united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22153

Dunham Funds

(Exact name of registrant as specified in charter)

10251 Vista Sorrento Pkwy, Ste. 200, San Diego, CA 92121

(Address of principal executive offices) (Zip code)

Richard Malinowski

Ultimus Fund Solutions LLC., 4221 N 203rd St., Suite 100, Elkhorn, NE 68022

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 10/31

Date of reporting period: 4/30/22

Item 1. Reports to Stockholders.

| This Semi-Annual Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements also include those preceded by, followed by or that include the words “believes”, “expects”, “anticipates” or similar expressions. Such statements should be viewed with caution. Actual results or experience could differ materially from the forward-looking statements as a result of many factors. Each Fund makes no commitments to disclose any revisions to forward-looking statements, or any facts, events or circumstances after the date hereof that may bear upon forward-looking statements. In addition, prospective purchasers of the Funds should consider carefully the information set forth herein and the applicable fund’s prospectus. Other factors and assumptions not identified above may also have been involved in the derivation of these forward-looking statements, and the failure of these other assumptions to be realized may also cause actual results to differ materially from those projected. |

Dear Fellow Shareholders:

The silver lining to volatile markets is that new opportunities may be presented. These are most common when sell-offs are broad and appear to ignore fundamental valuations. The current prominent issues, such as high inflation and Russia’s invasion of Ukraine, have placed additional pressures on both equity and fixed income markets. Although fixed income markets, particularly bonds with high credit quality, have historically served as a buoy in portfolios during larger equity declines, rising interest rates in response to high inflation in the U.S. have driven bond values lower – in some cases representing even greater declines than equities.

At the start of the fiscal year, inflation1 was already running well-above the Fed’s target rate, hitting 6.2 percent year-over-year through October 2021. When excluding food and energy, the number was lower (but still high) at 4.6 percent year-over-year. The reading at the end of April was substantially higher, reaching 8.5 percent and when excluding food and energy it was at 6.2 percent. Raising interest rates generally takes time to have an impact on inflation, which means that these substantial average price increases will continue to impact consumers, companies, etc. and affect spending habits, production, etc. many of which will have long-term repercussions. We anticipate that the Fed’s discussion of how aggressive to increase rates will be balanced with what it believes our economy can withstand.

We have been clear in our concern of how rising interest rates could have significant adverse effects on fixed income securities, as the 10-year U.S. Treasury2 declined 10.3 percent since the start of this fiscal year and the 20-year U.S. Treasury3 plummeted 16.3 percent. While the magnitude of these negative returns may not come as a surprise given their longer maturities, the 7.1 percent decline in the 5-year U.S. Treasury4 over the past six-month period may be a bit more jarring. This intermediate-term maturity is more aligned with the average intermediate-term corporate bond and as this segment of the yield curve lurched upwards (sending prices spiraling downward), the average investment grade corporate bond5 lost 12.4 percent. This decline was even worse than the 11.6 percent decline experienced by global equities6 over the same time period. Therefore, we remain encouraged about the potential prospects of the other Dunham Fund choices we make available to each of you within the fixed income space. We believe that other fixed income asset classes and strategies that have less interest rate sensitivity may be an important consideration, especially since we believe that we are in the early stages of the interest rate hiking cycle and monetary tightening.

We have continued to receive questions from many of you about our views on the various major (and minor) themes present today. In our responses, the core tenet we have not deviated from is that we believe it is crucial to maintain diversification and to remain disciplined and methodical, especially when many other investors are not. I continue to personally invest alongside you, and I remain confident that we at Dunham have the tools and the discipline to succeed as our economy recovers. You can continue to rely on us to apply a rational and unemotional approach. We thank you for your continued trust and the confidence you have placed in us. We take that trust very seriously. We look forward to servicing the investment needs for you and your family for generations to come.

Sincerely,

Jeffrey A. Dunham

President

Dunham & Associates

April 30, 2022

| 1 | As measured by the US Consumer Price Index Urban Consumers NSA |

| 2 | As measured by the ICE BofA Current 10-Year US Treasury Index |

| 3 | As measured by the ICE BofA Current 20-Year US Treasury Index |

| 4 | As measured by the ICE BofA Current 5-Year US Treasury Index |

| 5 | As measured by the ICE BofA U.S. Corporate Index |

| 6 | As measured by the MSCI All Country World Index NR |

| Dunham Corporate/Government Bond Fund (Unaudited) |

| Message from the Sub-Adviser (Newfleet Asset Management, LLC) |

Asset Class Recap

Global bond markets largely sold off over the first half of the fiscal year which ended April 30, 2022, as hawkish tones from the Federal Reserve (Fed) and other central banks rattled markets prices for treasury bonds, corporate bonds, and municipal debt have slumped this year in response to the Fed’s moves to raise interest rates in an effort to rein in inflation. The Bloomberg U.S. Aggregate Bond Index, which is largely U.S. Treasurys, investment grade corporate bonds, and mortgage- backed securities, declined 9.5 percent this fiscal period. Rising yields are often associated with a strengthening economy because faster growth and a tighter labor market can lead central banks to crack down on inflation. In this case, the labor market is particularly tight, and inflation is running at its fastest pace in decades, prompting the Fed to signal a rapid series of interest-rate increases and sparking a steep climb in yields that has sent shock waves through markets. Investors are unlikely to get much relief until inflation concerns abate, a wild card when Covid-19 outbreaks in Asia are pressuring global supply chains and the war in Ukraine is driving up commodity prices. The 10-year U.S. Treasury yield spiked to a high of 2.93 percent in late April 2022, a level not seen in over three years, to close the fiscal half. Following the increase in the 10- year U.S. Treasury yield, longer-dated investment-grade corporate and government bonds sold off. In the U.S., investment-grade corporate bonds and U.S. government bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, fell 9.5 percent over the fiscal half. Overseas, bonds fared worse, with the Bloomberg Global Aggregate ex-US Bond Index, down 10.8 percent. Fixed income asset classes with less interest rate sensitivity, such as high-yield bonds, performed better than their investment-grade counterparts, however, still finished in negative territory. U.S. high-yield bonds, as measured by the ICE BofA U.S. Cash Pay High-Yield Index, dropped 5.4 percent. Leveraged loans, as measured by the Credit Suisse Leveraged Loan Index, outperformed its index counterparts significantly, falling 0.3 percent over the fiscal half.

Allocation Review

Almost half of U.S. investment- grade bonds in the benchmark index are represented by Treasury and government agency bonds. Therefore, much of the performance of the benchmark index is dictated by how those U.S. government-related bonds perform, and far less is dependent on the performance of corporate bonds and non-agency mortgage-backed securities. Over the fiscal half, U.S. government bonds, which make up about 39 percent of the benchmark, fell 8.3 percent and was the worst performing asset class. The higher duration exposure within the U.S. government bonds sector minimized any gains. The next largest weighting in the benchmark index was investment-grade corporate bonds, representing 25.0 percent. The Sub-Adviser’s underweight position to investment-grade corporate bonds at about 22 percent, coupled with superior security selection, contributed to Fund performance. Securitized debt, which is primarily comprised of commercial and residential mortgage-backed securities, was the top contributor to Fund performance. The Fund’s overweight allocation and strong security selection within securitized debt added to relative performance. Leveraged loans, which are not represented in the benchmark index, fell only 0.7 percent over the fiscal half, it was the Fund’s best performing asset class. The Fund’s 10.1 percent allocation to leveraged loans proved beneficial in a rising rate environment. Within the high- yield asset class of the Fund, corporate high-yield bonds fell 10.1 percent, while emerging markets high-yield bonds dropped 10.3 percent. Given, their minimal allocation within the benchmark, the Fund’s overweight allocation was a drag on performance.

Holdings Insights

The largest contributor to Fund performance over the fiscal half was a high-yield bond, Tenneco, Inc. 5.125% Due 4/15/2029 (880349AT2) (holding weight*: 0.19 percent). Tenneco is an American automotive components original equipment manufacturer and an aftermarket ride control and emissions products manufacturer. Tenneco performed well on news it entered into an agreement to be acquired by the Apollo Funds (APO) (not held) at an enterprise value of $7.1 billion. The purchase price of $20 per share was a 100 percent premium over the company’s share price at the time this was announced. The next largest contributor over the fiscal half came from within the investment-grade corporate bond sector, Citrix Systems, Inc. 3.3% Due 3/1/2030 (177376AF7) (holding weight*: 0.37 percent). Citrix Systems, Inc. is an American multinational cloud computing and virtualization technology company that provides server, application, and desktop virtualization, networking, software as a service, and cloud computing technologies. Citrix is being acquired by a strategic investor and therefore the Sub-Adviser could exercise their change of control option which entitles the Sub-Adviser to 101% of par. Despite interest rate volatility, these bonds should remain close to par. Within the emerging markets high-yield bonds, the Government of Oman 7.375% Due 10/28/2032 (68205LAE3) (holding weight*: 0.31 percent), contributed meaningfully to Fund performance. Oman is a country in Western Asia that is dependent on oil exports. Oman bond prices have been supported by the move higher in oil prices, which are now at levels where the fiscal and current account begin to generate material surpluses thus reducing the governments need to borrow and put the sovereign credit outlook on a positive arc.

The largest detractor to Fund performance over the fiscal year was an investment- grade corporate bond, Boeing Company 5.93% Due 5/01/2060 (097023CX) (holding weight*: 0.15 percent) . Boeing Company designs, manufacturers, and sells airplanes, rotorcraft, rockets, satellites, telecommunications equipment, and missiles worldwide. Boeing Company’s price movement has largely been driven by the 2060 maturity and in addition to first half earnings coming in below expectations due to cost overruns and program delays. Another detractor over the fiscal half was Ford Motor Company 4.75% Due 1/15/2043 (345370CQ1) (holding weight*: 0.07 percent). Ford Motor Company is an American automobile manufacturer and seller. The Ford bond sold off as its high duration was impacted by the rise in interest rates. It has been a tough environment for Autos, but recent results have been relatively solid. Another detractor over the fiscal half came from within the high - yield bond sector, Coinbase Global, Inc. 3.63% Due 10/1/2031 (19260QAD9) (holding weight*: 0.17 percent). Coinbase Global is a provider of financial infrastructure and technology for cryptocurrency markets. Competition has increased and same data suggests Coinbase is losing market share and may result in higher future marketing spending. Valuation is dependent on transactions, market share, and commissions, all of which have a wide variation in forecasts. Falling valuations in the technology sector have also weighed on the equity which impacts the bond price.

Sub-Adviser Outlook

The Sub-Adviser believes that the backdrop for fixed income may remain positive as the market continues to acclimate to the ebbs and flows of COVID, while broadening the dissemination and accessibility of vaccines. Developments in COVID variants could be worth monitoring as well, as the numerous COVID variants continue to disrupt multiple industries, including logistics. Persistent COVID cases have led to bottlenecks in the supply chain, resulting in rising input costs and extended delivery times, with some deliveries taking months to complete. Investors will look for clarity regarding the various supply chain bottlenecks from central banks, governments, and other industry leaders. The Sub-Adviser believes issuer selection and allocation will be imperative moving forward, as spreads appear to be tight across most fixed income asset classes.

| * | Holdings percentage(s) of total investments, cash and unsettled trades excluding collateral for securities loaned as of 4/30/2022. |

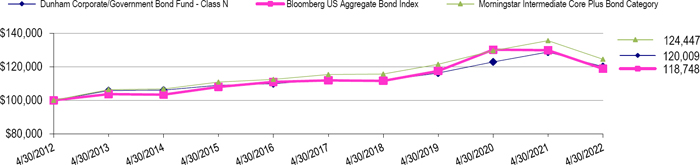

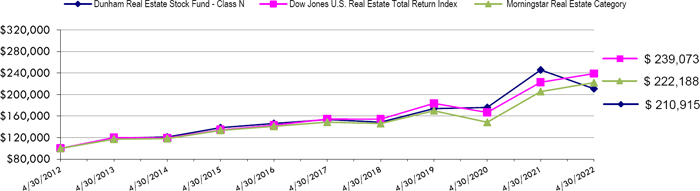

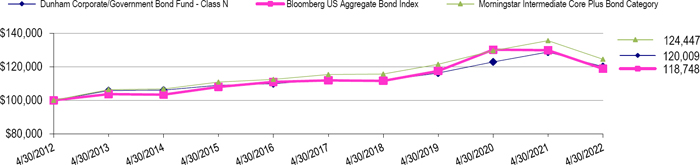

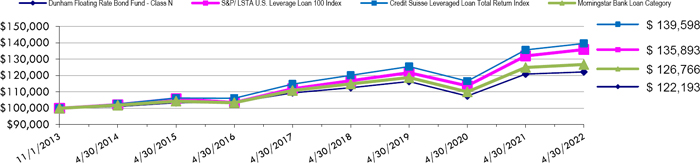

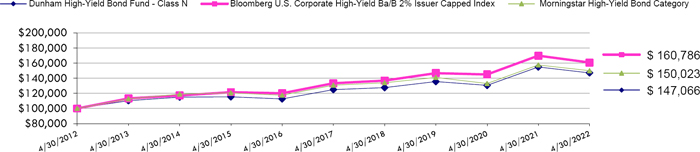

Growth of $100,000 Investment

| Total Returns (a) as of April 30, 2022 |

| | | | Annualized | Annualized |

| | Six Months | One Year | Five Years | Ten Years |

| Class N | (7.87)% | (6.78)% | 1.32% | 1.84% |

| Class A with load of 4.50% | (12.09)% | (11.54)% | 0.14% | 1.13% |

| Class A without load | (7.93)% | (7.02)% | 1.07% | 1.59% |

| Class C | (8.14)% | (7.46)% | 0.58% | 1.08% |

| Bloomberg US Aggregate Bond Index | (9.47)% | (8.51)% | 1.20% | 1.73% |

| Morningstar Intermediate Core Plus Bond Category | (9.12)% | (8.17)% | 1.52% | 2.21% |

| (a) | Total Returns are calculated based on traded NAVs. |

The Bloomberg US Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed- rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

The Morningstar Intermediate Core Plus Bond Category is generally representative of intermediate-term bond mutual funds that primarily invest in corporate and other investment-grade U.S. fixed-income securities and typically have durations of 3.5 to 6.0 years. Funds in this category also invest in high-yield and foreign bonds.

| As disclosed in the Trust’s latest registration statement, the Fund’s total annual operating expenses, including underlying funds, are 1.25% for Class N, 2.00% for Class C and 1.50% for Class A. Class A shares are subject to a sales load of 4.50% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of Fund shares or Fund distributions. For performance information current to the most recent month- end, please call 1-800-442-4358 or visit our website www.dunham.com. |

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 33.0% | | | | | | | | | | |

| | | | | AUTO LOAN — 6.6% | | | | | | | | | | |

| | 170,000 | | | American Credit Acceptance Receivables Trust (a) | | | | 1.7700 | | 12/14/26 | | $ | 164,657 | |

| | 280,000 | | | American Credit Acceptance Receivables Trust (a) | | | | 0.9700 | | 07/13/27 | | | 272,476 | |

| | 220,000 | | | American Credit Acceptance Receivables Trust (a) | | | | 2.4600 | | 03/13/28 | | | 205,810 | |

| | 230,000 | | | AmeriCredit Automobile Receivables Trust | | | | 1.0600 | | 08/18/26 | | | 220,349 | |

| | 135,000 | | | Americredit Automobile Receivables Trust 2018-1 D | | | | 3.8200 | | 03/18/24 | | | 135,978 | |

| | 125,000 | | | Avis Budget Rental Car Funding AESOP, LLC (a) | | | | 3.0700 | | 09/20/23 | | | 125,257 | |

| | 155,000 | | | Avis Budget Rental Car Funding AESOP, LLC (a) | | | | 2.3600 | | 03/20/26 | | | 149,501 | |

| | 140,000 | | | Carmax Auto Owner Trust 2019-1 | | | | 3.7400 | | 01/15/25 | | | 140,617 | |

| | 160,507 | | | Carvana Auto Receivables Trust 2019-3 (a) | | | | 2.7100 | | 10/15/24 | | | 160,650 | |

| | 175,000 | | | Carvana Auto Receivables Trust 2019-3A Class D (a) | | | | 3.0400 | | 04/15/25 | | | 174,815 | |

| | 241,644 | | | Carvana Auto Receivables Trust 2021-N1 | | | | 1.3000 | | 01/10/28 | | | 236,914 | |

| | 280,000 | | | Carvana Auto Receivables Trust 2021-N2 | | | | 1.0700 | | 03/10/28 | | | 272,238 | |

| | 225,000 | | | Carvana Auto Receivables Trust 2021-P3 | | | | 1.4200 | | 08/10/27 | | | 209,946 | |

| | 225,000 | | | CPS Auto Receivables Trust 2019-D (a) | | | | 3.8600 | | 10/15/25 | | | 222,978 | |

| | 138,524 | | | Credito Real USA Auto Receivables Trust 2021-1 A (a) | | | | 1.3500 | | 02/16/27 | | | 135,841 | |

| | 55,823 | | | Drive Auto Receivables Trust 2019-4 | | | | 2.5100 | | 11/17/25 | | | 55,877 | |

| | 107,418 | | | First Investors Auto Owner Trust 2019-1 (a) | | | | 3.2600 | | 03/17/25 | | | 107,772 | |

| | 180,000 | | | Flagship Credit Auto Trust 2020-4 20-4 C (a) | | | | 1.2800 | | 02/16/27 | | | 174,642 | |

| | 180,000 | | | Foursight Capital Automobile Receivables Trust (a) | | | | 2.1500 | | 05/17/27 | | | 171,065 | |

| | 205,000 | | | Prestige Auto Receivables Trust 2020-1 (a) | | | | 1.3100 | | 11/16/26 | | | 202,866 | |

| | 275,000 | | | Santander Drive Auto Receivables Trust 2021-3 | | | | 0.9500 | | 09/15/27 | | | 268,417 | |

| | 275,000 | | | United Auto Credit Securitization Trust (a) | | | | 0.8400 | | 06/10/26 | | | 270,825 | |

| | 14,857 | | | United Auto Credit Securitization Trust 2020-1 C (a) | | | | 2.1500 | | 02/10/25 | | | 14,859 | |

| | 103,446 | | | Veros Automobile Receivables Trust 2020-1 B (a) | | | | 2.1900 | | 06/16/25 | | | 103,407 | |

| | 170,000 | | | Westlake Automobile Receivables Trust 2020-3 (a) | | | | 1.2400 | | 11/17/25 | | | 166,597 | |

| | 345,000 | | | Westlake Automobile Receivables Trust 2022-1 (a) | | | | 2.7500 | | 03/15/27 | | | 338,490 | |

| | | | | | | | | | | | | | 4,702,844 | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS—9.4% | | | | | | | | | | |

| | 154,793 | | | AJAX Mortgage Loan Trust (a),(b) | | | | 1.0650 | | 09/25/65 | | | 142,631 | |

| | 157,921 | | | Angel Oak Mortgage Trust 2020-R1 (a),(b) | | | | 1.2470 | | 12/26/24 | | | 154,930 | |

| | 80,702 | | | Angel Oak Mortgage Trust 2021-8 (a),(b) | | | | 1.8200 | | 11/25/66 | | | 75,067 | |

| | 142,230 | | | Arroyo Mortgage Trust 2019-1 2019-1 Class A1 (a),(b) | | | | 3.8050 | | 01/25/49 | | | 139,088 | |

| | 56,167 | | | Arroyo Mortgage Trust 2019-2 2019-2 Class A1 (a),(b) | | | | 3.3470 | | 04/25/49 | | | 55,345 | |

| | 18,098 | | | Banc of America Funding 2005-1 Trust | | | | 5.5000 | | 02/25/35 | | | 17,729 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 33.0% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 9.4% (Continued) | | | | | | | | | | |

| | 105,942 | | | Bunker Hill Loan Depositary Trust 2019-2 (a),(c) | | | | 2.8790 | | 07/25/49 | | $ | 104,285 | |

| | 135,000 | | | CAFL 2021-RTL1 Issuer, LLC (a),(c) | | | | 2.2390 | | 03/26/29 | | | 126,305 | |

| | 43,123 | | | Chase Mortgage Finance Corporation (a),(b) | | | | 3.7500 | | 02/25/44 | | | 41,937 | |

| | 57,801 | | | Chase Mortgage Finance Corporation (a),(b) | | | | 3.7500 | | 04/25/45 | | | 56,133 | |

| | 148,701 | | | CIM Trust (a),(c) | | | | 2.8160 | | 10/25/61 | | | 141,732 | |

| | 148,971 | | | COLT 2020-RPL1 Trust (a),(b) | | | | 1.3900 | | 01/25/65 | | | 139,230 | |

| | 93,802 | | | COLT Funding, LLC (a),(b) | | | | 1.0510 | | 12/25/64 | | | 91,222 | |

| | 31,482 | | | CSMC 2020-NQM1 Trust (a),(c) | | | | 1.2080 | | 05/25/65 | | | 30,393 | |

| | 169,687 | | | CSMC 2020-RPL4 Trust (a),(b) | | | | 2.0000 | | 01/25/60 | | | 162,265 | |

| | 83,189 | | | CSMC 2021-NQM1 (a),(b) | | | | 0.8090 | | 05/25/65 | | | 80,926 | |

| | 34,328 | | | Deephaven Residential Mortgage Trust 2020-2 (a) | | | | 1.6920 | | 05/25/65 | | | 34,312 | |

| | 26,883 | | | Ellington Financial Mortgage Trust 2019-2 (a),(b) | | | | 3.0460 | | 11/25/59 | | | 26,338 | |

| | 26,991 | | | Flagstar Mortgage Trust 2017-1 (a),(b) | | | | 3.5000 | | 03/25/47 | | | 25,977 | |

| | 13,543 | | | Galton Funding Mortgage Trust 2017-1 (a),(b) | | | | 3.5000 | | 11/25/57 | | | 13,118 | |

| | 92,722 | | | GS Mortgage-Backed Securities Trust 2020-NQM1 (a),(b) | | | | 2.3520 | | 09/27/60 | | | 90,880 | |

| | 57,075 | | | JP Morgan Mortgage Trust 2017-5 (a),(b) | | | | 3.0500 | | 12/15/47 | | | 57,082 | |

| | 220,000 | | | LHOME Mortgage Trust 2021-RTL1 (a),(b) | | | | 2.0900 | | 09/25/26 | | | 212,175 | |

| | 100,000 | | | METLIFE S.E.CURITIZATION TRUST (a),(b) | | | | 3.4500 | | 04/25/55 | | | 95,848 | |

| | 50,100 | | | METLIFE S.E.CURITIZATION TRUST 2019-1 (a),(b) | | | | 3.7500 | | 04/25/58 | | | 50,204 | |

| | 277,084 | | | MFA 2021-NQM1 Trust (a),(b) | | | | 1.1530 | | 04/25/65 | | | 265,520 | |

| | 199,632 | | | Mill City Mortgage Loan Trust 2019-1 (a),(b) | | | | 3.5000 | | 10/25/69 | | | 187,628 | |

| | 170,000 | | | New Residential Mortgage Loan Trust (a) | | | | 4.3360 | | 12/25/26 | | | 169,665 | |

| | 69,099 | | | New Residential Mortgage Loan Trust (a),(b) | | | | 0.9410 | | 09/25/58 | | | 67,322 | |

| | 186,827 | | | New Residential Mortgage Loan Trust 2014-3 (a),(b) | | | | 3.7500 | | 11/25/54 | | | 183,725 | |

| | 173,675 | | | New Residential Mortgage Loan Trust 2016-3 (a),(b) | | | | 4.0000 | | 09/25/56 | | | 169,025 | |

| | 47,438 | | | New Residential Mortgage Loan Trust 2016-4 (a),(b) | | | | 3.7500 | | 11/25/56 | | | 46,382 | |

| | 382,084 | | | New Residential Mortgage Loan Trust 2017-2 (a),(b) | | | | 4.0000 | | 03/25/57 | | | 376,224 | |

| | 101,659 | | | New Residential Mortgage Loan Trust 2018-1 (a),(b) | | | | 4.0000 | | 12/25/57 | | | 99,914 | |

| | 215,000 | | | New Residential Mortgage Loan Trust 2019-RPL2 (a),(b) | | | | 3.7500 | | 02/25/59 | | | 206,106 | |

| | 478,325 | | | New Residential Mortgage Loan Trust 2020-1 (a),(b) | | | | 3.5000 | | 10/25/59 | | | 464,451 | |

| | 20,583 | | | OBX 2019-INV1 Trust (a),(b) | | | | 4.5000 | | 11/25/48 | | | 20,446 | |

| | 102,583 | | | Onslow Bay Mortgage Loan Trust (a) | | | | 1.9570 | | 08/25/61 | | | 94,859 | |

| | 135,000 | | | Palisades Mortgage Loan Trust 2021-RTL1 (a),(c) | | | | 2.8570 | | 06/25/26 | | | 134,241 | |

| | 214,769 | | | PRET 2021-RN3, LLC (a),(c) | | | | 1.8430 | | 09/25/51 | | | 204,386 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 33.0% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 9.4% (Continued) | | | | | | | | | | |

| | 35,077 | | | Provident Funding Mortgage Loan Trust 2019-1 A2 (a),(b) | | | | 3.0000 | | 12/25/49 | | $ | 33,559 | |

| | 213,595 | | | PRPM 2021-2, LLC (a),(b) | | | | 2.1150 | | 03/25/26 | | | 206,427 | |

| | 68,277 | | | RCKT Mortgage Trust 2020-1 (a),(b) | | | | 3.0000 | | 02/25/50 | | | 65,381 | |

| | 133,617 | | | RCO VI Mortgage, LLC 2022-1 (a),(c) | | | | 3.0000 | | 01/25/27 | | | 129,017 | |

| | 149,011 | | | RCO VII Mortgage, LLC 2021-2 (a),(c) | | | | 2.1160 | | 09/25/26 | | | 143,758 | |

| | 20,935 | | | Residential Mortgage Loan Trust 2019-2 (a),(b) | | | | 2.9130 | | 05/25/59 | | | 20,895 | |

| | 110,878 | | | Residential Mortgage Loan Trust 2020-1 (a),(b) | | | | 2.3760 | | 02/25/24 | | | 109,407 | |

| | 225,000 | | | ROC Securities Trust 2013-1 (a),(b) | | | | 2.4870 | | 08/25/26 | | | 219,511 | |

| | 188,429 | | | SG Residential Mortgage Trust 2021-1 (a),(b) | | | | 1.5600 | | 07/25/61 | | | 176,960 | |

| | 44,342 | | | Starwood Mortgage Residential Trust 2020-1 (a),(b) | | | | 2.2750 | | 02/25/50 | | | 44,132 | |

| | 4,178 | | | Starwood Mortgage Residential Trust 2020-2 (a),(b) | | | | 2.7180 | | 04/25/60 | | | 4,178 | |

| | 32,642 | | | Starwood Mortgage Residential Trust 2020-3 (a),(b) | | | | 1.4860 | | 04/25/65 | | | 32,117 | |

| | 365,000 | | | Towd Point Mortgage Trust 2021-1 (a),(b) | | | | 2.7500 | | 11/25/61 | | | 328,249 | |

| | 100,000 | | | Verus Securitization Trust 2019-4 (a),(b) | | | | 3.2070 | | 11/25/59 | | | 99,554 | |

| | 73,418 | | | Verus Securitization Trust 2019-INV2 (a),(b) | | | | 2.9130 | | 07/25/59 | | | 73,501 | |

| | 32,732 | | | Verus Securitization Trust 2020-1 (a),(c) | | | | 2.4170 | | 01/25/60 | | | 32,444 | |

| | 57,797 | | | Verus Securitization Trust 2021-2 (a),(b) | | | | 1.0310 | | 02/25/66 | | | 54,666 | |

| | 31,416 | | | Wells Fargo Mortgage Backed Securities 2020-4 (a),(b) | | | | 3.0000 | | 07/25/50 | | | 29,959 | |

| | | | | | | | | | | | | | 6,658,761 | |

| | | | | CREDIT CARD — 0.6% | | | | | | | | | | |

| | 410,000 | | | Genesis Sales Finance Master Trust (a) | | | | 1.6500 | | 09/22/25 | | | 405,252 | |

| | | | | | | | | | | | | | | |

| | | | | NON AGENCY CMBS — 2.2% | | | | | | | | | | |

| | 173,968 | | | Angel Oak SB Commercial Mortgage Trust 2020-SBC1 (a),(b) | | | | 2.0680 | | 05/25/50 | | | 169,136 | |

| | 90,000 | | | BPR Trust (a),(d) | | US0001M + 1.250% | | 1.8040 | | 02/15/29 | | | 89,386 | |

| | 130,000 | | | BX Trust 2019-OC11 2019-OC11 D (a),(b) | | | | 4.0750 | | 12/09/41 | | | 116,772 | |

| | 233,297 | | | CHC Commercial Mortgage Trust 2019 - CHC (a),(d) | | US0001M + 1.120% | | 1.6740 | | 06/15/34 | | | 229,727 | |

| | 119,479 | | | Citigroup Commercial Mortgage Trust 2015-GC27 | | | | 2.8780 | | 02/10/48 | | | 116,634 | |

| | 305,000 | | | GCT Commercial Mortgage Trust 2021-GCT (a),(d) | | US0001M + 0.800% | | 1.3540 | | 02/15/23 | | | 299,754 | |

| | 135,000 | | | GS Mortgage Securities Trust 2020-GC45 (b) | | | | 3.1730 | | 02/13/53 | | | 127,283 | |

| | 185,000 | | | Hilton USA Trust 2016-SFP (a) | | | | 3.3230 | | 11/05/35 | | | 182,026 | |

| | 179,398 | | | Onslow Bay Mortgage Loan Trust (a),(b) | | | | 1.1010 | | 05/25/61 | | | 167,627 | |

| | 62,000 | | | WFRBS Commercial Mortgage Trust 2014-C24 | | | | 3.9310 | | 11/15/47 | | | 61,197 | |

| | | | | | | | | | | | | | 1,559,542 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 33.0% (Continued) | | | | | | | | | | |

| | | | | OTHER ABS — 9.2% | | | | | | | | | | |

| | 230,000 | | | American Homes 4 Rent 2014-SFR2 Trust (a) | | | | 4.7050 | | 10/17/36 | | $ | 231,455 | |

| | 220,000 | | | American Homes 4 Rent 2015-SFR2 Trust (a) | | | | 4.6910 | | 10/17/45 | | | 222,194 | |

| | 175,000 | | | AMSR 2020-SFR1 Trust (a) | | | | 2.1200 | | 04/17/37 | | | 162,976 | |

| | 250,000 | | | AMSR 2020-SFR2 Trust (a) | | | | 2.5330 | | 07/17/37 | | | 233,630 | |

| | 100,000 | | | AMSR 2020-SFR2 Trust (a) | | | | 3.2820 | | 07/17/37 | | | 94,461 | |

| | 136,489 | | | Aqua Finance Trust 2019-A (a) | | | | 3.1400 | | 07/16/40 | | | 134,224 | |

| | 275,000 | | | Aqua Finance Trust 2019-A (a) | | | | 4.0100 | | 07/16/40 | | | 267,237 | |

| | 270,000 | | | Aqua Finance Trust 2020-A (a) | | | | 2.7900 | | 07/17/46 | | | 256,772 | |

| | 100,000 | | | CCG Receivables Trust 2019-2 (a) | | | | 2.5500 | | 03/15/27 | | | 99,620 | |

| | 220,000 | | | CCG Receivables Trust 2021-1 (a) | | | | 0.8400 | | 06/14/27 | | | 207,556 | |

| | 105,858 | | | CF Hippolyta, LLC (a) | | | | 1.6900 | | 07/15/60 | | | 98,345 | |

| | 8,391 | | | Consumer Loan Underlying Bond CLUB Credit Trust (a) | | | | 2.9200 | | 03/15/28 | | | 8,394 | |

| | 118,943 | | | CoreVest American Finance 2018-2 Trust (a) | | | | 4.0260 | | 11/15/52 | | | 118,583 | |

| | 100,000 | | | Corevest American Finance 2019-3 Trust (a) | | | | 3.2650 | | 10/15/52 | | | 88,281 | |

| | 108,693 | | | Corevest American Finance 2020-1 Trust 2020-1 A1 (a) | | | | 1.8320 | | 03/15/50 | | | 102,467 | |

| | 203,761 | | | Corevest American Finance 2020-4 Trust (a) | | | | 1.1740 | | 12/15/52 | | | 185,469 | |

| | 240,000 | | | Dext A.B.S 2020-1, LLC (a) | | | | 1.9200 | | 11/15/27 | | | 233,628 | |

| | 285,000 | | | FirstKey Homes 2020-SFR1 Trust (a) | | | | 2.1890 | | 08/17/28 | | | 252,431 | |

| | 375,000 | | | FirstKey Homes 2020-SFR2 Trust (a) | | | | 1.5670 | | 10/19/37 | | | 342,756 | |

| | 38,054 | | | Foundation Finance Trust 2019-1 (a) | | | | 3.8600 | | 11/15/34 | | | 38,006 | |

| | 121,456 | | | HIN Timeshare Trust 2020-A C 20-A (a) | | | | 3.4200 | | 10/09/39 | | | 117,478 | |

| | 129,675 | | | Jersey Mike’s Funding (a) | | | | 4.4330 | | 02/15/50 | | | 126,126 | |

| | 5,685 | | | LL A.B.S Trust 2020-1 2020-1A A (a) | | | | 2.3300 | | 07/15/22 | | | 5,686 | |

| | 85,006 | | | MVW 2020-1, LLC (a) | | | | 1.7400 | | 10/20/37 | | | 81,302 | |

| | 18,043 | | | MVW Owner Trust 2016-1 (a) | | | | 2.2500 | | 12/20/33 | | | 18,061 | |

| | 157 | | | Octane Receivables Trust 2019-1 2019-1A A (a) | | | | 3.1600 | | 09/20/23 | | | 157 | |

| | 59,939 | | | Octane Receivables Trust 2020-1 2020-1A A (a) | | | | 1.7100 | | 02/20/25 | | | 59,594 | |

| | 255,000 | | | Oportun Funding 2022-1, LLC (a) | | | | 3.2500 | | 06/15/29 | | | 253,824 | |

| | 57,802 | | | Orange Lake Timeshare Trust 2019-A (a) | | | | 3.3600 | | 04/09/38 | | | 56,391 | |

| | 550,000 | | | Progress Residential 2020-SFR2 Trust (a) | | | | 5.1150 | | 06/17/37 | | | 546,991 | |

| | 201,000 | | | Progress Residential 2021-SFR1 (a) | | | | 1.5550 | | 04/17/38 | | | 179,493 | |

| | 265,000 | | | Progress Residential 2021-SFR3 (a) | | | | 2.2880 | | 05/17/26 | | | 235,986 | |

| | 220,000 | | | Progress Residential Trust (a) | | | | 2.1970 | | 04/19/38 | | | 197,795 | |

| | 275,000 | | | Purchasing Power Funding 2021-A, LLC 2021-A A (a) | | | | 1.5700 | | 10/15/25 | | | 265,630 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 33.0% (Continued) | | | | | | | | | | |

| | | | | OTHER ABS — 9.2% | | | | | | | | | | |

| | 265,000 | | | Regional Management Issuance Trust 2021-1 (a) | | | | 1.6800 | | 03/17/31 | | $ | 250,883 | |

| | 77,149 | | | Sierra Timeshare 2020-2 Receivables Funding, LLC (a) | | | | 2.3200 | | 07/20/37 | | | 75,028 | |

| | 85,725 | | | Taco Bell Funding, LLC 2016-1A Class A23 (a) | | | | 4.9700 | | 05/25/46 | | | 87,012 | |

| | 165,000 | | | Tricon American Homes 2019-SFR1 Trust (a) | | | | 3.1490 | | 03/17/38 | | | 156,411 | |

| | 200,000 | | | Tricon American Homes 2020-SFR2 Trust (a) | | | | 2.2810 | | 11/17/27 | | | 170,423 | |

| | 160,000 | | | Tricon Residential 2021-SFR1 Trust (a) | | | | 2.2440 | | 07/17/38 | | | 145,345 | |

| | 122,009 | | | VSE 2016-A VOI Mortgage, LLC (a) | | | | 2.5400 | | 07/20/33 | | | 120,170 | |

| | | | | | | | | | | | | | 6,528,271 | |

| | | | | RESIDENTIAL MORTGAGE — 4.9% | | | | | | | | | | |

| | 98,447 | | | Ajax Mortgage Loan Trust 2019-D (a),(c) | | | | 2.9560 | | 09/25/65 | | | 98,598 | |

| | 100,000 | | | Bayview Opportunity Master Fund IVa Trust (a),(b) | | | | 4.0000 | | 06/28/57 | | | 95,877 | |

| | 22,260 | | | Bayview Opportunity Master Fund IVa Trust 2017-RT1 (a),(b) | | | | 3.0000 | | 03/28/57 | | | 21,935 | |

| | 100,000 | | | Mill City Mortgage Loan Trust 2017-1 2017-1 M2 (a),(b) | | | | 3.2500 | | 11/25/58 | | | 98,496 | |

| | 180,691 | | | Pretium Mortgage Credit Partners, LLC (a),(c) | | | | 2.2390 | | 09/27/60 | | | 173,644 | |

| | 345,000 | | | Towd Point Mortgage Trust 2016-3 (a),(b) | | | | 3.5000 | | 04/25/56 | | | 344,923 | |

| | 135,000 | | | Towd Point Mortgage Trust 2016-4 (a),(b) | | | | 3.8000 | | 07/25/56 | | | 132,202 | |

| | 115,000 | | | Towd Point Mortgage Trust 2017-1 (a),(b) | | | | 3.7500 | | 10/25/56 | | | 112,749 | |

| | 460,000 | | | Towd Point Mortgage Trust 2017-4 (a),(b) | | | | 3.0000 | | 06/25/57 | | | 437,941 | |

| | 111,213 | | | Towd Point Mortgage Trust 2018-4 Class A1 (a),(b) | | | | 3.0000 | | 06/25/58 | | | 108,416 | |

| | 300,000 | | | Towd Point Mortgage Trust 2018-6 (a),(b) | | | | 3.7500 | | 03/25/58 | | | 293,201 | |

| | 140,000 | | | Towd Point Mortgage Trust 2018-6 (a),(b) | | | | 3.7500 | | 03/25/58 | | | 138,544 | |

| | 255,000 | | | Towd Point Mortgage Trust 2019-2 (a),(b) | | | | 3.7500 | | 12/25/58 | | | 246,995 | |

| | 235,000 | | | Towd Point Mortgage Trust 2019-4 (a),(b) | | | | 3.2500 | | 10/25/59 | | | 222,785 | |

| | 100,000 | | | Towd Point Mortgage Trust 2020-1 (a),(b) | | | | 3.5000 | | 01/25/60 | | | 92,597 | |

| | 190,698 | | | VCAT 2021-NPL1, LLC (a),(c) | | | | 2.2890 | | 12/26/50 | | | 185,365 | |

| | 130,000 | | | VCAT 2021-NPL1, LLC (a),(c) | | | | 4.8260 | | 12/26/50 | | | 124,693 | |

| | 68,090 | | | VCAT 2021-NPL2, LLC (a),(c) | | | | 2.1150 | | 03/27/51 | | | 65,830 | |

| | 112,869 | | | VCAT Asset Securitization, LLC (a),(c) | | | | 1.7430 | | 05/25/51 | | | 107,339 | |

| | 80,331 | | | VOLT C, LLC (a),(c) | | | | 1.9920 | | 05/25/51 | | | 76,994 | |

| | 90,667 | | | VOLT CVI, LLC (a),(c) | | | | 2.7340 | | 12/26/51 | | | 86,271 | |

| | 178,251 | | | VOLT XCII, LLC (a),(c) | | | | 1.8920 | | 02/27/51 | | | 172,350 | |

| | | | | | | | | | | | | | 3,437,745 | |

| | | | | STUDENT LOANS — 0.1% | | | | | | | | | | |

| | 83,917 | | | Commonbond Student Loan Trust 2020-1 (a) | | | | 1.6900 | | 10/25/51 | | | 75,779 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 33.0% (Continued) | | | | | | | | | | |

| | | | | TOTAL ASSET BACKED SECURITIES (Cost $24,598,481) | | | | | | | | $ | 23,368,194 | |

| | | | | | | | | | | | | | | |

| | | | | CORPORATE BONDS — 30.7% | | | | | | | | | | |

| | | | | AEROSPACE & DEFENSE — 0.6% | | | | | | | | | | |

| | 108,000 | | | Boeing Company (The) | | | | 5.9300 | | 05/01/60 | | | 107,461 | |

| | 236,000 | | | Huntington Ingalls Industries, Inc. (a) | | | | 2.0430 | | 08/16/28 | | | 206,845 | |

| | 75,000 | | | Spirit AeroSystems, Inc. (a) | | | | 5.5000 | | 01/15/25 | | | 74,887 | |

| | 80,000 | | | TransDigm, Inc. | | | | 5.5000 | | 11/15/27 | | | 73,462 | |

| | | | | | | | | | | | | | 462,655 | |

| | | | | ASSET MANAGEMENT — 1.7% | | | | | | | | | | |

| | 190,000 | | | Ares Finance Co LLC (a) | | | | 4.0000 | | 10/08/24 | | | 189,755 | |

| | 92,000 | | | Blackstone Private Credit Fund (a) | | | | 2.6250 | | 12/15/26 | | | 80,831 | |

| | 125,000 | | | Blue Owl Finance, LLC (a) | | | | 3.1250 | | 06/10/31 | | | 100,423 | |

| | 245,000 | | | Charles Schwab Corporation (The) (b) | | H15T10Y + 3.079% | | 4.0000 | | 03/01/69 | | | 207,973 | |

| | 155,000 | | | Citadel, L.P. (a) | | | | 4.8750 | | 01/15/27 | | | 152,364 | |

| | 250,000 | | | Drawbridge Special Opportunities Fund, L.P. / (a) | | | | 3.8750 | | 02/15/26 | | | 236,402 | |

| | 145,000 | | | Icahn Enterprises, L.P. / Icahn Enterprises | | | | 6.2500 | | 05/15/26 | | | 144,015 | |

| | 180,000 | | | OWL Rock Core Income Corporation (a) | | | | 4.7000 | | 02/08/27 | | | 170,133 | |

| | | | | | | | | | | | | | 1,281,896 | |

| | | | | AUTOMOTIVE — 0.4% | | | | | | | | | | |

| | 96,000 | | | Ford Motor Company | | | | 3.2500 | | 02/12/32 | | | 78,157 | |

| | 65,000 | | | Ford Motor Company | | | | 4.7500 | | 01/15/43 | | | 52,451 | |

| | 140,000 | | | Tenneco, Inc. (a) | | | | 5.1250 | | 04/15/29 | | | 135,687 | |

| | | | | | | | | | | | | | 266,295 | |

| | | | | BANKING — 4.7% | | | | | | | | | | |

| | 200,000 | | | Banco Mercantil del Norte S.A. (a),(b) | | H15T10Y + 5.034% | | 6.6250 | | 01/24/70 | | | 179,300 | |

| | 250,000 | | | Bank of America Corporation (d) | | US0003M + 0.770% | | 1.0850 | | 02/05/26 | | | 249,046 | |

| | 715,000 | | | Bank of America Corporation (b) | | SOFRRATE + 1.320% | | 2.6870 | | 04/22/32 | | | 615,056 | |

| | 230,000 | | | Bank of America Corporation (b) | | H15T5Y + 1.200% | | 2.4820 | | 09/21/36 | | | 184,611 | |

| | 200,000 | | | BBVA Bancomer S.A. (a),(b) | | H15T5Y + 2.650% | | 5.1250 | | 01/18/33 | | | 186,581 | |

| | 325,000 | | | Citigroup, Inc. (d) | | US0003M + 1.250% | | 2.2170 | | 07/01/26 | | | 327,963 | |

| | 113,000 | | | Citigroup, Inc. (d) | | SOFRRATE + 1.280% | | 1.4800 | | 02/24/28 | | | 112,249 | |

| | 175,000 | | | JPMorgan Chase & Company (b),(d) | | SOFRRATE + 1.180% | | 1.3840 | | 02/24/28 | | | 173,099 | |

| | 425,000 | | | JPMorgan Chase & Company | | SOFRRATE + 1.065% | | 1.9530 | | 02/04/32 | | | 347,984 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 30.7% (Continued) | | | | | | | | | | |

| | | | | BANKING — 4.7% (Continued) | | | | | | | | | | |

| | 47,000 | | | JPMorgan Chase & Company HH (b) | | SOFRRATE + 3.125% | | 4.6000 | | 08/01/68 | | $ | 43,375 | |

| | 205,000 | | | Santander Holdings USA, Inc. | | | | 4.4000 | | 07/13/27 | | | 202,724 | |

| | 60,000 | | | Synovus Financial Corporation (b) | | USSW5 + 3.379% | | 5.9000 | | 02/07/29 | | | 60,962 | |

| | 200,000 | | | Texas Capital Bancshares, Inc. (b) | | H15T5Y + 3.150% | | 4.0000 | | 05/06/31 | | | 191,916 | |

| | 185,000 | | | Truist Financial Corporation (b) | | H15T10Y + 4.349% | | 5.1000 | | 03/01/69 | | | 185,231 | |

| | 330,000 | | | Wells Fargo & Company (b), (f) | | H15T5Y + 3.453% | | 3.9000 | | 03/15/69 | | | 301,315 | |

| | | | | | | | | | | | | | 3,361,412 | |

| | | | | BEVERAGES — 0.4% | | | | | | | | | | |

| | 200,000 | | | Bacardi Ltd. (a) | | | | 4.7000 | | 05/15/28 | | | 201,098 | |

| | 75,000 | | | Central American Bottling Corp / CBC Bottling (a) | | | | 5.2500 | | 04/27/29 | | | 71,529 | |

| | | | | | | | | | | | | | 272,627 | |

| | | | | BIOTECH & PHARMA — 0.6% | | | | | | | | | | |

| | 40,000 | | | Bausch Health Companies, Inc. (a) | | | | 5.7500 | | 08/15/27 | | | 37,474 | |

| | 160,000 | | | Mylan N.V. | | | | 3.9500 | | 06/15/26 | | | 155,659 | |

| | 40,000 | | | Par Pharmaceutical, Inc. (a) | | | | 7.5000 | | 04/01/27 | | | 36,542 | |

| | 110,000 | | | Teva Pharmaceutical Finance Netherlands III BV (f) | | | | 3.1500 | | 10/01/26 | | | 94,497 | |

| | 681 | | | Viatris, Inc. (a) | | | | 2.3000 | | 06/22/27 | | | 604 | |

| | 150,000 | | | Viatris, Inc. | | | | 2.3000 | | 06/22/27 | | | 133,056 | |

| | | | | | | | | | | | | | 457,832 | |

| | | | | CABLE & SATELLITE — 0.1% | | | | | | | | | | |

| | 35,000 | | | CCO Holdings, LLC / CCO Holdings Capital (a) | | | | 4.7500 | | 03/01/30 | | | 31,216 | |

| | 40,000 | | | CCO Holdings, LLC / CCO Holdings Capital (a), (f) | | | | 4.5000 | | 08/15/30 | | | 34,966 | |

| | | | | | | | | | | | | | 66,182 | |

| | | | | CHEMICALS — 0.6% | | | | | | | | | | |

| | 235,000 | | | Bayport Polymers, LLC (a) | | | | 5.1400 | | 04/14/32 | | | 235,578 | |

| | 245,000 | | | Nutrition & Biosciences, Inc. (a) | | | | 2.3000 | | 11/01/30 | | | 206,062 | |

| | | | | | | | | | | | | | 441,640 | |

| | | | | COMMERCIAL SUPPORT SERVICES — 0.3% | | | | | | | | | | |

| | 45,000 | | | Aramark Services, Inc. (a) | | | | 6.3750 | | 05/01/25 | | | 45,891 | |

| | 115,000 | | | GFL Environmental Inc (a) | | | | 4.0000 | | 08/01/28 | | | 101,355 | |

| | 78,000 | | | Waste Management, Inc. | | | | 4.1500 | | 04/15/32 | | | 77,865 | |

| | | | | | | | | | | | | | 225,111 | |

| | | | | CONSUMER SERVICES — 0.1% | | | | | | | | | | |

| | 55,000 | | | Carriage Services, Inc. (a) | | | | 4.2500 | | 05/15/29 | | | 47,924 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 30.7% (Continued) | | | | | | | | | | |

| | | | | DIVERSIFIED INDUSTRIALS — 0.2% | | | | | | | | | | |

| | 181,000 | | | General Electric Company D (b) | | US0003M + 3.330% | | 4.1560 | | 06/15/69 | | $ | 171,700 | |

| | | | | | | | | | | | | | | |

| | | | | ELECTRIC UTILITIES — 1.2% | | | | | | | | | | |

| | 260,000 | | | Alliant Energy Finance, LLC (a) | | | | 3.6000 | | 03/01/32 | | | 241,415 | |

| | 238,000 | | | Puget Energy, Inc. | | | | 2.3790 | | 06/15/28 | | | 212,283 | |

| | 244,000 | | | Southern Company (The) (b) | | H15T5Y + 2.915% | | 3.7500 | | 09/15/51 | | | 220,210 | |

| | 145,000 | | | Vistra Corporation (a),(b) | | H15T5Y + 6.930% | | 8.0000 | | 04/15/70 | | | 146,175 | |

| | | | | | | | | | | | | | 820,083 | |

| | | | | ENGINEERING & CONSTRUCTION — 0.5% | | | | | | | | | | |

| | 130,000 | | | Global Infrastructure Solutions, Inc. (a) | | | | 7.5000 | | 04/15/32 | | | 121,147 | |

| | 238,000 | | | Sempra Infrastructure Partners, L.P. (a) | | | | 3.2500 | | 01/15/32 | | | 206,725 | |

| | | | | | | | | | | | | | 327,872 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS — 0.1% | | | | | | | | | | |

| | 90,000 | | | Suzano Austria GmbH | | | | 2.5000 | | 09/15/28 | | | 76,806 | |

| | | | | | | | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES — 0.5% | | | | | | | | | | |

| | 125,000 | | | HCA, Inc. (f) | | | | 5.2500 | | 06/15/49 | | | 119,789 | |

| | 145,000 | | | Molina Healthcare, Inc. (a) | | | | 3.8750 | | 05/15/32 | | | 127,524 | |

| | 5,000 | | | Prime Healthcare Services, Inc. (a) | | | | 7.2500 | | 11/01/25 | | | 5,020 | |

| | 150,000 | | | Universal Health Services, Inc. (a) | | | | 2.6500 | | 01/15/32 | | | 123,455 | |

| | | | | | | | | | | | | | 375,788 | |

| | | | | HOME CONSTRUCTION — 0.5% | | | | | | | | | | |

| | 90,000 | | | M/I Homes, Inc. | | | | 4.9500 | | 02/01/28 | | | 82,919 | |

| | 235,000 | | | PulteGroup, Inc. | | | | 6.3750 | | 05/15/33 | | | 254,603 | |

| | | | | | | | | | | | | | 337,522 | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES — 1.9% | | | | | | | | | | |

| | 160,000 | | | Bank of New York Mellon Corporation (The) (b) | | H15T5Y + 4.358% | | 4.7000 | | 09/20/68 | | | 160,000 | |

| | 370,000 | | | Brookfield Finance, Inc. | | | | 2.7240 | | 04/15/31 | | | 325,279 | |

| | 160,000 | | | Coinbase Global, Inc. (a) | | | | 3.6250 | | 10/01/31 | | | 118,898 | |

| | 290,000 | | | Jefferies Group, LLC / Jefferies Group Capital | | | | 2.6250 | | 10/15/31 | | | 238,960 | |

| | 285,000 | | | Morgan Stanley | | | | 3.1250 | | 07/27/26 | | | 273,463 | |

| | 175,000 | | | Morgan Stanley (f) | | | | 6.3750 | | 07/24/42 | | | 211,147 | |

| | | | | | | | | | | | | | 1,327,747 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 30.7% (Continued) | | | | | | | | | | |

| | | | | INSURANCE — 2.1% | | | | | | | | | | |

| | 150,000 | | | Allstate Corporation (The) (b) | | US0003M + 2.938% | | 5.7500 | | 08/15/53 | | $ | 145,710 | |

| | 185,000 | | | Ascot Group Ltd. (a) | | | | 4.2500 | | 12/15/30 | | | 179,567 | |

| | 170,000 | | | Brighthouse Financial, Inc. (f) | | | | 5.6250 | | 05/15/30 | | | 177,922 | |

| | 160,000 | | | Liberty Mutual Group, Inc. (a),(b) | | H15T5Y + 3.315% | | 4.1250 | | 12/15/51 | | | 145,447 | |

| | 275,000 | | | Lincoln National Corporation (b),(d) | | US0003M + 2.040% | | 3.1030 | | 04/20/67 | | | 225,390 | |

| | 160,000 | | | MetLife, Inc. (b) | | H15T5Y + 3.576% | | 3.8500 | | 03/15/69 | | | 153,810 | |

| | 76,000 | | | MetLife, Inc. (b) | | US0003M + 2.959% | | 5.8750 | | 09/15/66 | | | 75,284 | |

| | 70,000 | | | Prudential Financial, Inc. (b) | | US0003M + 4.175% | | 5.8750 | | 09/15/42 | | | 69,904 | |

| | 230,000 | | | Prudential Financial, Inc. (b), (f) | | US0003M + 3.920% | | 5.6250 | | 06/15/43 | | | 230,223 | |

| | 59,000 | | | Prudential Financial, Inc. (b), (f) | | H15T5Y + 3.162% | | 5.1250 | | 03/01/52 | | | 57,469 | |

| | | | | | | | | | | | | | 1,460,726 | |

| | | | | INTERNET MEDIA & SERVICES — 0.2% | | | | | | | | | | |

| | 85,000 | | | TripAdvisor, Inc. (a) | | | | 7.0000 | | 07/15/25 | | | 87,239 | |

| | 60,000 | | | Twitter, Inc. (a) | | | | 3.8750 | | 12/15/27 | | | 58,950 | |

| | | | | | | | | | | | | | 146,189 | |

| | | | | LEISURE FACILITIES & SERVICES — 0.1% | | | | | | | | | | |

| | 75,000 | | | Hilton Grand Vacations Borrower Escrow, LLC / (a) | | | | 5.0000 | | 06/01/29 | | | 67,804 | |

| | 15,000 | | | Scientific Games International, Inc. (a) | | | | 7.0000 | | 05/15/28 | | | 15,372 | |

| | | | | | | | | | | | | | 83,176 | |

| | | | | LEISURE PRODUCTS — 0.2% | | | | | | | | | | |

| | 166,000 | | | Brunswick Corporation | | | | 2.4000 | | 08/18/31 | | | 130,913 | |

| | | | | | | | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES — 0.8% | | | | | | | | | | |

| | 265,000 | | | Baxter International, Inc. (a) | | | | 2.5390 | | 02/01/32 | | | 226,307 | |

| | 124,000 | | | Bio-Rad Laboratories, Inc. | | | | 3.3000 | | 03/15/27 | | | 118,907 | |

| | 39,000 | | | Bio-Rad Laboratories, Inc. | | | | 3.7000 | | 03/15/32 | | | 36,170 | |

| | 243,000 | | | Illumina, Inc. | | | | 2.5500 | | 03/23/31 | | | 207,552 | |

| | | | | | | | | | | | | | 588,936 | |

| | | | | METALS & MINING — 1.3% | | | | | | | | | | |

| | 125,000 | | | Alliance Resource Operating Partners, L.P. / (a) | | | | 7.5000 | | 05/01/25 | | | 125,496 | |

| | 65,000 | | | Cleveland-Cliffs, Inc. (a) | | | | 6.7500 | | 03/15/26 | | | 68,167 | |

| | 130,000 | | | FMG Resources August 2006 Pty Ltd. (a) | | | | 5.8750 | | 04/15/30 | | | 129,251 | |

| | 205,000 | | | Freeport-McMoRan, Inc. | | | | 5.4500 | | 03/15/43 | | | 205,238 | |

| | 185,000 | | | Glencore Funding, LLC (a) | | | | 2.8500 | | 04/27/31 | | | 158,196 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 30.7% (Continued) | | | | | | | | | | |

| | | | | METALS & MINING — 1.3%(Continued) | | | | | | | | | | |

| | 205,000 | | | Teck Resources Ltd. | | | | 6.1250 | | 10/01/35 | | $ | 226,381 | |

| | | | | | | | | | | | | | 912,729 | |

| | | | | OIL & GAS PRODUCERS — 3.6% | | | | | | | | | | |

| | 155,000 | | | Boardwalk Pipelines, L.P. B | | | | 4.9500 | | 12/15/24 | | | 158,599 | |

| | 115,000 | | | Chesapeake Escrow Issuer, LLC B (a) | | | | 5.5000 | | 02/01/26 | | | 114,161 | |

| | 65,000 | | | CrownRock, L.P. / CrownRock Finance, Inc. (a) | | | | 5.6250 | | 10/15/25 | | | 65,080 | |

| | 115,000 | | | DT Midstream, Inc. (a) | | | | 4.1250 | | 06/15/29 | | | 104,801 | |

| | 160,000 | | | Energy Transfer, L.P. (b) | | H15T5Y + 5.694% | | 6.5000 | | 11/15/69 | | | 152,418 | |

| | 245,000 | | | Flex Intermediate Holdco, LLC (a) | | | | 3.3630 | | 06/30/31 | | | 215,647 | |

| | 165,000 | | | HF Sinclair Corporation (a) | | | | 5.8750 | | 04/01/26 | | | 169,726 | |

| | 45,000 | | | Kinder Morgan, Inc. (a) | | | | 7.7500 | | 01/15/32 | | | 54,837 | |

| | 200,000 | | | Lundin Energy Finance BV | | | | 2.0000 | | 07/15/26 | | | 180,807 | |

| | 95,000 | | | Occidental Petroleum Corporation | | | | 6.1250 | | 01/01/31 | | | 99,978 | |

| | 70,000 | | | Parsley Energy, LLC / Parsley Finance Corporation (a) | | | | 4.1250 | | 02/15/28 | | | 66,188 | |

| | 200,000 | | | Pertamina Persero PT (a) | | | | 6.4500 | | 05/30/44 | | | 213,866 | |

| | 185,000 | | | Petroleos Mexicanos | | | | 7.6900 | | 01/23/50 | | | 145,330 | |

| | 200,000 | | | Petronas Capital Ltd. (a) | | | | 3.5000 | | 04/21/30 | | | 192,912 | |

| | 250,000 | | | Reliance Industries Ltd. (a) | | | | 2.8750 | | 01/12/32 | | | 214,463 | |

| | 65,000 | | | Sabine Pass Liquefaction, LLC | | | | 4.2000 | | 03/15/28 | | | 63,923 | |

| | 225,000 | | | Transcanada Trust (b) | | H15T5Y + 3.986% | | 5.6000 | | 03/07/82 | | | 217,968 | |

| | 85,000 | | | Venture Global Calcasieu Pass, LLC (a) | | | | 3.8750 | | 08/15/29 | | | 77,673 | |

| | 80,000 | | | Venture Global Calcasieu Pass, LLC (a) | | | | 3.8750 | | 11/01/33 | | | 69,723 | |

| | | | | | | | | | | | | | 2,578,100 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT — 0.1% | | | | | | | | | | |

| | 30,000 | | | Patterson-UTI Energy, Inc. (f) | | | | 5.1500 | | 11/15/29 | | | 28,594 | |

| | 24,256 | | | Transocean Guardian Ltd. (a) | | | | 5.8750 | | 01/15/24 | | | 23,251 | |

| | | | | | | | | | | | | | 51,845 | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 1.8% | | | | | | | | | | |

| | 220,000 | | | EPR Properties | | | | 4.7500 | | 12/15/26 | | | 216,283 | |

| | 155,000 | | | GLP Capital, L.P. / GLP Financing II, Inc. | | | | 5.7500 | | 06/01/28 | | | 162,945 | |

| | 23,000 | | | GLP Capital, L.P. / GLP Financing II, Inc. | | | | 3.2500 | | 01/15/32 | | | 19,386 | |

| | 35,000 | | | MPT Operating Partnership, L.P. / MPT Finance | | | | 5.0000 | | 10/15/27 | | | 33,625 | |

| | 20,000 | | | MPT Operating Partnership, L.P. / MPT Finance (f) | | | | 4.6250 | | 08/01/29 | | | 18,408 | |

| | 115,000 | | | MPT Operating Partnership, L.P. / MPT Finance (f) | | | | 3.5000 | | 03/15/31 | | | 98,074 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 30.7% (Continued) | | | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 1.8% (Continued) | | | | | | | | | | |

| | 170,000 | | | Office Properties Income Trust | | | | 4.5000 | | 02/01/25 | | $ | 168,967 | |

| | 240,000 | | | Phillips Edison Grocery Center Operating | | | | 2.6250 | | 11/15/31 | | | 198,720 | |

| | 105,000 | | | Retail Opportunity Investments Partnership, L.P. | | | | 4.0000 | | 12/15/24 | | | 104,144 | |

| | 225,000 | | | Retail Properties of America, Inc. | | | | 4.7500 | | 09/15/30 | | | 222,933 | |

| | 70,000 | | | Service Properties Trust | | | | 4.9500 | | 02/15/27 | | | 60,756 | |

| | | | | | | | | | | | | | 1,304,241 | |

| | | | | REAL ESTATE OWNERS & DEVELOPERS — 0.3% | | | | | | | | | | |

| | 275,000 | | | Ontario Teachers’ Cadillac Fairview Properties (a) | | | | 2.5000 | | 10/15/31 | | | 238,985 | |

| | | | | | | | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES — 0.0%(e) | | | | | | | | | | |

| | 10,000 | | | Albertsons Companies Inc / Safeway Inc / New (a) | | | | 3.5000 | | 03/15/29 | | | 8,437 | |

| | | | | | | | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY — 0.5% | | | | | | | | | | |

| | 160,000 | | | American Builders & Contractors Supply Company, (a) | | | | 4.0000 | | 01/15/28 | | | 149,426 | |

| | 160,000 | | | BlueLinx Holdings, Inc. (a) | | | | 6.0000 | | 11/15/29 | | | 145,000 | |

| | 159,000 | | | Dick’s Sporting Goods, Inc. | | | | 3.1500 | | 01/15/32 | | | 133,059 | |

| | | | | | | | | | | | | | 427,485 | |

| | | | | SEMICONDUCTORS — 0.5% | | | | | | | | | | |

| | 171,000 | | | Broadcom, Inc. | | | | 4.1500 | | 11/15/30 | | | 162,356 | |

| | 9,000 | | | Broadcom, Inc. (a), (f) | | | | 3.1870 | | 11/15/36 | | | 7,128 | |

| | 222,000 | | | Entegris Escrow Corporation (a) | | | | 4.7500 | | 04/15/29 | | | 214,267 | |

| | | | | | | | | | | | | | 383,751 | |

| | | | | SOFTWARE — 0.6% | | | | | | | | | | |

| | 265,000 | | | Citrix Systems, Inc. (f) | | | | 3.3000 | | 03/01/30 | | | 261,911 | |

| | 15,000 | | | Consensus Cloud Solutions, Inc. (a) | | | | 6.0000 | | 10/15/26 | | | 14,271 | |

| | 20,000 | | | Consensus Cloud Solutions, Inc. (a) | | | | 6.5000 | | 10/15/28 | | | 18,825 | |

| | 90,000 | | | Oracle Corporation | | | | 2.8750 | | 03/25/31 | | | 76,132 | |

| | 45,000 | | | Oracle Corporation | | | | 3.8500 | | 04/01/60 | | | 31,986 | |

| | | | | | | | | | | | | | 403,125 | |

| | | | | SPECIALTY FINANCE — 1.0% | | | | | | | | | | |

| | 194,000 | | | Ally Financial, Inc. B (b) | | H15T5Y + 3.868% | | 4.7000 | | 08/15/69 | | | 168,125 | |

| | 145,000 | | | Aviation Capital Group, LLC (a) | | | | 3.5000 | | 11/01/27 | | | 133,757 | |

| | 125,000 | | | Avolon Holdings Funding Ltd. (a) | | | | 4.3750 | | 05/01/26 | | | 120,231 | |

| | 182,000 | | | Capital One Financial Corporation (b) | | SOFRRATE + 1.337% | | 2.3590 | | 07/29/32 | | | 146,851 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 30.7% (Continued) | | | | | | | | | | |

| | | | | SPECIALTY FINANCE — 1.0% (Continued) | | | | | | | | | | |

| | 110,000 | | | Ladder Capital Finance Holdings LLLP / Ladder (a) | | | | 4.2500 | | 02/01/27 | | $ | 101,248 | |

| | 60,000 | | | OneMain Finance Corporation | | | | 6.8750 | | 03/15/25 | | | 60,563 | |

| | | | | | | | | | | | | | 730,775 | |

| | | | | TECHNOLOGY HARDWARE — 0.8% | | | | | | | | | | |

| | 224,000 | | | CDW, LLC / CDW Finance Corporation | | | | 3.5690 | | 12/01/31 | | | 196,540 | |

| | 84,000 | | | Dell International, LLC / EMC Corporation | | | | 8.1000 | | 07/15/36 | | | 103,822 | |

| | 50,000 | | | Motorola Solutions, Inc. | | | | 4.6000 | | 05/23/29 | | | 49,365 | |

| | 280,000 | | | TD SYNNEX Corporation (a) | | | | 2.3750 | | 08/09/28 | | | 244,247 | |

| | | | | | | | | | | | | | 593,974 | |

| | | | | TECHNOLOGY SERVICES — 0.6% | | | | | | | | | | |

| | 137,000 | | | Kyndryl Holdings, Inc. (a) | | | | 2.7000 | | 10/15/28 | | | 114,621 | |

| | 245,000 | | | Leidos, Inc. | | | | 2.3000 | | 02/15/31 | | | 202,304 | |

| | 140,000 | | | Science Applications International Corporation (a) | | | | 4.8750 | | 04/01/28 | | | 134,061 | |

| | | | | | | | | | | | | | 450,986 | |

| | | | | TELECOMMUNICATIONS — 0.9% | | | | | | | | | | |

| | 145,000 | | | Level 3 Financing, Inc. (a) | | | | 4.2500 | | 07/01/28 | | | 122,766 | |

| | 150,000 | | | Sprint Spectrum Company, LLC / Sprint Spectrum (a) | | | | 4.7380 | | 03/20/25 | | | 151,284 | |

| | 265,000 | | | T-Mobile USA, Inc. | | | | 3.8750 | | 04/15/30 | | | 251,728 | |

| | 123,000 | | | Verizon Communications, Inc. | | | | 2.5500 | | 03/21/31 | | | 107,059 | |

| | | | | | | | | | | | | | 632,837 | |

| | | | | TOBACCO & CANNABIS — 0.5% | | | | | | | | | | |

| | 195,000 | | | BAT Capital Corporation | | | | 4.9060 | | 04/02/30 | | | 188,583 | |

| | 165,000 | | | Vector Group Ltd. (a) | | | | 5.7500 | | 02/01/29 | | | 145,061 | |

| | | | | | | | | | | | | | 333,644 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL CORPORATE BONDS (Cost $23,861,135) | | | | | | | | | 21,781,946 | |

| | | | | | | | | | | | | | | |

| | | | | MUNICIPAL BONDS — 5.7% | | | | | | | | | | |

| | | | | CITY — 0.7% | | | | | | | | | | |

| | 340,000 | | | City of Bristol VA | | | | 4.2100 | | 01/01/42 | | | 346,349 | |

| | 145,000 | | | City of San Antonio TX | | | | 1.9630 | | 02/01/33 | | | 121,424 | |

| | | | | | | | | | | | | | 467,773 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Rate (%) | | Maturity | | Fair Value | |

| | | | | MUNICIPAL BONDS — 5.7% (Continued) | | | | | | | | |

| | | | | GOVERNMENT LEASE — 0.1% | | | | | | | | |

| | 145,000 | | | Texas Public Finance Authority | | 2.1400 | | 02/01/35 | | $ | 115,457 | |

| | | | | | | | | | | | | |

| | | | | HOSPITALS — 0.2% | | | | | | | | |

| | 135,000 | | | Idaho Health Facilities Authority | | 5.0200 | | 03/01/48 | | | 144,392 | |

| | | | | | | | | | | | | |

| | | | | LOCAL AUTHORITY — 1.3% | | | | | | | | |

| | 325,000 | | | San Diego County Regional Airport Authority | | 5.5940 | | 07/01/43 | | | 343,517 | |

| | 600,000 | | | State of Texas | | 3.2110 | | 04/01/44 | | | 527,842 | |

| | 35,000 | | | Texas Transportation Commission State Highway Fund | | 4.0000 | | 10/01/33 | | | 35,508 | |

| | | | | | | | | | | | 906,867 | |

| | | | | MISCELLANEOUS TAX — 1.2% | | | | | | | | |

| | 765,000 | | | Metropolitan Transportation Authority | | 5.0000 | | 11/15/45 | | | 844,065 | |

| | | | | | | | | | | | | |

| | | | | SALES TAX — 0.0%(e) | | | | | | | | |

| | 20,000 | | | Sales Tax Securitization Corporation | | 3.4110 | | 01/01/43 | | | 17,223 | |

| | | | | | | | | | | | | |

| | | | | WATER AND SEWER — 2.2% | | | | | | | | |

| | 705,000 | | | Broward County FL Water & Sewer Utility Revenue | | 4.0000 | | 10/01/47 | | | 716,568 | |

| | 625,000 | | | New York State Environmental Facilities | | 5.0000 | | 06/15/51 | | | 710,383 | |

| | 160,000 | | | Santa Clara Valley Water District | | 2.9670 | | 06/01/50 | | | 128,708 | |

| | | | | | | | | | | | 1,555,659 | |

| | | | | | | | | | | | | |

| | | | | TOTAL MUNICIPAL BONDS (Cost $4,302,230) | | | | | | | 4,051,436 | |

| | | | | | | | | | | | | |

| | | | | NON U.S. GOVERNMENT & AGENCIES — 1.4% | | | | | | | | |

| | | | | SOVEREIGN — 1.4% | | | | | | | | |

| | 280,000 | | | Dominican Republic International Bond (a) | | 6.0000 | | 02/22/33 | | | 255,290 | |

| | 200,000 | | | Emirate of Dubai Government International Bonds | | 5.2500 | | 01/30/43 | | | 196,779 | |

| | 200,000 | | | Mexico Government International Bond (f) | | 2.6590 | | 05/24/31 | | | 169,500 | |

| | 200,000 | | | Oman Government International Bond (a) | | 7.3750 | | 10/28/32 | | | 220,543 | |

| | 200,000 | | | Panama Government International Bond | | 3.2980 | | 01/19/33 | | | 174,493 | |

| | | | | TOTAL NON U.S. GOVERNMENT & AGENCIES (Cost $1,130,537) | | | | | | | 1,016,605 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | TERM LOANS — 8.6% | | | | | | | | | | |

| | | | | AEROSPACE & DEFENSE — 0.2% | | | | | | | | | | |

| | 131,241 | | | TransDigm, Inc. (d) | | US0001M + 2.250% | | 2.7070 | | 05/30/25 | | $ | 128,993 | |

| | | | | | | | | | | | | | | |

| | | | | AUTOMOTIVE — 0.2% | | | | | | | | | | |

| | 142,106 | | | Cooper-Standard Automotive, Inc. (d) | | US0003M + 2.000% | | 2.7500 | | 11/02/23 | | | 131,544 | |

| | | | | | | | | | | | | | | |

| | | | | BIOTECH & PHARMA — 0.0%(e) | | | | | | | | | | |

| | 19,842 | | | Bausch Health Americas, Inc. (d) | | US0003M + 2.750% | | 2.8710 | | 06/01/25 | | | 19,763 | |

| | 5,744 | | | Bausch Health Americas, Inc. (d) | | US0003M + 3.000% | | 3.1210 | | 06/01/25 | | | 5,725 | |

| | | | | | | | | | | | | | 25,488 | |

| | | | | CABLE & SATELLITE — 0.1% | | | | | | | | | | |

| | 83,043 | | | Directv Financing, LLC (d) | | US0001M + 5.000% | | 5.7640 | | 07/22/27 | | | 82,801 | |

| | 20,000 | | | Virgin Media Bristol, LLC (d) | | US0001M + 3.250% | | 3.3530 | | 01/10/29 | | | 19,934 | |

| | | | | | | | | | | | | | 102,735 | |

| | | | | CHEMICALS — 0.4% | | | | | | | | | | |

| | 350 | | | Diamond BC BV | | | | 3.2500 | | 09/15/28 | | | 339 | |

| | 231,697 | | | INEOS US Finance, LLC (d) | | US0001M + 2.000% | | 2.4490 | | 03/31/24 | | | 230,920 | |

| | 338 | | | INEOS US Petrochem, LLC (d) | | US0001M + 2.750% | | 3.2500 | | 01/21/26 | | | 334 | |

| | 78,875 | | | Trinseo Materials Operating SCA (d) | | US0001M + 2.500% | | 2.9570 | | 03/18/28 | | | 78,026 | |

| | | | | | | | | | | | | | 309,619 | |

| | | | | COMMERCIAL SUPPORT SERVICES — 0.0%(e) | | | | | | | | | | |

| | 513 | | | AlixPartners LLP (d) | | US0001M + 2.750% | | 3.2500 | | 01/28/28 | | | 508 | |

| | 23,313 | | | Aramark Services, Inc. (d) | | US0001M + 1.750% | | 1.8710 | | 12/10/26 | | | 22,983 | |

| | | | | | | | | | | | | | 23,491 | |

| | | | | CONSTRUCTION MATERIALS — 0.6% | | | | | | | | | | |

| | 180,087 | | | CPG International, LLC (d) | | US0001M + 2.500% | | 3.2500 | | 05/05/24 | | | 179,861 | |

| | 130,000 | | | CPG International, LLC (d) | | | | 0.000 | | 04/18/29 | | | 128,538 | |

| | 140,000 | | | QUIKRETE HOLDINGS, INC. (d) | | US0001M + 3.000% | | 3.5540 | | 06/11/28 | | | 136,627 | |

| | | | | | | | | | | | | | 445,026 | |

| | | | | CONTAINERS & PACKAGING — 0.1% | | | | | | | | | | |

| | 80,837 | | | Berry Global, Inc. (d) | | US0001M + 1.750% | | 2.2380 | | 07/01/26 | | | 79,718 | |

| | | | | | | | | | | | | | | |

| | | | | ELECTRIC UTILITIES — 0.2% | | | | | | | | | | |

| | 121,209 | | | Astoria Energy, LLC (d) | | US0003M + 3.500% | | 4.5000 | | 12/10/27 | | | 119,745 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | TERM LOANS — 8.6% (Continued) | | | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT — 0.2% | | | | | | | | | | |

| | 115,600 | | | Brookfield WEC Holdings, Inc. (d) | | US0001M + 2.750% | | 3.2500 | | 08/01/25 | | $ | 113,685 | |

| | | | | | | | | | | | | | | |

| | | | | FOOD — 0.2% | | | | | | | | | | |

| | 50,000 | | | CHG PPC Parent, LLC (d) | | US0001M + 3.000% | | 3.5000 | | 11/17/28 | | | 49,250 | |

| | 102,722 | | | Hostess Brands, LLC (d) | | US0001M + 2.250% | | 3.0000 | | 08/03/25 | | | 101,625 | |

| | | | | | | | | | | | | | 150,875 | |

| | | | | HEALTH CARE FACILITIES & SERVICES — 0.3% | | | | | | | | | | |

| | 54,718 | | | Agiliti Health, Inc. (d) | | US0003M + 2.750% | | 3.2500 | | 10/18/25 | | | 54,308 | |

| | 131,596 | | | Legacy LifePoint Health, LLC (d) | | US0001M + 3.750% | | 4.4990 | | 11/16/25 | | | 130,245 | |

| | 30,000 | | | Phoenix Newco, Inc. (d) | | US0001M + 3.500% | | 4.0000 | | 08/11/28 | | | 29,833 | |

| | | | | | | | | | | | | | 214,386 | |

| | | | | HOME CONSTRUCTION — 0.1% | | | | | | | | | | |

| | 54,863 | | | Chariot Buyer, LLC (d) | | US0003M + 3.500% | | 4.0000 | | 10/22/28 | | | 53,911 | |

| | | | | | | | | | | | | | | |

| | | | | INDUSTRIAL INTERMEDIATE PROD — 0.2% | | | | | | | | | | |

| | 177,750 | | | Gates Global, LLC (d) | | US0001M + 2.750% | | 3.2500 | | 03/31/27 | | | 174,676 | |

| | | | | | | | | | | | | | | |

| | | | | INDUSTRIAL SUPPORT SERVICES — 0.2% | | | | | | | | | | |

| | 109,100 | | | Resideo Funding, Inc. (d) | | US0003M + 2.250% | | 2.7500 | | 02/09/28 | | | 108,895 | |

| | | | | | | | | | | | | | | |

| | | | | INSURANCE — 0.2% | | | | | | | | | | |

| | 34,737 | | | Asurion, LLC (d) | | US0001M + 3.250% | | 3.3590 | | 07/28/27 | | | 33,999 | |

| | 95,554 | | | Sedgwick Claims Management Services, Inc. (d) | | US0001M + 3.250% | | 3.3420 | | 11/05/25 | | | 94,768 | |

| | | | | | | | | | | | | | 128,767 | |

| | | | | INTERNET MEDIA & SERVICES — 0.1% | | | | | | | | | | |

| | 68 | | | Pug, LLC (d) | | US0001M + 4.250% | | 4.7500 | | 02/13/27 | | | 67 | |

| | 58,359 | | | Pug, LLC (d) | | US0001M + 3.500% | | 3.9570 | | 12/31/49 | | | 57,119 | |

| | | | | | | | | | | | | | 57,186 | |

| | | | | LEISURE FACILITIES & SERVICES — 1.0% | | | | | | | | | | |

| | 178,242 | | | Caesars Resort Collection, LLC (d) | | US0003M + 2.750% | | 3.2070 | | 10/02/24 | | | 177,628 | |

| | 180,000 | | | Hilton Worldwide Finance, LLC (d) | | US0003M + 1.750% | | 2.4180 | | 06/21/26 | | | 178,169 | |

| | 40,000 | | | Scientific Games Corporation (d) | | SOFRRATE + 3.000% | | 3.5730 | | 04/07/29 | | | 39,869 | |

| | 30,000 | | | Scientific Games Holdings, L.P. (d) | | SOFRRATE + 3.500% | | 4.4670 | | 02/04/29 | | | 29,727 | |

| | 138,937 | | | Station Casinos, LLC (d) | | US0001M + 2.250% | | 2.5000 | | 01/31/27 | | | 137,410 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | TERM LOANS — 8.6% (Continued) | | | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES — 1.0% (Continued) | | | | | | | | | | |

| | 119,347 | | | UFC Holdings, LLC (d) | | US0001M + 2.750% | | 3.5000 | | 04/29/26 | | $ | 117,809 | |

| | | | | | | | | | | | | | 680,612 | |

| | | | | MACHINERY — 0.3% | | | | | | | | | | |

| | 116,634 | | | Alliance Laundry Systems, LLC (d) | | US0003M + 3.500% | | 4.5210 | | 09/30/27 | | | 116,197 | |

| | 102,654 | | | Standard Industries, Inc. (d) | | US0003M + 2.500% | | 3.7880 | | 08/06/28 | | | 102,501 | |

| | | | | | | | | | | | | | 218,698 | |

| | | | | MEDICAL EQUIPMENT & DEVICES — 0.1% | | | | | | | | | | |

| | 55,000 | | | Mozart Borrower, L.P. (d) | | US0001M + 3.250% | | 3.7500 | | 09/30/28 | | | 54,138 | |

| | | | | | | | | | | | | | | |

| | | | | OIL & GAS PRODUCERS — 0.4% | | | | | | | | | | |

| | 57,477 | | | CITGO Petroleum Corporation (d) | | US0001M + 6.250% | | 7.2500 | | 03/27/24 | | | 57,462 | |

| | 110,000 | | | Freeport LNG Investments LLLP (d) | | US0003M + 3.500% | | 4.5630 | | 11/17/28 | | | 109,509 | |

| | 109,548 | | | Oryx Midstream Services Permian Basin, LLC (d) | | US0003M + 3.250% | | 3.7500 | | 09/30/28 | | | 109,153 | |

| | | | | | | | | | | | | | 276,124 | |

| | | | | PUBLISHING & BROADCASTING — 0.1% | | | | | | | | | | |

| | 78,333 | | | Nexstar Broadcasting, Inc. (d) | | US0001M + 2.500% | | 2.9550 | | 06/20/26 | | | 77,752 | |

| | | | | | | | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY — 0.3% | | | | | | | | | | |

| | 89,550 | | | PetSmart, Inc. (d) | | US0003M + 3.750% | | 4.5000 | | 01/29/28 | | | 88,923 | |

| | 89,550 | | | RH (d) | | US0001M + 2.500% | | 3.0000 | | 10/15/28 | | | 86,328 | |

| | | | | | | | | | | | | | 175,251 | |

| | | | | SOFTWARE — 0.8% | | | | | | | | | | |

| | 113,368 | | | Applied Systems, Inc. (d) | | US0003M + 3.200% | | 3.7500 | | 09/19/24 | | | 113,177 | |

| | 71,765 | | | Boxer Parent Company, Inc. (d) | | US0001M + 3.750% | | 4.5140 | | 10/02/25 | | | 70,985 | |

| | 134,663 | | | CCC Intelligent Solutions, Inc. (d) | | US0003M + 2.500% | | 3.2560 | | 09/17/28 | | | 133,119 | |

| | 123,752 | | | Sophia, L.P. (d) | | US0001M + 3.500% | | 4.2560 | | 10/07/27 | | | 122,515 | |

| | 40,000 | | | Sophia, L.P. (d) | | SOFRRATE + 4.250% | | 4.7720 | | 10/07/27 | | | 39,850 | |

| | 102,245 | | | UKG, Inc. (d) | | US0003M + 3.250% | | 4.2120 | | 05/03/26 | | | 101,327 | |

| | | | | | | | | | | | | | 580,973 | |

| | | | | SPECIALTY FINANCE — 0.1% | | | | | | | | | | |

| | 95,531 | | | Trans Union, LLC (d) | | US0001M + 2.250% | | 2.7500 | | 11/18/28 | | | 94,663 | |

| | | | | | | | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE — 0.1% | | | | | | | | | | |

| | 89,770 | | | NCR Corporation (d) | | US0001M + 2.500% | | 2.7200 | | 08/08/26 | | | 87,526 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | TERM LOANS — 8.6% (Continued) | | | | | | | | | | |

| | | | | TECHNOLOGY SERVICES — 1.0% | | | | | | | | | | |

| | 179,070 | | | Blackhawk Network Holdings, Inc. (d) | | US0001M + 3.000% | | 3.4570 | | 05/22/25 | | $ | 176,975 | |

| | 92,931 | | | Dun & Bradstreet Corporation (The) (d) | | US0001M + 3.250% | | 3.6970 | | 02/08/26 | | | 92,361 | |

| | 20,000 | | | Dun & Bradstreet Corporation (The) (d) | | SOFRRATE + 3.250% | | 3.3090 | | 01/07/29 | | | 19,888 | |

| | 129,575 | | | NAB Holdings, LLC (d) | | SOFRRATE + 3.000% | | 3.8010 | | 11/18/28 | | | 127,988 | |

| | 87,490 | | | Peraton Corporation (d) | | US0001M + 3.750% | | 4.5140 | | 02/24/28 | | | 87,019 | |

| | 194,513 | | | Tenable, Inc. (d) | | US0003M + 2.750% | | 3.2500 | | 06/17/28 | | | 194,025 | |

| | 38,050 | | | WEX, Inc. (d) | | US0001M + 2.250% | | 2.7070 | | 03/19/28 | | | 37,760 | |

| | | | | | | | | | | | | | 736,016 | |

| | | | | TELECOMMUNICATIONS — 0.3% | | | | | | | | | | |

| | 39,088 | | | CenturyLink, Inc. (d) | | US0001M + 2.250% | | 2.3370 | | 03/15/27 | | | 37,484 | |

| | 177,957 | | | SBA Senior Finance II, LLC (d) | | US0001M + 1.750% | | 2.2100 | | 04/11/25 | | | 175,308 | |

| | | | | | | | | | | | | | 212,792 | |

| | | | | TRANSPORTATION & LOGISTICS — 0.7% | | | | | | | | | | |

| | 24,706 | | | Air Canada (d) | | US0003M + 3.500% | | 4.2500 | | 07/27/28 | | | 24,515 | |

| | 101,936 | | | Brown Group Holding, LLC (d) | | US0003M + 2.500% | | 3.5060 | | 04/22/28 | | | 100,623 | |

| | 74,538 | | | KKR Apple Bidco, LLC (d) | | US0001M + 3.000% | | 3.5000 | | 07/13/28 | | | 73,862 | |

| | 85,000 | | | Mileage Plus Holdings, LLC (d) | | US0003M + 5.250% | | 6.2500 | | 06/25/27 | | | 88,336 | |

| | 118,878 | | | PODS, LLC (d) | | US0003M + 3.000% | | 3.7500 | | 03/19/28 | | | 117,626 | |

| | 140,000 | | | SkyMiles IP Ltd. (d) | | US0003M + 3.750% | | 4.7500 | | 09/16/27 | | | 144,862 | |

| | | | | | | | | | | | | | 549,824 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL TERM LOANS (Cost $6,157,952) | | | | | | | | | 6,113,109 | |

| | | | | | | | | | | | | | | |

| | | | | U.S. GOVERNMENT & AGENCIES — 18.7% | | | | | | | | | | |

| | | | | AGENCY FIXED RATE — 0.8% | | | | | | | | | | |

| | 9,389 | | | Fannie Mae Pool 735061 | | | | 6.0000 | | 11/01/34 | | | 10,157 | |

| | 11,504 | | | Fannie Mae Pool 866009 | | | | 6.0000 | | 03/01/36 | | | 12,715 | |

| | 82,462 | | | Fannie Mae Pool 938574 | | | | 5.5000 | | 09/01/36 | | | 87,758 | |

| | 28,008 | | | Fannie Mae Pool 310041 | | | | 6.5000 | | 05/01/37 | | | 31,082 | |

| | 13,992 | | | Fannie Mae Pool 962752 | | | | 5.0000 | | 04/01/38 | | | 14,958 | |

| | 15,506 | | | Fannie Mae Pool 909175 | | | | 5.5000 | | 04/01/38 | | | 16,699 | |

| | 58,178 | | | Fannie Mae Pool 909220 | | | | 6.0000 | | 08/01/38 | | | 63,891 | |

See accompanying notes which are an integral part to these financial statements.

| DUNHAM CORPORATE/GOVERNMENT BOND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2022 |

| | | | | | Coupon | | | | | |

| Principal Amount ($) | | | | | Rate (%) | | Maturity | | Fair Value | |

| | | | | U.S. GOVERNMENT & AGENCIES — 18.7% (Continued) | | | | | | | | |

| | | | | AGENCY FIXED RATE — 0.8% (Continued) | | | | | | | | |

| | 80,125 | | | Fannie Mae Pool AA7001 | | 5.0000 | | 06/01/39 | | $ | 84,836 | |

| | 57,012 | | | Fannie Mae Pool AS7026 | | 4.0000 | | 04/01/46 | | | 57,482 | |

| | 94,296 | | | Fannie Mae Pool BJ9260 | | 4.0000 | | 04/01/48 | | | 94,556 | |

| | 96,202 | | | Freddie Mac Gold Pool G01980 | | 5.0000 | | 12/01/35 | | | 102,747 | |

| | 13,345 | | | Freddie Mac Gold Pool G05888 | | 5.5000 | | 10/01/39 | | | 14,385 | |

| | | | | | | | | | | | 591,266 | |

| | | | | U.S. TREASURY BILLS — 7.2% | | | | | | | | |

| | 915,000 | | | United States Treasury Note | | 0.1250 | | 08/31/23 | | | 887,496 | |

| | 485,000 | | | United States Treasury Note | | 0.8750 | | 11/15/30 | | | 411,549 | |

| | 715,000 | | | United States Treasury Note | | 1.6250 | | 05/15/31 | | | 643,584 | |

| | 715,000 | | | United States Treasury Note | | 2.3750 | | 02/15/42 | | | 633,669 | |

| | 2,045,000 | | | United States Treasury Note | | 1.8750 | | 02/15/51 | | | 1,611,076 | |

| | 1,135,000 | | | United States Treasury Note | | 1.8750 | | 11/15/51 | | | 894,522 | |

| | | | | | | | | | | | 5,081,896 | |

| | | | | U.S. TREASURY BONDS — 5.8% | | | | | | | | |

| | 1,280,000 | | | United States Treasury Bond | | 2.8750 | | 05/15/49 | | | 1,247,200 | |

| | 1,440,000 | | | United States Treasury Bond | | 2.0000 | | 02/15/50 | | | 1,168,144 | |

| | 2,500,000 | | | United States Treasury Bond | | 1.3750 | | 08/15/50 | | | 1,729,883 | |

| | | | | | | | | | | | 4,145,227 | |

| | | | | U.S. TREASURY NOTES — 4.9% | | | | | | | | |

| | 1,010,000 | | | United States Treasury Note | | 0.1250 | | 05/31/22 | | | 1,009,722 | |

| | 2,505,000 | | | United States Treasury Note | | 2.6250 | | 02/15/29 | | | 2,456,955 | |

| | | | | | | | | | | | 3,466,677 | |

| | | | | | | | | | | | | |

| | | | | TOTAL U.S. GOVERNMENT & AGENCIES (Cost $15,677,500) | | | | | | | 13,285,066 | |

| | | | | | | | | | | | | |

| | | | | COLLATERAL FOR SECURITIES LOANED – 2.4% | | | | | | | | |