERAGES — 0.1% | ||||||||||||||

| 150,000 | Central American Bottling Corp / CBC Bottling(b) | 5.2500 | 04/27/29 | $ | 140,193 | |||||||||

| BIOTECH & PHARMA — 0.8% | ||||||||||||||

| 113,000 | Amgen, Inc.(f) | 5.2500 | 03/02/33 | 110,560 | ||||||||||

| 258,000 | Amgen, Inc. | 5.6500 | 03/02/53 | 247,820 | ||||||||||

| 45,000 | Par Pharmaceutical, Inc.(b),(g) | 7.5000 | 04/01/27 | — | ||||||||||

| 315,000 | Roche Holdings, Inc.(b) | 5.2180 | 03/08/54 | 300,387 | ||||||||||

| 155,000 | Royalty Pharma plc | 2.1500 | 09/02/31 | 121,517 | ||||||||||

| 195,000 | Royalty Pharma plc | 3.3500 | 09/02/51 | 119,598 | ||||||||||

| 120,000 | Teva Pharmaceutical Finance Netherlands III BV | 3.1500 | 10/01/26 | 111,400 | ||||||||||

| 265,000 | Utah Acquisition Sub, Inc. | 3.9500 | 06/15/26 | 254,119 | ||||||||||

| 681 | Viatris, Inc.(b) | 2.3000 | 06/22/27 | 612 | ||||||||||

| 155,000 | Viatris, Inc.(f) | 4.0000 | 06/22/50 | 101,447 | ||||||||||

| 1,367,460 | ||||||||||||||

| CABLE & SATELLITE — 0.2% | ||||||||||||||

| 14,000 | CCO Holdings, LLC / CCO Holdings Capital(b),(f) | 6.3750 | 09/01/29 | 12,933 | ||||||||||

| 180,000 | CCO Holdings, LLC / CCO Holdings Capital(b) | 4.7500 | 03/01/30 | 149,984 | ||||||||||

| 45,000 | CCO Holdings, LLC / CCO Holdings Capital(b) | 4.5000 | 08/15/30 | 36,598 | ||||||||||

| 200,000 | CSC Holdings, LLC(b) | 11.7500 | 01/31/29 | 177,747 | ||||||||||

| 377,262 | ||||||||||||||

| CHEMICALS — 0.5% | ||||||||||||||

| 235,000 | Bayport Polymers, LLC(b) | 5.1400 | 04/14/32 | 208,202 | ||||||||||

| 189,000 | INEOS Quattro Finance 2 plc(b) | 3.3750 | 01/15/26 | 179,275 | ||||||||||

| 200,000 | INEOS Quattro Finance 2 plc(b),(f) | 9.6250 | 03/15/29 | 211,537 | ||||||||||

| 130,000 | Windsor Holdings III, LLC(b) | 8.5000 | 06/15/30 | 135,734 | ||||||||||

| 734,748 | ||||||||||||||

| COMMERCIAL SUPPORT SERVICES — 0.0%(a) | ||||||||||||||

| 10,000 | GFL Environmental, Inc.(b) | 6.7500 | 01/15/31 | 10,085 | ||||||||||

| CONTAINERS & PACKAGING — 0.5% | ||||||||||||||

| 380,000 | Berry Global, Inc.(b) | 5.6500 | 01/15/34 | 367,237 | ||||||||||

| 435,000 | Smurfit Kappa Treasury ULC(b) | 5.7770 | 04/03/54 | 417,589 | ||||||||||

| 784,826 | ||||||||||||||

See accompanying notes which are an integral part of these financial statements.

12

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| ELEC & GAS MARKETING & TRADING — 0.2% | ||||||||||||||

| 380,000 | New York State Electric & Gas Corporation(b) | 5.8500 | 08/15/33 | $ | 381,168 | |||||||||

| ELECTRIC UTILITIES — 2.5% | ||||||||||||||

| 380,000 | Black Hills Corporation | 6.1500 | 05/15/34 | 379,700 | ||||||||||

| 355,000 | CMS Energy Corporation(c) | H15T5Y + 4.116% | 4.7500 | 06/01/50 | 321,080 | |||||||||

| 450,000 | Electricite de France S.A.(b) | 6.9000 | 05/23/53 | 472,214 | ||||||||||

| 235,000 | Enel Finance International N.V.(b) | 7.5000 | 10/14/32 | 258,188 | ||||||||||

| 260,000 | Entergy Texas, Inc. | 5.8000 | 09/01/53 | 255,480 | ||||||||||

| 330,000 | Exelon Corporation | 5.6000 | 03/15/53 | 313,003 | ||||||||||

| 188,000 | National Rural Utilities Cooperative Finance(c) | TSFR3M + 3.172% | 8.5010 | 04/30/43 | 187,492 | |||||||||

| 384,000 | NRG Energy, Inc.(b) | 7.0000 | 03/15/33 | 400,590 | ||||||||||

| 365,000 | PacifiCorporation | 5.8000 | 01/15/55 | 337,060 | ||||||||||

| 403,000 | Puget Energy, Inc. | 2.3790 | 06/15/28 | 354,492 | ||||||||||

| 404,000 | Southern Company (The)(c) | H15T5Y + 2.915% | 3.7500 | 09/15/51 | 370,775 | |||||||||

| 245,000 | Vistra Corporation(b),(c) | H15T5Y + 6.930% | 8.0000 | 04/15/70 | 247,766 | |||||||||

| 220,000 | Vistra Operations Company, LLC(b) | 6.8750 | 04/15/32 | 219,593 | ||||||||||

| 4,117,433 | ||||||||||||||

| ELECTRICAL EQUIPMENT — 0.1% | ||||||||||||||

| 285,000 | Vontier Corporation | 2.9500 | 04/01/31 | 233,573 | ||||||||||

| ENGINEERING & CONSTRUCTION — 0.3% | ||||||||||||||

| 140,000 | Global Infrastructure Solutions, Inc.(b) | 7.5000 | 04/15/32 | 134,444 | ||||||||||

| 398,000 | Sempra Infrastructure Partners, L.P.(b) | 3.2500 | 01/15/32 | 321,524 | ||||||||||

| 455,968 | ||||||||||||||

| FOOD — 0.3% | ||||||||||||||

| 300,000 | Pilgrim’s Pride Corporation | 6.2500 | 07/01/33 | 298,738 | ||||||||||

| 130,000 | Post Holdings, Inc. | 6.2500 | 02/15/32 | 128,814 | ||||||||||

| 427,552 | ||||||||||||||

| GAS & WATER UTILITIES — 0.3% | ||||||||||||||

| 260,000 | Brooklyn Union Gas Company (The)(b) | 4.8660 | 08/05/32 | 236,131 | ||||||||||

| 255,000 | KeySpan Gas East Corporation(b) | 5.9940 | 03/06/33 | 251,758 | ||||||||||

| 487,889 | ||||||||||||||

| HEALTH CARE FACILITIES & SERVICES — 1.1% | ||||||||||||||

| 290,000 | Catalent Pharma Solutions, Inc.(b) | 3.5000 | 04/01/30 | 276,179 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

13

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| HEALTH CARE FACILITIES & SERVICES — 1.1% (Continued) | ||||||||||||||

| 458,000 | CVS Health Corporation | 5.8750 | 06/01/53 | $ | 436,668 | |||||||||

| 185,000 | HCA, Inc. | 5.5000 | 06/01/33 | 179,831 | ||||||||||

| 345,000 | HCA, Inc. | 5.2500 | 06/15/49 | 298,346 | ||||||||||

| 116,000 | HCA, Inc. | 6.0000 | 04/01/54 | 110,639 | ||||||||||

| 145,000 | Icon Investments Six DAC | 6.0000 | 05/08/34 | 145,107 | ||||||||||

| 465,000 | Universal Health Services, Inc. | 2.6500 | 01/15/32 | 370,253 | ||||||||||

| 1,817,023 | ||||||||||||||

| HOME & OFFICE PRODUCTS — 0.2% | ||||||||||||||

| 275,000 | Newell Brands, Inc.(f) | 6.3750 | 09/15/27 | 269,646 | ||||||||||

| HOME CONSTRUCTION — 0.5% | ||||||||||||||

| 410,000 | Ashton Woods USA, LLC / Ashton Woods Finance(b) | 4.6250 | 04/01/30 | 366,807 | ||||||||||

| 494,000 | Meritage Homes Corporation(b) | 3.8750 | 04/15/29 | 448,289 | ||||||||||

| 815,096 | ||||||||||||||

| INDUSTRIAL SUPPORT SERVICES — 0.2% | ||||||||||||||

| 405,000 | Ashtead Capital, Inc.(b) | 5.5000 | 08/11/32 | 388,375 | ||||||||||

| INSTITUTIONAL FINANCIAL SERVICES — 1.7% | ||||||||||||||

| 260,000 | Bank of New York Mellon Corporation (The)(c) | SOFRINDX + 2.074% | 5.8340 | 10/25/33 | 264,363 | |||||||||

| 345,000 | Bank of New York Mellon Corporation (The)(c) | H15T5Y + 4.358% | 4.7000 | 09/20/68 | 337,905 | |||||||||

| 285,000 | Goldman Sachs Group, Inc. (The)(c) | SOFRRATE + 1.090% | 1.9920 | 01/27/32 | 225,094 | |||||||||

| 310,000 | Goldman Sachs Group, Inc. (The) | 6.4500 | 05/01/36 | 321,881 | ||||||||||

| 225,000 | Morgan Stanley Series F | 3.1250 | 07/27/26 | 213,817 | ||||||||||

| 395,000 | Morgan Stanley | 6.3750 | 07/24/42 | 426,134 | ||||||||||

| 215,000 | Northern Trust Corporation(d) | 3.3750 | 05/08/32 | 198,927 | ||||||||||

| 340,000 | Northern Trust Corporation(f) | 6.1250 | 11/02/32 | 349,944 | ||||||||||

| 220,000 | State Street Corporation(c) | SOFRRATE + 1.726% | 4.1640 | 08/04/33 | 198,789 | |||||||||

| 175,000 | State Street Corporation(c) | H15T5Y + 2.613% | 6.7000 | 03/15/74 | 175,550 | |||||||||

| 2,712,404 | ||||||||||||||

| INSURANCE — 2.5% | ||||||||||||||

| 200,000 | Allianz S.E.(b),(c) | H15T5Y + 3.232% | 6.3500 | 09/06/53 | 205,715 | |||||||||

| 320,000 | Allstate Corporation (The)(c) | TSFR3M + 3.200% | 8.5070 | 08/15/53 | 320,069 | |||||||||

See accompanying notes which are an integral part of these financial statements.

14

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| INSURANCE — 2.5% (Continued) | ||||||||||||||

| 425,000 | Aon North America, Inc. | 5.7500 | 03/01/54 | $ | 411,458 | |||||||||

| 410,000 | Ascot Group Ltd.(b) | 4.2500 | 12/15/30 | 333,276 | ||||||||||

| 85,000 | Athene Holding Ltd. | 6.2500 | 04/01/54 | 82,733 | ||||||||||

| 391,000 | Corebridge Financial, Inc.(c) | H15T5Y + 3.846% | 6.8750 | 12/15/52 | 387,370 | |||||||||

| 198,000 | Global Atlantic Fin Company(b) | 7.9500 | 06/15/33 | 214,357 | ||||||||||

| 105,000 | Global Atlantic Fin Company(b) | 6.7500 | 03/15/54 | 101,866 | ||||||||||

| 45,000 | HUB International Ltd.(b) | 7.2500 | 06/15/30 | 45,691 | ||||||||||

| 175,000 | Liberty Mutual Group, Inc.(b),(c) | H15T5Y + 3.315% | 4.1250 | 12/15/51 | 159,701 | |||||||||

| 168,000 | Lincoln National Corporation(c) | TSFR3M + 2.302% | 7.6260 | 04/20/67 | 125,225 | |||||||||

| 325,000 | MetLife, Inc.(c) | H15T5Y + 3.576% | 3.8500 | 03/15/69 | 311,378 | |||||||||

| 126,000 | MetLife, Inc.(c) | TSFR3M + 3.221% | 5.8750 | 09/15/66 | 123,053 | |||||||||

| 335,000 | Nippon Life Insurance Company(b),(c) | H15T5Y + 2.954% | 6.2500 | 09/13/53 | 336,320 | |||||||||

| 30,000 | Panther Escrow Issuer, LLC(b) | 7.1250 | 06/01/31 | 30,180 | ||||||||||

| 104,000 | Prudential Financial, Inc.(c) | H15T5Y + 3.162% | 5.1250 | 03/01/52 | 96,110 | |||||||||

| 210,000 | Prudential Financial, Inc.(c) | H15T5Y + 2.848% | 6.7500 | 03/01/53 | 214,543 | |||||||||

| 45,000 | Prudential Financial, Inc.(c) | H15T5Y + 2.404% | 6.5000 | 03/15/54 | 44,434 | |||||||||

| 160,000 | Sammons Financial Group, Inc.(b) | 6.8750 | 04/15/34 | 157,939 | ||||||||||

| 415,000 | Willis North America, Inc. | 5.9000 | 03/05/54 | 398,378 | ||||||||||

| 4,099,796 | ||||||||||||||

| LEISURE FACILITIES & SERVICES — 0.0%(a) | ||||||||||||||

| 20,000 | Royal Caribbean Cruises Ltd.(b) | 6.2500 | 03/15/32 | 19,752 | ||||||||||

| MACHINERY — 0.7% | ||||||||||||||

| 580,000 | Regal Rexnord Corporation(b) | 6.4000 | 04/15/33 | 584,899 | ||||||||||

| 515,000 | Veralto Corporation(b) | 5.4500 | 09/18/33 | 505,713 | ||||||||||

| 1,090,612 | ||||||||||||||

| MEDICAL EQUIPMENT & DEVICES — 0.9% | ||||||||||||||

| 570,000 | DENTSPLY SIRONA, Inc. | 3.2500 | 06/01/30 | 492,173 | ||||||||||

| 293,000 | Illumina, Inc.(f) | 2.5500 | 03/23/31 | 236,224 | ||||||||||

| 65,000 | Medline Borrower, L.P./Medline Co-Issuer, Inc.(b) | 6.2500 | 04/01/29 | 64,776 | ||||||||||

| 450,000 | Smith & Nephew plc | 5.4000 | 03/20/34 | 434,166 | ||||||||||

| 350,000 | Zimmer Biomet Holdings, Inc.(f) | 3.5500 | 03/20/30 | 311,362 | ||||||||||

| 1,538,701 | ||||||||||||||

See accompanying notes which are an integral part of these financial statements.

15

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| METALS & MINING — 0.7% | ||||||||||||||

| 115,000 | Alliance Resource Operating Partners, L.P. /(b) | 7.5000 | 05/01/25 | $ | 114,897 | |||||||||

| 255,000 | Corp Nacional del Cobre de Chile(b) | 5.9500 | 01/08/34 | 247,628 | ||||||||||

| 140,000 | FMG Resources August Pty Ltd. Series 2006(b) | 5.8750 | 04/15/30 | 134,717 | ||||||||||

| 295,000 | Glencore Funding, LLC(b) | 2.8500 | 04/27/31 | 244,719 | ||||||||||

| 240,000 | Glencore Funding, LLC(b) | 5.6340 | 04/04/34 | 232,327 | ||||||||||

| 215,000 | Teck Resources Ltd. | 6.1250 | 10/01/35 | 214,761 | ||||||||||

| 1,189,049 | ||||||||||||||

| OIL & GAS PRODUCERS — 3.6% | ||||||||||||||

| 540,000 | BP Capital Markets plc(c) | H15T5Y + 4.398% | 4.8750 | 12/22/00 | 506,118 | |||||||||

| 130,000 | Civitas Resources, Inc.(b) | 8.7500 | 07/01/31 | 138,056 | ||||||||||

| 150,000 | Columbia Pipelines Operating Company, LLC(b) | 6.0360 | 11/15/33 | 150,543 | ||||||||||

| 165,000 | Columbia Pipelines Operating Company, LLC(b) | 6.5440 | 11/15/53 | 170,263 | ||||||||||

| 35,000 | Columbia Pipelines Operating Company, LLC(b) | 6.7140 | 08/15/63 | 36,105 | ||||||||||

| 95,000 | CrownRock, L.P. / CrownRock Finance, Inc.(b) | 5.0000 | 05/01/29 | 93,705 | ||||||||||

| 425,000 | Diamondback Energy, Inc. | 5.9000 | 04/18/64 | 406,151 | ||||||||||

| 125,000 | DT Midstream, Inc.(b) | 4.1250 | 06/15/29 | 113,703 | ||||||||||

| 205,000 | Ecopetrol S.A. | 8.8750 | 01/13/33 | 209,918 | ||||||||||

| 275,000 | Enbridge, Inc.(c),(f) | H15T5Y + 4.418% | 7.6250 | 01/15/83 | 274,479 | |||||||||

| 25,000 | Encino Acquisition Partners Holdings, LLC(b) | 8.7500 | 05/01/31 | 25,473 | ||||||||||

| 120,000 | Energy Transfer, L.P.(c) | H15T5Y + 5.306% | 7.1250 | 05/15/69 | 115,605 | |||||||||

| 175,000 | Energy Transfer, L.P.(c) | H15T5Y + 5.694% | 6.5000 | 11/15/69 | 170,247 | |||||||||

| 80,000 | EQM Midstream Partners, L.P.(b) | 6.3750 | 04/01/29 | 79,313 | ||||||||||

| 425,000 | Flex Intermediate Holdco, LLC(b) | 3.3630 | 06/30/31 | 338,188 | ||||||||||

| 225,000 | Genesis Energy, L.P. / Genesis Energy Finance | 8.8750 | 04/15/30 | 233,172 | ||||||||||

| 475,000 | KazMunayGas National Company JSC(b) | 5.7500 | 04/19/47 | 394,323 | ||||||||||

| 320,000 | Kinder Morgan, Inc. | 7.7500 | 01/15/32 | 354,350 | ||||||||||

| 50,000 | NGL Energy Partners, L.P.(b) | 8.1250 | 02/15/29 | 50,846 | ||||||||||

| 80,000 | NGL Energy Partners, L.P.(b) | 8.3750 | 02/15/32 | 81,347 | ||||||||||

| 360,000 | Northern Natural Gas Company(b) | 5.6250 | 02/01/54 | 344,682 | ||||||||||

| 185,000 | Occidental Petroleum Corporation(f) | 6.1250 | 01/01/31 | 187,892 | ||||||||||

| 200,000 | Pertamina Persero PT(b) | 6.4500 | 05/30/44 | 201,394 | ||||||||||

| 365,000 | Petroleos Mexicanos | 6.5000 | 03/13/27 | 342,097 | ||||||||||

| 185,000 | Petroleos Mexicanos | 7.6900 | 01/23/50 | 129,051 | ||||||||||

| 335,000 | Reliance Industries Ltd.(b) | 2.8750 | 01/12/32 | 275,979 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

16

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| OIL & GAS PRODUCERS — 3.6% (Continued) | ||||||||||||||

| 95,000 | Venture Global Calcasieu Pass, LLC(b) | 3.8750 | 08/15/29 | $ | 84,420 | |||||||||

| 315,000 | Western Midstream Operating, L.P. | 5.2500 | 02/01/50 | 267,557 | ||||||||||

| 5,774,977 | ||||||||||||||

| OIL & GAS SERVICES & EQUIPMENT — 0.1% | ||||||||||||||

| 210,000 | Nabors Industries Ltd.(b),(f) | 7.2500 | 01/15/26 | 208,855 | ||||||||||

| REAL ESTATE INVESTMENT TRUSTS — 1.3% | ||||||||||||||

| 310,000 | EPR Properties | 4.7500 | 12/15/26 | 297,467 | ||||||||||

| 108,000 | GLP Capital, L.P. / GLP Financing II, Inc. | 3.2500 | 01/15/32 | 88,476 | ||||||||||

| 405,000 | GLP Capital, L.P. / GLP Financing II, Inc. | 6.7500 | 12/01/33 | 415,431 | ||||||||||

| 25,000 | MPT Operating Partnership, L.P. / MPT Finance(f) | 4.6250 | 08/01/29 | 18,737 | ||||||||||

| 355,000 | Sabra Health Care, L.P. | 3.2000 | 12/01/31 | 285,502 | ||||||||||

| 390,000 | Safehold GL Holdings, LLC | 6.1000 | 04/01/34 | 377,536 | ||||||||||

| 75,000 | Service Properties Trust | 4.9500 | 02/15/27 | 68,968 | ||||||||||

| 205,000 | VICI Properties, L.P. | 4.9500 | 02/15/30 | 194,605 | ||||||||||

| 165,000 | VICI Properties, L.P. | 5.1250 | 05/15/32 | 153,450 | ||||||||||

| 150,000 | VICI Properties, L.P. / VICI Note Company, Inc.(b) | 4.1250 | 08/15/30 | 133,821 | ||||||||||

| 2,033,993 | ||||||||||||||

| REAL ESTATE OWNERS & DEVELOPERS — 0.1% | ||||||||||||||

| 275,000 | Ontario Teachers’ Cadillac Fairview Properties(b) | 2.5000 | 10/15/31 | 217,637 | ||||||||||

| RETAIL - DISCRETIONARY — 0.5% | ||||||||||||||

| 175,000 | Beacon Roofing Supply, Inc.(b) | 6.5000 | 08/01/30 | 174,839 | ||||||||||

| 175,000 | BlueLinx Holdings, Inc.(b),(f) | 6.0000 | 11/15/29 | 166,059 | ||||||||||

| 405,000 | Hertz Corporation (The)(b) | 4.6250 | 12/01/26 | 313,385 | ||||||||||

| 105,000 | PetSmart, Inc. / PetSmart Finance Corporation(b),(f) | 7.7500 | 02/15/29 | 100,045 | ||||||||||

| 754,328 | ||||||||||||||

| SOFTWARE — 0.3% | ||||||||||||||

| 90,000 | Consensus Cloud Solutions, Inc.(b) | 6.5000 | 10/15/28 | 78,894 | ||||||||||

| 105,000 | Helios Software Holdings, Inc. / ION Corporate(b) | 8.7500 | 05/01/29 | 105,241 | ||||||||||

| 115,000 | Oracle Corporation | 6.2500 | 11/09/32 | 119,358 | ||||||||||

| 188,000 | Oracle Corporation | 5.5500 | 02/06/53 | 173,068 | ||||||||||

| 75,000 | Oracle Corporation | 3.8500 | 04/01/60 | 49,915 | ||||||||||

| 526,476 | ||||||||||||||

See accompanying notes which are an integral part of these financial statements.

17

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| SPECIALTY FINANCE — 1.3% | ||||||||||||||

| 330,000 | AerCap Ireland Capital DAC / AerCap Global | 3.3000 | 01/30/32 | $ | 275,731 | |||||||||

| 470,000 | American Express Company(c) | SOFRRATE + 1.930% | 5.6250 | 07/28/34 | 460,098 | |||||||||

| 235,000 | Aviation Capital Group, LLC(b) | 3.5000 | 11/01/27 | 216,368 | ||||||||||

| 210,000 | Avolon Holdings Funding Ltd.(b) | 4.3750 | 05/01/26 | 202,315 | ||||||||||

| 472,000 | Capital One Financial Corporation(d) | 2.3590 | 07/29/32 | 358,690 | ||||||||||

| 210,000 | Fortress Transportation and Infrastructure(b) | 7.0000 | 05/01/31 | 211,419 | ||||||||||

| 225,000 | GGAM Finance Ltd.(b) | 6.8750 | 04/15/29 | 225,614 | ||||||||||

| 150,000 | Synchrony Financial | 4.8750 | 06/13/25 | 147,518 | ||||||||||

| 67,000 | Synchrony Financial | 3.7000 | 08/04/26 | 63,282 | ||||||||||

| 2,161,035 | ||||||||||||||

| TECHNOLOGY HARDWARE — 0.2% | ||||||||||||||

| 189,000 | Dell International, LLC / EMC Corporation | 8.1000 | 07/15/36 | 220,715 | ||||||||||

| 175,000 | ViaSat, Inc.(b) | 5.6250 | 09/15/25 | 168,269 | ||||||||||

| 388,984 | ||||||||||||||

| TECHNOLOGY SERVICES — 1.4% | ||||||||||||||

| 140,000 | Booz Allen Hamilton, Inc.(b) | 3.8750 | 09/01/28 | 129,630 | ||||||||||

| 400,000 | Booz Allen Hamilton, Inc.(b) | 4.0000 | 07/01/29 | 367,319 | ||||||||||

| 485,000 | CoStar Group, Inc.(b) | 2.8000 | 07/15/30 | 402,579 | ||||||||||

| 425,000 | Gartner, Inc.(b) | 3.7500 | 10/01/30 | 370,281 | ||||||||||

| 320,000 | Leidos, Inc. | 2.3000 | 02/15/31 | 258,285 | ||||||||||

| 556,000 | MSCI, Inc.(b) | 3.6250 | 09/01/30 | 484,541 | ||||||||||

| 245,000 | Science Applications International Corporation(b) | 4.8750 | 04/01/28 | 231,490 | ||||||||||

| 2,244,125 | ||||||||||||||

| TELECOMMUNICATIONS — 0.3% | ||||||||||||||

| 160,000 | Level 3 Financing, Inc.(b) | 4.2500 | 07/01/28 | 63,200 | ||||||||||

| 270,000 | Level 3 Financing, Inc.(b) | 3.6250 | 01/15/29 | 93,164 | ||||||||||

| 205,000 | Sprint Capital Corporation | 8.7500 | 03/15/32 | 242,247 | ||||||||||

| 50,000 | Sprint Spectrum Company, LLC / Sprint Spectrum(b) | 4.7380 | 03/20/25 | 49,712 | ||||||||||

| 448,323 | ||||||||||||||

| TOBACCO & CANNABIS — 0.2% | ||||||||||||||

| 295,000 | BAT Capital Corporation | 7.7500 | 10/19/32 | 327,526 | ||||||||||

See accompanying notes which are an integral part of these financial statements.

18

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 32.7% (Continued) | ||||||||||||||

| TRANSPORTATION & LOGISTICS — 0.8% | ||||||||||||||

| 370,803 | Alaska Airlines Class A Pass Through Trust Series 2021-1(b) | 4.8000 | 08/15/27 | $ | 359,702 | |||||||||

| 335,000 | BNSF Funding Trust I(d) | 6.6130 | 12/15/55 | 331,598 | ||||||||||

| 277,447 | British Airways Class A Pass Through Trust Series 2021-1(b) | 2.9000 | 03/15/35 | 236,092 | ||||||||||

| 337,436 | Delta Air Lines Class AA Pass Through Trust Series 2015-1 | 3.6250 | 07/30/27 | 315,956 | ||||||||||

| 1,243,348 | ||||||||||||||

| TOTAL CORPORATE BONDS (Cost $54,841,437) | 53,224,855 | |||||||||||||

| MUNICIPAL BONDS — 0.3% | ||||||||||||||

| LOCAL AUTHORITY — 0.2% | ||||||||||||||

| 310,000 | San Diego County Regional Airport Authority | 5.5940 | 07/01/43 | 296,437 | ||||||||||

| WATER AND SEWER — 0.1% | ||||||||||||||

| 160,000 | Santa Clara Valley Water District | 2.9670 | 06/01/50 | 105,380 | ||||||||||

| TOTAL MUNICIPAL BONDS (Cost $470,000) | 401,817 | |||||||||||||

| NON U.S. GOVERNMENT & AGENCIES — 1.8% | ||||||||||||||

| SOVEREIGN — 1.8% | ||||||||||||||

| 565,000 | Brazilian Government International Bond | 6.0000 | 10/20/33 | 540,800 | ||||||||||

| 515,000 | Dominican Republic International Bond(b) | 4.8750 | 09/23/32 | 452,170 | ||||||||||

| 250,000 | Hungary Government International Bond(b) | 6.2500 | 09/22/32 | 252,606 | ||||||||||

| 200,000 | Mexico Government International Bond | 2.6590 | 05/24/31 | 162,756 | ||||||||||

| 250,000 | Mexico Government International Bond | 6.3500 | 02/09/35 | 249,394 | ||||||||||

| 200,000 | Mexico Government International Bond | 6.0000 | 05/07/36 | 193,248 | ||||||||||

| 400,000 | Panama Government International Bond | 8.0000 | 03/01/38 | 408,651 | ||||||||||

| 505,000 | Romanian Government International Bond(b) | 5.8750 | 01/30/29 | 495,405 | ||||||||||

| 200,000 | Serbia International Bond(b) | 6.5000 | 09/26/33 | 200,272 | ||||||||||

| 2,955,302 | ||||||||||||||

| TOTAL NON U.S. GOVERNMENT & AGENCIES (Cost $3,012,632) | 2,955,302 | |||||||||||||

See accompanying notes which are an integral part of these financial statements.

19

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| TERM LOANS — 6.7% | ||||||||||||||

| AEROSPACE & DEFENSE — 0.1% | ||||||||||||||

| 194,145 | TransDigm, Inc.(c) | TSFR1M + 2.750% | 8.0590 | 08/24/28 | $ | 195,336 | ||||||||

| ASSET MANAGEMENT — 0.3% | ||||||||||||||

| 34,738 | FinCompany I, LLC(c) | TSFR1M + 3.000% | 8.3130 | 06/27/29 | 34,886 | |||||||||

| 39,900 | GIP Pilot Acquisition Partners, L.P.(c) | TSFR3M + 3.000% | 8.3080 | 09/15/30 | 40,149 | |||||||||

| 75,000 | GTCR W Merger Sub, LLC(c) | TSFR1M + 3.000% | 8.3090 | 09/20/30 | 75,352 | |||||||||

| 267,308 | Wec US Holdings Ltd.(c) | TSFR1M + 2.750% | 8.0770 | 01/20/31 | 267,800 | |||||||||

| 418,187 | ||||||||||||||

| AUTOMOTIVE — 0.1% | ||||||||||||||

| 214,463 | Clarios Global, L.P.(c) | TSFR1M + 3.000% | 8.3300 | 05/06/30 | 215,468 | |||||||||

| BEVERAGES — 0.2% | ||||||||||||||

| 94,763 | Pegasus Bidco BV(c) | TSFR1M + 3.750% | 9.0570 | 07/12/29 | 95,178 | |||||||||

| 170,000 | Triton Water Holdings, Inc.(c) | TSFR1M + 3.500% | 8.9020 | 03/29/28 | 169,542 | |||||||||

| 264,720 | ||||||||||||||

| BIOTECH & PHARMA — 0.1% | ||||||||||||||

| 113,898 | Perrigo Investments, LLC(c) | TSFR1M + 2.500% | 7.6800 | 04/07/29 | 113,934 | |||||||||

| CABLE & SATELLITE — 0.6% | ||||||||||||||

| 215,000 | Cogeco Communications USA II, L.P.(c) | TSFR1M + 3.250% | 8.5800 | 09/18/30 | 210,085 | |||||||||

| 244,381 | CSC Holdings, LLC(c) | TSFR1M + 4.500% | 9.8250 | 01/18/28 | 236,482 | |||||||||

| 263,461 | Directv Financing, LLC(c) | TSFR1M + 5.365% | 10.6950 | 08/02/29 | 263,918 | |||||||||

| 205,000 | Virgin Media Bristol, LLC(c) | TSFR1M + 2.500% | 7.9400 | 01/04/28 | 201,489 | |||||||||

| 911,974 | ||||||||||||||

| CHEMICALS — 0.4% | ||||||||||||||

| 158,534 | INEOS US Finance, LLC(c) | TSFR1M + 3.750% | 9.1800 | 11/08/27 | 159,284 | |||||||||

| 128,992 | Innophos Holdings, Inc.(c) | TSFR1M + 3.250% | 8.6950 | 02/04/27 | 129,141 | |||||||||

| 114,138 | LSF11 A5 HoldCo, LLC(c) | TSFR1M + 4.350% | 9.6770 | 10/15/28 | 114,594 | |||||||||

| 60,000 | Lummus Technology Holdings V, LLC(c) | TSFR1M + 3.615% | 8.9450 | 12/31/29 | 60,284 | |||||||||

| 54,724 | Nouryon USA, LLC(c) | TSFR1M + 4.100% | 9.4190 | 04/03/28 | 54,938 | |||||||||

| 164,176 | Windsor Holdings III, LLC(c) | TSFR1M + 4.000% | 9.3190 | 08/01/30 | 165,797 | |||||||||

| 684,038 | ||||||||||||||

| COMMERCIAL SUPPORT SERVICES — 0.2% | ||||||||||||||

| 166,978 | Brightview Landscapes, LLC(c) | TSFR1M + 3.250% | 8.3130 | 04/22/29 | 167,527 | |||||||||

See accompanying notes which are an integral part of these financial statements.

20

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| TERM LOANS — 6.7% (Continued) | ||||||||||||||

| COMMERCIAL SUPPORT SERVICES — 0.2% (Continued) | ||||||||||||||

| 102,764 | CHG Healthcare Services, Inc.(c) | TSFR1M + 3.500% | 8.6950 | 09/30/28 | $ | 103,102 | ||||||||

| 69,825 | CHG Healthcare Services, Inc.(c) | TSFR3M + 3.750% | 9.0800 | 09/30/28 | 70,261 | |||||||||

| 340,890 | ||||||||||||||

| CONSTRUCTION MATERIALS — 0.1% | ||||||||||||||

| 160,000 | Quikrete Holdings, Inc.(c) | TSFR1M + 2.500% | 7.8290 | 03/18/31 | 160,286 | |||||||||

| CONTAINERS & PACKAGING — 0.1% | ||||||||||||||

| 170,000 | TricorBraun Holdings, Inc.(c) | TSFR1M + 3.365% | 7.3210 | 01/29/28 | 168,399 | |||||||||

| ELECTRIC UTILITIES — 0.1% | ||||||||||||||

| 58,672 | Generation Bridge Northeast, LLC(c) | TSFR1M + 4.250% | 8.8260 | 08/07/29 | 59,015 | |||||||||

| 15,000 | Generation Bridge Northeast, LLC(c) | TSFR1M + 3.500% | 8.8260 | 08/22/29 | 15,087 | |||||||||

| 40,000 | Vistra Operations Company, LLC(c) | TSFR1M + 2.750% | 8.0790 | 03/20/31 | 40,168 | |||||||||

| 114,270 | ||||||||||||||

| ENGINEERING & CONSTRUCTION — 0.1% | ||||||||||||||

| 200,000 | Pike Corporation(c) | TSFR1M + 3.000% | 8.4420 | 12/21/27 | 200,991 | |||||||||

| ENTERTAINMENT CONTENT — 0.2% | ||||||||||||||

| 247,455 | Univision Communications, Inc.(c) | TSFR1M + 3.250% | 8.6950 | 03/24/26 | 247,933 | |||||||||

| FOOD — 0.3% | ||||||||||||||

| 54,863 | Chobani, LLC(c) | TSFR1M + 3.750% | 9.0750 | 10/25/27 | 55,231 | |||||||||

| 173,246 | Del Monte Foods, Inc.(c) | TSFR1M + 4.250% | 9.6800 | 05/16/29 | 148,038 | |||||||||

| 266,703 | Froneri US, Inc.(c) | TSFR1M + 2.250% | 7.6800 | 01/30/27 | 267,292 | |||||||||

| 470,561 | ||||||||||||||

| GAS & WATER UTILITIES — 0.0%(a) | ||||||||||||||

| 35,000 | NGL Energy Operating, LLC(c) | TSFR1M + 4.500% | 9.8300 | 01/27/31 | 35,188 | |||||||||

| HEALTH CARE FACILITIES & SERVICES — 0.4% | ||||||||||||||

| 325,000 | DaVita, Inc.(c) | TSFR1M + 2.000% | 7.3210 | 05/06/31 | 323,528 | |||||||||

| 300,000 | Phoenix Guarantor, Inc.(c) | TSFR1M + 3.365% | 8.5770 | 02/13/31 | 298,242 | |||||||||

| 29,924 | Phoenix Newco, Inc.(c) | TSFR1M + 3.250% | 8.6920 | 08/11/28 | 30,053 | |||||||||

| 45,000 | Radnet Management, Inc.(c) | TSFR1M + 2.500% | 7.8230 | 04/10/31 | 44,979 | |||||||||

See accompanying notes which are an integral part of these financial statements.

21

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| TERM LOANS — 6.7% (Continued) | ||||||||||||||

| HEALTH CARE FACILITIES & SERVICES — 0.4% (Continued) | ||||||||||||||

| $ | 696,802 | |||||||||||||

| HOME CONSTRUCTION — 0.0%(a) | ||||||||||||||

| 15,000 | MIWD Holdco II, LLC(c) | TSFR1M + 3.600% | 8.8250 | 03/21/31 | 15,088 | |||||||||

| INSTITUTIONAL FINANCIAL SERVICES — 0.1% | ||||||||||||||

| 160,084 | Citadel Securities, L.P.(c) | TSFR1M + 2.250% | 7.5770 | 07/29/30 | 160,585 | |||||||||

| INSURANCE — 0.1% | ||||||||||||||

| 44,888 | Acrisure, LLC(c) | TSFR1M + 4.500% | 9.8300 | 10/20/30 | 45,140 | |||||||||

| 150,000 | Truist Insurance Holdings, LLC(c) | TSFR1M + 3.250% | 8.5680 | 03/24/31 | 150,493 | |||||||||

| 195,633 | ||||||||||||||

| INTERNET MEDIA & SERVICES — 0.1% | ||||||||||||||

| 201,036 | Uber Technologies, Inc.(c) | TSFR1M + 2.750% | 8.0790 | 03/03/30 | 202,607 | |||||||||

| LEISURE FACILITIES & SERVICES — 0.8% | ||||||||||||||

| 5,000 | Alterra Mountain Company(c) | TSFR1M + 3.250% | 9.1730 | 05/31/30 | 5,033 | |||||||||

| 59,400 | Caesars Entertainment, Inc.(c) | TSFR1M + 3.250% | 8.6630 | 01/26/30 | 59,597 | |||||||||

| 25,000 | Caesars Entertainment, Inc.(c) | TSFR1M + 2.750% | 8.0660 | 01/24/31 | 25,066 | |||||||||

| 95,380 | Carnival Corporation(c) | TSFR1M + 3.000% | 8.3190 | 08/08/27 | 95,991 | |||||||||

| 165,000 | Entain plc(c) | TSFR1M + 2.750% | 8.0660 | 10/31/29 | 165,747 | |||||||||

| 194,513 | Flutter Financing BV(c) | TSFR1M + 2.250% | 7.6590 | 11/18/30 | 195,103 | |||||||||

| 35,000 | Hilton Grand Vacations Borrower, LLC(c) | TSFR1M + 2.850% | 8.0770 | 01/10/31 | 35,113 | |||||||||

| 95,000 | Hilton Worldwide Finance, LLC(c) | TSFR1M + 2.100% | 7.4290 | 11/09/30 | 95,319 | |||||||||

| 39,400 | Light & Wonder International, Inc.(c) | TSFR1M + 2.850% | 8.0710 | 04/16/29 | 39,537 | |||||||||

| 154,613 | Ontario Gaming GTA, L.P.(c) | TSFR1M + 4.250% | 9.5590 | 07/20/30 | 155,643 | |||||||||

| 153,058 | Scientific Games Holdings, L.P.(c) | SOFRRATE + 3.500% | 8.5560 | 02/04/29 | 153,309 | |||||||||

| 249,008 | UFC Holdings, LLC(c) | TSFR1M + 2.750% | 8.3360 | 04/29/26 | 249,856 | |||||||||

| 1,275,314 | ||||||||||||||

| MACHINERY — 0.2% | ||||||||||||||

| 63,096 | Alliance Laundry Systems, LLC(c) | TSFR3M + 3.500% | 8.9250 | 09/30/27 | 63,415 | |||||||||

| 123,731 | Filtration Group Corporation(c) | TSFR1M + 3.500% | 8.9450 | 10/19/28 | 124,203 | |||||||||

| 69,855 | Standard Industries, Inc.(c) | TSFR1M + 2.500% | 7.6930 | 08/06/28 | 70,117 | |||||||||

| 118,734 | Titan Acquisition Ltd.(c) | TSFR1M + 5.000% | 10.3350 | 02/01/29 | 119,488 | |||||||||

See accompanying notes which are an integral part of these financial statements.

22

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| Principal Amount ($) | Spread | Coupon Rate (%) | Maturity | Fair Value | ||||||||||

| TERM LOANS — 6.7% (Continued) | ||||||||||||||

| MACHINERY — 0.2% (Continued) | ||||||||||||||

| $ | 377,223 | |||||||||||||

| MEDICAL EQUIPMENT & DEVICES — 0.1% | ||||||||||||||

| 193,373 | Medline Borrower, L.P.(c) | TSFR1M + 2.750% | 8.0770 | 10/23/28 | 194,102 | |||||||||

| METALS & MINING — 0.0%(a) | ||||||||||||||

| 49,788 | Arsenal AIC Parent, LLC(c) | TSFR1M + 3.750% | 9.0800 | 08/19/30 | 50,223 | |||||||||

| OIL & GAS PRODUCERS — 0.2% | ||||||||||||||

| 153,010 | Freeport LNG Investments LLLP(c) | TSFR3M + 3.500% | 9.0790 | 11/17/28 | 152,366 | |||||||||

| 97,111 | Oryx Midstream Services Permian Basin, LLC(c) | TSFR1M + 3.615% | 8.4360 | 10/05/28 | 97,545 | |||||||||

| 75,000 | WhiteWater DBR HoldCo, LLC(c) | TSFR1M + 2.750% | 8.0520 | 02/18/31 | 75,172 | |||||||||

| 325,083 | ||||||||||||||

| PUBLISHING & BROADCASTING — 0.1% | ||||||||||||||

| 94,000 | Century DE Buyer, LLC(c) | TSFR3M + 4.000% | 9.3170 | 09/27/30 | 94,517 | |||||||||

| REAL ESTATE INVESTMENT TRUSTS — 0.1% | ||||||||||||||

| 239,400 | Iron Mountain, Inc.(c) | TSFR1M + 2.250% | 7.5800 | 01/31/31 | 239,200 | |||||||||

| RETAIL - DISCRETIONARY — 0.3% | ||||||||||||||

| 39,900 | 84 Lumber Company(c) | TSFR1M + 2.850% | 8.1770 | 11/18/30 | 40,118 | |||||||||

| 85,000 | Peer Holding III BV(c) | TSFR1M + 3.250% | 8.5590 | 10/19/30 | 85,407 | |||||||||

| 152,646 | PetSmart, Inc.(c) | TSFR1M + 3.750% | 9.1800 | 01/29/28 | 150,738 | |||||||||

| 134,311 | SRS Distribution, Inc.(c) | TSFR1M + 3.500% | 8.9450 | 05/20/28 | 135,432 | |||||||||

| 411,695 | ||||||||||||||

| SOFTWARE — 0.6% | ||||||||||||||

| 290,167 | Applied Systems, Inc.(c) | TSFR1M + 3.500% | 8.8090 | 02/07/31 | 292,670 | |||||||||

| 25,000 | Camelot US Acquisition, LLC(c) | TSFR1M + 2.750% | 8.0770 | 01/31/31 | 25,078 | |||||||||